UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05309

Nuveen Investment Funds, Inc.

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: June 30

Date of reporting period: June 30, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

| | |

| | |  |

| Mutual Funds | |

| | | | | | |

| | | | | | | Annual Report June 30, 2016 |

| | | | | | | | | | | | | | | | |

| | | | | | | Share Class / Ticker Symbol | | |

| | | Fund Name | | | | Class A | | Class C | | Class R3 | | Class R6 | | Class I | | |

|

| | Nuveen Core Bond Fund | | | | FAIIX | | NTIBX | | — | | NTIFX | | FINIX | | |

| | Nuveen Core Plus Bond Fund | | | | FAFIX | | FFAIX | | FFISX | | FPCFX | | FFIIX | | |

| | Nuveen Inflation Protected Securities Fund | | | | FAIPX | | FCIPX | | FRIPX | | FISFX | | FYIPX | | |

| | Nuveen Intermediate Government Bond Fund | | | | FIGAX | | FYGCX | | FYGRX | | — | | FYGYX | | |

| | Nuveen Short Term Bond Fund | | | | FALTX | | FBSCX | | NSSRX | | NSSFX | | FLTIX | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | |

| | | | | | | | |

| | |

| | Life is Complex. | | |

| | |

| | Nuveen makes things e-simple. | | |

| | |

| | It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish. | | |

| | | | |

| | | | | | Free e-Reports right to your e-mail! | | |

| | | |

| | | | | | www.investordelivery.com If you receive your Nuveen Fund distributions and statements from your

financial advisor or brokerage account. |

| | | | |

| | | | or | | www.nuveen.com/accountaccess If you receive your Nuveen Fund distributions and statements directly from Nuveen. Must be preceded by or accompanied by a prospectus. NOT FDIC INSURED MAY LOSE VALUE

NO BANK GUARANTEE | | |

| | | | | | | | | | |

| | | | | | | | | | | | | |

Table

of Contents

Chairman’s Letter

to Shareholders

Dear Shareholders,

The U.S. economy is now seven years into the recovery, but its pace remains stubbornly subpar compared to past recoveries. Economic data continues to be a mixed bag, as it has been throughout this expansion period. While the unemployment rate fell below its pre-recession level and wages have grown slightly, a surprisingly weak jobs growth report in May cast doubt over the future strength of the labor market. The June employment report was much stronger, however, easing fears that a significant downtrend was emerging. The housing market has improved markedly but its contribution to the recovery has been lackluster. Deflationary pressures, including the dramatic slide in commodity prices, have kept inflation much lower for longer than many expected.

U.S. growth remains modest, while economic conditions elsewhere continue to appear vulnerable. On June 23, 2016, the U.K. voted to leave the European Union, known as “Brexit.” The outcome surprised the global markets, leading to high levels of volatility across equities, fixed income and currencies in the days following the vote. Although the turbulence subsided not long after and many asset classes have largely recovered, uncertainties remain about the Brexit separation process and the economic and political impacts on the U.K., Europe and the rest of the world.

In the meantime, global central banks remain accommodative in efforts to bolster growth. The European Central Bank and Bank of Japan have been providing aggressive monetary stimulus, including adopting negative interest rates in both Europe and Japan, as their economies continue to lag the U.S.’s recovery. China’s policy makers have also continued to manage its slowdown, but investors are still worried about where the world’s second-largest economy might ultimately land.

Many of these ambiguities – both domestic and international – have kept the U.S. Federal Reserve (Fed) from raising short-term interest rates any further since December’s first and only increase thus far. While markets rallied earlier in the year on the widely held expectation that the Fed would defer any increases until June, the unusually weak May jobs report and the Brexit concerns compelled the Fed to hold rates steady at its June meeting. Although labor market conditions improved in June, Britain’s “leave” vote is expected to keep the Fed on hold until later in 2016.

With global economic growth still looking fairly fragile, during certain periods financial markets were volatile over the past year. Although sentiment has improved and conditions have generally recovered from the intense volatility seen in early 2016 and following the Brexit vote in June, we expect that turbulence remains on the horizon for the time being. In this environment, Nuveen remains committed to both managing downside risks and seeking upside potential. If you’re concerned about how resilient your investment portfolio might be, we encourage you to talk to your financial advisor.

On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

William J. Schneider

Chairman of the Board

August 23, 2016

Portfolio Managers’

Comments

Nuveen Core Bond Fund

Nuveen Core Plus Bond Fund

Nuveen Inflation Protected Securities Fund

Nuveen Intermediate Government Bond Fund

Nuveen Short Term Bond Fund

These Funds feature portfolio management by Nuveen Asset Management, LLC, an affiliate of Nuveen Investments, Inc. In this report, the various portfolio management teams for the Funds discuss economic and fixed income market conditions, key investment strategies and the Funds’ performance for the twelve-month reporting period ended June 30, 2016. These management teams include:

Nuveen Core Bond Fund

Chris J. Neuharth has managed the Fund since 2012. Jeffrey J. Ebert and Wan-Chong Kung, CFA, joined the Fund as co-portfolio managers in 2000 and 2002, respectively. Jason J. O’Brien, CFA, joined the Fund as a co-portfolio manager on March 18, 2016.

Nuveen Core Plus Bond Fund

Timothy A. Palmer, CFA, has managed the Fund since 2003. Wan-Chong Kung, CFA, Jeffrey J. Ebert and Chris J. Neuharth joined the Fund as co-portfolio managers in 2001, 2005 and 2006, respectively. Douglas M. Baker, CFA, joined the Fund as co-portfolio manager on March 18, 2016.

Nuveen Inflation Protected Securities Fund

Wan-Chong Kung, CFA, has managed the Fund since its inception in 2004 and Chad W. Kemper joined the Fund as a co-portfolio manager in 2010.

Nuveen Intermediate Government Bond Fund

Wan-Chong Kung, CFA, has managed the Fund since 2002. Chris J. Neuharth and Jason J. O’Brien, CFA, have been on the Fund’s management team since 2009.

Nuveen Short Term Bond Fund

Chris J. Neuharth has managed the Fund since 2004. Peter L. Agrimson, CFA, joined the Fund as a co-portfolio manager in 2011. Jason J. O’Brien, CFA, and Mackenzie S. Meyer joined the Fund as co-portfolio managers on March 18, 2016.

What factors affected the U.S. economy and financial markets during the twelve-month reporting period ended June 30, 2016?

Over the twelve-month period, U.S. economic data continued to point to subdued growth, rising employment and tame inflation. Economic activity has continued to hover around a 2% annualized growth rate since the end of the Great Recession in 2009, as measured by real gross domestic product (GDP), which is the value of the goods and services produced by the nation’s economy less

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Portfolio Managers’ Comments (continued)

the value of the goods and services used up in production, adjusted for price changes. For the second quarter of 2016, real GDP increased at an annual rate of 1.2%, as reported by the “advance” estimate of the Bureau of Economic Analysis, up from 0.8% in the first quarter of 2016.

The labor and housing markets improved over the reporting period, although the momentum appeared to slow toward the end of the reporting period. As reported by the Bureau of Labor Statistics, the unemployment rate fell to 4.9% in June 2016 from 5.3% in June 2015, and job gains averaged slightly above 200,000 per month for the past twelve months. The S&P CoreLogic Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 5.0% annual gain in May 2016 (most recent data available at the time this report was prepared) (effective July 26, 2016, subsequent to the close of this reporting period, the S&P/Case-Shiller U.S. National Home Price Index was renamed the S&P CoreLogic Case-Shiller U.S. National Home Price Index). The 10-City and 20-City Composites reported year-over-year increases of 4.4% and 5.2%, respectively.

