UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-05514

Wilmington Funds

(Exact name of registrant as specified in charter)

Wilmington Funds Management Corporation

Rodney Square North

1100 North Market Street

Wilmington, DE 19890

(Address of principal executive offices) (Zip code)

John McDonnell

Wilmington Funds Management Corporation

Rodney Square North

1100 North Market Street

Wilmington, DE 19890

(Name and address of agent for service)

Registrant’s telephone number, including area code:302-651-8409

Date of fiscal year end: April 30

Date of reporting period: April 30, 2019

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

April 30, 2019 PRESIDENT’S MESSAGE AND Annual Report WILMINGTON FUNDS Equity Fund Wilmington International Fund Alternatives Fund Wilmington Global Alpha Equities Fund Asset Allocation Funds Wilmington Real Asset Fund Wilmington Diversified Income Fund Beginning on or about June 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your Fund’s shareholder reports will no longer be sent to you by mail, unless you specifically request them from the Fund or from your financial intermediary, such as a broker/dealer, bank, or insurance company. Instead, you will be notified by mail each time a report is posted on the website and provided with a link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you do not need to take any action. You may elect to receive shareholder reports and other communications from the Wilmington Funds electronically by contacting your financial intermediary or, if you are a direct investor, by calling 1-800-836-2211. You may elect to receive paper copies of all future shareholder reports free of charge. If you own these shares through a financial intermediary, you may contact your financial intermediary to elect to continue to receive paper copies of your shareholder reports. If you are a direct investor you can inform the Wilmington Funds that you wish to continue receiving paper copies of your shareholder reports by contacting us at 1-800-836-2211. Your election to receive reports in paper will apply to all funds held directly with the Wilmington Funds and may apply to all funds held with your financial intermediary. FUNDS

Wilmington International Fund (“International Fund”)

Wilmington Global Alpha Equities Fund (“Global Alpha Equities Fund”)

Wilmington Real Asset Fund (“Real Asset Fund”)

Wilmington Diversified Income Fund (“Diversified Income Fund”)

[This Page Intentionally Left Blank]

i

Esteemed Shareholder:

I am pleased to present the Annual Report of the Wilmington Funds (the “Trust”), covering the Trust’s annual fiscal year of May 1, 2018, through April 30, 2019. Inside you will find a comprehensive review of the Trust’s holdings and financial statements.

The economy and financial markets in review

Wilmington Funds Management Corporation and Wilmington Trust Investment Advisors, Inc. (the Trust’s investment advisor and subadvisor, respectively), have provided the following review of the economy, bond markets, and stock markets for the Trust’s annual fiscal year period.

The economy

The past year saw the U.S. economy continued to display solid growth, on pace for the longest economic expansion on record. A combination of tax cuts and fiscal spending buoyed the U.S. economy through 2018, with the U.S. posting Gross Domestic Product (“GDP”) growth of 2.9% (seasonally adjusted) in 2018. Beginning in December, we began to experience some hiccups in the economic data due to a confluence of factors: a sharp equity market selloff, a prolonged government shutdown, and weather-related seasonality issues. However, after accounting for these circumstances, it appears the U.S. economy remained on solid footing through the beginning of 2019, with first-quarter GDP growth clocking in at 3.2%. The U.S. labor market grew by an average 219,000 jobs per month over the fiscal year, defying expectations for a slowing of the labor market at this point in the cycle. Inflation, as measured by the Core Consumer Price Index1 on a year-over-year basis, has decelerated since July, as a combination of slowing growth, easing commodity price pressures, and transitory factors weighed on prices. After raising the federal funds rate three times between June and December, the Federal Reserve (the “Fed”) has shifted to a more patient stance alongside disinflation and global risks, including trade.

Outside of the U.S., the economic picture was weaker, and this contributed to a strengthening of the U.S. dollar. After efforts by Chinese policymakers to reign in leverage and excessive credit growth in 2018, the Chinese economy spent most of the year in slowing mode. This weighed on emerging and developed economies more exposed to trade and exports. In Europe and Japan, in particular, a number of region-specific issues (including weather, auto regulations, and protests) also detracted from growth. Chinese policymakers have taken several measured steps to stabilize the economy, and as of April 2019, it appeared some of these measures were beginning to make their way into the economy. European economic data was also showing tepid signs of improvement.

Bond markets

The past year resulted in solid returns from the bond market. To the surprise of many market forecasters, interest rates fell over the course of the year, with the10-year Treasury yield declining from 3% to as low as 2.36%mid-March and finishing the fiscal year around 2.5%. Long interest rates were dragged lower by a combination of muted inflation and disappointing growth abroad, as the German10-year bund (i.e., bond) moved back into negative territory in March. This contributed to a dramatic flattening of the U.S. yield curve, with the10-year minus3-month portion of the Treasury yield curve inverting in March 2019, sparking a fresh round of concerns about a U.S. recession.

Despite some modest widening of credit spreads, high-yield bonds delivered solid returns in excess of Treasuries and corporate bonds. Default rates remained low, and risk appetite over the course of the year supported returns for the asset class.

For the12-month period May 1, 2018 to April 30, 2019, certain Bloomberg indices performed as follows:2

| | | | | | | | |

| | | | |

Bloomberg Barclays U.S. Treasury Bond Index3 | | Bloomberg Barclays U.S. Aggregate Bond Index4 | | Bloomberg Barclays U.S. Credit Bond Index5 | | Bloomberg Barclays Municipal Bond Index6 | | Bloomberg Barclays U.S. Corporate High Yield Bond Index7 |

4.77% | | 5.29% | | 6.38% | | 6.16% | | 6.74% |

Past performance is no guarantee of future results.

Source: Lipper. You cannot invest directly in an index.

PRESIDENT’S MESSAGE / April 30, 2019 (unaudited)

ii

Equity markets

The past year has reflected a tale of two equity markets, with U.S. equities enjoying robust returns, while international developed and emerging markets equities faltered alongside slower growth. U.S. equities climbed to new highs through most of 2018 before hitting the brakes in the fourth quarter as a trifecta of concerns—slowing growth, the Fed rate hikes, and tariffs—led to the sharpest pullback for the S&P 500 since 2011. After declining nearly-20%, the S&P 500 bounced sharply on trade optimism and the Fed pledging to remain on hold. The S&P 500 once again reached new highs on April 30, 2019. U.S. small cap exhibited a sharper fourth-quarter pullback and had not yet recovered to new highs.

International equities suffered from the aforementioned growth dynamics, as well as a stronger U.S. dollar (which weakens returns for overseas equities after converting back into U.S. dollar terms). While international developed and emerging markets equities rebounded in 2019 (slightly trailing U.S. equities), it was not enough to overcome disappointing 2018 performance.

For the12-month period May 1, 2018 to April 30, 2019, certain stock market indices performed as follows:

| | | | | | |

S&P 500® Index8 | | Russell 2000® Index9 | | MSCI EAFE (Net) Index10 | | MSCI Emerging Markets (Net) Index11 |

13.49% | | 4.61% | | -3.22% | | -5.04% |

Past performance is no guarantee of future results.

Source: Lipper. You cannot invest directly in an index.

As investors know all too well, uncertainty in financial markets is certain. Other ongoing certainties include our fiduciary, clients-first mindset as we strive to manage risk and protect your portfolio’s assets. Another constant is our disciplined yet flexibleeconomics-led investment process that is delivered through innovative multi-asset class solutions and is designed to help you achieve your long-term objectives.

Sincerely,

Dominick J. D’Eramo, CFA

President

May 24, 2019

April 30, 2019 (unaudited) / PRESIDENT’S MESSAGE

iii

Must be preceded or accompanied by a prospectus.

Past performance is no guarantee of future results. The index performance quoted is for illustrative purposes only and is not representative of any specific investment. Diversification does not ensure a profit nor protect against loss.

All investments involve risk, including the possible loss of principal. Equity Securities are subject to price fluctuation and possible loss of principal. Small- andmid-cap stocks involve greater risks and volatility thanlarge-cap stocks. International investments are subject to special risks, including currency fluctuations, social, economic, and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

High-yield, lower-rated securities generally entail greater market, credit, and liquidity risks than investment grade securities and may include higher volatility and higher risk of default.

1. The Consumer Price Index (“CPI”) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas. Average price data for select utility, automotive fuel, and food items are also available.

2. Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause decline in their prices.

3. Bloomberg Barclays U.S. Treasury Bond Index is a market capitalization weighted index that includes all publicly issued, U.S. Treasury securities that have a remaining maturity of at least one year, are rated investment-grade, and have $250 million or more of outstanding face value. The index is unmanaged and investments cannot be made directly in an index.

4. Bloomberg Barclays U.S. Aggregate Bond Index is widely used benchmark index for the domestic investment-grade bond market composed of securities from the Barclays Government/Corporate Bond Index, Mortgage-Backed Securities Index and Asset-Backed Securities Index. The index typically includes fixed income securities with overall intermediate- to long-term average maturities. The index is unmanaged and investments cannot be made directly in an index.

5. Bloomberg Barclays U.S. Credit Bond Index tracks the performance of domestic investment-grade corporate bonds and is composed of all publicly issued, fixed-rate, nonconvertible, investment-grade corporate debt. The index is unmanaged and investments cannot be made directly in an index.

6. Bloomberg Barclays Municipal Bond Index tracks the performance of long-term,tax-exempt, investment-grade bond market. To be included in the index, bonds must have an outstanding par balance of at least $7 million and be issued as part of a transaction of at least $75 million. The index is unmanaged and investments cannot be made directly in an index.

7. Bloomberg Barclays U.S. Corporate High Yield Bond Index measures theUSD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on the Bloomberg Barclays EM country definition, are excluded. The U.S. Corporate High Yield Bond Index is a component of the U.S. Universal and Global High Yield Indices. An investment cannot be made directly in an index.

8. The S&P 500® Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and investments cannot be made directly in an index.

9. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. As of its latest reconstitution, the index had a total market capitalization range of approximately $128 million to $1.3 billion.

10. MSCI EAFE (Net) Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of developed markets, excluding the U.S. & Canada. The index consisted of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. The index is unmanaged and investments cannot be made directly in an index. The performance of this index is reduced by the taxes on dividends paid by the international securities issuers in the index.

11. MSCI Emerging Markets (Net) Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The MSCI Emerging Markets Index consisted of the following 21 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. The index is unmanaged and investments cannot be made directly in an index. The performance of this index is reduced by the taxes on dividends paid by the international securities issuers in the index.

