UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | | | | | |

| Investment Company Act file number | 811-05447 |

| | |

| AMERICAN CENTURY QUANTITATIVE EQUITY FUNDS, INC. |

| (Exact name of registrant as specified in charter) |

| | |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| | |

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| | |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| | |

| Date of fiscal year end: | 06-30 |

| | |

| Date of reporting period: | 06-30-15 |

ITEM 1. REPORTS TO STOCKHOLDERS.

|

| |

| ANNUAL REPORT | JUNE 30, 2015 |

Core Equity Plus Fund

|

| | |

| President's Letter | 2 |

|

| Performance | 3 |

|

| Portfolio Commentary | |

|

| Fund Characteristics | |

|

| Shareholder Fee Example | |

|

| Schedule of Investments | |

|

| Statement of Assets and Liabilities | |

|

| Statement of Operations | |

|

| Statement of Changes in Net Assets | |

|

| Statement of Cash Flows | |

|

| Notes to Financial Statements | |

|

| Financial Highlights | |

|

| Report of Independent Registered Public Accounting Firm | |

|

| Management | |

|

| Approval of Management Agreement | |

|

| Additional Information | |

|

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

|

| |

| Dear Investor:

Thank you for reviewing this annual report for the 12 months ended June 30, 2015. It provides investment performance and portfolio information for the reporting period, plus longer-term historical performance data.

Annual reports remain important vehicles for conveying information about fund returns, including market and economic factors that affected performance during the reporting period. For additional, updated investment and market insights, we encourage you to visit our website, americancentury.com. |

| Jonathan Thomas |

Global Divergence Favored U.S. Assets

“Global divergence” between the U.S. and the rest of the world emerged as a prevalent theme during the reporting period. This theme embraced not only the relatively stronger economic growth enjoyed by the U.S. compared with most of the world, but also the related contrast between the U.S. Federal Reserve’s unwinding of monetary stimulus compared with the continuation and expansion of stimulus by other major central banks. Low inflation also prevailed, after crude oil prices plunged over 40% amid muted demand for commodities in general. In this environment, the U.S. dollar, U.S. growth stocks, and longer-maturity U.S. Treasuries generally benefited from “flight to quality” capital flows, reinforced by geopolitical and financial turmoil, particularly in Greece, Russia/Ukraine, China, and the Middle East.

Strong global capital flows into U.S. assets generated a global divergence between investment returns for U.S. and non-U.S. markets, especially for U.S. investors who realized their returns in dollar terms. For the reporting period, the U.S. Dollar Index, the S&P 500 Index, and the Barclays U.S. Aggregate Bond Index returned 19.74%, 7.42%, and 1.86%, respectively. By contrast, the MSCI EAFE Index, the MSCI Emerging Markets Index, and the Barclays Global Aggregate Bond ex-USD (Unhedged) Index returned -4.22%, -5.12%, and -13.19%, respectively, for U.S. investors unhedged for the strong dollar’s impact on non-dollar-denominated returns.

We expect more monetary policy divergence between the U.S. and other major developed economies in the coming months, accompanied by continued market volatility. This could present both challenges and opportunities for active investment managers. Upward pressures on inflation and interest rates could develop as the massive amount of global monetary stimulus in progress takes hold and economies improve. In this environment, we continue to believe in a disciplined, diversified, long-term investment approach, using professionally managed stock and bond portfolios to meet financial goals. We appreciate your continued trust in us.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

|

| | | | |

| Total Returns as of June 30, 2015 | | |

| | Average Annual Returns | |

| | Ticker Symbol | 1 year | Since Inception | Inception Date |

| Investor Class | ACPVX | 4.84% | 16.61% | 10/31/11 |

| S&P 500 Index | — | 7.42% | 17.06% | — |

| Institutional Class | ACPKX | 5.04% | 16.85% | 10/31/11 |

| A Class | ACPQX | | | 10/31/11 |

| No sales charge* | | 4.59% | 16.33% | |

| With sales charge* | | -1.41% | 14.46% | |

| C Class | ACPHX | 3.77% | 15.44% | 10/31/11 |

| R Class | ACPWX | 4.28% | 16.03% | 10/31/11 |

| |

| * | Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied. |

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

|

|

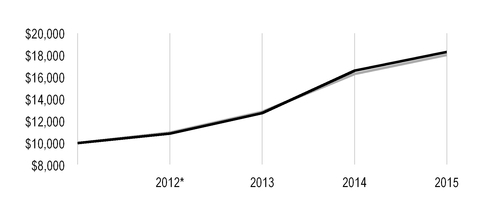

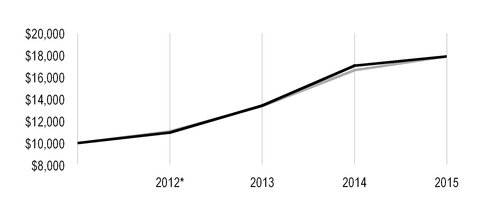

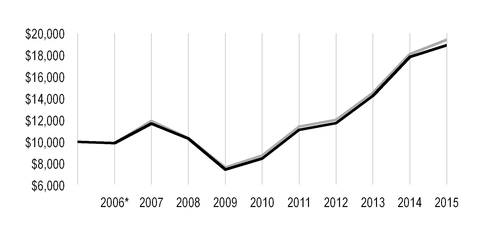

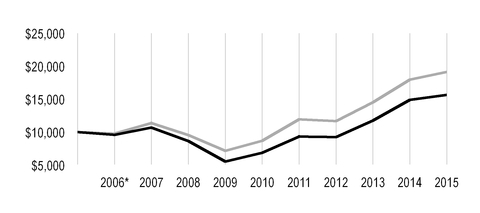

| Growth of $10,000 Over Life of Class |

| $10,000 investment made October 31, 2011 |

| Performance for other share classes will vary due to differences in fee structure. |

|

| |

| Value on June 30, 2015 |

| | Investor Class — $17,564 |

| |

| | S&P 500 Index — $17,816 |

| |

*From October 31, 2011, the Investor Class’s inception date. Not annualized.

|

| | | | |

| Total Annual Fund Operating Expenses |

| Investor Class | Institutional Class | A Class | C Class | R Class |

| 1.77% | 1.57% | 2.02% | 2.77% | 2.27% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

Portfolio Managers: Scott Wittman, Bill Martin and Claudia Musat

Performance Summary

Core Equity Plus returned 4.84%* for the fiscal year ended June 30, 2015, compared with the 7.42% return of its benchmark, the S&P 500 Index.

U.S. equity markets endured substantial volatility, but ended the 12-month period with advances. Core Equity Plus produced gains for the 12-month period, but was unable to match the return of its benchmark. The fund is managed to have a 100% net exposure to the equity market by investing approximately 130% of its net assets in long positions, while 30% of its net assets are sold short. The proceeds from the securities sold short are used to fund the purchase of the additional 30% of long positions. The fund’s stock selection process incorporates factors of valuation, quality, growth, and sentiment while striving to minimize unintended risks along industries and other risk characteristics. Within the fund, growth-based factors proved most difficult, although valuation and sentiment indicators also detracted modestly. Security selection in the information technology and consumer discretionary sectors weighed on relative performance the most, while energy sector positioning and stock selection among industrials contributed to relative gains.

Information Technology Was Leading Detractor

Security selection in the information technology sector was the principal detractor from the fund’s 12-month results. The IT services and computers and peripherals industries were leading drivers of sector underperformance, although leading individual detraction came from a short position (a trade made to benefit from a stock’s decline) in travel and expense management software provider Concur Technologies, which rallied on its acquisition by Germany-based enterprise software giant SAP. The company’s acquisition was completed during the reporting period and the fund’s short position was exited.

The consumer discretionary sector was another area of underperformance, driven by a number of declining specialty retailers including Abercrombie & Fitch. The teen apparel retailer’s stock sank on weak sales, both in the U.S. and in Europe, as young shoppers turned away from clothing sporting the retailer’s logo. The non-benchmark position was ultimately liquidated. Elsewhere in the sector, a portfolio-only position in casino operator Las Vegas Sands was detrimental. The company’s stock price fell dramatically on weaker-than-expected revenue and earnings, and management’s announced dividend increase and two-billion-dollar buyback program were not enough to stave off price declines. Our conviction in the holding is driven by strong quality and valuation insights.

