UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-05125 |

| |

| Dreyfus Variable Investment Fund | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Bennett A. MacDougall, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6400 |

| |

Date of fiscal year end: | 12/31 | |

Date of reporting period: | 12/31/17 | |

| | | | | | | |

FORM N-CSR

Item 1. Reports to Stockholders.

Dreyfus Variable Investment Fund, Appreciation Portfolio

| | | |

| | ANNUAL REPORT

December 31, 2017 |

| |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

THE FUND

FOR MORE INFORMATION

Back Cover

| | | | |

| |

Dreyfus Variable Investment Fund, Appreciation Portfolio

| | The Fund |

A LETTER FROM THE PRESIDENT OF DREYFUS

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Variable Investment Fund, Appreciation Portfolio, covering the 12-month period from January 1, 2017 through December 31, 2017. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Stocks set a series of new record highs and bonds produced modestly positive results during 2017. Financial markets early in the year were dominated by the inauguration of a new U.S. president, as equities and corporate-backed bonds surged higher in anticipation of more business-friendly regulatory, tax, and fiscal policies. U.S. and international stocks continued to rally in the spring as corporate earnings grew and global economic conditions improved. Later in the year, the passage of tax reform legislation fueled additional stock market gains.

Despite three short-term interest rate hikes and concerns early in the year that inflation might accelerate in a growing economy, bonds generally produced positive total returns in 2017. Corporate-backed securities and municipal bonds fared particularly well.

The markets’ strong performance last year was supported by solid underlying fundamentals, including sustained economic growth, a robust labor market, and low inflation. We currently expect these favorable conditions to persist in 2018, but we remain watchful for economic and political developments that could negatively impact the markets. As always, we encourage you to discuss the risks and opportunities of today’s investment environment with your financial advisor.

Thank you for your continued confidence and support.

Sincerely,

Renee Laroche-Morris

President

The Dreyfus Corporation

January 16, 2017

2

DISCUSSION OF FUND PERFORMANCE

For the period from January 1, 2017 through December 31, 2017, as provided by portfolio manager Fayez Sarofim of Fayez Sarofim & Co., Sub-Investment Adviser

Market and Fund Performance Overview

For the 12-month period ended December 31, 2017, Dreyfus Variable Investment Fund, Appreciation Portfolio’s Initial shares achieved a total return of 27.33%, and its Service shares achieved a total return of 27.00%.1 In comparison, the S&P 500® Index (the “Index”), the fund’s benchmark, provided a total return of 21.82% for the same period.2

Stocks gained ground in 2017 amid better-than-expected corporate earnings and in anticipation of more stimulative U.S. government policies. Favorable stock selections in the information technology and health care sectors enabled the fund to outperform the Index.

The Fund’s Investment Approach

The fund seeks long-term capital growth consistent with the preservation of capital. Its secondary goal is current income. To pursue these goals, the fund normally invests at least 80% of its net assets in common stocks. The fund focuses on blue-chip companies with total market capitalizations of more than $5 billion at the time of purchase, including multinational companies. These are established companies that have demonstrated sustained patterns of profitability, strong balance sheets, an expanding global presence, and the potential to achieve predictable, above-average earnings growth.

In choosing stocks, we identify economic sectors we believe will expand over the next three to five years or longer. Using fundamental analysis, we then seek companies within these sectors that have proven track records and dominant positions in their industries. The fund employs a “buy-and-hold” investment strategy, which generally has resulted in an annual portfolio turnover rate of below 15%. A low portfolio turnover rate helps reduce the fund’s trading costs and can help limit the distribution of capital gains generated due to portfolio turnover.3

Rising Corporate Earnings Drove Markets Higher

U.S. equities enjoyed steady gains in 2017 as the economy expanded, corporate profits rebounded, and financial-markets volatility waned, powering the Index to a series of all-time highs and a double-digit return for the year. The Federal Reserve Board’s tightening cycle gained traction while most other central banks continued to ease, and the value of the U.S. dollar declined relative to other major currencies. The softer dollar, coupled with strengthening global growth prospects, helped support the performance of many foreign equity markets as well as domestic companies with ample international sales exposure. The information technology sector proved to be

3

DISCUSSION OF FUND PERFORMANCE (continued)

the best-performing market segment in 2017, contributing almost 40% of the Index’s rise with strength concentrated in mega-cap companies. The telecommunication services and energy sectors were the only segments of the Index to post declines for the year.

Security Selections Drove Relative Performance

The fund meaningfully outperformed the Index in 2017, supported by the overall impact of our stock selection strategy. The fund’s overweighted and selectively focused representation in the top-performing information technology sector was the most significant contributor to relative and absolute results. Correctly emphasized representation in the health care sector also added value compared to the Index. Positions in pharmaceutical developers AbbVie, Abbott Laboratories, and Novo Nordisk generated returns of more than 50% for the year. In the financials sector, the fund’s focus on capital markets, one of the sector’s better-performing segments, also was constructive. The largest contributors to the fund’s return for the year included Apple, Facebook, Microsoft, Philip Morris International, and Texas Instruments.

Factors that modestly constrained relative results during the year included an above-market allocation to the lagging energy sector. This impact, however, was tempered by an emphasis on the major integrated oils, which generally are less sensitive to crude oil prices than oilfield and equipment stocks. Another impediment to relative results was overweighted exposure to the consumer staples sector, though correct stock focus within the sector entirely offset the negative allocation effect, and the sector’s total relative impact on the fund’s performance was positive. The largest detractors from the fund’s returns in 2017 were Exxon Mobil, Occidental Petroleum, Walgreens Boots Alliance, Gilead Sciences, and Air Products and Chemicals.

Positioned for Continued Growth

Although the current bull market is just three months shy of its ninth birthday, we believe that stocks enter 2018 with strong tailwinds, including improving global growth, strong corporate earnings, the impact of tax-reform legislation, and accommodative monetary policies among central banks. However, last year’s supportive combination of positive economic surprises and subdued volatility will be hard to replicate, and we expect market leadership to narrow as the economic cycle matures and as investors seek out fundamentally sound companies with risk-mitigating qualities. Our long-practiced investment approach focuses on such companies. The fund’s portfolio is composed of what we believe are high-quality, competitively advantaged businesses that have proven themselves capable of growing global market share and earnings across market cycles. With their solid balance sheets, ample financial resources, and disciplined capital allocation policies,

4

these multinational industry leaders should be well positioned to build shareholder value even through periods of market fluctuations.

January 16, 2018

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. The fund’s performance does not reflect the deduction of additional charges and expenses imposed in connection with investing in variable insurance contracts, which will reduce returns.

2 Source: Lipper Inc. — The S&P 500® Index is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. Investors cannot invest directly in any index.

