available to the Fund for investing. IPO and secondary offering shares frequently are volatile in price due to the absence of a prior public market, the small number of shares available for trading and limited information about the issuer. Therefore, the Fund may hold IPO and secondary offering shares for a very short period of time. This may increase the turnover of the Fund and may lead to increased expenses for the Fund, such as commissions and transaction costs. In addition, IPO and secondary offering shares can experience an immediate drop in value if the demand for the securities does not continue to support the offering price.

| | |

Alpine Global Consumer Growth Fund |

| |

| | |

| | | | | | | | | |

| | | | | | | | | | |

|

Comparative Annualized Returns as of 4/30/12 (Unaudited) |

| | | | | | |

| | 6 Months(1) | | 1 Year | | Since Inception

(12/29/2010)(1) |

| | | | | | | |

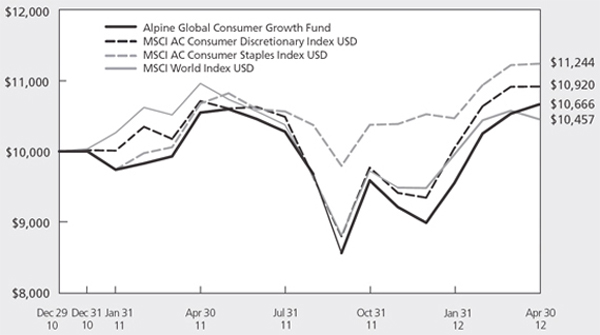

Alpine Global Consumer Growth Fund — Institutional | | 11.22 | % | | 1.10 | % | | 4.93 | % |

| | | | | | | | | | |

MSCI World Index USD(2) | | 7.54 | % | | -4.63 | % | | 3.39 | % |

| | | | | | | | | | |

MSCI ACWI Consumer Discretionary Index USD | | 11.31 | % | | 1.51 | % | | 6.80 | % |

| | | | | | | | | | |

MSCI ACWI Consumer Staples Index USD | | 8.23 | % | | 5.18 | % | | 9.16 | % |

| | | | | | | | | | |

Lipper Consumer Goods Funds Average(3) | | 10.22 | % | | 5.07 | % | | 9.33 | % |

| | | | | | | | | | |

Lipper Consumer Goods Funds Ranking(3) | | N/A(4) | | 34/39 | | 34/38 |

| | | | | | | | | | |

Gross Expense Ratio: 2.96%(5) | | | | | | | | | |

| | | | | | | | | | |

Net Expense Ratio: 1.35%(5) | | | | | | | | | |

| | | | | | | | | | |

| | | |

| | |

| (1) | Not annualized. |

| (2) | Effective February 28, 2012, the Fund changed the primary benchmark against which it measures its performance to the MSCI World Index. The Adviser believes the MSCI World Index more accurately reflects the investment strategy of the Fund. |

| (3) | The since inception data represents the period beginning 12/31/2010. |

| (4) | FINRA does not recognize rankings for less than one year. |

| (5) | As disclosed in the prospectus dated February 28, 2012. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than the performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced.

Performance of Class A shares is not shown because this share class commenced operations on December 30, 2011.

The MSCI World Index USD is an unmanaged index considered representative of growth stocks of developed countries. Index performance is calculated with net dividends. The MSCI ACWI Consumer Staples Index USD is a free float adjusted market capitalization weighted index designed to measure the combined equity market performance of the consumer staples sector of developed and emerging markets countries. Component securities include those of food and drug retailers, food producers, tobacco companies and household products manufacturers. As of September 30, 2010, the Underlying Index consisted of companies in the following countries: Australia, Belgium, Brazil, Canada, Chile, China, Colombia, Denmark, Finland, France, Germany, Greece, India, Indonesia, Ireland, Italy, Japan, Malaysia, Mexico, the Netherlands, Poland, Portugal, Russia, Singapore, South Africa, South Korea, Sweden, Switzerland, Taiwan, Thailand, Turkey, United Kingdom, and the United States. The MSCI ACWI Consumer Discretionary Index USD is a free float adjusted market capitalization weighted index designed to measure the combined equity market performance of the consumer discretionary sector of developed and emerging markets countries. Component securities include those of manufacturers of automobiles and automotive components, consumer durables and apparel companies, consumer services companies, media producers and retailers. As of September 30, 2010, the Underlying Index consisted of companies in the following countries: Australia, Belgium, Brazil, Canada, Chile, China, Colombia, Denmark, Finland, France, Germany, Greece, India, Indonesia, Ireland, Italy, Japan, Malaysia, Mexico, the Netherlands, Poland, Portugal, Russia, Singapore, South Africa, South Korea, Sweden, Switzerland, Taiwan, Thailand, Turkey, United Kingdom, and the United States. The Lipper Consumer Goods Funds Average is an average of funds that invest primarily in the equity securities of domestic and foreign companies engaged in manufacturing and distributing consumer goods such as food, beverages, tobacco, and nondurable household goods and personal products. The MSCI ACWI Consumer Staples Index USD, the MSCI ACWI Consumer Discretionary Index USD and the Lipper Consumer Goods Funds Average are unmanaged and do not reflect direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Consumer Goods Funds Average reflects fees charged by the underlying funds. The performance for the Global Consumer Growth Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index. Lipper rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges.

Expense Ratios reflect the ratios reported in the Fund’s most recent prospectus. The Alpine Global Consumer Growth Fund has a contractual expense waiver that continues through February 28, 2013. Where a Fund’s gross and net expense ratio are the same for the period reported, the contractual expense reimbursement level was not reached as of the end of that period. To the extent the Fund’s expenses were reduced by waivers, the Fund’s total returns were increased. In these cases, in the absence of the expense waivers, the Fund’s total returns would have been lower.

To the extent that the Fund’s historical performance resulted from gains derived from participation in initial public offerings (“IPOs”) and/or secondary offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary allocations in the future.

38

| |

Alpine Global Consumer Growth Fund |

|

| | |

| | | | | | | |

| | | | | | | | |

|

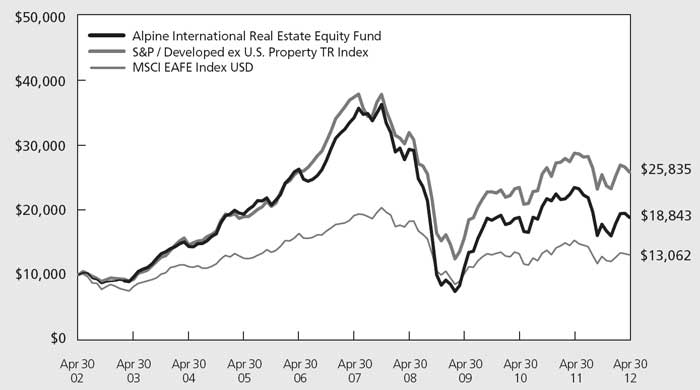

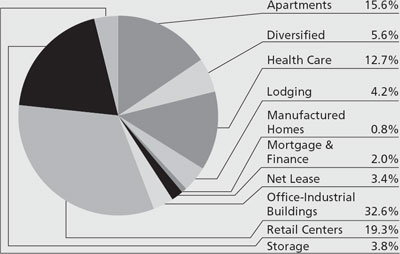

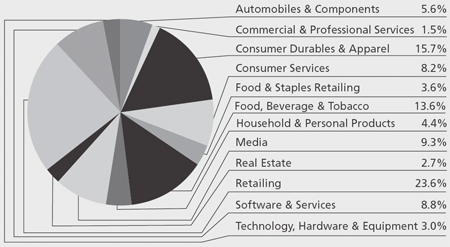

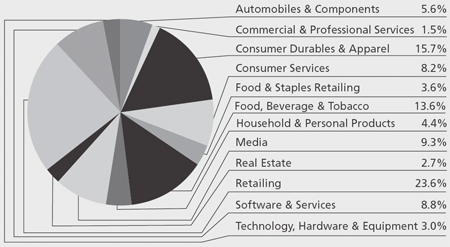

Portfolio Distributions* (Unaudited) | | Top 10 Holdings* (Unaudited) | |

| | 1. | | Anheuser-Busch InBev | | | |

| | | NV-ADR | | 2.99% | |

| 2. | | Nestle SA | | 2.79% | |

| 3. | | Apple, Inc. | | 2.79% | |

| 4. | | VF Corp. | | 2.64% | |

| 5. | | Yum! Brands, Inc. | | 2.52% | |

| 6. | | Comcast Corp.-Class A | | 2.30% | |

| 7. | | Visa, Inc.-Class A | | 2.27% | |

| 8. | | NIKE, Inc.-Class B | | 2.18% | |

| 9. | | PepsiCo, Inc. | | 2.15% | |

| 10. | | McDonald’s Corp. | | 2.11% | |

| | | | | | |

| |

| * | Top 10 Holdings do not include short-term investments and percentages are based on total net assets, Portfolio Distributions percentages are based on total investments. Portfolio holdings and sector distributions are as of 4/30/12 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. |

| | | | | | | |

|

| |

|

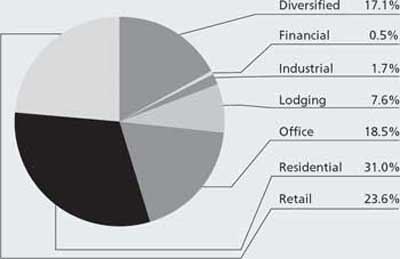

Value of a $10,000 Investment (Unaudited) |

|

|

|

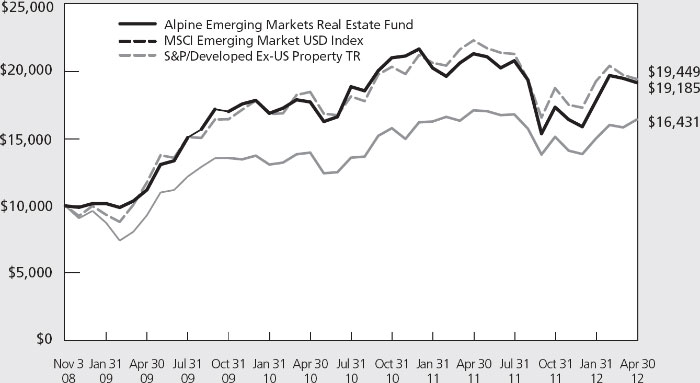

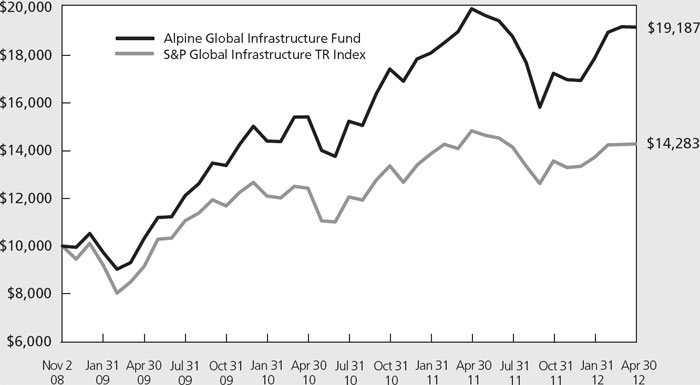

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees. Without the waiver and recovery of fees, the Fund’s total return would have differed.

