UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-05624 |

|

Morgan Stanley Institutional Fund, Inc. |

(Exact name of registrant as specified in charter) |

|

522 Fifth Avenue New York, NY | | 10036 |

(Address of principal executive offices) | | (Zip code) |

|

Ronald E. Robison

522 Fifth Avenue New York, New York 10036 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-800-221-6726 | |

|

Date of fiscal year end: | 12/31 | |

|

Date of reporting period: | 12/31/07 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The Fund’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

| 2007 Annual Report |

|

December 31, 2007 |

Morgan Stanley Institutional Fund, Inc.

Global and International Equity Portfolios | U.S. Real Estate |

| U.S. Small/Mid Cap Value |

Active International Allocation | |

Emerging Markets | Fixed Income Portfolio |

Global Franchise | |

Global Real Estate | Emerging Markets Debt |

Global Value Equity | |

International Equity | |

International Growth Active Extension | |

International Growth Equity | |

International Magnum | |

International Real Estate | |

International Small Cap | |

| |

U.S. Equity Portfolios | |

| |

Disciplined Large Cap Value Active Extension | |

Focus Equity | |

Large Cap Relative Value | |

Small Company Growth | |

Systematic Active Large Cap Core | |

Systematic Active Small Cap Core | |

Systematic Active Small Cap Growth | |

Systematic Active Small Cap Value | |

Systematic Large Cap Core Active Extension | |

U.S. Large Cap Growth | |

| 2007 Annual Report |

| |

| December 31, 2007 |

Table of Contents

Shareholder’s Letter | 3 |

Performance Summary | 4 |

Investment Overview and Portfolios of Investments Global and International Equity Portfolios: | |

Active International Allocation | 6 |

Emerging Markets | 23 |

Global Franchise | 30 |

Global Real Estate | 34 |

Global Value Equity | 41 |

International Equity | 46 |

International Growth Active Extension | 52 |

International Growth Equity | 58 |

International Magnum | 63 |

International Real Estate | 70 |

International Small Cap | 76 |

U.S. Equity Portfolios: | |

Disciplined Large Cap Value Active Extension | 81 |

Focus Equity | 88 |

Large Cap Relative Value | 92 |

Small Company Growth | 97 |

Systematic Active Large Cap Core | 102 |

Systematic Active Small Cap Core | 109 |

Systematic Active Small Cap Growth | 118 |

Systematic Active Small Cap Value | 126 |

Systematic Large Cap Core Active Extension | 135 |

U.S. Large Cap Growth | 143 |

U.S. Real Estate | 147 |

U.S. Small/Mid Cap Value | 153 |

Fixed Income Portfolio: | |

Emerging Markets Debt | 158 |

Statements of Assets and Liabilities | 163 |

Statements of Operations | 175 |

Statements of Changes in Net Assets | 180 |

Statements of Cash Flows | 192 |

Financial Highlights | 193 |

Notes to Financial Statements | 218 |

Report of Independent Registered | |

Public Accounting Firm | 231 |

Federal Income Tax Information | 232 |

U.S. Privacy Policy | 234 |

Director and Officer Information | 236 |

This report is authorized for distribution only when preceded or accompanied by prospectuses of the Morgan Stanley Institutional Fund, Inc. To receive a prospectus and/or SAI, which contains more complete information such as investment objectives, charges, expenses, policies for voting proxies, risk considerations, and describes in detail each of the Portfolio’s investment policies to the prospective investor, please call 1-(800)-548-7786. Please read the prospectuses carefully before you invest or send money. Additionally, you can access portfolio information including performance, characteristics, and investment team commentary through Morgan Stanley Investment Management’s website: www.morganstanley.com/msim.

Market forecasts provided in this report may not necessarily come to pass. There is no guarrantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Fund in the future. There is no assurance that a Fund will achieve its investment objective. Funds are subject to market risk, which is the possibility that market values of securities owned by the Fund will decline and, therefore, the value of the Fund’s shares may be less than what you paid for them. Accordingly, you can lose money investing in Funds. Please see the prospectus for more complete information on investment risks.

(This Page has been left blank intentionally.)

| 2007 Annual Report |

| |

| December 31, 2007 |

Shareholder’s Letter

Dear Shareholders:

We are pleased to present to you the Fund’s Annual Report for the year ended December 31, 2007. Our Fund currently offers 24 portfolios providing investors with a full array of global and domestic equity and fixed-income products. The Fund’s portfolios, together with the portfolios of the Morgan Stanley Institutional Fund Trust, provide investors with a means to help them meet specific investment needs and to allocate their investments among equities (e.g., value and growth; small, medium, and large capitalization) and fixed income (e.g., short, medium, and long duration; investment grade and high yield).

Sincerely,

Ronald E. Robison

President and Principal Executive Officer

January 2008

2007 Annual Report | |

| |

December 31, 2007 | |

Performance Summary

| | Inception Dates | | | | One Year

Total Return | | |

| | Class A | | Class B | | Class A | | Class B | | Comparable

Indices | |

Global and International Equity Portfolios: | | | | | | | | | | | | |

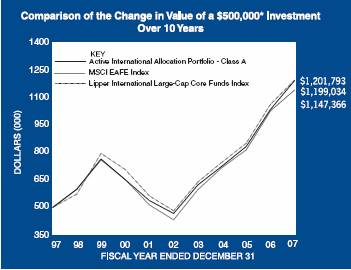

Active International Allocation | | 1/17/92 | | 1/2/96 | | 15.30 | % | 14.95 | % | 11.17 | % | (1) |

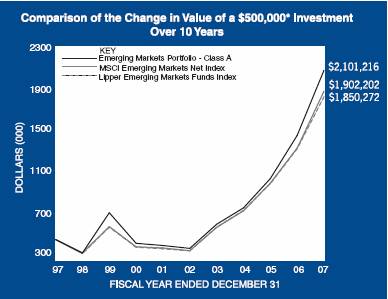

Emerging Markets | | 9/25/92 | | 1/2/96 | | 41.56 | | 41.20 | | 39.39 | | (2) |

Global Franchise | | 11/28/01 | | 11/28/01 | | 9.58 | | 9.26 | | 9.04 | | (3) |

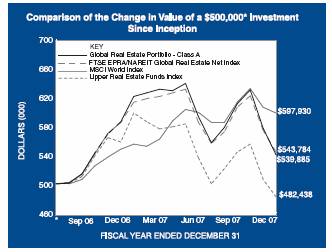

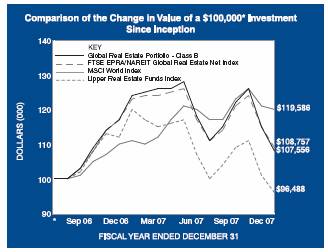

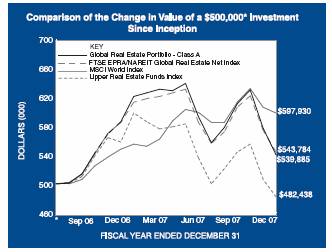

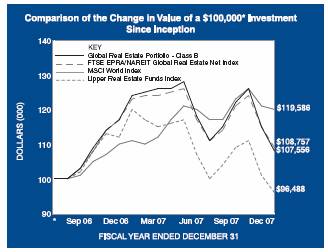

Global Real Estate | | 8/30/06 | | 8/30/06 | | (7.87 | ) | (8.15 | ) | (7.06 | ) | (4) |

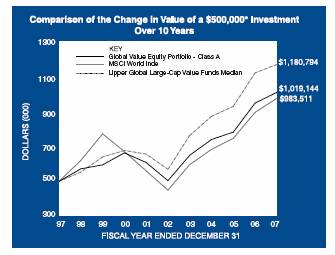

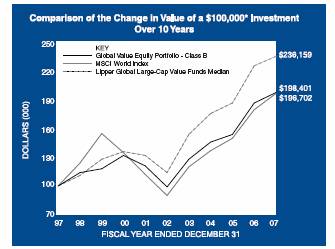

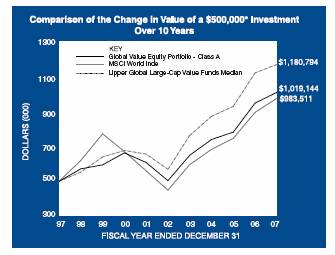

Global Value Equity | | 7/15/92 | | 1/2/96 | | 6.65 | | 6.37 | | 9.04 | | (3) |

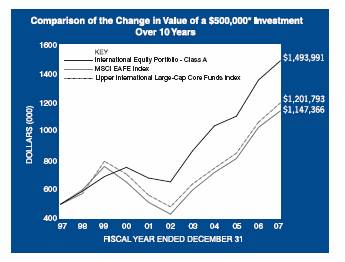

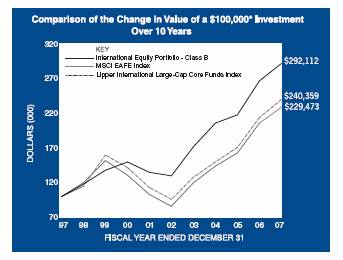

International Equity | | 8/4/89 | | 1/2/96 | | 9.84 | | 9.52 | | 11.17 | | (1) |

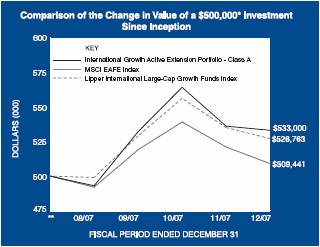

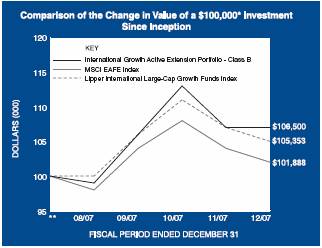

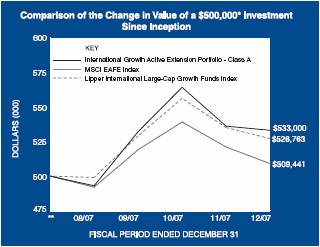

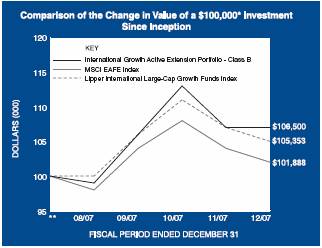

International Growth Active Extension† | | 7/31/07 | | 7/31/07 | | — | | — | | — | | (1) |

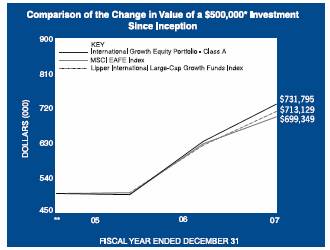

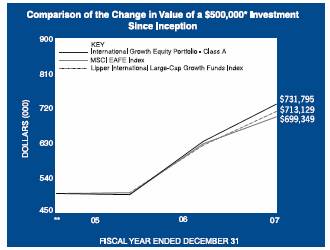

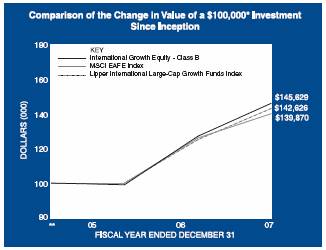

International Growth Equity | | 12/27/05 | | 12/27/05 | | 15.22 | | 15.03 | | 11.17 | | (1) |

International Magnum | | 3/15/96 | | 3/15/96 | | 14.77 | | 14.47 | | 11.17 | | (1) |

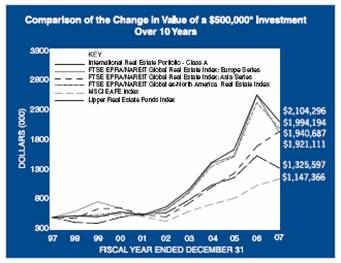

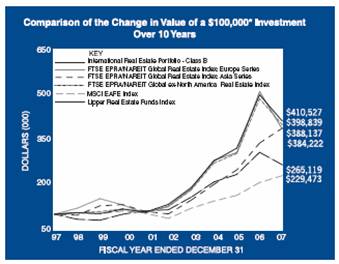

International Real Estate | | 10/1/97 | | 10/1/97 | | (17.59 | ) | (17.76 | ) | (17.88 | ) | (5) |

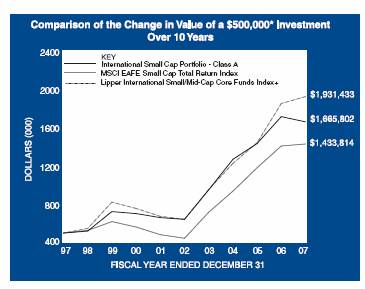

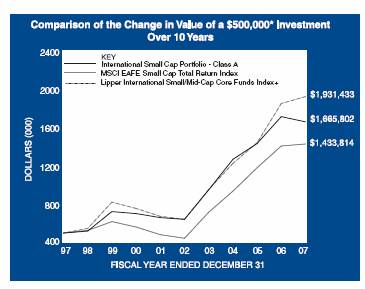

International Small Cap | | 12/15/92 | | — | | (3.22 | ) | — | | 1.45 | | (6) |

U.S. Equity Portfolios: | | | | | | | | | | | | |

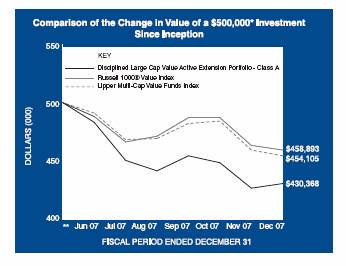

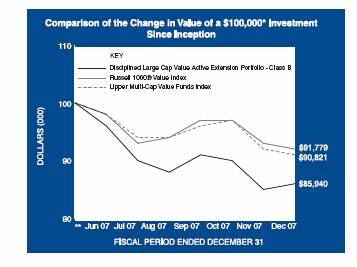

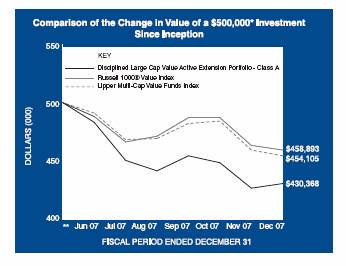

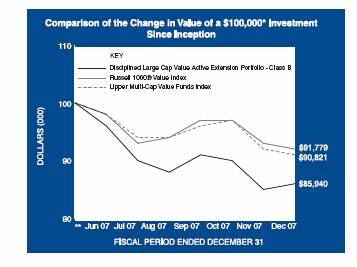

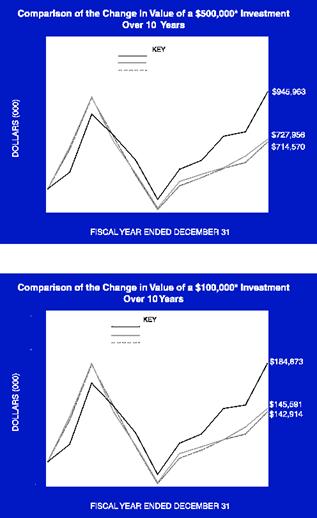

Disciplined Large Cap Value Active Extension†† | | 5/31/07 | | 5/31/07 | | — | | — | | — | | (7) |