3 Achieving tax efficiency is not a part of the fund’s investment objective, and there can be no guarantee that the fund will achieve any particular level of taxable distributions in future years. In periods when the manager has to sell significant amounts of securities (e.g., during periods of significant net redemptions or changes in index components), the fund can be expected to be less tax efficient than during periods of more stable market conditions and asset flows.

Please note: the position in any security highlighted with italicized typeface was sold during the reporting period.

Equities are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

The fund is only available as a funding vehicle under variable life insurance policies or variable annuity contracts issued by insurance companies. Individuals may not purchase shares of the fund directly. A variable annuity is an insurance contract issued by an insurance company that enables investors to accumulate assets on a tax-deferred basis for retirement or other long-term goals. The investment objective and policies of Dreyfus Variable Investment Fund, Appreciation Portfolio made available through insurance products may be similar to those of other funds managed by Dreyfus. However, the investment results of the fund may be higher or lower than, and may not be comparable to, those of any other Dreyfus fund.

5

FUND PERFORMANCE

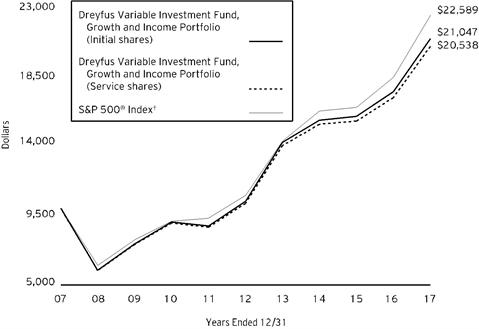

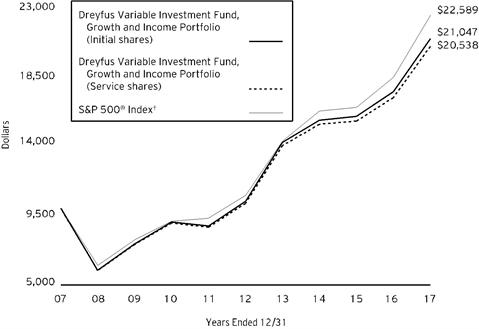

Comparison of change in value of $10,000 investment in Dreyfus Variable Investment Fund, Appreciation Portfolio Initial shares and Service shares and the S&P 500® Index (the “Index”)

† Source: Lipper Inc.

Past performance is not predictive of future performance. The fund’s performance does not reflect the deduction of additional charges and expenses imposed in connection with investing in variable insurance contracts which will reduce returns.

The above graph compares a $10,000 investment made in Initial and Service shares of Dreyfus Variable Investment Fund, Appreciation Portfolio on 12/31/07 to a $10,000 investment made in the Index on that date.

The fund’s performance shown in the line graph above takes into account all applicable fund fees and expenses for Initial and Service shares. The Index is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

| | | | |

Average Annual Total Returns as of 12/31/17 |

| 1 Year | 5 Years | 10 Years |

Initial shares | 27.33% | 11.90% | 7.72% |

Service shares | 27.00% | 11.62% | 7.45% |

S&P 500® Index | 21.82% | 15.78% | 8.49% |

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to Dreyfus.com for the fund’s most recent month-end returns.

The fund’s Initial shares are not subject to a Rule 12b-1 fee. The fund’s Service shares are subject to a 0.25% annual Rule 12b-1 fee. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

6

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads), redemption fees and expenses associated with variable annuity or insurance contracts, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Variable Investment Fund, Appreciation Portfolio from July 1, 2017 to December 31, 2017. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming actual returns for the six months ended December 31, 2017 | |

| | | | Initial Shares | Service Shares |

Expenses paid per $1,000† | | | $4.28 | | $5.61 |

Ending value (after expenses) | | | $1,122.90 | | $1,121.50 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming a hypothetical 5% annualized return for the six months ended December 31, 2017 |

| | | | Initial Shares | Service Shares |

Expenses paid per $1,000† | | | $4.08 | | $5.35 |

Ending value (after expenses) | | | $1,021.17 | | $1,019.91 |

† Expenses are equal to the fund’s annualized expense ratio of .80% for Initial shares and 1.05% for Service shares, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

7

STATEMENT OF INVESTMENTS

December 31, 2017

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 99.4% | | | | | |

Banks - 4.8% | | | | | |

JPMorgan Chase & Co. | | | | 138,000 | | 14,757,720 | |

Wells Fargo & Co. | | | | 87,325 | | 5,298,008 | |

| | | | | 20,055,728 | |

Capital Goods - 1.6% | | | | | |

United Technologies | | | | 51,900 | | 6,620,883 | |

Consumer Durables & Apparel - 2.5% | | | | | |

Hermes International | | | | 2,677 | | 1,432,976 | |

LVMH Moet Hennessy Louis Vuitton | | | | 15,500 | | 4,553,112 | |

NIKE, Cl. B | | | | 72,840 | | 4,556,142 | |

| | | | | 10,542,230 | |

Consumer Services - 1.5% | | | | | |

McDonald's | | | | 36,650 | | 6,308,198 | |

Diversified Financials - 8.9% | | | | | |

American Express | | | | 73,125 | | 7,262,044 | |

BlackRock | | | | 21,750 | | 11,173,192 | |

Intercontinental Exchange | | | | 81,700 | | 5,764,752 | |

S&P Global | | | | 35,675 | | 6,043,345 | |

State Street | | | | 71,425 | | 6,971,794 | |

| | | | | 37,215,127 | |

Energy - 6.7% | | | | | |

Chevron | | | | 86,950 | | 10,885,270 | |

ConocoPhillips | | | | 89,650 | | 4,920,889 | |

Exxon Mobil | | | | 147,614 | | 12,346,435 | |

| | | | | 28,152,594 | |

Food & Staples Retailing - .9% | | | | | |

Walgreens Boots Alliance | | | | 52,100 | | 3,783,502 | |

Food, Beverage & Tobacco - 18.5% | | | | | |

Altria Group | | | | 190,200 | | 13,582,182 | |

Anheuser-Busch, ADR | | | | 37,800 | | 4,216,968 | |

Coca-Cola | | | | 246,125 | | 11,292,215 | |

Constellation Brands, Cl. A | | | | 23,100 | | 5,279,967 | |

Nestle, ADR | | | | 117,575 | | 10,107,923 | |

PepsiCo | | | | 66,575 | | 7,983,674 | |

Philip Morris International | | | | 232,850 | | 24,600,602 | |

| | | | | 77,063,531 | |

Health Care Equipment & Services - 2.6% | | | | | |

Abbott Laboratories | | | | 110,825 | | 6,324,783 | |

UnitedHealth Group | | | | 20,500 | | 4,519,430 | |

| | | | | 10,844,213 | |

Household & Personal Products - 3.7% | | | | | |

Estee Lauder, Cl. A | | | | 84,825 | | 10,793,133 | |

8

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 99.4% (continued) | | | | | |