39

| |

Alpine Global Consumer Growth Fund |

|

| | |

Through the first six months of the fiscal year, the Alpine Global Consumer Growth Fund generated a total return of 11.22%. Over the same period, the MSCI World Index and the MSCI All Country World Consumer Discretionary Indices posted total returns of 7.54% and 11.31%, respectively. The outperformance of the consumer discretionary and technology sectors aided the Fund’s strong relative performance to the MSCI World Index, while our emerging market exposure and being relatively underweight in automotives contributed to the Fund’s performance relative to the MSCI All Country World Consumer Discretionary Index.

Portfolio Drivers

After a difficult finish to fiscal 2011, market sentiment turned positive as we entered 2012 as the economic data in the US pointed to a bit of a recovery and the macro economic situation in the Euro zone stabilized. As such, the global markets recovered swiftly in the beginning of the calendar year, led by the more cyclical sectors.

| | |

| • | The country exposure of the Fund played a large part in the performance over the first six months of the fiscal year. China/Hong Kong (average weight 12.56%) and Brazil (9.64%) represented the Fund’s largest country exposures outside of the US (45.24%). Both of these markets experienced a strong recovery after difficult years in calendar 2011 despite some weakening in their respective economies. The US was the Fund’s top performing country, while Taiwan and Russia were the weakest. |

| | |

| • | From an industry standpoint, food, beverage and tobacco (average weight 13.85%) was the top performing segment. The more cyclical consumer durables & apparel and software & services industries were also among the top performers. Meanwhile, the market’s move toward higher beta over the last six months resulted in the underperformance of the less volatile food & staples retailing group. |

| | |

| • | As we entered the winter months, there were significant concerns about the pace of growth in emerging economies and for global consumer spending in particular. However, as December period results were released and macro economic data proved more resilient than expected, the focus of the market returned to the more cyclically oriented sectors of consumer discretionary and technology. As this event occurred, the Fund’s performance improved. |

Portfolio Analysis

The top five contributors to the Fund’s performance for the six months ended April 30, 2012 were Anheuser-Busch InBev N.V. (33.41%), Apple Inc (44.34%),Yum! Brands (36.98%), Lumber Liquidators Holdings, Inc (93.25%) and Visa Inc (32.42%).

| | |

| • | Anheuser Busch InBev N.V. (average weight 3.25%) was the top contributor to the Fund’s performance over the period as the company executed on its cost improvement plan and began to generate volume growth in many of its markets. |

| | |

| • | The success of Apple’s (average weight 2.56%) iPhone and iPad products contributed to the stock’s strong performance over the first half of the fiscal year. Earnings estimates have continued to trend higher over the past few quarters. The initiation of a dividend also introduced Apple stock to a new class of investors. |

| | |

| • | Yum! Brands (average weight 2.47%) posted strong results driven by its large and fast growing international business, particularly in China. Meanwhile, the US business has made strides in improving its performance. |

| | |

| • | After a difficult first nine months of 2011, Lumber Liquidators (average weight 1.15%) experienced some top-line improvement during the spring of 2012. Plus, management appears to have overcome the operational issues that hindered profitability in 2011. |

| | |

| • | Visa (average weight 2.23%) registered above plan financial results driven by strong global transaction volume growth. Near term, there may be some confusion in the numbers due to the changing regulatory landscape but as the world transitions to digital payments, Visa’s network is poised to benefit. |

| | |

| Abercrombie & Fitch Co (-32.08%), Digital Generation Inc (-50.21%), HTC Corp (-39.70%), Lianhua Supermarket Holdings Co (-35.07%) and Magazine Luiza S.A. (-22.98%) were the bottom five contributors to the Fund’s performance for the six months ended April 30, 2012. |

| | |

| • | Abercrombie & Fitch (average weight 1.29%) hit a few bumps in its growth path over the past few quarters. The company’s international growth engine has slowed a bit as the macro economic issues have dampened consumer enthusiasm throughout much of Europe. |

| | |

| • | Digital Generation (average weight 0.64%) made a series of acquisitions during 2011 that have |

40

| |

Alpine Global Consumer Growth Fund |

|

| | |

| | |

| | hampered their growth rate as they integrate the new businesses into the overall firm. In addition, the business has suffered from reduced pricing as a transition from standard definition to high definition content progresses. |

| | |

| • | HTC (average weight 0.15%) was slow to transition to the next generation of smart phones in the back half of 2011 and lost its technology edge. In addition, the company faced a lawsuit over patent infringement, which weighed on the shares. |

| | |

| • | Grocery store chain Lianhua (average weight 0.89%) is transitioning its operating model at a time when competition in the category is heating up and food inflation is slowing. As such, the expansion of net new stores has slowed and comparable store sales have weakened. |

| | |

| • | Hard goods retailer Magazine Luiza’s (average weight 0.88%) shares languished over the period as the Brazilian consumer slowed its spending patterns and as a result same store sales decelerated. In addition, since many of its higher cost items are sold via credit, concerns about the potential for rising delinquencies had an impact on the shares. |

Summary & Outlook

The Global Consumer Growth Fund seeks long-term capital appreciation by investing in companies which have exposure to the rising purchasing power of the global consumer. The Fund aims to achieve diversification by investing primarily across consumer discretionary, consumer staples and technology sectors among both multi-national and local companies. In the developed world, we emphasize investment in consumer consumption trends, such as the rise in Internet spending and the usage of mobile devices, as well as in firms that have the ability to expand their brands domestically and

abroad. In emerging markets, the focus is on those businesses that we believe stand to benefit from the demographic shifts that are taking place as disposable income levels rise over the next few years.

As we look ahead, consumer spending trends remain mixed. In the US, warm weather and an improving jobs picture helped boost consumer confidence levels, while high oil prices have had an impact on the lower income brackets. As we enter the back half of the year, we believe we are poised to benefit from the falling input costs that have been flowing through the cost structures over the past six months. In Europe, austerity measures and political and macro economic instability have hindered consumer confidence. But we are approaching the anniversary of many of the austerity measures in the coming months, which barring any large shocks to the economic system may result in an improving consumer spending environment as we exit 2012. Finally, we expect the emerging market consumers to continue their superior growth pace albeit at lower levels than in previous years. Discretionary spending should continue to benefit from strong wage growth and the growing middle class. Brazil and China remain the focus of our emerging market exposure but we are also looking at opportunities outside these two countries.

In closing, we are excited about the opportunities for the Global Consumer Growth Fund. We believe that the prospects for the long term global consumer story are attractive. Despite some near term headwinds, rising income levels and changing consumer consumption patterns across the globe should provide ample investment opportunities.

Sincerely,

Bryan Keane

Samuel A. Lieber

Co-Portfolio Managers

| |

| | |

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to the following risks: |

Concentration Risk – The Fund’s strategy of concentrating in companies in a specific industry means that its performance will be closely tied to the performance of a particular market segment. The Fund’s concentration in these companies may present more risks than if it were broadly diversified over numerous industries and sectors of the economy. A downturn in these companies would have a larger impact on the Fund than on a mutual fund that does not concentrate in such companies. At times, the performance of these companies will lag the performance of other industries or the broader market as a whole.

Consumer Products/Services Sector Risk – Significant problems may affect a particular sector, and returns from that sector may be lower than returns from the overall stock market. Events that affect the consumer products/services sector will have a greater effect on the Fund than they would on a fund that is more widely diversified among a number of unrelated industries. Daily fluctuations in specific market sectors are often more extreme than fluctuations in the overall market. Because the Fund invests a substantial amount of its assets in the consumer product/services sector, the Fund’s performance largely depends on the general condition of that sector. The consumer product/services

41

| |

Alpine Global Consumer Growth Fund |

|

| | |

sector could be adversely affected by overall economic conditions, interest rates, competition, consumer confidence, disposable income, changes in demographics and consumer tastes, and legislative or regulatory changes. The prices of the securities of those issuers also may fluctuate widely in response to such events.

Emerging Market Securities Risk – The risks of investing in foreign securities can be intensified in the case of investments in issuers domiciled or operating in emerging market countries. These risks include lack of liquidity and greater price volatility, greater risks of expropriation, less developed legal systems and less reliable custodial services and settlement practices.

Equity Securities Risk – The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry).

Foreign Currency Transactions – Foreign securities are often denominated in foreign currencies. As a result, the value of the Fund’s shares is affected by changes in exchange rates. A Fund may enter into foreign currency transactions to try to manage this risk. A Fund’s ability to use foreign currency transactions successfully depends on a number of factors, including the foreign currency transactions being available at prices that are not too costly, the availability of liquid markets and the ability of the portfolio managers to accurately predict the direction of changes in currency exchange rates.

