Washington, D.C. 20549

ITEM 1. REPORTS TO STOCKHOLDERS.

ANNUAL REPORT JUNE 30, 2012

| | Strategic Inflation Opportunities Fund |

| President’s Letter | 2 |

| Market Perspective | 3 |

| Performance | 4 |

| Portfolio Commentary | 6 |

| Fund Characteristics | 8 |

| Shareholder Fee Example | 9 |

| Schedule of Investments | 11 |

| Statement of Assets and Liabilities | 21 |

| Statement of Operations | 22 |

| Statement of Changes in Net Assets | 23 |

| Notes to Financial Statements | 24 |

| Financial Highlights | 33 |

| Report of Independent Registered Public Accounting Firm | 35 |

| Management | 36 |

| Approval of Management Agreement | 39 |

| Additional Information | 44 |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Dear Investor:

Thank you for reviewing this annual report for the period ended June 30, 2012. Our report offers investment performance and portfolio information, presented with the expert perspective of our portfolio management team.

This report remains one of our most important vehicles for conveying information about fund returns, as well as market factors and strategies that affected fund performance. For additional, updated information, we encourage you to visit our website, americancentury.com. Click on the “Fund Performance” and “Insights & News” headings at the top of our Individual Investors site.

Flight to Quality as Economic and Financial Uncertainties Resurfaced

During the second half of 2011 and the first half of 2012, the global economy and financial markets struggled to move beyond the lingering aftereffects of the 2008 Financial Crisis and Great Recession. Global economic fundamentals have improved since 2008, but weakened since 2010, with increased uncertainty surrounding near-term economic growth levels in major developed economies such as the U.S., Japan, and Europe. There were also questions about near-term growth levels in influential emerging economies such as China.

These near-term uncertainties manifested themselves in asset returns for the 12 months ended June 30, 2012. Assets perceived to be “safe-haven” investments rallied—the 30-year U.S. Treasury bond posted a 39% total return. At the other end of the spectrum, international stock returns for U.S. investors were undermined by a combination of risk-averse investing attitudes, weakening global economic growth, and a stronger U.S. dollar versus the euro and currencies of other struggling economies. Commodity prices also plunged during the period.

Unfortunately, the instability that triggered much of this flight-to-quality trading remains largely in place, and the coming months may bring additional uncertainties about the U.S. presidential election and what might happen when various U.S. tax cuts and other stimulative measures expire in 2013 (the so-called “Fiscal Cliff”). In this uncertain, unstable environment, we continue to believe in a disciplined, diversified, long-term investment approach, using both stocks and bonds, as appropriate. We appreciate your continued trust in us during these unsettled times.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

By Scott Wittman, Chief Investment Officer, Quantitative Equity

and Asset Allocation

Risk Aversion Took Center Stage

Market sentiment wavered between “risk on” and “risk off” during the 12-month period ended June 30, 2012. Nevertheless, persistent concerns about weakening global economies and Europe’s ongoing sovereign debt and banking crises overshadowed the periodic bouts of optimism that emerged. Overall, riskier assets, including global stocks and commodities, experienced sharp losses during the period, while higher-quality assets—including U.S. Treasury bonds, Treasury inflation-protected securities (TIPS), and the U.S. dollar—posted strong gains.

The period began with weak labor market and housing data, a first-ever U.S. credit-rating downgrade, and Europe’s expanding sovereign-debt crisis triggering recession fears and “risk-off” trading. Those fears subsided beginning in late 2011 as select economic data improved, and action by the European Central Bank calmed investors’ eurozone fears. But, beginning in April, slowing global growth, combined with ongoing problems in Europe, triggered another round of risk aversion.

Concerned about the economy, the Federal Reserve (the Fed) committed to keeping the federal funds rate target near zero until late 2014. In addition, the Fed extended “Operation Twist,” a stimulus strategy designed to reduce longer-term interest rates, through the end of 2012.

Inflation Tumbled on Weaker Commodity Prices

Commodity prices generally increased into early 2012, before tumbling on slowing demand and sluggish growth. Overall, Brent oil prices fell more than 13% for the period, while WTI crude futures declined 11%. Prices for other commodities also plunged; the S&P Goldman Sachs Commodities Index declined -10.74%.

In this environment of falling commodity prices and weakening economic outlooks, inflationary pressures eased. The 12-month change in the U.S. Consumer Price Index as of June 30, 2012, was 1.7%, compared with 3.6% a year earlier.

At the same time, ongoing concerns related to Europe’s debt and banking-sector solvency fueled demand for perceived “safe-haven” currencies. This helped the U.S. dollar increase in value versus the euro and other major currencies. The dollar’s strength also magnified the decline in commodity prices and stifled demand for gold.

| 12-Month Total Returns | |

| As of June 30, 2012 | |

| S&P Goldman Sachs Commodities Index (total returns) | | | -10.74 | % |

| London Gold PM Fix, in U.S. dollars | | | 6.18 | % |

| Barclays Global Treasury ex-U.S. Bond Index | | | 0.73 | % |

| Barclays U.S. Treasury Inflation Protected Securities (TIPS) Index | | | 11.66 | % |

| Barclays U.S. 1-3 Month Treasury Bill Index | | | 0.04 | % |

| U.S. Dollar (Dollar Spot Index) | | | 9.86 | % |

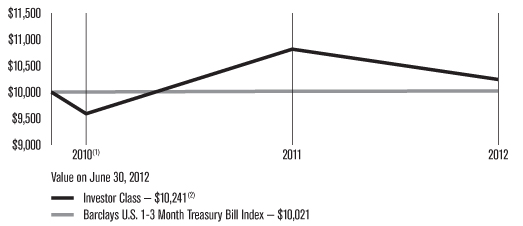

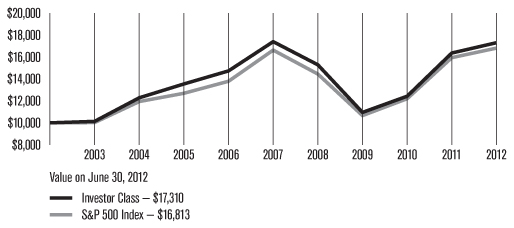

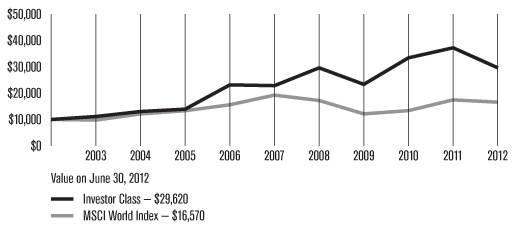

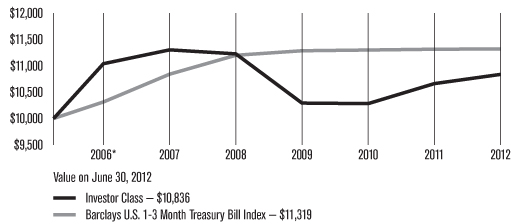

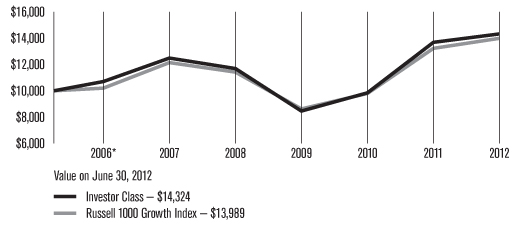

| Total Returns as of June 30, 2012 |

| | | | Average Annual Returns | |

| | Ticker Symbol | 1 year | Since Inception | Inception Date |

| Investor Class | ASIOX | -5.32% | 1.10%(1) | 4/30/10 |

| Barclays U.S. 1-3 Month Treasury Bill Index | — | 0.04% | 0.10% | — |

| Institutional Class | ASINX | -5.13% | 1.26%(1) | 4/30/10 |

A Class No sales charge* With sales charge* | ASIDX | -5.51% -10.92% | 0.85%(1) -1.87%(1) | 4/30/10 |

| C Class | ASIZX | -6.33% | 0.03%(1) | 4/30/10 |

| R Class | ASIUX | -5.78% | 0.54%(1) | 4/30/10 |

| * | Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied. |

| (1) | Returns would have been lower if a portion of the management fee had not been waived. |

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. As interest rates rise, bond values will decline. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks. There are certain risks involved in investing in forward foreign currency exchange contracts; changes in the value of foreign currencies against the U.S. dollar could result in losses to the fund. Commodity investing involves special risks, such as weather, disease, embargoes, tariffs, taxes and economic, political and regulatory developments.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

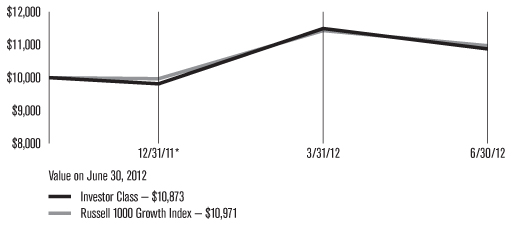

| Growth of $10,000 Over Life of Class |

| $10,000 investment made April 30, 2010 |

| (1) | From 4/30/10, the Investor Class’s inception date. Not annualized. |

| (2) | Ending value would have been lower if a portion of the management fee had not been waived. |

| Total Annual Fund Operating Expenses |

| Investor Class | Institutional Class | A Class | C Class | R Class |

| 1.19% | 0.99% | 1.44% | 2.19% | 1.69% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. As interest rates rise, bond values will decline. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks. There are certain risks involved in investing in forward foreign currency exchange contracts; changes in the value of foreign currencies against the U.S. dollar could result in losses to the fund. Commodity investing involves special risks, such as weather, disease, embargoes, tariffs, taxes and economic, political and regulatory developments.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

Portfolio Managers: Bob Gahagan, Bill Martin, Brian Howell, John Lovito, and Federico Garcia Zamora

Performance Summary

For the 12 months ended June 30, 2012, Strategic Inflation Opportunities declined -5.32%.* The portfolio’s benchmark, the Barclays U.S. 1-3 Month Treasury Bill Index, advanced 0.04% during the same period.

