UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-5344

William Blair Funds

(Exact name of registrant as specified in charter)

| | |

| 222 West Adams Street, Chicago, IL | | 60606 |

| (Address of principal executive offices) | | (Zip Code) |

Michelle R. Seitz

William Blair Funds

222 West Adams Street, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: 312-236-1600

Date of fiscal year end: December 31

Date of reporting period: June 30, 2010

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A Registrant is not required to respond to the collection of information contained in Form N-CSR unless the form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimates and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. (ss) 3507.

| Item 1. | June 30, 2010 Annual Reports transmitted to shareholders. |

SEMI-ANNUAL REPORT

JUNE 30, 2010

Table of Contents

This report is submitted for the general information of the shareholders of the William Blair Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by a prospectus of the William Blair Funds. Please carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

June 30, 2010 | William Blair Funds 1 |

PERFORMANCE AS OF JUNE 30, 2010—CLASS N SHARES (unaudited)

| | | | | | | | | | | | | | | | | | |

| | | Year

to Date | | | 1 Yr. | | 3 Yr. | | | 5 Yr. | | | 10 Yr

(or since

inception) | | | Inception

Date | | Overall

Morningstar

Rating |

Growth Fund | | | | | | | | | | | | | | | | | | ««««

Among 1,545 large growth funds |

Class N | | (8.09 | ) | | 8.47 | | (5.81 | ) | | 2.30 | | | (1.83 | ) | | 3/20/1946 | |

Morningstar Large Growth | | (8.24 | ) | | 12.41 | | (8.11 | ) | | (0.18 | ) | | (3.37 | ) | | | |

Russell 3000® Growth | | (7.25 | ) | | 13.95 | | (6.97 | ) | | 0.44 | | | (4.89 | ) | | | | |

Standard & Poor’s 500 | | (6.65 | ) | | 14.43 | | (9.81 | ) | | (0.79 | ) | | (1.59 | ) | | | | |

| | | | | | | |

Large Cap Growth Fund | | | | | | | | | | | | | | | | | | «««

Among 1,545 large growth funds |

Class N | | (8.44 | ) | | 9.09 | | (8.16 | ) | | (1.65 | ) | | (5.68 | ) | | 12/27/1999 | |

Morningstar Large Growth | | (8.24 | ) | | 12.41 | | (8.11 | ) | | (0.18 | ) | | (3.37 | ) | | | |

Russell 1000® Growth | | (7.65 | ) | | 13.62 | | (6.91 | ) | | 0.38 | | | (5.14 | ) | | | | |

| | | | | | | |

Small Cap Growth Fund | | | | | | | | | | | | | | | | | | ««««

Among 666 small growth funds |

Class N | | (3.65 | ) | | 17.44 | | (7.96 | ) | | 0.47 | | | 6.76 | | | 12/27/1999 | |

Morningstar Small Growth | | (2.45 | ) | | 19.07 | | (8.73 | ) | | 0.33 | | | (0.31 | ) | | | |

Russell 2000® Growth | | (2.31 | ) | | 17.96 | | (7.54 | ) | | 1.14 | | | (1.72 | ) | | | | |

Russell 2000® | | (1.95 | ) | | 21.48 | | (8.60 | ) | | 0.37 | | | 3.00 | | | | | |

| The Small Cap Growth Fund’s Performance during 2000 was primarily attributable to investments in initial public offerings (IPOs) during a rising market. Since then, IPOs have had an insignificant effect on the Fund’s performance. | | | | | | | | |

| | | | | | | |

Mid Cap Growth Fund | | | | | | | | | | | | | | | | | | ««««

Among 694 mid-cap growth funds |

Class N | | (2.58 | ) | | 16.49 | | (4.23 | ) | | — | | | 0.83 | | | 2/1/2006 | |

Morningstar Mid-Cap Growth | | (3.53 | ) | | 19.58 | | (7.94 | ) | | — | | | — | | | | |

Russell MidCap® Growth | | (3.31 | ) | | 21.30 | | (7.53 | ) | | — | | | (1.99 | ) | | | | |

| | | | | | | |

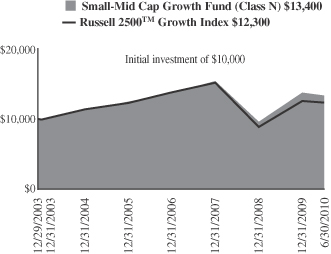

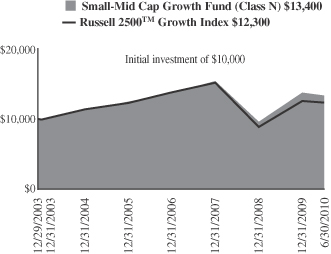

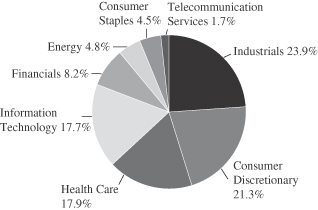

Small-Mid Cap Growth Fund | | | | | | | | | | | | | | | | | | ««««

Among 694 mid-cap growth funds |

Class N | | (3.07 | ) | | 16.86 | | (4.87 | ) | | 3.55 | | | 4.55 | | | 12/29/2003 | |

Morningstar Mid-Cap Growth | | (3.53 | ) | | 19.58 | | (7.94 | ) | | 1.13 | | | — | | | | |

Russell 2500™ Growth | | (1.82 | ) | | 21.44 | | (7.10 | ) | | 1.81 | | | 3.28 | | | | | |

| | | | | | | |

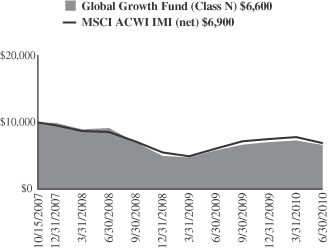

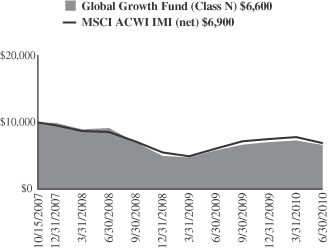

Global Growth Fund | | | | | | | | | | | | | | | | | | Not rated. |

Class N | | (5.74 | ) | | 13.86 | | — | | | — | | | (14.15 | ) | | 10/15/2007 | | |

Morningstar World Stock | | (8.42 | ) | | 12.13 | | — | | | — | | | — | | | | | |

MSCI All Country World IMI (net) | | (8.65 | ) | | 13.07 | | — | | | — | | | (12.92 | ) | | | | |

| | | | | | | |

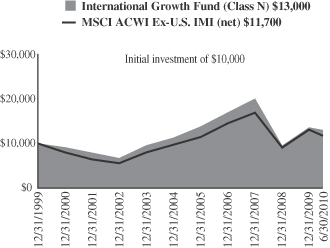

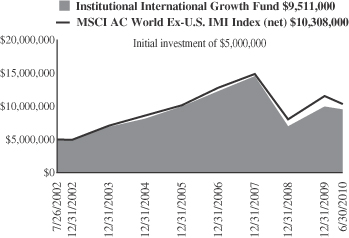

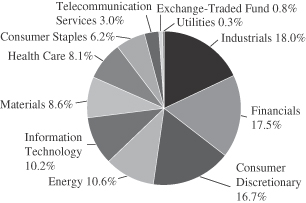

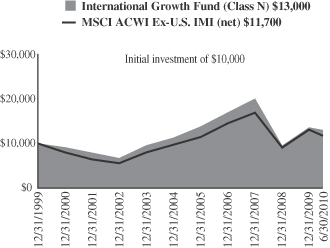

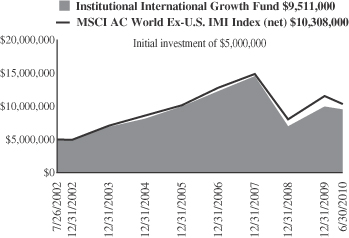

International Growth Fund | | | | | | | | | | | | | | | | | | ««««

Among 215 foreign large growth funds |

Class N | | (4.20 | ) | | 16.42 | | (11.75 | ) | | 2.51 | | | 2.47 | | | 10/1/1992 | |

Morningstar Foreign Large Growth | | (9.44 | ) | | 11.03 | | (10.92 | ) | | 2.53 | | | (0.23 | ) | | | |

MSCI All Country World Ex-U.S. IMI (net) | | (10.41 | ) | | 11.49 | | (10.50 | ) | | 3.63 | | | 2.23 | | | | | |

| | | | | | | |

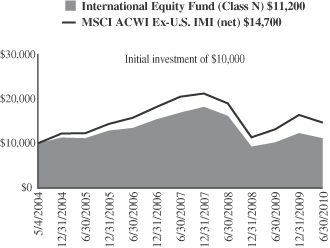

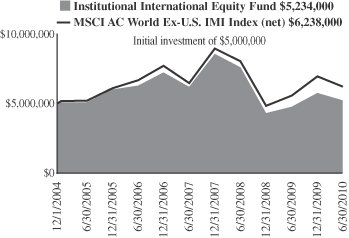

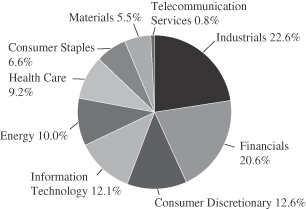

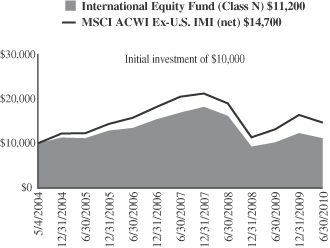

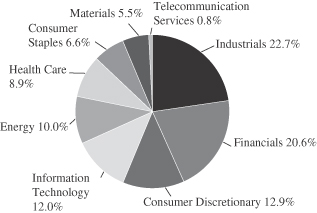

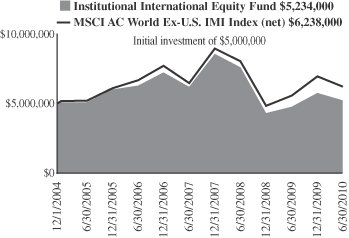

International Equity Fund | | | | | | | | | | | | | | | | | | ««

Among 215

foreign large growth funds |

Class N | | (9.21 | ) | | 9.45 | | (12.77 | ) | | 0.01 | | | 1.89 | | | 5/24/2004 | |

Morningstar Foreign Large Growth | | (9.44 | ) | | 11.03 | | (10.92 | ) | | 2.53 | | | — | | | | |

