UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| Caroline Kraus, Esq. | Copies to: | |

| Goldman, Sachs & Co. | Geoffrey R.T. Kenyon, Esq. | |

| 200 West Street | Dechert LLP | |

| New York, New York 10282 | 100 Oliver Street | |

| 40th Floor | ||

| Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: August 31

Date of reporting period: August 31, 2016

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| The Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| Annual Report | August 31, 2016 | |||

Financial Square FundsSM | ||||

Federal Instruments* | ||||

Government | ||||

Money Market | ||||

Prime Obligations | ||||

Tax-Exempt Money Market** | ||||

Treasury Instruments | ||||

Treasury Obligations | ||||

Treasury Solutions | ||||

* The Goldman Sachs Financial Square Federal Instruments Fund commenced operations on October 30, 2015.

** The Goldman Sachs Financial Square Tax-Exempt Money Market Fund commenced operations on March 31, 2016.

Goldman Sachs Financial Square Funds

| n | FEDERAL INSTRUMENTS FUND |

| n | GOVERNMENT FUND |

| n | MONEY MARKET FUND |

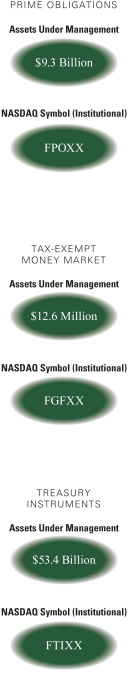

| n | PRIME OBLIGATIONS FUND |

| n | TAX-EXEMPT MONEY MARKET FUND |

| n | TREASURY INSTRUMENTS FUND |

| n | TREASURY OBLIGATIONS FUND |

| n | TREASURY SOLUTIONS FUND |

TABLE OF CONTENTS | ||||

Portfolio Results | 1 | |||

Fund Basics | 6 | |||

Yield Summary | 8 | |||

Sector Allocations | 9 | |||

Schedules of Investments | 11 | |||

Financial Statements | 40 | |||

Financial Highlights | 48 | |||

Notes to Financial Statements | 64 | |||

Report of Independent Registered Public Accounting Firm | 82 | |||

Other Information | 83 | |||

| NOT FDIC-INSURED | May Lose Value | No Bank Guarantee | ||

PORTFOLIO RESULTS

Goldman Sachs Financial Square Funds

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Money Market Portfolio Management Team discusses the Goldman Sachs Financial

Square Funds’ (the “Funds”) performance and positioning for the 12-month period ended August 31, 2016 (the “Reporting Period”).*

| Q | What economic and market factors most influenced the money markets as a whole during the Reporting Period? |

| A | When the Reporting Period began in September 2015, the Federal Reserve (the “Fed”) remained on hold, keeping the targeted federal funds (“fed funds”) rate near zero and sending a dovish message to the financial markets. (Dovish messaging tends to suggest lower interest rates.) As a result, participant projections for the fed funds rate and the timing of Fed action shifted down and extended out, respectively. Inflation projections for the next few years also came down as did the expected unemployment rate. However, we believe Fed messaging increasingly indicated a desire to raise rates in 2015. As for economic data, U.S. non-farm payrolls were disappointing, with 142,000 new jobs added in August 2015, below market expectations of approximately 200,000. The unemployment rate remained at 5.1%. The U.S. Institute for Supply Management (“ISM”) Manufacturing Purchasing Managers’ Index (“PMI”) declined to 50.2 in September 2015 from 51.1 in August 2015. Core inflation was flat at 1.8% year over year in September 2015. The end of September 2015 also saw the biggest use of the Fed’s reverse repurchase agreement program (“RRP”) facility since it was instituted, with $475 billion in total bids across the two term auctions and the overnight facility and $450 billion in total take-up or purchases.1 (Through the RRP, the Fed lends U.S. Treasury securities to counterparties, such as dealers, money market funds and government-sponsored entities, in exchange for cash. The RRP is intended to help set a floor under short-term interest rates after years of near-zero Fed policy rates and quantitative easing.) The total bids across all three auctions slightly exceeded year-end 2014. Sharp bill pay-downs as a result of debt ceiling constraints, quarter-end balance sheet pressures and a contingent of front-end investors caught off-guard by the Fed remaining on hold all contributed to the increase. Short-term Treasury bills were offered at negative rates into 2016, and liquidity was challenged across the board as the U.S. Treasury cut bill supply. |

| In the fourth quarter of 2015, the Fed delivered its first interest rate hike since 2006. More specifically, the Fed raised the targeted fed funds rate by 25 basis points in December 2015 and projected four rate hikes for the 2016 calendar year. (A basis point is 1/100th of a percentage point.) The U.S. economy continued to display a positive growth trend. U.S. non-farm payrolls indicated 292,000 new jobs in December 2015, above market expectations of approximately 200,000, and the data for October and November 2015 were also revised upward by 50,000 new jobs. The December 2015 unemployment rate fell to 5.0% despite a 0.1% increase in the labor participation rate. In contrast, economic growth in other developed countries softened, and emerging markets economies broadly weakened, due largely to falling commodity prices and concerns around a slowdown in China’s economy. Outside the U.S., the global monetary policy environment remained highly accommodative. Despite accommodative monetary policies, inflation remained subdued in the world’s major economies during the fourth calendar quarter. |

| In the first quarter of 2016, all eyes were on the Fed, with the release of its policy statement, updated economic projections and a press conference following a two-day meeting in March 2016 of particular attention. The statement leaned dovish, as it twice mentioned global economic conditions as a key concern. The projections were also dovish, as the path of interest rates came down, with the median projection then calling for two hikes in 2016, down from four in December 2015. Near-term core inflation was unchanged. The press conference was fairly balanced, focusing on global concerns and inflation expectations, which remained lower than the Fed would like, among other topics. However, the Fed was also careful to note that it does not view an overshoot of its inflation target as an acceptable outcome. Markets reacted accordingly, with rates rallying, the U.S. dollar weakening, equities rising and the derivative market reflecting the reduced probability of a June 2016 interest rate hike. The Fed signaled more sensitivity to the global economic environment than expected by many market participants. On the economic |

| * | For the Goldman Sachs Financial Square Federal Instruments Fund, the Reporting Period is from its inception on October 30, 2015 through August 31, 2016. For the Goldman Sachs Financial Square Tax-Exempt Money Market Fund, the Reporting Period is from its inception on March 31, 2016 through August 31, 2016. |

| 1 | Source: Federal Reserve. |

1

PORTFOLIO RESULTS

| front, the labor market performed well, and developments at the end of the first quarter of 2016 maintained the dichotomy between further improvement in the labor market and concerns about global conditions on the part of the Fed leadership. Non-farm payrolls were above consensus expectations. The unemployment rate remained at 5.0%, however, this was largely due to an uptick in the participation rate, also by 0.1%, to 63.0%. Average hourly earnings rose more than the consensus expected, increasing at a 2.3% year over year pace. |

| During the second quarter of 2016, commodities prices seemed to stabilize and perceived risks surrounding slowing Chinese economic growth and the potential of a U.S. recession declined. In June 2016, however, the U.K.’s surprise “leave” vote in its referendum about membership in the European Union, popularly known as “Brexit,” produced a renewed sense of uncertainty in the markets. The upcoming U.S. elections also appeared, in our view, to increase market uncertainty and volatility. U.S. economic news was positive, with U.S. non-farm payrolls indicating 287,000 new jobs in June 2016, significantly above market expectations of approximately 180,000. The unemployment rate ticked down to 4.9%. Still, it remained unclear what the jobs report would mean for the Fed given limited wage/inflation pressure. The Fed remained focused on downside risk and lack of inflation pressure. |

| The Fed met in June 2016. Although its subsequent statement was marginally dovish, and the economic data estimates for Gross Domestic Product (“GDP”), inflation and unemployment were largely unchanged, the fed funds rate forecasts shifted in a materially dovish way. Median projections for 2017-2018 as well as the long-term fed funds rate estimate all came down. In addition, the tone of the press conference leaned dovish, with worries about slowing labor market momentum as the key takeaway. Given the small changes to the economic forecasts followed by the larger changes to the fed funds rate projections, we believed this dichotomy could be explained by one of two — or possibly both — ways. One is a dovish shift in the Fed reaction function (how it interprets and reacts to economic data and market developments). The other is a belief that the U.S. economy’s long-term potential is diminished and therefore may require a lower rate of interest going forward, a theory the Fed had previously been reluctant to embrace. |

| During July 2016, growth in many economies outside the U.S. was faltering, political and geopolitical event risk was elevated and central bank monetary policy was, in our view, increasingly disruptive. In this environment, steady job gains in the U.S. and positive global economic data surprises provided critical fundamental support for the financial markets and for market expectations of a Fed rate hike by year-end 2016. The Global Manufacturing PMI rose to 51.0 in July 2016 from 50.3 in June 2016, signaling improvements in global manufacturing activity — an eight-month high, according to J.P. Morgan — reversing weakness seen during the first half of 2016. In the U.S., non-farm payrolls indicated 255,000 new jobs were created in July 2016, higher than the market expectations of approximately 180,000 new jobs. The U.S. unemployment rate remained stable at 4.9%. The U.S. ISM Manufacturing PMI edged down to 52.6 in July 2016 from 53.2 in June 2016. Core inflation for June 2016, which was reported in July 2016, rose modestly to 2.3% year over year from 2.2% in May 2016. |

| In August 2016, global central banks maintained their accommodative monetary policies in the face of political uncertainties as well as anemic economic growth and inflation outlooks. The Bank of England (“BoE”) also unveiled monetary easing measures to cushion the potential impact of Brexit. BoE Governor Carney described the package as “timely, coherent and comprehensive” and assured financial markets that all of its four measures had “scope for further action.” Elsewhere, the Bank of Japan (“BoJ”) fell short of market expectations with the announcement of an equity purchase program and the lack of key monetary measures, such as an interest rate cut and increased government bond purchases. In the U.S., hawkish comments from the Fed boosted market expectations of a rate hike during 2016. (Hawkish comments tend to suggest higher interest rates.) Economic data surprises on both the positive and negative sides suggested monetary policy action was most likely in December 2016. U.S. non-farm payrolls showed approximately 151,000 new jobs were created in August 2016, adding to the strong and above consensus readings of prior summer months. While the gains were moderate and below market expectations of 180,000, they were above the breakeven rate, which is the pace of job gains the Fed considers sufficient to hold unemployment steady over time. The U.S. unemployment rate remained at 4.9%. The U.S. ISM Manufacturing PMI edged down to 52.0 in August 2016. Core inflation for July 2016, which was reported in August 2016, fell marginally to 2.2% year over year from 2.3% in June 2016. |

2

PORTFOLIO RESULTS

| Q | What key factors were responsible for the performance of the Funds during the Reporting Period? |

| A | The taxable and tax-exempt Funds’ yields edged up, but stayed low, during the Reporting Period due primarily to the economic and market factors discussed above. Both the taxable and tax-exempt money market yield curves, or spectrum of maturities, flattened as yields on the shorter end of the curve rose more than yields on the longer end of the curve. |

| The interest rate and market environment did not provide bountiful opportunities to pick up additional yield. However, in keeping with our investment approach, we sought to position the Funds to take advantage of changes in the interest rate environment, and throughout the Reporting Period, we found pockets of opportunity to add extra yield. That said, it should be noted that regardless of interest rate conditions, we seek to manage the Funds consistently. Our investment approach has always been tri-fold — to seek preservation of capital, daily liquidity and maximization of yield potential. We manage interest and credit risk daily. Whether interest rates are historically low, high or in-between, we intend to continue to use our actively managed approach to seek to provide the best possible return within the framework of the Funds’ guidelines and objectives. |

| Q | How did you manage the taxable Funds during the Reporting Period? |

| A | Collectively, the taxable Funds had investments in commercial paper, asset-backed commercial paper, U.S. Treasury securities, government agency securities, repurchase agreements (“repos”), government guaranteed paper, variable rate demand notes, and certificates of deposit during the Reporting Period. |

| From the start of the Reporting Period through the end of 2015, we maintained positions at the longer end of our targeted weighted average maturity range within the taxable government repo strategies (i.e., the Goldman Sachs Financial Square Government Fund, the Goldman Sachs Financial Square Treasury Obligations Fund and the Goldman Sachs Financial Square Treasury Solutions Fund) and the taxable government non-repo strategies (i.e., the Goldman Sachs Financial Square Federal Instruments Fund2 and the Goldman Sachs Financial Square Treasury Instruments Fund). This positioning was in anticipation of the Fed’s December 2015 policy meeting and because we continued to find pockets of value in the longer-term segment of the money market yield curve. In addition, we sought to take advantage of the money market’s expectations for aggressive Fed rate hikes, as well as a favorable technical (supply and demand) environment, to purchase what we considered to be attractive securities at relatively cheap levels. Within our taxable commercial paper strategies (i.e., the Goldman Sachs Financial Square Money Market Fund and the Goldman Sachs Financial Square Prime Obligations Fund), we focused on maintaining high levels of liquidity in addition to holding positions at the shorter end of our targeted weighted average maturity range ahead of what we expected to be a rotation of cash from commercial paper strategies to government strategies before the implementation of money market fund reform, which will become effective in October 2016. Toward the end of 2015, we opportunistically extended the weighted average maturity of our taxable commercial paper strategies as we found what we believed to be attractive values. Overall, during the first four months of the Reporting Period, we targeted a weighted average maturity of between 30 days and 50 days in our taxable commercial paper strategies, between 40 days and 60 days in our taxable government repo strategies and between 50 days and 60 days in our taxable government non-repo strategies. The weighted average maturity of a money market fund is a measure of its price sensitivity to changes in interest rates. Also known as effective maturity, weighted average maturity measures the weighted average of the maturity date of bonds held by each respective strategy taking into consideration any available maturity shortening features. |

| During the first quarter of 2016, we maintained positions at the longer end of our targeted weighted average maturity range within the taxable government repo strategies and the taxable government non-repo strategies, extending on an opportunistic basis as we found value in the longer-term segment of the money market yield curve. In general, the taxable money markets continued to price in more aggressive Fed rate hikes than we anticipated, creating what we viewed as attractive investment opportunities. Within our taxable commercial paper strategies, we focused on maintaining high levels of liquidity and continued to hold positions at the shorter end of our weighted average maturity range because we expected cash to rotate out of commercial paper strategies and into government strategies in advance of the implementation of money market fund reform. Overall, during the first quarter of 2016, we targeted a weighted average maturity of between 35 days and 55 days in our taxable commercial paper strategies and between 40 days and |

| 2 | The Goldman Sachs Financial Square Federal Instruments Fund commenced operations on October 30, 2015. |

3

PORTFOLIO RESULTS

| 60 days in both our taxable government repo strategies and our taxable government non-repo strategies. |

| In the second quarter of 2016, we shortened the targeted weighted average maturity of our taxable government repo strategies and our taxable government non-repo strategies, as we felt yield levels did not offer enough compensation for the potential of a summer 2016 rate hike by the Fed. After the Fed’s dovish statement in June 2016, we opportunistically extended the weighted average maturity of our taxable government repo strategies and taxable government non-repo strategies. Within our taxable commercial paper strategies, we continued to focus on maintaining liquidity and holding positions on the shorter end of our targeted weighted average maturity range because we expected cash to rotate out of commercial paper strategies and into government strategies ahead of the implementation of money market fund reform. Overall, we targeted a weighted average maturity of between 30 days and 50 days in our taxable commercial paper strategies, between 25 days and 45 days in our taxable government repo strategies and between 30 days and 50 days in our taxable government non-repo strategies. |

| During the final two months of the Reporting Period, we further shortened the targeted weighted average maturity of our taxable commercial paper strategies and continued to focus on maintaining liquidity ahead of the implementation of money market fund reform. We placed a high premium on liquidity because we did not know how the money markets overall would react when money market fund reform was implemented. Within our taxable government repo strategies and taxable government non-repo strategies, we extended our targeted weighted average maturity as we believed the Fed rate hike cycle would be gradual. Overall, during the final two months of Reporting Period, we targeted a weighted average maturity of between one day and 15 days in our taxable commercial paper strategies, between 25 days and 50 days in our taxable government repo strategies and between 35 days and 55 days in our taxable government non-repo strategies. |

| Q | How did you manage the tax-exempt Fund during the Reporting Period? |

| A | During the Reporting Period, the tax-exempt Fund (i.e., the Goldman Sachs Financial Square Tax-Exempt Money Market Fund3) had investments in variable rate demand notes (“VRDNs”), tax-exempt commercial paper and municipal put bonds. |

| In particular, the tax-exempt Fund benefited from its significant position in VRDNs, which bolstered its yields during the Reporting Period. During 2016, the Securities Industry and Financial Markets Association (“SIFMA”) 7-day VRDN Index rose from its 2015 lows as outflows from tax-exempt money market funds increased, especially around tax time. Between January 2016 and the end of the Reporting Period, tax-exempt money market funds experienced approximately $100 billion of outflows — the highest in several years — as short-maturity tax-exempt bonds remained relatively expensive compared to a number of other assets.4 There was also a dramatic increase in VRDN investments by taxable money market funds, as the SIFMA 7-day VRDN Index traded near levels that taxable money market funds would have to pay in interest for overnight time deposits. At the end of 2015, taxable commercial paper strategies held $16 billion in VRDNs, but by the end of June 2016, that number had increased to $26 billion. The SIFMA 7-day VRDN Index finished the Reporting Period at approximately 0.60%. |

| During the Reporting Period, the tax-exempt Fund held positions at the shorter end of our targeted weighted average maturity range in response to upcoming money market fund reform (which becomes effective in October 2016), the likelihood of rising rates in 2016 and our focus on maintaining high liquidity. The tax-exempt Fund’s weighted average maturity was generally in a range of between five days and 15 days for the Reporting Period overall. |

| Q | How did you manage the Funds’ weighted average life during the Reporting Period? |

| A | During the Reporting Period, we managed the weighted average life of all the taxable and tax-exempt Funds below 120 days. The weighted average life of a money market fund is a measure of a money market fund’s price sensitivity to changes in liquidity and/or credit risk. |

| Q | Did you make any changes to the Funds’ portfolios during the Reporting Period? |

| A | During the Reporting Period, we made adjustments to the Funds’ weighted average maturities and their allocations to specific investments based on then-current market conditions, our near-term view and anticipated and actual Fed monetary policy statements. |

| 3 | The Goldman Sachs Financial Square Tax-Exempt Money Market Fund commenced operations on March 31, 2016. |

| 4 | Source: iMoney Net |

4

PORTFOLIO RESULTS

| Q | What are the Funds’ tactical views and strategies for the months ahead? |

| A | At the end of the Reporting Period, weaker than consensus expected U.S. manufacturing and service sector data, combined with moderate non-farm payroll employment gains, reduced the market-implied probability of a Fed rate hike in September 2016. Given that the employment gains were above the Fed’s breakeven rate, however, we continued to expect an interest rate hike by year-end 2016. |

| In our taxable commercial paper strategies, we plan to focus on maintaining high levels of liquidity and positions at the shorter end of our targeted weighted average maturity range. In our taxable government repo strategies and taxable government non-repo strategies, we plan to maintain positions at the longer end of our targeted weighted average maturity range, looking to opportunistically extend as we find pockets of value at the longer end of the money market yield curve. In our tax-exempt Fund, we plan on maintaining positions at the shorter end of our targeted weighted average maturity range because of upcoming money market fund reform and the potential, in our view, of a Fed rate hike by the end of the calendar year. We will also plan to focus on maintaining high levels of liquidity. |

| Overall, we expect to keep all the Funds conservatively positioned as we continue to focus on preservation of capital and daily liquidity. We do not believe there is value in sacrificing liquidity in exchange for opportunities that only modestly increase yield potential. We will continue to use our actively managed approach to seek the best possible return within the framework of our Funds’ investment guidelines and objectives. In addition, we will continue to manage interest, liquidity and credit risk daily. We will also continue to closely monitor economic data, Fed policy and any shifts in the money market yield curve, as we strive to navigate the interest rate environment. |

The U.S. Securities and Exchange Commission (“SEC”) adopted changes to the rules that govern money market funds. These changes will: (1) permit money market funds to impose a “liquidity fee” (up to 2%) or “redemption gate” that temporarily restricts redemptions from the funds, if weekly liquidity levels fall below the required regulatory threshold, and (2) require “institutional” money market funds to operate with a floating net asset value (“NAV”) rounded to the fourth decimal place. For additional information, refer to the Funds’ current prospectuses at www.gsamfunds.com.

5

FUND BASICS

Financial Square Funds

as of August 31, 2016

| PERFORMANCE REVIEW1 | ||||||||||

| September 1, 2015–August 31, 2016 | Fund Total Return (based on NAV)2 Institutional Shares | iMoneynet Institutional Average3 | ||||||||

| Government | 0.20 | % | 0.08 | %4 | ||||||

| Money Market | 0.32 | 0.19 | 5 | |||||||

| Prime Obligations | 0.29 | 0.19 | 5 | |||||||

| Treasury Instruments | 0.13 | 0.05 | 6 | |||||||

| Treasury Obligations | 0.15 | 0.06 | 7 | |||||||

| Treasury Solutions | 0.14 | 0.08 | 4 | |||||||

| October 30, 2015–August 31, 2016 | ||||||||||

| Federal Instruments | 0.16 | % | 0.08 | %4 | ||||||

| March 31, 2016–August 31, 2016 | ||||||||||

| Tax-Exempt Money Market | 0.09 | % | 0.08 | %8 | ||||||

The returns represent past performance. Past performance does not guarantee future results. The Funds’ investment returns will fluctuate. Current performance may be lower or higher than the performance quoted above. Please visit our Web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| 1 | As of August 31, 2016, each of the Treasury Obligations, Money Market, Treasury Instruments and Treasury Solutions Funds offers nine separate classes of shares (Institutional, Select, Preferred, Capital, Administration, Service, Cash Management, Premier and Resource), the Tax-Exempt Money Market Fund offers seven separate share classes (Institutional, Select, Preferred, Capital, Administration, Service and Resource), the Federal Instruments Fund offers eight separate classes of shares (Institutional, Select, Preferred, Capital, Administration, Service, Cash Management and Premier), the Prime Obligations Fund offers ten separate classes of shares (Institutional, Select, Preferred, Capital, Administration, Service, Cash Management, Premier, Resource, and Class C), and the Government Fund offers twelve separate classes of shares (Institutional, Select, Preferred, Capital, Administration, Service, Cash Management, Premier, Resource, Class R6, Class A and Class C), each of which is subject to different fees and expenses that affect performance and entitles shareholders to different services. The Institutional and Class R6 Shares do not have distribution (12b-1), administration or shareholder service fees. The Select, Preferred, Capital, Administration, Service, Cash Management, Premier, Resource, Class A and Class C Shares offer financial institutions the opportunity to receive fees for providing certain distribution (12b-1), administrative support and/or shareholder services (as applicable). As an annualized percentage of average daily net assets, these share classes pay combined distribution (12b-1), administration and/or shareholder service fees (as applicable) at the following contractual rates: the Select Shares pay 0.03%, Preferred Shares pay 0.10%, Capital Shares pay 0.15%, Administration Shares pay 0.25%, Service Shares pay 0.50%, Cash Management Shares pay 0.80%, Premier Shares pay 0.35%, Resource Shares pay 0.65%, Class A Shares pay 0.25% and Class C Shares pay 1.00%. |

| If these fees were reflected in the above performance, performance would have been reduced. |

| 2 | The net asset value (NAV) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. A Fund’s performance reflects the reinvestment of dividends and other distributions. A Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 3 | Source: iMoneyNet, Inc. August 2016. |

6

FUND BASICS

| 4 | Government & Agencies Institutional — Category includes the most broadly based of the government institutional funds. These funds may invest in U.S. treasuries, U.S. agencies, repurchase agreements, or government-backed floating rate notes. |

| 5 | First Tier Institutional — Category includes only non-government institutional funds that also are not holding any second tier securities. Portfolio holdings of First Tier funds include U.S. Treasury, U.S. other, repurchase agreements, time deposits, domestic bank obligations, foreign bank obligations, first tier commercial paper, floating rate notes, and asset-backed commercial paper. |

| 6 | Treasury Institutional — Category includes only institutional government funds that hold 100 percent in U.S. Treasuries. |

| 7 | Treasury & Repo Institutional — Category includes only institutional government funds that hold U.S. Treasuries and repurchase agreements backed by the U.S. Treasury. |

| 8 | Tax-Free National — Category includes all retail and institutional national tax-free and municipal money funds. Portfolio holdings of tax-free funds include rated and unrated demand notes, rated and unrated general market notes, commercial paper, put bonds — 6 months & less, put bonds — over 6 months, AMT paper, and other tax-free holdings. |

| STANDARDIZED TOTAL RETURNS1,9 | ||||||||||||||||||||||||

| For the period ended 6/30/16 | SEC 7-Day Current Yield10 | One Year | Five Years | Ten Years | Since Inception | Inception Date | ||||||||||||||||||

| Federal Instruments | 0.19 | % | N/A | N/A | N/A | 0.11 | % | 10/30/15 | ||||||||||||||||

| Government | 0.29 | 0.15 | % | 0.04 | % | 1.08 | % | 2.76 | 4/6/93 | |||||||||||||||

| Money Market | 0.43 | 0.28 | 0.14 | 1.18 | 2.82 | 5/18/94 | ||||||||||||||||||

| Prime Obligations | 0.41 | 0.25 | 0.10 | 1.14 | 3.16 | 3/8/90 | ||||||||||||||||||

| Tax-Exempt Money Market | 0.24 | N/A | N/A | N/A | 0.04 | 3/31/16 | ||||||||||||||||||

| Treasury Instruments | 0.19 | 0.10 | 0.02 | 0.86 | 2.10 | 3/3/97 | ||||||||||||||||||

| Treasury Obligations | 0.23 | 0.11 | 0.03 | 0.92 | 2.96 | 4/25/90 | ||||||||||||||||||

| Treasury Solutions | 0.16 | 0.10 | 0.03 | 1.04 | 2.31 | 2/28/97 | ||||||||||||||||||

| 9 | The Standardized Total Returns are average annual or cumulative total returns (only if the performance period is one year or less) of Institutional Shares as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. |

| Because Institutional Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The yields returns represent past performance. Past performance does not guarantee future results. The Funds’ investment yield and return will fluctuate as market conditions change. Current performance may be lower or higher than the performance quoted above. Please visit our Web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| 10 | The SEC 7-Day Current Yield figures are as of 6/30/16 and are calculated in accordance with securities industry regulations and do not include net capital gains. SEC 7-Day Current Yield may differ slightly from the actual distribution rate of a given Fund because of the exclusion of distributed capital gains, which are non-recurring. The SEC 7-Day Current Yield more closely reflects a Fund’s current earnings than do the Standardized Total Return figures. |

7

YIELD SUMMARY

| SUMMARY OF THE INSTITUTIONAL SHARES1 AS OF 8/31/16 | ||||||||||||||||||||||

| Funds | 7-Day Dist. Yield11 | SEC 7-Day Effective Yield12 | 30-Day Average Yield13 | Weighted Avg. Maturity (days)14 | Weighted Avg. Life (days)15 | |||||||||||||||||

| Federal Instruments | 0.29 | % | 0.26 | % | 0.30 | % | 47 | 110 | ||||||||||||||

| Government | 0.27 | 0.27 | 0.28 | 29 | 106 | |||||||||||||||||

| Money Market | 0.30 | 0.30 | 0.32 | 3 | 3 | |||||||||||||||||

| Prime Obligations | 0.31 | 0.31 | 0.31 | 3 | 3 | |||||||||||||||||

| Tax-Exempt Money Market | 0.35 | 0.35 | 0.28 | 5 | 5 | |||||||||||||||||

| Treasury Instruments | 0.19 | 0.18 | 0.19 | 50 | 108 | |||||||||||||||||

| Treasury Obligations | 0.21 | 0.18 | 0.22 | 46 | 101 | |||||||||||||||||

| Treasury Solutions | 0.21 | 0.15 | 0.20 | 47 | 108 | |||||||||||||||||

The Yields represent past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance quoted above.

Yields reflect fee waivers and expense limitations in effect and will fluctuate as market conditions change. The yield quotations more closely reflect the current earnings of the Fund. Please visit our Web site at www.GSAMFUNDS.com to obtain the most recent month-end performance.

| 11 | The 7-Day Distribution yield is the average total return over the previous seven days. It is a Fund’s total income net of expenses, divided by the total number of outstanding shares. This yield can include capital gain/loss distribution, if any. This is not a SEC Yield. |

| 12 | The SEC 7-Day Effective Yield of a Fund is calculated in accordance with securities industry regulations and do not include net capital gains. The SEC 7-Day Effective Yield assumes reinvestment of dividends for one year. |

| 13 | The 30-Day Average Yield is a net annualized yield of 30 days back from the current date listed. This yield includes capital gain/loss distribution. |

| 14 | A Fund’s weighted average maturity (WAM) is an average of the effective maturities of all securities held in the portfolio, weighted by each security’s percentage of net assets. This must not exceed 60 days as calculated under SEC Rule 2a-7. |

| 15 | A Fund’s weighted average life (WAL) is an average of the final maturities of all securities held in the portfolio, weighted by each security’s percentage of net assets. This must not exceed 120 days as calculated under SEC Rule 2a-7. |

8

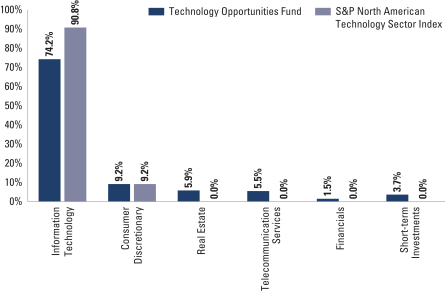

SECTOR ALLOCATIONS

| TAXABLE FUNDS16 | ||||||||||||||||||||||||||||||

| As of August 31, 2016 | ||||||||||||||||||||||||||||||

Security Type (Percentage of Net Assets) | Federal Instruments17 | Government | Money Market | Prime Obligations | Treasury Instruments | Treasury Obligations | Treasury Solutions | |||||||||||||||||||||||

| Certificates of Deposit - Yankeedollar | — | — | 7.4 | % | 7.5 | % | — | — | — | |||||||||||||||||||||

| Commercial Paper & Corporate Obligations | — | — | 0.5 | 1.0 | — | — | — | |||||||||||||||||||||||

| Fixed Rate Municipal Debt Obligations | — | — | 0.9 | 1.0 | — | — | — | |||||||||||||||||||||||

| Repurchase Agreements | — | 56.6 | % | 26.4 | 22.3 | — | 64.6 | % | 51.3 | % | ||||||||||||||||||||

| Time Deposits | — | — | 40.3 | 35.2 | — | — | — | |||||||||||||||||||||||

| U.S. Government Agency Obligations | 68.4 | % | 43.0 | 0.7 | 4.2 | — | — | — | ||||||||||||||||||||||

| U.S. Treasury Obligations | 31.5 | 2.7 | — | — | 101.2 | % | 32.3 | 49.2 | ||||||||||||||||||||||

| Variable Rate Municipal Debt Obligations | — | — | 23.9 | 28.9 | — | — | — | |||||||||||||||||||||||

| As of August 31, 2015 | ||||||||||||||||||||||||||||||

Security Type (Percentage of Net Assets) | Federal Instruments | Government | Money Market | Prime Obligations | Treasury Instruments | Treasury Obligations | Treasury Solutions | |||||||||||||||||||||||

| Certificates of Deposit - Eurodollar | — | — | 1.7 | % | — | — | — | — | ||||||||||||||||||||||

| Certificates of Deposit - Yankeedollar | — | — | 16.9 | — | — | — | — | |||||||||||||||||||||||

| Commercial Paper & Corporate Obligations | — | — | 14.5 | 31.6 | % | — | — | — | ||||||||||||||||||||||

| Fixed Rate Municipal Debt Obligations | — | — | 0.5 | 2.1 | — | — | — | |||||||||||||||||||||||

| Repurchase Agreements | — | 54.4 | % | 21.3 | 43.9 | — | 58.1 | % | 37.8 | % | ||||||||||||||||||||

| Time Deposits | — | — | 16.7 | — | — | — | — | |||||||||||||||||||||||

| U.S. Government Agency Obligations | — | 43.6 | 2.0 | 7.7 | — | — | 37.1 | |||||||||||||||||||||||

| U.S. Treasury Obligations | — | — | — | 2.0 | 99.2 | % | 57.4 | 58.8 | ||||||||||||||||||||||

| Variable Rate Municipal Debt Obligations | — | — | 0.6 | 2.5 | — | — | — | |||||||||||||||||||||||

| Variable Rate Obligations | — | — | 26.4 | 11.0 | — | — | — | |||||||||||||||||||||||

| 16 | Each Fund is actively managed and, as such, its portfolio composition may differ over time. The percentage shown for each investment category reflects the value (based on amortized cost) of investments in that category as a percentage of net assets. Figures in the above table may not sum to 100% due to the exclusion of other assets and liabilities. |

| 17 | Commenced operations on October 30, 2015. |

9

SECTOR ALLOCATIONS

| TAX-EXEMPT MONEY MARKET FUND18 | ||||||

| As of August 31, 2016 | ||||||

| Security Type | Percentage of Net Assets | |||||

| Commercial Paper | 6.9 | % | ||||

| Variable Rate Obligations | 91.0 | |||||

| 18 | The Fund is actively managed and, as such, its portfolio composition may differ over time. The percentage shown for each investment category reflects the value (based on amortized cost) of investments in that category as a percentage of net assets. Figures in the above table may not sum to 100% due to the exclusion of other assets and liabilities. |

10

FINANCIAL SQUARE FEDERAL INSTRUMENTS FUND

Schedule of Investments

August 31, 2016

| Principal Amount | Interest Rate | Maturity Date | Amortized Cost | |||||||||||

| U.S. Government Agency Obligations – 68.4% | ||||||||||||||

| Federal Farm Credit Bank |

| ||||||||||||

| $ | 1,000,000 | 0.588 | %(a) | 09/14/16 | $ | 1,000,000 | ||||||||

| 3,000,000 | 0.530 | (a) | 09/19/16 | 3,000,165 | ||||||||||

| 15,000,000 | 0.490 | (a) | 09/20/16 | 15,000,310 | ||||||||||

| 7,000,000 | 0.469 | 09/28/16 | 6,997,585 | |||||||||||

| 3,500,000 | 0.554 | (a) | 09/29/16 | 3,499,994 | ||||||||||

| 100,000 | 5.875 | 10/03/16 | 100,466 | |||||||||||

| 17,000,000 | 0.490 | 10/06/16 | 16,992,067 | |||||||||||

| 7,000,000 | 0.481 | (a) | 12/02/16 | 6,999,934 | ||||||||||

| 380,000 | 0.499 | (a) | 12/19/16 | 379,938 | ||||||||||

| 3,500,000 | 0.584 | (a) | 12/29/16 | 3,499,887 | ||||||||||

| 200,000 | 0.511 | (a) | 12/30/16 | 200,041 | ||||||||||

| 25,000,000 | 0.460 | (a) | 01/17/17 | 24,997,230 | ||||||||||

| 2,500,000 | 0.597 | (a) | 01/20/17 | 2,500,000 | ||||||||||

| 1,000,000 | 0.458 | (a) | 02/15/17 | 999,149 | ||||||||||

| 1,100,000 | 0.578 | (a) | 04/07/17 | 1,099,973 | ||||||||||

| 1,000,000 | 0.624 | (a) | 04/25/17 | 1,000,000 | ||||||||||

| 200,000 | 0.626 | (a) | 06/13/17 | 200,190 | ||||||||||

| 650,000 | 0.513 | (a) | 06/15/17 | 650,000 | ||||||||||

| 3,500,000 | 0.549 | (a) | 06/30/17 | 3,499,883 | ||||||||||

| 25,000,000 | 0.538 | (a) | 07/13/17 | 25,000,168 | ||||||||||

| 1,250,000 | 0.757 | (a) | 08/01/17 | 1,249,438 | ||||||||||

| 700,000 | 0.548 | (a) | 09/15/17 | 699,963 | ||||||||||

| Federal Home Loan Bank |

| ||||||||||||

| 2,000,000 | 0.597 | (a) | 09/22/16 | 2,000,000 | ||||||||||

| 82,000,000 | 0.281 | 09/23/16 | 81,986,169 | |||||||||||

| 7,450,000 | 0.500 | 09/23/16 | 7,449,905 | |||||||||||

| 2,500,000 | 0.587 | (a) | 10/12/16 | 2,499,955 | ||||||||||

| 625,000 | 0.463 | 10/21/16 | 624,606 | |||||||||||

| 2,500,000 | 0.677 | (a) | 11/01/16 | 2,500,000 | ||||||||||

| 30,000,000 | 0.554 | (a) | 11/03/16 | 30,000,000 | ||||||||||

| 15,000,000 | 0.679 | (a) | 11/03/16 | 15,000,000 | ||||||||||

| 35,000,000 | 0.708 | (a) | 11/08/16 | 34,999,998 | ||||||||||

| 400,000 | 0.457 | 11/14/16 | 399,631 | |||||||||||

| 3,000,000 | 0.508 | (a) | 12/15/16 | 3,000,000 | ||||||||||

| 3,250,000 | 0.482 | (a) | 12/23/16 | 3,250,000 | ||||||||||

| 1,270,000 | 0.554 | (a) | 12/23/16 | 1,269,678 | ||||||||||

| 2,500,000 | 0.589 | (a) | 01/17/17 | 2,499,121 | ||||||||||

| 1,000,000 | 0.565 | (a) | 01/25/17 | 1,000,000 | ||||||||||

| 1,500,000 | 0.728 | (a) | 02/07/17 | 1,499,923 | ||||||||||

| 15,000,000 | 0.744 | (a) | 02/17/17 | 15,000,000 | ||||||||||

| 6,500,000 | 0.556 | (a) | 03/03/17 | 6,500,000 | ||||||||||

| 4,000,000 | 0.596 | (a) | 03/13/17 | 4,000,000 | ||||||||||

| 4,000,000 | 0.595 | (a) | 03/16/17 | 4,000,000 | ||||||||||

| 6,600,000 | 0.569 | (a) | 03/21/17 | 6,600,000 | ||||||||||

| 20,000,000 | 0.512 | (a) | 03/23/17 | 20,000,799 | ||||||||||

| 7,500,000 | 0.517 | (a) | 03/29/17 | 7,500,000 | ||||||||||

| 6,350,000 | 0.539 | (a) | 04/05/17 | 6,350,000 | ||||||||||

| 4,450,000 | 0.569 | (a) | 04/13/17 | 4,450,000 | ||||||||||

| 3,500,000 | 0.579 | (a) | 04/18/17 | 3,500,000 | ||||||||||

| 17,500,000 | 0.527 | (a) | 04/21/17 | 17,500,000 | ||||||||||

| 25,000,000 | 0.535 | (a) | 04/25/17 | 25,000,000 | ||||||||||

| 4,000,000 | 0.799 | (a) | 08/28/17 | 3,999,601 | ||||||||||

| 1,500,000 | 0.653 | (a) | 09/01/17 | 1,500,000 | ||||||||||

|

| |||||||||||||

| | TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS | | $ | 435,445,767 | ||||||||||

|

| |||||||||||||

| U.S. Treasury Obligations – 31.5% | ||||||||||||||

| United States Treasury Bills |

| ||||||||||||

| $ | 40,700,000 | 0.265 | % | 09/01/16 | $ | 40,700,000 | ||||||||

| 3,500,000 | 0.193 | 09/08/16 | 3,499,871 | |||||||||||

| 2,100,000 | 0.244 | 09/08/16 | 2,099,902 | |||||||||||

| 1,500,000 | 0.265 | 09/08/16 | 1,499,924 | |||||||||||

| 4,000,000 | 0.275 | 09/08/16 | 3,999,790 | |||||||||||

| 30,000,000 | 0.280 | 09/15/16 | 29,996,792 | |||||||||||

| 17,500,000 | 0.255 | 09/22/16 | 17,497,448 | |||||||||||

| 15,000,000 | 0.280 | 09/22/16 | 14,997,594 | |||||||||||

| 6,150,000 | 0.347 | 12/29/16 | 6,143,088 | |||||||||||

| 1,100,000 | 0.403 | 02/02/17 | 1,098,141 | |||||||||||

| 500,000 | 0.428 | 02/09/17 | 499,061 | |||||||||||

| 10,000,000 | 0.449 | 02/09/17 | 9,980,322 | |||||||||||

| 300,000 | 0.439 | 02/16/17 | 299,398 | |||||||||||

| 900,000 | 0.459 | 02/16/17 | 898,110 | |||||||||||

| 2,750,000 | 0.454 | 02/23/17 | 2,744,051 | |||||||||||

| 600,000 | 0.459 | 02/23/17 | 598,688 | |||||||||||

| United States Treasury Floating Rate Note |

| ||||||||||||

| 10,000,000 | 0.388 | (a) | 10/31/16 | 10,000,216 | ||||||||||

| United States Treasury Notes |

| ||||||||||||

| 400,000 | 0.875 | 09/15/16 | 400,090 | |||||||||||

| 11,450,000 | 1.000 | 10/31/16 | 11,462,847 | |||||||||||

| 800,000 | 3.125 | 10/31/16 | 803,666 | |||||||||||

| 800,000 | 4.625 | 11/15/16 | 806,348 | |||||||||||

| 100,000 | 0.625 | 12/31/16 | 100,069 | |||||||||||

| 750,000 | 3.125 | 01/31/17 | 758,309 | |||||||||||

| 7,000,000 | 4.625 | 02/15/17 | 7,132,852 | |||||||||||

| 1,650,000 | 0.875 | 02/28/17 | 1,653,292 | |||||||||||

| 200,000 | 3.000 | 02/28/17 | 202,519 | |||||||||||

| 7,750,000 | 3.250 | 03/31/17 | 7,874,056 | |||||||||||

| 1,000,000 | 4.500 | 05/15/17 | 1,027,247 | |||||||||||

| 4,500,000 | 2.750 | 05/31/17 | 4,573,492 | |||||||||||

| 800,000 | 0.625 | 06/30/17 | 800,252 | |||||||||||

| 2,500,000 | 2.500 | 06/30/17 | 2,539,451 | |||||||||||

| 7,900,000 | 0.875 | 07/15/17 | 7,919,317 | |||||||||||

| 800,000 | 0.875 | 08/15/17 | 801,697 | |||||||||||

| 3,600,000 | 4.750 | 08/15/17 | 3,740,755 | |||||||||||

| 1,500,000 | 0.625 | 08/31/17 | 1,499,476 | |||||||||||

|

| |||||||||||||

| | TOTAL U.S. TREASURY OBLIGATIONS | | $ | 200,648,131 | ||||||||||

|

| |||||||||||||

| TOTAL INVESTMENTS – 99.9% | $ | 636,093,898 | ||||||||||||

|

| |||||||||||||

| | OTHER ASSETS IN EXCESS OF LIABILITIES – 0.1% | | 334,921 | |||||||||||

|

| |||||||||||||

| NET ASSETS – 100.0% | $ | 636,428,819 | ||||||||||||

|

| |||||||||||||

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. | ||

(a) | Variable or floating rate security. Interest rate disclosed is that which is in effect at August 31, 2016. | |

Interest rates represent either the stated coupon rate, annualized yield on date of purchase for discounted securities, or, for floating rate securities, the current reset rate, which is based upon interest rate indices.

Maturity dates represent either the final legal maturity date on the security, the demand date for puttable securities, or the prerefunded date for those types of securities.

| The accompanying notes are an integral part of these financial statements. | 11 |

FINANCIAL SQUARE GOVERNMENT FUND

Schedule of Investments

August 31, 2016

| Principal Amount | Interest Rate | Maturity Date | Amortized Cost | |||||||||||

| U.S. Government Agency Obligations – 43.0% | ||||||||||||||

| Federal Farm Credit Bank |

| ||||||||||||

| $ | 29,590,000 | 0.528 | %(a) | 09/14/16 | $ | 29,589,329 | ||||||||

| 98,000,000 | 0.588 | (a) | 09/14/16 | 98,000,000 | ||||||||||

| 34,457,000 | 0.530 | (a) | 09/19/16 | 34,458,544 | ||||||||||

| 200,000,000 | 0.743 | (a) | 09/23/16 | 200,002,875 | ||||||||||

| 200,000,000 | 0.668 | (a) | 11/04/16 | 200,011,396 | ||||||||||

| 15,000,000 | 0.481 | (a) | 12/02/16 | 14,999,859 | ||||||||||

| 95,000,000 | 0.584 | (a) | 12/29/16 | 94,996,928 | ||||||||||

| 14,700,000 | 0.511 | (a) | 12/30/16 | 14,703,006 | ||||||||||

| 195,000,000 | 0.597 | (a) | 01/20/17 | 195,000,000 | ||||||||||

| 99,000,000 | 0.458 | (a) | 02/15/17 | 98,915,725 | ||||||||||

| 12,510,000 | 0.579 | (a) | 02/27/17 | 12,505,263 | ||||||||||

| 73,400,000 | 0.578 | (a) | 04/07/17 | 73,398,228 | ||||||||||

| 131,300,000 | 0.624 | (a) | 04/25/17 | 131,300,000 | ||||||||||

| 150,000,000 | 0.730 | (a) | 04/27/17 | 149,998,769 | ||||||||||

| 200,000,000 | 0.722 | (a) | 05/15/17 | 199,997,447 | ||||||||||

| 490,000,000 | 0.581 | (a) | 05/23/17 | 490,000,000 | ||||||||||

| 13,450,000 | 0.626 | (a) | 06/13/17 | 13,462,799 | ||||||||||

| 49,000,000 | 0.512 | (a) | 06/15/17 | 49,000,000 | ||||||||||

| 275,000,000 | 0.744 | (a) | 06/26/17 | 274,996,752 | ||||||||||

| 294,500,000 | 0.549 | (a) | 06/30/17 | 294,490,148 | ||||||||||

| 75,000,000 | 0.538 | (a) | 07/13/17 | 75,000,504 | ||||||||||

| 65,000,000 | 0.657 | (a) | 07/21/17 | 64,999,911 | ||||||||||

| 6,500,000 | 0.757 | (a) | 08/01/17 | 6,497,076 | ||||||||||

| 64,000,000 | 0.548 | (a) | 09/15/17 | 63,996,649 | ||||||||||

| Federal Home Loan Bank |

| ||||||||||||

| 40,000,000 | 0.436 | (a) | 09/02/16 | 40,000,149 | ||||||||||

| 507,850,000 | 0.519 | 09/21/16 | 507,706,391 | |||||||||||

| 938,550,000 | 0.500 | 09/23/16 | 938,538,061 | |||||||||||

| 157,840,000 | 0.500 | 09/28/16 | 157,837,584 | |||||||||||

| 184,750,000 | 0.454 | 10/03/16 | 184,676,921 | |||||||||||

| 250,000,000 | 0.490 | 10/05/16 | 249,996,931 | |||||||||||

| 34,500,000 | 0.449 | 10/07/16 | 34,484,820 | |||||||||||

| 245,000,000 | 0.587 | (a) | 10/12/16 | 244,995,591 | ||||||||||

| 27,900,000 | 0.454 | 10/13/16 | 27,885,515 | |||||||||||

| 368,125,000 | 0.463 | 10/21/16 | 367,892,877 | |||||||||||

| 248,000,000 | 0.474 | 10/26/16 | 247,823,817 | |||||||||||

| 250,000,000 | 0.460 | 10/27/16 | 249,985,437 | |||||||||||

| 170,000,000 | 0.677 | (a) | 11/01/16 | 170,000,000 | ||||||||||

| 554,000,000 | 0.554 | (a) | 11/03/16 | 554,000,000 | ||||||||||

| 232,500,000 | 0.679 | (a) | 11/03/16 | 232,500,000 | ||||||||||

| 191,280,000 | 0.464 | 11/04/16 | 191,125,276 | |||||||||||

| 246,000,000 | 0.459 | 11/07/16 | 245,793,975 | |||||||||||

| 459,500,000 | 0.708 | (a) | 11/08/16 | 459,499,972 | ||||||||||

| 134,400,000 | 0.457 | 11/14/16 | 134,276,232 | |||||||||||

| 177,500,000 | 0.590 | 11/25/16 | 177,257,762 | |||||||||||

| 99,400,000 | 0.515 | 12/07/16 | 99,264,747 | |||||||||||

| 204,400,000 | 0.521 | 12/07/16 | 204,119,120 | |||||||||||

| 206,600,000 | 0.510 | 12/09/16 | 206,315,925 | |||||||||||

| 245,500,000 | 0.508 | (a) | 12/15/16 | 245,500,000 | ||||||||||

| 245,000,000 | 0.482 | (a) | 12/23/16 | 245,000,000 | ||||||||||

| 32,000,000 | 0.518 | 12/23/16 | 31,948,974 | |||||||||||

| 465,000,000 | 0.473 | (a) | 01/13/17 | 464,994,780 | ||||||||||

| 495,500,000 | 0.565 | (a) | 01/25/17 | 495,500,000 | ||||||||||

| 250,000,000 | 0.622 | (a) | 01/30/17 | 249,984,334 | ||||||||||

| 50,000,000 | 0.624 | (a) | 02/03/17 | 49,996,654 | ||||||||||

| 895,000,000 | 0.618 | (a) | 02/06/17 | 895,000,000 | ||||||||||

|

| |||||||||||||

| U.S. Government Agency Obligations – (continued) | ||||||||||||||

| Federal Home Loan Bank – (continued) |

| ||||||||||||

| $ | 125,000,000 | 0.653 | %(a) | 02/07/17 | $ | 124,991,375 | ||||||||

| 43,000,000 | 0.728 | (a) | 02/07/17 | 42,997,803 | ||||||||||

| 50,000,000 | 0.682 | (a) | 02/13/17 | 49,995,060 | ||||||||||

| 40,000,000 | 0.682 | (a) | 02/14/17 | 39,997,106 | ||||||||||

| 480,000,000 | 0.744 | (a) | 02/17/17 | 480,000,000 | ||||||||||

| 49,700,000 | 0.490 | 02/24/17 | 49,583,371 | |||||||||||

| 467,500,000 | 0.491 | 02/24/17 | 466,400,648 | |||||||||||

| 1,460,500,000 | 0.556 | (a) | 03/03/17 | 1,460,500,000 | ||||||||||

| 748,000,000 | 0.611 | (a) | 03/03/17 | 748,000,000 | ||||||||||

| 725,000,000 | 0.616 | (a) | 03/03/17 | 725,000,000 | ||||||||||

| 244,500,000 | 0.596 | (a) | 03/13/17 | 244,500,000 | ||||||||||

| 244,500,000 | 0.595 | (a) | 03/16/17 | 244,500,000 | ||||||||||

| 247,500,000 | 0.569 | (a) | 03/21/17 | 247,500,000 | ||||||||||

| 739,000,000 | 0.517 | (a) | 03/29/17 | 739,000,000 | ||||||||||

| 490,500,000 | 0.539 | (a) | 04/05/17 | 490,500,000 | ||||||||||

| 250,000,000 | 0.580 | (a) | 04/11/17 | 250,000,000 | ||||||||||

| 238,100,000 | 0.569 | (a) | 04/13/17 | 238,100,000 | ||||||||||

| 195,000,000 | 0.579 | (a) | 04/18/17 | 195,000,000 | ||||||||||

| 475,000,000 | 0.527 | (a) | 04/21/17 | 475,000,000 | ||||||||||

| 396,200,000 | 0.535 | (a) | 04/25/17 | 396,200,000 | ||||||||||

| 250,000,000 | 0.679 | (a) | 05/02/17 | 249,983,341 | ||||||||||

| 1,468,000,000 | 0.547 | (a) | 06/09/17 | 1,468,000,000 | ||||||||||

| 198,500,000 | 0.518 | (a) | 06/15/17 | 198,500,000 | ||||||||||

| 152,500,000 | 0.799 | (a) | 08/28/17 | 152,484,801 | ||||||||||

| 581,900,000 | 0.000 | (a)(b) | 09/01/17 | 581,900,000 | ||||||||||

| 348,000,000 | 0.000 | (a)(b) | 09/06/17 | 348,000,000 | ||||||||||

| 994,500,000 | 0.000 | (a)(b) | 10/02/17 | 994,500,000 | ||||||||||

| 148,500,000 | 0.613 | (a) | 11/08/17 | 148,500,000 | ||||||||||

| 248,000,000 | 0.673 | (a) | 02/05/18 | 248,000,000 | ||||||||||

| 133,000,000 | 0.667 | (a) | 02/15/18 | 133,000,000 | ||||||||||

| 497,000,000 | 0.661 | (a) | 02/22/18 | 497,000,000 | ||||||||||

| Federal Home Loan Mortgage Corporation |

| ||||||||||||

| 15,000,000 | 0.497 | (a) | 09/16/16 | 15,000,316 | ||||||||||

| 200,000,000 | 0.707 | (a) | 11/14/16 | 199,993,735 | ||||||||||

| 300,000,000 | 0.517 | (a) | 04/20/17 | 299,970,951 | ||||||||||

| 755,000,000 | 0.709 | (a) | 04/26/17 | 754,950,923 | ||||||||||

| 102,000,000 | 1.250 | 05/12/17 | 102,403,704 | |||||||||||

| 27,300,000 | 1.000 | 06/29/17 | 27,392,558 | |||||||||||

| 500,000,000 | 0.642 | (a) | 07/21/17 | 499,954,482 | ||||||||||

| 1,992,500,000 | 0.567 | (a) | 12/20/17 | 1,992,500,000 | ||||||||||

| 997,000,000 | 0.631 | (a) | 01/08/18 | 997,000,000 | ||||||||||

| 249,000,000 | 0.637 | (a) | 01/12/18 | 249,000,000 | ||||||||||

| Federal National Mortgage Association |

| ||||||||||||

| 837,500,000 | 0.587 | (a) | 10/21/16 | 837,492,263 | ||||||||||

| 19,100,000 | 1.375 | 11/15/16 | 19,136,333 | |||||||||||

| 26,400,000 | 0.750 | 04/20/17 | 26,416,198 | |||||||||||

| 151,000,000 | 5.000 | 05/11/17 | 155,407,097 | |||||||||||

| 14,900,000 | 0.609 | 06/01/17 | 14,832,580 | |||||||||||

| 87,550,000 | 5.375 | 06/12/17 | 90,752,577 | |||||||||||

| 143,175,000 | 0.532 | (a) | 07/20/17 | 143,098,648 | ||||||||||

|

| |||||||||||||

| | TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS | | $ | 30,637,158,923 | ||||||||||

|

| |||||||||||||

| 12 | The accompanying notes are an integral part of these financial statements. |

FINANCIAL SQUARE GOVERNMENT FUND

| Principal Amount | Interest Rate | Maturity Date | Amortized Cost | |||||||||||

| U.S. Treasury Obligations – 2.7% | ||||||||||||||

| United States Treasury Bills |

| ||||||||||||

| $ | 744,100,000 | 0.449 | % | 02/09/17 | $ | 742,635,779 | ||||||||

| 29,000,000 | 0.439 | 02/16/17 | 28,941,807 | |||||||||||

| 93,200,000 | 0.459 | 02/16/17 | 93,004,280 | |||||||||||

| 72,700,000 | 0.459 | 02/23/17 | 72,540,969 | |||||||||||

| United States Treasury Notes |

| ||||||||||||

| 29,750,000 | 3.000 | 09/30/16 | 29,807,004 | |||||||||||

| 5,000,000 | 4.625 | 11/15/16 | 5,039,672 | |||||||||||

| 2,500,000 | 7.500 | 11/15/16 | 2,534,932 | |||||||||||

| 175,000,000 | 2.750 | 05/31/17 | 177,818,622 | |||||||||||

| 229,232,000 | 0.625 | 06/30/17 | 229,297,906 | |||||||||||

| 46,000,000 | 2.500 | 06/30/17 | 46,721,966 | |||||||||||

| 91,850,000 | 0.875 | 08/15/17 | 92,044,779 | |||||||||||

| 386,961,000 | 4.750 | 08/15/17 | 402,090,689 | |||||||||||

| 38,800,000 | 0.625 | 08/31/17 | 38,786,434 | |||||||||||

|

| |||||||||||||

| TOTAL U.S. TREASURY OBLIGATIONS | $ | 1,961,264,839 | ||||||||||||

|

| |||||||||||||

| | TOTAL INVESTMENTS BEFORE REPURCHASE AGREEMENTS | | $ | 32,598,423,762 | ||||||||||

|

| |||||||||||||

| Repurchase Agreements(c) – 56.6% | ||||||||||||||

| Bank of Montreal |

| ||||||||||||

| $ | 325,000,000 | 0.310 | % | 09/01/16 | $ | 325,000,000 | ||||||||

| Maturity Value: $325,002,799 |

| ||||||||||||

| Collateralized by Federal Farm Credit Bank, 2.870% to 2.980%, | | ||||||||||||

| 200,000,000 | 0.330 | (a)(d) | 09/07/16 | 200,000,000 | ||||||||||

| Maturity Value: $200,056,834 |

| ||||||||||||

| Settlement Date: 08/19/16 |

| ||||||||||||

| Collateralized by Federal Farm Credit Bank, 0.520% to 2.360%, | | ||||||||||||

|

| |||||||||||||

| Bank of Nova Scotia (The) |

| ||||||||||||

| 1,300,000,000 | 0.340 | 09/01/16 | 1,300,000,000 | |||||||||||

| Maturity Value: $1,300,012,278 |

| ||||||||||||

| Collateralized by Cash and Federal Home Loan Mortgage Corp., | | ||||||||||||

|

| |||||||||||||

| Repurchase Agreements(c) – (continued) | ||||||||||||||

| Bank of Nova Scotia (The) – (continued) |

| ||||||||||||

| $ | 250,000,000 | 0.400 | %(a)(d) | 09/07/16 | $ | 250,000,000 | ||||||||

| Maturity Value: $250,758,333 |

| ||||||||||||

| Settlement Date: 02/11/16 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 3.500% to | | ||||||||||||

| 250,000,000 | 0.470 | (a)(d) | 09/07/16 | 250,000,000 | ||||||||||

| Maturity Value: $251,214,171 |

| ||||||||||||

| Settlement Date: 10/07/15 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 4.000%, | | ||||||||||||

| 500,000,000 | 0.570 | (a)(d) | 09/07/16 | 500,000,000 | ||||||||||

| Maturity Value: $502,169,162 |

| ||||||||||||

| Settlement Date: 04/07/16 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 2.500% to | | ||||||||||||

|

| |||||||||||||

| BNP Paribas |

| ||||||||||||

| 900,000,000 | 0.310 | 09/01/16 | 900,000,000 | |||||||||||

| Maturity Value: $900,007,750 |

| ||||||||||||

| Collateralized by U.S. Treasury Bond, 8.500%, due 02/15/20, | | ||||||||||||

| 500,000,000 | 0.350 | (a)(d) | 09/01/16 | 500,000,000 | ||||||||||

| Maturity Value: $501,020,831 |

| ||||||||||||

| Settlement Date: 02/23/16 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 3.000% to | | ||||||||||||

|

| |||||||||||||

| The accompanying notes are an integral part of these financial statements. | 13 |

FINANCIAL SQUARE GOVERNMENT FUND

Schedule of Investments (continued)

August 31, 2016

| Principal Amount | Interest Rate | Maturity Date | Amortized Cost | |||||||||||

| Repurchase Agreements(c) – (continued) | ||||||||||||||

| BNP Paribas – (continued) |

| ||||||||||||

| $ | 550,000,000 | 0.350 | %(a)(d) | 09/01/16 | $ | 550,000,000 | ||||||||

| Maturity Value: $551,085,484 |

| ||||||||||||

| Settlement Date: 02/23/16 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 3.000% to | | ||||||||||||

| 750,000,000 | 0.340 | (a)(d) | 09/07/16 | 750,000,000 | ||||||||||

| Maturity Value: $750,637,497 |

| ||||||||||||

| Settlement Date: 07/07/16 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 3.000% to | | ||||||||||||

| 1,000,000,000 | 0.340 | (a)(d) | 09/07/16 | 1,000,000,000 | ||||||||||

| Maturity Value: $1,000,594,997 |

| ||||||||||||

| Settlement Date: 07/18/16 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 2.500% to | | ||||||||||||

| 1,000,000,000 | 0.350 | (a)(d) | 09/07/16 | 1,000,000,000 | ||||||||||

| Maturity Value: $1,000,894,442 |

| ||||||||||||

| Settlement Date: 07/05/16 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 2.000% to | | ||||||||||||

|

| |||||||||||||

| Repurchase Agreements(c) – (continued) | ||||||||||||||

| BNP Paribas – (continued) |

| ||||||||||||

| $ | 1,000,000,000 | 0.360 | %(a)(d) | 09/07/16 | $ | 1,000,000,000 | ||||||||

| Maturity Value: $1,000,900,000 |

| ||||||||||||

| Settlement Date: 08/05/16 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 2.500% to | | ||||||||||||

|

| |||||||||||||

| BNP Paribas Securities Corp. |

| ||||||||||||

| 195,900,000 | 0.330 | 09/01/16 | 195,900,000 | |||||||||||

| Maturity Value: $195,901,796 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 3.000% to | | ||||||||||||

|

| |||||||||||||

| Citibank N.A. |

| ||||||||||||

| 400,000,000 | 0.340 | 09/07/16 | 400,000,000 | |||||||||||

| Maturity Value: $400,026,444 |

| ||||||||||||

| Collateralized by Federal Farm Credit Bank, 2.470%, due | | ||||||||||||

|

| |||||||||||||

| Citigroup Global Markets, Inc. |

| ||||||||||||

| 63,100,000 | 0.340 | 09/01/16 | 63,100,000 | |||||||||||

| Maturity Value: $63,100,596 |

| ||||||||||||

| Collateralized by U.S. Treasury Notes, 0.875%, due 09/15/16 to | | ||||||||||||

|

| |||||||||||||

| 14 | The accompanying notes are an integral part of these financial statements. |

FINANCIAL SQUARE GOVERNMENT FUND

| Principal Amount | Interest Rate | Maturity Date | Amortized Cost | |||||||||||

| Repurchase Agreements(c) – (continued) | ||||||||||||||

| Credit Agricole Corporate and Investment Bank |

| ||||||||||||

| $ | 500,000,000 | 0.330 | % | 09/06/16 | $ | 500,000,000 | ||||||||

| Maturity Value: $500,032,083 |

| ||||||||||||

| Settlement Date: 08/30/16 |

| ||||||||||||

| Collateralized by Federal Farm Credit Bank, 1.680% to 2.670%, | | ||||||||||||

| 500,000,000 | 0.320 | 09/07/16 | 500,000,000 | |||||||||||

| Maturity Value: $500,031,111 |

| ||||||||||||

| Collateralized by U.S. Treasury Bond, 3.000%, due 05/15/42, | | ||||||||||||

|

| |||||||||||||

| Credit Suisse Securities (USA) LLC |

| ||||||||||||

| 750,000,000 | 0.370 | 09/07/16 | 750,000,000 | |||||||||||

| Maturity Value: $750,485,625 |

| ||||||||||||

| Settlement Date: 07/06/16 |

| ||||||||||||

| Collateralized by Federal National Mortgage Association, 2.000% | | ||||||||||||

| 500,000,000 | 0.380 | 09/07/16 | 500,000,000 | |||||||||||

| Maturity Value: $500,327,222 |

| ||||||||||||

| Settlement Date: 07/07/16 |

| ||||||||||||

| Collateralized by Federal National Mortgage Association, 2.000% | | ||||||||||||

|

| |||||||||||||

| Deutsche Bank Securities, Inc. |

| ||||||||||||

| 775,000,000 | 0.340 | 09/01/16 | 775,000,000 | |||||||||||

| Maturity Value: $775,007,319 |

| ||||||||||||

| Collateralized by U.S. Treasury Bill, 0.000%, due 07/20/17 and | | ||||||||||||

| 300,000,000 | 0.350 | 09/01/16 | 300,000,000 | |||||||||||

| Maturity Value: $300,002,917 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 3.000% to | | ||||||||||||

|

| |||||||||||||

| Repurchase Agreements(c) – (continued) | ||||||||||||||

| Federal Reserve Bank of New York |

| ||||||||||||

| $ | 6,400,000,000 | 0.250 | % | 09/01/16 | $ | 6,400,000,000 | ||||||||

| Maturity Value: $6,400,044,444 |

| ||||||||||||

| Collateralized by U.S. Treasury Bonds, 3.125% to 6.125%, due | | ||||||||||||

|

| |||||||||||||

| HSBC Securities (USA), Inc. |

| ||||||||||||

| 500,000,000 | 0.300 | 09/01/16 | 500,000,000 | |||||||||||

| Maturity Value: $500,004,167 |

| ||||||||||||

| Collateralized by Federal National Mortgage Association, 3.500% | | ||||||||||||

|

| |||||||||||||

| ING Financial Markets LLC |

| ||||||||||||

| 300,000,000 | 0.320 | 09/01/16 | 300,000,000 | |||||||||||

| Maturity Value: $300,002,667 |

| ||||||||||||

| Collateralized by Federal National Mortgage Association, 3.000% | | ||||||||||||

| 500,000,000 | 0.484 | (a)(e) | 10/07/16 | 500,000,000 | ||||||||||

| Maturity Value: $503,456,008 |

| ||||||||||||

| Settlement Date: 05/26/15 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 7.000%, | | ||||||||||||

| 500,000,000 | 0.501 | (a)(e) | 10/18/16 | 500,000,000 | ||||||||||

| Maturity Value: $500,577,609 |

| ||||||||||||

| Settlement Date: 07/27/16 |

| ||||||||||||

| Collateralized by Federal National Mortgage Association, 2.500% | | ||||||||||||

| 100,000,000 | 0.481 | (a)(e) | 10/21/16 | 100,000,000 | ||||||||||

| Maturity Value: $100,506,450 |

| ||||||||||||

| Settlement Date: 10/08/15 |

| ||||||||||||

| Collateralized by Federal National Mortgage Association, 2.000% | | ||||||||||||

| 100,000,000 | 0.494 | (a)(e) | 10/28/16 | 100,000,000 | ||||||||||

| Maturity Value: $100,655,069 |

| ||||||||||||

| Settlement Date: 07/09/15 |

| ||||||||||||

| Collateralized by Federal National Mortgage Association, 2.000% | | ||||||||||||

|

| |||||||||||||

| Joint Repurchase Agreement Account I |

| ||||||||||||

| 1,892,800,000 | 0.316 | 09/01/16 | 1,892,800,000 | |||||||||||

| Maturity Value: $1,892,816,591 |

| ||||||||||||

|

| |||||||||||||

| The accompanying notes are an integral part of these financial statements. | 15 |

FINANCIAL SQUARE GOVERNMENT FUND

Schedule of Investments (continued)

August 31, 2016

| Principal Amount | Interest Rate | Maturity Date | Amortized Cost | |||||||||||

| Repurchase Agreements(c) – (continued) | ||||||||||||||

| Joint Repurchase Agreement Account III |

| ||||||||||||

| $ | 8,351,700,000 | 0.335 | % | 09/01/16 | $ | 8,351,700,000 | ||||||||

| Maturity Value: $8,351,777,775 |

| ||||||||||||

|

| |||||||||||||

| JP Morgan Securities LLC |

| ||||||||||||

| 500,000,000 | 0.370 | 10/11/16 | 500,000,000 | |||||||||||

| Maturity Value: $500,472,778 |

| ||||||||||||

| Settlement Date: 07/11/16 |

| ||||||||||||

| Collateralized by Federal National Mortgage Association, 2.500% | | ||||||||||||

|

| |||||||||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc. |

| ||||||||||||

| 127,800,000 | 0.340 | 09/01/16 | 127,800,000 | |||||||||||

| Maturity Value: $127,801,207 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 3.500% to | | ||||||||||||

| 315,900,000 | 0.340 | 09/01/16 | 315,900,000 | |||||||||||

| Maturity Value: $315,902,984 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 3.000% to | | ||||||||||||

|

| |||||||||||||

| MUFG Securities Americas, Inc. |

| ||||||||||||

| 100,000,000 | 0.320 | 09/01/16 | 100,000,000 | |||||||||||

| Maturity Value: $100,000,889 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 2.500% to | | ||||||||||||

|

| |||||||||||||

| Repurchase Agreements(c) – (continued) | ||||||||||||||

| Nomura Securities International, Inc. |

| ||||||||||||

| $ | 2,875,000,000 | 0.380 | % | 09/01/16 | $ | 2,875,000,000 | ||||||||

| Maturity Value: $2,875,030,347 |

| ||||||||||||

| Collateralized by Federal Home Loan Bank, 4.875%, due | | ||||||||||||

|

| |||||||||||||

| RBC Capital Markets LLC |

| ||||||||||||

| 300,000,000 | 0.300 | 09/01/16 | 300,000,000 | |||||||||||

| Maturity Value: $300,002,500 |

| ||||||||||||

| Collateralized by U.S. Treasury Bonds, 2.500% to 4.250%, due | | ||||||||||||

| 50,000,000 | 0.340 | (a)(d) | 09/07/16 | 50,000,000 | ||||||||||

| Maturity Value: $50,141,194 |

| ||||||||||||

| Settlement Date: 01/15/16 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 3.000% to | | ||||||||||||

| 200,000,000 | 0.340 | (a)(d) | 09/07/16 | 200,000,000 | ||||||||||

| Maturity Value: $201,120,106 |

| ||||||||||||

| Settlement Date: 03/27/15 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 2.500% to | | ||||||||||||

|

| |||||||||||||

| 16 | The accompanying notes are an integral part of these financial statements. |

FINANCIAL SQUARE GOVERNMENT FUND

| Principal Amount | Interest Rate | Maturity Date | Amortized Cost | |||||||||||

| Repurchase Agreements(c) – (continued) | ||||||||||||||

| RBC Capital Markets LLC – (continued) |

| ||||||||||||

| $ | 350,000,000 | 0.340 | %(a)(d) | 09/07/16 | $ | 350,000,000 | ||||||||

| Maturity Value: $350,300,804 |

| ||||||||||||

| Settlement Date: 08/08/16 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 2.500% to | | ||||||||||||

| 250,000,000 | 0.350 | (a)(d) | 09/07/16 | 250,000,000 | ||||||||||

| Maturity Value: $250,301,388 |

| ||||||||||||

| Settlement Date: 07/13/16 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 2.500% to | | ||||||||||||

| 250,000,000 | 0.350 | (a)(d) | 09/07/16 | 250,000,000 | ||||||||||

| Maturity Value: $250,294,097 |

| ||||||||||||

| Settlement Date: 07/18/16 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 3.000% to | | ||||||||||||

| 250,000,000 | 0.350 | (a)(d) | 09/07/16 | 250,000,000 | ||||||||||

| Maturity Value: $250,291,666 |

| ||||||||||||

| Settlement Date: 07/20/16 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 3.000% to | | ||||||||||||

| 1,000,000,000 | 0.350 | (a)(d) | 09/07/16 | 1,000,000,000 | ||||||||||

| Maturity Value: $1,000,884,720 |

| ||||||||||||

| Settlement Date: 08/22/16 |

| ||||||||||||

| Collateralized by Federal Home Loan Bank, 1.020%, due | | ||||||||||||

|

| |||||||||||||

| Repurchase Agreements(c) – (continued) | ||||||||||||||

| RBC Capital Markets LLC – (continued) |

| ||||||||||||

| $ | 250,000,000 | 0.360 | %(a)(d) | 09/07/16 | $ | 250,000,000 | ||||||||

| Maturity Value: $250,227,500 |

| ||||||||||||

| Settlement Date: 06/28/16 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 3.500% to | | ||||||||||||

| 250,000,000 | 0.340 | (d) | 10/04/16 | 250,000,000 | ||||||||||

| Maturity Value: $250,212,500 |

| ||||||||||||

| Settlement Date: 07/06/16 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 3.000% to | | ||||||||||||

|

| |||||||||||||

| Societe Generale |

| ||||||||||||

| 38,400,000 | 0.340 | 09/01/16 | 38,400,000 | |||||||||||

| Maturity Value: $38,400,363 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 3.500% to | | ||||||||||||

| 250,000,000 | 0.320 | 09/06/16 | 250,000,000 | |||||||||||

| Maturity Value: $250,015,556 |

| ||||||||||||

| Settlement Date: 08/30/16 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 1.200% to | | ||||||||||||

|

| |||||||||||||

| TD Securities (USA) LLC |

| ||||||||||||

| 100,000,000 | 0.340 | 09/07/16 | 100,000,000 | |||||||||||

| Maturity Value: $100,006,611 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 3.500%, | | ||||||||||||

|

| |||||||||||||

| The accompanying notes are an integral part of these financial statements. | 17 |

FINANCIAL SQUARE GOVERNMENT FUND

Schedule of Investments (continued)

August 31, 2016

| Principal Amount | Interest Rate | Maturity Date | Amortized Cost | |||||||||||

| Repurchase Agreements(c) – (continued) | ||||||||||||||

| Wells Fargo Bank N.A. |

| ||||||||||||

| $ | 200,000,000 | 0.340 | % | 09/01/16 | $ | 200,000,000 | ||||||||

| Maturity Value: $200,001,889 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 3.000%, to | | ||||||||||||

| 500,000,000 | 0.340 | 09/01/16 | 500,000,000 | |||||||||||

| Maturity Value: $500,004,722 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 3.500%, | | ||||||||||||

| 37,500,000 | 0.600 | (e) | 02/27/17 | 37,500,000 | ||||||||||

| Maturity Value: $37,613,750 |

| ||||||||||||

| Settlement Date: 08/29/16 |

| ||||||||||||

| Collateralized by U.S. Treasury Bond, 6.250%, due 05/15/30 and | | ||||||||||||

| 25,000,000 | 0.580 | (e) | 03/02/17 | 25,000,000 | ||||||||||

| Maturity Value: $25,073,708 |

| ||||||||||||

| Collateralized by U.S. Treasury Note, 1.375%, due 03/31/20. The | | ||||||||||||

| 121,500,000 | 0.580 | (e) | 03/03/17 | 121,500,000 | ||||||||||

| Maturity Value: $121,860,180 |

| ||||||||||||

| Collateralized by U.S. Treasury Bond, 2.500%, due 02/15/46. The | | ||||||||||||

|

| |||||||||||||

| Wells Fargo Securities LLC |

| ||||||||||||

| 500,000,000 | 0.340 | 09/01/16 | 500,000,000 | |||||||||||

| Maturity Value: $500,004,722 |

| ||||||||||||

| Collateralized by Federal Home Loan Mortgage Corp., 2.500% to | | ||||||||||||

| 325,000,000 | 0.420 | (e) | 10/12/16 | 325,000,000 | ||||||||||

| Maturity Value: $325,348,833 |

| ||||||||||||

| Settlement Date: 07/12/16 |

| ||||||||||||

| Collateralized by Federal National Mortgage Association, | | ||||||||||||

|

| |||||||||||||

| TOTAL REPURCHASE AGREEMENTS | $ | 40,319,600,000 | ||||||||||||

|

| |||||||||||||

| TOTAL INVESTMENTS – 102.3% | $ | 72,918,023,762 | ||||||||||||

|

| |||||||||||||

| | LIABILITIES IN EXCESS OF OTHER ASSETS – (2.3)% | | (1,649,300,814 | ) | ||||||||||

|

| |||||||||||||

| NET ASSETS – 100.0% | $ | 71,268,722,948 | ||||||||||||

|

| |||||||||||||

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. | ||

(a) | Variable or floating rate security. Interest rate disclosed is that which is in effect at August 31, 2016. | |

(b) | All or a portion represents a forward commitment. | |

(c) | Unless noted, all repurchase agreements were entered into on August 31, 2016. Additional information on Joint Repurchase Agreement Accounts I and III appear on pages 37-39. | |

(d) | The instrument is subject to a demand feature. | |

(e) | Security has been determined to be illiquid by the Investment Adviser. At August 31, 2016, these securities amounted to $1,709,000,000 or approximately 2.4% of net assets. | |

Interest rates represent either the stated coupon rate, annualized yield on date of purchase for discounted securities, or, for floating rate securities, the current reset rate, which is based upon current interest rate indices.

Maturity dates represent either the final legal maturity date on the security, the demand date for puttable securities, or the prerefunded date for those types of securities.

| 18 | The accompanying notes are an integral part of these financial statements. |

FINANCIAL SQUARE MONEY MARKET FUND

Schedule of Investments

August 31, 2016

Principal Amount | Interest Rate | Maturity Date | Amortized Cost | |||||||||||

| Commercial Paper and Corporate Obligations – 0.5% | ||||||||||||||

| Gotham Funding Corp. |

| ||||||||||||

| $ | 30,000,000 | 0.408 | % | 09/01/16 | $ | 30,000,000 | ||||||||

| LMA Americas LLC |

| ||||||||||||

| 25,000,000 | 0.408 | 09/01/16 | 25,000,000 | |||||||||||

| Nieuw Amsterdam Receivables Corp. |

| ||||||||||||

| 30,000,000 | 0.407 | 09/01/16 | 30,000,000 | |||||||||||

|

| |||||||||||||

| | TOTAL COMMERCIAL PAPER AND CORPORATE OBLIGATIONS | | $ | 85,000,000 | ||||||||||

|

| |||||||||||||

| Certificates of Deposit-Yankeedollar – 7.4% | ||||||||||||||

| Bank of Tokyo-Mitsubishi UFJ, Ltd. (The) |

| ||||||||||||

| $ | 600,000,000 | 0.420 | % | 09/07/16 | $ | 600,000,000 | ||||||||

| Sumitomo Mitsui Trust Bank Ltd. |

| ||||||||||||

| 650,000,000 | 0.420 | 09/06/16 | 650,000,000 | |||||||||||

|

| |||||||||||||

| | TOTAL CERTIFICATES OF DEPOSIT-YANKEEDOLLAR | | $ | 1,250,000,000 | ||||||||||

|

| |||||||||||||

| Fixed Rate Municipal Debt Obligations – 0.9% | ||||||||||||||

| City & County of San Francisco, California Public Utilities Commission, | | ||||||||||||

| $ | 25,042,000 | 0.550 | % | 09/06/16 | $ | 25,042,000 | ||||||||

| District of Columbia Water & Sewer Authority CP Series C (Landesbank Hessen- | | ||||||||||||

| 29,200,000 | 0.630 | 09/09/16 | 29,200,000 | |||||||||||

| San Antonio, Texas Electric & Gas Systems CP Series 2016 B (State Street | | ||||||||||||

| 50,000,000 | 0.570 | 09/06/16 | 50,000,000 | |||||||||||

| San Antonio, Texas Electric & Gas Systems CP Series 2016 C (Bank of Tokyo | | ||||||||||||

| 55,000,000 | 0.610 | 09/09/16 | 55,000,000 | |||||||||||

|

| |||||||||||||

| | TOTAL FIXED RATE MUNICIPAL DEBT OBLIGATIONS | | $ | 159,242,000 | ||||||||||

|

| |||||||||||||

| Time Deposits – 40.3% | ||||||||||||||

| Australia & New Zealand Banking Group Ltd. |

| ||||||||||||

| $ | 600,000,000 | 0.430 | % | 09/01/16 | $ | 600,000,000 | ||||||||

| Credit Agricole Corporate and Investment Bank |

| ||||||||||||

| 750,000,000 | 0.310 | 09/01/16 | 750,000,000 | |||||||||||

| Credit Industriel et Commercial |

| ||||||||||||

| 600,000,000 | 0.340 | 09/01/16 | 600,000,000 | |||||||||||

| DBS Bank Ltd. |

| ||||||||||||

| 250,000,000 | 0.430 | 09/02/16 | 250,000,000 | |||||||||||

| 150,000,000 | 0.430 | 09/06/16 | 150,000,000 | |||||||||||

| DNB Bank ASA |

| ||||||||||||

| 700,000,000 | 0.300 | 09/01/16 | 700,000,000 | |||||||||||

| National Bank of Kuwait |

| ||||||||||||

| 700,000,000 | 0.350 | 09/01/16 | 700,000,000 | |||||||||||

| Natixis SA |

| ||||||||||||

| 700,000,000 | 0.310 | 09/01/16 | 700,000,000 | |||||||||||