UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-5344

William Blair Funds

(Exact name of registrant as specified in charter)

| | |

| 222 West Adams Street, Chicago, IL | | 60606 |

| (Address of principal executive offices) | | (Zip Code) |

Michelle R. Seitz

William Blair Funds

222 West Adams Street, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: 312-236-1600

Date of fiscal year end: December 31

Date of reporting period: June 30, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A Registrant is not required to respond to the collection of information contained in Form N-CSR unless the form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimates and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. (ss) 3507.

| Item 1. | June 30, 2012 Annual Reports transmitted to shareholders. |

William Blair Funds

Semiannual Report

June 30, 2012

Table of Contents

June 30, 2012 | William Blair Funds 1 |

The views expressed in the commentary for each Fund reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The portfolio management team’s views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Statements involving predictions, assessments, analyses, or outlook for individual securities, industries, market sectors, and/or markets involve risks and uncertainties, and there is no guarantee they will come to pass.

This report is submitted for the general information of the shareholders of the William Blair Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by a prospectus of the William Blair Funds. Please carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

2 Semi-Annual Report | June 30, 2012 |

PERFORMANCE AS OF JUNE 30, 2012—CLASS N SHARES (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year

To Date | | | 1 yr | | | 3 yr | | | 5 yr | | | 10 yr

(or since

inception) | | | Inception

Date | | Overall

Morningstar

Rating |

Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 8.95 | | | | 1.11 | | | | 12.88 | | | | 2.07 | | | | 5.51 | | | 3/20/1946 | | «««

Among 1,510 Large Growth Funds |

Morningstar Large Growth | | | 9.23 | | | | 0.81 | | | | 14.83 | | | | 0.96 | | | | 5.19 | | | | |

Russell 3000® Growth | | | 9.98 | | | | 5.05 | | | | 17.55 | | | | 2.79 | | | | 6.13 | | | | |

S&P’s 500 | | | 9.49 | | | | 5.45 | | | | 16.40 | | | | 0.22 | | | | 5.33 | | | | | |

| | | | | | | |

Large Cap Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 12.06 | | | | 4.19 | | | | 14.25 | | | | 1.15 | | | | 3.59 | | | 12/27/1999 | | «««

Among 1,510 Large Growth Funds |

Morningstar Large Growth | | | 9.23 | | | | 0.81 | | | | 14.83 | | | | 0.96 | | | | 5.19 | | | | |

Russell 1000® Growth | | | 10.08 | | | | 5.76 | | | | 17.50 | | | | 2.87 | | | | 6.03 | | | | |

| | | | | | | |

Small Cap Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 9.19 | | | | (6.63 | ) | | | 10.25 | | | | (2.31 | ) | | | 7.15 | | | 12/27/1999 | | ««

Among 662 Small Growth Funds |

Morningstar Small Growth | | | 7.67 | | | | (5.09 | ) | | | 17.34 | | | | 0.94 | | | | 6.70 | | | | |

Russell 2000® Growth | | | 8.81 | | | | (2.71 | ) | | | 18.09 | | | | 1.99 | | | | 7.39 | | | | |

| | | | | | | |

Mid Cap Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 7.03 | | | | (2.86 | ) | | | 17.28 | | | | 3.99 | | | | 5.81 | | | 2/1/2006 | | ««««

Among 678 Mid-Cap Growth Funds |

Morningstar Mid-Cap Growth | | | 7.55 | | | | (4.31 | ) | | | 17.04 | | | | 1.17 | | | | — | | | | |

Russell MidCap® Growth | | | 8.10 | | | | (2.99 | ) | | | 19.01 | | | | 1.90 | | | | 3.82 | | | | |

| | | | | | | |

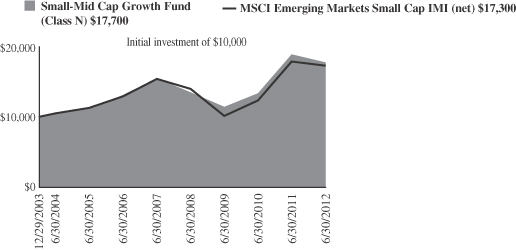

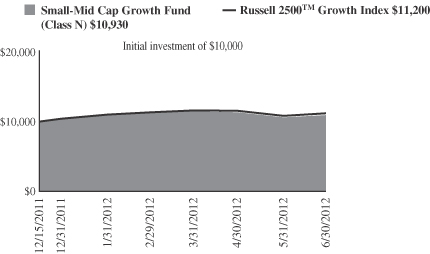

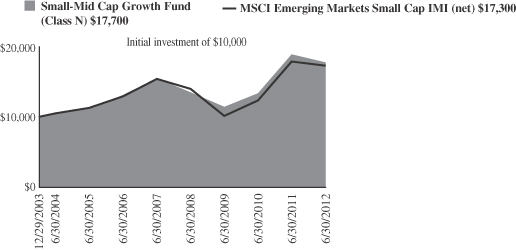

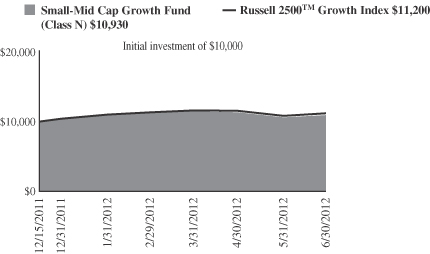

Small-Mid Cap Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 5.00 | | | | (6.10 | ) | | | 15.72 | | | | 2.69 | | | | 6.95 | | | 12/29/2003 | | ««««

Among 678 Mid-Cap Growth Funds |

Morningstar Mid-Cap Growth | | | 7.55 | | | | (4.31 | ) | | | 17.04 | | | | 1.17 | | | | — | | | | |

Russell 2500TM Growth | | | 8.44 | | | | (3.19 | ) | | | 19.38 | | | | 2.35 | | | | 6.65 | | | | |

| | | | | | | |

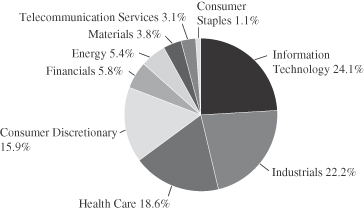

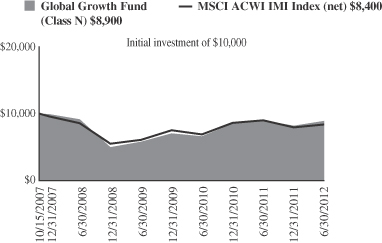

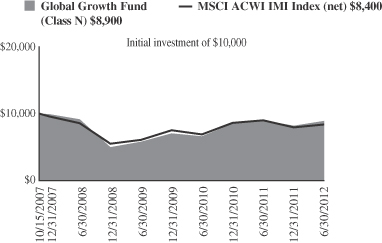

Global Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 8.64 | | | | (1.24 | ) | | | 15.15 | | | | — | | | | (2.52 | ) | | 10/15/2007 | | ««««

Among 706 World Stock Funds |

Morningstar World Stock | | | 5.38 | | | | (7.48 | ) | | | 10.79 | | | | — | | | | — | | | | |

MSCI All Country World IMI (net) | | | 5.76 | | | | (6.91 | ) | | | 11.30 | | | | — | | | | (3.70 | ) | | | |

| | | | | | | |

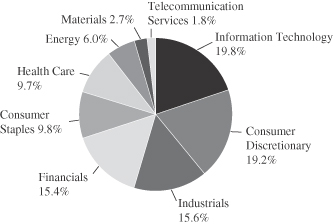

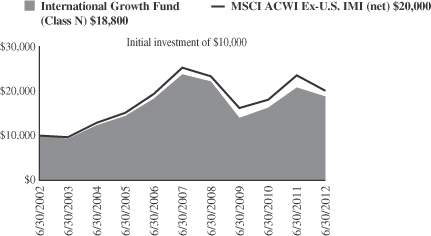

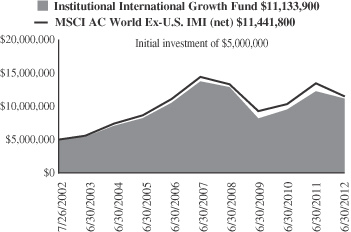

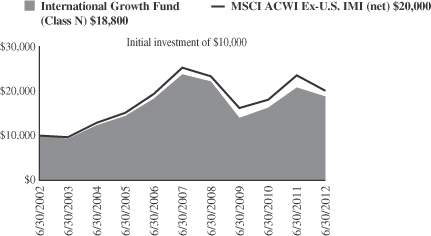

International Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 7.66 | | | | (9.74 | ) | | | 10.34 | | | | (4.53 | ) | | | 6.50 | | | 10/1/1992 | | «««

Among 210 Foreign Large Growth Funds |

Morningstar Foreign Large Growth | | | 4.86 | | | | (11.51 | ) | | | 9.53 | | | | (3.38 | ) | | | 6.03 | | | | |

MSCI All Country World Ex-U.S.

IMI (net) | | | 2.93 | | | | (14.79 | ) | | | 7.36 | | | | (4.46 | ) | | | 7.19 | | | | |

| | | | | | | |

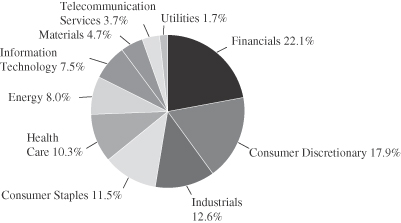

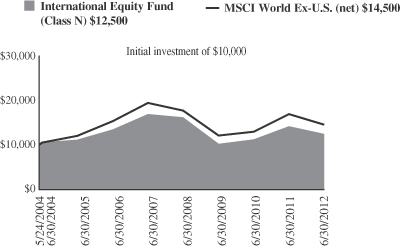

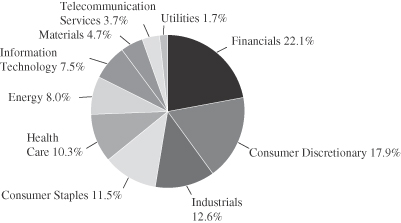

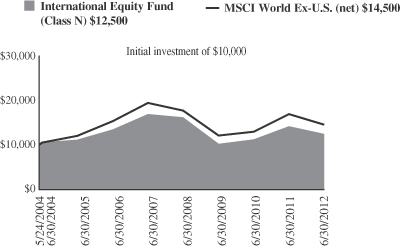

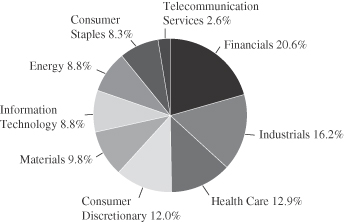

International Equity Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 4.55 | | | | (11.75 | ) | | | 6.80 | | | | (5.88 | ) | | | 2.76 | | | 5/24/2004 | | ««

Among 210 Foreign Large Growth Funds |

Morningstar Foreign Large Growth | | | 4.86 | | | | (11.51 | ) | | | 9.53 | | | | (3.38 | ) | | | — | | | | |

MSCI World Ex-U.S. (net) | | | 2.43 | | | | (14.13 | ) | | | 6.20 | | | | (5.67 | ) | | | 4.69 | | | | |

| | | | | | | |

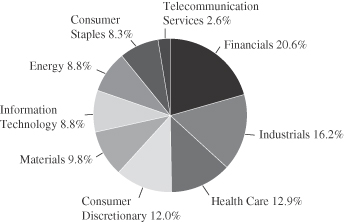

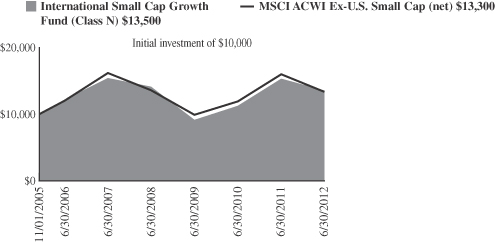

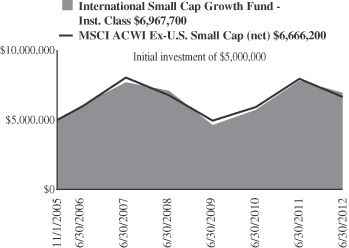

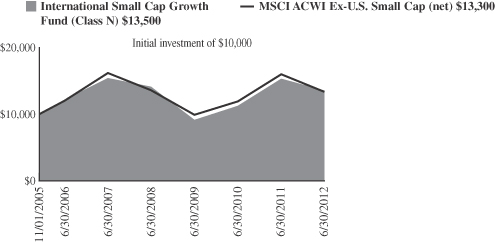

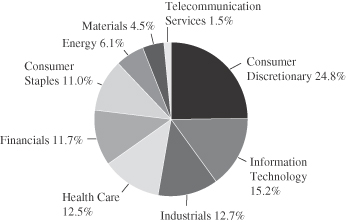

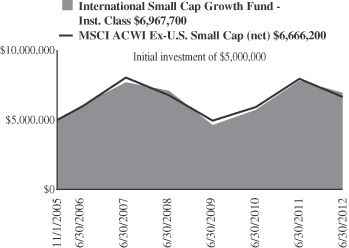

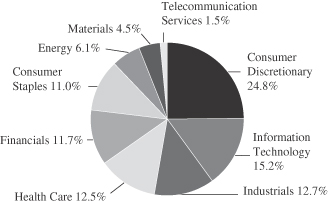

International Small Cap Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 6.16 | | | | (11.55 | ) | | | 13.91 | | | | (2.56 | ) | | | 4.59 | | | 11/1/2005 | | «««

