UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive,

Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

Copies to: |

Caroline Kraus | | Geoffrey R.T. Kenyon, Esq. |

Goldman, Sachs & Co. | | Dechert LLP |

200 West Street | | 200 Clarendon Street |

New York, New York 10282 | | 27th Floor |

| | Boston, MA 02116-5021 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: March 31

Date of reporting period: September 30, 2012

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Stockholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | September 30, 2012 |

| | |

| | | | Short Duration and Government Fixed Income Funds |

| | | | Enhanced Income |

| | | | Government Income |

| | | | High Quality Floating Rate* |

| | | | Inflation Protected Securities |

| | | | Short Duration Government |

| | | | Short Duration Income |

*Effective July 27, 2012, the Goldman Sachs Ultra-Short Duration Government Fund was renamed the Goldman Sachs High Quality Floating Rate Fund.

Goldman Sachs Short Duration and Government Fixed Income Funds

| n | | HIGH QUALITY FLOATING RATE |

| n | | INFLATION PROTECTED SECURITIES |

| n | | SHORT DURATION GOVERNMENT |

| | | | |

TABLE OF CONTENTS | | | | |

| |

Principal Investment Strategies and Risks | | | 1 | |

| |

Investment Process | | | 3 | |

| |

Market Review | | | 4 | |

| |

Portfolio Management Discussions and Performance Summaries | | | 7 | |

| |

Schedules of Investments | | | 34 | |

| |

Financial Statements | | | 70 | |

| |

Financial Highlights | | | 78 | |

| |

Notes to Financial Statements | | | 90 | |

| |

Other Information | | | 115 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS SHORT DURATION AND GOVERNMENT FIXED INCOME FUNDS

Principal Investment Strategies and Risks

This is not a complete list of risks that may affect the Funds. For additional information concerning the risks applicable to the Funds, please see the Funds’ Prospectuses.

The Goldman Sachs Enhanced Income Fund invests primarily in a portfolio of U.S. dollar denominated securities, including non-mortgage U.S. government securities, corporate notes, commercial paper, fixed and floating rate asset-backed securities and foreign securities. The Fund’s investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. Any guarantee on U.S. government securities applies only to the underlying securities of the Fund if held to maturity and not to the value of the Fund’s shares. The Fund may invest in foreign securities, which may be more volatile and less liquid than investments in U.S. securities and will be subject to the risks of adverse economic or political developments. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; the risk of default by a counterparty; and liquidity risk. At times, the Fund may be unable to sell certain of its investments without a substantial drop in price, if at all.

The Goldman Sachs Government Income Fund invests primarily in U.S. government securities and in repurchase agreements collateralized by such securities. The Fund’s investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. The Fund’s net asset value and yield are not guaranteed by the U.S. government or by its agencies, instrumentalities or sponsored enterprises. Any guarantee on U.S. government securities applies only to the underlying securities of the Fund if held to maturity and not to the value of the Fund’s shares. The Fund’s investments in mortgage-backed securities are also subject to prepayment risk (i.e., the risk that in a declining interest rate environment, issuers may pay principal more quickly than expected, causing the Fund to reinvest proceeds at lower prevailing interest rates). Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; the risk of default by a counterparty; and liquidity risk. At times, the Fund may be unable to sell certain of its investments without a substantial drop in price, if at all.

The Goldman Sachs High Quality Floating Rate Fund invests primarily in high quality floating rate or variable rate obligations, and the Fund considers “high quality” obligations to be (i) those rated AAA or Aaa by a nationally recognized statistical rating organization at the time of purchase (or, if unrated, determined by the Investment Adviser to be of comparable quality), and (ii) U.S. government securities, including mortgage-backed securities, and repurchase agreements collateralized by U.S. government securities. The Fund’s investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. Any guarantee on U.S. government securities applies only to the underlying securities of the Fund if held to maturity and not to the value of the Fund’s shares. The Fund’s investments in mortgage-backed securities are also subject to prepayment risk (i.e., the risk that in a declining interest rate environment, issuers may pay principal more quickly than expected, causing the Fund to reinvest proceeds at lower prevailing interest rates). The Fund’s investments in foreign securities may be more volatile and less liquid than investments in U.S. securities and will be subject to the risks of adverse economic or political developments. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; the risk of default by a counterparty; and liquidity risk. At times, the Fund may be unable to sell certain of its investments without a substantial drop in price, if at all.

1

GOLDMAN SACHS SHORT DURATION AND GOVERNMENT FIXED INCOME FUNDS

The Goldman Sachs Inflation Protected Securities Fund invests primarily in inflation protected securities (IPS) of varying maturities issued by the U.S. Treasury and other U.S. and non-U.S. Government agencies and corporations. Fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. IPS are fixed income securities whose interest and principal payments are periodically adjusted according to the rate of inflation. The market value of IPS is not guaranteed, and will fluctuate in response to changes in real interest rates. The market for IPS may be less developed or liquid, and more volatile, than certain other securities markets. If deflation were to occur, IPS would likely decline in price. Any guarantee on U.S. government securities applies only to the underlying securities of the Fund if held to maturity and not to the value of the Fund’s shares.

The Goldman Sachs Short Duration Government Fund invests primarily in U.S. government securities and in repurchase agreements collateralized by such securities. The Fund’s investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. The Fund’s net asset value and yield are not guaranteed by the U.S. government or by its agencies, instrumentalities or sponsored enterprises. Any guarantee on U.S. government securities applies only to the underlying securities of the Fund if held to maturity and not to the value of the Fund’s shares. The Fund’s investments in mortgage-backed securities are also subject to prepayment risk (i.e., the risk that in a declining interest rate environment, issuers may pay principal more quickly than expected, causing the Fund to reinvest proceeds at lower prevailing interest rates). Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; the risk of default by a counterparty; and liquidity risk. At times, the Fund may be unable to sell certain of its investments without a substantial drop in price, if at all.

The Goldman Sachs Short Duration Income Fund invests primarily in U.S. or foreign fixed income securities, including U.S. government securities, corporate debt securities, collateralized loan obligations, agency and privately issued mortgage-backed securities, asset-backed securities, high yield non-investment grade securities, bank loans and emerging countries debt. The Fund’s investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity, interest rate, call and extension risk. Any guarantee on U.S. government securities applies only to the underlying securities of the Fund if held to maturity and not to the value of the Fund’s shares. The Fund’s investments in mortgage-backed securities are also subject to prepayment risk (i.e., the risk that in a declining interest rate environment, issuers may pay principal more quickly than expected, causing the Fund to reinvest proceeds at lower prevailing interest rates). High yield, lower rated securities involve greater price volatility and present greater risks than higher rated fixed income securities. Indirect loan participations may subject the Fund to greater delays, expenses and risks than direct obligations in the case that a borrower fails to pay scheduled principal and interest. The Fund may invest in foreign and emerging markets securities, which may be more volatile and less liquid than investments in U.S. securities and will be subject to the risks of currency fluctuations and adverse economic and political developments. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; risks of default by a counterparty; and liquidity risk. At times, the Fund may be unable to sell certain of its investments without a substantial drop in price, if at all. The Fund’s use of derivatives may result in leverage, which can make the Fund more volatile. The Fund’s investments in other investment companies subject it to additional expenses. The Fund may be more sensitive to adverse economic, business or political developments if it invests a substantial portion of its assets in bonds of similar projects or in particular types of municipal securities.

