UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

| Caroline Kraus, Esq. | | Copies to: |

| Goldman Sachs & Co. LLC | | Geoffrey R.T. Kenyon, Esq. |

| 200 West Street | | Dechert LLP |

| New York, New York 10282 | | 100 Oliver Street |

| | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: August 31

Date of reporting period: February 28, 2021

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | February 28, 2021 |

| | |

| | | | Fundamental Equity Growth Funds |

| | | | Capital Growth |

| | | | Concentrated Growth |

| | | | Flexible Cap |

| | | | Growth Opportunities |

| | | | Small Cap Growth |

| | | | Small/Mid Cap Growth |

| | | | Strategic Growth |

| | | | Technology Opportunities |

| | | | U.S. Equity ESG |

Goldman Sachs Fundamental Equity Growth Funds

| ∎ | | TECHNOLOGY OPPORTUNITIES |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

FUND BASICS

Capital Growth Fund

as of February 28, 2021

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | |

| | | September 1, 2020–February 28, 2021 | | Fund Total Return

(based on NAV)1 | | | Russell 1000®

Index2 | |

| | Class A | | | 11.22 | % | | | 11.78 | % |

| | Class C | | | 10.84 | | |

| 11.78

|

|

| | Institutional | | | 11.41 | | |

| 11.78

|

|

| | Service | | | 11.16 | | | | 11.78 | |

| | Investor | | | 11.36 | | | | 11.78 | |

| | Class R6 | | | 11.43 | | | | 11.78 | |

| | Class R | | | 11.12 | | | | 11.78 | |

| | | Class P | | | 11.44 | | | | 11.78 | |

| 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | | The Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe. It includes those Russell 1000 Index companies with lower price-to-book ratios and lower expected growth values. The Russell 1000 Index is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment. The Russell 1000 Index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics. It is not possible to invest directly in an index. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 2/28/20213 |

| | | |

| | | Holding | | % of Net Assets | | | Line of Business |

| | | |

| | Microsoft Corp. | | | 5.1 | % | | Software |

| | | |

| | Apple, Inc. | | | 4.9 | | | Technology Hardware, Storage & Peripherals |

| | | |

| | Amazon.com, Inc. | | | 4.3 | | | Internet & Direct Marketing Retail |

| | | |

| | Alphabet, Inc., Class A | | | 2.2 | | | Interactive Media & Services |

| | | |

| | Facebook, Inc., Class A | | | 1.9 | | | Interactive Media & Services |

| | | |

| | Alphabet, Inc., Class C | | | 1.8 | | | Interactive Media & Services |

| | | |

| | Visa, Inc., Class A | | | 1.7 | | | IT Services |

| | | |

| | American Express Co. | | | 1.6 | | | Consumer Finance |

| | | |

| | PayPal Holdings, Inc. | | | 1.5 | | | IT Services |

| | | Eli Lilly and Co. | | | 1.4 | | | Pharmaceuticals |

| 3 | | The top 10 holdings may not be representative of the Fund’s future investments. |

1

FUND BASICS

|

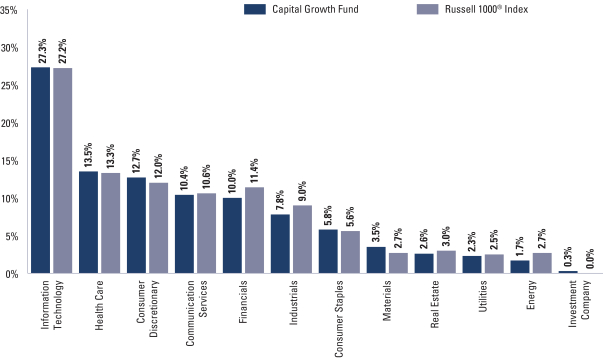

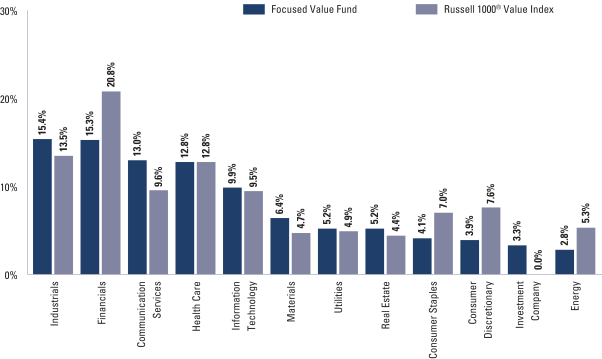

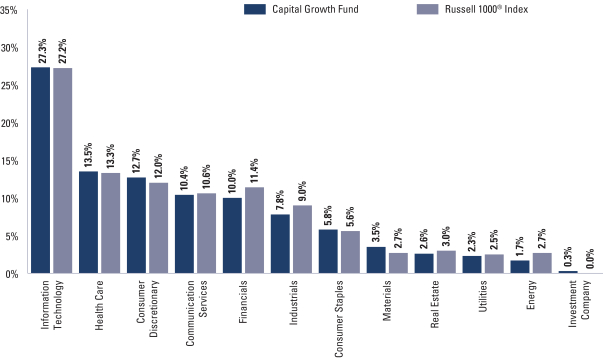

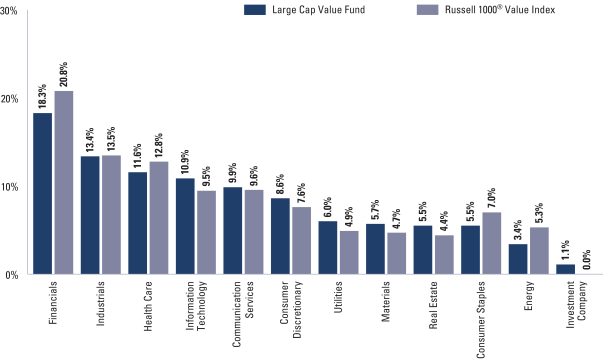

| FUND VS. BENCHMARK SECTOR ALLOCATION4 |

|

| As of February 28, 2021 |

| 4 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

2

FUND BASICS

Concentrated Growth Fund

as of February 28, 2021

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | |

| | | September 1, 2020–February 28, 2021 | | Fund Total Return

(based on NAV)1 | | | Russell 1000®

Growth Index2 | |

| | Class A | | | 5.93 | % | | | 5.34 | % |

| | Class C | | | 5.56 | | | | 5.34 | |

| | Institutional | | | 6.10 | | | | 5.34 | |

| | Investor | | | 6.10 | | | | 5.34 | |

| | Class R6 | | | 6.11 | | | | 5.34 | |

| | Class R | | | 5.81 | | | | 5.34 | |

| | | Class P | | | 6.12 | | | | 5.34 | |

| 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | | The Russell 1000® Growth Index is an unmanaged index that measures the performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000® Growth Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 2/28/20213 |

| | | |

| | | Holding | | % of Net Assets | | | Line of Business |

| | | |

| | Microsoft Corp. | | | 8.2 | % | | Software |

| | | |

| | Apple, Inc. | | | 7.5 | | | Technology Hardware, Storage & Peripherals |

| | | |

| | Alphabet, Inc., Class A | | | 6.4 | | | Interactive Media & Services |

| | | |

| | Visa, Inc., Class A | | | 4.8 | | | IT Services |

| | | |

| | Amazon.com, Inc. | | | 4.7 | | | Internet & Direct Marketing Retail |

| | | |

| | PayPal Holdings, Inc. | | | 3.8 | | | IT Services |

| | | |

| | Eli Lilly and Co. | | | 3.2 | | | Pharmaceuticals |

| | | |

| | NVIDIA Corp. | | | 3.1 | | | Semiconductors & Semiconductor Equipment |

| | | |

| | Marvell Technology Group Ltd. | | | 3.1 | | | Semiconductors & Semiconductor Equipment |

| | | NXP Semiconductors NV | | | 3.0 | | | Semiconductors & Semiconductor Equipment |

| 3 | | The top 10 holdings may not be representative of the Fund’s future investments. |

3

FUND BASICS

|

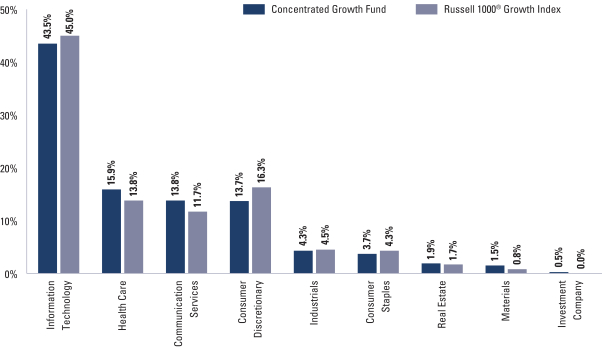

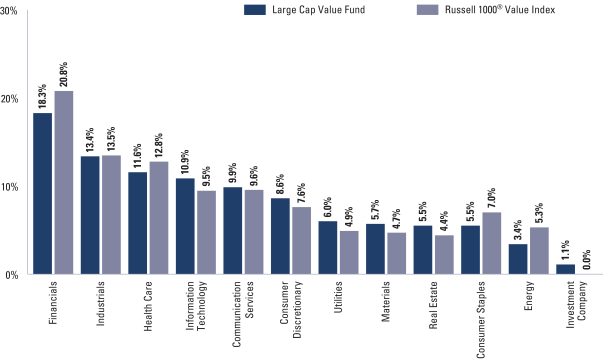

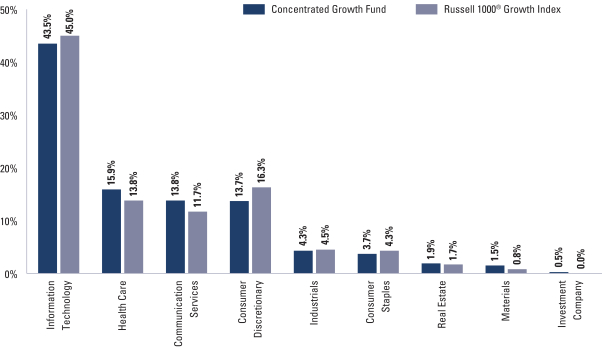

| FUND VS. BENCHMARK SECTOR ALLOCATION4 |

|

| As of February 28, 2021 |

| 4 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”); however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

