UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-5344

William Blair Funds

(Exact name of registrant as specified in charter)

| | |

| 222 West Adams Street, Chicago, IL | | 60606 |

| (Address of principal executive offices) | | (Zip Code) |

Michelle R. Seitz

William Blair Funds

222 West Adams Street, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: 312-236-1600

Date of fiscal year end: December 31

Date of reporting period: June 30, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A Registrant is not required to respond to the collection of information contained in Form N-CSR unless the form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimates and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. (ss) 3507.

| Item 1. | June 30, 2011 Annual Reports transmitted to shareholders. |

SEMI-ANNUAL REPORT

JUNE 30, 2011

Table of Contents

The views expressed in the commentary for each Fund reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The portfolio management team’s views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Statements involving predictions, assessments, analyses, or outlook for individual securities, industries, market sectors, and/or markets involve risks and uncertainties, and there is no guarantee they will come to pass.

This report is submitted for the general information of the shareholders of the William Blair Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by a prospectus of the William Blair Funds. Please carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

June 30, 2011 | William Blair Funds 1 |

PERFORMANCE AS OF JUNE 30, 2011—CLASS N SHARES (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year

To Date | | | 1 Yr. | | | 3 Yr. | | | 5 Yr. | | | 10 Yr

(or since

inception) | | | Inception

Date | | Overall

Morningstar

Rating |

Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 5.67 | | | | 31.13 | | | | 3.99 | | | | 5.36 | | | | 3.31 | | | 3/20/1946 | | ««««

Among 1,476 Large Growth Funds |

Morningstar Large Growth | | | 5.65 | | | | 33.08 | | | | 3.02 | | | | 4.07 | | | | 2.24 | | | | |

Russell 3000® Growth | | | 6.98 | | | | 35.68 | | | | 5.28 | | | | 5.36 | | | | 2.43 | | | | |

Standard & Poor’s 500 | | | 6.02 | | | | 30.69 | | | | 3.34 | | | | 2.94 | | | | 2.72 | | | | | |

| | | | | | | |

Large Cap Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 3.64 | | | | 31.21 | | | | 2.46 | | | | 2.91 | | | | 0.43 | | | 12/27/1999 | | «««

Among 1,476 Large Growth Funds |

Morningstar Large Growth | | | 5.65 | | | | 33.08 | | | | 3.02 | | | | 4.07 | | | | 2.24 | | | | |

Russell 1000® Growth | | | 6.83 | | | | 35.01 | | | | 5.01 | | | | 5.33 | | | | 2.24 | | | | |

| | | | | | | |

Small Cap Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 1.38 | | | | 22.22 | | | | 8.25 | | | | 2.28 | | | | 7.96 | | | 12/27/1999 | | «««

Among 666 Small Growth Funds |

Morningstar Small Growth | | | 9.35 | | | | 42.52 | | | | 7.81 | | | | 5.08 | | | | 5.05 | | | | |

Russell 2000® Growth | | | 8.59 | | | | 43.50 | | | | 8.35 | | | | 5.79 | | | | 4.63 | | | | |

Russell 2000® | | | 6.21 | | | | 37.41 | | | | 7.77 | | | | 4.08 | | | | 6.27 | | | | | |

| | | | | | | |

Mid Cap Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 12.00 | | | | 42.57 | | | | 10.06 | | | | 8.20 | | | | 7.50 | | | 2/1/2006 | | ««««

Among 681 Mid-Cap Growth Funds |

Morningstar Mid-Cap Growth | | | 8.08 | | | | 39.49 | | | | 5.18 | �� | | | 5.59 | | | | — | | | | |

Russell MidCap® Growth | | | 9.59 | | | | 43.25 | | | | 6.58 | | | | 6.28 | | | | 5.11 | | | | |

| | | | | | | |

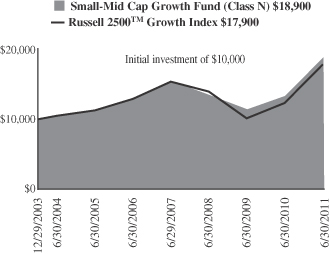

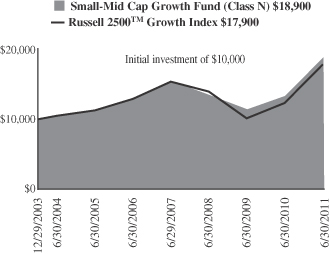

Small-Mid Cap Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 11.53 | | | | 41.25 | | | | 11.84 | | | | 7.53 | | | | 8.83 | | | 12/29/2003 | | ««««

Among 681 Mid-Cap Growth Funds |

Morningstar Mid-Cap Growth | | | 8.08 | | | | 39.49 | | | | 5.18 | | | | 5.59 | | | | — | | | | |

Russell 2500TM Growth | | | 10.25 | | | | 44.71 | | | | 8.51 | | | | 6.67 | | | | 8.01 | | | | |

| | | | | | | |

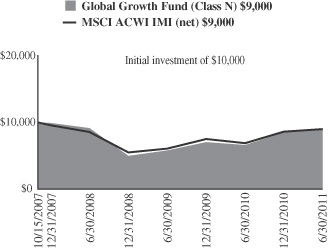

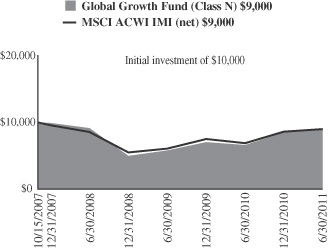

Global Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 6.19 | | | | 35.77 | | | | (0.52 | ) | | | — | | | | (2.86 | ) | | 10/15/2007 | | ««

Among 683 World Stock Funds |

Morningstar World Stock | | | 4.72 | | | | 30.18 | | | | 1.70 | | | | — | | | | — | | | | |

MSCI All Country World IMI (net) | | | 4.66 | | | | 31.00 | | | | 1.74 | | | | — | | | | (2.81 | ) | | | |

| | | | | | | |

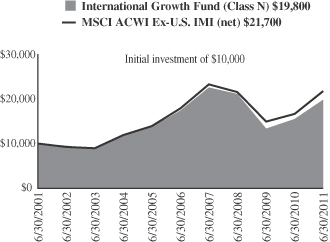

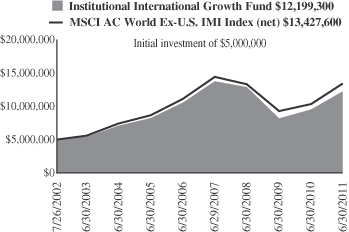

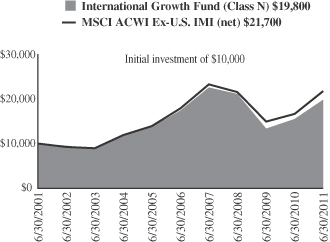

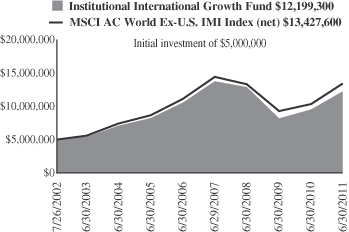

International Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 1.97 | | | | 27.83 | | | | (2.04 | ) | | | 2.65 | | | | 7.06 | | | 10/1/1992 | | «««

Among 209 Foreign Large Growth Funds |

Morningstar Foreign Large Growth | | | 4.05 | | | | 31.68 | | | | (0.10 | ) | | | 3.49 | | | | 6.09 | | | | |

MSCI All Country World Ex-U.S. IMI (net) | | | 3.52 | | | | 30.26 | | | | 0.31 | | | | 3.96 | | | | 8.05 | | | | |

| | | | | | | |

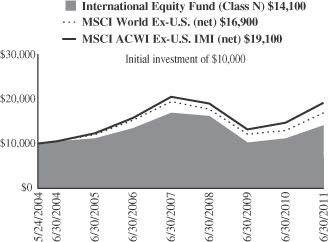

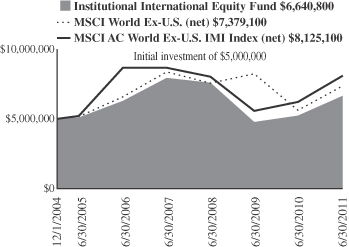

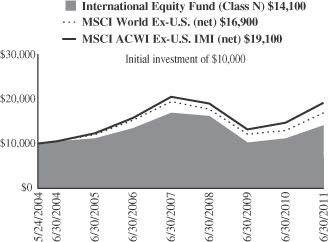

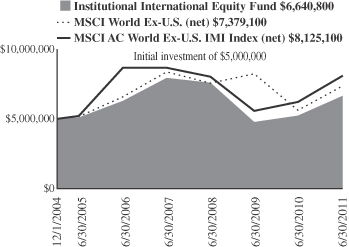

International Equity Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 3.22 | | | | 26.11 | | | | (4.36 | ) | | | 0.98 | | | | 4.99 | | | 5/24/2004 | | ««

Among 209 Foreign Large Growth Funds |

Morningstar Foreign Large Growth | | | 4.05 | | | | 31.68 | | | | (0.10 | ) | | | 3.49 | | | | — | | | | |

MSCI World Ex-U.S. (net) | | | 4.72 | | | | 30.33 | | | | (1.56 | ) | | | 2.02 | | | | 7.63 | | | | |

MSCI All Country World Ex-U.S. IMI (net) | | | 3.52 | | | | 30.26 | | | | 0.31 | | | | 3.96 | | | | 9.54 | | | | | |

| | | | | |

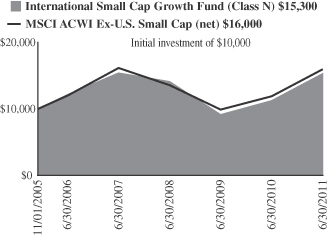

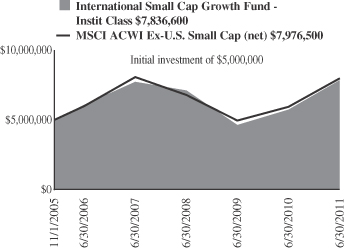

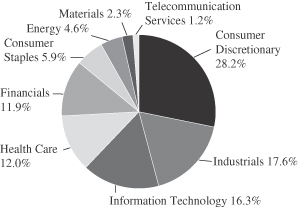

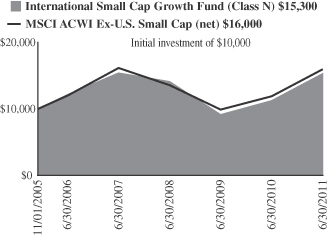

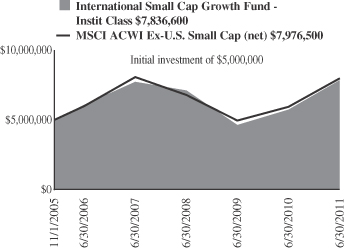

International Small Cap Growth Fund | | | | | | | | | | | | | | | | | |

Class N | | | 5.43 | | | | 35.85 | | | | 2.71 | | | | 4.72 | | | | 7.74 | | | 11/1/2005 | | «««

Among 129 Foreign Small/Mid Growth Funds |

Morningstar Foreign Small/Mid Growth | | | 3.47 | | | | 36.50 | | | | 2.30 | | | | 4.02 | | | | — | | | | |

MSCI All Country World Ex-U.S. Small Cap (net) | | | 1.51 | | | | 34.24 | | | | 5.56 | | | | 5.92 | | | | 8.57 | | | | |

Please see the next page for important disclosure information.

2 Semi-Annual Report | June 30, 2011 |

PERFORMANCE AS OF JUNE 30, 2011—CLASS N SHARES—CONTINUED (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year

To Date | | | 1 Yr. | | | 3 Yr. | | | 5 Yr. | | | 10 Yr

(or since

inception) | | | Inception

Date | | Overall

Morningstar

Rating |

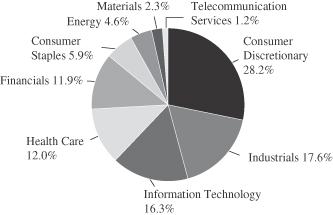

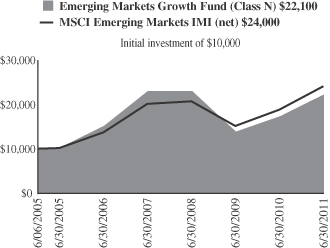

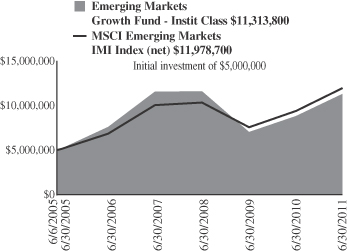

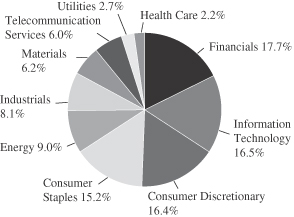

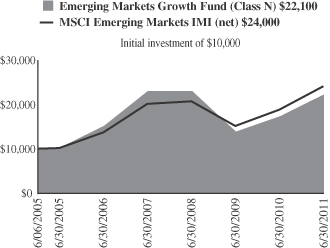

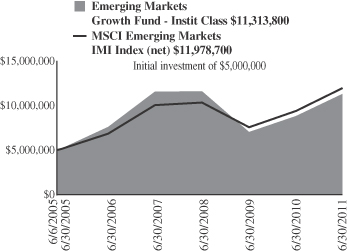

Emerging Markets Growth Fund | | | | | | | | | | | | | | | | | |

Class N | | | (0.70 | ) | | | 28.05 | | | | (1.15 | ) | | | 7.92 | | | | 13.95 | | | 6/6/2005 | | ««

Among 291 Diversified Emerging Markets Funds |

Morningstar Diversified Emerging Markets | | | (0.42 | ) | | | 26.76 | | | | 1.97 | | | | 9.54 | | | | — | | | | |

MSCI Emerging Markets IMI (net) | | | 0.32 | | | | 27.53 | | | | 5.13 | | | | 11.90 | | | | 15.43 | | | | |

| | | | | |

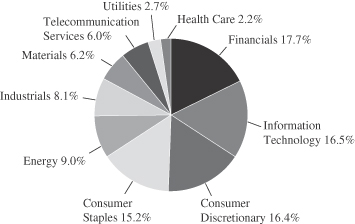

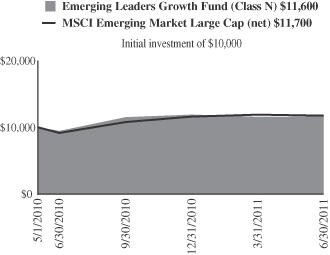

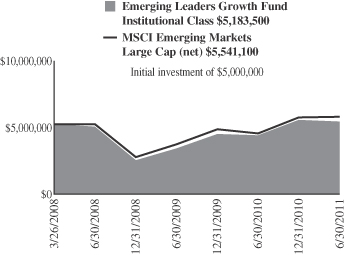

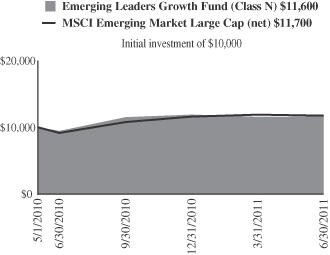

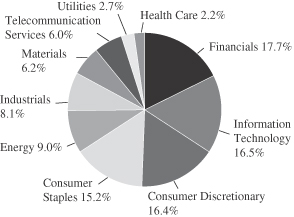

Emerging Leaders Growth Fund | | | | | | | | | | | | | | | | | |

Class N | | | (2.42 | ) | | | 23.12 | | | | — | | | | — | | | | 13.20 | | | 5/3/2010 | | Not rated. |

Morningstar Diversified Emerging Markets | | | (0.42 | ) | | | 26.76 | | | | — | | | | — | | | | — | | | | |

MSCI Emerging Markets Large Cap (net) | | | 0.97 | | | | 27.87 | | | | — | | | | — | | | | 14.22 | | | | |

| | | | | |

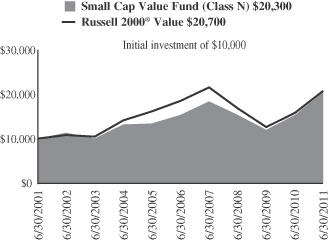

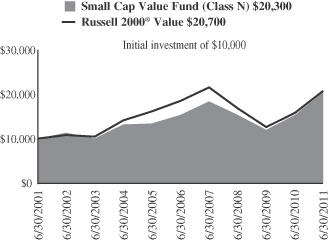

Small Cap Value | | | | | | | | | | | | | | | | | |

Class N | | | 2.19 | | | | 33.30 | | | | 9.91 | | | | 5.83 | | | | 7.36 | | | 12/23/1996 | | ««««

Among 305 Small Value Funds |

Morningstar Small Value | | | 4.58 | | | | 32.28 | | | | 8.73 | | | | 3.49 | | | | 8.31 | | | | |

Russell 2000® Value | | | 3.77 | | | | 31.35 | | | | 7.09 | | | | 2.24 | | | | 7.53 | | | | |

| | | | | |

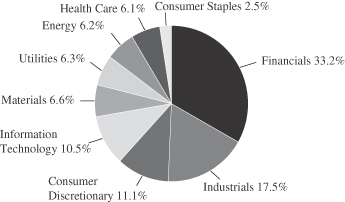

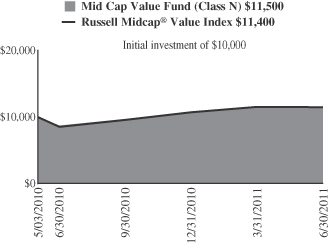

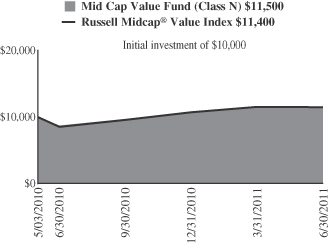

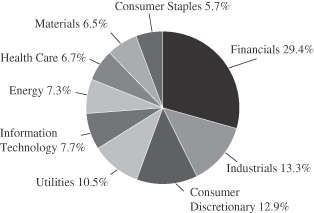

Mid Cap Value Fund | | | | | | | | | | | | | | | | | |

Class N | | | 5.86 | | | | 32.15 | | | | — | | | | — | | | | 12.47 | | | 5/3/2010 | | Not rated. |

Morningstar Short-term Bond | | | 6.16 | | | | 32.92 | | | | — | | | | — | | | | — | | | | | |

Russell Midcap® Value Index | | | 6.69 | | | | 34.28 | | | | — | | | | — | | | | 12.17 | | | | |

| | | | | |

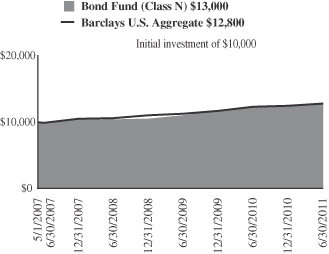

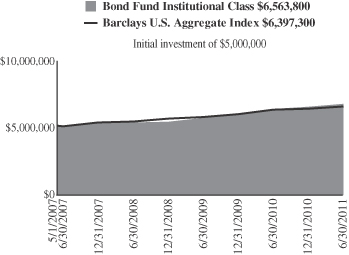

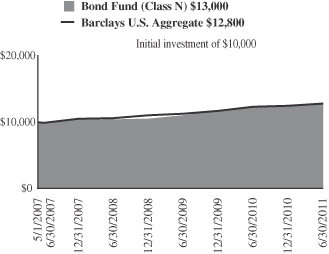

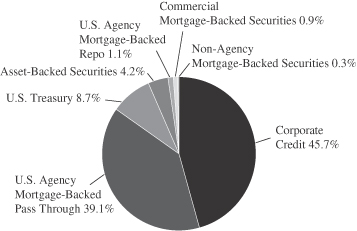

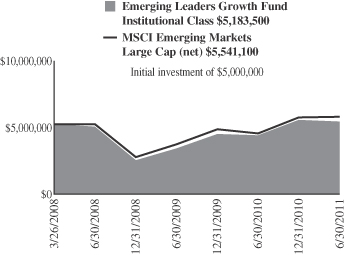

Bond Fund | | | | | | | | | | | | | | | | | |

Class N | | | 2.90 | | | | 5.43 | | | | 7.51 | | | | — | | | | 6.41 | | | 5/1/2007 | | ««««

Among 1,017 Intermediate-Term Bond Funds |

Morningstar Intermediate-term Bond | | | 2.84 | | | | 5.33 | | | | 6.69 | | | | — | | | | — | | | | |

Barclays Capital U.S. Aggregate Bond Index | | | 2.72 | | | | 3.90 | | | | 6.46 | | | | — | | | | 6.07 | | | | |

| | | | | |

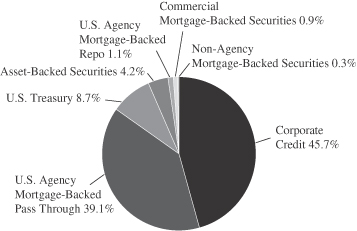

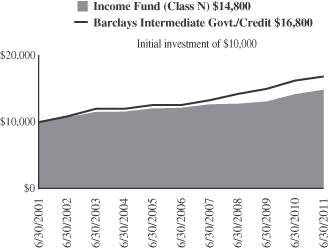

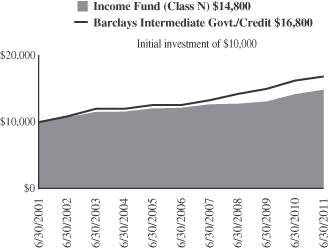

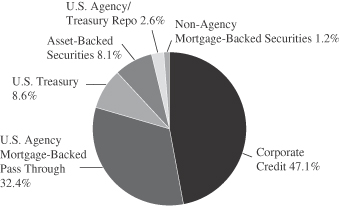

Income Fund | | | | | | | | | | | | | | | | | |

Class N | | | 2.48 | | | | 4.56 | | | | 5.26 | | | | 4.13 | | | | 4.03 | | | 10/1/1990 | | ««««

Among 376 Short-Term Bond Funds |

Morningstar Short-term Bond | | | 1.42 | | | | 3.02 | | | | 3.93 | | | | 3.98 | | | | 3.67 | | | | |

