UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-5344

William Blair Funds

(Exact name of registrant as specified in charter)

| 150 North Riverside Plaza, Chicago, IL | | 60606 |

| (Address of principal executive offices) | | (Zip Code) |

Stephanie G. Braming, Principal Executive Officer

William Blair Funds

150 North Riverside Plaza, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: 312-236-1600

Date of fiscal year end: December 31

Date of reporting period: June 30, 2022

Item 1. June 30, 2022 Semiannual Reports transmitted to shareholders.

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | June 30, 2022 |

William Blair Funds

Semiannual Report | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| June 30, 2022 | William Blair Funds | 1 |

The views expressed in the commentary for each Fund reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The portfolio management team’s views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Statements involving predictions, assessments, analyses, or outlook for individual securities, industries, market sectors, and/or markets involve risks and uncertainties, and there is no guarantee they will come to pass.

This report is submitted for the general information of the shareholders of William Blair Funds. It is not authorized for distribution to prospective Fund investors unless accompanied or preceded by the Fund’s prospectus. Please carefully consider a Fund’s investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Fund’s prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

| 2 | Semiannual Report | June 30, 2022 |

U.S. Growth & Core Market Review and Outlook

Following the first quarter of 2022 equity market decline, performance of U.S. equity indices worsened during the second quarter. Using the S&P 500 Index as a proxy for U.S. equity market performance, it was the weakest first half of a year since 1970.

In a volatile first quarter, the Omicron wave, inflation concerns, and the invasion of Ukraine weighed on equity valuations. Elevated inflation drove expectations for faster monetary tightening by the Federal Open Market Committee (FOMC) and corresponded with a rise in 10-year U.S. Treasury bond yields and U.S. mortgage rates. During March, the FOMC increased the target federal funds rate by 25 basis points for the first increase in this cycle.

The second quarter was characterized by tightening financial conditions and weakening economic data. The Consumer Price Index hit a multi-decade high and the Federal Reserve (Fed) implemented two additional rate increases. In total, the Fed raised rates by 150 basis points year-to-date, and signaled further increases for the balance of the year. With record-high gas prices, elevated mortgage rates, lower asset prices and higher food costs, consumer sentiment declined in the second quarter. Other economic data points, including U.S. manufacturing trends and housing-related indicators, also weakened. While these dynamics pressured stock prices, U.S. corporate earnings remained solid.

Recent data points suggest a slow-down in economic activity relative to the extremely strong levels experienced in 2021. Supply chain disruptions present continued challenges as over-ordering amid shortages is now yielding excessive inventories in some pockets of the economy. U.S. consumers are increasingly feeling the pressures of inflation, dampening real income and confidence, while a supportive labor market and healthy post-COVID demand for experiential purchases remain bright spots.

With the backdrop of inflationary pressures and rising interest rates, equity market weakness year-to-date has been driven primarily by valuation compression while corporate earnings have exhibited resilience thus far. It is broadly anticipated that in the coming quarters, corporate earnings will begin to reflect the challenges observed in other parts of the economy.

As investor focus shifts from higher rates to the potential for an economic slowdown, we believe it is increasingly likely that investors will differentiate among stocks on the basis of quality attributes, such as the durability of margins and earnings, and growth, as fewer companies will exhibit that characteristic. In our view, companies with these attributes are in a better position than many of their peers to navigate turbulence. We believe our philosophy of identifying durable growth businesses whose stocks present attractive risk/reward opportunities should add value in this economic environment.

| June 30, 2022 | William Blair Funds | 3 |

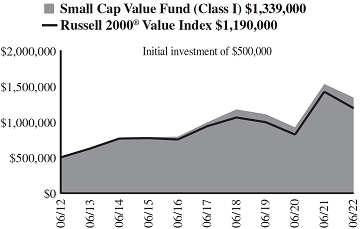

U.S. Value Market Review and Outlook

The first half of 2022 was historically challenging for U.S. small cap investors, as the 23.43% decline in the Russell 2000 Index was its worst quarterly decline ever. Small cap value shares, which declined 17.3%, fared somewhat better, but the loss was nonetheless severe. The markets were weak throughout the first half of 2022 as the Federal Reserve (Fed) became increasingly hawkish even as the economy began to show increasing strains such as declining consumer confidence and manufacturing activity. The watershed moment in the second quarter was the June Consumer Price Index reading of 8.6%, a 40 year high, followed by the Fed’s aggressive 75 basis point increase in its policy rate. The market has concluded that the Fed is willing to induce an economic recession to cool inflation. In our view, the near-term trajectory of the stock market will depend on the level and direction of inflation. As discussed above, the Fed has put its price stability mandate ahead of its employment mandate. Thus, the longer inflation remains elevated, the more likely it becomes in our view that the Fed’s actions will result in a recession for the U.S. economy. The good news is that, in our view, there are growing signs that inflation has peaked and that the Fed’s recent rate moves and future signaling are beginning to work. Even oil and agricultural commodity prices, which are beyond the Fed’s control, have begun to ease as of late.

During this period of economic uncertainty, we are comforted by the historically low valuation of the Small Cap Value Fund’s holdings, which trade at just 10.2x estimated earnings for the next twelve months. We agree with the growing number of commentators arguing that earnings estimates for many companies are too high, but much of this is already discounted in current prices. If estimates prove to be 30% too high, this still leaves the portfolio trading for just 14.3x earnings, a level in line with the historical average for small cap value shares. Of course, one can never be certain what exactly is priced into the market, but the upcoming reporting season is likely to give us a clearer picture.

| 4 | Semiannual Report | June 30, 2022 |

| | Growth Fund |

| | |

| | The Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGER |

| | |

David C. Fording, CFA | The William Blair Growth Fund (Class N shares) (the “Fund”) posted a 28.54% decrease, net of fees, for the six months ended June 30, 2022. By comparison, the Fund’s benchmark index, the Russell 3000® Growth Index (the “Index”), decreased 28.15%. For the year-to-date period, style factors and stock-specific dynamics were largely offsetting. From a style standpoint, our emphasis on longer duration growth companies was a headwind as companies with lower growth characteristics outperformed during the period. From a stock-specific perspective, Information Technology holdings PayPal Holdings and Advanced Micro Devices, as well as not owning Apple, detracted from relative returns. Shares of PayPal declined due to forward looking revenue guidance that was below expectations, driven in part by e-commerce spending headwinds. Stock selection in Consumer Discretionary, including our positions in Farfetch and Burlington Stores, and Industrials, including our position in Kornit Digital, also dampened performance. Among top contributors were UnitedHealth (Health Care), New Fortress (Energy), Coca-Cola (Consumer Staples) and Mastercard (Information Technology). Positive stock selection in Communication Services, including our position in Zynga and not owning Meta Platforms, also added value during the period. Shares of Meta Platforms lagged due to slowing advertising revenue growth; thus, not owning this laggard resulted in a tailwind to relative performance. Please refer to the U.S. Growth & Core Market Review and Outlook relating to the Fund on page 3. |

| June 30, 2022 | William Blair Funds | 5 |

Growth Fund

Performance Highlights (Unaudited)

Average Annual Total Returns through 6/30/2022

| | | Year to

Date | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception(a) |

| Class N | | | (28.54 | )% | | | (22.85 | )% | | | 8.56 | % | | | 12.97 | % | | | 12.54 | % | | | — | % |

| Class I | | | (28.44 | ) | | | (22.58 | ) | | | 8.87 | | | | 13.29 | | | | 12.89 | | | | — | |

| Class R6 | | | (28.36 | ) | | | (22.52 | ) | | | 8.98 | | | | — | | | | — | | | | 9.36 | |

| Russell 3000® Growth Index | | | (28.15 | ) | | | (19.78 | ) | | | 11.84 | | | | 13.63 | | | | 14.41 | | | | 11.46 | |

| S&P 500® Index | | | (19.96 | ) | | | (10.62 | ) | | | 10.60 | | | | 11.31 | | | | 12.96 | | | | 10.36 | |

| | |

| (a) | Since inception is for the period from May 2, 2019 (Commencement of Operations) to June 30, 2022. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are not subject to a sales load. Class I shares are not subject to a sales load or distribution (Rule 12b-1) fees. Class R6 shares are not subject to a sales load, distribution (Rule 12b-1) fees, or sub-transfer agent fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 3000® Growth Index consists of large, medium, and small capitalization companies with above average price-to-book ratios and forecasted growth rates. The index is weighted by market capitalization and large/medium/small companies make up approximately 80%/15%/5% of the index.

The S&P 500® Index indicates broad larger capitalization equity market performance.

This report identifies the Fund’s investments on June 30, 2022. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

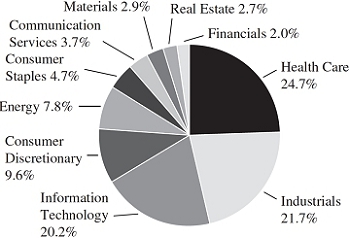

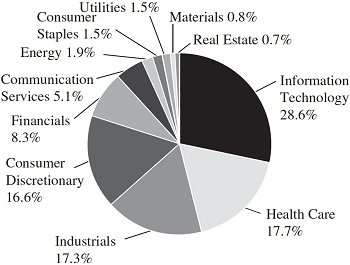

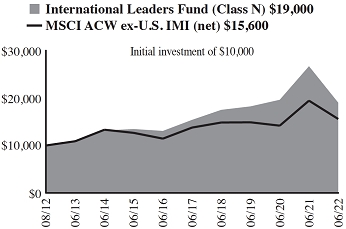

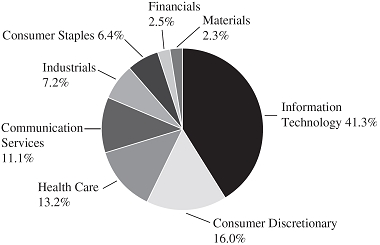

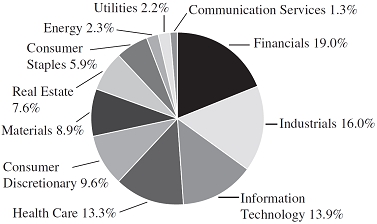

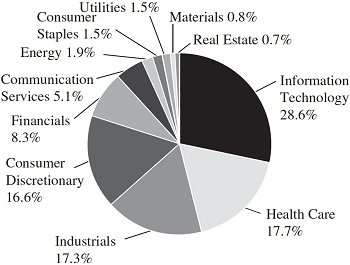

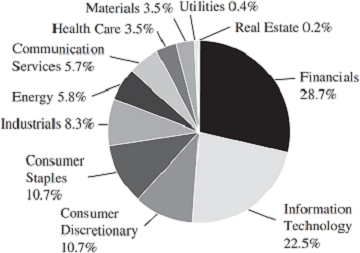

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| 6 | Semiannual Report | June 30, 2022 |

