UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive,

Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

Copies to: |

Caroline Kraus | | Geoffrey R.T. Kenyon, Esq. |

Goldman, Sachs & Co. | | Dechert LLP |

200 West Street | | 200 Clarendon Street |

New York, New York 10282 | | 27th Floor |

| | Boston, MA 02116-5021 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: August 31

Date of reporting period: February 28, 2013

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Stockholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | February 28, 2013 |

| | |

| | | | Fundamental Equity Growth Funds |

| | | | Capital Growth |

| | | | Concentrated Growth |

| | | | Flexible Cap Growth |

| | | | Focused Growth |

| | | | Growth Opportunities |

| | | | Small/Mid Cap Growth |

| | | | Strategic Growth |

| | | | Technology Tollkeeper |

| | | | U.S. Equity |

Goldman Sachs Fundamental Equity Growth Funds

| | | | |

TABLE OF CONTENTS | | | | |

| |

Principal Investment Strategies and Risks | | | 1 | |

| |

Investment Process | | | 3 | |

| |

Market Review | | | 4 | |

| |

Portfolio Management Discussions and Performance Summaries | | | 6 | |

| |

Schedules of Investments | | | 60 | |

| |

Financial Statements | | | 78 | |

| |

Financial Highlights | | | 88 | |

| |

Notes to Financial Statements | | | 106 | |

| |

Other Information | | | 127 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS FUNDAMENTAL EQUITY GROWTH FUNDS

Principal Investment Strategies and Risks

This is not a complete list of risks that may affect the Funds. For additional information concerning the risks applicable to the Funds, please see the Funds’ Prospectuses.

The Goldman Sachs Capital Growth Fund invests primarily in U.S. equity investments and invests, under normal circumstances, in approximately 30–40 companies. The Fund’s equity investments are subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. Different investment styles (e.g., “growth”) tend to shift in and out of favor, and at times the Fund may underperform other funds that invest in similar asset classes.

The Goldman Sachs Concentrated Growth Fund invests primarily in U.S. equity investments. The Fund’s equity investments are subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. The securities of small- and mid-capitalization companies involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements. Different investment styles (e.g., “growth”) tend to shift in and out of favor, and at times the Fund may underperform other funds that invest in similar asset classes. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

The Goldman Sachs Flexible Cap Growth Fund invests primarily in U.S. equity investments in small-, mid- and large-capitalization issuers. The Fund’s equity investments are subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. The securities of small- and mid-capitalization companies involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements. Different investment styles (e.g., “growth”) tend to shift in and out of favor, and at times the Fund may underperform other funds that invest in similar asset classes.

The Goldman Sachs Focused Growth Fund invests primarily in U.S. equity investments and invests, under normal circumstances, in approximately 20–25 companies. The Fund’s equity investments are subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. The securities of small- and mid-capitalization companies involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements. Different investment styles (e.g., “growth”) tend to shift in and out of favor, and at times the Fund may underperform other funds that invest in similar asset classes. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

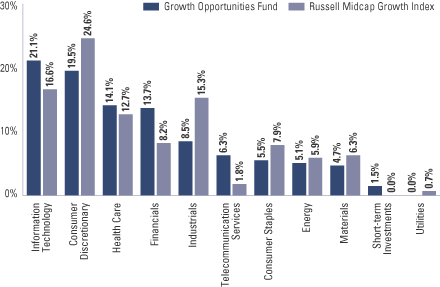

The Goldman Sachs Growth Opportunities Fund invests primarily in U.S. equity investments with a primary focus on mid-capitalization companies. The Fund’s equity investments are subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. The securities of small- and mid-capitalization companies involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements. Different investment styles (e.g., “growth”) tend to shift in and out of favor, and at times the Fund may underperform other funds that invest in similar asset classes.

1

GOLDMAN SACHS FUNDAMENTAL EQUITY GROWTH FUNDS

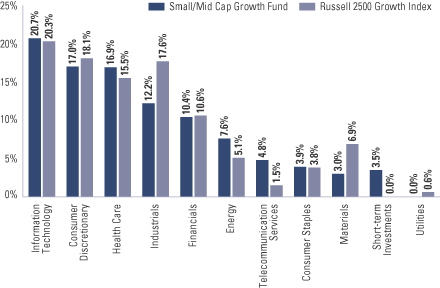

The Goldman Sachs Small/Mid Cap Growth Fund invests primarily in U.S. equity investments with a primary focus on small- and mid-capitalization companies. The Fund’s equity investments are subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. The securities of small- and mid-capitalization companies involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements. Different investment styles (e.g., “growth”) tend to shift in and out of favor, and at times the Fund may underperform other funds that invest in similar asset classes.

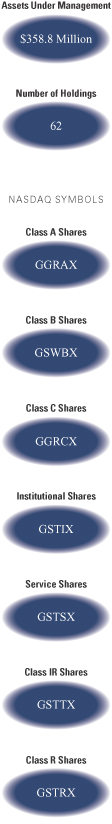

The Goldman Sachs Strategic Growth Fund invests primarily in U.S. equity investments. The Fund’s equity investments are subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. Different investment styles (e.g., “growth”) tend to shift in and out of favor, and at times the Fund may underperform other funds that invest in similar asset classes.

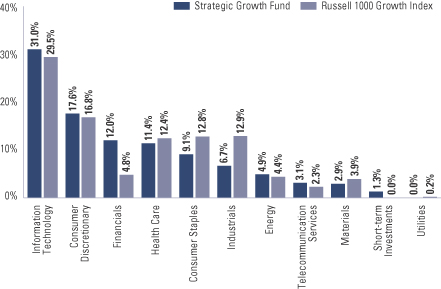

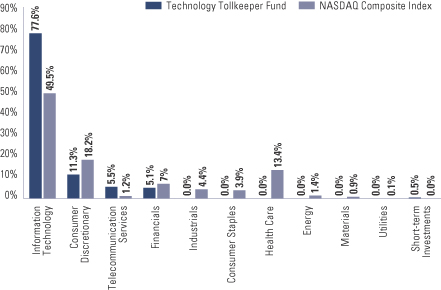

The Goldman Sachs Technology Tollkeeper Fund invests primarily in equity securities of high quality technology, media or service companies that adopt or use technology to improve their cost structure, revenue opportunities or competitive advantage (“Technology Tollkeeper” companies). Because the Fund concentrates its investments in certain specific industries, the Fund is subject to greater risk of loss as a result of adverse economic, business or other developments affecting those industries than if its investments were more diversified across different industries. Stock prices of internet and internet-related companies in particular may be especially volatile. The securities of small- and mid-capitalization companies involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements. Different investment styles (e.g., “growth”) tend to shift in and out of favor, and at times the Fund may underperform other funds that invest in similar asset classes.

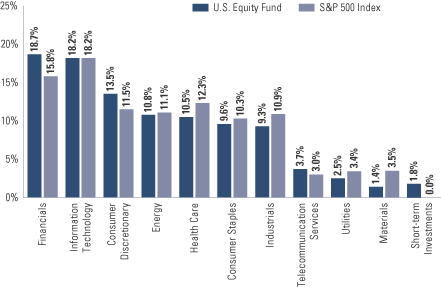

The Goldman Sachs U.S. Equity Fund invests primarily in large-capitalization U.S. equity investments. The Fund’s equity investments are subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. Different investment styles (e.g., “growth” and “value”) tend to shift in and out of favor, and at times the Fund may underperform other funds that invest in similar asset classes.

2

GOLDMAN SACHS FUNDAMENTAL EQUITY GROWTH FUNDS

What Differentiates the Goldman Sachs Growth Team’s Investment Process?

For over 30 years, the Goldman Sachs Growth Team has consistently applied a three-step investment process based on our belief that wealth is created through the long-term ownership of growing businesses.

| n | | Make decisions as long-term business owners rather than as stock traders |

| n | | Perform in-depth, fundamental research |

| n | | Focus on long-term structural and competitive advantages |

Result

Performance driven by the compounding growth of businesses over time — not short-term market movements

Long-term participation in growing businesses — less reliance on macroeconomic predictions, market timing, sector rotation or momentum

Identify high quality growth businesses. Some required investment criteria include:

| n | | Established brand names |

| n | | Recurring revenue streams |

| n | | Long product life cycles |

| n | | Favorable long-term growth prospects |

Result

Investments in businesses that we believe are strategically positioned for consistent, sustainable long-term growth

| n | | Perform rigorous valuation analysis of every potential investment |

| n | | Use valuation tools and analytics to ensure that the high-quality business franchises we have identified also represent sound investments |

Result

Good investment decisions based on solid understanding of what each business is worth

Attractive buying opportunities as the stock prices of quality growth businesses fluctuate over time

Effective April 17, 2013, alongside Steve Barry, the CIO of the Growth Equity team, the portfolio managers for the Growth Equity Funds will be:

| | n | | Capital Growth, Concentrated Growth, Focused Growth and Strategic Growth Funds — Tim Leahy and Steve Becker |

| | n | | Flexible Cap Growth, Growth Opportunities, Small/Mid Cap Growth and Technology Tollkeeper Funds — Jeff Rabinowitz |

3

MARKET REVIEW

Goldman Sachs Fundamental Equity Growth Funds

Market Review

Overall, U.S. equities advanced for the six months ended February 28, 2013 (the “Reporting Period”) with broad sector participation. The Standard & Poor’s 500® Index (the “S&P 500 Index”) ended the Reporting Period with a gain of 8.95%, and the Russell 3000® Index generated a return of 9.97%.

As the Reporting Period began in September 2012, U.S. equities were in the midst of a rally that had begun in the summer of 2012 following assurance of ongoing easing monetary policy from the Federal Reserve Board (the “Fed”) and the European Central Bank. However, the U.S. equity market then pulled back in October 2012 on some cautious corporate earnings guidance and uncertainty surrounding the U.S. presidential election. Also pressuring the U.S. equity market was the worst storm in decades battering the East Coast.

The U.S. equity market subsequently regained momentum in November 2012, as election day largely preserved the status quo in the White House and Congress and economic data continued to show signs of improvement. More specifically, the U.S. reported better than expected third calendar quarter Gross Domestic Product growth of 2%, the 13th consecutive quarter of economic expansion, and the unemployment rate dropped to 7.8%, the lowest rate seen since January 2009. U.S. manufacturing activity increased, and the housing market showed further signs of improvement, as construction of new homes hit a four-year high. In December 2012, further clarification from the Fed, tying its low interest rate policy, in part, to the condition that unemployment drop to 6.5% or lower, helped to offset increasing worries about the then-looming fiscal cliff of tax increases and spending cuts. Following weeks of tense negotiations and technically falling off the fiscal cliff for one day, the U.S. Congress finally reached an agreement averting the full force of tax increases that were scheduled to take effect on January 1, 2013. While spending cuts and other important fiscal issues were not truly addressed but merely postponed, the passage of The American Taxpayer Relief Act (ATRA) of 2012 did resolve some lingering uncertainties.

The U.S. equity market rally picked up steam in the first two months of 2013, with the S&P 500 Index reaching a five-year high and then a new record level and the Dow Jones Industrial Average hitting the 14,000 milestone. Further strengthening in home prices and improving U.S. employment data lifted markets, despite the realization that no deal would be reached in Washington D.C. to avoid the sequester, or automatic spending cuts, scheduled by the federal government to go into effect on March 1, 2013.

For the Reporting Period overall, mid-cap companies performed best with small-cap companies close behind. While generating solid positive returns, large-cap stocks followed at some distance. Value stocks significantly outpaced growth stocks across the capitalization spectrum. (All as measured by Russell Investments indices.) Within the S&P 500 Index, nine of ten sectors made gains during the Reporting Period. The consistent and persistent commitment to accommodative monetary policy from the U.S. Fed and other central banks throughout the Reporting Period drove market leading returns in the financials sector. On optimism about the economy and improved consumer confidence, the industrials, health care and consumer discretionary sectors also posted double-digit gains. The information technology sector was the only one to decline during the Reporting Period, largely due to some weaker than expected corporate earnings reports.

4

MARKET REVIEW

Looking Ahead

With the U.S. equity market trading near all-time highs at the end of the Reporting Period, we continue to use our bottom-up, fundamental research process to drive our investment decisions for the Funds rather than sentiment or headlines. Even after a strong start to 2013, many of the reasons we began the Reporting Period constructive on U.S. equities still held true at the end of the Reporting Period. First, corporate balance sheets remained strong, which we believe provides companies with the ability to generate shareholder value, even in a slow-growth economic environment. Second, the S&P 500 Index was trading below its historical average price to earnings (P/E) ratio, while its dividend yield was greater than the yield on the 10-year U.S. Treasury bond. Third, continued strength in the U.S. housing recovery should, in our view, provide further support to the economy and boost confidence among consumers.

Of course, risks remain. Fiscal policy will likely be a drag on U.S. economic growth as 2013 progresses. Further, with the ultimate direction of fiscal policy still unclear, there is the potential for political headlines, in both the U.S. and overseas, to impact the U.S. equity market. We have long been cautious regarding companies that have a high degree of government dependency, whether it is related to sales, subsidies or regulations.

We believe companies with strong business franchises and competitive advantages may provide some degree of stability against an uncertain backdrop. As always, deep research resources, a forward-looking investment process and truly actively managed portfolios are keys, in our view, to both preserving capital and outperforming the market over the long term.

5

PORTFOLIO RESULTS

Goldman Sachs Capital Growth Fund

Portfolio Composition

The Fund invests primarily in U.S. equity investments. Since the Fund’s inception, the Goldman Sachs Growth Investment Team has focused on several key investment criteria that it believes can drive a company’s growth over the long term. These characteristics are: dominant market share, established brand name, pricing power, recurring revenue stream, free cash flow, high returns on invested capital, predictable growth, sustainable growth, long product life cycle, enduring competitive advantage, favorable demographic trends and excellent management. The Team strives to purchase these companies at reasonable valuations in order to capture the full benefits of their growth.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Growth Investment Team discusses the Goldman Sachs Capital Growth Fund’s (the “Fund”) performance and positioning for the six-month period ended February 28, 2013 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, B, C, Institutional, Service, IR and R Shares generated cumulative total returns, without sales charges, of 7.17%, 6.79%, 6.74%, 7.38%, 7.14%, 7.31% and 7.02%, respectively. These returns compare to the 6.23% cumulative total return of the Fund’s benchmark, the Russell 1000® Growth Index (with dividends reinvested) (the “Russell Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Stock selection overall contributed most to the Fund’s performance relative to the Russell Index during the Reporting Period. |

| Q | | Which equity market sectors most significantly affected Fund performance? |

| A | | Effective stock selection in the information technology, financials and consumer staples sectors helped the Fund’s performance most relative to the Russell Index. Detracting from the Fund’s relative results most was having underweighted positions in industrials and materials, each of which outperformed the Russell Index during the Reporting Period, and weak stock selection in the energy sector. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The Fund benefited most relative to the Russell Index from positions in global commercial real estate services firm CBRE Group, biotechnology company Gilead Sciences and software giant Microsoft. |

| | | CBRE Group contributed most to the Fund’s relative performance during the Reporting Period. Its shares rose on the heels of announcing a solid fourth calendar quarter, during which earnings beat analysts’ expectations. In addition, CBRE Group published positive guidance for 2013. At the end of the Reporting Period, we believed the company still had strong growth potential, as it was gaining market share and continued to boost margins through international expansion. Additionally, in our view, the deal struck by CBRE Group to buy a majority of the real estate investment management business of Dutch financial company ING Group should be beneficial, as it provides relatively stable assets under management, recurring revenues and solid margins. |

| | | Gilead Sciences was a top contributor to the Fund’s relative performance during the Reporting Period. In our view, the company is a dominant player in the HIV and hepatitis C treatment areas, and indeed it was positive pipeline development in these areas that drove the company’s strong performance during the Reporting Period. At the end of the Reporting Period, we continued to have high conviction in the company, as we believed it was well positioned within the biotechnology industry, holding significant market share in several niche areas. In our view, Gilead Sciences remained attractively valued at the end of the Reporting Period given its strong pipeline and dominant HIV franchise. |

6

PORTFOLIO RESULTS

| | | Microsoft was a strong contributor to the Fund’s performance during the Reporting Period despite the stock underperforming the Russell Index. As we had been reducing the Fund’s position during the Reporting Period and ultimately exited the position completely, the Fund’s underweighted allocation compared to the Russell Index contributed positively to relative results. During the Reporting Period, Microsoft announced disappointing fiscal first quarter results caused by slower than expected enterprise adoption of the Windows 8 operating system. Investors were also disappointed by the sudden departure of the head of the Windows division. This departure was unexpected, as he was viewed by many as a potential chief executive officer successor. We exited the Fund’s position in Microsoft prior to this announcement, based on our view of slower anticipated growth ahead and limited traction in the mobile computing industry. While Microsoft pays an attractive dividend and should continue to generate large amounts of free cash flow, we believe its flagship Windows product is maturing. We also see the changes being driven by mobile and cloud computing potentially leading to disruptions in the company’s markets. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Detracting most from the Fund’s results relative to its benchmark index were positions in personal computer and mobile communications device giant Apple, point-of-sale card payment device manufacturer VeriFone Systems and retail electronic payments network operator Visa. |

| | | A position in Apple detracted most from the Fund’s returns during the Reporting Period. Shares of Apple pulled back as concern persisted around disappointing first calendar quarter iPhone guidance. The iPhone accounts for approximately 60% of the company’s gross profits and remains the key driver of Apple’s growth. At the end of the Reporting Period, we continued to have a positive outlook on the company and saw a number of potential catalysts that could contribute to additional growth. We believe an iPhone that targets the emerging market consumer could reaccelerate growth and help expand the overall market for Apple products. We also believe the market is discounting the optionality in Apple’s stock from new product introductions. (Optionality is the value of additional optional investment opportunities available only after having made an initial investment.) In addition, there is the possibility that Apple could sign a deal with China Mobile, the largest wireless carrier in China with approximately 700 million subscribers. Were this to be realized, this deal could significantly expand the addressable market for Apple’s iPhone. Even as near-term expectations are reduced, we believe the company’s long-term growth potential is still greater than the broader market. We believe Apple has plenty of financial flexibility with its strong balance sheet and healthy free cash flow to return capital to shareholders. Overall, then, we remain positive on Apple and believed, at the end of the Reporting Period, that its stock was trading at a reasonable valuation for a high quality franchise with solid growth potential. |

| | | VeriFone Systems was another significant detractor from the Fund’s relative results during the Reporting Period. Its shares declined sharply following a revenue and earnings miss and a disappointing outlook for the fiscal first quarter of 2013. In our view, the results highlight the challenges the company is facing in migrating from a hardware business to a services business and demonstrate its management’s failure to integrate recent acquisitions. As a result, we exited the Fund’s position in VeriFone Systems by the end of the Reporting Period. |

| | | Visa, a new position for the Fund during the Reporting Period, was a relative detractor from results, given the Fund’s underweight position in this strongly performing stock. In October 2012, the company announced a new chief executive officer, named Charles Scharf, which we viewed as a positive. Visa also reported a solid fiscal first quarter driven by earnings and net revenue growth that exceeded analysts’ expectations. The company also extended its existing partnership with JPMorgan Chase for another ten years. |

7

PORTFOLIO RESULTS

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we did not use derivatives as part of an active management strategy. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | We initiated a Fund position in Activision Blizzard, a leading publisher of gaming software and content, during the Reporting Period. Activision Blizzard owns three of the largest franchises in the electronic gaming industry — Call of Duty and Skylanders on console and World of Warcraft on personal computer. World of Warcraft is offered through a monthly subscription model that provides a large and reliable stream of cash flow, which, in turn, can be used to invest for growth in newer intellectual properties. In our view, these newer properties, including Call of Duty and Skylanders, and upcoming new releases have margin structures that are higher than the corporate average, which should drive Activision Blizzard’s operating margins higher if the company grows over the next few years as anticipated. In addition, we believe the company’s valuations were attractive at the time of purchase. |

| | | We established a Fund position in Allergan, a health care company focused on developing pharmaceuticals, biologics, medical devices and over-counter products. Continued strong growth in key franchises as well as regulatory successes drove the company’s share price appreciation during the Reporting Period. In our view, Allergan has stable growth franchises in ophthalmology and botox for therapeutic and cosmetic applications. Furthermore, we believe the company has a strong pipeline, include DARPins (designed ankyrin repeat proteins) for wet macular degeneration and diabetic macular edema, which could produce significant long-term growth opportunities. |

| | | Conversely, in addition to the sale of Microsoft, already mentioned, we eliminated the Fund’s position in specialty retailer Urban Outfitters during the Reporting Period. Shares of Urban Outfitters rose after the company announced strong results during a mid-quarter update during the fourth calendar quarter. While we still have conviction in the company, its story was becoming more understood by the market and thus the valuation gap narrowed in our view. Therefore, we exited the Fund’s position. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | In constructing the Fund’s portfolio, we focus on picking stocks rather than on making industry or sector bets. We seek to outpace the benchmark index by overweighting stocks that we expect to outperform and underweighting those that we think may lag. Consequently, changes in its sector weights are generally the direct result of individual stock selection or of stock appreciation or depreciation. That said, during the Reporting Period, the Fund’s exposure to consumer discretionary, consumer staples, industrials, financials, information technology and telecommunication services increased and its allocations to energy, health care and materials decreased relative to the Russell Index. |

| Q | | How was the Fund positioned relative to its benchmark index at the end of February 2013? |

| A | | At the end of February 2013, the Fund had an overweighted position relative to the Russell Index in the financials sector. On the same date, the Fund had underweighted positions compared to the Russell Index in industrials and materials. The Fund was rather neutrally weighted to the Russell Index in information technology, consumer discretionary, telecommunication services, energy, health care and consumer staples and had no position at all in utilities on February 28, 2013. |

8

FUND BASICS

Capital Growth Fund

as of February 28, 2013

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | September 1, 2012–February 28, 2013 | | Fund Total Return

(based on NAV)1 | | | Russell 1000

Growth Index2 | |

| | Class A | | | 7.17 | % | | | 6.23 | % |

| | Class B | | | 6.79 | | | | 6.23 | |

| | Class C | | | 6.74 | | | | 6.23 | |

| | Institutional | | | 7.38 | | | | 6.23 | |

| | Service | | | 7.14 | | | | 6.23 | |

| | Class IR | | | 7.31 | | | | 6.23 | |

| | | Class R | | | 7.02 | | | | 6.23 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Russell 1000 Growth Index (with dividends reinvested) is an unmanaged index that measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 12/31/12 | | One Year | | | Five Years | | Ten Years | | Since Inception | | Inception Date |

| | Class A | | | 12.01 | % | | 0.73% | | 5.39% | | 8.27% | | 4/20/90 |

| | Class B | | | 12.62 | | | 0.71 | | 5.34 | | 5.82 | | 5/01/96 |

| | Class C | | | 16.63 | | | 1.12 | | 5.20 | | 3.54 | | 8/15/97 |

| | Institutional | | | 18.96 | | | 2.29 | | 6.41 | | 4.72 | | 8/15/97 |

| | Service | | | 18.40 | | | 1.78 | | 5.88 | | 8.46 | | 8/15/97 |

| | Class IR | | | 18.82 | | | 2.13 | | N/A | | 2.23 | | 11/30/07 |

| | | Class R | | | 18.26 | | | 1.63 | | N/A | | 1.73 | | 11/30/07 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class B Shares (5% maximum declining to 0% after six years) and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Class B Shares automatically convert to Class A Shares on or about the fifteenth day of the last month of the calendar year that is eight years after purchase. Returns for Class B Shares for the period after the conversion reflect the performance of Class A Shares. Because Institutional, Service, Class IR and Class R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. The Fund’s Class B Shares are no longer available for purchase by new or existing shareholders (although current Class B shareholders may continue to reinvest income and capital gains distributions into Class B Shares, and Class B shareholders may continue to exchange their shares for Class B Shares of certain other Goldman Sachs Funds). |

| | | | The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

9

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | | | | | | | | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.14 | % | | | 1.48 | % |

| | Class B | | | 1.89 | | | | 2.23 | |

| | Class C | | | 1.89 | | | | 2.23 | |

| | Institutional | | | 0.74 | | | | 1.08 | |

| | Service | | | 1.24 | | | | 1.58 | |

| | Class IR | | | 0.89 | | | | 1.23 | |

| | | Class R | | | 1.39 | | | | 1.73 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least December 29, 2013, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 2/28/135 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Apple, Inc. | | | 7.3 | % | | Computers & Peripherals |

| | Google, Inc. Class A | | | 4.1 | | | Internet Software & Services |

| | QUALCOMM, Inc. | | | 3.4 | | | Communications Equipment |

| | Schlumberger Ltd. | | | 2.6 | | | Energy Equipment & Services |

| | Honeywell International, Inc. | | | 2.5 | | | Aerospace & Defense |

| | Philip Morris International, Inc. | | | 2.5 | | | Tobacco |

| | American Tower Corp. | | | 2.4 | | | Real Estate Investment Trusts |

| | Amazon.com, Inc. | | | 2.3 | | | Internet & Catalog Retail |

| | NIKE, Inc. Class B | | | 2.3 | | | Textiles, Apparel & Luxury

Goods |

| | | SBA Communications Corp. Class A | | | 2.3 | | | Wireless Telecommunication

Services |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

10

FUND BASICS

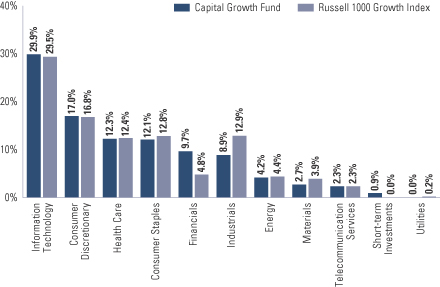

| | |

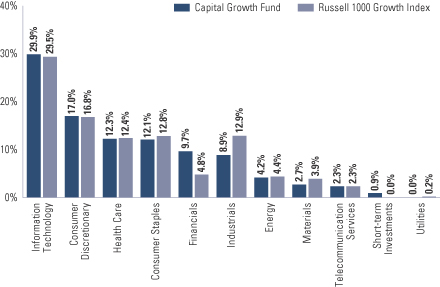

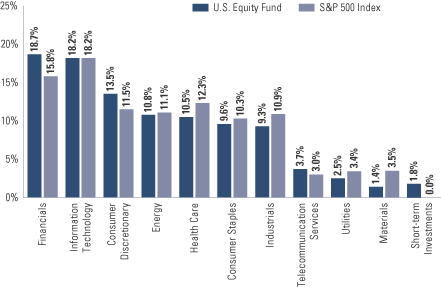

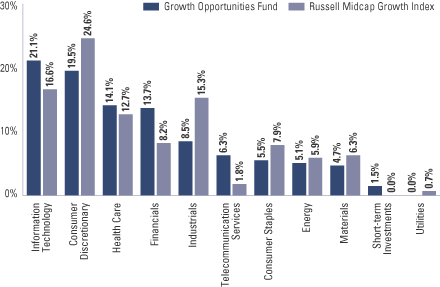

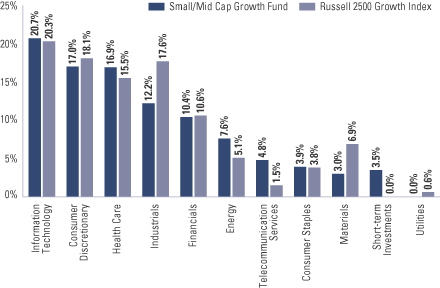

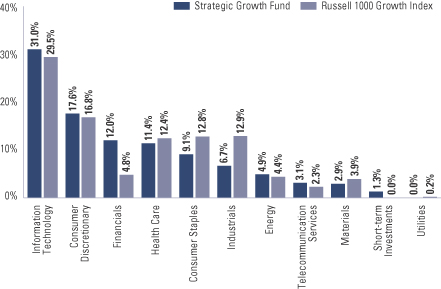

| FUND VS. BENCHMARK SECTOR ALLOCATION6 | | |

| As of February 28, 2013 | | |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the graph above. The graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. Short-term investments represent repurchase agreements. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

11

PORTFOLIO RESULTS

Goldman Sachs Concentrated Growth Fund

Portfolio Composition

The Fund invests primarily in U.S. equity investments. The Fund typically holds 30–40 high quality growth companies and tends to be more concentrated in individual holdings, industries and sectors than the typical broadly diversified large-cap growth fund. Since the Fund’s inception, the Goldman Sachs Growth Investment Team has focused on several key investment criteria that it believes can drive a company’s growth over the long term. These characteristics are: dominant market share, established brand name, pricing power, recurring revenue stream, free cash flow, high returns on invested capital, predictable growth, sustainable growth, long product life cycle, enduring competitive advantage, favorable demographic trends and excellent management. The Team strives to purchase these companies at reasonable valuations in order to capture the full benefits of their growth.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Growth Investment Team discusses the Goldman Sachs Concentrated Growth Fund’s (the “Fund”) performance and positioning for the six-month period ended February 28, 2013 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, B, C, Institutional, IR and R Shares generated cumulative total returns, without sales charges, of 7.66%, 7.32%, 7.33%, 7.91%, 7.80% and 7.62%, respectively. These returns compare to the 6.23% cumulative total return of the Fund’s benchmark, the Russell 1000® Growth Index (with dividends reinvested) (the “Russell Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Stock selection overall contributed most to the Fund’s performance relative to the Russell Index during the Reporting Period. |

| Q | | Which equity market sectors most significantly affected Fund performance? |

| A | | Effective stock selection in the information technology, financials and consumer staples sectors helped the Fund’s performance most relative to the Russell Index. Detracting from the Fund’s relative results most was weak stock selection in the health care and materials sectors and having underweighted positions in industrials and health care, each of which outperformed the Russell Index during the Reporting Period. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The Fund benefited most relative to the Russell Index from positions in global commercial real estate services firm CBRE Group, gaming software and content publisher Activision Blizzard and apparel and footwear company PVH. |

| | | CBRE Group contributed most to the Fund’s relative performance during the Reporting Period. Its shares rose on the heels of announcing a solid fourth calendar quarter, during which earnings beat analysts’ expectations. In addition, CBRE Group published positive guidance for 2013. At the end of the Reporting Period, we believed the company still had strong growth potential, as it was gaining market share and continued to boost margins through international expansion. Additionally, in our view, the deal struck by CBRE Group to buy a majority of the real estate investment management business of Dutch financial company ING Group should be beneficial, as it provides relatively stable assets under management, recurring revenues and solid margins. |

| | | Activision Blizzard, a new position for the Fund during the Reporting Period, was a top contributor to its relative results. Activision Blizzard owns three of the largest franchises in the electronic gaming industry — Call of Duty and Skylanders on console and World of Warcraft on personal computer. World of Warcraft is offered through a monthly subscription model that provides a large and reliable stream of cash flow, which, in turn, can be used to invest for growth in newer intellectual properties. In our view, these newer properties, including Call of Duty and Skylanders, and |

12

PORTFOLIO RESULTS

| | upcoming new releases have margin structures that are higher than the corporate average, which should drive Activision Blizzard’s operating margins higher if the company grows over the next few years as anticipated. In addition, we believe the company’s valuations were attractive at the time of purchase. During the Reporting Period, the company reported solid fourth calendar quarter results, driven by strong performance in key franchises. Its management announced its Skylanders franchise crossed the $1 billion revenue threshold following its launch in 2011, while its Call of Duty franchise grew year-over-year and saw increases in online engagement for Black Ops 2, particularly in December 2012. |

| | | PVH is an apparel company whose portfolio of brands includes Calvin Klein, Tommy Hilfiger, Van Heusen and IZOD, amongst others. Its shares performed well during the Reporting Period after the company announced its strategic acquisition of rival Warnaco Group. Warnaco Group had licensed Calvin Klein’s jeans from PVH, which bought Calvin Klein’s company from the designer in 2003. Analysts, including ours, believe the deal should be substantially accretive to earnings per share upon completion, as it will give the company full control of the Calvin Klein brand and expand PVH’s presence in Europe, Asia and Latin America. PVH’s stock also performed well as both the Tommy Hilfiger and Calvin Klein brands continued to demonstrate high growth both in the U.S. and in international markets. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Detracting most from the Fund’s results relative to its benchmark index were positions in personal computer and mobile communications device giant Apple, computer storage and data management company NetApp and generic drug manufacturer Teva Pharmaceutical Industries. |

| | | A position in Apple detracted most from the Fund’s returns during the Reporting Period. Shares of Apple pulled back as concern persisted around disappointing first calendar quarter iPhone guidance. The iPhone accounts for approximately 60% of the company’s gross profits and remains the key driver of Apple’s growth. At the end of the Reporting Period, we continued to have a positive outlook on the company and saw a number of potential catalysts that could contribute to additional growth. We believe an iPhone that targets the emerging market consumer could reaccelerate growth and help expand the overall market for Apple products. We also believe the market is discounting the optionality in Apple’s stock from new product introductions. (Optionality is the value of additional optional investment opportunities available only after having made an initial investment.) In addition, there is the possibility that Apple could sign a deal with China Mobile, the largest wireless carrier in China with approximately 700 million subscribers. Were this to be realized, this deal could significantly expand the addressable market for Apple’s iPhone. Even as near-term expectations are reduced, we believe the company’s long-term growth potential is still greater than the broader market. We believe Apple has plenty of financial flexibility with its strong balance sheet and healthy free cash flow to return capital to shareholders. Overall, then, we remain positive on Apple and believed, at the end of the Reporting Period, that its stock was trading at a reasonable valuation for a high quality franchise with solid growth potential. |

| | | NetApp was another significant detractor from the Fund’s relative results during the Reporting Period despite posting an in-line fiscal third quarter 2012 and giving positive guidance. We believe that fears of weak demand from the U.S. government were an overhang on the stock, as the government represents approximately 15% of NetApp’s revenues. However, at the end of the Reporting Period, we continued to like the business and thought its management was executing well. In our view, the combination of already low expectations and any real improvement in the demand environment should support the company’s growth. |

| | | Teva Pharmaceutical Industries detracted from the Fund’s results relative to the Russell Index during the Reporting Period. The company has a high concentration of profits in a single product, Copaxone. Concerns arose that a new pill from Biogen Idec and the threat of generics to Copaxone would challenge the firm’s profitability. However, we believe Teva Pharmaceutical Industries is competitively well positioned in the industry given its expansive global footprint and its ability to launch products earlier than other generics manufacturers. In our view, Teva Pharmaceutical Industries benefits from economies of scale and also produces about half of the active ingredients used in their products, enabling the company to keep costs low. We further believe the company’s strong free cash flow generation gives it financial flexibility. |

13

PORTFOLIO RESULTS

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we did not use derivatives as part of an active management strategy. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | In addition to the purchase of Activision Blizzard, already mentioned, we initiated a Fund position in Intercontinental Exchange, an operator of regulated futures exchanges, over-the-counter (“OTC”) markets and derivatives clearing houses. We believe the globalization of markets, rising demand for commodities, movement toward clearing and post-trade automation, and need for better risk management amidst an uncertain macro environment should drive Intercontinental Exchange’s growth going forward. |

| | | Conversely, we exited the Fund’s position in social networking website operator Facebook, as we came to believe its path to growth has been extended and is less certain. While the company delivered in-line second calendar quarter earnings on a strong increase in ad revenue, payments revenue growth was challenged and a large amount of insider selling, due to the expiration of the lock-up, caused material weakness in the stock. (Underwriters in Initial Public Offerings (“IPOs”) and insiders of the issuing company agree on lock-ups to prevent insiders from selling their stock within a given time window after the IPO. This time window normally amounts to 180 days. The lock-up agreement attempts to ensure the stability of the issuing company and to align insiders’ incentives with the goals of the company. After the expiration of the lock-up period, insiders are free to sell but potentially have to take into account insider regulation.) The Fund’s position in Facebook detracted from its relative returns during the Reporting Period. In our view, Facebook has achieved tremendous scale in the U.S. and has a large market opportunity as its networking effect creates stickiness, or loyalty, in its user, or customer, base. Though we continue to believe Facebook is well positioned to benefit from targeted advertising on its platform as a result of the information it has on its users as well as the potential to monetize new ad formats and the social networking ad medium over time, we sold the position. |

| | | We sold the Fund’s position in beauty products company Avon Products during the Reporting Period. Avon Products’ stock performed poorly, and thus detracted from the Fund’s results, due to the company’s difficulties executing and managing inventory in key markets. The company’s new chief executive officer, Sheri McCoy, made it clear that the organization she inherited was dysfunctional in a number of ways and communicated a frank assessment of the business as it stands today. She stated that she believes company fundamentals are unlikely to improve during the second half of 2013. While we continue to believe in the growth opportunity of Avon Products’ direct selling model and its research and development capabilities, we also believe improvements will likely require a lot of investment during a time when cost pressures in the business remain fairly significant. We are optimistic about the company’s new management team and its ability to improve past weakness. However, in our view, new products will need to work in order to reinvigorate top-line growth and create operating leverage. Given the variability in outcomes that we perceive and the headwinds the company is facing, we decided to exit the position. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | In constructing the Fund’s portfolio, we focus on picking stocks rather than on making industry or sector bets. We seek to outpace the benchmark index by overweighting stocks that we expect to outperform and underweighting those that we think may lag. Consequently, changes in its sector weights are generally the direct result of individual stock selection or of stock appreciation or depreciation. That said, during the Reporting Period, the Fund’s exposure to information technology increased and its allocations to financials, energy, consumer staples, health care and industrials decreased relative to the Russell Index. |

| Q | | How was the Fund positioned relative to its benchmark index at the end of February 2013? |

| A | | At the end of February 2013, the Fund had overweighted positions relative to the Russell Index in the financials, information technology, energy and telecommunication services sectors. On the same date, the Fund had underweighted positions compared to the Russell Index in industrials, health care, consumer staples, consumer discretionary and materials. The Fund had no position at all in the utilities sector on February 28, 2013. |

14

FUND BASICS

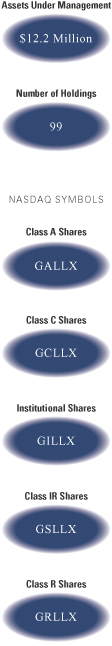

Concentrated Growth Fund

as of February 28, 2013

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | September 1, 2012–February 28, 2013 | | Fund Total Return

(based on NAV)1 | | | Russell 1000

Growth Index2 | |

| | Class A | | | 7.66 | % | | | 6.23 | % |

| | Class B | | | 7.32 | | | | 6.23 | |

| | Class C | | | 7.33 | | | | 6.23 | |

| | Institutional | | | 7.91 | | | | 6.23 | |

| | Class IR | | | 7.80 | | | | 6.23 | |

| | | Class R | | | 7.62 | | | | 6.23 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Russell 1000 Growth Index (with dividends reinvested) is an unmanaged index that measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 12/31/12 | | One Year | | | Five Years | | Ten Years | | Since Inception | | Inception Date |

| | Class A | | | 12.80 | % | | 0.10% | | 5.11% | | 5.07% | | 9/03/02 |

| | Class B | | | 13.57 | | | 0.08 | | 5.05 | | 5.04 | | 9/03/02 |

| | Class C | | | 17.49 | | | 0.48 | | 4.92 | | 4.85 | | 9/03/02 |

| | Institutional | | | 19.84 | | | 1.64 | | 6.13 | | 6.07 | | 9/03/02 |

| | Class IR | | | 19.68 | | | 1.46 | | N/A | | 1.44 | | 11/30/07 |

| | | Class R | | | 19.08 | | | 0.99 | | N/A | | 0.97 | | 11/30/07 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class B Shares (5% maximum declining to 0% after six years) and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Class B Shares automatically convert to Class A Shares on or about the fifteenth day of the last month of the calendar year that is eight years after purchase. Returns for Class B Shares for the period after the conversion reflect the performance of Class A Shares. Because Institutional, Service, Class IR and Class R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. The Fund’s Class B Shares are no longer available for purchase by new or existing shareholders (although current Class B shareholders may continue to reinvest income and capital gains distributions into Class B Shares, and Class B shareholders may continue to exchange their shares for Class B Shares of certain other Goldman Sachs Funds). |

| | | | The returns represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our Web site at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

15

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | | | | | | | | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.26 | % | | | 1.57 | % |

| | Class B | | | 2.01 | | | | 2.32 | |

| | Class C | | | 2.01 | | | | 2.32 | |

| | Institutional | | | 0.86 | | | | 1.17 | |

| | Class IR | | | 1.01 | | | | 1.32 | |

| | | Class R | | | 1.51 | | | | 1.82 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least December 29, 2013, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 2/28/135 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Apple, Inc. | | | 7.7 | % | | Computers & Peripherals |

| | Google, Inc. Class A | | | 6.2 | | | Internet Software & Services |

| | QUALCOMM, Inc. | | | 6.2 | | | Communications Equipment |

| | American Tower Corp. | | | 5.3 | | | Real Estate Investment Trusts |

| | Schlumberger Ltd. | | | 5.1 | | | Energy Equipment & Services |

| | CBRE Group, Inc. Class A | | | 3.6 | | | Real Estate Management &

Development |

| | Crown Castle International Corp. | | | 3.6 | | | Wireless Telecommunication Services |

| | NIKE, Inc. Class B | | | 3.6 | | | Textiles, Apparel & Luxury Goods |

| | Costco Wholesale Corp. | | | 3.4 | | | Food & Staples Retailing |

| | | Activision Blizzard, Inc. | | | 3.4 | | | Software |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

16

FUND BASICS

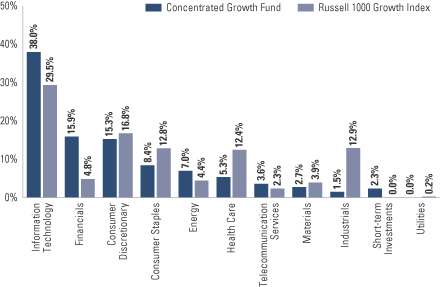

| | |

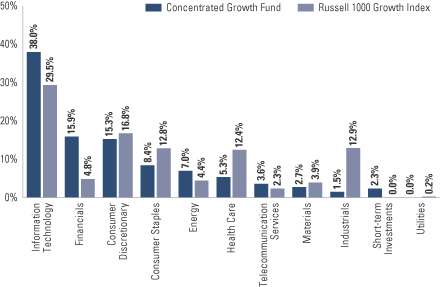

| FUND VS. BENCHMARK SECTOR ALLOCATION6 | | |

| As of February 28, 2013 | | |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. Short-term investments represent repurchase agreements. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

17

PORTFOLIO RESULTS

Goldman Sachs Flexible Cap Growth Fund

Portfolio Composition

The Fund invests primarily in U.S. equity investments in small-, mid- and large-capitalization issuers. Since the Fund’s inception, the Goldman Sachs Growth Investment Team has focused on several key investment criteria that it believes can drive a company’s growth over the long term. These characteristics are: dominant market share, established brand name, pricing power, recurring revenue stream, free cash flow, high returns on invested capital, predictable growth, sustainable growth, long product life cycle, enduring competitive advantage, favorable demographic trends and excellent management. The Team strives to purchase these companies at reasonable valuations in order to capture the full benefits of their growth.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Growth Investment Team discusses the Goldman Sachs Flexible Cap Growth Fund’s (the “Fund”) performance and positioning for the six-month period ended February 28, 2013 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, IR and R Shares generated cumulative total returns, without sales charges, of 7.11%, 6.80%, 7.41%, 7.36% and 7.01%, respectively. These returns compare to the 6.62% cumulative total return of the Fund’s benchmark, the Russell 3000® Growth Index (with dividends reinvested) (the “Russell Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Stock selection overall contributed most to the Fund’s performance relative to the Russell Index during the Reporting Period. |

| Q | | Which equity market sectors most significantly affected Fund performance? |

| A | | Effective stock selection in the financials, information technology and consumer staples sectors helped the Fund’s performance most relative to the Russell Index. Detracting from the Fund’s relative results most was weak stock selection in the consumer discretionary and health care sectors and having underweighted positions in industrials and health care, each of which outpaced the Russell Index during the Reporting Period. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The Fund benefited most relative to the Russell Index from positions in global commercial real estate services firm CBRE Group, software giant Microsoft and apparel and footwear company PVH. |

| | | CBRE Group contributed most to the Fund’s relative performance during the Reporting Period. Its shares rose on the heels of announcing a solid fourth calendar quarter, during which earnings beat analysts’ expectations. In addition, CBRE Group published positive guidance for 2013. At the end of the Reporting Period, we believed the company still had strong growth potential, as it was gaining market share and continued to boost margins through international expansion. Additionally, in our view, the deal struck by CBRE Group to buy a majority of the real estate investment management business of Dutch financial company ING Group should be beneficial, as it provides relatively stable assets under management, recurring revenues and solid margins. |

| | | Microsoft was a strong contributor to the Fund’s performance during the Reporting Period despite the stock underperforming the Russell Index. As we had been reducing the Fund’s position during the Reporting Period and ultimately exited the position completely, the Fund’s underweighted allocation compared to the Russell Index contributed positively to relative results. During the Reporting Period, Microsoft announced disappointing fiscal first quarter results caused by slower than expected enterprise |

18

PORTFOLIO RESULTS

| | adoption of the Windows 8 operating system. Investors were also disappointed by the sudden departure of the head of the Windows division. This departure was unexpected, as he was viewed by many as a potential chief executive officer successor. We exited the Fund’s position in Microsoft prior to this announcement, based on our view of slower anticipated growth ahead and limited traction in the mobile computing industry. While Microsoft pays an attractive dividend and should continue to generate large amounts of free cash flow, we believe its flagship Windows product is maturing. We also see the changes being driven by mobile and cloud computing potentially leading to disruptions in the company’s markets. |

| | | PVH is an apparel company whose portfolio of brands includes Calvin Klein, Tommy Hilfiger, Van Heusen and IZOD, amongst others. Its shares performed well during the Reporting Period after the company announced its strategic acquisition of rival Warnaco Group. Warnaco Group had licensed Calvin Klein’s jeans from PVH, which bought Calvin Klein’s company from the designer in 2003. Analysts, including ours, believe the deal should be substantially accretive to earnings per share upon completion, as it will give the company full control of the Calvin Klein brand and expand PVH’s presence in Europe, Asia and Latin America. PVH’s stock also performed well as both the Tommy Hilfiger and Calvin Klein brands continued to demonstrate high growth both in the U.S. and in international markets. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Detracting most from the Fund’s results relative to its benchmark index were positions in personal computer and mobile communications device giant Apple, point-of-sale card payment device manufacturer VeriFone Systems and information technology integrated systems company Micros Systems. |

| | | A position in Apple detracted most from the Fund’s returns during the Reporting Period. Shares of Apple pulled back as concern persisted around disappointing first calendar quarter iPhone guidance. The iPhone accounts for approximately 60% of the company’s gross profits and remains the key driver of Apple’s growth. At the end of the Reporting Period, we continued to have a positive outlook on the company and saw a number of potential catalysts that could contribute to additional growth. We believe an iPhone that targets the emerging market consumer could reaccelerate growth and help expand the overall market for Apple products. We also believe the market is discounting the optionality in Apple’s stock from new product introductions. (Optionality is the value of additional optional investment opportunities available only after having made an initial investment.) In addition, there is the possibility that Apple could sign a deal with China Mobile, the largest wireless carrier in China with approximately 700 million subscribers. Were this to be realized, this deal could significantly expand the addressable market for Apple’s iPhone. Even as near-term expectations are reduced, we believe the company’s long-term growth potential is still greater than the broader market. We believe Apple has plenty of financial flexibility with its strong balance sheet and healthy free cash flow to return capital to shareholders. Overall, then, we remain positive on Apple and believed, at the end of the Reporting Period, that its stock was trading at a reasonable valuation for a high quality franchise with solid growth potential. |

| | | VeriFone Systems, a new position for the Fund during the Reporting Period, was another significant detractor from the Fund’s relative results. Its shares declined sharply following a revenue and earnings miss and a disappointing outlook for the fiscal first quarter of 2013. In our view, the results highlight the challenges the company is facing in migrating from a hardware business to a services business and demonstrate its management’s failure to integrate recent acquisitions. As a result, we exited the Fund’s position in VeriFone Systems by the end of the Reporting Period. |

| | | Micros Systems is a designer, manufacturer and servicer of enterprise information solutions. Its shares were weak during the Reporting Period as fiscal uncertainty affected the company’s underlying customer base of hospitality providers, retailers and restaurants. Despite the near-term weakness, the company maintained dominant market share with high margins at the end of the Reporting Period and, in our view, was well capitalized. The company also generated recurring revenue through the high-touch servicing it provides to clients. We believe Micros Systems operates a unique franchise that is well positioned for growth as the company appears to be increasing its customer base through new contracts with hotel chains and expanding its business globally. |

19

PORTFOLIO RESULTS

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we did not use derivatives as part of an active management strategy. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | We established a Fund position in Philip Morris International during the Reporting Period. Philip Morris International produces, sells, distributes and markets a wide range of branded cigarettes and tobacco products. In our view, the company has a fundamentally attractive business with price inelasticity for its products and an industry structure that supports persistent pricing power. We believe the company has an attractive geographic profile, with approximately two-thirds of its volume and half of its revenues coming from emerging markets. In our view, Philip Morris International is led by a competent management team that has been successful in producing robust free cash flow and returns on invested capital while aggressively returning cash to shareholders through dividends and buybacks. |

| | | We initiated a Fund position in Activision Blizzard, a leading publisher of gaming software and content, during the Reporting Period. Activision Blizzard owns three of the largest franchises in the electronic gaming industry — Call of Duty and Skylanders on console and World of Warcraft on personal computer. World of Warcraft is offered through a monthly subscription model that provides a large and reliable stream of cash flow, which, in turn, can be used to invest for growth in newer intellectual properties. In our view, these newer properties, including Call of Duty and Skylanders, and upcoming new releases have margin structures that are higher than the corporate average, which should drive Activision Blizzard’s operating margins higher if the company grows over the next few years as anticipated. In addition, we believe the company’s valuations were attractive at the time of purchase. |

| | | Conversely, in addition to the sale of Microsoft, already mentioned, we eliminated the Fund’s position in specialty retailer Urban Outfitters during the Reporting Period. Shares of Urban Outfitters rose after the company announced strong results during a mid-quarter update during the fourth calendar quarter. While we still have conviction in the company, its story was becoming more understood by the market and thus the valuation gap narrowed in our view. Therefore, we exited the Fund’s position. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | In constructing the Fund’s portfolio, we focus on picking stocks rather than on making industry or sector bets. We seek to outpace the benchmark index by overweighting stocks that we expect to outperform and underweighting those that we think may lag. Consequently, changes in its sector weights are generally the direct result of individual stock selection or of stock appreciation or depreciation. That said, during the Reporting Period, the Fund’s exposure to consumer staples, health care and industrials increased and its allocations to financials, information technology, energy and consumer discretionary decreased relative to the Russell Index. |

| Q | | How was the Fund positioned relative to its benchmark index at the end of February 2013? |

| A | | At the end of February 2013, the Fund had an overweighted position relative to the Russell Index in the financials sector. On the same date, the Fund had underweighted positions compared to the Russell Index in industrials, consumer staples and health care and was rather neutrally weighted to the Russell Index in information technology, materials, telecommunication services, energy and consumer discretionary. The Fund had no position at all in the utilities sector on February 28, 2013. |

20

FUND BASICS

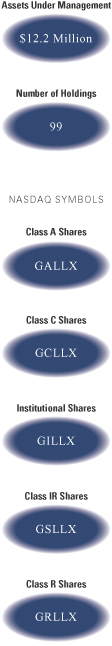

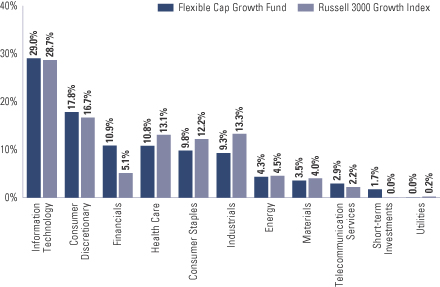

Flexible Cap Growth Fund

as of February 28, 2013

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | September 1, 2012–February 28, 2013 | | Fund Total Return

(based on NAV)1 | | | Russell 3000

Growth Index2 | |

| | Class A | | | 7.11 | % | | | 6.62 | % |

| | Class C | | | 6.80 | | | | 6.62 | |

| | Institutional | | | 7.41 | | | | 6.62 | |

| | Class IR | | | 7.36 | | | | 6.62 | |

| | | Class R | | | 7.01 | | | | 6.62 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The unmanaged Russell 3000 Growth Index (with dividends reinvested) measures the performance of the 3,000 largest U.S. companies based on total market capitalization. The Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 12/31/12 | | One Year | | | Since Inception | | Inception Date |

| | Class A | | | 12.42 | % | | 4.50% | | 1/31/08 |

| | Class C | | | 16.99 | | | 4.98 | | 1/31/08 |

| | Institutional | | | 19.48 | | | 6.16 | | 1/31/08 |

| | Class IR | | | 19.28 | | | 6.01 | | 1/31/08 |

| | | Class R | | | 18.68 | | | 5.48 | | 1/31/08 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Class IR and Class R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

| | | | The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

21

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | | | | | | | | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.26 | % | | | 3.14 | % |

| | Class C | | | 2.01 | | | | 3.89 | |

| | Institutional | | | 0.86 | | | | 2.74 | |

| | Class IR | | | 1.01 | | | | 2.89 | |

| | | Class R | | | 1.51 | | | | 3.39 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least December 29, 2013, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 2/28/135 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Apple, Inc. | | | 6.7 | % | | Computers & Peripherals |

| | Google, Inc. Class A | | | 3.9 | | | Internet Software & Services |

| | QUALCOMM, Inc. | | | 3.3 | | | Communications Equipment |

| | Schlumberger Ltd. | | | 2.7 | | | Energy Equipment & Services |

| | SBA Communications Corp. Class A | | | 2.1 | | | Wireless Telecommunication Services |

| | Costco Wholesale Corp. | | | 2.0 | | | Food & Staples Retailing |

| | American Tower Corp. | | | 1.9 | | | Real Estate Investment Trusts |

| | NIKE, Inc. Class B | | | 1.7 | | | Textiles, Apparel & Luxury Goods |

| | CBRE Group, Inc. Class A | | | 1.6 | | | Real Estate Management &

Development |

| | | Amazon.com, Inc. | | | 1.6 | | | Internet & Catalog Retail |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

22

FUND BASICS

| | |

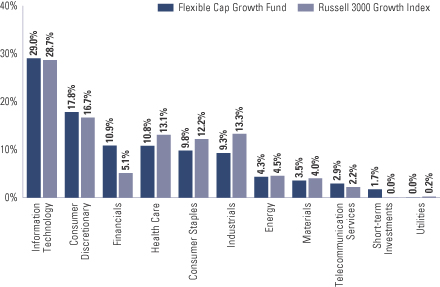

| FUND VS. BENCHMARK SECTOR ALLOCATION6 | | |

| As of February 28, 2013 | | |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. Short-term investments represent repurchase agreements. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

23

PORTFOLIO RESULTS

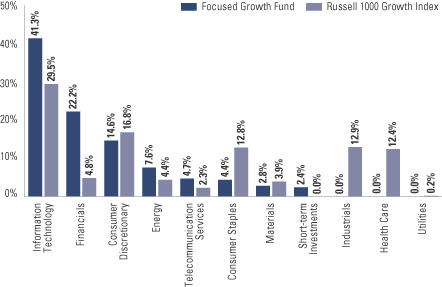

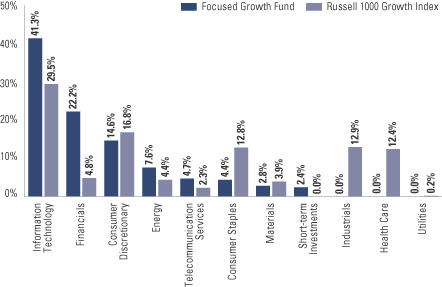

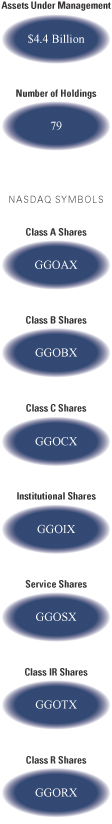

Goldman Sachs Focused Growth Fund

Portfolio Composition

The Fund invests primarily in U.S. equity investments. Since the Fund’s inception, the Goldman Sachs Growth Investment Team has focused on several key investment criteria that it believes can drive a company’s growth over the long term. These characteristics are: dominant market share, established brand name, pricing power, recurring revenue stream, free cash flow, high returns on invested capital, predictable growth, sustainable growth, long product life cycle, enduring competitive advantage, favorable demographic trends and excellent management. The Team strives to purchase these companies at reasonable valuations in order to capture the full benefits of their growth.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Growth Investment Team discusses the Goldman Sachs Focused Growth Fund’s (the “Fund”) performance and positioning for the six-month period ended February 28, 2013 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, IR and R Shares generated cumulative total returns, without sales charges, of 9.65%, 9.16%, 9.84%, 9.68% and 9.48%, respectively. These returns compare to the 6.23% cumulative total return of the Fund’s benchmark, the Russell 1000® Growth Index (with dividends reinvested) (the “Russell Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Stock selection overall contributed most to the Fund’s performance relative to the Russell Index during the Reporting Period. |

| Q | | Which equity market sectors most significantly affected Fund performance? |

| A | | Effective stock selection in the financials, information technology and consumer discretionary sectors helped the Fund’s performance most relative to the Russell Index. Having an overweighted exposure to the financials sector, which outpaced the Russell Index, also boosted the Fund’s relative results. Detracting from the Fund’s relative results most was having no exposure to the industrials and health care sectors, each of which outperformed the Russell Index during the Reporting Period. To a lesser extent, weak stock selection in and having an underweighted allocation to the materials sector also hurt. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The Fund benefited most relative to the Russell Index from positions in global commercial real estate services firm CBRE Group, apparel and footwear company PVH and gaming software and content publisher Activision Blizzard. |