UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive,

Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

Copies to: |

Caroline Kraus | | Geoffrey R.T. Kenyon, Esq. |

Goldman, Sachs & Co. | | Dechert LLP |

200 West Street | | 200 Clarendon Street |

New York, New York 10282 | | 27th Floor |

| | Boston, MA 02116-5021 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: August 31

Date of reporting period: February 28, 2013

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Stockholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | February 28, 2013 |

| | |

| | | | Global Tax-Aware Equity Portfolios |

| | | | Enhanced Dividend Global Equity Portfolio |

| | | | Tax-Advantaged Global Equity Portfolio |

| | | | |

| | | | |

| | | | |

Goldman Sachs Global Tax-Aware Equity Portfolios

| n | | ENHANCED DIVIDEND GLOBAL EQUITY PORTFOLIO |

| n | | TAX-ADVANTAGED GLOBAL EQUITY PORTFOLIO |

| | | | |

TABLE OF CONTENTS | | | | |

| |

Principal Investment Strategies and Risks | | | 1 | |

| |

Market Review | | | 2 | |

| |

Portfolio Management Discussion and Performance Summaries | | | 7 | |

| |

Schedules of Investments | | | 17 | |

| |

Financial Statements | | | 19 | |

| |

Financial Highlights | | | 22 | |

| |

Notes to Financial Statements | | | 26 | |

| |

Other Information | | | 40 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS GLOBAL TAX-AWARE EQUITY PORTFOLIOS

Principal Investment Strategies and Risks

This is not a complete list of risks that may affect the Portfolios. For additional information concerning the risks applicable to the Portfolios, please see the Portfolios’ Prospectus.

The Goldman Sachs Enhanced Dividend Global Equity Portfolio invests primarily in affiliated domestic and international equity and fixed income funds (“Underlying Funds”). The Portfolio will also invest directly in other securities, including exchange-traded funds. The Portfolio is intended for investors who want current income. The Portfolio expects to invest primarily in underlying equity funds and equity securities with a blend of domestic large cap, small cap and international exposure, and expects to invest a relatively significant percentage of this equity allocation in the Goldman Sachs U.S. Equity Dividend and Premium and Goldman Sachs International Equity Dividend and Premium Funds, which employ call writing strategies and have an emphasis on dividend paying stocks. In addition, the Portfolio will have a small strategic allocation in U.S. investment grade bonds, which may consist of an investment in the Goldman Sachs Core Fixed Income Fund, the Goldman Sachs High Yield Fund or other fixed income securities. The Portfolio may also engage in short selling. Short sales involve the risk of an unlimited increase in the market value of the security sold short, which could result in a theoretically unlimited loss.

The Portfolio is subject to the risk factors of the Underlying Funds in direct proportion to its investments in those Underlying Funds, and the ability of the Portfolio to meet its investment objective is directly related to the ability of the Underlying Funds to meet their investment objectives, as well as the allocation among those Underlying Funds by the Investment Adviser. An Underlying Fund is subject to the risks associated with its investments, including (as applicable) those associated with equity, fixed income, foreign and derivative investments generally. From time to time, the Underlying Funds in which the Portfolio invests, and the size of the investments in the Underlying Funds, may change. Because the Portfolio is subject to the Underlying Fund expenses as well as its own expenses, the cost of investing in the Portfolio may be higher than investing in a mutual fund that only invests directly in stocks and bonds.

The Goldman Sachs Tax-Advantaged Global Equity Portfolio invests primarily in affiliated domestic and international equity and fixed income funds (“Underlying Funds”). The Portfolio will also invest directly in other securities, including exchange-traded funds. The Portfolio is intended for investors who wish to minimize short-term gains and defer long-term gains. The Portfolio expects to invest primarily in underlying equity funds and equity securities with a blend of domestic large cap, small cap and international exposure, and expects to invest a relatively significant percentage of this equity allocation in the Goldman Sachs Structured Tax- Managed Equity and Goldman Sachs Structured International Tax-Managed Equity Funds. In addition, the Portfolio will have a small strategic allocation in U.S. investment grade bonds, which may consist of an investment in the Goldman Sachs Core Fixed Income Fund, the Goldman Sachs High Yield Fund or other fixed income securities. The Portfolio may also engage in short selling. Short sales involve the risk of an unlimited increase in the market value of the security sold short, which could result in a theoretically unlimited loss. No assurance can be offered that the Portfolio’s tax-managed strategies will reduce the amount of taxable income and capital gains distributed by the Portfolio to shareholders.

The Portfolio is subject to the risk factors of the Underlying Funds in direct proportion to its investments in those Underlying Funds, and the ability of the Portfolio to meet its investment objective is directly related to the ability of the Underlying Funds to meet their investment objectives, as well as the allocation among those Underlying Funds by the Investment Adviser. An Underlying Fund is subject to the risks associated with its investments, including (as applicable) those associated with equity, fixed income, foreign and derivative investments generally. From time to time, the Underlying Funds in which the Portfolio invests, and the size of the investments in the Underlying Funds, may change. Because the Portfolio is subject to the Underlying Fund expenses as well as its own expenses, the cost of investing in the Portfolio may be higher than investing in a mutual fund that only invests directly in stocks and bonds.

1

MARKET REVIEW

Goldman Sachs Global Tax-Aware Equity Portfolios

|

| |

| Investment Strategy |

| |

| The Portfolios invest in a strategic mix of Underlying Funds and other securities with the goal of achieving long-term growth of capital (both Portfolios) and current income (Enhanced Dividend Global Equity Portfolio only). Under normal conditions, at least 80% of the Portfolios’ net assets plus any borrowings for investment purposes will be allocated among the Underlying Equity Funds and equity securities with a blend of domestic large-cap, small-cap and international exposure, to seek capital appreciation. The Portfolios may also invest directly in other securities and instruments, including unaffiliated exchange-traded funds. Under normal circumstances, each of the Portfolios also has a small strategic allocation to U.S. investment grade bonds and can use these investments for implementing tactical tilts. |

Market Review

Accommodative monetary policies by global central banks supported the performance of the equity and fixed income markets during the six months ended February 28, 2013 (“the Reporting Period”).

U.S. Equity Markets

As the Reporting Period began in September 2012, U.S. equities were in the midst of a rally that had begun during the summer of 2012 following assurances of ongoing easy monetary policy from the Federal Reserve Board (the “Fed”) and the European Central Bank (“ECB”). However, the U.S. equity market then pulled back in October 2012 on some cautious corporate earnings guidance and uncertainty surrounding the U.S. presidential election. Also pressuring the U.S. equity market was the worst storm in decades battering the East Coast.

The U.S. equity market subsequently regained momentum in November 2012, as election day largely preserved the status quo in the White House and Congress and economic data continued to show signs of improvement. More specifically, the U.S. reported better than expected third calendar quarter Gross Domestic Product (“GDP”) growth of 2%, the 13th consecutive quarter of economic expansion, and the unemployment rate dropped to 7.8%, the lowest rate seen since January 2009. U.S. manufacturing activity increased, and the housing market showed further signs of improvement, as construction of new homes hit a four-year high. In December 2012, further clarification from the Fed, tying its low interest rate policy, in part, to the condition that unemployment drop to 6.5% or lower, helped to offset increasing worries about the then-looming fiscal cliff of tax increases and spending cuts. Following weeks of tense negotiations and technically falling off the fiscal cliff for one day, the U.S. Congress finally reached an agreement averting the full force of tax increases that were scheduled to take effect on January 1, 2013. While spending cuts and other important fiscal issues were not truly addressed but merely postponed, the passage of The American Taxpayer Relief Act (ATRA) of 2012 did resolve some lingering uncertainties.

2

MARKET REVIEW

The U.S. equity market rally picked up steam in the first two months of 2013, with the S&P 500® Index reaching a five-year high and then a new record level and the Dow Jones Industrial Average hitting the 14,000 milestone. Further strengthening in home prices and improving U.S. employment data lifted markets, despite the realization that no deal would be reached in Washington D.C. to avoid the sequester, or automatic spending cuts, scheduled to go into effect on March 1, 2013.

For the Reporting Period overall, the S&P 500® Index (with dividends reinvested) gained 8.95%, and the Russell 3000® Index recorded a return of 9.97%. From a capitalization perspective, U.S. mid-cap stocks performed best with small-cap stocks close behind. While generating solid positive returns, U.S. large-cap stocks followed at some distance. Value stocks significantly outperformed growth stocks across the capitalization spectrum. (All as measured by Russell Investments indices.) The consistent and persistent commitment to accommodative monetary policy from the Fed and other central banks throughout the Reporting Period drove market leading returns in the financials sector. On optimism about the economy and improved consumer confidence, the industrials, health care and consumer discretionary sectors also posted double-digit gains. The information technology sector was the only one to decline during the Reporting Period, largely due to some weaker than expected corporate earnings reports.

