UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-5344

William Blair Funds

(Exact name of registrant as specified in charter)

| | |

| 222 West Adams Street, Chicago, IL | | 60606 |

| (Address of principal executive offices) | | (Zip Code) |

Marco Hanig

William Blair Funds

222 West Adams Street, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: 312-236-1600

Date of fiscal year end: December 31

Date of reporting period: June 30, 2006

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A Registrant is not required to respond to the collection of information contained in Form N-CSR unless the form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimates and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. (ss) 3507.

June 30, 2006 Semi-Annual Reports transmitted to shareholders.

Table of Contents

This report is submitted for the general information of the shareholders of the William Blair Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by a prospectus of the William Blair Funds. Please carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

June 30, 2006 | William Blair Funds 1 |

Marco Hanig

A LETTER FROM THE PRESIDENT

Dear Shareholders:

In the first half of 2006, the U.S. stock market got off to a great start in the first quarter, and then pulled back in the second quarter to end up with modestly positive returns. The Standard and Poor’s 500 Index of large cap stocks posted a 2.71% return, and the Russell 2000 Index of small cap stocks was up 8.21%. Rising interest rates led to slightly negative bond returns, with the Lehman Aggregate Bond Index declining -0.72%. Foreign stocks continued to outperform the U.S., with the MSCI All Country World ex-US Index up 9.99%.

The first quarter rally was fueled by strong corporate earnings and the hope that the Fed would soon end its tightening cycle. In mid-May, the Fed’s hawkish comments about inflation signaled that the end to interest rate hikes would likely be delayed. In addition, concern about high energy prices and a soft housing market led to worries about the strength of the consumer sector. On the bright side, the U.S. economy is still growing robustly, and after the recent market correction valuations have become more reasonable, so the outlook for stock returns in the second half of the year is generally flat to moderately positive.

Differences in style were fairly pronounced, with value continuing its five-year winning streak over growth, and small caps outperforming large caps. While many observers continue to expect large caps and growth stocks to outperform, this change in tide has yet to materialize.

Total Returns by Russell Style Index

January 1 through June 30, 2006

| | | | | | | | | |

| | | Value

| | | Blend

| | | Growth

| |

Large Cap (Russell 1000) | | 6.56 | % | | 2.76 | % | | -0.93 | % |

Mid Cap (Russell MidCap) | | 7.02 | % | | 4.84 | % | | 2.56 | % |

Small Cap (Russell 2000) | | 10.44 | % | | 8.21 | % | | 6.07 | % |

The relative returns of the William Blair Funds were mixed. Year-to-date, all the domestic equity funds beat their respective Morningstar peer groups, with the standout funds being the Growth Fund, up 2.38% vs. a decline of -1.34% for the Morningstar Large Growth universe, and the Small-Mid Cap Growth Fund, up 5.08% vs. 2.88% for the Morningstar Mid-Cap Growth universe. Our foreign funds all lagged in the first half, with our largest fund, International Growth Fund, posting a return of 5.95% vs. 8.20% for the Morningstar Foreign Large Growth peers. The Fund managers’ letters discuss the reasons for their respective over- or under-performance in greater detail.

As always, thank you for investing with us!

Marco Hanig

2 Semi-Annual Report | June 30, 2006 |

PERFORMANCE AS OF JUNE 30, 2006—CLASS N SHARES

| | | | | | | | | | | | | | |

| | | Year to

Date

| | 1 Yr

| | 3 Yr

| | 5 Yr

| | 10 Yr (or since

inception)

| | Inception

Date

| | Overall Morningstar Rating

|

| | | (unaudited) | | | | | | | | | | | | |

Growth Fund | | 2.38 | | 13.21 | | 10.88 | | 1.31 | | 5.50 | | 3/20/1946 | | «««« |

Morningstar Large Growth | | -1.34 | | 6.83 | | 8.83 | | -0.56 | | 5.68 | | | | Among 1,361 large growth funds |

Russell 3000® Growth | | -0.32 | | 6.84 | | 8.96 | | -0.43 | | 5.24 | | | |

Standard & Poor’s 500 | | 2.71 | | 8.63 | | 11.22 | | 2.49 | | 8.32 | | | | |

| | | | | | | |

Tax-Managed Growth Fund | | | | | | | | | | | | | | «««« |

Return before Taxes | | 1.48 | | 13.00 | | 11.36 | | 2.25 | | 0.39 | | 12/27/1999 | | Among 1,361 large growth funds |

After Taxes on Distributions | | 1.48 | | 13.00 | | 11.36 | | 2.25 | | 0.39 | | | |

After Taxes on Distributions and Sale of Fund Shares | | 0.96 | | 8.45 | | 9.80 | | 1.92 | | 0.34 | | | | |

Morningstar Large Growth | | -1.34 | | 6.83 | | 8.83 | | -0.56 | | — | | | | |

Russell 3000® Growth | | -0.32 | | 6.84 | | 8.96 | | -0.43 | | -6.07 | | | | |

| | | | | | | |

Large Cap Growth Fund | | -0.93 | | 4.57 | | 6.95 | | -2.00 | | -6.58 | | 12/27/1999 | | ««« |

Morningstar Large Growth | | -1.34 | | 6.83 | | 8.83 | | -0.56 | | — | | | | Among 1,361 large growth funds |

Russell 1000® Growth | | -0.93 | | 6.12 | | 8.35 | | -0.76 | | -6.53 | | | |

| | | | | | | |

Small Cap Growth Fund | | 5.85 | | 11.75 | | 20.82 | | 13.95 | | 19.09 | | 12/27/1999 | | ««««« |

Morningstar Small Growth | | 4.89 | | 12.73 | | 15.23 | | 3.70 | | — | | | | Among 646 small growth funds |

Russell 2000® Growth | | 6.07 | | 14.58 | | 16.27 | | 3.49 | | -0.48 | | | |

The Small Cap Growth Fund’s Performance during 2000 was primarily attributable to investments in initial public offerings (IPOs) during a rising market. Since then, IPOs have had an insignificant effect on the Fund’s performance. | | | | | | |

| | | | | | | |

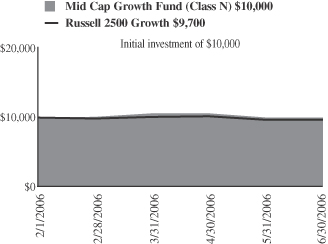

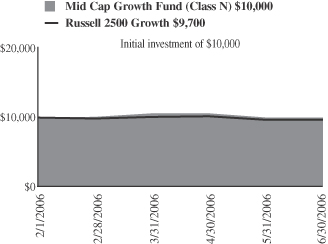

Mid Cap Growth Fund | | — | | — | | — | | — | | -0.30 | | 2/1/2006 | | Not rated. |

Russell Mid Cap Growth Index | | — | | — | | — | | — | | -3.36 | | | | |

| | | | | | | |

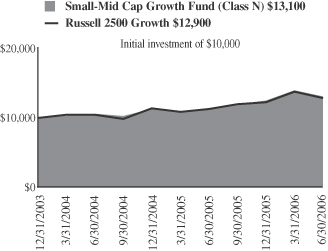

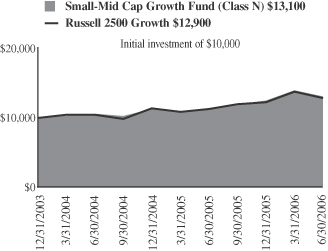

Small-Mid Cap Growth Fund | | 5.08 | | 16.97 | | — | | — | | 11.41 | | 12/29/2003 | | Not rated. |

Morningstar Mid-Cap Growth | | 2.88 | | 12.66 | | — | | — | | — | | | | |

Russell 2500TM Growth | | 4.98 | | 14.62 | | — | | — | | 10.77 | | | | |

| | | | | | | |

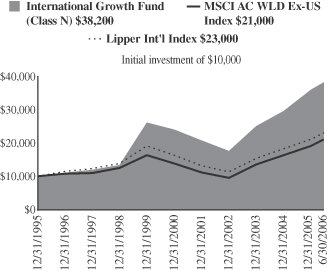

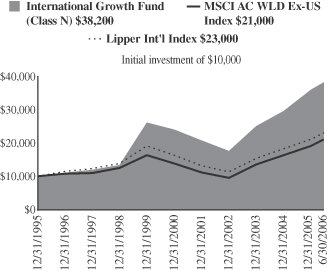

International Growth Fund | | 5.95 | | 26.99 | | 25.02 | | 11.66 | | 13.44 | | 10/1/1992 | | ««««« |

Morningstar Foreign Large Growth | | 8.20 | | 26.99 | | 21.10 | | 7.64 | | 5.63 | | | | Among 195 foreign large growth funds |

MSCI World Ex-US | | 9.99 | | 28.40 | | 25.78 | | 11.85 | | 7.16 | | | |

| | | | | | | |

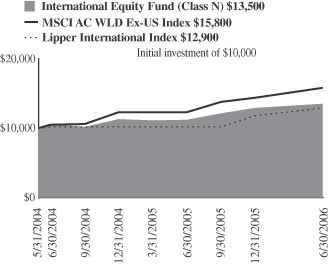

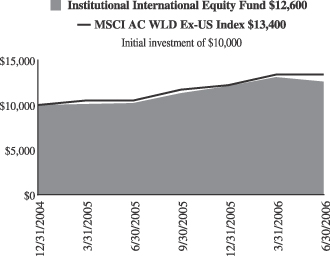

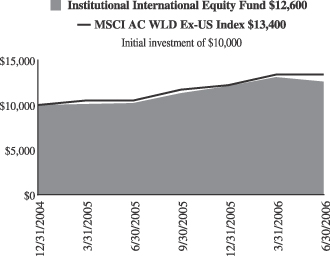

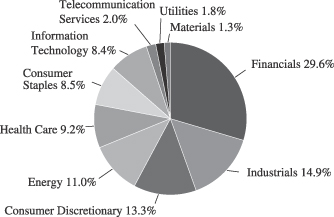

International Equity Fund | | 4.67 | | 20.18 | | — | | — | | 15.11 | | 5/24/2004 | | Not rated. |

