UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-5344

William Blair Funds

(Exact name of registrant as specified in charter)

| | |

| 222 West Adams Street, Chicago, IL | | 60606 |

| (Address of principal executive offices) | | (Zip Code) |

Marco Hanig

William Blair Funds

222 West Adams Street, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: 312-236-1600

Date of fiscal year end: December 31

Date of reporting period: June 30, 2005

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A Registrant is not required to respond to the collection of information contained in Form N-CSR unless the form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimates and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. (ss) 3507.

| Item 1. | June 30, 2005 Semi-Annual Reports transmitted to shareholders. |

WILLIAM BLAIR FUNDS

SEMI - ANNUAL REPORT

JUNE 30, 2005

Table of Contents

This report is submitted for the general information of the shareholders of the William Blair Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by a prospectus of the William Blair Funds. Please carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

June 30, 2005 | William Blair Funds 1 |

Marco Hanig

A LETTER FROM THE PRESIDENT

Dear Shareholders:

After losses in the first quarter, stocks rebounded in the second quarter and were virtually flat for the first half of the year. The S&P 500 Index of large cap stocks closed at -0.81%, the Russell 2000 Index of small cap stocks at -1.25%, and the MSCI World ex-US Index of foreign stocks at 0.32%. Bonds did well, with the Lehman Intermediate Government/Credit Bond index up 1.58% despite rising interest rates.

While the market pretty much drifted sideways, it was not without surprises. International stocks were supposed to outperform US stocks, as the dollar was expected to continue to weaken in light of the chronic trade deficit. But when voters in France and the Netherlands rejected the European constitution, the US dollar strengthened by over 10% versus the Euro, offsetting the good performance of international stocks as measured in their local currencies. Also, three more hikes in short-term interest rates were expected to lead to negative returns for long-term bonds, but in fact long-term rates have actually decreased slightly, resulting in a relatively flat yield curve.

The final surprise was the relative performance of different asset classes. The expectation was that after several years where value had beaten growth and small cap had beaten large cap, the trend would reverse. What actually happened is that the race between the nine Morningstar style boxes was almost too close to call: the best asset class (Mid-cap Value, up 2.25%) was only about 4% ahead of the worst asset class (Large Cap Growth, down 1.78%), which is the smallest performance gap of the last five years. More generally, mid-cap was a modest winner over small and large, and value continued to edge growth.

Total Returns by Morningstar Fund Category

January 1 through June 30, 2005

| | | | | | | | | |

| | | Value

| | | Blend

| | | Growth

| |

Large Cap | | 0.39 | % | | -0.60 | % | | -1.78 | % |

Mid Cap | | 2.25 | % | | 1.65 | % | | 0.05 | % |

Small Cap | | 0.48 | % | | 0.21 | % | | -1.50 | % |

The relative returns for the William Blair Funds were mixed. The Small Cap Growth and Value Discovery Funds trailed their Morningstar peers in the first semester, in part because some large outflows put pressure on the values of their holdings. Details on each fund are provided in the respective portfolio manager discussions. The standout funds were the International Growth Fund, up 1.49% vs. -1.65% for Foreign Large Growth Morningstar peers, Tax-Managed Growth Fund, up 1.00% vs. - -1.78% for Large Growth Morningstar peers, and Income Fund, up 1.33% vs. 0.94% for Short-term Bond Morningstar peers.

As always, we thank you for investing with us!

Marco Hanig

Please see page 4 for important performance disclosure information.

2 Semi-Annual Report | June 30, 2005 |

PERFORMANCE AS OF JUNE 30, 2005—CLASS N SHARES

| | | | | | | | | | | | | | |

| | | Year to

Date

| | 1 Yr

| | 3 Yr

| | 5 Yr

| | 10 Yr (or since

inception)

| | Inception

Date

| | Overall Morningstar Rating

|

Growth Fund | | -0.75 | | 6.63 | | 4.79 | | -5.80 | | 6.38 | | 3/20/46 | | ««« |

Morningstar Large Growth | | -1.78 | | 3.24 | | 6.47 | | -8.27 | | 7.37 | | | | Among 1,074 large growth funds |

Russell 3000® Growth | | -1.88 | | 1.90 | | 7.56 | | -9.93 | | 7.13 | | | |

Standard & Poor’s 500 | | -0.81 | | 6.32 | | 8.28 | | -2.37 | | 9.94 | | | | |

| | | | | | | |

Tax-Managed Growth Fund | | | | | | | | | | | | | | «««« |

Return before Taxes | | 1.00 | | 6.82 | | 5.97 | | -2.62 | | -1.73 | | 12/27/99 | | Among 1,074 large growth funds |

After Taxes on Distributions | | 1.00 | | 6.82 | | 5.97 | | -2.62 | | -1.73 | | | |

After Taxes on Distributions and Sale of

Fund Shares | | 0.65 | | 4.44 | | 5.12 | | -2.21 | | -1.47 | | | | |

Morningstar Large Growth | | -1.78 | | 3.24 | | 6.47 | | -8.27 | | — | | | | |

Russell 3000® Growth | | -1.88 | | 1.90 | | 7.56 | | -9.93 | | -8.17 | | | | |

| | | | | | | |

Large Cap Growth Fund | | -1.76 | | 4.25 | | 4.19 | | -9.54 | | -8.46 | | 12/27/99 | | ««« |

Morningstar Large Growth | | -1.78 | | 3.24 | | 6.47 | | -8.27 | | — | | | | Among 1,074 large growth funds |

Russell 1000® Growth | | -1.72 | | 1.68 | | 7.26 | | -10.36 | | -8.59 | | | |

| | | | | | | |

Small Cap Growth Fund | | -4.16 | | 9.33 | | 19.53 | | 13.44 | | 20.47 | | 12/27/99 | | ««««« |

Morningstar Small Growth | | -1.50 | | 6.10 | | 10.50 | | -2.49 | | — | | | | Among 573 small growth funds |

Russell 2000® Growth | | -3.58 | | 4.29 | | 11.37 | | -4.51 | | -2.86 | | | |

| The Small Cap Growth Fund’s performance during 2000 was primarily attributable to investments in initial public offerings (IPOs) during a rising market. Since then, IPOs have had an insignificant effect on the Fund’s performance. | | | | | | | | |

| | | | | | | |

Small-Mid Cap Growth Fund | | -0.53 | | 5.45 | | — | | — | | 7.89 | | 12/29/03 | | Not rated. |

Morningstar Mid-Cap Growth | | 0.05 | | 7.75 | | — | | — | | — | | | | |

Russell 2500TM Growth | | -0.92 | | 7.46 | | — | | — | | 9.42 | | | | |

| | | | | | | |

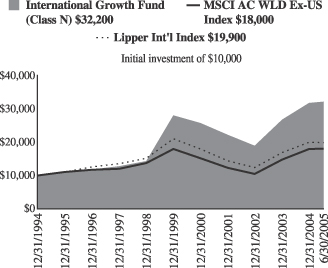

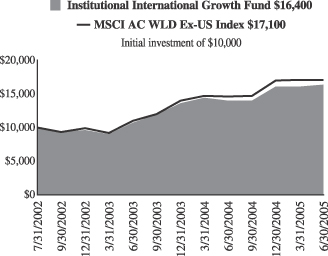

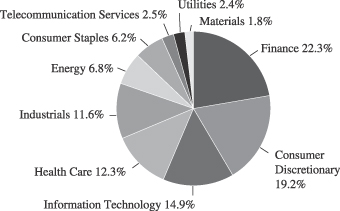

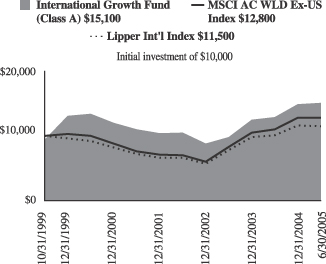

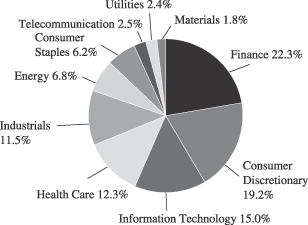

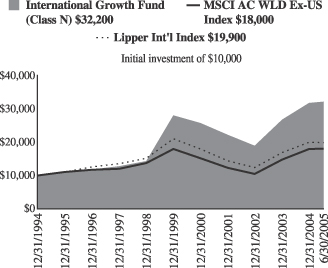

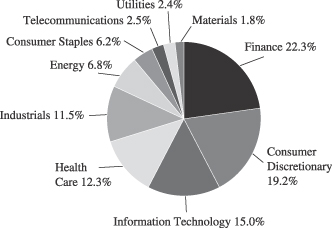

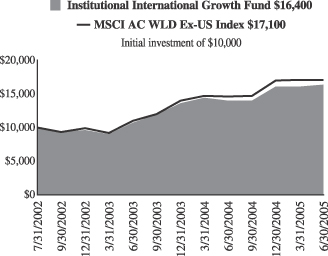

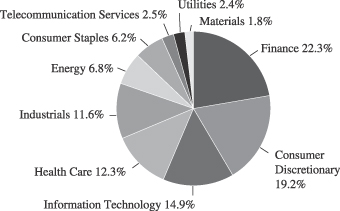

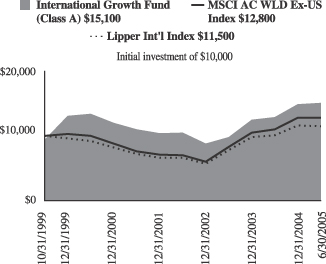

International Growth Fund | | 1.49 | | 16.80 | | 12.83 | | 2.43 | | 12.58 | | 10/1/92 | | ««««« |

Morningstar Foreign Large Growth | | -1.65 | | 10.98 | | 8.75 | | -4.56 | | 4.72 | | | | Among 167 foreign large growth funds |