MSCI All Country World Ex-U.S. IMI (net) | | (10.41 | ) | | 11.49 | | (10.50 | ) | | 3.63 | | | 6.49 | | | | | |

| | | | | | | |

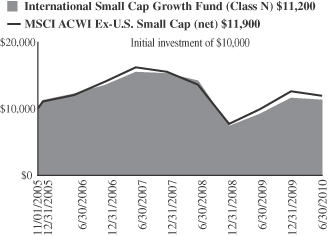

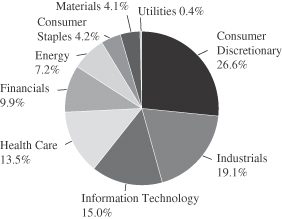

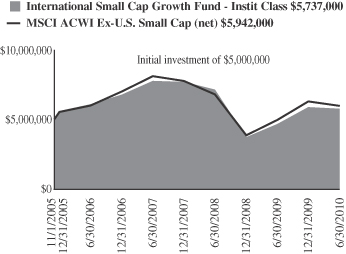

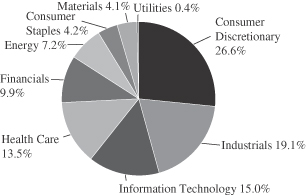

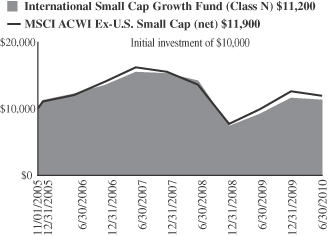

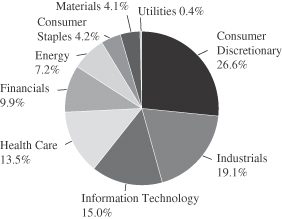

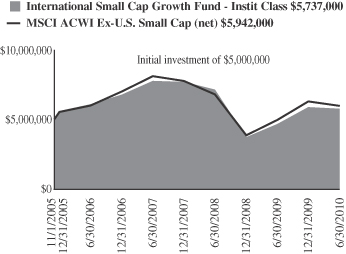

International Small Cap Growth Fund | | | | | | | | | | | | | | | | | | «««

Among 112 foreign small/mid

growth funds |

Class N | | (2.31 | ) | | 23.00 | | (9.91 | ) | | — | | | 2.51 | | | 11/1/2005 | |

Morningstar Foreign Small/Mid Growth | | (6.76 | ) | | 16.12 | | (12.27 | ) | | — | | | — | | | | |

MSCI All Country World Small Cap

Ex-U.S. (net) | | (5.32 | ) | | 19.98 | | (9.68 | ) | | — | | | 3.76 | | | | |

| | | | | | | |

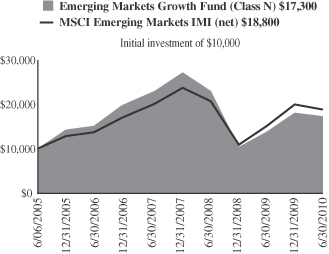

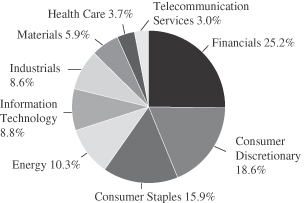

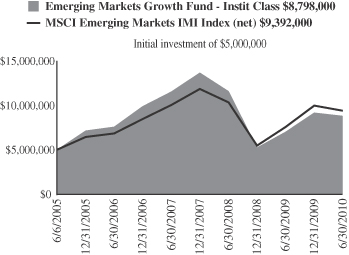

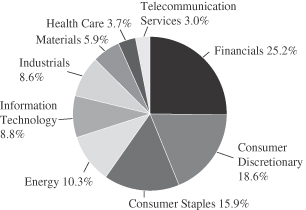

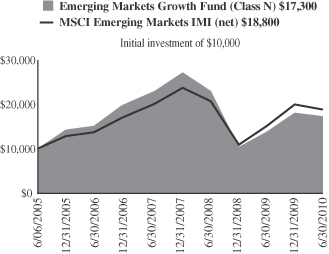

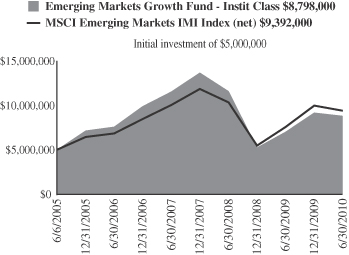

Emerging Markets Growth Fund | | | | | | | | | | | | | | | | | | ««

Among 269 diversified emerging

markets funds |

Class N | | (4.27 | ) | | 25.02 | | (9.01 | ) | | 10.95 | | | 11.36 | | | 6/6/2005 | |

Morningstar Diversified Emerging Markets | | (6.28 | ) | | 21.84 | | (5.33 | ) | | 10.64 | | | — | | | | |

MSCI Emerging Markets IMI (net) | | (5.68 | ) | | 24.57 | | (2.17 | ) | | 12.98 | | | 13.20 | | | | |

Please see the next page for important disclosure information.

2 Semi-Annual Report | June 30, 2010 |

PERFORMANCE AS OF JUNE 30, 2010—CLASS N SHARES—CONTINUED (unaudited)

| | | | | | | | | | | | | | | | | | |

| | | Year to

Date | | | 1 Yr. | | 3 Yr. | | | 5 Yr. | | | 10 Yr

(or since

inception) | | | Inception

Date | | Overall

Morningstar

Rating |

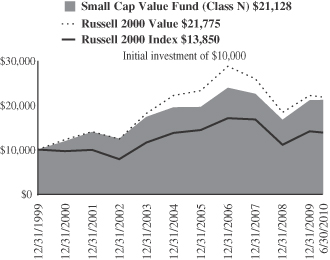

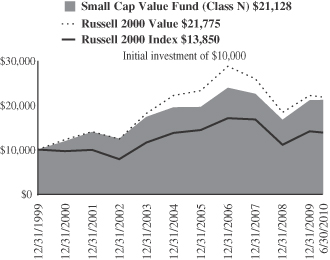

Small Cap Value Fund | | | | | | | | | | | | | | | | | | ««««

Among 321 small value funds |

Class N | | 0.38 | | | 27.49 | | (5.88 | ) | | 2.65 | | | 6.57 | | | 12/23/1996 | |

Morningstar Small Value | | (0.70 | ) | | 25.88 | | (8.66 | ) | | 0.36 | | | 8.13 | | | | |

Russell 2000® Value | | (1.64 | ) | | 25.07 | | (9.85 | ) | | (0.51 | ) | | 7.48 | | | | | |

Russell 2000® | | (1.95 | ) | | 21.48 | | (8.60 | ) | | 0.37 | | | 3.00 | | | | | |

| | | | | | | |

Mid Cap Value Fund | | | | | | | | | | | | | | | | | | |

Class N | | — | | | — | | — | | | — | | | (13.20 | ) | | 5/3/2010 | | Not rated. |

Russell Midcap® Value | | — | | | — | | — | | | — | | | (13.47 | ) | | | | |

| | | | | | | |

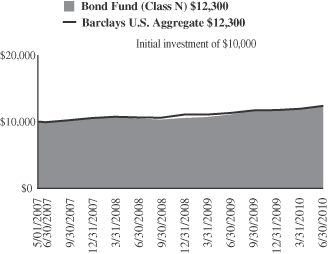

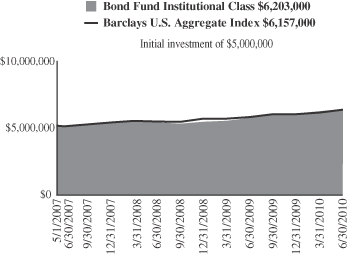

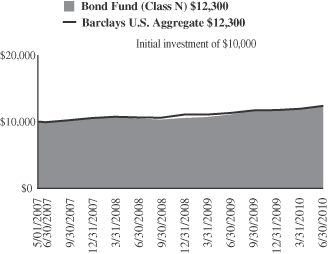

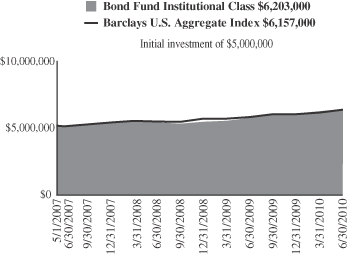

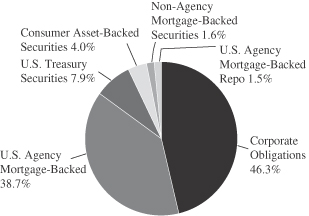

Bond Fund | | | | | | | | | | | | | | | | | | ««««

Among 1,011 intermediate-term

bond funds |

Class N | | 5.27 | | | 11.42 | | 7.53 | | | — | | | 6.73 | | | 5/1/2007 | |

Morningstar Intermediate-Term Bond | | 5.21 | | | 13.11 | | 6.03 | | | — | | | — | | | | |

Barclays Capital U.S. Aggregate Bond Index | | 5.33 | | | 9.50 | | 7.55 | | | — | | | 6.77 | | | | |

| | | | | | | |

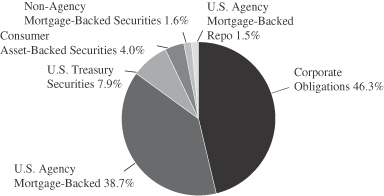

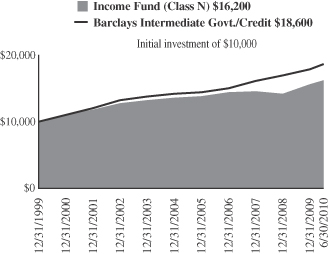

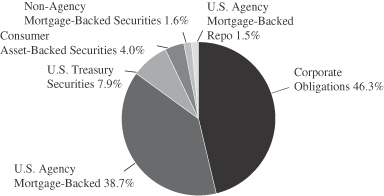

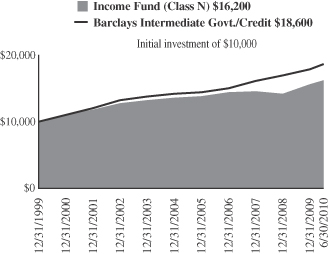

Income Fund | | | | | | | | | | | | | | | | | | «««

Among 398 short-term bond funds |

Class N | | 3.94 | | | 8.69 | | 3.88 | | | 3.34 | | | 4.57 | | | 10/1/1990 | |

Morningstar Short-term Bond | | 2.46 | | | 7.12 | | 3.65 | | | 3.51 | | | 4.13 | | | | |

Barclays Capital Intermediate Govt./Credit

Bond Index | | 4.56 | | | 8.29 | | 6.97 | | | 5.26 | | | 6.06 | | | | | |

| | | | | | | |

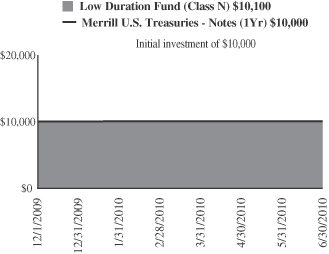

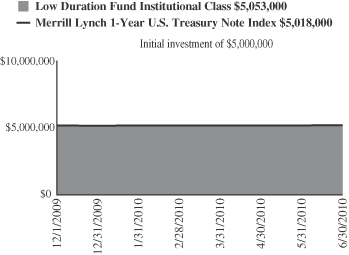

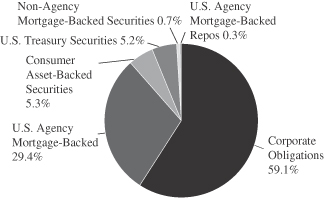

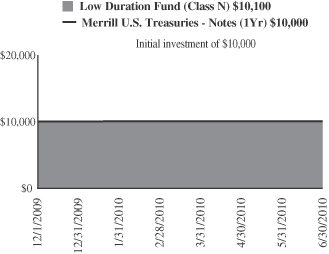

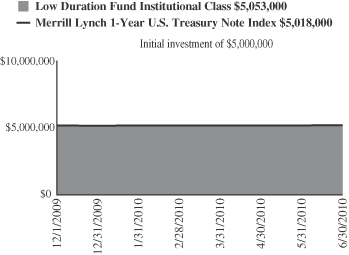

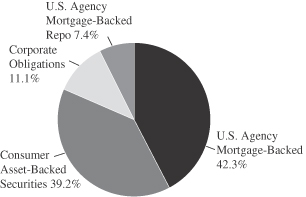

Low Duration Fund | | | | | | | | | | | | | | | | | | Not rated. |

Class N | | 1.43 | | | — | | — | | | — | | | 0.82 | | | 12/1/2009 | | |

Merrill Lynch 1-Year U.S. Treasury Note Index | | 0.51 | | | — | | — | | | — | | | 0.36 | | | | | |

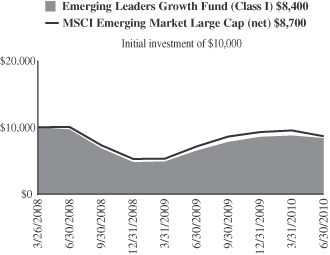

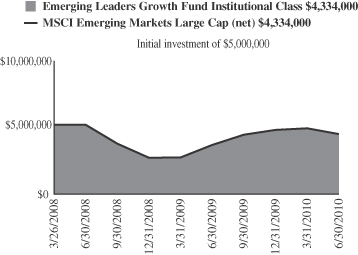

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or a loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the Advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. International and emerging markets investing involves special risk considerations, including currency fluctuations, lower liquidity, economic and political risk. As interest rates rise, bond prices will fall and bond funds may become more volatile. Class N shares are available to the general public without a sales load. The Emerging Leaders Class N commenced operations on May 3, 2010 and had one share outstanding as of June 30, 2010.