Morningstar Foreign Large Growth | | 8.20 | | 26.99 | | — | | — | | — | | | | |

MSCI World Ex-US | | 9.99 | | 28.40 | | — | | — | | 24.01 | | | | |

| | | | | | | |

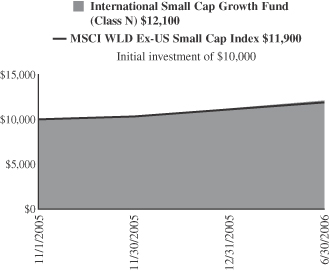

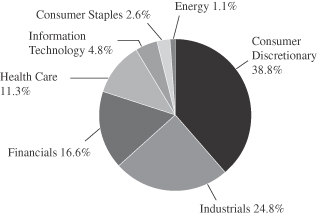

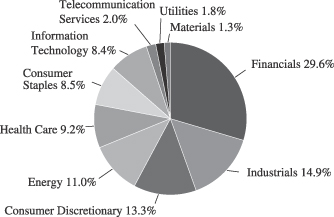

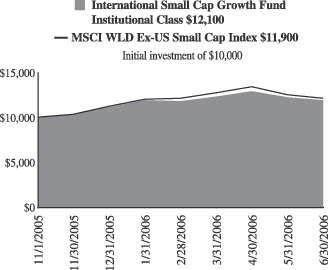

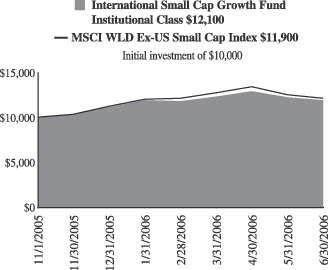

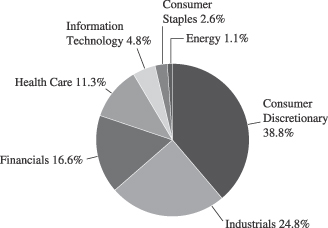

International Small Cap Growth Fund | | 8.51 | | — | | — | | — | | 21.10 | | 11/1/2005 | | Not rated. |

Morningstar Foreign Small/Mid Growth | | 9.44 | | — | | — | | — | | — | | | | |

MSCI World Small Cap Ex-US | | 7.06 | | — | | — | | — | | 18.49 | | | | |

Please see the next page for important disclosure information.

June 30, 2006 | William Blair Funds 3 |

| | | | | | | | | | | | | | |

| | | Year to

Date

| | 1 Yr

| | 3 Yr

| | 5 Yr

| | 10 Yr (or since

inception)

| | Inception

Date

| | Overall Morningstar Rating

|

| | | | | | | |

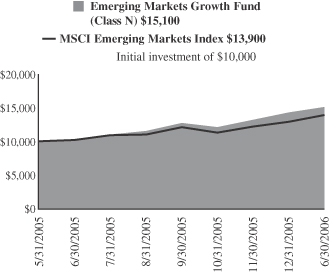

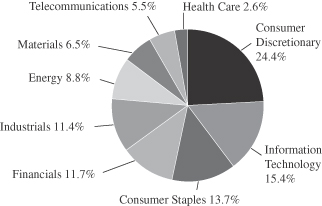

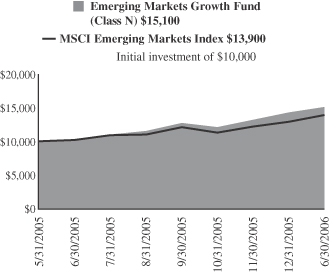

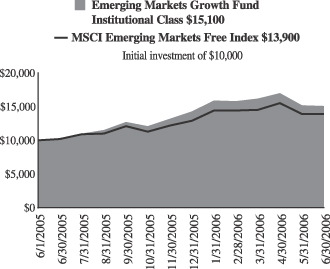

Emerging Markets Growth Fund | | 5.86 | | 47.05 | | — | | — | | 46.71 | | 6/6/2005 | | Not rated. |

Morningstar Diversified Emerging Markets | | 6.74 | | 34.14 | | — | | — | | — | | | | |

MSCI Emerging Markets | | 7.33 | | 35.91 | | — | | — | | 35.68 | | | | |

| A portion of the Emerging Markets Growth Funds performance since inception was attributable to an investment in an initial public offering (IPO). | | | | | | |

| | | | | | | |

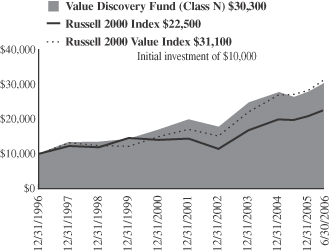

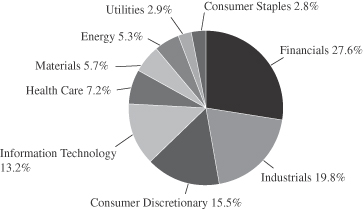

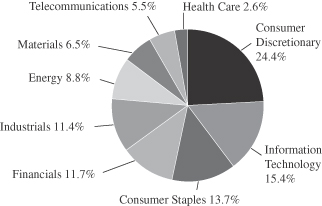

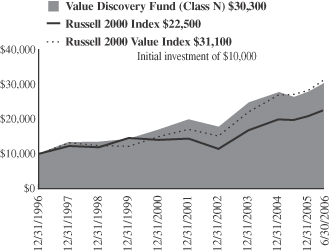

Value Discovery Fund | | 8.56 | | 14.43 | | 15.23 | | 8.92 | | 12.28 | | 12/23/1996 | | « |

Morningstar Small Value | | 7.13 | | 12.64 | | 19.35 | | 12.34 | | — | | | | Among 291 small value funds |

Russell 2000® | | 8.21 | | 14.58 | | 18.70 | | 8.50 | | 9.11 | | | |

Russell 2000® Value | | 10.44 | | 14.61 | | 21.01 | | 13.09 | | 12.82 | | | | |

| | | | | | | |

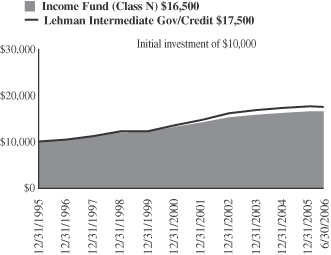

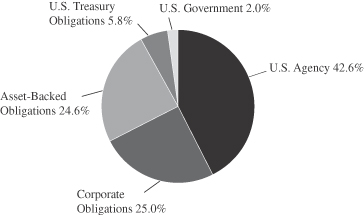

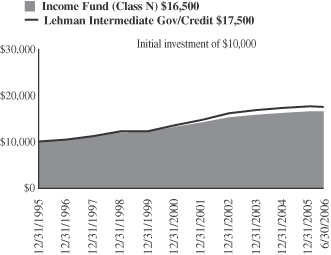

Income Fund | | 0.23 | | 0.61 | | 1.74 | | 3.92 | | 5.16 | | 10/1/1990 | | «««« |

Morningstar Short-Term Bond | | 0.84 | | 1.38 | | 1.45 | | 3.17 | | 4.64 | | | | Among 335 short-term bond funds |

Lehman Intermediate Govt./Credit Bond Index | | -0.18 | | -0.19 | | 1.48 | | 4.61 | | 5.80 | | | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher that the data quoted. Returns shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or a loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. International and emerging markets investing involves special risk considerations, including currency fluctuations, lower liquidity, economic and political risk. As interest rates rise, bond prices will fall and bond funds become more volatile. From time to time, the investment advisor may waive fees or reimburse expenses for certain Funds. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load.

Tax-Managed Growth Fund’s after-tax returns are calculated using the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are shown only for Class N and the after-tax returns for Class N shares will vary.

Morningstar RatingsTM are as of 6/30/06 and are subject to change every month. The ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each Category receive 5 stars, the next 22.5% receive 4 stars, the middle 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. The 3/5/10 year Morningstar ratings were as follows: Growth Fund ««««/««««/«««, Tax-Managed Growth Fund ««««/««««/NA, and Large Cap Growth Fund «««/«««/NA, out of 1361/1081/402 large growth funds; Small Cap Growth Fund «««««/«««««/NA out of 646/509/NA small growth funds; Value Discovery Fund «/«/NA out of 291/205/NA small value funds; International Growth Fund ««««/««««/««««« out of 195/153/66 foreign large growth funds; Income Fund ««««/««««/«««« out of 335/239/141 short-term bond funds.

Please carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

4 Semi-Annual Report | June 30, 2006 |

David C. Fording

John F. Jostrand

GROWTH FUND

The Growth Fund invests primarily in common stocks of domestic growth companies that the Advisor expects to have sustainable, above-average growth from one business cycle to the next.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

How did the Fund perform over the first half of the year? How did the Fund’s performance compare to its benchmark?

The Growth Fund posted a 2.38% increase on a total return basis (Class N Shares) for the six month period ended June 30, 2006. By comparison, the Fund’s benchmark, the Russell 3000 Growth® Index, posted a loss of 0.32% during the same period.

What were the most significant factors impacting Fund performance?

For the six months ended June 30, 2006, the domestic equity markets were flat to modestly positive. The first few months of the year witnessed relatively strong gains, due to fourth quarter earnings reports that generally exceeded market expectations. Smaller capitalization stocks significantly outperformed in the early months, achieving double-digit gains in the first three months of the year. The optimism in the market held until mid-May, when hawkish language from the Federal Reserve regarding inflation concerns sent the domestic and international markets into a tailspin. Most of the early gains were given back, and investors shunned the higher beta stocks such as technology issues in favor of more defensive stocks such as consumer staples and utilities. Smaller capitalization stocks fell more significantly than larger caps, but still maintain a healthy lead on the year-to-date basis. Value stocks were also more heavily favored than growth, with a 400 basis point lead in the small cap area, and a 7.50% lead in large cap, as measured by the Russell indices.

The Growth Fund outpaced the Russell 3000 Growth Index for the six month period ended June 30, 2006, primarily due to strong stock selection, especially among the smallest capitalization stocks in the portfolio. With smaller capitalization issues continuing to lead larger counterparts on a year-to-date basis, our relative overweight in this area was a modest benefit, but by far the largest contributing factor to relative returns was our stock selection amongst the smallest cap stocks.

A couple of the strongest leaders during the period were small cap software-related stocks WebEx Communications and Nuance Communications. As a provider of on-demand, web-enabled collaboration services, WebEx continue to grow rapidly and surpass Street expectations. Moreover, it is effectively executing the transition to a new pricing model, and thus experienced significant price/earnings multiple expansion in the first quarter as the market’s perception of business risk receded. Nuance announced the acquisition of a major competitor in the voice recognition software business, Dictaphone, thus further securing its leadership position in this high growth area.

