UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-5344

William Blair Funds

(Exact name of registrant as specified in charter)

| 150 North Riverside Plaza, Chicago, IL | | 60606 |

| (Address of principal executive offices) | | (Zip Code) |

Stephanie G. Braming, Principal Executive Officer

William Blair Funds

150 North Riverside Plaza, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: 312-236-1600

Date of fiscal year end: December 31

Date of reporting period: June 30, 2019

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A Registrant is not required to respond to the collection of information contained in Form N-CSR unless the form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimates and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. (ss) 3507.

Item 1. June 30, 2019 Semiannual Reports transmitted to shareholders.

| |

| | |

| | |

| | |

| | |

| | June 30, 2019 |

William Blair Funds Semiannual Report | |

| | IMPORTANT NOTE: Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the William Blair Funds’ (the “Funds”) annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the shareholder reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, shareholder reports will be available on the Funds’ website (https://www.williamblairfunds.com/investor_services/prospectus_reports_forms.fs), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by notifying your financial intermediary or, if you are a direct investor, by calling 1-800-635-2886. You may elect to receive all future shareholder reports in paper free of charge. You can inform your financial intermediary that you wish to continue receiving paper copies of your shareholder reports, or if you are a direct investor, by calling 1-800-635-2886. Your election to receive reports in paper will apply to all Funds you hold directly or through your financial intermediary, as applicable. | | |

| | |

| | |

| June 30, 2019 | William Blair Funds | 1 |

The views expressed in the commentary for each Fund reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The portfolio management team’s views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Statements involving predictions, assessments, analyses, or outlook for individual securities, industries, market sectors, and/or markets involve risks and uncertainties, and there is no guarantee they will come to pass.

This report is submitted for the general information of the shareholders of William Blair Funds. It is not authorized for distribution to prospective Fund investors unless accompanied or preceded by the Fund’s prospectus. Please carefully consider a Fund’s investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Fund’s prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

| 2 | Semiannual Report | June 30, 2019 |

Performance as of June 30, 2019—Class N Shares (Unaudited)

| | | | | | | | | | | 10 yr | | | | Overall |

| | | Year | | | | | | | | (or since | | Inception | | Morningstar |

| | | to Date | | 1 yr | | 3 yr | | 5 yr | | inception) | | Date | | Rating |

| |

| Growth Fund | | | | | | | | | | | | | | | | | | | |

| Class N | | 22.38 | | | 14.07 | | | 17.32 | | | 11.44 | | | 13.87 | | | 3/20/1946 | | *** |

| Morningstar Large Growth | | 21.11 | | | 10.02 | | | 16.97 | | | 11.33 | | | 14.71 | | | | | Among 1,235 |

| Russell 3000®Growth Index | | 21.41 | | | 10.60 | | | 17.81 | | | 13.02 | | | 16.13 | | | | | Large Growth Funds |

| S&P 500®Index | | 18.54 | | | 10.42 | | | 14.19 | | | 10.71 | | | 14.70 | | | | | |

| |

| Large Cap Growth Fund | | | | | | | | | | | | | | | | | | | |

| Class N | | 24.10 | | | 16.01 | | | 20.40 | | | 14.73 | | | 16.11 | | | 12/27/1999 | | **** |

| Morningstar Large Growth | | 21.11 | | | 10.02 | | | 16.97 | | | 11.33 | | | 14.71 | | | | | Among 1,235 |

| Russell 1000®Growth Index | | 21.49 | | | 11.56 | | | 18.07 | | | 13.39 | | | 16.28 | | | | | Large Growth Funds |

| |

| Mid Cap Growth Fund | | | | | | | | | | | | | | | | | | | |

| Class N | | 27.40 | | | 12.75 | | | 15.38 | | | 9.88 | | | 13.42 | | | 2/1/2006 | | *** |

| Morningstar Mid-Cap Growth | | 24.97 | | | 9.88 | | | 15.59 | | | 9.78 | | | 14.53 | | | | | Among 539 |

| Russell Midcap®Growth Index | | 26.08 | | | 13.94 | | | 16.49 | | | 11.10 | | | 16.02 | | | | | Mid-Cap Growth Funds |

| |

| Small-Mid Cap Growth Fund | | | | | | | | | | | | | | | | | | | |

| Class N | | 24.27 | | | 9.65 | | | 18.07 | | | 12.99 | | | 15.99 | | | 12/29/2003 | | **** |

| Morningstar Mid-Cap Growth | | 24.97 | | | 9.88 | | | 15.59 | | | 9.78 | | | 14.53 | | | | | Among 539 |

| Russell 2500TMGrowth Index | | 23.92 | | | 6.13 | | | 16.14 | | | 9.98 | | | 15.67 | | | | | Mid-Cap Growth Funds |

| |

| Small-Mid Cap Value Fund | | | | | | | | | | | | | | | | | | | |

| Class N | | 16.67 | | | (2.03 | ) | | 7.18 | | | 5.04 | | | 10.42 | | | 12/15/2011 | | *** |

| Morningstar Small Blend | | 15.74 | | | (3.76 | ) | | 10.09 | | | 5.65 | | | — | | | | | Among 633 |

| Russell 2500TMValue Index | | 15.26 | | | (1.92 | ) | | 8.98 | | | 5.55 | | | 11.93 | | | | | Small Blend Funds |

| |

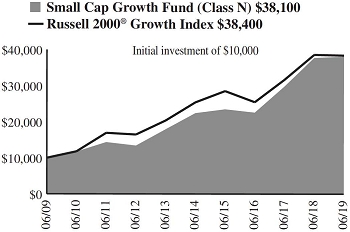

| Small Cap Growth Fund | | | | | | | | | | | | | | | | | | | |

| Class N | | 18.98 | | | 0.89 | | | 19.06 | | | 11.20 | | | 14.31 | | | 12/27/1999 | | **** |

| Morningstar Small Growth | | 21.82 | | | 3.22 | | | 16.12 | | | 9.18 | | | 14.47 | | | | | Among 583 |

| Russell 2000®Growth Index | | 20.36 | | | (0.49 | ) | | 14.69 | | | 8.63 | | | 14.41 | | | | | Small Growth Funds |

| |

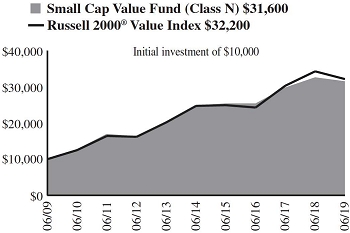

| Small Cap Value Fund | | | | | | | | | | | | | | | | | | | |

| Class N | | 16.22 | | | (3.35 | ) | | 7.48 | | | 4.87 | | | 12.18 | | | 12/23/1996 | | ** |

| Morningstar Small Blend | | 15.74 | | | (3.76 | ) | | 10.09 | | | 5.65 | | | 12.70 | | | | | Among 633 |

| Russell 2000®Value Index | | 13.47 | | | (6.24 | ) | | 9.81 | | | 5.39 | | | 12.40 | | | | | Small Blend Funds |

| |

| Global Leaders Fund | | | | | | | | | | | | | | | | | | | |

| Class N | | 20.66 | | | 4.14 | | | 13.86 | | | 8.11 | | | 11.89 | | | 10/15/2007 | | **** |

| Morningstar World Large Stock | | 16.46 | | | 4.89 | | | 11.07 | | | 5.96 | | | 10.24 | | | | | Among 722 |

| MSCI ACW IMI (net) | | 16.07 | | | 4.56 | | | 11.42 | | | 6.03 | | | 10.32 | | | | | World Large Stock Funds |

| |

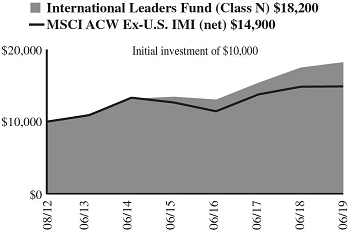

| International Leaders Fund | | | | | | | | | | | | | | | | | | | |

| Class N | | 20.58 | | | 4.18 | | | 11.77 | | | 6.72 | | | 9.14 | | | 8/16/2012 | | **** |

| Morningstar Foreign Large Growth | | 18.29 | | | 2.25 | | | 9.63 | | | 4.09 | | | — | | | | | Among 396 |

| MSCI ACW Ex-U.S. IMI (net) | | 13.33 | | | 0.26 | | | 9.17 | | | 2.25 | | | 5.96 | | | | | Foreign Large Growth Funds |

| | | |

| June 30, 2019 | William Blair Funds | 3 |

Performance as of June 30, 2019—Class N Shares (Unaudited)—continued

| | | | | | | | | | | 10 yr | | | | Overall |

| | | Year | | | | | | | | (or since | | Inception | | Morningstar |

| | | to Date | | 1 yr | | 3 yr | | 5 yr | | inception) | | Date | | Rating |

| | | | | | | | | | | | | | | | | | | | |

| International Developed Plus Fund | | | | | | | | | | | | | | | | | | | |

| Class N | | 21.02 | | | 3.51 | | | 8.15 | | | 3.14 | | | 7.17 | | | 5/24/2004 | | ** |

| Morningstar Foreign Large Growth | | 18.29 | | | 2.25 | | | 9.63 | | | 4.09 | | | 8.20 | | | | | Among 396 |

| MSCI World Ex-U.S. Index (net) | | 14.64 | | | 1.29 | | | 9.01 | | | 2.04 | | | 6.75 | | | | | Foreign Large Growth Funds |

| |

| International Growth Fund | | | | | | | | | | | | | | | | | | | |

| Class N | | 19.27 | | | (0.43 | ) | | 8.44 | | | 2.84 | | | 8.04 | | | 10/1/1992 | | *** |

| Morningstar Foreign Large Growth | | 18.29 | | | 2.25 | | | 9.63 | | | 4.09 | | | 8.20 | | | | | Among 396 |