Barclays Capital Intermediate Govt./Credit Bond Index | | | 2.47 | | | | 3.77 | | | | 5.76 | | | | 6.08 | | | | 5.35 | | | | |

| | | | | |

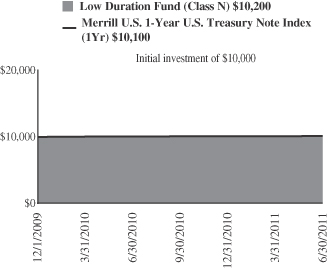

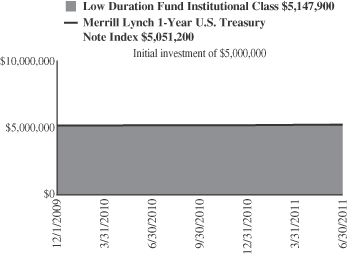

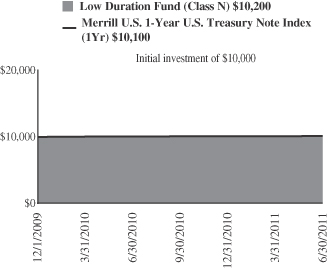

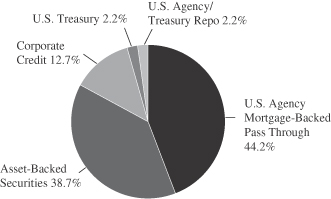

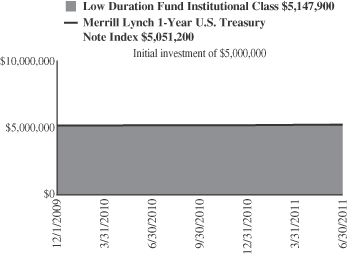

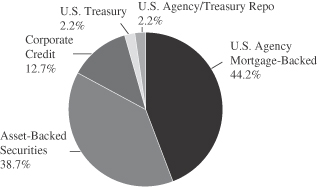

Low Duration Fund | | | | | | | | | | | | | | | | | |

Class N | | | 1.13 | | | | 1.56 | | | | — | | | | — | | | | 1.51 | | | 12/1/2009 | | Not rated. |

Morningstar Ultra Short Bond | | | 0.62 | | | | 1.63 | | | | — | | | | — | | | | — | | | | | |

Merrill Lynch 1-Year U.S. Treasury Note Index | | | 0.35 | | | | 0.67 | | | | — | | | | — | | | | 0.65 | | | | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or a loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. International and emerging markets investing involves special risk considerations, including currency fluctuations, lower liquidity, economic and political risk. As interest rates rise, bond prices will fall and bond funds may become more volatile. Class N shares are available to the general public without a sales load.

June 30, 2011 | William Blair Funds 3 |

PERFORMANCE AS OF JUNE 30, 2011—CLASS N SHARES—CONTINUED (unaudited)

Morningstar RatingsTM are as of 6/30/2011 and are subject to change every month. The ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each Category receive 5 stars, the next 22.5% receive 4 stars, the middle 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. The 3/5/10 year Morningstar ratings were as follows: Growth Fund «««/««««/««««, and Large Cap Growth Fund «««/«««/««, out of 1,476/1,276/803 large growth funds; Small Cap Growth Fund «««/««/««««, out of 666/565/358 small growth funds; Mid Cap Growth Fund «««««/««««/NA and Small-Mid Cap Growth Fund «««««/««««/NA out of 681/609/NA mid cap growth funds; Global Growth Fund ««/NA/NA out of 683/NA/NA world stocks; International Growth Fund «««/«««/««« and International Equity Fund ««/««/NA out of 209/168/103 foreign large growth funds; International Small Cap Growth Fund «««/«««/NA out of 129/104/NA foreign small/mid growth funds; Emerging Markets Growth Fund ««/««/NA out of 291/225/NA diversified emerging markets growth funds; Small Cap Value Fund ««««/««««/««« out of 305/255/141 small value funds; Income Fund ««««/«««/«««« out of 376/323/189 short-term bond funds; Bond Fund ««««/NA/NA out of 1,017/NA/NA intermediate-term bond fund.

Please carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

See accompanying Notes to Financial Statements.

4 Semi-Annual Report | June 30, 2011 |

David C. Fording

John F. Jostrand

GROWTH FUND

The Growth Fund seeks long-term capital appreciation.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

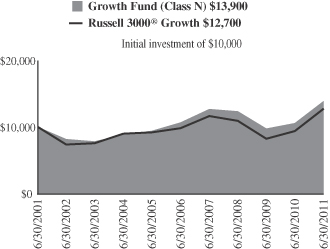

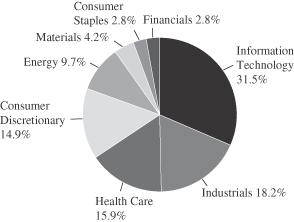

The Growth Fund posted an 5.67% increase (Class N Shares) for the six months ended June 30, 2011. By comparison, the Fund’s benchmark, the Russell 3000® Growth Index, gained 6.98%.

Our quality growth approach assisted during May and June when the market declined, but stock picking challenges in both Energy and Information Technology have held back year-to-date relative returns.

Overcoming several major shocks, the U.S. equity markets finished with solid gains in the first half of 2011. Most of these gains occurred in the first quarter on better-than-expected corporate earnings and positive economic reports including unemployment, which dropped below 9% for the first time in almost two years. The Russell 3000® Growth climbed 6.3%. Generally, investors had a growing level of confidence that the economic recovery had become self-sustaining. In fact, the upward market momentum could not be deterred by the political turmoil in the Middle East and North Africa (MENA), the natural disasters in Japan, and re-emergence of the debt crisis in Europe. In the second quarter, U.S. stocks retracted and market volatility picked up, as investors reacted to several concerns. First, U.S. and global economic growth saw some deceleration driven by China’s monetary tightening and sluggish developed market consumer spending due to continued deleveraging and inflationary pressures such as high gas prices and food costs. Helping to slow global economic growth further, Japan’s economic output slipped for several months due to the earthquake and tsunami, which caused supply chain disruptions throughout the world. We view this event as temporary. Sovereign debt issues in Europe flared up as well, particularly in Greece. Also, QE2 (the second round of U.S. quantitative easing) ended in June, which increased speculation about a potential rise in rates and the need for QE3. Lastly, investors were worried over the slow recovery in employment as initial claims increased and job growth decelerated. Surprisingly, the Russell 3000® Growth Index gained ground at 0.64% in the second quarter, after being down nearly 8% intra-quarter.

Given the uncertainty, the markets returned to a familiar risk on/risk off pattern with investor confidence bolstered only by the last macro data point or political resolution announced. Year-to-date, the more defensive sectors benefited including Utilities and Health Care. Despite the weakness in the second quarter, Energy stocks were strong due to high oil prices, continued demand, and potential supply issues with the turmoil in the MENA region. Conversely, the weaker relative performers were Telecommunication, Materials and Information Technology. In terms of capitalization, mid capitalization stocks were best followed by small caps and then large caps. The Russell Mid Cap Growth Index increased 9.59%, the Russell 2000® Growth Index rose 8.59%, and the Russell 1000® Growth climbed 6.83%.

The Fund’s greatest sector detractor to performance was Energy due to both stock selection and an underweight in a strong performing group. Most of the difficulty occurred in the first quarter. We did not own Exxon Mobil, the largest benchmark stock, which performed well and hurt relative results. Also, we held E&P (exploration and production) companies that had exposure to the Middle East and North Africa; as a result, Occidental Petroleum and Apache had more muted relative results. Lastly, Weatherford struggled as it announced plans to restate taxes, a near term issue. Another sector with weak relative results was Information Technology due to primarily stock selection and to a lesser extent, an overweight in a poor

June 30, 2011 | William Blair Funds 5 |

performing group. Notably, a few of our large cap stocks trailed the group average. Google, one of our top positions, declined after reporting better than expected revenues, which were offset by higher operating costs. Its management set a more aggressive tone on pursuing growth opportunities such as mobile, social and local advertising by increasing its investments, primarily in people. In our view, the company continues to have a strong market position, and is well positioned to benefit from an increase in ad spending as the economy recovers. Microsoft was a relative laggard as well despite its attractive earnings reports that beat analyst expectations driven by its business division (Office 2010) and entertainment and devices group (Xbox 360 console and Kinect). While Microsoft has nicely exceeded street expectations since the Fund bought the stock in mid-2009, on very strong product cycles and disciplined cost management, we believed there were signs of waning financial discipline as well as questionable strategic moves (e.g. Skype purchase) in the second quarter. As a result, the Fund eliminated the stock in June. Also, Dolby came under pressure on reduced 2011 revenue guidance due to weakness in the PC end market. The Fund has added to its position in Dolby as its valuation has become much more attractive.

Turning to the portfolio’s strengths, consumer sectors were standouts among the contributors. The best performing stock overall was Green Mountain Coffee Roasters, Inc., a specialty coffee company and leader in the single-serve segment through its Keurig brand. This staples stock rallied on an announcement that Starbucks plans to make its coffee and Tazo tea available as single-serve K-Cup portion packs for use in the Keurig brewing system. Starbucks will be their exclusive super premium licensed coffee brand. In Consumer Discretionary, Tempur-Pedic International, Inc. and McDonald’s Corporation also showed strength. Tempur-Pedic benefited from strong sales momentum and margin leverage. In our view, the company should see further upside to earnings as a result of its differentiated products, increasing brand awareness, strong channel relationships, and recent launch of new products including the Cloud line in Europe and the Contour line in the U.S. McDonald’s stock rose due to better-than-expected quarterly sales in both the U.S. and Europe. The company continues to drive traffic with strong execution, advertising, and broad price selections on its menu, which helps offset macroeconomic headwinds of rising commodity prices and austerity in Europe. Select Information Technology stocks were additive to results as well. Atheros Communications, a leading innovator in Wi-Fi connectivity, announced it would be acquired by Qualcomm. The stock rallied substantially, and the Fund sold the stock. Also, we did not own shares of Cisco, which declined in the quarter and helped relative results. Lastly, in Industrials, TransDigm Group rose on continued strength in the commercial aircraft aftermarket, as well as the continued execution of its acquisition strategy.

On the outlook for the U.S. economy, we are cautiously optimistic. As the year progresses, we expect to see acceleration in economic growth, driven by Japan coming back on-line with lessening of supply chain disruptions and the growing likelihood of China halting its monetary tightening, thus moderating an existing headwind to global economic activity. In addition, some lessening of commodity cost inflationary pressures should be a positive for spending while a low interest rate environment in the developed markets should continue to assist businesses and consumers. Also, the increased clarity of regulatory framework in the banking system is another positive and we have already seen modest year-over-year growth in banking loans. In combination, these trends should be good for equity markets as well.

However, macro uncertainty remains and volatility may continue as investors seek resolution of outstanding concerns. On sovereign debt, we may have continued flare-ups, but European government officials are likely to respond adequately in order to avoid a crisis. In regard to U.S. employment, it is not a surprise that a return to more normal trends has been slow given the greater efficiency in corporate America and the changing skill set required for America’s workforce. Further recovery will be important for improvements in consumer spending and the housing market. Moreover, the price of gas may stay at elevated levels due to global demand, especially from emerging markets, which may temper consumer discretionary purchases. Finally, political events remain at the forefront of investor’s minds. Given the fragile state of both consumer and business confidence, the resolution of important issues such as the Greek debt crisis and the U.S. debt ceiling negotiations (to name a few) are

6 Semi-Annual Report | June 30, 2011 |

critical to averting the much feared double dip recession. Handicapping such political outcomes is more difficult and, as such, uncertainty is likely to persist for some time.

In a slower growth environment, our quality growth investment discipline should benefit in our view. Leading companies with superior and sustainable earnings growth and strong management teams will be able to navigate the market challenges and be rewarded while less attractive firms wane. Our focus will continue to be intensive fundamental research seeking quality companies, which have durable business franchises with sustainable competitive advantages, strong management teams, healthy cash flows and balance sheets, as well as outstanding execution; these companies should be exceptional investment opportunities over time in our view.