Consumers, whose purchases comprise the largest component of the U.S. economy, benefited from employment growth and firming wages over the twelve-month reporting period. Although consumer spending gains were rather muted in the latter half of 2015, a spending surge in the second quarter of 2016 helped offset weaker business investment. A backdrop of low inflation also contributed to consumers’ willingness to buy. The Consumer Price Index (CPI) rose 1.0% over the twelve-month period ended June 30, 2016 on a seasonally adjusted basis, as reported by the U.S. Bureau of Labor Statistics. The core CPI (which excludes food and energy) increased 2.3% during the same period, slightly above the Fed’s unofficial longer term inflation objective of 2.0%.

At the start of the reporting period, a slowdown in China and ongoing weakness across emerging markets led to renewed volatility and downward pressure for commodity prices across the board. China fears plus a global supply glut led oil prices to sell off sharply, hitting a 12-year low of approximately $26-per-barrel for West Texas Intermediate (WTI) crude in February 2016. However, in the final four months or so of the reporting period, news of a possible production freeze and a string of unexpected production outages helped prices rally back to around the $50-per-barrel mark for WTI crude.

Business investment remained weak over the reporting period. Corporate earnings growth slowed during 2015, reflecting an array of factors ranging from weakening demand amid sluggish U.S. and global growth to the impact of falling commodity prices and a strong U.S. dollar. Although energy prices rebounded off their lows and the dollar pared some of its gains in the first half of 2016, caution prevailed. Financial market turbulence in early 2016 and political uncertainties surrounding the U.K.’s late-June referendum on whether to stay or leave the European Union (EU) and the upcoming U.S. presidential election dampened capital spending.

With the current expansion considered to be on solid footing, the U.S. Federal Reserve (Fed) prepared to raise one of its main interest rates, which had been held near zero since December 2008 to help stimulate the economy. After delaying the rate change for most of 2015 because of a weak global economic growth outlook, the Fed announced in December 2015 that it would raise the fed funds target rate by 0.25%. The news was widely expected and therefore had a relatively muted impact on the financial markets.

Although the Fed continued to emphasize future rate increases would be gradual, investors worried about the pace. This, along with uncertainties about the global macroeconomic backdrop, another downdraft in oil prices and a spike in stock market volatility triggered significant losses across assets that carry more risk and fueled demand for “safe haven” assets such as Treasury bonds and gold from January through mid-February. However, fear began to subside in March, propelling assets that carry more risk higher. The Fed held the rate steady at both the January and March policy meetings, as well as lowered its expectations to two rate increases in 2016 from four. Also boosting investor confidence were reassuring statements from the European Central Bank (ECB), some positive economic data in the U.S. and abroad, a retreat in the U.S. dollar and an oil price rally. At its April meeting, the Fed indicated its readiness to raise its benchmark rate at the next policy meeting in June. However, concerns surrounding a disappointing jobs growth report in May, the increasing divergence between U.S. and global growth as well as tepid inflation readings led the Fed to again hold rates steady at its June and July meetings.

While the U.S. economy remained on firmer footing, the economic outlook outside the U.S. grew more uncertain as the U.K.’s late-June referendum increasingly weighed on sentiment and markets, especially in Europe. Angst surrounding growth in China also remained front and center as policymakers struggled to promote growth in this weakening economy. Japan attempted to boost growth and stave off deflation with an unexpected rate cut at the end of January, but then held off on any additional response, much to the chagrin of investors. The ECB unleashed its own combination of easing measures in March. Then on June 23, 2016, British

voters shocked the world with their unexpected “Brexit” decision to leave the EU, forcing the resignation of the country’s prime minister and temporarily rocking global financial markets. In the days after the vote, U.K. sterling fell precipitously, global equities were turbulent and safe-haven assets such as gold, the U.S. dollar and U.S. Treasuries saw notable inflows. However, the markets stabilized fairly quickly, buoyed by reassurances from global central banks and a perception that the temporary price rout presented an attractive buying opportunity.

As a result of the broad array of factors over the reporting period, the Treasury yield curve flattened as rates for Treasury securities with maturities of one year and less moved modestly higher, while rates for intermediate- and long-term Treasuries fell substantially. For example, yields on one-year T-bills rose by 17 basis points, while 10-year Treasury rates were 85 basis points lower by period end. While Treasury yields ended the reporting period at extremely low levels by historical standards, they remained attractive when compared to the negative rates found in many places across Europe and Asia.

How did the Funds perform during the twelve-month reporting period ended June 30, 2016?

The tables in the Fund Performance and Expense Ratios section of this report provide total returns for the Funds for the one-year, five-year, ten-year and/or since inception periods ended June 30, 2016. Each Funds’ Class A Share total returns at net asset value (NAV) are compared with the performance of the appropriate Barclays Index and Lipper classification average. A more detailed account of each Fund’s performance is provided later in this report.

What strategies were used to manage the Funds during the twelve-month reporting period and how did these strategies influence performance?

All of the Funds continued to employ the same fundamental investment strategies and tactics used previously, although implementation of those strategies depended on the individual characteristics of the portfolios, as well as market conditions. The Funds’ management teams use a highly collaborative, research-driven approach that we believe offers the best opportunity to achieve consistent, superior long-term performance on a risk-adjusted basis across the full range of market environments. During the reporting period, the Funds were generally positioned for an environment of continued moderate economic growth. Nonetheless, during the reporting period we made smaller scaled shifts on an ongoing basis that were geared toward improving each Fund’s profile in response to changing conditions and valuations. These strategic moves are discussed in more detail within each Fund’s section of this report.

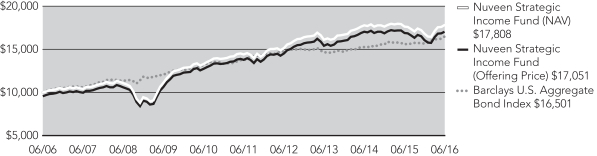

Nuveen Core Bond Fund

The Fund’s Class A Shares at net asset value (NAV) underperformed the Barclays U.S. Aggregate Bond Index and the Lipper Core Bond Classification Average for the twelve-month reporting period. In the first seven-and-a-half months of the reporting period, risk premiums widened across all fixed income sectors as investors favored higher quality segments of the market such as Treasuries and mortgage-backed securities. In the investment grade corporate market, commodity price volatility and heavy new issue supply kept technicals weak in higher risk sectors, causing lower quality bonds and commodity related industries to underperform significantly. Analysts at ratings agencies reduced price forecasts for energy and metals, causing negative outlook changes for several issuers and exacerbating selling pressure in an already weak market. A large amount of merger and acquisition (M&A) related financing in the latter part of 2015 also took a toll on the technical backdrop. Market technicals remained weak as dealers tried to keep inventory levels low, which created stress across all segments of the corporate market. Financial sector spreads remained steady and outperformed industrials, which were challenged by commodity price volatility and heavy new issue supply. Around mid-February 2016, oil prices began to rebound off their lows and the Fed indicated a more cautious approach to rate hikes, causing a strong rally in both high yield and investment grade credit. The technical backdrop also improved after the ECB announced that it would start buying euro-denominated credit issues in both the primary and secondary markets. This caused foreign investors to increase their holdings of U.S. corporate paper given more attractive valuations in the U.S. market. Industrials outperformed financials in this latter part of the reporting period as commodity prices stabilized and investors became concerned about loan performance given uncertainty in the global economic outlook.

In the securitized sectors, commercial mortgage-backed securities (CMBS) performed well overall during the reporting period as global central bank support, increased appetite for risk, sharply reduced supply and strong demand for high quality, non-government

Portfolio Managers’ Comments (continued)

securities all contributed to the tightening of risk premiums in the segment. Traditional consumer asset-backed securities (ABS) outperformed Treasuries as consumer credit metrics outside of subprime auto remained solid. Agency and non-agency mortgage-backed securities (MBS) also performed fairly well during the reporting period, outpacing Treasuries as mortgage delinquencies continued to decline and housing market fundamentals remained broadly supportive of this segment of the MBS market.

