UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-5251

Fidelity Concord Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | February 29 |

|

|

Date of reporting period: | February 29, 2016 |

Item 1.

Reports to Stockholders

Spartan® Total Market Index Fund Class F Annual Report February 29, 2016 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-835-5092 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2016 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended February 29, 2016 | Past 1 year | Past 5 years | Past 10 years |

| Class F | (7.91)% | 9.56% | 6.45% |

The initial offering of Class F shares took place on September 24, 2009. Returns prior to September 24, 2009 are those of Investor Class, the original class of the fund.

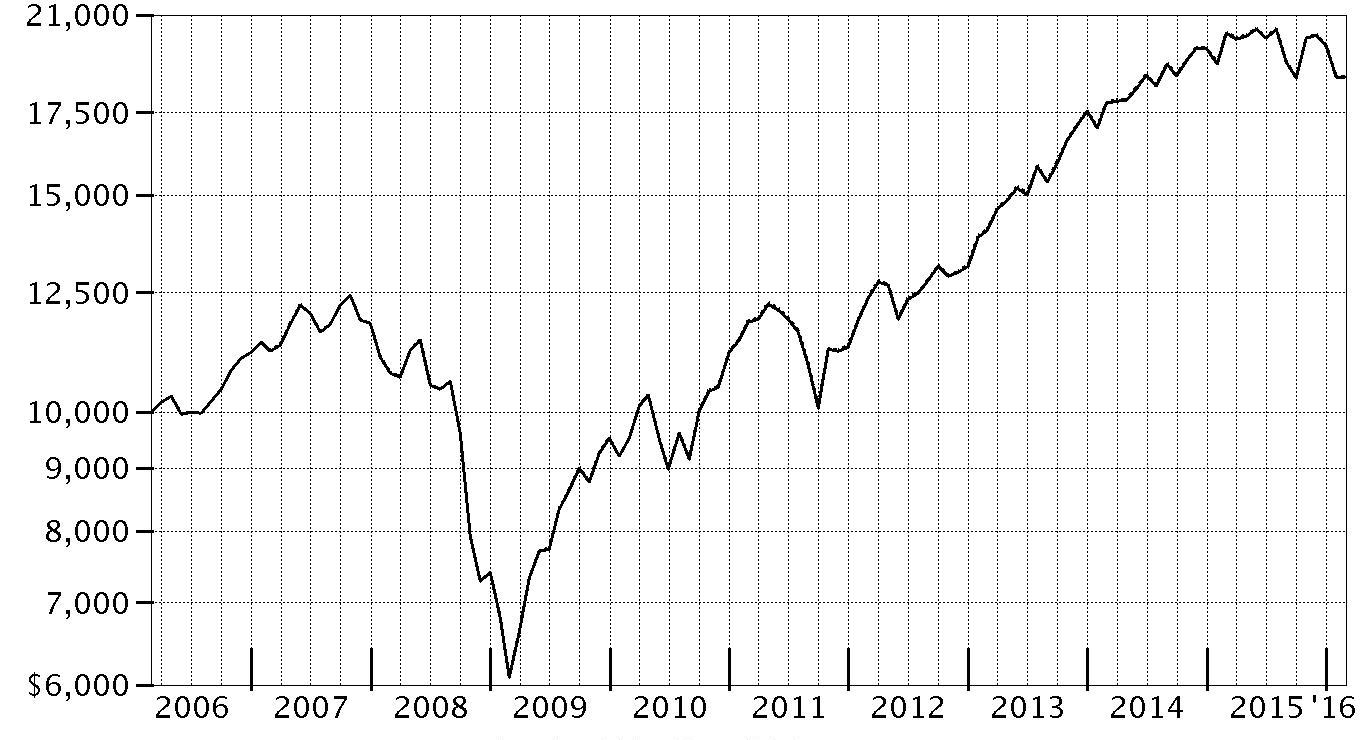

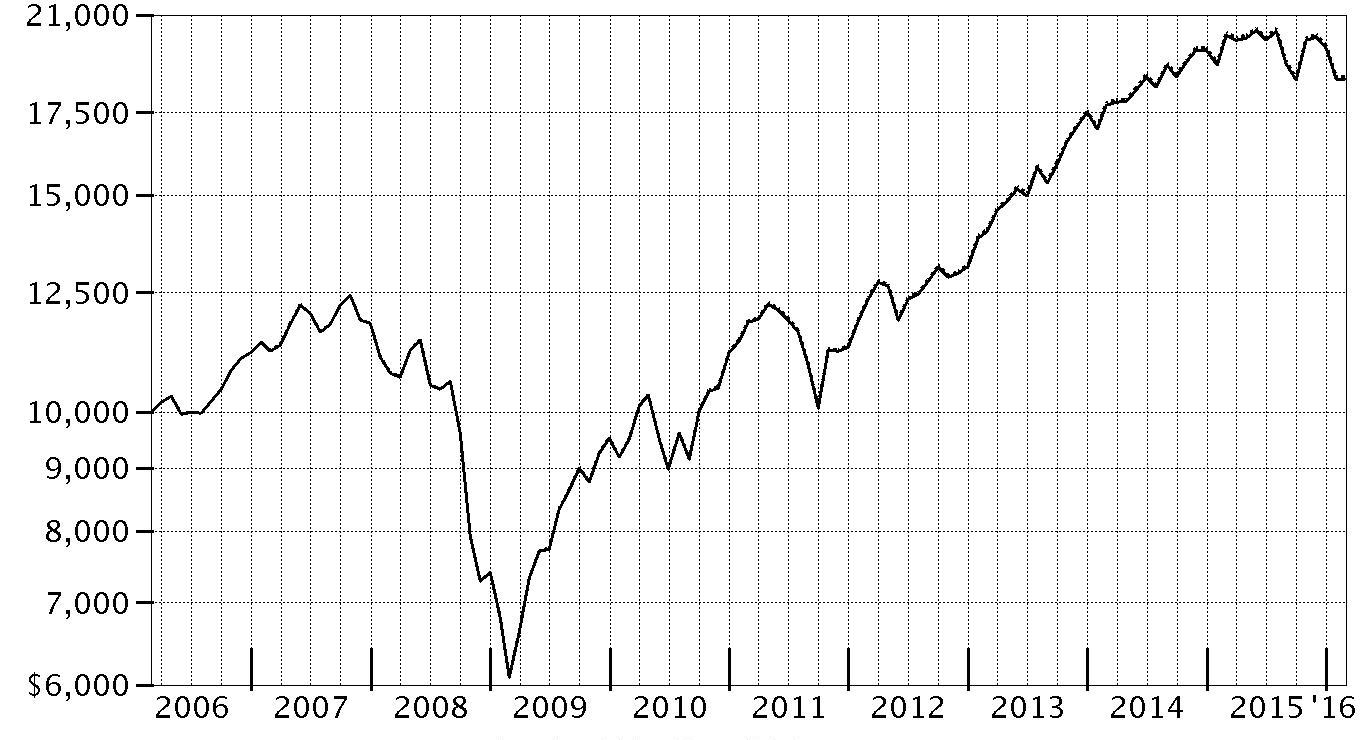

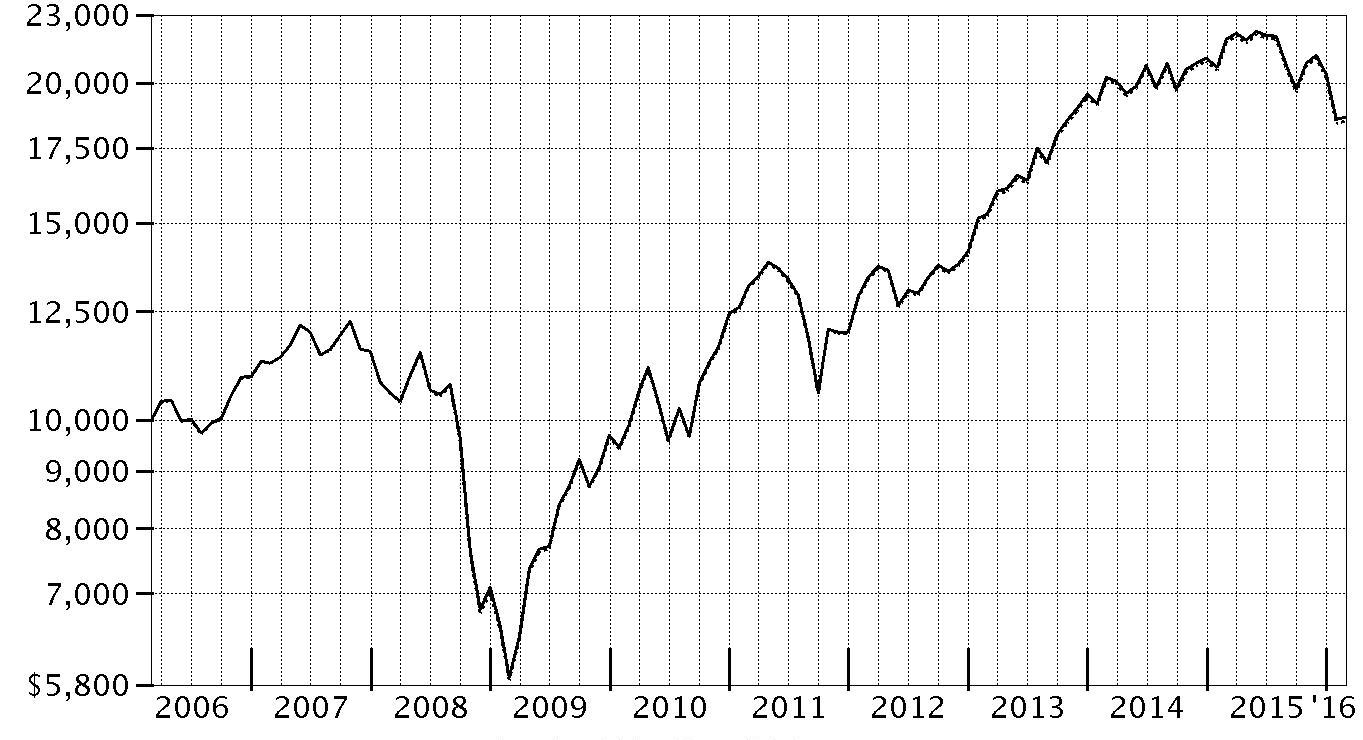

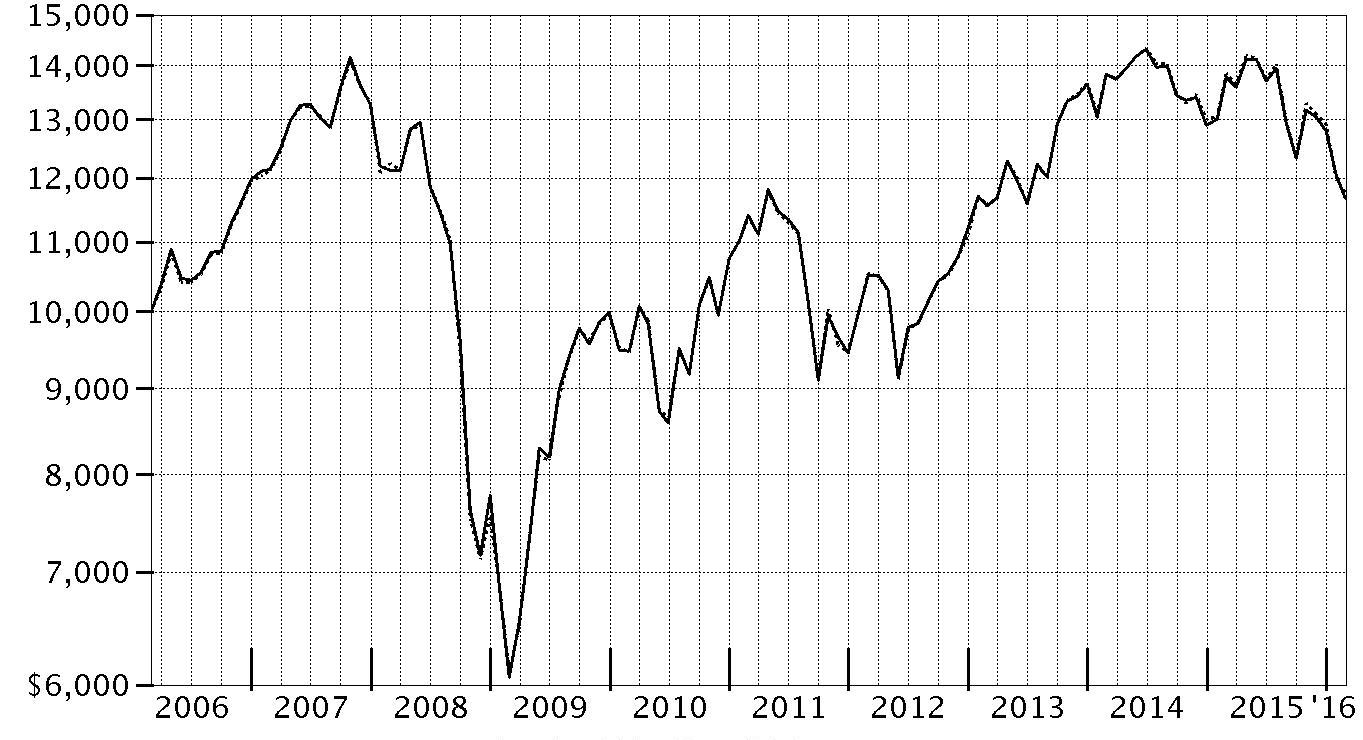

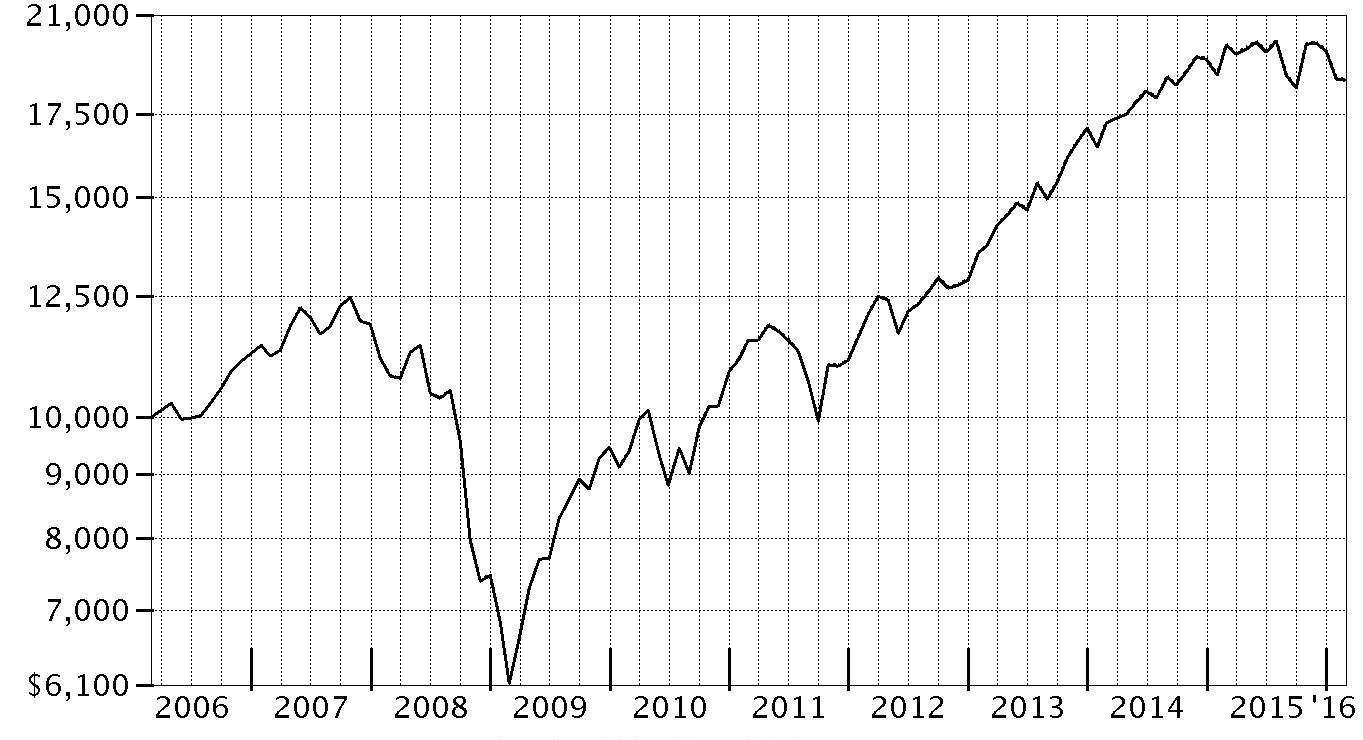

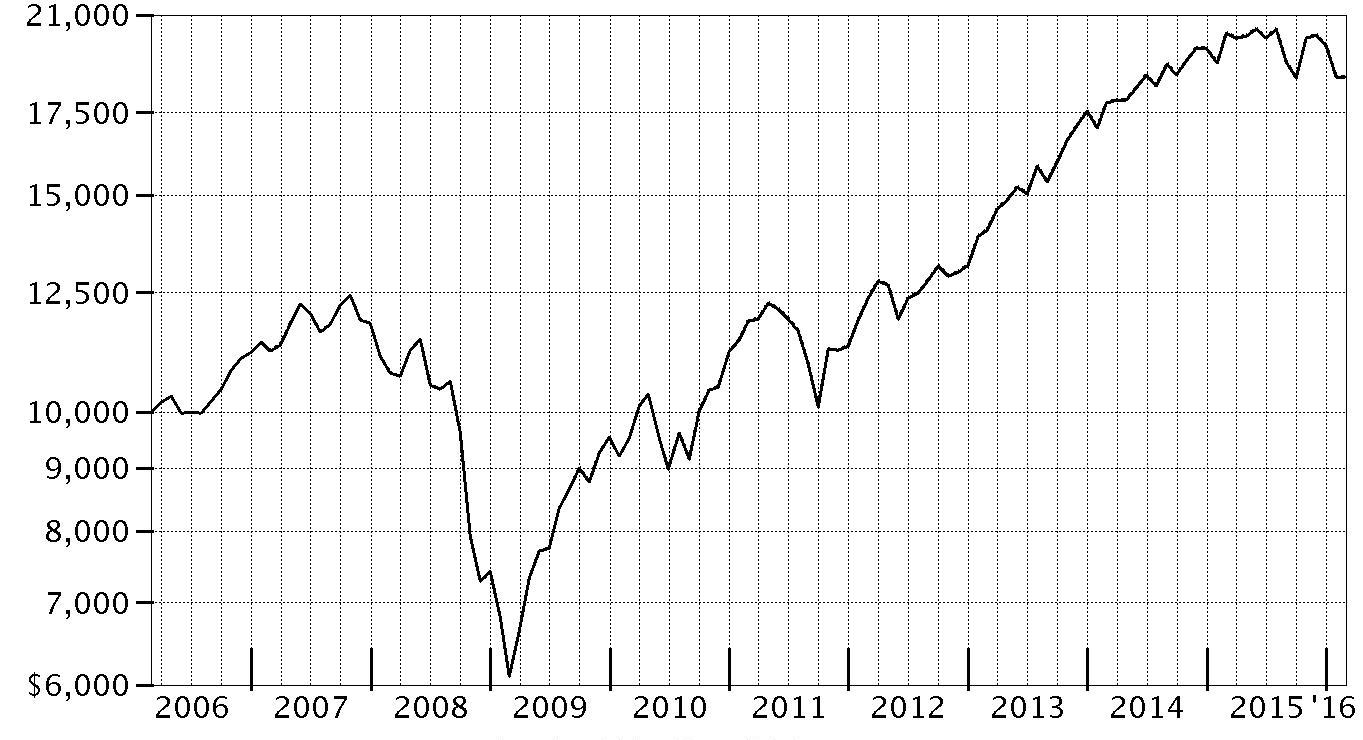

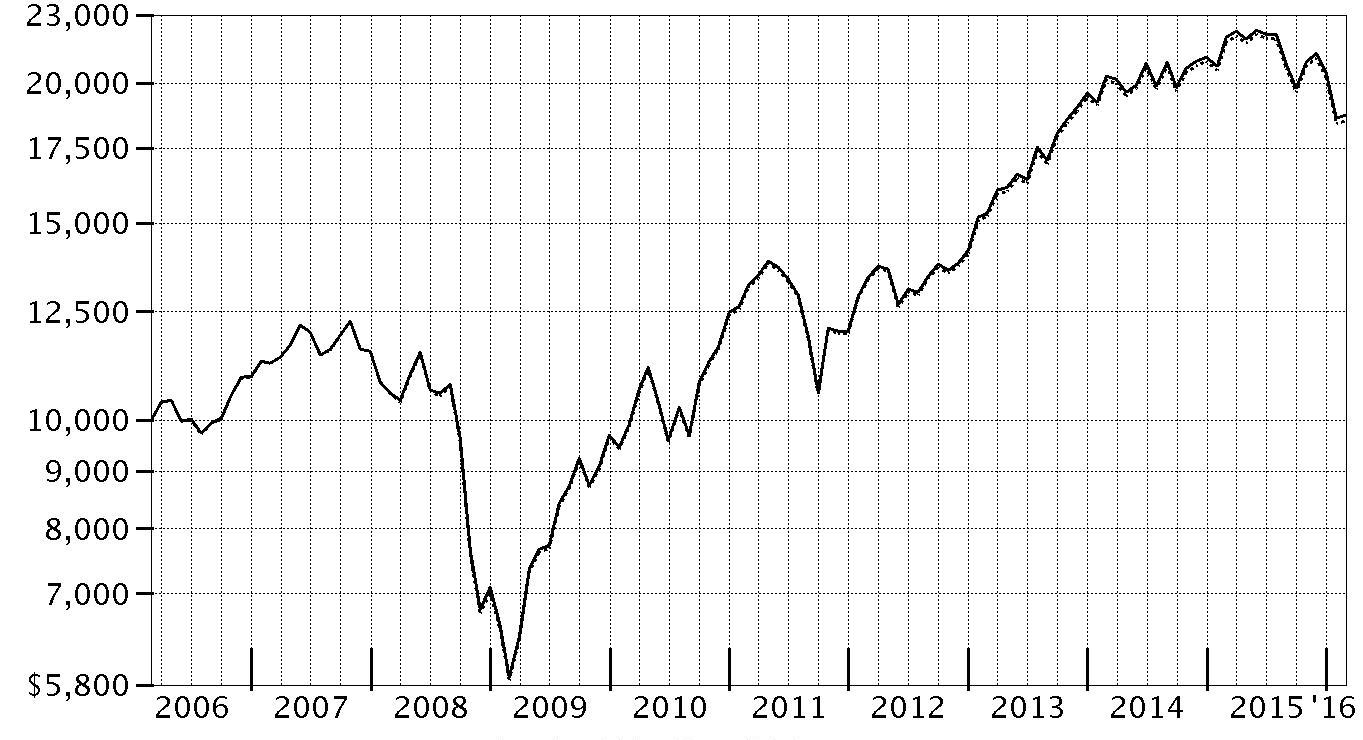

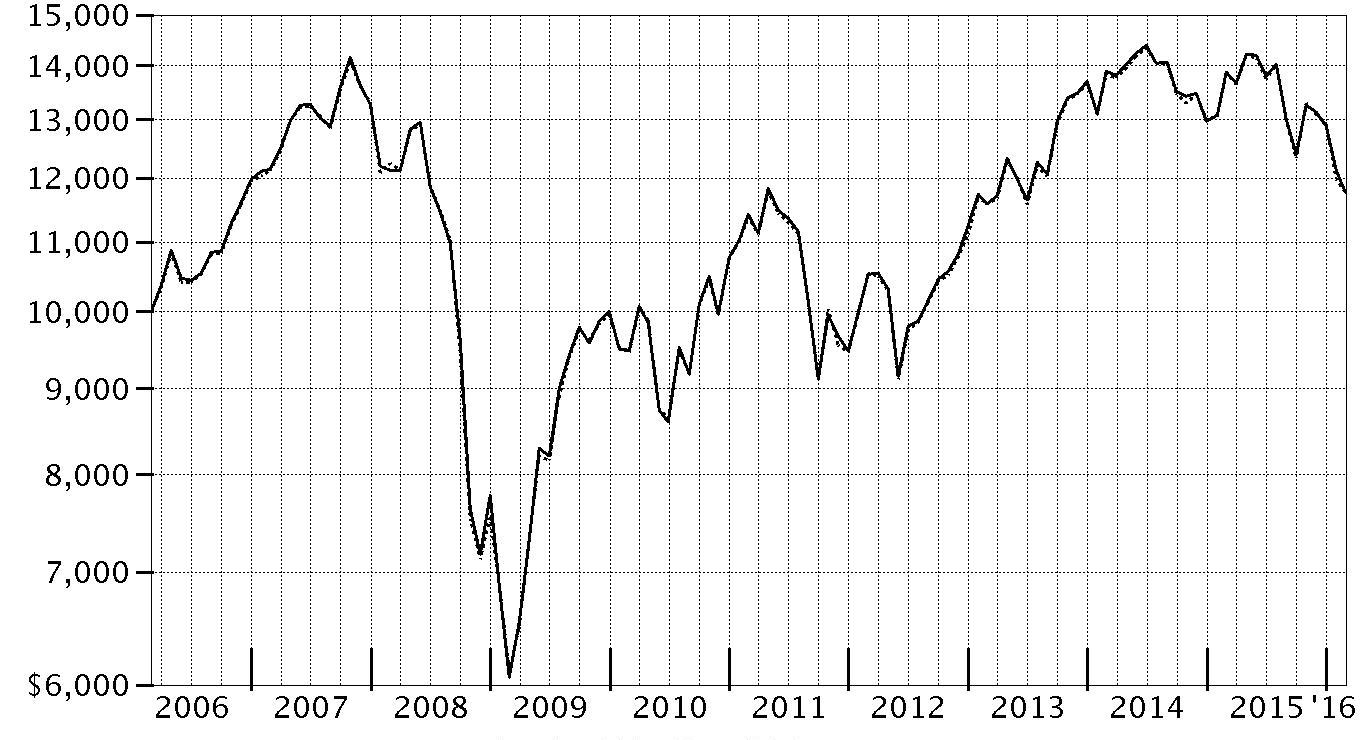

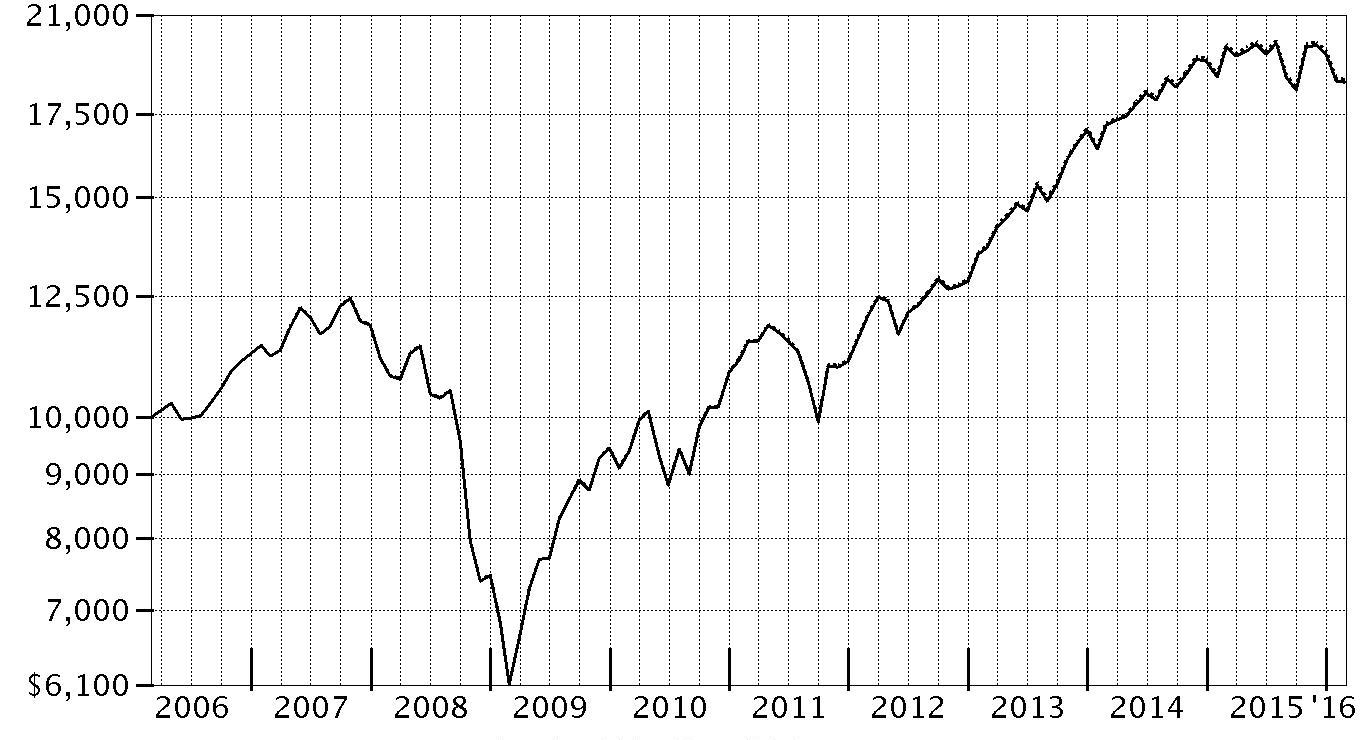

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Spartan® Total Market Index Fund - Class F on February 28, 2006.

The chart shows how the value of your investment would have changed, and also shows how the Dow Jones U.S. Total Stock Market Index℠ performed over the same period.

