UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05639

Pacholder High Yield Fund, Inc.

(Exact name of registrant as specified in charter)

8044 Montgomery Road, Ste. 555

Cincinnati, OH 45236

(Address of principal executive offices) (Zip code)

Gary J. Madich

8044 Montgomery Road, Ste. 555

Cincinnati, OH 45236

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (513) 985-3200

Date of fiscal year end: December 31

Date of reporting period: January 1, 2007 through December 31, 2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

PACHOLDER HIGH YIELD FUND, INC.

Directors and Officers

| | |

Gary J. Madich, CFA President Patricia A. Maleski Vice President and Chief Administrative Officer Stephanie J. Dorsey Treasurer Penny Grandominico Chief Compliance Officer Jessica K. Ditullio Secretary | | John F. Williamson Chairman and Director George D. Woodard Director Daniel A. Grant Director William J. Morgan Director |

Investment Objective

A closed-end fund seeking a high level of total return

through current income and capital appreciation by

investing primarily in high-yield, fixed income securities

of domestic companies.

Investment Advisor

J.P. Morgan Investment Management Inc.

Administrator

JPMorgan Funds Management, Inc.

Custodian

JPMorgan Chase Bank, N.A.

Transfer Agent

Computershare Investor Services, LLC

Legal Counsel

Kirkpatrick & Lockhart Preston Gates Ellis LLP

Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP

Executive Offices

Pacholder High Yield Fund, Inc.

8044 Montgomery Road

Suite 555

Cincinnati, Ohio 45236

Shareholder Services

(877) 217-9502

Please visit our web site, www.phf-hy.com, for information on the Fund’s NAV, share price, news releases, and SEC filings. We created this site to provide stockholders quick and easy access to the timeliest information available regarding the Fund.

This report is for the information of stockholders of Pacholder High Yield Fund, Inc. It is not a prospectus, offering circular or other representation intended for use in connection with the purchase or sale of shares of the Fund or any securities mentioned in this report.

PACHOLDER HIGH YIELD FUND, INC.

ANNUAL REPORT

DECEMBER 31, 2007

PACHOLDER HIGH YIELD FUND, INC.

(Unaudited)

Dear Stockholders:

Fourth Quarter and Annual Overview

For the year ended December 31, 2007, the Fund posted a 1.36% net-of-fees net asset value (NAV) return (i.e., net of expenses, including preferred stock dividends, and the effect of the Fund’s leveraged capital structure) and a 4.23% gross-of-fees NAV return (gross of leverage, fees and expenses), compared to the -5.37% average total return of the Morningstar Closed-End High Yield Category and the 2.54% return of the Credit Suisse High Yield Index, Developed Countries Only (the “Index”).

Further sub-prime related concerns triggered the credit markets’ deepest and longest sell-off in five years during the second half of 2007. Despite a strong first half and a couple of abbreviated rallies, the Index gained only 2.54%, the lowest return since 2002. In this environment of general risk avoidance, U.S. Treasury securities outperformed other U.S. fixed income sectors. Treasury-sensitive or less cyclical sectors generally submitted the best results within the markets, with healthcare, utilities and metals/minerals leading the way. Negative returns were generally produced by sectors exposed to the declining housing or sub-prime markets. Financials, housing and consumer durables dropped furthest within the market.

Performance benefited from one of the Fund’s total return investments and an underweight in the housing and building materials sector. Detractors from performance included an underweight in BB-rated securities and certain total return investments that lagged the market in the second half of the year. The Fund’s allocation to leveraged loans (which historically have performed better than high yield in down markets) did not perform as expected during the year ended December 31, 2007, as leveraged loans slightly underperformed the high-yield market. This performance was due, in part, to new issues of loans that Wall Street firms were not able to sell into the market.

The Fund posted a -2.83% net-of-fees return and a -1.51% gross-of-fees return for the fourth quarter ended December 31, 2007, outperforming the -5.25% average total return of the Morningstar Closed-End High Yield Category and underperforming the Index’s -1.11% total return. Performance during the quarter was very mixed; the Index posted a 1.24% return in October, as the stock market hit new all-time highs and the credit markets briefly rallied. However, November and December Index results of -2.56% and -0.17% clearly showed that the markets were not out of the woods, as headlines and continued housing and financial sector issues took their toll on equity and credit markets in general. Results for broad equity indexes during the fourth quarter were indicative of the equity markets’ concerns about a slowing economy and credit markets. The Russell 2000, S&P 500, NASDAQ Composite and Dow Jones Industrial Indexes returned -4.58%, -3.33%, -1.62% and -3.91%, respectively.

The trailing 12-month issuer default rate for below-investment-grade issuers, as measured by Moody’s Investors Service, closed 2007 at 0.9%, down from 1.7% at the end of 2006. Continued economic growth, strong corporate profits, low interest rates and abundant liquidity in the capital markets combined to keep the default rate low. Moody’s currently believes that the trailing 12-month default rate will rise to 4.8% by the end of 2008, which is just below its historical average of 5%.

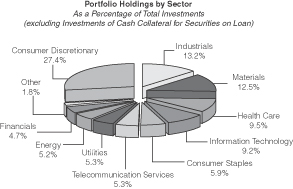

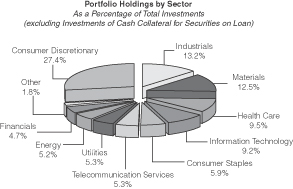

During the fourth quarter, only six of the Index’s 19 industry sectors posted positive results. Industry sectors of the high-yield market that performed relatively well were healthcare, utilities and aerospace. Sectors that provided weak relative performance included financials, housing and transportation (auto). The Fund is well diversified, with investments in 184 issuers from 48 different industries. As of December 31, 2007, the Fund’s largest industry concentration was in media, which accounted for 10.8% of the Fund’s total market value (excluding investments of cash collateral for securities loaned).

In the fourth quarter, intermediate Treasury rates dropped between 56 and 78 basis points (bps). The average price of the Index dropped 3.34 points from 97.37 to 94.03, the average yield rose 96 bps from 8.54% to 9.50% and the spread over the comparable Treasury widened 168 bps from 423 to 591.

The principal factors that determine the income available for common shares are the yield on the Fund’s investment portfolio, the number of defaults in the Fund’s portfolio, the cost of the preferred share dividends and the Fund’s expenses. From 2004 to mid-2007, issuers refinancing at lower yields generally lowered the yield earned by the Fund and other high-yield investors. The Fund’s income was helped during this time period due to default rates being well below the long-term historical average of approximately 5%.

Over the last several weeks, a number of auctions for preferred shares of closed-end funds and other issuers have failed including the auctions for the Fund’s auction rate preferred shares (“Preferred Shares”). A “failed auction” occurs when there are not enough buyers to match with sellers at the auction. Holders of preferred shares who wish to sell may not be able to do so until there is a successful auction with sufficient demand for the shares. In addition, a failed auction may increase the cost of the Fund’s leverage and impact the income available for the Fund’s common stockholders. A failed auction is not a default event. Preferred stockholders continue to receive dividends at the maximum rate set on the date of the failed auction, and their “liquidation preference” of $25,000 per share (plus accumulated but unpaid dividends, if any) is unaffected. The maximum rate is based on the rating assigned to the Fund’s preferred shares and may range from 150% to 275% of the “AA” Financial

PACHOLDER HIGH YIELD FUND, INC.

(Unaudited)

Composite Commercial Paper Rate. Based on the current credit ratings assigned to the Preferred Shares, the maximum rate is equal to 150% of the “AA” Financial Composite Commercial Paper Rate on the date of the auction and was 4.368% for the auction held on February 27, 2008.

Portfolio Strategy and Outlook

We are continuing the Fund’s dual strategy of increasing positions with lower credit volatility, such as senior secured loans (12.4% portfolio weighting), while also selectively investing in total return opportunities. The investment team continues to cull the portfolio of issues with poor structure (diminished amount of leverage, lack of adequate covenant protection, etc.) and eliminate credits deemed to be over-valued or not hitting operating performance expectations.

The portfolio management team continues to focus on securities that we believe are better able to handle a slowing economy predicated on bottom-up fundamental analysis of the individual issuers and securities available in the market.

As always, we appreciate your interest in the Fund and look forward to your continued support.

Sincerely,

Gary J. Madich, CFA

President

February 28, 2008

Portfolio Holdings Availability

The Fund’s monthly portfolio holdings are available on our website (www.phf-hy.com) no sooner than 10 days after each month end.

The performance quoted is past performance and is not a guarantee of future results. Closed-end funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown.

JPMorgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase & Co. Those businesses include, but are not limited to, J.P. Morgan Investment Management Inc., JPMorgan Investment Advisors, Inc., Security Capital Research & Management Incorporated and J.P. Morgan Alternative Asset Management, Inc.

Securities rated below investment grade are called “high-yield bonds,” “non-investment grade bonds,” “below investment-grade bonds,” or “junk bonds.” They generally are rated in the fifth or lower rating categories of Standard & Poor’s and Moody’s Investors Service. Although these securities tend to provide higher yields than higher rated securities, there is a greater risk that the Fund’s share value will decline. Because this Fund primarily invests in bonds, it is subject to interest rate risks. Bond prices generally fall when interest rates rise.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Figure 1

PACHOLDER HIGH YIELD FUND, INC.