PRESIDENT’S MESSAGE / April 30, 2019(unaudited)

1

WILMINGTON INTERNATIONAL FUND

Management’s Discussion of Fund Performance

For the fiscal year ended April 30, 2019, Wilmington International Fund (the “Fund”) had a total return of-4.07%* for Class A Shares and-3.91%* for Class I Shares, versus its benchmark, the MSCI –All Country Worldex-US Index (Net, USD) ( MSCI ACW Iex-US)** which had a total return of-3.23%. The MSCI ACWIex-US is a free float-adjusted market capitalization index that is designed to measure developed and emerging market equity performance, excluding the United States.

International equity markets fell during the first eight months of the fiscal year and recovered during the subsequent four months. During the market drop, the Fund returned-14.94% versus-14.53% for its benchmark. During the market recovery, the Fund returned 14.36% versus 13.22% for its benchmark.

For the full fiscal year, the Schroder Asian Opportunities strategy outperformed its MSCI Asiaex-Japan benchmark, 4.67% versus-4.09%. It outperformed during the first eight months,-12.32% versus-15.54%, as well as during the last four months, 19.37% versus 13.55%. The strategy’s portfolio management team is based mainly in Hong Kong.

For the full fiscal year, the Nikko Japan Active Value strategy outperformed its TOPIX benchmark,-9.17% versus-9.19%. It under-performed in the first eight months,-16.65% versus-16.06%, but outperformed in the subsequent four months, 8.99% versus 8.19%. The strategy’s portfolio management team is based in Tokyo.

In Europe, the Fund utilizes four complementary strategies. For the fiscal year, Allianz Europe Equity Growth Select produced the highest absolute return of the four European strategies, 0.24%. However, it underperformed its own S&P Europe Large Growth benchmark, which returned 1.56%. This strategy underperformed in the first eight months,-17.42% versus-12.86%, but outperformed during the last four months, 21.38% versus 16.55%. The strategy’s portfolio management team is based in Frankfurt.

For the fiscal year, AXA Framlington Europe Small Cap produced the second best absolute return of the four European strategies,-0.29%. It outperformed its own STOXX Europe 200 benchmark, which returned-3.44%. This strategy outperformed both during the first eight months,-15.74% versus-17.04%, and in the subsequent four months, 18.33% versus 16.61%. The strategy’s portfolio management team is based in Paris.

Allianz High Dividend Europe produced an absolute return of-7.17% for the full fiscal year, outperforming its MSCI Europe Value benchmark, which returned-7.30%. The strategy outperformed during the first eight months,-17.15% versus-17.35%. It slightly underper-formed during the subsequent four months, 12.05% versus 12.15%. The strategy’s portfolio management team is based in Frankfurt.

Berenberg European Equity Selection produced an absolute return of-10.58% for the full fiscal year, underperforming its EURO STOXX 50 benchmark, which returned-5.28%. The strategy outperformed during the first eight months, -17.10% versus-18.22%. However, it underperformed in the subsequent four months, 7.86% versus 15.83%. The strategy’s portfolio management team is based in Hamburg.

During the full fiscal year, pure stock selection (removing the influences of industry, style, country, currency) was the primary contributor to the portfolio’s positive excess return. Industry allocations contributed, particularly the over-weight to technology and underweights to financials, energy, and materials. Style factors were a large detractor, particularly the portfolio’s underweights to size and to dividend yield. The combination of country and currency factors detracted, due to portfolio’s over-weights to the Euro Area and Japan, and under-weights to Brazil, Australia, and Canada.

| | * | Performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The total return shown assumes the reinvestment of all distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. The total return for Class A Shares was-9.34%, adjusted for the Fund’s maximum sales charge of 5.50%. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For the most recentmonth-end performance, please visit www.wilmingtonfunds.com or call1-800-836-2211. |

| | ** | The MSCI All Country Worldex-US Index (Net, USD) (MSCI ACWIex-US) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the United States. |

The MSCI Asia ex Japan Index captures large andmid-cap representation across 2 of 3 Developed Markets (DM) countries (excluding Japan) and 9 Emerging Markets (EM) countries in Asia.

TOPIX is a free-float adjusted market capitalization-weighted index that is calculated based on all the domestic common stocks listed on the Tokyo Stock Exchange First Section.

The S&P Europe Large Cap Growth is designed to measurelarge-cap constituents of the S&P Europe Broad Market Index.

The STOXX Europe Small 200 Index is a fixed component index designed to provide a representation of small capitalization companies in Europe.

The MSCI Europe Value Index captures large andmid-cap securities exhibiting overall value style characteristics across the 15 Developed Markets (DM) countries in Europe.

The Euro STOXX 50 Index is a market capitalization weighted stock index of 50 large, blue-chip European companies operating within Eurozone nations. Components are selected from the Euro STOXX Index which includes large-,mid- andsmall-cap stocks in the Eurozone.

International investing involves special risks including currency risks, increased volatility of foreign securities, political risks and differences in auditing and other financial standards.

April 30, 2019 (unaudited) / ANNUAL REPORT

2

WILMINGTON INTERNATIONAL FUND

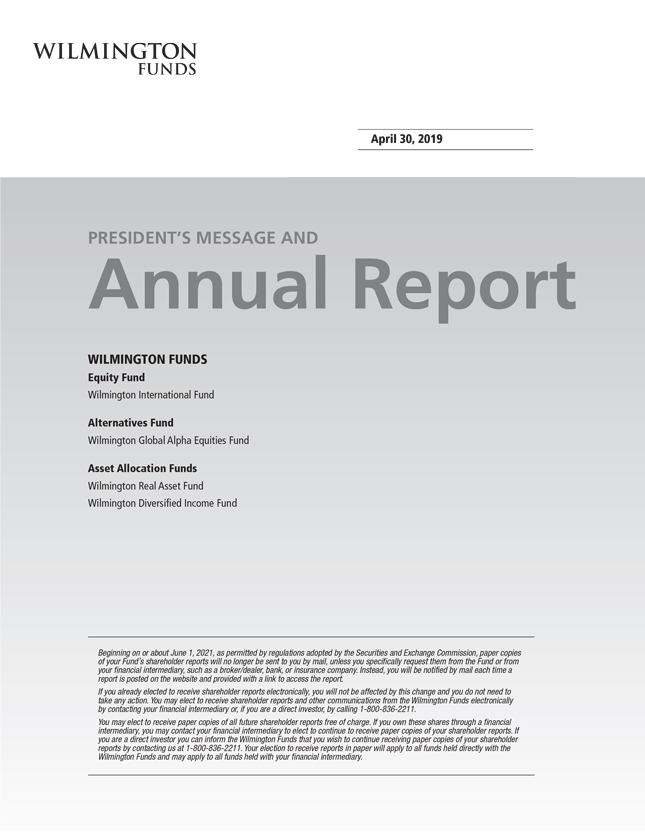

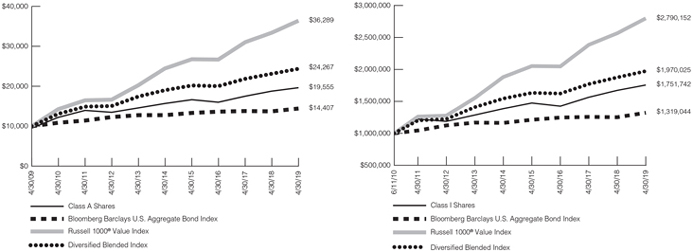

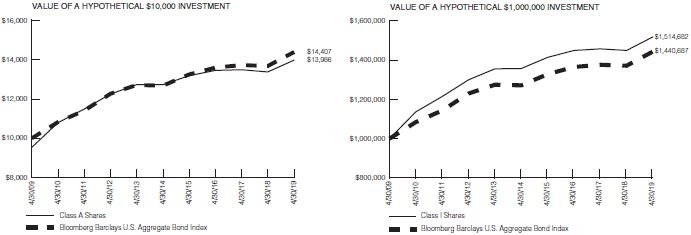

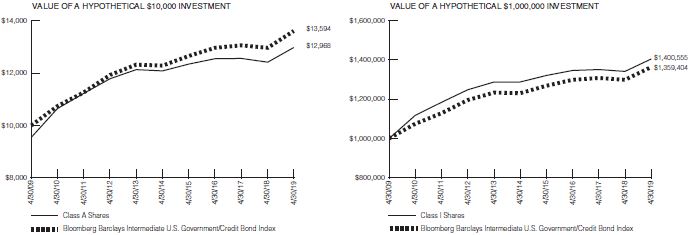

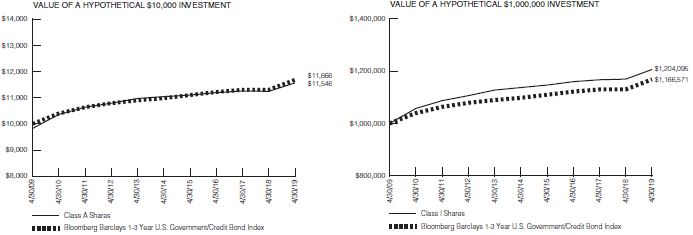

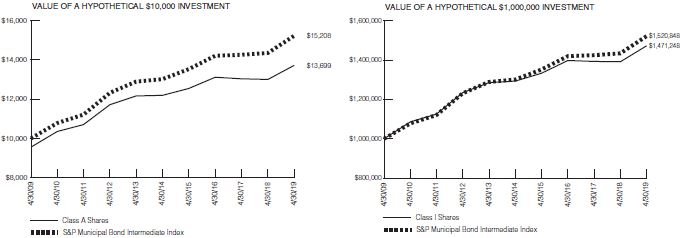

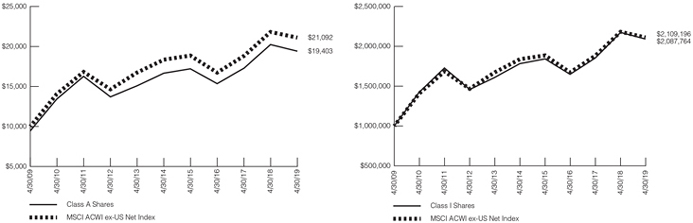

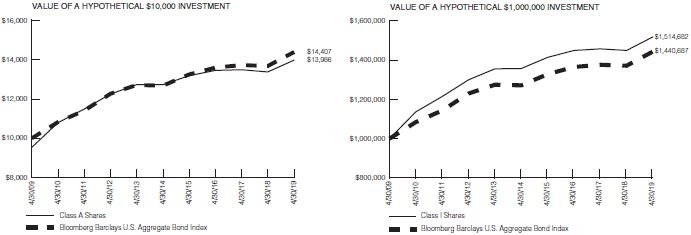

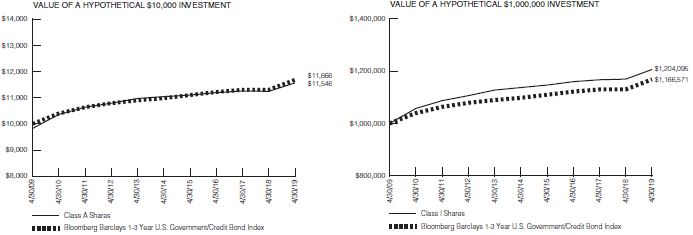

The graphs below illustrate the hypothetical investment of $10,0001 in the Class A Shares and $1,000,0001 in the Class I Shares of Wilmington International Fund from April 30, 2009 to April 30, 2019, compared to the MSCI ACWIex-US Net Index2.

