UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-5344

William Blair Funds

(Exact name of registrant as specified in charter)

| 222 West Adams Street, Chicago, IL | 60606 |

| (Address of principal executive offices) | (Zip Code) |

Michelle R. Seitz

William Blair Funds

222 West Adams Street, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: 312-236-1600

Date of fiscal year end: October 31

Date of reporting period: April 30, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A Registrant is not required to respond to the collection of information contained in Form N-CSR unless the form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimates and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. (ss) 3507.

| Item 1. | April 30, 2013 Semi Annual Reports transmitted to shareholders. |

| | April 30, 2013 |

| | Multi-Asset and Alternatives Funds |

| | |

William Blair Funds

Semiannual Report | |

| | |

| April 30, 2013 | William Blair Funds | 1 |

| | MACRO ALLOCATION FUND |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

Brian D. Singer

Edwin Denson

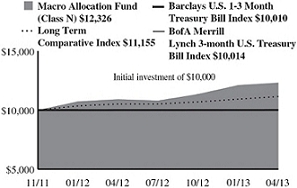

Thomas Clarke | The Macro Allocation Fund (Class N shares) posted an 8.49% increase, net of fees, for the six months ended April 30, 2013. By comparison, the Fund’s benchmarks, the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index and its Long-Term Comparative Index, returned 0.06% and 4.31%, respectively, for the same period. The Long-Term Comparative Index return is comprised of the following indices: 40% Barclays U.S. Aggregate Index, 30% MSCI All Country World Index (net), and 30% BofA Merrill Lynch 3-Month U.S. Treasury Bill Index. The Fund benefited from positive contributions from both its market-oriented strategies and its currency-oriented strategy during the period covered by this report. Market performance benefited from an aggregate long exposure to equities, particularly within developed Europe and Japan, as well as from a long exposure to U.S. high yield. Market performance suffered due to short exposures to safe haven sovereign bond markets within the European Monetary Union and an average effective net short exposure to U.S. equities. Currency performance benefited from short exposures to the Japanese yen, as well as from an aggregate long exposure to emerging markets currencies, particularly within Asia. Currency performance was hurt by short exposures to the Australian dollar and the New Zealand dollar. We believe that the Fund remains positioned consistent with an elevated level of long-term opportunity, with an anticipation of continued long-term certainty about near-term stability, particularly within Europe. We are keeping a cautious eye toward safe haven sovereigns, and continue to anticipate the second half of calendar 2013 where much remains to be resolved in the U.S. with respect to the debt ceiling, the sequester, and the budget. Long equity exposure continues to be tilted toward Europe and the emerging markets. Call options on U.S. bonds remain in place and are designed to limit the downside from the Fund’s otherwise short exposure to these markets in case yields fall further. The Fund also has kept much of its long equity exposure protected with put options. |

| 2 | Semi-Annual Report | April 30, 2013 |

Macro Allocation Fund

Performance Highlights (Unaudited)

| Average Annual Total Return at 4/30/2013 | | | | | |

| | Fiscal Year | | | | Since |

| | to Date | | 1 Year | | Inception(a) |

| Class N | 8.49% | | 12.89% | | 15.84% |

| Class I | 8.52% | | 13.12% | | 16.08% |

BofA Merrill Lynch 3-month

U.S. Treasury Bill Index | 0.06% | | 0.12% | | 0.10% |

Barclays U.S. 1-3 Month

Treasury Bill Index | 0.04% | | 0.08% | | 0.07% |

| Long-Term Comparitive Index | 4.31% | | 6.01% | | 7.99% |

| (a) | For the period from November 29, 2011 (Commencement of Operations) to April 30, 2013. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. The Fund involves a high level of risk and may not be appropriate for everyone. You could lose money by investing in the Fund. There can be no assurance that the Fund’s investment objective will be achieved or that the Fund’s investment strategies will be successful. The Fund is not a complete investment program. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Effective March 1, 2013, the Fund uses the BofA Merrill Lynch 3-month U.S. Treasury Bill Index as the broad-based index because it is included as part of the Long-Term Comparative Index.

The BofA Merrill Lynch 3-Month U.S. Treasury Bill Index measures total return on cash, including price and interest income, based on short-term government Treasury Bills of about 90-day maturity. The Index is unmanaged, does not incur fees or expenses, and cannot be invested in directly.

The Barclays 1-3 Month U.S. Treasury Bill Index includes all publicly issued zero-coupon U.S. Treasury Bills that have a remaining maturity of less than 3 months and more than 1 month, are rated investment grade, and have $250 million or more of outstanding face value. In addition, the securities must be denominated in U.S. dollars and must be fixed rate and non convertible.

The Long-Term Comparative Index return is comprised of the following indices: 40% Barclays Capital U.S. Aggregate Index, 30% Morgan Stanley Capital International (MSCI) All Country World Index (net), and 30% Bank of America/Merrill Lynch 3-month U.S. Treasury Bill Index.

This report identifies the Fund’s investments on April 30, 2013. These holdings are subject to change. Not all investments in the Fund performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

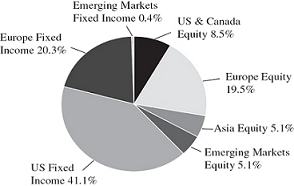

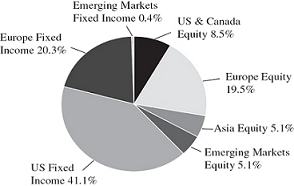

Sector Diversification (Unaudited)

The chart to the right is a graphical representation of gross portfolio exposure excluding forward foreign currency contracts as of April 30, 2013.

| April 30, 2013 | William Blair Funds | 3 |

| William Blair Macro Allocation Fund |

Portfolio of Investments, April 30, 2013 (unaudited)

| Issuer | | Shares or

Principal

Amount | | | Value | |

| | | | | | | | | |

| Exchange-Traded Funds—58.7% | | | | | | | | |

| Equity Exchange-Traded Funds—37.0% | | | | | | | | |

| Guggenheim China Small Cap ETF (a) | | | 45,000 | | | $ | 1,077,750 | |

| Guggenheim Frontier Markets ETF (a) | | | 150,000 | | | | 2,781,000 | |

| iShares FTSE China 25 Index Fund (a) | | | 28,000 | | | | 1,056,720 | |

| iShares MSCI EAFE Value Index (a) | | | 29,000 | | | | 1,532,940 | |

| iShares Russell 1000 Value Index Fund (a) | | | 110,000 | | | | 9,062,900 | |

| iShares S&P Global Energy Sector Index Fund (a) | | | 93,000 | | | | 3,719,070 | |

| SPDR S&P 500 ETF Trust (a) | | | 75,000 | | | | 11,976,000 | |

| SPDR S&P Emerging Markets Small Cap ETF (a) | | | 133,000 | | | | 6,526,310 | |

| Vanguard MSCI Emerging Markets ETF (a) | | | 24,000 | | | | 1,050,240 | |

| Vanguard MSCI European ETF (a) | | | 125,000 | | | | 6,420,000 | |

| Total Equity Exchange-Traded Funds | | | | | | | 45,202,930 | |

| Fixed Income Exchange-Traded Funds—21.7% | | | | |

| iShares iBoxx Investment Grade Corporate Bond Fund (a) | | | 127,000 | | | | 15,510,510 | |

| SPDR Barclays Capital High Yield Bond ETF (a) | | | 240,000 | | | | 10,020,000 | |

| WisdomTree Emerging Markets Local Debt ETF (a) | | | 19,000 | | | | 1,020,110 | |