| MSCI ACW Ex-U.S. IMI (net) | | 13.33 | | | 0.26 | | | 9.17 | | | 2.25 | | | 6.78 | | | | | Foreign Large Growth Funds |

| |

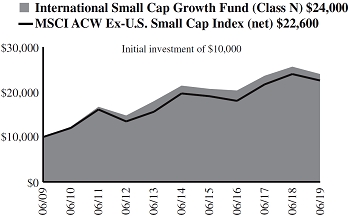

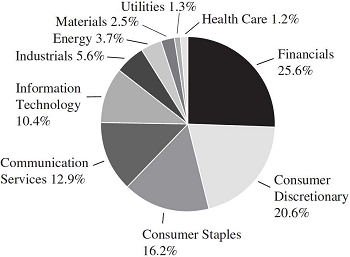

| International Small Cap Growth Fund | | | | | | | | | | | | | | | | | | | |

| Class N | | 18.73 | | | (6.34 | ) | | 5.68 | | | 2.31 | | | 9.15 | | | 11/1/2005 | | ** |

| Morningstar Foreign Small/Mid Growth | | 17.12 | | | (4.52 | ) | | 9.50 | | | 4.65 | | | 10.59 | | | | | Among 122 |

| MSCI ACW Ex-U.S. Small Cap Index (net) | | 11.60 | | | (5.94 | ) | | 7.76 | | | 2.77 | | | 8.48 | | | | | Foreign Small/Mid Growth Funds |

| |

| Emerging Markets Leaders Fund | | | | | | | | | | | | | | | | | | | |

| Class N | | 16.71 | | | 3.20 | | | 9.74 | | | 2.56 | | | 3.50 | | | 5/3/2010 | | *** |

| Morningstar Diversified Emerging Markets | | 12.06 | | | 1.16 | | | 8.92 | | | 1.71 | | | — | | | | | Among 712 |

| MSCI Emerging Markets Index (net) | | 10.58 | | | 1.21 | | | 10.66 | | | 2.49 | | | 2.97 | | | | | Diversified Emerging Markets Funds |

| |

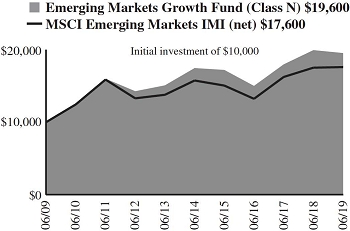

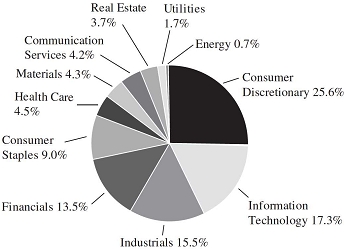

| Emerging Markets Growth Fund | | | | | | | | | | | | | | | | | | | |

| Class N | | 15.80 | | | (2.03 | ) | | 9.20 | | | 2.27 | | | 6.94 | | | 6/6/2005 | | **** |

| Morningstar Diversified Emerging Markets | | 12.06 | | | 1.16 | | | 8.92 | | | 1.71 | | | 5.82 | | | | | Among 712 |

| MSCI Emerging Markets IMI (net) | | 10.14 | | | 0.47 | | | 10.01 | | | 2.25 | | | 5.83 | | | | | Diversified Emerging Markets Funds |

| |

| Emerging Markets Small Cap Growth Fund | | | | | | | | | | | | | | | | | | | |

| Class N | | 8.88 | | | (8.06 | ) | | 3.04 | | | 1.24 | | | 7.92 | | | 10/24/2011 | | ** |

| Morningstar Diversified Emerging Markets | | 12.06 | | | 1.16 | | | 8.92 | | | 1.71 | | | — | | | | | Among 712 |

| MSCI Emerging Markets Small Cap Index (net) | | 6.70 | | | (5.12 | ) | | 5.46 | | | 0.53 | | | 3.41 | | | | | Diversified Emerging Markets Funds |

| |

| Bond Fund | | | | | | | | | | | | | | | | | | | |

| Class N | | 8.05 | | | 7.89 | | | 2.74 | | | 2.80 | | | 4.62 | | | 5/1/2007 | | *** |

| Morningstar Intermediate Core-Plus Bond | | 6.40 | | | 7.35 | | | 2.95 | | | 2.84 | | | 4.82 | | | | | Among 539 |

| Bloomberg Barclays U.S. Aggregate Index | | 6.11 | | | 7.87 | | | 2.31 | | | 2.95 | | | 3.90 | | | | | Intermediate Core-Plus Bond Funds |

| |

| Income Fund | | | | | | | | | | | | | | | | | | | |

| Class N | | 4.33 | | | 4.60 | | | 1.45 | | | 1.63 | | | 3.07 | | | 10/1/1990 | | *** |

| Morningstar Short-Term Bond | | 3.20 | | | 4.19 | | | 1.97 | | | 1.60 | | | 2.48 | | | | | Among 478 |

| Bloomberg Barclays Intermediate Government/Credit Bond Index | | 4.97 | | | 6.93 | | | 1.99 | | | 2.39 | | | 3.24 | | | | | Short-Term Bond Funds |

| | | | | | | | | | | | | | | | | | | | |

| 4 | Semiannual Report | June 30, 2019 |

Performance as of June 30, 2019—Class N Shares (Unaudited)—continued

| | | | | | | | | | | 10 yr | | | | Overall |

| | | Year | | | | | | | | (or since | | Inception | | Morningstar |

| | | to Date | | 1 yr | | 3 yr | | 5 yr | | inception) | | Date | | Rating |

| | | | | | | | | | | | | | | | | | | | |

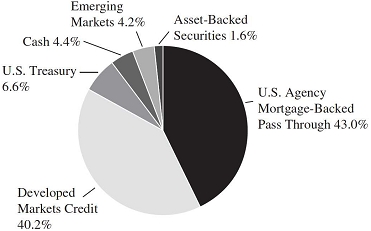

| Low Duration Fund | | | | | | | | | | | | | | |

| Class N | | 2.46 | | | 2.97 | | | 1.38 | | | 1.14 | | | 1.21 | | | 12/1/2009 | | ** |

| Morningstar Ultrashort Bond | | 1.85 | | | 2.76 | | | 1.85 | | | 1.32 | | | — | | | | | Among 151 |

| Bank of America Merrill Lynch 1-Year U.S. Treasury Note Index | | 1.76 | | | 2.98 | | | 1.43 | | | 1.02 | | | 0.73 | | | | | Ultrashort Bond Funds |

| |

| Macro Allocation Fund | | | | | | | | | | | | | | | | | | | |

| Class N | | 2.45 | | | 2.77 | | | 2.63 | | | 0.43 | | | 4.35 | | | 11/29/2011 | | ** |

| Morningstar Multialternative | | 5.39 | | | 1.81 | | | 2.85 | | | 1.19 | | | — | | | | | Among 265 |

| Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index | | 1.24 | | | 2.31 | | | 1.38 | | | 0.87 | | | 0.60 | | | | | Multialternative Funds |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted.Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or a loss when you sell shares.For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site atwww.williamblairfunds.com. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. International and emerging markets investing involves special risk considerations, including currency fluctuations, lower liquidity, economic and political risk. As interest rates rise, bond prices will typically fall and bond funds may become more volatile.Class N shares are available to the general public without a sales load.

Morningstar RatingsTMare as of 6/30/2019 and are subject to change every month. The ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each Category receive 5 stars, the next 22.5% receive 4 stars, the middle 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. The 3/5/10 year Morningstar ratings were as follows: Growth Fund ***/***/** and Large Cap Growth Fund ****/*****/**** out of 1,235/1,100/812 large growth funds; Mid Cap Growth Fund ***/***/*** and Small-Mid Cap Growth Fund ****/****/**** out of 539/484/367 mid-cap growth funds; Small Cap Growth Fund ****/****/***, out of 583/515/393 small growth funds; Small-Mid Cap Value Fund **/***/NA and Small Cap Value Fund **/**/** out of 633/516/375 small blend funds; Global Leaders Fund ****/****/**** out of 722/594/350 world large stock funds; International Developed Plus Fund **/***/**, International Growth Fund **/**/***, and International Leaders Fund ****/****/NA out of 396/336/247 foreign large growth funds; International Small Cap Growth Fund */*/*** out of 122/99/59 foreign small/mid growth funds; Emerging Markets Leaders Fund ***/***/****, Emerging Markets Growth Fund ***/***/****, and Emerging Markets Small Cap Growth */***/NA out of 712/560/240 diversified emerging markets funds; Bond Fund ***/***/*** out of 539/453/332 intermediate core-plus bond funds; Income Fund **/***/**** out of 478/421/269 short-term bond funds; Low Duration Fund **/**/NA out of 151/128/NA ultrashort bond funds; and Macro Allocation Fund ***/**/NA out of 265/177/NA multialternative funds.

Please carefully consider a Fund’s investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Fund’s prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

| June 30, 2019 | William Blair Funds | 5 |

U.S. Growth Market Review and Outlook

Following a pronounced sell-off to end 2018, U.S. equities had a strong start to 2019. Spurring the first quarter recovery were comments from the Federal Open Market Committee (“FOMC”) indicating that it would be patient and flexible with future monetary policy decisions. A solid U.S. economic backdrop and healthy corporate earnings trends further supported the market.

Relative to the robust first quarter, positive performance was more moderate in the second quarter of 2019 and included significant swings on a monthly basis. U.S. corporations reported first quarter earnings that were broadly better than investors’ previously-lowered expectations, providing support for equities to move higher during the month of April. From there, macro considerations, most notably rising trade tensions and a perceived shift in U.S. Federal Reserve (the “Fed”) policy, seemed to drive the direction of the market. As trade threats dominated the news, rising investor angst around the possible impacts of protectionism on global economic growth and corporate earnings corresponded with a decline in equities. A subsequent recovery during the month of June was helped by the perception of a shift in Fed policy and its increased willingness to cut interest rates if economic conditions deteriorate.