MSCI All Country World Free Ex-US | | 0.32 | | 16.95 | | 14.08 | | 0.76 | | 5.82 | | | |

| | | | | | | |

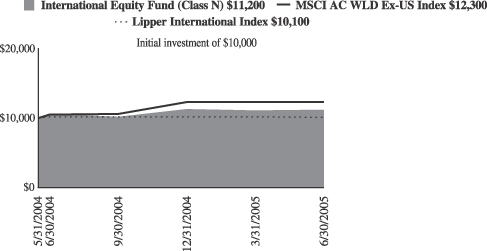

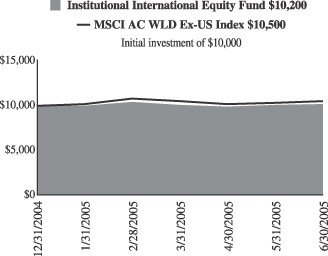

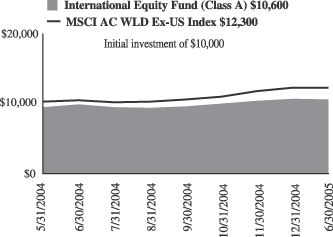

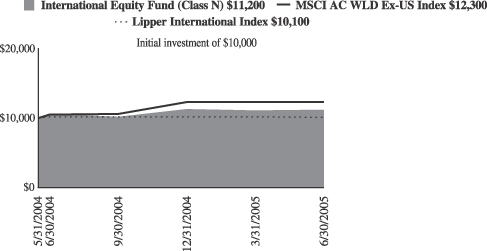

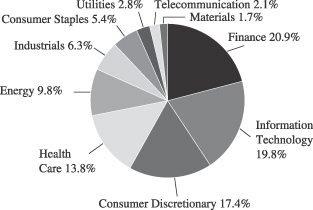

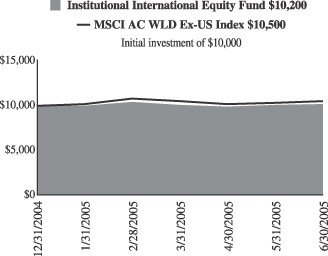

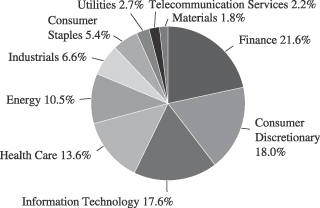

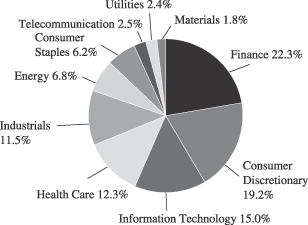

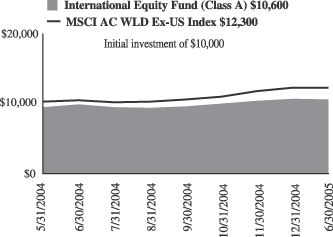

International Equity Fund | | -1.15 | | 6.06 | | — | | — | | 10.73 | | 5/24/04 | | Not rated. |

Morningstar Foreign Large Growth | | -1.65 | | 10.98 | | — | | — | | — | | | | |

MSCI World Free Ex-US | | 0.32 | | 16.95 | | — | | — | | 20.47 | | | | |

| | | | | | | |

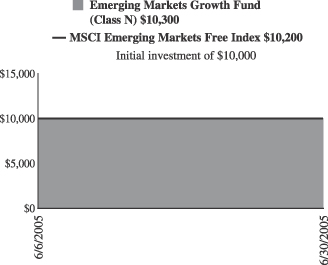

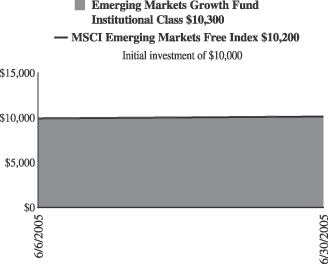

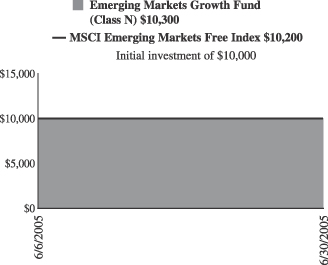

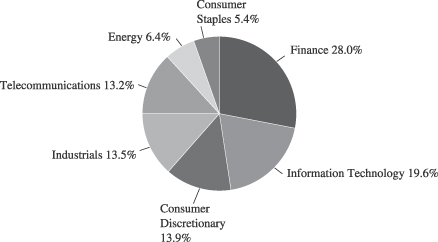

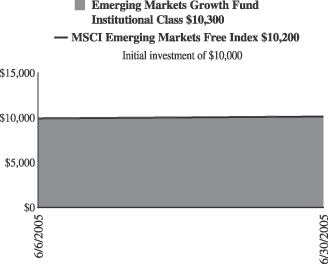

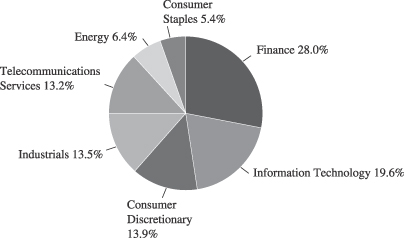

Emerging Markets Growth Fund | | 2.60 | | — | | — | | — | | 2.60 | | 6/6/05 | | Not rated. |

MSCI Emerging Markets Free | | 2.09 | | — | | — | | — | | 2.09 | | | | |

| | | | | | | |

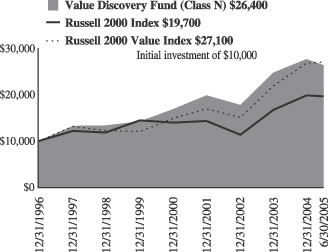

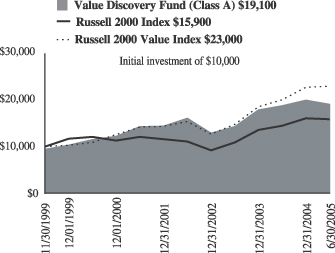

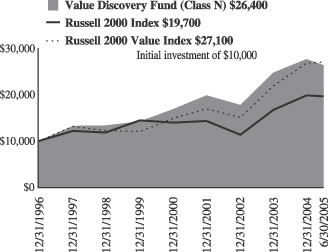

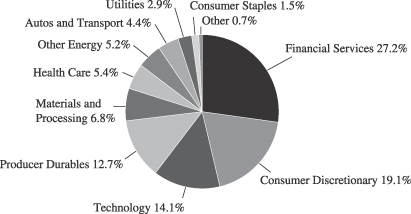

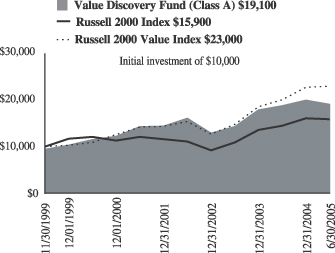

Value Discovery Fund | | -4.67 | | 1.49 | | 5.81 | | 10.65 | | 12.03 | | 12/23/96 | | « |

Morningstar Small Value | | 0.96 | | 12.85 | | 13.94 | | 14.96 | | — | | | | Among 218 small value funds |

Russell 2000® | | -1.25 | | 9.45 | | 12.81 | | 5.71 | | 8.44 | | | |

Russell 2000® Value | | 0.90 | | 14.39 | | 14.15 | | 16.12 | | 12.60 | | | | |

| | | | | | | |

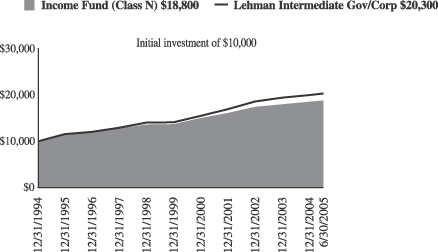

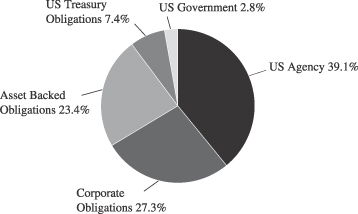

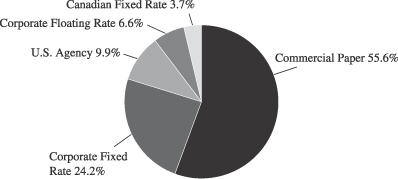

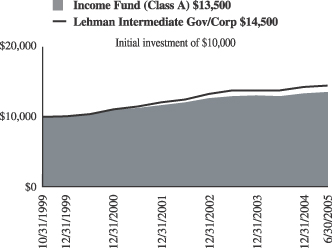

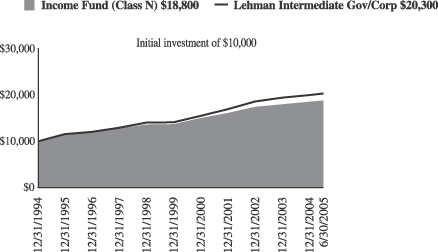

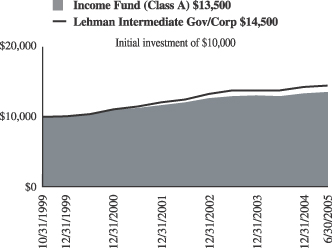

Income Fund | | 1.33 | | 4.43 | | 4.08 | | 5.81 | | 5.61 | | 10/1/90 | | ««««« |

Morningstar Short-Term Bond | | 0.94 | | 2.59 | | 2.91 | | 4.60 | | 4.95 | | | | Among 235 short-term bond funds |

Lehman Intermediate Govt./Credit

Bond Index | | 1.58 | | 4.77 | | 5.08 | | 6.87 | | 6.34 | | | |

Please see the next page for important disclosure information.

June 30, 2005 | William Blair Funds 3 |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher that the data quoted. Returns shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or a loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. International and emerging markets investing involves special risk considerations, including currency fluctuations, lower liquidity, economic and political risk. As interest rates rise, bond prices will fall and bond funds become more volatile. From time to time, the investment advisor may waive fees or reimburse expenses for certain Funds. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load.

Tax-Managed Growth Fund’s after-tax returns are calculated using the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are shown only for Class N and the after-tax returns for other classes will vary.

Morningstar RatingsTM are as of 6/30/05 and are subject to change every month. The ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each Category receive 5 stars, the next 22.5% receive 4 stars, the middle 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. The 3/5/10 year Morningstar ratings were as follows: Growth Fund «««/«««/«««, Tax-Managed Growth Fund «««/««««/NA, and Large Cap Growth Fund ««/«««/NA, out of 1074/817/272 large growth funds; Small Cap Growth Fund «««««/«««««/NA out of 573/409 small growth funds; Value Discovery Fund «/«/NA out of 218/157 small value funds; International Growth Fund «««««/«««««/««««« out of 167/122/44 foreign large growth funds; Income Fund ««««/«««««/««««« out of 235/178/101 short-term bond funds.

Please carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money. ©William Blair & Company, L.L.C., distributor. 08/05.

4 Semi-Annual Report | June 30, 2005 |

John F. Jostrand

GROWTH FUND

The Growth Fund invests primarily in common stocks of domestic growth companies that the Advisor expects to have sustainable, above-average growth from one business cycle to the next.

AN OVERVIEW FROM THE PORTFOLIO MANAGER

How did the Fund perform over the first half of the year? How did the Fund’s performance compare to its benchmark?

The Growth Fund posted a 0.75% decrease on a total return basis (Class N Shares) for the six months ended June 30, 2005. By comparison, the Fund’s benchmarks, the Russell 3000® Growth Index decreased 1.88%, while the Standard & Poor’s 500 Index declined 0.81%.

What were the most significant factors impacting Fund performance?

In the first six months of 2005, value stocks outperformed growth stocks, as evidenced by the Russell 3000® Value Index up 1.69%, versus the 1.88% decline of the Russell 3000® Growth Index. Larger cap growth stocks outperformed their smaller cap counterparts, with the Russell 2000® Growth Index decreasing 3.58% and the Russell 1000® Growth Index down 1.72% for the year. Rising oil prices and continued monetary tightening by the Federal Reserve provided headwinds for companies in the first six months of 2005. Crude oil closed the first half of the year near $60 a barrel, which continues to put pressure on stocks reliant on the lower end consumer. Although Energy sector returns were strong, the relatively low weighting of this sector in the Russell 3000® Growth Index had a modest impact on Index’s overall results. Dissecting the period by quarter, growth-oriented issues began to show signs of strength particularly in May, as Technology issues and Biotech stocks took leadership from cyclical stocks that had done well in 2004, such as Materials and Industrial-related stocks.

