UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number | | 811-05583 |

Franklin Templeton Variable Insurance Products Trust

|

| (Exact name of registrant as specified in charter) |

| | |

| One Franklin Parkway, San Mateo, CA | | 94403-1906 |

| (Address of principal executive offices) | | (Zip code) |

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (650) 312-2000

Date of fiscal year end: 12/31

Date of reporting period: 12/31/07

| Item 1. | Reports to Stockholders. |

December 31, 2007

TEMPLETON INVESTMENT PLUS

ANNUAL REPORT

THE PHOENIX EDGE SERIES FUND

· PHOENIX MONEY MARKET SERIES

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

· TEMPLETON DEVELOPING MARKETS SECURITIES FUND - CLASS 1

· TEMPLETON FOREIGN SECURITIES FUND - CLASS 1

· TEMPLETON GLOBAL ASSET ALLOCATION FUND - CLASS 1

· TEMPLETON GLOBAL INCOME SECURITIES FUND - CLASS 1

· TEMPLETON GROWTH SECURITIES FUND - CLASS 1

ANNUAL REPORT

THE PHOENIX EDGE

SERIES FUND

Variable Products Fund

December 31, 2007

To our Templeton Investment Plus contractowners:

The 2007 annual report for the Phoenix Money Market Series, an investment option offered through your contract, is included in the following compilation of Phoenix Edge Series Fund annual reports.

Table of Contents

Proxy Voting Procedures and Voting Record (Form N-PX)

The advisor and subadvisors vote proxies relating to portfolio securities in accordance with procedures that have been approved by the Fund’s Board of Trustees. You may obtain a description of these procedures, along with information regarding how the series voted proxies during the most recent 12-month period ended June 30, 2007, free of charge, by calling toll-free 800-541-0171. This information is also available through the Securities and Exchange Commission’s website at http://www.sec.gov.

Form N-Q Information

The Fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year on Form N-Q. Form N-Q is available on the SEC’s website at http://www.sec.gov. Form N-Q may be reviewed and copied at the SEC’s Public Reference Room. Information on the operation of the SEC’s Public Reference Room can be obtained by calling toll-free 1-800-SEC-0330.

| | | | |

| Not FDIC Insured | | No Bank Guarantee | | May Lose Value |

A MESSAGE FROM THE PRESIDENT

Dear Phoenix Edge Series Fund Shareholder:

| | |

| | This report provides performance and portfolio details about the underlying investments of your Phoenix variable annuity or life insurance policy for the fiscal year ended December 31, 2007. I hope you will take time to review this important information. At Phoenix, we are committed to providing you with a choice of quality investment options from professional money managers across the industry, including many well-known names. In addition to The Phoenix Edge Series Fund options discussed in this report, we also offer a selection of other investment options for your consideration. You may wish to visit our Web site, phoenixwm.com, to learn more about the variable investments available to you, which may include new offerings from time to time. Also, if you haven’t done so, this is a good time of year to meet with your financial professional to review your portfolio and make sure that your asset allocation strategy is consistent with your financial goals, especially if there have been any recent changes in your personal situation. |

We appreciate your business and thank you for choosing Phoenix to be part of your financial plan. It is our great privilege to serve you.

Sincerely yours,

|

|

|

| Philip K. Polkinghorn |

| President, The Phoenix Edge Series Fund |

January 2008

Asset Allocation does not guarantee against a loss, and there is no guarantee that a diversified portfolio will outperform a non-diversified portfolio.

1

GLOSSARY

ADR (American Depositary Receipt)

Represents shares of foreign companies traded in U.S. dollars on U.S. exchanges that are held by a bank or a trust. Foreign companies use ADRs in order to make it easier for Americans to buy their shares.

AMBAC

American Municipal Bond Assurance Corporation.

Composite Index for Strategic Allocation Series

A composite index made up of 60% of the S&P 500 Index, which measures stock market total return performance, and 40% of the Lehman Brothers Aggregate Bond Index, which measures bond market total return performance.

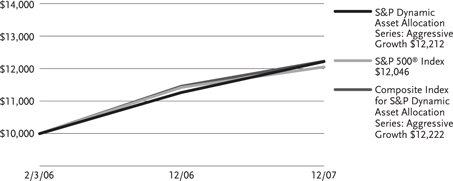

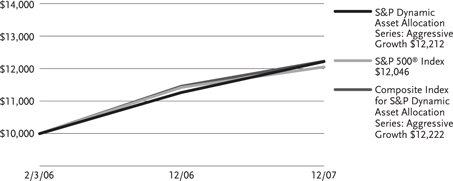

Composite Index for S&P Dynamic Asset Allocation Series: Aggressive Growth

A composite index made up of 75% of the S&P 500 Index, which measures stock market total return performance, 8% of the Lehman Brothers Aggregate Bond Index, which measures bond market total return performance, and 17% of the MSCI EAFE Index, which measures foreign market equity performance.

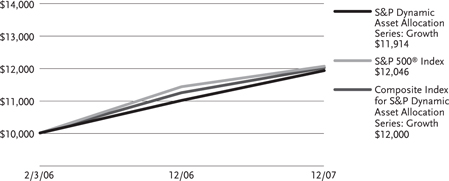

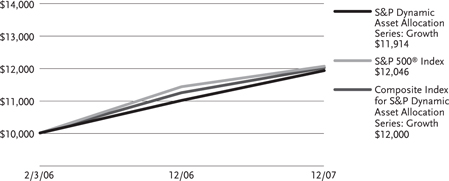

Composite Index for S&P Dynamic Asset Allocation Series: Growth

A composite index made up of 60% of the S&P 500 Index, which measures stock market total return performance, 27% of the Lehman Brothers Aggregate Bond Index, which measures bond market total return performance, and 13% of the MSCI EAFE Index, which measures foreign market equity performance.

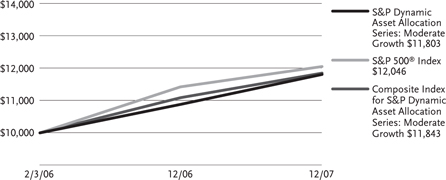

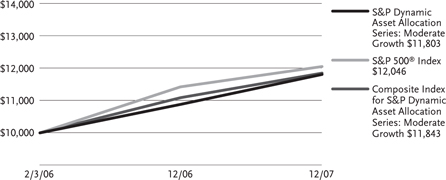

Composite Index for S&P Dynamic Asset Allocation Series: Moderate Growth

A composite index made up of 50% of the S&P 500 Index, which measures stock market total return performance, 40% of the Lehman Brothers Aggregate Bond Index, which measures bond market total return performance, and 10% of the MSCI EAFE Index, which measures foreign market equity performance.

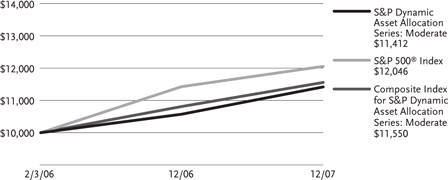

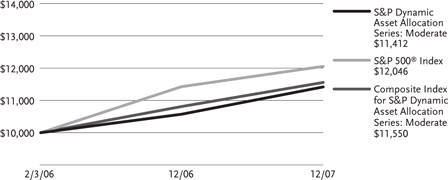

Composite Index for S&P Dynamic Asset Allocation Series: Moderate

A composite index made up of 30% of the S&P 500 Index, which measures stock market total return performance, 65% of the Lehman Brothers Aggregate Bond Index, which measures bond market total return performance, and 5% of the MSCI EAFE Index, which measures foreign market equity performance.

ETF (Exchange Traded Fund)

A Fund that tracks an index, but can be traded like a stock.

Federal Reserve (the “Fed”)

The central bank of the United States, responsible for controlling the money supply, interest rates and credit with the goal of keeping the U.S. economy and currency stable. Governed by a seven-member board, the system includes 12 regional Federal Reserve Banks, 25 branches and all national and state banks that are part of the system.

FGIC

Financial Guaranty Insurance Company.

FHLB

Federal Home Loan Bank.

FHLMC

Federal Home Loan Mortgage Corporation.

FNMA or “Fannie Mae”

Federal National Mortgage Association.

FSA

Financial Security Assurance, Inc.

FTSE NAREIT Equity REITs Index

The FTSE NAREIT Equity REITs Index is a free-float market capitalization-weighted index measuring equity tax-qualified real estate investment trusts, which meet minimum size and liquidity criteria, that are listed on the New York Stock Exchange, the American Stock Exchange and the NASDAQ National Market System. The index is calculated on a total return basis with dividends reinvested.