While equities moved higher over the course of the second quarter, the 10 year Treasury yield declined and the 10 year to 3 month yield curve inverted, which some view as a leading indicator of a potential recession. Further supporting the notion of slowing economic growth, U.S. manufacturing activity weakened, while growth in housing prices slowed. However, strength in consumption and retail sales, bolstered by low unemployment and moderate wage growth, allowed investors to look through some of the more cautionary indicators, bringing U.S. equities back near all-time highs to close out the second quarter.

Despite strong equity market performance during the first half of 2019, many of the risks that contributed to the late 2018 selloff remain on the horizon. From a Fed policy perspective, it is not clear how much impact the interest rate increases implemented in 2017 and 2018 will have on the economy or how effective monetary policy will be in stimulating the economy from here, given that financial conditions are already quite supportive. Global interest rates have declined year-to-date with continued monetary stimulus from China and other central banks. In addition, the Fed faces the challenge of managing the economy against investor expectations, which call for several interest rate cuts over the next twelve months, and a trade policy that is in flux and could ultimately have varying effects on U.S. economic growth. In the meantime, tariff uncertainty can have a real economic impact by disrupting supply chains and causing corporations to delay investment activity. Ongoing trade negotiations, as well as political disruption leading into the 2020 U.S. presidential election, are likely to result in continued market volatility.

Balancing some of these uncertainties are data points that indicate a still healthy U.S. economy, now in its eleventh year of expansion. The labor market, in particular, remains robust with continued low unemployment and moderate wage growth. U.S. consumer confidence remains high and spending healthy, while corporate bond yields have declined, reducing interest expense for corporations. Corporate profit margins are strong, notwithstanding the fact that they broadly contracted during the second quarter of 2019 as many companies have not been able to fully offset wage growth and higher input costs with price increases. We feel relatively well positioned in this regard as our investment approach has always emphasized companies with strong value propositions that enable better than average pricing flexibility.

We believe our longstanding focus on identifying durable businesses, whose stocks present attractive risk/reward opportunities, will serve us well in an environment of uncertainty where business fundamentals are especially important.

| 6 | Semiannual Report | June 30, 2019 |

U.S. Value Market Review and Outlook

U.S. equities drifted higher during the second quarter of 2019, adding to the robust returns from earlier in the year. The dramatic bounce-back from a dismal finish to 2018 was largely the result of a dovish pivot by the Federal Reserve (“Fed”) and the Fed’s lack of commitment to future rate moves as it takes a more patient approach to future monetary policy decisions. Healthy corporate earnings and expectations for a trade deal between the U.S. and China helped boost investor confidence and fueled strong U.S. equity returns early in the year.

In contrast to the robust returns in the first quarter of 2019, positive market performance was more moderate during the second quarter. Although corporate earnings growth continued to be solid and contributed to positive market performance in April, relatively uninspiring economic data and increased geopolitical instability, mainly around trade, seemed to temper returns during the quarter. As the exchanges surrounding trade intensified and dominated the news, bond yields plummeted as concerns regarding the potential implications of protectionism on global economic growth and corporate earnings contributed to the market decline in May. Late in the quarter, the Fed signaled its willingness to lower short-term interest rates in an effort to sustain economic expansion, which was positively received by investors. Generally speaking, it appears that a more dovish Fed and its patience regarding future monetary policy decisions is helping to offset a more volatile trade situation overall.

Despite the strong rebound in U.S. equity performance through the second quarter, many of the risks that contributed to the dramatic market sell-off late in 2018 remain intact. The constantly evolving trade/tariff landscape seems to present a challenge for the Fed and complicates future monetary policy decisions as it is forced to make assumptions about harder-to-predict geopolitical risks and their impact on the economy. Continued trade policy uncertainty may result in supply chain disruption and delayed corporate investment activity, which could alter the trajectory of global growth. The Fed may be proactive and move more quickly than in previous cycles in an effort to spark growth and prolong the current economic expansion.

We remain cognizant that corporate debt levels continue to rise and could contribute to higher market volatility should these more highly levered companies feel pressure as a greater percentage of their cash flow is needed to service their rising debt levels. The main difference between this cycle and what transpired during the global financial crisis is that these higher debt levels are not on bank balance sheets, but rather have been privately financed. Should these lower quality/more highly levered companies have trouble accessing the capital markets or get squeezed as high yield spreads increase, this could be the impetus for sustained higher quality stock outperformance. We remain focused on companies with solid balance sheets and have gravitated towards companies with even stronger balance sheets given our concern about corporate debt levels and expectations for increased market volatility. As always, our focus remains on identifying quality companies at discount prices and corporate transformation opportunities. We continue to find opportunities across multiple sectors and believe the Fund is well-suited to withstand a variety of market scenarios and add value over the long-term.

| June 30, 2019 | William Blair Funds | 7 |

| | Growth Fund |

| | |

| | The Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGER |

| | |

David C. Fording | The William Blair Growth Fund (Class N shares) posted a 22.38% increase, net of fees, for the six months ended June 30, 2019. By comparison, the Fund’s benchmark index, the Russell 3000®Growth Index (the “Index”), increased 21.41%. Outperformance for the year-to-date period was driven by stock selection and a tailwind for our investment style. From a stock selection perspective, Industrials and Health Care were standout sectors, in part due to our positions in CoStar Group, Inc. (Industrials), Copart, Inc. (Industrials) and Veeva Systems, Inc. (Health Care). Real estate information services company CoStar Group advanced on business trends that were consistent with our investment thesis, including strong growth in its commercial real estate business and continued market share gains in its apartment rental advertising business. Other top contributors were metal packaging provider Ball Corporation (Materials), as strong demand drove volume growth for aluminum cans, and Worldpay, Inc. (Information Technology). From a style perspective, our higher valuation exposure, driven by the Fund’s quality growth bias, was a tailwind as stocks with higher valuations generally outperformed during the period. Conversely, top detractors from performance year-to-date included Healthcare Services Group, Inc. (Industrials), UnitedHealth Group, Inc. (Health Care), Pure Storage, Inc. (Information Technology) and Weight Watchers International, Inc. (Consumer Discretionary). Healthcare Services Group provides outsourced housekeeping, facility maintenance and food services to nursing homes and other care facilities. The stock’s underperformance was most notable during the first quarter, as the company reported revenue that disappointed investors and was attributable to a contract change with one of its food service customers that would dampen revenue, but ultimately lift margins. In addition, the Communication Services sector was a detractor as our position in Alphabet, Inc. and not owning Facebook, Inc. contributed to lagging returns in the sector. We sold Facebook in late 2018 on concerns over slowing revenue growth, margin compression and stepped up regulatory scrutiny around privacy and use of personal data; the latter of which remains a fundamental threat to Facebook’s long term business model. Please refer to the U.S. Growth Market Review and Outlook relating to the Fund on page 6 for additional information. |

| 8 | Semiannual Report | June 30, 2019 |

Growth Fund

Performance Highlights (Unaudited)

| Average Annual Total Return through 6/30/2019 |

| | | Year

to Date | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception(a) |

| Class N | | | 22.38 | % | | | 14.07 | % | | | 17.32 | % | | | 11.44 | % | | | 13.87 | % | | | — | |

| Class I | | | 22.59 | | | | 14.43 | | | | 17.66 | | | | 11.77 | | | | 14.23 | | | | — | |

| Class R6 | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2.53 | % |

| Russell 3000® Growth Index | | | 21.41 | | | | 10.60 | | | | 17.81 | | | | 13.02 | | | | 16.13 | | | | 0.81 | |

| S&P 500®Index | | | 18.54 | | | | 10.42 | | | | 14.19 | | | | 10.71 | | | | 14.70 | | | | 1.00 | |

| (a) | Since inception is for the period from May 2, 2019 (Commencement of Operations) to June 30, 2019. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site atwww.williamblairfunds.com. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are not subject to a sales load. Class I shares are not subject to a sales load or distribution (Rule 12b-1) fees. Class R6 shares are not subject to a sales load, distribution (Rule 12b-1) fees, or sub-transfer agent fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 3000® Growth Index consists of large, medium, and small capitalization companies with above average price-to-book ratios and forecasted growth rates. The index is weighted by market capitalization and large/medium/small companies make up approximately 80%/15%/5% of the index.

The S&P 500® Index indicates broad larger capitalization equity market performance.

This report identifies the Fund’s investments on June 30, 2019. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

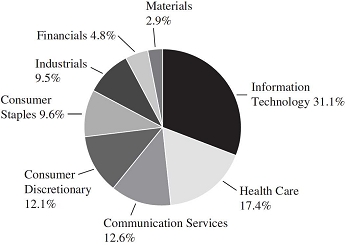

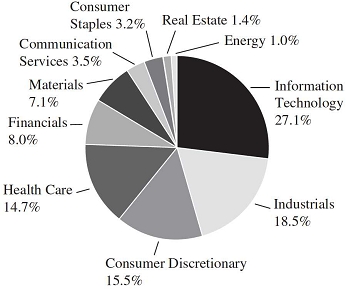

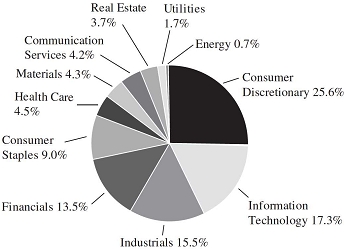

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| June 30, 2019 | William Blair Funds | 9 |

