UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

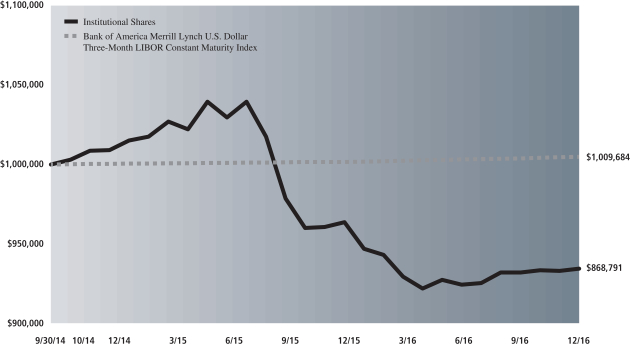

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| Caroline Kraus, Esq. | Copies to: | |

| Goldman, Sachs & Co. | Geoffrey R.T. Kenyon, Esq. | |

| 200 West Street | Dechert LLP | |

| New York, New York 10282 | 100 Oliver Street | |

| 40th Floor | ||

| Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: December 31

Date of reporting period: December 31, 2016

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| The Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| Annual Report | December 31, 2016 | |||

Fund of Funds Portfolios | ||||

Balanced Strategy | ||||

Equity Growth Strategy | ||||

Growth and Income Strategy | ||||

Growth Strategy | ||||

Satellite Strategies | ||||

Goldman Sachs Fund of Funds Portfolios

| ∎ | BALANCED STRATEGY |

| ∎ | EQUITY GROWTH STRATEGY |

| ∎ | GROWTH AND INCOME STRATEGY |

| ∎ | GROWTH STRATEGY |

| ∎ | SATELLITE STRATEGIES |

TABLE OF CONTENTS | ||||

Market Review | 1 | |||

Investment Process | 7 | |||

Portfolio Management Discussions and Performance Summaries | 9 | |||

Index Definitions | 40 | |||

Schedules of Investments | 42 | |||

Financial Statements | 48 | |||

Financial Highlights | 56 | |||

Notes to Financial Statements | 66 | |||

Report of Independent Registered Public Accounting Firm | 86 | |||

Other Information | 87 | |||

| NOT FDIC-INSURED | May Lose Value | No Bank Guarantee | ||

MARKET REVIEW

Fund of Funds Portfolios

Dear Shareholder:

This report provides an overview of regional and sector preferences of the Goldman Sachs Fund of Funds Portfolios (each, a “Portfolio,” and collectively, the “Portfolios”) during the 12-month period ended December 31, 2016 (the “Reporting Period”).

Market Review

During the 12 months ended December 31, 2016 (the “Reporting Period”), the U.S. and international equity markets generated positive returns, with U.S. equities posting especially strong gains. The broad fixed income market generated more modest, but positive, returns.

U.S. Equities

As the Reporting Period began in January 2016, U.S. equities were embroiled in a global rout, triggered by investor concerns about an intensifying economic slowdown in China and exacerbated by an oil price plunge. Following a December 2015 interest rate hike, the January 2016 Federal Reserve (“Fed”) statement acknowledged these external risks and tightening financial conditions. U.S. equities stabilized in February 2016, as market sentiment improved on the more dovish tone set by global central banks. (Dovish language tends to suggest lower interest rates; opposite of hawkish.) U.S. equities were also supported by stronger economic data, rallying as fourth quarter 2015 U.S. Gross Domestic Product (“GDP”) growth came in above consensus expectations. In March 2016, the Fed kept interest rates on hold and surprised on the dovish side, reducing its forecast to two interest rate hikes in 2016, down from four. Along with receding global economic concerns, this helped to drive a recovery in U.S. equities. Released in March 2016, February 2016 unemployment data came in ahead of market consensus, with unemployment steady at 4.9% in spite of higher participation rates and declining underemployment.

Following the rebound in March 2016, market sentiment appeared to remain sanguine in April 2016, as oil prices rose and China economic growth concerns abated. U.S. equities fell near the end of the month as investors were disappointed by a lack of additional stimulus from the Bank of Japan (“BoJ”) and by a weaker than consensus expected first quarter U.S. GDP growth rate of 0.5%. Weaker than expected May 2016 payroll data drove expectations for a Fed interest rate hike in June 2016 temporarily lower, but subsequent hawkish Fed meeting minutes revived market expectations. (Hawkish language tends to suggest higher interest rates; opposite of dovish.) The Fed ultimately held interest rates steady in June 2016 and signaled a slower pace of hikes, acknowledging the slowdown in the labor market. Markets were otherwise dominated in June 2016 by the U.K. referendum on membership in the European Union, popularly known as Brexit. U.S. equities sold off in the global risk-off, or heightened risk averse sentiment, in June 2016 following the surprise “leave” result. Markets rebounded in the latter days of the month owing to improving risk sentiment as markets digested the Brexit vote outcome and on dovish remarks from Bank of England (“BoE”) Governor Carney.

In July 2016, U.S. equities were buoyed by strong economic data and corporate earnings, despite increased uncertainty post-Brexit. In her Jackson Hole speech toward the end of August 2016, Fed Chair Janet Yellen acknowledged the case for an interest rate hike had strengthened in the then-recent months. Along with strong labor market data and other hawkish comments from the Fed, this significantly increased the market-implied probability of an interest rate hike by year-end 2016, causing U.S. equities to sell off. In early September 2016, equities fell as the

1

MARKET REVIEW

European Central Bank (“ECB”) disappointed markets with its lack of commitment to extend quantitative easing. However, there was a subsequent rebound following the Fed’s decision in September 2016 to leave interest rates unchanged.

In October 2016, a combination of hawkish Fed commentary and mounting strong U.S. economic data led to increased market pricing for a December 2016 interest rate hike. U.S. GDP growth increased by 3.5% on an annualized basis for the third quarter of 2016, above consensus expectations and the strongest growth rate in two years. Following the unexpected victory of Donald Trump in the November 2016 U.S. elections, U.S. equities quickly reversed a short-lived sell-off and surged on anticipation of a pro-growth effect of Mr. Trump’s fiscal stimulus plan. The Fed raised rates 0.25% in December 2016, for the first time in 2016 but as had largely been anticipated, and set a more hawkish hike path for 2017, causing equities to decline, albeit modestly, following the announcement.

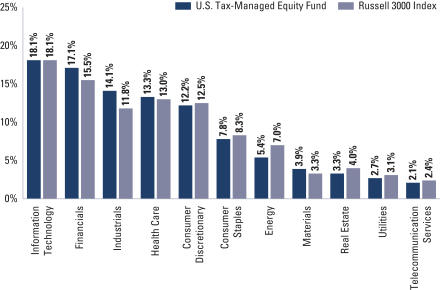

U.S. equities, as represented by the Standard & Poor’s 500® Index (the S&P 500® Index”), gained 11.93% during the Reporting Period. Energy, telecommunication services and financials were the best performing sectors in the S&P 500® Index by a wide margin. Industrials, materials, utilities and information technology also posted double-digit gains that outpaced the S&P 500® Index during the Reporting Period. The weakest performing sectors in the S&P 500® Index were real estate and health care, the only two to post negative absolute returns, followed by consumer staples and consumer discretionary, which were comparatively weak but generated positive returns during the Reporting Period.

Within the U.S. equity market, there was significant disparity in performance not only among sectors but also among the various capitalization and style segments. While all capitalization segments posted positive returns, small-cap stocks, as measured by the Russell 2000® Index, performed best, followed at some distance by mid-cap stocks, as measured by the Russell Midcap® Index, and then, large-cap stocks, as measured by the Russell 1000® Index. From a style perspective, value-oriented stocks significantly outpaced growth-oriented stocks across the capitalization spectrum. (All as measured by the Russell indices.)

International Equities

International equities suffered amid a global rout at the beginning of 2016, triggered by investor concerns of an intensifying economic slowdown in China and exacerbated by an oil price plunge. Sentiment improved following a dovish January ECB press conference on January 21, 2016, and the BoJ’s introduction of negative interest rates. In turn, international equities stabilized a bit in February 2016. However, the MSCI Europe, Australasia, Far East (“EAFE”) Index still fell 1.83% in February 2016. In March 2016, further central bank dovishness, along with receding global economic concerns and oil price stabilization, helped to finally drive a global equity market recovery. Notably, the ECB implemented heavy easing, cutting its deposit rate to -40 basis points, raising its monthly quantitative easing purchases, including those of corporate bonds, and unveiling a new series of four-year loans to banks. (A basis point is 1/100th of a percentage point.) The BoJ left its monetary policy unchanged in

2

MARKET REVIEW

March 2016, but its rhetoric about negative interest rates heightened expectations for further easing to come.

Market sentiment appeared to remain sanguine in April 2016, as oil prices rose and China economic growth concerns abated with modestly improving economic data. Both the ECB and BoJ were on hold, or did not make any monetary policy changes, in April 2016. BoJ inaction came as a major disappointment against expectations of further easing, causing international equities to sell off once again and the yen to appreciate. Relative currency appreciation was exacerbated by U.S. dollar weakness following a weaker than expected first quarter U.S. GDP release and an uneventful Fed meeting during which rates were left unchanged.

In May 2016, weaker than market expected payroll data drove expectations for a Fed rate hike in June 2016 temporarily lower, but subsequent hawkish Fed minutes revived market expectations. Equities rallied toward the end of May 2016 on anticipation of better economic data, rising oil prices and optimism that the economy could withstand rate hikes. Japanese equities also benefited from stronger than expected first quarter 2016 GDP growth and a weaker yen.

Markets were dominated in June 2016 by anticipation around the Brexit vote. International equities declined in the global risk-off sentiment that dominated the days following the June 23, 2016 vote given the surprise “leave” result. Markets rebounded in the latter days of June 2016 owing to improving risk appetite, as markets digested the outcome of the Brexit vote and on dovish remarks from Bank of England Governor Carney. Still, the MSCI EAFE Index declined 3.36% in June 2016.