See above for additional information regarding the performance of Class F.

| Period Ending Values | ||

| $18,678 | Spartan® Total Market Index Fund - Class F | |

| $18,727 | Dow Jones U.S. Total Stock Market Index℠ | |

Management's Discussion of Fund Performance

Market Recap: The S&P 500® index returned -6.19% for the year ending February 29, 2016. Largely range-bound for the first half of the period, U.S. stocks suffered a steep, late-summer decline on concern about an economic slowdown in China. The market recovered in October, lifted by the U.S. Federal Reserve's decision to delay raising near-term interest rates until mid-December. Investors also drew courage from a rate cut in China and economic stimulus in Europe. But continued oil-price weakness and U.S.-dollar strength, plus fresh worries about China and the Middle East, pushed the S&P 500® to its worst January since 2009, followed by a volatile but ultimately flattish February. Overall, growth-oriented and larger-cap stocks fared better than value and smaller-cap complements. In this environment, the tech-heavy Nasdaq Composite Index® returned -7.07% for the 12 months; the Russell 2000® Index, -14.97%. Few sectors within the broad-market S&P 500® gained ground, with a wide gap separating leaders from laggards. Despite increased competition among wireless carriers, telecommunication services (+8%) led the way, followed by the more defensive utilities sector (+6%). Rising wages and low inflation buoyed consumer staples (+4%), less so consumer discretionary (0%). Meanwhile, energy (-24%) foundered amid commodity weakness that also hurt materials (-17%). The financials sector (-12%) struggled as well.Comments from Patrick Waddell, Senior Portfolio Manager of the Geode Capital Management, LLC, investment management team: For the year, the fund's share classes struggled along with the stock market, posting returns of roughly -8%, nearly in line with the Dow Jones U.S. Total Stock Market Index℠. The biggest individual detractor was consumer electronics and personal computer manufacturer Apple, which struggled, as investors were concerned about a possible decline in iPhone sales. Also in the information technology sector, communications chipmaker Qualcomm performed poorly, reflecting weaker-than-expected earnings and difficulty obtaining licensing revenue from Chinese customers. Elsewhere, various energy companies – led by exploration and production firms ConocoPhillips (-46%) and Chevron (-18%) and pipeline operator Kinder Morgan (-54%) – saw their shares drop along with the price of oil. As a group, energy stocks were by far the weakest performers in the index. In another poor-performing category, financials, Citigroup, Bank of America and Wells Fargo lost ground, as it became clear that interest rates would not rise as quickly as anticipated. In turn, this made for a less profitable lending environment for these and other banks. On the positive side, several technology companies were meaningful contributors, led by software maker Microsoft. Social networking leader Facebook and Internet search giant Alphabet, parent company of Google, also contributed.The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Investment Summary (Unaudited)