Growth Fund

Portfolio of Investments, June 30, 2019(all dollar amounts in thousands) (unaudited)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | |

| | Common Stocks | | | | | | | | |

| | Information Technology—30.1% | | | | | | | | |

| * | Adobe, Inc. | | | 17,315 | | | $ | 5,102 | |

| * | Arista Networks, Inc. | | | 7,980 | | | | 2,072 | |

| | Booz Allen Hamilton Holding Corporation | | | 64,052 | | | | 4,241 | |

| | Dolby Laboratories, Inc. | | | 57,743 | | | | 3,730 | |

| | Genpact, Ltd.† | | | 89,815 | | | | 3,421 | |

| * | Guidewire Software, Inc. | | | 25,832 | | | | 2,619 | |

| | Mastercard, Inc. Class “A” | | | 45,773 | | | | 12,108 | |

| * | MaxLinear, Inc. | | | 86,201 | | | | 2,021 | |

| | Microsoft Corporation | | | 159,227 | | | | 21,330 | |

| | National Instruments Corporation | | | 58,571 | | | | 2,459 | |

| * | Pure Storage, Inc. | | | 162,374 | | | | 2,479 | |

| * | Rogers Corporation | | | 10,013 | | | | 1,728 | |

| | Sabre Corporation | | | 150,569 | | | | 3,343 | |

| | Texas Instruments, Inc. | | | 47,508 | | | | 5,452 | |

| * | Verra Mobility Corporation | | | 146,920 | | | | 1,923 | |

| * | Worldpay, Inc. Class “A” | | | 34,044 | | | | 4,172 | |

| | | | | | | | | 78,200 | |

| | Consumer Discretionary—15.2% | | | | | | | | |

| | Advance Auto Parts, Inc. | | | 18,432 | | | | 2,841 | |

| * | Amazon.com, Inc. | | | 9,185 | | | | 17,393 | |

| * | Burlington Stores, Inc. | | | 27,931 | | | | 4,752 | |

| | Domino’s Pizza, Inc. | | | 8,959 | | | | 2,493 | |

| * | Grand Canyon Education, Inc. | | | 28,985 | | | | 3,392 | |

| * | GrubHub, Inc. | | | 27,027 | | | | 2,108 | |

| * | Laureate Education, Inc. | | | 175,293 | | | | 2,754 | |

| * | Ulta Salon Cosmetics & Fragrance, Inc. | | | 11,249 | | | | 3,902 | |

| | | | | | | | | 39,635 | |

| | Health Care—14.5% | | | | | | | | |

| * | Veeva Systems, Inc. Class “A” | | | 17,918 | | | | 2,905 | |

| | Abbott Laboratories | | | 48,107 | | | | 4,046 | |

| * | ABIOMED, Inc. | | | 10,029 | | | | 2,612 | |

| | Agilent Technologies, Inc. | | | 34,104 | | | | 2,547 | |

| * | Codexis, Inc. | | | 72,198 | | | | 1,331 | |

| * | Horizon Therapeutics plc† | | | 96,598 | | | | 2,324 | |

| * | Portola Pharmaceuticals, Inc. | | | 72,527 | | | | 1,968 | |

| | Stryker Corporation | | | 19,800 | | | | 4,070 | |

| | Teleflex, Inc. | | | 7,798 | | | | 2,582 | |

| | UnitedHealth Group, Inc. | | | 36,212 | | | | 8,836 | |

| | Zoetis, Inc. | | | 39,750 | | | | 4,511 | |

| | | | | | | | | 37,732 | |

| | Industrials—11.4% | | | | | | | | |

| | BWX Technologies, Inc. | | | 116,151 | | | | 6,051 | |

| * | Copart, Inc. | | | 65,272 | | | | 4,878 | |

| * | CoStar Group, Inc. | | | 9,651 | | | | 5,347 | |

| | Healthcare Services Group, Inc. | | | 77,543 | | | | 2,351 | |

| | Luxfer Holdings plc† | | | 61,357 | | | | 1,505 | |

| | Raytheon Co. | | | 26,878 | | | | 4,674 | |

| * | The Middleby Corporation | | | 23,790 | | | | 3,228 | |

| * | Trex Co., Inc. | | | 20,779 | | | | 1,490 | |

| | | | | | | | | 29,524 | |

| | | | Shares or | | | | |

| | | | Principal | | | | |

| | Issuer | | Amount | | | Value | |

| | | | | | | | | | |

| | Common Stocks—(continued) | | | | | | | | |

| | Communication Services—9.9% | | | | | | | | |

| | Activision Blizzard, Inc. | | | 68,249 | | | $ | 3,221 | |

| * | Alphabet, Inc. Class “A” | | | 14,876 | | | | 16,108 | |

| * | Cars.com, Inc. | | | 51,495 | | | | 1,016 | |

| * | Live Nation Entertainment, Inc. | | | 47,354 | | | | 3,137 | |

| * | Take-Two Interactive Software, Inc. | | | 19,122 | | | | 2,171 | |

| | | | | | | | | 25,653 | |

| | Consumer Staples—7.6% | | | | | | | | |

| | Costco Wholesale Corporation | | | 21,306 | | | | 5,630 | |

| * | Primo Water Corporation | | | 135,512 | | | | 1,667 | |

| | The Coca-Cola Co. | | | 161,109 | | | | 8,204 | |

| | The Estee Lauder Cos., Inc. Class “A” | | | 22,986 | | | | 4,209 | |

| | | | | | | | | 19,710 | |

| | Financials—5.3% | | | | | | | | |

| | East West Bancorp, Inc. | | | 48,408 | | | | 2,264 | |

| * | Encore Capital Group, Inc. | | | 49,311 | | | | 1,670 | |

| | Intercontinental Exchange, Inc. | | | 84,168 | | | | 7,233 | |

| | Virtu Financial, Inc. | | | 123,894 | | | | 2,699 | |

| | | | | | | | | 13,866 | |

| | Materials—4.6% | | | | | | | | |

| | Ball Corporation | | | 98,773 | | | | 6,913 | |

| | Linde plc† | | | 24,618 | | | | 4,943 | |

| | | | | | | | | 11,856 | |

| | Energy—0.8% | | | | | | | | |

| | Cameco Corporation† | | | 190,907 | | | | 2,049 | |

| | Total Common Stocks—99.4%

(cost $168,795) | | | | | | | 258,225 | |

| | | | | | | | | | |

| | Repurchase Agreement | | | | | | | | |

| | Fixed Income Clearing Corporation, 0.500% dated 6/28/19, due 7/1/19, repurchase price $1,760, collateralized by U.S. Treasury Note, 1.500%, due 8/15/26 | | | $1,760 | | | | 1,760 | |

| | Total Repurchase Agreement—0.7%

(cost $1,760) | | | | | | | 1,760 | |

| | Total Investments—100.1%

(cost $170,555) | | | | | | | 259,985 | |

| | Liabilities, plus cash and other assets—(0.1)% | | | | | | | (201 | ) |

| | Net assets—100.0% | | | | | | $ | 259,784 | |

* = Non-income producing security

† = U.S. listed foreign security

See accompanying Notes to Financial Statements.

| 10 | Semiannual Report | June 30, 2019 |

| | Large Cap Growth Fund |

| | |

| | The Large Cap Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

James S. Golan

David P. Ricci | The William Blair Large Cap Growth Fund (Class N shares) posted a 24.10% increase, net of fees, for the six months ended June 30, 2019. By comparison, the Fund’s benchmark index, the Russell 1000®Growth Index (the “Index”), increased 21.49%. Outperformance for the year-to-date period was driven by stock selection and a tailwind for our investment style. From a stock selection perspective, Industrials and Health Care were standout sectors, in part due to our positions in Copart, Inc. (Industrials), Equifax, Inc. (Industrials) and Veeva Systems, Inc. (Health Care). Veeva Systems and Copart were easily the Fund’s top contributors during the period as generally strong business fundamentals persisted year-to-date. Shares of Copart, an online auction platform for salvage vehicles, outperformed as a growing buyer base drove higher average selling prices and as Copart raised buyer fees on select vehicles. Veeva Systems, a cloud-based software and data solutions provider primarily for the life sciences industry, outperformed after reporting record-high customer additions and strong subscription revenue growth. Other notable contributors to performance were PayPal Holdings, Inc. (Information Technology) and The Estee Lauder Cos., Inc. (Consumer Staples). From a style perspective, our higher valuation exposure, driven by the Fund’s quality growth bias, was a tailwind as stocks with higher valuations generally outperformed during the period. Conversely, top detractors from performance year-to-date included advanced medical technologies company, ABIOMED, Inc. (Health Care), UnitedHealth Group, Inc. (Health Care) and Red Hat, Inc. (Information Technology). ABIOMED underperformed as uncertainty related to FDA guidance around the appropriate patient population for its Impella heart pump caused shares to decline. Concern around a potential competitive entrant also pressured shares of ABIOMED during the first quarter. Communication Services was also a detractor as our positions in Alphabet, Inc. and Activision Blizzard, Inc., as well as not owning Facebook, Inc., contributed to lagging returns in the sector. We sold Facebook in late 2018 on concerns over slowing revenue growth, margin compression, governance issues and stepped up regulatory scrutiny around privacy and use of personal data; the latter of which remains a fundamental threat to Facebook’s long term business model. Please refer to the U.S. Growth Market Review and Outlook relating to the Fund on page 6 for additional information. |

| June 30, 2019 | William Blair Funds | 11 |

Large Cap Growth Fund

Performance Highlights (Unaudited)

| Average Annual Total Return through 6/30/2019 |

| | | Year

to Date | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception(a) |

| Class N | | | 24.10 | % | | | 16.01 | % | | | 20.40 | % | | | 14.73 | % | | | 16.11 | % | | | — | |

| Class I | | | 24.25 | | | | 16.32 | | | | 20.73 | | | | 15.02 | | | | 16.39 | | | | — | |

| Class R6 | | | — | | | | — | | | | — | | | | — | | | | — | | | | 4.03 | % |

| Russell 1000® Growth Index | | | 21.49 | | | | 11.56 | | | | 18.07 | | | | 13.39 | | | | 16.28 | | | | 0.81 | |

| (a) | Since inception is for the period from May 2, 2019 (Commencement of Operations) to June 30, 2019. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site atwww.williamblairfunds.com. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are not subject to a sales load. Class I shares are not subject to a sales load or distribution (Rule 12b-1) fees. Class R6 shares are not subject to a sales load, distribution (Rule 12b-1) fees, or sub-transfer agent fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 1000®Growth Index consists of large capitalization companies with above average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on June 30, 2019. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

