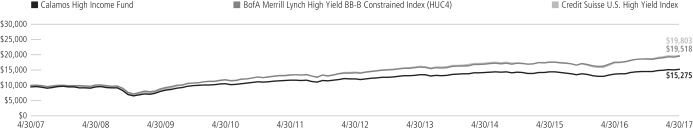

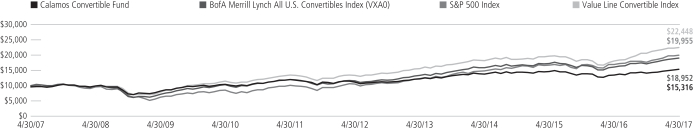

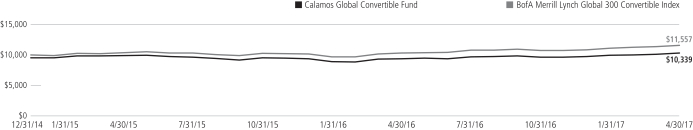

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

INVESTMENT COMPANY ACT FILE NUMBER: | | 811-05443 |

| |

| EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER: | | Calamos Investment Trust |

| |

ADDRESS OF PRINCIPAL EXECUTIVE OFFICES: | | 2020 Calamos Court, Naperville Illinois 60563-2787 |

| |

NAME AND ADDRESS OF AGENT FOR SERVICE: | | John P Calamos, Sr., President, Calamos Advisors LLC 2020 Calamos Court, Naperville, Illinois 60563-2787 |

REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE: (630) 245-7200

DATE OF FISCAL YEAR END: October 31, 2017

DATE OF REPORTING PERIOD: November 1, 2016 through April 30, 2017

Item 1. Report to Shareholders

Experience and Foresight

About Calamos Investments

For 40 years, we have helped investors like you manage and build wealth to meet long-term objectives. Because investors have different time horizons, risk tolerances and goals, we offer funds to suit a variety of asset allocation needs. Our 16 mutual funds include equity, fixed income, convertible and alternative funds. We offer U.S. funds as well as global and international choices.

We are dedicated to helping our clients build and protect wealth. We understand when you entrust us with your assets, you also entrust us with your achievements, goals and aspirations. We believe we best honor this trust by making investment decisions guided by integrity, discipline and our conscientious research.

We believe an active, risk-conscious approach is essential for wealth creation. In the 1970s, we pioneered the use of convertible securities as a means to control risk in volatile markets. We followed with strategies that combine convertibles and stocks, with the aim of participating in equity market upside with potentially less volatility than an all-stock portfolio. In the 1990s, we introduced our first stock fund, which invests in growth companies both large and small. Across our funds, our investment process seeks to manage risk at multiple levels and draws upon our experience investing through many market cycles. In a rapidly changing environment, we believe that this active management is essential.

We are global in our perspective. We believe globalization offers tremendous opportunities for countries and companies all over the world. In our U.S., global and international portfolios, we are seeking to capitalize on the potential growth of the global economy.

We believe there are opportunities in all markets. Our history traces back to the 1970s, a period of significant volatility and economic concerns. We have invested through multiple market cycles, each with its own challenges. Out of this experience comes our belief that the flipside of volatility is opportunity.

Letter to Shareholders

JOHN P. CALAMOS, SR.

Founder, Chairman and Global CIO

Dear Fellow Shareholder:

Welcome to your semiannual report for the six-month period ended April 30, 2017. In this report, you will find commentary from the Calamos portfolio management teams, as well as a listing of portfolio holdings, financial statements and highlights, and detailed information about the performance and positioning of the Calamos Funds. I encourage you to review this information carefully.

Market Review

During the semiannual period, investors were encouraged by the prospect of increased fiscal policy, generally improving economic data, globally accommodative monetary policy and a weakening dollar. Against this backdrop, equity markets around the world advanced. The MSCI World Index, a measure of developed market equity performance, returned 12.44%, while the S&P 500 Index, a measure of the U.S. market advanced even further, gaining 13.32%. Emerging market equities also rallied, gaining 9.03% based on the MSCI Emerging Markets Index. Convertible securities, which combine attributes of stocks and bonds, participated in the upside performance of the equity markets. The U.S. focused BofA Merrill Lynch All U.S. Convertibles ex-Mandatory Index returned 11.28%, while the BofA Merrill Lynch Global 300 Convertible Index advanced 7.44%.

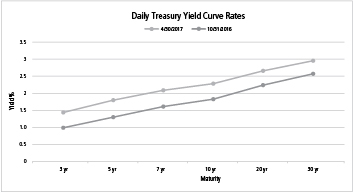

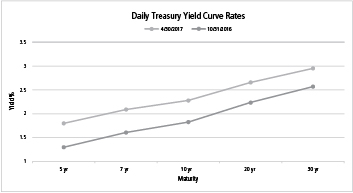

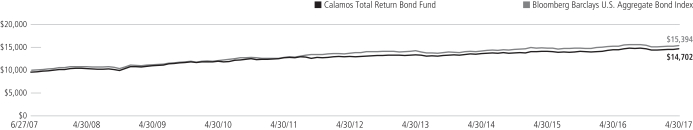

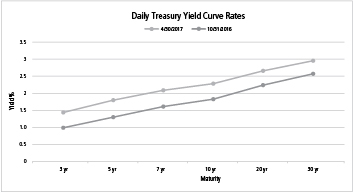

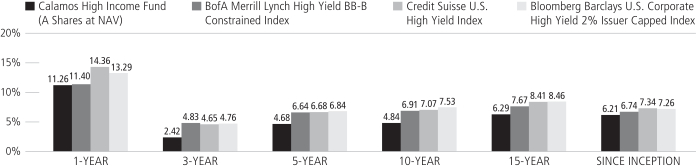

As the Federal Reserve continued tightening short-term rates, investor enthusiasm for fixed income securities waned. Still, there were opportunities within the fixed income markets. Although the government and investment-grade corporate bond markets inched into negative territory for the period, as measured by a -0.67% return for the Bloomberg Barclays U.S. Aggregate Bond Index, high-yield securities benefited from their equity sensitivity and market participants’ continued quest for income, as demonstrated by the Credit Suisse U.S. High Yield Index’s gain of 5.64%.

Outlook

We expect sustained and balanced global economic growth to continue, supported by favorable economic trends in the United States, Europe, and many emerging markets. A stabilizing dollar, contained inflation, and an increased emphasis on fiscal policy—most notably but not exclusively in the United States—can provide tailwinds to sustain economic growth. These conditions also set the stage for additional stock market upside, particularly in growth areas of the market.

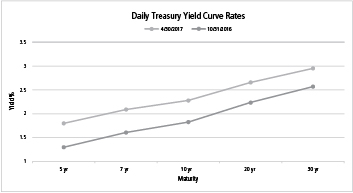

Letter to Shareholders

We expect the Federal Reserve to continue gradually tightening short-term rates. Many investors have been conditioned to think of any rate increase in negative terms, but we believe controlled rate increases made in response to improving economic conditions should be viewed more positively. For example, a more normal rate environment can provide incentives for banks to lend capital to smaller businesses, a key engine of job growth.

While we have a constructive outlook on the global economy and equity markets, we are vigilant to the crosscurrents of a highly politically charged environment, both in the U.S. and globally. Further, although pro-growth policies offer tremendous potential, fiscal policy takes time to implement and work through the economy. We expect volatility in the markets due to these factors, as well as longer-standing geopolitical concerns and conflicts.

Drawing on our collective experience navigating upside opportunity and downside risk, our investment organization believes the Calamos Funds are well positioned. As you will read in the investment manager commentaries, we continue to identify opportunities across the global markets. We see considerable potential for growth equities, as economic conditions continue to improve around the world. We also believe convertible securities remain an attractive diversification tool, as they have tended to demonstrate greater resilience to rising interest rates than traditional bonds, as well as resilience during equity market volatility. Finally, although rising interest rates are likely to create headwinds for some areas of the bond market, longer-term rates have remained well behaved and are unlikely to soar. In this environment, we believe there are opportunities for active managers in select segments, including in high yield.

Conclusion

As the saying goes, every bull market climbs a wall of worry. In other words, opportunity and volatility always go hand in hand. Even upward-moving markets see their share of shorter-term downturns and at times, corrections. When retracements occur, I encourage investors to maintain a long-term focus and rely on their financial advisors. A financial advisor can help align your asset allocation with the opportunities in the global markets as well as your risk tolerance and goals.

In closing, thank you for the trust you have placed in Calamos Investments to help you achieve your financial goals. We are honored to serve you. I invite you to visit our website, www.calamos.com, on an ongoing basis. You will find many resources, including blogs and videos from our investment team and thought leadership pieces.

Sincerely,

John P. Calamos, Sr.

Founder, Chairman and Global Chief Investment Officer

| | | | |

| 2 | | CALAMOS OPEN-END FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Letter to Shareholders

Before investing, carefully consider a fund’s investment objectives, risks, charges and expenses. Please see the prospectus containing this and other information or call 800.582.6959. Please read the prospectus carefully. Performance data represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted.

The MSCI World Index is a market-capitalization weighted index composed of companies representative of the market structure of developed market countries in North America, Europe and the Asia/Pacific region. The S&P 500 Index is an unmanaged index generally considered representative of the U.S. stock market. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index considered broadly representative of emerging market equity performance. The index represents companies within the constituent emerging markets that are available to investors worldwide. The BofA Merrill Lynch All U.S. Convertibles ex-Mandatory Index represents the U.S. convertible securities market excluding mandatory convertibles. The BofA Merrill Lynch Global 300 Convertible Index is a global convertible index composed of companies representative of the market structure of countries in North America, Europe and the Asia/Pacific region. The Credit Suisse U.S. High Yield Index is an unmanaged index of high yield debt securities. The Bloomberg Barclays U.S. Aggregate Bond Index is considered generally representative of the investment-grade bond market. Sources: Lipper, Inc. and Morningstar, Inc.

Unmanaged index returns assume reinvestment of any and all distributions and, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index. Investments in overseas markets pose special risks, including currency fluctuation and political risks. These risks are generally intensified for investments in emerging markets. Countries, regions, and sectors mentioned are presented to illustrate countries, regions, and sectors in which a fund may invest. Fund holdings are subject to change daily. The Funds are actively managed.

The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to accuracy or completeness, has been obtained from sources we believe to be reliable. There are certain risks involved with investing in convertible securities in addition to market risk, such as call risk, dividend risk, liquidity risk and default risk, that should be carefully considered prior to investing. This information is being provided for informational purposes only and should not be considered investment advice or an offer to buy or sell any security in the portfolio. Investments in alternative strategies may not be suitable for all investors.

This report is intended for informational purposes only and should not be considered investment advice.

Calamos Growth Fund

OVERVIEW

The fund invests in the equities of U.S. companies from a range of market capitalizations that we believe offer the best potential for growth.

KEY FEATURES

| | ◾ | | Utilizes more than two decades of extensive research experience in growth investing | |

| | ◾ | | Active management focuses on top-down views and bottom-up fundamentals | |

| | ◾ | | Research-driven approach identifies opportunities by combining top-down analysis with a focus on key growth characteristics | |

PORTFOLIO FIT

This actively managed fund seeks to provide attractive returns through its emphasis on higher growth companies primarily in large and mid cap arenas.

| | |

| FUND NASDAQ SYMBOLS |

A Shares | | CVGRX |

B Shares | | CVGBX |

C Shares | | CVGCX |

I Shares | | CGRIX |

R Shares | | CGRRX |

T Shares | | CVGTX |

|

| FUND CUSIP NUMBERS |

A Shares | | 128119302 |

B Shares | | 128119740 |

C Shares | | 128119856 |

I Shares | | 128119807 |

R Shares | | 128119435 |

T Shares | | 128120623 |

CALAMOS GROWTH FUND

INVESTMENT TEAM DISCUSSION

How has the Fund performed?

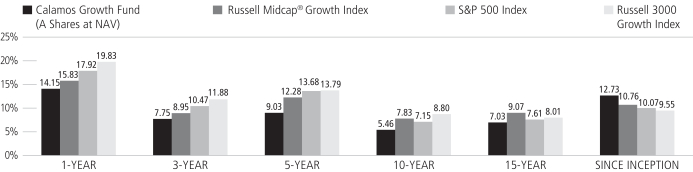

For the six-month period ended April 30, 2017, Calamos Growth Fund gained 12.22% (Class A shares at net asset value), versus a 15.47% gain for the Russell 3000 Growth Index. For the same period, the S&P 500 Index rose 13.32% and the Russell Midcap Growth Index gained 13.59%.

The U.S. equity market rallied strongly during the six-month period on the heels of the November election results. Pre- and post-election, President Trump discussed plans to reduce regulations, overhaul health care, decrease taxes, re-patriate overseas cash holdings and spur further infrastructure projects. Many have referred to the market’s rally as the “Trump Trade,” referencing the initial success of stocks for businesses that stand to gain from these proposals.

However, after a brief selloff in the beginning of November, the market actually started to rally ahead of the U.S. election. Perhaps the U.S. equity market rally was more a reflection of improving economic conditions, highlighted in employment data, consumer confidence, and housing data, to name a few. Toward the latter stages of the reporting period, the market rotated away from the “Trump Trade” while still moving higher and providing strong returns for investors.

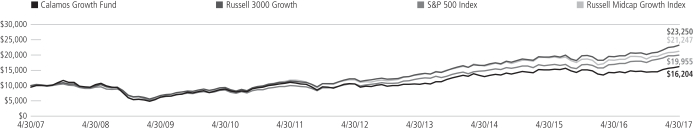

Since its inception on September 4, 1990, the Fund has returned 12.73% on an annualized basis (Class A shares at net asset value). We believe this demonstrates the Fund’s ability to outdistance the growth and broad indices over full market cycles. Over the same period, the Russell 3000 Growth Index returned 9.55%, while the S&P 500 Index and the Russell Midcap Growth Index returned 10.07% and 10.76%, respectively.

What factors influenced performance over the period?

The Fund’s overall conservative positioning led the Fund to lag the Russell 3000 Growth Index for the six-month period. While the Fund delivered strong absolute returns, the Fund lagged in the early stages of the period when deep cyclical stocks and more value-oriented names drove benchmark returns. Fund management at the time had a more cautious view of market and economic potential and thought the election would likely add more volatility to U.S. equity markets.

The Fund’s selection in information technology hindered performance. Holdings within semiconductors lagged those of the benchmark, and an underweight to that more cyclically oriented industry also detracted from relative performance. Selection within data processing also hindered relative performance. The Fund maintains a generous-but-selective investment to high-quality tech names. Our technology sector positioning reflects our positive view of the Internet and software industry and our selective view within the hardware and semiconductor industries.

Selection in financials also weighed on relative performance, as regional bank holdings and consumer finance names underperformed. The Fund has selectively increased investment in financials, as an improving economy and easing regulatory pressures should provide support for the businesses.

| | | | |

| 4 | | CALAMOS OPEN-END FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos Growth Fund

Health care selections were additive to the Fund’s relative performance as holdings within the pharmaceuticals and biotechnology industries strongly outperformed those of the benchmark. The Fund has a relatively neutral stance to benchmark weightings in health care, as the sector needs to tackle the problems of excessive costs. The good news is the sector is highly diverse, allowing for selective opportunities.

An underweight to consumer staples holdings was also beneficial to the Fund’s relative performance. Consumer staples significantly lagged the overall market and Fund management continues to believe the sector is broadly expensive relative to growth potential.

How is the Fund positioned?

In this all-cap growth equity Fund, we seek to invest in U.S. companies that we believe have the best prospects for sustainable and high relative growth. The Fund offers a diversified approach and participates in long-term growth trends by focusing on companies with solid fundamentals, global brands, and strong growth catalysts, while being mindful of valuations.

Information technology continues to be the Fund’s largest sector weight, but is only a modest overweight relative to the benchmark. The sector represents quite a diverse group of industries, and we have been selective in looking for those businesses that offer a compelling combination of higher-growth potential, strong balance sheets, and relatively attractive valuations. We also hold an overweight to financials as we are enthusiastic about the prospects for growth and the sector remains a relatively small percentage of the growth index. Financials may offer faster growth than other areas of the market and stand to gain with an improving economy and deregulation.

The Fund remains underweight to consumer staples, as we have been wary of the perceived safety trade and yield trade, which seemingly have driven the market over the past few years. The Fund holds a modest underweight within health care as political risks could potentially punish portions of that sector with either the prospect of reduced utilization due to changes to federal health care laws or onerous pricing regulations for biotechnology companies. As mentioned previously, health care must also contend with escalating costs.

What closing thoughts do you have for Fund shareholders?

We are constructive on the U.S. equity market given our view that the U.S. economy appears positioned for measured expansion with growth picking up steam as the year progresses. The equity market’s gains do not appear overly enthusiastic in our view, because they are underpinned by stronger earnings and sales growth, which the market hasn’t seen in many years. We also believe that the potent mix of potential tax reform and less regulation has yet to be fully priced into U.S. equities, offering further support for the U.S. equity market. In that sense, the “Trump Trade” may not be over and the Fund has accordingly increased cyclical growth opportunities while maintaining investments in higher, secular growth businesses. As global growth improves and central banks around the world look to synchronize their efforts toward normalization of interest rate policy, U.S. businesses and U.S. equities may yet see further support.

| | | | |

| SECTOR WEIGHTINGS | |

Information Technology | | | 34.2 | % |

Consumer Discretionary | | | 19.9 | |

Industrials | | | 14.6 | |

Health Care | | | 12.5 | |

Financials | | | 9.1 | |

Consumer Staples | | | 3.6 | |

Materials | | | 2.8 | |

Energy | | | 2.4 | |

Sector weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad-based index hedging securities the Fund may hold.

Calamos Growth Fund

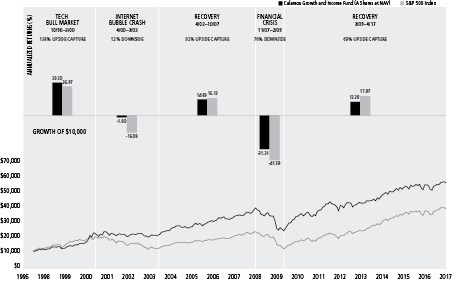

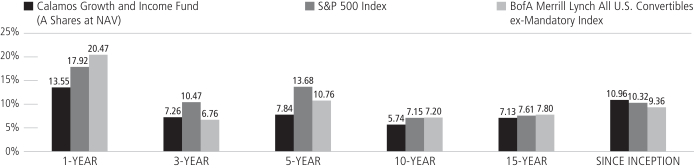

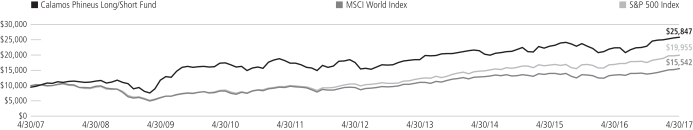

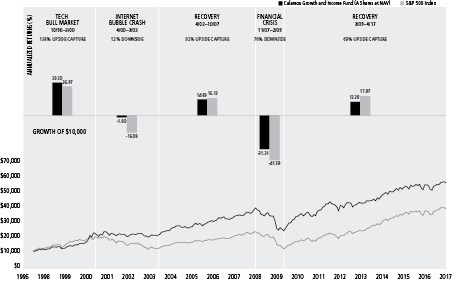

ANNUALIZED RETURN: SINCE INCEPTION (9/4/90) THROUGH 4/30/17

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted.

The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by visiting www.calamos.com. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. Performance is for the Fund’s Class A shares at net asset value and does not include the Fund’s maximum front-end sales charge of 4.75%. Had it been included, the Fund’s return would have been lower. The Fund also offers Class B, Class C, Class I and Class R shares, the performance of which may vary. Source: State Street Corporation and Lipper, Inc.

| | | | |

| 6 | | CALAMOS OPEN-END FAMILY OF FUNDS SEMIANNUAL REPORT | | |

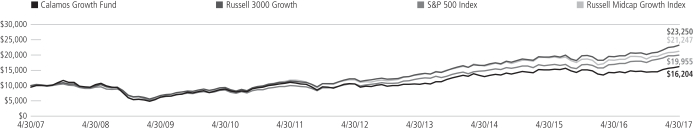

Calamos Growth Fund

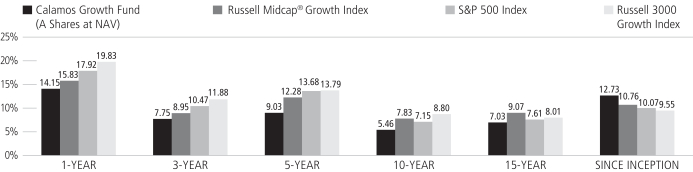

GROWTH OF $10,000: FOR THE 10-YEAR PERIOD ENDED 4/30/17

AVERAGE ANNUAL TOTAL RETURN† AS OF 4/30/17

| | | | | | | | | | | | | | | | | | | | |

| | | 6

MONTHS | | 1

YEAR | | 5

YEARS | | 10 YEARS OR ^SINCE

INCEPTION |

Class A Shares – Inception 9/4/90 | | | | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 12.22 | % | | | | 14.15 | % | | | | 9.03 | % | | | | 5.46 | % |

With Sales Charge | | | | 6.90 | | | | | 8.72 | | | | | 7.97 | | | | | 4.94 | |

Class B Shares – Inception 9/11/00 | | | | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 11.80 | | | | | 13.30 | | | | | 8.21 | | | | | 4.83 | |

With Sales Charge | | | | 6.80 | | | | | 8.30 | | | | | 8.05 | | | | | 4.83 | |

Class C Shares – Inception 9/3/96 | | | | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 11.80 | | | | | 13.30 | | | | | 8.21 | | | | | 4.67 | |

With Sales Charge | | | | 10.80 | | | | | 12.30 | | | | | 8.21 | | | | | 4.67 | |

Class I Shares – Inception 9/18/97 | | | | 12.36 | | | | | 14.44 | | | | | 9.30 | | | | | 5.72 | |

Class R Shares – Inception 3/1/07 | | | | 12.08 | | | | | 13.88 | | | | | 8.76 | | | | | 5.20 | |

Class T Shares – Inception 2/28/17 | | | | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | | | | | | | | | | | | | | | 2.88 | ^ |

With Sales Charge | | | | | | | | | | | | | | | | | | | 0.31 | ^ |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

As of the prospectus dated 2/28/17, the Fund’s gross expense ratio for Class A shares is 1.35%; Class B and C shares is 2.10%; Class I shares is 1.10%; Class R shares is 1.60%; Class T shares is 1.35%. The expense ratios shown above may differ from the more recent expense ratios reported in the Financial Highlights section of this report.

| † | Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions. Performance shown reflects the effects of an expense reimbursement that improved results and was in effect until March 31, 2000. Load-adjusted returns are adjusted for the maximum front-end sales load of 4.75% for Class A shares and returns for Class B and C shares have been adjusted for the contingent deferred sales charge (CDSC). |

NOTES:

The graphs do not reflect the income taxes that you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends and adjustment for the maximum sales charge for Class A shares. The performance of other classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes.

The Russell 3000® Growth Index measures the performance of companies with higher price-to-book ratios and higher forecasted growth values. Index data shown for the Annualized Return Since Inception graph is from 8/31/90, since comparative index data is only available for full monthly periods. Source: Lipper, Inc.

The S&P 500 Index is an unmanaged index generally considered representative of the U.S. stock market. Index data shown for the Annualized Return Since Inception graph is from 8/31/90, since comparative index data is only available for full monthly periods. Source: Lipper, Inc.

The Russell Midcap® Growth Index measures the performance of mid-sized companies with growth characteristics. Index data shown for the Annualized Return Since Inception graph is from 8/31/90, since comparative index data is only available for full monthly periods. Source: Lipper, Inc.

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

Calamos Opportunistic Value Fund

OVERVIEW

The fund invests in the equities of small, midsize and large U.S. companies that we believe are undervalued according to certain financial measurements of their intrinsic values.

KEY FEATURES

| | ◾ | | Utilizes bottom-up stock picking and a benchmark-agnostic approach, which focuses on good businesses with solid cash flow and value prices | |

PORTFOLIO FIT

The fund is a core value option that may balance a growth allocation and complement other value strategies. Our flexibility in analyzing all companies regardless of sector helps us avoid the cyclicality inherent in a deep value strategy or momentum growth strategy.

| | |

| FUND NASDAQ SYMBOLS |

A Shares | | CVAAX |

B Shares | | CVABX |

C Shares | | CVACX |

I Shares | | CVAIX |

R Shares | | CVARX |

T Shares | | CVATX |

|

| FUND CUSIP NUMBERS |

A Shares | | 128119666 |

B Shares | | 128119658 |

C Shares | | 128119641 |

I Shares | | 128119633 |

R Shares | | 128119419 |

T Shares | | 128120615 |

CALAMOS OPPORTUNISTIC VALUE FUND

INVESTMENT TEAM DISCUSSION

How has the Fund performed?

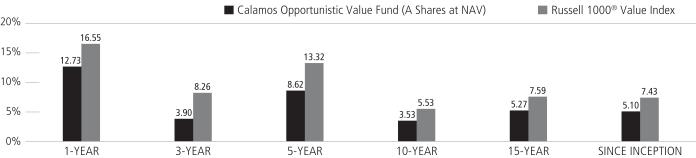

For the six-month period ended April 30, 2017, the Fund gained 10.85% (Class A shares at net asset value) versus a gain of 11.69% for the Russell 1000 Value Index.

The Fund performed in line, but slightly lagged the Russell 1000 Value Index for the reporting period. Prior to and following the U.S. election, investor sentiment was on the rise, leading the U.S. equity market to rally strongly during the six-month period. Pre- and post-election, President Trump discussed plans to reduce regulations, overhaul health care, decrease taxes, re-patriate overseas cash holdings and spur further infrastructure projects. Consequently, many referred to the market’s rally as the “Trump Trade.”

The initial success of stocks associated with businesses that stood to gain from President Trump’s proposed initiatives corroborated the idea of the “Trump Trade.” However, save for a brief sell-off in the beginning of November, the market had actually started to rally ahead of the U.S. election. Perhaps the U.S. equity market rally was more indicative of improving economic conditions overall, reflected in positive trends in employment, consumer confidence, and housing data, to name a few. Toward the latter stages of the reporting period, the market rotated away from the “Trump Trade” while still moving higher and providing strong returns for investors.

What factors influenced performance?

The Fund benefitted from the reflation trade that occurred during the reporting period, as the financials, industrials and materials sectors all enjoyed strong performance and outperformed the Russell 1000 Value Index on whole. Within both the Russell 1000 Value Index and the S&P 500 Index, companies with the highest debt-to-capital ratios—in other words, more leveraged and economically distressed companies—enjoyed the best returns. This phenomenon seems to indicate an investor preference for these more speculative, distressed names, suggesting a belief that a rising economy would benefit these businesses most. While the Fund did own some names within that group, the Fund was underweight lower-quality, more distressed businesses overall. Sector positioning was additive, as an overweight to information technology and a well-timed increase to consumer discretionary names proved additive. Within stock selection, securities in energy and materials lagged those of the market, and contributed to the slight lag in relative performance.

How is the Fund positioned?

The Fund seeks to identify attractively valued, temporarily out-of-favor stocks, or mispriced companies with good future business prospects. In essence, we believe that the Fund’s positioning reflects good businesses trading at value prices.

We continue to actively manage our sector exposures in conjunction with our fundamental, bottom-up research and our top-down views of economic and market opportunities. Our view of the economy is that we may continue to see reflationary opportunities, but that slow-yet-increasing economic growth may be most likely. As such, the Fund has taken a measured approach to balancing cyclical and secular

| | | | |

| 8 | | CALAMOS OPEN-END FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos Opportunistic Value Fund

growth opportunities. During the period, we added to information technology and consumer discretionary holdings on the belief that dynamic market leaders will be able to offer stronger growth and still trade with attractive valuations. Looking to cyclical growth opportunities, the Fund has slightly increased investment in the industrials sector, and still holds significant investment in the financials sector.

What closing thoughts do you have for Fund shareholders?

We are constructive on the U.S. equity market, given our view that the U.S. economy appears positioned for measured expansion with growth picking up steam as the year progresses. The equity market’s gains do not appear overly enthusiastic in our view, yet are supported by stronger earnings and sales growth, which the market hasn’t seen in many years. We also believe that the potent mix of potential tax reform and less regulation has yet to be fully priced into U.S. equities, offering support for the U.S. equity market. In that sense, the “Trump Trade” may not be over and the Fund has accordingly increased cyclical opportunities while maintaining investments in secular businesses. As global growth improves and central banks around the world look to synchronize their efforts toward normalization of interest rate policy, U.S. businesses and U.S. equities may see further support.

Our focus remains on solid businesses with sustainable cash flows that are trading at attractive prices. We are mindful of valuations and have been trimming positions where valuations may subject stocks to increased volatility. In addition, we have used market pullbacks in an attempt to selectively add to positions offering solid fundamentals.

| | | | |

| SECTOR WEIGHTINGS | |

Information Technology | | | 23.4 | % |

Financials | | | 19.5 | |

Industrials | | | 11.5 | |

Health Care | | | 11.0 | |

Consumer Discretionary | | | 9.8 | �� |

Energy | | | 6.7 | |

Consumer Staples | | | 6.1 | |

Utilities | | | 3.3 | |

Materials | | | 3.0 | |

Real Estate | | | 2.6 | |

Telecommunication Services | | | 1.2 | |

| | | | | |

Sector weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad-based index hedging securities the Fund may hold.

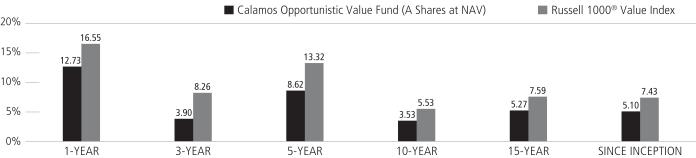

ANNUALIZED RETURN: SINCE INCEPTION (10/2/02) THROUGH 4/30/17

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted.

The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by visiting www.calamos.com. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. Performance is for the Fund’s Class A shares at net asset value and does not include the Fund’s maximum front-end sales charge of 4.75%. Had it been included, the Fund’s return would have been lower. The Fund also offers Class B, Class C, Class I and Class R shares, the performance of which may vary. Performance shown reflects an expense reimbursement that improved results. Source: State Street Corporation and Lipper, Inc.

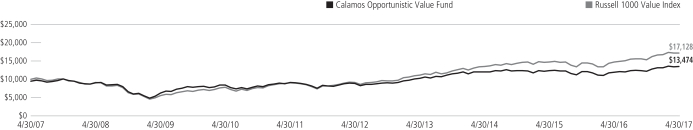

Calamos Opportunistic Value Fund

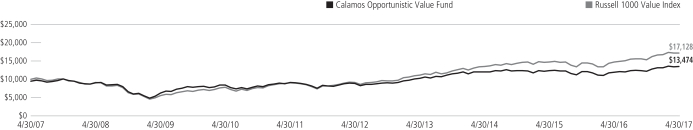

GROWTH OF $10,000: FOR THE 10-YEAR PERIOD ENDED 4/30/17

AVERAGE ANNUAL TOTAL RETURN† AS OF 4/30/17

| | | | | | | | | | | | | | | | |

| | | 6

MONTHS | | | 1

YEAR | | | 5

YEARS | | | 10 YEARS

OR ^SINCE

INCEPTION | |

Class A Shares – Inception 1/2/02 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | 10.85 | % | | | 12.73 | % | | | 8.62 | % | | | 3.53 | % |

With Sales Charge | | | 5.57 | | | | 7.36 | | | | 7.56 | | | | 3.03 | |

Class B Shares – Inception 1/2/02 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | 10.41 | | | | 11.86 | | | | 7.80 | | | | 2.91 | |

With Sales Charge | | | 5.41 | | | | 6.86 | | | | 7.50 | | | | 2.91 | |

Class C Shares – Inception 1/2/02 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | 10.51 | | | | 11.98 | | | | 7.81 | | | | 2.76 | |

With Sales Charge | | | 9.51 | | | | 10.98 | | | | 7.81 | | | | 2.76 | |

Class I Shares – Inception 3/1/02 | | | 11.08 | | | | 13.09 | | | | 8.89 | | | | 3.79 | |

Class R Shares – Inception 3/1/07 | | | 10.75 | | | | 12.47 | | | | 8.35 | | | | 3.27 | |

Class T Shares – Inception 2/28/17 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | | | | | | | | | | | -1.14 | ^ |

With Sales Charge | | | | | | | | | | | | | | | -3.61 | ^ |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

As of the prospectus dated 2/28/17, the Fund’s gross expense ratio for Class A shares is 1.57%; Class B shares is 2.33%; Class C shares is 2.32%; Class I shares is 1.32%; Class R shares is 1.83%; Class T shares is 1.57%. The Fund’s investment advisor has contractually agreed to reimburse Fund expenses through March 1, 2019, to the extent necessary so that Total Annual Fund Operating Expenses (excluding taxes, interest, short interest, short dividend expenses, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, if any) of Class A, Class B, Class C, Class I, Class R and T shares are limited to 1.12%, 1.88%, 1.87%, 0.87%, 1.37% and 1.12% of average net assets, respectively. The expense ratios shown above may differ from the more recent expense ratios reported in the Financial Highlights section of this report.

| † | Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions. Performance shown reflects the effects of an expense reimbursement that improved results and was in effect until March 31, 2004. Load-adjusted returns are adjusted for the maximum front-end sales load of 4.75% for Class A shares and returns for Class B and C shares have been adjusted for the contingent deferred sales charge (CDSC). |

NOTES:

The graphs do not reflect the income taxes that you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends and adjustment for the maximum sales charge for Class A shares. The performance of other classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes.

The Russell 1000® Value Index measures the performance of those companies in the Russell 1000® Index with lower price-to-book ratios and lower forecasted growth values. Index data shown for the Annualized Return Since Inception graph is from 12/31/01, since comparative index data is only available for full monthly periods. Source: Lipper, Inc.

The S&P 500 Index is an unmanaged index generally considered representative of the U.S. stock market.

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

| | | | |

| 10 | | CALAMOS OPEN-END FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos Dividend Growth Fund

CALAMOS DIVIDEND GROWTH FUND

INVESTMENT TEAM DISCUSSION

How has the Fund performed?

For the six-month period ended April 30, 2017, the Fund gained 13.13% (Class A shares at net asset value) versus a 13.32% gain for the S&P 500 Index and a 13.46% gain for the Russell 1000 Index.

The Fund performed broadly in line with the S&P 500 Index during a rapidly rising equity market which saw leadership changes between reflationary and cyclical stocks to secular and “defensive” growth stocks.

The U.S. equity market rallied strongly during the period following the U.S. election. Prior to and following the election, President Trump discussed plans to reduce regulations, overhaul health care, decrease taxes, re-patriate overseas cash holdings and spur further infrastructure projects. Consequently, many referred to the market’s rally as the “Trump Trade.”

The initial success of stocks associated with businesses that stood to gain from President Trump’s proposed initiatives corroborated the idea of the “Trump Trade.” However, save for a brief sell-off in the beginning of November, the market had actually started to rally ahead of the U.S. election. Perhaps the U.S. equity market rally was more indicative of improving economic conditions overall, reflected in positive employment numbers, consumer confidence, and housing data, to name a few. Toward the latter stages of the reporting period, the market rotated away from the “Trump Trade” while still moving higher, providing strong returns for investors.

Our screening and fundamental research process, which favors companies with higher-quality balance sheets over those likely to require additional financing to maintain operations, led us away from the riskier and higher-P/E* names within the market. Stocks of companies with higher levels of debt-to-capital and lower-quality ratings (as measured by Standard & Poor’s) outperformed the overall market. Despite the market’s preference and Fund management’s leaning toward risk management and higher-quality businesses, Fund performance was broadly in line with the S&P 500 Index during the period.

What factors influenced performance?

Even though the Fund’s overweights and underweights were not extreme, the Fund’s sector positioning was a slight positive to relative performance as compared to the S&P 500 Index. An overweight to financials and an underweight to real estate both proved beneficial, but a slight overweight to energy was a drag on relative performance. Stock selection was a positive as well, highlighted by strong selection in industrials, notably in the railroad space. Selection within consumer discretionary names—namely in cable and satellite stocks—was also additive to relative performance, as was our avoidance of struggling names in the apparel and luxury goods industry. Selection in financials lagged those of the market, as both regional bank holdings and asset management and custody bank holdings underperformed relative to the benchmark’s names. Cash,

| * | Price/earnings ratio is the current stock price over the trailing 12-month earnings per share. The P/E shows how much investors are willing to pay per dollar of earnings. |

OVERVIEW

The fund invests in companies that we believe have the ability to increase dividends over time, either through increasing profits or more efficient use of capital.

KEY FEATURES

| | ◾ | | Utilizes bottom-up stock picking and a benchmark-agnostic approach, which focuses on good businesses with solid cash flow and value prices | |

PORTFOLIO FIT

The fund seeks to provide a regular stream of income and dividend-paying equity investments that tend to be less volatile than non-dividend payers.

| | |

| FUND NASDAQ SYMBOLS |

A Shares | | CADVX |

C Shares | | CCDVX |

I Shares | | CIDVX |

T Shares | | CTDVX |

|

| FUND CUSIP NUMBERS |

A Shares | | 128120839 |

C Shares | | 128120821 |

I Shares | | 128120813 |

T Shares | | 128120490 |

Calamos Dividend Growth Fund

| | | | |

| SECTOR WEIGHTINGS | |

Information Technology | | | 22.4 | % |

Financials | | | 14.0 | |

Consumer Discretionary | | | 13.9 | |

Health Care | | | 13.7 | |

Industrials | | | 10.5 | |

Consumer Staples | | | 8.9 | |

Energy | | | 6.5 | |

Materials | | | 2.6 | |

Telecommunication Services | | | 2.3 | |

Utilities | | | 2.2 | |

Real Estate | | | 2.0 | |

| | | | | |

Sector weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad-based index hedging securities the Fund may hold.

which on average was less than 2% of Fund assets over the reporting period, also created a slight drag on performance during a time when the market showed high returns over a short period.

How is the Fund positioned?

The Fund’s investments reflect our positive long-term outlook for equities and our preference for dividend-paying companies with sound fundamentals and attractive valuations. Furthermore, we seek companies that have an ability to increase dividends over time, either through increasing profits or more efficient use of capital. We continue to actively manage our sector exposures in conjunction with our fundamental, bottom-up research approach. While we have a positive long-term view, we are cognizant of short-term risks, which include a market with higher valuations, increasing political risks, as well as low volatility as measured by the CBOE Volatility Index (VIX).

We have not made significant shifts to sector weights as a result of the market’s gains, but we have sold names where risk/reward dynamics may have changed. We are mindful of valuations and have been trimming positions where valuations may subject stocks to increased volatility. In addition, we have used market pullbacks in an attempt to selectively add to positions offering solid fundamentals. The Fund has a modest overweight to consumer discretionary names. The sector is quite diverse and we have found opportunities while being selective in areas such as Internet retail and restaurants. Our focus remains on solid businesses with sustainable cash flows, trading at attractive prices.

What closing thoughts do you have for Fund shareholders?

We are constructive on the U.S. equity market given our view that the U.S. economy appears positioned for measured expansion with growth picking up steam as the year progresses. The equity market’s gains do not appear overly enthusiastic in our view, given the increase is supported by stronger earnings and sales growth, which the market hasn’t seen in many years. We also believe that the potent mix of potential tax reform and reduced regulation has yet to be fully priced into U.S. equities. In that sense, the “Trump Trade” may not be over and the Fund has accordingly kept a balance of cyclical growth opportunities while maintaining investments in higher, secular growth businesses. As global growth improves and central banks around the world look to synchronize their efforts toward normalization of interest rate policy, U.S. businesses and U.S. equities may see further support.

| | | | |

| 12 | | CALAMOS OPEN-END FAMILY OF FUNDS SEMIANNUAL REPORT | | |

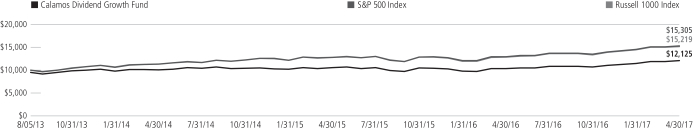

Calamos Dividend Growth Fund

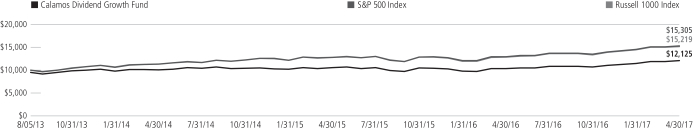

GROWTH OF $10,000: SINCE INCEPTION (8/5/13) THROUGH 4/30/17

AVERAGE ANNUAL TOTAL RETURN† AS OF 4/30/17

| | | | | | | | | | | | |

| | | 6

MONTHS | | | 1

YEAR | | | SINCE

INCEPTION | |

Class A Shares – Inception 8/5/2013 | | | | | | | | | | | | |

Without Sales Charge | | | 13.13 | % | | | 16.77 | % | | | 6.68 | % |

With Sales Charge | | | 7.73 | | | | 11.26 | | | | 5.30 | |

Class C Shares – Inception 8/5/2013 | | | | | | | | | | | | |

Without Sales Charge | | | 12.70 | | | | 15.86 | | | | 5.88 | |

With Sales Charge | | | 11.70 | | | | 14.86 | | | | 5.88 | |

Class I Shares – Inception 8/5/2013 | | | 13.35 | | | | 17.15 | | | | 6.96 | |

Class T Shares – Inception 2/28/2017 | | | | | | | | | | | | |

Without Sales Charge | | | | | | | | | | | 1.20 | |

With Sales Charge | | | | | | | | | | | -1.33 | |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

As of the prospectus dated 2/28/17, the Fund’s gross expense ratio for Class A shares is 1.74%; Class C shares is 2.49%; Class I shares is 1.49%; Class T shares is 1.74%. The Fund’s Investment Adviser has contractually agreed to reimburse Fund expenses through March 1, 2019 to the extent necessary so that Total Annual Fund Operating Expenses (excluding taxes, interest, short interest, short dividend expenses, brokerage commissions, acquired fund fees and expenses and extraordinary expenses, if any) of Class A, Class C, Class I and Class T shares are limited to 1.34%, 2.09%,1.09% and 1.34% of average net assets, respectively. This agreement is not terminable by either party. The expense ratios shown above may differ from the more recent expense ratios reported in the Financial Highlights section of this report.

| † | Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions. Load-adjusted returns are adjusted for the maximum front-end sales load of 4.75% for Class A shares. Returns for Class C shares have been adjusted for the contingent deferred sales charge (CDSC). |

NOTES:

The graph does not reflect the income taxes that you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends and adjustment for the maximum sales charge for Class A shares. The performance of other classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes.

The S&P 500 Index is an unmanaged index generally considered representative of the U.S. stock market. Index data shown for the Annualized Return Since Inception graph is from 8/31/13, since comparative index data is only available for full monthly periods. Source: Lipper, Inc.

The Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000 Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership.

The Chicago Board Options Exchange Volatility Index (VIX) shows the market’s expectation of 30-day volatility by using the implied volatilities of a wide range of S&P 500 index options.

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

Calamos International Growth Fund

OVERVIEW

The fund invests in non-U.S. growth companies. We focus on those firms that we believe demonstrate key growth characteristics, including increasing profit margins and high returns on invested capital.

KEY FEATURES

| | ◾ | | Focuses on growth in an asset class that is mostly defined by core and value offerings | |

| | ◾ | | Stresses company fundamentals, including global presence and strong or accelerated earnings growth | |

| | ◾ | | Investments driven by international sources of revenue for companies, not on location of headquarters | |

PORTFOLIO FIT

Investors tend to underinvest in growth outside the U.S. and emphasize growth with U.S.-oriented equity funds. The fund stands as a potential growth-focused addition to a mostly core- or value-intensive international allocation.

| | |

| FUND NASDAQ SYMBOLS |

A Shares | | CIGRX |

B Shares | | CIGBX |

C Shares | | CIGCX |

I Shares | | CIGIX |

R Shares | | CIGFX |

T Shares | | CITGX |

| |

| FUND CUSIP NUMBERS | | |

A Shares | | 128119575 |

B Shares | | 128119567 |

C Shares | | 128119559 |

I Shares | | 128119542 |

R Shares | | 128119393 |

T Shares | | 128120599 |

CALAMOS INTERNATIONAL GROWTH FUND

INVESTMENT TEAM DISCUSSION

How has the Fund performed?

For the six-month period ended April 30, 2017, Calamos International Growth Fund returned 8.53% (Class A shares at net asset value), versus a 9.81% return for the MSCI ACWI ex-U.S. Growth Index and 10.60% for the MSCI EAFE Growth Index. International equities experienced a broad advance during the period, with gains across regions and almost all sectors. Higher prices reflected generally better economic data, higher corporate earnings and more bullish investor sentiment across both developed and emerging markets.

In the early stage of the six-month period—and in the time preceding it—our team had been skeptical of the sustainability of the global recovery and generally positioned the portfolio for a low growth environment. The Fund’s tilt toward higher growth and quality fundamentals detracted from relative security selection and moderated performance in the period, as more cyclical-oriented businesses outperformed on a wave of optimism for improving global growth. Following the resolution of certain geopolitical risks and given increasing evidence of a more synchronized international expansion, we became more comfortable with this uptick in growth and inflation, and chose to increase Fund holdings in financials, industrials, and select resource-related businesses as the period progressed.

What factors influenced performance over the period?

From a sector perspective, security selection in the consumer discretionary sector negatively affected Fund returns in the period. Specifically, holdings in both the autos and the apparel and accessories industries underperformed those in the index. We hold a significant weight in the sector and own companies in diversified categories, including Internet retail, apparel and accessories, automotive, and cable and satellite industries. The Fund’s holdings in the financials sector also trailed the index and hampered Fund return. In particular, Fund positions in the asset management and custody banks industry lagged those of the index. During the period, we added to our weight in financials in order to benefit from improving credit quality, increased lending activity, and the potential for higher interest rates.

Conversely, The Fund’s overweight position and selection in information technology contributed positively to performance. Fund holdings in both the data processing and outsourced services and the application software industries performed well on leading growth fundamentals. The Fund’s overweight stance in information technology reflects our view of positive fundamentals, reasonable valuations, and compelling secular tailwinds. The Fund’s underweight position and security selection in consumer staples also boosted performance in the period. Within the sector, we own a set of global leaders with long-term growth potential in multiple consumer categories. Our holdings offer diversified revenue streams, attractive free cash flow and earnings growth catalysts.

From a geographic perspective, the Fund’s country positioning contributed positively to performance, while selection within countries hurt overall return versus the index. In particular, the Fund’s selection in Germany and South Korea trailed the index. The Fund’s holdings in India and the Netherlands contributed the most to performance.

| | | | |

| 14 | | CALAMOS OPEN-END FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos International Growth Fund

How is the Fund positioned?

The Fund’s regional and country positioning reflects the combined inputs from our top-down global framework and our bottom-up security analysis. Our investment team continually evaluates macroeconomic factors and growth opportunities, then actively integrates these insights into investment decision making.

From a regional perspective, we hold a moderate overweight to Europe, reflecting our view of improving economic data, reasonable valuations, favorable liquidity and potential upside in corporate margins. We own select multinationals domiciled in Europe that place a greater emphasis on global revenue exposure.

We hold a relatively neutral view of Japan but have found a number of attractive individual opportunities. Japan’s macroeconomic fundamentals remain lackluster despite continued monetary accommodation. Equity valuations are attractive, and we favor exporters benefiting from the improvement in global growth and favorable currency effects.

We have a positive view and select overweight in emerging market holdings. On a regional basis, the Fund’s largest weight is in Emerging Asia with select positions in Emerging Europe and Latin America. The outlook for earnings growth is strong, and emerging markets are poised to benefit from the stabilization in many currencies and commodities, as well as from a pickup in global demand.

From a sector standpoint, we made certain shifts during the period. We increased the Fund’s weight in industrials, financials and select resource-related holdings, representing cyclical and bottom-up opportunities.

We offset this increase with decreased weights in consumer discretionary and health care, driven mainly by security-specific rationale. In terms of largest absolute weights, we have an emphasis in information technology, industrials, financials, and consumer companies.

What closing thoughts do you have for Fund shareholders?

Recent economic data points to a synchronized pickup in growth across international regions. Accommodative monetary policy overall and a pivot toward fiscal stimulus is also supporting global activity. As a result, we see continued opportunities in international equities, offering good fundamentals and valuations. In terms of broad positioning, we favor a blend of investments in secular and core growth companies, in addition to economically sensitive cyclical businesses. We see significant opportunities in companies with growing earnings and pricing power, solid cash flow generation, and improving-to-strong balance sheets. From a thematic and sector perspective, we see opportunities in the information technology sector, in consumer companies with targeted areas of demand, and in an increased universe of cyclical companies in the industrials, financials and resource sectors with improving fundamentals and catalysts. Our active investment approach and long-term perspective enables us to take advantage of the opportunities in international equities.

| | | | |

| SECTOR WEIGHTINGS | | | |

Information Technology | | | 23.8 | % |

Industrials | | | 16.7 | |

Financials | | | 13.7 | |

Consumer Discretionary | | | 12.2 | |

Consumer Staples | | | 11.3 | |

Health Care | | | 10.6 | |

Materials | | | 5.6 | |

Energy | | | 3.4 | |

Telecommunication Services | | | 1.0 | |

Real Estate | | | 0.7 | |

Other | | | 0.1 | |

| | | | | |

Sector weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad-based index hedging securities the Fund may hold.

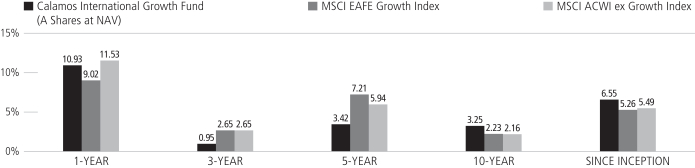

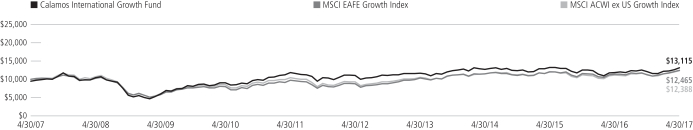

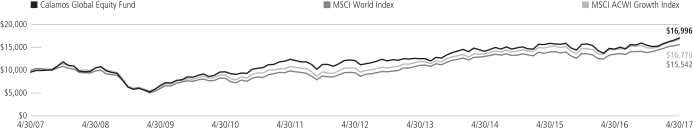

Calamos International Growth Fund

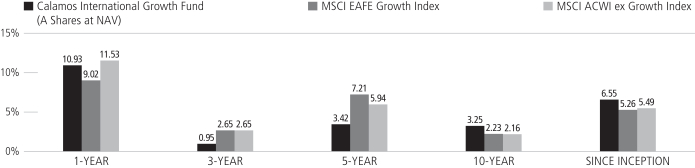

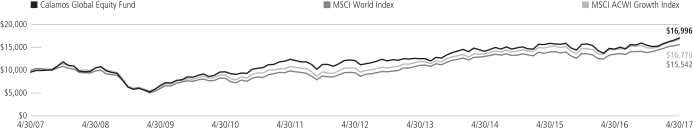

ANNUALIZED RETURN: SINCE INCEPTION (3/16/05) THROUGH 4/30/17

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted.

The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by visiting www.calamos.com. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. Performance is for the Fund’s Class A shares at net asset value and does not include the Fund’s maximum front-end sales charge of 4.75%. Had it been included, the Fund’s return would have been lower. The Fund also offers Class B, Class C, Class I and Class R shares, the performance of which may vary. Source: State Street Corporation and Lipper, Inc.

| | | | |

| 16 | | CALAMOS OPEN-END FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos International Growth Fund

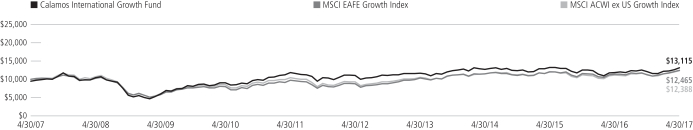

GROWTH OF $10,000: FOR THE 10-YEAR PERIOD ENDED 4/30/17

AVERAGE ANNUAL TOTAL RETURN† AS OF 4/30/17

| | | | | | | | | | | | | | | | |

| | | 6

MONTHS | | | 1

YEAR | | | 5

YEARS | | | 10 YEARS

OR ^SINCE

INCEPTION | |

Class A Shares – Inception 3/16/05 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | 8.53 | % | | | 10.93 | % | | | 3.42 | % | | | 3.25 | % |

With Sales Charge | | | 3.38 | | | | 5.67 | | | | 2.43 | | | | 2.75 | |

Class B Shares – Inception 3/16/05 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | 8.13 | | | | 10.07 | | | | 2.64 | | | | 2.63 | |

With Sales Charge | | | 3.13 | | | | 5.07 | | | | 2.28 | | | | 2.63 | |

Class C Shares – Inception 3/16/05 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | 8.14 | | | | 10.08 | | | | 2.65 | | | | 2.48 | |

With Sales Charge | | | 7.14 | | | | 9.08 | | | | 2.65 | | | | 2.48 | |

Class I Shares – Inception 3/16/05 | | | 8.67 | | | | 11.23 | | | | 3.67 | | | | 3.51 | |

Class R Shares – Inception 3/1/07 | | | 8.34 | | | | 10.64 | | | | 3.15 | | | | 2.99 | |

Class T Shares – Inception 2/28/17 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | | | | | | | | | | | 6.42 | ^ |

With Sales Charge | | | | | | | | | | | | | | | 3.76 | ^ |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

As of the prospectus dated 2/28/17, the Fund’s gross expense ratio for Class A shares is 1.39%; Class B shares is 2.13%; Class C shares is 2.14%; Class I shares is 1.14%; Class R shares is 1.64%; Class T shares is 1.39%. The Fund’s investment advisor has contractually agreed to reimburse Fund expenses through March 1, 2019, to the extent necessary so that Total Annual Fund Operating Expenses (excluding taxes, interest, short interest, short dividend expenses, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, if any) of Class A, Class B, Class C, Class I, Class R and Class T shares are 1.38%, 2.12%, 2.13%, 1.13%, 1.63% and 1.38%. The expense ratios shown above may differ from the more recent expense ratios reported in the Financial Highlights section of this report.

| † | Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions. Performance shown reflects the effects of an expense reimbursement that improved results and was in effect until March 31, 2005. Load-adjusted returns are adjusted for the maximum front-end sales load of 4.75% for Class A shares and returns for Class B and C shares have been adjusted for the contingent deferred sales charge (CDSC). |

NOTES:

The graphs do not reflect the income taxes that you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends and adjustment for the maximum sales charge for Class A shares. The performance of other classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes.

The MSCI EAFE Growth Index measures developed market growth equity performance (excluding the U.S. and Canada). Source: MSCI Barra.

The MSCI ACWI ex U.S. Growth Index measures equity market performance of companies outside of the United States with higher growth values in developed and emerging markets.

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

Calamos Evolving World Growth Fund

OVERVIEW

The fund globally invests in growth companies, emphasizing businesses with revenue streams derived within or from emerging markets. The fund is designed to actively manage risk over a full market cycle.

KEY FEATURES

| | ◾ | | Active risk management aims to generate alpha with less downside risk than the benchmark and peers | |

| | ◾ | | Stresses strong or accelerated earnings growth and solid returns on invested capital | |

| | ◾ | | Targets well-positioned global growth companies that may benefit from long-term secular themes in emerging markets such as the rise of the emerging-market consumer | |

PORTFOLIO FIT

Given its focus on risk management, the fund can serve as a long-term emerging market allocation.

| | |

| FUND NASDAQ SYMBOLS |

A Shares | | CNWGX |

B Shares | | CNWZX |

C Shares | | CNWDX |

I Shares | | CNWIX |

R Shares | | CNWRX |

T Shares | | CNWTX |

|

| FUND CUSIP NUMBERS |

A Shares | | 128119161 |

B Shares | | 128119153 |

C Shares | | 128119146 |

I Shares | | 128119138 |

R Shares | | 128119120 |

T Shares | | 128120581 |

CALAMOS EVOLVING WORLD GROWTH FUND

INVESTMENT TEAM DISCUSSION

How has the Fund performed?

For the six-month period ended April 30, 2017, Calamos Evolving World Growth Fund returned 5.12% (Class A shares at net asset value), versus a 9.03% return for the MSCI Emerging Market Index.

Our risk-managed, higher-quality growth approach faced multiple challenges in the period. The portion of our Fund that holds developed-market companies with significant ties to emerging markets trailed the stronger high single-digit return in emerging market equities. In addition, the Fund’s select positions in equity-sensitive securities, primarily in convertible bonds, trailed the robust rally in equities. As part of the Fund’s risk-managed strategy, convertibles can provide a critical source of downside resilience over a market cycle.

What factors influenced performance?

With respect to specific positioning effects on performance during the period, we would highlight the following areas:

| • | | From a broad geographic perspective, country return perspective, the Fund’s positioning detracted from performance in terms of country weights and selection within countries. In particular, the Fund’s selection in Mexico and South Korea trailed the index, while the Fund’s holdings in India and Turkey contributed the most positively to performance. |

| • | | From a sector perspective, the Fund’s security selection in information technology contributed the most value to performance during the period. Holdings in both the data processing and outsourced services industry and internet software and services industry delivered strong gains. We hold our largest sector weight in information technology based on its large addressable markets and leading earnings growth potential. We see strong thematic alignment in the sector with holdings positioned to benefit from innovation in mobility, e-commerce, among other trends in emerging economies. |

| • | | The Fund’s holdings in industrials also lifted performance. Positions in the aerospace and defense industry performed well because of strong market demand and a leading fundamental profile. We see increasing opportunities in the sector and own positions in the machinery, construction and engineering and the defense industries, which are benefiting from a pickup in global demand and more cyclical growth prospects in emerging markets. |

| • | | The Fund’s overweight position and selection in the consumer discretionary sector negatively affected results. Specifically, holdings in the restaurants and automobile industries trailed those in the index. We have a positive view on trends in the sector and own companies in diverse industries including internet retail, automotive, cable and satellite, and casinos and gaming. |

| • | | The Fund’s underweight and selection in financials also held back returns in the period. In particular, our positions in the diversified banks industry trailed stronger gains in the index. We have a selective view of opportunities in financials and |

| | | | |

| 18 | | CALAMOS OPEN-END FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos Evolving World Growth Fund

| | | maintain a modest underweight stance toward banks and the sector overall. We expect our positioning to benefit as investors reward companies exhibiting higher-quality fundamentals, improvements in efficiency and earnings growth. |

How is the Fund positioned?

Our positioning favors economies benefiting from domestic demand trends, pro-growth fiscal reforms, and a blend of secular demand and more cyclical opportunities. We favor investments in China, India, South Korea and select opportunities in Brazil, Taiwan, Russia, Mexico, South Africa and Indonesia.

From a sector perspective, the Fund is overweight opportunities in information technology, consumer discretionary and industrials, while the Fund has an underweight stance in consumer staples, utilities, telecom services, financials and real estate, as compared to the index.

We maintained relatively stable sector weights during the period. We modestly increased the portfolio weight in financials, industrials and technology reflecting our view of increased opportunities in more economically sensitive areas within global and emerging markets. We offset this by decreasing the weight in consumer staples and health care based on our view of valuations in certain defensive areas and bottom-up fundamentals.

What closing thoughts do you have for Fund shareholders?

We have a positive view of investment opportunities in emerging markets. Emerging markets are navigating a path influenced by the U.S. dollar, higher interest rates, and potential protectionist sentiments regarding trade. Despite these potential headwinds, the outlook for earnings growth is strong and emerging markets are poised to benefit from stabilization in many currencies and commodities as well as a pickup in global demand.

Emerging market equity valuations and growth characteristics are favorable and may benefit from a re-focus on corporate fundamentals versus broader macro topics. While we do not expect a rapid acceleration in economic growth, we see improving trends in emerging market data and perhaps a greater appreciation of the divergent conditions among economies. We have also seen notable improvements in current account and fiscal measures, for both net commodity consumers and producers, which has significantly reduced vulnerability to external currencies and capital flows.

A significant portion of the upside move in emerging market equities over the last year was driven by a relatively narrow rally in many lower-quality, higher-beta companies. In 2017 year-to-date, we are seeing companies with higher-quality fundamentals and more sustainable growth characteristics perform well. We believe our active and risk-aware investment approach enables us to take advantage of the improving opportunity set while also providing downside resilience should market volatility return.

| | | | |

| SECTOR WEIGHTINGS | | | |

Information Technology | | | 24.9 | % |

Financials | | | 21.9 | |

Consumer Discretionary | | | 14.9 | |

Industrials | | | 10.4 | |

Telecommunication Services | | | 7.6 | |

Energy | | | 6.4 | |

Materials | | | 5.9 | |

Consumer Staples | | | 3.5 | |

Health Care | | | 2.2 | |

Real Estate | | | 1.6 | |

Other | | | 0.1 | |

| | | | | |

Sector weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad-based index hedging securities the Fund may hold.

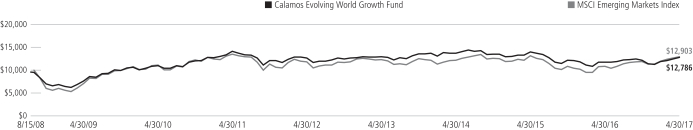

Calamos Evolving World Growth Fund

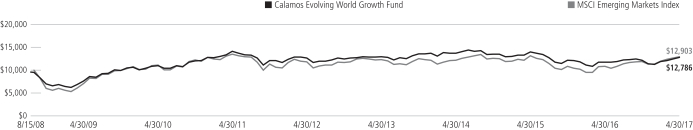

GROWTH OF $10,000: SINCE INCEPTION (8/15/08) THROUGH 4/30/17

AVERAGE ANNUAL TOTAL RETURN† AS OF 4/30/17

| | | | | | | | | | | | | | | | | | | | |

| | | 6

MONTHS | | 1

YEAR | | 5

YEARS | | SINCE

INCEPTION |

Class A Shares – Inception 8/15/08 | | | | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 5.12 | % | | | | 8.90 | % | | | | 0.26 | % | | | | 3.44 | % |

With Sales Charge | | | | 0.16 | | | | | 3.75 | | | | | -0.71 | | | | | 2.86 | |

Class B Shares – Inception 8/15/08 | | | | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 4.67 | | | | | 8.13 | | | | | -0.48 | | | | | 2.73 | |

With Sales Charge | | | | -0.33 | | | | | 3.13 | | | | | -0.86 | | | | | 2.73 | |

Class C Shares – Inception 8/15/08 | | | | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 4.68 | | | | | 8.14 | | | | | -0.49 | | | | | 2.67 | |

With Sales Charge | | | | 3.68 | | | | | 7.14 | | | | | -0.49 | | | | | 2.67 | |

Class I Shares – Inception 8/15/08 | | | | 5.17 | | | | | 9.11 | | | | | 0.49 | | | | | 3.69 | |

Class R Shares – Inception 8/15/08 | | | | 4.92 | | | | | 8.64 | | | | | 0.01 | | | | | 3.18 | |

Class T Shares – Inception 2/28/17 | | | | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | | | | | | | | | | | | | | | 5.56 | |

With Sales Charge | | | | | | | | | | | | | | | | | | | 2.92 | |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

As of the prospectus dated 2/28/17, the Fund’s gross expense ratio for Class A shares is 1.64%; Class B is 2.41% and C shares is 2.39%; Class I shares is 1.39%; Class R shares is 1.89%; Class T shares is 1.64%. The expense ratios shown above may differ from the more recent expense ratios reported in the Financial Highlights section of this report.

| † | Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions. Load-adjusted returns are adjusted for the maximum front-end sales load of 4.75% for Class A shares and returns for Class B and C shares have been adjusted for the contingent deferred sales charge (CDSC). |

NOTES:

The graph does not reflect the income taxes that you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends and adjustment for the maximum sales charge for Class A shares. The performance of other classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index considered broadly representative of emerging market equity performance. The index represents companies within the constituent emerging markets that are available to investors worldwide. Index data shown for the Since Inception Growth of $10,000 graph is from 8/31/08, since comparative index data is only available for full monthly periods. Source: Lipper, Inc.

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

| | | | |

| 20 | | CALAMOS OPEN-END FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos Emerging Market Equity Fund

CALAMOS EMERGING MARKET

EQUITY FUND

INVESTMENT TEAM DISCUSSION

How has the Fund performed?

For the six-month period ended April 30, 2017, Calamos Emerging Market Equity Fund returned 4.07% (Class A shares at net asset value), versus a 9.03% return for the MSCI Emerging Market Index.

The period comprised two relatively distinct periods reflecting rotational markets and significant changes in sentiment and fundamentals. Our active, higher-quality growth approach faced challenges as many higher-beta and lower-quality emerging market equities outperformed, particularly in the first half of the period.

Following an extended period of heightened risk appetite, EMs experienced a widespread sell-off after the U.S. election due to concerns over rising protectionist sentiment, higher interest rates, and the path of the U.S. dollar. Fund returns struggled during this sell-off phase, due to our overweight positioning in India and Mexico and secular-growth holdings in China, which lagged many cyclical, value-oriented companies in the index.

What factors influenced performance?

Our conviction and overweight positioning in India as well as a higher-quality fundamental profile added considerable value in the second half of the period, as we saw performance broaden out beyond last year’s narrow value-led rally. Moreover, we believe our stance will continue to benefit the Fund in the current environment.

With respect to more specific positioning effects on performance during the period, we would highlight the following areas:

| • | | The Fund’s overweight position and selection in the consumer discretionary sector negatively affected results. Specifically, holdings in the restaurants and automobile industries trailed those in the index. We have a positive view on trends in the sector and own companies in diverse industries including internet retail, automotive, cable and satellite, and casinos and gaming. |

| • | | The Fund’s average underweight and selection in financials also hampered returns in the period. In particular, our positions in the diversified banks industry trailed stronger gains in the index. We increased our weight in financials in the period but maintain a selective view of opportunities. We expect our positioning to benefit as investors reward companies exhibiting relatively higher-quality fundamentals, improvements in efficiency and earnings growth. |

| • | | The Fund’s overweight allocation and stronger selection in information technology contributed the most value to performance during the period. Holdings in the data processing and outsourced services and semiconductors industries delivered strong gains. We hold a significant weight in information technology based on its large addressable markets and leading earnings growth potential. We see strong thematic alignment in the sector with holdings positioned to benefit from innovation in mobility, e-commerce, among other trends in emerging economies. |

OVERVIEW

The fund globally invests in growth companies, whose principal activities are in a developing market or are economically tied to a developing market country that we believe offers the best opportunities for growth.

KEY FEATURES

| | ◾ | | Stresses company fundamentals, including global presence, strong revenue and earnings growth, solid returns on invested capital, and lower debt-to-capital levels | |

| | ◾ | | Actively seeks growth opportunities by investing in equities with at least 80% emerging-market exposure | |

| | ◾ | | Draws upon decades of Calamos experience investing globally through multiple economic, market and credit cycles | |

PORTFOLIO FIT

This actively managed fund complements emerging-market strategies with a less-pronounced growth orientation, such as those that more closely track the broad EM equity market.

| | |

| FUND NASDAQ SYMBOLS |

A Shares | | CEGAX |

C Shares | | CEGCX |

I Shares | | CIEIX |

T Shares | | CEGTX |

|

| FUND CUSIP NUMBERS |

A Shares | | 128120789 |

C Shares | | 128120771 |

I Shares | | 128120763 |

T Shares | | 128120482 |

Calamos Emerging Market Equity Fund

| | | | |

| SECTOR WEIGHTINGS | |

Information Technology | | | 27.9 | % |

Financials | | | 25.7 | |

Consumer Discretionary | | | 13.1 | |

Industrials | | | 6.2 | |

Consumer Staples | | | 6.2 | |

Energy | | | 5.7 | |

Materials | | | 5.1 | |

Other | | | 3.7 | |

Telecommunication Services | | | 2.1 | |

Health Care | | | 1.5 | |

Real Estate | | | 0.6 | |

| | | | | |

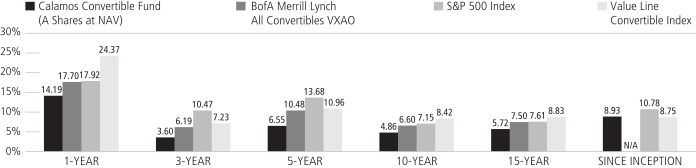

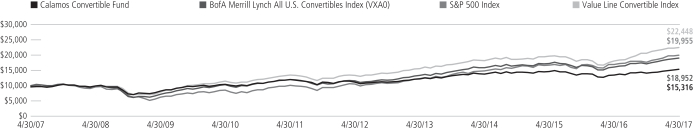

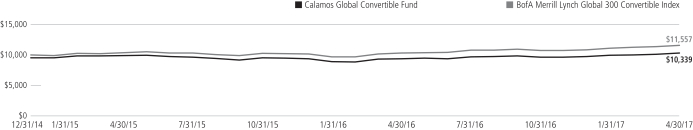

Sector weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad-based index hedging securities the Fund may hold.