International equities rebounded strongly in July 2016, buoyed by expectations of easier monetary policy and a rebound in risk appetite, despite the increased uncertainty post Brexit. Market sentiment was propped up as BoE Governor Carney hinted at monetary easing during the summer. In August 2016, the BoE delivered, cutting its policy rates by 25 basis points and introducing a large extension to its quantitative easing program. However, investor concerns about an impending U.S. interest rate hike intensified following a strong July 2016 U.S. jobs report and Fed Chair Yellen’s hawkish Jackson Hole speech in late August 2016. In September 2016, international equities declined on the ECB’s lack of commitment to extend easing beyond March 2017. Meanwhile, the Fed left interest rates unchanged, while the BoJ introduced a 0% target for its 10-year government bond yield to exercise “yield curve control.” (The “yield curve control” framework is designed to steepen Japan’s government bond yield curve and alleviate the impact on financial institutions of low longer-term rates.) International equities rebounded following the Fed and BoJ decisions, which markets viewed as generally benign.

In October 2016, the ECB minutes stressed a commitment to ongoing monthly bond-buying of 80 billion euros at least through March 2017, helping to dispel concerns about potential tapering. The U.K.’s first official GDP growth figure since the Brexit vote was more robust than consensus-expected at 0.5%. Japanese equities enjoyed strong performance owing to

3

MARKET REVIEW

weakness of the yen, as BoJ governor Kuroda stated there was room for further easing if necessary to achieve its 2% inflation target. Following the unexpected victory of Donald Trump in the U.S. elections in November 2016, international equity markets rallied on anticipation of a pro-growth impact of Mr. Trump’s fiscal stimulus plan. However, U.S. dollar appreciation against local currencies detracted from their U.S. dollar returns. The MSCI EAFE Index declined 1.98% in November 2016. The MSCI EAFE Index saw a 3.42% rally during an eventful December 2016, with the resignation of Prime Minister Renzi after Italian voters’ rejection of that nation’s constitutional reform referendum, the Fed’s first interest rate hike in a year and the ECB’s decision to slow its monthly pace of quantitative easing while extending the program to the end of 2017.

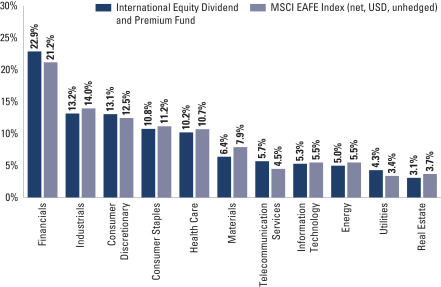

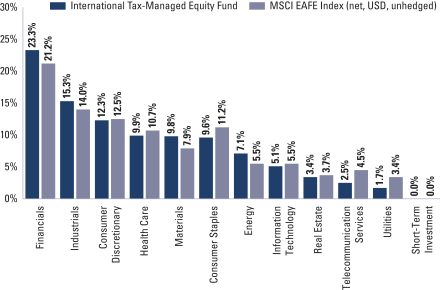

For the Reporting Period overall, international equities, as measured by the MSCI EAFE Index, posted a return of 1.51%. Energy and materials were the best performing sectors in the MSCI EAFE Index by a wide margin. Industrials, information technology and financials, also posted positive, albeit more modest, returns. The weakest performing sectors in the MSCI EAFE Index during the Reporting Period were health care and telecommunication services, followed by real estate, utilities, consumer staples and consumer discretionary, each of which posted negative absolute returns.

From a country perspective, New Zealand was the best performing equity market in the MSCI EAFE Index by a wide margin during the Reporting Period, followed by Norway, Australia, Austria and France. Israel was the weakest individual country constituent in the MSCI EAFE Index during the Reporting Period, followed at some distance by Denmark, Italy, Belgium and Ireland.

Fixed Income Markets

When the Reporting Period started, spread (or non-government bond) sectors retreated, selling off significantly from January to mid-February 2016. The selloff was driven by an increase in a number of perceived risks, including slowing Chinese economic activity, the possibility of persistent oil oversupply and deteriorating corporate bond fundamentals, as the U.S. credit cycle entered its later stage. Some of these risks eased in the second half of the first calendar quarter, as economic news from China improved, U.S. oil production showed signs of slowing, and commodity prices appeared to stabilize. As a result, spread sectors largely retraced their losses by the end of March 2016. Global central banks remained accommodative. The BoJ, in a surprise move at its January 2016 policy meeting, introduced a -0.1% interest rate, reaffirming its commitment to achieving a 2% inflation target. The ECB shifted its focus from currency depreciation to credit creation by leaving the deposit rate unchanged, expanding its asset purchase program to include purchases of non-financial corporate credit and announcing a new series of easing measures in the form of targeted long-term refinancing operations. In the U.S., the Fed left interest rates unchanged and reduced its previous forecast of four rate hikes in 2016 to two. After a sustained period of appreciation,

4

MARKET REVIEW

the U.S. dollar weakened during the first quarter of 2016 due to generally tighter financial conditions, mixed U.S. economic data and the Fed’s more dovish commentary.

During the second quarter of 2016, spread sectors rallied on stabilization of commodities prices as well as on declining fears about slowing Chinese economic growth and the potential for a U.S. economic recession. Global interest rates broadly declined amid continued accommodative monetary policy from the world’s central banks. In the U.S., minutes from the Fed’s April 2016 policy meeting, released in mid-May 2016, suggested Fed policymakers might raise interest rates in June 2016 if U.S. economic growth strengthened, employment data firmed and inflation rose toward the Fed’s 2% target. In early June 2016, however, the release of weak May 2016 employment data raised concerns about the health of the U.S. economy, pushing down expectations of a Fed rate hike. Indeed, the Fed did not raise interest rates at its June 2016 policy meeting. In the last week of June 2016, Brexit renewed investor uncertainty about the path of global economic growth. Spread sectors withstood the Brexit vote relatively well, selling off at first but then recovering most of their losses afterwards. The U.S. dollar strengthened versus most global currencies during the second calendar quarter, though it weakened against the Japanese yen.

During the third calendar quarter, spread sectors continued to advance. Overall, global interest rates remained low, as the world’s central banks remained broadly accommodative. In July 2016, however, the Fed’s policy statement was more hawkish than most observers expected, reflecting cautious optimism amid the market’s relatively muted reaction to the Brexit outcome and strengthening U.S. economic data. The July 2016, U.S. non-farm payrolls report showed 255,000 new jobs added, exceeding market expectations and countering a disappointing second quarter 2016 GDP report that showed growth of 1.2%. The ECB kept interest rates unchanged during July 2016. The BoJ, meanwhile, fell short of market expectations with the announcement of an equity purchase program and the absence of changes to key policy tools, such as an interest rate cut and increased government bond purchases. In August 2016, the BoE unveiled a “timely, coherent and comprehensive package,” as described by Governor Mark Carney, which included a number of measures intended to help the U.K. economy navigate a post-Brexit environment. Although the ECB kept monetary policy unchanged during the month, the European and U.K. credit markets received technical, or supply/demand, support from the ongoing corporate bond purchases of central banks. In the U.S., non-farm payroll gains moderated in August 2016 and manufacturing and services data weakened, but continued hawkish comments from the Fed boosted market expectations of a rate hike by the end of 2016. However, at its September 2016 policy meeting, the Fed kept short-term interest rates unchanged. In Japan, during September 2016, the BoJ announced a new “yield curve control” framework designed to steepen Japan’s government bond yield curve and alleviate the impact on financial institutions of low longer-term rates. During the third quarter of 2016, the U.S. dollar depreciated versus many world currencies.

5

MARKET REVIEW

In the fourth quarter of 2016, spread sectors generally outperformed U.S. Treasury securities in a reversal from the volatile start to the calendar year. Commodity prices stabilized and crude oil prices rose following an agreement in November 2016 by the Organization of the Petroleum Exporting Countries (“OPEC”) and non-OPEC producers to cut production, which provided support for energy issuers within the corporate credit market as well as for oil-exporting emerging economies. Donald Trump’s victory in the November 2016 U.S. election marked an important regime change in monetary, fiscal and regulatory policy. Market expectations shifted toward a faster pace of Fed monetary policy tightening, increased fiscal stimulus and a potentially looser regulatory agenda. After the U.S. election, global interest rates rose and the U.S. dollar strengthened versus most developed market and emerging market currencies. The U.S. economy strengthened, with strong job growth and increased consumer spending reported. In December 2016, the Fed raised the targeted federal funds rate 0.25% to a range of between 0.50% and 0.75%. The rate hike resulted in a further rise in U.S. Treasury yields, with a notable increase in shorter-term yields, and additional appreciation in the U.S. dollar. In the Eurozone, the ECB announced it would reduce its monthly pace of asset purchases starting in April 2017 but said it would maintain its monetary easing policies throughout 2017. Meanwhile, Italy voted to reject constitutional reforms, while the outcome of Austria’s election defied the populist tide that had claimed victories in the U.K. and U.S. during 2016.

For the Reporting Period overall, high yield corporate bonds outperformed U.S. Treasuries, posting a double-digit gain. Sovereign emerging market debt and investment grade corporate bonds also outpaced U.S. Treasuries, followed by commercial mortgage-backed securities, agency securities and asset-backed securities. Mortgage-backed securities slightly underperformed U.S. Treasuries. The U.S. Treasury yield curve, or spectrum of maturities, flattened during the Reporting Period and shifted upwards, though it steepened during the final three months of the calendar year. The yield on the bellwether 10-year U.S. Treasury rose approximately 16 basis points to end the Reporting Period at 2.43%. (A basis point is 1/100th of a percentage point. A flattening yield curve is one wherein the differential in yields between longer-term and shorter-term maturities narrows.)

6

GOLDMAN SACHS FUND OF FUNDS PORTFOLIO

What Differentiates Goldman Sachs’ Approach to Asset Allocation?