In general, concerns about the stalling global economic recovery, combined with worries about the stability of Europe’s sovereign debt and the solvency of its banking sector, helped trigger sharp losses among global stocks and other “riskier” assets during the 12-month period. In this environment, investors favored perceived “safe-haven” investments, including U.S. Treasury securities, particularly longer-term Treasuries, and the U.S. dollar. Despite waning inflation expectations during the period, the Treasury inflation-protected securities (TIPS) benchmark outpaced the nominal Treasury index and was among the leading performers in the taxable fixed-income universe.

The portfolio’s underperformance relative to its Treasury bill benchmark was primarily due to weak results from positions in commodities, foreign stocks, and foreign currencies, which lagged as risk aversion generally dominated during the period.

Current Inflation Slowed

Current inflation, as measured by the yearly change in the Consumer Price Index (CPI), increased 1.7% as of June 30, 2012, representing a decline of nearly 2 percentage points from the inflation rate a year earlier. Much of the slowdown in inflation was due to falling commodity prices, including oil. After generally rising through March 2012, oil prices fell 20% (Brent crude) during the final three months of the period, which led to an overall decline for the one-year period.

Bucking the general trend among commodities, gold bullion advanced during the 12-month period, but the gain was much more modest than in previous fiscal years. After rallying to a record high in August 2011, gold prices generally tumbled through the end of the fiscal year. The decline stemmed from waning demand triggered by a stronger U.S. dollar (gold is priced in dollars, so a stronger dollar makes it more expensive for foreign buyers) and declining inflation (rising inflation often triggers demand for gold from investors looking to hedge against the threat).

Inflation Outlook Eased

Longer-term inflation expectations also eased during the period, according to one market indicator. The yield difference (or breakeven rate) between 10-year TIPS and nominal 10-year Treasuries declined from 2.38 percentage points at the end of June 2011 to 2.10 percentage points at the end of June 2012. Theoretically, the 10-year breakeven rate reflects the market’s expectations for inflation for the next 10 years and also reflects the inflation rate required for TIPS to outperform nominal Treasuries during that period.

* All fund returns referenced in this commentary are for Investor Class shares.

Portfolio Positioning & Strategy

As of June 30, 2012, approximately 37% of Strategic Inflation Opportunities was invested in TIPS. The portfolio also had an additional small percentage of inflation-linked fixed income exposure in the form of inflation “swaps” (synthetic inflation-linked overlays for corporate and mortgage securities). Commodity-linked investments (including commodity exchange-traded funds—ETFs), domestic and foreign stocks, and foreign currency instruments generally comprised the remainder of the portfolio.

Within the portfolio’s inflation-linked allocation, TIPS outperformed the benchmark and contributed favorably to the portfolio’s relative performance. In addition, the investment team’s use of inflation swaps also contributed favorably to performance, as these securities outperformed short-maturity TIPS and the portfolio’s benchmark.

Within the commodities component, the portfolio was evenly weighted between futures and commodity-related stocks and ETFs, which generally detracted from performance. In terms of specific commodities exposure, the portfolio ended the period with overweight positions in gold and fertilizer companies and an underweight in oil. This positioning reflects the investment team’s outlook for weak economic growth, particularly among developed countries, and continued re-inflationary policies of lower interest rates and quantitative easing from the world’s central banks. A small weighting to global REITs (real estate investment trusts) contributed positively to performance, benefiting from the declining interest rate environment.

After specific currency positions performed well in late 2011 and early 2012, the investment team sold some of that currency exposure to lock in profits and reduce risk. However, remaining exposure to commodity-driven currencies in Canada, Sweden, Australia, New Zealand, and Norway dragged down overall performance. In addition, underweight positions in the outperforming Japanese yen and U.S. dollar detracted from results, while an underweight in the lagging euro helped.

Outlook

The portfolio’s investment team expects inflation to remain relatively contained in the near term, due to slowing economic growth, a weak labor market, and lower commodity prices. Longer term, though, the team believes record federal debt and historically low and highly stimulative interest rate levels eventually may result in higher inflation than what is currently priced into the U.S. Treasury market. The team believes this scenario underscores the importance of products designed to hedge against inflation and protect purchasing power, such as Strategic Inflation Opportunities.

| JUNE 30, 2012 | |

| Types of Investments in Portfolio | % of net assets |

| U.S. Treasury Securities | 46.2% |

| Domestic Common Stocks | 11.3% |

| Foreign Common Stocks | 5.8% |

| Commodity ETFs | 14.6% |

| Commercial Paper | 12.4% |

| Corporate Bonds | 2.6% |

| Commercial Mortgage-Backed Securities | 1.8% |

| Collateralized Mortgage Obligations | 1.4% |

| Temporary Cash Investments | 4.2% |

| Other Assets and Liabilities | (0.3)% |

| | |

| Top Ten Stock Holdings | % of net assets |

| Chevron Corp. | 1.0% |

| Exxon Mobil Corp. | 1.0% |

| Schlumberger Ltd. | 0.7% |

| Occidental Petroleum Corp. | 0.5% |

| ConocoPhillips | 0.5% |

| Apache Corp. | 0.3% |

| Goldcorp, Inc. New York Shares | 0.3% |

| Freeport-McMoRan Copper & Gold, Inc. | 0.3% |

| Halliburton Co. | 0.3% |

| Barrick Gold Corp. | 0.3% |

| | |

| Geographic Composition of Stock Holdings | % of net assets |

| United States | 11.3% |

| Canada | 3.0% |

| Hong Kong | 0.7% |

| Japan | 0.5% |

| Other Countries | 1.6% |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from January 1, 2012 to June 30, 2012.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | |

| | Beginning Account Value 1/1/12 | Ending Account Value 6/30/12 | Expenses Paid During Period(1) 1/1/12 – 6/30/12 | Annualized Expense Ratio(1) |

| Actual | | | | |

| Investor Class | $1,000 | $997.00 | $5.41 | 1.09% |

| Institutional Class | $1,000 | $997.60 | $4.42 | 0.89% |

| A Class | $1,000 | $996.00 | $6.65 | 1.34% |

| C Class | $1,000 | $991.00 | $10.35 | 2.09% |

| R Class | $1,000 | $994.00 | $7.88 | 1.59% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,019.44 | $5.47 | 1.09% |

| Institutional Class | $1,000 | $1,020.44 | $4.47 | 0.89% |

| A Class | $1,000 | $1,018.20 | $6.72 | 1.34% |

| C Class | $1,000 | $1,014.47 | $10.47 | 2.09% |

| R Class | $1,000 | $1,016.96 | $7.97 | 1.59% |

| (1) | Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 182, the number of days in the most recent fiscal half-year, divided by 366, to reflect the one-half year period. |

| | | Principal Amount/ Shares | | | Value | |

| U.S. Treasury Securities — 46.2% | |

| U.S. Treasury Inflation Indexed Notes, 1.875%, 7/15/13 | | | $2,874,947 | | | | $2,946,596 | |

| U.S. Treasury Inflation Indexed Notes, 2.00%, 1/15/14 | | | 4,856,202 | | | | 5,045,900 | |

| U.S. Treasury Inflation Indexed Notes, 1.25%, 4/15/14 | | | 3,702,833 | | | | 3,825,778 | |

| U.S. Treasury Inflation Indexed Notes, 2.00%, 7/15/14 | | | 2,203,147 | | | | 2,336,369 | |

| U.S. Treasury Inflation Indexed Notes, 1.625%, 1/15/15 | | | 3,415,977 | | | | 3,633,212 | |

U.S. Treasury Inflation Indexed Notes, 0.50%, 4/15/15(1) | | | 6,322,245 | | | | 6,570,690 | |

| U.S. Treasury Inflation Indexed Notes, 1.875%, 7/15/15 | | | 4,096,210 | | | | 4,459,429 | |

| U.S. Treasury Inflation Indexed Notes, 2.00%, 1/15/16 | | | 3,333,888 | | | | 3,692,541 | |

| U.S. Treasury Inflation Indexed Notes, 0.125%, 4/15/16 | | | 2,579,792 | | | | 2,688,223 | |

| U.S. Treasury Inflation Indexed Notes, 2.50%, 7/15/16 | | | 478,489 | | | | 548,356 | |

| U.S. Treasury Inflation Indexed Notes, 2.375%, 1/15/17 | | | 3,650,848 | | | | 4,217,872 | |

| U.S. Treasury Inflation Indexed Notes, 0.125%, 4/15/17 | | | 2,025,940 | | | | 2,141,165 | |

| U.S. Treasury Inflation Indexed Notes, 1.625%, 1/15/18 | | | 164,735 | | | | 188,287 | |

