As filed with the Securities and Exchange Commission on June 7, 2012

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-05339)

Concorde Funds, Inc.

(Exact name of registrant as specified in charter)

1000 Three Lincoln Centre

5430 LBJ Freeway LB3

Dallas, TX 75240-2650

(Address of principal executive offices) (Zip code)

Gary B. Wood

1000 Three Lincoln Centre, 5430 LBJ Freeway LB3, Dallas, TX 75240-2650

(Name and address of agent for service)

(972)-701-5400

Registrant's telephone number, including area code

Date of fiscal year end: 09/30/2012

Date of reporting period: 03/31/2012

Item 1. Reports to Stockholders.

A NO-LOAD

MUTUAL FUND

SEMI-ANNUAL REPORT

Dated March 31, 2012

May 15, 2012

Dear Shareholders,

We are pleased to present the Semi-Annual report of Concorde Funds, Inc. for the six month period ending March 31, 2012.

Concorde Value Fund

Concorde Value Fund, managed by Concorde Investment Management, produced a total return of 21.63% during the first half of the fiscal year ending March 31, 2012. The fund held more cash than normal, pending adding to equity holdings, which damped the upside total return by approximately 1.5% during the strong overall market performance during the period while the underlying equities tracked the general market’s performance.

| | Six Months Ended | Annualized | Annualized | Annualized |

| | 03/31/2012 | 1 Year Ending | 5 Years Ending | 10 Years Ending |

| | (Unaudited) | 03/31/2012 | 03/31/2012 | 03/31/2012 |

| Concorde Value Fund | 21.63% | -2.02% | -3.97% | 0.86% |

| Russell 3000 Value Total Return | 25.97% | 4.30% | -0.75% | 4.73% |

| S&P 500 | 25.89% | 8.54% | 2.01% | 4.12% |

| Russell 2000 | 29.83% | -0.18% | 2.13% | 6.45% |

| Lipper Multi-Cap Value | 27.28% | 1.47% | -0.75% | 4.03% |

| Wilshire 4500 | 28.90% | 1.56% | 3.53% | 7.98% |

| NASDAQ | 28.05% | 11.75% | 5.67% | 5.60% |

The broad appreciation enjoyed across most equity indices during the first half of the fiscal year generally offset the sharp selloff that occurred in the late summer of 2011. The recovery consisted of a fairly steady increase over the period that included almost all broad market sectors. As typically occurs in these phases of an equity market, the more economically sensitive groups outperformed what are usually considered defensive industry stocks.

The negative divergence in the appreciation performance for the fund vs. the listed market indices can be attributed to the following. Underweighting in the following sectors impacted performance negatively: energy, capital goods, media, retailing and technology hardware. In addition, the fund maintained between 5-10% of assets in cash reserves which impacts performance negatively vs. indices which are essentially fully invested. From a positive perspective, either position overweight or outperformance added to relative returns from the following: retailing (investment outperformance), household products, healthcare equipment, insurance and software and services.

A review of individual sector and security performance for the period reflects the general rally that occurred. Sectors that exceeded the Fund’s total return of 21.63% include energy, capital goods, media, retailing, food beverage and tobacco, household products, healthcare equipment, software and services, and technology hardware. Within these groups a few holdings had smaller single digit percentage gains. Canadian Oil Sands underperformed the energy group as discounts for Canadian

oil sales prices and concerns over production costs weighed on investors. CAE continued it business recovery from the recession, but worries about defense business budgets were expressed. We believe tightening budgets should increase the CAE defense business as they offer a more cost advantageous alternative for training. General Mills’ stock lagged in the food group primarily because of the defensive nature of its products. Oracle rose in the low single digits as it consolidated earlier gains. The company’s business results continue to progress satisfactorily.

Individual names that outperformed within the better sectors are as follows. Penn West Petroleum and Devon Energy both rose significantly despite gradually weakening commodity prices. We have subsequently sold Penn West in order to lessen energy exposure. Titan International rose significantly as the market recovered from the August-September 2011 drop. Walt Disney Co. rallied as business results continue to advance well despite the tepid U.S. recovery. Performance in the cable network business and theme parks has been good. The lone retailing holding of the fund, Lowes Companies, rallied as their results have begun to firm and investors recognize the potential leverage if consumers only modestly increase home maintenance and repair/remodel projects. There are definite signs that this is beginning to occur. AB-Inbev rose as reported results were good and investors begin to realize the potential for dividend increases and other capital projects as the company returns to modest debt levels after the Anheuser Busch acquisition. Fortune Brands Home & Security, a new holding, rose modestly after initial purchase as signs of modest improvement in the repair/remodel, residential and multi-family residential markets have begun to appear. Fortune has remained profitable even during the worst of the housing crisis, and has shrunk their cost structure; however, remains positioned to increase profit meaningfully even in a modest recovery. HCA Holdings, another new holding as of last August, rose as investors recognized the current and potential earnings prospects despite the uncertain healthcare environment that currently exists.

In software and services, Corelogic, Fiserv, and Microsoft all rose significantly. Corelogic recovered a large percentage of the drop incurred earlier in 2011 before we sold the position. The company solicited either a buyout or major capital transaction which focused investors on the value of its market positions despite recent disappointing results. Microsoft and Fiserv rose as their franchise positions and steady results continue to be attractive to wary equity investors. Lastly, in the technology hardware and equipment group, both of the fund’s holdings — Agilent Technologies and EMC Corp. — rallied with the market. Business results for both have been good in the lackluster business recovery. Agilent, through its life science divisions and EMC through its VMware subsidiary, both appear to have large divisions with continued extraordinary growth prospects.

Individual stock performances included in the remaining industry and sector groups that are worthy of note are as follows. PotashCorp contributed a single digit gain as concern over 2012 demand tempered enthusiasm. Potash is the dominant world suppler of potash along with meaningful reserves of nitrogen and phosphate and long term demand for agricultural products projects excellent prospects. Waste Management, which we repurchased in the 2011 correction, rose low double digits. The three transportation holdings produced mixed results as Knightsbridge Tankers fell during the first half on weaker day rates in the oil and dry goods shipping markets. Union Pacific and UPS both rose in excess of the fund gains as results reported continued to be very good.