Morningstar RatingsTM are as of 6/30/2010 and are subject to change every month. The ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each Category receive 5 stars, the next 22.5% receive 4 stars, the middle 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. The 3/5/10 year Morningstar ratings were as follows: Growth Fund ««««/«« ««/««« , and Large Cap Growth Fund «««/««« /««, out of 1,545/1,298/739 large growth funds; Small Cap Growth Fund «««/««« /«««« out of 666/549/315 small growth funds; Mid Cap Growth Fund ««««/NA /NA and Small-Mid Cap Growth Fund ««««/«« ««/NA out of 694/612/NA mid cap growth funds; Small Cap Value Fund ««««/«« ««/««« out of 321/251/129 small value funds; International Growth Fund «««/««« /«««« and International Equity Fund «««/««/NA out of 215/158/81 foreign large growth funds; International Small Cap Growth Fund «««/NA/NA out of 112/NA/NA foreign small/mid growth funds; Emerging Markets Growth Fund ««/««/NA out of 269/205/NA diversified emerging markets growth funds; Income Fund «««/««« /««« out of 398/336/180 short-term bond funds; Bond Fund ««««/NA/NA out of 1,011/NA/NA intermediate-term bond funds.

Please carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

June 30, 2010 | William Blair Funds 3 |

David C. Fording

John F. Jostrand

GROWTH FUND

The Growth Fund seeks long-term capital appreciation.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

How did the Fund perform over the first half of the year? How did the Fund’s performance compare to its benchmark?

The Growth Fund posted an 8.09% decrease (Class N Shares) for the six months ended June 30, 2010. By comparison, the Fund’s benchmark, the Russell 3000® Growth Index, declined 7.25%.

What were the most significant factors impacting Fund performance?

The Fund fell in response to overall negative market sentiment and stock specific exposures. In the first quarter, U.S. equity markets had strong gains followed by deep second quarter declines. The Russell 3000® Growth rose 4.87% in the first quarter due to continued signs of economic recovery and above expectation corporate earnings. Like 2009, investors continued to seek riskier assets. In the second quarter, investors worried about the sustainability of global economic growth due to mixed economic data, and continued sovereign debt issues, especially in Europe, where calls for fiscal austerity reinforced concerns over economic growth into 2011. With greater uncertainty, market volatility increased, but never reached the extremes of late 2008 and early 2009. Many pundits discussed the possibility of a “double-dip” recession (a recession that is followed by a short-lived recovery and then another recession) even though this phenomenon is very rare, which added to the downward pressures. The Russell 3000® Growth fell 11.55% in the second quarter. During the first half, there were several notable positives such as continued improvement of corporate profitability, China’s move away from its currency’s peg to the U.S. dollar and some clarity around financial regulation; however, they were outweighed by the questions over economic stability and recovery.

All benchmark sectors declined in the first six months of the year. Consumer Discretionary stocks held up well and benefited from the return of some consumer activity or the potential for it in the future. The Industrials sector was also a relative performer as investors sought companies that would benefit from the late stages of economic recovery. Energy and Materials stocks tumbled sharply as demand came into question with a global slowdown particularly in emerging markets. Utilities were also weak. From a market capitalization perspective, smaller cap stocks outshined larger caps, which may seem uncharacteristic in a challenging environment. Smaller cap stocks had strong relative results in the first quarter, which carried into April as investors continued to seek riskier assets. However, as the second quarter progressed, smaller caps lost steam and in June were the weakest performers.

Were there any investment strategies or themes that did not measure up to your expectations?

We were disappointed that the portfolio lagged in the period, but it did hold up well in the market downturn in the last two months of the period as you would expect from a quality growth manager. We had stock specific issues in Health Care and Information Technology and not enough strength in our contributors to outweigh them. In the Health Care sector, one of our largest stocks and a more defensive position, in our view, disappointed unexpectedly.

4 Semi-Annual Report | June 30, 2010 |

Baxter International, Inc., a leading global diversified manufacturer of hospital supplies and medical equipment, had a weak earnings report due to competitive pricing pressures in its blood plasma division and lower than anticipated guidance for 2010. We sold the company on these issues amid lower confidence in management’s ability to execute in a more competitive environment. Select Information Technology stocks also struggled, which is a reversal from last year where it was the best performing group. QUALCOMM, Inc., one of our larger positions, declined on a disappointment in the company’s estimate for handset ASPs (average selling price). Handset ASPs came under pressure due to a change in geographic mix increasing emerging markets exposure where a larger portion of sales occurred in lower-end phones. A lower ASP negatively affected the company’s royalty calculation and its revenue outlook. In our view, the secular growth case for the stock remains intact; it should continue to benefit from the shift from 2G to 3G technologies and a strong position in smartphones. Globally, there are only 900 million 3G subscribers and over four billion 2G subscribers. Additionally, we think its competitive position remains very strong and will likely continue to take more market share in a less competitive chipset market (with Texas Instruments and Freescale Semiconductor exiting). Lastly, despite solid earnings reports, Google, Inc. declined on high expectations from investors and concerns about its strategy in China. We believe the firm continues to have a strong market position, and is well positioned to benefit from an increase in ad spending as the economy recovers.

Which sectors enhanced the Fund’s return? What were among the best performing investments for the Fund?

The Fund had strong stock selection in both Industrials and Consumer Discretionary. Both of these groups were also overweighted in comparison to the benchmark and held up well, which was helpful. In Industrials, the biggest contributors were Fastenal Co. and IHS, Inc. Fastenal Co., the largest fastener supplier in North America, benefited from improving sales to manufacturing and non-residential construction customers as well as its U.S. focus. We believe it can take advantage of further store and sales force expansion in combination with strong management execution and accelerating fundamentals. IHS, Inc., the leading global provider of critical technical information to customers primarily in the energy field, also gained ground driven by subscription-based organic growth.

In Consumer Discretionary, McDonald’s Corporation and our education stocks were additive. McDonald’s Corporation, one of our larger positions, continued to demonstrate sustainable growth. It had revenue driving initiatives with the dollar breakfast, new beverage platform, advertising spending, strong margins due to higher than industry average unit volumes and buying power on commodities, as well as strong performance in several geographic regions. In education—a group that rebounded from 2009—our best performers were Capella Education Co. and K12, Inc. Capella Education Co., an on-line post secondary education company, had strong enrollment growth across degree levels. With the market turmoil, it held up well; many view it as more defensive since individuals seek higher education when unemployed to gain new skills or to advance their career at their current employer. In addition, K12, Inc., a technology-based provider of curriculum to students in kindergarten through 12th grade, reported strong quarterly earnings due to solid management execution leveraging its instructional costs. In our view, K12, Inc. should see attractive growth as the firm continues to leverage costs as it expands into new markets, and state budget headwinds subside further.

What is your current strategy? How is the Fund Positioned?

The U.S. economy should continue to see growth, though slower, in the second half of 2010 as indicated by the Conference Board’s Leading Economic Index (LEI). However, we remain concerned about a slowdown in the global economic recovery as fiscal stimulus begins to wear off. Also, growth prospects could be negatively impacted by continued consumer deleveraging, the government deficit, the effects of Chinese interest rate tightening as this

June 30, 2010 | William Blair Funds 5 |

country attempts to slowdown its residential real estate market, and the depths of European government fiscal austerity and the weakness of Europe’s banking group. In our view, a double dip economic recession is unlikely unless China has a hard landing or European sovereign debt contagion spreads.

For the U.S., it is likely that the Federal Reserve will continue to hold interest rates low in order to continue to assist growth. A low interest environment is critical for businesses nationwide as well as the housing group, which appears to have stabilized, but has yet to show recovery. For improvement in housing, employment and wages will need to rise. A catalyst for growth may be corporations where a positive bias for capital spending remains as many firms have pulled back expenditures over the last several years. Also, for many companies, their balance sheets are cash rich and ripe for investment in their business or M&A activity.

In this slow growth environment, we believe our quality growth investment discipline should benefit; companies with superior and sustainable earnings growth will be rewarded as weaker firms fall behind. With the recent change in market sentiment in the quarter, we have begun to see a return to quality stocks, especially in May and June. We would expect this trend to strengthen as the year unfolds and the slow growth environment continues.

In regard to the portfolio, we have adopted a modestly more defensive stance, given the aforementioned concerns over risks to growth in the second half of 2010 and 2011. We expect this positioning to continue with the uncertainty in the market direction. As always, we remain focused on our research intensive investment process, which will be even more critical in identifying durable business franchises in a slow growth economic environment.

6 Semi-Annual Report | June 30, 2010 |

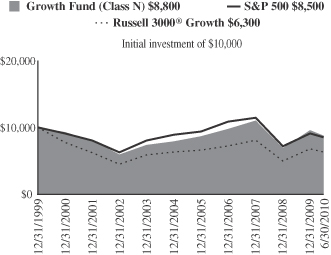

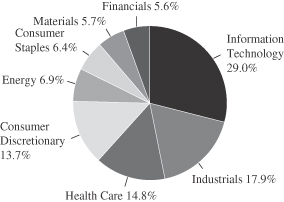

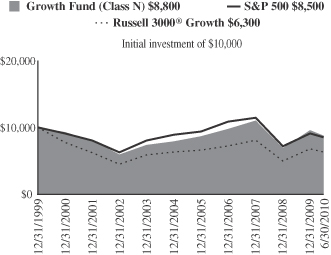

Growth Fund

Performance Highlights (unaudited)

Average Annual Total Return at 6/30/2010

| | | | | | | | | | | | | | | |

| | | Year to

Date | | | 1

Year | | | 3

Year | | | 5

Year | | | 10

Year | |

Class N | | (8.09 | )% | | 8.47 | % | | (5.81 | )% | | 2.30 | % | | (1.83 | )% |

Class I | | (8.01 | ) | | 8.79 | | | (5.52 | ) | | 2.61 | | | (1.56 | ) |

Russell 3000® Growth Index | | (7.25 | ) | | 13.95 | | | (6.97 | ) | | 0.44 | | | (4.89 | ) |

S&P 500 Index | | (6.65 | ) | | 14.43 | | | (9.81 | ) | | (0.79 | ) | | (1.59 | ) |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company L.L.C. without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 3000® Growth Index consists of large, medium, and small capitalization companies with above average price-to-book ratios and forecasted growth rates. The index is weighted by market capitalization and large/medium/small companies make up approximately 80%/15%/5% of the index.

The S&P 500 Index indicates broad larger capitalization equity market performance.

