UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File number: 811-05684

Alpine Equity Trust

(Exact name of registrant as specified in charter)

2500 Westchester Avenue, Suite 215

Purchase, New York 10577

(Address of principal executive offices)(Zip code)

(Name and Address of Agent for

Service) | Copy to: |

| | |

Samuel A. Lieber

Alpine Woods Capital Investors, LLC

2500 Westchester Avenue, Suite 215

Purchase, New York 10577 | Rose DiMartino

Attorney at Law

Willkie Farr & Gallagher

787 7th Avenue, 40th Floor

New York, New York 10019 |

Registrant’s telephone number, including area code: (914) 251-0880

Date of fiscal year end: October 31, 2013

Date of reporting period: November 1, 2012 – October 31, 2013

Item 1. Shareholder Report.

Real Estate Funds

Annual Report

Table of Contents

Additional Alpine Funds are offered in the Alpine Series Trust and Alpine Income Trust. These Funds include:

| Alpine Dynamic Dividend Fund | Alpine Transformations Fund |

| | |

| Alpine Accelerating Dividend Fund | Alpine Foundation Fund |

| | |

| Alpine Financial Services Fund | Alpine Ultra Short Tax Optimized Income Fund |

| | |

| Alpine Innovators Fund | Alpine Municipal Money Market Fund |

| | |

| | Alpine High Yield Managed Duration Municipal Fund |

Alpine’s Series and Income Funds’ investment objectives, risks, charges and expenses must be considered carefully before investing in funds of the Alpine Series Trust and Alpine Income Trust. The statutory and summary prospectuses contain this and other important information about the investment company, and it may be obtained by calling 1-888-785-5578, or visiting www.alpinefunds.com. Read it carefully before investing.

Mutual fund investing involves risk. Principal loss is possible.

Alpine’s Investment Outlook

President’s Letter

Dear Investors:

The fiscal year ended October 31, 2013 presented a difficult and complex year for investors across capital markets. However, like 2012, it has produced positive returns as economic and business momentum remain favorable. We are nearly five years past the trough of the global financial crisis which occurred from November, 2008 through early March, 2009. The positive performance of stocks since that time may appear to have moved ahead of the economic recovery in the real economy, however, this must be considered in the context of the extreme trough of valuations after the 2008 financial crisis. Generally, the price of many equities today, as measured against typical parameters such as price to earnings multiples, earnings yield relative to treasury yields, share price to cash flow, discounted cash flows, or EV/EBITDA (enterprise value divided by earnings before interest taxes depreciation and amortization), are typically less expensive than during the 2007 peak. Thus, in the context of a normalized business cycle we believe that the most relevant question becomes where are corporate earnings and overall business activity trending? Given the slow pace of recovery, Alpine believes that we are only in the middle of a protracted economic cycle.

The slow pace of recovery as measured by job creation, business capital expenditures, per capita income growth, new business formation, the pace of car and home sales, as well as retail consumption patterns amongst other components of gross domestic product (GDP), suggests that the tepid economy is far from testing the limits of capacity or productivity. This has contributed to the continued lack of material goods inflation, despite the sustained efforts of the global central bankers to provide inexpensive financial liquidity. The lack of growth is evident from the recent earnings reports of the S&P 500® Index companies, which in many cases reflected positive earnings growth with minimal or even declining top line revenue trends. Companies have wrung productivity gains through technological streamlining, enhanced production processes, cost containment and reducing costs of capital through refinancing or restructuring debt. Increasingly,

market participants are concerned that companies may be approaching the limits of such profit margin enhancements. Going forward, we believe the market’s focus may turn to macro factors underpinning the prospects for economic growth which, if positive, should stimulate incremental demand for goods and services, boost aggregate revenues, and ultimately drive returns.

The year began with the traditional economic concerns as it became increasingly evident that the more than thirty-year trend of declining interest rates was nearing an end. The tug-of-war between inflation and deflation seemed to be tilting in the direction of the former as 2012 rolled into 2013, but swung abruptly in the second calendar quarter back to worries over U.S. economic slowing due to reduced government spending as sequestration cuts were implemented. Then the Federal Reserve (Fed) upset the capital markets shortly after interest rates hit record lows at the end of April when Fed Chairman Bernanke announced a process through which the economy would be weaned off the current Quantitative Easing (QE) program, the mechanism by which the Federal Reserve is making $85 billion of monthly purchases of treasury and mortgage backed securities in order to keep interest rates low. The Fed proposed that they would ‘taper’ down QE from $85 billion to $0 in the coming year contingent on the domestic economy showing signs of recovery. Thus, two new words entered the economists’ lexicon this year: ‘sequestration’ and ‘taper’.

Due to the inability of the President and Congress to find common ground between ideology and political opportunism, there has been limited fiscal stimulus deployed towards economic recovery over the past three years. This is in stark contrast to historical precedent where economic stimulus typically extended for two to three years after a recession. Since some lawmakers, investors and economists believed that more stimulus would only inflate the existing debt position, they argued for austerity measures, which precluded more fiscal deficit spending. Sequestration came into play earlier this year as a force majeure created by Congress in anticipation of their inability to come to terms with both current and future fiscal responsibilities. Most economists forecasted that the sequestration process, which

1

indiscriminately reduced spending across the U.S. government, would impact the economy by over a half percent of GDP. In effect, Congress chose to impose the burden of deficit reduction now, rather than waiting until a future date, even if the economy might be on a more stable footing then. It is clear that uncertainty surrounding government policy has significantly dampened business investment sentiment.

In the wake of the financial crisis the Fed was left as the only entity which could provide economic stimulus in the form of cheap money. However, low interest rates alone would not been enough to stimulate economic activity because the lending operations of many domestic financial institutions were significantly impaired by the near collapse of 2008. Since the onset of the crisis the Fed has utilized numerous tools in order to repair the credit mechanism in the economy. In 2012, the Fed acknowledged the potential of a deflationary effect from diminished fiscal spending combined with restricted bank lending practices, and launched the current wave of its QE program which targeted the open-ended purchase of mortgage and treasury bonds from the banks at a profit. We believe the program almost certainly has helped to stabilize the U.S. banking system, to raise the value of financial assets, and even to stimulate modest job growth. Unfortunately, the liquidity introduced into global markets through the latest QE measures also introduced distortions into the economy including excess leverage and speculation in some segments of the capital markets. Thus in our opinion, the limitless duration of open-ended easing could not go on indefinitely without causing more problems. The market became both concerned that the taper would undermine the renewed strength of our banking system and feared the unknown potential level where unsupported interest rates might settle (presumably higher). This forced many investors holding positions in interest sensitive investments to sell, hedge or otherwise reduce much of their interest rate exposure. As a result of the sudden unwinding of these positions, prices fell sharply in May and June of this year. Bond yields, foreign sovereign yields and mortgage yields rose precipitously as the market began discounting the potential impact of Fed tapering.

The market’s knee-jerk reaction to the May taper announcement proved to be premature as the Fed, in fact, did not begin tapering in September as most expected. In fact, since the sell-off in May, the Fed has gone to great lengths to communicate its decision making parameters and to strengthen the credibility of its forward guidance on interest rates. Indeed, in recent comments by prospective Fed Governor Janet Yellen, after the close of our Funds’ fiscal year, she emphasized

that when tapering does occur it will be done in accordance with improvement in economic data and will be at a very gradual pace. Thus, bonds have rallied somewhat as we enter a new phase in the seemingly never ending dance of the capital markets.

Despite tapering concerns, which have at times had traders responding to changes in sentiment on what often seems to be a daily basis, the overall direction and tone of the markets has been positive. Indeed, the S&P 500® Index, as well as other indices, surpassed the price levels of 2007 in April of this year, establishing new highs through the end of the fiscal year. As we reported in the past, the equity markets continue to climb a ‘wall of worry’, two steps forward, one step back, looking over a shoulder both to see how far we have advanced as well as whether danger lurks in our shadow. This could be a very positive stance for investment markets, provided that the fundamentals are supportive. In this light, let us return to the story of limited top-line revenue growth as opposed to bottom-line earnings growth.

