UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05628

Name of Registrant: | Vanguard Malvern Funds |

Address of Registrant: | P.O. Box 2600 |

| Valley Forge, PA 19482 |

| |

Name and address of agent for service: | Anne E. Robinson, Esquire |

| P.O. Box 876 |

| Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: September 30

Date of reporting period: October 1, 2018—September 30, 2019

Item 1: Reports to Shareholders

Annual Report | September 30, 2019 Vanguard U.S. Value Fund |

See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. |

Important information about access to shareholder reports

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com.

You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard.

Contents | |

| |

| |

A Note From Our Chairman | 1 |

| |

Your Fund’s Performance at a Glance | 2 |

| |

Advisor’s Report | 3 |

| |

About Your Fund’s Expenses | 5 |

| |

Performance Summary | 7 |

| |

Financial Statements | 9 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

A Note From Our Chairman

Tim Buckley

Chairman and Chief Executive Officer

Dear Shareholder,

Recent volatility in financial markets—affecting stocks, bonds, and commodities—has been a good reminder of the wise old adage, “Never keep all your eggs in one basket.” Maintaining balance and diversification in your investment portfolio can help to both limit risk and set you up for long-term success.

It’s understandable why some investors might become complacent after a long market run-up like the one that lifted stock prices, especially U.S. stock prices, in the years following the global financial crisis. But failing to rebalance regularly can leave a portfolio with a much different mix of assets than intended and, often, more risk than intended.

Balance across and diversification within asset classes are powerful tools for managing risk and achieving your investment goals. A portfolio’s allocation will determine a large portion of its long-term return and also the majority of its volatility risk. A well-diversified portfolio is less vulnerable to significant swings in the performance of any one segment of the asset classes in which it invests.

Balance and diversification will never eliminate the risk of loss, nor will they guarantee positive returns in a declining market. But they should reduce the chance that you’ll suffer disproportionate losses in one particular high-flying asset class or sector when it comes back to earth. And exposure to all key market components should give you at least some participation in the sectors that are performing best at any given time.

Vanguard is committed to helping you achieve balance and diversification in your portfolios to help meet your investment goals. We thank you for your continued loyalty.

Sincerely,

Mortimer J. Buckley

Chairman and Chief Executive Officer

October 14, 2019

1

Your Fund’s Performance at a Glance

· Vanguard U.S. Value Fund posted a return of about —3% for the 12 months ended September 30, 2019, well below the performance of its benchmark, the Russell 3000 Value Index, which had a positive return of more than 3% for the period

· The broad U.S. stock market as measured by the Russell 3000 Index returned nearly 3% during the period. While stocks endured stretches of volatility at the end of 2018 and during the spring of 2019, performance was boosted by the accommodative stance of the Federal Reserve. The Fed cut interest rates in August and September in response to a softening economy.

· Information technology was the only sector that contributed positively to performance on a relative basis. Energy, industrial, and health care stocks detracted most.

· Over the ten years ended September 30, 2019, the fund’s average annual return of 11.39% was slightly above that of its benchmark.

Market Barometer | | | |

| Average Annual Total Returns |

| Periods Ended September 30, 2019 |

| One Year | Three Years | Five Years |

Stocks | | | |

Russell 1000 Index (Large-caps) | 3.87% | 13.19% | 10.62% |

Russell 2000 Index (Small-caps) | -8.89 | 8.23 | 8.19 |

Russell 3000 Index (Broad U.S. market) | 2.92 | 12.83 | 10.44 |

FTSE All-World ex US Index (International) | -1.12 | 6.46 | 3.24 |

| | | |

Bonds | | | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | |

(Broad taxable market) | 10.30% | 2.92% | 3.38% |

Bloomberg Barclays Municipal Bond Index | | | |

(Broad tax-exempt market) | 8.55 | 3.19 | 3.66 |

FTSE Three-Month U.S. Treasury Bill Index | 2.36 | 1.52 | 0.95 |

| | | |

CPI | | | |

Consumer Price Index | 1.71% | 2.07% | 1.53% |

2

Advisor’s Report

For the 12 months ended September 30, 2019, Vanguard U.S. Value Fund posted a return of about —3%, well below the return of its benchmark index, the Russell 3000 Value Index.

Investment objective and strategy

Although it’s important to understand how overall performance is affected by macroeconomic factors, our strategy focuses on company-specific fundamentals—not technical analysis. Our stock selection model evaluates companies within our investment universe to identify those with attractive characteristics that we believe will outperform over the long run.

To do this, we use a strict quantitative process that focuses on a combination of five key themes or decision models: high quality—healthy balance sheets and consistent cash-flow generation; effective use of capital by management—sound investment policies that favor internal over external funding; consistent earnings growth—a demonstrated ability to grow earnings year after year; strong market sentiment—market confirmation of our view; and reasonable valuation—avoidance of overpriced stocks.

The interaction of these themes generates an opinion on all the stocks in our universe each day. Using the results of our model, we then construct our portfolio with the goal of maximizing expected return while minimizing exposure to risks that our research indicates do not improve returns, such as industry selection and other risks relative to our benchmark.

Investment environment

The recent macroeconomic environment—characterized by high economic and policy uncertainty, low GDP growth, and low interest rates—has contributed to some extraordinary trends in the equity markets. These trends are not unusual at the late stage of a business cycle and include:

· Value underperformance. We’ve seen the longest stretch of value underperformance since the dot-com bubble burst in 2000. Investors have been flocking to high-growth-potential companies with the hope of higher returns without necessarily looking at the underlying earnings. As a result, these companies are trading at inflated valuations that increasingly diverge from those of value companies.

· Sentiment rules. The equity market has mostly been trading on sentiment, with investors reacting to macroeconomic shocks such as tariffs and Federal Reserve interest rate announcements while largely ignoring fundamentals (quality, growth, etc.) since spring 2018.

· “Junk” rally. A big junk rally in which stocks with high valuations and low-quality earnings outperform began in January. It has been a risk-on and fundamental-off market, in which investors give up safety for returns.

3

While market environments such as the one we’ve experienced can be challenging for investors, it is crucial to maintain a long-term focus. These market conditions are not unusual at the late stage of a business cycle, and investors should expect to experience them at least once during their investment life.

As with any other form of active equity management, our strategies are designed to deliver long-term outperformance. Often, quantitatively driven funds are among the first to bounce back after a drop in the markets and can weather unpredictable markets by staying focused on the historical trends and in-depth data analysis performed regularly by expert portfolio managers, analysts, and traders.

Our successes and failures

Against this backdrop, the fund underperformed across the board as all five of our decision models did not perform as expected, and ten of the fund’s 11 industry sectors detracted from performance on a relative basis. Only information technology added to performance while energy, industrials, and health care were the biggest detractors.

The portfolio benefited from its holdings in information technology stocks Enphase Energy, Booz Allen Hamilton, and Electro Scientific Industries. The greatest shortfalls came from Mallinckrodt in health care, Tailored Brands in consumer discretionary, and Universal Insurance Holdings in financials.

We continue to believe that constructing a portfolio focused on the fundamentals we’ve described will benefit investors over the long term, although we recognize that markets can reward or punish us in the near term. We believe the fund offers a strong mix of stocks with attractive valuation and growth characteristics.

Portfolio Managers:

James P. Stetler

Binbin Guo, Principal, Head of

Alpha Equity Investments

Vanguard Quantitative Equity Group

October 18, 2019

4

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

· Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

· Based on hypothetical 5% yearly return. This section is intended to help you compare your fund’s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

5

Six Months Ended September 30, 2019 | | | |

| Beginning | Ending | Expenses |

| Account Value | Account Value | Paid During |

U.S. Value Fund | 3/31/2019 | 9/30/2019 | Period |

Based on Actual Fund Return | $1,000.00 | $1,027.92 | $1.12 |

Based on Hypothetical 5% Yearly Return | 1,000.00 | 1,023.97 | 1.12 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratio for that period is 0.22%. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period (183/365).

6

U.S. Value Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

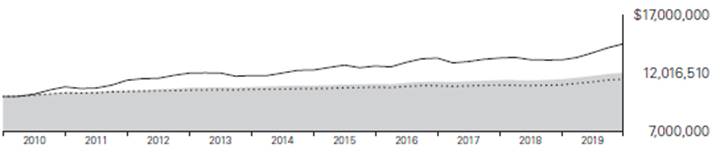

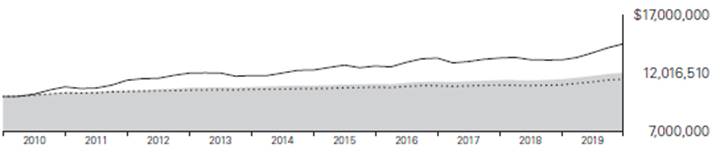

Cumulative Performance: September 30, 2009, Through September 30, 2019

Initial Investment of $10,000

| | Average Annual Total Returns | |

| | Periods Ended September 30, 2019 | |

| | | | | Final Value |

| | One | Five | Ten | of a $10,000 |

| | Year | Years | Years | Investment |

| U.S. Value Fund | -2.98% | 6.71% | 11.39% | $29,397 |

| Russell 3000 Value Index | 3.10 | 7.76 | 11.36 | 29,336 |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 2.81 | 10.40 | 13.09 | 34,207 |

See Financial Highlights for dividend and capital gains information.

7

U.S. Value Fund

Sector Diversification

As of September 30, 2019

Communication Services | | 7.7 | % |

Consumer Discretionary | | 6.6 | |

Consumer Staples | | 8.6 | |

Energy | | 8.3 | |

Financials | | 24.0 | |

Health Care | | 12.1 | |

Industrials | | 9.9 | |

Information Technology | | 6.1 | |

Materials | | 4.2 | |

Real Estate | | 5.7 | |

Utilities | | 6.8 | |

The table reflects the fund’s equity exposure, based on its investments in stocks and stock index futures. Any holdings in short-term reserves are excluded. Sector categories are based on the Global Industry Classification Standard (“GICS”), except for the “Other” category (if applicable), which includes securities that have not been provided a GICS classification as of the effective reporting period.

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard and Poor’s, a division of McGraw-Hill Companies, Inc. (“S&P”), and is licensed for use by Vanguard. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classification makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of its affiliates or any third party involved in making or compiling the GICS or any classification have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

8

U.S. Value Fund

Financial Statements

Statement of Net Assets

As of September 30, 2019

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The fund’s Form N-PORT reports are available on the SEC’s website at www.sec.gov.

