UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-05447 |

| | |

| | |

| | |

| AMERICAN CENTURY QUANTITATIVE EQUITY FUNDS, INC. |

| (Exact name of registrant as specified in charter) |

| | |

| | |

| | |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| | |

| | |

| | |

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| | |

| | |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| | |

| | |

| Date of fiscal year end: | 06-30 |

| | |

| | |

| Date of reporting period: | 06-30-2011 |

ITEM 1. REPORTS TO STOCKHOLDERS.

ANNUAL REPORT JUNE 30, 2011

| President’s Letter | 2 |

| Market Perspective | 3 |

| Performance | 4 |

| Portfolio Commentary | 6 |

| Fund Characteristics | 8 |

| Shareholder Fee Example | 9 |

| Schedule of Investments | 11 |

| Statement of Assets and Liabilities | 14 |

| Statement of Operations | 15 |

| Statement of Changes in Net Assets | 16 |

| Notes to Financial Statements | 17 |

| Financial Highlights | 22 |

| Report of Independent Registered Public Accounting Firm | 28 |

| Management | 29 |

| Approval of Management Agreement | 32 |

| Additional Information | 37 |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Dear Investor:

Thank you for reviewing this annual report for the period ended June 30, 2011. Our report offers investment performance and portfolio information, presented with the expert perspective and commentary of our portfolio management team.

This report remains one of our most important vehicles for conveying information about investment performance and the market factors and strategies that affect fund returns. For additional, updated information on fund performance, portfolio strategy, and the investment markets, we encourage you to visit our website, americancentury.com. Click on the “Fund Performance” and “Insights & News” headings at the top of our Individual Investors site.

Reporting Period Perspective: Highest Broad Fiscal-Year U.S. Stock Returns Since 1997

Benefitting from favorable conditions and expectations, the U.S. stock market produced exceptional returns, the highest for any 12-month period ended June 30 since the fiscal year ended June 30, 1997. Back then, the S&P 500 Index gained 34.71%, compared with 30.69% for the most-recent reporting period. The intervening 14 years help illustrate how infrequently such a high level of performance occurs, requiring an alignment of economic and market conditions that’s difficult to duplicate.

The exceptional returns experienced during the reporting period represent a rebound from previous declines. After experiencing 10–12% declines during the second quarter of 2010—stemming from the European sovereign debt crisis and double-dip recession fears—most broad U.S. stock indices advanced 30% or more during the following 12 months. Monetary and fiscal intervention in 2010 stimulated growth and fueled investor optimism about economic and financial market conditions in 2011 and 2012, encouraging investments in riskier assets.

However, that optimism has diminished in the summer of 2011 as the European debt crisis returned to prominence and other debt and economic challenges emerged. As the reporting period came to a close in June 2011, we saw increasing signs that the U.S. economic recovery had lost momentum. As a result, economic growth forecasts were reduced, and broad U.S. stock indices trended downward beginning in May. As we enter the third quarter of 2011, investor concern over fiscal austerity measures in the U.S. and other developed economies raised fears of a return to recession and accelerated a decline in global equity markets. We appreciate your continued trust in us during these uncertain times.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

By Scott Wittman, Chief Investment Officer, Quantitative Equity and Asset Allocation

U.S. Stocks Soared as Economy Improved

The U.S. stock market enjoyed very strong results for the 12 months ended June 30, 2011, with the broad equity indices returning more than 30%. The main catalyst for the sharp rally in stocks was growing investor confidence in a U.S. economic recovery, though that confidence faltered somewhat late in the period.

After a bumpy start resulting from an uncertain economic outlook, the equity market began a steady rise in September 2010 as improving economic data reassured investors that the economy would avoid a “double-dip” recession (a return to recession after a brief period of recovery). Most notably, employment growth turned positive after 2½ years of persistent job losses, and the manufacturing sector showed signs of life. In addition, a renewal of the Federal Reserve’s quantitative easing program and an extension of expiring federal tax breaks further boosted the market’s confidence that a promising economic recovery

was under way.

Stocks continued to advance in early 2011 despite unrest in the Middle East and North Africa, as well as a devastating earthquake and tsunami in Japan. By May, however, evidence of a slowdown in economic activity and renewed concerns about a European sovereign debt crisis weighed on investor confidence. As a result, stocks experienced a modest pullback in the final two months of the period.

Smaller Stocks and Growth-Oriented Issues Outperformed

Despite finishing on a down note, the broad equity indices posted robust returns overall for the 12-month period. As the table below illustrates, mid- and small-cap issues generated the best returns, outpacing large-cap shares. Meanwhile, growth stocks outperformed value across all market capitalizations, most dramatically among smaller companies. Every sector of the market produced double-digit gains for the period, led by energy and materials stocks, which benefited from strong demand and rising commodity prices. Other economically sensitive sectors—such as consumer discretionary and industrials—also fared well. The laggard was the financials sector, which continued to face mortgage-related challenges and regulatory uncertainty.

| U.S. Stock Index Returns |

| For the 12 months ended June 30, 2011 |

| Russell 1000 Index (Large-Cap) | 31.93% | | Russell 2000 Index (Small-Cap) | 37.41% |

| Russell 1000 Growth Index | 35.01% | | Russell 2000 Growth Index | 43.50% |

| Russell 1000 Value Index | 28.94% | | Russell 2000 Value Index | 31.35% |

| Russell Midcap Index | 38.47% | | | |

| Russell Midcap Growth Index | 43.25% | | | |

| Russell Midcap Value Index | 34.28% | | | |

| Total Returns as of June 30, 2011 |

| | | | Average Annual Returns | |

| | Ticker Symbol | 1 year(1) | 5 years | Since Inception | Inception Date |

| Investor Class | ADSIX | 39.00% | 5.03% | 5.61% | 9/30/05 |

| Russell 1000 Growth Index | — | 35.01% | 5.33% | 4.98% | — |

| Institutional Class | ADCIX | 39.26% | 5.24% | 5.81% | 9/30/05 |

A Class(2) No sales charge* With sales charge* | ADCVX | 38.71% 30.78% | 4.76% 3.52% | 5.34% 4.26% | 9/30/05 |

B Class No sales charge* With sales charge* | ADYBX | 37.65% 33.65% | — — | 0.22% -0.58% | 9/28/07 |

| C Class | ADCCX | 37.54% | — | 0.20% | 9/28/07 |

| R Class | ADRRX | 38.28% | 4.50% | 5.07% | 9/30/05 |

*Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a maximum 5.75% initial sales charge and may be subject to a maximum CDSC of 1.00%. B Class shares redeemed within six years of purchase are subject to a CDSC that declines from 5.00% during the first year after purchase to 0.00% the sixth year after purchase. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

| (1) | Extraordinary performance is attributable in part to unusually favorable market conditions and may not be repeated or consistently achieved in the future. |

| (2) | Prior to September 4, 2007, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that date has been adjusted to reflect this charge. |

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The fund’s investment process may result in high portfolio turnover, which could mean high transaction costs, affecting both performance and capital gains tax liabilities to investors.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

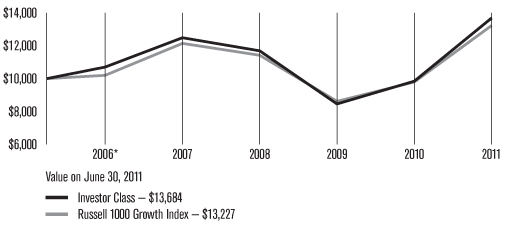

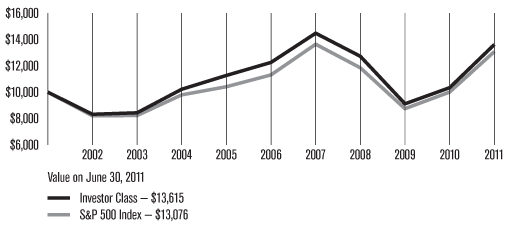

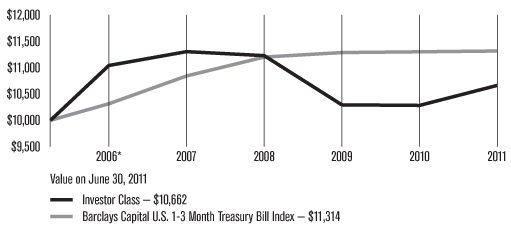

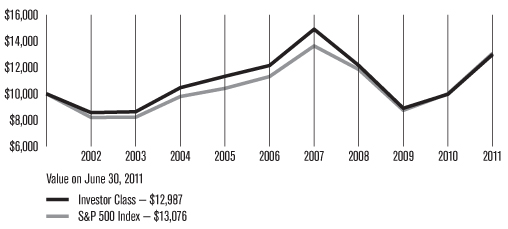

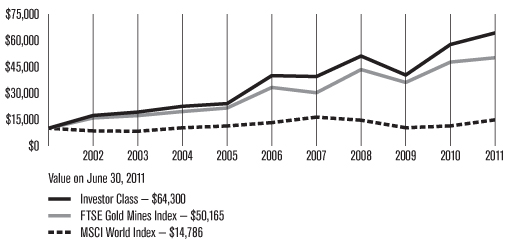

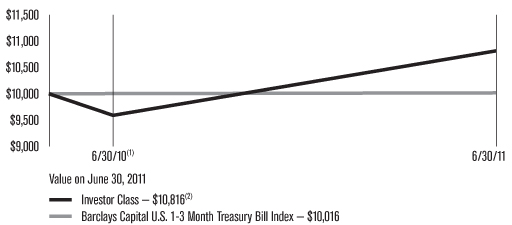

| Growth of $10,000 Over Life of Class |

| $10,000 investment made September 30, 2005 |

*From 9/30/05, the Investor Class’s inception date. Not annualized.