Household & Personal Products - 3.7% (continued) | | | | | |

Procter & Gamble | | | | 49,025 | | 4,504,417 | |

| | | | | 15,297,550 | |

Insurance - 2.8% | | | | | |

Chubb | | | | 79,350 | | 11,595,415 | |

Materials - 2.0% | | | | | |

Air Products & Chemicals | | | | 9,925 | | 1,628,494 | |

Praxair | | | | 42,825 | | 6,624,171 | |

| | | | | 8,252,665 | |

Media - 5.6% | | | | | |

Comcast, Cl. A | | | | 253,375 | | 10,147,669 | |

Twenty-First Century Fox, Cl. A | | | | 140,711 | | 4,858,751 | |

Walt Disney | | | | 75,850 | | 8,154,634 | |

| | | | | 23,161,054 | |

Pharmaceuticals, Biotechnology & Life Sciences - 6.6% | | | | | |

AbbVie | | | | 83,925 | | 8,116,387 | |

Novartis, ADR | | | | 57,925 | | 4,863,383 | |

Novo Nordisk, ADR | | | | 149,175 | | 8,006,222 | |

Roche Holding, ADR | | | | 212,400 | | 6,707,592 | |

| | | | | 27,693,584 | |

Semiconductors & Semiconductor Equipment - 5.0% | | | | | |

ASML Holding | | | | 38,250 | | 6,648,615 | |

Texas Instruments | | | | 136,675 | | 14,274,337 | |

| | | | | 20,922,952 | |

Software & Services - 16.7% | | | | | |

Alphabet, Cl. C | | | | 13,769 | a | 14,407,882 | |

Automatic Data Processing | | | | 18,965 | | 2,222,508 | |

Facebook, Cl. A | | | | 119,185 | a | 21,031,385 | |

Microsoft | | | | 257,010 | | 21,984,635 | |

Visa, Cl. A | | | | 87,900 | b | 10,022,358 | |

| | | | | 69,668,768 | |

Technology Hardware & Equipment - 5.9% | | | | | |

Apple | | | | 145,825 | | 24,677,965 | |

Transportation - 3.1% | | | | | |

Canadian Pacific Railway | | | | 32,575 | | 5,953,407 | |

Union Pacific | | | | 52,200 | | 7,000,020 | |

| | | | | 12,953,427 | |

Total Common Stocks (cost $174,392,042) | | | | 414,809,386 | |

9

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Other Investment - .5% | | | | | |

Registered Investment Company; | | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund

(cost $1,867,769) | | | | 1,867,769 | c | 1,867,769 | |

Total Investments (cost $176,259,811) | | 99.9% | | 416,677,155 | |

Cash and Receivables (Net) | | .1% | | 598,029 | |

Net Assets | | 100.0% | | 417,275,184 | |

ADR—American Depository Receipt

aNon-income producing security.

bSecurity, or portion thereof, on loan. At December 31, 2017, the value of the fund’s securities on loan was $9,922,134 and the value of the collateral held by the fund was $10,150,840, consisting of U.S. Government & Agency securities.

cInvestment in affiliated money market mutual fund.

| | |

Portfolio Summary (Unaudited) † | Value (%) |

Food, Beverage & Tobacco | 18.5 |

Software & Services | 16.7 |

Diversified Financials | 8.9 |

Energy | 6.7 |

Pharmaceuticals, Biotechnology & Life Sciences | 6.6 |

Technology Hardware & Equipment | 5.9 |

Media | 5.6 |

Semiconductors & Semiconductor Equipment | 5.0 |

Banks | 4.8 |

Household & Personal Products | 3.7 |

Transportation | 3.1 |

Insurance | 2.8 |

Health Care Equipment & Services | 2.6 |

Consumer Durables & Apparel | 2.5 |

Materials | 2.0 |

Capital Goods | 1.6 |

Consumer Services | 1.5 |

Food & Staples Retailing | .9 |

Money Market Investment | .5 |

| | 99.9 |

† Based on net assets.

See notes to financial statements.

10

STATEMENT OF INVESTMENTS IN AFFILIATED ISSUERS

| | | | | | | |

Registered Investment Companies | Value

12/31/16($) | Purchases($) | Sales ($) | Value

12/31/17($) | Net

Assets(%) | Dividends/

Distributions($) |

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares | 1,363,070 | 125,398,599 | 126,761,669 | – | – | – |

Dreyfus Institutional Preferred Government Plus Money Market Fund | 2,116,167 | 44,868,509 | 45,116,907 | 1,867,769 | .5 | 14,735 |

Total | 3,479,237 | 170,267,108 | 171,878,576 | 1,867,769 | .5 | 14,735 |

See notes to financial statements.

11

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2017

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments

(including securities on loan, valued at $9,922,134)—Note 1(c): | | | |

Unaffiliated issuers | 174,392,042 | | 414,809,386 | |

Affiliated issuers | | 1,867,769 | | 1,867,769 | |

Cash | | | | | 13,407 | |

Dividends and securities lending income receivable | | 806,913 | |

Receivable for investment securities sold | | 613,104 | |

Prepaid expenses | | | | | 4,239 | |

| | | | | 418,114,818 | |

Liabilities ($): | | | | |

Due to The Dreyfus Corporation and affiliates—Note 3(b) | | | | | 237,695 | |

Due to Fayez Sarofim & Co. | | | | | 76,895 | |

Payable for shares of Beneficial Interest redeemed | | 449,420 | |

Accrued expenses | | | | | 75,624 | |

| | | | | 839,634 | |

Net Assets ($) | | | 417,275,184 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 125,908,730 | |

Accumulated undistributed investment income—net | | 313,234 | |

Accumulated net realized gain (loss) on investments | | | | | 50,631,889 | |

Accumulated net unrealized appreciation (depreciation)

on investments and foreign currency transactions | | | | 240,421,331 | |

Net Assets ($) | | | 417,275,184 | |

| | | | |

Net Asset Value Per Share | Initial Shares | Service Shares | |

Net Assets ($) | 271,790,016 | 145,485,168 | |

Shares Outstanding | 6,079,171 | 3,281,330 | |

Net Asset Value Per Share ($) | 44.71 | 44.34 | |

| | | | |

See notes to financial statements. | | | |

12

STATEMENT OF OPERATIONS

Year Ended December 31, 2017

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Cash dividends (net of $192,268 foreign taxes withheld at source): | |