| | |

| VALUE OF A HYPOTHETICAL $10,000 INVESTMENT | | VALUE OF A HYPOTHETICAL $1,000,000 INVESTMENT |

Performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The total return shown assumes the reinvestment of all distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. The total return for Class A Shares was-9.34%, adjusted for the Fund’s maximum sales charge of 5.50%. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For the most recentmonth-end performance, please visit www.wilmingtonfunds.com or call1-800-836-2211.

| | | | | | |

| | | Average Annual Total Returns for the Periods Ended 4/30/19 |

| | | |

| | | 1 Year | | 5 Years | | 10 Years |

| | | | |

Class A^ | | -9.34% | | 1.94% | | 6.85% |

| | | | |

Class I^ | | -3.91% | | 3.25% | | 7.64% |

| | | | |

MSCI ACWIex-US Net Index2 | | -3.23% | | 2.83% | | 7.75% |

^Expense Ratios Before Waivers and Expense Ratios After Waivers for Class A are 1.50% and 1.00%, respectively. Expense Ratios Before Waivers and Expense Ratios After Waivers for Class I are 1.25% and 0.87%, respectively. Expense Ratios Before Waiver represent the operating costs borne by the Fund, expressed as a percentage of the Fund’s average net assets, as shown in the Fees and Expenses table in the Fund’s current prospectus (under “Total Annual Fund Operating Expenses”). Current information regarding the Fund’s Operating Expenses can be found in the Fund’s Financial Highlights.

| 1 | Represents a hypothetical investment of $10,000 in Class A of the Fund after deducting the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge = $9,450) and $1,000,000 in Class I of the Fund and assumes the reinvestment of all dividends and distributions. |

| 2 | The performance for the MSCI ACWIex-US Net Index assumes the reinvestment of all dividends and distributions but does not reflect the deduction of a sales charge required for the Fund’s performance by the Securities and Exchange Commission. The performance of this index is reduced by the taxes on dividends paid by the international securities issuers in the index. It is not possible to invest directly in an index and the represented index is unmanaged. |

ANNUAL REPORT / April 30, 2019(unaudited)

3

WILMINGTON GLOBAL ALPHA EQUITIES FUND

Management’s Discussion of Fund Performance

For the fiscal year ended April 30, 2019, the Wilmington Global Alpha Equities Fund (the “Fund”) had a total return of 3.87%* for Class A Shares and 4.18%* for Class I Shares, versus its benchmark, the HFRX Equity Hedge Fund Index**, which had a total return of-3.97%. The Fund also substantially outperformed its Morningstar peer group, which returned 1.84%.

During the fiscal year that ended April 30, 2019, the Fund had strong risk-adjusted performance and met its objective of providing downside protected, hedged equity exposure.

The Fund outperformed both its benchmark and its peers, with substantially less risk. The Fund had an annualized standard deviation of 6.0%, notably less than both the peer average of 8.8% and the benchmark’s of 7.7%. Additionally, the Fund had a maximum peak to trough drawdown during the period of only 6.3% versus 11.3% for the peer group and over 17% for the MSCIACWI. The outperformance was concentrated during the volatile fourth quarter of 2018 where the Fund lost slightly over 4%, which was less than half the loss experienced by peers or the benchmark.

The Fund is a portfolio of long only equity strategies run by Wellington’s different portfolio management teams overseen and hedged with market futures by Wellington’s Investment Strategy and Risk Team.

For the year, the long only equity strategies significantly outperformed Global Equities as represented by the MSCI ACWI Index. The Fund was helped by stock selection, though it was hurt considerably by sector selection, where the Fund was underweight tech. Country selection was a wash, as the Fund was helped by its underweight to emerging markets, but hurt by its overweight to Japan.

From an underlying strategy perspective four Portfolio Managers (“PM”) outperformed significantly, two managers underperformed and the rest were roughlyin-line with their benchmarks. The top performer was a manager who focused on high quality companies with an overweight to U.S. markets. The poorest performer was an international value manager – a style that was very out of favor. The second poorest performer was a Japanese Value manager, who actually outperformed Japanese markets, but still detracted from Fund performance.

The Fund uses equity index futures to reduce the Fund’s net long exposure to the global equity market. The use of equity index futures detracted from absolute performance for the year but allowed the Fund to maintain its beta and volatility profile and was instrumental in the Fund’s strong down market outperformance.

| | * | Performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The total return shown assumes the reinvestment of all distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. The total return for Class A Shares was-1.84%, adjusted |

| | for the Fund’s maximum sales charge of 5.50%. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For the most recentmonth-end performance, please visit www.wilmingtonfunds.com or call1-800-836-2211. |

| | ** | The HFRX Equity Hedge Fund Index measures the performance of hedge fund strategies that primarily maintain long and short positions in equity and equity derivative securities. Equity Hedge managers typically maintain at least 50%, and in some cases may be entirely invested in equity-related securities, both long and short. Managers may employ a broad range of processes and strategies, including both quantitative and fundamental techniques, as well as net exposures, level of concentration, use of leverage, holding periods, and market capitalizations. The Index is weighted by asset size among reporting funds, which must have at least $50 million in assets or have been active for at least 12 months. The index is unmanaged and it is not possible to invest directly in an index. |

The MSCI All Country World Index (Net, USD) (MSCI ACWI) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

Standard deviation indicates the percentage by which a portfolio’s performance has varied from its average performance in any given month during the period indicated. The higher the standard deviation, the greater the range of performance, indicating greater volatility.

Investing involves risk and you may incur a profit or a loss. Investments such as mutual funds which focus on alternative strategies are subject to increased risk and loss of principal and are not suitable for all investors. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will be successful.Any investment in the Fund should be part of an overall investment program rather than, in itself, a complete program. Because the Fund invests in underlying mutual funds or other managed strategies, an investor in the Fund will bear the management fees and operating expenses of the “Underlying Strategies” in which the Fund invests. The total expenses borne by an investor in the Fund will be higher than if the investor invested directly in the Underlying Strategies, and the returns may therefore be lower.

The Fund, theSub-Advisors, and the Underlying Strategies may use aggressive investment strategies, which are riskier than those used by typical mutual funds. If the Fund andSub-Advisors are unsuccessful in applying these investment strategies, the Fund and you may lose more money than if you had invested in another fund that did not invest aggressively. The Fund is subject to risks associated with theSub-Advisors making trading decisions independently, investing in other investment companies, using a particular style or set of styles, basing investment decisions on historical relationships and correlations, trading frequently, using leverage, making short sales, beingnon-diversified, and investing in securities with low correlation to the market. The use of leverage may magnify losses.

The Fund is also subject to risks associated with investments in foreign markets, emerging market securities, small cap companies, debt securities, derivatives, commodity-linked instruments, illiquid securities, asset-backed securities, and Collaterized Mortgage Obligations (“CMO”). Please see the prospectus and summary prospectus for information on these as well as other risk considerations.

Acollateralized mortgage obligation (CMO) refers to a type of mortgage-backed security that contains a pool of mortgages bundled together and sold as an investment.

April 30, 2019 (unaudited) / ANNUAL REPORT

4

WILMINGTON GLOBAL ALPHA EQUITIES FUND

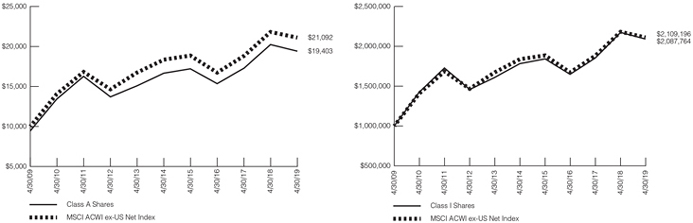

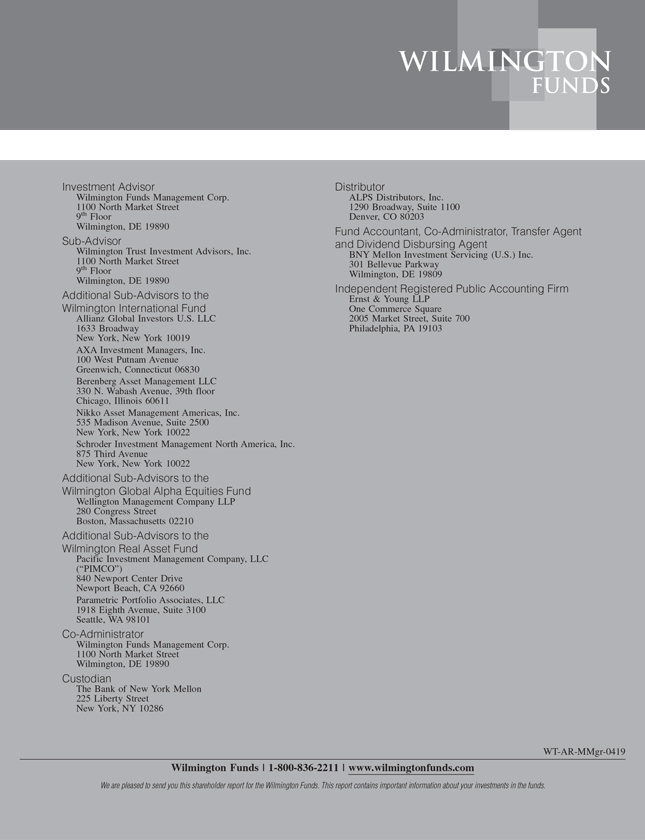

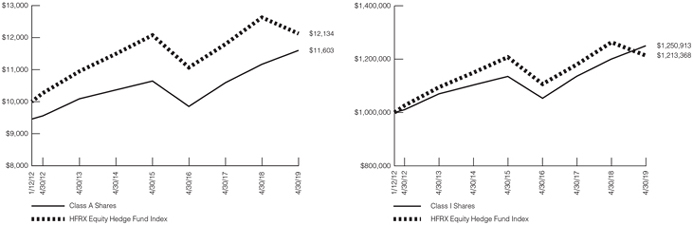

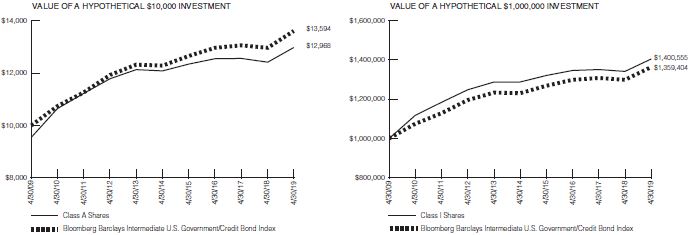

The graphs below illustrate the hypothetical investment of $10,0001 in the Class A Shares and $1,000,0001 in the Class I Shares of the Wilmington Global Alpha Equities Fund from January 12, 2012 (start of performance) to April 30, 2019 compared to the HFRX Equity Hedge Fund Index2.