Top Ten Stocks as of February 29, 2016

| % of fund's net assets | % of fund's net assets 6 months ago | |

| Apple, Inc. | 2.6 | 3.0 |

| Microsoft Corp. | 2.0 | 1.6 |

| Exxon Mobil Corp. | 1.6 | 1.4 |

| Johnson & Johnson | 1.4 | 1.2 |

| General Electric Co. | 1.3 | 1.1 |

| Berkshire Hathaway, Inc. Class B | 1.2 | 1.1 |

| Facebook, Inc. Class A | 1.2 | 0.9 |

| AT&T, Inc. | 1.1 | 0.9 |

| Procter & Gamble Co. | 1.1 | 0.9 |

| Wells Fargo & Co. | 1.0 | 1.2 |

| 14.5 |

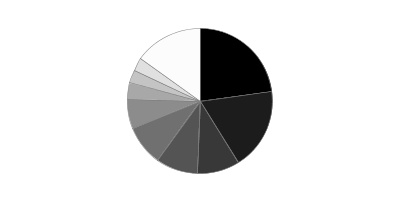

Market Sectors as of February 29, 2016

| % of fund's net assets | % of fund's net assets 6 months ago | |

| Information Technology | 19.3 | 18.8 |

| Financials | 17.5 | 17.9 |

| Health Care | 14.1 | 14.8 |

| Consumer Discretionary | 13.5 | 13.5 |

| Industrials | 10.6 | 10.5 |

| Consumer Staples | 9.3 | 8.3 |

| Energy | 5.8 | 6.5 |

| Utilities | 3.4 | 3.0 |

| Materials | 3.1 | 3.2 |

| Telecommunication Services | 2.5 | 2.2 |

Investments February 29, 2016

Showing Percentage of Net Assets

| Common Stocks - 99.1% | |||

| Shares | Value | ||

| CONSUMER DISCRETIONARY - 13.5% | |||

| Auto Components - 0.5% | |||

| American Axle & Manufacturing Holdings, Inc. (a) | 110,253 | $1,611,899 | |

| Autoliv, Inc. (b) | 129,417 | 13,747,968 | |

| BorgWarner, Inc. | 311,707 | 10,186,585 | |

| Clean Diesel Technologies, Inc. (a)(b) | 42,378 | 29,076 | |

| Cooper Tire & Rubber Co. | 72,740 | 2,858,682 | |

| Cooper-Standard Holding, Inc. (a)(b) | 27,202 | 1,992,547 | |

| Dana Holding Corp. | 208,374 | 2,592,173 | |

| Delphi Automotive PLC | 396,399 | 26,431,885 | |

| Dorman Products, Inc. (a)(b) | 47,584 | 2,406,323 | |

| Drew Industries, Inc. | 37,718 | 2,270,246 | |

| Federal-Mogul Corp. Class A (a) | 65,766 | 477,461 | |

| Fox Factory Holding Corp. (a) | 28,748 | 429,208 | |

| Fuel Systems Solutions, Inc. (a) | 20,668 | 93,213 | |

| Gentex Corp. (b) | 415,639 | 6,051,704 | |

| Gentherm, Inc. (a) | 48,381 | 2,017,488 | |

| Horizon Global Corp. (a) | 22,811 | 201,421 | |

| Johnson Controls, Inc. | 926,946 | 33,796,451 | |

| Lear Corp. | 103,907 | 10,530,974 | |

| Metaldyne Performance Group, Inc. (b) | 30,783 | 439,581 | |

| Modine Manufacturing Co. (a) | 62,657 | 593,988 | |

| Motorcar Parts of America, Inc. (a) | 25,941 | 894,965 | |

| Quantum Fuel Systems Technologies Worldwide, Inc. (a)(b) | 28,606 | 20,596 | |

| Shiloh Industries, Inc. (a) | 7,922 | 34,381 | |

| Spartan Motors, Inc. | 44,931 | 161,302 | |

| Standard Motor Products, Inc. | 32,576 | 980,863 | |

| Stoneridge, Inc. (a) | 33,804 | 407,000 | |

| Strattec Security Corp. | 4,334 | 222,941 | |

| Superior Industries International, Inc. | 39,790 | 785,853 | |

| Sypris Solutions, Inc. (a) | 16,848 | 14,321 | |

| Tenneco, Inc. (a) | 83,068 | 3,781,255 | |

| The Goodyear Tire & Rubber Co. | 369,580 | 11,131,750 | |

| Tower International, Inc. | 25,690 | 551,307 | |

| UQM Technologies, Inc. (a)(b) | 38,648 | 23,382 | |

| Visteon Corp. | 50,405 | 3,524,318 | |

| 141,293,107 | |||

| Automobiles - 0.6% | |||

| Ford Motor Co. | 5,463,350 | 68,346,509 | |

| General Motors Co. | 1,990,073 | 58,587,749 | |

| Harley-Davidson, Inc. | 281,657 | 12,159,133 | |

| Tesla Motors, Inc. (a)(b) | 142,118 | 27,276,708 | |

| Thor Industries, Inc. | 80,180 | 4,440,368 | |

| Winnebago Industries, Inc. (b) | 39,123 | 732,774 | |

| 171,543,241 | |||

| Distributors - 0.1% | |||

| Core-Mark Holding Co., Inc. | 37,639 | 2,771,360 | |

| Educational Development Corp. | 2,866 | 32,500 | |

| Fenix Parts, Inc. (b) | 13,969 | 69,566 | |

| Genuine Parts Co. | 210,267 | 18,955,570 | |

| LKQ Corp. (a) | 429,119 | 11,843,684 | |

| Pool Corp. | 56,544 | 4,538,787 | |

| VOXX International Corp. (a) | 18,073 | 72,111 | |

| Weyco Group, Inc. | 5,169 | 140,700 | |

| 38,424,278 | |||

| Diversified Consumer Services - 0.2% | |||

| 2U, Inc. (a)(b) | 52,685 | 1,177,510 | |

| American Public Education, Inc. (a) | 20,589 | 317,688 | |

| Apollo Education Group, Inc. Class A (non-vtg.) (a) | 147,069 | 1,204,495 | |

| Ascent Capital Group, Inc. (a)(b) | 16,905 | 234,980 | |

| Bridgepoint Education, Inc. (a) | 19,443 | 123,074 | |

| Bright Horizons Family Solutions, Inc. (a) | 60,651 | 3,843,454 | |

| Cambium Learning Group, Inc. (a) | 12,514 | 55,562 | |

| Capella Education Co. | 13,812 | 638,667 | |

| Career Education Corp. (a) | 92,297 | 232,588 | |

| Carriage Services, Inc. | 24,048 | 495,629 | |

| Chegg, Inc. (a)(b) | 67,008 | 287,464 | |

| Collectors Universe, Inc. | 4,772 | 76,113 | |

| DeVry, Inc. (b) | 76,042 | 1,388,527 | |

| Graham Holdings Co. | 6,749 | 3,294,254 | |

| Grand Canyon Education, Inc. (a) | 72,456 | 2,824,335 | |

| H&R Block, Inc. (b) | 339,125 | 11,150,430 | |

| Houghton Mifflin Harcourt Co. (a) | 170,821 | 3,213,143 | |

| ITT Educational Services, Inc. (a) | 22,063 | 64,865 | |

| K12, Inc. (a) | 45,198 | 442,488 | |

| Liberty Tax, Inc. (b) | 8,571 | 145,536 | |

| LifeLock, Inc. (a)(b) | 121,981 | 1,345,450 | |

| Lincoln Educational Services Corp. (a) | 15,671 | 41,685 | |

| National American University Holdings, Inc. | 5,378 | 8,390 | |

| Regis Corp. (a) | 52,945 | 758,702 | |

| Service Corp. International | 271,822 | 6,393,253 | |

| ServiceMaster Global Holdings, Inc. (a) | 192,610 | 7,305,697 | |

| Sotheby's Class A (Ltd. vtg.) (b) | 86,398 | 1,965,555 | |

| Strayer Education, Inc. (a) | 14,558 | 657,003 | |

| Universal Technical Institute, Inc. | 29,419 | 115,028 | |

| Weight Watchers International, Inc. (a)(b) | 37,785 | 444,729 | |

| 50,246,294 | |||

| Hotels, Restaurants & Leisure - 2.2% | |||

| ARAMARK Holdings Corp. | 314,447 | 9,879,925 | |

| Belmond Ltd. Class A (a) | 124,751 | 1,146,462 | |

| Biglari Holdings, Inc. (a) | 2,475 | 912,582 | |

| BJ's Restaurants, Inc. (a) | 35,904 | 1,582,648 | |

| Bloomin' Brands, Inc. | 203,436 | 3,517,408 | |

| Bob Evans Farms, Inc. | 27,901 | 1,197,232 | |

| Bojangles', Inc. (a)(b) | 24,608 | 355,832 | |

| Boyd Gaming Corp. (a)(b) | 116,149 | 2,011,701 | |

| Bravo Brio Restaurant Group, Inc. (a) | 12,451 | 97,242 | |

| Brinker International, Inc. | 84,914 | 4,228,717 | |

| Buffalo Wild Wings, Inc. (a)(b) | 25,209 | 3,999,408 | |

| Caesars Entertainment Corp. (a)(b) | 56,403 | 509,883 | |

| Carnival Corp. unit | 648,205 | 31,087,912 | |

| Carrols Restaurant Group, Inc. (a) | 43,906 | 582,633 | |

| Century Casinos, Inc. (a) | 28,742 | 193,434 | |

| Chipotle Mexican Grill, Inc. (a)(b) | 43,978 | 22,391,838 | |

| Choice Hotels International, Inc. | 53,065 | 2,750,359 | |

| Churchill Downs, Inc. | 18,170 | 2,464,215 | |

| Chuy's Holdings, Inc. (a)(b) | 19,492 | 624,524 | |

| ClubCorp Holdings, Inc. | 87,722 | 1,164,071 | |

| Cosi, Inc. (a)(b) | 30,434 | 19,295 | |

| Cracker Barrel Old Country Store, Inc. (b) | 37,351 | 5,529,816 | |

| Darden Restaurants, Inc. (b) | 157,343 | 10,051,071 | |

| Dave & Buster's Entertainment, Inc. (a) | 34,931 | 1,289,303 | |

| Del Frisco's Restaurant Group, Inc. (a) | 28,720 | 443,437 | |

| Del Taco Restaurants, Inc. (a) | 75,328 | 815,802 | |

| Denny's Corp. (a) | 117,334 | 1,212,060 | |

| Diamond Resorts International, Inc. (a)(b) | 93,410 | 2,035,404 | |

| DineEquity, Inc. (b) | 27,200 | 2,487,984 | |

| Domino's Pizza, Inc. | 74,049 | 9,851,479 | |

| Dover Downs Gaming & Entertainment, Inc. (a) | 1,508 | 1,689 | |

| Dover Motorsports, Inc. | 9,993 | 22,284 | |

| Dunkin' Brands Group, Inc. | 131,377 | 6,119,541 | |

| El Pollo Loco Holdings, Inc. (a)(b) | 42,298 | 546,067 | |

| Eldorado Resorts, Inc. (a) | 30,709 | 307,397 | |

| Empire Resorts, Inc. (a)(b) | 4,022 | 49,792 | |

| Entertainment Gaming Asia, Inc. (a) | 2,060 | 4,099 | |

| Extended Stay America, Inc. unit | 100,289 | 1,482,271 | |

| Famous Dave's of America, Inc. (a)(b) | 7,623 | 44,366 | |

| Fiesta Restaurant Group, Inc. (a)(b) | 37,794 | 1,251,737 | |

| Fogo de Chao, Inc. | 4,278 | 68,448 | |

| Golden Entertainment, Inc. (a) | 1,436 | 14,863 | |

| Good Times Restaurants, Inc. (a)(b) | 7,939 | 33,661 | |

| Habit Restaurants, Inc. Class A (a)(b) | 13,363 | 277,683 | |

| Hilton Worldwide Holdings, Inc. | 747,231 | 15,527,460 | |

| Hyatt Hotels Corp. Class A (a)(b) | 40,191 | 1,854,815 | |

| Ignite Restaurant Group, Inc. (a)(b) | 4,841 | 15,733 | |

| International Speedway Corp. Class A | 39,245 | 1,353,560 | |

| Interval Leisure Group, Inc. (b) | 54,818 | 709,893 | |

| Intrawest Resorts Holdings, Inc. (a)(b) | 22,150 | 189,383 | |

| Isle of Capri Casinos, Inc. (a) | 30,947 | 351,248 | |

| J. Alexanders Holdings, Inc. (a) | 20,559 | 213,402 | |

| Jack in the Box, Inc. | 48,147 | 3,310,106 | |

| Jamba, Inc. (a)(b) | 19,136 | 253,935 | |

| Kona Grill, Inc. (a)(b) | 8,466 | 125,466 | |

| Krispy Kreme Doughnuts, Inc. (a)(b) | 100,846 | 1,476,385 | |

| La Quinta Holdings, Inc. (a) | 115,379 | 1,253,016 | |

| Las Vegas Sands Corp. | 518,808 | 25,048,050 | |

| Lindblad Expeditions Holdings (a) | 22,275 | 215,177 | |

| Luby's, Inc. (a) | 14,614 | 72,339 | |

| Marcus Corp. | 26,625 | 497,355 | |

| Marriott International, Inc. Class A (b) | 280,107 | 19,089,292 | |

| Marriott Vacations Worldwide Corp. | 38,724 | 2,344,738 | |

| McDonald's Corp. | 1,294,309 | 151,680,072 | |

| MGM Mirage, Inc. (a) | 672,280 | 12,726,260 | |

| Monarch Casino & Resort, Inc. (a) | 11,528 | 231,943 | |

| Morgans Hotel Group Co. (a) | 27,678 | 40,963 | |

| Nathan's Famous, Inc. (a)(b) | 3,561 | 179,866 | |

| Noodles & Co. (a)(b) | 28,579 | 366,669 | |

| Norwegian Cruise Line Holdings Ltd. (a) | 225,639 | 11,085,644 | |

| Panera Bread Co. Class A (a) | 33,222 | 6,883,598 | |

| Papa John's International, Inc. (b) | 38,520 | 2,239,938 | |

| Papa Murphy's Holdings, Inc. (a)(b) | 22,690 | 245,733 | |

| Penn National Gaming, Inc. (a) | 107,531 | 1,488,229 | |

| Pinnacle Entertainment, Inc. (a) | 78,730 | 2,276,084 | |

| Planet Fitness, Inc. (a)(b) | 15,590 | 223,405 | |

| Popeyes Louisiana Kitchen, Inc. (a)(b) | 35,356 | 1,926,548 | |

| Potbelly Corp. (a) | 30,614 | 384,206 | |

| Rave Restaurant Group, Inc. (a)(b) | 9,079 | 47,211 | |

| RCI Hospitality Holdings, Inc. | 5,726 | 50,561 | |

| Red Lion Hotels Corp. (a) | 6,989 | 51,579 | |

| Red Robin Gourmet Burgers, Inc. (a)(b) | 21,139 | 1,376,149 | |

| Royal Caribbean Cruises Ltd. (b) | 241,980 | 17,996,053 | |

| Ruby Tuesday, Inc. (a)(b) | 88,086 | 465,975 | |

| Ruth's Hospitality Group, Inc. | 42,076 | 739,275 | |

| Scientific Games Corp. Class A (a)(b) | 70,193 | 597,342 | |

| SeaWorld Entertainment, Inc. | 103,555 | 1,873,310 | |

| Shake Shack, Inc. Class A (b) | 8,653 | 360,224 | |

| Six Flags Entertainment Corp. | 119,451 | 6,075,278 | |

| Sonic Corp. | 74,649 | 2,192,441 | |

| Speedway Motorsports, Inc. | 23,497 | 428,115 | |

| Starbucks Corp. | 2,094,783 | 121,937,318 | |

| Starwood Hotels & Resorts Worldwide, Inc. | 234,365 | 16,196,965 | |