2

GOLDMAN SACHS SHORT DURATION AND GOVERNMENT FIXED INCOME FUNDS

What Differentiates Goldman Sachs Asset Management’s Fixed Income Investment Process?

At Goldman Sachs Asset Management, L.P. (“GSAM”), the goal of our fixed income investment process is to provide consistent, strong performance by actively managing our portfolios within a research-intensive, risk-managed framework.

A key element of our fixed income investment philosophy is to evaluate the broadest global opportunity set to capture relative value across sectors and instruments. Our globally integrated investment process involves managing dynamically along the risk/return spectrum, as we continue to develop value-added strategies through:

| n | | Assess relative value among securities and sectors |

| n | | Leverage the vast resources of GSAM in selecting securities for each portfolio |

| n | | Team approach to decision making |

| n | | Manage risk by avoiding significant sector and interest rate bets |

| n | | Careful management of yield curve strategies — while closely managing portfolio duration |

Fixed Income portfolios that:

| | n | | Include domestic and global investment options, income opportunities, and access to areas of specialization such as high yield | |

| | n | | Capitalize on GSAM’s industry-renowned credit research capabilities | |

| | n | | Use a risk-managed framework to seek total return, recognizing the importance of investors’ capital accumulation goals as well as their need for income | |

3

MARKET REVIEW

Goldman Sachs Short Duration and Government Fixed Income Funds

Market Review

Fixed income market performance during the six months ended September 30, 2012 (the “Reporting Period”) was strong but volatile, as corporate bonds and other riskier sectors of the market posted solid gains even as government bond yields fell to new lows.

Riskier fixed income assets, i.e., non-U.S. Treasury sectors, began the Reporting Period under pressure, as U.S. economic data softened in April after a strong start to the year 2012. In particular, March payroll data released in early April showed a significant slowing in job gains. In January and February, payrolls had climbed by more than 200,000 jobs per month, but the March report showed a gain of just more than 100,000 jobs. That report set the tone for April fixed income performance, as U.S. Treasury yields declined, and non-U.S. Treasury sectors underperformed. (Remember, there is usually an inverse relationship between bond prices and yield movements, such that bond prices rise when yields decline and vice versa.)

The performance trend continued in May, as the benchmark 10-year U.S. Treasury yield fell to a new low of 1.56%, and non-U.S. Treasury sectors of the fixed income market continued to perform poorly. Economic data was again a key driver of the weakness in riskier assets, as U.S. payrolls added just 69,000 jobs, less than half the expected gain. Concerns about Europe, and the health of the Spanish banking system in particular, also weighed on investors’ risk appetites. Although Spain announced several measures in May to support its banks, Spanish government bond yields spiked on investor worries about the country’s ability to support its banks given its own debt challenges.

June marked a turning point for non-U.S. Treasury sectors, although U.S. Treasury yields continued to decline. Developments in Europe were again a key driver of risk sentiment, as Greece held a presidential election that raised concerns about the country potentially exiting the Eurozone, and Spain finally appealed to the European Union for assistance for its banking system. Continued weakness in U.S. and global economic data also weighed on sentiment. As a result, U.S. Treasury yields continued to decline, but non-U.S. Treasury sectors gained ground during the month as Greece elected a pro-Eurozone administration and the European Union agreed to provide support to Spain’s banking system. Even as government bond yields hit new record lows, investors began moving back into higher-yielding corporate and emerging market bonds.

Non-U.S. Treasury sectors continued to outperform U.S. Treasuries through the remainder of the Reporting Period, largely as a function of the market searching for yield in an environment of extremely low interest rates. In addition, market expectations for more quantitative easing by the U.S. Federal Reserve (the “Fed”) increased in August in light of minutes from the August 1, 2012 Federal Open Market Committee meeting and Fed Chairman Ben Bernanke’s speech at the Fed’s annual conference in Jackson Hole, Wyoming. Overall economic growth in the U.S. remained sluggish, with housing a key exception as the Standard & Poor’s/Case-Shiller Home Price Index data showed the strongest house price gains since the index’s inception.

In September, the Fed exceeded most expectations for additional quantitative easing, with an announcement of open-ended asset purchases, dubbed QE3, and an extension of the likely period of low short-term interest rates from mid-2014 to at least mid-2015. With the Fed holding short-term interest rates at low levels, demand for higher yielding sectors remained strong. As evidence, the high yield corporate bond sector received record investment inflows on a year-to-date basis during September.

4

MARKET REVIEW

Looking Ahead

Going forward, we believe aggressive central bank action may not provide much of a boost to global economic growth, but we think recent policy measures significantly reduce the downside risks. The Fed has committed to purchase bonds until the U.S. labor market improves substantially, while the European Central Bank has committed to unlimited bond purchases to preserve the euro. These open-ended commitments are a significant departure from previous central bank policies, which focused on specific amounts of bond purchases or liquidity support. We not only doubt these measures will have a significant positive effect on economic growth, but we also worry about the longer-term consequences of further central bank balance sheet expansion. However, in the intermediate term, we think the open-ended nature of the Fed and European Central Bank bond purchases has meaningfully reduced the probability — and the potential severity — of downside economic and market scenarios.

In the U.S., we believe economic growth could see some benefit if there is a reduction in downside scenarios related to Europe and resolution of the uncertainties related to the fiscal cliff and November elections. (The major components of the so-called fiscal cliff include tax increases and spending cuts totaling approximately $576 billion scheduled to take effect on January 1, 2013.) The U.S. corporate sector has continued to stockpile cash and defer hiring and investment as a form of self-insurance against risk and uncertainty. However, the timeline for resolving uncertainties around the fiscal cliff and election is finite in our view. One way or another, within a few months, businesses will have a much better sense of U.S. fiscal policy and the regulatory regime going forward. We think politicians will ultimately defer most of the impact of the fiscal cliff, leaving the U.S. with fiscal restraint1 of about 1.5% of Gross Domestic Product (“GDP”) in 2013, which is close to the level of fiscal restraint seen at the end of the Reporting Period. We believe the combination of a lower than feared fiscal impact, reduced risk of a crisis in Europe and the Fed’s additional support for the U.S. housing recovery should provide modest upside potential for U.S. economic growth in 2013.