Key detraction came from a short position in Puma Biotechnology, which advanced strongly after the release of positive phase three data for its breast cancer treatment. Despite generally weak fundamentals overall, the trial’s results led us to cover the fund’s short position. A number of portfolio-only positions in the financials sector weighed on the fund’s returns. Shares of real estate management company Altisource Portfolio Solutions declined steeply on disappointing quarterly earnings and again after a New York State investigation implicated a subsidiary. We ultimately eliminated the holding. A position in Nationstar Mortgage Holdings also weighed on results. The residential mortgage servicer reported subdued earnings due to declines in mortgage origination and real estate services. Despite these difficulties, the holding remains strong across sentiment and valuation and has above-average growth insights.

| |

| * | All fund returns referenced in this commentary are for Investor Class shares. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the fund's benchmark, other share classes may not. See page 3 for returns for all share classes. |

Energy Sector was Leading Contributor

Limited exposure to the underperforming energy sector, particularly underweight positioning, relative to the benchmark, in oil, gas, and consumable fuels holdings, bolstered the fund’s relative returns. Key contribution stemmed from holding less than the benchmark weighting in Chevron, which declined steadily throughout the period together with the price of oil.

Stock selection in the industrials sector also contributed to the fund’s relative returns. A short position in equipment manufacturer Chart Industries bolstered the sector’s return after the company’s stock fell on soft demand in the liquefied natural gas market, for which the company manufactures equipment. We covered the short position during the reporting period. Elsewhere in the sector, shipping company Matson appreciated steeply, rising on unexpectedly strong quarterly results driven by container volume increases.

Gains were also bolstered by an overweight position in Broadcom. The semiconductor designer’s stock rose following strong quarterly results, and again after a merger announcement with industry rival Avago in a deal that is expected to create the world’s leading communications semiconductor company. Our valuation and quality indicators showed modest deterioration late in the period and we liquidated the position. Insurance and managed care provider Aetna was a key contributor, advancing amid merger speculation in the recent wave of health insurance industry consolidation.

A Look Ahead

The U.S. economy seems poised to continue to experience hesitant economic growth through the second half of 2015. Economic activity appears to have somewhat diminished in breadth, though it remains slow yet steady. We believe that divergence in monetary policy between the U.S. and much of the rest of the world is likely to continue. Therefore, questions surrounding when and how much the U.S. Federal Reserve might act to tighten money supply, and the potential impact of such a move, are likely to continue driving investor sentiment in equity markets. Our disciplined, objective, and systematic investment strategy is designed to take advantage of opportunities at the individual company level in both the long and short portions of the portfolio. We believe this approach is the most powerful way to capitalize on market inefficiencies that lead to the mispricing of individual stocks. The fund’s largest overweights are in industrials, health care, and information technology, while the underweights are led by the utilities, energy, and financials sectors.

|

| |

| JUNE 30, 2015 |

| Top Ten Long Holdings | % of net assets |

| Apple, Inc. | 3.99% |

| Johnson & Johnson | 2.21% |

| Microsoft Corp. | 2.18% |

| Pfizer, Inc. | 1.95% |

| Procter & Gamble Co. (The) | 1.91% |

| Bank of America Corp. | 1.74% |

| Merck & Co., Inc. | 1.64% |

| International Business Machines Corp. | 1.57% |

| Cisco Systems, Inc. | 1.56% |

| Intel Corp. | 1.52% |

| | |

| Top Five Short Holdings | % of net assets |

| WEX, Inc. | (0.86)% |

| SunEdison, Inc. | (0.86)% |

| Advisory Board Co. (The) | (0.85)% |

| Louisiana-Pacific Corp. | (0.84)% |

| WR Grace & Co. | (0.81)% |

| | |

| Types of Investments in Portfolio | % of net assets |

| Common Stocks | 128.4% |

| Common Stocks Sold Short | (29.5)% |

| Temporary Cash Investments | 0.9% |

| Other Assets and Liabilities | 0.2% |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from January 1, 2015 to June 30, 2015.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