| U.S. Treasury Notes, 0.375%, 8/31/12 | | | 10,000,000 | | | | 10,005,860 | |

TOTAL U.S. TREASURY SECURITIES (Cost $52,077,088) | | | | 52,300,278 | |

| Common Stocks — 17.1% | |

| CHEMICALS — 0.5% | |

| Agrium, Inc. | | | 1,967 | | | | 174,020 | |

| Monsanto Co. | | | 1,765 | | | | 146,107 | |

| Mosaic Co. (The) | | | 1,547 | | | | 84,714 | |

| Potash Corp. of Saskatchewan, Inc. | | | 4,419 | | | | $193,066 | |

| | | | | | | | 597,907 | |

| ENERGY EQUIPMENT AND SERVICES — 2.0% | |

| Baker Hughes, Inc. | | | 4,867 | | | | 200,034 | |

| Diamond Offshore Drilling, Inc. | | | 1,751 | | | | 103,537 | |

| Ensco plc Class A | | | 3,416 | | | | 160,450 | |

| Halliburton Co. | | | 11,371 | | | | 322,823 | |

Nabors Industries Ltd.(2) | | | 3,922 | | | | 56,477 | |

| National Oilwell Varco, Inc. | | | 3,542 | | | | 228,246 | |

Noble Corp.(2) | | | 2,853 | | | | 92,808 | |

| Oceaneering International, Inc. | | | 2,102 | | | | 100,602 | |

| Patterson-UTI Energy, Inc. | | | 4,622 | | | | 67,296 | |

Rowan Cos. plc(2) | | | 2,380 | | | | 76,945 | |

| Schlumberger Ltd. | | | 11,374 | | | | 738,286 | |

| Tidewater, Inc. | | | 1,616 | | | | 74,918 | |

Weatherford International Ltd.(2) | | | 7,094 | | | | 89,597 | |

| | | | | | | | 2,312,019 | |

| HOTELS, RESTAURANTS AND LEISURE — 0.1% | |

| Wyndham Worldwide Corp. | | | 2,239 | | | | 118,085 | |

| HOUSEHOLD DURABLES — 0.2% | |

| Lennar Corp., Class A | | | 4,145 | | | | 128,122 | |

PulteGroup, Inc.(2) | | | 11,680 | | | | 124,976 | |

| | | | | | | | 253,098 | |

| METALS AND MINING — 2.3% | |

Allied Nevada Gold Corp.(2) | | | 3,150 | | | | 89,355 | |

B2Gold Corp.(2) | | | 35,517 | | | | 106,750 | |

| Barrick Gold Corp. | | | 8,146 | | | | 306,045 | |

| BHP Billiton Ltd. ADR | | | 833 | | | | 54,395 | |

Detour Gold Corp.(2) | | | 2,169 | | | | 43,695 | |

| Eldorado Gold Corp. | | | 1,982 | | | | 24,412 | |

First Majestic Silver Corp.(2) | | | 1,994 | | | | 28,813 | |

| Franco-Nevada Corp. | | | 3,170 | | | | 143,352 | |

| Freeport-McMoRan Copper & Gold, Inc. | | | 10,049 | | | | 342,369 | |

| Goldcorp, Inc. New York Shares | | | 9,336 | | | | 350,847 | |

| Kinross Gold Corp. New York Shares | | | 8,063 | | | | 65,713 | |

New Gold, Inc.(2) | | | 8,120 | | | | 77,444 | |

| Newmont Mining Corp. | | | 4,317 | | | | 209,418 | |

Osisko Mining Corp.(2) | | | 9,846 | | | | 67,697 | |

| Royal Gold, Inc. | | | 739 | | | | 57,938 | |

| | | | | | | | | |

| | | Principal Amount/ Shares | | | | Value | |

Sandstorm Gold Ltd.(2) | | | 8,636 | | | | $70,405 | |

| Silver Wheaton Corp. | | | 4,795 | | | | 128,698 | |

SunCoke Energy, Inc.(2) | | | 2,353 | | | | 34,471 | |

Tahoe Resources, Inc.(2) | | | 6,116 | | | | 84,522 | |

| Teck Resources Ltd. | | | 4,267 | | | | 132,021 | |

Torex Gold Resources, Inc.(2) | | | 13,663 | | | | 22,143 | |

| Yamana Gold, Inc. New York Shares | | | 9,279 | | | | 142,897 | |

| | | | | | | | 2,583,400 | |

| OIL, GAS AND CONSUMABLE FUELS — 7.0% | |

Alpha Natural Resources, Inc.(2) | | | 3,765 | | | | 32,793 | |

| Anadarko Petroleum Corp. | | | 3,957 | | | | 261,953 | |

| Apache Corp. | | | 4,312 | | | | 378,982 | |

| Cabot Oil & Gas Corp. | | | 1,546 | | | | 60,912 | |

| Canadian Natural Resources Ltd. | | | 5,562 | | | | 149,340 | |

| Canadian Oil Sands Ltd. | | | 3,618 | | | | 70,079 | |

| Chesapeake Energy Corp. | | | 5,968 | | | | 111,005 | |

| Chevron Corp. | | | 10,464 | | | | 1,103,952 | |

| Cimarex Energy Co. | | | 1,012 | | | | 55,781 | |

Cobalt International Energy, Inc.(2) | | | 2,652 | | | | 62,322 | |

| ConocoPhillips | | | 10,153 | | | | 567,350 | |

Continental Resources, Inc.(2) | | | 911 | | | | 60,691 | |

Denbury Resources, Inc.(2) | | | 4,275 | | | | 64,595 | |

| Devon Energy Corp. | | | 4,044 | | | | 234,512 | |

| Encana Corp. | | | 8,354 | | | | 174,014 | |

| Energy Transfer Equity LP | | | 1,452 | | | | 59,561 | |

| EOG Resources, Inc. | | | 2,901 | | | | 261,409 | |

| Exxon Mobil Corp. | | | 12,897 | | | | 1,103,596 | |

Forest Oil Corp.(2) | | | 3,215 | | | | 23,566 | |

| Hess Corp. | | | 3,881 | | | | 168,629 | |

| Marathon Oil Corp. | | | 7,771 | | | | 198,704 | |

| Marathon Petroleum Corp. | | | 3,347 | | | | 150,347 | |

Newfield Exploration Co.(2) | | | 1,179 | | | | 34,556 | |

| Noble Energy, Inc. | | | 1,600 | | | | 135,712 | |

| Occidental Petroleum Corp. | | | 6,874 | | | | 589,583 | |

| Peabody Energy Corp. | | | 2,232 | | | | 54,729 | |

Phillips 66(2) | | | 6,017 | | | | 200,005 | |

Pinecrest Energy, Inc.(2) | | | 24,948 | | | | 43,373 | |

| Pioneer Natural Resources Co. | | | 742 | | | | 65,452 | |

Plains Exploration & Production Co.(2) | | | 1,702 | | | | 59,876 | |

| Range Resources Corp. | | | 1,669 | | | | 103,261 | |

Renegade Petroleum Ltd.(2) | | | 19,080 | | | | 48,726 | |

Southwestern Energy Co.(2) | | | 2,776 | | | | $88,638 | |

| Spectra Energy Corp. | | | 4,923 | | | | 143,062 | |

| Suncor Energy, Inc. | | | 10,086 | | | | 291,990 | |

| Sunoco, Inc. | | | 2,074 | | | | 98,515 | |

| Talisman Energy, Inc. | | | 1,430 | | | | 16,391 | |

| Talisman Energy, Inc., New York shares | | | 7,515 | | | | 86,122 | |

| TransCanada Corp. | | | 1,078 | | | | 45,181 | |

| Valero Energy Corp. | | | 7,251 | | | | 175,112 | |

Whiting Petroleum Corp.(2) | | | 1,442 | | | | 59,295 | |

| Williams Cos., Inc. (The) | | | 4,659 | | | | 134,272 | |

WPX Energy, Inc.(2) | | | 3,731 | | | | 60,368 | |

| | | | | | | | 7,888,312 | |

PAPER AND FOREST PRODUCTS† | |

| Domtar Corp. | | | 505 | | | | 38,739 | |

| REAL ESTATE INVESTMENT TRUSTS (REITs) — 3.4% | |

| Advance Residence Investment Corp. | | | 17 | | | | 33,028 | |

| American Tower Corp. | | | 3,726 | | | | 260,485 | |

| Apartment Investment & Management Co., Class A | | | 4,929 | | | | 133,231 | |

| Camden Property Trust | | | 2,048 | | | | 138,588 | |

| Capital Property Fund | | | 21,965 | | | | 26,885 | |

| CDL Hospitality Trusts | | | 29,000 | | | | 44,859 | |

| CFS Retail Property Trust | | | 40,739 | | | | 81,022 | |

| Derwent London plc | | | 2,859 | | | | 83,068 | |

| Extra Space Storage, Inc. | | | 4,272 | | | | 130,723 | |

| Frasers Centrepoint Trust | | | 34,000 | | | | 44,883 | |

| Goodman Group | | | 21,812 | | | | 82,677 | |

| Great Portland Estates plc | | | 13,149 | | | | 81,387 | |

| Hammerson plc | | | 13,661 | | | | 95,228 | |

| Health Care REIT, Inc. | | | 3,108 | | | | 181,196 | |

| Highwoods Properties, Inc. | | | 3,677 | | | | 123,731 | |

| Host Hotels & Resorts, Inc. | | | 4,546 | | | | 71,918 | |

| Japan Real Estate Investment Corp. | | | 5 | | | | 45,968 | |

| Japan Retail Fund Investment Corp. | | | 24 | | | | 38,056 | |

| Kilroy Realty Corp. | | | 2,544 | | | | 123,155 | |

| Klepierre | | | 3,468 | | | | 114,279 | |

| Link Real Estate Investment Trust (The) | | | 36,500 | | | | 149,228 | |

| Newcastle Investment Corp. | | | 10,162 | | | | 68,085 | |

| Nippon Building Fund, Inc. | | | 5 | | | | 48,415 | |

| Public Storage | | | 1,584 | | | | 228,745 | |

| Rayonier, Inc. | | | 3,247 | | | | 145,790 | |

| RioCan Real Estate Investment Trust | | | 1,935 | | | | 52,647 | |