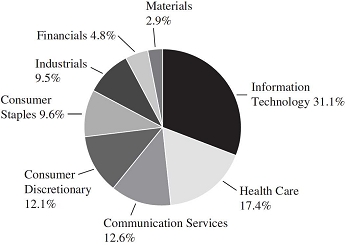

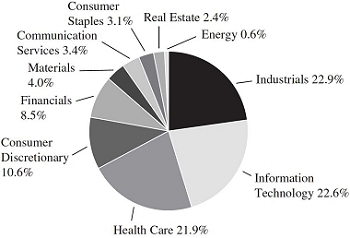

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| 12 | Semiannual Report | June 30, 2019 |

Large Cap Growth Fund

Portfolio of Investments, June 30, 2019(all dollar amounts in thousands) (unaudited)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | |

| | Common Stocks | | | | | | | | |

| | Information Technology—30.9% | | | | | | | | |

| | Accenture plc† | | | 45,790 | | | $ | 8,461 | |

| * | Adobe, Inc. | | | 23,900 | | | | 7,042 | |

| * | Guidewire Software, Inc. | | | 44,980 | | | | 4,560 | |

| | Intuit, Inc. | | | 26,230 | | | | 6,855 | |

| | Mastercard, Inc. | | | 30,810 | | | | 8,150 | |

| | Microsoft Corporation | | | 151,020 | | | | 20,231 | |

| * | PayPal Holdings, Inc. | | | 75,950 | | | | 8,693 | |

| | Texas Instruments, Inc. | | | 63,170 | | | | 7,249 | |

| | | | | | | | | 71,241 | |

| | Health Care—17.2% | | | | | | | | |

| | Abbott Laboratories | | | 69,920 | | | | 5,880 | |

| * | ABIOMED, Inc. | | | 15,010 | | | | 3,910 | |

| | Stryker Corporation | | | 28,260 | | | | 5,810 | |

| | UnitedHealth Group, Inc. | | | 42,190 | | | | 10,295 | |

| * | Veeva Systems, Inc. Class “A” | | | 36,830 | | | | 5,970 | |

| | Zoetis, Inc. | | | 68,360 | | | | 7,758 | |

| | | | | | | | | 39,623 | |

| | Communication Services—12.4% | | | | | | | | |

| | Activision Blizzard, Inc. | | | 112,880 | | | | 5,328 | |

| * | Alphabet, Inc. Class “A” | | | 9,410 | | | | 10,189 | |

| * | Alphabet, Inc. Class “C” | | | 4,096 | | | | 4,428 | |

| * | Live Nation Entertainment, Inc. | | | 75,340 | | | | 4,991 | |

| * | Netflix, Inc. | | | 10,040 | | | | 3,688 | |

| | | | | | | | | 28,624 | |

| | Consumer Discretionary—11.9% | | | | | | | | |

| * | Amazon.com, Inc. | | | 9,320 | | | | 17,648 | |

| | McDonald’s Corporation | | | 20,080 | | | | 4,170 | |

| | Starbucks Corporation | | | 67,360 | | | | 5,647 | |

| | | | | | | | | 27,465 | |

| | Consumer Staples—9.5% | | | | | | | | |

| | Costco Wholesale Corporation | | | 18,070 | | | | 4,775 | |

| * | Monster Beverage Corporation | | | 99,810 | | | | 6,371 | |

| | The Coca-Cola Co. | | | 100,190 | | | | 5,102 | |

| | The Estee Lauder Cos., Inc. Class “A” | | | 30,160 | | | | 5,522 | |

| | | | | | | | | 21,770 | |

| | Industrials—9.4% | | | | | | | | |

| * | Copart, Inc. | | | 86,330 | | | | 6,452 | |

| | Equifax, Inc. | | | 43,010 | | | | 5,817 | |

| | Fortive Corporation | | | 42,100 | | | | 3,432 | |

| | Raytheon Co. | | | 33,960 | | | | 5,905 | |

| | | | | | | | | 21,606 | |

| | Financials—4.7% | | | | | | | | |

| | Aon plc† | | | 24,530 | | | | 4,734 | |

| | Intercontinental Exchange, Inc. | | | 72,200 | | | | 6,205 | |

| | | | | | | | | 10,939 | |

| | Materials—2.9% | | | | | | | | |

| | Linde plc† | | | 32,730 | | | | 6,573 | |

| | Total Common Stocks—98.9%

(cost $156,334) | | | | | | | 227,841 | |

| | | | | | | | | | |

| | Issuer | | Principal

Amount | | | | Value | |

| | | | | | | | | | |

| | Repurchase Agreement | | | | | | | | |

| | Fixed Income Clearing Corporation, 0.500% dated 6/28/19, due 7/1/19, repurchase price $2,803, collateralized by U.S. Treasury Note, 1.500%, due 8/15/26 | | | $2,803 | | | $ | 2,803 | |

| | Total Repurchase Agreement—1.2%

(cost $2,803) | | | | | | | 2,803 | |

| | Total Investments—100.1%

(cost $159,137) | | | | | | | 230,644 | |

| | Liabilities, plus cash and other assets—(0.1)% | | | | | | | (242 | ) |

| | Net assets—100.0% | | | | | | $ | 230,402 | |

† = U.S. listed foreign security

* = Non-income producing security

See accompanying Notes to Financial Statements.

| June 30, 2019 | William Blair Funds | 13 |

| | Mid Cap Growth Fund |

| | |

| | The Mid Cap Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

Daniel Crowe

Robert C. Lanphier, IV | The William Blair Mid Cap Growth Fund (Class N shares) posted a 27.40% increase, net of fees, for the six months ended June 30, 2019. By comparison, the Fund’s benchmark index, the Russell Midcap®Growth Index (the “Index”), increased 26.08%. With the Index up approximately 26% year-to-date, Fund outperformance over the period was driven by strong stock selection. The Fund generally lagged during the strongest periods of benchmark returns, but that was more than offset by outperformance during other periods and attributable to the generally strong fundamental performance of the companies held by the Fund. Stock selection in the Industrials sector was a standout contributor to performance, in part due to our positions in CoStar Group, Inc. and Copart, Inc. Real estate information services company CoStar Group outperformed on business trends that were consistent with our investment thesis, including strong growth in its commercial real estate business and continued market share gains in its apartment rental advertising business. Other top contributors were metal packaging provider, Ball Corporation (Materials), Worldpay, Inc. (Information Technology) and Wayfair, Inc. (Consumer Discretionary). Ball Corporation benefited as strong demand drove volume growth for aluminum cans. Conversely, top detractors from performance year-to-date included Lamb Weston Holdings, Inc. (Consumer Staples) and Pure Storage, Inc. (Information Technology). Flash-based storage solutions provider Pure Storage underperformed due to an increased focus on large enterprise accounts with lengthened sales cycles. Shares of potato processor Lamb Weston were weighed down as some investors became concerned that incremental industry capacity coming online over the next two years could pressure margins. Other notable laggards were Health Care holdings Centene Corporation and ABIOMED, Inc. In addition, stock selection in Financials, including our position in Cboe Global Markets, Inc., detracted from relative results. Please refer to the U.S. Growth Market Review and Outlook relating to the Fund on page 6 for additional information. |

| 14 | Semiannual Report | June 30, 2019 |

Mid Cap Growth Fund

Performance Highlights (Unaudited)

| Average Annual Total Return through 6/30/2019 |

| | | Year

to Date | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception(a) |

| Class N | | | 27.40 | % | | | 12.75 | % | | | 15.38 | % | | | 9.88 | % | | | 13.42 | % | | | — | |

| Class I | | | 27.43 | | | | 13.05 | | | | 15.67 | | | | 10.15 | | | | 13.71 | | | | — | |

| Class R6 | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2.01 | % |

| Russell Midcap® Growth Index | | | 26.08 | | | | 13.94 | | | | 16.49 | | | | 11.10 | | | | 16.02 | | | | 1.99 | |

| (a) | Since inception is for the period from May 2, 2019 (Commencement of Operations) to June 30, 2019. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site atwww.williamblairfunds.com. Investing in medium capitalization companies involves special risks, including higher volatility and lower liquidity. Medium capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are not subject to a sales load. Class I shares are not subject to a sales load or distribution (Rule 12b-1) fees. Class R6 shares are not subject to a sales load, distribution (Rule 12b-1) fees, or sub-transfer agent fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell Midcap®Growth Index is an index that is constructed to provide a comprehensive and unbiased barometer of the mid-cap growth market.