We believe that strong investment results through asset allocation are best achieved through teams of experts working together on a global scale:

| ∎ | Goldman Sachs’ Quantitative Investment Strategies Team determines the strategic and monthly tactical asset allocations. The team is comprised of over 90* professionals with significant academic and practitioner experience. |

| ∎ | Goldman Sachs’ Portfolio Management Teams offer expert management of the mutual funds that are contained within each Portfolio. These same teams manage portfolios for institutional and high net worth investors. |

Goldman Sachs Asset Allocation Investment Process

Quantitative Investment Strategies Team

Each Portfolio represents a diversified global portfolio on the efficient frontier.† The Portfolios differ in their long-term objective, and therefore, their asset allocation mix. The long-term strategic asset allocation is the primary source of risk and the corresponding primary determinant of total return. It therefore represents an anchor, or neutral starting point, from which tactical asset allocation decisions are made.

Quantitative Investment Strategies Team

For each Portfolio, the strategic asset allocation is combined with a measured amount of tactical risk. Changing market conditions create opportunities to capitalize on investing in different countries and asset classes relative to others over time. Within each strategy, we shift assets away from the strategic allocation (over and underweighting certain asset classes and countries) to seek to benefit from changing conditions in global capital markets.

Using proprietary portfolio construction models to maintain each Portfolio’s original risk/ return profile over time, the team makes ten active decisions based on its current outlook on global equity, fixed income and currency markets.

∎ Asset class selection | Are stocks, bonds or cash more attractive? | |

∎ Regional equity selection | Are U.S. or non-U.S. equities more attractive? | |

∎ Regional bond selection | Are U.S. or non-U.S. bonds more attractive? | |

∎ U.S. equity style selection | Are U.S. value or U.S. growth equities more attractive? | |

∎ U.S. equity size selection | Are U.S. large-cap or U.S. small-cap equities more attractive? | |

∎ Emerging/developed equity selection | Are emerging or developed equities more attractive? |

| * | As of December 2016. |

| † | Portfolios on the efficient frontier are optimal in both the sense that they offer maximal expected return for some given level of risk and minimal risk for some given level of expected return. The efficient frontier is the line created from the risk-reward graph, comprised of optimal portfolios. The optimal portfolios plotted along the curve have the highest expected return possible for the given amount of risk. Diversification does not protect an investor from market risk and does not ensure a profit. |

7

GOLDMAN SACHS FUND OF FUNDS PORTFOLIO

∎ Developed equity country selection | Which international countries are more attractive? | |

∎ Emerging equity country selection | Which emerging market countries are more attractive? | |

∎ High yield selection | Are high yield or core fixed income securities more attractive? | |

∎ Emerging/developed bond selection | Are emerging or developed bonds more attractive? |

Mutual Fund Portfolio Management Teams

Each Portfolio is comprised of underlying Goldman Sachs Mutual Funds managed by broad, deep portfolio management teams. In addition to global tactical asset allocation, we seek to generate excess returns through security selection within each underlying mutual fund. Whether in the equity or fixed income arenas, these portfolio management teams share a commitment to firsthand fundamental research and seek performance driven by successful security selection.

8

PORTFOLIO RESULTS

Fund of Funds Portfolios – Asset Allocation

Investment Process and Principal Strategies

Each Portfolio seeks to achieve its investment objective by investing in a combination of underlying funds that currently exist or that may become available for investment in the future for which Goldman Sachs Asset Management (“GSAM”) or an affiliate, now or in the future, acts as investment adviser or principal underwriter (the “underlying funds”). Some of the Portfolios’ underlying funds invest primarily in fixed income or money market instruments, and some invest primarily in equity securities. Some underlying funds also invest dynamically across equity, fixed income, commodity and other markets through a managed volatility or trend-following approach.

The investment adviser allows the Portfolios’ strategic targets to shift with their respective market returns but continues to adjust tactical tilts on an ongoing basis to reflect the investment adviser’s latest views. The investment adviser adjusts the overall asset allocation of the Portfolios based on current market conditions and the investment adviser’s economic and market forecasts.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Quantitative Investment Strategies Team discusses the Portfolios’ performance and positioning for the 12-month period ended December 31, 2016 (the “Reporting Period”).

| Q | How did the Portfolios perform during the Reporting Period? |

| A | Goldman Sachs Balanced Strategy Portfolio — During the Reporting Period, the Balanced Strategy Portfolio’s Class A, C, Institutional, Service, IR, R and R6 Shares generated average annual total returns of 5.04%, 4.24%, 5.36%, 5.67%, 5.33%, 5.02% and 5.46%, respectively. This compares to the 5.54% average annual total return of the Portfolio’s blended benchmark, which is composed 60% of the Bloomberg Barclays Global Aggregate Bond Index (Gross, USD, Unhedged) (“Bloomberg Barclays Global Index”) and 40% of the MSCI All Country World Index (Net, USD, Unhedged) (“MSCI ACWI Index”), during the same period. |

| The components of the Portfolio’s blended benchmark, the Bloomberg Barclays Global Index and the MSCI ACWI Index, generated average annual total returns of 3.94% and 7.84%, respectively, during the Reporting Period. |

| Goldman Sachs Equity Growth Strategy Portfolio — During the Reporting Period, the Equity Growth Strategy Portfolio’s Class A, C, Institutional, Service, IR, R and R6 Shares generated average annual total returns of 6.81%, 5.95%, 7.18%, 6.66%, 6.99%, 6.49% and 7.12%, respectively. This compares to the 7.84% average annual total return of the Portfolio’s benchmark, the MSCI ACWI Index, during the same period. |

| Goldman Sachs Growth and Income Strategy Portfolio — During the Reporting Period, the Growth and Income Strategy |

| Portfolio’s Class A, C, Institutional, Service, IR, R and R6 Shares generated average annual total returns of 5.75%, 4.86%, 6.15%, 5.58%, 6.04%, 5.40% and 6.07%, respectively. This compares to the 6.32% average annual total return of the Portfolio’s blended benchmark, which is composed 40% of the Bloomberg Barclays Global Index and 60% of the MSCI ACWI Index, during the same period. |

| The components of the Portfolio’s blended benchmark, the Bloomberg Barclays Global Index and the MSCI ACWI Index, generated average annual total returns of 3.94% and 7.84%, respectively, during the Reporting Period. |

| Goldman Sachs Growth Strategy Portfolio — During the Reporting Period, the Growth Strategy Portfolio’s Class A, C, Institutional, Service, IR, R and R6 Shares generated average annual total returns of 6.38%, 5.57%, 6.76%, 6.26%, 6.70%, 6.16% and 6.76%, respectively. This compares to the 7.09% average annual total return of the Portfolio’s blended benchmark, which is composed 80% of the MSCI ACWI Index and 20% of the Bloomberg Barclays Global Index, during the same period. |

| The components of the Portfolio’s blended benchmark, the Bloomberg Barclays Global Index and the MSCI ACWI Index, generated average annual total returns of 3.94% and 7.84%, respectively, during the same period. |

9

PORTFOLIO RESULTS

| Q | What key factors affected the Portfolios’ performance during the Reporting Period? |

| A | During the Reporting Period, the Portfolios generated positive results on an absolute basis, with those having greater equity exposure performing best. However, all four of the Portfolios underperformed their respective benchmark indices. Overall, security selection within the underlying funds detracted from the performance of each of the Portfolios. The implementation of our tactical views contributed positively to three of the Portfolios and detracted from the performance of one of the Portfolios. All four Portfolios benefited from our strategic, long-term asset allocation policy. |

| Q | How did Global Tactical Asset Allocation decisions affect the Portfolios’ performance during the Reporting Period? |

| A | During the Reporting Period, the implementation of our tactical views added to the performance of three of the Portfolios — the Goldman Sachs Balanced Strategy Portfolio, the Goldman Sachs Growth and Income Strategy Portfolio and the Goldman Sachs Growth Strategy Portfolio. The fourth Portfolio, the Goldman Sachs Equity Growth Portfolio, was hurt by the implementation of our tactical views, more specifically by an overweight position in emerging markets equities versus developed markets equities. |

| Overall, the Portfolios benefited from our preference for equities over fixed income. Within equity allocations, an overweight position in U.S. equities versus international equities contributed most positively to performance. The Portfolios’ overweight positions in U.S. value stocks versus U.S. growth stocks also bolstered returns. Conversely, the Portfolios’ overweight position in emerging markets stocks versus developed markets stocks hurt results. Our views on U.S. small-cap stocks versus U.S. large-cap stocks had a relatively neutral impact on performance during the Reporting Period. |

| Within fixed income allocations, the Portfolios’ overweight positions in high yield corporate bonds versus investment grade corporate bonds added to performance. Overweight positions in U.S. dollar-denominated emerging markets debt versus developed markets debt was also advantageous, especially during the third quarter of 2016. In addition, the Portfolios’ overweight positions in international fixed income versus U.S. fixed income had a positive impact on returns during the Reporting Period. Offsetting these gains somewhat were overweight positions in local emerging markets debt versus developed markets debt, especially in the fourth quarter of 2016. The performance of the Portfolios’ overweight positions in U.S. dollar-denominated emerging markets debt and local emerging markets debt, both versus developed markets debt, was held back by the strong appreciation of the U.S. dollar during the Reporting Period. |

| In terms of our country-level views, the Portfolios were helped by our country selection strategy within international equities (implemented through an investment in the Goldman Sachs International Equity Insights Fund) and within emerging markets equities (accomplished through an investment in the Goldman Sachs Emerging Markets Equity Insights Fund) during the Reporting Period. |

| Q | How did the Portfolios’ underlying funds perform relative to their respective benchmark indices during the Reporting Period? |

| A | Of the Portfolios’ underlying equity funds, the Goldman Sachs International Equity Insights Fund and the Goldman Sachs Small Cap Equity Insights Fund outperformed their respective benchmark indices the most. The Goldman Sachs Strategic Growth Fund and the Goldman Sachs Large Cap Value Fund underperformed their respective benchmark indices most during the Reporting Period. |

| On the fixed income side, the Goldman Sachs Short Duration Government Fund outperformed its benchmark index most during the Reporting Period. The Goldman Sachs Core Fixed Income Fund, the Goldman Sachs Global Income Fund and the Goldman Sachs Emerging Markets Debt Fund were relatively flat compared to their respective benchmark indices. The Goldman Sachs High Yield Fund, the Goldman Sachs High Yield Floating Rate Fund and the Goldman Sachs Local Emerging Markets Debt Fund underperformed their respective benchmark indices the most. |

