UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

| Caroline Kraus, Esq. | | Copies to: |

| Goldman, Sachs & Co. | | Geoffrey R.T. Kenyon, Esq. |

| 200 West Street | | Dechert LLP |

| New York, New York 10282 | | 100 Oliver Street |

| | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: October 31

Date of reporting period: April 30, 2014

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Stockholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | April 30, 2014 |

| | |

| | | | Fundamental Emerging Markets Equity Funds |

| | | | Asia Equity |

| | | | BRIC |

| | | | Emerging Markets Equity |

| | | | N-11 Equity |

Goldman Sachs Fundamental Emerging Markets Equity Funds

| n | | EMERGING MARKETS EQUITY |

| | | | |

TABLE OF CONTENTS | | | | |

| |

Principal Investment Strategies and Risks | | | 1 | |

| |

Investment Process | | | 3 | |

| |

Market Review | | | 4 | |

| |

Portfolio Management Discussions and Performance Summaries | | | 6 | |

| |

Schedules of Investments | | | 29 | |

| |

Financial Statements | | | 40 | |

| |

Financial Highlights | | | 44 | |

| |

Notes to Financial Statements | | | 52 | |

| |

Other Information | | | 68 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS FUNDAMENTAL EMERGING MARKETS EQUITY FUNDS

Principal Investment Strategies and Risks

This is not a complete list of risks that may affect the Funds. For additional information concerning the risks applicable to the Funds, please see the Funds’ Prospectuses.

The Goldman Sachs Asia Equity Fund invests primarily in a diversified portfolio of equity investments in Asian issuers (excluding Japanese issuers). The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. Foreign and emerging markets investments may be more volatile than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. Because of its exposure to Asian issuers, the Fund is subject to greater risk of loss as a result of adverse securities markets, exchange rates and social, political, regulatory or economic events that may occur in Asian countries. The securities of mid- and small-capitalization companies involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all.

The Goldman Sachs BRIC Fund invests primarily in a portfolio of equity investments in Brazil, Russia, India and China (“BRIC countries”) or in issuers that participate in the markets of the BRIC countries. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/ or general economic conditions. Foreign and emerging markets investments may be more volatile than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. Because of its exposure to the BRIC countries, the Fund is subject to greater risk of loss as a result of adverse securities markets, exchange rates and social, political, regulatory or economic events that may occur in those countries. Because the Fund may invest heavily in specific sectors, the Fund is subject to greater risk of loss as a result of adverse economic, business or other developments affecting such sectors. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all. The Fund is “non-diversified” and may invest a larger percentage of its assets in fewer issuers than “diversified” mutual funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

The Goldman Sachs Emerging Markets Equity Fund invests primarily in a diversified portfolio of equity investments in emerging country issuers. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. Foreign and emerging markets investments may be more volatile than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. The securities markets of emerging countries have less government regulation and are subject to less extensive accounting and financial reporting requirements than the markets of more developed countries. Because the Fund may invest heavily in specific sectors, the Fund is subject to greater risk of loss as a result of adverse economic, business or other developments affecting such sectors. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all.

The Goldman Sachs N-11 Equity Fund invests primarily in a portfolio of equity investments that are tied economically to the “N-11 countries” or in issuers that participate in the markets of the following N-11 countries: Bangladesh, Egypt, Indonesia, Mexico, Nigeria, Pakistan, Philippines, South Korea, Turkey and Vietnam. While Iran is among the N-11 countries, the Fund will not invest in issuers organized under the laws of Iran, or domiciled in Iran, or in certain other issuers as necessary to comply

1

GOLDMAN SACHS FUNDAMENTAL EMERGING MARKETS EQUITY FUNDS

with U.S. economic sanctions against Iran. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. Foreign and emerging markets investments may be more volatile than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. Such securities are also subject to foreign custody risk. Because of its exposure to the N-11 countries, the Fund is subject to greater risk of loss as a result of adverse securities markets, exchange rates and social, political, regulatory or economic events that may occur in those countries. The N-11 countries generally have smaller economies or less developed capital markets than traditional emerging markets countries, and, as a result, the risks of investing in these countries are magnified. Because the Fund may invest heavily in specific sectors, the Fund is subject to greater risk of loss as a result of adverse economic, business or other developments affecting such sectors. The Fund may concentrate its investments in a specific industry (only in the event that that industry represents 20% or more of the Fund’s benchmark index at the time of investment), subjecting it to greater risk of loss as a result of adverse economic, business or other developments affecting that industry. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all. The Fund is “non-diversified” and may invest a larger percentage of its assets in fewer issuers than “diversified” mutual funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

2

GOLDMAN SACHS FUNDAMENTAL EMERGING MARKETS EQUITY FUNDS

What Differentiates Goldman Sachs’ Fundamental Emerging Markets Equity Investment Process?

Goldman Sachs’ Fundamental Emerging Markets Equity investment process is based on the belief that strong, consistent results are best achieved through expert stock selection, performed by our dedicated Emerging Markets Team that works together on a global scale. Our deep, diverse and experienced team of research analysts and portfolio managers combines local insights with global, industry-specific expertise to identify its best investment ideas.

| n | | The Emerging Markets Equity research team, based in the United States, United Kingdom, Japan, China, Korea, Singapore, Brazil, India, and Australia focuses on long- term business and management quality |

| n | | Proprietary, bottom-up research is the key driver of our investment process |

| n | | Analysts collaborate regularly to leverage regional and industry-specific research and insights |

| n | | Members of each local investment team are aligned by sector and are responsible for finding ideas with the best risk-adjusted upside in their respective areas of coverage |

| n | | The decision-making process includes active participation in frequent and regular research meetings |

| n | | The Emerging Market Equity team benefits from the country and currency expertise of our Global Emerging Markets Debt and Currency teams |

| n | | Security selections are aligned with levels of investment conviction and risk-adjusted upside |

| n | | Continual risk monitoring identifies various risks at the stock and portfolio level and assesses whether they are intended and justified |

| n | | Dedicated portfolio construction team assists in ongoing monitoring and adjustment of the Funds |

Emerging markets equity portfolios that strive to offer:

| | n | | Access to markets across emerging markets | |

| | n | | Disciplined approach to stock selection | |

| | n | | Optimal risk/return profiles | |

3

MARKET REVIEW

Goldman Sachs Fundamental Emerging

Markets Equity Funds

Market Review

Emerging markets equities declined during the six-month period ended April 30, 2014 (the “Reporting Period”). The MSCI Emerging Markets Index (gross, USD, unhedged) (the “MSCI EM Index”) posted a return of -2.98%.* Emerging markets equities significantly lagged developed markets equities, as measured by the MSCI Europe, Australasia, Far East (net) Index (unhedged) (the “MSCI EAFE Index”), as concerns over slowing economic growth, high inflation and election uncertainty weighed on many of the growth and emerging markets during the Reporting Period. Also contributing to weak performance of emerging market equities during the Reporting Period was the December 2013 announcement by the U.S. Federal Reserve (the “Fed”) that it would begin tapering its asset purchases in January 2014. The announcement ended seven months of speculation about the beginning of the end of ultra-loose monetary policy that had fueled many emerging market economies in recent years. Further, Argentina’s currency devaluation in January 2014 rippled through emerging market currency and equity markets, forcing many central banks to hike interest rates, which further pressured equity markets.

Looking at some key individual emerging markets more specifically, Chinese equities struggled during most of the Reporting Period amidst renewed concerns about China’s shadow banking system, credit quality and decelerating growth. The Russian equity market plunged during the Reporting Period due to the rapidly escalating geopolitical situation in Ukraine. Weakness in Latin American equity markets persisted into early 2014, though the region began to rebound later in the Reporting Period. After a slow start, Indian equities also rallied sharply later in the Reporting Period, as polls suggested that the Bharatiya Janata Party (“BJP”), which is perceived as business-friendly, is likely to win in the country’s upcoming election. Protest movements increased the political risk of some countries, such as Turkey, which was one of the worst performing markets during the Reporting Period. At the other end of the spectrum, Indonesia’s equity market rallied such that it was one of the best performing markets during the Reporting Period, largely due to an improving current account balance and strong foreign flows.

For the Reporting Period overall, the energy sector declined particularly sharply, reflecting a mix of geopolitical and economic issues in big energy-producing countries, such as Russia and Brazil. In line with global trends, information technology was the best performing sector in the MSCI EM Index during the Reporting Period, largely due to increased merger and acquisition activity.

Looking Ahead

During the Reporting Period, emerging markets equities underperformed developed markets equities, as many developing markets faced macroeconomic headwinds, negative headlines and country-specific challenges. We fully acknowledge these medium-term factors—including the end of Chinese double-digit economic growth, the impact of quantitative easing tapering on broader equity markets, currency volatility and upcoming elections in India and Brazil—and incorporate them in our bottom-up fundamental analysis.

| *All | | index returns are expressed in U.S. dollar terms. |

4

MARKET REVIEW

The macro concerns that pressured emerging markets equities during the Reporting Period have not changed our longer-term positive view of emerging markets equity fundamentals. We believe the structural story is still intact and the domestically-focused growth of the emerging markets should continue to drive strong returns in their equity markets over the long term. Finally, we believe the sell-off amongst emerging markets equities, which, at the end of the Reporting Period, were trading at a significant discount to developed markets on a forward-looking price/earnings ratio basis, forms an attractive entry point for long-term investors.

As bottom-up fundamental investors, we constantly look across a broad range of sectors, countries and market capitalizations to identify what we believe are the most compelling investment opportunities trading at attractive valuations and that may outperform over the market cycle. In particular, we look for companies with strong or improving cash flows and sustainable competitive advantages that should be able to withstand inflationary pressures on their margins while taking advantage of secular growth themes in the growth and emerging markets. Finally, we seek to invest in companies with strong corporate governance track records, especially with respect to their treatment of minority shareholders. With the uncertainty of the markets anticipated to continue, we believe our focus on companies with strong or improving fundamentals and secular growth opportunities should serve our shareholders well.

As always, we maintain our focus on seeking high-quality equity investments trading at what we believe to be compelling valuations and intend to stay true to our long-term discipline as we seek to navigate potentially volatile markets ahead.

5

PORTFOLIO RESULTS

Goldman Sachs Asia Equity Fund

Investment Objective

The Fund seeks long-term capital appreciation.

Portfolio Management Discussion and Analysis

Effective as of the close of business on April 25, 2014, the Goldman Sachs China Equity Fund was merged into the Goldman Sachs Asia Equity Fund. The reorganization was recommended by Goldman Sachs Asset Management International in connection with an effort to optimize the Goldman Sachs Funds and eliminate overlapping products. The Goldman Sachs Asia Equity Fund (the “Fund”) acquired all of the assets of the Goldman Sachs China Equity Fund — which totaled approximately $25.1 million as of April 25, 2014 — and the Goldman Sachs China Equity Fund was subsequently liquidated and shareholders of the Goldman Sachs China Equity Fund became shareholders of the Fund. Below, the Goldman Sachs Fundamental Asia ex Japan Equity Portfolio Management Team discusses the Goldman Sachs Asia Equity Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2014 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, B, C and Institutional Shares generated cumulative total returns, without sales charges, of 0.41%, 0.00%, 0.06% and 0.59%, respectively. These returns compare to the -0.94% cumulative total return of the Fund’s benchmark, the MSCI All Country Asia ex-Japan Index (net, USD, unhedged) (the “Index”), during the same time period. During the period from inception on February 28, 2014 to April 30, 2014, the Fund’s Class IR Shares generated a cumulative total return, without sales charges, of -2.99%. This compares to the 1.73% cumulative total return of the Index during the same time period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund’s outperformance relative to the Index during the Reporting Period can be primarily attributed to individual stock selection. From a country perspective, effective stock selection in China, South Korea, the Philippines and India contributed most positively. Stock selection in Indonesia and Thailand detracted. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The Fund benefited most relative to the Index from holdings in Bloomage Biotechnology, Hanssem and Canadian Solar. |

| | The top individual stock contributor to the Fund’s results during the Reporting Period was Bloomage Biotechnology, which engages in the manufacture and sale of a diversified portfolio of hyaluronic acid (“HA”) products. The company began to diversify its business to end products, such as HA dermal fillers, which are used in cosmetic surgeries, for which we believe there could be significant demand that could drive volume growth over the next decade. |

| | Another significant contributor was Hanssem, which primarily engages in the manufacture and distribution of kitchen and interior furniture. South Korean-listed Hanssem reported strong first quarter 2014 sales revenue growth and gained market share on effective branding and on its strong distribution channel strategy. The company particularly benefited from a shift in consumer behavior toward selecting key brand name products over the non-brand market. In our view, major competitors of Hanssem have not yet been successful reading this change in the market, causing them to lose market share. |

| | Canadian Solar designs, manufactures and sells solar module products. The company reported revenues at the higher end of its preannouncement and provided strong 2014 shipment guidance. Its stock also performed well as key growth markets accounted for a larger than expected proportion of its shipments. |

6

PORTFOLIO RESULTS

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Detracting most from the Fund’s results relative to the Index were positions in distressed asset management company China Cinda Asset Management (“Cinda”), Chinese integrated oilfield equipment and service provider Hilong Holdings and Indonesian integrated textile manufacturer Sri Rejeki Isman. |

| | A position in Cinda detracted most from the Fund’s results. The stock’s pullback during the Reporting Period was due primarily to concerns about property price weakness impacting the value of its assets. We believe the negative sentiment may have been overdone given that Cinda’s acquisition costs of these assets were attractive, in our view, leaving substantial room for potential profit realization. Indeed, we maintained the Fund’s position in Cinda because we believe the company has a strong growth opportunity in the coming years, as banks and non-financial companies in China are expected to increase the securitization and sales of their non-performing loans and receivables in order to strengthen their balance sheets. We believe this provides a robust business opportunity for distressed asset managers such as Cinda. |

| | Hilong Holdings is one of China’s leading non-state-owned integrated oilfield equipment and services providers, with a focus on drill pipes, line pipes, oil country tubular goods (“OCTG”) coatings and oilfield services. We believe its stock underperformed during the Reporting Period, as corruption investigations of senior management of its key domestic customer, PetroChina, somewhat impacted its drill pipe sales during the second half of 2013. |

| | Sri Rejeki Isman is the largest integrated textile manufacturer in Indonesia’s consumer discretionary sector. We initially liked the company because we believed that Indonesia, with its low labor costs, young demographic profile and low tariffs, was well positioned to benefit from a shift by retailers to production in low-cost economies and to reduce their dependence on Chinese manufacturers. Positive macro tailwinds, such as a weak rupiah and China’s labor cost hikes, further affirmed our investment thesis. However, we were concerned about the company’s lack of management depth, and the company founder’s sudden and unfortunate death without any proper succession plans significantly increased our concern about the company’s ability to make sizable deals with global brands and caused its stock price to decline. We thus exited the Fund’s position in the company. |

| Q | | Which equity market sectors most significantly affected Fund performance during the Reporting Period? |

| A | | The sectors that contributed most positively to the Fund’s performance relative to the Index were materials, information technology and financials. Stock selection proved particularly effective in materials. Having an overweight allocation to information technology, which strongly outpaced the Index during the Reporting Period, also added value. Financials was a strong contributor based on both effective stock selection and having an underweighted exposure to the poorly performing sector. The biggest detractors from the Fund’s relative results during the Reporting Period were the consumer discretionary, health care and industrials sectors, each due primarily to poor stock selection. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we did not use derivatives to hedge positions or as part of an active management strategy, but we used index futures on an opportunistic basis to ensure the Fund remained almost fully exposed to equities following cash inflows or stock sales. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | We established a Fund position in KT, a South Korean telecommunication services company. KT operates in the mobile, broadband Internet, telephone, wireless broadband Internet and Internet protocol television industries. With the appointment of its new chief executive officer, Mr. Hwang Chang-gyu, the man who built Samsung’s semiconductor business, we believe KT could transition into a corporation from a state-owned enterprise. We believe Mr. Hwang may bring back the company’s core competency in telecommunication operations, which contrasts with the ex-management’s unsuccessful expansion of non-core operations. We believe under the new leadership KT will make restructuring efforts throughout 2014, some of which may include realignment of its operations, disposal of idle, non-performing assets and reasonable reductions in advertising and promotions spending. |

Any mention of an investment decision is intended only to illustrate our investment approach or strategy, and is not indicative of the performance of our strategy as a whole. Any such illustration is not necessarily representative of other investment decisions.

7

PORTFOLIO RESULTS

| | We also established a Fund position in Silergy, a Taiwan-based information technology company. Silergy engages in the manufacture and sale of power management integrated circuits. The company has already penetrated the supply chains of light emitting diode (“LED”) lighting, tablets, laptops, personal computers, LED television, branded smartphone clients and security surveillance. The company is also attempting to gain new clients in other applications through its integrated circuit distributors. We expect Silergy to enjoy strong sales growth following the increase of new products and localization of component purchases in China. We further expect Silergy’s earnings performance to drive its share price performance going forward. |

| | In addition to those sales already mentioned, we eliminated the Fund’s position in NCSoft, a South Korea-based online video and mobile game development company. We liked NCSoft when it decided to float one of its games, Blade and Soul, in the Chinese market despite some failures from similar trials in China several years ago. Because of Blade and Soul’s improved game content and the strong marketing power of NCSoft’s publisher, Tencent, the initial results were promising. However, we remained cautious to interpret this data, as stock prices and investor sentiment for game makers are often highly influenced by the performance of new games. As evidenced by its declining user base, Blade and Soul’s spectacular launch did not last long and its user traffic declined. We thus sold the Fund’s position in NCSoft. |

| | We sold the Fund’s position in Anhui Conch Cement, a Chinese company in the materials sector that engages in the production and sale of clinker and cement products. In our view, most of the company’s positive attributes had already been priced into its stock following relative outperformance. Due to sluggish industry demand growth, we expect a deceleration in price increases and believe the company’s earnings growth peaked at the end of 2013. With earnings growth losing momentum, we saw more downside risk at Anhui Conch Cement’s then-current valuation. Thus, as our investment thesis had played out, we took a profit and eliminated the position. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | Most sector weights are usually established within a relatively narrow range from the Index, as our team prefers to make decisions at the individual stock level, where we believe we can generate more added value. That said, during the Reporting Period, the Fund’s exposure to financials, consumer discretionary and utilities increased, and its allocations to information technology, industrials and telecommunication services decreased. |

| | Similarly, allocations to countries are directly the result of various stock selection decisions. During the Reporting Period, the Fund’s allocations to China, the Philippines and India increased, and its exposure to South Korea, Thailand and Singapore decreased. |

| Q | | How was the Fund positioned relative to the Index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund had overweighted exposure to China, the Philippines and India compared to the Index. On the same date, the Fund had underweighted exposure relative to the Index to Hong Kong, Taiwan, Singapore, Malaysia, South Korea and Thailand and had rather neutral exposure relative to the Index in Indonesia. |

| | From a sector allocation perspective, the Fund had overweighted positions relative to the Index in the information technology, consumer discretionary, utilities and health care sectors at the end of the Reporting Period. On the same date, the Fund had underweighted positions compared to the Index in the financials, telecommunication services and energy sectors and was relatively neutrally weighted compared to the Index in materials, consumer staples and industrials. |

| | As always, we remained focused on individual stock selection, with sector and country positioning being a secondary, closely-monitored effect. |

| Q | | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | | During the Reporting Period, Eddie Perkin, managing director and chief investment officer (“CIO”) of International and Emerging Markets Equity and a lead portfolio manager of the Fund, left the firm. The Fund continues to be managed by Kevin Ohn, CFA, Managing Director, who has managed the Fund since 2013, and Alina Chiew, CFA, Managing Director, who has managed the Fund since 2011. |

8

FUND BASICS

Asia Equity Fund

as of April 30, 2014

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2013–April 30, 2014 | | Fund Total Return

(based on NAV)1 | | | MSCI AC (All Country)

Asia ex-Japan Index2 | |

| | Class A | | | 0.41 | % | | | -0.94 | % |

| | Class B | | | 0.00 | | | | -0.94 | |

| | Class C | | | 0.06 | | | | -0.94 | |

| | | Institutional | | | 0.59 | | | | -0.94 | |

| | | February 28, 2014–April 30, 2014 | | | | | | |

| | | Class IR | | | -2.99 | % | | | 1.73 | % |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The MSCI AC (All Country) Asia ex-Japan Index (net, USD, unhedged) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of Asia, excluding Japan. The MSCI AC Asia ex-Japan Index consists of the following 10 developed and emerging market country indices: China, Hong Kong, India, Indonesia, Korea, Malaysia, Philippines, Singapore, Taiwan, and Thailand. This index is net of dividends re-invested after deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties. This series approximates the minimum possible dividend reinvestment. The dividend is reinvested after deduction of withholding tax, applying the rate to nonresident individuals who do not benefit from double taxation treaties. MSCI Barra uses withholding tax rates applicable to Luxembourg holding companies, as Luxembourg applies the highest rates. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 3/31/14 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | 1.71 | % | | | 13.88 | % | | | 6.32 | % | | | 2.23 | % | | 7/08/94 |

| | Class B | | | 1.86 | | | | 14.11 | | | | 6.26 | | | | 1.26 | | | 5/01/96 |

| | Class C | | | 5.82 | | | | 14.30 | | | | 6.11 | | | | 1.45 | | | 8/15/97 |

| | Institutional | | | 8.09 | | | | 15.67 | | | | 7.35 | | | | 2.26 | | | 2/02/96 |

| | | Class IR | | | N/A | | | | N/A | | | | N/A | | | | -2.99 | | | 2/28/14 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares, the assumed contingent deferred sales charge for Class B Shares (5% maximum declining to 0% after six years) and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Class B Shares convert to Class A Shares on or about the fifteenth day of the last month of the calendar quarter that is eight years after purchase. Returns for Class B Shares for the period after conversion reflect the performance of Class A Shares. Because Institutional and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. The Fund’s Class B Shares are no longer available for purchase by new or existing shareholders (although current Class B shareholders may continue to reinvest income and capital gains distributions into Class B Shares, and Class B shareholders may continue to exchange their shares for Class B Shares of certain other Goldman Sachs Funds). |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

9

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.69 | % | | | 2.19 | % |

| | Class B | | | 2.45 | | | | 2.95 | |

| | Class C | | | 2.45 | | | | 2.95 | |

| | Institutional | | | 1.29 | | | | 1.79 | |

| | | Class IR | | | 1.44 | | | | 1.94 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least February 28, 2015, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | | | |

| | TOP TEN HOLDINGS AS OF 4/30/145 |

| | | Holding | | % of Total

Net Assets | | | Line of Business | | Country |

| | Taiwan Semiconductor Manufacturing Co. Ltd. | | | 3.4 | % | | Semiconductors & Semiconductor Equipment | | Taiwan |

| | Industrial & Commercial Bank of China Ltd. Class H | | | 3.2 | | | Banks | | China |

| | China Cinda Asset Management Co. Ltd. Class H | | | 3.1 | | | Diversified Financials | | China |

| | SIIC Environment Holdings Ltd. | | | 2.8 | | | Utilities | | Singapore |

| | Samsung Electronics Co. Ltd. | | | 2.7 | | | Semiconductors & Semiconductor Equipment | | South Korea |

| | Hollysys Automation Technologies Ltd. | | | 2.5 | | | Technology Hardware & Equipment | | China |

| | Tencent Holdings Ltd. | | | 2.4 | | | Software & Services | | China |

| | ENN Energy Holdings Ltd. | | | 2.4 | | | Utilities | | China |

| | Just Dial Ltd. | | | 2.2 | | | Software & Services | | India |

| | | Bloomage Biotechnology Corp. Ltd. | | | 2.1 | | | Materials | | China |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

10

FUND BASICS

|

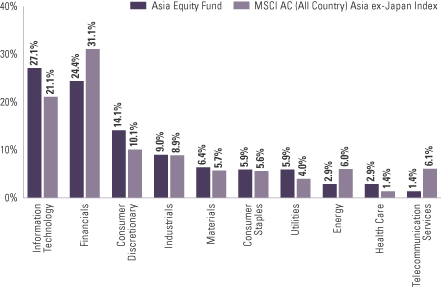

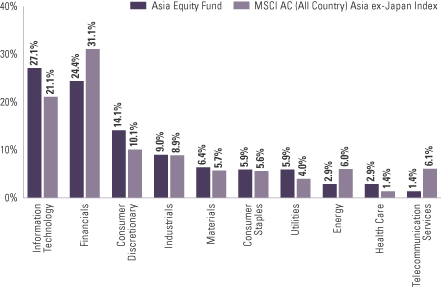

| FUND VS. BENCHMARK SECTOR ALLOCATIONS6 |

| As of April 30, 2014 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the graph above. The graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. Underlying sector allocations of exchange traded funds held by the Fund are not reflected in the graph above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedules of Investments. |

11

PORTFOLIO RESULTS

Goldman Sachs BRIC Fund

Investment Objective

The Fund seeks long-term capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Fundamental Emerging Markets Equity Portfolio Management Team discusses the Goldman Sachs BRIC Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2014 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional and IR Shares generated cumulative total returns, without sales charges, of -5.36%, -5.69%, -5.21% and -5.29%, respectively. These returns compare to the -6.78% cumulative total return of the Fund’s benchmark, the MSCI BRIC Index (net, USD, unhedged) (the “Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund generated disappointing absolute returns but outperformed the Index on a relative basis during the Reporting Period. Weak stock selection and a modest overweighting in the poorly performing Russian equity market and weak stock selection and a modest underweighting in the better performing Brazilian equity market detracted most. The Fund benefited from effective stock selection in China and India as well as from having a modest underweight to China and a modest overweight to India. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The strongest contributors to the Fund’s performance during the Reporting Period were Chinese automation control systems manufacturer Hollysys Automation Technology, Brazilian insurance and brokerage holding company BB Seguridade and Chinese Internet service company Tencent Holdings. |

| | Hollysys Automation Technology is China’s leading manufacturer of automation control systems, including railway signaling systems. It is not a component of the Index and thus its strong performance during the Reporting Period made it a top contributor to Fund results. The stock outperformed the Index, as market participants focused on its expanding order book in the industrial automation and railway signaling businesses. Its management has guided to robust net profit growth for its fiscal year 2014. |

| | BB Seguridade performed well following better than expected 2013 results and positive 2014 return on equity guidance. The company was able to significantly increase its market share in new pension contribution and insurance premiums by leveraging the existing client base of Banco do Brasil, its parent company. |

| | Tencent Holdings is an Internet service company in China engaged in social networks, web portals, e-commerce and multiplayer online games. Tencent Holdings’ stock performed well during the Reporting Period, as its introduction of a new version of WeChat — its proprietary social messaging platform, saw the monetization of its mobile platform in 2013. Also, subscriber growth for WeChat was strong in both its domestic and overseas markets. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Detracting most from the Fund’s results relative to the Index were positions in Brazilian bank Itau, Russian bank Sberbank and Russian retailer Magnit. |

| | Itau detracted from relative results because the Fund held an underweighted position in this strongly performing Brazilian bank. However, we had maintained an underweight exposure to Brazilian banks broadly in the Fund given our concerns related to necessary adjustments at the macro level after the nation’s elections and the effects of the deteriorating asset quality of public sector banks on the industry and the Brazilian economy. Itau, Brazil’s second biggest bank by assets, performed well after reporting stronger than expected fourth quarter 2013 results and raising its 2014 guidance. |

12

PORTFOLIO RESULTS

| | Sberbank, Russia’s largest bank, and Magnit, Russia’s biggest retailer, performed poorly during the Reporting Period due to heightened tensions in Ukraine and worries around potential sanctions imposed by the West. |

| Q | | Which equity market sectors most significantly affected Fund performance during the Reporting Period? |

| A | | Having an overweight to the strongly performing information technology sector boosted the Fund’s results most during the Reporting Period. Effective stock selection in information technology, financials and utilities also contributed positively to the Fund’s performance. In information technology, the Fund’s position in Hollysys Automation Technology, mentioned earlier, was the strongest contributor to relative performance within the sector. In financials, the Fund’s holding in BB Seguridade, already mentioned, was a particularly strong performer. In utilities, a position in Enn Energy, which operates and manages gas pipeline infrastructure and also engages in the sale and distribution of piped and bottled gas in China, was the largest contributor. |

| | Conversely, weak stock selection in the industrials, consumer staples and energy sectors detracted most from the Fund’s performance relative to the Index during the Reporting Period. At an individual stock level, the Fund’s position in Global Trans Investment, a Russian rail freight transportation service provider, was the largest detractor within the industrials sector. Within consumer staples, the Fund’s position in Magnit, mentioned earlier, detracted most from performance during the Reporting Period. In energy, the Fund’s holding in Lukoil, Russia’s second-largest oil company, detracted most from returns. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, the Fund gained exposure to select stocks through equity-linked notes and participatory notes. We used index futures on an opportunistic basis to ensure the Fund remained almost fully exposed to equities following cash inflows or stock sales. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | We opted to change the Fund’s positioning within the financials sector during the Reporting Period. We eliminated the Fund’s position in BM&F Bovespa, Latin America’s biggest exchange operator. The company had revised its volume guidance for 2014, which we believed would have a significant impact on its profitability, as 80% of its revenues are non-recurrent and depend on volumes. The company also revised its capital expenditures guidance upwards. Further, BM&F Bovespa had an outstanding tax dispute appeal with the authorities, and a potential setback weighed on its stock price. Within China, we trimmed the Fund’s position in Industrial and Commercial Bank of China (“ICBC”), the world’s largest bank by market capitalization and one of the largest commercial banks in China. We trimmed the Fund’s position in the stock to reduce exposure to Chinese banks given headwinds in the form of slower economic growth and competition from Internet finance. Conversely, we established new Fund positions in ICICI Bank and Axis Bank. Both are commercial banks and are the second and third biggest lenders in India, respectively. We believe the banks are well poised to benefit from the prospect of economic recovery and falling interest rates in India, anticipated to be realized later in 2014. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | Most sector weights are usually established within a narrow range from the Index, as our team prefers to make decisions at the individual stock level, where we believe we can generate more added value. That said, during the Reporting Period, the Fund’s exposure relative to the Index in health care, consumer discretionary, industrials and information technology increased, and its allocations relative to the Index to financials, energy and telecommunication services decreased. |

| | Resulting from various stock selection decisions, the Fund’s exposure relative to the Index to India and Russia increased, and its allocations relative to the Index to China and more modestly so to Brazil decreased. |

| Q | | How was the Fund positioned relative to the Index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund had overweighted exposure to India and Russia and underweighted exposure to Brazil and China relative to the Index. |

| | From a sector perspective, the Fund had overweighted allocations to information technology, consumer discretionary, consumer staples and health care compared to the Index at the end of the Reporting Period. On the same date, the Fund had underweighted exposure to the energy, telecommunication services, financials, utilities and materials |

13

PORTFOLIO RESULTS

| | sectors and was rather neutrally weighted relative to the Index in the industrials sector. |

| | As always, we remained focused on individual stock selection, with sector and country positioning being a secondary, closely-monitored effect. |

| Q | | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | | During the Reporting Period, Eddie Perkin, managing director and chief investment officer (“CIO”) of International and Emerging Markets Equity and a lead portfolio manager of the Fund, left the firm. The Fund continues to be managed by Alina Chiew, CFA, Managing Director, who has managed the Fund since 2010. |

14

FUND BASICS

BRIC Fund

as of April 30, 2014

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2013–April 30, 2014 | | Fund Total Return

(based on NAV)1 | | | MSCI BRIC Index2 | |

| | Class A | | | -5.36 | % | | | -6.78 | % |

| | Class C | | | -5.69 | | | | -6.78 | |

| | Institutional | | | -5.21 | | | | -6.78 | |

| | | Class IR | | | -5.29 | | | | -6.78 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The MSCI BRIC Index (net, USD, unhedged) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the following four emerging market country indices: Brazil, Russia, India and China. This series approximates the minimum possible dividend reinvestment. The dividend is reinvested after deduction of withholding tax, applying the rate to non-resident individuals who do not benefit from double taxation treaties. MSCI Barra uses withholding tax rates applicable to Luxembourg holding companies, as Luxembourg applies the highest rates. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 3/31/14 | | One Year | | | Five Years | | | Since Inception | | | Inception Date |

| | Class A | | | -5.23 | % | | | 10.55 | % | | | 3.26 | % | | 6/30/06 |

| | Class C | | | -1.48 | | | | 10.96 | | | | 3.23 | | | 6/30/06 |

| | Institutional | | | 0.67 | | | | 12.24 | | | | 4.42 | | | 6/30/06 |

| | | Class IR | | | 0.55 | | | | N/A | | | | -1.54 | | | 8/31/10 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

15

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.71 | % | | | 1.97 | % |

| | Class C | | | 2.45 | | | | 2.71 | |

| | Institutional | | | 1.31 | | | | 1.57 | |

| | | Class IR | | | 1.46 | | | | 1.72 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least February 28, 2015, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | | | |

| | TOP TEN HOLDINGS AS OF 4/30/145 |

| | | Holding | | % of Total

Net Assets | | | Line of Business | | Country |

| | Tencent Holdings Ltd. | | | 6.8 | % | | Software & Services | | China |

| | BB Seguridade Participacoes SA | | | 4.0 | | | Insurance | | Brazil |

| | OAO Lukoil ADR | | | 3.2 | | | Energy | | Russia |

| | AMBEV SA | | | 3.1 | | | Food, Beverage & Tobacco | | Brazil |

| | China Mengniu Dairy Co. Ltd. | | | 3.0 | | | Food, Beverage & Tobacco | | China |

| | Vale SA ADR | | | 2.9 | | | Materials | | Brazil |

| | Odontoprev SA | | | 2.8 | | | Health Care Equipment & Services | | Brazil |

| | ENN Energy Holdings Ltd. | | | 2.7 | | | Utilities | | China |

| | Sberbank of Russia | | | 2.6 | | | Banks | | Russia |

| | | Agricultural Bank of China Ltd. Class H | | | 2.4 | | | Banks | | China |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

16

FUND BASICS

| | |

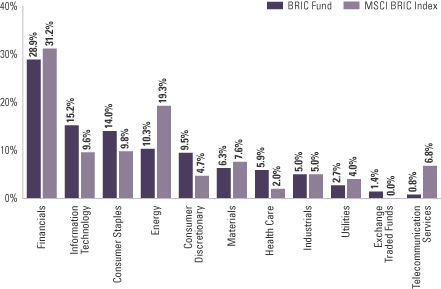

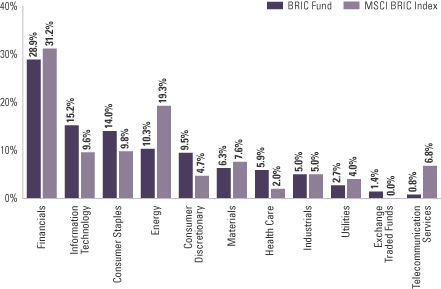

| FUND VS. BENCHMARK SECTOR ALLOCATIONS6 | | |

| As of April 30, 2014 | | |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the graph above. The graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. Underlying sector allocations of exchange traded funds held by the Fund are not reflected in the graph above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedules of Investments. |

17

PORTFOLIO RESULTS

Goldman Sachs Emerging Markets Equity Fund

Investment Objective

The Fund seeks long-term capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Fundamental Emerging Markets Equity Portfolio Management Team discusses the Goldman Sachs Emerging Markets Equity Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2014 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, B, C, Institutional, Service and IR Shares generated cumulative total returns, without sales charges, of 0.19%, -0.15%, -0.22%, 0.45%, 0.11% and 0.32%, respectively. These returns compare to the -2.98% cumulative total return of the Fund’s benchmark, the MSCI Emerging Markets Index (gross, USD, unhedged) (the “Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund generated disappointing absolute returns but outperformed the Index on a relative basis during the Reporting Period. Effective stock selection in China, South Korea and India benefited the Fund’s performance most. Having an overweighted allocation to India, which significantly outpaced the Index during the Reporting Period, also boosted the Fund’s results. Such positive contributors were only partially offset by the detracting effect of weak stock selection and allocation positioning in Russia, South Africa and Brazil. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The strongest contributors to the Fund’s performance during the Reporting Period were Hanssem, Bajaj Finance and Interpark. |

| | The top individual stock contributor to the Fund’s results during the Reporting Period was Hanssem, which primarily engages in the manufacture and distribution of kitchen and interior furniture. South Korean-listed Hanssem reported strong first quarter 2014 sales revenue growth and gained market share on effective branding and on its strong distribution channel strategy. The company particularly benefited from a shift in consumer behavior toward selecting key brand name products over the non-brand market. In our view, major competitors of Hanssem have not yet been successful reading this change in the market, causing them to lose market share. |

| | Bajaj Finance, a non-banking finance company engaged in consumer finance, small and medium enterprises (“SME”) finance and commercial lending in India, contributed positively to the Fund’s returns. The company reported a strong set of results, performing well in terms of loan growth, margins and asset quality. At the end of the Reporting Period, we continued to like the company’s return ratios and valuations relative to its peers. |

| | Interpark is a South Korea-based on-line retailer operating an Internet-based shopping mall. Its stock performed well during the Reporting Period, as the company reported better than expected results and continued to grow revenues ahead of the industry average. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Detracting most from the Fund’s results relative to the Index were positions in Magnit, Lukoil and Haier Electronics. |

| | Magnit, Russia’s biggest retailer, and Lukoil, Russia’s second largest oil producer, performed poorly during the Reporting Period due to heightened tensions in Ukraine and worries around potential sanctions imposed by the West. |

| | Haier Electronics is a Hong Kong-based home appliance manufacturer focusing on washing machines and water heaters. Its stock fell after the company posted a decline in its washing machine segment due to a weak macro environment and dampened consumer confidence. |

18

PORTFOLIO RESULTS

| Q | | Which equity market sectors most significantly affected Fund performance during the Reporting Period? |

| A | | Relative to the Index, strong stock selection within the financials, information technology and consumer discretionary sectors contributed most positively to the Fund’s performance. Having an overweighted allocation to the information technology sector, which significantly outpaced the Index during the Reporting Period, also boosted the Fund’s results. In financials, the Fund’s holding in Bajaj Finance, already mentioned, was the strongest contributor. In information technology, the Fund’s position in Hollysys Automation Technology, China’s leading manufacturer of automation control systems, including railway signaling systems, was an outstanding performer. In consumer discretionary, the Fund’s holding in Hanssem, mentioned earlier, boosted Fund results most. |

| | Conversely, the only two sectors to detract from the Fund’s relative results during the Reporting Period were consumer staples and health care, each primarily driven by weak stock selection. In consumer staples, the Fund’s position in Magnit, already mentioned, was a large detractor from relative returns. In health care, the Fund’s position in Netcare Limited, the largest provider of private health care in South Africa, was the biggest disappointment. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, the Fund used equity-linked notes and participatory notes to gain exposure to select stocks. We used index futures on an opportunistic basis to ensure the Fund remained almost fully exposed to equities following cash inflows or stock sales. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | Within the industrials sector in South Korea, we initiated a Fund position in Hanjin Kal, a holding company with subsidiaries in the South Korean travel industry. We believe the company may be a direct beneficiary of strong tourism in South Korea and that its recent restructuring should improve transparency of the company and crystalize its value. |

| | Within the consumer discretionary sector in South Korea, we added to the Fund’s position in Hanssem, mentioned earlier. We increased the Fund’s position in Hanssem because we believe the company has good growth prospects based on what we consider to be its strong brand, focus on superior design and material quality, well diversified business-to-consumer distribution channels and execution capability of its management. Additionally, we expect a recovery in the property market in 2014 to help Hanssem’s performance. |

| | We exited the Fund’s position in Naver, a South Korean information technology company engaged in Internet search engines and online computer games. In Japan, key operational metrics, such as per-user-expenditure, ad rate-per-unit time and number of games launched, were showing signs of a slowdown, prompting us to eliminate the position. |

| | Within the consumer staples sector in Brazil, we trimmed the Fund’s position in beverage company Ambev during the Reporting Period. The company reported lower than expected sales in the fourth quarter of 2013, and we believe it is likely to face both structural deceleration of volume growth and the headwind posed by a proposed excise hike in Brazil. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | Most sector weights are usually established within a narrow range from the Index, as our team prefers to make decisions at the individual stock level, where we believe we can generate more added value. That said, during the Reporting Period, the Fund’s exposure relative to the Index to financials, industrials, health care and consumer discretionary increased, and its allocations relative to the Index to energy and telecommunication services decreased. |

| | Similarly, allocations to countries are directly the result of various stock selection decisions. As such, the Fund’s exposure relative to the Index in India, Colombia, the Philippines and Peru increased, and its allocations relative to the Index to South Africa, South Korea, China and Taiwan decreased. |

| Q | | How was the Fund positioned relative to the Index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund had overweighted exposures to India, Russia, Peru, Turkey, the Philippines and Indonesia and underweighted exposures to South Africa, South Korea, Taiwan, Malaysia, China and Poland relative to the Index. On the same date, the Fund was relatively neutrally weighted to the Index in the remaining components of the Index. |

| | From a sector allocation perspective, the Fund had overweighted positions relative to the Index in consumer |

19

PORTFOLIO RESULTS

| | staples, health care, information technology, consumer discretionary, industrials and financials at the end of the Reporting Period. The Fund had underweighted positions compared to the Index in the energy, telecommunication services, materials and utilities sectors at the end of the Reporting Period. |

| | As always, we remained focused on individual stock selection, with sector and country positioning being a secondary, closely-monitored effect. |

| Q | | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | | During the Reporting Period, Eddie Perkin, managing director and chief investment officer (“CIO”) of International and Emerging Markets Equity and a lead portfolio manager of the Fund, left the firm. The Fund continues to be managed by Alina Chiew, CFA, Managing Director, who has managed the Fund since 2010. |

20

FUND BASICS

Emerging Markets Equity Fund

as of April 30, 2014

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2013–April 30, 2014 | | Fund Total Return

(based on NAV)1 | | | MSCI Emerging

Markets Index2 | |

| | Class A | | | 0.19 | % | | | -2.98 | % |

| | Class B | | | -0.15 | | | | -2.98 | |

| | Class C | | | -0.22 | | | | -2.98 | |

| | Institutional | | | 0.45 | | | | -2.98 | |

| | Service | | | 0.11 | | | | -2.98 | |

| | | Class IR | | | 0.32 | | | | -2.98 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The MSCI Emerging Markets Index (gross, USD, unhedged) is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. As of November 27, 2013 the MSCI Emerging Markets Index consisted of the following 21 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. This Index offers an exhaustive representation of the emerging markets by targeting all companies with a market capitalization within the top 85% of their investable equity universe, subject to a global minimum size requirement. It is based on the Global Investable Market Indices methodology. This series approximates the minimum possible dividend reinvestment. The dividend is reinvested after deduction of withholding tax, applying the rate to non-resident individuals who do not benefit from double taxation treaties. MSCI Barra uses withholding tax rates applicable to Luxembourg holding companies, as Luxembourg applies the highest rates. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 3/31/14 | | One Year | | | Five Years | | Ten Years | | Since Inception | | Inception Date |

| | Class A | | | -5.46 | % | | 12.18% | | 7.39% | | 6.07% | | 12/15/97 |

| | Class B | | | -5.68 | | | 12.38 | | 7.36 | | 6.18 | | 12/15/97 |

| | Class C | | | -1.71 | | | 12.62 | | 7.18 | | 5.76 | | 12/15/97 |

| | Institutional | | | 0.45 | | | 13.92 | | 8.43 | | 6.98 | | 12/15/97 |

| | Service | | | -0.03 | | | 13.38 | | 7.89 | | 6.32 | | 12/15/97 |

| | | Class IR | | | 0.38 | | | N/A | | N/A | | 2.30 | | 8/31/10 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares, the assumed contingent deferred sales charge for Class B Shares (5% maximum declining to 0% after six years) and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Class B Shares convert to Class A Shares on or about the fifteenth day of the last month of the calendar quarter that is eight years after purchase. Returns for Class B Shares for the period after conversion reflect the performance of Class A Shares. Because Institutional, Service and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. The Fund’s Class B Shares are no longer available for purchase by new or existing shareholders (although current Class B shareholders may continue to reinvest income and capital gains distributions into Class B Shares, and Class B shareholders may continue to exchange their shares for Class B Shares of certain other Goldman Sachs Funds). |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

21

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.72 | % | | | 1.90 | % |

| | Class B | | | 2.47 | | | | 2.65 | |

| | Class C | | | 2.47 | | | | 2.65 | |

| | Institutional | | | 1.32 | | | | 1.50 | |

| | Service | | | 1.82 | | | | 2.00 | |

| | | Class IR | | | 1.47 | | | | 1.65 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least February 28, 2015, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | | | |

| | TOP TEN HOLDINGS AS OF 4/30/145 |

| | | Holding | | % of Total

Net Assets | | | Line of Business | | Country |

| | Taiwan Semiconductor Manufacturing Co. Ltd. | | | 3.4 | % | | Semiconductors &

Semiconductor Equipment | | Taiwan |

| | Tencent Holdings Ltd. | | | 3.1 | | | Software & Services | | China |

| | Vale SA ADR | | | 2.0 | | | Materials | | Brazil |

| | BB Seguridade Participacoes SA | | | 1.9 | | | Insurance | | Brazil |

| | Odontoprev SA | | | 1.8 | | | Health Care Equipment &

Services | | Brazil |

| | OAO Lukoil ADR | | | 1.8 | | | Energy | | Russia |

| | Hanssem Co. Ltd. | | | 1.8 | | | Consumer Durables &

Apparel | | South Korea |

| | PT Bank Central Asia Tbk | | | 1.7 | | | Banks | | Indonesia |

| | ENN Energy Holdings Ltd. | | | 1.6 | | | Utilities | | China |

| | | Airports of Thailand PCL | | | 1.5 | | | Transportation | | Thailand |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

22

FUND BASICS

|

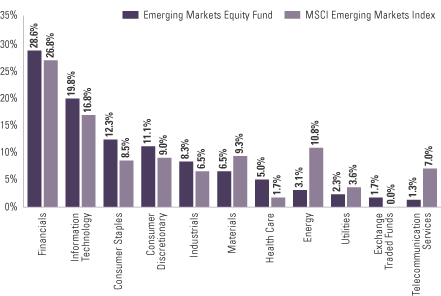

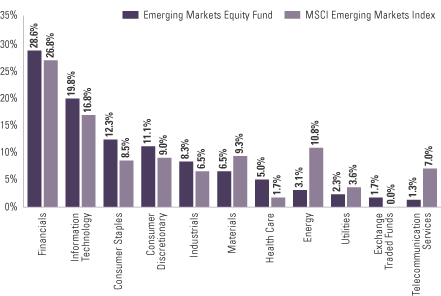

| FUND VS. BENCHMARK SECTOR ALLOCATIONS6 |

| As of April 30, 2014 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the graph above. The graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. Underlying sector allocations of exchange traded funds held by the Fund are not reflected in the graph above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedules of Investments. |

23

PORTFOLIO RESULTS

Goldman Sachs N-11 Equity Fund

Investment Objective

The Fund seeks long-term capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Fundamental Emerging Markets Equity Portfolio Management Team discusses the Goldman Sachs N-11 Equity Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2014 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional and IR Shares generated cumulative total returns, without sales charges, of 2.45%, 2.03%, 2.61% and 2.58%, respectively. These returns compare to the 2.83% cumulative total return of the Fund’s benchmark, the MSCI Next 11 ex-Iran GDP Weighted Index (net, unhedged, USD) (the “Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund only modestly underperformed the Index during the Reporting Period. The Fund’s stock selection in South Korea, Bangladesh and South Vietnam detracted most. Having underweighted allocations to South Vietnam and Bangladesh, which each significantly outpaced the Index during the Reporting Period, also hurt. Such detractors were only partially offset by the positive contributions of effective stock selection in Mexico, Nigeria and Pakistan. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Detracting most from the Fund’s results relative to the Index were positions in Square Pharmaceuticals, Turkiye Halk Bank and Commercial International Bank. |

| | Square Pharmaceuticals is an industry leader in Bangladesh. It was a significant detractor from the Fund’s results during the Reporting Period, as the Fund was underweight this stock, and its shares rallied robustly. The company reported third quarter 2013 earnings results that showed its net profit after tax had increased significantly compared to the same quarter the previous year. These strong results were driven by revenue growth, lower cost of sales and higher operating efficiency. |

| | Turkiye Halk Bank, a Turkish bank, saw its share decline driven by political instability in Turkey. |

| | Commercial International Bank is a financial company based in Egypt. It detracted from the Fund’s relative results because the Fund held an underweight position in its stock, and the stock rallied in response to greater political stability in Egypt, as the military government maintained power and benefited from the financial support of Saudi Arabia. Commercial International Bank is a sizable constituent of the Index. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The strongest contributors to the Fund’s performance during the Reporting Period were Turkiye IS Bankasi, Infraestructura Energetica Nova (“IENova”) and Engro. |

| | Turkiye IS Bankasi, Turkey’s first public bank and one of the largest financial institutions in the country, was the top contributor to the Fund’s relative results during the Reporting Period. The stock declined during the Reporting Period, but the Fund held an underweighted position in Turkiye IS Bankasi when its stock price dipped amidst Turkey’s political instability. We subsequently increased the Fund’s position in Turkiye IS Bankasi as its valuation became more attractive in our view. |

| | IENova develops, builds and operates energy infrastructure in Mexico. A series of reforms widely anticipated to impact the energy sector were being pushed by Mexico’s Congress, and as many investors believed IENova is likely to benefit from post-reform projects in 2015, creating new growth opportunities, its stock rallied sharply. |

| | Engro, a conglomerate based in Pakistan that produces fertilizer, performed well after the company and other industry players entered into long-term gas supply agreements with the field operators that are expected to ensure long-term gas supply from fields to fertilizer plants. |

24

PORTFOLIO RESULTS

| Q | | Which equity market sectors most significantly affected Fund performance during the Reporting Period? |

| A | | Relative to the Index, weak stock selection within the financials and consumer discretionary sectors detracted most from the Fund’s performance during the Reporting Period. Having an underweighted allocation to health care, which outpaced the Index during the Reporting Period, also hurt. Notable individual drivers of underperformance in the financials sector were holdings in the banks industry. The Fund’s holding in Turkey’s Turkiye Halk Bank and its exposure to Egypt’s Commercial International Bank, each already mentioned, were the largest detractors from performance. In consumer discretionary, holdings in the retail industry hurt most, with a position in South Korea’s Hyundai Department Store especially disappointing. A position in Hyundai Motor was another detractor. |

| | Conversely, strong stock selection within consumer staples, information technology and energy contributed most positively to the Fund’s performance. In consumer staples, holdings within the food and beverage industry performed particularly well, with Indonesian cigarette manufacturer Gudang Garam and Egyptian tobacco company Eastern Company boosting results. In information technology, holdings within the semiconductor industry helped most, with South Korea’s SK Hynix and Seoul Semiconductor especially strong performers. In energy, a position in Pakistan Oilfields was the largest individual contributor to relative returns. A holding in SK Innovation, a South Korean company, was also a strong performer. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, the Fund gained exposure to select stocks through equity-linked notes and participatory notes. We used index futures on an opportunistic basis to ensure the Fund remained almost fully exposed to equities following cash inflows or stock sales. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | In Egypt, we added shares of Commercial International Bank to bring the underweight position in its stock, held earlier in the Reporting Period, closer to a neutral position relative to the Index. We trimmed the Fund’s position in Telecom Egypt, which had performed well, in order to fund the position. |

| | We eliminated the Fund’s position in NCSoft, a South Korea-based online video and mobile game development company. |

| | We liked NCSoft when it decided to float one of its games, Blade and Soul, in the Chinese market despite some failures from similar trials in China several years ago. Because of Blade and Soul’s improved game content and the strong marketing power of NCSoft’s publisher, Tencent, the initial results were promising. However, we remained cautious to interpret this data, as stock prices and investor sentiment for game makers are often highly influenced by the performance of new games. As evidenced by its declining user base, Blade and Soul’s spectacular launch did not last long and its user traffic declined. We thus sold the Fund’s position in NCSoft and reallocated some of the proceeds to Orion, an entertainment and sports business. In our view, Orion’s stock was attractively valued at the time of purchase. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

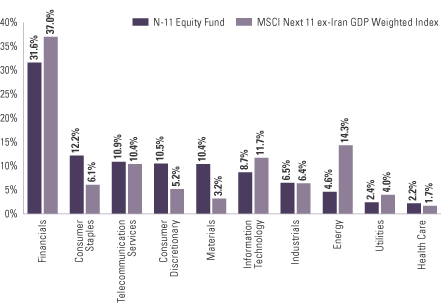

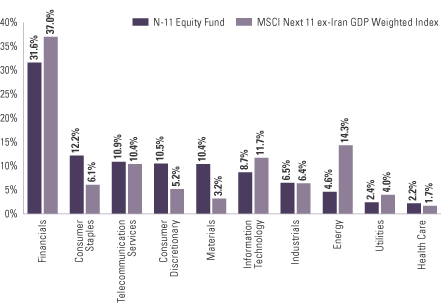

| A | | Most sector weights are usually established within a narrow range from the Index, as our team prefers to make decisions at the individual stock level, where we believe we can generate more added value. That said, during the Reporting Period, the Fund’s exposure relative to the Index to financials and materials increased, and its allocations relative to the Index to industrials, consumer staples and information technology decreased. |