UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05684

Alpine Equity Trust

(Exact name of registrant as specified in charter)

2500 Westchester Avenue, Suite 215

Purchase, New York 10577

(Address of principal executive offices)(Zip code)

| | (Name and Address of Agent for Service) | Copy to: | |

| | | | |

| | Samuel A. Lieber

Alpine Woods Capital Investors, LLC

2500 Westchester Avenue, Suite 215

Purchase, New York 10577 | Rose DiMartino

Attorney at Law

Willkie Farr & Gallagher

787 7th Avenue, 40th Floor

New York, New York 10019 | |

Registrant’s telephone number, including area code: (914) 251-0880

Date of fiscal year end: October 31

Date of reporting period: November 1, 2014 - October 31, 2015

Item 1: Shareholder Report

Real Estate Funds

Alpine International Real Estate Equity Fund

Institutional Class (EGLRX)

Class A (EGALX) | | Alpine Emerging Markets Real Estate Fund

Institutional Class (AEMEX)

Class A (AEAMX) |

| | | |

Alpine Realty Income & Growth Fund

Institutional Class (AIGYX)

Class A (AIAGX) | | Alpine Global Infrastructure Fund

Institutional Class (AIFRX)

Class A (AIAFX) |

October 31,

2015

Annual Report

Table of Contents

Additional Alpine Funds are offered in the Alpine Series Trust and Alpine Income Trust. These Funds include:

| Alpine Dynamic Dividend Fund | Alpine Small Cap Fund |

| | |

| Alpine Rising Dividend Fund | Alpine Ultra Short Municipal Income Fund |

| | |

| Alpine Financial Services Fund | Alpine High Yield Managed Duration Municipal Fund |

Alpine’s Series and Income Funds’ investment objectives, risks, charges and expenses must be considered carefully before investing in funds of the Alpine Series Trust and Alpine Income Trust. The statutory and summary prospectuses contain this and other important information about the investment company, and it may be obtained by calling 1-888-785-5578, or visiting www.alpinefunds.com. Read it carefully before investing.

Mutual fund investing involves risk. Principal loss is possible.

Alpine’s Investment Outlook

Dear Shareholders:

A few of the watchwords for financial markets over the past year included excess liquidity, unicorn valuations, risk-on/risk-off, deflation, income inequality and, unfortunately, terrorism. Perhaps there is another way to describe the overarching themes driving the markets as we enter the eighth year of recovery since the Great Financial Recession. The markets are still captive to the complexity and contradiction of fundamental data. Alpine believes that this condition stems from the unfocused, weak economic expansion. Atypically, the markets are dependent not upon the leadership of governments or industry but from central banks. Historically, economic leadership has not been the role of central banks. However, corporate spending has been limited and government stimulus has been constrained by either ideology (austerity) or weak tax revenues. This has placed an unusual burden on central banks, worldwide, which are designed and staffed to balance or neutralize unfavorable economic forces. Perhaps that is why both consumer and business confidence has been weak during this cycle as central banks have, by default, become the primary source of both economic stimulus and direction during the past six years, yet by their nature, they can only provide monetary leadership.

As we look back on fiscal year 2015, and prepare for 2016, the slow recovery of both global economies and evolving capital markets is very clear. Nonetheless, this has been an eventful year filled with notable shifts and even dramatic reversals leading to periods of increased volatility. The dominant factors have been the anticipated emergence of divergent interest rate trends between cyclically advancing countries and those which lag behind. At the start of 2015, it was clear to the markets that the Federal Reserve was done with quantitative easing (QE), — after first signaling this intention back in May 2013 — to the point where the Fed was about to raise interest rates. Also, at the beginning of the year it was clear that the European Central Bank (ECB) was about to embark upon a program of quantitative easing trailing the Fed’s lead by over five years.

As we embark upon 2016, the Fed seems likely to finally raise interest rates, if only by a quarter percent, while the ECB has announced an extension of QE into 2017. Long-term trends remain in place, so we believe that this divergence between slowly strengthening economies and still weak, lagging countries, may continue for another two to three years, taking us into 2018. It is conceivable that even more time will be required before another global

super cycle of demand exceeding supply emerges. At minimum, any major global upswing of demand for goods and services may take three to five years to emerge. This suggests that inflation may not become a significant threat for such a period of time. The upshot is that we may see U.S. interest rates gradually increase over several years by 100 to 250 basis points towards normalized historical levels. We believe the ECB is at least three years behind the Fed. This also suggests that we may be experiencing an historically extended period of economic growth without recession that could last into the next decade.

Members of our Investment team, with respect to their areas of expertise, have made the following observations covering both the past year and the new year. Bruce Ebnother, a member of our real estate investment team noted that “Unlike typical recovery cycles ... only a moderate amount of new supply has come online.” Mark Austin, who covers global housing stocks, commented that “wages (in the U.S.) have grown faster over the past year than at any other point during this recovery since 2008 and unemployment has dropped to its lowest level since then. Despite this, industry fundamentals continue to point to merely another year of slow but steady growth”. He is, however, more optimistic because in 2018 “40 million millennials will turn 25, an age when historically increased numbers begin looking for new homes. Already, we are experiencing a pick-up in household formation.” So, it appears that both commercial and residential real estate in the U.S., among other countries, is undersupplied from a cyclical perspective and demand is underpinned by solid fundamentals.

In contrast, the energy and mining sectors have only recently experienced a significant downdraft in demand at a time where productive capacity hit a new peak. Thus, over the past year, we have only begun to see a modest reduction of output despite a significant collapse in prices due to the excesses of the commodity sector. Sarah Hunt, who follows industrial companies and the oil sector, in particular, as part of our commodities team, observed that the old oil industry adage that “low prices cure low prices” (where supplies typically reduce production in the face of falling prices only when the cost of extraction is higher than the sales price) did not hold true as “large fiscal inventories ... and current future strip pricing is not predicting a quick fix for low oil prices”. Thus, we believe consumers and certain industries should continue to benefit from the lowest oil prices since 2004, roughly 60% below peak levels. This could last well into 2016, before gradually moving higher.

1

Supply-side issues have generally not been such a factor in the healthcare sector as demand growth continues. Jonathan Gelb, who follows the healthcare sector for us, notes that “companies that produce clinically different drugs that create cost savings will remain insulated from pricing pressure, however, companies whose models depend on aggressive pricing actions without significant innovation are likely to see growth impacted as soon as 2016.” No doubt his comments apply to both Turing Pharmaceutical and Valent Pharmaceuticals, which relied upon repackaging acquired medication at higher prices for a captive marketplace. With limited innovation, he believes that consolidation “is a theme that will likely continue into 2016, since nearly $265 billion worth of mergers or acquisitions (M&As) were announced during 2015.

Another area where acquisitions have been on the rise, creating revenue and hopefully, earnings growth, has been the financial sector. Peter Kovalski, who follows regional banks and financial services for us, noted that M&A activity in the U.S. for 2015 to date has totaled 243 announced deals. What’s notable is that this volume is only slightly behind last year’s level of 284 deals, the most since 2006 when 299 transactions took place. The difference is one of scale as the aggregate deal value in 2006 was $109 billion compared to only $19 billion in 2014. Thus, the typical transaction was less than a fifth of the size of previous transactions in 2006, suggesting that “the main driver behind these small bank deals is the rising cost of regulatory compliance ... a burden which is not going away.” The implication of this trend is that small local banks may not be as competitive in their local markets as larger, regional players. This may accelerate the underlying consolidation trend in which the number of banks in the U.S. has fallen from 14,907 in 1984 to 5,410 in 2015.

