UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| Caroline Kraus, Esq. | Copies to: | |

| Goldman, Sachs & Co. | Geoffrey R.T. Kenyon, Esq. | |

| 200 West Street | Dechert LLP | |

| New York, New York 10282 | 100 Oliver Street | |

| 40th Floor | ||

| Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: October 31

Date of reporting period: October 31, 2016

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| The Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| Annual Report | October 31, 2016 | |||

Dividend Focus Funds | ||||

Income Builder | ||||

Rising Dividend Growth | ||||

Goldman Sachs Dividend Focus Funds

| n | INCOME BUILDER |

| n | RISING DIVIDEND GROWTH |

TABLE OF CONTENTS | ||||

Investment Process — Income Builder | 1 | |||

Portfolio Management Discussion and Performance Summary — Income Builder | 2 | |||

Portfolio Management Discussion and Performance Summary — Rising Dividend Growth | 14 | |||

Schedules of Investments | 22 | |||

Financial Statements | 36 | |||

Financial Highlights | 40 | |||

Notes to Financial Statements | 44 | |||

Report of the Independent Registered Public Accounting Firm | 62 | |||

Other Information | 63 | |||

| NOT FDIC-INSURED | May Lose Value | No Bank Guarantee | ||

GOLDMAN SACHS INCOME BUILDER FUND

What Differentiates Goldman Sachs’

Income Builder Fund Investment Process?

Income Builder Fund is a broadly diversified portfolio that seeks to provide income and capital appreciation.

The Goldman Sachs Income Builder Fund provides exposure to the wealth-building opportunities of stocks and the regular income potential of bonds. The Fund invests in both equity and fixed income securities with a focus on yield enhancing strategies to earn a monthly income stream. The Fund seeks to maintain broad exposure to equities with lower than general equity market volatility.

We believe that similar themes can perform differently across asset classes. The Fund can potentially take advantage of these cross-asset class opportunities as it is a dynamic portfolio that allows the flexibility to allocate across equities and fixed income from a top-down perspective, given our views on macro opportunities and valuations.

In our risk management process, we identify, monitor and measure a fund’s risk profile. We consider the risk relative to the benchmark and the fund’s investment goal to seek income stability and capital growth.

The Fund’s portfolio comprises the ideas of two experienced Goldman Sachs investment groups:

Global Fundamental Equity Group: A group of investment professionals averaging over 17 years of investment experience and with a strong commitment to fundamental research.

Global Fixed Income Group: Broad, deep capabilities across global fixed income markets, with a total return investment philosophy.

1

PORTFOLIO RESULTS

Goldman Sachs Income Builder Fund

Investment Objective

The Goldman Sachs Income Builder Fund seeks to provide income and capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Fundamental Equity Team and the Goldman Sachs Fixed Income Investment Management Team, collectively the Goldman Sachs Income Builder Team (the “Income Builder Team”), discuss the Goldman Sachs Income Builder Fund’s (the “Fund”) performance and positioning for the 12-month period ended October 31, 2016 (the “Reporting Period”).

| Q | How did the Fund perform during the Reporting Period? |

| A | During the Reporting Period, the Fund’s Class A, C, Institutional, IR and R6 Shares generated average annual total returns, without sales charges, of 3.04%, 2.25%, 3.42%, 3.28% and 3.38%, respectively. These returns compare to the 6.35% and 8.90% average annual total returns of the Russell 1000® Value Index (with dividends reinvested) (the “Russell Index”) and the Bank of America Merrill Lynch BB to B U.S. High Yield Constrained Index (the “BofA Merrill Lynch Index”), respectively, during the same period. |

| Q | What economic and market factors most influenced the equity and fixed income markets as a whole during the Reporting Period? |

| A | U.S. equities generated a positive return for the Reporting Period overall. Federal Reserve (“Fed”) monetary policy and economic data were among the biggest themes dominating the U.S. equity markets during the Reporting Period. |

| After leaving the targeted federal funds rate unchanged at its September and October 2015 policy meetings, the Fed voted unanimously for a 25 basis point interest rate increase in December 2015, a move largely expected by the markets. (A basis point is 1/100th of a percentage point.) However, the fairly dovish language in the announcement, which emphasized “gradual” future adjustments to policy, helped to somewhat assuage the markets. (Dovish language tends to imply lower interest rates; opposite of hawkish.) |

| At the beginning of 2016, U.S. equities were embroiled in a rout that encompassed the broad global equity market, triggered by investor concerns of an intensifying economic slowdown in China and exacerbated by an oil price plunge. In its January 2016 policy statement, the Fed acknowledged these external risks and tightening financial conditions. U.S. equity markets stabilized in mid-February 2016, as market sentiment improved on the more dovish tone set by global central banks broadly. U.S. equities were also supported by stronger economic data, rallying as the fourth quarter 2015 U.S. Gross Domestic Product (“GDP”) came in above market expectations. In March 2016, the Fed kept interest rates on hold and surprised on the dovish side, reducing its forecast to two hikes in 2016, down from four. Along with receding global economic concerns, the dovish forecast helped to drive a recovery in U.S. equities. |

| Market sentiment appeared to remain sanguine in April 2016, as oil prices rose and China economic growth concerns abated with modestly improving economic data. However, U.S. equities fell near the end of April 2016, as investors were disappointed by a lack of additional stimulus from the Bank of Japan (“BoJ”) and by first quarter 2016 U.S. GDP that was weaker than expected at 0.5%. In May 2016, weaker payroll data drove market expectations for a Fed interest rate hike during June 2016 temporarily lower, but subsequent hawkish Fed minutes revived market expectations. The Fed ultimately held interest rates steady and signaled a slower pace of hikes, acknowledging the slowdown in the labor market. During June 2016, investors were focused on the U.K. referendum about whether to leave the European Union. Late in the month, after the surprise “leave” result, popularly known as Brexit, U.S. equities declined amid a broad global sell-off. The market later rebounded, owing to improving risk appetite, as investors digested the outcome and on dovish remarks from Bank of England (“BoE”) Governor Mark Carney. |

U.S. equities were further buoyed in July 2016 by strong economic data and corporate earnings, though uncertainty generally increased following the Brexit vote. In her Jackson Hole speech toward the end of July 2016, Fed Chair Janet |

2

PORTFOLIO RESULTS

Yellen acknowledged that the case for an interest rate hike had strengthened in recent months. Along with strong labor data and other hawkish comments from the Fed, Yellen’s speech significantly increased market expectations of an interest rate hike by year-end 2016, leading to a selloff in U.S. equities. In early September 2016, U.S. equities declined as the European Central Bank (“ECB”) disappointed markets with its lack of commitment to extending monetary easing beyond March 2017. However, U.S. equities rebounded after the Fed decided to leave interest rates unchanged. In October 2016, a combination of hawkish Fed commentary and stronger U.S. economic data heightened market expectations of a December 2016 rate hike. Third quarter 2016 U.S. GDP increased at a 2.9% annualized rate, higher than consensus expectations and the strongest growth rate in two years. |

| Within the fixed income markets, spread (or non-Treasury) sectors advanced for the Reporting Period overall. They started off on a positive note, performing well during November and December 2015. Spread sectors then sold off in January 2016 through mid-February 2016. The selloff was driven by an increase in a number of potential risks, such as slowing Chinese economic activity, the possibility of persistent oil oversupply and concerns about the effect of negative interest rates on the banking system after the BoJ surprised markets by cutting interest rates into negative territory. Some of these risks eased in the second half of the first quarter of 2016, as economic news from China improved, U.S. oil production showed signs of slowing and commodity prices appeared to stabilize. As a result, spread sectors largely retraced their earlier losses by the end of March 2016. |

| During the second quarter of 2016, spread sectors rallied on stabilization of commodities prices as well as on declining fears about slowing Chinese economic growth and the potential for a U.S. economic recession. Global interest rates broadly declined amid continued accommodative monetary policy from the world’s central banks. In the U.S., minutes from the Fed’s April 2016 policy meeting, released in mid-May 2016, suggested to many observers that policymakers might raise interest rates in June 2016 if U.S. economic growth strengthened, employment data firmed and inflation rose toward the Fed’s 2% target. In early June 2016, however, the release of weak May 2016 employment data raised concerns about the health of the U.S. economy, pushing down market expectations of a Fed interest rate hike. Indeed, the Fed did not raise interest rates at its June 2016 policy meeting. In the last week of June 2016, Brexit renewed investor uncertainty about the path of global economic growth. Spread sectors withstood the “leave” vote relatively well, selling off at first but then recovering most of their losses afterwards. |

| During the third calendar quarter and through the end of the Reporting Period, spread sectors generally advanced. Overall, global interest rates remained low, as the world’s central banks remained broadly accommodative. However, the Fed’s July 2016 policy statement was more hawkish than most observers expected, reflecting cautious optimism amid the market’s relatively muted reaction to the Brexit outcome and strengthening U.S. economic data. The July 2016 U.S. non-farm payrolls report showed 255,000 new jobs added, exceeding market expectations and countering a disappointing second quarter 2016 U.S. GDP report that showed growth of 1.2%. In the Eurozone, the ECB kept interest rates unchanged during July 2016. The BoJ, meanwhile, fell short of market expectations with the announcement of an equity purchase program and the lack of key monetary measures, such as an interest rate cut and increased government bond purchases. In August 2016, the BoE unveiled a “timely, coherent and comprehensive package,” as described by Governor Mark Carney, which included a number of measures intended to help the U.K. economy navigate a post-Brexit environment. Although the ECB kept monetary policy unchanged that same month, the European and U.K. credit markets received support from the ongoing corporate bond purchases of central banks. In the U.S., non-farm payroll gains moderated in August 2016 and manufacturing and services data weakened, but continued hawkish comments from the Fed boosted market expectations of a rate hike by the end of 2016. However, at its September 2016 policy meeting, the Fed kept short-term interest rates unchanged. In Japan, the BoJ announced a new “yield curve control” framework designed to steepen Japan’s government bond yield curve and alleviate the impact on financial institutions of low longer-term rates. (Yield curve is a spectrum of maturities.) During October 2016, the ECB kept monetary policy unchanged and offered little guidance on the possibility of an extension to its asset purchase program. Other central banks, including those in Australia, Canada and Sweden, also kept policy rates unchanged at their October 2016 meetings. In the U.S., the October 2016 non-farm payroll report indicated 161,000 new jobs were added, below market consensus, although August and September 2016 figures were revised upwards. |