What were among the best performing investments for the Fund?

One of the largest contributors to portfolio returns for the first half of 2005 was Health Care. Strong stock selection led to good results on both a relative and an absolute return basis for the portfolio. Alcon, Inc., a leader in the eye-care area, showed strong results buoyed particularly by the outlook for its Restor Lens interocular product. United Healthcare, a health care service provider, continued to be a top portfolio performer and a dominant player in its segment.

Technology stocks provided the strongest portfolio returns relative to the Russell 3000® Growth Index. Although overall returns in the portfolio were flat for the six months and negative in the benchmark, strength in the second quarter seems to indicate investors are warming to this sector. Digital Insight Corporation, a provider of outsourced on-line banking services to smaller financial institutions, experienced strong results after reporting double-digit earnings growth with strong margins and cash flows. Taiwan Semiconductor, the world’s largest contract chipmaker, had good stock appreciation after reporting strong results for 2004. Although 2005 will likely see a contraction in shipments due to client inventory issues, the outlook for 2006 remains strong.

What were among the weakest performing investments for the Fund?

Financial stocks suffered significantly during the first quarter, resulting in negative results for the first half of the year. With accounting concerns surrounding insurers such as AIG and

June 30, 2005 | William Blair Funds 5 |

regulatory issues plaguing Fannie Mae, “collision avoidance” was key during the first quarter. In the second quarter, stock selection in certain areas of Financials was the key to success, particularly if spots were picked appropriately. While capital markets firms were leaders in the sector, Goldman Sachs Group, Inc. a portfolio holding, experienced a stock pullback due to lower trading volumes and hence smaller commissions.

Consumer Discretionary and Consumer Staples stocks showed weakness in the portfolio and the benchmark during the first six months, with two of the larger portfolio disappointments coming in these two areas. Harley-Davidson, Inc., a manufacturer of motorcycle equipment and accessories, experienced significantly weak operating earnings during the second quarter. Additionally, the company decreased its earnings outlook and reduced manufacturing plans for the next several quarters. The stock was sold out of the portfolio due to our concern that the motorcycle market is maturing at a rate faster than anticipated. Estee Lauder Companies, Inc. reported quarterly revenues in line with expectations, but fell short on their bottom line results. We continue to think the company will deliver improved longer term results, especially in the latter part of the year with the launch of the new fragrance lines.

What is your current outlook?

We postulated that 2005 would bring a deceleration in earnings growth, as the business cycle is advancing from a recovery stage into a more normalized growth phase. While companies experienced double digit earnings growth in the last several quarters, estimates for the second quarter through the last half of 2005 are closer to the mid to upper single digit range. The Federal Reserve’s posture indicates a likelihood that it will continue to raise interest rates to create a less stimulative monetary environment. Although consumers continue to show resilience, fueled by the strong real estate market and low mortgage rates, the combination of higher oil prices and interest rates will likely take a toll on spending at some point. Investors anticipated that cash-heavy corporations would probably initiate capital spending, but to date corporations have had greater interest in using cash to repurchase shares or increase dividends. All of these trends tend to be harbingers for a lower growth environment.

6 Semi-Annual Report | June 30, 2005 |

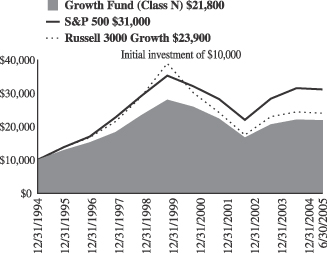

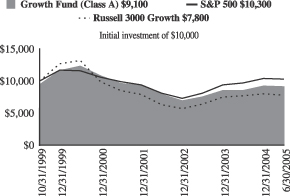

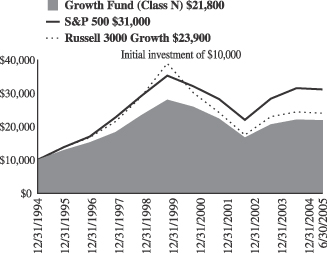

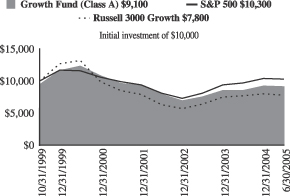

Growth Fund

Performance Highlights

Average Annual Total Return at 6/30/2005

| | | | | | | | | | | | | | | | | |

| | | 1 Year

| | | 3 Year

| | | 5 Year

| | | 10 Year

| | | Since Inception(a)

| | | |

Growth Fund Class N | | 6.63 | % | | 4.79 | % | | (5.80 | )% | | 6.38 | % | | — | % | | |

Growth Fund Class I | | 6.94 | | | 5.05 | | | (5.55 | ) | | — | | | (0.96 | ) | | |

Russell 3000® Growth Index | | 1.90 | | | 7.56 | | | (9.93 | ) | | 7.13 | | | (4.32 | ) | | |

S&P 500 Index | | 6.32 | | | 8.28 | | | (2.37 | ) | | 9.94 | | | 0.25 | | | |

| | (a) | | For the period from October 1, 1999 to June 30, 2005. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company L.L.C. without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 3000® Growth Index consists of large, medium, and small-capitalization companies with above average price-to-book ratios and forecasted growth rates. The index is weighted by market capitalization and large/medium/small companies make up approximately 80%/15%/5% of the index.

The S&P 500 Index indicates broad larger capitalization equity market performance.

This report identifies the Fund’s investments on June 30, 2005. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

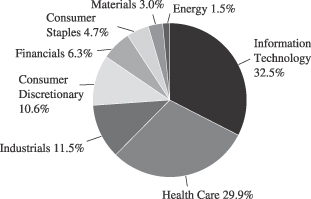

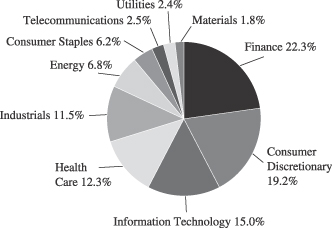

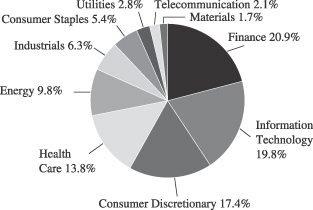

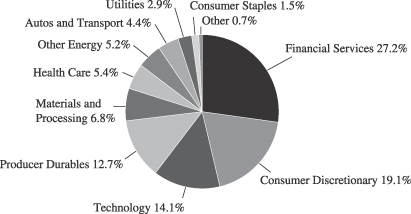

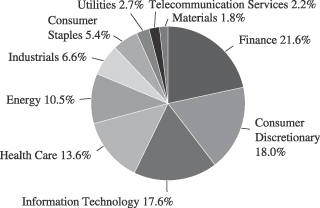

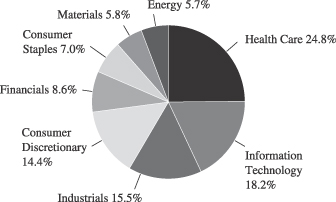

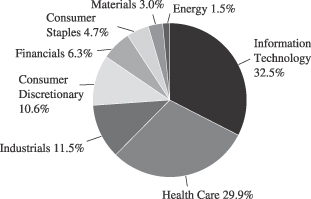

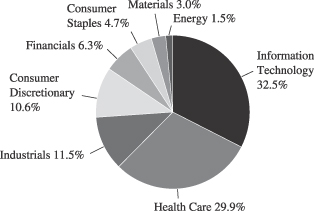

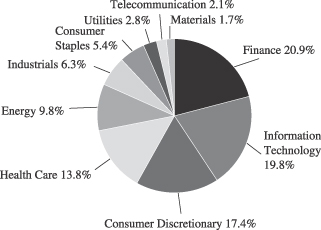

Sector Diversification

The sector diversification shown is based on the total investment portfolio.

June 30, 2005 | William Blair Funds 7 |

Growth Fund

Portfolio of Investments, June 30, 2005 (all dollar amounts in thousands) (unaudited)