| Total Annual Fund Operating Expenses |

| Investor Class | Institutional Class | A Class | B Class | C Class | R Class |

| 1.05% | 0.85% | 1.30% | 2.05% | 2.05% | 1.55% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The fund’s investment process may result in high portfolio turnover, which could mean high transaction costs, affecting both performance and capital gains tax liabilities to investors.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

Portfolio Managers: Bill Martin and Lynette Pang

Performance Summary

Disciplined Growth returned 39.00%* for the fiscal year ended June 30, 2011, compared with the 35.01% return of its benchmark, the Russell 1000 Growth Index, and the 30.69%** return of the broad S&P 500 Index.

Disciplined Growth posted a strong absolute return for the 12 months, reflecting a robust rally for stocks in general and growth-oriented stocks in particular during the period (see page 3 for details). The fund also outperformed the Russell 1000 Growth Index as individual stock selection (a key component of

our investment process) added value in seven of ten market sectors.

Consumer Discretionary and Energy Boosted Absolute Results

On an absolute basis, every sector of the Disciplined Growth fund returned more than 30% for the 12 months (except for a small position in telecommunication services that consisted of a single stock). The best-performing sectors in the portfolio were consumer discretionary and energy. The fund’s consumer discretionary stocks returned more than 60% as a group for the 12-month period, while its energy holdings gained approximately 50% overall. The leading performance contributors from these two sectors included oil and gas producer Exxon Mobil (the fund’s top contributor), online movie rental company Netflix, and online retailer Amazon.com.

Disciplined Growth’s information technology holdings, which comprised approximately one-third of the portfolio on average during the 12-month period, also had a meaningful impact on absolute performance. Five of the fund’s top ten absolute performance contributors came from this sector, led by consumer electronics maker Apple, IT services provider International Business Machines, and enterprise software maker Oracle.

On the downside, the biggest individual detractors in the portfolio included pharmacy benefits manager Medco Health Solutions, printer maker Lexmark International, and memory chip maker Micron Technology.

Consumer Discretionary and Technology Outperformed

Looking at relative performance, Disciplined Growth’s holdings in the consumer discretionary and information technology sectors contributed the most to its outperformance of the Russell 1000 Growth Index for the fiscal year. Stock selection among hotels and restaurants and an overweight position in internet retailers generated much of the outperformance in the consumer discretionary sector. The top contributor in this sector was online movie rental firm Netflix, which delivered strong earnings growth as its subscriber base rose and online streaming of movies became increasingly popular. Other top contributors in this sector included casino operator Wynn Resorts, which benefited from improving casino traffic, and off-road vehicle maker Polaris Industries, which enjoyed rising demand for its products.

| * | All fund returns referenced in this commentary are for Investor Class shares. |

| ** | The S&P 500 Index average annual returns were 2.94% for the five-year period ended June 30, 2011, and 3.40% since the fund’s inception on September 30, 2005, through June 30, 2011. |

The bulk of the outperformance in the information technology sector resulted from stock selection among communications equipment makers and IT services providers. The leading contributors in this sector were networking products maker Riverbed Technology and electronic payments provider VeriFone Systems. Riverbed Technology experienced a sharp increase in sales and earnings thanks to the growth of cloud computing, while VeriFone Systems consistently raised its earnings and revenue projections as point-of-sale transactions increased markedly.

Other top individual contributors to relative performance during the 12 months included bearings producer Timken and biotechnology firm Biogen Idec. Growing demand from the auto industry boosted Timken, while Biogen Idec saw earnings expectations rise thanks to robust sales of its multiple sclerosis medications.

Industrials Detracted

The only sector in the Disciplined Growth portfolio to detract meaningfully from performance versus the Russell 1000 Growth Index was the industrials sector. Stock selection among industrial conglomerates and aerospace and defense companies had the biggest negative impact in this sector. The most significant individual detractors included defense contractor Raytheon and heavy-duty vehicle maker Oshkosh, both of which faced potential declines in federal defense spending.

An underweight position in the energy sector—one of the top-performing sectors in the index—also weighed on relative results. In particular, underweight positions in oilfield services companies Halliburton and Schlumberger hurt results as greater drilling activity provided a lift to both stocks.

Other noteworthy detractors from performance versus the index were two health care stocks—robotic surgical equipment maker Intuitive Surgical and pharmacy benefits manager Medco Health Solutions. Intuitive Surgical struggled with declining demand overseas, while Medco faced regulatory uncertainty stemming from new federal health care legislation.

A Look Ahead

The eye-catching turmoil in the headlines over the last six months—democratic change sweeping through the Middle East, a devastating natural disaster in Japan, the possibility of a sovereign debt default in Europe—has led to heightened uncertainty and growing volatility in the equity market. But when you look at the past decade, there have been many other dramatic events that have had a similar impact on the market. When viewed through this lens, change and volatility have become more the rule than the exception.

It is this change dynamic that our investment process seeks to exploit and capitalize upon. Change and volatility leads to market inefficiencies, and within these inefficiencies lie investment opportunities. Rather than base investment decisions on vague financial headlines, we use our disciplined, data-driven, multi-factor investment process to take advantage of inefficiencies at the individual company level. We believe this approach will produce favorable returns over the long term.

| JUNE 30, 2011 |

| Top Ten Holdings | % of net assets |

| Exxon Mobil Corp. | 4.4% |

| Apple, Inc. | 4.3% |

| International Business Machines Corp. | 3.1% |

| Microsoft Corp. | 2.6% |

| Philip Morris International, Inc. | 2.2% |

| Oracle Corp. | 2.1% |

| United Technologies Corp. | 1.7% |

| Caterpillar, Inc. | 1.5% |

| QUALCOMM, Inc. | 1.4% |

| Freeport-McMoRan Copper & Gold, Inc. | 1.4% |

| |

| Top Five Industries | % of net assets |

| Software | 8.2% |

| Oil, Gas & Consumable Fuels | 8.0% |

| IT Services | 6.6% |

| Computers & Peripherals | 5.6% |

| Health Care Equipment & Supplies | 4.5% |

| |

| Types of Investments in Portfolio | % of net assets |

| Common Stocks | 98.9% |

| Temporary Cash Investments | 2.5% |

| Other Assets and Liabilities | (1.4)% |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from January 1, 2011 to June 30, 2011.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. We will not charge the fee as long as you choose to manage your accounts exclusively online. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning Account Value 1/1/11 | Ending Account Value 6/30/11 | Expenses Paid During Period* 1/1/11 – 6/30/11 | Annualized Expense Ratio* |

| Actual |

| Investor Class | $1,000 | $1,086.20 | $5.33 | 1.03% |

| Institutional Class | $1,000 | $1,087.80 | $4.30 | 0.83% |

| A Class | $1,000 | $1,084.70 | $6.62 | 1.28% |

| B Class | $1,000 | $1,081.00 | $10.47 | 2.03% |

| C Class | $1,000 | $1,080.20 | $10.47 | 2.03% |

| R Class | $1,000 | $1,083.80 | $7.91 | 1.53% |

| Hypothetical |

| Investor Class | $1,000 | $1,019.69 | $5.16 | 1.03% |

| Institutional Class | $1,000 | $1,020.68 | $4.16 | 0.83% |

| A Class | $1,000 | $1,018.45 | $6.41 | 1.28% |

| B Class | $1,000 | $1,014.73 | $10.14 | 2.03% |

| C Class | $1,000 | $1,014.73 | $10.14 | 2.03% |

| R Class | $1,000 | $1,017.21 | $7.65 | 1.53% |

*Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period.