Without broad economic growth, revenue growth is dependent upon market share gains or an expanding demand for specific goods and services. For most economies to grow there has to be job creation first and foremost, followed by income growth which should be sustained by enhanced productive capacity. As we closely monitor business trends and capital flows it is becoming increasingly apparent that the world’s more robust economies, notably the developed economies of North America and Asia, are at the nascent stages of a durable recovery, even if broad growth has yet to be sustained. Specifically, the United States and Japan are showing positive, if not consistent, trends in new orders and capital investment. While such investment is not as broad based as we would like to see across different segments of the economy, automobile sales, new building starts (both commercial and residential), as well as selective capital goods hold the potential for a sustained capital goods cycle.

Outside the United States, the traditional engines of global economic growth appear to be aligning in part due to significant monetary easing utilizing QE type policies in both Japan and Great Britain as well as, to a limited degree, the Eurozone. This is providing scope for these countries domestic banking sectors to heal and for capital markets to begin re-pricing risk more favorably in terms of higher stock prices and increasing money flows moving along the capital stack toward a higher risk/reward profile. Japan is riding the wave of ‘Abenomics’, pushing both aggressive monetary loosening and increasing fiscal reforms into the economy. If both the business and consumer segments of the

2

economy can be kick started, then markets could continue pricing in a reflation of growth expectations across the economy, which in turn could create a virtuous cycle across other countries given Japan’s oversized role in the global economy. While the overall economic picture in Europe remains difficult due to continued high unemployment and a weak banking system, particularly in Southern Europe, the economies in Germany and Great Britain continue to motor along. Emblematic of this stage of recovery in Europe is Ireland, which was arguably one of the major beneficiaries of the prior period of excess capital in the early part of last decade. Following a period of fiscal austerity and recapitalization of its banking system, there is strong evidence for recovery as property prices rise and investment capital begins to flow into new business formation ultimately leading to job growth.

With respect to the larger emerging markets we can look to continued solid growth out of China, in spite of the fact that China faces challenges of its own in terms of its banking structure and lending channels. Nonetheless, China’s current account surpluses and foreign capital reserves provide significant support for them to maintain stability as the economy continues its transformation from a pure low priced exporter towards a higher value added producer with a growing consumer base. We note that a number of trends of internet retail demand are globally led by the Chinese consumer, both in terms of the double-digit growth rate of retail sales to the single day record for sales volume ($5.75 billion of sales were recorded by Alibaba.com on November 11 of this year). We believe that the business cycle in many other emerging markets will remain a bit choppy over the first half of next year, however, to a certain extent, the developing economies have been able to take advantage of the delay in Fed tapering, to implement agendas to address the uncertain growth outlook and the expected rise in bond yields. We expect such adjustments could drive business capital expenditure to offset fading governmental economic support (be it fiscal or monetary) to set the stage for the next phase of global economic activity.

While we believe that as economies begin to pick up steam over the next two to three years there will be greater consumer demand for goods and services which may again lead to an excess rate of expansion in prices as well as activity, none of this appears to be present in traditional measures of inflation. The price of gold fell by 23.11% over the fiscal year, while silver declined by 32.03%. As uncertainties over China’s growth trajectory worked through the global economy, resource-based countries saw their currencies decline, notably the Australian Dollar was down 8.87%, Brazilian Real down

9.33%, South African Rand down 10.73% and Indonesian Rupiah down 12.49%. It’s worth noting that Japan was able to depreciate what many believed was an overvalued Yen, leading to an 18.9% fall, which corresponded with significant monetary stimulus and Quantitative Easing in an effort to raise equity prices and jumpstart inflation in its economy. Just to emphasize that currency markets are especially sensitive to global flows of capital, it is worth noting that the largest currency declines during the fiscal year occurred in the Syrian Pound and the Iranian Rial, both of which dropped by over 50% as those countries endured the hardships of civil war and economic blockade respectively.

In summary, we believe the current data suggest that establishing a new trend in global inflation, economic activity and capital availability could be a few years away. Interest rates could remain low relative to history, with the prospect for the yield curve tilting higher over time. This implies relatively appealing prospects for equities, assuming valuations remain sensible. At this time current equity valuations appear reasonable, notwithstanding the selective exuberance of the crowd searching for “the next new thing”, be it web retailers, new energy technology or social media related stocks.

In our view other issues that the capital markets would look at favorably include Congress providing a modicum of current fiscal stimulus over the next twelve to twenty-four months via appropriate tax incentives combined with enacting a program to tackle the long term entitlement pressures before they become more corrosive in 2020. In the meantime, the prospect of reasonable earnings growth, moderate top line expansion, rising corporate capex and gradual strengthening of the employment market could lead to a more traditional balance between the corporate sector, government and public expenditures and thereby provide a sustained basis for equity total returns over the next few years.

We appreciate your interest and support.

Sincerely,

Samuel A. Lieber

President

3

Past performance is not a guarantee of future results. The specific market, sector or investment conditions that contribute to a Fund’s performance may not be replicated in future periods.

Mutual fund investing involves risk. Principal loss is possible. Please refer to individual fund letters for risks specific to that fund.

This letter and the letters that follow represent the opinions of the Funds’ management and are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security. The information provided is not intended to be, and is not, a forecast of future events, a guarantee of future results, or investment advice.

4

| Disclosures and Definitions |  |

Real Estate Funds Disclosures

The specific market, sector or investment conditions that contributed to a Fund’s performance may not be replicated in future periods.

Please refer to the Schedule of Portfolio Investments for Fund holdings information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

Current and future portfolio holdings are subject to risk.

Diversification does not assure a profit or protect against loss in a declining market.

Favorable tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws. Alpine may not be able to anticipate the level of dividends that companies will pay in any given timeframe.

The Funds’ monthly distributions may consist of net investment income, net realized capital gains and / or a return of capital. If a distribution includes anything other than net investment income, the Funds will provide a notice of the best estimate of its distribution sources when distributed, which will be posted on the Funds’ website, www.alpinefunds.com. A return of capital distribution does not necessarily reflect the funds’ investment performance and should not be confused with “yield” or “income.” Final determination of the federal income tax characteristics of distributions paid during calendar year 2013 will be provided on U.S. Form 1099-DIV, which will be mailed to shareholders.

Neither the Fund nor any of its representatives may give tax advice. Investors should consult their tax advisor for information concerning their particular situation.

All investments involve risk. Principal loss is possible. A small portion of the S&P 500 yield may include return of capital; the 10-year Treasury yield does not include return of capital; Corporate Bonds and High Yield Bonds generally do not have return of capital; a portion of the dividend paid by REITs and REIT preferred stock may be deemed a return of capital for tax purposes in the event the company pays a dividend greater than its taxable income. A stock may trade with more or less liquidity than a bond depending on the number of shares and bonds outstanding, the size of the company, and the demand for the securities. The REIT and REIT preferred stock market are smaller than the broader equity and bond markets and often trade with less liquidity than these markets depending upon the size of the individual issue and the demand of the securities. Treasury notes are guaranteed by the U.S. government and thus they are

considered to be safer than other asset classes. Tax features of a Treasury Note, Corporate Bond, Stock, High Yield Bond, REITs and REIT preferred stock may vary based on an individual’s circumstances. Consult a tax professional for additional information.

Earnings Growth & EPS Growth are not measures of the Funds’ future performance.

Must be preceded or accompanied by a prospectus.

Quasar Distributors, LLC, distributor.

Real Estate Funds – Definitions

Adjusted Funds From Operations (AFFO) is generally equal to a trust’s funds from operation with adjustments made for recurring capital expenditures.

Average Weight refers to the average weight of the holding in the portfolio during the reporting period.

Capex (aka Capitalization Expenditure) are funds used by a company to acquire or upgrade physical assets such as property, industrial buildings or equipment. This type of outlay is made by companies to maintain or increase the scope of their operations.

Cap Rate (aka Capitalization Rate) is a rate of return on a real estate investment property based on the expected income that the property will generate. Capitalization rate is used to estimate the investor’s potential return on his or her investment by dividing the income the property will generate (after fixed costs and variable costs) by the total value of the property.

Cash Flow measures the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income.

Correlations are statistical measures of how two securities move in relation to each other.

Developing Markets (“DM”) operate in a country with a relatively high level of economic growth and security and are therefore less risky.

EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) is essentially Net Income with Interest, Taxes, Depreciation, and Amortization added back to it. EBITDA can be used to analyze and compare profitability between companies and industries because it eliminates the effects of financing and accounting decisions.

Earnings Growth is a measure of a company’s net income over a specific period, generally one year, is a key indicator for measuring a company’s success, and the driving force behind stock price appreciation.

5

| Disclosures and Definitions (Continued) |  |

Earnings Per Share Growth is a measure of a company’s net income over a specific period, generally one year, is a key indicator for measuring a company’s success, and the driving force behind stock price appreciation.

Emerging Markets (“EM”) generally do not have the level of market efficiency and strict standards in accounting and securities regulation to be on par with advanced economies (such as the United States, Europe and Japan), but emerging markets will typically have a physical financial infrastructure including banks, a stock exchange and a unified currency.

EV (Enterprise Value) is a measure of a company’s value.

Free cash flow is a measure of financial performance calculated as operating cash flow minus capital expenditures. Free cash flow (FCF) represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base. Free cash flow is important because it allows a company to pursue opportunities that enhance shareholder value.

FTSE EPRA/NAREIT® Emerging Index is an unmanaged index designed to track the performance of listed real estate securities companies in emerging countries worldwide.

FTSE EPRA/NAREIT® Global Index is an unmanaged index designed to track the performance of publicly traded companies engaged in the real estate business in developed and emerging real estate markets/regions around the world.

FTSE EPRA/NAREIT® Global ex U.S. Real Estate Index is an unmanaged index designed to track the performance of publicly traded companies engaged in the real estate business outside the United States. The funds or securities referred to herein are not sponsored, endorsed, or promoted by the index providers, and the index providers bear no liability with respect to any such funds or securities or any index on which such funds or securities are based. The prospectus contains a more detailed description of the limited relationship the index providers have with the licensee and any related funds.

Funds From Operations is a figure used by real estate investment trusts (REITs) to define the cash flow from their operations. It is calculated by adding depreciation and amortization expenses to earnings, and sometimes quoted on a per share basis.

Hedge involves making an investment to reduce the risk of adverse price movements in an asset. Normally, a hedge consists of taking an offsetting position in a related security, such as a futures contract.

Hang Seng Index is a free-float capitalization-weighted index of selection of companies from the Stock Exchange of Hong Kong. The components of the index are divided into four subindexes: Commerce and Industry, Finance, Utilities, and properties. The index was developed with a base level of 100 as of July 31, 1964.

Ibovespa Index is a total return index weighted by traded volume and is comprised of the most liquid stocks traded on the Sao Paulo Stock Exchange.

Lipper Real Estate Funds Average is an average of funds that invest at least 80% of their portfolio in equity securities of domestic and foreign companies engaged in the real estate industry.

MSCI All Country World Index USD* is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets. Source: MSCI.

MSCI ACWI Consumer Discretionary Index* is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets for the Consumer Discretionary GICS® sector. Source: MSCI.

MSCI ACWI Consumer Staples Index USD is a market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets for the Consumer Staples GICS® sector. Source: MSCI.

MSCI Emerging Markets Index USD* is a free float-adjusted market cap-weighted index that is designed to measure equity market performance in the global emerging markets. Source: MSCI.

MSCI US REIT Index* is a free float-adjusted market capitalization-weighted index that is comprised of the most actively-traded equity REITs that are of reasonable size in terms of full- and free-float-adjusted market capitalization. Source: MSCI.

MSCI World Index* is a free-float weighted equity index which includes developed world markets, and does not include emerging markets. Source: MSCI.

*MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Net Operating Income is a company’s operating income after operating expenses are deducted, but before income taxes and interest are deducted. If this is a

6

| Disclosures and Definitions (Continued) |  |

positive value, it is referred to as net operating income, while a negative value is called a net operating loss.

Price/Earnings Ratio (P/E) is a valuation ratio of a company’s current share price compared to its per-share earnings. Normalized earnings — earnings metric that shows you want earnings look like smoothed out in the long run, taking into account the cyclical changes in an economy or stock.

Return on Equity (ROE) is the amount of net income returned as a percentage of shareholders’ equity. Return on equity measures a corporation’s profitability by revealing how much profit a company generates with the money shareholders have invested.

Risk Premium is the return in excess of the risk-free rate of return that an investment is expected to yield. An asset’s risk premium is a form of compensation for investors who tolerate the extra risk - compared to that of a risk-free asset - in a given investment.

S&P 500® Index is a float-adjusted, market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance.

S&P Developed BMI Property Net Total Return Index is an unmanaged market-weighted total return index available on a monthly basis. The index consists of many companies from developed markets whose floats are larger than $100 million and derive more than half of their revenue from property-related activities. Net total returns include cash dividends reinvested in the index but adjusted for

country specific withholding taxes based on the highest tax rate possible.

S&P Developed Ex-U.S. Property Total Return Index defines and measures the investable universe of publicly-traded real estate companies domiciled in developed countries outside of the United States. The companies in the Index are engaged in real estate-related activities such as property ownership, management, development, rental and investment.

S&P Global Infrastructure Index is comprised of 75 of the largest publicly-listed infrastructure companies that meet specific investability requirements. The Index is designed to provide liquid exposure to the leading publicly-listed companies in the global infrastructure industry, from both developed markets and emerging markets.

S&P 500® Utilities Index comprises those companies included in the S&P 500 that are classified as members of the GICS® utilities sector.

STOXX Europe 600 (Price) Index is a broad based capitalization-weighted index of European stocks designed to provide a broad yet liquid representation of companies in the European region. The equities use free float shares in the index calculation. The index was developed with a base value of 100 as of December 31, 1991. This index uses float shares.

STOXX 600 Utilities Index is a capitalization-weighted index which includes European companies that are involved in the utility sector.

An investor cannot invest directly in an index.

7

Equity Manager Reports

| | Alpine International Real Estate

Equity Fund | |

| | | |

| | Alpine Realty Income & Growth Fund | |

| | | |

| | Alpine Cyclical Advantage Property Fund | |

| | | |

| | Alpine Emerging Markets Real Estate Fund | |

| | | |

| | Alpine Global Infrastructure Fund | |

| | | |

| | Alpine Global Consumer Growth Fund | |

| Alpine International Real Estate Equity Fund |  |

| Comparative Annualized Returns as of 10/31/13 (Unaudited) | | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Since Inception(1) |

Alpine International Real Estate Equity Fund —

Institutional Class | | | 7.83% | | | | -0.52% | | | | 16.45% | | | | 4.92% | | | | 5.51% | |

Alpine International Real Estate Equity Fund —

Class A (Without Load) | | | 7.53% | | | | N/A | | | | N/A | | | | N/A | | | | 16.86% | |

Alpine International Real Estate Equity Fund —

Class A (With Load) | | | 1.63% | | | | N/A | | | | N/A | | | | N/A | | | | 13.32% | |

| FTSE EPRA/NAREIT® Global Ex-U.S. Real Estate Index(2) | | | 12.76% | | | | 6.84% | | | | 15.46% | | | | N/A | | | | N/A | |

| MSCI EAFE Index | | | 26.88% | | | | 8.38% | | | | 11.99% | | | | 7.71% | | | | 4.82% | |

| S&P Developed Ex-U.S. Property Total Return Index(3) | | | 16.55% | | | | 10.11% | | | | 16.64% | | | | 10.34% | | | | N/A | |

| Lipper International Real Estate Funds Average(4) | | | 12.59% | | | | 7.18% | | | | 13.23% | | | | 8.04% | | | | 5.53% | |

| Lipper International Real Estate Funds Ranking(4) | | | 46/58 | | | | 44/44 | | | | 3/43 | | | | 3/3 | | | | 1/1 | |

| Gross Expense Ratio (Institutional Class): 1.51%(5) | | | | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Institutional Class): 1.51%(5) | | | | | | | | | | | | | | | | | | | | |

| Gross Expense Ratio (Class A): 1.76%(5) | | | | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Class A): 1.76%(5) | | | | | | | | | | | | | | | | | | | | |

| | (1) | Institutional Class shares commenced on February 1, 1989 and Class A shares commenced on December 30, 2011. Returns for indices are since February 1, 1989. |

| | (2) | Index commenced on October 31, 2008. |

| | (3) | Index commenced on July 31, 1989. |

| | (4) | The since inception data represents the period beginning February 2, 1989 (Institutional Class only). |

| | (5) | As disclosed in the prospectus dated February 28, 2013. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than the performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced. Returns for the Class A shares with sales charge reflect a maximum sales charge of 5.50%. Performance for the Class A shares without sales charges does not reflect this load.

FTSE EPRA/NAREIT® Global ex-U.S. Real Estate Index is an unmanaged index designed to track the performance of publicly traded companies engaged in the real estate business outside the United States. The funds or securities referred to herein are not sponsored, endorsed, or promoted by the index providers, and the index providers bear no liability with respect to any such funds or securities or any index on which such funds or securities are based. The prospectus contains a more detailed description of the limited relationship the index providers have with the licensee and any related funds. MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market-cap-weighted index designed to measure developed market equity performance. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI. The S&P Developed Ex-U.S. Property Total Return Index defines and measures the investable universe of publicly-traded real estate companies domiciled in developed countries outside of the United States. The companies in the Index are engaged in real estate-related activities such as property ownership, management, development, rental and investment. The Lipper International Real Estate Funds Average is an average of funds that invest at least 80% of their portfolio in equity securities of domestic and foreign companies engaged in the real estate industry. Lipper rankings for the periods shown are based on fund total returns with dividends and distributions reinvested and do not reflect sales charges. The FTSE EPRA/NAREIT® Global ex-U.S. Real Estate Index, the MSCI EAFE Index, the S&P Developed Ex-U.S. Property Total Return Index and the Lipper International Real Estate Funds Average are unmanaged and do not reflect direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper International Real Estate Funds Average reflects fees charged by the underlying funds. The performance for the Alpine International Real Estate Equity Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

To the extent that the Fund’s historical performance resulted from gains derived from participation in Initial Public Offerings (“IPOs”) and/or Secondary Offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary Offerings in the future.

9

| Alpine International Real Estate Equity Fund (Continued) |  |

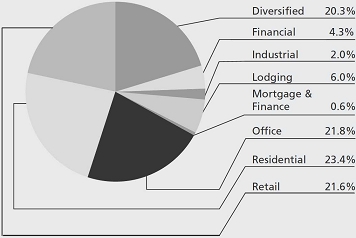

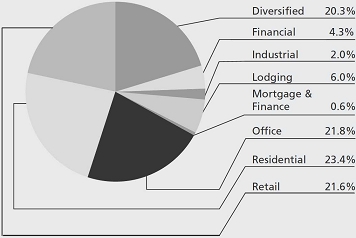

Portfolio Distributions* (Unaudited)

| Top 10 Holdings* (Unaudited) |

| 1. | | Regus PLC | 7.93 | % |

| 2. | | South Asian Real Estate PLC | 5.51 | % |

| 3. | | Central Pattana PCL | 5.02 | % |

| 4. | | Hulic Co., Ltd. | 4.33 | % |

| 5. | | Kenedix, Inc. | 4.32 | % |

| 6. | | Direcional Engenharia SA | 4.04 | % |

| 7. | | Sao Carlos Empreendimentos e Participacoes SA | 4.03 | % |

| 8. | | LXB Retail Properties PLC | 3.74 | % |

| 9. | | SM Prime Holdings, Inc. | 3.56 | % |

| 10. | | Iguatemi Empresa de Shopping Centers SA | 3.14 | % |

| * | Portfolio Distributions percentages are based on total investments. Top 10 Holdings do not include short-term investments and percentages are based on total net assets. Portfolio holdings and sector distributions are as of 10/31/13 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. |

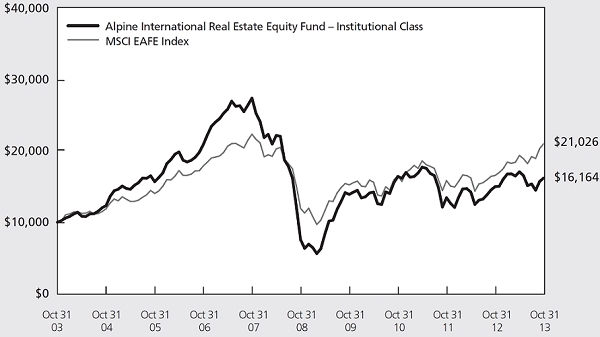

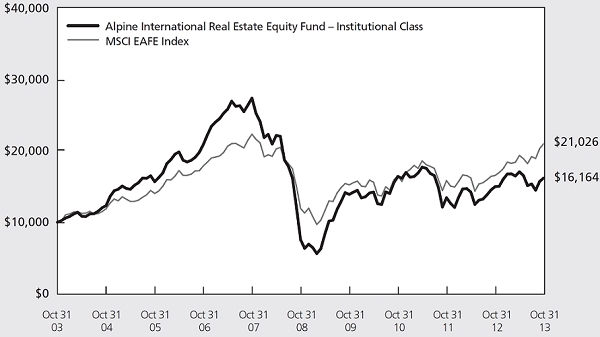

| Value of a $10,000 Investment (Unaudited) |

|

| |

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmarks. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees, if applicable. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost.

10

| Alpine International Real Estate Equity Fund (Continued) |  |

Commentary

Dear Investors:

We are pleased to present the 2013 annual report for the Alpine International Real Estate Equity Fund. For the twelve months ended October 31, 2013, the Fund generated a total return of 7.83%. This compares with the total return of the Fund’s primary benchmark, the FTSE EPRA/NAREIT® Global Ex-US Real Estate Index of 12.76% and the return of its secondary benchmark, the S&P Developed Ex-US Property Total Return Index, of 16.55%. The Fund’s relative performance for the year reflects primarily the impact of an acute shift in capital flows out of emerging markets. The largely indiscriminate exodus in the second half of the fiscal year was motivated in large part by investor concerns that the Federal Reserve’s (Fed) decision to taper its Quantitative Easing (QE) program would remove the monetary stimulus that has been supporting global economic growth. Emerging market economies, which have been the primary driver of global GDP growth since the financial crisis, were the most exposed to a pull back in Fed liquidity. All references in this letter to the Fund’s performance relate to the performance of the Fund’s Institutional Class.

Big Picture for Real Estate in 2013/2014

Since real estate asset pricing typically recovers later in the economic cycle, while stocks generally move in anticipation of economic earnings, real estate equities overall tend to perform in a hybrid fashion. As interest rates were falling in the period after the financial crisis, rate-sensitive sectors such as real estate, and particularly REITs which pay much of their income out in the form of dividends, outperformed the broader equity market and saw strong demand consistent with other income-producing assets. However, this year as interest rates have started to move higher, real estate stock returns have been positive but have lagged the broader market indices. While the S&P 500 finally moved above levels achieved in 2007, during this fiscal year, price-only real estate stock indices are generally well below their prior peak levels. Our analysis has led us to believe that real estate stock price indices are approximately 30% below their 2007 peak. Thus we believe the moderate pace of economic expansion will underpin real estate stock valuations in 2014, as global growth offsets rising interest rate trends.

With weak economic activity suggesting lower levels of demand for goods and services, the construction of new supply of real estate has been limited to specific geographies or subsectors. Thus, the supply and demand balance for many segments of the real estate market is

generally supportive, with limited new supply while demand remains flat to modestly higher. We believe that this gap between demand and supply could widen and translate into stable or rising rents and capital values over the next 12 to 24 months. We expect that if rents increase in ensuing years then dividend growth should follow. Such a scenario would provide a landscape in which real estate equities could sustain current price levels or perhaps move higher even as interest rates rise, because their income and dividend growth could potentially offset the impact of higher relative yields and costs. Of course, this is more likely in an environment where rates are rising at a moderate pace, as opposed to when rates are fluctuating rapidly, such as this summer, when talk of the Fed tapering consumed the market.

Assuming that our assessment of the economic recovery is correct-that we are in the middle of a protracted economic cycle — and given that real estate rents and values tend to perform better in the latter stages of the business cycle-then one might expect positive returns from real estate securities over the next few years. By and large, capital values have moved ahead of rents, due to still low interest rates, but if rents grow appreciably, then development returns could become significant for well capitalized property companies. In our view this could drive the next phase of real estate value creation for property stocks. It is Alpine’s view that selectivity, by stock, sector and geography will be significantly influenced by our analysis of competitive business models.

2013 Portfolio Overview

During the period the Fund reduced its significant overweight position in Brazil from 37.2% down to 21.3% at fiscal year-end. This year end position was surpassed by the Fund’s weight in the U.K. which rose from 13.3% last year to 22.1% this past October. India’s position grew marginally from 10.5% to 12.4%, while the exposure to Japan was increased from 2.2% to 11.5% at year end. The Fund’s next largest positions were in the Philippines which expanded from 3.0% to 6.4% and Thailand which grew from 4.4% to 6.4%. We have continued to hedge a portion of Japanese Yen exposure. We have also continued to employ leverage both in the execution of the Fund’s investment strategy and to manage significant unexpected net outflows from the Fund during the period.

The drivers of portfolio performance in terms of stock selection were generally quite positive, while the macro calls which effect country allocations were decidedly mixed at best. This is perhaps best illustrated by comparing the

11

| Alpine International Real Estate Equity Fund (Continued) |  |

benchmark FTSE EPRA/NAREIT® Global Ex-US Real Estate Index (EPRA Index) with the portfolio returns for the same countries. Japan was the largest weighting in the EPRA Index with an average weight of 19.34% and the stocks in the index produced a 43.23% return. By comparison, the Fund had a much smaller 6.93% average weighting in Japan and despite the lower weighting the Fund generated a comparable contribution from Japan because of the 204.73% return from its holdings. Hong Kong was the second highest weighting in the benchmark with an average weight of 14.72% and generated a total return of 0.92% resulting in a negligible contribution to the Index return, while the Fund’s average weighting of 1.88% generated an 11.28% total return for a comparable portfolio impact. The Index’s third largest weighting was Australia with an average weight of 11.43%, which generated a 2.77% total return compared with a zero exposure in the Fund’s portfolio. The fourth largest index weighting was in the U.K. where an average weight of 7.77% of the index generated a 27.69% total return. This compares with the Fund’s larger 17.64% average U.K. weighting which generated a 49.71% total return. The index’s fifth largest country’s average weight was Singapore with 7.20% which generated a 2.78% total return which compared with the Fund’s 3.40% average weighting and 11.85% total return. In aggregate, the top five country weightings accounted for 60.46% of the index and generated 10.09% of the index’s 12.76% total return. By comparison, the Fund had 29.85% of its portfolio invested in these same five countries, generating a contribution of over 15%. Stock selection in these countries played a key role in the Fund’s generating more than a 50% higher return with 50% less invested in the index’s top 5 countries.

Unfortunately, some of these gains were offset by some other country allocations in the Fund’s portfolio, which dragged down the Fund’s overall return. Specifically, the Fund had an average weighting of 30.26% in Brazil which produced a -20.87% return compared with the Index average weighting of 3.2%, which generated a -22.81% return. Add to this India at an 11.96% average weight, generating a -15.59% return compared with the benchmark’s small 0.41% average weight generating -33.71% total return. While the Fund’s stock selection in Brazil and India were positive contributors relative to the index selection, the Fund’s performance suffered severely from the overweight allocations to these countries. Specifically the Fund’s weighting to Brazil and India

averaged 42.22% during the period and contributed -9.21%, versus a benchmark average exposure of 3.61% for the period which contributed -0.85%.

The Fund’s primary exposure in Brazil was to shopping mall owners and developers and, in fact, the six publically traded Brazilian mall companies have continued to fare quite well, posting aggregate robust third quarter same store sales growth of 9.3% and same store rental growth of 11.13%. Nonetheless, the macro conditions weighed heavily on Brazilian equity returns. While our holdings in these countries may be fundamentally inexpensive and may prove to be attractive investments over a longer period of time, the outsized position in Brazil during this period exposed the Fund to considerable currency volatility as well as poor share performance. This is why exposure has been reduced from 37.2% to 21.2% and we will continue to monitor this level of exposure closely.

Top Ten Largest Holdings

The largest holding at year end was in U.K-based Regus PLC which moved up from fifth position last year with a total return of 107.90%. This reflects a continued strong demand for flexible office accommodation of which Regus is the world’s leading provider. South Asian Real Estate*, which oversees residential development in India, fell from top position last year to second this year with a decline of -27.90% as a slowdown in new orders for homes and continued weakness in the macro environment impaired the probability for an IPO in 2015. Central Pattana, Thailand’s largest shopping mall owner added 33.76% as it rose from tenth position to third, primarily due to the Fund’s purchase of additional shares during the year. Hulic Co., a Japanese office owner specializing in renovating older medium-sized buildings in prime locations gained 172.92% for the Fund. Kenedix, Inc., a Japanese manager of REITs and private real estate funds is very well positioned to benefit from the potential reflationary trend and rose 318.26%. The Fund’s sixth largest holding, Direcional Engenharia S.A. from Brazil, fell from the second position last year and had a relatively flat return of -0.03%. The company is the sole home builder focused on the very low income, subsidized apartment construction upon which it is executing its business plan profitably. The Brazilian office investor Sao Carlos fell from sixth to seventh position, losing -19.65% despite recording excellent cash flow growth over the year. LXB Retail Properties in the eighth slot is a U.K. developer of supermarket anchored shopping centers and generated

*The Fund purchased South Asian Real Estate through a private placement in 2007. There is no public market for the holding and we have valued it based upon discounting both its current and projected adjusted book value, as well as taking into consideration the potential for a public offering of the shares in the future. As of October 31, 2013, the position has increased to approximately 6% of the Fund’s net assets as a result of net outflows from the Fund during the period.

12

| Alpine International Real Estate Equity Fund (Continued) |  |

4.88% total return. SM Prime Holdings, in the ninth position, generated a return of 5.95%. SM Prime is the parent of SM Development Corp. a long term holding which was acquired by the Philippines largest shopping mall company. Iguatemi, a Brazilian developer of premier shopping malls fell from third place to tenth after the stock posted a -7.51% total return, despite the successful open of the JK Shopping Mall in Sao Paolo.

Top Five Positive/Negative Impact

From the top ten holdings come the three top contributors as well as two with negative impact. In aggregrate, the relative importance of these positive/negative contributors by average weighting and returns, respectively, were 13.97% of holdings adding a contribution of over 12% versus 14.88% detracting over 5%.

The top contributor was Regus PLC (+107.90%, average weight 5.61%), followed by Kenedix (+318.26, average weight 2.11%) and Hulic (+172.92%, average weight 2.62%) from the Fund’s top ten. All three are long term holdings, although we added shares to Japanese positions this year. Quintain Estates (+80.62%, average weight 2.08%) owns developments in London on the Greenwich Peninsula across the Thames River from Canary Wharf and surrounding Wembley Stadium. Progress in redesigning its potential value and paying back debt were catalysts for this long term holding. JM AB, Stockholm’s leading condo developer, continued to perform for the Fund (+65.20%, average weight 1.56%).

Negative contributors include South Asian Real Estate Limited, a non-traded Indian homebuilder whose valuation was impacted (-27.90%, average weight 6.12%) by rising interest rates and cyclically soft demand in the greater Delhi (NCR) area and in Chennai. Homex, a Mexican homebuilder suffered (-86.23%, average weight 0.66%) after the new Federal government eliminated decade old mortgage subsidy programs. The weakening Brazilian macro picture hurt our holdings in retail mall/condo builder JHSF (-40.65%, average weight 1.79%), office owner Sao Carlos (-19.65%, average weight 3.76%) despite strong growth in both cash flow and underlying net asset value, as well as hotelier BHG (-25.53%, average weight 2.55%) which is attempting to become a nationwide consolidator.

Real Estate Cycle

Earlier in this report, we stated that real estate equities had benefited from falling interest rates and by their nature tend to be forward looking incorporating some measure of future growth into current valuations. This raises the question as to what extent do valuations of real estate equities today reflect future prices and valuations three to five years from now. While there is uncertainty with respect

to the duration of the business cycle, the rate of inflation, interest rates and prospective supply vs. demand for property, among other factors that could adversely impact the Fund’s holdings, it might be constructive to develop a context in which to understand the relative prices of real estate equities.

In the year end 2008 shareholder report we provided a table showing the performance of nine separate indices for select countries and major regions covering historical cyclical performance. We noted when the previous cyclical rally had started how much they gained to their peak in 2007 and then how large a fall there had been through the post-Lehman debacle. We also showed average historic returns for these different indices with both positive and negative ranges during the 1980’s and 1990’s. Suffice it to say that the decline through November of 2008 from the previous peaks was far larger than the average historic cyclical decline. In fact, many indices continued to decline until March of 2009.

Real estate stock cycles are usually a bit like a waltz, two steps forward, then one step back. During the 1980’s and 1990’s the S&P Developed Property Index (Global Price Only) averaged 87% cyclical increases, followed by 31% average decline. Notably, the prior cycle from 1998 through 2007 showed a gain of 225% and the subsequent 2008/09 financial crisis decline was -74%. Since the cycle began March, 2009, the index regained 211% to the peak on May 8, 2013, before concerns over ‘taper’-talk induced retracement through the end of October, 2013. What is relevant is that at the end of the fiscal year, this real estate index had only regained 75% of their prior peaks before the great financial crisis of 2008. Other indices are even further behind, notably U.S. Homebuilder (-59%) and Euro Zone Real Estate (-46%). The implication here is that even if there were no inflation in real estate values or rents over the next few years, the potential for real estate equities to catch up with broad stock indices, which have already surpassed 2007 levels, seems plausible. If we are correct that the typical late cycle period of expansion takes hold, there could be additional uplift in real estate prices and activity, and with it the potential for further share price appreciation.

Currently, we expect that 2014 could be less volatile than prior years and we hope to see a gradual uptick in global growth towards the latter half of the year. As we begin the next fiscal year we remain steadfast in our belief that real estate should continue to be a store of value that is sought after for both its income potential and its ability to capture economic growth and inflation in terms of rents and prices.

Sincerely,

Samuel A. Lieber

Portfolio Manager

13

| Alpine International Real Estate Equity Fund (Continued) |  |

This letter represents the opinions of the Fund’s management and is subject to change, is not guaranteed and should not be considered a recommendation to buy or sell any security. The information provided is not intended to be, and is not, a forecast of future events, a guarantee of future results, or investment advice. Views expressed may vary from those of the firm as a whole. Past performance is no guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to risks, including the following:

Concentration Risk – The Fund’s strategy of concentrating in companies in a specific industry means that its performance will be closely tied to the performance of a particular market segment. The Fund’s concentration in these companies may present more risks than if it were broadly diversified over numerous industries and sectors of the economy. A downturn in these companies would have a larger impact on the Fund than on a mutual fund that does not concentrate in such companies. At times, the performance of these companies will lag the performance of other industries or the broader market as a whole.

Emerging Market Securities Risk – The risks of foreign investments are heightened when investing in issuers in emerging market countries. Emerging market countries tend to have economic, political and legal systems that are less fully developed and are less stable than those of more developed countries. They are often particularly sensitive to market movements because their market prices tend to reflect speculative expectations. Low trading volumes may result in a lack of liquidity and in extreme price volatility.

Equity Securities Risk – The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry).

Foreign Currency Transactions Risk – Foreign securities are often denominated in foreign currencies. As a result, the value of the Fund’s shares is affected by changes in exchange rates. The Fund may enter into foreign currency transactions to try to manage this risk. The Fund’s ability to use foreign currency transactions successfully depends on a number of factors, including the foreign currency transactions being available at prices that are not too costly, the availability of liquid markets and the ability of the Adviser to accurately predict the direction of changes in currency exchange rates.

Foreign Securities Risk – The Fund’s investments in securities of foreign issuers or issuers with significant exposure to foreign markets involve additional risk. Foreign countries in which the Fund may invest may have markets that are less liquid, less regulated and more volatile than U.S. markets. The value of the Fund’s investments may decline because of factors affecting the particular issuer as well as foreign markets and issuers generally, such as unfavorable government actions, and political or financial instability. Lack of information may also affect the value of these securities. The risks of foreign investment are heightened when investing in issuers of emerging market countries.

Growth Stock Risk – Growth stocks typically are very sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall. Growth stocks as a group may be out of favor and underperform the overall equity market while the market concentrates on undervalued stocks.

Initial Public Offerings (IPO) and Secondary Offerings Risk – The Fund may invest a portion of its assets in shares of IPOs or secondary offerings of an issuer. IPOs and secondary offerings may have a magnified impact on the performance of a Fund with a small asset base. The impact of IPOs and secondary offerings on a Fund’s performance likely will decrease as the Fund’s asset size increases, which could reduce a Fund’s returns. IPOs and secondary offerings may not be consistently available to the Fund for investing. IPO and secondary offering shares frequently are volatile in price due to the absence of a prior public market, the small number of shares available for trading and limited information about the issuer. Therefore, the Fund may hold IPO and secondary offering shares for a very short period of time. This may increase the turnover of the Fund and may lead to increased expenses for the Fund, such as commissions and transaction costs. In addition, IPO and secondary offering shares can experience an immediate drop in value if the demand for the securities does not continue to support the offering price.

Leverage Risk – The Fund may use leverage to purchase securities. Increases and decreases in the value of the Fund’s portfolio will be magnified when the Fund uses leverage.

14

| Alpine International Real Estate Equity Fund (Continued) |  |

Liquidity Risk – Some securities held by the Fund may be difficult to sell, or illiquid, particularly during times of market turmoil. Illiquid securities may also be difficult to value. If the Fund is forced to sell an illiquid asset to meet redemption requests or other cash needs, the Fund may be forced to sell at a loss.

Management Risk – The Adviser’s judgment about the quality, relative yield or value of, or market trends affecting, a particular security or sector, or about interest rates generally, may be incorrect. The Adviser’s security selections and other investment decisions might produce losses or cause the Fund to underperform when compared to other funds with similar investment objectives and strategies.

Market Risk – The price of a security held by the Fund may fall due to changing market, economic or political conditions.

Micro Capitalization Company Risk – Stock prices of micro capitalization companies are significantly more volatile, and more vulnerable to adverse business and economic developments than those of larger companies. Micro capitalization companies often have narrower markets for their goods and/or services and more limited managerial and financial resources than larger, more established companies, including small or medium capitalization companies.

Real Estate Investment Trusts (REITs) Risk – REITs’ share prices may decline because of adverse developments affecting the real estate industry including changes in interest rates. The returns from REITs may trail returns from the overall market. Additionally, there is always a risk that a given REIT will fail to qualify for favorable tax treatment.

Real Estate Securities Risk – Risks associated with investment in securities of companies in the real estate industry include: declines in the value of real estate; risks related to local economic conditions, overbuilding and increased competition; increases in property taxes and operating expenses; changes in zoning laws; casualty or condemnation losses; variations in rental income, neighborhood values or the appeal of properties to tenants; changes in interest rates and changes in general economic and market conditions.

Small- and Medium-Capitalization Company Risk – Securities of small- or medium-capitalization companies are more likely to experience sharper swings in market values, and may be less liquid, in which case it may be more difficult for the Adviser to sell at times and at prices that the Adviser believes appropriate and generally are more volatile than those of larger companies.

Undervalued Stock Risk – The Fund may pursue strategies that may include investing in securities, which, in the opinion of the Adviser, are undervalued. The identification of investment opportunities in undervalued securities is a difficult task and there is no assurance that such opportunities will be successfully recognized or acquired. While investments in undervalued securities offer opportunities for above-average capital appreciation, these investments involve a high degree of financial risk and can result in substantial losses.

Please refer to page 5-7 for other important disclosures and definitions.

15

| Alpine Realty Income & Growth Fund |  |

| Comparative Annualized Returns as of 10/31/13 (Unaudited) |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Since Inception(1) |

Alpine Realty Income & Growth Fund —

Institutional Class | | | 9.02% | | | | 11.85% | | | | 19.28% | | | | 7.52% | | | | 11.02% | |

Alpine Realty Income & Growth Fund —

Class A (Without Load) | | | 8.85% | | | | N/A | | | | N/A | | | | N/A | | | | 12.74% | |

Alpine Realty Income & Growth Fund —

Class A (With Load) | | | 2.86% | | | | N/A | | | | N/A | | | | N/A | | | | 9.32% | |

| MSCI US REIT Index | | | 11.42% | | | | 12.26% | | | | 15.30% | | | | 9.77% | | | | 10.93% | |

| S&P 500® Index | | | 27.18% | | | | 16.56% | | | | 15.17% | | | | 7.46% | | | | 4.37% | |

| Lipper Real Estate Funds Average(2) | | | 8.96% | | | | 11.19% | | | | 14.77% | | | | 9.09% | | | | 10.26% | |

| Lipper Real Estate Funds Ranking(2) | | | 131/242 | | | | 47/204 | | | | 13/179 | | | | 105/120 | | | | 17/58 | |

| Gross Expense Ratio (Institutional Class): 1.41%(3) | | | | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Institutional Class): 1.41%(3) | | | | | | | | | | | | | | | | | | | | |

| Gross Expense Ratio (Class A): 1.66%(3) | | | | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Class A): 1.66%(3) | | | | | | | | | | | | | | | | | | | | |

| (1) | Institutional Class shares commenced on December 29, 1998 and Class A shares commenced on December 30, 2011. Returns for indices are since December 29, 1998. |

| | (2) | The since inception data represents the period beginning December 31, 1998 (Institutional Class only). |

| | (3) | As disclosed in the prospectus dated February 28, 2013. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than the performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced. Returns for the Class A shares with sales charge reflect a maximum sales charge of 5.50%. Performance for the Class A shares without sales charges does not reflect this load.

MSCI US REIT Index is a free float-adjusted market capitalization-weighted index that is comprised of the most actively-traded equity REITs that are of reasonable size in terms of full- and free-float-adjusted market capitalization. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI. The S&P 500® Index is a float-adjusted market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. The Lipper Real Estate Funds Average is an average of funds that invest at least 80% of their portfolio in equity securities of domestic and foreign companies engaged in the real estate industry. Lipper rankings for the periods shown are based on fund total returns with dividends and distributions reinvested and do not reflect sales charges. The MSCI US REIT Index, the S&P 500® Index and the Lipper Real Estate Funds Average are unmanaged and do not reflect direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Real Estate Funds Average reflects fees charged by the underlying funds. The performance for the Alpine Realty Income & Growth Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

Expense Ratios reflect the ratios reported in the Fund’s most recent prospectus. The Alpine Realty Income & Growth Fund has a contractual expense waiver that continues through February 28, 2014. Where a Fund’s gross and net expense ratios are the same for the period reported, the contractual expense reimbursement level was not reached as of the end of that period. To the extent the Fund’s expenses were reduced by waivers, the Fund’s total returns were increased. In these cases, in the absence of the expense waivers, the Fund’s total returns would have been lower.

To the extent that the Fund’s historical performance resulted from gains derived from participation in Initial Public Offerings (“IPOs”) and/or Secondary Offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary Offerings in the future.

16

| Alpine Realty Income & Growth Fund (Continued) |  |

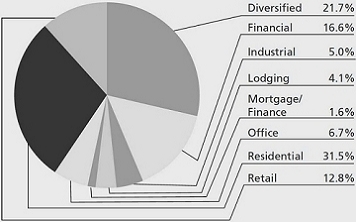

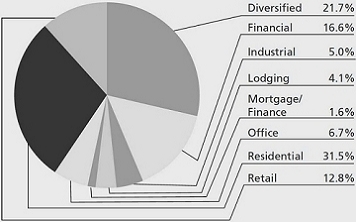

Portfolio Distributions* (Unaudited)

| Top 10 Holdings* (Unaudited) |

| 1 | . | Simon Property Group, Inc. | 8.86 | % |

| 2 | . | Boston Properties, Inc. | 5.14 | % |

| 3 | . | Public Storage | 4.89 | % |

| 4 | . | SL Green Realty Corp. | 4.67 | % |

| 5 | . | Vornado Realty Trust | 4.20 | % |

| 6 | . | Prologis, Inc. | 4.18 | % |

| 7 | . | Ventas, Inc. | 4.16 | % |

| 8 | . | Essex Property Trust, Inc. | 3.81 | % |

| 9 | . | Equity Residential | 3.58 | % |

| 10 | . | Alexandria Real Estate Equities, Inc. | 3.39 | % |

| * | Portfolio Distributions percentages are based on total investments. Top 10 Holdings do not include short-term investments and percentages are based on total net assets. Portfolio holdings and sector distributions are as of 10/31/13 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. |

| Value of a $10,000 Investment (Unaudited) |

|

| |

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmarks. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees, if applicable. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost.

17

| Alpine Realty Income & Growth Fund (Continued) |  |

Commentary

We welcome the opportunity to report the results of the Alpine Realty Income & Growth Fund for the fiscal year that ended October 31, 2013. During the fiscal year, the Fund produced a total return of 9.02% which compares to the 8.96% return of the Lipper Real Estate Funds Average, the 11.42% return of the MSCI REIT Index (the “RMS Index”), and the 27.18% return of the S&P 500® Index (the “S&P”). All references in this letter to the Fund’s performance relate to the performance of the Fund’s Institutional Class.

At October 31, 2013, the Fund’s net asset value had increased to $18.17 from $17.37 twelve months prior. During this timeframe, the Fund paid four quarterly distributions of $0.1875 per share totaling $0.75 per share for the fiscal period, which represented a 4.2% increase over the Fund’s distributions in the prior fiscal year. Since its inception on December 29, 1998 through October 31, 2013, the Fund has delivered an annualized total return to shareholders of 11.02% which includes cumulative distributions of $15.48. The performance chart on page 16 presents the Fund’s returns for the latest one-year, three-year, five year, ten year, and since inception periods.

The most impactful factor influencing returns for REIT securities during the fiscal year was the volatile upward trend in long-term interest rates. During the fiscal year, the 10 year Treasury rate increased from 1.69% on October 31, 2012 to 2.55% on October 31, 2013, but nearly reached 3.00% in early September.

Prior to May 21, 2013, the 10 year rate remained within a relatively narrow band, averaging approximately 1.81%, and the RMS Index broke through its previous high water marks reaching an all-time high on May 21st. On that date, however, the Federal Reserve indicated an intention to taper its purchases of government bonds as signs of an improving economy are achieved. Following that announcement, the 10 year Treasury rate increased quickly, reaching a high for the period of 2.995% on September 5th and the RMS Index fell -17.64% during that timeframe. REIT securities recovered part of those losses before the end of the Fund’s fiscal year, rising 9.27% from September 5th through October 31st and in fact the RMS Index had its biggest one day move of 2013 (+3.41%) on September 18th, the day the Federal Reserve surprised the market by not beginning to taper. Nevertheless, prevailing market sentiment appears to be that REIT valuations cannot advance in the face of rising long-term rates, and, as a result, REIT stock price movements have been highly correlated recently with changes in the 10 year Treasury rate.

It is our view, based on historical data, that how REITs will perform in a rising interest rate environment is dependent upon numerous factors, including the cause of the rate increase, the speed or pace of that increase, the underlying fundamentals of real estate markets, the relative valuations for REIT securities, and what other attractive investment alternatives exist for investors. REIT cash flows are able to grow in a recovering economy and REIT management teams have the ability to create value through improving rents and occupancies, renovating assets, and developing new properties when it is appropriate to do so. If rates are rising because of underlying strength in the economy leading to inflationary pressures, then that underlying strength may also manifest itself in tighter real estate market conditions and growth in revenues from improving rents for landlords. That growth in cash flows may in turn translate into rising dividend yields which combined with likely rising material costs for the underlying assets may allow real estate to potentially provide some level of inflation protection.

The history of REIT stock performance during periods of rises in the 10 year Treasury rate is mixed but dispels, in our view, the notion that REITs cannot perform with a rising rate headwind. In a study recently published by Citigroup1, REIT performance was tracked during 8 periods of rising rates with the first period occurring between October 1993 and December 1994 and the last period occurring between October 2010 and April 2011. The average rise in 10 year Treasury yields over these eight periods was 170 basis points. During those periods, REITs outperformed the S&P five times and underperformed 3 times and on average produced total returns of 13.5% which lagged the average returns of the S&P during those periods of 15.9%. Significantly impacting those average period returns was the October 1998 through February 2000 period when the S&P increased 41.8%, and REITs, which were viewed as relatively unattractive defensive investments, delivered a negative 6.5% return. So, in conclusion, while the history of REIT performance in a rising rate environment is somewhat mixed, it seems apparent that (1) rising rates have not necessarily precluded positive REIT returns, and (2) numerous factors have come into play including the cause of the rate increase, the conditions of real estate markets, and whether other attractive investment alternatives exist. Nevertheless, in the past fiscal year, the rapid pace of the rise in long term interest rates occurring at a point when the RMS Index had reached an all-time high created a large discrepancy between REIT stock returns and that of broader market indices such as the S&P.

1 Citi Research, 1 July 2013

18

| Alpine Realty Income & Growth Fund (Continued) |  |

For the Fund, among the top contributors to its 9.02% return during the fiscal year were a large-capitalization self-storage owning company, a global owner of industrial warehouse properties, two companies with office property investments in central business districts, two healthcare REITs focused on skilled nursing facilities, and our lodging company investments as a group. Public Storage (average weight 4.43%), the largest self-storage facility owner, and Prologis (average weight 3.74%), the largest global industrial warehouse REIT, both top ten holdings for the Fund, produced returns of 24.39% and 20.02%, respectively. Within the healthcare REIT sector, Omega Healthcare Investors (average weight 1.84%) and Sabra Healthcare (average weight 1.65%) delivered strong returns of 53.77% and 28.33%, respectively, while above average performances were also produced by two of the Fund’s other top ten investments, SL Green (27.58%, average weight 4.03%), a New York City focused office landlord, and Vornado Realty Trust (16.42%, average weight 3.76%), a diversified REIT with significant office holdings in New York and Washington, D.C. Additionally, our lodging company investments, while not a significant percentage of the portfolio, also provided attractive returns as business and leisure travel continued to drive above average revenue growth against a backdrop of historically limited supply additions. For the Fund, leading returns were generated by Chesapeake Lodging Trust (35.44%, average weight 0.72%), Pebblebrook Hotel Trust (45.63%, average weight 0.36%), Starwood Hotels and Resorts (45.12%, average weight 1.15%), Diamondrock Hospitality (39.18%, average weight 0.63%), LaSalle Hotel Properties (34.16%, average weight 0.30%), and Host Hotels & Resorts (31.52%, average weight 1.35%). Relative to the overall returns of the RMS Index, the Fund’s most positive attribution was provided by our overweight positions in Omega Healthcare, SL Green, Sabra, and Starwood and our underweight/non-ownership of American Campus Communities (average index weight 0.90%), an owner and developer of student housing facilities which significantly underperformed the RMS Index with a -21.19% return.

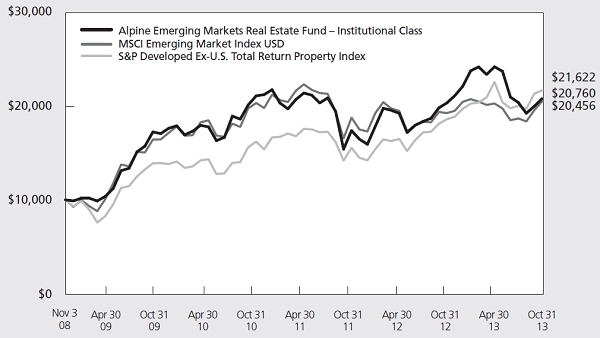

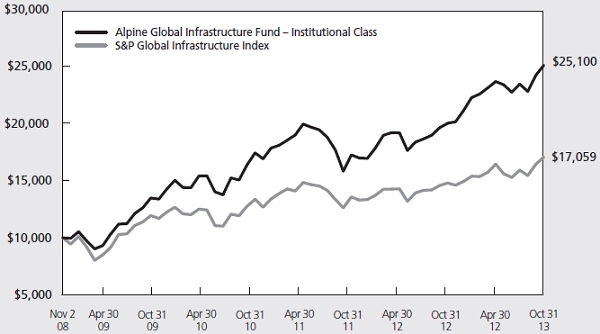

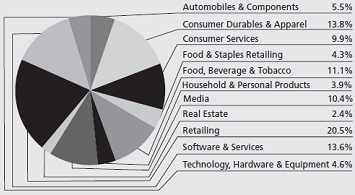

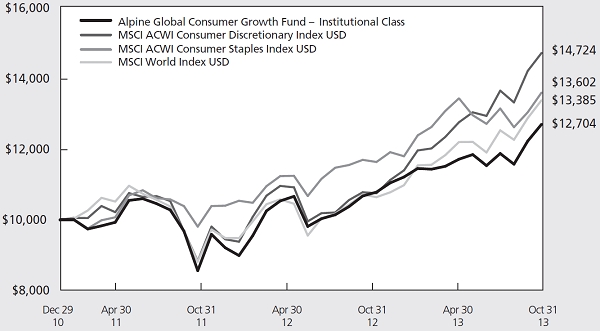

Holdings that underperformed REIT average returns and detracted from performance included the data center owner and developer, Digital Realty, the regional mall owning companies, CBL & Associates and Taubman Centers, two apartment landlords, Equity Residential and AvalonBay Communities, and a Canadian shopping center and office company, Crombie REIT. Digital Realty (-18.46%, average weight 3.22%) disappointed investors during 2013 by missing earnings guidance for its leasing results and lowering near term growth expectations. The two regional mall entities, CBL & Associates (-7.60%, average weight 3.08%), whose low operating income and