| Simon Property Group, Inc. | | | 1,520 | | | | 236,603 | |

| | | | | | | | | |

| | | Principal Amount/ Shares | | | | Value | |

| Taubman Centers, Inc. | | | 1,829 | | | | $141,126 | |

| UDR, Inc. | | | 5,562 | | | | 143,722 | |

| United Urban Investment Corp. | | | 32 | | | | 34,522 | |

| Ventas, Inc. | | | 3,442 | | | | 217,259 | |

| Westfield Group | | | 18,173 | | | | 177,054 | |

| Westfield Retail Trust | | | 23,243 | | | | 68,136 | |

| Weyerhaeuser Co. | | | 9,025 | | | | 201,799 | |

| | | | | | | | 3,847,498 | |

| REAL ESTATE MANAGEMENT AND DEVELOPMENT — 1.5% | |

| Ayala Land, Inc. | | | 69,300 | | | | 35,652 | |

| BR Malls Participacoes SA | | | 5,600 | | | | 63,430 | |

| Brookfield Asset Management, Inc. Class A | | | 5,268 | | | | 174,371 | |

| Cheung Kong Holdings Ltd. | | | 3,000 | | | | 37,033 | |

| China Overseas Grand Oceans Group Ltd. | | | 45,500 | | | | 41,001 | |

| China Overseas Land & Investment Ltd. | | | 42,000 | | | | 98,527 | |

| Daito Trust Construction Co. Ltd. | | | 500 | | | | 47,431 | |

| Daiwa House Industry Co. Ltd. | | | 3,000 | | | | 42,590 | |

Global Logistic Properties Ltd.(2) | | | 49,000 | | | | 81,630 | |

| Growthpoint Properties Ltd. | | | 17,462 | | | | 49,195 | |

| GSW Immobilien AG | | | 1,833 | | | | 62,624 | |

| Hang Lung Properties Ltd. | | | 10,000 | | | | 34,040 | |

| Keppel Land Ltd. | | | 18,000 | | | | 46,264 | |

| Mitsubishi Estate Co. Ltd. | | | 7,000 | | | | 125,574 | |

| Mitsui Fudosan Co. Ltd. | | | 5,000 | | | | 96,994 | |

| New World Development Co. Ltd. | | | 60,000 | | | | 70,835 | |

| PT Ciputra Development Tbk | | | 393,500 | | | | 27,363 | |

| PT Lippo Karawaci Tbk | | | 223,500 | | | | 19,092 | |

| Shimao Property Holdings Ltd. | | | 44,500 | | | | 68,911 | |

| SM Prime Holdings, Inc. | | | 107,000 | | | | 33,295 | |

| Sobha Developers Ltd. | | | 1,701 | | | | 10,381 | |

| Sumitomo Realty & Development Co. Ltd. | | | 3,000 | | | | 73,815 | |

| Sun Hung Kai Properties Ltd. | | | 8,000 | | | | 94,931 | |

| Swire Properties Ltd. | | | 19,961 | | | | 60,120 | |

| TAG Immobilien AG | | | 8,494 | | | | 79,817 | |

| Wheelock & Co. Ltd. | | | 20,000 | | | | 75,995 | |

| | | | | | | | 1,650,911 | |

| TRADING COMPANIES AND DISTRIBUTORS — 0.1% | |

| Noble Group Ltd. | | | 80,290 | | | | $71,685 | |

TOTAL COMMON STOCKS (Cost $20,282,127) | | | | 19,361,654 | |

| Commodity ETFs — 14.6% | |

iShares S&P GSCI Commodity Indexed Trust(2) | | | 262,373 | | | | 7,986,634 | |

PowerShares DB Commodity Index Tracking Fund(2) | | | 200,812 | | | | 5,170,909 | |

SPDR Gold Shares(2) | | | 10,882 | | | | 1,688,778 | |

Sprott Physical Gold Trust(2) | | | 124,062 | | | | 1,710,815 | |

TOTAL COMMODITY ETFs (Cost $17,688,501) | | | | 16,557,136 | |

Commercial Paper(3) — 12.4% | |

BASF SE, 0.16%, 7/24/12(4) | | | $2,000,000 | | | | 1,999,833 | |

BP Capital Markets plc, 0.17%, 8/22/12(4) | | | 750,000 | | | | 749,820 | |

| City of Austin, 0.20%, 8/15/12 | | | 2,011,000 | | | | 2,010,598 | |

CRC Funding LLC, 0.46%, 7/9/12(4) | | | 1,300,000 | | | | 1,299,937 | |

Govco LLC, 0.47%, 7/5/12(4) | | | 2,000,000 | | | | 1,999,926 | |

| Nestle Finance International Ltd., 0.18%, 8/30/12 | | | 2,000,000 | | | | 1,999,549 | |

Sanofi, 0.16%, 9/14/12(4) | | | 2,000,000 | | | | 1,999,229 | |

Thunder Bay Funding LLC, 0.18%, 8/14/12(4) | | | 2,000,000 | | | | 1,999,385 | |

TOTAL COMMERCIAL PAPER (Cost $14,058,170) | | | | 14,058,277 | |

| Corporate Bonds — 2.6% | |

| AUTO COMPONENTS — 0.1% | |

| Visteon Corp., 6.75%, 4/15/19 | | | 70,000 | | | | 68,425 | |

| AUTOMOBILES — 0.1% | |

| Ford Motor Credit Co. LLC, 5.625%, 9/15/15 | | | 70,000 | | | | 76,266 | |

| Ford Motor Credit Co. LLC, 5.00%, 5/15/18 | | | 100,000 | | | | 106,492 | |

| | | | | | | | 182,758 | |

BEVERAGES† | |

| Anheuser-Busch InBev Worldwide, Inc., 5.375%, 1/15/20 | | | 30,000 | | | | 35,828 | |

| CHEMICALS — 0.2% | |

| Ashland, Inc., 9.125%, 6/1/17 | | | 170,000 | | | | 187,850 | |

| CF Industries, Inc., 6.875%, 5/1/18 | | | 25,000 | | | | 29,719 | |

| | | | | | | | 217,569 | |

| | | | | | | | | |

| | | Principal Amount/ Shares | | | | Value | |

COMMERCIAL BANKS† | |

| Capital One Financial Corp., 2.125%, 7/15/14 | | | $50,000 | | | | $50,456 | |

| CONSUMER FINANCE — 0.1% | |

CIT Group, Inc., 4.75%, 2/15/15(4) | | | 75,000 | | | | 77,063 | |

| Credit Suisse (New York), 5.50%, 5/1/14 | | | 20,000 | | | | 21,214 | |

| | | | | | | | 98,277 | |

| CONTAINERS AND PACKAGING — 0.1% | |

Ardagh Packaging Finance plc, 7.375%, 10/15/17(4) | | | 70,000 | | | | 74,725 | |

| Ball Corp., 7.125%, 9/1/16 | | | 70,000 | | | | 76,562 | |

| | | | | | | | 151,287 | |

| DIVERSIFIED FINANCIAL SERVICES — 0.2% | |

| Ally Financial, Inc., 8.30%, 2/12/15 | | | 70,000 | | | | 76,475 | |

| Citigroup, Inc., 6.00%, 12/13/13 | | | 60,000 | | | | 63,083 | |

| Goldman Sachs Group, Inc. (The), 3.625%, 2/7/16 | | | 45,000 | | | | 45,057 | |

| Morgan Stanley, 5.625%, 9/23/19 | | | 20,000 | | | | 19,835 | |

| UBS AG (Stamford Branch), 2.25%, 8/12/13 | | | 40,000 | | | | 40,136 | |

| | | | | | | | 244,586 | |

| DIVERSIFIED TELECOMMUNICATION SERVICES — 0.2% | |

| CenturyLink, Inc., Series L, 7.875%, 8/15/12 | | | 30,000 | | | | 30,213 | |

| Cincinnati Bell, Inc., 8.25%, 10/15/17 | | | 70,000 | | | | 73,150 | |

| Frontier Communications Corp., 6.25%, 1/15/13 | | | 50,000 | | | | 51,281 | |

| Windstream Corp., 7.875%, 11/1/17 | | | 30,000 | | | | 32,850 | |

| | | | | | | | 187,494 | |

| ELECTRIC UTILITIES — 0.1% | |

| AES Corp. (The), 9.75%, 4/15/16 | | | 70,000 | | | | 83,300 | |

FOOD PRODUCTS† | |

| Tyson Foods, Inc., 6.85%, 4/1/16 | | | 20,000 | | | | 22,975 | |

| HEALTH CARE PROVIDERS AND SERVICES — 0.1% | |

| DaVita, Inc., 6.375%, 11/1/18 | | | 25,000 | | | | 25,875 | |

Fresenius Medical Care US Finance II, Inc., 5.625%, 7/31/19(4) | | | 70,000 | | | | 73,150 | |

| Universal Health Services, Inc., 7.125%, 6/30/16 | | | 40,000 | | | | 44,800 | |

| | | | | | | | 143,825 | |

HOTELS, RESTAURANTS AND LEISURE† | |

| Wynn Las Vegas LLC / Wynn Las Vegas Capital Corp., 7.875%, 11/1/17 | | | $50,000 | | | | $55,250 | |

| INDUSTRIAL CONGLOMERATES — 0.1% | |

Bombardier, Inc., 5.75%, 3/15/22(4) | | | 70,000 | | | | 70,088 | |

| INSURANCE — 0.1% | |

| International Lease Finance Corp., 4.875%, 4/1/15 | | | 70,000 | | | | 70,400 | |

| IT SERVICES — 0.1% | |

Fidelity National Information Services, Inc., 5.00%, 3/15/22(4) | | | 70,000 | | | | 71,575 | |

| International Business Machines Corp., 1.95%, 7/22/16 | | | 50,000 | | | | 51,505 | |

| | | | | | | | 123,080 | |

| MEDIA — 0.2% | |

| CCO Holdings LLC/CCO Holdings Capital Corp., 7.25%, 10/30/17 | | | 70,000 | | | | 76,650 | |

| DISH DBS Corp., 7.00%, 10/1/13 | | | 50,000 | | | | 52,750 | |

Sirius XM Radio, Inc., 8.75%, 4/1/15(4) | | | 70,000 | | | | 79,100 | |

| | | | | | | | 208,500 | |

METALS AND MINING† | |

| Barrick Gold Corp., 2.90%, 5/30/16 | | | 30,000 | | | | 31,509 | |

| MULTI-UTILITIES — 0.2% | |

Calpine Construction Finance Co. LP/CCFC Finance Corp., 8.00%, 6/1/16(4) | | | 45,000 | | | | 48,825 | |