This report identifies the Fund’s investments on June 30, 2010. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

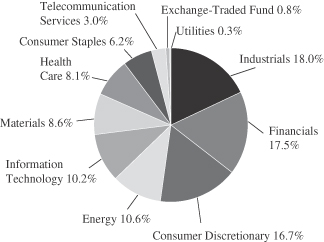

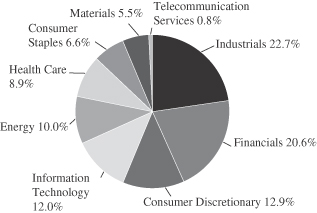

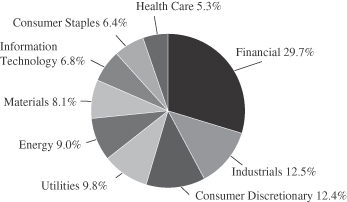

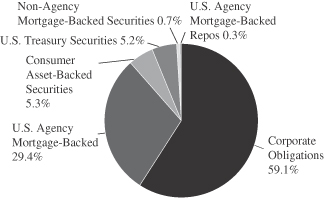

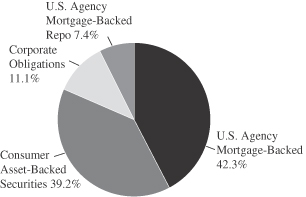

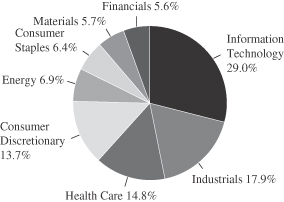

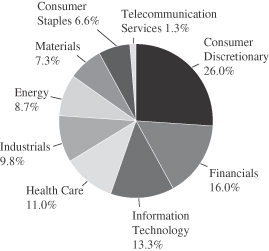

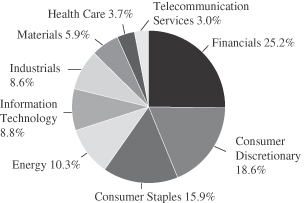

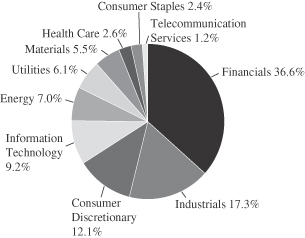

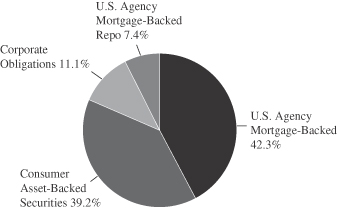

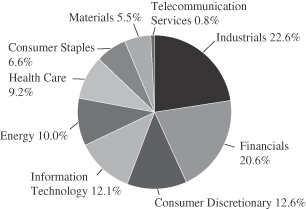

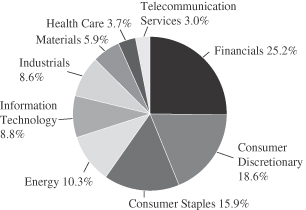

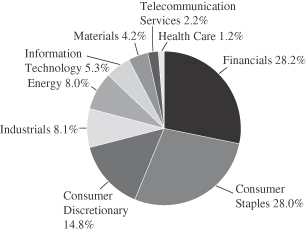

Sector Diversification (unaudited)

The sector diversification shown is based on the total long-term securities.

June 30, 2010 | William Blair Funds 7 |

Growth Fund

Portfolio of Investments, June 30, 2010 (all dollar amounts in thousands) (unaudited)

| | | | | |

Issuer | | Shares | | Value |

| | |

Common Stocks | | | | | |

Information Technology—28.1% | | | | | |

*Apple, Inc. | | 77,985 | | $ | 19,616 |

*Genpact, Ltd.† | | 256,740 | | | 3,987 |

*Google, Inc. Class “A” | | 29,505 | | | 13,128 |

Hewlett-Packard Co. | | 423,300 | | | 18,320 |

*McAfee, Inc. | | 174,800 | | | 5,370 |

Microsoft Corporation | | 798,700 | | | 18,378 |

QUALCOMM, Inc. | | 280,740 | | | 9,220 |

*Silicon Laboratories, Inc. | | 185,440 | | | 7,522 |

Solera Holdings, Inc. | | 120,667 | | | 4,368 |

*Trimble Navigation, Ltd. | | 196,500 | | | 5,502 |

*Ultimate Software Group, Inc. | | 191,450 | | | 6,291 |

*VistaPrint N.V.† | | 150,607 | | | 7,152 |

| | | | | |

| | | | | 118,854 |

| | | | | |

Industrials—17.4% | | | | | |

Allegiant Travel Co. | | 85,900 | | | 3,667 |

Fastenal Co. | | 212,129 | | | 10,647 |

Flowserve Corporation | | 57,600 | | | 4,884 |

Goodrich Corporation | | 100,100 | | | 6,632 |

*IHS, Inc. Class “A” | | 218,415 | | | 12,760 |

Knight Transportation, Inc. | | 312,430 | | | 6,323 |

Manpower, Inc. | | 187,700 | | | 8,105 |

Roper Industries, Inc. | | 131,070 | | | 7,335 |

TransDigm Group, Inc. | | 164,380 | | | 8,388 |

Union Pacific Corporation | | 69,700 | | | 4,845 |

| | | | | |

| | | | | 73,586 |

| | | | | |

Health Care—14.4% | | | | | |

Allergan, Inc. | | 154,300 | | | 8,989 |

*CareFusion Corporation | | 183,400 | | | 4,163 |

*Celgene Corporation | | 233,180 | | | 11,850 |

*Cerner Corporation | | 72,000 | | | 5,464 |

*Gilead Sciences, Inc. | | 184,935 | | | 6,340 |

*IDEXX Laboratories, Inc. | | 113,230 | | | 6,896 |

*Illumina, Inc. | | 141,900 | | | 6,177 |

*NuVasive, Inc. | | 113,600 | | | 4,028 |

*NxStage Medical, Inc. | | 81,987 | | | 1,217 |

*VCA Antech, Inc. | | 231,500 | | | 5,732 |

| | | | | |

| | | | | 60,856 |

| | | | | |

Consumer Discretionary—13.3% | | | | | |

*Bed Bath & Beyond, Inc. | | 129,900 | | | 4,817 |

*Capella Education Co. | | 69,328 | | | 5,640 |

DeVry, Inc. | | 209,948 | | | 11,020 |

*Dick’s Sporting Goods, Inc. | | 207,500 | | | 5,164 |

Johnson Controls, Inc. | | 263,600 | | | 7,083 |

*K12, Inc. | | 202,188 | | | 4,484 |

McDonald’s Corporation | | 214,464 | | | 14,127 |

P.F. Chang’s China Bistro, Inc. | | 97,200 | | | 3,854 |

| | | | | |

| | | | | 56,189 |

| | | | | |

*Non-income producing securities

† = U.S. listed foreign security

| | | | | | |

Issuer | | Shares or

Principal

Amount | | Value |

| | |

Common Stocks—(continued) | | | | | | |

Energy—6.7% | | | | | | |

Apache Corporation | | | 93,465 | | $ | 7,869 |

*Cameron International Corporation | | | 145,147 | | | 4,720 |

Occidental Petroleum Corporation | | | 117,600 | | | 9,073 |

*Southwestern Energy Co. | | | 166,427 | | | 6,431 |

| | | | | | |

| | | | | | 28,093 |

| | | | | | |

Consumer Staples—6.2% | | | | | | |

*Green Mountain Coffee Roasters, Inc. | | | 287,400 | | | 7,386 |

PepsiCo, Inc. | | | 311,100 | | | 18,962 |

| | | | | | |

| | | | | | 26,348 |

| | | | | | |

Materials—5.5% | | | | | | |

Ecolab, Inc. | | | 222,320 | | | 9,985 |

Freeport-McMoRan Copper & Gold, Inc. | | | 58,400 | | | 3,453 |

Monsanto Co. | | | 55,930 | | | 2,585 |

Praxair, Inc. | | | 95,765 | | | 7,277 |

| | | | | | |

| | | | | | 23,300 |

| | | | | | |

Financials—5.5% | | | | | | |

*Affiliated Managers Group, Inc. | | | 87,763 | | | 5,333 |

Greenhill & Co., Inc. | | | 141,700 | | | 8,662 |

*MSCI, Inc. | | | 118,905 | | | 3,220 |

The Charles Schwab Corporation | | | 409,975 | | | 5,814 |

| | | | | | |

| | | | | | 23,029 |

| | | | | | |

Total Common Stocks—97.1%

(cost $391,070) | | | 410,255 |

| | | | | | |

| | |

Investment in Affiliate | | | | | | |

William Blair Ready Reserves Fund | | | 1,262,245 | | | 1,262 |

| | | | | | |

Total Investment in Affiliate—0.3%

(cost $1,262) | | | 1,262 |

| | | | | | |

| | |

Repurchase Agreement | | | | | | |

Fixed Income Clearing Corporation, 0.000% dated 6/30/10, due 7/1/10, repurchase price $9,847, collateralized by FHLMC, 2.000%, due 4/15/13 | | $ | 9,847 | | | 9,847 |

| | | | | | |

Total Repurchase Agreement—2.3%

(cost $9,847) | | | 9,847 |

| | | | | | |

Total Investments—99.7%

(cost $402,179) | | | 421,364 |

Cash and other assets, less liabilities—0.3% | | | 1,447 |

| | | | | | |

Net assets—100.0% | | $ | 422,811 |

| | | | | | |

See accompanying Notes to Financial Statements.

8 Semi-Annual Report | June 30, 2010 |

James S. Golan

John F. Jostrand

Tracy McCormick

LARGE CAP GROWTH FUND

The Large Cap Growth Fund seeks long-term capital appreciation.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

How did the Fund perform over the first half of the year? How did the Fund’s performance compare to its benchmark?

The Large Cap Growth Fund posted an 8.44% decrease (Class N Shares) for the six months ended June 30, 2010. By comparison, the Fund’s benchmark, the Russell 1000® Growth Index, declined 7.65%.

What were the most significant factors impacting Fund performance?

The Fund fell in response to overall negative market sentiment and stock specific exposures. In the first quarter, U.S. equity markets had strong gains followed by deep second quarter declines. The Russell 1000® Growth rose 4.65% in the first quarter due to continued signs of economic recovery and above expectation corporate earnings. Like 2009, investors continued to seek riskier assets. In the second quarter, investors worried about the sustainability of global economic growth due to mixed economic data, and continued sovereign debt issues, especially in Europe, where calls for fiscal austerity reinforced concerns over economic growth into 2011. With greater uncertainty, market volatility increased, but never reached the extremes of late 2008 and early 2009. Many pundits discussed the possibility of a “double-dip” recession (a recession that is followed by a short-lived recovery and then another recession) even though this phenomenon is very rare, which added to the downward pressures. The Russell 1000® Growth fell 11.75% in the second quarter. During the first half, there were several notable positives such as continued improvement in corporate profitability, China’s move away from its currency’s peg to the U.S. dollar and some clarity around financial regulation; however, they were outweighed by the questions over economic stability and recovery.

All benchmark sectors declined in the first six months of the year. The more defensive Telecommunication Services sector was best, followed by Industrials, where investors sought companies that would benefit from the late stages of economic recovery. Consumer Discretionary also held up well and benefited from the return of some consumer activity or the potential for it in the future. Energy and Materials stocks tumbled sharply as demand came into question with a global slowdown particularly in emerging markets. Utilities were also weak. From a market capitalization perspective, smaller cap stocks outshined larger caps, which may seem uncharacteristic in a challenging environment. Smaller cap stocks had strong relative results in the first quarter, which carried into April as investors continued to seek riskier assets. However, as the second quarter progressed, smaller caps lost steam and in June were the weakest performers.