This report identifies the Fund’s investments on June 30, 2019. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

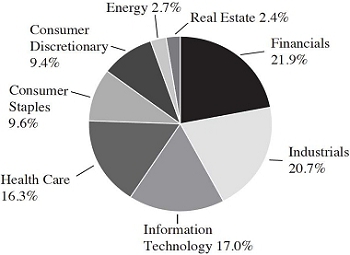

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| June 30, 2019 | William Blair Funds | 15 |

Mid Cap Growth Fund

Portfolio of Investments, June 30, 2019(all dollar amounts in thousands) (unaudited)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks | | | | | | | | |

| | Information Technology—27.1% | | | | | | | | |

| * | Advanced Micro Devices, Inc. | | | 40,575 | | | $ | 1,232 | |

| * | Arista Networks, Inc. | | | 2,860 | | | | 742 | |

| * | Autodesk, Inc. | | | 9,900 | | | | 1,613 | |

| | Booz Allen Hamilton Holding Corporation | | | 19,084 | | | | 1,264 | |

| | Dolby Laboratories, Inc. | | | 19,885 | | | | 1,285 | |

| * | EPAM Systems, Inc. | | | 4,945 | | | | 856 | |

| | Global Payments, Inc. | | | 11,100 | | | | 1,777 | |

| * | GoDaddy, Inc. | | | 17,745 | | | | 1,245 | |

| * | Guidewire Software, Inc. | | | 6,863 | | | | 696 | |

| | j2 Global, Inc. | | | 7,265 | | | | 646 | |

| | MAXIMUS, Inc. | | | 11,705 | | | | 849 | |

| | Microchip Technology, Inc. | | | 15,980 | | | | 1,385 | |

| * | Pure Storage, Inc. | | | 58,910 | | | | 900 | |

| | Sabre Corporation | | | 63,008 | | | | 1,399 | |

| * | WEX, Inc. | | | 8,570 | | | | 1,783 | |

| * | Worldpay, Inc. Class “A” | | | 7,694 | | | | 943 | |

| | | | | | | | | 18,615 | |

| | Industrials—18.4% | | | | | | | | |

| | BWX Technologies, Inc. | | | 39,044 | | | | 2,034 | |

| * | Copart, Inc. | | | 28,200 | | | | 2,108 | |

| * | CoStar Group, Inc. | | | 3,709 | | | | 2,055 | |

| | Equifax, Inc. | | | 9,785 | | | | 1,323 | |

| | Fortive Corporation | | | 16,125 | | | | 1,314 | |

| * | The Middleby Corporation | | | 10,250 | | | | 1,391 | |

| | Verisk Analytics, Inc. | | | 3,500 | | | | 513 | |

| | Waste Connections, Inc.† | | | 11,585 | | | | 1,107 | |

| | Xylem, Inc. | | | 9,800 | | | | 820 | |

| | | | | | | | | 12,665 | |

| | Consumer Discretionary—15.5% | | | | | | | | |

| | Advance Auto Parts, Inc. | | | 8,470 | | | | 1,305 | |

| | Aptiv plc† | | | 7,965 | | | | 644 | |

| * | Burlington Stores, Inc. | | | 9,655 | | | | 1,643 | |

| * | CarMax, Inc. | | | 10,575 | | | | 918 | |

| | Domino’s Pizza, Inc. | | | 2,080 | | | | 579 | |

| | Ross Stores, Inc. | | | 11,410 | | | | 1,131 | |

| | Service Corporation International | | | 20,200 | | | | 945 | |

| * | Ulta Salon Cosmetics & Fragrance, Inc. | | | 4,235 | | | | 1,469 | |

| | Vail Resorts, Inc. | | | 6,035 | | | | 1,347 | |

| * | Wayfair, Inc. | | | 4,395 | | | | 642 | |

| | | | | | | | | 10,623 | |

| | Health Care—14.6% | | | | | | | | |

| * | ABIOMED, Inc. | | | 3,600 | | | | 938 | |

| | Agilent Technologies, Inc. | | | 15,410 | | | | 1,151 | |

| * | Align Technology, Inc. | | | 3,010 | | | | 824 | |

| * | Centene Corporation | | | 21,826 | | | | 1,144 | |

| * | DexCom, Inc. | | | 2,805 | | | | 420 | |

| | Encompass Health Corporation | | | 18,385 | | | | 1,165 | |

| * | IDEXX Laboratories, Inc. | | | 2,890 | | | | 796 | |

| * | Mettler-Toledo International, Inc. | | | 1,405 | | | | 1,180 | |

| | Teleflex, Inc. | | | 4,335 | | | | 1,435 | |

| * | Veeva Systems, Inc. Class “A” | | | 5,941 | | | | 963 | |

| | | | | | | | | 10,016 | |

| | Issuer | | Shares or

Principal

Amount | | | Value | |

| | | | | | | | | | |

| | Common Stocks—(continued) | | | | | | | | |

| | Financials—7.9% | | | | | | | | |

| | Arthur J Gallagher & Co. | | | 19,130 | | | $ | 1,675 | |

| | Cboe Global Markets, Inc. | | | 13,005 | | | | 1,348 | |

| | East West Bancorp, Inc. | | | 21,450 | | | | 1,003 | |

| | Signature Bank | | | 4,980 | | | | 602 | |

| * | SVB Financial Group | | | 3,625 | | | | 814 | |

| | | | | | | | | 5,442 | |

| | Materials—7.1% | | | | | | | | |

| | Ball Corporation | | | 33,950 | | | | 2,376 | |

| | Celanese Corporation | | | 6,920 | | | | 746 | |

| | Vulcan Materials Co. | | | 12,715 | | | | 1,746 | |

| | | | | | | | | 4,868 | |

| | Communication Services—3.4% | | | | | | | | |

| * | Live Nation Entertainment, Inc. | | | 15,910 | | | | 1,054 | |

| * | Take-Two Interactive Software, Inc. | | | 11,520 | | | | 1,308 | |

| | | | | | | | | 2,362 | |

| | Consumer Staples—3.2% | | | | | | | | |

| | Conagra Brands, Inc. | | | 32,000 | | | | 849 | |

| | Lamb Weston Holdings, Inc. | | | 20,835 | | | | 1,320 | |

| | | | | | | | | 2,169 | |

| | Real Estate—1.4% | | | | | | | | |

| * | SBA Communications Corporation | | | 4,260 | | | | 958 | |

| | Energy—0.9% | | | | | | | | |

| * | Parsley Energy, Inc. | | | 34,380 | | | | 654 | |

| | Total Common Stocks—99.5%

(cost $55,237) | | | | | | | 68,372 | |

| | | | | | | | | | |

| | Repurchase Agreement | | | | | | | | |

| | Fixed Income Clearing Corporation, 0.500% dated 6/28/19, due 7/1/19, repurchase price $925, collateralized by U.S. Treasury Note, 1.500%, due 8/15/26 | | | $925 | | | | 925 | |

| | Total Repurchase Agreement—1.3%

(cost $925) | | | | | | | 925 | |

| | Total Investments—100.8%

(cost $56,162) | | | | | | | 69,297 | |

| | Liabilities, plus cash and other assets—(0.8)% | | | | | | | (550 | ) |

| | Net assets—100.0% | | | | | | $ | 68,747 | |

* = Non-income producing security

† = U.S. listed foreign security

See accompanying Notes to Financial Statements.

| 16 | Semiannual Report | June 30, 2019 |

| | Small-Mid Cap Growth Fund |

| | |

| | The Small-Mid Cap Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

Daniel Crowe  Robert C. Lanphier, IV | The William Blair Small-Mid Cap Growth Fund (Class N shares) posted a 24.27% increase, net of fees, for the six months ended June 30, 2019. By comparison, the Fund’s benchmark index, the Russell 2500TMGrowth Index (the “Index”), increased 23.92%. The Fund outperformed for the year-to-date period as stock selection and a tailwind for our investment style contributed to excess returns. From a stock selection perspective, selection in the Industrials and Health Care sectors was positive, helped by positions in CoStar Group, Inc. (Industrials), Copart, Inc. (Industrials) and Catalent, Inc. (Health Care). Real estate information services company CoStar Group advanced on business trends that were consistent with our investment thesis, including strong growth in its commercial real estate business and continued share gains in its apartment rental advertising business. Outperformance from Information Technology holdings Euronet Worldwide, Inc. and Rogers Corporation also added to relative returns. Shares of Euronet Worldwide, an electronic payment and transaction processing solutions company, advanced as all three business segments performed well and the company disclosed details about a new cloud-based payments platform which could add to growth over the long term. From a style perspective, our typical larger market cap bias provided a tailwind as the larger cap stocks within our small-mid cap universe outperformed the smaller cap stocks. This year-to-date style dynamic was strongest during the second quarter. Top detractors from performance during the period included Inogen, Inc. (Health Care), Healthcare Services Group, Inc. (Industrials), Pure Storage, Inc. (Information Technology) and Lamb Weston Holdings, Inc. (Consumer Staples). Shares of Inogen, a manufacturer of portable oxygen concentrators, underperformed on a decline in sales growth that resulted from the combination of lower sales productivity and a large customer that was restructuring. In addition, our Consumer Discretionary holdings lagged those of the benchmark. Notable among them was Adtalem Global Education, Inc., which underperformed due to lowered earnings expectations for its Brazil programs and escalating rhetoric around free education ahead of the forthcoming U.S. presidential primaries. Please refer to the U.S. Growth Market Review and Outlook relating to the Fund on page 6 for additional information. |

| June 30, 2019 | William Blair Funds | 17 |

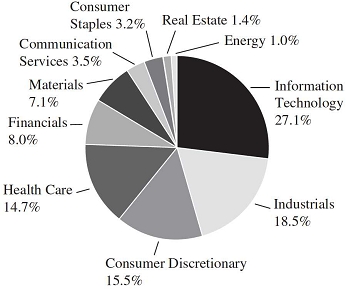

Small-Mid Cap Growth Fund

Performance Highlights (Unaudited)

| Average Annual Total Return through 6/30/2019 |

| | | Year

to Date | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception(a) |

| Class N | | | 24.27 | % | | | 9.65 | % | | | 18.07 | % | | | 12.99 | % | | | 15.99 | % | | | — | |

| Class I | | | 24.46 | | | | 9.91 | | | | 18.37 | | | | 13.29 | | | | 16.28 | | | | — | |

| Class R6 | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2.91 | % |

| Russell 2500TM Growth Index | | | 23.92 | | | | 6.13 | | | | 16.14 | | | | 9.98 | | | | 15.67 | | | | 1.81 | |

| (a) | Since inception is for the period from May 2, 2019 (Commencement of Operations) to June 30, 2019. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site atwww.williamblairfunds.com. Investing in smaller and medium capitalization companies involves special risks, including higher volatility and lower liquidity. Smaller and medium capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are not subject to a sales load. Class I shares are not subject to a sales load or distribution (Rule 12b-1) fees. Class R6 shares are not subject to a sales load, distribution (Rule 12b-1) fees, or sub-transfer agent fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2500TMGrowth Index measures the performance of those Russell 2500 companies with above average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on June 30, 2019. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

