UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

| Caroline Kraus, Esq. | | Copies to: |

| Goldman, Sachs & Co. | | Geoffrey R.T. Kenyon, Esq. |

| 200 West Street | | Dechert LLP |

| New York, New York 10282 | | 100 Oliver Street |

| | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: December 31

Date of reporting period: June 30, 2014

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Stockholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | June 30, 2014 |

| | |

| | | | Fund of Funds Portfolios |

| | | | Balanced Strategy |

| | | | Equity Growth Strategy |

| | | | Growth and Income Strategy |

| | | | Growth Strategy |

| | | | Satellite Strategies |

Goldman Sachs Fund of Funds Portfolios

| n | | GROWTH AND INCOME STRATEGY |

| | | | |

TABLE OF CONTENTS | | | | |

| |

Principal Investment Strategies and Risks | | | 1 | |

| |

Market Review | | | 3 | |

| |

Investment Process | | | 5 | |

| |

Portfolio Management Discussions and Performance Summaries | | | 7 | |

| |

Schedules of Investments | | | 32 | |

| |

Financial Statements | | | 38 | |

| |

Financial Highlights | | | 46 | |

| |

Notes to Financial Statements | | | 56 | |

| |

Other Information | | | 74 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS FUND OF FUNDS PORTFOLIOS

Principal Investment Strategies and Risks

This is not a complete list of risks that may affect the Portfolios. For additional information concerning the risks applicable to the Portfolios, please see the Portfolios’ Prospectus.

The Goldman Sachs Balanced Strategy Portfolio invests in affiliated domestic and international fixed income and equity funds (“underlying funds”). The Portfolio’s investment in any of the underlying funds may exceed 25% of its assets. The Portfolio currently expects to invest a relatively significant percentage of its assets in the Goldman Sachs Short Duration Government, Goldman Sachs Global Income, Goldman Sachs Core Fixed Income, Goldman Sachs Large Cap Growth Insights, Goldman Sachs Large Cap Value Insights, and Goldman Sachs International Equity Insights Funds. The Portfolio is subject to the risk factors of the underlying funds in direct proportion to its investments in those underlying funds, and the ability of the Portfolio to meet its investment objective is directly related to the ability of the underlying funds to meet their investment objectives, as well as the allocation among those underlying funds by the Investment Adviser. An underlying fund is subject to the risks associated with its investments, including (as applicable) those associated with equity, fixed income, foreign and derivative investments generally. From time to time, the underlying funds in which the Portfolio invests, and the size of the investments in the underlying funds, may change. Because the Portfolio is subject to the underlying fund expenses as well as its own expenses, the cost of investing in the Portfolio may be higher than investing in a mutual fund that only invests directly in stocks and bonds.

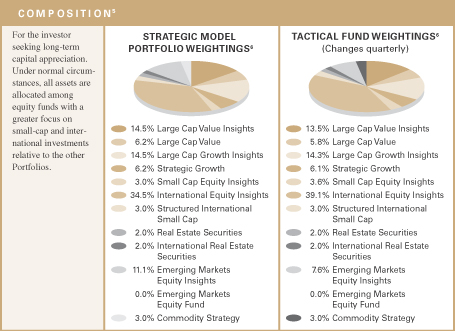

The Goldman Sachs Equity Growth Strategy Portfolio invests substantially all of its assets in affiliated domestic and international equity funds (“underlying funds”). The Portfolio’s investment in any of the underlying funds may exceed 25% of its assets. The Portfolio currently expects to invest a relatively significant percentage of its assets in the Goldman Sachs Large Cap Growth Insights, Goldman Sachs Large Cap Value Insights, and Goldman Sachs International Equity Insights Funds. The Portfolio is subject to the risk factors of the underlying funds in direct proportion to its investments in those underlying funds, and the ability of the Portfolio to meet its investment objective is directly related to the ability of the underlying funds to meet their investment objectives, as well as the allocation among those underlying funds by the Investment Adviser. An underlying fund is subject to the risks associated with its investments, including (as applicable) those associated with equity, fixed income, foreign and derivative investments generally. From time to time, the underlying funds in which the Portfolio invests, and the size of the investments in the underlying funds, may change. Because the Portfolio is subject to the underlying fund expenses as well as its own expenses, the cost of investing in the Portfolio may be higher than investing in a mutual fund that only invests directly in stocks and bonds.

The Goldman Sachs Growth and Income Strategy Portfolio invests in affiliated domestic and international fixed income and equity funds (“underlying funds”). The Portfolio’s investment in any of the underlying funds may exceed 25% of its assets. The Portfolio currently expects to invest a relatively significant percentage of its assets in the Goldman Sachs Large Cap Growth Insights, Goldman Sachs Large Cap Value Insights, and Goldman Sachs International Equity Insights Funds, Goldman Sachs Core Fixed Income and Goldman Sachs Global Income Funds. The Portfolio is subject to the risk factors of the underlying funds in direct proportion to its investments in those underlying funds, and the ability of the Portfolio to meet its investment objective is directly related to the ability of the underlying funds to meet their investment objectives, as well as the allocation among those underlying funds by the Investment Adviser. An underlying fund is subject to the risks associated with its investments, including (as applicable) those associated with equity, fixed income, foreign and derivative investments generally. From time to time, the underlying funds in which the Portfolio invests, and the size of the investments in the underlying funds, may change. Because the Portfolio is subject to the underlying fund expenses as well as its own expenses, the cost of investing in the Portfolio may be higher than investing in a mutual fund that only invests directly in stocks and bonds.

1

GOLDMAN SACHS FUND OF FUNDS PORTFOLIOS

The Goldman Sachs Growth Strategy Portfolio invests in affiliated domestic and international fixed income and equity funds (“underlying funds”). The Portfolio’s investment in any of the underlying funds may exceed 25% of its assets. The Portfolio currently expects to invest a relatively significant percentage of its assets in the Goldman Sachs Large Cap Growth Insights, Goldman Sachs Large Cap Value Insights, and Goldman Sachs International Equity Insights Funds. The Portfolio is subject to the risk factors of the underlying funds in direct proportion to its investments in those underlying funds, and the ability of the Portfolio to meet its investment objective is directly related to the ability of the underlying funds to meet their investment objectives, as well as the allocation among those underlying funds by the Investment Adviser. An underlying fund is subject to the risks associated with its investments, including (as applicable) those associated with equity, fixed income, foreign and derivative investments generally. From time to time, the underlying funds in which the Portfolio invests, and the size of the investments in the underlying funds, may change. Because the Portfolio is subject to the underlying fund expenses as well as its own expenses, the cost of investing in the Portfolio may be higher than investing in a mutual fund that only invests directly in stocks and bonds.

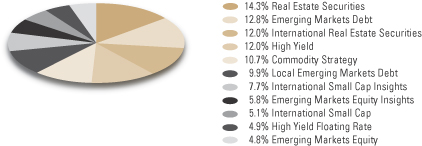

The Goldman Sachs Satellite Strategies Portfolio invests primarily in affiliated fixed income and equity funds (“underlying funds”) which are considered to invest in satellite asset classes. Satellite asset classes are those that have traditionally had low correlations to traditional market exposures such as large capitalization equities and investment grade fixed income. The Portfolio’s investment in any of the underlying funds may exceed 25% of its assets. The Investment Adviser expects to invest relatively significant percentages in the following satellite equity asset classes: emerging markets equity, international small cap, U.S. and international real estate securities. The Investment Adviser may invest a relatively significant percentage in the following satellite fixed income asset classes: high yield, emerging markets debt and commodities. The Portfolio is subject to the risk factors of the underlying funds in direct proportion to its investments in those underlying funds, and the ability of the Portfolio to meet its investment objective is directly related to the ability of the underlying funds to meet their investment objectives, as well as the allocation among those underlying funds by the Investment Adviser. An underlying fund is subject to the risks associated with its investments, including (as applicable) those associated with equity, fixed income, foreign, commodity and derivative investments generally. From time to time, the underlying funds in which the Portfolio invests, and the size of the investments in the underlying funds, may change. Because the Portfolio is subject to the underlying fund expenses as well as its own expenses, the cost of investing in the Portfolio may be higher than investing in a mutual fund that only invests directly in stocks and bonds.