| | | | | |

Issuer

| | Shares

| | Value

|

| | |

Common Stocks | | | | | |

Information Technology—32.0% | | | | | |

*Accenture Ltd.† | | 199,085 | | $ | 4,513 |

Adobe Systems Incorporated | | 125,590 | | | 3,594 |

Arm Holding plc—ADR | | 640,165 | | | 3,931 |

*Dell, Inc. | | 278,630 | | | 11,009 |

*Digital Insight Corporation | | 152,395 | | | 3,645 |

*EMC Corporation | | 451,395 | | | 6,189 |

First Data Corporation | | 203,440 | | | 8,166 |

*Jabil Circuit, Inc. | | 209,975 | | | 6,452 |

Linear Technology Corporation | | 106,035 | | | 3,890 |

Microchip Technology, Inc. | | 90,870 | | | 2,692 |

Paychex, Inc. | | 177,550 | | | 5,777 |

*PDF Solutions, Inc. | | 90,130 | | | 1,183 |

*ScanSoft, Inc. | | 799,620 | | | 3,023 |

Taiwan Semiconductor Mfg. Co. Ltd.—ADR | | 748,812 | | | 6,829 |

*ValueClick, Inc. | | 307,765 | | | 3,795 |

*WebEx Communications, Inc. | | 148,330 | | | 3,917 |

| | | | |

|

|

| | | | | | 78,605 |

| | | | |

|

|

Health Care—29.5% | | | | | |

Alcon, Inc.† | | 60,170 | | | 6,580 |

Allergan, Inc. | | 48,335 | | | 4,120 |

*Amgen, Inc. | | 115,900 | | | 7,007 |

*Axcan Pharma, Inc.† | | 240,325 | | | 3,672 |

Eli Lilly & Company | | 86,310 | | | 4,808 |

*Express Scripts, Inc., Class “A” | | 86,560 | | | 4,326 |

*IDEXX Laboratories, Inc. | | 64,240 | | | 4,004 |

*Integra Lifesciences Holding Corporation | | 99,010 | | | 2,891 |

*Kyphon, Inc. | | 110,670 | | | 3,850 |

Medtronic, Inc. | | 183,615 | | | 9,510 |

*ResMed, Inc. | | 44,510 | | | 2,937 |

Sanofi-Aventis—ADR | | 180,655 | | | 7,405 |

UnitedHealth Group, Inc. | | 177,800 | | | 9,271 |

Valeant Pharmaceuticals International | | 113,310 | | | 1,998 |

| | | | |

|

|

| | | | | | 72,379 |

| | | | |

|

|

Industrials—11.4% | | | | | |

Corporate Executive Board Company | | 48,705 | | | 3,815 |

Danaher Corporation | | 202,331 | | | 10,590 |

*Education Management Corporation | | 151,165 | | | 5,099 |

Graco, Inc. | | 90,610 | | | 3,087 |

Knight Transportation, Inc. | | 218,240 | | | 5,310 |

| | | | |

|

|

| | | | | | 27,901 |

| | | | |

|

|

*Non-income producing securities

ADR = American Depository Receipt

† = U.S. listed foreign security

VRN = Variable Rate Note

| | | | | | |

Issuer

| | Shares or

Principal

Amount

| | Value

|

| | |

Common Stocks—(continued) | | | | | | |

Consumer Discretionary—10.5% | | | | | | |

*Bed, Bath & Beyond, Inc. | | | 218,730 | | $ | 9,138 |

*CarMax, Inc. | | | 110,230 | | | 2,938 |

*Comcast Corporation, Class “A” | | | 216,760 | | | 6,492 |

*Kohl’s Corporation | | | 128,600 | | | 7,190 |

| | | | | |

|

|

| | | | | | | 25,758 |

| | | | | |

|

|

Financials—6.2% | | | | | | |

Goldman Sachs Group, Inc. | | | 46,360 | | | 4,730 |

SEI Investments Company | | | 140,435 | | | 5,245 |

SLM Corporation | | | 102,585 | | | 5,211 |

| | | | | |

|

|

| | | | | | | 15,186 |

| | | | | |

|

|

Consumer Staples—4.6% | | | | | | |

Estee Lauder Companies, Inc. | | | 130,205 | | | 5,095 |

PepsiCo, Inc. | | | 116,215 | | | 6,268 |

| | | | | |

|

|

| | | | | | | 11,363 |

| | | | | |

|

|

Materials—2.9% | | | | | | |

Praxair, Inc. | | | 153,630 | | | 7,159 |

| | | | | |

|

|

Energy—1.5% | | | | | | |

Suncor Energy, Inc.† | | | 77,310 | | | 3,658 |

| | | | | |

|

|

Total Common Stock—98.6%

(cost $192,092) | | | 242,009 |

| | | | | |

|

|

| | |

Investment in Affiliate—0.4% | | | | | | |

William Blair Ready Reserves | | | 921,944 | | | 922 |

| | | | | |

|

|

Total Investment in Affiliate

(cost $922) | | | 922 |

| | | | | |

|

|

| | |

Short-Term Investments—0.3% | | | | | | |

Prudential Funding Demand Note, VRN, 3.368%, due 7/1/05 | | $ | 670,000 | | | 670 |

| | | | | |

|

|

Total Short-Term Investments

(cost $670) | | | 670 |

| | | | | |

|

|

Total Investments—99.3%

(cost $193,684) | | | 243,601 |

Cash and other assets, less liabilities—0.7% | | | 1,699 |

| | | | | |

|

|

Net assets—100.0% | | $ | 245,300 |

| | | | | |

|

|

See accompanying Notes to Financial Statements.

8 Semi-Annual Report | June 30, 2005 |

Mark A. Fuller III

Gregory J. Pusinelli

TAX-MANAGED GROWTH FUND

The Tax-Managed Growth Fund invests primarily in common stocks of large, medium and small domestic growth companies that the Advisor expects will have sustainable, above-average growth from one business cycle to the next.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

How did the Fund perform over the first half of the year? How did the Fund’s performance compare to its benchmark?

The Tax-Managed Growth Fund posted a 1.00% gain on a total return basis (Class N Shares) for the six-months ended June 30, 2005. By comparison, the Fund’s benchmark, the Russell 3000® Growth Index declined 1.88% and the Standard & Poor’s 500 Stock Index dropped 0.81%.

What were the most significant market factors impacting Fund performance?

Concerns that rising energy prices could dampen economic growth weighed on the equity markets during the first half of the year. In addition, indications early in the year that inflationary pressures had the potential to increase were worrisome to equity market participants.

Amid mounting concerns that corporate profits might slow, investors were also troubled by signs that the Federal Reserve’s campaign to raise short-term interest rates at a “measured” pace was not over. The Federal Reserve raised the federal funds rate on overnight loans once during the first quarter and twice during the second quarter, and investors grew increasingly concerned that the Fed was being overly cautious—and perhaps too restrictive—with its monetary policy.

What were among the best performing investments for the Fund?

Information Technology was the best-performing sector for the Fund for the first six months of 2005. The Fund was underweight the Russell 3000® Growth Index in terms of Information Technology exposure—at 17.1% versus 26.3% for the Index. However, our Information Technology stocks performed better, posting a 2.3% gain, as compared to a 5.6% decline for the stocks in the Russell 3000® Growth.

Energy was the second-best performing sector for the Fund. Our Energy sector exposure at 4.8% was more than double the weighting of the Russell 3000® Growth at 2.1%, and the Fund benefited from the positive performance of its Energy holdings.

Health Care was the third-best performing sector for the Fund during the first half of the year. More specifically, four of the top five-best performing investments for the Fund during the first six months were from the Health Care sector, and three of these companies—Genentech, Inc., Alcon, Inc. and St. Jude Medical, Inc.—deserve mention. Applications for Genentech’s cancer products—and their broader use for different types of cancers—look promising. Increased earnings estimates for the company during the second quarter reinforced our enthusiasm for this company. We especially favor this company because Genentech has an entire portfolio of products, compared to other biotechnology companies which may only have one drug either in test trials or to market. Alcon is a global leader in developing, manufacturing, and selling ophthalmology drugs, supplies, and surgical devices, and also sells consumer eye-care products

June 30, 2005 | William Blair Funds 9 |

such as contact lens-cleaning solution. Alcon has a new drug for age-related macular degeneration, and the company’s stock responded favorably to news that its Phase 3 testing of this product was going well. As the aging segment of the population continues to grow, we expect the growth prospects for Alcon to be strong. St. Jude Medical manufactures cardiovascular medical devices, including the world’s most widely used mechanical heart valve. The firm’s cardiac care business benefited from the misfortune of Boston Scientific Corporation, which had announced a stent recall during the quarter.

What were among the weakest performing investments for the Fund?

Our Financial sector weightings were a material drag on performance during the first half of the year. Investors Financial Service Corporation was a weak performing investment for the Fund. The flattening interest rate yield curve resulting from the Federal Reserve’s short-term interest rate hikes has taken a bite out of Investors Financial’s earnings, as the short-term rates the company pays out have increased relative to the lower long term rates at which the company borrows money.

Another poor performing investment for the Fund was Valeant Pharmaceuticals International. Concerns arose that Phase 2 test trials for Valeant’s Viramidine drug for Hepatitis C were poorly designed by the company’s previous management, which led to speculation regarding the drug’s ability to be approved by the FDA. We nonetheless believe in this company, which has strong new management that has joined the firm from many of the top pharmaceutical companies from around the world. We are willing to withstand the short-term pain with the company’s share price because of this management, and because of Valeant’s promising portfolio of products which is in various stages of testing.

CarMax, Inc. also turned in a disappointing performance. Management lowered expectations for comparable store sales, and the downward guidance caused our investment in CarMax, Inc. to decline. Although we have begun to see greater volatility in comparable store sales from quarter to quarter—which impacts our valuation parameters for the stock—we still believe in this company, its business model and its excellent management.

What is your current strategy? How is the Fund positioned?

As we mentioned last quarter, interest rates have been edging up, turning what had been a favorable tailwind for equity investors into a headwind. We are thoughtfully navigating this market environment. We will continue to maintain our modest underweight in the Financial sector given the likelihood for additional “measured” interest rate increases by the Federal Reserve in the months ahead. Otherwise, we presently intend to maintain reasonable weightings in each sector and we are not currently inclined to significantly over- or under-weight any other particular area.

In addition, rising energy costs are expected to cause a slowdown in earnings growth among companies in the broad market as well as the nation’s Gross Domestic Product (GDP). However, it is also a market environment we believe should favor the type of companies we invest in—companies that demonstrate above-average earnings growth no matter what the economic climate.

As always, we will continue to focus on and emphasize high-quality names that we believe will serve our investors well.

10 Semi-Annual Report | June 30, 2005 |

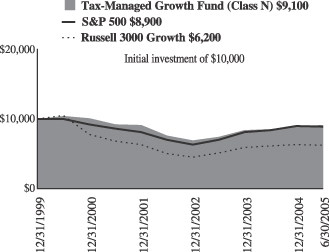

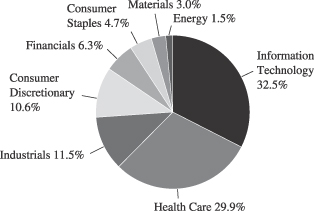

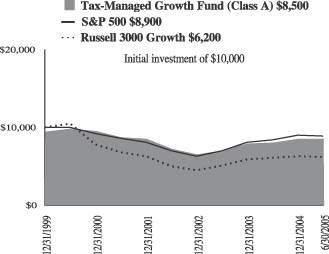

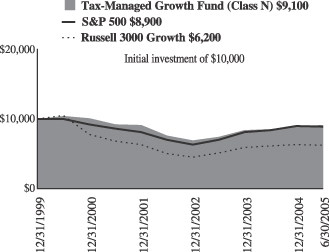

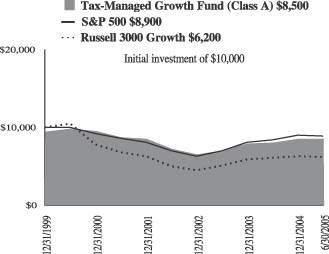

Tax-Managed Growth Fund

Performance Highlights

Average Annual Total Return at 6/30/2005

| | | | | | | | | | | | |

| | | 1

Year

| | | 3

Year

| | | 5

Year

| | | Since Inception(a)

| |

Tax-Managed Growth

Fund Class N | | 6.82 | % | | 5.97 | % | | (2.62 | )% | | (1.73 | )% |

Tax-Managed Growth

Fund Class I | | 6.97 | | | 6.24 | | | (2.38 | ) | | (1.48 | ) |

Russell 3000®

Growth Index | | 1.90 | | | 7.56 | | | (9.93 | ) | | (8.17 | ) |

S&P 500 Index | | 6.32 | | | 8.28 | | | (2.37 | ) | | (2.09 | ) |

| | (a) | | For the period from December 27, 1999 to June 30, 2005. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 3000® Growth Index consists of large, medium, and small-capitalization companies with above average price-to-book ratios and forecasted growth rates. The index is weighted by market capitalization and large/medium/small companies make up approximately 80%/15%/5% of the index.

The S&P 500 Index indicates broad larger capitalization equity market performance.

This report identifies the Fund’s investments on June 30, 2005. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

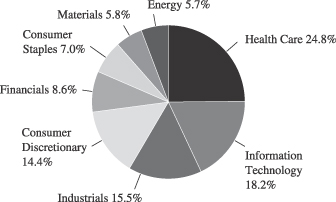

Sector Diversification

The sector diversification shown is based on the total investment portfolio.

June 30, 2005 | William Blair Funds 11 |

Tax-Managed Growth Fund

Portfolio of Investments, June 30, 2005 (all dollar amounts in thousands) (unaudited)

| | | | | |

Issuer

| | Shares

| | Value

|

| | |

Common Stocks | | | | | |

Health Care—23.8% | | | | | |

Alcon, Inc.† | | 965 | | $ | 106 |

*Amgen, Inc. | | 2,435 | | | 147 |

*Express Scripts, Inc., Class “A” | | 2,470 | | | 123 |

*Genentech, Inc. | | 1,800 | | | 145 |

IMS Health, Inc. | | 4,740 | | | 117 |

Pfizer, Inc. | | 5,325 | | | 147 |

*ResMed, Inc. | | 2,197 | | | 145 |

Sanofi-Aventis—ADR | | 2,480 | | | 102 |

*St. Jude Medical, Inc. | | 2,360 | | | 103 |

Stryker Corporation | | 1,230 | | | 58 |

Valeant Pharmaceuticals International | | 3,420 | | | 60 |

*Zimmer Holdings, Inc. | | 1,910 | | | 145 |

| | | | |

|

|

| | | | | | 1,398 |

| | | | |

|

|

Information Technology—17.4% | | | | | |

Arm Holdings plc—ADR | | 9,500 | | | 58 |

*CACI International, Inc., Class “A” | | 1,360 | | | 86 |

CDW Corporation | | 1,620 | | | 93 |

*EMC Corporation | | 6,590 | | | 90 |

First Data Corporation | | 2,900 | | | 116 |

*Intuit, Inc. | | 2,455 | | | 111 |

*Jabil Circuit, Inc. | | 3,545 | | | 109 |

Microchip Technology, Inc. | | 4,170 | | | 124 |

Paychex, Inc. | | 3,390 | | | 110 |

*ScanSource, Inc. | | 1,230 | | | 53 |

Taiwan Semiconductor Mfg. Co. Ltd.—ADR | | 8,220 | | | 75 |

| | | | |

|

|

| | | | | | 1,025 |

| | | | |

|

|

Industrials—14.9% | | | | | |

*Apollo Group, Inc., Class “A” | | 750 | | | 59 |

C.H. Robinson Worldwide, Inc. | | 2,335 | | | 136 |

Danaher Corporation | | 3,020 | | | 158 |

Expeditors International of Washington | | 2,245 | | | 112 |

Fastenal Company | | 2,520 | | | 154 |

General Electric Company | | 3,355 | | | 116 |

Knight Transportation, Inc. | | 3,255 | | | 79 |

Pentair, Inc. | | 1,400 | | | 60 |

| | | | |

|

|

| | | | | | 874 |

| | | | |

|

|

Consumer Discretionary—13.8% | | | | | |

*Bed, Bath & Beyond, Inc. | | 2,070 | | | 87 |

*CarMax, Inc. | | 2,710 | | | 72 |

Dollar General Corporation | | 4,230 | | | 86 |

*eBAY, Inc. | | 1,720 | | | 57 |

*IAC InterActiveCorp | | 3,240 | | | 78 |

*Laureate Education, Inc. | | 1,250 | | | 60 |

Lowe’s Companies, Inc. | | 1,735 | | | 101 |

Time Warner, Inc. | | 4,530 | | | 76 |

*Univision Communications, Inc. | | 1,820 | | | 50 |

*Williams-Sonoma, Inc. | | 3,645 | | | 144 |

| | | | |

|

|

| | | | | | 811 |

| | | | |

|

|

*Non-income producing securities

ADR = American Depository Receipt

† = U.S. listed foreign security

VRN = Variable Rate Note

| | | | | | | |

Issuer

| | Shares or

Principal

Amount

| | Value

| |

| | |

Common Stocks—(continued) | | | | | | | |

Financials—8.2% | | | | | | | |

AFLAC, Inc. | | | 1,390 | | $ | 60 | |

Ambac Financial Group, Inc. | | | 1,450 | | | 101 | |

American International Group | | | 2,210 | | | 129 | |

Investors Financial Service Corporation | | | 2,240 | | | 85 | |

Moody’s Corporation | | | 2,430 | | | 109 | |

| | | | | |

|

|

|

| | | | | | | 484 | |

| | | | | |

|

|

|

Consumer Staples—6.7% | | | | | | | |

Colgate-Palmolive Company | | | 1,100 | | | 55 | |

PepsiCo, Inc. | | | 2,825 | | | 152 | |

Walgreen Co. | | | 2,365 | | | 109 | |

Whole Foods Market, Inc. | | | 680 | | | 80 | |

| | | | | |

|

|

|

| | | | | | | 396 | |

| | | | | |

|

|

|

Materials—5.6% | | | | | | | |

Airgas, Inc. | | | 5,550 | | | 137 | |

Ecolab, Inc. | | | 2,090 | | | 67 | |

Praxair, Inc. | | | 2,660 | | | 124 | |

| | | | | |

|

|

|

| | | | | | | 328 | |

| | | | | |

|

|

|

Energy—5.5% | | | | | | | |

*Smith International, Inc. | | | 950 | | | 61 | |

Suncor Energy, Inc.† | | | 5,580 | | | 264 | |

| | | | | |

|

|

|

| | | | | | | 325 | |

| | | | | |

|

|

|

Total Common Stock—95.9%

(cost $4,269) | | | 5,641 | |

| | | | | |

|

|

|

| | |

Investment in Affiliate—3.0% | | | | | | | |

William Blair Ready Reserves | | | 177,340 | | | 177 | |

| | | | | |

|

|

|

Total Investment in Affiliate

(cost $177) | | | 177 | |

| | | | | |

|

|

|

| | |

Short-Term Investments—3.4% | | | | | | | |

Prudential Funding Demand Note, VRN,

3.368%, due 7/1/05 | | $ | 200,000 | | | 200 | |

| | | | | |

|

|

|

Total Short-Term Investments

(cost $200) | | | 200 | |

| | | | | |

|

|

|

Total Investments—102.3%

(cost $4,646) | | | 6,018 | |

Liabilities, plus cash and other assets—(2.3)% | | | (134 | ) |

| | | | | |

|

|

|

Net assets—100.0% | | $ | 5,884 | |

| | | | | |

|

|

|

See accompanying Notes to Financial Statements.

12 Semi-Annual Report | June 30, 2005 |

John F. Jostrand

Norbert W. Truderung

James W. Golan

LARGE CAP GROWTH FUND

The Large Cap Growth Fund invests primarily in common stocks of large domestic growth companies of high quality that the Advisor believes have demonstrated sustained growth over a long period of time.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

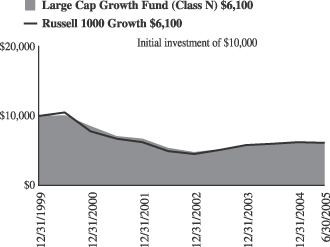

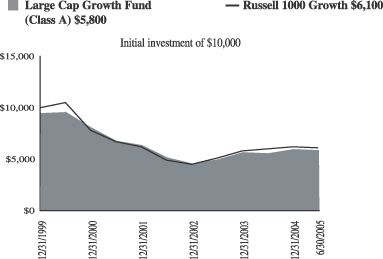

How did the Fund perform over the first half of the year? How did the Fund’s performance compare to its benchmark?

The Large Cap Growth Fund posted a 1.76% decrease on a total return basis (Class N Shares) for the six months ended June 30, 2005. By comparison, the Fund’s benchmark, the Russell 1000® Growth Index, declined 1.72%.

What were the most significant factors impacting Fund performance? What factors were behind the Fund’s performance versus the benchmark?

The broad domestic equity market showed mixed results for the first half of the year, with midcap value-oriented stocks having the best overall results, while growth-oriented issues were generally weak. Oil prices marched higher, and the Federal Reserve continued its tightening policy. With concerns about the potential for slowing earnings growth, investors rotated away from more cyclical issues such as Materials and Industrials, and began to show favor to Health Care and some select Technology stocks in the latter part of the second quarter.

What were among the best performing investments for the Fund?

The largest contributor to the portfolio during the year to date period on an absolute and relative basis was the Health Care sector. Alcon, a provider of eye care products, achieved strong results due to favorable outlook for its new Restor Lens product. This interocular device provides improved sight for both near and distance vision, and has proven to be a good option for patients with cataracts as well. The product received additional good news with the approval by Medicare for reimbursements, making the relatively expensive product available to a sizably larger market.

The Energy sector enjoyed the strongest absolute results during the first six months, boosted by oil rising to $60 per barrel. Although the returns were strong, the Energy weighting in both the benchmark and the portfolio was less than two percent. Nevertheless, Energy proved to be the second strongest performer in relative terms for the portfolio during the first six months. Suncor Energy Inc., an integrated energy company which has a proprietary method for extracting oil from the Canadian tar sands, enjoyed particularly strong returns during the quarter.

What were among the weakest performing investments for the Fund?

Industrial stocks detracted from overall portfolio results. This area showed significant weakness during the year to date period, as investors turned to stocks with less orientation to the recovery phase of the economic cycle. The portfolio’s relative overweight position to this area, combined with particularly soft performances by 3M Company and Danaher Corporation, contributed to weakness in overall portfolio returns.

June 30, 2005 | William Blair Funds 13 |

Although stocks in the Consumer Discretionary sector held up well given the potential effects of rising oil prices and increasing interest rates, one of the largest disappointments during the first six months came in this area. Harley-Davidson, Inc., a manufacturer of motorcycle equipment and accessories, experienced significantly weak operating earnings during the second quarter. Additionally, the company decreased its earnings outlook and reduced manufacturing plans for the next several quarters. The stock was sold out of the portfolio due to our concern that the motorcycle market is maturing at a rate faster than anticipated.

What is your current outlook?

We postulated that 2005 would bring a deceleration in earnings growth, as the business cycle is advancing from a recovery stage into a more normalized growth phase. While companies experienced double digit earnings growth in the last several quarters, estimates for the second quarter through the last half of 2005 are closer to the mid to upper single digit range. The Federal Reserve’s posture indicates a likelihood that it will continue to raise interest rates to create a less stimulative monetary environment. Although consumers continue to show resilience, fueled by the strong real estate market and low mortgage rates, the combination of higher oil prices and interest rates will likely take a toll on spending at some point. Investors anticipated that cash-heavy corporations would probably initiate capital spending, but to date corporations have had greater interest in using cash to repurchase shares or increase dividends. All of these trends tend to be harbingers for a lower growth environment.

14 Semi-Annual Report | June 30, 2005 |

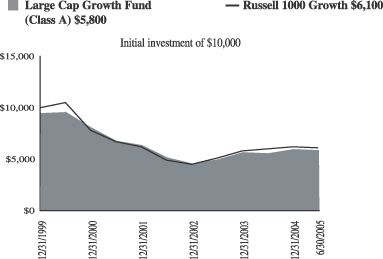

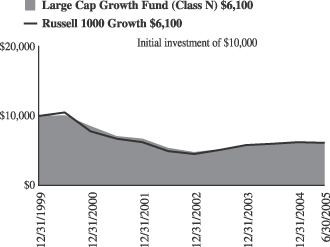

Large Cap Growth Fund

Performance Highlights

Average Annual Total Return at 6/30/2005

| | | | | | | | | | | | |

| | | 1

Year

| | | 3

Year

| | | 5

Year

| | | Since

Inception(a)

| |

Large Cap Growth Fund Class N | | 4.25 | % | | 4.19 | % | | (9.54 | )% | | (8.46 | )% |

Large Cap Growth Fund Class I | | 4.38 | | | 4.39 | | | (9.37 | ) | | (8.27 | ) |

Russell 1000®

Growth Index | | 1.68 | | | 7.26 | | | (10.36 | ) | | (8.59 | ) |

| | (a) | | For the period from December 27, 1999 to June 30, 2005. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 1000® Growth Index consists of large-capitalization companies with above average-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on June 30, 2005. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

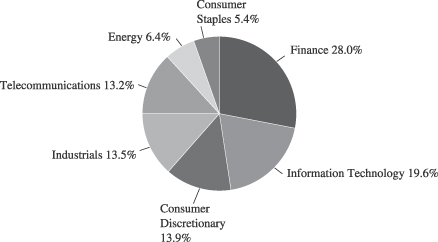

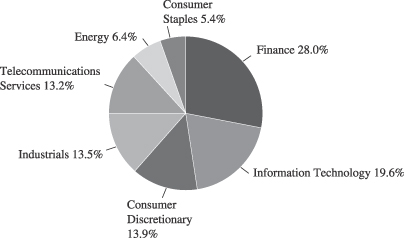

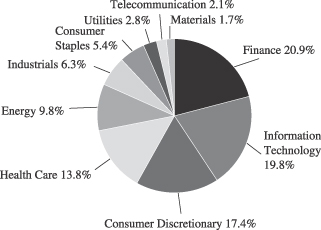

Sector Diversification

The sector diversification shown is based on the total investment portfolio.