| | | | |

| | Beginning

Account Value

1/1/15 | Ending

Account Value

6/30/15 | Expenses Paid

During Period(1)1/1/15 - 6/30/15 | Annualized Expense Ratio(1) |

| Actual |

| Investor Class | $1,000 | $989.10 | $8.68 | 1.76% |

| Institutional Class | $1,000 | $989.90 | $7.70 | 1.56% |

| A Class | $1,000 | $988.00 | $9.91 | 2.01% |

| C Class | $1,000 | $984.20 | $13.58 | 2.76% |

| R Class | $1,000 | $986.20 | $11.13 | 2.26% |

| Hypothetical |

| Investor Class | $1,000 | $1,016.07 | $8.80 | 1.76% |

| Institutional Class | $1,000 | $1,017.06 | $7.80 | 1.56% |

| A Class | $1,000 | $1,014.83 | $10.04 | 2.01% |

| C Class | $1,000 | $1,011.11 | $13.76 | 2.76% |

| R Class | $1,000 | $1,013.59 | $11.28 | 2.26% |

| |

| (1) | Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

JUNE 30, 2015

|

| | | | | |

| | Shares | Value |

| COMMON STOCKS — 128.4% | | |

| Aerospace and Defense — 5.1% | | |

Boeing Co. (The)(1) | 9,495 |

| $ | 1,317,146 |

|

Honeywell International, Inc.(1) | 19,405 |

| 1,978,728 |

|

| Huntington Ingalls Industries, Inc. | 10,965 |

| 1,234,549 |

|

Moog, Inc., Class A(2) | 5,439 |

| 384,429 |

|

Spirit AeroSystems Holdings, Inc., Class A(2) | 22,978 |

| 1,266,318 |

|

Teledyne Technologies, Inc.(1)(2) | 3,301 |

| 348,288 |

|

Textron, Inc.(1) | 31,175 |

| 1,391,340 |

|

| Triumph Group, Inc. | 8,506 |

| 561,311 |

|

| | | 8,482,109 |

|

| Air Freight and Logistics — 0.1% | | |

United Parcel Service, Inc., Class B(1) | 1,981 |

| 191,979 |

|

| Airlines — 1.4% | | |

Southwest Airlines Co.(1) | 34,524 |

| 1,142,399 |

|

United Continental Holdings, Inc.(1)(2) | 24,073 |

| 1,276,110 |

|

| | | 2,418,509 |

|

| Auto Components — 0.1% | | |

| Delphi Automotive plc | 2,296 |

| 195,367 |

|

| Automobiles — 0.1% | | |

| General Motors Co. | 7,344 |

| 244,776 |

|

| Banks — 3.7% | | |

Bank of America Corp.(1) | 170,981 |

| 2,910,097 |

|

Citigroup, Inc.(1) | 22,052 |

| 1,218,152 |

|

JPMorgan Chase & Co.(1) | 14,392 |

| 975,202 |

|

Wells Fargo & Co.(1) | 17,829 |

| 1,002,703 |

|

| | | 6,106,154 |

|

| Beverages — 2.6% | | |

Coca-Cola Co. (The)(1) | 4,501 |

| 176,574 |

|

Dr Pepper Snapple Group, Inc.(1) | 21,533 |

| 1,569,756 |

|

PepsiCo, Inc.(1) | 26,975 |

| 2,517,846 |

|

| | | 4,264,176 |

|

| Biotechnology — 4.0% | | |

Amgen, Inc.(1) | 9,447 |

| 1,450,304 |

|

Biogen, Inc.(1)(2) | 3,138 |

| 1,267,564 |

|

Celgene Corp.(1)(2) | 10,465 |

| 1,211,167 |

|

Gilead Sciences, Inc.(1) | 16,703 |

| 1,955,587 |

|

Medivation, Inc.(2) | 3,737 |

| 426,765 |

|

United Therapeutics Corp.(1)(2) | 2,393 |

| 416,262 |

|

| | | 6,727,649 |

|

| Building Products — 0.5% | | |

USG Corp.(1)(2) | 29,365 |

| 816,053 |

|

|

| | | | | |

| | Shares | Value |

| Capital Markets — 4.1% | | |

Ameriprise Financial, Inc.(1) | 11,778 |

| $ | 1,471,425 |

|

| Artisan Partners Asset Management, Inc., Class A | 14,567 |

| 676,783 |

|

Evercore Partners, Inc., Class A(1) | 26,230 |

| 1,415,371 |

|

Franklin Resources, Inc.(1) | 28,284 |

| 1,386,764 |

|

Legg Mason, Inc.(1) | 24,907 |

| 1,283,458 |

|

Waddell & Reed Financial, Inc., Class A(1) | 12,096 |

| 572,262 |

|

| | | 6,806,063 |

|

| Chemicals — 3.3% | | |

Cabot Corp.(1) | 30,783 |

| 1,147,898 |

|

Dow Chemical Co. (The)(1) | 35,622 |

| 1,822,778 |

|

E.I. du Pont de Nemours & Co.(1) | 24,428 |

| 1,562,170 |

|

LyondellBasell Industries NV, Class A(1) | 10,034 |

| 1,038,720 |

|

| | | 5,571,566 |

|

| Commercial Services and Supplies — 2.4% | | |

Deluxe Corp.(1) | 17,495 |

| 1,084,690 |

|

Herman Miller, Inc.(1) | 43,020 |

| 1,244,569 |

|

Pitney Bowes, Inc.(1) | 51,444 |

| 1,070,550 |

|

| Waste Management, Inc. | 14,438 |

| 669,201 |

|

| | | 4,069,010 |

|

| Communications Equipment — 3.7% | | |

Brocade Communications Systems, Inc.(1) | 119,948 |

| 1,424,982 |

|

Cisco Systems, Inc.(1) | 94,966 |

| 2,607,766 |

|

QUALCOMM, Inc.(1) | 34,001 |

| 2,129,483 |

|

| | | 6,162,231 |

|

| Consumer Finance — 1.0% | | |

Credit Acceptance Corp.(1)(2) | 6,521 |

| 1,605,340 |

|

| Containers and Packaging — 0.3% | | |

Berry Plastics Group, Inc.(2) | 13,048 |

| 422,755 |

|

| Diversified Consumer Services — 0.7% | | |

H&R Block, Inc.(1) | 41,886 |

| 1,241,920 |

|

| Diversified Financial Services — 0.5% | | |

Berkshire Hathaway, Inc., Class B(1)(2) | 6,295 |

| 856,812 |

|

| Diversified Telecommunication Services — 0.5% | | |

AT&T, Inc.(1) | 9,339 |

| 331,721 |

|

Verizon Communications, Inc.(1) | 10,921 |

| 509,028 |

|

| | | 840,749 |

|

| Electric Utilities — 0.5% | | |

Entergy Corp.(1) | 7,827 |

| 551,803 |

|

| NextEra Energy, Inc. | 2,164 |

| 212,137 |

|

| | | 763,940 |

|

| Electrical Equipment — 1.8% | | |

Emerson Electric Co.(1) | 28,604 |

| 1,585,519 |

|

Rockwell Automation, Inc.(1) | 11,248 |

| 1,401,951 |

|

| | | 2,987,470 |

|

|

| | | | | |

| | Shares | Value |

| Electronic Equipment, Instruments and Components — 1.1% | | |

Corning, Inc.(1) | 73,322 |

| $ | 1,446,643 |

|

Dolby Laboratories, Inc., Class A(1) | 8,633 |

| 342,558 |

|

| | | 1,789,201 |

|

| Energy Equipment and Services — 2.6% | | |

Dril-Quip, Inc.(2) | 11,123 |

| 837,006 |

|

FMC Technologies, Inc.(2) | 6,552 |

| 271,842 |

|

Schlumberger Ltd.(1) | 26,273 |

| 2,264,470 |

|

Superior Energy Services, Inc.(1) | 48,627 |

| 1,023,112 |

|

| | | 4,396,430 |

|

| Food and Staples Retailing — 3.5% | | |

CVS Health Corp.(1) | 22,502 |

| 2,360,010 |

|

| Kroger Co. (The) | 6,688 |

| 484,947 |

|

SUPERVALU, Inc.(1)(2) | 83,112 |

| 672,376 |

|

Wal-Mart Stores, Inc.(1) | 31,636 |

| 2,243,941 |

|

| | | 5,761,274 |

|

| Food Products — 4.3% | | |

Archer-Daniels-Midland Co.(1) | 32,978 |

| 1,590,199 |

|

Bunge Ltd.(1) | 13,974 |

| 1,226,917 |

|

ConAgra Foods, Inc.(1) | 21,987 |

| 961,272 |

|

| Dean Foods Co. | 26,272 |

| 424,818 |

|

| Ingredion, Inc. | 3,566 |

| 284,603 |

|

Pilgrim's Pride Corp.(1) | 42,817 |

| 983,507 |

|

Sanderson Farms, Inc.(1) | 14,540 |

| 1,092,826 |

|

Seaboard Corp.(2) | 150 |

| 539,850 |

|

| | | 7,103,992 |

|

| Health Care Equipment and Supplies — 3.2% | | |

Boston Scientific Corp.(2) | 10,442 |

| 184,823 |

|

| C.R. Bard, Inc. | 855 |

| 145,949 |

|

DENTSPLY International, Inc.(1) | 19,878 |

| 1,024,711 |

|

Hologic, Inc.(2) | 7,935 |

| 302,006 |

|

St. Jude Medical, Inc.(1) | 21,417 |

| 1,564,940 |

|

Stryker Corp.(1) | 16,114 |

| 1,540,015 |

|

| Teleflex, Inc. | 4,519 |

| 612,099 |

|

| | | 5,374,543 |

|

| Health Care Providers and Services — 4.4% | | |

Aetna, Inc.(1) | 13,901 |

| 1,771,821 |

|

| Cardinal Health, Inc. | 2,786 |

| 233,049 |

|

Express Scripts Holding Co.(2) | 15,100 |

| 1,342,994 |

|

HCA Holdings, Inc.(1)(2) | 19,327 |

| 1,753,345 |

|

Health Net, Inc.(1)(2) | 12,740 |

| 816,889 |

|

Molina Healthcare, Inc.(2) | 8,543 |

| 600,573 |

|

| UnitedHealth Group, Inc. | 6,520 |

| 795,440 |

|

| | | 7,314,111 |

|

| Health Care Technology — 1.2% | | |

Allscripts Healthcare Solutions, Inc.(1)(2) | 44,801 |

| 612,878 |

|

Cerner Corp.(1)(2) | 20,472 |

| 1,413,796 |

|

| | | 2,026,674 |

|

|

| | | | | |

| | Shares | Value |

| Hotels, Restaurants and Leisure — 4.6% | | |

Brinker International, Inc.(1) | 23,168 |

| $ | 1,335,635 |

|

| Cracker Barrel Old Country Store, Inc. | 9,084 |

| 1,354,969 |

|

| Darden Restaurants, Inc. | 9,664 |

| 686,917 |

|

Diamond Resorts International, Inc.(2) | 22,279 |

| 702,903 |

|

Las Vegas Sands Corp.(1) | 24,001 |

| 1,261,733 |

|

| Marriott Vacations Worldwide Corp. | 7,724 |

| 708,677 |

|