| | |

VALUE OF A HYPOTHETICAL $10,000 INVESTMENT | | VALUE OF A HYPOTHETICAL $1,000,000 INVESTMENT |

Performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The total return shown assumes the reinvestment of all distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. The total return for Class A Shares was-1.84%, adjusted for the Fund’s maximum sales charge of 5.50%. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For the most recentmonth-end performance, please visit www.wilmingtonfunds.com or call1-800-836-2211.

| | | | | | |

| | | Average Annual Total Returns for the Periods Ended 4/30/19 |

| | | | | | | Start of Performance |

| | | 1 Year | | 5 Year | | (1/12/2012) |

| | | |

Class A^ | | -1.84% | | 1.13% | | 2.06% |

| | | |

Class I^ | | 4.18% | | 2.55% | | 3.11% |

| | | |

HFRX Equity Hedge Fund Index2 | | -3.97% | | 1.09% | | 2.68% |

^Expense Ratios Before Waivers and Expense Ratios After Waivers for Class A are 2.47% and 1.50%, respectively. Expense Ratios Before Waivers and Expense Ratios After Waivers for Class I are 2.22% and 1.25%, respectively. Expense Ratios Before Waiver represent the operating costs borne by the Fund, expressed as a percentage of the Fund’s average net assets, as shown in the Fees and Expenses table in the Fund’s current prospectus (under “Total Annual Fund Operating Expenses”). Current information regarding the Fund’s Operating Expenses can be found in the Fund’s Financial Highlights.

| 1 | Represents a hypothetical investment of $10,000 in Class A of the Fund after deducting the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge = $9,450) and $1,000,000 in Class I of the Fund and assumes the reinvestment of all dividends and distributions. |

| 2 | The performance for the HFRX Equity Hedge Fund Index assumes the reinvestment of all dividends and distributions but does not reflect the deduction of a sales charge required for the Fund’s performance by the Securities and Exchange Commission. It is not possible to invest directly in an index and the represented index is unmanaged. |

ANNUAL REPORT / April 30, 2019(unaudited)

5

WILMINGTON REAL ASSET FUND

Management’s Discussion of Fund Performance

For the fiscal year ended April 30, 2019, Wilmington Real Asset Fund (the “Fund”) had a total return of 2.05%* for Class A Shares and 2.29%* for Class I Shares, versus its benchmark, the S&P Developed Property Index**, and the Real Asset Blended Index, which had total returns of 7.79% and 3.51%, respectively.

The Real Asset Blended Index is currently a mix of 60% S&P Developed Property Index, 20% Bloomberg Barclays U.S. Treasury Inflation Protected Securities Index (“Bloomberg Barclays U.S. TIPS Index”)***, and 20% Bloomberg Commodity Index (Total Return)****. Prior to October 1, 2018, the Real Asset Blended Index consisted of 50% Bloomberg Barclays U.S. TIPS Index, 35% S&P Developed Property Index, and 15% Bloomberg Commodity Index (Total Return). During the fiscal year, the Fund’s relative underperformance was due to geography exposure within the Real Estate allocation.

U.S. inflation-linked bond (“ILB”) markets posted positive returns for the fiscal year as real yields fell, specifically in the belly of the curve. ILB’s trailed nominal bonds, however, as inflation expectations declined across most maturities, excepting very near term inflation which was impacted by tariffs. The Fund’s TIPS exposure outperformed the index, helped by duration positioning as well as some spread trades in other bond sectors.

Global real estate securities, as measured by the S&P Developed Property Index, were up high-single digits for the year, with significant dispersion by geography. The U.S. outperformed international markets by over 18%, as U.S. risk assets broadly outperformed, and the strong U.S. dollar further hurt international markets. This geographic dispersion led the Fund Real Estate allocation to significantly underperform, as the Fund is roughly 75% international while the index is only 50% international.

Commodities fell during the fiscal year, with all major categories seeing declines, led by agriculture which was impacted by tariffs, particularly in soybeans. Despite remarkable volatility in oil, as Brent saw a peak to trough drawdown of nearly 40%, energy ended the year roughly where it began. The Fund outperformed the Bloomberg Commodity Index, due to its exposure to MLP’s and other commodity related equities.

The Fund uses derivatives, which include interest rate/inflation options, interest rate futures, interest rate/inflation swaps, and credit default swaps, to seek to enhance returns of the Fund and to potentially hedge (or protect) against adverse movements in interest rates and movements in the bond markets During the fiscal year, the Fund’s use of derivatives had a positive impact on the relative performance of the Fund’s exposure to inflation protected securities versus the asset class benchmark.

| | * | Performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The total return shown assumes the reinvestment of all distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. The total return for Class A Shares was -3.55%, adjusted for the Fund’s maximum sales charge of 5.50%. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For the most recent month-end performance, please visit www.wilmingtonfunds.com or call1-800-836-2211. |

| | ** | S&P Developed Property Index defines and measures the investable universe of publicly traded property companies in developed global markets. |

| | *** | The Bloomberg Barclays U.S. Treasury Inflation Protected Securities Index measures the performance of the U.S. Treasury Inflation Protected Securities market. Federal Reserve holdings of US TIPS are not index eligible and are excluded from the face amount outstanding of each bond in the index. |

**** Bloomberg Commodity Index (Total Return) is designed to be a diversified benchmark for commodities as an asset class, and reflects the returns that are potentially available through an unleveraged investment in the futures contracts on physical commodities comprising the Index plus the rate of interest that could be earned on cash collateral invested in specified Treasury Bills. The Index is currently composed of futures contracts on 20 physical commodities.

International investing involves special risks including currency risks, increased volatility of foreign securities, political risks and differences in auditing and other financial standards.

April 30, 2019 (unaudited) / ANNUAL REPORT

6

WILMINGTON REAL ASSET FUND

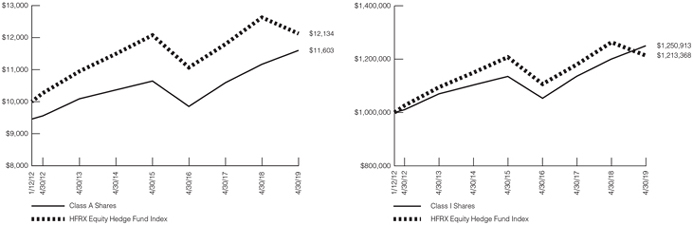

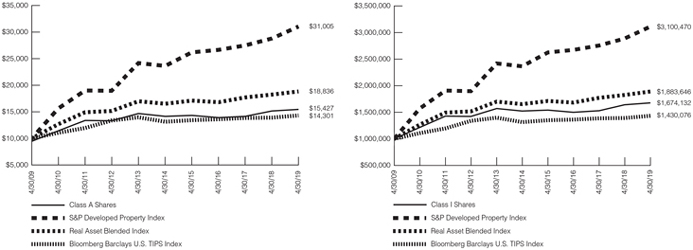

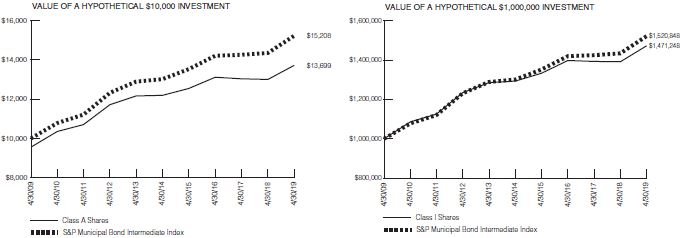

The graphs below illustrate the hypothetical investment of $10,0001 in the Class A Shares and $1,000,0001 in the Class I Shares of the Wilmington Real Asset Fund from April 30, 2009 to April 30, 2019 compared to the S&P Developed Property Index2, the Bloomberg Barclays U.S. TIPS Index2, and the Real Asset Blended Index3.

| | |

VALUE OF A HYPOTHETICAL $10,000 INVESTMENT | | VALUE OF A HYPOTHETICAL $1,000,000 INVESTMENT |

Performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The total return shown assumes the reinvestment of all distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. The total return for Class A Shares was-3.55%, adjusted for the Fund’s maximum sales charge of 5.50%. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For the most recentmonth-end performance, please visit www.wilmingtonfunds.com or call1-800-836-2211.

| | | | | | |

| | | Average Annual Total Returns for the Periods Ended 4/30/19 |

| | | 1 Year | | 5 Years | | 10 Years |

| | | |

Class A^ | | -3.55% | | 0.60% | | 4.43% |

| | | |

| | | |

Class I^ | | 2.29% | | 1.99% | | 5.29% |

| | | |

| | | |

Bloomberg Barclays U.S. TIPS Index2 | | 3.11% | | 1.74% | | 3.64% |

| | | |

| | | |

S&P Developed Property Index2 | | 7.79% | | 5.63% | | 11.98% |

| | | |

| | | |

Real Asset Blended Index3 | | 3.51% | | 2.67% | | 6.54% |

| | | |

^Expense Ratios Before Waivers and Expense Ratios After Waivers for Class A are 1.45% and 1.09%, respectively. Expense Ratios Before Waivers and Expense Ratios After Waivers for Class I are 1.20% and 0.84%, respectively. Expense Ratios Before Waiver represent the operating costs borne by the Fund, expressed as a percentage of the Fund’s average net assets, as shown in the Fees and Expenses table in the Fund’s current prospectus (under “Total Annual Fund Operating Expenses”). Current information regarding the Fund’s Operating Expenses can be found in the Fund’s Financial Highlights.