China’s economic slowdown, on the other hand, remains a source of greater uncertainty, in our view, as policymakers attempt to transition the Chinese economy from growth driven by exports and investment to growth driven by domestic consumption. China’s leaders have said economic growth will slow, and policymakers are targeting GDP of 7.5% in their latest five-year plan, which is close to the economy’s growth rate over the first half of 2012. Policymakers appear to be taking a conservative approach to stimulating economic growth and are focusing on measures such as subsidies for energy-efficient appliances rather than large infrastructure projects. China has virtually no track record when it comes to stimulating consumption, thereby raising concerns the economic slowdown could be deeper than targeted. That said, we are cautious about overreacting to the short-term trend in Chinese economic growth given policymakers’ long-term focus and 7.5% GDP growth target. Should economic growth slow more significantly, we would expect additional policy responses.

| 1 | | Fiscal restraint in this context refers to the net dollar amount of tax increase and/or government spending decrease, expressed as a percent of the dollar amount of US GDP, for the purpose of indicating the size of the change in taxes and government spending relative to the size of the economy. |

5

MARKET REVIEW

From an investment perspective, we believe the policy and economic growth backdrop anticipated for the coming months favors U.S. non-Treasury sectors. We think strong economic growth is probably the only scenario that could lead central banks to allow a significant rise in real yields, and we believe strong economic growth is a low probability. As a result, we expect yields on government bonds to generally remain in the range seen at the end of the Reporting Period, and we favor a tactical approach to duration management. We also think U.S. corporate credit valuations were attractive relative to fundamentals at the end of the Reporting Period, due largely to risk premiums for European tail risk. (Here, tail risk simply means the risk or probability of rare events.) Should European risk decline and government bond yields remain low as expected, we think U.S. corporate credit should benefit from investor demand for yield as well as from favorable fundamentals. In emerging markets, we do not see the slowdown in China leading to a boom/bust cycle in emerging countries broadly. We believe emerging market countries with good economic growth and strong balance sheets should continue to perform well.

The economic and market forecasts presented herein have been generated by GSAM for informational purposes as of the date of this presentation. They are based on proprietary models and there can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation.

6

PORTFOLIO RESULTS

Goldman Sachs Enhanced Income Fund

Investment Objective

The Fund seeks to generate return in excess of traditional money market products while maintaining an emphasis on preservation of capital and liquidity.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs U.S. Fixed Income Investment Management Team discusses the Goldman Sachs Enhanced Income Fund’s (the “Fund”) performance and positioning for the six-month period ended September 30, 2012 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, B, Institutional, Administration and IR Shares generated cumulative total returns, without sales charges, of 0.59%, 0.26%, 0.76%, 0.63% and 0.71%, respectively. These returns compare to the 0.14% cumulative total return of the Goldman Sachs Enhanced Income Fund Composite Index (the “Enhanced Income Composite”) during the same period. The Enhanced Income Composite is comprised 50% of the Six-Month U.S. Treasury Bill Index and 50% of the One-Year U.S. Treasury Note Index, which generated cumulative total returns of 0.11% and 0.18%, respectively, over the same time period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Both top-down and bottom-up strategies had an impact on the Fund’s performance during the Reporting Period. Within our top-down strategies, our duration and yield curve positioning strategy contributed positively to Fund performance. Duration is a measure of the Fund’s sensitivity to changes in interest rates. Yield curve indicates the spectrum of maturities within a particular sector. Our cross-sector strategy generated mixed results, but also contributed positively to the Fund’s results during the Reporting Period overall. Our cross-sector strategy is one in which we invest Fund assets across a variety of fixed income sectors, including some that may not be included in the Fund’s benchmark. Bottom-up individual issue selection amongst corporate bonds, covered bonds and government/agency securities also boosted results. |

| Q | | Which fixed income market sectors most significantly affected Fund performance? |

| A | | Sector positioning contributed positively to the Fund’s results during the Reporting Period, with allocations to corporate bonds and covered bonds helping most. The positive effect of the Fund’s allocation to covered bonds, which are debt securities backed by cash flows from mortgage loans or public sector loans, was primarily seen late in the Reporting Period, as risk assets, or non-U.S. Treasury sectors, rallied during the third quarter of 2012. Partially offsetting this positive contribution was the detracting effect of an underweighted allocation to U.S. government securities, held during April and May 2012 when interest rates fell significantly on deteriorating economic data, political challenges in Europe and a possibility of a Greek exit from the European Union. An exposure to high quality spread, or non-U.S. Treasury, sectors also detracted from the Fund’s results early in the Reporting Period, as investors were then looking for more safe-haven assets. Developments in Europe in June, supported by additional easing from the European Central Bank and Federal Reserve (the “Fed”), pushed interest rates higher off of their historic lows and sparked a rally in risk assets later in the Reporting Period, and the Fund’s overweighted allocations to corporate bonds, covered bonds, asset-backed securities and agency securities then added value. |

| | Our individual security selection strategies were the primary contributor to the Fund’s relative results during the Reporting Period, especially individual selection of corporate bonds, U.S. government securities and covered bonds. Within the corporate bond sector, a focus on short-dated, high credit quality issuers within the financials industry, added most to relative performance. Among U.S. government securities, a bias toward short-dated securities helped most. |

7

PORTFOLIO RESULTS

| Q | | Did the Fund’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period? |

| A | | Tactical management of the Fund’s duration and yield curve positioning helped its results during the Reporting Period. A steeper yield curve bias benefited the Fund’s performance, particularly in September when aggressive quantitative easing by the Fed pushed the inflation premium at the long-term end of the yield curve higher. However, such positive contribution was partially offset by the detracting effect of having a shorter duration than the benchmark index, especially in the five-year segment of the U.S. Treasury yield curve, during the early months of the Reporting Period. Interest rates declined significantly during April and May 2012, with the 10-year U.S. Treasury yield dropping 66 basis points to 1.56%. (A basis point is 1/100th of a percentage point.) We shifted to a long duration position overall relative to the benchmark index in mid-June and extended the duration modestly further by the end of the Reporting Period. The Fund ended the Reporting Period with a longer duration position than the benchmark index. As mentioned earlier, duration is a measure of the Fund’s sensitivity to changes in interest rates. Yield curve indicates the spectrum of maturities within a particular sector. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund used Treasury futures and Eurodollar futures during the Reporting Period for the purpose of managing the duration and term structure of the Fund. (Term structure, most often depicted as a yield curve, refers to the term structure of interest rates, which is the relationship between the yield to maturity and the time to maturity for pure discount bonds.) The Fund employed credit default swaps to manage the credit profile of the Fund. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | The Fund’s exposure to U.S. government-guaranteed obligations, investment grade corporate bonds and covered bonds decreased during the Reporting Period. A corresponding increase in allocation was concentrated in U.S. Treasury securities and asset-backed securities. Additionally, as indicated earlier, we shifted the Fund’s duration positioning during the Reporting Period as market conditions changed. At the start of the Reporting Period, the Fund maintained a shorter duration position than the benchmark index. We maintained that position through mid-June. We subsequently shifted to a longer duration position than the benchmark index, extending duration further by the end of September. |

| Q | | How was the Fund positioned relative to its benchmark index at the end of September 2012? |

| A | | While the Fund is benchmarked to U.S. Treasuries, it continued to hold a portion of its assets in non-Treasury sectors not represented in the benchmark index. Indeed, the Fund maintained exposures to high quality spread, or non-Treasury, sectors throughout the Reporting Period, most notably quasi-government securities, including agency-issued debentures, as well as asset-backed securities, covered bonds and investment grade corporate bonds. The Fund maintained an underweighted exposure to government bonds at the end of the Reporting Period. |

8

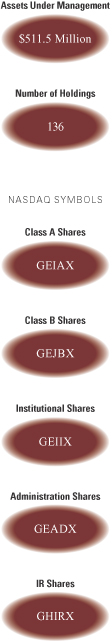

FUND BASICS

Enhanced Income Fund

as of September 30, 2012

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | April 1, 2012–

September 30, 2012 | | Fund Total

Return

(based

on NAV)1 | | | Goldman Sachs

Enhanced

Income Fund

Composite Index2 | | | Six-Month

U.S.

