UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05583

Franklin Templeton Variable Insurance Products Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: (650) 312-2000

Date of fiscal year end: 12/31

Date of reporting period: 12/31/06

| Item 1. | Reports to Stockholders. |

December 31, 2006

TEMPLETON INVESTMENT PLUS

ANNUAL REPORT

THE PHOENIX EDGE SERIES FUND

· PHOENIX MONEY MARKET SERIES

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

· TEMPLETON DEVELOPING MARKETS SECURITIES FUND - CLASS 1

· TEMPLETON FOREIGN SECURITIES FUND - CLASS 1

· TEMPLETON GLOBAL ASSET ALLOCATION FUND - CLASS 1

· TEMPLETON GLOBAL INCOME SECURITIES FUND - CLASS 1

· TEMPLETON GROWTH SECURITIES FUND - CLASS 1

ANNUAL REPORT

THE PHOENIX EDGE

SERIES FUND

Variable Products Fund

December 31, 2006

A MESSAGE FROM THE PRESIDENT

Dear Phoenix Edge Series Fund Shareholder:

We are pleased to provide this report for the fiscal year ended December 31, 2006. It includes valuable information about your Phoenix variable insurance product’s investment options, such as performance-and fee-related data and information about portfolio holdings and transactions for the reporting period.

At Phoenix, we strive to provide investors with choice. Regardless of your level of investment expertise, we seek to provide you with access to a wide selection of quality investment options from today’s leading money managers. For that reason, we expanded our asset allocation program twice in 2006. Most recently, we added an asset allocation portfolio from Franklin Advisors, Inc. – the Franklin Templeton Founding Investment Strategy. Comprised of three underlying funds, this portfolio seeks to offer diversification, low relative volatility and consistent performance.

Earlier this year, we also added four active asset allocation portfolios sub-advised by Standard & Poor’s Investment Advisory Services, LLC, which provide built-in diversification according to four risk tolerance levels and active asset allocation using exchange-traded funds. Finally, we continue to offer five preset asset allocation portfolio models from Ibbotson Associates, each of which is comprised of eight or more individual investment options that are also available outside of our asset allocation program to eligible policyholders.

With so many new asset allocation portfolios available to you, this may be an excellent time to meet with your financial professional to make sure that your investment allocation remains consistent with your current goals. Or you may prefer to explore your options and select your own investments. For more information on the asset allocation portfolios and individual investment options currently available to you, be sure to visit our Web site, at PhoenixWealthManagement.com.

Thank you for choosing a Phoenix variable product as part of your financial strategy. It’s our privilege to serve you.

Sincerely yours,

Philip K. Polkinghorn

President, The Phoenix Edge Series Fund

January 2007

Asset Allocation does not guarantee against a loss, and there is no guarantee that a diversified portfolio will outperform a non-diversified portfolio.

“Standard & Poor’s” and “S&P” are trademarks of The McGraw-Hill Companies, Inc. Standard & Poor’s Investment Advisory Services LLC (“SPIAS”) is a registered investment advisor and a wholly owned subsidiary of The McGraw-Hill Companies, Inc. SPIAS is not affiliated with The Phoenix Companies, Inc. and its affiliates.

Ibbotson Associates and Franklin Advisers, Inc. are not affiliated with The Phoenix Companies.

More complete information about the Standard & Poor’s, Ibbotson Associates and Franklin Advisers, Inc. asset allocation models may be obtained through your financial representative or in the prospectus.

1

THIS PAGE INTENTIONALLY BLANK.

Table of Contents

Proxy Voting Procedures and Voting Record (Form N-PX)

The advisors and subadvisors vote proxies relating to portfolio securities in accordance with procedures that have been approved by the Fund’s Board of Trustees. You may obtain a description of these procedures, along with information regarding how the series voted proxies during the most recent 12-month period ended June 30, 2006, free of charge, by calling toll-free 800-541-0171. This information is also available through the Securities and Exchange Commission’s website at http://www.sec.gov.

Form N-Q Information

The Fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year on Form N-Q. Form N-Q is available on the SEC’s website at http://www.sec.gov. Form N-Q may be reviewed and copied at the SEC’s Public Reference Room. Information on the operation of the SEC’s Public Reference Room can be obtained by calling toll-free 1-800-SEC-0330.

| | | | |

| Not FDIC Insured | | No Bank Guarantee | | May Lose Value |

3

GLOSSARY

ADR (American Depositary Receipt)

Represents shares of foreign companies traded in U.S. dollars on U.S. exchanges that are held by a bank or a trust. Foreign companies use ADRs in order to make it easier for Americans to buy their shares.

AMBAC

American Municipal Bond Assurance Corporation.

Citigroup 90-Day Treasury Bill Index

The Citigroup 90-Day Treasury Bill Index measures monthly return equivalents of yield averages that are not marked to market. The 90-Day Treasury Bill Index is an average of the last three three-month Treasury bill issues.

Composite Index for Strategic Allocation Series

A composite index made up of 60% of the S&P 500 Index, which measures stock market total return performance, and 40% of the Lehman Brothers Aggregate Bond Index, which measures bond market total return performance.

Composite Index for S&P Dynamic Asset Allocation Series: Aggressive Growth

A composite index made up of 75% of the S&P 500 Index, which measures stock market total return performance, 8% of the Lehman Brothers Aggregate Bond Index, which measures bond market total return performance, and 17% of the MSCI EAFE Index, which measures foreign market equity performance.

Composite Index for S&P Dynamic Asset Allocation Series: Growth

A composite index made up of 60% of the S&P 500 Index, which measures stock market total return performance, 27% of the Lehman Brothers Aggregate Bond Index, which measures bond market total return performance, and 13% of the MSCI EAFE Index, which measures foreign market equity performance.

Composite Index for S&P Dynamic Asset Allocation Series: Moderate Growth

A composite index made up of 50% of the S&P 500 Index, which measures stock market total return performance, 40% of the Lehman Brothers Aggregate Bond Index, which measures bond market total return performance, and 10% of the MSCI EAFE Index, which measures foreign market equity performance.

Composite Index for S&P Dynamic Asset Allocation Series: Moderate

A composite index made up of 30% of the S&P 500 Index, which measures stock market total return performance, 65% of the Lehman Brothers Aggregate Bond Index, which measures bond market total return performance, and 5% of the MSCI EAFE Index, which measures foreign market equity performance.

ETF (Exchange Traded Fund)

A Fund that tracks an index, but can be traded like a stock.

Federal Reserve (the “Fed”)

The central bank of the United States, responsible for controlling the money supply, interest rates and credit with the goal of keeping the U.S. economy and currency stable. Governed by a seven-member board, the system includes 12 regional Federal Reserve Banks, 25 branches and all national and state banks that are part of the system.

FGIC

Financial Guaranty Insurance Company.

FHLB

Federal Home Loan Bank.

FHLMC

Federal Home Loan Mortgage Corporation.

FNMA or “Fannie Mae”

Federal National Mortgage Association.

FSA

Financial Security Assurance, Inc.

4

GLOSSARY (Continued)

FTSE NAREIT Equity REITs Index

The FTSE NAREIT Equity REITs Index is a free-float market capitalization-weighted index measuring equity tax-qualified real estate investment trusts, which meet minimum size and liquidity criteria, that are listed on the New York Stock Exchange, the American Stock Exchange and the NASDAQ National Market System. The index is calculated on a total return basis with dividends reinvested.

GDR (Global Depositary Receipt)

A negotiable certificate held in the bank of one country representing a specific number of shares of a stock traded on an exchange of another country.

Lehman Brothers Aggregate Bond Index

The Lehman Brothers Aggregate Bond Index measures the U.S. investment grade fixed rate bond market. The index is calculated on a total return basis.

MBIA

Municipal Bond Insurance Association.

Merrill Lynch 1-2.99 Year Medium Quality Corporate Bonds Index

The Merrill Lynch 1-2.99 Year Medium Quality Corporate Bonds Index measures performance of U.S. investment grade corporate bond issues rated “BBB” and “A” by Standard & Poor’s/Moody’s with maturities between one and three years. The index is calculated on a total return basis.

MSCI EAFE® Index

The MSCI EAFE® Index is a free float-adjusted market capitalization index that measures developed foreign market equity performance, excluding the U.S. and Canada. The index is calculated on a total return basis with gross dividends reinvested.

MSCI Information Technology Index

Morgan Stanley Capital International World Information Technology Index is a capitalization weighted index that measures the performance of information technology companies from around the world.

MSCI Japan Index

The MSCI Japan IndexSM is an equity index of securities listed on Japanese stock exchanges. The index is calculated on a total return basis with gross dividends reinvested.

MSCI Latin America Index

Morgan Stanley Capital International Emerging Markets Free Latin American Index is a capitalization weighted index that measures the performance of Latin American companies. The average size of the emerging markets capitalization is US $800 million for the companies included in the MSCI Emerging Markets Free universe.