| SeaWorld Entertainment, Inc. | 11,335 |

| 209,017 |

|

| Vail Resorts, Inc. | 8,419 |

| 919,355 |

|

Wyndham Worldwide Corp.(1) | 6,915 |

| 566,408 |

|

| | | 7,745,614 |

|

| Household Durables — 0.7% | | |

| Garmin Ltd. | 7,078 |

| 310,937 |

|

| Harman International Industries, Inc. | 7,393 |

| 879,323 |

|

| | | 1,190,260 |

|

| Household Products — 1.9% | | |

Procter & Gamble Co. (The)(1) | 40,718 |

| 3,185,776 |

|

| Industrial Conglomerates — 2.9% | | |

3M Co.(1) | 13,943 |

| 2,151,405 |

|

Danaher Corp.(1) | 17,264 |

| 1,477,626 |

|

General Electric Co.(1) | 44,209 |

| 1,174,633 |

|

| | | 4,803,664 |

|

| Insurance — 1.3% | | |

| Allstate Corp. (The) | 18,365 |

| 1,191,338 |

|

Amtrust Financial Services, Inc.(1) | 4,590 |

| 300,691 |

|

| Hanover Insurance Group, Inc. (The) | 8,312 |

| 615,337 |

|

| | | 2,107,366 |

|

| Internet and Catalog Retail — 0.3% | | |

Expedia, Inc.(1) | 3,688 |

| 403,283 |

|

Liberty Interactive Corp. QVC Group, Class A(2) | 2,951 |

| 81,890 |

|

| | | 485,173 |

|

| Internet Software and Services — 2.6% | | |

eBay, Inc.(1)(2) | 32,678 |

| 1,968,523 |

|

Facebook, Inc., Class A(2) | 3,892 |

| 333,797 |

|

Google, Inc., Class A(1)(2) | 3,540 |

| 1,911,742 |

|

VeriSign, Inc.(2) | 1,459 |

| 90,049 |

|

| | | 4,304,111 |

|

| IT Services — 3.9% | | |

Accenture plc, Class A(1) | 19,461 |

| 1,883,436 |

|

Amdocs Ltd.(1) | 6,764 |

| 369,247 |

|

Computer Sciences Corp.(1) | 14,117 |

| 926,640 |

|

| Convergys Corp. | 7,593 |

| 193,546 |

|

International Business Machines Corp.(1) | 16,120 |

| 2,622,079 |

|

Teradata Corp.(1)(2) | 5,383 |

| 199,171 |

|

| Western Union Co. (The) | 6,461 |

| 131,352 |

|

| Xerox Corp. | 12,810 |

| 136,298 |

|

| | | 6,461,769 |

|

|

| | | | | |

| | Shares | Value |

| Life Sciences Tools and Services — 1.0% | | |

Bio-Rad Laboratories, Inc., Class A(1)(2) | 10,433 |

| $ | 1,571,314 |

|

Bruker Corp.(1)(2) | 5,245 |

| 107,051 |

|

| | | 1,678,365 |

|

| Machinery — 4.4% | | |

Caterpillar, Inc.(1) | 20,510 |

| 1,739,658 |

|

Cummins, Inc.(1) | 10,949 |

| 1,436,399 |

|

| Illinois Tool Works, Inc. | 9,048 |

| 830,516 |

|

| PACCAR, Inc. | 6,185 |

| 394,665 |

|

Parker-Hannifin Corp.(1) | 11,844 |

| 1,377,813 |

|

Stanley Black & Decker, Inc.(1) | 14,462 |

| 1,521,981 |

|

| | | 7,301,032 |

|

| Marine — 0.5% | | |

Matson, Inc.(1) | 19,768 |

| 831,047 |

|

| Media — 3.3% | | |

Cablevision Systems Corp., Class A(1) | 66,272 |

| 1,586,552 |

|

Comcast Corp., Class A(1) | 19,904 |

| 1,197,027 |

|

DIRECTV(2) | 4,233 |

| 392,780 |

|

| Omnicom Group, Inc. | 11,751 |

| 816,577 |

|

| Scripps Networks Interactive, Inc., Class A | 13,176 |

| 861,315 |

|

| Viacom, Inc., Class B | 6,216 |

| 401,802 |

|

Walt Disney Co. (The)(1) | 2,616 |

| 298,590 |

|

| | | 5,554,643 |

|

| Metals and Mining — 1.4% | | |

Alcoa, Inc.(1) | 103,944 |

| 1,158,976 |

|

United States Steel Corp.(1) | 58,296 |

| 1,202,063 |

|

| | | 2,361,039 |

|

| Multi-Utilities — 0.3% | | |

| Public Service Enterprise Group, Inc. | 14,002 |

| 549,999 |

|

| Multiline Retail — 3.2% | | |

Big Lots, Inc.(1) | 30,850 |

| 1,387,942 |

|

Dillard's, Inc., Class A(1) | 8,136 |

| 855,826 |

|

| Kohl's Corp. | 21,112 |

| 1,321,822 |

|

Macy's, Inc.(1) | 1,202 |

| 81,099 |

|

Target Corp.(1) | 21,554 |

| 1,759,453 |

|

| | | 5,406,142 |

|

| Oil, Gas and Consumable Fuels — 5.4% | | |

Chevron Corp.(1) | 4,240 |

| 409,033 |

|

| CVR Energy, Inc. | 33,612 |

| 1,265,156 |

|

Denbury Resources, Inc.(1) | 38,164 |

| 242,723 |

|

EOG Resources, Inc.(1) | 8,532 |

| 746,977 |

|

Exxon Mobil Corp.(1) | 22,807 |

| 1,897,542 |

|

Murphy Oil Corp.(1) | 31,194 |

| 1,296,734 |

|

Valero Energy Corp.(1) | 30,377 |

| 1,901,600 |

|

Western Refining, Inc.(1) | 28,484 |

| 1,242,472 |

|

| | | 9,002,237 |

|

|

| | | | | |

| | Shares | Value |

| Paper and Forest Products — 0.2% | | |

| Domtar Corp. | 3,343 |

| $ | 138,400 |

|

| International Paper Co. | 2,934 |

| 139,629 |

|

| | | 278,029 |

|

| Personal Products — 0.2% | | |

Avon Products, Inc.(1) | 50,305 |

| 314,909 |

|

| Pharmaceuticals — 7.2% | | |

AbbVie, Inc.(1) | 36,010 |

| 2,419,512 |

|

Johnson & Johnson(1) | 37,768 |

| 3,680,869 |

|

Merck & Co., Inc.(1) | 47,941 |

| 2,729,281 |

|

Pfizer, Inc.(1) | 96,987 |

| 3,251,974 |

|

| | | 12,081,636 |

|

| Professional Services — 0.2% | | |

ManpowerGroup, Inc.(1) | 2,925 |

| 261,436 |

|

TriNet Group, Inc.(2) | 4,739 |

| 120,134 |

|

| | | 381,570 |

|

| Real Estate Investment Trusts (REITs) — 3.0% | | |

Hospitality Properties Trust(1) | 41,091 |

| 1,184,243 |

|

Lamar Advertising Co., Class A(1) | 21,461 |

| 1,233,578 |

|

| Plum Creek Timber Co., Inc. | 3,912 |

| 158,710 |

|

| RLJ Lodging Trust | 42,031 |

| 1,251,683 |

|

Ryman Hospitality Properties, Inc.(1) | 21,433 |

| 1,138,307 |

|

| | | 4,966,521 |

|

| Real Estate Management and Development — 1.6% | | |

CBRE Group, Inc.(1)(2) | 34,925 |

| 1,292,225 |

|

| Jones Lang LaSalle, Inc. | 7,620 |

| 1,303,020 |

|

| | | 2,595,245 |

|

| Semiconductors and Semiconductor Equipment — 2.7% | | |

Fairchild Semiconductor International, Inc.(2) | 5,624 |

| 97,745 |

|

Intel Corp.(1) | 83,507 |

| 2,539,865 |

|

| Marvell Technology Group Ltd. | 9,479 |

| 124,981 |

|

Micron Technology, Inc.(1)(2) | 20,750 |

| 390,930 |

|

Texas Instruments, Inc.(1) | 25,261 |

| 1,301,194 |

|

| | | 4,454,715 |

|

| Software — 6.2% | | |

| Activision Blizzard, Inc. | 12,803 |

| 309,961 |

|

Cadence Design Systems, Inc.(1)(2) | 66,598 |

| 1,309,317 |

|

Electronic Arts, Inc.(2) | 7,870 |

| 523,355 |

|

Mentor Graphics Corp.(1) | 31,358 |

| 828,792 |

|

Microsoft Corp.(1) | 82,339 |

| 3,635,267 |

|

Oracle Corp.(1) | 59,724 |

| 2,406,877 |

|

Symantec Corp.(1) | 4,926 |

| 114,529 |

|

Synopsys, Inc.(1)(2) | 25,422 |

| 1,287,624 |

|

| | | 10,415,722 |

|

| Specialty Retail — 3.7% | | |

Best Buy Co., Inc.(1) | 20,617 |

| 672,320 |

|

|

| | | | | |

| | Shares | Value |

Foot Locker, Inc.(1) | 22,490 |

| $ | 1,507,055 |

|

Gap, Inc. (The)(1) | 33,641 |

| 1,284,077 |

|

Lowe's Cos., Inc.(1) | 28,855 |

| 1,932,419 |

|

Murphy USA, Inc.(1)(2) | 13,585 |

| 758,315 |

|

| | | 6,154,186 |

|

| Technology Hardware, Storage and Peripherals — 7.1% | | |

Apple, Inc.(1) | 53,098 |

| 6,659,816 |

|

EMC Corp.(1) | 68,390 |

| 1,804,812 |

|

Hewlett-Packard Co.(1) | 53,005 |

| 1,590,680 |

|

| NetApp, Inc. | 2,940 |

| 92,786 |

|

SanDisk Corp.(1) | 8,480 |

| 493,706 |

|

Seagate Technology plc(1) | 4,964 |

| 235,790 |

|

Western Digital Corp.(1) | 12,438 |

| 975,388 |

|

| | | 11,852,978 |

|

| Textiles, Apparel and Luxury Goods — 0.7% | | |

| Wolverine World Wide, Inc. | 40,084 |

| 1,141,592 |

|

| Thrifts and Mortgage Finance — 1.2% | | |

Essent Group Ltd.(2) | 47,914 |

| 1,310,448 |

|

Nationstar Mortgage Holdings, Inc.(1)(2) | 43,313 |

| 727,658 |

|

| | | 2,038,106 |

|

TOTAL COMMON STOCKS (Cost $191,375,967) | | 214,184,299 |

|

| TEMPORARY CASH INVESTMENTS — 0.9% | | |

Repurchase Agreement, Bank of America Merrill Lynch, (collateralized by various U.S. Treasury obligations, 1.50%, 1/31/19 - 11/30/19, valued at $264,657), in a joint trading account at 0.10%, dated 6/30/15, due 7/1/15 (Delivery value $259,377) | | 259,376 |

|

| Repurchase Agreement, Fixed Income Clearing Corp., (collateralized by various U.S. Treasury obligations, 2.375%, 8/15/24, valued at $1,063,378), at 0.01%, dated 6/30/15, due 7/1/15 (Delivery value $1,038,000) | | 1,038,000 |