Focus Equity | | 3/8/95 | | 1/2/96 | | 24.02 | | 23.70 | | 11.81 | | (8) |

Large Cap Relative Value | | 1/31/90 | | 1/2/96 | | 2.90 | | 2.72 | | (0.17 | ) | (7) |

Small Company Growth | | 11/1/89 | | 1/2/96 | | 3.04 | | 2.81 | | 7.05 | | (9) |

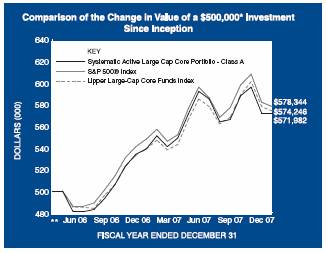

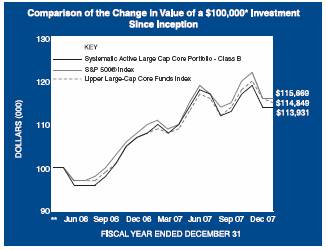

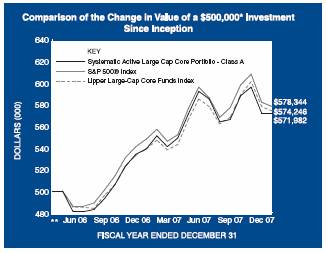

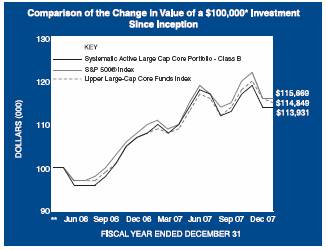

Systematic Active Large Cap Core | | 4/28/06 | | 4/28/06 | | 6.07 | | 5.81 | | 5.49 | | (10) |

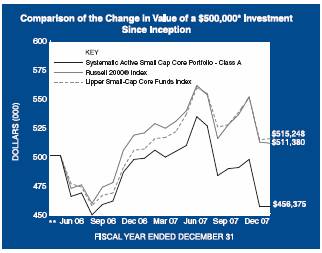

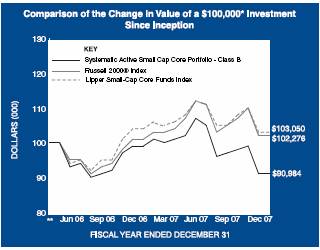

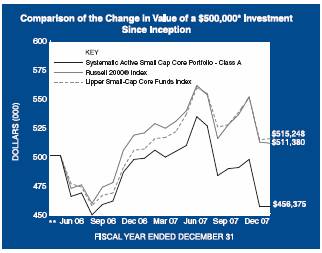

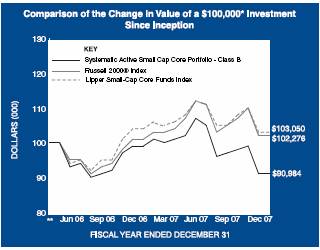

Systematic Active Small Cap Core | | 4/28/06 | | 4/28/06 | | (8.35 | ) | (8.49 | ) | (1.57 | ) | (11) |

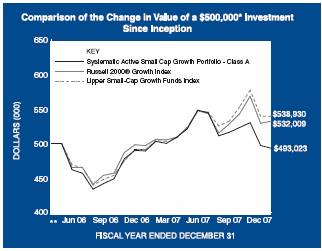

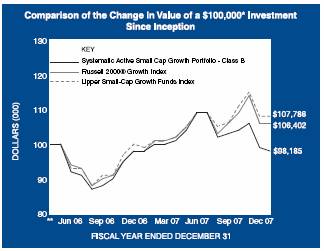

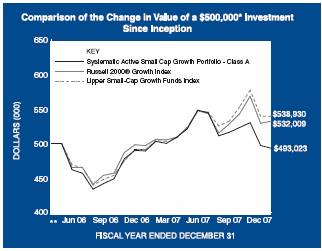

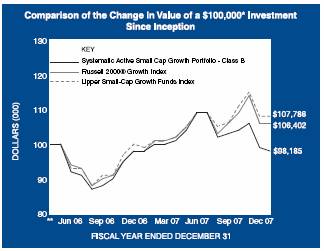

Systematic Active Small Cap Growth | | 4/28/06 | | 4/28/06 | | 0.82 | | 0.50 | | 7.05 | | (9) |

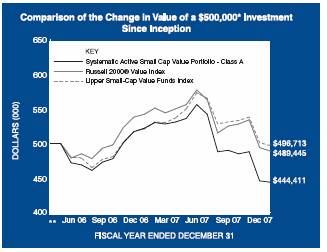

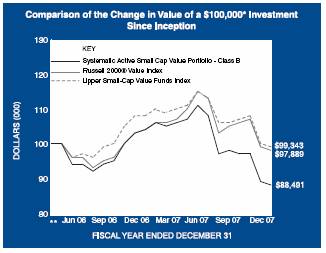

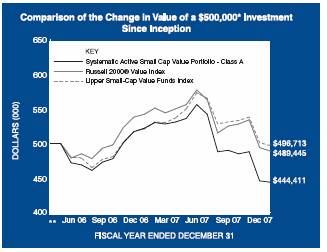

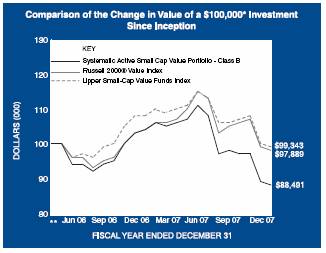

Systematic Active Small Cap Value | | 4/28/06 | | 4/28/06 | | (14.78 | ) | (15.03 | ) | (9.78 | ) | (12) |

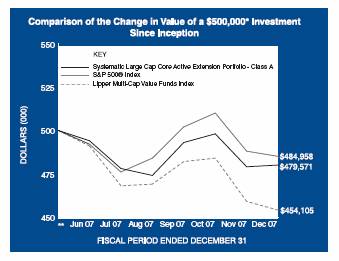

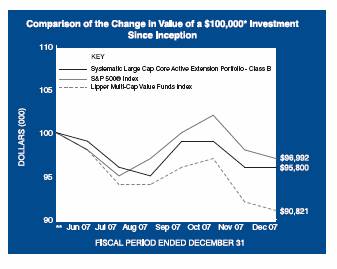

Systematic Large Cap Core Active Extension†† | | 5/31/07 | | 5/31/07 | | — | | — | | — | | (10) |

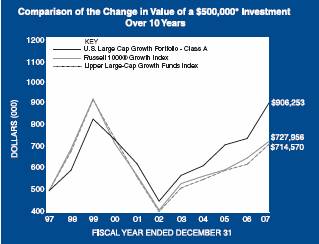

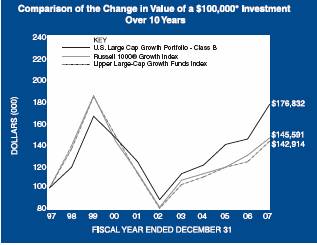

U.S. Large Cap Growth | | 4/2/91 | | 1/2/96 | | 22.29 | | 21.93 | | 11.81 | | (8) |

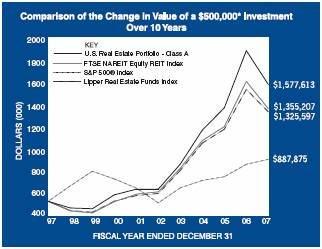

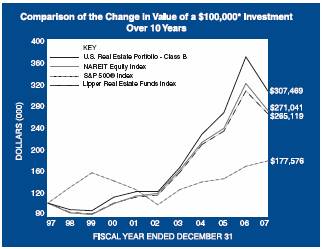

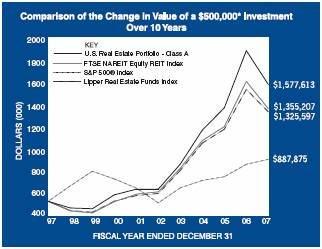

U.S. Real Estate | | 2/24/95 | | 1/2/96 | | (16.63 | ) | (16.80 | ) | (15.69 | ) | (13) |

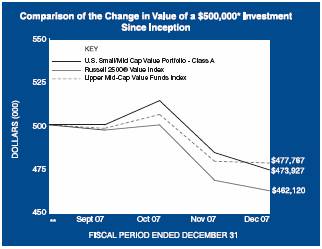

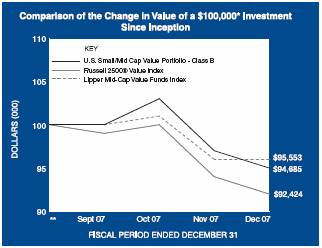

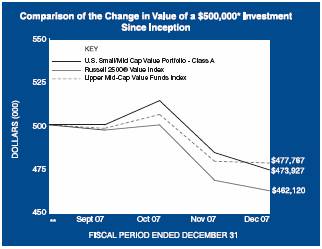

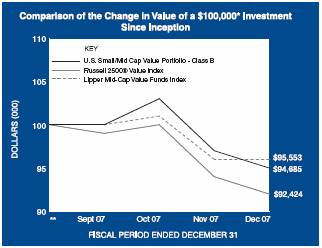

U.S. Small/Mid Cap Value††† | | 9/27/07 | | 9/27/07 | | — | | — | | — | | (14) |

Fixed Income Portfolio: | | | | | | | | | | | | |

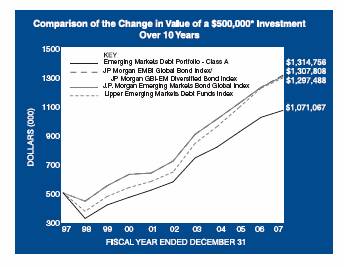

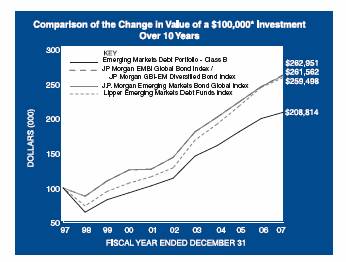

Emerging Markets Debt | | 2/1/94 | | 1/2/96 | | 4.68 | | 4.29 | | 6.84 | | (15) |

† | Performance figures are cumulative since inception as the Portfolio commenced operations on July 31, 2007. |

| |

†† | Performance figures are cumulative since inception as the Portfolios commenced operations on May 31, 2007. |

| |

††† | Performance figures are cumulative since inception as the Portfolio commenced operations on September 27, 2007. |

| 2007 Annual Report |

| |

| December 31, 2007 |

Performance Summary (cont’d)

Five Year

Average Annual Total Return | | | | Ten Year

Average Annual Total Return | | | Since Inception

Average Annual Total Return | | |

Class A | | Class B | | Comparable

Indices | | | | | Class A | | Class B | | Comparable

Indices | | | | Class A | | Comparable

Indices -

Class A | | Class B | | Comparable

Indices -

Class B | | | |

20.75 | % | 20.40 | % | 21.59 | % | | (1) | | 9.14 | % | 8.88 | % | 8.66 | % | | (1) | 8.97 | % | 8.40 | % | 8.87 | % | 7.85 | % | | (1) |

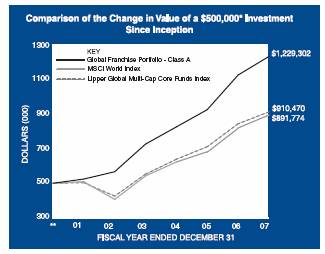

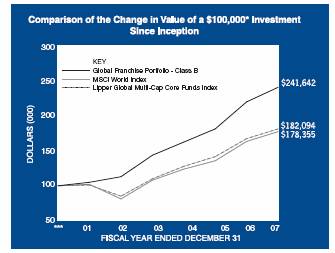

38.26 | | 37.88 | | 37.02 | | | (2) | | 15.44 | | 15.13 | | 14.30 | | | (2) | 13.58 | | 12.35 | | 13.32 | | 11.12 | | | (2) |

16.76 | | 16.46 | | 16.96 | | | (3) | | — | | — | | — | | | (3) | 15.92 | | 9.97 | | 15.59 | | 9.97 | | | (3) |

— | | — | | — | | | (4) | | — | | — | | — | | | (4) | 5.91 | | 6.48 | | 5.60 | | 6.48 | | | (4) |

15.10 | | 14.81 | | 16.96 | | | (3) | | 7.38 | | 7.09 | | 7.00 | | | (3) | 11.69 | | 9.32 | | 9.55 | | 8.20 | | | (3) |

17.93 | | 17.63 | | 21.59 | | | (1) | | 11.57 | | 11.32 | | 8.66 | | | (1) | 11.86 | | 6.43 | | 12.09 | | 7.85 | | | (1) |

— | | — | | — | | | (1) | | — | | — | | — | | | (1) | 6.60 | | 1.89 | | 6.50 | | 1.89 | | | (1) |

— | | — | | — | | | (1) | | — | | — | | — | | | (1) | 20.85 | | 18.16 | | 20.55 | | 18.16 | | | (1) |

19.63 | | 19.27 | | 21.59 | | | (1) | | 7.54 | | 7.27 | | 8.66 | | | (1) | 7.66 | | 8.02 | | 7.37 | | 8.02 | | | (1) |

25.56 | | 25.26 | | 26.15 | | | (5) | | 15.46 | | 15.17 | | 14.84 | | | (5) | 14.51 | | 13.41 | | 14.23 | | 13.41 | | | (5) |

20.99 | | — | | 26.37 | | | (6) | | 12.79 | | — | | 11.11 | | | (6) | 12.82 | | 7.89 | | — | | — | | | (6) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

— | | — | | — | | | (7) | | — | | — | | — | | | (7) | (13.93 | ) | (8.22 | ) | (14.06 | ) | (8.22 | ) | | (7) |

15.98 | | 15.68 | | 12.11 | | | (8) | | 6.58 | | 6.33 | | 3.83 | | | (8) | 13.41 | | 9.03 | | 10.82 | | 7.27 | | | (8) |

14.70 | | 14.40 | | 14.63 | | | (7) | | 7.82 | | 7.56 | | 7.68 | | | (7) | 10.90 | | 12.03 | | 10.07 | | 10.81 | | | (7) |

17.59 | | 17.30 | | 16.50 | | | (9) | | 13.63 | | 13.34 | | 4.32 | | | (9) | 12.85 | | 7.65 | | 12.31 | | 5.57 | | | (9) |

— | | — | | — | | | (10) | | — | | — | | — | | | (10) | 8.35 | | 9.07 | | 8.09 | | 9.07 | | | (10) |

— | | — | | — | | | (11) | | — | | — | | — | | | (11) | (5.30 | ) | 1.35 | | (5.48 | ) | 1.35 | | | (11) |

— | | — | | — | | | (9) | | — | | — | | — | | | (9) | (0.83 | ) | 3.77 | | (1.09 | ) | 3.77 | | | (9) |

— | | — | | — | | | (12) | | — | | — | | — | | | (12) | (6.79 | ) | (1.26 | ) | (7.03 | ) | (1.26 | ) | | (12) |

— | | — | | — | | | (10) | | — | | — | | — | | | (10) | (4.09 | ) | (3.01 | ) | (4.20 | ) | (3.01 | ) | | (10) |

14.94 | | 14.65 | | 12.11 | | | (8) | | 6.13 | | 5.87 | | 3.83 | | | (8) | 11.17 | | 8.92 | | 9.62 | | 7.27 | | | (8) |

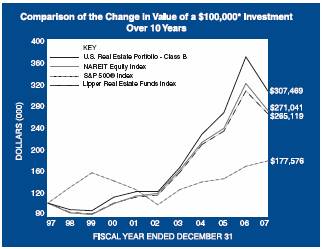

20.81 | | 20.51 | | 18.17 | | | (13) | | 12.18 | | 11.89 | | 10.49 | | | (13) | 16.09 | | 13.47 | | 15.10 | | 13.17 | | | (13) |

— | | — | | — | | | (14) | | — | | — | | — | | | (14) | (5.21 | ) | (7.58 | ) | (5.31 | ) | (7.58 | ) | | (14) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

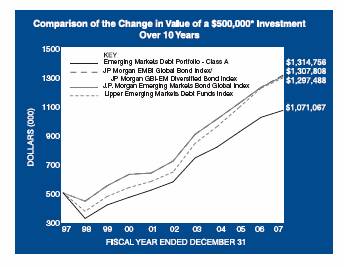

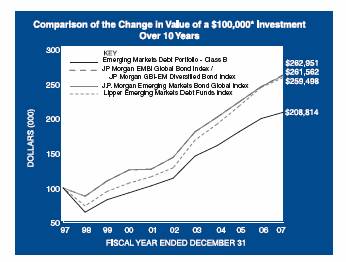

13.22 | | 12.89 | | 12.79 | | | (15) | | 7.92 | | 7.64 | | 10.15 | | | (15) | 10.85 | | 10.62 | | 11.42 | | 12.09 | | | (15) |

Performance data quoted assumes that all dividends and distributions, if any, were reinvested and represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit www.morganstanley.com/msim or call 1-800-548-7786. Investment returns and principal value will fluctuate and fund shares, when redeemed, may be worth more or less than their original cost.