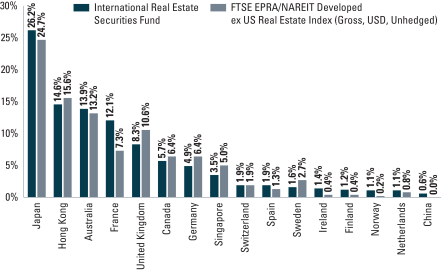

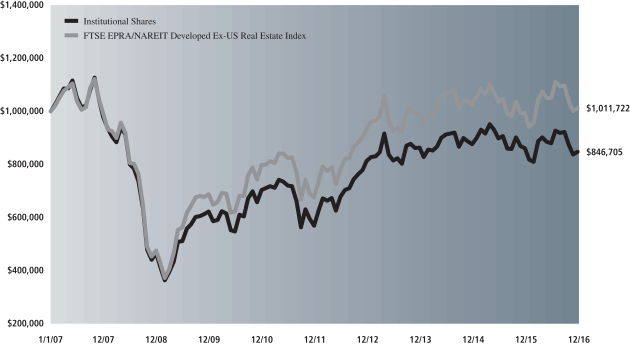

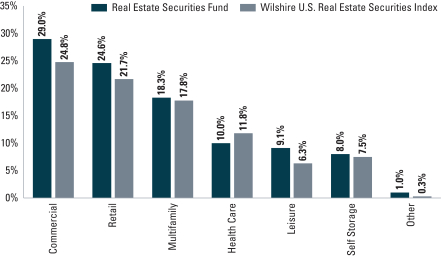

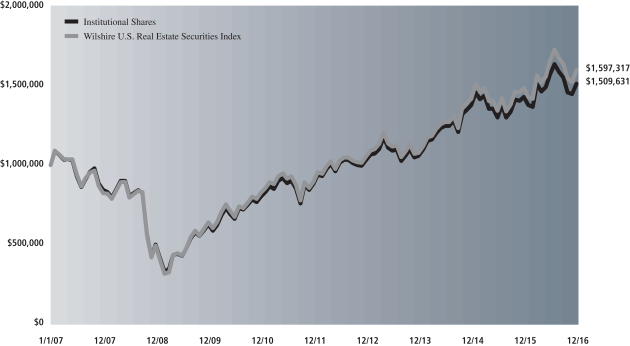

| Among alternative and dynamic investment strategies, the Goldman Sachs Commodity Strategy Fund outperformed its benchmark index most during the Reporting Period. The Goldman Sachs Dynamic Allocation Fund and the Goldman Sachs Strategic Income Fund also outperformed their respective benchmark indices. The Goldman Sachs Real Estate Securities Fund and the Goldman Sachs International Real Estate Securities Fund underperformed their respective benchmark indices most during the Reporting Period. The Goldman Sachs Managed Futures Strategy Fund also underperformed its benchmark index. |

| Q | How did the Portfolios use derivatives and similar instruments during the Reporting Period? |

| A | The Portfolios do not directly invest in derivatives. However, some of the underlying funds used derivatives during the |

10

PORTFOLIO RESULTS

| Reporting Period to apply their active investment views with greater versatility and to potentially afford greater risk management precision. As market conditions warranted during the Reporting Period, some of these underlying funds engaged in forward foreign currency exchange contracts, financial futures contracts, options, swap contracts and structured securities to attempt to enhance portfolio return and for hedging purposes. |

| Q | What changes did you make during the Reporting Period within both the equity and fixed income portions of the Portfolios? |

| A | In implementing our strategies, we held a neutral view on equities versus fixed income at the start of the Reporting Period. We shifted to a slightly bullish view on equities versus fixed income during the first quarter of 2016, increasing our bullish view during the second calendar quarter. In the third quarter of 2016, we maintained our bullish view of equities relative to fixed income and then somewhat tempered that bullish view during the fourth calendar quarter. |

| Within equities, at the beginning of the Reporting Period, we favored U.S. stocks over international stocks, a view driven by strong momentum in the U.S. stock market. We became neutral on U.S. stocks versus international stocks during the first calendar quarter. In the second calendar quarter, we shifted our view from neutral to very bullish on U.S. stocks versus international stocks due to strong short-term momentum and what we viewed as attractive risk premiums in U.S. stocks. For the same reasons, we continued to be bullish on U.S. equities relative to international equities for the rest of the Reporting Period. |

| When the Reporting Period started, we had a bearish view on emerging markets equities versus developed markets equities because of poor momentum and weak macroeconomic conditions in the emerging markets. We continued to favor developed markets stocks over emerging markets stocks during the first quarter of 2016 due to poor momentum and weak macroeconomic conditions in the emerging markets. We were bullish on developed markets stocks versus emerging markets stocks during the second calendar quarter because of poor momentum and what we viewed as expensive valuations among emerging markets stocks. In the third calendar quarter, we became bullish on emerging markets equities versus developed markets equities because of what we considered to be less attractive valuations, weaker momentum and diminished risk appetite for developed markets stocks. We maintained our bullish view on emerging markets stocks versus developed markets stocks during the fourth quarter of 2016, driven by what we saw as less attractive valuations, weaker momentum and diminished risk appetite in developed markets stocks. |

| We implemented our country level views within the Goldman Sachs International Equity Insights Fund and the Goldman Sachs Emerging Markets Equity Insights Fund, which served as underlying funds during the Reporting Period. Among developed markets equities at the end of the Reporting Period, we were bullish on Austria and Japan because of what we considered to be strong dividends and attractive valuations. We held bearish views on Finland and Australia due to what we viewed as higher risk premiums and lower valuations. Among emerging markets equities at the end of the Reporting Period, we preferred Russia and Brazil, primarily because of what we saw as attractive long-term valuations as well as favorable inflation outlooks. We were bearish on Mexico and India as a result of what we considered less attractive long-term valuations. |

| Among U.S. equities, we began the Reporting Period bullish on growth stocks relative to value stocks because of improved market sentiment for growth stocks. We remained bullish on growth stocks relative to value stocks in the first quarter of 2016 due to continued positive market sentiment for growth stocks. During the second calendar quarter, we moderated our bullish view on growth stocks versus value stocks. We became bullish on value stocks versus growth stocks during the third quarter of 2016, growing more bullish during the fourth calendar quarter in response to increased investor risk aversion. At the beginning of the Reporting Period and through the end of the first calendar quarter, we were bullish on large-cap stocks versus small-cap stocks given heightened investor risk aversion. In the second quarter of 2016, we shifted to a neutral view on large-cap stocks versus small-cap stocks, as positive sentiment was offset by what we considered poor valuations among small-cap stocks. We became slightly bullish on small-cap stocks versus large-cap stocks during the third quarter of 2016 because of increased investor risk aversion. During the fourth calendar quarter, we reversed our view, slightly favoring large-cap stocks over small-cap stocks because of what we saw as decreased valuations. |

Within fixed income, at the start of the Reporting Period, we had a slightly bearish view on U.S. fixed income versus international fixed income because of what we saw as more attractive yields in the international fixed income market. We increased our bearish view on U.S. fixed income relative to |

11

PORTFOLIO RESULTS

international fixed income during the first calendar quarter as a result of weak cross-sector momentum within the U.S. fixed income market. In the second quarter of 2016, we favored international fixed income over U.S. fixed income, maintaining this view in the third and fourth calendar quarters, because the yields of international fixed income were more attractive and momentum was worse in the U.S. fixed income market. At the beginning of the Reporting Period and through the first quarter of 2016, we were bullish on investment grade corporate bonds relative to high yield corporate bonds given heightened risk aversion and negative momentum in the high yield corporate bond market. During the second calendar quarter, we became bullish on high yield corporate bonds versus investment grade corporate bonds due to improving momentum in high yield corporate bonds. We continued to be bullish on high yield corporate bonds versus investment grade corporate bonds during the third calendar quarter because of improving risk appetite for high yield corporate bonds. In the fourth quarter of 2016, we tempered our bullish view on high yield corporate bonds relative to investment grade corporate bonds due to positive, but declining, investor risk appetite. |

| When the Reporting Period started, we had a bearish view on U.S. dollar-denominated emerging markets debt versus developed markets debt. In the first calendar quarter, we shifted to a neutral view on U.S. dollar-denominated emerging markets debt versus developed markets debt because of improved momentum in U.S. dollar-denominated emerging markets debt. During the second quarter of 2016, we became slightly bullish on U.S. dollar-denominated emerging markets debt relative to developed markets debt due to improving momentum in U.S. dollar-denominated emerging markets debt. For the same reason, we maintained our bullish view on U.S. dollar-denominated emerging markets debt versus developed markets debt during the third calendar quarter. In the fourth calendar quarter, we became bullish on developed markets debt versus U.S. dollar-denominated emerging markets debt because of weak momentum in emerging markets debt, emerging markets equities and emerging markets currencies. At the beginning of the Reporting Period, we were bearish on local emerging markets debt versus developed markets debt, largely because of weak momentum in emerging markets currencies. We adopted a neutral view on local emerging markets debt relative to developed markets debt during the first calendar quarter as a result of improved momentum in local emerging markets debt. In the second calendar quarter, we shifted to a slightly bullish view on local emerging markets debt versus developed markets debt due to improving momentum in emerging markets currencies. We continued to hold a slightly bullish view on local emerging markets debt versus developed markets debt during the third quarter of 2016 because of strong momentum in emerging markets currencies. In the fourth calendar quarter, we became bullish on developed markets debt relative to local emerging markets debt because of weak momentum in emerging markets debt, emerging markets equities and emerging markets currencies. |

| In addition, during the first quarter of 2016, there was a reorganization that affected two of the Portfolios’ underlying funds. Effective February 5, 2016, the Goldman Sachs International Small Cap Fund was closed and its corresponding shares were reorganized into the Goldman Sachs International Small Cap Insights Fund. There was no material impact on the Portfolios’ risk exposures. |

| Q | What is the Portfolios’ tactical view and strategy for the months ahead? |

| A | Global equilibrium is the foundation of our strategic asset allocation process — that is, we believe that a globally-diversified portfolio of asset classes, weighted by their market capitalization, provides economically intuitive, meaningful and balanced exposures to investment opportunities. We make 10 active decisions within the Portfolios based on our current outlook on global equity, fixed income and currency markets. On an ongoing basis, we shift assets away from the strategic allocation (tilting our positions in certain asset classes and countries from their longer-term, strategic weights) in an effort to benefit from changing conditions in global capital markets. |

| At the end of the Reporting Period, we maintained our bullish view on stocks relative to bonds. We favored U.S. equities over international equities and emerging markets stocks over developed markets stocks. Within U.S. equities, we held a bullish view on value stocks versus growth stocks and had shifted to a slightly bullish view on large-cap stocks versus small-cap stocks. |

| In fixed income at the end of the Reporting Period, we favored international fixed income over U.S. fixed income. We had moderated our bullish view on high yield corporate bonds versus investment grade corporate bonds. In addition, we were bullish on developed markets debt versus U.S. dollar-denominated emerging markets debt and on developed markets debt versus local emerging markets debt. |

12

FUND BASICS

Balanced Strategy

as of December 31, 2016

| PERFORMANCE REVIEW | ||||||||||||||||||

| January 1, 2016– December 31, 2016 | Portfolio Total Return (based on NAV)1 | Balanced Strategy Composite Index2 | Bloomberg Barclays Global Index | MSCI ACWI Index | ||||||||||||||

| Class A | 5.04 | % | 5.54 | % | 3.94 | % | 7.84 | % | ||||||||||

| Class C | 4.24 | 5.54 | 3.94 | 7.84 | ||||||||||||||

| Institutional | 5.36 | 5.54 | 3.94 | 7.84 | ||||||||||||||

| Service | 5.67 | 5.54 | 3.94 | 7.84 | ||||||||||||||

| Class IR | 5.33 | 5.54 | 3.94 | 7.84 | ||||||||||||||

| Class R | 5.02 | 5.54 | 3.94 | 7.84 | ||||||||||||||

| Class R6 | 5.46 | 5.54 | 3.94 | 7.84 | ||||||||||||||

| 1 | The net asset value (“NAV”) represents the net assets of the class of the Portfolio (ex-dividend) divided by the total number of shares of the class outstanding. The Portfolio’s performance assumes the reinvestment of dividends and other distributions. The Portfolio’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The Balanced Strategy Composite Index (“Balanced Composite”) is a composite representation prepared by the investment adviser of the performance of the Portfolio’s asset classes weighted according to their respective weightings in the Portfolio’s target range. The Balanced Composite is comprised of a blend of the Bloomberg Barclays Global Aggregate Bond Index (Gross, USD, Hedged) (“Bloomberg Barclays Global Index”) (60%) and the MSCI All Country World Index (Net, USD, Unhedged) (“MSCI® ACWI Index”) (40%). The Bloomberg Barclays Global Index is an unmanaged index, provides a broad-based measure of the global investment grade fixed-rate debt markets and covers the most liquid portion of the global investment grade fixed-rate bond market, including government, credit and collateralized securities. The Index figures do not include any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. The MSCI® ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI® ACWI Index consists of 46 country indices comprising 23 developed and 23 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The emerging market country indices are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, South Korea, Malaysia, Mexico, Peru, Philippines, Poland, Russia, Qatar, South Africa, Taiwan, Thailand, Turkey and the United Arab Emirates. The Index figures do not include any deduction for fees or expenses. It is not possible to invest directly in an unmanaged index. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.gsamfunds.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

13

FUND BASICS

| STANDARDIZED TOTAL RETURNS3 | ||||||||||||||||||||

| For the period ended 12/31/16 | One Year | Five Years | Ten Years | Since Inception | Inception Date | |||||||||||||||

| Class A | -0.76 | % | 3.71 | % | 2.46 | % | 3.98 | % | 1/2/98 | |||||||||||

| Class C | 3.24 | 4.11 | 2.28 | 3.52 | 1/2/98 | |||||||||||||||

| Institutional | 5.36 | 5.28 | 3.45 | 4.71 | 1/2/98 | |||||||||||||||

| Service | 5.67 | 4.95 | 3.02 | 4.23 | 1/2/98 | |||||||||||||||

| Class IR | 5.33 | 5.15 | N/A | 3.04 | 11/30/07 | |||||||||||||||

| Class R | 5.02 | 4.67 | N/A | 2.56 | 11/30/07 | |||||||||||||||

| Class R6 | 5.46 | N/A | N/A | 2.34 | 7/31/15 | |||||||||||||||

| 3 | The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Service, Class IR, Class R and Class R6 Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.gsamfunds.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| EXPENSE RATIOS4 | ||||||||||

| Net Expense Ratio (Current) | Gross Expense Ratio (Before Waivers) | |||||||||

| Class A | 1.34 | % | 1.40 | % | ||||||

| Class C | 2.09 | 2.15 | ||||||||

| Institutional | 0.94 | 1.00 | ||||||||

| Service | 1.44 | 1.50 | ||||||||

| Class IR | 1.09 | 1.15 | ||||||||

| Class R | 1.59 | 1.65 | ||||||||

| Class R6 | 0.92 | 0.98 | ||||||||

| 4 | The expense ratios of the Portfolio, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Portfolio and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Portfolio’s fee waivers and/or expense limitations will remain in place through at least April 29, 2017, and prior to such date, the Investment Adviser may not terminate the arrangements without the approval of the Portfolio’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

14

FUND BASICS

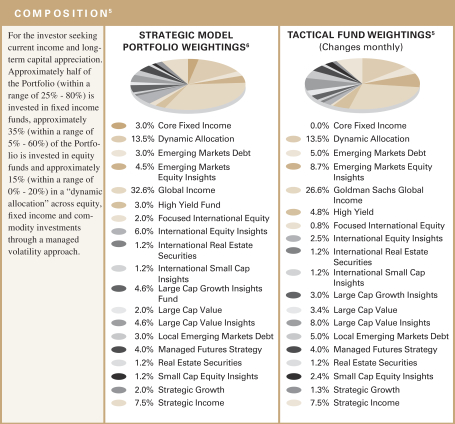

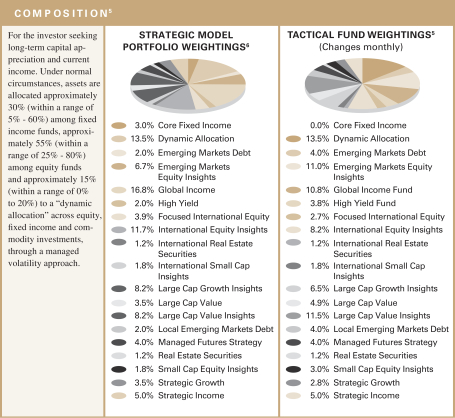

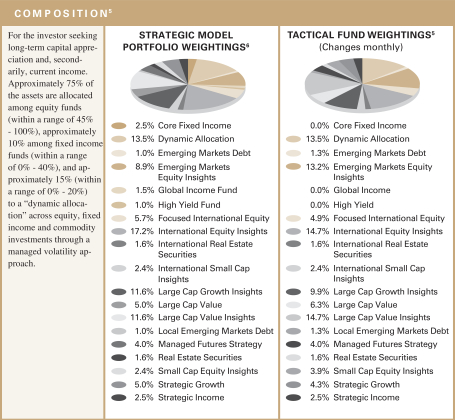

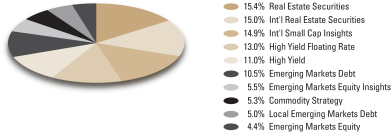

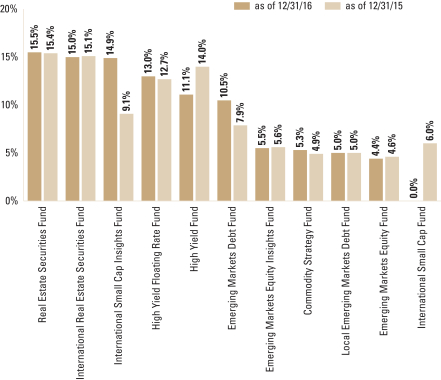

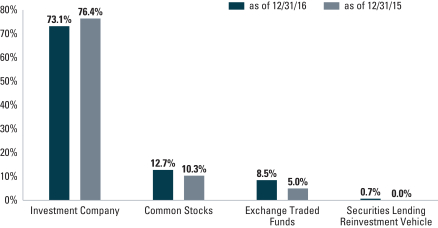

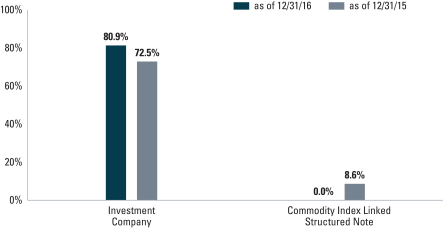

| 5 | The tactical fund weightings are set at the beginning of each calendar quarter. The weightings in the chart above reflect the allocations from September 30, 2016 to December 31, 2016. Actual Fund weighting in the Portfolios may differ from the figures shown above due to rounding, differences in returns of the Underlying Funds, or both. The above figures are not indicative of future allocations. |

| 6 | Strategic allocation is the process of determining the areas of the global markets in which to invest, and in what long-term proportion, for each underlying fund. Our global approach attempts to generate strong long-term returns across geographies and asset classes, and is determined through a careful review of market opportunities and risk/return tradeoffs. It is rebalanced annually. On a monthly basis, we shift assets around the strategic allocation, over and under-weighting asset classes and countries relative to the neutral starting point, seeking to benefit from changing short-term conditions in global capital markets. This is called tactical asset allocation. |

15

FUND BASICS

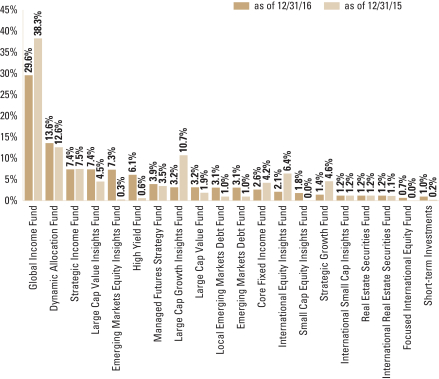

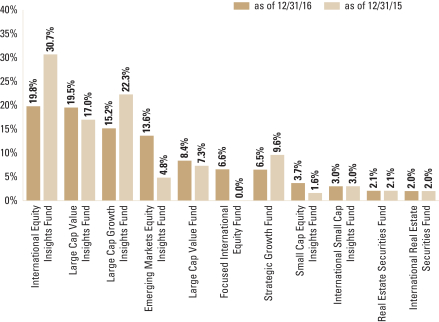

| OVERALL UNDERLYING FUND WEIGHTINGS7 | ||

| Percentage of Net Assets |

| 7 | The Portfolio is actively managed and, as such, its composition may differ over time. The percentage shown for each underlying fund reflects the value of that underlying fund as a percentage of net assets of the Portfolio. Short-term investments represent repurchase agreements. Figures in the above graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. |

16

GOLDMAN SACHS BALANCED STRATEGY PORTFOLIO

Performance Summary

December 31, 2016

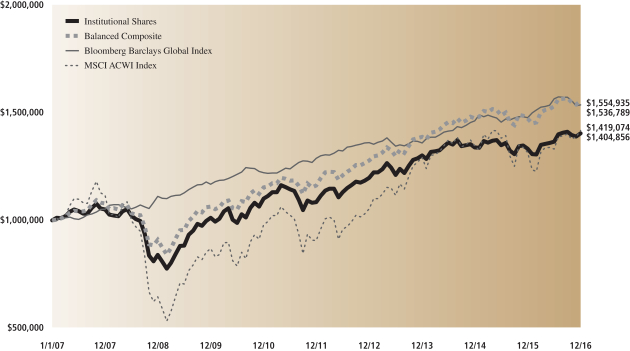

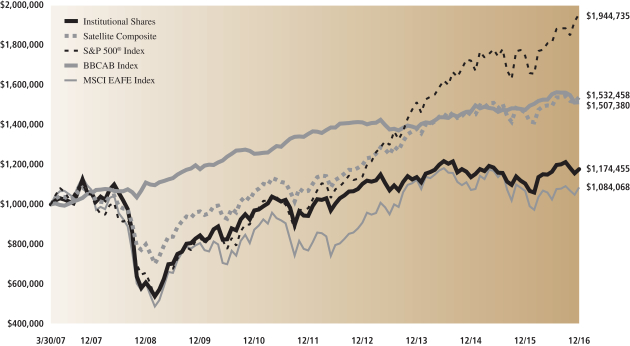

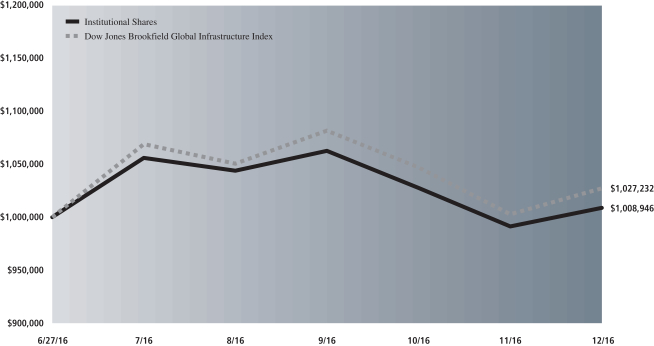

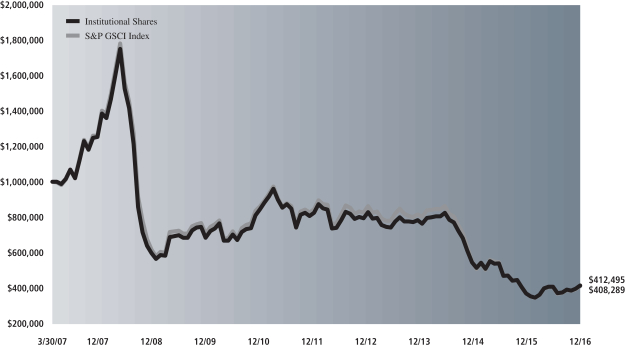

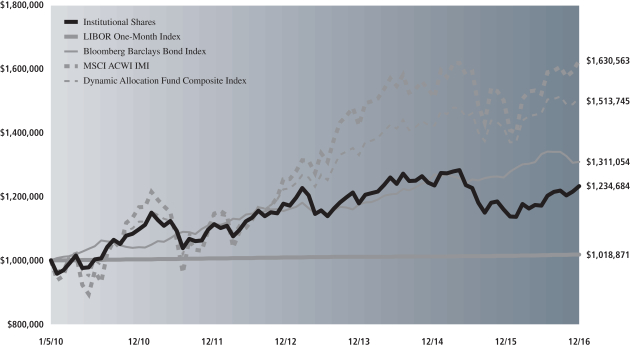

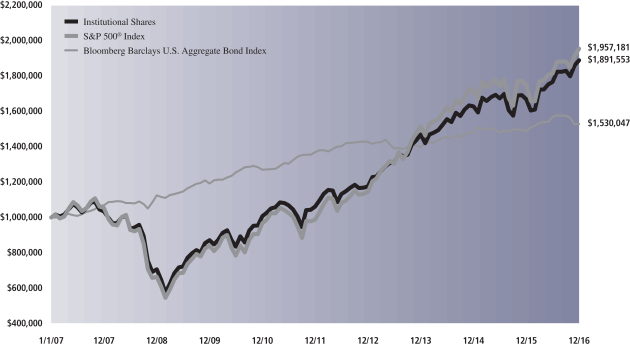

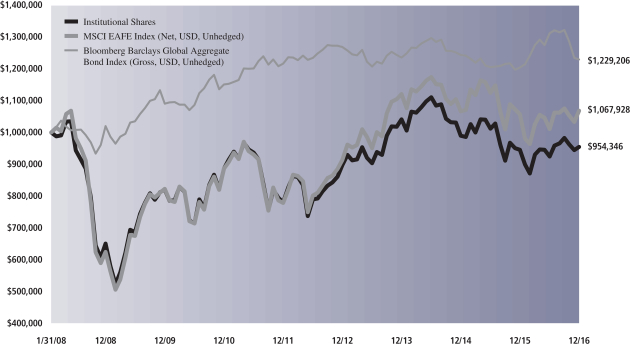

The following graph shows the value, as of December 31, 2016, of a $1,000,000 investment made on January 1, 2007 in Institutional Shares at NAV. For comparative purposes, the performance of the Portfolio’s benchmarks, the Balanced Strategy Composite Index (the “Balanced Composite”), which is comprised of 60% of the Bloomberg Barclays Global Aggregate Bond Index (Gross, USD, Hedged) (the “Bloomberg Barclays Global Index”) and 40% of the MSCI® All Country World Index (Net, USD, Unhedged) (the “MSCI ACWI Index”), the Bloomberg Barclays Global Index and the MSCI ACWI Index (each with distributions reinvested), are shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations may cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations currently in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance of Class A, Class C, Service, Class IR, Class R and Class R6 Shares will vary from Institutional Shares due to differences in class specific fees and any applicable sales charges. In addition to the Investment Adviser’s decisions regarding underlying fund selection and allocations among them, other factors may affect Portfolio performance. These factors include, but are not limited to, Portfolio operating fees and expenses, portfolio turnover and subscription and redemption cash flows affecting the Portfolio.

| Balanced Strategy Portfolio’s 10 Year Performance |

Performance of a $1,000,000 investment, with distributions reinvested, from January 1, 2007 through December 31, 2016.

| Average Annual Total Return through December 31, 2016 | One Year | Five Years | Ten Years | Since Inception | ||||||||||

Class A (Commenced January 2, 1998) | ||||||||||||||

Excluding sales charges | 5.04% | 4.88% | 3.04% | 4.29% | ||||||||||

Including sales charges | -0.76% | 3.71% | 2.46% | 3.98% | ||||||||||

| ||||||||||||||

Class C (Commenced January 2, 1998) | ||||||||||||||

Excluding contingent deferred sales charges | 4.24% | 4.11% | 2.28% | 3.52% | ||||||||||

Including contingent deferred sales charges | 3.24% | 4.11% | 2.28% | 3.52% | ||||||||||

| ||||||||||||||

Institutional (Commenced January 2, 1998) | 5.36% | 5.28% | 3.45% | 4.71% | ||||||||||

| ||||||||||||||

Service (Commenced January 2, 1998) | 5.67% | 4.95% | 3.02% | 4.23% | ||||||||||

| ||||||||||||||

Class IR (Commenced November 30, 2007) | 5.33% | 5.15% | N/A | 3.04% | ||||||||||

| ||||||||||||||

Class R (Commenced November 30, 2007) | 5.02% | 4.67% | N/A | 2.56% | ||||||||||

| ||||||||||||||

Class R6 (Commenced July 31, 2015) | 5.46% | N/A | N/A | 2.34% | ||||||||||

| ||||||||||||||

17

FUND BASICS

Equity Growth Strategy

as of December 31, 2016

| PERFORMANCE REVIEW | ||||||||||

| January 1, 2016–December 31, 2016 | Portfolio Total Return (based on NAV)1 | MSCI® ACWI Index2 | ||||||||

| Class A | 6.81 | % | 7.84 | % | ||||||

| Class C | 5.95 | 7.84 | ||||||||

| Institutional | 7.18 | 7.84 | ||||||||

| Service | 6.66 | 7.84 | ||||||||

| Class IR | 6.99 | 7.84 | ||||||||

| Class R | 6.49 | 7.84 | ||||||||

| Class R6 | 7.12 | 7.84 | ||||||||

| 1 | The net asset value (“NAV”) represents the net assets of the class of the Portfolio (ex-dividend) divided by the total number of shares of the class outstanding. The Portfolio’s performance assumes the reinvestment of dividends and other distributions. The Portfolio’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The Portfolio’s benchmark is the MSCI All Country World Index (Net, USD, Unhedged) (“MSCI® ACWI Index”). The MSCI® ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI® ACWI Index consists of 46 country indices comprising 23 developed and 23 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The emerging market country indices are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, South Korea, Malaysia, Mexico, Peru, Philippines, Poland, Russia, Qatar, South Africa, Taiwan, Thailand, Turkey and the United Arab Emirates. The Index figures do not include any deduction for fees or expenses. It is not possible to invest directly in an unmanaged index. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.gsamfunds.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

18

FUND BASICS

| STANDARDIZED TOTAL RETURNS3 | ||||||||||||||||||||

| For the period ended 12/31/16 | One Year | Five Years | Ten Years | Since Inception | Inception Date | |||||||||||||||

| Class A | 0.96 | % | 8.65 | % | 2.09 | % | 4.23 | % | 1/2/98 | |||||||||||

| Class C | 4.95 | 9.06 | 1.90 | 3.78 | 1/2/98 | |||||||||||||||

| Institutional | 7.18 | 10.33 | 3.07 | 4.94 | 1/2/98 | |||||||||||||||

| Service | 6.66 | 9.78 | 2.56 | 4.44 | 1/2/98 | |||||||||||||||

| Class IR | 6.99 | 10.16 | N/A | 2.48 | 11/30/07 | |||||||||||||||

| Class R | 6.49 | 9.60 | N/A | 2.02 | 11/30/07 | |||||||||||||||

| Class R6 | 7.12 | N/A | N/A | 2.05 | 7/31/15 | |||||||||||||||

| 3 | The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) or cumulative as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Service, Class IR, Class R and Class R6 Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.gsamfunds.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| EXPENSE RATIOS4 | ||||||||||

| Net Expense Ratio (Current) | Gross Expense Ratio (Before Waivers) | |||||||||

| Class A | 1.34 | % | 1.42 | % | ||||||

| Class C | 2.09 | 2.17 | ||||||||

| Institutional | 0.94 | �� | 1.02 | |||||||

| Service | 1.44 | 1.52 | ||||||||

| Class IR | 1.09 | 1.17 | ||||||||

| Class R | 1.59 | 1.67 | ||||||||

| Class R6 | 0.92 | 1.00 | ||||||||

| 4 | The expense ratios of the Portfolio, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Portfolio and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Portfolio’s fee waivers and/or expense limitations will remain in place through at least April 29, 2017, and prior to such date, the Investment Adviser may not terminate the arrangements without the approval of the Portfolio’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

19

FUND BASICS

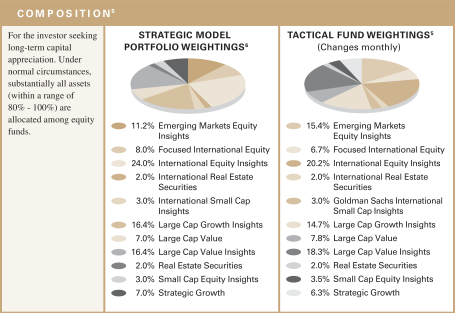

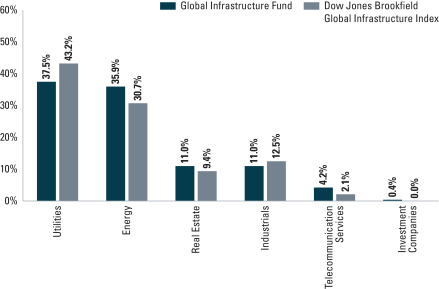

| 5 | The tactical fund weightings are set at the beginning of each calendar quarter. The weightings in the chart above reflect the allocations from September 30, 2016 to December 31, 2016. Actual underlying fund weighting in the Portfolios may differ from the figures shown above due to rounding, differences in returns of the underlying funds, or both. The above figures are not indicative of future allocations. |

| 6 | Strategic allocation is the process of determining the areas of the global markets in which to invest, and in what long-term proportion, for each underlying fund. Our global approach attempts to generate strong long-term returns across geographies and asset classes, and is determined through a careful review of market opportunities and risk/return tradeoffs. It is rebalanced annually. On a monthly basis, we shift assets around the strategic allocation, over and under-weighting asset classes and countries relative to the neutral starting point, seeking to benefit from changing short-term conditions in global capital markets. This is called tactical asset allocation. |

20

FUND BASICS

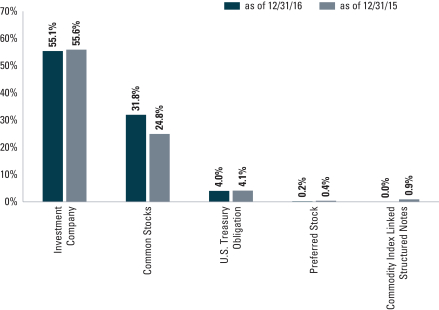

| OVERALL UNDERLYING FUND WEIGHTINGS7 | ||

| Percentage of Net Assets |

| 7 | The Portfolio is actively managed and, as such, its composition may differ over time. The percentage shown for each underlying fund reflects the value of that underlying fund as a percentage of net assets of the Portfolio. Figures in the above graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. |

21

GOLDMAN SACHS EQUITY GROWTH STRATEGY PORTFOLIO

Performance Summary

December 31, 2016

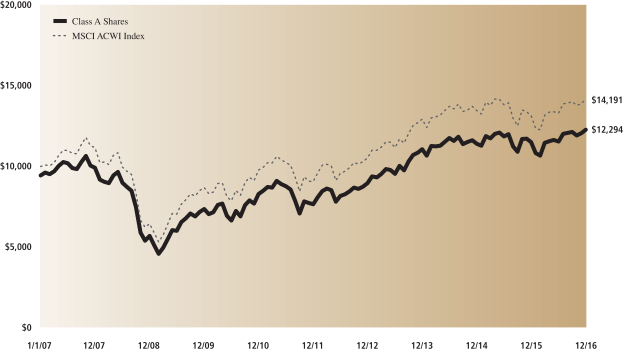

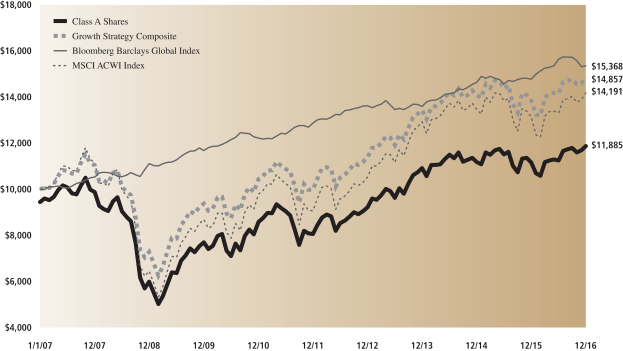

The following graph shows the value, as of December 31, 2016, of a $10,000 investment made on January 1, 2007 in Class A Shares (with the maximum sales charge of 5.5%). For comparative purposes, the performance of the Portfolio’s benchmark, the MSCI® All Country World Index (Net, USD, Unhedged) (“MSCI ACWI Index”) (with distributions reinvested), is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations may cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations currently in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance of Class C, Institutional, Service, Class IR, Class R and Class R6 Shares will vary from Class A Shares due to differences in class specific fees and any applicable sales charges. In addition to the Investment Adviser’s decisions regarding underlying fund selection and allocations among them, other factors may affect Portfolio performance. These factors include, but are not limited to, Portfolio operating fees and expenses, portfolio turnover and subscription and redemption cash flows affecting the Portfolio.

| Equity Growth Strategy Portfolio’s 10 Year Performance |

Performance of a $10,000 investment, with distributions reinvested, from January 1, 2007 through December 31, 2016.

| Average Annual Total Return through December 31, 2016 | One Year | Five Years | Ten Years | Since Inception | ||||||||||

Class A (Commenced January 2, 1998) | ||||||||||||||

Excluding sales charges | 6.81% | 9.89% | 2.66% | 4.54% | ||||||||||

Including sales charges | 0.96% | 8.65% | 2.09% | 4.23% | ||||||||||

| ||||||||||||||

Class C (Commenced January 2, 1998) | ||||||||||||||

Excluding contingent deferred sales charges | 5.95% | 9.06% | 1.90% | 3.78% | ||||||||||

Including contingent deferred sales charges | 4.95% | 9.06% | 1.90% | 3.78% | ||||||||||

| ||||||||||||||

Institutional (Commenced January 2, 1998) | 7.18% | 10.33% | 3.07% | 4.94% | ||||||||||

| ||||||||||||||

Service (Commenced January 2, 1998) | 6.66% | 9.78% | 2.56% | 4.44% | ||||||||||

| ||||||||||||||

Class IR (Commenced November 30, 2007) | 6.99% | 10.16% | N/A | 2.48% | ||||||||||

| ||||||||||||||

Class R (Commenced November 30, 2007) | 6.49% | 9.60% | N/A | 2.02% | ||||||||||

| ||||||||||||||

Class R6 (Commenced July 31, 2015) | 7.12% | N/A | N/A | 2.05% | ||||||||||

| ||||||||||||||

22

FUND BASICS

Growth and Income Strategy

as of December 31, 2016

| PERFORMANCE REVIEW | ||||||||||||||||||

| January 1, 2016– December 31, 2016 | Portfolio Total Return (based on NAV)1 | Growth and Income Composite Index2 | Bloomberg Barclays Global Index | MSCI ACWI Index | ||||||||||||||

| Class A | 5.75 | % | 6.32 | % | 3.94 | % | 7.84 | % | ||||||||||

| Class C | 4.86 | 6.32 | 3.94 | 7.84 | ||||||||||||||

| Institutional | 6.15 | 6.32 | 3.94 | 7.84 | ||||||||||||||

| Service | 5.58 | 6.32 | 3.94 | 7.84 | ||||||||||||||

| Class IR | 6.04 | 6.32 | 3.94 | 7.84 | ||||||||||||||

| Class R | 5.40 | 6.32 | 3.94 | 7.84 | ||||||||||||||

| Class R6 | 6.07 | 6.32 | 3.94 | 7.84 | ||||||||||||||

| 1 | The net asset value (“NAV”) represents the net assets of the class of the Portfolio (ex-dividend) divided by the total number of shares of the class outstanding. The Portfolio’s performance assumes the reinvestment of dividends and other distributions. The Portfolio’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The Growth and Income Strategy Composite Index (“Growth and Income Composite”) is a composite representation prepared by the investment adviser of the performance of the Portfolio’s asset classes weighted according to their respective weightings in the Portfolio’s target range. The Growth and Income Composite is comprised of a blend of the Bloomberg Barclays Global Aggregate Bond Index (Gross, USD, Hedged) (“Bloomberg Barclays Global Index”) (40%) and the MSCI All Country World Index (Net, USD, Unhedged) (“MSCI® ACWI Index”) (60%). The Growth and Income Composite figures do not reflect any deduction for fees, expenses or taxes. The Bloomberg Barclays Global Index is an unmanaged index, provides a broad-based measure of the global investment-grade fixed-rate debt markets and covers the most liquid portion of the global investment grade fixed-rate bond market, including government, credit and collateralized securities. The Index figures do not include any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. The MSCI® ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI® ACWI Index consists of 46 country indices comprising 23 developed and 23 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The emerging market country indices are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, South Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey and the United Arab Emirates. The Index figures do not include any deduction for fees or expenses. It is not possible to invest directly in an unmanaged index. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.gsamfunds.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

23

FUND BASICS

| STANDARDIZED TOTAL RETURNS3 | ||||||||||||||||||||

| For the period ended 12/31/16 | One Year | Five Years | Ten Years | Since Inception | Inception Date | |||||||||||||||

| Class A | -0.09 | % | 5.25 | % | 2.14 | % | 4.22 | % | 1/2/98 | |||||||||||

| Class C | 3.85 | 5.63 | 1.95 | 3.75 | 1/2/98 | |||||||||||||||

| Institutional | 6.15 | 6.86 | 3.12 | 4.95 | 1/2/98 | |||||||||||||||

| Service | 5.58 | 6.33 | 2.62 | 4.43 | 1/2/98 | |||||||||||||||

| Class IR | 6.04 | 6.71 | N/A | 2.57 | 11/30/07 | |||||||||||||||

| Class R | 5.40 | 6.18 | N/A | 2.08 | 11/30/07 | |||||||||||||||

| Class R6 | 6.07 | N/A | N/A | 2.12 | 7/31/15 | |||||||||||||||

| 3 | The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Service, Class IR, Class R and Class R6 Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.gsamfunds.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| EXPENSE RATIOS4 | ||||||||||

| Net Expense Ratio (Current) | Gross Expense Ratio (Before Waivers) | |||||||||

| Class A | 1.33 | % | 1.37 | % | ||||||

| Class C | 2.08 | 2.12 | ||||||||

| Institutional | 0.93 | 0.97 | ||||||||

| Service | 1.43 | 1.47 | ||||||||

| Class IR | 1.08 | 1.12 | ||||||||

| Class R | 1.58 | 1.62 | ||||||||

| Class R6 | 0.91 | 0.95 | ||||||||

| 4 | The expense ratios of the Portfolio, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Portfolio and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Portfolio’s fee waivers and/or expense limitations will remain in place through at least April 29, 2017, and prior to such date, the Investment Adviser may not terminate the arrangements without the approval of the Portfolio’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

24

FUND BASICS

| 5 | The tactical fund weightings are set at the beginning of each calendar quarter. The weightings in the chart above reflect the allocations from September 30, 2016 to December 31, 2016. Actual underlying fund weighting in the Portfolios may differ from the figures shown above due to rounding, differences in returns of the underlying funds, or both. The above figures are not indicative of future allocations. |

| 6 | Strategic allocation is the process of determining the areas of the global markets in which to invest, and in what long-term proportion, for each underlying fund. Our global approach attempts to generate strong long-term returns across geographies and asset classes, and is determined through a careful review of market opportunities and risk/return tradeoffs. It is rebalanced annually. On a monthly basis, we shift assets around the strategic allocation, over and under-weighting asset classes and countries relative to the neutral starting point, seeking to benefit from changing short-term conditions in global capital markets. This is called tactical asset allocation. |

25

FUND BASICS

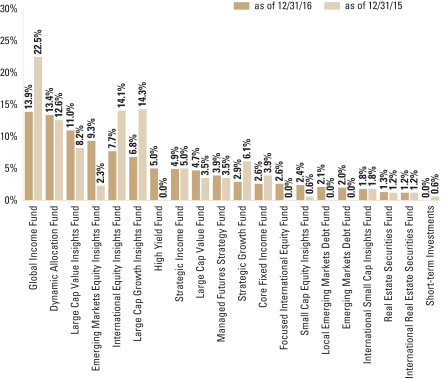

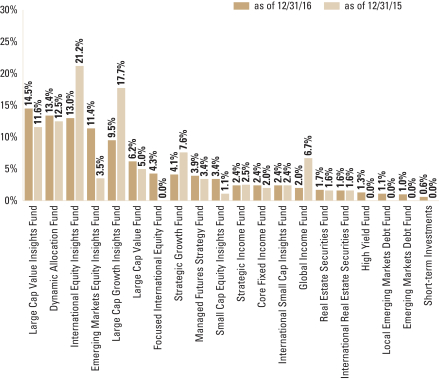

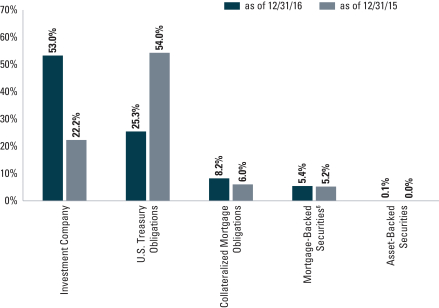

| OVERALL UNDERLYING FUND WEIGHTINGS7 | ||

| Percentage of Net Assets |

| 7 | The Portfolio is actively managed and, as such, its composition may differ over time. The percentage shown for each underlying fund reflects the value of that underlying fund as a percentage of net assets of the Portfolio. Short-term investments represent repurchase agreements. Figures in the above graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. |

26

GOLDMAN SACHS GROWTH AND INCOME STRATEGY PORTFOLIO

Performance Summary

December 31, 2016

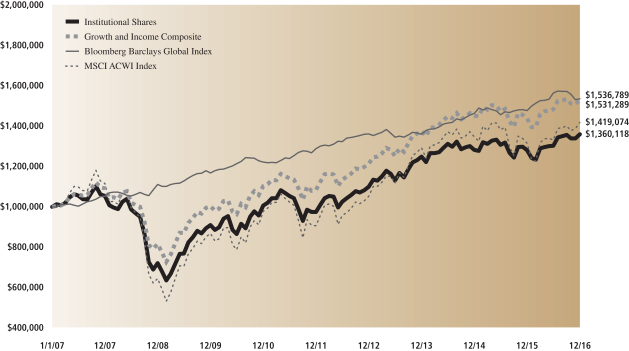

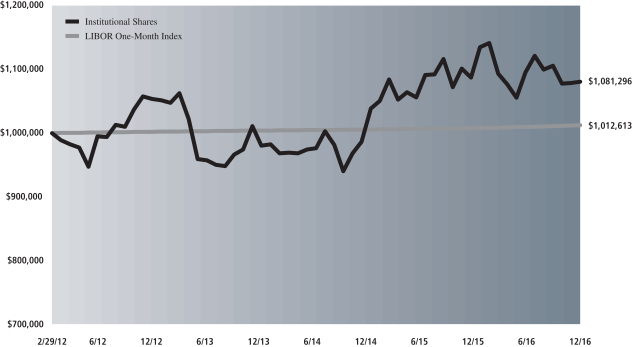

The following graph shows the value, as of December 31, 2016, of a $1,000,000 investment made on January 1, 2007 in Institutional Shares at NAV. For comparative purposes, the performance of the Portfolio’s benchmarks, the Growth and Income Strategy Composite Index (the “Growth and Income Composite”), which is comprised of 60% of the MSCI® All Country World Index (Net, USD, Unhedged) (the “MSCI ACWI Index”) and 40% of the Bloomberg Barclays Global Aggregate Bond Index (Gross, USD, Hedged) (the “Bloomberg Barclays Global Index”), the Bloomberg Barclays Global Index and the MSCI ACWI Index (each with distributions reinvested), are shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations may cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations currently in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance of Class A, Class C, Service, Class IR, Class R and Class R6 Shares will vary from Institutional Shares due to differences in class specific fees and any applicable sales charges. In addition to the Investment Adviser’s decisions regarding underlying mutual fund selection and allocations among them, other factors may affect Portfolio performance. These factors include, but are not limited to, Portfolio operating fees and expenses, portfolio turnover and subscription and redemption cash flows affecting the Portfolio.

| Growth and Income Strategy Portfolio’s 10 Year Performance |

Performance of a $1,000,000 investment, with distributions reinvested, from January 1, 2007 through December 31, 2016.

| Average Annual Total Return through December 31, 2016 | One Year | Five Years | Ten Years | Since Inception | ||||||||||

Class A (Commenced January 2, 1998) | ||||||||||||||

Excluding sales charges | 5.75% | 6.45% | 2.71% | 4.53% | ||||||||||

Including sales charges | -0.09% | 5.25% | 2.14% | 4.22% | ||||||||||

| ||||||||||||||

Class C (Commenced January 2, 1998) | ||||||||||||||

Excluding contingent deferred sales charges | 4.86% | 5.63% | 1.95% | 3.75% | ||||||||||