Growth Fund

Portfolio of Investments, June 30, 2022 (all dollar amounts in thousands) (unaudited)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks | | | | | | | | |

| | Information Technology—35.6% | | | | | | | | |

| * | Adobe, Inc. | | | 13,866 | | | $ | 5,076 | |

| * | Advanced Micro Devices, Inc. | | | 53,884 | | | | 4,121 | |

| * | Dynatrace, Inc. | | | 54,015 | | | | 2,130 | |

| | Fidelity National Information Services, Inc. | | | 47,287 | | | | 4,335 | |

| | Mastercard, Inc. | | | 33,762 | | | | 10,651 | |

| | Microsoft Corporation | | | 88,325 | | | | 22,685 | |

| * | MongoDB, Inc. | | | 5,491 | | | | 1,425 | |

| | National Instruments Corporation | | | 101,961 | | | | 3,184 | |

| * | Nice, Ltd.—ADR | | | 13,143 | | | | 2,529 | |

| | NVIDIA Corporation | | | 33,666 | | | | 5,103 | |

| * | PayPal Holdings, Inc. | | | 43,495 | | | | 3,038 | |

| * | Pure Storage, Inc. | | | 153,195 | | | | 3,939 | |

| | Texas Instruments, Inc. | | | 32,157 | | | | 4,941 | |

| * | Verra Mobility Corporation | | | 236,237 | | | | 3,711 | |

| * | Workday, Inc. | | | 20,977 | | | | 2,928 | |

| | | | | | | | | 79,796 | |

| | Health Care—14.9% | | | | | | | | |

| | Agilent Technologies, Inc. | | | 16,118 | | | | 1,914 | |

| | Azenta, Inc. | | | 22,676 | | | | 1,635 | |

| * | HealthEquity, Inc. | | | 36,344 | | | | 2,231 | |

| * | Horizon Therapeutics plc† | | | 39,546 | | | | 3,154 | |

| * | Intuitive Surgical, Inc. | | | 13,959 | | | | 2,802 | |

| * | Penumbra, Inc. | | | 9,955 | | | | 1,240 | |

| | STERIS plc† | | | 15,821 | | | | 3,261 | |

| | Stryker Corporation | | | 17,276 | | | | 3,437 | |

| | UnitedHealth Group, Inc. | | | 14,561 | | | | 7,479 | |

| * | Veeva Systems, Inc. | | | 13,229 | | | | 2,620 | |

| | Zoetis, Inc. | | | 20,796 | | | | 3,575 | |

| | | | | | | | | 33,348 | |

| | Consumer Discretionary—12.8% | | | | | | | | |

| * | Amazon.com, Inc. | | | 135,280 | | | | 14,368 | |

| * | Bright Horizons Family Solutions, Inc. | | | 34,962 | | | | 2,955 | |

| * | Burlington Stores, Inc. | | | 15,683 | | | | 2,136 | |

| * | Etsy, Inc. | | | 14,461 | | | | 1,059 | |

| * | Farfetch, Ltd.† | | | 126,695 | | | | 907 | |

| | NIKE, Inc. | | | 37,479 | | | | 3,830 | |

| * | Overstock.com, Inc. | | | 24,256 | | | | 607 | |

| * | Revolve Group, Inc. | | | 44,008 | | | | 1,140 | |

| * | Skyline Champion Corporation | | | 37,845 | | | | 1,795 | |

| | | | | | | | | 28,797 | |

| | Communication Services—11.1% | | | | | | | | |

| * | Alphabet, Inc. Class “A” | | | 7,966 | | | | 17,360 | |

| * | Take-Two Interactive Software, Inc. | | | 23,031 | | | | 2,822 | |

| | Warner Music Group Corporation | | | 127,039 | | | | 3,094 | |

| * | ZipRecruiter, Inc. | | | 115,511 | | | | 1,712 | |

| | | | | | | | | 24,988 | |

| | Industrials—6.9% | | | | | | | | |

| * | ACV Auctions, Inc. | | | 100,855 | | | | 659 | |

| * | Copart, Inc. | | | 41,440 | | | | 4,503 | |

| * | CoStar Group, Inc. | | | 43,099 | | | | 2,604 | |

| * | Energy Recovery, Inc. | | | 124,874 | | | | 2,425 | |

| * | Kornit Digital, Ltd.† | | | 19,671 | | | | 623 | |

| | The Brink’s Co. | | | 56,531 | | | | 3,432 | |

| * | Trex Co., Inc. | | | 20,465 | | | | 1,114 | |

| | | | | | | | | 15,360 | |

| | Issuer | | Shares or

Principal

Amount | | | Value | |

| | | | | | | | | | |

| | Common Stocks—(continued) | | | | | | | | |

| | Consumer Staples—5.7% | | | | | | | | |

| * | Performance Food Group Co. | | | 73,913 | | | $ | 3,399 | |

| | The Coca-Cola Co. | | | 98,998 | | | | 6,228 | |

| | The Estee Lauder Cos., Inc. | | | 12,523 | | | | 3,189 | |

| | | | | | | | | 12,816 | |

| | Energy—4.0% | | | | | | | | |

| | Cameco Corporation | | | 192,384 | | | | 4,044 | |

| * | Green Plains, Inc. | | | 67,237 | | | | 1,827 | |

| | New Fortress Energy, Inc. | | | 80,964 | | | | 3,203 | |

| | | | | | | | | 9,074 | |

| | Financials—3.3% | | | | | | | | |

| | Aon plc† | | | 11,264 | | | | 3,038 | |

| | Ares Management Corporation | | | 49,657 | | | | 2,823 | |

| | Bridge Investment Group Holdings, Inc. | | | 98,524 | | | | 1,433 | |

| | | | | | | | | 7,294 | |

| | Real Estate—2.0% | | | | | | | | |

| | SBA Communications Corporation | | | 9,047 | | | | 2,895 | |

| * | Zillow Group, Inc. | | | 46,852 | | | | 1,488 | |

| | | | | | | | | 4,383 | |

| | Materials—1.8% | | | | | | | | |

| | Ball Corporation | | | 57,375 | | | | 3,946 | |

| | Total Common Stocks—98.1%

(cost $158,474) | | | | | | | 219,802 | |

| | | | | | | | | | |

| | Repurchase Agreement | | | | | | | | |

| | Fixed Income Clearing Corporation, 0.240% dated 6/30/22, due 7/1/22, repurchase price $4,963, collateralized by U.S. Treasury Note, 1.250%, due 06/30/28, valued at $5,062 | | | $4,963 | | | | 4,963 | |

| | Total Repurchase Agreement—2.2%

(cost $4,963) | | | | | | | 4,963 | |

| | Total Investments—100.3%

(cost $163,437) | | | | | | | 224,765 | |

| | Liabilities, plus cash and other assets—(0.3)% | | | | | | | (709 | ) |

| | Net assets—100.0% | | | | | | $ | 224,056 | |

ADR = American Depository Receipt

* = Non-income producing security

† = U.S. listed foreign security

See accompanying Notes to Financial Statements.

| June 30, 2022 | William Blair Funds | 7 |

| | Large Cap Growth Fund |

| | |

| | The Large Cap Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

James S. Golan, CFA

David P. Ricci, CFA | The William Blair Large Cap Growth Fund (Class N shares) (the “Fund”) posted a 31.81% decrease, net of fees, for the six months ended June 30, 2022. By comparison, the Fund’s benchmark index, the Russell 1000® Growth Index (the “Index”), decreased 28.07%. The Fund underperformed the Index during the period. Trailing returns on a year-to-date basis were driven by a combination of style factors and stock-specific dynamics. From a style standpoint, our emphasis on longer duration growth companies was a headwind as companies with lower growth characteristics outperformed during the period. From a stock-specific perspective, selection in Information Technology, including our positions in PayPal Holdings, Unity Software and Advanced Micro Devices, as well as not owning Apple, detracted from relative returns. Shares of PayPal declined due to forward looking revenue guidance that was below expectations, driven in part by e-commerce spending headwinds. Other top detractors were Netflix (Communication Services) and Amazon.com (Consumer Discretionary). Netflix reported a decline in subscribers and announced related business initiatives in hope of re-igniting subscriber growth. Top contributors for the year-to-date period included UnitedHealth (Health Care) and Mastercard (Information Technology), largely due to the reasons outlined above. Other notable outperformers included Costco (Consumer Staples), Marriott (Consumer Discretionary) and Linde (Materials). Our decision to not own Meta Platforms (Communication Services) also aided relative returns as shares lagged due to slowing advertising revenue growth. Please refer to the U.S. Growth & Core Market Review and Outlook relating to the Fund on page 3. |

| 8 | Semiannual Report | June 30, 2022 |

Large Cap Growth Fund

Performance Highlights (Unaudited)

| Average Annual Total Returns through 6/30/2022 |

| | | Year to

Date | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception(a) |

| Class N | | | (31.81 | )% | | | (23.54 | )% | | | 9.25 | % | | | 14.62 | % | | | 14.56 | % | | | — | % |

| Class I | | | (31.74 | ) | | | (23.34 | ) | | | 9.52 | | | | 14.89 | | | | 14.85 | | | | — | |

| Class R6 | | | (31.73 | ) | | | (23.32 | ) | | | 9.56 | | | | — | | | | — | | | | 10.41 | |

| Russell 1000® Growth Index | | | (28.07 | ) | | | (18.77 | ) | | | 12.58 | | | | 14.29 | | | | 14.80 | | | | 12.17 | |

| (a) | Since inception is for the period from May 2, 2019 (Commencement of Operations) to June 30, 2022. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are not subject to a sales load. Class I shares are not subject to a sales load or distribution (Rule 12b-1) fees. Class R6 shares are not subject to a sales load, distribution (Rule 12b-1) fees, or sub-transfer agent fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 1000® Growth Index consists of large capitalization companies with above average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on June 30, 2022. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

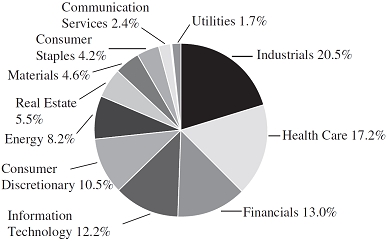

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| June 30, 2022 | William Blair Funds | 9 |