| Total Fixed Income Exchange-Traded Funds | | | | | | | 26,550,620 | |

Total Exchange-Traded Funds—58.7%

(cost $68,426,967) | | | | | | | 71,753,550 | |

| | | | | | | | | |

| Common Stock—0.6% | | | | | | | | |

| | | | | | | | | |

| Europe—0.6% | | | | | | | | |

| France—0.6% | | | | | | | | |

| Schneider Electric S.A. (Electrical equipment) | | | 8,859 | | | | 675,511 | |

Total Common Stocks—0.6%

(cost $667,301) | | | | | | | 675,511 | |

| | | | | | | | | |

| Repurchase Agreement—27.7% | | | | | | | | |

Fixed Income Clearing Corporation,

0.060% dated 4/30/13, due 5/1/13,

repurchase price $33,775,983

collateralized by U.S. Treasury Note,

2.375%, due 10/31/14 | | $ | 33,775,927 | | | | 33,775,927 | |

Total Repurchase Agreement—27.7%

(cost $33,775,927) | | | | | | | 33,775,927 | |

| | | | | | | | | |

| U.S. Government—8.7% | | | | | | | | |

U.S. Treasury Bill,

0.180%, 5/2/13 | | | 125,000 | | | | 124,999 | |

U.S. Treasury Bill,

0.170%, 5/30/13 | | | 50,000 | | | | 49,993 | |

U.S. Treasury Bill,

0.180%–0.204%, 6/27/13 (a)(b) | | | 200,000 | | | | 199,938 | |

U.S. Treasury Bill,

0.170%–0.180%, 7/25/13 (a)(b) | | | 350,000 | | | | 349,853 | |

| Issuer | | Shares/

Principal

Amount/

Contracts | | | Value | |

| | | | | | | |

| U.S. Government—(continued) | | | | | | | | |

U.S. Treasury Bill,

0.180%, 8/22/13 (a)(b) | | $ | 100,000 | | | $ | 99,942 | |

U.S. Treasury Bill,

0.150%–0.170%, 9/19/13 (a)(b) | | | 1,550,000 | | | | 1,549,019 | |

U.S. Treasury Bill,

0.170%–0.180%, 10/17/13 (a)(b) | | | 1,250,000 | | | | 1,248,985 | |

U.S. Treasury Bill,

0.170%, 11/14/13 (a)(b) | | | 1,000,000 | | | | 999,097 | |

U.S. Treasury Bill,

0.130%, 1/9/14 (a)(b) | | | 1,000,000 | | | | 999,097 | |

U.S. Treasury Bill,

0.150%, 2/6/14 (a)(b) | | | 1,000,000 | | | | 998,841 | |

U.S. Treasury Bill,

0.130%–0.150%, 3/6/14 (a)(b) | | | 2,000,000 | | | | 1,997,588 | |

U.S. Treasury Bill,

0.130%, 4/3/14 (a)(b) | | | 2,000,000 | | | | 1,997,622 | |

Total U.S. Government—8.7%

(cost $10,614,974) | | | | | | | 10,614,974 | |

| | | | | | | | | |

| Purchased Options—0.8% | | | | | | | | |

| 10 Year U.S. Treasury Note, May 2013, Strike $131, CALL | | | 250 | | | | 601,563 | |

| S&P 500 Index, July 2013, Strike $1,475, PUT | | | 360 | | | | 423,000 | |

Total Purchased Options—0.8%

(cost $1,120,267) | | | | | | | 1,024,563 | |

| Total Investments in Securities—96.5% (cost $114,605,436) | | | | | | | 117,844,525 | |

| | | | | | | | | |

| Securities Sold Short—(6.0)% | | | | | | | | |

| Exchange-Traded Funds | | | | | | | | |

| iShares Russell 1000 Growth Index Fund | | | (100,000 | ) | | | (7,288,000 | ) |

Total Securities Sold Short—(6.0)%

(proceeds $6,706,050) | | | | | | | (7,288,000 | ) |

| Cash and other assets, less liabilities—9.5% | | | | | | | 11,585,708 | |

| Net assets—100.0% | | | | | | $ | 122,142,233 | |

| (a) | Security, or portion of security, is segregated as collateral for securities sold short and swap contracts aggregating a total value of $12,818,271. |

| (b) | Security, or portion of security, is pledged as collateral to cover initial margin requirements on open futures contracts aggregating a total value of $4,455,629. |

See accompanying Notes to Financial Statements.

| 4 | Semi-Annual Report | April 30, 2013 |

| William Blair Macro Allocation Fund |

Portfolio of Investments, April 30, 2013 (unaudited)

Forward Foreign Currency Contracts

Settlement

Date | | Deliver/Receive | | Counterparty | | Local Currency | | Current Value | | Net Unrealized

Appreciation

(Depreciation) |

| | | | | | | | | | | | | | |

| Purchased | | | | | | | | | | | | | |

| 5/15/13 | | Chinese Yuan Renminbi | | State Street Bank & Trust Company | | 87,808,000 | | $14,234,136 | | | $ | 254,819 | |

| 5/15/13 | | British Pound Sterling | | State Street Bank & Trust Company | | 8,261,000 | | 12,831,115 | | | | 55,763 | |

| 5/15/13 | | Hong Kong Dollar | | State Street Bank & Trust Company | | 29,487,000 | | 3,800,045 | | | | (2,120 | ) |

| 5/15/13 | | Hungarian Forint | | State Street Bank & Trust Company | | 470,759,000 | | 2,068,638 | | | | (42,950 | ) |

| 5/15/13 | | Indian Rupee | | State Street Bank & Trust Company | | 1,006,473,000 | | 18,638,110 | | | | 93,266 | |

| 5/15/13 | | Japanese Yen | | State Street Bank & Trust Company | | 637,564,000 | | 6,540,520 | | | | 16,616 | |

| 5/15/13 | | South Korean Won | | State Street Bank & Trust Company | | 15,501,409,000 | | 14,069,373 | | | | (54,936 | ) |

| 5/15/13 | | Mexican Peso | | State Street Bank & Trust Company | | 74,231,000 | | 6,107,337 | | | | 240,066 | |

| 5/15/13 | | Malaysian Ringgit | | State Street Bank & Trust Company | | 22,233,000 | | 7,300,976 | | | | 133,570 | |

| 5/15/13 | | Polish Zloty | | State Street Bank & Trust Company | | 5,777,000 | | 1,827,033 | | | | (11,194 | ) |

| 5/15/13 | | Thai Baht | | State Street Bank & Trust Company | | 151,157,000 | | 5,146,556 | | | | 78,424 | |

| 5/15/13 | | Taiwan Dollar | | State Street Bank & Trust Company | | 198,462,000 | | 6,725,804 | | | | 9,746 | |

| | | | | | | | | | | | $ | 771,070 | |

| Sold | | | | | | | | | | | | | |

| 5/15/13 | | Australian Dollar | | State Street Bank & Trust Company | | 16,607,000 | | $17,199,589 | | | $ | (160,464 | ) |

| 5/15/13 | | Brazilian Real | | State Street Bank & Trust Company | | 19,508,000 | | 9,736,874 | | | | (22,886 | ) |

| 5/15/13 | | Canadian Dollar | | State Street Bank & Trust Company | | 4,766,000 | | 4,729,242 | | | | (11,584 | ) |

| 5/15/13 | | Swiss Franc | | State Street Bank & Trust Company | | 21,966,000 | | 23,627,092 | | | | 150,107 | |

| 5/15/13 | | Czech Koruna | | State Street Bank & Trust Company | | 51,742,000 | | 2,641,819 | | | | 41,526 | |

| 5/15/13 | | Danish Krone | | State Street Bank & Trust Company | | 34,309,000 | | 6,061,293 | | | | 47,666 | |

| 5/15/13 | | Euro | | State Street Bank & Trust Company | | 5,705,000 | | 7,513,777 | | | | 113,026 | |

| 5/15/13 | | Japanese Yen | | State Street Bank & Trust Company | | 1,897,933,000 | | 19,470,155 | | | | 675,535 | |

| 5/15/13 | | New Zealand Dollar | | State Street Bank & Trust Company | | 10,492,000 | | 8,985,270 | | | | (203,553 | ) |

| 5/15/13 | | Singapore Dollar | | State Street Bank & Trust Company | | 4,832,000 | | 3,923,045 | | | | (26,406 | ) |

| 5/15/13 | | Thai Baht | | State Street Bank & Trust Company | | 151,157,000 | | 5,146,556 | | | | 122,074 | |

| 5/15/13 | | South African Rand | | State Street Bank & Trust Company | | 1,414,000 | | 157,320 | | | | (165 | ) |

| | | | | | | | | | | | $ | 724,876 | |

Futures Contracts

Number of

Contracts | | Description | | Expiration Date | | Local Currency | | Notional Amount

(Local) | | Net Unrealized

Appreciation

(Depreciation)

(USD) |

| | | | | | | | | | | | | | |

| Long | | | | | | | | | | | | | |

| 146 | | CAC 40 Index | | May 2013 | | Euro | | 5,204,433 | | | $ | 451,499 | |

| 105 | | IBEX 35 Index | | May 2013 | | Euro | | 8,230,843 | | | | 798,846 | |

| 40 | | NIKKEI 225 Index | | June 2013 | | Japanese Yen | | 243,008,080 | | | | 352,792 | |

| 9 | | ASX SPI 200 Index | | June 2013 | | Australian Dollar | | 1,134,906 | | | | 28,918 | |

| 190 | | EURO STOXX 50 Index | | June 2013 | | Euro | | 5,018,755 | | | | 68,936 | |

| 70 | | FTSE 100 Index | | June 2013 | | British Pound Sterling | | 4,487,082 | | | | (28,941 | ) |

| 47 | | FTSE MIB Index | | June 2013 | | Euro | | 3,929,648 | | | | (49,799 | ) |

| 43 | | S&P 500 E Mini Index | | June 2013 | | United States Dollar | | 3,328,119 | | | | 95,111 | |

| | | | | | | | | | | | $ | 1,717,362 | |

| Short | | | | | | | | | | | | | |

| 82 | | German Euro Bund* | | June 2013 | | Euro | | 11,791,100 | | | $ | (300,871 | ) |

| 151 | | Swiss Government Bond | | June 2013 | | Swiss Franc | | 23,042,500 | | | | (289,180 | ) |

| 91 | | 10YR JGB Mini | | June 2013 | | Japanese Yen | | 1,317,797,953 | | | | 18,946 | |

| 268 | | 10YR US Treasury Notes* | | June 2013 | | United States Dollar | | 35,259,149 | | | | (481,163 | ) |

| 85 | | FTSE 40 Index | | June 2013 | | South African Rand | | 29,249,833 | | | | 14,736 | |

| 29 | | S&P TSE 60 Index | | June 2013 | | Canadian Dollar | | 4,217,550 | | | | 103,419 | |

| 13 | | DAX Index | | June 2013 | | Euro | | 2,576,440 | | | | 2,785 | |

| 78 | | 5YR US Treasury Notes* | | June 2013 | | United States Dollar | | 9,667,438 | | | | (54,531 | ) |

| | | | | | | | | | | | $ | (985,859 | ) |

| * | Exposure to Futures Contract is achieved through the use of a swap contract with Credit Suisse. |