International Equity Markets

When the Reporting Period began, the bull market in international equities that had begun during the summer of 2012 continued, fueled by a number of positive developments around the world. Positive sentiment about Spain’s plan to restructure its banks, as well as an agreement among European Union (“EU”) finance ministers to reschedule some of Greece’s debt and release aid to that country, lifted European equity markets through the end of 2012. Market sentiment continued to improve and by early 2013, bond yields in the EU peripheral countries were down significantly from their highs during the summer of 2012, with the yield on the Greek 10-year government bond dropping below 10% for the first time in more than two years. In addition, competitiveness and trade imbalances appeared to be improving in the peripheral countries and economic activity within the EU appeared to be increasing, though from low levels.

In February 2013, the lack of a clear winner in Italy’s general elections renewed concerns about that nation’s ability to improve its economy and about the fate of the EU as a whole. The U.K.’s loss of its AAA debt rating and reports of fourth quarter 2012 economic contractions in Germany and France weighed on European equity markets and the euro. In addition, a Eurozone flash purchasing manager’s index (“PMI”) reading at the end of the February 2013 dimmed hopes from earlier in the year that the EU was squarely back on the path to economic growth.

3

MARKET REVIEW

The Japanese equity market rose sharply during the Reporting Period on optimism that its newly elected prime minister would focus on weakening the yen and establishing an inflation target. Haruhiko Kuroda, a critic of the Bank of Japan’s (“BoJ”) failure to end deflation and a supporter of balance sheet expansion to meet inflation targets, was nominated to head the BoJ. By early 2013, following the Japanese government’s announcement of a ¥103 trillion stimulus package, the yen weakened to its lowest level against the U.S. dollar in two and a half years. A weak yen is perceived as good for Japan’s export-oriented economy, and in fact, Japanese exports increased in January 2013 for the first time in eight months as the weak yen made Japanese goods more competitive in the global marketplace. However, a weakening yen reduced equity returns expressed in U.S. dollars.

The international equity markets, as represented by the MSCI EAFE Index (net), returned 14.41% during the Reporting Period. All regions contributed to the strong performance. Asia-ex-Japan, as measured by the MSCI All Country Asia ex Japan Index (net, USD, unhedged, with dividends reinvested), was the best performing region in U.S. dollars during the Reporting Period, led by strong returns in Australia. From a sector perspective within the MSCI Europe, Australasia, Far East (EAFE) Index, financials was by far the best performer and the biggest contributor to overall performance. Cyclical sectors such as materials and consumer discretionary also performed well, while more defensive sectors such as telecommunication services and utilities underperformed the broader market.

Fixed Income Markets

Spread sectors (that is, non-U.S. Treasury sectors) rallied during the Reporting Period overall. U.S. government bonds weakened, with the benchmark 10-year U.S. Treasury yield rising 33 basis points (a basis point is 1/100th of a percent) from 1.56% to 1.89%.

Monetary policy stimulus was the driving factor in the spread sector rally. During September 2012, the Fed announced open-ended purchases of agency mortgage-backed securities in a third round of quantitative easing (“QE3”), and the ECB pledged to purchase potentially unlimited amounts of distressed government bonds in secondary markets with its Outright Monetary Transactions (“OMT”) program. These easing measures helped assuage investors’ concerns about the slow-moving U.S. economy and the potential for a financial crisis in the Eurozone and also gave fresh impetus to the hunt for yield in an exceptionally low interest rate environment.

Spread sectors weathered the political uncertainty leading into the November 6, 2012 U.S. elections, which returned Barack Obama to the Presidency and slightly increased the Democratic majority in the Senate. However, the rally faltered after the election, due in part to the unwinding of trades that would have benefited from a Mitt Romney victory. With the elections over, fixed income investors focused their attention on negotiations between lawmakers to avert the fiscal cliff — automatic tax increases and spending cuts scheduled to take effect at year-end 2012. Concern about the fiscal cliff benefited U.S. Treasuries. The 10-year U.S. Treasury yield, for example, dropped nine basis points to 1.62% during November 2012.

4

MARKET REVIEW

Despite a lack of clarity on U.S. fiscal policy, spread sectors recovered in December 2012. The monetary policy outlook remained accommodative — the Fed confirmed that sales of short-maturity U.S. Treasuries would cease at year-end 2012 with the expiration of Operation Twist but that its purchases of longer-maturity securities would continue at a pace of $45 billion a month. At the same time, the Fed abandoned its previous calendar guidance on short-term interest rates in favor of an outcome-based approach focusing on inflation and unemployment levels. Investors’ risk appetite also benefited from improved economic data. U.S. home prices continued to rise in December 2012, and non-farm payrolls numbers were better than expected, with the unemployment rate dropping to 7.7%. Among spread sectors, high yield corporate credit was the strongest performer in December 2012, overtaking a rally in investment grade corporate bonds that had occurred during September and October 2012.

In January 2013, investor risk appetite benefited further from a last-minute deal on the fiscal cliff. U.S. lawmakers agreed to extend the Bush-era tax cuts for all but the highest income earners. U.S. Treasury yields rose in January 2013 for a second month in a row, with the 10-year U.S. Treasury yield climbing 22 basis points to 1.98%.

During February 2013, risk appetite cooled, and the prices of U.S. Treasury securities rebounded, mainly because of concerns about U.S. fiscal policy gridlock and global market volatility as potentially driven by Italy’s upcoming elections. U.S. lawmakers appeared unwilling to reach a compromise on spending cuts and revenue raising measures, which had been held over from the fiscal cliff debate, and more rancorous talks loomed on a potential debt ceiling increase during the second quarter of 2013.

For the Reporting Period overall, higher yielding sectors generally outperformed U.S. Treasuries. In the U.S. fixed income market, high yield corporate bonds, as represented by the Barclays U.S. High Yield Bond Index (2% Cap), recorded a gain of 6.67%. U.S. mortgage-backed securities posted a small decline, with the Barclays U.S. Securitized Index returning -0.01% during the Reporting Period. The global fixed income market, as represented by the Barclays Global Aggregate Bond Index (U.S. dollar hedged), returned 1.35% during the Reporting Period. Emerging markets debt, as measured by the JP Morgan EMBI Global Diversified Index, returned 2.76%. Local emerging markets debt, as represented by the J.P. Morgan GBI-EM Global Diversified Index (U.S. dollar hedged), returned 7.28%.

Looking Ahead

Within the U.S. economy, we see a divergence between private sector growth and public sector drag. At the end of the Reporting Period, the private sector was growing organically at around 3.5% to 4%, and there had been significant gains in equity prices and house prices. We believe that going forward business investment is likely to provide as strong a contribution to 2013 growth as housing did during 2012, though concern about tax increases and spending cuts appear to have delayed the pickup. At the end of the Reporting Period, the impact from fiscal tightening had been less than feared, but there are likely more spending cuts to come. In our opinion, the increase in payroll taxes will trim 1.5% from consumption, and the net impact of sequestration cuts on GDP will be between -0.3% and -0.5%. Possible offsets to the fiscal drag include the possibility that consumers will draw down on savings to compensate for the impact of a higher payroll tax (a view supported by retail sales figures in January and February 2013) and the increased contribution to economic growth from general construction spending due to the housing market recovery.

5

MARKET REVIEW

Investor sentiment about China, which tends to fluctuate sharply, was positive at the end of the Reporting Period, largely because growth concerns had eased and the leadership handover within the nation was a smooth one. We see the potential for another negative swing in sentiment, as food prices drive Chinese inflation higher, raising the prospect of more tightening by China’s central bank. We believe China’s economic growth should reach 8% in 2013 but its momentum appears to no longer be strengthening, and we see the pace of its economic growth slipping to 7.6% in 2014.

The policy-driven depreciation of the yen appears to be having a positive economic impact in Japan. Exports have recovered somewhat, though headwinds of the territorial dispute with China over the Diaoyu/Senkaku islands remain. We expect Japan’s current account (that is, its net income) to stabilize and perhaps improve in the months ahead.