What sectors and investments did not measure up to your expectations?

We were disappointed that the portfolio lagged in the period, but it did hold up well in the market downturn in the last two months of the period as you would expect from a quality growth manager. We had stock specific issues in Information Technology and Health Care and not enough strength in our contributors to outweigh them. In Information Technology,

June 30, 2010 | William Blair Funds 9 |

select stocks struggled, which is a reversal from last year where it was the best performing group. QUALCOMM, Inc., one of our larger positions, declined on a disappointment in the company’s estimate for handset ASPs (average selling price). Handset ASPs came under pressure due to a change in geographic mix increasing emerging markets exposure where a larger portion of sales occurred in lower-end phones. A lower ASP negatively affected the company’s royalty calculation and its revenue outlook. In our view, the secular growth case for the stock remains intact; it should continue to benefit from the shift from 2G to 3G technologies and a strong position in smartphones. Globally, there are only 900 million 3G subscribers and over four billion 2G subscribers. Additionally, we think its competitive position remains very strong and will likely continue to take more market share in a less competitive chipset market (with Texas Instruments and Freescale Semiconductor exiting). Lastly, Microsoft Corporation, our largest position, trailed even though it had very strong earnings reports in the first half. Windows sales exceeded consensus expectations combined with favorable cost of goods sold and continued cost control. However, investors were more focused on technology companies where confidence was greater that growth expectations could be met regardless of the macro backdrop. A good example would be Apple, Inc., which did well and which we continue to own.

In the Health Care sector, one of our largest stocks and a more defensive position, in our view, disappointed unexpectedly. Baxter International, Inc., a leading global diversified manufacturer of hospital supplies and medical equipment, had a weak earnings report due to competitive pricing pressures in its blood plasma division and lower than anticipated guidance for 2010. We sold the company on these issues amid lower confidence in management’s ability to execute in a more competitive environment.

Which sectors enhanced the Fund’s return? What were among the best performing investments for the Fund?

The Fund had strong stock selection in both the Consumer Discretionary and Industrials sectors. Both of these groups were also overweighted in comparison to the benchmark and held up well, which was helpful. In Consumer Discretionary, O’Reilly Automotive, Inc., Discovery Communications, Inc. and Yum! Brands, Inc. each were additive. One of the best overall portfolio performers was O’Reilly Automotive, Inc., an automotive specialty retailer. The company reported better than expected earnings results driven by strength in core O’Reilly stores and newly acquired CSK stores. We believe it is well positioned to continue to gain market share. Discovery Communications, Inc. benefited from solid international and U.S. advertising growth as a result of strong programming. It will launch the Oprah Winfrey Network (OWN) early next year, which should provide additional earnings upside in our view. Yum! Brands, Inc.’s stock price was assisted by strengthened sales and profits from China, a key driver to growth going forward. The company added 15% to its store base in China during 2009.

In Industrials, Rockwell Automation, Inc. and W.W. Grainger, Inc. were best. As a global provider of industrial automation power, control and information solutions, Rockwell Automation, Inc. had upside surprise in its earnings. Its results were driven by higher demand and volume growth, which dramatically improved its operating margin leverage. W.W. Grainger, Inc., a leading supplier of facilities maintenance products, also had above expectations earnings due to improving industrial activity. We believe the firm has a leading market position and brand, broad product offering, seasoned management, and a strong balance sheet.

What is your current strategy? How is the Fund positioned?

The U.S. economy should continue to see growth, though slower, in the second half of 2010 as indicated by the Conference Board’s Leading Economic Index (LEI). However, we remain concerned about a slowdown in the global economic recovery as fiscal stimulus begins to

10 Semi-Annual Report | June 30, 2010 |

wear off. Also, growth prospects could be negatively impacted by continued consumer deleveraging, the government deficit, the effects of Chinese interest rate tightening as this country attempts to slowdown its residential real estate market, and the depths of European government fiscal austerity and the weakness of Europe’s banking group. In our view, a double dip economic recession is unlikely unless China has a hard landing or European sovereign debt contagion spreads.

For the U.S., it is likely that the Federal Reserve will continue to hold interest rates low in order to continue to assist growth. A low interest environment is critical for businesses nationwide as well as the housing group, which appears to have stabilized, but has yet to show recovery. For improvement in housing, employment and wages will need to rise. A catalyst for growth may be corporations where a positive bias for capital spending remains as many firms have pulled back expenditures over the last several years. Also, for many companies, their balance sheets are cash rich and ripe for investment in their business or M&A activity.

In this slow growth environment, we believe our quality growth investment discipline should benefit; companies with superior and sustainable earnings growth will be rewarded as weaker firms fall behind. With the recent change in market sentiment in the quarter, we have begun to see a return to quality stocks, especially in May and June. We would expect this trend to strengthen as the year unfolds and the slow growth environment continues.

In regard to the portfolio, we have adopted a modestly more defensive stance, given the aforementioned concerns over risks to growth in the second half of 2010 and 2011. We expect this positioning to continue with the uncertainty in the market direction. As always, we remain focused on our research intensive investment process, which will be even more critical in identifying durable business franchises in a slow growth economic environment.

June 30, 2010 | William Blair Funds 11 |

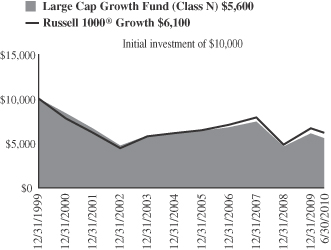

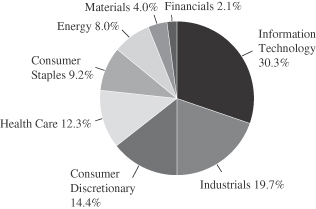

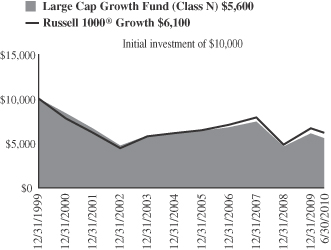

Large Cap Growth Fund

Performance Highlights (unaudited)

Average Annual Total Return at 6/30/2010

| | | | | | | | | | | | | | | |

| | | Year to

Date | | | 1

Year | | | 3

Year | | | 5

Year | | | 10

Year | |

Class N | | (8.44 | )% | | 9.09 | % | | (8.16 | )% | | (1.65 | )% | | (5.68 | )% |

Class I | | (8.57 | ) | | 9.17 | | | (7.93 | ) | | (1.44 | ) | | (5.49 | ) |

Russell 1000® Growth Index | | (7.65 | ) | | 13.62 | | | (6.91 | ) | | 0.38 | | | (5.14 | ) |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 1000® Growth Index consists of large capitalization companies with above average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on June 30, 2010. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

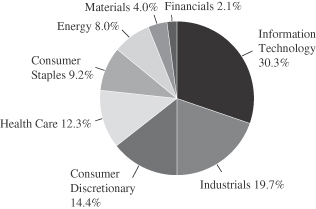

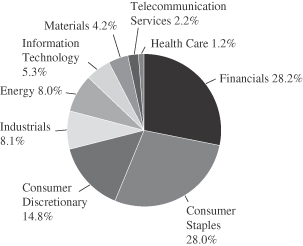

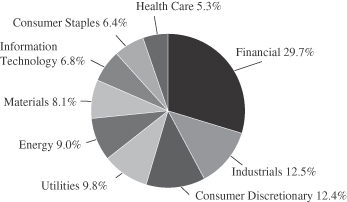

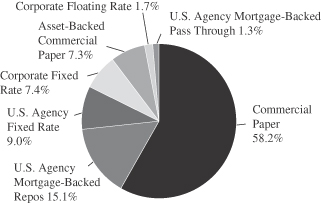

Sector Diversification (unaudited)

The sector diversification shown is based on the total long-term securities.

12 Semi-Annual Report | June 30, 2010 |

Large Cap Growth Fund

Portfolio of Investments, June 30, 2010 (all dollar amounts in thousands) (unaudited)

| | | | | |

| |

Issuer | | Shares | | Value |

| | |

Common Stocks | | | | | |

Information Technology—29.4% | | | | | |

*Apple, Inc. | | 6,225 | | $ | 1,566 |

Broadcom Corporation Class “A” | | 13,950 | | | 460 |

*eBay, Inc. | | 36,750 | | | 721 |

*EMC Corporation | | 36,750 | | | 672 |

*Google, Inc. Class “A” | | 2,065 | | | 919 |

Hewlett-Packard Co. | | 24,645 | | | 1,067 |

*McAfee, Inc. | | 18,050 | | | 554 |

Microsoft Corporation | | 69,135 | | | 1,591 |

QUALCOMM, Inc. | | 12,215 | | | 401 |

| | | | | |

| | | | | 7,951 |

| | | | | |

Industrials—19.2% | | | | | |

Danaher Corporation | | 15,644 | | | 581 |

Goodrich Corporation | | 8,750 | | | 580 |

J.B. Hunt Transport Services, Inc. | | 12,020 | | | 393 |

Manpower, Inc. | | 10,800 | | | 466 |

Rockwell Automation, Inc. | | 13,250 | | | 650 |

Roper Industries, Inc. | | 8,400 | | | 470 |

*Stericycle, Inc. | | 6,650 | | | 436 |

United Parcel Service, Inc. Class “B” | | 17,470 | | | 994 |

W.W. Grainger, Inc. | | 6,180 | | | 615 |

| | | | | |

| | | | | 5,185 |

| | | | | |

Consumer Discretionary—13.9% | | | | | |

*Discovery Communications, Inc. | | 17,000 | | | 607 |

Johnson Controls, Inc. | | 21,650 | | | 582 |

*Kohl’s Corporation | | 12,246 | | | 582 |

McDonald’s Corporation | | 10,685 | | | 704 |

*O’Reilly Automotive, Inc. | | 13,530 | | | 643 |

Yum! Brands, Inc. | | 16,700 | | | 652 |

| | | | | |

| | | | | 3,770 |

| | | | | |

Health Care—12.0% | | | | | |

Allergan, Inc. | | 9,565 | | | 557 |

*Celgene Corporation | | 15,240 | | | 775 |

*Illumina, Inc. | | 9,600 | | | 418 |

*Medco Health Solutions, Inc. | | 9,350 | | | 515 |

*Thermo Fisher Scientific, Inc. | | 19,945 | | | 978 |

| | | | | |

| | | | | 3,243 |

| | | | | |

Consumer Staples—9.0% | | | | | |

Colgate-Palmolive Co. | | 10,730 | | | 845 |

Mead Johnson Nutrition Co. | | 12,550 | | | 629 |

PepsiCo, Inc. | | 15,600 | | | 951 |

| | | | | |

| | | | | 2,425 |

| | | | | |

* Non-income producing securities

† = U.S. listed foreign security

| | | | | | | |

| | |

Issuer | | Shares or

Principal

Amount | | Value | |

| | |

Common Stocks—(continued) | | | | | | | |

Energy—7.7% | | | | | | | |

Apache Corporation | | | 3,665 | | $ | 309 | |

EOG Resources, Inc. | | | 4,570 | | | 450 | |

Occidental Petroleum Corporation | | | 8,050 | | | 621 | |

Schlumberger, Ltd.† | | | 12,980 | | | 718 | |

| | | | | | | |

| | | | | | 2,098 | |

| | | | | | | |

Materials—3.8% | | | | | | | |

Freeport-McMoRan Copper & Gold, Inc. | | | 5,550 | | | 328 | |

Praxair, Inc. | | | 9,425 | | | 716 | |

| | | | | | | |

| | | | | | 1,044 | |

| | | | | | | |

Financials—2.1% | | | | | | | |

CME Group, Inc. | | | 2,000 | | | 563 | |

| | | | | | | |

Total Common Stocks—97.1%

(cost $24,228) | | | 26,279 | |

| | | | | | | |

| | |

Repurchase Agreement | | | | | | | |

State Street Bank and Trust Company, 0.000% dated 6/30/10, due 7/1/10, repurchase price $803, collateralized by FHLB,

4.375%, due 9/17/10 | | $ | 803 | | | 803 | |

| | | | | | | |

Total Repurchase Agreement—3.0%

(cost $803) | | | 803 | |

| | | | | | | |

Total Investments—100.1%

(cost $25,031) | | | 27,082 | |

Liabilities, plus cash and other assets—(0.1)% | | | (32 | ) |

| | | | | | | |

Net assets—100.0% | | $ | 27,050 | |

| | | | | | | |

See accompanying Notes to Financial Statements.