See accompanying Notes to Financial Statements.

| April 30, 2013 | William Blair Funds | 5 |

| William Blair Macro Allocation Fund |

Portfolio of Investments, April 30, 2013 (unaudited)

Total Return Swaps

| Reference Entity | | Floating Rate | | Pay/Receive

Floating Rate | | Expiration

Date | | Counterparty | | Notional

Amount | | Unrealized

Appreciation

(Depreciation) |

Credit Suisse Custom Equity Index

(U.S. Equities) | | 1 Month LIBOR

plus 45 bps | | | Pay | | 3/28/14 | | Credit Suisse International | | $ | 1,856,933 | | | | $ | (41,262 | ) |

Credit Suisse Custom Equity Index

(U.S. ETF) | | 1 Month LIBOR

minus 35 bps | | | Receive | | 3/28/14 | | Credit Suisse International | | | (2,107,919 | ) | | | | (36,109 | ) |

Credit Suisse Custom Equity Index

(Japanese Equities) | | 1 Month JPY LIBOR

plus 20 bps | | | Pay | | 7/17/13 | | Credit Suisse International | | | 3,576,708 | | | | | 210,870 | |

Credit Suisse Custom Equity Index

(U.S. Equities) | | 1 Month LIBOR

plus 65 bps | | | Pay | | 2/11/14 | | Credit Suisse International | | | 2,745,708 | | | | | 59,688 | |

Credit Suisse Custom Equity Index

(U.S. ETF) | | 1 Month LIBOR

minus 20 bps | | | Receive | | 2/11/14 | | Credit Suisse International | | | (3,107,809 | ) | | | | (204,604 | ) |

| | | | | | | | | | | | | | | | | $ | (11,417 | ) |

See accompanying Notes to Financial Statements.

| 6 | Semi-Annual Report | April 30, 2013 |

| | COMMODITY STRATEGY LONG/SHORT FUND |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

John Abunassar

Peter Carl

Toby Elliman

Chris Walvoord

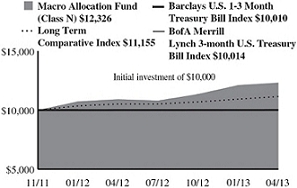

Brian Ziv, CFA | Introduction The Commodity Strategy Long/Short Fund (Class N shares) posted a 3.40% decrease, net of fees, for the six months ended April 30, 2013. By comparison, the Fund’s benchmark index, the Morningstar Long/Short Commodity Index (the “Index”), decreased 0.82%. Over this stretch, inflation pressures remained subdued and long-only commodity indices were correspondingly negative (Dow Jones-UBS Commodity Index1 -6.34%, S&P GSCI2 -3.42%). Precious metals had a particularly difficult time over the last six months as risk assets, such as equities, remained popular and “safe haven” assets struggled; gold returned -14.37% and silver was an even worse -25.16% over the last six months. The cool, wet spring across the U.S. grain belt caused agricultural prices to ease considerably as well, with wheat (-15.44%), corn (-13.99%), and soybeans (-9.67%) leading the way to the downside. Portfolio Results While the Fund underperformed its benchmark Index over the period, the Fund has outperformed the Index since its inception on April 25, 2012 through April 30, 2013. The systematic portion of the portfolio, especially trend-following, continues to experience difficult trading conditions. The two trend-following managers in the portfolio returned -3.58% and -5.74% during the period. While trend-following is an essential element of the Fund’s strategy, steadily declining volatility provides a stiff headwind as trend-followers tend to carry an implicit long volatility profile. Commodity volatility, as measured by the Merrill Lynch (3-month) Commodity Volatility Index, dropped markedly during the period before rebounding slightly. On April 30, 2013, the Index reading stood at 12.03, down almost 40% from six months earlier. The lack of volatility tends to be most acutely felt by trend-followers but all types of commodity managers tend to suffer when volatility is low and/or declining. The performance highlight in the portfolio was the cotton specialist which was added during the period. This manager has returned a healthy 15.88% since its addition to the portfolio. While this manager trades an exceedingly narrow product set, its performance highlights the potential of specialized information and experience. While other agricultural commodities sold off strongly, cotton futures bucked the trend and rallied during the last six months, a move which the manager correctly anticipated and participated significantly in. The fixed income portion of the portfolio is invested in a diverse group of short duration and high-quality securities. This portion of the portfolio is intended to remain stable while the commodity future investments are intended to drive the overall return of the Fund. Outlook and Positioning With commodity volatility near all-time lows, we believe that the timing appears excellent for the strategies employed by commodity long-short managers. However, other conditions, such as a sustained disconnect between commodity fundamentals and commodity prices as well as persistently low interest rates, call for a conservative approach to portfolio construction. Given this backdrop, the portion of the portfolio dedicated to commodities continues to emphasize specialist managers (42.95% of the commodities portfolio) and fundamental managers (17.40%) relative to systematic managers (30.97% trend-following, 8.68% spread trading). In the coming six months, our preference for specialist managers is likely to become ever greater as our research efforts to extend both the depth and breadth of our manager lineup bears fruit. We are particularly excited by potential opportunities in energy (crude oil as well as refined products) and agricultural (e.g., soybeans) markets. In addition to a focused approach, we believe specialist managers tend to bring global networks of industry contacts, a firm grasp of supply and demand, and a full understanding of the positioning and tendencies of other market participants. Furthermore, specialist managers often have direct links to physical commodity businesses which can provide a steady stream of unique, timely, and actionable insights to assist their trading. As such, we believe the Fund’s positioning is not only excellent currently but should also improve incrementally going forward. 1 The S&P GSCI Index is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. 2 The Dow Jones-UBS Commodity Index is a broadly diversified index that allows investors to track commodity futures through a single measure. |

| April 30, 2013 | William Blair Funds | 7 |

Commodity Strategy Long/Short Fund

Performance Highlights (Unaudited)

| Average Annual Total Return at 4/30/2013 | | | | | |

| | Fiscal Year | | | | Since |

| | to Date | | 1 Year | | Inception(a) |

| Class N | (3.40)% | | (4.65)% | | (4.40)% |

| Class I | (3.35)% | | (4.41)% | | (4.16)% |

| Morningstar Long/Short Commodity Index | (0.82)% | | (14.07)% | | (14.13)% |

| (a) | For the period from April 25, 2012 (Commencement of Operations) to April 30, 2013. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. The Fund involves a high level of risk and may not be appropriate for everyone. You could lose money by investing in the Fund. There can be no assurance that the Fund's investment objective will be achieved or that the Fund's investment strategies will be successful. The Fund is not a complete investment program. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Morningstar Long/Short Commodity Index is a commodity futures index that uses the momentum rule to determine if each commodity is held long, short, or flat. The momentum rule compares a commodity's price to its 12 month moving average. If at monthly rebalance a commodity price is above its 12 month moving average, the index will take a long position. If the price is below its 12 month moving average, the index will take a short position. However, if the commodity is in the energy sector and the price is below its 12 month moving average, the index takes a flat position (position moved to cash).