Foreign Securities Risk – Public information available concerning foreign issuers may be more limited than would be with respect to domestic issuers. Different accounting standards may be used by foreign issuers, and foreign trading markets may not be as liquid as U.S. markets. Additionally, foreign securities also involve currency fluctuation risk, possible imposition of withholding or confiscatory taxes and adverse political or economic developments. These risks may be greater in emerging markets.

Growth Stock Risk – Growth stocks typically are very sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall. Growth stocks as a group may be out of favor and underperform the overall equity market while the market concentrates on undervalued stocks.

Management Risk – The Adviser’s judgment about the quality, relative yield or value of, or market trends affecting, a particular security or sector, or about interest rates generally, may be incorrect. The Adviser’s security selections and other investment decisions might produce losses or cause the Fund to underperform when compared to other funds with similar investment objectives and strategies.

Market Risk – The price of a security held by the Fund may fall due to changing market, economic or political conditions.

Micro Capitalization Company Risk – Investments in micro-cap companies are associated with similar risks as investments in small and medium capitalization companies, but these risks may be even greater with respect to investments in micro-cap companies.

Small and Medium Capitalization Company Risk – Securities of small or medium capitalization companies are more likely to experience sharper swings in market values, less liquid markets, in which it may be more difficult for the Adviser to sell at times and at prices that the Adviser believes appropriate and generally are more volatile than those of larger companies.

Undervalued Stock Risk – The Fund may pursue strategies that may include investing in securities, which, in the opinion of the Adviser, are undervalued. The identification of investment opportunities in undervalued securities is a difficult task and there is no assurance that such opportunities will be successfully recognized or acquired. While investments in undervalued securities offer opportunities for above-average capital appreciation, these investments involve a high degree of financial risk and can result in substantial losses.

Please refer to pages 4-5 for other important disclosures and definitions

42

|

Alpine Mutual Funds |

| |

|

Information about your Funds Expenses (Unaudited)

April 30, 2012 |

Fund expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end on purchase payments; and (2) ongoing costs, including management fees; service and/or distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on November 1, 2011 and held for the six months ended April 30, 2012.

Actual Expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical Example for Comparison Purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

International Real Estate Equity Fund

Based on actual total return (1)

| | | | | | | | | | | | |

Class | | | Actual Total

Return Without

Sales Charges (2) | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (3) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | |

Class A | | 17.75% | | $1,000.00 | | $1,177.50 | | 1.68% | | $6.05 | |

| | | | | | | | | | | |

Institutional | | 6.00% | | $1,000.00 | | $1,060.00 | | 1.44% | | $7.38 | |

| | | | | | | | | | | |

Based on hypothetical total return (1) | | | | | | | | | | | |

| | | | | | | | | | | | |

Class | | | Hypothetical

Annualized

Total Return | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (4) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | |

Class A | | 5.00% | | $1,000.00 | | $1,016.51 | | 1.68% | | $8.42 | |

| | | | | | | | | | | |

Institutional | | 5.00% | | $1,000.00 | | $1,017.70 | | 1.44% | | $7.22 | |

43

|

Alpine Mutual Funds |

| |

|

Information about your Funds Expenses (Unaudited)—Continued

Expense Examples

April 30, 2012 |

|

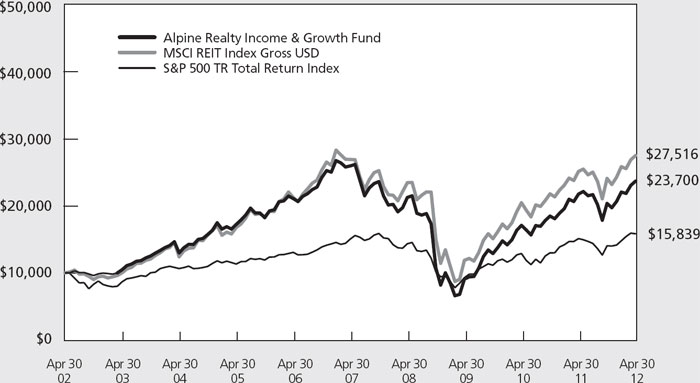

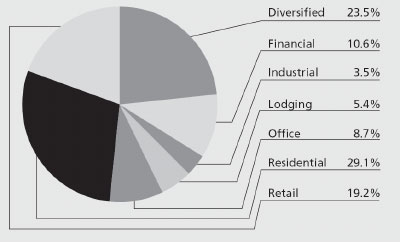

Realty Income and Growth Fund |

| | | | | | | | | | | | |

Based on actual total return (1) | | | | | | | | | | | |

Class | | | Actual Total

Return Without

Sales Charges (2) | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (3) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | |

Class A | | 14.58% | | $1,000.00 | | $1,145.80 | | 1.59% | | $5.64 | |

| | | | | | | | | | | |

Institutional | | 16.26% | | $1,000.00 | | $1,162.60 | | 1.34% | | $7.21 | |

| | | | | | | | | | | |

Based on hypothetical total return (1) | | | | | | | | | | | |

Class | | | Hypothetical

Annualized

Total Return | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (4) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | |

Class A | | 5.00% | | $1,000.00 | | $1,016.96 | | 1.59% | | $7.97 | |

| | | | | | | | | | | |

Institutional | | 5.00% | | $1,000.00 | | $1,018.20 | | 1.34% | | $6.72 | |

| | | | | | | | | | | |

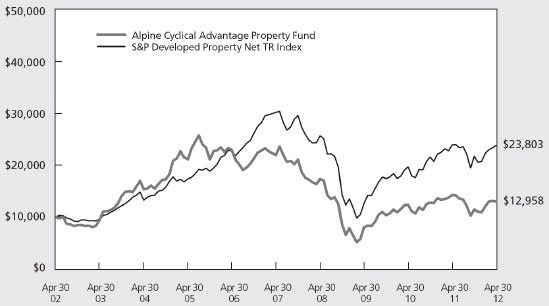

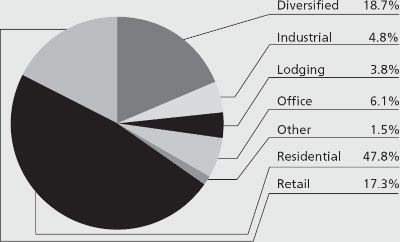

Cyclical Advantage Property Fund | | | | | | | | | | | |

| | | | | | | | | | | |

Based on actual total return (1) | | | | | | | | | | | |

Class | | | Actual Total

Return Without

Sales Charges (2) | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (3) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | |

Institutional | | 13.20% | | $1,000.00 | | $1,132.00 | | 1.48% | | $7.85 | |

| | | | | | | | | | | |

Based on hypothetical total return (1) | | | | | | | | | | | |

Class | | | Hypothetical

Annualized

Total Return | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (3) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | |

Institutional | | 5.00% | | $1,000.00 | | $1,017.50 | | 1.48% | | $7.42 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Emerging Markets Real Estate Fund | | | | | | | | | | | |

| | | | | | | | | | | |

Based on actual total return (1) | | | | | | | | | | | |

Class | | | Actual Total

Return Without

Sales Charges (2) | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (3) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | |

Class A | | 20.52% | | $1,000.00 | | $1,205.20 | | 1.61% | | $5.87 | |

| | | | | | | | | | | |

Institutional | | 10.56% | | $1,000.00 | | $1,105.60 | | 1.35% | | $7.07 | |

| | | | | | | | | | | |

Based on hypothetical total return (1) | | | | | | | | | | | |

Class | | | Hypothetical

Annualized

Total Return | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (4) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | |

Class A | | 5.00% | | $1,000.00 | | $1,016.86 | | 1.61% | | $8.07 | |

| | | | | | | | | | | |

Institutional | | 5.00% | | $1,000.00 | | $1,018.15 | | 1.35% | | $6.77 | |

44

|

Alpine Mutual Funds |

| |

|

Information about your Funds Expenses (Unaudited)—Continued

Expense Examples

April 30, 2012 |

| | | | | | | | | | | | |

Global Infrastructure Fund | | | | | | | | | | | |

| | | | | | | | | | | |

Based on actual total return (1) | | | | | | | | | | | |

Class | | | Actual Total

Return Without

Sales Charges (2) | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (3) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | |

Class A | | 13.16% | | $1,000.00 | | $1,131.60 | | 1.53% | | $5.39 | |

| | | | | | | | | | | |

Institutional | | 11.25% | | $1,000.00 | | $1,112.50 | | 1.28% | | $6.72 | |

| | | | | | | | | | | |

Based on hypothetical total return (1) | | | | | | | | | | | |

Class | | | Hypothetical

Annualized

Total Return | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (4) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | |

Class A | | 5.00% | | $1,000.00 | | $1,017.26 | | 1.53% | | $7.67 | |

| | | | | | | | | | | |

Institutional | | 5.00% | | $1,000.00 | | $1,018.50 | | 1.28% | | $6.42 | |

| | | | | | | | | | | |

Global Consumer Growth Fund | | | | | | | | | | | |

| | | | | | | | | | | |

Based on actual total return (1) | | | | | | | | | | | |

Class | | | Actual Total

Return Without

Sales Charges (2) | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (3) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | |

Class A | | 18.55% | | $1,000.00 | | $1,185.50 | | 1.60% | | $5.78 | |

| | | | | | | | | | | |

Institutional | | 11.22% | | $1,000.00 | | $1,112.20 | | 1.35% | | $7.09 | |

| | | | | | | | | | | |

Based on hypothetical total return (1) | | | | | | | | | | | |

Class | | | Hypothetical

Annualized

Total Return | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (4) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | |

Class A | | 5.00% | | $1,000.00 | | $1,016.91 | | 1.60% | | $8.02 | |

| | | | | | | | | | | |

Institutional | | 5.00% | | $1,000.00 | | $1,018.15 | | 1.35% | | $6.77 | |

| | |

| | |

(1) | For the six months ended April 30, 2012. |

(2) | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

(3) | Expenses (net of fee waivers and/or expense reimbursements) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (121 and 182, for Class A and Institutional Shares, respectfully), then divided by 366. |