Indices:

(1) | | MSCI EAFE (Europe, Australasia, and Far East) |

(2) | | MSCI Emerging Markets Net |

(3) | | MSCI World |

(4) | | FTSE EPRA/NAREIT Global Real Estate (Net) |

(5) | | FTSE EPRA/NAREIT Global ex-North America Real Estate (80% Europe/20% Asia) |

(6) | | MSCI EAFE Small Cap Total Return |

(7) | | Russell 1000® Value |

(8) | | Russell 1000® Growth |

(9) | | Russell 2000® Growth |

(10) | | S&P 500® |

(11) | | Russell 2000® |

(12) | | Russell 2000® Value |

(13) | | FTSE NAREIT Equity REIT |

(14) | | Russell 2500® Value |

(15) | | J.P. Morgan EMBI Global Bond Index/J.P. Morgan GBI-EM Global Diversified Bond Index |

2007 Annual Report

December 31, 2007

Investment Overview (unaudited)

Active International Allocation Portfolio

* Minimum Investment

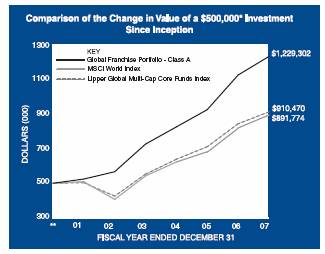

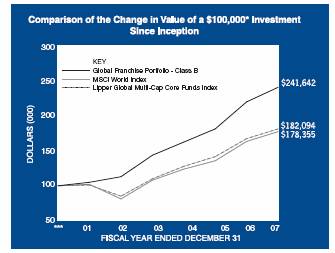

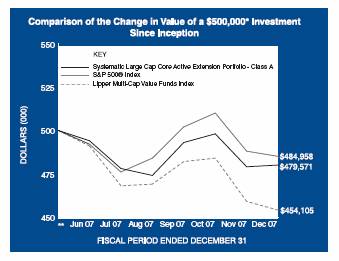

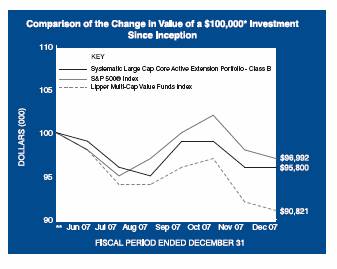

In accordance with SEC regulations, Portfolio’s performance shown assumes that all recurring fees (including management fees) were deducted and all dividends and distributions were reinvested. The performance of Class B shares will vary from the Class A shares based upon its different inception date and will be negatively impacted by additional fees assessed to this class.

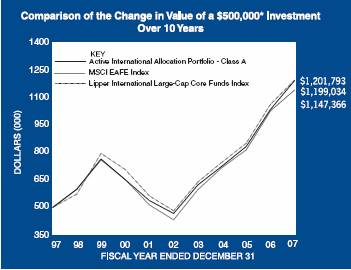

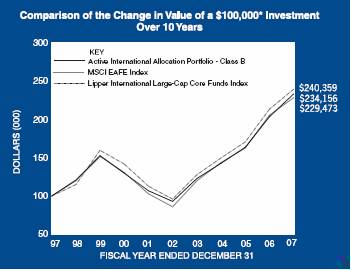

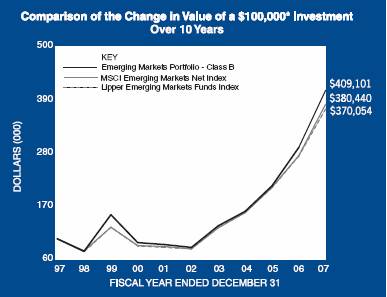

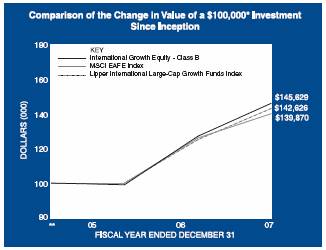

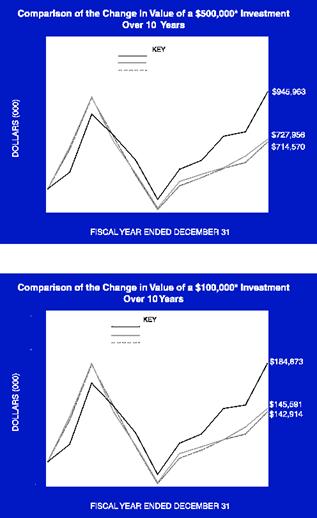

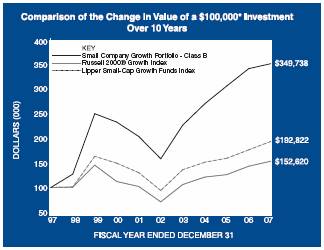

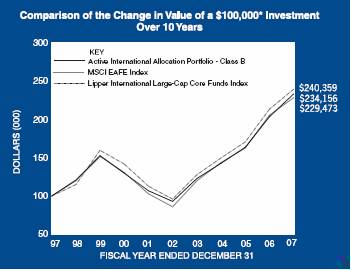

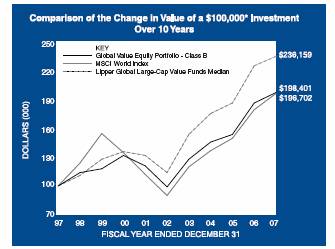

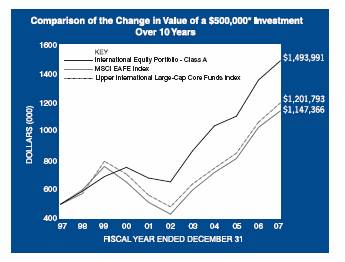

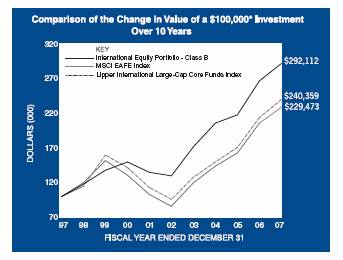

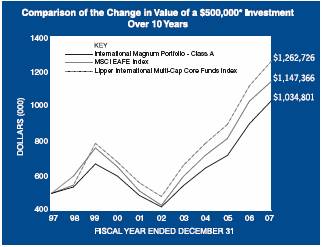

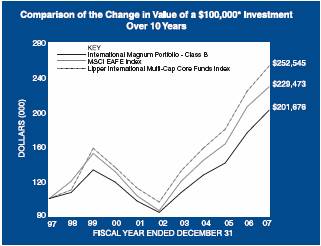

Performance Compared to the Morgan Stanley Capital International (MSCI) EAFE Index(1) and the Lipper International Large-Cap Core Funds Index(2)

| | Total Returns(3) | |

| | | | Average Annual | |

| | One

Year | | Five

Years | | Ten

Years | | Since

Inception(6) | |

Portfolio – Class A (4) | | 15.30 | % | 20.75 | % | 9.14 | % | 8.97 | % |

MSCI EAFE Index | | 11.17 | | 21.59 | | 8.66 | | 8.40 | |

Lipper International Large-Cap | | | | | | | | | |

Core Funds Index | | 12.51 | | 20.03 | | 9.17 | | 10.01 | |

Portfolio – Class B (5) | | 14.95 | | 20.40 | | 8.88 | | 8.87 | |

MSCI EAFE Index | | 11.17 | | 21.59 | | 8.66 | | 7.85 | |

Lipper International Large-Cap | | | | | | | | | |

Core Funds Index | | 12.51 | | 20.03 | | 9.17 | | 9.60 | |

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. Performance assumes that all dividends and distributions, if any, were reinvested. For the most recent month-end performance figures, please visit www.morganstanley.com/msim. Investment return and principal value will fluctuate so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

(1) | The Morgan Stanley Capital International (MSCI) EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the U.S. & Canada. The term “free float” represents the portion of shares outstanding that are deemed to be available for purchase in the public equity markets by investors. The MSCI EAFE Index consists of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index. |

(2) | The Lipper International Large-Cap Core Funds Index is an equally weighted performance index of the largest qualifying funds (based on net assets) in the Lipper International Large-Cap Core Funds classification. The Index, which is adjusted for capital gains distributions and income dividends, is unmanaged and should not be considered an investment. There are currently 30 funds represented in this Index. As of the date of this report, the Portfolio is in the Lipper International Large-Cap Core Funds classification. |

(3) | Total returns for the Portfolio reflect fees waived and expenses reimbursed, if applicable, by the Adviser. Without such waivers and reimbursements, total returns would have been lower. Fee waivers and/or expense reimbursements are voluntary and the Adviser reserves the right to commence or terminate any waiver and/or reimbursement at any time. |

(4) | Commenced operations on January 17, 1992 |

(5) | Commenced operations on January 2, 1996 |

(6) | For comparative purposes, average annual since inception returns listed for the Indexes refer to the inception date or initial offering of the respective share class of the Portfolio, not the inception of the Index. |

The Active International Allocation Portfolio (the “Portfolio”) seeks long-term capital appreciation by investing primarily, in accordance with country and sector weightings determined by the Adviser, in equity securities of non-U.S. issuers which, in the aggregate, attempt to replicate broad market indices.

6

2007 Annual Report

December 31, 2007

Investment Overview (cont’d)

Active International Allocation Portfolio

Foreign investing involves certain risks, including currency fluctuations and controls, restrictions on foreign investments, less governmental supervision and regulation, less liquidity and the potential for market volatility and political instability. The risks of investing in emerging-market countries are greater than the risks generally associated with foreign investments.

Performance

For the year ended December 31, 2007, the Portfolio had a total return based on net asset value and reinvestment of distributions per share of 15.30%, net of fees, for Class A shares and 14.95%, net of fees, for Class B shares. The Portfolio’s Class A and Class B shares outperformed against their benchmark, the Morgan Stanley Capital International (MSCI) EAFE Index (the “Index”) which returned 11.17%.

Factors Affecting Performance

· | For the 12-month period ended December 31, 2007, the Index returned 11.17% in U.S. dollar terms and 3.5% in local currency terms. Asia ex-Japan (up 30.7% in U.S. dollar terms) led performance, followed by Europe ex-U.K. (up 16.7%). Japan (down 4.2%) was the only major market with a negative return during the period, and the U.S. market had a modestly positive gain (up 5.4%). The emerging markets again outperformed the developed regions, appreciating 39.4%. All major currencies gained against the U.S. dollar, with the Australian dollar and Euro rising 11.4% and 10.9%, respectively. The Japanese yen showed greater strength in the second half of the year, to finish the year up 6.7% versus the U.S. dollar. The British pound rose a modest 1.7% relative to the U.S. dollar. |

· | In the U.S., consensus estimates for fourth quarter gross domestic product (GDP) now average around 1.1%, and we expect the estimates to continue falling, given the broad-based weakening across the U.S. economy and with the housing sector especially fragile. New housing starts fell to a cycle low that has not been seen since 1995, and house prices continued to decline. The Institute of Supply Management (ISM) Manufacturing survey fell to 47.7, indicating falling manufacturing output. Job creation also stalled in December, although November’s non-farm payroll figure was revised upward. More worrisome was the increase in the unemployment rate to 5%, but its magnitude may have been partially influenced by a five-year revision to the base figure. Inflationary pressures remained elevated at year end. However, inflation is a lagging indicator, and we believe it should not be a problem if the U.S. enters a recession. |

· | European economic growth (excluding the U.K.) generally deteriorated as the year progressed, but ticked upward at year end. Inflationary pressures mounted due to energy and food price increases, and given these strong inflation readings, the European Central Bank (ECB) remained hawkish going into the new year. European financials are feeling the negative impact of the U.S. subprime problems and credit slump – but Europe only experienced pockets of housing overinvestment (notably in Ireland and Spain). The U.K. housing sector has been an issue – not due to overinvestment, but rather because of sharp price rises from greater demand than supply. House prices are falling again there, as is the pound sterling. This is negative in the medium term, but a weaker currency and looser monetary and fiscal conditions could set up the U.K. economy nicely for a rebound by second half of 2008. |

· | The Japanese economy was weak overall during the year. Housing starts have recovered from their lows and construction expectations are moving up. While real income growth is flat to down, Japan’s unemployment rate fell again and headline inflation rose. We believe this should be a positive for Japan, but caution is warranted as core inflation is still negative. Japanese equities were the worst performing major market in the year, although the yen has rebounded from its previous lows. We believe relative equity valuations have been getting more and more compelling here. |

· | The Portfolio’s returns were aided by the allocations to Germany, Hong Kong, Singapore and the emerging markets. The Portfolio was underweight financials throughout the year, which was additive to performance. However, underexposure to Australia and the U.K. detracted from performance, as did the above- Index allocation to Japan earlier in the year. |

Management Strategies

· | Global equities faced increasing headwinds in the fourth quarter of 2007, which continue to buffet markets in early 2008. The subprime mortgage crisis clearly spread to other areas of the financial markets (prime mortgages, asset backed paper, other collateralized debt obligations, and equity financings) and mindboggling write-offs were announced by many firms. The authorities have responded, but with less conviction than the markets crave – and credit spreads have remained wide. |

· | Heated discussion continues as to whether or not the U.S. is in (or entering) a recession or in a mid-cycle slowdown. While seemingly pedantic, this is an important distinction. In general, a recession would mean rising unemployment, sharp earnings drops and a |

7

2007 Annual Report

December 31, 2007

Investment Overview (cont’d)

Active International Allocation Portfolio

| negative global stock market bias. In this scenario, the emerging markets would correct. A mid-cycle slowdown, on the other hand, would bring sideways employment and mildly negative to flat earnings, followed by economic resurgence and global equities moving decisively up out of their multi-month trading range. |

· | While we remain in the mid-cycle slowdown camp, we are admittedly worried by recent poor stock market action, continued financial distress, falling earnings and poor economic numbers. Positive offsets to this are good corporate and consumer balance sheets/wealth, still- decent disposable income growth, and very low real bond yields combined with (hopefully more) prospective rate cuts. |

· | We have positioned the Portfolio more defensively, as we have been doing for the past couple of quarters. We trimmed our emerging market and cyclical positions, have added some to defensive sectors and have raised cash to about 5% of the Portfolio. With the exception of global financial and retailing sectors, we do not think a significant slowdown has been priced in. We remain watchful. |

Expense Examples

As a shareholder of the Portfolio, you may incur two types of costs: (1) transactional costs, including redemption fees; (2) ongoing costs, including management fees, shareholder servicing fees (in the case of Class B); and other Portfolio expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the six-month period ended December 31, 2007 and held for the entire six-month period.

