UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

| Caroline Kraus, Esq. | | Copies to: |

| Goldman, Sachs & Co. | | Geoffrey R.T. Kenyon, Esq. |

| 200 West Street | | Dechert LLP |

| New York, New York 10282 | | 100 Oliver Street |

| | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: March 31

Date of reporting period: September 30, 2013

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Stockholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | September 30, 2013 |

| | |

| | | | Multi Sector Fixed Income Funds |

| | | | Core Fixed Income |

| | | | Core Plus Fixed Income |

| | | | Global Income |

| | | | Strategic Income |

| | | | World Bond |

Goldman Sachs Multi Sector Fixed Income Funds

| | | | |

TABLE OF CONTENTS | | | | |

| |

Principal Investment Strategies and Risks | | | 1 | |

| |

Investment Process | | | 3 | |

| |

Market Review | | | 4 | |

| |

Portfolio Management Discussions and Performance Summaries | | | 7 | |

| |

Schedules of Investments | | | 32 | |

| |

Financial Statements | | | 116 | |

| |

Financial Highlights | | | 124 | |

| |

Notes to the Financial Statements | | | 134 | |

| |

Other Information | | | 164 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS MULTI SECTOR FIXED INCOME FUNDS

Principal Investment Strategies and Risks

This is not a complete list of risks that affect the Funds. For additional information concerning the risks applicable to the Funds, please see the Funds’ prospectus.

The Goldman Sachs Core Fixed Income Fund invests primarily in fixed income securities, including U.S. government securities, corporate debt securities, privately issued mortgage-backed securities and asset-backed securities. The Fund’s investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. Any guarantee on U.S. government securities applies only to the underlying securities of the Fund if held to maturity and not to the value of the Fund’s shares. Investments in mortgage-backed securities are also subject to prepayment risk (i.e., the risk that in a declining interest rate environment, issuers may pay principal more quickly than expected, causing the Fund to reinvest proceeds at lower prevailing interest rates). Foreign and emerging markets investments may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic and political developments. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; risks of default by a counterparty; and liquidity risk (i.e., the risk that an investment may not be able to be sold without a substantial drop in price, if at all).

The Goldman Sachs Core Plus Fixed Income Fund invests primarily in fixed income securities, including U.S. government securities, corporate debt securities, privately issued mortgage-backed securities, asset-backed securities, high yield non-investment grade securities and fixed income securities of issuers located in emerging countries. The Fund’s investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. Any guarantee on U.S. government securities applies only to the underlying securities of the Fund if held to maturity and not to the value of the Fund’s shares. Investments in mortgage-backed securities are also subject to prepayment risk (i.e., the risk that in a declining interest rate environment, issuers may pay principal more quickly than expected, causing the Fund to reinvest proceeds at lower prevailing interest rates). High yield, lower rated investments involve greater price volatility and present greater risks than higher rated fixed income securities. Foreign and emerging markets investments may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic and political developments. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; risks of default by a counterparty; and liquidity risk (i.e., the risk that an investment may not be able to be sold without a substantial drop in price, if at all).

The Goldman Sachs Global Income Fund invests primarily in a portfolio of fixed income securities of U.S. and foreign issuers. The Fund’s investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. Foreign and emerging markets investments may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. Issuers of sovereign debt may be unable or unwilling to repay principal or interest when due. Any guarantee on U.S. government securities applies only to the underlying securities of the Fund if held to maturity and not to the value of the Fund’s shares. Investments in mortgage-backed securities are also subject to prepayment risk (i.e., the risk that in a declining interest rate environment, issuers may pay principal more quickly than expected, causing the Fund to reinvest proceeds at lower prevailing interest rates). Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; risks of default by a counterparty; and liquidity risk (i.e., the risk that an investment may not be able to be sold without a substantial drop in price, if at all). The Fund may invest heavily in investments in particular

1

GOLDMAN SACHS MULTI SECTOR FIXED INCOME FUNDS

countries or regions and may be subject to greater losses than if it were less concentrated in a particular country or region. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

The Goldman Sachs Strategic Income Fund invests in a broadly diversified portfolio of U.S. and foreign investment grade and non-investment grade fixed income investments including, but not limited to: U.S. government securities, non-U.S. sovereign debt, agency securities, corporate debt securities, agency and non-agency mortgage-backed securities, asset-backed securities, custodial receipts, municipal securities, loans and loan assignments and convertible securities. Investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. Investments in mortgage-backed securities are also subject to, among other risks, prepayment risk (i.e., the risk that in a declining interest rate environment, issuers may pay principal more quickly than expected, causing the Fund to reinvest proceeds at lower prevailing interest rates). High yield, lower rated investments involve greater price volatility, are less liquid and present greater risks than higher rated fixed income securities. Foreign and emerging markets investments may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. The Fund is also subject to the risk that the issuers of sovereign debt or the government authorities that control the payment of debt may be unable or unwilling to repay principal or interest when due. The Fund may be more sensitive to adverse economic, business or political developments if it invests a substantial portion of its assets in bonds of similar projects or in particular types of municipal securities. The Fund may invest in loans directly or indirectly, by purchasing participations or sub-participations from financial institutions. Indirect purchases may subject the Fund to greater delays, expenses and risks than direct obligations in the case that a borrower fails to pay scheduled principal and interest. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; risks of default by a counterparty; and liquidity risk. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all. The Fund is subject to the risks associated with implementing short positions. Taking short positions involves leverage of the Fund’s assets and presents various other risks. Losses on short positions are potentially unlimited as a loss occurs when the value of an asset with respect to which the Fund has a short position increases.

The Goldman Sachs World Bond Fund invests primarily in a portfolio of debt instruments, including bonds, derivatives and other instruments with similar economic exposures. Investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. High yield, lower rated investments involve greater price volatility and present greater risks than higher rated fixed income securities. Foreign and emerging market investments may be more volatile and less liquid than investments in U.S. securities and will be subject to the risks of currency fluctuations and adverse economic or political developments. Issuers of sovereign debt may be unable or unwilling to repay principal or interest when due. Any guarantee on U.S. government securities applies only to the underlying securities of the Fund if held to maturity and not to the value of the Fund’s shares. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; risks of default by a counterparty; and liquidity risk. The Fund is subject to the risks associated with implementing short positions. Taking short positions involves leverage of the Fund’s assets and presents various other risks. Losses on short positions are potentially unlimited as a loss occurs when the value of an asset with respect to which the Fund has a short position increases. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

2

GOLDMAN SACHS MULTI SECTOR FIXED INCOME FUNDS

What Differentiates the Goldman Sachs Asset Management Fixed Income Investment Process?

At Goldman Sachs Asset Management, L.P. (“GSAM”), the goal of our fixed income investment process is to provide consistent, strong performance by actively managing our portfolios within a research-intensive, risk-managed framework.