MSCI USA/Utilities Index

The MSCI USA/Utilities Index is a market capitalization-weighted index that monitors the performance of utility stocks from the United States. The index is calculated on a total return basis with gross dividends reinvested.

New York Shares (Guilder Shares)

Shares representing Dutch companies that are not permitted to trade outside of national borders.

REIT (Real Estate Investment Trust)

A publicly traded company that owns, develops and operates income-producing real estate such as apartments, office buildings, hotels, shopping centers and other commercial properties.

Russell 1000® Growth Index

The Russell 1000® Growth Index is a market capitalization-weighted index of growth-oriented stocks of the 1,000 largest companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested.

Russell 1000® Value Index

The Russell 1000® Value Index is a market capitalization-weighted index of value-oriented stocks of the 1,000 largest companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested.

5

GLOSSARY (Continued)

Russell 2000® Index

The Russell 2000® Index is a market capitalization-weighted index of the 2,000 smallest companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested.

Russell 2000® Growth Index

The Russell 2000® Growth Index is a market capitalization-weighted index of growth-oriented stocks of the smallest 2,000 companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested.

Russell 2000® Value Index

The Russell 2000® Value Index is a market capitalization-weighted index of value-oriented stocks of the smallest 2,000 companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested.

Russell 2500TM Value Index

The Russell 2500™ Value Index is a market capitalization-weighted index of value-oriented stocks of the smallest 2,500 companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested.

Russell MidCap® Growth Index

The Russell MidCap® Growth Index is a market capitalization-weighted index of medium-capitalization, growth-oriented stocks of U.S. companies. The index is calculated on a total return basis with dividends reinvested.

SBA

Small Business Administration.

S&P 500® Index

The S&P 500® Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested.

Sponsored ADR (American Depositary Receipt)

An ADR which is issued with the cooperation of the company whose stock will underlie the ADR. These shares carry all the rights of the common share such as voting rights. ADRs must be sponsored to be able to trade on the NYSE.

Indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with the active management of an actual portfolio.

6

PHOENIX MONEY MARKET SERIES

(FORMERLY PHOENIX-GOODWIN MONEY MARKET SERIES)

ABOUT YOUR SERIES EXPENSES (Unaudited)

(For the six-month period of June 30, 2006 to December 31, 2006)

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of the Money Market Series, you incur ongoing costs including investment advisory fees and other expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the series and to compare these costs with the ongoing costs of investing in other mutual funds. This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period.

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. The expense estimate does not include the fees or expenses associated with the separate insurance accounts, and if such charges were included, returns would be lower.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the series’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not your series’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your series and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the accompanying table are meant to highlight your ongoing costs only and do not reflect additional fees and expenses associated with the annuity or life insurance policy through which you invest. Therefore, the second line of the accompanying table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if the annuity or life insurance policy costs were included, your costs would have been higher. The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

| | | | | | | | | |

Money Market Series | | Beginning

Account Value

June 30, 2006 | | Ending

Account Value

December 31, 2006 | | Expenses Paid

During

Period* |

Actual | | $ | 1,000.00 | | $ | 1,023.00 | | $ | 3.31 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,021.89 | | | 3.32 |

| * | Expenses are equal to the series’ annualized expense ratio of 0.65%, which includes waived fees and reimbursed expenses, if applicable, multiplied by the average account value over the period, multiplied by the number of days (184) expenses were accrued in the most recent fiscal half-year, then divided by 365 to reflect the one-half year period. |

You can find more information about the series’ expenses in the Financial Statements section that follows. For additional information on operating expenses and other shareholder costs including contractual charges associated with the separate account refer to the series prospectus and the contract prospectus.

7

PHOENIX MONEY MARKET SERIES

(FORMERLY PHOENIX-GOODWIN MONEY MARKET SERIES)

| | |

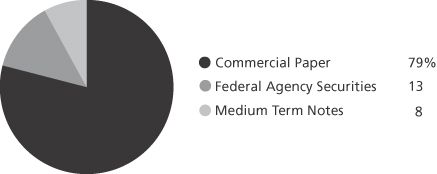

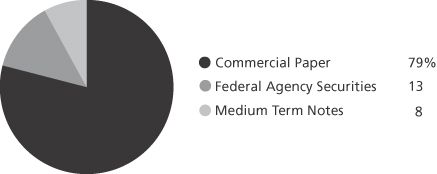

| Sector Weightings | | 12/31/06 |

As a percentage of total investments

SCHEDULE OF INVESTMENTS

DECEMBER 31, 2006

| | | | | | | | | | |

FACE

VALUE

(000) | | DESCRIPTION | | INTEREST

RATE | | | MATURITY

DATE | | VALUE |

| FEDERAL AGENCY SECURITIES(b)—11.5% | | | | | | | | |

| $1,450 | | FHLB | | 3.00 | % | | 1/5/07 | | $ | 1,449,635 |

| 3,560 | | FNMA | | 3.31 | | | 1/26/07 | | | 3,555,201 |

| 1,000 | | FHLB(c) | | 4.47 | | | 2/22/07 | | | 998,754 |

| 920 | | FHLB | | 3.60 | | | 2/23/07 | | | 917,662 |

| 570 | | FHLB | | 3.63 | | | 2/28/07 | | | 568,442 |

| 1,000 | | FHLMC | | 4.13 | | | 4/12/07 | | | 996,801 |

| 3,000 | | FHLB(c) | | 5.17 | | | 6/14/07 | | | 3,000,000 |

| 240 | | FHLB | | 3.25 | | | 6/18/07 | | | 237,782 |

| 3,500 | | FHLB(c) | | 5.18 | | | 7/30/07 | | | 3,409,784 |

| 3,000 | | FHLB | | 5.27 | | | 11/21/07 | | | 2,998,668 |

| | | | | | | | | | |

| TOTAL FEDERAL AGENCY SECURITIES | | | | | | | | 18,132,729 |

| | | | | | | | | | |

| | | | |

| | | | | | | | RESET

DATE | | |

| FEDERAL AGENCY SECURITIES—VARIABLE(c)—1.2% | | | | | | | | |

| 323 | | SBA (Final Maturity 10/25/22) | | 5.75 | | | 1/1/07 | | | 320,744 |

| 501 | | SBA (Final Maturity 11/25/21) | | 5.88 | | | 1/1/07 | | | 501,221 |

| 170 | | SBA (Final Maturity 2/25/23) | | 5.75 | | | 1/1/07 | | | 169,831 |

| 199 | | SBA (Final Maturity 2/25/23) | | 5.75 | | | 1/1/07 | | | 199,406 |

| 211 | | SBA (Final Maturity 3/25/24) | | 5.63 | | | 1/1/07 | | | 210,744 |

| 64 | | SBA (Final Maturity 5/25/21) | | 5.75 | | | 1/1/07 | | | 63,667 |

| 399 | | SBA (Final Maturity 9/25/23) | | 5.63 | | | 1/1/07 | | | 396,514 |

| 15 | | SBA (Final Maturity 1/25/21) | | 5.75 | | | 1/1/07 | | | 15,149 |

| | | | | | | | | | |

| TOTAL FEDERAL AGENCY SECURITIES—VARIABLE | | | | | | | | 1,877,276 |

| | | | | | | | | | |

| | | | |

| | | | | | | | MATURITY

DATE | | |

| COMMERCIAL PAPER(d)—79.2% | | | | | | | | |

| 3,175 | | Abbott Laboratories | | 5.24 | | | 1/31/07 | | | 3,161,136 |

| 1,648 | | Archer Daniels Midland Co | | 5.24 | | | 1/16/07 | | | 1,644,402 |

| 1,960 | | Archer Daniels Midland Co | | 5.24 | | | 1/17/07 | | | 1,955,435 |

| 1,915 | | Archer Daniels Midland Co | | 5.30 | | | 1/30/07 | | | 1,906,824 |

| 2,080 | | Archer Daniels Midland Co | | 5.25 | | | 2/27/07 | | | 2,062,710 |

| 900 | | Bank of America Corp | | 5.26 | | | 1/17/07 | | | 897,896 |

| 3,100 | | Bank of America Corp | | 5.25 | | | 2/1/07 | | | 3,085,985 |

| 1,800 | | Bank of America Corp | | 5.24 | | | 2/15/07 | | | 1,788,210 |

| 2,140 | | CAFCO LLC | | 5.26 | | | 1/24/07 | | | 2,132,808 |

| 2,200 | | CAFCO LLC | | 5.26 | | | 1/30/07 | | | 2,190,678 |

| 1,700 | | CAFCO LLC | | 5.24 | | | 2/13/07 | | | 1,689,360 |

| 3,535 | | Cargill, Inc | | 5.25 | | | 1/11/07 | | | 3,529,845 |

| 3,500 | | Cargill, Inc | | 5.24 | | | 2/2/07 | | | 3,483,698 |

| 800 | | Cargill, Inc | | 5.28 | | | 2/2/07 | | | 796,245 |

| 2,975 | | Chariot Funding LLC | | 5.31 | | | 1/11/07 | | | 2,970,612 |

| 2,830 | | CIT Group, Inc | | 5.24 | | | 3/9/07 | | | 2,802,401 |

See Notes to Financial Statements

8

PHOENIX MONEY MARKET SERIES

(FORMERLY PHOENIX-GOODWIN MONEY MARKET SERIES)