Hanesbrands rose about the same as the fund as prospects continue to brighten from international growth and debt reduction, tempered by near term cotton input price increases. Abbott Labs and

Johnson & Johnson both rose during the period. Johnson & Johnson is beginning to move forward from disappointing quality controls problems of the past two years and Abbott has announced a split of the company into two more logical product groups, and this appears to have investors focusing on the intrinsic value that we see. Bank New York Mellon contributed a gain, however we sold the position as other new investments possessed better risk reward relationships in our view. Lastly, AON and Travelers Companies both rose as business results were steady. We believe upside is good for both the insurance brokers (AON) and property and casualty (Travelers) industries when a more firm pricing environment likely evolves over the next several years.

In summary, the last 12 months represents a volatile period in a longer term trend of recovery from the declines during the global financial crisis. The most recent six months strong performance essentially offset declines during the first six months of the last year. General negative sentiment seems to be focused primarily on the short term with some lingering concerns over intermediate risks in the developed markets. In markets like the current environment, we believe a focus on investing in businesses that have solid longer term performance expectations is the prudent approach to balancing risks and returns.

Thank you for your continued support. We will continue to strive for the highest professional standards of performance and stewardship in the management of the Value Fund.

| | Best regards, |

| |  |

| | Gary B. Wood, Ph.D. |

| | President |

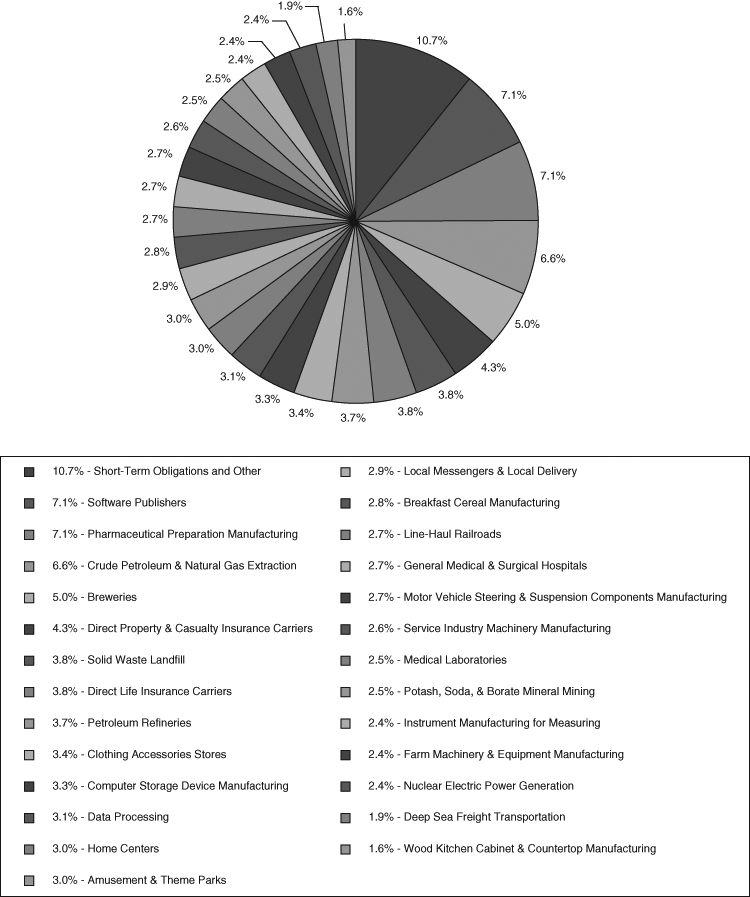

CONCORDE VALUE FUND

PORTFOLIO HOLDINGS BY SECTOR

March 31, 2012 (Unaudited)

The portfolio’s holdings and allocations are subject to change. The percentages are of net assets as of March 31, 2012.

FUND EXPENSES (Unaudited)

As a shareholder of the FUND, you incur two types of costs: (1) transaction costs and exchange fees; and (2) ongoing costs, including management fees and other FUND expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the FUND and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six month period ended March 31, 2012.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the FUND’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the FUND’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the FUND and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs or exchange fees. While the FUND does not currently assess sales charges, redemption or exchange fees, other funds do, and those costs will not be reflected in their expense tables. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | Beginning Account | Ending Account | Expenses Paid During Period* – |

| | Value – 10/1/11 | Value – 3/31/12 | Six Months Ended 3/31/12 |

| Actual | $1,000.00 | $1,213.60 | $12.01 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,014.65 | $10.93 |

______________

| * | Expenses are equal to the FUND’s annualized expense ratio of 2.17%, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period ended March 31, 2012). |

CONCORDE VALUE FUND

SCHEDULE OF INVESTMENTS IN SECURITIES

March 31, 2012 (Unaudited)