| 1 | Represents a hypothetical investment of $10,000 in Class A of the Fund after deducting the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge = $9,450) and $1,000,000 in Class I of the Fund and assumes the reinvestment of all dividends and distributions. |

| 2 | The performance for the S&P Developed Property Index and the Bloomberg Barclays U.S. TIPS Index assumes the reinvestment of all dividends and distributions but does not reflect the deduction of a sales charge required for the Fund’s performance by the Securities and Exchange Commission. It is not possible to invest directly in an index and the represented index is unmanaged. |

| 3 | The Real Asset Blended Index is calculated by the investment advisor and is currently based on a weighting of the following indices: 60% S&P Developed Property Index, 20% Bloomberg Barclays U.S. TIPS Index, and 20% Bloomberg Commodity Index (Total Return). |

ANNUAL REPORT / April 30, 2019(unaudited)

7

WILMINGTON DIVERSIFIED INCOME FUND

Management’s Discussion of Fund Performance

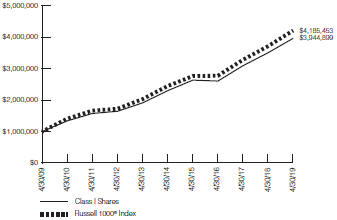

For the fiscal year ended April 30, 2019, Wilmington Diversified Income Fund (the “Fund”) had a total return of 4.66%* for Class A Shares and 4.82%* for Class I Shares, versus its benchmarks, the Russell 1000® Value Index**, Barclays US Aggregate Bond Index**, and the Diversified Blended Index**, which had total returns of 9.06%, 5.29%, and 5.39% respectively.

The Wilmington Diversified Income Fund seeks to achieve a high level of total return consistent with a moderate level of risk, with added emphasis on providing an attractive level of current income. The Fund is diversified across asset classes and geographies, with a philosophy that focuses on strategic positioning, minimizing tactical allocation shifts, and restrained turnover.

The fiscal year began with firm U.S. equity markets. Domestic companies reaped the benefits of tax reform, resulting in impressive earnings growth. Job growth remained strong in an environment of still low, but rising interest rates. The international picture was less rosy, with growth still challenged in Europe, resulting in an MSCI EAFE Index total return that was negative throughout the year. The complexion of the U.S. market was noteworthy, with a narrow set of high-growth mega cap companies leading the advance through most of the year.

End of cycle concerns were evident throughout the year, but reached a climax when the Federal Reserve raised rates in December. The market, interpreting the rate move as a policy error, sold off sharply, pushing major equity benchmarks into negative territory for the calendar year. January marked a sharp turnaround, as the Federal Reserve signaled an end to rate hikes, igniting a strong rally in the U.S. markets. The market’s strength continued through the end of the Fund’s fiscal year, as corporate earnings reports were generally better than expected.

Against this backdrop of sharply gyrating markets, the Fund posted attractive absolute returns while also delivering an attractive yield, but trailed the Diversified Blended Index for the full year. The shortfall in relative performance was concentrated in the period surrounding the market’s rally in the first quarter of 2019. With the Federal Reserve signaling an end to rate hikes, the market rally favored growth stocks and generally lower quality companies over higher yielding and higher quality companies, a headwind for the Enhanced Dividend Income Strategy (EDIS), the single largest component of the Fund.

A bright spot for relative performance came from the iShares International Select Dividend ETF (IDV), which outperformed the MSCI EAFE component of the Diversified Blended Index for the fiscal year. As mentioned earlier, developed international markets struggled during the fiscal year, and IDV’s higher yield provided a defensive cushion during a difficult period for the overseas markets.

With regard to the outlook, the issue of tariffs and trade wars has recently resurfaced, returning volatility to the markets. The prospects of a trade deal with China, once thought to be close at hand, have been spoiled as China reversed course on several agreements in an 11th hour move that precipitated a new and much larger round of tariffs from both sides. While the outcome remains uncertain, we take comfort in the idea that the defensive characteristics of the

Diversified Income Fund offer the prospect of a sturdy backstop in volatile markets.

| | * | Performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The total return shown assumes the reinvestment of all distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. The total return for Class A Shares was-1.10%, adjusted for the Fund’s maximum sales charge of 5.50%. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For the most recentmonth-end performance, please visit www.wilmingtonfunds.com or call1-800-836-2211. |

| | ** | The Russell 1000® Value Index measures the performance of those Russell 1000® Index companies with lowerprice-to-book ratios and lower forecasted growth values. The Bloomberg Barclays US Aggregate Bond Index is an index measuring both the capital price changes and income provided by the underlying universe of securities, comprised of U.S. Treasury obligations, U.S. investment grade corporate debt and mortgage backed obligations. |

The Diversified Blended Index is calculated by the investment advisor and represents the weighted returns of the following indices: 36.0% Russell 1000® Value Index; 24.0% Bloomberg Barclays US Aggregate Bond Index; 17.0% MSCI EAFE Index; 7.0% Bloomberg Barclays US Corporate High Yield Bond Index; 7.0%, Bloomberg Barclays US Government Inflation-Linked Bond Index; 4.5% Dow Jones Globalex-US Select Real Estate Securities Index; 2.5% S&P US REIT Index; and 2.0% Ibbotson Associates SBBI30-Day UST-Bill Index.

The Bloomberg Barclays US Government Inflation-linked Bond Index includes publicly issued, U.S. Treasury inflation protected securities that have at least 1 year remaining to maturity on index rebalancing date, with an issue size equal to or in excess of $500 million.

The Dow Jones Globalex-US Select Real Estate Securities Index is a float adjusted market capitalization index designed to measure the performance of publicly traded real estate securities in developed and emerging countries excluding the United States.

The S&P US REIT Index measures the investable U.S. real estate investment trust market and maintains a constituency that reflects the market’s overall composition.

The Ibbotson Associates SBBI 30 DayT-Bill Total Return Index is an index that reflects U.S. Treasury bill returns. Data from the Wall Street Journal are used for 1977-present; the CRSP U.S. Government Bond File is the source from 1926 to 1976. Each month a one bill portfolio containing the shortest-term bill having not less than one month to maturity is constructed.

International investing involves special risks including currency risk, political risks, increased volatility of foreign securities, and differences in auditing and other financial standards.

Bond prices are sensitive to changes in interest rates and a rise in short-term interest rates could cause a decline in bond prices.

Due to its strategy of investing in other mutual funds, this Fund may incur certain additional expenses and tax results that would not be present with a direct investment in the underlying funds.

April 30, 2019 (unaudited) / ANNUAL REPORT

8

WILMINGTON DIVERSIFIED INCOME FUND

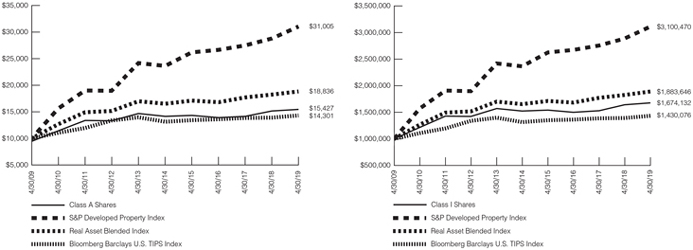

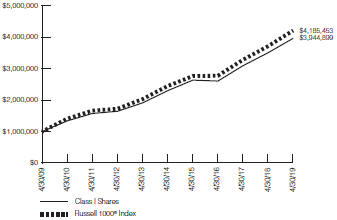

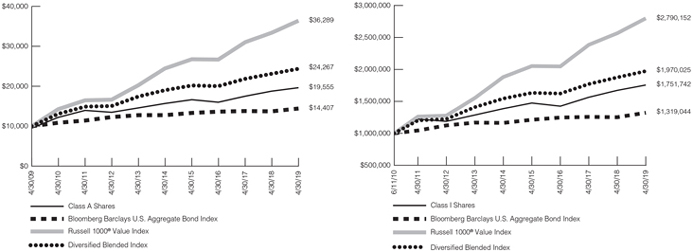

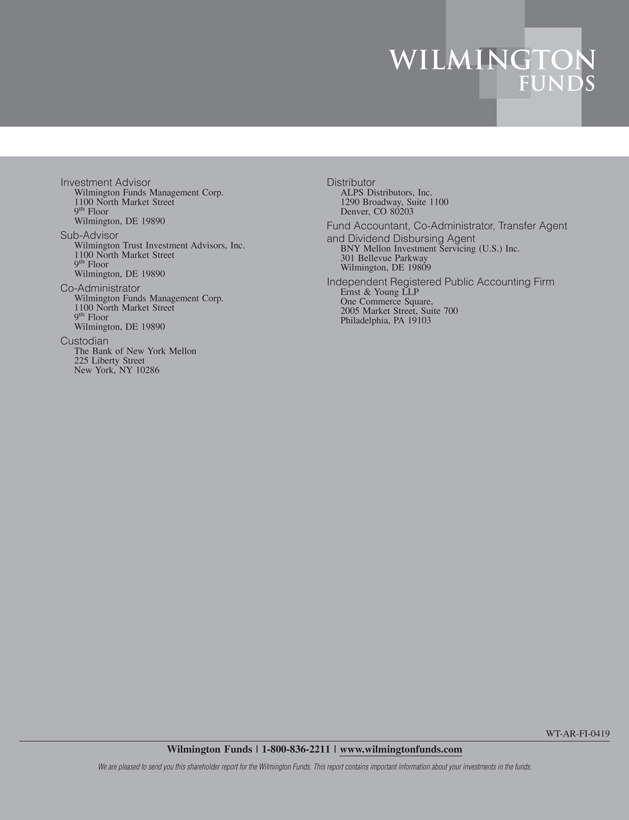

The graphs below illustrate the hypothetical investment of $10,0001 in the Class A Shares and $1,000,0001 in the Class I Shares of the Wilmington Diversified Income Fund from April 30, 2009 to April 30, 2019 and June 11, 2010 (start of performance) to April 30, 2019, respectively, compared to the Russell 1000® Value Index2, the Bloomberg Barclays U.S. Aggregate Bond Index2 and the Diversified Blended Index2,3.

| | |

VALUE OF A HYPOTHETICAL $10,000 INVESTMENT | | VALUE OF A HYPOTHETICAL $1,000,000 INVESTMENT |

Performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The total return shown assumes the reinvestment of all distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. The total return for Class A Shares was-1.10%, adjusted for the Fund’s maximum sales charge of 5.50%. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For the most recentmonth-end performance, please visit www.wilmingtonfunds.com or call1-800-836-2211.