Unaffiliated issuers | | | 8,860,481 | |

Affiliated issuers | | | 14,735 | |

Income from securities lending—Note 1(c) | | | 22,012 | |

Total Income | | | 8,897,228 | |

Expenses: | | | | |

Investment advisory fee—Note 3(a) | | | 2,194,334 | |

Sub-investment advisory fee—Note 3(a) | | | 896,277 | |

Distribution fees—Note 3(b) | | | 395,060 | |

Professional fees | | | 108,379 | |

Custodian fees—Note 3(b) | | | 54,102 | |

Trustees’ fees and expenses—Note 3(c) | | | 26,761 | |

Prospectus and shareholders’ reports | | | 18,647 | |

Loan commitment fees—Note 2 | | | 8,176 | |

Shareholder servicing costs—Note 3(b) | | | 2,369 | |

Miscellaneous | | | 19,979 | |

Total Expenses | | | 3,724,084 | |

Less—reduction in fees due to earnings credits—Note 3(b) | | | (175) | |

Net Expenses | | | 3,723,909 | |

Investment Income—Net | | | 5,173,319 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments | 50,697,356 | |

Net unrealized appreciation (depreciation) on investments

and foreign currency transactions | | | 42,703,302 | |

Net Realized and Unrealized Gain (Loss) on Investments | | | 93,400,658 | |

Net Increase in Net Assets Resulting from Operations | | 98,573,977 | |

| | | | | | | |

See notes to financial statements. | | | | | |

13

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | Year Ended December 31, |

| | | | 2017 | | 2016 | |

Operations ($): | | | | | | | | |

Investment income—net | | | 5,173,319 | | | | 6,615,195 | |

Net realized gain (loss) on investments | | 50,697,356 | | | | 54,795,197 | |

Net unrealized appreciation (depreciation)

on investments | | 42,703,302 | | | | (29,273,746) | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | 98,573,977 | | | | 32,136,646 | |

Distributions to Shareholders from ($): | |

Investment income—net: | | | | | | | | |

Initial Shares | | | (3,397,259) | | | | (4,007,827) | |

Service Shares | | | (1,710,007) | | | | (2,543,769) | |

Net realized gain on investments: | | | | | | | | |

Initial Shares | | | (32,675,856) | | | | (36,865,750) | |

Service Shares | | | (22,119,380) | | | | (33,615,443) | |

Total Distributions | | | (59,902,502) | | | | (77,032,789) | |

Beneficial Interest Transactions ($): | |

Net proceeds from shares sold: | | | | | | | | |

Initial Shares | | | 7,444,269 | | | | 5,270,922 | |

Service Shares | | | 8,089,313 | | | | 8,903,056 | |

Distributions reinvested: | | | | | | | | |

Initial Shares | | | 36,073,115 | | | | 40,873,577 | |

Service Shares | | | 23,829,387 | | | | 36,159,212 | |

Cost of shares redeemed: | | | | | | | | |

Initial Shares | | | (35,224,654) | | | | (42,252,305) | |

Service Shares | | | (61,387,520) | | | | (92,527,613) | |

Increase (Decrease) in Net Assets

from Beneficial Interest Transactions | (21,176,090) | | | | (43,573,151) | |

Total Increase (Decrease) in Net Assets | 17,495,385 | | | | (88,469,294) | |

Net Assets ($): | |

Beginning of Period | | | 399,779,799 | | | | 488,249,093 | |

End of Period | | | 417,275,184 | | | | 399,779,799 | |

Undistributed investment income—net | 313,234 | | | | 247,181 | |

Capital Share Transactions (Shares): | |

Initial Shares | | | | | | | | |

Shares sold | | | 177,820 | | | | 127,906 | |

Shares issued for distributions reinvested | | | 937,609 | | | | 1,041,157 | |

Shares redeemed | | | (847,904) | | | | (1,035,420) | |

Net Increase (Decrease) in Shares Outstanding | 267,525 | | | | 133,643 | |

Service Shares | | | | | | | | |

Shares sold | | | 198,043 | | | | 217,885 | |

Shares issued for distributions reinvested | | | 625,749 | | | | 928,366 | |

Shares redeemed | | | (1,507,252) | | | | (2,328,849) | |

Net Increase (Decrease) in Shares Outstanding | (683,460) | | | | (1,182,598) | |

| | | | | | | | | | |

See notes to financial statements. | | | | | | | | |

14

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. The fund’s total returns do not reflect expenses associated with variable annuity or insurance contracts. These figures have been derived from the fund’s financial statements.

| | | | | | | | | | | | | |

| | | | | | | |

| | | |

Initial Shares | | | Year Ended December 31, |

| | | 2017 | 2016 | 2015 | 2014 | 2013 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 41.01 | 45.23 | 49.51 | 47.95 | 40.47 |

Investment Operations: | | | | | | |

Investment income—neta | | .56 | .68 | .80 | .89 | .86 |

Net realized and unrealized

gain (loss) on investments | | 9.55 | 2.48 | (1.97) | 2.86 | 7.59 |

Total from Investment Operations | | 10.11 | 3.16 | (1.17) | 3.75 | 8.45 |

Distributions: | | | | | | |

Dividends from

investment income—net | | (.57) | (.69) | (.81) | (.90) | (.87) |

Dividends from net realized

gain on investments | | (5.84) | (6.69) | (2.30) | (1.29) | (.10) |

Total Distributions | | (6.41) | (7.38) | (3.11) | (2.19) | (.97) |

Net asset value, end of period | | 44.71 | 41.01 | 45.23 | 49.51 | 47.95 |

Total Return (%) | | 27.33 | 7.91 | (2.47) | 8.09 | 21.11 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | .81 | .82 | .80 | .80 | .81 |

Ratio of net expenses

to average net assets | | .81 | .82 | .80 | .80 | .81 |

Ratio of net investment income

to average net assets | | 1.35 | 1.64 | 1.70 | 1.84 | 1.95 |

Portfolio Turnover Rate | | 3.97 | 4.19 | 11.97 | 3.65 | 7.71 |

Net Assets, end of period ($ x 1,000) | | 271,790 | 238,340 | 256,828 | 329,802 | 360,197 |

a Based on average shares outstanding.

See notes to financial statements.

15

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | | | |

| | | | | | | |

| | | |

Service Shares | | | Year Ended December 31, |

| | | 2017 | 2016 | 2015 | 2014 | 2013 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 40.72 | 44.96 | 49.23 | 47.69 | 40.25 |

Investment Operations: | | | | | | |

Investment income—neta | | .46 | .57 | .68 | .76 | .75 |

Net realized and unrealized

gain (loss) on investments | | 9.46 | 2.46 | (1.96) | 2.85 | 7.55 |

Total from Investment Operations | | 9.92 | 3.03 | (1.28) | 3.61 | 8.30 |

Distributions: | | | | | | |

Dividends from

investment income—net | | (.46) | (.58) | (.69) | (.78) | (.76) |

Dividends from net realized

gain on investments | | (5.84) | (6.69) | (2.30) | (1.29) | (.10) |

Total Distributions | | (6.30) | (7.27) | (2.99) | (2.07) | (.86) |

Net asset value, end of period | | 44.34 | 40.72 | 44.96 | 49.23 | 47.69 |

Total Return (%) | | 27.00 | 7.64 | (2.72) | 7.83 | 20.83 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 1.06 | 1.07 | 1.05 | 1.05 | 1.06 |

Ratio of net expenses

to average net assets | | 1.06 | 1.07 | 1.05 | 1.05 | 1.06 |

Ratio of net investment income

to average net assets | | 1.11 | 1.41 | 1.45 | 1.59 | 1.70 |

Portfolio Turnover Rate | | 3.97 | 4.19 | 11.97 | 3.65 | 7.71 |

Net Assets, end of period ($ x 1,000) | | 145,485 | 161,440 | 231,421 | 264,795 | 254,928 |

a Based on average shares outstanding.