| Texas Roadhouse, Inc. Class A | 107,584 | 4,487,329 | |

| The Cheesecake Factory, Inc. | 58,805 | 2,934,370 | |

| Town Sports International Holdings, Inc. (a) | 13,107 | 14,680 | |

| Vail Resorts, Inc. | 54,383 | 6,928,938 | |

| Wendy's Co. | 363,065 | 3,401,919 | |

| Wingstop, Inc. (b) | 9,647 | 229,792 | |

| Wyndham Worldwide Corp. (b) | 161,084 | 11,733,359 | |

| Wynn Resorts Ltd. (b) | 115,887 | 9,558,360 | |

| Yum! Brands, Inc. | 579,198 | 41,974,479 | |

| Zoe's Kitchen, Inc. (a)(b) | 27,188 | 949,677 | |

| 653,138,785 | |||

| Household Durables - 0.6% | |||

| Bassett Furniture Industries, Inc. | 12,950 | 401,191 | |

| Beazer Homes U.S.A., Inc. (a) | 40,506 | 296,504 | |

| CalAtlantic Group, Inc. | 115,129 | 3,493,014 | |

| Cavco Industries, Inc. (a) | 12,220 | 991,531 | |

| Century Communities, Inc. (a) | 18,579 | 292,433 | |

| Comstock Holding Companies, Inc. (a) | 1,496 | 2,483 | |

| CSS Industries, Inc. | 16,118 | 436,314 | |

| D.R. Horton, Inc. | 449,767 | 12,017,774 | |

| Dixie Group, Inc. (a)(b) | 11,105 | 49,861 | |

| Emerson Radio Corp. (a) | 23,724 | 21,826 | |

| Ethan Allen Interiors, Inc. (b) | 36,464 | 1,040,318 | |

| Flexsteel Industries, Inc. | 9,186 | 375,064 | |

| Garmin Ltd. (b) | 171,103 | 6,931,383 | |

| GoPro, Inc. Class A (a)(b) | 103,866 | 1,233,928 | |

| Green Brick Partners, Inc. (a)(b) | 37,398 | 228,502 | |

| Harman International Industries, Inc. | 106,630 | 8,176,388 | |

| Helen of Troy Ltd. (a)(b) | 38,566 | 3,677,654 | |

| Hooker Furniture Corp. | 13,495 | 430,760 | |

| Hovnanian Enterprises, Inc. Class A (a)(b) | 177,163 | 267,516 | |

| Installed Building Products, Inc. (a) | 20,583 | 459,824 | |

| iRobot Corp. (a)(b) | 45,351 | 1,421,300 | |

| Jarden Corp. (a) | 294,274 | 15,561,209 | |

| KB Home (b) | 112,206 | 1,368,913 | |

| Koss Corp. (a) | 2,669 | 5,738 | |

| La-Z-Boy, Inc. | 79,546 | 1,936,945 | |

| Leggett& Platt, Inc. | 188,164 | 8,403,404 | |

| Lennar Corp. Class A (b) | 282,096 | 11,831,106 | |

| LGI Homes, Inc. (a)(b) | 15,810 | 375,329 | |

| Libbey, Inc. | 30,735 | 511,123 | |

| Lifetime Brands, Inc. | 10,885 | 130,185 | |

| M.D.C. Holdings, Inc. | 56,801 | 1,255,870 | |

| M/I Homes, Inc. (a)(b) | 33,201 | 583,342 | |

| Meritage Homes Corp. (a)(b) | 46,552 | 1,511,543 | |

| Mohawk Industries, Inc. (a) | 87,734 | 15,768,432 | |

| NACCO Industries, Inc. Class A | 6,219 | 307,281 | |

| New Home Co. LLC (a)(b) | 11,951 | 120,108 | |

| Newell Rubbermaid, Inc. (b) | 383,075 | 14,560,681 | |

| NVR, Inc. (a) | 5,363 | 8,779,231 | |

| PulteGroup, Inc. | 446,640 | 7,677,742 | |

| Skullcandy, Inc. (a) | 12,653 | 44,792 | |

| Skyline Corp. (a) | 21,741 | 87,616 | |

| Stanley Furniture Co., Inc. (a) | 5,699 | 14,475 | |

| Taylor Morrison Home Corp. (a)(b) | 40,708 | 566,248 | |

| Tempur Sealy International, Inc. (a)(b) | 91,766 | 5,292,145 | |

| Toll Brothers, Inc. (a) | 226,510 | 6,217,700 | |

| TopBuild Corp. (a) | 49,387 | 1,332,461 | |

| TRI Pointe Homes, Inc. (a)(b) | 234,174 | 2,414,334 | |

| Tupperware Brands Corp. | 71,204 | 3,557,352 | |

| Turtle Beach Corp. (a)(b) | 6,672 | 6,739 | |

| UCP, Inc. (a) | 9,479 | 57,727 | |

| Universal Electronics, Inc. (a) | 22,307 | 1,185,394 | |

| Vuzix Corp. (a)(b) | 16,394 | 93,118 | |

| WCI Communities, Inc. (a) | 24,951 | 430,405 | |

| Whirlpool Corp. | 108,257 | 16,814,477 | |

| William Lyon Homes, Inc. (a)(b) | 35,265 | 418,243 | |

| Zagg, Inc. (a)(b) | 38,365 | 399,763 | |

| 171,866,739 | |||

| Internet & Catalog Retail - 1.7% | |||

| 1-800-FLOWERS.com, Inc. Class A (a) | 31,570 | 246,562 | |

| Amazon.com, Inc. (a) | 544,055 | 300,601,269 | |

| Blue Nile, Inc. | 17,894 | 466,318 | |

| Etsy, Inc. (b) | 36,404 | 289,048 | |

| EVINE Live, Inc. (a) | 71,405 | 36,352 | |

| Expedia, Inc. | 166,017 | 17,284,030 | |

| FTD Companies, Inc. (a)(b) | 25,393 | 590,387 | |

| Gaiam, Inc. Class A (a) | 12,609 | 71,493 | |

| Groupon, Inc. Class A (a)(b) | 645,768 | 3,086,771 | |

| HSN, Inc. | 48,658 | 2,583,253 | |

| Lands' End, Inc. (a)(b) | 26,352 | 634,029 | |

| Liberty Interactive Corp.: | |||

| (Venture Group) Series A (a) | 213,209 | 7,822,638 | |

| QVC Group Series A (a) | 678,792 | 17,227,741 | |

| Liberty TripAdvisor Holdings, Inc. (a) | 92,302 | 1,882,038 | |

| Netflix, Inc. (a)(b) | 604,711 | 56,486,055 | |

| NutriSystem, Inc. | 38,425 | 781,949 | |

| Overstock.com, Inc. (a) | 16,325 | 238,345 | |

| PetMed Express, Inc. (b) | 32,292 | 532,818 | |

| Priceline Group, Inc. (a) | 70,268 | 88,903,776 | |

| Shutterfly, Inc. (a)(b) | 48,378 | 2,149,918 | |

| TripAdvisor, Inc. (a)(b) | 160,329 | 10,036,595 | |

| U.S. Auto Parts Network, Inc. (a) | 5,048 | 13,882 | |

| Wayfair LLC Class A (a)(b) | 39,043 | 1,521,506 | |

| 513,486,773 | |||

| Leisure Products - 0.2% | |||

| Arctic Cat, Inc. | 18,718 | 327,191 | |

| Black Diamond, Inc. (a)(b) | 32,583 | 140,107 | |

| Brunswick Corp. | 137,381 | 5,844,188 | |

| Callaway Golf Co. | 134,839 | 1,198,719 | |

| Escalade, Inc. | 7,022 | 88,477 | |

| Hasbro, Inc. | 156,173 | 11,848,846 | |

| JAKKS Pacific, Inc. (a)(b) | 19,661 | 142,346 | |

| Johnson Outdoors, Inc. Class A | 3,505 | 76,865 | |

| Leapfrog Enterprises, Inc. Class A (a) | 85,630 | 83,061 | |

| Malibu Boats, Inc. Class A (a) | 18,719 | 289,209 | |

| Marine Products Corp. | 11,741 | 86,296 | |

| Mattel, Inc. | 487,004 | 15,837,370 | |

| MCBC Holdings, Inc. (a) | 4,800 | 63,744 | |

| Nautilus, Inc. (a) | 41,820 | 706,340 | |

| Polaris Industries, Inc. | 84,256 | 7,406,945 | |

| Smith & Wesson Holding Corp. (a) | 80,794 | 2,048,936 | |

| Sturm, Ruger & Co., Inc. | 28,534 | 2,006,226 | |

| Summer Infant, Inc. (a) | 32,605 | 63,254 | |

| Vista Outdoor, Inc. (a) | 87,436 | 4,310,595 | |

| 52,568,715 | |||

| Media - 3.2% | |||

| A.H. Belo Corp. Class A | 22,177 | 132,618 | |

| AMC Entertainment Holdings, Inc. Class A | 30,240 | 726,667 | |

| AMC Networks, Inc. Class A (a) | 82,576 | 5,412,031 | |

| Ballantyne of Omaha, Inc. (a) | 17,964 | 73,293 | |

| Cable One, Inc. | 6,260 | 2,682,848 | |

| Cablevision Systems Corp. - NY Group Class A | 311,061 | 10,118,814 | |

| Carmike Cinemas, Inc. (a) | 37,234 | 816,914 | |

| CBS Corp. Class B | 618,689 | 29,932,174 | |

| Central European Media Enterprises Ltd. Class A (a)(b) | 87,763 | 215,897 | |

| Charter Communications, Inc. Class A (a)(b) | 107,082 | 19,227,644 | |

| Cinedigm Corp. (a)(b) | 56,149 | 14,627 | |

| Cinemark Holdings, Inc. | 164,899 | 5,458,157 | |

| Clear Channel Outdoor Holding, Inc. Class A | 57,659 | 208,149 | |

| Comcast Corp. Class A | 3,455,965 | 199,512,859 | |

| Crown Media Holdings, Inc. Class A (a) | 54,807 | 240,603 | |

| Cumulus Media, Inc. Class A (a)(b) | 143,016 | 35,754 | |

| Discovery Communications, Inc.: | |||

| Class A (a)(b) | 247,368 | 6,184,200 | |

| Class C (non-vtg.) (a) | 327,382 | 8,069,966 | |

| DISH Network Corp. Class A (a) | 322,580 | 15,203,195 | |

| DreamWorks Animation SKG, Inc. Class A (a) | 95,520 | 2,451,043 | |

| E.W. Scripps Co. Class A (b) | 84,251 | 1,454,172 | |

| Emmis Communications Corp. Class A (a) | 7,973 | 4,226 | |

| Entercom Communications Corp. Class A (a)(b) | 25,850 | 295,466 | |

| Entravision Communication Corp. Class A | 84,255 | 650,449 | |

| Gannett Co., Inc. | 167,355 | 2,553,837 | |

| Global Eagle Entertainment, Inc. (a)(b) | 63,441 | 570,335 | |

| Gray Television, Inc. (a) | 96,772 | 1,116,749 | |

| Harte-Hanks, Inc. | 45,482 | 140,539 | |

| Hemisphere Media Group, Inc. (a)(b) | 10,964 | 151,742 | |

| Insignia Systems, Inc. (a) | 5,038 | 13,099 | |

| Interpublic Group of Companies, Inc. | 543,898 | 11,633,978 | |

| John Wiley & Sons, Inc. Class A | 79,959 | 3,480,615 | |

| Journal Media Group, Inc. | 21,889 | 263,106 | |

| Lee Enterprises, Inc. (a) | 58,988 | 78,454 | |

| Liberty Broadband Corp.: | |||

| Class A (a) | 33,151 | 1,667,164 | |

| Class C (a) | 99,103 | 4,991,818 | |

| Liberty Global PLC: | |||

| Class A (a)(b) | 345,647 | 12,733,635 | |

| Class C (a) | 879,281 | 31,618,945 | |

| LiLAC Class A (a) | 16,713 | 567,406 | |

| LiLAC Class C (a)(b) | 47,583 | 1,745,820 | |

| Liberty Media Corp.: | |||

| Class A (a) | 142,736 | 5,084,256 | |

| Class C (a) | 317,834 | 11,092,407 | |

| Lions Gate Entertainment Corp. | 133,966 | 2,826,683 | |

| Live Nation Entertainment, Inc. (a) | 201,074 | 4,421,617 | |

| Loral Space & Communications Ltd. (a) | 17,760 | 569,386 | |

| Media General, Inc. (a)(b) | 134,814 | 2,240,609 | |

| Meredith Corp. | 55,681 | 2,421,567 | |

| MSG Network, Inc. Class A (a) | 76,074 | 1,249,135 | |

| National CineMedia, Inc. | 85,967 | 1,285,207 | |

| New Media Investment Group, Inc. | 54,682 | 854,680 | |

| News Corp.: | |||

| Class A | 686,011 | 7,422,639 | |

| Class B | 50,000 | 570,500 | |

| Nexstar Broadcasting Group, Inc. Class A | 42,990 | 1,920,793 | |

| Omnicom Group, Inc. | 336,353 | 26,171,627 | |

| Radio One, Inc. Class D (non-vtg.) (a)(b) | 32,336 | 43,654 | |

| ReachLocal, Inc. (a)(b) | 5,194 | 9,921 | |

| Reading International, Inc. Class A (a) | 17,900 | 180,074 | |

| Regal Entertainment Group Class A (b) | 109,971 | 2,165,329 | |

| RLJ Entertainment, Inc. (a) | 17,180 | 8,762 | |

| Saga Communications, Inc. Class A | 3,882 | 145,691 | |

| Salem Communications Corp. Class A | 1,732 | 8,331 | |

| Scholastic Corp. | 44,904 | 1,572,987 | |

| Scripps Networks Interactive, Inc. Class A | 128,495 | 7,612,044 | |

| Sinclair Broadcast Group, Inc. Class A | 88,523 | 2,732,705 | |

| Sirius XM Holdings, Inc. (a)(b) | 3,124,954 | 11,624,829 | |

| Sizmek, Inc. (a) | 26,444 | 86,207 | |

| Spanish Broadcasting System, Inc. Class A (a) | 698 | 2,269 | |

| Starz Series A (a)(b) | 128,013 | 3,224,647 | |

| Tegna, Inc. | 316,572 | 7,800,334 | |

| The Madison Square Garden Co. (a) | 30,403 | 4,712,465 | |

| The McClatchy Co. Class A (a)(b) | 60,729 | 64,980 | |

| The New York Times Co. Class A (b) | 193,567 | 2,433,137 | |

| The Walt Disney Co. | 2,152,334 | 205,590,944 | |

| Time Warner Cable, Inc. | 398,481 | 76,054,084 | |

| Time Warner, Inc. | 1,131,852 | 74,928,602 | |

| Time, Inc. | 144,432 | 2,036,491 | |

| Townsquare Media, Inc. (a) | 1,285 | 12,529 | |

| Tribune Media Co. Class A | 139,096 | 4,993,546 | |

| Tribune Publishing Co. | 24,064 | 201,897 | |

| Twenty-First Century Fox, Inc.: | |||

| Class A | 1,669,581 | 45,112,079 | |

| Class B | 581,751 | 15,800,357 | |

| Viacom, Inc. Class B (non-vtg.) | 508,252 | 18,729,086 | |

| World Wrestling Entertainment, Inc. Class A (b) | 44,310 | 740,863 | |

| 939,208,958 | |||

| Multiline Retail - 0.6% | |||

| Big Lots, Inc. (b) | 72,215 | 2,921,097 | |

| Dillard's, Inc. Class A (b) | 32,687 | 2,735,575 | |

| Dollar General Corp. | 408,015 | 30,295,114 | |

| Dollar Tree, Inc. (a) | 330,936 | 26,557,614 | |

| Fred's, Inc. Class A | 47,418 | 677,603 | |