Large Cap Growth Fund

Portfolio of Investments, June 30, 2022 (all dollar amounts in thousands) (unaudited)

| | | | | | | | |

| | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks | | | | | | | | |

| | Information Technology—40.7% | | | | | | | | |

| | Accenture plc† | | | 126,290 | | | $ | 35,064 | |

| * | Adobe, Inc. | | | 66,060 | | | | 24,182 | |

| * | Advanced Micro Devices, Inc. | | | 159,088 | | | | 12,166 | |

| * | Guidewire Software, Inc. | | | 173,670 | | | | 12,329 | |

| | Intuit, Inc. | | | 73,070 | | | | 28,164 | |

| | Lam Research Corporation | | | 40,650 | | | | 17,323 | |

| | Mastercard, Inc. | | | 183,510 | | | | 57,894 | |

| | Microsoft Corporation | | | 573,890 | | | | 147,392 | |

| | NVIDIA Corporation | | | 184,840 | | | | 28,020 | |

| * | PayPal Holdings, Inc. | | | 334,320 | | | | 23,349 | |

| * | salesforce.com, Inc. | | | 148,980 | | | | 24,588 | |

| | Texas Instruments, Inc. | | | 129,290 | | | | 19,865 | |

| * | Unity Software, Inc. | | | 220,050 | | | | 8,102 | |

| | | | | | | | | 438,438 | |

| | Consumer Discretionary—15.8% | | | | | | | | |

| * | Amazon.com, Inc. | | | 784,100 | | | | 83,279 | |

| | Marriott International, Inc. | | | 241,900 | | | | 32,901 | |

| | NIKE, Inc. | | | 245,070 | | | | 25,046 | |

| | Starbucks Corporation | | | 381,700 | | | | 29,158 | |

| | | | | | | | | 170,384 | |

| | Health Care—13.0% | | | | | | | | |

| * | ABIOMED, Inc. | | | 77,738 | | | | 19,241 | |

| | Stryker Corporation | | | 130,460 | | | | 25,952 | |

| | UnitedHealth Group, Inc. | | | 111,140 | | | | 57,085 | |

| * | Veeva Systems, Inc. | | | 26,980 | | | | 5,343 | |

| | Zoetis, Inc. | | | 188,670 | | | | 32,431 | |

| | | | | | | | | 140,052 | |

| | Communication Services—10.9% | | | | | | | | |

| * | Alphabet, Inc. Class “A” | | | 37,200 | | | | 81,068 | |

| * | Alphabet, Inc. Class “C” | | | 4,330 | | | | 9,472 | |

| * | Live Nation Entertainment, Inc. | | | 327,150 | | | | 27,016 | |

| | | | | | | | | 117,556 | |

| | Industrials—7.1% | | | | | | | | |

| * | Copart, Inc. | | | 298,090 | | | | 32,390 | |

| * | CoStar Group, Inc. | | | 396,620 | | | | 23,960 | |

| | Equifax, Inc. | | | 110,300 | | | | 20,161 | |

| | | | | | | | | 76,511 | |

| | Consumer Staples—6.4% | | | | | | | | |

| | Costco Wholesale Corporation | | | 95,540 | | | | 45,791 | |

| | The Estee Lauder Cos., Inc. | | | 88,920 | | | | 22,645 | |

| | | | | | | | | 68,436 | |

| | Financials—2.4% | | | | | | | | |

| | Apollo Global Management, Inc. | | | 539,150 | | | | 26,138 | |

| | Materials—2.2% | | | | | | | | |

| | Linde plc† | | | 83,910 | | | | 24,126 | |

| | Total Common Stocks—98.5%

(cost $1,090,689) | | | | | | | 1,061,641 | |

| | | | | | | | | | |

| | Issuer | | Principal

Amount | | | Value | |

| | | | | | | | | | |

| | Repurchase Agreement | | | | | | | | |

| | Fixed Income Clearing Corporation, 0.240% dated 6/30/22, due 7/1/22, repurchase price $13,037, collateralized by U.S. Treasury Bond, 3.000%, due 02/15/49, valued at $13,297 | | | $13,037 | | | $ | 13,037 | |

| | Total Repurchase Agreement—1.2%

(cost $13,037) | | | | | | | 13,037 | |

| | Total Investments—99.7%

(cost $1,103,726) | | | | | | | 1,074,678 | |

| | Cash and other assets, less liabilities—0.3% | | | | | | | 2,964 | |

| | Net assets—100.0% | | | | | | $ | 1,077,642 | |

† = U.S. listed foreign security

* = Non-income producing security

See accompanying Notes to Financial Statements.

| 10 | Semiannual Report | June 30, 2022 |

| | Mid Cap Growth Fund |

| | |

| | The Mid Cap Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

Daniel Crowe, CFA

James E. Jones, CFA | The William Blair Mid Cap Growth Fund (Class N shares) (the “Fund”) posted a 32.05% decrease, net of fees, for the six months ended June 30, 2022. By comparison, the Fund’s benchmark index, the Russell Midcap® Growth Index (the “Index”), decreased 31.00%. The Fund modestly trailed the Index in the year-to-date period. Relative performance was driven by both style factors and stock-specific dynamics. From a style perspective, similar to second quarter dynamics, our emphasis on longer duration growth companies was a headwind. From a stock-specific perspective, our top individual detractors included Coupa Software (Information Technology), Align Technology (Health Care) and Burlington Stores (Consumer Discretionary). Coupa Software, provider of a cloud-based business spend management platform, reported a slowdown of demand in Europe, primarily due to the ongoing Russia/Ukraine crisis. Stock selection in Consumer Discretionary, including our positions in Farfetch and Etsy, was also a detractor. Farfetch is a leading e-commerce marketplace focused on the luxury market whose shares were pressured by macro-related issues, including the company’s exposure to consumers in Europe and China, and difficult year-over-year comparisons. Conversely, our top individual contributors included New Fortress Energy (Energy), BWX Technologies (Industrials) and Veeva Systems (Health Care). New Fortress Energy develops, finances and constructs liquified natural gas assets and related infrastructure. The company announced a number of project milestones and shares were further supported by a strong backdrop to sign new deals. Shares of BWX Technologies advanced for the reasons outlined above. Stock selection in Information Technology, including our positions in SolarEdge Technologies and Teledyne Technologies, contributed positively to relative returns. Please refer to the U.S. Growth & Core Market Review and Outlook relating to the Fund on page 3. |

| June 30, 2022 | William Blair Funds | 11 |

Mid Cap Growth Fund

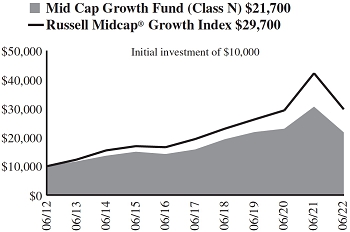

Performance Highlights (Unaudited)

| Average Annual Total Returns through 6/30/2022 |

| | | Year to

Date | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception(a) |

| Class N | | | (32.05 | )% | | | (29.08 | )% | | | (0.19 | )% | | | 6.54 | % | | | 8.06 | % | | | — | % |

| Class I | | | (31.97 | ) | | | (28.84 | ) | | | 0.07 | | | | 6.81 | | | | 8.34 | | | | — | |

| Class R6 | | | (31.93 | ) | | | (28.80 | ) | | | 0.14 | | | | — | | | | — | | | | 0.76 | |

| Russell Midcap® Growth Index | | | (31.00 | ) | | | (29.57 | ) | | | 4.25 | | | | 8.88 | | | | 11.50 | | | | 4.67 | |

| (a) | Since inception is for the period from May 2, 2019 (Commencement of Operations) to June 30, 2022. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in medium capitalization companies involves special risks, including higher volatility and lower liquidity. Medium capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are not subject to a sales load. Class I shares are not subject to a sales load or distribution (Rule 12b-1) fees. Class R6 shares are not subject to a sales load, distribution (Rule 12b-1) fees, or sub-transfer agent fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell Midcap® Growth Index is an index that is constructed to provide a comprehensive and unbiased barometer of the mid-cap growth market.

This report identifies the Fund’s investments on June 30, 2022. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

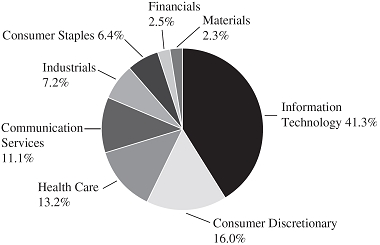

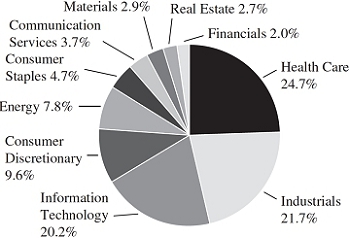

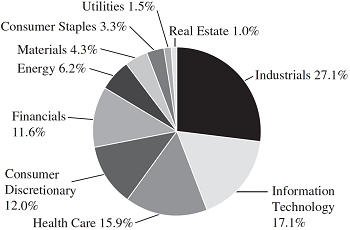

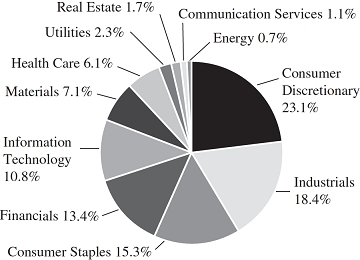

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| 12 | Semiannual Report | June 30, 2022 |