|

| State Street Institutional Liquid Reserves Fund, Premier Class | 257,595 |

| 257,595 |

|

TOTAL TEMPORARY CASH INVESTMENTS (Cost $1,554,971) | | 1,554,971 |

|

TOTAL INVESTMENT SECURITIES BEFORE SECURITIES SOLD SHORT — 129.3% (Cost $192,930,938) | 215,739,270 |

|

| COMMON STOCKS SOLD SHORT — (29.5)% | | |

| Aerospace and Defense — (1.2)% | | |

| DigitalGlobe, Inc. | (41,710 | ) | (1,159,121 | ) |

| Orbital ATK, Inc. | (11,007 | ) | (807,473 | ) |

| | | (1,966,594 | ) |

| Air Freight and Logistics — (0.2)% | | |

| UTi Worldwide, Inc. | (31,634 | ) | (316,024 | ) |

| Airlines — (0.9)% | | |

| Allegiant Travel Co. | (4,115 | ) | (731,976 | ) |

| Spirit Airlines, Inc. | (13,230 | ) | (821,583 | ) |

| | | (1,553,559 | ) |

| Auto Components — (0.9)% | | |

| BorgWarner, Inc. | (10,221 | ) | (580,962 | ) |

| Visteon Corp. | (8,388 | ) | (880,572 | ) |

| | | (1,461,534 | ) |

|

| | | | | |

| | Shares | Value |

| Chemicals — (1.1)% | | |

| Platform Specialty Products Corp. | (4,131 | ) | $ | (105,671 | ) |

| Tronox Ltd., Class A | (23,248 | ) | (340,118 | ) |

| WR Grace & Co. | (13,454 | ) | (1,349,436 | ) |

| | | (1,795,225 | ) |

| Communications Equipment — (0.9)% | | |

| Motorola Solutions, Inc. | (19,559 | ) | (1,121,513 | ) |

| ViaSat, Inc. | (6,955 | ) | (419,108 | ) |

| | | (1,540,621 | ) |

| Construction and Engineering — (1.4)% | | |

| AECOM | (40,495 | ) | (1,339,574 | ) |

| Granite Construction, Inc. | (30,482 | ) | (1,082,416 | ) |

| | | (2,421,990 | ) |

| Diversified Financial Services — (0.7)% | | |

| Leucadia National Corp. | (47,703 | ) | (1,158,229 | ) |

| Electric Utilities — (0.1)% | | |

| ALLETE, Inc. | (5,087 | ) | (235,986 | ) |

| Electrical Equipment — (0.3)% | | |

| Franklin Electric Co., Inc. | (16,211 | ) | (524,102 | ) |

| Electronic Equipment, Instruments and Components — (1.6)% | | |

| Anixter International, Inc. | (18,727 | ) | (1,220,064 | ) |

| FEI Co. | (12,227 | ) | (1,013,985 | ) |

| SYNNEX Corp. | (2,554 | ) | (186,928 | ) |

| Zebra Technologies Corp., Class A | (1,825 | ) | (202,666 | ) |

| | | (2,623,643 | ) |

| Energy Equipment and Services — (1.3)% | | |

| Bristow Group, Inc. | (14,942 | ) | (796,409 | ) |

| Rowan Cos. plc | (60,640 | ) | (1,280,110 | ) |

| RPC, Inc. | (8,763 | ) | (121,192 | ) |

| | | (2,197,711 | ) |

| Food and Staples Retailing — (1.2)% | | |

| PriceSmart, Inc. | (14,187 | ) | (1,294,422 | ) |

| United Natural Foods, Inc. | (10,819 | ) | (688,954 | ) |

| | | (1,983,376 | ) |

| Food Products — (0.6)% | | |

| Post Holdings, Inc. | (17,270 | ) | (931,371 | ) |

| Gas Utilities — (0.2)% | | |

| South Jersey Industries, Inc. | (13,401 | ) | (331,407 | ) |

| Health Care Equipment and Supplies — (0.1)% | | |

| Cooper Cos., Inc. (The) | (668 | ) | (118,884 | ) |

| Health Care Providers and Services — (3.1)% | | |

| Acadia Healthcare Co., Inc. | (16,601 | ) | (1,300,357 | ) |

| Brookdale Senior Living, Inc. | (34,936 | ) | (1,212,279 | ) |

| Henry Schein, Inc. | (4,611 | ) | (655,315 | ) |

| Owens & Minor, Inc. | (25,702 | ) | (873,868 | ) |

| Tenet Healthcare Corp. | (18,917 | ) | (1,094,916 | ) |

| | | (5,136,735 | ) |

|

| | | | | |

| | Shares | Value |

| Hotels, Restaurants and Leisure — (0.4)% | | |

| MGM Resorts International | (34,983 | ) | $ | (638,440 | ) |

| Household Durables — (1.0)% | | |

| Lennar Corp., Class A | (13,312 | ) | (679,445 | ) |

| M.D.C. Holdings, Inc. | (33,589 | ) | (1,006,662 | ) |

| | | (1,686,107 | ) |

| Insurance — (0.8)% | | |

| MBIA, Inc. | (131,996 | ) | (793,296 | ) |

| Old Republic International Corp. | (30,518 | ) | (476,996 | ) |

| | | (1,270,292 | ) |

| Internet Software and Services — (0.5)% | | |

| Yahoo!, Inc. | (22,457 | ) | (882,336 | ) |

| IT Services — (1.4)% | | |

| Gartner, Inc. | (997 | ) | (85,523 | ) |

| Global Payments, Inc. | (7,190 | ) | (743,805 | ) |

| WEX, Inc. | (12,647 | ) | (1,441,379 | ) |

| | | (2,270,707 | ) |

| Machinery — (0.7)% | | |

| Donaldson Co., Inc. | (33,473 | ) | (1,198,333 | ) |

| Media — (0.7)% | | |

| Loral Space & Communications, Inc. | (18,706 | ) | (1,180,723 | ) |

| Metals and Mining — (0.5)% | | |

| Allegheny Technologies, Inc. | (3,178 | ) | (95,975 | ) |

| Freeport-McMoRan, Inc. | (4,832 | ) | (89,972 | ) |

| Hecla Mining Co. | (280,354 | ) | (737,331 | ) |

| | | (923,278 | ) |

| Multi-Utilities — (0.1)% | | |

| Dominion Resources, Inc. | (3,210 | ) | (214,653 | ) |

| Oil, Gas and Consumable Fuels — (1.3)% | | |

| Cobalt International Energy, Inc. | (39,021 | ) | (378,894 | ) |

| Diamondback Energy, Inc. | (9,757 | ) | (735,483 | ) |

| Gulfport Energy Corp. | (21,577 | ) | (868,474 | ) |

| Teekay Corp. | (5,693 | ) | (243,774 | ) |

| | | (2,226,625 | ) |

| Paper and Forest Products — (0.8)% | | |

| Louisiana-Pacific Corp. | (81,890 | ) | (1,394,587 | ) |

| Pharmaceuticals — (0.2)% | | |

| Akorn, Inc. | (9,346 | ) | (408,046 | ) |

| Professional Services — (0.9)% | | |

| Advisory Board Co. (The) | (26,008 | ) | (1,421,857 | ) |

| Real Estate Management and Development — (0.6)% | | |

| Howard Hughes Corp. (The) | (3,501 | ) | (502,534 | ) |

| Kennedy-Wilson Holdings, Inc. | (24,319 | ) | (598,004 | ) |

| | | (1,100,538 | ) |

| Road and Rail — (0.6)% | | |

| Kansas City Southern | (10,124 | ) | (923,309 | ) |

|

| | | | | |

| | Shares | Value |

| Semiconductors and Semiconductor Equipment — (0.9)% | | |

| SunEdison, Inc. | (48,096 | ) | $ | (1,438,551 | ) |

| Software — (0.1)% | | |

| FireEye, Inc. | (2,748 | ) | (134,405 | ) |

| Specialty Retail — (1.2)% | | |

| Cabela's, Inc. | (19,983 | ) | (998,750 | ) |

| CarMax, Inc. | (15,509 | ) | (1,026,851 | ) |

| | | (2,025,601 | ) |

| Textiles, Apparel and Luxury Goods — (0.2)% | | |

| Under Armour, Inc., Class A | (3,837 | ) | (320,159 | ) |

| Trading Companies and Distributors — (0.1)% | | |

| Watsco, Inc. | (854 | ) | (105,674 | ) |

| Transportation Infrastructure — (0.7)% | | |

| Macquarie Infrastructure Corp. | (13,599 | ) | (1,123,685 | ) |

TOTAL COMMON STOCKS SOLD SHORT — (29.5)% (Proceeds $48,254,336) | | (49,184,897 | ) |

| OTHER ASSETS AND LIABILITIES — 0.2% | | 332,660 |

|

| TOTAL NET ASSETS — 100.0% | | $ | 166,887,033 |

|

|

| | |

| NOTES TO SCHEDULE OF INVESTMENTS |

| |

| (1) | Security, or a portion thereof, has been pledged at the custodian bank or with a broker for collateral requirements on securities sold short. At the period end, the aggregate value of securities pledged was $149,709,293. |

See Notes to Financial Statements.

|

|

| Statement of Assets and Liabilities |

|

| | | |

| JUNE 30, 2015 |

| Assets |

| Investment securities, at value (cost of $192,930,938) | $ | 215,739,270 |

|

| Deposits with broker for securities sold short | 156,023 |

|

| Receivable for investments sold | 10,043,312 |

|

| Receivable for capital shares sold | 3,893 |

|

| Dividends and interest receivable | 222,013 |

|

| | 226,164,511 |

|

| | |

| Liabilities | |

| Securities sold short, at value (proceeds of $48,254,336) | 49,184,897 |

|

| Payable for investments purchased | 9,861,119 |

|

| Payable for capital shares redeemed | 25,213 |

|

| Accrued management fees | 181,120 |

|

| Distribution and service fees payable | 783 |

|

| Dividend expense payable on securities sold short | 24,346 |

|

| | 59,277,478 |

|

| | |

| Net Assets | $ | 166,887,033 |

|

| | |

| Net Assets Consist of: |

| Capital (par value and paid-in surplus) | $ | 132,107,141 |

|

| Undistributed net investment income | 57,387 |

|

| Undistributed net realized gain | 12,844,734 |

|

| Net unrealized appreciation | 21,877,771 |

|

| | $ | 166,887,033 |

|

|

| | | | | | |

| | Net Assets | Shares Outstanding | Net Asset Value Per Share |

| Investor Class, $0.01 Par Value |

| $163,486,502 |

| 11,805,836 |

| $13.85 |

| Institutional Class, $0.01 Par Value |

| $1,853,598 |

| 133,799 |

| $13.85 |

| A Class, $0.01 Par Value |

| $801,403 |

| 57,885 |

| $13.84* |

| C Class, $0.01 Par Value |

| $736,083 |

| 53,778 |

| $13.69 |

| R Class, $0.01 Par Value |

| $9,447 |

| 683 |

| $13.83 |

*Maximum offering price $14.68 (net asset value divided by 0.9425).

See Notes to Financial Statements.

|

| | | |

| YEAR ENDED JUNE 30, 2015 |

| Investment Income (Loss) |

| Income: | |

| Dividends (net of foreign taxes withheld of $2,537) | $ | 4,190,422 |

|

| Interest | 1,137 |

|

| | 4,191,559 |

|

| | |

| Expenses: | |

| Dividend expense on securities sold short | 418,706 |

|

| Broker fees and charges on securities sold short | 288,046 |

|

| Management fees | 2,117,965 |

|

| Distribution and service fees: | |

| A Class | 1,969 |

|

| C Class | 6,721 |

|

| R Class | 770 |

|

| Directors' fees and expenses | 8,161 |

|

| | 2,842,338 |

|

| | |

| Net investment income (loss) | 1,349,221 |

|

| | |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on: | |

| Investment transactions | 23,074,086 |

|

| Securities sold short transactions | (3,235,774 | ) |

| | 19,838,312 |

|

| | |

| Change in net unrealized appreciation (depreciation) on: | |

| Investments | (16,347,005 | ) |

| Securities sold short | 2,704,235 |

|

| | (13,642,770 | ) |

| | |

| Net realized and unrealized gain (loss) | 6,195,542 |

|

| | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ | 7,544,763 |

|

See Notes to Financial Statements.

|

|

| Statement of Changes in Net Assets |

|

| | | | | | |

| YEARS ENDED JUNE 30, 2015 AND JUNE 30, 2014 |

| Increase (Decrease) in Net Assets | June 30, 2015 | June 30, 2014 |

| Operations | | |

| Net investment income (loss) | $ | 1,349,221 |

| $ | 967,747 |

|

| Net realized gain (loss) | 19,838,312 |

| 17,231,018 |

|

| Change in net unrealized appreciation (depreciation) | (13,642,770 | ) | 14,388,597 |

|

| Net increase (decrease) in net assets resulting from operations | 7,544,763 |

| 32,587,362 |

|

| | | |

| Distributions to Shareholders | | |

| From net investment income: | | |

| Investor Class | (1,232,745 | ) | (1,048,352 | ) |

| Institutional Class | (26,296 | ) | (49,529 | ) |

| A Class | (4,050 | ) | (3,670 | ) |

| R Class | (277 | ) | (421 | ) |

| From net realized gains: | | |

| Investor Class | (18,776,418 | ) | (8,566,466 | ) |

| Institutional Class | (402,248 | ) | (326,217 | ) |

| A Class | (95,019 | ) | (46,967 | ) |

| C Class | (78,672 | ) | (61,677 | ) |

| R Class | (22,123 | ) | (10,354 | ) |

| Decrease in net assets from distributions | (20,637,848 | ) | (10,113,653 | ) |

| | | |

| Capital Share Transactions | | |

Net increase (decrease) in net assets from capital share transactions (Note 5) | 23,670,442 |

| 13,863,840 |

|

| | | |

| Net increase (decrease) in net assets | 10,577,357 |

| 36,337,549 |

|

| | | |

| Net Assets | | |

| Beginning of period | 156,309,676 |

| 119,972,127 |

|

| End of period | $ | 166,887,033 |

| $ | 156,309,676 |

|

| | | |

| Undistributed net investment income | $ | 57,387 |

| — |

|

See Notes to Financial Statements.