| Gordmans Stores, Inc. (a)(b) | 10,233 | 24,150 | |

| JC Penney Corp., Inc. (a)(b) | 439,535 | 4,483,257 | |

| Kohl's Corp. (b) | 269,067 | 12,557,357 | |

| Macy's, Inc. | 450,921 | 19,484,296 | |

| Nordstrom, Inc. (b) | 187,081 | 9,600,997 | |

| Ollie's Bargain Outlet Holdings, Inc. (a)(b) | 25,686 | 518,857 | |

| Sears Holdings Corp. (a)(b) | 72,471 | 1,266,068 | |

| Target Corp. | 868,532 | 68,136,335 | |

| The Bon-Ton Stores, Inc. (b) | 19,775 | 37,573 | |

| Tuesday Morning Corp. (a)(b) | 61,992 | 417,206 | |

| 179,713,099 | |||

| Specialty Retail - 2.6% | |||

| Aarons, Inc. Class A | 98,760 | 2,270,492 | |

| Abercrombie & Fitch Co. Class A | 93,188 | 2,707,111 | |

| Advance Auto Parts, Inc. | 102,932 | 15,279,226 | |

| Aeropostale, Inc. (a)(b) | 110,952 | 22,745 | |

| America's Car Mart, Inc. (a)(b) | 10,422 | 262,009 | |

| American Eagle Outfitters, Inc. (b) | 259,564 | 3,960,947 | |

| Asbury Automotive Group, Inc. (a) | 40,476 | 2,363,798 | |

| Ascena Retail Group, Inc. (a)(b) | 233,731 | 1,975,027 | |

| AutoNation, Inc. (a)(b) | 105,216 | 5,415,468 | |

| AutoZone, Inc. (a)(b) | 42,836 | 33,179,481 | |

| Barnes & Noble Education, Inc. (a) | 60,796 | 649,301 | |

| Barnes & Noble, Inc. (b) | 82,041 | 795,798 | |

| bebe stores, Inc. (b) | 66,951 | 30,804 | |

| Bed Bath & Beyond, Inc. (a) | 241,299 | 11,570,287 | |

| Best Buy Co., Inc. (b) | 416,544 | 13,491,860 | |

| Big 5 Sporting Goods Corp. | 23,104 | 316,525 | |

| Boot Barn Holdings, Inc. (a)(b) | 15,310 | 155,550 | |

| Build-A-Bear Workshop, Inc. (a) | 15,205 | 217,127 | |

| Burlington Stores, Inc. (a) | 108,131 | 6,061,824 | |

| Cabela's, Inc. Class A (a)(b) | 66,953 | 3,212,405 | |

| Caleres, Inc. | 68,568 | 1,943,217 | |

| CarMax, Inc. (a)(b) | 288,976 | 13,368,030 | |

| Chico's FAS, Inc. | 193,672 | 2,471,255 | |

| Christopher & Banks Corp. (a)(b) | 57,707 | 81,367 | |

| Citi Trends, Inc. | 19,731 | 364,826 | |

| Conn's, Inc. (a)(b) | 39,904 | 677,171 | |

| CST Brands, Inc. | 101,651 | 3,297,558 | |

| Destination Maternity Corp. | 22,235 | 179,659 | |

| Destination XL Group, Inc. (a)(b) | 51,406 | 228,757 | |

| Dick's Sporting Goods, Inc. | 126,777 | 5,384,219 | |

| DSW, Inc. Class A | 102,377 | 2,682,277 | |

| Express, Inc. (a) | 106,219 | 1,830,153 | |

| Finish Line, Inc. Class A | 58,534 | 1,066,489 | |

| Five Below, Inc. (a)(b) | 73,748 | 2,828,236 | |

| Foot Locker, Inc. (b) | 196,550 | 12,284,375 | |

| Francesca's Holdings Corp. (a) | 57,702 | 1,043,252 | |

| GameStop Corp. Class A (b) | 148,697 | 4,582,842 | |

| Gap, Inc. (b) | 325,018 | 8,986,748 | |

| Genesco, Inc. (a) | 32,141 | 2,120,663 | |

| GNC Holdings, Inc. | 120,441 | 3,430,160 | |

| Group 1 Automotive, Inc. | 30,918 | 1,723,988 | |

| Guess?, Inc. (b) | 92,962 | 1,984,739 | |

| Haverty Furniture Companies, Inc. | 26,172 | 508,784 | |

| hhgregg, Inc. (a)(b) | 15,184 | 26,268 | |

| Hibbett Sports, Inc. (a)(b) | 34,547 | 1,226,419 | |

| Home Depot, Inc. | 1,794,856 | 222,777,527 | |

| Kirkland's, Inc. | 21,240 | 303,520 | |

| L Brands, Inc. | 361,595 | 30,659,640 | |

| Lithia Motors, Inc. Class A (sub. vtg.) | 30,888 | 2,863,935 | |

| Lowe's Companies, Inc. | 1,296,501 | 87,552,713 | |

| Lumber Liquidators Holdings, Inc. (a)(b) | 34,626 | 392,313 | |

| MarineMax, Inc. (a) | 36,815 | 653,098 | |

| Mattress Firm Holding Corp. (a)(b) | 25,874 | 1,165,106 | |

| Michaels Companies, Inc. (a) | 120,574 | 2,809,374 | |

| Monro Muffler Brake, Inc. (b) | 48,486 | 3,314,988 | |

| Murphy U.S.A., Inc. (a) | 55,943 | 3,563,010 | |

| New York & Co., Inc. (a) | 34,393 | 68,786 | |

| O'Reilly Automotive, Inc. (a)(b) | 143,531 | 37,363,990 | |

| Office Depot, Inc. (a) | 731,144 | 3,714,212 | |

| Outerwall, Inc. (b) | 30,388 | 947,802 | |

| Pacific Sunwear of California, Inc. (a)(b) | 60,120 | 11,603 | |

| Party City Holdco, Inc. (b) | 32,051 | 316,984 | |

| Penske Automotive Group, Inc. | 59,093 | 2,228,988 | |

| Perfumania Holdings, Inc. (a) | 876 | 2,251 | |

| Pier 1 Imports, Inc. | 118,802 | 586,882 | |

| Rent-A-Center, Inc. (b) | 68,968 | 880,721 | |

| Restoration Hardware Holdings, Inc. (a)(b) | 53,020 | 2,014,230 | |

| Ross Stores, Inc. | 575,127 | 31,620,482 | |

| Sally Beauty Holdings, Inc. (a) | 219,034 | 6,917,094 | |

| Sears Hometown & Outlet Stores, Inc. (a) | 10,000 | 67,700 | |

| Select Comfort Corp. (a) | 68,724 | 1,230,160 | |

| Shoe Carnival, Inc. | 21,330 | 502,748 | |

| Signet Jewelers Ltd. | 110,816 | 12,012,454 | |

| Sonic Automotive, Inc. Class A (sub. vtg.) | 40,396 | 773,583 | |

| Sportsman's Warehouse Holdings, Inc. (a) | 33,271 | 431,525 | |

| Stage Stores, Inc. | 38,699 | 325,072 | |

| Staples, Inc. | 928,965 | 8,778,719 | |

| Stein Mart, Inc. | 33,638 | 249,258 | |

| Systemax, Inc. (a) | 10,113 | 89,096 | |

| Tailored Brands, Inc. | 69,976 | 1,080,429 | |

| The Buckle, Inc. | 40,527 | 1,288,759 | |

| The Cato Corp. Class A (sub. vtg.) | 36,544 | 1,322,893 | |

| The Children's Place Retail Stores, Inc. | 27,695 | 1,887,137 | |

| The Container Store Group, Inc. (a)(b) | 22,029 | 119,177 | |

| Tiffany & Co., Inc. (b) | 153,074 | 9,946,749 | |

| Tile Shop Holdings, Inc. (a) | 33,873 | 427,477 | |

| Tilly's, Inc. (a) | 14,113 | 101,472 | |

| TJX Companies, Inc. | 945,367 | 70,051,695 | |

| Tractor Supply Co. | 191,323 | 16,180,186 | |

| Trans World Entertainment Corp. (a) | 2,977 | 10,568 | |

| Ulta Salon, Cosmetics & Fragrance, Inc. (a) | 90,178 | 14,896,504 | |

| Urban Outfitters, Inc. (a)(b) | 126,843 | 3,360,071 | |

| Vitamin Shoppe, Inc. (a)(b) | 37,155 | 1,025,106 | |

| West Marine, Inc. (a) | 16,394 | 134,103 | |

| Williams-Sonoma, Inc. | 125,525 | 6,541,108 | |

| Winmark Corp. | 1,991 | 192,928 | |

| Zumiez, Inc. (a)(b) | 31,066 | 641,824 | |

| 774,656,987 | |||

| Textiles, Apparel & Luxury Goods - 1.0% | |||

| Carter's, Inc. | 76,972 | 7,822,664 | |

| Cherokee, Inc. (a)(b) | 20,319 | 345,829 | |

| Coach, Inc. | 392,667 | 15,290,453 | |

| Columbia Sportswear Co. | 42,368 | 2,521,743 | |

| Crocs, Inc. (a)(b) | 99,425 | 973,371 | |

| Culp, Inc. | 12,256 | 312,283 | |

| Deckers Outdoor Corp. (a) | 43,271 | 2,447,408 | |

| Delta Apparel, Inc. (a) | 1,905 | 32,156 | |

| Fossil Group, Inc. (a)(b) | 55,600 | 2,608,196 | |

| G-III Apparel Group Ltd. (a)(b) | 55,777 | 2,942,237 | |

| Hanesbrands, Inc. | 555,398 | 15,823,289 | |

| Iconix Brand Group, Inc. (a)(b) | 61,164 | 532,127 | |

| Joe's Jeans, Inc. (a) | 1,083 | 4,874 | |

| Kate Spade & Co. (a)(b) | 171,315 | 3,395,463 | |

| Lakeland Industries, Inc. (a)(b) | 6,813 | 81,211 | |

| lululemon athletica, Inc. (a)(b) | 157,883 | 9,904,001 | |

| Michael Kors Holdings Ltd. (a) | 267,639 | 15,161,749 | |

| Movado Group, Inc. (b) | 22,005 | 642,766 | |

| NIKE, Inc. Class B | 1,905,864 | 117,382,164 | |

| Oxford Industries, Inc. | 19,698 | 1,430,666 | |

| Perry Ellis International, Inc. (a) | 15,961 | 294,800 | |

| PVH Corp. | 121,699 | 9,632,476 | |

| Ralph Lauren Corp. | 81,118 | 7,362,270 | |

| Rocky Brands, Inc. | 8,326 | 95,832 | |

| Sequential Brands Group, Inc. (a)(b) | 63,961 | 445,808 | |

| Skechers U.S.A., Inc. Class A (sub. vtg.) (a) | 179,562 | 5,911,181 | |

| Steven Madden Ltd. (a)(b) | 86,611 | 3,048,707 | |

| Superior Uniform Group, Inc. | 11,974 | 212,539 | |

| Tumi Holdings, Inc. (a)(b) | 75,723 | 1,495,529 | |

| Under Armour, Inc. Class A (sub. vtg.) (a)(b) | 253,224 | 21,192,317 | |

| Unifi, Inc. (a) | 18,843 | 422,272 | |

| Vera Bradley, Inc. (a) | 29,957 | 498,185 | |

| VF Corp. | 484,021 | 31,514,607 | |

| Vince Holding Corp. (a) | 20,302 | 131,151 | |

| Wolverine World Wide, Inc. | 136,279 | 2,579,761 | |

| 284,492,085 | |||

| TOTAL CONSUMER DISCRETIONARY | 3,970,639,061 | ||

| CONSUMER STAPLES - 9.3% | |||

| Beverages - 2.0% | |||

| Boston Beer Co., Inc. Class A (a)(b) | 13,052 | 2,455,212 | |

| Brown-Forman Corp.: | |||

| Class A | 20,000 | 2,131,800 | |

| Class B (non-vtg.) | 171,789 | 16,916,063 | |

| Castle Brands, Inc. (a)(b) | 38,689 | 32,081 | |

| Coca-Cola Bottling Co. Consolidated | 6,914 | 1,208,014 | |

| Coca-Cola Enterprises, Inc. | 288,966 | 14,017,741 | |

| Constellation Brands, Inc. Class A (sub. vtg.) | 246,097 | 34,805,499 | |

| Craft Brew Alliance, Inc. (a) | 6,981 | 57,733 | |

| Dr. Pepper Snapple Group, Inc. | 261,698 | 23,953,218 | |

| MGP Ingredients, Inc. | 19,078 | 446,234 | |

| Molson Coors Brewing Co. Class B | 255,774 | 21,809,849 | |

| Monster Beverage Corp. | 212,560 | 26,676,280 | |

| National Beverage Corp. (a) | 17,250 | 655,845 | |

| PepsiCo, Inc. | 2,062,149 | 201,719,415 | |

| Primo Water Corp. (a) | 16,948 | 157,786 | |

| REED'S, Inc. (a) | 1,830 | 9,242 | |

| The Coca-Cola Co. | 5,532,614 | 238,621,642 | |

| 585,673,654 | |||

| Food & Staples Retailing - 2.1% | |||

| Andersons, Inc. | 36,988 | 993,128 | |

| Casey's General Stores, Inc. | 56,112 | 5,923,744 | |

| Chefs' Warehouse Holdings (a)(b) | 22,894 | 432,010 | |

| Costco Wholesale Corp. | 617,514 | 92,645,625 | |

| CVS Health Corp. | 1,564,838 | 152,055,308 | |

| Fairway Group Holdings Corp. (a)(b) | 15,014 | 4,519 | |

| Fresh Market, Inc. (a)(b) | 59,148 | 1,364,544 | |

| Ingles Markets, Inc. Class A | 19,385 | 653,856 | |

| Kroger Co. | 1,374,257 | 54,846,597 | |

| Natural Grocers by Vitamin Cottage, Inc. (a)(b) | 12,082 | 243,090 | |

| Performance Food Group Co. | 62,824 | 1,553,638 | |

| PriceSmart, Inc. | 26,710 | 2,063,615 | |

| Rite Aid Corp. (a) | 1,464,258 | 11,640,851 | |

| Smart & Final Stores, Inc. (a) | 46,551 | 756,454 | |

| SpartanNash Co. | 50,930 | 1,398,029 | |

| Sprouts Farmers Market LLC (a)(b) | 208,239 | 5,930,647 | |

| SUPERVALU, Inc. (a) | 422,858 | 2,160,804 | |

| Sysco Corp. | 753,753 | 33,263,120 | |

| United Natural Foods, Inc. (a)(b) | 66,521 | 2,052,838 | |

| Village Super Market, Inc. Class A | 6,879 | 182,362 | |

| Wal-Mart Stores, Inc. | 2,221,306 | 147,361,440 | |

| Walgreens Boots Alliance, Inc. | 1,234,287 | 97,434,616 | |

| Weis Markets, Inc. | 21,073 | 877,269 | |

| Whole Foods Market, Inc. (b) | 483,264 | 15,130,996 | |

| 630,969,100 | |||

| Food Products - 1.8% | |||

| Alico, Inc. | 4,002 | 95,808 | |

| Amplify Snack Brands, Inc. (b) | 21,604 | 222,305 | |

| Archer Daniels Midland Co. | 853,201 | 29,827,907 | |

| B&G Foods, Inc. Class A (b) | 77,184 | 2,669,795 | |

| Blue Buffalo Pet Products, Inc. (a)(b) | 81,644 | 1,494,085 | |

| Bunge Ltd. | 200,541 | 9,970,899 | |

| Cal-Maine Foods, Inc. (b) | 44,003 | 2,348,880 | |

| Calavo Growers, Inc. (b) | 20,904 | 1,119,618 | |

| Campbell Soup Co. (b) | 248,162 | 15,324,004 | |

| Coffee Holding Co., Inc. (a) | 3,401 | 11,121 | |

| ConAgra Foods, Inc. | 608,325 | 25,586,150 | |

| Darling International, Inc. (a) | 262,702 | 2,366,945 | |

| Dean Foods Co. (b) | 129,419 | 2,496,493 | |

| Diamond Foods, Inc. (a) | 36,720 | 1,389,861 | |