In a world where the pie is only growing slowly or for just a few, where their industry or market share is shrinking due to regulations, technological change or better-capitalized competition, the best business alternative may be a merger or acquisition. Indeed, Brian Hennessey, who follows commodity-related businesses in the mining and industrial materials companies for us, described 2015 as “the year of the mega mergers.” He expects this to continue in 2016 as “many forces driving consolidation across the developed world with low interest rates and high uncertainty with respect to the regulatory and macro-economic backdrop.” Naturally such consolidation can create opportunities for both astute and opportunistic acquirers as well as for companies whose shares have been undervalued by the market place. The broad economic implications of strategic or complementary consolidation is that it encourages buyers to shut the least effective operators or least efficient

producers, which curtails excess production, permitting supply and demand to find equilibrium levels faster than they might otherwise. Companies structured merely to grow through acquisitions, however, may lose their luster if they cannot innovate or continue to find M&A opportunities for expansion. Such risks have driven the market to place of particularly high earnings multiples on technological leaders including Facebook, Amazon, Netflix and Google (now known as Alphabet), among others which are expanding geographically, across platforms and market segments, while both making acquisitions and pushing innovation in ways that portend an extended period of revenue expansion.

As we look forward to 2016 and beyond, we should note that a key fundamental driver of growth is in fact demographic. That is, continual global population growth and the trending evolution of agrarian populations moving to urban industrial lifestyles, transitioning from subsistence to higher levels of productivity. This ongoing shift has not only been true of emerging countries but even here at home where many recent college graduates have chosen to live in urban settings, leading to a rebirth of a number of downtowns throughout the U.S. This has put extra demands upon infrastructure while creating new nodes for consumer activity, which, of course, has led to rising real estate values in many places. The rapidly expanding capacity to make the world our “oyster,” no longer depending upon local merchants or service providers to enhance our lifestyle, may prove to be an affirmation of our technological prowess even though there might be a range of social consequences. That said, the increased access to information, as well as goods and services, is opening up new avenues for creativity on both personal and societal levels. Those companies that can benefit from these different trends — old and new, small and large-should be able to generate attractive growth. As the global economy gradually returns to normalized levels of expansion, we would anticipate that the period of corporate consolidation through M&A will evolve towards a new period of capital investment and innovation. Even though this recent period of economic recovery has been quite extended, we are optimistic that the longer-term dynamic for continued expansion will become more apparent in the months and quarters ahead of us.

Thank you for your interest and support.

Sincerely,

Samuel A. Lieber

President

Past performance is not a guarantee of future results. The specific market, sector or investment conditions that contribute to a Fund’s performance may not be replicated in future periods.

Mutual fund investing involves risk. Principal loss is possible. Please refer to individual fund letters for risks specific to that fund.

This letter and the letters that follow represent the opinions of the Funds’ management and are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security. The information provided is not intended to be, and is not, a forecast of future events, a guarantee of future results, or investment advice.

2

| Disclosures and Definitions |  |

Real Estate Funds Disclosures

The specific market, sector or investment conditions that contributed to a Fund’s performance may not be replicated in future periods.

Please refer to the Schedule of Portfolio Investments for Fund holdings information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

Diversification does not assure a profit or protect against loss in a declining market.

Favorable tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws. Alpine may not be able to anticipate the level of dividends that companies will pay in any given timeframe.

The Funds’ monthly distributions may consist of net investment income, net realized capital gains and/or a return of capital. If a distribution includes anything other than net investment income, the Funds will provide a notice of the best estimate of its distribution sources when distributed, which will be posted on the Funds’ website; www.alpinefunds.com, or can be obtained by calling 1-800-617-7616. We estimate Alpine Global Infrastructure Fund paid a portion of the 2015 distributions (approximately 7.5%) through a return of capital and Alpine International Real Estate Equity Fund, Alpine Realty Income & Growth Fund and Alpine Emerging Markets Real Estate Fund did not pay any distribution through a return of capital during the fiscal annual period ending October 31, 2015 through a return of capital. A return of capital distribution does not necessarily reflect the Funds’ performance and should not be confused with “yield” or “income.” Final determination of the federal income tax characteristics of distributions paid during the calendar year will be provided on U.S. Form 1099-DIV, which will be mailed to shareholders. Please consult your tax advisor for further information.

Neither the Fund nor any of its representatives may give tax advice. Investors should consult their tax advisor for information concerning their particular situation.

All investments involve risk. Principal loss is possible. A small portion of the S&P 500 yield may include return of capital; the 10-year Treasury yield does not include return of capital; Corporate Bonds and High Yield Bonds generally do not have return of capital; a portion of the dividend paid by REITs and REIT preferred stock may be deemed a return of capital for tax purposes in the event the company pays a dividend greater than its taxable income. A stock may trade with more or less liquidity than a bond depending on the number of shares and bonds outstanding, the size of the company, and the demand for the securities. The REIT and REIT preferred stock market are smaller than the broader equity and bond markets and often trade with less liquidity than

these markets depending upon the size of the individual issue and the demand of the securities. Treasury notes are guaranteed by the U.S. government and thus they are considered to be safer than other asset classes. Tax features of a Treasury Note, Corporate Bond, Stock, High Yield Bond, REITs and REIT preferred stock may vary based on an individual’s circumstances. Consult a tax professional for additional information.

Earnings Growth & EPS Growth are not measures of the Funds’ future performance.

Must be preceded or accompanied by a prospectus.

Quasar Distributors, LLC, distributor.

Real Estate Funds – Definitions

Alerian MLP Index is a composite of the 50 most prominent energy master limited partnerships calculated by Standard & Poor’s using a float-adjusted market capitalization methodology. The index is disseminated by the New York Stock Exchange real-time on a price return basis (NYSE: AMZ).

Basis point is a value equaling one one-hundredth of a percent (1/100 of 1%).

Cash flow measures the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income.

Chicago Board Options Exchange Volatility Index (VIX) reflects a market estimate of future volatility, based on the weighted average of the implied volatilities for a wide range of strikes.

Fibra is a real estate investment trust structured according to Mexican law.

Free cash flow is a measure of financial performance calculated as operating cash flow minus capital expenditures. Free cash flow (FCF) represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base. Free cash flow is important because it allows a company to pursue opportunities that enhance shareholder value.

FTSE EPRA/NAREIT Emerging Index is a total return index, designed to track the performance of listed real estate companies and REITS in emerging markets.

FTSE EPRA/NAREIT Global ex US Index is a total return index that is designed to represent general trends in eligible real estate equities outside the United States.

Source: FTSE the funds or securities referred to herein are not sponsored, endorsed, or promoted by the index providers, and the index providers bear no liability with respect to any such funds or securities or any index on which such funds or securities are based. The prospectus contains a more detailed description of the limited relationship the index providers have with the licensee and any related funds.

3

| Disclosures and Definitions (continued) |  |

Lipper Real Estate Funds Average is an average of funds that invest at least 80% of their portfolio in equity securities of domestic and foreign companies engaged in the real estate industry.

Markit Index of Manufacturing measures the performance of the manufacturing sector and is derived from a survey of 600 industrial companies.

MSCI EAFE Index is a total return, free-float adjusted market capitalization weighted index that measures the performance of stocks from Europe, Asia, and the Far East. This is one of the most widely used measures of international stock performance. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder.

MSCI Emerging Markets Index is a total return, free-float adjusted market capitalization weighted index that is designed to measure the equity market performance in the global emerging markets. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder.

MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. The MSCI Europe Index consists of the following 15 developed market country indexes: Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom*. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

MSCI US REIT Index is a gross, total return, free float-adjusted market capitalization index that is comprised of equity REITs. The index is based on MSCI USA Investable Market Index (IMI) its parent index which captures large, mid and small caps securities. With 144 constituents, it represents about 99% of the US REIT universe and securities are classified in the REIT sector according to the Global Industry Classification Standard (GICS®). It however excludes Mortgage REIT and selected Specialized REITs. This index reinvests as much as possible of a company’s dividend distributions. The reinvested amount is equal to the total dividend amount distributed to persons residing in the country of the dividend-paying company. Gross total return indexes do not, however, include any tax credits. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. MSCI

provides no warranties, has not prepared or approved this report, and has no liability hereunder.

Return on Equity (ROE) is the amount of net income returned as a percentage of shareholders equity. Return on equity measures a corporation’s profitability by revealing how much profit a company generates with the money shareholders have invested.

Risk on/Risk off refers to changes in investment activity in response to global economic patterns. When risk is perceived as low, investors tend to engage in higher-risk investments. When risk is perceive as high, investors tend to engage in lower-risk investments.

S&P 500® Index is a total return, float-adjusted market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. Total return indexes include reinvestments of all dividends

S&P Developed Ex-US Property Index is a total return index that defines and measures the investable universe of publicly traded property companies domiciled in developed countries outside of the U.S. The companies included are engaged in real estate related activities, such as property ownership, management, development, rental and investment. Total return indexes include reinvestments of all dividends.

S&P Global Infrastructure Index is a total return index that is designed to track 75 companies from around the world chosen to represent the listed infrastructure industry while maintaining liquidity and tradability. To create diversified exposure, the index includes three distinct infrastructure clusters: energy, transportation, and utilities. Net Total Return (NTR) indexes include reinvestments of all dividends minus taxes.

The S&P 500® Index, the S&P Developed ex. U.S. Property Index, and the S&P Global Infrastructure Index (the “Indices”) are products of S&P Dow Jones Indices LLC and have been licensed for use by Alpine Woods Capital Investors, LLC. Copyright © 2015 by S&P Dow Jones Indices LLC. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written the permission of S&P Dow Jones Indices LLC. S&P Dow Jones Indices LLC, its affiliates, and third party licensors make no representation or warranty, express or implied, with respect to the Index and none of such parties shall have any liability for any errors, omissions, or interruptions in the Index or the data included therein.

Unicorn valuations is a term which denotes a start-up company whose valuation has exceeded $1 billion.

US trade-weighted dollar index, also known as the broad index, is a measure of the value of the United States dollar relative to other world currencies.

An investor cannot invest directly in an index.

4

Equity Manager Reports

| | Alpine International Real Estate

Equity Fund |

| | |

| | Alpine Realty Income & Growth Fund |

| | |

| | Alpine Emerging Markets Real Estate Fund |

| | |

| | Alpine Global Infrastructure Fund |

5

| Alpine International Real Estate Equity Fund |  |

| Comparative Annualized Returns as of 10/31/15 (Unaudited) |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Since Inception(1) | |

| Alpine International Real Estate Equity Fund — Institutional Class | | | -8.05% | | | | -0.26% | | | | -1.96% | | | | -0.53% | | | | 4.76% | | | |

| Alpine International Real Estate Equity Fund — Class A (Without Load) | | | -8.25% | | | | -0.53% | | | | N/A | | | | N/A | | | | 5.28% | | | |

| Alpine International Real Estate Equity Fund — Class A (With Load) | | | -13.29% | | | | -2.39% | | | | N/A | | | | N/A | | | | 3.75% | | | |

| FTSE EPRA/NAREIT Global Ex-U.S. Index(2) | | | -2.07% | | | | 4.13% | | | | 4.08% | | | | N/A | | | | N/A | | | |

| MSCI EAFE Index | | | -0.07% | | | | 8.02% | | | | 4.81% | | | | 4.05% | | | | 4.43% | | | |

| Lipper International Real Estate Funds Average(3) | | | -0.12% | | | | 5.26% | | | | 5.39% | | | | 3.61% | | | | 4.76% | | | |

| Lipper International Real Estate Funds Ranking(3) | | | 52/53 | | | | 49/50 | | | | 36/36 | | | | 8/8 | | | | 1/1 | | | |

| Gross Expense Ratio (Institutional Class): 1.62%(4) | | | | | | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Institutional Class): 1.62%(4) | | | | | | | | | | | | | | | | | | | | | | |

| Gross Expense Ratio (Class A): 1.87%(4) | | | | | | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Class A): 1.87%(4) | | | | | | | | | | | | | | | | | | | | | | |

| | (1) | Institutional Class shares commenced on February 1, 1989 and Class A shares commenced on December 30, 2011. Returns for indices are since February 1, 1989. |

| | (2) | Index commenced on October 31, 2008. |

| | (3) | The since inception data represents the period beginning February 2, 1989 (Institutional Class only). |

| | (4) | As disclosed in the prospectus dated February 27, 2015. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than the performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced. Returns for the Class A shares with sales charge reflect a maximum sales charge of 5.50%. Performance for the Class A shares without sales charges does not reflect this load.

FTSE EPRA/NAREIT Global ex US Index is a total return index that is designed to represent general trends in eligible real estate equities outside the United States. MSCI EAFE Index is a total return, free-float adjusted market capitalization weighted index that measures the performance of stocks from Europe, Asia, and the Far East. This is one of the most widely used measures of international stock performance. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. The Lipper International Real Estate Funds Average is an average of funds that invest at least 80% of their portfolio in equity securities of domestic and foreign companies engaged in the real estate industry. Lipper rankings for the periods shown are based on fund total returns with dividends and distributions reinvested and do not reflect sales charges. The FTSE EPRA/NAREIT Global ex-U.S. Index, the MSCI EAFE Index and the Lipper International Real Estate Funds Average are unmanaged and do not reflect direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper International Real Estate Funds Average reflects fees charged by the underlying funds. The performance for the Alpine International Real Estate Equity Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

To the extent that the Fund’s historical performance resulted from gains derived from participation in Initial Public Offerings (“IPOs”) and/or Secondary Offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary Offerings in the future.

6

| Alpine International Real Estate Equity Fund (Continued) |  |

Portfolio Distributions* (Unaudited)

| Top 10 Holdings* (Unaudited) |

| 1. | | Regus PLC | 6.39% |

| 2. | | Mitsui Fudosan Co., Ltd. | 3.54% |

| 3. | | Great Portland Estates PLC | 3.40% |

| 4. | | Mitsubishi Estate Co., Ltd. | 3.34% |

| 5. | | Dalata Hotel Group PLC | 3.19% |

| 6. | | Invincible Investment Corp. | 3.02% |

| 7. | | South Asian Real Estate PLC | 2.98% |

| 8. | | China Resources Land, Ltd. | 2.93% |

| 9. | | LXB Retail Properties PLC | 2.59% |

| 10. | | Kenedix, Inc. | 2.46% |

| * | Portfolio Distributions percentages are based on total investments. Top 10 Holdings do not include short-term investments and percentages are based on total net assets. Portfolio holdings and sector distributions are as of 10/31/15 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. |

Value of a $10,000 Investment (Unaudited)

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmarks. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees, if applicable. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost.

