UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-05447 |

| | |

| | |

| | |

AMERICAN CENTURY QUANTITATIVE EQUITY FUNDS, INC. |

(Exact name of registrant as specified in charter) |

| | |

| | |

| | |

4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

(Address of principal executive offices) | (Zip Code) |

| | |

| | |

| | |

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

(Name and address of agent for service) |

| | |

| | |

Registrant’s telephone number, including area code: | 816-531-5575 |

| | |

| | |

Date of fiscal year end: | 06-30 |

| | |

| | |

Date of reporting period: | 06-30-2013 |

ITEM 1. REPORTS TO STOCKHOLDERS.

ANNUAL REPORT | JUNE 30, 2013 |

Core Equity Plus Fund

President’s Letter | 2 |

Market Perspective | 3 |

Performance | 4 |

Portfolio Commentary | 6 |

Fund Characteristics | 8 |

Shareholder Fee Example | 9 |

Schedule of Investments | 11 |

Statement of Assets and Liabilities | 17 |

Statement of Operations | 18 |

Statement of Changes in Net Assets | 19 |

Statement of Cash Flows | 20 |

Notes to Financial Statements | 21 |

Financial Highlights | 28 |

Report of Independent Registered Public Accounting Firm | 30 |

Management | 31 |

Approval of Management Agreement | 34 |

Additional Information | 39 |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Jonathan Thomas

Dear Investor:

Thank you for reviewing this annual report for the 12 months ended June 30, 2013. It provides investment performance, market analysis, and portfolio information, presented with the expert perspective of our portfolio management team.

Annual reports remain important vehicles for conveying information about fund returns, including key factors that affected fund performance. For additional, updated investment and market insights, we encourage you to visit our website, americancentury.com.

Generally Favorable Fiscal-Year Returns for U.S. Stocks and High-Yield Bonds

The 12-month reporting period began in the summer of 2012 with uncertainties caused by slowing economies, as well as the upcoming November elections and year-end fiscal deadlines in the U.S. It ended with more uncertainty about the future of U.S. monetary stimulus. In between, aggressive monetary intervention by central banks encouraged investors to take more risk, generally boosting stocks at the expense of government bonds.

U.S. mid-cap, small-cap, and value stock indices achieved performance leadership during the period, outpacing the S&P 500 Index’s 20.60% return. U.S. stocks generally outperformed non-U.S. equities—the MSCI EAFE Index returned 18.62% and the MSCI Emerging Markets Index advanced 2.87%, affected by slowing growth in emerging market economies.

Slower emerging market growth also hindered commodity price gains and helped keep inflation under control. As a result, assets used as inflation hedges, including inflation-indexed securities and precious metals, lagged other assets. Gold, in particular, plunged, starting last October. And Treasury inflation-protected securities (TIPS) were among the lowest performers in the U.S. bond market. Bond index returns generally ranged from approximately 10% gains for U.S. corporate high-yield indices all the way down to negative returns for longer-maturity global Treasury benchmarks.

Despite signs of improvement in 2013, U.S. economic growth is subpar compared with past recession recoveries, and remains vulnerable to threats that could trigger another slowdown and market volatility. Therefore, we continue to believe in a disciplined, diversified, long-term investment approach, using professionally managed stock and bond portfolios—as appropriate—for meeting financial goals. We appreciate your continued trust in us in this volatile environment.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

By Scott Wittman, Chief Investment Officer, Asset Allocation and

Quantitative Equity

Central Bank Actions, Relative U.S. Economic Gains Drove Stocks Higher

Stock market performance remained robust during the 12-month period ended June 30, 2013. Despite persistent concerns about weak global growth and Europe’s ongoing financial crisis, investors largely focused on central bank stimulus measures and marginally-improving U.S. economic data, which fueled market optimism.

Early in the period, in response to disappointing U.S. economic data, the U.S. Federal Reserve (the Fed) launched its third—and most aggressive—quantitative easing (QE) program, or monthly purchases of $40 billion in government agency mortgage-backed securities. Later in 2012, the Fed expanded the program to include $45 billion in Treasury purchases, bringing its total bond buying to $85 billion per month. This unprecedented program, combined with relatively healthy corporate earnings, significant housing market gains and modest improvements in the labor market, helped keep stocks and other riskier assets

in favor.

The Fed rattled the financial markets late in the reporting period, with comments about “tapering” its quantitative easing program. Fed Chairman Ben Bernanke said the central bank could begin scaling back its bond buying later in 2013 if the economy continues to improve. After reaching record highs in May, stocks stumbled in June, following Bernanke’s comments. Late in the month, the Fed toned down its tapering talk, and stocks recovered some of their June losses. Overall, most U.S. stock benchmarks generated stellar 12-month returns, largely aided by strong double-digit gains posted during the first calendar quarter of 2013.

Value Stocks Outpaced Growth Stocks

Across the capitalization spectrum, value stocks were the performance leaders for the 12-month period. Much of this was due to strong one-year returns from the financials and health care sectors, where many value-oriented stocks reside. In particular, expectations for rising interest rates—and the late-quarter rate increase triggered by Fed tapering talk—helped boost returns within the financial sector’s banking industry. At the opposite end, the rate-sensitive utilities sector was the weakest relative performer, held back by the prospect of rising interest rates.

U.S. Stock Index Returns |

For the 12 months ended June 30, 2013 |

Russell 1000 Index (Large-Cap) | 21.24% | | Russell 2000 Index (Small-Cap) | 24.21% |

Russell 1000 Growth Index | 17.07% | | Russell 2000 Growth Index | 23.67% |

Russell 1000 Value Index | 25.32% | | Russell 2000 Value Index | 24.77% |

Russell Midcap Index | 25.41% | | | |

Russell Midcap Growth Index | 22.88% | | | |

Russell Midcap Value Index | 27.65% | | | |

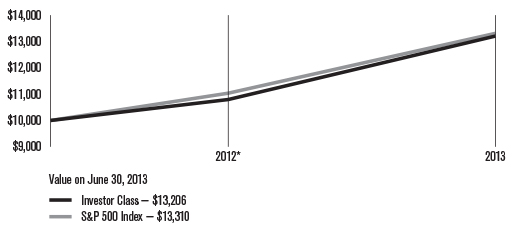

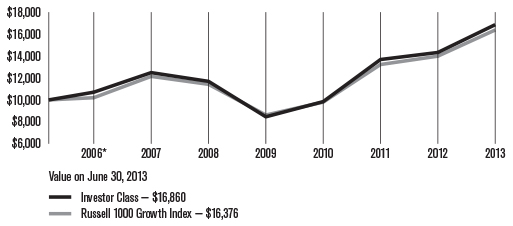

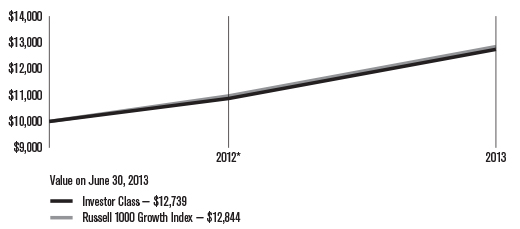

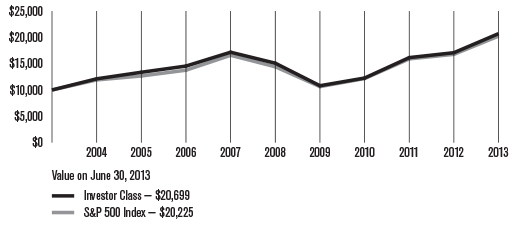

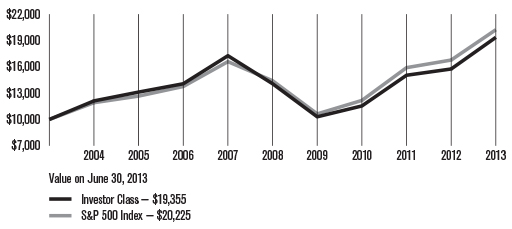

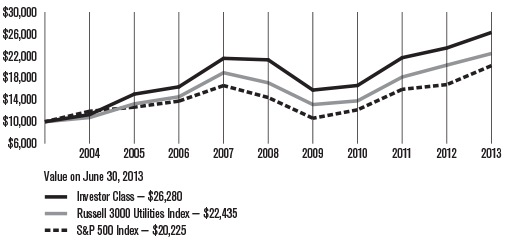

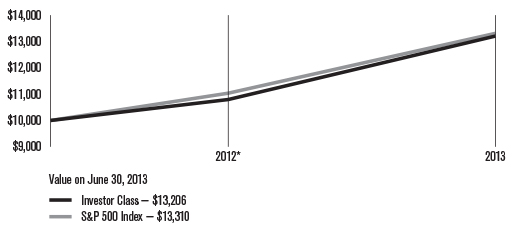

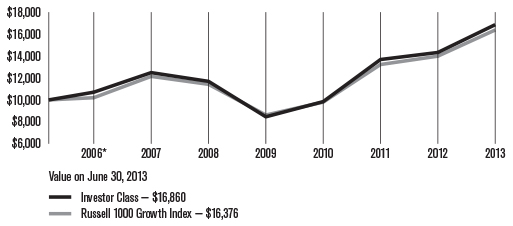

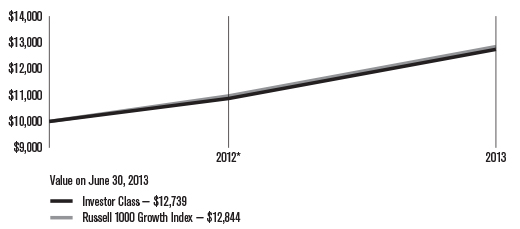

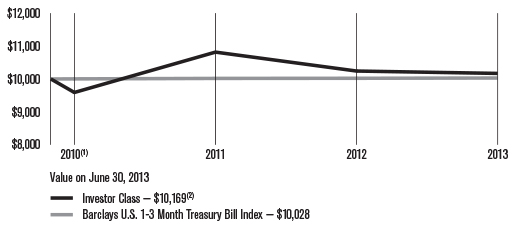

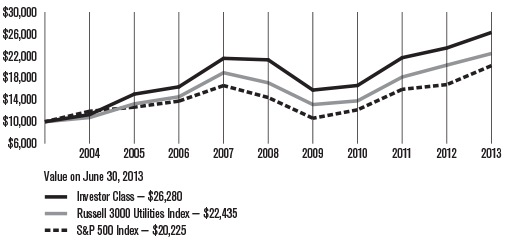

Total Returns as of June 30, 2013 |

| | | | Average

Annual Returns | |

| | Ticker Symbol | 1 year | Since Inception | Inception Date |

Investor Class | ACPVX | 22.33% | 18.17% | 10/31/11 |

S&P 500 Index | — | 20.60% | 18.72% | — |

Institutional Class | ACPKX | 22.45% | 18.39% | 10/31/11 |

A Class No sales charge* With sales charge* | ACPQX | 22.01% 14.97% | 17.88% 13.77% | 10/31/11 |