Among 96 Foreign Small/Mid Growth Funds |

Morningstar Foreign Small/Mid Growth | | | 7.36 | | | | (11.25 | ) | | | 12.80 | | | | (3.49 | ) | | | — | | | | |

MSCI All Country World Small Cap Ex-U.S. (net) | | | 4.09 | | | | (16.43 | ) | | | 10.41 | | | | (3.74 | ) | | | 4.41 | | | | |

| | | | | | | |

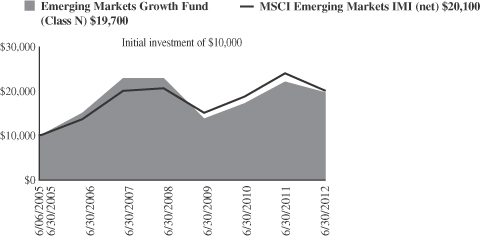

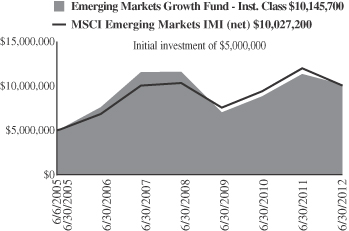

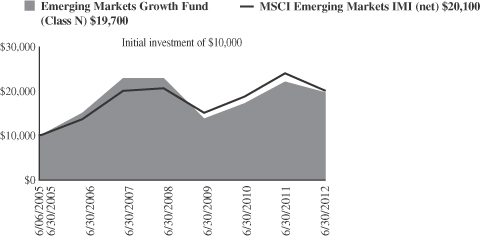

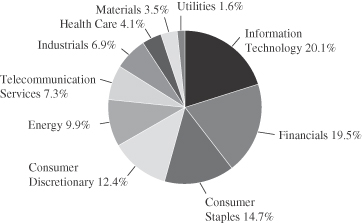

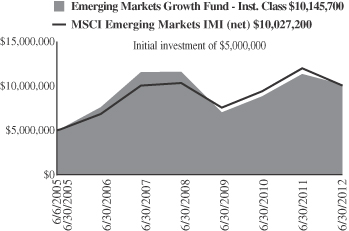

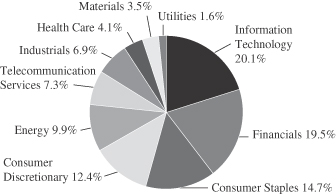

Emerging Markets Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 7.08 | | | | (10.81 | ) | | | 12.61 | | | | (2.96 | ) | | | 10.07 | | | 6/6/2005 | | «««

Among 353 Diversified Emerging Markets Funds |

Morningstar Diversified Emerging Markets | | | 4.15 | | | | (16.10 | ) | | | 8.96 | | | | (2.02 | ) | | | — | | | | |

MSCI Emerging Markets IMI (net) | | | 4.31 | | | | (16.29 | ) | | | 9.97 | | | | (0.01 | ) | | | 10.34 | | | | |

Please see the next page for important disclosure information.

June 30, 2012 | William Blair Funds 3 |

PERFORMANCE AS OF JUNE 30, 2012—CLASS N SHARES (Unaudited)—CONTINUED

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year

To Date | | | 1 yr | | | 3 yr | | | 5 yr | | | 10 yr

(or since

inception) | | | Inception

Date | | Overall

Morningstar

Rating |

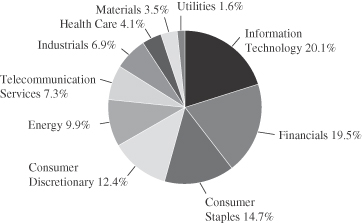

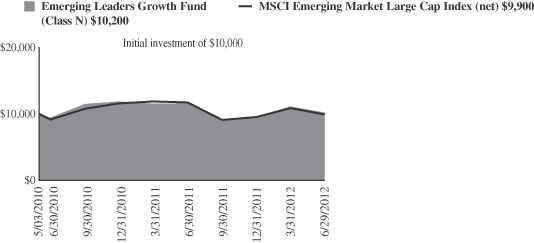

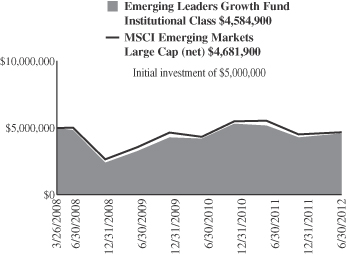

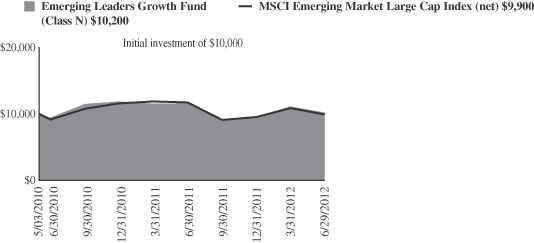

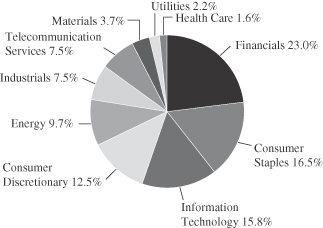

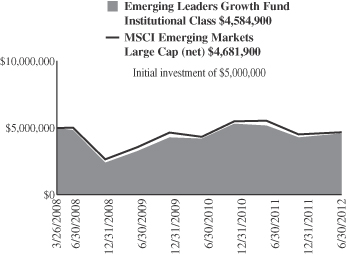

Emerging Leaders Growth Fund | | | | | | | | | | | | | | | | | |

Class N | | | 6.90 | | | | (11.87 | ) | | | — | | | | — | | | | 0.85 | | | 5/3/2010 | | Not rated. |

Morningstar Diversified Emerging Markets | | | 4.15 | | | | (16.10 | ) | | | — | | | | — | | | | — | | | | | |

MSCI Emerging Markets Large Cap (net) | | | 3.60 | | | | (15.51 | ) | | | — | | | | — | | | | (0.63 | ) | | | | |

| | | | | | | |

Emerging Markets Small Cap Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 14.29 | | | | — | | | | — | | | | — | | | | 11.20 | | | 10/24/2011 | | Not rated. |

Morningstar Diversified Emerging Markets | | | 4.15 | | | | — | | | | — | | | | — | | | | — | | | | | |

MSCI EM (Emerging Markets)

Small Cap | | | 7.27 | | | | — | | | | — | | | | — | | | | 0.49 | | | | | |

| | | | | | | |

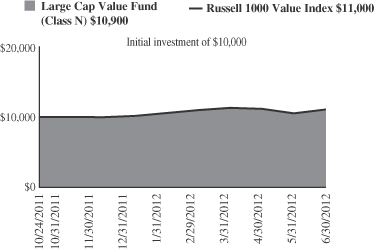

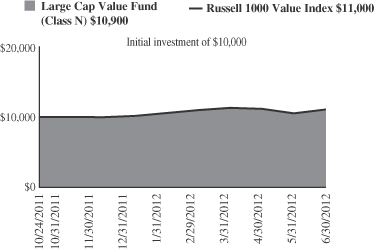

Large Cap Value Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 9.15 | | | | — | | | | — | | | | — | | | | 8.93 | | | 10/24/2011 | | Not rated. |

Morningstar Large Value | | | 7.01 | | | | — | | | | — | | | | — | | | | — | | | | | |

Russell 1000® Value | | | 8.68 | | | | — | | | | — | | | | — | | | | 10.48 | | | | | |

| | | | | | | |

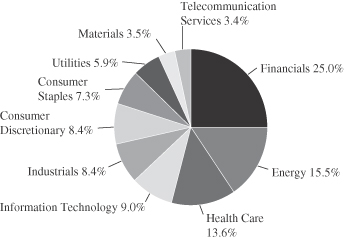

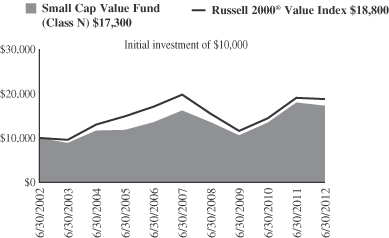

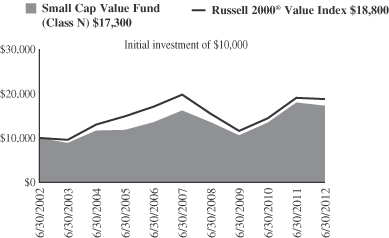

Small Cap Value Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 5.46 | | | | (3.97 | ) | | | 17.74 | | | | 1.31 | | | | 5.62 | | | 12/23/1996 | | «««

Among 284 Small Value Funds |

Morningstar Small Value | | | 6.53 | | | | (2.74 | ) | | | 17.37 | | | | (0.20 | ) | | | 7.34 | | | | |

Russell 2000® Value | | | 8.23 | | | | (1.44 | ) | | | 17.43 | | | | (1.05 | ) | | | 6.50 | | | | |

| | | | | | | |

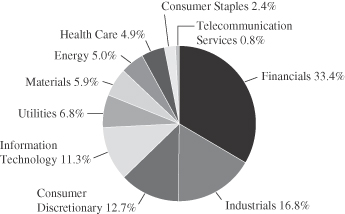

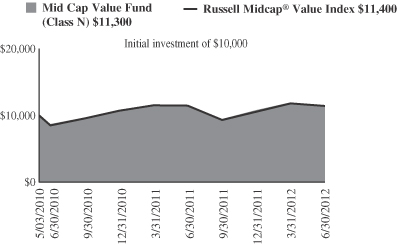

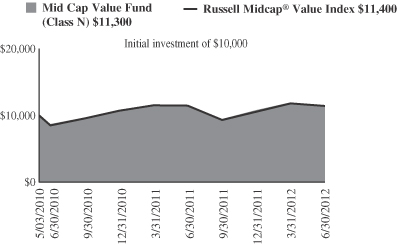

Mid Cap Value Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 4.68 | | | | (1.46 | ) | | | — | | | | — | | | | 5.82 | | | 5/3/2010 | | Not rated. |

Morningstar Mid-Cap Value | | | 6.95 | | | | (3.42 | ) | | | — | | | | — | | | | — | | | | | |

Russell Midcap® Value | | | 7.78 | | | | (0.37 | ) | | | — | | | | — | | | | 6.21 | | | | | |

| | | | | | | |

Small-Mid Cap Value Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 4.59 | | | | — | | | | — | | | | — | | | | 9.30 | | | 12/15/2011 | | Not rated. |

Morningstar Mid-Cap Value | | | 6.16 | | | | — | | | | — | | | | — | | | | — | | | | | |