Calpine Corp., 7.25%, 10/15/17(4) | | | 70,000 | | | | 75,600 | |

| CMS Energy Corp., 4.25%, 9/30/15 | | | 30,000 | | | | 31,345 | |

| CMS Energy Corp., 8.75%, 6/15/19 | | | 25,000 | | | | 30,980 | |

| DTE Energy Co., 1.17%, 6/3/13 | | | 40,000 | | | | 40,076 | |

| | | | | | | | 226,826 | |

| OIL, GAS AND CONSUMABLE FUELS — 0.2% | |

| Alpha Natural Resources, Inc., 6.00%, 6/1/19 | | | 70,000 | | | | 60,025 | |

| Anadarko Petroleum Corp., 5.95%, 9/15/16 | | | 20,000 | | | | 22,725 | |

| Newfield Exploration Co., 6.875%, 2/1/20 | | | 50,000 | | | | 53,500 | |

| | | | | | | | | |

| | | Principal Amount/ Shares | | | | Value | |

| Peabody Energy Corp., 7.375%, 11/1/16 | | | $30,000 | | | | $33,150 | |

| Peabody Energy Corp., 6.50%, 9/15/20 | | | 30,000 | | | | 30,525 | |

| | | | | | | | 199,925 | |

| PAPER AND FOREST PRODUCTS — 0.1% | |

Georgia-Pacific LLC, 8.25%, 5/1/16(4) | | | 80,000 | | | | 88,326 | |

PERSONAL PRODUCTS† | |

| Procter & Gamble Co. (The), 0.70%, 8/15/14 | | | 50,000 | | | | 50,161 | |

| PHARMACEUTICALS — 0.1% | |

Valeant Pharmaceuticals International, 6.50%, 7/15/16(4) | | | 70,000 | | | | 73,500 | |

| REAL ESTATE INVESTMENT TRUSTS (REITs) — 0.1% | |

| Developers Diversified Realty Corp., 5.375%, 10/15/12 | | | 40,000 | | | | 40,048 | |

| ERP Operating LP, 5.20%, 4/1/13 | | | 25,000 | | | | 25,750 | |

| Reckson Operating Partnership LP, 6.00%, 3/31/16 | | | 50,000 | | | | 53,198 | |

| | | | | | | | 118,996 | |

| SEMICONDUCTORS AND SEMICONDUCTOR EQUIPMENT — 0.1% | |

| Advanced Micro Devices, Inc., 8.125%, 12/15/17 | | | 70,000 | | | | 76,300 | |

TEXTILES, APPAREL AND LUXURY GOODS† | |

| Gap, Inc. (The), 5.95%, 4/12/21 | | | 10,000 | | | | 10,390 | |

| WIRELESS TELECOMMUNICATION SERVICES — 0.1% | |

| Sprint Nextel Corp., 6.00%, 12/1/16 | | | 70,000 | | | | 67,375 | |

TOTAL CORPORATE BONDS(Cost $2,882,165) | | | | 2,957,406 | |

Commercial Mortgage-Backed Securities(5) — 1.8% | |

| Banc of America Commercial Mortgage, Inc., Series 2004-1, Class A4 SEQ, 4.76%, 11/10/39 | | | 150,000 | | | | 156,760 | |

| Banc of America Commercial Mortgage, Inc., Series 2004-6, Class A3 SEQ, 4.51%, 12/10/42 | | | 29,781 | | | | 30,064 | |

| Banc of America Commercial Mortgage, Inc., Series 2005-5, Class A4, VRN, 5.12%, 7/1/12 | | | 100,000 | | | | 111,802 | |

| Banc of America Commercial Mortgage, Inc., Series 2005-5, Class AM, VRN, 5.18%, 7/1/12 | | | $75,000 | | | | $80,469 | |

| Greenwich Capital Commercial Funding Corp., Series 2004-GG1, Class B, VRN, 5.43%, 7/1/12 | | | 25,000 | | | | 25,641 | |

| Greenwich Capital Commercial Funding Corp., Series 2005-GG3, Class A3 SEQ, 4.57%, 8/10/42 | | | 95,685 | | | | 96,926 | |

| Greenwich Capital Commercial Funding Corp., Series 2005-GG3, Class A4, VRN, 4.80%, 7/10/12 | | | 200,000 | | | | 215,974 | |

| GS Mortgage Securities Corp. II, Series 2004-GG2, Class A6 SEQ, VRN, 5.40%, 7/1/12 | | | 200,000 | | | | 214,530 | |

| GS Mortgage Securities Corp. II, Series 2005-GG4, Class A4A SEQ, 4.75%, 7/10/39 | | | 200,000 | | | | 216,460 | |

| LB-UBS Commercial Mortgage Trust, Series 2004-C1, Class A4 SEQ, 4.57%, 1/15/31 | | | 75,000 | | | | 78,722 | |

| LB-UBS Commercial Mortgage Trust, Series 2004-C2, Class A4 SEQ, 4.37%, 3/15/36 | | | 155,000 | | | | 162,256 | |

| LB-UBS Commercial Mortgage Trust, Series 2004-C4, Class A4, VRN, 5.45%, 7/11/12 | | | 150,000 | | | | 159,830 | |

| LB-UBS Commercial Mortgage Trust, Series 2004-C8, Class AJ, VRN, 4.86%, 7/11/12 | | | 25,000 | | | | 26,687 | |

| LB-UBS Commercial Mortgage Trust, Series 2005-C3, Class AJ SEQ, 4.84%, 7/15/40 | | | 85,000 | | | | 84,426 | |

| LB-UBS Commercial Mortgage Trust, Series 2005-C5, Class AM, VRN, 5.02%, 7/11/12 | | | 125,000 | | | | 134,482 | |

| LB-UBS Commercial Mortgage Trust, Series 2005-C7, Class AM SEQ, VRN, 5.26%, 7/11/12 | | | 75,000 | | | | 81,656 | |

| | | | | | | | | |

| | | Principal Amount/ Shares | | | | Value | |

| Wachovia Bank Commercial Mortgage Trust, Series 2004-C15, Class A3 SEQ, 4.50%, 10/15/41 | | | $21,489 | | | | $21,721 | |

| Wachovia Bank Commercial Mortgage Trust, Series 2005-C20, Class AMFX, VRN, 5.18%, 7/1/12 | | | 100,000 | | | | 108,730 | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES (Cost $1,966,800) | | | | 2,007,136 | |

Collateralized Mortgage Obligations(5) — 1.4% | |

| PRIVATE SPONSOR COLLATERALIZED MORTGAGE OBLIGATIONS — 1.3% | |

| ABN Amro Mortgage Corp., Series 2003-6, Class 1A4, 5.50%, 5/25/33 | | | 20,965 | | | | 21,818 | |

| Banc of America Mortgage Securities, Inc., Series 2004-7, Class 7A1, 5.00%, 8/25/19 | | | 22,530 | | | | 23,132 | |

| Bear Stearns Adjustable Rate Mortgage Trust, Series 2006-1, Class A1, VRN, 2.52%, 7/1/12 | | | 122,874 | | | | 106,087 | |

| Citigroup Mortgage Loan Trust, Inc., Series 2005-4, Class A, VRN, 5.33%, 7/1/12 | | | 102,546 | | | | 98,492 | |

| Countrywide Home Loan Mortgage Pass-Through Trust, Series 2003-35, Class 1A3 SEQ, 5.00%, 9/25/18 | | | 18,104 | | | | 18,929 | |

| Countrywide Home Loan Mortgage Pass-Through Trust, Series 2004-5, Class 2A4, 5.50%, 5/25/34 | | | 20,907 | | | | 21,698 | |

| JP Morgan Mortgage Trust, Series 2005-A6, Class 7A1, VRN, 2.72%, 7/1/12 | | | 35,283 | | | | 27,142 | |

| MASTR Asset Securitization Trust, Series 2003-10, Class 3A1, 5.50%, 11/25/33 | | | 53,916 | | | | 56,691 | |

| PHHMC Mortgage Pass-Through Certificates, Series 2007-6, Class A1, VRN, 6.00%, 7/1/12 | | | 47,458 | | | | 49,535 | |

| Wamu Mortgage Pass-Through Certificates, Series 2003-S11, Class 3A5, 5.95%, 11/25/33 | | | 33,298 | | | | 35,127 | |

| Wells Fargo Mortgage-Backed Securities Trust, Series 2004-1, Class A10, 5.50%, 2/25/34 | | | $28,828 | | | | $30,365 | |

| Wells Fargo Mortgage-Backed Securities Trust, Series 2005-17, Class 1A1, 5.50%, 1/25/36 | | | 127,282 | | | | 126,117 | |

| Wells Fargo Mortgage-Backed Securities Trust, Series 2005-2, Class 1A1 SEQ, 5.50%, 4/25/35 | | | 18,974 | | | | 18,973 | |

| Wells Fargo Mortgage-Backed Securities Trust, Series 2005-5, Class 1A1, 5.00%, 5/25/20 | | | 41,770 | | | | 42,392 | |

| Wells Fargo Mortgage-Backed Securities Trust, Series 2005-6, Class A1 SEQ, 5.25%, 8/25/35 | | | 36,645 | | | | 36,743 | |

| Wells Fargo Mortgage-Backed Securities Trust, Series 2005-AR14, Class A1, VRN, 5.35%, 7/1/12 | | | 46,509 | | | | 46,167 | |

| Wells Fargo Mortgage-Backed Securities Trust, Series 2005-AR16, Class 1A1, VRN, 2.75%, 7/1/12 | | | 117,390 | | | | 118,610 | |

| Wells Fargo Mortgage-Backed Securities Trust, Series 2006-10, Class A4 SEQ, 6.00%, 8/25/36 | | | 90,350 | | | | 89,666 | |

| Wells Fargo Mortgage-Backed Securities Trust, Series 2006-13, Class A5, 6.00%, 10/25/36 | | | 118,128 | | | | 115,960 | |

| Wells Fargo Mortgage-Backed Securities Trust, Series 2006-3, Class A9 SEQ, 5.50%, 3/25/36 | | | 71,153 | | | | 71,549 | |

| Wells Fargo Mortgage-Backed Securities Trust, Series 2006-9, Class 1A15 SEQ, 6.00%, 8/25/36 | | | 38,913 | | | | 39,310 | |

| Wells Fargo Mortgage-Backed Securities Trust, Series 2006-9, Class 1A9 SEQ, 6.00%, 8/25/36 | | | 45,891 | | | | 44,842 | |

| Wells Fargo Mortgage-Backed Securities Trust, Series 2006-AR19, Class A1, VRN, 5.41%, 7/1/12 | | | 35,941 | | | | 33,821 | |

| Wells Fargo Mortgage-Backed Securities Trust, Series 2007-13, Class A1, 6.00%, 9/25/37 | | | 106,431 | | | | 106,359 | |

| | | | | | | | | |

| | | Principal Amount/ Shares | | | | Value | |

| Wells Fargo Mortgage-Backed Securities Trust, Series 2007-3, Class 3A1, 5.50%, 4/25/22 | | | $37,081 | | | | $38,515 | |

| Wells Fargo Mortgage-Backed Securities Trust, Series 2007-AR10, Class 1A1, VRN, 6.07%, 7/1/12 | | | 14,752 | | | | 14,901 | |

| | | | | | | | 1,432,941 | |

| U.S. GOVERNMENT AGENCY COLLATERALIZED MORTGAGE OBLIGATIONS — 0.1% | |

| FHLMC, Series 2824, Class LB SEQ, 4.50%, 7/15/24 | | | 136,693 | | | | 148,732 | |