Our economic outlook for the Eurozone remains negative, as we believe growth in the region will remain close to zero for the foreseeable future. We think that Italy will probably need to restructure its debt, and that France faces a likely recession. The main risks to the Eurozone, in our view, include Germany’s elections, Italy’s politics and financial sector reform. On the positive side, debt/budget trajectories are moving in the right direction, and Eurozone current accounts and competitiveness are improving.

The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation.

6

PORTFOLIO RESULTS

Goldman Sachs Enhanced Dividend

Global Equity Portfolio

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Quantitative Investment Strategies Team discusses the Goldman Sachs Enhanced Dividend Global Equity Portfolio’s (the “Portfolio”) performance and positioning for the six-month period ended February 28, 2013 (the “Reporting Period”).

| Q | | How did the Portfolio perform during the Reporting Period? |

| A | | During the Reporting Period, the Portfolio’s Class A and Institutional Shares generated cumulative total returns, without sales charges, of 8.35% and 8.65%, respectively. |

| | These returns compare to the 10.24% cumulative total return of the Enhanced Dividend Global Equity (“EDGE”) Composite Index (“EDGE Composite Index”) over the same time period. The EDGE Composite Index is comprised of the Barclays U.S. Aggregate Bond Index (10%), the MSCI All Country World Index (ACWI), ex North America® (30%) and the Russell 3000® Index (60%). |

| | The components of the Portfolio’s blended benchmark generated cumulative total returns of 0.15%, 14.24% and 9.97% for the Barclays U.S. Aggregate Bond Index, the MSCI ACWI, ex North America® and the Russell 3000® Index, respectively, during the same period. |

| Q | | What key factors affected the Portfolio’s performance during the Reporting Period? |

| A | | Although tactical asset allocation decisions added to relative returns, the Portfolio underperformed the EDGE Composite Index during the Reporting Period. In keeping with its investment process, the Portfolio had a significant percentage of its equity allocation invested in two Underlying Funds, the Goldman Sachs U.S. Equity Dividend and Premium Fund and the Goldman Sachs International Equity Dividend and Premium Fund, which each employ call writing strategies and have an emphasis on dividend paying stocks. As stock markets appreciated during the Reporting Period, the index call writing strategy of both these Underlying Funds detracted from the Portfolio’s performance. |

| | Stock selection within the Underlying Funds detracted from the Portfolio’s returns. In addition to the two Underlying Funds mentioned above, two others of the five Underlying Funds we use to implement our strategic allocation decisions underperformed their respective benchmark indices. One of the five Underlying Funds we use to implement our strategic allocation decisions outperformed its benchmark index during the Reporting Period. |

| Q | | How did Global Tactical Asset Allocation decisions affect the Portfolio’s performance during the Reporting Period? |

| A | | The implementation of our tactical views contributed positively to performance. The Portfolio was underweight U.S. investment grade bonds. It was overweight U.S. high yield corporate bonds. The Fed’s decision to keep short-term interest rates near zero until certain unemployment and/or inflation data points are reached suggested to us that investors’ search for yield would continue — to the benefit of high yield corporate bonds, which at the end of the Reporting Period had yields to maturity (or, redemption yields) of approximately 6.6%. High yield corporate spreads (or, yield differentials to U.S. Treasuries) were near the historic median, a level that we believe implies a default rate of nearly 4%. In our opinion, the actual default rate would have to be more than 8% — even if we assume a conservative recovery rate by bondholders of 35% — to fully erode these spread levels. |

| | The Portfolio was overweight the U.S. banking sector through an exchange traded fund (“ETF”), which appreciated in value during the Reporting Period. We believed U.S. bank stocks had attractive valuations relative to their historical performance and relative to the broad U.S. equity market. Furthermore, bank credit costs have been falling, early-stage delinquencies continued to improve and banks have been fortifying their balance sheets. |

| | Because we saw several sources of downside risk to the stocks in the S&P® 500 Index, the Portfolio had an allocation to April 2013 S&P® 500 Index put options. (S&P® 500 Index put options have an underlying value that is equal to the full value on the day of purchase of the S&P® 500 Index.) Although truly adverse downside risks appear to have been mitigated by global central bank action, such as the Fed’s QE3 and the ECB’s OMT programs, we anticipated several other sources of potential downside risk to come into focus in the months ahead, including Italy’s elections in March 2013, the initiation of sequester-related spending cuts in the U.S., and the risk of a U.S. government shutdown if temporary spending authority was not extended. In addition, during January 2013, when we initiated the Portfolio’s S&P® 500 |

7

PORTFOLIO RESULTS

| | Index put options position, U.S. equity market volatility had collapsed, with the VIX (a measure of the implied volatility of S&P® 500 Index options) dropping to near 13. As a result, the cost of purchasing the April 2013 S&P® 500 Index put options was low by historical standards. |

| | The Portfolio was overweight the Japanese and European equity markets during the Reporting Period. The Portfolio was overweight Japanese equities because we believed their valuations were attractive. Japanese stocks had been trading at a discount to their own historical performance and relative to U.S. and international stocks. Also, we believed that Japanese corporate earnings would outgrow the corporate earnings in other major regions, thanks to government policy changes, supportive domestic economic growth, Japan’s exposure to emerging markets growth and high profit margins. The Portfolio was overweight European equities because of what we considered to be attractive valuations. During the Reporting Period, the Euro Stoxx 50® Index (which covers 50 blue chip stocks from 12 Eurozone countries) was trading near its 2003 and 2009 lows, and European stock valuations stood well within the lower quartile of their historical levels on both an absolute basis and relative to U.S. stocks. Additionally, the European equity market offered a dividend yield of approximately 5%, which we believed added a margin of downside protection for the Portfolio. Although the Eurozone still faces many challenges, financial stress seemed to be abating as result of policy changes within the European Union and a reduction in the pace of European bank deleveraging. In addition, nearly half the sales of Euro Stoxx 50® Index companies are overseas. The Portfolio’s weightings in the European and Japanese equity markets were implemented through investment in stock futures. (A stock future, which is traded on an exchange, is a contract that obligates a buyer to purchase stock at a predetermined future date and price.) |

| | Through an allocation to the Goldman Sachs Emerging Markets Debt Fund, we adopted an overweight position in emerging markets debt. We believe the global financial crisis has increased the relative structural attractiveness of emerging markets bonds. The debt burden of the emerging markets is widely projected to be much lower than that of G-10 (Group of Ten) economies in the next decade. (The Group of Ten economies, though so-called, are actually eleven, namely Belgium, Canada, France, Germany, Italy, Japan, the Netherlands, Sweden, Switzerland, the U.K. and the U.S.) However, in our view, emerging markets debt spreads relative to U.S. Treasuries remained attractive. We believe demand for emerging markets local debt should increase because emerging markets countries are for the first time showing the ability to manage their monetary and fiscal policies, which should help them navigate the global business cycle better than many had expected. |

| Q | | How did the Portfolio’s Underlying Funds perform relative to their respective benchmark indices during the Reporting Period? |

| A | | Four of the five Underlying Funds we use to express our strategic views within the Portfolio underperformed their respective benchmark indices during the Reporting Period. Two of the Underlying Funds that underperformed in relative terms — the Goldman Sachs U.S. Equity Dividend and Premium Fund and the Goldman Sachs International Equity Dividend Fund — were those in which the Portfolio invested a significant percentage of its equity allocation. The Goldman Sachs U.S. Equity Dividend and Premium Fund underperformed its benchmark, the S&P 500® Index (with dividends reinvested), by approximately 3.44%. The Goldman Sachs International Equity Dividend and Premium Fund underperformed its benchmark, the MSCI EAFE Index, by approximately 2.45% during the Reporting Period. The Goldman Sachs Structured Small Cap Equity Fund and the Goldman Sachs Structured International Small Cap Equity Fund also underperformed their respective benchmark indices. The Goldman Sachs Structured Emerging Markets Equity Fund outperformed its benchmark index during the Reporting Period. |

| Q | | How did call writing affect performance? |

| A | | As mentioned above, the Portfolio’s two largest allocations were to the Goldman Sachs U.S. Equity Dividend and Premium Fund and the Goldman Sachs International Equity Dividend and Premium Fund, which earn premiums through an equity index call writing strategy. When equity markets are down, flat or only modestly positive, these Underlying Funds tend to outperform their respective benchmark indices because of the premiums they earn from call writing. When equity markets rally strongly, these two Underlying Funds are likely to trail their respective benchmark indices. Although the Underlying Funds keep the premiums they earn from call writing, they can underperform when the call options are exercised. |

8

| | The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation. |

PORTFOLIO RESULTS

| | The U.S. and international equity markets appreciated during the Reporting Period and the call writing strategy of both Underlying Funds detracted from performance as call options were exercised. |

| Q | | How did the Portfolio use derivatives and similar instruments during the Reporting Period? |

| A | | The Portfolio used equity index futures, equity swap contracts and equity index options. Equity index futures were used to implement our views on the Japanese and European stock markets. Equity swap contracts were used to implement the Portfolio’s tactical tilt in Financial Times Stock Exchange 100 share index (the “FTSE 100”) dividend futures, a position we eliminated during the Reporting Period. Equity index options were used to implement the Portfolio’s position in S&P® 500 Index put options. We used forward foreign currency exchange contracts to take a long position in the Chinese renminbi, a position we eliminated during the Reporting Period. In addition, some of the Portfolio’s Underlying Funds used derivatives during the Reporting Period to apply their active investment views with greater versatility and to afford greater risk management precision. As market conditions warranted during the Reporting Period, some of these Underlying Funds engaged in forward foreign currency exchange contracts, financial futures contracts, options and swap contracts to enhance portfolio return and for hedging purposes. |

| Q | | What changes did you make during the Reporting Period within both the equity and fixed income portions of the Portfolio? |

| A | In September 2012, we increased the Portfolio’s overweight in European equities through an investment in Euro Stoxx 50® Index futures. At the same time, we reduced the Portfolio’s allocations to investment grade fixed income through the Goldman Sachs Core Fixed Income Fund and to U.S. equities through the Goldman Sachs U.S. Equity Dividend and Premium Fund and the Goldman Sachs Structured Small Cap Equity Fund. |

| | At the beginning of the Reporting Period, the Portfolio had a position in FTSE 100 dividend futures, implemented through equity swap contracts. The dividend futures market allows investors to take a view on the amount of dividends that a specific company or index of companies will pay over the course of a calendar year. We eliminated the position in October 2012. |

| | During November 2012, we decreased the Portfolio’s exposure to high yield corporate bonds by reducing its allocation to the Goldman Sachs High Yield Fund. We reallocated the proceeds to investment grade fixed income through the Goldman Sachs Core Fixed Income Fund. Also in November 2012, we allowed the Portfolio’s allocation to the Chinese renminbi to mature. We had initiated the position in October 2011. In December 2012, we allowed the Portfolio’s position in December 2012 S&P® 500 Index put options, which we had initiated in August 2012, to expire. |

| | During January 2013, we decreased the Portfolio’s overweighted exposure to Japanese equities and invested the proceeds into investment grade fixed income through the Goldman Sachs Core Fixed Income Fund. Later that month, we purchased April 2013 S&P® 500 Index put options at a strike price of 1500. (For put options, the strike price is the price at which shares can be sold.) We funded the position by reducing the Portfolio’s allocation to investment grade fixed income through the Goldman Sachs Core Fixed Income Fund. |

| Q | | What was the Portfolio’s tactical view and strategy at the end of the Reporting Period? |

| A | | As of February 28, 2013, the Portfolio — through its holdings in equity index futures — was overweight the Japanese and European stock markets. It was overweight large-cap U.S. bank stocks through an investment in an ETF. The Portfolio held a position in S&P® 500 Index put options. In fixed income, through allocations to the Underlying Funds, the Portfolio held an overweighted position in high yield securities and an underweighted position in investment grade securities. It was overweight emerging markets debt relative to the EDGE Composite Index. |

9

FUND BASICS

Enhanced Dividend Global Equity Portfolio

as of February 28, 2013

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | September 1, 2012–February 28, 2013 | | Portfolio Total Return

(based on NAV)1 | | | EDGE Composite

Index2 | |

| | Class A | | | 8.35 | % | | | 10.24 | % |

| | | Institutional | | | 8.65 | | | | 10.24 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Portfolio (ex-dividend) divided by the total number of shares of the class outstanding. The Portfolio’s performance reflects the reinvestment of dividends and other distributions. The Portfolio’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The EDGE Composite Index is comprised of the Barclays U.S. Aggregate Bond Index (10%), the MSCI ACWI Index, ex North America® (30%) and the Russell 3000® Index (60%). The Index figures do not reflect any deduction of fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. |

| | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 12/31/12 | | | | One Year | | | Since Inception | | Inception Date |

| | Class A | | | | | 7.21 | % | | 1.50% | | 4/30/08 |

| | | Institutional | | | | | 13.99 | | | 3.16 | | 4/30/08 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares. Because Institutional Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

| | | | The returns represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our website at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. |

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.46 | % | | | 1.56 | % |

| | | Institutional | | | 1.06 | | | | 1.16 | |

| | 4 | | The expense ratios of the Portfolio, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations), are as set forth above according to the most recent publicly available Prospectus for the Portfolio and will differ from the expense ratios disclosed in the Financial Highlights in this report due to the inclusion of underlying Fund fees and expenses, which are not included in the operating expenses of the Portfolio reflected in the Financial Highlights. The Portfolio’s waivers and/or expense limitations, if any, will remain in place through at least December 29, 2013, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Portfolio’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

10

FUND BASICS

| | | | | | | | | | |

| | STANDARDIZED AFTER-TAX PERFORMANCE AS OF 12/31/125 | |

| | | Class A Shares | | One Year | | | Since Inception (4/30/08) | |

| | Returns before taxes* | | | 7.21 | % | | �� | 1.50 | % |

| | Returns after taxes on distributions** | | | 6.50 | | | | 1.01 | |

| | | Returns after taxes on distributions*** and sale of Portfolio shares | | | 5.43 | | | | 1.19 | |

| | 5 | | The after-tax returns are calculated using the historically highest individual federal marginal income tax rates at the time of distributions (currently 15% for qualifying ordinary income dividends and long-term capital gain distributions and 35% for non-qualifying ordinary income dividends) and do not reflect state and local taxes. Actual after-tax returns will be calculated at calendar year-end and depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Portfolio shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. Under certain circumstances, the addition of the tax benefits from capital losses resulting from redemptions may cause the Returns After Taxes on Distributions and Sale of Portfolio Shares to be greater than the Returns After Taxes on Distributions or even Returns Before Taxes. Standardized after-tax returns assume reinvestment of all distributions at NAV and reflect a maximum initial sales charge of 5.5% for Class A Shares. |

| | *Returns | | Before Taxes do not reflect taxes on distributions on the Portfolio’s Class A Shares nor do they show how performance can be impacted by taxes when shares are redeemed. |

| | **Returns | | After Taxes on Distributions assume that taxes are paid on distributions on the Portfolio’s Class A Shares (i.e., dividends and capital gains) but do not reflect taxes that may be incurred upon redemption of the Class A Shares at the end of the performance period. |

| ***Returns | | After Taxes on Distributions and Sale of Portfolio Shares reflect taxes paid on distributions on the Portfolio’s Class A Shares and taxes applicable when the shares are redeemed. |

|

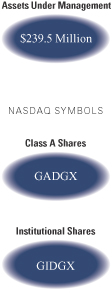

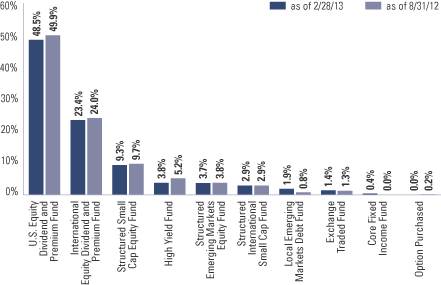

| OVERALL UNDERLYING FUND WEIGHTINGS6 |

| Percentage of Net Assets |

| | 6 | | The Portfolio is actively managed and, as such, its composition may differ over time. The percentage shown for each Underlying Fund reflects the value of that underlying fund as a percentage of net assets of the Portfolio. Figures in the graph above may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. Underlying sector allocations of ETFs held by the Portfolio are not reflected in the graph above. The above graph depicts the Portfolio’s investments but may not represent the Portfolio’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

11

PORTFOLIO RESULTS

Goldman Sachs Tax-Advantaged

Global Equity Portfolio

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Quantitative Investment Strategies Team discuss the Goldman Sachs Tax-Advantaged Global Equity Portfolio’s (the “Portfolio”) performance and positioning for the six-month period ended February 28, 2013 (the “Reporting Period”).

| Q | | How did the Portfolio perform during the Reporting Period? |

| A | | During the Reporting Period, the Portfolio’s Class A and Institutional Shares generated cumulative total returns, without sales charges, of 10.70% and 10.86%, respectively. These returns compare to the 10.24% cumulative total return of the Tax-Advantaged Global (“TAG”) Composite Index (“TAG Composite Index”) over the same time period. The TAG Composite Index is comprised of the Barclays U.S. Aggregate Bond Index (10%), the MSCI All Country World Index (ACWI), ex North America® (30%) and the Russell 3000® Index (60%). |

| | The components of the Portfolio’s blended benchmark generated cumulative total returns of 0.15%, 14.24% and 9.97% for the Barclays U.S. Aggregate Bond Index, the MSCI ACWI, ex North America® and the Russell 3000® Index, respectively, during the same period. |

| Q | | What key factors affected the Portfolio’s performance during the Reporting Period? |

| A | | The Portfolio outperformed the TAG Composite Index during the Reporting Period, primarily as a result of our tactical asset allocation decisions. Security selection within the Underlying Funds detracted modestly. Two of the Portfolio’s four Underlying Funds, which we use to implement our strategic allocation decisions, underperformed their respective benchmark indices. |

| Q | | How did Global Tactical Asset Allocation decisions affect the Portfolio’s performance during the Reporting Period? |

| A | | The implementation of our tactical views contributed positively to performance. The Portfolio was underweight U.S. investment grade bonds. It was overweight U.S. high yield corporate bonds. The Fed’s decision to keep short-term interest rates near zero until certain unemployment and/or inflation data points are reached suggested to us that investors’ search for yield would continue — to the benefit of high yield corporate bonds, which at the end of the Reporting Period had yields to maturity (or, redemption yields) of approximately 6.6%. High yield corporate spreads (or, yield differentials to U.S. Treasuries) were near the historic median, a level that implies a default rate of nearly 4%. In our opinion, the actual default rate would have to be more than 8% — even if we assume a conservative recovery rate by bondholders of 35% — to fully erode these spread levels. |

| | The Portfolio was overweight the U.S. banking sector through an exchange traded fund (“ETF”), which appreciated in value during the Reporting Period. We believed U.S. bank stocks had attractive valuations relative to their historical performance and relative to the broad U.S. equity market. Furthermore, bank credit costs have been falling, early-stage delinquencies continued to improve and banks have been fortifying their balance sheets. |

| | Because we saw several sources of downside risk to the stocks in the S&P® 500 Index, the Portfolio had an allocation to April 2013 S&P® 500 Index put options. (S&P® 500 Index put options have an underlying value that is equal to the full value on the day of purchase of the S&P® 500 Index.) Although truly adverse downside risks appear to have been mitigated by global central bank action, such as the Fed’s QE3 and the ECB’s OMT programs, we anticipated several other sources of potential downside risk to come into focus in the months ahead, including Italy’s elections in March 2013, the initiation of sequester-related spending cuts in the U.S. and the risk of a U.S. government shutdown if temporary spending authority is not extended. In addition, during January 2013 when we initiated the Portfolio’s S&P® 500 Index put options position, U.S. equity market volatility had collapsed, with the VIX (a measure of the implied volatility of S&P® 500 index options) dropping to near 13. As a result, the cost of purchasing the April 2013 S&P® 500 Index put options was low by historical standards. |

12

PORTFOLIO RESULTS

| | The Portfolio was overweight the Japanese and European equity markets. The Portfolio was overweight Japanese equities because we believed their valuations were attractive. Japanese stocks had been trading at a discount to their own historical performance and relative to U.S. and international stocks. Also, we believed that Japanese corporate earnings would outgrow the corporate earnings in other major regions, thanks to government policy changes, supportive domestic economic growth, Japan’s exposure to emerging markets growth and high profit margins. The Portfolio was overweight European equities because of what we considered to be attractive valuations. During the Reporting Period, the Euro Stoxx 50® Index (which covers 50 blue chip stocks from 12 Eurozone countries) was trading near its 2003 and 2009 lows, and European stock valuations stood well within the lower quartile of their historical levels on both an absolute basis and relative to U.S. stocks. Additionally, the European equity market offered a dividend yield of approximately 5%, which we believed added a margin of downside protection for the Portfolio. Although the Eurozone still faces many challenges, financial stress seemed to be abating as result of policy changes within the European Union and a reduction in the pace of European bank deleveraging. In addition, nearly half the sales of Euro Stoxx 50® Index companies are overseas. The Portfolio’s weightings in the European and Japanese equity markets were implemented through investment in stock futures. (A stock future, which is traded on an exchange, is a contract that obligates a buyer to purchase stock at a predetermined future date and price.) |

| | Through an allocation to the Goldman Sachs Emerging Markets Debt Fund, we adopted an overweight position in emerging markets debt. We believe the global financial crisis has increased the relative structural attractiveness of emerging markets bonds. The debt burden of the emerging markets is widely projected to be much lower than that of G-10 (Group of Ten) economies in the next decade. (The Group of Ten economies, though so-called, are actually eleven, namely Belgium, Canada, France, Germany, Italy, Japan, the Netherlands, Sweden, Switzerland, the U.K. and the U.S.) However, in our view, emerging markets debt spreads relative to U.S. Treasuries remained attractive. We believe demand for emerging markets local debt should increase because emerging markets countries are for the first time showing the ability to manage their monetary and fiscal policies, which should help them navigate the global business cycle better than most expected. |

| Q | | How did the Portfolio’s Underlying Funds perform relative to their respective benchmark indices during the Reporting Period? |

| A | | Two of the four Underlying Funds we use to implement our strategic allocation decisions within the Portfolio underperformed their respective benchmark indices. These Underlying Funds were the Goldman Sachs Structured International Small Cap Equity Fund and the Goldman Sachs Structured Tax-Managed Fund. The Goldman Sachs Structured Emerging Markets Equity Fund and the Goldman Sachs Structured International Tax-Managed Equity Fund outperformed their respective benchmark indices. Of the Underlying Funds in which the Portfolio held its greatest weightings, the Goldman Sachs Structured Tax-Managed Equity Fund underperformed its benchmark, the Russell 3000® Index, by approximately 0.88%, and the Goldman Sachs Structured International Tax-Managed Equity Fund outperformed its benchmark, the MSCI EAFE Index, by approximately 0.01% during the Reporting Period. |

| Q | | How did the Portfolio use derivatives and similar instruments during the Reporting Period? |

| A | | The Portfolio used equity index futures, equity swap contracts and equity index options. Equity index futures were used to implement our views on the Japanese and European stock markets. Equity swap contracts were used to implement the Portfolio’s tactical tilt in the FTSE 100 dividend futures, a position we eliminated during the Reporting Period. Equity index options were used to implement the Portfolio’s position in S&P® 500 Index put options. We used forward foreign currency exchange contracts to take a long position in the Chinese renminbi, a position we eliminated during the Reporting Period. In addition, some of the Portfolio’s Underlying Funds used derivatives during the Reporting Period to apply their active investment views with greater versatility and to afford greater risk management precision. As market conditions warranted during the Reporting Period, some of these Underlying Funds engaged in forward foreign currency exchange contracts, financial futures contracts, options and swap contracts to enhance portfolio return and for hedging purposes. |

| | | The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation. |

13

PORTFOLIO RESULTS

| Q | | What changes did you make during the Reporting Period within both the equity and fixed income portions of the Portfolio? |

| A | | In September 2012, we increased the Portfolio’s overweight in European equities through an investment in Euro Stoxx 50® Index futures. At the same time, we reduced the Portfolio’s allocations to investment grade fixed income through the Goldman Sachs Core Fixed Income Fund and to U.S. equities through the Goldman Sachs Structured Tax-Managed Equity Fund. |

| | At the beginning of the Reporting Period, the Portfolio had a position in FTSE 100 dividend futures, implemented through equity swap contracts. The dividend futures market allows investors to take a view on the amount of dividends that a specific company or index of companies will pay over the course of a calendar year. We eliminated the position in October 2012. |

| | During November 2012, we decreased the Portfolio’s exposure to high yield corporate bonds by reducing its allocation to the Goldman Sachs High Yield Fund. We reallocated the proceeds to investment grade fixed income through the Goldman Sachs Core Fixed Income Fund. Also in November 2012, we allowed the Portfolio’s allocation to the Chinese renminbi to mature. We had initiated the position in October 2011. In December 2012, we allowed the Portfolio’s position in December 2012 S&P® 500 Index put options, which we had initiated in August 2012, to expire. |

| | During January 2013, we decreased the Portfolio’s overweighted exposure to Japanese equities and invested the proceeds into investment grade fixed income through the Goldman Sachs Core Fixed Income Fund. Later that month, we purchased April 2013 S&P® 500 Index put options at a strike price of 1500. (For put options, the strike price is the price at which shares can be sold.) We funded the position by reducing the Portfolio’s allocation to investment grade fixed income through the Goldman Sachs Core Fixed Income Fund. |

| Q | | What was the Portfolio’s tactical view and strategy at the end of the Reporting Period? |

| A | | As of February 28, 2013, the Portfolio — through its holdings in equity index futures — was overweight the Japanese and European stock markets. It was overweight large-cap U.S. bank stocks through an investment in an ETF. The Portfolio held a position in S&P® 500 Index put options. In fixed income, through allocations to the Underlying Funds, the Portfolio held an overweighted position in high yield securities and an underweighted position in investment grade securities. It was overweight emerging markets debt relative to the TAG Composite Index. |

14

FUND BASICS

Tax-Advantaged Global Equity Portfolio

as of February 28, 2013

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | September 1, 2012–February 28, 2013 | | Portfolio Total Return

(based on NAV)1 | | | TAG Composite

Index2 | |

| | Class A | | | 10.70 | % | | | 10.24 | % |

| | | Institutional | | | 10.86 | | | | 10.24 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Portfolio (ex-dividend) divided by the total number of shares of the class outstanding. The Portfolio’s performance reflects the reinvestment of dividends and other distributions. The Portfolio’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The TAG Composite Index is comprised of the Barclay’s U.S. Aggregate Bond Index (10%), the MSCI ACWI Index, ex North America® (30%) and the Russell 3000® Index (60%). The Index figures do not reflect any deduction of fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. |

| | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 | | | | | |

| | | For the period ended 12/31/12 | | One Year | | | Since Inception | | | Inception Date | |

| | Class A | | | 10.90 | % | | | 0.85 | % | | | 4/30/08 | |

| | | Institutional | | | 17.83 | | | | 2.50 | | | | 4/30/08 | |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares. Because Institutional Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

| | The | | returns represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our Website at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. |

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.38 | % | | | 1.43 | % |

| | | Institutional | | | 0.98 | | | | 1.03 | |

| | 4 | | The expense ratios of the Portfolio, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Portfolio and will differ from the expense ratios disclosed in the Financial Highlights in this report due to the inclusion of underlying Fund fees and expenses, which are not included in the operating expenses of the Portfolio reflected in the Financial Highlights. The Portfolio’s waivers and/or expense limitations will remain in place through at least December 29, 2013, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Portfolio’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

15

FUND BASICS

| | | | | | | | | | |

| | STANDARDIZED AFTER-TAX PERFORMANCE AS OF 12/31/125 | |

| | | Class A Shares | | One Year | | | Since Inception

(4/30/08) | |

| | Returns before taxes* | | | 10.90 | % | | | 0.85 | % |

| | Returns after taxes on distributions** | | | 10.47 | | | | 0.53 | |

| | | Returns after taxes on distributions*** and sale of Portfolio shares | | | 7.42 | | | | 0.63 | |

| | 5 | | The after-tax returns are calculated using the historically highest individual federal marginal income tax rates at the time of distributions (currently 15% for qualifying ordinary income dividends and long-term capital gain distributions and 35% for non-qualifying ordinary income dividends) and do not reflect state and local taxes. Actual after-tax returns will be calculated at calendar year-end and depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Portfolio shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. Under certain circumstances, the addition of the tax benefits from capital losses resulting from redemptions may cause the Returns After Taxes on Distributions and Sale of Portfolio Shares to be greater than the Returns After Taxes on Distributions or even Returns Before Taxes. Standardized after-tax returns assume reinvestment of all distributions at NAV and reflect a maximum initial sales charge of 5.5% for Class A Shares. |

| | * | | Returns Before Taxes do not reflect taxes on distributions on the Portfolio’s Class A Shares nor do they show how performance can be impacted by taxes when shares are redeemed. |

| | ** | | Returns After Taxes on Distributions assume that taxes are paid on distributions on the Portfolio’s Class A Shares (i.e., dividends and capital gains) but do not reflect taxes that may be incurred upon redemption of the Class A Shares at the end of the performance period. |

| *** | | Returns After Taxes on Distributions and Sale of Portfolio Shares reflect taxes paid on distributions on the Portfolio’s Class A Shares and taxes applicable when the shares are redeemed. |

|

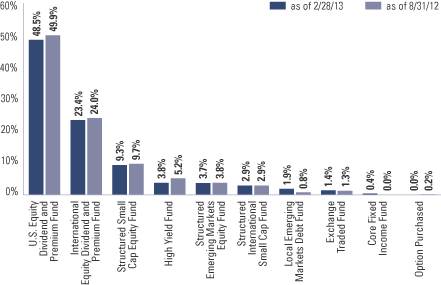

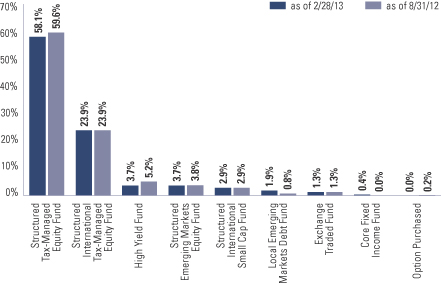

| OVERALL UNDERLYING FUND WEIGHTINGS6 |

| Percentage of Net Assets |

| | 6 | | The Portfolio is actively managed and, as such, its composition may differ over time. The percentage shown for each Underlying Fund reflects the value of that underlying fund as a percentage of net assets of the Portfolio. Figures in the graph above may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. Underlying sector allocations of ETFs held by the Portfolio are not reflected in the graph above. The above graph depicts the Portfolio’s investments but may not represent the Portfolio’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

16

GOLDMAN SACHS ENHANCED DIVIDEND GLOBAL EQUITY PORTFOLIO

Schedule of Investments

February 28, 2013 (Unaudited)

| | | | | | | | |

Shares | | | Description | | Value | |

| | Underlying Funds (Institutional Shares)(a) – 93.9% | |

| | Equity – 87.8% | |

| | 11,547,081 | | | Goldman Sachs U.S. Equity Dividend and Premium Fund | | $ | 116,048,168 | |

| | 7,632,596 | | | Goldman Sachs International Equity Dividend and Premium Fund | | | 55,946,927 | |

| | 1,535,167 | | | Goldman Sachs Structured Small Cap Equity Fund | | | 22,398,089 | |

| | 973,994 | | | Goldman Sachs Structured Emerging Markets Equity Fund | | | 8,834,127 | |

| | 803,220 | | | Goldman Sachs Structured International Small Cap Fund | | | 7,020,143 | |

| | | | | | | | |

| | | | | | | 210,247,454 | |

| | |

| | Fixed Income – 6.1% | |

| | 1,208,130 | | | Goldman Sachs High Yield Fund | | | 8,903,920 | |

| | 464,435 | | | Goldman Sachs Local Emerging Markets Debt Fund | | | 4,565,394 | |

| | 93,405 | | | Goldman Sachs Core Fixed Income Fund | | | 995,700 | |

| | | | | | | | |

| | | | | | | 14,465,014 | |

| | |

| TOTAL UNDERLYING FUNDS

(INSTITUTIONAL SHARES) – 93.9% |

|

| | (Cost $190,518,110) | | $ | 224,712,468 | |

| | |

| | | | | | | | |

Shares | | | Description | | Value | |

| | | | | | | | |

| | Exchange Traded Fund – 1.4% | |

| | 130,534 | | | SPDR S&P Bank Fund | | $ | 3,393,884 | |

| | (Cost $2,837,947) | |

| | |

| | | | | | | | |

| Contracts | | Strike Price | | Expiration Date | | Value | |

| | | | | | | | |

| Option Purchased – 0.0% | |

S&P 500 Index Put Option | | | | | | |

| 29 | | $1,500 | | 04/20/13 | | $ | 73,950 | |

| (Cost $102,457) | | | | | | |

| |

| TOTAL INVESTMENTS – 95.3% | | | | |

| (Cost $193,458,514) | | $ | 228,180,302 | |

| |

OTHER ASSETS IN EXCESS OF

LIABILITIES – 4.7% | | | 11,276,644 | |

| |

| NET ASSETS – 100.0% | | | | $ | 239,456,946 | |

| |

| | |

| The percentage shown for each investment and investment category reflects the value of the respective investment or category as a percentage of net assets. |

(a) | | Represents Affiliated Funds. |

| | |

|

Investment Abbreviation: |

SPDR | | —Standard and Poor’s Depositary Receipts |

|

|

| ADDITIONAL INVESTMENT INFORMATION |

FUTURES CONTRACTS — At February 28, 2013, the Portfolio had the following futures contracts:

| | | | | | | | | | | | | | |

| Type | | Number of

Contracts

Long (Short) | | | Expiration

Date | | Current

Value | | | Unrealized

Gain (Loss) | |

EURO STOXX 50 Index | | | 182 | | | March 2013 | | $ | 6,261,026 | | | $ | (13,662 | ) |

Nikkei 225 Index | | | 40 | | | March 2013 | | | 2,305,000 | | | | 381,870 | |

| TOTAL | | | | | | | | | | | | $ | 368,208 | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 17 |

GOLDMAN SACHS TAX-ADVANTAGED GLOBAL EQUITY PORTFOLIO

Schedule of Investments

February 28, 2013 (Unaudited)

| | | | | | | | |

Shares | | | Description | | Value | |

| | Underlying Funds (Institutional Shares)(a) – 94.6% | |

| | Equity – 88.6% | |

| | 27,469,337 | | | Goldman Sachs Structured Tax-Managed Equity Fund | | $ | 338,147,541 | |

| | 17,754,645 | | | Goldman Sachs Structured International Tax-Managed Equity Fund | | | 139,018,868 | |

| | 2,386,092 | | | Goldman Sachs Structured Emerging Markets Equity Fund | | | 21,641,856 | |

| | 1,921,122 | | | Goldman Sachs Structured International Small Cap Fund | | | 16,790,609 | |

| | | | | | | | |

| | | | | | | 515,598,874 | |

| | |

| | Fixed Income – 6.0% | |

| | 2,925,528 | | | Goldman Sachs High Yield Fund | | | 21,561,140 | |

| | 1,130,957 | | | Goldman Sachs Local Emerging Markets Debt Fund | | | 11,117,304 | |

| | 234,714 | | | Goldman Sachs Core Fixed Income Fund | | | 2,502,055 | |

| | | | | | | | |

| | | | | | | 35,180,499 | |

| | |

| TOTAL UNDERLYING FUNDS

(INSTITUTIONAL SHARES) – 94.6% |

|

| | (Cost $422,489,568) | | $ | 550,779,373 | |

| | |

| | | | | | | | |

Shares | | | Description | | Value | |

| | | | | | | | |

| | Exchange Traded Fund – 1.3% | |

| | 290,793 | | | SPDR S&P Bank Fund | | $ | 7,560,618 | |

| | (Cost $6,389,485) | |

| | |

| | | | | | | | | | |

| Contracts | | Strike Price | | Expiration

Date | | | Value | |

| | | | | | | | | | |

| Option Purchased – 0.0% | |

S&P 500 Index Put Option | |

| 70 | | $1,500 | | | 04/20/13 | | | $ | 178,500 | |

| (Cost $247,310) | |

| |

| TOTAL INVESTMENTS – 95.9% | | | | | |

| (Cost $429,126,363) | | | | | | $ | 558,518,491 | |

| |

OTHER ASSETS IN EXCESS OF

LIABILITIES – 4.1% | | | | | | | 23,643,596 | |

| |

| NET ASSETS – 100.0% | | | | | | $ | 582,162,087 | |

| |

| | |

| The percentage shown for each investment and investment category reflects the value of the respective investment or category as a percentage of net assets. |

(a) | | Represents Affiliated Funds. |

| | |

|

Investment Abbreviation: |

SPDR | | —Standard and Poor’s Depositary Receipts |

|

|

| ADDITIONAL INVESTMENT INFORMATION |

FUTURES CONTRACTS — At February 28, 2013, the Portfolio had the following futures contracts:

| | | | | | | | | | | | | | |

| Type | | Number of

Contracts

Long (Short) | | | Expiration

Date | | Current

Value | | | Unrealized

Gain (Loss) | |

EURO STOXX 50 Index | | | 413 | | | March 2013 | | $ | 14,207,713 | | | $ | (31,002 | ) |

Nikkei 225 Index | | | 91 | | | March 2013 | | | 5,243,875 | | | | 868,754 | |

| TOTAL | | | | | | | | | | | | $ | 837,752 | |

| | |

| 18 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS GLOBAL TAX-AWARE EQUITY PORTFOLIOS

Statements of Assets and Liabilities

February 28, 2013 (Unaudited)

| | | | | | | | | | |

| | | | | Enhanced Dividend

Global Equity

Portfolio | | | Tax-Advantaged

Global Equity

Portfolio | |

| | Assets: | |

| | Investments in Affiliated Underlying Funds, at value (cost $190,518,110 and $422,489,568) | | $ | 224,712,468 | | | $ | 550,779,373 | |

| | Investments, at value (cost $2,940,404 and $6,636,795) | | | 3,467,834 | | | | 7,739,118 | |

| | Cash | | | 8,603,064 | | | | 19,415,896 | |

| | Receivables: | | | | | | | | |

| | Portfolio shares sold | | | 3,790,875 | | | | 3,763,068 | |

| | Collateral on certain derivative contracts(a) | | | 765,000 | | | | 1,555,000 | |

| | Investments sold | | | 239,149 | | | | 261,040 | |

| | Dividends | | | 67,976 | | | | 163,530 | |

| | Futures variation margin | | | 66,589 | | | | 151,181 | |

| | Reimbursement from investment adviser | | | 14,439 | | | | 23,029 | |

| | Other assets | | | 1,944 | | | | 4,529 | |

| | Total assets | | | 241,729,338 | | | | 583,855,764 | |

| | | | | | | | | | |

| | Liabilities: | |

| | Payables: | | | | | | | | |

| | Portfolio shares redeemed | | | 2,065,138 | | | | 1,294,427 | |

| | Amounts owed to affiliates | | | 75,268 | | | | 162,121 | |

| | Investments purchased | | | 67,976 | | | | 163,530 | |

| | Accrued expenses | | | 64,010 | | | | 73,599 | |

| | Total liabilities | | | 2,272,392 | | | | 1,693,677 | |

| | | | | | | | | | |

| | Net Assets: | |

| | Paid-in capital | | | 212,217,108 | | | | 468,710,154 | |

| | Distributions in excess of net investment income | | | (1,299,582 | ) | | | (157,599 | ) |

| | Accumulated net realized loss | | | (6,559,151 | ) | | | (16,640,001 | ) |

| | Net unrealized gain | | | 35,098,571 | | | | 130,249,533 | |

| | | NET ASSETS | | $ | 239,456,946 | | | $ | 582,162,087 | |

| | | Net Assets: | | | | | | | | |

| | | Class A | | $ | 130,076,511 | | | $ | 253,216,474 | |

| | | Institutional | | | 109,380,435 | | | | 328,945,613 | |

| | | Total Net Assets | | $ | 239,456,946 | | | $ | 582,162,087 | |

| | | Shares outstanding $0.001 par value (unlimited shares authorized): | | | | | | | | |

| | | Class A | | | 12,708,141 | | | | 23,882,871 | |

| | | Institutional | | | 10,643,550 | | | | 30,878,655 | |

| | | Net asset value, offering and redemption price per share:(b) | | | | | | | | |

| | | Class A | | | $10.24 | | | | $10.60 | |

| | | Institutional | | | 10.28 | | | | 10.65 | |

| | (a) | | Represents segregated cash relating to collateral on futures transactions. |

| | (b) | | Maximum public offering price per share for Class A Shares of the Enhanced Dividend Global Equity and Tax-Advantaged Global Equity Portfolios is $10.84 and $11.22, respectively. |

| | |

| The accompanying notes are an integral part of these financial statements. | | 19 |

GOLDMAN SACHS GLOBAL TAX-AWARE EQUITY PORTFOLIOS

Statements of Operations

For the Six Months Ended February 28, 2013 (Unaudited)

| | | | | | | | | | |

| | | | | Enhanced Dividend

Global Equity

Portfolio | | | Tax-Advantaged

Global Equity

Portfolio | |

| | Investment income: | |

| | Dividends from Affiliated Underlying Funds | | $ | 3,045,806 | | | $ | 9,670,939 | |

| | Dividends from Unaffiliated Funds | | | 39,378 | | | | 86,457 | |

| | Total investment income | | | 3,085,184 | | | | 9,757,396 | |

| | | | | | | | | | |

| | Expenses: | |

| | Distribution and Service fees — Class A Shares | | | 161,936 | | | | 313,566 | |

| | Management fees | | | 161,122 | | | | 372,123 | |

| | Transfer Agent fees(a) | | | 140,128 | | | | 287,374 | |

| | Professional fees | | | 34,037 | | | | 33,541 | |

| | Custody, accounting and administrative services | | | 25,055 | | | | 31,361 | |

| | Printing and mailing costs | | | 19,595 | | | | 24,646 | |

| | Registration fees | | | 11,345 | | | | 15,082 | |

| | Trustee fees | | | 7,697 | | | | 9,700 | |

| | Other | | | 4,668 | | | | 6,232 | |

| | Total expenses | | | 565,583 | | | | 1,093,625 | |

| | Less — expense reductions | | | (90,904 | ) | | | (94,118 | ) |

| | Net expenses | | | 474,679 | | | | 999,507 | |

| | NET INVESTMENT INCOME | | | 2,610,505 | | | | 8,757,889 | |

| | | | | | | | | | |

| | Realized and unrealized gain (loss): | |

| | Net realized gain (loss) from: | | | | | | | | |

| | Investments in Affiliated Underlying Funds | | | (871,785 | ) | | | 250,766 | |

| | Investments | | | (312,158 | ) | | | (688,896 | ) |

| | Futures contracts | | | 1,764,134 | | | | 3,932,442 | |

| | Swap contracts | | | 37,873 | | | | 84,367 | |

| | Forward foreign currency exchange contracts | | | 25,198 | | | | 57,746 | |

| | Foreign currency transactions | | | 20,958 | | | | 46,929 | |

| | Capital gain distributions from Affiliated Underlying Funds | | | 5,743,216 | | | | 355,328 | |

| | Net change in unrealized gain (loss) on: | | | | | | | | |

| | Investments in Affiliated Underlying Funds | | | 8,354,270 | | | | 38,175,850 | |

| | Investments | | | 390,837 | | | | 855,582 | |

| | Futures contracts | | | (371,837 | ) | | | (796,984 | ) |

| | Swap contracts | | | (22,727 | ) | | | (50,628 | ) |

| | Forward foreign currency exchange contracts | | | (3,699 | ) | | | (8,478 | ) |

| | Foreign currency translation | | | 11,559 | | | | 26,400 | |

| | Net realized and unrealized gain | | | 14,765,839 | | | | 42,240,424 | |

| | NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 17,376,344 | | | $ | 50,998,313 | |

| | (a) | | Class specific Transfer Agent fees were as follows: |

| | | | | | | | | | |

| | | | | Transfer Agent Fees | |

| | | Portfolio | | Class A | | | Institutional | |

| | Enhanced Dividend Global Equity | | | $123,072 | | | | $17,056 | |

| | Tax-Advantaged Global Equity | | | 238,312 | | | | 49,062 | |

| | |

| 20 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS GLOBAL TAX-AWARE EQUITY PORTFOLIOS

Statements of Changes in Net Assets

| | | | | | | | | | | | | | | | | | |

| | | | | Enhanced Dividend Global

Equity Portfolio | | | Tax-Advantaged Global

Equity Portfolio | |

| | | | | For the

Six Months Ended

February 28, 2013

(Unaudited) | | | For the Fiscal

Year Ended

August 31, 2012 | | | For the

Six Months Ended

February 28, 2013

(Unaudited) | | | For the Fiscal

Year Ended

August 31, 2012 | |

| | From operations: | | | | | | | | | |

| | Net investment income | | $ | 2,610,505 | | | $ | 3,918,889 | | | $ | 8,757,889 | | | $ | 6,955,754 | |

| | Net realized gain (loss) | | | 6,407,436 | | | | (1,230,848 | ) | | | 4,038,682 | | | | (5,294,626 | ) |

| | Net change in unrealized gain | | | 8,358,403 | | | | 12,319,913 | | | | 38,201,742 | | | | 39,023,173 | |

| | Net increase in net assets resulting from operations | | | 17,376,344 | | | | 15,007,954 | | | | 50,998,313 | | | | 40,684,301 | |

| | | | | | | | | | | | | | | | | | |

| | Distributions to shareholders: | | | | | | | | | |

| | From net investment income | | | | | | | | | | | | | | | | |

| | Class A Shares | | | (2,274,221 | ) | | | (3,145,048 | ) | | | (4,171,091 | ) | | | (3,193,242 | ) |

| | Institutional Shares | | | (1,638,242 | ) | | | (2,151,392 | ) | | | (5,177,323 | ) | | | (2,955,554 | ) |

| | From net realized gains | | | | | | | | | | | | | | | | |

| | Class A Shares | | | (1,476,537 | ) | | | (70,490 | ) | | | (793,567 | ) | | | (167,113 | ) |

| | Institutional Shares | | | (941,687 | ) | | | (45,892 | ) | | | (745,537 | ) | | | (119,000 | ) |

| | Total distributions to shareholders | | | (6,330,687 | ) | | | (5,412,822 | ) | | | (10,887,518 | ) | | | (6,434,909 | ) |

| | | | | | | | | | | | | | | | | | |

| | From share transactions: | | | | | | | | | |

| | Proceeds from sales of shares | | | 35,160,058 | | | | 66,990,762 | | | | 128,715,345 | | | | 117,049,494 | |

| | Reinvestment of distributions | | | 5,994,376 | | | | 4,924,873 | | | | 9,635,536 | | | | 5,815,636 | |

| | Cost of shares redeemed | | | (15,769,008 | ) | | | (46,838,528 | ) | | | (47,294,628 | ) | | | (75,969,330 | ) |

| | Net increase in net assets resulting from share transactions | | | 25,385,426 | | | | 25,077,107 | | | | 91,056,253 | | | | 46,895,800 | |

| | TOTAL INCREASE | | | 36,431,083 | | | | 34,672,239 | | | | 131,167,048 | | | | 81,145,192 | |

| | | | | | | | | | | | | | | | | | |

| | Net assets: | | | | | | | | | |

| | Beginning of period | | | 203,025,863 | | | | 168,353,624 | | | | 450,995,039 | | | | 369,849,847 | |

| | End of period | | $ | 239,456,946 | | | $ | 203,025,863 | | | $ | 582,162,087 | | | $ | 450,995,039 | |

| | Undistributed (distributions in excess of) net investment income | | $ | (1,299,582 | ) | | $ | 2,376 | | | $ | (157,599 | ) | | $ | 432,926 | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 21 |

GOLDMAN SACHS ENHANCED DIVIDEND GLOBAL EQUITY PORTFOLIO

Financial Highlights

Selected Data for a Share Outstanding Throughout Each Period

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Income (loss) from

investment operations | | | Distributions

to shareholders | |

| | | Year - Share Class | |

Net asset

value,

beginning

of period | | | Net

investment

income(a)(b) | | | Net realized

and unrealized

gain (loss) | | | Total from

investment

operations | | | From net

investment

income | | | From net

realized

gains | | | From

capital | | | Total

distributions | |

| | FOR THE SIX MONTHS ENDED FEBRUARY 28, (UNAUDITED) | |

| | 2013 - A | | $ | 9.73 | | | $ | 0.11 | | | $ | 0.68 | | | $ | 0.79 | | | $ | (0.17 | ) | | $ | (0.11 | ) | | $ | — | | | $ | (0.28 | ) |

| | 2013 - Institutional | | | 9.76 | | | | 0.13 | | | | 0.69 | | | | 0.82 | | | | (0.19 | ) | | | (0.11 | ) | | | — | | | | (0.30 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | FOR THE FISCAL YEARS ENDED AUGUST 31, | |

| | 2012 - A | | | 9.23 | | | | 0.19 | | | | 0.58 | | | | 0.77 | | | | (0.26 | ) | | | (0.01 | ) | | | — | | | | (0.27 | ) |

| | 2012 - Institutional | | | 9.27 | | | | 0.23 | | | | 0.57 | | | | 0.80 | | | | (0.30 | ) | | | (0.01 | ) | | | — | | | | (0.31 | ) |

| | 2011 - A | | | 8.27 | | | | 0.18 | | | | 1.03 | | | | 1.21 | | | | (0.20 | ) | | | (0.05 | ) | | | — | | | | (0.25 | ) |

| | 2011 - Institutional | | | 8.30 | | | | 0.22 | | | | 1.04 | | | | 1.26 | | | | (0.24 | ) | | | (0.05 | ) | | | — | | | | (0.29 | ) |

| | 2010 - A | | | 7.98 | | | | 0.15 | | | | 0.32 | | | | 0.47 | | | | (0.16 | ) | | | (0.02 | ) | | | — | | | | (0.18 | ) |