June 30, 2011 | William Blair Funds 7 |

Growth Fund

Performance Highlights (unaudited)

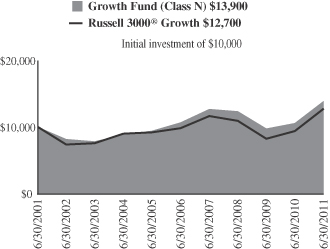

Average Annual Total Return at 6/30/2011

| | | | | | | | | | | | | | | | | | | | |

| | | Year

To Date | | | 1

Year | | | 3

Year | | | 5

Year | | | 10

Year | |

Class N | | | 5.67 | % | | | 31.13 | % | | | 3.99 | % | | | 5.36 | % | | | 3.31 | % |

Class I | | | 5.89 | | | | 31.64 | | | | 4.36 | | | | 5.70 | | | | 3.61 | |

Russell 3000® Growth Index | | | 6.98 | | | | 35.68 | | | | 5.28 | | | | 5.36 | | | | 2.43 | |

S&P 500 Index | | | 6.02 | | | | 30.69 | | | | 3.34 | | | | 2.94 | | | | 2.72 | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company L.L.C. without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 3000® Growth Index consists of large, medium, and small capitalization companies with above average price-to-book ratios and forecasted growth rates. The index is weighted by market capitalization and large/medium/small companies make up approximately 80%/15%/5% of the index.

The S&P 500 Index indicates broad larger capitalization equity market performance.

This report identifies the Fund’s investments on June 30, 2011. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

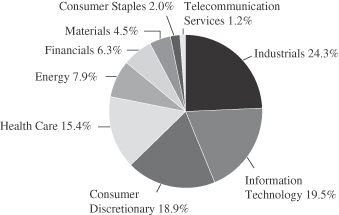

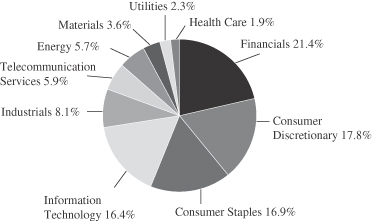

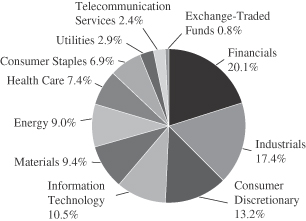

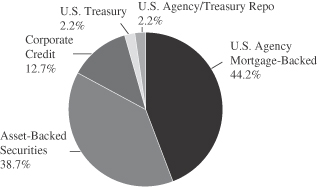

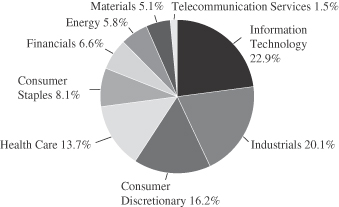

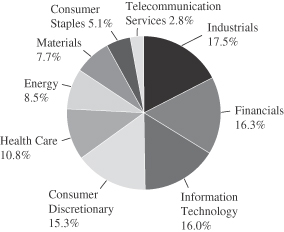

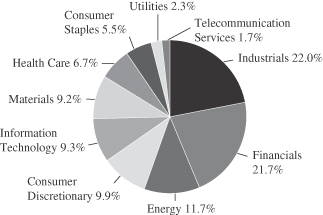

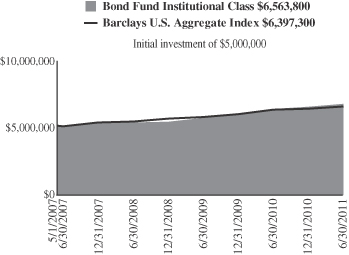

Sector Diversification (unaudited)

The sector diversification shown is based on the total long-term securities.

8 Semi-Annual Report | June 30, 2011 |

Growth Fund

Portfolio of Investments, June 30, 2011 (all dollar amounts in thousands) (unaudited)

| | | | | | | | |

Issuer | | Shares | | | Value | |

| | |

Common Stocks | | | | | | | | |

Information Technology—31.0% | | | | | | | | |

*Apple, Inc. | | | 89,685 | | | $ | 30,105 | |

*Broadcom Corporation Class “A” | | | 288,000 | | | | 9,688 | |

*Dolby Laboratories, Inc. Class “A” | | | 225,000 | | | | 9,553 | |

FLIR Systems, Inc. | | | 269,000 | | | | 9,068 | |

*Fusion-io, Inc. | | | 15,007 | | | | 452 | |

*Genpact, Ltd.† | | | 636,518 | | | | 10,974 | |

*Google, Inc. Class “A” | | | 51,805 | | | | 26,233 | |

*Juniper Networks, Inc. | | | 242,800 | | | | 7,648 | |

*Monolithic Power Systems, Inc. | | | 649,400 | | | | 10,014 | |

QUALCOMM, Inc. | | | 307,740 | | | | 17,476 | |

*RightNow Technologies, Inc. | | | 193,156 | | | | 6,258 | |

*Silicon Laboratories, Inc. | | | 320,840 | | | | 13,238 | |

Solera Holdings, Inc. | | | 159,300 | | | | 9,424 | |

TE Connectivity, Ltd.† | | | 362,600 | | | | 13,329 | |

*Trimble Navigation, Ltd. | | | 323,300 | | | | 12,816 | |

VeriSign, Inc. | | | 306,000 | | | | 10,239 | |

| | | | | | | | |

| | | | | | | 196,515 | |

| | | | | | | | |

Industrials—17.8% | | | | | | | | |

CH Robinson Worldwide, Inc. | | | 113,800 | | | | 8,972 | |

*Corrections Corporation of America | | | 242,700 | | | | 5,254 | |

Fastenal Co. | | | 331,858 | | | | 11,943 | |

Flowserve Corporation | | | 66,300 | | | | 7,286 | |

Goodrich Corporation | | | 95,300 | | | | 9,101 | |

*IHS, Inc. Class “A” | | | 222,720 | | | | 18,579 | |

*Jacobs Engineering Group, Inc. | | | 318,200 | | | | 13,762 | |

Manpower, Inc. | | | 161,000 | | | | 8,638 | |

The Corporate Executive Board Co. | | | 291,339 | | | | 12,717 | |

*TransDigm Group, Inc. | | | 109,580 | | | | 9,993 | |

*Trimas Corporation | | | 279,781 | | | | 6,925 | |

| | | | | | | | |

| | | | | | | 113,170 | |

| | | | | | | | |

Health Care—15.6% | | | | | | | | |

*Align Technology, Inc. | | | 271,300 | | | | 6,186 | |

Allergan, Inc. | | | 122,600 | | | | 10,206 | |

*Celgene Corporation | | | 156,380 | | | | 9,433 | |

*Cerner Corporation | | | 163,600 | | | | 9,997 | |

*DaVita, Inc. | | | 146,700 | | | | 12,706 | |

*Gilead Sciences, Inc. | | | 213,035 | | | | 8,822 | |

*Haemonetics Corporation | | | 117,000 | | | | 7,531 | |

*Hologic, Inc. | | | 298,300 | | | | 6,017 | |

*IDEXX Laboratories, Inc. | | | 130,230 | | | | 10,101 | |

*Illumina, Inc. | | | 133,100 | | | | 10,002 | |

*NxStage Medical, Inc. | | | 393,915 | | | | 8,201 | |

| | | | | | | | |

| | | | | | | 99,202 | |

| | | | | | | | |

Consumer Discretionary—14.6% | | | | | | | | |

Harley-Davidson, Inc. | | | 162,999 | | | | 6,678 | |

Johnson Controls, Inc. | | | 435,900 | | | | 18,159 | |

*K12, Inc. | | | 227,788 | | | | 7,549 | |

McDonald’s Corporation | | | 352,064 | | | | 29,686 | |

*Tempur-Pedic International, Inc. | | | 182,700 | | | | 12,391 | |

*Urban Outfitters, Inc. | | | 213,000 | | | | 5,996 | |

*Valassis Communications, Inc. | | | 400,800 | | | | 12,144 | |

| | | | | | | | |

| | | | | | | 92,603 | |

| | | | | | | | |

*Non-income producing securities

† = U.S. listed foreign security

| | | | | | | | |

Issuer | | Shares or

Principal

Amount | | | Value | |

| | |

Common Stocks—(continued) | | | | | | | | |

Energy—9.5% | | | | | | | | |

*Cameron International Corporation | | | 122,147 | | | $ | 6,143 | |

Occidental Petroleum Corporation | | | 165,300 | | | | 17,198 | |

Schlumberger, Ltd.† | | | 235,400 | | | | 20,339 | |

Suncor Energy, Inc.† | | | 255,100 | | | | 9,974 | |

*Weatherford International, Ltd.† | | | 343,800 | | | | 6,446 | |

| | | | | | | | |

| | | | | | | 60,100 | |

| | | | | | | | |

Materials—4.1% | | | | | | | | |

Airgas, Inc. | | | 94,500 | | | | 6,619 | |

Ecolab, Inc. | | | 256,320 | | | | 14,451 | |

*Stillwater Mining Co. | | | 227,900 | | | | 5,016 | |

| | | | | | | | |

| | | | | | | 26,086 | |

| | | | | | | | |

Consumer Staples—2.8% | | | | | | | | |

*Green Mountain Coffee Roasters, Inc. | | | 197,659 | | | | 17,643 | |

| | | | | | | | |

Financials—2.7% | | | | | | | | |

*IntercontinentalExchange, Inc. | | | 95,800 | | | | 11,947 | |

The Charles Schwab Corporation | | | 336,075 | | | | 5,529 | |

| | | | | | | | |

| | | | | | | 17,476 | |

| | | | | | | | |

Total Common Stocks—98.1%

(cost $514,813) | | | | 622,795 | |

| | | | | | | | |

| |

Repurchase Agreement | | | | | |

Fixed Income Clearing Corporation, 0.010%

dated 6/30/11, due 7/1/11, repurchase price

$10,350, collateralized by FHLMC, 2.000%, due 12/3/15 | | $ | 10,350 | | | | 10,350 | |

| | | | | | | | |

Total Repurchase Agreement—1.6%

(cost $10,350) | | | | 10,350 | |

| | | | | | | | |

Total Investments—99.7%

(cost $525,163) | | | | 633,145 | |

Cash and other assets, less liabilities—0.3% | | | | 1,636 | |

| | | | | | | | |

Net assets—100.0% | | | $ | 634,781 | |

| | | | | | | | |

See accompanying Notes to Financial Statements.

June 30, 2011 | William Blair Funds 9 |

James S. Golan

Tracy McCormick

LARGE CAP GROWTH FUND

The Large Cap Growth Fund seeks long-term capital appreciation.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

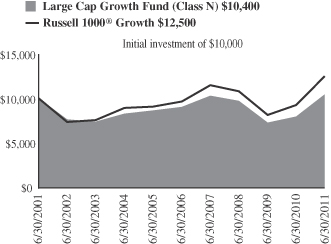

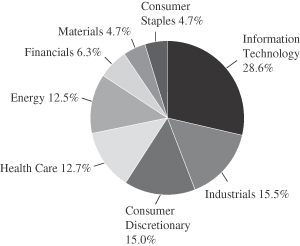

The Large Cap Growth Fund posted a 3.64% increase (Class N Shares) for the six months ended June 30, 2011. By comparison, the Fund’s benchmark, the Russell 1000® Growth Index, increased 6.83%.

In the first six months of 2011, the William Blair Large Cap Growth Fund trailed its benchmark primarily due to results in the first quarter; major cross currents in the marketplace were a headwind. Notably, our quality growth approach assisted during May and June when the market declined.