7

| Alpine International Real Estate Equity Fund (Continued) |  |

Commentary

Dear Shareholders:

We present below the annual results for the Alpine International Real Estate Equity Fund. For the period ended October 31, 2015, the closing NAV was $21.92 per share, representing a total return of -8.05%. The Fund’s benchmark index, the FTSE EPRA/NAREIT Global Ex-U.S. Index returned -2.07% over the same period. In the context of broader equity markets, the MSCI EAFE Index produced a total return of -0.07%. All references in this letter to the Fund’s performance relate to the performance of the Fund’s Institutional Class.

Performance Drivers

Broadly speaking, international equity performance for the year was a story of contrasts with strength in the first half of the year giving way to uncertainty in the second half. The broad themes driving the momentum of returns were the slow-motion global recovery, expectations for the timing and pace of Fed policy, and questions surrounding China and its ability to manage its economy through a pronounced cyclical downturn. During the first half of the period markets took a constructive view of these variables and as such the risk on trade was firmly established. Adding to this was the Chinese government’s use of moral suasion to encourage equity market speculation seemingly as a means for promoting mainland IPO activity and acting as a pressure valve for over-indebted corporates. The bubble in the China A-share market that followed shortly thereafter was the inflection point for the risk trade in global markets. Downward pressure on equities gathered further momentum in August when China embarked on a managed depreciation of its currency, which was communicated poorly and subsequently sent markets into a tailspin. Concerns were amplified by foreign exchange (FX) volatility (USD strength), persistent commodity weakness and a seemingly endless list of geopolitical flare ups ranging from Greece to Russia to the constantly evolving situation in the Middle East.

Nevertheless, the risk off environment in the second half did nothing to dampen transaction volumes in the listed and physical property markets. According to Jones Lang LaSalle (JLL), transaction volumes through Q3 2015 were $497bn, up 13% from 2014 in local currency terms, while UBS calculates $154bn in listed real estate mergers and acquisitions (M&A) during the period which lags only 2007 values in aggregate. The Fund’s largest position was in the UK whose economy continued to muddle along and real estate equities handily outperformed despite

the lingering threat of a rate hike as rental growth in London offices continued to surge higher. In Japan both the developers and the Japanese REITs (JREITs) lagged the broader market despite robust evidence of a recovery in operational markets, especially in Tokyo. Market focus has shifted toward expectations for further Bank of Japan (BoJ) easing as the macroeconomic data follows a prolonged downtrend. European real estate outperformed by a wide margin due largely to the European Central Bank (ECB) launching its quantitative easing (QE) program. Smaller markets including Ireland and Spain saw strong returns. The data in Europe have been lackluster and there remain downside risks to growth and inflation which could prompt the ECB to consider further measures to support the recovery. The deterioration in the macroeconomic and currency outlook in Australia continued to weigh on the Australian REIT (AREIT) market on an absolute basis but it nevertheless outperformed on a relative basis due to reasonable valuations, stable fundamentals and yield support. Emerging markets (EM) generally tracked the momentum in China which ultimately was a significant drag on returns as EMs took the brunt of the impact from the Renminbi devaluation, via FX channels as well as the equities.

Portfolio Analysis

At the headline level, the relative underperformance of the Fund during the period was driven primarily by stock selection, however this aggregate perspective masks the wide variance of contributions across geographies as economic and policy divergence became increasingly more pronounced for international investors. For example, the Fund saw relative outperformance across the majority of developed markets due to both stock selection and allocation (i.e., the UK, Japan and many European countries including Ireland, France and Spain) or due to allocation decisions entirely (i.e., Canada and Australia). By contrast the primary detractors to relative performance during the past year could largely be attributed to select emerging markets countries, specifically the overweight allocations to India, Brazil and Mexico or stock selection in Indonesia weighing on performance.

At quarter end the top 10 positions accounted for 33.84% of the portfolio versus 37.30% twelve months ago and the composition shifted considerably due to M&A and corporate actions. There were six companies falling out of the top 10: three of them including Songbird Estates in the UK, Unitech Corporate Parks in India and BHG in

8

| Alpine International Real Estate Equity Fund (Continued) |  |

Brazil were taken private; one of them, Yatra Capital in India, was reduced through a tender offer and two, SM Prime in the Philippines and Nexity in France, were bumped out due to an increased allocation to Japan. During the period under review, the aggregate weightings in India and Brazil were pared back due to a lack of recovery in fundamentals in the residential markets in the former and a deteriorating macroeconomic position in the latter. However the portfolio is significantly overweight India and we remain very constructive on the long term prospects for the overall economy as well as its real estate sector. The weakness of select EM currencies versus the USD further guided portfolio weighting considerations. The overweight allocation to the UK was reduced due primarily to M&A activity in Songbird and Quintain Estates. Japan positioning was increased due to continued evidence of robust rental dynamics in commercial assets in prime Tokyo. The European positions were buoyed by the introduction of QE by the ECB. Positioning in Germany shifted slightly as the Fund established positions in the commercial real estate operator TLG and the Berlin residential developer ADO Properties. Finally, the position in China/HK was increased due to a growing focus on policy tools to reinvigorate the economy and mounting evidence of diminishing inventory levels and stabilizing demand across many tier one and two residential markets. The Philippines remains one of the strongest macroeconomic stories in EMs. The Fund maintained large underweights to the Australian, Canadian and South African markets due to a weakening macroeconomic outlook, specifically commodity pricing, as well as instability in the currencies.

The Fund hedged a portion of its currency exposures to the Euro, the Japanese Yen and the British Pound. The currency hedging mitigated a portion of the overall negative impact of currency in the portfolio. We have also used leverage both in the execution of the strategy of the Fund and to manage outflows during the period.

The top five contributors to the Fund’s absolute performance over the period under discussion based on contribution to total return were Regus, Nexity, Songbird Estates, Invincible Investment, and Dalata Hotel Group.

| • | Regus PLC, which is the world’s largest operator of business centers offering temporary office rental space, is a long-term holding of the Fund. The stock saw a re-rating during the year based on its robust |

| | growth outlook, strong cash flow generation and private market transactions in the space that reinforced its relative value. |

| | |

| • | Nexity is one of the largest residential developers in France and has been a perceived beneficiary of government housing incentives as well as early evidence of a recovery in Europe. |

| | |

| • | Songbird Estates was a UK owner and manager of, among other assets, Canary Wharf in the East of London. The company was taken private by an existing shareholder, the Qatari Investment Authority, and Brookfield in the largest UK property transaction this decade. |

| | |

| • | Invincible Investment, a Japanese REIT, enjoyed strong share price appreciation during the period as it aggressively expanded its property portfolio and added hotels to its diversified mix of property assets. |

| | |

| • | Dalata Hotel Group, Ireland’s largest hotel operator, benefitted from its game-changing €455 million acquisition of Moran Bewley, continued robust economic growth in Ireland and a record numbers of overseas visitors. |

The top five negative contributors to the Fund’s absolute performance for the year ended October 31 based on contribution to total return were South Asian Real Estate, Direcional Engenharia, General Shopping, Sao Carlos and Bakrieland Development.

| • | South Asian Real Estate (SARE)* is a residential developer in India. |

| | |

| • | Direcional Engenharia S.A. is a Brazilian homebuilder whose operating results were negatively impacted by the challenging macroeconomic environment in Brazil. In addition, the weakness in the Brazilian currency negatively impacted the value of the Fund’s position. |

| | |

| • | General Shopping is a niche Brazilian shopping mall and outlet operator. The company has exhibited resilient operating performance but has not been able to recover from a suboptimal capital structure in a time of rising interest rates and depreciating currency. |

| | |

| • | Sao Carlos, a Brazilian developer and operator of commercial properties, struggled with its operating performance as a weak Brazilian macroeconomic environment coupled with an increase in new office supply caused vacancy levels to rise. |

*The Fund purchased South Asian Real Estate PLC (“SARE”) through a private placement in 2007. There is no public market for the holding. As of October 31, 2015, the holding was valued based upon an equal weighting of an income approach and a market approach.

9

| Alpine International Real Estate Equity Fund (Continued) |  |

| • | Bakrieland Development, a large land-owner and residential developer majority owned by a political family in Indonesia, saw its performance suffer as it continues its protracted efforts to restructure its bonds. |

Outlook

Modest levels of growth, a measured pace of inflation, and a benign real interest rate environment are generally supportive for real estate returns on a historical basis. The JLL report referenced above supports Alpine’s long-held bias for continued demand for real estate assets, which could continue to drive cap rate compression and capital values globally, albeit at a slower pace. As markets enter the middle innings of the real estate cycle we would expect the breadth of bids slowly to narrow over time. As we have outlined frequently in our discussions with shareholders, the next leg of the equity story would almost certainly require an inflection point in cash earnings whereby the drivers underpinning demand for real estate begin shifting away from yield spreads and safe haven characteristics to the prospects for rising net absorption trends as well as heightened rental tension across occupational markets. In this respect we are encouraged to note that across many markets we are seeing traction in the rental markets and, perhaps more importantly, there has not been a significant supply response that is typically seen as cycles mature. The JLL report goes on to conclude that, “major commercial real estate markets are now on sounder footing than at any time since the Global Financial Crisis.” We would tend to agree and see clear evidence of this second leg of growth in select markets in the US, the UK and to a lesser degree Japan and Europe, but downside risks still remain.

The Fed’s tentative approach to raising rates underscores the fragility of the economic recovery, and when it comes to monetary policy, investors are becoming increasingly sensitive to the fine line between prudence and indecisiveness. It is important to reiterate that divergent monetary policies and their spillover effects could likely remain one of the dominant drivers of asset market volatility and returns for the foreseeable future. While markets are now pricing in a Fed lift off in December, monetary policy will nonetheless be tethered to growth prospects and could remain exceptionally accommodative by any historic measure. The global monetary environment remains extremely supportive and markets are expecting further stimulus from the ECB and BoJ in the weeks to come. Accordingly we remain cautiously optimistic on the growth outlook while recognizing that movements of the yield curve post the Fed’s first rate hike could prompt intervals of reflexive risk aversion across

asset classes. Some are even calling for a replay of the taper tantrum of May 2013. Indeed, the first move off of the zero bound in close to seven years – no matter how well it is signaled – could undoubtedly create air pockets of uncertainty. In any case, we firmly believe that the true risks to a sustainable global recovery are likely entrenched prospects of weak growth and disinflation rather than fears of measured rate tightening due to a recovery in aggregate demand.

As we parse uneven economic data and try to identify long-term trends, we acknowledge that prolonged uncertainty could further unnerve risk/reward dynamics, intensify volatility and galvanize fears of secular stagnation. A fifth consecutive year of deteriorating fundamentals in EMs has certainly dragged down global growth expectations. Lower commodity prices present both challenges and opportunities to the overall outlook. FX could continue to represent a more relevant component of total return as US yields drift higher and currency depreciation becomes an important macroeconomic adjustment mechanism. Additionally, M&A should continue to be a major investment theme as divergent valuations, cheap financing and the market’s emphasis on growth could drive consolidation. It will be interesting to see whether developed market corporates, particularly in Europe, follow the US road map since 2008 and take up cheap debt in order to facilitate increasing dividends and to buy back shares. Although it requires some patience, we would expect China to stabilize its economy through a balanced mix of monetary and fiscal measures which should help to assuage fears over a raft of potential problems including devaluation of the currency, corporate debt levels and a possible balance of payments crisis. Finally, as always, investors should keep a close eye on geopolitical concerns.

Differentiation – whether in markets, asset types or growth models – should remain a dominant theme in portfolio construction. Alpine’s Real Estate team carefully evaluates the risk/reward proposition of each position in the portfolio and monitors volatility carefully. The managers remain extremely selective in our approach to the markets and deploying capital. We thank our shareholders for their interest and support.

Sincerely,

Samuel A. Lieber

Portfolio Manager

10

| Alpine International Real Estate Equity Fund (Continued) |  |

This letter represents the opinions of the Fund’s management and is subject to change, is not guaranteed and should not be considered a recommendation to buy or sell any security. The information provided is not intended to be, and is not, a forecast of future events, a guarantee of future results, or investment advice. Views expressed may vary from those of the firm as a whole.

Past performance is no guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to risks, including the following:

Concentration Risk – The Fund’s strategy of concentrating in companies in a specific industry means that its performance will be closely tied to the performance of a particular market segment. The Fund’s concentration in these companies may present more risks than if it were broadly diversified over numerous industries and sectors of the economy. A downturn in these companies would have a larger impact on the Fund than on a mutual fund that does not concentrate in such companies. At times, the performance of these companies will lag the performance of other industries or the broader market as a whole.

Currency Risk – The value of investments in securities denominated in foreign currencies increases or decreases as the rates of exchange between those currencies and the U.S. dollar change. Currency conversion costs and currency fluctuations could erase investment gains or add to investment losses. Currency exchange rates can be volatile, and are affected by factors such as general economic conditions, the actions of the U.S. and foreign governments or central banks, the imposition of currency controls and speculation.

Emerging Market Securities Risk – The risks of foreign investments are heightened when investing in issuers in emerging market countries. Emerging market countries tend to have economic, political and legal systems that are less fully developed and are less stable than those of more developed countries. They are often particularly sensitive to market movements because their market prices tend to reflect speculative expectations. Low trading volumes may result in a lack of liquidity and in extreme price volatility.

Equity Securities Risk – The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry).

Foreign Currency Transactions Risk – Foreign securities are often denominated in foreign currencies. As a result, the value of the Fund’s shares is affected by changes in exchange rates. The Fund may enter into foreign currency transactions to try to manage this risk. The Fund’s ability to use foreign currency transactions successfully depends on a number of factors, including the foreign currency transactions being available at prices that are not too costly, the availability of liquid markets and the ability of the Adviser to accurately predict the direction of changes in currency exchange rates.

Foreign Securities Risk – The Fund’s investments in securities of foreign issuers or issuers with significant exposure to foreign markets involve additional risk. Foreign countries in which the Fund may invest may have markets that are less liquid, less regulated and more volatile than U.S. markets. The value of the Fund’s investments may decline because of factors affecting the particular issuer as well as foreign markets and issuers generally, such as unfavorable government actions, and political or financial instability. Lack of information may also affect the value of these securities. The risks of foreign investment are heightened when investing in issuers of emerging market countries.

Growth Stock Risk – Growth stocks typically are very sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall. Growth stocks as a group may be out of favor and underperform the overall equity market while the market concentrates on undervalued stocks.