3

PORTFOLIO RESULTS

| Q | What enhancements were made to the Fund’s investment strategies during the Reporting Period? |

| A | At a meeting held on April 13-14, 2016, the Board of Trustees of the Goldman Sachs Trust approved certain enhancements to the Fund’s investment strategies, consistent with its investment objective and overall investment approach. Beginning on July 12, 2016, the Fund sought to generate additional cash flow and potentially reduce volatility by sales of call options on the S&P 500® Index or other regional stock market indices (or related exchange traded funds (“ETFs”)). |

| Q | What was the Fund’s asset allocation positioning during the Reporting Period? |

| A | As part of its principal investment strategies, the Fund has a baseline allocation of 60% to fixed income securities and 40% to equity securities, though in seeking to meet its investment objective, the Fund has the flexibility to opportunistically tilt the allocation to fixed income and equity securities up to 15% above or below that baseline allocation. The Fund seeks to provide a high and stable income stream plus capital appreciation, with lower volatility than the equity market. The percentage of the portfolio invested in equity and fixed income securities will vary from time to time as the Income Builder Team evaluates such securities’ relative attractiveness based on, among other factors, income opportunities, market valuations, economic growth and inflation prospects. Because of these stated goals of the Fund, the Income Builder Team believes the returns of the Russell Index and the BofA Merrill Lynch Index should be considered for reference only. |

| At the beginning of the Reporting Period, the Fund was invested 39.4% in equities and 55.2% in fixed income, with the balance of 5.4% in cash and cash equivalents. During the Reporting Period, we gradually reduced the Fund’s overall exposure to equities because of our increasing concerns about the global economy and equity market volatility. Within the Fund’s fixed income allocation, we favored investment grade corporate bonds, becoming more tactical in our management of the Fund’s positions amid elevated concerns about commodity price volatility and market activity suggesting the U.S. was in the later stages of the credit cycle. We also remained cautiously positive on high yield corporate bonds, with a focus on increasing the credit quality of the Fund’s holdings. At the end of the Reporting Period, the Fund was invested 36.5% in equities and 61.9% in fixed income, with the balance of 1.6% in cash and cash equivalents. |

| Q | What was the Fund’s 12-month distribution rate and what was its 30-day SEC yield during the Reporting Period? |

| A | During the Reporting Period, the Fund’s Class A, C, Institutional, IR and R6 Shares provided 12-month distribution rates of 3.70%, 3.05%, 4.00%, 3.87% and 4.01%, respectively. As October 31, 2016, the Fund’s 30-day SEC yields (subsidized) for its Class A, C, Institutional, IR and R6 Shares were 3.11%, 2.57%, 3.72%, 3.57% and 3.71%, respectively. |

| Q | What key factors had the greatest impact on the performance of the Fund’s equity allocation during the Reporting Period? |

| A | Relative to the Russell Index, stock selection had the greatest impact on the Fund’s equity allocation during the Reporting Period. The Fund’s call writing strategy, which seeks to generate additional cash flow and potentially reduce volatility by sales of call options on the S&P 500® Index or other regional stock market indices (or related ETFs), bolstered performance. |

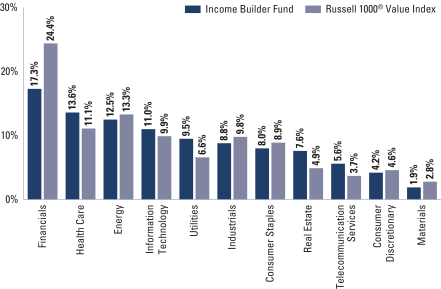

| Q | Which equity market sectors most significantly affected Fund performance during the Reporting Period? |

| A | During the Reporting Period, the Fund was hurt by its underweight relative to the Russell Index in the financials sector and its overweight in the health care sector. Its allocation to master limited partnerships (“MLPs”)/energy infrastructure names, which are not represented as a sector in the Russell Index, also detracted from performance. Conversely, the Fund benefited from its underweight position relative to the Russell Index in the energy sector and from its overweight positions in the information technology and utilities sectors. |

| Q | Which stocks detracted significantly from the Fund’s relative performance during the Reporting Period? |

| A | During the Reporting Period, the Fund’s investments in Banco Bilbao Vizcaya Argentaria, a Spain-based banking group; Credit Suisse Group, a Switzerland-based financial services holding company; and Hennes & Mauritz, a Swedish multinational clothing retailer detracted most from performance relative to the Russell Index. |

Shares of Banco Bilbao Vizcaya Argentaria declined, driven by political uncertainty surrounding Spain’s December 2015 elections, which resulted in a hung parliament and weighed |

4

PORTFOLIO RESULTS

on the Spanish financial sector. (A hung parliament is one in which no party has won enough seats to have a majority.) We ultimately decided to exit the Fund’s position in the name, reallocating the proceeds to other opportunities we viewed more positively. |

| Credit Suisse Group’s (“CSG”) stock price was hurt by difficult market conditions during the Reporting Period, with its shares coming under pressure in the fourth quarter of 2015 as the company was in the process of raising equity. CSG finished its rights issue during the second week of November 2015 but performed poorly following weaker than expected fourth quarter 2015 results, which management attributed to efforts to shrink the investment bank and focus on the private bank. (A rights issue is an issue of shares offered at a special price by a company to its existing shareholders in proportion to their holding of old shares.) In our view, CSG’s growth and deleveraging initiatives were challenged by an illiquid credit market and continued fears of a global economic slowdown. The Fund exited the position during the Reporting Period in favor of companies about which we had stronger conviction. |

| Hennes & Mauritz’s (“H&M”) shares retreated on weakness in sales due in part to Easter falling early in the 2016 calendar year and in part to generally adverse weather conditions for retailers overall. Additionally, H&M’s comparable store sales were hurt by unseasonably hot temperatures during September 2016. Despite these challenges, at the end of the Reporting Period, we continued to favor the company as it moderates its investment spending, which should, in our view, help improve margins. In addition, we believed H&M’s announcement that it plans to launch two new store formats in 2017, as well as the potential reduction of its large inventories, could boost the retailer’s outlook in the near term. The Fund maintained a position in H&M at the end of the Reporting Period. |

| Q | Which stocks contributed significantly to the Fund’s relative performance during the Reporting Period? |

| A | The largest positive contributors to the Fund’s relative performance during the Reporting Period were AT&T, Apache and ConocoPhillips. |

| AT&T, a telecommunication services provider, was the top contributor to the Fund’s relative returns. Its shares advanced during the first half of the Reporting Period driven by synergies from its acquisition of DirecTV. Based on the strong performance of the stock price and its gains relative to industry peers, we chose to exit the Fund’s position in AT&T during the Reporting Period and reallocate the proceeds to other opportunities. |

| �� | Another leading positive contributor to the Fund’s relative performance was Apache, a petroleum and natural gas exploration and production company. Its shares rallied as oil prices strengthened during the Reporting Period. We had originally initiated the Fund’s position in Apache because of what we considered to be the company’s investment grade balance sheet and our confidence in the company’s management team. Additionally, we had a positive view on Apache’s positions in the Permian Basin and Eagle Ford Shale as well as the company’s international exposure. We also believed its shares were trading at an attractive valuation relative to its exploration and production peers. After the stock’s strong performance during the Reporting Period, with our investment thesis largely played out, we decided to exit the Fund’s investment in Apache in favor of names that offered, in our view, the potential for more attractive risk-adjusted returns. |

| The Fund benefited from an investment in ConocoPhillips. The exploration and production company’s stock price is tightly correlated with oil prices, which rose during the Reporting Period, driving strong performance. We remained positive about its management’s focus on cost reductions and capital efficiency, which have the goal of keeping production stable. That said, following the stock’s strong performance during the Reporting Period, ConocoPhillips reached our price target, and we exited the Fund’s position, reallocating the assets to companies about which we held more positive views. |

| Q | Were any significant purchases or sales made within the equity allocation of the Fund during the Reporting Period? |

| A | During the Reporting Period, the Fund purchased shares of Verizon Communications, as we believe the telecommunications company has some of the best assets in the industry. We further believe the company can modestly grow should it continue to invest and focus on its strong wireless business. In our view, Verizon is a high quality franchise with solid revenues from its FiOS service, customer growth and improving free cash flow profile. |

We initiated a Fund position in Duke Energy, a regulated utility company and the largest electric power holding company in the U.S. In our view, the company had underperformed relative to its peers, primarily because of its announced acquisition of Piedmont Natural Gas, which the market appeared to view as expensive and possibly an |

5

PORTFOLIO RESULTS

indication of issues with organic growth. (The acquisition was completed in October 2016.) Additionally, Duke Energy’s exposure to Brazil adversely impacted its stock price. Despite these near-term headwinds, we did not think the stock’s relative underperformance was merited over the long term and believed the company would generate earnings growth in line with its peers. |

| In addition to those sales already mentioned, we exited the Fund’s position in PepsiCo, the global beverage and snacks company. Because of its stock’s strong performance during the Reporting Period and as our investment thesis was largely played out, we decided to exit the Fund’s position in favor of opportunities where we saw more attractive risk-adjusted return potential. |

| Q | What changes were made to the Fund’s equity market sector weightings during the Reporting Period? |

| A | During the Reporting Period, we shifted the Fund from an overweight position relative to the Russell Index in the financials sector to an underweight position. We reduced the size of the Fund’s overweight in the telecommunication services sector. We shifted the Fund from an underweight in information technology to a slight overweight. Also, we moved the Fund from relatively neutral positions in health care and utilities to overweight positions. We added an overweight in the real estate sector. (Effective after the market close on August 31, 2016, real estate was reclassified as an eleventh sector within the Global Industry Classification Standard (“GICS”)). At the end of the Reporting Period, the Fund was overweight the health care, utilities, real estate, telecommunication services and information technology sectors, and it was underweight the financials, energy and industrials sectors relative to the Russell Index. Compared to the Russell Index, the Fund was relatively neutrally weighted in the materials, consumer discretionary and consumer staples sectors at the end of the Reporting Period. |

| Q | Which fixed income market sectors significantly affected the Fund’s performance during the Reporting Period? |

