UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811- 5454

Dreyfus New Jersey Municipal Bond Fund, Inc.

(Exact name of Registrant as specified in charter)

c/o The Dreyfus Corporation

200 Park Avenue

New York, New York 10166

(Address of principal executive offices) (Zip code)

Michael A. Rosenberg, Esq.

200 Park Avenue

New York, New York 10166

(Name and address of agent for service)

| Registrant's telephone number, including area code: | (212) 922-6000 | | |

| Date of fiscal year end: | 12/31 | | |

| Date of reporting period: | 12/31/09 | | |

FORM N-CSR

Item 1. Reports to Stockholders.

Dreyfus

New Jersey Municipal Bond Fund, Inc.

ANNUAL REPORT December 31, 2009

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

| | Contents |

| | THE FUND |

| 2 | A Letter from the Chairman and CEO |

| 3 | Discussion of Fund Performance |

| 6 | Fund Performance |

| 8 | Understanding Your Fund’s Expenses |

| 8 | Comparing Your Fund’s Expenses With Those of Other Funds |

| 9 | Statement of Investments |

| 26 | Statement of Assets and Liabilities |

| 27 | Statement of Operations |

| 28 | Statement of Changes in Net Assets |

| 30 | Financial Highlights |

| 35 | Notes to Financial Statements |

| 45 | Report of Independent Registered Public Accounting Firm |

| 46 | Important Tax Information |

| 47 | Information About the Review and Approval of the Fund’s Management Agreement |

| 52 | Board Members Information |

| 54 | Officers of the Fund |

| | FOR MORE INFORMATION |

| | Back Cover |

Dreyfus

New Jersey Municipal

Bond Fund, Inc.

The Fund

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

We are pleased to present this annual report for Dreyfus New Jersey Municipal Bond Fund, Inc., covering the 12-month period from January 1, 2009, through December 31, 2009.

The municipal bond market ended 2009 with healthy total returns relative to year’s past, and also compared to benchmark U.S.Treasury securities, which generally lost value in 2009. The municipal bond market’s advance was the result of a somewhat unique and bifurcated dynamic: beneficial supply-and-demand factors attributed to the American Recovery and Reinvestment Act of 2009, and improved investor sentiment throughout the credit spectrum.After four consecutive quarters of contraction, the U.S. economy returned to growth during the third quarter of 2009, buoyed by greater manufacturing activity to replenish depleted inventories and satisfy export demand. The slumping housing market also showed signs of renewed life later in the year when home sales and prices rebounded modestly. However, economic headwinds remain, including a high unemployment rate and the fiscal well-being of many state and local municipality issuers .

As 2010 begins, our Chief Economist, as well as many securities analysts and portfolio managers have continued to find opportunities and survey potential challenges within the municipal bond markets.While no one can predict the future, we believe that the 2010 investment environment will likely require a broader range of investment considerations relative to last year.As always, your financial adviser can help you determine the mix of investments that may be best suited to helping you achieve your goals at a level of risk that is comfortable for you.

For information about how the fund performed during the reporting period, as well as market perspectives, we have provided a Discussion of Fund Performance.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chairman and Chief Executive Officer

The Dreyfus Corporation

January 15, 2010

2

DISCUSSION OF FUND PERFORMANCE

For the period of January 1, 2009, through December 31, 2009, as provided by James Welch and Dan Barton, Portfolio Managers

Fund and Market Performance Overview

For the 12-month period ended December 31, 2009, Dreyfus New Jersey Municipal Bond Fund’s Class A, B, C, I and Z shares produced total returns of 13.65%, 12.98%, 12.71%, 13.91% and 13.72%, respectively.1 In comparison, the Barclays Capital Municipal Bond Index (the “Index”), the fund’s benchmark, achieved a total return of 12.91% for the same period.2

Municipal bonds rallied over the reporting period as the U.S. economy and credit markets stabilized. The fund’s returns were higher than its benchmark, primarily due to overweighted exposure to bonds with credit ratings at the lower end of the investment-grade range.

The Fund’s Investment Approach

The fund normally invests at least 80% of its assets in municipal bonds that provide income exempt from federal and New Jersey personal income taxes. To pursue its goal, the fund invests at least 80% of its assets in investment-grade municipal bonds or the unrated equivalent as determined by Dreyfus.The fund may invest up to 20% of its assets in municipal bonds rated below investment grade (“high yield” or “junk” bonds) or the unrated equivalent as determined by Dreyfus. The dollar-weighted average maturity of the fund’s portfolio normally exceeds 10 years.

We focus on identifying undervalued sectors and securities and minimize the use of interest rate forecasting.The portfolio managers select municipal bonds for the fund’s portfolio by:

Using fundamental credit analysis to estimate the relative value and attractiveness of various sectors and securities and to exploit pricing inefficiencies in the municipal bond market; and

Actively trading among various sectors, such as pre-refunded, gen- eral obligation, and revenue, based on their apparent relative values.

The fund seeks to invest in several of these sectors.

The Fund 3

DISCUSSION OF FUND PERFORMANCE (continued)

Municipal Bonds Rebounded with U.S. Economy

In the wake of severe declines stemming from a global financial crisis and recession in 2008, the municipal bond market rebounded strongly in 2009.The rally was fueled by changing investor sentiment as government and monetary authorities’ aggressive remedial measures—including historically low interest rates, a massive economic stimulus package and injections of liquidity into the banking system—gained traction. Additional evidence of economic stabilization later appeared, supporting the market rally through the reporting period’s end.

In addition, the municipal bond market was boosted by favorable supply-and-demand dynamics. Issuance of new tax-exempt bonds moderated significantly during the year as states and municipalities turned to the federally subsidized Build America Bonds program, enacted as part of the economic stimulus package, shifting a substantial portion of new issuance to the taxable bond market. Meanwhile, demand for tax-exempt securities from individuals and institutions intensified as investors sought alternatives to low yielding money market funds and U.S.Treasury securities.

Security Selection Strategy Bolstered Fund Returns

The fund benefited in 2009 from its relatively heavy exposure to municipal bonds with “triple-B” credit ratings, the lowest tier in the investment-grade spectrum, as investors sought higher tax-equivalent yields in a low interest-rate environment.The fund’s holdings of bonds backed by hospitals and housing agencies fared particularly well in the recovering market.

As the lower-quality end of the market rebounded, we attempted to upgrade the fund’s overall credit quality by reducing its exposure to bonds rated “triple-B” and below in favor of those rate “single-A” or better. While we made some progress in this regard, our ability to do so was constrained by a dearth of new issuance meeting our investment criteria.

Our interest-rate strategies also contributed positively to performance, including an average duration that, at times, was modestly longer than

4

industry averages. This positioning enabled the fund to participate in price gains when longer-term interest rates fell.

Most states and municipalities have continued to face fiscal challenges stemming from lower-than-projected tax receipts and intensifying demands for services.These pressures were particularly intense in New Jersey, where fiscal conditions also have been hurt by a heavy debt load and unfunded pension liabilities. Consequently, we are carefully monitoring the state’s fiscal condition, and all investment candidates undergo extensive evaluation by our credit analysts.

Supply-and-Demand Factors May Remain Favorable

With short-term interest rates expected to remain low, we believe that credit conditions may be the dominant influence on market sentiment in 2010. With that said, we are cautiously optimistic regarding the prospects for municipal bonds, as technical factors remain favorable due to robust investor demand, limited new issuance and a recent shift in investors’ focus to higher-quality securities.We expect these influences to persist over the foreseeable future.

January 15, 2010

| 1 | Total return includes reinvestment of dividends and any capital gains paid and does not take into consideration the maximum initial sales charge in the case of Class A shares or the applicable contingent deferred sales charges imposed on redemptions in the case of Class B and Class C shares. Had these charges been reflected, returns would have been lower. Class Z and Class I shares are not subject to any initial or deferred sales charge. Each share class is subject to a different sales charge and distribution expense structure and will achieve different returns. Past performance is no guarantee of future results. Share price, yield and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. Income may be subject to state and local taxes for non-New Jersey residents, and some income may be subject to the federal alternative minimum tax (AMT) for certain investors. Cap ital gains, if any, are fully taxable. Return figures provided for Class A, B and C shares reflect the absorption of certain fund expenses pursuant to an agreement by The Dreyfus Corporation which may be terminated upon 90 days’ notice to shareholders, and for Class I shares, which reflect the absorption of certain fund expenses by The Dreyfus Corporation pursuant to an agreement that may be extended, modified or terminated. Had these expenses not been absorbed, the fund’s Class I returns, as well as the fund’s other returns would have been lower. |

| 2 | SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital gain distributions.The Barclays Capital Municipal Bond Index is a widely accepted, unmanaged total return performance benchmark for the long-term, investment-grade, tax-exempt bond market. |

| | Index returns do not reflect fees and expenses associated with operating a mutual fund. |

The Fund 5

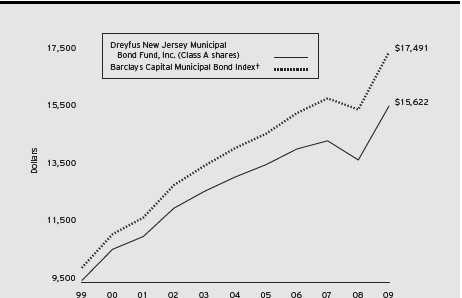

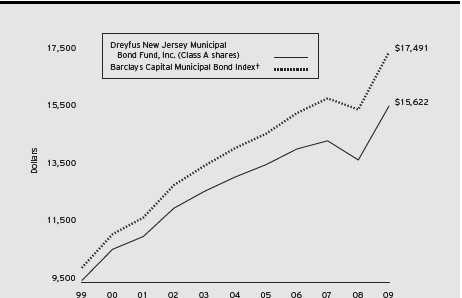

FUND PERFORMANCE

Years Ended 12/31

Comparison of change in value of $10,000 investment in Dreyfus New Jersey Municipal Bond Fund, Inc. Class A shares and the Barclays Capital Municipal Bond Index

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a $10,000 investment made in Class A shares of Dreyfus New Jersey Municipal Bond Fund, Inc. on 12/31/99 to a $10,000 investment made in the Barclays Capital Municipal Bond Index (the “Index”) on that date.All dividends and capital gain distributions are reinvested.

The fund invests primarily in New Jersey municipal securities and its performance shown in the line graph takes into account the maximum initial sales charge on Class A shares and all applicable fees and expenses. Performance for Class B, Class C, Class I and Class Z shares will vary from the performance of Class A shares shown above due to differences in charges and expenses.The Index is not limited to investments in New Jersey municipal obligations.The Index is an unmanaged total return performance benchmark for the long-term, investment-grade, geographically unrestricted tax-exempt bond market, calculated by using municipal bonds selected to be representative of the municipal market overall. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index.These factors can contribute to the Index potentially outperforming or underperforming the fund. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| | | | | |

| Average Annual Total Returns as of 12/31/09 | | | |

| |

| | Inception | | | | From |

| | Date | 1 Year | 5 Years | 10 Years | Inception |

| Class A shares | | | | | |

| with maximum sales charge (4.5%) | 11/6/87 | 8.53% | 2.56% | 4.56% | — |

| without sales charge | 11/6/87 | 13.65% | 3.50% | 5.04% | — |

| Class B shares | | | | | |

| with applicable redemption charge † | 1/7/03 | 8.98% | 2.62% | 4.87%†††,†††† | — |

| without redemption | 1/7/03 | 12.98% | 2.96% | 4.87%†††,†††† | — |

| Class C shares | | | | | |

| with applicable redemption charge †† | 1/7/03 | 11.71% | 2.71% | 4.47%††† | — |

| without redemption | 1/7/03 | 12.71% | 2.71% | 4.47%††† | — |

| Class I shares | 12/15/08 | 13.91% | 3.53%††† | 5.06%††† | — |

| Class Z shares | 6/7/07 | 13.72% | — | — | 4.05% |

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| |

| † | The maximum contingent deferred sales charge for Class B shares is 4%.After six years Class B shares convert to |

| | Class A shares. |

| †† | The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of |

| | the date of purchase. |

| ††† | The total return performance figures presented for Class B and C shares of the fund reflect the performance of the |

| | fund’s Class A shares for periods prior to 1/7/03 (the inception date for Class B and C shares), adjusted to reflect |

| | the applicable sales load for that class. |

| | The total return performance figures presented for Class I shares of the fund reflect the performance of the fund’s |

| | Class A shares for periods prior to 12/15/08 (the inception date for Class I shares). |

| †††† | Assumes the conversion of Class B shares to Class A shares at the end of the sixth year following the date |

| | of purchase. |

The Fund 7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus New Jersey Municipal Bond Fund, Inc. from July 1, 2009 to December 31, 2009. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended December 31, 2009

| | | | | |

| | Class A | Class B | Class C | Class I | Class Z |

| Expenses paid per $1,000† | $ 4.41 | $ 7.00 | $ 8.29 | $ 3.64 | $ 3.90 |

| Ending value (after expenses) | $1,060.10 | $1,056.50 | $1,055.30 | $1,061.60 | $1,060.60 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended December 31, 2009

| | | | | |

| | Class A | Class B | Class C | Class I | Class Z |

| Expenses paid per $1,000† | $ 4.33 | $ 6.87 | $ 8.13 | $ 3.57 | $ 3.82 |

| Ending value (after expenses) | $1,020.92 | $1,018.40 | $1,017.14 | $1,021.68 | $1,021.42 |

|

| † Expenses are equal to the fund’s annualized expense ratio of .85% for Class A, 1.35% for Class B, 1.60% for |

| Class C, .70% for Class I and .75% for Class Z, multiplied by the average account value over the period, |

| multiplied by 184/365 (to reflect the one-half year period). |

8

STATEMENT OF INVESTMENTS

December 31, 2009

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments—97.4% | Rate (%) | Date | Amount ($) | | Value ($) |

| New Jersey—89.3% | | | | | |

| Atlantic County Utilities | | | | | |

| Authority, Solid Waste | | | | | |

| System Revenue | 7.13 | 3/1/16 | 11,975,000 | | 11,973,204 |

| Bergen County Utilities Authority, | | | | | |

| Water Pollution Control | | | | | |

| Revenue (Insured; National | | | | | |

| Public Finance Guarantee Corp.) | 5.38 | 12/15/13 | 1,155,000 | | 1,238,044 |

| Bordentown Sewer Authority, | | | | | |

| Revenue (Insured; National | | | | | |

| Public Finance Guarantee Corp.) | 5.38 | 12/1/20 | 3,880,000 | | 4,002,298 |

| Burlington County Bridge | | | | | |

| Commission, EDR (The | | | | | |

| Evergreens Project) | 5.63 | 1/1/38 | 5,500,000 | | 4,659,655 |

| Camden, | | | | | |

| GO (Insured; Assured Guaranty | | | | | |

| Municipal Corp.) | 0.00 | 2/15/12 | 4,385,000 | a | 4,215,607 |

| Camden County Improvement | | | | | |

| Authority, Health Care | | | | | |

| Redevelopment Project Revenue | | | | | |

| (The Cooper Health System | | | | | |

| Obligated Group Issue) | 5.25 | 2/15/20 | 4,545,000 | | 4,321,931 |

| Camden County Improvement | | | | | |

| Authority, Health Care | | | | | |

| Redevelopment Project Revenue | | | | | |

| (The Cooper Health System | | | | | |

| Obligated Group Issue) | 5.25 | 2/15/20 | 2,000,000 | | 1,901,840 |

| Carteret Board of Education, | | | | | |

| COP (Insured; National Public | | | | | |

| Finance Guarantee Corp.) | | | | | |

| (Prerefunded) | 6.00 | 1/15/10 | 440,000 | b | 445,381 |

| East Orange, | | | | | |

| GO (Insured; Assured Guaranty | | | | | |

| Municipal Corp.) | 0.00 | 8/1/10 | 4,240,000 | a | 4,229,146 |

| East Orange, | | | | | |

| GO (Insured; Assured Guaranty | | | | | |

| Municipal Corp.) | 0.00 | 8/1/11 | 2,500,000 | a | 2,473,625 |

| East Orange Board of Education, | | | | | |

| COP, LR (Insured; Assured | | | | | |

| Guaranty Municipal Corp.) | 0.00 | 2/1/21 | 685,000 | a | 406,020 |

The Fund 9

STATEMENT OF INVESTMENTS (continued)

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| New Jersey (continued) | | | | | |

| East Orange Board of Education, | | | | | |

| COP, LR (Insured; Assured | | | | | |

| Guaranty Municipal Corp.) | 0.00 | 2/1/26 | 745,000 | a | 327,815 |

| East Orange Board of Education, | | | | | |

| COP, LR (Insured; Assured | | | | | |

| Guaranty Municipal Corp.) | 0.00 | 2/1/28 | 2,345,000 | a | 910,282 |

| Essex County Improvement | | | | | |

| Authority, LR (County | | | | | |

| Correctional Facility Project) | | | | | |

| (Insured; FGIC) (Prerefunded) | 6.00 | 10/1/10 | 10,000,000 | b | 10,423,900 |

| Freehold Regional High School | | | | | |

| District, School District | | | | | |

| Bonds (Guaranteed; School Bond | | | | | |

| Reserve Act and Insured; | | | | | |

| National Public Finance | | | | | |

| Guarantee Corp.) | 5.50 | 3/1/10 | 2,460,000 | | 2,481,550 |

| Gloucester County Improvement | | | | | |

| Authority, County Guaranteed | | | | | |

| Loan Revenue (County | | | | | |

| Capital Program) | 5.00 | 4/1/38 | 8,000,000 | | 8,362,320 |

| Gloucester Township Municipal | | | | | |

| Utilities Authority, Sewer | | | | | |

| Revenue (Insured; AMBAC) | 5.65 | 3/1/18 | 2,530,000 | | 2,876,585 |

| Higher Education Student | | | | | |

| Assistance Authority of New | | | | | |

| Jersey, Student Loan Revenue | | | | | |

| (Insured; National Public | | | | | |

| Finance Guarantee Corp.) | 6.13 | 6/1/17 | 280,000 | | 284,959 |

| Hudson County Improvement | | | | | |

| Authority, County-Guaranteed | | | | | |

| Parking Revenue (Harrison | | | | | |

| Parking Facility Redevelopment | | | | | |

| Project) (Insured; Assured | | | | | |

| Guaranty Municipal Corp.) | 5.25 | 1/1/39 | 5,000,000 | | 5,278,800 |

| Hudson County Improvement | | | | | |

| Authority, Harrison Stadium | | | | | |

| Land Acquisition Special | | | | | |

| Obligation Revenue (Harrison | | | | | |

| Redevelopment Project) | | | | | |

| (Insured; National Public | | | | | |

| Finance Guarantee Corp.) | 0.00 | 12/15/34 | 3,000,000 | a | 708,090 |

10

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| New Jersey (continued) | | | | | |