|

| | | |

| YEAR ENDED JUNE 30, 2015 | |

| Cash Flows From (Used In) Operating Activities | |

| Net increase (decrease) in net assets resulting from operations | $ | 7,544,763 |

|

| Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash from (used in) operating activities: | |

| Purchases of investment securities | (174,941,581 | ) |

| Proceeds from investments sold | 168,576,131 |

|

| Purchases to cover securities sold short | (52,056,440 | ) |

| Proceeds from securities sold short | 53,549,281 |

|

| (Increase) decrease in short-term investments | 832,999 |

|

| (Increase) decrease in deposits with broker for securities sold short | 641,234 |

|

| (Increase) decrease in receivable for investments sold | (9,613,908 | ) |

| (Increase) decrease in dividends and interest receivable | (46,003 | ) |

| Increase (decrease) in payable for investments purchased | 8,649,902 |

|

| Increase (decrease) in accrued management fees | 16,764 |

|

| Increase (decrease) in distribution and service fees payable | (60 | ) |

| Increase (decrease) in dividend expense payable on securities sold short | 2,212 |

|

| Change in net unrealized (appreciation) depreciation on investments | 16,347,005 |

|

| Net realized (gain) loss on investment transactions | (23,074,086 | ) |

| Change in net unrealized (appreciation) depreciation on securities sold short | (2,704,235 | ) |

| Net realized (gain) loss on securities sold short transactions | 3,235,774 |

|

| Net cash from (used in) operating activities | (3,040,248 | ) |

| | |

| Cash Flows From (Used In) Financing Activities | |

| Proceeds from shares sold | 20,755,721 |

|

| Payments for shares redeemed | (17,674,926 | ) |

| Distributions paid, net of reinvestments | (43,281 | ) |

| Net cash from (used in) financing activities | 3,037,514 |

|

| | |

| Net Increase (Decrease) In Cash | (2,734 | ) |

| Cash at beginning of period | 2,734 |

|

| Cash at end of period | — |

|

| | |

| Supplemental disclosure of cash flow information: | |

| Non cash financing activities not included herein consist of all reinvestment of distributions of $20,594,567. |

See Notes to Financial Statements.

|

|

| Notes to Financial Statements |

JUNE 30, 2015

1. Organization

American Century Quantitative Equity Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Maryland corporation. Core Equity Plus Fund (the fund) is one fund in a series issued by the corporation. The fund is diversified as defined under the 1940 Act. The fund’s investment objective is to seek long-term capital growth.

The fund offers the Investor Class, the Institutional Class, the A Class, the C Class and the R Class. The A Class may incur an initial sales charge. The A Class and C Class may be subject to a contingent deferred sales charge. The share classes differ principally in their respective sales charges and distribution and shareholder servicing expenses and arrangements. The Institutional Class is made available to institutional shareholders or through financial intermediaries whose clients do not require the same level of shareholder and administrative services as shareholders of other classes. As a result, the Institutional Class is charged a lower unified management fee.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The fund is an investment company and follows accounting and reporting guidance in accordance with accounting principles generally accepted in the United States of America. This may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates. Management evaluated the impact of events or transactions occurring through the date the financial statements were issued that would merit recognition or disclosure.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value per share at the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open. The Board of Directors has adopted valuation policies and procedures to guide the investment advisor in the fund’s investment valuation process and to provide methodologies for the oversight of the fund’s pricing function.

Equity securities that are listed or traded on a domestic securities exchange are valued at the last reported sales price or at the official closing price as provided by the exchange. Equity securities traded on foreign securities exchanges are generally valued at the closing price of such securities on the exchange where primarily traded or at the close of the NYSE, if that is earlier. If no last sales price is reported, or if local convention or regulation so provides, the mean of the latest bid and asked prices may be used. Securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official closing price.

Fixed income securities maturing within 60 days at the time of purchase may be valued at cost, plus or minus any amortized discount or premium or at the evaluated mean as provided by an independent pricing service. Evaluated mean prices are commonly derived through utilization of market models, which may consider, among other factors: trade data, quotations from dealers and active market makers, relevant yield curve and spread data, related sector levels, creditworthiness, trade data or market information on comparable securities, and other relevant security specific information.

Open-end management investment companies are valued at the reported net asset value per share. Repurchase agreements are valued at cost, which approximates fair value.

If the fund determines that the market price for an investment is not readily available or the valuation methods mentioned above do not reflect an investment’s fair value, such investment is valued as determined in good faith by the Board of Directors or its delegate, in accordance with policies and procedures adopted by the Board of Directors. In its determination of fair value, the fund may review several factors including, but not limited to, market information regarding the specific investment or comparable investments and correlation with other investment types, futures indices or general market indicators. Circumstances that may cause the fund to use these procedures to value an investment include, but are not limited to: an investment has been declared in default or is distressed; trading in a security has been suspended during the trading day or a

security is not actively trading on its principal exchange; prices received from a regular pricing source are deemed unreliable; or there is a foreign market holiday and no trading occurred.

The fund monitors for significant events occurring after the close of an investment’s primary exchange but before the fund’s net asset value per share is determined. Significant events may include, but are not limited to: corporate announcements and transactions; governmental action and political unrest that could impact a specific investment or an investment sector; or armed conflicts, natural disasters and similar events that could affect investments in a specific country or region. The fund also monitors for significant fluctuations between domestic and foreign markets, as evidenced by the U.S. market or such other indicators that the Board of Directors, or its delegate, deems appropriate. If significant fluctuations in foreign markets are identified, the fund may apply a model-derived factor to the closing price of equity securities traded on foreign securities exchanges. The factor is based on observable market data as provided by an independent pricing service.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Distributions received on securities that represent a return of capital or long-term capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund may estimate the components of distributions received that may be considered nontaxable distributions or long-term capital gain distributions for income tax purposes. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Securities Sold Short — The fund enters into short sales, which is selling securities it does not own, as part of its normal investment activities. Upon selling a security short, the fund will segregate cash, cash equivalents or other appropriate liquid securities in at least an amount equal to the current market value of the securities sold short until the fund replaces the borrowed security. Interest earned on segregated cash for securities sold short is reflected as interest income. The fund is required to pay any dividends or interest due on securities sold short. Such dividends and interest are recorded as an expense. The fund may pay fees or charges to the broker on the assets borrowed for securities sold short. These fees are calculated daily based upon the value of each security sold short and a rate that is dependent on the availability of such security. Liabilities for securities sold short are valued daily and changes in value are recorded as change in net unrealized appreciation (depreciation) on securities sold short. The fund records realized gain (loss) on a security sold short when it is terminated by the fund and includes as a component of net realized gain (loss) on securities sold short transactions.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that American Century Investment Management, Inc. (ACIM) (the investment advisor) has determined are creditworthy pursuant to criteria adopted by the Board of Directors. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Segregated Assets — In accordance with the 1940 Act, the fund segregates assets on its books and records to cover certain types of investments, including, but not limited to, futures contracts and short sales. ACIM monitors, on a daily basis, the securities segregated to ensure the fund designates a sufficient amount of liquid assets, marked-to-market daily. The fund may also receive assets or be required to pledge assets at the custodian bank or with a broker for margin requirements on futures contracts and short sales.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. Accordingly, no provision has been made for income taxes. The fund files U.S. federal, state, local and non-U.S. tax returns as applicable. The fund's tax returns are subject to examination by the relevant taxing authority until expiration of the applicable statute of limitations, which is generally three years from the date of filing but can be longer in certain jurisdictions. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination

and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Multiple Class — All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Distributions to Shareholders — Distributions from net investment income, if any, are generally declared and paid semiannually. Distributions from net realized gains, if any, are generally declared and paid annually.

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

Statement of Cash Flows — The Statement of Cash Flows has been prepared using the indirect method which requires net increase (decrease) in net assets resulting from operations to be adjusted to reconcile to net cash from (used in) operating activities. The beginning of period and end of period cash is the amount of domestic and foreign currency included in the fund's Statement of Assets and Liabilities and represents the cash on hand at the custodian bank and does not include any short-term investments or deposits with brokers for securities sold short.

3. Fees and Transactions with Related Parties

Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC). The corporation’s investment advisor, ACIM, the corporation's distributor, American Century Investment Services, Inc. (ACIS), and the corporation’s transfer agent, American Century Services, LLC, are wholly owned, directly or indirectly, by ACC. Various funds issued by American Century Asset Allocation Portfolios, Inc. and American Century Strategic Asset Allocations, Inc. own, in aggregate, 91% of the shares of the fund. Related parties do not invest in the fund for the purpose of exercising management or control.