Lehman Brothers Aggregate Bond Index

The Lehman Brothers Aggregate Bond Index measures the U.S. investment grade fixed rate bond market. The index is calculated on a total return basis.

MBIA

Municipal Bond Insurance Association.

Merrill Lynch 1-2.99 Year Medium Quality Corporate Bonds Index

The Merrill Lynch 1-2.99 Year Medium Quality Corporate Bonds Index measures performance of U.S. investment grade corporate bond issues rated “BBB” and “A” by Standard & Poor’s/Moody’s with maturities between one and three years. The index is calculated on a total return basis.

2

GLOSSARY (Continued)

MSCI Asia excluding Japan Total Return Index

The MSCI AC (All Country) Far East ex Japan Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the Far East, excluding Japan. As of June 2007 the MSCI AC Far East ex Japan Index consisted of the following 9 developed and emerging market country indices: China, Hong Kong, Indonesia, Korea, Malaysia, Philippines, Singapore Free, Taiwan, and Thailand.

MSCI EAFE® Index

The MSCI EAFE® Index is a free float-adjusted market capitalization index that measures developed foreign market equity performance, excluding the U.S. and Canada. The index is calculated on a total return basis with gross dividends reinvested.

MSCI Eastern Europe Total Return Index

The MSCI EM (Emerging Markets) Europe, Middle East and Africa Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the emerging market countries of Europe, the Middle East & Africa. As of June 2007, the MSCI EM EMEA Index consisted of the following 10 emerging market country indices: Czech Republic, Hungary, Poland, Russia, Turkey, Israel, Jordan, Egypt, Morocco, and South Africa.

MSCI EMU Total Return Index

The MSCI EMU (European Economic and Monetary Union) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of countries within EMU. As of June 2007 the MSCI EMU Index consisted of the following 11 developed market country indices: Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, the Netherlands, Portugal, and Spain.

MSCI Europe Total Return Index

The MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. As of June 2007, the MSCI Europe Index consisted of the following 16 developed market country indices: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom.

MSCI Japan Index

The MSCI Japan IndexSM is an equity index of securities listed on Japanese stock exchanges. The index is calculated on a total return basis with gross dividends reinvested.

MSCI Latin America Total Return Index

The MSCI EM (Emerging Markets) Latin America Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of emerging markets in Latin America. As of June 2007 the MSCI EM Latin America Index consisted of the following 6 emerging market country indices: Argentina, Brazil, Chile, Colombia, Mexico, and Peru.

MSCI World excluding U.S. Total Return Index

The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. As of June 2007 the MSCI World Index consisted of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States.

PIK (Payment-in-Kind)

A bond which pays interest in the form of additional bonds, or preferred stock which pays dividends in the form of additional preferred stock.

REIT (Real Estate Investment Trust)

A publicly traded company that owns, develops and operates income-producing real estate such as apartments, office buildings, hotels, shopping centers and other commercial properties.

Russell 1000® Growth Index

The Russell 1000® Growth Index is a market capitalization-weighted index of growth-oriented stocks of the 1,000 largest companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested.

Russell 1000® Value Index

The Russell 1000® Value Index is a market capitalization-weighted index of value-oriented stocks of the 1,000 largest companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested.

3

GLOSSARY (Continued)

Russell 2000® Growth Index

The Russell 2000® Growth Index is a market capitalization-weighted index of growth-oriented stocks of the smallest 2,000 companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested.

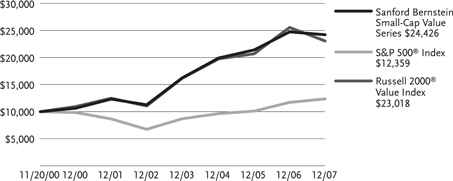

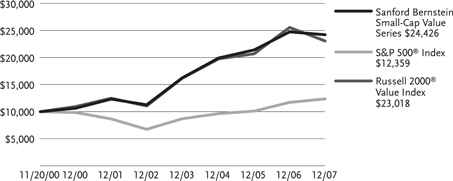

Russell 2000® Value Index

The Russell 2000® Value Index is a market capitalization-weighted index of value-oriented stocks of the smallest 2,000 companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested.

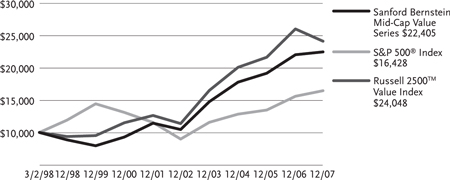

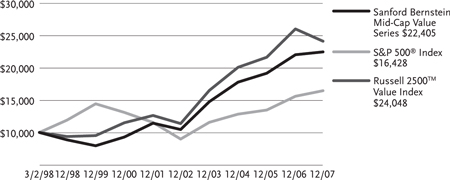

Russell 2500TM Value Index

The Russell 2500™ Value Index is a market capitalization-weighted index of value-oriented stocks of the smallest 2,500 companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested.

Russell MidCap® Growth Index

The Russell MidCap® Growth Index is a market capitalization-weighted index of medium-capitalization, growth-oriented stocks of U.S. companies. The index is calculated on a total return basis with dividends reinvested.

SBA

Small Business Administration.

S&P 500® Index

The S&P 500® Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested.

Sponsored ADR (American Depositary Receipt)

An ADR which is issued with the cooperation of the company whose stock will underlie the ADR. These shares carry all the rights of the common share such as voting rights. ADRs must be sponsored to be able to trade on the NYSE.

Indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

4

THIS PAGE INTENTIONALLY BLANK.

THE PHOENIX EDGE SERIES FUND

Disclosure of Fund Expenses (Unaudited)

For the six-month period of July 1, 2007 to December 31, 2007

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of The Phoenix Edge Series Fund, you incur ongoing costs including investment advisory fees and other expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in one of the series and to compare these costs with the ongoing costs of investing in other mutual funds. These examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period.

Actual Expenses

This section of the accompanying tables provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. The expense estimate does not include the fees or expenses associated with the separate insurance accounts, and if such charges were included, returns would be lower.

Hypothetical Example for Comparison Purposes

This section of the accompanying tables provides information about hypothetical account values and hypothetical expenses based on the series’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not your series’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your series and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the accompanying tables are meant to highlight your ongoing costs only and do not reflect additional fees and expenses associated with the annuity or life insurance policy through which you invest. Therefore, this section of the accompanying tables is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if the annuity or life insurance policy costs were included, your costs would have been higher. The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

| | | | | | | | | | | | |

Expense Table | | | | | | | | | |

| | | Beginning | | Ending | | Annualized | | | Expenses Paid |

| | | Account Value | | Account Value | | Expense | | | During |

| | | 7/1/07 | | 12/31/07 | | Ratio | | | Period* |

Capital Growth Series | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,017.88 | | 0.91 | % | | $ | 4.63 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,020.56 | | 0.91 | | | | 4.65 |

| | | | |

Growth and Income Series | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 998.09 | | 0.85 | % | | $ | 4.28 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,020.87 | | 0.85 | | | | 4.34 |

| | | | |

Mid-Cap Growth Series | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,049.44 | | 1.05 | % | | $ | 5.42 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,019.85 | | 1.05 | | | | 5.36 |

| | | | |

Money Market Series | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,024.61 | | 0.59 | % | | $ | 3.01 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,022.19 | | 0.59 | | | | 3.01 |

| | | | |

Multi-Sector Fixed Income Series | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,022.49 | | 0.75 | % | | $ | 3.82 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,021.38 | | 0.75 | | | | 3.83 |

| | | | |

Multi-Sector Short Term Bond Series | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,020.23 | | 0.70 | % | | $ | 3.56 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,021.63 | | 0.70 | | | | 3.57 |

| | | | |

Strategic Allocation Series | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,015.68 | | 0.86 | % | | $ | 4.37 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,020.82 | | 0.86 | | | | 4.39 |

| * | Expenses are equal to the Series’ annualized expense ratio which includes waived fees and reimbursed expenses, if applicable multiplied by the average account value over the period, multiplied by the number of days (184) expenses were accrued in the most recent fiscal half-year, then divided by 365 days to reflect the one-half year period. |

You can find more information about the Series’ expenses in the Financial Statements section that follows. For additional information on operating expenses and other shareholder costs including contractual charges associated with the separate account refer to the series prospectus and the contract prospectus.

6

THE PHOENIX EDGE SERIES FUND

Disclosure of Fund Expenses (Unaudited) (Continued)

For the six-month period of July 1, 2007 to December 31, 2007

| | | | | | | | | | | | |

Expense Table | | | | | | | | | |

| | | Beginning | | Ending | | Annualized | | | Expenses Paid |

| | | Account Value | | Account Value | | Expense | | | During |

| | | 7/1/07 | | 12/31/07 | | Ratio | | | Period* |

Aberdeen International Series | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,048.86 | | 0.98 | % | | $ | 5.06 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,020.20 | | 0.98 | | | | 5.00 |

| | | | |

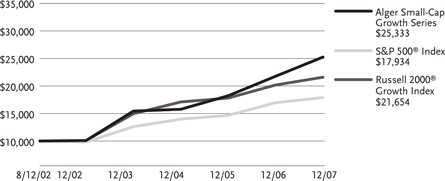

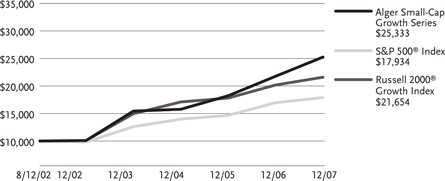

Alger Small-Cap Growth Series | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,036.63 | | 1.00 | % | | $ | 5.13 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,020.10 | | 1.00 | | | | 5.10 |

| | | | |

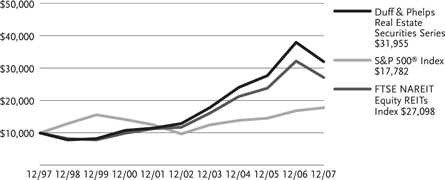

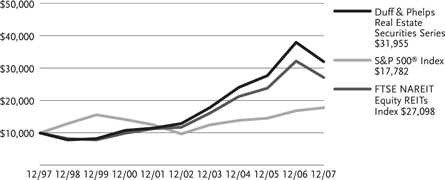

Duff & Phelps Real Estate Securities Series | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 913.58 | | 1.00 | % | | $ | 4.82 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,020.10 | | 1.00 | | | | 5.10 |

| | | | |

S&P Dynamic Asset Allocation Series: Aggressive Growth | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,000.86 | | 0.70 | % | | $ | 3.53 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,021.63 | | 0.70 | | | | 3.57 |

| | | | |

S&P Dynamic Asset Allocation Series: Growth | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,012.16 | | 0.70 | % | | $ | 3.55 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,021.63 | | 0.70 | | | | 3.57 |

| | | | |

S&P Dynamic Asset Allocation Series: Moderate | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,039.69 | | 0.70 | % | | $ | 3.60 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,021.63 | | 0.70 | | | | 3.57 |

| | | | |

S&P Dynamic Asset Allocation Series: Moderate Growth | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,025.21 | | 0.70 | % | | $ | 3.57 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,021.63 | | 0.70 | | | | 3.57 |

| | | | |

Sanford Bernstein Mid-Cap Value Series | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 891.06 | | 1.30 | % | | $ | 6.20 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,018.57 | | 1.30 | | | | 6.64 |

| | | | |

Sanford Bernstein Small-Cap Value Series | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 878.16 | | 1.30 | % | | $ | 6.15 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,018.57 | | 1.30 | | | | 6.64 |

| | | | |

Van Kampen Comstock Series | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 921.26 | | 0.95 | % | | $ | 4.60 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,020.36 | | 0.95 | | | | 4.85 |

| | | | |

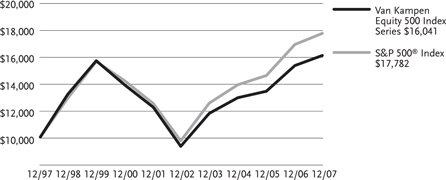

Van Kampen Equity 500 Index Series | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 983.01 | | 0.55 | % | | $ | 2.75 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,022.40 | | 0.55 | | | | 2.81 |

| * | Expenses are equal to the Series’ annualized expense ratio which includes waived fees and reimbursed expenses, if applicable multiplied by the average account value over the period, multiplied by the number of days (184) expenses were accrued in the most recent fiscal half-year, then divided by 365 days to reflect the one-half year period. |

You can find more information about the Series’ expenses in the Financial Statements section that follows. For additional information on operating expenses and other shareholder costs including contractual charges associated with the separate account refer to the series prospectus and the contract prospectus.

7

Capital Growth Series

Product Manager Commentary

| • | | Phoenix Capital Growth Series (“Capital Growth”) Seeks intermediate and long-term capital appreciation, with income as a secondary consideration. |

• | | For the 12-month reporting period, the Series returned 10.75%. For the same period, the S&P 500® Index, a broad-based equity index, returned 5.49% and the Russell 1000® Growth Index, the Series’ style-specific benchmark, returned 11.81%. |

All performance figures assume the reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above.

How did the equity markets perform during the Fund’s fiscal year?

| • | | The four quarters of 2007 experienced significant shifts in economic expectations. In the first quarter of 2007 the market’s focus became the subprime mortgage issues, and the widespread impact. The result being the toll taken on financial stocks, resulting in a volatile and flat equity market. Second quarter ‘07 experienced thriving merger and acquisition activity, despite rising inflationary (commodity driven) fears, interest rates, and the continued deterioration of the housing markets. Third quarter of ‘07 experienced a liquidity freeze-up and credit-market meltdown which led to a volatile quarter. Investors reassessed their appetite for risk, as mergers and acquisitions activity came to a near standstill. These pressures and issues inspired the Federal Reserve to lower interest rates, leading to a rally, yet overall equity market sectors posted mixed results. During this period, as Hedge funds were forced to unwind leveraged positions (sell long holdings and cover short positions) to raise liquidity, investment strategies focusing on attractive valuations and higher quality suffered. Many of the same themes which impacted returns in the third quarter continued to negatively impact the U.S. equity markets during fourth quarter ‘07 as well. Most notably, the uncertainty surrounding the real estate and subprime mortgage markets intensified, leading to further doubt as to whether the ever-resilient consumer will be able to keep the economy free from recession in 2008. Further, energy prices continued on their upward path, resulting in a further cut of the consumer wallet. The Fed is doing its best trapeze act — trying to balance inflation and economic weakness. In all, these fears, issues and uncertainties have led to a volatile market environment. Over the year, growth stocks generally outperformed value. |

What factors affected the Fund’s performance during its fiscal year?

| • | | Overall, sector allocation proved very additive to returns due primarily to being underweight in the Consumer Discretionary Sector and overweight in the Materials and Energy Sectors. However, selective stock holdings detracted from returns, primarily within the Industrials and Information Technology Sectors. |

| • | | Apple, a computer, digital music and mobile communications equipment manufacturer; Freeport-McMoRan, a metals mining and manufacturing company; Celanese, an industrial chemical provider; and Oracle, an enterprise software provider were the top contributors during the year. Detracting from performance were Continental Airlines, an air carrier; Electronic Data Systems, an electronic data processing provider; Watson Pharmaceuticals, a generic and branded pharmaceutical products company and WellCare Group, a managed healthcare provider. |

| • | | Looking ahead to 2008, investors will continue to weigh the severity of any potential economic slowdown, the Federal Reserve’s stance on inflationary pressures, the impact of the mortgage and real estate markets, the trend in both energy prices and the dollar, the level and outlook for employment, and overall, the affects felt by the consumer. We strongly believe that over the long-term, what matters most is the earnings growth and valuation of individual companies. Our investment process mirrors this view, with a continued focus on quality companies exhibiting improving fundamentals, attractive valuations and positive investor interest. We remain confident that the consistent application of our disciplined investment process will continue to produce superior results over the long term. |

The preceding information is the opinion of portfolio management only through the end of the period of the report as stated on the cover. Any such opinions are subject to change at any time based upon market or conditions and should not be relied on as investment advice.

Because the Series is heavily weighted in the technology sector, it will be impacted by that Sector’s performance more than a series with broader sector diversification.

For information regarding the indexes and certain investment terms see the glossary starting on page 2.

8

Capital Growth Series (continued)

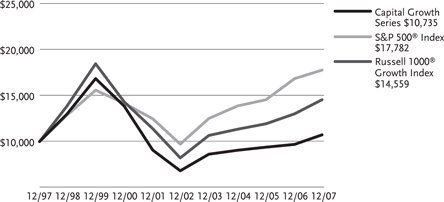

Average Annual Total Return1 for periods ended 12/31/07

| | | | | | | | | |

| | | 1 year | | | 5 years | | | 10 years | |

Capital Growth Series | | 10.75 | % | | 9.50 | % | | 0.71 | % |

S&P 500® Index | | 5.49 | | | 12.83 | | | 5.92 | |

Russell 1000® Growth Index | | 11.81 | | | 12.11 | | | 3.83 | |

Series expense ratios2: Gross: 0.92%; Net: 0.92%.

Returns represent past performance, which is no guarantee of future results. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Total return does not reflect expenses associated with the separate account such as the administrative fees, account charges and surrender charges, which if reflected, would reduce total return. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Please visit PhoenixWM.com for performance data current to the most recent month-end.

1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

2 | The expense ratio(s) of the Series, both net and gross are set forth according to the prospectus for the Series effective 5/1/07, and may differ from the expense ratios disclosed in the financial highlights tables in this report. Net expenses: Expenses reduced by a contractual waiver in effect through 4/30/08. Gross Expenses: Do not reflect the effect of the contractual waiver. |

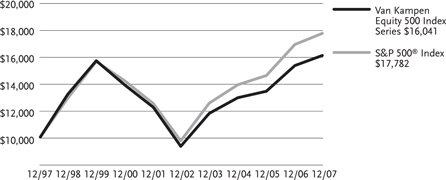

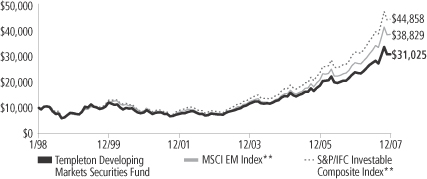

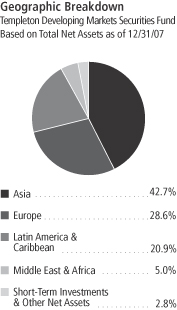

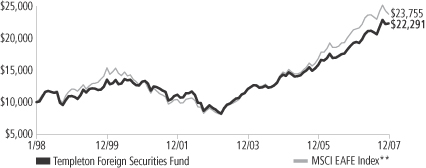

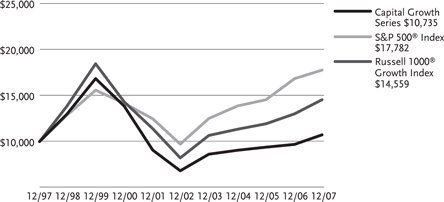

Growth of $10,000 For periods ended 12/31

This chart assumes an initial investment of $10,000 made on 12/31/97. Returns shown include the reinvestment of all distributions at net asset value, and the change in share price for the stated period.

Sector Weightings as of 12/31/07*

| | | |

Information Technology | | 31 | % |

Health Care | | 19 | |

Industrials | | 12 | |

Energy | | 9 | |

Consumer Discretionary | | 7 | |

Materials | | 7 | |

Consumer Staples | | 6 | |

Other (includes short-term investments) | | 9 | |

| * | % of total investments as of December 31, 2007. |

For information regarding the indexes and certain investment terms see the glossary starting on page 2.

9

Growth and Income Series

Product Manager Commentary

| • | | Phoenix Growth and Income Series (“Growth and Income”) Seeks dividend growth, current income and capital appreciation. |

• | | For the 12-month reporting period the Series returned 6.66%. For the same period, the S&P 500® Index, a broad-based equity index, returned 5.49%. |

All performance figures assume the reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown.

How did the Equity markets perform during the Series’ fiscal year?

| • | | The return of volatility was the key theme for the year. After posting new highs for the S&P 500 in early October, stocks turned lower on credit issues tied to subprime mortgages. The mortgages had been dissected and repackaged into securities held by large banks, brokers and insurance companies. When the low teaser rates on the mortgages reset, homeowners could no longer make their payments and the instruments defaulted. This resulted in a huge credit squeeze, causing the Fed to begin lowering interest rates in order to steer the economy away from falling into a recession. There were billion dollar write-downs of investments and several CEOs were fired. |

Also affecting the markets was a rise in the price of crude oil and a sharp decline in the value of the U.S. Dollar. Because of these issues, the United States equity markets posted mixed returns for the calendar year 2007.

The fund’s benchmark, the Standard & Poor’s 500, is a representative index for large capitalization stocks and it returned 5.49%. The small cap benchmark, Russell 2000, posted a loss of 1.57%. In terms of style indices, Value stocks returned less than Growth stocks for the fiscal year. The Russell 1000 Value Index had a slight loss of 0.17%, while the Russell 1000 Growth Index had a double-digit gain of 11.81%. With sub-par returns in broad-based U.S. indices, the real action was in overseas emerging markets stocks. The MSCI Emerging Markets index posted a huge gain of 39.78%. We did not participate in this market because emerging foreign companies are not in our investment universe.

What factors affected the Series’ performance during its fiscal year?

| • | | Performance for the year was favorable. The Growth & Income Series returned 6.66%. The investment portfolio return was 117 basis points higher than the 5.49% total return for the fund’s benchmark, the Standard & Poor’s 500. |

In relation to the benchmark index, the fund benefited the most from sector positioning in Financials, Consumer Discretionary and Health Care. Sector positioning in Information Technology, Consumer Staples and Materials had an adverse impact on the funds performance relative to its benchmark. The top five individual stock contributors were Exxon Mobil, Occidental Petroleum, Microsoft, AT&T and National Oilwell Varco. The bottom five contributors were Citigroup, Bank of America, Merrill Lynch, American International Group and Tyco.

The preceding information is the opinion of portfolio management only through the end of the period of the report as stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied on as investment advice.

Investing internationally involves risks not associated with investing solely in the U.S., such as currency fluctuation, political risk, differences in accounting and the limited availability of information.

For information regarding the indexes and certain investment terms see the glossary starting on page 2.

10

Growth and Income Series (continued)

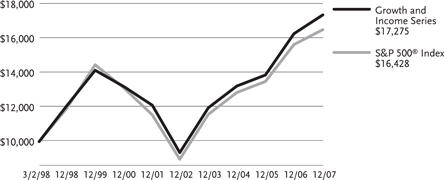

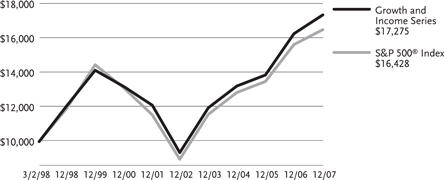

Average Annual Total Return1 for periods ended 12/31/07

| | | | | | | | | | | |

| | | | | | | | | Inception | | | Inception |

| | | 1 year | | | 5 years | | | to 12/31/07 | | | Date |

Growth and Income Series | | 6.66 | % | | 13.02 | % | | 5.71 | % | | 3/2/98 |

S&P 500® Index | | 5.49 | | | 12.83 | | | 5.18 | | | 3/2/98 |

Series expense ratios2: Gross: 0.97%; Net: 0.91%.

Returns represent past performance, which is no guarantee of future results. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return does not reflect expenses associated with the separate account such as the administrative fees, account charges and surrender charges, which if reflected, would reduce total return. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Please visit PhoenixWM.com for performance data current to the most recent month-end.

1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

2 | The expense ratio(s) of the Series, both net and gross are set forth according to the prospectus for the Series effective 5/1/07 and may differ from the expense ratios disclosed in the financial highlights tables in this report. Net expenses: Expenses reduced by a contractual waiver in effect through 4/30/08. Gross Expenses: Do not reflect the effect of the contractual waiver. |

Growth of $10,000 For periods ended 12/31

This chart assumes an initial investment of $10,000 made on 3/2/98. Returns shown include the reinvestment of all distributions at net asset value, and the change in share price for the stated period.

Sector Weightings as of 12/31/07*

| | | |

Financials | | 20 | % |

Information Technology | | 18 | |

Health Care | | 13 | |

Energy | | 12 | |

Industrials | | 11 | |

Consumer Discretionary | | 9 | |

Consumer Staples | | 7 | |

Other (includes short-term investments) | | 10 | |

| * | % of total investments as of December 31, 2007. |

For information regarding the indexes and certain investment terms see the glossary starting on page 2.

11

Mid-Cap Growth Series

Product Manager Commentary

| • | | Phoenix Mid-Cap Growth Series (“Mid-Cap Growth”) Seeks capital appreciation. |

• | | For the 12-month reporting period the Series returned 21.80%. For the same period, the S&P 500® Index, a broad-based equity index, returned 5.49% and the Russell MidCap® Growth Index, the Series’ style-specific benchmark, returned 11.43%. |

| • | | All performance figures assume the reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. |

For the period of January 1, 2007 through November 2007 Bennett Lawrence Management, LLC was the sub-advisor for the Phoenix Mid-Cap Growth Edge Series.

How did the Equity markets perform during the Series’ fiscal year?

In the following commentary Bennett Lawrence Management, LLC discusses the performance under their management Series.

| • | | The year started off on a strong note as inflation and interest rate concerns took a back seat to good earnings reports and reasonable equity valuations. Beneath the surface, a change in investor preferences had begun. For the first time in a long while, demand for growth stocks strengthened. Historically, mid-cycle slowdowns (the stage in the cycle that we appeared to be in the majority of the year) have tended to favor equities in general and growth stocks in particular. As a result, earnings visibility became a most desirable trait and for the first time in seven years, growth stocks outperformed value. |

| • | | Toward the end of the year, worries mounted over housing, a credit crunch and possible recession. Volatility became pronounced and the averages started to lose ground. Fortunately, the Federal Reserve had begun a campaign to restore liquidity to the credit markets. Hopefully this will provide a counterbalance to the host of issues that are on the minds of investors and weighing on share prices. |

What factors affected the Series’ performance during its fiscal year?

| • | | The combination of strong demand for growth stocks, prescient industry/sector allocation decisions and strong operating results from our portfolio companies enabled the Series portfolio to enjoy performance that was over 2.5 times greater than the Russell Midcap Growth Index. |

| • | | For the first time in a long while, earnings growth was directly correlated to share performance. Generally speaking, the better the operating results, the more impressive the share gains. Needless to say, this was a very good backdrop for our high-growth investment strategy. In addition, we were rewarded for overweighting the technology sector, as trends including electronic payment transfer, e-commerce, software as a service, online advertising and solar energy were very pervasive. Finally, the overwhelming majority of our companies delivered operating results that exceeded consensus estimates and led to positive momentum among the Series’ portfolio holdings. |

Neuberger Berman began sub-advising the Portfolio at the end of November 2007.

How did the Equity markets perform during the Series’ fiscal year?

| • | | In the following commentary Neuberger Berman Management, Inc. discusses the Series performance since their becoming subadvisor. |

| • | | In 2007, Large- and Mid-Cap shares outpaced smaller issues while growth style results outpaced value across the capitalization spectrum, the first time since 1999. As the subprime issues continued to work their way through the system, Financials, a large percentage of the value indices, were among the weakest performing sectors for the year. Other sectors that were weaker links included consumer-related areas. Telecom was an area of weakness as concerns regarding a slowdown in consumer spending negatively impacted the sector. Mid-Caps were the best performing capitalization bucket for the year. This was in part due to private equity firms fueling acquisitions in the Mid-Cap space which impacted the portfolio as we had several take overs during the year. |

What factors affected the Series’ performance during its fiscal year?

| • | | Equity market returns for the year 2007 were for the most part positive and volatility had been on an up tick for much of the year as subprime issues continued to unfold throughout the year. As volatility increases, companies that exhibit earnings quality, which is what we seek to identify in our process, continue to be rewarded in the marketplace. This type of environment serves our quality focus well. We continue to believe that companies that demonstrate the ability to grow earnings on a consistent basis in this slowing environment will be rewarded as investors will pay up for this attribute. This was the case for much of 2007 and we believe that this will continue to be the backdrop for adding value in 2008. |

| • | | We remain cautious of areas linked to the average consumer and will therefore remain market-underweight in both Consumer Staples and Discretionary. We continue to play niche areas within Consumer Discretionary such as hotels, gaming and secondary education. The Portfolio continues to be market weight in Industrials with an emphasis on niche areas such as aviation. Although slightly underweight at this time, we continue to believe that Energy will provide earnings growth potential given worldwide demand, and we anticipate moving toward a neutral weighting opportunistically. Due to the spread of subprime worries, and especially their effect on Financials, we will remain underweight in this area at this time. We are also currently overweighted in both the Health Care and Information Technology sectors emphasizing medical diagnostics and specialized software and services, respectively. |

The preceding information is the opinion of portfolio management only through the end of the period of the report as stated on the cover. Any such opinions are subject to change at any time based upon market or conditions and should not be relied on as investment advice.

Investing internationally involves risks not associated with investing solely in the U.S., such as currency fluctuation, political risk, differences in accounting and the limited availability of information.

Investing in the securities of small and mid-sized companies involves risks, such as relatively low trading volumes, more price volatility and less liquidity than securities from larger, more established companies.

For information regarding the indexes and certain investment terms see the glossary starting on page 2.

12

Mid-Cap Growth Series (continued)

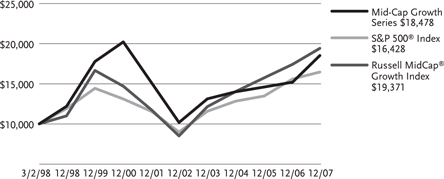

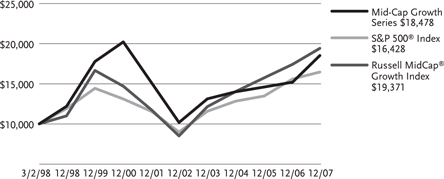

Average Annual Total Return1 for periods ended 12/31/07

| | | | | | | | | | | |

| | | | | | | | | Inception

to 12/31/07 | | | Inception

Date |

| | | 1 year | | | 5 years | | | |

Mid-Cap Growth Series | | 21.80 | % | | 12.68 | % | | 6.44 | % | | 3/2/98 |

S&P 500® Index | | 5.49 | | | 12.83 | | | 5.18 | | | 3/2/98 |

Russell MidCap® Growth Index | | 11.43 | | | 17.90 | | | 6.95 | | | 3/2/98 |

Series expense ratios2: Gross: 1.14%; Net: 1.10%.

Returns represent past performance, which is no guarantee of future results. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return does not reflect expenses associated with the separate account such as the administrative fees, account charges and surrender charges, which if reflected, would reduce total return. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Please visit PhoenixWM.com for performance data current to the most recent month-end.

1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

2 | The expense ratio(s) of the Series, both net and gross are set forth according to the prospectus for the Series effective 5/1/07, and may differ from the expense ratios disclosed in the financial highlights tables in this report. Net expenses: Expenses reduced by a contractual waiver in effect through 4/30/08. Gross Expenses: Do not reflect the effect of the contractual waiver. |

Growth of $10,000 For periods ended 12/31

This chart assumes an initial investment of $10,000 made on 3/2/98. Returns shown include the reinvestment of all distributions at net asset value, and the change in share price for the stated period.

Fund Investment Allocation as of 12/31/07*

| | | |

Information Technology | | 21 | % |

Industrials | | 16 | |

Health Care | | 16 | |

Consumer Discretionary | | 15 | |

Energy | | 10 | |

Financials | | 6 | |

Consumer Staples | | 5 | |

Other (includes short-term investments) | | 11 | |

| * | % of total investments as of December 31, 2007. |

For information regarding the indexes and certain investment terms see the glossary starting on page 2.

13

Money Market Series

| • | | Phoenix Money Market Series (“Money Market”) |

Seeks as high a level of current income as is consistent with the preservation of capital and maintenance of liquidity.

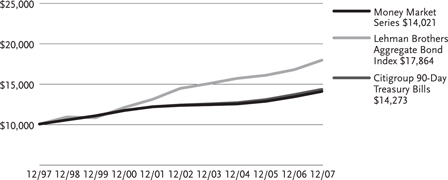

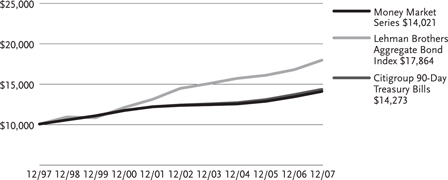

Average Annual Total Return1 for periods ended 12/31/07

| | | | | | | | | |

| | | 1 year | | | 5 years | | | 10 years | |

Money Market Series at NAV2 | | 4.88 | % | | 2.65 | % | | 3.44 | % |

Lehman Brothers Aggregate Bond Index | | 6.97 | | | 4.42 | | | 5.97 | |

Citigroup 90-Day Treasury Bills | | 4.74 | | | 2.95 | | | 3.62 | |

Series expense ratios2: Gross: 0.66%; Net: 0.65%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit phoenixfunds.com for performance data current to the most recent month-end.

1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

2 | The expense ratio(s) of the Series, both net and gross are set forth according to the prospectus for the Series effective 5/1/07, and may differ from the expense ratios disclosed in the financial highlights tables in this report. Net expenses: Expenses reduced by a contractual waiver in effect through 4/30/08. Gross Expenses: Do not reflect the effect of the contractual waiver. |

Growth of $10,000 For periods ended 12/31

This chart assumes an initial investment of $10,000 made on 12/31/97. Returns shown include the reinvestment of all distributions at net asset value, and the change in share price for the stated period.

Sector Weightings as of 12/31/07*

| | | |

Commercial Paper | | 64 | % |

Federal Agency Securities | | 19 | |

Medium Term Notes | | 17 | |

| * | % of total investments as of December 31, 2007. |

For information regarding the indexes and certain investment terms see the glossary starting on page 2.

14

THIS PAGE INTENTIONALLY BLANK.

Multi-Sector Fixed Income Series

Product Manager Commentary

| • | | Phoenix Multi-Sector Fixed Income Series (“Multi-Sector Fixed Income”) Seeks long-term total return. |

| • | | For the 12-month reporting period the Series returned 3.71%. For the same period, the Lehman Brothers Aggregate Bond Index, a broad-based fixed income index, returned 6.97%. |

All performance figures assume the reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown.

How did the Fixed Income markets perform during the Series’ fiscal year?

• | | The broad U.S. fixed income market, as represented by the Lehman Brothers Aggregate Bond Index returned 6.97% for the fiscal year ended December 31, 2007. In the first five meetings of the year, the Fed kept the federal funds rate unchanged at 5.25%. On September 18, 2007, the Fed cut the federal funds rate by 0.50% to 4.75%, citing concerns that tightening credit conditions could potentially increase the strain on the housing market, eventually leading to lower-than-expected economic growth. The Fed proceeded to cut rates another 0.25% at each of its next two meetings on October 31 st and December 11th. Since the beginning of the year the yield curve has steepened, with rates declining across the curve. |

• | | The 1st half of 2007 can best be characterized as a low volatility, benign credit environment. It was in this atmosphere that non-treasury fixed income sectors outperformed. In stark contrast, the 2nd half of 2007 was extraordinarily volatile. This was primarily due to fear surrounding the subprime mortgage market and its resulting contagion. These fears caused a very significant flight to quality which resulted in dramatic spread widening in all sectors of the bond market. So significant was this flight to quality, that it caused treasuries to outperform almost all spread sectors, the exception being out-performance by some non-U.S. Dollar investments. |

What factors affected the Series’ performance during its fiscal year?

| • | | The decision to maintain an underweight to U.S. Treasuries in favor of spread sectors was the largest detractor to performance for the fiscal year ended December 31, 2007. Treasuries outperformed as concerns over subprime sparked a flight to quality, causing spreads in many sectors to widen. This environment typically does not favor our style of investing. Among the series’ investment in spread sectors, the allocation to emerging market securities detracted the most from performance. Within emerging markets, the overweight to Argentina and Venezuela were the key drivers of underperformance. |

| • | | The largest positive contributor to performance was the series’ exposure to non U.S. Dollar investments, which benefited from market expectations that the Federal Reserve would cut U.S. interest rates in 2007 and stronger growth outside of the United States. An additional positive contributor to the series’ performance was our issue selection within the investment grade corporate sector, which out-performed the Lehman U.S. Corporate Investment Grade Bond Index. Although the series’ allocation to the corporate high-yield sector hurt performance the higher quality focus and underweight to CCC securities within the sector helped performance. For the year the Caa component of the Lehman High Yield Index returned -0.13%, while the Ba and B components returned 1.75% and 3.12%, respectively. |

The preceding information is the opinion of portfolio management only through the end of the period of the report as stated on the cover. Any such opinions are subject to change at any time based upon market or conditions and should not be relied on as investment advice.

Investing internationally involves risks not associated with investing solely in the U.S., such as currency fluctuation, political risk, differences in accounting and the limited availability of information.

The series’ use of derivatives such as futures, options and swap agreements to pursue their investment objectives may expose the series to additional risks that it would not be subject to if it invested directly in the securities underlying those derivatives. These risks may cause the series to experience higher losses than series that do not use derivatives.

For information regarding the indexes and certain investment terms see the glossary starting on page 2.

16

Multi-Sector Fixed Income Series (continued)

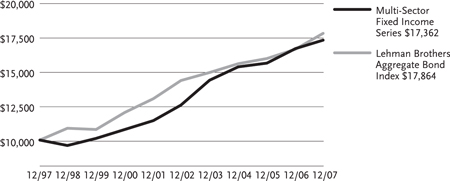

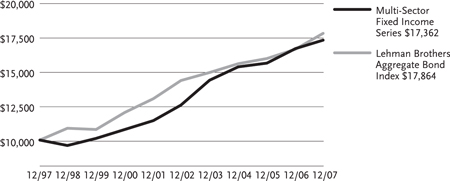

Average Annual Total Return1 for periods ended 12/31/07

| | | | | | | | | |

| | | 1 year | | | 5 years | | | 10 years | |

Multi-Sector Fixed Income Series | | 3.71 | % | | 6.66 | % | | 5.67 | % |

Lehman Brothers Aggregate Bond Index | | 6.97 | | | 4.42 | | | 5.97 | |

Series expense ratios2: Gross: 0.74%; Net: 0.74%.

Returns represent past performance, which is no guarantee of future results. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Total return does not reflect expenses associated with the separate account such as the administrative fees, account charges and surrender charges, which if reflected, would reduce total return. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Please visit PhoenixWM.com for performance data current to the most recent month-end.

1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

2 | The expense ratio(s) of the Series, both net and gross are set forth according to the prospectus for the Series effective 5/1/07, and may differ from the expense ratios disclosed in the financial highlights tables in this report. Net expenses: Expenses reduced by a contractual waiver in effect through 4/30/08. Gross Expenses: Do not reflect the effect of the contractual waiver. |

Growth of $10,000 For periods ended 12/31

This chart assumes an initial investment of $10,000 made on 12/31/97. Returns shown include the reinvestment of all distributions at net asset value, and the change in share price for the stated period.

Fund Investment Allocation as of 12/31/07*

| | | |

Domestic Corporate Bonds | | 24 | % |

Foreign Government Securities | | 17 | |

Foreign Corporate Bonds | | 9 | |

Non-Agency Mortgage-Backed Securities | | 8 | |

Domestic Loan Agreements | | 8 | |

Agency Mortgage-Backed Securities | | 7 | |

U.S. Government Securities | | 5 | |

Other (includes short-term investments) | | 22 | |

| * | % of total investments as of December 31, 2007. |

For information regarding the indexes and certain investment terms see the glossary starting on page 2.

17

Multi-Sector Short Term Bond Series

Product Manager Commentary

| • | | Phoenix Multi-Sector Short-Term Bond Series (“Multi-Sector Short Term Bond”) Seeks to provide high current income while attempting to limit changes in the Series net assets caused by interest rate changes. |

| • | | For the 12-month reporting period the Series returned 3.99%. For the same period, the Lehman Brothers Aggregate Bond Index, a broad-based fixed income index, returned 6.97% and the Merrill Lynch 1-2.99 Year Medium Quality Corporate Bonds Index, the Series’ style-specific benchmark, returned 5.31%. |

All performance figures assume the reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown.

How did the Fixed Income markets perform during the Series’ fiscal year?

• | | The broad U.S. fixed income market, as represented by the Lehman Brothers Aggregate Bond Index returned 6.97% for the fiscal year ended December 31, 2007. In the first five meetings of the year the Fed kept the federal funds rate unchanged at 5.25%. On September 18, 2007, the Fed cut the federal funds rate by 0.50% to 4.75%, citing concerns that tightening credit conditions could potentially increase the strain on the housing market, eventually leading to lower than expected economic growth. The Fed proceeded to cut rates another 0.25% at each of its next two meetings on October 31 st and December 11th. Since the beginning of the year the yield curve has steepened, with rates declining across the curve. |

• | | The 1st half of 2007 can best be characterized as a low volatility, benign credit environment. It was in this atmosphere that non-treasury fixed income sectors outperformed. In stark contrast, the 2nd half of 2007 was extraordinarily volatile. This was primarily due to fear surrounding the subprime mortgage market and its resulting contagion. These fears caused a very significant flight to quality which resulted in dramatic spread widening in all sectors of the bond market. So significant was this flight to quality, that it caused treasuries to outperform almost all spread sectors, the exception being out-performance by some non-U.S. Dollar investments. |

What factors affected the Series’ performance during its fiscal year?

| • | | The decision to maintain an underweight to U.S. Treasuries in favor of spread sectors was the largest detractor to performance for the fiscal year ended December 31, 2007. Treasuries outperformed as concerns over subprime sparked a flight to quality, causing spreads in many sectors to widen. This environment typically does not favor our style of investing, however, our ability to be tactical in our use of high quality substitutes for investment-grade corporates contributed positively to performance for the year. Among the series’ investment in spread sectors, the overweight to asset backed securities detracted the most from performance. The asset-backed sector was pressured by the home equity sub-component, which suffered from weakness in the underlying collateral. |

| • | | The largest positive contributor to performance was the series’ exposure to non U.S. Dollar investments, which benefited from market expectations that the Federal Reserve would cut U.S. interest rates in 2007 and stronger growth outside of the United States. Although the series’ allocation to the corporate high yield sector hurt performance the higher quality focus and underweight to CCC securities within the sector helped performance. For the year the Caa component of the Lehman High Yield Index returned -0.13%, while the Ba and B components returned 1.75% and 3.12% respectively. As of 12/31/07, the series held 0% in Caa U.S. corporate securities, while the index had 19.96%. |

The preceding information is the opinion of portfolio management only through the end of the period of the report as stated on the cover. Any such opinions are subject to change at any time based upon market or conditions and should not be relied on as investment advice.

Investing internationally involves risks not associated with investing solely in the U.S., such as currency fluctuation, political risk, differences in accounting and the limited availability of information.

The value of mortgage-backed and other asset securities, including pass-through type securities and collateralized mortgage obligations (CMO’s) may fluctuate to a greater degree than other debt securities in response to interest rate changes.

The series’ use of derivatives such as futures, options and swap agreements to pursue their investment objectives may expose the series to additional risks that it would not be subject to if it invested directly in the securities underlying those derivatives. These risks may cause the series to experience higher losses than series that do not use derivatives.

For information regarding the indexes and certain investment terms see the glossary starting on page 2.

18

Multi-Sector Short Term Bond Series (continued)

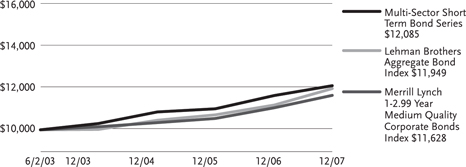

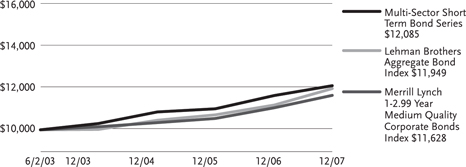

Average Annual Total Return1 for periods ended 12/31/07

| | | | | | | | |

| | | | | | Inception | | | Inception |

| | | 1 year | | | to 12/31/07 | | | Date |

Multi-Sector Short Term Bond Series | | 3.99 | % | | 4.22 | % | | 6/2/03 |

Lehman Brothers Aggregate Bond Index | | 6.97 | | | 3.96 | | | 6/2/03 |

Merrill Lynch 1-2.99 Year Medium Quality Corporate Bonds Index | | 5.31 | | | 3.40 | | | 6/2/03 |

Series expense ratios2: Gross: 0.88%; Net: 0.70%.

Returns represent past performance, which is no guarantee of future results. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return does not reflect expenses associated with the separate account such as the administrative fees, account charges and surrender charges, which if reflected, would reduce total return. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Please visit PhoenixWM.com for performance data current to the most recent month-end.

1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

2 | The expense ratio(s) of the Series, both net and gross are set forth according to the prospectus for the Series effective 5/1/07, and may differ from the expense ratios disclosed in the financial highlights tables in this report. Net expenses: Expenses reduced by a contractual waiver in effect through 4/30/08. Gross Expenses: Do not reflect the effect of the contractual waiver. |

Growth of $10,000 For periods ended 12/31

This chart assumes an initial investment of $10,000 made on 6/2/03. Returns shown include the reinvestment of all distributions at net asset value, and the change in share price for the stated period.

Fund Investment Allocation as of 12/31/07*

| | | |

Non-Agency Mortgage-Backed Securities | | 22 | % |

Domestic Corporate Bonds | | 19 | |

Foreign Government Securities | | 16 | |

Foreign Corporate Bonds | | 9 | |

Domestic Loan Agreements | | 9 | |

Agency Mortgage-Backed Securities | | 8 | |

Asset-Backed Securities | | 6 | |

Other (includes short-term investments) | | 11 | |

| * | % of total investments as of December 31, 2007. |

For information regarding the indexes and certain investment terms see the glossary starting on page 2.

19

Strategic Allocation Series

Product Manager Commentary

| • | | Phoenix Strategic Allocation Series (“Strategic Allocation”) Seeks high total return over an extended period of time consistent with prudent investment risk. |

• | | For the 12-month reporting period the Series returned 5.98%. For the same period, the S&P 500® Index, a broad-based equity index, returned 5.49% and the Lehman Brothers Aggregate Bond Index, a broad-based fixed income index returned 6.97%. The Composite Index for Strategic Allocation Series, the Series’ style-specific benchmark, returned 6.22%. |

All performance figures assume the reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown.

How did the Equity markets perform during the Series’ fiscal year?

| • | | The return of volatility was the key theme for the year. After posting new highs for the S&P 500 in early October, stocks turned lower on credit issues tied to subprime mortgages. The mortgages had been dissected and repackaged into securities held by large banks, brokers and insurance companies. When the low teaser rates on the mortgages reset, homeowners could no longer make their payments and the instruments defaulted. This resulted in a huge credit squeeze, causing the Fed to begin lowering interest rates in order to steer the economy away from falling into a recession. There were billion dollar write-downs of investments and several CEOs were fired. Also, affecting the markets was a rise in the price of crude oil and a sharp decline in the value of the U.S. dollar. Because of these issues, the United States equity markets posted mixed returns for the calendar year 2007. |

The fund’s benchmark, the Standard & Poor’s 500, is a representative index for large capitalization stocks and it returned 5.49%. The small cap benchmark, Russell 2000, posted a loss of 1.57%. In terms of style indices, Value stocks returned less than Growth stocks for the fiscal year. The Russell 1000 Value Index had a slight loss of 0.17%, while the Russell 1000 Growth Index had a double-digit gain of 11.81%. With sub-par returns in broad-based U.S. indices, the real action was in overseas emerging markets stocks.

The MSCI Emerging Markets index posted a huge gain of 39.78%. We did not participate in this market because emerging foreign companies are not in our investment universe.

What factors affected the equity portion Series’ performance during its fiscal year?

| • | | Equity performance for the year was favorable. The Strategic Allocation Series stock portion of the portfolio returned 7.47% before taking into account fund expenses. The investment portfolio return was 198 basis points higher than the 5.49% total return for the fund’s benchmark, the Standard & Poor’s 500. |

In relation to the benchmark index, the fund benefited the most from sector positioning in Financials, Consumer Discretionary and Health Care. Sector positioning in Information Technology, Consumer Staples and Materials had an adverse impact on the Series’ performance relative to its benchmark. The top five individual stock contributors were Exxon Mobil, Occidental Petroleum, Microsoft, AT&T and National Oilwell Varco. The bottom five contributors were Citigroup, Bank of America, Merrill Lynch, American International Group and Tyco.

How did the Fixed Income markets perform during the Series’ fiscal year?

• | | The broad U.S. fixed income market, as represented by the Lehman Brothers Aggregate Bond Index returned 6.97% for the fiscal year ended December 31, 2007. In the first five meetings of the year the Fed kept the federal funds rate unchanged at 5.25%. On September 18, 2007, the Fed cut the federal funds rate by 0.50% to 4.75%, citing concerns that tightening credit conditions could potentially increase the strain on the housing market, eventually leading to lower than expected economic growth. The Fed proceeded to cut rates another 0.25% at each of its next two meetings on October 31 st and December 11th. Since the beginning of the year the yield curve has steepened, with rates declining across the curve. |

• | | The 1st half of 2007 can best be characterized as a low volatility, benign credit environment. It was in this atmosphere that non-treasury fixed income sectors outperformed. In stark contrast, the 2nd half of 2007 was extraordinarily volatile. This was primarily due to fear surrounding the subprime mortgage market and its resulting contagion. These fears caused a very significant flight to quality which resulted in dramatic spread widening in all sectors of the bond market. So significant was this flight to quality, that it caused treasuries to outperform almost all spread sectors, the exception being out-performance by some non-U.S. Dollar investments. |

What factors affected the Series’ performance during its fiscal year?

| • | | The decision to maintain an underweight to U.S. Treasuries in favor of spread sectors was the largest detractor to performance for the fiscal year ended December 31, 2007. Treasuries outperformed as concerns over subprime sparked a flight to quality, causing spreads in many sectors to widen. This environment typically does not favor our style of investing, however, our ability to be tactical in our use of high quality substitutes for investment-grade corporates contributed positively to performance for the year. Among the series’ investment in spread sectors, the overweight to asset backed securities and corporate high yield detracted the most from performance. The asset-backed sector was pressured by the home equity sub-component, which suffered from weakness in the underlying collateral. The high-yield market weakened over increased concerns that tightening credit conditions could potentially increase the strain on the housing market, eventually leading to lower than expected economic growth. |

| • | | The largest positive contributor to performance was the series’ exposure to non U.S. Dollar investments, which benefited from market expectations that the Federal Reserve would cut U.S. interest rates in 2007 and stronger growth outside of the United States. An additional positive contributor to the series’ performance was our issue selection within the investment grade corporate sector, which out-performed the Lehman U.S. Corporate Investment Grade Bond Index. |

The preceding information is the opinion of portfolio management only through the end of the period of the report as stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied on as investment advice.

For information regarding the indexes and certain investment terms see the glossary starting on page 2.

20

Strategic Allocation Series (continued)

Portfolios that invest in high yield securities are subject to greater credit risk and price fluctuation than portfolios that invest in higher quality securities. The series’ use of derivatives such as futures, options and swap agreements to pursue the investment objectives may expose the series to additional risks that it would not be subject to if the investment options invested directly in the securities underlying those derivatives. These risks may cause the series to experience higher losses than series that do not use derivatives.

The economies of developing countries may be adversely affected by trade barriers, exchange controls, managed adjustments in relative currency values and other protagonist measures imposed or negotiated by the countries with which they trade.

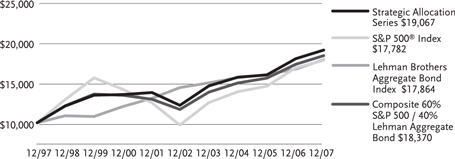

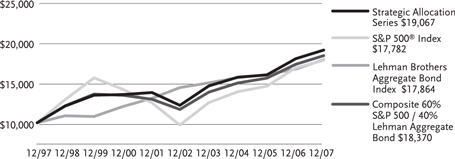

Average Annual Total Return1 for periods ended 12/31/07

| | | | | | | | | |

| | | 1 year | | | 5 years | | | 10 years | |

Strategic Allocation Series | | 5.98 | % | | 9.38 | % | | 6.67 | % |

S&P 500® Index | | 5.49 | | | 12.83 | | | 5.92 | |

Lehman Brothers Aggregate Bond Index | | 6.97 | | | 4.42 | | | 5.97 | |

Composite Index for Strategic Allocation Series | | 6.22 | | | 9.51 | | | 6.27 | |

Series expense ratios2: Gross: 0.84%; Net: 0.83%.

Returns represent past performance, which is no guarantee of future results. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Total return does not reflect expenses associated with the separate account such as the administrative fees, account charges and surrender charges, which if reflected, would reduce total return. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Please visit PhoenixWM.com for performance data current to the most recent month-end.

1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

2 | The expense ratio(s) of the Series, both net and gross are set forth according to the prospectus for the Series effective 5/1/07, and may differ from the expense ratios disclosed in the financial highlights tables in this report. Net expenses: Expenses reduced by a contractual waiver in effect through 4/30/08. Gross Expenses: Do not reflect the effect of the contractual waiver. |

Growth of $10,000 For periods ended 12/31

This chart assumes an initial investment of $10,000 made on 12/31/97. Returns shown include the reinvestment of all distributions at net asset value, and the change in share price for the stated period.

Sector Weightings as of 12/31/07*

| | | |

Domestic Common Stocks | | 57 | % |

Non-Agency Mortgage-Backed Securities | | 12 | |

Domestic Corporate Bonds | | 9 | |

Agency Mortgage-Backed Securities | | 7 | |

Foreign Corporate Bonds | | 3 | |

Municipal Bonds | | 3 | |

Asset-Backed Securities | | 3 | |

Other (includes short-term investments) | | 6 | |

| * | % of total investments as of December 31, 2007. |

For information regarding the indexes and certain investment terms see the glossary starting on page 2.

21

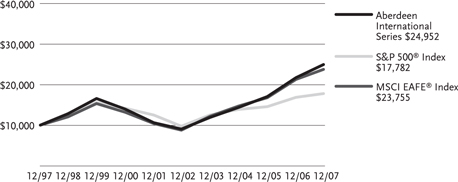

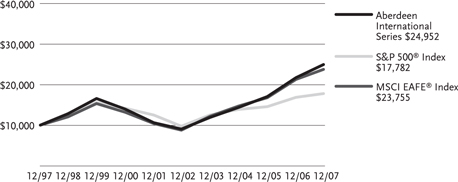

Aberdeen International Series

Product Manager Commentary

| • | | Phoenix-Aberdeen International Series (“Aberdeen International”) Seeks high total return consistent with reasonable risk. |

• | | For the 12-month reporting period the Series returned 14.94%. For the same period, the S&P 500® Index, a broad-based equity index, returned 5.49% and the MSCI EAFE® Index, the Series’ style-specific benchmark, returned 11.63%. |

All performance figures assume the reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown.

How did the Equity markets perform during the Series’ fiscal year?

| • | | The majority of International equity markets posted positive returns in 2007, despite ending the year on a negative tone. The MSCI EAFE index had a total return of 11.63% for the year. U.S. investors benefited once again from the weakness of the U.S. Dollar against most foreign currencies, helping to boost overall returns. |

| • | | Latin America was again the highest returning region, posting a return of 50.7%. Within Latin America, Brazil was a notable standout, achieving a return of 80% as it benefited from significant exposure to its rich natural resources within the commodities sector. Elsewhere in Emerging Markets, China and India also performed exceptionally well posting returns in excess of 50% each for the year. |

| • | | In Continental Europe, equity market returns were boosted by a sharp rise in the Euro versus the U.S. Dollar while continued strong economic growth boosted corporate profits. Europe’s largest economy, Germany, was the single best performing market in the region, posting a U.S. Dollar return of 35.6%. Of the other major International markets Japan was the greatest disappointment, posting a negative return of 4.1% for the fiscal year under review. |

| • | | Within sectors, financials fared worst as the fallout from the U.S. subprime crisis proved to be a major problem for Financial institutions globally rather than being solely confined to the U.S. financial market. The Materials and Energy sectors achieved high returns aided by continued upward momentum in the underlying prices of oil and other natural resources. |

What factors affected the Series’ performance during its fiscal year?

| • | | The fund produced a return of 14.94% for 2007. The exposure to Emerging Markets had a positive contribution to performance with companies such as Petrobras in Brazil, ICICI Bank in India, and Grupo Asur in Mexico, producing very strong returns and comfortably outperforming the benchmark index. This was partly offset by disappointing negative returns from longterm holdings Samsung Electronics in South Korea and Taiwan Semiconductor in Taiwan. The two Chinese positions of Petrochina and China Mobile also contributed very strong returns during the year and profits were taken in October 2007 due to our concern over the very high valuation levels of Chinese equities. |

| • | | Stock selection was strong within the United Kingdom (“UK”), as engineering company, Weir Group continued to perform robustly and British American Tobacco, Vodafone and food retailer William Morrison also posted solid returns. Within the Continental European holdings, strong showings from Belgacom and German companies Eon and Adidas, were partly offset by disappointments in Swedish telecommunications company Ericsson and Dutch financial giant ING Groep, where we sold our position in the second half of the year. Within the Japanese portion of the portfolio, a number of financial holdings suffered a knock on effect from the U.S. subprime crisis with banking giant MUFJ performing poorly as did leasing company Orix. Export giants Canon and Toyota also underperformed on fears of a U.S. economic slowdown and a rise in the Yen in the second half of the year. |