Overcoming several major shocks, the U.S. equity markets finished with solid gains in the first half of 2011. Most of these gains occurred in the first quarter on better-than-expected corporate earnings and positive economic reports including unemployment, which dropped below 9% for the first time in almost two years. The Russell 1000® Growth climbed 6.0%. Generally, investors had a growing level of confidence that the economic recovery had become self-sustaining. In fact, the upward market momentum could not be deterred by the political turmoil in the Middle East and North Africa (MENA), the natural disasters in Japan, and re-emergence of the debt crisis in Europe. In the second quarter, U.S. stocks retracted and market volatility picked up, as investors reacted to several concerns. First, U.S. and global economic growth saw some deceleration driven by China’s monetary tightening and sluggish developed market consumer spending due to continued deleveraging and inflationary pressures such as high gas prices and food costs. Helping to slow global economic growth further, Japan’s economic output slipped for several months due to the earthquake and tsunami, which caused supply chain disruptions throughout the world. We view this event as temporary. Sovereign debt issues in Europe flared up as well, particularly in Greece. Also, QE2 (the second round of U.S. quantitative easing) ended in June, which increased speculation about a potential rise in rates and the need for QE3. Lastly, investors were worried over the slow recovery in employment as initial claims increased and job growth decelerated. Surprisingly, the Russell 1000® Growth Index gained ground at 0.76% in the second quarter, after being down more than 7% intra-quarter.

Given the uncertainty, the markets returned to a familiar risk on/risk off pattern with investor confidence bolstered only by the last macro data point or political resolution announced. Year-to-date, the more defensive sectors benefited including Utilities and Health Care. Despite the weakness in the second quarter, Energy stocks were strong due to high oil prices, continued demand, and potential supply issues with the turmoil in the MENA region. Conversely, the weaker relative performers were Telecommunication Services, Materials and Information Technology (IT). In terms of capitalization, mid capitalization stocks were best followed by small caps and then large caps. The Russell Mid Cap® Growth Index increased 9.59% while the Russell 2000® Growth Index rose 8.59%.

We were disappointed with the portfolio results in the semi-annual period. Headwinds were challenging for active managers as investors relied more heavily on the macroeconomic environment, especially in the first quarter, and had less of a commitment to underlying fundamentals. However, we were encouraged by the relative outperformance from our stock positions in the second quarter as the macro influences subsided to a lesser degree.

The Fund’s greatest sector laggard was Consumer Discretionary where Marriott International, Inc. came under pressure on softness in North America revenue per available room (RevPAR); we view this as a near-term issue. The Energy sector was also challenging. Most

10 Semi-Annual Report | June 30, 2011 |

of the difficulty occurred in the first quarter. The Fund did not own Exxon Mobil Corporation, the largest benchmark stock at 5.1%, which performed well and hurt results. Also, we held E&P (exploration and production) companies that had exposure to the Middle East and North Africa; as a result, Occidental Petroleum Corporation and Apache Corporation had more muted relative results. The Fund continues to own Occidental due to its attractive long-term growth profile, but the Fund sold Apache on its higher exposure to this region. Lastly, Information Technology stock performance was mixed. Some of our large cap technology holdings lagged such as Microsoft Corporation and Google, Inc. Microsoft was a relative laggard despite its attractive earnings reports that beat analyst expectations driven by its business division (Office 2010) and entertainment and devices group (Xbox 360 console and Kinect). From a research perspective, we had the earnings view correct; however, the market was unwilling to reward the stock due to concerns over slowing PC sales especially in consumer and competition from tablets (i.e. iPads). As a result, the Fund sold the stock in May. Google, one of the Fund’s top positions, declined after reporting better than expected revenues, which were offset by higher operating costs. Its management set a more aggressive tone on pursuing growth opportunities such as mobile, social and local advertising by increasing its investments, primarily in people. In our view, the company continues to have a strong market position, and is well positioned to benefit from an increase in ad spend as the economy recovers. Also, Dolby Laboratories, Inc. came under pressure on reduced 2011 revenue guidance due to weakness in the PC end market. We believe the longer-term thesis remains unchanged. The consumption of entertainment from a variety of consumer electronics devices is beneficial for Dolby’s license streams.

Turning to the portfolio’s strengths, Materials and Health Care were standouts among the sector contributors. In Materials, the portfolio benefited from good stock selection with more defensive companies such as Praxair, Inc., and lacked any exposure to metals and mining stocks, which performed poorly as global growth showed signs of slowing. In Health Care, Agilent Technologies, Inc., a leading global provider of measurement tools and services to the bioanalytical and electronic marketplaces, was best. It had a strong above expectation earnings report and significantly raised guidance for fiscal year 2011. The Electronic Measurement Group had impressive revenues that were up 18% organically; it benefited from share gains as well as market adoption of smart phones and 3G networks. In our view, demand from its end markets remains attractive and it should continue to benefit from a cyclical recovery, exposure to growing Asian economies, and potential for additional acquisition activity. Notably, select stocks in other sectors also were strong contributors. In Industrials, Rockwell Automation, Inc. shined with the continued recovery in industrial activity. In Information Technology, Accenture plc, a leading global IT consulting firm, reported robust demand for its services as corporations continued to upgrade IT systems with new technology in order to improve business efficiency and find new avenues for growth. Also, the Fund did not own shares of Cisco Systems, Inc. and Hewlett-Packard Co., which declined and helped relative results. Lastly, in Financials, American Express Co. performed well as credit trends and business spending continued to improve.

On the outlook for the U.S. economy, we are cautiously optimistic. As the year progresses, we expect to see acceleration in economic growth, driven by Japan coming back on-line with lessening of supply chain disruptions and the growing likelihood of China halting its monetary tightening, thus moderating an existing headwind to global economic activity. In addition, some lessening of commodity cost inflationary pressures should be a positive for spending while a low interest rate environment in the developed markets should continue to assist businesses and consumers. Also, the increased clarity of regulatory framework in the banking system is another positive and we have already seen modest year-over-year growth in banking loans. In combination, these trends should be good for equity markets as well.

However, macro uncertainty remains and volatility may continue as investors seek resolution of outstanding concerns. On sovereign debt, we may have continued flare-ups, but European government officials are likely to respond adequately in order to avoid a crisis. In regard to U.S. employment, it is not a surprise that a return to more normal trends has been slow given the greater efficiency in corporate America and the changing skill set required for America’s

June 30, 2011 | William Blair Funds 11 |

workforce. Further recovery will be important for improvements in consumer spending and the housing market. Moreover, the price of gas may stay at elevated levels due to global demand, especially from emerging markets, which may temper consumer discretionary purchases. Finally, political events remain at the forefront of investor’s minds. Given the fragile state of both consumer and business confidence, the resolution of important issues such as the Greek debt crisis and the U.S. debt ceiling negotiations (to name a few) are critical to averting the much feared double dip recession. Handicapping such political outcomes is more difficult and, as such, uncertainty is likely to persist for some time.

In a slower growth environment, our quality growth investment discipline should benefit in our view. Leading companies with superior and sustainable earnings growth and strong management teams will be able to navigate the market challenges and be rewarded while less attractive firms wane. Our focus will continue to be intensive fundamental research seeking quality companies, which have durable business franchises with sustainable competitive advantages, strong management teams, healthy cash flows and balance sheets, as well as outstanding execution; these companies should be exceptional investment opportunities over time in our view.

12 Semi-Annual Report | June 30, 2011 |

Large Cap Growth Fund

Performance Highlights (unaudited)

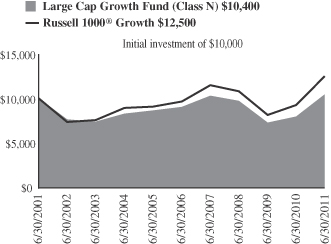

Average Annual Total Return at 6/30/2011

| | | | | | | | | | | | | | | | | | | | |

| | | Year

To Date | | | 1

Year | | | 3

Year | | | 5

Year | | | 10

Year | |

Class N | | | 3.64 | % | | | 31.21 | % | | | 2.46 | % | | | 2.91 | % | | | 0.43 | % |

Class I | | | 3.84 | | | | 31.77 | | | | 2.76 | | | | 3.18 | | | | 0.65 | |

Russell 1000® Growth Index | | | 6.83 | | | | 35.01 | | | | 5.01 | | | | 5.33 | | | | 2.24 | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 1000® Growth Index consists of large capitalization companies with above average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on June 30, 2011. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

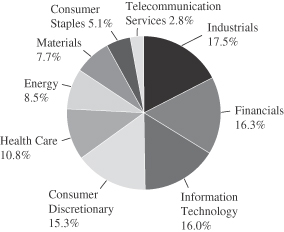

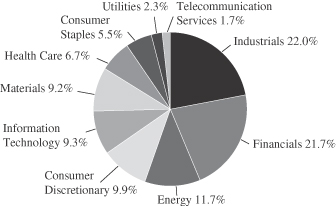

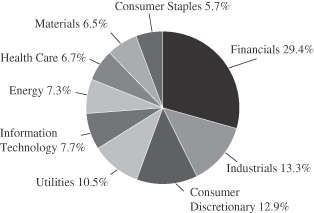

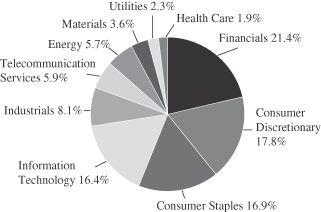

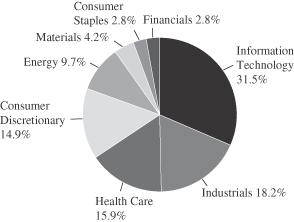

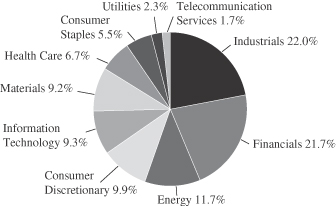

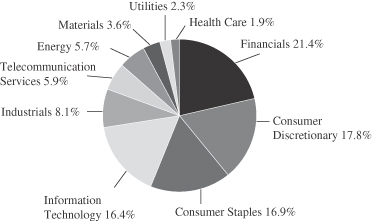

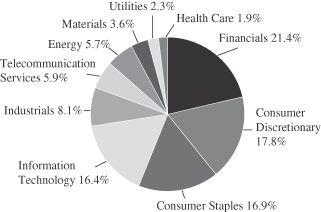

Sector Diversification (unaudited)

The sector diversification shown is based on the total long-term securities.