| Jersey City, | | | | | |

| GO (Insured; Assured Guaranty | | | | | |

| Municipal Corp.) | 0.00 | 5/15/10 | 4,745,000 | a | 4,730,670 |

| Mercer County Improvement | | | | | |

| Authority, County Secured Open | | | | | |

| Space Revenue (Insured; | | | | | |

| National Public Finance | | | | | |

| Guarantee Corp.) | 5.00 | 8/1/40 | 3,290,000 | | 3,380,771 |

| Middlesex County Improvement | | | | | |

| Authority, Utility System | | | | | |

| Revenue (Perth Amboy Project) | | | | | |

| (Insured; AMBAC) | 0.00 | 9/1/20 | 3,745,000 | a | 1,996,909 |

| Middlesex County Improvement | | | | | |

| Authority, Utility System | | | | | |

| Revenue (Perth Amboy Project) | | | | | |

| (Insured; AMBAC) | 0.00 | 9/1/22 | 4,740,000 | a | 2,204,195 |

| Middlesex County Utilities | | | | | |

| Authority, Sewer Revenue | | | | | |

| (Insured; National Public | | | | | |

| Finance Guarantee Corp.) | 6.25 | 8/15/10 | 335,000 | | 340,940 |

| New Jersey, | | | | | |

| GO (Insured; National Public | | | | | |

| Finance Guarantee Corp.) | 6.00 | 7/15/10 | 7,400,000 | | 7,626,736 |

| New Jersey Economic Development | | | | | |

| Authority, Cigarette Tax Revenue | 5.50 | 6/15/24 | 2,300,000 | | 2,250,619 |

| New Jersey Economic Development | | | | | |

| Authority, Cigarette Tax Revenue | 5.75 | 6/15/29 | 12,500,000 | | 12,074,125 |

| New Jersey Economic Development | | | | | |

| Authority, Department of | | | | | |

| Human Services Composite | | | | | |

| Revenue (Division of | | | | | |

| Developmental Disabilities) | 6.25 | 7/1/24 | 1,240,000 | | 1,273,170 |

| New Jersey Economic Development | | | | | |

| Authority, Department of Human | | | | | |

| Services Composite Revenue | | | | | |

| (Division of Mental Health Services) | 6.10 | 7/1/17 | 2,195,000 | | 2,260,762 |

| New Jersey Economic Development | | | | | |

| Authority, EDR (Masonic | | | | | |

| Charity Foundation of | | | | | |

| New Jersey Project) | 5.00 | 6/1/18 | 1,680,000 | | 1,725,612 |

The Fund 11

STATEMENT OF INVESTMENTS (continued)

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| New Jersey (continued) | | | | | |

| New Jersey Economic Development | | | | | |

| Authority, EDR (Masonic | | | | | |

| Charity Foundation of New | | | | | |

| Jersey Project) | 5.88 | 6/1/18 | 2,750,000 | | 2,853,235 |

| New Jersey Economic Development | | | | | |

| Authority, EDR (Masonic | | | | | |

| Charity Foundation of New | | | | | |

| Jersey Project) | 5.50 | 6/1/21 | 1,920,000 | | 1,963,622 |

| New Jersey Economic Development | | | | | |

| Authority, EDR (Masonic | | | | | |

| Charity Foundation of New | | | | | |

| Jersey Project) | 6.00 | 6/1/25 | 1,000,000 | | 1,029,740 |

| New Jersey Economic Development | | | | | |

| Authority, EDR (Masonic | | | | | |

| Charity Foundation of New | | | | | |

| Jersey Project) | 5.25 | 6/1/32 | 350,000 | | 333,165 |

| New Jersey Economic Development | | | | | |

| Authority, EDR (United | | | | | |

| Methodist Homes of New Jersey | | | | | |

| Obligated Group Issue) | 5.50 | 7/1/19 | 3,000,000 | | 2,712,780 |

| New Jersey Economic Development | | | | | |

| Authority, Gas Facilities Revenue | | | | | |

| (NUI Corporation Project) | 5.25 | 11/1/33 | 2,780,000 | | 2,448,791 |

| New Jersey Economic Development | | | | | |

| Authority, Motor Vehicle | | | | | |

| Surcharge Revenue (Insured; | | | | | |

| National Public Finance | | | | | |

| Guarantee Corp.) | 0.00 | 7/1/20 | 3,350,000 | a | 2,123,364 |

| New Jersey Economic Development | | | | | |

| Authority, Motor Vehicle | | | | | |

| Surcharge Revenue (Insured; | | | | | |

| National Public Finance | | | | | |

| Guarantee Corp.) | 0.00 | 7/1/21 | 2,620,000 | a | 1,565,240 |

| New Jersey Economic Development | | | | | |

| Authority, Retirement | | | | | |

| Community Revenue | | | | | |

| (Seabrook Village, Inc. Facility) | 5.25 | 11/15/26 | 1,700,000 | | 1,419,789 |

| New Jersey Economic Development | | | | | |

| Authority, Revenue (Department | | | | | |

| of Human Services Pooled | | | | | |

| Financing Program) | 5.75 | 7/1/14 | 1,080,000 | | 1,165,536 |

12

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| New Jersey (continued) | | | | | |

| New Jersey Economic Development | | | | | |

| Authority, Revenue (Hillcrest | | | | | |

| Health Service System Project) | | | | | |

| (Insured; AMBAC) | 0.00 | 1/1/12 | 1,000,000 | a | 937,370 |

| New Jersey Economic Development | | | | | |

| Authority, Revenue (Hillcrest | | | | | |

| Health Service System Project) | | | | | |

| (Insured; AMBAC) | 0.00 | 1/1/13 | 1,000,000 | a | 897,700 |

| New Jersey Economic Development | | | | | |

| Authority, Revenue (Hillcrest | | | | | |

| Health Service System Project) | | | | | |

| (Insured; AMBAC) | 0.00 | 1/1/15 | 3,250,000 | a | 2,610,595 |

| New Jersey Economic Development | | | | | |

| Authority, Revenue (Hillcrest | | | | | |

| Health Service System Project) | | | | | |

| (Insured; AMBAC) | 0.00 | 1/1/17 | 5,000,000 | a | 3,526,550 |

| New Jersey Economic Development | | | | | |

| Authority, Revenue (Hillcrest | | | | | |

| Health Service System Project) | | | | | |

| (Insured; AMBAC) | 0.00 | 1/1/18 | 2,500,000 | a | 1,655,400 |

| New Jersey Economic Development | | | | | |

| Authority, Revenue (Hillcrest | | | | | |

| Health Service System Project) | | | | | |

| (Insured; AMBAC) | 0.00 | 1/1/20 | 6,500,000 | a | 3,737,890 |

| New Jersey Economic Development | | | | | |

| Authority, Revenue (Hillcrest | | | | | |

| Health Service System Project) | | | | | |

| (Insured; AMBAC) | 0.00 | 1/1/22 | 6,000,000 | a | 3,021,240 |

| New Jersey Economic Development | | | | | |

| Authority, Revenue | | | | | |

| (Transportation Project) | | | | | |

| (Insured; Assured Guaranty | | | | | |

| Municipal Corp.) | 5.25 | 5/1/11 | 2,210,000 | | 2,335,616 |

| New Jersey Economic Development | | | | | |

| Authority, School Facilities | | | | | |

| Construction Revenue | | | | | |

| (Insured; AMBAC) | 5.50 | 9/1/24 | 10,000,000 | | 11,167,400 |

| New Jersey Economic Development | | | | | |

| Authority, School Facilities | | | | | |

| Construction Revenue (Insured; | | | | | |

| AMBAC) (Prerefunded) | 5.25 | 6/15/11 | 10,000,000 | b | 10,683,600 |

The Fund 13

STATEMENT OF INVESTMENTS (continued)