A key element of our fixed income investment philosophy is to evaluate the broadest global opportunity set to capture relative value across sectors and instruments. Our globally integrated investment process involves managing dynamically along the risk/return spectrum, as we continue to develop value-added strategies through:

| n | | Assess relative value among sectors (such as mortgage-backed and corporate debt securities) and sub-sectors |

| n | | Leverage the vast resources of GSAM in selecting securities for each portfolio |

| n | | Team approach to decision making |

| n | | Manage risk by avoiding significant sector and interest rate bets |

| n | | Careful management of yield curve strategies — while closely managing portfolio duration |

Fixed Income portfolios that:

| | n | | Include domestic and global investment options, income opportunities, and access to areas of specialization | |

| | n | | Capitalize on GSAM’s industry-renowned credit research capabilities | |

| | n | | Use a risk-managed framework to seek total return, recognizing the importance of investors’ capital accumulation goals as well as their need for income | |

3

MARKET REVIEW

Goldman Sachs Multi Sector Fixed Income Funds

Market Review

Expectations that the U.S. Federal Reserve (the “Fed”) might taper its asset purchases via its quantitative easing program primarily drove global fixed income market performance during the six months ended September 30, 2013 (the “Reporting Period”).

When the Reporting Period began in April 2013, spread, or non-government bond, sectors were performing well, as investors sought higher yielding assets in the artificially low interest rate environment created by accommodative monetary policies of central banks around the world. The Fed, for example, maintained its quantitative easing program, through which it purchased approximately $85 billion of U.S. Treasury and mortgage-backed securities every month. In early May 2013, the European Central Bank (“ECB”) cut its main policy interest rate by 25 basis points to a record low 0.50%, citing weak Eurozone economic growth and slowing inflation. (A basis point is 1/100th of a percentage point.)

Meanwhile, U.S. economic data strengthened in late April and through May 2013, led by robust housing data and an improved employment picture. The strengthening trend prompted the Fed in mid-May 2013 to signal a possible reduction, or tapering, of its asset purchases later in 2013. In response to Fed Chair Bernanke’s testimony, government bond yields rose substantially, while spread sectors grew more volatile, reflecting widespread uncertainty over how markets might function should the Fed indeed withdraw support.

In June 2013, bond investors focused on the U.S. economy and stronger than expected payrolls data, which reinforced expectations the Fed would start tapering its quantitative easing purchases during 2013. Government bond yields continued to rise, as the June Fed meeting and press conference were more hawkish than expected. Spread sectors remained volatile. Meanwhile, European economic data improved, with modest increases in the Eurozone Purchasing Managers indices (“PMI”) and accelerating expansion in the U.K. Japan’s economy continued to respond positively to the policies of its government and central bank. In contrast, China’s economic data raised concerns about the duration and extent of that nation’s slowdown.

During July 2013, the Fed’s tilt toward a reduction in asset purchases continued to drive volatility in the global fixed income markets broadly. Debate over the successor to Fed Chair Bernanke introduced new concerns about future Fed policy. Government bond yields rose during July and continued to climb in August 2013 on speculation that Lawrence Summers, not Fed Vice Chair Janet Yellen, might be the frontrunner. It was widely believed the Fed would become more hawkish under Summers. In the Eurozone, economic data suggested the region had pulled itself out of an extended recessionary period, with manufacturing activity pointing to an expansion for the first time in two years. Elsewhere, China showed signs of modest growth in its industrial and export sectors, suggesting to many that Chinese policymakers would likely be successful in engineering a soft landing for China’s economic slowdown. Meanwhile, in Japan, Prime Minister Abe’s Liberal Democratic Party won an expected but resounding victory in its upper house parliamentary election, allowing the Prime Minister to proceed with the structural reforms outlined in his economic policy.

In mid-September 2013, the Fed surprised the financial markets by announcing it would delay tapering of its quantitative easing program asset purchases, citing concerns about the strength of the U.S. economic recovery and the pressures of fiscal tightening, including tax increases that took effect at the beginning of 2013 and federal spending cuts known as sequestration. Volatility in the spread sectors subsided on the unexpected decision and on the implication the Fed’s commitment to an accommodative monetary policy would persist. Also in September

4

MARKET REVIEW

2013, Lawrence Summers withdrew himself from consideration as the next Fed Chair. (In October 2013, after the end of the Reporting Period, President Obama nominated Janet Yellen for the post.) However, such reduced volatility in the fixed income markets was short lived. Toward the end of the month, U.S. lawmakers did not reach agreement on a bill to keep the federal government funded after September 30, 2013, which led to the first U.S. government shutdown in 17 years. In the Eurozone, German Chancellor Angela Merkel secured a third term, though her Christian Democratic Union fell just short of an absolute majority, and she had to seek a coalition partner. The Italian government under Prime Minister Enrico Letta received a vote of confidence as former Prime Minister Silvio Berlusconi backed down on a threat to destabilize the ruling coalition in Italy due to a lack of support from his Freedom People party. More broadly, global PMI improved in September 2013, with Asia, Europe and the U.S. all demonstrating month-over-month expansion in manufacturing activity, suggesting to many that the worldwide economic recovery was ongoing.

For the Reporting Period overall, high yield corporate bonds posted the strongest performance within the fixed income market. Mortgage-backed securities, investment grade corporate bonds and commercial mortgage-backed securities also outperformed U.S. Treasury securities during the Reporting Period, but more modestly so. Sovereign emerging market debt was weakest within the fixed income market, as the combination of anticipation of the Fed tapering its quantitative easing program, U.S. economic growth outpacing emerging markets economic growth, and worries over an economic slowdown in China drove a sell-off in the sector during the Reporting Period. Agency securities and asset-backed securities also trailed U.S. Treasury returns, albeit more modestly. Meanwhile, U.S. Treasury yields rose during the Reporting Period across the yield curve, or spectrum of maturities. The yield on the bellwether 10-year U.S. Treasury rose approximately 75 basis points to 2.61%. Overall, the U.S. Treasury yield curve steepened during the Reporting Period, with rates on longer-term maturities increasing more than those on shorter-term maturities.

Looking Ahead

At the end of the Reporting Period, the U.S., in our view, was making good progress on the path to sustainable economic growth, and other major economies seemed to be joining the upswing. Leading economic indicators showed broad-based improvement in economic activity, especially in Europe. Going forward, we believe the combination of improving economic growth and ongoing monetary policy accommodation should be positive for spread sector performance. Further, credit fundamentals remained solid at the end of the Reporting Period, including a low number of defaults and strong balance sheets in the corporate sector. Though leverage has increased and merger and acquisition activity has risen, corporate behavior remains moderate, in our view, compared to that seen in the years before the financial crisis. On the other hand, strengthening economic growth, we believe, may well maintain upward pressure on core government yields, particularly in the U.S. (Remember, there is usually an inverse relationship between bond prices and yield movements, so that bond prices fall when yields rise and vice versa.)