Mid Cap Growth Fund

Portfolio of Investments, June 30, 2022 (all dollar amounts in thousands) (unaudited)

| | | | | | | | |

| | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks | | | | | | | | |

| | Information Technology—29.8% | | | | | | | | |

| * | Cadence Design Systems, Inc. | | | 8,360 | | | $ | 1,254 | |

| * | Coupa Software, Inc. | | | 5,488 | | | | 313 | |

| * | Dynatrace, Inc. | | | 28,670 | | | | 1,131 | |

| * | EPAM Systems, Inc. | | | 2,565 | | | | 756 | |

| * | Euronet Worldwide, Inc. | | | 9,820 | | | | 988 | |

| * | Guidewire Software, Inc. | | | 4,012 | | | | 285 | |

| | MKS Instruments, Inc. | | | 6,955 | | | | 714 | |

| * | MongoDB, Inc. | | | 1,815 | | | | 471 | |

| * | Nice, Ltd.—ADR | | | 3,830 | | | | 737 | |

| * | Palo Alto Networks, Inc. | | | 2,295 | | | | 1,134 | |

| * | Pure Storage, Inc. | | | 33,895 | | | | 872 | |

| * | SolarEdge Technologies, Inc. | | | 3,220 | | | | 881 | |

| * | Teledyne Technologies, Inc. | | | 2,680 | | | | 1,005 | |

| | | | | | | | | 10,541 | |

| | Health Care—19.6% | | | | | | | | |

| * | ABIOMED, Inc. | | | 3,233 | | | | 800 | |

| | Agilent Technologies, Inc. | | | 6,325 | | | | 751 | |

| * | Align Technology, Inc. | | | 1,240 | | | | 293 | |

| * | Charles River Laboratories International, Inc. | | | 2,440 | | | | 522 | |

| * | DexCom, Inc. | | | 8,800 | | | | 656 | |

| * | Horizon Therapeutics plc† | | | 11,190 | | | | 893 | |

| * | IDEXX Laboratories, Inc. | | | 1,385 | | | | 486 | |

| * | Mettler-Toledo International, Inc. | | | 545 | | | | 626 | |

| | STERIS plc† | | | 2,145 | | | | 442 | |

| * | Veeva Systems, Inc. | | | 7,290 | | | | 1,444 | |

| | | | | | | | | 6,913 | |

| | Industrials—17.0% | | | | | | | | |

| * | Axon Enterprise, Inc. | | | 6,300 | | | | 587 | |

| * | Builders FirstSource, Inc. | | | 11,375 | | | | 611 | |

| | BWX Technologies, Inc. | | | 20,679 | | | | 1,139 | |

| * | Clarivate plc† | | | 53,005 | | | | 734 | |

| * | Copart, Inc. | | | 11,897 | | | | 1,293 | |

| * | CoStar Group, Inc. | | | 21,805 | | | | 1,317 | |

| * | Generac Holdings, Inc. | | | 1,500 | | | | 316 | |

| | | | | | | | | 5,997 | |

| | Consumer Discretionary—8.9% | | | | | | | | |

| * | Aptiv plc† | | | 5,455 | | | | 486 | |

| * | Bright Horizons Family Solutions, Inc. | | | 8,120 | | | | 686 | |

| * | Burlington Stores, Inc. | | | 4,385 | | | | 597 | |

| * | Chipotle Mexican Grill, Inc. | | | 704 | | | | 920 | |

| * | Etsy, Inc. | | | 4,479 | | | | 328 | |

| * | Farfetch, Ltd.† | | | 18,920 | | | | 136 | |

| | | | | | | | | 3,153 | |

| | Energy—5.5% | | | | | | | | |

| | Cameco Corporation | | | 21,770 | | | | 458 | |

| | Hess Corporation | | | 7,205 | | | | 763 | |

| | New Fortress Energy, Inc. | | | 18,658 | | | | 738 | |

| | | | | | | | | 1,959 | |

| | Issuer | | Shares or

Principal

Amount | | | Value | |

| | | | | | |

| | Common Stocks—(continued) | | | | | | | | |

| | Communication Services—5.0% | | | | | | | | |

| | Cable One, Inc. | | | 176 | | | $ | 227 | |

| * | Live Nation Entertainment, Inc. | | | 6,379 | | | | 527 | |

| * | Take-Two Interactive Software, Inc. | | | 3,495 | | | | 428 | |

| | Warner Music Group Corporation | | | 23,505 | | | | 573 | |

| | | | | | | | | 1,755 | |

| | Materials—4.5% | | | | | | | | |

| | Crown Holdings, Inc. | | | 6,495 | | | | 599 | |

| | Vulcan Materials Co. | | | 7,065 | | | | 1,004 | |

| | | | | | | | | 1,603 | |

| | Financials—3.7% | | | | | | | | |

| | Ares Management Corporation | | | 5,880 | | | | 334 | |

| | PacWest Bancorp | | | 13,555 | | | | 362 | |

| | Western Alliance Bancorp | | | 8,470 | | | | 598 | |

| | | | | | | | | 1,294 | |

| | Real Estate—2.9% | | | | | | | | |

| | SBA Communications Corporation | | | 1,940 | | | | 621 | |

| * | Zillow Group, Inc. | | | 12,390 | | | | 393 | |

| | | | | | | | | 1,014 | |

| | Consumer Staples—1.3% | | | | | | | | |

| * | Performance Food Group Co. | | | 10,210 | | | | 469 | |

| | Total Common Stocks—98.2%

(cost $38,052) | | | | | | | 34,698 | |

| | | | | | | | | | |

| | Repurchase Agreement | | | | | | | | |

| | Fixed Income Clearing Corporation, 0.240% dated 6/30/22, due 7/1/22, repurchase price $692, collateralized by U.S. Treasury Bond, 3.000%, due 02/15/49, valued at $705 | | | $692 | | | | 692 | |

| | Total Repurchase Agreement—1.9%

(cost $692) | | | | | | | 692 | |

| | Total Investments—100.1%

(cost $38,744) | | | | | | | 35,390 | |

| | Liabilities, plus cash and other assets—(0.1)% | | | | | (50 | ) |

| | Net assets—100.0% | | | | | | $ | 35,340 | |

ADR = American Depository Receipt

* = Non-income producing security

† = U.S. listed foreign security

See accompanying Notes to Financial Statements.

| June 30, 2022 | William Blair Funds | 13 |

| | Mid Cap Value Fund |

| | |

| | The Mid Cap Value Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

William Heaphy, CFA

Matthew Fleming, CFA | The William Blair Mid Cap Value Fund (Class I shares) (the “Fund”) posted a 12.60% decrease, net of fees, for the period from inception on March 16, 2022 to June 30, 2022. By comparison, the Fund’s benchmark index, the Russell Midcap® Value Index (the “Index”), decreased 10.57%. The Fund’s sector allocation was a headwind to relative performance in the partial period. A small cash holding, an overweight to the Health Care sector, and an underweight to the Communication Services sector were offset by an above Index allocation to the Information Technology sector and underweight to the Energy and Utilities sectors. Positively impacting performance for the partial period were the Fund’s investments in the Consumer Staples sector. The Fund’s investments in brewer Molson Coors Beveridge Company and food ingredient manufacturer Ingredion Inc. were both strong contributors as these companies reported solid earnings as their strong pricing power has allowed them to maintain margins in the current inflationary environment. On the negative side, the Fund’s investments in the Industrials segment were the worst performers and negatively impacted relative performance. Airline Alaska Air Group, Inc. and agricultural equipment manufacturer AGCO Corporation were large detractors to relative performance for the partial period. The Fund was also significantly underweight Energy shares, which was a large drag on relative performance as oil and natural gas prices spiked on the heels of the Russian invasion of Ukraine. An underweight position to the richly valued yet defensive Utilities sector also detracted from relative performance for the partial period. Please refer to the U.S. Value Market Review and Outlook relating to the Fund on page 4. |

| 14 | Semiannual Report | June 30, 2022 |

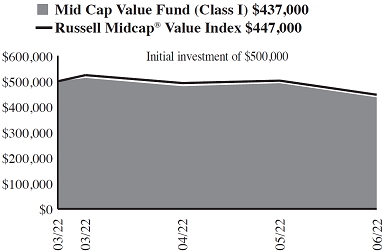

Mid Cap Value Fund

Performance Highlights (Unaudited)

| Average Annual Total Returns through 6/30/2022 |

| | | Since

Inception(a) |

| Class I | | | (12.60 | )% |

| Class R6 | | | (12.60 | ) |

| Russell Midcap® Value Index | | | (10.57 | ) |

| (a) | Since inception is for the period from March 16, 2022 (Commencement of Operations) to June 30, 2022. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller and medium capitalization companies involves special risks, including higher volatility and lower liquidity. Smaller and medium capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class I shares are not subject to a sales load or distribution (Rule 12b-1) fees. Class R6 shares are not subject to a sales load, distribution (Rule 12b-1) fees, or sub-transfer agent fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell Midcap® Value Index measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values.

This report identifies the Fund’s investments on June 30, 2022. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

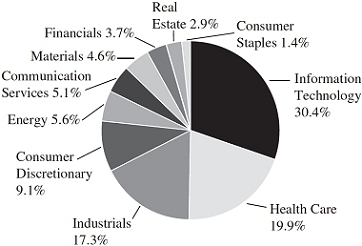

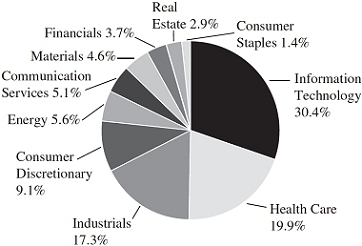

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| June 30, 2022 | William Blair Funds | 15 |

Mid Cap Value Fund

Portfolio of Investments, June 30, 2022 (all dollar amounts in thousands) (unaudited)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | |

| | Common Stocks | | | | | | |

| | Financials—16.7% | | | | | | |

| * | Arch Capital Group, Ltd.† | | | 700 | | | $ | 32 | |

| | Comerica, Inc. | | | 326 | | | | 24 | |

| | East West Bancorp, Inc. | | | 368 | | | | 24 | |

| | Huntington Bancshares, Inc. | | | 1,942 | | | | 24 | |

| | Invesco, Ltd.† | | | 1,306 | | | | 21 | |

| | SLM Corporation | | | 1,960 | | | | 31 | |

| | Synovus Financial Corporation | | | 590 | | | | 21 | |

| | The Hartford Financial Services Group, Inc. | | | 398 | | | | 26 | |

| | Willis Towers Watson plc† | | | 132 | | | | 26 | |

| | | | | | | | | 229 | |

| | Industrials—16.2% | | | | | | | | |

| | Acuity Brands, Inc. | | | 200 | | | | 31 | |

| | AGCO Corporation | | | 246 | | | | 24 | |

| * | Alaska Air Group, Inc. | | | 533 | | | | 21 | |

| | Flowserve Corporation | | | 590 | | | | 17 | |

| | Knight-Swift Transportation Holdings, Inc. | | | 592 | | | | 28 | |

| | MSC Industrial Direct Co., Inc. | | | 250 | | | | 19 | |

| | Regal Rexnord Corporation | | | 293 | | | | 33 | |

| | Snap-on, Inc. | | | 135 | | | | 27 | |

| | The Timken Co. | | | 420 | | | | 22 | |

| | | | | | | | | 222 | |

| | Information Technology—14.0% | | | | | | | | |

| * | Check Point Software Technologies, Ltd.† | | | 243 | | | | 30 | |

| | Cognizant Technology Solutions Corporation | | | 358 | | | | 24 | |

| * | DXC Technology Co. | | | 876 | | | | 26 | |

| * | F5, Inc. | | | 142 | | | | 22 | |

| * | Flex, Ltd.† | | | 1,540 | | | | 22 | |

| | Hewlett Packard Enterprise Co. | | | 1,897 | | | | 25 | |

| | Jabil, Inc. | | | 451 | | | | 23 | |

| | Skyworks Solutions, Inc. | | | 213 | | | | 20 | |

| | | | | | | | | 192 | |

| | Health Care—13.4% | | | | | | | | |

| | AmerisourceBergen Corporation | | | 170 | | | | 24 | |

| * | Centene Corporation | | | 439 | | | | 37 | |

| | Encompass Health Corporation | | | 408 | | | | 23 | |

| * | Henry Schein, Inc. | | | 359 | | | | 28 | |

| * | Hologic, Inc. | | | 396 | | | | 27 | |

| | Laboratory Corporation of America Holdings | | | 104 | | | | 24 | |

| | Viatris, Inc. | | | 2,020 | | | | 21 | |

| | | | | | | | | 184 | |

| | Consumer Discretionary—9.7% | | | | | | | | |

| | Brunswick Corporation | | | 287 | | | | 19 | |

| | LKQ Corporation | | | 577 | | | | 29 | |

| * | Mohawk Industries, Inc. | | | 162 | | | | 20 | |

| | Ralph Lauren Corporation | | | 260 | | | | 23 | |

| | Toll Brothers, Inc. | | | 495 | | | | 22 | |

| | Whirlpool Corporation | | | 131 | | | | 20 | |

| | | | | | | | | 133 | |

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | |

| | Common Stocks—(continued) | | | | | | |

| | Materials—9.0% | | | | | | |

| * | Axalta Coating Systems, Ltd.† | | | 977 | | | $ | 22 | |

| | Crown Holdings, Inc. | | | 262 | | | | 24 | |

| | Huntsman Corporation | | | 988 | | | | 28 | |

| | Sealed Air Corporation | | | 481 | | | | 28 | |

| | Westlake Corporation | | | 218 | | | | 21 | |

| | | | | | | | | 123 | |

| | Real Estate—7.7% | | | | | | | | |

| | Camden Property Trust | | | 183 | | | | 25 | |

| | Duke Realty Corporation | | | 617 | | | | 34 | |

| | Highwoods Properties, Inc. | | | 611 | | | | 21 | |

| | Host Hotels & Resorts, Inc. | | | 1,676 | | | | 26 | |

| | | | | | | | | 106 | |

| | Consumer Staples—6.0% | | | | | | | | |

| | Ingredion, Inc. | | | 301 | | | | 27 | |

| | Molson Coors Brewing Co. | | | 590 | | | | 32 | |

| | Tyson Foods, Inc. | | | 271 | | | | 23 | |

| | | | | | | | | 82 | |

| | Energy—2.3% | | | | | | | | |

| | Diamondback Energy, Inc. | | | 266 | | | | 32 | |

| | Utilities—2.3% | | | | | | | | |

| | Entergy Corporation | | | 274 | | | | 31 | |

| | Communication Services—1.3% | | | | | | | | |

| * | Warner Bros Discovery, Inc. | | | 1,345 | | | | 18 | |

| | Total Common Stocks—98.6%

(cost $1,563) | | | | | | | 1,352 | |

| | Total Investments—98.6%

(cost $1,563) | | | | | | | 1,352 | |

| | Cash and other assets, less liabilities—1.4% | | | | | | | 20 | |

| | Net assets—100.0% | | | | | | $ | 1,372 | |

* = Non-income producing security

† = U.S. listed foreign security

See accompanying Notes to Financial Statements.

| 16 | Semiannual Report | June 30, 2022 |

| | Small-Mid Cap Core Fund |

| | |

| | The Small-Mid Cap Core Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

Daniel Crowe, CFA

Ward D. Sexton, CFA | The William Blair Small-Mid Cap Core Fund (Class I shares) (the “Fund”) posted a 21.77% decrease, net of fees, for the six months ended June 30, 2022. By comparison, the Fund’s benchmark index, the Russell 2500™ Index (the “Index”), decreased 21.81%. The Fund modestly trailed its Index in the year-to-date period, driven by a combination of style factors and stock-specific dynamics. From a style perspective, while our typical underweight to companies without earnings was a modest tailwind, our underweight to the cheapest stocks in the Index was an offsetting headwind. Notably, among companies with earnings, there was minimal performance differentiation on quality factors, which did not provide their typical down-market benefit. From a stock perspective, our top detractors included Kornit Digital (Industrials), Coupa Software (Information Technology), Trex Company (Industrials) and Builders FirstSource (Industrials). Kornit Digital, a manufacturer of innovative digital textile printers and inks, experienced macro-related headwinds that impacted orders. Coupa Software, a provider of a cloud-based business spending management platform, reported a slowdown of demand in Europe, primarily due to the ongoing Russia/Ukraine crisis. Stock selection in Consumer Discretionary, including our position in Burlington Stores, also detracted from relative returns. Conversely, our top contributors included New Fortress Energy (Energy), Whitecap Resources (Energy), CF Industries (Materials), BWX Technologies (Industrials) and Mercury Systems (Industrials). New Fortress Energy develops, finances and constructs liquified natural gas assets and related infrastructure. The company announced a number of project milestones and shares were further supported by a strong backdrop to sign new deals. Whitecap Resources is a Canadian exploration & production company that sources a portion of its production from tertiary oil recovery (CO2 injections), which lowers its carbon footprint. A number of accretive acquisitions by the company, a material share buyback and a dividend raise all contributed to outperformance in the period. Please refer to the U.S. Growth & Core Market Review and Outlook relating to the Fund on page 3. |

| June 30, 2022 | William Blair Funds | 17 |

Small-Mid Cap Core Fund

Performance Highlights (Unaudited)

| Average Annual Total Returns through 6/30/2022 |

| | | Year to

Date | | 1 Year | | Since

Inception(a) |

| Class I | | | (21.77 | )% | | | (16.27 | )% | | | 9.29 | % |

| Class R6 | | | (21.75 | ) | | | (16.26 | ) | | | 9.33 | |

| Russell 2500TM Index | | | (21.81 | ) | | | (21.00 | ) | | | 6.96 | |

| (a) | Since inception is for the period from October 1, 2019 (Commencement of Operations) to June 30, 2022. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller and medium capitalization companies involves special risks, including higher volatility and lower liquidity. Smaller and medium capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class I shares are not subject to a sales load or distribution (Rule 12b-1) fees. Class R6 shares are not subject to a sales load, distribution (Rule 12b-1) fees, or sub-transfer agent fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2500TMIndex measures the performance of those Russell 2500 companies with above average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on June 30, 2022. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

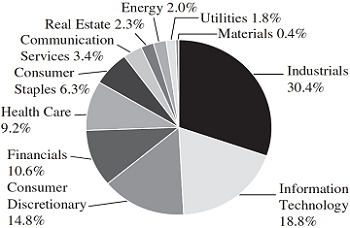

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| 18 | Semiannual Report | June 30, 2022 |

Small-Mid Cap Core Fund

Portfolio of Investments, June 30, 2022 (all dollar amounts in thousands) (unaudited)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | |

| | Common Stocks | | | | | | |

| | Industrials—20.0% | | | | | | |

| * | Axon Enterprise, Inc. | | | 19,148 | | | $ | 1,784 | |

| * | Builders FirstSource, Inc. | | | 37,916 | | | | 2,036 | |

| | BWX Technologies, Inc. | | | 37,661 | | | | 2,075 | |

| * | Casella Waste Systems, Inc. | | | 22,198 | | | | 1,613 | |

| * | Chart Industries, Inc. | | | 12,312 | | | | 2,061 | |

| | Douglas Dynamics, Inc. | | | 21,093 | | | | 606 | |

| * | Energy Recovery, Inc. | | | 64,235 | | | | 1,247 | |

| * | Kornit Digital, Ltd.† | | | 18,560 | | | | 588 | |

| | Lincoln Electric Holdings, Inc. | | | 11,290 | | | | 1,393 | |

| * | Mercury Systems, Inc. | | | 36,717 | | | | 2,362 | |

| | Owens Corning | | | 14,483 | | | | 1,076 | |

| * | Shoals Technologies Group, Inc. | | | 72,184 | | | | 1,190 | |

| * | Stem, Inc. | | | 110,453 | | | | 791 | |

| | The Brink’s Co. | | | 29,417 | | | | 1,786 | |

| * | Trex Co., Inc. | | | 22,786 | | | | 1,240 | |

| * | WillScot Mobile Mini Holdings Corporation | | | 55,279 | | | | 1,792 | |

| | | | | | | | | 23,640 | |

| | Health Care—16.7% | | | | | | | | |

| * | Acadia Healthcare Co., Inc. | | | 27,589 | | | | 1,866 | |

| | Azenta, Inc. | | | 16,679 | | | | 1,203 | |

| * | Certara, Inc. | | | 46,985 | | | | 1,008 | |

| | Chemed Corporation | | | 2,866 | | | | 1,345 | |

| * | Globus Medical, Inc. | | | 29,290 | | | | 1,644 | |

| * | Halozyme Therapeutics, Inc. | | | 29,203 | | | | 1,285 | |

| * | Hanger, Inc. | | | 50,969 | | | | 730 | |

| * | Horizon Therapeutics plc† | | | 11,219 | | | | 895 | |

| * | Ligand Pharmaceuticals, Inc. | | | 8,582 | | | | 766 | |

| * | Merit Medical Systems, Inc. | | | 37,373 | | | | 2,028 | |

| | Owens & Minor, Inc. | | | 86,774 | | | | 2,729 | |

| * | Penumbra, Inc. | | | 5,509 | | | | 686 | |

| * | Repligen Corporation | | | 7,485 | | | | 1,216 | |

| * | Sotera Health Co. | | | 54,634 | | | | 1,070 | |

| | STERIS plc† | | | 6,043 | | | | 1,246 | |

| | | | | | | | | 19,717 | |

| | Financials—12.7% | | | | | | | | |

| | Ares Management Corporation | | | 25,483 | | | | 1,449 | |

| | Columbia Banking System, Inc. | | | 43,711 | | | | 1,252 | |

| | East West Bancorp, Inc. | | | 29,629 | | | | 1,920 | |

| | Hannon Armstrong Sustainable Infrastructure Capital, Inc. | | | 32,843 | | | | 1,244 | |