Russell 2500® Value | | | 8.15 | | | | — | | | | — | | | | — | | | | 12.69 | | | | | |

| | | | | | | |

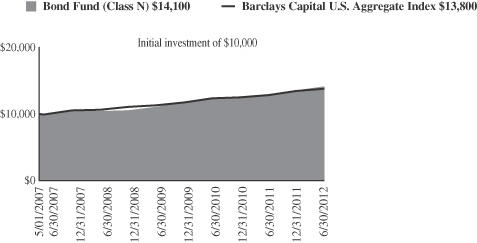

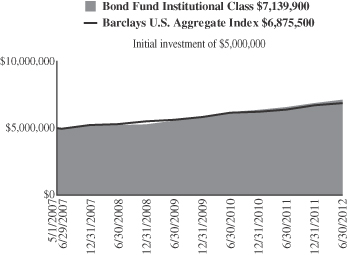

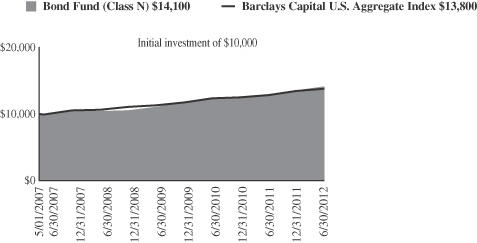

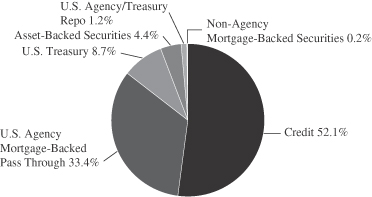

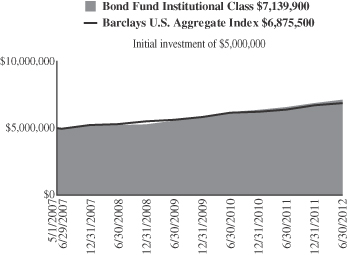

Bond Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 3.93 | | | | 8.49 | | | | 8.42 | | | | 7.30 | | | | 6.81 | | | 5/1/2007 | | ««««

Among 1,015 Intermediate-Term Bond Funds |

Morningstar Intermediate-Term Bond | | | 3.46 | | | | 6.57 | | | | 8.31 | | | | 6.20 | | | | — | | | | |

Barclays Capital U.S. Aggregate Bond | | | 2.37 | | | | 7.47 | | | | 6.93 | | | | 6.79 | | | | 6.35 | | | | |

| | | | | | | |

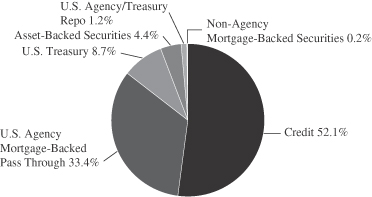

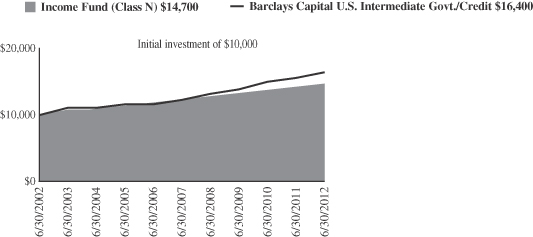

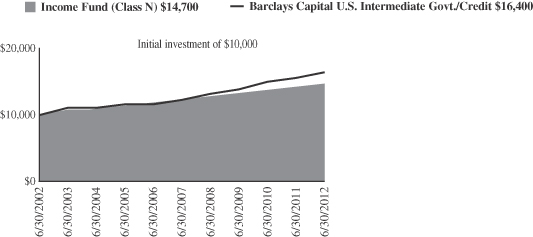

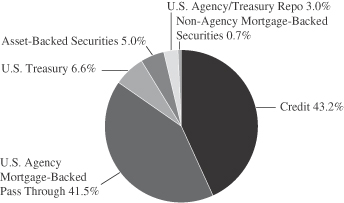

Income Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 2.94 | | | | 5.68 | | | | 6.30 | | | | 4.37 | | | | 3.91 | | | 10/1/1990 | | ««««

Among 352 Short-Term Bond Funds |

Morningstar Short-term Bond | | | 1.86 | | | | 2.05 | | | | 4.11 | | | | 3.50 | | | | 3.36 | | | | |

Barclays Capital Intermediate | | | 2.10 | | | | 5.42 | | | | 5.81 | | | | 6.01 | | | | 5.08 | | | | |

Govt./Credit Bond | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

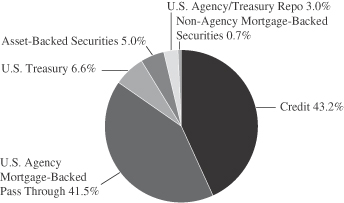

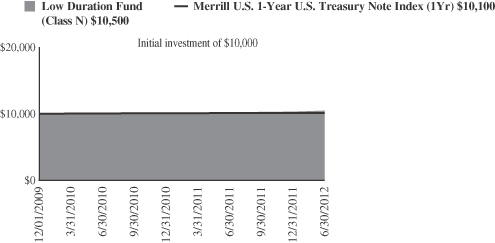

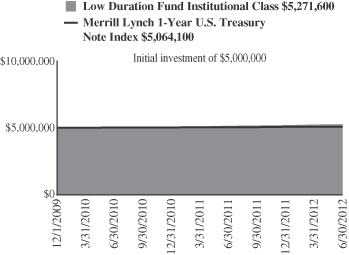

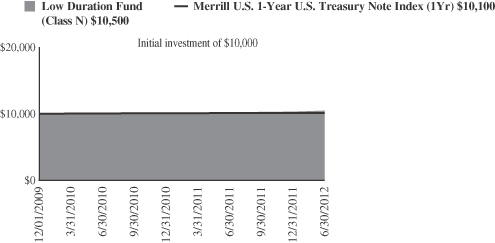

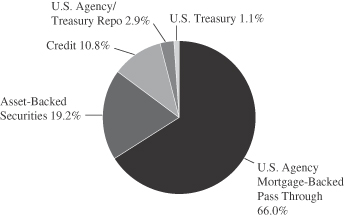

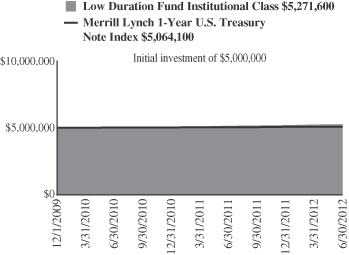

Low Duration Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 1.59 | | | | 2.19 | | | | — | | | | — | | | | 1.77 | | | 12/1/2009 | | Not rated. |

Morningstar Ultra Short Bond | | | 1.05 | | | | 0.79 | | | | — | | | | — | | | | — | | | | | |

Merrill Lynch 1-Year U.S. Treasury Note | | | 0.04 | | | | 0.26 | | | | — | | | | — | | | | 0.50 | | | | | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or a loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Investing in smaller companies involves special risks, including higher

4 Semi-Annual Report | June 30, 2012 |

PERFORMANCE AS OF JUNE 30, 2012—CLASS N SHARES (Unaudited)—CONTINUED

volatility and lower liquidity. International and emerging markets investing involves special risk considerations, including currency fluctuations, lower liquidity, economic and political risk. As interest rates rise, bond prices will fall and bond funds may become more volatile. Class N shares are available to the general public without a sales load.

Morningstar RatingsTM are as of 6/30/2012 and are subject to change every month. The ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each Category receive 5 stars, the next 22.5% receive 4 stars, the middle 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. The 3/5/10 year Morningstar ratings were as follows: Growth Fund ««/««««/««« and Large Cap Growth Fund «««/«««/««, out of 1,510/1,297/855 large growth funds; Small Cap Growth Fund «/««/«««, out of 662/574/378 small growth funds; Mid Cap Growth Fund «««/««««/NA and Small-Mid Cap Growth Fund «««/««««/NA out of 678/598/NA mid cap growth funds; Global Growth Fund ««««/NA/NA out of 706/NA/NA world stocks; International Growth Fund ««««/«««/««« and International Equity Fund ««/««/NA out of 210/171/96 foreign large growth funds; International Small Cap Growth Fund ««««/«««/NA out of 96/88/NA foreign small/mid growth funds; Emerging Markets Growth Fund ««««/««/NA and Emerging Leaders Growth Fund ««««/NA/NA, out of 353/243/NA diversified emerging markets growth funds; Small Cap Value Fund «««/««««/«« out of 284/253/150 small value funds; Income Fund «««««/««««/«««« out of 352/324/190 short-term bond funds; Bond Fund «««/««««/NA out of 1,015/880/NA intermediate-term bond fund.

Please carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

See accompanying Notes to Financial Statements.

June 30, 2012 | William Blair Funds 5 |

David C. Fording

John F. Jostrand

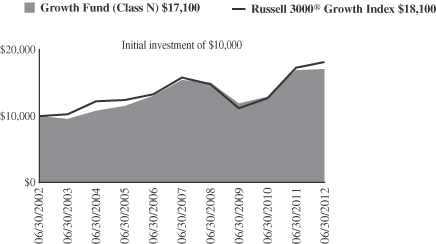

GROWTH FUND

The Growth Fund seeks long-term capital appreciation.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

Thus far in 2012, U.S. equity markets posted strong results; the Russell 3000® Growth Index rose 9.98%. However, performance varied widely in each quarter. Like the past several years, the familiar pattern of risk-on occurred during periods of optimism while risk-off occurred during periods of pessimism due to rising macro and political concerns. The period began with robust upward momentum as investors gained confidence in the strengthening U.S. economy and were comforted by stabilization in Europe; the Russell 3000® Growth Index climbed 14.58% in the first quarter. Notably, investors differentiated based on underlying company fundamentals, a sound environment for active managers. However, during the second quarter, markets reversed course due to worries over U.S. economic growth, the re-intensified European debt crisis and continued slowing growth in emerging markets; the Russell 3000® Growth Index fell 4.02% in the second quarter. In the latter period, volatility and stock correlations picked up; investors preferred low risk, defensives and domestically focused companies.

Portfolio Results

The William Blair Growth Fund Class N rose 8.95% modestly trailing its benchmark, the Russell 3000® Growth Index. The positive results occurred primarily in the first quarter. Importantly, most of our companies had good quarterly earnings reports, which assisted.

Our Health Care and Industrials stock selection was strong. In Health Care, we added HMS Holdings Corporation to the portfolio in April and it rallied sharply at the end of June when the Supreme Court upheld the Patient Protection and Affordable Care Act (PPACA), which potentially expands the Medicaid population by 10 million in 2014. HMS Holdings’ coordination of benefit business should benefit as it ensures Medicaid does not pay claims that should be covered by other parties. More broadly, we had a half dozen other outperforming Health Care stocks in the portfolio in the first half. In Industrials, TransDigm Group, Inc. – a designer, producer, and supplier of engineered aircraft components, and IHS, Inc. – the leading global provider of critical technical information, decision support tools, and related services, contributed nicely to results. TransDigm Group reported quarterly earnings that were above consensus due to strong growth in all end markets. In our view, it has a superior business model relative to peers focusing its design and acquisition efforts on complex, low volume, low dollar value parts within an aircraft. Once it has a design win, it is the sole source provider for the life of the aircraft (30 to 40 years per platform). IHS had healthy quarterly results with attractive organic revenue growth. We believe the firm should continue to benefit from strong subscription renewal trends, a robust new product pipeline, improved cross-selling initiatives, as well as cost and efficiency improvements projects. Lastly, in Information Technology, eBay, Inc. continued to be a standout as the best overall portfolio contributor. It continued to experience strong top line growth and margin expansion for the Paypal business as well as continued improvement for the Marketplace division. We believe Paypal should continue to benefit from market share gains and market growth online as well as in the fast growing mobile payments arena.

Our weakest sector was Consumer Discretionary due to positions in Gentex Corporation and McDonald’s Corporation. Gentex, a technology company serving the global automotive industry, came under pressure given another delay by the National Transportation Safety Board in providing guidance for how auto manufacturers are to comply with the government’s mandate for rear cameras in vehicles. This news disappointed investors as it

6 Semi-Annual Report | June 30, 2012 |

continues the uncertainty in regard to an avenue of growth for Gentex. We believe the firm has attractive long term growth prospects from both current and upcoming products. For McDonald’s, it was a strong performer in 2011 and investors took profits in 2012. In our view, it is one of highest quality investments that did not perform as well as comparable peers especially in the second quarter. Notably, we had trimmed this large position early in 2012 on valuation and added back to it later in the first quarter period at a more attractive price; we believe it is a well positioned long term winner. Another sector that lagged was Consumer Staples due to a position in Green Mountain Coffee Roasters, Inc. It came under pressure on weaker than expected sales growth driven by a K-cup attachment rate that appears to be slowing faster than expected. The many moving parts of the model, notably the shifting channels of distribution and evolving consumer behavior as single-serve coffee goes mainstream, led to wide variability in company results versus Wall Street expectations, and investors lost confidence. This coincides with concerns around long-term K-cup profitability as select K-cup related patents expire. We believe current valuation implies substantial cuts to estimates based on various negative scenarios, which we do not consider probable; therefore, we maintained our relatively small position.