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $1,558,789) | | | | 1,581,673 | |

| | | Shares | | | Value | |

| Temporary Cash Investments — 4.2% | |

| SSgA U.S. Government Money Market Fund (Cost $4,723,508) | | | 4,723,508 | | | | $4,723,508 | |

TOTAL INVESTMENT SECURITIES — 100.3% (Cost $115,237,148) | | | | 113,547,068 | |

| OTHER ASSETS AND LIABILITIES — (0.3)% | | | | (391,775 | ) |

| TOTAL NET ASSETS — 100.0% | | | | $113,155,293 | |

| | |

| Forward Foreign Currency Exchange Contracts | |

| Contracts to Buy | Counterparty | Settlement Date | | Value | | | Unrealized Gain (Loss) | |

| | 1,223,200 | | CHF for EUR | UBS AG | 7/27/12 | | | $1,289,437 | | | | $(17,820 | ) |

| | 320,538 | | EUR for CHF | Deutsche Bank | 7/27/12 | | | 405,718 | | | | 2,593 | |

| | 538,139 | | EUR for SEK | Deutsche Bank | 7/27/12 | | | 681,143 | | | | 11,322 | |

| | 536,677 | | EUR for SEK | UBS AG | 7/27/12 | | | 679,294 | | | | 4,905 | |

| | 4,842,300 | | SEK for EUR | UBS AG | 7/27/12 | | | 699,392 | | | | 27,736 | |

| | 34,900 | | AUD for USD | Barclays Bank plc | 7/27/12 | | | 35,639 | | | | 1,845 | |

| | 17,400 | | AUD for USD | Barclays Bank plc | 7/27/12 | | | 17,768 | | | | (235 | ) |

| | 1,000 | | AUD for USD | HSBC Holdings plc | 7/27/12 | | | 1,021 | | | | (4 | ) |

| | 455,500 | | AUD for USD | Westpac Group | 7/27/12 | | | 465,145 | | | | (2,243 | ) |

| | 1,054,500 | | BRL for USD | Barclays Bank plc | 7/27/12 | | | 522,321 | | | | (38,375 | ) |

| | 46,100 | | CAD for USD | Barclays Bank plc | 7/27/12 | | | 45,257 | | | | (1,631 | ) |

| | 200,600 | | CAD for USD | Barclays Bank plc | 7/27/12 | | | 196,930 | | | | 1,047 | |

| | 78,600 | | CAD for USD | Barclays Bank plc | 7/27/12 | | | 77,162 | | | | 1,691 | |

| | 4,807,200 | | CAD for USD | Barclays Bank plc | 7/27/12 | | | 4,719,260 | | | | (140,375 | ) |

| | 114,500 | | CAD for USD | HSBC Holdings plc | 7/27/12 | | | 112,405 | | | | (2,970 | ) |

| | 45,200 | | CHF for USD | Barclays Bank plc | 7/27/12 | | | 47,648 | | | | 562 | |

| | 2,600 | | CHF for USD | HSBC Holdings plc | 7/27/12 | | | 2,741 | | | | (126 | ) |

| | 115,821,000 | | CLP for USD | Barclays Bank plc | 7/27/12 | | | 230,567 | | | | (5,441 | ) |

| | 819,000 | | CNY for USD | HSBC Holdings plc | 7/27/12 | | | 129,210 | | | | 9 | |

| | 33,823,000 | | CNY for USD | HSBC Holdings plc | 7/27/12 | | | 5,336,088 | | | | (22,860 | ) |

| | 204,847,992 | | COP for USD | Barclays Bank plc | 7/27/12 | | | 114,362 | | | | (270 | ) |

| | 95,700 | | EUR for USD | Barclays Bank plc | 7/27/12 | | | 121,131 | | | | 1,513 | |

| | 2,694,278 | | EUR for USD | Barclays Bank plc | 7/27/12 | | | 3,410,253 | | | | (127,738 | ) |

| | 31,500 | | EUR for USD | Barclays Bank plc | 7/27/12 | | | 39,871 | | | | (1,889 | ) |

| | 29,800 | | EUR for USD | HSBC Holdings plc | 7/27/12 | | | 37,719 | | | | (1,741 | ) |

| | 73,900 | | EUR for USD | HSBC Holdings plc | 7/27/12 | | | 93,538 | | | | (923 | ) |

| | 64,000 | | EUR for USD | HSBC Holdings plc | 7/27/12 | | | 81,007 | | | | (3,090 | ) |

| | 5,600 | | EUR for USD | Westpac Group | 7/27/12 | | | 7,088 | | | | 22 | |

| | 17,000 | | GBP for USD | Barclays Bank plc | 7/27/12 | | | 26,623 | | | | 457 | |

| | 400 | | GBP for USD | Barclays Bank plc | 7/27/12 | | | 626 | | | | 4 | |

| | | | | | | | | |

| Contracts to Buy | Counterparty | Settlement Date | | Value | | | Unrealized Gain (Loss) | |

| | 7,800 | | GBP for USD | Barclays Bank plc | 7/27/12 | | | $12,215 | | | | $(448 | ) |

| | 274,300 | | GBP for USD | Deutsche Bank | 7/27/12 | | | 429,570 | | | | (7,206 | ) |

| | 8,100 | | GBP for USD | HSBC Holdings plc | 7/27/12 | | | 12,685 | | | | (214 | ) |

| | 2,731,000 | | HKD for USD | Westpac Group | 7/27/12 | | | 352,051 | | | | (39 | ) |

| | 3,413,969,974 | | IDR for USD | UBS AG | 7/27/12 | | | 362,880 | | | | (6,670 | ) |

| | 1,105,600 | | ILS for USD | UBS AG | 7/27/12 | | | 282,453 | | | | (10,437 | ) |

| | 32,459,000 | | INR for USD | UBS AG | 7/27/12 | | | 582,388 | | | | (35,887 | ) |

| | 302,000 | | JPY for USD | Barclays Bank plc | 7/27/12 | | | 3,779 | | | | 23 | |

| | 6,873,000 | | JPY for USD | Barclays Bank plc | 7/27/12 | | | 86,012 | | | | (538 | ) |

| | 29,613,342 | | JPY for USD | Barclays Bank plc | 7/27/12 | | | 370,595 | | | | 3,347 | |

| | 3,281,000 | | JPY for USD | HSBC Holdings plc | 7/27/12 | | | 41,060 | | | | 471 | |

| | 57,580,006 | | KRW for USD | HSBC Holdings plc | 7/27/12 | | | 50,217 | | | | 1,098 | |

| | 1,199,460,000 | | KRW for USD | HSBC Holdings plc | 7/27/12 | | | 1,046,077 | | | | (3,458 | ) |

| | 2,000,000 | | MXN for USD | Barclays Bank plc | 7/27/12 | | | 149,577 | | | | 5,637 | |

| | 1,500,000 | | MXN for USD | Barclays Bank plc | 7/27/12 | | | 112,183 | | | | 5,236 | |

| | 1,700,000 | | MXN for USD | Barclays Bank plc | 7/27/12 | | | 127,140 | | | | 7,917 | |

| | 1,000,000 | | MXN for USD | Barclays Bank plc | 7/27/12 | | | 74,788 | | | | 3,164 | |

| | 38,262,000 | | MXN for USD | Barclays Bank plc | 7/27/12 | | | 2,861,554 | | | | (39,434 | ) |

| | 1,819,900 | | MYR for USD | Westpac Group | 7/27/12 | | | 575,421 | | | | (16,147 | ) |

| | 329,300 | | NOK for USD | Barclays Bank plc | 7/27/12 | | | 55,310 | | | | 1,300 | |

| | 146,900 | | NOK for USD | Barclays Bank plc | 7/27/12 | | | 24,674 | | | | (877 | ) |

| | 4,279,300 | | NOK for USD | Deutsche Bank | 7/27/12 | | | 718,756 | | | | (24,436 | ) |

| | 18,200 | | NZD for USD | Barclays Bank plc | 7/27/12 | | | 14,545 | | | | 800 | |

| | 8,100 | | NZD for USD | Barclays Bank plc | 7/27/12 | | | 6,473 | | | | (121 | ) |

| | 1,700 | | NZD for USD | HSBC Holdings plc | 7/27/12 | | | 1,359 | | | | (20 | ) |

| | 214,300 | | NZD for USD | Westpac Group | 7/27/12 | | | 171,266 | | | | (3,848 | ) |

| | 10,434,000 | | PHP for USD | Westpac Group | 7/27/12 | | | 248,409 | | | | 4,567 | |

| | 29,999 | | PLN for USD | Deutsche Bank | 7/27/12 | | | 8,978 | | | | (376 | ) |

| | 9,463,000 | | RUB for USD | UBS AG | 7/27/12 | | | 291,205 | | | | (24,319 | ) |

| | 620,200 | | SEK for USD | Barclays Bank plc | 7/27/12 | | | 89,578 | | | | 3,348 | |

| | 7,236,500 | | SEK for USD | Barclays Bank plc | 7/27/12 | | | 1,045,195 | | | | (21,962 | ) |

| | 300,500 | | SEK for USD | Barclays Bank plc | 7/27/12 | | | 43,402 | | | | (1,150 | ) |

| | 27,300 | | SEK for USD | HSBC Holdings plc | 7/27/12 | | | 3,943 | | | | (104 | ) |

| | 588,100 | | SGD for USD | HSBC Holdings plc | 7/27/12 | | | 464,256 | | | | (6,224 | ) |

| | 14,556,000 | | THB for USD | Westpac Group | 7/27/12 | | | 459,854 | | | | (10,833 | ) |