C Class | ACPHX | 20.99% | 16.96% | 10/31/11 |

R Class | ACPWX | 21.70% | 17.57% | 10/31/11 |

* Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The fund’s investment process may result in high portfolio turnover, which could mean high transaction costs, affecting both performance and capital gains tax liabilities to investors. In addition, its investment approach may involve higher price volatility, short sales risk, leverage risk and overweighting risk.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

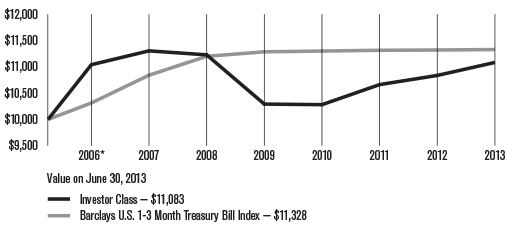

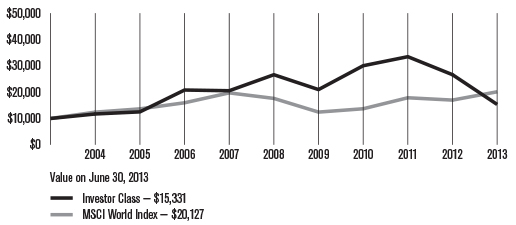

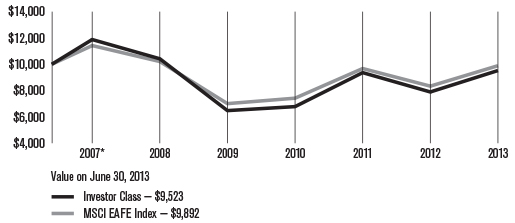

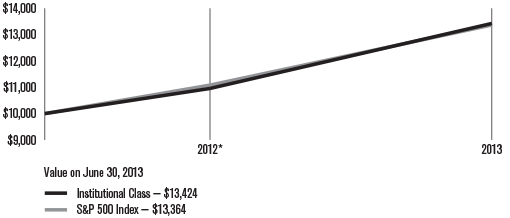

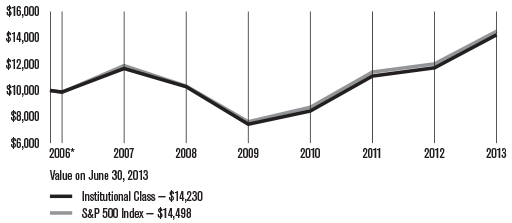

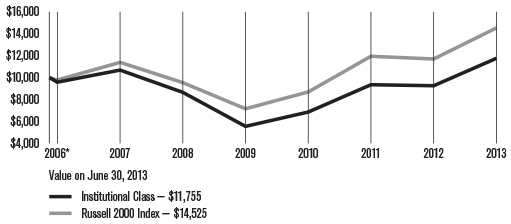

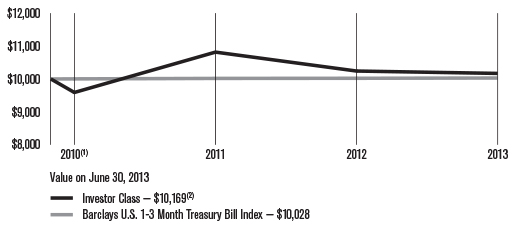

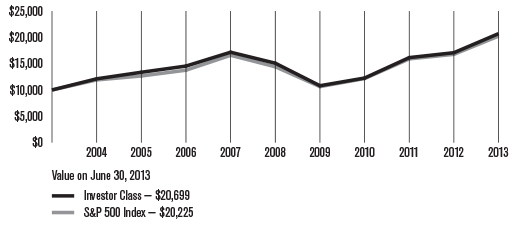

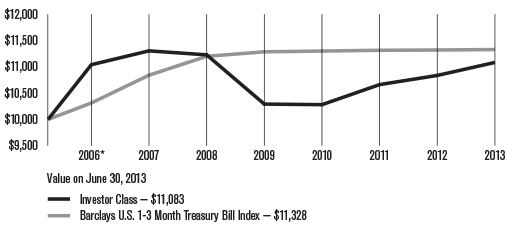

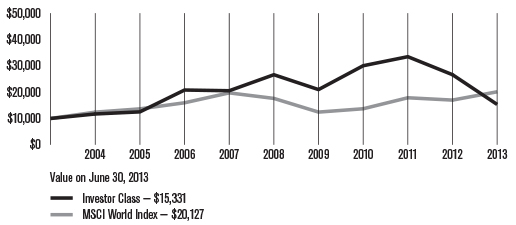

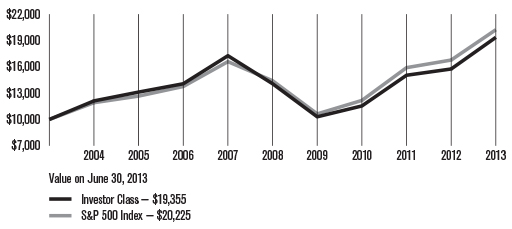

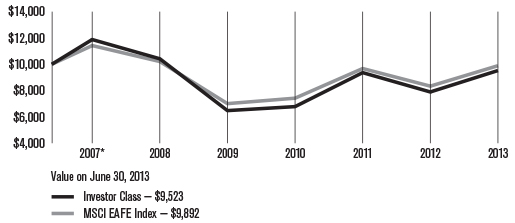

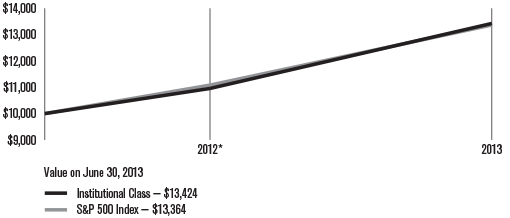

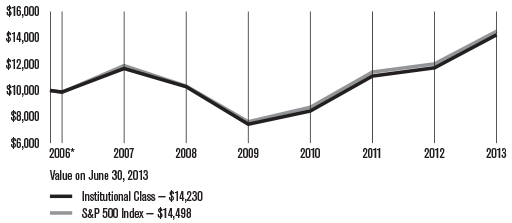

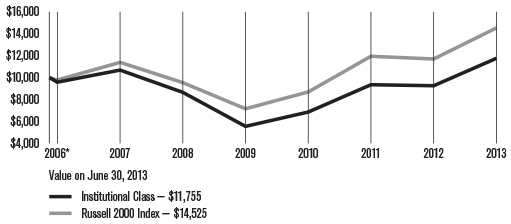

Growth of $10,000 Over Life of Class |

$10,000 investment made October 31, 2011 |

*From 10/31/11, the Investor Class’s inception date. Not annualized.

Total Annual Fund Operating Expenses |

Investor Class | Institutional Class | A Class | C Class | R Class |

2.06% | 1.86% | 2.31% | 3.06% | 2.56% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The fund’s investment process may result in high portfolio turnover, which could mean high transaction costs, affecting both performance and capital gains tax liabilities to investors. In addition, its investment approach may involve higher price volatility, short sales risk, leverage risk and overweighting risk.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

Portfolio Managers: Scott Wittman, Bill Martin, and Claudia Musat

Performance Summary

Core Equity Plus returned 22.33%* for the fiscal year ended June 30, 2013, compared with the 20.60% return of its benchmark, the S&P 500 Index.

In a year of strength for U.S. equity markets (see page 3 for details), Core Equity Plus posted a solid gain for the 12-month period, outperforming the S&P 500 Index. The fund is managed to have a 100% net exposure to the equity market by investing approximately 130% of its net assets in long positions, while 30% of its net assets are sold short. The proceeds from the securities sold short are used to fund the purchase of the additional 30% of long positions. The portfolio’s stock selection process incorporates factors of growth, value, quality, and momentum, and is designed to minimize unintended risks along industries and other risk characteristics. Quality and value signals were aligned with outperforming names in the fund, while momentum insights, particularly with longer horizon signals, detracted from returns during the year.

Absolute Performance Driven by Health Care and Financials

The fund’s strong absolute returns were driven primarily by holdings in the health care and financials sectors. In health care, where pharmaceuticals were particularly helpful, drug maker Pfizer and consumer health manufacturer Johnson & Johnson contributed the most with gains of 26% and 31%, respectively. In financials, the biggest boost came from financial services giant JPMorgan Chase, whose shares rose more than 50% for the year. Among individual securities, positions in several mega-cap technology companies, including Google and Cisco Systems, as well as home improvement retailer Home Depot also boosted absolute returns.

No sector declined on an absolute basis during the year, but a number of short positions—which are designed to profit when a stock’s price declines—weighed on results during a period when many stocks saw significant appreciation.

Materials and Health Care Outperformed

The materials and health care sectors were the best contributors to the fund’s returns relative to the S&P 500. Materials sector outperformance was driven by stock picks in both the metals and mining and chemicals industries. Short positions in a number of mining companies were particularly successful during a period when precious metals prices weakened. A top performer here was gold and silver producer Allied Nevada Gold, whose stock price declined over 80% during the year. An out-of-benchmark position in integrated chemicals and building products manufacturer Axiall (formerly Georgia Gulf) was also beneficial. Axiall’s stock rose nearly 40% thanks to strong demand from an improving housing sector.

In health care, the biggest industry-level contributions came from holdings in health care equipment and supplies and pharmaceuticals. Medical device manufacturer Boston Scientific, where the fund had more exposure than the index, was especially beneficial. Our research shows strong rankings across growth and quality, and we maintain our overweight. Likewise, biopharmaceutical holding Bristol-Myers Squibb enhanced performance after the company posted healthy gains on consistent earnings growth and sector momentum.

*All fund returns referenced in this commentary are for Investor Class shares.

Other holdings that added value included electronic game retailer GameStop, oil refiner Marathon Petroleum, and mobile hydraulic manufacturer Sauer-Danfoss. GameStop, whose stock climbed 140% during the year, appreciated on improved revenue outlook as investor concerns regarding new console compatibility with prior generations’ games were allayed.

Technology and Consumer Discretionary Detracted from Results

The fund’s holdings in the information technology and consumer discretionary sectors had a negative impact on performance during the year. The most significant detractor in the technology sector, as well as the fund, was a short position in solar industry semiconductor producer SunEdison (formerly MEMC Electronic Materials). Despite high valuations and negative net margins, the company’s stock appreciated on hopes of increased traction of solar energy usage. However, our research confirms that the company looks expensive, and we maintain the fund’s short position. Similarly, a short position in broadband service provider ViaSat hurt results after investors overlooked negative earnings and below-estimate revenue guidance, sending shares soaring 90% during the year. An overweight to semiconductor manufacturer Advanced Micro Devices was also detrimental.

The consumer discretionary sector also proved difficult for relative performance, especially in the diversified consumer services industry. Top detractors in the sector included Bridgepoint Education, whose shares tumbled along with other for-profit education companies. A position in Outerwall Inc. (formerly Coinstar, Inc.) also impacted results after the company issued a weaker-than-expected outlook early in the fiscal year. Our research suggests strong value and quality indicators, and we maintain exposure to the company.

Elsewhere in the portfolio, short positions in several industrials sector holdings also detracted meaningfully. Infrastructure construction company MasTec and industrial manufacturer Colfax both saw significant stock price appreciation on steady revenue growth.

A Look Ahead

As we move into the second half of 2013, the U.S. economic recovery seems to be progressing, albeit with headwinds. Improvements in housing, employment, and economic indicators have been consistent and point to slow but positive growth. Volatility is likely to remain elevated as ongoing concerns over interest rates, Federal Reserve action, and a potential slowdown in China dominate headlines. Heightened levels of volatility often provide investment opportunities in both the long and short portions of the portfolio. Our disciplined, objective, and systematic investment strategy is designed to take advantage of these opportunities at the individual company level. We believe this approach is the most powerful way to capitalize on market inefficiencies that lead to the mispricing of individual stocks.

JUNE 30, 2013 | |

Top Ten Long Holdings | | % of net assets |

Exxon Mobil Corp. | | | 3.49 | % |

Apple, Inc. | | | 2.88 | % |

Microsoft Corp. | | | 2.59 | % |

Johnson & Johnson | | | 2.40 | % |

Pfizer, Inc. | | | 2.13 | % |

AT&T, Inc. | | | 2.05 | % |

Google, Inc., Class A | | | 1.85 | % |

Cisco Systems, Inc. | | | 1.74 | % |

Merck & Co., Inc. | | | 1.71 | % |

Home Depot, Inc. (The) | | | 1.57 | % |

| | | | | |

Top Five Short Holdings | | % of net assets |

DreamWorks Animation SKG, Inc., Class A | | | (0.95 | )% |

NCR Corp. | | | (0.88 | )% |

SunEdison, Inc. | | | (0.86 | )% |

Hexcel Corp. | | | (0.81 | )% |

Air Lease Corp. | | | (0.80 | )% |

| | | | | |

Types of Investments in Portfolio | | % of net assets |

Common Stocks | | | 128.1 | % |

Common Stocks Sold Short | | | (29.3 | )% |

Temporary Cash Investments | | | 1.1 | % |

Other Assets and Liabilities | | | 0.1 | % |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from January 1, 2013 to June 30, 2013.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning

Account Value 1/1/13 | Ending

Account Value 6/30/13 | Expenses Paid During Period(1) 1/1/13 – 6/30/13 | Annualized

Expense Ratio(1) |

Actual |

Investor Class | $1,000 | $1,144.00 | $9.46 | 1.78% |

Institutional Class | $1,000 | $1,145.00 | $8.40 | 1.58% |

A Class | $1,000 | $1,142.70 | $10.78 | 2.03% |

C Class | $1,000 | $1,138.00 | $14.74 | 2.78% |

R Class | $1,000 | $1,141.50 | $12.11 | 2.28% |

Hypothetical |

Investor Class | $1,000 | $1,015.97 | $8.90 | 1.78% |

Institutional Class | $1,000 | $1,016.96 | $7.90 | 1.58% |

A Class | $1,000 | $1,014.73 | $10.14 | 2.03% |

C Class | $1,000 | $1,011.01 | $13.86 | 2.78% |

R Class | $1,000 | $1,013.49 | $11.38 | 2.28% |

(1) | Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

JUNE 30, 2013

| | | | | | |

| | | Shares | | | Value | |

Common Stocks — 128.1% | |

AEROSPACE AND DEFENSE — 6.3% | |

Alliant Techsystems, Inc. | | 6,479 | | | $ 533,416 | |

Boeing Co. (The)(1) | | 16,386 | | | 1,678,582 | |

Esterline Technologies Corp.(2) | | 6,758 | | | 488,536 | |

General Dynamics Corp.(1) | | 13,254 | | | 1,038,186 | |

Honeywell International, Inc.(1) | | 14,914 | | | 1,183,276 | |

L-3 Communications Holdings, Inc. | | 1,252 | | | 107,346 | |

Northrop Grumman Corp.(1) | | 14,441 | | | 1,195,715 | |

Raytheon Co. | | 8,483 | | | 560,896 | |

Textron, Inc.(1) | | 30,458 | | | 793,431 | |

| | | | | | 7,579,384 | |

AUTO COMPONENTS — 0.2% | |

BorgWarner, Inc.(2) | | 3,048 | | | 262,585 | |

BEVERAGES — 0.4% | |

Coca-Cola Co. (The)(1) | | 8,752 | | | 351,043 | |

PepsiCo, Inc.(1) | | 852 | | | 69,685 | |

| | | | | | 420,728 | |

BIOTECHNOLOGY — 2.4% | |

Amgen, Inc.(1) | | 8,939 | | | 881,922 | |

Biogen Idec, Inc.(1)(2) | | 921 | | | 198,199 | |

Celgene Corp.(1)(2) | | 5,951 | | | 695,731 | |

Cubist Pharmaceuticals, Inc.(2) | | 5,738 | | | 277,145 | |

Gilead Sciences, Inc.(1)(2) | | 9,655 | | | 494,433 | |

United Therapeutics Corp.(1)(2) | | 4,355 | | | 286,646 | |

| | | | | | 2,834,076 | |

CAPITAL MARKETS — 3.9% | |

Evercore Partners, Inc., Class A | | 12,380 | | | 486,286 | |

Federated Investors, Inc., Class B(1) | | 37,602 | | | 1,030,671 | |

Goldman Sachs Group, Inc. (The) | | 9,642 | | | 1,458,353 | |

Investment Technology Group, Inc.(1)(2) | | 28,968 | | | 404,973 | |

Janus Capital Group, Inc.(1) | | 36,767 | | | 312,887 | |

SEI Investments Co.(1) | | 22,576 | | | 641,836 | |

T. Rowe Price Group, Inc. | | 916 | | | 67,005 | |

Waddell & Reed Financial, Inc., Class A | | 6,960 | | | 302,760 | |

| | | | | | 4,704,771 | |

CHEMICALS — 4.6% | |

CF Industries Holdings, Inc.(1) | | 4,053 | | | 695,089 | |

LyondellBasell Industries NV, Class A(1) | | 16,796 | | | 1,112,903 | |

Monsanto Co.(1) | | 13,128 | | | 1,297,046 | |

NewMarket Corp. | | 2,651 | | | 696,047 | |

PPG Industries, Inc. | | 7,561 | | | 1,107,006 | |

Sherwin-Williams Co. (The) | | 988 | | | 174,481 | |

Valspar Corp. (The)(1) | | 6,959 | | | 450,039 | |

| | | | | | 5,532,611 | |

COMMERCIAL BANKS — 0.8% | |

Hancock Holding Co. | | 2,545 | | | 76,528 | |

Wells Fargo & Co.(1) | | 20,359 | | | 840,216 | |

| | | | | | 916,744 | |

COMMERCIAL SERVICES AND SUPPLIES — 1.7% | |

Deluxe Corp. | | 17,495 | | | 606,202 | |

Mine Safety Appliances Co.(1) | | 15,211 | | | 708,072 | |

RR Donnelley & Sons Co.(1) | | 48,188 | | | 675,114 | |

| | | | | | 1,989,388 | |

COMMUNICATIONS EQUIPMENT — 3.9% | |

ARRIS Group, Inc.(2) | | 32,308 | | | 463,620 | |

Brocade Communications Systems, Inc.(1)(2) | | 119,948 | | | 690,900 | |

Cisco Systems, Inc.(1) | | 85,729 | | | 2,084,072 | |

InterDigital, Inc. | | 1,601 | | | 71,485 | |

QUALCOMM, Inc.(1) | | 11,471 | | | 700,649 | |

Research In Motion Ltd.(1)(2) | | 62,841 | | | 657,945 | |

| | | | | | 4,668,671 | |

COMPUTERS AND PERIPHERALS — 4.9% | |

Apple, Inc.(1) | | 8,710 | | | 3,449,857 | |

EMC Corp.(1) | | 54,839 | | | 1,295,297 | |

Hewlett-Packard Co. | | 34,784 | | | 862,643 | |

Seagate Technology plc(1) | | 2,569 | | | 115,168 | |

Western Digital Corp. | | 3,232 | | | 200,675 | |

| | | | | | 5,923,640 | |

CONSTRUCTION AND ENGINEERING — 0.5% | |

AECOM Technology Corp.(2) | | 19,963 | | | 634,624 | |

CONSUMER FINANCE — 0.8% | |

Cash America International, Inc.(1) | | 17,728 | | | 805,915 | |

Credit Acceptance Corp.(2) | | 1,491 | | | 156,629 | |

| | | | | | 962,544 | |

CONTAINERS AND PACKAGING — 2.3% | |

Greif, Inc., Class A(1) | | 14,899 | | | 784,730 | |

Owens-Illinois, Inc.(1)(2) | | 36,794 | | | 1,022,505 | |

Packaging Corp. of America | | 18,314 | | | 896,654 | |

| | | | | | 2,703,889 | |

DIVERSIFIED CONSUMER SERVICES — 0.7% | |

Coinstar, Inc.(1)(2) | | 14,195 | | | 832,821 | |

DIVERSIFIED FINANCIAL SERVICES — 2.7% | |

Bank of America Corp.(1) | | 16,587 | | | $ 213,309 | |

Citigroup, Inc.(1) | | 4,098 | | | 196,581 | |

JPMorgan Chase & Co.(1) | | 29,722 | | | 1,569,024 | |

Moody’s Corp. | | 7,149 | | | 435,589 | |

MSCI, Inc., Class A(1)(2) | | 26,167 | | | 870,576 | |

| | | | | | 3,285,079 | |

DIVERSIFIED TELECOMMUNICATION SERVICES — 4.1% | |

AT&T, Inc.(1) | | 69,346 | | | 2,454,848 | |

CenturyLink, Inc.(1) | | 30,328 | | | 1,072,095 | |

Verizon Communications, Inc.(1) | | 25,780 | | | 1,297,765 | |

Vonage Holdings Corp.(1)(2) | | 50,982 | | | 144,279 | |

| | | | | | 4,968,987 | |

ELECTRIC UTILITIES — 1.6% | |

Edison International(1) | | 21,814 | | | 1,050,562 | |

Portland General Electric Co.(1) | | 28,417 | | | 869,276 | |

| | | | | | 1,919,838 | |

ELECTRICAL EQUIPMENT — 2.8% | |

Brady Corp., Class A(1) | | 8,556 | | | 262,926 | |

Emerson Electric Co.(1) | | 21,673 | | | 1,182,045 | |

EnerSys(1) | | 19,571 | | | 959,762 | |

Rockwell Automation, Inc. | | 11,485 | | | 954,863 | |

| | | | | | 3,359,596 | |

ELECTRONIC EQUIPMENT, INSTRUMENTS AND COMPONENTS — 1.1% | |

Itron, Inc.(1)(2) | | 16,287 | | | 691,058 | |

TE Connectivity Ltd. | | 12,982 | | | 591,200 | |

| | | | | | 1,282,258 | |

ENERGY EQUIPMENT AND SERVICES — 1.4% | |

Ensco plc, Class A | | 1,155 | | | 67,128 | |

Nabors Industries Ltd.(1) | | 42,328 | | | 648,042 | |

RPC, Inc.(1) | | 68,633 | | | 947,822 | |

| | | | | | 1,662,992 | |

FOOD AND STAPLES RETAILING — 3.0% | |

CVS Caremark Corp.(1) | | 25,948 | | | 1,483,707 | |

Rite Aid Corp.(1)(2) | | 310,133 | | | 886,980 | |

Safeway, Inc. | | 40,844 | | | 966,369 | |

Wal-Mart Stores, Inc.(1) | | 4,140 | | | 308,389 | |

| | | | | | 3,645,445 | |

FOOD PRODUCTS — 2.3% | |

Archer-Daniels-Midland Co. | | 32,450 | | | 1,100,379 | |

General Mills, Inc. | | 11,556 | | | 560,813 | |

Hershey Co. (The) | | 3,461 | | | 308,998 | |

Ingredion, Inc. | | 6,929 | | | 454,681 | |

Pilgrim’s Pride Corp.(1)(2) | | 18,696 | | | 279,318 | |

| | | | | | 2,704,189 | |

GAS UTILITIES — 0.4% | |

UGI Corp. | | 11,469 | | | 448,553 | |

HEALTH CARE EQUIPMENT AND SUPPLIES — 5.0% | |

Abbott Laboratories(1) | | 37,768 | | | 1,317,348 | |

Becton Dickinson and Co. | | 7,329 | | | 724,325 | |

Boston Scientific Corp.(1)(2) | | 107,316 | | | 994,819 | |

Medtronic, Inc.(1) | | 26,855 | | | 1,382,227 | |

St. Jude Medical, Inc.(1) | | 23,155 | | | 1,056,563 | |

Stryker Corp.(1) | | 7,211 | | | 466,407 | |

| | | | | | 5,941,689 | |

HEALTH CARE PROVIDERS AND SERVICES — 1.0% | |

AmerisourceBergen Corp. | | 11,322 | | | 632,107 | |

Select Medical Holdings Corp.(1) | | 63,993 | | | 524,743 | |

| | | | | | 1,156,850 | |

HOTELS, RESTAURANTS AND LEISURE — 2.2% | |

Bally Technologies, Inc.(1)(2) | | 16,810 | | | 948,420 | |

Cracker Barrel Old Country Store, Inc. | | 8,264 | | | 782,270 | |

International Game Technology(1) | | 55,431 | | | 926,252 | |

| | | | | | 2,656,942 | |

HOUSEHOLD DURABLES — 1.4% | |

Garmin Ltd.(1) | | 20,340 | | | 735,494 | |

Newell Rubbermaid, Inc.(1) | | 37,158 | | | 975,398 | |

| | | | | | 1,710,892 | |

HOUSEHOLD PRODUCTS — 2.4% | |

Energizer Holdings, Inc. | | 9,461 | | | 950,925 | |

Kimberly-Clark Corp. | | 12,221 | | | 1,187,148 | |

Procter & Gamble Co. (The)(1) | | 8,993 | | | 692,371 | |

| | | | | | 2,830,444 | |

INDEPENDENT POWER PRODUCERS AND ENERGY TRADERS — 0.5% | |

AES Corp. (The)(1) | | 51,129 | | | 613,037 | |

INDUSTRIAL CONGLOMERATES — 2.0% | |

3M Co. | | 2,449 | | | 267,798 | |

Danaher Corp.(1) | | 19,225 | | | 1,216,943 | |

General Electric Co.(1) | | 40,621 | | | 942,001 | |

| | | | | | 2,426,742 | |

INSURANCE — 7.4% | |

Aflac, Inc.(1) | | 21,022 | | | 1,221,799 | |

American International Group, Inc.(1)(2) | | 32,241 | | | 1,441,173 | |

Amtrust Financial Services, Inc. | | 11,749 | | | 419,439 | |

Axis Capital Holdings Ltd.(1) | | 20,452 | | | 936,293 | |

Berkshire Hathaway, Inc., Class B(1)(2) | | 7,122 | | | 797,094 | |

First American Financial Corp. | | 29,170 | | | 642,907 | |

HCC Insurance Holdings, Inc.(1) | | 13,738 | | | 592,245 | |

MetLife, Inc.(1) | | 21,457 | | | $ 981,872 | |

Prudential Financial, Inc.(1) | | 3,850 | | | 281,165 | |

Reinsurance Group of America, Inc. | | 2,512 | | | 173,604 | |

RenaissanceRe Holdings Ltd. | | 919 | | | 79,760 | |

Torchmark Corp. | | 6,923 | | | 450,964 | |

Travelers Cos., Inc. (The) | | 6,416 | | | 512,767 | |

XL Group plc | | 11,797 | | | 357,685 | |

| | | | | | 8,888,767 | |

INTERNET AND CATALOG RETAIL — 1.1% | |

Expedia, Inc.(1) | | 16,463 | | | 990,249 | |

HomeAway, Inc.(2) | | 11,937 | | | 386,043 | |

| | | | | | 1,376,292 | |

INTERNET SOFTWARE AND SERVICES — 2.0% | |

Dice Holdings, Inc.(1)(2) | | 7,510 | | | 69,167 | |

Google, Inc., Class A(1)(2) | | 2,527 | | | 2,224,695 | |

United Online, Inc.(1) | | 13,795 | | | 104,566 | |

| | | | | | 2,398,428 | |

IT SERVICES — 1.9% | |

Accenture plc, Class A(1) | | 1,668 | | | 120,029 | |

CoreLogic, Inc.(2) | | 8,097 | | | 187,608 | |

International Business Machines Corp.(1) | | 6,983 | | | 1,334,521 | |

SAIC, Inc.(1) | | 25,909 | | | 360,912 | |

Unisys Corp.(1)(2) | | 9,918 | | | 218,890 | |

| | | | | | 2,221,960 | |

LEISURE EQUIPMENT AND PRODUCTS — 2.2% | |

Hasbro, Inc.(1) | | 20,936 | | | 938,561 | |

Mattel, Inc.(1) | | 22,927 | | | 1,038,822 | |

Polaris Industries, Inc. | | 7,000 | | | 665,000 | |

| | | | | | 2,642,383 | |

LIFE SCIENCES TOOLS AND SERVICES — 1.5% | |

Agilent Technologies, Inc.(1) | | 17,574 | | | 751,464 | |

Thermo Fisher Scientific, Inc.(1) | | 12,609 | | | 1,067,100 | |

| | | | | | 1,818,564 | |

MACHINERY — 2.8% | |

Actuant Corp., Class A(1) | | 22,498 | | | 741,759 | |

Crane Co.(1) | | 16,764 | | | 1,004,499 | |

Dover Corp. | | 5,472 | | | 424,956 | |

Ingersoll-Rand plc(1) | | 4,436 | | | 246,287 | |

WABCO Holdings, Inc.(2) | | 11,921 | | | 890,379 | |

| | | | | | 3,307,880 | |

MEDIA — 4.2% | |

Comcast Corp., Class A(1) | | 42,589 | | | 1,783,627 | |

DIRECTV(2) | | 1,126 | | | 69,384 | |

Gannett Co., Inc. | | 26,441 | | | 646,747 | |

Lions Gate Entertainment Corp.(2) | | 6,177 | | | 169,682 | |

Regal Entertainment Group, Class A | | 6,798 | | | 121,684 | |

Scholastic Corp.(1) | | 16,339 | | | 478,569 | |

Time Warner Cable, Inc.(1) | | 10,293 | | | 1,157,757 | |

Time Warner, Inc. | | 10,252 | | | 592,771 | |

| | | | | | 5,020,221 | |

METALS AND MINING — 1.1% | |

Coeur Mining, Inc.(1)(2) | | 30,545 | | | 406,249 | |

Reliance Steel & Aluminum Co. | | 5,093 | | | 333,897 | |

Worthington Industries, Inc.(1) | | 19,419 | | | 615,776 | |

| | | | | | 1,355,922 | |

MULTILINE RETAIL — 0.6% | |

Dillard’s, Inc., Class A(1) | | 7,833 | | | 642,071 | |

Macy’s, Inc.(1) | | 1,972 | | | 94,656 | |

| | | | | | 736,727 | |

OIL, GAS AND CONSUMABLE FUELS — 8.4% | |

Chevron Corp.(1) | | 8,491 | | | 1,004,825 | |

ConocoPhillips(1) | | 20,700 | | | 1,252,350 | |

Delek US Holdings, Inc. | | 3,936 | | | 113,278 | |

Exxon Mobil Corp.(1) | | 46,298 | | | 4,183,024 | |

Marathon Petroleum Corp.(1) | | 14,300 | | | 1,016,158 | |

Suncor Energy, Inc.(1) | | 5,966 | | | 175,937 | |

Tesoro Corp.(1) | | 15,107 | | | 790,398 | |

Valero Energy Corp.(1) | | 23,702 | | | 824,119 | |

Western Refining, Inc.(1) | | 26,335 | | | 739,224 | |

| | | | | | 10,099,313 | |

PHARMACEUTICALS — 8.5% | |

AbbVie, Inc. | | 12,907 | | | 533,575 | |

Allergan, Inc. | | 2,036 | | | 171,513 | |

Bristol-Myers Squibb Co.(1) | | 19,777 | | | 883,834 | |

Eli Lilly & Co.(1) | | 22,980 | | | 1,128,778 | |

Johnson & Johnson(1) | | 33,473 | | | 2,873,992 | |

Merck & Co., Inc.(1) | | 44,052 | | | 2,046,215 | |

Pfizer, Inc.(1) | | 91,063 | | | 2,550,675 | |

| | | | | | 10,188,582 | |

PROFESSIONAL SERVICES — 0.5% | |

Dun & Bradstreet Corp. | | 6,531 | | | 636,446 | |

SEMICONDUCTORS AND SEMICONDUCTOR EQUIPMENT — 3.3% | |

Applied Materials, Inc.(1) | | 62,323 | | | 929,236 | |

Broadcom Corp., Class A(1) | | 28,679 | | | 968,203 | |

First Solar, Inc.(2) | | 8,175 | | | 365,668 | |

Intel Corp.(1) | | 3,064 | | | 74,210 | |

KLA-Tencor Corp.(1) | | 11,598 | | | 646,356 | |

LSI Corp.(1)(2) | | 70,559 | | | 503,791 | |

NVIDIA Corp.(1) | | 32,429 | | | 454,979 | |

| | | | | | 3,942,443 | |

SOFTWARE — 6.2% | |

Activision Blizzard, Inc.(1) | | 51,562 | | | $ 735,274 | |

CA, Inc. | | 2,574 | | | 73,694 | |

Cadence Design Systems, Inc.(1)(2) | | 4,875 | | | 70,590 | |

Intuit, Inc. | | 1,037 | | | 63,288 | |

Mentor Graphics Corp.(1) | | 38,347 | | | 749,684 | |

Microsoft Corp.(1) | | 90,115 | | | 3,111,671 | |

Oracle Corp.(1) | | 56,375 | | | 1,731,840 | |

Symantec Corp.(1) | | 39,983 | | | 898,418 | |

| | | | | | 7,434,459 | |

SPECIALTY RETAIL — 5.4% | |

Abercrombie & Fitch Co., Class A | | 5,576 | | | 252,314 | |

American Eagle Outfitters, Inc. | | 9,516 | | | 173,762 | |

Buckle, Inc. (The)(1) | | 14,052 | | | 730,985 | |

Foot Locker, Inc.(1) | | 8,440 | | | 296,497 | |

GameStop Corp., Class A(1) | | 26,158 | | | 1,099,421 | |

Gap, Inc. (The)(1) | | 26,237 | | | 1,094,870 | |

Home Depot, Inc. (The)(1) | | 24,282 | | | 1,881,127 | |

PetSmart, Inc.(1) | | 14,603 | | | 978,255 | |

| | | | | | 6,507,231 | |

TEXTILES, APPAREL AND LUXURY GOODS — 1.1% | |

Hanesbrands, Inc.(1) | | 19,542 | | | 1,004,850 | |

Iconix Brand Group, Inc.(1)(2) | | 11,359 | | | 334,068 | |

| | | | | | 1,338,918 | |

THRIFTS AND MORTGAGE FINANCE — 0.7% | |

Ocwen Financial Corp.(1)(2) | | 19,808 | | | 816,486 | |

TOBACCO — 1.5% | |

Altria Group, Inc. | | 16,757 | | | 586,327 | |

Philip Morris International, Inc.(1) | | 3,751 | | | 324,912 | |

Universal Corp.(1) | | 15,443 | | | 893,378 | |

| | | | | | 1,804,617 | |

TRADING COMPANIES AND DISTRIBUTORS — 0.4% | |

MRC Global, Inc.(2) | | 19,369 | | | 534,972 | |

TOTAL COMMON STOCKS (Cost $130,818,362) | | | 153,650,620 | |

Temporary Cash Investments — 1.1% | |

Repurchase Agreement, Bank of America Merrill Lynch, (collateralized by various U.S. Treasury obligations, 1.00%, 1/15/14, valued at $176,890), in a joint trading account at 0.06%, dated 6/28/13, due 7/1/13 (Delivery value $173,273) | | | 173,272 | |

Repurchase Agreement, Credit Suisse First Boston, Inc., (collateralized by various U.S. Treasury obligations, 4.25%, 11/15/40, valued at $529,638), in a joint trading account at 0.05%, dated 6/28/13,

due 7/1/13 (Delivery value $519,817) | | | 519,815 | |

Repurchase Agreement, Goldman Sachs & Co., (collateralized by various U.S. Treasury obligations, 3.125%, 11/15/41, valued at $176,241), in a joint trading account at 0.04%, dated 6/28/13, due 7/1/13 (Delivery value $173,273) | | | 173,272 | |

SSgA U.S. Government Money Market Fund | | 487,467 | | | 487,467 | |

TOTAL TEMPORARY CASH INVESTMENTS (Cost $1,353,826) | | | 1,353,826 | |

TOTAL INVESTMENT SECURITIES BEFORE SECURITIES SOLD SHORT — 129.2% (Cost $132,172,188) | | | 155,004,446 | |

Common Stocks Sold Short — (29.3)% | |

AEROSPACE AND DEFENSE — (1.3)% | |

DigitalGlobe, Inc. | | (18,902 | ) | | (586,151 | ) |

Hexcel Corp. | | (28,509 | ) | | (970,731 | ) |

| | | | | | (1,556,882 | ) |

AIR FREIGHT AND LOGISTICS — (0.5)% | |

UTi Worldwide, Inc. | | (39,649 | ) | | (653,019 | ) |

BIOTECHNOLOGY — (0.7)% | |

Ariad Pharmaceuticals, Inc. | | (15,972 | ) | | (279,350 | ) |

Medivation, Inc. | | (6,070 | ) | | (298,644 | ) |

Theravance, Inc. | | (7,684 | ) | | (296,065 | ) |

| | | | | | (874,059 | ) |

CAPITAL MARKETS — (0.4)% | |

Cohen & Steers, Inc. | | (4,583 | ) | | (155,731 | ) |

Stifel Financial Corp. | | (9,763 | ) | | (348,246 | ) |

| | | | | | (503,977 | ) |

CHEMICALS — (1.3)% | |

Cytec Industries, Inc. | | (11,537 | ) | | (845,085 | ) |

Praxair, Inc. | | (2,004 | ) | | (230,781 | ) |

Tronox Ltd., Class A | | (26,160 | ) | | (527,124 | ) |

| | | | | | (1,602,990 | ) |

COMMERCIAL BANKS — (0.4)% | |

Investors Bancorp, Inc. | | (3,561 | ) | | (75,066 | ) |

Trustmark Corp. | | (16,429 | ) | | (403,825 | ) |

| | | | | | (478,891 | ) |

COMMERCIAL SERVICES AND SUPPLIES — (0.3)% | |

Clean Harbors, Inc. | | (6,729 | ) | | (340,016 | ) |

COMMUNICATIONS EQUIPMENT — (0.8)% | |

ViaSat, Inc. | | (12,778 | ) | | (913,116 | ) |

COMPUTERS AND PERIPHERALS — (0.9)% | |

NCR Corp. | | (32,046 | ) | | (1,057,198 | ) |

CONTAINERS AND PACKAGING — (0.3)% | |

MeadWestvaco Corp. | | (9,794 | ) | | $ (334,073 | ) |

ELECTRICAL EQUIPMENT — (0.5)% | |

Franklin Electric Co., Inc. | | (6,421 | ) | | (216,067 | ) |

GrafTech International Ltd. | | (56,770 | ) | | (413,285 | ) |

| | | | | | (629,352 | ) |

ENERGY EQUIPMENT AND SERVICES — (0.5)% | |

Hornbeck Offshore Services, Inc. | | (1,752 | ) | | (93,732 | ) |

SEACOR Holdings, Inc. | | (6,076 | ) | | (504,612 | ) |

Unit Corp. | | (1,602 | ) | | (68,213 | ) |

| | | | | | (666,557 | ) |

FOOD PRODUCTS — (0.9)% | |

Hain Celestial Group, Inc. (The) | | (7,609 | ) | | (494,357 | ) |

Snyders-Lance, Inc. | | (20,703 | ) | | (588,172 | ) |

| | | | | | (1,082,529 | ) |

GAS UTILITIES — (0.9)% | |

New Jersey Resources Corp. | | (14,920 | ) | | (619,627 | ) |

ONEOK, Inc. | | (5,841 | ) | | (241,292 | ) |

South Jersey Industries, Inc. | | (4,451 | ) | | (255,532 | ) |

| | | | | | (1,116,451 | ) |

HEALTH CARE EQUIPMENT AND SUPPLIES — (1.0)% | |

Haemonetics Corp. | | (18,341 | ) | | (758,400 | ) |

Hologic, Inc. | | (24,476 | ) | | (472,387 | ) |

| | | | | | (1,230,787 | ) |

HEALTH CARE PROVIDERS AND SERVICES — (1.4)% | |

Air Methods Corp. | | (1,729 | ) | | (58,579 | ) |

Catamaran Corp. | | (4,441 | ) | | (216,366 | ) |

DaVita HealthCare Partners, Inc. | | (2,116 | ) | | (255,613 | ) |

Health Net, Inc. | | (14,393 | ) | | (457,985 | ) |

Team Health Holdings, Inc. | | (7,934 | ) | | (325,849 | ) |

WellCare Health Plans, Inc. | | (6,197 | ) | | (344,243 | ) |

| | | | | | (1,658,635 | ) |

HOTELS, RESTAURANTS AND LEISURE — (0.5)% | |

BJ’s Restaurants, Inc. | | (8,975 | ) | | (332,973 | ) |

Penn National Gaming, Inc. | | (4,841 | ) | | (255,895 | ) |

| | | | | | (588,868 | ) |

HOUSEHOLD DURABLES — (1.3)% | |

Ryland Group, Inc. | | (7,196 | ) | | (288,559 | ) |

Standard Pacific Corp. | | (84,988 | ) | | (707,950 | ) |

Toll Brothers, Inc. | | (18,133 | ) | | (591,680 | ) |

| | | | | | (1,588,189 | ) |

INDEPENDENT POWER PRODUCERS AND ENERGY TRADERS — (0.7)% | |

NRG Energy, Inc. | | (31,617 | ) | | (844,174 | ) |

INSURANCE — (0.6)% | |

RLI Corp. | | (8,825 | ) | | (674,318 | ) |

IT SERVICES — (0.6)% | |

Convergys Corp. | | (39,575 | ) | | (689,792 | ) |

MACHINERY — (0.5)% | |

Pentair Ltd. | | (10,467 | ) | | (603,841 | ) |

MEDIA — (1.7)% | |

DreamWorks Animation SKG, Inc., Class A | | (44,560 | ) | | (1,143,409 | ) |

Loral Space & Communications, Inc. | | (14,156 | ) | | (849,077 | ) |

| | | | | | (1,992,486 | ) |

METALS AND MINING — (2.0)% | |

AK Steel Holding Corp. | | (25,644 | ) | | (77,958 | ) |

Allied Nevada Gold Corp. | | (21,031 | ) | | (136,281 | ) |

AuRico Gold, Inc. | | (56,818 | ) | | (248,295 | ) |

Compass Minerals International, Inc. | | (3,883 | ) | | (328,230 | ) |

Hecla Mining Co. | | (76,165 | ) | | (226,972 | ) |

Royal Gold, Inc. | | (5,428 | ) | | (228,410 | ) |

Silver Standard Resources, Inc. | | (27,416 | ) | | (173,817 | ) |

Stillwater Mining Co. | | (62,183 | ) | | (667,845 | ) |

Tahoe Resources, Inc. | | (4,538 | ) | | (64,213 | ) |

Thompson Creek Metals Co., Inc. | | (81,873 | ) | | (248,075 | ) |

| | | | | | (2,400,096 | ) |

MULTILINE RETAIL — (0.1)% | |

J.C. Penney Co., Inc. | | (4,200 | ) | | (71,736 | ) |

OIL, GAS AND CONSUMABLE FUELS — (1.4)% | |

Approach Resources, Inc. | | (4,252 | ) | | (104,472 | ) |

Bill Barrett Corp. | | (11,618 | ) | | (234,916 | ) |

Consol Energy, Inc. | | (16,931 | ) | | (458,830 | ) |

Gulfport Energy Corp. | | (1,611 | ) | | (75,830 | ) |

Kodiak Oil & Gas Corp. | | (38,134 | ) | | (339,011 | ) |

Range Resources Corp. | | (900 | ) | | (69,588 | ) |

SM Energy Co. | | (7,227 | ) | | (433,475 | ) |

| | | | | | (1,716,122 | ) |

PHARMACEUTICALS — (0.2)% | |

ViroPharma, Inc. | | (3,807 | ) | | (109,071 | ) |

VIVUS, Inc. | | (13,538 | ) | | (170,308 | ) |

| | | | | | (279,379 | ) |

REAL ESTATE INVESTMENT TRUSTS (REITs) — (0.2)% | |

SL Green Realty Corp. | | (3,078 | ) | | (271,449 | ) |

REAL ESTATE MANAGEMENT AND DEVELOPMENT — (0.7)% | |

Brookfield Office Properties, Inc. | | (50,242 | ) | | (838,037 | ) |

Forest City Enterprises, Inc., Class A | | (3,841 | ) | | (68,792 | ) |

| | | | | | (906,829 | ) |

ROAD AND RAIL — (0.7)% | |

Genesee & Wyoming, Inc., Class A | | (9,722 | ) | | $ (824,814 | ) |

SEMICONDUCTORS AND SEMICONDUCTOR EQUIPMENT — (0.9)% | |

SunEdison, Inc. | | (126,480 | ) | | (1,033,342 | ) |

SOFTWARE — (0.4)% | |

Solera Holdings, Inc. | | (7,806 | ) | | (434,404 | ) |

SPECIALTY RETAIL — (1.9)% | |

CarMax, Inc. | | (19,208 | ) | | (886,641 | ) |

Pier 1 Imports, Inc. | | (23,668 | ) | | (555,962 | ) |

Tiffany & Co. | | (11,588 | ) | | (844,070 | ) |

| | | | | | (2,286,673 | ) |

TEXTILES, APPAREL AND LUXURY GOODS — (0.5)% | |

Wolverine World Wide, Inc. | | (10,328 | ) | | (564,012 | ) |

THRIFTS AND MORTGAGE FINANCE — (0.2)% | |

Capitol Federal Financial, Inc. | | (8,544 | ) | | (103,724 | ) |

MGIC Investment Corp. | | (15,254 | ) | | (92,592 | ) |

| | | | | | (196,316 | ) |

TRADING COMPANIES AND DISTRIBUTORS — (2.1)% | |

Air Lease Corp. | | (34,760 | ) | | (959,029 | ) |

GATX Corp. | | (3,265 | ) | | (154,859 | ) |

Textainer Group Holdings Ltd. | | (23,750 | ) | | (912,950 | ) |

Watsco, Inc. | | (5,493 | ) | | (461,192 | ) |

| | | | | | (2,488,030 | ) |

TOTAL COMMON STOCKS SOLD SHORT — (29.3)% (Proceeds $33,453,088) | | | (35,153,402 | ) |

OTHER ASSETS AND LIABILITIES — 0.1% | | | 121,083 | |

TOTAL NET ASSETS — 100.0% | | | $ 119,972,127 | |

Notes to Schedule of Investments

(1) | Security, or a portion thereof, has been pledged at the custodian bank or with a broker for collateral requirements on securities sold short. At the period end, the aggregate value of securities pledged was $99,828,778. |

See Notes to Financial Statements.

Statement of Assets and Liabilities |

JUNE 30, 2013 | |

Assets | |

Investment securities, at value (cost of $132,172,188) | | $155,004,446 | |

Deposits with broker for securities sold short | | 123,022 | |

Receivable for capital shares sold | | 15,242 | |

Dividends and interest receivable | | 135,166 | |

| | | 155,277,876 | |

| | | | |

Liabilities | | | |

Securities sold short, at value (proceeds of $33,453,088) | | 35,153,402 | |

Payable for capital shares redeemed | | 2,075 | |

Accrued management fees | | 128,115 | |

Distribution and service fees payable | | 467 | |

Dividend expense payable on securities sold short | | 20,767 | |

Broker fees and charges payable on securities sold short | | 923 | |

| | | 35,305,749 | |

| | | | |

Net Assets | | $119,972,127 | |

| | | | |

Net Assets Consist of: | | | |

Capital (par value and paid-in surplus) | | $ 94,572,909 | |

Undistributed net investment income | | 169,014 | |

Undistributed net realized gain | | 4,098,260 | |

Net unrealized appreciation | | 21,131,944 | |

| | | $119,972,127 | |

| | | Net assets | | Shares outstanding | | Net asset value per share |

Investor Class, $0.01 Par Value | | $114,443,772 | | | 8,913,261 | | | $12.84 | |

Institutional Class, $0.01 Par Value | | $4,427,461 | | | 344,739 | | | $12.84 | |

A Class, $0.01 Par Value | | $515,450 | | | 40,150 | | | $12.84* | |

C Class, $0.01 Par Value | | $448,637 | | | 35,094 | | | $12.78 | |

R Class, $0.01 Par Value | | $136,807 | | | 10,663 | | | $12.83 | |

*Maximum offering price $13.62 (net asset value divided by 0.9425). | |

See Notes to Financial Statements.

YEAR ENDED JUNE 30, 2013 | |

Investment Income (Loss) | |

Income: | | | |

Dividends (net of foreign taxes withheld of $8,190) | | $ 3,132,797 | |

Interest | | 1,642 | |

| | | 3,134,439 | |

| | | | |

Expenses: | | | |

Dividend expense on securities sold short | | 327,925 | |

Broker fees and charges on securities sold short | | 254,628 | |

Management fees | | 1,344,355 | |

Distribution and service fees: | | | |

A Class | | 1,036 | |

C Class | | 1,908 | |

R Class | | 621 | |

Directors’ fees and expenses | | 4,670 | |

| | | 1,935,143 | |

| | | | |

Net investment income (loss) | | 1,199,296 | |

| | | | |

Realized and Unrealized Gain (Loss) | | | |

Net realized gain (loss) on: | | | |

Investment transactions | | 10,111,012 | |

Securities sold short transactions | | (4,080,875 | ) |

Foreign currency transactions | | 197 | |

| | | 6,030,334 | |

| | | | |

Change in net unrealized appreciation (depreciation) on: | | | |

Investments | | 16,839,910 | |

Securities sold short | | (3,083,349 | ) |

Translation of assets and liabilities in foreign currencies | | (47 | ) |

| | | 13,756,514 | |

| | | | |

Net realized and unrealized gain (loss) | | 19,786,848 | |

| | | | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | $20,986,144 | |

See Notes to Financial Statements.

Statement of Changes in Net Assets |

YEAR ENDED JUNE 30, 2013 AND PERIOD ENDED JUNE 30, 2012 |

Increase (Decrease) in Net Assets | June 30, 2013 | | | June 30, 2012(1) | |

Operations |

Net investment income (loss) | $1,199,296 | | | $187,820 | |

Net realized gain (loss) | 6,030,334 | | | (315,357 | ) |

Change in net unrealized appreciation (depreciation) | 13,756,514 | | | 7,375,430 | |

Net increase (decrease) in net assets resulting from operations | 20,986,144 | | | 7,247,893 | |

| | | | | | |

Distributions to Shareholders |

From net investment income: | | | | | |

Investor Class | (1,217,032 | ) | | (35,029 | ) |

Institutional Class | (52,597 | ) | | (82 | ) |

A Class | (3,014 | ) | | (9 | ) |

R Class | (593 | ) | | — | |

From net realized gains: | | | | | |

Investor Class | (1,479,849 | ) | | — | |

Institutional Class | (38,590 | ) | | — | |

A Class | (4,572 | ) | | — | |

C Class | (2,741 | ) | | — | |

R Class | (1,862 | ) | | — | |

Decrease in net assets from distributions | (2,800,850 | ) | | (35,120 | ) |

| | | | | | |

Capital Share Transactions |

Net increase (decrease) in net assets from capital share transactions | 16,682,302 | | | 77,891,758 | |

| | | | | | |

Net increase (decrease) in net assets | 34,867,596 | | | 85,104,531 | |

| | | | | | |

Net Assets |

Beginning of period | 85,104,531 | | | — | |

End of period | $119,972,127 | | | $85,104,531 | |

| | | | | | |

Undistributed net investment income | $169,014 | | | $160,238 | |

(1) | October 31, 2011 (fund inception) through June 30, 2012. |

See Notes to Financial Statements.

YEAR ENDED JUNE 30, 2013 | |

Cash Flows From (Used In) Operating Activities | |

Net increase (decrease) in net assets resulting from operations | | $20,986,144 | |

Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash from (used in) operating activities: | | | |

Purchases of investment securities | | (114,448,835 | ) |

Proceeds from investments sold | | 97,170,560 | |

Purchases to cover securities sold short | | (41,291,614 | ) |

Proceeds from securities sold short | | 43,783,764 | |

(Increase) decrease in short-term investments | | (1,178,864 | ) |

(Increase) decrease in deposits with broker for securities sold short | | 440,972 | |

(Increase) decrease in receivable for investments sold | | 428,068 | |

(Increase) decrease in dividends and interest receivable | | (29,698 | ) |

Increase (decrease) in accrued management fees | | 40,132 | |

Increase (decrease) in distribution and service fees payable | | 290 | |

Increase (decrease) in dividend expense payable on securities sold short | | 12,645 | |

Increase (decrease) in broker fees and charges payable on securities sold short | | (869 | ) |

Change in net unrealized (appreciation) depreciation on investments | | (16,839,910 | ) |

Net realized (gain) loss on investment transactions | | (10,111,012 | ) |

Change in net unrealized (appreciation) depreciation on securities sold short | | 3,083,349 | |

Net realized (gain) loss on securities sold short transactions | | 4,080,875 | |

Net cash from (used in) operating activities | | (13,874,003 | ) |

| | | | |

Cash Flows From (Used In) Financing Activities | |

Proceeds from shares sold | | 19,695,079 | |

Payments for shares redeemed | | (5,822,561 | ) |

Distributions paid, net of reinvestments | | (4,486 | ) |

Net cash from (used in) financing activities | | 13,868,032 | |

| | | | |

Net Increase (Decrease) In Cash | | (5,971 | ) |

Cash at beginning of period | | 5,971 | |

Cash at end of period | | — | |

Supplemental disclosure of cash flow information:

Non cash financing activities not included herein consist of all reinvestment of distributions of $2,796,364.

See Notes to Financial Statements.

Notes to Financial Statements |

JUNE 30, 2013

1. Organization

American Century Quantitative Equity Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Maryland corporation. Core Equity Plus Fund (the fund) is one fund in a series issued by the corporation. The fund is diversified as defined under the 1940 Act. The fund’s investment objective is to seek long-term

capital growth.

The fund offers the Investor Class, the Institutional Class, the A Class, the C Class and the R Class. The A Class may incur an initial sales charge. The A Class and C Class may be subject to a contingent deferred sales charge. The share classes differ principally in their respective sales charges and distribution and shareholder servicing expenses and arrangements. The Institutional Class is made available to institutional shareholders or through financial intermediaries whose clients do not require the same level of shareholder and administrative services as shareholders of other classes. As a result, the Institutional Class is charged a lower unified management fee. All classes of the fund commenced sale on October 31, 2011, the fund’s inception date.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America, which may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value per share as of the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open.

Equity securities that are listed or traded on a domestic securities exchange are valued at the last reported sales price or at the official closing price as provided by the exchange. Equity securities traded on foreign securities exchanges are typically valued at the closing price on the exchange where primarily traded or as of the close of the NYSE, if that is earlier. If no last sales price is reported, or if local convention or regulation so provides, the mean of the latest bid and asked prices is used. Depending on local convention or regulation, securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official closing price. In its determination of fair value, the fund may review several factors including: market information specific to a security; news developments in U.S. and foreign markets; the performance of particular U.S. and foreign securities, indices, comparable securities, American Depositary Receipts, Exchange-Traded Funds, and other relevant market indicators.

Debt securities maturing within 60 days at the time of purchase may be valued at cost, plus or minus any amortized discount or premium or at the evaluated mean as provided by an independent pricing service. Evaluated mean prices are commonly derived through utilization of market models, which may consider, among other factors, trade data, quotations from dealers and active market makers, relevant yield curve and spread data, related sector levels, creditworthiness, and other relevant market information on the same or comparable securities.

Investments in open-end management investment companies are valued at the reported net asset value per share. Repurchase agreements are valued at cost.

The value of investments initially expressed in foreign currencies is translated into U.S. dollars at prevailing exchange rates.

If the fund determines that the market price for a portfolio security is not readily available or the valuation methods mentioned above do not reflect a security’s fair value, such security is valued as determined in good faith by the Board of Directors or its designee, in accordance with procedures adopted by the Board of Directors. Circumstances that may cause the fund to use these procedures to value a security include, but are not limited to: a security has been declared in default; trading in a security has been halted during the trading day; there is a foreign market holiday and no trading occurred; or an event occurred between the close of a foreign exchange and the NYSE that may affect the value of a security.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Distributions received on securities that represent a return of capital or long-term capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund may estimate the components of distributions received that may be considered nontaxable distributions or long-term capital gain distributions for income tax purposes. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Securities Sold Short — The fund enters into short sales, which is selling securities it does not own, as part of its normal investment activities. Upon selling a security short, the fund will segregate cash, cash equivalents or other appropriate liquid securities in at least an amount equal to the current market value of the securities sold short until the fund replaces the borrowed security. Interest earned on segregated cash for securities sold short is reflected as interest income. The fund is required to pay any dividends or interest due on securities sold short. Such dividends and interest are recorded as an expense. The fund may pay fees or charges on the assets borrowed for securities sold short. Liabilities for securities sold short are valued daily and changes in value are recorded as change in net unrealized appreciation (depreciation) on securities sold short. The fund records realized gain (loss) on a security sold short when it is terminated by the fund and includes as a component of net realized gain (loss) on securities sold short transactions.

Foreign Currency Translations — All assets and liabilities initially expressed in foreign currencies are translated into U.S. dollars at prevailing exchange rates at period end. The fund may enter into spot foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of investment securities, dividend and interest income, spot foreign currency exchange contracts, and expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. Net realized and unrealized foreign currency exchange gains or losses related to investment securities are a component of net realized gain (loss) on investment transactions and change in net unrealized appreciation (depreciation) on investments, respectively. Net realized and unrealized foreign currency exchange gains or losses related to securities sold short are a component of net realized gain (loss) on securities sold short transactions and change in net unrealized appreciation (depreciation) on securities sold short, respectively.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that American Century Investment Management, Inc. (ACIM) (the investment advisor) has determined are creditworthy pursuant to criteria adopted by the Board of Directors. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Segregated Assets — In accordance with the 1940 Act, the fund segregates assets on its books and records to cover certain types of investments, including, but not limited to, futures contracts and short sales. ACIM monitors, on a daily basis, the securities segregated to ensure the fund designates a sufficient amount of liquid assets, marked-to-market daily. The fund may also receive assets or be required to pledge assets at the custodian bank or with a broker for margin requirements on futures contracts and short sales.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. Accordingly, no provision has been made for income taxes. The fund files U.S. federal, state, local and non-U.S. tax returns as applicable. The fund’s tax returns are subject to examination by the relevant taxing authority until expiration of the applicable statute of limitations, which is generally three years from the date of filing but can be longer in certain jurisdictions. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Multiple Class — All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Distributions to Shareholders — Distributions from net investment income, if any, are generally declared and paid semiannually. Distributions from net realized gains, if any, are generally declared and paid annually.

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

Statement of Cash Flows — The beginning of period and end of period cash in the Statement of Cash Flows is the amount of domestic and foreign currency included in the fund’s Statement of Assets and Liabilities and represents the cash on hand at the custodian bank and does not include any short-term investments or deposits with brokers for securities sold short.

3. Fees and Transactions with Related Parties

Management Fees — The corporation has entered into a management agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The agreement provides that all expenses of managing and operating the fund, except distribution and service fees, expenses on securities sold short, brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), and extraordinary expenses, will be paid by ACIM. The fee is computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fee consists of (1) an Investment Category Fee based on the daily net assets of the fund and certain other accounts managed by the investment advisor that are in the same broad investment category as the fund and (2) a Complex Fee based on the assets of all the funds in the American Century Investments family of funds. The rates for the Investment Category Fee range from 0.9680% to 1.1500%. The rates for the Complex Fee range from 0.2500% to 0.3100% for the Investor Class, A Class, C Class and R Class. The Institutional Class is 0.2000% less at each point within the Complex Fee range. The effective annual management fee for each class for the year ended June 30, 2013 was 1.30% for the Investor Class, A Class, C Class and R Class and 1.10% for the Institutional Class.

Distribution and Service Fees — The Board of Directors has adopted a separate Master Distribution and Individual Shareholder Services Plan for each of the A Class, C Class and R Class (collectively the plans), pursuant to Rule 12b-1 of the 1940 Act. The plans provide that the A Class will pay American Century Investment Services, Inc. (ACIS) an annual distribution and service fee of 0.25%. The plans provide that the C Class will pay ACIS an annual distribution and service fee of 1.00%, of which 0.25% is paid for individual shareholder services and 0.75% is paid for distribution services. The plans provide that the R Class will pay ACIS an annual distribution and service fee of 0.50%. The fees are computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fees are used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plans during the year ended June 30, 2013 are detailed in the Statement of Operations.

Related Parties — Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC). The corporation’s investment advisor, ACIM, the corporation’s distributor, ACIS, and the corporation’s transfer agent, American Century Services, LLC are wholly owned, directly or indirectly, by ACC. Various funds issued by American Century Asset Allocation Portfolios, Inc. and American Century Strategic Asset Allocations, Inc. own, in aggregate, 94% of the shares of the fund. Related parties do not invest in the fund for the purpose of exercising management or control.

4. Investment Transactions

Purchases and sales of investment securities and securities sold short, excluding short-term investments, for the year ended June 30, 2013 were $155,591,633 and $140,934,031, respectively.

5. Capital Share Transactions

Transactions in shares of the fund were as follows:

| | | Year ended June 30, 2013 | | | Period ended June 30, 2012(1) | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

Investor Class/Shares Authorized | | 70,000,000 | | | | | | 70,000,000 | | | | |

Sold | | 1,247,179 | | | $14,456,890 | | | 8,085,420 | | | $80,041,339 | |

Issued in reinvestment of distributions | | 233,568 | | | 2,692,484 | | | 3,502 | | | 34,990 | |

Redeemed | | (360,423 | ) | | (4,304,852 | ) | | (295,985 | ) | | (3,167,463 | ) |

| | | 1,120,324 | | | 12,844,522 | | | 7,792,937 | | | 76,908,866 | |

Institutional Class/Shares Authorized | | 10,000,000 | | | | | | 10,000,000 | | | | |

Sold | | 389,399 | | | 4,516,129 | | | 80,225 | | | 821,989 | |

Issued in reinvestment of distributions | | 7,857 | | | 91,187 | | | 8 | | | 82 | |

Redeemed | | (101,967 | ) | | (1,290,661 | ) | | (30,783 | ) | | (297,884 | ) |

| | | 295,289 | | | 3,316,655 | | | 49,450 | | | 524,187 | |

A Class/Shares Authorized | | 10,000,000 | | | | | | 10,000,000 | | | | |

Sold | | 36,112 | | | 420,654 | | | 65,012 | | | 662,759 | |

Issued in reinvestment of distributions | | 651 | | | 7,497 | | | 1 | | | 9 | |

Redeemed | | (18,020 | ) | | (216,949 | ) | | (43,606 | ) | | (433,630 | ) |

| | | 18,743 | | | 211,202 | | | 21,407 | | | 229,138 | |

C Class/Shares Authorized | | 10,000,000 | | | | | | 10,000,000 | | | | |

Sold | | 25,347 | | | 316,261 | | | 43,858 | | | 440,045 | |

Issued in reinvestment of distributions | | 243 | | | 2,741 | | | — | | | — | |

Redeemed | | (913 | ) | | (11,921 | ) | | (33,441 | ) | | (326,171 | ) |

| | | 24,677 | | | 307,081 | | | 10,417 | | | 113,874 | |

R Class/Shares Authorized | | 10,000,000 | | | | | | 10,000,000 | | | | |

Sold | | 30 | | | 387 | | | 40,000 | | | 400,000 | |

Issued in reinvestment of distributions | | 216 | | | 2,455 | | | — | | | — | |

Redeemed | | — | | | — | | | (29,583 | ) | | (284,307 | ) |

| | | 246 | | | 2,842 | | | 10,417 | | | 115,693 | |

Net increase (decrease) | | 1,459,279 | | | $16,682,302 | | | 7,884,628 | | | $77,891,758 | |

(1) | October 31, 2011 (fund inception) through June 30, 2012. |

6. Fair Value Measurements

The fund’s securities valuation process is based on several considerations and may use multiple inputs to determine the fair value of the positions held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels as follows:

• | Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical securities; |

• | Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for similar securities, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.); or |

• | Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions). |

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments.

The following is a summary of the level classifications as of period end. The Schedule of Investments provides additional information on the fund’s portfolio holdings.

| | | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 |

Investment Securities | |

Common Stocks | | $153,650,620 | | | — | | | — | |

Temporary Cash Investments | | 487,467 | | | $866,359 | | | — | |

Total Value of Investment Securities | | $154,138,087 | | | $866,359 | | | — | |

| | | | | | | | | | |

Securities Sold Short | |

Total Value of Common Stocks Sold Short | | $(35,153,402 | ) | | — | | | — | |

7. Risk Factors

The fund’s investment strategy utilizes leverage, which can increase market exposure and subject the fund to greater risk and higher volatility.

The fund’s investment process may result in high portfolio turnover, which could mean high transaction costs, affecting both performance and capital gains tax liabilities to investors.

The fund is subject to short sales risk. If the market price of a security increases after the fund borrows the security, the fund may suffer a loss when it replaces the borrowed security at the higher price. Any loss will be increased by the amount of compensation, interest or dividends, and transaction costs the fund must pay to the lender of the borrowed security.

If the fund is overweighted in a stock or sector, any negative development related to that stock or sector will have a greater impact on the fund than other funds that are not overweighted in that stock or sector.

8. Federal Tax Information

The tax character of distributions paid during the year ended June 30, 2013 and period October 31, 2011 (fund inception) through June 30, 2012 were as follows:

| | | 2013 | | | 2012 | |

Distributions Paid From | |

Ordinary income | | $2,800,850 | | | $35,120 | |

Long-term capital gains | | — | | | — | |

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of June 30, 2013, the federal tax cost of investments and the components of distributable earnings on a tax-basis were as follows:

Federal tax cost of investments | | $132,212,308 | |

Gross tax appreciation of investments | | $24,845,664 | |

Gross tax depreciation of investments | | (2,053,526 | ) |

Net tax appreciation (depreciation) of investments | | $22,792,138 | |

Net tax appreciation (depreciation) on securities sold short | | $(1,700,779 | ) |

Net tax appreciation (depreciation) | | $21,091,359 | |

Undistributed ordinary income | | $1,043,975 | |

Accumulated long-term gains | | $3,263,884 | |

The difference between book-basis and tax-basis unrealized appreciation (depreciation) is attributable primarily to the tax deferral of losses on wash sales.

| |

For a Share Outstanding Throughout the Years Ended June 30 (except as noted) |

Per-Share Data | Ratios and Supplemental Data |

| | | Income From Investment Operations: | Distributions From: | | | Ratio to Average Net Assets of: | | |

| | Net Asset Value, Beginning

of Period | Net

Investment Income

(Loss)(1) | Net

Realized and Unrealized Gain (Loss) | Total From Investment Operations | Net

Investment Income | Net

Realized

Gains | Total Distributions | Net Asset Value,

End of Period | Total

Return(2) | Operating Expenses | Operating Expenses (excluding expenses on securities

sold short) | Net

Investment Income

(Loss) | Portfolio Turnover

Rate | Net Assets, End of Period (in thousands) |

Investor Class |

2013 | $10.79 | 0.14 | 2.23 | 2.37 | (0.14) | (0.18) | (0.32) | $12.84 | 22.33% | 1.87% | 1.30% | 1.15% | 107% | $114,444 |

2012(3) | $10.00 | 0.03 | 0.76 | 0.79 | —(4) | — | —(4) | $10.79 | 7.95% | 2.06%(5) | 1.31%(5) | 0.39%(5) | 105% | $84,116 |

Institutional Class |

2013 | $10.80 | 0.15 | 2.25 | 2.40 | (0.18) | (0.18) | (0.36) | $12.84 | 22.45% | 1.67% | 1.10% | 1.35% | 107% | $4,427 |

2012(3) | $10.00 | 0.06 | 0.75 | 0.81 | (0.01) | — | (0.01) | $10.80 | 8.19% | 1.86%(5) | 1.11%(5) | 0.59%(5) | 105% | $534 |

A Class | | | | | | | | | | | | | | |

2013 | $10.78 | 0.10 | 2.24 | 2.34 | (0.10) | (0.18) | (0.28) | $12.84 | 22.01% | 2.12% | 1.55% | 0.90% | 107% | $515 |