Outlook

While U.S. equity markets oscillate between optimism and pessimism from quarter to quarter, these moves seem more based on the latest macro or political news release than a change in the long-term trajectory for the U.S. economy. The Federal Reserve remains accommodative and stands ready to enact additional measures if necessary, which should be supportive of businesses and consumers. While in the second quarter unemployment ticked up and manufacturing modestly declined due to Europe’s recessionary environment, U.S. housing sales improved. Corporate balance sheets and operating margins in aggregate remain healthy. Falling commodity prices should provide some relief; the price of oil traded from $99 to $85 per barrel in the first half of 2012.

Typically, markets crave certainty; until clarity appears, volatility will likely remain elevated. Investors remain concerned over further deterioration in the European debt crisis and slowing emerging market growth, which in turn impacts U.S. exports. Also, in the U.S., stability of economic growth remains a primary focus, along with the November elections and the outcome for the fiscal cliff (i.e., expiration of the Bush-era tax cuts, coupled with mandatory federal spending cuts.) Finally, with revenue growth broadly decelerating and operating margins at or near peak levels for the U.S. market as a whole, the ability of corporations to sustain high levels of earnings growth is of some concern.

As always, our concentration remains on our quality growth philosophy, disciplined investment process, and deep fundamental research. We believe strategically advantaged companies with unique products/services, strong business models and seasoned management teams can sustain growth over peers and the benchmark. In terms of valuation, quality growth stocks remain attractive if consensus earnings can be achieved, while perceived “safe” stocks are elevated relative to history. In general, we continue to find attractive investment opportunities and use volatility to our advantage to buy quality growth companies with strong risk/reward profiles.

June 30, 2012 | William Blair Funds 7 |

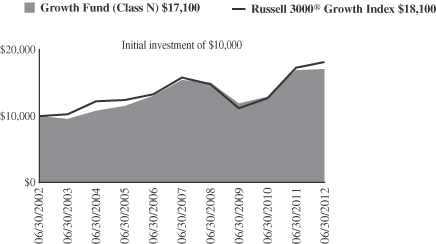

Growth Fund

Performance Highlights (Unaudited)

Average Annual Total Return at 6/30/2012

| | | | | | | | | | | | | | | | | | | | |

| | | Year

To Date | | | 1

Year | | | 3

Year | | | 5

Year | | | 10

Year | |

Class N | | | 8.95 | % | | | 1.11 | % | | | 12.88 | % | | | 2.07 | % | | | 5.51 | % |

Class I | | | 9.12 | | | | 1.41 | | | | 13.24 | | | | 2.40 | | | | 5.82 | |

Russell 3000® Growth Index | | | 9.98 | | | | 5.05 | | | | 17.55 | | | | 2.79 | | | | 6.13 | |

S&P 500 Index | | | 9.49 | | | | 5.45 | | | | 16.40 | | | | 0.22 | | | | 5.33 | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company L.L.C. without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 3000® Growth Index consists of large, medium, and small capitalization companies with above average price-to-book ratios and forecasted growth rates. The index is weighted by market capitalization and large/medium/small companies make up approximately 80%/15%/5% of the index.

The S&P 500 Index indicates broad larger capitalization equity market performance.

This report identifies the Fund’s investments on June 30, 2012. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

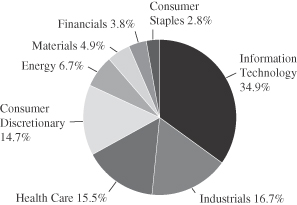

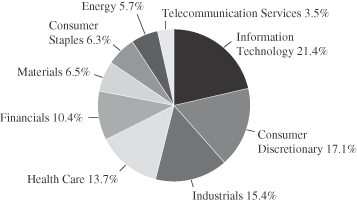

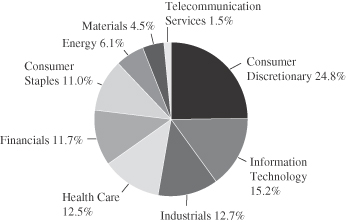

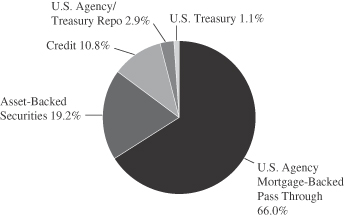

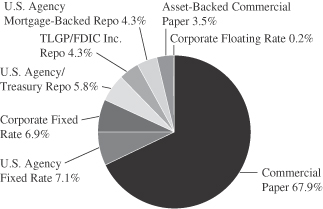

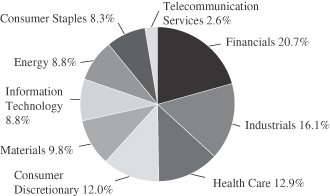

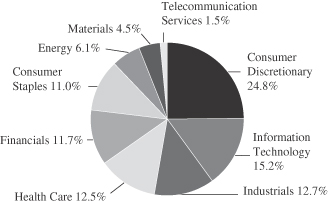

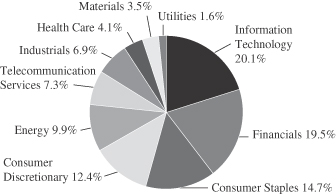

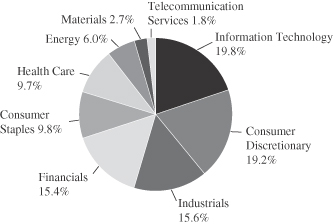

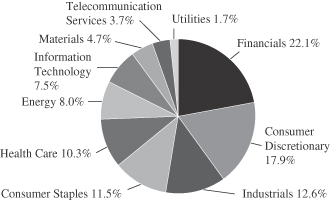

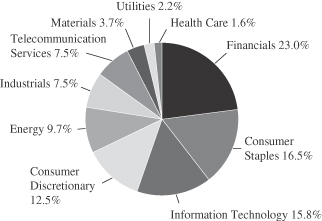

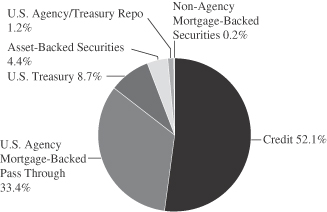

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

8 Semi-Annual Report | June 30, 2012 |

Growth Fund

Portfolio of Investments, June 30, 2012 (all dollar amounts in thousands) (unaudited)

| | | | | | | | |

Issuer | | Shares | | | Value | |

| | |

Common Stocks | | | | | | | | |

Information Technology—34.5% | | | | | | | | |

*Apple, Inc. | | | 85,285 | | | $ | 49,806 | |

*Cavium, Inc. | | | 242,700 | | | | 6,796 | |

*eBay, Inc. | | | 497,200 | | | | 20,887 | |

*Genpact, Ltd.† | | | 805,418 | | | | 13,394 | |

*Google, Inc. Class “A” | | | 44,905 | | | | 26,048 | |

Mastercard, Inc. Class “A” | | | 39,200 | | | | 16,860 | |

*Monolithic Power Systems, Inc. | | | 283,452 | | | | 5,632 | |

QUALCOMM, Inc. | | | 402,740 | | | | 22,425 | |

*RealPage, Inc. | | | 302,761 | | | | 7,012 | |

*Silicon Laboratories, Inc. | | | 179,227 | | | | 6,793 | |

*SolarWinds, Inc. | | | 184,500 | | | | 8,037 | |

Solera Holdings, Inc. | | | 142,300 | | | | 5,947 | |

TE Connectivity, Ltd.† | | | 383,500 | | | | 12,238 | |

*VeriSign, Inc. | | | 220,000 | | | | 9,585 | |

| | | | | | | | |

| | | | | | | 211,460 | |

| | | | | | | | |

Industrials—16.4% | | | | | | | | |

*BE Aerospace, Inc. | | | 146,600 | | | | 6,401 | |

Fastenal Co. | | | 223,458 | | | | 9,008 | |

*IHS, Inc. Class “A” | | | 203,869 | | | | 21,963 | |

*Jacobs Engineering Group, Inc. | | | 334,200 | | | | 12,653 | |

*Stericycle, Inc. | | | 148,600 | | | | 13,622 | |

*TransDigm Group, Inc. | | | 124,180 | | | | 16,677 | |

*Trimas Corporation | | | 316,423 | | | | 6,360 | |

Union Pacific Corporation | | | 116,900 | | | | 13,947 | |

| | | | | | | | |

| | | | | | | 100,631 | |

| | | | | | | | |

Health Care—15.2% | | | | | | | | |

*Align Technology, Inc. | | | 137,200 | | | | 4,591 | |

Allergan, Inc. | | | 176,200 | | | | 16,311 | |

*Cerner Corporation | | | 42,300 | | | | 3,497 | |

*DaVita, Inc. | | | 80,300 | | | | 7,886 | |

*Gilead Sciences, Inc. | | | 347,835 | | | | 17,837 | |

*Haemonetics Corporation | | | 134,100 | | | | 9,938 | |

*HMS Holdings Corporation | | | 302,100 | | | | 10,063 | |

*IDEXX Laboratories, Inc. | | | 118,518 | | | | 11,393 | |

*Illumina, Inc. | | | 115,900 | | | | 4,681 | |

*NxStage Medical, Inc. | | | 442,090 | | | | 7,409 | |

| | | | | | | | |

| | | | | | | 93,606 | |

| | | | | | | | |

Consumer Discretionary—14.5% | | | | | | | | |

*Amazon.com, Inc. | | | 82,600 | | | | 18,862 | |

*Discovery Communications, Inc. Class “A” | | | 176,600 | | | | 9,536 | |

Gentex Corporation | | | 288,200 | | | | 6,015 | |

Harley-Davidson, Inc. | | | 227,599 | | | | 10,408 | |

*K12, Inc. | | | 212,299 | | | | 4,947 | |

Issuer | | Shares or

Principal

Amount | | | Value | |

| | |

Common Stocks—(continued) | | | | | | | | |

Consumer Discretionary—(continued) | | | | | | | | |

McDonald’s Corporation | | | 267,764 | | | $ | 23,705 | |

*Pandora Media, Inc. | | | 568,000 | | | | 6,174 | |

*Teavana Holdings, Inc. | | | 357,280 | | | | 4,834 | |

*Vera Bradley, Inc. | | | 219,300 | | | | 4,623 | |

| | | | | | | | |

| | | | | | | 89,104 | |

| | | | | | | | |

Energy—6.6% | | | | | | | | |

*Cameron International Corporation | | | 148,147 | | | | 6,327 | |

Occidental Petroleum Corporation | | | 157,500 | | | | 13,509 | |

Schlumberger, Ltd.† | | | 314,900 | | | | 20,440 | |

| | | | | | | | |

| | | | | | | 40,276 | |

| | | | | | | | |

Materials—4.8% | | | | | | | | |

Airgas, Inc. | | | 150,700 | | | | 12,660 | |

Ecolab, Inc. | | | 243,720 | | | | 16,702 | |

| | | | | | | | |

| | | | | | | 29,362 | |

| | | | | | | | |

Financials—3.7% | | | | | | | | |

*IntercontinentalExchange, Inc. | | | 118,000 | | | | 16,046 | |

LPL Financial Holdings, Inc. | | | 197,500 | | | | 6,669 | |

| | | | | | | | |

| | | | | | | 22,715 | |

| | | | | | | | |

Consumer Staples—2.8% | | | | | | | | |

*Green Mountain Coffee Roasters, Inc. | | | 254,700 | | | | 5,548 | |

Mead Johnson Nutrition Co. | | | 141,700 | | | | 11,408 | |

| | | | | | | | |

| | | | | | | 16,956 | |

| | | | | | | | |

Total Common Stocks—98.5%

(cost $502,304) | | | | 604,110 | |

| | | | | | | | |

| | |

Repurchase Agreement | | | | | | | | |

Fixed Income Clearing Corporation, 0.100% dated 6/29/12, due 7/2/12, repurchase price $8,273, collateralized by FNMA,

5.00%, due 4/15/2015. | | $ | 8,272 | | | | 8,272 | |

| | | | | | | | |

Total Repurchase Agreement—1.3%

(cost $8,273) | | | | 8,272 | |

| | | | | | | | |

Total Investments—99.8%

(cost $510,576) | | | | 612,382 | |

Cash and other assets, less liabilities—0.2% | | | | 1,181 | |

| | | | | | | | |

Net assets—100.0% | | | $ | 613,563 | |

| | | | | | | | |

* Non-income producing securities

† = U.S. listed foreign security

See accompanying Notes to Portfolio of Investments.

June 30, 2012 | William Blair Funds 9 |

James S. Golan

David P. Ricci

LARGE CAP GROWTH FUND

The Large Cap Growth Fund seeks long-term capital appreciation.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

Thus far in 2012, U.S. equity markets posted strong results; the Russell 1000® Growth Index rose 10.08%. However, performance varied widely in each quarter. Like the past several years, the familiar pattern of risk-on occurred during periods of optimism while risk-off occurred during periods of pessimism due to rising macro and political concerns. The period began with robust upward momentum as investors gained confidence in the strengthening U.S. economy and were comforted by stabilization in Europe; the Russell 1000® Growth Index climbed 14.69% in the first quarter. Notably, investors differentiated based on underlying company fundamentals, a sound environment for active managers. However, during the second quarter, markets reversed course due to worries over U.S. economic growth, the re-intensified European debt crisis and continued slowing growth in emerging markets; the Russell 1000® Growth Index fell 4.02% in the second quarter. In the latter period, volatility and stock correlations picked up; investors preferred low risk, defensives and domestically focused companies.

Portfolio Results

The William Blair Large Cap Growth Fund Class N rose 12.06% surpassing the benchmark, the Russell 1000® Growth Index. Stock selection in the first quarter drove the positive relative results. Importantly, most of our companies had good quarterly earnings reports, which assisted.

Our Information Technology (IT) stock selection contributed most to the overall return; eBay, Inc., Apple, Inc. and Citrix Systems, Inc. ranked among the best performers. eBay continued to experience strong top line growth and margin expansion for the Paypal business as well as continued improvement for the Marketplace division. We believe Paypal should continue to benefit from market share gains and market growth online as well as in the fast growing mobile payments arena. Apple also continued to gain ground due to healthy iPhone, iPad, and Mac sales. Additionally, the company launched the newest iPad and announced it is initiating a dividend as well as a share repurchase program. Citrix Systems benefited from above expectations revenues driven by strong desktop virtualization license growth, increased traction with its networking product and momentum with its SaaS (software-as-a-service) business. We believe Citrix is well positioned to take advantage of attractive trends in desktop virtualization, which is primarily driven by Windows 7 upgrades, desktop refreshes, security, disaster recovery planning, and a move to support a variety of client access devices due to the continued proliferation of smartphones and the emerging iPad/tablet category. Outside of IT, Whole Foods Market, Inc. contributed nicely delivering strong sales and margin leverage. The management team continues to execute at a high level in a robust market for health conscious consumers – a long-term secular trend. Going forward, we believe Whole Foods Market has the potential to triple the number of stores in North America based on underpenetrated geographies and smaller stores in smaller cities.

The portfolio had only a couple of notable stock detractors across various sectors. In Consumer Staples, Green Mountain Coffee Roasters, Inc. came under pressure on slowing sales growth, driven primarily by a K-cup attachment rate that is deteriorating as the user base evolves from high coffee consuming early adopters to mass market. Given the broader uncertainty on the company (patent expiration, and hence the emergence of potential competition), this new information severely rattled investors. We believe the current valuation is unusually punishing and a dire view of the situation; therefore, we maintained our

10 Semi-Annual Report | June 30, 2012 |

relatively small position. In IT, Google, Inc. trailed peers; it slightly missed revenues in its fourth quarter report, which disappointed investors. Also, with increased attention over the Facebook IPO, some investors had concerns over Google’s competitive position and a potential threat to its advertising revenues. In our view, Google should continue to be a beneficiary of advertisers shifting their spending to the internet and wireless applications. Lastly, in Consumer Discretionary, Nike, Inc.’s stock detracted in the second quarter. The company’s fiscal fourth quarter results disappointed due to lower than expected gross margin and a deceleration of futures orders in China. We believe these issues will not be secular in nature. Over the long-term, Nike should enjoy compelling global growth due to its strong brand, innovation and further expansion into emerging markets.

Outlook

While U.S. equity markets oscillate between optimism and pessimism from quarter to quarter, these moves seem more based on the latest macro or political news release than a change in the long-term trajectory for the U.S. economy. The Federal Reserve remains accommodative and stands ready to enact additional measures if necessary, which should be supportive of businesses and consumers. While in the second quarter unemployment ticked up and manufacturing modestly declined due to Europe’s recessionary environment, U.S. housing sales improved. Corporate balance sheets and operating margins in aggregate remain healthy. Falling commodity prices should provide some relief; the price of oil traded from $99 to $85 per barrel in the first half of 2012.

Typically, markets crave certainty; until clarity appears, volatility will likely remain elevated. Investors remain concerned over further deterioration in the European debt crisis and slowing emerging market growth, which in turn impacts U.S. exports. Also, in the U.S., stability of economic growth remains a primary focus, along with the November elections and the outcome for the fiscal cliff (i.e., expiration of the Bush-era tax cuts, coupled with mandatory federal spending cuts.) Finally, with revenue growth broadly decelerating and operating margins at or near peak levels for the U.S. market as a whole, the ability of corporations to sustain high levels of earnings growth is of some concern.

As always, our concentration remains on our quality growth philosophy, disciplined investment process, and deep fundamental research. We believe strategically advantaged companies with unique products/services, strong business models and seasoned management teams can sustain growth over peers and the benchmark. In terms of valuation, quality growth stocks remain attractive if consensus earnings can be achieved, while perceived “safe” stocks are elevated relative to history. In general, we continue to find attractive investment opportunities and use volatility to our advantage to buy quality growth companies with strong risk/reward profiles.

June 30, 2012 | William Blair Funds 11 |

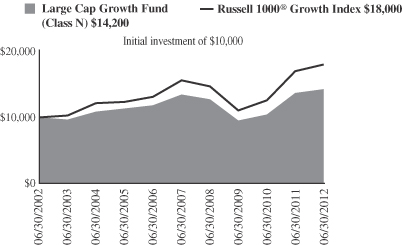

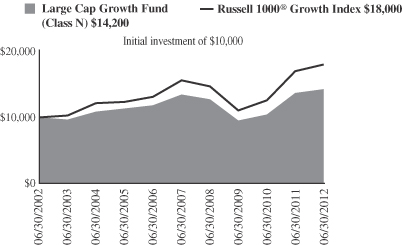

Large Cap Growth Fund

Performance Highlights (Unaudited)

Average Annual Total Return at 6/30/2012

| | | | | | | | | | | | | | | | | | | | |

| | | Year

To Date | | | 1

Year | | | 3

Year | | | 5

Year | | | 10

Year | |

Class N | | | 12.06 | % | | | 4.19 | % | | | 14.25 | % | | | 1.15 | % | | | 3.59 | % |

Class I | | | 12.38 | | | | 4.40 | | | | 14.52 | | | | 1.43 | | | | 3.83 | |

Russell 1000® Growth Index | | | 10.08 | | | | 5.76 | | | | 17.50 | | | | 2.87 | | | | 6.03 | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 1000® Growth Index consists of large capitalization companies with above average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on June 30, 2012. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

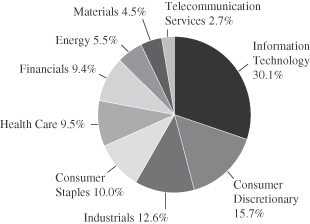

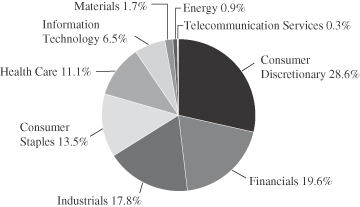

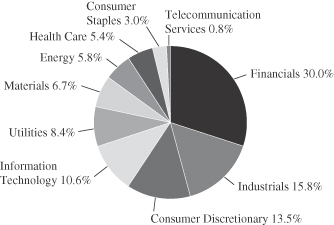

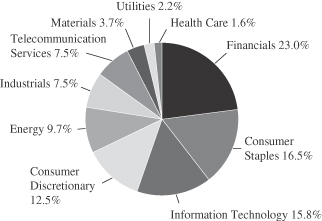

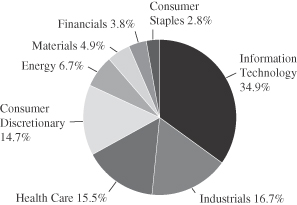

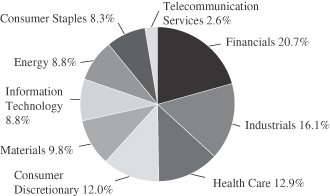

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

12 Semi-Annual Report | June 30, 2012 |

Large Cap Growth Fund

Portfolio of Investments, June 30, 2012 (all dollar amounts in thousands) (unaudited)

| | | | | | | | |

Issuer | | Shares | | | Value | |

| | |

Common Stocks | | | | | | | | |

Information Technology—29.7% | | | | | | | | |

Accenture plc Class “A”† | | | 13,030 | | | $ | 783 | |

*Apple, Inc. | | | 4,680 | | | | 2,733 | |

*Broadcom Corporation Class “A” | | | 7,730 | | | | 261 | |

*Citrix Systems, Inc. | | | 10,170 | | | | 854 | |

*eBay, Inc. | | | 24,410 | | | | 1,026 | |

*Google, Inc. Class “A” | | | 1,483 | | | | 860 | |

Mastercard, Inc. Class “A” | | | 940 | | | | 404 | |

QUALCOMM, Inc. | | | 15,125 | | | | 842 | |

*Trimble Navigation, Ltd. | | | 5,470 | | | | 252 | |

| | | | | | | | |

| | | | | | | 8,015 | |

| | | | | | | | |

Consumer Discretionary—15.5% | | | | | | | | |

*Amazon.com, Inc. | | | 2,680 | | | | 612 | |

*Discovery Communications, Inc. Class “A” | | | 10,270 | | | | 555 | |

*Dollar General Corporation | | | 7,350 | | | | 400 | |

Harley-Davidson, Inc. | | | 14,860 | | | | 679 | |

NIKE, Inc. Class “B” | | | 6,850 | | | | 601 | |

*priceline.com, Inc. | | | 725 | | | | 482 | |

Starbucks Corporation | | | 15,960 | | | | 851 | |

| | | | | | | | |

| | | | | | | 4,180 | |

| | | | | | | | |

Industrials—12.4% | | | | | | | | |

Donaldson Co., Inc. | | | 14,720 | | | | 491 | |

Precision Castparts Corporation | | | 5,130 | | | | 844 | |

*Stericycle, Inc. | | | 8,110 | | | | 743 | |

Union Pacific Corporation | | | 5,110 | | | | 610 | |

W.W. Grainger, Inc. | | | 3,450 | | | | 660 | |

| | | | | | | | |

| | | | | | | 3,348 | |

| | | | | | | | |

Consumer Staples—9.9% | | | | | | | | |

Colgate-Palmolive Co. | | | 8,930 | | | | 929 | |

*Green Mountain Coffee Roasters, Inc. | | | 12,520 | | | | 273 | |

Mead Johnson Nutrition Co. | | | 10,120 | | | | 815 | |

Whole Foods Market, Inc. | | | 6,810 | | | | 649 | |

| | | | | | | | |

| | | | | | | 2,666 | |

| | | | | | | | |

Health Care—9.4% | | | | | | | | |

Allergan, Inc. | | | 8,155 | | | | 755 | |

*DaVita, Inc. | | | 5,620 | | | | 552 | |

*Gilead Sciences, Inc. | | | 18,380 | | | | 942 | |

*IDEXX Laboratories, Inc. | | | 2,870 | | | | 276 | |

| | | | | | | | |

| | | | | | | 2,525 | |

| | | | | | | | |

Issuer | | Shares or

Principal

Amount | | | Value | |

| | |

Common Stocks—(continued) | | | | | | | | |

Financials—9.3% | | | | | | | | |

*Affiliated Managers Group, Inc. | | | 4,290 | | | $ | 470 | |

American Express Co. | | | 10,000 | | | | 582 | |

JPMorgan Chase & Co. | | | 25,860 | | | | 924 | |

T Rowe Price Group, Inc. | | | 8,350 | | | | 526 | |

| | | | | | | | |

| | | | | | | 2,502 | |

| | | | | | | | |

Energy—5.4% | | | | | | | | |

National Oilwell Varco, Inc. | | | 4,340 | | | | 280 | |

Occidental Petroleum Corporation | | | 5,110 | | | | 438 | |

Schlumberger, Ltd.† | | | 11,410 | | | | 741 | |

| | | | | | | | |

| | | | | | | 1,459 | |

| | | | | | | | |

Materials—4.4% | | | | | | | | |

Praxair, Inc. | | | 6,695 | | | | 728 | |

Syngenta AG—ADR | | | 6,840 | | | | 468 | |

| | | | | | | | |

| | | | | | | 1,196 | |

| | | | | | | | |

Telecommunication Services—2.6% | | | | | | | | |

*SBA Communications Corporation

Class “A” | | | 12,450 | | | | 710 | |

| | | | | | | | |

Total Common Stocks—98.6%

(cost $20,696) | | | | | | | 26,601 | |

| | | | | | | | |

| | |

Repurchase Agreement | | | | | | | | |

Fixed Income Clearing Corporation, 0.100% dated 6/29/12, due 7/2/12, repurchase price $467, collateralized by FNMA,

5.00%, due 4/15/2015 | | $ | 467 | | | | 467 | |

| | | | | | | | |

Total Repurchase Agreement—1.7%

(cost $467) | | | | 467 | |

| | | | | | | | |

Total Investments—100.3%

(cost $21,163) | | | | 27,068 | |

Liabilities, plus cash and other assets—(0.3)% | | | | (69 | ) |

| | | | | | | | |

Net assets—100.0% | | | $ | 26,999 | |

| | | | | | | | |

See accompanying Notes to Portfolio of Investments.

June 30, 2012 | William Blair Funds 13 |

ADR = American Depository Receipt

† = U.S. listed foreign security

* Non-income producing securities

Michael P. Balkin

Karl W. Brewer

SMALL CAP GROWTH FUND

The Small Cap Growth Fund seeks long-term capital appreciation.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

The Small Cap Growth Fund increased 9.19% on a total return basis (Class N shares) for the six months ended June 30, 2012. By comparison the Fund’s benchmark, the Russell 2000® Growth Index, increased 8.81%.

After a nearly 30% advance over the previous two quarters, U.S. equities corrected in the second quarter. Robust first quarter returns primarily were driven by improving economic data points in the U.S. and continued strength in the corporate sector. However, in the second quarter, investors refocused their attention on negative headline news from Europe. While news from Greece continued, the elevated fear in the market revolved around more substantial European economies. Investors focused on Europe’s efforts to stabilize the Spanish banking system and the potential risks to the Spanish government’s borrowing capacity. Essentially, investors grappled with the region’s ability to preserve the single-currency bloc.

The slowdown was felt worldwide; China’s growth notably decelerated, joined by other emerging economies, due in part to developed nations’ decreased demand for exports. The U.S. was not immune to the slowdown; U.S. companies with direct business exposure to these regions, combined with declining U.S. business confidence due to the barrage of negative global headlines, translated into slowing business investment and worsening economic data at home. A string of disappointing data points ensued: employment growth slowed significantly from earlier this year, consumer confidence declined, and manufacturing activity slowed.

Broadly speaking, investors’ risk appetite continued from last year during the first quarter, but they gravitated to stocks of companies with less economic sensitivity during the second quarter. From a sector perspective, the typically defensive Health Care and Consumer Staples sectors outperformed in both the second quarter and year-to-date period. Energy has been the standout underperformer in 2012 to date, in part due to the global slowdown’s impact on oil demand.

Year-to-date, the Fund gained 9.19%, surpassing its benchmark, the Russell 2000® Growth Index, which rose 8.81%. The Fund’s outperformance during the first half of 2012 is attributable to stock selection. Notably absent in 2012 as compared to recent years are meaningful style dynamics (i.e., neither tailwinds nor headwinds). From a stock selection perspective, two of the biggest contributors to relative return during the first half of the year were Kensey Nash and Catamaran (formerly SXC Health Solutions). Kensey Nash was one of the Fund’s worst performers in 2011 given royalty disputes with a partner, St. Jude Medical. The resolution of that issue lifted the stock in the first quarter. Then, in the second quarter, the stock rallied further after the company announced it was being acquired by a European biomedical company. The Fund sold its position after this announcement and prior to closing of the acquisition. Catamaran, a pharmacy benefit manager, has seen strong business momentum and announced the acquisition of a competitor, enabling the company to better compete with some of the largest pharmacy benefit managers in the world. On the other hand, Gentherm and Polypore have been the largest detractors from relative return this year. Gentherm has underperformed given complications relating to a German acquisition made in 2011. Polypore underperformed as investors questioned the proprietary nature of its battery separation processes and as the outlook for the electric vehicle market, a big growth driver for the company, became increasingly clouded.

Regarding the second quarter specifically, the Fund’s underperformance was attributable to stock selection. Gentherm and Office Depot were the two leading reasons for the quarter’s

14 Semi-Annual Report | June 30, 2012 |

underperformance. On the other hand, helping relative performance were Kensey Nash and Six Flags. While the recovery works to regain traction, there are a few positive developments to highlight: the stubborn housing market finally seems to be reversing course, as indicated by encouraging data on home prices and sales trends. Gas prices have declined from their April highs, although savings at the pump have yet to translate into higher confidence among consumers. Improving loan demand and banks’ willingness to lend are displaying some encouraging trends as well. Regarding the stock market specifically, while fundamentals are at a critical juncture given the current pause in business confidence, valuations appear attractive if estimated earnings growth materializes.

Today’s unresolved issues make for a cloudy outlook as the world waits to see how the next chapter of the euro zone will read. Much attention will be focused on U.S. politics leading up to the November elections, the potential “fiscal cliff” (i.e., expiration of the Bush-era tax cuts, coupled with mandatory federal spending cuts), and the overall pace of economic growth. While this quarter’s market pullback resembles the past two years’ mid-year slumps, the global easing cycle along with a strengthening housing market could serve as tailwinds unique to 2012.

In the end, while we factor various economic scenarios into our stock picking, we focus our time on constructing the Fund from a bottom-up perspective. We continue to find good ideas across sectors, and are confident the Fund consists of well-managed companies with solid competitive positions whose stocks are at attractive valuations compared to the expected growth and consistency of their business.

June 30, 2012 | William Blair Funds 15 |

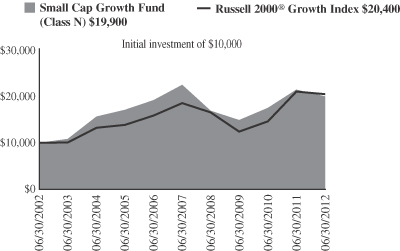

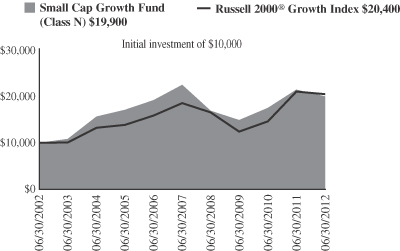

Small Cap Growth Fund

Performance Highlights (Unaudited)

Average Annual Total Return at 6/30/2012

| | | | | | | | | | | | | | | | | | | | |

| | | Year

To Date | | | 1

Year | | | 3

Year | | | 5

Year | | | 10

Year | |

Class N | | | 9.19 | % | | | (6.63 | )% | | | 10.25 | % | | | (2.31 | )% | | | 7.15 | % |

Class I | | | 9.33 | | | | (6.39 | ) | | | 10.57 | | | | (2.03 | ) | | | 7.44 | |

Russell 2000® Growth Index | | | 8.81 | | | | (2.71 | ) | | | 18.09 | | | | 1.99 | | | | 7.39 | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. Smaller Capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2000® Growth Index is an unmanaged composite of the smallest 2000 stocks of the Russell 3000® Growth Index.

This report identifies the Fund’s investments on June 30, 2012. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

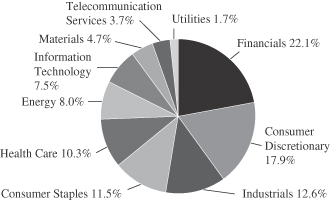

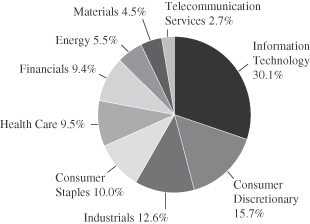

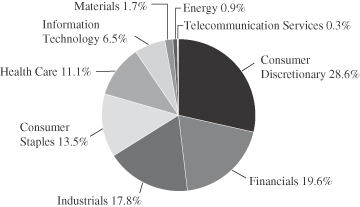

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

16 Semi-Annual Report | June 30, 2012 |

Small Cap Growth Fund

Portfolio of Investments, June 30, 2012 (all dollar amounts in thousands) (unaudited)

| | | | | | | | |

Issuer | | Shares | | | Value | |

| | |

Common Stocks | | | | | | | | |

Information Technology—21.0% | | | | | | | | |

*Bottomline Technologies, Inc. | | | 413,073 | | | $ | 7,456 | |

*Cardtronics, Inc. | | | 79,340 | | | | 2,397 | |

*Cavium, Inc. | | | 215,316 | | | | 6,029 | |

*Inuvo, Inc. | | | 2,171,739 | | | | 1,477 | |

*Liquidity Services, Inc. | | | 102,140 | | | | 5,229 | |

*MaxLinear, Inc. Class “A” | | | 795,912 | | | | 3,948 | |

*Monolithic Power Systems, Inc. | | | 456,571 | | | | 9,072 | |

*RealPage, Inc. | | | 308,553 | | | | 7,146 | |

*Silicon Laboratories, Inc. | | | 152,674 | | | | 5,786 | |

*SolarWinds, Inc. | | | 160,280 | | | | 6,982 | |

*Stamps.com, Inc. | | | 251,620 | | | | 6,208 | |

Syntel, Inc. | | | 116,992 | | | | 7,101 | |

*Tangoe, Inc. | | | 240,729 | | | | 5,130 | |

*TeleTech Holdings, Inc. | | | 474,520 | | | | 7,592 | |

*Ultimate Software Group, Inc. | | | 78,556 | | | | 7,001 | |

*ValueClick, Inc. | | | 241,733 | | | | 3,962 | |

*Volterra Semiconductor Corporation | | | 231,017 | | | | 5,417 | |

*WNS Holdings, Ltd.—ADR | | | 789,008 | | | | 7,677 | |

*Wright Express Corp. | | | 42,630 | | | | 2,631 | |

| | | | | | | | |

| | | | | | | 108,241 | |

| | | | | | | | |

Industrials—20.5% | | | | | | | | |

*Acacia Research Corporation | | | 116,010 | | | | 4,320 | |

Acorn Energy, Inc. | | | 496,520 | | | | 4,131 | |

*CAI International, Inc. | | | 537,020 | | | | 10,676 | |

*Cenveo, Inc. | | | 2,090,976 | | | | 4,036 | |

*Clean Harbors, Inc. | | | 141,875 | | | | 8,005 | |

*Encore Capital Group, Inc. | | | 156,137 | | | | 4,625 | |

*Franklin Covey Co. | | | 715,830 | | | | 7,330 | |

*Furmanite Corporation | | | 670,735 | | | | 3,260 | |

Healthcare Services Group, Inc. | | | 361,656 | | | | 7,009 | |

*Heritage-Crystal Clean, Inc. | | | 317,291 | | | | 5,188 | |

*Huron Consulting Group, Inc. | | | 219,442 | | | | 6,945 | |

*ICF International, Inc. | | | 288,353 | | | | 6,874 | |

*Mistras Group, Inc. | | | 281,818 | | | | 7,406 | |

*Navigant Consulting, Inc. | | | 407,260 | | | | 5,148 | |

*On Assignment, Inc. | | | 589,800 | | | | 9,413 | |

*Trimas Corporation | | | 554,755 | | | | 11,150 | |

| | | | | | | | |

| | | | | | | 105,516 | |

| | | | | | | | |

Health Care—17.5% | | | | | | | | |

*ABIOMED, Inc. | | | 157,999 | | | | 3,606 | |

*Air Methods Corporation | | | 57,525 | | | | 5,652 | |

*Brookdale Senior Living, Inc. | | | 389,250 | | | | 6,905 | |

*Conceptus, Inc. | | | 161,658 | | | | 3,204 | |

*Cyberonics, Inc. | | | 142,509 | | | | 6,404 | |

*ExamWorks Group, Inc. | | | 584,638 | | | | 7,735 | |

*Haemonetics Corporation | | | 107,455 | | | | 7,964 | |

*HealthSouth Corporation | | | 344,370 | | | | 8,010 | |

*HMS Holdings Corporation | | | 138,807 | | | | 4,624 | |

*Natus Medical, Inc. | | | 441,770 | | | | 5,133 | |

*NxStage Medical, Inc. | | | 602,217 | | | | 10,093 | |

*Quidel Corporation | | | 413,256 | | | | 6,480 | |

*The Providence Service Corporation | | | 416,053 | | | | 5,704 | |

| | | | | | | | |

Issuer | | Shares | | | Value | |

| | |

Common Stocks—(continued) | | | | | | | | |

Health Care—(continued) | | | | | | | | |

Trinity Biotech plc—ADR | | | 744,674 | | | $ | 8,936 | |

| | | | | | | | |

| | | | | | | 90,450 | |

| | | | | | | | |

Consumer Discretionary—16.6% | | | | | | | | |

*Amerigon, Inc. | | | 742,757 | | | | 8,534 | |

*Genesco, Inc. | | | 91,257 | | | | 5,489 | |

*Grand Canyon Education, Inc. | | | 375,834 | | | | 7,870 | |

Jarden Corporation | | | 166,632 | | | | 7,002 | |

*K12, Inc. | | | 247,544 | | | | 5,768 | |

*Mattress Firm Holding Corporation | | | 85,731 | | | | 2,599 | |

*Office Depot, Inc. | | | 2,066,151 | | | | 4,463 | |

*Pandora Media, Inc. | | | 430,210 | | | | 4,676 | |

*Select Comfort Corporation | | | 159,109 | | | | 3,329 | |

*Shuffle Master, Inc. | | | 375,820 | | | | 5,186 | |

Six Flags Entertainment Corporation | | | 232,950 | | | | 12,621 | |

*Steven Madden, Ltd. | | | 121,545 | | | | 3,859 | |

Texas Roadhouse, Inc. | | | 89,694 | | | | 1,653 | |

*U.S. Auto Parts Network, Inc. | | | 1,116,362 | | | | 4,666 | |

*Vera Bradley, Inc. | | | 237,022 | | | | 4,997 | |

*WMS Industries, Inc. | | | 139,567 | | | | 2,784 | |

| | | | | | | | |

| | | | | | | 85,496 | |

| | | | | | | | |

Financials—11.3% | | | | | | | | |

*Cowen Group, Inc. | | | 2,741,550 | | | | 7,293 | |

*First Cash Financial Services, Inc. | | | 297,050 | | | | 11,932 | |

*FirstService Corporation† | | | 209,742 | | | | 5,866 | |

*FX Alliance, Inc. | | | 142,455 | | | | 2,238 | |

GFI Group, Inc. | | | 641,714 | | | | 2,285 | |

*ICG Group, Inc. | | | 941,898 | | | | 8,713 | |

Manning & Napier, Inc. | | | 437,183 | | | | 6,221 | |

Marlin Business Services Corporation | | | 280,138 | | | | 4,591 | |

*National Financial Partners Corporation | | | 695,076 | | | | 9,314 | |

| | | | | | | | |

| | | | | | | 58,453 | |

| | | | | | | | |

Energy—5.3% | | | | | | | | |

*Atwood Oceanics, Inc. | | | 155,090 | | | | 5,868 | |

*Hornbeck Offshore Services, Inc. | | | 171,633 | | | | 6,656 | |

*Laredo Petroleum Holdings, Inc. | | | 192,915 | | | | 4,013 | |

*Oil States International, Inc. | | | 93,420 | | | | 6,184 | |

*PDC Energy, Inc. | | | 178,253 | | | | 4,371 | |

| | | | | | | | |

| | | | | | | 27,092 | |

| | | | | | | | |

Materials—1.7% | | | | | | | | |

*Horsehead Holding Corporation | | | 426,220 | | | | 4,245 | |

*Stillwater Mining Co. | | | 509,626 | | | | 4,352 | |

| | | | | | | | |

| | | | | | | 8,597 | |

| | | | | | | | |

Total Common Stocks—93.9%

(cost $449,228) | | | | | | | 483,845 | |

| | | | | | | | |

Exchange-Traded Fund | | | | | | | | |

iShares Russell 2000 Growth Index Fund | | | 199,462 | | | | 18,245 | |

| | | | | | | | |

Total Exchange-Traded Fund—3.5%

(cost $16,936) | | | | | | | 18,245 | |

| | | | | | | | |

See accompanying Notes to Portfolio of Investments.

June 30, 2012 | William Blair Funds 17 |

Small Cap Growth Fund

Portfolio of Investments, June 30, 2012 (all dollar amounts in thousands) (unaudited)

| | | | | | | | |

Issuer | | Principal

Amount | | | Value | |

| | |

Repurchase Agreement | | | | | | | | |

Fixed Income Clearing Corporation, 0.100% dated 6/29/12, due 7/2/12, repurchase price $12,551, collateralized by U.S. Treasury Note, 4.250%, due 8/15/15; | | $ | 12,551 | | | $ | 12,551 | |

| | | | | | | | |

Total Repurchase Agreement—2.4%

(cost $12,551) | | | | | | | 12,551 | |

| | | | | | | | |

Total Investments—99.8%

(cost $478,715) | | | | | | | 514,641 | |

Cash and other assets, less liabilities—0.2% | | | | 795 | |

| | | | | | | | |

Net assets—100.0% | | | | | | $ | 515,436 | |

| | | | | | | | |

ADR = American Depository Receipt

* Non-income producing securities

† = U.S. listed foreign security

If the Fund’s portfolio holdings represent ownership of 5% or more of the voting securities of a company, the company is deemed to be an affiliate as defined in the Investment Company Act of 1940. The Small Cap Growth Fund had the following transactions during the period ended June 30, 2012 with companies deemed affiliated during the period or at June 30, 2012.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Share Activity | | | Period Ended

June 30, 2012 | |

| | | | | | | | | | | | | | | | | (in thousands) | |

Security Name | | Balance

12/31/2011 | | | Purchases | | | Sales | | | Balance

6/30/2012 | | | Value | | | Dividends

Included

in Income | |

| | Dreams, Inc. | | | 2,671,926 | | | | 119,643 | | | | 2,791,569 | | | | — | | | $ | — | | | $ | — | |

| | Inuvo, Inc. | | | 861,747 | | | | 1,309,992 | | | | — | | | | 2,171,739 | | | | 1,477 | | | | — | |

| | Kensey Nash Corporation | | | 483,937 | | | | 44,009 | | | | 527,946 | | | | — | | | | — | | | | 217 | |

* | | Vertro, Inc. | | | 847,343 | | | | — | | | | 847,343 | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | $ | 1,477 | | | $ | 217 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

* Vertro, Inc. was acquired by Inuvo, Inc. at a rate of 1.546 shares of Inuvo, Inc. for each share of Vertro, Inc. on March 2, 2012.

See accompanying Notes to Portfolio of Investments.

18 Semi-Annual Report | June 30, 2012 |

Robert C. Lanphier, IV

David P. Ricci

MID CAP GROWTH FUND

The Mid Cap Growth Fund seeks long-term capital appreciation.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

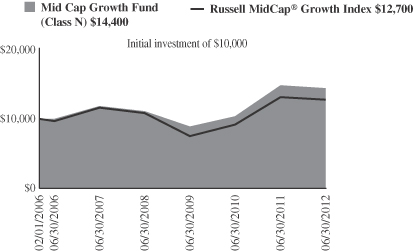

The Mid Cap Growth Fund posted a 7.03% increase on a total return basis (Class N Shares) for the six months ended June 30, 2012. By comparison, the Fund’s benchmark, the Russell Midcap® Growth Index, increased 8.10% during the period.

After a nearly 30% advance over the previous two quarters, U.S. equities corrected in the second quarter. Robust first quarter returns primarily were driven by improving economic data points in the U.S. and continued strength in the corporate sector. However, in the second quarter, investors refocused their attention on negative headline news from Europe. While news from Greece continued, the elevated fear in the market revolved around more substantial European economies. Investors focused on Europe’s efforts to stabilize the Spanish banking system and the potential risks to the Spanish government’s borrowing capacity. Essentially, investors grappled with the region’s ability to preserve the single-currency bloc.

The slowdown was felt worldwide; China’s growth notably decelerated, joined by other emerging economies, due in part to developed nations’ decreased demand for exports. The U.S. was not immune to the slowdown; U.S. companies with direct business exposure to these regions, combined with declining U.S. business confidence due to the barrage of negative global headlines, translated into slowing business investment and worsening economic data at home. A string of disappointing data points ensued: employment growth slowed significantly from earlier this year, consumer confidence declined, and manufacturing activity slowed.

Broadly speaking, investors’ risk appetite continued from last year during the first quarter, but they gravitated to stocks of companies with less economic sensitivity during the second quarter. From a sector perspective, the typically defensive Health Care and Consumer Staples sectors outperformed in both the second quarter and year-to-date period. Energy has been the standout underperformer in 2012 to date, in part due to the global slowdown’s impact on oil demand and rising natural gas supplies.

Year-to-date, the Fund gained 7.03%, closely trailing its benchmark, the Russell Midcap® Growth Index, which rose 8.10%. The Fund’s underperformance during the first half of 2012 is primarily attributable to style headwinds in the first quarter. Over 100% of our year-to-date underperformance occurred during the first quarter when the market was up nearly 15%, a robust environment not ideal for our style of investing. Detracting from performance were Green Mountain Coffee Roasters, Inc. and Gentex Corporation. While Green Mountain Coffee Roasters, Inc. continues to grow at a rapid pace, its rate of growth is slowing from the hyper levels of the past few years, in large part due to a greater-than-expected decrease in the amount of k-cups consumed per brewer as brewer sales expand beyond the early-adopters. Gentex Corporation has underperformed given uncertainty in its rear camera display division as governmental clarity on the issue is not expected until later this year. We continue to hold both of these detractors. From a stock-specific perspective, Illumina, Inc. has been the largest contributor to relative return in 2012 as the company announced it was being acquired by Roche Holdings (note: we liquidated our position on the announcement and the deal has since dissolved). TransDigm Group, Inc. has been the second largest contributor given continued business strength and its less-cyclical business model among aerospace-related companies.

For the second quarter specifically, the Fund’s outperformance was a result of style tailwinds and mixed stock selection. The Fund outpaced its benchmark during the second quarter declining 5.38% while the Russell Midcap® Growth Index declined 5.60%. In general, the

June 30, 2012 | William Blair Funds 19 |

market’s preference for stocks with less economic sensitivity benefitted our Fund’s performance. From a stock selection perspective, HMS Holdings Corporation and TransDigm Group, Inc. Group were two of the strongest contributors to relative return. On the other hand, Green Mountain Coffee Roasters, Inc. and NetApp detracted from relative performance.

While the recovery works to regain traction, there are a few positive developments to highlight: the stubborn housing market finally seems to be reversing course, with encouraging data on home prices and sales trends. Gas prices have declined from their April highs, although savings at the pump have yet to translate into higher confidence among consumers. Improving loan demand and banks’ willingness to lend are displaying some encouraging trends as well. Regarding the stock market specifically, while fundamentals are at a critical juncture given the current pause in business confidence, valuations appear attractive if estimated earnings growth materializes.

Today’s unresolved issues make for a cloudy outlook as the world waits to see how the next chapter of the euro zone will read. Much attention will be focused on U.S. politics leading up to the November elections, the potential “fiscal cliff” (i.e., expiration of the Bush-era tax cuts, coupled with mandatory federal spending cuts), and the overall pace of economic growth. On the other hand, the current global easing cycle and a strengthening U.S. housing market could serve as buffers.

In the end, while we factor various economic scenarios into our stock picking, we focus our time on constructing the Fund from a bottom-up perspective. We continue to find good ideas across sectors, and are confident the Fund consists of well-managed companies with solid competitive positions whose stocks are at attractive valuations compared to the expected growth and consistency of their business.

20 Semi-Annual Report | June 30, 2012 |

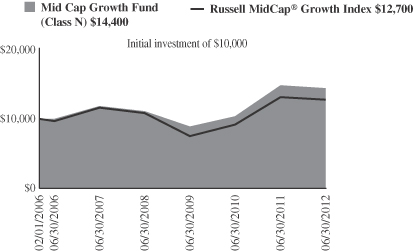

Mid Cap Growth Fund

Performance Highlights (Unaudited)

Average Annual Total Return at 6/30/2012

| | | | | | | | | | | | | | | | | | | | |

| | | Year

To Date | | | 1

Year | | | 3

Year | | | 5

Year | | | Since

Inception(a) | |

Class N | | | 7.03 | % | | | (2.86) | % | | | 17.28 | % | | | 3.99 | % | | | 5.81 | % |

Class I | | | 7.25 | | | | (2.53) | | | | 17.58 | | | | 4.26 | | | | 6.11 | |

Russell MidCap® Growth Index | | | 8.10 | | | | (2.99) | | | | 19.01 | | | | 1.90 | | | | 3.82 | |

| | (a) | | For the period from February 1, 2006 (Commencement of Operations) to June 30, 2012. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in medium capitalization companies involves special risks, including higher volatility and lower liquidity. Medium Capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell MidCap® Growth Index is an index that is constructed to provide a comprehensive and unbiased barometer of the mid-cap growth market.

This report identifies the Fund’s investments on June 30, 2012. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

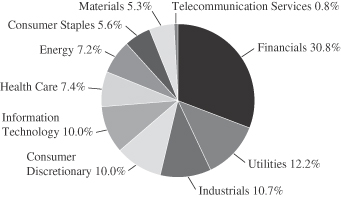

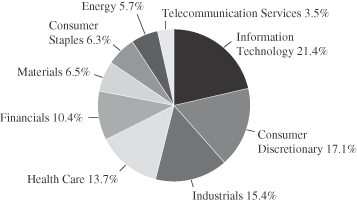

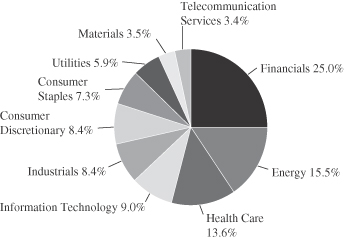

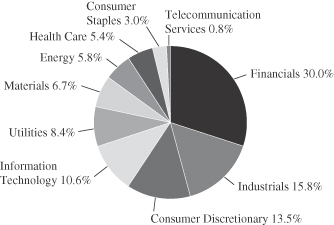

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

June 30, 2012 | William Blair Funds 21 |

Mid Cap Growth Fund

Portfolio of Investments, June 30, 2012 (all dollar amounts in thousands) (unaudited)

| | | | | | | | |

Issuer | | Shares | | | Value | |

| | |

Common Stocks | | | | | | | | |

Information Technology—20.4% | | | | | | | | |

Amphenol Corporation | | | 117,000 | | | $ | 6,426 | |

*Aruba Networks, Inc. | | | 383,100 | | | | 5,766 | |

*Cavium, Inc. | | | 246,519 | | | | 6,902 | |

*Citrix Systems, Inc. | | | 134,700 | | | | 11,307 | |

*Concur Technologies, Inc. | | | 73,130 | | | | 4,980 | |

*Genpact, Ltd.† | | | 190,207 | | | | 3,163 | |

*Informatica Corporation | | | 35,100 | | | | 1,487 | |

*Silicon Laboratories, Inc. | | | 186,780 | | | | 7,079 | |

*SolarWinds, Inc. | | | 152,000 | | | | 6,621 | |

TE Connectivity, Ltd.† | | | 160,851 | | | | 5,133 | |

*Trimble Navigation, Ltd. | | | 112,104 | | | | 5,158 | |

*VeriSign, Inc. | | | 178,200 | | | | 7,764 | |

| | | | | | | | |

| | | | | | | 71,786 | |

| | | | | | | | |

Consumer Discretionary—16.2% | | | | | | | | |

*Bed Bath & Beyond, Inc. | | | 123,960 | | | | 7,661 | |

*Chipotle Mexican Grill, Inc. | | | 4,840 | | | | 1,839 | |

Dick’s Sporting Goods, Inc. | | | 229,329 | | | | 11,008 | |

Gentex Corporation | | | 147,080 | | | | 3,069 | |

Harley-Davidson, Inc. | | | 169,800 | | | | 7,765 | |

Harman International Industries, Inc. | | | 123,006 | | | | 4,871 | |

*Lululemon Athletica, Inc. | | | 136,400 | | | | 8,133 | |

*O’Reilly Automotive, Inc. | | | 92,480 | | | | 7,747 | |

*Select Comfort Corporation | | | 175,700 | | | | 3,676 | |

Tractor Supply Co. | | | 18,200 | | | | 1,512 | |

| | | | | | | | |

| | | | | | | 57,281 | |

| | | | | | | | |

Industrials—14.7% | | | | | | | | |

*Clean Harbors, Inc. | | | 110,200 | | | | 6,218 | |

Donaldson Co., Inc. | | | 186,300 | | | �� | 6,217 | |

Fastenal Co. | | | 82,462 | | | | 3,324 | |

Gardner Denver, Inc. | | | 60,800 | | | | 3,217 | |

J.B. Hunt Transport Services, Inc. | | | 146,800 | | | | 8,749 | |

*Jacobs Engineering Group, Inc. | | | 127,100 | | | | 4,812 | |

*Polypore International, Inc. | | | 50,300 | | | | 2,032 | |

*Stericycle, Inc. | | | 97,230 | | | | 8,913 | |

*TransDigm Group, Inc. | | | 61,350 | | | | 8,239 | |

| | | | | | | | |

| | | | | | | 51,721 | |

| | | | | | | | |

Health Care—13.0% | | | | | | | | |

*Cerner Corporation | | | 72,600 | | | | 6,001 | |

*HealthSouth Corporation | | | 328,024 | | | | 7,630 | |

*HMS Holdings Corporation | | | 373,300 | | | | 12,435 | |

*IDEXX Laboratories, Inc. | | | 119,072 | | | | 11,446 | |

Perrigo Co. | | | 72,200 | | | | 8,514 | |

| | | | | | | | |

| | | | | | | 46,026 | |

| | | | | | | | |

| | | | | | | | |

Issuer | | Shares or

Principal

Amount | | | Value | |

| | |

Common Stocks—(continued) | | | | | | | | |

Financials—9.9% | | | | | | | | |

*Affiliated Managers Group, Inc. | | | 48,775 | | | $ | 5,338 | |

*First Republic Bank | | | 172,700 | | | | 5,803 | |

LPL Financial Holdings, Inc. | | | 311,700 | | | | 10,526 | |

*Signature Bank | | | 102,600 | | | | 6,256 | |

T Rowe Price Group, Inc. | | | 111,100 | | | | 6,995 | |

| | | | | | | | |

| | | | | | | 34,918 | |

| | | | | | | | |

Materials—6.2% | | | | | | | | |

Airgas, Inc. | | | 120,800 | | | | 10,148 | |

Ecolab, Inc. | | | 168,600 | | | | 11,554 | |

| | | | | | | | |

| | | | | | | 21,702 | |

| | | | | | | | |

Consumer Staples—6.0% | | | | | | | | |

*Green Mountain Coffee Roasters, Inc. | | | 177,846 | | | | 3,873 | |

McCormick & Co., Inc. | | | 139,000 | | | | 8,430 | |

Mead Johnson Nutrition Co. | | | 109,000 | | | | 8,776 | |

| | | | | | | | |

| | | | | | | 21,079 | |

| | | | | | | | |

Energy—5.4% | | | | | | | | |

*Cameron International Corporation | | | 104,100 | | | | 4,446 | |

*Denbury Resources, Inc. | | | 264,670 | | | | 3,999 | |

*FMC Technologies, Inc. | | | 142,800 | | | | 5,602 | |

Range Resources Corporation | | | 83,700 | | | | 5,179 | |

| | | | | | | | |

| | | | | | | 19,226 | |

| | | | | | | | |

Telecommunication Services—3.3% | | | | | | | | |

*SBA Communications Corporation Class “A” | | | 204,000 | | | | 11,638 | |

| | | | | | | | |

Total Common Stocks—95.1%

(cost $317,572) | | | | | | | 335,377 | |

| | | | | | | | |

| | |

Repurchase Agreement | | | | | | | | |

Fixed Income Clearing Corporation, 0.100% dated 6/29/12, due 7/2/12, repurchase price $19,372, collateralized by FNMA, 5.000%, due 4/15/15 | | $ | 19,372 | | | | 19,372 | |

| | | | | | | | |

Total Repurchase Agreement—5.5%

(cost $19,372) | | | | 19,372 | |

| | | | | | | | |

Total Investments—100.6%

(cost $336,944) | | | | 354,749 | |

Liabilities, plus cash and other assets—(0.6)% | | | | (2,182 | ) |

| | | | | | | | |

Net assets—100.0% | | | $ | 352,567 | |

| | | | | | | | |

See accompanying Notes to Portfolio of Investments.

22 Semi-Annual Report | June 30, 2012 |

* Non-income producing securities

† = U.S. listed foreign security

Karl W. Brewer

Robert C. Lanphier, IV

Matthew A. Litfin

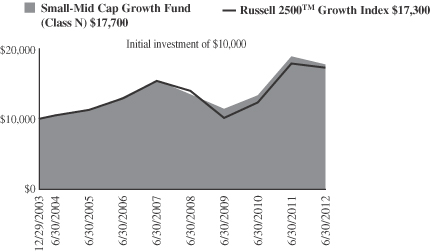

SMALL-MID CAP GROWTH FUND

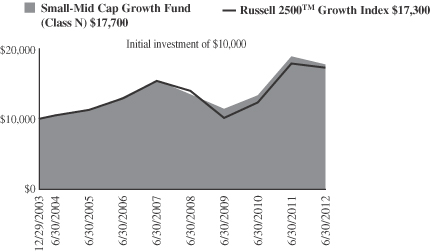

The Small-Mid Cap Growth Fund seeks long-term capital appreciation.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

The Small-Mid Cap Growth Fund increased 5.00% on a total return basis (Class N Shares) for the six months ended June 30, 2012. By comparison, the Fund’s benchmark, the Russell 2500TM Growth Index, increased 8.44% during the period.

After a nearly 30% advance over the previous two quarters, U.S. equities corrected in the second quarter. Robust first quarter returns primarily were driven by improving economic data points in the U.S. and continued strength in the corporate sector. However, in the second quarter, investors refocused their attention on negative headline news from Europe. While news from Greece continued, the elevated fear in the market revolved around more substantial European economies. Investors focused on Europe’s efforts to stabilize the Spanish banking system and the potential risks to the Spanish government’s borrowing capacity. Essentially, investors grappled with the region’s ability to preserve the single-currency bloc.

The slowdown was felt worldwide; China’s growth notably decelerated, joined by other emerging economies, due in part to developed nations’ decreased demand for exports. The U.S. was not immune to the slowdown; U.S. companies with direct business exposure to these regions, combined with declining U.S. business confidence due to the barrage of negative global headlines, translated into slowing business investment and worsening economic data at home. A string of disappointing data points ensued: employment growth slowed significantly from earlier this year, consumer confidence declined, and manufacturing activity slowed.

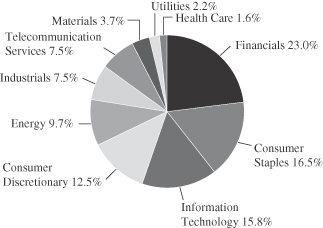

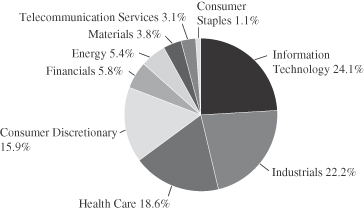

Broadly speaking, investors’ risk appetite continued from last year during the first quarter, but investors gravitated to stocks of companies with less economic sensitivity during the second quarter. From a sector perspective, the typically defensive Health Care and Consumer Staples sectors outperformed in both the second quarter and year-to-date period. Energy has been the standout underperformer in 2012 to date, in part due to the global slowdown’s impact on oil demand and rising natural gas supplies.