| A | Relative to the BofA Merrill Lynch Index, the Fund was hurt by its exposure to high yield corporate bonds within the energy, financials and commercial services/products market segments. On the positive side, the Fund benefited from its overall positioning, as high yield corporate bond spreads (or yield differentials versus duration-equivalent U.S. Treasury securities) tightened between mid-February 2016 and the end of the Reporting Period. In addition, the Fund’s exposure to high yield corporate bonds within the industrial manufacturing market segment added to performance. |

| Q | How did the Fund’s duration and yield curve positioning strategies affect performance during the Reporting Period? |

| A | During the Reporting Period, the Fund’s duration strategy contributed positively to its performance. More specifically, the Fund benefited from its short duration positioning relative to the BofA Merrill Lynch Index, which it held for most of the Reporting Period because we expected the Fed to raise rates before the end of 2016. We shifted the Fund to a neutral duration position in mid-October 2016, given that shorter-term interest rates had risen and U.S. inflation data remained, in our view, surprisingly weak. Duration is a measure of the Fund’s sensitivity to changes in interest rates. We do not actively manage the Fund’s yield curve positioning as part of our investment process. |

| Q | What changes were made to the Fund’s fixed income weightings during the Reporting Period? |

| A | During the Reporting Period, we focused the Fund’s investments on what we considered to be stable and non-cyclical industries, including cable and cellular telecommunications. We also favored financial companies based on our view that their earnings are likely to benefit from a modest increase in U.S. interest rates. We limited investments in cyclical industries, such as energy and metals/ mining, which we considered more sensitive to global economic growth worries. We also invested in high yield loans, as we believe their lower yields relative to high yield corporate bonds are more than offset by their more defensive characteristics, such as yields that float with prevailing interest rates and a senior position in most capital structures. (A senior position in the capital structure means that the debt generally has priority over unsecured or more junior debt when repayments are made by the issuer.) In addition, during the Reporting Period, we increased the Fund’s credit quality by adding positions in BB-rated credits and steadily reducing exposure to CCC-rated credits. |

| Q | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | During the Reporting Period, the Income Builder Team used options as part of the call writing strategy within the Fund’s equity allocation. The use of these options added to the performance of the Fund’s equity allocation during the Reporting Period. In managing the Fund’s fixed income allocation, the Income Builder Team used U.S. Treasury |

6

PORTFOLIO RESULTS

futures and Eurodollar futures to hedge and manage interest rate exposure and to facilitate specific duration and yield curve strategies. Eurodollar futures are contracts that have underlying assets linked to time deposits denominated in U.S. dollars at banks outside the U.S. The use of these derivatives had a negative impact on the performance of the Fund’s fixed income allocation during the Reporting Period. The Fund also utilized forward foreign currency exchange contracts to hedge currency exposure, which had a positive impact on the performance of the Fund’s fixed income allocation during the Reporting Period. |

| Q | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | Lale Topcuoglu and Andrew Braun no longer served as portfolio managers for the Fund as of May 3, 2016 and June 30, 2016, respectively. By design, all investment decisions for the Fund are performed within a co-lead or team structure, with multiple subject matter experts. This strategic decision making has been the cornerstone of our approach and ensures continuity in the Fund. The portfolio managers for the equity portion of the Fund are Collin Bell, Daniel Lochner and Charles “Brook” Dane. The portfolio managers for the fixed income portion of the Income Builder Fund are Ron Arons and David Beers. |

| Q | What is the Income Builder Team’s tactical view and strategy for the months ahead? |

| A | At the end of the Reporting Period, the Income Builder team believed U.S. equities still looked attractive relative to most other asset classes. That said, we believed returns were likely to be lower in the near term because of slow U.S. economic growth and a scarcity of inexpensive valuations. We also recognized the potential impact of risks stemming from the U.S. election, rising geopolitical tensions and possible changes in global central bank monetary policy. Accordingly, at the end of the Reporting Period, we generally favored high quality, U.S.-oriented companies with what we viewed as strong management teams. Overall, in an environment where we expect lower absolute returns, we believe an active approach will likely be paramount to generating strong risk-adjusted returns. Regardless of market direction, however, fundamental, bottom-up stock selection will continue to drive our process, not headlines or investor sentiment. At the end of the Reporting Period, we maintained high conviction in the companies owned by the equity portion of Fund, and we believed they have the potential to outperform relative to the broader market regardless of the growth environment. We intend to continue to focus on undervalued companies that we believe are in control of their own future, such as innovators with differentiated products, companies with low-cost structures and firms that have been investing in their own businesses and are poised to gain market share. We will maintain our discipline in identifying companies with what we consider to be strong or improving balance sheets, led by quality management teams and trading at discounted valuations, seeking to generate long-term outperformance. |

| In terms of fixed income, the Income Builder Team thought the backdrop for high yield corporate bonds and high yield loans was improving at the end of the Reporting Period. Our view was supported, we believed, by accommodative central bank monetary policies, what we considered “good enough” economic growth and surging commodity prices, which seemed likely, in our opinion, to bolster the broad corporate bond market by dampening volatility and keeping credit spreads contained. (Credit spreads are yield differentials between corporate bonds and U.S. Treasury securities of comparable duration.) Although we observed deterioration in many fundamental measures of creditworthiness consistent with a more advanced stage of the credit cycle, we expected defaults to trend lower in the near term as commodity-related bankruptcies peaked and credit losses remained near credit cycle lows in most other industry sectors. With regard to positioning at the end of the Reporting Period, we continued to increase the Fund’s credit quality by adding BB-rated credits and reducing exposure to CCC-rated credits. We generally favored non-cyclical industries, such as cable and cellular telecommunications, as well as financial companies. At the same time, we remained cautious about increasing the Fund’s exposure to cyclical industries such as energy and metals/mining. We maintained a positive view on high yield loans at the end of the Reporting Period. |

7

FUND BASICS

Income Builder Fund

as of October 31, 2016

| PERFORMANCE REVIEW | ||||||||||||||

| November 1, 2015–October 31, 2016 | Fund Total Return (based on NAV)1 | Russell 1000 Value Index2 | Bank of America Merrill Lynch BB to B U.S. High Yield Constrained Index3 | |||||||||||

| Class A | 3.04 | % | 6.35 | % | 8.90 | % | ||||||||

| Class C | 2.25 | 6.35 | 8.90 | |||||||||||

| Institutional | 3.42 | 6.35 | 8.90 | |||||||||||

| Class IR | 3.28 | 6.35 | 8.90 | |||||||||||

| Class R6 | 3.38 | 6.35 | 8.90 | |||||||||||

| 1 | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® Index companies with lower price-to-book ratios and lower expected growth values. This index is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment. The Index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics. |

| 3 | The BofA Merrill Lynch BB to B US High Yield Constrained Index contains all securities in the BofA Merrill Lynch U.S. High Yield Index rated BB1 through B3, based on an average of Moody’s, S&P and Fitch, but caps issuer exposure at 2%. Index constituents are capitalization-weighted, based on their current amount outstanding, provided the total allocation to an individual issuer does not exceed 2%. Issuers that exceed the limit are reduced to 2% and the face value of each of their bonds is adjusted on a pro-rata basis. Similarly, the face values of bonds of all other issuers that fall below the 2% cap are increased on a pro-rata basis. It is not possible to invest directly in an unmanaged index. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

8

FUND BASICS

| PERFORMANCE REVIEW CONTINUED | ||||||||||||||

| November 1, 2015–October 31, 2016 | 12-Month Distribution Rate4 | 30-Day Standardized Subsidized Yield5 | 30-Day Standardized Unsubsidized Yield5 | |||||||||||

| Class A | 3.70 | % | 3.11 | % | 2.99 | % | ||||||||

| Class C | 3.05 | 2.57 | 2.44 | |||||||||||

| Institutional | 4.00 | 3.72 | 3.59 | |||||||||||

| Class IR | 3.87 | 3.57 | 3.44 | |||||||||||

| Class R6 | 4.01 | 3.71 | 3.58 | |||||||||||

| 4 | The 12 month distribution rate is calculated by taking the sum of all cash distributions over the past 12 months and dividing by the month end NAV in the last month of the period. Distributions may include interest from fixed income, dividends from equities, short term and long term capital gains, return of capital, and special distributions. Return of capital distribution may include a return of some or all of the money that an investor invested in Fund shares. Distributions from securities such as MLPs passing through the Fund may also be characterized as return of capital. Special distributions may include any off-cycle distributions that occur outside of regular interest or dividend payment dates, such as when a company opts to pay a special dividend. The amounts and sources of distribution are not provided for tax reporting purposes. The Fund reports the character of distributions for federal income tax purposes each calendar year on Form 1099-DIV. Distributions will fluctuate over time and a large proportion of the distribution may occur at the end of the year in the form of capital gains. Distributions and market value movements affect the NAV of the Fund and will also affect this calculation. 12 month distribution rate numbers are based on historical distributions and NAVs and are not predictive of future distributions or yields. 12 month distribution rate is calculated to provide a sense of the total cash flow associated with investment in the Fund, but should not be confused with SEC yield, dividend yield or interest yield. |

| 5 | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the SEC and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/ or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

9

FUND BASICS

| STANDARDIZED TOTAL RETURNS6 | ||||||||||||||||||||

| For the period ended 9/30/16 | One Year | Five Years | Ten Years | Since Inception | Inception Date | |||||||||||||||

| Class A | 1.85 | % | 7.54 | % | 5.03 | % | 6.50 | % | 10/12/94 | |||||||||||

| Class C | 5.97 | 7.95 | 4.84 | 3.92 | 8/15/97 | |||||||||||||||

| Institutional | 8.21 | 9.20 | 6.04 | 5.17 | 8/15/97 | |||||||||||||||

| Class IR | 8.07 | 9.04 | N/A | 8.80 | 8/31/10 | |||||||||||||||

| Class R6 | 8.22 | N/A | N/A | 1.87 | 7/31/15 | |||||||||||||||

| 6 | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Class IR and Class R6 Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| EXPENSE RATIOS7 | ||||||||||

| Net Expense Ratio (Current) | Gross Expense Ratio (Before Waivers) | |||||||||

| Class A | 0.98 | % | 1.10 | % | ||||||

| Class C | 1.73 | 1.85 | ||||||||

| Institutional | 0.58 | 0.70 | ||||||||

| Class IR | 0.73 | 0.85 | ||||||||

| Class R6 | 0.56 | 0.69 | ||||||||

| 7 | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least February 26, 2017, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