The volatile market conditions and pressures on credit and economically sensitive sectors of the market drove the Fund’s shortfall versus the benchmarks, with the majority of the negative impact taking place in the first seven months of the reporting period. We had positioned the Fund to benefit from our outlook for trend-like economic growth, strong corporate performance and a Fed interest rate hike in the fall of 2015 with an approximately 15% overweight in the investment grade credit sector relative to the benchmark. While the overweight was not a significant detractor over the period as a whole, our security selection and a lower quality bias in the sector weighed on results. Within investment grade, we had positioned the Fund with an overweight in energy and metals/mining names, segments of the market that experienced relentless selling pressure during the first seven months of the reporting period due to volatile commodity prices and a large amount of new issues. The one theme that worked to our advantage in investment grade credit during this reporting period was a large overweight to financials, due to their strong relative returns within the sector.

The investing landscape shifted in the final five months of the reporting period as some of these same themes in investment grade credit worked to the Fund’s benefit. Our lower quality bias was additive to results from February 2016 through June 2016 due to the excess returns the BBB segment provided versus higher rated segments of the investment grade market. Unfortunately, security selection continued to detract as financials underperformed in the reporting period’s final months due to Brexit and credit fears, while certain industrial names also hurt investment returns.

In securitized sectors, the Fund maintained a modest overweight to CMBS that was beneficial given the slight outperformance of this sector. However, our overweight position in ABS and our close-to-benchmark weight in MBS were not meaningful drivers of returns during the reporting period.

In aggregate, our interest rate strategies had little impact on performance as our yield curve strategy was modestly beneficial, while our duration moves slightly detracted. We started the reporting period with the Fund positioned for the likelihood that short-term interest rates would increase more than long-term rates and that the yield curve would flatten as the Fed continued to normalize policy. As such, we had lowered exposure to short- and intermediate-duration securities and modestly overweighted securities at the longer end of the yield curve. This stance generally aided the Fund’s results since the yield curve did flatten, because long rates fell significantly while short rates moved only modestly higher. On the other hand, we positioned the Fund to benefit from higher rates with a duration (interest rate sensitivity) that averaged around 0.25 years shorter than the benchmark for the majority of the reporting period. This posture detracted due to the sharp decline in rates.

Over the course of the reporting period, we modestly adjusted the Fund’s sector weights in response to shifting technicals and changing valuations. While the portfolio remains overweight in investment grade credit, we modestly reduced its overall exposure after the segment recovered on the back of the commodity sector rebound and strong overseas interest in the final months of the reporting period. The sales we made in the segment were primarily driven by changes in views on specific corporate issuers. In the process, we slightly upgraded the Fund’s overall portfolio credit quality by reducing its overweight to BBB rated issuers, due to that segment’s strong results. Although we believe credit fundamentals have likely peaked, we expect key credit metrics to remain fairly stable and broadly supportive of valuations. Periods of volatility are almost certain to persist; however, strong technicals and accommodative monetary policy are providing a solid backdrop for credit investors. We believe long-term investors are being fairly compensated for taking credit and liquidity risk; therefore, we are maintaining the Fund’s overweight to investment grade credit.

In the CMBS sector, we sold some positions as spread targets were reached, slightly reducing the Fund’s weighting in this sector. The Fund’s agency MBS exposure was relatively stable, with trading activity in the sector generally bottom up in nature and geared toward managing risk in line with the benchmark.

At the end of the reporting period, the market was priced for no changes in Fed policy for the rest of 2016, which seemed appropriate given the macro outlook. That being said, 10-year Treasury rates at the end of the reporting period were at levels we have not seen for more than a year and that embody a significant amount of risk aversion and uncertainty. We see a reasonable probability

that rates will retrace some of their downward movement over the coming months as the durability of the U.S. economy is confirmed by incoming data and investors reassess the global macro environment. Absent a significant downgrade to our view for the U.S. economy or a repricing of rates higher, we expect to keep the Fund’s duration neutral versus its benchmark.

In addition, we continued to utilize various derivative instruments in the Fund during the reporting period. We use Treasury note and bond futures as part of an overall construction strategy to manage the Fund’s duration and yield curve exposure. These derivative positions detracted from performance during the reporting period. We also used interest rate swaps to manage portfolio duration and overall portfolio yield curve exposure and these positions also detracted from performance during the reporting period. These contracts were terminated prior to the end of the reporting period.

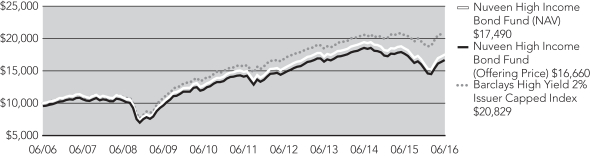

Nuveen Core Plus Bond Fund

The Fund’s Class A Shares at net asset value (NAV) underperformed both the Barclays U.S. Aggregate Bond Index and the Lipper Core Bond Plus Classification Average for the twelve-month reporting period. In the first seven-and-a-half months of the reporting period, risk premiums widened across all fixed income sectors as investors favored higher quality segments of the market such as Treasuries and mortgage-backed securities. In the investment grade corporate market, commodity price volatility and heavy new issue supply kept technicals weak in higher risk sectors, causing lower quality bonds and commodity related industries to underperform significantly. Analysts at ratings agencies reduced price forecasts for energy and metals, causing negative outlook changes for several issuers and exacerbating selling pressure in an already weak market. A large amount of merger and acquisition (M&A) related financing in the latter part of 2015 also took a toll on the technical backdrop. Market technicals remained weak as dealers tried to keep inventory levels low, which created stress across all segments of the corporate market. Financial spreads remained steady and this sector outperformed industrials, which were challenged by commodity price volatility and heavy new issue supply. Around mid-February 2016, oil prices began to rebound off their lows and the Fed indicated a more cautious approach to rate hikes, causing a strong rally in both high yield and investment grade credit. The technical backdrop also improved after the ECB announced that it would start buying euro-denominated credit issues in both the primary and secondary markets. This caused foreign investors to increase their holdings of U.S. corporate paper given more attractive valuations in the U.S. market. Industrials outperformed financials in this latter part of the reporting period as commodity prices stabilized and investors became concerned about loan performance given uncertainty in the global economic outlook.

High yield bond prices were under extreme pressure in the first seven months of the reporting period as global growth concerns, the Fed’s mixed messages and accumulating sector specific issues weighed on confidence and led to a poor technical backdrop. A flight-to-quality ensued due to persistent commodity weakness and increased distress among lower rated issues. Energy bonds, which comprise approximately 13% of the market, continued to be pressured by falling crude prices, while the weak global growth outlook also caused base metal, iron ore and coal bonds to trade at multi-year lows. Elevated risks in the commodity sector curbed risk appetites and led to underperformance in the CCC credit rating space, which is more exposed to these cyclically weak areas. However, high yield bond prices finally found support midway through February 2016, after suffering through a 20-month long bear market. High yield spreads tightened significantly and the energy and metals/mining sectors enjoyed strong recoveries after bearing the brunt of the market sell-off. The recovery, however, was not enough to offset earlier underperformance and U.S. high yield fell short of all other U.S. fixed income asset classes for the full reporting period. On the other hand, the segment outperformed European issues, given Brexit uncertainty, as well as the relative richness of euro high yield given its outperformance in last year’s sell-off.

In the securitized sectors, commercial mortgage-backed securities (CMBS) performed well overall during the reporting period as global central bank support, increased appetite for risk, sharply reduced supply and strong demand for high quality, non-government securities all contributed to the tightening of risk premiums in the segment. Traditional consumer asset-backed securities (ABS) outperformed Treasuries as consumer credit metrics outside of subprime auto remained solid. Agency and non-agency mortgage-backed securities (MBS) performed fairly well during the reporting period, outpacing Treasuries as mortgage delinquencies continued to decline and housing market fundamentals remained broadly supportive of this segment of the MBS market.