| | LPL Financial Holdings, Inc. | | | 8,452 | | | | 1,559 | |

| | PacWest Bancorp | | | 63,851 | | | | 1,702 | |

| | Virtu Financial, Inc. | | | 81,973 | | | | 1,919 | |

| | Western Alliance Bancorp | | | 33,754 | | | | 2,383 | |

| | Wintrust Financial Corporation | | | 19,073 | | | | 1,529 | |

| | | | | | | | | 14,957 | |

| | Information Technology—11.9% | | | | | | | | |

| * | Alarm.com Holdings, Inc. | | | 15,475 | | | | 957 | |

| * | Coupa Software, Inc. | | | 15,148 | | | | 865 | |

| * | Dynatrace, Inc. | | | 28,145 | | | | 1,110 | |

| | Entegris, Inc. | | | 8,913 | | | | 821 | |

| * | Euronet Worldwide, Inc. | | | 16,873 | | | | 1,697 | |

| | MKS Instruments, Inc. | | | 7,829 | | | | 804 | |

| * | Nice, Ltd.—ADR | | | 5,889 | | | | 1,133 | |

| | Power Integrations, Inc. | | | 15,801 | | | | 1,185 | |

| * | Pure Storage, Inc. | | | 47,626 | | | | 1,225 | |

| * | SolarEdge Technologies, Inc. | | | 5,702 | | | | 1,561 | |

| * | Verra Mobility Corporation | | | 132,362 | | | | 2,079 | |

| * | Wolfspeed, Inc. | | | 8,809 | | | | 559 | |

| | | | | | | | | 13,996 | |

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | |

| | Common Stocks—(continued) | | | | | | |

| | Consumer Discretionary—10.2% | | | | | | |

| | Aramark | | | 46,311 | | | $ | 1,418 | |

| * | Boot Barn Holdings, Inc. | | | 9,954 | | | | 686 | |

| * | Bright Horizons Family Solutions, Inc. | | | 9,532 | | | | 806 | |

| * | Burlington Stores, Inc. | | | 6,338 | | | | 863 | |

| * | Fox Factory Holding Corporation | | | 10,505 | | | | 846 | |

| * | Leslie’s, Inc. | | | 69,343 | | | | 1,053 | |

| * | National Vision Holdings, Inc. | | | 60,945 | | | | 1,676 | |

| * | Overstock.com, Inc. | | | 16,178 | | | | 405 | |

| * | Petco Health & Wellness Co., Inc. | | | 69,160 | | | | 1,019 | |

| * | Revolve Group, Inc. | | | 29,684 | | | | 769 | |

| * | Skyline Champion Corporation | | | 28,459 | | | | 1,349 | |

| | Wyndham Hotels & Resorts, Inc. | | | 18,360 | | | | 1,207 | |

| | | | | | | | | 12,097 | |

| | Energy—7.9% | | | | | | | | |

| | Cameco Corporation | | | 100,352 | | | | 2,110 | |

| * | Denbury, Inc. | | | 23,501 | | | | 1,410 | |

| * | Green Plains, Inc. | | | 41,967 | | | | 1,140 | |

| | New Fortress Energy, Inc. | | | 37,320 | | | | 1,477 | |

| * | TechnipFMC plc† | | | 212,538 | | | | 1,430 | |

| | Whitecap Resources, Inc. | | | 257,289 | | | | 1,793 | |

| | | | | | | | | 9,360 | |

| | Real Estate—5.4% | | | | | | | | |

| | Americold Realty Trust | | | 45,890 | | | | 1,379 | |

| | Equity LifeStyle Properties, Inc. | | | 23,775 | | | | 1,675 | |

| | Healthcare Realty Trust, Inc. | | | 75,811 | | | | 2,062 | |

| | Pebblebrook Hotel Trust | | | 43,339 | | | | 718 | |

| * | The Howard Hughes Corporation | | | 7,187 | | | | 489 | |

| | | | | | | | | 6,323 | |

| | Materials—4.5% | | | | | | | | |

| * | Century Aluminum Co. | | | 70,161 | | | | 517 | |

| | CF Industries Holdings, Inc. | | | 20,674 | | | | 1,773 | |

| | Crown Holdings, Inc. | | | 21,915 | | | | 2,020 | |

| | Eagle Materials, Inc. | | | 9,098 | | | | 1,000 | |

| | | | | | | | | 5,310 | |

| | Consumer Staples—4.1% | | | | | | | | |

| | Inter Parfums, Inc. | | | 15,619 | | | | 1,141 | |

| * | Performance Food Group Co. | | | 29,575 | | | | 1,360 | |

| | Primo Water Corporation | | | 60,898 | | | | 815 | |

| | Spectrum Brands Holdings, Inc. | | | 17,986 | | | | 1,475 | |

| | | | | | | | | 4,791 | |

| | Communication Services—2.3% | | | | | | | | |

| | Cable One, Inc. | | | 773 | | | | 997 | |

| * | Live Nation Entertainment, Inc. | | | 8,020 | | | | 662 | |

| * | ZipRecruiter, Inc. | | | 70,179 | | | | 1,040 | |

| | | | | | | | | 2,699 | |

| | Utilities—1.6% | | | | | | | | |

| | IDACORP, Inc. | | | 18,313 | | | | 1,940 | |

| | Total Common Stocks—97.3%

(cost $133,302) | | | | | | | 114,830 | |

See accompanying Notes to Financial Statements.

| June 30, 2022 | William Blair Funds | 19 |

Small-Mid Cap Core Fund

Portfolio of Investments, June 30, 2022 (all dollar amounts in thousands) (unaudited)

| | | | | | | | |

| | Issuer | | Principal

Amount | | | Value | |

| | | | | | | | |

| | Repurchase Agreement | | | | | | |

| | Fixed Income Clearing Corporation, 0.240% dated 6/30/22, due 7/1/22, repurchase price $3,125, collateralized by U.S. Treasury Note, 1.625%, due 05/15/31, valued at $3,188 | | | $3,125 | | | $ | 3,125 | |

| | Total Repurchase Agreement—2.6%

(cost $3,125) | | | | | | | 3,125 | |

| | Total Investments—99.9%

(cost $136,427) | | | | | | | 117,955 | |

| | Cash and other assets, less liabilities—0.1% | | | | | | | 124 | |

| | Net assets—100.0% | | | | | | $ | 118,079 | |

ADR = American Depository Receipt

* = Non-income producing security

† = U.S. listed foreign security

See accompanying Notes to Financial Statements.

| 20 | Semiannual Report | June 30, 2022 |

| | Small-Mid Cap Growth Fund |

| | |

| | The Small-Mid Cap Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

Daniel Crowe, CFA

James E. Jones, CFA | The William Blair Small-Mid Cap Growth Fund (Class N shares) (the “Fund”) posted a 28.60% decrease, net of fees, for the six months ended June 30, 2022. By comparison, the Fund’s benchmark index, the Russell 2500™ Growth Index (the “Index”), decreased 29.45%. The Fund modestly outperformed its Index in the year-to-date period, driven by a combination of style factors and stock-specific dynamics. From a style perspective, our typical underweight to companies without earnings was a modest tailwind. Notably, among companies with earnings, there was minimal performance differentiation on quality factors, which did not provide their typical down-market benefit. From a stock-specific perspective, our top individual contributors were BWX Technologies (Industrials), Mercury Systems (Industrials), Acadia Healthcare (Health Care), New Fortress (Energy) and HealthEquity (Health Care). Shares of BWX Technologies advanced for the reasons outlined above. Mercury Systems, a provider of sensor processing subsystems, reported strong organic revenue growth and orders against a more supportive backdrop for defense spending. Conversely, our top individual detractors included Trex Company (Industrials), Coupa Software (Information Technology), Revolve Group (Consumer Discretionary), Penumbra (Health Care) and Kornit Digital (Industrials). Shares of Trex, the industry leader in composite residential decking, were pressured by higher-than-expected sales and marketing expense forecasts and concerns that higher interest rates could dampen demand. Coupa Software, provider of a cloud-based business spend management platform, reported a slowdown of demand in Europe, primarily due to the ongoing Russia/Ukraine crisis. Please refer to the U.S. Growth & Core Market Review and Outlook relating to the Fund on page 3. |

| June 30, 2022 | William Blair Funds | 21 |

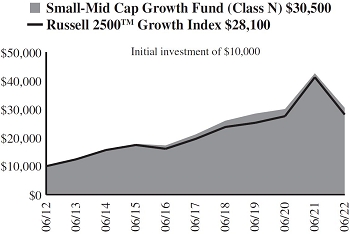

Small-Mid Cap Growth Fund

Performance Highlights (Unaudited)

| Average Annual Total Returns through 6/30/2022 |

| | | Year to

Date | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception(a) |

| Class N | | | (28.60 | )% | | | (28.45 | )% | | | 2.32 | % | | | 7.60 | % | | | 11.78 | % | | | — | % |

| Class I | | | (28.51 | ) | | | (28.26 | ) | | | 2.57 | | | | 7.86 | | | | 12.06 | | | | — | |

| Class R6 | | | (28.49 | ) | | | (28.21 | ) | | | 2.63 | | | | — | | | | — | | | | 3.43 | |

| Russell 2500TM Growth Index | | | (29.45 | ) | | | (31.81 | ) | | | 3.68 | | | | 7.53 | | | | 10.88 | | | | 4.07 | |

| (a) | Since inception is for the period from May 2, 2019 (Commencement of Operations) to June 30, 2022. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller and medium capitalization companies involves special risks, including higher volatility and lower liquidity. Smaller and medium capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are not subject to a sales load. Class I shares are not subject to a sales load or distribution (Rule 12b-1) fees. Class R6 shares are not subject to a sales load, distribution (Rule 12b-1) fees, or sub-transfer agent fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2500TM Growth Index measures the performance of those Russell 2500 companies with above average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on June 30, 2022. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