| Farmer Brothers Co. (a)(b) | 9,145 | 241,062 | |

| Flowers Foods, Inc. | 267,320 | 4,579,192 | |

| Fresh Del Monte Produce, Inc. | 55,694 | 2,233,886 | |

| Freshpet, Inc. (a)(b) | 24,280 | 161,462 | |

| General Mills, Inc. | 841,967 | 49,549,758 | |

| Hormel Foods Corp. (b) | 379,833 | 16,146,701 | |

| Ingredion, Inc. | 106,403 | 10,770,112 | |

| Inventure Foods, Inc. (a) | 20,016 | 122,498 | |

| J&J Snack Foods Corp. | 19,285 | 2,136,585 | |

| John B. Sanfilippo & Son, Inc. | 10,819 | 753,002 | |

| Kellogg Co. | 369,375 | 27,341,138 | |

| Keurig Green Mountain, Inc. | 164,488 | 15,123,027 | |

| Lancaster Colony Corp. | 29,148 | 2,966,392 | |

| Landec Corp. (a) | 30,155 | 304,264 | |

| Lifeway Foods, Inc. (a) | 1,962 | 22,151 | |

| Limoneira Co. (b) | 13,723 | 191,573 | |

| McCormick & Co., Inc. (non-vtg.) (b) | 167,367 | 15,608,646 | |

| Mead Johnson Nutrition Co. Class A | 262,707 | 19,377,268 | |

| Mondelez International, Inc. | 2,247,265 | 91,081,650 | |

| Omega Protein Corp. (a) | 32,056 | 761,330 | |

| Pilgrim's Pride Corp. (b) | 94,260 | 2,304,657 | |

| Pinnacle Foods, Inc. | 149,733 | 6,466,968 | |

| Post Holdings, Inc. (a) | 91,007 | 6,321,346 | |

| Sanderson Farms, Inc. (b) | 25,904 | 2,363,999 | |

| Seaboard Corp. (a) | 405 | 1,184,625 | |

| Seneca Foods Corp. Class A (a) | 7,029 | 233,785 | |

| Snyders-Lance, Inc. (b) | 99,658 | 2,328,952 | |

| The Hain Celestial Group, Inc. (a)(b) | 150,414 | 5,560,806 | |

| The Hershey Co. | 204,968 | 18,629,542 | |

| The J.M. Smucker Co. | 167,379 | 21,352,539 | |

| The Kraft Heinz Co. | 844,110 | 65,013,352 | |

| Tootsie Roll Industries, Inc. (b) | 37,180 | 1,238,838 | |

| TreeHouse Foods, Inc. (a)(b) | 76,236 | 6,435,843 | |

| Tyson Foods, Inc. Class A | 415,713 | 26,917,417 | |

| WhiteWave Foods Co. (a) | 252,591 | 9,780,324 | |

| 530,528,561 | |||

| Household Products - 1.7% | |||

| Central Garden & Pet Co. Class A (non-vtg.) (a) | 71,078 | 961,685 | |

| Church & Dwight Co., Inc. | 189,254 | 17,176,693 | |

| Clorox Co. | 182,744 | 23,102,496 | |

| Colgate-Palmolive Co. | 1,266,046 | 83,103,259 | |

| Energizer Holdings, Inc. | 88,029 | 3,427,849 | |

| HRG Group, Inc. (a) | 170,026 | 1,979,103 | |

| Kimberly-Clark Corp. | 515,915 | 67,223,725 | |

| Oil-Dri Corp. of America | 2,105 | 77,548 | |

| Orchids Paper Products Co. (b) | 9,720 | 267,494 | |

| Procter & Gamble Co. | 3,855,304 | 309,542,358 | |

| Spectrum Brands Holdings, Inc. (b) | 41,932 | 4,015,828 | |

| WD-40 Co. | 22,073 | 2,383,884 | |

| 513,261,922 | |||

| Personal Products - 0.2% | |||

| Avon Products, Inc. | 621,958 | 2,369,660 | |

| Coty, Inc. Class A (b) | 113,859 | 3,242,704 | |

| Cyanotech Corp. (a) | 2,300 | 9,890 | |

| DS Healthcare Group, Inc. (a) | 14,476 | 20,845 | |

| Edgewell Personal Care Co. (a) | 82,856 | 6,334,341 | |

| Elizabeth Arden, Inc. (a)(b) | 31,918 | 197,892 | |

| Estee Lauder Companies, Inc. Class A | 315,807 | 28,842,653 | |

| Herbalife Ltd. (a)(b) | 93,550 | 5,121,863 | |

| Inter Parfums, Inc. | 25,837 | 653,934 | |

| LifeVantage Corp. (a)(b) | 12,829 | 128,162 | |

| Mannatech, Inc. (a) | 599 | 10,860 | |

| MediFast, Inc. | 14,005 | 425,052 | |

| Natural Health Trends Corp. (b) | 11,452 | 356,959 | |

| Nature's Sunshine Products, Inc. | 6,985 | 58,534 | |

| Nu Skin Enterprises, Inc. Class A (b) | 81,268 | 2,477,861 | |

| Nutraceutical International Corp. (a) | 7,518 | 184,492 | |

| Revlon, Inc. (a) | 25,388 | 888,580 | |

| Synutra International, Inc. (a)(b) | 26,200 | 133,358 | |

| The Female Health Co. (a)(b) | 11,731 | 22,641 | |

| USANA Health Sciences, Inc. (a)(b) | 10,174 | 1,146,813 | |

| 52,627,094 | |||

| Tobacco - 1.5% | |||

| 22nd Century Group, Inc. (a)(b) | 13,751 | 13,201 | |

| Alliance One International, Inc. (a) | 8,945 | 93,296 | |

| Altria Group, Inc. | 2,776,174 | 170,929,033 | |

| Philip Morris International, Inc. | 2,192,484 | 199,581,819 | |

| Reynolds American, Inc. | 1,174,303 | 59,220,100 | |

| Universal Corp. (b) | 35,243 | 1,920,039 | |

| Vector Group Ltd. | 149,599 | 3,475,185 | |

| 435,232,673 | |||

| TOTAL CONSUMER STAPLES | 2,748,293,004 | ||

| ENERGY - 5.8% | |||

| Energy Equipment & Services - 1.0% | |||

| Archrock, Inc. (a) | 90,110 | 359,539 | |

| Aspen Aerogels, Inc. (a) | 9,858 | 35,982 | |

| Atwood Oceanics, Inc. (b) | 79,282 | 545,460 | |

| Baker Hughes, Inc. | 617,833 | 26,486,501 | |

| Basic Energy Services, Inc. (a)(b) | 48,473 | 84,828 | |

| Bristow Group, Inc. | 47,191 | 717,775 | |

| C&J Energy Services Ltd. (a)(b) | 59,040 | 60,811 | |

| Cameron International Corp. (a) | 268,743 | 17,618,791 | |

| Carbo Ceramics, Inc. (b) | 26,245 | 524,638 | |

| Core Laboratories NV (b) | 61,124 | 6,414,353 | |

| Dawson Geophysical Co. (a) | 19,081 | 65,066 | |

| Diamond Offshore Drilling, Inc. (b) | 88,657 | 1,774,027 | |

| Dril-Quip, Inc. (a) | 54,128 | 2,936,444 | |

| ENGlobal Corp. (a) | 5,637 | 4,624 | |

| Ensco PLC Class A (b) | 322,529 | 2,796,326 | |

| Era Group, Inc. (a)(b) | 30,759 | 283,598 | |

| Exterran Corp. (a) | 59,232 | 807,924 | |

| Fairmount Santrol Holidings, Inc. (a)(b) | 86,660 | 171,587 | |

| FMC Technologies, Inc. (a) | 321,085 | 7,876,215 | |

| Forbes Energy Services Ltd. (a) | 500 | 147 | |

| Forum Energy Technologies, Inc. (a)(b) | 82,786 | 973,563 | |

| Frank's International NV (b) | 66,668 | 926,019 | |

| Geospace Technologies Corp. (a)(b) | 25,924 | 289,571 | |

| GreenHunter Energy, Inc. (a) | 12,193 | 1,128 | |

| Gulf Island Fabrication, Inc. | 17,861 | 159,142 | |

| Gulfmark Offshore, Inc. Class A (a)(b) | 30,820 | 110,644 | |

| Halliburton Co. | 1,203,159 | 38,837,973 | |

| Helix Energy Solutions Group, Inc. (a) | 125,576 | 489,746 | |

| Helmerich & Payne, Inc. (b) | 160,774 | 8,516,199 | |

| Hornbeck Offshore Services, Inc. (a)(b) | 41,835 | 359,363 | |

| Independence Contract Drilling, Inc. (a)(b) | 5,209 | 20,055 | |

| ION Geophysical Corp. (a) | 10,360 | 32,116 | |

| Key Energy Services, Inc. (a)(b) | 163,573 | 37,458 | |

| Matrix Service Co. (a) | 47,813 | 879,281 | |

| McDermott International, Inc. (a)(b) | 337,356 | 1,113,275 | |

| Mitcham Industries, Inc. (a)(b) | 23,287 | 76,614 | |

| Nabors Industries Ltd. | 435,341 | 3,117,042 | |

| National Oilwell Varco, Inc. (b) | 528,206 | 15,460,590 | |

| Natural Gas Services Group, Inc. (a) | 21,602 | 390,132 | |

| Newpark Resources, Inc. (a) | 122,453 | 456,750 | |

| Noble Corp. (b) | 354,375 | 2,951,944 | |

| Oceaneering International, Inc. | 135,665 | 3,747,067 | |

| Oil States International, Inc. (a) | 62,779 | 1,639,160 | |

| Parker Drilling Co. (a) | 180,331 | 281,316 | |

| Patterson-UTI Energy, Inc. | 212,278 | 3,298,800 | |

| PHI, Inc. (non-vtg.) (a) | 18,377 | 335,196 | |

| Pioneer Energy Services Corp. (a) | 82,168 | 112,570 | |

| Profire Energy, Inc. (a) | 14,213 | 11,177 | |

| RigNet, Inc. (a)(b) | 15,376 | 202,963 | |

| Rowan Companies PLC (b) | 172,571 | 2,298,646 | |

| RPC, Inc. (b) | 78,821 | 1,069,601 | |

| Schlumberger Ltd. | 1,785,480 | 128,054,626 | |

| SEACOR Holdings, Inc. (a)(b) | 30,397 | 1,470,911 | |

| Seventy Seven Energy, Inc. (a)(b) | 63,215 | 30,343 | |

| Superior Energy Services, Inc. | 194,953 | 2,004,117 | |

| Synthesis Energy Systems, Inc. (a)(b) | 138,081 | 127,725 | |

| Tesco Corp. | 53,676 | 388,614 | |

| TETRA Technologies, Inc. (a) | 113,155 | 570,301 | |

| Tidewater, Inc. (b) | 61,246 | 352,165 | |

| Transocean Ltd. (United States) (b) | 471,136 | 4,075,326 | |

| U.S. Silica Holdings, Inc. (b) | 67,342 | 1,292,293 | |

| Unit Corp. (a)(b) | 64,642 | 346,481 | |

| Weatherford International Ltd. (a) | 1,081,334 | 6,920,538 | |

| Willbros Group, Inc. (a) | 69,552 | 91,113 | |

| 303,484,290 | |||

| Oil, Gas & Consumable Fuels - 4.8% | |||

| Abraxas Petroleum Corp. (a)(b) | 126,005 | 113,405 | |

| Adams Resources & Energy, Inc. | 2,090 | 68,385 | |

| Aemetis, Inc. (a) | 10,055 | 18,401 | |

| Alon U.S.A. Energy, Inc. (b) | 48,399 | 477,214 | |

| Amyris, Inc. (a)(b) | 58,883 | 88,913 | |

| Anadarko Petroleum Corp. | 717,297 | 27,221,421 | |

| Antero Resources Corp. (a)(b) | 139,550 | 3,188,718 | |

| Apache Corp. (b) | 533,388 | 20,418,093 | |

| Approach Resources, Inc. (a)(b) | 44,511 | 33,557 | |

| Ardmore Shipping Corp. | 32,573 | 261,887 | |

| Barnwell Industries, Inc. (a) | 2,847 | 3,758 | |

| Bill Barrett Corp. (a)(b) | 57,665 | 164,922 | |

| Bonanza Creek Energy, Inc. (a)(b) | 47,310 | 87,997 | |

| Cabot Oil & Gas Corp. (b) | 581,264 | 11,700,844 | |

| California Resources Corp. (b) | 563,327 | 316,646 | |

| Callon Petroleum Co. (a) | 103,916 | 662,984 | |

| Carrizo Oil & Gas, Inc. (a)(b) | 113,343 | 2,436,875 | |

| Cheniere Energy, Inc. (a) | 335,349 | 11,988,727 | |

| Chesapeake Energy Corp. (b) | 711,819 | 1,857,848 | |

| Chevron Corp. | 2,666,358 | 222,480,912 | |

| Cimarex Energy Co. | 135,188 | 11,359,848 | |

| Clayton Williams Energy, Inc. (a)(b) | 7,754 | 113,441 | |

| Clean Energy Fuels Corp. (a)(b) | 142,581 | 410,633 | |

| Cloud Peak Energy, Inc. (a)(b) | 86,697 | 147,385 | |

| Cobalt International Energy, Inc. (a) | 514,040 | 1,367,346 | |

| Columbia Pipeline Group, Inc. | 629,243 | 11,420,760 | |

| Comstock Resources, Inc. (a)(b) | 50,200 | 40,662 | |

| Concho Resources, Inc. (a) | 180,589 | 16,296,351 | |

| ConocoPhillips Co. | 1,744,525 | 59,017,281 | |

| CONSOL Energy, Inc. (b) | 323,988 | 2,796,016 | |

| Contango Oil & Gas Co. (a) | 29,433 | 177,481 | |

| Continental Resources, Inc. (a)(b) | 114,814 | 2,661,389 | |

| CVR Energy, Inc. | 23,933 | 566,015 | |

| Dakota Plains Holdings, Inc. (a) | 40,463 | 6,676 | |

| Delek U.S. Holdings, Inc. | 76,562 | 1,211,211 | |

| Denbury Resources, Inc. (b) | 468,655 | 599,878 | |

| Devon Energy Corp. | 723,162 | 14,231,828 | |

| Diamondback Energy, Inc. | 98,380 | 7,009,575 | |

| Eclipse Resources Corp. (a)(b) | 76,688 | 72,754 | |

| Emerald Oil, Inc. (a)(b) | 3,637 | 2,909 | |

| Energen Corp. (b) | 134,058 | 3,549,856 | |

| Energy XXI (Bermuda) Ltd. (b) | 106,493 | 39,637 | |

| EOG Resources, Inc. | 772,738 | 50,027,058 | |

| EP Energy Corp. (a)(b) | 48,938 | 84,173 | |

| EQT Corp. | 219,281 | 12,222,723 | |

| Evolution Petroleum Corp. | 29,931 | 129,302 | |

| EXCO Resources, Inc. (a)(b) | 234,793 | 246,533 | |

| Exxon Mobil Corp. | 5,898,120 | 472,734,318 | |

| Gastar Exploration, Inc. (a)(b) | 74,542 | 51,434 | |

| Gener8 Maritime, Inc. (a)(b) | 28,403 | 176,383 | |

| Gevo, Inc. (a)(b) | 21,621 | 8,220 | |

| Green Plains, Inc. | 43,197 | 587,479 | |

| Gulfport Energy Corp. (a) | 152,147 | 3,651,528 | |

| Halcon Resources Corp. (a)(b) | 128,274 | 74,502 | |

| Hallador Energy Co. | 19,418 | 93,789 | |

| Harvest Natural Resources, Inc. (a)(b) | 51,649 | 27,410 | |

| Hess Corp. (b) | 368,875 | 16,082,950 | |

| HollyFrontier Corp. | 258,598 | 8,745,784 | |

| Houston American Energy Corp. (a) | 36,485 | 6,297 | |

| Isramco, Inc. (a)(b) | 123 | 10,025 | |

| Jones Energy, Inc. (a) | 48,096 | 72,144 | |

| Kinder Morgan, Inc. | 2,586,689 | 46,793,204 | |

| Kosmos Energy Ltd. (a)(b) | 234,975 | 1,146,678 | |

| Laredo Petroleum, Inc. (a)(b) | 170,381 | 870,647 | |

| Lilis Energy, Inc. (a) | 8,026 | 1,276 | |

| Lucas Energy, Inc. (a)(b) | 376 | 1,132 | |

| Magellan Petroleum Corp. (a) | 4,486 | 4,441 | |

| Magnum Hunter Resources Corp. warrants 4/16/16 (a)(b) | 15,652 | 0 | |

| Marathon Oil Corp. (b) | 969,079 | 7,956,139 | |

| Marathon Petroleum Corp. | 752,012 | 25,756,411 | |

| Matador Resources Co. (a)(b) | 100,803 | 1,626,960 | |

| Memorial Resource Development Corp. (a) | 126,866 | 1,226,794 | |

| Murphy Oil Corp. | 219,468 | 3,770,460 | |

| Newfield Exploration Co. (a) | 230,098 | 6,265,569 | |

| Noble Energy, Inc. | 597,615 | 17,629,643 | |

| Northern Oil & Gas, Inc. (a)(b) | 93,777 | 313,215 | |

| Oasis Petroleum, Inc. (a)(b) | 247,381 | 1,333,384 | |

| Occidental Petroleum Corp. | 1,081,335 | 74,417,475 | |

| ONEOK, Inc. (b) | 298,116 | 7,154,784 | |

| Pacific Ethanol, Inc. (a) | 28,969 | 114,138 | |

| Panhandle Royalty Co. Class A | 17,964 | 279,161 | |

| Par Petroleum Corp. (a)(b) | 39,236 | 772,949 | |

| Parsley Energy, Inc. Class A (a) | 146,744 | 2,697,155 | |

| PBF Energy, Inc. Class A | 150,971 | 4,559,324 | |

| PDC Energy, Inc. (a)(b) | 53,784 | 2,695,116 | |

| Peabody Energy Corp. (b) | 23,367 | 57,015 | |

| Petroquest Energy, Inc. (a)(b) | 70,948 | 30,153 | |

| Phillips 66 Co. | 671,433 | 53,305,066 | |

| Pioneer Natural Resources Co. | 226,414 | 27,289,679 | |

| QEP Resources, Inc. | 226,080 | 2,206,541 | |

| Range Resources Corp. (b) | 242,010 | 5,742,897 | |

| Renewable Energy Group, Inc. (a) | 48,243 | 351,691 | |

| Resolute Energy Corp. (a) | 59,120 | 30,151 | |

| Rex American Resources Corp. (a)(b) | 8,227 | 415,464 | |

| Rex Energy Corp. (a)(b) | 63,386 | 37,423 | |

| Rice Energy, Inc. (a)(b) | 106,141 | 972,252 | |

| Ring Energy, Inc. (a)(b) | 35,672 | 149,109 | |

| RSP Permian, Inc. (a)(b) | 94,454 | 2,258,395 | |

| Sanchez Energy Corp. (a)(b) | 73,315 | 261,001 | |

| SemGroup Corp. Class A | 63,641 | 1,209,179 | |

| SM Energy Co. (b) | 92,021 | 831,870 | |

| Solazyme, Inc. (a)(b) | 98,314 | 153,370 | |

| Southwestern Energy Co. (a)(b) | 535,428 | 3,094,774 | |

| Spectra Energy Corp. (b) | 948,231 | 27,688,345 | |

| Stone Energy Corp. (a)(b) | 67,092 | 103,993 | |

| Synergy Resources Corp. (a)(b) | 214,845 | 1,342,781 | |

| Syntroleum Corp. (a)(b) | 15,037 | 0 | |

| Targa Resources Corp. | 230,155 | 6,186,566 | |

| Teekay Corp. (b) | 68,637 | 549,096 | |

| Tengasco, Inc. (a) | 12,601 | 1,575 | |

| Tesoro Corp. | 169,272 | 13,656,865 | |

| The Williams Companies, Inc. | 965,580 | 15,439,624 | |

| TransAtlantic Petroleum Ltd. (a) | 18,382 | 11,399 | |

| Triangle Petroleum Corp. (a)(b) | 83,126 | 26,600 | |

| U.S. Energy Corp. (a) | 13,579 | 4,853 | |

| Ultra Petroleum Corp. (a)(b) | 197,021 | 70,139 | |

| Uranium Energy Corp. (a)(b) | 101,154 | 87,104 | |

| Uranium Resources, Inc. (a)(b) | 26,282 | 5,913 | |

| VAALCO Energy, Inc. (a) | 68,248 | 72,343 | |

| Valero Energy Corp. | 681,461 | 40,942,177 | |

| Vertex Energy, Inc. (a)(b) | 17,824 | 26,736 | |

| W&T Offshore, Inc. (a)(b) | 37,319 | 67,921 | |

| Warren Resources, Inc. (a)(b) | 91,512 | 7,275 | |

| Western Refining, Inc. | 93,791 | 2,501,406 | |

| Westmoreland Coal Co. (a)(b) | 23,319 | 143,412 | |

| Whiting Petroleum Corp. (a)(b) | 269,027 | 1,078,798 | |

| World Fuel Services Corp. | 106,709 | 4,995,048 | |

| WPX Energy, Inc. (a)(b) | 310,511 | 1,276,200 | |

| Zion Oil & Gas, Inc. (a)(b) | 27,782 | 48,619 | |

| Zion Oil & Gas, Inc. rights 3/31/16 (b) | 277 | 0 | |

| 1,423,839,364 | |||

| TOTAL ENERGY | 1,727,323,654 | ||

| FINANCIALS - 17.5% | |||

| Banks - 5.3% | |||

| 1st Source Corp. | 33,223 | 1,011,640 | |

| Access National Corp. | 1,270 | 23,622 | |

| ACNB Corp. | 3,789 | 81,880 | |

| American National Bankshares, Inc. | 2,748 | 69,772 | |

| Ameris Bancorp | 34,183 | 922,599 | |

| Ames National Corp. | 2,652 | 62,083 | |

| Arrow Financial Corp. | 16,456 | 430,654 | |

| Associated Banc-Corp. | 228,253 | 3,925,952 | |

| Atlantic Capital Bancshares, Inc. (a) | 10,644 | 138,478 | |

| Banc of California, Inc. | 46,638 | 714,961 | |

| BancFirst Corp. | 17,711 | 1,000,672 | |

| Bancorp, Inc., Delaware (a) | 42,844 | 204,366 | |

| BancorpSouth, Inc. | 112,604 | 2,243,072 | |

| Bank of America Corp. | 14,702,315 | 184,072,984 | |

| Bank of Hawaii Corp. | 64,151 | 4,073,589 | |

| Bank of Marin Bancorp | 4,167 | 205,683 | |

| Bank of the Ozarks, Inc. (b) | 117,298 | 4,438,556 | |

| BankUnited, Inc. | 139,847 | 4,491,886 | |

| Banner Corp. | 37,219 | 1,477,966 | |

| Bar Harbor Bankshares | 4,029 | 133,320 | |

| BB&T Corp. | 1,110,802 | 35,723,392 | |

| BBCN Bancorp, Inc. | 115,823 | 1,657,427 | |

| BCB Bancorp, Inc. | 2,814 | 27,662 | |

| Berkshire Hills Bancorp, Inc. | 55,545 | 1,434,172 | |

| Blue Hills Bancorp, Inc. | 41,132 | 567,622 | |

| BNC Bancorp | 54,841 | 1,112,175 | |

| BOK Financial Corp. (b) | 49,801 | 2,433,775 | |

| Boston Private Financial Holdings, Inc. | 110,492 | 1,166,796 | |

| Bridge Bancorp, Inc. | 16,022 | 455,185 | |

| Brookline Bancorp, Inc., Delaware | 100,105 | 1,052,104 | |

| Bryn Mawr Bank Corp. | 22,435 | 563,792 | |

| C & F Financial Corp. | 1,992 | 79,939 | |

| C1 Financial, Inc. (a) | 6,494 | 145,790 | |

| Camden National Corp. | 9,213 | 357,557 | |

| Capital Bank Financial Corp. Series A | 33,462 | 985,456 | |

| Capital City Bank Group, Inc. | 7,146 | 102,902 | |

| Cardinal Financial Corp. | 51,939 | 1,000,345 | |

| Cascade Bancorp (a) | 23,889 | 128,045 | |

| Cathay General Bancorp | 106,141 | 2,832,903 | |

| Centerstate Banks of Florida, Inc. | 74,327 | 1,040,578 | |

| Central Pacific Financial Corp. | 46,756 | 931,847 | |

| Central Valley Community Bancorp | 3,159 | 38,129 | |

| Century Bancorp, Inc. Class A (non-vtg.) | 686 | 27,063 | |

| Chemical Financial Corp. | 71,259 | 2,410,692 | |

| CIT Group, Inc. | 236,055 | 7,036,800 | |

| Citigroup, Inc. | 4,211,564 | 163,619,261 | |

| Citizens & Northern Corp. | 8,777 | 174,662 | |

| Citizens Financial Group, Inc. | 730,439 | 14,046,342 | |

| City Holding Co. | 22,173 | 977,164 | |

| CNB Financial Corp., Pennsylvania | 7,083 | 125,582 | |

| CoBiz, Inc. | 48,540 | 526,659 | |

| Columbia Banking Systems, Inc. | 85,736 | 2,471,769 | |

| Comerica, Inc. | 245,900 | 8,306,502 | |

| Commerce Bancshares, Inc. | 130,299 | 5,535,102 | |

| Community Bank System, Inc. | 68,432 | 2,534,037 | |

| Community Trust Bancorp, Inc. | 26,677 | 899,548 | |

| CommunityOne Bancorp (a) | 12,418 | 159,447 | |

| ConnectOne Bancorp, Inc. | 44,434 | 685,172 | |

| CU Bancorp (a) | 12,826 | 280,633 | |

| Cullen/Frost Bankers, Inc. | 71,142 | 3,409,836 | |

| Customers Bancorp, Inc. (a) | 31,152 | 705,593 | |

| CVB Financial Corp. | 125,947 | 1,955,957 | |

| Eagle Bancorp, Inc. (a) | 43,309 | 1,985,285 | |

| East West Bancorp, Inc. | 211,572 | 6,340,813 | |

| Eastern Virginia Bankshares, Inc. | 969 | 6,589 | |

| Enterprise Bancorp, Inc. | 803 | 18,252 | |

| Enterprise Financial Services Corp. | 26,898 | 745,882 | |

| Farmers Capital Bank Corp. | 6,822 | 175,394 | |

| Farmers National Banc Corp. | 14,652 | 124,542 | |

| FCB Financial Holdings, Inc. Class A (a) | 21,708 | 651,457 | |

| Fidelity Southern Corp. | 20,350 | 305,047 | |

| Fifth Third Bancorp | 1,094,989 | 16,709,532 | |

| Financial Institutions, Inc. | 15,118 | 400,929 | |

| First Bancorp, North Carolina | 13,154 | 243,217 | |

| First Bancorp, Puerto Rico (a)(b) | 202,591 | 542,944 | |

| First Busey Corp. | 33,307 | 631,168 | |

| First Business Finance Services, Inc. | 3,936 | 83,089 | |

| First Citizen Bancshares, Inc. | 14,854 | 3,477,767 | |

| First Commonwealth Financial Corp. | 139,377 | 1,197,248 | |

| First Community Bancshares, Inc. | 12,848 | 232,549 | |

| First Connecticut Bancorp, Inc. | 11,897 | 191,423 | |

| First Financial Bancorp, Ohio | 94,231 | 1,580,254 | |

| First Financial Bankshares, Inc. (b) | 96,784 | 2,556,065 | |

| First Financial Corp., Indiana | 15,656 | 515,865 | |

| First Foundation, Inc. (a) | 16,220 | 352,298 | |

| First Horizon National Corp. | 287,965 | 3,461,339 | |

| First Internet Bancorp | 2,571 | 67,155 | |

| First Interstate Bancsystem, Inc. | 24,776 | 663,997 | |

| First Merchants Corp. | 66,873 | 1,483,912 | |

| First Midwest Bancorp, Inc., Delaware | 122,035 | 2,037,985 | |

| First NBC Bank Holding Co. (a) | 23,508 | 554,319 | |

| First Niagara Financial Group, Inc. | 529,611 | 4,893,606 | |

| First of Long Island Corp. | 14,198 | 395,272 | |

| First Republic Bank | 205,210 | 12,628,623 | |

| First United Corp. (a) | 3,018 | 31,266 | |

| FirstMerit Corp. | 250,282 | 4,913,036 | |

| Flushing Financial Corp. | 47,044 | 971,459 | |

| FNB Corp., Pennsylvania | 261,905 | 3,216,193 | |

| Franklin Financial Network, Inc. | 2,240 | 61,533 | |

| Fulton Financial Corp. | 224,854 | 2,835,409 | |

| German American Bancorp, Inc. | 13,231 | 422,466 | |

| Glacier Bancorp, Inc. | 110,270 | 2,626,631 | |

| Great Southern Bancorp, Inc. | 13,342 | 501,259 | |

| Great Western Bancorp, Inc. | 68,399 | 1,683,299 | |

| Green Bancorp, Inc. (a) | 8,255 | 59,023 | |

| Guaranty Bancorp | 16,534 | 246,191 | |

| Hampton Roads Bankshares, Inc. (a) | 89,921 | 151,067 | |

| Hancock Holding Co. | 109,529 | 2,526,834 | |

| Hanmi Financial Corp. | 38,186 | 795,414 | |

| Heartland Financial U.S.A., Inc. | 25,788 | 758,167 | |

| Heritage Commerce Corp. | 19,687 | 183,680 | |

| Heritage Financial Corp., Washington | 51,567 | 899,328 | |

| Heritage Oaks Bancorp | 21,517 | 156,213 | |

| Hilltop Holdings, Inc. (a) | 119,649 | 1,995,745 | |

| Home Bancshares, Inc. | 95,737 | 3,783,526 | |

| HomeTrust Bancshares, Inc. (a) | 24,994 | 440,144 | |

| Horizon Bancorp Industries | 6,951 | 168,214 | |

| Huntington Bancshares, Inc. (b) | 1,140,927 | 9,983,111 | |

| IBERIABANK Corp. | 53,736 | 2,562,132 | |

| Independent Bank Corp. | 21,519 | 316,975 | |

| Independent Bank Corp., Massachusetts | 41,598 | 1,797,034 | |

| Independent Bank Group, Inc. | 14,281 | 392,728 | |

| International Bancshares Corp. | 86,896 | 1,959,505 | |

| Investors Bancorp, Inc. | 472,999 | 5,354,349 | |

| JPMorgan Chase & Co. | 5,210,052 | 293,325,928 | |

| KeyCorp | 1,224,496 | 12,918,433 | |

| Lakeland Bancorp, Inc. | 41,438 | 414,380 | |

| Lakeland Financial Corp. | 23,917 | 1,021,495 | |

| LegacyTexas Financial Group, Inc. | 64,665 | 1,147,804 | |

| Live Oak Bancshares, Inc. | 5,533 | 73,257 | |

| M&T Bank Corp. | 223,920 | 22,962,996 | |

| Macatawa Bank Corp. | 22,839 | 139,318 | |

| MainSource Financial Group, Inc. | 24,998 | 517,459 | |

| MB Financial, Inc. (b) | 91,216 | 2,783,912 | |

| MBT Financial Corp. | 1,650 | 13,481 | |

| Mercantile Bank Corp. | 17,364 | 391,905 | |

| Merchants Bancshares, Inc. | 5,246 | 151,609 | |

| Midsouth Bancorp, Inc. | 7,208 | 49,303 | |

| MidWestOne Financial Group, Inc. | 9,068 | 236,312 | |

| Monarch Financial Holdings, Inc. | 3,982 | 60,526 | |

| MutualFirst Financial, Inc. | 20,181 | 494,435 | |

| National Bank Holdings Corp. | 145,617 | 2,816,233 | |

| National Bankshares, Inc. (b) | 5,803 | 193,008 | |

| National Penn Bancshares, Inc. | 233,564 | 2,599,567 | |

| NBT Bancorp, Inc. | 82,441 | 2,126,978 | |

| NewBridge Bancorp | 47,129 | 515,120 | |

| Northrim Bancorp, Inc. | 2,935 | 70,968 | |

| OFG Bancorp | 53,595 | 311,923 | |

| Old National Bancorp, Indiana | 151,814 | 1,694,244 | |

| Old Second Bancorp, Inc. (a) | 18,605 | 124,467 | |

| Opus Bank | 31,202 | 1,006,577 | |

| Orrstown Financial Services, Inc. | 5,669 | 99,718 | |

| Pacific Continental Corp. | 13,395 | 206,819 | |

| Pacific Mercantile Bancorp (a) | 10,321 | 71,525 | |

| Pacific Premier Bancorp, Inc. (a) | 24,205 | 497,413 | |

| PacWest Bancorp | 182,577 | 5,875,328 | |

| Park National Corp. | 20,366 | 1,734,980 | |

| Park Sterling Corp. | 35,080 | 218,548 | |

| Peapack-Gladstone Financial Corp. | 20,893 | 346,406 | |

| Penns Woods Bancorp, Inc. | 3,854 | 149,188 | |

| Peoples Bancorp, Inc. | 27,844 | 496,737 | |

| Peoples Financial Corp., Mississippi (a) | 2,667 | 23,630 | |

| Peoples Financial Services Corp. (b) | 12,111 | 438,660 | |

| Peoples United Financial, Inc. (b) | 460,969 | 6,734,757 | |

| Pinnacle Financial Partners, Inc. | 49,595 | 2,299,720 | |

| PNC Financial Services Group, Inc. | 713,820 | 58,040,704 | |

| Popular, Inc. | 148,822 | 3,943,783 | |

| Preferred Bank, Los Angeles | 16,109 | 459,912 | |

| Premier Financial Bancorp, Inc. | 115 | 1,783 | |

| PrivateBancorp, Inc. | 128,395 | 4,411,652 | |

| Prosperity Bancshares, Inc. (b) | 97,786 | 3,955,444 | |

| QCR Holdings, Inc. | 6,184 | 138,645 | |

| Regions Financial Corp. | 1,757,603 | 13,217,175 | |

| Renasant Corp. | 61,033 | 1,905,450 | |

| Republic Bancorp, Inc., Kentucky Class A | 18,205 | 466,230 | |

| Royal Bancshares of Pennsylvania, Inc. Class A (a) | 5,400 | 10,800 | |

| S&T Bancorp, Inc. | 72,150 | 1,819,623 | |

| Sandy Spring Bancorp, Inc. | 36,755 | 954,895 | |

| Seacoast Banking Corp., Florida (a) | 33,020 | 489,356 | |

| ServisFirst Bancshares, Inc. | 44,394 | 1,622,601 | |

| Shore Bancshares, Inc. | 2,958 | 33,337 | |

| Sierra Bancorp | 3,618 | 67,910 | |

| Signature Bank (a) | 67,430 | 8,735,557 | |

| Simmons First National Corp. Class A | 56,478 | 2,326,329 | |

| South State Corp. | 37,647 | 2,351,055 | |

| Southern National Bancorp of Virginia, Inc. | 3,574 | 45,104 | |

| Southside Bancshares, Inc. | 31,211 | 730,962 | |

| Southwest Bancorp, Inc., Oklahoma | 17,648 | 267,367 | |

| State Bank Financial Corp. | 55,381 | 1,036,732 | |

| Sterling Bancorp | 186,202 | 2,683,171 | |

| Stock Yards Bancorp, Inc. | 20,531 | 766,833 | |

| Stonegate Bank | 14,759 | 423,731 | |

| Suffolk Bancorp | 15,697 | 380,338 | |

| Sun Bancorp, Inc. (a) | 9,760 | 202,813 | |

| SunTrust Banks, Inc. | 734,782 | 24,380,067 | |

| SVB Financial Group (a) | 76,218 | 6,771,969 | |

| Synovus Financial Corp. | 198,807 | 5,286,278 | |

| Talmer Bancorp, Inc. Class A | 137,867 | 2,316,166 | |

| TCF Financial Corp. | 303,183 | 3,438,095 | |

| Texas Capital Bancshares, Inc. (a)(b) | 58,898 | 1,904,172 | |

| The First Bancorp, Inc. | 2,896 | 54,619 | |

| Tompkins Financial Corp. | 20,551 | 1,160,515 | |

| TowneBank | 84,468 | 1,472,277 | |

| Trico Bancshares | 33,947 | 841,886 | |

| TriState Capital Holdings, Inc. (a) | 31,167 | 374,316 | |

| Triumph Bancorp, Inc. (a) | 15,765 | 215,508 | |

| Trustmark Corp. | 94,171 | 2,060,461 | |

| U.S. Bancorp | 2,345,961 | 90,366,418 | |

| UMB Financial Corp. | 60,645 | 2,978,276 | |

| Umpqua Holdings Corp. | 368,620 | 5,544,045 | |

| Union Bankshares Corp. | 76,873 | 1,749,629 | |

| United Bankshares, Inc., West Virginia (b) | 94,604 | 3,314,924 | |

| United Community Bank, Inc. | 91,017 | 1,575,504 | |

| Univest Corp. of Pennsylvania | 24,791 | 473,260 | |

| Valley National Bancorp (b) | 247,734 | 2,229,606 | |

| Washington Trust Bancorp, Inc. | 22,987 | 852,818 | |

| Webster Financial Corp. | 175,987 | 5,914,923 | |

| Wells Fargo & Co. | 6,583,510 | 308,898,289 | |

| WesBanco, Inc. | 67,375 | 1,904,691 | |

| West Bancorp., Inc. | 59,222 | 1,039,938 | |

| Westamerica Bancorp. (b) | 45,279 | 2,037,102 | |

| Westbury Bancorp, Inc. (a) | 4,860 | 93,020 | |

| Western Alliance Bancorp. (a) | 115,909 | 3,444,815 | |

| Wilshire Bancorp, Inc. | 110,533 | 1,087,645 | |

| Wintrust Financial Corp. | 65,304 | 2,775,420 | |

| Yadkin Financial Corp. | 31,003 | 671,215 | |

| Your Community Bankshares, Inc. | 385 | 12,674 | |

| Zions Bancorporation | 288,701 | 6,155,105 | |

| 1,568,734,902 | |||

| Capital Markets - 1.8% | |||

| Affiliated Managers Group, Inc. (a) | 77,232 | 10,711,306 | |

| Ameriprise Financial, Inc. | 249,771 | 20,968,275 | |

| Arlington Asset Investment Corp. (b) | 25,721 | 311,481 | |

| Artisan Partners Asset Management, Inc. (b) | 53,526 | 1,519,068 | |

| Ashford, Inc. (a) | 1,254 | 50,160 | |

| Associated Capital Group, Inc. (a) | 6,083 | 166,248 | |

| Bank of New York Mellon Corp. | 1,541,534 | 54,554,888 | |

| BGC Partners, Inc. Class A | 270,826 | 2,339,937 | |

| BlackRock, Inc. Class A | 177,779 | 55,459,937 | |

| Calamos Asset Management, Inc. Class A | 22,184 | 187,898 | |

| Charles Schwab Corp. | 1,691,553 | 42,373,403 | |

| Cohen & Steers, Inc. | 29,933 | 931,515 | |

| Cowen Group, Inc. Class A (a)(b) | 169,746 | 575,439 | |

| Diamond Hill Investment Group, Inc. | 4,042 | 683,098 | |

| E*TRADE Financial Corp. (a) | 448,071 | 10,511,746 | |

| Eaton Vance Corp. (non-vtg.) | 172,774 | 4,994,896 | |

| Evercore Partners, Inc. Class A | 47,875 | 2,234,326 | |

| FBR & Co. | 6,019 | 105,032 | |

| Federated Investors, Inc. Class B (non-vtg.) | 132,184 | 3,459,255 | |

| Financial Engines, Inc. (b) | 75,157 | 1,833,831 | |

| Franklin Resources, Inc. | 551,204 | 19,760,663 | |

| FXCM, Inc. Class A (a)(b) | 5,137 | 64,367 | |

| GAMCO Investors, Inc. Class A | 6,083 | 211,323 | |

| Goldman Sachs Group, Inc. | 560,333 | 83,786,593 | |

| Greenhill & Co., Inc. | 34,523 | 796,100 | |

| HFF, Inc. | 50,180 | 1,256,005 | |

| Houlihan Lokey | 18,859 | 482,036 | |

| Institutional Financial Markets, Inc. | 6,881 | 5,711 | |

| Interactive Brokers Group, Inc. | 78,906 | 2,696,218 | |

| INTL FCStone, Inc. (a) | 19,656 | 501,818 | |

| Invesco Ltd. | 605,065 | 16,179,438 | |

| Investment Technology Group, Inc. | 55,680 | 1,020,058 | |

| Janus Capital Group, Inc. | 187,399 | 2,423,069 | |

| KCG Holdings, Inc. Class A (a) | 107,133 | 1,132,396 | |

| Ladenburg Thalmann Financial Services, Inc. (a)(b) | 146,974 | 342,449 | |

| Lazard Ltd. Class A | 180,170 | 6,338,381 | |

| Legg Mason, Inc. | 154,159 | 4,402,781 | |

| LPL Financial (b) | 109,368 | 2,212,515 | |

| Manning & Napier, Inc. Class A | 21,800 | 149,548 | |

| Moelis & Co. Class A | 17,990 | 444,713 | |

| Morgan Stanley | 2,132,837 | 52,681,074 | |

| Northern Trust Corp. | 307,338 | 18,249,730 | |

| NorthStar Asset Management Group, Inc. | 280,199 | 3,062,575 | |

| Oppenheimer Holdings, Inc. Class A (non-vtg.) | 13,547 | 191,826 | |

| Piper Jaffray Companies (a) | 20,940 | 886,809 | |

| PJT Partners, Inc. | 43,421 | 1,207,972 | |

| Pzena Investment Management, Inc. | 4,972 | 31,025 | |

| Raymond James Financial, Inc. | 181,475 | 7,955,864 | |

| Safeguard Scientifics, Inc. (a)(b) | 26,745 | 316,126 | |

| SEI Investments Co. | 192,803 | 7,359,291 | |

| Silvercrest Asset Management Group Class A | 6,008 | 65,607 | |

| State Street Corp. | 571,933 | 31,330,490 | |

| Stifel Financial Corp. (a) | 97,319 | 2,818,358 | |

| T. Rowe Price Group, Inc. | 350,946 | 24,253,878 | |

| TD Ameritrade Holding Corp. | 372,136 | 10,635,647 | |

| U.S. Global Investments, Inc. Class A | 7,637 | 12,448 | |

| Vector Capital Corp. rights (a) | 4,280 | 0 | |

| Virtu Financial, Inc. Class A | 31,929 | 712,336 | |

| Virtus Investment Partners, Inc. | 8,765 | 804,715 | |

| Waddell & Reed Financial, Inc. Class A | 111,918 | 2,621,120 | |

| Westwood Holdings Group, Inc. | 9,364 | 464,361 | |

| WisdomTree Investments, Inc. (b) | 153,169 | 1,815,053 | |

| 525,654,226 | |||

| Consumer Finance - 0.7% | |||

| Ally Financial, Inc. (a) | 660,316 | 11,608,355 | |

| American Express Co. | 1,181,977 | 65,694,282 | |

| Asta Funding, Inc. (a) | 4,468 | 32,259 | |

| Atlanticus Holdings Corp. (a) | 35,598 | 106,438 | |

| Capital One Financial Corp. | 753,348 | 49,517,564 | |

| Cash America International, Inc. | 36,022 | 1,213,581 | |

| Consumer Portfolio Services, Inc. (a) | 11,930 | 52,373 | |

| Credit Acceptance Corp. (a)(b) | 14,282 | 2,814,554 | |

| Discover Financial Services | 608,168 | 28,231,159 | |

| Emergent Capital, Inc. (a) | 20,885 | 79,990 | |

| Encore Capital Group, Inc. (a)(b) | 29,815 | 693,199 | |

| Enova International, Inc. (a) | 32,960 | 190,509 | |

| EZCORP, Inc. (non-vtg.) Class A (a)(b) | 64,428 | 186,841 | |

| First Cash Financial Services, Inc. | 42,812 | 1,805,382 | |

| First Marblehead Corp. (a) | 5,188 | 17,432 | |

| Green Dot Corp. Class A (a) | 74,413 | 1,537,373 | |

| Imperial Holdings, Inc. warrants 4/11/19 (a) | 1,880 | 628 | |

| J.G. Wentworth Co. (a)(b) | 8,584 | 10,902 | |

| LendingClub Corp. (a)(b) | 328,200 | 2,865,186 | |

| Navient Corp. | 519,922 | 5,630,755 | |

| Nelnet, Inc. Class A | 31,753 | 1,193,913 | |

| Nicholas Financial, Inc. (a) | 5,705 | 60,131 | |

| OneMain Holdings, Inc. (a)(b) | 61,722 | 1,393,066 | |

| PRA Group, Inc. (a)(b) | 66,508 | 1,622,795 | |

| Regional Management Corp. (a) | 12,187 | 186,461 | |

| Santander Consumer U.S.A. Holdings, Inc. (a)(b) | 164,266 | 1,683,727 | |

| SLM Corp. (a) | 610,909 | 3,567,709 | |

| Synchrony Financial (a) | 1,183,802 | 31,903,464 | |

| World Acceptance Corp. (a)(b) | 15,268 | 560,794 | |

| 214,460,822 | |||

| Diversified Financial Services - 2.2% | |||

| Berkshire Hathaway, Inc. Class B (a) | 2,653,606 | 356,034,317 | |

| Broadcom Ltd. | 566,987 | 75,959,248 | |

| CBOE Holdings, Inc. | 119,150 | 7,446,875 | |

| CME Group, Inc. | 477,599 | 43,671,653 | |

| FactSet Research Systems, Inc. | 57,702 | 8,683,574 | |

| Gain Capital Holdings, Inc. | 33,946 | 245,430 | |

| IntercontinentalExchange, Inc. | 167,190 | 39,868,127 | |

| Leucadia National Corp. | 507,011 | 7,326,309 | |

| MarketAxess Holdings, Inc. | 54,847 | 6,497,176 | |

| Marlin Business Services Corp. | 13,319 | 183,935 | |

| McGraw Hill Financial, Inc. | 382,883 | 34,359,920 | |