(4) | Class A Shares commenced operations on December 30, 2011. Hypothetical expense examples assume a 5% return over a hypothetical 182 day period. |

45

|

Alpine International Real Estate Equity Fund |

| |

Schedule of Portfolio Investments

April 30, 2012 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

|

Common Stocks—102.9% | | | | |

Asia—31.1% | | | | |

China—5.1% | | | | |

| 3,000,000 | | Evergrande Real Estate

Group, Ltd. | | $ | 1,736,127 | |

| 11,028,960 | | Franshion Properties China, Ltd. | | | 3,056,236 | |

| 1,500,000 | | Guangzhou R&F Properties

Co., Ltd. | | | 2,002,926 | |

| 6,000,000 | | Kaisa Group Holdings, Ltd. (a) | | | 1,268,262 | |

| 4,000,000 | | Poly Hong Kong Investments, Ltd. | | | 2,103,459 | |

| 3,991,373 | | SOCAM Development, Ltd. | | | 4,321,310 | |

| 2,199,515 | | Soho China, Ltd. | | | 1,709,456 | |

| | | | | | | |

| | | | | | 16,197,776 | |

| | | | | | | |

Hong Kong—1.7% | | | | |

| 1,615,000 | | Mandarin Oriental International,

Ltd. | | | 2,567,850 | |

| 176,522 | | Sun Hung Kai Properties, Ltd. | | | 2,131,829 | |

| 550,632 | | The Hongkong & Shanghai

Hotels, Ltd. | | | 722,475 | |

| | | | | | | |

| | | | | | 5,422,154 | |

| | | | | | | |

India—8.5% | | | | |

| 90,390 | | DB Realty, Ltd. (a) | | | 126,151 | |

| 2,290,373 | | Hirco PLC (a) | | | 2,137,301 | |

| 2,000,000 | | South Asian Real Estate PLC

(a)(b)(c)(d) | | | 15,287,716 | |

| 7,240,153 | | Unitech Corporate Parks PLC (a) | | | 3,760,014 | |

| 1,491,800 | | Yatra Capital, Ltd. (a)(e) | | | 5,825,354 | |

| | | | | | | |

| | | | | | 27,136,536 | |

| | | | | | | |

Indonesia—3.0% | | | | |

| 267,462,031 | | PT Bakrieland Development

TBK (a) | | | 3,404,935 | |

| 16,765,928 | | PT Bumi Serpong Damai TBK | | | 2,608,702 | |

| 37,288,857 | | PT Lippo Karawaci TBK | | | 3,367,581 | |

| | | | | | | |

| | | | | | 9,381,218 | |

| | | | | | | |

Japan—1.1% | | | | |

| 10,000 | | Kenedix, Inc. (a) | | | 1,814,880 | |

| 100,000 | | Nomura Real Estate Holdings, Inc. | | | 1,762,274 | |

| | | | | | | |

| | | | | | 3,577,154 | |

| | | | | | | |

Malaysia—0.4% | | | | |

| 3,100,591 | | Aseana Properties, Ltd. | | | 1,360,384 | |

| | | | | | | |

Philippines—2.3% | | | | |

| 40,000,000 | | Megaworld Corp. | | | 2,055,898 | |

| 32,035,959 | | SM Development Corp. | | | 5,319,092 | |

| | | | | | | |

| | | | | | 7,374,990 | |

| | | | | | | |

Singapore—3.9% | | | | |

| 6,979,000 | | Banyan Tree Holdings, Ltd. | | | 3,609,341 | |

| 1,250,000 | | CapitaMalls Asia, Ltd. | | | 1,555,556 | |

| 3,401,420 | | Global Logistic Properties, Ltd. (a) | | | 5,662,162 | |

| 625,000 | | Keppel Land, Ltd. | | | 1,601,010 | |

| | | | | | | |

| | | | | | 12,428,069 | |

| | | | | | | |

Thailand—5.1% | | | | |

| 4,702,300 | | Central Pattana PCL | | | 7,684,246 | |

| 18,920,357 | | Minor International PCL | | | 8,675,676 | |

| | | | | | | |

| | | | | | 16,359,922 | |

| | | | | | | |

| | | Total Asia (Cost $129,685,945) | | | 99,238,203 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

|

Europe—26.5% | | | | |

France—2.2% | | | | |

| 135,544 | | Kaufman & Broad SA (a) | | $ | 2,562,112 | |

| 154,193 | | Nexity SA | | | 4,396,429 | |

| | | | | | | |

| | | | | | 6,958,541 | |

| | | | | | | |

Germany—3.8% | | | | |

| 277,424 | | DIC Asset AG | | | 2,583,436 | |

| 1,099,999 | | IVG Immobilien AG (a) | | | 2,546,665 | |

| 1,100 | | Patrizia Immobilien AG (a) | | | 7,124 | |

| 7,642,900 | | Sirius Real Estate, Ltd. (a) | | | 2,377,474 | |

| 317,573 | | TAG Immobilien AG (a) | | | 3,152,786 | |

| 12,440,218 | | Treveria PLC (a) | | | 1,497,685 | |

| | | | | | | |

| | | | | | 12,165,170 | |

| | | | | | | |

Norway—0.5% | | | | |

| 697,582 | | BWG Homes ASA | | | 1,420,042 | |

| 207,485 | | Norwegian Property ASA | | | 308,167 | |

| | | | | | | |

| | | | | | 1,728,209 | |

| | | | | | | |

Poland—0.2% | | | | |

| 3,265,000 | | Nanette Real Estate Group NV

(a)(b)(d) | | | 757,889 | |

| | | | | | | |

Russia—1.7% | | | | |

| 799,367 | | Mirland Development Corp.

PLC (a) | | | 2,048,101 | |

| 1,724,911 | | RGI International, Ltd. (a) | | | 3,449,822 | |

| | | | | | | |

| | | | | | 5,497,923 | |

| | | | | | | |

Sweden—1.9% | | | | |

| 320,877 | | JM AB | | | 5,943,670 | |

| | | | | | | |

Turkey—3.1% | | | | |

| 6,100,522 | | Emlak Konut Gayrimenkul

Yatirim Ortakligi AS | | | 8,024,032 | |

| 2,471,294 | | Sinpas Gayrimenkul Yatirim

Ortakligi AS | | | 1,758,928 | |

| | | | | | | |

| | | | | | 9,782,960 | |

| | | | | | | |

United Kingdom—13.1% | | | | |

| 674,280 | | Development Securities PLC | | | 1,805,577 | |

| 700,339 | | Great Portland Estates PLC | | | 4,092,825 | |

| 5,000,713 | | LXB Retail Properties PLC (a) | | | 9,637,342 | |

| 1,161,792 | | Metric Property Investments PLC | | | 1,687,497 | |

| 5,218,398 | | Quintain Estates & Development

PLC (a) | | | 3,239,368 | |

| 7,808,407 | | Regus PLC | | | 13,521,303 | |

| 2,740,130 | | Songbird Estates PLC (a) | | | 5,202,939 | |

| 800,130 | | Unite Group PLC | | | 2,535,381 | |

| | | | | | | |

| | | | | | 41,722,232 | |

| | | | | | | |

| | | Total Europe (Cost $129,386,573) | | | 84,556,594 | |

| | | | | | | |

Middle East/Africa—0.2% | | | | |

Egypt—0.2% | | | | |

| 1,021,442 | | Talaat Moustafa Group (a) | | | 704,589 | |

| | | | | | | |

| | | Total Middle East/Africa

(Cost $749,574) | | | 704,589 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

46

|

Alpine International Real Estate Equity Fund |

| |

Schedule of Portfolio Investments—Continued

April 30, 2012 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

|

North & South America—45.1% | | | | |

Brazil—41.2% | | | | |

| 718,077 | | Aliansce Shopping Centers SA | | $ | 6,788,420 | |

| 793,138 | | BHG SA—Brazil Hospitality

Group (a) | | | 9,603,455 | |

| 950,037 | | BR Malls Participacoes SA | | | 11,802,259 | |

| 680,298 | | BR Properties SA | | | 8,440,599 | |

| 580,200 | | Brasil Brokers Participacoes SA | | | 1,984,578 | |

| 1,043,085 | | Cyrela Commercial Properties SA

Empreendimentos e

Participacoes | | | 11,491,638 | |

| 2,503,408 | | Direcional Engenharia SA | | | 12,844,388 | |

| 302,684 | | Even Construtora e

Incorporadora SA | | | 1,132,197 | |

| 1,207,100 | | Gafisa SA | | | 2,241,762 | |

| 912,132 | | General Shopping Brasil SA (a) | | | 5,531,698 | |

| 600,151 | | Iguatemi Empresa de Shopping

Centers SA | | | 13,185,911 | |

| 1,653,500 | | JHSF Participacoes SA | | | 5,187,383 | |

| 37,900 | | LPS Brasil Consultoria de

Imoveis SA | | | 654,151 | |

| 1,047,600 | | MRV Engenharia e

Participacoes SA | | | 6,094,947 | |

| 640,400 | | Multiplan Empreendimentos

Imobiliarios SA | | | 15,118,433 | |

| 3,040,610 | | PDG Realty SA Empreendimentos

e Participacoes | | | 7,178,210 | |

| 699,568 | | Rossi Residencial SA | | | 2,936,046 | |

| 475,394 | | Sao Carlos Empreendimentos e

Participacoes SA | | | 7,915,959 | |

| 303,227 | | Tecnisa SA | | | 1,364,891 | |

| | | | | | | |

| | | | | | 131,496,925 | |

| | | | | | | |

Canada—0.0%* | | | | |

| 320,000 | | Lakeview Hotel Real Estate

Investment Trust (a) | | | 90,702 | |

| | | | | | | |

Mexico—0.8% | | | | |

| 2,000,000 | | Corp. GEO SAB de CV—Series B (a) | | | 2,671,590 | |

| | | | | | | |

United States—3.1% | | | | |

| 282,300 | | Sunrise Senior Living, Inc. (a) | | | 1,772,844 | |

| 519,696 | | Verde Realty Corp. (a)(b)(c)(d) | | | 8,159,227 | |

| | | | | | | |

| | | | | | 9,932,071 | |

| | | | | | | |

| | | Total North & South America

(Cost $134,262,074) | | | 144,191,288 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $394,084,166) | | | 328,690,674 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

|

Equity-Linked Structured Notes—1.5% | | | | |

Asia—1.5% | | | | |

India—1.5% | | | | |

| 1,190,000 | | Phoenix Mills, Ltd.—

Merrill Lynch & Co., Inc. | | $ | 4,735,161 | |

| | | | | | | |

| | | Total Asia (Cost $3,920,217) | | | 4,735,161 | |

| | | | | | | |

| | | Total Equity-Linked Structured

Notes (Cost $3,920,217) | | | 4,735,161 | |

| | | | | | | |

Investment Companies—0.8% | | | | |

Asia—0.6% | | | | |

India—0.6% | | | | |

| 7,497,900 | | Trinity Capital PLC (a) | | | 1,962,145 | |

| | | | | | | |

| | | Total Asia (Cost $12,613,773) | | | 1,962,145 | |

| | | | | | | |

Europe—0.2% | | | | |

Turkey—0.2% | | | | |

| 920,000 | | The Ottoman Fund, Ltd. (a) | | | 582,296 | |

| | | | | | | |

| | | Total Europe (Cost $1,507,548) | | | 582,296 | |

| | | | | | | |

| | | Total Investment Companies

(Cost $14,121,321) | | | 2,544,441 | |

| | | | | | | |

Warrants—0.1% | | | | |

Asia—0.1% | | | | |

Thailand—0.1% | | | | |

| 2,569,584 | | Minor International PCL (a)

Expiration: October, 2013

Exercise Price: THB 13.000 | | | 247,349 | |

| | | | | | | |

| | | Total Asia (Cost $0) | | | 247,349 | |

| | | | | | | |

| | | Total Warrants (Cost $0) | | | 247,349 | |

| | | | | | | |

| | | Total Investments

(Cost $412,125,704)—105.3% (f) | | | 336,217,625 | |

| | | Liabilities in Excess of

Other Assets—(5.3)% | | | (16,976,009 | ) |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 319,241,616 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

47

|

Alpine International Real Estate Equity Fund |

| |

Schedule of Portfolio Investments—Continued

April 30, 2012 (Unaudited)

| | |

| | |

Percentages are stated as a percent of net assets. |

|

* | Less than 0.05% of Net Assets. |

|

(a) | Non-income producing security. |

|

(b) | Illiquid security. |

|

(c) | Private placement. |

|

(d) | Security fair valued in accordance with procedures approved by the Board of Trustees. These securities comprised 7.6% of the Fund’s net assets. |

|

(e) | Affiliated issuer. See Note 6 in the Notes to Financial Statements. |

|

(f) | Includes securities pledged as collateral for line of credit outstanding on April 30, 2012. |

|

AB—Aktiebolag is the Swedish equivalent of the term corporation. |

|

AG—Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders. |

|

AS—Anonim Sirketi is the Turkish term for joint stock company. |

|

AAllmennaksjeselskap is the Norwegian term for a public limited company. |

|

NV—Naamloze Vennootschap is the Dutch term for a public limited liability corporation. |

|

PCL—Public Company Limited. |

|

PLC—Public Limited Company. |

|

SA—Generally designates corporations in various countries, mostly those employing the civil law. |

|

SAB de CV—Sociedad Anonima Bursátil de Capital Variable. Is the Spanish equivalent to Variable Capital Company. |

|

THB—Thailand Baht. |

The accompanying notes are an integral part of these financial statements.

48

|

Alpine Realty Income & Growth Fund |

| |

Schedule of Portfolio Investments

April 30, 2012 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

|

Real Estate Investment Trusts—96.6% | | | | |

Apartments—16.4% | | | | |

| 12,000 | | Associated Estates Realty Corp. | | $ | 203,160 | |

| 25,625 | | AvalonBay Communities, Inc. | | | 3,725,875 | |

| 34,900 | | BRE Properties, Inc. | | | 1,832,250 | |

| 10,000 | | Camden Property Trust | | | 676,700 | |

| 68,360 | | Equity Residential | | | 4,200,038 | |

| 23,665 | | Essex Property Trust, Inc. | | | 3,738,360 | |

| 50,200 | | Home Properties, Inc. | | | 3,064,710 | |

| 31,400 | | UDR, Inc. | | | 826,762 | |

| | | | | | | |

| | | | | | 18,267,855 | |

| | | | | | | |

Diversified—5.4% | | | | |

| 26,114 | | American Assets Trust, Inc. | | | 613,940 | |

| 88,700 | | Crombie Real Estate Investment

Trust | | | 1,275,032 | |

| 48,617 | | Vornado Realty Trust | | | 4,173,283 | |

| | | | | | | |

| | | | | | 6,062,255 | |

| | | | | | | |

Health Care—13.3% | | | | |

| 78,772 | | HCP, Inc. | | | 3,265,099 | |

| 44,546 | | Health Care REIT, Inc. | | | 2,523,976 | |

| 90,047 | | Omega Healthcare Investors, Inc. | | | 1,927,906 | |

| 126,200 | | Sabra Health Care REIT, Inc. | | | 2,112,588 | |

| 29,000 | | Senior Housing Properties Trust | | | 640,320 | |

| 74,212 | | Ventas, Inc. | | | 4,362,924 | |

| | | | | | | |

| | | | | | 14,832,813 | |

| | | | | | | |

Lodging—2.4% | | | | |

| 37,942 | | Chatham Lodging Trust | | | 493,246 | |

| 20,303 | | Chesapeake Lodging Trust | | | 367,484 | |

| 65,000 | | Host Hotels & Resorts, Inc. | | | 1,081,600 | |

| 12,000 | | LaSalle Hotel Properties | | | 352,920 | |

| 15,000 | | Pebblebrook Hotel Trust | | | 361,200 | |

| | | | | | | |

| | | | | | 2,656,450 | |

| | | | | | | |

Manufactured Homes—0.8% | | | | |

| 12,850 | | Equity Lifestyle Properties, Inc. | | | 898,729 | |

| | | | | | | |

Mortgage & Finance—2.1% | | | | |

| 79,232 | | Apollo Commercial Real Estate

Finance, Inc. | | | 1,278,012 | |

| 50,000 | | Starwood Property Trust, Inc. | | | 1,043,500 | |

| | | | | | | |

| | | | | | 2,321,512 | |

| | | | | | | |

Net Lease—0.9% | | | | |

| 22,112 | | Entertainment Properties Trust | | | 1,061,155 | |

| | | | | | | |

Office-Industrial Buildings—32.4% | | | | |

| 51,528 | | Alexandria Real Estate

Equities, Inc. | | | 3,860,478 | |

| 61,111 | | Boston Properties, Inc. | | | 6,615,266 | |

| 37,671 | | Coresite Realty Corp. | | | 938,385 | |

| 23,153 | | Corporate Office Properties

Trust | | | 545,253 | |

| 52,600 | | Digital Realty Trust, Inc. | | | 3,949,734 | |

| 139,509 | | Douglas Emmett, Inc. | | | 3,242,189 | |

| 40,352 | | DuPont Fabros Technology, Inc. (a) | | | 1,095,557 | |

| 54,473 | | Kilroy Realty Corp. | | | 2,584,744 | |

| 32,208 | | Liberty Property Trust | | | 1,173,982 | |

| 23,508 | | Mack—Cali Realty Corp. | | | 675,150 | |

| 38,581 | | Mission West Properties, Inc. | | | 338,741 | |

| 393,165 | | MPG Office Trust, Inc. (a) | | | 829,578 | |

| 104,700 | | ProLogis, Inc. | | | 3,746,166 | |

| 50,551 | | SL Green Realty Corp. | | | 4,167,424 | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

|

Real Estate Investment Trusts—continued | | | | |

Office-Industrial Buildings—continued | | | | |

| 51,271 | | STAG Industrial, Inc. | | $ | 713,692 | |

| 20,000 | | Terreno Realty Corp. | | | 286,000 | |

| 86,364 | | Verde Realty Corp. (a)(b)(c)(d) | | | 1,355,915 | |

| | | | | | | |

| | | | | | 36,118,254 | |

| | | | | | | |

Retail Centers—19.0% | | | | |

| 205,211 | | CBL & Associates Properties, Inc. | | | 3,823,081 | |

| 12,100 | | Federal Realty Investment Trust | | | 1,217,986 | |

| 60,000 | | General Growth Properties, Inc. | | | 1,068,000 | |

| 50,000 | | Kimco Realty Corp. | | | 970,500 | |

| 55,795 | | Simon Property Group, Inc. | | | 8,681,702 | |

| 24,706 | | Taubman Centers, Inc. | | | 1,906,809 | |

| 56,428 | | The Macerich Co. | | | 3,474,272 | |

| | | | | | | |

| | | | | | 21,142,350 | |

| | | | | | | |

Storage—3.9% | | | | |

| 30,765 | | Public Storage | | | 4,407,394 | |

| | | | | | | |

| | | Total Real Estate Investment Trusts

(Cost $73,695,799) | | | 107,768,767 | |

| | | | | | | |

Common Stocks—2.0% | | | | |

Lodging—1.1% | | | | | |

| 20,000 | | Starwood Hotels & Resorts

Worldwide, Inc. | | | 1,184,000 | |

| | | | | | | |

Office-Industrial Buildings—0.9% | | | | |

| 57,000 | | Brookfield Office Properties, Inc. | | | 1,035,120 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $1,645,471) | | | 2,219,120 | |