June 30, 2011 | William Blair Funds 13 |

Large Cap Growth Fund

Portfolio of Investments, June 30, 2011 (all dollar amounts in thousands) (unaudited)

| | | | | | | | |

Issuer | | Shares | | | Value | |

| | |

Common Stocks | | | | | | | | |

Information Technology—28.1% | | | | | | | | |

Accenture plc Class “A”† | | | 15,200 | | | $ | 918 | |

*Apple, Inc. | | | 4,275 | | | | 1,435 | |

*Citrix Systems, Inc. | | | 7,250 | | | | 580 | |

*Dolby Laboratories, Inc. Class “A” | | | 7,050 | | | | 299 | |

*eBay, Inc. | | | 26,800 | | | | 865 | |

*EMC Corporation | | | 19,750 | | | | 544 | |

*Google, Inc. Class “A” | | | 1,633 | | | | 827 | |

*Juniper Networks, Inc. | | | 10,850 | | | | 342 | |

QUALCOMM, Inc. | | | 17,765 | | | | 1,009 | |

TE Connectivity, Ltd.† | | | 19,140 | | | | 704 | |

*Trimble Navigation, Ltd. | | | 9,850 | | | | 390 | |

| | | | | | | | |

| | | | | | | 7,913 | |

| | | | | | | | |

Industrials—15.3% | | | | | | | | |

CH Robinson Worldwide, Inc. | | | 5,580 | | | | 440 | |

Danaher Corporation | | | 13,544 | | | | 718 | |

Goodrich Corporation | | | 6,200 | | | | 592 | |

*Jacobs Engineering Group, Inc. | | | 13,850 | | | | 599 | |

Rockwell Automation, Inc. | | | 5,100 | | | | 442 | |

*Stericycle, Inc. | | | 4,370 | | | | 389 | |

United Parcel Service, Inc. Class “B” | | | 8,620 | | | | 629 | |

W.W. Grainger, Inc. | | | 3,160 | | | | 486 | |

| | | | | | | | |

| | | | | | | 4,295 | |

| | | | | | | | |

Consumer Discretionary—14.7% | | | | | | | | |

*Discovery Communications, Inc. | | | 6,100 | | | | 250 | |

Harley-Davidson, Inc. | | | 15,652 | | | | 641 | |

Johnson Controls, Inc. | | | 18,650 | | | | 777 | |

Marriott International, Inc. Class “A” | | | 20,300 | | | | 721 | |

NIKE, Inc. Class “B” | | | 8,350 | | | | 751 | |

Scripps Networks Interactive, Inc. Class “A” | | | 8,735 | | | | 427 | |

Starbucks Corporation | | | 14,330 | | | | 566 | |

| | | | | | | | |

| | | | | | | 4,133 | |

| | | | | | | | |

Health Care—12.5% | | | | | | | | |

*Agilent Technologies, Inc. | | | 13,450 | | | | 688 | |

Allergan, Inc. | | | 5,815 | | | | 484 | |

Cardinal Health, Inc. | | | 16,950 | | | | 770 | |

Covidien plc† | | | 9,900 | | | | 527 | |

*DaVita, Inc. | | | 7,150 | | | | 619 | |

*Gilead Sciences, Inc. | | | 10,100 | | | | 418 | |

| | | | | | | | |

| | | | | | | 3,506 | |

| | | | | | | | |

Energy—12.3% | | | | | | | | |

National Oilwell Varco, Inc. | | | 8,550 | | | | 669 | |

Occidental Petroleum Corporation | | | 9,750 | | | | 1,014 | |

Schlumberger, Ltd.† | | | 13,930 | | | | 1,203 | |

Suncor Energy, Inc.† | | | 14,850 | | | | 581 | |

| | | | | | | | |

| | | | | | | 3,467 | |

| | | | | | | | |

Financials—6.2% | | | | | | | | |

*Affiliated Managers Group, Inc. | | | 2,750 | | | | 279 | |

American Express Co. | | | 15,300 | | | | 791 | |

*Non-income producing securities

ADR = American Depository Receipt

† = U.S. listed foreign security

| | | | | | | | |

Issuer | | Shares or

Principal

Amount | | | Value | |

| | |

Common Stocks—(continued) | | | | | | | | |

Financials—(continued) | | | | | | | | |

CME Group, Inc. | | | 2,250 | | | $ | 656 | |

| | | | | | | | |

| | | | | | | 1,726 | |

| | | | | | | | |

Materials—4.6% | | | | | | | | |

Praxair, Inc. | | | 7,325 | | | | 794 | |

Syngenta AG—ADR | | | 7,530 | | | | 509 | |

| | | | | | | | |

| | | | | | | 1,303 | |

| | | | | | | | |

Consumer Staples—4.6% | | | | | | | | |

Anheuser-Busch InBev N.V.—ADR | | | 10,750 | | | | 624 | |

Mead Johnson Nutrition Co. | | | 9,850 | | | | 665 | |

| | | | | | | | |

| | | | | | | 1,289 | |

| | | | | | | | |

Total Common Stocks—98.3%

(cost $21,536) | | | | 27,632 | |

| | | | | | | | |

| | |

Repurchase Agreement | | | | | | | | |

State Street Bank and Trust Company, 0.010% dated 6/30/11, due 7/1/11, repurchase price $659, collateralized by U.S. Treasury Bill, 0.020%, due 8/11/11 | | $ | 659 | | | | 659 | |

| | | | | | | | |

Total Repurchase Agreement—2.3%

(cost $659) | | | | 659 | |

| | | | | | | | |

Total Investments—100.6%

(cost $22,195) | | | | 28,291 | |

Liabilities, plus cash and other assets—(0.6)% | | | | (158 | ) |

| | | | | | | | |

Net assets—100.0% | | | $ | 28,133 | |

| | | | | | | | |

See accompanying Notes to Financial Statements.

14 Semi-Annual Report | June 30, 2011 |

Michael P. Balkin

Karl W. Brewer

SMALL CAP GROWTH FUND

The Small Cap Growth Fund seeks long-term capital appreciation.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

The Small Cap Growth Fund posted a 1.38% increase (Class N Shares) for the six months ended June 30, 2011. By comparison, the Fund’s benchmark, the Russell 2000® Growth Index, gained 8.59%.

After a near-uninterrupted rally since last August, U.S. equities stumbled during May and June. Small cap growth stocks, as measured by the Russell 2000® Growth Index, corrected over 10% during that period, but rallied in late-June to close the quarter near breakeven and to remain solidly in positive territory for the year-to-date period. The Fund finished just behind its Russell 2000® Growth benchmark during the second quarter. For the first half of the year, the strategy has underperformed given poor relative performance in the first quarter.

The first four months of 2011 witnessed a continuation of the upward trend in stock prices. This was primarily driven by solid corporate fundamentals and reasonable stock valuations. But 2011 to date has mirrored 2010: a strong start to the year followed by a mid-year correction primarily due to disappointing economic data and European sovereign debt woes. Specifically, the most recent correction came on the heels of heightened Greek sovereign debt concerns, sluggish jobs data in the U.S., a potential Chinese housing market downturn, the U.S. government debt ceiling negotiations, uncertainty around the end of the Federal Reserves’ quantitative easing (QE2) and a U.S. housing market that remains on life support. While the negatives are plentiful, the market’s ability to remain relatively flat in the second quarter and up over 8% as measured by the Russell 2000® Growth for the year is telling. Investors continue to focus on healthy corporate fundamentals and on an economy that is slowly recovering, albeit in fits and starts.

From a style perspective during the first half of the year, the small cap growth market witnessed outperformance by larger market cap, higher price momentum and more expensive stocks, primarily due to the magnitude of these dynamics in the first quarter. From a sector perspective, there was little disparity in performance during the first half of the year. Most sectors returned 7-9% during the period including Financials, Materials, Consumer Discretionary, Information Technology (IT) and Energy. Two of the more defensive sectors, Health Care (+10.60 %) and Consumer Staples (+14.93%), outperformed, while Industrials (+4.97%) narrowly trailed the overall small cap growth market during the six-month period.

The Fund’s underperformance over the first half of the year was due to a combination of style factors and stock selection. The vast majority of the negative year-to-date performance occurred in the first quarter. During the first quarter, some of the largest individual stock detractors and the style headwinds during that period, namely our contrarian bias, valuation sensitivity and smaller market cap bias. Information Technology and Consumer Discretionary stock selection have been the most troublesome, while Industrials and Energy stock selection has helped relative results.

In the second quarter specifically, style factors were muted and somewhat offsetting stock picks translated into modest underperformance relative to our benchmark. Favorable stock picks in Industrials, Energy and Information Technology were outweighed by disappointing stock performances in Financials and Consumer Discretionary.

The second quarter correction has kept the broad equity market valuation in check while corporate fundamentals continue to improve. Because of this and despite the macroeconomic and geopolitical headwinds, we believe the market remains relatively balanced looking forward. We believe investors will continue to differentiate between true growth businesses

June 30, 2011 | William Blair Funds 15 |

and those that benefitted primarily from the initial economic recovery. Investors already may be making this distinction as stock correlations have fallen from the elevated levels seen over the past few years. This should bode well for our style of investing and for active management in general. While we factor various economic scenarios into our stock picking, we focus our time on constructing the portfolio from a bottom-up perspective. We continue to find good ideas across sectors, and are confident the Fund consists of great companies with solid competitive positions whose stocks are at attractive valuations compared to the growth and consistency of their business.

Detractors from Return during the Second Quarter:

Demand Media, Inc. develops and acquires professional content to help its clients place more targeted advertisements. Two of the company’s largest online properties are eHow.com and livestrong.com. Reason for underperformance: Recent changes by Google to its search algorithms have decreased traffic to Demand Media’s content sites, and therefore has the potential to impact the company’s value proposition to advertisers. Action: The Fund continues to hold a position in the stock.

Horsehead Holding Corporation is a leading producer of specialty zinc and a manufacturer of value-added zinc products including zinc oxide and zinc powder. The company is a low-cost producer in the industry as much of its raw materials come from recycled sources such as electric arc furnace dust created in the steel manufacturing process. Reason for underperformance: Given the company benefits from increased steel production (lower raw materials cost) and rising zinc pricing (top line benefit), global growth concerns and falling commodity prices sank investor confidence in Horsehead’s fundamental outlook. Action: The Fund maintained its position in the stock given the company’s competitive position and longer-term growth outlook.

National Financial Partners Corporation is a financial services firm that offers high net worth individuals and corporations a variety of financial services such as life insurance and wealth transfer, corporate and executive benefits, and investment advisory. Reason for underperformance: The company announced disappointing earnings during the quarter in part due to weakness in their Individual Client Group. More generally, during the second quarter market correction, the stock likely underperformed given National Financial Partners exposure to individual life insurance sales which has been more discretionary than other financial services over past few years. Action: The Fund maintained its position in the stock as we believe the long-term growth opportunity for the company remains intact despite the near term selloff in the stock.

ChinaCast Education Corporation is a post-secondary and e-Learning services provider. Reason for underperformance: The stock underperformed primarily due to reduced investor confidence in US-listed Chinese companies given accounting concerns at other US-listed Chinese companies unrelated to ChinaCast Education. Action: The Fund liquidated its shares given the increased uncertainty.

QuinStreet, Inc. is an online direct marketing firm, primarily focused on lead generation for the education and financial services industries. Reason for underperformance: The company is experiencing significant pricing pressure from its auto insurance clients as evolving consumer behavior on the internet puts into question the amount an auto insurer client is willing to pay QuinStreet for an online lead. Action: The Fund exited its position as the company’s value proposition is more unknown, causing us to question the total market opportunity for QuinStreet given the importance of its auto insurance clients to the company’s diversification and growth strategy.

Contributors to Return during the Second Quarter:

ICF International, Inc. provides management, technology and policy consulting and implementation services to government and commercial entities. Its key consulting practices

16 Semi-Annual Report | June 30, 2011 |

include: defense and homeland security, energy, environmental and infrastructure and health and human services. Reason for outperformance: In April, the company reiterated its forward earnings guidance, easing investor concerns from the first quarter over the potential impact from government budget cuts and delays. In addition, another government consulting firm was purchased by a private equity firm during the quarter at an attractive valuation, representing the second such transaction in the industry in the past year and giving support to ICF International’s valuation. Action: The Fund continues to hold the stock as we believe the company is exposed to high priority government initiatives such as energy efficiency, education, climate change, healthcare, infrastructure and housing. In addition, we believe these areas of expertise represent a large international opportunity for the company and that the market also underestimates the growth potential of ICF International’s commercial (non-government) business.