June 30, 2010 | William Blair Funds 13 |

Michael P. Balkin

Karl W. Brewer

SMALL CAP GROWTH FUND

The Small Cap Growth Fund seeks long-term capital appreciation.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

The Small Cap Growth Fund posted a 3.65% decrease (Class N Shares) for the six months ended June 30, 2010. By comparison, the Fund’s benchmark, the Russell 2000® Growth Index, declined 2.31%.

After a strong first quarter, the U.S. equity market reversed course during the second quarter to finish in negative territory for the first half of the year. The Russell 2000® Growth returned -9.22% during the second quarter to produce a -2.31% return for 2010 through June. The Fund underperformed during the second quarter and is now slightly behind for the six-month period.

While the year started off on a positive note on the heels of better-than-expected corporate sales and earnings, macro concerns across the globe instilled fear and volatility back into the markets. European sovereign debt downgrades and fiscal austerity measures, the Gulf of Mexico oil catastrophe, U.S. state budget woes and expiring stimulus programs all contributed to investor skepticism. More importantly, given the significance of job growth to a sustainable economic recovery, stubbornly lackluster employment and housing data have stoked fears of slipping back into a recession. Given these negative developments and with the 2008 downturn fresh in investors’ minds, stock prices corrected as they once again succumbed to macro factors rather than specific company fundamentals.

During the second quarter, all sectors within the Russell 2000® Growth finished well into the red. The Consumer Discretionary (-11%) and Energy (-14%) sectors were the worst performing sectors given the macro concerns discussed above. Industrials and Consumer Staples posted the “best” returns in the down market, finishing -6% apiece.

For the year-to-date period, sector returns were more dispersed. Energy was the outlying loser at down 13% for the six-month period. Consumer Discretionary and Consumer Staples performed well over the period, finishing up 3% each. Most of the other major economic sectors such as Information Technology, Industrials, Financials and Health Care were each down 2-3%.

The Fund’s underperformance during the second quarter is primarily attributable to negative stock selection. This was most pronounced in Consumer Discretionary, Financials and Materials. On the other hand, positive stock selection in Telecommunication Services, Energy and Information Technology each buoyed relative results.

For the first half of the year, the Fund’s narrower underperformance was the result of mixed stock selection across sectors. While stock selection was good in Information Technology, Telecommunication Services and Energy, stock selection in Consumer Discretionary, Materials, Industrials and Health Care outweighed and brought relative performance below the benchmark for the six-month period overall.

Two specific stocks detracting from returns were Cenveo Inc. and Healthways Inc. Cenveo is a specialty printing company. The company operates in two segments: Envelopes, Forms and Labels, and Commercial Printing. The stock was a leading detractor from returns during the second quarter and the year-to-date period as investors became increasingly nervous about the economic sensitivity of Cenveo’s business. However, we added to our position in the stock as we continue to believe the stock offers an attractive reward-to-risk ratio given a solid management team (many of whom have bought stock recently), its leading position in a higher growth segment of the printing industry and an unjustifiably low valuation.

14 Semi-Annual Report | June 30, 2010 |

Healthways Inc. is a healthcare services firm that provides disease management solutions. The company’s services are implemented by managed care companies, governments, employers and hospitals in order to reduce both short term and long term healthcare costs within their patient populations. The stock detracted from returns during the second quarter and the year-to-date period overall in part due to skepticism toward the healthcare reform bill’s impact on managed care, Healthways’ primary customer base. Also, lackluster employment data hurt investor sentiment as Healthways’ business model benefits as the employed base increases. We maintained our position as we believe disease management solutions and Healthways specifically will be a partial solution to lower healthcare costs. Nearer term, we believe data on new contract wins, contract renewals and the new business pipeline are encouraging.

Two specific stocks boosting relative performance were Lionbridge Technologies Inc. and Stanley Inc. Lionbridge Technologies is a market leader in language translation for online content, software manuals and training for leading global companies. The stock was the Fund’s number one contributor during both the first quarter and second quarter, and therefore the year-to-date period as well. Lionbridge’s business momentum has been driven by new business wins from large companies such as Caterpillar and a new contract with IBM to provide its translation technology. The company has also benefitted from existing customers such as Microsoft and Google restarting projects after the recession. We continue to hold the stock as we believe the company is well positioned for additional new customer wins and will benefit from the secular increase in cross-border business activity.

Stanley Inc. is a government information technology services company. The stock was one of the leading contributors to returns during the second quarter and the year-to-date period as it was announced to be acquired by CGI Group, one of the largest independent information technology and business process services firms in the world. We liquidated our position on the rally following this announcement.

Looking forward, while the economic recovery may have a different trajectory (less steep) than some were expecting earlier this year, the market’s decline has improved valuations and lowered expectations. Corporate financial discipline and balance sheets remain strong while inventories are lean throughout most industries. This should lay the groundwork for operating margin expansion, likely beyond prior peak margins, and drive continued earnings growth over the intermediate term. However, investor pessimism is understandably high given the expiration of stimulus plans and diminished appetite for additional programs, U.S. state budget crunches, still absent employment growth and likely further consumer deleveraging.

We consider the impact of these economic scenarios into our stock-specific risk/reward assessments, and focus our time analyzing business models and managements of growth companies who “control their own destiny” to a greater degree and are less dependent on broad economic growth. We continue to find solid investment opportunities across sectors. We believe the Fund consists of great companies with solid competitive positions whose stock prices are trading at attractive valuations.

June 30, 2010 | William Blair Funds 15 |

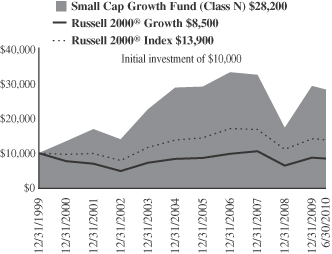

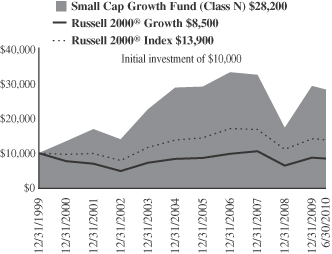

Small Cap Growth Fund

Performance Highlights (unaudited)

Average Annual Total Return at 6/30/2010

| | | | | | | | | | | | | | | |

| | | Year to

Date | | | 1

Year | | | 3

Year | | | 5

Year | | | 10

Year | |

Class N | | (3.65 | )% | | 17.44 | % | | (7.96 | )% | | 0.47 | % | | 6.76 | % |

Class I | | (3.49 | ) | | 17.80 | | | (7.70 | ) | | 0.75 | | | 7.03 | |

Russell 2000® Growth Index | | (2.31 | ) | | 17.96 | | | (7.54 | ) | | 1.14 | | | (1.72 | ) |

Russell 2000® Index | | (1.95 | ) | | 21.48 | | | (8.60 | ) | | 0.37 | | | 3.00 | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2000® Growth Index consists of small-capitalization companies with above average price-to-book ratios and forecasted growth rates.

The Russell 2000® Index is an unmanaged composite of the smallest 2000 stocks of the Russell 3000® Index.

This report identifies the Fund’s investments on June 30, 2010. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

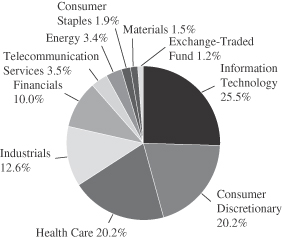

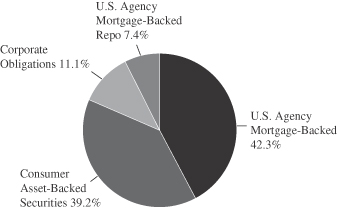

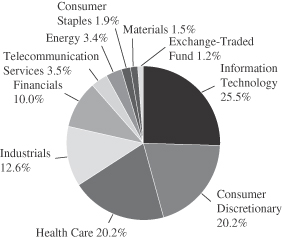

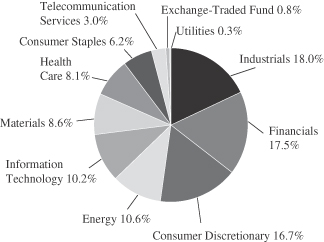

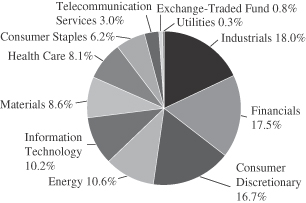

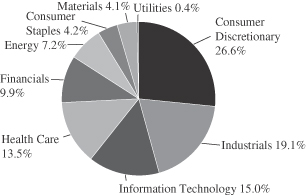

Sector Diversification (unaudited)

The sector diversification shown is based on the total long-term securities.

16 Semi-Annual Report | June 30, 2010 |

Small Cap Growth Fund

Portfolio of Investments, June 30, 2010 (all dollar amounts in thousands) (unaudited)