| | 67,000 | | TRY for USD | Deutsche Bank | 7/27/12 | | | 36,840 | | | | 199 | |

| | 21,571,000 | | TWD for USD | HSBC Holdings plc | 7/27/12 | | | 723,393 | | | | (10,065 | ) |

| | | | | | | | | $31,566,445 | | | | $(501,731 | ) |

(Value on Settlement Date $32,068,176)

| | | | | | | | | |

| Contracts to Sell | Counterparty | Settlement Date | | Value | | | Unrealized Gain (Loss) | |

| | 1,019,045 | | EUR for CHF | UBS AG | 7/27/12 | | | $1,289,845 | | | | $17,412 | |

| | 384,800 | | CHF for EUR | Deutsche Bank | 7/27/12 | | | 405,637 | | | | (2,512 | ) |

| | 4,718,400 | | SEK for EUR | Deutsche Bank | 7/27/12 | | | 681,496 | | | | (11,675 | ) |

| | 4,803,800 | | SEK for EUR | UBS AG | 7/27/12 | | | 693,831 | | | | (19,442 | ) |

| | 536,127 | | EUR for SEK | UBS AG | 7/27/12 | | | 678,597 | | | | (6,942 | ) |

| | 6,300 | | AUD for USD | Barclays Bank plc | 7/27/12 | | | 6,433 | | | | (103 | ) |

| | 26,200 | | CAD for USD | Barclays Bank plc | 7/27/12 | | | 25,721 | | | | (188 | ) |

| | 16,700 | | CAD for USD | HSBC Holdings plc | 7/27/12 | | | 16,394 | | | | 522 | |

| | 3,700 | | CHF for USD | Barclays Bank plc | 7/27/12 | | | 3,900 | | | | 187 | |

| | 800 | | CHF for USD | Barclays Bank plc | 7/27/12 | | | 843 | | | | (12 | ) |

| | 257,833 | | CHF for USD | UBS AG | 7/27/12 | | | 271,795 | | | | 9,798 | |

| | 1,004,009 | | CZK for USD | Deutsche Bank | 7/27/12 | | | 49,782 | | | | 3,498 | |

| | 19,900 | | EUR for USD | Barclays Bank plc | 7/27/12 | | | 25,188 | | | | (363 | ) |

| | 8,700 | | GBP for USD | HSBC Holdings plc | 7/27/12 | | | 13,625 | | | | 482 | |

| | 6,833,467 | | HUF for USD | Deutsche Bank | 7/27/12 | | | 30,162 | | | | (268 | ) |

| | 7,145,000 | | JPY for USD | Barclays Bank plc | 7/27/12 | | | 89,416 | | | | 1,986 | |

| | 1,632,000 | | JPY for USD | Barclays Bank plc | 7/27/12 | | | 20,424 | | | | 48 | |

| | 3,670,000 | | JPY for USD | HSBC Holdings plc | 7/27/12 | | | 45,928 | | | | (129 | ) |

| | 33,824,000 | | JPY for USD | Westpac Group | 7/27/12 | | | 423,289 | | | | 6,495 | |

| | 23,700 | | NOK for USD | Barclays Bank plc | 7/27/12 | | | 3,981 | | | | (63 | ) |

| | 5,100 | | NOK for USD | HSBC Holdings plc | 7/27/12 | | | 857 | | | | 33 | |

| | 9,200 | | NZD for USD | Barclays Bank plc | 7/27/12 | | | 7,352 | | | | (84 | ) |

| | 194,000 | | PEN for USD | Barclays Bank plc | 7/27/12 | | | 72,639 | | | | 142 | |

| | 144,800 | | SEK for USD | Barclays Bank plc | 7/27/12 | | | 20,914 | | | | (390 | ) |

| | 176,000 | | ZAR for USD | Deutsche Bank | 7/27/12 | | | 21,452 | | | | 799 | |

| | | | | | | | | $4,899,501 | | | | $(769 | ) |

(Value on Settlement Date $4,898,732)

| Futures Contracts | |

| Contracts Purchased | Expiration Date | | Underlying Face Amount at Value | | | Unrealized Gain (Loss) | |

| | 10 | | U.S. Treasury 5-Year Notes | September 2012 | | | $1,239,688 | | | | $(491 | ) |

| Total Return Swap Agreements | |

| Counterparty | | Notional Amount | | Floating Rate Referenced Index | Pay/Receive Total Return of Referenced Index | | Fixed Rate | | Termination Date | | Value | |

| Bank of America N.A. | | | $925,000 | | U.S. CPI Urban Consumers NSA Index | Receive | | | 2.28 | % | 1/21/16 | | | $(5,715 | ) |

| Bank of America N.A. | | | 1,000,000 | | U.S. CPI Urban Consumers NSA Index | Receive | | | 1.97 | % | 12/21/16 | | | 473 | |

| Barclays Bank plc | | | 700,000 | | U.S. CPI Urban Consumers NSA Index | Receive | | | 1.84 | % | 8/4/13 | | | (6,349 | ) |

| Barclays Bank plc | | | 800,000 | | U.S. CPI Urban Consumers NSA Index | Receive | | | 1.29 | % | 8/31/13 | | | 3,359 | |

| Barclays Bank plc | | | 500,000 | | U.S. CPI Urban Consumers NSA Index | Receive | | | 1.58 | % | 9/6/13 | | | (846 | ) |

| Barclays Bank plc | | | 900,000 | | U.S. CPI Urban Consumers NSA Index | Receive | | | 2.30 | % | 1/11/16 | | | (6,343 | ) |

| Barclays Bank plc | | | 2,100,000 | | U.S. CPI Urban Consumers NSA Index | Receive | | | 2.52 | % | 5/13/16 | | | (55,648 | ) |

| | | | | | | | | | | | | | | $(71,069 | ) |

Notes to Schedule of Investments

ADR = American Depositary Receipt

AUD = Australian Dollar

BRL = Brazilian Real

CAD = Canadian Dollar

CHF = Swiss Franc

CLP = Chilean Peso

CNY = Chinese Yuan

COP = Colombian Peso

CPI = Consumer Price Index

CZK = Czech Koruna

DB = Deutsche Bank

ETF = Exchange-Traded Fund

EUR = Euro

FHLMC = Federal Home Loan Mortgage Corporation

GBP = British Pound

GSCI = Goldman Sachs Commodities Index

HKD = Hong Kong Dollar

HUF = Hungarian Forint

IDR = Indonesian Rupiah

ILS = Israeli Shekel

INR = Indian Rupee

JPY = Japanese Yen

KRW = Korea Won

LB-UBS = Lehman Brothers, Inc. — UBS AG

MASTR = Mortgage Asset Securitization Transactions, Inc.

MXN = Mexican Peso

MYR = Malaysian Ringgit

NOK = Norwegian Krone

NSA = Not Seasonally Adjusted

NZD = New Zealand Dollar

PEN = Peruvian Nuevo Sol

PHHMC = PHH Mortgage Corporation

PHP = Philippine Peso

PLN = Polish Zloty

REIT = Real Estate Investment Trust

RUB = Russian Rouble

SEK = Swedish Krona

SEQ = Sequential Payer

SGD = Singapore Dollar

SPDR = Standard & Poor’s Depositary Receipts

THB = Thai Baht

TRY = Turkish Lira

TWD = Taiwanese Dollar

USD = United States Dollar

VRN = Variable Rate Note. Interest reset date is indicated. Rate shown is effective at the period end.

ZAR = South African Rand

† Category is less than 0.05% of total net assets.

| (1) | Security, or a portion thereof, has been pledged at the custodian bank or with a broker for margin requirements on futures contracts. At the period end, the aggregate value of securities pledged was $20,786 |

| (3) | The rate indicated is the yield to maturity at purchase for non-interest bearing securities. For interest bearing securities, the stated coupon rate is shown. |

| (4) | Security was purchased under Rule 144A or Section 4(2) of the Securities Act of 1933 or is a private placement and, unless registered under the Act or exempted from registration, may only be sold to qualified institutional investors. The aggregate value of these securities at the period end was $10,780,082, which represented 9.5% of total net assets. |

| (5) | Final maturity date indicated, unless otherwise noted. |

See Notes to Financial Statements.

Statement of Assets and Liabilities |

| JUNE 30, 2012 | |

| Assets | |

| Investment securities, at value (cost of $115,237,148) | | | $113,547,068 | |

| Foreign currency holdings, at value (cost of $8,764) | | | 8,770 | |

| Receivable for investments sold | | | 105,661 | |

| Receivable for capital shares sold | | | 286,572 | |

| Unrealized gain on forward foreign currency exchange contracts | | | 132,215 | |

| Swap agreements, at value | | | 3,832 | |

| Dividends and interest receivable | | | 342,007 | |

| | | | 114,426,125 | |

| | | | | |

| Liabilities | | | | |

| Payable for investments purchased | | | 196,834 | |

| Payable for capital shares redeemed | | | 250,826 | |

| Payable for variation margin on futures contracts | | | 2,109 | |

| Unrealized loss on forward foreign currency exchange contracts | | | 634,715 | |

| Swap agreements, at value | | | 74,901 | |

| Accrued management fees | | | 97,794 | |

| Distribution and service fees payable | | | 13,521 | |

| Accrued foreign taxes | | | 132 | |

| | | | 1,270,832 | |

| | | | | |

| Net Assets | | | $113,155,293 | |

| | | | | |

| Net Assets Consist of: | | | | |

| Capital (par value and paid-in surplus) | | | $117,350,264 | |

| Undistributed net investment income | | | 294,710 | |

| Accumulated net realized loss | | | (2,225,563 | ) |

| Net unrealized depreciation | | | (2,264,118 | ) |

| | | | $113,155,293 | |

| | | | | | | | | | |

| | | Net assets | | Shares outstanding | | Net asset value per share |

| Investor Class, $0.01 Par Value | | | $65,968,178 | | | | 6,605,013 | | | | $9.99 | |

| Institutional Class, $0.01 Par Value | | | $7,078,141 | | | | 708,306 | | | | $9.99 | |

| A Class, $0.01 Par Value | | | $31,305,373 | | | | 3,141,116 | | | | $9.97 | * |

| C Class, $0.01 Par Value | | | $8,667,086 | | | | 875,027 | | | | $9.90 | |

| R Class, $0.01 Par Value | | | $136,515 | | | | 13,727 | | | | $9.94 | |

*Maximum offering price $10.58 (net asset value divided by 0.9425)