TriMas Corporation manufacturers and distributes a diversified portfolio of products for the commercial, industrial and consumer markets. Reason for outperformance: The company reported better-than-expected earnings and increased forward earnings guidance, in part a reflection of the new management team’s efforts to more effectively manage and deploy capital between TriMas’s five segments. Action: The Fund continues to hold a position in the stock as we believe investors still underestimate the management team and earnings power of the company.

Quidel Corporation is a leading provider of point of care diagnostic tests primarily for infectious diseases, women’s health and gastrointestinal diseases. Reason for outperformance: The company reported solid earnings as the business continues to reaccelerate. More importantly, management outlined several new products that it expects to launch both domestically and abroad. Action: The Fund continues to hold a position in the stock as we believe Quidel’s pipeline of products will drive earnings growth and diversify the business beyond its historical dependence on flu tests, thereby supporting a higher valuation as well.

ValueClick, Inc. is a leading online marketing services firm. Reason for outperformance: The company’s growth is reaccelerating faster than expected due to management execution, a rebound in advertising generally and advertising increasing appetite for digital advertising. Action: The Fund continues to hold as we believe ValueClick’s service offering continues to expand, enabling it to serve the increasingly complex needs of advertisers and ad agencies.

Steven Madden, Ltd. designs and markets handbags and accessories, as well as footwear for women, men and children. Reason for outperformance: Business trends continue to surprise investors as demand for Steven Madden’s shoes and accessories increases. In addition, the company’s recently announced acquisitions give investors confidence in the duration of growth given multiple brands and products available for distribution in the US and abroad. Action: The Fund maintained its position in the stock as we believe management execution will continue to be strong as it integrates recent acquisitions and expands sales of its core brands.

June 30, 2011 | William Blair Funds 17 |

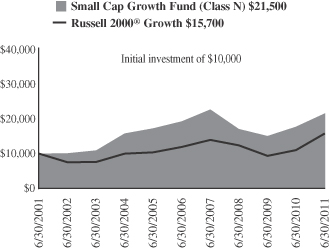

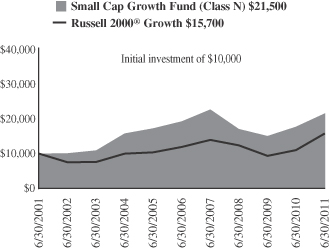

Small Cap Growth Fund

Performance Highlights (unaudited)

Average Annual Total Return at 6/30/2011

| | | | | | | | | | | | | | | | | | | | |

| | | Year

To Date | | | 1

Year | | | 3

Year | | | 5

Year | | | 10

Year | |

Class N | | | 1.38 | % | | | 22.22 | % | | | 8.25 | % | | | 2.28 | % | | | 7.96 | % |

Class I | | | 1.45 | | | | 22.59 | | | | 8.58 | | | | 2.58 | | | | 8.26 | |

Russell 2000® Growth Index | | | 8.59 | | | | 43.50 | | | | 8.35 | | | | 5.79 | | | | 4.63 | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. Smaller Capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2000® Growth Index is an unmanaged composite of the smallest 2000 stocks of the Russell 3000® Growth Index.

This report identifies the Fund’s investments on June 30, 2011. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

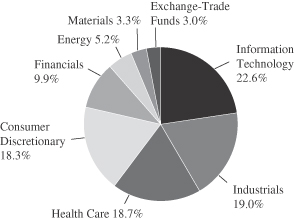

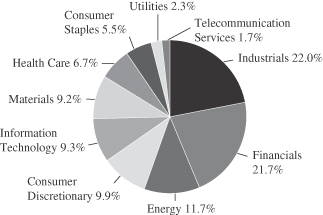

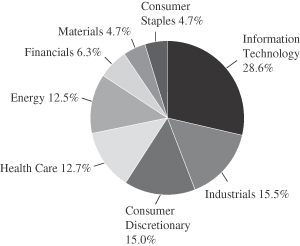

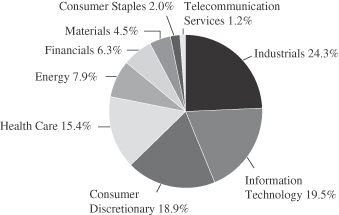

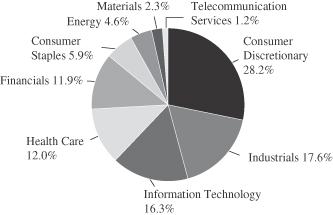

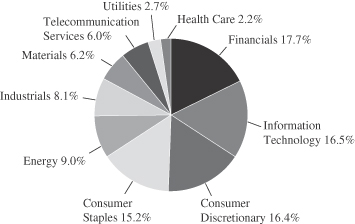

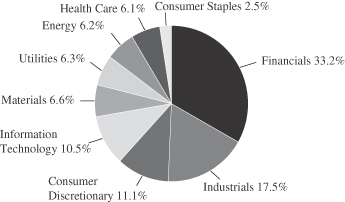

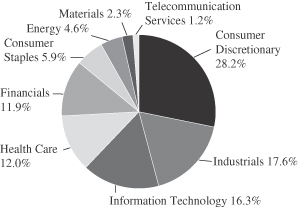

Sector Diversification (unaudited)

The sector diversification shown is based on the total long-term securities.

18 Semi-Annual Report | June 30, 2011 |

Small Cap Growth Fund

Portfolio of Investments, June 30, 2011 (all dollar amounts in thousands) (unaudited)