| | | | | | |

| | | Average Annual Total Returns for the Periods Ended 4/30/19 |

| | | 1 Year | | 5 Years | | 10 Years |

| | | |

Class A^ | | -1.10% | | 3.41% | | 6.94% |

| | | |

| | | |

Class I^ | | 4.82% | | 4.83% | | 6.51%4 |

| | | |

| | | |

Russell 1000®Value Index2 | | 9.06% | | 8.27% | | 13.76% |

| | | |

| | | |

Bloomberg Barclays U.S. Aggregate Bond Index2 | | 5.29% | | 2.57% | | 3.72% |

| | | |

| | | |

Diversified Blended Index2,3 | | 5.39% | | 5.06% | | 9.27% |

| | | |

^Expense Ratios Before Waivers and Expense Ratios After Waivers for Class A are 1.88% and 0.75%, respectively. Expense Ratios Before Waivers and Expense Ratios After Waivers for Class I are 1.63% and 0.50%, respectively. Expense Ratios Before Waiver represent the operating costs borne by the Fund, expressed as a percentage of the Fund’s average net assets, as shown in the Fees and Expenses table in the Fund’s current prospectus (under “Total Annual Fund Operating Expenses”). Current information regarding the Fund’s Operating Expenses can be found in the Fund’s Financial Highlights.

| 1 | Represents a hypothetical investment of $10,000 in Class A of the Fund after deducting the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge = $9,450) and $1,000,000 in Class I of the Fund and assumes the reinvestment of all dividends and distributions. |

| 2 | The performance for the Russell 1000® Value Index, the Bloomberg Barclays U.S. Aggregate Bond Index and the Diversified Blended Index assumes the reinvestment of all dividends and distributions but does not reflect the deduction of a sales charge required for the Fund’s performance by the Securities and Exchange Commission. It is not possible to invest directly in an index and the represented indices are unmanaged. |

| 3 | The Diversified Blended Index is calculated by the investment advisor and represents the weighted returns of the following indices: 36.0% Russell 1000® Value Index; 24.0% Bloomberg Barclays U.S. Aggregate Bond Index; 17.0% MSCI EAFE Index; 7.0% Bloomberg Barclays |

ANNUAL REPORT / April 30, 2019(unaudited)

9

| | U.S. Corporate High Yield Bond Index; 7.0%, Bloomberg Barclays U.S. Government Inflation-Linked Bond Index; 4.5% Dow Jones Globalex-U.S. Select Real Estate Securities Index; 2.5% S&P U.S. REIT Index; and 2.0% Ibbotson Associates SBBI30-Day U.ST-Bill Index. |

| 4 | Represents the average total return for Class I Shares from June 11, 2010 (start of performance) to April 30, 2019. |

April 30, 2019 (unaudited) / ANNUAL REPORT

10

SHAREHOLDER EXPENSE EXAMPLE (unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; and redemption fees; and (2) ongoing costs, including management fees; distribution and/or service(12b-1) fees; and other Fund expenses. This Example is intended to help you to understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from November 1, 2018 to April 30, 2019.

Actual Expenses

This section of the following table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

Hypothetical Example for

Comparison Purposes

This section of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and assumed rates of return of 5% per year before expenses, which are not the Fund’s actual returns. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are required to be provided to enable you to compare the ongoing costs of investing in the Funds with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the Annualized Net Expense Ratio section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

The Annualized Net Expense Ratios may be different from the net expense ratios in the Financial Highlights which are for the fiscal year ended April 30, 2019.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

11/01/18 | | | Ending

Account Value

4/30/19 | | | Expenses Paid

During Period1

| | | Annualized Net

Expense Ratio2

| |

| | | | |

WILMINGTON INTERNATIONAL FUND | | | | | | | | | | | | | | | | |

| | | | |

Actual | | | | | | | | | | | | | | | | |

| | | | |

Class A | | | $1,000.00 | | | | $1,087.90 | | | | $5.07 | | | | 0.98% | |

| | | | |

Class I | | | $1,000.00 | | | | $1,089.20 | | | | $4.40 | | | | 0.85% | |

| | | | |

Hypothetical (assuming a 5% return before expense) | | | | | | | | | | | | | | | | |

| | | | |

Class A | | | $1,000.00 | | | | $1,019.93 | | | | $4.91 | | | | 0.98% | |

| | | | |

Class I | | | $1,000.00 | | | | $1,020.58 | | | | $4.26 | | | | 0.85% | |

| | | | |

WILMINGTON GLOBAL ALPHA EQUITIES FUND | | | | | | | | | | | | | | | | |

| | | | |

Actual | | | | | | | | | | | | | | | | |

| | | | |

Class A | | | $1,000.00 | | | | $1,051.20 | | | | $7.58 | | | | 1.49% | |

| | | | |

Class I | | | $1,000.00 | | | | $1,052.20 | | | | $6.31 | | | | 1.24% | |

| | | | |

Hypothetical (assuming a 5% return before expense) | | | | | | | | | | | | | | | | |

| | | | |

Class A | | | $1,000.00 | | | | $1,017.41 | | | | $7.45 | | | | 1.49% | |

| | | | |

Class I | | | $1,000.00 | | | | $1,018.65 | | | | $6.21 | | | | 1.24% | |

| | | | |

WILMINGTON REAL ASSET FUND | | | | | | | | | | | | | | | | |

| | | | |

Actual | | | | | | | | | | | | | | | | |

| | | | |

Class A | | | $1,000.00 | | | | $1,081.20 | | | | $4.95 | | | | 0.96% | |

| | | | |

Class I | | | $1,000.00 | | | | $1,081.70 | | | | $3.66 | | | | 0.71% | |

| | | | |

Hypothetical (assuming a 5% return before expense) | | | | | | | | | | | | | | | | |

| | | | |

Class A | | | $1,000.00 | | | | $1,020.03 | | | | $4.81 | | | | 0.96% | |

| | | | |

Class I | | | $1,000.00 | | | | $1,021.27 | | | | $3.56 | | | | 0.71% | |

ANNUAL REPORT / April 30, 2019(unaudited)

11

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

11/01/18 | | | Ending

Account Value

4/30/19 | | | Expenses Paid

During Period1

| | | Annualized Net

Expense Ratio2

| |

| | | | |

WILMINGTON DIVERSIFIED INCOME FUND | | | | | | | | | | | | | | | | |

| | | | |

Actual | | | | | | | | | | | | | | | | |

| | | | |

Class A | | | $1,000.00 | | | | $1,063.70 | | | | $3.02 | | | | 0.59% | |

| | | | |

Class I | | | $1,000.00 | | | | $1,064.00 | | | | $1.74 | | | | 0.34% | |

| | | | |

Hypothetical (assuming a 5% return before expense) | | | | | | | | | | | | | | | | |

| | | | |

Class A | | | $1,000.00 | | | | $1,021.87 | | | | $2.96 | | | | 0.59% | |

Class I | | | $1,000.00 | | | | $1,023.11 | | | | $1.71 | | | | 0.34% | |

| (1) | Expenses are equal to the Funds’ annualized net expense ratios, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the most recentone-half year period). |

| (2) | Expense ratio does not reflect the indirect expenses of the underlying funds in which it invests. |

April 30, 2019 (unaudited) / ANNUAL REPORT

12

PORTFOLIO OF INVESTMENTS SUMMARY TABLE

Wilmington International Fund

At April 30, 2019, the Fund’s sector classifications and country allocations were as follows (unaudited):

| | | | | |

| | | Percentage of |

| Common Stocks | | Total Net Assets |

Financials | | | | 19.1 | % |

Industrials | | | | 13.8 | % |

Consumer Discretionary | | | | 12.9 | % |

Information Technology | | | | 11.5 | % |

Communication Services | | | | 7.5 | % |

Health Care | | | | 6.7 | % |

Consumer Staples | | | | 5.7 | % |

Materials | | | | 4.5 | % |

Energy | | | | 4.1 | % |

Real Estate | | | | 3.7 | % |

Utilities | | | | 3.1 | % |

Chemicals | | | | 0.5 | % |

Warrants | | | | 1.2 | % |

Investment Companies | | | | 0.9 | % |

Preferred Stock | | | | 0.0 | %3 |

Cash Equivalents1 | | | | 10.7 | % |

Other Assets and Liabilities – Net2 | | | | (5.9 | )% |

| | | | | |

TOTAL | | | | 100.0 | % |

| | | | | |

| (1) | Cash Equivalents include investments in a money market fund and repurchase agreements. |

| (2) | Assets, other than investments in securities, less liabilities. See Statements of Assets and Liabilities. |