Management Fees — The corporation has entered into a management agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The agreement provides that all expenses of managing and operating the fund, except distribution and service fees, expenses on securities sold short, brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), and extraordinary expenses, will be paid by ACIM. The fee is computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fee consists of (1) an Investment Category Fee based on the daily net assets of the fund and certain other accounts managed by the investment advisor that are in the same broad investment category as the fund and (2) a Complex Fee based on the assets of all the funds in the American Century Investments family of funds. The rates for the Investment Category Fee range from 0.9680% to 1.1500%. The rates for the Complex Fee range from 0.2500% to 0.3100% for the Investor Class, A Class, C Class and R Class. The rates for the Complex Fee range from 0.0500% to 0.1100% for the Institutional Class. The effective annual management fee for each class for the year ended June 30, 2015 was 1.29% for the Investor Class, A Class, C Class and R Class and 1.09% for the Institutional Class.

Distribution and Service Fees — The Board of Directors has adopted a separate Master Distribution and Individual Shareholder Services Plan for each of the A Class, C Class and R Class (collectively the plans), pursuant to Rule 12b-1 of the 1940 Act. The plans provide that the A Class will pay ACIS an annual distribution and service fee of 0.25%. The plans provide that the C Class will pay ACIS an annual distribution and service fee of 1.00%, of which 0.25% is paid for individual shareholder services and 0.75% is paid for distribution services. The plans provide that the R Class will pay ACIS an annual distribution and service fee of 0.50%. The fees are computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fees are used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plans during the year ended June 30, 2015 are detailed in the Statement of Operations.

Directors' Fees and Expenses — The Board of Directors is responsible for overseeing the investment advisor’s management and operations of the fund. The directors receive detailed information about the fund and its investment advisor regularly throughout the year, and meet at least quarterly with management of the

investment advisor to review reports about fund operations. The fund’s officers do not receive compensation from the fund.

4. Investment Transactions

Purchases and sales of investment securities and securities sold short, excluding short-term investments, for the year ended June 30, 2015 were $226,998,021 and $222,013,556, respectively.

5. Capital Share Transactions

Transactions in shares of the fund were as follows:

|

| | | | | | | | | | |

| | Year ended

June 30, 2015 | Year ended June 30, 2014 |

| | Shares | Amount | Shares | Amount |

| Investor Class/Shares Authorized | 100,000,000 |

| | 50,000,000 |

| |

| Sold | 1,406,752 |

| $ | 20,361,600 |

| 754,248 |

| $ | 10,606,746 |

|

| Issued in reinvestment of distributions | 1,445,917 |

| 19,965,882 |

| 686,141 |

| 9,588,838 |

|

| Redeemed | (874,930 | ) | (12,704,161 | ) | (525,553 | ) | (7,370,989 | ) |

| | 1,977,739 |

| 27,623,321 |

| 914,836 |

| 12,824,595 |

|

| Institutional Class/Shares Authorized | 30,000,000 |

| | 10,000,000 |

| |

| Sold | 3,136 |

| 48,379 |

| 214,905 |

| 2,995,143 |

|

| Issued in reinvestment of distributions | 30,989 |

| 428,544 |

| 26,818 |

| 375,746 |

|

| Redeemed | (296,499 | ) | (4,411,976 | ) | (190,289 | ) | (2,702,023 | ) |

| | (262,374 | ) | (3,935,053 | ) | 51,434 |

| 668,866 |

|

| A Class/Shares Authorized | 15,000,000 |

| | 10,000,000 |

| |

| Sold | 11,300 |

| 166,833 |

| 28,772 |

| 402,615 |

|

| Issued in reinvestment of distributions | 7,183 |

| 99,069 |

| 3,632 |

| 50,637 |

|

| Redeemed | (10,400 | ) | (149,820 | ) | (22,752 | ) | (318,636 | ) |

| | 8,083 |

| 116,082 |

| 9,652 |

| 134,616 |

|

| C Class/Shares Authorized | 15,000,000 |

| | 10,000,000 |

| |

| Sold | 10,465 |

| 147,523 |

| 32,457 |

| 463,111 |

|

| Issued in reinvestment of distributions | 5,781 |

| 78,672 |

| 4,473 |

| 61,677 |

|

| Redeemed | (13,629 | ) | (202,879 | ) | (20,863 | ) | (303,218 | ) |

| | 2,617 |

| 23,316 |

| 16,067 |

| 221,570 |

|

| R Class/Shares Authorized | 15,000,000 |

| | 10,000,000 |

| |

| Sold | 1,175 |

| 16,782 |

| 241 |

| 3,418 |

|

| Issued in reinvestment of distributions | 1,630 |

| 22,400 |

| 775 |

| 10,775 |

|

| Redeemed | (13,801 | ) | (196,406 | ) | — |

| — |

|

| | (10,996 | ) | (157,224 | ) | 1,016 |

| 14,193 |

|

| Net increase (decrease) | 1,715,069 |

| $ | 23,670,442 |

| 993,005 |

| $ | 13,863,840 |

|

6. Fair Value Measurements

The fund’s investments valuation process is based on several considerations and may use multiple inputs to determine the fair value of the investments held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels.

| |

| • | Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical investments. |

| |

| • | Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for comparable investments, evaluations of subsequent market events, interest rates, prepayment speeds, |

credit risk, etc.). These inputs also consist of quoted prices for identical investments initially expressed in local currencies that are adjusted through translation into U.S. dollars.

| |

| • | Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions). |

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments. There were no significant transfers between levels during the period.

The following is a summary of the level classifications as of period end. The Schedule of Investments provides additional information on the fund’s portfolio holdings.

|

| | | | | | | | |

| | Level 1 | Level 2 | Level 3 |

| Assets |

| Investment Securities |

| Common Stocks | $ | 214,184,299 |

| — |

| — |

|

| Temporary Cash Investments | 257,595 |

| $ | 1,297,376 |

| — |

|

| | $ | 214,441,894 |

| $ | 1,297,376 |

| — |

|

| | | | |

| Liabilities |

| Securities Sold Short |

| Common Stocks | $ | (49,184,897 | ) | — |

| — |

|

7. Risk Factors

The fund is subject to short sales risk. If the market price of a security increases after the fund borrows the security, the fund may suffer a loss when it replaces the borrowed security at the higher price. Any loss will be increased by the amount of compensation, interest or dividends, and transaction costs the fund must pay to the lender of the borrowed security.

The fund's investment strategy utilizes leverage, which can increase market exposure and subject the fund to greater risk and higher volatility.

If the fund is overweighted in a stock or sector, any negative development related to that stock or sector will have a greater impact on the fund than other funds that are not overweighted in that stock or sector.

The fund’s investment process may result in high portfolio turnover, which could mean high transaction costs, affecting both performance and capital gains tax liabilities to investors.

8. Federal Tax Information

The tax character of distributions paid during the years ended June 30, 2015 and June 30, 2014 were as follows:

|

| | | | | | |

| | 2015 | 2014 |

| Distributions Paid From | | |

| Ordinary income | $ | 2,984,097 |

| $ | 2,724,056 |

|

| Long-term capital gains | $ | 17,653,751 |

| $ | 7,389,597 |

|

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of June 30, 2015, the federal tax cost of investments and the components of distributable earnings on a tax-basis were as follows:

|

| | | |

| Federal tax cost of investments | $ | 192,954,377 |

|

| Gross tax appreciation of investments | $ | 31,353,257 |

|

| Gross tax depreciation of investments | (8,568,364 | ) |

| Net tax appreciation (depreciation) of investments | 22,784,893 |

|

| Net tax appreciation (depreciation) on securities sold short | (1,043,144 | ) |

| Net tax appreciation (depreciation) | $ | 21,741,749 |

|

| Undistributed ordinary income | $ | 57,387 |

|

| Accumulated long-term gains | $ | 13,498,358 |

|

| Post-October capital loss deferral | $ | (517,602 | ) |

The difference between book-basis and tax-basis unrealized appreciation (depreciation) is attributable primarily to deferral of losses on unsettled short positions.

Loss deferrals represent certain qualified losses that the fund has elected to treat as having been incurred in the following fiscal year for federal income tax purposes.

|

| | | | | | | | | | | | | | | | |

| For a Share Outstanding Throughout the Years Ended June 30 (except as noted) |

| Per-Share Data | Ratios and Supplemental Data |

| | | Income From Investment Operations: | Distributions From: | | | Ratio to Average Net Assets of: | | |