10

FUND BASICS

| TOP TEN EQUITY HOLDINGS AS OF 10/31/168 | ||||||||

| Holding | % of Net Assets | Line of Business | ||||||

| Wells Fargo & Co. | 1.7 | % | Banks | |||||

| Verizon Communications, Inc. | 1.5 | Diversified Telecommunication Services | ||||||

| Exxon Mobil Corp. | 1.4 | Oil, Gas & Consumable Fuels | ||||||

| Microsoft Corp. | 1.3 | Software | ||||||

| General Electric Co. | 1.3 | Industrial Conglomerates | ||||||

| Duke Energy Corp. | 1.1 | Electric Utilities | ||||||

| M&T Bank Corp. | 1.1 | Banks | ||||||

| Chevron Corp. | 1.1 | Oil, Gas & Consumable Fuels | ||||||

| Abbott Laboratories | 1.0 | Health Care Equipment & Supplies | ||||||

| Royal Dutch Shell PLC ADR Class A | 0.8 | Oil, Gas & Consumable Fuels | ||||||

| 8 | The top 10 holdings may not be representative of the Fund’s future investments. |

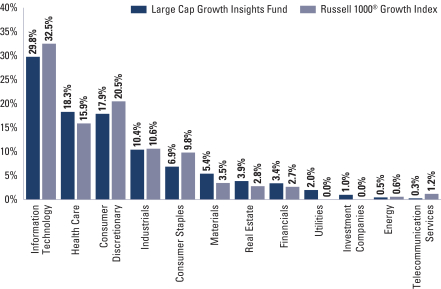

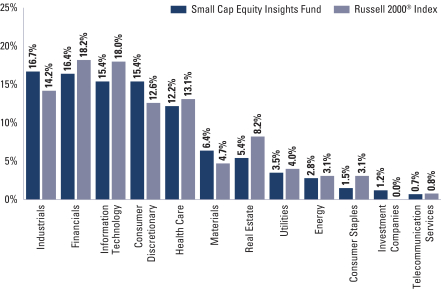

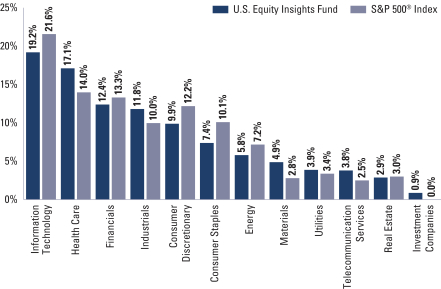

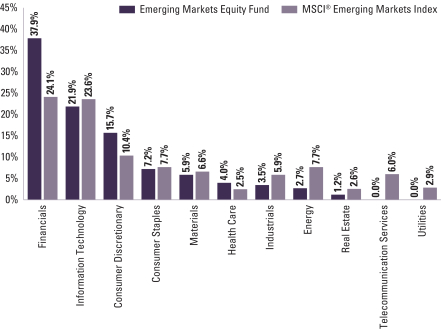

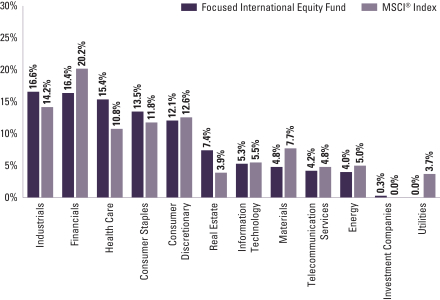

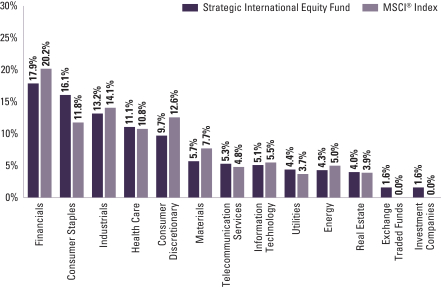

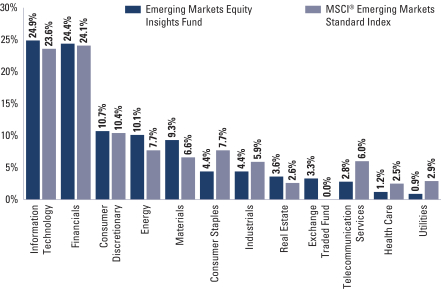

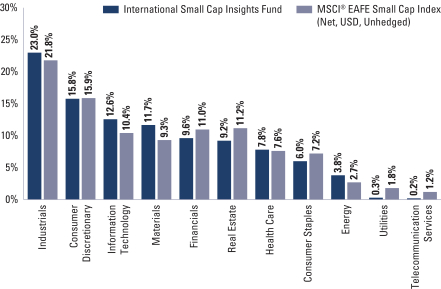

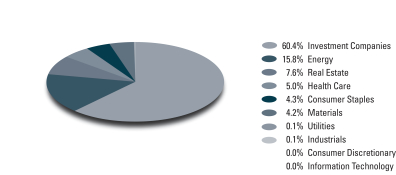

| FUND’S EQUITY SECTOR ALLOCATIONS VS. BENCHMARK9 |

| As of October 31, 2016 |

| 9 | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of the total value of the Fund’s Equity investments. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

11

FUND BASICS

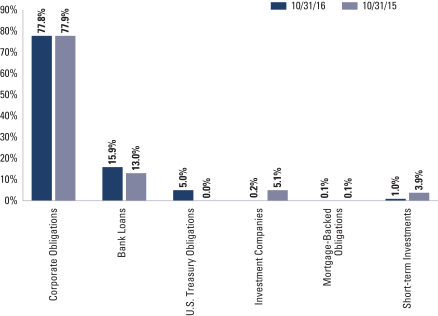

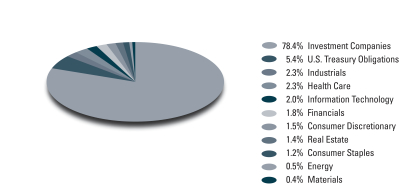

| FUND’S FIXED INCOME FUND COMPOSITION10 |

| 10 | The percentage shown for each investment category reflects the value of investments in that category as a percentage of the Fund’s fixed income investments. Short-term investments represent commercial paper and certificate of deposits. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