| (3) | Represents less than 0.05%. |

| | | | | |

| Country Allocation | | Percentage of Total Net Assets |

Common Stocks | | | | | |

Japan | | | | 18.2 | % |

France | | | | 9.8 | % |

United Kingdom | | | | 8.7 | % |

Germany | | | | 8.7 | % |

Cayman Islands | | | | 6.2 | % |

Hong Kong | | | | 5.3 | % |

Italy | | | | 3.6 | % |

Netherlands | | | | 3.3 | % |

Taiwan | | | | 2.9 | % |

Sweden | | | | 2.8 | % |

China | | | | 2.6 | % |

South Korea | | | | 2.5 | % |

Spain | | | | 2.3 | % |

Switzerland | | | | 2.3 | % |

Ireland | | | | 2.3 | % |

India | | | | 1.7 | % |

Denmark | | | | 1.6 | % |

Belgium | | | | 1.6 | % |

Norway | | | | 1.5 | % |

All other countries less than 1.0% | | | | 5.2 | % |

Warrants | | | | 1.2 | % |

Investment Companies | | | | 0.9 | % |

Preferred Stock | | | | 0.0 | %3 |

Cash Equivalents1 | | | | 10.7 | % |

Other Assets and Liabilities – Net2 | | | | (5.9 | )% |

| | | | | |

TOTAL | | | | 100.0 | % |

| | | | | |

PORTFOLIO OF INVESTMENTS

April 30, 2019

| | | | | | | | |

| Description | | Number of Shares | | | Value | |

| | |

COMMON STOCKS – 93.1% | | | | | | | | |

| | |

AUSTRALIA – 0.6% | | | | | | | | |

| | |

Rio Tinto Ltd. | | | 50,326 | | | $ | 3,392,092 | |

| | |

AUSTRIA – 0.5% | | | | | | | | |

| | |

Erste Group Bank AG | | | 78,984 | | | | 3,160,641 | |

| | |

BELGIUM – 1.6% | | | | | | | | |

| | |

Ageas | | | 1,240 | | | | 65,529 | |

| | |

Anheuser-Busch InBev SA/NV | | | 35,100 | | | | 3,120,653 | |

| | |

bpost SA# | | | 12,543 | | | | 151,006 | |

| | |

Colruyt SA | | | 1,920 | | | | 138,604 | |

| | |

KBC Group NV | | | 4,449 | | | | 330,277 | |

| | | | | | | | |

| Description | | Number of Shares | | | Value | |

| | |

Proximus SADP | | | 9,660 | | | $ | 270,550 | |

| | |

UCB SA | | | 41,850 | | | | 3,326,205 | |

| | |

Xior Student Housing NV# | | | 40,831 | | | | 1,967,606 | |

| | |

TOTAL BELGIUM | | | | | | $ | 9,370,430 | |

| | |

BERMUDA – 1.0% | | | | | | | | |

| | |

Hiscox Ltd. | | | 89,427 | | | | 1,956,012 | |

| | |

Hongkong Land Holdings Ltd. | | | 330,100 | | | | 2,304,726 | |

| | |

Johnson Electric Holdings Ltd. | | | 710,608 | | | | 1,672,928 | |

| | |

TOTAL BERMUDA | | | | | | $ | 5,933,666 | |

| | |

BULGARIA – 0.0%** | | | | | | | | |

| | |

Petrol AD* | | | 2,384 | | | | 1,025 | |

ANNUAL REPORT / April 30, 2019

13 PORTFOLIOS OF INVESTMENTS

Wilmington International Fund (continued)

| | | | | | | | |

| Description | | Number of

Shares | | | Value | |

| | |

CAYMAN ISLANDS – 6.2% | | | | | | | | |

| | |

Alibaba Group Holding Ltd. ADR* | | | 50,229 | | | $ | 9,320,996 | |

| | |

ASM Pacific Technology Ltd. | | | 159,500 | | | | 1,850,045 | |

| | |

China Resources Medical Holdings Co. Ltd. | | | 21,000 | | | | 15,266 | |

| | |

Haitian International Holdings Ltd. | | | 454,000 | | | | 1,138,451 | |

| | |

Huazhu Group Ltd. ADR | | | 52,850 | | | | 2,240,840 | |

| | |

NetEase, Inc. ADR | | | 5,052 | | | | 1,437,446 | |

| | |

New Oriental Education & Technology Group, Inc. ADR* | | | 39,953 | | | | 3,813,913 | |

| | |

Sands China Ltd. | | | 581,200 | | | | 3,199,019 | |

| | |

Shenzhou International Group Holdings Ltd. | | | 148,000 | | | | 1,989,242 | |

| | |

Tencent Holdings Ltd. | | | 222,000 | | | | 10,941,861 | |

| | |

TOTAL CAYMAN ISLANDS | | | | | | $ | 35,947,079 | |

| | |

CHINA – 2.6% | | | | | | | | |

| | |

China Mobile Ltd. | | | 240,500 | | | | 2,294,707 | |

| | |

China Pacific Insurance Group Co. Ltd., Class H | | | 1,017,000 | | | | 4,173,654 | |

| | |

China Petroleum & Chemical Corp., Class H | | | 2,426,000 | | | | 1,864,889 | |

| | |

Hollysys Automation Technologies Ltd. | | | 73,213 | | | | 1,532,348 | |

| | |

Ping An Insurance Group Co. of China Ltd., Class H# | | | 350,000 | | | | 4,236,633 | |

| | |

Sinopharm Group Co. Ltd., Class H | | | 248,000 | | | | 974,714 | |

| | |

TOTAL CHINA | | | | | | $ | 15,076,945 | |

| | |

DENMARK – 1.6% | | | | | | | | |

| | |

Ambu A/S, Class B# | | | 55,700 | | | | 1,602,581 | |

| | |

Coloplast A/S, Class B | | | 17,143 | | | | 1,851,812 | |

| | |

DSV A/S | | | 31,258 | | | | 2,896,612 | |

| | |

Novo Nordisk A/S, Class B | | | 61,117 | | | | 2,994,400 | |

| | |

Topdanmark A/S | | | 1,440 | | | | 77,695 | |

| | |

Tryg A/S | | | 2,730 | | | | 83,551 | |

| | |

TOTAL DENMARK | | | | | | $ | 9,506,651 | |

| | |

FINLAND – 0.7% | | | | | | | | |

| | |

DNA OYJ# | | | 93,531 | | | | 2,228,330 | |

| | |

Fortum OYJ | | | 11,807 | | | | 250,433 | |

| | |

Kesko OYJ, Class B | | | 3,629 | | | | 188,708 | |

| | |

Neste OYJ | | | 7,110 | | | | 235,005 | |

| | |

Sampo OYJ, Class A | | | 9,810 | | | | 449,183 | |

| | |

UPM-Kymmene OYJ | | | 15,708 | | | | 443,514 | |

| | |

Valmet OYJ | | | 6,984 | | | | 192,389 | |

| | |

TOTAL FINLAND | | | | | | $ | 3,987,562 | |

| | |

FRANCE – 9.8% | | | | | | | | |

| | |

AXA SA# | | | 48,198 | | | | 1,285,279 | |

| | |

BNP Paribas SA | | | 25,924 | | | | 1,380,020 | |

| | |

Bouygues SA# | | | 7,604 | | | | 286,234 | |

| | |

Carrefour SA | | | 167,500 | | | | 3,264,594 | |

| | |

Casino Guichard Perrachon SA# | | | 3,828 | | | | 156,737 | |

| | | | | | | | |

| Description | | Number of

Shares | | | Value | |

| | |

Cie de Saint-Gobain | | | 12,770 | | | $ | 523,571 | |

| | |

Cie Generale des Etablissements Michelin | | | | | | | | |

| | |

SCA | | | 1,230 | | | | 159,053 | |

| | |

CNP Assurances# | | | 10,256 | | | | 242,255 | |

| | |

Credit Agricole SA | | | 24,533 | | | | 336,890 | |

| | |

Dassault Systemes SA | | | 8,410 | | | | 1,331,837 | |

| | |

Devoteam SA | | | 10,166 | | | | 1,191,841 | |

| | |

Edenred | | | 76,276 | | | | 3,596,256 | |

| | |

Elior Group SA# | | | 133,538 | | | | 1,849,798 | |

| | |

Engie SA | | | 26,096 | | | | 387,331 | |

| | |

Eurazeo SE | | | 39,067 | | | | 3,066,177 | |

| | |

Hermes International | | | 340 | | | | 239,213 | |

| | |

ID Logistics Group* | | | 7,864 | | | | 1,405,504 | |

| | |

Ingenico Group SA | | | 5,445 | | | | 459,561 | |

| | |

Legrand SA | | | 5,044 | | | | 371,002 | |

| | |

L’Oreal SA# | | | 5,595 | | | | 1,538,925 | |

| | |

LVMH Moet Hennessy Louis Vuitton SA# | | | 14,235 | | | | 5,588,928 | |

| | |

Orange SA | | | 244,356 | | | | 3,818,945 | |

| | |

Renault SA | | | 4,864 | | | | 331,854 | |

| | |

Sanofi# | | | 59,295 | | | | 5,173,468 | |

| | |

Sartorius Stedim Biotech | | | 10,006 | | | | 1,359,068 | |

| | |

SCOR SE# | | | 38,314 | | | | 1,564,159 | |

| | |

Societe BIC SA | | | 920 | | | | 79,255 | |

| | |

Societe Generale SA | | | 23,423 | | | | 742,781 | |

| | |

SPIE SA | | | 64,246 | | | | 1,240,298 | |

| | |

Thales SA | | | 25,400 | | | | 3,034,739 | |

| | |

TOTAL SA | | | 43,013 | | | | 2,391,134 | |

| | |

Veolia Environnement SA | | | 131,800 | | | | 3,117,406 | |

| | |

Vinci SA# | | | 33,603 | | | | 3,393,790 | |

| | |

Virbac SA* | | | 7,574 | | | | 1,349,158 | |

| | |

TOTAL FRANCE | | | | | | $ | 56,257,061 | |

| | |

GERMANY – 8.7% | | | | | | | | |

| | |

Aareal Bank AG | | | 1,376 | | | | 48,130 | |

| | |

AIXTRON SE#,* | | | 81,934 | | | | 948,627 | |

| | |

Allianz SE | | | 13,100 | | | | 3,166,468 | |

| | |

alstria Office REIT AG | | | 103,828 | | | | 1,630,178 | |

| | |

AURELIUS Equity Opportunities SE & Co. | | | | | | | | |

| | |

KGaA# | | | 28,845 | | | | 1,436,761 | |

| | |

BASF SE | | | 18,010 | | | | 1,470,359 | |

| | |

Bayer AG | | | 19,650 | | | | 1,307,415 | |

| | |

Bayerische Motoren Werke AG | | | 9,538 | | | | 813,675 | |

| | |

Covestro AG | | | 7,549 | | | | 414,801 | |

| | |

Daimler AG | | | 15,675 | | | | 1,028,848 | |

| | |

Deutsche Lufthansa AG | | | 9,293 | | | | 224,833 | |

| | |

Deutsche Post AG | | | 5,620 | | | | 195,354 | |

| | |

Deutsche Telekom AG | | | 215,226 | | | | 3,606,105 | |

| | |

Deutsche Wohnen SE | | | 68,200 | | | | 3,072,112 | |

| | |

Evotec SE* | | | 51,557 | | | | 1,286,827 | |

April 30, 2019 / ANNUAL REPORT

PORTFOLIOS OF INVESTMENTS 14

Wilmington International Fund (continued)