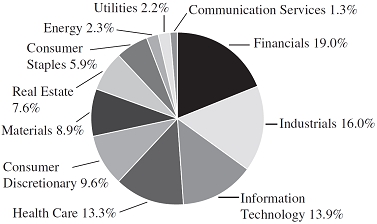

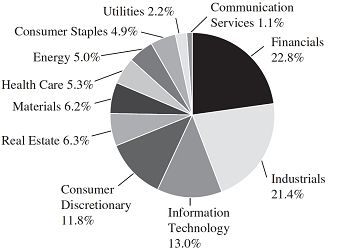

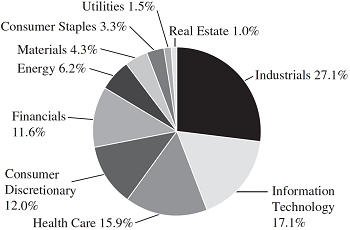

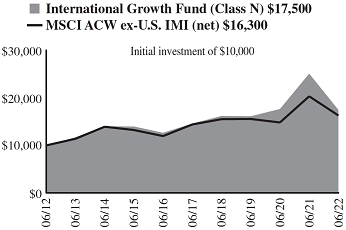

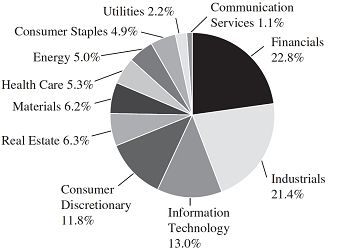

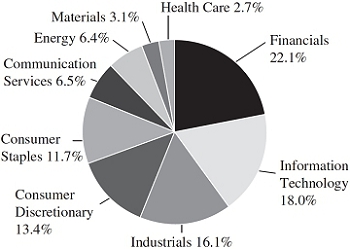

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| 22 | Semiannual Report | June 30, 2022 |

Small-Mid Cap Growth Fund

Portfolio of Investments, June 30, 2022 (all dollar amounts in thousands) (unaudited)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks | | | | | | | | |

| | Information Technology—22.7% | | | | | | | | |

| * | Alarm.com Holdings, Inc. | | | 425,741 | | | $ | 26,336 | |

| * | Avalara, Inc. | | | 380,549 | | | | 26,867 | |

| | Cognex Corporation | | | 440,247 | | | | 18,719 | |

| * | Coupa Software, Inc. | | | 223,609 | | | | 12,768 | |

| * | Dynatrace, Inc. | | | 1,073,286 | | | | 42,330 | |

| | Entegris, Inc. | | | 315,376 | | | | 29,056 | |

| * | Euronet Worldwide, Inc. | | | 451,480 | | | | 45,414 | |

| * | Guidewire Software, Inc. | | | 320,755 | | | | 22,770 | |

| | MKS Instruments, Inc. | | | 194,765 | | | | 19,989 | |

| | National Instruments Corporation | | | 965,848 | | | | 30,164 | |

| * | Nice, Ltd.—ADR | | | 149,468 | | | | 28,765 | |

| * | Novanta, Inc.† | | | 179,054 | | | | 21,714 | |

| * | PagerDuty, Inc. | | | 797,309 | | | | 19,757 | |

| * | Pure Storage, Inc. | | | 1,121,848 | | | | 28,843 | |

| * | SolarEdge Technologies, Inc. | | | 177,241 | | | | 48,507 | |

| * | Varonis Systems, Inc. | | | 968,432 | | | | 28,395 | |

| * | Wolfspeed, Inc. | | | 202,213 | | | | 12,831 | |

| * | Workiva, Inc. | | | 165,892 | | | | 10,947 | |

| | | | | | | | | 474,172 | |

| | Health Care—21.5% | | | | | | | | |

| * | ABIOMED, Inc. | | | 129,433 | | | | 32,036 | |

| * | Acadia Healthcare Co., Inc. | | | 638,780 | | | | 43,201 | |

| | Azenta, Inc. | | | 523,316 | | | | 37,731 | |

| * | Blueprint Medicines Corporation | | | 193,004 | | | | 9,749 | |

| * | Certara, Inc. | | | 775,535 | | | | 16,643 | |

| * | Charles River Laboratories International, Inc. | | | 165,037 | | | | 35,313 | |

| | Chemed Corporation | | | 77,684 | | | | 36,464 | |

| * | Globus Medical, Inc. | | | 233,195 | | | | 13,091 | |

| * | Halozyme Therapeutics, Inc. | | | 738,877 | | | | 32,510 | |

| * | HealthEquity, Inc. | | | 470,708 | | | | 28,897 | |

| * | Horizon Therapeutics plc† | | | 288,306 | | | | 22,995 | |

| * | Insmed, Inc. | | | 645,551 | | | | 12,730 | |

| * | Inspire Medical Systems, Inc. | | | 111,542 | | | | 20,375 | |

| * | Insulet Corporation | | | 106,546 | | | | 23,221 | |

| * | Merit Medical Systems, Inc. | | | 455,026 | | | | 24,694 | |

| * | Penumbra, Inc. | | | 158,021 | | | | 19,677 | |

| * | Repligen Corporation | | | 135,300 | | | | 21,973 | |

| * | Twist Bioscience Corporation | | | 505,773 | | | | 17,682 | |

| | | | | | | | | 448,982 | |

| | Industrials—20.5% | | | | | | | | |

| | Advanced Drainage Systems, Inc. | | | 186,000 | | | | 16,753 | |

| * | Axon Enterprise, Inc. | | | 392,948 | | | | 36,611 | |

| * | Builders FirstSource, Inc. | | | 940,115 | | | | 50,484 | |

| | BWX Technologies, Inc. | | | 1,093,252 | | | | 60,227 | |

| * | Casella Waste Systems, Inc. | | | 279,461 | | | | 20,311 | |

| * | Chart Industries, Inc. | | | 221,544 | | | | 37,082 | |

| | HEICO Corporation | | | 179,156 | | | | 18,880 | |

| | Lincoln Electric Holdings, Inc. | | | 174,735 | | | | 21,555 | |

| * | Mercury Systems, Inc. | | | 758,501 | | | | 48,795 | |

| | Ritchie Bros Auctioneers, Inc. | | | 341,503 | | | | 22,218 | |

| * | Shoals Technologies Group, Inc. | | | 945,768 | | | | 15,586 | |

| * | Stem, Inc. | | | 803,329 | | | | 5,752 | |

| | The Brink’s Co. | | | 710,416 | | | | 43,129 | |

| * | Trex Co., Inc. | | | 569,221 | | | | 30,977 | |

| | | | | | | | | 428,360 | |

| | Consumer Discretionary—12.9% | | | | | | | | |

| * | Bright Horizons Family Solutions, Inc. | | | 238,501 | | | | 20,158 | |

| * | Burlington Stores, Inc. | | | 123,961 | | | | 16,887 | |

| * | Fox Factory Holding Corporation | | | 287,006 | | | | 23,115 | |

| | Issuer | | Shares or

Principal

Amount | | | Value | |

| | | | | | | | | | |

| | Common Stocks—(continued) | | | | | | | | |

| | Consumer Discretionary—(continued) | | | | | | | | |

| * | Helen of Troy, Ltd.† | | | 4,502 | | | $ | 731 | |

| * | Leslie’s, Inc. | | | 2,016,774 | | | | 30,615 | |

| * | National Vision Holdings, Inc. | | | 1,259,162 | | | | 34,627 | |

| * | Overstock.com, Inc. | | | 503,901 | | | | 12,602 | |

| * | Petco Health & Wellness Co., Inc. | | | 1,426,100 | | | | 21,021 | |

| * | Planet Fitness, Inc. | | | 245,400 | | | | 16,690 | |

| | Pool Corporation | | | 65,082 | | | | 22,859 | |

| * | Revolve Group, Inc. | | | 1,010,992 | | | | 26,195 | |

| | Wyndham Hotels & Resorts, Inc. | | | 680,245 | | | | 44,706 | |

| | | | | | | | | 270,206 | |

| | Energy—5.7% | | | | | | | | |

| | Cameco Corporation | | | 1,911,062 | | | | 40,171 | |

| * | Denbury, Inc. | | | 534,685 | | | | 32,076 | |

| | New Fortress Energy, Inc. | | | 735,212 | | | | 29,092 | |

| | Whitecap Resources, Inc. | | | 2,565,700 | | | | 17,883 | |

| | | | | | | | | 119,222 | |

| | Materials—5.1% | | | | | | | | |

| | CF Industries Holdings, Inc. | | | 395,631 | | | | 33,918 | |

| | Crown Holdings, Inc. | | | 582,287 | | | | 53,669 | |

| | Martin Marietta Materials, Inc. | | | 65,496 | | | | 19,599 | |

| | | | | | | | | 107,186 | |

| | Financials—4.4% | | | | | | | | |

| | Ares Management Corporation | | | 528,540 | | | | 30,053 | |

| | Virtu Financial, Inc. | | | 1,279,536 | | | | 29,954 | |

| | Western Alliance Bancorp | | | 468,082 | | | | 33,046 | |

| | | | | | | | | 93,053 | |

| | Consumer Staples—3.2% | | | | | | | | |

| * | Celsius Holdings, Inc. | | | 267,258 | | | | 17,441 | |

| * | Performance Food Group Co. | | | 821,795 | | | | 37,786 | |

| * | The Beauty Health Co. | | | 868,022 | | | | 11,163 | |

| | | | | | | | | 66,390 | |

| | Communication Services—1.9% | | | | | | | | |

| | Cable One, Inc. | | | 19,646 | | | | 25,330 | |

| * | Live Nation Entertainment, Inc. | | | 183,060 | | | | 15,117 | |

| | | | | | | | | 40,447 | |

| | Real Estate—1.0% | | | | | | | | |

| | FirstService Corporation | | | 167,968 | | | | 20,358 | |

| | Total Common Stocks—98.9%

(cost $2,136,540) | | | | | | | 2,068,376 | |

| | | | | | | | | | |

| | Repurchase Agreement | | | | | | | | |

| | Fixed Income Clearing Corporation, 0.240% dated 6/30/22, due 7/1/22, repurchase price $51,493, collateralized by U.S. Treasury Note, 1.625%, due 05/15/31, valued at $52,522 | | | $51,492 | | | | 51,492 | |

| | Total Repurchase Agreement—2.4%

(cost $51,492) | | | | | | | 51,492 | �� |

| | Total Investments—101.3%

(cost $2,188,032) | | | | | | | 2,119,868 | |

| | Liabilities, plus cash and other assets—(1.3)% | | | | | | | (28,199 | ) |

| | Net assets—100.0% | | | | | | $ | 2,091,669 | |

ADR = American Depository Receipt

* = Non-income producing security

† = U.S. listed foreign security

See accompanying Notes to Financial Statements.