Treasury

Bill Index3 | | | One-Year

U.S.

Treasury

Note Index3 | | | 30-Day

Standardized

Subsidized

Yield4 | | | 30-Day

Standardized

Unsubsidized

Yield4 | |

| | Class A | | | 0.59 | % | | | 0.14 | % | | | 0.11 | % | | | 0.18 | % | | | 0.04 | % | | | 0.04 | % |

| | Class B | | | 0.26 | | | | 0.14 | | | | 0.11 | | | | 0.18 | | | | -0.52 | | | | -0.71 | |

| | Institutional | | | 0.76 | | | | 0.14 | | | | 0.11 | | | | 0.18 | | | | 0.38 | | | | 0.38 | |

| | Administration | | | 0.63 | | | | 0.14 | | | | 0.11 | | | | 0.18 | | | | 0.13 | | | | 0.13 | |

| | | Class IR | | | 0.71 | | | | 0.14 | | | | 0.11 | | | | 0.18 | | | | 0.29 | | | | 0.29 | |

| | 1 | | The net asset value (NAV) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Goldman Sachs Enhanced Income Fund Composite Index is an equal weight blend of the Six-Month U.S. Treasury Bill Index and the One-Year U.S. Treasury Note Index. |

| | 3 | | The Six-Month U.S. Treasury Bill Index and One-Year U.S. Treasury Note Index, as reported by Merrill Lynch, do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | 4 | | The 30-Day Standardized Subsidized Yield of the Fund is calculated by dividing the net investment income per share (as defined by securities industry regulations) earned by the Fund over a 30-day period (ending on the stated month-end date) by the maximum public offering price (“POP”) per share of the Fund on the last day of the period. This number is then annualized. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not reflect any applicable expense reductions. |

| | | | The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

9

FUND BASICS

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS5 |

| | | For the period ended 9/30/12 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | -0.29 | % | | | 1.16 | % | | | 1.85 | % | | | 2.50 | % | | 8/2/00 |

| | Class B | | | -4.63 | | | | 0.30 | | | | N/A | | | | 0.63 | | | 6/20/07 |

| | Institutional | | | 1.41 | | | | 1.80 | | | | 2.36 | | | | 2.99 | | | 8/2/00 |

| | Administration | | | 1.27 | | | | 1.58 | | | | 2.13 | | | | 2.77 | | | 8/2/00 |

| | | Class IR | | | 1.32 | | | | N/A | | | | N/A | | | | 0.60 | | | 7/30/10 |

| | 5 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 1.5% for Class A Shares and the assumed contingent deferred sales charge for Class B Shares (5% maximum declining to 0% after six years). Class B shares convert automatically to Class A shares on or about the fifteenth day of the last month of the calendar quarter that is eight years after purchase. Because Institutional Shares, Class IR Shares and Administration Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. The Fund’s Class B Shares are no longer available for purchase by new or existing shareholders (although current Class B shareholders may continue to reinvest income and capital gains distributions into Class B Shares, and Class B shareholders may continue to exchange their shares for Class B Shares of certain other Goldman Sachs Funds). |

| | | | The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | | | | | | | | | |

| | EXPENSE RATIOS6 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 0.69 | % | | | 0.69 | % |

| | Class B | | | 1.44 | | | | 1.44 | |

| | Institutional | | | 0.35 | | | | 0.35 | |

| | Administration | | | 0.60 | | | | 0.60 | |

| | | Class IR | | | 0.44 | | | | 0.44 | |

| | 6 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least July 27, 2013, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

10

FUND BASICS

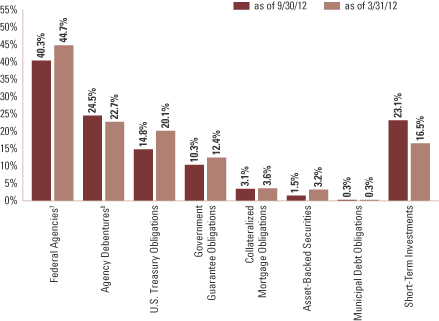

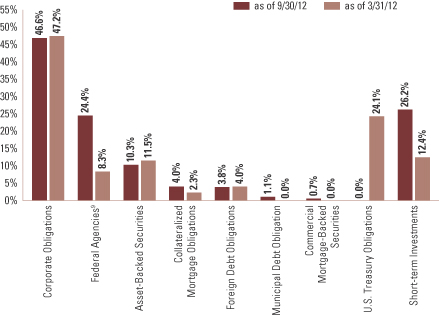

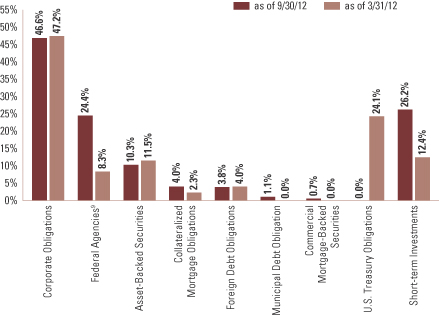

| | 7 | | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Short-term investments represent commercial paper and repurchase agreements. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| | 8 | | “Agency Debentures” include agency securities offered by companies such as the Federal National Mortgage Association (“FNMA”) and Federal Home Loan Mortgage Corp. (“FHLMC”), which operate under a government charter. While they are required to report to a government regulator, their assets are not explicitly guaranteed by the government and they otherwise operate like any other publicly traded company. |

11

PORTFOLIO RESULTS

Goldman Sachs Government Income Fund

Investment Objective

The Fund seeks a high level of current income, consistent with safety of principal.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs U.S. Fixed Income Investment Management Team discusses the Goldman Sachs Government Income Fund’s (the “Fund”) performance and positioning for the six-month period ended September 30, 2012 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, B, C, Institutional, Service, IR and R Shares generated cumulative total returns, without sales charges, of 2.83%, 2.45%, 2.44%, 3.07%, 2.74%, 2.96% and 2.77%, respectively. These returns compare to the 2.79% cumulative total return of the Fund’s benchmark, the Barclays Government/ Mortgage Index (the “Barclays Index”), during the same time period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Bottom-up individual issue selection within the collateralized sector contributed most positively to the Fund’s performance during the Reporting Period. Within our top-down strategies, our cross-sector strategy also added value. Our cross-sector strategy is one in which we invest Fund assets across a variety of fixed income sectors, including some that may not be included in the Fund’s benchmark. |

| | The primary detractor from Fund performance was individual issue selection within the government/agency sector. |

| Q | | Which fixed income market sectors most significantly affected Fund performance? |

| A | | During the Reporting Period, individual issue selection within the collateralized sector contributed most positively, particularly selection of agency mortgage-backed security pass-throughs. (Pass-through mortgages consist of a pool of residential mortgage loans, where homeowners’ monthly payments of principal, interest and prepayments pass from the original bank through a government agency or investment bank to investors.) An emphasis on these securities during the months of May, June, July and early August—with a bias toward lower coupon securities—particularly helped. |