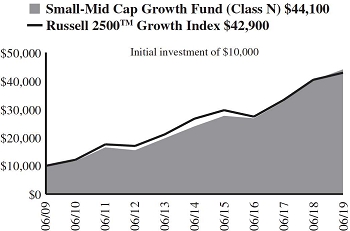

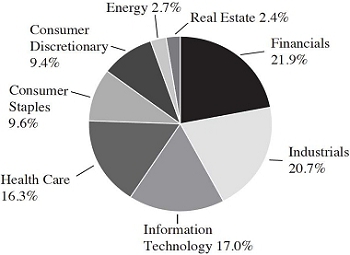

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| 18 | Semiannual Report | June 30, 2019 |

Small-Mid Cap Growth Fund

Portfolio of Investments, June 30, 2019(all dollar amounts in thousands) (unaudited)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | |

| | Common Stocks | | | | | | | | |

| | Industrials—22.5% | | | | | | | | |

| | BWX Technologies, Inc. | | | 1,558,221 | | | $ | 81,183 | |

| * | Copart, Inc. | | | 1,150,220 | | | | 85,967 | |

| * | CoStar Group, Inc. | | | 77,938 | | | | 43,182 | |

| * | Genesee & Wyoming, Inc. | | | 350,736 | | | | 35,074 | |

| | Healthcare Services Group, Inc. | | | 934,721 | | | | 28,341 | |

| | HEICO Corporation | | | 428,457 | | | | 44,290 | |

| | Ritchie Bros Auctioneers, Inc.† | | | 806,250 | | | | 26,784 | |

| * | SiteOne Landscape Supply, Inc. | | | 323,681 | | | | 22,431 | |

| * | Teledyne Technologies, Inc. | | | 208,751 | | | | 57,171 | |

| | The Brink’s Co. | | | 345,000 | | | | 28,007 | |

| * | The Middleby Corporation | | | 346,137 | | | | 46,971 | |

| | The Toro Co. | | | 178,063 | | | | 11,912 | |

| | TransUnion | | | 850,076 | | | | 62,489 | |

| * | Trex Co., Inc. | | | 908,763 | | | | 65,158 | |

| | | | | | | | | 638,960 | |

| | Information Technology—22.1% | | | | | | | | |

| * | Aspen Technology, Inc. | | | 430,563 | | | | 53,510 | |

| * | Avalara, Inc. | | | 474,308 | | | | 34,245 | |

| | Booz Allen Hamilton Holding Corporation | | | 799,236 | | | | 52,917 | |

| * | Euronet Worldwide, Inc. | | | 545,604 | | | | 91,793 | |

| * | GoDaddy, Inc. | | | 554,737 | | | | 38,915 | |

| * | Guidewire Software, Inc. | | | 274,787 | | | | 27,858 | |

| | j2 Global, Inc. | | | 312,415 | | | | 27,771 | |

| * | MaxLinear, Inc. | | | 581,160 | | | | 13,622 | |

| | National Instruments Corporation | | | 590,876 | | | | 24,811 | |

| * | Nice, Ltd.-ADR | | | 323,640 | | | | 44,339 | |

| * | Novanta, Inc.† | | | 242,277 | | | | 22,847 | |

| * | Pure Storage, Inc. | | | 2,801,019 | | | | 42,772 | |

| * | Qualys, Inc. | | | 309,122 | | | | 26,918 | |

| * | Rogers Corporation | | | 286,419 | | | | 49,430 | |

| | Sabre Corporation | | | 1,621,125 | | | | 35,989 | |

| * | WEX, Inc. | | | 193,803 | | | | 40,330 | |

| | | | | | | | | 628,067 | |

| | Health Care—21.4% | | | | | | | | |

| * | ABIOMED, Inc. | | | 157,000 | | | | 40,897 | |

| * | Amedisys, Inc. | | | 238,400 | | | | 28,944 | |

| * | Cambrex Corporation | | | 589,830 | | | | 27,610 | |

| * | Catalent, Inc. | | | 563,959 | | | | 30,572 | |

| * | DexCom, Inc. | | | 116,498 | | | | 17,456 | |

| | Encompass Health Corporation | | | 828,504 | | | | 52,494 | |

| * | Exact Sciences Corporation | | | 271,368 | | | | 32,032 | |

| * | Glaukos Corporation | | | 593,968 | | | | 44,785 | |

| * | Halozyme Therapeutics, Inc. | | | 865,956 | | | | 14,877 | |

| * | Horizon Therapeutics plc† | | | 1,574,146 | | | | 37,874 | |

| * | Inspire Medical Systems, Inc. | | | 257,454 | | | | 15,615 | |

| * | Insulet Corporation | | | 638,567 | | | | 76,232 | |

| * | Ligand Pharmaceuticals, Inc. | | | 208,886 | | | | 23,844 | |

| * | Penumbra, Inc. | | | 259,356 | | | | 41,497 | |

| * | Portola Pharmaceuticals, Inc. | | | 1,117,940 | | | | 30,330 | |

| * | STERIS plc† | | | 275,844 | | | | 41,068 | |

| | Teleflex, Inc. | | | 155,548 | | | | 51,510 | |

| | | | | | | | | 607,637 | |

| | Issuer | | Shares or

Principal

Amount | | | Value | |

| | | | | | | | |

| | Common Stocks—(continued) | | | | | | | | |

| | Consumer Discretionary—10.3% | | | | | | | | |

| * | Adtalem Global Education, Inc. | | | 1,063,747 | | | $ | 47,922 | |

| * | Burlington Stores, Inc. | | | 419,546 | | | | 71,386 | |

| | Domino’s Pizza, Inc. | | | 138,204 | | | | 38,459 | |

| * | Grand Canyon Education, Inc. | | | 565,020 | | | | 66,119 | |

| | Vail Resorts, Inc. | | | 192,788 | | | | 43,026 | |

| * | Wayfair, Inc. | | | 182,675 | | | | 26,671 | |

| | | | | | | | | 293,583 | |

| | Financials—8.3% | | | | | | | | |

| | BrightSphere Investment Group plc† | | | 1,012,271 | | | | 11,550 | |

| | Cboe Global Markets, Inc. | | | 592,080 | | | | 61,357 | |

| | East West Bancorp, Inc. | | | 885,718 | | | | 41,425 | |

| * | Encore Capital Group, Inc. | | | 689,276 | | | | 23,346 | |

| | FirstCash, Inc. | | | 455,138 | | | | 45,523 | |

| | Signature Bank | | | 207,400 | | | | 25,062 | |

| | Virtu Financial, Inc. | | | 1,260,564 | | | | 27,455 | |

| | | | | | | | | 235,718 | |

| | Materials—3.9% | | | | | | | | |

| * | Axalta Coating Systems, Ltd.† | | | 794,580 | | | | 23,655 | |

| * | Crown Holdings, Inc. | | | 390,536 | | | | 23,862 | |

| | Martin Marietta Materials, Inc. | | | 274,280 | | | | 63,114 | |

| | | | | | | | | 110,631 | |

| | Communication Services—3.3% | | | | | | | | |

| | Cable One, Inc. | | | 29,958 | | | | 35,080 | |

| * | Live Nation Entertainment, Inc. | | | 877,916 | | | | 58,162 | |

| | | | | | | | | 93,242 | |

| | Consumer Staples—3.1% | | | | | | | | |

| * | BJ’s Wholesale Club Holdings, Inc. | | | 1,335,347 | | | | 35,253 | |

| | Lamb Weston Holdings, Inc. | | | 809,146 | | | | 51,268 | |

| | | | | | | | | 86,521 | |

| | Real Estate—2.4% | | | | | | | | |

| | Colliers International Group, Inc.† | | | 224,479 | | | | 16,077 | |

| | FirstService Corporation† | | | 338,448 | | | | 32,464 | |

| | Jones Lang LaSalle, Inc. | | | 134,588 | | | | 18,935 | |

| | | | | | | | | 67,476 | |

| | Energy—0.6% | | | | | | | | |

| * | Parsley Energy, Inc. | | | 863,444 | | | | 16,414 | |

| | Total Common Stocks—97.9%

(cost $2,306,990) | | | | | | | 2,778,249 | |

| | | | | | | | | | |

| | Repurchase Agreement | | | | | | | | |

| | Fixed Income Clearing Corporation, 0.500% dated 6/28/19, due 7/1/19, repurchase price $58,029, collateralized by U.S. Treasury Note, 1.500%, due 8/15/26 | | | $58,026 | | | | 58,026 | |

| | Total Repurchase Agreement—2.0%

(cost $58,026) | | | | | | | 58,026 | |

| | Total Investments—99.9%

(cost $2,365,016) | | | | | | | 2,836,275 | |

| | Cash and other assets, less liabilities—0.1% | | | | | | | 3,086 | |

| | Net assets—100.0% | | | | | | $ | 2,839,361 | |

ADR = American Depository Receipt

* = Non-income producing security

† = U.S. listed foreign security

See accompanying Notes to Financial Statements.