| | | | | |

Issuer | | Shares | | Value |

| | |

Common Stocks | | | | | |

Information Technology—25.1% | | | | | |

*BancTec, Inc.—144A§** | | 603,327 | | $ | 3,017 |

*Cavium Networks, Inc. | | 344,300 | | | 9,017 |

*DG FastChannel, Inc. | | 523,989 | | | 17,072 |

*DJSP Enterprises, Inc.† | | 633,000 | | | 3,576 |

*Internet Capital Group, Inc. | | 1,035,346 | | | 7,869 |

*Inuvo, Inc. | | 8,813,761 | | | 1,498 |

*j2 Global Communications, Inc. | | 699,948 | | | 15,287 |

*Lionbridge Technologies, Inc. | | 4,326,258 | | | 19,771 |

*MaxLinear, Inc. Class “A” | | 385,140 | | | 5,384 |

*Monolithic Power Systems, Inc. | | 528,471 | | | 9,438 |

*ShoreTel, Inc. | | 695,800 | | | 3,229 |

*Silicon Laboratories, Inc. | | 178,677 | | | 7,247 |

*Sonic Solutions, Inc. | | 906,916 | | | 7,573 |

*TeleNav, Inc. | | 907,925 | | | 7,617 |

*TeleTech Holdings, Inc. | | 644,900 | | | 8,313 |

*Ultimate Software Group, Inc. | | 559,085 | | | 18,372 |

United Online, Inc. | | 2,416,546 | | | 13,919 |

*ValueClick, Inc. | | 1,344,740 | | | 14,375 |

*Vertro, Inc. | | 4,333,215 | | | 2,145 |

*VistaPrint N.V.† | | 222,768 | | | 10,579 |

| | | | | |

| | | | | 185,298 |

| | | | | |

Consumer Discretionary—19.9% | | | | | |

Abercrombie & Fitch Co. Class “A” | | 257,200 | | | 7,893 |

*Belo Corporation | | 2,128,943 | | | 12,114 |

*Career Education Corporation | | 547,226 | | | 12,597 |

*ChinaCast Education Corporation† | | 1,387,639 | | | 8,243 |

*Duckwall-ALCO Stores, Inc. | | 439,493 | | | 6,439 |

Gaiam, Inc. Class “A” | | 1,358,374 | | | 8,245 |

*Grand Canyon Education, Inc. | | 569,210 | | | 13,337 |

Jarden Corporation | | 657,717 | | | 17,673 |

*Kona Grill, Inc. | | 1,042,992 | | | 3,828 |

*Lincoln Educational Services Corporation | | 377,098 | | | 7,764 |

MDC Partners, Inc. Class “A”† | | 949,988 | | | 10,146 |

*Office Depot, Inc. | | 1,483,300 | | | 5,993 |

*Princeton Review, Inc. | | 3,381,896 | | | 7,846 |

Strayer Education, Inc. | | 36,695 | | | 7,628 |

*U.S. Auto Parts Network, Inc. | | 1,047,636 | | | 6,286 |

*WMS Industries, Inc. | | 279,500 | | | 10,970 |

| | | | | |

| | | | | 147,002 |

| | | | | |

Health Care—19.9% | | | | | |

*AGA Medical Holdings, Inc. | | 634,500 | | | 8,052 |

*Air Methods Corporation | | 455,882 | | | 13,562 |

*American Medical Systems Holdings, Inc. | | 511,800 | | | 11,321 |

*Brookdale Senior Living, Inc. | | 439,900 | | | 6,598 |

*CardioNet, Inc. | | 471,713 | | | 2,585 |

*Eurand N.V.† | | 1,013,712 | | | 9,823 |

*Haemonetics Corporation | | 143,265 | | | 7,668 |

*Healthways, Inc. | | 844,253 | | | 10,063 |

*Integra LifeSciences Holdings Corporation | | 217,400 | | | 8,044 |

*Kensey Nash Corporation | | 541,501 | | | 12,839 |

*LCA-Vision, Inc. | | 808,806 | | | 4,481 |

*MedAssets, Inc. | | 349,200 | | | 8,060 |

*Natus Medical, Inc. | | 571,600 | | | 9,311 |

*Quidel Corporation | | 576,846 | | | 7,320 |

*SurModics, Inc. | | 475,248 | | | 7,799 |

*The Providence Service Corporation | | 575,911 | | | 8,063 |

*Trinity Biotech plc—ADR | | 1,853,763 | | | 11,252 |

| | | | | |

| | | | | 146,841 |

| | | | | |

| | | | | |

Issuer | | Shares | | Value |

| | |

Common Stocks—(continued) | | | | | |

Industrials—12.3% | | | | | |

*Cenveo, Inc. | | 2,494,045 | | $ | 13,667 |

*Dolan Media Co. | | 1,178,966 | | | 13,110 |

*Franklin Covey Co. | | 647,917 | | | 4,212 |

*GrafTech International, Ltd. | | 802,900 | | | 11,738 |

*ICF International, Inc. | | 285,139 | | | 6,823 |

Kaydon Corporation | | 310,460 | | | 10,202 |

MSC Industrial Direct Co. Class “A” | | 87,226 | | | 4,419 |

*Odyssey Marine Exploration, Inc. | | 3,454,930 | | | 3,455 |

*On Assignment, Inc. | | 1,936,419 | | | 9,740 |

TransDigm Group, Inc. | | 270,014 | | | 13,779 |

| | | | | |

| | | | | 91,145 |

| | | | | |

Financials—8.9% | | | | | |

*Affiliated Managers Group, Inc. | | 137,282 | | | 8,342 |

Allied World Assurance Co. Holdings, Ltd.† | | 198,100 | | | 8,990 |

*CBOE Holdings, Inc. | | 124,028 | | | 4,037 |

*Cowen Group, Inc. | | 1,766,517 | | | 7,243 |

*FirstService Corporation† | | 554,971 | | | 11,527 |

*Marlin Business Services Corporation | | 970,279 | | | 11,731 |

*National Financial Partners Corporation | | 1,094,330 | | | 10,691 |

*Penson Worldwide, Inc. | | 255,201 | | | 1,439 |

United Western Bancorp, Inc. | | 2,342,215 | | | 1,874 |

| | | | | |

| | | | | 65,874 |

| | | | | |

Telecommunication Services—3.4% | | | | | |

*Cbeyond, Inc. | | 459,231 | | | 5,741 |

*Syniverse Holdings, Inc. | | 958,300 | | | 19,597 |

| | | | | |

| | | | | 25,338 |

| | | | | |

Energy—3.4% | | | | | |

*Comstock Resources, Inc. | | 276,460 | | | 7,663 |

*Concho Resources, Inc. | | 129,113 | | | 7,144 |

*Oil States International, Inc. | | 255,800 | | | 10,125 |

| | | | | |

| | | | | 24,932 |

| | | | | |

Consumer Staples—1.9% | | | | | |

*Overhill Farms, Inc. | | 959,252 | | | 5,650 |

*Smart Balance, Inc. | | 2,077,700 | | | 8,498 |

| | | | | |

| | | | | 14,148 |

| | | | | |

Materials—1.5% | | | | | |

*Horsehead Holding Corporation | | 987,100 | | | 7,463 |

*Stillwater Mining Co. | | 284,100 | | | 3,301 |

| | | | | |

| | | | | 10,764 |

| | | | | |

Total Common Stocks—96.3%

(cost $725,989) | | | 711,342 |

| | | | | |

| | |

Preferred Stock | | | | | |

Grubb & Ellis Co.—144A, 12.00%§ | | 83,121 | | | 6,484 |

| | | | | |

Total Preferred Stock—0.9%

(cost $8,312) | | | 6,484 |

| | | | | |

| | |

Exchange-Traded Fund | | | | | |

iShares Russell 2000 Growth Index Fund | | 126,500 | | | 8,422 |

| | | | | |

Total Exchange-Traded Fund—1.2%

(cost $8,194) | | | 8,422 |

| | | | | |

See accompanying Notes to Financial Statements.

June 30, 2010 | William Blair Funds 17 |

Small Cap Growth Fund

Portfolio of Investments, June 30, 2010 (all dollar amounts in thousands) (unaudited)

| | | | | | |

Issuer | | Shares or

Principal

Amount | | Value |

| | |

Investment in Affiliate | | | | | | |

William Blair Ready Reserves Fund | | | 3,296,931 | | | 3,297 |

| | | | | | |

Total Investment in Affiliate—0.4%

(cost $3,297) | | | 3,297 |

| | | | | | |

| | |

Short-Term Investment | | | | | | |

American Express Credit Corporation Demand Note, VRN, 0.191%, due 7/1/10 | | $ | 500 | | | 500 |

| | | | | | |

Total Short-Term Investment—0.1%

(cost $500) | | | 500 |

| | | | | | |

| | |

Repurchase Agreement | | | | | | |

Fixed Income Clearing Corporation, 0.000% dated 6/30/10, due 7/1/10, repurchase price $4,705 collateralized by FFCB, 1.625%, due 3/7/13 | | | 4,705 | | | 4,705 |

| | | | | | |

Total Repurchase Agreement—0.6%

(cost $4,705) | | | 4,705 |

| | | | | | |

Total Investments—99.5%

(cost $750,997) | | | 734,750 |

Cash and other assets, less liabilities—0.5% | | | 3,728 |

| | | | | | |

Net assets—100.0% | | $ | 738,478 |

| | | | | | |

ADR = American Depository Receipt

VRN = Variable Rate Note

*Non-income producing securities

§ = Deemed illiquid pursuant to Liquidity Procedures approved by the Board of Trustees. These holdings represent 1.29% of the net assets at June 30, 2010.

** = Fair valued pursuant to Valuation Procedures adopted by the Board of Trustees. This holding represents 0.41% of the Fund’s net assets at June 30, 2010.

† = U.S. listed foreign security

See accompanying Notes to Financial Statements.

18 Semi-Annual Report | June 30, 2010 |

Small Cap Growth Fund

If the Fund’s portfolio holdings represent ownership of 5% or more of the voting securities of a company, the company is deemed to be a affiliate as defined in the Investment Company Act of 1940. The Small Cap Growth Fund had the following transactions during the period ended June 30, 2010 with companies deemed affiliated during the period or at June 30, 2010:

| | | | | | | | | | | | | | |

| | | Share Activity | | Period Ended June 30, 2010 |

| | | | | | | | | | | (in thousands) |

Security Name | | Balance

12/31/2009 | | Purchases | | Sales | | Balance

6/30/2010 | | Value | | Dividends

Included in

Income |

CardioNet, Inc. | | 1,344,381 | | 208,600 | | 1,081,268 | | 471,713 | | $ | 2,585 | | $ | — |

pDJSP Enterprises | | — | | 633,000 | | — | | 633,000 | | | 3,576 | | | — |

pDuckwall-ALCO Stores, Inc. | | 460,853 | | — | | 21,360 | | 439,493 | | | 6,439 | | | — |

pGaiam, Inc. | | 1,511,007 | | 62,900 | | 215,533 | | 1,358,374 | | | 8,254 | | | 214 |

pInuvo, Inc | | 8,037,127 | | 776,634 | | — | | 8,813,761 | | | 1,498 | | | — |

pKensey Nash | | 422,340 | | 119,161 | | — | | 541,501 | | | 12,839 | | | — |

pKona Grill, Inc. | | 1,042,992 | | — | | — | | 1,042,992 | | | 3,828 | | | — |

LCA-Vision Inc. | | 948,955 | | 66,854 | | 207,003 | | 808,806 | | | 4,481 | | | — |

pLionbridge Technologies, Inc. | | 4,293,158 | | 509,700 | | 476,600 | | 4,326,258 | | | 19,771 | | | — |

pMarlin Business Services Corp. | | 988,701 | | — | | 18,422 | | 970,279 | | | 11,731 | | | — |

pOdyssey Marine Exploration | | 2,677,030 | | 777,900 | | — | | 3,454,930 | | | 3,455 | | | — |

pOn Assignment Inc | | 1,516,133 | | 891,986 | | 471,700 | | 1,936,419 | | | 9,740 | | | — |

pOverhill Farms, Inc. | | 1,184,052 | | 53,900 | | 278,700 | | 959,252 | | | 5,650 | | | — |

pPrinceton Review | | — | | 3,381,896 | | — | | 3,381,896 | | | 7,846 | | | — |

The Providence Service Corporation | | 547,293 | | 166,918 | | 138,300 | | 575,911 | | | 8,063 | | | — |

pTrinity Biotech | | 1,501,163 | | 352,600 | | — | | 1,853,763 | | | 11,252 | | | — |

pUnited Western Bancorp, Inc. | | 2,342,215 | | — | | — | | 2,342,215 | | | 1,874 | | | — |

pVertro, Inc. | | 4,333,215 | | — | | — | | 4,333,215 | | | 2,145 | | | — |

| | | | | | | | | | | | | | |

| | | | | | | | | | $ | 125,027 | | $ | 214 |

| | | | | | | | | | | | | | |

p Affiliated company at June 30, 2010. The Small Cap Growth Fund’s total value in companies deemed to be affiliated at June 30, 2010 was $ 109,898 (thousands).

See accompanying Notes to Financial Statements.