The durability of economic growth outside the U.S. is still unclear. Whereas in the U.S., private sector strength has been offsetting temporary headwinds, such as weak capital expenditure and fiscal tightening, the same quality of growth is not yet evident elsewhere. Improvement in the economies of Eurozone peripheral nations has been coming from a low level, and demand remains weak across the region overall. In Japan, the initial benefits from the yen’s steep decline — the result of government and central bank policy — appeared to be

5

MARKET REVIEW

subsiding at the end of the Reporting Period, and the prospects for effective corporate reform remained in doubt. China’s economic rebound, in our opinion, has been mainly due to renewed investment, demonstrating policymakers’ determination to hit their 7% to 7.5% economic growth target. However, we are concerned about rising inventories and the softening of policies meant to restrain credit growth in China, which could increase the risk of crisis over the longer term, with possible spillover to the emerging markets broadly. That said, we think the emerging markets are better positioned than in the past to weather shocks, with greater economic growth, lower debt and tighter fiscal policy than many developed countries. At the same time, we expect emerging market debt returns to become more varied in the months ahead according to the strengths and weaknesses of individual economies. Such weaknesses include current account deficits, high foreign liabilities and excessive credit growth.

At the end of the Reporting Period, global liquidity remained quite strong, in our view. Eurozone and U.K. central banks were officially biased to keep interest rates low, and we think the ECB may offer more special loans going forward. The Bank of Japan could ramp up quantitative easing to offset tax hikes next year, and the Fed continues to buy $85 billion of securities per month. While the Fed’s actions and statements suggest the normalization process of monetary policy will likely be gradual, we consider that process to be underway and expect a reduction in its asset purchases by early 2014.

6

PORTFOLIO RESULTS

Goldman Sachs Core Fixed Income Fund

Investment Objective

The Fund seeks a total return consisting of capital appreciation and income that exceeds the total return of the Barclays U.S. Aggregate Bond Index.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs U.S. Fixed Income Investment Management Team discusses the Goldman Sachs Core Fixed Income Fund’s (the “Fund”) performance and positioning for the six-month period ended September 30, 2013 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, B, C, Institutional, Service, IR and R Shares generated cumulative total returns, without sales charges, of -1.99%, -2.34%, -2.34%, -1.72%, -2.06%, -1.87% and -2.02%, respectively. These returns compare to the -1.77% cumulative total return of the Fund’s benchmark, the Barclays U.S. Aggregate Bond Index (the “Barclays Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Bottom-up individual issue selection within the U.S. government/agency and municipal bond sectors detracted from the Fund’s performance during the Reporting Period. The security selection strategies in these sectors were partially offset by selection within the collateralized, corporate bond and emerging market debt sectors, which added value. |

| | A primary contributor to Fund performance was our top-down cross-sector strategy. Our cross-sector strategy is one in which we invest Fund assets across a variety of fixed income sectors, including some that may not be included in the Fund’s benchmark. Tactical management of the Fund’s duration and yield curve positioning strategy also contributed positively, albeit more modestly, to Fund performance. Duration is a measure of the Fund’s sensitivity to changes in interest rates. Yield curve indicates the spectrum of maturities within a particular sector. |

| Q | | Which fixed income market sectors most significantly affected Fund performance? |

| A | | Selections of U.S. securities within the government/ agency sector detracted from the Fund’s relative results. So, too, did selection of municipal securities, especially in September 2013. |

| | Individual issue selection within the collateralized, corporate bond and emerging market debt sectors added value. Within the collateralized sector, selection of agency mortgage-backed security pass-throughs and collateralized mortgage obligations helped most. (Pass-through mortgages consist of a pool of residential mortgage loans, where homeowners’ monthly payments of principal, interest and prepayments pass from the original bank through a government agency or investment bank to investors.) Within the corporate bond sector, choices amongst investment grade financial and industrial securities proved particularly effective. Within the emerging market debt sector, selections of external Brazilian debt contributed most positively to the Fund’s performance. |

| | An overweighted allocation to corporate bonds, implemented via our cross-sector strategy, contributed positively to the Fund’s performance during the Reporting Period, despite an increase in volatility following comments by the Federal Reserve (the “Fed”) regarding the potential for tapering its asset purchases. |

| Q | | Did the Fund’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period? |

| A | | Tactical management of the Fund’s duration and yield curve positioning had a positive impact on its results during the Reporting Period. Early in the second calendar quarter, a short duration position in the U.S. relative to the Barclays Index detracted, as interest rates declined on mixed economic data. Later in the Reporting Period, the Fund’s short U.S. duration position compared to that of the Barclays Index contributed positively to results, as U.S. Treasury yields began a rising trend after the fixed income market reacted to the Fed’s mid-May 2013 comments that it could begin tapering asset purchases earlier than the market had |

7

PORTFOLIO RESULTS

| | anticipated. The Fund’s long European duration position detracted in June 2013, but the same positioning contributed positively to performance in September 2013 when interest rates moved lower. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | As market conditions warranted during the Reporting Period, currency transactions were carried out using primarily over-the-counter (“OTC”) spot and forward foreign exchange contracts as well as by purchasing OTC options. Currency transactions were used as we sought both to enhance returns and to hedge the Fund’s portfolio against currency exchange rate fluctuations. Also, Treasury futures were used as warranted to facilitate specific duration, yield curve and country strategies; swaptions (or options on interest rate swap contracts) to express an outright term structure view and manage volatility (term structure, most often depicted as a yield curve, refers to the term structure of interest rates, which is the relationship between the yield to maturity and the time to maturity for pure discount bonds); credit default swaps to manage exposure to fluctuations in credit spreads (or the differential in yields between Treasury securities and non-Treasury securities that are identical in all respects except for quality rating); and interest rate swaps to manage exposure to fluctuations in interest rates. The Fund also used forward sales contracts to help manage duration. Overall, we employ derivatives and similar instruments for the efficient management of the Fund’s portfolio. Derivatives and similar instruments allow us to manage interest rate, credit and currency risks more effectively by allowing us both to hedge and to apply active investment views with greater versatility and to afford greater risk management precision than we would otherwise be able to implement. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | During the Reporting Period, we adjusted the Fund’s duration positioning as market conditions shifted. We maintained the Fund’s short U.S. duration stance relative to that of the Barclays Index for most of the Reporting Period in the face of expected Fed tapering. However, we did move to a more neutral U.S. duration position toward the end of the Reporting Period as a result of the withdrawal of Lawrence Summers’ candidacy for Fed chair and in anticipation of the September 2013 Fed meeting. |