12

GOLDMAN SACHS INCOME BUILDER FUND

Performance Summary

October 31, 2016

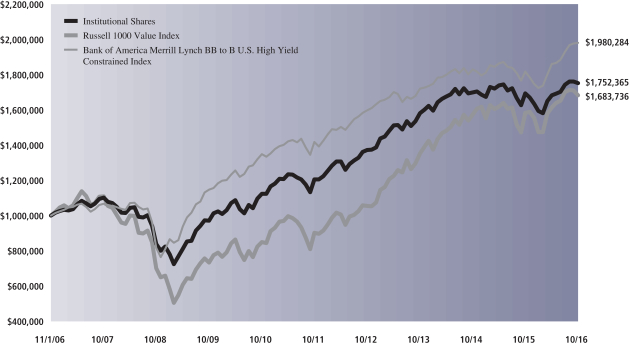

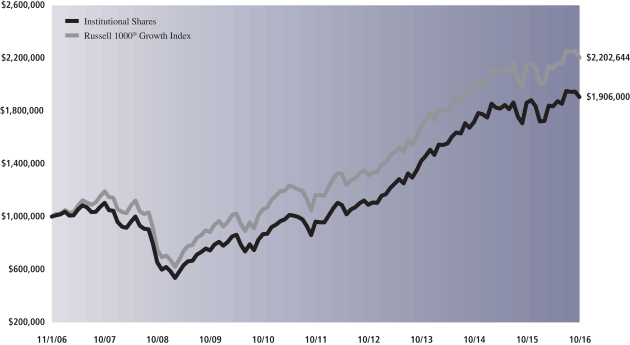

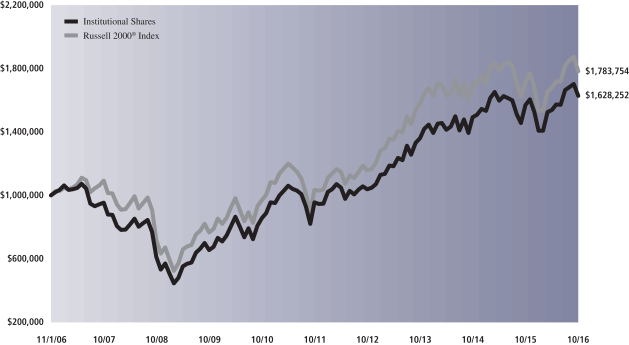

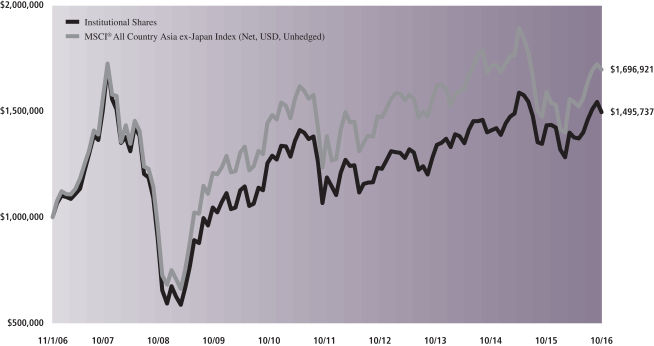

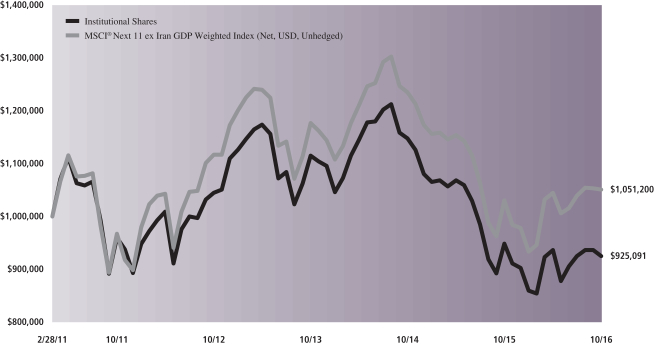

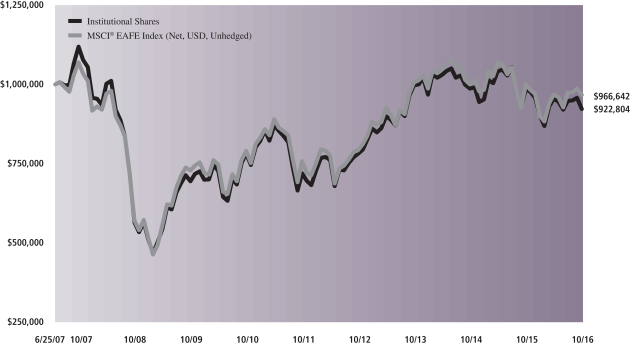

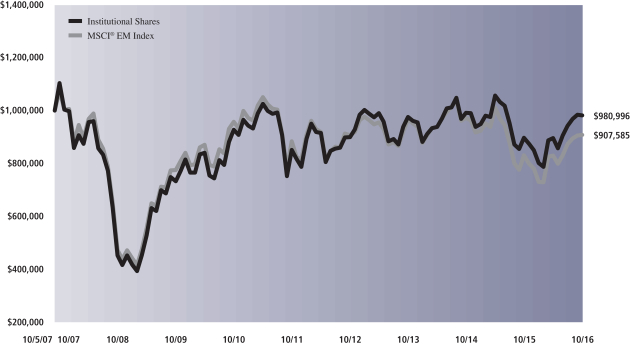

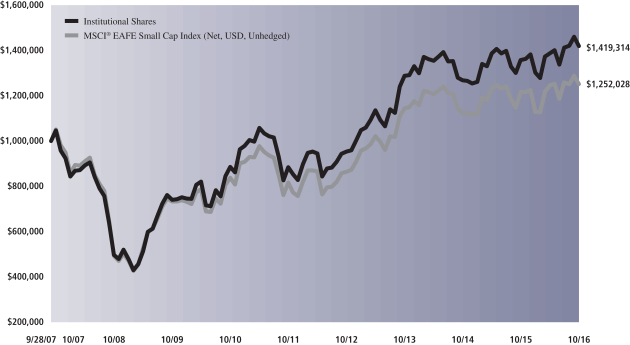

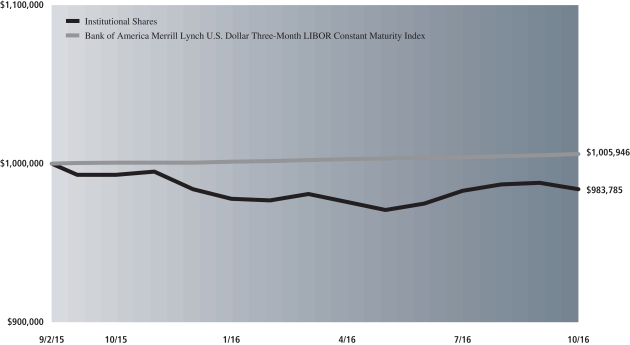

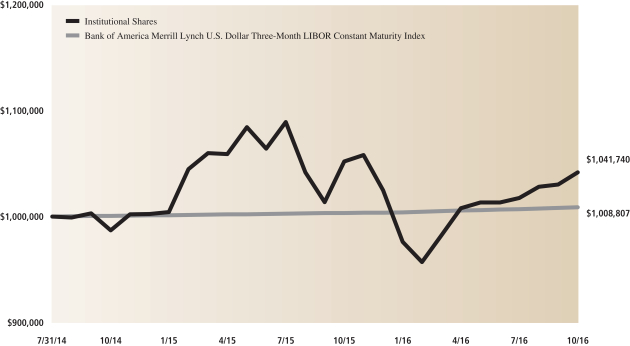

The following graph shows the value, as of October 31, 2016, of a $1,000,000 investment made on November 1, 2006 in Institutional Shares. For comparative purposes, the performance of the Fund’s current benchmarks, the Russell 1000 Value Index and the Bank of America Merrill Lynch BB to B U.S. High Yield Constrained Index, is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations will cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance of Class A, Class C, Class IR and Class R6 Shares will vary from Institutional Shares due to differences in class specific fees. In addition to the Investment Adviser’s decisions regarding issuer/industry/country investment selection and allocation, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover and subscription and redemption cash flows affecting the Fund.

| Income Builder Fund’s 10 Year Performance |

Performance of a $1,000,000 Investment, with distributions reinvested, from November 1, 2006 through October 31, 2016.

| Average Annual Total Return through October 31, 2016 | One Year | Five Years | Ten Years | Since Inception | ||||||||||

Class A (Commenced October 12, 1994) | ||||||||||||||

Excluding sales charges | 3.04% | 7.31% | 5.34% | 6.72% | ||||||||||

Including sales charges | -2.63% | 6.10% | 4.75% | 6.45% | ||||||||||

| ||||||||||||||

Class C (Commenced August 15, 1997) | ||||||||||||||

Excluding contingent deferred sales charges | 2.25% | 6.51% | 4.56% | 3.87% | ||||||||||

Including contingent deferred sales charges | 1.23% | 6.51% | 4.56% | 3.87% | ||||||||||

| ||||||||||||||

Institutional Class (Commenced August 15, 1997) | 3.42% | 7.75% | 5.77% | 5.12% | ||||||||||

| ||||||||||||||

Class IR (Commenced August 31, 2010) | 3.28% | 7.58% | N/A | 8.59% | ||||||||||

| ||||||||||||||

Class R6 (Commenced July 31, 2015) | 3.38% | N/A | N/A | 1.35% | ||||||||||

| ||||||||||||||

13

PORTFOLIO RESULTS

Goldman Sachs Rising Dividend Growth Fund

Investment Objective

The Fund seeks long-term growth of capital and current income.

Portfolio Management Discussion and Analysis

Below, the Dividend Assets Capital portfolio management team, the Fund’s sub-adviser, discusses the Goldman Sachs Rising Dividend Growth Fund’s (the “Fund”) performance and positioning for the 12-month period ended October 31, 2016 (the “Reporting Period”).

| Q | How did the Fund perform during the Reporting Period? |

| A | During the Reporting Period, the Fund’s Class A, C, Institutional, IR and R Shares generated average annual total returns, without sales charges, of -3.71%, -4.43%, -3.35%, -3.45% and -3.96%, respectively. These returns compare to the 4.50% average annual total return of the Fund’s benchmark, the Standard & Poor’s® 500 Index (with dividends reinvested) (the “S&P 500 Index”), during the same time period. |

| Q | What economic and market factors most influenced the equity markets as a whole during the Reporting Period? |

| A | Global equity markets experienced significant volatility during the Reporting Period, as geopolitical events, central bank policy initiatives, energy market dislocations and the then-upcoming U.S. presidential election each contributed heavily to market uncertainty. Amidst such persistent uncertainty, the underlying U.S. and global economies proved resilient, although economic growth remained benign. |

| Perhaps the most significant geopolitical event during the Reporting Period was the U.K.’s referendum to leave the European Union for which voters cast their ballots in June 2016. Commonly referred to as Brexit, consensus expectations were low that the measure would pass, but the populist movement afoot across the electorate was underestimated and sent shock waves throughout the world. The fallout was significant at first, as global equity markets worked to process the event. However, global equity markets recovered with the realization that it would take several years to fully assess the impact of the historic move. It would also likely prove to be an overhang for the markets for a considerable time, as trade deals, immigration policies, corporate associations and more are addressed. |

| Central banks around the world experienced a tide change during the Reporting Period, as easing monetary policy began to show signs of “pushing on a string,” and policy makers took steps to temper consensus expectations for additional monetary stimulus and, in some cases, even shifted to a tightening stance. (“Pushing on a string” is a term defined as when monetary policy cannot entice consumers into spending more money or investing in an economy, even if monetary policy is eased to put more money into peoples’ hands. This term is often attributed to noted economist John Maynard Keynes.) The U.S. Federal Reserve (the “Fed”) raised interest rates for the first time in almost a decade in December 2015, and the European Central Bank and Bank of Japan signaled to the markets that each was willing to be patient to see how current policies impacted the markets before providing additional stimulus. |

| The energy markets experienced what could only be described as significant price dislocations in the face of a sector recession. Oil prices had begun falling in 2014 and accelerated in 2015, as concerns of a global supply glut led to significant volatility and financial stress within the energy industry. The growth of U.S. production, coupled with Organization of Petroleum Exporting Countries (“OPEC”) desire to maintain market share, created an environment wherein visibility of return on investment led to capital allocation becoming less attractive to many investors. |

Finally, at the end of the Reporting Period, we were one week from election day in the U.S., and while polls were tight, it was still very much up in the air who would walk away victorious. We believe it is important to note that the populist movement that led to a surprise “victory” of the Brexit vote could also be seen influencing the U.S. presidential election. Generally, the electorate is wary of the status quo, and we |