Initial Public Offerings and Secondary Offerings Risk – The Fund may invest a portion of its assets in shares of IPOs or secondary offerings of an issuer. IPOs and secondary offerings may have a magnified impact on the performance of a Fund with a small asset base. The impact of IPOs and secondary offerings on a Fund’s performance likely will decrease as the Fund’s asset size increases, which could reduce a Fund’s returns. IPOs and secondary offerings may not be consistently available to the Fund for investing. IPO and secondary offering shares frequently are volatile in price due to the absence of a prior public market, the small number of shares available for trading and limited information about the issuer. Therefore, the Fund may hold IPO and secondary offering shares for a very short period of time. This may increase the

11

| Alpine International Real Estate Equity Fund (Continued) |  |

turnover of the Fund and may lead to increased expenses for the Fund, such as commissions and transaction costs. In addition, IPO and secondary offering shares can experience an immediate drop in value if the demand for the securities does not continue to support the offering price.

Interest Rate Risk – Interest rates may rise resulting in a decrease in the value of securities held by the Fund, or may fall resulting in an increase in the value of such securities. Securities having longer maturities generally involve a greater risk of fluctuations in the value resulting from changes in interest rates.

Leverage Risk – The Fund may use leverage to purchase securities. Increases and decreases in the value of the Fund’s portfolio will be magnified when the Fund uses leverage.

Liquidity Risk – Some securities held by the Fund may be difficult to sell, or illiquid, particularly during times of market turmoil. Illiquid securities may also be difficult to value. If the Fund is forced to sell an illiquid asset to meet redemption requests or other cash needs, the Fund may be forced to sell at a loss.

Management Risk – The Adviser’s judgment about the quality, relative yield or value of, or market trends affecting, a particular security or sector, or about interest rates generally, may be incorrect. The Adviser’s security selections and other investment decisions might produce losses or cause the Fund to underperform when compared to other funds with similar investment objectives and strategies.

Market Risk – The price of a security held by the Fund may fall due to changing market, economic or political conditions.

Micro Capitalization Company Risk – Stock prices of micro capitalization companies are significantly more volatile, and more vulnerable to adverse business and economic developments than those of larger companies. Micro capitalization companies often have narrower markets for their goods and/or services and more limited managerial and financial resources than larger, more established companies, including small or medium capitalization companies.

Real Estate Investment Trusts (“REITs”) Risk – REITs’ share prices may decline because of adverse developments affecting the real estate industry including changes in interest rates. The returns from REITs may trail returns from the overall market. Additionally, there is always a risk that a given REIT will fail to qualify for favorable tax treatment.

Real Estate Securities Risk – Risks associated with investment in securities of companies in the real estate industry include: declines in the value of real estate; risks related to local economic conditions, overbuilding and increased competition; increases in property taxes and operating expenses; changes in zoning laws; casualty or condemnation losses; variations in rental income, neighborhood values or the appeal of properties to tenants; changes in interest rates and changes in general economic and market conditions.

Small and Medium Capitalization Company Risk – Securities of small or medium capitalization companies are more likely to experience sharper swings in market values, less liquid markets, in which it may be more difficult for the Adviser to sell at times and at prices that the Adviser believes appropriate and generally are more volatile than those of larger companies.

Undervalued Stock Risk – The Fund may pursue strategies that may include investing in securities, which, in the opinion of the Adviser, are undervalued. The identification of investment opportunities in undervalued securities is a difficult task and there is no assurance that such opportunities will be successfully recognized or acquired. While investments in undervalued securities offer opportunities for above-average capital appreciation, these investments involve a high degree of financial risk and can result in substantial losses.

Please refer to pages 3-4 for other important disclosures and definitions.

12

| Alpine Realty Income & Growth Fund |  |

| Comparative Annualized Returns as of 10/31/15 (Unaudited) | | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Since Inception(1) | |

| Alpine Realty Income & Growth Fund — Institutional Class | | | 6.98% | | | | 12.44% | | | | 12.78% | | | | 6.35% | | | | 11.39% | | | |

| Alpine Realty Income & Growth Fund — Class A (Without Load) | | | 6.72% | | | | 12.17% | | | | N/A | | | | N/A | | | | 13.32% | | | |

| Alpine Realty Income & Growth Fund — Class A (With Load) | | | 0.84% | | | | 10.08% | | | | N/A | | | | N/A | | | | 11.66% | | | |

| MSCI US REIT Index | | | 5.32% | | | | 11.83% | | | | 12.17% | | | | 7.66% | | | | 11.06% | | | |

| S&P 500® Index | | | 5.20% | | | | 16.20% | | | | 14.33% | | | | 7.85% | | | | 5.14% | | | |

| Lipper Real Estate Funds Average(2) | | | 4.92% | | | | 10.75% | | | | 11.46% | | | | 7.02% | | | | 10.56% | | | |

| Lipper Real Estate Funds Ranking(2) | | | 36/261 | | | | 24/220 | | | | 18/182 | | | | 102/130 | | | | 12/49 | | | |

| Gross Expense Ratio (Institutional Class): 1.47%(3) | | | | | | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Institutional Class): 1.42%(3) | | | | | | | | | | | | | | | | | | | | | | |

| Gross Expense Ratio (Class A): 1.72%(3) | | | | | | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Class A): 1.67%(3) | | | | | | | | | | | | | | | | | | | | | | |

| | (1) | Institutional Class shares commenced on December 29, 1998 and Class A shares commenced on December 30, 2011. Returns for indices are since December 29, 1998. |

| | (2) | The since inception data represents the period beginning December 31, 1998 (Institutional Class only). |

| | (3) | As disclosed in the prospectus dated February 27, 2015. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than the performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced. Returns for the Class A shares with sales charge reflect a maximum sales charge of 5.50%. Performance for the Class A shares without sales charges does not reflect this load.

MSCI US REIT Index is a gross, total return, free float-adjusted market capitalization index that is comprised of equity REITs. The index is based on MSCI USA Investable Market Index (IMI) its parent index which captures large, mid and small caps securities. With 144 constituents, it represents about 99% of the US REIT universe and securities are classified in the REIT sector according to the Global Industry Classification Standard (GICS®). It however excludes Mortgage REIT and selected Specialized REITs. This index reinvests as much as possible of a company’s dividend distributions. The reinvested amount is equal to the total dividend amount distributed to persons residing in the country of the dividend-paying company. Gross total return indexes do not, however, include any tax credits. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. S&P 500® Index is a total return, float-adjusted market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. Total return indexes include reinvestments of all dividends. Lipper rankings for the periods shown are based on fund total returns with dividends and distributions reinvested and do not reflect sales charges. The MSCI US REIT Index, the S&P 500® Index and the Lipper Real Estate Funds Average are unmanaged and do not reflect direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Real Estate Funds Average reflects fees charged by the underlying funds. The performance for the Alpine Realty Income & Growth Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

Expense Ratios reflect the ratios reported in the Fund’s most recent prospectus. The Alpine Realty Income & Growth Fund has a contractual expense waiver that continues through March 1, 2016. Where a Fund’s gross and net expense ratios are the same for the period reported, the contractual expense reimbursement level was not reached as of the end of that period. To the extent the Fund’s expenses were reduced by waivers, the Fund’s total returns were increased. In these cases, in the absence of the expense waivers, the Fund’s total returns would have been lower.

To the extent that the Fund’s historical performance resulted from gains derived from participation in Initial Public Offerings (“IPOs”) and/or Secondary Offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary Offerings in the future.