| | Exposure to the agency mortgage-backed securities, non-agency mortgage-backed securities and asset-backed securities market sectors, implemented via our cross-sector strategy, also contributed positively to the Fund’s relative results, as riskier assets, or non-U.S. Treasury sectors, continued their rally from the beginning of 2012. |

| | Security selection within the government/agency sector detracted from the Fund’s relative results during the Reporting Period. Specifically, selection of agency securities and U.S. government-guaranteed debt proved disappointing. |

| Q | | Did the Fund’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period? |

| A | | The combination of the Fund’s duration and yield curve positioning had a modest positive impact on its results during the Reporting Period. The Fund’s longer U.S. duration than the Barclays Index proved helpful, as U.S. Treasury yields declined. While riskier assets did rally, the Fed implemented a third round of quantitative easing and extended its intention of maintaining low short-term interest rates through at least mid-2015. Amidst these conditions, investors continued to seek the perceived relative safety of U.S. Treasury securities as global concerns persisted. Duration is a measure of the Fund’s sensitivity to changes in interest rates. Yield curve refers to the spectrum of maturities. |

12

PORTFOLIO RESULTS

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund used Treasury futures and Eurodollar futures to hedge interest rate exposure, i.e., to manage exposure to fluctuations in interest rates, and to facilitate specific duration, yield curve and country strategies. Interest rate swaps were used to hedge interest rate exposure and express an outright term structure view. (Term structure, most often depicted as a yield curve, refers to the term structure of interest rates, which is the relationship between the yield to maturity and the time to maturity for pure discount bonds.) The Fund employed swaptions (or options on interest rate swap contracts) to hedge and express an outright term structure view. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | We extended the Fund’s duration, moving from a shorter-than-Barclays Index to a longer-than-Barclays Index duration, which proved beneficial as interest rates declined during the Reporting Period. We maintained the Fund’s overweighted exposure to non-agency mortgage-backed securities, which also was a driver of positive performance during the Reporting Period. The Fund also prudently held its substantial overweighting in agency mortgage-backed securities through much of the Reporting Period, as spreads, or the differential in yields between these securities and U.S. Treasuries, tightened considerably. Agency mortgage-backed securities outperformed U.S. Treasuries by 1.15% during the Reporting Period. We believed the Fed would re-enter the market and begin purchasing agency mortgages. Spreads tightened in anticipation of this Fed move, and we began unwinding the Fund’s position before the Fed actually announced its open-ended mortgage purchases. With the Fed’s announcement, agency mortgages’ spreads tightened even more. At the end of the Reporting Period, we had tactically shifted the Fund’s position, such that the Fund held a neutral to slightly overweight position in agency mortgage-backed securities relative to the Barclays Index, as the Fed had driven valuations, in our view, to be excessively rich. |

| Q | | How was the Fund positioned relative to its benchmark index at the end of September 2012? |

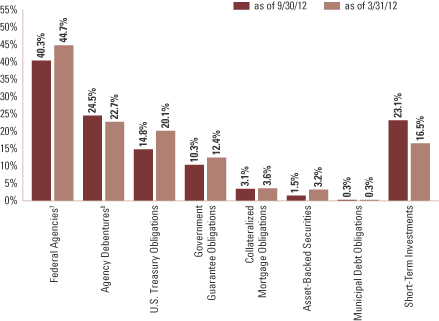

| A | | At the end of September 2012, the Fund had an overweighted allocation relative to the Barclays Index in quasi-government securities, including agency non-government guaranteed securities and government-guaranteed corporate bonds. To a more modest degree, the Fund also had an overweighted allocation relative to the Barclays Index in asset-backed securities. The Fund was significantly underweighted relative to the benchmark index in U.S. government securities. Within the residential mortgage-backed securities sector, the Fund had exposure to agency collateralized mortgage obligations (“CMOs”), which are not a component of the Barclays Index, and was underweighted relative to the Barclays Index in mortgage-backed security pass-throughs. The Fund had a modestly longer duration than that of the Barclays Index at the end of the Reporting Period. The Fund had 23.1% of its net assets invested in short-term investments at the end of the Reporting Period. |

13

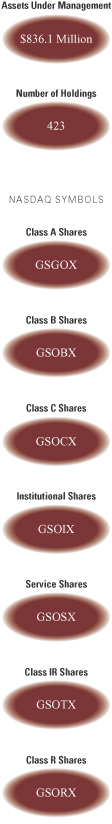

FUND BASICS

Government Income Fund

as of September 30, 2012

| | | | | | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | April 1, 2012– September 30, 2012 | | Fund Total Return

(based on NAV)1 | | | Barclays

Government/

Mortgage Index2 | | | 30-Day

Standardized

Subsidized Yield3 | | | 30-Day

Standardized

Unsubsidized Yield3 | |

| | Class A | | | 2.83 | % | | | 2.79 | % | | | 0.32 | % | | | 0.19 | % |

| | Class B | | | 2.45 | | | | 2.79 | | | | -0.41 | | | | -0.55 | |

| | Class C | | | 2.44 | | | | 2.79 | | | | -0.40 | | | | -0.55 | |

| | Institutional | | | 3.07 | | | | 2.79 | | | | 0.67 | | | | 0.53 | |

| | Service | | | 2.74 | | | | 2.79 | | | | 0.18 | | | | 0.04 | |

| | Class IR | | | 2.96 | | | | 2.79 | | | | 0.57 | | | | 0.44 | |

| | | Class R | | | 2.77 | | | | 2.79 | | | | 0.09 | | | | -0.05 | |

| | 1 | | The net asset value (NAV) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Barclays Government/Mortgage Index, an unmanaged index, does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | 3 | | The 30-Day Standardized Subsidized Yield of the Fund is calculated by dividing the net investment income per share (as defined by securities industry regulations) earned by the Fund over a 30-day period (ending on the stated month-end date) by the maximum public offering price (“POP”) per share of the Fund on the last day of the period. This number is then annualized. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not reflect any applicable expense reductions. |

| | | | The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

14

FUND BASICS

| | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS4 |

| | | For the period ended 9/30/12 | | One Year | | | Five Years | | Ten Years | | Since Inception | | Inception Date |

| | Class A | | | -0.42 | % | | 4.57% | | 3.99% | | 5.55% | | 2/10/93 |

| | Class B | | | -2.45 | | | 4.19 | | 3.75 | | 5.28 | | 5/1/96 |

| | Class C | | | 1.65 | | | 4.59 | | 3.62 | | 4.64 | | 8/15/97 |

| | Institutional | | | 3.79 | | | 5.74 | | 4.78 | | 5.82 | | 8/15/97 |

| | Service | | | 3.20 | | | 5.20 | | 4.25 | | 5.29 | | 8/15/97 |

| | Class IR | | | 3.70 | | | N/A | | N/A | | 5.21 | | 11/30/07 |

| | | Class R | | | 3.19 | | | N/A | | N/A | | 4.74 | | 11/30/07 |

| | 4 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 3.75% for Class A Shares, the assumed contingent deferred sales charge for Class B Shares (5% maximum declining to 0% after six years), and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Class B Shares convert automatically to Class A Shares on or about the fifteenth day of the last month of the calendar quarter that is eight years after purchase. Returns for Class B Shares for the period after conversion reflect the performance of Class A Shares. Prior to July 29, 2009, the maximum initial sales charge applicable to Class A Shares of the Fund was 4.5%, which is not reflected in the figures shown. Because Institutional Shares, Service Shares, Class IR and R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. The Fund’s Class B Shares are no longer available for purchase by new or existing shareholders (although current Class B shareholders may continue to reinvest income and capital gains distributions into Class B Shares, and Class B shareholders may continue to exchange their shares for Class B Shares of certain other Goldman Sachs Funds). |