Statement of Net Assets Applicable to Common Stockholders

December 31, 2007

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

CORPORATE DEBT SECURITIES — 126.6% | | | | | | |

AEROSPACE & DEFENSE — 0.2% | | | | | | |

L-3 Communications Corp., Sr Nt, 6.38%, 10/15/15 | | $ | 250 | | $ | 246,250 | | 0.2 | % |

| | | | | | | | | |

AIRLINES — 4.7% | | | | | | |

American Airlines, Inc., Collateral Trust Notes, 10.18%, 1/2/13 | | | 1,296 | | | 1,290,472 | | 1.1 | |

American Airlines, Inc., Pass Thru Cert, 7.379%, 5/23/16 | | | 564 | | | 524,081 | | 0.4 | |

American Airlines, Inc., Private Placement, Nt,

3.363%, 10/18/099

10.32%, 7/30/142 | |

| 572

750 | |

| 538,135

742,500 | | 0.4

0.6 |

|

Continental Airlines, Inc., Pass Thru Cert, 9.798%, 4/1/2110 | | | 1,844 | | | 1,871,814 | | 1.6 | |

Continental Airlines, Inc., Unsubordinated, 8.75%, 12/1/116 | | | 250 | | | 235,625 | | 0.2 | |

Delta Air Lines, Inc.,

8.30%, 12/15/291,4,6 | | | 1,500 | | | 71,250 | | 0.1 | |

Delta Air Lines, Inc.,

10.125%, 5/15/101,4 | | | 500 | | | 23,750 | | 0.0 | |

United Airlines, Inc., FRN,

7.64%, 7/2/142 | | | 200 | | | 177,000 | | 0.2 | |

United Airlines, Inc., Private Placement, Nt, 7.336%, 7/2/192 | | | 100 | | | 92,500 | | 0.1 | |

| | | | | | | | | |

| | | | | | 5,567,127 | | 4.7 | |

AUTO COMPONENTS — 2.9% | | | | | | |

Delphi Corp., 7.125% 5/1/291,4,6 | | | 725 | | | 442,250 | | 0.4 | |

JB Poindexter & Co., Inc., Co Guar, 8.75%, 3/15/1410 | | | 2,584 | | | 2,164,100 | | 1.8 | |

Lear Corp., Sr Nt, 8.75%, 12/1/16 | | | 960 | | | 873,600 | | 0.7 | |

| | | | | | | | | |

| | | | | | 3,479,950 | | 2.9 | |

AUTOMOBILES — 4.6% | | | | | | |

Ford Motor Co., Debentures,

7.13%, 11/15/25 | | | 400 | | | 274,000 | | 0.2 | |

Ford Motor Co., Nt,

7.45%, 7/16/3110

9.98%, 2/15/4710 | |

| 1,850

750 | |

| 1,373,625

618,750 | | 1.2

0.5 |

|

General Motors Corp., Debentures, 8.10%, 6/15/2410

8.375%, 7/15/336 | |

| 2,075

2,000 | |

| 1,514,750

1,610,000 | | 1.3

1.4 |

|

| | | | | | | | | |

| | | | | | 5,391,125 | | 4.6 | |

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

BEVERAGES — 0.2% | | | | | | |

Constellation Brands, Inc., Sr Nt, 8.375% 12/15/14 | | $ | 250 | | $ | 250,625 | | 0.2 | % |

| | | | | | | | | |

BUILDING PRODUCTS — 0.5% | | | | | | |

Associated Materials, Inc., Sr Nt, 11.25%, 3/1/146,7 | | | 400 | | | 256,000 | | 0.2 | |

Interline Brands, Inc., Sr Sub Nt, 8.125%, 6/15/14 | | | 350 | | | 346,500 | | 0.3 | |

| | | | | | | | | |

| | | | | | 602,500 | | 0.5 | |

CHEMICALS — 5.0% | | | | | | |

Mosaic Co., (The), Private

Placement, Sr Nt,

7.625%, 12/1/142

7.875%, 12/1/162 | |

| 125

125 | |

| 133,750

135,000 | | 0.1

0.1 |

|

PolyOne Corp., Nt, 8.875%, 5/1/1210 | | | 2,500 | | | 2,543,750 | | 2.1 | |

Quality Distribution LLC/QD Capital Corp., Co Guar,

9.00%, 11/15/109 | | | 1,250 | | | 1,062,500 | | 1.0 | |

Quality Distribution LLC/QD Capital Corp., FRN, Co Guar,

9.743%, 1/15/129 | | | 850 | | | 765,000 | | 0.6 | |

Sterling Chemicals, Inc., Private Placement, 10.25%, 4/1/152 | | | 850 | | | 850,000 | | 0.7 | |

Terra Capital, Inc., Series B, Sr Nt, 7.00%, 2/1/17 | | | 525 | | | 513,188 | | 0.4 | |

| | | | | | | | | |

| | | | | | 6,003,188 | | 5.0 | |

COMMERCIAL SERVICES & SUPPLIES — 3.4% | | | | | | |

Cenveo Corp., Sr Sub Nt,

7.875%, 12/1/136 | | | 325 | | | 289,656 | | 0.2 | |

Harland Clarke Holdings Corp.,

9.62%, 5/15/156 | | | 450 | | | 389,250 | | 0.3 | |

Harland Clarke Holdings Corp., FRN,

9.619%, 5/15/15 | | | 200 | | | 167,500 | | 0.1 | |

Phoenix Color Corp., Sr Sub Nt,

13.00%, 2/1/0910 | | | 2,030 | | | 2,017,313 | | 1.7 | |

Quebecor World Capital Corp. (Canada), Private Placement, Sr Nt,

8.75%, 3/15/162,10 | | | 250 | | | 184,063 | | 0.2 | |

3

PACHOLDER HIGH YIELD FUND, INC.

Statement of Net Assets Applicable to Common Stockholders (continued)

December 31, 2007

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

COMMERCIAL SERVICES & SUPPLIES (continued) | |

Quebecor World Capital Corp. (Canada), Sr Nt, 6.125%, 11/15/1310 | | $ | 850 | | $ | 661,938 | | 0.6 | % |

Quebecor World, Inc. (Canada), Private Placement, Sr Nt,

9.75%, 1/15/152,10 | | | 450 | | | 338,063 | | 0.3 | |

| | | | | | | | | |

| | | | | | 4,047,783 | | 3.4 | |

CONSTRUCTION ENGINEERING — 0.6% | | | | | | |

United Rentals North America, Inc., Co Guar, 6.50%, 2/15/12 | | | 750 | | | 680,625 | | 0.6 | |

| | | | | | | | | |

CONSUMER FINANCE — 4.8% | | | | | | |

ACE Cash Express, Inc., Private Placement, Sr Nt,

10.25%, 10/1/142 | | | 1,000 | | | 965,000 | | 0.8 | |

Ford Motor Credit Co., FRN,

7.99%, 1/13/12 | | | 300 | | | 251,989 | | 0.2 | |

Ford Motor Credit Co., Nt,

8.00%, 12/15/1610

8.625%, 11/1/1010 | |

| 1,400

1,330 | |

| 1,189,175

1,234,175 | | 1.0

1.0 |

|

Ford Motor Credit Co., Sr Nt,

9.75%, 9/15/10 | | | 250 | | | 238,551 | | 0.2 | |

GMAC LLC,

6.625%, 5/15/1210

8.00%, 11/1/31 | |

| 250

1,925 | |

| 207,829

1,614,834 | | 0.2

1.4 |

|

| | | | | | | | | |

| | | | | | 5,701,553 | | 4.8 | |

CONSUMER PRODUCTS — 2.8% | | | | | | |

Jarden Corp., 7.50%, 5/1/176 | | | 800 | | | 688,000 | | 0.6 | |

Southern States Coop, Inc., Private Placement, Sr Nt,

11.00%, 11/1/102 | | | 750 | | | 780,000 | | 0.7 | |

Spectrum Brands, Inc., Sr Nt,

7.375%, 2/1/156 | | | 1,700 | | | 1,258,000 | | 1.0 | |

True Temper Sports, Inc., Sr Nt,

8.375%, 9/15/11 | | | 990 | | | 598,950 | | 0.5 | |

| | | | | | | | | |

| | | | | | 3,324,950 | | 2.8 | |

CONTAINERS & PACKAGING — 4.7% | | | | | | |

Berry Plastics Holding Corp., Nt,

8.875%, 9/15/146 | | | 500 | | | 475,000 | | 0.4 | |

Cascades, Inc., (Canada), Sr Nt,

7.25%, 2/15/13 | | | 200 | | | 187,500 | | 0.1 | |

Constar International, Inc., FRN, Co Guar, 8.24%, 2/15/126 | | | 750 | | | 705,000 | | 0.6 | |

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

CONTAINERS & PACKAGING (continued) | | | | | | |

Constar International, Inc., Sr Sub Nt,

11.00%, 12/1/1210 | | $ | 2,680 | | $ | 2,010,000 | | 1.7 | % |

Plastipak Holdings, Inc., Private Placement, Sr Nt,

8.50%, 12/15/152 | | | 300 | | | 300,000 | | 0.3 | |

Portola Packaging, Inc., Sr Nt,

8.25%, 2/1/1210 | | | 1,260 | | | 929,250 | | 0.8 | |

Smurfit-Stone Container Enterprises, Inc., Sr Nt, 8.00%, 3/15/176,10 | | | 1,000 | | | 966,250 | | 0.8 | |

| | | | | | | | | |

| | | | | | 5,573,000 | | 4.7 | |

DISTRIBUTORS — 1.0% | | | | | | |

American Tire Distributors, Inc., Nt,

10.75%, 4/1/136 | | | 1,250 | | | 1,218,750 | | 1.0 | |

| | | | | | | | | |

DIVERSIFIED MANUFACTURING — 1.7% | | | | | | |

Polypore, Inc., Sr Sub Nt,

8.75%, 5/15/1210 | | | 2,035 | | | 1,989,213 | | 1.7 | |

| | | | | | | | | |

DIVERSIFIED CONSUMER SERVICES — 4.5% | | | | | | |

Allied Waste North America, Inc., Sr Nt,

6.125%, 2/15/14

6.875%, 6/1/17 | |

| 500

250 | |

| 480,625

243,750 | | 0.4

0.2 |

|

Knowledge Learning Corp., Inc., Private Placement, Sr Sub Nt,

7.75%, 2/1/152 | | | 2,100 | | | 2,000,250 | | 1.7 | |

Mac-Gray Corp., Sr Nt,

7.625%, 8/15/15 | | | 650 | | | 633,750 | | 0.5 | |

Service Corp. International, 7.00%, 6/15/17 | | | 750 | | | 718,125 | | 0.6 | |

Service Corp. International, Private Placement, 6.75%, 4/1/15 | | | 250 | | | 246,875 | | 0.2 | |

Stewart Enterprises, Inc., Sr Nt, 6.25%, 2/15/1310 | | | 1,084 | | | 1,018,960 | | 0.9 | |

| | | | | | | | | |

| | | | | | 5,342,335 | | 4.5 | |

DIVERSIFIED TELECOMMUNICATION SERVICES — 5.2% | | | |

Level 3 Financing, Inc., Co. Guar, 9.25%, 11/1/1410 | | | 1,500 | | | 1,357,500 | | 1.1 | |

Level 3 Financing, Inc., FRN, Private Placement, 9.15%, 2/15/15 | | | 250 | | | 210,625 | | 0.2 | |

Level 3 Financing, Inc., Sr Nt, 12.25%, 3/15/13 | | | 200 | | | 202,000 | | 0.2 | |

McLeod USA, Inc., Private Placement, Sec’d Nt, 10.50%, 10/1/112 | | | 433 | | | 483,878 | | 0.4 | |

4

PACHOLDER HIGH YIELD FUND, INC.