| | | | | | | |

Preferred Stocks—6.3% | | | | |

Diversified—0.5% | | | | |

| 20,000 | | Winthrop Realty Trust—

Series D, 9.250% | | | 513,000 | |

| | | | | | | |

Lodging—1.0% | | | | | |

| 14,800 | | LaSalle Hotel Properties—

Series G, 7.250% | | | 371,184 | |

| 30,300 | | Sunstone Hotel Investors, Inc.—

Series A, 8.000% | | | | |

| | | | | | 745,380 | |

| | | | | | | |

| | | | | | 1,116,564 | |

| | | | | | | |

Net Lease—2.7% | | | | |

| 19,630 | | CapLease, Inc.—Series A, 8.125% | | | 490,750 | |

| 97,865 | | Entertainment Properties Trust—

Series D, 7.375% | | | 2,468,155 | |

| | | | | | | |

| | | | | | 2,958,905 | |

| | | | | | | |

Office-Industrial Buildings—0.9% | | | | |

| 41,360 | | SL Green Realty Corp.—

Series D, 7.875% | | | 1,060,057 | |

| | | | | | | |

Retail Centers—1.2% | | | | |

| 55,198 | | CBL & Associates Properties, Inc.—

Series D, 7.375% | | | 1,392,646 | |

| | | | | | | |

| | | Total Preferred Stocks

(Cost $4,361,825) | | | 7,041,172 | |

| | | | | | | |

| | | Total Investments

(Cost $79,703,095)—104.9% (e) | | | 117,029,059 | |

| | | Liabilities in Excess of

Other Assets—(4.9)% | | | (5,503,104 | ) |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 111,525,955 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

49

|

Alpine Realty Income & Growth Fund |

| |

Schedule of Portfolio Investments—Continued

April 30, 2012 (Unaudited)

| | |

| | |

Percentages are stated as a percent of net assets. |

|

(a) | Non-income producing security. |

| |

(b) | Illiquid security. |

| |

(c) | Private placement. |

| |

(d) | Security fair valued in accordance with procedures approved by the Board of Trustees. These securities comprised 1.2% of the Fund’s net assets. |

| |

(e) | Includes securities pledged as collateral for line of credit outstanding on April 30, 2012. |

| |

REIT—Real Estate Investment Trust |

The accompanying notes are an integral part of these financial statements.

50

|

Alpine Cyclical Advantage Property Fund |

| |

Schedule of Portfolio Investments

April 30, 2012 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

|

Common Stocks—100.6% | | | | |

Asia—20.8% | | | | |

China—3.8% | | | | |

| 500,000 | | Evergrande Real Estate

Group, Ltd. | | $ | 289,355 | |

| 2,500,000 | | Franshion Properties China, Ltd. | | | 692,775 | |

| 200,000 | | Guangzhou R&F Properties

Co., Ltd. | | | 267,057 | |

| 500,000 | | Hopson Development

Holdings, Ltd. | | | 301,599 | |

| 1,000,000 | | Kaisa Group Holdings, Ltd. (a) | | | 211,377 | |

| 500,000 | | Poly Hong Kong Investments, Ltd. | | | 262,932 | |

| | | | | | | |

| | | | | | 2,025,095 | |

| | | | | | | |

Hong Kong—0.7% | | | | |

| 29,420 | | Sun Hung Kai Properties, Ltd. | | | 355,301 | |

| | | | | | | |

India—0.6% | | | | |

| 620,000 | | Unitech Corporate Parks PLC (a) | | | 321,983 | |

| | | | | | | |

Indonesia—2.2% | | | | |

| 36,204,016 | | PT Bakrieland Development

TBK (a) | | | 460,897 | |

| 3,500,000 | | PT Ciputra Development TBK | | | 289,429 | |

| 4,513,514 | | PT Lippo Karawaci TBK | | | 407,618 | |

| | | | | | | |

| | | | | | 1,157,944 | |

| | | | | | | |

Japan—2.0% | | | | |

| 60,000 | | Hulic Co., Ltd. | | | 691,383 | |

| 1,000 | | Kenedix, Inc. (a) | | | 181,488 | |

| 10,000 | | Nomura Real Estate Holdings, Inc. | | | 176,227 | |

| | | | | | | |

| | | | | | 1,049,098 | |

| | | | | | | |

Philippines—3.4% | | | | |

| 5,000,000 | | Megaworld Corp. | | | 256,987 | |

| 3,751,363 | | Robinsons Land Corp. | | | 1,538,930 | |

| | | | | | | |

| | | | | | 1,795,917 | |

| | | | | | | |

Singapore—1.7% | | | | |

| 200,000 | | CapitaMalls Asia, Ltd. | | | 248,889 | |

| 250,000 | | Global Logistic Properties, Ltd. (a) | | | 416,161 | |

| 100,000 | | Keppel Land, Ltd. | | | 256,162 | |

| | | | | | | |

| | | | | | 921,212 | |

| | | | | | | |

Thailand—6.4% | | | | |

| 300,000 | | Central Pattana PCL | | | 490,244 | |

| 2,200,000 | | LPN Development PCL—NVDR | | | 1,237,724 | |

| 1,100,000 | | Minor International PCL | | | 504,390 | |

| 1,400,000 | | Supalai PCL | | | 746,667 | |

| 1,000,000 | | Ticon Industrial Connection PCL | | | 422,764 | |

| | | | | | | |

| | | | | | 3,401,789 | |

| | | | | | | |

| | | Total Asia (Cost $8,500,456) | | | 11,028,339 | |

| | | | | | | |

Europe—14.9% | | | | |

France—2.2% | | | | |

| 67,000 | | Affine SA | | | 1,160,038 | |

| | | | | | | |

Germany—4.9% | | | | |

| 39,904 | | DIC Asset AG | | | 371,595 | |

| 100,000 | | Patrizia Immobilien AG (a) | | | 647,687 | |

| 159,090 | | TAG Immobilien AG (a) | | | 1,579,406 | |

| | | | | | | |

| | | | | | 2,598,688 | |

| | | | | | | |

Norway—0.1% | | | | |

| 38,720 | | BWG Homes ASA | | | 78,821 | |

| | | | | | | |

Poland—0.4% | | | | |

| 40,000 | | Atrium European Real Estate, Ltd. | | | 194,848 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

|

Common Stocks—continued | | | | |

Russia—1.5% | | | | |

| 800,000 | | Raven Russia, Ltd. | | $ | 808,204 | |

| | | | | | | |

United Kingdom—5.8% | | | | |

| 778,923 | | LXB Retail Properties PLC (a) | | | 1,501,135 | |

| 964,231 | | Quintain Estates & Development

PLC (a) | | | 598,555 | |

| 341,253 | | Songbird Estates PLC (a) | | | 647,969 | |

| 100,014 | | Unite Group PLC | | | 316,916 | |

| | | | | | | |

| | | | | | 3,064,575 | |

| | | | | | | |

| | | Total Europe (Cost $7,598,973) | | | 7,905,174 | |

| | | | | | | |

Middle East/Africa—0.6% | | | | |

Egypt—0.6% | | | | |

| 81,405 | | Six of October Development &

Investment Co. | | | 214,378 | |

| 153,251 | | Talaat Moustafa Group (a) | | | 105,712 | |

| | | | | | | |

| | | | | | 320,090 | |

| | | | | | | |

| | | Total Middle East/Africa

(Cost $550,617) | | | 320,090 | |

| | | | | | | |

North & South America—64.3% | | | | |

Brazil—24.6% | | | | |

| 98,241 | | BHG SA—Brazil Hospitality

Group (a) | | | 1,189,519 | |

| 109,796 | | BR Malls Participacoes SA | | | 1,363,990 | |

| 95,538 | | BR Properties SA | | | 1,185,360 | |

| 7,500 | | Cyrela Commercial Properties SA

Empreendimentos e

Participacoes—ADR | | | 332,577 | |

| 15,000 | | Cyrela Commercial Properties SA

Empreendimentos e

Participacoes—ADR (b) | | | 665,154 | |

| 230,654 | | Direcional Engenharia SA | | | 1,183,430 | |

| 100,526 | | Even Construtora e

Incorporadora SA | | | 376,020 | |

| 180,100 | | Gafisa SA | | | 334,472 | |

| 40,000 | | General Shopping Brasil SA (a) | | | 242,583 | |

| 72,140 | | Iguatemi Empresa de Shopping

Centers SA | | | 1,584,987 | |

| 150,000 | | JHSF Participacoes SA | | | 470,582 | |

| 28,000 | | LPS Brasil Consultoria de

Imoveis SA | | | 483,278 | |

| 88,290 | | Multiplan Empreendimentos

Imobiliarios SA | | | 2,084,332 | |

| 310,000 | | PDG Realty SA Empreendimentos

e Participacoes | | | 731,842 | |

| 140,000 | | Rossi Residencial SA | | | 587,572 | |

| 54,181 | | Tecnisa SA | | | 243,881 | |

| | | | | | | |

| | | | | | 13,059,579 | |

| | | | | | | |

Canada—1.1% | | | | |

| 49,146 | | Brookfield Residential

Properties, Inc. (a) | | | 571,077 | |

| | | | | | | |

Mexico—0.7% | | | | |

| 254,825 | | Corp. GEO SAB de CV—Series B (a) | | | 340,394 | |

| | | | | | | |

United States—37.9% | | | | |

| 30,000 | | Altisource Portfolio Solutions

SA (a) | | | 1,794,900 | |

| 17,493 | | American Capital Agency Corp. | | | 546,481 | |

| 20,000 | | American Capital Mortgage

Investment Corp. | | | 454,600 | |

The accompanying notes are an integral part of these financial statements.