| | | Market |

| | | Value· |

| | Shares | ($000) |

Common Stocks (99.5%)1 | | |

Communication Services (7.6%) | | |

| Verizon Communications Inc. | 390,178 | 23,551 |

| AT&T Inc. | 523,836 | 19,822 |

| Walt Disney Co. | 116,813 | 15,223 |

| Comcast Corp. Class A | 304,245 | 13,715 |

* | Discovery Communications Inc. Class A | 287,571 | 7,658 |

| New York Times Co. Class A | 229,783 | 6,544 |

* | T-Mobile US Inc. | 67,771 | 5,338 |

| CenturyLink Inc. | 321,929 | 4,018 |

| News Corp. Class B | 182,235 | 2,605 |

| Sinclair Broadcast Group Inc. Class A | 41,621 | 1,779 |

| Fox Corp. Class A | 55,012 | 1,735 |

* | Glu Mobile Inc. | 312,253 | 1,558 |

| Telephone & Data Systems Inc. | 53,439 | 1,379 |

* | Bandwidth Inc. Class A 20 | 20,773 | 1,353 |

| TEGNA Inc. | 79,331 | 1,232 |

* | United States Cellular Corp. | 29,991 | 1,127 |

* | Discovery Communications Inc. | 35,934 | 885 |

| News Corp. Class A | 50,656 | 705 |

| Fox Corp. Class B | 22,271 | 702 |

| | | 110,929 |

Consumer Discretionary (6.5%) | | |

| Home Depot Inc. | 46,169 | 10,712 |

| Whirlpool Corp. | 54,037 | 8,557 |

| Gentex Corp. | 290,292 | 7,993 |

| Brinker International Inc. | 175,159 | 7,474 |

| Rent-A-Center Inc. | 266,840 | 6,882 |

*,^ | YETI Holdings Inc. | 218,522 | 6,119 |

| Best Buy Co. Inc. | 87,831 | 6,060 |

| McDonald’s Corp. | 26,141 | 5,613 |

| Carnival Corp. | 117,386 | 5,131 |

* | frontdoor Inc. | 105,261 | 5,113 |

* | Genesco Inc. | 103,922 | 4,159 |

| Yum! Brands Inc. | 27,639 | 3,135 |

| Expedia Group Inc. | 20,261 | 2,723 |

* | Stoneridge Inc. | 80,727 | 2,500 |

| Lear Corp. | 20,934 | 2,468 |

| Standard Motor Products Inc. | 31,812 | 1,545 |

* | American Axle & Manufacturing Holdings Inc. | 145,783 | 1,198 |

* | AutoZone Inc. | 772 | 837 |

* | Deckers Outdoor Corp. | 5,425 | 799 |

* | K12 Inc. | 30,137 | 796 |

* | Under Armour Inc. Class C | 42,469 | 770 |

| Las Vegas Sands Corp. | 12,474 | 721 |

| Signet Jewelers Ltd. | 42,624 | 714 |

| Dine Brands Global Inc. | 9,390 | 712 |

* | Modine Manufacturing Co. | 62,644 | 712 |

* | 1-800-Flowers.com Inc. Class A | 40,399 | 598 |

| | | 94,041 |

Consumer Staples (8.6%) | | |

| Procter & Gamble Co. | 216,996 | 26,990 |

| Philip Morris International Inc. | 253,984 | 19,285 |

| Walmart Inc. | 132,912 | 15,774 |

| PepsiCo Inc. | 77,170 | 10,580 |

| Bunge Ltd. | 143,599 | 8,131 |

| Molson Coors Brewing Co. Class B | 126,312 | 7,263 |

| Campbell Soup Co. | 141,283 | 6,629 |

| Coty Inc. Class A | 597,585 | 6,281 |

* | TreeHouse Foods Inc. | 111,529 | 6,184 |

| Casey’s General Stores Inc. | 31,867 | 5,136 |

* | Edgewell Personal Care Co. | 151,831 | 4,933 |

* | US Foods Holding Corp. | 78,406 | 3,222 |

| Kimberly-Clark Corp. | 16,132 | 2,291 |

^ | B&G Foods Inc. | 67,753 | 1,281 |

| | | 123,980 |

9

U.S. Value Fund

| | | Market |

| | | Value· |

| | Shares | ($000) |

Energy (8.3%) | | |

| Chevron Corp. | 263,716 | 31,277 |

| Exxon Mobil Corp. | 388,922 | 27,462 |

| ConocoPhillips | 257,893 | 14,695 |

| Devon Energy Corp. | 332,036 | 7,989 |

| Occidental Petroleum Corp. | 169,454 | 7,536 |

* | Southwestern Energy Co. | 3,719,332 | 7,178 |

| HollyFrontier Corp. | 130,111 | 6,979 |

* | W&T Offshore Inc. | 1,134,668 | 4,958 |

| Range Resources Corp. | 949,275 | 3,626 |

| Phillips 66 | 27,425 | 2,808 |

| Valero Energy Corp. | 30,714 | 2,618 |

| Cabot Oil & Gas Corp. | 51,486 | 905 |

* | Continental Resources Inc. | 25,935 | 798 |

* | CONSOL Energy Inc. | 42,615 | 666 |

| Delek US Holdings Inc. | 12,227 | 444 |

| | | 119,939 |

Financials (23.9%) | | |

| JPMorgan Chase & Co. | 390,091 | 45,910 |

* | Berkshire Hathaway Inc. Class B | 167,775 | 34,900 |

| Bank of America Corp. | 1,154,489 | 33,676 |

| Citigroup Inc. | 217,792 | 15,045 |

| Wells Fargo & Co. | 282,515 | 14,250 |

| Allstate Corp. | 117,135 | 12,730 |

| Capital One Financial Corp. | 138,994 | 12,646 |

| MetLife Inc. | 232,985 | 10,988 |

| American Express Co. | 90,841 | 10,745 |

| Ally Financial Inc. | 307,578 | 10,199 |

| Fifth Third Bancorp | 363,719 | 9,959 |

| Regions Financial Corp. | 614,456 | 9,721 |

| Discover Financial Services | 116,698 | 9,463 |

| Synchrony Financial | 276,354 | 9,421 |

| Ameriprise Financial Inc. | 62,878 | 9,249 |

| Aflac Inc. | 168,343 | 8,808 |

| AXA Equitable Holdings Inc. | 388,784 | 8,615 |

| OFG Bancorp | 380,221 | 8,327 |

| Zions Bancorp NA | 183,761 | 8,181 |

| Hanover Insurance Group Inc. | 59,764 | 8,100 |

| Progressive Corp. | 83,293 | 6,434 |

| Comerica Inc. | 89,763 | 5,923 |

| Unum Group | 182,016 | 5,409 |

| Navient Corp. | 416,359 | 5,329 |

| Popular Inc. | 92,006 | 4,976 |

* | Brighthouse Financial Inc. | 113,410 | 4,590 |

| Erie Indemnity Co. Class A | 21,971 | 4,079 |

| FNB Corp. | 284,976 | 3,286 |

| Universal Insurance Holdings Inc. | 104,809 | 3,143 |

| Radian Group Inc. | 132,231 | 3,020 |

* | Athene Holding Ltd. Class A | 54,524 | 2,293 |

| Walker & Dunlop Inc. | 29,961 | 1,676 |

| Primerica Inc. | 10,922 | 1,390 |

| First Horizon National Corp. | 70,037 | 1,135 |

| OneMain Holdings Inc. | 25,615 | 940 |

| US Bancorp | 13,462 | 745 |

| Morgan Stanley | 16,775 | 716 |

| | | 346,017 |

Health Care (12.1%) | | |

| Johnson & Johnson | 231,223 | 29,916 |

| Abbott Laboratories | 204,950 | 17,148 |

| Pfizer Inc. | 383,094 | 13,765 |

| Anthem Inc. | 50,374 | 12,095 |

* | IQVIA Holdings Inc. | 71,153 | 10,629 |

| Bristol-Myers Squibb Co. | 195,841 | 9,931 |

| Merck & Co. Inc. | 116,773 | 9,830 |

| McKesson Corp. | 67,825 | 9,269 |

| Cooper Cos. Inc. | 30,759 | 9,135 |

| HCA Healthcare Inc. | 67,342 | 8,109 |

| Cardinal Health Inc. | 158,846 | 7,496 |

* | Integer Holdings Corp. | 94,435 | 7,136 |

| Medtronic plc | 56,807 | 6,170 |

| Danaher Corp. | 27,864 | 4,024 |

| Amgen Inc. | 16,037 | 3,103 |

* | Medpace Holdings Inc. | 35,233 | 2,961 |

* | Syneos Health Inc. | 49,504 | 2,634 |

| Eli Lilly & Co. | 18,858 | 2,109 |

| Thermo Fisher Scientific Inc. | 7,055 | 2,055 |

* | Enanta Pharmaceuticals Inc. | 30,245 | 1,817 |

*,^ | Mallinckrodt plc | 651,539 | 1,570 |

* | AMAG Pharmaceuticals Inc. | 122,911 | 1,420 |

*,^ | Intrexon Corp. | 229,669 | 1,314 |

| Owens & Minor Inc. | 185,151 | 1,076 |

| | | 174,712 |

Industrials (9.9%) | | |

| Honeywell International Inc. | 80,563 | 13,631 |

| L3Harris Technologies Inc. | 51,911 | 10,831 |

* | United Airlines Holdings Inc. | 116,786 | 10,325 |

| General Electric Co. | 1,125,501 | 10,062 |

* | FTI Consulting Inc. | 87,268 | 9,249 |

10

U.S. Value Fund

| | | Market |

| | | Value· |

| | Shares | ($000) |

| WW Grainger Inc. | 28,276 | 8,402 |

| Caterpillar Inc. | 65,272 | 8,244 |

| Spirit AeroSystems Holdings Inc. Class A | 100,085 | 8,231 |

| Lockheed Martin Corp. | 19,777 | 7,714 |

* | Aerojet Rocketdyne Holdings Inc. | 141,967 | 7,171 |

| Pentair plc | 148,117 | 5,599 |

* | Builders FirstSource Inc. | 261,585 | 5,382 |

| Landstar System Inc. | 38,366 | 4,319 |

| AGCO Corp. | 52,338 | 3,962 |

| Macquarie Infrastructure Corp. | 92,497 | 3,651 |

| Triumph Group Inc. | 132,811 | 3,039 |

* | WESCO International Inc. | 60,136 | 2,873 |

| United Technologies Corp. | 20,867 | 2,849 |

| ArcBest Corp. | 86,175 | 2,624 |

| Expeditors International of Washington Inc. | 30,014 | 2,230 |

* | GMS Inc. | 71,327 | 2,048 |

* | BMC Stock Holdings Inc. | 67,221 | 1,760 |

* | JetBlue Airways Corp. | 91,085 | 1,526 |

| Allison Transmission Holdings Inc. | 32,313 | 1,520 |

| Nielsen Holdings plc | 45,923 | 976 |

| PACCAR Inc. | 13,678 | 958 |

* | Hub Group Inc. Class A | 19,751 | 918 |

* | Echo Global Logistics Inc. | 37,389 | 847 |

| Delta Air Lines Inc. | 13,136 | 757 |

| Heidrick & Struggles International Inc. | 27,371 | 747 |

* | Foundation Building Materials Inc. | 48,218 | 747 |

| | | 143,192 |

Information Technology (6.0%) | | |

| Intel Corp. | 383,654 | 19,770 |

| Booz Allen Hamilton Holding Corp. Class A | 119,493 | 8,486 |

| HP Inc. | 386,126 | 7,306 |

* | CACI International Inc. Class A | 30,175 | 6,978 |

* | Dell Technologies Inc. | 126,010 | 6,535 |

| QUALCOMM Inc. | 82,982 | 6,330 |

* | Enphase Energy Inc. | 263,285 | 5,853 |

* | Tech Data Corp. | 43,184 | 4,502 |

* | Synaptics Inc. | 82,165 | 3,283 |

* | SunPower Corp. Class A | 263,324 | 2,889 |

* | Diebold Nixdorf Inc. | 257,001 | 2,878 |

* | Cardtronics plc Class A | 86,554 | 2,617 |

* | ON Semiconductor Corp. | 129,696 | 2,491 |

| Avnet Inc. | 51,281 | 2,281 |

* | SMART Global Holdings Inc. | 53,288 | 1,358 |

| International Business Machines Corp. | 8,059 | 1,172 |

* | Teradata Corp. | 31,306 | 970 |

* | eGain Corp. | 107,212 | 858 |

* | Unisys Corp. | 97,678 | 726 |

| | | 87,283 |

Materials (4.2%) | | |

| CF Industries Holdings Inc. | 206,205 | 10,145 |

| Ecolab Inc. | 43,500 | 8,615 |

| Ball Corp. | 112,265 | 8,174 |

* | Element Solutions Inc. | 719,200 | 7,322 |

| Reliance Steel & Aluminum Co. | 62,462 | 6,225 |

| International Paper Co. | 115,361 | 4,824 |

| Domtar Corp. | 99,425 | 3,560 |

| Linde plc | 12,212 | 2,366 |

| FMC Corp. | 25,100 | 2,201 |

| Valvoline Inc. | 98,321 | 2,166 |

* | Allegheny Technologies Inc. | 95,305 | 1,930 |

| Dow Inc. | 38,534 | 1,836 |

| Owens-Illinois Inc. | 118,402 | 1,216 |

| | | 60,580 |

Real Estate (5.7%) | | |

| Spirit Realty Capital Inc. | 200,026 | 9,573 |

| Essex Property Trust Inc. | 28,710 | 9,378 |

| Medical Properties Trust Inc. | 475,548 | 9,302 |

| EPR Properties | 108,875 | 8,368 |

| Brixmor Property Group Inc. | 393,410 | 7,982 |

| Park Hotels & Resorts Inc. | 266,018 | 6,643 |

| HCP Inc. | 177,498 | 6,324 |

| Ventas Inc. | 55,949 | 4,086 |

| Omega Healthcare Investors Inc. | 86,154 | 3,600 |

| Hannon Armstrong Sustainable Infrastructure Capital Inc. | 123,045 | 3,587 |

| Lexington Realty Trust Class B | 294,082 | 3,014 |

| SITE Centers Corp. | 164,527 | 2,486 |

| Macerich Co. | 63,231 | 1,998 |

| Equity Commonwealth | 43,148 | 1,478 |

| Regency Centers Corp. | 20,257 | 1,408 |

| CoreCivic Inc. | 66,922 | 1,157 |

| Equity Residential | 12,674 | 1,093 |

| Kennedy-Wilson Holdings Inc. | 37,564 | 823 |

| | | 82,300 |

11

U.S. Value Fund

| | | Market |

| | | Value· |

| | Shares | ($000) |

Utilities (6.7%) | | |

| Southern Co. | 245,343 | 15,155 |

| Exelon Corp. | 283,033 | 13,673 |

| FirstEnergy Corp. | 240,593 | 11,604 |

| NRG Energy Inc. | 241,775 | 9,574 |

| AES Corp. | 578,792 | 9,457 |

| Vistra Energy Corp. | 327,595 | 8,757 |

| Ameren Corp. | 64,491 | 5,163 |

| Eversource Energy | 53,531 | 4,575 |

| Evergy Inc. | 59,952 | 3,990 |

| Entergy Corp. | 24,642 | 2,892 |

| Duke Energy Corp. | 29,624 | 2,840 |

| IDACORP Inc. | 22,155 | 2,496 |

| NextEra Energy Inc. | 10,610 | 2,472 |

| ALLETE Inc. | 22,165 | 1,937 |

| Hawaiian Electric Industries Inc. | 31,520 | 1,438 |

| PNM Resources Inc. | 15,267 | 795 |

| Clearway Energy Inc. Class A | 45,607 | 791 |

| | | 97,609 |

Total Common Stocks (Cost $1,236,797) | | 1,440,582 |

Temporary Cash Investments (2.2%)1 | | |

Money Market Fund (2.1%) | | |

2,3 | Vanguard Market Liquidity Fund, 2.098% | 306,381 | 30,641 |

| | Face | |

| | Amount | |

| | ($000) | |

U.S. Government and Agency Obligations (0.1%) | | |

4 | United States Treasury Bill, 1.931%, 11/29/19 | 400 | 399 |

Total Temporary Cash Investments (Cost $31,039) | 31,040 | |

Total Investments (101.7%) (Cost $1,267,836) | 1,471,622 | |

| Amount |

| ($000) |

Other Assets and Liabilities (-1.7%) | |

Other Assets | |

Investment in Vanguard | 67 |

Receivables for Investment Securities Sold | 3,232 |

Receivables for Accrued Income | 2,020 |

Receivables for Capital Shares Issued | 381 |

Variation Margin Receivable— Futures Contracts | 37 |

Other Assets4 | 675 |

Total Other Assets | 6,412 |

Liabilities | |

Payables for Investment Securities Purchased | (4,434) |

Collateral for Securities on Loan | (8,324) |

Payables for Capital Shares Redeemed | (1,238) |

Payables to Vanguard | (806) |

Other Liabilities | (15,853) |

Total Liabilities | (30,655) |

Net Assets (100%) | |

Applicable to 80,237,132 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | 1,447,379 |

Net Asset Value Per Share | $18.04 |

| |

At September 30, 2019, net assets consisted of: | |

| Amount |

| ($000) |

Paid-in Capital | 1,207,852 |

Total Distributable Earnings (Loss) | 239,527 |

Net Assets | 1,447,379 |

· See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $7,957,000.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 100.0% and 1.7%, respectively, of net assets.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

3 Includes $8,324,000 of collateral received for securities on loan.

4 Securities with a value of $399,000 and cash of $15,000 have been segregated as initial margin for open futures contracts.

12

U.S. Value Fund

Derivative Financial Instruments Outstanding as of Period End | | |

| | |

Futures Contracts | | | | |

| | | | ($000) |

| | | | Value and |

| | Number of | | Unrealized |

| | Long (Short) | Notional | Appreciation |

| Expiration | Contracts | Amount | (Depreciation) |

Long Futures Contracts | | | | |

E-mini S&P 500 Index | December 2019 | 49 | 7,297 | (64) |

See accompanying Notes, which are an integral part of the Financial Statements.

13

U.S. Value Fund

Statement of Operations

| Year Ended |

| September 30, 2019 |

| ($000) |

Investment Income | |

Income | |

Dividends | 37,745 |

Interest1 | 134 |

Securities Lending—Net | 1,795 |

Total Income | 39,674 |

Expenses | |

The Vanguard Group—Note B | |

Investment Advisory Services | 1,213 |

Management and Administrative | 1,848 |

Marketing and Distribution | 162 |

Custodian Fees | 11 |

Auditing Fees | 32 |

Shareholders’ Reports | 27 |

Trustees’ Fees and Expenses | 1 |

Total Expenses | 3,294 |

Net Investment Income | 36,380 |

Realized Net Gain (Loss) | |

Investment Securities Sold1 | 11,837 |

Futures Contracts | 5 |

Realized Net Gain (Loss) | 11,842 |

Change in Unrealized Appreciation (Depreciation) | |

Investment Securities1 | (106,092) |

Futures Contracts | (56) |

Change in Unrealized Appreciation (Depreciation) | (106,148) |

Net Increase (Decrease) in Net Assets Resulting from Operations | (57,926) |

1 Interest income, realized net gain (loss), and change in unrealized appreciation (depreciation) from an affiliated company of the fund were $122,000, $3,000, and $1,000, respectively. Purchases and sales are for temporary cash investment purposes.

See accompanying Notes, which are an integral part of the Financial Statements.

14

U.S. Value Fund

Statement of Changes in Net Assets

| Year Ended September 30, |

| 2019 | 2018 |

| ($000) | ($000) |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net Investment Income | 36,380 | 32,402 |

Realized Net Gain (Loss) | 11,842 | 81,508 |

Change in Unrealized Appreciation (Depreciation) | (106,148) | 50,866 |

Net Increase (Decrease) in Net Assets Resulting from Operations | (57,926) | 164,776 |

Distributions | | |

Net Investment Income | (32,254) | (32,253) |

Realized Capital Gain1 | (71,059) | (97,416) |

Total Distributions | (103,313) | (129,669) |

Capital Share Transactions | | |

Issued | 184,404 | 214,440 |

Issued in Lieu of Cash Distributions | 96,928 | 121,791 |

Redeemed | (364,718) | (354,645) |

Net Increase (Decrease) from Capital Share Transactions | (83,386) | (18,414) |

Total Increase (Decrease) | (244,625) | 16,693 |

Net Assets | | |

Beginning of Period | 1,692,004 | 1,675,311 |

End of Period | 1,447,379 | 1,692,004 |

1 Includes fiscal 2019 and 2018 short-term gain distributions totaling $0 and $22,953,000, respectively. Short-term gain distributions are treated as ordinary income dividends for tax purposes.

See accompanying Notes, which are an integral part of the Financial Statements.

15

U.S. Value Fund

Financial Highlights

For a Share Outstanding | | | Year Ended September 30, |

Throughout Each Period | 2019 | 2018 | 2017 | 2016 | 2015 |

Net Asset Value, Beginning of Period | $20.03 | $19.63 | $17.25 | $16.48 | $16.95 |

Investment Operations | | | | | |

Net Investment Income | .4321 | .3731 | .4371 | .440 | .355 |

Net Realized and Unrealized Gain (Loss) on Investments | (1.176) | 1.563 | 2.606 | 1.341 | (.543) |

Total from Investment Operations | (.744) | 1.936 | 3.043 | 1.781 | (.188) |

Distributions | | | | | |

Dividends from Net Investment Income | (.389) | (.382) | (.386) | (.358) | (.282) |

Distributions from Realized Capital Gains | (.857) | (1.154) | (.277) | (.653) | — |

Total Distributions | (1.246) | (1.536) | (.663) | (1.011) | (.282) |

Net Asset Value, End of Period | $18.04 | $20.03 | $19.63 | $17.25 | $16.48 |

| | | | | |

Total Return2 | -2.98% | 10.22% | 17.87% | 11.09% | -1.18% |

| | | | | |

Ratios/Supplemental Data | | | | | |

Net Assets, End of Period (Millions) | $1,447 | $1,692 | $1,675 | $1,374 | $1,215 |

Ratio of Total Expenses to Average Net Assets | 0.22% | 0.22% | 0.23% | 0.23% | 0.26% |

Ratio of Net Investment Income to Average Net Assets | 2.43% | 1.92% | 2.36% | 2.63% | 2.10% |

Portfolio Turnover Rate | 61% | 75% | 95% | 76% | 66% |

1 Calculated based on average shares outstanding.

2 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

See accompanying Notes, which are an integral part of the Financial Statements.

16

U.S. Value Fund

Notes to Financial Statements

Vanguard U.S. Value Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services.

2. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market. Counterparty risk involving futures is mitigated because a regulated clearinghouse is the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures contracts on an exchange, monitors the financial strength of its clearing brokers and clearinghouse, and has entered into clearing agreements with its clearing brokers. The clearing-house imposes initial margin requirements to secure the fund’s performance and requires daily settlement of variation margin representing changes in the market value of each contract. Any assets pledged as initial margin for open contracts are noted in the Statement of Net Assets.

Futures contracts are valued at their quoted daily settlement prices. The notional amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

During the year ended September 30, 2019, the fund’s average investments in long and short futures contracts represented 1% and 0% of net assets, respectively, based on the average of the notional amounts at each quarter-end during the period.

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (September 30, 2016–2019), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

17

U.S. Value Fund

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes.

5. Securities Lending: To earn additional income, the fund lends its securities to qualified institutional borrowers. Security loans are subject to termination by the fund at any time, and are required to be secured at all times by collateral in an amount at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When this occurs, the collateral is adjusted and settled before the opening of the market on the next business day. The fund further mitigates its counterparty risk by entering into securities lending transactions only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master securities lending agreements with its counterparties. The master securities lending agreements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any loans with that borrower, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund; however, such actions may be subject to legal proceedings. While collateral mitigates counterparty risk, in the event of a default, the fund may experience delays and costs in recovering the securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability in the Statement of Net Assets for the return of the collateral, during the period the securities are on loan. Securities lending income represents fees charged to borrowers plus income earned on invested cash collateral, less expenses associated with the loan. During the term of the loan, the fund is entitled to all distributions made on or in respect of the loaned securities.

6. Credit Facility: The fund and certain other funds managed by The Vanguard Group (“Vanguard”) participate in a $4.3 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement that may be renewed annually; each fund is individually liable for its borrowings, if any, under the credit facility. Borrowings may be utilized for temporary and emergency purposes, and are subject to the fund’s regulatory and contractual borrowing restrictions. The participating funds are charged administrative fees and an annual commitment fee of 0.10% of the undrawn amount of the facility; these fees are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under this facility bear interest at a rate based upon the higher of the one-month London Interbank Offered Rate, federal funds effective rate, or overnight bank funding rate plus an agreed-upon spread.

The fund had no borrowings outstanding at September 30, 2019, or at any time during the period then ended.

7. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

18

U.S. Value Fund

B. In accordance with the terms of a Funds’ Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund investment advisory, corporate management, administrative, marketing, distribution, and cash management services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees. Vanguard does not require reimbursement in the current period for certain costs of operations (such as deferred compensation/ benefits and risk/insurance costs); the fund’s liability for these costs of operations is included in Payables to Vanguard on the Statement of Net Assets. All other costs of operations payable to Vanguard are generally settled twice a month.

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At September 30, 2019, the fund had contributed to Vanguard capital in the amount of $67,000, representing less than 0.01% of the fund’s net assets and 0.03% of Vanguard’s capital received pursuant to the FSA. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments). Any investments valued with significant unobservable inputs are noted on the Statement of Net Assets.

The following table summarizes the market value of the fund’s investments and derivatives as of September 30, 2019, based on the inputs used to value them:

| Level 1 | Level 2 | Level 3 |

Investments | ($000) | ($000) | ($000) |

Common Stocks | 1,440,582 | — | — |

Temporary Cash Investments | 30,641 | 399 | — |

Futures Contracts—Assets1 | 37 | — | — |

Total | 1,471,260 | 399 | — |

1 Represents variation margin on the last day of the reporting period.

D. Permanent differences between book-basis and tax-basis components of net assets are reclassified among capital accounts in the financial statements to reflect their tax character. These reclassifications have no effect on net assets or net asset value per share. As of period end, permanent differences primarily attributable to the accounting for distributions in connection with fund share redemptions were reclassified between the following accounts:

| Amount |

| ($000) |

Paid-in Capital | 1,731 |

Total Distributable Earnings (Loss) | (1,731) |

19

U.S. Value Fund

Temporary differences between book-basis and tax-basis components of total distributable earnings (loss) arise when certain items of income, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. The differences are primarily related to the tax deferral of losses on wash sales and the realization of unrealized gains or losses on certain futures contracts. As of period end, the tax-basis components of total distributable earnings (loss) are detailed in the table as follows:

| Amount |

| ($000) |

Undistributed Ordinary Income | 24,945 |

Undistributed Long-Term Gains | 11,450 |

Capital Loss Carryforwards (Non-expiring) | — |

Net Unrealized Gains (Losses) | 203,779 |

As of September 30, 2019, gross unrealized appreciation and depreciation for investments and derivatives based on cost for U.S. federal income tax purposes were as follows:

| Amount |

| ($000) |

Tax Cost | 1,267,843 |

Gross Unrealized Appreciation | 264,556 |

Gross Unrealized Depreciation | (60,777) |

Net Unrealized Appreciation (Depreciation) | 203,779 |

E. During the year ended September 30, 2019, the fund purchased $918,939,000 of investment securities and sold $1,065,427,000 of investment securities, other than temporary cash investments.

F. Capital shares issued and redeemed were:

| Year Ended September 30, |

| 2019 | 2018 |

| Shares | Shares |

| (000) | (000) |

Issued | 10,484 | 11,008 |

Issued in Lieu of Cash Distributions | 6,009 | 6,353 |

Redeemed | (20,731) | (18,245) |

Net Increase (Decrease) in Shares Outstanding | (4,238) | (884) |

G. Management has determined that no events or transactions occurred subsequent to September 30, 2019, that would require recognition or disclosure in these financial statements.

20

Report of Independent Registered

Public Accounting Firm

To the Board of Trustees of Vanguard Malvern Funds and Shareholders of Vanguard U.S. Value Fund

Opinion on the Financial Statements

We have audited the accompanying statement of net assets of Vanguard U.S. Value Fund (one of the funds constituting Vanguard Malvern Funds, referred to hereafter as the “Fund”) as of September 30, 2019, the related statement of operations for the year ended September 30, 2019, the statement of changes in net assets for each of the two years in the period ended September 30, 2019, including the related notes, and the financial highlights for each of the five years in the period ended September 30, 2019 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of September 30, 2019, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended September 30, 2019 and the financial highlights for each of the five years in the period ended September 30, 2019 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of September 30, 2019 by correspondence with the custodian and brokers and by agreement to the underlying ownership records of the transfer agent; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

November 13, 2019

We have served as the auditor of one or more investment companies in The Vanguard Group of Funds since 1975.

21

Special 2019 tax information (unaudited) for Vanguard U.S. Value Fund

This information for the fiscal year ended September 30, 2019, is included pursuant to provisions of the Internal Revenue Code.

The fund distributed $71,485,000 as capital gain dividends (20% rate gain distributions) to shareholders during the fiscal year.

The fund distributed $29,943,000 of qualified dividend income to shareholders during the fiscal year.

For corporate shareholders, 96.7% of investment income (dividend income plus short-term gains, if any) qualifies for the dividends-received deduction.

22

The People Who Govern Your Fund

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals. The independent board members have distinguished backgrounds in business, academia, and public service. Each of the trustees and executive officers oversees 212 Vanguard funds.

Information for each trustee and executive officer of the fund appears below. That information, as well as the Vanguard fund count, is as of the date on the cover of this fund report. The mailing address of the trustees and officers is P.O. Box 876, Valley Forge, PA 19482. More information about the trustees is in the Statement of Additional Information, which can be obtained, without charge, by contacting Vanguard at 800-662-7447, or online at vanguard.com.

Interested Trustee1

Mortimer J. Buckley

Born in 1969. Trustee since January 2018. Principal occupation(s) during the past five years and other experience: chairman of the board (January 2019–present) of Vanguard and of each of the investment companies served by Vanguard; chief executive officer (January 2018–present) of Vanguard; chief executive officer, president, and trustee (January 2018–present) of each of the investment companies served by Vanguard; president and director (2017–present) of Vanguard; and president (February 2018–present) of Vanguard Marketing Corporation. Chief investment officer (2013–2017), managing director (2002–2017), head of the Retail Investor Group (2006–2012), and chief information officer (2001–2006) of Vanguard. Chairman of the board (2011–2017) and trustee (2009–2017) of the Children’s Hospital of Philadelphia; trustee (2018–present) of The Shipley School.

Independent Trustees

Emerson U. Fullwood

Born in 1948. Trustee since January 2008. Principal occupation(s) during the past five years and other experience: executive chief staff and marketing officer for North America and corporate vice president (retired 2008) of Xerox Corporation (document management products and services). Former president of the Worldwide Channels Group, Latin America, and Worldwide Customer Service and executive chief staff officer of Developing Markets of Xerox. Executive in residence and 2009–2010 Distinguished Minett Professor at the Rochester Institute of Technology. Director of SPX FLOW, Inc. (multi-industry manufacturing). Director of the University of Rochester Medical Center, the Monroe Community College Foundation, the United Way of Rochester, North Carolina A&T University, and Roberts Wesleyan College. Trustee of the University of Rochester.

Amy Gutmann

Born in 1949. Trustee since June 2006. Principal occupation(s) during the past five years and other experience: president (2004–present) of the University of Pennsylvania. Christopher H. Browne Distinguished Professor of Political Science, School of Arts and Sciences, and professor of communication, Annenberg School for Communication, with secondary faculty appointments in the Department of Philosophy, School of Arts and Sciences, and at the Graduate School of Education, University of Pennsylvania. Trustee of the National Constitution Center.

F. Joseph Loughrey

Born in 1949. Trustee since October 2009. Principal occupation(s) during the past five years and other experience: president and chief operating officer (retired 2009) and vice chairman of the board (2008–2009) of Cummins Inc. (industrial machinery). Chairman of the board of Hillenbrand, Inc. (specialized consumer services), and the Lumina Foundation.

1 Mr. Buckley is considered an “interested person,” as defined in the Investment Company Act of 1940, because he is an officer of the Vanguard funds.

Director of the V Foundation and Oxfam America. Member of the advisory council for the College of Arts and Letters and chair of the advisory board to the Kellogg Institute for International Studies, both at the University of Notre Dame.

Mark Loughridge

Born in 1953. Trustee since March 2012. Principal occupation(s) during the past five years and other experience: senior vice president and chief financial officer (retired 2013) of IBM (information technology services). Fiduciary member of IBM’s Retirement Plan Committee (2004–2013), senior vice president and general manager (2002–2004) of IBM Global Financing, vice president and controller (1998–2002) of IBM, and a variety of other prior management roles at IBM. Member of the Council on Chicago Booth.