June 30, 2005 | William Blair Funds 15 |

Large Cap Growth Fund

Portfolio of Investments, June 30, 2005 (all dollar amounts in thousands) (unaudited)

| | | | | |

Issuer

| | Shares

| | Value

|

| | |

Common Stocks | | | | | |

Information Technology—29.2% | | | | | |

*Accenture, Ltd.† | | 11,865 | | $ | 269 |

Adobe Systems Incorporated | | 4,570 | | | 131 |

*Dell, Inc. | | 10,890 | | | 430 |

*EMC Corporation | | 18,670 | | | 256 |

First Data Corporation | | 8,790 | | | 353 |

Intel Corporation | | 7,565 | | | 197 |

Linear Technology Corporation | | 7,475 | | | 274 |

Paychex, Inc. | | 6,480 | | | 211 |

Qualcomm Incorporated | | 2,410 | | | 80 |

Taiwan Semiconductor Mfg. Co. Ltd.—ADR | | 33,432 | | | 305 |

*Yahoo!, Inc. | | 4,675 | | | 162 |

| | | | |

|

|

| | | | | | 2,668 |

| | | | |

|

|

Health Care—24.6% | | | | | |

Alcon, Inc.† | | 2,210 | | | 242 |

Allergan, Inc. | | 2,195 | | | 187 |

*Amgen, Inc. | | 4,285 | | | 259 |

*Boston Scientific Corporation | | 2,145 | | | 58 |

*Caremark Rx, Inc. | | 3,655 | | | 163 |

Eli Lilly & Company | | 2,965 | | | 165 |

Medtronic, Inc. | | 8,400 | | | 435 |

Pfizer, Inc. | | 7,200 | | | 198 |

Sanofi-Aventis—ADR | | 4,925 | | | 202 |

UnitedHealth Group, Inc. | | 6,525 | | | 340 |

| | | | |

|

|

| | | | | | 2,249 |

| | | | |

|

|

Industrials—12.6% | | | | | |

3M Company | | 3,680 | | | 266 |

*Apollo Group, Inc., Class “A” | | 2,535 | | | 198 |

Danaher Corporation | | 8,142 | | | 426 |

General Electric Company | | 7,635 | | | 265 |

| | | | |

|

|

| | | | | | 1,155 |

| | | | |

|

|

Consumer Discretionary—11.6% | | | | | |

*Bed, Bath & Beyond, Inc. | | 8,265 | | | 345 |

*Comcast Corporation, Class “A” | | 7,945 | | | 238 |

*Kohl’s Corporation | | 6,563 | | | 367 |

Nike, Inc., Class “B” | | 1,300 | | | 113 |

| | | | |

|

|

| | | | | | 1,063 |

| | | | |

|

|

*Non-income producing securities

ADR = American Depository Receipt

† = U.S. listed foreign security

| | | | | | |

Issuer

| | Shares

| | Value

| |

| | |

Common Stocks—(continued) | | | | | | |

Consumer Staples—8.3% | | | | | | |

Avon Products, Inc. | | 5,320 | | $ | 201 | |

PepsiCo, Inc. | | 4,185 | | | 226 | |

Walgreen Co. | | 7,225 | | | 332 | |

| | | | |

|

|

|

| | | | | | 759 | |

| | | | |

|

|

|

Financials—4.6% | | | | | | |

Goldman Sachs Group, Inc. | | 2,355 | | | 240 | |

SLM Corporation | | 3,565 | | | 181 | |

| | | | |

|

|

|

| | | | | | 421 | |

| | | | |

|

|

|

Materials—2.9% | | | | | | |

Praxair, Inc. | | 5,655 | | | 264 | |

| | | | |

|

|

|

Energy—2.6% | | | | | | |

Schlumberger Limited† | | 1,275 | | | 97 | |

Suncor Energy, Inc.† | | 2,895 | | | 137 | |

| | | | |

|

|

|

| | | | | | 234 | |

| | | | |

|

|

|

Total Common Stock—96.4%

(cost $7,855) | | | 8,813 | |

| | | | |

|

|

|

| | |

Investment in Affiliate—3.6% | | | | | | |

William Blair Ready Reserves | | 329,775 | | | 330 | |

| | | | |

|

|

|

Total Investment in Affiliate

(cost $330) | | | 330 | |

| | | | |

|

|

|

Total Investments—100.0%

(cost $8,185) | | | 9,143 | |

Liabilities, plus cash and other assets—0.0% | | | (1 | ) |

| | | | |

|

|

|

Net assets—100.0% | | $ | 9,142 | |

| | | | |

|

|

|

See accompanying Notes to Financial Statements.

16 Semi-Annual Report | June 30, 2005 |

Karl W. Brewer

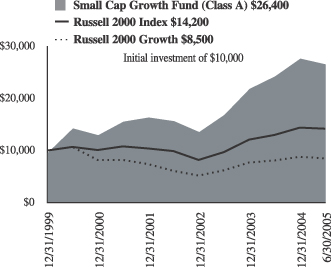

SMALL CAP GROWTH FUND

The Small Cap Growth Fund invests primarily in common stocks of small domestic growth companies that the Advisor expects to have solid growth in earnings.

AN OVERVIEW FROM THE PORTFOLIO MANAGER

How did the Fund perform over the first half of the year? How did the Fund’s performance compare to its benchmark?

The Small Cap Growth Fund posted a 4.16% decrease on a total return basis (Class N Shares) for the six months ended June 30, 2005. By comparison, the Fund’s benchmark, the Russell 2000® Growth Index, declined 3.58% during the period, while the Russell 2000® Index decreased 1.25%.

What were the most significant factors impacting Fund performance? What factors were behind the Fund’s performance versus the benchmark?

Small cap growth stocks underperformed large cap stocks during the first six months of the year, as evidenced by the Russell 2000® Index (of small company stocks) return of -1.25% versus the Russell 1000® Index (of large company stocks) return of 0.11%. From a style perspective within the small cap space, value continued to outperform growth as the Russell 2000® Value Index returned 0.90%.

The financial markets were again faced with the backdrop of a rising interest rate environment and high energy prices during the first half of 2005. The Federal Reserve continued its tightening at a measured pace to take the target Federal Funds interest rate to 3.25% by the end of June. Crude oil closed the first half of the year near $60 a barrel and continues to be a headwind for investors’ outlook on the consumer. With these elevated energy prices, the Energy sector within the Russell 2000® Growth Index has sustained its strong performance in 2005 to date. Consumer Discretionary stocks also turned in positive results. On the other hand, Health Care stocks finished just in negative territory for the Russell 2000® Growth Index. The Information Technology sector once again produced negative results for the Russell 2000® Growth Index as it did in 2004. The Industrials and Materials sectors, after their strong performances in 2004, ended the first half of 2005 with negative returns within the Russell 2000® Growth Index. With respect to the Fund, Health Care, Industrials, Consumer Discretionary and Financials produced negative absolute returns while Information Technology and Energy saw positive results in absolute terms.

On a relative basis, our outperformance during the first quarter was more than offset by our underperformance during the second quarter to end the period down relative to the Russell 2000® Growth Index. There were a few dynamics that contributed to our relative performance during the first six months of the year. First, we had some fundamental disappointments. Stock selection in Health Care was a major detractor from relative performance. In addition to Health Care, stock selection in the Financials and Consumer Discretionary sectors were two other main sources of relative underperformance. Among the positive contributors to the Fund’s relative performance for the first six months of 2005 was stock selection within the Information Technology sector.

Another dynamic that added to the Fund’s underperformance, specifically during the second quarter, was client withdrawals. As a result, we were forced to raise cash in an already difficult small cap market during April and then again in May, which we believe put downward pressure on some of our portfolio holdings. From the end of the first quarter

June 30, 2005 | William Blair Funds 17 |

through May 24, representing roughly the end of the liquidations and the trough in relative performance for the quarter, a substantial amount of the roughly 550 basis point underperformance came from our smaller market capitalization, and typically less liquid stocks. In the period from May 24 through the end of the quarter, after the liquidations were complete, we outperformed compared to the Index by over 300 basis points. While we are not satisfied with our underperformance in the second quarter, and therefore through the first six months of 2005, we feel a portion of this was due to short term dynamics and we remain positive on the positioning of the Fund.

What were among the weakest performing investments for the Fund?

Integra LifeSciences Holdings Corporation and Cell Therapeutics, Inc. were two stocks within Health Care that performed poorly. Integra LifeSciences, a medical products company, reported earnings below expectations and guided future earnings lower during May. We continue to hold the position as we expect Integra’s business momentum to reaccelerate. The small cap biotechnology industry experienced relatively weak returns during the first half of the year. Cell Therapeutics is one of the Fund’s biotechnology holdings that underperformed its peers in the quarter. The company announced negative data from a Phase III trial in the FDA approval process during the first quarter. We have since sold the position after subsequent data points dampened our outlook for the company’s prospects.

What were among the best performing investments for the Fund?

Two stocks that contributed to the Information Technology sector’s positive relative performance were Optimal Group, Inc. and Intermix Media, Inc. Optimal Group was our most significant contributor within our Information Technology holdings and in the Fund overall. Optimal Group, Inc. is an undiscovered transaction processing company. The stock appreciated through the first six months of the year as investors became increasingly aware of the company and its ability to execute fundamentally. Intermix Media, Inc. operates a network of unique websites that allow marketers to target hard-to-reach consumers. The company’s business is accelerating and the stock has responded accordingly.

What is your current outlook?

Looking forward, the markets will continue to face various headwinds. Year over year earnings comparisons are getting tougher after the strong double digit earnings growth rates witnessed in 2004. More companies are reigning in expectations as the ratio of negative to positive preannouncements was significantly higher during the second quarter of 2005 versus the year earlier period. There will be continued debate in regard to near record high energy prices and their effect on overall economic activity. With respect to interest rates, current consensus is for the Federal Reserve to raise rates another 25 basis points at its August meeting but beyond that investors differ on their expectations. Future data points on inflation, economic activity and employment will weigh in on the direction of interest rates so investors will be watching these statistics in anticipation of the Fed’s moves.

With the backdrop of slower yet more sustainable economic and corporate earnings growth rates, we anticipate a stock picker’s market. Our bottom up, fundamental quality growth philosophy of selecting companies with durable business franchises and consistent earnings streams should position the Fund well in this type of environment.

18 Semi-Annual Report | June 30, 2005 |

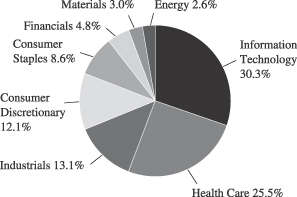

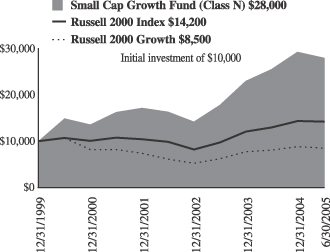

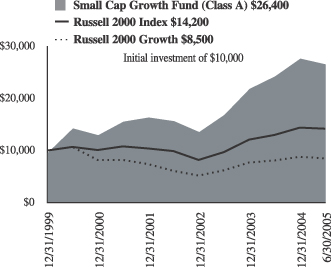

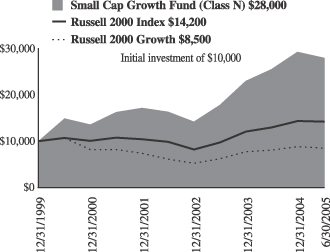

Small Cap Growth Fund

Performance Highlights

Average Annual Total Return at 6/30/2005

| | | | | | | | | | | | |

| | | 1

Year

| | | 3

Year

| | | 5

Year

| | | Since Inception(a)

| |

Small Cap Growth Fund Class N | | 9.33 | % | | 19.53 | % | | 13.44 | % | | 20.47 | % |

Small Cap Growth Fund Class I | | 9.61 | | | 19.81 | | | 13.70 | | | 20.75 | |

Russell 2000®

Growth Index | | 4.29 | | | 11.37 | | | (4.51 | ) | | (2.86 | ) |

Russell 2000® Index | | 9.45 | | | 12.81 | | | 5.71 | | | 6.59 | |

| | (a) | | For the period from December 27, 1999 to June 30, 2005. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2000® Growth Index consists of small-capitalization companies with above average price-to-book ratios and forecasted growth rates.

The Russell 2000® Index is an unmanaged composite of the smallest 2000 stocks of the Russell 3000® Index.

This report identifies the Fund’s investments on June 30, 2005. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

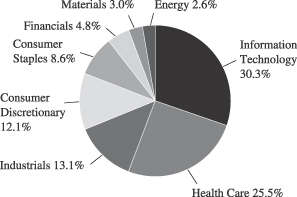

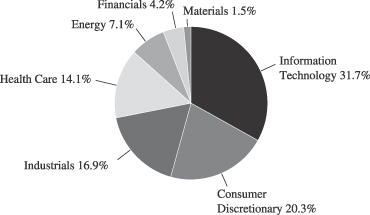

Sector Diversification

The sector diversification shown is based on the total investment portfolio.

June 30, 2005 | William Blair Funds 19 |

Small Cap Growth Fund

Portfolio of Investments, June 30, 2005 (all dollar amounts in thousands) (unaudited)

| | | | | |

Issuer

| | Shares

| | Value

|

| | |

Common Stocks | | | | | |

Information Technology—30.2% | | | | | |

*AMIS Holdings, Inc. | | 1,126,040 | | $ | 15,021 |

ARM Holdings, plc—ADR | | 1,511,435 | | | 9,280 |

*Blackbaud, Inc. | | 493,782 | | | 6,666 |

*DSP Group, Inc. | | 323,020 | | | 7,711 |

*Euronet Worldwide, Inc. | | 290,184 | | | 8,436 |

*Intermix Media, Inc. | | 558,228 | | | 4,672 |

*Internet Capital Group, Inc. | | 466,363 | | | 3,418 |

*Intrado, Inc. | | 652,664 | | | 9,764 |

*J2 Global Communications, Inc. | | 189,169 | | �� | 6,515 |

*Kanbay International, Inc. | | 494,320 | | | 11,424 |

*Lionbridge Technologies, Inc. | | 1,916,651 | | | 12,995 |

*Macrovision Corporation | | 317,400 | | | 7,154 |

*Open Solutions, Inc. | | 223,442 | | | 4,538 |

*OPNET Technologies, Inc. | | 822,590 | | | 6,663 |

*Optimal Group, Inc.† | | 928,807 | | | 15,000 |

*PDF Solutions, Inc. | | 921,372 | | | 12,088 |

*Plexus Corporation | | 482,606 | | | 6,868 |

*ScanSoft, Inc. | | 2,312,750 | | | 8,742 |

*Ultimate Software Group, Inc. | | 754,863 | | | 12,380 |

*ValueClick, Inc. | | 1,269,797 | | | 15,657 |

*Volterra Semiconductor Corporation | | 525,570 | | | 7,826 |

*WebEx Communications, Inc. | | 520,160 | | | 13,737 |

*Workstream, Inc.† | | 2,736,960 | | | 4,921 |

| | | | |

|

|

| | | | | | 211,476 |

| | | | |

|

|

Consumer Discretionary—19.4% | | | | | |

*4 Kids Entertainment, Inc. | | 464,245 | | | 9,229 |

*Century Casinos, Inc. | | 844,596 | | | 6,351 |

*Cumulus Media, Inc., Class “A” | | 686,895 | | | 8,092 |

*Insight Enterprises, Inc. | | 626,240 | | | 12,637 |

*Jarden Corporation | | 268,650 | | | 14,486 |

*Laureate Education, Inc. | | 406,177 | | | 19,440 |

*Life Time Fitness, Inc. | | 52,900 | | | 1,736 |

*Lions Gate Entertainment Corporation† | | 1,282,915 | | | 13,163 |

Nautilus Group, Inc. | | 238,909 | | | 6,809 |

*Scientific Games Corporation, Class “A” | | 222,507 | | | 5,992 |

*Shuffle Master, Inc. | | 249,376 | | | 6,990 |

Speedway Motorsports, Inc. | | 189,280 | | | 6,920 |

Strayer Education, Inc. | | 72,095 | | | 6,219 |

*ValueVision Media, Inc., Class “A” | | 751,690 | | | 9,028 |

*WMS Industries, Inc. | | 246,585 | | | 8,322 |

| | | | |

|

|

| | | | | | 135,414 |

| | | | |

|

|

Industrials—16.1% | | | | | |

*Coinstar, Inc. | | 552,347 | | | 12,533 |

*Comfort Systems USA, Inc. | | 1,230,365 | | | 8,096 |

*Corrections Corporation of America | | 233,310 | | | 9,157 |

*Educate, Inc. | | 413,818 | | | 5,855 |

*Electronic Clearing House | | 598,262 | | | 5,205 |

*FirstService Corporation† | | 411,025 | | | 8,208 |

*Frozen Food Express Industries, Inc. | | 284,466 | | | 3,220 |

*Hudson Highland Group, Inc. | | 466,235 | | | 7,269 |

*Huron Consulting Group, Inc. | | 341,789 | | | 8,049 |

*Kforce, Inc. | | 1,475,315 | | | 12,481 |

| | | | | |

Issuer

| | Shares

| | Value

|

| | |

Common Stocks—(continued) | | | | | |

Industrials—(continued) | | | | | |

*Labor Ready, Inc. | | 533,241 | | $ | 12,430 |

*Marten Transport, Ltd. | | 235,680 | | | 4,947 |

*Providence Service Corporation | | 283,873 | | | 7,048 |

*TRM Copy Centers Corporation | | 495,191 | | | 8,329 |

| | | | |

|

|

| | | | | | 112,827 |

| | | | |

|

|

Health Care—13.4% | | | | | |

*Allied Healthcare International | | 1,586,937 | | | 11,235 |

*Amicas, Inc. | | 1,576,102 | | | 7,140 |

*Axcan Pharma, Inc.† | | 565,955 | | | 8,648 |

*Barrier Therapeutics, Inc. | | 434,323 | | | 3,444 |

*Connectics Corporation | | 409,500 | | | 7,223 |

*Integra Lifesciences Holdings Corporation | | 368,240 | | | 10,752 |

*Kensey Nash Corporation | | 271,020 | | | 8,196 |

*LifeCell Corporation | | 208,715 | | | 3,300 |

*Martek Biosciences Corporation | | 196,738 | | | 7,466 |

*Matria Healthcare, Inc. | | 275,183 | | | 8,869 |

*Sangamo Biosciences, Inc. | | 531,005 | | | 1,896 |

*Santarus, Inc. | | 848,685 | | | 3,480 |

*Telik, Inc. | | 487,560 | | | 7,928 |

*Zila, Inc. | | 1,530,641 | | | 4,378 |

| | | | |

|

|

| | �� | | | | 93,955 |

| | | | |

|

|

Energy—6.8% | | | | | |

*ATP Oil and Gas Corporation | | 312,481 | | | 7,312 |

*Gasco Energy Inc. | | 2,401,050 | | | 8,884 |

*Grey Wolf, Inc. | | 1,430,573 | | | 10,601 |

*InterOil Corporation† | | 156,075 | | | 4,242 |

OMI Corporation | | 454,770 | | | 8,645 |

*Remington Oil and Gas Corporation | | 218,943 | | | 7,816 |

| | | | |

|

|

| | | | | | 47,500 |

| | | | |

|

|

Consumer Staples—4.0% | | | | | |

*Elizabeth Arden, Inc. | | 459,900 | | | 10,757 |

Nu Skin Enterprises, Inc. | | 341,390 | | | 7,955 |

*Usana Health Services, Inc. | | 214,545 | | | 9,075 |

| | | | |

|

|

| | | | | | 27,787 |

| | | | |

|

|

Financials—4.0% | | | | | |

*Affiliated Managers Group, Inc. | | 186,685 | | | 12,756 |

ECC Capital Corporation | | 1,090,485 | | | 7,262 |

*First Cash Financial Services, Inc. | | 360,309 | | | 7,700 |

| | | | |

|

|

| | | | | | 27,718 |

| | | | |

|

|

Materials—1.5% | | | | | |

Airgas, Inc. | | 413,280 | | | 10,196 |

| | | | |

|

|

Total in Common Stock—95.4%

(Total cost $557,100) | | | 666,873 |

| | | | |

|

|

| | |

Investment in Affiliate—0.9% | | | | | |

William Blair Ready Reserves | | 6,242,722 | | | 6,243 |

| | | | |

|

|

Total Investment in Affiliate

(cost $6,243) | | | 6,243 |

| | | | |

|

|

See accompanying Notes to Financial Statements.

20 Semi-Annual Report | June 30, 2005 |

Small Cap Growth Fund

Portfolio of Investments, June 30, 2005 (all dollar amounts in thousands) (unaudited)

| | | | | | |

Issuer

| | Principal

Amount

| | Value

|

| | |

Short-Term Investments—2.9% | | | | | | |

American Express Demand Note, VRN, 3.164%, due 7/1/05 | | $ | 10,046,000 | | $ | 10,046 |

Prudential Funding Demand Note, VRN, 3.368%, due 4/1/05 | | | 10,046,000 | | | 10,046 |

| | | | | |

|

|

Total Short-Term Investments

(cost $20,092) | | | 20,092 |

| | | | | |

|

|

Total Investments—99.2%

(cost $583,435 ) | | | 693,208 |

Cash and other assets, less liabilities—0.8% | | | 5,911 |

| | | | | |

|

|

Net assets—100.0% | | $ | 699,119 |

| | | | | |

|

|

*Non-income producing securities

ADR = American Depository Receipt

† = U.S. listed foreign security

VRN = Variable Rate Note

See accompanying Notes to Financial Statements.

June 30, 2005 | William Blair Funds 21 |

Karl W. Brewer

Harvey H. Bundy, III

Robert C. Lanphier, IV

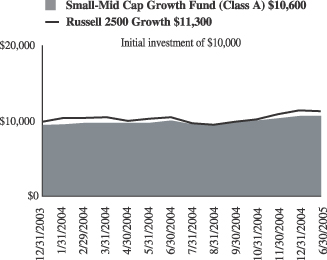

SMALL-MID CAP GROWTH FUND

The Small-Mid Cap Growth Fund primarily invests in a diversified portfolio of common stocks of small and medium-sized domestic growth companies that the Advisor expects to experience solid growth in earnings.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

How did the Fund perform over the first half of the year? How did the Fund’s performance compare to its benchmark?

The Small-Mid Cap Growth Fund posted a 0.53% decrease on a total return basis (Class N Shares) for the six months ended June 30, 2005. By comparison, the Fund’s benchmark, the Russell 2500® Growth Index, declined 0.92% during the period.

What were the most significant factors impacting Fund performance? What factors were behind the Fund’s performance versus the benchmark?

Small to mid cap stocks outperformed large cap stocks through the first six months of the year, as evidenced by the Russell 2500® Growth Index’s return of -0.92%, versus the Russell 1000® Growth Index return of -1.72%. From a style perspective within the small to mid cap space, value continued to outperform growth as the Russell 2500® Value Index returned 3.09%.

The financial markets were again faced with the backdrop of a rising interest rate environment and high energy prices during the first half of 2005. The Federal Reserve continued its tightening at a measured pace, taking the target Federal Funds interest rate to 3.25% by the end of June. Crude oil closed the first half of the year near $60 a barrel and continues to be a headwind for investors as they consider the outlook for consumer spending.

With the elevation in energy prices, the Energy sector within the Russell 2500® Growth Index has sustained strong returns in 2005 to date. Consumer Discretionary stocks also turned in positive results while Health Care stocks finished just in positive territory in the Russell 2500® Growth Index. The Information Technology sector once again produced negative returns for the first half of the year in the Russell 2500® Growth Index as it did in 2004. The Industrials and Materials sectors, after their strong performances in 2004, also turned in negative returns within the Russell 2500® Growth Index. With respect to the Fund, Healthcare, Industrials and Financials produced negative absolute returns, while Information Technology, Consumer Discretionary and Energy saw positive results.

A few dynamics occurred during the first six months of the year that affected our relative performance. Stock selection in the Information Technology sector was the largest source of outperformance. Being underweight in the Financials sector during the first six months of the year outweighed poor stock selection in the sector.

What were among the best performing investments for the Fund?

Jabil Circuit, Inc. in the electronics manufacturing services (EMS) business was a strong contributor to the Fund’s performance in the first half of the year. Jabil Circuit, Inc. distinguishes itself with a customer-centric approach that delivers higher service levels and superior financial performance relative to its competition. The stock benefited as earnings estimates were taken up during the first quarter. The stock continued to move higher after the

22 Semi-Annual Report | June 30, 2005 |

company released earnings and guidance in June. We remain positive on the long-term prospects for the company. Ultimate Software Group, Inc. is another company in the Information Technology sector that delivered strong appreciation in the first six months of the year. The company provides innovative web-based payroll services. Customers indicate that the programs are easy to use, flexible in managing complex payroll accounting issues, and competitively priced. The company has gained attention from other growth managers and research analysts as the company transitioned to profitability.

What were among the weakest performing investments for the Fund?

One of the underperformers in the Financials sector was East West Bancorp, a bank focused on the Chinese-American market in California. There was a general market sell off, in the second quarter in part due to increased competition in their region. Finally, negative stock selection in the Consumer Discretionary space was a detractor from relative performance. Strayer Education, a post-secondary educator primarily targeting working adults, was one of the underperformers in the sector. The company’s first quarter earnings disappointed investors as new student enrollment came in below expectations. We feel this was a short term problem that they will resolve.

What is your current outlook?

Looking forward, the markets will continue to face various headwinds. Year over year earnings comparisons are getting tougher after the strong double digit earnings growth rates witnessed in 2004. More companies are reigning in expectations as the ratio of negative to positive pre-announcements was significantly higher during the second quarter of 2005 versus the year earlier period. There will be continued debate in regard to near record high energy prices and their effect on overall economic activity. Future data points on inflation, economic activity and employment will weigh in on the direction of interest rates so investors will be watching these statistics in anticipation of the Fed’s moves in the coming months.

With the backdrop of slower yet more sustainable economic and corporate earnings growth rates, we anticipate a stock picker’s market. We believe that our bottom-up, fundamental quality growth philosophy of selecting companies with durable business franchises and consistent earnings streams should position the Fund well in this type of environment.

June 30, 2005 | William Blair Funds 23 |

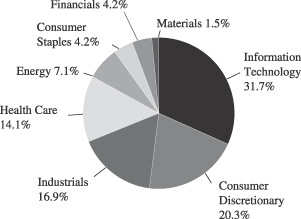

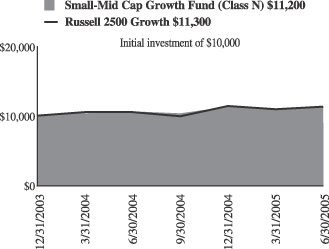

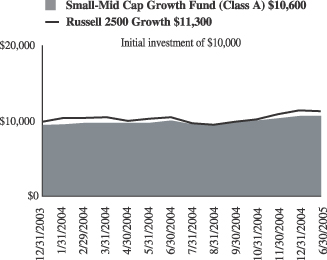

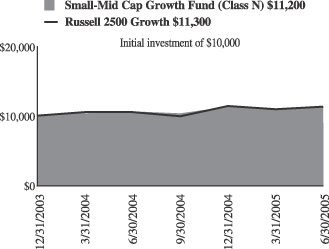

Small-Mid Cap Growth Fund

Performance Highlights

Average Annual Total Return at 6/30/2005

| | | | | | |

| | | Year

| | | Since Inception(a)

| |

Small-Mid Cap Growth Fund

Class N | | 5.45 | % | | 7.89 | % |

Small-Mid Cap Growth Fund

Class I | | 5.73 | | | 8.15 | |

Russell 2500® Growth Index | | 7.46 | | | 9.42 | |

| | (a) | | For the period from December 29, 2003 to June 30, 2005. | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2500™ Growth Index measures the performance of those Russell 2500 companies with above average price-to-book ratios and forcasted growth rates.

This report identifies the Fund’s investments on June 30, 2005. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

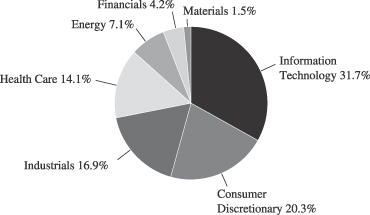

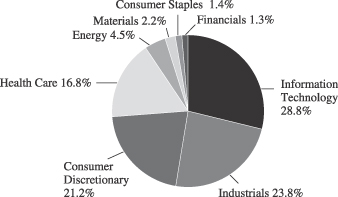

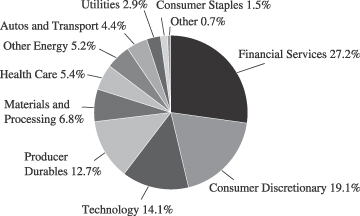

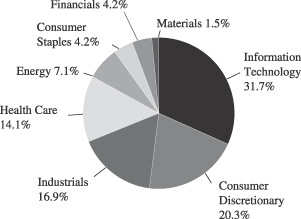

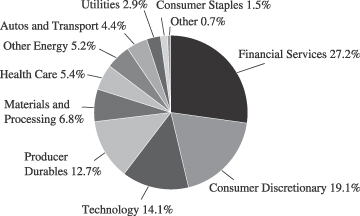

Sector Diversification

The sector diversification shown is based on the total investment portfolio.

24 Semi-Annual Report | June 30, 2005 |

Small-Mid Cap Growth Fund

Portfolio of Investments, June 30, 2005 (all dollar amounts in thousands) (unaudited)

| | | | | |

Issuer

| | Shares

| | Value

|

| | |

Common Stocks | | | | | |

Information Technology—27.6% | | | | | |

*AMIS Holdings, Inc. | | 60,800 | | $ | 811 |

CDW Corporation | | 21,700 | | | 1,239 |

*Fiserv, Inc. | | 30,200 | | | 1,297 |

*Intrado, Inc. | | 37,170 | | | 556 |

*Intuit, Inc. | | 39,000 | | | 1,759 |

*Iron Mountain, Inc. | | 37,850 | | | 1,174 |

*J2 Global Communications, Inc. | | 31,800 | | | 1,095 |

*Jabil Circuit, Inc. | | 41,900 | | | 1,288 |

Microchip Technology, Inc. | | 49,900 | | | 1,478 |

*OPNET Technologies, Inc. | | 44,900 | | | 364 |

*PDF Solutions, Inc. | | 48,500 | | | 636 |

*Ultimate Software Group, Inc. | | 44,600 | | | 731 |

*ValueClick, Inc. | | 86,500 | | | 1,067 |

*WebEx Communications, Inc. | | 38,800 | | | 1,025 |

Xilinx, Inc. | | 14,200 | | | 362 |

| | | | |

|

|

| | | | | | 14,882 |

| | | | |

|

|

Industrials—22.8% | | | | | |

*Beacon Roofing Supply, Inc. | | 24,603 | | | 647 |

C.H. Robinson Worldwide, Inc. | | 10,000 | | | 582 |

Cintas Corporation | | 16,100 | | | 622 |

*Coinstar, Inc. | | 42,505 | | | 964 |

Corporate Executive Board Company | | 17,700 | | | 1,386 |

*Corrections Corporation of America | | 19,000 | | | 746 |

Expeditors International of Washington | | 24,600 | | | 1,225 |

Fastenal Company | | 32,100 | | | 1,966 |

*Kforce, Inc. | | 54,765 | | | 463 |

Knight Transportation, Inc. | | 44,800 | | | 1,090 |

MSC Industrial Direct Company, Inc., Class “A” | | 17,740 | | | 599 |

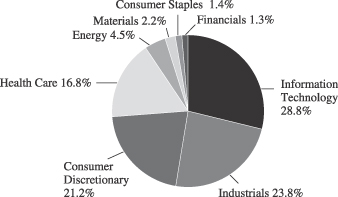

Pentair, Inc. | | 29,100 | | | 1,246 |