See notes to financial statements.

16

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Appreciation Portfolio (the “fund”) is a separate diversified series of Dreyfus Variable Investment Fund (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering seven series, including the fund. The fund is only offered to separate accounts established by insurance companies to fund variable annuity contracts and variable life insurance policies. The fund’s investment objective is to seek long-term capital growth consistent with the preservation of capital. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Fayez Sarofim & Co. (“Sarofim & Co.”) serves as the fund’s sub–investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus, is the distributor of the fund’s shares, which are sold without a sales charge. The fund is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Initial and Service. Each class of shares has identical rights and privileges, except with respect to the Distribution Plan, and the expenses borne by each class, the allocation of certain transfer agency costs, and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these

17

NOTES TO FINANCIAL STATEMENTS (continued)

arrangements is unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. For open short positions, asked prices are used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All of

18

the preceding securities are generally categorized within Level 1 of the fair value hierarchy.

Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. These securities are generally categorized within Level 2 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined to not accurately reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Company’s Board of Trustees (the “Board”). Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are generally categorized within Level 3 of the fair value hierarchy.

Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange.

The following is a summary of the inputs used as of December 31, 2017 in valuing the fund’s investments:

19

NOTES TO FINANCIAL STATEMENTS (continued)

| | | | | | |

| | Level 1 -

Unadjusted

Quoted Prices | Level 2 - Other

Significant

Observable Inputs | Level 3 –

Significant

Unobservable

Inputs | Total |

Assets ($) | | | |

Investments in Securities: | | | |

Equity Securities - Domestic Common Stocks† | 362,319,188 | - | - | 362,319,188 |

Equity Securities - Foreign Common Stocks† | 46,504,110 | 5,986,088†† | - | 52,490,198 |

Registered Investment Company | 1,867,769 | - | - | 1,867,769 |

† See Statement of Investments for additional detailed categorizations.

†† Securities classified within Level 2 at period end as the values were determined pursuant to the fund’s fair valuation procedures.

At December 31, 2017, the amount of securities transferred between levels equals fair value of exchange traded equity securities reported as Level 2 in the table above. It is the fund’s policy to recognize transfers between levels at the end of the reporting period.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions between trade and settlement date, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments resulting from changes in exchange rates. Foreign currency gains and losses on foreign currency transactions are also included with net realized and unrealized gain or loss on investments.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and

20

amortization of premium on investments, is recognized on the accrual basis.

Pursuant to a securities lending agreement with The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by Dreyfus, or U.S. Government and Agency securities. The fund is entitled to receive all dividends, interest and distributions on securities loaned, in addition to income earned as a result of the lending transaction. Should a borrower fail to return the securities in a timely manner, The Bank of New York Mellon is required to replace the securities for the benefit of the fund or credit the fund with the market value of the unreturned securities and is subrogated to the fund’s rights against the borrower and the collateral. Additionally, the contractual maturity of security lending transactions are on an overnight and continuous basis. During the period ended December 31, 2017, The Bank of New York Mellon earned $4,048 from lending portfolio securities, pursuant to the securities lending agreement.

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” under the Act.

(e) Dividends and distributions to shareholders: Dividends and distributions are recorded on the ex-dividend date. Dividends from investment income-net are normally declared and paid quarterly. Dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(f) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

21

NOTES TO FINANCIAL STATEMENTS (continued)

As of and during the period ended December 31, 2017, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended December 31, 2017, the fund did not incur any interest or penalties.

Each tax year in the four-year period ended December 31, 2017 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At December 31, 2017, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $408,388, undistributed capital gains $50,593,970 and unrealized appreciation $240,364,096.

The tax character of distributions paid to shareholders during the fiscal periods ended December 31, 2017 and December 31, 2016 were as follows: ordinary income $5,358,909 and $6,712,726, and long-term capital gains $54,543,593 and $70,320,063, respectively.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in an $830 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. Prior to October 4, 2017, the unsecured credit facility with Citibank, N.A. was $810 million. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing. During the period ended December 31, 2017, the fund did not borrow under the Facilities.

NOTE 3—Investment Advisory Fee, Sub-Investment Advisory Fee and Other Transactions with Affiliates:

(a) Pursuant to an investment advisory agreement with Dreyfus, the investment advisory fee is computed at the annual rate of .5325% of the value of the fund’s average daily net assets. Pursuant to a sub-investment advisory agreement with Sarofim & Co., the fund pays Sarofim & Co. a monthly sub-investment advisory fee at the annual rate of .2175% of the value of the fund’s average daily net assets. Both fees are payable monthly.

(b) Under the Distribution Plan adopted pursuant to Rule 12b-1 under the Act, Service shares pay the Distributor for distributing its shares, for servicing and/or maintaining Service shares’ shareholder accounts and for

22

advertising and marketing for Service shares. The Distribution Plan provides for payments to be made at an annual rate of .25% of the value of the Service shares’ average daily net assets. The Distributor may make payments to Participating Insurance Companies and to brokers and dealers acting as principal underwriter for their variable insurance products. The fees payable under the Distribution Plan are payable without regard to actual expenses incurred. During the period ended December 31, 2017, Service shares were charged $395,060 pursuant to the Distribution Plan.

The fund has arrangements with the transfer agent and the custodian whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset transfer agency and custody fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of Dreyfus, under a transfer agency agreement for providing transfer agency and cash management services for the fund. The majority of transfer agency fees are comprised of amounts paid on a per account basis, while cash management fees are related to fund subscriptions and redemptions. During the period ended December 31, 2017, the fund was charged $1,980 for transfer agency services and $175 for cash management services. These fees are included in Shareholder servicing costs in the Statement of Operations. Cash management fees were offset by earnings credits of $175.

The fund compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. These fees are determined based on net assets, geographic region and transaction activity. During the period ended December 31, 2017, the fund was charged $54,102 pursuant to the custody agreement.

During the period ended December 31, 2017, the fund was charged $11,202 for services performed by the Chief Compliance Officer and his staff.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: investment advisory fees $188,262, Distribution Plan fees $30,964, custodian fees $9,500, Chief Compliance Officer fees $8,406 and transfer agency fees $563.

(c) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

23

NOTES TO FINANCIAL STATEMENTS (continued)

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended December 31, 2017, amounted to $16,213,631 and $91,885,608, respectively.