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| New Jersey (continued) | | | | |

| New Jersey Economic Development | | | | |

| Authority, School Facilities | | | | |

| Construction Revenue (Insured; | | | | |

| National Public Finance | | | | |

| Guarantee Corp.) | 5.50 | 9/1/27 | 10,000,000 | 11,235,300 |

| New Jersey Economic Development | | | | |

| Authority, Special Facility | | | | |

| Revenue (Continental | | | | |

| Airlines, Inc. Project) | 6.25 | 9/15/19 | 1,500,000 | 1,381,845 |

| New Jersey Economic Development | | | | |

| Authority, Water Facilities | | | | |

| Revenue (New Jersey—American | | | | |

| Water Company, Inc. Project) | 5.70 | 10/1/39 | 5,000,000 | 4,930,400 |

| New Jersey Educational Facilities | | | | |

| Authority, Revenue (Fairleigh | | | | |

| Dickenson University Issue) | 6.00 | 7/1/20 | 4,535,000 | 4,649,690 |

| New Jersey Educational Facilities | | | | |

| Authority, Revenue (Georgian | | | | |

| Court University Project) | 5.00 | 7/1/27 | 1,000,000 | 985,100 |

| New Jersey Educational Facilities | | | | |

| Authority, Revenue (Georgian | | | | |

| Court University Project) | 5.25 | 7/1/27 | 500,000 | 503,695 |

| New Jersey Educational Facilities | | | | |

| Authority, Revenue (Georgian | | | | |

| Court University Project) | 5.00 | 7/1/33 | 1,880,000 | 1,768,648 |

| New Jersey Educational Facilities | | | | |

| Authority, Revenue (Georgian | | | | |

| Court University Project) | 5.25 | 7/1/37 | 750,000 | 715,410 |

| New Jersey Educational Facilities | | | | |

| Authority, Revenue (Montclair | | | | |

| State University Issue) | 5.25 | 7/1/38 | 2,000,000 | 2,041,220 |

| New Jersey Educational Facilities | | | | |

| Authority, Revenue (New Jersey | | | | |

| City University Issue) | | | | |

| (Insured; Assured Guaranty | | | | |

| Municipal Corp.) | 5.00 | 7/1/35 | 12,165,000 | 12,257,211 |

| New Jersey Educational Facilities | | | | |

| Authority, Revenue (Princeton | | | | |

| University) (Prerefunded) | 5.00 | 7/1/15 | 120,000 b | 140,125 |

14

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| New Jersey (continued) | | | | |

| New Jersey Educational Facilities | | | | |

| Authority, Revenue (Public | | | | |

| Library Project Grant Program | | | | |

| Issue) (Insured; AMBAC) | 5.50 | 9/1/17 | 1,500,000 | 1,655,115 |

| New Jersey Educational Facilities | | | | |

| Authority, Revenue (Rowan | | | | |

| University Issue) (Insured; | | | | |

| FGIC) (Prerefunded) | 5.75 | 7/1/10 | 15,405,000 b | 15,826,173 |

| New Jersey Educational Facilities | | | | |

| Authority, Revenue (Seton Hall | | | | |

| University Issue) | 6.25 | 7/1/37 | 5,000,000 | 5,568,100 |

| New Jersey Educational Facilities | | | | |

| Authority, Revenue (Stevens | | | | |

| Institute of Technology Issue) | 5.00 | 7/1/27 | 5,000,000 | 5,143,200 |

| New Jersey Educational Facilities | | | | |

| Authority, Revenue (Stevens | | | | |

| Institute of Technology Issue) | 5.00 | 7/1/34 | 7,655,000 | 7,601,568 |

| New Jersey Educational Facilities | | | | |

| Authority, Revenue (Stevens | | | | |

| Institute of Technology Issue) | | | | |

| (Prerefunded) | 5.38 | 7/1/14 | 2,500,000 b | 2,927,750 |

| New Jersey Educational Facilities | | | | |

| Authority, Revenue (The | | | | |

| College of New Jersey Issue) | | | | |

| (Insured; Assured Guaranty | | | | |

| Municipal Corp.) | 5.00 | 7/1/35 | 7,910,000 | 8,164,227 |

| New Jersey Educational Facilities | | | | |

| Authority, Revenue (The | | | | |

| William Paterson University | | | | |

| of New Jersey Issue) | | | | |

| (Insured; Assured | | | | |

| Guaranty Municipal Corp.) | 5.00 | 7/1/38 | 3,745,000 | 3,852,070 |

| New Jersey Environmental | | | | |

| Infrastructure Trust, | | | | |

| Environmental Infrastructure | | | | |

| Bonds (Prerefunded) | 5.25 | 9/1/10 | 4,070,000 b | 4,246,231 |

| New Jersey Health Care Facilities | | | | |

| Financing Authority, Revenue | | | | |

| (AHS Hospital Corporation Issue) | 5.00 | 7/1/27 | 5,400,000 | 5,448,384 |

The Fund 15

STATEMENT OF INVESTMENTS (continued)

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| New Jersey (continued) | | | | |

| New Jersey Health Care Facilities | | | | |

| Financing Authority, Revenue | | | | |

| (Atlantic City Medical Center Issue) | 6.00 | 7/1/12 | 4,740,000 | 4,948,750 |

| New Jersey Health Care Facilities | | | | |

| Financing Authority, Revenue | | | | |

| (Atlantic City Medical Center Issue) | 6.25 | 7/1/17 | 2,730,000 | 2,880,095 |

| New Jersey Health Care Facilities | | | | |

| Financing Authority, Revenue | | | | |

| (Atlantic City Medical Center | | | | |

| Issue) (Prerefunded) | 6.25 | 7/1/12 | 2,270,000 b | 2,548,801 |

| New Jersey Health Care Facilities | | | | |

| Financing Authority, Revenue | | | | |

| (AtlantiCare Regional Medical | | | | |

| Center Issue) | 5.00 | 7/1/22 | 3,975,000 | 4,115,675 |

| New Jersey Health Care Facilities | | | | |

| Financing Authority, Revenue | | | | |

| (Capital Health System | | | | |

| Obligated Group Issue) | | | | |

| (Prerefunded) | 5.75 | 7/1/13 | 3,000,000 b | 3,406,230 |

| New Jersey Health Care Facilities | | | | |

| Financing Authority, Revenue | | | | |

| (General Hospital Center at | | | | |

| Passaic, Inc. Obligated Group | | | | |

| Issue) (Insured; Assured | | | | |

| Guaranty Municipal Corp.) | 6.75 | 7/1/19 | 550,000 | 688,908 |

| New Jersey Health Care Facilities | | | | |

| Financing Authority, Revenue | | | | |

| (Hackensack University Medical | | | | |

| Center Issue) (Insured; Assured | | | | |

| Guaranty Municipal Corp.) | 5.25 | 1/1/36 | 2,900,000 | 2,962,669 |

| New Jersey Health Care Facilities | | | | |

| Financing Authority, Revenue | | | | |

| (Kimball Medical Center Issue) | | | | |

| (Insured; AMBAC) | 7.00 | 7/1/20 | 5,755,000 | 5,763,172 |

| New Jersey Health Care Facilities | | | | |

| Financing Authority, Revenue | | | | |

| (Meridian Health System Obligated | | | | |

| Group Issue) (Insured; Assured | | | | |

| Guaranty Municipal Corp.) | 5.00 | 7/1/38 | 5,000,000 | 5,010,300 |

16

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| New Jersey (continued) | | | | | |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, Revenue | | | | | |

| (Robert Wood Johnson | | | | | |

| University Hospital Issue) | 5.38 | 7/1/13 | 2,000,000 | | 2,024,300 |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, Revenue | | | | | |

| (Saint Barnabas Health Care | | | | | |

| System Issue) (Insured; | | | | | |

| National Public Finance | | | | | |

| Guarantee Corp.) | 0.00 | 7/1/23 | 2,280,000 | a | 1,326,071 |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, Revenue | | | | | |

| (Saint Barnabas Health Care | | | | | |

| System Issue) (Insured; | | | | | |

| National Public Finance | | | | | |

| Guarantee Corp.) | 0.00 | 7/1/23 | 3,220,000 | a | 1,212,072 |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, Revenue | | | | | |

| (South Jersey Hospital Issue) | 6.00 | 7/1/12 | 1,950,000 | | 2,019,323 |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, Revenue | | | | | |

| (Trinitas Hospital Obligated | | | | | |

| Group) (Prerefunded) | 7.38 | 7/1/10 | 4,000,000 | b | 4,164,680 |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, Revenue | | | | | |

| (Virtua Health Issue) | | | | | |

| (Insured; Assured Guaranty | | | | | |

| Municipal Corp.) | 5.50 | 7/1/38 | 5,000,000 | | 5,198,750 |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, State | | | | | |

| Contract Revenue (Hospital | | | | | |

| Asset Transformation Program) | 5.25 | 10/1/38 | 13,595,000 | | 13,900,072 |

| New Jersey Higher Education | | | | | |

| Student Assistance Authority, | | | | | |

| Student Loan Revenue | | | | | |

| (Insured; Assured Guaranty | | | | | |

| Municipal Corp.) | 5.88 | 6/1/21 | 12,000,000 | | 13,068,600 |

| New Jersey Highway Authority, | | | | | |

| Revenue (Garden State Parkway) | 6.00 | 1/1/19 | 6,645,000 | | 8,113,877 |

The Fund 17

STATEMENT OF INVESTMENTS (continued)

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| New Jersey (continued) | | | | |

| New Jersey Housing and Mortgage | | | | |

| Finance Agency, MFHR (Insured: | | | | |

| AMBAC and FHA) | 5.65 | 5/1/40 | 4,480,000 | 4,480,314 |

| New Jersey Housing and Mortgage | | | | |

| Finance Agency, MFHR (Insured; | | | | |

| Assured Guaranty Municipal Corp.) | 5.70 | 5/1/20 | 2,320,000 | 2,337,748 |

| New Jersey Housing and Mortgage | | | | |

| Finance Agency, Multi-Family | | | | |

| Revenue | 4.95 | 5/1/41 | 7,000,000 | 6,774,460 |

| New Jersey Housing and Mortgage | | | | |

| Finance Agency, SFHR | 5.20 | 10/1/25 | 7,500,000 | 7,526,700 |

| New Jersey Housing and Mortgage | | | | |

| Finance Agency, SFHR | 6.38 | 10/1/28 | 5,935,000 | 6,558,887 |

| New Jersey Housing and Mortgage | | | | |

| Finance Agency, SFHR | 5.25 | 10/1/37 | 1,945,000 | 1,978,123 |

| New Jersey Transportation | | | | |

| Trust Fund Authority | | | | |

| (Transportation System) | 5.00 | 6/15/20 | 4,000,000 | 4,226,960 |

| New Jersey Transportation | | | | |

| Trust Fund Authority | | | | |

| (Transportation System) | 5.50 | 12/15/23 | 7,000,000 | 8,001,350 |

| New Jersey Transportation | | | | |

| Trust Fund Authority | | | | |

| (Transportation System) | 6.00 | 12/15/38 | 10,000,000 | 11,002,500 |

| New Jersey Transportation Trust | | | | |

| Fund Authority (Transportation | | | | |

| System) (Insured; AMBAC) | 0.00 | 12/15/24 | 1,000,000 a | 450,400 |

| New Jersey Transportation Trust | | | | |

| Fund Authority (Transportation | | | | |

| System) (Insured; AMBAC) | 5.00 | 12/15/32 | 10,000,000 | 10,243,700 |

| New Jersey Transportation Trust | | | | |

| Fund Authority (Transportation | | | | |

| System) (Insured; AMBAC) | 5.00 | 12/15/34 | 5,150,000 | 5,237,756 |

| New Jersey Transportation Trust | | | | |

| Fund Authority (Transportation | | | | |

| System) (Insured; National | | | | |

| Public Finance Guarantee Corp.) | 7.00 | 6/15/12 | 2,255,000 | 2,594,693 |

| New Jersey Transportation Trust | | | | |

| Fund Authority (Transportation | | | | |

| System) (Insured; National | | | | |

| Public Finance Guarantee Corp.) | 7.00 | 6/15/12 | 3,745,000 | 4,229,903 |

18

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| New Jersey (continued) | | | | |

| New Jersey Transportation Trust | | | | |

| Fund Authority (Transportation | | | | |

| System) (Insured; National | | | | |

| Public Finance Guarantee | | | | |

| Corp.) (Prerefunded) | 6.00 | 12/15/11 | 5,000,000 b | 5,524,100 |

| New Jersey Turnpike Authority, | | | | |

| Turnpike Revenue | 6.50 | 1/1/16 | 60,000 | 71,200 |

| New Jersey Turnpike Authority, | | | | |

| Turnpike Revenue | 6.50 | 1/1/16 | 160,000 | 187,208 |

| New Jersey Turnpike Authority, | | | | |

| Turnpike Revenue | 5.00 | 1/1/36 | 3,500,000 | 3,566,045 |

| New Jersey Turnpike Authority, | | | | |

| Turnpike Revenue | 5.25 | 1/1/40 | 9,170,000 | 9,550,372 |

| New Jersey Turnpike Authority, | | | | |

| Turnpike Revenue (Insured; | | | | |

| Assured Guaranty | | | | |

| Municipal Corp.) | 6.50 | 1/1/16 | 835,000 | 972,307 |

| New Jersey Turnpike Authority, | | | | |

| Turnpike Revenue (Insured; | | | | |

| Assured Guaranty | | | | |

| Municipal Corp.) | 6.50 | 1/1/16 | 165,000 | 201,356 |

| New Jersey Turnpike Authority, | | | | |

| Turnpike Revenue (Insured; | | | | |

| National Public Finance | | | | |

| Guarantee Corp.) | 5.75 | 1/1/10 | 2,315,000 | 2,315,000 |

| New Jersey Turnpike Authority, | | | | |

| Turnpike Revenue (Insured; | | | | |

| National Public Finance | | | | |

| Guarantee Corp.) | 5.75 | 1/1/10 | 685,000 | 685,000 |

| New Jersey Turnpike Authority, | | | | |

| Turnpike Revenue (Insured; | | | | |

| National Public Finance | | | | |

| Guarantee Corp.) | 6.50 | 1/1/16 | 3,520,000 | 4,177,043 |

| North Jersey District Water Supply | | | | |

| Commission, Sewer Revenue | | | | |

| (Wanaque South Project) | | | | |

| (Insured; National Public | | | | |

| Finance Guarantee Corp.) | 6.00 | 7/1/19 | 2,000,000 | 2,369,880 |

| Port Authority of New York and | | | | |

| New Jersey (Consolidated | | | | |

| Bonds, 93rd Series) | 6.13 | 6/1/94 | 3,000,000 | 3,523,350 |

The Fund 19

STATEMENT OF INVESTMENTS (continued)

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| New Jersey (continued) | | | | |

| Port Authority of New York and New | | | | |

| Jersey (Consolidated Bonds, | | | | |

| 127th Series) (Insured; AMBAC) | 5.25 | 12/15/32 | 5,070,000 | 5,125,973 |

| Port Authority of New York and New | | | | |

| Jersey, Special Obligation | | | | |

| Revenue (JFK International Air | | | | |

| Terminal LLC Project) | | | | |

| (Insured; National Public | | | | |

| Finance Guarantee Corp.) | 6.25 | 12/1/15 | 5,000,000 | 5,266,800 |

| Rahway Valley Sewerage Authority, | | | | |

| Sewer Revenue (Insured; | | | | |

| National Public Finance | | | | |

| Guarantee Corp.) | 0.00 | 9/1/30 | 7,550,000 a | 2,368,888 |

| Salem County Improvement | | | | |

| Authority, City-Guaranteed | | | | |

| Revenue (Finlaw State Office | | | | |

| Building Project) (Insured; | | | | |

| Assured Guaranty | | | | |

| Municipal Corp.) | 5.25 | 8/15/38 | 3,640,000 | 3,821,490 |

| Salem County Pollution Control | | | | |

| Financing Authority, PCR | | | | |

| (Public Service Electric and | | | | |

| Gas Company Project) (Insured; | | | | |

| National Public Finance | | | | |

| Guarantee Corp.) | 5.45 | 2/1/32 | 1,590,000 | 1,519,213 |

| South Jersey Port Corporation, | | | | |

| Marine Terminal Revenue | | | | |

| (Insured; Assured Guaranty | | | | |

| Municipal Corp.) | 5.75 | 1/1/34 | 2,900,000 | 3,116,978 |

| South Jersey Port Corporation, | | | | |

| Marine Terminal Revenue | | | | |

| (Insured; Assured Guaranty | | | | |

| Municipal Corp.) | 5.88 | 1/1/39 | 6,000,000 | 6,457,800 |

| Tobacco Settlement Financing | | | | |

| Corporation of New Jersey, | | | | |

| Tobacco Settlement | | | | |

| Asset-Backed Bonds | 4.63 | 6/1/26 | 3,000,000 | 2,490,330 |

20

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| New Jersey (continued) | | | | |

| Tobacco Settlement Financing | | | | |

| Corporation of New Jersey, | | | | |

| Tobacco Settlement | | | | |

| Asset-Backed Bonds | 5.00 | 6/1/29 | 5,950,000 | 4,617,855 |

| Tobacco Settlement Financing | | | | |

| Corporation of New Jersey, | | | | |

| Tobacco Settlement | | | | |

| Asset-Backed Bonds | 5.75 | 6/1/32 | 5,560,000 | 6,039,216 |

| Tobacco Settlement Financing | | | | |

| Corporation of New Jersey, | | | | |

| Tobacco Settlement | | | | |

| Asset-Backed Bonds | 4.75 | 6/1/34 | 11,115,000 | 7,761,382 |

| Tobacco Settlement Financing | | | | |

| Corporation of New Jersey, | | | | |

| Tobacco Settlement Asset-Backed | | | | |

| Bonds (Prerefunded) | 5.38 | 6/1/12 | 2,500,000 b | 2,767,350 |

| Tobacco Settlement Financing | | | | |

| Corporation of New Jersey, | | | | |

| Tobacco Settlement | | | | |

| Asset-Backed Bonds | | | | |

| (Prerefunded) | 6.75 | 6/1/13 | 1,790,000 b | 2,122,564 |

| Tobacco Settlement Financing | | | | |

| Corporation of New Jersey, | | | | |

| Tobacco Settlement | | | | |

| Asset-Backed Bonds | | | | |

| (Prerefunded) | 7.00 | 6/1/13 | 10,630,000 b | 12,689,669 |

| Union County Improvement | | | | |

| Authority, Revenue | | | | |

| (Correctional Facility Project) | 5.00 | 6/15/22 | 1,780,000 | 1,891,855 |

| Union County Utilities Authority, | | | | |

| Solid Waste Revenue (Ogden | | | | |

| Martin Systems of Union, Inc.) | | | | |

| (Insured; AMBAC) | 5.38 | 6/1/20 | 4,990,000 | 4,993,743 |

| University of Medicine and | | | | |

| Dentistry of New Jersey, GO | | | | |

| (Insured; AMBAC) | 5.50 | 12/1/27 | 15,425,000 | 15,498,269 |

The Fund 21

STATEMENT OF INVESTMENTS (continued)

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| U.S. Related—8.1% | | | | | |

| Government of Guam, | | | | | |

| GO | 6.75 | 11/15/29 | 2,000,000 | | 2,057,820 |

| Guam Waterworks Authority, | | | | | |

| Water and Wastewater | | | | | |

| System Revenue | 6.00 | 7/1/25 | 1,000,000 | | 1,003,240 |

| Puerto Rico Commonwealth, | | | | | |

| Public Improvement GO | 6.00 | 7/1/39 | 2,000,000 | | 2,008,620 |

| Puerto Rico Electric Power | | | | | |

| Authority, Power Revenue | 5.50 | 7/1/38 | 10,445,000 | | 10,508,401 |

| Puerto Rico Electric Power | | | | | |

| Authority, Power Revenue | | | | | |

| (Insured; National Public | | | | | |

| Finance Guarantee Corp.) | 5.25 | 7/1/30 | 5,000,000 | | 5,075,550 |

| Puerto Rico Infrastructure | | | | | |

| Financing Authority, Special | | | | | |

| Tax Revenue (Insured; AMBAC) | 5.50 | 7/1/27 | 4,715,000 | | 4,626,782 |

| Puerto Rico Sales Tax Financing | | | | | |

| Corporation, Sales Tax Revenue | | | | | |

| (First Subordinate Series) | 5.75 | 8/1/37 | 2,990,000 | | 3,101,318 |

| Puerto Rico Sales Tax Financing | | | | | |

| Corporation, Sales Tax Revenue | | | | | |

| (First Subordinate Series) | 6.00 | 8/1/42 | 9,000,000 | | 9,351,630 |

| Puerto Rico Sales Tax Financing | | | | | |

| Corporation, Sales Tax Revenue | | | | | |

| (Insured; Berkshire Hathaway | | | | | |

| Assurance Corporation) | 0.00 | 8/1/54 | 36,600,000 | a | 2,687,538 |

| Puerto Rico Sales Tax Financing | | | | | |

| Corporation, Sales Tax Revenue | | | | | |

| (Insured; National Public | | | | | |

| Finance Guarantee Corp.) | 0.00 | 8/1/43 | 18,000,000 | a | 2,318,940 |

22

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| U.S. Related (continued) | | | | |

| Virgin Islands Public Finance | | | | |

| Authority, Revenue (Virgin | | | | |

| Islands Gross Receipts Taxes | | | | |

| Loan Note) | 6.38 | 10/1/19 | 2,000,000 | 2,039,300 |

| Virgin Islands Public Finance | | | | |

| Authority, Revenue (Virgin | | | | |

| Islands Gross Receipts Taxes | | | | |

| Loan Note) (Prerefunded) | 6.50 | 10/1/10 | 3,000,000 b | 3,169,740 |

| Virgin Islands Public Finance | | | | |

| Authority, Revenue (Virgin Islands | | | | |

| Matching Fund Loan Notes) | 5.00 | 10/1/25 | 2,000,000 | 1,967,740 |

| |

| Total Investments (cost $577,184,574) | | | 97.4% | 601,220,340 |

| |

| Cash and Receivables (Net) | | | 2.6% | 16,302,094 |

| |

| Net Assets | | | 100.0% | 617,522,434 |

|

| a Security issued with a zero coupon. Income is recognized through the accretion of discount. |

| b These securities are prerefunded; the date shown represents the prerefunded date. Bonds which are prerefunded are |

| collateralized by U.S. Government securities which are held in escrow and are used to pay principal and interest on |

| the municipal issue and to retire the bonds in full at the earliest refunding date. |

The Fund 23

STATEMENT OF INVESTMENTS (continued)

| | | |

| Summary of Abbreviations | | |

| |

| ABAG | Association of Bay Area Governments | ACA | American Capital Access |

| AGC | ACE Guaranty Corporation | AGIC | Asset Guaranty Insurance Company |

| AMBAC | American Municipal Bond | ARRN | Adjustable Rate Receipt Notes |

| | Assurance Corporation | | |

| BAN | Bond Anticipation Notes | BPA | Bond Purchase Agreement |

| CIFG | CDC Ixis Financial Guaranty | COP | Certificate of Participation |

| CP | Commercial Paper | EDR | Economic Development Revenue |

| EIR | Environmental Improvement Revenue | FGIC | Financial Guaranty Insurance |

| | | | Company |

| FHA | Federal Housing Administration | FHLB | Federal Home Loan Bank |

| FHLMC | Federal Home Loan Mortgage | FNMA | Federal National |

| | Corporation | | Mortgage Association |

| GAN | Grant Anticipation Notes | GIC | Guaranteed Investment Contract |

| GNMA | Government National | GO | General Obligation |

| | Mortgage Association | | |

| HR | Hospital Revenue | IDB | Industrial Development Board |

| IDC | Industrial Development Corporation | IDR | Industrial Development Revenue |

| LOC | Letter of Credit | LOR | Limited Obligation Revenue |

| LR | Lease Revenue | MFHR | Multi-Family Housing Revenue |

| MFMR | Multi-Family Mortgage Revenue | PCR | Pollution Control Revenue |

| PILOT | Payment in Lieu of Taxes | RAC | Revenue Anticipation Certificates |

| RAN | Revenue Anticipation Notes | RAW | Revenue Anticipation Warrants |

| RRR | Resources Recovery Revenue | SAAN | State Aid Anticipation Notes |

| SBPA | Standby Bond Purchase Agreement | SFHR | Single Family Housing Revenue |

| SFMR | Single Family Mortgage Revenue | SONYMA State of New York Mortgage Agency |

| SWDR | Solid Waste Disposal Revenue | TAN | Tax Anticipation Notes |

| TAW | Tax Anticipation Warrants | TRAN | Tax and Revenue Anticipation Notes |

| XLCA | XL Capital Assurance | | |

24

| | | | | |

| Summary of Combined Ratings (Unaudited) | |

| |

| Fitch | or | Moody’s | or | Standard & Poor’s | Value (%)† |

| AAA | | Aaa | | AAA | 39.8 |

| AA | | Aa | | AA | 15.7 |

| A | | A | | A | 25.9 |

| BBB | | Baa | | BBB | 14.9 |

| BB | | Ba | | BB | .6 |

| B | | B | | B | .6 |

| Not Ratedc | | Not Ratedc | | Not Ratedc | 2.5 |

| | | | | | 100.0 |

|

| † Based on total investments. |

| c Securities which, while not rated by Fitch, Moody’s and Standard & Poor’s, have been determined by the Manager to |

| be of comparable quality to those rated securities in which the fund may invest. |

See notes to financial statements.

The Fund 25

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2009

| | |

| | Cost | Value |

| Assets ($): | | |

| Investments in securities—See Statement of Investments | 577,184,574 | 601,220,340 |

| Cash | | 8,329,494 |

| Interest receivable | | 8,857,459 |

| Receivable for shares of Common Stock subscribed | | 48,152 |

| Prepaid expenses | | 38,408 |

| | | 618,493,853 |

| Liabilities ($): | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(c) | | 445,392 |

| Payable for shares of Common Stock redeemed | | 448,630 |

| Accrued expenses | | 77,397 |

| | | 971,419 |

| Net Assets ($) | | 617,522,434 |

| Composition of Net Assets ($): | | |

| Paid-in capital | | 602,650,127 |

| Accumulated net realized gain (loss) on investments | | (9,163,459) |

| Accumulated net unrealized appreciation | | |

| (depreciation) on investments | | 24,035,766 |

| Net Assets ($) | | 617,522,434 |

| | | | | |

| Net Asset Value Per Share | | | | |

| | Class A | Class B | Class C | Class I | Class Z |

| Net Assets ($) | 458,013,623 | 774,474 | 9,008,350 | 958,324 | 148,767,663 |

| Shares Outstanding | 36,074,613 | 61,067 | 710,180 | 75,482 | 11,715,186 |

| Net Asset Value | | | | | |

| Per Share ($) | 12.70 | 12.68 | 12.68 | 12.70 | 12.70 |

See notes to financial statements.

26

STATEMENT OF OPERATIONS

Year Ended December 31, 2009

| |

| Investment Income ($): | |

| Interest Income | 31,428,340 |

| Expenses: | |

| Management fee—Note 3(a) | 3,591,193 |

| Shareholder servicing costs—Note 3(c) | 1,517,322 |

| Professional fees | 94,039 |

| Registration fees | 69,407 |

| Custodian fees—Note 3(c) | 62,608 |

| Distribution fees—Note 3(b) | 60,565 |

| Directors’ fees and expenses—Note 3(d) | 58,484 |

| Prospectus and shareholders’ reports | 23,679 |

| Loan commitment fees—Note 2 | 11,772 |

| Interest expense—Note 2 | 59 |

| Miscellaneous | 48,424 |

| Total Expenses | 5,537,552 |

| Less—reduction in management fee due to undertaking—Note 3(a) | (459,863) |

| Less—reduction in fees due to earnings credits—Note 1(b) | (18,280) |

| Net Expenses | 5,059,409 |

| Investment Income—Net | 26,368,931 |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | |

| Net realized gain (loss) on investments | (3,654,561) |

| Net unrealized appreciation (depreciation) on investments | 52,400,640 |

| Net Realized and Unrealized Gain (Loss) on Investments | 48,746,079 |

| Net Increase in Net Assets Resulting from Operations | 75,115,010 |

| |

| See notes to financial statements. | |

The Fund 27

STATEMENT OF CHANGES IN NET ASSETS

| | |

| | Year Ended December 31, |

| | 2009 | 2008 |

| Operations ($): | | |

| Investment income—net | 26,368,931 | 26,260,924 |

| Net realized gain (loss) on investments | (3,654,561) | (4,248,360) |

| Net unrealized appreciation | | |

| (depreciation) on investments | 52,400,640 | (49,527,054) |

| Net Increase (Decrease) in Net Assets | | |

| Resulting from Operations | 75,115,010 | (27,514,490) |

| Dividends to Shareholders from ($): | | |

| Investment income—net: | | |

| Class A Shares | (19,195,733) | (19,021,061) |

| Class B Shares | (45,515) | (60,398) |

| Class C Shares | (259,406) | (147,847) |

| Class I Shares | (6,802) | (24) |

| Class Z Shares | (6,546,993) | (6,876,960) |

| Total Dividends | (26,054,449) | (26,106,290) |

| Capital Stock Transactions ($): | | |

| Net proceeds from shares sold: | | |

| Class A Shares | 45,433,393 | 41,543,250 |

| Class B Shares | 6,740 | 86,093 |

| Class C Shares | 4,329,785 | 2,136,106 |

| Class I Shares | 1,018,529 | 10,000 |

| Class Z Shares | 9,625,210 | 7,835,647 |

| Dividends reinvested: | | |

| Class A Shares | 14,259,894 | 14,093,812 |

| Class B Shares | 33,691 | 40,424 |

| Class C Shares | 135,405 | 68,673 |

| Class Z Shares | 5,316,818 | 5,599,524 |

| Cost of shares redeemed: | | |

| Class A Shares | (41,159,750) | (52,791,117) |

| Class B Shares | (830,961) | (166,345) |

| Class C Shares | (680,349) | (861,204) |

| Class I Shares | (71,858) | — |

| Class Z Shares | (19,403,642) | (22,515,718) |

| Increase (Decrease) in Net Assets | | |

| from Capital Stock Transactions | 18,012,905 | (4,920,855) |

| Total Increase (Decrease) in Net Assets | 67,073,466 | (58,541,635) |

| Net Assets ($): | | |

| Beginning of Period | 550,448,968 | 608,990,603 |

| End of Period | 617,522,434 | 550,448,968 |

28

| | |

| | Year Ended December 31, |

| | 2009 | 2008 |

| Capital Share Transactions: | | |

| Class Aa | | |

| Shares sold | 3,667,406 | 3,341,634 |

| Shares issued for dividends reinvested | 1,145,748 | 1,144,566 |

| Shares redeemed | (3,303,598) | (4,296,280) |

| Net Increase (Decrease) in Shares Outstanding | 1,509,556 | 189,920 |

| Class Ba | | |

| Shares sold | 549 | 6,973 |

| Shares issued for dividends reinvested | 2,716 | 3,287 |

| Shares redeemed | (65,797) | (13,478) |

| Net Increase (Decrease) in Shares Outstanding | (62,532) | (3,218) |

| Class C | | |

| Shares sold | 349,293 | 177,134 |

| Shares issued for dividends reinvested | 10,837 | 5,594 |

| Shares redeemed | (54,361) | (71,610) |

| Net Increase (Decrease) in Shares Outstanding | 305,769 | 111,118 |

| Class I | | |

| Shares sold | 80,262 | 887 |

| Shares redeemed | (5,667) | — |

| Net Increase (Decrease) in Shares Outstanding | 74,595 | 887 |

| Class Z | | |

| Shares sold | 769,666 | 630,396 |

| Shares issued for dividends reinvested | 427,277 | 454,531 |

| Shares redeemed | (1,559,126) | (1,815,061) |

| Net Increase (Decrease) in Shares Outstanding | (362,183) | (730,134) |

|

| a During the period ended December 31, 2009, 36,812 Class B shares representing $472,567 were automatically |

| converted to 36,779 Class A shares and during the period ended December 31, 2008, 4,671 Class B shares |

| representing $58,505, were automatically converted to 4,667 Class A shares. |

See notes to financial statements.

The Fund 29

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | | | |

| | | Year Ended December 31, | |

| Class A Shares | 2009 | 2008 | 2007 | 2006 | 2005 |

| Per Share Data ($): | | | | | |

| Net asset value, beginning of period | 11.67 | 12.79 | 13.07 | 13.12 | 13.26 |

| Investment Operations: | | | | | |

| Investment income—neta | .55 | .55 | .54 | .56 | .56 |

| Net realized and unrealized | | | | | |

| gain (loss) on investments | 1.02 | (1.12) | (.28) | (.05) | (.14) |

| Total from Investment Operations | 1.57 | (.57) | .26 | .51 | .42 |

| Distributions: | | | | | |

| Dividends from investment income—net | (.54) | (.55) | (.54) | (.56) | (.56) |

| Net asset value, end of period | 12.70 | 11.67 | 12.79 | 13.07 | 13.12 |

| Total Return (%)b | 13.65 | (4.61) | 2.05 | 4.00 | 3.22 |

| Ratios/Supplemental Data (%): | | | | | |

| Ratio of total expenses | | | | | |

| to average net assets | .96 | 1.00 | 1.10 | 1.18 | 1.12 |

| Ratio of net expenses | | | | | |

| to average net assets | .85 | .90 | 1.00 | 1.06 | 1.01 |

| Ratio of interest and expense related | | | | | |

| to floating rate notes issued | | | | | |

| to average net assets | — | .05 | .13 | .22 | .16 |

| Ratio of net investment income | | | | | |

| to average net assets | 4.40 | 4.45 | 4.21 | 4.32 | 4.25 |

| Portfolio Turnover Rate | 17.17 | 50.33 | 36.63 | 17.13 | 11.22 |

| Net Assets, end of period ($ x 1,000) | 458,014 | 403,333 | 439,752 | 465,695 | 475,203 |

| |

| a | Based on average shares outstanding at each month end. |

| b | Exclusive of sales charge. |

See notes to financial statements.

30

| | | | | |

| | | Year Ended December 31, | |

| Class B Shares | 2009 | 2008 | 2007 | 2006 | 2005 |

| Per Share Data ($): | | | | | |

| Net asset value, beginning of period | 11.66 | 12.78 | 13.06 | 13.10 | 13.25 |

| Investment Operations: | | | | | |

| Investment income—neta | .48 | .49 | .47 | .50 | .50 |

| Net realized and unrealized | | | | | |

| gain (loss) on investments | 1.02 | (1.12) | (.27) | (.04) | (.16) |

| Total from Investment Operations | 1.50 | (.63) | .20 | .46 | .34 |

| Distributions: | | | | | |

| Dividends from investment income—net | (.48) | (.49) | (.48) | (.50) | (.49) |

| Net asset value, end of period | 12.68 | 11.66 | 12.78 | 13.06 | 13.10 |

| Total Return (%)b | 12.98 | (5.09) | 1.53 | 3.56 | 2.63 |

| Ratios/Supplemental Data (%): | | | | | |

| Ratio of total expenses | | | | | |

| to average net assets | 1.53 | 1.57 | 1.67 | 1.74 | 1.67 |

| Ratio of net expenses | | | | | |

| to average net assets | 1.35 | 1.40 | 1.50 | 1.56 | 1.51 |

| Ratio of interest and expense related | | | | | |

| to floating rate notes issued | | | | | |

| to average net assets | — | .05 | .13 | .22 | .16 |

| Ratio of net investment income | | | | | |

| to average net assets | 3.90 | 3.95 | 3.71 | 3.82 | 3.74 |

| Portfolio Turnover Rate | 17.17 | 50.33 | 36.63 | 17.13 | 11.22 |

| Net Assets, end of period ($ x 1,000) | 774 | 1,441 | 1,621 | 2,129 | 2,025 |

| |

| a | Based on average shares outstanding at each month end. |

| b | Exclusive of sales charge. |

See notes to financial statements.

The Fund 31

FINANCIAL HIGHLIGHTS (continued)

| | | | | |

| | | Year Ended December 31, | |

| Class C Shares | 2009 | 2008 | 2007 | 2006 | 2005 |

| Per Share Data ($): | | | | | |

| Net asset value, beginning of period | 11.66 | 12.78 | 13.06 | 13.11 | 13.25 |

| Investment Operations: | | | | | |

| Investment income—neta | .45 | .45 | .45 | .46 | .46 |

| Net realized and unrealized | | | | | |

| gain (loss) on investments | 1.02 | (1.12) | (.29) | (.05) | (.14) |

| Total from Investment Operations | 1.47 | (.67) | .16 | .41 | .32 |

| Distributions: | | | | | |

| Dividends from investment income—net | (.45) | (.45) | (.44) | (.46) | (.46) |

| Net asset value, end of period | 12.68 | 11.66 | 12.78 | 13.06 | 13.11 |

| Total Return (%)b | 12.71 | (5.34) | 1.28 | 3.22 | 2.45 |

| Ratios/Supplemental Data (%): | | | | | |

| Ratio of total expenses | | | | | |

| to average net assets | 1.72 | 1.77 | 1.87 | 1.96 | 1.89 |

| Ratio of net expenses | | | | | |

| to average net assets | 1.60 | 1.64 | 1.75 | 1.81 | 1.76 |

| Ratio of interest and expense related | | | | | |

| to floating rate notes issued | | | | | |

| to average net assets | — | .05 | .13 | .22 | .16 |

| Ratio of net investment income | | | | | |

| to average net assets | 3.61 | 3.69 | 3.44 | 3.57 | 3.51 |

| Portfolio Turnover Rate | 17.17 | 50.33 | 36.63 | 17.13 | 11.22 |

| Net Assets, end of period ($ x 1,000) | 9,008 | 4,714 | 3,749 | 2,768 | 2,732 |

| |

| a | Based on average shares outstanding at each month end. |

| b | Exclusive of sales charge. |

See notes to financial statements.

32

| | |

| | Year Ended December 31, |

| Class I Shares | 2009 | 2008a |

| Per Share Data ($): | | |

| Net asset value, beginning of period | 11.66 | 11.28 |

| Investment Operations: | | |

| Investment income—netb | .56 | .03 |

| Net realized and unrealized | | |

| gain (loss) on investments | 1.04 | .38 |

| Total from Investment Operations | 1.60 | .41 |

| Distributions: | | |

| Dividends from investment income—net | (.56) | (.03) |

| Net asset value, end of period | 12.70 | 11.66 |

| Total Return (%) | 13.91 | 3.61c |

| Ratios/Supplemental Data (%): | | |

| Ratio of total expenses to average net assets | .78 | .76d |

| Ratio of net expenses to average net assets | .70 | .70d |

| Ratio of net investment income to average net assets | 4.55 | 5.03d |

| Portfolio Turnover Rate | 17.17 | 50.33 |

| Net Assets, end of period ($ x 1,000) | 958 | 10 |

| |

| a | From December 15, 2008 (commencement of initial offering) to December 31, 2008. |

| b | Based on average shares outstanding at each month end. |

| c | Not annualized. |

| d | Annualized. |

See notes to financial statements.

The Fund 33

FINANCIAL HIGHLIGHTS (continued)

| | | |

| | Year Ended December 31, |

| Class Z Shares | 2009 | 2008 | 2007a |

| Per Share Data ($): | | | |

| Net asset value, beginning of period | 11.67 | 12.79 | 12.84 |

| Investment Operations: | | | |

| Investment income—netb | .56 | .56 | .31 |

| Net realized and unrealized | | | |

| gain (loss) on investments | 1.02 | (1.12) | (.05) |

| Total from Investment Operations | 1.58 | (.56) | .26 |

| Distributions: | | | |

| Dividends from investment income—net | (.55) | (.56) | (.31) |

| Net asset value, end of period | 12.70 | 11.67 | 12.79 |

| Total Return (%) | 13.72 | (4.56) | 2.03c |

| Ratios/Supplemental Data (%): | | | |

| Ratio of total expenses to average net assets | .79 | .85 | .91d |

| Ratio of net expenses to average net assets | .78 | .85e | .91d,e |

| Ratio of interest and expense related to floating | | | |

| rate notes issued to average net assets | — | .05 | .13d |

| Ratio of net investment income | | | |

| to average net assets | 4.47 | 4.50 | 4.26d |

| Portfolio Turnover Rate | 17.17 | 50.33 | 36.63 |

| Net Assets, end of period ($ x 1,000) | 148,768 | 140,950 | 163,869 |

| |

| a | From June 7, 2007 (commencement of initial offering) to December 31, 2007. |

| b | Based on average shares outstanding at each month end. |

| c | Not annualized. |

| d | Annualized. |

| e | Expense waivers and/or reimbursements amounted to less than .01%. |

See notes to financial statements.

34

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus New Jersey Municipal Bond Fund, Inc. (the “fund”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as a non-diversified open-end management investment com-pany.The fund’s investment objective is to provide investors with as high a level of current income exempt from federal and New Jersey personal income taxes, as is consistent with the preservation of capital. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares. The fund is authorized to issue 675 million shares of $.001 par value Common Stock.The fund currently offers five classes of shares: Class A (200 million shares authorized), Class B (150 million shares authorized), Class C (150 million shares authorized), Class I (150 million shares authorized) and Class Z (25 million shares authorized). Class A shares are subject to a sales charge imposed at the time of purchase. Class B shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class B share redemptions made within six years of purchase and automatically convert to Class A shares after six years. The fund does not offer Class B shares, except in connection with dividend reinvestment and permitted exchanges of Class B shares. Class C shares are subject to a CDSC imposed on Class C shares redeemed within one year of purchase. Class I shares are sold at net asset value per share only to institutional investors. Class Z shares generally are offered only to shareholders of the fund who received Class Z shares of the fund in exchange for shares of certain other Dreyfus Funds as a result of the reorganization of such funds and to existing shareholders of the fund who have continuously maintained a fund account since the date the fund’s shares were classified as Class Z. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than

The Fund 35

NOTES TO FINANCIAL STATEMENTS (continued)

expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) has become the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The ASC has superseded all existing non-SEC accounting and reporting standards. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: Investments in securities are valued each business day by an independent pricing service (the “Service”) approved by the fund’s Board of Directors. Investments for which quoted bid prices are readily available and are representative of the bid side of the market in the judgment of the Service are valued at the mean between the quoted bid prices (as obtained by the Service from dealers in such securities) and asked prices (as calculated by the Service based upon its evaluation of the market for such securities). Other investments (which constitute a majority of the portfolio securities) are carried at fair value as determined by the Service, based on methods which include consideration of: yields or prices of municipal securities of comparable quality, coupon, maturity and type, indications as to values from deale rs, and general market conditions. Options and financial futures on municipal and U.S.Treasury securities are valued at the last sales price on the securities exchange on which such securities are primarily traded or at the last sales price on the national securities market on each business day.

36

The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e. the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value.This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for

identical investments.

Level 2—other significant observable inputs (including quoted

prices for similar investments, interest rates, prepayment speeds,

credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own

assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of December 31, 2009 in valuing the fund’s investments:

| | | | |

| | | Level 2—Other | Level 3— | |

| | Level 1— | Significant | Significant | |

| | Unadjusted | Observable | Unobservable | |

| | Quoted Prices | Inputs | Inputs | Total |

| Assets ($) | | | | |

| Investments in Securities: | | | |

| Municipal Bonds | — | 601,220,340 | — | 601,220,340 |

The Fund 37

NOTES TO FINANCIAL STATEMENTS (continued)

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Interest income, adjusted for accretion of discount and amortization of premium on investments, is earned from settlement date and recognized on the accrual basis. Securities purchased or sold on a when issued or delayed-delivery basis may be settled a month or more after the trade date.

The fund has arrangements with the custodian and cash management bank whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset custody and cash management fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The fund follows an investment policy of investing primarily in municipal obligations of one state. Economic changes affecting the state and certain of its public bodies or municipalities may affect the ability of issuers within the state to pay interest on, or repay principal of, municipal obligations held by the fund.

(c) Dividends to shareholders: It is the policy of the fund to declare dividends from investment income-net on each business day. Such dividends are paid monthly. Dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.