Actual Expenses

The first line of the tables below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Please note that “Expenses Paid During Period” are grossed up to reflect Portfolio expenses prior to the effect of Expense Offset (See Note E in the Notes to Financial Statements). Therefore, the annualized net expense ratios may differ from the ratio of the expenses to average net assets shown in the Financial Highlights.

Hypothetical Example for Comparison Purposes

The second line of the tables below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning

Account Value

July 1, 2007 | | Ending Account

Value

December 31,

2007 | | Expenses Paid

During Period*

July 1, 2007 —

December 31,

2007 | |

Class A | | | | | | | |

Actual | | $1,000.00 | | $1,020.60 | | $4.07 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,021.17 | | 4.08 | |

| | | | | | | |

Class B | | | | | | | |

Actual | | 1,000.00 | | 1,018.80 | | 5.34 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,019.91 | | 5.35 | |

* Expenses are equal to Class A and Class B annualized net expense ratios of 0.80% and 1.05%, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

8

2007 Annual Report

December 31, 2007

Investment Overview (cont’d)

Active International Allocation Portfolio

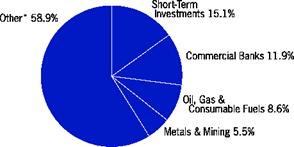

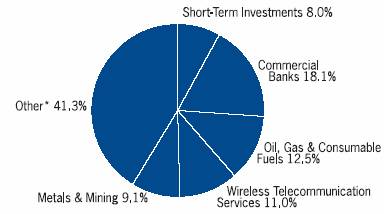

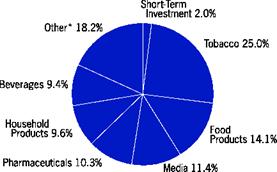

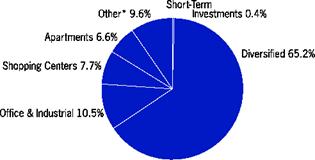

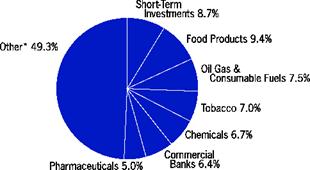

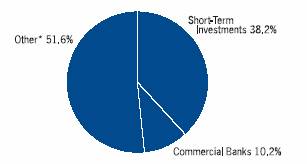

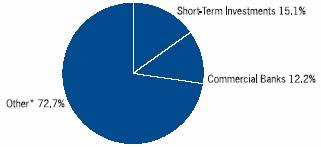

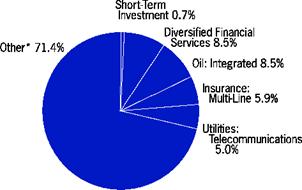

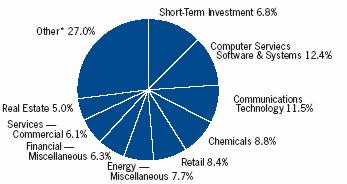

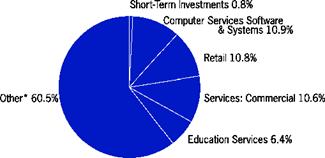

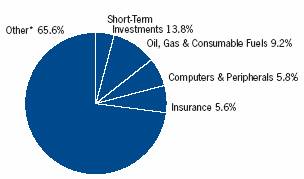

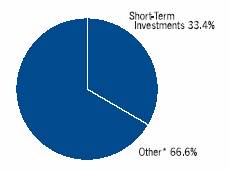

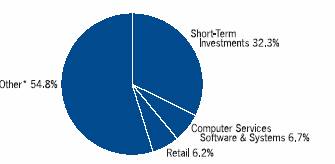

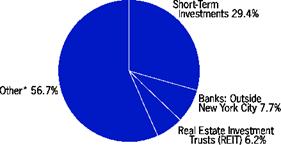

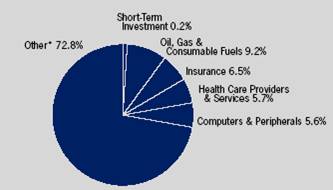

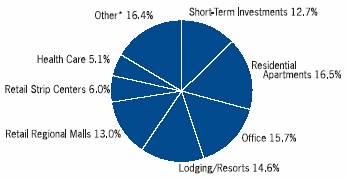

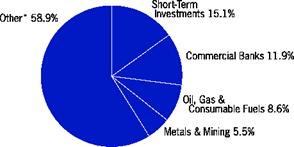

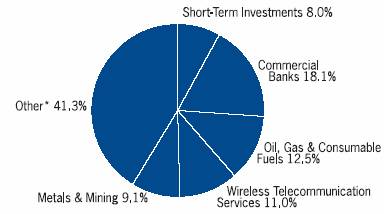

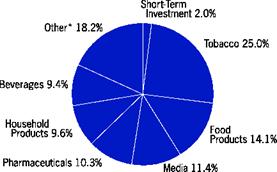

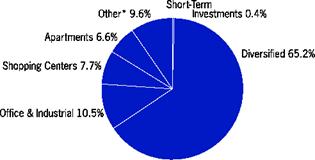

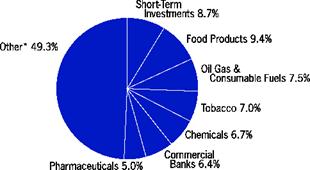

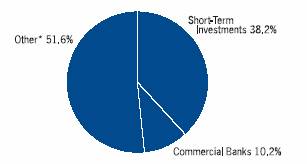

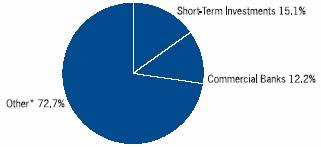

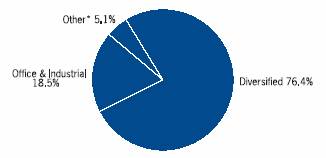

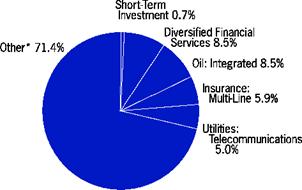

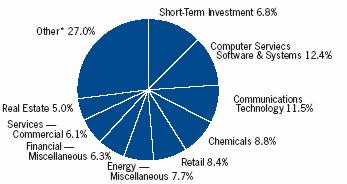

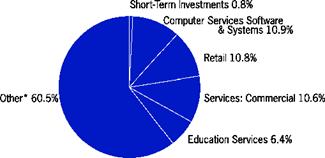

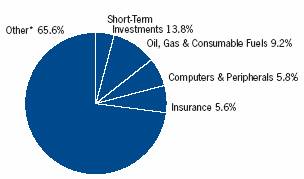

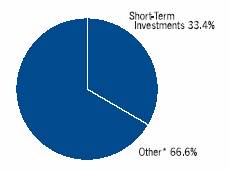

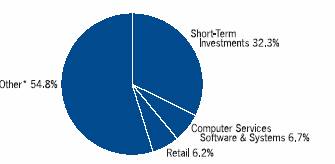

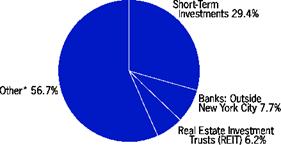

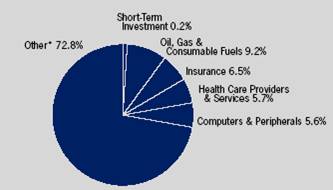

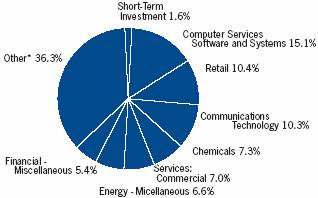

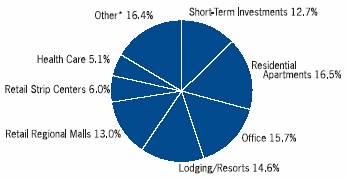

Graphic Presentation of Portfolio Holdings

The following graph depicts the Portfolio’s holdings by industry and/or security type, as a percentage of total investments.

* Industries which do not appear in the above graph, as well as those which represent less than 5% of total investments, if applicable, are included in the category labeled “Other”.

9

2007 Annual Report

December 31, 2007

Portfolio of Investments

Active International Allocation Portfolio

| | | | Value | |

| | Shares | | (000) | |

Common Stocks (90.9%) | | | | | |

Australia (3.3%) | | | | | |

AGL Energy Ltd. | | 14,942 | | $ 174 | |

Alumina Ltd. | | 91,525 | | 507 | |

Amcor Ltd. | | 71,068 | | 430 | |

AMP Ltd. | | 42,736 | | 372 | |

Ansell Ltd. | | 5,679 | | 60 | |

Asciano Group | | (c)12,151 | | 74 | |

Australia & New Zealand Banking Group Ltd. | | (c)46,465 | | 1,114 | |

BHP Billiton Ltd. | | 249,722 | | 8,757 | |

BlueScope Steel Ltd. | | (c)62,766 | | 529 | |

Boral Ltd. | | 47,082 | | 252 | |

Brambles Ltd. | | 31,812 | | 321 | |

Caltex Australia Ltd. | | 29,853 | | 505 | |

Coca-Cola Amatil Ltd. | | 17,210 | | 143 | |

Commonwealth Bank of Australia | | (c)38,394 | | 1,983 | |

CSL Ltd. | | 8,526 | | 271 | |

CSR Ltd. | | (c)77,935 | | 212 | |

Fairfax Media Ltd. | | (c)32,240 | | 132 | |

Foster’s Group Ltd. | | 65,602 | | 377 | |

Insurance Australia Group Ltd. | | (c)54,613 | | 197 | |

James Hardie Industries N.V. | | 37,648 | | 212 | |

Leighton Holdings Ltd. | | (c)7,115 | | 379 | |

Lend Lease Corp., Ltd. | | 13,618 | | 206 | |

Macquarie Group Ltd. | | (c)6,715 | | 445 | |

Macquarie Infrastructure Group | | 74,866 | | 198 | |

National Australia Bank Ltd. | | 51,258 | | 1,691 | |

Newcrest Mining Ltd. | | 26,212 | | 755 | |

OneSteel Ltd. | | 44,821 | | 241 | |

Orica Ltd. | | 23,038 | | 640 | |

Origin Energy Ltd. | | 213,888 | | 1,657 | |

PaperlinX Ltd. | | 36,382 | | 85 | |

QBE Insurance Group Ltd. | | 22,311 | | 650 | |

Rio Tinto Ltd. | | (c)22,901 | | 2,674 | |

Santos Ltd. | | 157,070 | | 1,949 | |

Sonic Healthcare Ltd. | | 5,616 | | 82 | |

Stockland REIT | | 1,074 | | 8 | |

Suncorp-Metway Ltd. | | (c)17,718 | | 262 | |

Symbion Health Ltd. | | 28,935 | | 101 | |

TABCORP Holdings Ltd. | | 13,036 | | 169 | |

Telstra Corp., Ltd. | | 69,366 | | 285 | |

Toll Holdings Ltd. | | 12,293 | | 123 | |

Transurban Group | | (c)24,712 | | 148 | |

Wesfarmers Ltd., Class P | | (a)4,906 | | 175 | |

Wesfarmers Ltd. | | (c)12,365 | | 438 | |

Westpac Banking Corp. | | 54,298 | | 1,323 | |

Woodside Petroleum Ltd. | | 87,804 | | 3,862 | |

Woolworths Ltd. | | 33,517 | | 995 | |

| | | | 36,163 | |

Austria (0.8%) | | | | | |

Andritz AG | | 3,900 | | 234 | |

Boehler - Uddeholm AG | | 2,303 | | 232 | |

Erste Bank der Oesterreichischen Sparkassen AG | | 8,250 | | 586 | |

Flughafen Wien AG | | 1,465 | | 169 | |

IMMOFINANZ AG | | (c)36,096 | | 364 | |

Mayr-Melnhof Karton AG | | 1,194 | | $ 129 | |

Meinl European Land Ltd. | | (a)11,846 | | 164 | |

OMV AG | | 33,891 | | 2,727 | |

Raiffeisen International Bank Holding AG | | 5,402 | | 814 | |

Telekom Austria AG | | 50,283 | | 1,393 | |

Verbund-Oesterreichische Elektrizitaetswirtschafts AG, Class A | | 10,670 | | 743 | |

Voestalpine AG | | 10,008 | | 717 | |

Wiener Staedtische Allgemeine Versicherung AG | | 2,862 | | 230 | |

Wienerberger AG | | 7,967 | | 440 | |

| | | | 8,942 | |

Belgium (0.7%) | | | | | |

AGFA-Gevaert N.V. | | 4,251 | | 65 | |

Bekaert S.A. | | 539 | | 72 | |

Belgacom S.A. | | 7,474 | | 367 | |

Dexia S.A. | | 60,615 | | 1,523 | |

Fortis | | 68,182 | | 1,772 | |

InBev N.V. | | 16,863 | | 1,391 | |

KBC Group N.V. | | 8,355 | | 1,167 | |

Solvay S.A., Class A | | 3,603 | | 502 | |

UCB S.A. | | 6,548 | | 295 | |

Umicore | | 1,532 | | 378 | |

| | | | 7,532 | |

Brazil (1.8%) | | | | | |

All America Latina Logistica S.A. | | 86,400 | | 1,107 | |

Aracruz Celulose S.A., Class B (Preference) | | 16,145 | | 120 | |

Banco Bradesco S.A. (Preference) | | 32,725 | | 1,047 | |

Banco do Brasil S.A. | | 69,100 | | 1,165 | |

Banco Itau Holding Financeira S.A. (Preference) | | 63,527 | | 1,645 | |

Brasil Telecom Participacoes S.A. (Preference) | | 8,591 | | 128 | |

Centrias Eletricas Brasilieras, Class B (Preference) | | 8,147 | | 104 | |

Cia Brasileira de Distribuicao Grupo Pao de Acucar ADR (Preference) | | 500 | | 18 | |

Cia de Bebidas das Americas | | 2,415 | | 166 | |

Cia de Bebidas das Americas (Preference) | | 2,539 | | 181 | |

Cia Energetica de Minas Gerias (Preference) | | 10,763 | | 198 | |

Cia Siderurgica Nacional S.A. | | 2,976 | | 267 | |

Cia Vale do Rio Doce, Class A (Preference) | | 91,102 | | 2,554 | |

Contax Participacoes S.A. (Preference) | | 491 | | 14 | |

Cyrela Brazil Realty S.A. | | 42,900 | | 574 | |

Cyrela Commercial Properties S.A. Empreendimentos e Participacoes | | (a)8,580 | | 58 | |

Embratel Participacoes S.A. (Preference) | | 7,170,555 | | 27 | |

Empresa Brasileira de Aeronautica S.A. | | 19,596 | | 223 | |

Gerdau S.A. (Preference) | | 11,731 | | 340 | |

Gol Linhas Aereas Inteligentes S.A. ADR | | (c)39,200 | | 973 | |

Klabin S.A. (Preference) | | 26,365 | | 97 | |

Lojas Renner S.A. | | 29,100 | | 582 | |

Perdigao S.A. | | 41,900 | | 1,025 | |

Petroleo Brasileiro S.A. (Preference) | | 79,975 | | 3,864 | |

Sadia S.A. (Preference) | | 174,759 | | 998 | |

Souza Cruz S.A. | | 3,876 | | 104 | |

Tele Norte Leste Participacoes S.A. (Preference) | | 13,121 | | 253 | |

Unibanco Uniao de Bancos Brasileiros S.A. GDR | | (c)8,150 | | 1,138 | |

10 | The accompanying notes are an integral part of the financial statements. |

2007 Annual Report

December 31, 2007

Portfolio of Investments (cont’d)

Active International Allocation Portfolio

| | | | Value | |

| | Shares | | (000) | |

Brazil (cont’d) | | | | | |

Usiminas Siderurgicas de Minas Gerias S.A., Class A (Preference) | | 5,601 | | $ 253 | |

Vivo Participacoes S.A. (Preference) | | 15,829 | | 87 | |

Votorantim Celulose e Papel S.A. (Preference) | | 3,048 | | 91 | |

| | | | 19,401 | |

Colombia (0.1%) | | | | | |

BanColombia S.A. ADR | | (c)16,100 | | 548 | |

Denmark (0.6%) | | | | | |

AP Moller - Maersk A/S | | 74 | | 784 | |

Danske Bank A/S | | 46,745 | | 1,812 | |

DSV A/S | | 11,750 | | 255 | |

GN Store Nord | | (a)67,329 | | 526 | |

Novo-Nordisk A/S, Class B | | 28,460 | | 1,858 | |

Novozymes A/S, Class B | | 2,864 | | 323 | |

Vestas Wind Systems A/S | | (a)10,650 | | 1,139 | |

| | | | 6,697 | |

Finland (1.5%) | | | | | |

Cargotec Corp., Class B | | (c)2,604 | | 120 | |

Fortum Oyj | | 16,886 | | 756 | |

Kesko Oyj, Class B | | 5,410 | | 297 | |

Kone Oyj, Class B | | (c)5,208 | | 362 | |

Metso Oyj | | (c)20,949 | | 1,130 | |

Neste Oil Oyj | | (c)8,252 | | 289 | |

Nokia Oyj | | 267,836 | | 10,313 | |

Outokumpu Oyj | | (c)15,450 | | 471 | |

Rautaruukki Oyj | | 6,293 | | 268 | |

Sampo Oyj, Class A | | 21,019 | | 550 | |

Stora Enso Oyj, Class R | | 41,550 | | 617 | |

TietoEnator Oyj | | 12,781 | | 285 | |

UPM-Kymmene Oyj | | 36,167 | | 724 | |

Uponor Oyj | | 2,904 | | 72 | |

Wartsila Oyj, Class B | | 4,034 | | 305 | |

| | | | 16,559 | |

France (8.2%) | | | | | |

Accor S.A. | | 17,180 | | 1,363 | |

Air Liquide | | (c)17,786 | | 2,635 | |

Alcatel - Lucent | | 116,127 | | 844 | |

Alstom | | 21,368 | | 4,541 | |

ArcelorMittal | | 59,440 | | 4,570 | |

Arkema | | (a)2,887 | | 188 | |

Atos Origin S.A. | | (a)1,889 | | 97 | |

AXA S.A. | | 76,954 | | 3,064 | |

BNP Paribas | | 56,928 | | 6,119 | |

Bouygues | | 18,764 | | 1,556 | |

Business Objects S.A. | | (a)(c)5,580 | | 340 | |

Cap Gemini S.A. | | 15,920 | | 989 | |

Carrefour S.A. | | (c)31,579 | | 2,448 | |

Casino Guichard Perrachon S.A. | | 4,458 | | 485 | |

Cie de Saint - Gobain | | 18,247 | | 1,729 | |

Cie Generale d’Optique Essilor International S.A. | | 21,786 | | 1,387 | |

CNP Assurances | | 4,936 | | 640 | |

Compagnie Generale des Establissements Michelin, Class B | | (c)4,696 | | 538 | |

Credit Agricole S.A. | | (c)28,577 | | 959 | |

Dassault Systemes S.A. | | 5,148 | | $ 303 | |

European Aeronautic Defense & Space Co. N.V. | | (c)14,611 | | 464 | |

France Telecom S.A. | | (c)98,884 | | 3,549 | |

Gecina S.A. REIT | | 2,351 | | 369 | |

Groupe Danone | | (c)27,890 | | 2,492 | |

Hermes International | | 3,740 | | 476 | |

Imerys S.A. | | 2,205 | | 181 | |

Klepierre REIT | | 5,946 | | 302 | |

L’Oreal S.A. | | 12,076 | | 1,724 | |

Lafarge S.A. | | (c)15,530 | | 2,811 | |

Lagardere S.C.A. | | (c)8,523 | | 636 | |

LVMH Moet Hennessy Louis Vuitton S.A. | | (c)21,401 | | 2,572 | |

Neopost S.A. | | 3,273 | | 336 | |

Pernod-Ricard S.A. | | 1,304 | | 300 | |

Peugeot S.A. | | (c)5,348 | | 402 | |

PPR | | 2,823 | | 451 | |

Publicis Groupe | | (c)4,217 | | 164 | |

Renault S.A. | | (c)5,505 | | 772 | |

Safran S.A. | | (c)4,910 | | 100 | |

Sanofi-Aventis S.A. | | (c)56,814 | | 5,193 | |

Schneider Electric S.A. | | (c)20,308 | | 2,715 | |

Societe BIC S.A. | | 1,627 | | 116 | |

Societe Generale | | (c)23,415 | | 3,346 | |

Societe Television Francaise 1 | | 11,185 | | 298 | |

Sodexho Alliance S.A. | | (c)9,509 | | 583 | |

STMicroelectronics N.V. | | 49,380 | | 703 | |

Suez S.A. | | (c)31,273 | | 2,120 | |

Suez S.A. | | 2,940 | | 198 | |

Technip S.A. | | 7,405 | | 586 | |

Thales S.A. | | 6,720 | | 398 | |

Thomson | | 10,855 | | 153 | |

Total S.A. | | (c)159,524 | | 13,239 | |

Unibail-Rodamco REIT | | (c)2,618 | | 570 | |

Valeo S.A. | | 5,295 | | 217 | |

Vallourec | | 2,536 | | 683 | |

Veolia Environnement | | (c)34,946 | | 3,174 | |

Vinci S.A. | | (c)16,860 | | 1,239 | |

Vivendi | | 39,320 | | 1,792 | |

Zodiac S.A. | | (a)631 | | 40 | |

| | | | 90,259 | |

Germany (7.0%) | | | | | |

Adidas AG | | 16,450 | | 1,225 | |

Allianz SE (Registered) | | 21,656 | | 4,632 | |

Altana AG | | 3,752 | | 91 | |

Arcandor AG | | (a)4,851 | | 115 | |

BASF AG | | 27,879 | | 4,120 | |

Bayer AG | | 41,596 | | 3,793 | |

Beiersdorf AG | | 8,080 | | 624 | |

Celesio AG | | (c)6,488 | | 400 | |

Commerzbank AG | | 42,694 | | 1,616 | |

Continental AG | | 7,896 | | 1,024 | |

DaimlerChrysler AG | | 49,424 | | 4,787 | |

Deutsche Bank AG (Registered) | | 15,036 | | 1,945 | |

Deutsche Boerse AG | | (c)12,506 | | 2,468 | |

Deutsche Lufthansa AG (Registered) | | 13,860 | | 367 | |

Deutsche Post AG (Registered) | | 43,545 | | 1,488 | |

The accompanying notes are an integral part of the financial statements. | 11 |

2007 Annual Report

December 31, 2007

Portfolio of Investments (cont’d)

Active International Allocation Portfolio

| | | | Value | |

| | Shares | | (000) | |

Germany (cont’d) | | | | | |

Deutsche Postbank AG | | 3,517 | | $ 311 | |

Deutsche Telekom AG | | (c)191,355 | | 4,185 | |

E.ON AG | | 43,979 | | 9,338 | |

Fresenius Medical Care AG | | 15,577 | | 833 | |

Heidelberger Druckmaschinen AG | | (c)3,177 | | 106 | |

Henkel KGaA (Non-Voting Shares) | | 11,107 | | 623 | |

Hochtief AG | | 3,367 | | 448 | |

Hypo Real Estate Holding AG | | 13,469 | | 701 | |

Infineon Technologies AG | | (a)35,063 | | 410 | |

Linde AG | | 7,963 | | 1,049 | |

MAN AG | | 9,453 | | 1,555 | |

Merck KGaA | | 3,771 | | 484 | |

Metro AG | | 19,246 | | 1,606 | |

Muenchener Rueckversicherungs AG (Registered) | | 10,932 | | 2,113 | |

Porsche Automobil Holding SE (Non-Voting Shares) | | 900 | | 1,814 | |

Puma AG Rudolf Dassler Sport | | 768 | | 305 | |

Qiagen N.V. | | (a)(c)8,326 | | 179 | |

RWE AG | | (c)28,097 | | 3,937 | |

RWE AG (Non-Voting Shares) | | 2,201 | | 267 | |

SAP AG | | 106,235 | | 5,489 | |

Siemens AG (Registered) | | 48,828 | | 7,666 | |

Suedzucker AG | | (c)28,507 | | 671 | |

ThyssenKrupp AG | | 22,130 | | 1,235 | |

TUI AG | | (a)(c)12,933 | | 359 | |

Volkswagen AG | | 9,553 | | 2,173 | |

Volkswagen AG (Non-Voting Shares) | | 5,703 | | 828 | |

| | | | 77,380 | |

Greece (0.7%) | | | | | |

Alpha Bank A.E. | | 38,383 | | 1,401 | |

EFG Eurobank Ergasias S.A. | | 24,405 | | 862 | |

National Bank of Greece S.A. | | 42,490 | | 2,927 | |

OPAP S.A. | | 12,910 | | 515 | |

Piraeus Bank S.A. | | 37,600 | | 1,465 | |

Titan Cement Co., S.A. | | 3,950 | | 180 | |

| | | | 7,350 | |

Hong Kong (2.9%) | | | | | |

Agile Property Holdings Ltd. | | 291,280 | | 523 | |

Air China Ltd., Class H | | 131,000 | | 191 | |

Aluminum Corp. of China Ltd., Class H | | 132,000 | | 269 | |

Angang Steel Co. Ltd., Class H | | 6,000 | | 16 | |

Anhui Conch Cement Co., Ltd., Class H | | 2,000 | | 17 | |

Anhui Expressway Co., Class H | | 369,000 | | 341 | |

Bank of China Ltd., Class H | | (c)686,000 | | 327 | |

Bank of Communications Co., Ltd., Class H | | 452,000 | | 618 | |

Bank of East Asia Ltd. | | 73,263 | | 496 | |

BOC Hong Kong Holdings Ltd. | | 168,000 | | 464 | |

Cathay Pacific Airways Ltd. | | 48,000 | | 125 | |

Chaoda Modern Agriculture | | 170,100 | | 153 | |

Cheung Kong Holdings Ltd. | | 70,000 | | 1,276 | |

Cheung Kong Infrastructure Holdings Ltd. | | (c)26,000 | | 97 | |

China Communications Construction Co. Ltd., Class H | | 319,000 | | 823 | |

China Construction Bank, Class H | | 1,684,835 | | 1,413 | |

China Cosco Holdings Co. Ltd., Class H | | 115,450 | | $ 315 | |

China Infrastructure Machinery Holdings Ltd. | | 224,000 | | 352 | |

China Life Insurance Co., Ltd. | | 225,000 | | 1,145 | |

China Petroleum & Chemical Corp., Class H | | 528,000 | | 785 | |

China Resources Enterprise | | 102,000 | | 434 | |

China Resources Land Ltd. | | 145,000 | | 316 | |

China Shenhua Energy Co., Ltd. | | 106,500 | | 632 | |

China Shipping Development Co., Ltd., Class H | | 51,891 | | 135 | |

China Telecom Corp., Ltd., Class H | | 502,000 | | 392 | |

China Travel International Investment Hong Kong Ltd. | | 768,000 | | 499 | |

China Water Affairs Group Ltd. | | (a)(c)1,731,741 | | 1,062 | |

Chow Sang Sang Holdings | | 57,438 | | 99 | |

CLP Holdings Ltd. | | 78,811 | | 536 | |

COSCO Pacific Ltd. | | 152,000 | | 402 | |

Datang International Power Generation Co., Ltd., Class H | | 118,000 | | 103 | |

Dongfeng Motor Group Co., Ltd. | | 80,324 | | 56 | |

Esprit Holdings Ltd. | | 43,800 | | 644 | |

Guangdong Investment Ltd. | | 1,456,000 | | 819 | |

Guangzhou R&F Properties Co., Ltd., Class H | | 33,200 | | 117 | |

Hang Lung Properties Ltd. | | 234,500 | | 1,049 | |

Hang Seng Bank Ltd. | | (c32,600 | ) | 667 | |

Henderson Land Development Co., Ltd. | | 34,000 | | 315 | |

Hong Kong & China Gas Co., Ltd. | | 190,424 | | 580 | |

Hong Kong Exchanges & Clearing Ltd. | | 48,500 | | 1,364 | |

HongKong Electric Holdings Ltd. | | 63,500 | | 364 | |

Hopewell Highway Infrastructure Ltd. | | (c)343,231 | | 294 | |

Hopewell Holdings Ltd. | | 30,000 | | 138 | |

Huaneng Power International, Inc., Class H | | 130,000 | | 136 | |

Hutchison Telecommunications International, Ltd. | | (c)64,000 | | 96 | |

Hutchison Whampoa Ltd. | | 96,282 | | 1,083 | |

Hysan Development Co., Ltd. | | 31,732 | | 90 | |

Jiangxi Copper Co., Ltd., Class H | | 46,000 | | 112 | |

Johnson Electric Holdings Ltd. | | (c)73,063 | | 40 | |

Kerry Properties Ltd. | | 20,215 | | 161 | |

Kingboard Chemical Holdings Ltd. | | 32,000 | | 189 | |

Li & Fung Ltd. | | 235,757 | | 942 | |

Li Ning Co. Ltd. | | 94,000 | | 345 | |

Link REIT (The) | | 77,539 | | 168 | |

MTR Corp. | | 66,687 | | 243 | |

New World China Land Ltd. | | (c)271,600 | | 242 | |

New World Development Ltd. | | 109,563 | | 385 | |

NWS Holdings Ltd. | | 130,592 | | 414 | |

PCCW Ltd. | | 171,490 | | 101 | |

PetroChina Co., Ltd., Class H | | 496,000 | | 875 | |

Ping An Insurance Group Co. of China Ltd., Class H | | 41,000 | | 435 | |

Prime Success International Group Ltd. | | 321,200 | | 237 | |

Rexcapital Financial Holdings Ltd. | | (a)891,948 | | 169 | |

Shanghai Electric Group Co., Ltd., Class H | | 26,000 | | 22 | |

Shangri-La Asia Ltd. | | 48,636 | | 151 | |

Sino Land Co. | | 56,197 | | 197 | |

Sinofert Holdings Ltd. | | (c)916,000 | | 849 | |

Sinopec Shangai Petrochemical Co., Ltd., Class H | | 32,000 | | 20 | |

12 | The accompanying notes are an integral part of the financial statements. |

| 2007 Annual Report |

| |

| December 31, 2007 |

Portfolio of Investments (cont’d)

Active International Allocation Portfolio

| | | | Value | |

| | Shares | | (000) | |

Hong Kong (cont’d) | | | | | |

Sun Hung Kai Properties Ltd. | | 89,500 | | $ 1,883 | |

Swire Pacific Ltd., Class A | | 42,000 | | 575 | |

Techtronic Industries Co. | | 42,500 | | 42 | |

Television Broadcasts Ltd. | | 14,000 | | 84 | |

Wasion Meters Group Ltd. | | 186,379 | | 111 | |

Wharf Holdings Ltd. | | 56,662 | | 292 | |

Yanzhou Coal Mining Co., Ltd., Class H | | 72,000 | | 140 | |

Yue Yuen Industrial Holdings Ltd. | | (c)27,500 | | 98 | |

Zhejiang Expressway Co., Ltd. | | 18,000 | | 28 | |

Zijin Mining Group Co., Ltd. | | 123,500 | | 189 | |

| | | | 31,907 | |

India (1.5%) | | | | | |

ABB Ltd. | | 3,735 | | 143 | |

ACC Ltd. | | 1,409 | | 36 | |

Axis Bank Ltd. | | 5,400 | | 133 | |

Bajaj Auto Ltd. | | 1,485 | | 99 | |

Bharat Forge Ltd. | | 4,739 | | 42 | |

Bharat Heavy Electricals Ltd. | | 26,557 | | 1,734 | |

Bharti Airtel Ltd. | | (a)40,943 | | 1,029 | |

Cipla Ltd. | | 8,807 | | 47 | |

Dish TV India Ltd. | | (a)8,026 | | 21 | |

Dr. Reddy's Laboratories Ltd. | | 4,849 | | 90 | |

GAIL India Ltd. | | 12,345 | | 169 | |

GlaxoSmithKline Pharmaceuticals Ltd. | | 898 | | 23 | |

Glenmark Pharmaceuticals Ltd. | | 5,851 | | 88 | |

Grasim Industries Ltd. | | (d)1,671 | | 157 | |

HDFC Bank Ltd. | | 16,278 | | 710 | |

Hero Honda Motors Ltd. | | 3,953 | | 70 | |

Hindalco Industries Ltd. | | 25,800 | | 139 | |

Hindustan Lever Ltd. | | 39,177 | | 212 | |

Housing Development Finance Corp. | | 8,718 | | 631 | |

I-Flex Solutions Ltd. | | (a)867 | | 33 | |

ICICI Bank Ltd. | | 29,787 | | 932 | |

ICICI Bank Ltd. ADR | | (c)5,600 | | 344 | |

Infosys Technologies Ltd. | | 18,793 | | 839 | |

ITC Ltd. | | 52,100 | | 277 | |

IVRCL Infrastructures & Projects Ltd. | | 73,900 | | 1,039 | |

Larsen & Toubro Ltd. | | 4,922 | | 518 | |

Mahanagar Telephone Nigam Ltd. | | 9,050 | | 44 | |

Mahindra & Mahindra Ltd. | | 4,939 | | 108 | |

Maruti Suzuki India Ltd. | | 3,345 | | 84 | |

Oil & Natural Gas Corp., Ltd. | | 11,554 | | 360 | |

Ranbaxy Laboratories Ltd. | | 7,151 | | 77 | |

Reliance Communications Ltd. | | 61,700 | | 1,164 | |

Reliance Energy Ltd. | | 2,888 | | 156 | |

Reliance Industries Ltd. | | 30,673 | | 2,241 | |

Satyam Computer Services Ltd. | | 22,065 | | 252 | |

Sun Pharma Advanced Research Co., Ltd. | | (a)1,644 | | 7 | |

Sun Pharmaceutical Industries Ltd. | | 2,255 | | 69 | |

Tata Consultancy Services Ltd. | | 6,104 | | 166 | |

Tata Motors Ltd. | | 9,131 | | 171 | |

Tata Steel Ltd. | | (d)6,392 | | 153 | |

Unitech Ltd. | | 147,912 | | 1,828 | |

Wipro Ltd. | | 9,530 | | 127 | |

Wire and Wireless India Ltd. | | (a)3,588 | | 9 | |

Zee Entertainment Enterprises Ltd. | | 9,845 | | $ 82 | |

Zee News Ltd. | | (a)(d)3,244 | | 7 | |

| | | | 16,660 | |

Indonesia (0.5%) | | | | | |

Astra International Tbk PT | | 258,000 | | 743 | |

Bank Central Asia Tbk PT | | 1,960,500 | | 1,508 | |

Bank Mandiri Persero Tbk PT | | 856,500 | | 316 | |

Bank Rakyat Indonesia Tbk PT | | 536,500 | | 419 | |

Bumi Resources Tbk PT | | 1,867,500 | | 1,178 | |

United Tractors Tbk PT | | 1,323,000 | | 1,522 | |

| | | | 5,686 | |

Italy (1.2%) | | | | | |

Alleanza Assicurazioni S.p.A. | | 2,521 | | 32 | |

Assicurazioni Generali S.p.A. | | 66,961 | | 3,002 | |

Atlantia S.p.A. | | 3,681 | | 139 | |

Autogrill S.p.A. | | 1,797 | | 30 | |

Banca Monte dei Paschi di Siena S.p.A. | | (c)2,336 | | 12 | |

Banca Popolare di Milano Scarl | | 695 | | 9 | |

Banco Popolare Scarl | | (a)3,074 | | 68 | |

Benetton Group S.p.A. | | 456 | | 8 | |

Bulgari S.p.A. | | 24,753 | | 345 | |

Enel S.p.A. | | 9,815 | | 116 | |

ENI S.p.A. | | 60,164 | | 2,192 | |

Fiat S.p.A. | | 3,080 | | 79 | |

Finmeccanica S.p.A. | | 3,429 | | 109 | |

Intesa San Paolo S.p.A. | | 291,793 | | 2,289 | |

Intesa San Paolo S.p.A. RNC | | 2,270 | | 16 | |

Italcementi S.p.A. | | 370 | | 8 | |

Luxottica Group S.p.A. | | (c)1,328 | | 42 | |

Mediaset S.p.A. | | 7,072 | | 71 | |

Mediobanca S.p.A. | | 6,639 | | 136 | |

Mediolanum S.p.A. | | 611 | | 5 | |

Pirelli & C S.p.A. | | (a)27,686 | | 30 | |

Seat Pagine Gialle S.p.A. | | (c)13,264 | | 5 | |

Snam Rete Gas S.p.A. | | (c)1,548 | | 10 | |

Telecom Italia S.p.A., Class S | | 118,151 | | 366 | |

Telecom Italia S.p.A. RNC | | 67,652 | | 159 | |

Tiscali S.p.A. | | (a)(c)935 | | 3 | |

UniCredito Italiano S.p.A. | | 455,445 | | 3,791 | |

Unione di Banche Italiane SCPA | | 20,600 | | 567 | |

| | | | 13,639 | |

Japan (19.2%) | | | | | |

77 Bank Ltd. (The) | | 79,000 | | 493 | |

Acom Co., Ltd. | | 1,980 | | 40 | |

Advantest Corp. | | (c)18,190 | | 512 | |

Aeon Co., Ltd. | | 38,900 | | 568 | |

Aeon Credit Service Co., Ltd. | | (c)2,300 | | 34 | |

Aiful Corp. | | (c)1,750 | | 31 | |

Ajinomoto Co., Inc. | | 62,400 | | 706 | |

Alps Electric Co., Ltd. | | (c)13,900 | | 180 | |

Amada Co., Ltd. | | 25,000 | | 220 | |

Asahi Breweries Ltd. | | 18,900 | | 320 | |

Asahi Glass Co., Ltd. | | 108,800 | | 1,443 | |

Asahi Kasei Corp. | | (c)102,000 | | 680 | |

Asatsu - DK, Inc. | | (c)3,300 | | 92 | |

The accompanying notes are an integral part of the financial statements. | 13 |

2007 Annual Report |

| |

December 31, 2007 |

Portfolio of Investments (cont’d)