| | | | | | | | | | | | |

FACE VALUE (000) | | DESCRIPTION | | INTEREST RATE | | | MATURITY

DATE | | | VALUE | |

| COMMERCIAL PAPER(d)—continued | | | | | | | | | | |

| $ 1,900 | | CIT Group, Inc. | | 5.18 | % | | 5/16/07 | | | $ | 1,863,093 | |

| 3,037 | | Clipper Receivables Co. LLC | | 5.30 | | | 2/6/07 | | | | 3,020,904 | |

| 760 | | Clipper Receivables Co. LLC | | 5.26 | | | 2/15/07 | | | | 755,003 | |

| 765 | | Danske Corp. | | 5.37 | | | 1/5/07 | | | | 764,544 | |

| 3,400 | | Danske Corp. | | 5.26 | | | 1/18/07 | | | | 3,391,563 | |

| 230 | | Danske Corp. | | 5.29 | | | 1/18/07 | | | | 229,426 | |

| 3,420 | | Danske Corp. | | 5.21 | | | 4/10/07 | | | | 3,371,000 | |

| 3,500 | | Gemini Securitization LLC | | 5.26 | | | 2/9/07 | | | | 3,480,075 | |

| 2,400 | | General Electric Capital Corp. | | 5.24 | | | 2/9/07 | | | | 2,386,376 | |

| 2,700 | | General Electric Capital Corp. | | 5.23 | | | 2/15/07 | | | | 2,682,349 | |

| 3,000 | | General Electric Capital Corp. | | 5.22 | | | 3/16/07 | | | | 2,967,810 | |

| 550 | | George Street Finance LLC | | 5.29 | | | 1/16/07 | | | | 548,788 | |

| 3,500 | | George Street Finance LLC | | 5.27 | | | 1/22/07 | | | | 3,489,240 | |

| 2,000 | | George Street Finance LLC | | 5.34 | | | 1/29/07 | | | | 1,991,693 | |

| 2,000 | | George Street Finance LLC | | 5.25 | | | 3/13/07 | | | | 1,979,292 | |

| 1,405 | | Govco, Inc. | | 5.24 | | | 1/10/07 | | | | 1,403,159 | |

| 1,000 | | Govco, Inc. | | 5.27 | | | 2/26/07 | | | | 991,802 | |

| 1,900 | | Govco, Inc. | | 5.25 | | | 3/8/07 | | | | 1,881,713 | |

| 1,000 | | Govco, Inc. | | 5.26 | | | 3/14/07 | | | | 989,480 | |

| 2,500 | | Govco, Inc. | | 5.25 | | | 1/25/07 | | | | 2,491,250 | |

| 2,955 | | Harley-Davidson Funding Co. | | 5.22 | | | 2/26/07 | | | | 2,931,005 | |

| 1,005 | | Honeywell International Co. | | 5.35 | | | 1/4/07 | | | | 1,004,552 | |

| 1,000 | | International Lease Finance Corp. | | 5.24 | | | 2/15/07 | | | | 993,450 | |

| 3,000 | | Lockhart Funding LLC | | 5.24 | | | 1/24/07 | | | | 2,989,957 | |

| 2,000 | | Lockhart Funding LLC | | 5.25 | | | 2/13/07 | | | | 1,987,458 | |

| 3,300 | | Lockhart Funding LLC | | 5.26 | | | 2/23/07 | | | | 3,274,445 | |

| 1,800 | | Old Line Funding Corp. | | 5.25 | | | 1/8/07 | | | | 1,798,163 | |

| 2,600 | | Old Line Funding Corp. | | 5.25 | | | 1/12/07 | | | | 2,595,829 | |

| 2,600 | | Old Line Funding Corp. | | 5.27 | | | 2/8/07 | | | | 2,585,537 | |

| 3,000 | | Private Export Funding Corp. | | 5.21 | | | 1/25/07 | | | | 2,989,580 | |

| 3,200 | | Private Export Funding Corp. | | 5.20 | | | 3/7/07 | | | | 3,169,956 | |

| 3,065 | | Ranger Funding Co. LLC | | 5.25 | | | 1/16/07 | | | | 3,058,295 | |

| 1,893 | | Ranger Funding Co. LLC | | 5.24 | | | 2/5/07 | | | | 1,883,356 | |

| 3,100 | | Ranger Funding Co. LLC | | 5.28 | | | 2/7/07 | | | | 3,083,177 | |

| 3,485 | | Sysco Corp. | | 5.33 | | | 1/3/07 | | | | 3,483,968 | |

| 2,500 | | Sysco Corp. | | 5.23 | | | 3/8/07 | | | | 2,476,029 | |

| 2,315 | | UBS Finance Delaware LLC | | 5.26 | | | 1/12/07 | | | | 2,311,279 | |

| 5,005 | | UBS Finance Delaware LLC | | 5.24 | | | 1/26/07 | | | | 4,986,787 | |

| | | | | | | | | | | | |

| TOTAL COMMERCIAL PAPER | | | | | | | | | 124,379,628 | |

| | | | | | | | | | | | |

| MEDIUM TERM NOTES—7.8% | | | | | | | | | | |

| 3,000 | | National Australia Bank Ltd. 144A (Australia) (c) (e) (f) | | 5.32 | | | 1/8/07 | (g) | | | 3,000,000 | |

| 3,000 | | Nordea Bank AB 144A (Sweden) (c) (e) (f) | | 5.33 | | | 1/9/07 | (g) | | | 3,000,000 | |

| 1,250 | | Bank of America (MBNA) Corp. (b) | | 6.25 | | | 1/17/07 | | | | 1,250,451 | |

| 5,000 | | HSH Nordbank AG 144A (Germany) (c) (e) (f) | | 5.38 | | | 1/23/07 | (g) | | | 5,000,000 | |

| | | | | | | | | | | | |

| TOTAL MEDIUM TERM NOTES | | | | | | | | | 12,250,451 | |

| | | | | | | | | | | | |

| TOTAL INVESTMENTS—99.7% | | | | | | | | | | |

| (Identified cost $156,640,084) | | | | | | | | | 156,640,084 | (a) |

| Other assets and liabilities, net—0.3% | | | | | | | | | 518,060 | |

| | | | | | | | | | | | |

| NET ASSETS—100.0% | | | | | | | | $ | 157,158,144 | |

| | | | | | | | | | | | |

(a) | Federal Income Tax Information: At December 31, 2006, the aggregate cost of securities was the same for book and federal income tax purposes. |

(b) | The interest rate shown is the coupon rate. |

(c) | Variable or step coupon security; interest rate shown reflects the rate currently in effect. |

(d) | The rate shown is the discount rate. |

(e) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At December 31, 2006, these securities amounted to a value of $11,000,000 or 7.0% of net assets. |

(f) | The country of risk, noted parenthetically, is determined based on criteria described in Note 2G “Foreign security country determination” in the Notes to Financial Statements. |

(g) | The maturity date shown is the reset date. |

See Notes to Financial Statements

9

PHOENIX MONEY MARKET SERIES

(FORMERLY PHOENIX-GOODWIN MONEY MARKET SERIES)

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2006

| | | | |

Assets | | | | |

Investment securities at value (Identified cost $156,640,084) | | $ | 156,640,084 | |

Cash | | | 69,205 | |

Receivables | | | | |

Fund shares sold | | | 398,539 | |

Interest | | | 312,116 | |

Prepaid expenses | | | 21,029 | |

Other assets | | | 5,778 | |

| | | | |

Total assets | | | 157,446,751 | |

| | | | |

Liabilities | | | | |

Payables | | | | |

Fund shares repurchased | | | 84,783 | |

Investment advisory fee | | | 55,665 | |

Printing fee | | | 43,953 | |

Dividend distributions | | | 39,483 | |

Professional fee | | | 23,843 | |

Administration fee | | | 9,815 | |

Service fee | | | 8,868 | |

Trustee deferred compensation plan | | | 5,778 | |

Trustees’ fee | | | 5,409 | |

Other accrued expenses | | | 11,010 | |

| | | | |

Total liabilities | | | 288,607 | |

| | | | |

Net Assets | | $ | 157,158,144 | |

| | | | |

Net Assets Consist of: | | | | |

Capital paid in on shares of beneficial interest | | $ | 157,158,144 | |

| | | | |

Net Assets | | $ | 157,158,144 | |

| | | | |

Shares of beneficial interest outstanding, $1 par value, unlimited authorization | | | 15,715,878 | |

| | | | |

Net asset value and offering price per share | | $ | 10.00 | |

| | | | |

| |

STATEMENT OF OPERATIONS | | | | |

Year Ended December 31, 2006 | | | | |

| |

Investment Income | | | | |

Interest | | $ | 8,039,088 | |

| | | | |

Total investment income | | | 8,039,088 | |

| | | | |

Expenses | | | | |

Investment advisory fee | | | 642,741 | |

Financial agent fee | | | 54,221 | |

Administration fee | | | 33,706 | |

Service fee | | | 104,445 | |

Printing | | | 89,192 | |

Professional | | | 31,401 | |

Trustees | | | 26,777 | |

Custodian | | | 22,533 | |

Miscellaneous | | | 51,041 | |

| | | | |

Total expenses | | | 1,056,057 | |

Less expenses reimbursed by investment advisor | | | (9,904 | ) |

Custodian fees paid indirectly | | | (1,777 | ) |

| | | | |

Net expenses | | | 1,044,376 | |

| | | | |

Net investment income (loss) | | $ | 6,994,712 | |

| | | | |

See Notes to Financial Statements

10

PHOENIX MONEY MARKET SERIES

(FORMERLY PHOENIX-GOODWIN MONEY MARKET SERIES)

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Year Ended

December 31,

2006 | | | Year Ended

December 31,

2005 | |

From Operations | | | | | | | | |

Net investment income | | $ | 6,994,712 | | | $ | 3,856,408 | |

| | | | | | | | |

Increase (decrease) in net assets resulting from operations | | | 6,994,712 | | | | 3,856,408 | |

| | | | | | | | |

From Distributions to Shareholders | | | | | | | | |

Net investment income | | | (6,994,712 | ) | | | (3,856,408 | ) |

| | | | | | | | |

Decrease in net assets from distributions to shareholders | | | (6,994,712 | ) | | | (3,856,408 | ) |

| | | | | | | | |

From Share Transactions | | | | | | | | |

Proceeds from sales of shares (10,626,027 and 9,829,813 shares, respectively) | | | 106,260,270 | | | | 98,298,132 | |

Net asset value of shares issued from reinvestment of distributions

(699,471 and 385,641 shares, respectively) | | | 6,994,712 | | | | 3,856,408 | |

Cost of shares repurchased (10,252,807 and 11,271,888 shares, respectively) | | | (102,528,067 | ) | | | (112,718,881 | ) |

| | | | | | | | |

Increase (decrease) in net assets from share transactions | | | 10,726,915 | | | | (10,564,341 | ) |

| | | | | | | | |

Net increase (decrease) in net assets | | | 10,726,915 | | | | (10,564,341 | ) |

Net Assets | | | | | | | | |

Beginning of period | | | 146,431,229 | | | | 156,995,570 | |

| | | | | | | | |

End of period | | $ | 157,158,144 | | | $ | 146,431,229 | |

| | | | | | | | |

FINANCIAL HIGHLIGHTS

(Selected data for a share outstanding throughout the indicated period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

Net asset value, beginning of period | | $ | 10.00 | | | $ | 10.00 | | | $ | 10.00 | | | $ | 10.00 | | | $ | 10.00 | |

Income from investment operations | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.43 | | | | 0.26 | | | | 0.08 | | | | 0.07 | | | | 0.14 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.43 | | | | 0.26 | | | | 0.08 | | | | 0.07 | | | | 0.14 | |

| | | | | | | | | | | | | | | | | | | | |

Less distributions | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.43 | ) | | | (0.26 | ) | | | (0.08 | ) | | | (0.07 | ) | | | (0.14 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.43 | ) | | | (0.26 | ) | | | (0.08 | ) | | | (0.07 | ) | | | (0.14 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 10.00 | | | $ | 10.00 | | | $ | 10.00 | | | $ | 10.00 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | 4.41 | % | | | 2.58 | % | | | 0.79 | % | | | 0.68 | % | | | 1.42 | % |

Ratios/supplemental data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (thousands) | | $ | 157,158 | | | $ | 146,431 | | | $ | 156,996 | | | $ | 202,644 | | | $ | 255,759 | |

Ratio to average net assets of: | | | | | | | | | | | | | | | | | | | | |

Net operating expenses | | | 0.65 | % | | | 0.65 | % | | | 0.64 | % | | | 0.59 | % | | | 0.56 | % |

Gross operating expenses | | | 0.66 | % | | | 0.66 | % | | | 0.64 | % | | | 0.59 | % | | | 0.56 | % |

Net investment income | | | 4.35 | % | | | 2.54 | % | | | 0.77 | % | | | 0.69 | % | | | 1.41 | % |

See Notes to Financial Statements

11

THE PHOENIX EDGE SERIES FUND

NOTES TO FINANCIAL STATEMENTS

December 31, 2006

Note 1—Organization

The Phoenix Edge Series Fund (the “Fund”) is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Fund is organized with series, which are available only to the following separate accounts: Phoenix Life Variable Accumulation Account, Phoenix Life Variable Universal Life Account, PHL Variable Accumulation Account, PHLVIC Variable Universal Life Account, Phoenix Life and Annuity Variable Universal Life Account, and Phoenix Life Separate Accounts B, C, and D.

The Fund is comprised of 18 series (each a “series”) each having a distinct investment objective as outlined below:

| | |

Fund Name | | Investment Objective |

Phoenix Capital Growth Series | | Intermediate and long-term capital appreciation, with income as a |

(“Capital Growth”) | | secondary consideration. |

(f/k/a Phoenix-Engemann Capital Growth) | | |

| |

Phoenix Growth and Income Series | | Dividend growth, current income and capital appreciation. |

(“Growth and Income”) | | |

(f/k/a Phoenix-Engemann Growth and Income Series) | | |

| |

Phoenix Mid-Cap Growth Series | | Capital appreciation. |

(“Mid-Cap Growth”) | | |

| |

Phoenix Money Market Series | | As high a level of current income as is consistent with the |

(“Money Market”) | | preservation of capital and maintenance of liquidity. |

(f/k/a Phoenix-Goodwin Money Market Series) | | |

| |

Phoenix Multi-Sector Fixed Income Series | | Long-term total return. |

(“Multi-Sector Fixed Income”) | | |

(f/k/a Phoenix-Goodwin Multi-Sector Fixed Income Series) | | |

| |

Phoenix Multi-Sector Short Term Bond Series | | To provide high current income while attempting to limit changes |

(“Multi-Sector Short Term Bond”) | | in the series’ net asset value per share caused by interest |

(f/k/a Phoenix-Goodwin Multi-Sector Short Term Bond Series) | | rate changes. |

| |

Phoenix Strategic Allocation Series | | High total return over an extended period of time consistent with |

(“Strategic Allocation”) | | prudent investment risk. |

(f/k/a Phoenix-Engemann Strategic Allocation Series) | | |

| |

Phoenix-Aberdeen International Series | | High total return consistent with reasonable risk. |

(“Aberdeen International”) | | |

| |

Phoenix-Alger Small-Cap Growth Series | | Long-term capital growth. |

(“Alger Small-Cap Growth”) | | |

| |

Phoenix-Duff & Phelps Real Estate Securities Series | | Capital appreciation and income with approximately equal |

(“Duff & Phelps Real Estate Securities”) | | emphasis. |

| |

Phoenix-S&P Dynamic Asset Allocation Series: Aggressive | | Seek long-term capital growth. |

Growth | | |

(“S&P Aggressive Growth”) | | |

| |

Phoenix-S&P Dynamic Asset Allocation Series: Growth | | Seek long-term capital growth with current income as a |

(“S&P Growth”) | | secondary consideration. |

| |

Phoenix-S&P Dynamic Asset Allocation Series: Moderate | | Seek long-term capital growth and current income, with a greater |

Growth | | emphasis on capital growth. |

(“S&P Moderate Growth”) | | |

| |

Phoenix-S&P Dynamic Asset Allocation Series: Moderate | | Seek current income with capital growth as a secondary |

(“S&P Moderate”) | | consideration. |

| |

Phoenix-Sanford Bernstein Mid-Cap Value Series | | Long-term capital appreciation with current income as a |

(“Sanford Bernstein Mid-Cap Value”) | | secondary consideration. |

| |

Phoenix-Sanford Bernstein Small-Cap Value Series | | Long-term capital appreciation by investing primarily in small- |

(“Sanford Bernstein Small-Cap Value”) | | capitalization stocks that appear to be undervalued, with current |

| | income as a secondary consideration. |

| |

Phoenix-Van Kampen Comstock Series | | Long-term capital appreciation with current income as a |

(“Van Kampen Comstock”) | | secondary consideration. |

(f/k/a Phoenix-Engemann Value Equity) | | |

| |

Phoenix-Van Kampen Equity 500 Index Series | | High total return. |

(“Van Kampen Equity 500 Index”) | | |

(f/k/a Phoenix-Alliance/Bernstein Enhanced Index Series) | | |

12

THE PHOENIX EDGE SERIES FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

December 31, 2006

Note 2—Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Equity securities are valued at the official closing price (typically last sale) on the exchange on which the securities are primarily traded, or if no closing price is available, at the last bid price.

Debt securities are valued on the basis of broker quotations or valuations provided by a pricing service, which utilizes information with respect to recent sales, market transactions in comparable securities, quotations from dealers, and various relationships between securities in determining value.

As required, some securities and assets may be valued at fair value as determined in good faith by or under the direction of the Trustees.

Certain foreign common stocks may be fair valued in cases where closing prices are not readily available or are deemed not reflective of readily available market prices. For example, significant events (such as movement in the U.S. securities market, or other regional and local developments) may occur between the time that foreign markets close (where the security is principally traded) and the time that the series calculates its net asset value (generally, the close of the NYSE) that may impact the value of securities traded in these foreign markets. In these cases, information from an external vendor may be utilized to adjust closing market prices of certain foreign common stocks to reflect their fair value. Because the frequency of significant events is not predictable, fair valuation of certain foreign common stocks may occur on a frequent basis.

Certain securities held by the Fund were valued on the basis of a price provided by a principal market maker. The prices provided by the principal market makers may differ from the value that would be realized if the securities were sold. At December 31, 2006, the total value of these securities represented the following approximate percentage of net assets:

| | | |

Series | | Percentage of Net Assets | |

Multi-Sector Fixed Income | | 3.3 | % |

Multi-Sector Short Term Bond | | 5.1 | |

Short-term investments having a remaining maturity of 60 days or less are valued at amortized cost, which approximates market.

Money Market uses the amortized cost method of security valuation absent extraordinary or unusual market conditions. In the opinion of the Trustees, this represents the fair value of the securities. The Trustees monitor the deviations between the net asset value per share as determined by using available market quotations and its net asset value per share using amortized cost. If the deviation exceeds 1/2 of 1%, the Board of Trustees will consider what action, if any, should be initiated to provide fair valuation. Using this method, the series attempts to maintain a constant net asset value of $10 per share.

In September 2006, Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (“SFAS 157”), was issued and is effective for fiscal years beginning after November 15, 2007. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. Management is currently evaluating the impact the adoption of SFAS 157 will have on the Fund’s financial statement disclosures.

| B. | Security Transactions and Related Income |

Security transactions are recorded on the trade date. Dividend income is recorded on the ex-dividend date, or in the case of certain foreign securities, as soon as the series is notified. Interest income is recorded on the accrual basis. Each series amortizes premiums and accretes discounts using the effective interest method. Realized gains and losses are determined on the identified cost basis.

Each series is treated as a separate taxable entity. It is the policy of each series in the Fund to comply with the requirements of the Internal Revenue Code and to distribute substantially all of its taxable income to its shareholders. Therefore, no provision for federal income taxes or excise taxes has been made.

Certain series may be subject to foreign taxes on income, gains on investments or currency repatriation, a portion of which may be recoverable. Each series will accrue such taxes and recoveries as applicable based upon current interpretations of the tax rules and regulations that exist in the markets in which they invest.

In June 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation 48 (“FIN 48”), “Accounting for Uncertainty in Income Taxes.” This standard defines the threshold for recognizing the benefits of tax-return positions in the financial statements as “more-likely-than-not” to be sustained by the taxing authority and requires measurement of a tax position meeting the more-likely-than-not criterion, based on the largest benefit that is more than 50 percent likely to be realized. FIN 48 is effective as of the beginning of the first fiscal year beginning after December 15, 2006, with early application permitted if no interim financial

13

THE PHOENIX EDGE SERIES FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

December 31, 2006

statements have been issued. At adoption, companies must adjust their financial statements to reflect only those tax positions that are more likely-than-not to be sustained as of the adoption date. The evaluation of the impact that may result from adopting FIN 48 is in progress.

| D. | Distributions to shareholders |

Distributions are recorded by each series on the ex-dividend date. For Money Market, income distributions are recorded daily. Income and capital gain distributions are determined in accordance with income tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences may include the treatment of non-taxable dividends, market premium and discount, non-deductible expenses, expiring capital loss carryovers, foreign currency gain or loss, gain or loss on futures contracts, partnerships, operating losses and losses deferred due to wash sales. Permanent book and tax basis differences relating to shareholder distributions will result in reclassifications to capital paid in on shares of beneficial interest.

Expenses incurred by the Fund with respect to more than one series are allocated in proportion to the net assets of each series, except where allocation of direct expense to each series or an alternative allocation method can be more appropriately made. In addition to the net operating expenses that the Phoenix-S&P Asset Allocation series’ bear directly, the contract owners, as investors in the series, indirectly bear the series’ pro-rata expenses of the underlying funds in which each series invests.

| F. | Foreign currency translation |

Foreign securities and other assets and liabilities are valued using the foreign currency exchange rate effective at the end of the reporting period. Cost of investments is translated at the currency exchange rate effective at the trade date. The gain or loss resulting from a change in currency exchange rates between the trade and settlement date of a portfolio transaction is treated as a gain or loss on foreign currency. Likewise, the gain or loss resulting from a change in currency exchange rates between the date income is accrued and paid, is treated as a gain or loss on foreign currency. The Fund does not isolate that portion of the results of operations arising from either changes in exchange rates or in the market prices of securities.

| G. | Foreign security country determination |

A combination of the following criteria is used to assign the countries of risk listed in the schedules of investments: country of incorporation, actual building address, primary exchange on which the security is traded and country in which the greatest percentage of company revenue is generated.

| H. | Forward currency contracts |

Certain series may enter into forward currency contracts in conjunction with the planned purchase or sale of foreign denominated securities in order to hedge the U.S. dollar cost or proceeds. Forward currency contracts involve, to varying degrees, elements of market risk in excess of the amount recognized in the Statements of Assets and Liabilities. Risks arise from the possible movements in foreign exchange rates or if a counterparty does not perform under the contract.

A forward currency contract involves an obligation to purchase or sell a specific currency at a future date, which may be any number of days from the date of the contract agreed upon by the parties, at a price set at the time of the contract. These contracts are traded directly between currency traders and their customers. The contract is marked-to-market daily and the change in market value is recorded by each series as unrealized gain or loss. When the contract is closed or offset with the same counterparty, the series records a realized gain or loss equal to the change in the value of the contract when it was opened and the value at the time it was closed or offset.

At December 31, 2006, the Fund had entered into forward currency contracts as follows:

| | | | | | | | | | | | | | | | | |

| | | Contract to Receive | | In Exchange for | | Settlement

Date | | Value | | Net Unrealized

Appreciation

(Depreciation) | |

Multi-Sector Fixed Income | | JPY | | 71,375,850 | | USD | | 610,050 | | 2/7/07 | | $ | 603,012 | | $ | (7,038 | ) |

| | JPY | | 139,794,450 | | USD | | 1,200,983 | | 2/7/07 | | | 1,181,040 | | | (19,943 | ) |

| | JPY | | 69,523,200 | | USD | | 599,855 | | 2/14/07 | | | 587,862 | | | (11,993 | ) |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | $ | (38,974 | ) |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | Contract to Receive | | In Exchange for | | Settlement

Date | | Value | | Net Unrealized

Appreciation

(Depreciation) | |

Multi-Sector Short-Term Bond | | JPY | | 13,550,640 | | USD | | 114,724 | | 1/12/07 | | $ | 114,088 | | $ | (636 | ) |

| | JPY | | 42,683,625 | | USD | | 365,442 | | 1/24/07 | | | 359,969 | | | (5,473 | ) |

| | JPY | | 26,862,895 | | USD | | 230,781 | | 2/7/07 | | | 226,949 | | | (3,832 | ) |

| | JPY | | 10,980,900 | | USD | | 93,854 | | 2/7/07 | | | 92,771 | | | (1,083 | ) |

| | JPY | | 14,484,000 | | USD | | 124,970 | | 2/14/07 | | | 122,471 | | | (2,499 | ) |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | $ | (13,523 | ) |

| | | | | | | | | | | | | | | | | |

14

THE PHOENIX EDGE SERIES FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

December 31, 2006

| | | | | | | | | | | | | |

| | | Contract to

Receive | | In Exchange

for | | Settlement

Date | | Value | | Net Unrealized

Appreciation

(Depreciation) | |

Strategic Allocation | | JPY 38,433,150 | | USD 328,488 | | 2/7/07 | | $ | 324,698 | | $ | (3,790 | ) |

| | JPY 40,555,200 | | USD 349,915 | | 2/14/07 | | | 342,919 | | | (6,996 | ) |

| | | | | | | | | | | | | |

| | | | | | | | | | | $ | (10,786 | ) |

| | | | | | | | | | | | | |

A futures contract is an agreement between two parties to buy and sell a security at a set price on a future date. Certain series may enter into financial futures contracts as a hedge against anticipated changes in the market value of their portfolio securities. Upon entering into a futures contract, the series is required to pledge to the broker an amount of cash and/or securities equal to the “initial margin” requirements of the futures exchange on which the contract is traded. Pursuant to the contract, the series agrees to receive from or pay to the broker an amount of cash equal to the daily fluctuation in value of the contract. Such receipts or payments are known as variation margin and are recorded by the series as unrealized gains or losses. When the contract is closed, the series records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. The potential risk to the series is that the change in value of the futures contract may not correspond to the change in value of the hedged instruments.

At December 31, 2006, the series had entered into futures contracts as follows:

| | | | | | | | | | | | | | |

| | | Expiration

Date | | Number

of

Contracts | | Value of

Contracts

when

Opened | | Market

Value of

Contracts | | Unrealized

Appreciation

(Depreciation) | |

Van Kampen Equity 500 Index | | | | | | | | | | | | | | |

S&P 500® Index | | March ‘07 | | 6 | | $ | 2,140,275 | | $ | 2,143,200 | | $ | 2,925 | |

S&P 500® Index E-Mini | | March ‘07 | | 4 | | | 287,800 | | | 285,850 | | | (1,950 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | $ | 975 | |

| | | | | | | | | | | | | | |

Dividend income is recorded using management’s estimate of the income included in distributions received from the REIT investments. Distributions received in excess of this estimated amount are recorded as a reduction of the cost of investments or reclassified to capital gains. The actual amounts of income, return of capital, and capital gains are only determined by each REIT after its fiscal year-end, and may differ from the estimated amounts.

Certain series may loan securities to qualified brokers through an agreement with State Street Bank and Trust (the “Custodian”). Under the terms of the agreement, the series receives collateral with a market value not less than 100% of the market value of loaned securities. Collateral is adjusted daily in connection with changes in the market value of securities on loan. Collateral may consist of cash, securities issued or guaranteed by the U.S. Government or its agencies and the sovereign debt of foreign countries. Cash collateral is invested in a short-term money market fund. Dividends earned on the collateral and premiums paid by the borrower are recorded as income by the series net of fees and rebates charged by the Custodian for its services in connection with this securities lending program. Lending portfolio securities involves a risk of delay in the recovery of the loaned securities or in the foreclosure on collateral.

Certain series may invest in direct debt instruments, which are interests in amounts owed by a corporate, governmental, or other borrower to lenders or lending syndicates. The series’ investments in loans may be in the form of participations in loans or assignments of all or a portion of loans from third parties.

A loan is often administered by a bank or other financial institution (the lender) that acts as agent for all holders. The agent administers the terms of the loan, as specified in the loan agreement. When investing in a loan participation, the series has the right to receive payments of principal, interest and any fees to which it is entitled only from the lender selling the loan agreement and only upon receipt by the lender of payments from the borrower. The series generally has no right to enforce compliance with the terms of the loan agreement with the borrower. As a result, the series may be subject to the credit risk of both the borrower and the lender that is selling the loan agreement. When the series purchases assignments from lenders it acquires direct rights against the borrower on the loan.

15

THE PHOENIX EDGE SERIES FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

December 31, 2006

Direct indebtedness of emerging countries involves a risk that the government entities responsible for the repayment of the debt may be unable, or unwilling to pay the principal and interest when due.

| M. | When-Issued and Delayed Delivery Transactions |

Certain series may engage in when-issued or delayed delivery transactions. Each series records when-issued and delayed delivery securities on the trade date. Each series maintains collateral for the securities purchased. Securities purchased on a when-issued or delayed delivery basis begin earning interest on the settlement date.

A repurchase agreement is a transaction where a series acquires a security for cash and obtains a simultaneous commitment from the seller to repurchase the security at an agreed upon price and date. Each series, through its custodian, takes possession of securities collateralizing the repurchase agreement. The collateral is marked-to-market daily to ensure that the market value of the underlying assets remains sufficient to protect the series in the event of default by the seller. If the seller defaults and the value of the collateral declines, or if the seller enters insolvency proceedings, realization of collateral may be delayed or limited.

Certain series may invest in credit-linked notes, which are usually issued by a special purpose vehicle that is selling credit protection through a credit default swap. The performance of the notes is linked to the performance of the underlying reference obligation. The special purpose vehicle invests the proceeds from the notes to cover its contingent obligation. Credit linked notes may also have risks with default by the referenced obligation, currency and/or interest rates.

Note 3—Investment Advisory Fees and Related Party Transactions

The advisors to the Fund are Phoenix Investment Counsel, Inc. (“PIC”), Phoenix Variable Advisors, Inc. (“PVA”), and Duff & Phelps Investment Management Co. (“DPIM”). PIC is an indirect wholly-owned subsidiary of Phoenix Investment Partners, Ltd. (“PXP”). DPIM is a direct subsidiary of PXP. PXP in turn is an indirect-wholly-owned subsidiary of The Phoenix Companies, Inc. (“PNX”). PVA is a wholly-owned subsidiary of PM Holdings. Inc., which is an indirect, wholly-owned subsidiary of Phoenix Life Insurance Company (“PLIC”).

As compensation for their services to the Fund, the advisors are entitled to a fee based upon the following annual rates as a percentage of the average daily net assets of each separate series listed below:

| | | | | | | | | | | | |

Series | | Advisor | | | $250 million | | | $250 million | | | $500 million | |

Capital Growth | | PIC | | | 0.70 | % | | 0.65 | % | | 0.60 | % |

Growth and Income | | PIC | (3) | | 0.70 | | | 0.65 | | | 0.60 | |

Mid-Cap Growth | | PVA | | | 0.80 | | | 0.80 | | | 0.80 | |

Money Market | | PIC | | | 0.40 | | | 0.35 | | | 0.30 | |

Multi-Sector Fixed Income | | PIC | | | 0.50 | | | 0.45 | | | 0.40 | |

Multi-Sector Short Term Bond | | PIC | | | 0.50 | | | 0.45 | | | 0.40 | |

Strategic Allocation | | PIC | | | 0.60 | | | 0.55 | | | 0.50 | |

Aberdeen International | | PIC | | | 0.75 | | | 0.70 | | | 0.65 | |

Alger Small-Cap Growth | | PVA | | | 0.85 | | | 0.85 | | | 0.85 | |

S&P Aggressive Growth | | PVA | (1) | | 0.40 | | | 0.40 | | | 0.40 | |

S&P Growth | | PVA | (1) | | 0.40 | | | 0.40 | | | 0.40 | |

S&P Moderate Growth | | PVA | (1) | | 0.40 | | | 0.40 | | | 0.40 | |

S&P Moderate | | PVA | (1) | | 0.40 | | | 0.40 | | | 0.40 | |

Sanford Bernstein Mid-Cap Value | | PVA | | | 1.05 | | | 1.05 | | | 1.05 | |

Sanford Bernstein Small-Cap Value | | PVA | | | 1.05 | | | 1.05 | | | 1.05 | |

Van Kampen Comstock | | PVA | (2) | | 0.70 | | | 0.65 | | | 0.60 | |

Van Kampen Equity 500 Index | | PVA | | | 0.45 | | | 0.45 | | | 0.45 | |

(1) | For the period February 3, 2006 through April 30, 2006, PIC served as the advisor to the series. |

(2) | For the period January 1, 2006 through April 30, 2006, Engemann Asset Management (“EAM”) served as the advisor to the series. |

(3) | For the period January 1, 2006 through October 22, 2006, EAM served as the advisor to the series. |

| | | | | | | | | | |

| | | | | Rate for first

$1 Billion | | | Rate for next

$1 Billion | | | Rate for over

$2 Billion |

Duff & Phelps Real Estate Securities | | DPIM | | 0.75 | % | | 0.70 | % | | 0.65 |

16

THE PHOENIX EDGE SERIES FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

December 31, 2006

Pursuant to a subadvisory agreement with the Fund, certain advisors delegate certain investment decisions and/or research functions with respect to the following series to the subadvisor indicated, for which each is paid a fee by the respective advisor.

| | |

Series | | Subadvisor |

Capital Growth(1) | | Harris Investment Management, Inc. (“Harris”) |

Mid-Cap Growth | | Bennett Lawrence Management LLC (“Bennett Lawrence”) |

Aberdeen International | | Aberdeen Asset Management Inc. (“Aberdeen”) |

Alger Small-Cap Growth | | Fred Alger Management, Inc. (“Alger”) |

S&P Aggressive Growth | | Standard & Poor’s Investment Advisory Services LLC (“SPIAS”) |

S&P Growth | | Standard & Poor’s Investment Advisory Services LLC (“SPIAS”) |

S&P Moderate Growth | | Standard & Poor’s Investment Advisory Services LLC (“SPIAS”) |

S&P Moderate | | Standard & Poor’s Investment Advisory Services LLC (“SPIAS”) |

Sanford Bernstein Mid-Cap Value | | AllianceBernstein, L.P. (“Alliance”) |

Sanford Bernstein Small-Cap Value | | AllianceBernstein, L.P. (“Alliance”) |

Van Kampen Comstock | | Morgan Stanley Investment Management Inc. dba Van Kampen

(“Van Kampen”) |

Van Kampen Equity 500 Index(2) | | Morgan Stanley Investment Management Inc. dba Van Kampen

(“Van Kampen”) |

(1) | For the period of January 1, 2006 through June 22, 2006, EAM was the subadvisor to this series. |

(2) | For the period of January 1, 2006 through August 31, 2006, Alliance was the subadvisor to this series. |

PIC and PVA employ subadvisors to furnish portfolio management services to the series, subject to Investment Subadvisory Agreements.

For the period January 1, 2006 through October 22, 2006, with respect to the equity portion of Strategic Allocation, EAM was the subadvisor to the series. Effective October 23, 2006, PIC manages the equity portion of the series.

Effective September 1, 2006, the advisors (excluding management and distribution fees, interest, taxes, brokerage fees and commissions) have contractually agreed to reimburse expenses of the Fund, to the extent that such expenses exceed the operating expenses of the series’ average net assets (the “expense caps”) until December 31, 2007 as listed in the chart below.

| | | |

Series | | Maximum Operating

Expense | |

Capital Growth | | 0.25 | % |

Growth and Income | | 0.15 | (2) |

Mid-Cap Growth | | 0.30 | (3) |

Money Market | | 0.25 | |

Multi-Sector Fixed Income | | 0.25 | |

Multi-Sector Short Term Bond | | 0.20 | |

Strategic Allocation | | 0.25 | |

Aberdeen International | | 0.30 | (2) |

Alger Small-Cap Growth | | 0.15 | |

Duff & Phelps Real Estate Securities | | 0.35 | |

S&P Aggressive Growth | | 0.05 | (1) |

S&P Growth | | 0.05 | (1) |

S&P Moderate Growth | | 0.05 | (1) |

S&P Moderate | | 0.05 | (1) |

Sanford Bernstein Mid-Cap Value | | 0.25 | |

Sanford Bernstein Small-Cap Value | | 0.25 | |

Van Kampen Comstock | | 0.25 | |

Van Kampen Equity 500 Index | | 0.15 | (3) |

(1) | The Advisor has contractually agreed to reimburse certain operating expenses for the series until December 31, 2007. |

(2) | For the period of January 1, 2006 through August 31, 2006, the maximum operating expense was 0.10% higher than the rate shown in the table above. |

(3) | For the period of January 1, 2006 through August 31, 2006, the maximum operating expense was 0.05% higher than the rate shown in the table above. |

Effective July 1, 2006, Phoenix Equity Planning Corporation (“PEPCO”), an indirect majority-owned subsidiary of PNX, serves as the Administrator to the Fund. PEPCO receives an administration fee at an annual rate of 0.09% of the first $5 billion, 0.08% on the next $10 billion, and 0.07% over $15 billion of the average net assets across all non-money market funds in the Phoenix Funds and The Phoenix Edge Series Fund. For the money market funds, the fee is 0.035% of the average net assets across all Phoenix money market funds within the Phoenix Funds Family.

Until June 30, 2006, PEPCO served as Financial Agent to the Fund. PEPCO received a financial agent fee equal to the sum of (1) the documented cost of fund accounting and related services provided by PFPC, Inc., as subagent, to Financial Agent, plus (2) the documented cost to Financial Agent to provide tax services and oversight of subagent’s performance. For the fiscal year (the “period”) ended December 31, 2006, the Fund incurred administration and/or financial agent fees totaling $1,770,841.

17

THE PHOENIX EDGE SERIES FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

December 31, 2006

Pursuant to a Service Agreement, Phoenix Life Insurance Company (“PLIC”), a wholly-owned subsidiary of PNX, receives a service fee at the annual rate of 0.065% of the average daily net assets of each series for providing certain stock transfer and accounting services for each series. For the period ended December 31, 2006, the Fund paid PLIC $1,471,678.

PEPCO serves as the distributor to the Phoenix-S&P Series’ shares. For its services each Phoenix-S&P Series pays PEPCO distribution and/or service fees at an annual rate not to exceed 0.25% of the average daily net assets of each respective Phoenix-S&P Series.

At December 31, 2006, PLIC and its affiliates held shares in the Fund which aggregate the following:

| | | | | |

| | | Shares | | Aggregate

Net Asset

Value |

S&P Aggressive Growth | | 20,202 | | $ | 225,225 |

S&P Growth | | 20,240 | | | 219,950 |

S&P Moderate Growth | | 20,292 | | | 217,559 |

S&P Moderate | | 20,299 | | | 211,384 |

The Fund provides a deferred compensation plan for its disinterested trustees. Under the deferred compensation plan, disinterested trustees may elect to defer all or a portion of their compensation. Amounts deferred are retained by the Fund, and to the extent permitted by the 1940 Act, as amended, and then, in turn, may be invested in the shares of unaffiliated mutual funds selected by the disinterested trustees. Investments in such unaffiliated mutual funds are included in “Other” assets on the Statement of Assets and Liabilities at December 31, 2006. As of December 31, 2006, the aggregate value of such investments is $94,818.

Note 4—Purchases and Sales of Securities

Purchases and sales of securities (excluding U.S. Government and agency securities, short-term securities, futures contracts, and forward currency contracts) during the period ended December 31, 2006, were as follows:

| | | | | | |

| | | Purchases | | Sales |

Capital Growth | | $ | 746,995,027 | | $ | 825,295,178 |

Growth and Income | | | 54,033,637 | | | 60,760,751 |

Mid-Cap Growth | | | 43,654,012 | | | 55,651,832 |

Money Market | | | 9,499,631 | | | — |

Multi-Sector Fixed Income | | | 158,472,426 | | | 157,307,512 |

Multi-Sector Short Term Bond | | | 28,998,326 | | | 26,433,425 |

Strategic Allocation | | | 241,071,378 | | | 294,947,339 |

Aberdeen International | | | 143,442,336 | | | 139,074,948 |

Alger Small-Cap Growth | | | 48,796,569 | | | 53,094,985 |

Duff & Phelps Real Estate Securities | | | 48,651,373 | | | 45,414,389 |

S&P Aggressive Growth | | | 16,549,340 | | | 6,020,711 |

S&P Growth | | | 20,376,277 | | | 8,040,448 |

S&P Moderate Growth | | | 13,160,382 | | | 4,259,429 |

S&P Moderate | | | 5,139,737 | | | 1,384,919 |

Sanford Bernstein Mid-Cap Value | | | 65,523,084 | | | 67,140,452 |

Sanford Bernstein Small-Cap Value | | | 41,422,709 | | | 42,437,983 |

Van Kampen Comstock | | | 106,453,283 | | | 128,149,474 |

Van Kampen Equity 500 Index | | | 80,658,562 | | | 100,060,805 |

Purchases and sales of long-term U.S. Government and agency securities during the period ended December 31, 2006, were as follows:

| | | | | | |

| | | Purchases | | Sales |

Multi-Sector Fixed Income | | $ | 63,259,103 | | $ | 58,719,256 |

Multi-Sector Short Term Bond | | | 11,415,202 | | | 13,784,671 |

Strategic Allocation | | | 37,265,696 | | | 44,434,864 |

Note 5—Credit Risk and Asset Concentrations

In countries with limited or developing markets, investments may present greater risks than in more developed markets and the prices of such investments may be volatile. The consequences of political, social or economic changes in these markets may have disruptive effects on the market prices of these investments and the income they generate, as well as a series’ ability to repatriate such amounts.

Certain series may invest a high percentage of their assets in specific sectors of the market in their pursuit of a greater investment return. Fluctuations in these sectors of concentration may have a greater impact on a series, positive or negative, than if a series did not concentrate its investments in such sectors.

18

THE PHOENIX EDGE SERIES FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

December 31, 2006

At December 31, 2006, the series held securities in specific sectors as detailed below:

| | | | | |

Series | | Sector | | Percentage of Total Net Assets | |

| Growth and Income | | Financials | | 25 | % |

| Mid-Cap Growth | | Information Technology | | 26 | |

| Sanford Bernstein Mid-Cap Value | | Financials | | 26 | |

| Sanford Bernstein Small-Cap Value | | Financials | | 27 | |

| Van Kampen Comstock | | Financials | | 27 | |

High yield/high risk securities typically entail greater price volatility and/or principal and interest rate risk. There is a greater chance that an issuer will not be able to make principal and interest payments on time. Analysis of the creditworthiness of issuers of high yield securities may be complex, and as a result, it may be more difficult for the advisors and/or subadvisors to accurately predict risk.

Note 6—Illiquid and Restricted Securities

Investments shall be considered illiquid if they cannot be disposed of in seven days in the ordinary course of business at the approximate amount at which such securities have been valued by the series. Additionally, the following information is also considered in determining illiquidity: the frequency of trades and quotes for the investment, whether the investment is listed for trading on a recognized domestic exchange and/or whether two or more brokers are willing to purchase or sell the security at a comparable price, the extent of market making activity in the investment and the nature of the market for investment. Illiquid securities are noted as such at the end of each series’ Schedule of Investments where applicable.

Restricted securities are illiquid securities, as defined above, not registered under the Securities Act of 1933. Generally, 144A securities are excluded from this category, except where defined as illiquid.

At December 31, 2006, the Fund held the following restricted securities:

| | | | | | | | | | | |

| | | Acquisition Date | | Acquisition Cost | | Market

Value | | % of Net Assets

at December 31, 2006 | |

Multi-Sector Fixed Income | | | | | | | | | | | |

Candescent Technologies Corp. Cv

144A 8%, 5/1/03 | | 3/6/00 | | $ | 40,000 | | $ | 0 | | 0 | % |

Strategic Allocation | | | | | | | | | | | |

ITW Cupids Financing Trust I

144A 6.55%, 12/31/11 | | 4/18/02 | | | 1,996,980 | | | 2,082,706 | | 0.7 | |

Alger Small-Cap Growth | | | | | | | | | | | |

Autobytel, Inc | | 6/20/03 | | | 20,288 | | | 13,150 | | 0 | |

Van Kampen Equity 500 Index | | | | | | | | | | | |

Seagate Technology Tax Refund Rights | | 11/22/00 | | | 0 | | | 0 | | 0 | |

Each series will bear any costs, including those involved in registration under the Securities Act of 1933, in connection with the disposition of such securities.

Note 7—Indemnifications

Under the series’ organizational documents, its trustees and officers are indemnified against certain liabilities arising out of the performance of their duties to the series. In addition, the series enter into contracts that contain a variety of indemnifications. The series’ maximum exposure under these arrangements is unknown. However, the Fund has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

Note 8—Regulatory Exams

Federal and state regulatory authorities from time to time make inquiries and conduct examinations regarding compliance by The Phoenix Companies, Inc. and its subsidiaries (collectively “the Company”) with securities and other laws and regulations affecting their registered products. During 2004 and 2005, the Boston District Office of the Securities and Exchange Commission (“SEC”) conducted an examination of the Company’s investment company and investment adviser affiliates. Following the examination, the staff of the Boston District Office issued a deficiency letter noting perceived weaknesses in procedures for monitoring trading to prevent market timing activity prior to 2004. The staff requested the Company to conduct an analysis as to whether shareholders, policyholders and contract holders who invested in the funds that may have been affected by undetected market timing activity had suffered harm and to advise the staff whether the Company believes reimbursement is necessary or appropriate under the circumstances. Market timing is an investment technique involving frequent short-term trading of mutual fund shares that is designed to exploit market movements or inefficiencies in the way mutual fund companies price their shares. A third party was retained to assist the Company in preparing the analysis. In 2005, based on the third party analysis the Company notified the staff at the SEC Boston District Office that reimbursements were not appropriate under the circumstances. The Company does not believe that the outcome of this matter will be material to these financial statements.

19

THE PHOENIX EDGE SERIES FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

December 31, 2006

Note 9—Federal Income Tax Information

The following series have capital loss carryovers which may be used to offset future capital gains.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Expiration Year |

| | | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | | 2014 | | Total |

Capital Growth | | | — | | | — | | $ | 211,269,784 | | $ | 84,341,763 | | $ | 5,973,373 | | $ | 2,820,243 | | | — | | | — | | $ | 304,405,163 |

Growth and Income | | | — | | | — | | | — | | | 1,919,085 | | | 5,418,582 | | | — | | | — | | | — | | | 7,337,667 |

Mid-Cap Growth | | | — | | $ | 60,050,708 | | | 39,729,684 | | | 16,035,347 | | | | | | | | $ | 980,825 | | | — | | | 116,796,564 |

Multi-Sector Fixed Income | | $ | 135,565 | | | 6,659,630 | | | 4,980,791 | | | 7,850,329 | | | — | | | — | | | — | | | — | | | 19,626,315 |

Multi-Sector Short

Term Bond | | | | | | | | | | | | | | | 18,992 | | | 171,793 | | | 158,707 | | $ | 167,631 | | | 517,123 |

Strategic Allocation | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — |

Aberdeen International | | | — | | | — | | | — | | | — | | | 7,445,260 | | | — | | | — | | | — | | | 7,445,260 |

Alger Small-Cap Growth | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — |

Duff & Phelps Real

Estate Securities | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — |

S&P Aggressive Growth | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 9,598 | | | 9,598 |

S&P Growth | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 24,010 | | | 24,010 |

S&P Moderate Growth | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — |

S&P Moderate | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 2,051 | | | 2,051 |

Sanford Bernstein

Mid-Cap Value | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — |

Sanford Bernstein

Small-Cap Value | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — |

Van Kampen Comstock | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — |

Van Kampen Equity

500 Index | | | — | | | — | | | — | | | 9,710,619 | | | 8,593,478 | | | 574,626 | | | 1,188,323 | | | | | | 20,067,046 |

Included in the Capital Growth amounts are $6,011,292 and $32,228,924, respectively, which were acquired in connection with the mergers of the Engemann Nifty Fifty Series on April 5, 2002 and AIM Growth, on October 27, 2006.

Included in the Growth and Income amounts are $6,488 and $303,453, respectively, which were acquired in connection with the mergers of the MFS Investors Trust Series and Alliance/Bernstein Growth & Value Series on September 17, 2004.

Included in the Mid-Cap Growth amounts are $88,351,165, which were acquired in connection with the merger of the Strategic Theme Series on October 27, 2006.

Included in the Van Kampen Equity 500 Index amounts are $729,773 and $2,722,300, respectively, which were acquired in connection with the mergers of the Northern Dow 30 Series and Northern Nasdaq-100 Index Series on October 27, 2006.

A series may not realize the benefit of these losses to the extent it does not realize gains on investments prior to the expiration of the capital loss carryovers.

The following series utilized losses deferred in prior years against current year capital gains as follows:

| | | |

Capital Growth | | $ | 51,382,377 |

Growth and Income | | | 3,452,935 |

Mid-Cap Growth | | | 476,342 |

Multi-Sector Fixed Income | | | 842,036 |

Aberdeen International | | | 28,715,906 |

Alger Small-Cap Growth | | | 2,253,947 |

Van Kampen Comstock | | | 1,311,866 |

Van Kampen Equity 500 Index | | | 9,044,207 |

Under current tax law, foreign currency and capital losses realized after October 31 may be deferred and treated as occurring on the first day of the following tax year. For the period ended December 31, 2006, the following series deferred and/or recognized post October losses as follows:

| | | | | | | | | | | | |

Series | | Capital

Deferred | | Capital

Recognized | | Currency

Deferred | | Currency

Recognized |

Mid-Cap Growth | | $ | 17,508 | | | — | | | — | | | — |

Multi-Sector Fixed Income | | | — | | $ | 185,847 | | $ | 111,258 | | $ | 289,184 |

Multi-Sector Short Term Bond | | | 5,333 | | | 44,414 | | | — | | | 101,921 |

Strategic Allocation | | | — | | | — | | | 17,426 | | | 114,841 |

Aberdeen International | | | — | | | — | | | 6,685 | | | 36,915 |

Alger Small-Cap Growth | | | — | | | 258,832 | | | — | | | — |

20

THE PHOENIX EDGE SERIES FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

December 31, 2006

The components of distributable earnings on a tax basis, (excluding unrealized appreciation (depreciation), which are disclosed in the respective schedule of investments), consist of undistributed ordinary income and undistributed long-term capital gains as follows:

| | | | | | |

| | | Undistributed

Ordinary

Income | | Undistributed

Long-Term

Capital Gains |

Capital Growth | | $ | 226,129 | | | — |

Growth and Income | | | 47,025 | | | — |

Mid-Cap Growth | | | — | | | — |

Money Market | | | 3,905 | | | — |

Multi-Sector Fixed Income | | | 888,333 | | | — |

Multi-Sector Short Term Bond | | | 197,594 | | | — |

Strategic Allocation | | | 2,517,264 | | $ | 2,096,985 |

Aberdeen International | | | 1,415,002 | | | — |