14

PORTFOLIO RESULTS

expected continued political uncertainty to play an important role in the equity markets. |

| Q | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | The Fund posted negative absolute returns that underperformed the S&P 500 Index on a relative basis during the Reporting Period. From a broad perspective, stock selection overall detracted most. Sector allocation decisions as a whole also hurt relative results, albeit more modestly. More specifically, material differences between the Fund and the S&P 500 Index included the Fund’s emphasis on dividend growth stocks, and its investment in Master Limited Partnerships (“MLPs”). Both dividend growth stocks and MLPs underperformed the S&P 500 Index during the Reporting Period. (We define dividend growth stocks as equities that have averaged at least 10% growth in annual dividends over 10 consecutive years.1) During the Reporting Period, the portion of the Fund allocated to dividend growth stocks delivered a total return of -3.33%, which underperformed the 4.50% return of the S&P 500 Index. The MLPs in the Fund, with an average weight of 15.10% during the Reporting Period, had a total return of 0.14%, while the Alerian MLP Index2 posted a total return of -1.80%. |

| Q | Which equity market sectors most significantly affected Fund performance? |

| A | Of the sectors within the S&P 500 Index, the largest detractors from Fund performance were health care, consumer discretionary and information technology. While the Fund was prudently allocated to the health care sector, stock selection within the sector proved weak. Both having an overweight to and weak stock selection in the consumer discretionary sector detracted. In information technology, having a significantly underweight position in the sector, which was among the strongest in the S&P 500 Index during the Reporting Period, hurt most. |

| Partially offsetting these detractors were the positive contributions made by positioning in the industrials, materials and consumer staples sectors. The Fund was overweight industrials, and overall performance was supported by both sector allocation and strong security selection. Positioning in the industrial machinery industry within the sector was a key driver of added value. For both materials and consumer staples, the benefits of having overweighted allocations to these strongly performing sectors more than offset weak security selection in each. Having an allocation to cash during the Reporting Period also proved beneficial. |

| Q | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | Detracting most from the Fund’s results relative to the S&P 500 Index were positions in pharmaceutical companies Perrigo and Novo-Nordisk and in off-road and on-road vehicle manufacturer Polaris Industries. |

| Perrigo’s shares declined significantly during the Reporting Period, driven by poor financial results, deterioration in pricing for generic drugs, and its Chief Executive Officer’s departure from the company. Novo-Nordisk’s share price decline was mostly driven by pressures in drug pricing that were not overcome by increased volume in new drugs. Additionally, the company traditionally traded at a high price/earnings ratio on the stability of its results; however, during the Reporting Period, its price/earnings ratio compressed to levels more in line with the broader industry following disappointing results. Shares of Polaris Industries declined on a combination of both external and internal factors. The company delivered disappointing investment results due to end-market weakness, including energy and agricultural-related end-markets. In addition, the company experienced recall issues within its off-road vehicle business that led to adjustments to its guidance. This drove some investors to |

| 1 | The Fund’s strategy is to only buy the stocks of companies where the dividend has increased every year for at least ten years at an average rate of approximately 10% per year. Dividends are not guaranteed and a company’s future ability to pay dividends may be limited. |

| 2 | The Alerian MLP Index is the leading gauge of large- and mid-cap energy MLPs. The float-adjusted, capitalization-weighted index, which includes 50 prominent companies and captures approximately 75% of available market capitalization, is disseminated real-time on a price-return basis (AMZ) and on a total-return basis (AMZX). |

15

PORTFOLIO RESULTS

believe the brand had been impaired or that its margins would be negatively affected for the next few years. |

| Q | What were some of the Fund’s best-performing individual stocks? |

| A | The top contributors to the Fund’s relative performance during the Reporting Period were specialty chemicals manufacturer Valspar, packaged foods manufacturer Hormel Foods and industrial products and equipment manufacturer Illinois Tool Works. |

| Valspar’s share price surge during the Reporting Period was driven primarily by news the company had agreed to be acquired by Sherwin Williams (both Fund holdings) in an all-cash transaction. Hormel Foods performed well, as its stock valuation became more attractive to many after investors had seemingly oversold their shares following a quarter that missed consensus expectations. Shares of Illinois Tool Works rose substantially during the Reporting Period, as the company delivered solid results and made progress toward achieving its long-term goals. The company’s consumer-facing businesses were key drivers of its growth during much of the Reporting Period, with many of its industrial-facing businesses returning to growth later in the Reporting Period. As conditions improved, its management increased forward guidance several times during the Reporting Period. |

| Q | How did the Fund use derivatives during the Reporting Period? |

| A | The Fund did not use derivatives during the Reporting Period. |

| Q | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | We initiated a Fund position in technology giant Microsoft, which represents to us an opportunity to participate in the performance of a leader in the transition to a mobile-first, cloud-first world. We believe Microsoft should be able to leverage its existing enterprise relationships to build on its cloud position. Further, the company’s cloud-based offerings should open new opportunities with small and medium-sized businesses, in our view. We expect Microsoft’s focus on the cloud, along with cost discipline, to lead to solid long-term earnings growth. |

| We established a Fund position in specialty retailer Ross Stores. We expect the company to benefit from consumers seeking value in the off-price channel, a space in which Ross Stores has been a leader. We also believe Ross Stores should be able to execute on its new initiatives to boost margins, expand geographically and gain market share from struggling department stores. |

| We established a Fund position in Buckeye Partners LP, a diversified midstream3 MLP (i.e. a mover of refined products), which, in our view, has excellent defensive characteristics, as it delivered solid financial results that beat consensus expectations even in a challenging energy price environment. Further, its distribution growth is visible; its balance sheet, in our view, is solid with an investment grade credit rating, and the MLP has no incentive distribution rights burden, which significantly reduces its cost of capital. (Incentive distribution rights give a limited partnership’s general partner an increasing share in the incremental distributable cash flow the partnership generates. This occurs alongside of per-unit distribution increases to the limited partners.) We believe Buckeye Partners LP presents an attractive risk/reward profile for long-term investors. |

| Conversely, during the Reporting Period, we sold the Fund’s position in Nestle, as the stock no longer qualified as an investment for the Fund. Although Nestle continued to grow its dividend, its 10-year average dividend growth rate dropped below 10%. Based on the Fund’s investment criteria, which is to invest in companies that grow their respective dividends for at least 10% over 10 consecutive years, we decided to pursue other opportunities. |

| We exited the Fund’s position in NGL Energy Partnership LP, as it was disqualified as a Fund holding after it cut its distribution in April 2016 to protect its balance sheet. We also sold the Fund’s position in luxury retailer Tiffany & Co., as |

| 3 | The midstream component of the energy industry is usually defined as those companies providing products or services that help link the supply side, i.e. energy producers, and the demand side, i.e. energy end-users, for any type of energy commodity. Such midstream business can include, but are not limited to, those that process, store, market and transport various energy commodities. The downstream component of the energy industry is usually defined as the oil and gas operations that take place after the production phase, through to the point of sale. Downstream operations can include refining crude oil and distributing the by-products down to the retail level. By-products can include gasoline, natural gas liquids, diesel and a variety of other energy sources. The upstream component of the energy industry is usually defined as those operations stages in the oil and gas industry that involve exploration and production. Upstream operations deal primarily with the exploration stages of the oil and gas industry, with upstream firms taking the first steps to first locate, test and drill for oil and gas. Later, once reserves are proven, upstream firms will extract any oil and gas from the reserve. |

16

PORTFOLIO RESULTS

we believe near-term execution risks and what we consider to be a full valuation make the stock less attractive. |

| Q | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | During the Reporting Period, we reduced the Fund’s exposure to the consumer staples sector from an overweight to an underweight relative to the S&P 500 Index. Also, the Fund established a weighting in the newly created real estate sector, which was carved out as a separate sector from the financial sector in the S&P 500 Index effective September 2016. |

| Q | How was the Fund positioned relative to its benchmark index at the end of the Reporting Period? |

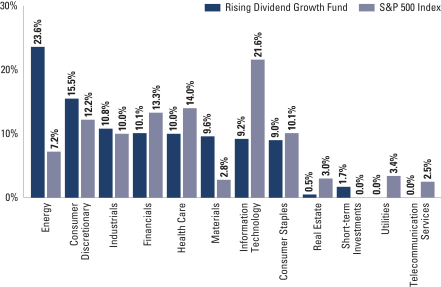

| A | At the end of October 2016, the Fund had overweighted positions relative to the S&P 500 Index in energy (mostly MLPs), materials, consumer discretionary and industrials. On the same date, the Fund had underweighted positions compared to the S&P 500 Index in consumer staples, real estate, financials, health care and information technology. The Fund had no exposure to the utilities and telecommunication services sectors at the end of the Reporting Period. |

| Q | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | There were no changes to the Fund’s portfolio management team during the Reporting Period. |

| Q | What is the Fund’s tactical view and strategy for the months ahead? |

| A | At the end of the Reporting Period, we believe we would likely witness a “hangover” effect should global monetary stimulus be reduced and efforts to revive more organic Gross Domestic Product (“GDP”) through capital investment be in focus, as we anticipate. We believe this scenario would require a shift to greater fiscal stimulus measures, which should include an improved regulatory environment and changes to the tax code here in the U.S. |

| In our view, the U.S. economy should remain on stable ground with housing, employment conditions, low interest rates and credit availability providing favorable support. While we believe the consumer will continue to be a primary driver of GDP growth, governmental spending could pick up and provide support if consumer spending weakens. |

| As we approach a more mid-to-late economic and market cycle, we intend to place an emphasis on sector positioning and on investing in market leaders with sustainable earnings growth. We anticipate earnings growth for the market to be fairly anemic and expect the types of companies we invest in to be attractive on a relative and absolute basis. |

| Our outlook for energy infrastructure investment is constructive, and we believe the markets may benefit from greater export activities of oil and gas throughout the world. As global energy markets have experienced a reduction of new production, coupled with continued consumption growth, we look for the supply/demand imbalance to shift, resulting in stable to increasing energy prices. |

| As always, we continue to monitor domestic and global economies, geopolitical factors, interest rates and equity market fundamentals as we actively manage the Fund, with a focus on income through quality in an effort to offer investors the potential for rising income and competitive total returns with lower volatility. |

17

FUND BASICS

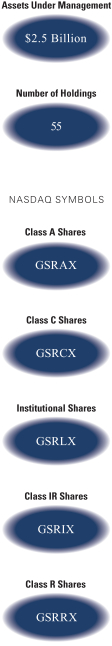

Rising Dividend Growth Fund

as of October 31, 2016

| PERFORMANCE REVIEW | ||||||||||

| November 1, 2015–October 31, 2016 | Fund Total Return (based on NAV)1 | S&P 500 Index2 | ||||||||

| Class A | -3.71 | % | 4.50 | % | ||||||

| Class C | -4.43 | 4.50 | ||||||||

| Institutional | -3.35 | 4.50 | ||||||||

| Class IR | -3.45 | 4.50 | ||||||||

| Class R | -3.96 | 4.50 | ||||||||

| 1 | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The S&P 500 Index is the Standard & Poor’s 500 Composite Index of 500 stocks, an unmanaged index of common stock prices. The Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| STANDARDIZED TOTAL RETURNS3 | ||||||||||||||||||||

| For the period ended 9/30/16 | One Year | Five Years | Ten Years | Since Inception | Inception Date | |||||||||||||||

| Class A | 1.22 | % | 9.78 | % | 6.65 | % | 7.13 | % | 3/23/04 | |||||||||||

| Class C | 5.31 | 10.23 | 6.61 | 7.12 | 4/14/05 | |||||||||||||||

| Institutional | 7.57 | 11.49 | N/A | 7.29 | 3/21/07 | |||||||||||||||

| Class IR | 7.37 | N/A | N/A | 8.56 | 2/27/12 | |||||||||||||||

| Class R | 6.83 | N/A | N/A | 8.03 | 2/27/12 | |||||||||||||||

| 3 | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. Effective February 27, 2012, the Rising Dividend Growth Fund, a series of Dividend Growth Trust (the “Predecessor Fund”), was reorganized into the Fund. As accounting successor to the Predecessor Fund, the Fund has assumed the Predecessor Fund’s historical performance. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Prior to February 27, 2012 (the effective date of the reorganization of the Predecessor Fund into the Fund), the maximum initial sales charge applicable to sales of Class A Shares of the Predecessor Fund was 5.75%, which is not reflected in the average annual total return figures shown. Because Institutional, Class IR and Class R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