| June 30, 2019 | William Blair Funds | 19 |

| | Small-Mid Cap Value Fund |

| | |

| | The Small-Mid Cap Value Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

Chad M. Kilmer

Mark T. Leslie

David S. Mitchell | The William Blair Small-Mid Cap Value Fund (Class N shares) posted a 16.67% increase, net of fees, for the six months ended June 30, 2019. By comparison, the Fund’s benchmark index, the Russell 2500TMValue Index (the “Index”), increased 15.26%. The Fund’s outperformance relative to the Index was due to the combination of stock selection and style tailwinds given the strategy’s higher growth profile and lack of exposure to deeper value stocks. At the sector level, the most significant contributor to the Fund’s relative performance was Industrials due to strong stock selection within Road & Rail, Machinery, and Building Products. Within Information Technology, the best performing sector of the market during the period, the Fund’s relative performance was primarily the result of strong stock selection within Software. Strong stock selection within Banks and Diversified Financial Services contributed to the relative returns within Financials. Consumer Discretionary was the most significant detractor from the Fund’s relative returns due to stock selection within Diversified Consumer Services and Hotels, Restaurants & Leisure. The relative underperformance within Energy was the result of stock selection within Oil & Gas Exploration & Production. The Fund’s relative performance within Consumer Staples, the worst performing sector of the market during the period, was driven by stock selection within Packaged Food & Meats. Looking specifically at stock selection, the Fund’s largest contributors to relative performance were Gardner Denver Holdings, Inc. (Industrials), Booz Allen Hamilton Holding Corporation (Information Technology), and TopBuild Corporation (Consumer Discretionary). Offsetting these contributors were our investments in Whiting Petroleum Corporation (Energy), Lamb Weston Holdings, Inc. (Consumer Staples), and Range Resources Corporation (Energy). Please refer to the U.S. Value Market Review and Outlook relating to the Fund on page 7 for additional information. |

| 20 | Semiannual Report | June 30, 2019 |

Small-Mid Cap Value Fund

Performance Highlights (Unaudited)

| Average Annual Total Return through 6/30/2019 |

| | | Year

to Date | | 1 Year | | 3 Year | | 5 Year | | Since

Inception |

| Class N(a) | | | 16.67 | % | | | (2.03 | )% | | | 7.18 | % | | | 5.04 | % | | | 10.42 | % |

| Class I(a) | | | 16.79 | | | | (1.73 | ) | | | 7.45 | | | | 5.32 | | | | 10.72 | |

| Russell 2500TMValue Index(a) | | | 15.26 | | | | (1.92 | ) | | | 8.98 | | | | 5.55 | | | | 11.93 | |

| Class R6(b) | | | — | | | | — | | | | — | | | | — | | | | (1.28 | ) |

| Russell 2500TMValue Index(b) | | | — | | | | — | | | | — | | | | — | | | | (0.73 | ) |

| | |

| (a) | Since inception is for the period from December 15, 2011 (Commencement of Operations) to June 30, 2019. |

| (b) | Since inception is for the period from May 2, 2019 (Commencement of Operations) to June 30, 2019. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site atwww.williamblairfunds.com. Investing in smaller and medium capitalization companies involves special risks, including higher volatility and lower liquidity. Smaller and medium capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are not subject to a sales load. Class I shares are not subject to a sales load or distribution (Rule 12b-1) fees. Class R6 shares are not subject to a sales load, distribution (Rule 12b-1) fees, or sub-transfer agent fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2500TMValue Index consists of small to mid-capitalization companies with below average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on June 30, 2019. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

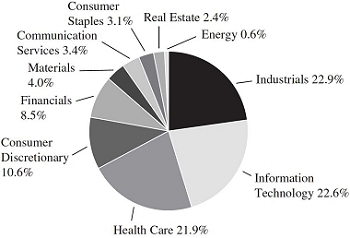

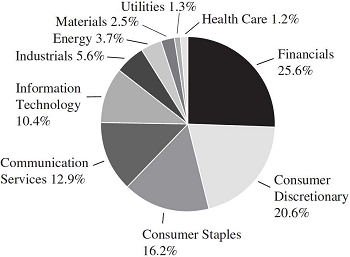

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| June 30, 2019 | William Blair Funds | 21 |

Small-Mid Cap Value Fund

Portfolio of Investments, June 30, 2019(all dollar amounts in thousands) (unaudited)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks | | | | | | | | |

| | Financials—22.4% | | | | | | | | |

| | American Financial Group, Inc. | | | 185 | | | $ | 19 | |

| | CNO Financial Group, Inc. | | | 865 | | | | 14 | |

| | E*TRADE Financial Corporation | | | 308 | | | | 14 | |

| | East West Bancorp, Inc. | | | 394 | | | | 18 | |

| | First American Financial Corporation | | | 275 | | | | 15 | |

| | FNB Corporation | | | 1,594 | | | | 19 | |

| | Hancock Whitney Corporation | | | 416 | | | | 17 | |

| | Hanover Insurance Group, Inc. | | | 174 | | | | 22 | |

| | Home BancShares, Inc. | | | 993 | | | | 19 | |

| | Iberiabank Corporation | | | 283 | | | | 22 | |

| | National Bank Holdings Corporation | | | 499 | | | | 18 | |

| | PacWest Bancorp | | | 756 | | | | 29 | |

| | Radian Group, Inc. | | | 948 | | | | 22 | |

| | Selective Insurance Group, Inc. | | | 326 | | | | 24 | |

| | Sterling Bancorp | | | 1,060 | | | | 23 | |

| * | SVB Financial Group | | | 80 | | | | 18 | |

| | Umpqua Holdings Corporation | | | 815 | | | | 14 | |

| | Voya Financial, Inc. | | | 496 | | | | 27 | |

| * | Western Alliance Bancorp | | | 390 | | | | 17 | |

| | WSFS Financial Corporation | | | 416 | | | | 17 | |

| | | | | | | | | 388 | |

| | Real Estate—14.6% | | | | | | | | |

| | Acadia Realty Trust | | | 769 | | | | 21 | |

| | American Assets Trust, Inc. | | | 379 | | | | 18 | |

| | American Campus Communities, Inc. | | | 603 | | | | 28 | |

| | Americold Realty Trust | | | 709 | | | | 23 | |

| | Camden Property Trust | | | 247 | | | | 26 | |

| | Douglas Emmett, Inc. | | | 588 | | | | 23 | |

| | EPR Properties | | | 300 | | | | 22 | |

| | Equity LifeStyle Properties, Inc. | | | 179 | | | | 22 | |

| | Healthcare Realty Trust, Inc. | | | 884 | | | | 28 | |

| | Pebblebrook Hotel Trust | | | 652 | | | | 18 | |

| | Terreno Realty Corporation | | | 484 | | | | 24 | |

| | | | | | | | | 253 | |

| | Industrials—13.3% | | | | | | | | |

| | Acuity Brands, Inc. | | | 170 | | | | 24 | |

| | AGCO Corporation | | | 287 | | | | 22 | |

| | Brady Corporation | | | 461 | | | | 23 | |

| | Curtiss-Wright Corporation | | | 204 | | | | 26 | |

| | Fortune Brands Home & Security, Inc. | | | 455 | | | | 26 | |

| * | Gardner Denver Holdings, Inc. | | | 645 | | | | 22 | |

| | Jacobs Engineering Group, Inc. | | | 300 | | | | 25 | |

| | Kansas City Southern | | | 177 | | | | 22 | |

| | Simpson Manufacturing Co., Inc. | | | 262 | | | | 17 | |

| | Watsco, Inc. | | | 143 | | | | 23 | |

| | | | | | | | | 230 | |

| | Consumer Discretionary—10.4% | | | | | | | | |

| * | Adtalem Global Education, Inc. | | | 490 | | | | 22 | |

| | Carter’s, Inc. | | | 238 | | | | 23 | |

| * | Cavco Industries, Inc. | | | 115 | | | | 18 | |

| | Dana, Inc. | | | 951 | | | | 19 | |

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks—(continued) | | | | | | | | |

| | Consumer Discretionary—(continued) | | | | | | | | |

| | Dick’s Sporting Goods, Inc. | | | 543 | | | $ | 19 | |

| | Foot Locker, Inc. | | | 525 | | | | 22 | |

| * | Grand Canyon Education, Inc. | | | 179 | | | | 21 | |

| * | TopBuild Corporation | | | 221 | | | | 18 | |

| | Wolverine World Wide, Inc. | | | 640 | | | | 18 | |

| | | | | | | | | 180 | |

| | Information Technology—10.1% | | | | | | | | |

| | Avnet, Inc. | | | 545 | | | | 25 | |

| | Belden, Inc. | | | 321 | | | | 19 | |

| | Booz Allen Hamilton Holding Corporation | | | 450 | | | | 30 | |

| * | Ciena Corporation | | | 337 | | | | 14 | |

| | j2 Global, Inc. | | | 320 | | | | 28 | |

| * | LiveRamp Holdings, Inc. | | | 397 | | | | 19 | |

| | MAXIMUS, Inc. | | | 374 | | | | 27 | |

| * | SolarWinds Corporation | | | 740 | | | | 14 | |

| | | | | | | | | 176 | |

| | Materials—6.3% | | | | | | | | |

| | Carpenter Technology Corporation | | | 441 | | | | 21 | |

| | FMC Corporation | | | 222 | | | | 18 | |

| | Minerals Technologies, Inc. | | | 276 | | | | 15 | |

| | PolyOne Corporation | | | 598 | | | | 19 | |

| | Sensient Technologies Corporation | | | 246 | | | | 18 | |

| | Steel Dynamics, Inc. | | | 579 | | | | 18 | |

| | | | | | | | | 109 | |

| | Utilities—5.7% | | | | | | | | |

| | Alliant Energy Corporation | | | 453 | | | | 22 | |

| | Atmos Energy Corporation | | | 243 | | | | 26 | |

| | Black Hills Corporation | | | 177 | | | | 14 | |

| | IDACORP, Inc. | | | 194 | | | | 20 | |

| | ONE Gas, Inc. | | | 202 | | | | 18 | |

| | | | | | | | | 100 | |

| | Energy—5.1% | | | | | | | | |

| | Murphy Oil Corporation | | | 660 | | | | 16 | |

| | Patterson-UTI Energy, Inc. | | | 1,896 | | | | 22 | |

| | Range Resources Corporation | | | 1,486 | | | | 11 | |

| | Targa Resources Corporation | | | 564 | | | | 22 | |

| * | WPX Energy, Inc. | | | 1,592 | | | | 18 | |

| | | | | | | | | 89 | |

| | Health Care—5.1% | | | | | | | | |

| | CONMED Corporation | | | 171 | | | | 15 | |

| | Encompass Health Corporation | | | 347 | | | | 22 | |