Non-U.S. interest rates and currencies took the Fed’s December 2015 rate increase in stride, reacting moderately to prospects for a higher U.S. rate structure. A moderate message from the Fed, below trend global growth, the lack of inflation pressures and ongoing risk aversion in credit helped keep market rates in check early in the reporting period. Europe and Japan, while posting reasonable growth data, continued to witness broadly disinflationary effects beyond energy, leading to meaningfully lower inflation

Portfolio Managers’ Comments (continued)

expectations. After a pause in its quantitative easing efforts, the ECB aggressively ramped up its efforts to reverse disinflation and expand lending activity in March 2016, by expanding its measures and pushing interest rates deeper into negative territory. After the Fed validated the market’s assessment that the pace of its rate hikes would slow further, global rates fell precipitously and the U.S. dollar declined. Risk appetite was supported, particularly corporate credit, in light of the ECB’s move to buy corporate bonds. China worked to stabilize its yuan currency, while rumors flourished that global policymakers agreed to a secret “Shanghai Accord” at the G-20 meeting, in a coordinated effort to weaken the dollar and end recent “currency wars.” In the final days of the reporting period, the unexpected Brexit vote had a significant impact on major currencies, slashing the value of the British pound and other European currencies versus the dollar. Conversely, the yen was driven up by the flight to quality and disappointment over the lack of any stimulative action by the Bank of Japan, as well as the dovish turn from the Fed. However, global leaders were relieved to see the relatively contained short-term asset reaction outside of Europe. The Japanese yen appreciated sharply over the reporting period, given flight-to-quality inflows and appreciation caused by the failure of “Abenomics” to remain on track.

Emerging Market (EM) bonds and currencies had a rocky start to the reporting period as decelerating data out of China continued to raise questions about the country’s growth and the resultant impact on the rest of the world. Political disarray, stagnant growth and currency weakness continued to plague Brazil, threatening further instability in this large EM player, while a surprise policy shift in South Africa exacerbated the volatility. As the reporting period progressed, however, EM bonds and currencies benefited from stabilizing domestic fundamentals and positive policy developments globally, which led to investor inflows and a reversal from very cheap valuations. Rising oil prices boosted growth and reduced the stress on commodity-dependent economies. The market was also supported by the aggressive ECB actions, the Fed’s cautious posture and evidence of Chinese fiscal stimulus. Despite elevated volatility in global markets at the end of the reporting period due to the U.K. referendum, EM debt posted strong returns over the reporting period, outperforming all other fixed income asset classes. EM currencies declined versus the U.S. dollar, owing to global growth concerns, volatile commodities and capital outflows. Commodity sensitive currencies were hardest hit.

The volatile market conditions and pressures on credit and economically sensitive sectors of the market drove the Fund’s shortfall versus the benchmarks, with the majority of the negative impact taking place in the first seven months of the reporting period. During the reporting period, investment grade credit was the biggest drag on the Fund’s performance, mainly due to security selection as well as our significant overweight to and quality bias within the sector. Within investment grade, our overweights to cyclical credits and lower quality bias (overweight BBB rated credits) both detracted from performance. Also, the benefit of the Fund’s large overweight to financials during this reporting period was more than offset by its smaller, but hard hit, positions in energy, metals and other cyclically sensitive industries. The tables turned in the final five months of the reporting period as some of these same themes in the investment grade sector, particularly our lower quality bias, worked to the Fund’s benefit. However, security selection continued to detract as financials, including preferred securities, meaningfully underperformed industrials in light of Brexit and credit fears. Additionally, some of our holdings in the industrial sectors continued to lag.

In terms of high yield exposure, we had positioned our weighting in the segment close to the top end of the Fund’s policy range due to our view of moderate global growth and supportive credit fundamentals. However, this substantial weighting in the high yield corporate sector was also a drag on results, with all of the negative impact taking place in the first seven months of the reporting period. Our positioning in oil and cyclical credits also contributed to the underperformance. After oil prices hit bottom in mid-February 2016, the high yield segment surged, contributing favorably to the Fund’s results later in the reporting period, but not enough to offset the earlier underperformance.

Away from credit, sector selection detracted modestly owing to the Fund’s underweight position in CMBS and MBS. Foreign currency exposure was also a marginal detractor given the strong “risk-off” appreciation of the Japanese yen and downward pressure on the Mexican peso driven by global uncertainties, economic concerns and commodity volatility. Our positions in foreign and EM bonds also had a modestly negative impact.

Yield curve positioning was a positive contributor to the Fund’s performance, driven by a flattening of the yield curve over the reporting period. However, our generally defensive duration stance detracted because the Fund did not keep up with the sharp decline in Treasury rates during the reporting period. Overall, rate positioning was not a major driver of return.

As the reporting period drew to a close, we maintained the Fund’s positioning for moderate economic growth and supportive financial conditions. Our portfolio construction continued to be focused on income generation driven primarily through diversified exposure to investment-grade corporates and a significant allocation to high yield. Toward the end of the reporting period, we marginally reduced the Fund’s weight to investment-grade credit as some holdings hit near-term valuation targets, using the proceeds to increase weights marginally in the high yield, non-U.S. and ABS sectors. Other activity focused on repositioning individual issues according to relative value opportunities and developing credit views. We continue to emphasize financials, which we believe are quite inexpensive in both relative and absolute terms and provide good income and performance potential to the portfolio. Outside of financials, credit selection remains crucial given the cross currents impacting various industries and credits in different ways in a slow-growth economy.

Away from credit, we continued to find opportunities in the CMBS and ABS sectors that provided attractive yields, while underweighting the MBS sector in light of better valuations elsewhere. We avoided Treasuries and agencies as these sectors offered unattractive duration and yield profiles.

Although we believe foreign markets and currencies provide select opportunities, we ended the reporting period with only small positions in these segments. We remain alert for economic shifts in key markets and await better fundamentals and catalysts for our investment themes before adding meaningfully to the Fund’s foreign positions.

We shifted the Fund’s interest rate positioning from an underweight to near neutral toward the end of the reporting period, given our view of an increased likelihood of a further deferral from the Fed and continued liquidity expansion globally.

During the reporting period, we also continued to utilize various derivative instruments. We use Treasury note and bond futures as part of an overall construction strategy to manage the Fund’s duration and yield curve exposure. These derivative positions detracted from performance during the reporting period. We also use interest rate swaps to manage portfolio duration and overall portfolio yield curve exposure, and these positions also detracted from performance.

We used forward foreign currency exchange contracts to manage the Fund’s foreign currency exposure. For example, the Fund may reduce unwanted currency exposure from the Fund’s bond portfolio, or may take long forward positions in select currencies in an attempt to benefit from the potential price appreciation. These positions had a positive impact on performance during the reporting period.

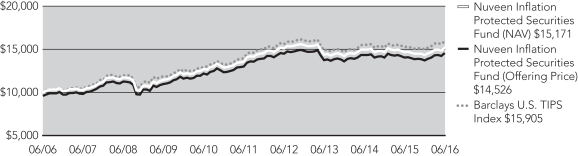

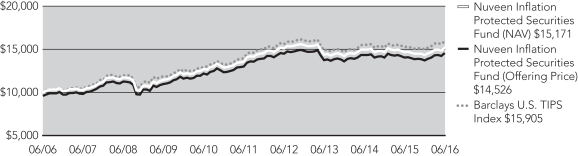

Nuveen Inflation Protected Securities Fund

The Fund’s Class A Shares at net asset value (NAV) underperformed the Barclays U.S. TIPS Index and outperformed the Lipper Inflation-Protected Bond Funds Classification Average for the twelve-month reporting period. Early in the reporting period, investors seemed indifferent to Treasury inflation protected securities (TIPS) as headline inflation remained weak in the face of rapidly declining energy prices. The Fed’s December rate liftoff in a low inflation environment caused yields on TIPS to rise significantly, particularly at the short end of the yield curve, even as breakeven rates mostly languished near multi-year lows. Breakeven rates measure the difference between the yields of nominal Treasuries versus TIPS with the same maturity. The yield on five-year TIPS, which began the reporting period at 0.02%, rose to 0.45% by year-end 2015. As we entered 2016, inflation expectations turned positive and investors returned to the TIPS asset class, partly due to the attractive valuations found in the segment. However, the Fed’s increasingly dovish tone in the second half of the reporting period sharply reduced the odds for any further rate hikes in 2016 as inflation remained below the Fed’s objective and concerns over global economic and financial developments continued. TIPS performed very strongly in the second half of the reporting period as investors poured money into the segment, pushing yields much lower and prices higher across the board. For example, yields on five-year TIPS fell 82 basis points between year-end 2015 and the end of the reporting period, back into negative territory at -0.37%. The yield on a TIPS bond is equal to the corresponding Treasury bond yield minus the expected rate of inflation, therefore, it falls into negative territory if the inflation rate is higher than the current Treasury yield. As interest rates tumbled toward historically low levels, the TIPS breakeven rate narrowed across the TIPS yield curve, indicating investor expectations of decreased inflation risk.

In the first seven-and-a-half months of the reporting period, risk premiums widened across all fixed income sectors as investors favored higher quality segments of the market such as Treasuries and mortgage-backed securities. High yield bond prices were under extreme pressure as global growth concerns, the Fed’s mixed messages and accumulating sector specific issues weighed on

Portfolio Managers’ Comments (continued)

confidence and led to a poor technical backdrop. A flight-to-quality ensued due to persistent commodity weakness and increased distress among lower-rated issues. Energy bonds, which comprise approximately 13% of the market, continued to be pressured by falling crude prices, while the weak global growth outlook also caused base metal, iron ore and coal bonds to trade at multi-year lows. Elevated risks in the commodity sector curbed risk appetites and led to underperformance in the CCC credit rated space, which is more exposed to these cyclically weak areas. However, high yield bond prices finally found support midway through February 2016 after suffering through a 20-month long bear market. High yield spreads tightened significantly and the energy and metals/mining sectors enjoyed strong recoveries after bearing the brunt of the market sell-off. The recovery, however, was not enough to offset earlier underperformance and U.S. high yield fell short of all other U.S. fixed income asset classes for the full reporting period.

In the securitized sectors, commercial mortgage-backed securities (CMBS) performed well overall during the reporting period. Global central bank support, increased appetite for risk, sharply reduced supply and strong demand for high-quality, non-government securities all contributed to the tightening of risk premiums in the segment.

In terms of performance, the Fund’s results versus the benchmark were hindered by its out-of-index exposures, particularly in high yield credit in the first seven months of the reporting period. As noted previously, high yield corporates were the worst performing area of the bond market during that time frame, significantly underperforming Treasuries and TIPS. While the Fund’s exposure to this asset class was fairly small, high yield bonds came under intense pressure during this extremely risk-averse period, exhibiting explosive volatility and impaired market liquidity. While this segment recovered sharply in the final months of the reporting period, it was not enough to offset the earlier underperformance.

On the other hand, the Fund’s performance versus its peer group benefited from our breakeven positioning, which is designed to take advantage of changing inflation expectations along the TIPS yield curve. Also, the Fund generally benefited from its underweight to TIPS as these securities underperformed nominal Treasuries. A longer duration profile for our nominal Treasury holdings was also helpful due to the outperformance of longer maturity Treasuries in the falling rate environment.

Based on our improving outlook for inflation and the attractive valuations in the TIPS asset class, we built up the Fund’s TIPS exposure from approximately 80% of the portfolio at the beginning of the reporting period to 86% at the end of the reporting period. While the fundamental backdrop for the TIPS market was neutral at the end of the period, the technical backdrop continued to be positive due to fairly steady demand as investors returned to the space. From a valuation standpoint, the segment also appeared favorable as breakeven spread levels were attractive and did not reflect the full inflation risk premium expected from an accommodative Fed. Although the very low real yields on TIPS may be a headwind for the segment in the near term, TIPS are likely to out yield Treasuries due to strong seasonal consumer price index (CPI) prints.

In the remainder of the portfolio, we kept modest allocations in out-of-index sectors including high yield credit, CMBS and investment grade credit, which ended the reporting period around 7% of the portfolio collectively. The portfolio also continued to have small allocations to nominal Treasury securities and cash. In the credit sectors, our view is that while fundamentals have clearly peaked, they will remain supportive of current valuations. Although periods of volatility are almost certain to persist, strong technicals and accommodative monetary policy are providing a solid environment for credit investors. We believe long-term investors are being fairly compensated for taking credit and liquidity risk. In the CMBS sector, we may look to modestly add back exposure after lowering the Fund’s weight in the segment slightly, if the sector cheapens versus competing assets.

At the end of the reporting period, the market was priced for no changes in Fed policy for the balance of the year, which we believe is appropriate given the current macro outlook. That being said, Treasury rates ended the reporting period at levels we have not seen for some time and that embody a significant amount of risk aversion and uncertainty. We see a reasonable probability that rates, while remaining historically low, may retrace some of their downward movement over the coming months as the durability of the U.S. economy is confirmed by incoming data and investors reassess the global macro environment. Absent a significant downgrade to our view for the U.S. economy or a repricing of rates higher, we expect to continue managing the Fund’s duration slightly short compared to its benchmark’s duration via a short duration in the TIPS portfolio, offset somewhat by a longer duration in our nominal Treasury securities. We continue to position the portfolio to benefit from a flattening in the breakeven inflation curve between 5 and 30 years, with 5-year TIPS outperforming due to our outlook for seasonally stronger inflation.

We also use Treasury note and bond futures as part of an overall portfolio construction strategy to manage the Fund’s duration and yield curve exposure. The overall effect of the positions on performance during the reporting period was negative. We also used interest rate swaps to manage portfolio duration and overall portfolio yield curve exposure and these positions also detracted from performance during the reporting period. These contracts were terminated prior to the end of the reporting period.

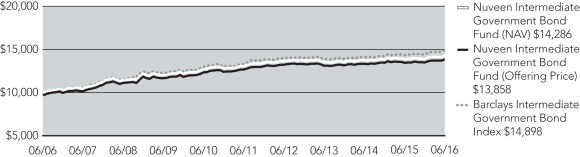

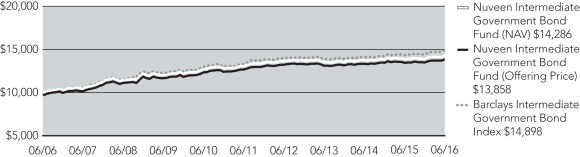

Nuveen Intermediate Government Bond Fund

The Fund’s Class A Shares at NAV underperformed both the Barclays Intermediate Government Bond Index and the Lipper Intermediate U.S. Government Funds Classification Average for the twelve-month reporting period. In the first seven-and-a-half months of the reporting period, risk premiums widened across all fixed income sectors as investors favored higher quality segments of the market such as Treasuries and mortgage-backed securities, which outpaced corporate bonds, particularly high yield, by a wide margin. Around mid-February 2016, oil prices began to rebound off their lows and the Fed indicated a more cautious approach to rate hikes, causing a strong rally in both high yield and investment grade credit. The technical backdrop for credit also improved after the ECB announced that it would start buying euro-denominated credit issues in both the primary and secondary markets. This caused foreign investors to increase their holdings of U.S. corporate paper given more attractive valuations in the U.S. market.

In the securitized sectors of the bond market, mortgage-backed securities (MBS) issued by government agencies such as Fannie Mae (FNMA), Ginnie Mae (GNMA) and Freddie Mac (FHLMC) performed fairly well during the reporting period, outpacing Treasuries as mortgage delinquencies continued to decline and housing market fundamentals remained broadly supportive of this segment of the MBS market. Generally speaking, valuations were steady and investors embraced the combination of lower volatility and superior liquidity found in the agency MBS sector. Also, the Fed implied that it would continue to re-invest MBS paydowns from its holdings until policy normalization was well under way, which gave investors comfort that technicals in the MBS segment would remain favorable through much of 2016. However, the segment did come under pressure in the final month of the reporting period due to the June rate rally, modest pickup in volatility and Brexit vote, which pushed mortgage spreads wider. Commercial mortgage-backed securities (CMBS) performed very well over the entirety of the reporting period, following a difficult first half caused by higher levels of new issuance and ongoing concerns about the quality of loans going into new deals. In the second half of the reporting period, the CMBS sector was boosted by global central bank support, increased appetite for risk, sharply reduced supply and strong demand for high quality, non-government securities, which all contributed to the tightening of risk premiums in the segment. Traditional consumer asset-backed securities (ABS) outperformed Treasuries as consumer credit metrics outside of subprime auto remained solid. The ABS sector continued to benefit from strong consumer loan performance and favorable supply/demand conditions.

As a whole, the Fund’s sector strategies had a modestly negative impact on performance during the reporting period. We positioned the Fund with overweight positions in several securitized sectors of the market, including CMBS, ABS and agency MBS, with a corresponding underweight to U.S. Treasuries. Most of the detraction was the result of security selection in non-traditional ABS during the first half of the reporting period. On the other hand, the Fund’s overweight exposure to agency MBS had a favorable impact on results, especially in the second half of the reporting period and was a positive contributor to performance.

In aggregate, our interest rate strategies had a positive impact on the Fund’s performance due to the benefits from our yield curve strategy. We started the reporting period with the Fund positioned for the likelihood that short-term interest rates would increase more than long-term rates and that the yield curve would flatten as the Fed continued to normalize policy. As such, we had lowered exposure to shorter maturity securities (out to five years) and modestly overweighted securities at the longer end of the yield curve (ten- and twenty-year maturities). This stance benefited the Fund’s results since the yield curve did flatten, more so because long rates fell significantly while short rates moved only modestly higher. On the other hand, we had positioned the Fund with a defensive duration (interest rate sensitivity), which modestly detracted due to the sharp decline in rates. However, the negative impact was not enough to offset the positive effects of our yield curve positioning.

In addition, we use Treasury note and bond futures as part of an overall portfolio construction strategy to manage the Fund’s duration and yield curve exposure. The overall effect of these positions on performance during the reporting period was negative. We also used interest rate swaps to manage portfolio duration and overall portfolio yield curve exposure and these positions also detracted from performance during the reporting period. These contracts were terminated prior to the end of the reporting period.

Portfolio Managers’ Comments (continued)

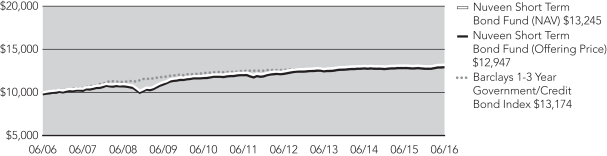

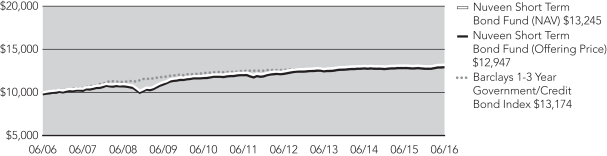

Nuveen Short Term Bond Fund

The Fund’s Class A Shares at NAV underperformed both the Barclays 1-3 Year Government/Credit Bond Index and the Lipper Short Investment Grade Debt Funds Classification Average for the twelve-month reporting period. In the first seven-and-a-half months of the reporting period, risk premiums widened across all fixed income sectors as investors favored higher quality segments of the market such as Treasuries and mortgage-backed securities. In the investment grade corporate market, commodity price volatility and heavy new issue supply kept technicals weak in higher risk sectors, causing lower quality bonds and commodity related industries to underperform significantly. Analysts at ratings agencies reduced price forecasts for energy and metals, causing negative outlook changes for several issuers and exacerbating selling pressure in an already weak market. A large amount of merger and acquisition (M&A) related financing in the latter part of 2015 also took a toll on the technical backdrop. Market technicals remained weak as dealers tried to keep inventory levels low, which created stress across all segments of the corporate market. Financial spreads remained steady and this sector outperformed industrials, which were challenged by commodity price volatility and heavy new issue supply. Although spreads were under pressure, short-duration investment-grade credit managed to outperform Treasuries during the reporting period. However, short-duration high yield corporates performed poorly as the risks of slower global growth, lower commodity prices and a hawkish Fed pressured prices lower across the board.

Around mid-February 2016, oil prices began to rebound off their lows and the Fed indicated a more cautious approach to rate hikes, causing a strong rally in both high yield and investment grade credit. The technical backdrop also improved after the ECB announced that it would start buying euro-denominated credit issues in both the primary and secondary markets. This caused foreign investors to increase their holdings of U.S. corporate paper given more attractive valuations in the U.S. market. Industrials outperformed financials in this latter part of the reporting period as commodity prices stabilized and investors became concerned about loan performance given uncertainty in the global economic outlook.

In the securitized sectors, commercial mortgage-backed securities (CMBS) performed well overall during the reporting period as global central bank support, increased appetite for risk, sharply reduced supply and strong demand for high-quality, non-government securities all contributed to the tightening of risk premiums in the segment. Traditional consumer asset-backed securities (ABS) with shorter durations performed well compared to other asset classes as consumer credit metrics outside of subprime auto remained solid. Short maturity agency and non-agency mortgage-backed securities (MBS) performed fairly well during the reporting period, outpacing Treasuries as mortgage delinquencies continued to decline and housing market fundamentals remained broadly supportive of this segment of the MBS market.

The Fund’s exposure to investment grade credit ranged between 35% and 42% of its portfolio during the reporting period, or roughly a 5-10% overweight to the benchmark. Given the outperformance of investment grade credit, this sector decision was incrementally beneficial to returns. However, within investment grade credit, our security selection was a drag on results. We maintained small overweights to both financials and industrials relative to the benchmark, with an emphasis on BBB rated paper. During the first seven months of market volatility during the reporting period, the Fund’s financial holdings held up well, but its industrial exposure was a detractor. While only a small amount of the Fund’s investment grade industrial exposure was in commodity-related sectors such as energy and metals/mining, our position still represented an overweight of about 1% versus the benchmark and therefore modestly detracted from performance.

The Fund’s modest exposure to high yield corporate bonds was also a performance detractor, with the majority of the negative impact happening in the first portion of the reporting period. We positioned the Fund with approximately a 6% weighting in short duration non-investment-grade corporate bonds, which were broadly diversified across industries and issuers in the BB and B rating credit categories. This exposure weighed on the Fund’s performance due to the significant underperformance of risk assets in the second half of 2015. However, in the final months of the reporting period, high yield bonds gave a stronger showing due to the improvement in risk appetites and the resurgence in the energy and basic materials segments.

As always, the Fund maintained a strong focus on the securitized sectors, holding somewhere between 40% and 50% in residential MBS, CMBS and ABS product throughout the reporting period. The strong performance of these sectors had a significant positive impact on the Fund’s returns.

Taken as a whole, our interest rate positioning benefited the Fund’s results during the reporting period. We had positioned the Fund defensively to limit its sensitivity to rising rates because we anticipated the Fed would begin to normalize monetary policy. This

included maintaining the Fund’s duration between 0.25 and 0.50 years short of the benchmark, while structuring the portfolio to benefit from a flatter yield curve. The duration stance worked to the Fund’s favor in the first part of the reporting period as interest rates rose, but then detracted later on amid the sharp drop in rates. On the other hand, the positioning for a flatter yield curve helped results throughout the reporting period as short-term rates rose modestly while intermediate-term rates fell quite dramatically, leading to a significantly flatter curve.

We made several changes to the Fund’s structure during the reporting period with most of our portfolio activity being bottom up in nature. Our focus remained on generating income via a significant overweight to the non-government sectors of the bond market. As spreads modestly tightened on the back of commodity sector recoveries and strong overseas interest later in the reporting period, we became more selective with adding investment grade credit exposure to the portfolio. While we do believe credit fundamentals have likely peaked, we expect key credit metrics to remain fairly stable and broadly supportive of current valuations. Periods of volatility are almost certain to persist; however, strong technicals and accommodative monetary policy are providing a solid backdrop for credit investors. We believe long-term investors are being fairly compensated for taking credit and liquidity risk. Therefore, we are maintaining the Fund’s overweight to investment-grade credit and small exposure to short-duration high yield corporate paper.

Given strong household balance sheets, we continue to focus the Fund’s securitized exposure in the consumer-related ABS and residential mortgage segments. We continue to favor government-sponsored enterprise (GSE) credit risk transfer securities and single-family rental bonds, which are short duration, floating-rate mortgage securities that should benefit from stringent mortgage underwriting standards and strong demand for rental housing. We’re also generally comfortable with commercial real estate fundamentals, at least in the short run, and are maintaining exposure in the CMBS sector, while becoming increasingly selective in our new issue underwriting processes in that segment. The Fund maintains between 5% to 10% of its assets in Treasury and agency securities as a liquidity and volatility buffer.

At the end of the reporting period, the market was priced for no changes in Fed policy for the rest of 2016, which seems appropriate given the current macro outlook. That being said, short-term Treasury rates dropped below 0.60% at the end of the reporting period, a level we have not seen for more than a year and that embodies a significant amount of risk aversion and uncertainty. We see a reasonable probability that rates can retrace some of their downward movement over the coming months as the durability of the U.S. economy is confirmed by incoming data and investors reassess the global macro environment. Absent a significant downgrade to our view for the U.S. economy or a repricing of rates higher, we are maintaining the Fund’s duration between 0.25-0.50 years short to its benchmark.

During the reporting period, we also continued to utilize various derivative instruments. We use Treasury note futures as part of an overall portfolio construction strategy to manage the Fund’s duration and yield curve exposure. The overall effect of these positions on the Fund’s performance during the reporting period was negative. We also used interest rate swaps to manage portfolio duration and overall portfolio yield curve exposure and these positions also detracted from performance during the reporting period. These contracts were terminated prior to the end of the reporting period.

We used forward foreign currency exchange contracts to manage the Fund’s foreign currency exposure. For example, the Fund may reduce unwanted currency exposure from the Fund’s bond portfolio, or may take long forward positions in select currencies in an attempt to benefit from the potential price appreciation. These positions had a negligible impact on performance during the reporting period.

Risk Considerations

and Dividend Information

Risk Considerations

Nuveen Core Bond Fund

Mutual fund investing involves risk; principal loss is possible. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, call risk, derivatives risk, dollar roll transaction risk, and income risk. As interest rates rise, bond prices fall. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity, and differing legal and accounting standards. Asset-backed and mortgage-backed securities are subject to additional risks such as prepayment risk, liquidity risk, default risk and adverse economic developments.

Nuveen Core Plus Bond Fund

Mutual fund investing involves risk; principal loss is possible. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, call risk, derivatives risk, dollar roll transaction risk, and income risk. As interest rates rise, bond prices fall. Below investment grade or high yield debt securities are subject to liquidity risk and heightened credit risk. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. Asset-backed and mortgage-backed securities are subject to additional risks such as prepayment risk, liquidity risk, default risk and adverse economic developments.

Nuveen Inflation Protected Securities Fund

Mutual fund investing involves risk; principal loss is possible. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, call risk, derivatives risk, income risk, and index methodology risk. As interest rates rise, bond prices fall. Below investment grade or high yield debt securities are subject to liquidity risk and heightened credit risk. The guarantee provided by the U.S. government to treasury inflation protected securities (TIPS) relates only to the prompt payment of principal and interest and does not remove the market risks of investing in the Fund shares. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. Asset-backed and mortgage-backed securities are subject to additional risks such as prepayment risk, liquidity risk, default risk, and adverse economic developments. The Fund’s investment in inflation protected securities has tax consequences that may result in income distributions to shareholders.

Nuveen Intermediate Government Bond Fund

Mutual fund investing involves risk; principal loss is possible. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, call risk, derivatives risk, dollar roll transaction risk, and income risk. As interest rates rise, bond prices fall. Asset-backed and mortgage-backed securities are subject to additional risks such as prepayment risk, liquidity risk, default risk and adverse economic developments.

Nuveen Short Term Bond Fund

Mutual fund investing involves risk; principal loss is possible. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, call risk, derivatives risk, and income risk. As interest rates rise, bond prices fall. Below investment grade or high yield debt securities are subject to liquidity risk and heightened credit risk. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. Asset-backed and mortgage-backed securities are subject to additional risks such as prepayment risk, liquidity risk, default risk and adverse economic developments.

Dividend Information

Each Fund seeks to pay regular monthly dividends out of its net investment income at a rate that reflects its past and projected net income performance. To permit each Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. If a Fund has cumulatively earned more than it has paid in dividends, it will hold the excess in reserve as undistributed net investment income (UNII) as part of the Fund’s net asset value. Conversely, if a Fund has cumulatively paid in dividends more than it has earned, the excess will constitute a negative UNII that will likewise be reflected in the Fund’s net asset value. Each Fund will, over time, pay all its net investment income as dividends to shareholders.

As of June 30, 2016, Nuveen Core Plus Bond, Nuveen Inflation Protected Securities and Nuveen Intermediate Government Bond had positive UNII balances while Nuveen Core Bond and Nuveen Short Term Bond had zero UNII balances for tax purposes. Nuveen Inflation Protected Securities Fund had a positive UNII balance, while the other Funds had negative UNII balances for financial reporting purposes.

All monthly dividends paid by Nuveen Core Plus Bond Fund, Nuveen Intermediate Government Bond Fund and Nuveen Short Term Bond Fund during the current reporting period were paid from net investment income. If a portion of a Fund’s monthly distributions was sourced from or comprised of elements other than net investment income, including capital gains and/or a return of capital, shareholders would have received a notice to that effect. For financial reporting purposes, the composition and per share amounts of each Fund’s dividends for the reporting period are presented in this report’s Statement of Changes in Net Assets and Financial Highlights, respectively. For income tax purposes, distribution information for each Fund as of its most recent tax year end is presented in Note 6 – Income Tax Information within the Notes to Financial Statements of this report.

The Nuveen Core Bond Fund seeks to pay regular monthly distributions at a level rate that reflects past and projected net income of the Fund. The Fund may own certain investments that can create uneven income flows. In some cases, such as a credit default swap position whose value falls after purchase, these investments may actually decrease overall levels of net income. During the current fiscal year, certain investments owned by the Fund decreased income. Although the Fund reduced its distribution level twice during the year, the Fund’s distribution amount over the entire fiscal year exceeded the actual amount of net income. As a result, a portion of the Fund’s fiscal year distribution have been deemed to be a return of capital, which is identified in the table below.