June 30, 2010 | William Blair Funds 19 |

Robert C. Lanphier, IV

David P. Ricci

MID CAP GROWTH FUND

The Mid Cap Growth Fund seeks long-term capital appreciation.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

The Mid Cap Growth Fund posted a 2.58% decrease (Class N Shares) for the six months ended June 30, 2009. By comparison, the Fund’s benchmark, the Russell Midcap® Growth Index, declined 3.31%.

After a strong first quarter, the U.S. equity market reversed course during the second quarter to finish in negative territory for the first half of the year. The Russell Midcap® Growth Index returned -10.20% during the second quarter to produce a -3.31% return for 2010 through June. The Fund outperformed during the second quarter’s decline and is ahead of the benchmark for the year-to-date period as well.

While the year started off on a positive note on the heels of better-than-expected corporate sales and earnings, macro concerns across the globe instilled fear, and volatility, back into the markets. European sovereign debt downgrades and fiscal austerity measures, the Gulf of Mexico oil catastrophe, U.S. state budget woes, and expiring stimulus programs all contributed to investor skepticism. More importantly, given the significance of job growth to a sustainable economic recovery, stubbornly lackluster employment and housing data have stoked fears of slipping back into a recession. Because of these negative developments and with the 2008 downturn fresh in investors’ minds, stock prices corrected as they once again succumbed to macro factors rather than company fundamentals.

During the second quarter, all sectors within the Russell Midcap® Growth Index finished in the red. The Energy sector (-19%) was the worst performing sector given the macro concerns discussed above. Financials also underperformed with a -13% return. Outperforming modestly were Information Technology (-8%) and the typical defensive sectors, Health Care (-7%) and Consumer Staples (-8%).

For the year-to-date period, sector returns were more dispersed. Energy was the standout loser at -16%. Information Technology (-6%) and Financials (-5%) were the next worst performing sectors. Of the other major economic sectors in the index, Health Care performed best at +4%, while Consumer Discretionary also outperformed, (+1)%.

The Fund’s outperformance during the second quarter is attributable to strong stock selection and our typical lower-beta investment style coming into favor. Fund holdings in Consumer Discretionary, Industrials, Materials and Energy were the largest positive contributors to relative return during the quarter. On the other hand, certain stocks in Health Care and Financials weighed on relative results.

For the first half of the year, the Fund’s outperformance was the result of good stock selection and a positive benefit of our typical smaller-than-benchmark weighted average market capitalization. Stock selection was most significant in the Industrials, Materials, Information Technology and Consumer Discretionary sectors. Detracting from relative performance were some of the Fund’s Health Care and Financials holdings.

Two specific stocks boosting relative performance were Illumina, Inc. and Stericycle, Inc. Illumina, Inc. develops and markets integrated systems used in the gene sequencing and genotyping markets. The company’s machines enable medical and academic institutions to understand the genetic make-up of individuals which allows for more productive research in disease treatment and prevention. With its next generation machine launching soon, investors

20 Semi-Annual Report | June 30, 2010 |

were expecting weak sales out of the company due to prospective customers delaying purchases in anticipation of the new machines. In reality, sales were better-than-expected. Illumina, Inc.’s order book remains robust and sales from non-genome research centers, the company’s core customer base, were quite strong. We maintained our position in the name given Illumina, Inc.’s technological leadership position and growth in the genetic sciences.

Stericycle, Inc. is the leading medical waste management company. The company collects and disposes of medical waste as a service for smaller facilities such as outpatient clinics and dental offices and larger facilities such as hospitals and blood banks. The stock was a leading contributor to returns during the second quarter and for the first half of the year. Given the non-cyclical nature of Stericycle, Inc.’s business, investors often flock to the stock when economic concerns are high as they were during the second quarter. We continue to own the stock, as we have for several years, given the growth opportunity and stability driven by its dominate market position.

On the other hand, two stocks detracting from returns were athenahealth, Inc. and Greenhill & Co., Inc. Athenahealth, Inc. is a provider of internet-based business services for physician practices. For example, the company’s solutions allow physician practices to improve accounts receivable days outstanding, bad debt expenses, and patient scheduling and follow-up. The stock was one of the leading detractors from returns during the second quarter and the first half of the year. During the first quarter, the company had to change a revenue recognition policy for a small piece of its business that weighed on investor confidence. During the second quarter, athenahealth, Inc. announced disappointing contract wins with new physician practices, which brought into question whether the company has the appropriate infrastructure in place to compete with larger competitors. We liquidated our position on the news, but would consider it for repurchase if we became comfortable with the company’s investment in infrastructure to support its growth.

Greenhill & Co., Inc. is a boutique merger and acquisition (M&A) advisory firm which has attracted many talented bankers from large Wall Street investment banks, allowing it to expand into new industry verticals and new geographies across the globe. The stock detracted from returns during the quarter and year-to-date period mainly due to disappointment regarding the expected reacceleration of the M&A cycle. We continue to hold a position as we believe the company is well-positioned to steal market share from larger competitors and will benefit when M&A activity improves.

Looking forward, while the economic recovery may have a different trajectory (less steep) than some were expecting earlier this year, the market’s decline has improved valuations and lowered expectations. Corporate financial discipline and balance sheets remain strong, and inventories are lean throughout most industries. This should lay the ground work for operating margin expansion, likely beyond prior peak margins, and drive continued earnings growth over the intermediate term. However, investor pessimism is understandably high given the expiration of stimulus plans and diminished appetite for additional programs, U.S. state budget crunches, still absent employment growth and likely further consumer deleveraging.

We consider the impact of these economic scenarios into our stock-specific risk/reward assessments, and focus our time analyzing business models and managements of growth companies who “control their own destiny” to a greater degree and are less dependent on broad economic growth. We continue to find solid investment opportunities across sectors. We believe the Fund consists of great companies with solid competitive positions whose stock prices are trading at attractive valuations.

June 30, 2010 | William Blair Funds 21 |

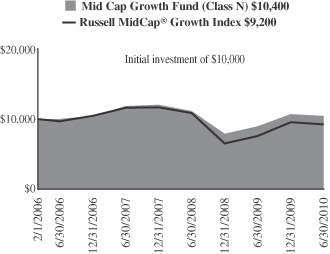

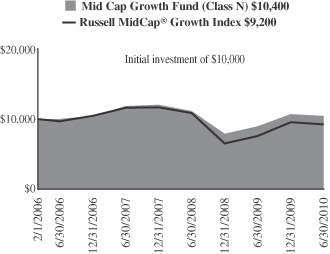

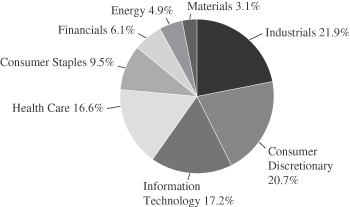

Mid Cap Growth Fund

Performance Highlights (unaudited)

Average Annual Total Return at 6/30/2010

| | | | | | | | | | | | |

| | | Year to

Date | | | 1

Year | | | 3

Year | | | Since

Inception(a) | |

Class N | | (2.58 | )% | | 16.49 | % | | (4.23 | )% | | 0.83 | % |

Class I | | (2.45 | ) | | 16.78 | | | (3.99 | ) | | 1.13 | |

Russell MidCap® Growth Index | | (3.31 | ) | | 21.30 | | | (7.53 | ) | | (1.99 | ) |

| | (a) | | For the period from February 1, 2006 (Commencement of Operations) to June 30, 2010. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller and medium capitalization companies involves special risks, including higher volatility and lower liquidity. Mid Cap stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell MidCap® Growth Index is an index that is constructed to provide a comprehensive and unbiased barometer of the mid-cap growth market.

This report identifies the Fund’s investments on June 30, 2010. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

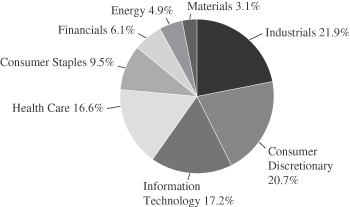

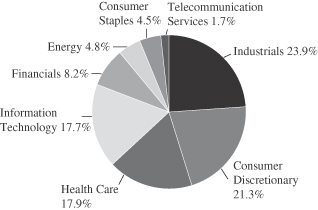

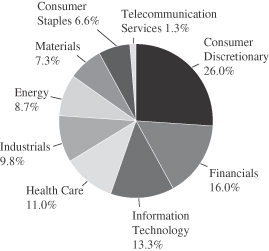

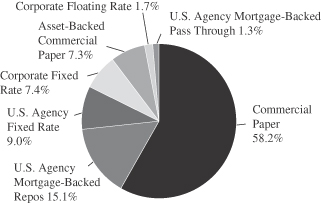

Sector Diversification (unaudited)

The sector diversification shown is based on the total long-term securities.

22 Semi-Annual Report | June 30, 2010 |

Mid Cap Growth Fund

Portfolio of Investments, June 30, 2010 (all dollar amounts in thousands) (unaudited)

| | | | | |

Issuer | | Shares | | Value |

| | |

Common Stocks | | | | | |

Industrials—20.9% | | | | | |

CH Robinson Worldwide, Inc. | | 20,400 | | $ | 1,135 |

Fastenal Co. | | 34,075 | | | 1,710 |

Gardner Denver, Inc. | | 21,400 | | | 954 |

Manpower, Inc. | | 16,790 | | | 725 |

MSC Industrial Direct Co. Class “A” | | 30,900 | | | 1,565 |

Precision Castparts Corporation | | 4,050 | | | 417 |

Robert Half International, Inc. | | 59,100 | | | 1,392 |

Rockwell Automation, Inc. | | 22,000 | | | 1,080 |

Roper Industries, Inc. | | 27,160 | | | 1,520 |

*Stericycle, Inc. | | 50,930 | | | 3,340 |

TransDigm Group, Inc. | | 34,950 | | | 1,784 |

| | | | | |

| | | | | 15,622 |

| | | | | |

Consumer Discretionary—19.7% | | | | | |

*Bed Bath & Beyond, Inc. | | 39,460 | | | 1,463 |

*CarMax, Inc. | | 95,770 | | | 1,906 |

*Chipotle Mexican Grill, Inc. | | 8,600 | | | 1,177 |

DeVry, Inc. | | 26,110 | | | 1,370 |

*Dick’s Sporting Goods, Inc. | | 84,529 | | | 2,104 |

*Discovery Communications, Inc. | | 42,400 | | | 1,514 |

Gentex Corporation | | 58,780 | | | 1,057 |

*Harman International Industries, Inc. | | 29,200 | | | 873 |

*O’Reilly Automotive, Inc. | | 39,380 | | | 1,873 |

*WMS Industries, Inc. | | 35,540 | | | 1,395 |

| | | | | |

| | | | | 14,732 |

| | | | | |

Information Technology—16.4% | | | | | |

*Alliance Data Systems Corporation | | 18,850 | | | 1,122 |

*Concur Technologies, Inc. | | 33,130 | | | 1,414 |

*Dolby Laboratories, Inc. Class “A” | | 12,770 | | | 801 |

*Genpact, Ltd.† | | 49,900 | | | 775 |

*McAfee, Inc. | | 38,100 | | | 1,170 |

*Silicon Laboratories, Inc. | | 33,910 | | | 1,375 |

Solera Holdings, Inc. | | 20,500 | | | 742 |

*Trimble Navigation, Ltd. | | 51,700 | | | 1,448 |

*VeriSign, Inc. | | 82,200 | | | 2,182 |

*VistaPrint N.V.† | | 25,830 | | | 1,227 |

| | | | | |

| | | | | 12,256 |

| | | | | |

Health Care—15.9% | | | | | |

*American Medical Systems Holdings, Inc. | | 33,300 | | | 737 |