This report identifies the Fund's investments on April 30, 2013. These holdings are subject to change. Not all investments in the Fund performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

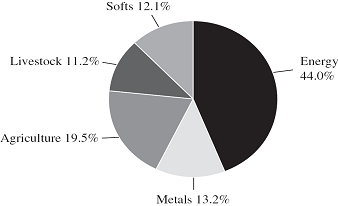

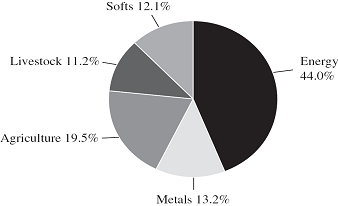

Sector Diversification (Unaudited)

The chart below provides a breakdown of the commodity exposure within the total return Swap as of April 30, 2013.

| 8 | Semi-Annual Report | April 30, 2013 |

| William Blair Commodity Strategy Long/Short Fund |

Consolidated Portfolio of Investments, April 30, 2013 (unaudited)

| | | | NRSRO | | Principal | | | | |

| | Issuer | | Rating | | Amount | | | Value | |

| | | | | | | | | | |

| | U.S. Government and U.S. Government Agency—74.6% | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Federal National Mortgage Association (FNMA)—52.4% | | | | | | | | | | | |

| # | 705741, 5.000%, due 6/1/18 | | | | | $ | 103,046 | | | $ | 110,313 | |

| # | 751313, 5.000%, due 3/1/19 | | | | | | 156,475 | | | | 170,926 | |

| # | 889670, 5.500%, due 6/1/23 | | | | | | 135,388 | | | | 149,814 | |

| # | AC3674, 4.500%, due 10/1/24 | | | | | | 1,123,975 | | | | 1,236,791 | |

| # | AC5124, 4.000%, due 11/1/24 | | | | | | 568,876 | | | | 623,642 | |

| # | AC0596, 4.000%, due 12/1/24 | | | | | | 379,800 | | | | 416,363 | |

| # | AC6257, 4.000%, due 12/1/24 | | | | | | 528,486 | | | | 579,364 | |

| # | 932629, 4.000%, due 3/1/25 | | | | | | 94,505 | | | | 103,603 | |

| # | AL2851, 4.000%, due 8/1/26 | | | | | | 325,453 | | | | 356,785 | |

| # | AK0498, 3.500%, due 1/1/27 | | | | | | 543,156 | | | | 590,036 | |

| # | AO0627, 3.500%, due 5/1/27 | | | | | | 1,693,638 | | | | 1,839,815 | |

| # | AP0446, 3.500%, due 7/1/27 | | | | | | 422,900 | | | | 459,401 | |

| # | AL2590, 4.000%, due 7/1/27 | | | | | | 558,214 | | | | 611,954 | |

| # | AA7611, 5.000%, due 5/1/39 | | | | | | 126,615 | | | | 143,031 | |

| # | 932638, 5.000%, due 3/1/40 | | | | | | 359,489 | | | | 399,809 | |

| | Total FNMA Mortgage Obligations | | | | | | | | | | 7,791,647 | |

| | | | | | | | | | | | | |

| | Federal Home Loan Mortgage Corp. (FHLMC)—18.4% | | | | | | | | | | | |

| # | G11697, 5.500%, due 4/1/20 | | | | | | 182,653 | | | | 197,590 | |

| # | G13124, 6.000%, due 12/1/22 | | | | | | 208,298 | | | | 230,213 | |

| # | J16051, 4.500%, due 7/1/26 | | | | | | 335,594 | | | | 365,801 | |

| # | J19032, 3.500%, due 5/1/27 | | | | | | 489,297 | | | | 531,342 | |

| # | J21621, 3.000%, due 12/1/27 | | | | | | 478,301 | | | | 512,933 | |

| # | G04053, 5.500%, due 3/1/38 | | | | | | 175,394 | | | | 195,527 | |

| # | G06964, 5.500%, due 11/1/38 | | | | | | 369,424 | | | | 418,270 | |

| # | G05723, 6.500%, due 11/1/38 | | | | | | 245,340 | | | | 276,542 | |

| | Total FHLMC Mortgage Obligations | | | | | | | | | | 2,728,218 | |

| | | | | | | | | | | | | |

| | U.S. Treasury Inflation Indexed Notes/Bonds—3.8% | | | | | | | | | | | |

| | U.S. Treasury Inflation Indexed Note,

2.375%, due 1/15/17 | | | | | | 299,244 | | | | 344,061 | |

| | U.S. Treasury Inflation Indexed Note,

1.625%, due 1/15/18 | | | | | | 193,884 | | | | 223,285 | |

| | Total U.S. Treasury Inflation Indexed Notes/Bonds | | | | | | | | | | 567,346 | |

| | | | | | | | | | | | | |

| | Total U.S. Government and U.S. Government Agency—74.6% | | | | | | | | | | | |

| | (cost $11,048,989) | | | | | | | | | | 11,087,211 | |

| | | | | | | | | | | | | |

| | Asset-Backed Securities—9.7% | | | | | | | | | | | |

| | CNH Equipment Trust, 2010-C, Tranche A3,

1.170%, 5/15/15 | | AAA | | | | 16,252 | | | | 16,279 | |

| | Harley-Davidson Motorcycle Trust, 2011-2, Tranche A2,

0.710%, 5/15/15 | | Aaa | | | | 22,800 | | | | 22,813 | |

| | Chase Issuance Trust, 2008-A11, Tranche A11,

5.400%, 7/15/15 | | AAA | | | | 100,000 | | | | 101,058 | |

| | BMW Vehicle Owner Trust, 2010-A, Tranche A4,

2.100%, 10/25/16 | | AAA | | | | 83,518 | | | | 83,821 | |

| | GE Dealer Floorplan Master Note Trust, 2012-1, Tranche A,

0.769%, 2/20/17, VRN | | Aaa | | | $ | 100,000 | | | $ | 100,745 | |

| | Capital One Multi-Asset Execution Trust, 2004-A4, Tranche A4,

0.419%, 3/15/17, VRN | | AAA | | | | 125,000 | | | | 125,132 | |

| | Bank of America Credit Card Trust, 2007-A15, Tranche A15,

0.549%, 4/17/17, VRN | | AAA | | | | 125,000 | | | | 125,484 | |

| | Citibank Credit Card Issuance Trust, 2008-A6, Tranche A6,

1.399%, 5/22/17, VRN | | AAA | | | | 200,000 | | | | 204,422 | |

| | Hertz Vehicle Financing LLC-144A, 2013-1A, Tranche B1,

1.860%, 8/25/17 | | Baa1 | | | | 150,000 | | | | 150,294 | |

| | Citibank Credit Card Issuance Trust, 2006-A8,

0.317%, 12/17/18, VRN | | AAA | | | | 200,000 | | | | 199,108 | |

| | SLM Student Loan Trust, 2008-5, Tranche A4,

1.976%, 7/25/23, VRN | | Aaa | | | | 300,000 | | | | 315,080 | |

| | Total Asset-Backed Securities—9.7% | | | | | | | | | | | |

| | (cost $1,449,549) | | | | | | | | | | 1,444,236 | |

| | | | | | | | | | | | | |

| | Corporate Obligations—10.0% | | | | | | | | | | | |

| | Citigroup, Inc.,

2.650%, due 3/2/15 | | A | | | | 200,000 | | | | 205,929 | |

| | The Goldman Sachs Group, Inc.,

3.300%, due 5/3/15 | | A | | | | 200,000 | | | | 208,650 | |

| | American Express Credit Corporation,

2.750%, due 9/15/15 | | A+ | | | | 250,000 | | | | 261,881 | |

| | Royal Bank of Scotland Group, PLC,

2.550%, due 9/18/15 | | A | | | | 100,000 | | | | 103,006 | |

| | Capital One Financial Corporation,

1.000%, due 11/6/15 | | A- | | | | 200,000 | | | | 199,452 | |

| | Morgan Stanley,

1.538%, due 2/25/16, VRN | | A | | | | 200,000 | | | | 201,104 | |

| | Bank of America Corporation,

1.104%, due 3/22/16, VRN | | A | | | | 100,000 | | | | 99,915 | |

| | Credit Agricole S.A.—144A,

1.438%, due 4/15/16, VRN | | A+ | | | | 200,000 | | | | 200,290 | |

| | Total Corporate Obligations—10.0%

(cost $1,457,805) | | | | | | | | | | 1,480,227 | |

| | Total Long-Term Investments—94.3%

(cost $13,956,343) | | | | | | | | | | 14,011,674 | |

| | | | | | | | | | | | | |

| | Short-Term Investments—15.5% | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Time Deposit—4.4% | | | | | | | | | | | |

| | State Street Euro Dollar Time Deposit,

0.010%, due 5/1/13 | | | | | | 650,266 | | | | 650,266 | |

See accompanying Notes to Financial Statements.

| April 30, 2013 | William Blair Funds | 9 |

| William Blair Commodity Strategy Long/Short Fund |

Consolidated Portfolio of Investments, April 30, 2013 (unaudited)

| Issuer | | Principal Amount | | | Value | |

| | | | | | | |

| Money Market Fund—5.0% | | | | | | |

| SSgA Prime Money Market Fund (a) | | $ | 750,000 | | | $ | 750,000 | |

| | | | | | | | | |

| Repurchase Agreement—6.1% | | | | | | | | |

| Fixed Income Clearing Corporation, 0.060% dated 4/30/13, due 5/1/13, repurchase price $906,757 collateralized by U.S. Treasury Bond, 4.500%, due 8/15/39 | | | 906,755 | | | | 906,755 | |

| Total Short-Term Investments—15.5% | | | | | | | | |

| (cost $2,307,021) | | | | | | | 2,307,021 | |

| Total Investments—109.8% | | | | | | | | |

| (cost $16,263,364) | | | | | | | 16,318,695 | |

| Liabilities, plus cash and other assets—(9.8)% | | | | | | | (1,451,448 | ) |

| Net assets—100.0% | | | | | | $ | 14,867,247 | |

Total Return Swap

| Reference Entity | | Effective/

Expiration

Date | | | Counterparty | | Notional

Amount | | | | Unrealized

Appreciation

(Depreciation) |

| William Blair Commodity Strategy Long-Short Mutual Fund Index | | 4/26/17 | | | Deutsche Bank AG, London Branch | | $ | 18,816,304 | | | | $(671,838) |

(a) Security, or portion of security, is segregated as collateral for the total return swap aggregating a total value of $750,000.