See Notes to Financial Statements.

| YEAR ENDED JUNE 30, 2012 | |

| Investment Income (Loss) | |

| Income: | | | |

| Dividends (net of foreign taxes withheld of $12,650) | | | $370,311 | |

| Interest | | | 880,077 | |

| | | | 1,250,388 | |

| | | | | |

| Expenses: | | | | |

| Management fees | | | 1,117,460 | |

| Distribution and service fees: | | | | |

| A Class | | | 83,592 | |

| C Class | | | 76,395 | |

| R Class | | | 661 | |

| Directors’ fees and expenses | | | 7,765 | |

| Other expenses | | | 703 | |

| | | | 1,286,576 | |

| Fees waived | | | (11,929 | ) |

| | | | 1,274,647 | |

| | | | | |

| Net investment income (loss) | | | (24,259 | ) |

| | | | | |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment transactions (net of foreign tax expenses paid (refunded) of $916) | | | (2,015,561 | ) |

| Futures contract transactions | | | 84,077 | |

| Swap agreement transactions | | | 6,500 | |

| Foreign currency transactions (net of foreign tax expenses paid (refunded) of $2,719) | | | (856,248 | ) |

| | | | (2,781,232 | ) |

| | | | | |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investments (includes (increase) decrease in accrued foreign taxes of $(132)) | | | (2,844,286 | ) |

| Futures contracts | | | 23,132 | |

| Swap agreements | | | (94,506 | ) |

| Translation of assets and liabilities in foreign currencies | | | (325,961 | ) |

| | | | (3,241,621 | ) |

| | | | | |

| Net realized and unrealized gain (loss) | | | (6,022,853 | ) |

| | | | | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | | $(6,047,112 | ) |

See Notes to Financial Statements.

Statement of Changes in Net Assets |

| YEARS ENDED JUNE 30, 2012 AND JUNE 30, 2011 | |

| Increase (Decrease) in Net Assets | June 30, 2012 | | | June 30, 2011 | |

| Operations | |

| Net investment income (loss) | | $(24,259 | ) | | | $502,933 | |

| Net realized gain (loss) | | (2,781,232 | ) | | | 1,141,612 | |

| Change in net unrealized appreciation (depreciation) | | (3,241,621 | ) | | | 1,174,865 | |

| Net increase (decrease) in net assets resulting from operations | | (6,047,112 | ) | | | 2,819,410 | |

| | | | | | | | |

| Distributions to Shareholders | | | | | | | |

| From net investment income: | | | | | | | |

| Investor Class | | (674,472 | ) | | | (262,159 | ) |

| Institutional Class | | (75,987 | ) | | | (27,223 | ) |

| A Class | | (369,850 | ) | | | (40,461 | ) |

| C Class | | (34,670 | ) | | | (2,042 | ) |

| R Class | | (1,046 | ) | | | (682 | ) |

| From net realized gains: | | | | | | | |

| Investor Class | | (145,643 | ) | | | (1,772 | ) |

| Institutional Class | | (13,696 | ) | | | (176 | ) |

| A Class | | (85,639 | ) | | | (301 | ) |

| C Class | | (18,728 | ) | | | (65 | ) |

| R Class | | (338 | ) | | | (11 | ) |

| Decrease in net assets from distributions | | (1,420,069 | ) | | | (334,892 | ) |

| | | | | | | | |

| Capital Share Transactions | | | | | | | |

| Net increase (decrease) in net assets from capital share transactions | | 24,791,565 | | | | 85,289,192 | |

| | | | | | | | |

| Net increase (decrease) in net assets | | 17,324,384 | | | | 87,773,710 | |

| | | | | | | | |

| Net Assets | | | | | | | |

| Beginning of period | | 95,830,909 | | | | 8,057,199 | |

| End of period | | $113,155,293 | | | | $95,830,909 | |

| | | | | | | | |

| Undistributed net investment income | | $294,710 | | | | $1,149,729 | |

See Notes to Financial Statements.

Notes to Financial Statements |

JUNE 30, 2012

1. Organization

American Century Quantitative Equity Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Maryland corporation. Strategic Inflation Opportunities Fund (the fund) is one fund in a series issued by the corporation. The fund is nondiversified as defined under the 1940 Act. The fund’s investment objective is to seek total real return (total return reduced by the expected impact of inflation). The fund pursues its objective by diversifying investments among U.S. Treasury inflation-indexed and other U.S. fixed-income securities, commodity-related investments, and non-U.S. dollar investments.

The fund offers the Investor Class, the Institutional Class, the A Class, the C Class and the R Class. The A Class may incur an initial sales charge. The A Class and C Class may be subject to a contingent deferred sales charge. The share classes differ principally in their respective sales charges and distribution and shareholder servicing expenses and arrangements. The Institutional Class is made available to institutional shareholders or through financial intermediaries whose clients do not require the same level of shareholder and administrative services as shareholders of other classes. As a result, the Institutional Class is charged a lower unified management fee.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America, which may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value per share as of the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open.

Debt securities maturing in greater than 60 days at the time of purchase are valued at the evaluated mean as provided by independent pricing services or at the mean of the most recent bid and asked prices as provided by investment dealers. Debt securities maturing within 60 days at the time of purchase may be valued at cost, plus or minus any amortized discount or premium or at the evaluated mean as provided by an independent pricing service. Evaluated mean prices are commonly derived through utilization of market models, which may consider, among other factors, trade data, quotations from dealers and active market makers, relevant yield curve and spread data, related sector levels, creditworthiness, and other relevant market information on the same or comparable securities.

Equity securities that are listed or traded on a domestic securities exchange are valued at the last reported sales price or at the official closing price as provided by the exchange. Equity securities traded on foreign securities exchanges are typically valued at the closing price on the exchange where primarily traded or as of the close of the NYSE, if that is earlier. If no last sales price is reported, or if local convention or regulation so provides, the mean of the latest bid and asked prices is used. Depending on local convention or regulation, securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official closing price. In its determination of fair value, the fund may review several factors including: market information specific to a security; news developments in U.S. and foreign markets; the performance of particular U.S. and foreign securities, indices, comparable securities, American Depositary Receipts, Exchange-Traded Funds, and other relevant market indicators.

Investments in open-end management investment companies are valued at the reported net asset value per share. Exchange-traded futures contracts are valued at the settlement price as provided by the appropriate clearing corporation. Swap agreements are valued at an evaluated price as provided by independent pricing services or investment dealers. Forward foreign currency exchange contracts are valued at the mean of the latest bid and asked prices of the forward currency rates as provided by an independent pricing service.

The value of investments initially expressed in foreign currencies is translated into U.S. dollars at prevailing exchange rates.

If the fund determines that the market price for a portfolio security is not readily available or the valuation methods mentioned above do not reflect a security’s fair value, such security is valued as determined in good faith by the Board of Directors or its designee, in accordance with procedures adopted by the Board of Directors. Circumstances that may cause the fund to use these procedures to value a security include, but are not limited to: a security has been declared in default; trading in a security has been halted during the trading day; there is a foreign market holiday and no trading occurred; or an event occurred between the close of a foreign exchange and the NYSE that may affect the value of a security.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes. Certain countries impose taxes on realized gains on the sale of securities registered in their country. The fund records the foreign tax expense, if any, on an accrual basis. The foreign tax expense on realized gains and unrealized appreciation reduces the net realized gain (loss) on investment transactions and net unrealized appreciation (depreciation) on investments, respectively.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund estimates the components of distributions received that may be considered nontaxable distributions or capital gain distributions for income tax purposes. Interest income is recorded on the accrual basis and includes paydown gain (loss) and accretion of discounts and amortization of premiums. Inflation adjustments related to inflation-linked debt securities are reflected as interest income.

Foreign Currency Translations — All assets and liabilities initially expressed in foreign currencies are translated into U.S. dollars at prevailing exchange rates at period end. The fund may enter into spot foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of investment securities, dividend and interest income, spot foreign currency exchange contracts, and expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. Net realized and unrealized foreign currency exchange gains or losses related to investment securities are a component of net realized gain (loss) on investment transactions and change in net unrealized appreciation (depreciation) on investments, respectively. Certain countries impose taxes on the contract amount of purchases and sales of foreign currency contracts in their currency. The fund records the foreign tax expense, if any, as a reduction to the net realized gain (loss) on foreign currency transactions.

Commodity Exchange-Traded Funds — The fund may invest in exchange-traded funds of underlying commodities (Commodity ETFs). Commodity ETFs are a type of index fund bought and sold on a securities exchange. A Commodity ETF trades like common stock and represents a portfolio designed to track the performance of a particular index of a physical commodity or group of physical commodities. The fund may purchase a Commodity ETF to gain exposure to the underlying physical commodities. The risks of owning a Commodity ETF generally reflect the risks of owning the underlying commodities they are designed to track, although a lack of liquidity on a Commodity ETF could result in it being more volatile. Commodities markets have historically been extremely volatile. Additionally, Commodity ETFs have fees and expenses that reduce their value.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. All tax years for the fund remain subject to examination by tax authorities. Additionally, non-U.S. tax returns filed by the fund due to investments in certain foreign securities remain subject to examination by the relevant taxing authority for seven years from the date of filing. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. Accordingly, no provision has been made for federal or state income taxes.

Segregated Assets — In accordance with the 1940 Act, the fund segregates assets on its books and records to cover certain types of investments, including, but not limited to, futures contracts, forward commitments, when-issued securities, swap agreements and certain forward foreign currency exchange contracts. American Century Investment Management, Inc. (ACIM) (the investment advisor) monitors, on a daily basis, the securities segregated to ensure the fund designates a sufficient amount of liquid assets, marked-to-market daily. The fund may also receive assets or be required to pledge assets at the custodian bank or with a broker for margin requirements on futures contracts and swap agreements.

Multiple Class — All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.