After the significant gains posted in the first quarter, valuations in certain areas of the market appeared relatively lofty, particularly in areas that are traditionally a little more volatile, like semiconductors. We took the opportunity to trim some stocks in Information Technology, and also repositioned some of our Health Care holdings to take advantage of gains in some issues and pursue new stocks with better product pipelines and longer-term growth outlooks. While we did not specifically anticipate the market slide in May and June, our repositioning due to valuation concerns helped our portfolio weather the turbulent environment.

June 30, 2006 | William Blair Funds 5 |

Which sectors enhanced the Fund’s return? What were among the best performing investments for the Fund?

Stocks in the Information Technology sector were the largest contributors to absolute and relative returns in the first six months. The primary contributors to portfolio results were the smaller capitalization stocks in this sector, such as WebEx Communications Inc. and Nuance Communications Inc., mentioned in the previous section. J2 Global Communications Inc., a leader in providing communication and messaging services such as fax, e-mail, and call options, was also one of the top performers during the period.

Consumer Discretionary stocks were generally flat during the period, but stock selection in the portfolio provided better returns. Shuffle Master Inc. and Kohl’s Corp. were two of the top performers in this sector during the six-month period. Shuffle Master’s stock appreciated significantly as its revenues and earnings continued to accelerate, and investor expectations regarding its potential growth in the Macao gaming market pushed the stock higher. Kohl’s is beginning to benefit from its new management team’s initiatives, including new and broadened product lines, improved inventory management systems and enhanced store displays. These factors are leading to relatively robust same store sales gains and corresponding improvements in margins.

Were there any investment strategies or themes that did not measure up to your expectations?

On both a relative and absolute basis, portfolio stocks in the Health Care sector were particularly weak during the first six months. After witnessing relatively robust returns in 2005, some of the portfolio’s large cap Health Care holdings came under some selling pressure in the first quarter. This was especially true in the medical technology area, where concerns about pricing and Medicare reimbursement cast a pall over the sector. This, in turn, put some pressure on several portfolio holdings, notably Medtronic, although we remain optimistic about the company’s future growth prospects. UnitedHealth Group Inc. continued to experience weakness, as Medicare providers continued to come under valuation pressure and subscriber rates are likely to decelerate. Medimmune Inc. also experienced significant weakness relative to the group during the quarter, as its primary earnings driver, Synagis (for respiratory ailments), experienced weaker than expected revenue growth. The falloff was due primarily to a distribution agreement issue, which has since been resolved. We anticipate that growth should improve, and pipeline products should benefit the company as well in coming quarters.

Although technology stocks broadly served as contributors to relative return, there were a few stocks in this area that experienced significant weakness during the six-month period. EMC Corp. is a global provider of systems and software that are used primarily for the management and storage of data. During the quarter the stock experienced significant price declines due to the company’s reporting lower than expected earnings and revenues reflecting, in our opinion, a tougher than anticipated competitive environment and intensified pricing pressures with respect to new products. Furthermore, EMC has made several acquisitions, the most recent of which caused investor concern regarding the company’s ability to gain synergies from such activities. Jabil Circuit Inc. provides services and solutions through the design, development, and manufacture of electronic equipment primarily to the telecommunications, technology and manufacturing industries. The stock experienced a relatively large loss during the quarter, after reporting lower earnings due to problems at a specific manufacturing plant.

The portfolio’s relatively low allocation to Consumer Staples stocks was also a detractor during the year-to-date period. In the volatile investment backdrop of the second quarter, investors sought refuge in more defensive issues, such as Consumer Staples. PepsiCo Inc., the portfolio’s primary holding in this sector, performed well versus other index stocks in this group, as unit volumes continued to do well, and the outlook, particularly for non-carbonated beverage sales abroad, looks robust. Our relative sector weights are based on fundamental,

6 Semi-Annual Report | June 30, 2006 |

bottom-up stock evaluation rather than a macro thematic position. While there are several companies in the Consumer Staples area that would score relatively well on our quality metrics, we do not think that most of them offer significant growth opportunities, which is why we have relatively low representation in this group.

What is your current strategy? How is the Fund Positioned?

The sell-off in May and June re-priced the market, bringing actual price/earnings multiples down to levels more appropriate to those implied by the current intermediate interest rates. We think it likely that stocks will remain in the new valuation band for the next nine months to a year until new or different information regarding market direction becomes apparent. The economic environment during the prior three calendar years provided an exceptional opportunity for strong earnings growth and historically high corporate profitability, which resulted in little delineation between a mediocre company and a great one. This tenor is changing in the market, as growth rates are decelerating and investors are beginning to adopt more conservative risk postures.

Given this environment, we believe favorable conditions exist for high quality growth investing to regain leadership in the stock market, and we continue to find investment ideas that fit within our “quality growth” framework. While our fundamental analysis and valuation discipline led us to reduce positions in select small cap names during the second quarter (thus modestly reducing our small cap exposure), we continue to seek out opportunities across the full spectrum of market capitalizations. Furthermore, we remain overweight both the Information Technology and Health Care sectors, largely at the expense of the consumer sectors, though we remain vigilant about continually assessing the risk-reward framework for individual companies within all sectors.

June 30, 2006 | William Blair Funds 7 |

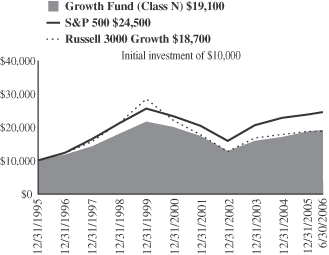

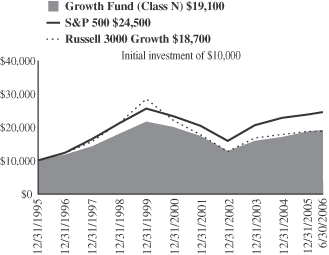

Growth Fund

Performance Highlights (unaudited)

Average Annual Total Return at 6/30/2006

| | | | | | | | | | | | | | | | | |

| | | 1 Year

| | | 3 Year

| | | 5 Year

| | | 10 Year

| | | Since Inception

| | | |

Growth Fund Class N | | 13.21 | % | | 10.88 | % | | 1.31 | % | | 5.50 | % | | — | % | | |

Growth Fund

Class I | | 13.48 | | | 11.19 | | | 1.57 | | | — | | | 1.05 | (a) | | |

Russell 3000® Growth Index | | 6.84 | | | 8.96 | | | (0.43 | ) | | 5.24 | | | (2.75 | )(a) | | |

S&P 500 Index | | 8.63 | | | 11.22 | | | 2.49 | | | 8.32 | | | 1.44 | (a) | | |

| | (a) | | For the period from October 1, 1999 to June 30, 2006. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company L.L.C. without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 3000® Growth Index consists of large, medium, and small-capitalization companies with above average price-to-book ratios and forecasted growth rates. The index is weighted by market capitalization and large/medium/small companies make up approximately 80%/15%/5% of the index.

The S&P 500 Index indicates broad larger capitalization equity market performance.

This report identifies the Fund’s investments on June 30, 2006. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

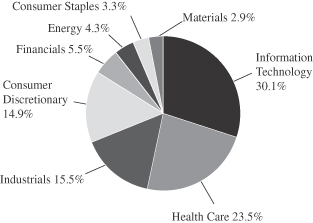

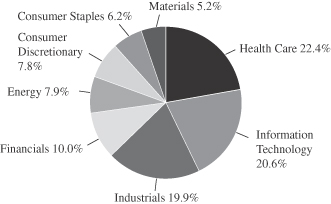

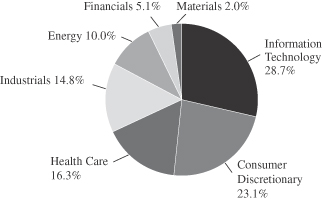

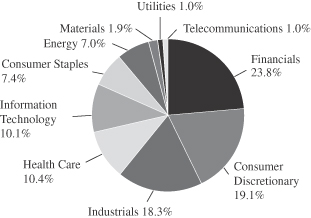

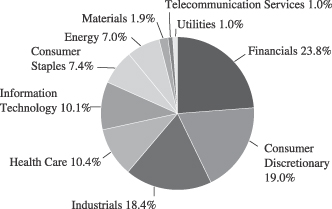

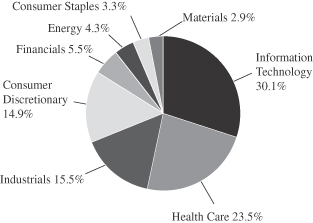

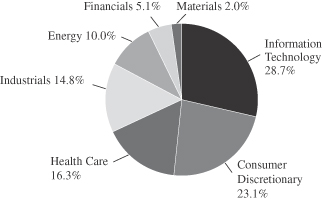

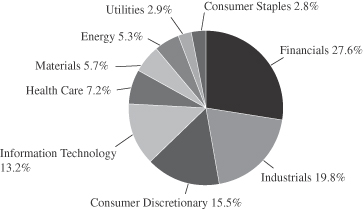

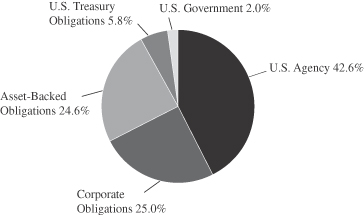

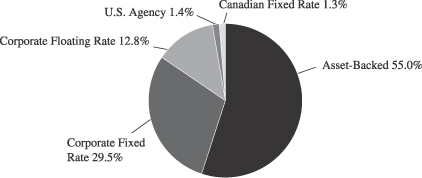

Sector Diversification (unaudited)

The sector diversification shown is based on the total investment portfolio.

8 William Blair Funds | June 30, 2006 |

Growth Fund

Portfolio of Investments, June 30, 2006 (all dollar amounts in thousands) (unaudited)

| | | | | |

Issuer

| | Shares

| | Value

|

| | |

Common Stocks | | | | | |

Information Technology—29.9% | | | | | |

*Activision, Inc. | | 208,515 | | $ | 2,373 |

*Adobe Systems Incorporated | | 92,440 | | | 2,807 |

Arm Holding plc—ADR | | 457,605 | | | 2,865 |

*Cognizant Technology Solutions Corporation | | 60,705 | | | 4,090 |

*Cognos, Inc.† | | 132,900 | | | 3,781 |

*EMC Corporation | | 511,710 | | | 5,614 |

*F5 Networks, Inc. | | 50,475 | | | 2,699 |

*J2 Global Communications, Inc. | | 200,000 | | | 6,244 |

Jabil Circuit, Inc. | | 179,760 | | | 4,602 |

*Kanbay International, Inc. | | 169,970 | | | 2,471 |

Linear Technology Corporation | | 91,590 | | | 3,067 |

*Network Appliance, Inc. | | 110,435 | | | 3,898 |

*Nuance Communications, Inc. | | 213,735 | | | 2,150 |

Paychex, Inc. | | 198,825 | | | 7,750 |

Taiwan Semiconductor Mfg. Co. Ltd.—ADR | | 497,485 | | | 4,567 |

*WebEx Communications, Inc. | | 248,345 | | | 8,826 |

*Yahoo!, Inc. | | 153,260 | | | 5,058 |

| | | | |

|

|

| | | | | | 72,862 |

| | | | |

|

|

Health Care—23.4% | | | | | |

Allergan, Inc. | | 25,455 | | | 2,730 |

*Amgen, Inc. | | 130,665 | | | 8,523 |

C. R. Bard, Inc. | | 34,930 | | | 2,559 |

Eli Lilly and Company | | 73,690 | | | 4,073 |

*IDEXX Laboratories, Inc. | | 37,380 | | | 2,808 |

*Integra Lifesciences Holding Corporation | | 134,820 | | | 5,232 |

*Kyphon, Inc. | | 107,520 | | | 4,125 |

*MedImmune, Inc. | | 88,395 | | | 2,396 |

Medtronic, Inc. | | 194,585 | | | 9,130 |

Pharmaceutical Product Development, Incorporated | | 109,370 | | | 3,841 |

*ResMed, Inc. | | 63,155 | | | 2,965 |

Sanofi-Aventis—ADR | | 82,535 | | | 4,020 |

UnitedHealth Group, Inc. | | 100,535 | | | 4,502 |

| | | | |

|

|

| | | | | | 56,904 |

| | | | |

|

|

Industrials—15.4% | | | | | |

*Coinstar, Inc. | | 155,910 | | | 3,733 |

Corporate Executive Board Company | | 42,070 | | | 4,215 |

Danaher Corporation | | 174,756 | | | 11,240 |

Graco, Inc. | | 105,000 | | | 4,828 |

Knight Transportation, Inc. | | 234,610 | | | 4,739 |

Rockwell Automation, Inc. | | 61,550 | | | 4,432 |

Rockwell Collins, Inc. | | 79,230 | | | 4,427 |

| | | | |

|

|

| | | | | | 37,614 |

| | | | |

|

|

Consumer Discretionary—14.8% | | | | | |

*Bed, Bath & Beyond, Inc. | | 164,005 | | | 5,440 |

*CarMax, Inc. | | 95,210 | | | 3,376 |

*Non-income producing securities

ADR = American Depository Receipt

† = U.S. listed foreign security

VRN = Variable Rate Note

| | | | | | |

Issuer

| | Shares or

Principal

Amount

| | Value

|

| | |

Common Stocks—(continued) | | | | | | |

Consumer Discretionary—(continued) | | | | | | |

*Guitar Center, Inc. | | | 70,710 | | $ | 3,144 |

Johnson Controls, Inc. | | | 49,625 | | | 4,080 |

*Kohl’s Corporation | | | 111,070 | | | 6,567 |

*Laureate Education, Inc. | | | 81,790 | | | 3,487 |

Marriott International, Inc., Class “A” | | | 143,130 | | | 5,456 |

Nike, Inc., Class “B” | | | 56,760 | | | 4,598 |

| | | | | |

|

|

| | | | | | | 36,148 |

| | | | | |

|

|

Financials—5.4% | | | | | | |

Goldman Sachs Group, Inc. | | | 40,040 | | | 6,023 |

Charles Schwab & Co., Inc. | | | 159,635 | | | 2,551 |

SLM Corporation | | | 88,600 | | | 4,689 |

| | | | | |

|

|

| | | | | | | 13,263 |

| | | | | |

|

|

Energy—4.3% | | | | | | |

Smith International, Inc. | | | 112,310 | | | 4,994 |

Suncor Energy, Inc.† | | | 66,775 | | | 5,410 |

| | | | | |

|

|

| | | | | | | 10,404 |

| | | | | |

|

|

Consumer Staples—3.3% | | | | | | |

PepsiCo, Inc. | | | 133,120 | | | 7,992 |

| | | | | |

|

|

Materials—2.9% | | | | | | |

Praxair, Inc. | | | 132,695 | | | 7,165 |

| | | | | |

|

|

Total Common Stock—99.4%

(cost $187,995) | | | 242,352 |

| | | | | |

|

|

| | |

Investment in Affiliate | | | | | | |

William Blair Ready Reserves Fund | | | 122,216 | | | 122 |

| | | | | |

|

|

Total Investment in Affiliate—0.1%

(cost $122) | | | 122 |

| | | | | |

|

|

| | |

Short-Term Investment | | | | | | |

Prudential Funding Demand Note, VRN 5.055%, due 7/03/06 | | $ | 1,287,000 | | | 1,287 |

| | | | | |

|

|

Total Short-Term Investment—0.5%

(cost $1,287) | | | 1,287 |

| | | | | |

|

|

Total Investments—100.0%

(cost $189,404) | | | 243,761 |

Cash and other assets, less liabilities—0.0% | | | 53 |

| | | | | |

|

|

Net assets—100.0% | | $ | 243,814 |

| | | | | |

|

|

See accompanying Notes to Financial Statements.

June 30, 2006 | William Blair Funds 9 |

Mark A. Fuller III

Gregory J. Pusinelli

TAX-MANAGED GROWTH FUND

The Tax-Managed Growth Fund invests primarily in common stocks of large, medium and small domestic growth companies that the Advisor expects will have sustainable, above-average growth from one business cycle to the next.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

How did the Fund perform over the first half of the year? How did the Fund’s performance compare to its benchmark?

The Tax-Managed Growth Fund posted a 1.48% gain on a total return basis (Class N Shares) for the six-months ended June 30, 2006. By comparison, the Fund’s benchmark, the Russell 3000® Growth Index declined 0.32% while the Standard & Poor’s 500 Stock Index rose 2.71%.

What were the most significant market factors impacting Fund performance?

Despite stubbornly high energy prices, economic uncertainty and the Federal Reserve’s ongoing campaign to raise short-term interest rates, the equity markets continued to forge ahead during the first quarter of 2006.

However, concerns about inflation and the sustainability of corporate profits led to a market sell-off late during the second quarter. By the end of June, the Fed had conducted its fourth interest rate increase of the year, and investors began to worry if the Fed was not being too heavy-handed in their administration of monetary policy.

What were among the best performing investments for the Fund?

The Fund’s top three contributors to return in the first half of the year were Suncor Energy, CH Robinson and Expeditors International of Washington.

Suncor Energy’s strong performance reflected the strength throughout the Energy sector, which was the second strongest sector in terms of overall contribution to return. Suncor Energy produces and refines oil from the Alberta oil sands in Canada and is a pioneer in oil sands production.

The next two biggest contributors were both from the Industrial sector, which provided the greatest contribution to the Fund’s return. CH Robinson Worldwide, provides transportation and logistics services through a network of more than 170 offices across North America, Europe, and South America. Expeditors International is primarily a consolidator and secondarily a forwarder of international air and ocean freight.

What were among the weakest performing investments for the Fund?

The weakest performing sector for the Fund during the first half of the year was Health Care. This lackluster showing was reflected in the poor performance of two stocks, which were the second and third greatest detractors to the Fund’s return: St. Jude Medical, and Alcon.

Mounting concerns over slowing sales of St Jude’s cardiac devices, began to weigh on the company’s share price during the first quarter. Generally speaking, investors grew concerned about the less-than-friendly competitive market environment the company was facing.

10 Semi-Annual Report | June 30, 2006 |

After appreciating to very high price levels, the price of Alcon declined as investors realized the company was unlikely to exceed growth targets.

Jabil Circuit, a company that provides customized electronic conductivity services and solutions to manufacturing clients, experienced a loss during the second quarter after reporting lower earnings due to problems with higher than expected start up costs in their new facilities. The ramp up was not as quick as expected so costs were greater then anticipated.

What is your current strategy? How is the Fund positioned?

We would describe our investment approach as somewhat less aggressive than it has been as we head into the second half of the year, especially in what we expect to be an environment of moderating economic growth.

We have trimmed or sold a number of positions in companies we own. For example, we scaled back our position in Suncor. We also reduced our position in Intercontinental Exchange, an electronic marketplace for trading of energy futures, options and over-the-counter contracts. Intercontinental Exchange has had a tremendous run up in price this year, and our concerns about valuation caused us to cut our position.

We also sold our entire positions in Expeditors, Alcon, Ebay, and Dollar General. In the case of Dollar General, we grew concerned about the impact of rising interest rates and higher energy prices on lower-income consumers. Similarly, we eliminated our position in D.R. Horton based on the expected slowdown in the housing market.

We added to our position in Smith International, the oil drilling company, and increased our stake in Rockwell Collins, the maker of avionics, as its share price dipped.

Reflecting our desire to increase exposure to larger cap high quality names, we established a new position in 3M, which we had owned previously, and we added to our positions in GE and Qualcomm.

We also established new positions in Psychiatric Solutions and WebEx. Psychiatric Solutions owns and operates 58 psychiatric facilities with more than 6,600 beds in 27 states, operating in an underserved area of health care with sizable barriers to entry. Lastly, WebEx provides multimedia communications services.

As we have stated, we believe the environment remains favorable for corporate profit growth in 2006. And we are encouraged by the earnings growth potential of the companies in the Fund’s portfolio, despite the potential for higher interest rates and slower growth in the economy this year. In such an environment, security selection becomes even more important. We believe our focus on quality franchise businesses and a respect for downside risk will serve us well as the year progresses.

June 30, 2006 | William Blair Funds 11 |

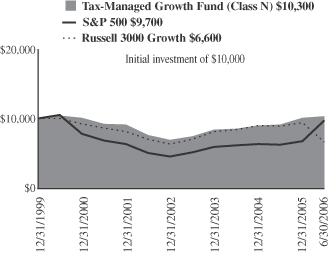

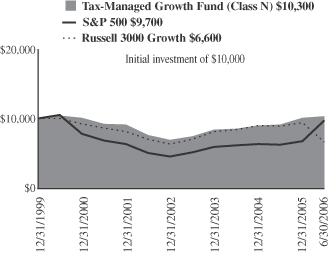

Tax-Managed Growth Fund

Performance Highlights (unaudited)

Average Annual Total Return at 6/30/2006

| | | | | | | | | | | | |

| | | 1

Year

| | | 3

Year

| | | 5

Year

| | | Since Inception(a)

| |

Tax-Managed Growth

Fund Class N | | 13.00 | % | | 11.36 | % | | 2.25 | % | | 0.39 | % |

Tax-Managed Growth

Fund Class I | | 13.36 | | | 11.66 | | | 2.52 | | | 0.66 | |

Russell 3000®

Growth Index | | 6.84 | | | 8.96 | | | (0.43 | ) | | (6.07 | ) |

S&P 500 Index | | 8.63 | | | 11.22 | | | 2.49 | | | (0.51 | ) |

| | (a) | | For the period from December 27, 1999 to June 30, 2006. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 3000® Growth Index consists of large, medium, and small-capitalization companies with above average price-to-book ratios and forecasted growth rates. The index is weighted by market capitalization and large/medium/small companies make up approximately 80%/15%/5% of the index.

The S&P 500 Index indicates broad larger capitalization equity market performance.

This report identifies the Fund’s investments on June 30, 2006. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

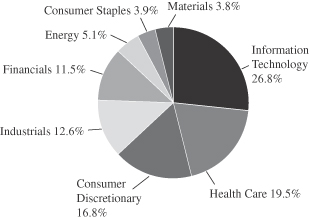

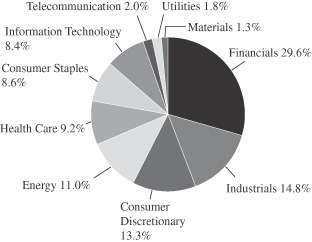

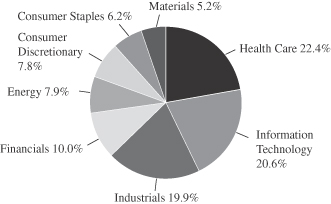

Sector Diversification (unaudited)

The sector diversification shown is based on the total investment portfolio.

12 Semi-Annual Report | June 30, 2006 |

Tax-Managed Growth Fund

Portfolio of Investments, June 30, 2006 (all dollar amounts in thousands) (unaudited)

| | | | | |

Issuer

| | Shares

| | Value

|

| | |

Common Stocks | | | | | |

Health Care—21.0% | | | | | |

*Amgen, Inc. | | 2,825 | | $ | 184 |

*Genentech, Inc. | | 2,090 | | | 171 |

*American Healthways, Inc. | | 1,720 | | | 90 |

IMS Health, Inc. | | 8,120 | | | 218 |

*MedImmune, Inc. | | 2,270 | | | 62 |

*Patterson Companies, Inc. | | 3,660 | | | 128 |

*Psychiatric Solutions, Inc. | | 4,480 | | | 128 |

*ResMed, Inc. | | 5,104 | | | 240 |

Sanofi-Aventis—ADR | | 2,870 | | | 140 |

*St. Jude Medical, Inc. | | 2,740 | | | 89 |

Stryker Corporation | | 1,430 | | | 60 |

Valeant Pharmaceuticals International | | 6,870 | | | 116 |

*Zimmer Holdings, Inc. | | 2,220 | | | 126 |

| | | | |

|

|

| | | | | | 1,752 |

| | | | |

|

|

Information Technology—19.3% | | | | | |

*Activision, Inc. | | 4,613 | | | 53 |

*Adobe Systems Incorporated | | 3,730 | | | 113 |

Arm Holdings plc—ADR | | 11,020 | | | 69 |

*CACI International, Inc., Class “A” | | 1,580 | | | 92 |

CDW Corporation | | 1,880 | | | 103 |

*EMC Corporation | | 7,650 | | | 84 |

First Data Corporation | | 3,370 | | | 152 |

Jabil Circuit, Inc. | | 4,115 | | | 105 |

Microchip Technology, Inc. | | 4,840 | | | 162 |

*Network Appliance, Inc. | | 5,210 | | | 184 |

Paychex, Inc. | | 3,930 | | | 153 |

Qualcomm Incorporated | | 1,880 | | | 75 |

*ScanSource, Inc. | | 2,860 | | | 84 |

Taiwan Semiconductor Mfg. Co. Ltd.—ADR | | 9,826 | | | 90 |

*WebEx Communications, Inc. | | 2,670 | | | 95 |

| | | | |

|

|

| | | | | | 1,614 |

| | | | |

|

|

Industrials—18.7% | | | | | |

3M Company | | 1,500 | | | 121 |

C.H. Robinson Worldwide, Inc. | | 2,700 | | | 144 |

Danaher Corporation | | 3,510 | | | 226 |

Fastenal Company | | 5,850 | | | 236 |

General Electric Company | | 6,465 | | | 213 |

Knight Transportation, Inc. | | 5,662 | | | 114 |

Pentair, Inc. | | 4,740 | | | 162 |

Rockwell Automation, Inc. | | 1,830 | | | 132 |

Rockwell Collins, Inc. | | 3,790 | | | 212 |

| | | | |

|

|

| | | | | | 1,560 |

| | | | |

|

|

Financials—9.3% | | | | | |

Ambac Financial Group, Inc. | | 1,680 | | | 136 |

American International Group | | 2,560 | | | 151 |

Capital One Financial Corporation | | 1,450 | | | 124 |

*IntercontinentalExchange, Inc. | | 1,690 | | | 98 |

Investors Financial Services Corporation | | 2,600 | | | 117 |

Moody’s Corporation | | 2,820 | | | 153 |

| | | | |

|

|

| | | | | | 779 |

| | | | |

|

|

*Non-income producing securities

ADR = American Depository Receipt

† = U.S. listed foreign security

VRN = Variable Rate Note

| | | | | | | |

Issuer

| | Shares or

Principal

Amount

| | Value

| |

| | |

Common Stocks—(continued) | | | | | | | |

Energy—7.4% | | | | | | | |

EOG Resources, Inc. | | | 1,090 | | $ | 76 | |

Smith International, Inc. | | | 4,010 | | | 178 | |

Suncor Energy, Inc.† | | | 4,490 | | | 364 | |

| | | | | |

|

|

|

| | | | | | | 618 | |

| | | | | |

|

|

|

Consumer Discretionary—7.3% | | | | | | | |

*Bed, Bath & Beyond, Inc. | | | 2,400 | | | 79 | |

*CarMax, Inc. | | | 3,150 | | | 112 | |

Johnson Controls, Inc. | | | 1,740 | | | 143 | |

*Laureate Education, Inc. | | | 3,120 | | | 133 | |

Williams-Sonoma, Inc. | | | 4,225 | | | 144 | |

| | | | | |

|

|

|

| | | | | | | 611 | |

| | | | | |

|

|

|

Consumer Staples—5.9% | | | | | | | |

Colgate-Palmolive Company | | | 2,780 | | | 167 | |

PepsiCo, Inc. | | | 3,285 | | | 197 | |

Walgreen Co. | | | 2,745 | | | 123 | |

| | | | | |

|

|

|

| | | | | | | 487 | |

| | | | | |

|

|

|

Materials—4.9% | | | | | | | |

Airgas, Inc. | | | 6,440 | | | 240 | |

Praxair, Inc. | | | 3,090 | | | 167 | |

| | | | | |

|

|

|

| | | | | | | 407 | |

| | | | | |

|

|

|

Total Common Stock—93.8%

(cost $6,224) | | | 7,828 | |

| | | | | |

|

|

|

| | |

Investment in Affiliate | | | | | | | |

William Blair Ready Reserves Fund | | | 144,958 | | | 145 | |

| | | | | |

|

|

|

Total Investment in Affiliate—1.7%

(cost $145) | | | 145 | |

| | | | | |

|

|

|

| | |

Short-Term Investment | | | | | | | |

Prudential Funding Demand Note, VRN 5.055%, due 7/03/06 | | $ | 406,000 | | | 406 | |

| | | | | |

|

|

|

Total Short-Term Investment—4.9%

(cost $406) | | | 406 | |

| | | | | |

|

|

|

Total Investments—100.4%

(cost $6,775) | | | 8,379 | |

Liabilities, plus cash and other assets—(0.4)% | | | (33 | ) |

| | | | | |

|

|

|

Net assets—100.0% | | $ | 8,346 | |

| | | | | |

|

|

|

See accompanying Notes to Financial Statements.

June 30, 2006 | William Blair Funds 13 |

James S. Golan

John F. Jostrand

Norbert W. Truderung

LARGE CAP GROWTH FUND

The Large Cap Growth Fund invests primarily in common stocks of large domestic growth companies of high quality that the Advisor believes have demonstrated sustained growth over a long period of time.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

How did the Fund perform over the first half of the year? How did the Fund’s performance compare to its benchmark?

The Large Cap Growth Fund posted a 0.93% decrease on a total return basis (Class N Shares) for the six-month period ended June 30, 2006. During the same period, the Fund’s benchmark, the Russell 1000 Growth® Index, declined 0.93%

What were the most significant factors impacting Fund performance?

For the six months ended June 30, 2006, the domestic equity markets were flat to modestly positive. The first few months of the year witnessed relatively strong gains, due to fourth quarter earnings reports that generally exceeded market expectations. Smaller capitalization stocks significantly outperformed in the early months, achieving double-digit gains in the first three months of the year. The optimism in the market held until mid-May, when hawkish language from the Federal Reserve regarding inflation concerns sent the domestic and international markets into a tailspin. Most of the early gains were given back, and investors shunned the higher beta stocks such as technology issues in favor of more defensive stocks such as consumer staples and utilities. Smaller capitalization stocks were beaten down more significantly than larger caps, but still maintain a healthy lead on the year-to-date basis. Value stocks were also more heavily favored than growth, with a 400 basis point lead in the small cap area, and a 7.50% lead in large cap, as measured by the Russell indices.

Valuations in certain areas of the market appeared particularly lofty shortly after the first quarter, particularly in areas that are traditionally a little more volatile, like semiconductors. We took the opportunity to trim some stocks in Information Technology, and also repositioned some of our Health Care holdings to take advantage of gains in some issues and pursue new stocks with better product pipelines and longer-term growth outlooks. In the past six months, we have found more interesting opportunities in Financial stocks and select Consumer Discretionary issues as well. While we did not specifically anticipate the market slide in May and June, our repositioning due to valuation concerns helped our portfolio weather the turbulent environment.

Which sectors enhanced the Fund’s return? What were among the best performing investments for the Fund?

On an absolute basis, Energy sector stocks were among the strongest performers in the portfolio. Schlumberger Ltd. in the oilfield drilling and services area, appreciated significantly due to both increased demand for its services and more favorable pricing. Technological advances helped improve profitability as well. Suncor Energy Inc. reported results that were generally in-line, but continues to have a favorable outlook with respect to current and future production expectations. Investor sentiment also reflects that higher oil prices are likely to have some sustainability in the market.

14 Semi-Annual Report | June 30, 2006 |

On a relative basis, the largest contributor to returns was the Information Technology sector. Although technology stocks were broadly weaker during the quarter, the portfolio held several stocks that performed very well versus the group. Network Appliance Inc., a company that provides network software and data storage, experienced strong revenue and earnings growth, and was a significant leader in its industry during the period. Corning, Inc., with its patented technology for the manufacture of LCD glass, continues to have a significant edge over competitors. Investor expectations for relatively strong growth in the flat panel television market, combined with larger units (more glass per television), contributed to stock appreciation in the first six months.

Consumer Discretionary stocks were generally flat during the period, but stock selection in the portfolio provided better returns. Marriott International Inc. and Kohl’s Corp. were two of the top performers in this sector during the period. As we surmised, Marriott is benefiting from strong trends among business travelers, resulting in high occupancy rates and higher room prices, particularly for hotels in bigger metropolitan areas. Kohl’s is beginning to benefit from its new management team’s initiatives, including new and broadened product lines, improved inventory management systems and enhanced store displays. These factors are leading to relatively robust same store sales gains and corresponding improvements in margins.

Were there any investment strategies or themes that did not measure up to your expectations?

On both a relative and absolute basis, portfolio stocks in the Health Care sector were particularly weak during the first six months. After witnessing relatively robust returns in 2005, some of the portfolio’s large cap Health Care holdings came under some selling pressure in the first quarter. This was especially true in the medical technology area, where concerns about pricing and Medicare reimbursement cast a pall over the sector. This, in turn, put some pressure on several portfolio holdings, notably Medtronic Inc., although we remain optimistic about the company’s future growth prospects. UnitedHealth Group Inc. continued to experience weakness, as Medicare providers continued to come under valuation pressure and subscriber rates are likely to decelerate. Medimmune Inc. also experienced significant weakness relative to the group during the quarter, as its primary earnings driver, Synagis (for respiratory ailments), experienced weaker than expected revenue growth. The falloff was due primarily to a distribution agreement issue, which has since been resolved. We anticipate that growth should improve and pipeline products should benefit the company as well in coming quarters.

Although technology stocks broadly served as contributors to relative return, there were a few stocks in this area that experienced significant weakness during the six-month period. EMC Corp. in particular detracted from returns. This company is a global provider of systems and software that are used primarily for the management and storage of data. During the quarter the stock experienced significant price declines due to the company’s reporting lower than expected earnings and revenues reflecting, in our opinion, a tougher than anticipated competitive environment and intensified pricing pressures with respect to new products. Furthermore, EMC has made several acquisitions, the most recent of which caused investor concern regarding the company’s ability to gain synergies from such activities.

The portfolio’s relatively low allocation to Consumer Staples stocks was also a detractor during the year-to-date period. In the volatile investment backdrop of the second quarter, investors sought refuge in more defensive issues, such as Consumer Staples. PepsiCo Inc., the portfolio’s primary holding in this sector, performed well versus other index stocks in this group, as unit volumes continued to do well, and the outlook, particularly for non-carbonated beverage sales abroad, looks robust. Our relative sector weights are based on fundamental, bottom-up stock evaluation rather than a macro thematic position. While there are several companies in the Consumer Staples area that would score relatively well on our quality metrics, we do not think that most of them offer significant growth opportunities, which is why we have relatively low representation in this group.

June 30, 2006 | William Blair Funds 15 |

What is your current strategy? How is the Fund positioned?

The sell-off in May and June re-priced the market, bringing actual price/earnings multiples down to levels more appropriate to those implied by the current intermediate interest rates. The economic environment during the prior three calendar years provided an exceptional opportunity for strong earnings growth and historically high corporate profitability, which resulted in little delineation between a mediocre company and a great one. This tenor is changing in the market, as growth rates are decelerating and investors are beginning to adopt more conservative risk postures. As a result, we believe higher quality larger capitalization stocks are well positioned to resume a leadership role. We continue to find some of the best opportunities for quality growth investing in the Health Care and Information Technology sectors. In more recent periods, we have added some new issues to our Financial sector holdings, particularly among asset managers and consumer finance. We have also repositioned our Consumer Discretionary sector to have less exposure to retail oriented names in favor of ones that tend to be more reliant on business related expenditures. We continue to find excellent opportunities for quality growth companies in the market.

16 Semi-Annual Report | June 30, 2006 |

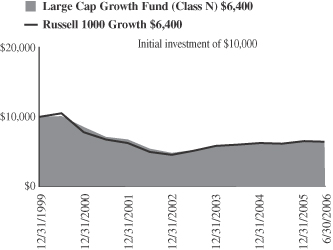

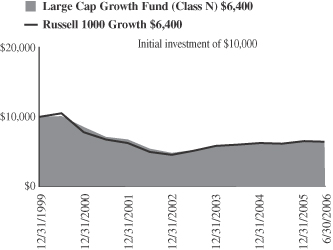

Large Cap Growth Fund

Performance Highlights (unaudited)

Average Annual Total Return at 6/30/2006

| | | | | | | | | | | | |

| | | 1

Year

| | | 3

Year

| | | 5

Year

| | | Since

Inception(a)

| |

Large Cap Growth Fund Class N | | 4.57 | % | | 6.95 | % | | (2.00 | )% | | (6.58 | )% |

Large Cap Growth Fund Class I | | 4.84 | | | 7.17 | | | (1.81 | ) | | (6.38 | ) |

Russell 1000®

Growth Index | | 6.12 | | | 8.35 | | | (0.76 | ) | | (6.53 | ) |

| | (a) | | For the period from December 27, 1999 to June 30, 2006. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 1000® Growth Index consists of large-capitalization companies with above average-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on June 30, 2006. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

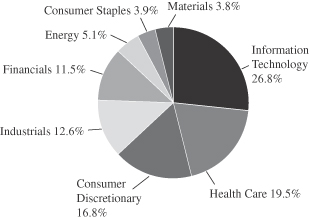

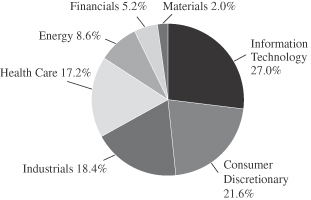

Sector Diversification (unaudited)

The sector diversification shown is based on the total investment portfolio.

June 30, 2006 | Semi-Annual Report 17 |

Large Cap Growth Fund

Portfolio of Investments, June 30, 2006 (all dollar amounts in thousands) (unaudited)

| | | | | |

Issuer

| | Shares

| | Value

|

| | |

Common Stocks | | | | | |

Information Technology—26.1% | | | | | |

*Adobe Systems Incorporated | | 15,770 | | $ | 479 |

*Cisco Systems Incorporated | | 22,714 | | | 444 |

*Corning Incorporated | | 20,810 | | | 503 |

*EMC Corporation | | 35,540 | | | 390 |

Infosys Technologies Ltd.—ADR | | 2,965 | | | 227 |

Linear Technology Corporation | | 11,800 | | | 395 |

*Network Appliance, Inc. | | 10,690 | | | 377 |

Paychex, Inc. | | 14,790 | | | 577 |

Qualcomm Incorporated | | 8,715 | | | 349 |

Taiwan Semiconductor Mfg. Co. Ltd.—ADR | | 47,649 | | | 437 |

*Yahoo!, Inc. | | 17,490 | | | 577 |

| | | | |

|

|

| | | | | | 4,755 |

| | | | |

|

|

Health Care—19.0% | | | | | |

Allergan, Inc. | | 2,260 | | | 243 |

*Amgen, Inc. | | 8,340 | | | 544 |

C. R. Bard, Inc. | | 2,550 | | | 187 |

Caremark Rx, Inc. | | 11,330 | | | 565 |

Eli Lilly and Company | | 4,150 | | | 229 |

*MedImmune, Inc. | | 6,910 | | | 187 |

Medtronic, Inc. | | 18,545 | | | 870 |

Sanofi-Aventis—ADR | | 6,085 | | | 296 |

UnitedHealth Group, Inc. | | 7,630 | | | 342 |

| | | | |

|

|

| | | | | | 3,463 |

| | | | |

|

|

Consumer Discretionary—16.3% | | | | | |

*Bed, Bath & Beyond, Inc. | | 12,475 | | | 414 |

Johnson Controls, Inc. | | 4,920 | | | 404 |

*Kohl’s Corporation | | 8,248 | | | 488 |

Marriott International, Inc., Class “A” | | 15,934 | | | 607 |

Nike, Inc., Class “B” | | 8,390 | | | 680 |

Staples, Inc. | | 15,665 | | | 381 |

| | | | |

|

|

| | | | | | 2,974 |

| | | | |

|

|

Industrials—12.3% | | | | | |

3M Company | | 4,625 | | | 373 |

Danaher Corporation | | 15,512 | | | 998 |

Rockwell Automation, Inc. | | 4,330 | | | 312 |

Rockwell Collins, Inc. | | 10,020 | | | 560 |

| | | | |

|

|

| | | | | | 2,243 |

| | | | |

|

|

*Non-income producing securities

ADR = American Depository Receipt

† = U.S. listed foreign security

| | | | | | |

Issuer

| | Shares or

Principal

Amount

| | Value

|

| | |

Common Stocks—(continued) | | | | | | |

Financials—11.3% | | | | | | |

Capital One Financial Corporation | | | 6,520 | | $ | 557 |

Franklin Resources, Inc. | | | 2,130 | | | 185 |

Goldman Sachs Group, Inc. | | | 3,910 | | | 588 |

Charles Schwab & Co, Inc. | | | 17,380 | | | 278 |

SLM Corporation | | | 8,370 | | | 443 |

| | | | | |

|

|

| | | | | | | 2,051 |

| | | | | |

|

|

Energy—5.0% | | | | | | |

Schlumberger Limited† | | | 7,090 | | | 462 |

Suncor Energy, Inc.† | | | 5,510 | | | 446 |

| | | | | |

|

|

| | | | | | | 908 |

| | | | | |

|

|

Consumer Staples—3.8% | | | | | | |

PepsiCo, Inc. | | | 11,390 | | | 684 |

| | | | | |

|

|

Materials—3.7% | | | | | | |

Praxair, Inc. | | | 12,415 | | | 670 |

| | | | | |

|

|

Total Common Stock—97.5%

(cost $16,308) | | | 17,748 |

| | | | | |

|

|

Investment in Affiliate | | | | | | |

William Blair Ready Reserves Fund | | | 73,566 | | | 74 |

| | | | | |

|

|

Total Investment in Affiliate—0.4%

(cost $74) | | | 74 |

| | | | | |

|

|

| | |

Short-Term Investment | | | | | | |

Prudential Funding Demand Note, VRN 5.055%, due 7/03/06 | | $ | 315,000 | | | 315 |

| | | | | |

|

|

Total Short-Term Investment—1.7%

(cost $315) | | | 315 |

| | | | | |

|

|

Total Investments—99.6%

(cost $16,697) | | | 18,137 |

Cash plus other assets less liabilities—0.4% | | | 65 |

| | | | | |

|

|

Net assets—100.0% | | $ | 18,202 |

| | | | | |

|

|

See accompanying Notes to Financial Statements.

18 Semi-Annual Report | June 30, 2006 |

Karl W. Brewer

Colin J. Williams

SMALL CAP GROWTH FUND

The Small Cap Growth Fund invests primarily in common stocks of small domestic growth companies that the Advisor expects to have solid growth in earnings.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

How did the Fund perform in the first half of 2006? How did the Fund’s performance compare to its benchmark?

The William Blair Small Cap Growth Fund gained 5.85% on a total return basis (Class N shares) during the first half of 2006. By comparison the Fund’s benchmark, the Russell 2000® Growth Index, increased 6.07%.

What were the most significant factors impacting Fund performance? What factors were behind the Fund’s performance versus the benchmark?

The Fund’s total return finished just behind the benchmark during the first half of the year. Looking across sectors, there were two main factors that influenced our relative performance. Stock selection in the Information Technology sector was superior to the Russell 2000 Growth Index while the Fund’s Consumer Discretionary holdings lagged their peers in the benchmark.

Small capitalization stocks outpaced their large cap counterparts during the first half of the year with the Russell 2000 Growth Index return of 6.07% as compared to the Russell 1000 Growth Index return of –0.93%. From a style perspective, value outperformed growth as the Russell 2000 Value Index returned 10.44% during the six month period.

The first half of 2006 saw explosive small cap returns during the first quarter before losing a great deal of that return in the second quarter. The first quarter brought strength across all major sectors. The broad based nature of small cap returns during the first quarter was due to corporate and economic health and in part due to expectations that an end to the Federal Reserve’s tightening cycle was in sight. However, during the second quarter inflationary data points indicated that the end to interest rate hikes may be delayed. Stocks with higher valuation risk turned south as investors discounted higher inflation going forward. Soft housing market data in the last few months also increased investor skepticism on the outlook for consumer spending. Across the entire six month period, energy stocks have led all other sectors in the Russell 2000 Growth Index after crude oil prices increased during the beginning of the year and remained at elevated levels throughout the period. The Industrials sector turned in the second best return among the six major sectors as global growth, despite recent pessimism, continues. With the aforementioned negative sentiment about consumer spending, the Consumer Discretionary sector finished barely in positive territory and therefore underperformed the broader market. It was joined by Information Technology and Health Care as investors took money out of some of the riskier stocks within these two sectors.

What were among the best performing investments for the Fund?

Two of the top performing stocks for the Fund were J2 Global Communications and Nuance Communications. J2 Global Communications offers messaging and communication services to individuals and businesses, including fax to email services. The stock performed extremely well despite a tough environment for technology stocks particularly in the second quarter. Concerns regarding possible government surcharges diminished during the first half of the

June 30, 2006 | William Blair Funds 19 |

year. In addition, investors began to anticipate the company’s potential price increases later this year. Nuance Communications is a leader in speech recognition and transcription software solutions. The continued evolution of speech recognition technology and increased coverage of the stock by Wall Street have helped drive growth in the stock price. The stock has continued its strength in part due to the company’s acquisition of Dictaphone, a leader in speech transcription software for the medical field, in early February. This accretive acquisition in a growth industry adds to its existing market leadership in other areas of speech recognition.

What were among the weakest performing investments for the Fund?

Laureate Education and Nautilus were two of the biggest detractors from the Fund’s return. Laureate Education is a for-profit educational institution operating online degree programs and primarily campus-based programs overseas. The stock is one of the Fund’s largest holdings but came under pressure in the second quarter after the company projected a temporary decline in enrollments for its U.S. online programs, which represent only 20% of its business. Management is making strategic adjustments to offset these headwinds. In addition, the majority of its business and the segment central to our investment thesis, is its international campus-based unit. This business is strong and our expectation for long term earnings growth remains robust. Nautilus designs and markets fitness apparel and equipment under various brand names. Some of the company’s most well known brands include Nautilus, Bowflex and Schwinn. Company management guided forward earnings guidance down for the second straight quarter during January. This reoccurrence was due to operational issues and we therefore liquidated the position.

What is your current outlook?

After the first quarter’s strong performance, we discussed the likelihood of a more sustainable level of stock market returns over the balance of 2006. Unfortunately, a great deal of the market’s early 2006 gain was negated by the second quarter’s weak performance. We had also discussed that the Federal Reserve’s effort to balance fighting inflation while maintaining economic growth had been on track. However, recent data points suggest inflation has been climbing while a housing market slowdown is underway—which could impact consumer spending and overall economic growth. This presents a bigger challenge for the Federal Reserve and along with it, greater uncertainty about what the future holds for interest rates. Investors’ aversion to this uncertainty has played out in the market’s decline over the past couple of months. That being said, we focus our time on finding quality growth companies with sustainable growth prospects despite the macro environment of the day. We feel such a portfolio better serves our clients over time.

Is there any other news with respect to the Fund?

As previously disclosed, Colin Williams was promoted to co-portfolio manager of the Fund. Colin has worked on the Fund as a research analyst for the past four years. Colin joins Karl Brewer who has been a portfolio manager for the Fund since its inception. Also, with respect to illiquid securities in the Fund, Think Partnership Inc. is a portfolio holding that we acquired through a Private Investment in Public Equity (PIPE) transaction during the first half of 2006. Think Partnership is a company that offers online services and solutions. We were able to purchase convertible preferred shares in the transaction that pay a preferred dividend. We expect these shares, if converted, to become freely tradable during the third quarter. The Fund’s Pricing Committee and Valuation Committee are currently pricing the security at fair value.

20 Semi-Annual Report | June 30, 2006 |

Small Cap Growth Fund

Performance Highlights (unaudited)

Average Annual Total Return at 6/30/2006

| | | | | | | | | | | | |

| | | 1

Year

| | | 3

Year

| | | 5

Year

| | | Since Inception(a)

| |

Small Cap Growth Fund Class N | | 11.75 | % | | 20.82 | % | | 13.95 | % | | 19.09 | % |

Small Cap Growth Fund Class I | | 12.04 | | | 21.11 | | | 14.25 | | | 19.37 | |

Russell 2000®

Growth Index | | 14.58 | | | 16.27 | | | 3.49 | | | (0.48 | ) |

Russell 2000® Index | | 14.58 | | | 18.70 | | | 8.50 | | | 7.71 | |

| | (a) | | For the period from December 27, 1999 to June 30, 2006. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2000® Growth Index consists of small-capitalization companies with above average price-to-book ratios and forecasted growth rates.

The Russell 2000® Index is an unmanaged composite of the smallest 2000 stocks of the Russell 3000® Index.

This report identifies the Fund’s investments on June 30, 2006. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

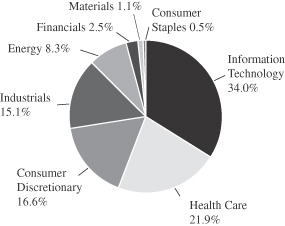

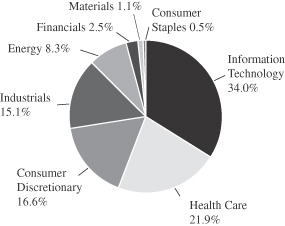

Sector Diversification (unaudited)

The sector diversification shown is based on the total investment portfolio.

June 30, 2006 | William Blair Funds 21 |

Small Cap Growth Fund

Portfolio of Investments, June 30, 2006 (all dollar amounts in thousands) (unaudited)

| | | | | |

Issuer

| | Shares

| | Value

|

| | |

Common Stocks | | | | | |

Information Technology—32.4% | | | | | |

*Access Integrated Technologies, Inc. | | 1,229,947 | | $ | 12,066 |

*BISYS Group, Inc. (The) | | 1,110,354 | | | 15,212 |

*Cogent, Inc. | | 770,546 | | | 11,612 |

*CyberSource Corporation | | 976,789 | | | 11,428 |

*DealerTrack Holdings, Inc. | | 272,908 | | | 6,034 |

*Digital Insight Corporation | | 300,115 | | | 10,291 |

*DTS, Inc. | | 791,976 | | | 15,428 |

*Electronic Clearing House | | 851,387 | | | 11,460 |

*Euronet Worldwide, Inc. | | 511,059 | | | 19,609 |

*F5 Networks, Inc. | | 303,072 | | | 16,208 |

*Heartland Payment Systems, Inc. | | 566,770 | | | 15,802 |

*J2 Global Communications, Inc. | | 782,846 | | | 24,440 |

*Kanbay International, Inc. | | 1,580,199 | | | 22,976 |

*Lionbridge Technologies, Inc. | | 1,182,962 | | | 6,542 |

*Nuance Communications, Inc. | | 1,616,430 | | | 16,261 |

*Optimal Group, Inc.† | | 1,318,631 | | | 17,815 |

*PDF Solutions, Inc. | | 763,013 | | | 9,469 |

*Silicon Labratories, Inc. | | 498,365 | | | 17,518 |

*Skillsoft, plc—ADR | | 1,625,107 | | | 9,946 |

*Ultimate Software Group, Inc. | | 842,403 | | | 16,140 |

*ValueClick, Inc. | | 1,745,686 | | | 26,796 |

*Volterra Semiconductor Corporation | | 1,714,989 | | | 26,171 |

*WebEx Communications, Inc. | | 708,044 | | | 25,164 |

*Workstream, Inc.† | | 4,365,092 | | | 6,460 |

| | | | |

|

|

| | | | | | 370,848 |

| | | | |

|

|

Health Care—21.3% | | | | | |

*American Medical Systems Holdings, Inc. | | 880,695 | | | 14,664 |

*Axcan Pharma, Inc.† | | 932,421 | | | 12,235 |

*CryoLife, Inc. | | 191,327 | | | 1,033 |

*Encore Medical Corporation | | 2,419,329 | | | 11,637 |

*Hythiam, Inc. | | 1,615,702 | | | 11,262 |

*Integra Lifesciences Holdings Corporation | | 421,808 | | | 16,370 |

*Kensey Nash Corporation | | 496,554 | | | 14,648 |

LCA-Vision, Inc. | | 287,909 | | | 15,233 |

*Lifecore Biomedical, Inc. | | 919,323 | | | 14,433 |

*Matria Healthcare, Inc. | | 525,475 | | | 11,256 |

PolyMedical Corporation | | 402,446 | | | 14,472 |

*PSS World Medical, Inc. | | 937,344 | | | 16,544 |

*Psychiatric Solutions, Inc. | | 665,400 | | | 19,070 |

*Sangamo Biosciences, Inc. | | 791,773 | | | 4,672 |

*Santarus, Inc. | | 3,397,305 | | | 22,592 |

*Surmodics, Inc. | | 481,572 | | | 17,390 |

*Telik, Inc. | | 588,818 | | | 9,716 |

*United Surgical Partners International, Inc. | | 254,885 | | | 7,664 |

*Zila, Inc. | | 2,552,677 | | | 8,271 |

| | | | |

|

|

| | | | | | 243,162 |

| | | | |

|

|

Consumer Discretionary—16.1% | | | | | |

*4 Kids Entertainment, Inc. | | 606,245 | | | 9,827 |

*AFC Enterprises, Inc. | | 874,311 | | | 11,148 |

*Century Casinos, Inc. | | 1,242,121 | | | 13,303 |

*Dick’s Sporting Goods, Inc. | | 302,751 | | | 11,989 |

*Duckwall-ALCO Stores, Inc. | | 107,555 | | | 3,228 |

*Guitar Center, Inc. | | 275,733 | | | 12,262 |

*Jarden Corporation | | 813,922 | | | 24,784 |

*Laureate Education, Inc. | | 647,879 | | | 27,619 |

*Lions Gate Entertainment Corporation† | | 1,231,842 | | | 10,532 |

*Shuffle Master, Inc. | | 396,696 | | | 13,004 |

Strayer Education, Inc. | | 142,950 | | | 13,883 |

| | | | | |

Issuer

| | Shares

| | Value

|

| | |

Common Stocks—(continued) | | | | | |

Consumer Discretionary—(continued) | | | | | |

*ValueVision Media, Inc., Class “A” | | 1,742,433 | | $ | 19,219 |

*VistaPrint Limited † | | 503,630 | | | 13,467 |

| | | | |

|

|

| | | | | | 184,265 |

| | | | |

|

|

Industrials—14.7% | | | | | |

*American Reprographics Company | | 326,052 | | | 11,820 |

*Coinstar, Inc. | | 589,820 | | | 14,120 |

Comfort Systems USA, Inc. | | 1,124,098 | | | 16,063 |

*Corrections Corporation of America | | 321,614 | | | 17,026 |

*FirstService Corporation † | | 701,995 | | | 18,701 |

*Frozen Food Express Industries, Inc. | | 628,125 | | | 6,922 |

*Huron Consulting Group, Inc. | | 418,702 | | | 14,692 |

*Kforce, Inc. | | 933,839 | | | 14,465 |

*Labor Ready, Inc. | | 727,185 | | | 16,471 |

*Luna Innovations, Inc. | | 759,300 | | | 4,556 |

*NCI Building Systems, Inc. | | 348,228 | | | 18,515 |

*SIRVA, Inc. | | 2,185,070 | | | 14,138 |

| | | | |

|

|

| | | | | | 167,489 |

| | | | |

|

|

Energy—8.0% | | | | | |

*Carrizo Oil & Gas, Inc. | | 435,876 | | | 13,647 |

*Hornbeck Offshore Services, Inc. | | 489,042 | | | 17,371 |

*Oil States International, Inc. | | 344,259 | | | 11,801 |

*Petrohawk Energy Corporation | | 1,223,554 | | | 15,417 |

*TETRA Technologies, Inc. | | 609,360 | | | 18,458 |

*W-H Energy Services, Inc. | | 297,978 | | | 15,146 |

| | | | |

|

|

| | | | | | 91,840 |

| | | | |

|

|

Financials—2.5% | | | | | |

Highland Hospitality Corporation | | 1,159,379 | | | 16,324 |

*Signature Bank New York | | 360,884 | | | 11,685 |

| | | | |

|

|

| | | | | | 28,009 |

| | | | |

|

|

Materials—1.0% | | | | | |

Airgas, Inc. | | 318,632 | | | 11,869 |

| | | | |

|

|

Consumer Staples—0.5% | | | | | |

*Overhill Farms, Inc. | | 1,903,720 | | | 5,920 |

| | | | |

|

|

Total Common Stock—96.5%

(Total cost $990,105) | | | 1,103,402 |

| | | | |

|

|

| | |

Preferred Stock | | | | | |

Think Partnership, Inc.** | | 7,120 | | | 6,057 |

| | | | |

|

|

Total Preferred Stock—0.5%

cost ($7,120) | | | 6,057 |

| | | | |

|

|

| | |

Investment in Warrants | | | | | |

*Think Partnership, Inc.** | | 1,424,000 | | | — |

| | | | |

|

|

Total Investment in Warrants—0.0%

(cost $0) | | | — |

| | | | |

|

|

| | |

Investment in Affiliate | | | | | |

William Blair Ready Reserves Fund | | 7,233,213 | | | 7,233 |

| | | | |

|

|

Total Investment in Affiliate—0.7%

(cost $7,233) | | | 7,233 |

| | | | |

|

|

See accompanying Notes to Financial Statements.

22 Semi-Annual Report | June 30, 2006 |

Small Cap Growth Fund

Portfolio of Investments, June 30, 2006 (all dollar amounts in thousands) (unaudited)

| | | | | | |

Issuer

| | Principal

Amount

| | Value

|

| | |

Short-Term Investments | | | | | | |

American Express Demand Note, VRN 5.200%, due 7/3/06 | | $ | 8,604,000 | | $ | 8,604 |

Prudential Funding Demand Note, VRN 5.055%, due 7/3/06 | | | 7,411,000 | | | 7,411 |

| | | | | |

|

|

Total Short-Term Investments—1.4%

(cost $16,015) | | | 16,015 |

| | | | | |

|

|

Total Investments—99.1%

(cost $1,020,473) | | | 1,132,707 |

Cash and other assets, less liabilities—0.9% | | | 10,387 |

| | | | | |

|

|

Net assets—100.0% | | $ | 1,143,094 |

| | | | | |

|

|

*Non-income producing securities

ADR = American Depository Receipt

† = U.S. listed foreign security

VRN = Variable Rate Note

**Fair Valued pursuant to Valuation Procedures adopted by the Board of Trustees. The holding represents 0.53% of the Fund’s net assets at June 30, 2006. This security was also deemed illiquid pursuant to Liquidity Procedures approved by the Board of Trustees.

See accompanying Notes to Financial Statements.

June 30, 2006 | William Blair Funds 23 |

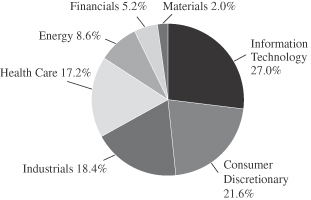

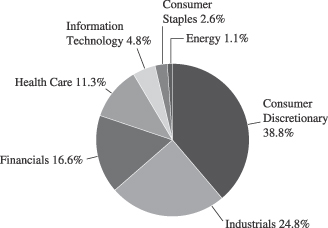

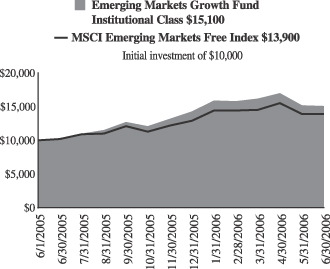

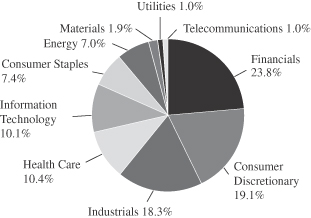

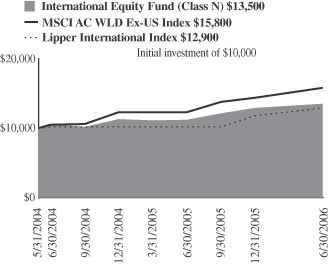

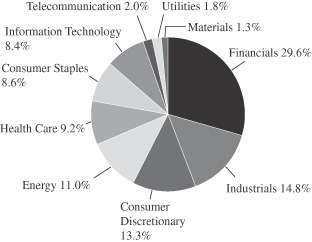

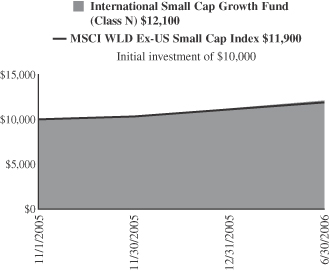

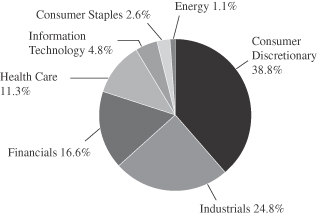

Harvey H. Bundy, III