Statement of Net Assets Applicable to Common Stockholders (continued)

December 31, 2007

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

DIVERSIFIED TELECOMMUNICATION SERVICES (continued) | | | |

PAETEC Holding Corp., Private Placement, 9.50%, 7/15/152 | | $ | 400 | | $ | 390,000 | | 0.3 | % |

Qwest Corp., Sr Nt, 7.625%, 6/15/1510 | | | 1,650 | | | 1,678,875 | | 1.4 | |

Time Warner Telecom Holdings, Inc.,

Sr Nt, 9.25%, 2/15/1410 | | | 1,000 | | | 1,022,500 | | 0.9 | |

Windstream Corp., 8.125%, 8/1/13 | | | 750 | | | 776,250 | | 0.7 | |

| | | | | | | | | |

| | | | | | 6,121,628 | | 5.2 | |

ELECTRIC UTILITIES — 1.8% | | | | | | |

Energy Future Holdings Corp., Private Placement, Nt, 10.875%, 11/1/172 | | | 450 | | | 452,250 | | 0.4 | |

Reliant Energy, Inc., 7.625%, 6/15/146 | | | 750 | | | 742,500 | | 0.6 | |

Reliant Energy, Inc., Sec’d Nt, 6.75%, 12/15/1410 | | | 1,000 | | | 1,002,500 | | 0.8 | |

| | | | | | | | | |

| | | | | | 2,197,250 | | 1.8 | |

ELECTRONIC EQUIPMENT & INSTRUMENTS — 1.6% | | | |

Flextronics International Ltd. (Singapore), Debentures, 6.25%, 11/15/14 | | | 60 | | | 57,150 | | 0.0 | 12 |

Intcomex, Inc., Sec’d Nt, 11.75%, 1/15/1110 | | | 1,100 | | | 1,127,500 | | 1.0 | |

Sanmina-SCI Corp., FRN, Private Placement, Sr Nt, 7.741%, 6/15/142 | | | 300 | | | 289,125 | | 0.2 | |

Smart Modular Technologies (Cayman Islands), FRN, Sr Nt, 10.731%, 4/1/12 | | | 423 | | | 439,920 | | 0.4 | |

| | | | | | | | | |

| | | | | | 1,913,695 | | 1.6 | |

ENERGY EQUIPMENT & SERVICES — 2.7% | | | | | | |

Bristow Group, Inc., Co Guar, 6.125%, 6/15/13 | | | 250 | | | 240,000 | | 0.2 | |

Calfrac Holdings LP, Private Placement, Debentures, 7.75%, 2/15/152 | | | 250 | | | 239,375 | | 0.2 | |

Chart Industries, Inc., Sr Sub Nt, 9.125%, 10/15/15 | | | 1,400 | | | 1,435,000 | | 1.2 | |

PHI, Inc., Co Guar, 7.125%, 4/15/13 | | | 783 | | | 751,680 | | 0.6 | |

Pride International, Inc., Sr Nt, 7.375%, 7/15/14 | | | 200 | | | 205,500 | | 0.2 | |

Seitel, Inc., Private Placement, 9.75%, 2/15/14 | | | 350 | | | 298,375 | | 0.3 | |

| | | | | | | | | |

| | | | | | 3,169,930 | | 2.7 | |

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

FOOD & STAPLES RETAILING — 1.9% | | | | | | |

Golden State Foods Corp., Private Placement, Sr Sub Nt, 9.24%, 1/10/122,8,9 | | $ | 1,550 | | $ | 1,579,063 | | 1.3 | % |

Rite Aid Corp., Debentures,

7.50%, 3/1/17 | | | 100 | | | 88,125 | | 0.1 | |

8.625%, 3/1/15 | | | 250 | | | 201,562 | | 0.2 | |

Rite Aid Corp., Private Placement, 9.375%, 12/15/15 | | | 400 | | | 332,000 | | 0.3 | |

| | | | | | | | | |

| | | | | | 2,200,750 | | 1.9 | |

FOOD PRODUCTS — 4.0% | | | | | | |

Chiquita Brands International, Inc., Sr Nt, 8.875%, 12/1/156 | | | 2,699 | | | 2,442,595 | | 2.1 | |

Eurofresh, Inc., Private Placement, Nt, 11.50%, 1/15/132 | | | 2,750 | | | 1,650,000 | | 1.4 | |

National Beef Packaging Co. LLC/NB Finance Corp., Sr Nt, 10.50%, 8/1/1110 | | | 500 | | | 475,000 | | 0.4 | |

Pilgrim’s Pride Corp., Debentures, 8.375%, 5/1/176 | | | 150 | | | 147,000 | | 0.1 | |

Tom’s Foods, Inc., Sr Nt, 10.50%, 11/1/041,4,9 | | | 907 | | | 9,068 | | 0.0 | 12 |

| | | | | | | | | |

| | | | | | 4,723,663 | | 4.0 | |

GAMING — 3.4% | | | | | | |

Mashantucket Western Pequot Tribe, Private Placement, 8.50%, 11/15/152,6 | | | 1,320 | | | 1,326,600 | | 1.1 | |

MGM Mirage, Inc., Co Guar, 7.625%, 1/15/176 | | | 150 | | | 148,125 | | 0.1 | |

MGM Mirage, Inc., Sr Nt, 7.50%, 6/1/16 | | | 250 | | | 247,500 | | 0.2 | |

Pokagon Gaming Authority, Private Placement, Sr Nt, 10.375%, 6/15/142 | | | 750 | | | 806,250 | | 0.7 | |

Seminole Hard Rock Entertainment, Inc., Private Placement, FRN,

7.49%, 3/15/142 | | | 500 | | | 477,500 | | 0.4 | |

Shingle Springs Tribal Gaming Authority, Private Placement, Sr Nt, 9.375%, 6/15/152 | | | 1,000 | | | 970,000 | | 0.9 | |

| | | | | | | | | |

| | | | | | 3,975,975 | | 3.4 | |

5

PACHOLDER HIGH YIELD FUND, INC.

Statement of Net Assets Applicable to Common Stockholders (continued)

December 31, 2007

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

HEALTH CARE EQUIPMENT & SUPPLIES — 1.3% | | | |

Bausch & Lomb, Inc., Private Placement, Debentures, 9.875%, 11/1/152,6 | | $ | 300 | | $ | 304,500 | | 0.3 | % |

Cooper Cos, Inc. (The), Sr Nt, 7.125%, 2/15/15 | | | 500 | | | 486,250 | | 0.4 | |

LVB Acquisition Merger Sub, Inc., Private Placement, 10.00%, 10/15/172 | | | 700 | | | 714,000 | | 0.6 | |

| | | | | | | | | |

| | | | | | 1,504,750 | | 1.3 | |

HEALTH CARE PROVIDERS & SERVICES — 10.9% | | | |

Community Health Systems, Inc., Private Placement, 8.875%, 7/15/15 | | | 1,000 | | | 1,018,750 | | 0.9 | |

HCA, Inc., Debentures,

6.30%, 10/1/1210 | | | 250 | | | 222,500 | | 0.2 | |

6.50%, 2/15/1610 | | | 500 | | | 422,500 | | 0.4 | |

HCA, Inc., Private Placement, Sec’d Nt,

9.125%, 11/15/14 | | | 475 | | | 494,000 | | 0.4 | |

9.25%, 11/15/16 | | | 1,000 | | | 1,050,000 | | 0.9 | |

Medical Services Co., FRN, Co Guar, 12.743%, 10/15/1110 | | | 2,800 | | | 2,562,000 | | 2.1 | |

Multiplan, Inc., Private Placement, 10.375%, 4/15/162 | | | 1,000 | | | 995,000 | | 0.8 | |

TeamHealth, Inc., Sr Sub Nt, 11.25%, 12/1/1310 | | | 2,184 | | | 2,315,040 | | 2.0 | |

Tenet Healthcare Corp., Sr Nt, 9.875%, 7/1/1410 | | | 1,800 | | | 1,714,500 | | 1.5 | |

United Surgical Partners International, Inc., Private Placement, Sr Nt, 8.875%, 5/1/176 | | | 150 | | | 148,125 | | 0.1 | |

Vanguard Health Holding Co. II LLC, Sr Sub Nt, 9.00%, 10/1/1410 | | | 2,000 | | | 1,925,000 | | 1.6 | |

| | | | | | | | | |

| | | | | | 12,867,415 | | 10.9 | |

HOTELS, RESTAURANTS & LEISURE — 0.8% | | | | | | |

OSI Restaurant Partners, Inc., Private Placement, 10.00%, 6/15/152,6 | | | 300 | | | 219,000 | | 0.2 | |

Six Flags, Inc., Sr Nt, 9.625%, 6/1/146 | | | 1,000 | | | 737,500 | | 0.6 | |

| | | | | | | | | |

| | | | | | 956,500 | | 0.8 | |

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

HOUSEHOLD DURABLES — 0.7% | | | | | | |

KB Home, Sr Nt, 5.875%, 1/15/15 | | $ | 700 | | $ | 603,750 | | 0.5 | % |

Meritage Homes Corp., Sr Nt, 7.00%, 5/1/14 | | | 250 | | | 178,750 | | 0.2 | |

| | | | | | | | | |

| | | | | | 782,500 | | 0.7 | |

INDEPENDENT POWER PRODUCERS & ENERGY TRADERS — 5.0% | |

AES Corp. (The), Private Placement, Sr Nt, 8.00%, 10/15/172 | | | 100 | | | 102,250 | | 0.1 | |

Calpine Corp., Private Placement, 8.50%, 7/15/101,2,4 | | | 1,000 | | | 1,070,000 | | 0.9 | |

Calpine Corp., Private Placement,

Sec’d Nt, 9.875%, 12/1/111,2,4, | | | 250 | | | 261,250 | | 0.2 | |

Calpine Corp., Private Placement,

Sr Sec’d Nt, 8.75%, 7/15/131,2,4 | | | 1,100 | | | 1,182,500 | | 1.0 | |

Calpine Generating Co. LLC, FRN,

Sec’d Nt, 14.37%, 4/1/111,3,4 | | | 1,000 | | | 162,559 | | 0.1 | |

Dynegy Holdings, Inc., Sr Unsec’d Nt, 7.125%, 5/15/18 | | | 500 | | | 442,500 | | 0.4 | |

Mirant Americas Generation LLC, Sr Nt,

8.30%, 5/1/1110 | | | 1,250 | | | 1,253,125 | | 1.0 | |

8.50%, 10/1/21 | | | 1,000 | | | 917,500 | | 0.8 | |

NRG Energy, Inc., Sr Nt, 7.375%, 1/15/17 | | | 250 | | | 243,750 | | 0.2 | |

Texas Competitive Electric Holdings Co. LLC, Private Placement, 10.25%, 11/1/152 | | | 350 | | | 346,500 | | 0.3 | |

| | | | | | | | | |

| | | | | | 5,981,934 | | 5.0 | |

INDUSTRIAL CONGLOMERATES — 2.1% | | | | | | |

Milacron Escrow Corp., Sec’d Nt,

11.50%, 5/15/1110 | | | 1,445 | | | 1,322,175 | | 1.1 | |

Trimas Corp., Co Guar,

9.875%, 6/15/1210 | | | 1,253 | | | 1,221,675 | | 1.0 | |

| | | | | | | | | |

| | | | | | 2,543,850 | | 2.1 | |

INDUSTRIAL MACHINERY — 1.5% | | | | | | | | | |

Baldor Electric Co., Sr Nt,

8.625%, 2/15/17 | | | 100 | | | 103,000 | | 0.1 | |

General Cable Corp., FRN, Private Placement, 7.606%, 4/1/15 | | | 250 | | | 237,500 | | 0.2 | |

6

PACHOLDER HIGH YIELD FUND, INC.

Statement of Net Assets Applicable to Common Stockholders (continued)

December 31, 2007

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

INDUSTRIAL MACHINERY (continued) | | | | | | |

RBS Global, Inc. & Rexnord Corp., Sr Nt,

8.875%, 9/1/1610 | | $ | 1,150 | | $ | 1,092,500 | | 0.9 | % |

RBS Global, Inc. & Rexnord Corp., Sr Sub Nt, 11.75%, 8/1/166 | | | 410 | | | 400,775 | | 0.3 | |

| | | | | | | | | |

| | | | | | 1,833,775 | | 1.5 | |

INSURANCE — 1.2% | | | | | | | | | |

Crum and Forster Holdings Corp., Private Placement, 7.75%, 5/1/17 | | | 600 | | | 588,750 | | 0.5 | |

HUB International Holdings, Inc., Private Placement,

9.00%, 12/15/142 | | | 500 | | | 446,250 | | 0.4 | |

10.25%, 6/15/152 | | | 500 | | | 425,000 | | 0.3 | |

| | | | | | | | | |

| | | | | | 1,460,000 | | 1.2 | |

IT SERVICES — 2.0% | | | | | | | | | |

First Data Corp., Private Placement,

9.875%, 9/24/152,6 | | | 500 | | | 465,000 | | 0.4 | |

Unisys Corp., Sr Nt,

8.00%, 10/15/1210 | | | 1,250 | | | 1,093,750 | | 0.9 | |

12.50%, 1/15/16 | | | 750 | | | 777,188 | | 0.7 | |

| | | | | | | | | |

| | | | | | 2,335,938 | | 2.0 | |

MARINE — 0.4% | | | | | | | | | |

Ultrapetrol Bahamas Ltd. (Bahamas), 1st Mtg, 9.00%, 11/24/14 | | | 450 | | | 427,500 | | 0.4 | |

| | | | | | | | | |

MEDIA — 13.4% | | | | | | | | | |

Adelphia Communications Corp.,

6.00%, 2/15/061,4 | | | 125 | | | 12 | | 0.0 | 12 |

Adelphia Communications Corp., Sr Nt, 8.125%, 7/15/031,4 | | | 750 | | | 74,062 | | 0.1 | |

9.375%, 11/15/091,4 | | | 560 | | | 58,100 | | 0.1 | |

Adelphia Recovery Trust, Contingent Value, 0%, 12/31/491,4 | | | 1,297 | | | 100,509 | | 0.1 | |

Barrington Broadcasting Group LLC and Barrington Broadcasting Capital Corp., Private Placement, Sr Sub Nt,

10.50%, 8/15/14 | | | 700 | | | 721,875 | | 0.6 | |

Block Communications, Inc., Private Placement, Sr Nt,

8.25%, 12/15/152 | | | 300 | | | 300,375 | | 0.3 | |

CanWest MediaWorks LP (Canada), Private Placement, Sr Nt,

9.25%, 8/1/152,6 | | | 750 | | | 734,062 | | 0.6 | |

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

MEDIA (continued) | | | | | | | | | |

CCH I Holdings LLC, Co Guar, 11.125%, 1/15/14 | | $ | 350 | | $ | 212,187 | | 0.2 | % |

CCH I Holdings LLC/CCH I Holdings Capital Corp., Sec’d Nt,

11.00%, 10/1/1510 | | | 1,805 | | | 1,471,075 | | 1.3 | |

Charter Communications Holdings II LLC/Charter Communications Holdings II Cap Corp., Series B,

Sr Nt, 10.25%, 9/15/10 | | | 500 | | | 487,500 | | 0.4 | |

DirecTV Holdings LLC/DirecTV Financing Co., Sr Nt,

8.375%, 3/15/13 | | | 750 | | | 780,000 | | 0.7 | |

Fisher Communications, Inc., Sr Nt,

8.625%, 9/15/14 | | | 500 | | | 510,625 | | 0.4 | |

Idearc, Inc., Sr Nt, 8.00%, 11/15/16 | | | 1,350 | | | 1,238,625 | | 1.1 | |

Intelsat Bermuda Ltd. (Bermuda), FRN, Debentures, 8.886%, 1/15/1510 | | | 150 | | | 150,375 | | 0.1 | |

Intelsat Bermuda Ltd. (Bermuda), Nt,

9.25%, 6/15/1610 | | | 600 | | | 603,000 | | 0.5 | |

11.25%, 6/15/1610 | | | 500 | | | 516,250 | | 0.4 | |

Intelsat Corp., Sr Nt, 9.00%, 8/15/14 | | | 749 | | | 752,745 | | 0.6 | |

Lamar Media Corp., Sr Sub Nt, 6.625%, 8/15/15 | | | 750 | | | 729,375 | | 0.6 | |

LBI Media, Inc., Sr Disc Nt,

11.00%, 10/15/137 | | | 625 | | | 564,843 | | 0.5 | |

Nexstar Finance Holdings LLC/Nexstar Finance Holdings, Inc., Sr Disc Nt, 0.00%, 4/1/137 | | | 750 | | | 743,437 | | 0.6 | |

Quebecor Media, Inc. (Canada), Sr Nt,

7.75%, 3/15/1610 | | | 750 | | | 720,000 | | 0.6 | |

Radio One, Inc., Sr Sub Nt,

6.375%, 2/15/136 | | | 500 | | | 413,125 | | 0.3 | |

RH Donnelley Corp., Sr Disc Nt,

6.875%, 1/15/13 | | | 250 | | | 223,750 | | 0.2 | |

RH Donnelley Corp., Sr Nt,

8.875%, 1/15/16 | | | 250 | | | 233,750 | | 0.2 | |

Valassis Communications, Inc., Private Placement, 8.25%, 3/1/156 | | | 1,250 | | | 1,114,062 | | 0.9 | |

Videotron Ltee (Canada), Co Guar, Sr Unsec’d Nt, 6.375%, 12/15/1510 | | | 500 | | | 469,375 | | 0.4 | |

7

PACHOLDER HIGH YIELD FUND, INC.

Statement of Net Assets Applicable to Common Stockholders (continued)

December 31, 2007

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

MEDIA (continued) | | | | | | | | | |

Virgin Media Finance plc (United Kingdom), Sr Nt,

9.125%, 8/15/16 | | $ | 1,000 | | $ | 990,000 | | 0.8 | % |

XM Satellite Radio, Inc., Private Placement, 10.00%, 6/1/13 | | | 1,000 | | | 985,000 | | 0.8 | |

| | | | | | | | | |

| | | | | | 15,898,094 | | 13.4 | |

METALS & MINERALS — 0.8% | | | | | | | | | |

Wolverine Tube, Inc., Sr Nt,

10.50%, 4/1/096 | | | 945 | | | 897,750 | | 0.8 | |

| | | | | | | | | |

MULTILINE RETAIL — 0.7% | | | | | | | | | |

Brookstone Co., Inc., Sr Nt,

12.00%, 10/15/126 | | | 150 | | | 139,875 | | 0.1 | |

Dollar General Corp., Private Placement, Sr Nt,

10.625%, 7/15/152,6 | | | 750 | | | 688,125 | | 0.6 | |

| | | | | | | | | |

| | | | | | 828,000 | | 0.7 | |

OIL, GAS & CONSUMABLE FUELS — 5.3% | | | | | | |

El Paso Corp., Sr Nt, 6.875%, 6/15/146 | | | 150 | | | 151,084 | | 0.1 | |

El Paso Performance-Linked Trust, Private Placement, Sr Nt, 7.75%, 7/15/112 | | | 500 | | | 513,115 | | 0.4 | |

Encore Acquisition Co., Sr Nt,

6.00%, 7/15/1510 | | | 1,000 | | | 900,000 | | 0.8 | |

Northwest Pipeline Corp., Sr Nt,

7.00%, 6/15/16 | | | 500 | | | 532,500 | | 0.5 | |

OPTI Canada, Inc., (Canada), Private Placement, Co Guar,

8.25%, 12/15/142 | | | 1,180 | | | 1,168,200 | | 1.0 | |

Range Resources Corp., Sr Sub Nt, 7.50%, 5/15/16 | | | 350 | | | 357,000 | | 0.3 | |

Swift Energy Co., Sr Nt,

7.125%, 6/1/17 | | | 1,510 | | | 1,434,500 | | 1.2 | |

W&T Offshore, Inc., Private Placement, Sr Nt,

8.25%, 6/15/142,6 | | | 1,000 | | | 937,500 | | 0.8 | |

Williams Partners LP/Williams Partners Finance Corp., Sr Nt, 7.25%, 2/1/17 | | | 250 | | | 257,500 | | 0.2 | |

| | | | | | | | | |

| | | | | | 6,251,399 | | 5.3 | |

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

PAPER & FOREST PRODUCTS — 3.2% | | | | | | |

Abitibi-Consolidated Co. of Canada,

Sr Nt, 8.375%, 4/1/156 | | $ | 870 | | $ | 645,975 | | 0.5 | % |

8.85%, 8/01/30 | | | 25 | | | 17,125 | | 0.0 | 12 |

Ainsworth Lumber Co., Ltd. (Canada), Sr Nt, 6.75%, 3/15/146 | | | 895 | | | 539,238 | | 0.5 | |

Bowater Canada Finance Corp. (Canada), Nt, 7.95%, 11/15/11 | | | 500 | | | 403,750 | | 0.3 | |

Georgia-Pacific Corp., Private

Placement, Co Guar,

7.00%, 1/15/152 | | | 125 | | | 121,563 | | 0.1 | |

7.125%, 1/15/172 | | | 325 | | | 316,063 | | 0.3 | |

NewPage Corp., Sr Nt, | | | | | | | | | |

10.00%, 5/1/12 | | | 200 | | | 201,000 | | 0.2 | |

12.00%, 5/1/136 | | | 800 | | | 826,000 | | 0.7 | |

Verso Paper Holdings LLC & Verson

Paper, Inc., Private Placement,

11.375%, 8/1/16 | | | 725 | | | 735,875 | | 0.6 | |

| | | | | | | | | |

| | | | | | 3,806,589 | | 3.2 | |

PHARMACEUTICALS — 1.1% | | | | | | | | | |

Celtic Pharma Phinco B.V.,

Private Placement (Bermuda),

17.00%, 6/15/129 | | | 1,147 | | | 1,112,167 | | 0.9 | |

Elan Finance plc/Elan Finance Corp. (Ireland), FRN, Sr Nt,

8.869%, 11/15/11 | | | 90 | | | 85,500 | | 0.1 | |

Valeant Pharmaceuticals International, 7.00%, 12/15/11 | | | 100 | | | 96,125 | | 0.1 | |

| | | | | | | | | |

| | | | | | 1,293,792 | | 1.1 | |

REAL ESTATE INVESTMENT TRUSTS (REITs) — 0.1% | | | |

Thornburg Mortgage, Inc., Sr Nt,

8.00%, 5/15/13 | | | 75 | | | 63,375 | | 0.1 | |

| | | | | | | | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT — 5.4% | | | |

Freescale Semiconductor, Inc., FRN, Private Placement, Sr Nt,

8.87%, 12/15/14 | | | 250 | | | 212,500 | | 0.2 | |

Freescale Semiconductor, Inc., Private Placement, Sr Nt,

8.875%, 12/15/14 | | | 1,000 | | | 892,500 | | 0.8 | |

MagnaChip Semiconductor S.A./MagnaChip Semiconductor Finance Co. (Luxembourg), FRN, Sec’d Nt, 8.241%, 12/15/11 | | | 1,000 | | | 890,000 | | 0.8 | |

8

PACHOLDER HIGH YIELD FUND, INC.

Statement of Net Assets Applicable to Common Stockholders (continued)

December 31, 2007

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT (continued) | |

MagnaChip Semiconductor S.A,/MagnaChip Semiconductor Finance Co. (Luxembourg), Sec’d Nt, 6.875%, 12/15/1110 | | $ | 750 | | $ | 630,938 | | 0.5 | % |

MagnaChip Semiconductor S.A./MagnaChip Semiconductor Finance Co. (Luxembourg), Sr Sub Nt, 8.00%, 12/15/146,10 | | | 1,315 | | | 986,250 | | 0.8 | |

NXP BV/NXP Funding LLC (Netherlands), FRN, Sr Nt, 7.993%, 10/15/13 | | | 400 | | | 368,000 | | 0.3 | |

NXP BV/NXP Funding LLC (Netherlands), Sr Nt, 7.875%, 10/15/14 | | | 1,640 | | | 1,558,000 | | 1.3 | |

Spansion, Inc., FRN, Private Placement, 8.249%, 6/1/132 | | | 1,000 | | | 900,000 | | 0.7 | |

| | | | | | | | | |

| | | | | | 6,438,188 | | 5.4 | |

SPECIALTY RETAIL — 1.1% | | | | | | |

Collective Brands, Inc.,

8.25%, 8/1/13 | | | 250 | | | 235,000 | | 0.2 | |

General Nutrition Centers, Inc., Private Placement, PIK, 10.009%, 3/15/14 | | | 340 | | | 321,300 | | 0.3 | |

Linens ‘N Things, Inc., FRN, Sec’d Nt, 10.868%, 1/15/146 | | | 1,335 | | | 700,875 | | 0.6 | |

| | | | | | | | | |

| | | | | | 1,257,175 | | 1.1 | |

TEXTILES, APPAREL & LUXURY GOODS — 1.6% | | | |

Broder Bros. Co., Series B, Sr Nt, 11.25%, 10/15/1010 | | | 1,835 | | | 1,412,950 | | 1.2 | |

Hanesbrands, Inc., FRN, Sr Nt, 8.204%, 12/15/14 | | | 500 | | | 495,000 | | 0.4 | |

Westpoint Stevens, Inc., Sr Nt, 7.875%, 6/15/051,3,4,9 | | | 1,000 | | | — | | 0.0 | |

| | | | | | | | | |

| | | | | | 1,907,950 | | 1.6 | |

THRIFTS & MORTGAGE FINANCE — 0.1% | | | | | | |

Countrywide Financial Corp., 6.25%, 5/15/166 | | | 275 | | | 158,281 | | 0.1 | |

| | | | | | | | | |

TOBACCO — 2.2% | | | | | | |

Alliance One International, Inc., Nt, 11.00%, 5/15/1210 | | | 2,400 | | | 2,508,000 | | 2.1 | |

12.75%, 11/15/126 | | | 150 | | | 156,750 | | 0.1 | |

| | | | | | | | | |

| | | | | | 2,664,750 | | 2.2 | |

| | | | | | | | | | |

| Description | | Par (000) | | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | | |

TRANSPORTATION SERVICES — 0.7% | | | | | | | |

IdleAire Technologies Corp., Private Placement, Sr Disc Nt, 13.00%, 12/15/127 | | $ | 1,415 | | | $ | 778,250 | | 0.7 | % |

| | | | | | | | | | |

WIRELESS TELECOMMUNICATION SERVICES — 2.8% | | | |

Cricket Communications, Inc., Private Placement, Sr Nt, 9.375%, 11/1/142 | | | 500 | | | | 468,750 | | 0.4 | |

Cricket Communications, Inc., Sr Nt, 9.375%, 11/1/14 | | | 300 | | | | 281,250 | | 0.2 | |

iPCS, Inc., FRN, Private Placement,

Sr Nt, 7.036%, 5/1/13 | | | 440 | | | | 414,700 | | 0.4 | |

MetroPCS Wireless, Inc., Private Placement, Sr Nt, 9.25%, 11/1/14 | | | 2,250 | | | | 2,115,000 | | 1.8 | |

| | | | | | | | | | |

| | | | | | | 3,279,700 | | 2.8 | |

Total Corporate Debt Securities | | | | | | | | | | |

(Cost $161,166,377) | | | | | | | 149,939,320 | | 126.6 | |

| | | | | | | | | | |

LOAN PARTICIPATIONS & ASSIGNMENTS — 17.8% | | | |

AUTOMOBILES — 1.6% | | | | | | | |

Ford Motor Co., Term Loan B, 8.00%, 12/15/13 | | | 1,985 | | | | 1,833,998 | | 1.6 | |

| | | | | | | | | | |

CHEMICALS — 0.7% | | | | | | | |

Millenium Chemicals, Inc., 1st Lien Term Loan, 7.45%, 1/26/139 | | | 500 | | | | 463,335 | | 0.4 | |

Millenium Chemicals, Inc., 2nd Lien Term Loan, 10.95%, 1/26/139 | | | 500 | | | | 420,000 | | 0.3 | |

| | | | | | | | | | |

| | | | | | | 883,335 | | 0.7 | |

COMMERCIAL SERVICES & SUPPLIES — 0.4% | | | | | | | |

Clarke American, Term Loan B, 7.33%, 6/30/14 | | | 97 | | | | 86,637 | | 0.1 | |

Clarke American, Term Loan B, 7.33%, 6/30/14 | | | 180 | | | | 161,076 | | 0.1 | |

Clarke American, Term Loan B, 7.33%, 6/30/14 | | | 62 | | | | 55,767 | | 0.1 | |

Clarke American, Term Loan B, 7.33%, 6/30/14 | | | 55 | | | | 49,543 | | 0.0 | 12 |

Clarke American, Term Loan B, 7.33%, 6/30/14 | | | 104 | | | | 92,861 | | 0.1 | |

| | | | | | | | | | |

| | | | | | | 445,884 | | 0.4 | |

COMPUTERS & PERIPHERALS — 0.7% | | | | | | | |

Stratus Technologies, Inc., 2nd Lien Term Loan, 14.58%, 3/28/12 | | | 1,000 | | | | 850,000 | | 0.7 | |

| | | | | | | | | | |

9

PACHOLDER HIGH YIELD FUND, INC.

Statement of Net Assets Applicable to Common Stockholders (continued)

December 31, 2007

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

DIVERSIFIED FINANCIAL SERVICES — 1.5% | | | | | | |

Realogy Corp., Bank Loan,

Letter of Credit, 5.32%, 5/4/14 | | $ | 422 | | $ | 368,183 | | 0.3 | % |

Realogy Corp., Term Loan B,

8.24%, 10/10/13 | | | 1,568 | | | 1,367,535 | | 1.2 | |

| | | | | | | | | |

| | | | | | 1,735,718 | | 1.5 | |

GAMING — 1.0% | | | | | | |

Venetian Macau, Term Loan B, 7.08%, 5/25/13 | | | 1,333 | | | 1,271,453 | | 1.0 | |

| | | | | | | | | |

HEALTH CARE PROVIDERS & SERVICES — 1.2% | | | |

Biomet, 1st Lien Term Loan 8.20%, 3/15/15 | | | 998 | | | 986,408 | | 0.8 | |

HCA, Inc., Term Loan B, 7.44%, 11/14/13 | | | 495 | | | 475,586 | | 0.4 | |

| | | | | | | | | |

| | | | | | 1,461,994 | | 1.2 | |

HOTELS, RESTAURANTS & LEISURE — 0.4% | | | | | | |

Outback Restaurant Partners, Inc.,

Term Loan, 4.88%, 6/14/14 | | | 5 | | | 4,903 | | 0.0 | 12 |

7.12%, 6/14/13 | | | 476 | | | 434,360 | | 0.4 | |

| | | | | | | | | |

| | | | | | 439,263 | | 0.4 | |

HOUSEHOLD DURABLES — 0.8% | | | | | | |

Jacuzzi Brands, Inc., 1st Lien,

Letter of Credit, 4.73%, 2/17/14 | | | 24 | | | 20,699 | | 0.0 | 12 |

Jacuzzi Brands, Inc., 2nd Lien | | | | | | | | | |

7.09%, 2/7/14 | | | 226 | | | 191,911 | | 0.2 | |

10.84%, 8/7/14 | | | 834 | | | 606,941 | | 0.5 | |

10.84%, 8/20/14 | | | 167 | | | 121,388 | | 0.1 | |

Jacuzzi Brands, Inc., 1st Lien, Term Loan B, 7.09%, 2/7/14 | | | 49 | | | 41,282 | | 0.0 | 12 |

| | | | | | | | | |

| | | | | | 982,221 | | 0.8 | |

INDEPENDENT POWER PRODUCERS & ENERGY TRADERS — 1.2% | |

Calpine Corp., Term Loan, 7.08%, 3/29/09 | | | 492 | | | 478,596 | | 0.4 | |

Texas Competitive Electric Holdings

Co. LLC, 8.40%, 10/10/14 | | | 998 | | | 978,248 | | 0.8 | |

| | | | | | | | | |

| | | | | | 1,456,844 | | 1.2 | |

IT SERVICES — 2.0% | | | | | | |

Compucom Systems, Inc., Term Loan, 8.35%, 9/1/14 | | | 998 | | | 972,563 | | 0.9 | |

First Data Corp., Term Loan B-1, 7.58%, 9/24/14 | | | 28 | | | 26,097 | | 0.0 | 12 |

7.63%, 9/24/14 | | | 371 | | | 352,063 | | 0.3 | |

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

IT SERVICES (continued) | | | | | | |

First Data Corp., Term Loan B-3, 7.58%, 9/24/14 | | $ | 69 | | $ | 65,554 | | 0.1 | % |

7.63%, 9/24/14 | | | 928 | | | 881,652 | | 0.7 | |

| | | | | | | | | |

| | | | | | 2,297,929 | | 2.0 | |

MEDIA — 2.3% | | | | | | |

Sirius Satellite, Term Loan B, 7.12%, 12/1/12 | | | 499 | | | 462,591 | | 0.4 | |

Univision, 1st Lien Term Loan, 7.21%, 9/29/14 | | | 1,418 | | | 1,290,382 | | 1.1 | |

Univision, 2nd Lien Term Loan, 7.34%, 3/29/09 | | | 1,000 | | | 975,000 | | 0.8 | |

Univision, Tranche 4, 1st Lien

Term Loan, 7.09%, 9/20/14 | | | 41 | | | 36,868 | | 0.0 | 12 |

| | | | | | | | | |

| | | | | | 2,764,841 | | 2.3 | |

MULTILINE RETAIL — 0.8% | | | | | | |

Dollar General Corp., Term Loan B1,

7.73%, 7/3/14 | | | 750 | | | 686,460 | | 0.6 | |

Dollar General Corp., Term Loan B2, 7.73%, 7/6/14 | | | 125 | | | 110,045 | | 0.1 | |

7.83%, 7/6/14 | | | 63 | | | 55,023 | | 0.1 | |

7.94%, 7/3/14 | | | 63 | | | 55,022 | | 0.0 | 12 |

| | | | | | | | | |

| | | | | | 906,550 | | 0.8 | |

PROPERTY & CASUALTY — 0.8% | | | | | | |

Swett & Crawford Group, 1st Lien

Bank Debt, 7.46%, 4/16/14 | | | 993 | | | 923,025 | | 0.8 | |

| | | | | | | | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT — 1.6% | | | |

Isola Group, 1st Lien Term Loan, 9.58%, 12/18/13 | | | 495 | | | 465,300 | | 0.4 | |

Isola Group, 2nd Lien Term Loan, 12.83%, 12/18/13 | | | 250 | | | 230,000 | | 0.2 | |

Sirius Computer Solutions, 2nd Lien Bank Loan, 10.83%, 5/30/13 | | | 1,000 | | | 942,500 | | 0.8 | |

TTM Technologies, Inc., Term Loan,

7.06%, 10/31/12

7.34%, 10/31/12 | |

| 73

140 | |

| 71,413

137,900 | | 0.1

0.1 |

|

| | | | | | | | | |

| | | | | | 1,847,113 | | 1.6 | |

10

PACHOLDER HIGH YIELD FUND, INC.

Statement of Net Assets Applicable to Common Stockholders (continued)

December 31, 2007

| | | | | | | | | |

| Description | | Shares/Par

(000) | | Value | | Percent

of Net

Assets* | |

WIRELESS TELECOMMUNICATION SERVICES — 0.8% | | | |

Alltel Communications, Inc.,

Term Loan B-3,

7.77%, 5/16/15 | | $ | 998 | | $ | 960,782 | | 0.8 | % |

| | | | | | | | | |

Total Loan Participations & Assignments | | | | | | |

(Cost $22,592,925) | | | | | | 21,060,950 | | 17.8 | |

| | | | | | | | | |

ASSET-BACKED SECURITIES — 0.3% | | | | | | |

Citigroup Mortgage Loan Trust, Inc., Series 2005-HE3, Class M12, FRN,

6.865%, 9/25/352,3,9 | | | 500 | | | 30,000 | | 0.0 | 12 |

Countrywide Asset-Backed Certificates, Series 2004-13, Class MV8, FRN,

6.565%, 1/25/359 | | | 250 | | | 193,220 | | 0.2 | |

Long Beach Mortgage Loan Trust, Series 2004-5, Class M6, FRN,

7.365%, 9/25/34 | | | 142 | | | 60,201 | | 0.1 | |

| | | | | | | | | |

Total Asset-Backed Securities | | | | | | | | | |

(Cost $769,173) | | | | | | 283,421 | | 0.3 | |

| | | | | | | | | |

Total Fixed Income Investments | | | | | | | | | |

(Cost $184,528,475) | | | | | | 171,283,691 | | 144.7 | |

| | | | | | | | | |

PREFERRED STOCKS — 0.2% | | | | | | | | | |

CONTAINERS & PACKAGING — 0.0% | | | | | | |

Glasstech, Inc., Series C, Pfd3,9 | | | — 11 | | | — | | 0.0 | |

| | | | | | | | | |

MEDIA — 0.2% | | | | | | | | | |

Spanish Broadcasting System, Series B, Pfd, PIK, 10.75%, 10/15/13 | | | 3 | | | 299,404 | | 0.2 | |

| | | | | | | | | |

Total Preferred Stocks | | | | | | | | | |

(Cost $296,000) | | | | | | 299,404 | | 0.2 | |

| | | | | | | | | |

COMMON STOCKS — 6.7% | | | | | | | | | |

AIRLINES — 0.6% | | | | | | | | | |

Delta Air Lines, Inc.1 | | | 46 | | | 685,729 | | 0.6 | |

| | | | | | | | | |

BUILDING PRODUCTS — 0.0%12 | | | | | | | | | |

Lexington Coal Co.1 | | | 25 | | | 31,639 | | 0.0 | 12 |

| | | | | | | | | |

CONSTRUCTION MATERIALS — 5.4% | | | | | | |

Oglebay Norton Co.1 | | | 185 | | | 6,388,951 | | 5.4 | |

| | | | | | | | | |

CONTAINERS & PACKAGING — 0.0% | | | | | | |

Glasstech, Inc., Class C1,3,9 | | | — 11 | | | — | | 0.0 | |

| | | | | | | | | |

| | | | | | | | | |

| Description | | Shares/Par

(000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

DIVERSIFIED TELECOMMUNICATION SERVICES — 0.1% | | | |

AboveNet, Inc.1 | | $ | 2 | | $ | 147,966 | | 0.1 | % |

XO Holdings, Inc.1 | | | 1 | | | 1,068 | | 0.0 | 12 |

| | | | | | | | | |

| | | | | | 149,034 | | 0.1 | |

HOTELS, RESTAURANTS & LEISURE — 0.0%12 | | | |

Bally Total Fitness Holding Corp.1,9 | | | 2 | | | 366 | | 0.0 | 12 |

Bally Total Fitness Holding Corp.1,3,6,8 | | | 4 | | | 402 | | 0.0 | 12 |

| | | | | | | | | |

| | | | | | 768 | | 0.0 | |

INDEPENDENT POWER PRODUCERS & ENERGY TRADERS — 0.1% | |

Mirant Corp.1 | | | 1 | | | 36,407 | | 0.1 | |

| | | | | | | | | |

MEDIA — 0.5% | | | | | | | | | |

Adelphia Recovery Trust1,3 | | | 157 | | | 2 | | 0.0 | 12 |

Time Warner Cable, Inc., Class A1 | | | 22 | | | 617,128 | | 0.5 | |

| | | | | | | | | |

| | | | | | 617,130 | | 0.5 | |

SPECIALTY RETAIL — 0.0%12 | | | | | | | | | |

Mattress Discounters Corp.1,3,9 | | | 8 | | | 13,909 | | 0.0 | 12 |

| | | | | | | | | |

TEXTILES, APPAREL & LUXURY GOODS — 0.0% | | | |

Westpoint Stevens, Inc.1,3,9 | | | 14 | | | — | | 0.0 | |

| | | | | | | | | |

Total Common Stocks | | | | | | | | | |

(Cost $5,912,023) | | | | | | 7,923,567 | | 6.7 | |

| | | | | | | | | |

RIGHTS — 0.0% | | | | | | | | | |

TEXTILES, APPAREL & LUXURY GOODS — 0.0% | | | |

Westpoint Stevens, Inc.1,3,9

Expiring 4/25/14 | | | | | | | | | |

(Cost $184,476) | | | 13 | | | — | | 0.0 | |

| | | | | | | | | |

WARRANTS — 0.1% | | | | | | | | | |

DIVERSIFIED TELECOMMUNICATION SERVICES — 0.1% | | | |

Abovenet, Inc., 9/8/081,3,9

(Strike Price $20.00) | | | 1 | | | 38,628 | | 0.0 | 12 |

Abovenet, Inc., 9/8/101,3,9

(Strike Price $24.00) | | | 1 | | | 42,282 | | 0.1 | |

XO Holdings, Inc., Series A, 1/16/101 (Strike Price $6.25) | | | 1 | | | 217 | | 0.0 | 12 |

XO Holdings, Inc., Series B, 1/16/101 (Strike Price $7.50) | | | 1 | | | 101 | | 0.0 | 12 |

XO Holdings, Inc., Series C, 1/16/101 (Strike Price $10.00) | | | 1 | | | 39 | | 0.0 | 12 |

| | | | | | | | | |

| | | | | | 81,267 | | 0.1 | |

| | | | | | | | | |

11

PACHOLDER HIGH YIELD FUND, INC.