Scott C. Malpass

Born in 1962. Trustee since March 2012. Principal occupation(s) during the past five years and other experience: chief investment officer (1989–present) and vice president (1996–present) of the University of Notre Dame. Assistant professor of finance at the Mendoza College of Business, University of Notre Dame, and member of the Notre Dame 403(b) Investment Committee. Chairman of the board of TIFF Advisory Services, Inc. Member of the board of Catholic Investment Services, Inc. (investment advisors) and the board of superintendence of the Institute for the Works of Religion.

Deanna Mulligan

Born in 1963. Trustee since January 2018. Principal occupation(s) during the past five years and other experience: president (2010–present) and chief executive officer (2011–present) of The Guardian Life Insurance Company of America. Chief operating officer (2010–2011) and executive vice president (2008–2010) of Individual Life and Disability of The Guardian Life Insurance Company of America. Member of the board of The Guardian Life Insurance Company of America, the American Council of Life Insurers, the Partnership for New York City (business leadership), and the Committee Encouraging Corporate Philanthropy. Trustee of the Economic Club of New York and the Bruce Museum (arts and science). Member of the Advisory Council for the Stanford Graduate School of Business.

André F. Perold

Born in 1952. Trustee since December 2004. Principal occupation(s) during the past five years and other experience: George Gund Professor of Finance and Banking, Emeritus at the Harvard Business School (retired 2011). Chief investment officer and co-managing partner of HighVista Strategies LLC (private investment firm). Board of advisors and investment committee member of the Museum of Fine Arts Boston. Board member (2018–present) of RIT Capital Partners (investment firm); investment committee member of Partners Health Care System.

Sarah Bloom Raskin

Born in 1961. Trustee since January 2018. Principal occupation(s) during the past five years and other experience: deputy secretary (2014–2017) of the United States Department of the Treasury. Governor (2010–2014) of the Federal Reserve Board. Commissioner (2007–2010) of financial regulation for the State of Maryland. Member of the board of directors (2012–2014) of Neighborhood Reinvestment Corporation. Director (2017–present) of i(x) Investments, LLC; director (2017–present) of Reserve Trust. Rubinstein Fellow (2017–present) of Duke University; trustee (2017–present) of Amherst College.

Peter F. Volanakis

Born in 1955. Trustee since July 2009. Principal occupation(s) during the past five years and other experience: president and chief operating officer (retired 2010) of Corning Incorporated (communications equipment) and director of Corning Incorporated (2000–2010) and Dow Corning (2001–2010). Director (2012) of SPX Corporation (multi-industry manufacturing). Overseer of the Amos Tuck School of Business Administration, Dartmouth College (2001–2013). Chairman of the board of trustees of Colby-Sawyer College. Member of the board of Hypertherm Inc. (industrial cutting systems, software, and consumables).

Executive Officers

Glenn Booraem

Born in 1967. Principal occupation(s) during the past five years and other experience: principal of Vanguard. Investment stewardship officer (2017–present), treasurer (2015–2017), controller (2010–2015), and assistant controller (2001–2010) of each of the investment companies served by Vanguard.

Christine M. Buchanan

Born in 1970. Principal occupation(s) during the past five years and other experience: principal of Vanguard and global head of Fund Administration at Vanguard. Treasurer (2017–present) of each of the investment companies served by Vanguard. Partner (2005–2017) at KPMG LLP (audit, tax, and advisory services).

Thomas J. Higgins

Born in 1957. Principal occupation(s) during the past five years and other experience: principal of Vanguard. Chief financial officer (2008–present) and treasurer (1998–2008) of each of the investment companies served by Vanguard.

Peter Mahoney

Born in 1974. Principal occupation(s) during the past five years and other experience: principal of Vanguard. Controller (2015–present) of each of the investment companies served by Vanguard. Head of International Fund Services (2008–2014) at Vanguard.

Anne E. Robinson

Born in 1970. Principal occupation(s) during the past five years and other experience: general counsel (2016–present) of Vanguard. Secretary (2016–present) of Vanguard and of each of the investment companies served by Vanguard. Managing director (2016–present) of Vanguard. Director and senior vice president (2016–2018) of Vanguard Marketing Corporation. Managing director and general counsel of Global Cards and Consumer Services (2014–2016) at Citigroup. Counsel (2003–2014) at American Express.

Michael Rollings

Born in 1963. Principal occupation(s) during the past five years and other experience: finance director (2017–present) and treasurer (2017) of each of the investment companies served by Vanguard. Managing director (2016–present) of Vanguard. Chief financial officer (2016–present) of Vanguard. Director (2016–present) of Vanguard Marketing Corporation. Executive vice president and chief financial officer (2006–2016) of MassMutual Financial Group.

John E. Schadl

Born in 1972. Principal occupation(s) during the past five years and other experience: principal of Vanguard. Chief compliance officer (2019–present) of Vanguard and of each of the investment companies served by Vanguard. Assistant vice president (May 2019–present) of Vanguard Marketing Corporation.

Vanguard Senior Management Team

Joseph Brennan | Chris D. McIsaac |

Mortimer J. Buckley | James M. Norris |

Gregory Davis | Thomas M. Rampulla |

John James | Karin A. Risi |

Martha G. King | Anne E. Robinson |

John T. Marcante | Michael Rollings |

| |

|

| | |

| | P.O. Box 2600 |

| | Valley Forge, PA 19482-2600 |

Connect with Vanguard® > vanguard.com

Fund Information > 800-662-7447

Direct Investor Account Services > 800-662-2739

Institutional Investor Services > 800-523-1036

Text Telephone for People

Who Are Deaf or Hard of Hearing > 800-749-7273

This material may be used in conjunction with the offering of shares of any Vanguard fund only if preceded or accompanied by the fund’s current prospectus.

All comparative mutual fund data are from Morningstar, Inc., unless otherwise noted.

You can obtain a free copy of Vanguard’s proxy voting guidelines by visiting vanguard.com/proxyreporting or by calling Vanguard at 800-662-2739. The guidelines are also available from the SEC’s website, www.sec.gov. In addition, you may obtain a free report on how your fund voted the proxies for securities it owned during the 12 months ended June 30. To get the report, visit either vanguard.com/proxyreporting or www.sec.gov.

You can review information about your fund on the SEC’s website, and you can receive copies of this information, for a fee, by sending a request via email addressed to publicinfo@sec.gov.

Source for Bloomberg Barclays indexes: Bloomberg Index Services Limited. Copyright 2019, Bloomberg. All rights reserved.

| © 2019 The Vanguard Group, Inc. |

| All rights reserved. |

| Vanguard Marketing Corporation, Distributor. |

| |

| Q1240 112019 |

Annual Report | September 30, 2019 Vanguard Capital Value Fund |

See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. |

Important information about access to shareholder reports

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com.

You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard.

Contents | |

| |

| |

A Note From Our Chairman | 1 |

| |

Your Fund’s Performance at a Glance | 2 |

| |

Advisor’s Report | 3 |

| |

About Your Fund’s Expenses | 6 |

| |

Performance Summary | 8 |

| |

Financial Statements | 10 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

A Note From Our Chairman

Tim Buckley

Chairman and Chief Executive Officer

Dear Shareholder,

Recent volatility in financial markets—affecting stocks, bonds, and commodities—has been a good reminder of the wise old adage, “Never keep all your eggs in one basket.” Maintaining balance and diversification in your investment portfolio can help to both limit risk and set you up for long-term success.

It’s understandable why some investors might become complacent after a long market run-up like the one that lifted stock prices, especially U.S. stock prices, in the years following the global financial crisis. But failing to rebalance regularly can leave a portfolio with a much different mix of assets than intended and, often, more risk than intended.

Balance across and diversification within asset classes are powerful tools for managing risk and achieving your investment goals. A portfolio’s allocation will determine a large portion of its long-term return and also the majority of its volatility risk. A well-diversified portfolio is less vulnerable to significant swings in the performance of any one segment of the asset classes in which it invests.

Balance and diversification will never eliminate the risk of loss, nor will they guarantee positive returns in a declining market. But they should reduce the chance that you’ll suffer disproportionate losses in one particular high-flying asset class or sector when it comes back to earth. And exposure to all key market components should give you at least some participation in the sectors that are performing best at any given time.

Vanguard is committed to helping you achieve balance and diversification in your portfolios to help meet your investment goals. We thank you for your continued loyalty.

Sincerely,

Mortimer J. Buckley

Chairman and Chief Executive Officer

October 14, 2019

1

Your Fund’s Performance at a Glance

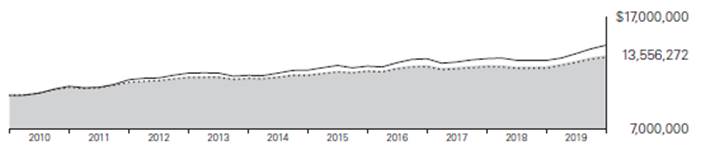

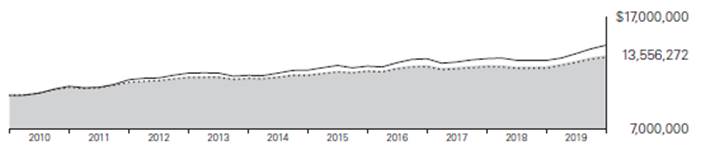

· Vanguard Capital Value Fund returned –0.18% for the 12 months ended September 30, 2019, lagging its benchmark, the Russell 3000 Value Index, which returned 3.10%.

· The broad U.S. stock market advanced nearly 3% for the year, which was marked by sharp intervals of volatility and uncertainty. Investors fretted over U.S.-China trade, heightened tensions with Iran, the imbroglio over Britain’s exit from the European Union, and whether an inverted yield curve signaled a recession ahead. With an eye toward the deteriorating global economic outlook, the Federal Reserve lowered short-term interest rates twice during the period to sustain the U.S. economic recovery.

· Large- and mid-capitalization stocks generally outdistanced their small-cap counterparts.

· The advisor’s strong selections in communication services made that sector the largest contributor to returns. The fund’s holdings in consumer staples, energy, health care, and financials lagged their benchmark counterparts and detracted most from relative results.

Market Barometer | | | |

| Average Annual Total Returns |

| Periods Ended September 30, 2019 |

| One Year | Three Years | Five Years |

Stocks | | | |

Russell 1000 Index (Large-caps) | 3.87% | 13.19% | 10.62% |

Russell 2000 Index (Small-caps) | -8.89 | 8.23 | 8.19 |

Russell 3000 Index (Broad U.S. market) | 2.92 | 12.83 | 10.44 |

FTSE All-World ex US Index (International) | -1.12 | 6.46 | 3.24 |

| | | |

Bonds | | | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | |

(Broad taxable market) | 10.30% | 2.92% | 3.38% |

Bloomberg Barclays Municipal Bond Index | | | |

(Broad tax-exempt market) | 8.55 | 3.19 | 3.66 |

FTSE Three-Month U.S. Treasury Bill Index | 2.36 | 1.52 | 0.95 |

| | | |

CPI | | | |

Consumer Price Index | 1.71% | 2.07% | 1.53% |

2

Advisor’s Report

For the 12 months ended September 30, 2019, Vanguard Capital Value Fund returned –0.18%, underperforming its benchmark, the Russell 3000 Value Index, which returned 3.10%.

The investment environment

Seven of the 11 sectors in the index posted positive returns and six sectors in the fund beat the return of the index as a whole. For the fund, the utilities, real estate, consumer discretionary, communication services, and information technology sectors exceeded the benchmark return by a wide margin, while industrials narrowly led the benchmark return. All other sectors for the fund trailed the benchmark’s result. Energy, consumer staples, health care, and financials posted negative returns.

Our shortfalls

Security selection drove relative underperformance. Weak selection in consumer staples, energy, and financials was partially offset by strong selection in communication services and industrials. Sector allocation also weighed on relative performance. The fund’s underweight allocation to utilities and overweight to energy detracted from results.

Within consumer staples, our holding of Walgreens Boots Alliance and British American Tobacco (BAT) hurt relative performance, as did our not holding Procter & Gamble. Walgreens traded down amid challenges for the drug retail industry as well as concerns about the Walgreens and Boots Alliance merger.

BAT has faced headwinds from faster-than-expected volume declines, competition from e-cigarettes and next-generation products, increased Food and Drug Administration regulation—specifically of menthol cigarettes—and increased balance sheet leverage on the back of an acquisition of Reynolds. We ultimately eliminated the name as our thesis about pricing and next-generation efforts offsetting volume declines was disproven.

We did not hold Procter & Gamble based on valuation discipline, because the company had been trading at a premium to industry peers.

In energy, our holdings of exploration and production companies Concho Resources and Cimarex Energy drove underperformance, along with our position in Halliburton.

Concho Resources, the fund’s largest detractor, reported disappointing second-quarter results and guidance for the balance of the year. Several poor operating decisions and cost inflation led to a production shortfall and increased expenses. Shares of Cimarex Energy declined as the company reported weak second-quarter results. In addition to lower-than-expected oil production guidance, the company contended with lower oil and natural gas prices because of pipeline constraints in the Permian Basin.

Shares of Halliburton and other oilfield services companies dropped during the period. Halliburton, a diversified provider

3

with a large market share in U.S. onshore shale drilling and completion areas, has seen a sharp stock pullback as customers scaled back capital spending plans. While customers’ oilfield spending can fluctuate widely, we anticipate an eventual tightening of Halliburton’s services markets as providers reduce capacity to better align with customer demand. In the meantime, we believe the company’s diversification and capital structure will allow it to maintain its equipment fleet while smaller competitors are forced to raid the cupboards for cash.

Our successes

Communication services marked an area of strength, with Comcast and Verizon contributing the most to relative results. Comcast shares rose during the period as the cable giant continued to exceed estimates on its high-speed internet business. Comcast also has gained traction with its message that the decline of traditional TV subscribers will hurt profits less than expected. Verizon demonstrated an encouraging trend of improving organic growth in its wireless services revenues. Investors also started to factor in benefits from the transition to 5G wireless, including new product offerings and uses, and the potential for different industry dynamics if T-Mobile and Sprint execute their merger plans.

Industrials also contributed to results, driven notably by Herman Miller and Johnson Controls. Herman Miller experienced strong sales and accelerating earnings growth in office furniture, equipment, and home furnishings. We continue to believe the company is moving from a period of apathy and compressed margins to one of operating leverage and pricing power. Johnson Controls, a manufacturer of HVAC and fire and security equipment, won investor favor by selling its Power Solutions battery business and redeploying capital into a large share buyback. Management also began focusing on improving operational execution to drive profitability.

Fund positioning and outlook

At the end of September, the fund’s most significant overweightings relative to the Russell 3000 Value Index were in the information technology, real estate, and materials sectors. The most notable shifts in active positioning over the period—a function of bottom-up stock selection—included increases to our information technology, communication services, and health care weights, and reductions in our consumer staples, utilities, and financials weights.