Nuveen Core Bond Fund

| | | | | | | | | | | | | | | | |

| | | Share Class | |

| Fiscal Year Ended June 30, 2016 | | Class A | | | Class C | | | Class R6 | | | Class I | |

Regular monthly per share distribution | | | | | | | | | | | | | | | | |

From net investment income | | $ | 0.2141 | | | $ | 0.1341 | | | $ | 0.2341 | | | $ | 0.2341 | |

From net realized capital gains | | | 0.0642 | | | | 0.0642 | | | | 0.0642 | | | | 0.0642 | |

Return of capital | | | 0.0417 | | | | 0.0417 | | | | 0.0417 | | | | 0.0417 | |

Total per share distribution | | $ | 0.3200 | | | $ | 0.2400 | | | $ | 0.3400 | | | $ | 0.3400 | |

Nuveen Inflation Protected Securities Fund did not pay monthly dividends during the current reporting period.

THIS PAGE INTENTIONALLY LEFT BLANK

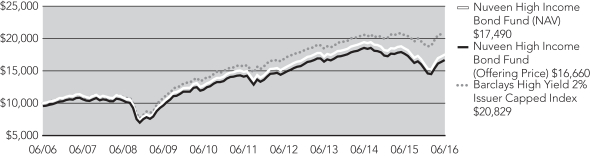

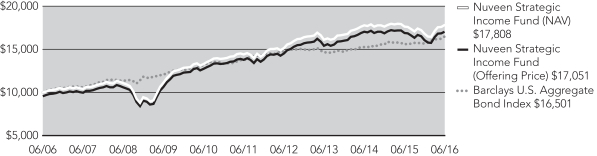

Fund Performance

and Expense Ratios

The Fund Performance and Expense Ratios for each Fund are shown within this section of the report.

Returns quoted represent past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns without sales charges would be lower if the sales charge were included. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Returns may reflect fee waivers and/or expense reimbursements by the investment adviser during the periods presented. If any such waivers and/or reimbursements had not been in place, returns would have been reduced. See Notes to Financial Statements, Note 7—Management Fees and Other Transactions with Affiliates for more information. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees, and assume reinvestment of dividends and capital gains.

Comparative index and Lipper return information is provided for Class A Shares at net asset value (NAV) only.

The expense ratios shown reflect total operating expenses (before fee waivers and/or expense reimbursements, if any) as shown in the most recent prospectus. The expense ratios include management fees and other fees and expenses.

Fund Performance and Expense Ratios (continued)

Nuveen Core Bond Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Average Annual Total Returns as of June 30, 2016

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Class A Shares at NAV | | | 4.12% | | | | 2.99% | | | | 4.48% | |

Class A Shares at maximum Offering Price | | | 0.98% | | | | 2.38% | | | | 4.17% | |

Barclays U.S. Aggregate Bond Index | | | 6.00% | | | | 3.76% | | | | 5.13% | |

Lipper Core Bond Classification Average | | | 4.95% | | | | 3.56% | | | | 4.65% | |

Class I Shares | | | 4.39% | | | | 3.25% | | | | 4.68% | |

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | Since

Inception | |

Class C Shares | | | 3.31% | | | | 2.20% | | | | 2.34% | |

| | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | Since

Inception | |

Class R6 Shares | | | 4.38% | | | | 1.97% | |

Since inception return for Class C Shares is from 1/18/11. Since inception return for Class R6 Shares is from 1/20/15. Indexes and Lipper averages are not available for direct investment.

Class A Shares have a maximum 3.00% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within eighteen months of purchase. Such CDSC will be equal to 1% for any shares purchased on or after November 1, 2015. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R6 Shares have no sales charge and are available only to certain limited categories as described in the prospectus. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | | | | | | | | | |

| | | Share Class | |

| | | Class A | | | Class C | | | Class R6 | | | Class I | |

Gross Expense Ratios | | | 0.85% | | | | 1.61% | | | | 0.56% | | | | 0.59% | |

Net Expense Ratios | | | 0.78% | | | | 1.53% | | | | 0.48% | | | | 0.53% | |

The Fund’s investment adviser has contractually agreed to waive fees and/or reimburse other Fund expenses through October 31, 2017 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, acquired fund fees and expenses, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses) do not exceed 0.53% of the average daily net assets of any class of Fund shares. However, because Class R6 Shares are not subject to sub-transfer agent and similar fees, the total annual Fund operating expenses for the Class R6 Shares will be less than the expense limitation. Fee waivers and/or expense reimbursements will not be terminated prior to that time without the approval of the Board of Directors of the Fund.

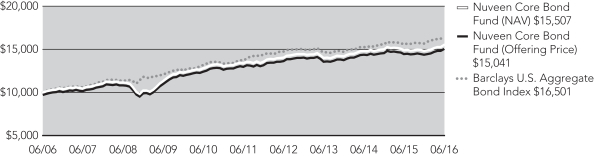

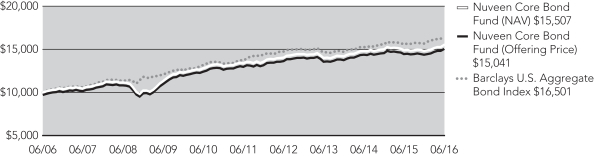

Growth of an Assumed $10,000 Investment as of June 30, 2016 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)

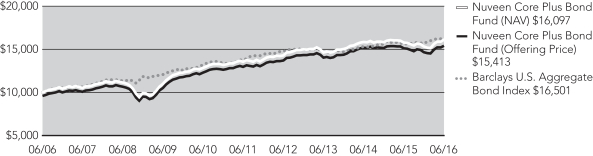

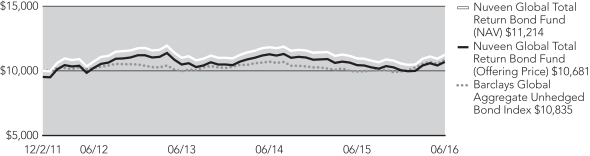

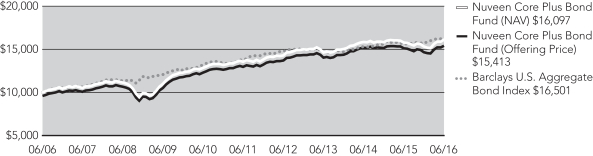

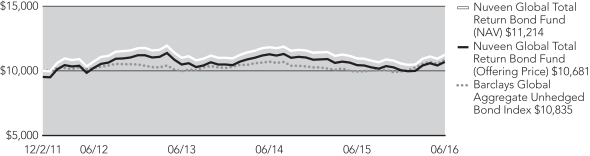

Nuveen Core Plus Bond Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Average Annual Total Returns as of June 30, 2016

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Class A Shares at NAV | | | 2.07% | | | | 3.52% | | | | 4.88% | |

Class A Shares at maximum Offering Price | | | (2.28)% | | | | 2.62% | | | | 4.43% | |

Barclays U.S. Aggregate Bond Index | | | 6.00% | | | | 3.76% | | | | 5.13% | |

Lipper Core Bond Plus Classification Average | | | 4.36% | | | | 3.95% | | | | 5.29% | |

| | | |

Class C Shares | | | 1.29% | | | | 2.74% | | | | 4.09% | |

Class R3 Shares | | | 1.83% | | | | 3.25% | | | | 4.64% | |

Class I Shares | | | 2.26% | | | | 3.77% | | | | 5.13% | |

| | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | Since

Inception | |

Class R6 Shares | | | 2.35% | | | | 1.42% | |

Since inception return for Class R6 Shares is from 1/20/15. Indexes and Lipper averages are not available for direct investment.

Class A Shares have a maximum 4.25% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within eighteen months of purchase. Such CDSC will be equal to 1% for any shares purchased on or after November 1, 2015. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are only available for purchase by eligible retirement plans. Class R6 Shares have no sales charge and are available only to certain limited categories as described in the prospectus. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | | | | | | | | | | | | | |