UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811- 5454 |

| |

| Dreyfus New Jersey Municipal Bond Fund, Inc. | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Janette E. Farragher, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6000 |

| |

Date of fiscal year end: | 12/31 | |

Date of reporting period: | 12/31/12 | |

| | | | | | | |

FORM N-CSR

Item 1. Reports to Stockholders.

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

| | Contents |

| | THE FUND |

| 2 | A Letter from the President |

| 3 | Discussion of Fund Performance |

| 6 | Fund Performance |

| 8 | Understanding Your Fund’s Expenses |

| 8 | Comparing Your Fund’s Expenses With Those of Other Funds |

| 9 | Statement of Investments |

| 24 | Statement of Assets and Liabilities |

| 25 | Statement of Operations |

| 26 | Statement of Changes in Net Assets |

| 28 | Financial Highlights |

| 32 | Notes to Financial Statements |

| 45 | Report of Independent Registered Public Accounting Firm |

| 46 | Important Tax Information |

| 47 | Proxy Results |

| 48 | Board Members Information |

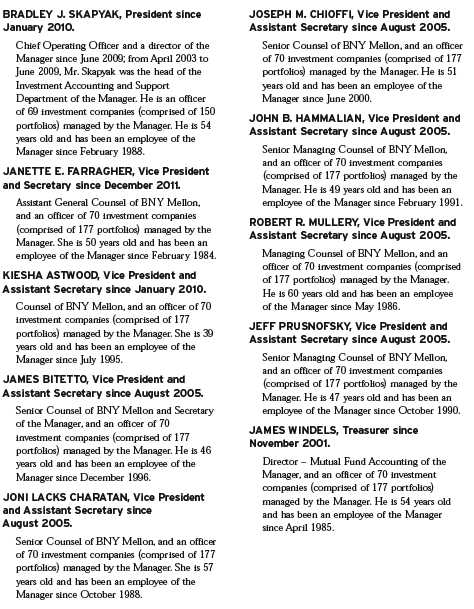

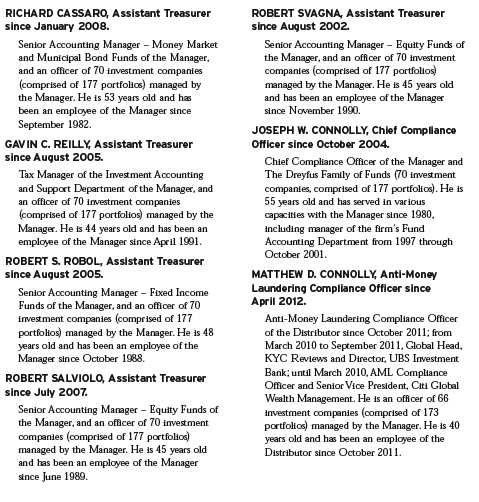

| 50 | Officers of the Fund |

| | FOR MORE INFORMATION |

| | Back Cover |

Dreyfus

New Jersey Municipal

Bond Fund, Inc.

The Fund

A LETTER FROM THE PRESIDENT

Dear Shareholder:

We are pleased to present this annual report for Dreyfus New Jersey Municipal Bond Fund, Inc., covering the 12-month period from January 1, 2012, through December 31, 2012. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

The search for higher nominal and tax-exempt yields amid historically low interest rates proved to be a major force in the solid performance of the municipal bond market in 2012, as the Federal Reserve Board’s efforts to infuse liquidity into the domestic financial system kept taxable bond yield spreads relatively moderate versus municipals. Robust investor demand in the municipal market, however, was met with a relatively meager supply of newly issued securities stemming from political pressure to reduce government spending and borrowing.The market also was buoyed by improvements in the fiscal condition of most states and many municipalities as tax revenues increased in a gradually recovering U.S. economy.

We currently expect the U.S. economy to be modestly stronger in 2013 than in 2012, especially during the second half of the year. Economic activity seems likely to benefit from greater certainty regarding U.S. tax and fiscal policies, the resumption of postponed spending by businesses, and a continued housing recovery. We encourage you to discuss the implications of our economic analysis with your financial advisor, who can help you align your investments with the year’s challenges and opportunities.

Thank you for your continued confidence and support.

Sincerely,

J. Charles Cardona

President

The Dreyfus Corporation

January 15, 2013

2

DISCUSSION OF FUND PERFORMANCE

For the period of January 1, 2012, through December 31, 2012, as provided by Daniel Barton and Jeffrey Burger, Portfolio Managers

Fund and Market Performance Overview

For the 12-month period ended December 31, 2012, Dreyfus New Jersey Municipal Bond Fund’s Class A shares produced a total return of 6.96%, Class C shares returned 6.09%, Class I shares returned 7.04% and Class Z shares returned 7.04%.1 In comparison, the Barclays Municipal Bond Index, the fund’s benchmark, achieved a total return of 6.78% for the same period.2

Falling long-term interest rates and favorable supply-and-demand dynamics supported municipal bond prices during 2012.The fund’s Class A, Class I, and Class Z shares produced higher returns than their benchmark, due primarily to overweighted exposure to revenue bonds.

The Fund’s Investment Approach

The fund seeks as high a level of current income exempt from federal and New Jersey state income taxes as is consistent with the preservation of capital.To pursue its goal the fund normally invests at least 80% of its assets in municipal bonds that provide income exempt from federal and New Jersey personal income taxes. The fund invests at least 80% of its assets in investment-grade municipal bonds or the unrated equivalent as determined by Dreyfus.The fund may invest up to 20% of its assets in municipal bonds rated below investment grade (“high yield” or “junk” bonds) or the unrated equivalent as determined by Dreyfus. The dollar-weighted average maturity of the fund’s portfolio normally exceeds 10 years.

We focus on identifying undervalued sectors and securities and minimize the use of interest rate forecasting.We select municipal bonds for the fund’s portfolio by using fundamental credit analysis to estimate the relative value and attractiveness of various sectors and securities and to exploit pricing inefficiencies in the municipal bond market; and actively trading among various sectors, such as pre-refunded, general obligation and revenue, based on their apparent relative values. The fund seeks to invest in several of these sectors.

The Fund 3

DISCUSSION OF FUND PERFORMANCE (continued)

Supply-and-Demand Dynamics Buoyed Municipal Bonds

Most U.S. financial markets were rallying at the start of 2012 amid domestic employment gains and a quantitative easing program in Europe. Investors grew more tolerant of risks, focusing more on underlying fundamentals and less on macroeconomic developments.These positive influences were called into question during the spring, when the U.S. labor market’s rebound slowed and measures designed to relieve fiscal pressures in Europe encountered resistance. Although these headwinds temporarily sparked a flight to perceived safe havens, markets resumed their rallies over the summer and fall.

Municipal bonds across the credit-quality range generally remained strong throughout the year, in part due to robust demand from investors seeking higher levels of after-tax income. Municipal bonds also responded positively to falling long-term interest rates amid quantitative easing and other stimulative measures by the Federal Reserve Board over the summer. Meanwhile, new issuance volumes remained muted when political pressure led to less borrowing for capital projects. Instead, municipalities mainly issued new bonds to refinance older debt, resulting in a net decrease in the national supply of tax-exempt securities. In this environment, lower-rated and longer maturity municipal bonds led the market higher, while highly rated and shorter-term securities generally lagged market averages.

From a credit quality perspective, New Jersey’s tax revenues have fallen short of budget projections, and the state has continued to struggle with rising retiree benefits costs, a relatively slow economic recovery, and depleted reserve fund balances.

New Jersey Bonds Beat National Market Averages

The fund’s relative performance was enhanced by relatively strong results from New Jersey municipal bonds compared to national averages, as investors reached for higher yields from lower rated securities.The fund also benefited from an emphasis on higher yielding, revenue-backed municipal bonds, particularly those with credit ratings in the BBB and A tiers. The fund received especially robust contributions from municipal bonds backed by revenues from hospitals, industrial development projects, and the state’s settlement of litigation with U.S. tobacco companies.

On the other hand, the fund’s relative performance was hindered to a degree by higher quality revenue bonds issued to finance essential municipal services, such as

4

water and sewer facilities. Our ongoing efforts to upgrade the fund’s overall credit quality also proved mildly counterproductive in 2012, when investors favored lower-rated securities.

The fund employed Municipal Market Data rate locks, a derivative instrument, at times during the year to implement certain interest rate strategies.

Adjusting to Changing Market Conditions

We have been encouraged by recently improved data, but the U.S. economy remains vulnerable to fiscal uncertainty. Therefore, while we have continued to favor income-oriented municipal bonds over their lower yielding counterparts, we have reduced the fund’s average duration toward a market-neutral position, and we have maintained a higher quality bias in our security selection strategy. In addition, we have continued to monitor the market for more attractive relative values among New Jersey municipal bonds.

January 15, 2013

Bond funds are subject generally to interest rate, credit, liquidity and market risks, to varying degrees, all of which are more fully described in the fund’s prospectus. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes, and rate increases can cause price declines.

High yield bonds are subject to increased credit risk and are considered speculative in terms of the issuer’s perceived ability to continue making interest payments on a timely basis and to repay principal upon maturity.

|

| 1 Total return includes reinvestment of dividends and any capital gains paid and does not take into consideration the |

| maximum initial sales charge in the case of Class A shares or the applicable contingent deferred sales charges imposed |

| on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Class I |

| and Class Z shares are not subject to any initial or deferred sales charge. Past performance is no guarantee of future |

| results. Share price, yield and investment return fluctuate such that upon redemption, fund shares may be worth more |

| or less than their original cost. Income may be subject to state and local taxes for non-New Jersey residents, and some |

| income may be subject to the federal alternative minimum tax (AMT) for certain investors. Capital gains, if any, are |

| fully taxable. Return figures provided for Class A and C shares reflect the absorption of certain fund expenses |

| pursuant to an agreement by The Dreyfus Corporation which may be terminated after May 1, 2013, upon 90 days’ |

| notice to shareholders. Return figures for Class I shares reflect the absorption of certain fund expenses by The Dreyfus |

| Corporation and may be terminated at any time. Had these expenses not been absorbed, the fund’s returns would |

| have been lower. |

| 2 SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital gain distributions. |

| The Barclays Municipal Bond Index is a widely accepted, unmanaged total return performance benchmark for the |

| long-term, investment-grade, tax-exempt bond market. Index returns do not reflect fees and expenses associated with |

| operating a mutual fund. Investors cannot invest directly in any index. |

The Fund 5

FUND PERFORMANCE

| |

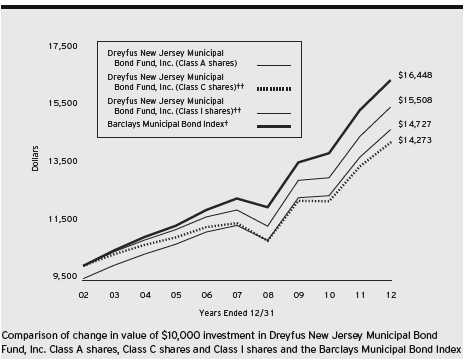

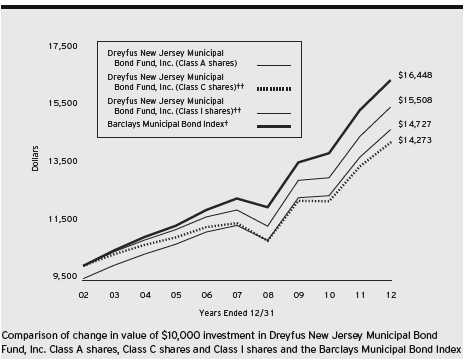

| † | Source: Lipper Inc. |

| †† | The total return figures presented for Class C shares of the fund reflect the performance of the fund’s Class A shares |

| | for the period prior to 1/7/03 (the inception date for Class C shares), adjusted to reflect the applicable sales load for |

| | this share class. |

| | The total return figures presented for Class I shares of the fund reflect the performance of the fund’s Class A shares |

| | for the period prior to 12/15/08 (the inception date for Class I shares). |

Past performance is not predictive of future performance.

The above graph compares a $10,000 investment made in each of the Class A, Class C and Class I shares of Dreyfus New Jersey Municipal Bond Fund, Inc. on 12/31/02 to a $10,000 investment made in the Barclays Municipal Bond Index (the “Index”) on that date.All dividends and capital gain distributions are reinvested.

The fund invests primarily in New Jersey municipal securities and its performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes. Performance for Class Z shares will vary from the performance of Class A, Class C and Class I shares shown above due to differences in charges and expenses.The Index is not limited to investments in New Jersey municipal obligations.The Index is an unmanaged total return performance benchmark for the long-term, investment-grade, geographically unrestricted tax-exempt bond market, calculated by using municipal bonds selected to be representative of the municipal market overall. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index.These factors can contribute to the Index potentially outperforming or underperforming the fund. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| | | | | | | | | |

| Average Annual Total Returns as of 12/31/12 | | | | | | | |

| |

| | Inception | | | | | | | From | |

| | Date | 1 | Year | 5 Years | | 10 Years | | Inception | |

| Class A shares | | | | | | | | | |

| with maximum sales charge (4.5%) | 11/6/87 | 2.17 | % | 4.28 | % | 3.95 | % | — | |

| without sales charge | 11/6/87 | 6.96 | % | 5.24 | % | 4.42 | % | — | |

| Class C shares | | | | | | | | | |

| with applicable redemption charge † | 1/7/03 | 5.09 | % | 4.44 | % | 3.62 | %†† | — | |

| without redemption | 1/7/03 | 6.09 | % | 4.44 | % | 3.62 | %†† | — | |

| Class I shares | 12/15/08 | 7.04 | % | 5.37 | %†† | 4.49 | %†† | — | |

| Class Z shares | 6/7/07 | 7.04 | % | 5.32 | % | — | | 5.14 | % |

| Barclays Municipal | | | | | | | | | |

| Bond Index | 5/31/07 | 6.78 | % | 5.91 | % | 5.10 | % | 5.78 | %††† |

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| |

| † | The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the |

| | date of purchase. |

| †† | The total return performance figures presented for Class C shares of the fund reflect the performance of the fund’s |

| | Class A shares for the period prior to 1/7/03 (the inception date for Class C shares), adjusted to reflect the |

| | applicable sales load for this share class. |

| | The total return performance figures presented for Class I shares of the fund reflect the performance of the fund’s |

| | Class A shares for the period prior to 12/15/08 (the inception date for Class I shares). |

| ††† | The Index date is based on the life of Class Z shares. For comparative purposes, the value of the Index as of |

| | 5/31/07 is used as the beginning value on 6/7/07 (the inception date for Class Z shares). |

The Fund 7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus New Jersey Municipal Bond Fund, Inc. from July 1, 2012 to December 31, 2012. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended December 31, 2012

| | | | | | | | |

| | | Class A | | Class C | | Class I | | Class Z |

| Expenses paid per $1,000† | $ | 4.39 | $ | 8.24 | $ | 3.62 | $ | 3.98 |

| Ending value (after expenses) | $ | 1,028.80 | $ | 1,024.20 | $ | 1,028.80 | $ | 1,028.40 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended December 31, 2012

| | | | | | | | |

| | | Class A | | Class C | | Class I | | Class Z |

| Expenses paid per $1,000† | $ | 4.37 | $ | 8.21 | $ | 3.61 | $ | 3.96 |

| Ending value (after expenses) | $ | 1,020.81 | $ | 1,016.99 | $ | 1,021.57 | $ | 1,021.22 |

|

| † Expenses are equal to the fund’s annualized expense ratio of .86% for Class A, 1.62% for Class C, .71% for |

| Class I and .78% for Class Z, multiplied by the average account value over the period, multiplied by 184/366 (to |

| reflect the one-half year period). |

8

| | | | | |

| STATEMENT OF INVESTMENTS | | | | |

| December 31, 2012 | | | | | |

| |

| |

| |

| |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments—97.3% | Rate (%) | Date | Amount ($) | | Value ($) |

| New Jersey—86.7% | | | | | |

| Burlington County Bridge | | | | | |

| Commission, EDR (The | | | | | |

| Evergreens Project) | 5.63 | 1/1/38 | 5,500,000 | | 5,724,345 |

| Camden County Improvement | | | | | |

| Authority, Health Care | | | | | |

| Redevelopment Project Revenue | | | | | |

| (The Cooper Health System | | | | | |

| Obligated Group Issue) | 5.25 | 2/15/20 | 2,000,000 | | 2,125,800 |

| Camden County Improvement | | | | | |

| Authority, Health Care | | | | | |

| Redevelopment Project Revenue | | | | | |

| (The Cooper Health System | | | | | |

| Obligated Group Issue) | 5.25 | 2/15/20 | 4,545,000 | | 4,830,880 |

| Delaware River and Bay Authority, | | | | | |

| Revenue | 5.00 | 1/1/42 | 1,000,000 | | 1,155,320 |

| Delaware River Port Authority, | | | | | |

| Revenue | 5.00 | 1/1/30 | 3,500,000 | | 4,009,145 |

| Delaware River Port Authority, | | | | | |

| Revenue | 5.00 | 1/1/35 | 3,500,000 | | 3,954,335 |

| East Orange Board of Education, | | | | | |

| COP, LR (Insured; Assured | | | | | |

| Guaranty Municipal Corp.) | 0.00 | 2/1/21 | 685,000 | a | 519,319 |

| East Orange Board of Education, | | | | | |

| COP, LR (Insured; Assured | | | | | |

| Guaranty Municipal Corp.) | 0.00 | 2/1/26 | 745,000 | a | 433,888 |

| East Orange Board of Education, | | | | | |

| COP, LR (Insured; Assured | | | | | |

| Guaranty Municipal Corp.) | 0.00 | 2/1/28 | 2,345,000 | a | 1,233,470 |

| Essex County, | | | | | |

| GO (General Improvement) | 5.00 | 8/1/23 | 15,200,000 | | 18,102,440 |

| Garden State Preservation Trust, | | | | | |

| Revenue (Open Space and | | | | | |

| Farmland Preservation Bonds) | 5.00 | 11/1/22 | 6,245,000 | | 7,989,915 |

| Garden State Preservation Trust, | | | | | |

| Revenue (Open Space and | | | | | |

| Farmland Preservation Bonds) | | | | | |

| (Insured; Assured Guaranty | | | | | |

| Municipal Corp.) | 5.75 | 11/1/28 | 5,000,000 | | 6,768,200 |

The Fund 9

STATEMENT OF INVESTMENTS (continued)

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| New Jersey (continued) | | | | | |

| Gloucester County Improvement | | | | | |

| Authority, County Guaranteed | | | | | |

| Loan Revenue (County | | | | | |

| Capital Program) | 5.00 | 4/1/38 | 7,000,000 | | 7,673,260 |

| Gloucester Township Municipal | | | | | |

| Utilities Authority, Sewer | | | | | |

| Revenue (Insured; AMBAC) | 5.65 | 3/1/18 | 1,825,000 | | 2,023,542 |

| Higher Education Student | | | | | |

| Assistance Authority of New | | | | | |

| Jersey, Student Loan Revenue | | | | | |

| (Insured; National Public | | | | | |

| Finance Guarantee Corp.) | 6.13 | 6/1/17 | 280,000 | | 280,000 |

| Hudson County Improvement | | | | | |

| Authority, Harrison Stadium | | | | | |

| Land Acquisition Special | | | | | |

| Obligation Revenue (Harrison | | | | | |

| Redevelopment Project) | | | | | |

| (Insured; National Public | | | | | |

| Finance Guarantee Corp.) | 0.00 | 12/15/34 | 3,000,000 | a | 1,147,590 |

| Mercer County Improvement | | | | | |

| Authority, County Secured | | | | | |

| Open Space Revenue (Insured; | | | | | |

| National Public Finance | | | | | |

| Guarantee Corp.) | 5.00 | 8/1/40 | 3,290,000 | | 3,525,630 |

| Middletown Township Board of | | | | | |

| Education, GO | 5.00 | 8/1/25 | 4,140,000 | | 4,989,114 |

| Middletown Township Board of | | | | | |

| Education, GO | 5.00 | 8/1/26 | 2,935,000 | | 3,520,797 |

| New Jersey Economic Development | | | | | |

| Authority, Cigarette Tax Revenue | 5.00 | 6/15/28 | 2,000,000 | | 2,266,400 |

| New Jersey Economic Development | | | | | |

| Authority, Cigarette Tax | | | | | |

| Revenue (Prerefunded) | 5.75 | 6/15/14 | 2,000,000 | b | 2,158,380 |

| New Jersey Economic Development | | | | | |

| Authority, Department of | | | | | |

| Human Services Composite | | | | | |

| Revenue (Division of | | | | | |

| Developmental Disabilities) | 6.25 | 7/1/24 | 1,240,000 | | 1,243,187 |

10

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| New Jersey (continued) | | | | | |

| New Jersey Economic Development | | | | | |

| Authority, Department of Human | | | | | |

| Services Composite Revenue | | | | | |

| (Division of Mental | | | | | |

| Health Services) | 6.10 | 7/1/17 | 1,215,000 | | 1,218,779 |

| New Jersey Economic Development | | | | | |

| Authority, EDR (Masonic | | | | | |

| Charity Foundation of New | | | | | |

| Jersey Project) | 5.00 | 6/1/18 | 1,365,000 | | 1,404,885 |

| New Jersey Economic Development | | | | | |

| Authority, Gas Facilities Revenue | | | | | |

| (NUI Corporation Project) | 5.25 | 11/1/33 | 2,780,000 | | 2,782,474 |

| New Jersey Economic Development | | | | | |

| Authority, Motor Vehicle | | | | | |

| Surcharge Revenue (Insured; | | | | | |

| National Public Finance | | | | | |

| Guarantee Corp.) | 0.00 | 7/1/20 | 3,350,000 | a | 2,665,696 |

| New Jersey Economic Development | | | | | |

| Authority, Motor Vehicle | | | | | |

| Surcharge Revenue (Insured; | | | | | |

| National Public Finance | | | | | |

| Guarantee Corp.) | 0.00 | 7/1/21 | 2,620,000 | a | 1,984,519 |

| New Jersey Economic Development | | | | | |

| Authority, Revenue (Hillcrest | | | | | |

| Health Service System Project) | | | | | |

| (Insured; AMBAC) | 0.00 | 1/1/15 | 3,250,000 | a | 3,030,918 |

| New Jersey Economic Development | | | | | |

| Authority, Revenue (Hillcrest | | | | | |

| Health Service System Project) | | | | | |

| (Insured; AMBAC) | 0.00 | 1/1/17 | 5,000,000 | a | 4,259,100 |

| New Jersey Economic Development | | | | | |

| Authority, Revenue (Hillcrest | | | | | |

| Health Service System Project) | | | | | |

| (Insured; AMBAC) | 0.00 | 1/1/18 | 2,500,000 | a | 2,034,850 |

| New Jersey Economic Development | | | | | |

| Authority, Revenue (Hillcrest | | | | | |

| Health Service System Project) | | | | | |

| (Insured; AMBAC) | 0.00 | 1/1/20 | 6,500,000 | a | 4,756,960 |

The Fund 11

STATEMENT OF INVESTMENTS (continued)

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| New Jersey (continued) | | | | | |

| New Jersey Economic Development | | | | | |

| Authority, Revenue (Hillcrest | | | | | |

| Health Service System Project) | | | | | |

| (Insured; AMBAC) | 0.00 | 1/1/22 | 6,000,000 | a | 3,894,600 |

| New Jersey Economic Development | | | | | |

| Authority, School Facilities | | | | | |

| Construction Revenue | 5.00 | 9/1/18 | 2,265,000 | | 2,690,276 |

| New Jersey Economic Development | | | | | |

| Authority, School Facilities | | | | | |

| Construction Revenue | 5.75 | 9/1/23 | 3,765,000 | | 4,652,712 |

| New Jersey Economic Development | | | | | |

| Authority, School Facilities | | | | | |

| Construction Revenue | | | | | |

| (Insured; AMBAC) | 5.50 | 9/1/24 | 10,000,000 | | 12,703,000 |

| New Jersey Economic Development | | | | | |

| Authority, School Facilities | | | | | |

| Construction Revenue (Insured; | | | | | |

| National Public Finance | | | | | |

| Guarantee Corp.) | 5.50 | 9/1/27 | 10,000,000 | | 13,038,700 |

| New Jersey Economic Development | | | | | |

| Authority, Water Facilities | | | | | |

| Revenue (New Jersey—American | | | | | |

| Water Company, Inc. Project) | 5.10 | 6/1/23 | 3,000,000 | | 3,408,570 |

| New Jersey Economic Development | | | | | |

| Authority, Water Facilities | | | | | |

| Revenue (New Jersey—American | | | | | |

| Water Company, Inc. Project) | 5.60 | 11/1/34 | 6,600,000 | | 7,505,256 |

| New Jersey Economic Development | | | | | |

| Authority, Water Facilities | | | | | |

| Revenue (New Jersey—American | | | | | |

| Water Company, Inc. Project) | 5.70 | 10/1/39 | 5,000,000 | | 5,594,400 |

| New Jersey Educational Facilities | | | | | |

| Authority, Revenue (Fairleigh | | | | | |

| Dickenson University Issue) | 6.00 | 7/1/20 | 4,535,000 | | 4,756,988 |

| New Jersey Educational Facilities | | | | | |

| Authority, Revenue (Kean | | | | | |

| University Issue) | 5.00 | 9/1/21 | 1,500,000 | | 1,793,475 |

| New Jersey Educational Facilities | | | | | |

| Authority, Revenue (Montclair | | | | | |

| State University Issue) | 5.25 | 7/1/38 | 2,000,000 | | 2,269,440 |

12

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| New Jersey (continued) | | | | | |

| New Jersey Educational Facilities | | | | | |

| Authority, Revenue (New Jersey | | | | | |

| City University Issue) | | | | | |

| (Insured; Assured Guaranty | | | | | |

| Municipal Corp.) | 5.00 | 7/1/35 | 12,165,000 | | 13,335,273 |

| New Jersey Educational Facilities | | | | | |

| Authority, Revenue (New Jersey | | | | | |

| Institute of Technology Issue) | 5.00 | 7/1/31 | 2,000,000 | | 2,266,140 |

| New Jersey Educational Facilities | | | | | |

| Authority, Revenue (Princeton | | | | | |

| Theological Seminary Issue) | 5.00 | 7/1/29 | 5,000,000 | | 6,007,100 |

| New Jersey Educational Facilities | | | | | |

| Authority, Revenue (Princeton | | | | | |

| University) (Prerefunded) | 5.00 | 7/1/15 | 120,000 | b | 133,606 |

| New Jersey Educational Facilities | | | | | |

| Authority, Revenue (Public | | | | | |

| Library Project Grant Program | | | | | |

| Issue) (Insured; AMBAC) | 5.50 | 9/1/17 | 1,500,000 | | 1,506,225 |

| New Jersey Educational Facilities | | | | | |

| Authority, Revenue (Ramapo | | | | | |

| College of New Jersey Issue) | 5.00 | 7/1/42 | 3,000,000 | | 3,409,080 |

| New Jersey Educational Facilities | | | | | |

| Authority, Revenue (Seton Hall | | | | | |

| University Issue) | 6.25 | 7/1/37 | 5,000,000 | | 5,962,950 |

| New Jersey Educational Facilities | | | | | |

| Authority, Revenue (Stevens | | | | | |

| Institute of Technology Issue) | 5.00 | 7/1/27 | 5,000,000 | | 5,366,800 |

| New Jersey Educational Facilities | | | | | |

| Authority, Revenue (Stevens | | | | | |

| Institute of Technology Issue) | 5.00 | 7/1/34 | 7,655,000 | | 8,108,023 |

| New Jersey Educational Facilities | | | | | |

| Authority, Revenue (Stevens | | | | | |

| Institute of Technology Issue) | | | | | |

| (Prerefunded) | 5.38 | 7/1/14 | 2,500,000 | b | 2,686,800 |

| New Jersey Educational Facilities | | | | | |

| Authority, Revenue (The | | | | | |

| College of New Jersey Issue) | | | | | |

| (Insured; Assured Guaranty | | | | | |

| Municipal Corp.) | 5.00 | 7/1/35 | 7,910,000 | | 8,774,800 |

The Fund 13

STATEMENT OF INVESTMENTS (continued)

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| New Jersey (continued) | | | | | |

| New Jersey Educational Facilities | | | | | |

| Authority, Revenue (The | | | | | |

| William Paterson University of | | | | | |

| New Jersey Issue) (Insured; | | | | | |

| Assured Guaranty Municipal Corp.) | 5.00 | 7/1/38 | 3,745,000 | | 4,077,556 |

| New Jersey Environmental | | | | | |

| Infrastructure Trust, | | | | | |

| Environmental | | | | | |

| Infrastructure Bonds | 5.00 | 9/1/17 | 4,165,000 | | 4,958,766 |

| New Jersey Environmental | | | | | |

| Infrastructure Trust, | | | | | |

| Environmental | | | | | |

| Infrastructure Bonds | 5.00 | 9/1/18 | 5,200,000 | | 6,354,296 |

| New Jersey Environmental | | | | | |

| Infrastructure Trust, | | | | | |

| Environmental | | | | | |

| Infrastructure Bonds | 5.00 | 9/1/22 | 3,550,000 | | 4,475,591 |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, Revenue | | | | | |

| (AHS Hospital Corporation Issue) | 5.00 | 7/1/27 | 5,400,000 | | 5,882,382 |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, Revenue | | | | | |

| (AtlantiCare Regional Medical | | | | | |

| Center Issue) | 5.00 | 7/1/22 | 3,975,000 | | 4,348,491 |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, Revenue | | | | | |

| (Barnabas Health Issue) | 5.63 | 7/1/32 | 3,000,000 | | 3,402,690 |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, Revenue | | | | | |

| (Capital Health System | | | | | |

| Obligated Group Issue) | | | | | |

| (Prerefunded) | 5.75 | 7/1/13 | 3,000,000 | b | 3,081,540 |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, Revenue | | | | | |

| (General Hospital Center at | | | | | |

| Passaic, Inc. Obligated Group | | | | | |

| Issue) (Insured; Assured | | | | | |

| Guaranty Municipal Corp.) | 6.75 | 7/1/19 | 550,000 | | 679,618 |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, Revenue | | | | | |

| (Hackensack University Medical | | | | | |

| Center Issue) | 5.00 | 1/1/28 | 2,780,000 | | 3,016,244 |

14

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| New Jersey (continued) | | | | | |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, Revenue | | | | | |

| (Hackensack University Medical | | | | | |

| Center Issue) (Insured; Assured | | | | | |

| Guaranty Municipal Corp.) | 5.25 | 1/1/36 | 2,900,000 | | 3,139,946 |

| New Jersey Health Care | | | | | |

| Facilities Financing Authority, | | | | | |

| Revenue (Holy Name | | | | | |

| Medical Center Issue) | 5.00 | 7/1/15 | 3,410,000 | | 3,638,027 |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, Revenue | | | | | |

| (Kennedy Health System | | | | | |

| Obligated Group Issue) | 5.00 | 7/1/31 | 1,525,000 | | 1,702,647 |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, Revenue | | | | | |

| (Meridian Health System | | | | | |

| Obligated Group Issue) | 5.00 | 7/1/23 | 2,500,000 | | 2,942,300 |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, Revenue | | | | | |

| (Meridian Health System | | | | | |

| Obligated Group Issue) | 5.00 | 7/1/26 | 1,000,000 | | 1,145,570 |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, Revenue | | | | | |

| (Meridian Health System | | | | | |

| Obligated Group Issue) | | | | | |

| (Insured; Assured Guaranty | | | | | |

| Municipal Corp.) | 5.00 | 7/1/38 | 4,915,000 | | 5,279,693 |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, Revenue | | | | | |

| (Robert Wood Johnson | | | | | |

| University Hospital Issue) | 5.00 | 7/1/31 | 4,950,000 | | 5,457,524 |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, Revenue | | | | | |

| (Saint Barnabas Health Care | | | | | |

| System Issue) (Insured; | | | | | |

| National Public Finance | | | | | |

| Guarantee Corp.) | 0.00 | 7/1/23 | 2,280,000 | a | 1,794,223 |

| New Jersey Health Care Facilities | | | | | |

| Financing Authority, Revenue | | | | | |

| (Virtua Health Issue) | | | | | |

| (Insured; Assured Guaranty | | | | | |

| Municipal Corp.) | 5.50 | 7/1/38 | 5,000,000 | | 5,581,500 |

The Fund 15

STATEMENT OF INVESTMENTS (continued)

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| New Jersey (continued) | | | | |

| New Jersey Health Care Facilities | | | | |

| Financing Authority, State | | | | |

| Contract Revenue (Hospital | | | | |

| Asset Transformation Program) | 5.25 | 10/1/38 | 13,595,000 | 14,864,365 |

| New Jersey Higher Education | | | | |

| Student Assistance Authority, | | | | |

| Student Loan Revenue | 5.00 | 12/1/25 | 1,000,000 | 1,105,440 |

| New Jersey Higher Education | | | | |

| Student Assistance Authority, | | | | |

| Student Loan Revenue | 5.00 | 12/1/26 | 2,330,000 | 2,565,377 |

| New Jersey Higher Education | | | | |

| Student Assistance Authority, | | | | |

| Student Loan Revenue (Insured; | | | | |

| Assured Guaranty Municipal Corp.) | 5.88 | 6/1/21 | 4,670,000 | 5,289,849 |

| New Jersey Highway Authority, | | | | |

| Revenue (Garden State Parkway) | 6.00 | 1/1/19 | 6,645,000 | 8,225,978 |

| New Jersey Housing and Mortgage | | | | |

| Finance Agency, MFHR (Insured: | | | | |

| AMBAC and FHA) | 5.65 | 5/1/40 | 4,480,000 | 4,484,928 |

| New Jersey Housing and Mortgage | | | | |

| Finance Agency, MFHR (Insured; | | | | |

| Assured Guaranty Municipal Corp.) | 5.70 | 5/1/20 | 2,180,000 | 2,185,363 |

| New Jersey Housing and | | | | |

| Mortgage Finance Agency, | | | | |

| Multi-Family Revenue | 4.95 | 5/1/41 | 7,000,000 | 7,541,240 |

| New Jersey Housing and Mortgage | | | | |

| Finance Agency, SFHR | 5.20 | 10/1/25 | 5,740,000 | 6,318,764 |

| New Jersey Housing and Mortgage | | | | |

| Finance Agency, SFHR | 6.38 | 10/1/28 | 4,135,000 | 4,465,800 |

| New Jersey Housing and Mortgage | | | | |

| Finance Agency, SFHR | 5.25 | 10/1/37 | 840,000 | 886,259 |

| New Jersey Institute of | | | | |

| Technology, GO | 5.00 | 7/1/32 | 1,000,000 | 1,178,290 |

| New Jersey Transportation | | | | |

| Trust Fund Authority | | | | |

| (Transportation System) | 5.00 | 6/15/20 | 4,000,000 | 4,380,160 |

| New Jersey Transportation | | | | |

| Trust Fund Authority | | | | |

| (Transportation System) | 5.50 | 12/15/23 | 7,000,000 | 8,877,750 |

16

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| New Jersey (continued) | | | | | |

| New Jersey Transportation | | | | | |

| Trust Fund Authority | | | | | |

| (Transportation System) | 5.50 | 6/15/31 | 2,500,000 | | 2,985,325 |

| New Jersey Transportation | | | | | |

| Trust Fund Authority | | | | | |

| (Transportation System) | 6.00 | 12/15/38 | 6,565,000 | | 7,795,084 |

| New Jersey Transportation Trust | | | | | |

| Fund Authority (Transportation | | | | | |

| System) (Insured; AMBAC) | 0.00 | 12/15/24 | 1,000,000 | a | 613,830 |

| New Jersey Transportation Trust | | | | | |

| Fund Authority (Transportation | | | | | |

| System) (Insured; AMBAC) | 5.00 | 12/15/32 | 8,000,000 | | 8,946,000 |

| New Jersey Transportation Trust | | | | | |

| Fund Authority (Transportation | | | | | |

| System) (Prerefunded) | 6.00 | 12/15/18 | 3,435,000 | b | 4,457,393 |

| New Jersey Turnpike Authority, | | | | | |

| Turnpike Revenue | 6.50 | 1/1/16 | 35,000 | | 40,478 |

| New Jersey Turnpike Authority, | | | | | |

| Turnpike Revenue | 6.50 | 1/1/16 | 120,000 | | 129,222 |

| New Jersey Turnpike Authority, | | | | | |

| Turnpike Revenue | 5.00 | 1/1/23 | 5,000,000 | | 6,127,250 |

| New Jersey Turnpike Authority, | | | | | |

| Turnpike Revenue | 5.00 | 1/1/35 | 3,000,000 | | 3,453,570 |

| New Jersey Turnpike Authority, | | | | | |

| Turnpike Revenue | 5.25 | 1/1/40 | 5,420,000 | | 6,093,001 |

| New Jersey Turnpike Authority, | | | | | |

| Turnpike Revenue (Insured; | | | | | |

| Assured Guaranty Municipal Corp.) | 6.50 | 1/1/16 | 655,000 | | 705,337 |

| New Jersey Turnpike Authority, | | | | | |

| Turnpike Revenue (Insured; | | | | | |

| Assured Guaranty Municipal Corp.) | 6.50 | 1/1/16 | 165,000 | | 193,766 |

| New Jersey Turnpike Authority, | | | | | |

| Turnpike Revenue (Insured; | | | | | |

| Assured Guaranty Municipal Corp.) | 5.25 | 1/1/27 | 3,000,000 | | 3,868,650 |

| New Jersey Turnpike Authority, | | | | | |

| Turnpike Revenue (Insured; | | | | | |

| National Public Finance | | | | | |

| Guarantee Corp.) | 6.50 | 1/1/16 | 1,210,000 | | 1,424,521 |

The Fund 17

STATEMENT OF INVESTMENTS (continued)

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| New Jersey (continued) | | | | |

| New Jersey Turnpike Authority, | | | | |

| Turnpike Revenue (Insured; | | | | |

| National Public Finance | | | | |

| Guarantee Corp.) | 6.50 | 1/1/16 | 2,310,000 | 2,671,561 |

| North Hudson Sewerage Authority, | | | | |

| Gross Revenue Senior Lien | | | | |

| Lease Certificates (Master | | | | |

| Lease Agreement) | 5.00 | 6/1/42 | 10,320,000 | 11,600,918 |

| North Jersey District Water Supply | | | | |

| Commission, Sewer Revenue | | | | |

| (Wanaque South Project) | | | | |

| (Insured; National Public | | | | |

| Finance Guarantee Corp.) | 6.00 | 7/1/19 | 1,520,000 | 1,788,265 |

| Port Authority of New York and New | | | | |

| Jersey (Consolidated Bonds, | | | | |

| 93rd Series) | 6.13 | 6/1/94 | 3,000,000 | 3,743,850 |

| Port Authority of New York and New | | | | |

| Jersey (Consolidated Bonds, | | | | |

| 139th Series) (Insured; National | | | | |

| Public Finance Guarantee Corp.) | 5.00 | 10/1/18 | 11,235,000 | 12,316,369 |

| Port Authority of New York and New | | | | |

| Jersey (Consolidated Bonds, | | | | |

| 167th Series) | 5.00 | 9/15/24 | 3,675,000 | 4,264,801 |

| Port Authority of New York and New | | | | |

| Jersey (Consolidated Bonds, | | | | |

| 167th Series) | 5.50 | 9/15/26 | 7,600,000 | 9,060,948 |

| Port Authority of New York and New | | | | |

| Jersey, Special Obligation | | | | |

| Revenue (JFK International Air | | | | |

| Terminal LLC Project) | | | | |

| (Insured; National Public | | | | |

| Finance Guarantee Corp.) | 6.25 | 12/1/15 | 5,000,000 | 5,483,900 |

| Port Authority of New York and New | | | | |

| Jersey, Special Project | | | | |

| Revenue (JFK International Air | | | | |

| Terminal LLC Project) | 5.00 | 12/1/20 | 2,500,000 | 2,889,975 |

18

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| New Jersey (continued) | | | | | |

| Rahway Valley Sewerage Authority, | | | | | |

| Sewer Revenue (Insured; | | | | | |

| National Public Finance | | | | | |

| Guarantee Corp.) | 0.00 | 9/1/30 | 7,550,000 | a | 3,651,029 |

| Rutgers, The State University, | | | | | |

| GO | 5.00 | 5/1/39 | 3,450,000 | | 3,839,919 |

| South Jersey Port Corporation, | | | | | |

| Marine Terminal Revenue | 5.75 | 1/1/23 | 4,000,000 | | 4,820,120 |

| South Jersey Port Corporation, | | | | | |

| Marine Terminal Revenue | | | | | |

| (Insured; Assured Guaranty | | | | | |

| Municipal Corp.) | 5.75 | 1/1/34 | 2,900,000 | | 3,344,396 |

| South Jersey Port Corporation, | | | | | |

| Marine Terminal Revenue | | | | | |

| (Insured; Assured Guaranty | | | | | |

| Municipal Corp.) | 5.88 | 1/1/39 | 6,000,000 | | 6,910,560 |

| South Jersey Transportation | | | | | |

| Authority, Transportation | | | | | |

| System Revenue | 5.00 | 11/1/23 | 4,250,000 | | 5,107,395 |

| Tobacco Settlement Financing | | | | | |

| Corporation of New Jersey, | | | | | |

| Tobacco Settlement | | | | | |

| Asset-Backed Bonds | 4.50 | 6/1/23 | 2,480,000 | | 2,475,834 |

| Tobacco Settlement Financing | | | | | |

| Corporation of New Jersey, | | | | | |

| Tobacco Settlement | | | | | |

| Asset-Backed Bonds | 4.63 | 6/1/26 | 3,000,000 | | 2,921,460 |

| Tobacco Settlement Financing | | | | | |

| Corporation of New Jersey, | | | | | |

| Tobacco Settlement | | | | | |

| Asset-Backed Bonds | 4.75 | 6/1/34 | 2,800,000 | | 2,505,104 |

| Tobacco Settlement Financing | | | | | |

| Corporation of New Jersey, | | | | | |

| Tobacco Settlement | | | | | |

| Asset-Backed Bonds | 5.00 | 6/1/41 | 4,000,000 | | 3,640,920 |

The Fund 19

STATEMENT OF INVESTMENTS (continued)

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| New Jersey (continued) | | | | | |

| Tobacco Settlement Financing | | | | | |

| Corporation of New Jersey, | | | | | |

| Tobacco Settlement | | | | | |

| Asset-Backed Bonds | | | | | |

| (Prerefunded) | 7.00 | 6/1/13 | 2,000,000 | b | 2,056,540 |

| University of Medicine and | | | | | |

| Dentistry of New Jersey, GO | | | | | |

| (Insured; AMBAC) | 5.50 | 12/1/27 | 15,425,000 | | 15,473,743 |

| U.S. Related—10.6% | | | | | |

| Guam, | | | | | |

| Business Privilege Tax Revenue | 5.00 | 1/1/42 | 2,000,000 | | 2,207,960 |

| Guam Power Authority, | | | | | |

| Revenue | 5.50 | 10/1/30 | 2,250,000 | | 2,548,125 |

| Guam Waterworks Authority, | | | | | |

| Water and Wastewater | | | | | |

| System Revenue | 6.00 | 7/1/25 | 1,000,000 | | 1,041,090 |

| Puerto Rico Aqueduct and Sewer | | | | | |

| Authority, Senior Lien Revenue | 5.13 | 7/1/37 | 2,000,000 | | 1,825,820 |

| Puerto Rico Commonwealth, | | | | | |

| Public Improvement GO | 5.50 | 7/1/39 | 6,000,000 | | 5,970,960 |

| Puerto Rico Electric Power | | | | | |

| Authority, Power Revenue | 5.25 | 7/1/22 | 5,000,000 | | 5,228,400 |

| Puerto Rico Electric Power | | | | | |

| Authority, Power Revenue | 5.50 | 7/1/38 | 10,445,000 | | 10,555,926 |

| Puerto Rico Infrastructure | | | | | |

| Financing Authority, Special | | | | | |

| Tax Revenue (Insured; AMBAC) | 5.50 | 7/1/27 | 4,715,000 | | 4,909,069 |

| Puerto Rico Public Buildings | | | | | |

| Authority, Government | | | | | |

| Facilities Revenue | 6.25 | 7/1/22 | 2,000,000 | | 2,228,060 |

| Puerto Rico Sales Tax Financing | | | | | |

| Corporation, Sales Tax Revenue | | | | | |

| (First Subordinate Series) | 5.75 | 8/1/37 | 2,990,000 | | 3,165,005 |

| Puerto Rico Sales Tax Financing | | | | | |

| Corporation, Sales Tax Revenue | | | | | |

| (First Subordinate Series) | 6.00 | 8/1/39 | 2,230,000 | | 2,406,393 |

| Puerto Rico Sales Tax Financing | | | | | |

| Corporation, Sales Tax Revenue | | | | | |

| (First Subordinate Series) | 6.00 | 8/1/42 | 9,000,000 | | 9,637,110 |

20

| | | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | | Value ($) |

| U.S. Related (continued) | | | | | | |

| Puerto Rico Sales Tax Financing | | | | | | |

| Corporation, Sales Tax Revenue | | | | | | |

| (Insured; Berkshire Hathaway | | | | | | |

| Assurance Corporation) | 0.00 | 8/1/54 | 21,100,000 | | a | 2,249,049 |

| Puerto Rico Sales Tax Financing | | | | | | |

| Corporation, Sales Tax Revenue | | | | | | |

| (Insured; National Public | | | | | | |

| Finance Guarantee Corp.) | 0.00 | 8/1/43 | 18,000,000 | | a | 3,185,820 |

| Virgin Islands Public Finance | | | | | | |

| Authority, Revenue (Virgin Islands | | | | | | |

| Matching Fund Loan Note) | 5.00 | 10/1/25 | 5,000,000 | | | 5,439,500 |

| Virgin Islands Public Finance | | | | | | |

| Authority, Revenue (Virgin Islands | | | | | | |

| Matching Fund Loan Notes) | 5.00 | 10/1/25 | 2,000,000 | | | 2,155,800 |

| Total Long-Term Municipal Investments | | | | | |

| (cost $540,142,563) | | | | | | 595,160,640 |

| |

| Short-Term Investment—.0% | | | | | | |

| U.S. Treasury Bills; | | | | | | |

| 0.07%, 2/7/13 | | | | | | |

| (cost $289,980) | | | 290,000 | | c | 289,992 |

| |

| Total Investments (cost $540,432,543) | | | 97.3 | % | | 595,450,632 |

| Cash and Receivables (Net) | | | 2.7 | % | | 16,430,864 |

| Net Assets | | | 100.0 | % | | 611,881,496 |

|

| a Security issued with a zero coupon. Income is recognized through the accretion of discount. |

| b These securities are prerefunded; the date shown represents the prerefunded date. Bonds which are prerefunded are |

| collateralized by U.S. Government securities which are held in escrow and are used to pay principal and interest on |

| the municipal issue and to retire the bonds in full at the earliest refunding date. |

| c Held by or on behalf of a counterparty for open swap positions. |

The Fund 21

STATEMENT OF INVESTMENTS (continued)

| | | |

| Summary of Abbreviations | | |

| |

| ABAG | Association of Bay Area | ACA | American Capital Access |

| | Governments | | |

| AGC | ACE Guaranty Corporation | AGIC | Asset Guaranty Insurance Company |

| AMBAC | American Municipal Bond | ARRN | Adjustable Rate |

| | Assurance Corporation | | Receipt Notes |

| BAN | Bond Anticipation Notes | BPA | Bond Purchase Agreement |

| CIFG | CDC Ixis Financial Guaranty | COP | Certificate of Participation |

| CP | Commercial Paper | DRIVERS | Derivative Inverse |

| | | | Tax-Exempt Receipts |

| EDR | Economic Development | EIR | Environmental Improvement |

| | Revenue | | Revenue |

| FGIC | Financial Guaranty | FHA | Federal Housing |

| | Insurance Company | | Administration |

| FHLB | Federal Home | FHLMC | Federal Home Loan Mortgage |

| | Loan Bank | | Corporation |

| FNMA | Federal National | GAN | Grant Anticipation Notes |

| | Mortgage Association | | |

| GIC | Guaranteed Investment | GNMA | Government National Mortgage |

| | Contract | | Association |

| GO | General Obligation | HR | Hospital Revenue |

| IDB | Industrial Development Board | IDC | Industrial Development Corporation |

| IDR | Industrial Development | LIFERS | Long Inverse Floating |

| | Revenue | | Exempt Receipts |

| LOC | Letter of Credit | LOR | Limited Obligation Revenue |

| LR | Lease Revenue | MERLOTS | Municipal Exempt Receipt |

| | | | Liquidity Option Tender |

| MFHR | Multi-Family Housing Revenue | MFMR | Multi-Family Mortgage Revenue |

| PCR | Pollution Control Revenue | PILOT | Payment in Lieu of Taxes |

| P-FLOATS | Puttable Floating Option | PUTTERS | Puttable Tax-Exempt Receipts |

| | Tax-Exempt Receipts | | |

| RAC | Revenue Anticipation Certificates | RAN | Revenue Anticipation Notes |

| RAW | Revenue Anticipation Warrants | ROCS | Reset Options Certificates |

| RRR | Resources Recovery Revenue | SAAN | State Aid Anticipation Notes |

| SBPA | Standby Bond Purchase Agreement | SFHR | Single Family Housing Revenue |

| SFMR | Single Family Mortgage Revenue | SONYMA | State of New York Mortgage Agency |

| SPEARS | Short Puttable Exempt | SWDR | Solid Waste Disposal Revenue |

| | Adjustable Receipts | | |

| TAN | Tax Anticipation Notes | TAW | Tax Anticipation Warrants |

| TRAN | Tax and Revenue Anticipation Notes | XLCA | XL Capital Assurance |

22

| | | | | |

| Summary of Combined Ratings (Unaudited) | |

| |

| Fitch | or | Moody’s | or | Standard & Poor’s | Value (%)† |

| AAA | | Aaa | | AAA | 9.0 |

| AA | | Aa | | AA | 27.6 |

| A | | A | | A | 44.3 |

| BBB | | Baa | | BBB | 15.3 |

| BB | | Ba | | BB | .2 |

| B | | B | | B | 1.9 |

| F1 | | MIG1/P1 | | SP1/A1 | .1 |

| Not Ratedd | | Not Ratedd | | Not Ratedd | 1.6 |

| | | | | | 100.0 |

|

| † Based on total investments. |

| d Securities which, while not rated by Fitch, Moody’s and Standard & Poor’s, have been determined by the Manager to |

| be of comparable quality to those rated securities in which the fund may invest. |

See notes to financial statements.

The Fund 23

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2012

| | | |

| | Cost | Value | |

| Assets ($): | | | |

| Investments in securities—See Statement of Investments | 540,432,543 | 595,450,632 | |

| Cash | | 8,281,744 | |

| Interest receivable | | 8,807,951 | |

| Unrealized appreciation on swap contracts—Note 4 | | 263,597 | |

| Receivable for shares of Common Stock subscribed | | 40,905 | |

| Prepaid expenses | | 43,613 | |

| | | 612,888,442 | |

| Liabilities ($): | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(c) | | 460,587 | |

| Unrealized depreciation on swap contracts—Note 4 | | 256,665 | |

| Payable for shares of Common Stock redeemed | | 195,308 | |

| Accrued expenses | | 94,386 | |

| | | 1,006,946 | |

| Net Assets ($) | | 611,881,496 | |

| Composition of Net Assets ($): | | | |

| Paid-in capital | | 565,691,974 | |

| Accumulated net realized gain (loss) on investments | | (8,835,499 | ) |

| Accumulated net unrealized appreciation (depreciation) | | | |

| on investments and swap transactions | | 55,025,021 | |

| Net Assets ($) | | 611,881,496 | |

| | | | |

| Net Asset Value Per Share | | | | |

| | Class A | Class C | Class I | Class Z |

| Net Assets ($) | 457,617,909 | 10,403,373 | 4,526,574 | 139,333,640 |

| Shares Outstanding | 34,111,563 | 776,196 | 337,359 | 10,384,094 |

| Net Asset Value Per Share ($) | 13.42 | 13.40 | 13.42 | 13.42 |

| |

| See notes to financial statements. | | | | |

24

STATEMENT OF OPERATIONS

Year Ended December 31, 2012

| | |

| Investment Income ($): | | |

| Interest Income | 27,762,243 | |

| Expenses: | | |

| Management fee—Note 3(a) | 3,676,707 | |

| Shareholder servicing costs—Note 3(c) | 1,521,560 | |

| Professional fees | 97,467 | |

| Directors’ fees and expenses—Note 3(d) | 94,175 | |

| Distribution fees—Note 3(b) | 74,047 | |

| Registration fees | 61,621 | |

| Custodian fees—Note 3(c) | 50,552 | |

| Prospectus and shareholders’ reports | 49,607 | |

| Loan commitment fees—Note 2 | 8,156 | |

| Miscellaneous | 53,356 | |

| Total Expenses | 5,687,248 | |

| Less—reduction in expenses due to undertaking—Note 3(a) | (506,058 | ) |

| Less—reduction in fees due to earnings credits—Note 3(c) | (655 | ) |

| Net Expenses | 5,180,535 | |

| Investment Income—Net | 22,581,708 | |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

| Net realized gain (loss) on investments | 2,109,276 | |

| Net realized gain (loss) on swap transactions | (190,000 | ) |

| Net Realized Gain (Loss) | 1,919,276 | |

| Net unrealized appreciation (depreciation) on investments | 16,269,633 | |

| Net unrealized appreciation (depreciation) on swap transactions | 6,932 | |

| Net Unrealized Appreciation (Depreciation) | 16,276,565 | |

| Net Realized and Unrealized Gain (Loss) on Investments | 18,195,841 | |

| Net Increase in Net Assets Resulting from Operations | 40,777,549 | |

| |

| See notes to financial statements. | | |

The Fund 25

STATEMENT OF CHANGES IN NET ASSETS

| | | | |

| | Year Ended December 31, | |

| | 2012 | a | 2011 | |

| Operations ($): | | | | |

| Investment income—net | 22,581,708 | | 24,238,697 | |

| Net realized gain (loss) on investments | 1,919,276 | | (2,528,365 | ) |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | 16,276,565 | | 36,597,601 | |

| Net Increase (Decrease) in Net Assets | | | | |

| Resulting from Operations | 40,777,549 | | 58,307,933 | |

| Dividends to Shareholders from ($): | | | | |

| Investment income—net: | | | | |

| Class A Shares | (16,714,197 | ) | (17,916,454 | ) |

| Class B Shares | (412 | ) | (11,078 | ) |

| Class C Shares | (284,662 | ) | (291,501 | ) |

| Class I Shares | (133,127 | ) | (100,906 | ) |

| Class Z Shares | (5,222,345 | ) | (5,633,078 | ) |

| Total Dividends | (22,354,743 | ) | (23,953,017 | ) |

| Capital Stock Transactions ($): | | | | |

| Net proceeds from shares sold: | | | | |

| Class A Shares | 35,392,609 | | 28,763,272 | |

| Class B Shares | 138 | | 2,102 | |

| Class C Shares | 2,580,263 | | 1,591,464 | |

| Class I Shares | 3,229,352 | | 834,997 | |

| Class Z Shares | 6,384,263 | | 4,012,360 | |

| Dividends reinvested: | | | | |

| Class A Shares | 12,523,211 | | 13,306,484 | |

| Class B Shares | 262 | | 7,868 | |

| Class C Shares | 153,502 | | 150,423 | |

| Class I Shares | 92,334 | | 63,443 | |

| Class Z Shares | 4,237,919 | | 4,545,138 | |

| Cost of shares redeemed: | | | | |

| Class A Shares | (47,960,219 | ) | (59,475,244 | ) |

| Class B Shares | (217,906 | ) | (298,762 | ) |

| Class C Shares | (1,653,583 | ) | (2,287,276 | ) |

| Class I Shares | (1,472,678 | ) | (710,540 | ) |

| Class Z Shares | (13,101,340 | ) | (14,941,227 | ) |

| Increase (Decrease) in Net Assets | | | | |

| from Capital Stock Transactions | 188,127 | | (24,435,498 | ) |

| Total Increase (Decrease) in Net Assets | 18,610,933 | | 9,919,418 | |

| Net Assets ($): | | | | |

| Beginning of Period | 593,270,563 | | 583,351,145 | |

| End of Period | 611,881,496 | | 593,270,563 | |

26

| | | | |

| | Year Ended December 31, | |

| | 2012 | a | 2011 | |

| Capital Share Transactions: | | | | |

| Class Ab | | | | |

| Shares sold | 2,647,586 | | 2,296,610 | |

| Shares issued for dividends reinvested | 935,333 | | 1,064,904 | |

| Shares redeemed | (3,583,544 | ) | (4,801,204 | ) |

| Net Increase (Decrease) in Shares Outstanding | (625 | ) | (1,439,690 | ) |

| Class Bb | | | | |

| Shares sold | 10 | | 169 | |

| Shares issued for dividends reinvested | 20 | | 633 | |

| Shares redeemed | (16,545 | ) | (24,189 | ) |

| Net Increase (Decrease) in Shares Outstanding | (16,515 | ) | (23,387 | ) |

| Class C | | | | |

| Shares sold | 193,235 | | 127,862 | |

| Shares issued for dividends reinvested | 11,469 | | 12,066 | |

| Shares redeemed | (123,510 | ) | (186,803 | ) |

| Net Increase (Decrease) in Shares Outstanding | 81,194 | | (46,875 | ) |

| Class I | | | | |

| Shares sold | 242,671 | | 67,258 | |

| Shares issued for dividends reinvested | 6,882 | | 5,065 | |

| Shares redeemed | (110,898 | ) | (57,453 | ) |

| Net Increase (Decrease) in Shares Outstanding | 138,655 | | 14,870 | |

| Class Z | | | | |

| Shares sold | 477,197 | | 320,272 | |

| Shares issued for dividends reinvested | 316,519 | | 363,730 | |

| Shares redeemed | (978,508 | ) | (1,212,600 | ) |

| Net Increase (Decrease) in Shares Outstanding | (184,792 | ) | (528,598 | ) |

|

| a Effective as of the close of business on March 13, 2012, the fund no longer offers Class B shares. |

| b During the period ended December 31, 2012, 1,079 Class B shares representing $14,086 were automatically |

| converted to 1,078 Class A shares and during the period ended December 31, 2011, 7,796 Class B shares |

| representing $97,746 were automatically converted to 7,788 Class A shares. |

See notes to financial statements.

The Fund 27

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | | | | | | | | |

| | | | Year Ended December 31, | | | |

| Class A Shares | 2012 | | 2011 | | 2010 | | 2009 | | 2008 | |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 13.01 | | 12.25 | | 12.70 | | 11.67 | | 12.79 | |

| Investment Operations: | | | | | | | | | | |

| Investment income—neta | .49 | | .53 | | .54 | | .55 | | .55 | |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | .41 | | .75 | | (.46 | ) | 1.02 | | (1.12 | ) |

| Total from Investment Operations | .90 | | 1.28 | | .08 | | 1.57 | | (.57 | ) |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | (.49 | ) | (.52 | ) | (.53 | ) | (.54 | ) | (.55 | ) |

| Net asset value, end of period | 13.42 | | 13.01 | | 12.25 | | 12.70 | | 11.67 | |

| Total Return (%)b | 6.96 | | 10.72 | | .56 | | 13.65 | | (4.61 | ) |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | .96 | | .96 | | .95 | | .96 | | 1.00 | |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | .85 | | .85 | | .85 | | .85 | | .90 | |

| Ratio of interest and expense related | | | | | | | | | | |

| to floating rate notes issued | | | | | | | | | | |

| to average net assets | — | | — | | — | | — | | .05 | |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | 3.68 | | 4.23 | | 4.22 | | 4.40 | | 4.45 | |

| Portfolio Turnover Rate | 12.10 | | 9.58 | | 18.88 | | 17.17 | | 50.33 | |

| Net Assets, end of period ($ x 1,000) | 457,618 | | 443,882 | | 435,549 | | 458,014 | | 403,333 | |

| |

| a | Based on average shares outstanding at each month end. |

| b | Exclusive of sales charge. |

See notes to financial statements.

28

| | | | | | | | | | |

| | | | Year Ended December 31, | | | |

| Class C Shares | 2012 | | 2011 | | 2010 | | 2009 | | 2008 | |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 13.00 | | 12.24 | | 12.68 | | 11.66 | | 12.78 | |

| Investment Operations: | | | | | | | | | | |

| Investment income—neta | .39 | | .43 | | .45 | | .45 | | .45 | |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | .40 | | .76 | | (.45 | ) | 1.02 | | (1.12 | ) |

| Total from Investment Operations | .79 | | 1.19 | | — | | 1.47 | | (.67 | ) |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | (.39 | ) | (.43 | ) | (.44 | ) | (.45 | ) | (.45 | ) |

| Net asset value, end of period | 13.40 | | 13.00 | | 12.24 | | 12.68 | | 11.66 | |

| Total Return (%)b | 6.09 | | 9.90 | | (.13 | ) | 12.71 | | (5.34 | ) |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | 1.74 | | 1.73 | | 1.72 | | 1.72 | | 1.77 | |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | 1.60 | | 1.60 | | 1.60 | | 1.60 | | 1.64 | |

| Ratio of interest and expense related | | | | | | | | | | |

| to floating rate notes issued | | | | | | | | | | |

| to average net assets | — | | — | | — | | — | | .05 | |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | 2.92 | | 3.48 | | 3.45 | | 3.61 | | 3.69 | |

| Portfolio Turnover Rate | 12.10 | | 9.58 | | 18.88 | | 17.17 | | 50.33 | |

| Net Assets, end of period ($ x 1,000) | 10,403 | | 9,035 | | 9,080 | | 9,008 | | 4,714 | |

| |

| a | Based on average shares outstanding at each month end. |

| b | Exclusive of sales charge. |

See notes to financial statements.

The Fund 29

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | | |

| | | | Year Ended December 31, | | | |

| Class I Shares | 2012 | | 2011 | | 2010 | | 2009 | | 2008 | a |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 13.02 | | 12.25 | | 12.70 | | 11.66 | | 11.28 | |

| Investment Operations: | | | | | | | | | | |

| Investment income—netb | .50 | | .54 | | .57 | | .56 | | .03 | |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | .41 | | .77 | | (.47 | ) | 1.04 | | .38 | |

| Total from Investment Operations | .91 | | 1.31 | | .10 | | 1.60 | | .41 | |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | (.51 | ) | (.54 | ) | (.55 | ) | (.56 | ) | (.03 | ) |

| Net asset value, end of period | 13.42 | | 13.02 | | 12.25 | | 12.70 | | 11.66 | |

| Total Return (%) | 7.04 | | 10.97 | | .70 | | 13.91 | | 3.61 | c |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | .74 | | .76 | | .72 | | .78 | | .76 | d |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | .70 | | .70 | | .70 | | .70 | | .70 | d |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | 3.82 | | 4.36 | | 4.34 | | 4.55 | | 5.03 | d |

| Portfolio Turnover Rate | 12.10 | | 9.58 | | 18.88 | | 17.17 | | 50.33 | |

| Net Assets, end of period ($ x 1,000) | 4,527 | | 2,586 | | 2,252 | | 958 | | 10 | |

| |

| a | From December 15, 2008 (commencement of initial offering) to December 31, 2008. |

| b | Based on average shares outstanding at each month end. |

| c | Not annualized. |

| d | Annualized. |

See notes to financial statements.

30

| | | | | | | | | | |

| | | | Year Ended December 31, | | | |

| Class Z Shares | 2012 | | 2011 | | 2010 | | 2009 | | 2008 | |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 13.01 | | 12.25 | | 12.70 | | 11.67 | | 12.79 | |

| Investment Operations: | | | | | | | | | | |

| Investment income—neta | .50 | | .54 | | .55 | | .56 | | .56 | |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | .41 | | .75 | | (.46 | ) | 1.02 | | (1.12 | ) |

| Total from Investment Operations | .91 | | 1.29 | | .09 | | 1.58 | | (.56 | ) |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | (.50 | ) | (.53 | ) | (.54 | ) | (.55 | ) | (.56 | ) |

| Net asset value, end of period | 13.42 | | 13.01 | | 12.25 | | 12.70 | | 11.67 | |

| Total Return (%) | 7.04 | | 10.80 | | .65 | | 13.72 | | (4.56 | ) |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | .78 | | .78 | | .77 | | .79 | | .85 | |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | .78 | | .78 | | .77 | | .78 | | .85 | |

| Ratio of interest and expense related | | | | | | | | | | |

| to floating rate notes issued | | | | | | | | | | |

| to average net assets | — | | — | | — | | — | | .05 | |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | 3.75 | | 4.30 | | 4.31 | | 4.47 | | 4.50 | |

| Portfolio Turnover Rate | 12.10 | | 9.58 | | 18.88 | | 17.17 | | 50.33 | |

| Net Assets, end of period ($ x 1,000) | 139,334 | | 137,552 | | 135,981 | | 148,768 | | 140,950 | |

| |

| a Based on average shares outstanding at each month end. | | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

The Fund 31

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus New Jersey Municipal Bond Fund, Inc. (the “fund”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as a non-diversified open-end management investment com-pany.The fund’s investment objective is to seek as high a level of current income exempt from federal and New Jersey income taxes as is consistent with the preservation of capital. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares. The fund is authorized to issue 675 million shares of $.001 par value Common Stock.The fund currently offers four classes of shares: Class A (350 million shares authorized), Class C (150 million shares authorized), Class I (150 million shares authorized) and Class Z (25 million shares authorized). Class A shares are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class C shares redeemed within one year of purchase. Class I shares are sold at net asset value per share only to institutional investors. Class Z shares generally are not available for new accounts.The fund’s Board of Directors (the “Board”) approved, effective as of the close of business on March 13, 2012, the transfer of shares authorized from Class B to Class A. Class B shares were subject to a CDSC imposed on Class B share redemptions made within six years of purchase and automatically converted to Class A shares after six years.The fund no longer offers Class B shares. Effective March 13, 2012, all outstanding Class B shares were automatically converted to Class A shares. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights.

32

Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value.This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

The Fund 33

NOTES TO FINANCIAL STATEMENTS (continued)

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements.These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued each business day by an independent pricing service (the “Service”) approved by the Board. Investments for which quoted bid prices are readily available and are representative of the bid side of the market in the judgment of the Service are valued at the mean between the quoted bid prices (as obtained by the Service from dealers in such securities) and asked prices (as calculated by the Service based upon its evaluation of the market for such securities). Other investments (which constitute a majority of the portfolio securities) are carried at fair value as determined by the Service, based on methods which include consideration of the following: yields or prices of municipal securities of comparable quality, coupon, maturity and type; indications as to values from dealers; and general market conditions. All of the preceding securities are categorized within Level 2 of the fair value hierarchy. Swaps are valued by the Service by using a swap pricing model which incorporates among other factors, default probabilities, recovery rates, credit curves of the underlying issuer and swap spreads on interest rates.These securities are generally categorized within Level 2 of the fair value hierarchy.

34

The Service’s procedures are reviewed by Dreyfus under the general supervision of the Board.

When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers.These securities are either categorized within Level 2 or 3 depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are categorized within Level 3 of the fair value hierarchy.

The following is a summary of the inputs used as of December 31, 2012 in valuing the fund’s investments:

| | | | | | |

| | | Level 2—Other | | Level 3— | | |

| | Level 1— | Significant | | Significant | | |

| | Unadjusted | Observable | | Unobservable | | |

| | Quoted Prices | Inputs | | Inputs | Total | |

| Assets ($) | | | | | | |

| Investments in Securities: | | | | | |

| Municipal Bonds | — | 595,160,640 | | — | 595,160,640 | |

| U.S. Treasury | — | 289,992 | | — | 289,992 | |

| Other Financial | | | | | | |

| Instruments: | | | | | | |

| Swaps† | — | 263,597 | | — | 263,597 | |

| Liabilities ($) | | | | | | |

| Other Financial | | | | | | |

| Instruments: | | | | | | |

| Swaps† | — | (256,665 | ) | — | (256,665 | ) |

| |

| † Amount shown represents unrealized appreciation (depreciation) at period end. | | |

The Fund 35

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2012, there were no transfers between Level 1 and Level 2 of the fair value hierarchy.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Interest income, adjusted for accretion of discount and amortization of premium on investments, is earned from settlement date and recognized on the accrual basis. Securities purchased or sold on a when issued or delayed delivery basis may be settled a month or more after the trade date.

The fund follows an investment policy of investing primarily in municipal obligations of one state. Economic changes affecting the state and certain of its public bodies or municipalities may affect the ability of issuers within the state to pay interest on, or repay principal of, municipal obligations held by the fund.

(c) Dividends to shareholders: It is the policy of the fund to declare dividends from investment income-net. Such dividends are paid monthly. Dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.