4

FUND BASICS

Flexible Cap Fund

as of February 28, 2021

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | |

| | | September 1, 2020–February 28, 2021 | | Fund Total Return

(based on NAV)1 | | | S&P 500®

Index2 | |

| | Class A | | | 9.61 | % | | | 9.74 | % |

| | Class C | | | 9.31 | | | | 9.74 | |

| | Institutional | | | 9.86 | | | | 9.74 | |

| | Investor | | | 9.77 | | | | 9.74 | |

| | Class R6 | | | 9.90 | | | | 9.74 | |

| | Class R | | | 9.52 | | | | 9.74 | |

| | | Class P | | | 9.83 | | | | 9.74 | |

| 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | | The S&P 500® Index is the Standard & Poor’s 500 Composite Index of 500 stocks, an unmanaged index of common stock prices. The S&P 500® Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 2/28/20213 |

| | | |

| | | Holding | | % of Net Assets | | | Line of Business |

| | | |

| | Microsoft Corp. | | | 5.9 | % | | Software |

| | | |

| | Apple, Inc. | | | 5.9 | | | Technology Hardware, Storage & Peripherals |

| | | |

| | Amazon.com, Inc. | | | 4.6 | | | Internet & Direct Marketing Retail |

| | | |

| | Alphabet, Inc., Class A | | | 2.3 | | | Interactive Media & Services |

| | | |

| | Facebook, Inc., Class A | | | 2.2 | | | Interactive Media & Services |

| | | |

| | JPMorgan Chase & Co. | | | 2.0 | | | Banks |

| | | |

| | Alphabet, Inc., Class C | | | 1.9 | | | Interactive Media & Services |

| | | |

| | Visa, Inc., Class A | | | 1.6 | | | IT Services |

| | | |

| | UnitedHealth Group, Inc. | | | 1.4 | | | Health Care Providers & Services |

| | | Walt Disney Co. (The) | | | 1.4 | | | Entertainment |

| 3 | | The top 10 holdings may not be representative of the Fund’s future investments. |

5

FUND BASICS

|

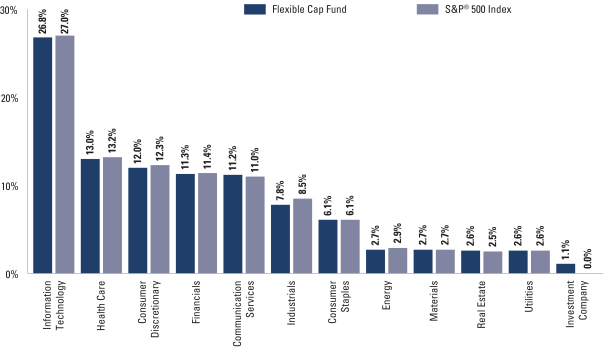

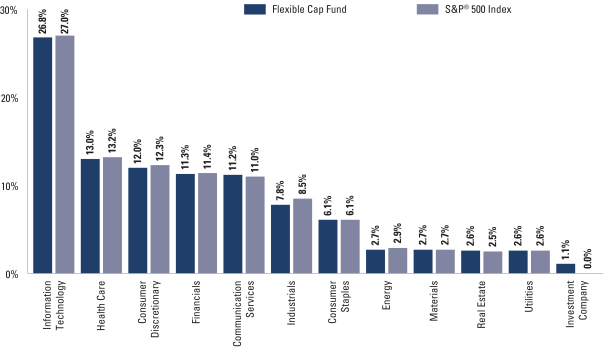

| FUND VS. BENCHMARK SECTOR ALLOCATION4 |

|

| As of February 28, 2021 |

| 4 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

6

FUND BASICS

Growth Opportunities Fund

as of February 28, 2021

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | |

| | | September 1, 2020–February 28, 2021 | | Fund Total Return

(based on NAV)1 | | | Russell Midcap®

Growth Index2 | |

| | Class A | | | 20.54 | % | | | 18.96 | % |

| | Class C | | | 20.19 | | | | 18.96 | |

| | Institutional | | | 20.73 | | | | 18.96 | |

| | Service | | | 20.46 | | | | 18.96 | |

| | Investor | | | 20.71 | | | | 18.96 | |

| | Class R6 | | | 20.75 | | | | 18.96 | |

| | Class R | | | 20.34 | | | | 18.96 | |

| | | Class P | | | 20.75 | | | | 18.96 | |

| 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | | The Russell Midcap® Growth Index is an unmanaged market capitalization weighted index that measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. The Russell Midcap® Growth Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 2/28/20213 |

| | | |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Veeva Systems, Inc., Class A | | | 2.6 | % | | Health Care Technology |

| | Cadence Design Systems, Inc. | | | 2.3 | | | Software |

| | RingCentral, Inc., Class A | | | 2.3 | | | Software |

| | Palo Alto Networks, Inc. | | | 2.3 | | | Software |

| | HubSpot, Inc. | | | 2.0 | | | Software |

| | DocuSign, Inc. | | | 2.0 | | | Software |

| | Amphenol Corp., Class A | | | 1.9 | | | Electronic Equipment, Instruments & Components |

| | Rockwell Automation, Inc. | | | 1.9 | | | Electrical Equipment |

| | Match Group, Inc. | | | 1.9 | | | Interactive Media & Services |

| | | Etsy, Inc. | | | 1.8 | | | Internet & Direct Marketing Retail |

| 3 | | The top 10 holdings may not be representative of the Fund’s future investments. |

7

FUND BASICS

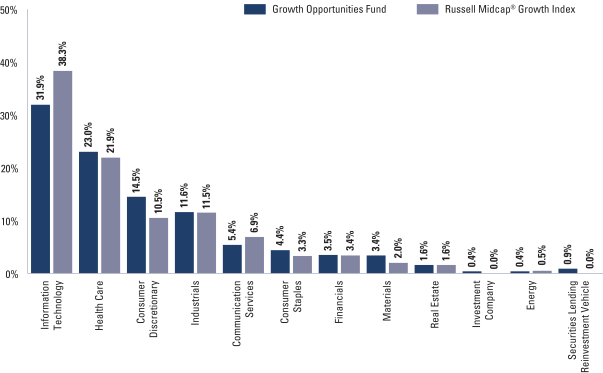

|

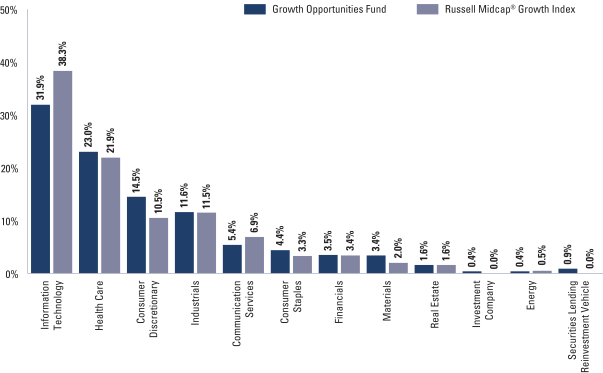

| FUND VS. BENCHMARK SECTOR ALLOCATION4 |

|

| As of February 28, 2021 |

| 4 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”); however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

8

FUND BASICS

Small Cap Growth Fund

as of February 28, 2021

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | |

| | | September 1, 2020–February 28, 2021 | | Fund Total Return

(based on NAV)1 | | | Russell 2000®

Growth Index2 | |

| | Class A | | | 36.75 | % | | | 37.33 | % |

| | Class C | | | 36.22 | | | | 37.33 | |

| | Institutional | | | 37.00 | | | | 37.33 | |

| | Investor | | | 36.93 | | | | 37.33 | |

| | Class R6 | | | 36.99 | | | | 37.33 | |

| | Class R | | | 36.56 | | | | 37.33 | |

| | | Class P | | | 36.92 | | | | 37.33 | |

| 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | | The Russell 2000® Growth Index (with dividends reinvested) is an unmanaged index of common stock prices that measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2000® Growth Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 2/28/20213 |

| | | |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Halozyme Therapeutics, Inc. | | | 1.8 | % | | Biotechnology |

| | Quanterix Corp. | | | 1.7 | | | Life Sciences Tools & Services |

| | Brooks Automation, Inc. | | | 1.6 | | | Semiconductors & Semiconductor Equipment |

| | Crocs, Inc. | | | 1.6 | | | Textiles, Apparel & Luxury Goods |

| | Colfax Corp. | | | 1.5 | | | Machinery |

| | RBC Bearings, Inc. | | | 1.5 | | | Machinery |

| | Workiva, Inc. | | | 1.5 | | | Software |

| | Omnicell, Inc. | | | 1.4 | | | Health Care Technology |

| | YETI Holdings, Inc. | | | 1.4 | | | Leisure Products |

| | | Kratos Defense & Security Solutions, Inc. | | | 1.4 | | | Aerospace & Defense |

| 3 | | The top 10 holdings may not be representative of the Fund’s future investments. |

9

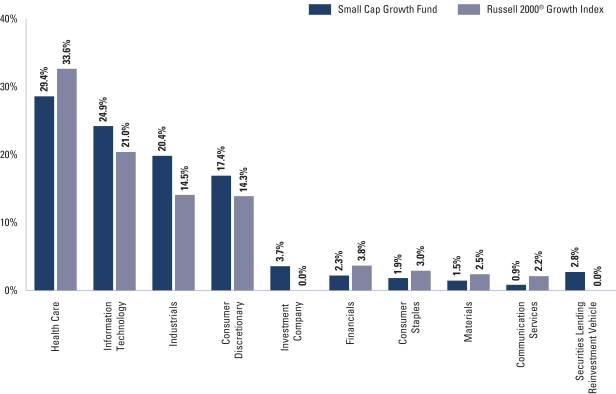

FUND BASICS

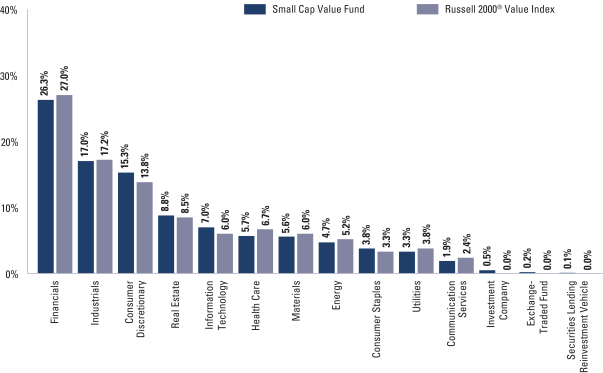

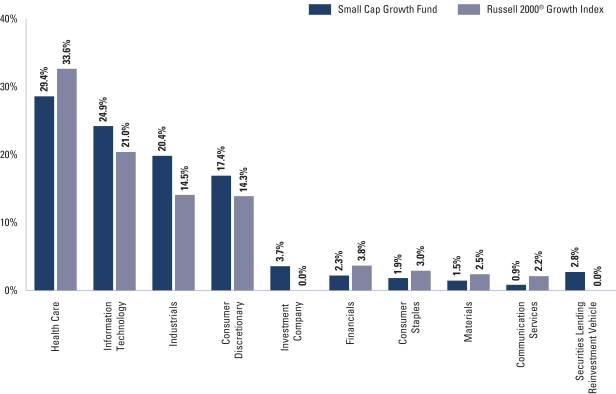

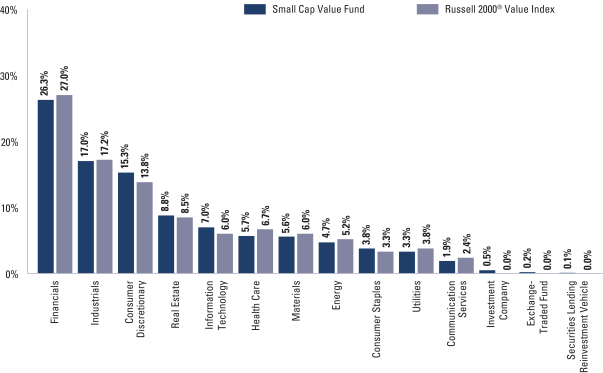

|

| FUND VS. BENCHMARK SECTOR ALLOCATION4 |

|

| As of February 28, 2021 |

| 4 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”); however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

10

FUND BASICS

Small/Mid Cap Growth Fund

as of February 28, 2021

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | |

| | | September 1, 2020–February 28, 2021 | | Fund Total Return

(based on NAV)1 | | | Russell 2500®

Growth Index2 | |

| | Class A | | | 29.47 | % | | | 32.45 | % |

| | Class C | | | 28.97 | | | | 32.45 | |

| | Institutional | | | 29.68 | | | | 32.45 | |

| | Service | | | 29.34 | | | | 32.45 | |

| | Investor | | | 29.63 | | | | 32.45 | |

| | Class R6 | | | 29.65 | | | | 32.45 | |

| | Class R | | | 29.32 | | | | 32.45 | |

| | | Class P | | | 29.69 | | | | 32.45 | |

| 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | | The Russell 2500® Growth Index is an unmanaged index that measures the performance of the small to mid-cap growth segment of the US equity universe. The Russell 2500® Growth Index is constructed to provide a comprehensive and unbiased barometer of the small- to mid-cap growth market. Based on ongoing empirical research of investment manager behavior, the methodology used to determine growth probability approximates the aggregate small- to mid-cap growth manager’s opportunity set. The Russell 2500® Growth Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 2/28/20213 |

| | | |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Generac Holdings, Inc. | | | 2.4 | % | | Electrical Equipment |

| | HubSpot, Inc. | | | 2.2 | | | Software |

| | Guardant Health, Inc. | | | 2.1 | | | Health Care Providers & Services |

| | Zendesk, Inc. | | | 1.8 | | | Software |

| | PerkinElmer, Inc. | | | 1.8 | | | Life Sciences Tools & Services |

| | Bio-Techne Corp. | | | 1.8 | | | Life Sciences Tools & Services |

| | Entegris, Inc. | | | 1.7 | | | Semiconductors & Semiconductor Equipment |

| | Colfax Corp. | | | 1.7 | | | Machinery |

| | Molina Healthcare, Inc. | | | 1.6 | | | Health Care Providers & Services |

| | | Dynatrace, Inc. | | | 1.6 | | | Software |

| 3 | | The top 10 holdings may not be representative of the Fund’s future investments. |

11

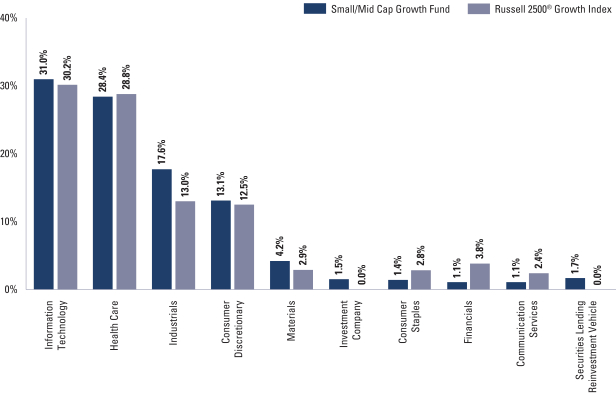

FUND BASICS

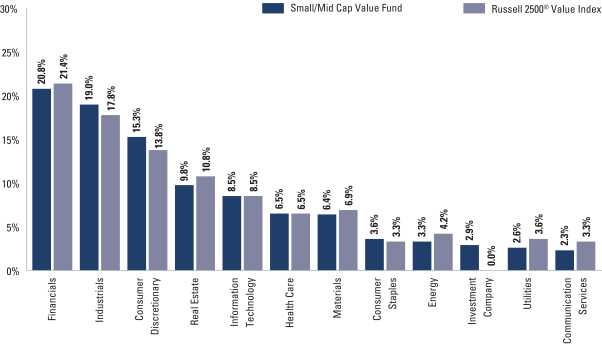

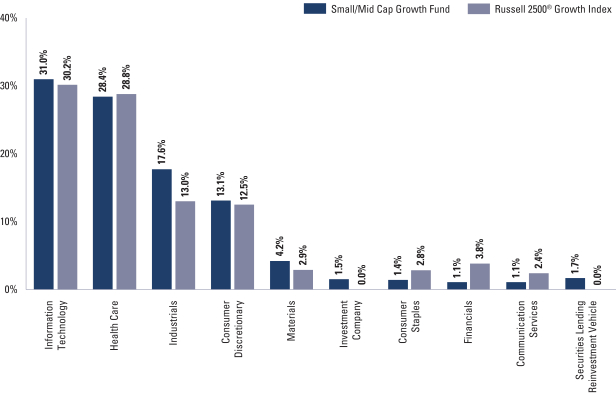

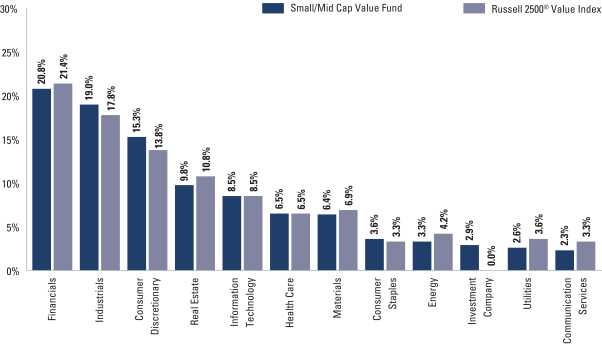

| | |

| | FUND VS. BENCHMARK SECTOR ALLOCATION4 |

| |

| | | As of February 28, 2021 |

| 4 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

12

FUND BASICS

Strategic Growth Fund

as of February 28, 2021

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | |

| | | September 1, 2020–February 28, 2021 | | Fund Total Return

(based on NAV)1 | | | Russell 1000®

Growth Index2 | |

| | Class A | | | 8.26 | % | | | 5.34 | % |

| | Class C | | | 7.93 | | | | 5.34 | |

| | Institutional | | | 8.46 | | | | 5.34 | |

| | Service | | | 8.17 | | | | 5.34 | |

| | Investor | | | 8.31 | | | | 5.34 | |

| | Class R6 | | | 8.42 | | | | 5.34 | |

| | Class R | | | 8.12 | | | | 5.34 | |

| | | Class P | | | 8.42 | | | | 5.34 | |

| 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | | The Russell 1000® Growth Index is an unmanaged index that measures the performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000® Growth Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 2/28/20213 |

| | | |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Apple, Inc. | | | 8.4 | % | | Technology Hardware, Storage & Peripherals |

| | Microsoft Corp. | | | 7.3 | | | Software |

| | Amazon.com, Inc. | | | 5.4 | | | Internet & Direct Marketing Retail |

| | Alphabet, Inc., Class A | | | 4.5 | | | Interactive Media & Services |

| | Visa, Inc., Class A | | | 3.5 | | | IT Services |

| | Facebook, Inc., Class A | | | 3.4 | | | Interactive Media & Services |

| | NVIDIA Corp. | | | 3.1 | | | Semiconductors & Semiconductor Equipment |

| | Alphabet, Inc., Class C | | | 2.7 | | | Interactive Media & Services |

| | Tesla, Inc. | | | 2.6 | | | Automobiles |

| | | PayPal Holdings, Inc. | | | 2.6 | | | IT Services |

| 3 | | The top 10 holdings may not be representative of the Fund’s future investments. |

13

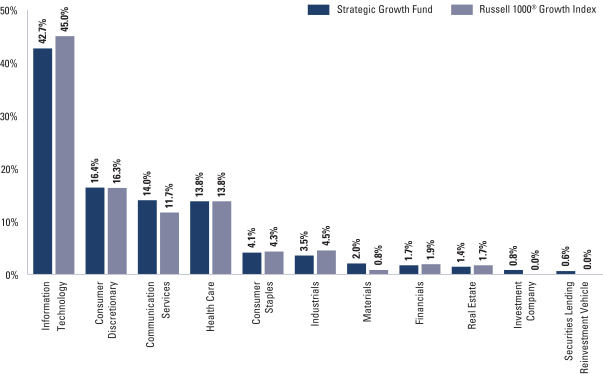

FUND BASICS

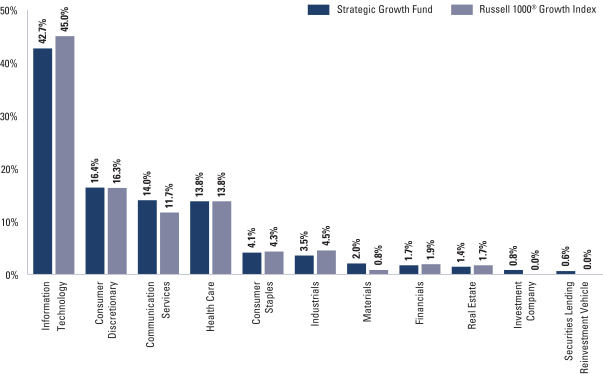

|

| FUND VS. BENCHMARK SECTOR ALLOCATION4 |

|

| As of February 28, 2021 |

| 4 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

14

FUND BASICS

Technology Opportunities Fund

as of February 28, 2021

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | |

| | | September 1, 2020–February 28, 2021 | | Fund Total Return

(based on NAV)1 | | | NASDAQ Composite

Total Return Index2 | |

| | Class A | | | 8.00 | % | | | 12.43 | % |

| | Class C | | | 7.59 | | | | 12.43 | |

| | Institutional | | | 8.14 | | | | 12.43 | |

| | Service | | | 7.85 | | | | 12.43 | |

| | Investor | | | 8.15 | | | | 12.43 | |

| | Class R6 | | | 8.13 | | | | 12.43 | |

| | | |

| | | Class P | | | 8.13 | | | | 12.43 | |

| 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | | The NASDAQ Composite Index includes all domestic and international based common type stocks listed on The NASDAQ Stock Market. The NASDAQ Composite Index is a broad based Index. It is not possible to invest directly in an index. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 2/28/20213 |

| | | |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Microsoft Corp. | | | 8.4 | % | | Software |

| | Alphabet, Inc., Class C | | | 6.1 | | | Interactive Media & Services |

| | Facebook, Inc., Class A | | | 5.3 | | | Interactive Media & Services |

| | Amazon.com, Inc. | | | 4.6 | | | Internet & Direct Marketing Retail |

| | PayPal Holdings, Inc. | | | 4.4 | | | IT Services |

| | Visa, Inc., Class A | | | 4.2 | | | IT Services |

| | Alphabet, Inc., Class A | | | 4.0 | | | Interactive Media & Services |

| | Marvell Technology Group Ltd. | | | 3.0 | | | Semiconductors & Semiconductor Equipment |

| | Apple, Inc. | | | 3.0 | | | Technology Hardware, Storage & Peripherals |

| | | Walt Disney Co. (The) | | | 2.8 | | | Entertainment |

| 3 | | The top 10 holdings may not be representative of the Fund’s future investments. |

15

FUND BASICS

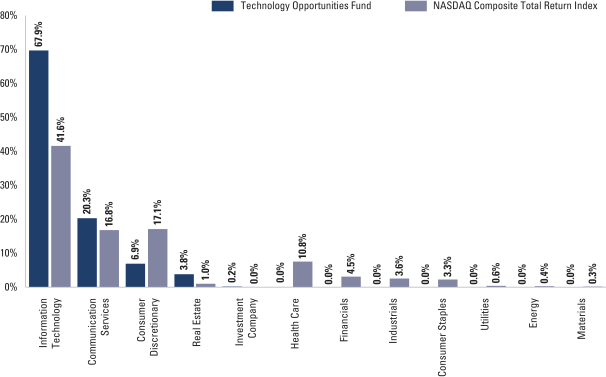

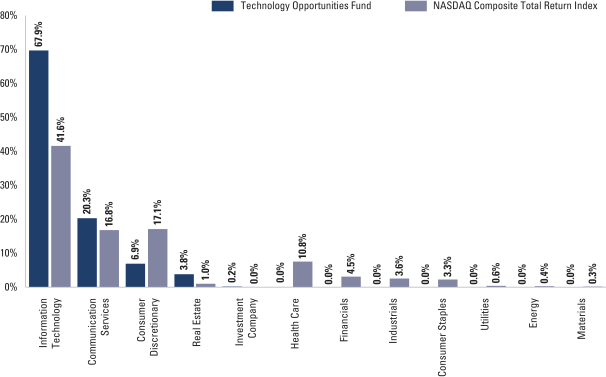

| | |

| | FUND VS. BENCHMARK SECTOR ALLOCATION4 |

| |

| | | As of February 28, 2021 |

| 4 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

16

FUND BASICS

U.S. Equity ESG Fund

as of February 28, 2021

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | |

| | | September 1, 2020–February 28, 2021 | | Fund Total Return

(based on NAV)1 | | | S&P 500®

Index2 | |

| | Class A | | | 12.49 | % | | | 9.74 | % |

| | Class C | | | 12.07 | | | | 9.74 | |

| | Institutional | | | 12.65 | | | | 9.74 | |

| | Investor | | | 12.63 | | | | 9.74 | |

| | Class R6 | | | 12.64 | | | | 9.74 | |

| | Class R | | | 12.37 | | | | 9.74 | |

| | | Class P | | | 12.65 | | | | 9.74 | |

| 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | | The S&P 500® Index is the Standard & Poor’s 500 Composite Index of 500 stocks, an unmanaged index of common stock prices. The S&P 500® Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 2/28/20213 |

| | | |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Microsoft Corp. | | | 6.4 | % | | Software |

| | Apple, Inc. | | | 5.4 | | | Technology Hardware, Storage & Peripherals |

| | Alphabet, Inc., Class A | | | 5.3 | | | Interactive Media & Services |

| | JPMorgan Chase & Co. | | | 3.7 | | | Banks |

| | Visa, Inc., Class A | | | 3.3 | | | IT Services |

| | Walt Disney Co. (The) | | | 3.3 | | | Entertainment |

| | Eli Lilly and Co. | | | 3.1 | | | Pharmaceuticals |

| | American Express Co. | | | 2.7 | | | Consumer Finance |

| | Union Pacific Corp. | | | 2.7 | | | Road & Rail |

| | | NextEra Energy, Inc. | | | 2.6 | | | Electric Utilities |

| 3 | | The top 10 holdings may not be representative of the Fund’s future investments. |

17

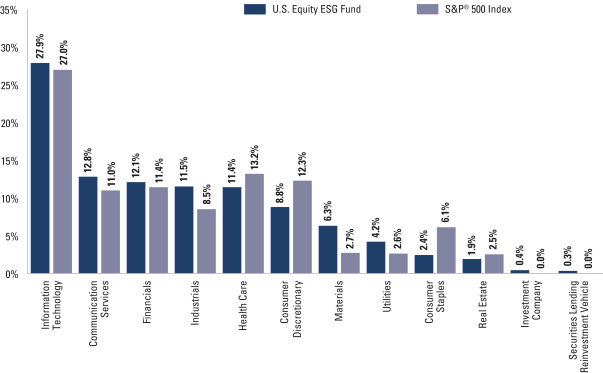

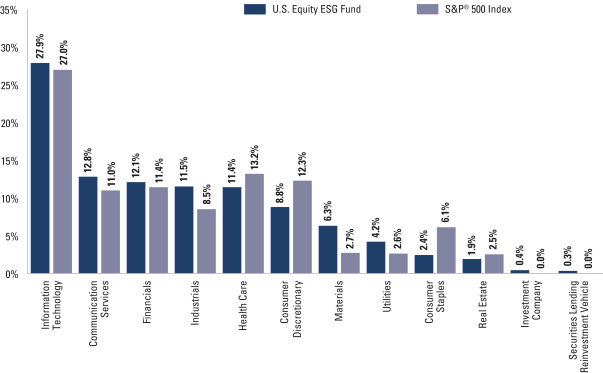

FUND BASICS

|

| FUND VS. BENCHMARK SECTOR ALLOCATION4 |

|

| As of February 28, 2021 |

| 4 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

18

GOLDMAN SACHS CAPITAL GROWTH FUND

Schedule of Investments

February 28, 2021 (Unaudited)

| | | | | | | | |

| Shares | | |

Description | | Value | |

|

| Common Stocks – 97.5% | |

| Aerospace & Defense – 1.4% | |

| | 26,233 | | | Boeing Co. (The)* | | $ | 5,561,658 | |

| | 15,006 | | | HEICO Corp. | | | 1,887,455 | |

| | 26,621 | | | L3Harris Technologies, Inc. | | | 4,842,626 | |

| | 8,576 | | | Northrop Grumman Corp. | | | 2,501,276 | |

| | | | | | | | |

| | | | | | | 14,793,015 | |

| | |

| Airlines – 0.2% | |

| | 45,214 | | | United Airlines Holdings, Inc.* | | | 2,381,874 | |

| | |

| Auto Components – 0.6% | |

| | 42,960 | | | Aptiv PLC* | | | 6,437,126 | |

| | |

| Automobiles – 0.8% | |

| | 11,811 | | | Tesla, Inc.* | | | 7,978,331 | |

| | |

| Banks – 2.4% | |

| | 70,349 | | | JPMorgan Chase & Co. | | | 10,353,262 | |

| | 14,988 | | | M&T Bank Corp. | | | 2,262,289 | |

| | 26,424 | | | Pinnacle Financial Partners, Inc. | | | 2,144,836 | |

| | 9,927 | | | SVB Financial Group* | | | 5,016,709 | |

| | 98,686 | | | Truist Financial Corp. | | | 5,621,154 | |

| | | | | | | | |

| | | | | | | 25,398,250 | |

| | |

| Beverages – 1.8% | |

| | 125,565 | | | Coca-Cola Co. (The) | | | 6,151,429 | |

| | 102,803 | | | Coca-Cola European Partners PLC (United Kingdom) | | | 5,237,813 | |

| | 27,707 | | | Constellation Brands, Inc., Class A | | | 5,933,177 | |

| | 22,387 | | | Monster Beverage Corp.* | | | 1,964,236 | |

| | | | | | | | |

| | | | | | | 19,286,655 | |

| | |

| Biotechnology – 1.6% | |

| | 38,595 | | | ACADIA Pharmaceuticals, Inc.* | | | 1,889,997 | |

| | 17,143 | | | Agios Pharmaceuticals, Inc.* | | | 813,264 | |

| | 8,208 | | | Biogen, Inc.* | | | 2,239,799 | |

| | 21,888 | | | BioMarin Pharmaceutical, Inc.* | | | 1,694,788 | |

| | 105,611 | | | Genmab A/S ADR (Denmark)* | | | 3,577,044 | |

| | 24,567 | | | Ionis Pharmaceuticals, Inc.* | | | 1,287,311 | |

| | 18,636 | | | Neurocrine Biosciences, Inc.* | | | 2,040,828 | |

| | 18,146 | | | Sarepta Therapeutics, Inc.* | | | 1,579,791 | |

| | 10,353 | | | Seagen, Inc.* | | | 1,564,442 | |

| | | | | | | | |

| | | | | | | 16,687,264 | |

| | |

| Building Products – 0.2% | |

| | 16,554 | | | Trane Technologies PLC | | | 2,536,735 | |

| | |

| Capital Markets – 2.5% | |

| | 22,389 | | | Bank of New York Mellon Corp. (The) | | | 943,920 | |

| | 5,193 | | | BlackRock, Inc. | | | 3,606,539 | |

| | 35,181 | | | Charles Schwab Corp. (The) | | | 2,171,371 | |

| | 6,807 | | | CME Group, Inc. | | | 1,359,358 | |

| | 21,277 | | | Intercontinental Exchange, Inc. | | | 2,347,066 | |

| | 140,363 | | | Morgan Stanley | | | 10,789,704 | |

| | 7,279 | | | Northern Trust Corp. | | | 692,451 | |

| | 11,639 | | | Raymond James Financial, Inc. | | | 1,358,737 | |

| | 9,078 | | | S&P Global, Inc. | | | 2,989,930 | |

| | | | | | | | |

| | | | | | | 26,259,076 | |

| | |

|

| Common Stocks – (continued) | |

| Chemicals – 1.9% | |

| | 33,934 | | | Ecolab, Inc. | | | 7,104,422 | |

| | 35,396 | | | Linde PLC (United Kingdom) | | | 8,646,181 | |

| | 7,135 | | | Sherwin-Williams Co. (The) | | | 4,854,226 | |

| | | | | | | | |

| | | | | | | 20,604,829 | |

| | |

| Commercial Services & Supplies – 0.1% | |

| | 5,686 | | | Waste Connections, Inc. | | | 555,465 | |

| | |

| Communications Equipment – 0.9% | |

| | 201,288 | | | Cisco Systems, Inc. | | | 9,031,792 | |

| | |

| Construction Materials – 0.9% | |

| | 26,855 | | | Martin Marietta Materials, Inc. | | | 9,046,644 | |

| | |

| Consumer Finance – 2.2% | |

| | 128,195 | | | American Express Co. | | | 17,339,656 | |

| | 63,904 | | | Discover Financial Services | | | 6,011,449 | |

| | | | | | | | |

| | | | | | | 23,351,105 | |

| | |

| Containers & Packaging – 0.5% | |

| | 63,708 | | | Ball Corp. | | | 5,440,026 | |

| | |

| Diversified Consumer Services – 0.1% | |

| | 7,245 | | | Bright Horizons Family Solutions, Inc.* | | | 1,156,737 | |

| | |

| Diversified Financial Services – 1.4% | |

| | 62,253 | | | Berkshire Hathaway, Inc., Class B* | | | 14,972,469 | |

| | |

| Diversified Telecommunication Services – 0.2% | |

| | 42,696 | | | Verizon Communications, Inc. | | | 2,361,089 | |

| | |

| Electric Utilities – 0.9% | |

| | 118,333 | | | NextEra Energy, Inc. | | | 8,695,109 | |

| | 20,943 | | | Xcel Energy, Inc. | | | 1,227,050 | |

| | | | | | | | |

| | | | | | | 9,922,159 | |

| | |

| Electrical Equipment – 0.3% | |

| | 24,984 | | | Eaton Corp. PLC | | | 3,252,667 | |

| | |

| Electronic Equipment, Instruments & Components – 0.6% | |

| | 49,248 | | | Amphenol Corp., Class A | | | 6,189,489 | |

| | |

| Entertainment – 2.9% | |

| | 21,746 | | | Activision Blizzard, Inc. | | | 2,079,135 | |

| | 24,105 | | | Electronic Arts, Inc. | | | 3,229,347 | |

| | 18,130 | | | Live Nation Entertainment, Inc.* | | | 1,611,032 | |

| | 18,763 | | | Netflix, Inc.* | | | 10,110,442 | |

| | 75,624 | | | Walt Disney Co. (The)* | | | 14,295,961 | |

| | | | | | | | |

| | | | | | | 31,325,917 | |

| | |

| Equity Real Estate Investment Trusts (REITs) – 2.6% | |

| | 23,187 | | | Alexandria Real Estate Equities, Inc. REIT | | | 3,702,732 | |

| | 16,424 | | | American Tower Corp. REIT | | | 3,549,719 | |

| | 29,579 | | | CyrusOne, Inc. REIT | | | 1,941,270 | |

| | 2,124 | | | Equinix, Inc. REIT | | | 1,377,074 | |

| | 21,937 | | | Equity LifeStyle Properties, Inc. REIT | | | 1,352,416 | |

| | 40,139 | | | Healthpeak Properties, Inc. REIT | | | 1,167,644 | |

| | 88,429 | | | Host Hotels & Resorts, Inc. REIT | | | 1,467,037 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 19 |

GOLDMAN SACHS CAPITAL GROWTH FUND

Schedule of Investments (continued)

February 28, 2021 (Unaudited)

| | | | | | | | |

| Shares | | |

Description | | Value | |

|

| Common Stocks – (continued) | |

| Equity Real Estate Investment Trusts (REITs) – (continued) | |

| | 84,773 | | | Invitation Homes, Inc. REIT | | $ | 2,470,285 | |

| | 34,506 | | | Life Storage, Inc. REIT | | | 2,895,053 | |

| | 57,854 | | | Prologis, Inc. REIT | | | 5,731,596 | |

| | 23,394 | | | Welltower, Inc. REIT | | | 1,588,453 | |

| | | | | | | | |

| | | | | | | 27,243,279 | |

| | |

| Food & Staples Retailing – 0.8% | |

| | 66,369 | | | Walmart, Inc. | | | 8,622,661 | |

| | |

| Food Products – 1.2% | |

| | 74,920 | | | McCormick & Co., Inc. | | | 6,314,258 | |

| | 126,020 | | | Mondelez International, Inc., Class A | | | 6,699,223 | |

| | | | | | | | |

| | | | | | | 13,013,481 | |

| | |

| Gas Utilities – 0.2% | |

| | 22,527 | | | Atmos Energy Corp. | | | 1,906,009 | |

| | |

| Health Care Equipment & Supplies – 4.4% | |

| | 245,316 | | | Boston Scientific Corp.* | | | 9,513,355 | |

| | 31,996 | | | Danaher Corp. | | | 7,028,561 | |

| | 37,293 | | | Hologic, Inc.* | | | 2,688,452 | |

| | 22,087 | | | Insulet Corp.* | | | 5,722,742 | |

| | 10,235 | | | Intuitive Surgical, Inc.* | | | 7,541,148 | |

| | 18,816 | | | West Pharmaceutical Services, Inc. | | | 5,280,710 | |

| | 55,203 | | | Zimmer Biomet Holdings, Inc. | | | 9,001,401 | |

| | | | | | | | |

| | | | | | | 46,776,369 | |

| | |

| Health Care Providers & Services – 2.7% | |

| | 128,218 | | | CVS Health Corp. | | | 8,735,492 | |

| | 30,781 | | | Guardant Health, Inc.* | | | 4,530,348 | |

| | 12,501 | | | Humana, Inc. | | | 4,746,005 | |

| | 32,856 | | | UnitedHealth Group, Inc. | | | 10,915,420 | |

| | | | | | | | |

| | | | | | | 28,927,265 | |

| | |

| Health Care Technology – 0.8% | |

| | 118,986 | | | American Well Corp., Class A* | | | 2,911,587 | |

| | 21,036 | | | Veeva Systems, Inc., Class A* | | | 5,892,394 | |

| | | | | | | | |

| | | | | | | 8,803,981 | |

| | |

| Hotels, Restaurants & Leisure – 2.0% | |

| | 33,493 | | | Las Vegas Sands Corp. | | | 2,096,662 | |

| | 41,390 | | | McDonald’s Corp. | | | 8,532,135 | |

| | 19,326 | | | Wyndham Hotels & Resorts, Inc. | | | 1,261,601 | |

| | 32,564 | | | Wynn Resorts Ltd.* | | | 4,289,656 | |

| | 45,897 | | | Yum! Brands, Inc. | | | 4,751,716 | |

| | | | | | | | |

| | | | | | | 20,931,770 | |

| | |

| Household Durables – 0.1% | |

| | 8,907 | | | Lennar Corp., Class A | | | 739,014 | |

| | |

| Household Products – 1.2% | |

| | 105,552 | | | Procter & Gamble Co. (The) | | | 13,038,839 | |

| | |

| Industrial Conglomerates – 1.6% | |

| | 591,899 | | | General Electric Co. | | | 7,422,413 | |

| | 48,200 | | | Honeywell International, Inc. | | | 9,753,270 | |

| | | | | | | | |

| | | | | | | 17,175,683 | |

| | |

|

| Common Stocks – (continued) | |

| Insurance – 1.5% | |

| | 12,818 | | | Allstate Corp. (The) | | | 1,366,399 | |

| | 15,375 | | | American International Group, Inc. | | | 675,731 | |

| | 32,647 | | | Chubb Ltd. | | | 5,307,749 | |

| | 25,209 | | | Globe Life, Inc. | | | 2,354,521 | |

| | 2,412 | | | Markel Corp.* | | | 2,626,186 | |

| | 24,458 | | | Marsh & McLennan Cos., Inc. | | | 2,818,051 | |

| | 3,476 | | | Progressive Corp. (The) | | | 298,762 | |

| | 7,332 | | | Reinsurance Group of America, Inc. | | | 896,190 | |

| | | | | | | | |

| | | | | | | 16,343,589 | |

| | |

| Interactive Media & Services – 6.1% | |

| | 11,288 | | | Alphabet, Inc., Class A* | | | 22,823,320 | |

| | 9,122 | | | Alphabet, Inc., Class C* | | | 18,580,237 | |

| | 77,239 | | | Facebook, Inc., Class A* | | | 19,898,311 | |

| | 45,513 | | | Snap, Inc., Class A* | | | 2,988,384 | |

| | | | | | | | |

| | | | | | | 64,290,252 | |

| | |

| Internet & Direct Marketing Retail – 4.7% | |

| | 14,643 | | | Amazon.com, Inc.* | | | 45,289,774 | |

| | 14,180 | | | Etsy, Inc.* | | | 3,123,429 | |

| | 20,076 | | | Farfetch Ltd., Class A (United Kingdom)* | | | 1,322,607 | |

| | | | | | | | |

| | | | | | | 49,735,810 | |

| | |

| IT Services – 6.5% | |

| | 7,278 | | | Accenture PLC, Class A | | | 1,826,050 | |

| | 15,156 | | | Booz Allen Hamilton Holding Corp. | | | 1,169,134 | |

| | 42,930 | | | Cognizant Technology Solutions Corp., Class A | | | 3,154,496 | |

| | 7,506 | | | EPAM Systems, Inc.* | | | 2,804,317 | |

| | 79,107 | | | Fidelity National Information Services, Inc. | | | 10,916,766 | |

| | 18,477 | | | Fiserv, Inc.* | | | 2,131,692 | |

| | 45,289 | | | International Business Machines Corp. | | | 5,386,221 | |

| | 21,619 | | | Mastercard, Inc., Class A | | | 7,649,883 | |

| | 60,472 | | | PayPal Holdings, Inc.* | | | 15,713,649 | |

| | 3,036 | | | Snowflake, Inc., Class A* | | | 787,963 | |

| | 84,694 | | | Visa, Inc., Class A | | | 17,988,159 | |

| | | | | | | | |

| | | | | | | 69,528,330 | |

| | |

| Leisure Products – 0.2% | |

| | 24,912 | | | Brunswick Corp. | | | 2,201,473 | |

| | |

| Life Sciences Tools & Services – 0.9% | |

| | 12,603 | | | Adaptive Biotechnologies Corp.* | | | 712,952 | |

| | 7,705 | | | Illumina, Inc.* | | | 3,385,654 | |

| | 29,404 | | | PerkinElmer, Inc. | | | 3,707,550 | |

| | 3,318 | | | Thermo Fisher Scientific, Inc. | | | 1,493,366 | |

| | | | | | | | |

| | | | | | | 9,299,522 | |

| | |

| Machinery – 1.5% | |

| | 23,900 | | | Deere & Co. | | | 8,343,968 | |

| | 39,735 | | | Illinois Tool Works, Inc. | | | 8,033,622 | |

| | | | | | | | |

| | | | | | | 16,377,590 | |

| | |

| Media – 0.9% | |

| | 191,271 | | | Comcast Corp., Class A | | | 10,083,807 | |

| | |

| | |

| 20 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS CAPITAL GROWTH FUND

| | | | | | | | |

| Shares | | |

Description | | Value | |

|

| Common Stocks – (continued) | |

| Metals & Mining – 0.2% | |

| | 61,702 | | | Freeport-McMoRan, Inc.* | | $ | 2,092,315 | |

| | |

| Multiline Retail – 0.7% | |

| | 11,766 | | | Dollar General Corp. | | | 2,223,656 | |

| | 47,985 | | | Dollar Tree, Inc.* | | | 4,712,127 | |

| | | | | | | | |

| | | | | | | 6,935,783 | |

| | |

| Multi-Utilities – 0.8% | |

| | 58,493 | | | Ameren Corp. | | | 4,110,303 | |

| | 84,200 | | | CMS Energy Corp. | | | 4,556,062 | |

| | | | | | | | |

| | | | | | | 8,666,365 | |

| | |

| Oil, Gas & Consumable Fuels – 1.7% | |

| | 106,984 | | | Cheniere Energy, Inc.* | | | 7,209,652 | |

| | 78,014 | | | Chevron Corp. | | | 7,801,400 | |

| | 49,477 | | | ConocoPhillips | | | 2,573,299 | |

| | | | | | | | |

| | | | | | | 17,584,351 | |

| | |

| Personal Products – 0.7% | |

| | 27,760 | | | Estee Lauder Cos., Inc. (The), Class A | | | 7,935,474 | |

| | |

| Pharmaceuticals – 3.1% | |

| | 49,000 | | | AstraZeneca PLC ADR (United Kingdom)(a) | | | 2,370,620 | |

| | 181,882 | | | Bristol-Myers Squibb Co. | | | 11,154,823 | |

| | 40,048 | | | Catalent, Inc.* | | | 4,553,858 | |

| | 73,655 | | | Eli Lilly and Co. | | | 15,091,173 | |

| | | | | | | | |

| | | | | | | 33,170,474 | |

| | |

| Professional Services – 0.4% | |

| | 41,242 | | | TransUnion | | | 3,472,989 | |

| | 3,826 | | | Verisk Analytics, Inc. | | | 626,890 | |

| | | | | | | | |

| | | | | | | 4,099,879 | |

| | |

| Road & Rail – 2.0% | |

| | 25,040 | | | Norfolk Southern Corp. | | | 6,311,582 | |

| | 22,404 | | | Old Dominion Freight Line, Inc. | | | 4,811,707 | |

| | 50,878 | | | Union Pacific Corp. | | | 10,478,833 | |

| | | | | | | | |

| | | | | | | 21,602,122 | |

| | |

| Semiconductors & Semiconductor Equipment – 4.5% | |

| | 48,006 | | | Advanced Micro Devices, Inc.* | | | 4,056,987 | |

| | 17,953 | | | KLA Corp. | | | 5,587,512 | |

| | 160,257 | | | Marvell Technology Group Ltd. | | | 7,737,208 | |

| | 24,210 | | | Micron Technology, Inc.* | | | 2,215,941 | |

| | 13,386 | | | NVIDIA Corp. | | | 7,343,292 | |

| | 43,161 | | | NXP Semiconductors NV (Netherlands) | | | 7,879,041 | |

| | 19,137 | | | Taiwan Semiconductor Manufacturing Co. Ltd. ADR (Taiwan) | | | 2,410,114 | |

| | 61,086 | | | Texas Instruments, Inc. | | | 10,523,285 | |

| | | | | | | | |

| | | | | | | 47,753,380 | |

| | |

| Software – 10.0% | |

| | 22,582 | | | Adobe, Inc.* | | | 10,380,268 | |

| | 14,823 | | | Atlassian Corp. PLC, Class A* | | | 3,523,427 | |

| | 18,926 | | | Bill.com Holdings, Inc.* | | | 3,122,979 | |

| | |

|

| Common Stocks – (continued) | |

| Software – (continued) | |

| | 13,185 | | | HubSpot, Inc.* | | | 6,790,275 | |

| | 12,556 | | | Intuit, Inc. | | | 4,898,598 | |

| | 234,260 | | | Microsoft Corp. | | | 54,437,339 | |

| | 14,063 | | | Palo Alto Networks, Inc.* | | | 5,038,913 | |

| | 4,771 | | | Paycom Software, Inc.* | | | 1,785,499 | |

| | 39,255 | | | Qualtrics International, Inc., Class A* | | | 1,491,690 | |

| | 10,017 | | | ServiceNow, Inc.* | | | 5,343,669 | |

| | 23,106 | | | Splunk, Inc.* | | | 3,304,389 | |

| | 23,428 | | | Workday, Inc., Class A* | | | 5,744,077 | |

| | | | | | | | |

| | | | | | | 105,861,123 | |

| | |

| Specialty Retail – 2.1% | |

| | 17,751 | | | Advance Auto Parts, Inc. | | | 2,846,373 | |

| | 4,539 | | | Burlington Stores, Inc.* | | | 1,174,784 | |

| | 29,706 | | | Lowe’s Cos., Inc. | | | 4,745,533 | |

| | 5,563 | | | O’Reilly Automotive, Inc.* | | | 2,488,497 | |

| | 3,759 | | | RH* | | | 1,843,301 | |

| | 40,746 | | | Ross Stores, Inc. | | | 4,752,613 | |

| | 13,751 | | | Ulta Beauty, Inc.* | | | 4,432,360 | |

| | | | | | | | |

| | | | | | | 22,283,461 | |

| | |

| Technology Hardware, Storage & Peripherals – 4.9% | |

| | 428,155 | | | Apple, Inc. | | | 51,918,075 | |

| | |

| Textiles, Apparel & Luxury Goods – 1.5% | |

| | 11,883 | | | Lululemon Athletica, Inc.* | | | 3,703,693 | |

| | 66,706 | | | NIKE, Inc., Class B | | | 8,990,635 | |

| | 34,153 | | | PVH Corp. | | | 3,413,934 | |

| | | | | | | | |

| | | | | | | 16,108,262 | |

| | |

| Water Utilities – 0.4% | |

| | 28,947 | | | American Water Works Co., Inc. | | | 4,107,000 | |

| | |

| Wireless Telecommunication Services – 0.2% | |

| | 21,190 | | | T-Mobile US, Inc.* | | | 2,542,164 | |

| | |

| | TOTAL COMMON STOCKS | |

| | (Cost $605,458,385) | | $ | 1,036,667,666 | |

| | |

| | | | | | | | |

| Shares | | | Dividend

Rate | | Value | |

|

| Investment Company – 0.3%(b) | |

| Goldman Sachs Financial Square Government Fund –

Institutional Shares |

|

| | 3,237,339 | | | 0.036% | | $ | 3,237,339 | |

| | (Cost $3,237,339) | |

| | |

| TOTAL INVESTMENTS BEFORE SECURITIES LENDING

REINVESTMENT VEHICLE |

|

| | (Cost $608,695,724) | | $ | 1,039,905,005 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 21 |

GOLDMAN SACHS CAPITAL GROWTH FUND

Schedule of Investments (continued)

February 28, 2021 (Unaudited)

| | | | | | | | |

| Shares | | | Dividend

Rate | | Value | |

|

| Securities Lending Reinvestment Vehicle – 0.0%(b) | |

| Goldman Sachs Financial Square Government Fund –

Institutional Shares |

|

| | 5,000 | | | 0.036% | | $ | 5,000 | |

| | (Cost $5,000) | |

| | |

| | TOTAL INVESTMENTS – 97.8% | |

| | (Cost $608,700,724) | | $ | 1,039,910,005 | |

| | |

| OTHER ASSETS IN EXCESS OF

LIABILITIES – 2.2% | | | 22,897,634 | |

| | |

| | NET ASSETS – 100.0% | | $ | 1,062,807,639 | |

| | |

| | |

|

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

| |

* | | Non-income producing security. |

| |

(a) | | All or a portion of security is on loan. |

| |

(b) | | Represents an affiliated issuer. |

| | | | |

|

Investment Abbreviations: |

ADR | | —American Depositary Receipt |

PLC | | —Public Limited Company |

REIT | | —Real Estate Investment Trust |

|

| | |

| 22 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS CONCENTRATED GROWTH FUND

Schedule of Investments

February 28, 2021 (Unaudited)

| | | | | | | | |

| Shares | | | Description | |

Value | |

|

| Common Stocks – 98.2% | |

| Aerospace & Defense – 1.3% | |

| | 11,477 | | | Boeing Co. (The)* | | $ | 2,433,239 | |

| | |

| Auto Components – 1.9% | |

| | 23,318 | | | Aptiv PLC* | | | 3,493,969 | |

| | |

| Beverages – 1.4% | |

| | 31,010 | | | Monster Beverage Corp.* | | | 2,720,817 | |

| | |

| Biotechnology – 3.2% | |

| | 24,851 | | | BioMarin Pharmaceutical, Inc.* | | | 1,924,213 | |

| | 61,539 | | | Genmab A/S ADR (Denmark)* | | | 2,084,326 | |

| | 24,315 | | | Sarepta Therapeutics, Inc.* | | | 2,116,864 | |

| | | | | | | | |

| | | | | | | 6,125,403 | |

| | |

| Chemicals – 1.5% | |

| | 13,922 | | | Ecolab, Inc. | | | 2,914,710 | |

| | |

| Entertainment – 4.2% | |

| | 31,484 | | | Live Nation Entertainment, Inc.* | | | 2,797,668 | |

| | 9,696 | | | Netflix, Inc.* | | | 5,224,690 | |

| | | | | | | | |

| | | | | | | 8,022,358 | |

| | |

| Equity Real Estate Investment Trusts (REITs) – 1.9% | |

| | 16,957 | | | American Tower Corp. REIT | | | 3,664,916 | |

| | |

| Food & Staples Retailing – 1.1% | |

| | 16,613 | | | Walmart, Inc. | | | 2,158,361 | |

| | |

| Food Products – 1.1% | |

| | 25,582 | | | McCormick & Co., Inc. | | | 2,156,051 | |

| | |

| Health Care Equipment & Supplies – 5.5% | |

| | 132,291 | | | Boston Scientific Corp.* | | | 5,130,245 | |

| | 12,205 | | | Danaher Corp. | | | 2,681,072 | |

| | 10,120 | | | Insulet Corp.* | | | 2,622,092 | |

| | | | | | | | |

| | | | | | | 10,433,409 | |

| | |

| Health Care Providers & Services – 1.3% | |

| | 6,363 | | | Humana, Inc. | | | 2,415,713 | |

| | |

| Health Care Technology – 1.2% | |

| | 8,114 | | | Veeva Systems, Inc., Class A* | | | 2,272,813 | |

| | |

| Hotels, Restaurants & Leisure – 1.5% | |

| | 13,561 | | | McDonald’s Corp. | | | 2,795,465 | |

| | |

| Interactive Media & Services – 9.5% | |

| | 5,976 | | | Alphabet, Inc., Class A* | | | 12,082,934 | |

| | 2,021 | | | Alphabet, Inc., Class C* | | | 4,116,494 | |

| | 28,098 | | | Snap, Inc., Class A* | | | 1,844,915 | |

| | | | | | | | |

| | | | | | | 18,044,343 | |

| | |

| Internet & Direct Marketing Retail – 4.7% | |

| | 2,850 | | | Amazon.com, Inc.* | | | 8,814,851 | |

| | |

| IT Services – 11.9% | |

| | 31,427 | | | Fidelity National Information Services, Inc. | | | 4,336,926 | |

| | 27,962 | | | PayPal Holdings, Inc.* | | | 7,265,925 | |

| | 7,531 | | | Snowflake, Inc., Class A* | | | 1,954,596 | |

| | |

|

| Common Stocks – (continued) | |

| IT Services – (continued) | |

| | 42,720 | | | Visa, Inc., Class A | | | 9,073,301 | |

| | | | | | | | |

| | | | | | | 22,630,748 | |

| | |

| Life Sciences Tools & Services – 1.5% | |

| | 6,470 | | | Illumina, Inc.* | | | 2,842,983 | |

| | |

| Pharmaceuticals – 3.2% | |

| | 29,170 | | | Eli Lilly and Co. | | | 5,976,641 | |

| | |

| Professional Services – 1.3% | |

| | 14,564 | | | Verisk Analytics, Inc. | | | 2,386,311 | |

| | |

| Road & Rail – 1.7% | |

| | 36,078 | | | CSX Corp. | | | 3,302,941 | |

| | |

| Semiconductors & Semiconductor Equipment – 9.2% | |

| | 122,130 | | | Marvell Technology Group Ltd. | | | 5,896,436 | |

| | 10,806 | | | NVIDIA Corp. | | | 5,927,955 | |

| | 31,061 | | | NXP Semiconductors NV (Netherlands) | | | 5,670,186 | |

| | | | | | | | |

| | | | | | | 17,494,577 | |

| | |

| Software – 14.9% | |

| | 12,061 | | | Adobe, Inc.* | | | 5,544,080 | |

| | 67,260 | | | Microsoft Corp. | | | 15,629,879 | |

| | 17,449 | | | Splunk, Inc.* | | | 2,495,382 | |

| | 18,691 | | | Workday, Inc., Class A* | | | 4,582,659 | |

| | | | | | | | |

| | | | | | | 28,252,000 | |

| | |

| Specialty Retail – 1.5% | |

| | 24,823 | | | Ross Stores, Inc. | | | 2,895,355 | |

| | |

| Technology Hardware, Storage & Peripherals – 7.5% | |

| | 116,698 | | | Apple, Inc. | | | 14,150,799 | |

| | |

| Textiles, Apparel & Luxury Goods – 4.2% | |

| | 7,935 | | | Lululemon Athletica, Inc.* | | | 2,473,181 | |

| | 40,377 | | | NIKE, Inc., Class B | | | 5,442,012 | |

| | | | | | | | |

| | | | | | | 7,915,193 | |

| | |

| | TOTAL COMMON STOCKS | |

| | (Cost $98,335,657) | | $ | 186,313,966 | |

| | |

| | |

| Shares | | | Dividend

Rate | | Value | |

|

| Investment Company – 0.4%(a) | |

| Goldman Sachs Financial Square Government Fund –

Institutional Shares |

|

| | 850,967 | | | 0.036% | | $ | 850,967 | |

| | (Cost $850,967) | |

| | |

| | TOTAL INVESTMENTS – 98.6% | |

| | (Cost $99,186,624) | | $ | 187,164,933 | |

| | |

| OTHER ASSETS IN EXCESS OF

LIABILITIES – 1.4% | | | 2,497,757 | |

| | |

| | NET ASSETS – 100.0% | | $ | 189,662,690 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 23 |

GOLDMAN SACHS CONCENTRATED GROWTH FUND

Schedule of Investments (continued)

February 28, 2021 (Unaudited)

| | |

|

The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

| |

* | | Non-income producing security. |

| |

(a) | | Represents an affiliated issuer. |

| | |

|

Investment Abbreviations: |

ADR | | —American Depositary Receipt |

PLC | | —Public Limited Company |

REIT | | —Real Estate Investment Trust |

|

| | |

| 24 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS FLEXIBLE CAP FUND

Schedule of Investments

February 28, 2021 (Unaudited)

| | | | | | | | |

| Shares | | | Description | |

Value | |

|

| Common Stocks – 98.8% | |

| Automobiles – 1.2% | |

| | 469 | | | Tesla, Inc.* | | $ | 316,810 | |

| | |

| Banks – 5.0% | |

| | 1,595 | | | Bank of America Corp. | | | 55,363 | |

| | 2,779 | | | East West Bancorp, Inc. | | | 200,533 | |

| | 3,579 | | | JPMorgan Chase & Co. | | | 526,721 | |

| | 1,145 | | | M&T Bank Corp. | | | 172,826 | |

| | 389 | | | SVB Financial Group* | | | 196,585 | |

| | 3,520 | | | Truist Financial Corp. | | | 200,499 | |

| | | | | | | | |

| | | | | | | 1,352,527 | |

| | |

| Beverages – 1.8% | |

| | 3,236 | | | Coca-Cola Co. (The) | | | 158,532 | |

| | 2,062 | | | Coca-Cola European Partners PLC (United Kingdom) | | | 105,059 | |

| | 568 | | | Constellation Brands, Inc., Class A | | | 121,631 | |

| | 1,245 | | | Monster Beverage Corp.* | | | 109,236 | |

| | | | | | | | |

| | | | | | | 494,458 | |

| | |

| Biotechnology – 1.6% | |

| | 1,445 | | | BioMarin Pharmaceutical, Inc.* | | | 111,886 | |

| | 3,181 | | | Genmab A/S ADR (Denmark)* | | | 107,741 | |

| | 1,239 | | | Neurocrine Biosciences, Inc.* | | | 135,683 | |

| | 833 | | | Sarepta Therapeutics, Inc.* | | | 72,521 | |

| | | | | | | | |

| | | | | | | 427,831 | |

| | |

| Building Products – 0.6% | |

| | 1,045 | | | Trane Technologies PLC | | | 160,136 | |

| | |

| Capital Markets – 1.7% | |

| | 1,398 | | | Cboe Global Markets, Inc. | | | 138,346 | |

| | 1,462 | | | Raymond James Financial, Inc. | | | 170,674 | |

| | 491 | | | S&P Global, Inc. | | | 161,716 | |

| | | | | | | | |

| | | | | | | 470,736 | |

| | |

| Chemicals – 0.5% | |

| | 693 | | | Ecolab, Inc. | | | 145,086 | |

| | |

| Communications Equipment – 0.9% | |

| | 4,965 | | | Juniper Networks, Inc. | | | 115,585 | |

| | 789 | | | Motorola Solutions, Inc. | | | 138,454 | |

| | | | | | | | |

| | | | | | | 254,039 | |

| | |

| Construction Materials – 0.6% | |

| | 497 | | | Martin Marietta Materials, Inc. | | | 167,424 | |

| | |

| Consumer Finance – 1.5% | |

| | 1,590 | | | American Express Co. | | | 215,063 | |

| | 2,092 | | | Discover Financial Services | | | 196,795 | |

| | | | | | | | |

| | | | | | | 411,858 | |

| | |

| Containers & Packaging – 0.9% | |

| | 1,430 | | | Ball Corp. | | | 122,108 | |

| | 973 | | | Packaging Corp. of America | | | 128,455 | |

| | | | | | | | |

| | | | | | | 250,563 | |

| | |

| Diversified Financial Services – 1.0% | |

| | 1,061 | | | Berkshire Hathaway, Inc., Class B* | | | 255,181 | |

| | |

|

| Common Stocks – (continued) | |

| Diversified Telecommunication Services – 0.9% | |

| | 1,518 | | | AT&T, Inc. | | | 42,337 | |

| | 3,565 | | | Verizon Communications, Inc. | | | 197,145 | |

| | | | | | | | |

| | | | | | | 239,482 | |

| | |

| Electrical Equipment – 1.1% | |

| | 1,351 | | | Eaton Corp. PLC | | | 175,886 | |

| | 542 | | | Rockwell Automation, Inc. | | | 131,858 | |

| | | | | | | | |

| | | | | | | 307,744 | |

| | |

| Electronic Equipment, Instruments & Components – 0.4% | |

| | 3,705 | | | Vontier Corp.* | | | 116,337 | |

| | |

| Energy Equipment & Services – 0.5% | |

| | 5,991 | | | Baker Hughes Co. | | | 146,660 | |

| | |

| Entertainment – 2.1% | |

| | 775 | | | Electronic Arts, Inc. | | | 103,827 | |

| | 151 | | | Netflix, Inc.* | | | 81,366 | |

| | 2,001 | | | Walt Disney Co. (The)* | | | 378,269 | |

| | | | | | | | |

| | | | | | | 563,462 | |

| | |

| Equity Real Estate Investment Trusts (REITs) – 2.6% | |

| | 750 | | | AvalonBay Communities, Inc. REIT | | | 131,812 | |

| | 496 | | | Essex Property Trust, Inc. REIT | | | 126,376 | |

| | 3,303 | | | Invitation Homes, Inc. REIT | | | 96,249 | |

| | 3,030 | | | MGM Growth Properties LLC, Class A REIT | | | 100,051 | |

| | 412 | | | SBA Communications Corp. REIT | | | 105,114 | |

| | 1,311 | | | Simon Property Group, Inc. REIT | | | 148,038 | |

| | | | | | | | |

| | | | | | | 707,640 | |

| | |

| Food & Staples Retailing – 0.9% | |

| | 1,774 | | | Walmart, Inc. | | | 230,478 | |

| | |

| Food Products – 1.3% | |

| | 1,379 | | | Lamb Weston Holdings, Inc. | | | 110,003 | |

| | 1,064 | | | McCormick & Co., Inc. | | | 89,674 | |

| | 2,657 | | | Mondelez International, Inc., Class A | | | 141,246 | |

| | | | | | | | |

| | | | | | | 340,923 | |

| | |

| Health Care Equipment & Supplies – 3.0% | |

| | 4,543 | | | Boston Scientific Corp.* | | | 176,178 | |

| | 1,072 | | | Danaher Corp. | | | 235,486 | |

| | 1,783 | | | Hologic, Inc.* | | | 128,536 | |

| | 461 | | | West Pharmaceutical Services, Inc. | | | 129,380 | |

| | 937 | | | Zimmer Biomet Holdings, Inc. | | | 152,787 | |

| | | | | | | | |

| | | | | | | 822,367 | |

| | |

| Health Care Providers & Services – 3.5% | |

| | 2,208 | | | Centene Corp.* | | | 129,256 | |

| | 2,724 | | | CVS Health Corp. | | | 185,586 | |

| | 378 | | | Humana, Inc. | | | 143,508 | |

| | 992 | | | Quest Diagnostics, Inc. | | | 114,665 | |

| | 1,148 | | | UnitedHealth Group, Inc. | | | 381,389 | |

| | | | | | | | |

| | | | | | | 954,404 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 25 |

GOLDMAN SACHS FLEXIBLE CAP FUND

Schedule of Investments (continued)

February 28, 2021 (Unaudited)

| | | | | | | | |

| Shares | | | Description | |

Value | |

|

| Common Stocks – (continued) | |

| Health Care Technology – 0.5% | |

| | 463 | | | Veeva Systems, Inc., Class A* | | $ | 129,691 | |

| | |

| Hotels, Restaurants & Leisure – 2.1% | |

| | 2,384 | | | Las Vegas Sands Corp. | | | 149,239 | |

| | 1,245 | | | McDonald’s Corp. | | | 256,644 | |

| | 1,451 | | | Yum! Brands, Inc. | | | 150,222 | |

| | | | | | | | |

| | | | | | | 556,105 | |

| | |

| Household Durables – 0.6% | |

| | 1,900 | | | Lennar Corp., Class A | | | 157,643 | |

| | |

| Household Products – 1.6% | |

| | 1,258 | | | Church & Dwight Co., Inc. | | | 99,067 | |

| | 2,662 | | | Procter & Gamble Co. (The) | | | 328,837 | |

| | | | | | | | |

| | | | | | | 427,904 | |

| | |

| Independent Power and Renewable Electricity Producers – 0.6% | |

| | 5,698 | | | AES Corp. (The) | | | 151,339 | |

| | |

| Industrial Conglomerates – 0.8% | |

| | 1,106 | | | Honeywell International, Inc. | | | 223,799 | |

| | |

| Insurance – 2.1% | |

| | 1,320 | | | Allstate Corp. (The) | | | 140,712 | |

| | 1,564 | | | American Financial Group, Inc. | | | 166,879 | |

| | 1,323 | | | Globe Life, Inc. | | | 123,568 | |

| | 2,872 | | | Hartford Financial Services Group, Inc. (The) | | | 145,582 | |

| | | | | | | | |

| | | | | | | 576,741 | |

| | |

| Interactive Media & Services – 6.7% | |

| | 310 | | | Alphabet, Inc., Class A* | | | 626,792 | |

| | 249 | | | Alphabet, Inc., Class C* | | | 507,178 | |

| | 2,261 | | | Facebook, Inc., Class A* | | | 582,479 | |

| | 670 | | | Match Group, Inc.* | | | 102,410 | |

| | | | | | | | |

| | | | | | | 1,818,859 | |

| | |

| Internet & Direct Marketing Retail – 4.6% | |

| | 398 | | | Amazon.com, Inc.* | | | 1,230,986 | |

| | |

| IT Services – 5.3% | |

| | 529 | | | Accenture PLC, Class A | | | 132,726 | |

| | 1,293 | | | Booz Allen Hamilton Holding Corp. | | | 99,742 | |

| | 2,084 | | | Cognizant Technology Solutions Corp., Class A | | | 153,132 | |

| | 1,274 | | | Fidelity National Information Services, Inc. | | | 175,812 | |

| | 1,902 | | | International Business Machines Corp. | | | 226,205 | |

| | 370 | | | Mastercard, Inc., Class A | | | 130,925 | |

| | 400 | | | PayPal Holdings, Inc.* | | | 103,940 | |

| | 1,975 | | | Visa, Inc., Class A | | | 419,470 | |

| | | | | | | | |

| | | | | | | 1,441,952 | |

| | |

| Leisure Products – 0.5% | |

| | 1,443 | | | Brunswick Corp. | | | 127,518 | |

| | |

| Life Sciences Tools & Services – 1.5% | |

| | 125 | | | Mettler-Toledo International, Inc.* | | | 139,506 | |

| | 938 | | | PerkinElmer, Inc. | | | 118,272 | |

| | |

|

| Common Stocks – (continued) | |

| Life Sciences Tools & Services – (continued) | |

| | 1,060 | | | PRA Health Sciences, Inc.* | | | 156,255 | |

| | | | | | | | |

| | | | | | | 414,033 | |

| | |

| Machinery – 3.1% | |

| | 607 | | | Cummins, Inc. | | | 153,692 | |

| | 2,091 | | | Fortive Corp. | | | 137,630 | |

| | 1,833 | | | Graco, Inc. | | | 127,119 | |

| | 656 | | | IDEX Corp. | | | 128,031 | |

| | 766 | | | Illinois Tool Works, Inc. | | | 154,870 | |

| | 1,667 | | | ITT, Inc. | | | 138,328 | |

| | | | | | | | |

| | | | | | | 839,670 | |

| | |

| Media – 1.5% | |

| | 5,805 | | | Comcast Corp., Class A | | | 306,040 | |

| | 2,174 | | | Liberty Media Corp.-Liberty SiriusXM, Class A* | | | 96,547 | |

| | | | | | | | |

| | | | | | | 402,587 | |

| | |

| Metals & Mining – 0.6% | |

| | 4,733 | | | Freeport-McMoRan, Inc.* | | | 160,496 | |

| | |

| Multiline Retail – 0.5% | |

| | 739 | | | Dollar General Corp. | | | 139,664 | |

| | |

| Multi-Utilities – 1.6% | |

| | 1,399 | | | Ameren Corp. | | | 98,308 | |

| | 1,836 | | | CMS Energy Corp. | | | 99,346 | |

| | 2,229 | | | Public Service Enterprise Group, Inc. | | | 119,987 | |

| | 985 | | | Sempra Energy | | | 114,240 | |

| | | | | | | | |

| | | | | | | 431,881 | |

| | |

| Oil, Gas & Consumable Fuels – 2.2% | |

| | 1,852 | | | Cheniere Energy, Inc.* | | | 124,806 | |

| | 2,825 | | | Chevron Corp. | | | 282,500 | |

| | 2,152 | | | Phillips 66 | | | 178,724 | |

| | | | | | | | |

| | | | | | | 586,030 | |

| | |

| Personal Products – 0.6% | |

| | 577 | | | Estee Lauder Cos., Inc. (The), Class A | | | 164,941 | |

| | |

| Pharmaceuticals – 2.8% | |

| | 4,293 | | | Bristol-Myers Squibb Co. | | | 263,290 | |

| | 1,325 | | | Eli Lilly and Co. | | | 271,479 | |

| | 1,403 | | | Johnson & Johnson | | | 222,319 | |

| | | | | | | | |

| | | | | | | 757,088 | |

| | |

| Professional Services – 0.5% | |

| | 797 | | | Verisk Analytics, Inc. | | | 130,588 | |

| | |

| Road & Rail – 1.2% | |

| | 1,998 | | | CSX Corp. | | | 182,917 | |

| | 607 | | | Old Dominion Freight Line, Inc. | | | 130,365 | |

| | | | | | | | |

| | | | | | | 313,282 | |

| | |

| Semiconductors & Semiconductor Equipment – 3.5% | |

| | 1,275 | | | Intel Corp. | | | 77,495 | |

| | 1,082 | | | Microchip Technology, Inc. | | | 165,146 | |

| | 868 | | | MKS Instruments, Inc. | | | 143,133 | |

| | |

| | |

| 26 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS FLEXIBLE CAP FUND

| | | | | | | | |

| Shares | | | Description | |

Value | |

|

| Common Stocks – (continued) | |

| Semiconductors & Semiconductor Equipment – (continued) | |

| | 271 | | | NVIDIA Corp. | | $ | 148,665 | |

| | 899 | | | NXP Semiconductors NV (Netherlands) | | | 164,112 | |

| | 1,492 | | | Texas Instruments, Inc. | | | 257,027 | |

| | | | | | | | |

| | | | | | | 955,578 | |

| | |

| Software – 10.0% | |

| | 613 | | | Adobe, Inc.* | | | 281,778 | |

| | 1,230 | | | Cadence Design Systems, Inc.* | | | 173,541 | |

| | 571 | | | Intuit, Inc. | | | 222,770 | |

| | 6,909 | | | Microsoft Corp. | | | 1,605,513 | |

| | 416 | | | Palo Alto Networks, Inc.* | | | 149,057 | |

| | 989 | | | Proofpoint, Inc.* | | | 119,590 | |

| | 182 | | | salesforce.com, Inc.* | | | 39,403 | |

| | 464 | | | Workday, Inc., Class A* | | | 113,763 | |

| | | | | | | | |

| | | | | | | 2,705,415 | |

| | |

| Specialty Retail – 2.7% | |

| | 713 | | | Advance Auto Parts, Inc. | | | 114,330 | |

| | 424 | | | Home Depot, Inc. (The) | | | 109,536 | |

| | 1,303 | | | Lowe’s Cos., Inc. | | | 208,154 | |

| | 343 | | | O’Reilly Automotive, Inc.* | | | 153,434 | |

| | 408 | | | Ulta Beauty, Inc.* | | | 131,511 | |

| | | | | | | | |

| | | | | | | 716,965 | |

| | |

| Technology Hardware, Storage & Peripherals – 6.6% | |

| | 13,216 | | | Apple, Inc. | | | 1,602,572 | |

| | 2,727 | | | NetApp, Inc. | | | 170,710 | |

| | | | | | | | |

| | | | | | | 1,773,282 | |

| | |

| Trading Companies & Distributors – 0.5% | |

| | 2,956 | | | Fastenal Co. | | | 137,070 | |

| | |

| Water Utilities – 0.4% | |

| | 825 | | | American Water Works Co., Inc. | | | 117,051 | |

| | |

| | TOTAL COMMON STOCKS | |

| | (Cost $18,027,218) | | $ | 26,724,304 | |