Statement of Net Assets Applicable to Common Stockholders (concluded)

December 31, 2007

| | | | | | | | | | |

| Description | | Shares/Par

(000) | | Value | | | Percent

of Net

Assets* | |

| | | | | | | | | | |

TRANSPORTATION SERVICES — 0.0%12 | | | | | | | |

IdleAire Technologies Corp. 12/15/151 (Strike Price $1.00) | | $ | 1 | | $ | 1,415 | | | 0.0 | %12 |

| | | | | | | | | | |

Total Warrants | | | | | | | | | | |

(Cost $417,200) | | | | | | 82,682 | | | 0.1 | |

| | | | | | | | | | |

Total Equity Investments | | | | | | | | | | |

(Cost $6,809,699) | | | | | | 8,305,653 | | | 7.0 | |

| | | | | | | | | | |

SHORT TERM INVESTMENT — 1.1% | | | | |

INVESTMENT COMPANY — 1.1% | | | | | | | | | | |

Federated Prime Obligations Fund

(Cost $1,326,415) | | | 1,326 | | | 1,326,415 | | | 1.1 | |

| | | | | | | | | | |

INVESTMENTS OF CASH COLLATERAL FOR SECURITIES ON LOAN — 18.7% | |

UBS Securities LLC — Repurchase agreement, 4.55%, dated 12/31/07, matures 01/02/08, repurchase price $22,185,377, collateralized by U.S. Government Agency Mortgages | | | | | | | | | | |

(Cost $22,179,770) | | | 22,180 | | | 22,179,770 | | | 18.7 | |

| | | | | | | | | | |

TOTAL INVESTMENTS | | | | | | | | | | |

(Cost $214,844,359) | | | | | $ | 203,095,529 | | | 171.5 | |

| | | | | | | | | | |

Payable Upon Return of Securities Loaned | | | (22,179,770 | ) | | (18.7 | ) |

Payable to Advisor | | | | | | (797,134 | ) | | (0.7 | ) |

Payable to Administrator | | | | | | (9,596 | ) | | 0.0 | 12 |

Unrealized Appreciation on Unfunded Commitments | | | 16,560 | | | 0.0 | 12 |

Unrealized Depreciation on Unfunded Commitments | | | (3,536 | ) | | 0.0 | 12 |

Unrealized Appreciation on Swap Agreements | | | 19,325 | | | 0.0 | 12 |

Unrealized Depreciation on Swap Agreements | | | (446,773 | ) | | (0.4 | ) |

Other Assets in Excess of Other Liabilities | | | 4,707,831 | | | 4.0 | |

Less: Outstanding Preferred Stock (2,640 shares at $25,000 per share)

at liquidation value. | | | (66,000,000 | ) | | (55.7 | ) |

| | | | | | | | | | |

Net Assets Applicable to

Common Stockholders | | $ | 118,402,436 | | | | |

| | | | | | | | | | |

| | | | | | | | |

| Description | | | | Value | | | |

| | | | | | | | |

Net Assets Applicable to

Common Stockholders: | | | |

Common Stock, $.01 par value; 49,996,320 shares authorized 12,942,215 shares issued and outstanding | | | | $ | 129,422 | | | |

Capital in excess of par value | | | | | 177,539,060 | | | |

Undistributed net investment income/loss | | | | | 1,075,430 | | | |

Accumulated net realized loss from security transactions | | | | | (48,178,222 | ) | | |

Net unrealized depreciation on investments | | | | | (12,163,254 | ) | | |

| | | | | | | | |

Net Assets Applicable to Common Stockholders | | | | $ | 118,402,436 | | | |

| | | | | | | | |

Net Asset Value Per Common Share ($118,402,436/12,942,215) | | | | $ | 9.15 | | | |

| | | | | | | | |

| * | | Applicable to common stockholders. |

1 | | Non-income producing security. |

2 | | Security is exempt from registration under Rule 144A of the Securities Act of 1933. Unless otherwise indicated, this security has been determined to be liquid under procedures established by the Board of Directors and may be resold in transactions exempt from registration, normally to qualified institutional buyers. These securities amounted to $28,071,170 and 23.7% of net assets applicable to common stockholders. |

3 | | Fair valued security. These securities amounted to $287,782 and 0.2% of net assets applicable to common stockholders. |

6 | | All or a portion of the security is on loan. Securities on loan have a fair market value of $20,521,742. |

7 | | Step-up bond. Interest rate shown is the rate in effect as of December 31, 2007. |

8 | | Restricted security. These securities amounted to $1,579,465 and 1.3% of net assets applicable to common stockholders. |

9 | | Security deemed to be illiquid. These securities amounted to $6,267,673 and 5.3% of net assets applicable to common stockholders. |

10 | | All or a portion of the security is reserved for current or potential holdings of swaps, TBAs, when-issued securities and delayed delivery securities. |

11 | | Amount rounds to less than 1,000 shares. |

12 | | Amount rounds to less than 0.1%. |

| FRN | | Floating Rate Note. Interest rate shown is rate in effect as of December 31, 2007. |

See accompanying Notes to Financial Statements.

12

PACHOLDER HIGH YIELD FUND, INC.

Statement of Operations

For the Year Ended December 31, 2007

| | | | |

| |

| | | | |

INVESTMENT INCOME: | | | | |

Interest | | $ | 17,753,407 | |

Dividends | | | 154,947 | |

Securities lending (net) | | | 167,891 | |

| | | | |

Total Income | | | 18,076,245 | |

EXPENSES: | | | | |

Investment advisory fees (Note 6) | | | 1,508,726 | |

Administrative fees (Note 6) | | | 187,584 | |

Printing fees | | | 98,734 | |

Stock exchange listing fees | | | 14,801 | |

Custodian and accounting fees (Note 6) | | | 27,503 | |

Transfer agent fees | | | 21,082 | |

Legal fees | | | 233,971 | |

Directors’ fees and expenses | | | 107,744 | |

Audit fee | | | 64,823 | |

Insurance | | | 30,856 | |

Interest expense | | | 1,301 | |

| | | | |

Operating Expenses | | | 2,297,125 | |

Commissions on auction rate preferred stock | | | 167,942 | |

| | | | |

Total Expenses | | | 2,465,067 | |

Less earnings credits | | | (6,486 | ) |

| | | | |

Net Expenses | | | 2,458,581 | |

| | | | |

Net Investment Income | | | 15,617,664 | |

| | | | |

NET REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | |

Net realized gain/(loss): | | | | |

Investments | | | (968,075 | ) |

Swaps | | | 336,553 | |

| | | | |

Net realized gain/(loss) on investments | | | (631,522 | ) |

| | | | |

Net change in unrealized appreciation/(depreciation): | | | | |

Investments | | | (9,426,943 | ) |

Unfunded commitments | | | 13,024 | |

Swaps | | | (732,441 | ) |

| | | | |

Net change in unrealized appreciation/(depreciation) on investments | | | (10,146,360 | ) |

| | | | |

Net realized and unrealized gain/(loss) on investments | | | (10,777,882 | ) |

| | | | |

Net Increase/(Decrease) Resulting from Operations | | | 4,839,782 | |

DISTRIBUTIONS TO PREFERRED STOCKHOLDERS FROM NET INVESTMENT INCOME | | | (3,515,352 | ) |

| | | | |

NET INCREASE/(DECREASE) IN NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS RESULTING FROM OPERATIONS | | $ | 1,324,430 | |

| | | | |

See accompanying Notes to Financial Statements.

Statements of Changes in Net Assets Applicable to Common Stockholders

| | | | | | | | |

| | | For the

Year Ended

December 31,

2007 | | | For the

Year Ended

December 31,

2006 | |

INCREASE/(DECREASE) IN NET ASSETS: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 15,617,664 | | | $ | 14,032,276 | |

Net realized gain/(loss) on investments | | | (631,522 | ) | | | 6,867,685 | |

Net change in unrealized appreciation/(depreciation) on investments | | | (10,146,360 | ) | | | 7,046,430 | |

Distributions to preferred stockholders from net investment income | | | (3,515,352 | ) | | | (3,239,730 | ) |

| | | | | | | | |

Net increase/(decrease) in net assets resulting from operations applicable to common stockholders | | | 1,324,430 | | | | 24,706,661 | |

| | | | | | | | |

DISTRIBUTIONS TO COMMON STOCKHOLDERS FROM: | | | | | | | | |

Net investment income | | | (11,647,388 | ) | | | (11,636,804 | ) |

| | | | | | | | |

Total distributions to common stockholders | | | (11,647,388 | ) | | | (11,636,804 | ) |

| | | | | | | | |

FUND SHARE TRANSACTIONS (NOTE 2): | | | | | | | | |

Value of 1,347 and 22,682 shares issued in reinvestment of dividends to common stockholders in 2007 and 2006, respectively | | | 13,523 | | | | 213,317 | |

| | | | | | | | |

Total increase in net assets derived from fund share transactions | | | 13,523 | | | | 213,317 | |

| | | | | | | | |

Total net increase/(decrease) in net assets applicable to common stockholders | | | (10,309,435 | ) | | | 13,283,174 | |

NET ASSETS APPLICABLE TO

COMMON STOCKHOLDERS: | | | | | | | | |

Beginning of period | | $ | 128,711,871 | | | $ | 115,428,697 | |

| | | | | | | | |

End of period | | $ | 118,402,436 | | | $ | 128,711,871 | |

| | | | | | | | |

Undistributed Net Investment Income | | $ | 1,075,430 | | | $ | 229,904 | |

| | | | | | | | |

See accompanying Notes to Financial Statements.

13

PACHOLDER HIGH YIELD FUND, INC.

Financial Highlights

(Contained below is per share operating performance data for a share of common stock outstanding, total return performance, ratios to average net assets and other supplemental data. This information has been derived from information provided in the financial statements calculated using average shares outstanding and market price data for the Fund’s shares.)

| | | | | | | | | | | | | | | | | | | | |

| | | For the Year Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Net asset value, beginning of period | | $ | 9.95 | | | $ | 8.94 | | | $ | 9.55 | | | $ | 8.59 | | | $ | 5.73 | |

| | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 1.21 | | | | 1.09 | | | | 1.12 | | | | 1.08 | | | | 1.10 | |

Net realized and unrealized gain/(loss) on investments | | | (0.84 | ) | | | 1.07 | | | | (0.67 | ) | | | 0.93 | | | | 2.77 | |

Cumulative effect on change in fixed income valuation (Note 1) | | | — | | | | — | | | | — | | | | (0.07 | ) | | | — | |

Distributions to preferred stockholders from net investment income | | | (0.27 | ) | | | (0.25 | ) | | | (0.16 | ) | | | (0.08 | ) | | | (0.07 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net increase/(decrease) in net asset value resulting from operations | | | 0.10 | | | | 1.91 | | | | 0.29 | | | | 1.86 | | | | 3.80 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions to Common Stockholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.90 | ) | | | (0.90 | ) | | | (0.90 | ) | | | (0.90 | ) | | | (0.89 | ) |

Return of capital | | | — | | | | — | | | | — | | | | — | | | | (0.05 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to common stockholders | | | (0.90 | ) | | | (0.90 | ) | | | (0.90 | ) | | | (0.90 | ) | | | (0.94 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 9.15 | | | $ | 9.95 | | | $ | 8.94 | | | $ | 9.55 | | | $ | 8.59 | |

| | | | | | | | | | | | | | | | | | | | |

Market value per share, end of period | | $ | 8.10 | | | $ | 9.80 | | | $ | 8.50 | | | $ | 9.82 | | | $ | 9.14 | |

| | | | | | | | | | | | | | | | | | | | |

TOTAL INVESTMENT RETURN(1): | | | | | | | | | | | | | | | | | | | | |

Based on market value per common share(2) | | | (9.01 | )% | | | 26.78 | % | | | (4.46 | )% | | | 18.67 | % | | | 67.19 | % |

Based on net asset value per common share(3)(4) | | | 1.24 | % | | | 22.38 | % | | | 3.33 | % | | | 22.79 | % | | | 68.92 | % |

RATIOS TO AVERAGE NET ASSETS(5): | | | | | | | | | | | | | | | | | | | | |

Expenses (prior to expenses related to leverage)(6) | | | 1.18 | % | | | 1.86 | % | | | 1.50 | % | | | 1.83 | % | | | 1.80 | % |

Applicable to common stockholders only(7)(8) | | | 1.79 | % | | | 2.87 | % | | | 2.34 | % | | | 2.88 | % | | | 3.08 | % |

Expenses (including expenses related to leverage)(6) | | | 1.27 | % | | | 1.95 | % | | | 1.59 | % | | | 1.92 | % | | | 1.91 | % |

Applicable to common stockholders only(7)(8) | | | 1.92 | % | | | 3.01 | % | | | 2.48 | % | | | 3.03 | % | | | 3.26 | % |

Net investment income(7)(8) | | | 12.18 | % | | | 11.61 | % | | | 12.39 | % | | | 12.14 | % | | | 17.17 | % |

SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

Net assets at end of period, net of preferred stock (000) | | $ | 118,402 | | | $ | 128,712 | | | $ | 115,429 | | | $ | 123,180 | | | $ | 110,476 | |

Portfolio turnover rate | | | 64 | % | | | 75 | % | | | 95 | % | | | 73 | % | | | 51 | % |

SENIOR SECURITIES: | | | | | | | | | | | | | | | | | | | | |

Number of preferred shares outstanding at end of period | | | 2,640 | | | | 2,640 | | | | 2,640 | | | | 2,640 | | | | 2,640 | |

Asset coverage per share of preferred stock outstanding at end of period(9) | | $ | 69,849 | | | $ | 73,755 | | | $ | 68,723 | | | $ | 71,660 | | | $ | 66,853 | |

Involuntary liquidation preference and average market value per share of preferred stock | | $ | 25,000 | | | $ | 25,000 | | | $ | 25,000 | | | $ | 25,000 | | | $ | 25,000 | |

1 | | Total investment return excludes the effects of commissions. Dividends and distributions to common stockholders, if any, are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund's dividend reinvestment plan. Rights offerings, if any, are assumed, for purposes of this calculation, to be fully subscribed under the terms of the rights offering. |

2 | | Assumes an investment at the common share market value at the beginning of the period indicated and sale of all shares at the closing common share market value at the end of the period indicated. Dividends and distributions are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund's dividend reinvestment plan. |

3 | | Assumes an investment at the common share net asset value at the beginning of the period indicated and sale of all shares at the closing common share net asset value at the end of the period indicated. Dividends and distributions are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund's dividend reinvestment plan. |

4 | | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for common stockholder transactions. |

5 | | Ratios calculated on an annualized basis of expenses and net investment income. Ratios do not include the effect of dividends to preferred stockholders. |

6 | | Ratios calculated relative to the average net assets of both common and preferred stockholders. |

7 | | Ratios calculated relative to the average net assets of common stockholders only. |

8 | | Information for the year 2003 was not audited by previous auditors. Ratios have been derived from audited financial statements for the year. |

9 | | Calculated by subtracting the Fund's total liabilities (not including the preferred stock) from the Fund's total assets, and dividing this by the number of preferred shares outstanding. |

See accompanying Notes to Financial Statements.

14

PACHOLDER HIGH YIELD FUND, INC.

Notes to Financial Statements

| 1. | | SIGNIFICANT ACCOUNTING POLICIES — Pacholder High Yield Fund, Inc. (the “Fund”) is a closed-end, diversified management investment company with a leveraged capital structure. The Fund’s investment objective is to provide a high level of total return through current income and capital appreciation. Under normal circumstances, the Fund invests at least 80% of the value of its assets in high yield debt securities. The Fund invests primarily in fixed income securities of domestic companies. The Fund was incorporated under the laws of the State of Maryland in August 1988. |

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

| | A. | | SECURITY VALUATIONS — Fixed income securities (other than short-term investments maturing in 60 days or less), are valued each day based on readily available market quotations received from third party broker-dealers of comparable securities or independent pricing services approved by the Board of Directors. Such pricing services and broker-dealers generally provide bid-side quotations. Short-term investments, other than certain distressed debt securities, with remaining maturities of 60 days or less are valued at amortized cost. Listed securities are valued at the last sale price on the exchange on which they are primarily traded. The value of National Market System equity securities quoted by the NASDAQ Stock Market shall generally be the NASDAQ Official Closing Price. Investments in other open-end investment companies are valued at such investment company’s current day closing net asset value per share. |

Swaps are priced generally by independent or affiliated pricing services or at an evaluated price provided by a counterparty or third party broker.

Securities or other assets for which market quotations are not readily available or for which market quotations do not represent the value at the time of pricing (including certain illiquid securities) are fair valued in accordance with procedures established and monitored by the Board of Directors. Valuations may be based upon current market prices of securities that are comparable in coupon, rating, maturity and industry. It is possible that the estimated values may differ significantly from the values that would have been used had a ready market for the investments existed, and such differences could have been material. At December 31, 2007, there were fair-valued securities of $287,782.

Prior to January 1, 2004, the Fund valued fixed income securities based on the mean of bid and asked prices. Effective January 1, 2004, the Fund changed its valuation policy to value fixed income securities based on bid prices, as bid prices are believed to be more representative of the price that could be obtained in sales transactions in the market for such securities. Bid prices generally are lower than those based on the mean of bid and asked prices. The cumulative effect of this accounting change on January 1, 2004 was to decrease the value of investments and net assets applicable to common stockholders by approximately $854,808 ($0.07 per common share). The financial highlights for periods prior to December 31, 2004 have not been restated to reflect this change in accounting policy.

| | B. | | REPURCHASE AGREEMENTS — Each repurchase agreement is valued at amortized cost. In connection with transactions in repurchase agreements, it is the Fund’s policy that a tri-party custodian take possession of the underlying collateral securities in a manner sufficient to enable the Fund to obtain collateral in the event of a counterparty default. If the counterparty defaults and the fair value of the collateral declines, realization of the collateral by the Fund may be delayed or limited. The repurchase agreements are fully collateralized by U.S. Government agency securities. |

| | C. | | FEDERAL TAXES — It is the Fund’s policy to make distributions to stockholders of net investment income and net realized capital gains to comply with the requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. |

The Fund intends to continue to qualify as a regulated investment company by complying with the appropriate provisions of the Internal Revenue Code and to distribute to stockholders each year substantially all of its taxable income, if any, including realized gains on investments.

The Fund seeks to maintain a level monthly dividend. Distributions paid by the Fund are subject to recharacterization for tax purposes. A portion of dividends paid may consist of net realized gains. To the extent that capital loss carryforwards are available to offset the distribution of capital gains but are not utilized at the end of the Fund’s fiscal year, such capital gain distributions may be taxable to stockholders as ordinary income.

The amount of dividends and distributions from net investment income and net realized capital gains is determined in accordance

15

PACHOLDER HIGH YIELD FUND, INC.

Notes to Financial Statements (continued)

with Federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America. To the extent these “book/tax” differences are permanent in nature (i.e., that they result from other than timing of recognition — “temporary differences”), such amounts are reclassified within the capital accounts based on their Federal tax-basis treatment.

The following amounts were reclassified within the capital accounts:

| | | | | | |

Capital in Excess

of Par Value | | Accumulated

Undistributed/

(Overdistributed)

Net Investment

Income | | Accumulated

Net Realized

Loss from

Security Transactions |

| $(2,587,486) | | $ | 390,602 | | $ | 2,196,884 |

The reclassification for the Fund relates primarily to defaulted bond interest, expiration of capital loss carryforwards and periodic and non-periodic payments from swap contracts.

The tax character of distributions paid during the years ended December 31, 2007 and 2006 was as follows:

| | | | | | |

| | | 2007 | | 2006 |

Common Stockholder Ordinary Income | | $ | 11,647,388 | | $ | 11,636,804 |

Preferred Stockholder Ordinary Income | | $ | 3,515,352 | | $ | 3,239,730 |

| | D. | | SECURITIES TRANSACTIONS AND INVESTMENT INCOME — Securities transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses on securities transactions are determined on an identified cost basis. Interest income is determined on the basis of coupon interest accrued using the effective interest method adjusted for amortization of premiums and accretion of discounts. Dividend income is recorded on the ex-dividend date. |

| | E. | | SECURITIES LENDING — To generate additional income, the Fund may lend its securities, through JPMorgan Chase Bank, N.A. (“JPMCB”) as lending agent (an affiliate of J.P. Morgan Investment Management Inc. (“JPMIM”)), to approved brokers and receives cash as collateral to secure the loans. The Fund receives payments from borrowers equivalent to the dividends and interest that would have been earned on securities lent while simultaneously seeking to earn income on the investment of collateral. Risks of delay in recovery of securities or even loss of rights in the securities may occur should the borrower of the securities fail financially. Risks may also arise to the extent that the value of the securities loaned increases above the value of the collateral received. JPMCB will indemnify the Fund from losses resulting from a borrower’s failure to return a loaned security when due. Such indemnification does not extend to losses associated with declines in the value of cash collateral investments. Loans are subject to termination by the Fund or the borrower at any time, and are, therefore, not considered to be illiquid investments. As of December 31, 2007, the Fund loaned securities having a value of $20,521,742. Collateral is marked to market daily to provide a level of collateral at not less than 100% of the value of loaned securities. The cash collateral of $22,179,770 received by the Fund at December 31, 2007 was invested in a repurchase agreement (with an interest rate of 4.55% and a maturity date of January 2, 2008). Information on the investment of cash collateral is shown in the Statement of Net Assets Applicable to Common Stockholders. |

Under the Securities Lending Agreement, JPMCB is entitled to a fee paid monthly in arrears equal to: (i) 0.06% of the average dollar value of loans of U.S. Securities outstanding during a given month; and (ii) 0.1142% of the average dollar value of loans of non-U.S. securities outstanding during a given month. For the year ended December 31, 2007, the fees have been voluntarily reduced to 0.05% and 0.10%, respectively. JPMCB received $14,462 in fees for services rendered in lending of securities during the year ended December 31, 2007.