Active International Allocation Portfolio

| | | | Value | |

| | Shares | | (000) | |

Japan (cont’d) | | | | | |

Astellas Pharma, Inc. | | 39,700 | | $ 1,732 | |

Bank of Kyoto Ltd. (The) | | 26,000 | | 307 | |

Bank of Yokohama Ltd. (The) | | 180,000 | | 1,273 | |

Benesse Corp. | | 5,100 | | 217 | |

Bridgestone Corp. | | 77,400 | | 1,363 | |

Canon, Inc. | | 81,800 | | 3,737 | |

Casio Computer Co., Ltd. | | 33,300 | | 388 | |

Central Japan Railway Co. | | 128 | | 1,089 | |

Chiba Bank Ltd. (The) | | 75,000 | | 608 | |

Chiyoda Corp. | | (c)18,000 | | 206 | |

Chubu Electric Power Co., Inc. | | (c)41,900 | | 1,094 | |

Chugai Pharmaceutical Co., Ltd. | | 20,907 | | 299 | |

Citizen Holdings Co., Ltd. | | (c)28,400 | | 276 | |

Coca-Cola West Holdings Co., Ltd. | | (c)700 | | 16 | |

COMSYS Holdings Corp. | | 16,000 | | 131 | |

Credit Saison Co., Ltd. | | 4,600 | | 126 | |

CSK Holdings Corp. | | 6,200 | | 201 | |

Dai Nippon Printing Co., Ltd. | | 37,600 | | 548 | |

Daicel Chemical Industries Ltd. | | (c)13,000 | | 78 | |

Daiichi Sankyo Co., Ltd. | | 54,000 | | 1,659 | |

Daikin Industries Ltd. | | (c)15,700 | | 877 | |

Dainippon Ink & Chemicals, Inc. | | (c)54,000 | | 270 | |

Daito Trust Construction Co., Ltd. | | 14,000 | | 777 | |

Daiwa House Industry Co., Ltd. | | (c)72,600 | | 934 | |

Daiwa Securities Group, Inc. | | 144,000 | | 1,327 | |

Denki Kagaku Kogyo KK | | 36,000 | | 155 | |

Denso Corp. | | 55,550 | | 2,258 | |

Dowa Holdings Co., Ltd. | | 49,000 | | 345 | |

East Japan Railway Co. | | 314 | | 2,578 | |

Ebara Corp. | | (c)29,800 | | 102 | |

Eisai Co., Ltd. | | 18,602 | | 733 | |

FamilyMart Co., Ltd. | | 5,100 | | 159 | |

Fanuc Ltd. | | 16,400 | | 1,600 | |

Fast Retailing Co., Ltd. | | (a)(c)7,700 | | 548 | |

Fuji Electric Holdings Co., Ltd. | | (c)15,000 | | 52 | |

Fuji Soft, Inc. | | 3,000 | | 47 | |

Fuji Television Network, Inc. | | 31 | | 51 | |

FUJIFILM Holdings Corp. | | 38,900 | | 1,649 | |

Fujikura Ltd. | | 22,000 | | 112 | |

Fujitsu Ltd. | | 147,200 | | 985 | |

Fukuoka Financial Group, Inc. | | 105,000 | | 626 | |

Furukawa Electric Co., Ltd. | | 52,800 | | 204 | |

H2O Retailing Corp. | | (c)9,000 | | 70 | |

Hirose Electric Co., Ltd. | | (c)2,300 | | 266 | |

Hitachi Construction Machinery Co., Ltd. | | 2,700 | | 81 | |

Hitachi Ltd. | | (c)266,000 | | 1,949 | |

Hokkaido Electric Power Co., Inc. | | 8,400 | | 182 | |

Hokuhoku Financial Group, Inc. | | 202,000 | | 580 | |

Honda Motor Co., Ltd. | | 132,004 | | 4,364 | |

Hoya Corp. | | 32,900 | | 1,050 | |

Ibiden Co., Ltd. | | 9,700 | | 670 | |

IHI Corp. | | (c)92,000 | | 191 | |

Index Holdings, Inc. | | (c)94 | | 28 | |

Inpex Holdings, Inc. | | 39 | | 420 | |

Isetan Co., Ltd. | | (c)15,900 | | 215 | |

Ito En Ltd. | | (c)2,100 | | $ 40 | |

Ito En Ltd. (Preference) | | 630 | | 9 | |

Itochu Corp. | | 146,000 | | 1,419 | |

Itochu Techno - Solutions Corp. | | 2,500 | | 84 | |

J Front Retailing Co., Ltd. | | (a)33,000 | | 290 | |

Japan Airlines Corp. | | (a)(c)77,000 | | 175 | |

Japan Real Estate Investment Corp. REIT | | (c)69 | | 853 | |

Japan Retail Fund Investment Corp. REIT | | (c)64 | | 451 | |

Japan Tobacco, Inc. | | 332 | | 1,969 | |

JFE Holdings, Inc. | | 31,800 | | 1,602 | |

JGC Corp. | | 23,000 | | 395 | |

Joyo Bank Ltd. (The) | | 141,000 | | 786 | |

JS Group Corp. | | (c)21,700 | | 348 | |

JSR Corp. | | 12,800 | | 331 | |

Kajima Corp. | | 112,400 | | 368 | |

Kamigumi Co., Ltd. | | (c)1,000 | | 7 | |

Kaneka Corp. | | 21,000 | | 174 | |

Kansai Electric Power Co., Inc. (The) | | (c)59,800 | | 1,395 | |

Kao Corp. | | 50,000 | | 1,504 | |

Kawasaki Heavy Industries Ltd. | | 92,000 | | 271 | |

Kawasaki Kisen Kaisha Ltd. | | (c)5,000 | | 49 | |

Keihin Electric Express Railway Co., Ltd. | | (c)33,000 | | 202 | |

Keio Corp. | | 20,000 | | 121 | |

Keyence Corp. | | 2,900 | | 710 | |

Kikkoman Corp. | | (c)10,000 | | 138 | |

Kinden Corp. | | 1,000 | | 8 | |

Kintetsu Corp. | | (c)146,200 | | 453 | |

Kirin Brewery Co., Ltd. | | (c)47,400 | | 695 | |

Kobe Steel Ltd. | | 164,000 | | 532 | |

Kokuyo Co., Ltd. | | (c)5,700 | | 51 | |

Komatsu Ltd. | | 95,700 | | 2,588 | |

Konami Corp. | | 8,600 | | 281 | |

Konica Minolta Holdings, Inc. | | 36,500 | | 642 | |

Kubota Corp. | | 131,000 | | 897 | |

Kuraray Co., Ltd. | | 29,500 | | 356 | |

Kurita Water Industries Ltd. | | (c)19,900 | | 605 | |

Kyocera Corp. | | 13,000 | | 1,137 | |

Kyowa Hakko Kogyo Co., Ltd. | | (c)23,028 | | 245 | |

Kyushu Electric Power Co., Inc. | | 26,100 | | 643 | |

Lawson, Inc. | | 4,800 | | 170 | |

Leopalace21 Corp. | | 15,100 | | 405 | |

Mabuchi Motor Co., Ltd. | | 2,300 | | 139 | |

Marubeni Corp. | | 266,000 | | 1,868 | |

Marui Co., Ltd. | | (c)35,500 | | 351 | |

Matsui Securities Co., Ltd. | | (c)14,400 | | 113 | |

Matsushita Electric Industrial Co., Ltd. | | 175,000 | | 3,580 | |

Matsushita Electric Works Ltd. | | 27,000 | | 299 | |

Meiji Dairies Corp. | | (c)17,000 | | 87 | |

Meiji Seika Kaisha Ltd. | | (c)19,000 | | 81 | |

Meitec Corp. | | (c)2,300 | | 69 | |

Millea Holdings, Inc. | | 64,352 | | 2,175 | |

Minebea Co., Ltd. | | 32,000 | | 205 | |

Mitsubishi Chemical Holdings Corp. | | 75,000 | | 575 | |

Mitsubishi Corp. | | 129,800 | | 3,536 | |

Mitsubishi Electric Corp. | | 185,800 | | 1,919 | |

Mitsubishi Estate Co., Ltd. | | 139,000 | | 3,332 | |

14 | The accompanying notes are an integral part of the financial statements. |

| 2007 Annual Report |

| |

| December 31, 2007 |

Portfolio of Investments (cont’d)

Active International Allocation Portfolio

| | | | Value | |

| | Shares | | (000) | |

Japan (cont’d) | | | | | |

Mitsubishi Heavy Industries Ltd. | | 314,000 | | $ 1,344 | |

Mitsubishi Logistics Corp. | | (c)7,000 | | 79 | |

Mitsubishi Materials Corp. | | 160,000 | | 680 | |

Mitsubishi Rayon Co., Ltd. | | 42,000 | | 203 | |

Mitsubishi UFJ Financial Group, Inc. | | 848,380 | | 7,897 | |

Mitsui & Co., Ltd. | | 156,800 | | 3,327 | |

Mitsui Chemicals, Inc. | | 42,000 | | 275 | |

Mitsui Fudosan Co., Ltd. | | 99,400 | | 2,148 | |

Mitsui Mining & Smelting Co., Ltd. | | (c)95,000 | | 380 | |

Mitsui OSK Lines Ltd. | | (c)14,000 | | 178 | |

Mitsui Sumitomo Insurance Co., Ltd. | | 108,000 | | 1,054 | |

Mitsui Trust Holdings, Inc. | | 59,545 | | 462 | |

Mitsukoshi Ltd. | | (c)32,000 | | 145 | |

Mizuho Financial Group, Inc. | | 1,036 | | 4,915 | |

Murata Manufacturing Co., Ltd. | | 16,100 | | 936 | |

Namco Bandai Holdings, Inc. | | (c)2,400 | | 38 | |

NEC Corp. | | 159,400 | | 736 | |

NEC Electronics Corp. | | (a)(c)4,800 | | 115 | |

Net One Systems Co., Ltd. | | (c)50 | | 56 | |

NGK Insulators Ltd. | | (c)33,600 | | 907 | |

NGK Spark Plug Co., Ltd. | | (c)20,000 | | 349 | |

Nidec Corp. | | (c)8,600 | | 638 | |

Nikon Corp. | | (c)26,000 | | 887 | |

Nintendo Co., Ltd. | | 6,300 | | 3,825 | |

Nippon Building Fund, Inc. REIT | | 83 | | 1,162 | |

Nippon Electric Glass Co., Ltd. | | 24,500 | | 398 | |

Nippon Express Co., Ltd. | | 77,800 | | 398 | |

Nippon Meat Packers, Inc. | | 18,600 | | 187 | |

Nippon Mining Holdings, Inc. | | 43,000 | | 276 | |

Nippon Oil Corp. | | 133,800 | | 1,090 | |

Nippon Paper Group, Inc. | | 69 | | 207 | |

Nippon Sheet Glass Co., Ltd. | | (c)37,000 | | 186 | |

Nippon Steel Corp. | | (c)415,000 | | 2,556 | |

Nippon Telegraph & Telephone Corp. | | 243 | | 1,203 | |

Nippon Yusen KK | | 98,000 | | 780 | |

Nishi-Nippon Bank Ltd. (The) | | 55,000 | | 136 | |

Nissan Chemical Industries Ltd. | | 11,000 | | 143 | |

Nissan Motor Co., Ltd. | | 196,100 | | 2,123 | |

Nisshin Seifun Group, Inc. | | 12,500 | | 125 | |

Nisshinbo Industries, Inc. | | (c)6,000 | | 73 | |

Nissin Food Products Co., Ltd. | | (c)6,400 | | 207 | |

Nitto Denko Corp. | | 17,700 | | 935 | |

Nomura Holdings, Inc. | | 207,100 | | 3,462 | |

Nomura Research Institute Ltd. | | 10,900 | | 358 | |

NSK Ltd. | | (c)62,000 | | 644 | |

NTN Corp. | | 44,000 | | 381 | |

NTT Data Corp. | | (c)121 | | 539 | |

NTT DoCoMo, Inc. | | 331 | | 548 | |

Obayashi Corp. | | 76,000 | | 383 | |

Obic Co., Ltd. | | 710 | | 131 | |

OJI Paper Co., Ltd. | | (c)95,400 | | 468 | |

Oki Electric Industry Co., Ltd. | | (a)(c)44,000 | | 69 | |

Okumura Corp. | | (c)21,000 | | 101 | |

Olympus Corp. | | (c)11,000 | | 451 | |

Omron Corp. | | 17,800 | | 421 | |

Onward Kashiyama Co., Ltd. | | (c)17,000 | | $ 174 | |

Oracle Corp. Japan | | (c)2,900 | | 128 | |

Oriental Land Co., Ltd. | | (c)5,600 | | 338 | |

Osaka Gas Co., Ltd. | | 155,600 | | 613 | |

Pioneer Corp. | | (c)14,654 | | 132 | |

Promise Co., Ltd. | | (c)2,350 | | 58 | |

Resona Holdings, Inc. | | (c)504 | | 922 | |

Ricoh Co., Ltd. | | 52,000 | | 956 | |

Rohm Co., Ltd. | | 13,100 | | 1,140 | |

Sanken Electric Co., Ltd. | | (c)14,000 | | 74 | |

Sanyo Electric Co., Ltd. | | (a)146,000 | | 202 | |

Sapporo Holdings Ltd. | | (c)10,000 | | 80 | |

SBI E*Trade Securities Co., Ltd. | | (c)191 | | 180 | |

Secom Co., Ltd. | | 14,500 | | 794 | |

Seiko Epson Corp. | | (c)9,700 | | 211 | |

Sekisui Chemical Co., Ltd. | | (c)44,000 | | 297 | |

Sekisui House Ltd. | | (c)87,600 | | 949 | |

Seven & I Holdings Co., Ltd. | | 64,000 | | 1,861 | |

Sharp Corp. | | (c)72,200 | | 1,293 | |

Shimachu Co., Ltd. | | (c)5,500 | | 156 | |

Shimamura Co., Ltd. | | 2,100 | | 177 | |

Shimano, Inc. | | (c)8,600 | | 310 | |

Shimizu Corp. | | 80,600 | | 351 | |

Shin-Etsu Chemical Co., Ltd. | | 33,696 | | 2,107 | |

Shinko Securities Co., Ltd. | | 52,000 | | 216 | |

Shinsei Bank Ltd. | | (c)172,000 | | 632 | |

Shionogi & Co., Ltd. | | (c)22,000 | | 388 | |

Shiseido Co., Ltd. | | 31,000 | | 734 | |

Shizuoka Bank Ltd. (The) | | 64,000 | | 704 | |

Showa Denko KK | | 54,000 | | 194 | |

Showa Shell Sekiyu KK | | 14,500 | | 161 | |

SMC Corp. | | 5,700 | | 678 | |

Softbank Corp. | | (c)80,700 | | 1,661 | |

Sompo Japan Insurance, Inc. | | 73,000 | | 658 | |

Sony Corp. | | 61,597 | | 3,343 | |

Stanley Electric Co., Ltd. | | 6,000 | | 149 | |

Sumitomo Bakelite Co., Ltd. | | 11,000 | | 66 | |

Sumitomo Chemical Co., Ltd. | | 116,600 | | 1,037 | |

Sumitomo Corp. | | (c)95,100 | | 1,354 | |

Sumitomo Electric Industries Ltd. | | (c)59,400 | | 946 | |

Sumitomo Heavy Industries Ltd. | | (c)38,000 | | 349 | |

Sumitomo Metal Industries Ltd. | | 247,000 | | 1,141 | |

Sumitomo Metal Mining Co., Ltd. | | (c)89,800 | | 1,538 | |

Sumitomo Mitsui Financial Group, Inc. | | 496 | | 3,691 | |

Sumitomo Realty & Development Co., Ltd. | | (c)43,000 | | 1,058 | |

Sumitomo Trust & Banking Co., Ltd. (The) | | 138,000 | | 919 | |

T&D Holdings, Inc. | | 20,250 | | 1,048 | |

Taiheiyo Cement Corp. | | (c)53,000 | | 127 | |

Taisei Corp. | | (c)109,000 | | 294 | |

Taisho Pharmaceutical Co., Ltd. | | (c)1 1,441 | | 220 | |

Taiyo Yuden Co., Ltd. | | (c)7,000 | | 113 | |

Takara Holdings, Inc. | | (c)6,000 | | 36 | |

Takashimaya Co., Ltd. | | (c)32,000 | | 386 | |

Takeda Pharmaceutical Co., Ltd. | | 65,600 | | 3,835 | |

Takefuji Corp. | | (c)3,010 | | 72 | |

TDK Corp. | | 10,000 | | 742 | |

The accompanying notes are an integral part of the financial statements. | 15 |

2007 Annual Report |

| |

December 31, 2007 |

Portfolio of Investments (cont’d)

Active International Allocation Portfolio

| | | | Value | |

| | Shares | | (000) | |

Japan (cont’d) | | | | | |

Teijin Ltd. | | 73,400 | | $ 314 | |

Terumo Corp. | | 17,100 | | 901 | |

THK Co., Ltd. | | 3,400 | | 69 | |

TIS, Inc. | | (c)2,904 | | 50 | |

Tobu Railway Co., Ltd. | | (c)79,400 | | 371 | |

Toho Co., Ltd. | | (c)6,300 | | 141 | |

Tohoku Electric Power Co., Inc. | | 35,200 | | 793 | |

Tokyo Broadcasting System, Inc. | | 9,000 | | 193 | |

Tokyo Electric Power Co., Inc. (The) | | 87,400 | | 2,264 | |

Tokyo Electron Ltd. | | 19,900 | | 1,216 | |

Tokyo Gas Co., Ltd. | | (c)182,600 | | 853 | |

Tokyo Tatemono Co., Ltd. | | (c)33,000 | | 311 | |

Tokyu Corp. | | 88,400 | | 583 | |

TonenGeneral Sekiyu KK | | (c)29,000 | | 286 | |

Toppan Printing Co., Ltd. | | (c)36,600 | | 361 | |

Toray Industries, Inc. | | (c)102,100 | | 793 | |

Toshiba Corp. | | (c)272,000 | | 2,028 | |

Tosoh Corp. | | 40,000 | | 172 | |

Toto Ltd. | | (c)43,600 | | 344 | |

Toyo Seikan Kaisha Ltd. | | 16,400 | | 290 | |

Toyoba Co., Ltd. | | 5,000 | | 10 | |

Toyoda Gosei Co., Ltd. | | (c)800 | | 28 | |

Toyota Industries Corp. | | 8,150 | | 332 | |

Toyota Motor Corp. | | 213,400 | | 11,486 | |

Trend Micro, Inc. | | (a)9,200 | | 330 | |

Unicharm Corp. | | (c)3,400 | | 214 | |

Uniden Corp. | | (c)5,000 | | 29 | |

UNY Co., Ltd. | | 10,000 | | 85 | |

Ushio, Inc. | | (c)3,500 | | 77 | |

USS Co., Ltd. | | 2,700 | | 168 | |

Wacoal Holdings Corp. | | (c)6,000 | | 78 | |

West Japan Railway Co. | | 33 | | 163 | |

Yahoo! Japan Corp. | | 1,439 | | 642 | |

Yakult Honsha Co., Ltd. | | (c)8,700 | | 201 | |

Yamada Denki Co., Ltd. | | 9,620 | | 1,095 | |

Yamaha Corp. | | 8,800 | | 201 | |

Yamaha Motor Co., Ltd. | | 2,700 | | 65 | |

Yamato Holdings Co., Ltd. | | (c)23,000 | | 332 | |

Yamazaki Baking Co., Ltd. | | (c)8,000 | | 78 | |

Yokogawa Electric Corp. | | (c)16,900 | | 185 | |

| | | | 210,690 | |

Malaysia (0.2%) | | | | | |

IJM Corp. Bhd | | 303,900 | | 787 | |

IOI Corp. Bhd | | 267,300 | | 621 | |

Kuala Lumpur Kepong Bhd | | 60,800 | | 318 | |

| | | | 1,726 | |

Mexico (0.2%) | | | | | |

Corp. GEO S.A.B. de C.V. | | (a)91,400 | | 263 | |

Desarrolladora Homex S.A.B. de C.V. ADR | | (a)(c)8,600 | | 425 | |

Grupo Financiero Banorte S.A.B. de C.V., Class O | | 232,400 | | 961 | |

Urbi Desarrollos Urbanos S.A. de C.V. | | (a)46,400 | | 160 | |

Wal-Mart de Mexico S.A.B. de C.V., Class V | | 163,200 | | 569 | |

| | | | 2,378 | |

Netherlands (2.6%) | | | | | |

Aegon N.V. | | (c)140,227 | | $ 2,460 | |

Akzo Nobel N.V. | | 15,671 | | 1,248 | |

ASML Holding N.V. | | (a)30,941 | | 978 | |

Corio N.V. REIT | | 4,462 | | 359 | |

Fugro N.V. CVA | | 3,443 | | 264 | |

Hagemeyer N.V. | | (c)4,613 | | 31 | |

Heineken N.V. | | 66,985 | | 4,314 | |

ING Groep N.V. CVA | | 85,155 | | 3,324 | |

Koninklijke DSM N.V. | | 8,803 | | 412 | |

Koninklijke Philips Electronics N.V. | | 56,394 | | 2,444 | |

OCE N.V. | | 8,354 | | 150 | |

Reed Elsevier N.V. | | (c)39,386 | | 781 | |

Royal KPN N.V. | | 117,591 | | 2,127 | |

Royal Numico N.V. | | 9,003 | | 724 | |

SBM Offshore N.V. | | 8,260 | | 259 | |

TNT N.V. | | 59,756 | | 2,487 | |

Unilever N.V. CVA | | 148,457 | | 5,435 | |

Wereldhave N.V. REIT | | 1,818 | | 198 | |

Wolters Kluwer N.V. | | (c)21,906 | | 716 | |

| | | | 28,711 | |

New Zealand (0.0%) | | | | | |

Telecom Corp. of New Zealand Ltd. | | (c)19,672 | | 66 | |

Norway (1.7%) | | | | | |

Acergy S.A. | | (c)26,400 | | 582 | |

Aker Kvaerner ASA | | 37,660 | | 993 | |

DNB NOR ASA | | 24,024 | | 364 | |

Norsk Hydro ASA | | 55,145 | | 780 | |

Norske Skogindustrier ASA | | (c)12,100 | | 99 | |

Ocean Rig ASA | | (a)(c)13,600 | | 98 | |

Orkla ASA | | 52,500 | | 1,011 | |

Prosafe SE | | (c)23,040 | | 397 | |

Renewable Energy Corp. A/S | | (a)13,900 | | 695 | |

SeaDrill Ltd. | | (a)47,400 | | 1,141 | |

StatoilHydro ASA | | 269,546 | | 8,334 | |

Tandberg ASA | | 14,060 | | 290 | |

Telenor ASA | | (a)48,800 | | 1,154 | |

TGS Nopec Geophysical Co. ASA | | (a)(c)26,200 | | 356 | |

Yara International ASA | | (c)58,377 | | 2,681 | |

| | | | 18,975 | |

Philippines (0.6%) | | | | | |

Ayala Corp. | | 50,300 | | 680 | |

Ayala Land, Inc. | | 3,746,651 | | 1,294 | |

Banco de Oro - EPCI, Inc. | | 309,055 | | 449 | |

Bank of the Philippine Islands | | 438,860 | | 647 | |

Globe Telecom, Inc. | | 10,400 | | 395 | |

Manila Electric Co. | | 176,500 | | 349 | |

Megaworld Corp. | | 3,479,000 | | 316 | |

Metropolitan Bank and Trust | | 153,200 | | 202 | |

Philippines Long Distance Telephone Co. | | 19,370 | | 1,483 | |

PNOC Energy Development Corp. | | 2,359,550 | | 372 | |

SM Investments Corp. | | 56,710 | | 463 | |

SM Prime Holdings, Inc. | | 1,431,000 | | 352 | |

| | | | 7,002 | |

16 | The accompanying notes are an integral part of the financial statements. |

| 2007 Annual Report |

| |

| December 31, 2007 |

Portfolio of Investments (cont’d)

Active International Allocation Portfolio

| | | | Value | |

| | Shares | | (000) | |

Poland (0.6%) | | | | | |

Agora S.A. | | 5,609 | | $ 126 | |

Bank BPH S.A. | | 1,394 | | 59 | |

Bank Pekao S.A. | | 23,721 | | 2,168 | |

Bank Zachodni WBK S.A. | | 3,886 | | 393 | |

Grupa Kety S.A. | | 163 | | 10 | |

KGHM Polska Miedz S.A. | | 19,397 | | 826 | |

Polski Koncern Naftowy Orlen | | (a)45,510 | | 951 | |

Powszechna Kasa Oszczednosci Bank Polski S.A. | | 56,862 | | 1,217 | |

Prokom Software S.A. | | 1,723 | | 93 | |

Telekomunikacja Polska S.A. | | 105,261 | | 959 | |

| | | | 6,802 | |

Portugal (0.2%) | | | | | |

Banco Comercial Portugues S.A. (Registered) | | (c)121,871 | | 517 | |

Brisa — Auto Estradas de Portugal S.A. | | (c)23,604 | | 346 | |

Energias de Portugal S.A. | | 24,260 | | 158 | |

Portugal Telecom SGPS S.A. (Registered) | | 44,891 | | 583 | |

PT Multimedia Servicos de Telecomunicacoes e Multimedia SGPS S.A. | | 17,166 | | 239 | |

| | | | 1,843 | |

Russia (1.8%) | | | | | |

LUKOIL ADR | | (c)27,780 | | 2,385 | |

MMC Norilsk Nickel ADR | | 11,136 | | 2,993 | |

Mobile Telesystems OJSC ADR | | 15,600 | | 1,588 | |

Novolipetsk Steel OJSC GDR | | 11,500 | | 456 | |

OAO Gazprom ADR | | 74,960 | | 4,221 | |

OAO Gazprom ADR | | 16,337 | | 920 | |

OGK-5 Holding | | 298,628 | | 52 | |

Polyus Gold Co. ADR | | (c)9,300 | | 427 | |

Sberbank GDR | | (a)1,135 | | 621 | |

Severstal GDR | | 22,600 | | 514 | |

Surgutneftegaz ADR | | (c)12,800 | | 779 | |

Surgutneftegaz ADR (Preference) | | 6,200 | | 402 | |

Tatneft GDR | | 5,900 | | 708 | |

TGK-5 Holding | | 9,856,375 | | 9 | |

Unified Energy System GDR | | (a)7,250 | | 942 | |

Vimpel-Communications ADR | | 41,000 | | 1,706 | |

Wimm-Bill-Dann Foods OJSC ADR | | 5,600 | | 734 | |

| | | | 19,457 | |

Singapore (2.1%) | | | | | |

Ascendas REIT | | 158,000 | | 269 | |

CapitaLand Ltd. | | (c)193,000 | | 830 | |

CapitaMall Trust REIT | | 140,500 | | 334 | |

Chartered Semiconductor Manufacturing Ltd. | | (a)(c)227,000 | | 152 | |

City Developments Ltd. | | (c)85,719 | | 835 | |

ComfortDelgro Corp., Ltd. | | 304,477 | | 383 | |

Cosco Corp. Singapore Ltd. | | 132,000 | | 519 | |

Creative Technology Ltd. | | (c)13,267 | | 58 | |

DBS Group Holdings Ltd. | | 171,612 | | 2,432 | |

Fraser & Neave, Ltd. | | 204,000 | | 826 | |

Hyflux Ltd. | | (c)95,000 | | 209 | |

Jardine Cycle & Carriage Ltd. | | 27,034 | | 403 | |

K-REIT Asia | | 9,200 | | 14 | |

Keppel Corp. Ltd. | | 174,000 | | 1,558 | |

Keppel Land Ltd. | | 57,000 | | $ 287 | |

Neptune Orient Lines Ltd. | | (c)113,000 | | 304 | |

Olam International Ltd. | | 160,000 | | 314 | |

Oversea-Chinese Banking Corp. | | 387,712 | | 2,237 | |

Parkway Holdings Ltd. | | 100,000 | | 272 | |

Raffles Education Corp., Ltd. | | 26,431 | | 56 | |

SembCorp Industries Ltd. | | 133,183 | | 532 | |

SembCorp Marine Ltd. | | 126,000 | | 351 | |

Singapore Airlines Ltd. | | 84,000 | | 1,005 | |

Singapore Exchange Ltd. | | (c)123,539 | | 1,129 | |

Singapore Land Ltd. | | 37,000 | | 203 | |

Singapore Post Ltd. | | 243,000 | | 189 | |

Singapore Press Holdings Ltd. | | 244,028 | | 761 | |

Singapore Technologies Engineering Ltd. | | (c)214,296 | | 555 | |

Singapore Telecommunications Ltd. | | 1,127,015 | | 3,093 | |

United Overseas Bank Ltd. | | 178,389 | | 2,469 | |

UOL Group Ltd. | | 98,189 | | 306 | |

Venture Corp., Ltd. | | 41,444 | | 363 | |

| | | | 23,248 | |

South Korea (0.5%) | | | | | |

Daelim Industrial Co. | | (a)350 | | 66 | |

Daewoo Engineering & Construction Co., Ltd. | | (a)2,534 | | 66 | |

Daewoo Securities Co., Ltd. | | 3,700 | | 119 | |

Daewoo Shipbuilding & Marine Engineering Co., Ltd. | | (a)1,650 | | 91 | |

GS Engineering & Construction Corp. | | (a)640 | | 105 | |

Hana Financial Group, Inc. | | 1,570 | | 85 | |

Hyundai Development Co. | | (a)870 | | 85 | |

Hyundai Engineering & Construction Co., Ltd. | | (a)970 | | 90 | |

Hyundai Heavy Industries | | (a)470 | | 219 | |

Hyundai Mipo Dockyard | | (a)170 | | 51 | |

Hyundai Mobis | | (a)630 | | 58 | |

Hyundai Motor Co. | | (a)1,980 | | 151 | |

Hyundai Steel Co. | | (a)720 | | 60 | |

Kookmin Bank | | (a)3,450 | | 254 | |

Korea Electric Power Corp. | | (a)3,230 | | 136 | |

Korea Exchange Bank | | (a)7,990 | | 123 | |

KT Corp. | | 1,980 | | 103 | |

KT&G Corp. | | (a)1,490 | | 127 | |

LG Chem Ltd. | | (a)1,090 | | 104 | |

LG Electronics, Inc. | | (a)1,110 | | 117 | |

LG.Philips LCD Co., Ltd. | | (a)1,150 | | 61 | |

Lotte Shopping Co., Ltd. | | (a)200 | | 88 | |

NHN Corp. | | (a)565 | | 134 | |

POSCO | | 732 | | 443 | |

S-Oil Corp. | | 1,000 | | 84 | |

Samsung Corp. | | (a)2,090 | | 159 | |

Samsung Electro-Mechanics Co., Ltd. | | (a)1,060 | | 55 | |

Samsung Electronics Co., Ltd. | | 1,348 | | 792 | |

Samsung Electronics Co., Ltd. (Preference) | | 216 | | 98 | |

Samsung Engineering Co., Ltd. | | (a)640 | | 63 | |

Samsung Fire & Marine Insurance Co., Ltd. | | 490 | | 132 | |

Samsung Heavy Industries Co., Ltd. | | (a)2,580 | | 109 | |

Samsung Securities Co., Ltd. | | 1,620 | | 154 | |

Samsung Techwin Co., Ltd. | | (a)960 | | 42 | |

Shinhan Financial Group Co., Ltd. | | (a)3,930 | | 225 | |

The accompanying notes are an integral part of the financial statements. | 17 |

2007 Annual Report | |

| |

December 31, 2007 | |

Portfolio of Investments (cont’d)

Active International Allocation Portfolio

| | | | Value | |

| | Shares | | (000) | |

South Korea (cont’d) | | | | | |

Shinsegae Co., Ltd. | | (a)223 | | $ 172 | |

SK Holdings Co., Ltd. | | (a)280 | | 59 | |

SK Energy Co., Ltd. | | (a)770 | | 148 | |

| | | | 5,228 | |

Spain (2.8%) | | | | | |

Abertis Infraestructuras S.A. | | (c)22,215 | | 712 | |

Acerinox S.A. | | (c)13,440 | | 328 | |

Altadis S.A. | | 19,021 | | 1,382 | |

Antena 3 de Television S.A. | | (c)6,882 | | 105 | |

Banco Bilbao Vizcaya Argentaria S.A. | | 134,005 | | 3,291 | |

Banco Popular Espanol S.A. | | (c)37,309 | | 630 | |

Banco Santander S.A. | | 250,129 | | 5,404 | |

Cintra Concesiones de Infraestructuras de Transporte S.A. | | 10,671 | | 160 | |

Gamesa Corp. Tecnologica S.A. | | 12,793 | | 592 | |

Gas Natural SDG S.A. | | (c)21,191 | | 1,234 | |

Iberdrola S.A. | | 124,444 | | 1,884 | |

Inditex S.A. | | 11,867 | | 721 | |

Indra Sistemas S.A. | | 3,324 | | 89 | |

Metrovacesa S.A. | | 1,164 | | 139 | |

Repsol YPF S.A. | | 55,394 | | 1,975 | |

Sociedad General de Aguas de Barcelona S.A., Class A | | 4,072 | | 164 | |

Telefonica S.A. | | 364,822 | | 11,790 | |

Union Fenosa S.A. | | 3,021 | | 203 | |

| | | | 30,803 | |

Sweden (2.4%) | | | | | |

Alfa Laval AB | | 1,250 | | 70 | |

Assa Abloy AB, Class B | | (c)20,477 | | 407 | |

Atlas Copco AB, Class A | | 217,296 | | 3,208 | |

Atlas Copco AB, Class B | | 24,594 | | 332 | |

Ssab Svenskt Stal AB, Class A | | (c)12,150 | | 326 | |

Electrolux AB, Class B | | (c)12,800 | | 213 | |

Eniro AB | | 7,721 | | 69 | |

Fabege AB | | 5,031 | | 51 | |

Getinge AB, Class B | | (c)33,047 | | 883 | |

Hennes & Mauritz AB, Class B | | 20,050 | | 1,212 | |

Holmen AB, Class B | | (c)3,400 | | 125 | |

Husqvarna AB, Class A | | (c)3,839 | | 45 | |

Husqvarna AB, Class B | | 12,800 | | 151 | |

Modern Times Group AB, Class B | | (c)3,337 | | 233 | |

Nordea Bank AB | | 189,644 | | 3,146 | |

Sandvik AB | | 214,090 | | 3,639 | |