| | | Shares | | | Value | |

| Common Stocks — 98.9% | |

| AEROSPACE & DEFENSE — 3.4% | |

| Boeing Co. (The) | | | 256 | | | | $18,926 | |

| General Dynamics Corp. | | | 2,478 | | | | 184,660 | |

| Honeywell International, Inc. | | | 3,919 | | | | 233,533 | |

| Northrop Grumman Corp. | | | 2,617 | | | | 181,489 | |

| United Technologies Corp. | | | 7,562 | | | | 669,313 | |

| | | | | | | | 1,287,921 | |

| AIR FREIGHT & LOGISTICS — 0.6% | |

Atlas Air Worldwide Holdings, Inc.(1) | | | 3,173 | | | | 188,825 | |

| United Parcel Service, Inc., Class B | | | 562 | | | | 40,987 | |

| | | | | | | | 229,812 | |

| AIRLINES — 0.6% | |

Alaska Air Group, Inc.(1) | | | 3,271 | | | | 223,933 | |

| AUTO COMPONENTS — 1.4% | |

| Magna International, Inc. | | | 5,085 | | | | 274,793 | |

TRW Automotive Holdings Corp.(1) | | | 4,623 | | | | 272,896 | |

| | | | | | | | 547,689 | |

| AUTOMOBILES — 0.3% | |

Ford Motor Co.(1) | | | 8,993 | | | | 124,014 | |

| BEVERAGES — 3.0% | |

| Coca-Cola Co. (The) | | | 7,364 | | | | 495,523 | |

| Dr Pepper Snapple Group, Inc. | | | 6,358 | | | | 266,591 | |

| PepsiCo, Inc. | | | 5,341 | | | | 376,167 | |

| | | | | | | | 1,138,281 | |

| BIOTECHNOLOGY — 1.5% | |

Biogen Idec, Inc.(1) | | | 3,616 | | | | 386,623 | |

Celgene Corp.(1) | | | 432 | | | | 26,058 | |

Cephalon, Inc.(1) | | | 897 | | | | 71,670 | |

Cubist Pharmaceuticals, Inc.(1) | | | 637 | | | | 22,926 | |

United Therapeutics Corp.(1) | | | 1,404 | | | | 77,360 | |

| | | | | | | | 584,637 | |

| CHEMICALS — 2.8% | |

| CF Industries Holdings, Inc. | | | 799 | | | | 113,194 | |

| Eastman Chemical Co. | | | 1,649 | | | | 168,313 | |

| Monsanto Co. | | | 6,420 | | | | 465,707 | |

| PPG Industries, Inc. | | | 3,616 | | | | 328,297 | |

| | | | | | | | 1,075,511 | |

| COMMUNICATIONS EQUIPMENT — 2.7% | |

| Cisco Systems, Inc. | | | 15,260 | | | | 238,209 | |

Motorola Solutions, Inc.(1) | | | 1,960 | | | | 90,238 | |

| QUALCOMM, Inc. | | | 9,452 | | | | 536,779 | |

Riverbed Technology, Inc.(1) | | | 4,714 | | | | 186,627 | |

| | | | | | | | 1,051,853 | |

| COMPUTERS & PERIPHERALS — 5.6% | |

Apple, Inc.(1) | | | 4,950 | | | | 1,661,566 | |

Dell, Inc.(1) | | | 21,110 | | | | 351,904 | |

EMC Corp.(1) | | | 2,398 | | | | 66,065 | |

| Hewlett-Packard Co. | | | 1,762 | | | | 64,137 | |

| | | | | | | | 2,143,672 | |

| CONSTRUCTION & ENGINEERING — 0.1% | |

| Fluor Corp. | | | 362 | | | | 23,407 | |

| CONSUMER FINANCE — 0.1% | |

| American Express Co. | | | 705 | | | | 36,449 | |

| DIVERSIFIED CONSUMER SERVICES — 1.1% | |

ITT Educational Services, Inc.(1) | | | 2,996 | | | | 234,407 | |

| Weight Watchers International, Inc. | | | 2,622 | | | | 197,882 | |

| | | | | | | | 432,289 | |

| DIVERSIFIED FINANCIAL SERVICES — 1.4% | |

| Interactive Brokers Group, Inc., Class A | | | 14,216 | | | | 222,481 | |

| McGraw-Hill Cos., Inc. (The) | | | 5,569 | | | | 233,397 | |

| Moody’s Corp. | | | 2,338 | | | | 89,662 | |

| | | | | | | | 545,540 | |

| DIVERSIFIED TELECOMMUNICATION SERVICES — 0.5% | |

| Verizon Communications, Inc. | | | 4,861 | | | | 180,975 | |

| ELECTRICAL EQUIPMENT — 0.8% | |

| Emerson Electric Co. | | | 5,380 | | | | 302,625 | |

| ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS — 1.1% | |

| Corning, Inc. | | | 8,877 | | | | 161,117 | |

| TE Connectivity Ltd. | | | 6,459 | | | | 237,433 | |

Vishay Intertechnology, Inc.(1) | | | 2,619 | | | | 39,390 | |

| | | | | | | | 437,940 | |

| ENERGY EQUIPMENT & SERVICES — 1.9% | |

| Core Laboratories NV | | | 915 | | | | 102,059 | |

| Schlumberger Ltd. | | | 4,621 | | | | 399,255 | |

| SEACOR Holdings, Inc. | | | 2,472 | | | | 247,101 | |

| | | | | | | | 748,415 | |

| FOOD & STAPLES RETAILING — 3.1% | |

| Costco Wholesale Corp. | | | 4,835 | | | | 392,795 | |

| Walgreen Co. | | | 9,205 | | | | 390,844 | |

| Wal-Mart Stores, Inc. | | | 2,525 | | | | 134,179 | |

| Whole Foods Market, Inc. | | | 4,573 | | | | 290,157 | |

| | | | | | | | 1,207,975 | |

| FOOD PRODUCTS — 1.1% | |

| Flowers Foods, Inc. | | | 1,125 | | | | 24,795 | |

| Hershey Co. (The) | | | 4,685 | | | | 266,342 | |

| Mead Johnson Nutrition Co. | | | 1,850 | | | | 124,968 | |

| | | | | | | | 416,105 | |

| | | | Shares | | | | Value | |

| HEALTH CARE EQUIPMENT & SUPPLIES — 4.5% | | | | | | | | |

Align Technology, Inc.(1) | | | 9,810 | | | | $223,668 | |

| Baxter International, Inc. | | | 2,966 | | | | 177,041 | |

| Cooper Cos., Inc. (The) | | | 3,247 | | | | 257,292 | |

| Hill-Rom Holdings, Inc. | | | 4,229 | | | | 194,703 | |

IDEXX Laboratories, Inc.(1) | | | 2,225 | | | | 172,571 | |

Intuitive Surgical, Inc.(1) | | | 816 | | | | 303,642 | |

Varian Medical Systems, Inc.(1) | | | 3,704 | | | | 259,354 | |

Zimmer Holdings, Inc.(1) | | | 2,242 | | | | 141,694 | |

| | | | | | | | 1,729,965 | |

| HEALTH CARE PROVIDERS & SERVICES — 1.4% | |

AMERIGROUP Corp.(1) | | | 3,725 | | | | 262,501 | |

| Humana, Inc. | | | 3,020 | | | | 243,231 | |

| UnitedHealth Group, Inc. | | | 77 | | | | 3,971 | |

WellCare Health Plans, Inc.(1) | | | 219 | | | | 11,259 | |

| | | | | | | | 520,962 | |

| HOTELS, RESTAURANTS & LEISURE — 2.5% | |

| International Game Technology | | | 12,741 | | | | 223,987 | |

| McDonald’s Corp. | | | 2,738 | | | | 230,868 | |

Panera Bread Co., Class A(1) | | | 1,606 | | | | 201,810 | |

| Wynn Resorts Ltd. | | | 2,038 | | | | 292,534 | |

| Yum! Brands, Inc. | | | 86 | | | | 4,751 | |

| | | | | | | | 953,950 | |

| HOUSEHOLD DURABLES — 0.9% | |

| Tupperware Brands Corp. | | | 2,369 | | | | 159,789 | |

| Whirlpool Corp. | | | 2,266 | | | | 184,271 | |

| | | | | | | | 344,060 | |

| INDUSTRIAL CONGLOMERATES — 1.4% | |

| 3M Co. | | | 2,150 | | | | 203,928 | |

| General Electric Co. | | | 17,341 | | | | 327,051 | |

| | | | | | | | 530,979 | |

INSURANCE(2) | |

| Travelers Cos., Inc. (The) | | | 59 | | | | 3,444 | |

| INTERNET & CATALOG RETAIL — 1.7% | |

Amazon.com, Inc.(1) | | | 1,524 | | | | 311,643 | |

Netflix, Inc.(1) | | | 920 | | | | 241,675 | |

priceline.com, Inc.(1) | | | 211 | | | | 108,017 | |

| | | | | | | | 661,335 | |

| INTERNET SOFTWARE & SERVICES — 1.5% | |