51

|

Alpine Cyclical Advantage Property Fund |

| |

Schedule of Portfolio Investments—Continued

April 30, 2012 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

|

Common Stocks—continued | | | | |

United States—continued | | | | |

| 19,852 | | Apollo Commercial Real Estate

Finance, Inc. | | $ | 320,213 | |

| 50,000 | | Brookdale Senior Living, Inc. (a) | | | 950,500 | |

| 40,491 | | Brookfield Office Properties, Inc. | | | 735,316 | |

| 45,000 | | CBRE Group, Inc.—Class A (a) | | | 846,450 | |

| 25,125 | | Chatham Lodging Trust | | | 326,625 | |

| 84,228 | | DiamondRock Hospitality Co. | | | 895,344 | |

| 40,000 | | Excel Trust, Inc. | | | 479,600 | |

| 89,053 | | General Growth Properties, Inc. | | | 1,585,143 | |

| 4,910 | | Hudson Pacific Properties, Inc. | | | 77,725 | |

| 5,000 | | Jones Lang LaSalle, Inc. | | | 399,700 | |

| 500 | | KB Home | | | 4,340 | |

| 25,000 | | Lennar Corp.—Class A | | | 693,500 | |

| 300 | | NVR, Inc. (a) | | | 235,182 | |

| 110,771 | | Ocwen Financial Corp. (a) | | | 1,651,596 | |

| 6,831 | | ProLogis, Inc. | | | 244,413 | |

| 100,000 | | PulteGroup, Inc. (a) | | | 984,000 | |

| 3,340 | | Rouse Properties, Inc. | | | 44,890 | |

| 1,923 | | Simon Property Group, Inc. | | | 299,219 | |

| 40,000 | | Starwood Property Trust, Inc. | | | 834,800 | |

| 40,000 | | Sunrise Senior Living, Inc. (a) | | | 251,200 | |

| 8,533 | | The Howard Hughes Corp. (a) | | | 572,650 | |

| 20,000 | | Toll Brothers, Inc. (a) | | | 508,000 | |

| 48,200 | | TravelCenters of America LLC (a) | | | 303,660 | |

| 87,912 | | Two Harbors Investment Corp. | | | 919,559 | |

| 143,940 | | Verde Realty Corp. (a)(c)(d)(e) | | | 2,259,858 | |

| 10,440 | | Vornado Realty Trust | | | 896,170 | |

| | | | | | | |

| | | | | | 20,115,634 | |

| | | | | | | |

| | | Total North & South America

(Cost $29,644,457) | | | 34,086,684 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $46,294,503) | | | 53,340,287 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

|

Equity-Linked Structured Notes—1.7% | | | | |

Asia—1.7% | | | | |

India—0.9% | | | | |

| 300,000 | | Peninsula Land, Ltd.—

Macquarie Bank, Ltd. (a) | | $ | 179,886 | |

| 50,000 | | Sobha Developers, Ltd.—

Macquarie Bank, Ltd. (a) | | | 311,432 | |

| | | | | | | |

| | | | | | 491,318 | |

| | | | | | | |

Vietnam—0.8% | | | | |

| 301,875 | | HAGL JSC—GDR—

Macquarie Bank, Ltd. (a) | | | 412,932 | |

| | | | | | | |

| | | Total Asia (Cost $1,542,321) | | | 904,250 | |

| | | | | | | |

| | | Total Equity-Linked Structured

Notes (Cost $1,542,321) | | | 904,250 | |

| | | | | | | |

Warrants—0.0%* | | | | |

Asia—0.0%* | | | | |

Thailand—0.0%* | | | | |

| 100,000 | | Minor International PLC

Expiration: May, 2013 | | | | |

| | | Exercise Price: THB 13.00 (a) | | | 9,626 | |

| | | | | | | |

| | | Total Asia (Cost $0) | | | 9,626 | |

| | | | | | | |

| | | Total Warrants (Cost $0) | | | 9,626 | |

| | | | | | | |

| | | Total Investments

(Cost $47,836,824)—102.3% (f) | | | 54,254,163 | |

| | | Liabilities in Excess of

Other Assets—(2.3)% | | | (1,224,340 | ) |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 53,029,823 | |

| | | | | | | |

| | |

| | |

|

Percentages are stated as a percent of net assets. |

|

* Amount is less than 0.05%. |

| |

(a) | Non-income producing security. |

| |

(b) | Restricted under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. These securities have been determined to be liquid under guidelines established by the Board of Trustees. Liquid securities restricted under Rule 144A comprised 1.3% of the Fund’s net assets. |

| |

(c) | Security fair valued in accordance with procedures approved by the Board of Trustees. These securities comprised 4.3% of the Fund’s net assets. |

| |

(d) | Illiquid security. |

| |

(e) | Private placement. |

| |

(f) | Includes securities pledged as collateral for line of credit outstanding on April 30, 2012. |

ADR—American Depositary Receipt.

AG—Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders.

ASA—Allmennaksjeselskap is the Norwegian term for a public limited company.

GDR—Global Depositary Receipt.

JSC—Joint Stock Company.

NVDR—Non-Voting Depositary Receipts.

PCL—Public Company Limited.

PLC—Public Limited Company.

SA—Generally designates corporations in various countries, mostly those employing the civil law.

SAB de CV—Sociedad Anonima Bursátil de Capital Variable. Is the Spanish equivalent to Variable Capital Company.

THB—Thailand Baht.

The accompanying notes are an integral part of these financial statements.

52

|

Alpine Emerging Markets Real Estate Fund |

| |

Schedule of Portfolio Investments

April 30, 2012 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | |

Common Stocks—93.6% | | | | |

Asia—49.7% | | | | |

China—13.4% | | | | |

| 100,000 | | C C Land Holdings, Ltd. | | $ | 21,396 | |

| 74,000 | | China Overseas Grand Oceans

Group, Ltd. | | | 99,574 | |

| 27,000 | | China Overseas Land &

Investment, Ltd. | | | 58,603 | |

| 31,000 | | China Resources Land, Ltd. | | | 59,693 | |

| 70,000 | | China State Construction

International Holdings, Ltd. | | | 64,689 | |

| 150,000 | | Evergrande Real Estate Group,

Ltd. | | | 86,806 | |

| 26,000 | | Franshion Properties China, Ltd. | | | 7,205 | |

| 27,000 | | Guangzhou R&F Properties Co.,

Ltd. | | | 36,053 | |

| 125,000 | | Kaisa Group Holdings, Ltd. (a) | | | 26,422 | |

| 20,000 | | KWG Property Holding, Ltd. | | | 13,224 | |

| 82,000 | | Poly Hong Kong Investments,

Ltd. (a) | | | 43,121 | |

| 58,500 | | Soho China, Ltd. | | | 45,466 | |

| | | | | | | |

| | | | | | 562,252 | |

| | | | | | | |

Hong Kong—3.2% | | | | |

| 3,000 | | Cheung Kong Holdings, Ltd. | | | 39,981 | |

| 11,000 | | Mandarin Oriental International,

Ltd. | | | 17,490 | |

| 3,500 | | Sun Hung Kai Properties, Ltd. | | | 42,269 | |

| 6,000 | | Wharf Holdings, Ltd. | | | 35,805 | |

| | | | | | | |

| | | | | | 135,545 | |

| | | | | | | |

India—0.8% | | | | |

| 65,000 | | Unitech Corporate Parks PLC (a) | | | 33,756 | |

| | | | | | | |

Indonesia—11.5% | | | | |

| 52,000 | | First Real Estate Investment Trust | | | 37,608 | |

| 149,000 | | Lippo Malls Indonesia Retail Trust | | | 49,366 | |

| 330,000 | | PT Agung Podomoro Land TBK (a) | | | 13,465 | |

| 1,700,000 | | PT Alam Sutera Realty TBK | | | 110,984 | |

| 1,006,945 | | PT Bakrieland Development

TBK (a) | | | 12,819 | |

| 524,659 | | PT Bumi Serpong Damai TBK | | | 81,635 | |

| 400,000 | | PT Ciputra Development TBK | | | 33,078 | |

| 100,000 | | PT Ciputra Property TBK | | | 8,596 | |

| 170,000 | | PT Ciputra Surya TBK | | | 38,844 | |

| 450,000 | | PT Lippo Karawaci TBK | | | 40,640 | |

| 300,000 | | PT Summarecon Agung TBK | | | 56,471 | |

| | | | | | | |

| | | | | | 483,506 | |

| | | | | | | |

Malaysia—1.6% | | | | |

| 50,000 | | Aseana Properties, Ltd. | | | 21,937 | |

| 23,000 | | IJM Land BHD | | | 16,798 | |

| 40,000 | | UEM Land Holdings BHD (a) | | | 26,570 | |

| | | | | | | |

| | | | | | 65,305 | |

| | | | | | | |

Philippines—6.4% | | | | |

| 140,000 | | Ayala Land, Inc. | | | 71,128 | |

| 700,000 | | Megaworld Corp. | | | 35,978 | |

| 145,136 | | Robinsons Land Corp. | | | 59,540 | |

| 93,356 | | SM Development Corp. | | | 15,500 | |

| 225,000 | | SM Prime Holdings, Inc. | | | 88,998 | |

| | | | | | | |

| | | | | | 271,144 | |

| | | | | | | |

Singapore—1.0% | | | | |

| 26,500 | | Global Logistic Properties,

Ltd. (a) | | | 44,113 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | |

Common Stocks—continued | | | | |

Thailand—11.8% | | | | |

| 120,000 | | Amata Corp. PCL | | $ | 69,854 | |

| 205,000 | | Asian Property Development PCL | | | 45,667 | |

| 45,000 | | Central Pattana PCL | | | 73,536 | |

| 170,000 | | LPN Development PCL—NVDR | | | 95,642 | |

| 204,500 | | Minor International PCL | | | 93,771 | |

| 180,000 | | Supalai PCL | | | 96,000 | |

| 50,000 | | Ticon Industrial Connection PCL | | | 21,138 | |

| | | | | | | |

| | | | | | 495,608 | |

| | | | | | | |

| | | Total Asia (Cost $1,605,262) | | | 2,091,229 | |

| | | | | | | |

Europe—6.3% | | | | |

Russia—4.3% | | | | |

| 11,500 | | Etalon Group, Ltd.—GDR (a)(b) | | | 76,245 | |

| 6,074 | | Mirland Development Corp.

PLC (a) | | | 15,562 | |

| 65,000 | | Raven Russia, Ltd. | | | 65,667 | |

| 11,000 | | RGI International, Ltd. (a) | | | 22,000 | |

| | | | | | | |

| | | | | | 179,474 | |

| | | | | | | |

Turkey—2.0% | | | | |

| 47,000 | | Emlak Konut Gayrimenkul

Yatirim Ortakligi AS | | | 61,819 | |

| 30,000 | | Sinpas Gayrimenkul Yatirim

Ortakligi AS | | | 21,352 | |

| | | | | | | |

| | | | | | 83,171 | |

| | | | | | | |

| | | Total Europe (Cost $220,946) | | | 262,645 | |

| | | | | | | |

Middle East/Africa—0.5% | | | | |

UAE—0.5% | | | | |

| 25,000 | | Emaar Properties PJSC | | | 22,257 | |

| | | | | | | �� |

| | | Total Middle East/Africa

(Cost $20,735) | | | 22,257 | |

| | | | | | | |

North & South America—37.1% | | | | |

Argentina—1.0% | | | | |

| 3,100 | | TGLT SA—ADR (a) | | | 40,203 | |

| | | | | | | |

Brazil—34.4% | | | | |

| 4,500 | | Aliansce Shopping Centers SA | | | 42,541 | |

| 3,762 | | BHG SA—Brazil Hospitality

Group (a) | | | 45,551 | |

| 17,049 | | BR Malls Participacoes SA | | | 211,799 | |

| 10,056 | | BR Properties SA | | | 124,767 | |

| 10,500 | | Brasil Brokers Participacoes SA | | | 35,915 | |

| 3,791 | | Cyrela Commercial Properties SA

Empreendimentos e

Participacoes | | | 41,765 | |

| 19,124 | | Direcional Engenharia SA | | | 98,121 | |

| 16,895 | | Even Construtora e

Incorporadora SA | | | 63,196 | |

| 8,000 | | Ez Tec Empreendimentos e

Participacoes SA | | | 88,346 | |

| 14,838 | | General Shopping Brasil SA (a) | | | 89,986 | |

| 6,000 | | Helbor Empreendimentos SA | | | 29,683 | |

| 1,000 | | Iguatemi Empresa de Shopping

Centers SA | | | 21,971 | |

| 35,000 | | JHSF Participacoes SA | | | 109,803 | |

| 2,250 | | LPS Brasil Consultoria de

Imoveis SA | | | 38,835 | |

| 18,050 | | MRV Engenharia e

Participacoes SA | | | 105,015 | |

| 2,000 | | Multiplan Empreendimentos

Imobiliarios SA | | | 47,216 | |

The accompanying notes are an integral part of these financial statements.

53

|

Alpine Emerging Markets Real Estate Fund |

| |

Schedule of Portfolio Investments—Continued

April 30, 2012 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | |

Common Stocks—continued | | | | |

Brazil—continued | | | | |

| 81,754 | | PDG Realty SA Empreendimentos

e Participacoes | | $ | 193,003 | |

| 6,677 | | Rossi Residencial SA | | | 28,023 | |

| 894 | | Sao Carlos Empreendimentos e

Participacoes SA | | | 14,886 | |

| 3,500 | | Tecnisa SA | | | 15,754 | |

| | | | | | | |

| | | | | | 1,446,176 | |

| | | | | | | |

Chile—0.8% | | | | |

| 12,000 | | Parque Arauco SA | | | 23,315 | |

| 20,000 | | Socovesa SA | | | 10,060 | |

| | | | | | | |

| | | | | | 33,375 | |

| | | | | | | |

Mexico—0.9% | | | | |

| 30,000 | | Corp. GEO SAB de CV—

Series B (a) | | | 40,074 | |

| | | | | | | |

| | | Total North & South America

(Cost $1,591,876) | | | 1,559,828 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $3,438,819) | | | 3,935,959 | |

| | | | | | | |

Equity-Linked Structured Notes—5.2% | | | | |

Asia—5.2% | | | | |

India—3.8% | | | | |

| 10,000 | | Anant Raj Industries, Ltd.—

Macquarie Bank, Ltd. | | | 11,091 | |

| 8,667 | | DLF, Ltd.—Macquarie Bank, Ltd. | | | 30,820 | |

| 25,000 | | Peninsula Land, Ltd.—

Macquarie Bank, Ltd. | | | 14,990 | |

| 12,310 | | Phoenix Mills, Ltd.—

Macquarie Bank, Ltd. | | | 48,983 | |

| 5,000 | | Phoenix Mills, Ltd.—

Merrill Lynch & Co., Inc. | | | 19,896 | |

| 15,500 | | Prestige Estates Projects, Ltd.—

Macqarie Bank, Ltd. | | | 32,353 | |

| | | | | | | |

| | | | | | 158,133 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | |

Equity-Linked Structured Notes—continued | | | | |

Vietnam—1.4% | | | | |

| 43,125 | | HAGL JSC—GDR—

Macquarie Bank, Ltd. (a) | | $ | 58,990 | |

| | | | | | | |

| | | Total Asia (Cost $253,055) | | | 217,123 | |

| | | | | | | |

| | | Total Equity-Linked Structured

Notes (Cost $253,055) | | | 217,123 | |

| | | | | | | |

Investment Companies—0.1% | | | | |

| 10,000 | | Vinaland, Ltd. (a) | | | 5,638 | |

| | | | | | | |

| | | Total Investment Companies

(Cost $4,857) | | | 5,638 | |

| | | | | | | |

Warrants—0.0%* | | | | |

Asia—0.0%* | | | | |

Thailand—0.0%* | | | | |

| 14,000 | | The Erawan Group PCL (a)

Expiration: December, 2013

Exercise Price: THB 2.80 | | | 278 | |

| 7,500 | | Minor International PCL (a)

Expiration: May, 2013

Exercise Price: THB 13.00 | | | 722 | |

| | | | | | | |

| | | | | | 1,000 | |

| | | | | | | |

| | | Total Asia (Cost $0) | | | 1,000 | |

| | | | | | | |

| | | Total Warrants (Cost $0) | | | 1,000 | |

| | | | | | | |

| | | Total Investments

(Cost $3,696,731)—98.9% (c) | | | 4,159,720 | |

| | | Other Assets in Excess of

Liabilities—1.1% | | | 45,307 | |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 4,205,027 | |

| | | | | | | |

| | |

| | |

|

Percentages are stated as a percent of net assets. |

|

* Amount is less than 0.05%. |

|

(a) | Non-income producing security. |

| |

(b) | Restricted under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. These securities have been determined to be liquid under guidelines established by the Board of Trustees. Liquid securities restricted under Rule 144A comprised 1.8% of the Fund’s net assets. |

| |

(c) | Includes securities pledged as collateral for line of credit outstanding on April 30, 2012. |

|

ADR—American Depositary Receipt. |

|

AS—Anonim Sirketi is the Turkish term for joint stock company. |

|

BHD—Malaysian equivalent to incorporated. |

|

GDR—Global Depositary Receipt. |

|

JSC—Joint Stock Company. |

|

NVDR—Non-Voting Depositary Receipts. |

|

PCL—Public Company Limited. |

|

PJSC—Public Joint Stock Company. |

|

PLC—Public Limited Company. |

|

SA—Generally designates corporations in various countries, mostly those employing the civil law. |

|

SAB de CV—Sociedad Anonima Bursátil de Capital Variable. Is the Spanish equivalent to Variable Capital Company. |

|

THB—Thailand Baht. |

The accompanying notes are an integral part of these financial statements.

54

|

Alpine Global Infrastructure Fund |

| |

Schedule of Portfolio Investments

April 30, 2012 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | |

Common Stocks—93.1% | | | | |

Asia—15.1% | | | | |

China—9.3% | | | | |

| 1,050,000 | | Anhui Expressway Co.—Class H (a) | | $ | 596,818 | |

| 35,000 | | China Mobile, Ltd. | | | 387,954 | |

| 350,000 | | China Railway Construction Corp.,

Ltd.—Class H | | | 279,237 | |

| 460,400 | | China State Construction

International Holdings, Ltd. | | | 425,469 | |

| 440,000 | | COSCO Pacific, Ltd. | | | 640,833 | |

| 1,200,000 | | Guangshen Railway Co., Ltd.—

Class H (a) | | | 445,438 | |

| 150,000 | | NWS Holdings, Ltd. | | | 226,586 | |

| 2,591,000 | | Tianjin Port Development

Holdings, Ltd. | | | 350,647 | |

| 1,050,000 | | Yuexiu Transport Infrastructure,

Ltd. | | | 507,498 | |

| 125,890 | | ZTE Corp.—Class H (a) | | | 305,369 | |

| | | | | | | |

| | | | | | 4,165,849 | |

| | | | | | | |

Indonesia—2.3% | | | | |

| 17,500,000 | | PT Bakrieland Development

TBK (a) | | | 222,785 | |

| 1,470,000 | | PT Citra Marga Nusaphala

Persada TBK | | | 351,885 | |

| 800,000 | | PT Jasa Marga TBK | | | 465,698 | |

| | | | | | | |

| | | | | | 1,040,368 | |

| | | | | | | |

Japan—1.3% | | | | |

| 9,500 | | East Japan Railway Co. | | | 592,560 | |

| | | | | | | |

Philippines—2.2% | | | | |

| 320,000 | | International Container Terminal

Services, Inc. | | | 515,395 | |

| 800,000 | | Manila Water Co., Inc. | | | 468,025 | |

| | | | | | | |

| | | | | | 983,420 | |

| | | | | | | |

| | | Total Asia (Cost $6,371,867) | | | 6,782,197 | |