NRSRO = Nationally Recognized Statistical Rating Organization—The credit quality ratings of the securities in the Fund reflect the highest category rating by either Fitch Ratings, Moody’s Investors Service Inc., or Standard & Poor’s, a division of the McGraw-Hill Companies, Inc.

The obligations of certain U. S. Government-sponsored securities are neither issued nor guaranteed by the U. S. Treasury.

VRN = Variable Rate Note

See accompanying Notes to Financial Statements.

| 10 | Semi-Annual Report | April 30, 2013 |

| Statements of Assets and Liabilities (unaudited) |

As of April 30, 2013

| | | | | | Commodity |

| | | | | | Strategy |

| | | Macro | | | Long/Short |

| | | Allocation | | | Fund |

| | | Fund | | | (Consolidated) |

| | | | | | |

| Assets | | | | | | | | | |

| Investments in securities, at cost | | $ | 114,605,436 | | | | $ | 16,263,364 | |

| | | | | | | | | | |

| Investments in securities, at value | | $ | 84,068,598 | | | | $ | 15,411,940 | |

| Repurchase agreement | | | 33,775,927 | | | | | 906,755 | |

| Segregated cash at broker | | | 7,264,897 | | | | | — | |

| Foreign currency, at value ($528,512 ; $—) | | | 538,298 | | | | | — | |

| Receivable for fund shares sold | | | 5,395,368 | | | | | — | |

| Receivable from Advisor | | | 66,960 | | | | | 93,907 | |

| Dividend and interest receivable | | | 56 | | | | | 42,082 | |

| Unrealized appreciation on forward currency contracts | | | 1,495,946 | | | | | — | |

| Total assets | | | 132,606,050 | | | | | 16,454,684 | |

| Liabilities | | | | | | | | | |

| Security sold short ($6,706,050 ; $—) | | | 7,288,000 | | | | | — | |

| Payable for futures variation margin | | | 952,920 | | | | | — | |

| Payable for investment securities purchased | | | 2,027,848 | | | | | 838,098 | |

| Payable for fund shares redeemed | | | 50,250 | | | | | — | |

| Payable to custodian | | | 7,932 | | | | | — | |

| Unrealized depreciation on swap contract | | | 11,417 | | | | | 671,838 | |

| Management fee payable | | | 72,827 | | | | | 16,905 | |

| Distribution and shareholder administration fees payable | | | 21,493 | | | | | 2,039 | |

| Other payables and accrued expenses | | | 31,130 | | | | | 58,557 | |

| Total liabilities | | | 10,463,817 | | | | | 1,587,437 | |

| Net Assets | | $ | 122,142,233 | | | | $ | 14,867,247 | |

| Capital | | | | | | | | | |

| Composition of Net Assets | | | | | | | | | |

| Par value of shares of beneficial interest | | | 10,243 | | | | | 1,558 | |

| Capital paid in excess of par value | | | 116,897,188 | | | | | 15,539,621 | |

| Accumulated net investment income (loss) | | | (192,613 | ) | | | | (28,133 | ) |

| Accumulated realized gain (loss) | | | 546,178 | | | | | (29,292 | ) |

| Net unrealized appreciation (depreciation) of investments and foreign currencies | | | 4,881,237 | | | | | (616,507 | ) |

| Net Assets | | $ | 122,142,233 | | | | $ | 14,867,247 | |

| | | | | | | | | | |

| Class N Shares | | | | | | | | | |

| Net Assets | | $ | 41,748,018 | | | | $ | 1,107,274 | |

| Shares Outstanding | | | 3,507,529 | | | | | 116,279 | |

| Net Asset Value Per Share | | $ | 11.91 | | | | $ | 9.52 | |

| Class I Shares | | | | | | | | | |

| Net Assets | | $ | 80,394,215 | | | | $ | 13,759,973 | |

| Shares Outstanding | | | 6,735,420 | | | | | 1,441,947 | |

| Net Asset Value Per Share | | $ | 11.94 | | | | $ | 9.54 | |

See accompanying Notes to Financial Statements.

| April 30, 2013 | William Blair Funds | 11 |

| Statements of Operations (unaudited) |

For the Period Ended April 30, 2013

| | | | | | Commodity |

| | | | | | Strategy |

| | | Macro | | | Long/Short |

| | | Allocation | | | Fund |

| | | Fund | | | (Consolidated) |

| | | | | | |

| Investment income | | | | | | | | | |

| Dividends | | $ | 636,290 | | | | $ | — | |

| Interest | | | 6,699 | | | | | 117,485 | |

| Total income | | | 642,989 | | | | | 117,485 | |

| Expenses | | | | | | | | | |

| Investment advisory fees | | | 272,905 | | | | | 99,556 | |

| Distribution fees | | | 26,287 | | | | | 1,405 | |

| Shareholder administration fees | | | 51,170 | | | | | 10,667 | |

| Custodian fees | | | 43,495 | | | | | 38,824 | |

| Transfer agent fees | | | 5,134 | | | | | 4,266 | |

| Sub-transfer agent fees | | | | | | | | | |

| Class N | | | 5,438 | | | | | 254 | |

| Class I | | | 4,596 | | | | | 1,465 | |

| Professional fees | | | 55,088 | | | | | 34,829 | |

| Registration fees | | | 18,616 | | | | | 41,423 | |

| Shareholder reporting fees | | | 25,770 | | | | | 39,542 | |

| Trustee fees | | | 311 | | | | | 293 | |

| Other expenses | | | 6,045 | | | | | 3,833 | |

| Short dividend expenses | | | 36,569 | | | | | — | |

| Total expenses before waiver | | | 551,424 | | | | | 276,357 | |

| Expenses reimbursed to (waived or absorbed by) the Advisor | | | (113,265 | ) | | | | (154,061 | ) |

| Net expenses | | | 438,159 | | | | | 122,296 | |

| Net investment income (loss) | | | 204,830 | | | | | (4,811 | ) |

| Realized and unrealized gain (loss) | | | | | | | | | |

| Net Realized gain (loss) on transactions from: | | | | | | | | | |

| Investments in securities | | | 133,326 | | | | | 6,715 | |

| Options | | | (1,542,376 | ) | | | | — | |

| Futures contracts | | | 645,471 | | | | | — | |

| Swaps | | | 561,863 | | | | | — | |

| Forward foreign currency contracts | | | 783,828 | | | | | — | |

| Foreign currency transactions | | | (80,364 | ) | | | | — | |

| Total net realized gain (loss) | | | 501,748 | | | | | 6,715 | |

| Change in net unrealized appreciation (depreciation) of: | | | | | | | | | |

| Investments | | | 2,173,678 | | | | | (21,419 | ) |

| Options | | | (4,257 | ) | | | | — | |

| Futures contracts | | | 1,101,207 | | | | | — | |

| Swaps | | | (73,523 | ) | | | | (456,651 | ) |

| Forward foreign currency contracts | | | 1,333,748 | | | | | — | |

| Foreign currency translations | | | 17,093 | | | | | — | |

| Change in net unrealized appreciation (depreciation) | | | 4,547,946 | | | | | (478,070 | ) |

| Net increase (decrease) in net assets resulting from operations | | $ | 5,254,524 | | | | $ | (476,166 | ) |

See accompanying Notes to Financial Statements.

| 12 | Semi-Annual Report | April 30, 2013 |

| Statements of Changes in Net Assets (unaudited) |

For the Period Ended April 30, 2013

| | | | | | | | | Commodity Strategy | |

| | | | | | | | | Long/Short Fund | |

| | | Macro Allocation Fund | | | (Consolidated) | |

| | | 2013 | | | 2012(a) | | | 2013 | | | 2012(b) | |

| | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | $ | 204,830 | | | $ | 178,321 | | | $ | (4,811 | ) | | $ | (3,789 | ) |

| Net realized gain (loss) on investments, and other assets and liabilities | | | 501,748 | | | | 670,771 | | | | 6,715 | | | | 1,578 | |

| Change in net unrealized appreciation (depreciation) on investments, and other assets and liabilities | | | 4,547,946 | | | | 333,291 | | | | (478,070 | ) | | | (138,437 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 5,254,524 | | | | 1,182,383 | | | | (476,166 | ) | | | (140,648 | ) |

| Distributions to shareholders from | | | | | | | | | | | | | | | | |

| Net investment income | | | | | | | | | | | | | | | | |

| Class N | | | (118,305 | ) | | | (7,330 | ) | | | (4,033 | ) | | | — | |

| Class I | | | (306,887 | ) | | | (35,165 | ) | | | (53,887 | ) | | | — | |

| Net realized gain | | | | | | | | | | | | | | | | |

| Class N | | | (211,562 | ) | | | — | | | | — | | | | — | |

| Class I | | | (523,901 | ) | | | — | | | | — | | | | — | |

| Total Distributions | | | (1,160,655 | ) | | | (42,495 | ) | | | (57,920 | ) | | | — | |

| Capital stock transactions | | | | | | | | | | | | | | | | |

| Net proceeds from sale of shares | | | 88,227,592 | | | | 35,028,121 | | | | 4,739,200 | | | | 13,555,573 | |

| Shares issued in reinvestment of income dividends and capital gain distributions | | | 954,059 | | | | 30,634 | | | | 38,744 | | | | — | |

| Less cost of shares redeemed | | | (4,273,054 | ) | | | (3,058,876 | ) | | | (2,358,441 | ) | | | (433,095 | ) |

| Net increase (decrease) in net assets resulting from capital share transactions | | | 84,908,597 | | | | 31,999,879 | | | | 2,419,503 | | | | 13,122,478 | |

| Increase (decrease) in net assets | | | 89,002,466 | | | | 33,139,767 | | | | 1,885,417 | | | | 12,981,830 | |

| Net assets | | | | | | | | | | | | | | | | |

| Beginning of period | | | 33,139,767 | | | | — | | | | 12,981,830 | | | | — | |

| End of period | | $ | 122,142,233 | | | $ | 33,139,767 | | | $ | 14,867,247 | | | $ | 12,981,830 | |

| Accumulated net investment income (loss) at the end of the period | | $ | (192,613 | ) | | $ | 27,749 | | | $ | (28,133 | ) | | $ | 34,598 | |

| (a) | For the period from November 29, 2011 (Commencement of Operations) to October 31, 2012 |

| (b) | For the period from April 25, 2012 (Commencement of Operations) to October 31, 2012 |

See accompanying Notes to Financial Statements.

| April 30, 2013 | William Blair Funds | 13 |

| |

| Notes to Financial Statements |

| |

(1) Organization

The William Blair Macro Allocation Fund (“MAF” or “Macro Allocation”) and the William Blair Commodity Strategy Long/Short Fund (“CLS” or “Commodity Strategy Long/Short”) are separate Funds (together the “Funds”) within the William Blair Funds (the “Trust”). The Trust is registered under the Investment Company Act of 1940 (the “1940 Act”), as amended, as an open-end management investment company. For each Fund, the number of shares authorized is unlimited.

(a) Share Classes

Three different classes of shares currently are available: N, I and Institutional. There are currently no assets in the Institutional Share Class. This report includes financial highlight information for Classes N and I. Below is a brief description of the Class N shares and the Class I shares covered by this report:

Class N shares are offered to the general public, either directly through the Trust’s distributor or through a select number of financial intermediaries. Class N shares are sold without any sales load, and carry an annual 12b-1 distribution fee of 0.25%, a Shareholder Administration fee of 0.15%, and may have a Sub-transfer agent fee that is not a fixed rate and may vary by Fund and class.

Class I shares are offered to a limited group of investors. They do not carry any sales load or distribution fees and generally have lower ongoing expenses than the Class N shares. Class I shares have a Shareholder Administration fee of 0.15% and may have a Sub-transfer agent fee that is not a fixed rate and may vary by Fund and class.

(b) Fund Objective and Description

Macro Allocation Fund

MAF’s objective is to maximize long-term risk-adjusted total return.

In pursuing its investment objective, MAF employs a dynamic global macro asset allocation strategy. This strategy attempts to exploit periodic market inefficiencies by taking long and short positions in various asset classes (e.g., equity and fixed income) and currencies with a view to profit from movements across and within such asset classes and currencies. MAF uses a top-down approach that focuses on general price movements in various asset classes and currencies rather than the performance of individual company securities. MAF’s macro asset allocation strategy is based primarily on the fundamental investment valuations of asset classes and currencies. The goal is to identify and exploit periodic discrepancies between fundamental values and market prices. These perceived value/price discrepancies are the foundation of the MAF’s portfolio construction. MAF may invest in or seek exposure to a wide range of asset classes including, without limitation, equity and fixed income markets (including asset-backed securities, mortgage-backed securities and other collateralized obligations and all grades and maturities of domestic and foreign credit, including high yield (junk bonds)), commodities, and real estate, and currencies. MAF has no geographical or other limits on the allocation of its assets among asset classes.

Commodity Strategy Long/Short Fund

CLS’s objective is to seek long-term risk-adjusted total return.

CLS’s investment strategies seeks to provide broad exposure to commodities, provide attractive risk-adjusted returns with low correlations to traditional asset classes, maintain the inflation protection of commodities investing and profit in both up and down commodity markets. CLS seeks to provide exposure to the commodity trading strategies of independent commodity trading advisors (“CTAs”) selected by William Blair & Company, L.L.C., (the “Advisor”) currently through derivative instruments (instruments whose values are based on, for example, indices, currencies or securities), and invests in fixed-income securities.

CLS’s commodity investments include derivative instruments that provide exposure to trading strategies of CTAs selected by the Advisor and/or by investing in limited liability companies, limited partnerships, corporations or other pooled vehicles (“Underlying Vehicles”) managed by such CTAs. The Advisor currently seeks exposure to CTA trading strategies through a total return swap (the “Swap”), with Deutsche Bank AG, London Branch (“Deutsche Bank”) as the counterparty. The Swap, which is a type of derivative instrument, is based on a customized index (the “Index”) designed to replicate the aggregate returns

| 14 | Semi-Annual Report | April 30, 2013 |

of the trading strategies of CTAs selected by the Advisor. The swap currently has exposure to seven different CTAs which can be broadly placed into three different trading strategies. Systematic strategies which utilize quantitative systems to exploit trending behavior of futures markets over various time frames and may include some counter trend and mean reversion aspects. Fundamental strategies conduct deep research into fundamental supply and demand factors that drive futures markets and use specialized models, data sources and other tools to construct expectations of fundamental values. Specialist strategies employ specialized knowledge, research and analysis systems to seek value from niche markets. As of April 30, 2013, the swap was made up of 39.7% Systematic strategies, 17.4% Fundamental strategies and 42.9% Specialist strategies.

The Swap is based on a notional amount agreed to by the Advisor and Deutsche Bank. The notional amount of the Swap may be adjusted from time to time and may exceed the net assets of the fund. The Advisor may add or remove CTAs from the Index or increase or decrease the weighting given to a CTA included in the Index. The Swap will expire on April 26, 2017, but may be terminated by the Fund on one day’s notice to Deutsche Bank. The notional amount of the Swap as of April 30, 2013 was $18,816,304.

The Swap value reflects the current cost of the fees of Deutsche Bank and the fixed fees of the CTAs together aggregating no more than 1.80% of the notional allocations to the CTAs included in the Index and may include a deduction for the performance fees of the individual CTAs in an amount not to exceed 20%. The deduction for performance fees in the Index will be based on the performance results of each individual CTA’s trading strategy represented in the Index. Accordingly, a performance fee for one or more CTA trading strategies represented in the Index may be deducted in calculating the Index even if the aggregate returns of the trading strategies of the CTAs are negative. To the extent the aggregate notional allocations to the CTAs included in the Index exceed the net assets of the Fund, the deduction from the Index for the fees of Deutsche Bank and the fixed fees of the CTAs will be greater as a percentage of the Fund’s net assets than the deduction would be if the aggregate notional allocations to the CTAs included in the Index were equal to or less than the net assets of the Fund. Fees are accrued daily within the Swap and deducted from the Swap value quarterly. During the period ended April 30, 2013, total fees of the Swap were $128,791 of which $29,476 was related to performance fees.

(2) Significant Accounting Policies

The following is a summary of the Funds’ significant accounting policies in effect during the period covered by the financial statements, which are in accordance with U.S. generally accepted accounting principles.

(a) Basis for Consolidation for Commodity Strategy Long/Short Fund

CLS’s investments in the Swap are made through William Blair CLS Ltd., a wholly-owned subsidiary of CLS organized under the laws of the Cayman Islands (the “Subsidiary”). The Subsidiary acts as an investment vehicle for CLS in order to effect certain investments for the Fund consistent with CLS’s investment objective and policies as specified in its Prospectus and Statement of Additional Information. CLS’s Portfolio of Investments has been consolidated and includes the portfolio holdings of CLS and the Subsidiary. The consolidated financial statements include the accounts of CLS and the Subsidiary. All inter-company transactions and balances have been eliminated. Under the Articles of Association, shares issued by the Subsidiary confer upon a shareholder the right to receive notice of, to attend and to vote at general meetings of the Subsidiary and shall confer upon the shareholder rights in a winding-up or repayment of capital and the right to participate in the profits or assets of the Subsidiary. Investments held within the Subsidiary are used to meet collateral requirements of the Swap and are invested in a money market fund. Under normal conditions, CLS will have an investment in the Subsidiary between 5% and 20% of the net assets of CLS. As of April 30, 2013, the total investment in the Subsidiary was $732,752, representing 4.9% of the net assets of CLS.

(b) Investment Income and Transactions

Dividend income and expense is recorded on the ex-dividend date, except for those dividends from certain foreign securities that are recorded when the information is available.

Interest income is recorded on an accrual basis, adjusted for amortization of premium or discount. Variable rate bonds and floating rate notes earn interest at coupon rates that fluctuate at specific time intervals. The interest rates shown in the Consolidated Portfolio of Investments for CLS were the rates in effect on April 30, 2013. Put bonds may be redeemed at the discretion of the holder on specified dates prior to maturity.

Premiums and discounts are accreted and amortized on a straight-line basis for short-term investments with maturities < 60 days and on an effective interest method for long-term investments.

Paydown gains and losses on mortgage and asset-backed securities are reclassified to interest income. For the period ended April 30, 2013, the Commodity Strategy Long/Short Fund recognized a reduction of income and an increase in net realized gains of $77,394.

| April 30, 2013 | William Blair Funds | 15 |

The Funds do not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Reported net realized foreign currency gains or losses arise from disposition of foreign currency, the difference in the foreign exchange rates between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the ex-date or accrual date and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes (due to the changes in the exchange rate) in the value of foreign currency and other assets and liabilities denominated in foreign currencies held at year end.

Security and shareholder transactions are accounted for no later than one business day following the trade date. However, for financial reporting purposes, security and shareholder transactions are accounted for on the trade date of the last business day of the reporting period. Realized gains and losses from securities transactions are recognized on a specifically identified cost basis.

(c) Share Valuation and Distributions to Shareholders

Shares are sold and redeemed on a continuous basis at net asset value (“NAV”). The NAV per share is determined separately for each class by dividing each Fund’s net assets attributable to that class by the number of shares of the class outstanding as of the close of regular trading on the New York Stock Exchange (the “Exchange”), which is generally 4:00 p.m. Eastern time, on each day the Exchange is open. Redemption fees may be applicable to redemptions or exchanges within 60 days of purchase. For both Class N and Class I shares, the Funds assess a 2% redemption fee on shares sold or exchanged that have been owned 60 days or less as disclosed within each Fund’s Prospectus. The redemption fees collected by the Funds are netted against the amount of redemptions for presentation on the (Consolidated) Statements of Changes in Net Assets. As of April 30, 2013, the Funds have not collected any redemption fees.

Distributions from net investment income, if any, of the Funds are declared and paid at least annually. Capital gain distributions, if any, are declared and paid at least annually in December. Distributions payable to shareholders are recorded on the ex-dividend date.

(d) Foreign Currency Translation

The Funds may invest in securities denominated in foreign currencies. As such, assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the current exchange rate on the date of valuation. The values of foreign investments, open forward foreign currency contracts, and cash denominated in foreign currencies are translated into U.S. dollars using a spot market rate of exchange as of the time of the determination of each Fund’s NAV, typically 4:00 p.m. Eastern time on days when there is regular trading on the New York Stock Exchange. Payables and receivables for securities transactions, dividends, interest income and tax reclaims are translated into U.S. dollars using a spot market rate of exchange as of 4:00 p.m. Eastern time. Settlement of purchases and sales and dividend and interest receipts are translated into U.S. dollars using a spot market rate of exchange as of 11:00 a.m. Eastern time.

(e) Income Taxes

Each Fund intends to comply with the provisions of Subchapter M of the Internal Revenue Code available to regulated investment companies. Each Fund intends to make the requisite distributions of income and capital gains to its shareholders sufficient to relieve it from all, or substantially all, federal income and excise taxes. No provision for federal income and excise taxes has been made.

Management has evaluated all of the uncertain tax positions of the Funds and has determined that no provision for income tax is required to be recorded in the financial statements. As of October 31, 2012, the Funds had not been in existence for a complete fiscal year and therefore have not made annual filings with the Internal Revenue Service.

The Funds treat the deferred loss associated with current period wash sales as an adjustment to the cost of investments for tax purposes. The cost of investments for federal income tax purposes and related gross unrealized appreciation/(depreciation) and net unrealized appreciation (depreciation) at April 30, 2013, were as follows:

| Fund | | Cost of

Investments | | Gross

Unrealized

Appreciation | | Gross

Unrealized

Depreciation | | Net

Unrealized

Appreciation/ (Depreciation) |

| Macro Allocation | | | $114,614,956 | | | $3,787,504 | | | | $557,935 | | | | $3,229,569 | |

| Commodity Strategy Long/Short | | | 16,263,364 | | | 73,241 | | | | 17,910 | | | | 55,331 | |

| 16 | Semi-Annual Report | April 30, 2013 |

The timing and characterization of certain income and capital gain distributions are determined annually in accordance with federal income tax regulations that may differ from U.S. generally accepted accounting principles. As a result, net investment income or loss and net realized gain or loss for a reporting period may differ from the amount distributed during such period. In addition, the Funds may periodically record reclassifications among certain capital accounts to reflect differences between financial reporting and income tax basis distributions. The reclassifications were reported in order to reflect the tax treatment for certain permanent differences that exist between income tax regulations and U.S. generally accepted accounting principles. The reclassifications generally relate to differing treatment of paydown gains and losses, Section 988 currency transactions and income and gains from swap contracts. These reclassifications have no impact on the net asset values of the Funds. Accordingly, at October 31, 2012, the following reclassifications were recorded:

| Fund | | Accumulated

Net Investment

Income(Loss) | | Accumulated

Net Realized

Gain(Loss) | | Capital Paid

in Excess

of Par Value |

| Macro Allocation | | $(108,077 | ) | | $109,122 | | | $(1,045 | ) |

| Commodity Strategy Long/Short. | | 38,387 | | | (37,585 | ) | | (802 | ) |

The tax character of distributions paid during fiscal year ended 2012 was as follows:

| Fund | | Ordinary

Income | | Long-Term

Capital Gains | | Total

Distributions |

| Macro Allocation | | $42,495 | | | $— | | | $42,495 | |

| Commodity Strategy Long/Short | | — | | | — | | | — | |

As of October 31, 2012, the components of distributable earnings on a tax basis were as follows:

| Fund | | Undistributed

Ordinary Income | | Accumulated

Capital and

Other Losses | | Undistributed

Long-Term

Capital Gain | | Net Unrealized

Appreciation

(Depreciation) |

| Macro Allocation | | | $753,928 | | | | $ — | | | | $141,124 | | | | $ 245,881 | |

| Commodity Strategy Long/Short | | | 34,598 | | | | (36,007 | ) | | | — | | | | (138,437 | ) |

As of October 31, 2012, the Commodity Strategy Long/Short Fund has short-term capital loss carryforward, without expiration, of $36,007.

(f) Repurchase Agreements

In a repurchase agreement, a Fund buys a security at one price and at the time of sale, the seller agrees to repurchase the obligation at a mutually agreed upon time and price (usually within seven days). The repurchase agreement thereby determines the yield during the purchaser’s holding period, while the seller’s obligation to repurchase is secured by the value of the underlying security. The Advisor will monitor, on an ongoing basis, the value of the underlying securities to ensure that the value always equals or exceeds the repurchase price plus accrued interest. Repurchase agreements may involve certain risks in the event of a default or insolvency of the other party to the agreement, including possible delays or restrictions upon a Fund’s ability to dispose of the underlying securities. The risk to a Fund is limited to the ability of the seller to pay the agreed upon sum on the delivery date. In the event of default, a repurchase agreement provides that a Fund is entitled to sell the underlying collateral. The loss, if any, to a Fund will be the difference between the proceeds from the sale and the repurchase price. However, if bankruptcy proceedings are commenced with respect to the seller of the security, disposition of the collateral by the Fund may be delayed or limited. Although no definitive creditworthiness criteria are used, the Advisor reviews the creditworthiness of the banks and non-bank dealers with which a Fund enters into repurchase agreements to evaluate those risks. A Fund may, for tax purposes, deem repurchase agreements collateralized by U.S. Government securities to be investments in U.S. Government securities.

(g) Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements. Actual results may differ from those estimates.

(h) Indemnifications

In the normal course of business, the Funds have entered into contracts in which the Funds agree to indemnify the other party or parties against various potential cost or liabilities. The Funds’ maximum exposure under these arrangements is unknown. No claim has been made for indemnification pursuant to any such agreement of the Funds.

| April 30, 2013 | William Blair Funds | 17 |

(3) Valuation

(a) Investment Valuation

The market value of domestic equity securities, including exchange-traded funds, is determined by valuing securities traded on national securities markets or in the over-the-counter markets at the last sale price or, if applicable, the official closing price or, in the absence of a recent sale on the date of determination, the mean between the last reported bid and ask prices.

Investments in mutual funds which are not traded on an exchange are valued at their respective net asset value per share.

The value of foreign equity securities is generally determined based upon the last sale price on the foreign exchange or market on which it is primarily traded and in the currency of that market as of the close of the appropriate exchange or, if there have been no sales during that day, at the mean between the latest bid and ask prices. The Board of Trustees has determined that the passage of time between when the foreign exchanges or markets close and when the Funds compute their net asset values could cause the value of foreign equity securities to no longer be representative or accurate, and as a result, may necessitate that such securities be fair valued. Accordingly, for foreign equity securities, the Funds may use an independent pricing service to fair value price the security as of the close of regular trading on the New York Stock Exchange. As a result, a Fund’s value for a security may be different from the last sale price (or the mean between the latest bid and ask prices).

Fixed-income securities are generally valued using evaluated prices provided by an independent pricing service. The evaluated prices are formed using various market inputs that the pricing service believes accurately represent the market value of a security at a particular point in time. The pricing service determines evaluated prices for fixed-income securities using inputs including, but not limited to, recent transaction prices, dealer quotes, transaction prices for securities with similar characteristics, collateral characteristics, credit quality, payment history, liquidity and market conditions.

Option contracts on securities, currencies and other financial instruments traded on one or more exchanges are valued at their most recent sale price on the exchange on which they are traded most extensively. Futures contracts (and options and swaps thereon) are valued at the most recent settlement price on the exchange on which they are traded most extensively. Forward foreign currency contracts are valued on the basis of the value of the underlying currencies at the prevailing currency exchange rate as supplied by an independent pricing service.

The total return swaps in the Macro Allocation Fund are valued by an independent pricing service using simulation pricing models. These models will value the underlying basket of exchange-traded equity securities within the total return swap based on readily observable market prices.

CLS’ shares of the Subsidiary are valued at the net asset value per share of the Subsidiary, which is calculated using the same valuation procedures as CLS. For CLS, the Subsidiary’s investment in the Swap is fair valued based on the calculation of the Index by the counterparty. The counterparty calculates the Index each index business day at the close of business in London, which is typically 11:00AM Eastern Time. The Advisor performs certain daily tests of the Swap value in order to test the reasonableness of the counterparty’s valuation. In determining the fair value of the Swap, the Advisor, under procedures approved by the Board of Trustees, will consider whether there have been significant events that have occurred from the close of business in London when the Swap is valued and the time that the Fund calculates its NAV.

Securities, and other assets, for which a market price is not available or is deemed unreliable (e.g., securities affected by unusual or extraordinary events, such as natural disasters or securities affected by market or economic events, such as bankruptcy filings), or the value of which is affected by a significant valuation event, are valued at a fair value as determined in good faith by, or under the direction of, the Board of Trustees and in accordance with the Trust’s valuation procedures. The value of fair valued securities may be different from the last sale price (or the latest bid price), and there is no guarantee that a fair valued security will be sold at the price at which a Fund is carrying the security.

(b) Fair Valuation Measurements

Fair value is defined as the price that a Fund would receive upon selling a security in an orderly transaction to an independent buyer in the principal or most advantageous market for the investment. Various inputs are used in determining the value of a Fund’s investments. A three-tier hierarchy of inputs is used to classify fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad levels listed below:

| · | Level 1—Quoted prices (unadjusted) in active markets for an identical security. |

| | | |

| · | Level 2—Prices determined using other significant observable inputs. Observable inputs are inputs that other market participants would use in pricing a security. These may include quoted prices for similar securities, interest rates, |

| 18 | Semi-Annual Report | April 30, 2013 |

| | | prepayment speeds, credit risk, and others. In addition, other observable inputs such as foreign exchange rates, benchmark securities indices and foreign futures contracts may be utilized in the valuation of certain foreign securities when significant events occur between the last sale on the foreign securities exchange and the time the net asset value of the Fund is calculated. |

| | | |

| | · | Level 3—Prices determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable (for example, when there is little or no market activity for an investment) unobservable inputs may be used. Unobservable inputs reflect the Fund’s own assumptions about the factors market participants would use in pricing an investment, and would be based on the best information available. |

The inputs or methodology used for valuing an investment are not necessarily an indication of the risk associated with investing in those securities. For example, money market securities are valued using amortized cost, in accordance with rules under the 1940 Act. Generally, amortized cost approximates the current fair value of a security, but since the value is not obtained from a quoted price in an active market, such securities are reflected as Level 2.

Any transfers between Level 1 and Level 2 are disclosed, effective as of the beginning of the period, in the tables below with the reasons for the transfers disclosed in a note to the tables, if applicable.

A description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis are as follows.

Exchange-Traded Securities

Securities traded on a national securities exchange (or reported on the NASDAQ national market), including exchange-traded funds, are stated at the last reported sales price on the day of valuation. Other securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are stated at the mean between the last reported bid and ask prices. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Fixed-Income Securities

Fixed-income securities including corporate, convertible and municipal bonds and notes, U.S. government agencies, U.S. treasury obligations, sovereign issues, bank loans, convertible preferred securities and non-U.S. bonds are generally valued using evaluated prices provided by an independent pricing service. The evaluated prices are formed using various market inputs that the pricing service believes accurately represent the market value of a security at a particular point in time. The pricing service determines evaluated prices for fixed-income securities using inputs including, but not limited to, recent transaction prices, dealer quotes, transaction prices for securities with similar characteristics, collateral characteristics, credit quality, payment history, liquidity and market conditions. Securities that use similar valuation techniques and observable inputs as described above are categorized as Level 2 of the fair value hierarchy.

Asset-Backed Securities

Mortgage-related and asset-backed securities are usually issued as separate tranches, or classes, of securities within each deal. These securities are also normally valued by pricing service providers that use broker dealer quotations or valuation estimates from their internal pricing models. The pricing models for these securities usually consider tranche-level attributes, current market data, estimated cash flows and market-based yield spreads for each tranche, and incorporate deal collateral performance, as available. Mortgage-related and asset-backed securities that use similar valuation techniques and inputs as described above are categorized as Level 2 of the fair value hierarchy.

Short-Term Investments

Short-term investments having a maturity of 60 days or less at the time of purchase are generally valued at amortized cost, which approximates fair market value. These investments are categorized as Level 2 of the fair value hierarchy.

Derivative Instruments

Listed derivatives, such as certain options and futures contracts, that are actively traded are valued based on quoted prices from the exchange on which they are traded most extensively and are categorized in Level 1 of the fair value hierarchy. Over-the-counter (OTC) derivative contracts include forward foreign currency contracts, swap and certain option contracts related to interest rates, foreign currencies, credit standing of reference entities, equity prices, or commodity prices. Depending on the

| April 30, 2013 | William Blair Funds | 19 |

product and the terms of the transaction, the fair value of OTC derivative products can be modeled taking into account the counterparties’ creditworthiness and using a series of techniques, including simulation models. Many pricing models do not entail material subjectivity because the methodologies employed do not necessitate significant judgments and the pricing inputs are observed from actively quoted markets, as is the case of forward foreign currency contracts and interest rate swaps. A substantial majority of OTC derivative products valued by a Fund using pricing models fall into this category and are categorized within Level 2 of the fair value hierarchy.

CLS Swap Contract

The Swap held by the Subsidiary of CLS is fair valued based on the calculation of the Index by the counterparty. The Swap is not a listed security nor does it actively trade. The fair value is based on inputs that are not readily observable in the market place, primarily of which are the underlying baskets of commodity investments on which the Swap value is derived. The Value of the Swap also reflects deductions for management and performance fees from the underlying CTAs, counterparty fees and trading costs. The Swap is categorized within Level 3 of the fair value hierarchy.

As of April 30, 2013, the hierarchical input levels of securities in each Portfolio, segregated by security class or other financial instrument, are as follows:

| Investments in Securities | | Macro

Allocation | | Commodity

Strategy

Long/Short |

| Assets | | | | | | | | |

| Level 1—Quoted Prices | | | | | | | | |

| Common Stock | | $ | 675,511 | | | $ | — | |

| Exchange-Traded Funds | | | 71,753,550 | | | | — | |

| Purchased Options | | | 1,024,563 | | | | — | |

| Level 2—Other Significant Observable Inputs | | | | | | | | |

| Government Securities | | | 10,614,974 | | | | 11,087,211 | |

| Asset-Backed Securities | | | — | | | | 1,444,236 | |

| Corporate Obligations | | | — | | | | 1,480,227 | |

| Short-term Investments | | | 33,775,927 | | | | 2,307,021 | |

| Liabilities | | | | | | | | |

| Level 1—Quoted Prices | | | | | | | | |

| Exchange-Traded Funds | | | (7,288,000 | ) | | | — | |

| Total Investments in Securities | | $ | 110,556,525 | | | $ | 16,318,695 | |

| | | | | | | | | |

| Other Financial Instruments | | | | | | | | |

| Assets | | | | | | | | |

| Level 1—Quoted Prices | | | | | | | | |

| Futures Contracts | | $ | 1,568,068 | | | $ | — | |

| Level 2—Other Significant Observable Inputs | | | | | | | | |

| Forward Foreign Currency Contracts | | | 1,495,946 | | | | — | |

| Liabilities | | | | | | | | |

| Level 2—Other Significant Observable Inputs | | | | | | | | |

| Futures Contracts | | | (836,565 | ) | | | — | |

| Total Return Swap | | | (11,417 | ) | | | — | |

| Level 3—Significant Unobservable Inputs | | | | | | | | |

| Total Return Swap | | | — | | | | (671,838 | ) |

| Total Other Financial Instruments | | $ | 2,216,032 | | | $ | (671,838 | ) |