13

| Alpine Realty Income & Growth Fund (Continued) |  |

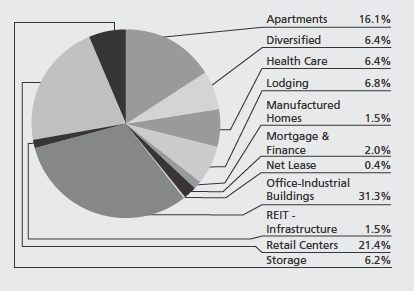

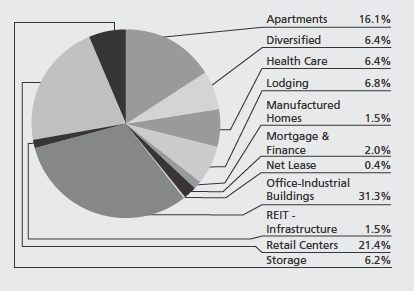

Portfolio Distributions* (Unaudited)

| Top 10 Holdings* (Unaudited) |

| 1. | | Simon Property Group, Inc. | 9.79% |

| 2. | | Boston Properties, Inc. | 5.39% |

| 3. | | Public Storage | 5.20% |

| 4. | | Equity Residential | 4.56% |

| 5. | | Essex Property Trust, Inc. | 4.50% |

| 6. | | Vornado Realty Trust | 4.00% |

| 7. | | Alexandria Real Estate Equities, Inc. | 3.99% |

| 8. | | AvalonBay Communities, Inc. | 3.87% |

| 9. | | Prologis, Inc. | 3.67% |

| 10. | | SL Green Realty Corp. | 3.58% |

| * | Portfolio Distributions percentages are based on total investments. Top 10 Holdings do not include short-term investments and percentages are based on total net assets. Portfolio holdings and sector distributions are as of 10/31/15 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. |

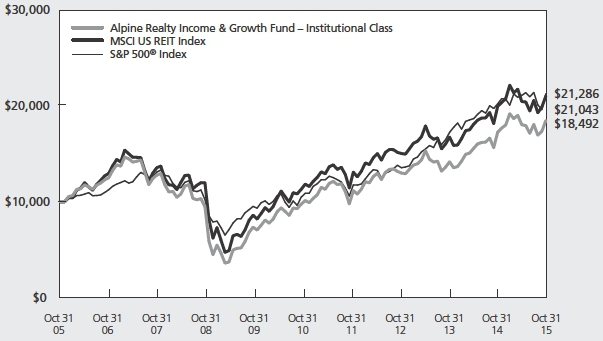

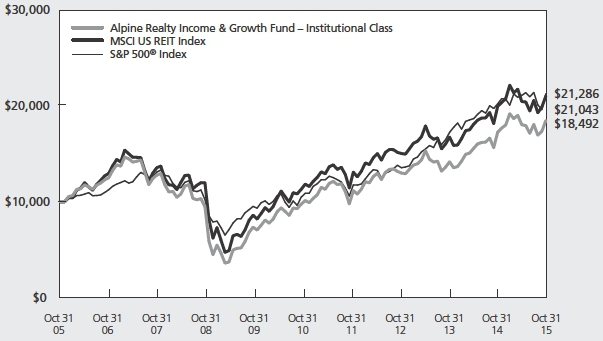

Value of a $10,000 Investment (Unaudited)

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmarks. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees, if applicable. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost.

14

| Alpine Realty Income & Growth Fund (Continued) |  |

Commentary

Dear Shareholders:

We are pleased to report the results of the Alpine Realty Income & Growth Fund for the fiscal year that ended October 31, 2015. During this past fiscal year, the Fund produced a total return of 6.98% which compares to the 4.92% return of the Lipper Real Estate Funds Average, the 5.32% return of the MSCI US REIT Index (the “RMS Index”), and the 5.20% return of the S&P 500® Index (the “S&P”). All references in this letter to the Fund’s performance relate to the performance of the Fund’s Institutional Class.

At October 31, 2015, the Fund’s net asset value had increased to $22.00 from $21.29 twelve months prior. During this timeframe, the Fund paid four quarterly distributions of $0.1875 per share totaling $0.75 per share for the fiscal year. Since its inception at $10.00 per share on December 29, 1998 through October 31, 2015, the Fund has delivered an annualized total return to shareholders of 11.39% which includes cumulative distributions of $16.98. The performance chart on page 13 presents the Fund’s returns for the latest one-year, three-year, five year, ten-year, and since inception periods.

In our view, the most impactful factors influencing returns for REIT securities during the fiscal year, consistent with the last few years, were (i) the level and direction of long term interest rates, specifically that of the Ten-Year US Treasury obligation; (ii) continued improvement in real estate property fundamentals nationally with particular strength in those coastal markets with notably higher than average job growth trends; and (iii) steady demand by both domestic and foreign capital for direct property investment in the private market and for debt investments in both the private and public markets.

The Ten-Year Treasury rate remained historically low during the fiscal year, even decreasing 0.20% over the twelve-month period to 2.14% as of October 31, 2015, and providing, in our view, a positive tailwind for public real estate securities valuations. Yet fluctuations in that rate – a fiscal year low of 1.64% on January 30th to a high of 2.49% on June 10th – caused above average volatility in REIT pricing, in our opinion, as investors remained concerned that significant rate increases would negatively impact underlying real estate valuations. In contrast to public market participants, private capital remained seemingly more confident in the continuance of economic growth and the real estate cycle; in the relative stability of US real estate cash flow prospects; and

in the ability to generate attractive returns on equity relative to other alternative investments. That conviction in ongoing improvement in real estate operating fundamentals has, in our opinion, increased transactional and merger and acquisition activity including privatizations of REIT entities perceived to be trading at discounts to their underlying net asset value. We believe this trend could continue and even accelerate in the upcoming year if US economic growth continues at a slow and steady pace, long term interest rates remain historically subdued, and discounts to private market valuations continue in REIT securities pricing.

For the Fund, the top contributors to its positive performance during the latest fiscal year included companies within the self-storage and apartment sectors as well as those within the segment of the regional mall category with the highest tenant sales productivity. Self-storage companies, including the Fund’s third largest holding, Public Storage, a national owner and developer of storage facilities, produced strong yearly growth in earnings from occupancy and rental increases and were rewarded with some of the top total returns within the REIT group. Apartment companies, including Essex Properties Trust, Equity Residential, and AvalonBay Communities, all top ten holdings for the Fund, demonstrated continued strength in achieving high occupancies and rates of rental increases, particularly in the western coastal markets from southern California to Seattle, Washington. Within the regional mall sector, there was a definitive bifurcation of fundamental operating performance and stock price appreciation between Class A malls achieving higher rents, sales productivity, and occupancies and their Class B brethren who struggled to maintain stable tenancy levels in the face of higher than average retailer bankruptcies and store closures during the period. Both retail landlords, Simon Property Group and The Macerich Company, whom Simon unsuccessfully targeted as an acquisition earlier in the year, produced above average returns for the Fund. Relative to the overall return of the RMS Index, some of the greatest positive attribution was produced by our overweight positions in CoreSite Realty, a data center owner and developer who experienced strong demand from network service, cloud, and information technology providers; Home Properties, an apartment properties owner that was acquired by a private equity entity; the aforementioned Macerich; and by our underweight position in the healthcare REIT, HCP, Inc.

15

| Alpine Realty Income & Growth Fund (Continued) |  |

Holdings that underperformed REIT average returns and detracted from performance included companies within the lodging and healthcare sectors as well as those within the Class B segment of the regional mall category. Lodging companies experienced a deceleration in revenue growth, albeit from historically high levels, from a combination of slowing international travel due to the strength in the dollar, less robust business transient business, and new supply pressures in certain markets such as New York City. For the Fund, all of its lodging REIT holdings, except for Strategic Hotels and Resorts which is subject to a privatization bid from private equity funds controlled by The Blackstone Group, L.P., produced negative returns during the period with Host Hotels and Resorts and Chesapeake Lodging Trust accounting for the largest detractions from overall portfolio results. Healthcare REITs, including the Fund’s holdings in Ventas Inc., Welltower Inc., and Sabra Health Care REIT, produced weak stock performances as investors demonstrated concerns about signs of new supply additions of senior housing facilities and the impact of potentially rising interest rates on healthcare REIT valuations. Finally, the Fund’s holding in CBL & Associates Properties, an operator of middle-market shopping malls with essentially flat growth in net operating income impacted by retailer bankruptcies, detracted from overall results. Relative to the return of the RMS Index, the securities that created the most impactful negative attribution to performance were our overweight positions in the aforementioned Ventas, Sabra, and CBL & Associates, and Emaar Properties, a diversified Dubai-based developer of housing and commercial properties, which declined on investor concerns regarding potential slowing economic conditions as a result of declining oil prices and was sold by the Fund during the period.

Prospects for continued positive trends in real estate operating performance, in our view, remain tied to domestic economic growth including gains in employment and to muted supply additions. We remain most constructive on investing in companies that we believe have the highest likelihood for above average internal growth supported by strong local economies and for shareholder valuation potential from development and redevelopment activities. We believe concerns about the impact of potential rises in long term interest rates on REIT valuations have been creating above average volatility in REIT pricing and a potential headwind to advancement in share price appreciation resulting in somewhat of a dislocation between how real estate is priced in the public arena versus the private market. As a result, over the past year, we witnessed an increase in privatizations and merger and acquisition activity among the publicly traded real estate companies that affected a number of Fund holdings including Home Properties, Strategic Hotels and Resorts, Campus Crest Communities and most recently Starwood Hotels & Resorts which agreed to a merger with Marriott International. We believe this trend could continue and even accelerate in the upcoming year if discounts to private market valuations persist in REIT securities’ pricing. Additionally, we anticipate that we will continue to employ low levels of leverage both in the execution of the Fund’s strategy and to manage unexpected Fund flows. We look forward to providing an update on real estate trends and Fund performance at the end of the semi-annual period in April 2016.

Sincerely,

Robert W. Gadsden

Portfolio Manager

16

| Alpine Realty Income & Growth Fund (Continued) |  |

This letter represents the opinions of the Fund’s management and is subject to change, is not guaranteed and should not be considered a recommendation to buy or sell any security. The information provided is not intended to be, and is not, a forecast of future events, a guarantee of future results, or investment advice. Views expressed may vary from those of the firm as a whole.

Past performance is no guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to risks, including the following:

Concentration Risk – The Fund’s strategy of concentrating in companies in a specific industry means that its performance will be closely tied to the performance of a particular market segment. The Fund’s concentration in these companies may present more risks than if it were broadly diversified over numerous industries and sectors of the economy. A downturn in these companies would have a larger impact on the Fund than on a mutual fund that does not concentrate in such companies. At times, the performance of these companies will lag the performance of other industries or the broader market as a whole.

Credit Risk – Credit risk refers to the possibility that the issuer of a security will not be able to make payments of interest and principal when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on both the financial condition of the issuer and the terms of the obligation.

Dividend Strategy Risk – The Fund’s strategy of investing in dividend-paying stocks involves the risk that such stocks may fall out favor with investors and underperform the market. Companies that issue dividend paying-stocks are not required to continue to pay dividends on such stocks. Therefore, there is the possibility that such companies could reduce or eliminate the payment of dividends in the future.

Equity Securities Risk – The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry).

Fixed Income Securities Risk – Fixed income securities are subject to issuer risk, interest rate risk and market risk.

Growth Stock Risk – Growth stocks typically are very sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall. Growth stocks as a group may be out of favor and underperform the overall equity market while the market concentrates on undervalued stocks.

Initial Public Offerings and Secondary Offerings Risk – The Fund may invest a portion of its assets in shares of IPOs or secondary offerings of an issuer. IPOs and secondary offerings may have a magnified impact on the performance of a Fund with a small asset base. The impact of IPOs and secondary offerings on a Fund’s performance likely will decrease as the Fund’s asset size increases, which could reduce a Fund’s returns. IPOs and secondary offerings may not be consistently available to the Fund for investing. IPO and secondary offering shares frequently are volatile in price due to the absence of a prior public market, the small number of shares available for trading and limited information about the issuer. Therefore, the Fund may hold IPO and secondary offering shares for a very short period of time. This may increase the turnover of the Fund and may lead to increased expenses for the Fund, such as commissions and transaction costs. In addition, IPO and secondary offering shares can experience an immediate drop in value if the demand for the securities does not continue to support the offering price.

Interest Rate Risk – Interest rates may rise resulting in a decrease in the value of securities held by the Fund, or may fall resulting in an increase in the value of such securities. Securities having longer maturities generally involve a greater risk of fluctuations in the value resulting from changes in interest rates.

Leverage Risk – The Fund may use leverage to purchase securities. Increases and decreases in the value of the Fund’s portfolio will be magnified when the Fund uses leverage.

Management Risk – The Adviser’s judgment about the quality, relative yield or value of, or market trends affecting, a particular security or sector, or about interest rates generally, may be incorrect. The Adviser’s security selections and other

17

| Alpine Realty Income & Growth Fund (Continued) |  |

investment decisions might produce losses or cause the Fund to underperform when compared to other funds with similar investment objectives and strategies.

Market Risk – The price of a security held by the Fund may fall due to changing market, economic or political conditions.

Non-Diversified Fund Risk – Performance of a non-diversified fund may be more volatile than a diversified fund because a non-diversified fund may invest a greater percentage of its total assets in the securities of a single issuer.

Preferred Stock Risk – Preferred stock represents an interest in a company that generally entitles the holder to receive, in preference to the holders of common stock, dividends and a fixed share of the proceeds resulting from a liquidation of the company. Preferred stocks may pay fixed or adjustable rates of return. Preferred stock has investment characteristics of both fixed income and equity securities. However, the value of these securities tends to vary more with fluctuations in the underlying common stock and less with fluctuations in interest rates and tends to exhibit greater volatility.

Real Estate Investment Trusts (“REITs”) Risk – REITs’ share prices may decline because of adverse developments affecting the real estate industry including changes in interest rates. The returns from REITs may trail returns from the overall market. Additionally, there is always a risk that a given REIT will fail to qualify for favorable tax treatment.

Real Estate Securities Risk – Risks associated with investment in securities of companies in the real estate industry include: declines in the value of real estate; risks related to local economic conditions, overbuilding and increased competition; increases in property taxes and operating expenses; changes in zoning laws; casualty or condemnation losses; variations in rental income, neighborhood values or the appeal of properties to tenants; changes in interest rates and changes in general economic and market conditions.

Small and Medium Capitalization Company Risk – Securities of small or medium capitalization companies are more likely to experience sharper swings in market values, less liquid markets, in which it may be more difficult for the Adviser to sell at times and at prices that the Adviser believes appropriate and generally are more volatile than those of larger companies.