| | | | | | | | |

Issuer | | Shares | | | Value | |

| | |

Common Stocks | | | | | | | | |

Information Technology—22.4% | | | | | | | | |

*Cavium, Inc. | | | 237,210 | | | $ | 10,340 | |

*Demand Media, Inc. | | | 467,620 | | | | 6,336 | |

*ExlService Holdings, Inc. | | | 384,140 | | | | 8,874 | |

iGate Corporation | | | 409,390 | | | | 6,681 | |

*Inuvo, Inc. | | | 861,747 | | | | 1,810 | |

*j2 Global Communications, Inc. | | | 332,408 | | | | 9,384 | |

*KIT Digital, Inc. | | | 608,766 | | | | 7,269 | |

*MaxLinear, Inc. Class “A” | | | 669,331 | | | | 5,796 | |

*Monolithic Power Systems, Inc. | | | 765,980 | | | | 11,811 | |

*RealD, Inc. | | | 192,140 | | | | 4,494 | |

*RightNow Technologies, Inc. | | | 395,230 | | | | 12,805 | |

*Silicon Laboratories, Inc. | | | 422,707 | | | | 17,441 | |

Syntel, Inc. | | | 131,690 | | | | 7,786 | |

*TeleTech Holdings, Inc. | | | 726,680 | | | | 15,318 | |

*Ultimate Software Group, Inc. | | | 127,876 | | | | 6,960 | |

United Online, Inc. | | | 1,183,275 | | | | 7,135 | |

*ValueClick, Inc. | | | 990,110 | | | | 16,436 | |

*Vertro, Inc. | | | 847,343 | | | | 1,907 | |

*Volterra Semiconductor Corporation | | | 498,530 | | | | 12,294 | |

| | | | | | | | |

| | | | | | | 170,877 | |

| | | | | | | | |

Industrials—18.9% | | | | | | | | |

*Cenveo, Inc. | | | 2,371,622 | | | | 15,178 | |

*Clean Harbors, Inc. | | | 81,490 | | | | 8,414 | |

*CoStar Group, Inc. | | | 103,643 | | | | 6,144 | |

*Dolan Media Co. | | | 93,004 | | | | 788 | |

*Franklin Covey Co. | | | 891,660 | | | | 8,631 | |

*GrafTech International, Ltd. | | | 352,760 | | | | 7,150 | |

Healthcare Services Group, Inc. | | | 537,220 | | | | 8,730 | |

*Heritage-Crystal Clean, Inc. | | | 96,032 | | | | 1,842 | |

*Higher One Holdings, Inc. | | | 299,130 | | | | 5,659 | |

*Huron Consulting Group, Inc. | | | 342,663 | | | | 10,352 | |

*ICF International, Inc. | | | 521,296 | | | | 13,230 | |

*Navigant Consulting, Inc. | | | 227,933 | | | | 2,391 | |

*On Assignment, Inc. | | | 1,296,309 | | | | 12,743 | |

*Polypore International, Inc. | | | 124,280 | | | | 8,431 | |

The Corporate Executive Board Co. | | | 133,530 | | | | 5,829 | |

*TransDigm Group, Inc. | | | 133,224 | | | | 12,149 | |

*Trimas Corporation | | | 665,163 | | | | 16,463 | |

| | | | | | | | |

| | | | | | | 144,124 | |

| | | | | | | | |

Health Care—18.5% | | | | | | | | |

*Air Methods Corporation | | | 149,351 | | | | 11,162 | |

*Align Technology, Inc. | | | 337,802 | | | | 7,702 | |

*Brookdale Senior Living, Inc. | | | 567,790 | | | | 13,769 | |

*ExamWorks Group, Inc. | | | 437,994 | | | | 11,121 | |

*Haemonetics Corporation | | | 112,055 | | | | 7,213 | |

*HealthSouth Corporation | | | 431,580 | | | | 11,329 | |

*Integra LifeSciences Holdings Corporation | | | 257,918 | | | | 12,331 | |

*Kensey Nash Corporation | | | 460,668 | | | | 11,623 | |

*Natus Medical, Inc. | | | 363,690 | | | | 5,510 | |

*NxStage Medical, Inc. | | | 431,917 | | | | 8,992 | |

*Quidel Corporation | | | 678,886 | | | | 10,285 | |

*SXC Health Solutions Corporation† | | | 128,540 | | | | 7,574 | |

*Team Health Holdings, Inc. | | | 181,100 | | | | 4,076 | |

*The Providence Service Corporation | | | 490,903 | | | | 6,210 | |

Trinity Biotech plc—ADR | | | 1,290,428 | | | | 12,827 | |

| | | | | | | | |

| | | | | | | 141,724 | |

| | | | | | | | |

| | | | | | | | |

Issuer | | Shares | | | Value | |

| | |

Common Stocks—(continued) | | | | | | | | |

Consumer Discretionary—18.1% | | | | | | | | |

*Amerigon, Inc. | | | 779,240 | | | $ | 13,543 | |

*Career Education Corporation | | | 505,196 | | | | 10,685 | |

DeVry, Inc. | | | 140,761 | | | | 8,323 | |

*Dreams, Inc. | | | 2,811,849 | | | | 7,311 | |

*Genesco, Inc. | | | 139,752 | | | | 7,281 | |

*Grand Canyon Education, Inc. | | | 289,606 | | | | 4,106 | |

Jarden Corporation | | | 320,547 | | | | 11,062 | |

*Kona Grill, Inc. | | | 1,019,792 | | | | 5,731 | |

MDC Partners, Inc. Class “A”† | | | 661,756 | | | | 11,951 | |

*Office Depot, Inc. | | | 2,514,870 | | | | 10,613 | |

*ReachLocal, Inc. | | | 203,304 | | | | 4,235 | |

*Steven Madden, Ltd. | | | 258,255 | | | | 9,687 | |

*U.S. Auto Parts Network, Inc. | | | 1,340,459 | | | | 10,268 | |

*Valassis Communications, Inc. | | | 426,000 | | | | 12,908 | |

*Vitacost.com, Inc. | | | 406,139 | | | | 1,966 | |

*WMS Industries, Inc. | | | 275,480 | | | | 8,463 | |

| | | | | | | | |

| | | | | | | 138,133 | |

| | | | | | | | |

Financials—9.8% | | | | | | | | |

*Cowen Group, Inc. | | | 3,435,800 | | | | 12,919 | |

*Financial Engines, Inc. | | | 265,451 | | | | 6,880 | |

*First Cash Financial Services, Inc. | | | 241,040 | | | | 10,121 | |

*FirstService Corporation† | | | 475,041 | | | | 16,408 | |

*ICG Group, Inc. | | | 1,224,755 | | | | 14,979 | |

*Marlin Business Services Corporation | | | 359,465 | | | | 4,547 | |

*National Financial Partners Corporation | | | 787,246 | | | | 9,085 | |

| | | | | | | | |

| | | | | | | 74,939 | |

| | | | | | | | |

Energy—5.1% | | | | | | | | |

*Dresser-Rand Group, Inc. | | | 107,719 | | | | 5,790 | |

*Dril-Quip, Inc. | | | 56,280 | | | | 3,818 | |

*Goodrich Petroleum Corporation | | | 390,545 | | | | 7,190 | |

*Northern Oil and Gas, Inc. | | | 204,790 | | | | 4,536 | |

*Oasis Petroleum, Inc. | | | 131,770 | | | | 3,911 | |

*Oil States International, Inc. | | | 173,700 | | | | 13,880 | |

| | | | | | | | |

| | | | | | | 39,125 | |

| | | | | | | | |

Materials—3.3% | | | | | | | | |

*Horsehead Holding Corporation | | | 730,430 | | | | 9,730 | |

PolyOne Corporation | | | 379,390 | | | | 5,869 | |

*Stillwater Mining Co. | | | 438,850 | | | | 9,659 | |

| | | | | | | | |

| | | | | | | 25,258 | |

| | | | | | | | |

Total Common Stocks—96.1%

(cost $615,106) | | | | | | | 734,180 | |

| | | | | | | | |

| | |

Exchange-Traded Fund | | | | | | | | |

iShares Russell 2000 Growth Index Fund | | | 239,830 | | | | 22,748 | |

| | | | | | | | |

Total Exchange-Traded Fund—3.0%

(cost $22,478) | | | | 22,748 | |

| | | | | | | | |

| | |

Investment in Warrants | | | | | | | | |

*Motorcar Parts of American, Inc. 2010, $0.00 | | | 111,575 | | | | 1 | |

| | | | | | | | |

Total Warrants—0.0%

(cost $0) | | | | 1 | |

| | | | | | | | |

See accompanying Notes to Financial Statements.

June 30, 2011 | William Blair Funds 19 |

Small Cap Growth Fund

Portfolio of Investments, June 30, 2011 (all dollar amounts in thousands) (unaudited)

| | | | | | | | |

Issuer | | Principal

Amount | | | Value | |

| | |

Repurchase Agreement | | | | | | | | |

Fixed Income Clearing Corporation, 0.010% dated 6/30/11, due 7/1/11, repurchase price $5,126, collateralized by FHLMC, 2.000%, due 12/3/15 | | $ | 5,126 | | | | 5,126 | |

| | | | | | | | |

Total Repurchase Agreement—0.7%

(cost $5,126) | | | | 5,126 | |

| | | | | | | | |

Total Investments—99.8%

(cost $642,710) | | | | 762,055 | |

Cash and other assets, less liabilities—0.2% | | | | 1,422 | |

| | | | | | | | |

Net assets—100.0% | | | $ | 763,477 | |

| | | | | | | | |

ADR = American Depository Receipt

* Non-income producing securities

† = U.S. listed foreign security

If the Fund’s portfolio holdings represent ownership of 5% or more of the voting securities of a company, the company is deemed to be an affiliate as defined in the Investment Company Act of 1940. The Small Cap Growth Fund had the following transactions during the period ended June 30, 2011 with companies deemed affiliated during the period or at June 30, 2011.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Share Activity | | | Period Ended

June 30, 2011 | |

| | | | | | | | | | | | | | | (in thousands) | |

Security Name | | Balance

12/31/2010 | | | Purchases | | | Sales | | | Balance

6/30/2011 | | | Value | | | Dividends

Included

in Income | |

pDreams, Inc. | | | 3,285,457 | | | | 126,038 | | | | 599,646 | | | | 2,811,849 | | | $ | 7,311 | | | $ | — | |

Duckwall-ALCO Stores, Inc. | | | 429,693 | | | | — | | | | 429,693 | | | | — | | | | — | | | | — | |

pFranklin Covey, Co | | | 758,841 | | | | 132,819 | | | | — | | | | 891,660 | | | | 8,631 | | | | — | |

Gaiam, Inc. Class “A” | | | 1,050,272 | | | | — | | | | 1,050,272 | | | | — | | | | — | | | | — | |

pInuvo, Inc. | | | 861,747 | | | | — | | | | — | | | | 861,747 | | | | 1,810 | | | | — | |

pKensey Nash Corporation | | | 424,466 | | | | 55,292 | | | | 19,090 | | | | 460,668 | | | | 11,623 | | | | — | |

pKona Grill, Inc. | | | 1,019,792 | | | | — | | | | — | | | | 1,019,792 | | | | 5,731 | | | | — | |

Marlin Business Services Corporation | | | 718,870 | | | | — | | | | 359,405 | | | | 359,465 | | | | 4,547 | | | | — | |

On Assignment Inc | | | 2,248,382 | | | | 61,860 | | | | 1,013,933 | | | | 1,296,309 | | | | 12,743 | | | | — | |

Princeton Review, Inc. | | | 3,519,896 | | | | — | | | | 3,519,896 | | | | — | | | | — | | | | — | |

pTrinity Biotech plc | | | 1,903,563 | | | | — | | | | 613,135 | | | | 1,290,428 | | | | 12,827 | | | | 144 | |

United Western Bancorp, Inc. | | | 2,290,015 | | | | — | | | | 2,290,015 | | | | — | | | | — | | | | — | |

U.S. Autoparts Network, Inc. | | | 1,448,391 | | | | 170,447 | | | | 278,379 | | | | 1,340,459 | | | | 10,268 | | | | — | |

pVertro, Inc. | | | 847,343 | | | | — | | | | — | | | | 847,343 | | | | 1,907 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | 77,398 | | | $ | 144 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

p Affiliated company at June 30, 2011. The Small Cap Growth Fund’s total value in companies deemed to be affiliated at June 30, 2011 was $49,840 (thousands).

See accompanying Notes to Financial Statements.

20 Semi-Annual Report | June 30, 2011 |

Robert C. Lanphier, IV

David P. Ricci

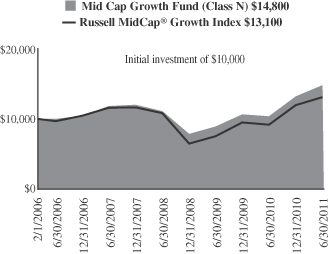

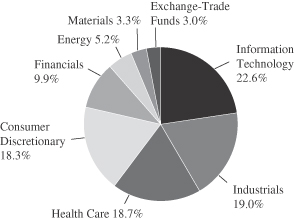

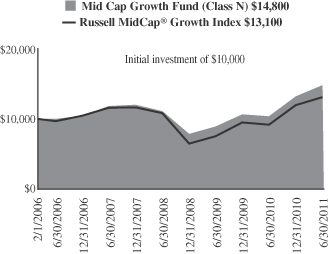

MID CAP GROWTH FUND

The Mid Cap Growth Fund seeks long-term capital appreciation.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

The Mid Cap Growth Fund posted a 12.00% increase (Class N Shares) for the six months ended June 30, 2011. By comparison, the Fund’s benchmark, the Russell Midcap® Growth Index, gained 9.59%.

After a near-uninterrupted rally since last August, US equities stumbled during May and June. Mid cap growth stocks, as measured by the Russell Midcap® Growth Index, corrected nearly 8% during that period, but rallied in late-June to close the quarter near breakeven and to remain solidly in positive territory for the year-to-date period. The Fund outperformed its Russell Midcap® Growth benchmark during the second quarter and for the first half of the year.

The first four months of 2011 witnessed a continuation of the upward trend in the stock prices, primarily driven by solid corporate fundamentals and reasonable stock valuations. But 2011 to date has mirrored 2010: a strong start to the year followed by a mid-year correction primarily due to sluggish economic data and European sovereign debt woes. Specifically, the most recent correction came on the heels of slowing GDP growth, heightened Greek sovereign debt concerns, sluggish jobs data in the U.S., a potential Chinese housing market downturn, the US government debt ceiling negotiations, uncertainty around the end of the Federal Reserve’s quantitative easing (QE2) and a US housing market that remains on life support. While the negatives are plentiful, the market’s ability to remain relatively flat in the second quarter and up over 9% for the year is telling. Investors continue to focus on healthy corporate profitability and on an economy that is slowly recovering, albeit in fits and starts.

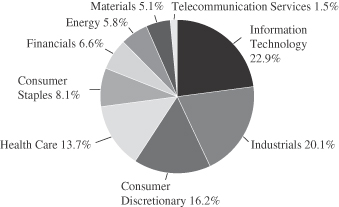

From a style perspective during the first half of the year, the mid cap growth market was characterized by higher quality and lower beta stocks outperforming, primarily driven by the second quarter market environment. Lower market cap stocks also outperformed, stemming from their strong outperformance during the first quarter. From a sector perspective, some of the more defensive sectors outperformed during the second quarter and the year-to-date period. Consumer Staples (+22.79%) and Health Care (+15.15%) were the two strongest sectors during the first half of the year. Consumer Discretionary also performed well, (+13.55%). After Energy’s second quarter correction (–9.81%) on falling crude oil prices, the sector returned 5.15% for the first half of the year. Information Technology and Industrials, two of the largest sectors in the Russell Midcap® Growth Index, underperformed given their 5.50% and 5.15% returns for the half-year period, respectively.

The Fund’s outperformance during the first half of the year was primarily attributable to solid stock selection. The Fund’s bias toward smaller market cap stocks relative to the Russell Midcap Growth® Index and our typical lower beta, especially in the second quarter, modestly helped relative performance as well. Green Mountain Coffee Roasters, Inc. within Consumer Staples was the leading contributor to return over the six month period, but solid picks in Health Care (e.g., American Medical Systems Holdings, Inc.), Industrials (e.g., Transdigm Group, Inc.) and Information Technology (e.g., Atheros Communications, Inc.) contributed positively as well. The main areas of weakness were in Consumer Discretionary (e.g., WMS Industries) and Financials (e.g., Greenhill & Co., Inc).

For the second quarter specifically, the Fund’s outperformance was driven by stock selection and our typical bias to lower beta stocks. Consumer Staples stock selection, namely Green Mountain Coffee Roasters, Inc., was the largest contributor to relative performance during the quarter. Fastenal Co. within Industrials and Ecolab, Inc. within Materials were also positive contributors. Holding back relative performance was stock selection in Consumer Discretionary (e.g., Dick’s Sporting Goods, Inc.) and Financials (e.g., Invesco, Ltd.).

June 30, 2011 | William Blair Funds 21 |

The second quarter correction has kept the broad equity market valuation in check while corporate fundamentals continue to improve. Because of this and despite the obvious macroeconomic and geopolitical headwinds, we believe the market remains relatively balanced. We believe investors will continue to differentiate between true growth businesses and those that benefitted primarily from the initial economic recovery. It appears investors are making this distinction as stock correlations have fallen from the elevated levels seen over the past few years. This should bode well for our style of investing and for active management generally. In the end, while we factor various economic scenarios into our stock picking, we focus our time on constructing the portfolio from a bottom-up perspective. We continue to find good ideas across sectors, and are confident the Fund consists of well-managed companies with solid competitive positions whose stocks are at attractive valuations compared to the growth and consistency of their business.