| June 30, 2022 | William Blair Funds | 23 |

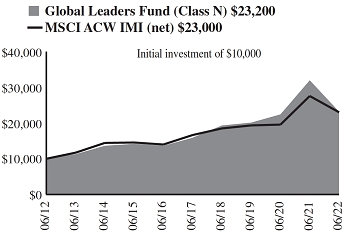

| | Small Cap Growth Fund |

| | |

| | The Small Cap Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

Ward D. Sexton, CFA

Mark C. Thompson, CFA | The William Blair Small Cap Growth Fund (Class N shares) (the “Fund”) posted a 27.96% decrease, net of fees, for the six months ended June 30, 2022. By comparison, the Fund’s benchmark index, the Russell 2000® Growth Index (the “Index”), decreased 29.45%. The Fund outperformed the Index in the year-to-date period, driven by a combination of style factors and stock-specific dynamics. From a style perspective, our typical valuation sensitivity was a modest tailwind as the more attractively valued stocks in the Index outperformed during the period. From a stock-specific perspective, selection in Information Technology, including our position in Verra Mobility, contributed positively to relative returns. Our top individual contributors included BWX Technologies (Industrials), Gogo (Communication Services), Acadia Healthcare (Health Care) and Mercury Systems (Industrials). Shares of BWX Technologies advanced for the reasons outlined above. Gogo, a provider of telecommunication services to the business aviation market, reported strong earnings results across all important metrics. Conversely, our top individual detractors included Kornit Digital (Industrials), Health Catalyst (Health Care), Codexis (Health Care), Montrose Environmental Group (Industrials) and Overstock.com (Consumer Discretionary). Kornit Digital, a manufacturer of innovative digital textile printers and inks, experienced macro-related headwinds that impacted orders. We liquidated our position in Health Catalyst, a provider of healthcare software solutions, during the period as we believe the market downturn is likely to slow future booking for the company, delaying the path of sustainable profit generation. Please refer to the U.S. Growth & Core Market Review and Outlook relating to the Fund on page 3. |

| 24 | Semiannual Report | June 30, 2022 |

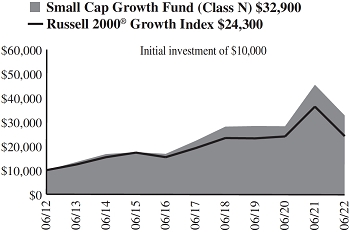

Small Cap Growth Fund

Performance Highlights (Unaudited)

| Average Annual Total Returns through 6/30/2022 |

| | | Year to

Date | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception(a) |

| Class N | | | (27.96 | )% | | | (27.92 | )% | | | 4.95 | % | | | 8.11 | % | | | 12.63 | % | | | — | % |

| Class I | | | (27.88 | ) | | | (27.74 | ) | | | 5.21 | | | | 8.39 | | | | 12.91 | | | | — | |

| Class R6 | | | (27.85 | ) | | | (27.68 | ) | | | 5.29 | | | | — | | | | — | | | | 4.96 | |

| Russell 2000® Growth Index | | | (29.45 | ) | | | (33.43 | ) | | | 1.40 | | | | 4.80 | | | | 9.30 | | | | 1.57 | |

| (a) | Since inception is for the period from May 2, 2019 (Commencement of Operations) to June 30, 2022. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. Smaller capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are not subject to a sales load. Class I shares are not subject to a sales load or distribution (Rule 12b-1) fees. Class R6 shares are not subject to a sales load, distribution (Rule 12b-1) fees, or sub-transfer agent fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2000® Growth Index is an unmanaged composite of the smallest 2000 stocks of the Russell 3000® Growth Index.

This report identifies the Fund’s investments on June 30, 2022. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

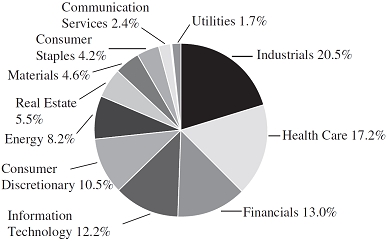

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| June 30, 2022 | William Blair Funds | 25 |

Small Cap Growth Fund

Portfolio of Investments, June 30, 2022 (all dollar amounts in thousands) (unaudited)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks | | | | | | | | |

| | Health Care—24.2% | | | | | | | | |

| * | Acadia Healthcare Co., Inc. | | | 113,229 | | | $ | 7,658 | |

| * | Amicus Therapeutics, Inc. | | | 718,590 | | | | 7,718 | |

| * | Artivion, Inc. | | | 14,550 | | | | 275 | |

| * | Axogen, Inc. | | | 462,234 | | | | 3,786 | |

| | Azenta, Inc. | | | 139,815 | | | | 10,081 | |

| * | Blueprint Medicines Corporation | | | 43,880 | | | | 2,216 | |

| * | Certara, Inc. | | | 315,013 | | | | 6,760 | |

| * | Codexis, Inc. | | | 291,311 | | | | 3,047 | |

| * | Globus Medical, Inc. | | | 74,370 | | | | 4,175 | |

| * | Halozyme Therapeutics, Inc. | | | 198,880 | | | | 8,751 | |

| * | Hanger, Inc. | | | 359,665 | | | | 5,150 | |

| * | HealthEquity, Inc. | | | 111,295 | | | | 6,832 | |

| * | Insmed, Inc. | | | 136,770 | | | | 2,697 | |

| * | Inspire Medical Systems, Inc. | | | 39,040 | | | | 7,131 | |

| * | Ligand Pharmaceuticals, Inc. | | | 80,348 | | | | 7,169 | |

| * | Merit Medical Systems, Inc. | | | 175,520 | | | | 9,525 | |

| | Owens & Minor, Inc. | | | 175,230 | | | | 5,511 | |

| * | Penumbra, Inc. | | | 39,470 | | | | 4,915 | |

| * | Pulmonx Corporation | | | 197,001 | | | | 2,900 | |

| * | Treace Medical Concepts, Inc. | | | 231,080 | | | | 3,314 | |

| * | Twist Bioscience Corporation | | | 94,366 | | | | 3,299 | |

| * | Veracyte, Inc. | | | 148,450 | | | | 2,954 | |

| * | Vericel Corporation | | | 129,930 | | | | 3,272 | |

| | | | | | | | | 119,136 | |

| | Industrials—21.1% | | | | | | | | |

| * | ACV Auctions, Inc. | | | 302,590 | | | | 1,979 | |

| | Albany International Corporation | | | 102,855 | | | | 8,104 | |

| * | Builders FirstSource, Inc. | | | 91,750 | | | | 4,927 | |

| | BWX Technologies, Inc. | | | 234,209 | | | | 12,903 | |

| * | Casella Waste Systems, Inc. | | | 137,620 | | | | 10,002 | |

| | Douglas Dynamics, Inc. | | | 169,843 | | | | 4,881 | |

| * | Ducommun, Inc. | | | 147,682 | | | | 6,356 | |

| * | Energy Recovery, Inc. | | | 372,116 | | | | 7,227 | |

| * | IAA, Inc. | | | 55,849 | | | | 1,830 | |

| * | Kornit Digital, Ltd.† | | | 87,190 | | | | 2,764 | |

| | Lincoln Electric Holdings, Inc. | | | 50,720 | | | | 6,257 | |

| | Luxfer Holdings plc† | | | 482,386 | | | | 7,294 | |

| * | Mercury Systems, Inc. | | | 147,476 | | | | 9,487 | |

| * | Montrose Environmental Group, Inc. | | | 172,978 | | | | 5,840 | |

| * | Stem, Inc. | | | 482,466 | | | | 3,454 | |

| | The Brink’s Co. | | | 174,236 | | | | 10,578 | |

| | | | | | | | | 103,883 | |

| | Information Technology—19.6% | | | | | | | | |

| * | Alarm.com Holdings, Inc. | | | 97,160 | | | | 6,010 | |

| | American Software, Inc. | | | 271,250 | | | | 4,383 | |

| * | BTRS Holdings, Inc. | | | 344,190 | | | | 1,714 | |

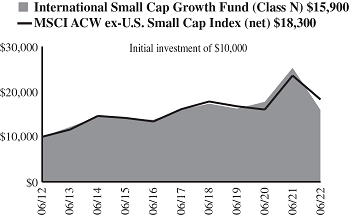

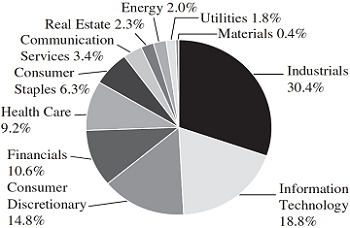

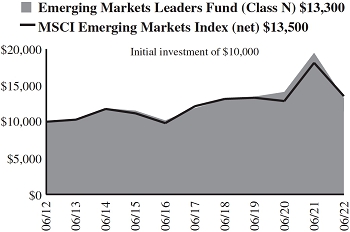

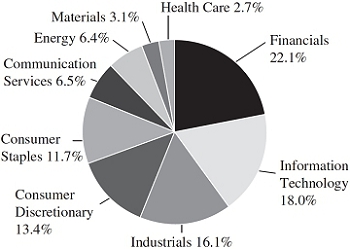

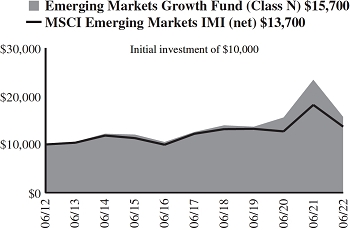

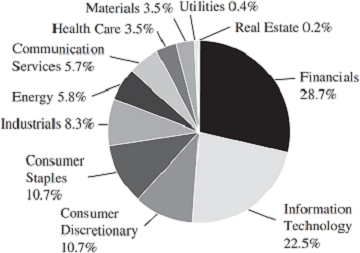

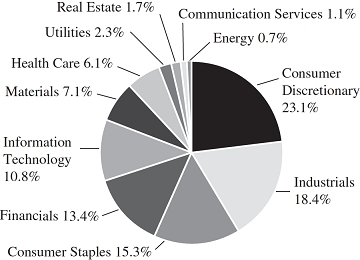

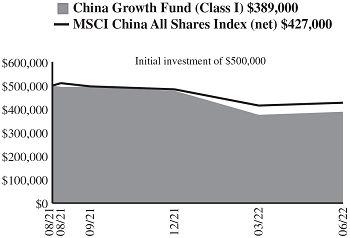

| | Computer Services, Inc. | | | 110,579 | | | | 4,087 | |