| | From a sector perspective, the Fund began the Reporting Period with an overweight position in corporate bonds, but we trimmed the position to an underweight relative to the Barclays Index during the summer months, as volatility increased and due to the weak seasonal period. We maintained a bias toward lower quality investment grade corporate bonds during these months. After the Fed announced in mid-September that it would keep pace with its asset purchase program, surprising the market that it would not yet begin to taper, we re-established the Fund’s overweight exposure to corporate bonds. |

| | Amongst agency mortgage-backed securities, the Fund maintained a modest overweight exposure to agency multi-family securities, while shifting between an underweight and neutral position relative to the Barclays Index in agency mortgage-backed security pass-throughs. |

| Q | | How was the Fund positioned relative to its benchmark index at the end of September 2013? |

| A | | At the end of September 2013, the Fund had overweighted allocations relative to the Barclays Index on a market-value weighted basis in asset-backed securities and investment grade corporate bonds, with an emphasis in the latter on the financials industry. The Fund also had modest exposure to municipal bonds, which is a sector not represented in the Barclays Index. The Fund had underweighted exposure relative to the Barclays Index in U.S. government securities and commercial mortgage-backed securities. The Fund had a rather neutral position compared to the Barclays Index in residential mortgage-backed securities overall. However, within the residential mortgage-backed securities sector, the fund had an overweighted allocation to agency collateralized mortgage obligations and non-U.S. mortgage-backed securities and an underweighted exposure to mortgage-backed security pass-throughs. The Fund also had a rather neutral position compared to the Barclays Index in quasi-government bonds, emerging market debt and covered bonds at the end of the Reporting Period. (Covered bonds are debt securities backed by cash flows from mortgage loans or public sector loans.) The Fund had a neutral overall duration compared to the Barclays Index at the end of the Reporting Period. |

8

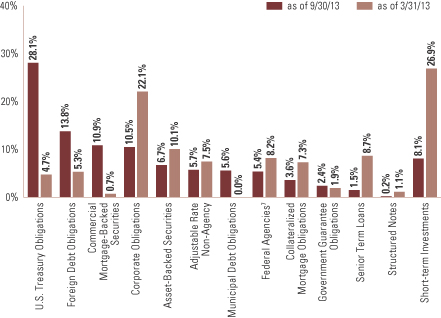

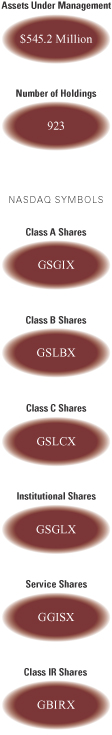

FUND BASICS

Core Fixed Income Fund

as of September 30, 2013

| | | | | | | | | | | | | | | | | | |

| | | April 1, 2013– September 30, 2013 | | Fund Total Return

(based on NAV)1 | | | Barclays

U.S. Aggregate

Bond Index2 | | | 30-Day

Standardized

Subsidized Yield3 | | | 30-Day

Standardized

Unsubsidized Yield3 | |

| | Class A | | | -1.99 | % | | | -1.77 | % | | | 1.82 | % | | | 1.82 | % |

| | Class B | | | -2.34 | | | | -1.77 | | | | 1.16 | | | | 1.16 | |

| | Class C | | | -2.34 | | | | -1.77 | | | | 1.16 | | | | 1.16 | |

| | Institutional | | | -1.72 | | | | -1.77 | | | | 2.23 | | | | 2.23 | |

| | Service | | | -2.06 | | | | -1.77 | | | | 1.74 | | | | 1.74 | |

| | Class IR | | | -1.87 | | | | -1.77 | | | | 2.14 | | | | 2.14 | |

| | | Class R | | | -2.02 | | | | -1.77 | | | | 1.65 | | | | 1.65 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Barclays U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds and mortgage-backed and asset-backed securities. The Index figure does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | 3 | | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. |

| | | | The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standard Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

9

FUND BASICS

| | |

| STANDARDIZED TOTAL RETURNS4 | | |

| | | | | | | | | | | | | | |

| | | For the period ended 9/30/13 | | One Year | | | Five Years | | Ten Years | | Since Inception | | Inception Date |

| | Class A | | | -5.19 | % | | 5.13% | | 3.48% | | 4.94% | | 5/1/97 |

| | Class B | | | -7.06 | | | 4.80 | | 3.25 | | 4.80 | | 5/1/97 |

| | Class C | | | -3.15 | | | 5.19 | | 3.12 | | 4.26 | | 8/15/97 |

| | Institutional | | | -1.01 | | | 6.31 | | 4.25 | | 5.65 | | 1/5/94 |

| | Service | | | -1.59 | | | 5.78 | | 3.74 | | 5.10 | | 3/13/96 |

| | Class IR | | | -1.20 | | | 6.20 | | N/A | | 3.90 | | 11/30/07 |

| | | Class R | | | -1.60 | | | 5.72 | | N/A | | 3.43 | | 11/30/07 |

| | 4 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 3.75% for Class A Shares, the assumed contingent deferred sales charge for Class B Shares (5% maximum declining to 0% after six years) and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Class B Shares convert automatically to Class A Shares on or about the fifteenth day of the last month of the calendar quarter that is eight years after purchase. Returns for Class B Shares for the period after conversion reflect the performance of Class A Shares. Prior to July 29, 2009, the maximum initial sales charge applicable to Class A Shares was 4.5%, which is not reflected in the average annual total return figures shown. Because Institutional, Service, Class IR and Class R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. The Fund’s Class B Shares are no longer available for purchase by new or existing shareholders (although current Class B shareholders may continue to reinvest income and capital gains distributions into Class B Shares, and Class B shareholders may continue to exchange their shares for Class B Shares of certain other Goldman Sachs Funds). |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 0.81 | % | | | 0.81 | % |

| | Class B | | | 1.56 | | | | 1.56 | |

| | Class C | | | 1.56 | | | | 1.56 | |

| | Institutional | | | 0.47 | | | | 0.47 | |

| | Service | | | 0.97 | | | | 0.97 | |

| | Class IR | | | 0.56 | | | | 0.56 | |

| | | Class R | | | 1.06 | | | | 1.06 | |

| | 5 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. |

10

FUND BASICS

| | |

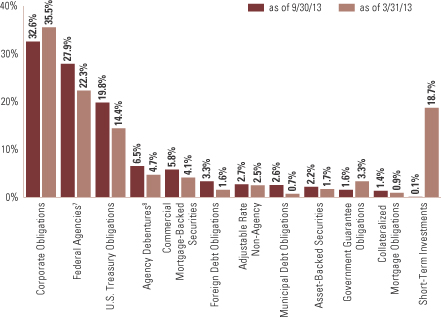

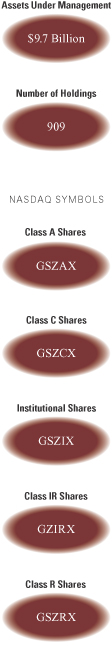

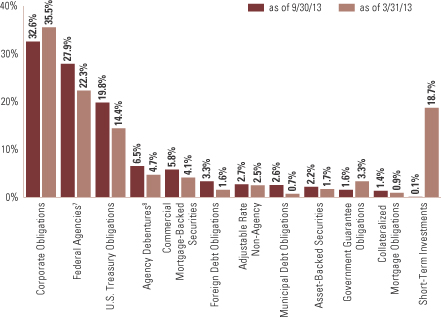

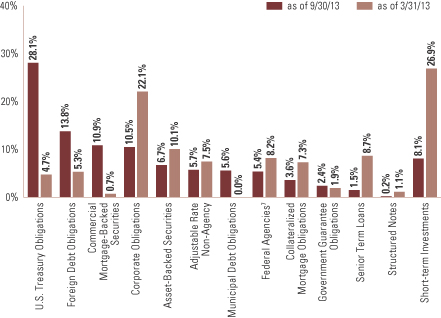

| SECTOR ALLOCATIONS6 | | |

| Percentage of Net Assets | | |

| | 6 | | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Short-term investments represent repurchase agreements. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| | 7 | | “Federal Agencies” are mortgage-backed securities guaranteed by the Government National Mortgage Association (“GNMA”), Federal National Mortgage Association (“FNMA”) and Federal Home Loan Mortgage Corp. (“FHLMC”). GNMA instruments are backed by the full faith and credit of the U.S. Government. |

| | 8 | | “Agency Debentures” include agency securities offered by companies such as FNMA and FHLMC, which operate under a government charter. While they are required to report to a government regulator, their assets are not explicitly guaranteed by the government and they otherwise operate like any other publicly traded company. |

11

PORTFOLIO RESULTS

Goldman Sachs Core Plus Fixed Income Fund

Investment Objective

The Fund seeks a total return consisting of capital appreciation and income that exceeds the total return of the Barclays U.S. Aggregate Bond Index.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs U.S. Fixed Income Investment Management Team discusses the Goldman Sachs Core Plus Fixed Income Fund’s (the “Fund”) performance and positioning for the six-month period ended September 30, 2013 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, B, C, Institutional, Service, IR and R Shares generated cumulative total returns, without sales charges, of -1.36%, -1.83%, -1.83%, -1.19%, -1.44%, -1.24% and -1.58%, respectively. These returns compare to the -1.77% cumulative total return of the Fund’s benchmark, the Barclays U.S. Aggregate Bond Index (the “Barclays Index”), during the same time period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | A primary contributor to Fund performance was our top-down cross-sector strategy. Our cross-sector strategy is one in which we invest Fund assets across a variety of fixed income sectors, including some that may not be included in the Fund’s benchmark. Tactical management of the Fund’s duration and yield curve positioning strategy also contributed positively, albeit more modestly, to Fund performance. Duration is a measure of the Fund’s sensitivity to changes in interest rates. Yield curve indicates the spectrum of maturities within a particular sector. |

| | Bottom-up individual issue selection within the collateralized and corporate bond sectors also added value during the Reporting Period. The security selection strategies in these sectors more than offset selection within the emerging market debt and U.S. government/agency sectors, which detracted. |

| Q | | Which fixed income market sectors most significantly affected Fund performance? |

| A | | Positioning in non-agency mortgage-backed securities, implemented via our cross-sector strategy, contributed positively to the Fund’s performance during the Reporting Period, as continued improvement in the housing market provided support for the sector. April 2013, in particular, proved to be a strong month for non-agency mortgage-backed securities, as a strong technical, or supply/demand, environment carried over from the first calendar quarter. Exposure to corporate bonds also contributed positively to the Fund’s performance, despite an increase in volatility following comments by the Federal Reserve (the “Fed”) regarding the potential for tapering its asset purchases. |

| | Individual issue selection within the collateralized and corporate bond sectors added value. Within the collateralized sector, selection of non-agency collateralized mortgage obligations helped most. Within the corporate bond sector, choices amongst investment grade industrial securities, with a lower quality bias, proved particularly effective. |

| | On the other hand, choices made within the emerging market debt sector detracted from the Fund’s relative results, as the combination of Fed tapering, U.S. economic growth outpacing economic growth in emerging markets, and China worries created headwinds for the sector throughout the third calendar quarter. Selection of government/agency securities also detracted from the Fund’s performance during the Reporting Period. |

| Q | | Did the Fund’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period? |

| A | | Tactical management of the Fund’s duration and yield curve positioning had a positive impact on its results during the Reporting Period. The Fund maintained a long duration position in both the U.S. and Germany, concentrated in the intermediate segment of the yield curve. This helped as yields generally moved lower. After a strong start to 2012, risk markets declined in the second quarter of the year on further evidence of slowing global economic growth and renewed tensions in Europe. As a result, core government |

12

PORTFOLIO RESULTS

| | bond markets rallied, driving U.S. and German government bond yields to multi-decade lows. Though risk assets recovered during the third calendar quarter, the Fed confirmed its commitment to keeping short-term interest rates near zero through at least mid-2015 and committed to a third round of quantitative easing in an open-ended program. Nearly simultaneously, the European Central Bank offered potentially unlimited government bond purchases on a formal request for aid. These central bank policies kept interest rates pinned low, and thus the Fund’s duration positioning contributed positively to its results. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | As market conditions warranted during the Reporting Period, currency transactions were carried out using primarily over-the-counter (“OTC”) spot and forward foreign exchange contracts as well as by purchasing OTC options. Currency transactions were used as we sought both to enhance returns and to hedge the Fund’s portfolio against currency exchange rate fluctuations. Also, Treasury futures were used as warranted to facilitate specific duration, yield curve and country strategies; swaptions (or options on interest rate swap contracts) to express an outright term structure view and manage volatility (term structure, most often depicted as a yield curve, refers to the term structure of interest rates, which is the relationship between the yield to maturity and the time to maturity for pure discount bonds); credit default swaps to manage exposure to fluctuations in credit spreads (or the differential in yields between Treasury securities and non-Treasury securities that are identical in all respects except for quality rating); and interest rate swaps to manage exposure to fluctuations in interest rates. The Fund also used forward sales contracts to help manage duration. Overall, we employ derivatives and similar instruments for the efficient management of the Fund’s portfolio. Derivatives and similar instruments allow us to manage interest rate, credit and currency risks more effectively by allowing us both to hedge and to apply active investment views with greater versatility and to afford greater risk management precision than we would otherwise be able to implement. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | During the Reporting Period, as mentioned earlier, we adjusted the Fund’s duration positioning as market conditions shifted. We maintained the Fund’s short U.S. duration stance relative to that of the Barclays Index for most of the Reporting Period in the face of expected Fed tapering. However, we did move to a more neutral U.S. duration position toward the end of the Reporting Period as a result of the withdrawal of Lawrence Summers’ candidacy for Fed chair and in anticipation of the September 2013 Fed meeting. We also tactically managed duration positioning in Japan, moving from a short duration stance early in the second calendar quarter to a modestly long duration stance later in the Reporting Period when aggressive policy stimulus was announced by the Bank of Japan. The Fund ended the Reporting Period with a neutral duration position in Japanese rates. |

| | From a sector perspective, the Fund began the Reporting Period with an overweight position in corporate bonds, but we subsequently trimmed the position to a rather neutral allocation relative to the Barclays Index as unfavorable seasonal factors were expected during the summer months. We maintained a bias toward lower quality investment grade corporate bonds during these months. After the Fed announced in mid-September 2013 that it would keep pace with its asset purchase program, surprising the market that it would not yet begin to taper, we re-established the Fund’s overweight exposure to corporate bonds. |

| | Amongst agency mortgage-backed securities, the Fund maintained an overweight exposure to agency multi-family securities, while shifting between an underweight and neutral position relative to the Barclays Index in agency mortgage-backed security pass-throughs. (Pass-through mortgages consist of a pool of residential mortgage loans, where homeowners’ monthly payments of principal, interest and prepayments pass from the original bank through a government agency or investment bank to investors.) |

| | We maintained the Fund’s overweighted allocation to non-agency mortgage-backed securities throughout the Reporting Period given positive housing market fundamentals. Such positioning proved to be a positive contributor to the Fund’s results during the Reporting Period. |

13

PORTFOLIO RESULTS

| | We reduced the Fund’s exposure to emerging market debt during the Reporting Period in light of the sell-off experienced in the sector through the beginning of the third calendar quarter. |

| Q | | How was the Fund positioned relative to its benchmark index at the end of September 2013? |

| A | | At the end of September 2013, the Fund had overweighted allocations relative to the Barclays Index on a market-value weighted basis in asset-backed securities, high yield corporate bonds, emerging market debt, investment grade corporate bonds, residential mortgage-backed securities and covered bonds. (Covered bonds are debt securities backed by cash flows from mortgage loans or public sector loans.) The Fund also had exposure to municipal bonds, which is a sector not represented in the Barclays Index. The Fund had underweighted exposure relative to the Barclays Index in U.S. government securities, commercial mortgage-backed securities and quasi-government securities. The Fund had a neutral overall duration compared to the Barclays Index at the end of the Reporting Period. |

14

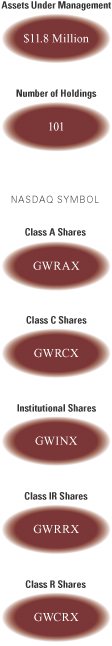

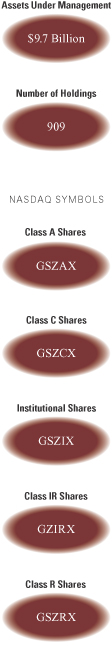

FUND BASICS

Core Plus Fixed Income Fund

as of September 30, 2013

| | | | | | | | | | | | | | | | | | |

| | | April 1, 2013– September 30, 2013 | | Fund Total Return

(based on NAV)1 | | | Barclays

U.S. Aggregate

Bond Index2 | | | 30-Day

Standardized

Subsidized Yield3 | | | 30-Day Standardized

Unsubsidized Yield3 | |

| | Class A | | | -1.36 | % | | | -1.77 | % | | | 2.40 | % | | | 2.10 | % |

| | Class B | | | -1.83 | | | | -1.77 | | | | 1.75 | | | | 1.45 | |

| | Class C | | | -1.83 | | | | -1.77 | | | | 1.76 | | | | 1.45 | |

| | Institutional | | | -1.19 | | | | -1.77 | | | | 2.84 | | | | 2.55 | |

| | Service | | | -1.44 | | | | -1.77 | | | | 2.33 | | | | 2.02 | |

| | Class IR | | | -1.24 | | | | -1.77 | | | | 2.74 | | | | 2.43 | |

| | | Class R | | | -1.58 | | | | -1.77 | | | | 2.25 | | | | 1.94 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Barclays U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds, and mortgage-backed and asset-backed securities. The Index figure does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | 3 | | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. |

| | | | The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standard Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

15

FUND BASICS

| | |

| STANDARDIZED TOTAL RETURNS4 | | |

| | | | | | | | | | | | |

| | | For the period ended 9/30/13 | | One Year | | | Five Years | | Since Inception | | Inception Date |

| | Class A | | | -3.19 | % | | 6.25% | | 4.62% | | 11/30/06 |

| | Class B | | | -5.16 | | | 5.89 | | 4.89 | | 6/20/07 |

| | Class C | | | -1.17 | | | 6.28 | | 4.41 | | 11/30/06 |

| | Institutional | | | 1.01 | | | 7.45 | | 5.57 | | 11/30/06 |

| | Service | | | 0.51 | | | 6.93 | | 5.53 | | 6/20/07 |

| | Class IR | | | 0.82 | | | 7.27 | | 5.34 | | 11/30/07 |

| | | Class R | | | 0.33 | | | 6.78 | | 4.86 | | 11/30/07 |

| | 4 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 3.75% for Class A Shares, the assumed contingent deferred sales charge for Class B Shares (5% maximum declining to 0% after six years) and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Class B Shares convert automatically to Class A Shares on or about the fifteenth day of the last month of the calendar quarter that is eight years after purchase. Prior to July 29, 2009, the maximum initial sales charge applicable to Class A Shares was 4.5%, which is not reflected in the average annual total return figures shown. Because Institutional, Service, Class IR and Class R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. The Fund’s Class B Shares are no longer available for purchase by new or existing shareholders (although current Class B shareholders may continue to reinvest income and capital gains distributions into Class B Shares, and Class B shareholders may continue to exchange their shares for Class B Shares of certain other Goldman Sachs Funds). |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 0.83 | % | | | 0.98 | % |

| | Class B | | | 1.58 | | | | 1.73 | |

| | Class C | | | 1.58 | | | | 1.73 | |

| | Institutional | | | 0.49 | | | | 0.64 | |

| | Service | | | 0.99 | | | | 1.13 | |

| | Class IR | | | 0.58 | | | | 0.73 | |

| | | Class R | | | 1.08 | | | | 1.24 | |

| | 5 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least July 29, 2014, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

16

FUND BASICS

| | |

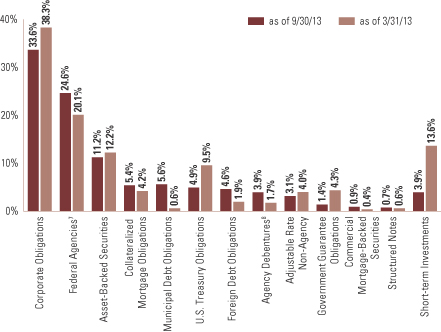

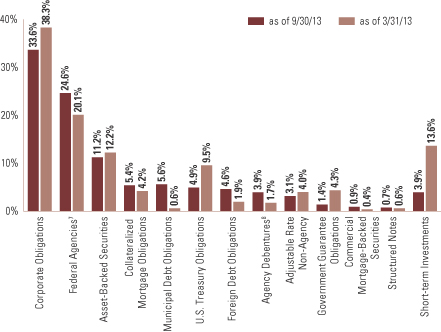

| SECTOR ALLOCATIONS6 | | |

| Percentage of Net Assets | | |

| | 6 | | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Short-term investments represent repurchase agreements. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| | 7 | | “Federal Agencies” are mortgage-backed securities guaranteed by the Government National Mortgage Association (“GNMA”), Federal National Mortgage Association (“FNMA”) and Federal Home Loan Mortgage Corp. (“FHLMC”). GNMA instruments are backed by the full faith and credit of the U.S. Government. |

| | 8 | | “Agency Debentures” include agency securities offered by companies such as FNMA and FHLMC, which operate under a government charter. While they are required to report to a government regulator, their assets are not explicitly guaranteed by the government and they otherwise operate like any other publicly traded company. |

17

PORTFOLIO RESULTS

Goldman Sachs Global Income Fund

Investment Objective

The Fund seeks a high total return, emphasizing current income, and, to a lesser extent, providing opportunities for capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Global Fixed Income Investment Management Team discusses the Goldman Sachs Global Income Fund’s (the “Fund”) performance and positioning for the six-month period ended September 30, 2013 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, B, C, Institutional, Service and IR Shares generated cumulative total returns, without sales charges, of -0.92%, -1.30%, -1.31%, -0.75%, -1.02% and -0.80%, respectively. These returns compare to the -0.92% cumulative total return of the Fund’s benchmark, the Barclays Global Aggregate Bond Index (Gross, USD, hedged) (the “Barclays Index”), during the same time period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Primary contributors to the Fund’s performance were our country, cross-sector and duration strategies. Within our country strategy, our five-year versus five-year relative value trading proved most effective. (The strategy looks at various countries, both developed and emerging market, for relative value opportunities.) Our long U.S. versus short Japan trade also proved to be beneficial, particularly in April 2013. Overall, the Fund’s positioning in the U.S. and Australia contributed positively to results, while positioning in Germany and Spain detracted. Our cross-sector strategy is one in which we invest Fund assets across a variety of fixed income sectors, including some that may not be included in the Fund’s benchmark. Duration is a measure of the Fund’s sensitivity to changes in interest rates. |

| | Our currency strategy detracted from the Fund’s results. An overweight position in the Mexican peso and tactical positioning in the euro hurt most. |

| Q | | Which fixed income market sectors most significantly affected Fund performance? |

| A | | The Fund’s tactical overweights to corporate bonds and to non-agency mortgage-backed securities contributed positively to its performance as did our tactical positioning within the agency mortgage-backed securities sector. Bottom-up individual issue selection within the emerging market debt, government/agency and collateralized sectors also boosted the Fund’s relative results during the Reporting Period. |

| | Conversely, overweighted allocations to asset-backed securities and emerging market debt detracted from the Fund’s results during the Reporting Period. Within the corporate bond sector, our regional positioning hurt performance modestly. |

| Q | | Did the Fund’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period? |

| A | | The combined effect of the Fund’s duration and yield curve positioning contributed positively to results during the Reporting Period. The Fund’s duration strategy is actively managed and constantly monitored in an effort to generate greater performance and reduced risk through volatile markets. We tactically adjusted the Fund’s duration position throughout the Reporting Period as market conditions shifted. Particularly benefiting the Fund’s results was our tactical short U.S. duration position relative to the Barclays Index maintained through most of the third calendar quarter, as U.S. yields rose through mid-September 2013 on expectations of a withdrawal of accommodative monetary policy by the U.S. Federal Reserve (the “Fed”). As it turns out, at its mid-September 2013 meeting, the Fed surprised markets by delaying the widely-anticipated reduction in asset |

18

PORTFOLIO RESULTS

| | purchases, with Fed Chair Ben Bernanke citing persistent concerns about the strength of the U.S. economic recovery and the pressure of fiscal tightening. |

| | The Fund’s short duration bias to the Japanese government bond yield curve also proved beneficial, particularly during the second quarter of 2013, when global government bond yields broadly increased. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | We used derivatives and similar instruments for the efficient management of the Fund. These derivatives and similar instruments allowed us to manage interest rate, credit and currency risks more effectively by allowing us both to hedge and to apply active investment views with greater versatility and to afford greater risk management precision than we would otherwise be able to implement. |

| | During the Reporting Period, we used interest rate and bond exchange traded futures contracts to implement duration and country strategies within the Fund, especially in the U.S., Eurozone, U.K. and Japanese markets. Currency transactions were carried out using primarily over-the-counter (“OTC”) spot and forward foreign exchange contracts as well as by purchasing OTC options. Currency transactions were used as we sought both to enhance returns and to hedge the Fund’s portfolio against currency exchange rate fluctuations. Interest rate and credit default swaps were also used as cost-efficient instruments to help grant us greater precision and versatility in the management of active strategies. Forward sales contracts were used to implement currency transactions based on our active views and for hedging purposes. Written option contracts were used to implement active views within our top-down and bottom-up selection strategies and for hedging purposes. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | As mentioned earlier, we tactically adjusted the Fund’s duration position throughout the Reporting Period as market conditions shifted. We increased the Fund’s weightings in commercial mortgage-backed securities, established a position in municipal bonds and reduced the Fund’s relative exposure to quasi-government securities, asset-backed securities, residential mortgage-backed securities and investment grade corporate bonds. We increased the Fund’s position in cash. |

| | From a country perspective, we decreased the Fund’s exposure to Italy from an overweight position to an underweight position relative to the Barclays Index. |

| Q | | How was the Fund positioned relative to its benchmark index at the end of September 2013? |

| A | | At the end of September 2013, the Fund had overweighted allocations relative to the Barclays Index in collateralized securities, including asset-backed securities and commercial mortgage-backed securities, as well as in emerging market debt and municipal bonds. The Fund had underweighted exposure relative to the Barclays Index in government securities and quasi-government securities and was rather neutral to the Barclays Index in corporate bonds, both investment grade and high yield, residential mortgage-backed securities and covered bonds. (Covered bonds are debt securities backed by cash flows from mortgage loans or public sector loans.) The Fund also had a sizable position in cash at the end of the Reporting Period. |

| | From a country perspective, the Fund was neutral relative to the benchmark in the Eurozone overall, but within the region, was underweight Spain, Italy and Ireland and overweight Germany, France and Slovenia at the end of the Reporting Period. The Fund was underweight relative to the Barclays Index in the U.K., Japan and the U.S. The Fund had a shorter duration than the Barclays Index at the end of the Reporting Period. |

19

FUND BASICS

Global Income Fund

as of September 30, 2013

| | | | | | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | April 1, 2013– September 30, 2013 | | Fund Total Return

(based on NAV)1 | | | Barclays Global

Aggregate Bond

Index (Gross,

USD, hedged)2 | | | 30-Day

Standardized

Subsidized Yield3 | | | 30-Day

Standardized

Unsubsidized Yield3 | |

| | Class A | | | -0.92 | % | | | -0.92 | % | | | 1.34 | % | | | 1.02 | % |

| | Class B | | | -1.30 | | | | -0.92 | | | | 0.66 | | | | 0.34 | |

| | Class C | | | -1.31 | | | | -0.92 | | | | 0.65 | | | | 0.33 | |

| | Institutional | | | -0.75 | | | | -0.92 | | | | 1.72 | | | | 1.40 | |

| | Service | | | -1.02 | | | | -0.92 | | | | 1.23 | | | | 0.91 | |

| | | Class IR | | | -0.80 | | | | -0.92 | | | | 1.64 | | | | 1.31 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Barclays Global Aggregate Bond Index (Gross, USD, hedged), an unmanaged index, provides a broad based measure of the global investment-grade fixed-rate debt markets and covers the most liquid portion of the global investment grade fixed-rate bond market, including government, credit and collateralized securities. The Index figures do not include any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | 3 | | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. |

| | | | The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standard Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

20

FUND BASICS

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS4 | | | |

| | | For the period ended 9/30/13 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | -2.73 | % | | | 5.23 | % | | | 3.73 | % | | | 5.47 | % | | 8/2/91 |

| | Class B | | | -4.71 | | | | 4.83 | | | | 3.50 | | | | 4.90 | | | 5/1/96 |

| | Class C | | | -0.70 | | | | 5.22 | | | | 3.37 | | | | 4.10 | | | 8/15/97 |

| | Institutional | | | 1.40 | | | | 6.38 | | | | 4.52 | | | | 5.93 | | | 8/1/95 |

| | Service | | | 0.88 | | | | 5.84 | | | | 4.00 | | | | 4.81 | | | 3/12/97 |

| | | Class IR | | | 1.24 | | | | N/A | | | | N/A | | | | 3.52 | | | 7/30/10 |

| | 4 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 3.75% for Class A Shares, the assumed contingent deferred sales charge for Class B Shares (5% maximum declining to 0% after six years) and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Class B Shares convert automatically to Class A Shares on or about the fifteenth day of the last month of the calendar quarter that is eight years after purchase. Returns for Class B Shares for the period after conversion reflect the performance of Class A Shares. Prior to July 29, 2009, the maximum initial sales charge applicable to Class A Shares was 4.5%, which is not reflected in the average annual total return figures shown. Because Institutional, Service and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. The Fund’s Class B Shares are no longer available for purchase by new or existing shareholders (although current Class B shareholders may continue to reinvest income and capital gains distributions into Class B Shares, and Class B shareholders may continue to exchange their shares for Class B Shares of certain other Goldman Sachs Funds). |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | EXPENSE RATIOS5 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.04 | % | | | 1.15 | % |

| | Class B | | | 1.79 | | | | 1.90 | |

| | Class C | | | 1.79 | | | | 1.90 | |

| | Institutional | | | 0.69 | | | | 0.81 | |

| | Service | | | 1.19 | | | | 1.31 | |

| | | Class IR | | | 0.79 | | | | 0.90 | |

| | 5 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least July 29, 2014, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

21

FUND BASICS

| | | | | | | | | | |

| | CURRENCY ALLOCATION6 | |

| | | | | Percentage of Net Assets | |

| | | | | as of 9/30/13 | | | as of 3/31/13 | |

| | U.S. Dollar7 | | | 48.6 | % | | | 56.7 | % |

| | Euro | | | 25.7 | | | | 28.2 | |

| | Japanese Yen | | | 8.1 | | | | 7.1 | |

| | British Pound | | | 3.6 | | | | 2.7 | |

| | Canadian Dollar | | | 2.0 | | | | 2.4 | |

| | Swedish Krona | | | 0.9 | | | | 1.1 | |

| | Mexican Peso | | | 0.9 | | | | 0.9 | |

| | South Korean Won | | | 0.7 | | | | 0.8 | |

| | Danish Krone | | | 0.6 | | | | 0.6 | |

| | Australian Dollar | | | 0.6 | | | | 0.7 | |

| | South African Rand | | | 0.5 | | | | 1.0 | |

| | Czech Koruna | | | 0.1 | | | | 0.0 | |

| | | Russian Ruble | | | 0.0 | | | | 0.3 | |

| | 6 | | The percentage shown for each currency reflects the value of investments in that category as a percentage of net assets. Figures in the table may not sum to 100% due to the exclusion of other assets and liabilities. The table depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| | 7 | | These figures represent the value excluding short-term obligations. If short-term obligations had been included, the percentages for 9/30/13 and 3/31/13 would have been 51.3% and 56.7%, respectively. |

22

PORTFOLIO RESULTS

Goldman Sachs Strategic Income Fund

Investment Objective

The Fund seeks total return comprised of income and capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs U.S. Fixed Income Investment Management Team discusses the Goldman Sachs Strategic Income Fund’s (the “Fund”) performance and positioning for the six-month period ended September 30, 2013 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, IR and R Shares generated cumulative total returns, without sales charges, of 1.25%, 0.87%, 1.43%, 1.28% and 1.13%, respectively. These returns compare to the 0.14% cumulative total return of the Fund’s benchmark, the BofA Merrill Lynch U.S. Dollar 3-Month LIBOR Constant Maturity Index (the “LIBOR Index”), during the same period. |

| | We note that the Fund’s benchmark being the LIBOR Index is a means of emphasizing that the Fund has an unconstrained strategy. That said, this Fund employs a benchmark agnostic strategy and thus comparisons to a benchmark index are not particularly relevant. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Overall, the Fund’s performance was driven by a pro-global economic growth view, including a constructive view on the U.S. economy expressed via sizable positions in corporate bonds and mortgage-backed securities. Additionally, the ability to hedge duration risk around the possibility of rising U.S. interest rates modestly helped the Fund’s performance. |

| | Within our top-down strategies, our cross-sector, country selection and duration strategies contributed positively to Fund performance. Our cross-sector strategy is one in which we invest Fund assets based on a discipline of valuing each fixed income sector in the context of all investment opportunities within the Fund’s universe. Within our country strategy, relative value trades of favoring Europe over the U.K. and favoring the U.S. versus Japan added value, as did our five-year versus five-year country valuation strategy. (The strategy looks at various countries, both developed and emerging market, for relative value opportunities.) Duration is a measure of the Fund’s sensitivity to changes in interest rates. Bottom-up individual issue selection within the mortgage-backed securities sector also added value during the Reporting Period. |