Google, Inc., Class A(1) | | | 888 | | | | 449,665 | |

IAC/InterActiveCorp(1) | | | 3,056 | | | | 116,648 | |

Open Text Corp.(1) | | | 102 | | | | 6,530 | |

| | | | | | | | 572,843 | |

| IT SERVICES — 6.6% | |

| Accenture plc, Class A | | | 7,703 | | | | 465,415 | |

Alliance Data Systems Corp.(1) | | | 1,577 | | | | 148,348 | |

| Global Payments, Inc. | | | 5,246 | | | | 267,546 | |

| International Business Machines Corp. | | | 6,961 | | | | 1,194,160 | |

| Visa, Inc., Class A | | | 5,204 | | | | 438,489 | |

| | | | | | | | 2,513,958 | |

| LEISURE EQUIPMENT & PRODUCTS — 0.7% | |

| Polaris Industries, Inc. | | | 2,370 | | | | 263,473 | |

| LIFE SCIENCES TOOLS & SERVICES — 1.6% | |

Agilent Technologies, Inc.(1) | | | 6,573 | | | | 335,946 | |

Illumina, Inc.(1) | | | 3,761 | | | | 282,639 | |

| | | | | | | | 618,585 | |

| MACHINERY — 3.3% | |

| Caterpillar, Inc. | | | 5,446 | | | | 579,781 | |

| Eaton Corp. | | | 3,742 | | | | 192,526 | |

| Gardner Denver, Inc. | | | 381 | | | | 32,023 | |

| Parker-Hannifin Corp. | | | 654 | | | | 58,690 | |

Sauer-Danfoss, Inc.(1) | | | 4,640 | | | | 233,810 | |

| Toro Co. (The) | | | 2,933 | | | | 177,446 | |

| | | | | | | | 1,274,276 | |

| MEDIA — 2.2% | |

DirecTV, Class A(1) | | | 9,087 | | | | 461,801 | |

DISH Network Corp., Class A(1) | | | 4,312 | | | | 132,249 | |

| Interpublic Group of Cos., Inc. (The) | | | 7,345 | | | | 91,813 | |

| Time Warner Cable, Inc. | | | 1,674 | | | | 130,639 | |

| Time Warner, Inc. | | | 740 | | | | 26,914 | |

| | | | | | | | 843,416 | |

| METALS & MINING — 1.9% | |

| Freeport-McMoRan Copper & Gold, Inc. | | | 9,796 | | | | 518,208 | |

| Walter Energy, Inc. | | | 1,832 | | | | 212,146 | |

| | | | | | | | 730,354 | |

| MULTILINE RETAIL — 0.5% | |

| Kohl’s Corp. | | | 3,805 | | | | 190,288 | |

| OIL, GAS & CONSUMABLE FUELS — 8.0% | |

| Chevron Corp. | | | 2,940 | | | | 302,349 | |

| ConocoPhillips | | | 4,420 | | | | 332,340 | |

| Exxon Mobil Corp. | | | 20,813 | | | | 1,693,762 | |

| Marathon Oil Corp. | | | 5,635 | | | | 296,852 | |

| Sunoco, Inc. | | | 422 | | | | 17,602 | |

| Valero Energy Corp. | | | 9,005 | | | | 230,258 | |

| W&T Offshore, Inc. | | | 8,046 | | | | 210,161 | |

| | | | | | | | 3,083,324 | |

| PAPER & FOREST PRODUCTS — 0.6% | |

| Domtar Corp. | | | 2,427 | | | | 229,886 | |

| PERSONAL PRODUCTS — 1.6% | |

| Estee Lauder Cos., Inc. (The), Class A | | | 1,336 | | | | 140,534 | |

| Herbalife Ltd. | | | 5,059 | | | | 291,601 | |

| Nu Skin Enterprises, Inc., Class A | | | 5,021 | | | | $188,538 | |

| | | | | | | | 620,673 | |

| PHARMACEUTICALS — 4.4% | |

| Abbott Laboratories | | | 4,510 | | | | 237,316 | |

| Bristol-Myers Squibb Co. | | | 8,363 | | | | 242,193 | |

| Eli Lilly & Co. | | | 8,342 | | | | 313,075 | |

Forest Laboratories, Inc.(1) | | | 5,753 | | | | 226,323 | |

| Johnson & Johnson | | | 5,754 | | | | 382,756 | |

| Merck & Co., Inc. | | | 6,741 | | | | 237,890 | |

| Pfizer, Inc. | | | 1,412 | | | | 29,087 | |

| | | | | | | | 1,668,640 | |

| PROFESSIONAL SERVICES — 0.7% | |

| Towers Watson & Co., Class A | | | 3,815 | | | | 250,684 | |

Verisk Analytics, Inc., Class A(1) | | | 972 | | | | 33,650 | |

| | | | | | | | 284,334 | |

| REAL ESTATE INVESTMENT TRUSTS (REITs) — 0.7% | |

| Rayonier, Inc. | | | 4,199 | | | | 274,405 | |

| ROAD & RAIL — 0.5% | | | | | | | | |

| Union Pacific Corp. | | | 1,763 | | | | 184,057 | |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT — 4.4% | |

| Altera Corp. | | | 4,114 | | | | 190,684 | |

| Applied Materials, Inc. | | | 8,343 | | | | 108,542 | |

| Avago Technologies Ltd. | | | 5,154 | | | | 195,852 | |

Cypress Semiconductor Corp.(1) | | | 5,522 | | | | 116,735 | |

| Intel Corp. | | | 10,937 | | | | 242,364 | |

LSI Corp.(1) | | | 33,830 | | | | 240,870 | |

Micron Technology, Inc.(1) | | | 15,420 | | | | 115,342 | |

NVIDIA Corp.(1) | | | 15,324 | | | | 244,188 | |

Teradyne, Inc.(1) | | | 16,478 | | | | 243,874 | |

| | | | | | | | 1,698,451 | |

| SOFTWARE — 8.2% | |

Cadence Design Systems, Inc.(1) | | | 24,743 | | | | 261,286 | |

Cerner Corp.(1) | | | 2,657 | | | | 162,369 | |

Citrix Systems, Inc.(1) | | | 3,432 | | | | 274,560 | |

Electronic Arts, Inc.(1) | | | 12,811 | | | | 302,340 | |

Fortinet, Inc.(1) | | | 1,348 | | | | 36,787 | |

Intuit, Inc.(1) | | | 5,936 | | | | 307,841 | |

| Microsoft Corp. | | | 37,823 | | | | 983,398 | |

| Oracle Corp. | | | 24,231 | | | | 797,442 | |

| | | | | | | | 3,126,023 | |

| SPECIALTY RETAIL — 3.0% | |

AutoZone, Inc.(1) | | | 768 | | | | 226,445 | |

Bed Bath & Beyond, Inc.(1) | | | 4,324 | | | | 252,392 | |

| Express, Inc. | | | 2,024 | | | | 44,123 | |

| Home Depot, Inc. (The) | | | 2,642 | | | | 95,693 | |

| Limited Brands, Inc. | | | 7,482 | | | | 287,683 | |

| PetSmart, Inc. | | | 1,619 | | | | 73,454 | |

| TJX Cos., Inc. (The) | | | 180 | | | | 9,455 | |

| Williams-Sonoma, Inc. | | | 3,952 | | | | 144,209 | |

| | | | | | | | 1,133,454 | |

| TEXTILES, APPAREL & LUXURY GOODS — 0.7% | |

| VF Corp. | | | 2,323 | | | | 252,185 | |

| TOBACCO — 2.3% | |

| Lorillard, Inc. | | | 407 | | | | 44,310 | |

| Philip Morris International, Inc. | | | 12,543 | | | | 837,496 | |

| | | | | | | | 881,806 | |

TOTAL COMMON STOCKS (Cost $32,793,375) | | | | 37,928,169 | |

| Temporary Cash Investments — 2.5% | |

| JPMorgan U.S. Treasury Plus Money Market Fund Agency Shares | | | 222,708 | | | | 222,708 | |

| Repurchase Agreement, Bank of America N.A., (collateralized by various U.S. Treasury obligations, 4.375%, 11/15/39, valued at $266,030), in a joint trading account at 0.00%, dated 6/30/11, due 7/1/11 (Delivery value $260,007) | | | | 260,007 | |

| Repurchase Agreement, Credit Suisse First Boston, Inc., (collateralized by various U.S. Treasury obligations, 3.50%, 5/15/20, valued at $221,072), in a joint trading account at 0.00%, dated 6/30/11, due 7/1/11 (Delivery value $216,672) | | | | 216,672 | |

| Repurchase Agreement, Goldman Sachs Group, Inc., (collateralized by various U.S. Treasury obligations, 1.375%, 9/15/12, valued at $265,235), in a joint trading account at 0.00%, dated 6/30/11, due 7/1/11 (Delivery value $260,007) | | | | 260,007 | |

TOTAL TEMPORARY CASH INVESTMENTS (Cost $959,394) | | | | 959,394 | |

TOTAL INVESTMENT SECURITIES — 101.4% (Cost $33,752,769) | | | | 38,887,563 | |

| OTHER ASSETS AND LIABILITIES — (1.4)% | | | | (549,593 | ) |

| TOTAL NET ASSETS — 100.0% | | | | $38,337,970 | |

Notes to Schedule of Investments

| (2) | Category is less than 0.05% of total net assets. |

See Notes to Financial Statements.

Statement of Assets and Liabilities |

| JUNE 30, 2011 | |

| Assets | |

| Investment securities, at value (cost of $33,752,769) | | | $38,887,563 | |

| Receivable for investments sold | | | 1,310,031 | |

| Receivable for capital shares sold | | | 90,536 | |

| Dividends and interest receivable | | | 37,572 | |

| | | | 40,325,702 | |

| | | | | |

| Liabilities | |

| Payable for investments purchased | | | 1,944,134 | |

| Payable for capital shares redeemed | | | 12,325 | |

| Accrued management fees | | | 30,354 | |

| Distribution and service fees payable | | | 919 | |

| | | | 1,987,732 | |

| | | | | |

| Net Assets | | | $38,337,970 | |

| | | | | |

| Net Assets Consist of: | |

| Capital (par value and paid-in surplus) | | | $34,644,326 | |

| Undistributed net investment income | | | 27,898 | |

| Accumulated net realized loss | | | (1,469,048 | ) |

| Net unrealized appreciation | | | 5,134,794 | |

| | | | $38,337,970 | |

| | Net assets | Shares outstanding | Net asset value per share |

| Investor Class, $0.01 Par Value | $31,450,070 | 2,448,031 | $12.85 |

| Institutional Class, $0.01 Par Value | $3,096,720 | 240,274 | $12.89 |

| A Class, $0.01 Par Value | $3,026,488 | 236,502 | $12.80* |

| B Class, $0.01 Par Value | $105,084 | 8,382 | $12.54 |

| C Class, $0.01 Par Value | $166,940 | 13,318 | $12.53 |

| R Class, $0.01 Par Value | $492,668 | 38,854 | $12.68 |

| *Maximum offering price $13.58 (net asset value divided by 0.9425) |

See Notes to Financial Statements.

| YEAR ENDED JUNE 30, 2011 | |

| Investment Income (Loss) | |

| Income: | | | |

| Dividends (net of foreign taxes withheld of $617) | | | $361,484 | |

| Interest | | | 339 | |

| | | | 361,823 | |

| | | | | |

| Expenses: | | | | |

| Management fees | | | 258,252 | |

| Distribution and service fees: | | | | |

| A Class | | | 3,195 | |

| B Class | | | 861 | |

| C Class | | | 1,228 | |

| R Class | | | 1,727 | |

| Directors’ fees and expenses | | | 1,157 | |

| Other expenses | | | 768 | |

| | | | 267,188 | |

| | | | | |

| Net investment income (loss) | | | 94,635 | |

| | | | | |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on investment transactions | | | 2,788,807 | |

| Change in net unrealized appreciation (depreciation) on investments | | | 3,976,993 | |

| | | | | |

| Net realized and unrealized gain (loss) | | | 6,765,800 | |

| | | | | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | | $6,860,435 | |

See Notes to Financial Statements.

Statement of Changes in Net Assets |

| YEARS ENDED JUNE 30, 2011 AND JUNE 30, 2010 | |

| Increase (Decrease) in Net Assets | | 2011 | | | 2010 | |

| Operations | |

| Net investment income (loss) | | | $94,635 | | | | $74,458 | |

| Net realized gain (loss) | | | 2,788,807 | | | | 571,034 | |

| Change in net unrealized appreciation (depreciation) | | | 3,976,993 | | | | 1,449,372 | |

| Net increase (decrease) in net assets resulting from operations | | | 6,860,435 | | | | 2,094,864 | |

| | | | | | | | | |

| Distributions to Shareholders | |

| From net investment income: | | | | | | | | |

| Investor Class | | | (52,830 | ) | | | (68,774 | ) |

| Institutional Class | | | (12,483 | ) | | | (20,108 | ) |

| A Class | | | (235 | ) | | | (1,108 | ) |

| R Class | | | — | | | | (95 | ) |

| Decrease in net assets from distributions | | | (65,548 | ) | | | (90,085 | ) |

| | | | | | | | | |

| Capital Share Transactions | |

| Net increase (decrease) in net assets from capital share transactions | | | 15,583,236 | | | | 345,348 | |

| | | | | | | | | |

| Net increase (decrease) in net assets | | | 22,378,123 | | | | 2,350,127 | |

| | | | | | | | | |

| Net Assets | |

| Beginning of period | | | 15,959,847 | | | | 13,609,720 | |

| End of period | | | $38,337,970 | | | | $15,959,847 | |

| | | | | | | | | |

| Undistributed net investment income | | | $27,898 | | | | — | |

See Notes to Financial Statements.

Notes to Financial Statements |

JUNE 30, 2011

1. Organization

American Century Quantitative Equity Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Maryland corporation. Disciplined Growth Fund (the fund) is one fund in a series issued by the corporation. The fund is diversified as defined under the 1940 Act. The fund’s investment objective is to seek long-term capital growth by investing in common stocks.

The fund is authorized to issue the Investor Class, the Institutional Class, the A Class, the B Class, the C Class and the R Class. The A Class may incur an initial sales charge. The A Class, B Class and C Class may be subject to a contingent deferred sales charge. The share classes differ principally in their respective sales charges and distribution and shareholder servicing expenses and arrangements. The Institutional Class is made available to institutional shareholders or through financial intermediaries whose clients do not require the same level of shareholder and administrative services as shareholders of other classes. As a result, the Institutional Class is charged a lower unified management fee.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America, which may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value per share as of the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open.

Equity securities that are listed or traded on a domestic securities exchange are valued at the last reported sales price or at the official closing price as provided by the exchange. Equity securities traded on foreign securities exchanges are typically valued at the closing price on the exchange where primarily traded or as of the close of the NYSE, if that is earlier. If no last sales price is reported, or if local convention or regulation so provides, the mean of the latest bid and asked prices is used. Depending on local convention or regulation, securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official closing price. In its determination of fair value, the fund may review several factors including: market information specific to a security; news developments in U.S. and foreign markets; the performance of particular U.S. and foreign securities, indices, comparable securities, American Depositary Receipts, Exchange-Traded Funds, and other relevant market indicators.

Debt securities maturing within 60 days at the time of purchase may be valued at cost, plus or minus any amortized discount or premium or at the evaluated mean as provided by an independent pricing service. Evaluated mean prices are commonly derived through utilization of market models, which may consider, among other factors, trade data, quotations from dealers and active market makers, relevant yield curve and spread data, related sector levels, creditworthiness, and other relevant market information on the same or comparable securities.

Investments in open-end management investment companies are valued at the reported net asset value per share. Repurchase agreements are valued at cost.

If the fund determines that the market price for a portfolio security is not readily available or the valuation methods mentioned above do not reflect a security’s fair value, such security is valued as determined in good faith by the Board of Directors or its designee, in accordance with procedures adopted by the Board of Directors. Circumstances that may cause the fund to use these procedures to value a security include, but are not limited to: a security has been declared in default; trading in a security has been halted during

the trading day; there is a foreign market holiday and no trading occurred; or an event occurred between the close of a foreign exchange and the NYSE that may affect the value of a security.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund estimates the components of distributions received that may be considered nontaxable distributions or capital gain distributions for income tax purposes. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that American Century Investment Management, Inc. (ACIM) (the investment advisor) has determined are creditworthy pursuant to criteria adopted by the Board of Directors. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. The fund is no longer subject to examination by tax authorities for years prior to 2008. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. Accordingly, no provision has been made for federal or state income taxes.

Multiple Class — All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Distributions to Shareholders — Distributions from net investment income, if any, are generally declared and paid semiannually. Distributions from net realized gains, if any, are generally declared and paid annually.

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

3. Fees and Transactions with Related Parties

Management Fees —The corporation has entered into a management agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The agreement provides that all expenses of managing and operating the fund, except distribution and service fees, brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), and extraordinary expenses, will be paid by ACIM. The fee is computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fee consists of (1) an Investment Category Fee based on the daily net assets of the fund and certain other accounts managed by the investment advisor that are in the same broad investment category as the fund and (2) a Complex Fee based on the assets of all the funds in the American Century Investments family of funds. The rates for the Investment Category Fee range from 0.6880% to 0.8700%. The rates for the Complex Fee range from 0.2500% to 0.3100% for the Investor Class, A Class, B Class, C Class and R Class. The Institutional Class is 0.2000% less at each point within the Complex Fee range. The effective annual management fee for each class for the year ended June 30, 2011 was 1.03% for the Investor Class, A Class, B Class, C Class and R Class and 0.83% for the Institutional Class.

Distribution and Service Fees — The Board of Directors has adopted a separate Master Distribution and Individual Shareholder Services Plan for each of the A Class, B Class, C Class and R Class (collectively the plans), pursuant to Rule 12b-1 of the 1940 Act. The plans provide that the A Class will pay American Century Investment Services, Inc. (ACIS) an annual distribution and service fee of 0.25%. The plans provide that the B Class and C Class will each pay ACIS an annual distribution and service fee of 1.00%, of which 0.25% is paid for individual shareholder services and 0.75% is paid for distribution services. The plans provide that the R Class will pay ACIS an annual distribution and service fee of 0.50%. The fees are computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fees are used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plans during the year ended June 30, 2011 are detailed in the Statement of Operations.

Related Parties — Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC), the parent of the corporation’s investment advisor, ACIM, the distributor of the corporation, ACIS, and the corporation’s transfer agent, American Century Services, LLC.

The fund is eligible to invest in a money market fund for temporary purposes, which is managed by J.P. Morgan Investment Management, Inc. (JPMIM). The fund has a securities lending agreement with JPMorgan Chase Bank (JPMCB) and a mutual funds services agreement with J.P. Morgan Investor Services Co. (JPMIS). JPMCB is a custodian of the fund. JPMIM, JPMIS and JPMCB are wholly owned subsidiaries of JPMorgan Chase & Co. (JPM). JPM is an equity investor in ACC. The services provided to the fund by JPMIM, JPMIS and JPMCB terminated on July 31, 2011.

4. Investment Transactions

Purchases and sales of investment securities, excluding short-term investments, for the year ended June 30, 2011 were $45,217,615 and $29,880,320, respectively.

5. Capital Share Transactions

Transactions in shares of the fund were as follows:

| | | Year ended June 30, 2011 | | | Year ended June 30, 2010 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Investor Class/Shares Authorized | | | 50,000,000 | | | | | | | 50,000,000 | | | | |

| Sold | | | 1,682,989 | | | | $20,358,748 | | | | 510,456 | | | | $4,912,469 | |

| Issued in reinvestment of distributions | | | 4,156 | | | | 49,256 | | | | 6,537 | | | | 64,129 | |

| Redeemed | | | (618,950 | ) | | | (7,255,643 | ) | | | (440,705 | ) | | | (4,161,868 | ) |

| | | | 1,068,195 | | | | 13,152,361 | | | | 76,288 | | | | 814,730 | |

| Institutional Class/Shares Authorized | | | 10,000,000 | | | | | | | | 10,000,000 | | | | | |

| Sold | | | 98,023 | | | | 1,194,467 | | | | 50,022 | | | | 482,024 | |

| Issued in reinvestment of distributions | | | 1,052 | | | | 12,483 | | | | 2,045 | | | | 20,108 | |

| Redeemed | | | (90,338 | ) | | | (1,049,782 | ) | | | (102,405 | ) | | | (972,968 | ) |

| | | | 8,737 | | | | 157,168 | | | | (50,338 | ) | | | (470,836 | ) |

| A Class/Shares Authorized | | | 10,000,000 | | | | | | | | 10,000,000 | | | | | |

| Sold | | | 191,652 | | | | 2,338,216 | | | | 52,199 | | | | 516,352 | |

| Issued in reinvestment of distributions | | | 19 | | | | 229 | | | | 111 | | | | 1,086 | |

| Redeemed | | | (26,791 | ) | | | (317,714 | ) | | | (31,879 | ) | | | (293,445 | ) |

| | | | 164,880 | | | | 2,020,731 | | | | 20,431 | | | | 223,993 | |

| B Class/Shares Authorized | | | 10,000,000 | | | | | | | | 10,000,000 | | | | | |

| Sold | | | 3,344 | | | | 38,679 | | | | 2,723 | | | | 26,373 | |

| Redeemed | | | (964 | ) | | | (11,820 | ) | | | — | | | | — | |

| | | | 2,380 | | | | 26,859 | | | | 2,723 | | | | 26,373 | |

| C Class/Shares Authorized | | | 10,000,000 | | | | | | | | 10,000,000 | | | | | |

| Sold | | | 17,046 | | | | 199,910 | | | | 1,067 | | | | 9,604 | |

| Redeemed | | | (8,227 | ) | | | (101,818 | ) | | | (3,432 | ) | | | (31,950 | ) |

| | | | 8,819 | | | | 98,092 | | | | (2,365 | ) | | | (22,346 | ) |

| R Class/Shares Authorized | | | 10,000,000 | | | | | | | | 10,000,000 | | | | | |

| Sold | | | 10,440 | | | | 132,524 | | | | 119 | | | | 1,182 | |

| Issued in reinvestment of distributions | | | — | | | | — | | | | 10 | | | | 95 | |

| Redeemed | | | (359 | ) | | | (4,499 | ) | | | (24,009 | ) | | | (227,843 | ) |

| | | | 10,081 | | | | 128,025 | | | | (23,880 | ) | | | (226,566 | ) |

| Net increase (decrease) | | | 1,263,092 | | | | $15,583,236 | | | | 22,859 | | | | $345,348 | |

6. Fair Value Measurements

The fund’s securities valuation process is based on several considerations and may use multiple inputs to determine the fair value of the positions held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels as follows:

| • | Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical securities; |

| Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for similar securities, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.); or |

| Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions). |

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments.

The following is a summary of the level classifications as of period end. The Schedule of Investments provides additional information on the fund’s portfolio holdings.

| | | Level 1 | | | Level 2 | | | Level 3 | |

| Investment Securities | |

| Common Stocks | | | $37,928,169 | | | | — | | | | — | |

| Temporary Cash Investments | | | 222,708 | | | | $736,686 | | | | — | |

| Total Value of Investment Securities | | | $38,150,877 | | | | $736,686 | | | | — | |

7. Risk Factors

The fund’s investment process may result in high portfolio turnover, which could mean high transaction costs, affecting both performance and capital gains tax liabilities to investors.

8. Federal Tax Information

The tax character of distributions paid during the years ended June 30, 2011 and June 30, 2010 were as follows:

| | | 2011 | | | 2010 | |

| Distributions Paid From | |

| Ordinary income | | | $65,548 | | | | $90,085 | |

| Long-term capital gains | | | — | | | | — | |

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of June 30, 2011, the federal tax cost of investments and the components of distributable earnings on a tax-basis were as follows:

| Federal tax cost of investments | | | $33,873,946 | |

| Gross tax appreciation of investments | | | $5,372,699 | |

| Gross tax depreciation of investments | | | (359,082 | ) |

| Net tax appreciation (depreciation) of investments | | | $5,013,617 | |

| Undistributed ordinary income | | | $27,898 | |

| Accumulated capital losses | | | $(1,347,871 | ) |

The difference between book-basis and tax-basis cost and unrealized appreciation (depreciation) is attributable primarily to the tax deferral of losses on wash sales.

The accumulated capital losses represent net capital loss carryovers that may be used to offset future realized capital gains for federal income tax purposes. Future capital loss carryover utilization in any given year may be subject to Internal Revenue Code limitations. Capital loss carryovers expire in 2018.

On December 22, 2010, the Regulated Investment Company Modernization Act of 2010 (the “Act”) was enacted, which changed various technical rules governing the tax treatment of regulated investment companies. The changes are generally effective for taxable years beginning after the date of enactment. Under the Act, the fund will be permitted to carry forward capital losses incurred in taxable years beginning after the date of enactment for an unlimited period. However, any losses incurred during those future taxable years will be required to be utilized prior to the losses incurred in pre-enactment taxable years, which carry an expiration date. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused.

| Investor Class | |

| For a Share Outstanding Throughout the Years Ended June 30 (except as noted) | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007(1) | | | 2006 | |

| Per-Share Data | |

| Net Asset Value, Beginning of Period | | | $9.27 | | | | $8.01 | | | | $11.12 | | | | $12.35 | | | | $11.59 | | | | $10.47 | |

Income From Investment Operations | | | | | | | | | | | | | | | | | | | | | | | | |

Net Investment Income (Loss)(2) | | | 0.04 | | | | 0.04 | | | | 0.04 | | | | (0.01 | ) | | | (0.02 | ) | | | (0.02 | ) |

Net Realized and Unrealized Gain (Loss) | | | 3.57 | | | | 1.27 | | | | (3.12 | ) | | | (0.74 | ) | | | 0.83 | | | | 1.20 | |

Total From Investment Operations | | | 3.61 | | | | 1.31 | | | | (3.08 | ) | | | (0.75 | ) | | | 0.81 | | | | 1.18 | |

| Distributions | | | | | | | | | | | | | | | | | | | | | | | | |

From Net Investment Income | | | (0.03 | ) | | | (0.05 | ) | | | (0.03 | ) | | | — | | | | — | | | | — | |

From Net Realized Gains | | | — | | | | — | | | | — | | | | (0.48 | ) | | | (0.05 | ) | | | (0.06 | ) |

| Total Distributions | | | (0.03 | ) | | | (0.05 | ) | | | (0.03 | ) | | | (0.48 | ) | | | (0.05 | ) | | | (0.06 | ) |

Net Asset Value, End of Period | | | $12.85 | | | | $9.27 | | | | $8.01 | | | | $11.12 | | | | $12.35 | | | | $11.59 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total Return(3) | | | 39.00 | % | | | 16.35 | % | | | (27.63 | )% | | | (6.38 | )% | | | 7.00 | % | | | 11.30 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | |

Ratio of Operating Expenses to Average Net Assets | | | 1.04 | % | | | 1.05 | % | | | 1.05 | % | | | 1.03 | % | | | 1.02 | %(4) | | | 1.02 | % |

Ratio of Net Investment Income (Loss) to Average Net Assets | | | 0.37 | % | | | 0.46 | % | | | 0.44 | % | | | (0.07 | )% | | | (0.29 | )%(4) | | | (0.21 | )% |

| Portfolio Turnover Rate | | | 117 | % | | | 84 | % | | | 98 | % | | | 134 | % | | | 78 | % | | | 124 | % |

| Net Assets, End of Period (in thousands) | | | $31,450 | | | | $12,787 | | | | $10,440 | | | | $16,093 | | | | $22,775 | | | | $16,709 | |

| (1) | January 1, 2007 through June 30, 2007. The fund’s fiscal year end was changed from December 31 to June 30, resulting in a six-month annual reporting period. For the years before June 30, 2007, the fund’s fiscal year end was December 31. |

| (2) | Computed using average shares outstanding throughout the period. |

| (3) | Total returns are calculated based on the net asset value of the last business day. Total returns for periods less than one year are not annualized. |

See Notes to Financial Statements.

| Institutional Class | |

| For a Share Outstanding Throughout the Years Ended June 30 (except as noted) | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007(1) | | | 2006 | |

| Per-Share Data | |

| Net Asset Value, Beginning of Period | | | $9.30 | | | | $8.03 | | | | $11.15 | | | | $12.36 | | | | $11.62 | | | | $10.47 | |

Income From Investment Operations | | | | | | | | | | | | | | | | | | | | | | | | |

Net Investment Income (Loss)(2) | | | 0.06 | | | | 0.06 | | | | 0.05 | | | | 0.01 | | | | — | (3) | | | — | (3) |

Net Realized and Unrealized Gain (Loss) | | | 3.59 | | | | 1.28 | | | | (3.12 | ) | | | (0.74 | ) | | | 0.81 | | | | 1.21 | |

Total From Investment Operations | | | 3.65 | | | | 1.34 | | | | (3.07 | ) | | | (0.73 | ) | | | 0.81 | | | | 1.21 | |

| Distributions | | | | | | | | | | | | | | | | | | | | | | | | |

From Net Investment Income | | | (0.06 | ) | | | (0.07 | ) | | | (0.05 | ) | | | — | | | | — | | | | — | |

From Net Realized Gains | | | — | | | | — | | | | — | | | | (0.48 | ) | | | (0.07 | ) | | | (0.06 | ) |

| Total Distributions | | | (0.06 | ) | | | (0.07 | ) | | | (0.05 | ) | | | (0.48 | ) | | | (0.07 | ) | | | (0.06 | ) |

Net Asset Value, End of Period | | | $12.89 | | | | $9.30 | | | | $8.03 | | | | $11.15 | | | | $12.36 | | | | $11.62 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total Return(4) | | | 39.26 | % | | | 16.67 | % | | | (27.50 | )% | | | (6.22 | )% | | | 7.02 | % | | | 11.59 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | |

Ratio of Operating Expenses to Average Net Assets | | | 0.84 | % | | | 0.85 | % | | | 0.85 | % | | | 0.83 | % | | | 0.82 | %(5) | | | 0.82 | % |

Ratio of Net Investment Income (Loss) to Average Net Assets | | | 0.57 | % | | | 0.66 | % | | | 0.64 | % | | | 0.13 | % | | | (0.09 | )%(5) | | | (0.01 | )% |

| Portfolio Turnover Rate | | | 117 | % | | | 84 | % | | | 98 | % | | | 134 | % | | | 78 | % | | | 124 | % |

| Net Assets, End of Period (in thousands) | | | $3,097 | | | | $2,152 | | | | $2,265 | | | | $4,194 | | | | $6,918 | | | | $3,940 | |

| (1) | January 1, 2007 through June 30, 2007. The fund’s fiscal year end was changed from December 31 to June 30, resulting in a six-month annual reporting period. For the years before June 30, 2007, the fund’s fiscal year end was December 31. |

| (2) | Computed using average shares outstanding throughout the period. |

| (3) | Per-share amount was less than $0.005. |

| (4) | Total returns are calculated based on the net asset value of the last business day. Total returns for periods less than one year are not annualized. |

See Notes to Financial Statements.

A Class(1) | |

| For a Share Outstanding Throughout the Years Ended June 30 (except as noted) | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007(2) | | | 2006 | |

| Per-Share Data | |

| Net Asset Value, Beginning of Period | | | $9.23 | | | | $7.98 | | | | $11.07 | | | | $12.33 | | | | $11.56 | | | | $10.46 | |

Income From Investment Operations | | | | | | | | | | | | | | | | | | | | | | | | |

Net Investment Income (Loss)(3) | | | 0.02 | | | | 0.02 | | | | 0.02 | | | | (0.04 | ) | | | (0.03 | ) | | | (0.05 | ) |

Net Realized and Unrealized Gain (Loss) | | | 3.55 | | | | 1.26 | | | | (3.09 | ) | | | (0.74 | ) | | | 0.82 | | | | 1.21 | |

Total From Investment Operations | | | 3.57 | | | | 1.28 | | | | (3.07 | ) | | | (0.78 | ) | | | 0.79 | | | | 1.16 | |

| Distributions | | | | | | | | | | | | | | | | | | | | | | | | |

From Net Investment Income | | | — | (4) | | | (0.03 | ) | | | (0.02 | ) | | | — | | | | — | | | | — | |

From Net Realized Gains | | | — | | | | — | | | | — | | | | (0.48 | ) | | | (0.02 | ) | | | (0.06 | ) |

| Total Distributions | | | — | (4) | | | (0.03 | ) | | | (0.02 | ) | | | (0.48 | ) | | | (0.02 | ) | | | (0.06 | ) |

Net Asset Value, End of Period | | | $12.80 | | | | $9.23 | | | | $7.98 | | | | $11.07 | | | | $12.33 | | | | $11.56 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total Return(5) | | | 38.71 | % | | | 16.00 | % | | | (27.76 | )% | | | (6.65 | )% | | | 6.84 | % | | | 11.12 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | |

Ratio of Operating Expenses to Average Net Assets | | | 1.29 | % | | | 1.30 | % | | | 1.30 | % | | | 1.28 | % | | | 1.27 | %(6) | | | 1.27 | % |

Ratio of Net Investment Income (Loss) to Average Net Assets | | | 0.12 | % | | | 0.21 | % | | | 0.19 | % | | | (0.32 | )% | | | (0.54 | )%(6) | | | (0.46 | )% |

| Portfolio Turnover Rate | | | 117 | % | | | 84 | % | | | 98 | % | | | 134 | % | | | 78 | % | | | 124 | % |

| Net Assets, End of Period (in thousands) | | | $3,026 | | | | $661 | | | | $408 | | | | $571 | | | | $1,248 | | | | $701 | |

| (1) | Prior to September 4, 2007, the A Class was referred to as the Advisor Class. |

| (2) | January 1, 2007 through June 30, 2007. The fund’s fiscal year end was changed from December 31 to June 30, resulting in a six-month annual reporting period. For the years before June 30, 2007, the fund’s fiscal year end was December 31. |

| (3) | Computed using average shares outstanding throughout the period. |

| (4) | Per-share amount was less than $0.005. |

| (5) | Total returns are calculated based on the net asset value of the last business day and do not reflect applicable sales charges. Total returns for periods less than one year are not annualized. |

See Notes to Financial Statements.

| B Class | |

| For a Share Outstanding Throughout the Years Ended June 30 (except as noted) | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008(1) | |

| Per-Share Data | |

| Net Asset Value, Beginning of Period | | | $9.11 | | | | $7.91 | | | | $11.04 | | | | $12.93 | |

| Income From Investment Operations | | | | | | | | | | | | | | | | |

Net Investment Income (Loss)(2) | | | (0.07 | ) | | | (0.06 | ) | | | (0.04 | ) | | | (0.09 | ) |

| Net Realized and Unrealized Gain (Loss) | | | 3.50 | | | | 1.26 | | | | (3.09 | ) | | | (1.32 | ) |

| Total From Investment Operations | | | 3.43 | | | | 1.20 | | | | (3.13 | ) | | | (1.41 | ) |

| Distributions | | | | | | | | | | | | | | | | |

| From Net Realized Gains | | | — | | | | — | | | | — | | | | (0.48 | ) |

| Net Asset Value, End of Period | | | $12.54 | | | | $9.11 | | | | $7.91 | | | | $11.04 | |

| | | | | | | | | | | | | | | | | |

Total Return(3) | | | 37.65 | % | | | 15.17 | % | | | (28.35 | )% | | | (11.22 | )% |

| | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | |

| Ratio of Operating Expenses to Average Net Assets | | | 2.04 | % | | | 2.05 | % | | | 2.05 | % | | | 2.03 | %(4) |

| Ratio of Net Investment Income (Loss) to Average Net Assets | | | (0.63 | )% | | | (0.54 | )% | | | (0.56 | )% | | | (1.02 | )%(4) |

| Portfolio Turnover Rate | | | 117 | % | | | 84 | % | | | 98 | % | | | 134 | %(5) |

| Net Assets, End of Period (in thousands) | | | $105 | | | | $55 | | | | $26 | | | | $22 | |

| (1) | September 28, 2007 (commencement of sale) through June 30, 2008. |

| (2) | Computed using average shares outstanding throughout the period. |

| (3) | Total returns are calculated based on the net asset value of the last business day and do not reflect applicable sales charges. Total returns for periods less than one year are not annualized. |

| (5) | Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended June 30, 2008. |

See Notes to Financial Statements.

| C Class | |

| For a Share Outstanding Throughout the Years Ended June 30 (except as noted) | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008(1) | |

| Per-Share Data | |

| Net Asset Value, Beginning of Period | | | $9.11 | | | | $7.91 | | | | $11.04 | | | | $12.93 | |

| Income From Investment Operations | | | | | | | | | | | | | | | | |

Net Investment Income (Loss)(2) | | | (0.07 | ) | | | (0.05 | ) | | | (0.04 | ) | | | (0.09 | ) |

| Net Realized and Unrealized Gain (Loss) | | | 3.49 | | | | 1.25 | | | | (3.09 | ) | | | (1.32 | ) |

| Total From Investment Operations | | | 3.42 | | | | 1.20 | | | | (3.13 | ) | | | (1.41 | ) |

| Distributions | | | | | | | | | | | | | | | | |

| From Net Realized Gains | | | — | | | | — | | | | — | | | | (0.48 | ) |

| Net Asset Value, End of Period | | | $12.53 | | | | $9.11 | | | | $7.91 | | | | $11.04 | |

| | | | | | | | | | | | | | | | | |

Total Return(3) | | | 37.54 | % | | | 15.17 | % | | | (28.35 | )% | | | (11.22 | )% |

| | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | |

| Ratio of Operating Expenses to Average Net Assets | | | 2.04 | % | | | 2.05 | % | | | 2.05 | % | | | 2.03 | %(4) |

| Ratio of Net Investment Income (Loss) to Average Net Assets | | | (0.63 | )% | | | (0.54 | )% | | | (0.56 | )% | | | (1.01 | )%(4) |

| Portfolio Turnover Rate | | | 117 | % | | | 84 | % | | | 98 | % | | | 134 | %(5) |

| Net Assets, End of Period (in thousands) | | | $167 | | | | $41 | | | | $54 | | | | $22 | |

| (1) | September 28, 2007 (commencement of sale) through June 30, 2008. |

| (2) | Computed using average shares outstanding throughout the period. |

| (3) | Total returns are calculated based on the net asset value of the last business day and do not reflect applicable sales charges. Total returns for periods less than one year are not annualized. |

| (5) | Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended June 30, 2008. |

See Notes to Financial Statements.

| R Class | |

| For a Share Outstanding Throughout the Years Ended June 30 (except as noted) | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007(1) | | | 2006 | |

| Per-Share Data | |

| Net Asset Value, Beginning of Period | | | $9.17 | | | | $7.92 | | | | $11.00 | | | | $12.28 | | | | $11.53 | | | | $10.46 | |

Income From Investment Operations | | | | | | | | | | | | | | | | | | | | | | | | |

Net Investment Income (Loss)(2) | | | (0.01 | ) | | | — | (3) | | | — | (3) | | | (0.07 | ) | | | (0.05 | ) | | | (0.08 | ) |

Net Realized and Unrealized Gain (Loss) | | | 3.52 | | | | 1.25 | | | | (3.08 | ) | | | (0.73 | ) | | | 0.82 | | | | 1.21 | |

Total From Investment Operations | | | 3.51 | | | | 1.25 | | | | (3.08 | ) | | | (0.80 | ) | | | 0.77 | | | | 1.13 | |

| Distributions | | | | | | | | | | | | | | | | | | | | | | | | |

From Net Investment Income | | | — | | | | — | (3) | | | — | | | | — | | | | — | | | | — | |

From Net Realized Gains | | | — | | | | — | | | | — | | | | (0.48 | ) | | | (0.02 | ) | | | (0.06 | ) |

| Total Distributions | | | — | | | | — | (3) | | | — | | | | (0.48 | ) | | | (0.02 | ) | | | (0.06 | ) |

Net Asset Value, End of Period | | | $12.68 | | | | $9.17 | | | | $7.92 | | | | $11.00 | | | | $12.28 | | | | $11.53 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total Return(4) | | | 38.28 | % | | | 15.82 | % | | | (28.00 | )% | | | (6.84 | )% | | | 6.68 | % | | | 10.83 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | |

Ratio of Operating Expenses to Average Net Assets | | | 1.54 | % | | | 1.55 | % | | | 1.55 | % | | | 1.53 | % | | | 1.52 | %(5) | | | 1.52 | % |

Ratio of Net Investment Income (Loss) to Average Net Assets | | | (0.13 | )% | | | (0.04 | )% | | | (0.06 | )% | | | (0.57 | )% | | | (0.79 | )%(5) | | | (0.71 | )% |

| Portfolio Turnover Rate | | | 117 | % | | | 84 | % | | | 98 | % | | | 134 | % | | | 78 | % | | | 124 | % |

| Net Assets, End of Period (in thousands) | | | $493 | | | | $264 | | | | $417 | | | | $576 | | | | $619 | | | | $580 | |

| (1) | January 1, 2007 through June 30, 2007. The fund’s fiscal year end was changed from December 31 to June 30, resulting in a six-month annual reporting period. For the years before June 30, 2007, the fund’s fiscal year end was December 31. |

| (2) | Computed using average shares outstanding throughout the period. |

| (3) | Per-share amount was less than $0.005. |

| (4) | Total returns are calculated based on the net asset value of the last business day. Total returns for periods less than one year are not annualized. |

See Notes to Financial Statements.

Report of Independent Registered Public Accounting Firm |

To the Directors of the American Century Quantitative Equity Funds, Inc. and Shareholders of the Disciplined Growth Fund: