| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

| FORM N-CSR |

|

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number | 811-05447 |

| |

| AMERICAN CENTURY QUANTITATIVE EQUITY FUNDS, INC. |

| (Exact name of registrant as specified in charter) |

| |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| |

| CHARLES A. ETHERINGTON |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

|

| Registrant’s telephone number, including area code: | 816-531-5575 |

| |

| Date of fiscal year end: | 06-30 |

| |

| Date of reporting period: | 06-30-2010 |

| |

| |

| |

| | |

| |

| ITEM 1. REPORTS TO STOCKHOLDERS. |

|

| Annual Report | |

| June 30, 2010 | |

|

| American Century Investments® |

Utilities Fund

| |

| President’s Letter | 2 |

| Market Perspective | 3 |

| U.S. Stock Index Returns | 3 |

| |

| Utilities | |

| |

| Performance | 4 |

| Portfolio Commentary | 6 |

| Utilities Market Returns | 7 |

| Top Ten Holdings | 8 |

| Industry Breakdown | 8 |

| Types of Investments in Portfolio | 8 |

| |

| Shareholder Fee Example | 9 |

| |

| Financial Statements | |

| |

| Schedule of Investments | 11 |

| Statement of Assets and Liabilities | 13 |

| Statement of Operations | 14 |

| Statement of Changes in Net Assets | 15 |

| Notes to Financial Statements | 16 |

| Financial Highlights | 21 |

| Report of Independent Registered Public Accounting Firm | 22 |

| |

| Other Information | |

| |

| Proxy Voting Results | 23 |

| Management | 24 |

| Board Approval of Management Agreements | 28 |

| Additional Information | 34 |

| Index Definitions | 35 |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Dear Investor:

To learn more about the capital markets, your investment, and the portfolio management strategies American Century Investments provides, we encourage you to review this shareholder report for the financial reporting period ended June 30, 2010.

On the following pages, you will find investment performance and portfolio information, presented with the expert perspective and commentary of our portfolio management team. This report remains one of our most important vehicles for conveying the information you need about your investment performance, and about the market factors and strategies that affect fund returns. For additional information on the markets, we encourage you to visit the “Insights & News” tab at our Web site, americancentury.com, for updates and further expert commentary.

The top of our Web site’s home page also provides a link to “Our Story,” which, first and foremost, outlines our commitment—since 1958—to helping clients reach their financial goals. We believe strongly that we will only be successful when our clients are successful. That’s who we are.

Another important, unique facet of our story and who we are is “Profits with a Purpose,” which describes our bond with the Stowers Institute for Medical Research (SIMR). SIMR is a world-class biomedical organization—founded by our company founder James E. Stowers, Jr. and his wife Virginia—that is dedicated to researching the causes, treatment, and prevention of gene-based diseases, including cancer. Through American Century Investments’ private ownership structure, more than 40% of our profits support SIMR.

Mr. Stowers’ example of achieving financial success and using that platform to help humanity motivates our entire American Century Investments team. His story inspires us to help each of our clients achieve success. Thank you for sharing your financial journey with us.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

2

By Scott Wittman, Chief Investment Officer, Quantitative Equity and Asset Allocation

Stocks Rallied as Economy Improved

U.S. stocks posted double-digit gains for the 12 months ended June 30, 2010, thanks largely to improving economic conditions and unexpectedly strong corporate earnings. As the period began, the U.S. economy was starting to show early signs of recovery following a sharp downturn in late 2008 and early 2009. Led by improving results in manufacturing activity, housing, and consumer spending, the economy posted positive growth in the third and fourth quarters of 2009 after four consecutive quarters of declining output. By the first quarter of 2010, jobs data turned positive, providing further evidence of a burgeoning economic recovery.

In addition, corporate profits consistently exceeded expectations as many companies implemented stringent cost-management programs that helped boost profit margins. Rising demand for delayed big-ticket purchases, such as cars and appliances, also contributed to stronger earnings. As a result, stocks rose steadily for much of the period, with the major equity indices advancing by more than 30% from the beginning of the period through April 30, 2010.

Growing Uncertainty Led to Late Decline

Market conditions changed abruptly in the last two months of the period as persistent worries about sovereign debt problems in Europe and questions about the sustainability of the domestic economic recovery (validated to some degree by weaker economic data late in the period) weighed on investor confidence. With these headwinds, the equity market peaked in late April and then reversed direction in May and June. In addition, market volatility increased dramatically—the S&P 500 Index moved up or down by more than 1% on nearly half of the trading days in the second quarter of 2010.

Although stocks gave back a notable portion of their gains late in the period, the broad market indices returned approximately 15% overall for the 12 months. Mid- and small-cap stocks posted the best returns (see the table below), outpacing large-cap shares, while value stocks outperformed growth-oriented issues across all market capitalizations.

| | | | |

| U.S. Stock Index Returns | | | | |

| For the 12 months ended June 30, 2010 | | | | |

| Russell 1000 Index (Large-Cap) | 15.24% | | Russell 2000 Index (Small-Cap) | 21.48% |

| Russell 1000 Value Index | 16.92% | | Russell 2000 Value Index | 25.07% |

| Russell 1000 Growth Index | 13.62% | | Russell 2000 Growth Index | 17.96% |

| Russell Midcap Index | 25.13% | | | |

| Russell Midcap Value Index | 28.91% | | | |

| Russell Midcap Growth Index | 21.30% | | | |

3

| | | | | | | |

| Utilities | | | | | | |

| |

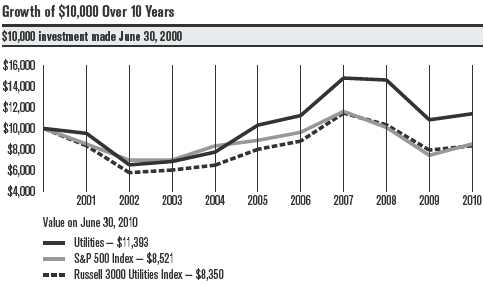

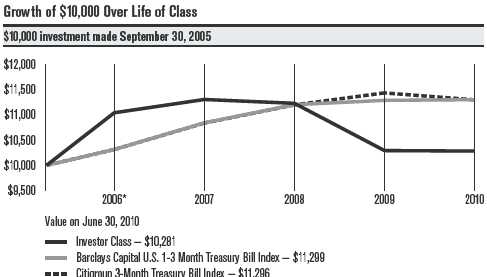

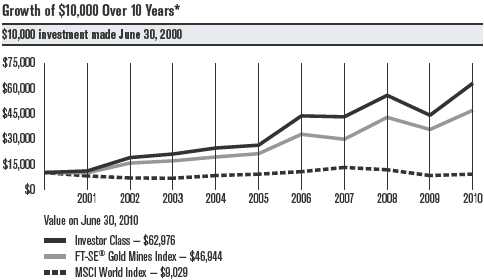

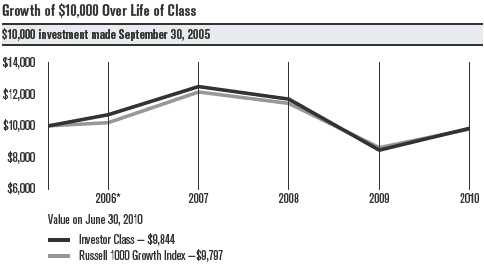

| Total Returns as of June 30, 2010 | | | | | |

| | | | | Average Annual Returns | |

| | | Ticker | | | | Since | Inception |

| | | Symbol | 1 year | 5 years | 10 years | Inception | Date |

| Utilities | BULIX | 5.30% | 2.01% | 1.31% | 6.46% | 3/1/93 |

| Russell 3000 | | | | | | |

| Utilities Index | — | 5.13% | 0.81% | -1.79% | N/A(1) | — |

| S&P 500 Index | — | 14.43% | -0.79% | -1.59% | 7.04%(2) | — |

| (1) | Index data first available 7/1/96. | | | | | | |

| (2) | Since 2/28/93, the date nearest the fund’s inception for which data are available. | | | |

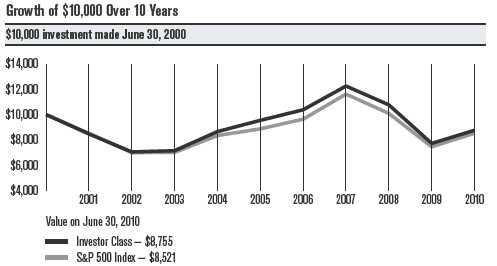

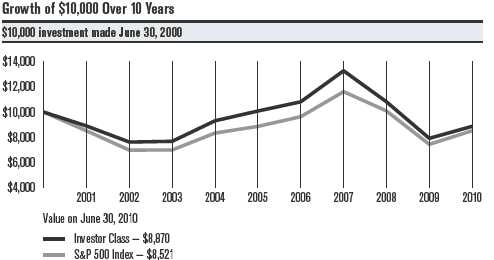

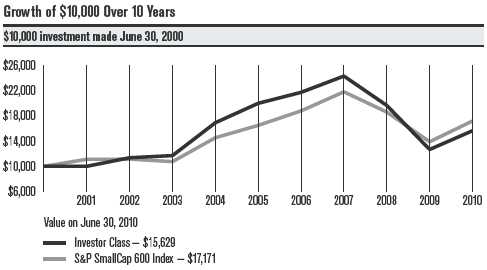

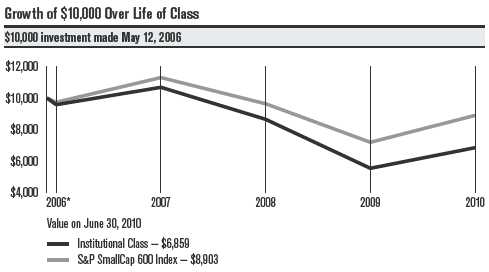

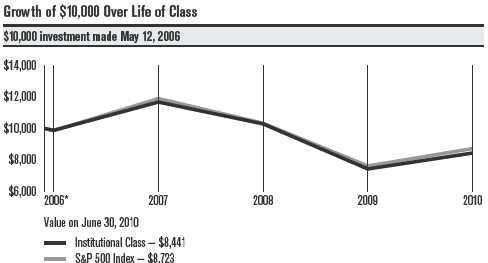

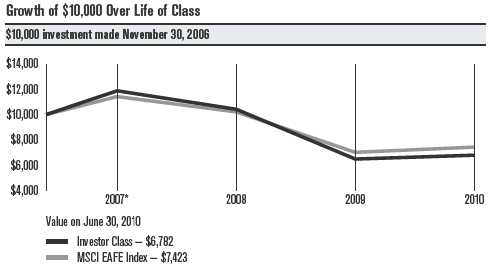

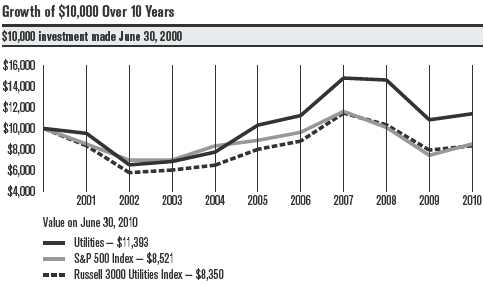

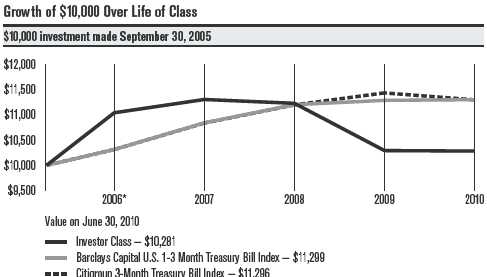

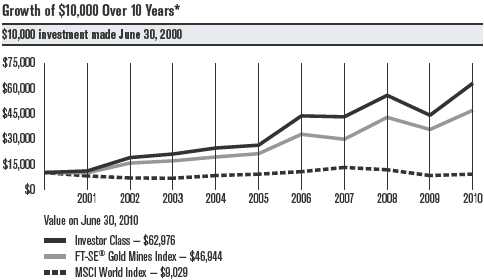

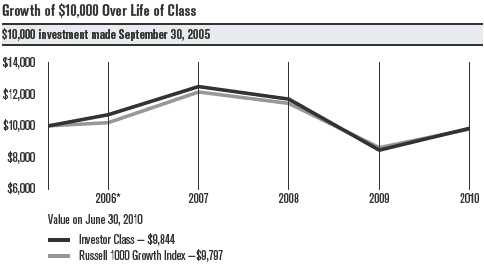

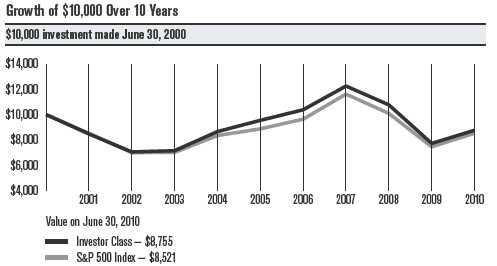

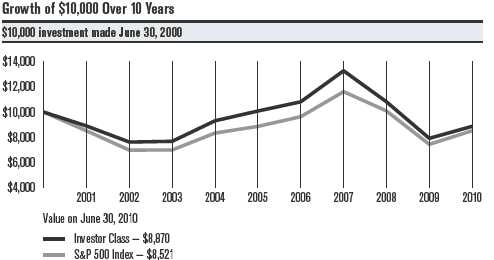

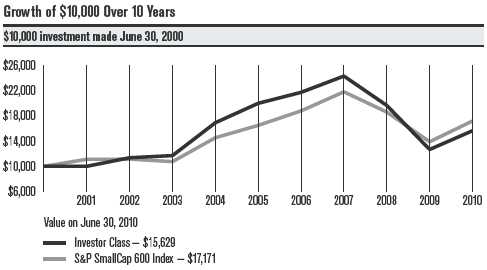

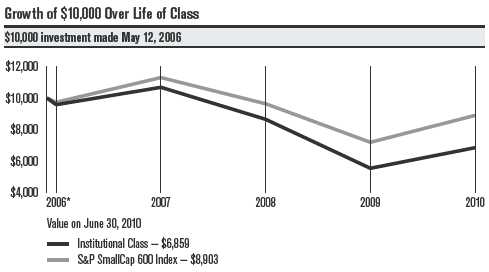

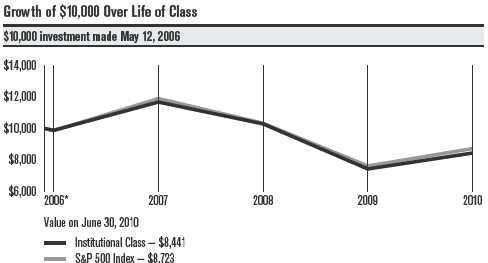

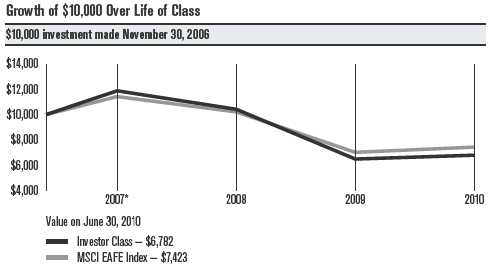

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The fund concentrates its investments in a narrow segment of the total market and is therefore subject to greater risks and market fluctuations than a portfolio representing a broader range of industries. International investing involves special risks, such as political instability and currency fluctuations.

Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

4

Utilities

| |

| Total Annual Fund Operating Expenses |

| Utilities | 0.70% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The fund concentrates its investments in a narrow segment of the total market and is therefore subject to g reater risks and market fluctuations than a portfolio representing a broader range of industries. International investing involves special risks, such as political instability and currency fluctuations.

Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

5

Utilities

Portfolio Manager: Joe Sterling

On March 31, 2010, Utilities portfolio manager John Schniedwind, who was also chief investment officer for quantitative equity, retired from American Century Investments after 27 years with the firm. Effective August 9, 2010, Bill Martin will join Joe Sterling as a portfolio manager of the Utilities Fund.

Performance Summary

Utilities Fund returned 5.30% for the 12 months ended June 30, 2010, outpacing the 5.13% return of its benchmark, the Russell 3000 Utilities Index. The S&P 500 Index, a broad market measure, returned 14.43%.

As described on page 3, equity indices advanced during the reporting period, responding positively to signs of improving economic conditions. Market gains were curbed in the second half of the reporting period, though, as economic trends in the U.S. and abroad softened, causing fears of a double-dip recession and reigniting concerns about the health of the global financial system. Against this backdrop, Utilities Fund delivered gains on an absolute basis, and modestly outperformed its benchmark.

From a broad sector perspective, an overweight allocation and effective stock selection within the traditional utilities sector accounted for the majority of the portfolio’s outperformance relative to its benchmark. Within the sector, a substantial overweight allocation to the gas utilities industry was a key contributor to absolute and relative gains. An underweight stake and effective stock selection in the independent power producer industry group also helped performance on a relative basis, although the group detracted from absolute returns. Holdings in the electric utilities industry were a source of underperformance. An overweight allocation and stock decisions in the telecommunications services sector also contributed significantly to relative returns. Stock selection in the information technology sector slightly trimmed returns relative to the benchmark.

Traditional Utilities Contributed

The traditional utilities group, which represented almost 75% of the portfolio, was the largest sector source of positive relative returns for the reporting period. Within the industry group, overweight positions in select gas utilities helped absolute and relative performance. In particular, a substantial overweight stake in ONEOK, Inc. represented the single largest contribution by far to relative gains, as the natural gas storage and transportation company’s share price climbed 53% in the period. The company had faced a number of issues early in 2009, including a weak economy, legislative debates over carbon restrictions, renewable energy mandates, and regulatory push back on recovery of costs and investments. During the reporting period, as investors gained confidence about these issues and recognized ONEOK’s sound fundamentals, the share price rebounded. Similarly, a significantly overweight positio n in diversified natural gas company National Fuel Gas Co. added meaningfully to absolute and relative performance as the company’s share price gained 31%.

An underweight allocation and effective stock decisions among independent power producers also helped relative returns. The portfolio successfully avoided key benchmark underperformers, including Dynegy, Inc. The electric power company reported a wider than expected net loss during the period due to lower commodities prices and slower demand. The portfolio also sidestepped energy company AES Corporation, which reported lower earnings and reduced its guidance for future earnings due to weaker forward prices and declining volume.

6

Utilities

The portfolio avoided the water utilities group altogether. This trimmed relative performance modestly, as water utilities delivered modest gains within the benchmark.

Stock selection in the electric utilities industry detracted from absolute and relative performance. Here, the portfolio held several detrimental positions in non-benchmark securities that declined amid sluggish demand for electricity.

Telecommunications, Energy Helped

The telecommunications services sector benefited relative returns. Within the sector, the portfolio held an underweight position in telecommunications provider Verizon. This decision proved advantageous, as the company’s share price declined due to charges associated with workforce reductions and a decline in contract customers. An overweight stake in telecommunications services provider Windstream Corp. added to absolute and relative performance. The company’s share price gained 39% as revenue climbed.

The energy sector also contributed to relative returns. Within the sector, the portfolio held select positions within the oil, gas, and consumable fuels group that were not benchmark members. These positions outperformed the benchmark average during the period.

Information Technology Detracted

The information technology sector was a source of weakness relative to the benchmark. Within the sector, the portfolio’s only position was QUALCOMM, which is not a benchmark constituent. The company’s share price declined during the period.

Outlook

Utilities Fund employs a structured, disciplined investment approach. The management team incorporates both growth and value measures into its stock selection process and attempts to balance the portfolio’s risk and expected return.

The team has continued to avoid water utilities in the portfolio. The portfolio has maintained overweight positions in gas utilities and multi-utilities, as our quantitative process has identified opportunities in these areas.

| | | | |

| Utilities Market Returns | | | | |

| For the 12 months ended June 30, 2010 | | | | |

| Broad U.S. Stock Market | | | Primary Utilities Industries in Fund Benchmark |

| S&P 500 Index | 14.43% | | Diversified Telecommunication Services | 3.23% |

| Nasdaq Composite Index* | 14.94% | | Electric Utilities | 0.98% |

| Broad Utilities Market | | | Multi-Utilities | 16.21% |

| Lipper Utility Fund Index | 9.09% | | Gas Utilities | 23.77% |

| Russell 3000 Utilities Index | 5.13% | | Independent Power Producers | |

| | | | & Energy Traders | -11.31% |

| | | | Wireless Telecommunication Services | –3.61% |

| *Return does not reflect the reinvestment of dividends on securities in the index. Had such reinvestments been included, returns would have |

| been higher. | | | | |

7

| |

| Utilities | |

| |

| Top Ten Holdings | |

| | % of net assets |

| | as of 6/30/10 |

| AT&T, Inc. | 4.6% |

| Verizon Communications, Inc. | 4.1% |

| Public Service Enterprise Group, Inc. | 3.5% |

| Southern Co. | 3.3% |

| Edison International | 3.1% |

| PG&E Corp. | 3.0% |

| ONEOK, Inc. | 3.0% |

| CenturyLink, Inc. | 3.0% |

| NextEra Energy, Inc. | 2.9% |

| American Electric Power Co., Inc. | 2.6% |

| |

| Industry Breakdown | |

| | % of net assets |

| | as of 6/30/10 |

| Electric Utilities | 26.0% |

| Multi-Utilities | 24.5% |

| Gas Utilities | 19.7% |

| Integrated Telecommunication Services | 17.7% |

| Wireless Telecommunication Services | 3.8% |

| Oil & Gas Storage & Transportation | 2.9% |

| Independent Power Producers & Energy Traders | 2.4% |

| Communications Equipment | 1.2% |

| Coal & Consumable Fuels | 0.4% |

| Cash & Equivalents(1) | 1.4% |

| (1) Includes temporary cash investments and other assets and liabilities. | |

| |

| Types of Investments in Portfolio | |

| | % of net assets |

| | as of 6/30/10 |

| Domestic Common Stocks | 92.3% |

| Foreign Common Stocks(2) | 6.3% |

| Total Common Stocks | 98.6% |

| Temporary Cash Investments | 1.2% |

| Other Assets and Liabilities | 0.2% |

| (2) Includes depositary shares, dual listed securities and foreign ordinary shares | |

8

|

| Shareholder Fee Example (Unaudited) |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/ exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from January 1, 2010 to June 30, 2010.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. We will not charge the fee as long as you choose to manage your accounts exclusively online. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

9

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | |

| | Beginning | Ending | Expenses Paid | |

| | Account Value | Account Value | During Period* | Annualized |

| | 1/1/10 | 6/30/10 | 1/1/10 – 6/30/10 | Expense Ratio* |

| Actual | $1,000 | $926.60 | $3.34 | 0.70% |

| Hypothetical | $1,000 | $1,021.32 | $3.51 | 0.70% |

| *Expenses are equal to the fund’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, |

| multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

10

| | | | | | |

| Utilities | | | | | | |

| |

| JUNE 30, 2010 | | | | | | |

| | Shares | Value | | | Shares | Value |

| Common Stocks — 98.6% | | | INTEGRATED TELECOMMUNICATION | |

| | | | | SERVICES—17.7% | | |

| COAL & CONSUMABLE FUELS—0.4% | | | AT&T, Inc. | 432,516 | $ 10,462,562 |

| Arch Coal, Inc. | 50,400 | $ 998,424 | | CenturyLink, Inc. | 204,254 | 6,803,701 |

| COMMUNICATIONS EQUIPMENT—1.2% | | | France Telecom SA ADR | 90,400 | 1,564,824 |

| QUALCOMM, Inc. | 81,900 | 2,689,596 | | Koninklijke KPN NV | 168,400 | 2,150,274 |

| ELECTRIC UTILITIES—26.0% | | | | Qwest Communications | | |

| Allegheny Energy, Inc. | 58,700 | 1,213,916 | | International, Inc. | 829,600 | 4,355,400 |

| American Electric | | | | Telefonica SA ADR | 20,000 | 1,110,600 |

| Power Co., Inc. | 184,440 | 5,957,412 | | Verizon | | |

| Duke Energy Corp. | 222,304 | 3,556,864 | | Communications, Inc. | 331,499 | 9,288,602 |

| E.ON AG ADR | 39,800 | 1,066,640 | | Windstream Corp. | 438,700 | 4,632,672 |

| Edison International | 224,500 | 7,121,140 | | | | 40,368,635 |

| EDP- Energias | | | | MULTI-UTILITIES—24.5% | | |

| de Portugal SA | 520,200 | 1,536,002 | | Alliant Energy Corp. | 39,600 | 1,256,904 |

| EDP- Energias | | | | CenterPoint Energy, Inc. | 438,900 | 5,775,924 |

| de Portugal SA ADR | 3,300 | 97,515 | | | | |

| Entergy Corp. | 65,500 | 4,691,110 | | CMS Energy Corp. | 168,700 | 2,471,455 |

| Exelon Corp. | 128,500 | 4,879,145 | | Consolidated Edison, Inc. | 126,600 | 5,456,460 |

| FirstEnergy Corp. | 105,300 | 3,709,719 | | Dominion Resources, Inc. | 147,712 | 5,722,363 |

| Iberdrola SA | 314,288 | 1,762,440 | | DTE Energy Co. | 97,200 | 4,433,292 |

| Iberdrola SA ADR | 1,410 | 31,626 | | MDU Resources Group, Inc. | 165,100 | 2,976,753 |

| NextEra Energy, Inc. | 135,900 | 6,626,484 | | NSTAR | 113,642 | 3,977,470 |

| PPL Corp. | 177,200 | 4,421,140 | | PG&E Corp. | 166,200 | 6,830,820 |

| | | | | Public Service | | |

| Progress Energy, Inc. | 88,000 | 3,451,360 | | Enterprise Group, Inc. | 255,500 | 8,004,815 |

| Southern Co. | 226,300 | 7,531,264 | | SCANA Corp. | 50,200 | 1,795,152 |

| UniSource Energy Corp. | 57,300 | 1,729,314 | | Sempra Energy | 49,100 | 2,297,389 |

| | | 59,383,091 | | Wisconsin Energy Corp. | 21,300 | 1,080,762 |

| GAS UTILITIES—19.7% | | | | Xcel Energy, Inc. | 180,400 | 3,718,044 |

| AGL Resources, Inc. | 128,100 | 4,588,542 | | | | 55,797,603 |

| Atmos Energy Corp. | 72,600 | 1,963,104 | | OIL & GAS STORAGE & TRANSPORTATION—2.9% |

| Energen Corp. | 99,900 | 4,428,567 | | El Paso Corp. | 346,900 | 3,854,059 |

| Laclede Group, Inc. (The) | 85,600 | 2,835,928 | | Williams Cos., Inc. (The) | 150,000 | 2,742,000 |

| National Fuel Gas Co. | 114,800 | 5,267,024 | | | | 6,596,059 |

| Nicor, Inc. | 137,800 | 5,580,900 | | WIRELESS TELECOMMUNICATION SERVICES—3.8% |

| Northwest Natural Gas Co. | 63,600 | 2,771,052 | | America Movil SAB de CV, | | |

| ONEOK, Inc. | 157,900 | 6,829,175 | | Series L ADR | 68,100 | 3,234,750 |

| Questar Corp. | 82,000 | 3,730,180 | | Sprint Nextel Corp.(1) | 903,042 | 3,828,898 |

| Southwest Gas Corp. | 41,100 | 1,212,450 | | Vodafone Group plc ADR | 83,000 | 1,715,610 |

| UGI Corp. | 221,000 | 5,622,240 | | | | 8,779,258 |

| | | 44,829,162 | | TOTAL COMMON STOCKS | | |

| INDEPENDENT POWER PRODUCERS | | | (Cost $216,581,908) | | 224,836,683 |

| & ENERGY TRADERS—2.4% | | | | | | |

| Constellation Energy | | | | | | |

| Group, Inc. | 83,100 | 2,679,975 | | | | |

| NRG Energy, Inc.(1) | 128,000 | 2,714,880 | | | | |

| | | 5,394,855 | | | | |

11

| | | | |

| Utilities | | | | |

| |

| | Shares | Value | | Notes to Schedule of Investments |

| Temporary Cash Investments — 1.2% | | ADR = American Depositary Receipt |

| JPMorgan U.S. Treasury | | | | (1) Non-income producing. |

| Plus Money Market | | | | |

| Fund Agency Shares | 39,761 | $ 39,761 | | Industry classifications are unaudited. |

| Repurchase Agreement, Bank of America | | | |

| Securities, LLC, (collateralized by various | | | |

| U.S. Treasury obligations, 1.125%, 6/30/11, | | | |

| valued at $2,855,814), in a joint trading | | | See Notes to Financial Statements. |

| account at 0.01%, dated 6/30/10, due | | | |

| 7/1/10 (Delivery value $2,800,001) | 2,800,000 | | |

| TOTAL TEMPORARY | | | | |

| CASH INVESTMENTS | | | | |

| (Cost $2,839,761) | | 2,839,761 | | |

| TOTAL INVESTMENT | | | | |

| SECURITIES — 99.8% | | | | |

| (Cost $219,421,669) | | 227,676,444 | | |

| OTHER ASSETS | | | | |

| AND LIABILITIES — 0.2% | | 424,770 | | |

| TOTAL NET ASSETS — 100.0% | | $228,101,214 | | |

12

|

| Statement of Assets and Liabilities |

| |

| JUNE 30, 2010 | |

| Assets | |

| Investment securities, at value (cost of $219,421,669) | $227,676,444 |

| Foreign currency holdings, at value (cost of $1,736) | 1,741 |

| Receivable for capital shares sold | 54,766 |

| Dividends and interest receivable | 857,854 |

| | 228,590,805 |

| | |

| Liabilities | |

| Payable for investments purchased | 313,028 |

| Payable for capital shares redeemed | 43,156 |

| Accrued management fees | 133,407 |

| | 489,591 |

| | |

| Net Assets | $228,101,214 |

| | |

| Capital Shares, $0.01 Par Value | |

| Authorized | 80,000,000 |

| Shares outstanding | 18,079,309 |

| | |

| Net Asset Value Per Share | $12.62 |

| | |

| Net Assets Consist of: | |

| Capital (par value and paid-in surplus) | $237,406,229 |

| Undistributed net investment income | 471,590 |

| Accumulated net realized loss on investment and foreign currency transactions | (18,030,633) |

| Net unrealized appreciation on investments and translation of assets and liabilities in foreign currencies | 8,254,028 |

| | $228,101,214 |

| |

| |

| See Notes to Financial Statements. | |

13

| |

| YEAR ENDED JUNE 30, 2010 | |

| Investment Income (Loss) | |

| Income: | |

| Dividends (net of foreign taxes withheld of $63,558) | $10,892,754 |

| Interest | 2,361 |

| | 10,895,115 |

| Expenses: | |

| Management fees | 1,689,841 |

| Directors’ fees and expenses | 7,413 |

| Other expenses | 10,588 |

| | 1,707,842 |

| | |

| Net investment income (loss) | 9,187,273 |

| | |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on investment and foreign currency transactions | (6,893,889) |

| Change in net unrealized appreciation (depreciation) on investments and translation | |

| of assets and liabilities in foreign currencies | 10,462,991 |

| | |

| Net realized and unrealized gain (loss) | 3,569,102 |

| | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $12,756,375 |

| |

| |

| See Notes to Financial Statements. | |

14

|

| Statement of Changes in Net Assets |

| | |

| YEARS ENDED JUNE 30, 2010 AND JUNE 30, 2009 | | |

| Increase (Decrease) in Net Assets | 2010 | 2009 |

| Operations | | |

| Net investment income (loss) | $ 9,187,273 | $ 9,289,159 |

| Net realized gain (loss) | (6,893,889) | (10,136,166) |

| Change in net unrealized appreciation (depreciation) | 10,462,991 | (96,933,284) |

| Net increase (decrease) in net assets resulting from operations | 12,756,375 | (97,780,291) |

| | | |

| Distributions to Shareholders | | |

| From net investment income | (8,908,274) | (10,297,789) |

| | | |

| Capital Share Transactions | | |

| Proceeds from shares sold | 38,240,653 | 26,237,168 |

| Proceeds from reinvestment of distributions | 8,390,010 | 9,704,306 |

| Payments for shares redeemed | (59,111,698) | (78,199,008) |

| Net increase (decrease) in net assets from capital share transactions | (12,481,035) | (42,257,534) |

| | | |

| Net increase (decrease) in net assets | (8,632,934) | (150,335,614) |

| | | |

| Net Assets | | |

| Beginning of period | 236,734,148 | 387,069,762 |

| End of period | $228,101,214 | $236,734,148 |

| | | |

| Undistributed net investment income | $471,590 | $453,735 |

| | | |

| Transactions in Shares of the Fund | | |

| Sold | 2,863,153 | 2,073,571 |

| Issued in reinvestment of distributions | 622,364 | 766,908 |

| Redeemed | (4,462,805) | (5,951,923) |

| Net increase (decrease) in shares of the fund | (977,288) | (3,111,444) |

| |

| |

| See Notes to Financial Statements. | | |

15

|

| Notes to Financial Statements |

JUNE 30, 2010

1. Organization and Summary of Significant Accounting Policies

Organization — American Century Quantitative Equity Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940 (the 1940 Act) as an open-end management investment company. Utilities Fund (the fund) is one fund in a series issued by the corporation. The fund is diversified under the 1940 Act. The fund’s investment objective is to seek current income and long-term growth of capital and income. The fund invests at least 80% of its assets in equity securities of companies engaged in the utilities industry. The following is a summary of the fund’s significant accounting policies.

Security Valuations — Securities traded primarily on a principal securities exchange are valued at the last reported sales price, or at the mean of the latest bid and asked prices where no last sales price is available. Depending on local convention or regulation, securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official close price. Investments in open-end management investment companies are valued at the reported net asset value. Discount notes may be valued through a commercial pricing service or at amortized cost, which approximates fair value. Securities traded on foreign securities exchanges and over-the-counter markets are normally completed before the close of business on days that the New York Stock Exchange (the Exchange) is open and may also take place on days when the Exchange is not open. If an event occurs after the value of a security was established but before the net asset value per share was determined that was likely to materially change the net asset value, that security would be valued as determined in accordance with procedures adopted by the Board of Directors. If the fund determines that the market price of a portfolio security is not readily available, or that the valuation methods mentioned above do not reflect the security’s fair value, such security is valued as determined by the Board of Directors or its designee, in accordance with procedures adopted by the Board of Directors, if such determination would materially impact a fund’s net asset value. Certain other circumstances may cause the fund to use alternative procedures to value a security such as: a security has been declared in default; trading in a security has been halted during the trading day; or there is a foreign market holiday and no trading will commence .

Security Transactions — For financial reporting purposes, security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Foreign Currency Translations — All assets and liabilities initially expressed in foreign currencies are translated into U.S. dollars at prevailing exchange rates at period end. The fund may enter into spot foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of investment securities, dividend and interest income, spot foreign currency exchange contracts, and certain expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. For assets and liabilities, other than investments in securities, net realized and unrealized gains and losses from foreign currency translations arise from changes in currency exchange rates.

Net realized and unrealized foreign currency exchange gains or losses occurring during the holding period of investment securities are a component of net realized gain (loss) on investment transactions and net unrealized appreciation (depreciation) on investments, respectively. Certain countries may impose taxes on the contract amount of purchases and sales of foreign currency contracts in their currency. The fund records the foreign tax expense, if any, as a reduction to the net realized gain (loss) on foreign currency transactions.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that American Century Investment Management, Inc. (ACIM) (the investment advisor) has determined are creditworthy pursuant to criteria adopted by the Board of Directors.

16

Each repurchase agreement is recorded at cost. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. The fund is no longer subject to examination by tax authorities for years prior to 2006. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. Accordingly, no provision has been made for federal or state income taxes.

Distributions to Shareholders — Distributions to shareholders are recorded on the ex-dividend date. Distributions from net investment income, if any, are generally declared and paid quarterly. Distributions from net realized gains, if any, are generally declared and paid annually.

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

Use of Estimates — The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America, which may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates.

Subsequent Events — In preparing the financial statements, management evaluated the impact of events or transactions occurring through the date the financial statements were issued that would merit recognition or disclosure.

2. Fees and Transactions with Related Parties

Management Fees — The corporation has entered into a Management Agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee). The Agreement provides that all expenses of managing and operating the fund, except brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), and extraordinary expenses, will be paid by ACIM. The fee is computed and accrued daily based on the daily net assets of the specific class of shares of the fund and paid monthly in arrears. The fee consists of (1) an Investment Category Fee based on the daily net assets of the fund and certain other accounts managed by the investment advisor that are in the same broad investment category as the fund and (2) a Complex Fee based on the assets of all the funds in the American Century Investments family of funds. The rates for the Investment Category Fee range from 0.3380% to 0.5200%. The rates for the Complex Fee range from 0.2500% to 0.3100%. The effective annual management fee for the year ended June 30, 2010 was 0.69%.

17

Related Parties — Certain officers and directors of the corporation are also officers and/ or directors of American Century Companies, Inc. (ACC), the parent of the corporation’s investment advisor, ACIM, the distributor of the corporation, American Century Investment Services, Inc., and the corporation’s transfer agent, American Century Services, LLC.

The fund is eligible to invest in a money market fund for temporary purposes, which is managed by J.P. Morgan Investment Management, Inc. (JPMIM). The fund has a Mutual Funds Services Agreement with J.P. Morgan Investor Services Co. (JPMIS) and a securities lending agreement with JPMorgan Chase Bank (JPMCB). JPMCB is a custodian of the fund. JPMIM, JPMIS and JPMCB are wholly owned subsidiaries of JPMorgan Chase & Co. (JPM). JPM is an equity investor in ACC.

3. Investment Transactions

Purchases and sales of investment securities, excluding short-term investments, for the year ended June 30, 2010, were $26,074,746 and $39,355,465, respectively.

4. Fair Value Measurements

The fund’s securities valuation process is based on several considerations and may use multiple inputs to determine the fair value of the positions held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels as follows:

• Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical securities;

• Level 2 valuation inputs consist of significant direct or indirect observable market data (including quoted prices for similar securities, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.); or

• Level 3 valuation inputs consist of significant unobservable inputs (including a fund’s own assumptions).

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not an indication of the risks associated with investing in these securities or other financial instruments.

The following is a summary of the valuation inputs used to determine the fair value of the fund’s securities as of June 30, 2010. The Schedule of Investments provides additional details on the fund’s portfolio holdings.

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investment Securities | | | |

| Domestic Common Stocks | $210,566,402 | — | — |

| Foreign Common Stocks | 8,821,565 | $5,448,716 | — |

| Temporary Cash Investments | 39,761 | 2,800,000 | — |

| Total Value of Investment Securities | $219,427,728 | $8,248,716 | — |

18

5. Interfund Lending

The fund, along with certain other funds in the American Century Investments family of funds, may participate in an interfund lending program, pursuant to an Exemptive Order issued by the Securities and Exchange Commission (SEC). This program provides an alternative credit facility allowing the fund to borrow from or lend to other funds in the American Century Investments family of funds that permit such transactions. Interfund lending transactions are subject to each fund’s investment policies and borrowing and lending limits. The interfund loan rate earned/paid on interfund lending transactions is determined daily based on the average of certain current market rates. Interfund lending transactions normally extend only overnight, but can have a maximum duration of seven days. The program is subject to annual approval by the Board of Directors. During the year ended June 30, 2010, the fund did not utilize the program.

6. Risk Factors

The fund concentrates its investments in a narrow segment of the total market. Because of this, the fund may be subject to greater risk and market fluctuations than a portfolio representing a broader range of industries.

There are certain risks involved in investing in foreign securities. These risks include those resulting from future adverse political, social, and economic developments, fluctuations in currency exchange rates, the possible imposition of exchange controls, and other foreign laws or restrictions.

7. Federal Tax Information

The tax character of distributions paid during the years ended June 30, 2010 and June 30, 2009 were as follows:

| | |

| | 2010 | 2009 |

| Distributions Paid From | | |

| Ordinary income | $8,908,274 | $10,297,789 |

| Long-term capital gains | — | — |

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of June 30, 2010, the federal tax cost of investments and the components of distributable earnings on a tax-basis were as follows:

| | |

| Federal tax cost of investments | $219,955,552 |

| Gross tax appreciation of investments | $ 28,504,301 |

| Gross tax depreciation of investments | (20,783,409) |

| Net tax appreciation (depreciation) of investments | $ 7,720,892 |

| Net tax appreciation (depreciation) on derivatives and translation | |

| of assets and liabilities in foreign currencies | $ (747) |

| Net tax appreciation (depreciation) | $7,720,145 |

| Undistributed ordinary income | $471,590 |

| Accumulated capital losses | $(14,489,405) |

| Capital loss deferral | $(3,007,345) |

The difference between book-basis and tax-basis cost and unrealized appreciation (depreciation) is attributable primarily to the tax deferral of losses on wash sales.

19

The accumulated capital losses listed on the previous page represent net capital loss carryovers that may be used to offset future realized capital gains for federal income tax purposes. Future capital loss carryover utilization in any given year may be subject to Internal Revenue Code limitations. The capital loss carryovers of $(492,967), $(2,580,682) and $(11,415,756) expire in 2011, 2017 and 2018, respectively.

The capital loss deferral listed on the previous page represents net capital losses incurred in the eight-month period ended June 30, 2010. The fund has elected to treat such losses as having been incurred in the following fiscal year for federal income tax purposes.

8. Corporate Event

As part of a long-standing estate and business succession plan established by ACC Co-Chairman James E. Stowers, Jr., the founder of American Century Investments, ACC Co-Chairman Richard W. Brown succeeded Mr. Stowers as trustee of a trust that holds a greater-than-25% voting interest in ACC, the parent corporation of the fund’s advisor. Under the 1940 Act, this is presumed to represent control of ACC even though it is less than a majority interest. The change of trustee may technically be considered a “change of control” of ACC and therefore also a change of control of the fund’s advisor even though there has been no change to its management and none is anticipated. The “change of control” resulted in the assignment of the fund’s investment advisory agreement. Under the 1940 Act, an assignment automatically terminated such agreement, making the approval of a new agreement neces sary.

On February 18, 2010, the Board of Directors approved an interim investment advisory agreement under which the fund will be managed until a new agreement is approved by fund shareholders. On April 1, 2010, the Board of Directors approved a new investment advisory agreement. The interim agreement and the new agreement are substantially identical to the terminated agreements (with the exception of different effective and termination dates) and will not result in changes in the management of American Century Investments, the fund, its investment objectives, fees or services provided.

The new agreement for the fund was approved by shareholders at a Special Meeting of Shareholders on June 16, 2010. The new agreement went into effect on July 16, 2010.

9. Other Tax Information (Unaudited)

The following information is provided pursuant to provisions of the Internal Revenue Code.

The fund hereby designates up to the maximum amount allowable as qualified dividend income for the fiscal year ended June 30, 2010.

For corporate taxpayers, the fund hereby designates $8,908,274, or up to the maximum amount allowable, of ordinary income distributions paid during the fiscal year ended June 30, 2010 as qualified for the corporate dividends received deduction.

20

| | | | | | | |

| Utilities | | | | | | |

| For a Share Outstanding Throughout the Years Ended June 30 (except as noted) | | |

| | | 2010 | 2009 | 2008 | 2007(1) | 2006 | 2005 |

| Per-Share Data | | | | | | |

| Net Asset Value, | | | | | | |

| Beginning of Period | $12.42 | $17.46 | $18.04 | $16.30 | $13.40 | $12.08 |

| Income From | | | | | | |

| Investment Operations | | | | | | |

| Net Investment | | | | | | |

| Income (Loss)(2) | 0.49 | 0.46 | 0.39 | 0.20 | 0.38 | 0.40 |

| Net Realized and | | | | | | |

| Unrealized Gain (Loss) | 0.19 | (4.98) | (0.61) | 1.70 | 2.92 | 1.32 |

| Total From | | | | | | |

| Investment Operations | 0.68 | (4.52) | (0.22) | 1.90 | 3.30 | 1.72 |

| Distributions | | | | | | |

| From Net | | | | | | |

| Investment Income | (0.48) | (0.52) | (0.36) | (0.16) | (0.40) | (0.40) |

| Net Asset Value, | | | | | | |

| End of Period | $12.62 | $12.42 | $17.46 | $18.04 | $16.30 | $13.40 |

| |

| Total Return(3) | 5.30% | (25.89)% | (1.26)% | 11.71% | 24.99% | 14.30% |

| | | | | | | |

| Ratios/Supplemental Data | | | | | | |

| Ratio of Operating | | | | | | |

| Expenses to Average | | | | | | |

| Net Assets | 0.70% | 0.70% | 0.68% | 0.67%(4) | 0.68% | 0.67% |

| Ratio of Net Investment | | | | | | |

| Income (Loss) | | | | | | |

| to Average Net Assets | 3.75% | 3.54% | 2.16% | 2.30%(4) | 2.62% | 3.09% |

| Portfolio Turnover Rate | 11% | 14% | 19% | 20% | 45% | 21% |

| Net Assets, End of Period | | | | | | |

| (in thousands) | $228,101 | $236,734 | $387,070 | $502,099 | $336,672 | $292,575 |

| (1) | January 1, 2007 through June 30, 2007. The fund’s fiscal year end was changed from December 31 to June 30, resulting in a six-month annual |

| | reporting period. For the years before June 30, 2007, the fund’s fiscal year end was December 31. | | |

| (2) | Computed using average shares outstanding throughout the period. | | | | |

| (3) | Total return assumes reinvestment of net investment income and capital gains distributions, if any. Total returns for periods less than one year |

| | are not annualized. Total returns are calculated based on the net asset value of the last business day. | | |

| (4) | Annualized. | | | | | | |

See Notes to Financial Statements.

21

|

| Report of Independent Registered Public Accounting Firm |

To the Directors of the American Century Quantitative Equity Funds, Inc.

and Shareholders of the Utilities Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of the Utilities Fund (one of the eleven funds comprising the American Century Quantitative Equity Funds, Inc., hereafter referred to as the “Fund”) at June 30, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at June 30, 2010 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Kansas City, Missouri

August 19, 2010

22

A special meeting of shareholders was held on June 16, 2010, to vote on the following proposals. Each proposal received the required number of votes and was adopted. A summary of voting results is listed below each proposal.

Proposal 1:

To elect one Director to the Board of Directors of American Century Quantitative Equity Funds, Inc. (the proposal was voted on by all shareholders of funds issued by American Century Quantitative Equity Funds, Inc.):

| | |

| Frederick L.A. Grauer | For: | 4,067,909,978 |

| | Withhold: | 174,470,448 |

| | Abstain: | 0 |

| | Broker Non-Vote: | 0 |

The other directors whose term of office continued after the meeting include Jonathan S. Thomas, John Freidenrich, Ronald J. Gilson, Peter F. Pervere, Myron S. Scholes, and John B. Shoven.

Proposal 2:

To approve a management agreement between the fund and American Century Investment Management, Inc.:

| | |

| Investor Class | For: | 143,449,883 |

| | Against: | 4,877,008 |

| | Abstain: | 5,206,489 |

| | Broker Non-Vote: | 23,455,454 |

23

The Board of Directors

The individuals listed below serve as directors of the fund. Each director will continue to serve in this capacity until death, retirement, resignation or removal from office. The mandatory retirement age for directors who are not “interested persons,” as that term is defined in the Investment Company Act (independent directors), is 73. However, the mandatory retirement age may be extended for a period not to exceed two years with the approval of the remaining independent directors.

Mr. Thomas is the only director who is an “interested person” because he currently serves as President and Chief Executive Officer of American Century Companies, Inc. (ACC), the parent company of American Century Investment Management, Inc. (ACIM or the advisor).

The other directors (more than three-fourths of the total number) are independent; that is, they have never been employees, directors or officers of, and have no financial interest in, ACC or any of its wholly owned, direct or indirect, subsidiaries, including ACIM, American Century Investment Services, Inc. (ACIS) and American Century Services, LLC (ACS). The directors serve in this capacity for eight (in the case of Mr. Thomas, 15) registered investment companies in the American Century Investments family of funds.

The following presents additional information about the directors. The mailing address for each director other than Mr. Thomas is 1665 Charleston Road, Mountain View, California 94043. The mailing address for Mr. Thomas is 4500 Main Street, Kansas City, Missouri 64111.

Independent Directors

John Freidenrich

Year of Birth: 1937

Position(s) with the Fund: Director

Length of Time Served: Since 2005

Principal Occupation(s) During the Past Five Years: Founder, Member and Manager, Regis

Management Company, LLC (investment management firm) (April 2004 to present)

Number of Funds in Fund Complex Overseen by Director: 41

Other Directorships Held by Director During the Past Five Years: None

Education/Other Professional Experience: AB in Economics, Stanford University; LLB,

Stanford Law School; formerly, Partner and Founder, Ware and Freidenrich Law

Firm and Bay Partners; formerly, President, Board of Trustees, Stanford University

Ronald J. Gilson

Year of Birth: 1946

Position(s) with the Fund: Director and Chairman of the Board

Length of Time Served: Since 1995

Principal Occupation(s) During the Past Five Years: Charles J. Meyers Professor of Law and

Business, Stanford Law School (1979 to present); Marc and Eva Stern Professor of

Law and Business, Columbia University School of Law (1992 to present)

Number of Funds in Fund Complex Overseen by Director: 41

Other Directorships Held by Director During the Past Five Years: None

Education/Other Professional Experience: BA, Washington University; JD, Yale Law School;

formerly, Attorney, Steinhart, Goldberg, Feigenbaum & Ladar

24

Frederick L. A. Grauer

Year of Birth: 1946

Position(s) with the Fund: Director

Length of Time Served: Since 2008

Principal Occupation(s) During the Past Five Years: Senior Advisor, BlackRock, Inc. (investment

management firm) (2010 to present); Senior Advisor, Barclays Global Investors

(investment management firm) (2003 to 2009)

Number of Funds in Fund Complex Overseen by Director: 41

Other Directorships Held by Director During the Past Five Years: None

Education/Other Professional Experience: BA in Economics, University of British Columbia;

MA in Economics, University of Chicago; PhD in Business, Stanford University;

formerly, Executive Chairman, Barclays Global Investors; Chairman and Chief

Executive Officer, Wells Fargo Nikko Investment Advisors; and Vice President,

Merrill Lynch Capital Markets Group; formerly, Director, New York Stock Exchange,

Chicago Mercantile Exchange and Columbia University; formerly, Faculty Member,

Graduate School of Business, Columbia University and Alfred P. Sloan School of

Management, Massachusetts Institute of Technology

Peter F. Pervere

Year of Birth: 1947

Position(s) with the Fund: Director

Length of Time Served: Since 2007

Principal Occupation(s) During the Past Five Years: Retired

Number of Funds in Fund Complex Overseen by Director: 41

Other Directorships Held by Director During the Past Five Years: Intraware, Inc. (2003 to 2009);

Digital Impact, Inc. (2003 to 2005)

Education/Other Professional Experience: BA in History, Stanford University; CPA; formerly,

Vice President and Chief Financial Officer, Commerce One, Inc. (software and

services provider); formerly, Vice President and Corporate Controller, Sybase, Inc.;

formerly with accounting firm of Arthur Young & Co.

Myron S. Scholes

Year of Birth: 1941

Position(s) with the Fund: Director

Length of Time Served: Since 1980

Principal Occupation(s) During the Past Five Years: Chairman, Platinum Grove Asset

Management, L.P. (asset manager) (1999 to 2009); Frank E. Buck Professor of

Finance-Emeritus, Stanford Graduate School of Business (1996 to present)

Number of Funds in Fund Complex Overseen by Director: 41

Other Directorships Held by Director During the Past Five Years: Dimensional Fund Advisors

(investment advisor); CME Group, Inc. (futures and options exchange)

Education/Other Professional Experience: BA in Economics, McMaster University (Ontario);

MBA and PhD, University of Chicago; formerly, Senior Research Fellow at the

Hoover Institute; formerly, Edward Eagle Brown Professor of Finance, University of

Chicago; recipient of the Alfred Nobel Memorial Prize in Economic Sciences

25

John B. Shoven

Year of Birth: 1947

Position(s) with the Fund: Director

Length of Time Served: Since 2002

Principal Occupation(s) During the Past Five Years: Professor of Economics, Stanford University

(1973 to present)

Number of Funds in Fund Complex Overseen by Director: 41

Other Directorships Held by Director During the Past Five Years: Cadence Design Systems;

Exponent; Financial Engines; PalmSource, Inc. (2002 to 2005); Watson Wyatt

Worldwide (2002 to 2006)

Education/Other Professional Experience: BA in Physics, University of California; PhD in

Economics, Yale University; Director of the Stanford Institute for Economic Policy

Research (1999 to present); formerly, Chair of Economics and Dean of Humanities

and Sciences, Stanford University

Interested Director

Jonathan S. Thomas

Year of Birth: 1963

Position(s) with the Fund: Director and President

Length of Time Served: Since 2007

Principal Occupation(s) During the Past Five Years: President and Chief Executive Officer,

ACC (March 2007 to present); Chief Administrative Officer, ACC (February 2006 to

February 2007); Executive Vice President, ACC (November 2005 to February 2007);

Global Chief Operating Officer and Managing Director, Morgan Stanley (investment

management) (March 2000 to November 2005). Also serves as: Chief Executive

Officer and Manager, ACS; Executive Vice President, ACIM; Director, ACC, ACIM

and other ACC subsidiaries

Number of Funds in Fund Complex Overseen by Director: 104

Other Directorships Held by Director During the Past Five Years: None

Education/Other Professional Experience: BA in Economics, University of Massachusetts;

MBA, Boston College; formerly held senior leadership roles with Fidelity

Investments, Boston Financial Services and Bank of America; serves on the Board of

Governors of the Investment Company Institute

26

Officers

The following table presents certain information about the executive officers of the fund. Each officer serves as an officer for each of the 15 investment companies in the American Century family of funds, unless otherwise noted. No officer is compensated for his or her service as an officer of the fund. The listed officers are interested persons of the fund and are appointed or re-appointed on an annual basis. The mailing address for each of the officers listed below is 4500 Main Street, Kansas City, Missouri 64111.

| | |

| Name | Offices with | |

| (Year of Birth) | the Fund | Principal Occupation(s) During the Past Five Years |

| Jonathan S. | Director and | President and Chief Executive Officer, ACC (March 2007 to present); |

| Thomas | President | Chief Administrative Officer, ACC (February 2006 to February 2007); |

| (1963) | since 2007 | Executive Vice President, ACC (November 2005 to February 2007); Global |

| | | Chief Operating Officer and Managing Director, Morgan Stanley (March |

| | | 2000 to November 2005). Also serves as: Chief Executive Officer and |

| | | Manager, ACS; Executive Vice President, ACIM; Director, ACC, ACIM and |

| | | other ACC subsidiaries |

| Barry Fink | Executive | Chief Operating Officer and Executive Vice President, ACC (September 2007 |

| (1955) | Vice President | to present); President, ACS (October 2007 to present); Managing Director, |

| | since 2007 | Morgan Stanley (2000 to 2007); Global General Counsel, Morgan Stanley |

| | | (2000 to 2006). Also serves as: Manager, ACS, and Director, ACC and |

| | | certain ACC subsidiaries |

| Maryanne L. | Chief Compliance | Chief Compliance Officer, American Century funds, ACIM and ACS (August |

| Roepke | Officer since 2006 | 2006 to present); Assistant Treasurer, ACC (January 1995 to August 2006); |

| (1956) | and Senior | and Treasurer and Chief Financial Officer, various American Century funds |

| | Vice President | (July 2000 to August 2006). Also serves as: Senior Vice President, ACS |

| | since 2000 | |

| Charles A. | General Counsel | Attorney, ACC (February 1994 to present); Vice President, ACC (November |

| Etherington | since 2007 and | 2005 to present); General Counsel, ACC (March 2007 to present); Also |

| (1957) | Senior Vice | serves as General Counsel, ACIM, ACS, ACIS and other ACC subsidiaries; |

| | President | and Senior Vice President, ACIM and ACS |

| | since 2006 | |

| Robert J. Leach | Vice President, | Vice President, ACS (February 2000 to present); and Controller, various |

| (1966) | Treasurer and | American Century funds (1997 to September 2006) |

| | Chief Financial | |

| | Officer since 2006 | |

| David H. Reinmiller | Vice President | Attorney, ACC (January 1994 to present); Associate General Counsel, ACC |

| (1963) | since 2001 | (January 2001 to present); Chief Compliance Officer, American Century |

| | | funds and ACIM (January 2001 to February 2005). Also serves as: Vice |

| | | President, ACIM and ACS |

| Ward D. Stauffer | Secretary | Attorney, ACC (June 2003 to Present) |

| (1960) | since 2005 | |

The SAI has additional information about the fund’s directors and is available without charge, upon request, by calling 1-800-345-2021.

27

|

| Board Approval of Management Agreements |

American Century Investment Management, Inc. (“ACIM” or the “Advisor”) currently serves as investment advisor to the Fund under a management agreement (the “Current Management Agreement”) that took effect on July 16, 2010, following approval by the Fund’s Board of Directors (the “Board”) and shareholders. The Advisor previously served as investment advisor to the Fund pursuant to a prior management agreement (the “Prior Management Agreement”) and an interim management agreement (the “Interim Management Agreement”). The Interim Management Agreement terminated in accordance with its terms on July 16, 2010, upon the effectiveness of the Current Management Agreement. The Prior Management Agreement terminated on February 16, 2010, as a result of a change of control of the Advisor’s parent company, American Century Companies, Inc. (“ACC”). T he change in control occurred as the result of a change in the trustee of a trust created by James E. Stowers, Jr., the founder of American Century Investments that holds shares representing a significant interest in ACC stock. Mr. Stowers previously served as the trustee of the trust. On February 16, 2010, Richard W. Brown, Co-Chairman of ACC with Mr. Stowers, became the trustee in accordance with the terms of the trust and Mr. Stowers’ long-standing estate and succession plan.

On February 18, 2010, the Board approved the Interim Management Agreement in accordance with Rule 15a-4 under the Investment Company Act to ensure continued management of the Fund by the Advisor after the termination of the Prior Management Agreement and until shareholder approval of the Current Management Agreement as required under the Act. The Board approved the Current Management Agreement and recommended its approval to shareholders. Fund shareholders approved the Current Management Agreement at a meeting held on June 16, 2010.

The Interim Management Agreement and the Current Management Agreement are substantially identical to the Prior Management Agreement except for their effective dates and the termination provisions of the Interim Management Agreement. Under the Interim and Current Management Agreements, the Advisor will provide the same services to the Fund and receive the same compensation rate as under the Prior Management Agreement.

Basis for Board Approval of Interim Management Agreement

In considering the approval of the Interim Management Agreement, Rule 15a-4 requires the Board to approve the contract within ten business days of the termination of the prior agreement and to determine that the compensation to be received under the interim agreement is no greater than would have been received under the prior agreement. In connection with the approval, the Board noted that it oversees on a continuous basis and evaluates at its quarterly meetings, directly and through the committees of the Board, the nature and quality of significant services provided by the Advisor, the investment performance of the Fund, shareholder services, audit and compliance functions and a variety of other matters relating to the Fund’s operations.

28

In evaluating the Interim Management Agreement, the Board, assisted by the advice of its independent legal counsel, considered a number of factors in addition to those required by the rule with no one factor being determinative to its analysis. Among the factors considered by the Board were the circumstances and effect of the change of control, the fact that the Advisor will provide the same services and receive the same compensation rate as under the Prior Management Agreement, and that the change of control did not result in a change of the personnel managing the Fund. Upon completion of its analysis, the Board approved the Interim Management Agreement, determining that the continued management of the Fund by the Advisor was in the best interests of the Fund and Fund shareholders.

Basis for Board Approval of Current Management Agreement

At a meeting held on April 1, 2010, after considering all information presented, the Board approved, and determined to recommend that shareholders approve, the Current Management Agreement. In connection with that approval, the Board requested and reviewed extensive data and information compiled by the Advisor and certain independent providers of evaluation data concerning the Fund and services provided to the Fund by the Advisor. The Board oversees on a continuous basis and evaluates at its quarterly meetings, directly and through the committees of the Board, the nature and quality of significant services provided by the Advisor, the investment performance of the Fund, shareholder services, audit and compliance functions and a variety of other matters relating to the Fund’s operations. The information considered and the discussions held at the meetings included, but were not limited to:

• the nature, extent and quality of investment management, shareholder services and other services provided to the Fund;

• the wide range of programs and services the Advisor provides to the Fund and its shareholders on a routine and non-routine basis;

• the compliance policies, procedures, and regulatory experience of the Advisor;

• data comparing the cost of owning the Fund to the cost of owning similar funds;

• the fact that there will be no changes to the fees, services, or personnel who provide such services as compared to the Prior Management Agreement;

• data comparing the Fund’s performance to appropriate benchmarks and/or a peer group of other mutual funds with similar investment objectives and strategies;

• financial data showing the profitability of the Fund to the Advisor and the overall profitability of the Advisor;

• data comparing services provided and charges to the Fund with those for other non-fund investment management clients of the Advisor; and

29

• consideration of collateral or “fall-out” benefits derived by the Advisor from the management of the Fund and potential sharing of economies of scale in connection with the management of the Fund.

The Board also considered whether there was any reason for not continuing the existing arrangement with the Advisor. In particular, the Board recognized that shareholders may have invested in the Fund on the strength of the Advisor’s industry standing and reputation and in the expectation that the Advisor will have a continuing role in providing advisory services to the Fund.

The Board considered all of the information provided by the Advisor, the independent data providers, and the Board’s independent legal counsel, and evaluated such information for the Fund. The Board did not identify any single factor as being all-important or controlling, and each Board member may have attributed different levels of importance to different factors. In deciding to approve the Current Management Agreement under the terms ultimately determined by the Board to be appropriate, the Board based its decision on a number of factors, including the following:

Nature, Extent and Quality of Services — Generally. Under the Current Management Agreement, the Advisor is responsible for providing or arranging for all services necessary for the operation of the Fund. The Board noted that under the Current Management Agreement, the Advisor provides or arranges at its own expense a wide variety of services including:

• constructing and designing the Fund

• portfolio research and security selection

• initial capitalization/funding

• securities trading

• Fund administration

• custody of Fund assets

• daily valuation of the Fund’s portfolio

• shareholder servicing and transfer agency, including shareholder

confirmations, recordkeeping and communications

• legal services

• regulatory and portfolio compliance

• financial reporting

• marketing and distribution

30

The Board noted that many of these services have expanded over time both in terms of quantity and complexity in response to shareholder demands, competition in the industry, changing distribution channels and the changing regulatory environment.

Investment Management Services. The investment management services provided to the Fund are complex and provide Fund shareholders access to professional money management, instant diversification of their investments within an asset class, the opportunity to easily diversify among asset classes, and liquidity. As a part of its general oversight and in evaluating investment performance, the Board expects the Advisor to manage the Fund in accordance with its investment objectives and approved strategies. In providing these services, the Advisor utilizes teams of investment professionals who require extensive information technology, research, training, compliance and other systems to conduct their business. The Board, directly and through its Portfolio Committee, regularly reviews investment performance information for the Fund, t ogether with comparative information for appropriate benchmarks and/or peer groups of similarly-managed funds, over different time horizons. If performance concerns are identified, the underperforming Fund receives special reviews until performance improves, during which time the Board discusses with the Advisor the reasons for such underperformance and any efforts being undertaken to improve performance.

Shareholder and Other Services. Under the Current Management Agreement, the Advisor will also provide the Fund with a comprehensive package of transfer agency, shareholder, and other services. The Board, directly and through the various committees of the Board, regularly reviews reports and evaluations of such services. These reports include, but are not limited to, information regarding the operational efficiency and accuracy of the shareholder and transfer agency services provided, staffing levels, shareholder satisfaction (as measured by external as well as internal sources), technology support, new products and services offered to Fund shareholders, securities trading activities, portfolio valuation services, auditing services, and legal and operational compliance activities. Certain aspects of shareholder and transfer age ncy service level efficiency and the quality of securities trading activities are measured by independent third party providers and are presented in comparison to other fund groups not managed by the Advisor.

Costs of Services Provided and Profitability. The Advisor provided detailed information concerning its cost of providing various services to the Fund, its profitability in managing the Fund, its overall profitability, and its financial condition. The Board reviewed with the Advisor the methodology used to prepare this financial information. The Board has also reviewed with the Advisor its methodology for compensating the investment professionals that provide services to the Fund as well as compensation to the five highest paid personnel of the Advisor. This financial information regarding the Advisor is considered in order to evaluate the Advisor’s financial condition, its ability to continue to provide services under the Current Management Agreement, and the reasonableness of the current management fees.

31

Ethics. The Board generally considers the Advisor’s commitment to providing quality services to shareholders and to conducting its business ethically. It noted that the Advisor’s practices generally meet or exceed industry best practices.