| | | | | | Fair | | | Percent of | |

| | | Shares | | | Value | | | Net Assets | |

| COMMON STOCKS - 89.33% | | | | | | | | | |

| AMUSEMENT & THEME PARKS | | | | | | | | | |

| The Walt Disney Co. | | | 7,500 | | | $ | 328,350 | | | | 2.99 | % |

| BREAKFAST CEREAL MANUFACTURING | | | | | | | | | | | | |

| General Mills, Inc. | | | 7,800 | | | | 307,710 | | | | 2.80 | |

| BREWERIES | | | | | | | | | | | | |

| Anheuser Busch InBev NV - ADR (b) | | | 7,500 | | | | 545,400 | | | | 4.96 | |

| CLOTHING ACCESSORIES STORES | | | | | | | | | | | | |

| Hanesbrands, Inc. (a) | | | 12,500 | | | | 369,250 | | | | 3.36 | |

| COMPUTER STORAGE DEVICE MANUFACTURING | | | | | | | | | | | | |

| EMC Corp. (a) | | | 12,000 | | | | 358,560 | | | | 3.26 | |

| CRUDE PETROLEUM & NATURAL GAS EXTRACTION | | | | | | | | | | | | |

| Canadian Oil Sands Ltd. (c) | | | 15,000 | | | | 316,200 | | | | 2.88 | |

| Devon Energy Corp. | | | 3,750 | | | | 266,700 | | | | 2.42 | |

| Penn West Petroleum Ltd. (b) | | | 7,000 | | | | 136,990 | | | | 1.25 | |

| | | | | | | | 719,890 | | | | 6.55 | |

| DATA PROCESSING | | | | | | | | | | | | |

| Fiserv, Inc. (a) | | | 5,000 | | | | 346,950 | | | | 3.15 | |

| DEEP SEA FREIGHT TRANSPORTATION | | | | | | | | | | | | |

| Knightsbridge Tankers Ltd. (b) | | | 15,000 | | | | 215,700 | | | | 1.96 | |

| DIRECT LIFE INSURANCE CARRIERS | | | | | | | | | | | | |

| Aon Corp. | | | 8,500 | | | | 417,010 | | | | 3.79 | |

| DIRECT PROPERTY & CASUALTY | | | | | | | | | | | | |

| INSURANCE CARRIERS | | | | | | | | | | | | |

| Travelers Companies, Inc. | | | 8,000 | | | | 473,600 | | | | 4.31 | |

| FARM MACHINERY & | | | | | | | | | | | | |

| EQUIPMENT MANUFACTURING | | | | | | | | | | | | |

| Deere & Co. | | | 3,300 | | | | 266,970 | | | | 2.43 | |

| GENERAL MEDICAL & SURGICAL HOSPITALS | | | | | | | | | | | | |

| HCA Holdings, Inc. | | | 12,000 | | | | 296,880 | | | | 2.70 | |

| HOME CENTERS | | | | | | | | | | | | |

| Lowe’s Companies, Inc. | | | 10,500 | | | | 329,490 | | | | 3.00 | |

| INSTRUMENT MANUFACTURING FOR MEASURING | | | | | | | | | | | | |

| Agilent Technologies, Inc. (a) | | | 6,000 | | | | 267,060 | | | | 2.43 | |

| LINE-HAUL RAILROADS | | | | | | | | | | | | |

| Union Pacific Corp. | | | 2,800 | | | | 300,944 | | | | 2.74 | |

The accompanying notes are an integral part of these financial statements.

CONCORDE VALUE FUND

SCHEDULE OF INVESTMENTS IN SECURITIES (continued)

March 31, 2012 (Unaudited)

| | | | | | Fair | | | Percent of | |

| | | Shares | | | Value | | | Net Assets | |

| COMMON STOCKS (continued) | | | | | | | | | |

| LOCAL MESSENGERS & LOCAL DELIVERY | | | | | | | | | |

| United Parcel Service, Inc. | | | 4,000 | | | $ | 322,880 | | | | 2.94 | % |

| MEDICAL LABORATORIES | | | | | | | | | | | | |

| Quest Diagnostics, Inc. | | | 4,500 | | | | 275,175 | | | | 2.50 | |

| MOTOR VEHICLE STEERING & | | | | | | | | | | | | |

| SUSPENSION COMPONENTS MANUFACTURING | | | | | | | | | | | | |

| Titan International, Inc. | | | 12,500 | | | | 295,625 | | | | 2.69 | |

| NUCLEAR ELECTRIC POWER GENERATION | | | | | | | | | | | | |

| Exelon Corp. | | | 6,750 | | | | 264,668 | | | | 2.41 | |

| PETROLEUM REFINERIES | | | | | | | | | | | | |

| ConocoPhillips | | | 3,500 | | | | 266,035 | | | | 2.42 | |

| Exxon Mobil Corp. | | | 1,600 | | | | 138,768 | | | | 1.26 | |

| | | | | | | | 404,803 | | | | 3.68 | |

| PHARMACEUTICAL | | | | | | | | | | | | |

| PREPARATION MANUFACTURING | | | | | | | | | | | | |

| Abbott Laboratories | | | 8,400 | | | | 514,836 | | | | 4.68 | |

| Johnson & Johnson | | | 4,000 | | | | 263,840 | | | | 2.40 | |

| | | | | | | | 778,676 | | | | 7.08 | |

| POTASH, SODA, & BORATE MINERAL MINING | | | | | | | | | | | | |

| Potash Corp. Saskatchewan - ADR (b) | | | 6,000 | | | | 274,140 | | | | 2.49 | |

| SERVICE INDUSTRY MACHINERY MANUFACTURING | | | | | | | | | | | | |

| CAE, Inc. (b) | | | 28,000 | | | | 286,440 | | | | 2.60 | |

| SOFTWARE PUBLISHERS | | | | | | | | | | | | |

| Microsoft Corp. | | | 15,500 | | | | 499,875 | | | | 4.55 | |

| Oracle Corp. | | | 9,600 | | | | 279,936 | | | | 2.55 | |

| | | | | | | | 779,811 | | | | 7.10 | |

| SOLID WASTE LANDFILL | | | | | | | | | | | | |

| Waste Management, Inc. | | | 12,000 | | | | 419,520 | | | | 3.81 | |

| WOOD KITCHEN CABINET & | | | | | | | | | | | | |

| COUNTERTOP MANUFACTURING | | | | | | | | | | | | |

| Fortune Brands Home & Security, Inc. (a) | | | 8,000 | | | | 176,560 | | | | 1.60 | |

| TOTAL COMMON STOCKS (Cost $6,925,391) | | | | | | | 9,822,062 | | | | 89.33 | |

The accompanying notes are an integral part of these financial statements.

CONCORDE VALUE FUND

SCHEDULE OF INVESTMENTS IN SECURITIES (continued)

March 31, 2012 (Unaudited)

| | | | | | Fair | | | Percent of | |

| | | Shares | | | Value | | | Net Assets | |

| SHORT-TERM INVESTMENTS - 9.37% | | | | | | | | | |

| INVESTMENT COMPANIES | | | | | | | | | |

| Fidelity Institutional Money Market - | | | | | | | | | |

| Select Class, 0.17% (d) | | | 435,000 | | | $ | 435,000 | | | | 3.96 | % |

| First American Prime Obligations Fund- Class Y, 0.00% (d) | | | 160,048 | | | | 160,048 | | | | 1.45 | |

| The STIC Prime Portfolio - Institutional Class, 0.12% (d) | | | 435,000 | | | | 435,000 | | | | 3.96 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $1,030,048) | | | | | | | 1,030,048 | | | | 9.37 | |

| Total Investments (Cost $7,955,439) - 98.70% | | | | | | | 10,852,110 | | | | 98.70 | |

| Other Assets in Excess of Liabilities - 1.30% | | | | | | | 143,086 | | | | 1.30 | |

| TOTAL NET ASSETS - 100.00% | | | | | | $ | 10,995,196 | | | | 100.00 | % |

______________

Notes:

ADR American Depository Receipt

| (a) | Presently non-income producing. |

| (b) | Foreign issued security listed directly on a U.S. securities exchange. |

| (c) | Foreign issued security traded over-the-counter in the U.S. |

| (d) | Rate shown is the 7-day yield as of March 31, 2012. |

The accompanying notes are an integral part of these financial statements.

CONCORDE VALUE FUND

STATEMENT OF ASSETS AND LIABILITIES

March 31, 2012 (Unaudited)

| ASSETS | | | |

| Investments in securities, at fair value (cost $7,955,439) | | $ | 10,852,110 | |

| Cash | | | 1,122 | |

| Receivables | | | | |

| Investment securities sold | | | 155,892 | |

| Fund shares sold | | | 12,000 | |

| Dividends | | | 9,069 | |

| Interest | | | 107 | |

| Prepaid expenses | | | 1,468 | |

| Other assets | | | 3,347 | |

| TOTAL ASSETS | | | 11,035,115 | |

| LIABILITIES | | | | |

| Investment advisory fee payable | | | 8,357 | |

| Accrued expenses | | | 31,562 | |

| TOTAL LIABILITIES | | | 39,919 | |

| NET ASSETS | | $ | 10,995,196 | |

| Composition of Net Assets: | | | | |

| Net capital paid in on shares of capital stock | | | 9,872,229 | |

| Accumulated net investment income | | | 21,453 | |

| Accumulated net realized loss | | | (1,795,157 | ) |

| Net unrealized appreciation | | | 2,896,671 | |

| NET ASSETS | | $ | 10,995,196 | |

| Capital shares outstanding | | | 908,842 | |

| | | | | |

| Net asset value, offering price and redemption price per share | | $ | 12.10 | |

The accompanying notes are an integral part of these financial statements.

CONCORDE VALUE FUND

STATEMENT OF OPERATIONS

For the Six Month Period Ended March 31, 2012 (Unaudited)

| Investment income | | | |

| Dividends (net of foreign taxes withheld of $2,881) | | $ | 134,496 | |

| Interest | | | 357 | |

| Total investment income | | | 134,853 | |

| Expenses | | | | |

| Investment advisory fees (Note 5) | | | 46,906 | |

| Administration fees | | | 19,175 | |

| Fund accounting fees | | | 13,212 | |

| Professional fees | | | 11,414 | |

| Transfer agent fees | | | 8,396 | |

| Printing, postage and delivery | | | 8,130 | |

| Other expenses | | | 2,355 | |

| Custodian fees | | | 1,625 | |

| Directors fees | | | 1,193 | |

| Federal and state registration fees | | | 994 | |

| Total expenses | | | 113,400 | |

| NET INVESTMENT INCOME | | | 21,453 | |

| REALIZED GAIN AND UNREALIZED | | | | |

| APPRECIATION FROM INVESTMENTS | | | | |

| Net realized loss on investments in securities | | | (23,017 | ) |

| Net increase in unrealized appreciation | | | | |

| on investments in securities | | | 1,974,940 | |

| NET GAIN FROM INVESTMENTS | | | 1,951,923 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 1,973,376 | |

The accompanying notes are an integral part of these financial statements.

CONCORDE VALUE FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | | |

| | | March 31, 2012 | | | Year Ended | |

| | | (Unaudited) | | | Sept. 30, 2011 | |

| INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS | | | | | | |

| Net investment income (loss) | | $ | 21,453 | | | $ | (26,369 | ) |

| Net realized gain (loss) on investments | | | (23,017 | ) | | | 807,011 | |

| Net change in unrealized appreciation (depreciation) of investments | | | 1,974,940 | | | | (1,365,073 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 1,973,376 | | | | (584,431 | ) |

CAPITAL SHARE TRANSACTIONS — NET (Note 3) | | | (308,936 | ) | | | (580,187 | ) |

| Total increase (decrease) in net assets | | | 1,664,440 | | | | (1,164,618 | ) |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 9,330,756 | | | | 10,495,374 | |

| End of year (including accumulated net investment | | | | | | | | |

| income (loss) of $21,453 and $0, respectively) | | $ | 10,995,196 | | | $ | 9,330,756 | |

The accompanying notes are an integral part of these financial statements.

CONCORDE VALUE FUND

FINANCIAL HIGHLIGHTS

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | | | | | | | | | | | | | | |

| | | March 31, | | | | | | | | | | | | | | | | |

| | | 2012(2) | | | | |

| | | (Unaudited) | | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

PER SHARE DATA(1): | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 9.97 | | | $ | 10.65 | | | $ | 9.98 | | | $ | 12.74 | | | $ | 18.39 | | | $ | 17.94 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.02 | | | | (0.03 | ) | | | (0.03 | ) | | | (0.02 | ) | | | 0.01 | | | | 0.04 | |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | | | | | | | | | |

| on investments | | | 2.08 | | | | (0.65 | ) | | | 0.70 | | | | (2.14 | ) | | | (3.88 | ) | | | 1.93 | |

| Total income (loss) from | | | | | | | | | | | | | | | | | | | | | | | | |

| investment operations | | | 2.13 | | | | (0.68 | ) | | | 0.67 | | | | (2.16 | ) | | | (3.87 | ) | | | 1.97 | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions from | | | | | | | | | | | | | | | | | | | | | | | | |

| net investment income | | | — | | | | — | | | | — | | | | — | | | | — | | | | (0.15 | ) |

| Distributions from net realized gains | | | — | | | | — | | | | — | | | | (0.60 | ) | | | (1.78 | ) | | | (1.37 | ) |

| Total distributions | | | — | | | | — | | | | — | | | | (0.60 | ) | | | (1.78 | ) | | | (1.52 | ) |

| Net asset value, end of period | | $ | 12.10 | | | $ | 9.97 | | | $ | 10.65 | | | $ | 9.98 | | | $ | 12.74 | | | $ | 18.39 | |

| TOTAL RETURN | | | 21.36 | % | | | (6.38 | %) | | | 6.71 | % | | | (16.40 | %) | | | (22.98 | %) | | | 11.24 | % |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, | | | | | | | | | | | | | | | | | | | | | | | | |

| end of period (in thousands) | | $ | 10,995 | | | $ | 9,331 | | | $ | 10,495 | | | $ | 12,487 | | | $ | 14,115 | | | $ | 18,972 | |

| Ratio of expenses to average net assets | | | 2.17 | % | | | 2.07 | % | | | 2.02 | % | | | 2.00 | % | | | 1.62 | % | | | 1.60 | % |

| Ratio of net investment income (loss) | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 0.41 | % | | | (0.24 | %) | | | (0.32 | %) | | | (0.24 | %) | | | 0.03 | % | | | 0.20 | % |

| Portfolio turnover rate | | | 8 | % | | | 37 | % | | | 33 | % | | | 51 | % | | | 34 | % | | | 29 | % |

______________

| (1) | Per share information has been calculated using the average number of shares outstanding. |

| (2) | Other than the ratios of expenses and net investment income (loss) to average net assets, financial highlights have not been annualized. |

The accompanying notes are an integral part of these financial highlights.

CONCORDE VALUE FUND

NOTES TO FINANCIAL STATEMENTS (Unaudited)

Note 1 – Nature of Business and Summary of Significant Accounting Policies

NATURE OF BUSINESS

Concorde Value Fund (Fund) is a separate series of shares of common stock of Concorde Funds, Inc. (Company). The Company was incorporated in the state of Texas in September of 1987, and is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company. The Fund is subject to various investment restrictions as set forth in the Statement of Additional Information. The effective date of the Fund’s Registration Statement under the Securities Act of 1933 was December 4, 1987. The primary investment objective of the Fund is to produce long-term growth of capital. The Company may designate one or more series of common stock. The Company presently has no series other than the Fund. Each capital share in the Fund represents an equal, proportionate interest in the net assets of the Fund with each other capital share in such series and no interest in any other series.

SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States.

VALUATION OF SECURITIES

All investments in securities are recorded on their estimated fair value, as described in note 2.

FEDERAL INCOME TAXES

The Fund’s policy is to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, by distributing substantially all of its net investment income and net realized capital gains to its shareholders. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed investment income and capital gains. Therefore, no federal income or excise tax provision is required.

Net investment income (loss), net realized gains (losses) and the cost of investments in securities may differ for financial statement and income tax purposes. The character of distributions from net investment income or net realized gains may differ from their ultimate characterization for income tax purposes. Accounting principles generally accepted in the United States of America require that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. For the year ended September 30, 2011, the Fund increased accumulated net investment income by $26,369, increased undistributed net realized loss by $236 and decreased net capital paid in on shares of capital stock by $26,133. These reclassifications have no effect on net assets, results of operations or net asset value per share. The permanent differences primarily relate to REIT and net operating loss reclassifications. Also, due to the timing of dividend distributions, the

CONCORDE VALUE FUND

NOTES TO FINANCIAL STATEMENTS (Unaudited)

Note 1 – Nature of Business and Summary of Significant Accounting Policies (continued)

fiscal year in which amounts are distributed may differ from the year that the income or realized gains were recorded by the Fund.

The Fund has adopted financial reporting rules regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. The Fund has reviewed all open tax years and major jurisdictions and concluded that there is no impact on the Fund’s net assets and no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on a tax return. As of March 31, 2012, open Federal tax years include the tax year ended September 30, 2009 through 2011.

SECURITY TRANSACTIONS AND RELATED INCOME

Security transactions are accounted for on the date the securities are purchased or sold. Realized gains and losses from securities transactions are reported on an identified cost basis. Dividend income is recognized on the ex-dividend date, and interest income is recognized on the accrual basis. Discounts and premiums on securities purchased are amortized, over the life of the respective securities.

DIVIDENDS AND DISTRIBUTIONS

Distributions to shareholders, which are determined in accordance of income tax regulations, are recorded on the ex-date. The Fund intends to distribute substantially all of its net investment income as dividends to its shareholders on an annual basis. The Fund intends to distribute substantially all of its net realized long-term capital gains and its net realized short-term capital gains at least once a year. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net assets values per share.

USE OF ESTIMATES

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of the assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

OPTION WRITING

When the Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability and is subsequently adjusted to the current fair value of the option written. The Fund treats

CONCORDE VALUE FUND

NOTES TO FINANCIAL STATEMENTS (Unaudited)

Note 1 – Nature of Business and Summary of Significant Accounting Policies (continued)

premiums received from writing options that expire unexercised on the expiration date as realized gains from investments. The difference between the premium and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or, if the premium is less than the amount paid for the closing purchase transaction, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security or currency in determining whether the Fund has realized a gain or loss. The Fund as writer of an option bears the market risk of an unfavorable change in the price of the security underlying the written option.

DERIVATIVES

The Fund has adopted the financial accounting reporting rules as required by the Derivatives and Hedging Topic of the FASB Accounting Standards Codification (“FASB ASC”). The Fund is required to include enhanced disclosure that enables investors to understand how and why an entity uses derivatives, how derivatives are accounted for, and how derivatives instruments affect an entity’s results of operations and financial position. During the six months ended March 31, 2012, the Fund did not hold any derivatives instruments.

EVENTS SUBSEQUENT TO THE FISCAL PERIOD END

The Fund has adopted financial reporting rules regarding subsequent events, which requires an entity to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed at the date of the balance sheet. Management has evaluated the Fund’s related events and transactions that occurred subsequent to March 31, 2012, through the date of issuance of the Fund’s financial statements. There were no events or transactions that occurred during this period that materially impacted the amounts or disclosures in the Fund’s financial statements.

NEW ACCOUNTING PRONOUNCEMENT

In May 2011, the Financial Accounting Standards Board (“FASB”) issued ASU No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements” in GAAP and the International Financial Reporting Standards (“IFRSs”). ASU No. 2011-04 amends FASB ASC Topic 820, Fair Value Measurements and Disclosures, to establish common requirements for measuring fair value and for disclosing information about fair value measurements in accordance with GAAP and IFRSs. ASU No. 2011-04 is effective for fiscal years beginning after December 15, 2011 and for interim periods within those fiscal years. Management is currently evaluating the impact of these amendments and does not believe they will have a material impact on the Fund’s financial statements.

In December 2011, FASB issued ASU No. 2011-11 related to disclosures about offsetting assets and liabilities. The amendments in this ASU require an entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. The ASU is effective for annual reporting periods beginning

CONCORDE VALUE FUND

NOTES TO FINANCIAL STATEMENTS (Unaudited)

Note 1 – Nature of Business and Summary of Significant Accounting Policies (continued)

on or after January 1, 2013, and interim periods within those annual periods. The guidance requires retrospective applications for all comparative periods presented. The Fund is currently evaluating the impact ASU 2011-11 will have on the financial statements disclosures.

Note 2 – Summary of Fair Value Exposure

The Fund has adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the period and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

| | Level 1 – | Quoted unadjusted prices for identical instruments in active markets to which the Fund has access at the date of measurement. |

| | Level 2 – | Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets. Level 2 inputs are those in markets for which there are few transactions, the prices are not current, little public information exists or instances where prices vary substantially over time or among brokered market makers. |

| | Level 3 – | Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the Fund’s own assumptions that market participants would use to price the asset or liability based on the best available information. |

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis.

Equity Securities – The Fund’s investments are carried at fair value. Securities which are traded on securities exchanges are valued at the last sale price on the exchange on which such securities are traded, as of the close of business on the day the securities are being valued or, lacking any reported sales, at the mean between the last available bid and asked price, except for call options written for which the last quoted bid price is used. To the extent, these securities are actively traded and valuation adjustments are not applied, they are categorized in level 1 of the fair value hierarchy.

Mutual Funds – Investments in mutual funds are generally priced at the ending net asset value (NAV) provided by the service agent of the Funds and will be classified as Level 1 securities.

Bonds & Notes – Bonds and notes are valued at the last quoted bid price obtained from independent pricing services. Short-term demand notes and certificates of deposit are stated at

CONCORDE VALUE FUND

NOTES TO FINANCIAL STATEMENTS (Unaudited)

Note 2 – Summary of Fair Value Exposure (continued)

amortized cost, which approximates fair value. Short-term debt obligations with remaining maturities in excess of 60 days are valued at current market prices.

Short-Term Debt Securities – Short-term investments in fixed income securities with maturities of less than 60 days when acquired, or which subsequently are within 60 days of maturity, are valued by using the amortized cost method of valuation, which the Board has determined will represent fair value. Short-term securities with 60 days or less remaining to maturity are, unless conditions indicate otherwise, amortized to maturity based on their cost to a Fund if acquired within 60 days of maturity or, if already held by the Fund on the 60th day, based on the value determined on the 61st day.

All other assets of the Funds are valued in such manner as the Board in good faith deems appropriate to reflect their fair value.

Securities for which market quotations are not readily available or if the closing price does not represent fair value, are valued at fair value as determined in good faith following procedures approved by the Board. Pursuant to those procedures, the Board considers, among other things; the last sale price on the securities exchange, if any, on which a security is primarily traded; the mean between the bid and asked prices; price quotations form an approved pricing service; yields or prices of investments of comparable quality, type of issue, coupon, maturity and rating, market quotes or indications of value from security dealers, evaluations of anticipated cash flows or collateral, general market conditions and other information and analysis, including the obligor’s credit characteristics considered relevant; and other factors as necessary to determine a fair value under certain circumstances. Depending on the relative significance of the valuation inputs, these securities may be classified in either level 2 or level 3 of the fair value hierarchy.

CONCORDE VALUE FUND

NOTES TO FINANCIAL STATEMENTS (Unaudited)

Note 2 – Summary of Fair Value Exposure (continued)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s net assets as of March 31, 2012:

| Investments at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | | | | | | | | | | | |

| Amusement & Theme Parks | | $ | 328,350 | | | $ | — | | | $ | — | | | $ | 328,350 | |

| Breakfast Cereal Manufacturing | | | 307,710 | | | | — | | | | — | | | | 307,710 | |

| Breweries | | | 545,400 | | | | — | | | | — | | | | 545,400 | |

| Clothing Accessories Stores | | | 369,250 | | | | — | | | | — | | | | 369,250 | |

| Computer Storage Device Manufacturing | | | 358,560 | | | | — | | | | — | | | | 358,560 | |

| Crude Petroleum & Natural Gas Extraction | | | 719,890 | | | | — | | | | — | | | | 719,890 | |

| Data Processing | | | 346,950 | | | | — | | | | — | | | | 346,950 | |

| Deep Sea Freight Transportation | | | 215,700 | | | | — | | | | — | | | | 215,700 | |

| Direct Life Insurance Carriers | | | 417,010 | | | | — | | | | — | | | | 417,010 | |

| Direct Property & Casualty Insurance Carriers | | | 473,600 | | | | — | | | | — | | | | 473,600 | |

| Farm Machinery & Equipment Manufacturing | | | 266,970 | | | | — | | | | — | | | | 266,970 | |

| General Medical and Surgical Hospitals | | | 296,880 | | | | — | | | | — | | | | 296,880 | |

| Home Centers | | | 329,490 | | | | — | | | | — | | | | 329,490 | |

| Instrument Manufacturing for Measuring | | | 267,060 | | | | — | | | | — | | | | 267,060 | |

| Line-Haul Railroads | | | 300,944 | | | | — | | | | — | | | | 300,944 | |

| Local Messengers & Local Delivery | | | 322,880 | | | | — | | | | — | | | | 322,880 | |

| Medical Laboratories | | | 275,175 | | | | — | | | | — | | | | 275,175 | |

| Motor Vehicle Steering & Suspension | | | | | | | | | | | | | | | | |

| Components Manufacturing | | | 295,625 | | | | — | | | | — | | | | 295,625 | |

| Nuclear Electric Power Generation | | | 264,668 | | | | — | | | | — | | | | 264,668 | |

| Petroleum Refineries | | | 404,803 | | | | — | | | | — | | | | 404,803 | |

| Pharmaceutical Preparation Manufacturing | | | 778,676 | | | | — | | | | — | | | | 778,676 | |

| Potash, Soda, & Borate Mineral Mining | | | 274,140 | | | | — | | | | — | | | | 274,140 | |

| Service Industry Machinery Manufacturing | | | 286,440 | | | | — | | | | — | | | | 286,440 | |

| Software Publishers | | | 779,811 | | | | — | | | | — | | | | 779,811 | |

| Solid Waste Landfill | | | 419,520 | | | | — | | | | — | | | | 419,520 | |

| Wood Kitchen Cabinet & Countertop | | | | | | | | | | | | | | | | |

| Manufacturing | | | 176,560 | | | | — | | | | — | | | | 176,560 | |

| Total Common Stocks | | | 9,822,062 | | | | — | | | | — | | | | 9,822,062 | |

| Short-Term Investments | | | 1,030,048 | | | | — | | | | — | | | | 1,030,048 | |

| Total Investments | | $ | 10,852,110 | | | $ | — | | | $ | — | | | $ | 10,852,110 | |

Transfers between levels are recognized at the end of the reporting period. During the six months ended March 31, 2012, the Fund recognized no transfers to/from level 1 and level 2. There were no level 3 securities held in the Fund during the six months ended March 31, 2012.

CONCORDE VALUE FUND

NOTES TO FINANCIAL STATEMENTS (Unaudited)

Note 3 – Capital Share Transactions

As of March 31, 2012, there were 30,000,000 shares of $1 par value capital stock authorized of which 9,841,293 shares are classified as the Fund’s series and the remaining balance is unallocated for future use. As of March 31, 2012, capital paid-in aggregated $9,872,229.

Transactions in shares of capital stock for the six months ended March 31, 2012 and September 30, 2011 were as follows:

| | | Six Months Ended | | | | | | | |

| | | March 31, 2012 | | | Year Ended | |

| | | (Unaudited) | | | September 30, 2011 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Shares sold | | | 1,252 | | | $ | 15,000 | | | | 7,449 | | | $ | 89,247 | |

| Shares issued in reinvestment of dividends | | | — | | | | — | | | | — | | | | — | |

| | | | 1,252 | | | | 15,000 | | | | 7,449 | | | | 89,247 | |

| Shares redeemed | | | (28,500 | ) | | | (323,936 | ) | | | (56,700 | ) | | | (669,434 | ) |

| Net increase (decrease) | | | (27,248 | ) | | $ | (308,936 | ) | | | (49,251 | ) | | $ | (580,187 | ) |

Note 4 – Investment Transactions

The aggregate cost of purchases and proceeds from sales of investment securities, excluding short-term investments, were $803,407 and $1,685,875, respectively. The cost of purchases and proceeds from sales of short-term securities aggregated $1,680,367 and $1,296,116, respectively, for the six months ended March 31, 2012.

Note 5 – Investment Advisory Fees and Other Transactions with Affiliates

The Fund has an Investment Advisory Agreement (Advisory Agreement) with Concorde Financial Corporation dba Concorde Investment Management (Concorde) to act as the Fund’s investment advisor. Concorde provides the Fund with investment advice and recommendations consistent with the Fund’s investment objectives, policies and restrictions, and supervises the purchase and sale of investment transactions on behalf of the Fund. For such services, Concorde receives an annual fee of 0.90% of the Fund’s average daily net assets, computed daily and paid on a monthly basis. The investment advisory fee was $46,906 for the six months ended March 31, 2012, of which $8,357 was payable at March 31, 2012.

Certain directors and officers of the Company are also directors, officers and/or employees of Concorde.

CONCORDE VALUE FUND

NOTES TO FINANCIAL STATEMENTS (Unaudited)

Note 6 – Federal Tax Information

At September 30, 2011, the Fund’s most recent fiscal year end, the components of accumulated earnings (losses) on a tax basis were as follows:

| Cost of Investments (a) | | $ | 8,489,375 | |

| Gross tax unrealized appreciation | | | 1,600,452 | |

| Gross tax unrealized depreciation | | | (691,358 | ) |

| Net tax unrealized appreciation | | $ | 909,094 | |

| Undistributed ordinary income | | | — | |

| Undistributed long-term capital gain | | | — | |

| Total distributable earnings | | $ | — | |

| Other accumulated gains (losses) | | $ | (1,759,503 | ) |

| Total accumulated earnings (losses) | | $ | (850,409 | ) |

| | (a) | Represents cost for federal income tax purposes and differs from the cost for financial reporting purposes primarily due to wash sale adjustments. |

At September 30, 2011, the Fund’s most recent fiscal year end, the Fund had tax basis capital losses of $1,759,503, which may be carried over to offset future capital gains and expires on September 30, 2018. Additionally, the Fund had no post-October capital loss.

BOARD APPROVAL OF CONTINUATION OF INVESTMENT ADVISORY AGREEMENT

At its meeting held on November 16, 2011, the Board of Directors (the “Board”) of Concorde Funds, Inc. (the “Company”) including all the Directors who are not “interested persons” (as defined in the Investment Company Act of 1940) considered and then voted to re-approve the current investment advisory agreement (the “Advisory Agreement”) between Concorde Financial Corporation (the “Advisor”) and the Company, on behalf of the Concorde Value Fund (the “Fund”). In connection with its re-approval of the Advisory Agreement, the Board reviewed and discussed the specific services provided by the Advisor. The Board considered the following factors:

The Advisor:

| | 1) | Provides daily investment management for the Concorde Value Fund. In providing investment management, Concorde Financial Corporation will oversee the trading of securities and the rebalancing of the portfolio. |

| | 2) | Retains the services of the Fund’s Chief Compliance Officer and will make all reasonable efforts to insure that the Fund is in compliance with the securities laws. |

| | 3) | Provide responsive customer and shareholder servicing which consists of responding to shareholder inquiries received, including specific mutual fund account information, in addition to calls directed to the transfer agent call center. |

| | 4) | Oversees distribution of the Fund through third-party broker/dealers and independent financial institutions. |

| | 5) | Oversees those third party service providers that support the Fund in providing fund accounting, fund administration, transfer agency and custodial services. |

The Board also: (i) compared the performance of the Fund to benchmark indices over various periods of time and concluded that the performance of the Fund, articulately on a risk-adjusted basis, warranted the continuation of the Advisory Agreement; (ii) compared the expense ratios of funds similar in asset size and investment objective to those of the Fund and concluded the expenses of the Fund were reasonable and warranted continuation of the Advisory Agreement; (iii) considered the fees charged by Concorde Financial Corporation to those of funds similar in asset size and investment objective to the Fund and concluded the advisory fees of the Fund were reasonable and warranted continuation of the Advisory Agreement; and (iv) considered the profitability of Concorde Financial Corporation with respect to the Fund, and concluded that the profits were reasonable and not excessive when compared to profitability guidelines set forth in relevant court cases.

The Board then discussed economies of scale and breakpoints and determined that the Fund, managed by Concorde Financial Corporation, has not yet grown in size, nor has the marketplace demonstrated significant rapid potential growth to any extent, that would warrant the imposition of breakpoints.

The Board reviewed the Fund’s expense ratios and comparable expense ratios for similar funds. The Board used data from Lipper, as presented in the charts in the Board Materials, showing funds classified by Lipper as Multi-Cap Value Funds, similar in nature to the Concorde Value Fund. The Board determined that the total expense ratio of the Fund falls within the range of the ratios of other funds in the Multi-Cap Value classification. The Board also referenced Concorde Financial Corporation’s Form ADV and a copy of the current Investment Advisory Agreement. They also referenced a Concorde Investment Management Fee and Service Agreement to compare fees charged by the Advisor to their other clients versus what they charge the Fund. After further discussion and upon a motion duly made and seconded, the Directors, including a majority of Directors who are not “interested persons,” as defined by the 1940 Act, of the Corporation unanimously approved the Continuation of Investment Advisory Agreement.

ADDITIONAL INFORMATION (Unaudited)

PROXY VOTING POLICIES AND PROCEDURES

For a description of the policies and procedures that the Fund uses to determine how to vote proxies relating to the portfolio securities, please call (972) 701-5400 and request a Statement of Additional Information. One will be mailed to you free of charge. The Statement of Additional Information is also available on the website of the Securities and Exchange Commission at http://www.sec.gov.

PROXY VOTING RECORDS

Information on how the Fund voted proxies relating to portfolio securities during the twelve month period ending June 30, 2011 is available without charge, upon request, by calling (972) 701-5400. Furthermore, you can obtain the Fund’s proxy voting records on the Securities and Exchange Commission’s website at http://www.sec.gov.

QUARTERLY FILINGS ON FORM N-Q

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal quarter on Form N-Q. The Fund’s Form N-Q is available (i) without charge, upon request, by calling (972) 701-5400, (ii) on the Securities and Exchange Commission’s website at http://www.sec.gov, or (iii) at the Securities and Exchange Commission’s public reference room.

DIRECTORS AND OFFICERS

The Fund’s Statement of Additional Information includes additional information about the Fund’s Directors and Officers and is available, without charge, upon request by calling (972) 701-5400.

HOUSEHOLD DELIVERY OF SHAREHOLDER DOCUMENTS

In an effort to decrease costs, the FUND intends to reduce the number of duplicate prospectuses and Annual and Semi-Annual Reports you receive by sending only one copy of each to those addresses shared by two or more accounts and to shareholders we reasonably believe are from the same family or household. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 1-800-294-1699 to request individual copies of these documents. Once the FUND receives notice to stop householding, we will begin sending individual copies thirty days after receiving your request. This policy does not apply to account statements.

(This Page Intentionally Left Blank.)

INVESTMENT ADVISOR

Concorde Investment Management

1000 Three Lincoln Centre

5430 LBJ Freeway LB3

Dallas, Texas 75240

OFFICERS

Gary B. Wood, Ph.D.

President and Treasurer

John A. Stetter

Secretary

DIRECTORS

William Marcy

John H. Wilson

Gary B. Wood, Ph.D.

CUSTODIAN

U.S. Bank, N.A.

Custody Operations

1555 North RiverCenter Drive, Suite 302

Milwaukee, Wisconsin 53212

TRANSFER AGENT AND

DIVIDEND DISBURSING AGENT

U.S. Bancorp Fund Services, LLC

Mutual Fund Services, 3rd Floor

615 East Michigan Street

Milwaukee, Wisconsin 53202

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Brad A. Kinder, CPA

815 Parker Square

Flower Mound, Texas 75028

LEGAL COUNSEL

Foley & Lardner LLP

777 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

TELEPHONE

(972) 701-5400

(Fund information)

(800) 294-1699

(Shareholder account information)

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

Not Applicable

Item 11. Controls and Procedures.

| (a) | The Registrant’s President and Treasurer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 12. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not Applicable for semi-annual reports |

(2) A separate certification for each principal executive and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

| (b) | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Concorde Funds, Inc.

By (Signature and Title)* /s/ Gary B. Wood

Gary B. Wood, President

Date 05/30/2012

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)* /s/ Gary B. Wood

Gary B. Wood, President

Date 05/30/2012

By (Signature and Title)* /s/ Gary B. Wood

Gary B. Wood, Treasurer

Date 05/30/2012

* Print the name and title of each signing officer under his or her signature.