18

FUND BASICS

| EXPENSE RATIOS4 | ||||||||||

| Net Expense Ratio (Current) | Gross Expense Ratio (Before Waivers) | |||||||||

| Class A | 1.13 | % | 1.15 | % | ||||||

| Class C | 1.88 | 1.90 | ||||||||

| Institutional | 0.73 | 0.74 | ||||||||

| Class IR | 0.88 | 0.89 | ||||||||

| Class R | 1.38 | 1.39 | ||||||||

| 4 | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least February 26, 2017, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| TOP TEN HOLDINGS AS OF 10/31/165 | ||||||||

| Holding | % of Net Assets | Line of Business | ||||||

| EOG Resources, Inc. | 3.4 | % | Oil, Gas & Consumable Fuels | |||||

| The TJX Cos., Inc. | 3.3 | Specialty Retail | ||||||

| Lowe’s Cos., Inc. | 3.2 | Specialty Retail | ||||||

| CVS Health Corp. | 3.1 | Food & Staples Retailing | ||||||

| NIKE, Inc. Class B | 3.1 | Textiles, Apparel & Luxury Goods | ||||||

| Cardinal Health, Inc. | 3.0 | Health Care Providers & Services | ||||||

| Chubb Ltd. | 2.9 | Insurance | ||||||

| The Sherwin-Williams Co. | 2.8 | Chemicals | ||||||

| Canadian National Railway Co. | 2.8 | Road & Rail | ||||||

| Illinois Tool Works, Inc. | 2.8 | Machinery | ||||||

| 5 | The top 10 holdings may not be representative of the Fund’s future investments. |

19

FUND BASICS

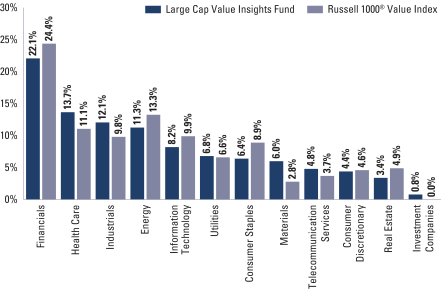

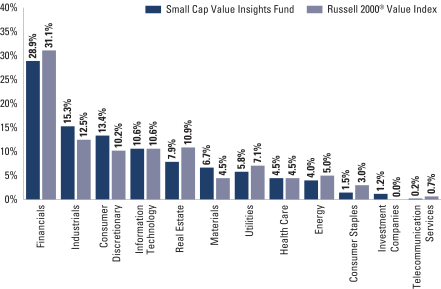

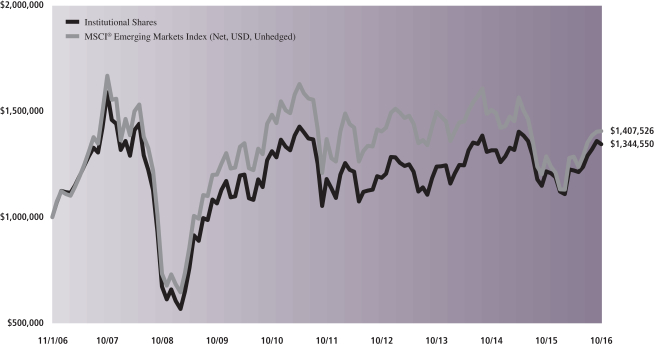

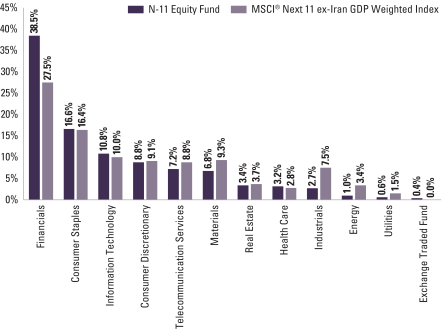

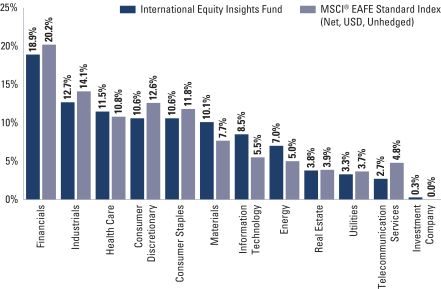

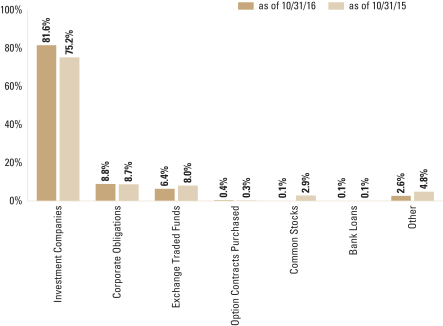

| FUND VS. BENCHMARK SECTOR ALLOCATION6 |

| As of October 31, 2016 |

| 6 | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. Short-term investments represent repurchase agreements. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

20

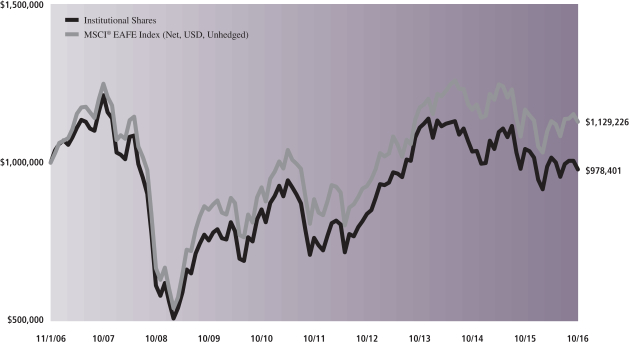

GOLDMAN SACHS RISING DIVIDEND GROWTH FUND

Performance Summary

October 31, 2016

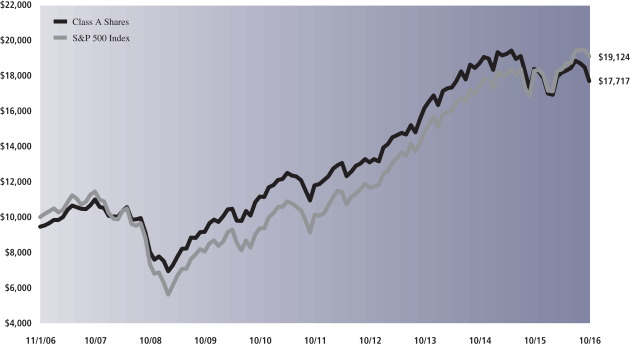

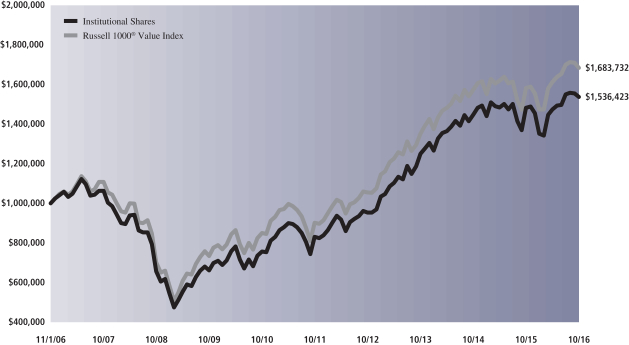

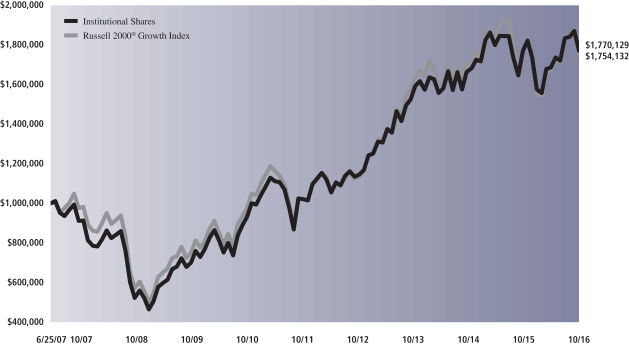

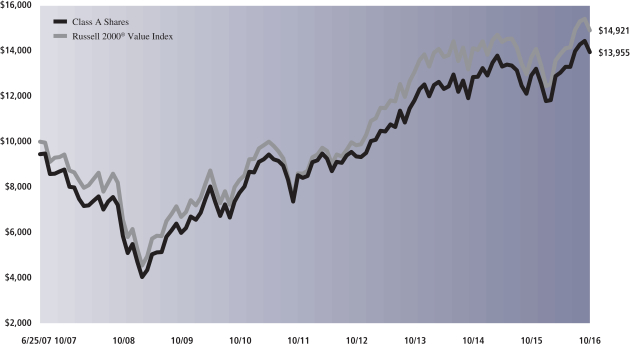

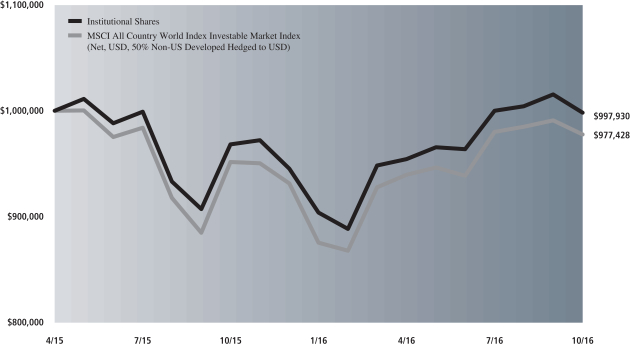

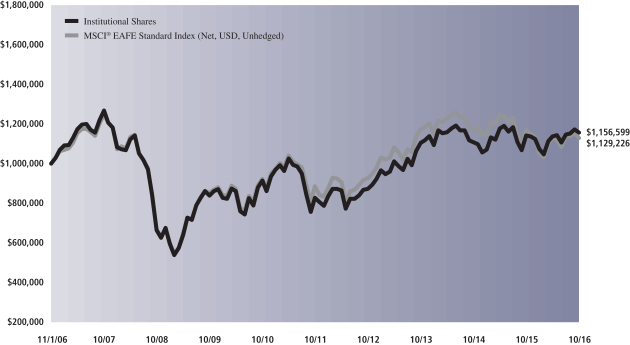

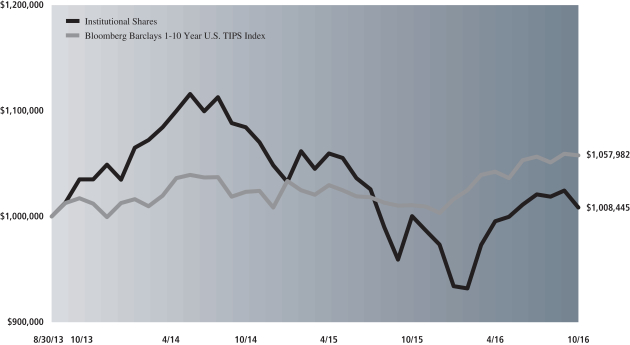

The following graph shows the value, as of October 31, 2016, of a $10,000 investment made on November 1, 2006 in Class A Shares (with the maximum sales charge of 5.5%). For comparative purposes, the performance of the Fund’s benchmark, the S&P 500 Index (with dividends reinvested), is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations will cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance of Class C, Institutional, Class IR and Class R Shares will vary from Class A Shares due to differences in class specific fees and any applicable sales charges. In addition to the Investment Adviser’s decisions regarding issuer/industry/country investment selection and allocation, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover and subscription and redemption cash flows affecting the Fund.

| Rising Dividend Growth Fund’s 10 Year Performance |

Performance of a $10,000 Investment, including any applicable sales charges, with distributions reinvested, from November 1, 2006 through October 31, 2016.

| Average Annual Total Return through October 31, 2016 | One Year | Five Years | Ten Years | Since Inception | ||||||||||

Class A (Commenced March 23, 2004) | ||||||||||||||

Excluding sales charges | -3.71% | 8.46% | 6.48% | 7.19% | ||||||||||

Including sales charges | -8.98% | 7.24% | 5.88% | 6.71% | ||||||||||

| ||||||||||||||

Class C (Commenced April 14, 2005) | ||||||||||||||

Excluding contingent deferred sales charges | -4.43% | 7.66% | 5.85% | 6.66% | ||||||||||

Including contingent deferred sales charges | -5.39% | 7.66% | 5.85% | 6.66% | ||||||||||

| ||||||||||||||

Institutional Class (Commenced March 21, 2007) | -3.35% | 8.88% | N/A | 6.75% | ||||||||||

| ||||||||||||||

Class IR (Commenced February 27, 2012) | -3.45% | N/A | N/A | 7.41% | ||||||||||

| ||||||||||||||

Class R (Commenced February 27, 2012) | -3.96% | N/A | N/A | 6.87% | ||||||||||

| ||||||||||||||

EffectiveFebruary 27, 2012, Rising Dividend Growth Fund (the “Predecessor Fund”) was reorganized into the Fund. As accounting successor to the Predecessor Fund, the Fund has assumed the Predecessor Fund’s historical performance. Therefore, the performance information above is the combined performance of the Predecessor Fund and Fund (except for Class IR and R Shares, which were not offered by the Predecessor Fund).

21

GOLDMAN SACHS INCOME BUILDER FUND

Schedule of Investments

October 31, 2016

Shares | Description | Value | ||||||

| Common Stocks – 35.3% | ||||||||

| Aerospace & Defense – 0.4% | ||||||||

| 93,267 | United Technologies Corp. | $ | 9,531,887 | |||||

|

| |||||||

| Air Freight & Logistics – 0.4% | ||||||||

| 74,384 | United Parcel Service, Inc. Class B | 8,015,620 | ||||||

|

| |||||||

| Auto Components – 0.2% | ||||||||

| 59,349 | Delphi Automotive PLC | 3,861,839 | ||||||

|

| |||||||

| Banks – 3.6% | ||||||||

| 250,250 | JPMorgan Chase & Co. | 17,332,315 | ||||||

| 198,137 | M&T Bank Corp. | 24,317,354 | ||||||

| 771,947 | Wells Fargo & Co. | 35,517,282 | ||||||

|

| |||||||

| 77,166,951 | ||||||||

|

| |||||||

| Biotechnology – 0.3% | ||||||||

| 91,910 | Gilead Sciences, Inc. | 6,767,333 | ||||||

|

| |||||||

| Capital Markets – 0.4% | ||||||||

| 269,036 | Morgan Stanley | 9,031,539 | ||||||

|

| |||||||

| Chemicals – 0.7% | ||||||||

| 107,011 | E.I. du Pont de Nemours & Co. | 7,361,287 | ||||||

| 67,742 | Praxair, Inc. | 7,929,878 | ||||||

|

| |||||||

| 15,291,165 | ||||||||

|

| |||||||

| Communications Equipment – 0.7% | ||||||||

| 502,295 | Cisco Systems, Inc. | 15,410,411 | ||||||

|

| |||||||

| Consumer Finance – 0.7% | ||||||||

| 209,826 | American Express Co. | 13,936,643 | ||||||

|

| |||||||

| Diversified Telecommunication Services – 1.5% | ||||||||

| 658,986 | Verizon Communications, Inc. | 31,697,227 | ||||||

|

| |||||||

| Electric Utilities – 3.0% | ||||||||

| 306,718 | Duke Energy Corp. | 24,543,574 | ||||||

| 470,169 | FirstEnergy Corp. | 16,122,095 | ||||||

| 309,731 | Iberdrola SA ADR | 8,430,878 | ||||||

| 45,777 | NextEra Energy, Inc. | 5,859,456 | ||||||

| 138,524 | PG&E Corp. | 8,605,111 | ||||||

|

| |||||||

| 63,561,114 | ||||||||

|

| |||||||

| Electrical Equipment – 0.3% | ||||||||

| 110,882 | Emerson Electric Co. | 5,619,500 | ||||||

|

| |||||||

| Electronic Equipment, Instruments & Components – 0.2% | ||||||||

| 62,324 | TE Connectivity Ltd. | 3,918,310 | ||||||

|

| |||||||

| Energy Equipment & Services – 0.4% | ||||||||

| 121,601 | Schlumberger Ltd. | 9,512,846 | ||||||

|

| |||||||

| Equity Real Estate Investment Trusts (REITs) – 1.8% | ||||||||

| 65,908 | AvalonBay Communities, Inc. | 11,282,132 | ||||||

| 161,960 | Brixmor Property Group, Inc. | 4,117,023 | ||||||

| 425,446 | DDR Corp. | 6,505,069 | ||||||

| 33,975 | Federal Realty Investment Trust | 4,934,189 | ||||||

| 97,401 | Mid-America Apartment Communities, Inc. | 9,033,943 | ||||||

| 47,467 | Post Properties, Inc. | 3,122,854 | ||||||

|

| |||||||

| 38,995,210 | ||||||||

|

| |||||||

| Food & Staples Retailing – 0.6% | ||||||||

| 171,244 | Wal-Mart Stores, Inc. | 11,990,505 | ||||||

|

| |||||||

Shares | Description | Value | ||||||

| Common Stocks – (continued) | ||||||||

| Food Products – 0.3% | ||||||||

| 130,562 | Campbell Soup Co. | $ | 7,094,739 | |||||

|

| |||||||

| Health Care Equipment & Supplies – 1.0% | ||||||||

| 535,335 | Abbott Laboratories | 21,006,545 | ||||||

|

| |||||||

| Health Care Providers & Services – 0.5% | ||||||||

| 70,072 | Aetna, Inc. | 7,522,229 | ||||||

| 47,843 | Cardinal Health, Inc. | 3,286,336 | ||||||

|

| |||||||

| 10,808,565 | ||||||||

|

| |||||||

| Hotels, Restaurants & Leisure – 0.6% | ||||||||

| 110,290 | McDonald’s Corp. | 12,415,345 | ||||||

|

| |||||||

| Household Products – 0.8% | ||||||||

| 87,717 | Kimberly-Clark Corp. | 10,035,702 | ||||||

| 81,409 | The Procter & Gamble Co. | 7,066,301 | ||||||

|

| |||||||

| 17,102,003 | ||||||||

|

| |||||||

| Industrial Conglomerates – 1.3% | ||||||||

| 937,927 | General Electric Co. | 27,293,676 | ||||||

|

| |||||||

| Insurance – 1.5% | ||||||||

| 84,934 | Arthur J. Gallagher & Co. | 4,096,367 | ||||||

| 115,870 | MetLife, Inc. | 5,441,255 | ||||||

| 191,441 | The Hartford Financial Services Group, Inc. | 8,444,463 | ||||||

| 433,199 | XL Group Ltd. | 15,032,005 | ||||||

|

| |||||||

| 33,014,090 | ||||||||

|

| |||||||

| Media – 0.7% | ||||||||

| 182,507 | Comcast Corp. Class A | 11,282,583 | ||||||

| 86,663 | Viacom, Inc. Class B | 3,255,062 | ||||||

|

| |||||||

| 14,537,645 | ||||||||

|

| |||||||

| Oil, Gas & Consumable Fuels – 4.3% | ||||||||

| 368,834 | BP PLC ADR | 13,112,049 | ||||||

| 224,764 | Chevron Corp. | 23,544,029 | ||||||

| 351,627 | Exxon Mobil Corp. | 29,297,562 | ||||||

| 259,219 | Magnum Hunter Resources Corp. PI(a)(b)(c) | 3,185,801 | ||||||

| 196,976 | Plains All American Pipeline LP | 5,980,191 | ||||||

| 351,122 | Royal Dutch Shell PLC ADR Class A | 17,489,387 | ||||||

|

| |||||||

| 92,609,019 | ||||||||

|

| |||||||

| Personal Products – 0.5% | ||||||||