At December 31, 2017, the cost of investments for federal income tax purposes was $176,317,046; accordingly, accumulated net unrealized appreciation on investments was $240,360,109, consisting of gross unrealized appreciation.

24

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and the Board of Trustees of Dreyfus Variable Investment Fund, Appreciation Portfolio

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Dreyfus Variable Investment Fund, Appreciation Portfolio (one of the series comprising Dreyfus Variable Investment Fund) (the “Fund”), including the statements of investments and investments in affiliated issuers, as of December 31, 2017, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of Dreyfus Variable Investment Fund, Appreciation Portfolio at December 31, 2017, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of the Fund’s internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2017, by correspondence with the custodian and others or by other appropriate auditing procedures where replies were not received. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more Dreyfus investment companies since at least 1957, but we are unable to determine the specific year.

New York, New York

February 09, 2018

25

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the fund hereby reports 100% of the ordinary dividends paid during the fiscal year ended December 31, 2017 as qualifying for the corporate dividends received deduction. Shareholders will receive notification in early 2018 of the percentage applicable to the preparation of their 2017 income tax returns. Also, the fund hereby reports $.0268 per share as a short-term capital gain distribution and $5.8089 per share as a long-term capital gain distribution paid on March 31, 2017.

26

INFORMATION ABOUT THE RENEWAL OF THE FUND’S INVESTMENT ADVISORY AND SUB-INVESTMENT ADVISORY AGREEMENTS (Unaudited)

At a meeting of the fund’s Board of Trustees held on July 18, 2017, the Board considered the renewal of the fund’s Investment Advisory Agreement, pursuant to which Dreyfus provides the fund with investment advisory and administrative services (the “Agreement”), and the Sub-Investment Advisory Agreement (together, the “Agreements”), pursuant to which Fayez Sarofim & Co. (the “Subadviser”) provides day-to-day management of the fund’s investments. The Board members, none of whom are “interested persons” (as defined in the Investment Company Act of 1940, as amended) of the fund, were assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of Dreyfus and the Subadviser. In considering the renewal of the Agreements, the Board considered all factors that it believed to be relevant, including those discussed below. The Board did not identify any one factor as dispositive, and each Board member may have attributed different weights to the factors considered.

Analysis of Nature, Extent, and Quality of Services Provided to the Fund. The Board considered information provided to them at the meeting and in previous presentations from Dreyfus representatives regarding the nature, extent, and quality of the services provided to funds in the Dreyfus fund complex. Dreyfus provided the number of open accounts in the fund, the fund’s asset size and the allocation of fund assets among distribution channels. Dreyfus also had previously provided information regarding the diverse intermediary relationships and distribution channels of funds in the Dreyfus fund complex (such as retail direct or intermediary, in which intermediaries typically are paid by the fund and/or Dreyfus) and Dreyfus’ corresponding need for broad, deep, and diverse resources to be able to provide ongoing shareholder services to each intermediary or distribution channel, as applicable to the fund.

The Board also considered research support available to, and portfolio management capabilities of, the fund’s portfolio management personnel and that Dreyfus also provides oversight of day-to-day fund operations, including fund accounting and administration and assistance in meeting legal and regulatory requirements. The Board also considered Dreyfus’ extensive administrative, accounting and compliance infrastructures, as well as Dreyfus’ supervisory activities over the Subadviser. The Board also considered portfolio management’s brokerage policies and practices (including policies and practices regarding soft dollars) and the standards applied in seeking best execution.

Comparative Analysis of the Fund’s Performance and Management Fee and Expense Ratio. The Board reviewed reports prepared by Broadridge Financial Solutions, Inc. (“Broadridge”), an independent provider of investment company data, which included information comparing (1) the fund’s performance with the performance of a group of comparable funds (the “Performance Group”) and with a broader group of funds (the “Performance Universe”), all for various periods ended May 31, 2017, and (2) the fund’s actual and contractual management fees and total expenses with those of a group of comparable funds (the “Expense Group”) and with a broader group of funds (the

27

INFORMATION ABOUT THE RENEWAL OF THE FUND’S INVESTMENT ADVISORY AND SUB-INVESTMENT ADVISORY AGREEMENTS (Unaudited) (continued)

“Expense Universe”), the information for which was derived in part from fund financial statements available to Broadridge as of the date of its analysis. Dreyfus previously had furnished the Board with a description of the methodology Broadridge used to select the Performance Group and Performance Universe and the Expense Group and Expense Universe.

Dreyfus representatives stated that the usefulness of performance comparisons may be affected by a number of factors, including different investment limitations that may be applicable to the fund and comparison funds. The Board discussed with representatives of Dreyfus, its affiliates and/or the Subadviser the results of the comparisons and considered that the fund’s total return performance was below the Performance Group and Performance Universe medians, except for the one- and ten-year periods when the fund’s performance was at the Performance Group median and above the Performance Universe median. Dreyfus also provided a comparison of the fund’s calendar year total returns to the returns of the fund’s benchmark index and noted that the fund’s performance was above the return of the index in four of the ten years.

The Board had discussed with representatives of Dreyfus, its affiliates and the Subadviser the investment strategy employed in the management of the fund’s assets and how that strategy affected the fund’s relative performance. They discussed, among other matters, the fact that the economic market in recent years was not of the type best suited to the Subadviser’s specific investment strategy.

The Board also reviewed the range of actual and contractual management fees and total expenses of the Expense Group and Expense Universe funds and discussed the results of the comparisons. The Board considered that the fund’s contractual management fee was at the Expense Group median and the fund’s actual management fee and total expenses were above the Expense Group and Expense Universe medians.

Dreyfus representatives reviewed with the Board the management or investment advisory fees (1) paid by funds advised or administered by Dreyfus that are in the same Broadridge category as the fund and (2) paid to Dreyfus or the Subadviser or its affiliates for advising any separate accounts and/or other types of client portfolios that are considered to have similar investment strategies and policies as the fund (the “Similar Clients”), and explained the nature of the Similar Clients. They discussed differences in fees paid and the relationship of the fees paid in light of any differences in the services provided and other relevant factors. The Board considered the relevance of the fee information provided for the Similar Clients to evaluate the appropriateness of the fund’s management fee.

The Board considered the fee to the Subadviser in relation to the fee paid to Dreyfus by the fund and the respective services provided by the Subadviser and Dreyfus.

Analysis of Profitability and Economies of Scale. Dreyfus representatives reviewed the expenses allocated and profit received by Dreyfus and its affiliates and the resulting profitability percentage for managing the fund and the aggregate profitability percentage to Dreyfus and its affiliates for managing the funds in the Dreyfus fund complex, and the method used to determine the expenses and profit. The Board concluded that the

28

profitability results were not unreasonable, given the services rendered and service levels provided by Dreyfus. The Board also had been provided with information prepared by an independent consulting firm regarding Dreyfus’ approach to allocating costs to, and determining the profitability of, individual funds and the entire Dreyfus fund complex. The consulting firm also had analyzed where any economies of scale might emerge in connection with the management of a fund.

The Board considered on the advice of its counsel the profitability analysis (1) as part of its evaluation of whether the fees under the Agreements, considered in relation to the mix of services provided by Dreyfus and the Subadviser, including the nature, extent and quality of such services, supported the renewal of the Agreements and (2) in light of the relevant circumstances for the fund and the extent to which economies of scale would be realized if the fund grows and whether fee levels reflect these economies of scale for the benefit of fund shareholders. Dreyfus representatives stated that a discussion of economies of scale is predicated on a fund having achieved a substantial size with increasing assets and that, if a fund’s assets had been stable or decreasing, the possibility that Dreyfus may have realized any economies of scale would be less. Dreyfus representatives also stated that, as a result of shared and allocated costs among funds in the Dreyfus fund complex, the extent of economies of scale could depend substantially on the level of assets in the complex as a whole, so that increases and decreases in complex-wide assets can affect potential economies of scale in a manner that is disproportionate to, or even in the opposite direction from, changes in the fund’s asset level. The Board also considered potential benefits to Dreyfus and the Subadviser from acting as investment adviser and sub-investment adviser, respectively, and took into consideration the soft dollar arrangements in effect for trading the fund’s investments.

At the conclusion of these discussions, the Board agreed that it had been furnished with sufficient information to make an informed business decision with respect to the renewal of the Agreements. Based on the discussions and considerations as described above, the Board concluded and determined as follows.

· The Board concluded that the nature, extent and quality of the services provided by Dreyfus and the Subadviser are adequate and appropriate.

· The Board agreed to continue to closely monitor performance and determined to approve renewal of the Agreements through March 31, 2018.

· The Board concluded that the fees paid to Dreyfus and the Subadviser continued to be appropriate under the circumstances and in light of the factors and the totality of the services provided as discussed above, subject to review no later than the next renewal consideration.

· The Board determined that the economies of scale which may accrue to Dreyfus and its affiliates in connection with the management of the fund had been adequately considered by Dreyfus in connection with the fee rate charged to the fund pursuant to the Agreement and that, to the extent in the future it were determined that material economies of scale had not been shared with the

29

INFORMATION ABOUT THE RENEWAL OF THE FUND’S INVESTMENT ADVISORY AND SUB-INVESTMENT ADVISORY AGREEMENTS (Unaudited) (continued)

fund, the Board would seek to have those economies of scale shared with the fund.

In evaluating the Agreements, the Board considered these conclusions and determinations and also relied on its previous knowledge, gained through meetings and other interactions with Dreyfus and its affiliates and the Subadviser, of Dreyfus and the Subadviser and the services provided to the fund by Dreyfus and the Subadviser. The Board also relied on information received on a routine and regular basis throughout the year relating to the operations of the fund and the investment management and other services provided under the Agreements, including information on the investment performance of the fund in comparison to similar mutual funds and benchmark performance indices; general market outlook as applicable to the fund; and compliance reports. In addition, the Board’s consideration of the contractual fee arrangements for this fund had the benefit of a number of years of reviews of the Agreements for the fund, or substantially similar agreements for other Dreyfus funds that the Board oversees, during which lengthy discussions took place between the Board and Dreyfus representatives. Certain aspects of the arrangements may receive greater scrutiny in some years than in others, and the Board’s conclusions may be based, in part, on their consideration of the fund’s arrangements, or substantially similar arrangements for other Dreyfus funds that the Board oversees, in prior years. The Board determined to renew the Agreements through March 31, 2018.

30

BOARD MEMBERS INFORMATION (Unaudited)

INDEPENDENT BOARD MEMBERS

Joseph S. DiMartino (74)

Chairman of the Board (1995)

Principal Occupation During Past 5 Years:

· Corporate Director and Trustee (1995-present)

Other Public Company Board Memberships During Past 5 Years:

· CBIZ (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small and medium size companies, Director (1997-present)

No. of Portfolios for which Board Member Serves: 127

———————

Peggy C. Davis (74)

Board Member (2006)

Principal Occupation During Past 5 Years:

· Shad Professor of Law, New York University School of Law (1983-present)

No. of Portfolios for which Board Member Serves: 46

———————

David P. Feldman (78)

Board Member (1994)

Principal Occupation During Past 5 Years:

· Corporate Director and Trustee (1985-present)

Other Public Company Board Memberships During Past 5 Years:

· BBH Mutual Funds Group (5 registered mutual funds), Director (1992-2014)

No. of Portfolios for which Board Member Serves: 32

———————

Joan Gulley (70)

Board Member (2017)

Principal Occupation During Past 5 Years:

· PNC Financial Services Group, Inc.(1993-2014), Executive Vice President and Chief Human Resources Officer and Executive Committee Member (2008-2014)

No. of Portfolios for which Board Member Serves: 54

———————

31

BOARD MEMBERS INFORMATION (Unaudited) (continued)

INDEPENDENT BOARD MEMBERS (continued)

Ehud Houminer (77)

Board Member (2006)

Principal Occupation During Past 5 Years:

· Board of Overseers at the Columbia Business School, Columbia University (1992-present)

· Trustee, Ben Gurion University

Other Public Company Board Memberships During Past 5 Years:

· Avnet, Inc., an electronics distributor, Director (1993-2012)

No. of Portfolios for which Board Member Serves: 54

———————

Lynn Martin (78)

Board Member (2012)

Principal Occupation During Past 5 Years:

· President of The Martin Hall Group LLC, a human resources consulting firm (2005-2012)

Other Public Company Board Memberships During Past 5 Years:

· AT&T, Inc., a telecommunications company, Director (1999-2012)

· Ryder System, Inc., a supply chain and transportation management company, Director (1993-2012)

No. of Portfolios for which Board Member Serves: 32

———————

Robin A. Melvin (54)

Board Member (2012)

Principal Occupation During Past 5 Years:

· Co-chairman, Illinois Mentoring Partnership, non-profit organization dedicated to increasing the quantity and quality of mentoring services in Illinois; (2014-present; board member since 2013)

· Director, Boisi Family Foundation, a private family foundation that supports youth-serving organizations that promote the self sufficiency of youth from disadvantaged circumstances (1995-2012)

No. of Portfolios for which Board Member Serves: 101

———————

32

Dr. Martin Peretz (78)

Board Member (1990)

Principal Occupation During Past 5 Years:

· Editor-in-Chief Emeritus of The New Republic Magazine (2011-2012) (previously,

Editor-in-Chief, 1974-2011)

· Lecturer at Harvard University (1969-2012)

No. of Portfolios for which Board Member Serves: 32

———————

Once elected all Board Members serve for an indefinite term, but achieve Emeritus status upon reaching age 80. The address of the Board Members and Officers is c/o The Dreyfus Corporation, 200 Park Avenue, New York, New York 10166. Additional information about the Board Members is available in the fund’s Statement of Additional Information which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-DREYFUS.

James F. Henry, Emeritus Board Member

Philip L. Toia, Emeritus Board Member

33

OFFICERS OF THE FUND (Unaudited)

BRADLEY J. SKAPYAK, President since January 2010.

Chief Operating Officer and a director of the Manager since June 2009, Chairman of Dreyfus Transfer, Inc., an affiliate of the Manager and the transfer agent of the funds, since May 2011 and Chief Executive Officer of MBSC Securities Corporation since August 2016. He is an officer of 63 investment companies (comprised of 127 portfolios) managed by the Manager. He is 59 years old and has been an employee of the Manager since February 1988.

BENNETT A. MACDOUGALL, Chief Legal Officer since October 2015.

Chief Legal Officer of the Manager and Associate General Counsel and Managing Director of BNY Mellon since June 2015; from June 2005 to June 2015, he served in various capacities with Deutsche Bank – Asset & Wealth Management Division, including as Director and Associate General Counsel, and Chief Legal Officer of Deutsche Investment Management Americas Inc. from June 2012 to May 2015. He is an officer of 64 investment companies (comprised of 152 portfolios) managed by the Manager. He is 46 years old and has been an employee of the Manager since June 2015.

JANETTE E. FARRAGHER, Vice President and Secretary since December 2011.

Associate General Counsel of BNY Mellon, and an officer of 64 investment companies (comprised of 152 portfolios) managed by the Manager. She is 55 years old and has been an employee of the Manager since February 1984.

JAMES BITETTO, Vice President and Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon and Secretary of the Manager, and an officer of 64 investment companies (comprised of 152 portfolios) managed by the Manager. He is 51 years old and has been an employee of the Manager since December 1996.

JOSEPH M. CHIOFFI, Vice President and Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon, and an officer of 64 investment companies (comprised of 152 portfolios) managed by the Manager. He is 56 years old and has been an employee of the Manager since June 2000.

MAUREEN E. KANE, Vice President and Assistant Secretary since April 2015.

Managing Counsel of BNY Mellon since July 2014; from October 2004 until July 2014, General Counsel, and from May 2009 until July 2014, Chief Compliance Officer of Century Capital Management. She is an officer of 64 investment companies (comprised of 152 portfolios) managed by the Manager. She is 55 years old and has been an employee of the Manager since July 2014.

SARAH S. KELLEHER, Vice President and Assistant Secretary since April 2014.

Senior Counsel of BNY Mellon since March 2013, from August 2005 to March 2013, Associate General Counsel of Third Avenue Management. She is an officer of 64 investment companies (comprised of 152 portfolios) managed by the Manager. She is 42 years old and has been an employee of the Manager since March 2013.

JEFF PRUSNOFSKY, Vice President and Assistant Secretary since August 2005.

Senior Managing Counsel of BNY Mellon, and an officer of 64 investment companies (comprised of 152 portfolios) managed by the Manager. He is 52 years old and has been an employee of the Manager since October 1990.

NATALYA ZELENSKY, Vice President and Assistant Secretary since March 2017.

Counsel and Vice President of BNY Mellon since May 2016; Attorney at Wildermuth Endowment Strategy Fund/Wildermuth Advisory, LLC from November 2015 until May 2016; Assistant General Counsel at RCS Advisory Services from July 2014 until November 2015; Associate at Sutherland, Asbill & Brennan from January 2013 until January 2014; Associate at K&L Gates from October 2011 until January 2013. She is an officer of 64 investment companies (comprised of 152 portfolios) managed by Dreyfus. She is 32 years old and has been an employee of the Manager since May 2016.

JAMES WINDELS, Treasurer since November 2001.

Director – Mutual Fund Accounting of the Manager, and an officer of 64 investment companies (comprised of 152 portfolios) managed by the Manager. He is 59 years old and has been an employee of the Manager since April 1985.

34

RICHARD CASSARO, Assistant Treasurer since January 2008.

Senior Accounting Manager – Money Market and Municipal Bond Funds of the Manager, and an officer of 64 investment companies (comprised of 152 portfolios) managed by the Manager. He is 58 years old and has been an employee of the Manager since September 1982.

GAVIN C. REILLY, Assistant Treasurer since December 2005.

Tax Manager of the Investment Accounting and Support Department of the Manager, and an officer of 64 investment companies (comprised of 152 portfolios) managed by the Manager. He is 49 years old and has been an employee of the Manager since April 1991.

ROBERT S. ROBOL, Assistant Treasurer since August 2005.

Senior Accounting Manager – Dreyfus Financial Reporting of the Manager, and an officer of 64 investment companies (comprised of 152 portfolios) managed by the Manager. He is 53 years old and has been an employee of the Manager since October 1988.

ROBERT SALVIOLO, Assistant Treasurer since July 2007.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 64 investment companies (comprised of 152 portfolios) managed by the Manager. He is 50 years old and has been an employee of the Manager since June 1989.

ROBERT SVAGNA, Assistant Treasurer since December 2002.

Senior Accounting Manager – Fixed Income and Equity Funds of the Manager, and an officer of 64 investment companies (comprised of 152 portfolios) managed by the Manager. He is 50 years old and has been an employee of the Manager since November 1990.

JOSEPH W. CONNOLLY, Chief Compliance Officer since October 2004.

Chief Compliance Officer of the Manager and The Dreyfus Family of Funds (64 investment companies, comprised of 152 portfolios). He is 60 years old and has served in various capacities with the Manager since 1980, including manager of the firm’s Fund Accounting Department from 1997 through October 2001.

CARIDAD M. CAROSELLA, Anti-Money Laundering Compliance Officer since January 2016.

Anti-Money Laundering Compliance Officer of the Dreyfus Family of Funds and BNY Mellon Funds Trust since January 2016; from May 2015 to December 2015, Interim Anti-Money Laundering Compliance Officer of the Dreyfus Family of Funds and BNY Mellon Funds Trust and the Distributor; from January 2012 to May 2015, AML Surveillance Officer of the Distributor and from 2007 to December 2011, Financial Processing Manager of the Distributor. She is an officer of 58 investment companies (comprised of 146 portfolios) managed by the Manager. She is 49 years old and has been an employee of the Distributor since 1997.

35

NOTES

36

NOTES

37

Dreyfus Variable Investment Fund, Appreciation Portfolio

200 Park Avenue

New York, NY 10166

Manager

The Dreyfus Corporation

200 Park Avenue

New York, NY 10166

Sub-Investment Adviser

Fayez Sarofim & Co.

Two Houston Center

Suite 2907

Houston, TX 77010

Custodian