2

MARKET REVIEW

Fund of Funds Portfolios

Dear Shareholder:

This report provides an overview of regional and sector preferences of the Goldman Sachs Fund of Funds Portfolios (each, a “Portfolio,” and collectively, the “Portfolios”) during the six-month period ended June 30, 2014 (the “Reporting Period”).

Market Review

After a weak January 2014, U.S. and international equities rallied through the remainder of the six months ended June 30, 2014 (the “Reporting Period”). Global spread (non-government bond) sectors also generated positive, albeit more modest, returns, as intermediate-term and longer-term yields declined.

Equity Markets

In the U.S., economic data was slightly disappointing early in the Reporting Period. The housing market maintained its recovery, but the labor market remained weaker than expected. Additionally, fourth quarter 2013 U.S. Gross Domestic Product (“GDP”) was revised down to an annualized rate of 2.4% from 3.2% . The Federal Reserve (the “Fed”) reduced its asset purchases each month beginning in January 2014 and suggested a more hawkish stance in March 2014, dropping the threshold of 6.5% unemployment as a condition for raising interest rates. Fed Chair Yellen implied that interest rates could start to increase six months after the asset purchase program ends. Many U.S. corporate earnings announcements reflected top-line growth, though overall management guidance for 2014 was less optimistic than consensus. Meanwhile, in the first quarter of 2014, the Eurozone reported that its economy grew at a stronger than expected 0.5% year over year rate for the fourth quarter of 2013, and the European Commission raised its estimates for GDP growth to 1.2% for calendar year 2014 and to 1.8% for calendar year 2015. Based largely on such economic optimism, many European stock markets outperformed the broader international equities market in the first calendar quarter, despite some disappointing corporate earnings reports and conservative guidance from management and the potentially immediate threat of disinflation. Economic activity was also strong in Japan during the first quarter of 2014 ahead of the consumption tax hike on April 1, 2014. However, the Japanese equity market underperformed international equities in the first quarter of 2014 in part based on concerns that economic trends would be more difficult to assess ahead of the tax increase.

During the second calendar quarter, first quarter 2014 U.S. GDP was revised down to a contraction of 2.9%, largely due to disruption from severe winter weather. However, other economic data suggested the economy is improving. U.S. non-farm payrolls added 217,000 jobs in May 2014, and the national manufacturing Purchasing Managers Index (“PMI”), which rose to 56.4 in May 2014 from 55.4 in April 2014, showed the strongest reading in the past three months. In Europe, the U.K. equity market rose on an improving economic outlook, but many continental European stock markets declined in June 2014 amidst worries about deflation, disappointing European PMI data and the lowest reading in six months of the German Ifo Business Climate Index, a survey of German business confidence. In an effort to stimulate the European economy, the European Central Bank (“ECB”) cut interest rates by 10 basis points, which put deposit rates in negative territory, to promote lending. (A basis point is 1/100th of a percentage point.) In contrast, Japanese stocks rallied sharply into the end of the Reporting Period, as evidence suggested that underlying growth trends following the consumption tax increase were stronger than expected. In addition, it was publicly reported

3

MARKET REVIEW

late in the second quarter of 2014 that the tax increase in Japan had driven the biggest year over year increase in inflation in that nation in more than 20 years in April 2014.

Fixed Income Markets

In January 2014, when the Reporting Period began, global spread sectors performed well, as intermediate-term and longer-term yields fell on concerns about growth in the emerging markets and the condition of China’s banking system as well as on unusually cold weather and disappointing economic data in the U.S. As mentioned earlier, the Fed reduced its asset purchases each month beginning in January 2014 and suggested a more hawkish stance in March 2014, dropping the threshold of 6.5% unemployment as a condition for raising interest rates. In the Eurozone, the ECB restated its accommodative bias, dwelling less on recent positive economic data and more on potential downside risks to growth and inflation. Russia’s military presence in Ukraine and tensions over Crimea’s possible secession weighed heavily on that region’s markets. Russian assets took the brunt of the selloff, and the Russian central bank hiked interest rates to curb further currency depreciation. During March 2014, fixed income investors generally focused on headlines regarding events in Ukraine and the implementation of U.S. and European sanctions on Russia. Although the global manufacturing PMI dipped, it remained in solidly expansionary territory — led by continued strong activity in the U.S. and U.K. — with the notable exception of China, where production contracted by the sharpest degree since November 2011. In March 2014, after Fed Chair Yellen suggested interest rates could start to increase six months after the Fed’s asset purchase program ends, intermediate-term and longer-term yields edged up.

During the second calendar quarter, intermediate-term and longer-term yields resumed their decline, and global spread sectors rallied. In April 2014, the U.S. announced first quarter 2014 GDP growth of 0.1%, which was weaker than expected, but April 2014 U.S. nonfarm payrolls data came in above expectations. During May 2014, first calendar quarter GDP growth was revised downward to -1.0% and subsequently in June 2014 to -2.9% . However, economic data releases, such as auto sales, jobless claims and manufacturing activity, suggested a rebound was underway. This supported the view of some market participants that the first calendar quarter contraction might have been due to inclement winter weather and that economic growth could accelerate in the second quarter of 2014. As mentioned earlier, in the Eurozone, during June 2014, the ECB cut interest rates by 10 basis points, moving the deposit rate into negative territory for the first time in history. The ECB also announced it would be implementing additional liquidity measures targeted at stimulating lending. Meanwhile, the June 2014 global manufacturing PMI hit a four-month high, with the U.S. and the U.K. experiencing some of the largest manufacturing output growth.

4

GOLDMAN SACHS FUND OF FUNDS PORTFOLIOS

What Differentiates Goldman Sachs’

Approach to Asset Allocation?

We believe that strong investment results through asset allocation are best achieved through teams of experts working together on a global scale:

| n | | Goldman Sachs’ Quantitative Investment Strategies Team determines the strategic and quarterly tactical asset allocations. The team is comprised of over 70* professionals with significant academic and practitioner experience. |

| n | | Goldman Sachs’ Portfolio Management Teams offer expert management of the mutual funds that are contained within each Asset Allocation Portfolio (each, a “Portfolio”). These same teams manage portfolios for institutional and high net worth investors. |

Goldman Sachs Asset Allocation Investment Process

Quantitative Investment Strategies Team

Each Fund of Funds Portfolio represents a diversified global portfolio on the efficient frontier.† The Portfolios differ in their long-term objective, and therefore, their asset allocation mix. The long-term strategic asset allocation is the primary source of risk and the corresponding primary determinant of total return. It therefore represents an anchor, or neutral starting point, from which tactical asset allocation decisions are made.

Quantitative Investment Strategies Team

For each Portfolio, the strategic asset allocation is combined with a measured amount of tactical risk. Changing market conditions create opportunities to capitalize on investing in different countries and asset classes relative to others over time. Within each strategy, we shift assets away from the strategic allocation (over and underweighting certain asset classes and countries) to seek to benefit from changing conditions in global capital markets.

Using proprietary portfolio construction models to maintain each Portfolio’s original risk/ return profile over time, the team makes ten active decisions based on its current outlook on global equity, fixed income and currency markets.

| | |

n Asset class selection | | Are stocks, bonds or cash more attractive? |

n Regional equity selection | | Are U.S. or non-U.S. equities more attractive? |

n Regional bond selection | | Are U.S. or non-U.S. bonds more attractive? |

n U.S. equity style selection | | Are U.S. value or U.S. growth equities more attractive? |

n U.S. equity size selection | | Are U.S. large-cap or U.S. small-cap equities more attractive? |

n Emerging/developed equity selection | | Are emerging or developed equities more attractive? |

| †Portfolios | | on the efficient frontier are optimal in both the sense that they offer maximal expected return for some given level of risk and minimal risk for some given level of expected return. The efficient frontier is the line created from the risk-reward graph, comprised of optimal portfolios. The optimal portfolios plotted along the curve have the highest expected return possible for the given amount of risk. |

5

GOLDMAN SACHS FUND OF FUNDS PORTFOLIOS

| | |

n Developed equity country selection | | Which international countries are more attractive? |

n Emerging equity country selection | | Which emerging market countries are more attractive? |

n High yield selection | | Are high yield or core fixed income securities more attractive? |

n Emerging/developed bond selection | | Are emerging or developed bonds more attractive? |

Mutual Fund Portfolio Management Teams

Each Portfolio is comprised of underlying Goldman Sachs Mutual Funds managed by broad, deep portfolio management teams. In addition to global tactical asset allocation, we seek to generate excess returns through security selection within each underlying mutual fund. Whether in the equity or fixed income arenas, these portfolio management teams share a commitment to firsthand fundamental research and seek performance driven by successful security selection.