| | | | | | | | |

| Description | | Number of

Shares | | | Value | |

| | |

Fielmann AG | | | 32,235 | | | $ | 2,291,892 | |

| | |

Freenet AG | | | 4,302 | | | | 101,077 | |

| | |

Fresenius SE & Co. KGaA | | | 33,751 | | | | 1,919,254 | |

| | |

Hannover Rueck SE | | | 1,560 | | | | 235,576 | |

| | |

HUGO BOSS AG | | | 26,136 | | | | 1,826,238 | |

| | |

Infineon Technologies AG | | | 132,939 | | | | 3,151,409 | |

| | |

Jenoptik AG | | | 46,823 | | | | 1,853,201 | |

| | |

METRO AG | | | 7,800 | | | | 132,534 | |

| | |

Muenchener Rueckversicherungs AG | | | 12,600 | | | | 3,135,572 | |

| | |

Nemetschek SE | | | 5,727 | | | | 1,059,500 | |

| | |

RWE AG | | | 122,300 | | | | 3,137,011 | |

| | |

SAP SE | | | 37,044 | | | | 4,775,296 | |

| | |

Scout24 AG | | | 211 | | | | 10,883 | |

| | |

Telefonica Deutschland Holding AG | | | 24,345 | | | | 79,057 | |

| | |

TLG Immobilien AG | | | 2,563 | | | | 75,508 | |

| | |

TUI AG | | | 13,976 | | | | 156,185 | |

| | |

Wirecard AG# | | | 6,863 | | | | 1,036,779 | |

| | |

XING SE | | | 8,830 | | | | 3,286,137 | |

| | |

Zalando SE* | | | 25,604 | | | | 1,206,631 | |

| | |

TOTAL GERMANY | | | | | | $ | 50,120,233 | |

| | |

HONG KONG – 5.3% | | | | | | | | |

| | |

AIA Group Ltd. | | | 783,800 | | | | 8,025,670 | |

| | |

BOC Hong Kong Holdings Ltd. | | | 700,500 | | | | 3,139,788 | |

| | |

CNOOC Ltd. | | | 1,866,000 | | | | 3,389,280 | |

| | |

Jardine Matheson Holdings Ltd. | | | 59,200 | | | | 3,897,141 | |

| | |

Sun Hung Kai Properties Ltd. | | | 180,500 | | | | 3,115,131 | |

| | |

Swire Properties Ltd. | | | 972,000 | | | | 3,955,374 | |

| | |

Techtronic Industries Co. Ltd. | | | 654,000 | | | | 4,732,671 | |

| | |

TOTAL HONG KONG | | | | | | $ | 30,255,055 | |

| | |

INDIA – 1.7% | | | | | | | | |

| | |

HDFC Bank Ltd. ADR | | | 61,691 | | | | 7,072,873 | |

| | |

Infosys Ltd. ADR | | | 243,047 | | | | 2,615,186 | |

| | |

TOTAL INDIA | | | | | | $ | 9,688,059 | |

| | |

IRELAND – 2.3% | | | | | | | | |

| | |

DCC PLC | | | 29,289 | | | | 2,621,672 | |

| | |

Glanbia PLC | | | 101,269 | | | | 1,862,496 | |

| | |

Kerry Group PLC, Class A | | | 15,076 | | | | 1,688,649 | |

| | |

Kingspan Group PLC | | | 76,229 | | | | 4,007,680 | |

| | |

Ryanair Holdings PLC ADR* | | | 15,064 | | | | 1,169,569 | |

| | |

UDG Healthcare PLC | | | 203,518 | | | | 1,747,190 | |

| | |

TOTAL IRELAND | | | | | | $ | 13,097,256 | |

| | |

ITALY – 3.6% | | | | | | | | |

| | |

Assicurazioni Generali SpA | | | 194,967 | | | | 3,782,772 | |

| | |

Atlantia SpA | | | 121,400 | | | | 3,314,321 | |

| | |

Enel SpA | | | 655,869 | | | | 4,153,086 | |

| | | | | | | | |

| Description | | Number of

Shares | | | Value | |

| | |

Eni SpA | | | 244,105 | | | $ | 4,159,845 | |

| | |

FinecoBank Banca Fineco SpA | | | 198,188 | | | | 2,610,528 | |

| | |

Intesa Sanpaolo SpA | | | 217,138 | | | | 568,907 | |

| | |

Italgas SpA | | | 14,936 | | | | 93,298 | |

| | |

Poste Italiane SpA | | | 14,720 | | | | 157,319 | |

| | |

Salvatore Ferragamo SpA# | | | 83,087 | | | | 1,885,071 | |

| | |

UnipolSai Assicurazioni SpA# | | | 56,200 | | | | 154,000 | |

| | |

TOTAL ITALY | | | | | | $ | 20,879,147 | |

| | |

JAPAN – 18.2% | | | | | | | | |

| | |

ABC-Mart, Inc. | | | 9,100 | | | | 565,564 | |

| | |

Aica Kogyo Co. Ltd. | | | 15,600 | | | | 541,264 | |

| | |

Ajinomoto Co., Inc. | | | 81,500 | | | | 1,318,631 | |

| | |

Alps Alpine Co. Ltd. | | | 11,036 | | | | 233,398 | |

| | |

Anritsu Corp.# | | | 36,800 | | | | 640,050 | |

| | |

Ariake Japan Co. Ltd. | | | 9,600 | | | | 560,974 | |

| | |

Asics Corp. | | | 50,900 | | | | 627,077 | |

| | |

Bandai Namco Holdings, Inc. | | | 11,700 | | | | 560,908 | |

| | |

Chubu Electric Power Co., Inc. | | | 69,700 | | | | 1,013,545 | |

| | |

Daihatsu Diesel Manufacturing Co. Ltd. | | | 61,600 | | | | 358,987 | |

| | |

Dai-ichi Life Holdings, Inc. | | | 103,000 | | | | 1,486,787 | |

| | |

Daikin Industries Ltd. | | | 18,700 | | | | 2,380,874 | |

| | |

Daiwa House Industry Co. Ltd. | | | 31,100 | | | | 871,718 | |

| | |

Daiwa Securities Group, Inc. | | | 52,400 | | | | 243,913 | |

| | |

Denka Co. Ltd. | | | 47,100 | | | | 1,422,201 | |

| | |

Denki Kogyo Co. Ltd. | | | 26,800 | | | | 785,972 | |

| | |

Ebara Corp. | | | 36,600 | | | | 1,126,433 | |

| | |

Electric Power Development Co. Ltd., Class C | | | 33,100 | | | | 769,424 | |

| | |

ESPEC Corp. | | | 21,600 | | | | 426,745 | |

| | |

Fujitsu General Ltd. | | | 35,300 | | | | 515,470 | |

| | |

Hino Motors Ltd. | | | 58,000 | | | | 549,868 | |

| | |

Hitachi Ltd. | | | 49,000 | | | | 1,629,654 | |

| | |

Hitachi Metals Ltd. | | | 61,000 | | | | 705,088 | |

| | |

Honda Motor Co. Ltd. | | | 42,800 | | | | 1,194,246 | |

| | |

Inpex Corp. | | | 130,600 | | | | 1,270,583 | |

| | |

Isetan Mitsukoshi Holdings Ltd. | | | 72,900 | | | | 694,927 | |

| | |

ITOCHU Corp. | | | 87,200 | | | | 1,573,389 | |

| | |

Itochu Techno-Solutions Corp. | | | 41,900 | | | | 1,029,696 | |

| | |

Izumi Co. Ltd. | | | 10,900 | | | | 476,064 | |

| | |

Jafco Co. Ltd. | | | 13,100 | | | | 495,912 | |

| | |

Japan Tobacco, Inc. | | | 51,000 | | | | 1,178,489 | |

| | |

JFE Holdings, Inc. | | | 27,300 | | | | 469,774 | |

| | |

JXTG Holdings, Inc. | | | 121,700 | | | | 592,094 | |

| | |

Komatsu Ltd. | | | 23,200 | | | | 599,266 | |

| | |

K’s Holdings Corp. | | | 100,500 | | | | 896,466 | |

| | |

Macromill, Inc. | | | 21,300 | | | | 244,291 | |

| | |

Megmilk Snow Brand Co. Ltd. | | | 21,200 | | | | 469,824 | |

ANNUAL REPORT / April 30, 2019

15 PORTFOLIOS OF INVESTMENTS

Wilmington International Fund (continued)

| | | | | | | | |

| Description | | Number of Shares | | | Value | |

| | |

Mirait Holdings Corp.# | | | 37,600 | | | $ | 553,129 | |

| | |

Mitsubishi Corp. | | | 39,300 | | | | 1,082,624 | |

| | |

Mitsubishi Electric Corp. | | | 71,900 | | | | 1,028,884 | |

| | |

Mitsubishi UFJ Financial Group, Inc. | | | 434,000 | | | | 2,153,302 | |

| | |

Mitsui Fudosan Co. Ltd. | | | 62,300 | | | | 1,442,989 | |

| | |

Mizuho Financial Group, Inc. | | | 549,200 | | | | 857,701 | |

| | |

Morinaga & Co. Ltd. | | | 5,100 | | | | 212,918 | |

| | |

NEC Networks & System Integration Corp. | | | 38,900 | | | | 937,109 | |

| | |

Nintendo Co. Ltd. | | | 8,800 | | | | 3,030,859 | |

| | |

Nippo Corp. | | | 60,600 | | | | 1,232,070 | |

| | |

Nippon Densetsu Kogyo Co. Ltd. | | | 43,600 | | | | 940,594 | |

| | |

Nippon Steel Corp. | | | 24,300 | | | | 434,649 | |

| | |

Nippon Telegraph & Telephone Corp. | | | 41,900 | | | | 1,743,393 | |

| | |

Nissin Kogyo Co. Ltd. | | | 199,000 | | | | 2,652,715 | |

| | |

Nitori Holdings Co. Ltd. | | | 3,700 | | | | 441,420 | |

| | |

Nitto Denko Corp. | | | 5,700 | | | | 308,183 | |

| | |

NTT Data Corp. | | | 63,600 | | | | 741,640 | |

| | |

NTT DOCOMO, Inc. | | | 35,200 | | | | 764,389 | |

| | |

Olympus Corp. | | | 284,400 | | | | 3,191,994 | |

| | |

ORIX Corp. | | | 54,800 | | | | 776,288 | |

| | |

OSAKA Titanium Technologies Co. Ltd. | | | 49,900 | | | | 693,156 | |

| | |

OSJB Holdings Corp. | | | 297,000 | | | | 709,611 | |

| | |

Otsuka Corp. | | | 46,000 | | | | 1,809,319 | |

| | |

Pacific Industrial Co. Ltd. | | | 49,500 | | | | 811,691 | |

| | |

Pan Pacific International Holdings Corp. | | | 17,400 | | | | 1,121,330 | |

| | |

Parco Co. Ltd. | | | 35,500 | | | | 341,036 | |

| | |

Persol Holdings Co. Ltd. | | | 16,200 | | | | 305,361 | |

| | |

Recruit Holdings Co. Ltd. | | | 58,300 | | | | 1,755,639 | |

| | |

Rengo Co. Ltd. | | | 108,400 | | | | 956,135 | |

| | |

Ryobi Ltd. | | | 15,800 | | | | 360,458 | |

| | |