| | | | The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | | | | | | | | | |

| | EXPENSE RATIOS5 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 0.92 | % | | | 1.00 | % |

| | Class B | | | 1.67 | | | | 1.75 | |

| | Class C | | | 1.67 | | | | 1.75 | |

| | Institutional | | | 0.58 | | | | 0.66 | |

| | Service | | | 1.08 | | | | 1.16 | |

| | Class IR | | | 0.67 | | | | 0.75 | |

| | | Class R | | | 1.17 | | | | 1.25 | |

| | 5 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least July 27, 2013, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

15

FUND BASICS

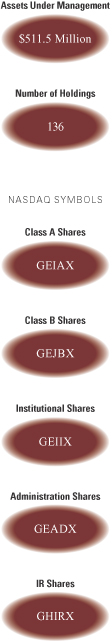

| | 6 | | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Short-term investments represent repurchase agreements. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| | 7 | | “Federal Agencies” are mortgage-backed securities guaranteed by the Government National Mortgage Association (“GNMA”), Federal National Mortgage Association (“FNMA”) and Federal Home Loan Mortgage Corp. (FHLMC). GNMA instruments are backed by the full faith and credit of the U.S. Government. |

| | 8 | | “Agency Debentures” include agency securities offered by companies such as FNMA and FHLMC, which operate under a government charter. While they are required to report to a government regulator, their assets are not explicitly guaranteed by the government and they otherwise operate like any other publicly traded company. |

16

PORTFOLIO RESULTS

Goldman Sachs High Quality Floating Rate Fund

Investment Objective

The Fund seeks a high level of current income, consistent with low volatility of principal.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs U.S. Fixed Income Investment Management Team discusses the Goldman Sachs High Quality Floating Rate Fund’s (the “Fund”) performance and positioning for the six-month period ended September 30, 2012 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, Institutional, Service and IR Shares generated cumulative total returns, without sales charges, of 0.22%, 0.50%, 0.25% and 0.45%, respectively. These returns compare to the 0.06% cumulative total return of the Fund’s new benchmark, the BofA ML Three Month U.S. Treasury Bill Index.* To compare, the Fund’s former benchmark, the Goldman Sachs Ultra-Short Duration Government Fund Composite Index (the “Ultra-Short Duration Government Composite Index”), posted a 0.14% cumulative total return during the same period. The Ultra-Short Duration Government Composite Index is comprised 50% of the BofA ML Six-Month U.S. Treasury Bill Index and 50% of the BofA ML One-Year U.S. Treasury Note Index, which generated cumulative total returns of 0.11% and 0.18%, respectively over the same period. |

| Q | | Were there any changes to the Fund during the Reporting Period? |

| A | | To enhance our ability to protect against rising rates and provide a competitive yield, the Goldman Sachs Ultra Short Duration Government Fund was renamed and repositioned as the Goldman Sachs High Quality Floating Rate Fund effective July 27, 2012. As of that date, the Fund invests primarily in high quality floating rate or variable rate obligations, and the Fund considers “high quality” obligations to be (i) those rated AAA or Aaa by a nationally recognized statistical rating organization at the time of purchase (or, if unrated, determined by the Investment Adviser to be of comparable quality), and (ii) U.S. government securities, including mortgage-backed securities, and repurchase agreements collateralized by U.S. government securities. While certain of the Fund’s investment strategies and policies changed and the Fund’s benchmark index changed, there was no change to the Fund’s investment objective or credit profile. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Both top-down and bottom-up strategies had an impact on the Fund’s performance during the Reporting Period. Within our top-down strategies, our cross-sector strategy was the primary positive contributor to the Fund’s results during the Reporting Period. Our cross-sector strategy is one in which we invest Fund assets across a variety of fixed income sectors, including some that may not be included in the Fund’s benchmark. Our duration and yield curve positioning strategy detracted from Fund performance. Duration is a measure of the Fund’s sensitivity to changes in interest rates. Yield curve indicates the spectrum of maturities within a particular sector. Bottom-up individual issue selection amongst agency mortgage-backed securities and agency debentures detracted from relative performance, mostly offset by the positive contribution made by individual issue selection amongst asset-backed securities and government securities. |

| Q | | Which fixed income market sectors most significantly affected Fund performance? |

| A | | Sector positioning contributed positively to the Fund’s results during the Reporting Period, with an allocation to agency mortgage-backed securities helping most, as the Federal Reserve (the “Fed”) made an open-ended commitment to buy $40 billion in mortgage-backed securities per month and extended its Operation Twist program until year-end 2012. |

| * | Effective July 27, 2012, the Fund’s performance benchmark was changed from the Goldman Sachs Ultra-Short Duration Government Fund Composite Index to the BofA ML Three Month U.S. Treasury Bill Index, which the Investment Adviser believes is a more appropriate benchmark against which to measure the Fund’s performance, in light of changes to the Fund’s investment strategies. |

17

PORTFOLIO RESULTS

| | The Fund’s exposure to asset-backed securities and corporate bonds added value late in the Reporting Period when risk assets, or non-U.S. Treasury sectors, rallied on further government stimulus. |

| | Individual issue selection amongst agency mortgage-backed securities was the greatest detractor from the Fund’s relative results during the Reporting Period. In particular, the Fund’s exposure to agency collateralized mortgage obligations (“CMOs”) had a significant negative impact. On the positive side, this detractor was largely offset by individual issue selection of mortgage-backed security pass-throughs, asset-backed securities backed by student loans, and short-term and intermediate maturity U.S. Treasuries, which boosted the Fund’s relative results. |

| Q | | Did the Fund’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period? |

| A | | Tactical management of the Fund’s duration and yield curve positioning detracted from its results during the Reporting Period, with the majority of negative return attributable to an underweighted position in long-term maturity U.S. Treasuries held throughout. Long-term U.S. Treasury rates steepened during the Reporting Period, as aggressive quantitative easing by the Fed pushed the inflation premium at the long-term end of the yield curve higher. Also detracting was the Fund’s shorter duration position than the benchmark index in the one-, five-, ten- and 30-year segments of the U.S. Treasury yield curve. Conversely, a longer duration position than the benchmark index in the two-, three- and seven-year segments of the U.S. Treasury yield curve positively impacted the Fund’s performance during the Reporting Period. Overall, we maintained a long duration position relative to the benchmark index within the Fund for the majority of the Reporting Period, having shifted from a shorter duration position than the benchmark index in mid-April. As mentioned earlier, duration is a measure of the Fund’s sensitivity to changes in interest rates. Yield curve indicates the spectrum of maturities within a particular sector. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund used Treasury futures, Eurodollar futures and interest rate swaps during the Reporting Period for the purpose of managing the duration and term structure of the Fund. (Term structure, most often depicted as a yield curve, refers to the term structure of interest rates, which is the relationship between the yield to maturity and the time to maturity for pure discount bonds.) The Fund employed swaptions (or options on interest rate swap contracts) for the purpose of taking modest short volatility positions, that is, positions that pay a modest return when market volatility remains relatively stable. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

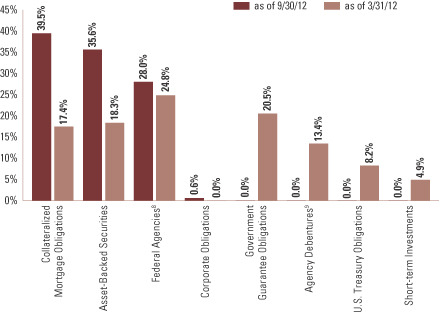

| A | | Due to the change in the Fund’s strategy effective July 27, 2012, the portfolio’s allocation to adjustable-rate mortgages (“ARMs”), collateralized mortgage obligations (“CMOs”) and asset-backed securities increased significantly during the Reporting Period. A corresponding decrease in allocation was concentrated in U.S. Treasury securities and quasi-government securities. Additionally, as indicated earlier, we shifted the Fund’s duration positioning during the Reporting Period as market conditions changed. At the start of the Reporting Period, the Fund maintained a shorter duration position than the benchmark index. We maintained that position through mid-April. This position then gave way to a longer duration position than the benchmark index in response to deteriorating economic data and fears over escalation of Europe’s sovereign debt crisis. By the end of the September, the Fund held a longer duration position than the benchmark index. |

| Q | | How was the Fund positioned relative to its benchmark index at the end of September 2012? |

| A | | While the Fund is benchmarked to U.S. Treasuries, it held all of its assets in non-Treasury sectors not represented in the benchmark index at the end of the Reporting Period. Indeed, the Fund maintained exposures to high quality spread, or non-Treasury, sectors throughout the Reporting Period, most notably agency mortgage-backed securities and asset-backed securities. The Fund had no exposure to government bonds and quasi-government securities at the end of the Reporting Period. |

18

FUND BASICS

High Quality Floating Rate Fund

as of September 30, 2012

| | | | | | | | | | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | April 1, 2012–

September 30, 2012 | | Fund Total

Return

(based on NAV)1 | | | BofA ML Three

Month U.S.

Treasury Bill

Index2 | | | Goldman

Sachs Ultra-

Short Duration

Government Fund

Composite Index3 | | | 30-Day

Standardized

Subsidized

Yield4 | | | 30-Day

Standardized

Unsubsidized

Yield4 | |

| | Class A | | | 0.22 | % | | | 0.06 | % | | | 0.14 | % | | | 0.13 | % | | | -0.05 | % |

| | Institutional | | | 0.50 | | | | 0.06 | | | | 0.14 | | | | 0.47 | | | | 0.28 | |

| | Service | | | 0.25 | | | | 0.06 | | | | 0.14 | | | | -0.02 | | | | -0.21 | |

| | | Class IR | | | 0.45 | | | | 0.06 | | | | 0.14 | | | | 0.38 | | | | 0.20 | |

| | 1 | | The net asset value (NAV) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The BofA ML Three Month U.S. Treasury Bill Index measures total return on cash, including price and interest income, based on short-term government Treasury Bills of about 90-day maturity, as reported by BofA Merrill Lynch, do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. |

| | 3 | | The Goldman Sachs Ultra-Short Duration Government Fund Composite Index is an equal blend of the BofA ML Six-Month U.S. Treasury Bill Index and the BofA ML One-Year U.S. Treasury Note Index. |

| | 4 | | The 30-Day Standardized Subsidized Yield of the Fund is calculated by dividing the net investment income per share (as defined by securities industry regulations) earned by the Fund over a 30-day period (ending on the stated month-end date) by the maximum public offering price (“POP”) per share of the Fund on the last day of the period. This number is then annualized. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not reflect any applicable expense reductions. |

| | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS5 |

| | | For the period ended 9/30/12 | | One Year | | | Five Years | | Ten Years | | Since Inception | | Inception Date |

| | Class A | | | -0.85 | % | | 0.35% | | 1.57% | | 3.17% | | 5/15/95 |

| | Institutional | | | 1.07 | | | 1.02 | | 2.08 | | 3.84 | | 7/17/91 |

| | Service | | | 0.57 | | | 0.54 | | 1.60 | | 2.79 | | 3/27/97 |

| | | Class IR | | | 0.98 | | | N/A | | N/A | | 0.82 | | 11/30/07 |

| | 5 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 1.5% for Class A Shares. Because Institutional Shares, Service Shares and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

| | | | The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www. goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

19

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS6 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 0.74 | % | | | 0.90 | % |

| | Institutional | | | 0.40 | | | | 0.56 | |

| | Service | | | 0.90 | | | | 1.06 | |

| | | Class IR | | | 0.49 | | | | 0.65 | |

| | 6 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least July 27, 2013, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

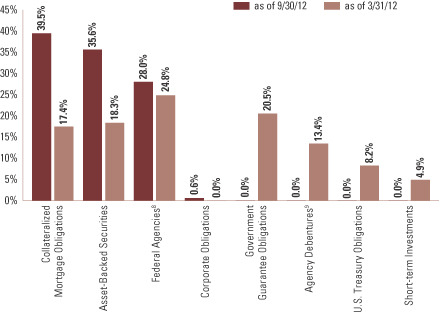

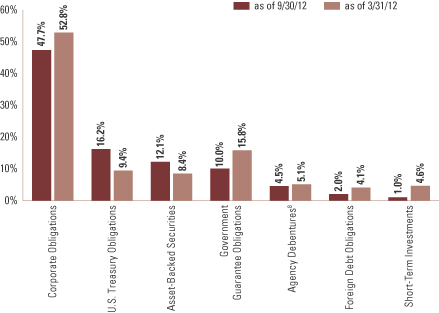

| | 7 | | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Short-term investments represent U.S. Treasury Bill and repurchase agreements. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| | 8 | | “Federal Agencies” are mortgage-backed securities guaranteed by the Government National Mortgage Association (“GNMA”), Federal National Mortgage Association (“FNMA”) and Federal Home Loan Mortgage Corp. (FHLMC). GNMA instruments are backed by the full faith and credit of the U.S. Government. |

| | 9 | | “Agency Debentures” include agency securities offered by companies such as FNMA and FHLMC, which operate under a government charter. While they are required to report to a government regulator, their assets are not explicitly guaranteed by the government and they otherwise operate like any other publicly traded company. |

20

PORTFOLIO RESULTS

Goldman Sachs Inflation Protected Securities Fund

Investment Objective

The Fund seeks real return consistent with preservation of capital.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs U.S. Fixed Income Investment Management Team discusses the Goldman Sachs Inflation Protected Securities Fund’s (the “Fund”) performance and positioning for the six-month period ended September 30, 2012 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, IR and R Shares generated cumulative total returns, without sales charges, of 5.39%, 4.99%, 5.56%, 5.52% and 5.16%, respectively. These returns compare to the 5.34% cumulative total return of the Fund’s benchmark, the Barclays U.S. TIPS Index (“Barclays Index”) during the same time period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