6

PORTFOLIO RESULTS

Fund of Funds Portfolios – Asset Allocation

Investment Process and Principal Strategy

Each Portfolio seeks to achieve its investment objective by investing in a combination of underlying funds that currently exist or that may become available for investment in the future for which Goldman Sachs Asset Management (“GSAM”) or an affiliate, now or in the future, acts as investment adviser or principal underwriter (the “underlying funds”). Some of the Portfolios’ underlying funds invest primarily in fixed income or money market instruments, and some invest primarily in equity securities. Some underlying funds also invest dynamically across equity, fixed income, commodity and other markets through a managed-volatility or trend-following approach.

The investment adviser allows the Portfolios’ strategic targets to shift with their respective market returns but continues to adjust tactical tilts on a quarterly basis to reflect the investment adviser’s latest views. The investment adviser adjusts the overall asset allocation of the Portfolios based on current market conditions and the investment adviser’s economic and market forecasts.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Quantitative Investment Strategies Team discusses the Portfolios’ performance and positioning for the six-month period ended June 30, 2014 (the “Reporting Period”).

| Q | | How did the Portfolios perform during the Reporting Period? |

| A | | Goldman Sachs Balanced Strategy Portfolio — During the Reporting Period, the Balanced Strategy Portfolio’s Class A, B, C, Institutional, Service, IR and R Shares generated cumulative total returns of 4.33%, 3.99%, 3.93%, 4.62%, 4.36%, 4.47% and 4.31%, respectively. This compares to the 4.93% cumulative total return of the Portfolio’s blended benchmark, which is comprised 60% of the Barclays Global Aggregate Bond Index (Gross, USD, Hedged) (“Barclays Global Index”) and 40% of the Morgan Stanley Capital International (MSCI) All Country World Index (Gross, USD, Unhedged) (“MSCI® ACWI Index”), during the same period. |

| | The components of the Portfolio’s blended benchmark, the Barclays Global Index and the MSCI® ACWI Index, generated cumulative total returns of 4.08% and 6.18%, respectively, during the same period. |

| | Goldman Sachs Equity Growth Strategy Portfolio — During the Reporting Period, the Equity Growth Strategy Portfolio’s Class A, B, C, Institutional, Service, IR and R Shares generated cumulative total returns of 6.23%, 5.89%, 5.77%, 6.45%, 6.19%, 6.31% and 6.14%, respectively. |

| | This compares to the 6.18% cumulative total return of the Portfolio’s benchmark, the MSCI® ACWI Index, during the same period. |

| | Goldman Sachs Growth and Income Strategy Portfolio — During the Reporting Period, the Growth and Income Strategy Portfolio’s Class A, B, C, Institutional, Service, IR and R Shares generated cumulative total returns of 4.88%, 4.49%, 4.42%, 5.07%, 4.83%, 4.95% and 4.77%, respectively. This compares to the 5.35% cumulative total return of the Portfolio’s blended benchmark, which is comprised 40% of the Barclays Global Index and 60% of the MSCI® ACWI Index, during the same period. |

| | The components of the Portfolio’s blended benchmarks, the Barclays Global Index and the MSCI® ACWI Index, generated cumulative total returns of 4.08% and 6.18%, respectively, during the same period. |

| | Goldman Sachs Growth Strategy Portfolio — During the Reporting Period, the Growth Strategy Portfolio’s Class A, B, C, Institutional, Service, IR and R Shares generated cumulative total returns of 5.35%, 5.00%, 4.98%, 5.59%, 5.37%, 5.50% and 5.24%, respectively. This compares to the 5.77% cumulative total return of the Portfolio’s blended benchmark, which is comprised 80% of the MSCI® ACWI Index and 20% of the Barclays Global Index, during the same period. |

| | The components of the Portfolio’s blended benchmarks, the Barclays Global Index and the MSCI® ACWI Index, generated cumulative total returns of 4.08% and 6.18%, respectively, during the same period. |

7

PORTFOLIO RESULTS

| Q | | What key factors affected the Portfolios’ performance during the Reporting Period? |

| A | | During the Reporting Period, the Portfolios generated positive absolute returns, with those having greater equity exposure performing more strongly. However, overall, with the exception of the Goldman Sachs Equity Growth Strategy Portfolio (our equity-only Portfolio), the Portfolios underperformed their respective blended benchmarks, largely as a result of our strategic, long-term asset allocation policy and the implementation of our quarterly tactical views. Security selection within the underlying funds added to the performance of each of the Portfolios. |

| Q | | How did Global Tactical Asset Allocation decisions affect the Portfolios’ performance during the Reporting Period? |

| A | | Although the Portfolios’ overweight in equities versus fixed income contributed positively to relative performance, the implementation of our quarterly tactical views detracted from the performance of the Portfolios during the Reporting Period. |

| | Within equity allocations, underweight positions in U.S. value stocks versus U.S. growth stocks detracted from performance, especially during the first quarter of 2014 and particularly in those Portfolios with greater equity exposure. Overweight positions in U.S. small-cap stocks relative to U.S. large-cap stocks also dampened returns. On the positive side, overweight positions in U.S. equities versus international equities added to performance. Underweight positions in emerging markets equities versus developed markets equities also contributed positively. |

| | Within fixed income allocations, underweight positions in local emerging markets debt relative to developed markets debt detracted from results. On the other hand, the Portfolios benefited from overweight positions in high yield corporate bonds versus investment grade corporate bonds. The impact of the Portfolios’ positioning in U.S. dollar denominated emerging markets debt (through which the Portfolios gain exposure to local currencies) versus developed markets debt was relatively neutral as was the effect of overweight positions in U.S. fixed income versus international fixed income. |

| Q | | How did the Portfolios’ underlying funds perform relative to their respective benchmark indices during the Reporting Period? |

| A | | Of the Portfolios’ underlying equity funds, the Goldman Sachs Large Cap Growth Insights Fund and the Goldman Sachs Large Cap Value Fund performed best relative to their respective benchmark indices. The Goldman Sachs Strategic Growth Fund underperformed its benchmark index most during the Reporting Period. |

| | On the fixed income side, the Goldman Sachs Global Income Fund and the Goldman Sachs Core Fixed Income Fund outperformed their respective benchmark indices most. The Goldman Sachs Local Emerging Markets Debt Fund underperformed its benchmark index most during the Reporting Period. |

| | Among alternative investment classes, all underlying funds underperformed their respective benchmark indices, with the Goldman Sachs International Real Estate Securities Fund underperforming its benchmark most during the Reporting Period. |

| Q | | How did the Portfolios use derivatives and similar instruments during the Reporting Period? |

| A | | The Portfolios do not directly invest in derivatives. However, some of the underlying funds used derivatives during the Reporting Period to apply their active investment views with greater versatility and to potentially afford greater risk management precision. As market conditions warranted during the Reporting Period, some of these underlying funds engaged in forward foreign currency exchange contracts, financial futures contracts, options, swap contracts and structured securities to attempt to enhance portfolio return and for hedging purposes. |

| Q | | What changes did you make during the Reporting Period within both the equity and fixed income portions of the Portfolio? |

| A | | Throughout the Reporting Period, we were bullish on equities versus fixed income in implementing our strategies. |

| | Within equities, at the beginning of the Reporting Period, we were slightly bullish on U.S. stocks versus international stocks because of continued strong momentum, high risk premiums and a supportive macroeconomic environment for U.S. equities. We remained slightly bullish on U.S. stocks relative to international stocks during the first quarter of 2014 primarily due to continued strong momentum. In the second calendar quarter, we remained slightly bullish on U.S. stocks versus international stocks, largely because of continued strong momentum and supportive macroeconomic conditions in the U.S. Also, when the Reporting Period started, we were bullish on developed markets equities versus emerging markets equities because of attractive |

8

PORTFOLIO RESULTS

| | relative valuations in developed markets equities. We became slightly less bullish during the first calendar quarter and then shifted to a modestly bullish view on emerging markets stocks versus developed markets stocks during the second calendar quarter due to supportive macroeconomic conditions in the emerging markets. |

| | We implemented our country level views within the Goldman Sachs International Equity Insights Fund and the Goldman Sachs Emerging Markets Equity Insights Fund, which were underlying funds during the Reporting Period. Among developed markets equities at the end of the Reporting Period, we were bullish on Japan due to attractive valuations and high risk premiums. We were bullish on Norway because of strong investment flows and attractive valuations. We had a bearish view on Portugal given expensive valuations and low risk premiums. We were bearish on the Netherlands primarily due to weak momentum. Among emerging markets equities at the end of the Reporting Period, we favored Russia and China because of attractive valuations. We were bearish on Taiwan due to low risk premiums and bearish on Mexico as a result of expensive valuations. |

| | Among U.S. equities, we began the Reporting Period bullish on growth stocks versus value stocks due to strong investor sentiment for growth stocks. In the first quarter of 2014, we adopted a neutral view on growth stocks versus value stocks because the high risk premiums of value stocks were offset by negative investor sentiment about growth stocks. During the second calendar quarter, we shifted our view from neutral to slightly bullish on value stocks relative to growth stocks because of positive sentiment for value stocks. We were neutral at the beginning of the Reporting Period on small-cap stocks relative to large-cap stocks as high risk premiums for small-cap stocks were offset by poor sentiment and less attractive valuations. During the first calendar quarter, we became slightly bullish on small-cap stocks versus large-cap stocks due to high risk premiums and positive sentiment for small-cap stocks. Although we continued to be bullish on small-cap stocks versus large-cap stocks during the second quarter of 2014, we moderated our view slightly because of high risk premiums for small-cap stocks. |

| | Within fixed income, throughout the Reporting Period, we remained neutral on international fixed income versus U.S. fixed income. We were bullish on high yield bonds versus investment grade bonds when the Reporting Period began, growing more bullish during the first calendar quarter because of the relatively strong momentum and high risk premiums of high yield bonds. Although we slightly moderated our bullish view on high yield bonds versus investment grade bonds during the second calendar quarter, we remained bullish given the strong momentum of high yield bonds. |

| | When the Reporting Period started, we held a bullish view on developed markets debt versus U.S. dollar denominated emerging markets debt due to strong momentum in developed markets debt. In the first calendar quarter, we became slightly bearish on developed markets debt versus U.S. dollar denominated emerging markets debt due to strong momentum in U.S. dollar denominated emerging markets debt. In the second calendar quarter, we became slightly bullish on U.S. dollar-denominated emerging markets debt versus developed market debt primarily because of strong momentum in U.S. dollar-denominated emerging markets debt. |

| | At the beginning of the Reporting Period and through the first quarter 2014, we were bearish on local emerging markets debt versus developed markets debt primarily because of poor momentum for local emerging markets debt. During the second calendar quarter, we shifted to a slightly bullish view on local emerging markets debt relative to developed markets debt due to high risk premiums and supportive macroeconomic conditions for local emerging markets debt. |

| Q | | What is the Portfolios’ tactical view and strategy for the months ahead? |

| A | | Global equilibrium is the foundation of our strategic asset allocation process — that is, we believe that a globally-diversified portfolio of asset classes, weighted by their market capitalization, may provide economically intuitive, meaningful and balanced exposures to investment opportunities. We make 10 active decisions within the Portfolios based on our current outlook on global equity, fixed income and currency markets. On a quarterly basis, we shift assets away from the strategic allocation (tilting our positions in certain asset classes and countries from their longer-term, strategic weights) in an effort to benefit from changing conditions in global capital markets. |

| | During the Reporting Period, we had introduced two new components to our strategic allocation — a managed futures trend-following strategy and an unconstrained fixed income strategy, both of which are implemented through two new underlying funds. The Goldman Sachs Managed Futures Strategy Fund seeks to profit from market trends while acting |

9

PORTFOLIO RESULTS

| | as an overall portfolio diversifier. The Goldman Sachs Strategic Income Fund takes a dynamic, flexible approach to fixed income investing while potentially being less sensitive to future interest rate movements. Ultimately, we believe the inclusion of these two components can potentially provide a more diversified investment experience for investors. The ability to express our tactical asset allocation tilts will not be affected, and all Portfolios will be constructed to maintain the same overall risk profile as their respective benchmarks. |

| | At the end of the Reporting Period, we remained bullish on equities relative to fixed income because of continued strong momentum in the global equities markets. We were slightly bullish on emerging markets equities versus developed markets equities, and we continued to be slightly bullish on U.S. equities versus international equities. Within U.S. equities, we had shifted our view from neutral to bullish on value stocks versus growth stocks and had moderated our bullish view on small-cap stocks versus large-cap stocks. |

| | In fixed income at the end of the Reporting Period, we were neutral on international fixed income relative to U.S. fixed income. We had become slightly less bullish on high yield bonds relative to investment grade bonds. Also, we maintained our slightly bullish view on U.S. dollar denominated emerging markets debt versus developed markets debt and had shifted to a bullish view on local emerging markets debt versus developed markets debt. |

10

FUND BASICS

Balanced Strategy

as of June 30, 2014

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | January 1, 2014–June 30, 2014 | | Portfolio Total Return

(based on NAV)1 | | | Balanced Strategy

Composite Index2 | |

| | Class A | | | 4.33 | % | | | 4.93 | % |

| | Class B | | | 3.99 | | | | 4.93 | |

| | Class C | | | 3.93 | | | | 4.93 | |

| | Institutional | | | 4.62 | | | | 4.93 | |

| | Service | | | 4.36 | | | | 4.93 | |

| | Class IR | | | 4.47 | | | | 4.93 | |

| | | Class R | | | 4.31 | | | | 4.93 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Portfolio (ex-dividend) divided by the total number of shares of the class outstanding. The Portfolio’s performance assumes the reinvestment of dividends and other distributions. The Portfolio’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Balanced Strategy Composite Index (“Balanced Composite”) is a composite representation prepared by the investment adviser of the performance of the Portfolio’s asset classes weighted according to their respective weightings in the Portfolio’s target range. The Balanced Composite is comprised of a blend of the Barclays Global Aggregate Bond Index (Gross, USD, Hedged) (“Barclays Global Index”) (60%) and the MSCI All Country World Index (Gross, USD, Unhedged) (“MSCI® ACWI Index”) (40%). The Barclays Global Index is an unmanaged index, provides a broad-based measure of the global investment grade fixed-rate debt markets and covers the most liquid portion of the global investment grade fixed-rate bond market, including government, credit and collateralized securities. The MSCI® ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI® ACWI Index consists of 45 country indices comprising 24 developed and 21 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The emerging market country indices are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. All index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.gsamfunds.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

11

FUND BASICS

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 6/30/14 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | 5.77 | % | | | 7.38 | % | | | 4.58 | % | | | 4.46 | % | | 1/2/98 |

| | Class B | | | 6.06 | | | | 7.48 | | | | 4.52 | | | | 4.43 | | | 1/2/98 |

| | Class C | | | 10.11 | | | | 7.80 | | | | 4.38 | | | | 4.05 | | | 1/2/98 |

| | Institutional | | | 12.40 | | | | 9.05 | | | | 5.60 | | | | 5.24 | | | 1/2/98 |

| | Service | | | 11.92 | | | | 8.52 | | | | 5.07 | | | | 4.72 | | | 1/2/98 |

| | Class IR | | | 12.20 | | | | 8.86 | | | | N/A | | | | 3.77 | | | 11/30/07 |

| | | Class R | | | 11.74 | | | | 8.37 | | | | N/A | | | | 3.29 | | | 11/30/07 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class B Shares (5% maximum declining to 0% after six years) and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Service, Class IR and Class R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. The Portfolio’s Class B Shares are no longer available for purchase by new or existing shareholders (although current Class B shareholders may continue to reinvest income and capital gains distributions into Class B Shares, and Class B shareholders may continue to exchange their shares for Class B Shares of certain other Goldman Sachs Funds). |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.gsamfunds.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.37 | % | | | 1.42 | % |

| | Class B | | | 2.11 | | | | 2.17 | |

| | Class C | | | 2.11 | | | | 2.17 | |

| | Institutional | | | 0.97 | | | | 1.02 | |

| | Service | | | 1.46 | | | | 1.52 | |

| | Class IR | | | 1.12 | | | | 1.17 | |

| | | Class R | | | 1.61 | | | | 1.67 | |

| | 4 | | The expense ratios of the Portfolio, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Portfolio and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Portfolio’s waivers and/or expense limitations will remain in place through at least April 30, 2015, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Portfolio’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

12

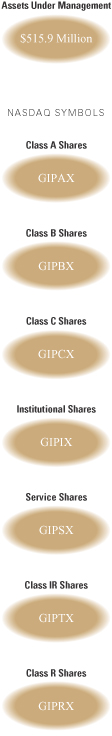

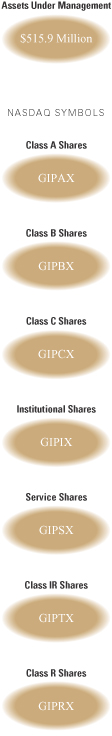

FUND BASICS

| | 5 | | The tactical fund weightings are set at the beginning of each calendar quarter. The weighting in the chart above reflects the allocations from March 31, 2014 to June 30, 2014. Actual Fund weighting in the Asset Allocation Portfolios may differ from the figures shown above due to rounding, differences in returns of the Underlying Funds, or both. The above figures are not indicative of future allocations. |

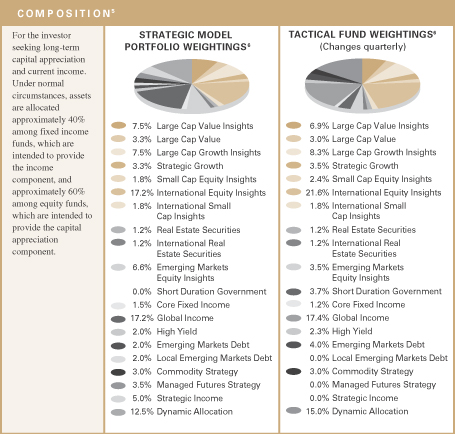

| | 6 | | Strategic allocation is the process of determining the areas of the global markets in which to invest, and in what long-term proportion, for each Fund. Our global approach attempts to generate strong long-term returns across geographies and asset classes, and is determined through a careful review of market opportunities and risk/return tradeoffs. It is rebalanced annually. On a quarterly basis, we shift assets around the strategic allocation, over and under-weighting asset classes and countries relative to the neutral starting point, seeking to benefit from changing short-term conditions in global capital markets. This is called tactical asset allocation. |

13

FUND BASICS

| | |

| OVERALL UNDERLYING FUND WEIGHTINGS7 | | |

| Percentage of Net Assets | | |

| | 7 | | The Portfolio is actively managed and, as such, its composition may differ over time. The percentage shown for each underlying fund reflects the value of that underlying fund as a percentage of net assets of the Portfolio. Short-term investments represent repurchase agreements. Figures in the above graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. |

14

FUND BASICS

Equity Growth Strategy

as of June 30, 2014

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | January 1, 2014–June 30, 2014 | | Portfolio Total Return

(based on NAV)1 | | | MSCI® All Country

World Index (Gross, USD, Unhedged)2 | |

| | Class A | | | 6.23 | % | | | 6.18 | % |

| | Class B | | | 5.89 | | | | 6.18 | |

| | Class C | | | 5.77 | | | | 6.18 | |

| | Institutional | | | 6.45 | | | | 6.18 | |

| | Service | | | 6.19 | | | | 6.18 | |

| | Class IR | | | 6.31 | | | | 6.18 | |

| | | Class R | | | 6.14 | | | | 6.18 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Portfolio (ex-dividend) divided by the total number of shares of the class outstanding. The Portfolio’s performance assumes the reinvestment of dividends and other distributions. The Portfolio’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Portfolio’s Index is the MSCI All Country World Index (Gross, USD, Unhedged) (“MSCI® ACWI Index”). The MSCI® ACWI Index figures do not reflect any deduction for fees, expenses or taxes. The MSCI® ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI® ACWI Index consists of 45 country indices comprising 24 developed and 21 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The emerging market country indices are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. All index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.gsamfunds.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

15

FUND BASICS

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 6/30/14 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | 16.53 | % | | | 13.10 | % | | | 6.05 | % | | | 4.62 | % | | 1/2/98 |

| | Class B | | | 17.45 | | | | 13.26 | | | | 5.99 | | | | 4.59 | | | 1/2/98 |

| | Class C | | | 21.38 | | | | 13.52 | | | | 5.85 | | | | 4.21 | | | 1/2/98 |

| | Institutional | | | 23.91 | | | | 14.83 | | | | 7.07 | | | | 5.37 | | | 1/2/98 |

| | Service | | | 23.22 | | | | 14.26 | | | | 6.53 | | | | 4.87 | | | 1/2/98 |

| | Class IR | | | 23.60 | | | | 14.69 | | | | N/A | | | | 2.66 | | | 11/30/07 |

| | | Class R | | | 23.01 | | | | 14.18 | | | | N/A | | | | 2.22 | | | 11/30/07 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class B Shares (5% maximum declining to 0% after six years) and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Service, Class IR and Class R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. The Portfolio’s Class B Shares are no longer available for purchase by new or existing shareholders (although current Class B shareholders may continue to reinvest income and capital gains distributions into Class B Shares, and Class B shareholders may continue to exchange their shares for Class B Shares of certain other Goldman Sachs Funds). |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.gsamfunds.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.41 | % | | | 1.49 | % |

| | Class B | | | 2.16 | | | | 2.24 | |

| | Class C | | | 2.16 | | | | 2.24 | |

| | Institutional | | | 1.01 | | | | 1.09 | |

| | Service | | | 1.51 | | | | 1.59 | |

| | Class IR | | | 1.16 | | | | 1.24 | |

| | | Class R | | | 1.65 | | | | 1.74 | |

| | 4 | | The expense ratios of the Portfolio, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Portfolio and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Portfolio’s waivers and/or expense limitations will remain in place through at least April 30, 2015, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Portfolio’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

16

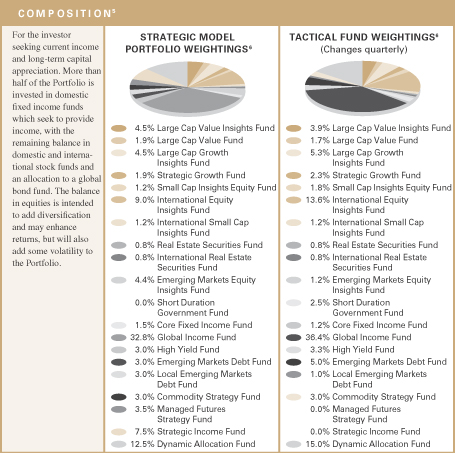

FUND BASICS

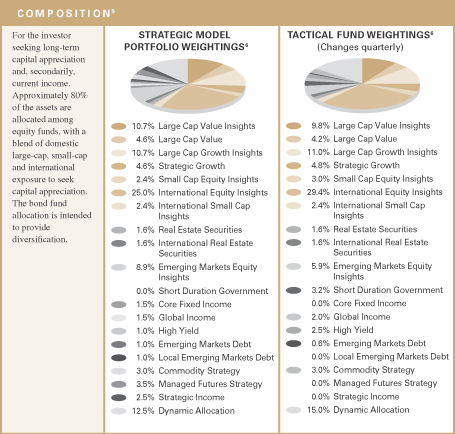

| | 5 | | The tactical fund weightings are set at the beginning of each calendar quarter. The weighting in the chart above reflects the allocations from March 31, 2014 to June 30, 2014. Actual Fund weighting in the Asset Allocation Portfolios may differ from the figures shown above due to rounding, differences in returns of the Underlying Funds, or both. The above figures are not indicative of future allocations. |

| | 6 | | Strategic allocation is the process of determining the areas of the global markets in which to invest, and in what long-term proportion, for each Fund. Our global approach attempts to generate strong long-term returns across geographies and asset classes, and is determined through a careful review of market opportunities and risk/return tradeoffs. It is rebalanced annually. On a quarterly basis, we shift assets around the strategic allocation, over and under-weighting asset classes and countries relative to the neutral starting point, seeking to benefit from changing short-term conditions in global capital markets. This is called tactical asset allocation. |

17

FUND BASICS

| | |

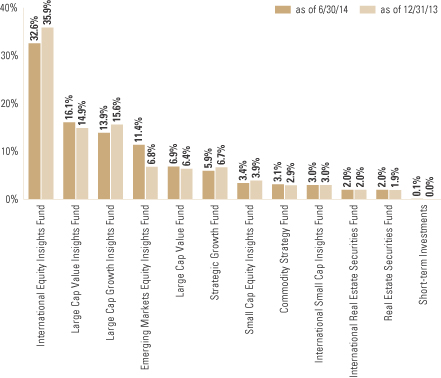

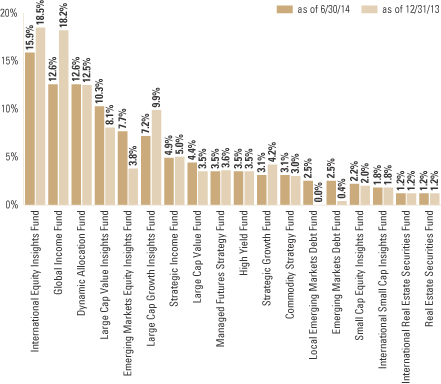

| OVERALL UNDERLYING FUND WEIGHTINGS7 | | |

| Percentage of Net Assets | | |

| | 7 | | The Portfolio is actively managed and, as such, its composition may differ over time. The percentage shown for each underlying fund reflects the value of that underlying fund as a percentage of net assets of the Portfolio. Figures in the above graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. |

18

FUND BASICS

Growth and Income Strategy

as of June 30, 2014

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | January 1, 2014–June 30, 2014 | | Portfolio Total Return

(based on NAV)1 | | | Growth and Income

Strategy

Composite Index2 | |

| | Class A | | | 4.88 | % | | | 5.35 | % |

| | Class B | | | 4.49 | | | | 5.35 | |

| | Class C | | | 4.42 | | | | 5.35 | |

| | Institutional | | | 5.07 | | | | 5.35 | |

| | Service | | | 4.83 | | | | 5.35 | |

| | Class IR | | | 4.95 | | | | 5.35 | |

| | | Class R | | | 4.77 | | | | 5.35 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Portfolio (ex-dividend) divided by the total number of shares of the class outstanding. The Portfolio’s performance assumes the reinvestment of dividends and other distributions. The Portfolio’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Growth and Income Strategy Composite Index (“Growth and Income Composite”) is a composite representation prepared by the investment adviser of the performance of the Portfolio’s asset classes weighted according to their respective weightings in the Portfolio’s target range. The Growth and Income Composite is comprised of a blend of the Barclays Global Aggregate Bond Index (Gross, USD, Hedged) (“Barclays Global Index”) (40%) and the MSCI All Country World Index (Gross, USD, Unhedged) (“MSCI® ACWI Index”) (60%). The Growth and Income Composite figures do not reflect any deduction for fees, expenses or taxes. The Barclays Global Index is an unmanaged index, provides a broad-based measure of the global investment-grade fixed-rate debt markets and covers the most liquid portion of the global investment grade fixed-rate bond market, including government, credit and collateralized securities. The MSCI® ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI® ACWI Index consists of 45 country indices comprising 24 developed and 21 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The emerging market country indices are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. All index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.gsamfunds.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

19

FUND BASICS

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 6/30/14 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | 9.39 | % | | | 9.60 | % | | | 5.13 | % | | | 4.72 | % | | 1/2/98 |

| | Class B | | | 9.79 | | | | 9.70 | | | | 5.07 | | | | 4.69 | | | 1/2/98 |

| | Class C | | | 13.83 | | | | 10.01 | | | | 4.93 | | | | 4.29 | | | 1/2/98 |

| | Institutional | | | 16.25 | | | | 11.29 | | | | 6.14 | | | | 5.50 | | | 1/2/98 |

| | Service | | | 15.60 | | | | 10.73 | | | | 5.62 | | | | 4.97 | | | 1/2/98 |

| | Class IR | | | 16.01 | | | | 11.06 | | | | N/A | | | | 3.06 | | | 11/30/07 |

| | | Class R | | | 15.40 | | | | 10.58 | | | | N/A | | | | 2.60 | | | 11/30/07 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class B Shares (5% maximum declining to 0% after six years) and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Service, Class IR and Class R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. The Portfolio’s Class B Shares are no longer available for purchase by new or existing shareholders (although current Class B shareholders may continue to reinvest income and capital gains distributions into Class B Shares, and Class B shareholders may continue to exchange their shares for Class B Shares of certain other Goldman Sachs Funds). |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.gsamfunds.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.39 | % | | | 1.42 | % |

| | Class B | | | 2.13 | | | | 2.17 | |

| | Class C | | | 2.13 | | | | 2.17 | |

| | Institutional | | | 0.99 | | | | 1.02 | |

| | Service | | | 1.49 | | | | 1.52 | |

| | Class IR | | | 1.14 | | | | 1.17 | |

| | | Class R | | | 1.64 | | | | 1.67 | |

| | 4 | | The expense ratios of the Portfolio, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Portfolio and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Portfolio’s waivers and/or expense limitations will remain in place through at least April 30, 2015, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Portfolio’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

20

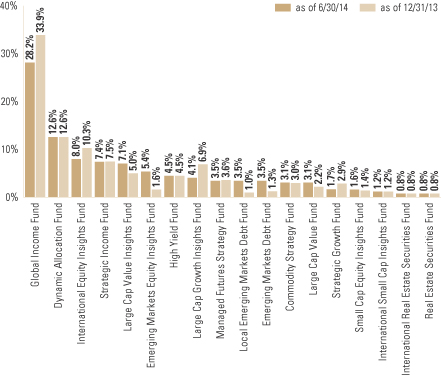

FUND BASICS

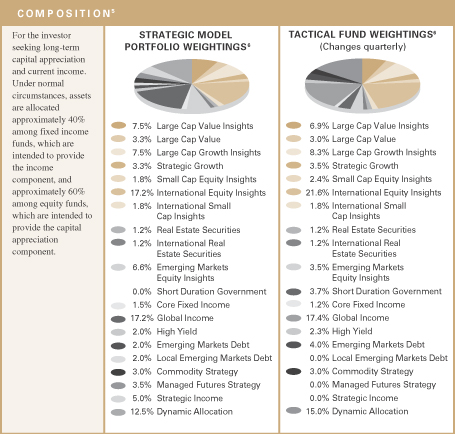

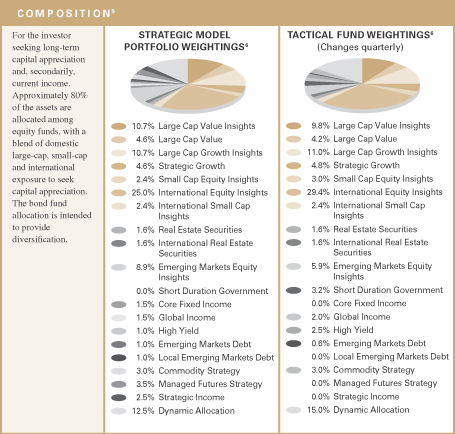

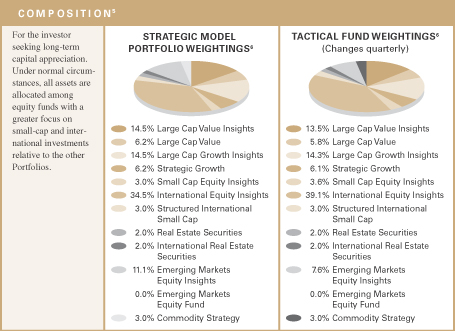

| | 5 | | The tactical fund weightings are set at the beginning of each calendar quarter. The weighting in the chart above reflects the allocations from March 31, 2014 to June 30, 2014. Actual Fund weighting in the Asset Allocation Portfolios may differ from the figures shown above due to rounding, differences in returns of the Underlying Funds, or both. The above figures are not indicative of future allocations. |

| | 6 | | Strategic allocation is the process of determining the areas of the global markets in which to invest, and in what long-term proportion, for each Fund. Our global approach attempts to generate strong long-term returns across geographies and asset classes, and is determined through a careful review of market opportunities and risk/return tradeoffs. It is rebalanced annually. On a quarterly basis, we shift assets around the strategic allocation, over and under-weighting asset classes and countries relative to the neutral starting point, seeking to benefit from changing short-term conditions in global capital markets. This is called tactical asset allocation. |

21

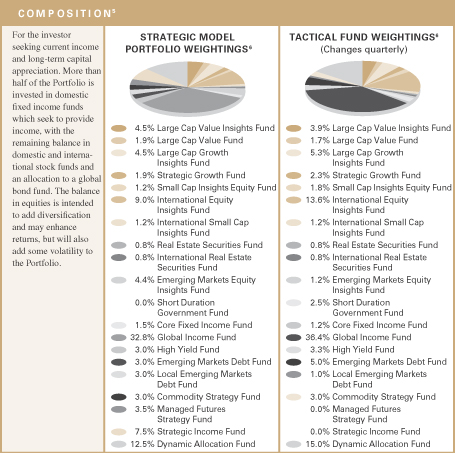

FUND BASICS

| | |

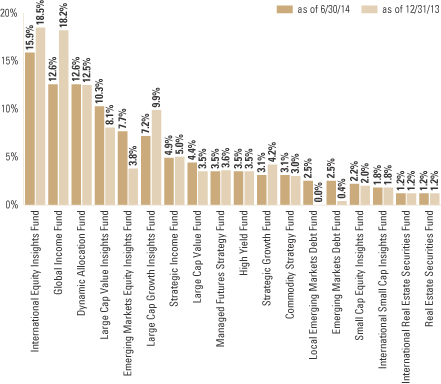

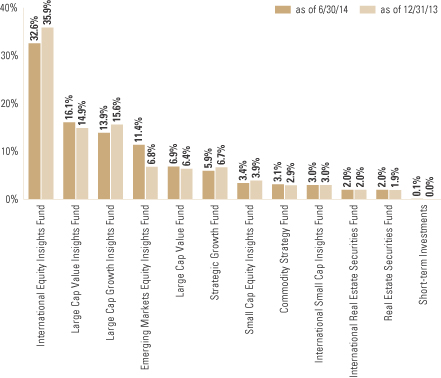

| OVERALL UNDERLYING FUND WEIGHTINGS7 | | |

| Percentage of Net Assets | | |

| | 7 | | The Portfolio is actively managed and, as such, its composition may differ over time. The percentage shown for each underlying fund reflects the value of that underlying fund as a percentage of net assets of the Portfolio. Short-term investments represent repurchase agreements. Figures in the above graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. |

22

FUND BASICS

Growth Strategy

as of June 30, 2014

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | January 1, 2014–June 30, 2014 | | Portfolio Total Return

(based on NAV)1 | | | Growth Strategy

Composite Index2 | |

| | Class A | | | 5.35 | % | | | 5.77 | % |

| | Class B | | | 5.00 | | | | 5.77 | |

| | Class C | | | 4.98 | | | | 5.77 | |

| | Institutional | | | 5.59 | | | | 5.77 | |

| | Service | | | 5.37 | | | | 5.77 | |

| | Class IR | | | 5.50 | | | | 5.77 | |

| | | Class R | | | 5.24 | | | | 5.77 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Portfolio (ex-dividend) divided by the total number of shares of the class outstanding. The Portfolio’s performance assumes the reinvestment of dividends and other distributions. The Portfolio’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Growth Strategy Composite Index (“Growth Composite”) is a composite representation prepared by the investment adviser of the performance of the Portfolio’s asset classes weighted according to their respective weightings in the Portfolio’s target range. The Growth Composite is comprised of a blend of the Barclays Global Aggregate Bond Index (Gross, USD, Hedged) (“Barclays Global Index”) (20%) and the MSCI All Country World Index (Gross, USD, Unhedged) (“MSCI® ACWI Index “) (80%). The Growth Strategy Composite figures do not reflect any deduction for fees, expenses or taxes. The Barclays Global Index is an unmanaged index, provides a broad-based measure of the global investment-grade fixed-rate debt markets and covers the most liquid portion of the global investment grade fixed-rate bond market, including government, credit and collateralized securities. The MSCI® ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI® ACWI Index consists of 45 country indices comprising 24 developed and 21 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The emerging market country indices are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. All index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.gsamfunds.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

23

FUND BASICS

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 6/30/14 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | 12.89 | % | | | 11.27 | % | | | 5.24 | % | | | 4.40 | % | | 1/2/98 |

| | Class B | | | 13.59 | | | | 11.44 | | | | 5.18 | | | | 4.38 | | | 1/2/98 |

| | Class C | | | 17.59 | | | | 11.71 | | | | 5.05 | | | | 3.99 | | | 1/2/98 |

| | Institutional | | | 19.91 | | | | 13.00 | | | | 6.26 | | | | 5.18 | | | 1/2/98 |

| | Service | | | 19.34 | | | | 12.44 | | | | 5.74 | | | | 4.65 | | | 1/2/98 |

| | Class IR | | | 19.69 | | | | 12.84 | | | | N/A | | | | 2.41 | | | 11/30/07 |

| | | Class R | | | 19.15 | | | | 12.25 | | | | N/A | | | | 1.91 | | | 11/30/07 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class B Shares (5% maximum declining to 0% after six years) and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Service, Class IR and Class R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. The Portfolio’s Class B Shares are no longer available for purchase by new or existing shareholders (although current Class B shareholders may continue to reinvest income and capital gains distributions into Class B Shares, and Class B shareholders may continue to exchange their shares for Class B Shares of certain other Goldman Sachs Funds). |

The returns represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.41 | % | | | 1.45 | % |

| | Class B | | | 2.16 | | | | 2.20 | |

| | Class C | | | 2.16 | | | | 2.20 | |

| | Institutional | | | 1.01 | | | | 1.05 | |

| | Service | | | 1.51 | | | | 1.55 | |

| | Class IR | | | 1.16 | | | | 1.20 | |

| | | Class R | | | 1.66 | | | | 1.70 | |

| | 4 | | The expense ratios of the Portfolio, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Portfolio and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Portfolio’s waivers and/or expense limitations will remain in place through at least April 30, 2015, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Portfolio’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

24

FUND BASICS

| | 5 | | The tactical fund weightings are set at the beginning of each calendar quarter. The weighting in the chart above reflects the allocations from March 31, 2014 to June 30, 2014. Actual Fund weighting in the Asset Allocation Portfolios may differ from the figures shown above due to rounding, differences in returns of the Underlying Funds, or both. The above figures are not indicative of future allocations. |

| | 6 | | Strategic allocation is the process of determining the areas of the global markets in which to invest, and in what long-term proportion, for each Fund. Our global approach attempts to generate strong long-term returns across geographies and asset classes, and is determined through a careful review of market opportunities and risk/return tradeoffs. It is rebalanced annually. On a quarterly basis, we shift assets around the strategic allocation, over and under-weighting asset classes and countries relative to the neutral starting point, seeking to benefit from changing short-term conditions in global capital markets. This is called tactical asset allocation. |

25

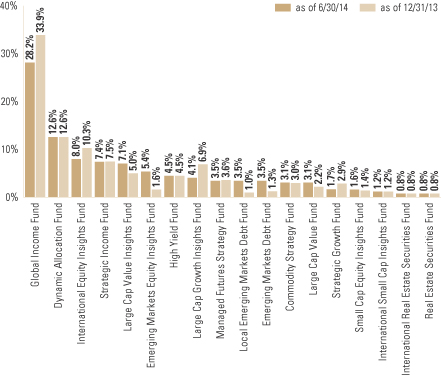

FUND BASICS

| | |

| OVERALL UNDERLYING FUND WEIGHTINGS7 | | |

| Percentage of Net Assets | | |

| | 7 | | The Portfolio is actively managed and, as such, its composition may differ over time. The percentage shown for each underlying fund reflects the value of that underlying fund as a percentage of net assets of the Portfolio. Short-term investments represent repurchase agreements. Figures in the above graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. |

26

PORTFOLIO RESULTS

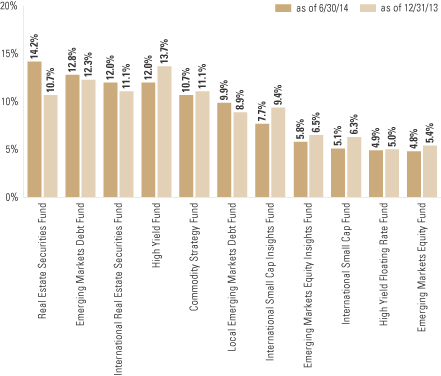

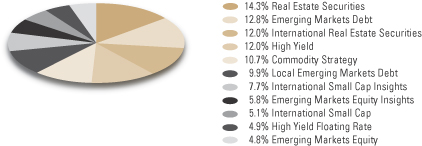

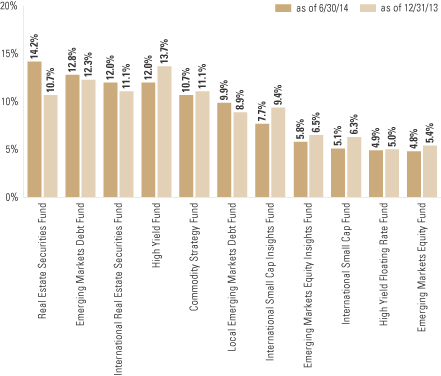

Goldman Sachs Satellite Strategies Portfolio

Investment Process and Principal Strategy

The Portfolio seeks to achieve its investment objective by investing in a combination of underlying funds that currently exist or that may become available for investment in the future for which Goldman Sachs Asset Management (“GSAM”) or an affiliate, now or in the future, acts as investment adviser or principal underwriter (the “underlying funds”). Some of the Portfolios’ underlying funds invest primarily in fixed income or money market instruments, and some invest primarily in equity securities.

The Portfolio invests assets in a strategic mix of underlying funds, which the investment adviser considers to be invested in satellite asset classes. Satellite asset classes are those that historically have lower correlations to traditional market exposures such as large cap equities and investment grade fixed income. The investment adviser allows strategic targets to shift with their respective market returns but adjusts the overall asset allocation of the Portfolio based on current market conditions and the investment adviser’s economic and market forecasts.

Portfolio Management Discussion and Analysis

Effective May 16, 2014, the Goldman Sachs Income Strategies Portfolio was merged into the Goldman Sachs Satellite Strategies Portfolio. The reorganization was recommended by Goldman Sachs Asset Management International in connection with an effort to optimize the Goldman Sachs Funds and eliminate overlapping products. The Goldman Sachs Satellite Strategies Portfolio acquired all of the assets of the Goldman Sachs Income Strategies Portfolio — which totaled approximately $26.4 million as of May 16, 2014 — and the Goldman Sachs Income Strategies Portfolio was subsequently liquidated and shareholders of the Goldman Sachs Income Strategies Portfolio became shareholders of the Goldman Sachs Satellite Strategies Portfolio. Below, the Goldman Sachs Quantitative Investment Strategies Team discusses the Goldman Sachs Satellite Strategies Portfolio’s (the “Portfolio”) performance and positioning for the six-month period ended June 30, 2014 (the “Reporting Period”).

| Q | | How did the Portfolio perform during the Reporting Period? |

| A | | During the Reporting Period, the Portfolio’s Class A, C, Institutional, Service, IR and R Shares generated cumulative total returns of 6.74%, 6.26%, 6.96%, 6.71%, 6.76% and 6.52%, respectively. This compares to the 5.31% cumulative total return of the Fund’s blended benchmark, which is comprised 40% of the Barclays U.S. Aggregate Bond Index, 30% of the S&P 500® Index and 30% of the Morgan Stanley Capital International (MSCI) Europe, Australasia, Far East (EAFE) Index (Gross, USD, Unhedged) (“MSCI® EAFE® Index”), during the same period. |

| | The components of the blended benchmark, the Barclays U.S. Aggregate Bond Index, the S&P 500® Index and the MSCI® EAFE® Index, generated cumulative total returns of 3.93%, 7.14% and 5.14%, respectively, during the same period. |

| Q | | How did the various satellite asset classes perform during the Reporting Period? |

| A | | Satellite asset classes performed well during the Reporting Period. U.S. real estate securities, as represented by the Wilshire Real Estate Securities Index, performed the best among the satellite asset classes represented in the Portfolio, returning almost 18%. U.S. dollar denominated emerging markets debt and international real estate securities also performed well. High yield floating rate loans posted positive absolute performance, but lagged other satellite asset classes. |

| Q | | What key factors affected the Portfolio’s performance during the Reporting Period? |

| A | | The Portfolio outperformed its blended benchmark during the Reporting Period, driven by the strong performance of its satellite asset class exposures relative to the performance of core asset classes. In particular, the Portfolio benefited from its allocations to U.S. and international real estate securities, |

27

PORTFOLIO RESULTS

| | as well as to U.S. dollar denominated emerging markets debt, as these asset classes outperformed global developed market equities overall. In addition, the Portfolio’s allocations to fixed income satellite asset classes contributed positively to performance because of the strong performance of U.S. dollar denominated emerging markets debt and high yield floating rate loans. In keeping with our investment approach, we dynamically adjusted Portfolio weights to ensure that overall risk and individual underlying fund contributions to risk remained within the ranges we feel are appropriate for a diversified satellite portfolio. |

| | Detracting from results was security selection within the Portfolio’s underlying funds. |

| Q | | How did the Portfolio’s underlying funds perform relative to their respective benchmark indices during the Reporting Period? |

| A | | Overall, as mentioned earlier, the performance of the underlying funds detracted from the Portfolio’s performance. The Goldman Sachs International Small Cap Fund, the Goldman Sachs International Real Estate Securities Fund and the Goldman Sachs Local Emerging Markets Debt Fund underperformed their respective benchmark indices the most. The Goldman Sachs Emerging Markets Equity Fund was the only underlying fund to outperform its benchmark index during the Reporting Period. |

| Q | | How did the Portfolio use derivatives and similar instruments during the Reporting Period? |

| A | | The Portfolio does not directly invest in derivatives. However, some of the underlying funds used derivatives during the Reporting Period to apply their active investment views with greater versatility and to afford greater risk management precision. As market conditions warranted during the Reporting Period, some of these underlying funds engaged in forward foreign currency exchange contracts, financial futures contracts, options, swap contracts and structured securities to enhance portfolio return and for hedging purposes. |

| Q | | What changes did you make during the Reporting Period within both the equity and fixed income portions of the Portfolio? |

| A | | In January and February 2014, contributions to portfolio risk from the underlying asset classes remained in line with our objectives. As a result, rebalancing trades were not required. Because of the reduced volatility of satellite asset classes compared to their longer-term averages, the Portfolio’s asset class weightings remained relatively stable. There were no outsized contributions to risk from any individual asset class or region. |

| | During March 2014, we rebalanced the Portfolio to maintain our target risk objectives in the Portfolio. The risk contributions of high yield loans had fallen below the Portfolio’s minimum weight constraint relative to other satellite asset classes in the Portfolio. In response, we reduced the Portfolio’s allocations to international small-cap equities and high yield bonds while increasing its allocations to international and U.S. real estate securities and local emerging markets debt. |