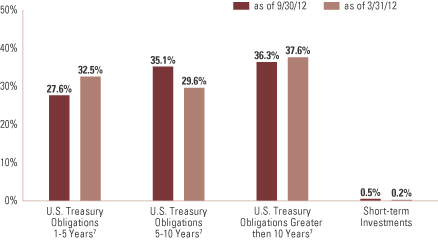

| A | | Bottom-up individual issue selection of various maturity Treasury inflation protected securities (“TIPS”) was the key positive contributor to the Fund’s performance during the Reporting Period. Our duration strategy also contributed positively to Fund performance. Duration is a measure of the Fund’s sensitivity to changes in interest rates. None of our strategies materially detracted from relative results during the Reporting Period. |

| Q | | Which fixed income market sectors most significantly affected Fund performance? |

| A | | Individual issue selection of various maturity TIPS contributed most positively to Fund performance during the Reporting Period. Through the Reporting Period, we tactically re-positioned the Fund’s exposure to inflation as market conditions evolved, which added value overall. In addition, our active management around TIPS auctions contributed positively to the Fund’s results during the Reporting Period. We held an overweight bias toward TIPS on the short-term end of the TIPS yield curve versus the long-term end of the TIPS yield curve during the Reporting Period, and these selection strategies boosted the Fund’s results relative to the Barclays Index. |

| Q | | Did the Fund’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period? |

| A | | Active U.S. duration positioning contributed positively, albeit modestly, to the Fund’s performance during the Reporting Period. We generally managed the Fund with a longer U.S. duration position than the Barclays Index, given our concern about the global economic growth slowdown, the potential Greek exit from the Eurozone and uncertainty in the U.S. regarding the November 2012 election and impending fiscal cliff. (The major components of the so-called fiscal cliff include tax increases and spending cuts totaling approximately $576 billion scheduled to take effect on January 1, 2013.) Such positioning added value, as U.S. Treasury yields generally declined during the Reporting Period. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund used Treasury futures and Eurodollar futures to hedge interest rate exposure and to facilitate specific duration and yield curve strategies. Interest rate swaps were used to hedge interest rate exposure and express an outright term structure view. (Term structure, most often depicted as a yield curve, refers to the term structure of interest rates, which is the relationship between the yield to maturity and the time to maturity for pure discount bonds.) |

21

PORTFOLIO RESULTS

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | We tactically managed the inflation exposure in the Fund via varying allocations to TIPS throughout the Reporting Period. As already discussed, we maintained the Fund’s duration position longer than that of the Barclays Index throughout the Reporting Period amid the Federal Reserve’s (the “Fed”) commitment to maintain an accommodative monetary policy and given our concerns about the global economic growth slowdown and what we perceived to be elevated levels of financial market risk. |

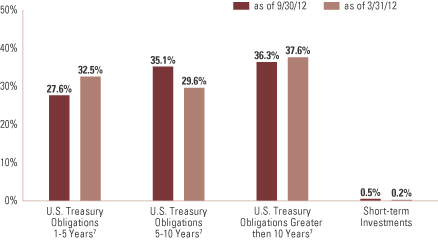

| Q | | How was the Fund positioned relative to its benchmark index at the end of September 2012? |

| A | | At the end of September 2012, the Fund had more than 98% of its total net assets invested in TIPS, with the remainder in cash or cash equivalents. The Fund had a modestly longer duration than the benchmark index at the end of the Reporting Period. |

22

FUND BASICS

Inflation Protected Securities Fund

as of September 30, 2012

| | | | | | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | April 1, 2012–

September 30, 2012 | | Fund Total Return

(based on NAV)1 | | | Barclays U.S.

TIPS Index2 | | | 30-Day

Standardized

Subsidized Yield3 | | | 30-Day

Standardized

Unsubsidized Yield3 | |

| | Class A | | | 5.39 | % | | | 5.34 | % | | | -2.85 | % | | | -2.97 | % |

| | Class C | | | 4.99 | | | | 5.34 | | | | -3.68 | | | | -3.81 | |

| | Institutional | | | 5.56 | | | | 5.34 | | | | -2.62 | | | | -2.76 | |

| | Class IR | | | 5.52 | | | | 5.34 | | | | -2.71 | | | | -2.84 | |

| | | Class R | | | 5.16 | | | | 5.34 | | | | -3.20 | | | | -3.33 | |

| | 1 | | The net asset value (NAV) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Barclays U.S. TIPS Index represents securities that protect against adverse inflation and provide a minimum level of real return. To be included in this index, bonds must have cash flows linked to an inflation index, be sovereign issues denominated in U.S. currency, and have more than one year to maturity, and, as a portion of the index, total a minimum amount outstanding of 100 million U.S. dollars. It is not possible to invest directly in an index. |

| | 3 | | The 30-Day Standardized Subsidized Yield of the Fund is calculated by dividing the net investment income per share (as defined by securities industry regulations) earned by the Fund over a 30-day period (ending on the stated month-end date) by the maximum public offering price (“POP”) per share of the Fund on the last day of the period. This number is then annualized. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The Fund invests in US TIPS bonds and similar inflation protected securities, and the 30-Day Standardized Yield of the Fund, as quoted above, includes the positive or negative income effect on those bonds of changes in the rate of inflation. When inflation factors increase, we expect the Fund’s 30-Day Standardized Yield to be higher than if the effects of inflation were excluded, and when the inflation factors decrease, we expect the Fund’s 30-Day Standardized Yield to be lower than if the effects of inflation were excluded. Relatively small changes in the rate of inflation can have significant positive or negative impacts on the 30-Day Standardized Yield of the Fund. To the extent the Yield shown above includes the positive effect of a rise in inflation, it may not be repeated. The 30-Day Standardized Unsubsidized Yield does not reflect any applicable expense reductions. |

| | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS4 |

| | | For the period ended 9/30/12 | | One Year | | | Five Years | | Since Inception | | Inception Date |

| | Class A | | | 4.78 | % | | 6.87% | | 6.98% | | 8/31/07 |

| | Class C | | | 7.03 | | | 6.97 | | 7.07 | | 8/31/07 |

| | Institutional | | | 9.18 | | | 8.14 | | 8.22 | | 8/31/07 |

| | Class IR | | | 9.00 | | | N/A | | 7.17 | | 11/30/07 |

| | | Class R | | | 8.46 | | | N/A | | 6.67 | | 11/30/07 |

| | 4 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 3.75% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Prior to July 29, 2009, the maximum initial sales charge applicable to Class A Shares of the Fund was 4.5%, which is not reflected in the figures shown. Because Institutional Shares, Class IR Shares and R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

| | | | The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

23

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS5 | | | | | | | | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 0.62 | % | | | 0.83 | % |

| | Class C | | | 1.37 | | | | 1.58 | |

| | Institutional | | | 0.28 | | | | 0.49 | |

| | Class IR | | | 0.37 | | | | 0.58 | |

| | | Class R | | | 0.87 | | | | 1.08 | |

| | 5 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least July 27, 2013, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |