| OMB APPROVAL |

OMB Number: 3235-0570 Expires: January 31, 2014 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05685

Williamsburg Investment Trust

(Exact name of registrant as specified in charter)

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

W. Lee H. Dunham, Esq.

Sullivan & Worcester LLP One Post Office Square Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: (513) 587-3400

Date of fiscal year end: March 31, 2011

Date of reporting period: March 31, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

ANNUAL REPORT

March 31, 2011 |

THE DAVENPORT FUNDS LETTER TO SHAREHOLDERS | |

Dear Shareholders,

Equity markets remained strong in the first quarter of 2011. The S&P 500 Index and Russell 2000 Index advanced 5.92% and 7.94%, respectively. However, it wasn’t exactly a smooth ride. Investors were first hit with unrest in the Middle East, causing oil prices to jump and raising fears of cost pressures for both consumers and corporations. Then, the world witnessed a tragic series of events in Japan involving an earthquake, tsunami, and disaster at a nuclear facility. Japan is the world’s third biggest economy and many have suggested this crisis could push the country’s already fragile economy into recession. Clearly, this would also have an impact on the many companies that export to Japan. Ultimately, fear subsided and U.S. markets were able to put together a strong showing. In fact, the Dow Jones Industrial Average closed the quarter right near a high for the year and the Russell 2000 Index was near 2007 highs.

There’s always something to worry about. Do massive fiscal deficits mean imminent doom? What will happen when Quantitative Easing Part 2 (QE2) ends this summer? Are profit margins peaking? Will higher interest rates crimp growth and asset values? Will high energy prices derail a consumer recovery? These questions can’t be answered precisely and are cause for pause, especially when considering the dramatic run stocks have enjoyed. Indeed, investors have been living in a QE driven utopia since this past August. As far as Japan goes, the recent disaster will undoubtedly have a material impact on the country’s companies and consumers in the near-term. While we don’t minimize this tragedy and the impact it will have on Japan’s people, events like this can sometimes give way to rebuilding efforts that support economic growth. We are reminded of Hurricane Katrina. The storm had a devastating short-term impact, but companies doing business on the Gulf Coast ultimately rebounded sharply.

We wouldn’t be surprised to see a little risk aversion creep back into the market. Still, we won’t make efforts to time market pullbacks. We sometimes sell a stock if it appears far overvalued and/or we see a better opportunity elsewhere. However, we typically don’t sell just for the sake of getting “defensive.” Barring a 2008-like meltdown, selling a good company as part of a hedging strategy rarely makes sense for long-term investors. It may look smart for a period of weeks or months in the event of market weakness; however, it generally proves to have been foolish a year or so after the fact. With a fresh financial crisis under our belt, we hope our stubbornness will be rewarded. Also, remember we are coming out of a recession, not going into one. Steady decreases in unemployment should provide a tailwind.

Commodities have been all the rage. Easy monetary policy, gigantic fiscal deficits, rising demand, and now, tension in the Middle East have coalesced to put upward pressure on oil, metals and agricultural commodities. At times, we’ve seen investors divide the market into haves and have-nots, with the haves being commodity producers and have-nots being any company feeling the pressure of rising input costs. We understand the inflationary forces that are upon us and have added to positions in commodity producers where there is a story of value creation beyond just hoping for higher prices. We are particularly attracted to natural gas producers, which we think will ultimately benefit from broader exploitation of our gas resources. We are also attracted to hard asset/infrastructure stories where pricing power provides us inflation protection. All this said, we hesitate to be too

aggressive in the commodity world for a couple of reasons: the space seems a little too popular and filled with momentum-oriented investors, and if monetary easing ends and/or fiscal austerity sets in, we could see the commodity complex take a breather alongside more subdued inflation expectations.

Over the past quarter, we have purchased shares in a few contrarian situations. In other words, a few of our recent buys have obvious headwinds and were very out of favor at the time of purchase. While we don’t classify ourselves strictly as deep value investors, we think it sometimes pays to look for opportunities in areas that others are shunning.

We have continued to emphasize the “when, not if” theme discussed in our fourth quarter letter. In our view, there has been significant deferral of spending in many industries ranging from aerospace to air conditioning. Such deferral has led to pent-up demand and, in a number of cases, we aren’t taking on much risk while we wait for demand to increase. Housing, also a “when, not if” situation, is more a story of recovery from a depressed base. Many housing data points remain fairly discouraging. New home sales for February 2011 fell 16.9% to an annualized rate of 250,000, which was the lowest level since the data series began nearly 50 years ago. As one member of our Investment Policy Committee recently noted, “you have to ignore a lot of facts to be bullish on housing.” We think we are in the process of building a bottom and suspect markets for home lots and building products could tighten.

We discuss the Davenport Funds in more detail below. As you will read, we are enjoying solid results thus far in 2011 and are excited about many new ideas.

Davenport Core Fund

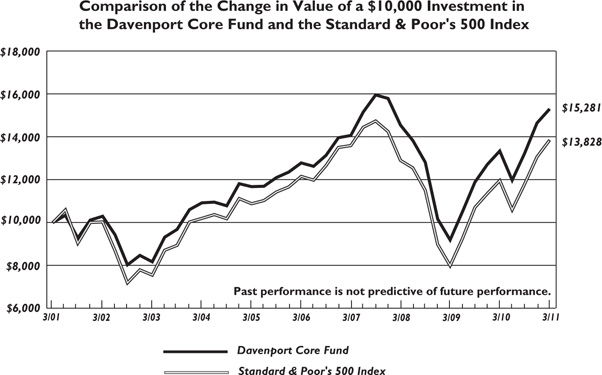

The following chart represents Davenport Core Fund (the “Core Fund”) performance and the performance of the S&P 500 Index*, the Core Fund’s primary benchmark, for the periods ended March 31, 2011.

| | | | | | | Since Inception** (1/15/98) | Fiscal Year 2011 Gross Expense Ratio |

| Core Fund | 4.40% | 14.61% | 1.67% | 3.65% | 4.33% | 4.42% | 0.99% |

| S&P 500 | 5.92% | 15.65% | 2.35% | 2.62% | 3.29% | 4.37% | |

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

| * | The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

The Core Fund enjoyed a strong fiscal year returning 14.61%, slightly lagging the 15.65% gain for the S&P 500 Index. There were many points throughout the year when it was easy to be pessimistic. Fortunately, we took advantage of market swoons to add to higher conviction ideas. At the end of the year, larger cap stocks started to close a performance gap with smaller companies. While tragic events in Japan held large caps in check late in the year, we still believe global exposure is a good thing and think shares of larger companies appear cheap.

The Financials sector was one of our best performing categories during the fiscal year. This was due in large part to our exposure to high quality asset managers such as T. Rowe Price (TROW) and Brookfield Asset Management (BAM) and less meaningful exposure to the banking sector. While being underweight in banks helped this past year, we think 2011 will be a better year for the sector as credit losses abate, loan demand approaches a bottom and dividend payments resume. We initiated a position in Bank of America (BAC) at the end of December. Bank of America is clearly among the riskier plays given well-publicized mortgage putback and foreclosure issues. However, the stock looks very cheap relative to long-term earnings power (could approach $2.00) and could work higher as headlines abate. Though we realize near-term news flow could be rough, we felt the risk/reward profile was too compelling to ignore.

Housing and autos are also areas where it seems suppressed demand will have to resurface in the event of an extended recovery. Throughout the year we have participated in improving sentiment in the auto sector via stocks such as CarMax (KMX) and AutoZone (AZO).We increased our housing exposure by adding to Lowe’s (LOW) and initiating a new position in leading homebuilder, NVR, Inc. (NVR). In our view, Lowe’s is a cheap stock that seems poised to benefit from an up-tick in remodeling demand. NVR is exposed to some of the most resilient housing markets in the country (Mid-Atlantic/Washington D.C.) and its practice of optioning lots (i.e. putting up as little capital as possible) helped the company maintain profitability throughout the entire downturn (something no other homebuilder can say). While we do not know when housing will turn, we think it will be difficult for things to get much worse. As such, we believe there shouldn’t be much downside from here for either stock. When things do improve however, earnings power should be markedly higher than current levels.

Energy stocks posted a strong quarter and were up nicely on the year. Schlumberger (SLB), Exxon Mobil (XOM) and Chevron (CVX) were standouts in the group. Throughout the year we began to warm up to companies with natural gas exposure. We realize it is tough to get excited about gas given high storage levels, elevated rig counts and anemic demand; however, we also think it is difficult to imagine things getting much worse. In November, we added to Exxon Mobil (XOM) and EOG Resources (EOG). While each company has taken steps to diversify their production mix (XOM out of oil to gas and EOG out of gas to oil), both have been criticized for their exposure to gas production. Over time, each of these companies has proven to be an excellent steward of shareholder capital, generating impressive multi-year returns. As the outlook for gas improves, we expect each of these stocks will recapture the premium valuations they once carried.

As one would expect in a strong market environment, the Consumer Staples and Health Care sectors underperformed recently. The Health Care sector’s relative performance benefited, thanks to robust gains in Novo Nordisk (NVO), LabCorp (LH) and WellPoint (WLP). However, our Consumer Staples holdings were a drag on both relative and absolute performance as the sector dealt with fears surrounding higher input costs. In both cases, the sectors’ generally defensive characteristics caused many investors to look elsewhere. While this sluggishness is frustrating in the context of a rising market, we still think it makes sense to have exposure to these areas. For many of these companies, underperformance has been a result of simply being out of favor rather than some deterioration in long term prospects.

In closing, we want to reiterate our dedication to delivering competitive returns while taking on less risk. While some of our recent actions could be deemed contrarian, we feel the potential returns from these investments significantly outweigh the risks. Furthermore, we continue to believe quality large-cap equities offer a compelling value proposition.

New Positions

The Boeing Company (BA) is the world’s largest manufacturer of commercial jetliners and military aircraft. The stock has stalled over the last couple of months due to setbacks and uncertainty in the 787 production process in addition to ongoing concerns surrounding the company’s defense segment. While headline risk associated with the 787 program will be an issue moving forward, we point out that the company’s 737 and 777 platforms are expected to deliver strong results and be the main drivers of earnings over the next few years. Furthermore, expectations for the defense business already seem to be at a low point despite many product lines positioning within the pentagon mandate of “cheaper but fully capable.” We believe more clarity on the outlook for the 787 should remove an overhang on the stock, redirecting attention to the company’s strong product franchises and significant earnings power.

Capital One Financial Corp. (COF) is the 5th largest U.S. credit card provider, with operations in auto lending, consumer installment lending, small business lending and deposit taking activities. After lagging in 2010, we think 2011 could be a better year for credit sensitive financials as the economy improves, credit losses abate and loan demand bottoms. Some of these developments have already started to shine through at COF in the form of net charge off declines and a slowdown in the rate of loan contraction. While we are not out of the woods yet we believe these trends should continue, leading to EPS well north of $5.00 over the next couple years. With the stock trading for less than 10x consensus EPS projections, we believe the risk reward profile is attractive.

Discovery Communications, Inc. (DISCK) is a leading global media and entertainment company whose 100+ channels include flagship properties such as the Discovery Channel, Animal Planet and TLC. We believe recent weakness in the name has yielded an opportunity to gain exposure to a well run company, with attractive assets and multiple long term growth drivers. The company’s core assets should continue to deliver a solid earnings stream as key channels close the gap with peers on a per-household affiliate and advertising revenue basis. Emerging networks should become more meaningful drivers of earnings growth as audience sizes reach a critical mass for advertisers. Furthermore, efforts to leverage the company’s popular (and easily translatable) content across international markets should lead to above average growth and support a higher multiple for the shares over time. We believe DISCK has a solid balance sheet and uses its strong cash flows to buy back stock and reinvest in the business.

WellPoint, Inc. (WLP) is one of the largest managed care companies in the U.S., operating the Blue Cross & Blue Shield plans in 14 states and covering roughly 34 million medical members in total. This is clearly a contrarian/value oriented investment that faces some well documented headwinds. However, we find the risk/reward to be appealing at current levels. While the stock has been held in check for some time, we believe that it could have solid upside as subscriber rates improve, investment income benefits from higher interest rates, and political rhetoric subsides.

Increased Positions

Brookfield Asset Management, Inc. (BAM) ** is a specialty asset manager with a concentration in property, power and infrastructure assets. Since the financial crisis, the company has utilized its strong balance sheet and liquidity to opportunistically purchase high quality assets at great values. Going forward, we are encouraged by recent third party asset gathering momentum and the potential for further value enhancing investments. Given management’s impressive track record of value creation, we are comfortable with their ability to allocate capital wisely and grow the entity at an above average pace for an extended period of time.

NVR, Inc. (NVR) is a leading homebuilder that operates primarily under the name Ryan Homes. The Mid-Atlantic is its biggest market. We aren’t expecting housing markets to improve materially anytime soon and could indeed be early to the stock; however, there shouldn’t be much downside from here and this company’s earnings power will be markedly higher than current levels when things do improve. We also note the company has $1 billion of excess cash (vs. its $3.8 billion market cap). Lastly, we note that we initiated the position at 1.0% in the previous quarter due to the stock’s limited trading liquidity.

Transocean Ltd. (RIG)** is the largest and most geographically diverse offshore oil & gas drilling company in the world. It is positioned to benefit from an increasing reliance on offshore/deepwater sources of supply to meet rising global demand. Given the stocks cheap valuation and small size relative to other holdings, we felt adding to the position was a good way to add high quality exposure to the sector. In addition to rising oil prices and a less restrictive regulatory approach in the Gulf of Mexico, we believe the company’s recent dividend announcement should provide support to the shares.

Davenport Value & Income Fund

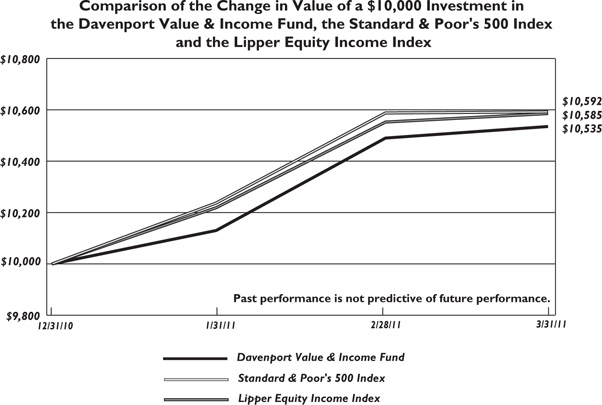

The following chart represents Davenport Value & Income Fund (the “Value & Income Fund”) performance and the performance of the S&P 500 Index*, the Fund’s primary benchmark, and the Lipper Equity Income Index for the periods ended March 31, 2011.

| | | Since Inception (12/31/2010) | |

| Value & Income Fund | 5.35% | 5.35% | 1.25% |

| S&P 500 Index* | 5.92% | 4.37% | |

| Lipper Equity Income Index* | 5.85% | 5.85% | |

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

| * | The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. The Lipper Equity Income Fund Index is an unmanaged index of the 30 largest funds, based on total year-end net asset value, in the Lipper Equity Income Fund category. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

The Value & Income Fund had a strong quarter, returning 5.35%, roughly in line with the 5.92 % gain for the S&P 500 Index and the 5.85% gain for the Lipper Equity Income Index. During the quarter, we saw companies increase or institute dividends at an accelerating pace. According to S&P Research, roughly 117 companies in the S&P 500 Index indicated an intention to either raise or start paying a dividend since the start of the calendar year 2011 compared to 78 companies who raised their dividends during the same period last year. Given record cash balances (and near record cash flows), a firmer economic backdrop, and historically low distribution levels (quarterly dividends by S&P 500 Index companies are still 13% below 2008 peak levels according to S&P Research), we expect to continue seeing businesses return

capital to shareholders in the form of dividends. As such, we believe this is an exciting time for the Value & Income Fund, which has many attractive opportunities for capital appreciation in addition to continued dividend growth.

One of the sectors that saw the greatest amount of dividend increases during the quarter was Financials. Much of this was due to the conclusion of the Fed’s stress test process, which paved the way for meaningful dividend increases for bank holdings such as JPMorgan (JPM) (quarterly dividend increased 5x to $0.25) and Wells Fargo (WFC) (quarterly dividend increased 2.4x to $0.12). Ironically, non-bank holdings such as Plum Creek Timber (PCL) and Willis Group Holdings (WSH) were our largest contributors to performance in the sector. High teens gains in these names helped to offset weakness in others such as Walter Investment Management (WAC) and Bank of America (BAC). We initiated a position in BAC at the beginning of the period, following the company’s settlement on rep and warranty claims with the Government Sponsored Entities (GSEs). The stock suffered some weakness after the Fed rejected its proposal for a modest dividend, likely due to legacy issues and concerns regarding internal capital generation. While we were disappointed to learn of this ruling, we still believe BAC is capable of paying a meaningful dividend as it moves towards its goal of a 30% payout ratio on earnings power that could approach $2.00 in coming years. Given this prospect, and considering that the stock trades at only a slight premium to tangible book value, we feel the shares offer a compelling risk/reward proposition.

A few of our commodity-related holdings stand to benefit from ongoing commodity inflation. Needless to say, as incremental factors such as the escalating unrest in the Middle East entered the equation, most of these names exhibited significant strength. Energy holdings Chevron (CVX), Exxon Mobil (XOM) and Encana (ECA) were top performers during the quarter; however, recent additions to the portfolio within the category also helped absolute performance.

We might look to lighten our exposure in the Consumer Staples and Health Care sectors and focus on a few more cyclical names. Throughout the quarter we acted on this inclination and, while Consumer Staples and Health Care continued to serve as a drag on performance, we feel much more comfortable with the Value & Income Fund’s positioning. In one instance, we sold our position in McCormick (MKC) and added to positions in ECA and Norfolk Southern (NSC). Relative to MKC, both of these companies are more cyclical, appear to have more EPS upside and could benefit from higher commodity prices. They are also quality franchises that pay solid dividends and can fare well in a variety of scenarios.

Also in the Energy category, we initiated positions in ConocoPhillips (COP) and Royal Dutch Shell (RDS.B). Each of these companies is a leading integrated energy company that pays an attractive dividend. In coming years, we believe both entities will begin to reap the benefits of elevated levels of capital spending from prior years. Ultimately, new projects, lower capital requirements and elevated commodity prices should lead to sustainable periods of cash flow and dividend growth.

As indicated by the actions highlighted above, the cyclicality of the Value & Income Fund has ticked up a bit. However, the actions taken were done with a focus on high quality franchises with cheap valuations and attractive dividends that can grow. As such, we feel comfortable with the portfolio’s risk profile and feel well positioned to participate as the economy gradually strengthens and corporate cash flows expand.

New Positions

Bank of America Corp. (BAC) is the nation’s largest consumer and small business bank, with nearly $1 trillion in deposits. The bank has offices in 32 states, Washington D.C., and over 30 countries. The company’s massive deposit base and geographic presence should serve as a valuable and stable source of low-cost funding. Moving forward, we believe the shares should exhibit significant earnings power as the economy recovers.

ConocoPhillips (COP) is an international integrated energy company created through the 2002 merger of Phillips Petroleum and Conoco Corp. In light of a few ill-timed acquisitions and difficulties replacing production, the stock now trades at a meaningful discount to its NAV. Looking ahead, we think the stock is at an inflection point and that a variety of developments could cause this discount to erode. As is the case for many peers, upstream results should benefit from higher commodity prices in addition to a shift to higher margin liquids production. Downstream/refining operations should also benefit from widening spreads. Alongside this improvement in cash flows, we expect management to continue to high grade the company’s asset portfolio through selective asset sales and prudent reinvestment. This activity should bolster the company’s already strong balance sheet ($10 billion in cash), allowing stock buybacks and further increases to the dividend (yields 3.5%).

Royal Dutch Shell plc (RDS.B)** is a leading energy integrated company and the largest producer of liquid natural gas (LNG). Amid seven straight years of production declines and a 2004 reserve downgrade, the company continued to invest heavily in value-creating projects. 2010 marked the first year of upstream production growth in 7 years, beginning what we believe to be a multi-year period of outsized production, free cash flow and dividend growth. Beyond meaningful new projects, increased production and higher commodity prices, we expect results to benefit from an above average earnings exposure to refining and chemicals (yields 5.0%).

Watsco, Inc. (WSO) is the largest independent distributor of heating, ventilation, air conditioning (HVAC) and refrigeration equipment, parts, and supplies in the U.S. Headquartered in Coconut Grove, Florida, the company was founded in 1947 as a parts manufacturer and entered the distribution business in 1989. Most of the executives have been with the company for an extended period of time and the company has about 23% ownership by insiders. WSO is still led by the CEO that bought the company in 1973. WSO has an estimated 7% market share in a $26 billion market and has 18 employees at its headquarters (yields 3.2%).

Increased Positions

Encana Corp. (ECA)** is one of the largest independent natural gas Exploration & Production (E&P) companies in North America, with a diverse portfolio of high quality/low cost assets across Canada and the U.S. ECA continues to lower its cost of production, enabling dividend coverage and sustainable production in even more draconian price environments. This intense focus on costs, in addition to management’s more efficient deployment of capital, should help generate attractive long-term returns as the company exploits its 20+ year drilling inventory. Management appears to be committed to the current $0.80 dividend (yields 2.8%).

Norfolk Southern Corp. (NSC) is the fourth largest rail network in North America, operating approximately 21,000 route miles of track. Over the past year, results have improved significantly alongside increasing industrial demand and firmer commodity prices. While we expect more earnings leverage to result from a continuation of these trends, we also believe the company

is well positioned to benefit from secular/structural developments that should make rails an increasingly attractive logistical alternative over time. NSC has a well respected and experienced management team, a solid balance sheet and an attractive dividend (yields 2.5%).

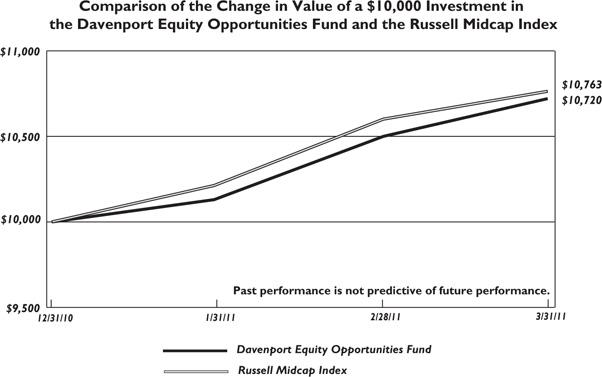

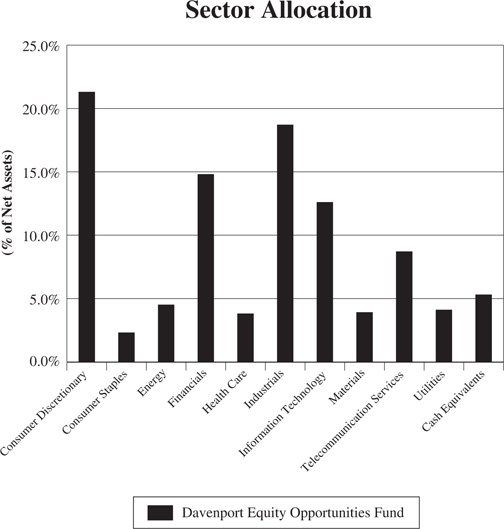

Davenport Equity Opportunities Fund

The following chart represents Davenport Equity Opportunities Fund (the “Equity Opportunities Fund”) performance and the performance of the Russell Midcap Index*, the Equity Opportunities Fund’s primary benchmark, and the S&P 500 Index, for the periods ended March 31, 2011.

| | | Since Inception (12/31/2010) | |

| Equity Opportunities Fund | 7.20% | 7.20% | 1.25% |

| Russell Midcap Index* | 7.63% | 7.63% | |

| S&P 500 Index* | 5.92% | 5.92% | |

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

| * | The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000, which represent approximately 25% of the total market capitalization of the Russell 1000. The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

The Equity Opportunities Fund enjoyed a strong quarter with a gain of 7.20%. This compares to a 7.63% advance for the Russell Midcap Index and a 5.92% gain for the S&P 500 Index. We don’t put much emphasis on short-term performance, but are pleased to have started on a good note.

Acacia Research (ACTG), a patent licensing company, was our top overall contributor. The shares have acted very well alongside new licensing agreements and additional analyst coverage. While a 30%+ return in one quarter is unusual, we were happy to see lighting strike. Construction equipment rental company RSC Holdings (RRR) was our biggest percentage gainer. We reduced our position in this cyclical company after an impressive run. Richmond-based NewMarket (NEU) was also a strong performer. The shares garnered significant attention when Berkshire Hathaway (BRK) agreed to buy Lubrizol (LZ), which is NEU’s closest comparable. Consumer related stocks such as Expedia (EXPE), Lamar (LAMR), and O’Reilly (ORLY) were among our weaker performers for the quarter. LAMR and ORLY seemed to take a timeout after strong gains in 2010. EXPE, which was already cheap, became even cheaper due to a dispute with American Airlines and disappointing earnings guidance. Given the company’s substantial cash generation and prospects for a resolution with American, we think the stock can bounce back. Also of note, our cash position was a modest drag during the quarter. We like having some fire power, but it can weigh on results in hot markets.

We believe in owning meaningful positions in companies we really like and understand. To that end, we opportunistically added to a number of existing positions during the quarter. ACTG had a sharp pullback, creating a great buying opportunity, and, as evidenced by our earlier remarks, weakness proved to be short-lived. We added to Hanesbrands (HBI) when rising cotton prices kept pressuring the shares and allowed us to make this a more meaningful position. HBI has since rallied as investors have become more comfortable with the company’s ability to pass through costs. CoreLogic (CLGX) provides real estate data and analytics to financial institutions. Prospects of weak short-term results, which can be attributed to a slow real estate market, pressured the shares. We were able to pick up shares at a very cheap price, especially when considering current results could mark the trough for this company.

During the quarter, we established a position in Watsco (WSO), the largest distributor of heating, ventilation and air conditioning (HVAC) equipment in the U.S. Over the last 20 years, the company has created significant value by purchasing small/family-owned businesses, giving them access to capital, and aligning them with WSO’s lean/entrepreneurial culture. Recently, the company has started doing this on a grander scale by purchasing majority stakes in a number of store locations from Carrier Corp. We think WSO can create value by changing the product mix, pricing, and cost structure at these locations. Perhaps more significant, we think pent-up demand could yield a major HVAC equipment replacement cycle. There are over 74 million units on the market over 10 years old, an all-time high. This strikes us as another “when, not if” situation, and we are being paid a 3% dividend yield while we wait. Additionally, Albert Nahmad has served as Chairman of the Board, President and CEO since 1973 and owns 10% of the company. We like it when managers are also meaningful owners.

We love stories of smart capital allocation and above average growth in cash flow per share and/or book value. Assuming a fair entry price, these ingredients tend to yield impressive value creation over time. The Fund is anchored by companies, like Brookfield (BAM), CarMax (KMX), Markel (MKL), ORLY and American Tower (AMT), that fit the bill. We can now add WSO to the team. Occasionally, we will consider a special situation that may be a turnaround story or a case of overlooked asset value. For example, we recently purchased a position in Sprint (S). Sprint provides telecommunications services and stands in the shadows of giants like AT&T (T) and Verizon (VZ). Its customer trends seem to be improving and the company is embarking on a network overhaul that could dramatically lower costs over time. There’s also an asset value story here. When considering the company’s majority stake in Clearwire (CLWR), Sprint owns a significant amount of wireless spectrum - a finite resource that is becoming scarce as wireless usage rises. We think this asset gives the company strategic options and provides valuation support. Since our purchase, AT&T announced plans to acquire T-Mobile. While this was an unforeseen development and takes a T-Mobile/Sprint combo off the table, we still think Sprint has upside and point out the stock is hovering around our initial purchase price even with this negative news having surprised investors.

No quarter would be complete without some regrets. Our most recent frustrations have involved selling positions in good companies, only to see them keep rising; no surprise in a strong market. We often use the proceeds from a sale to buy something else that seems to offer a more compelling risk/reward profile. Similar to what a company should do, we try to allocate our resources to the best opportunities we can find. Thank you for your trust. We look forward to reporting back as we progress through the year.

New Positions

Sprint Nextel Corp. (S) is the 3rd largest carrier in the U.S., serving over 45 million customers. The company spun off its fixed-line local phone business in 2006, acquired Virgin Mobile in 2009, and owns roughly 56% in Clearwire Corporation (CLWR). Sprint has lagged wireless peers for many years, but new network initiatives and an enviable spectrum position could put this company in a good spot going forward. Furthermore, the valuation is not very demanding and downside risk seems to be manageable relative to the potential upside.

Watsco, Inc. (WSO) is the largest independent distributor of heating, ventilation, air conditioning (HVAC) and refrigeration equipment, parts, and supplies in the U.S. Headquartered in Coconut Grove, Florida, the company was founded in 1947 as a parts manufacturer and entered the distribution business in 1989. Most of the executives have been with the company for an extended period of time and the company has about 23% ownership by insiders. WSO is still led by the CEO that bought the company in 1973. WSO has an estimated 7% market share in a $26 billion market and has 18 employees at its headquarters. We initiated and added to this position during the quarter.

Increased Positions

Acacia Research Corp. (ACTG) is a leader in the fast growing business of patent licensing. ACTG partners with patent owners, licenses the patents to corporate users and shares the revenues 50/50 with the patent owners. We are excited by some of the new developments and emerging opportunities at the company that should give way to significant earnings power over time.

CarMax, Inc. (KMX) is the largest retailer of used cars in the U.S.; however, it only controls 2% of the $275 billion market for 1-6 year old cars. This immense market opportunity, coupled with the company’s superior business model and solid track record of execution and constant improvement has always attracted us to this story. More recently, the company resumed its growth strategy and has begun to see the benefits of increased traffic and pricing. Over time we believe earnings power is substantial as the company takes its business model to various other markets.

CoreLogic, Inc. (CLGX) provides real estate data and analytics to financial institutions. While we do not expect numbers in the company’s housing transaction related businesses to recover immediately, management has set the bar low with its 2011 guidance. Over time, we expect a recovery in housing in addition to long term tail winds in the company’s core data and analytics franchise to be augmented by acquisitions and stock buybacks.

Expedia, Inc. (EXPE) is the largest online travel agency in the world and operates a diverse portfolio of travel properties, including Expedia.com, Hotels.com, Hotwire.com and TripAdvisor. In addition to benefiting from secular tailwinds as the travel industry moves online, the company continues to take market share and emphasize higher margin businesses. All of these factors coupled with the company’s scalable online platform suggest significant cash flow and earnings leverage in years to come.

Hanesbrands, Inc. (HBI) is an international consumer goods company that designs, manufactures, and sells high-volume, value-focused apparel essentials under brand names such as Hanes, Bali, Champion, and Playtex. Despite recent successes in restructuring/deleveraging initiatives and market share gains the stock has been a laggard due to concerns regarding the company’s exposure to rising cotton prices. We think this has provided a good entry point into the stock which could experience a lift as the “mania” surrounding cotton prices wanes.

Rockwell Collins, Inc. (COL) is a leading provider of communications equipment and aviation electronics for military and commercial aerospace customers. The company’s extremely attractive balance sheet (near net debt free), well above average returns on capital, cash flow generation (FCF/share next year could exceed $5), and stewardship of capital makes COL one of our most attractive picks in the sector. COL has exposure on every known growth platform (both military and civilian) scheduled to be delivered or upgraded in the next decade and double digit EPS growth seems doable for the foreseeable future.

We are pleased that The Davenport Funds are off to a good start thus far in 2011 and are particularly excited about the two new additions, the Value & Income Fund and the Equity Opportunities Fund. We thank you for your trust and look forward to reporting back as we proceed through the year.

Sincerely,

John P. Ackerly, IV

President, The Davenport Funds

DAVENPORT CORE FUND PERFORMANCE INFORMATION (Unaudited) |

| | Average Annual Total Returns(a) (for periods ended March 31, 2011) | |

| | 1 Year | 5 Years | 10 Years | |

| Davenport Core Fund | 14.61% | 3.65% | 4.33% | |

| Standard & Poor’s 500 Index | 15.65% | 2.62% | 3.29% | |

(a) The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

DAVENPORT VALUE & INCOME FUND PERFORMANCE INFORMATION (Unaudited) |

| | Total Returns(a) (for period ended March 31, 2011) | |

| | Since Inception(b) | |

| Davenport Value & Income Fund | 5.35% | |

| Standard & Poor’s 500 Index | 5.92% | |

| Lipper Equity Income Index | 5.85% | |

(a) The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) Commencement of operations was December 31, 2010. |

DAVENPORT EQUITY OPPORTUNITIES FUND PERFORMANCE INFORMATION (Unaudited) |

| | Total Returns(a) (for period ended March 31, 2011) | |

| | Since Inception(b) | |

| Davenport Equity Opportunities Fund | 7.20% | |

| Russell Midcap Index | 7.63% | |

(a) The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) Commencement of operations was December 31, 2010. |

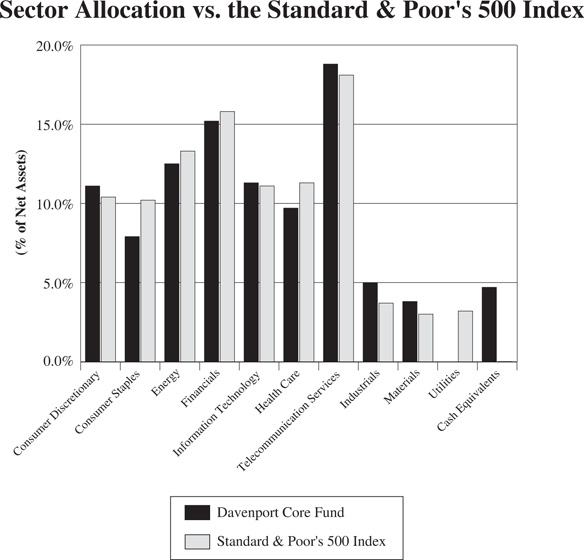

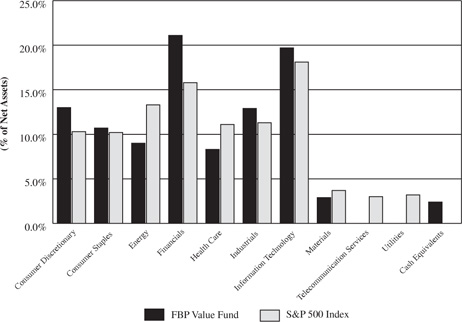

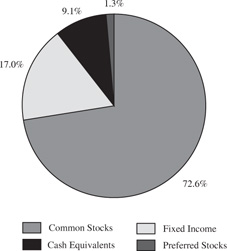

DAVENPORT CORE FUND PORTFOLIO INFORMATION March 31, 2011 (Unaudited) |

Top Ten Equity Holdings

| Security Description | % of Net Assets |

| Exxon Mobil Corporation | 2.7% |

| Schlumberger Ltd. | 2.5% |

| Brookfield Asset Management, Inc. - Class A | 2.4% |

| QUALCOMM, Inc. | 2.4% |

| Markel Corporation | 2.3% |

| Chevron Corporation | 2.3% |

| Danaher Corporation | 2.1% |

| United Technologies Corporation | 2.1% |

| International Business Machines Corporation | 2.1% |

| Apple, Inc. | 2.0% |

DAVENPORT VALUE & INCOME FUND PORTFOLIO INFORMATION March 31, 2011 (Unaudited) |

Top Ten Equity Holdings

| Security Description | % of Net Assets |

| Tortoise Energy Infrastructure Corporation | 2.8% |

| Chevron Corporation | 2.5% |

| Plum Creek Timber Company, Inc. | 2.4% |

| VF Corporation | 2.3% |

| Willis Group Holdings plc | 2.3% |

| Altria Group, Inc. | 2.3% |

| Vodafone Group plc - ADR | 2.2% |

| GlaxoSmithKline plc - ADR | 2.2% |

| Wells Fargo & Company | 2.2% |

| Exxon Mobil Corporation | 2.2% |

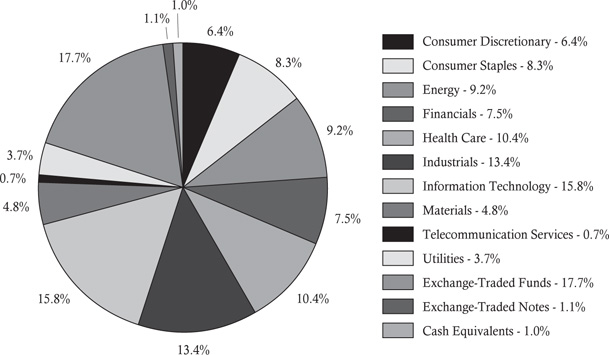

DAVENPORT EQUITY OPPORTUNITIES FUND PORTFOLIO INFORMATION March 31, 2011 (Unaudited) |

Top Ten Equity Holdings

| Security Description | % of Net Assets |

| Acacia Research Corporation | 4.7% |

| Millicom International Cellular S.A. | 4.5% |

| Penn National Gaming, Inc. | 4.2% |

| CarMax, Inc. | 3.9% |

| Markel Corporation | 3.7% |

| Hanesbrands, Inc. | 3.4% |

| Lamar Advertising Company - Class A | 3.1% |

| Fidelity National Financial, Inc. - Class A | 3.1% |

| NCR Corporation | 3.0% |

| Safety Insurance Group, Inc. | 3.0% |

DAVENPORT CORE FUND SCHEDULE OF INVESTMENTS March 31, 2011 | |

| | | | | | |

| Consumer Discretionary — 11.1% | | | | | | |

CarMax, Inc. (a) | | | 89,180 | | | $ | 2,862,678 | |

Discovery Communications, Inc. - Class C (a) | | | 65,880 | | | | 2,319,635 | |

Ford Motor Company (a) | | | 144,488 | | | | 2,154,316 | |

Lowe's Companies, Inc. | | | 118,639 | | | | 3,135,628 | |

McDonald's Corporation | | | 27,522 | | | | 2,094,149 | |

NVR, Inc. (a) | | | 2,972 | | | | 2,246,832 | |

Walt Disney Company (The) | | | 67,332 | | | | 2,901,336 | |

| | | | | | | | 17,714,574 | |

| Consumer Staples — 7.9% | | | | | | | | |

Anheuser-Busch InBev SA/NV - ADR | | | 33,873 | | | | 1,936,519 | |

PepsiCo, Inc. | | | 43,611 | | | | 2,808,985 | |

Procter & Gamble Company (The) | | | 36,064 | | | | 2,221,542 | |

SABMiller plc - ADR | | | 81,834 | | | | 2,928,839 | |

Wal-Mart Stores, Inc. | | | 52,016 | | | | 2,707,433 | |

| | | | | | | | 12,603,318 | |

| Energy — 12.5% | | | | | | | | |

Chevron Corporation | | | 34,412 | | | | 3,696,881 | |

EOG Resources, Inc. | | | 22,970 | | | | 2,722,175 | |

Exxon Mobil Corporation | | | 52,026 | | | | 4,376,947 | |

Occidental Petroleum Corporation | | | 27,511 | | | | 2,874,625 | |

Schlumberger Ltd. | | | 42,023 | | | | 3,919,065 | |

Transocean Ltd. (a) | | | 30,533 | | | | 2,380,047 | |

| | | | | | | | 19,969,740 | |

| Financials — 15.2% | | | | | | | | |

Bank of America Corporation | | | 133,638 | | | | 1,781,395 | |

Berkshire Hathaway, Inc. - Class B (a) | | | 31,491 | | | | 2,633,592 | |

| Brookfield Asset Management, Inc. - Class A | | | 117,220 | | | | 3,804,961 | |

Capital One Financial Corporation | | | 48,692 | | | | 2,530,036 | |

CME Group, Inc. | | | 4,657 | | | | 1,404,318 | |

JPMorgan Chase & Company | | | 51,423 | | | | 2,370,600 | |

Markel Corporation (a) | | | 8,997 | | | | 3,728,807 | |

T. Rowe Price Group, Inc. | | | 42,680 | | | | 2,834,806 | |

Wells Fargo & Company | | | 98,178 | | | | 3,112,243 | |

| | | | | | | | 24,200,758 | |

| Health Care — 11.3% | | | | | | | | |

Becton, Dickinson and Company | | | 31,491 | | | | 2,507,314 | |

Johnson & Johnson | | | 42,648 | | | | 2,526,894 | |

Laboratory Corporation of America Holdings (a) | | | 28,760 | | | | 2,649,659 | |

Medco Health Solutions, Inc. (a) | | | 27,945 | | | | 1,569,391 | |

Merck & Company, Inc. | | | 62,982 | | | | 2,079,036 | |

Novo Nordisk A/S - ADR | | | 19,318 | | | | 2,419,193 | |

Teva Pharmaceutical Industries Ltd. - ADR | | | 33,608 | | | | 1,686,113 | |

WellPoint, Inc. | | | 37,842 | | | | 2,640,993 | |

| | | | | | | | 18,078,593 | |

DAVENPORT CORE FUND SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.3% (Continued) | | | | | | |

| Industrials — 9.7% | | | | | | |

Boeing Company (The) | | | 32,020 | | | $ | 2,367,239 | |

Caterpillar, Inc. | | | 19,284 | | | | 2,147,273 | |

Danaher Corporation | | | 65,840 | | | | 3,417,096 | |

General Dynamics Corporation | | | 25,669 | | | | 1,965,219 | |

Illinois Tool Works, Inc. | | | 42,341 | | | | 2,274,558 | |

United Technologies Corporation | | | 39,694 | | | | 3,360,097 | |

| | | | | | | | 15,531,482 | |

| Information Technology — 18.8% | | | | | | | | |

Accenture plc - Class A | | | 52,111 | | | | 2,864,542 | |

Apple, Inc. (a) | | | 9,378 | | | | 3,267,764 | |

Automatic Data Processing, Inc. | | | 46,480 | | | | 2,384,889 | |

Check Point Software Technologies Ltd. (a) | | | 50,809 | | | | 2,593,800 | |

Fiserv, Inc. (a) | | | 50,703 | | | | 3,180,092 | |

Google, Inc. - Class A (a) | | | 3,864 | | | | 2,265,115 | |

Intel Corporation | | | 103,481 | | | | 2,087,212 | |

| International Business Machines Corporation | | | 20,218 | | | | 3,296,949 | |

Microsoft Corporation | | | 97,733 | | | | 2,478,509 | |

QUALCOMM, Inc. | | | 69,333 | | | | 3,801,528 | |

Visa, Inc. - Class A | | | 25,140 | | | | 1,850,807 | |

| | | | | | | | 30,071,207 | |

| Materials — 5.0% | | | | | | | | |

Albemarle Corporation | | | 51,402 | | | | 3,072,297 | |

International Flavors & Fragrances, Inc. | | | 39,694 | | | | 2,472,936 | |

Praxair, Inc. | | | 24,568 | | | | 2,496,109 | |

| | | | | | | | 8,041,342 | |

| Telecommunication Services — 3.8% | | | | | | | | |

American Tower Corporation - Class A (a) | | | 61,574 | | | | 3,190,765 | |

Millicom International Cellular S.A. | | | 30,147 | | | | 2,899,237 | |

| | | | | | | | 6,090,002 | |

| | | | | | | | | |

Total Common Stocks (Cost $117,419,104) | | | | | | $ | 152,301,016 | |

U.S. GOVERNMENT AGENCY OBLIGATIONS — 0.9% | | | | | | |

Federal Home Loan Bank, discount note, 0.01% (b), due 04/11/2011 (Cost $1,399,996) | | $ | 1,400,000 | | | $ | 1,399,992 | |

DAVENPORT CORE FUND SCHEDULE OF INVESTMENTS (Continued) |

MONEY MARKET FUNDS — 3.1% | | | | | | |

First American Treasury Obligations Fund - Class Z, 0.00% (c) (Cost $4,995,911) | | | 4,995,911 | | | $ | 4,995,911 | |

| | | | | | | | | |

Total Investments at Value — 99.3% (Cost $123,815,011) | | | | | | $ | 158,696,919 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.7% | | | | | | | 1,197,529 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 159,894,448 | |

| ADR - American Depositary Receipt. |

| (a) | Non-income producing security. |

| (b) | Rate shown is the annualized yield at time of purchase, not a coupon rate. |

| (c) | Variable rate security. The rate shown is the 7-day effective yield as of March 31, 2011. |

| See accompanying notes to financial statements. |

DAVENPORT VALUE & INCOME FUND SCHEDULE OF INVESTMENTS March 31, 2011 |

| | | | | | |

| Consumer Discretionary — 8.3% | | | | | | |

Home Depot, Inc. (The) | | | 26,450 | | | $ | 980,237 | |

Leggett & Platt, Inc. | | | 38,737 | | | | 949,056 | |

McDonald's Corporation | | | 12,820 | | | | 975,474 | |

VF Corporation | | | 11,500 | | | | 1,133,095 | |

| | | | | | | | 4,037,862 | |

| Consumer Staples — 14.9% | | | | | | | | |

Altria Group, Inc. | | | 42,548 | | | | 1,107,524 | |

Anheuser-Busch InBev SA/NV - ADR | | | 16,905 | | | | 966,459 | |

Coca-Cola Company (The) | | | 15,560 | | | | 1,032,406 | |

Diageo plc - ADR | | | 11,880 | | | | 905,494 | |

H.J. Heinz Company | | | 13,050 | | | | 637,101 | |

Philip Morris International, Inc. | | | 16,225 | | | | 1,064,847 | |

Procter & Gamble Company (The) | | | 12,820 | | | | 789,712 | |

Sysco Corporation | | | 28,405 | | | | 786,818 | |

| | | | | | | | 7,290,361 | |

| Energy — 12.9% | | | | | | | | |

Chevron Corporation | | | 11,551 | | | | 1,240,924 | |

ConocoPhillips | | | 12,390 | | | | 989,465 | |

Encana Corporation | | | 29,830 | | | | 1,030,030 | |

Exxon Mobil Corporation | | | 12,694 | | | | 1,067,946 | |

Royal Dutch Shell plc - ADR | | | 13,605 | | | | 996,430 | |

Spectra Energy Corporation | | | 35,465 | | | | 963,939 | |

| | | | | | | | 6,288,734 | |

| Financials — 16.1% | | | | | | | | |

Bank of America Corporation | | | 47,045 | | | | 627,110 | |

Fidelity National Financial, Inc. - Class A | | | 47,351 | | | | 669,070 | |

JPMorgan Chase & Company | | | 22,265 | | | | 1,026,417 | |

Plum Creek Timber Company, Inc. | | | 26,385 | | | | 1,150,650 | |

Royal Bank of Canada | | | 10,640 | | | | 659,361 | |

Travelers Companies, Inc. (The) | | | 15,665 | | | | 931,754 | |

| Walter Investment Management Corporation | | | 36,818 | | | | 593,874 | |

Wells Fargo & Company | | | 33,770 | | | | 1,070,509 | |

Willis Group Holdings plc | | | 27,751 | | | | 1,120,030 | |

| | | | | | | | 7,848,775 | |

| Health Care — 7.1% | | | | | | | | |

Abbott Laboratories | | | 13,785 | | | | 676,154 | |

GlaxoSmithKline plc - ADR | | | 28,370 | | | | 1,089,692 | |

Johnson & Johnson | | | 15,565 | | | | 922,226 | |

Merck & Company, Inc. | | | 23,410 | | | | 772,764 | |

| | | | | | | | 3,460,836 | |

| Industrials — 14.5% | | | | | | | | |

3M Company | | | 10,305 | | | | 963,517 | |

Emerson Electric Company | | | 16,220 | | | | 947,735 | |

DAVENPORT VALUE & INCOME FUND SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 87.8% (Continued) | | | | | | |

| Industrials — 14.5% (Continued) | | | | | | |

General Dynamics Corporation | | | 13,660 | | | $ | 1,045,810 | |

General Electric Company | | | 50,111 | | | | 1,004,725 | |

Illinois Tool Works, Inc. | | | 13,785 | | | | 740,530 | |

Norfolk Southern Corporation | | | 14,780 | | | | 1,023,811 | |

Waste Management, Inc. | | | 23,638 | | | | 882,643 | |

Watsco, Inc. | | | 7,235 | | | | 504,352 | |

| | | | | | | | 7,113,123 | |

| Information Technology — 5.6% | | | | | | | | |

Automatic Data Processing, Inc. | | | 19,170 | | | | 983,613 | |

Intel Corporation | | | 43,265 | | | | 872,655 | |

Microsoft Corporation | | | 35,115 | | | | 890,516 | |

| | | | | | | | 2,746,784 | |

| Materials — 2.1% | | | | | | | | |

E.I. du Pont de Nemours and Company | | | 18,688 | | | | 1,027,279 | |

| | | | | | | | | |

| Telecommunication Services — 4.3% | | | | | | | | |

Telefonica S.A. - ADR | | | 40,195 | | | | 1,013,718 | |

Vodafone Group plc - ADR | | | 38,010 | | | | 1,092,788 | |

| | | | | | | | 2,106,506 | |

| Utilities — 2.0% | | | | | | | | |

Dominion Resources, Inc. | | | 21,635 | | | | 967,085 | |

| | | | | | | | | |

Total Common Stocks (Cost $41,694,567) | | | | | | $ | 42,887,345 | |

| | | | | | |

| Tortoise Energy Infrastructure Corporation (Cost $1,302,951) | | | 33,332 | | | $ | 1,339,613 | |

MONEY MARKET FUNDS — 2.2% | | | | | | |

First American Treasury Obligations Fund - Class Z, 0.00% (a) (Cost $1,089,726) | | | 1,089,726 | | | $ | 1,089,726 | |

| | | | | | | | | |

Total Investments at Value — 92.8% (Cost $44,087,244) | | | | | | $ | 45,316,684 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 7.2% | | | | | | | 3,513,846 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 48,830,530 | |

| ADR- American Depositary Receipt. |

| (a) | Variable rate security. The rate shown is the 7-day effective yield as of March 31, 2011. |

| See accompanying notes to financial statements. |

DAVENPORT EQUITY OPPORTUNITIES FUND SCHEDULE OF INVESTMENTS March 31, 2011 |

| | | | | | |

| Consumer Discretionary — 21.3% | | | | | | |

CarMax, Inc. (a) | | | 42,280 | | | $ | 1,357,188 | |

Expedia, Inc. | | | 38,435 | | | | 870,937 | |

Hanesbrands, Inc. (a) | | | 43,455 | | | | 1,175,023 | |

Lamar Advertising Company - Class A (a) | | | 29,110 | | | | 1,075,323 | |

NVR, Inc. (a) | | | 877 | | | | 663,012 | |

O'Reilly Automotive, Inc. (a) | | | 12,624 | | | | 725,375 | |

Penn National Gaming, Inc. (a) | | | 38,825 | | | | 1,438,855 | |

| | | | | | | | 7,305,713 | |

| Consumer Staples — 2.3% | | | | | | | | |

Church & Dwight Company, Inc. | | | 9,750 | | | | 773,565 | |

| | | | | | | | | |

| Energy — 4.5% | | | | | | | | |

Plains Exploration & Production Company (a) | | | 21,150 | | | | 766,265 | |

Ultra Petroleum Corporation (a) | | | 15,510 | | | | 763,867 | |

| | | | | | | | 1,530,132 | |

| Financials — 14.8% | | | | | | | | |

| Brookfield Asset Management, Inc. - Class A | | | 23,360 | | | | 758,265 | |

Fidelity National Financial, Inc. - Class A | | | 74,515 | | | | 1,052,897 | |

Lazard Ltd. - Class A | | | 14,945 | | | | 621,413 | |

Markel Corporation (a) | | | 3,105 | | | | 1,286,867 | |

Safety Insurance Group, Inc. | | | 22,170 | | | | 1,022,259 | |

| Union First Market Bankshares Corporation | | | 30,255 | | | | 340,369 | |

| | | | | | | | 5,082,070 | |

| Health Care — 3.8% | | | | | | | | |

Henry Schein, Inc. (a) | | | 9,985 | | | | 700,648 | |

Laboratory Corporation of America Holdings (a) | | | 6,500 | | | | 598,845 | |

| | | | | | | | 1,299,493 | |

| Industrials — 18.7% | | | | | | | | |

Acacia Research Corporation (a) | | | 47,035 | | | | 1,609,538 | |

Babcock & Wilcox Company (a) | | | 11,389 | | | | 380,165 | |

Cooper Industries plc | | | 12,340 | | | | 800,866 | |

Foster Wheeler AG (a) | | | 19,845 | | | | 746,569 | |

Republic Services, Inc. | | | 24,930 | | | | 748,897 | |

Rockwell Collins, Inc. | | | 13,630 | | | | 883,633 | |

RSC Holdings, Inc. (a) | | | 38,620 | | | | 555,355 | |

Watsco, Inc. | | | 10,125 | | | | 705,814 | |

| | | | | | | | 6,430,837 | |

| Information Technology — 12.6% | | | | | | | | |

Check Point Software Technologies Ltd. (a) | | | 14,035 | | | | 716,487 | |

CoreLogic, Inc. | | | 46,880 | | | | 867,280 | |

Fiserv, Inc. (a) | | | 13,390 | | | | 839,821 | |

Intuit, Inc. (a) | | | 16,470 | | | | 874,557 | |

NCR Corporation (a) | | | 55,296 | | | | 1,041,776 | |

| | | | | | | | 4,339,921 | |

DAVENPORT EQUITY OPPORTUNITIES FUND SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 94.7% (Continued) | | | | | | |

| Materials — 3.9% | | | | | | |

Albemarle Corporation | | | 9,830 | | | $ | 587,539 | |

NewMarket Corporation | | | 4,825 | | | | 763,412 | |

| | | | | | | | 1,350,951 | |

| Telecommunication Services — 8.7% | | | | | | | | |

American Tower Corporation - Class A (a) | | | 14,945 | | | | 774,450 | |

Millicom International Cellular S.A. | | | 15,985 | | | | 1,537,277 | |

Sprint Nextel Corporation (a) | | | 149,970 | | | | 695,861 | |

| | | | | | | | 3,007,588 | |

| Utilities — 4.1% | | | | | | | | |

AES Corporation (The) (a) | | | 55,185 | | | | 717,405 | |

ITC Holdings Corporation | | | 10,050 | | | | 702,495 | |

| | | | | | | | 1,419,900 | |

| | | | | | | | | |

Total Common Stocks (Cost $31,209,526) | | | | | | $ | 32,540,170 | |

MONEY MARKET FUNDS — 2.5% | | | | | | |

First American Treasury Obligations Fund - Class Z, 0.00% (b) (Cost $866,058) | | | 866,058 | | | $ | 866,058 | |

| | | | | | | | | |

Total Investments at Value — 97.2% (Cost $32,075,584) | | | | | | $ | 33,406,228 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 2.8% | | | | | | | 969,193 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 34,375,421 | |

| (a) | Non-income producing security. |

| (b) | Variable rate security. The rate shown is the 7-day effective yield as of March 31, 2011. |

| See accompanying notes to financial statements. |

THE DAVENPORT FUNDS STATEMENTS OF ASSETS AND LIABILITIES March 31, 2011 |

| | | | | Davenport Value & Income Fund | | | Davenport Equity Opportunities Fund | |

| ASSETS | | | | | | | | | |

| Investments in securities: | | | | | | | | | |

At acquisition cost | | $ | 123,815,011 | | | $ | 44,087,244 | | | $ | 32,075,584 | |

At market value (Note 1) | | $ | 158,696,919 | | | $ | 45,316,684 | | | $ | 33,406,228 | |

Cash | | | — | | | | 2,808,044 | | | | 1,805,841 | |

Dividends receivable | | | 150,792 | | | | 99,754 | | | | 10,951 | |

Receivable for investment securities sold | | | 3,129,169 | | | | — | | | | — | |

Receivable for capital shares sold | | | 759,650 | | | | 3,137,673 | | | | 842,704 | |

Other assets | | | 8,817 | | | | 6,655 | | | | 6,488 | |

TOTAL ASSETS | | | 162,745,347 | | | | 51,368,810 | | | | 36,072,212 | |

| | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | |

Payable for investment securities purchased | | | 2,298,290 | | | | 2,460,445 | | | | 1,660,594 | |

Payable for capital shares redeemed | | | 417,638 | | | | 32,947 | | | | 5,000 | |

Accrued investment advisory fees (Note 3) | | | 111,262 | | | | 31,132 | | | | 24,833 | |

Accrued administration fees (Note 3) | | | 18,000 | | | | 5,300 | | | | 4,000 | |

Accrued compliance fees (Note 3) | | | 1,200 | | | | 750 | | | | 700 | |

Other accrued expenses | | | 4,509 | | | | 7,706 | | | | 1,664 | |

TOTAL LIABILITIES | | | 2,850,899 | | | | 2,538,280 | | | | 1,696,791 | |

| | | | | | | | | | | | | |

NET ASSETS | | $ | 159,894,448 | | | $ | 48,830,530 | | | $ | 34,375,421 | |

| | | | | | | | | | | | | |

| Net assets consist of: | | | | | | | | | | | | |

Paid-in capital | | $ | 135,737,614 | | | $ | 47,520,326 | | | $ | 32,881,980 | |

Undistributed net investment income | | | 21,810 | | | | 9,030 | | | | — | |

Accumulated net realized gains (losses)

from security transactions | | | (10,746,884 | ) | | | 71,734 | | | | 162,797 | |

Net unrealized appreciation on investments | | | 34,881,908 | | | | 1,229,440 | | | | 1,330,644 | |

Net assets | | $ | 159,894,448 | | | $ | 48,830,530 | | | $ | 34,375,421 | |

| | | | | | | | | | | | | |

Shares of beneficial interest outstanding

(unlimited number of shares authorized,

$0.01 par value) | | | 11,645,986 | | | | 4,651,554 | | | | 3,207,695 | |

| | | | | | | | | | | | | |

Net asset value, offering price and redemption

price per share (Note 1) | | $ | 13.73 | | | $ | 10.50 | | | $ | 10.72 | |

| See accompanying notes to financial statements. |

THE DAVENPORT FUNDS STATEMENTS OF OPERATIONS Year Ended March 31, 2011 (a) |

| | | | | Davenport Value & Income Fund | | | Davenport Equity Opportunities Fund | |

| INVESTMENT INCOME | | | | | | | | | |

Dividends | | $ | 2,171,996 | | | $ | 229,391 | | | $ | 45,704 | |

Foreign withholding taxes on dividends | | | (49,212 | ) | | | — | | | | (285 | ) |

Interest | | | 33 | | | | — | | | | — | |

TOTAL INVESTMENT INCOME | | | 2,122,817 | | | | 229,391 | | | | 45,419 | |

| | | | | | | | | | | | | |

| EXPENSES | | | | | | | | | | | | |

Investment advisory fees (Note 3) | | | 1,017,360 | | | | 53,111 | | | | 40,175 | |

Administration fees (Note 3) | | | 190,932 | | | | 13,493 | | | | 12,052 | |

Custodian and bank service fees | | | 20,553 | | | | 11,399 | | | | 8,199 | |

Registration fees | | | 16,395 | | | | — | | | | — | |

Professional fees | | | 19,822 | | | | 1,075 | | | | 1,075 | |

Trustees’ fees and expenses | | | 14,531 | | | | 3,256 | | | | 3,256 | |

Compliance service fees (Note 3) | | | 16,986 | | | | 1,963 | | | | 1,873 | |

Insurance expense | | | 12,680 | | | | — | | | | — | |

Printing of shareholder reports | | | 11,893 | | | | 360 | | | | — | |

Postage and supplies | | | 10,235 | | | | 973 | | | | — | |

Other expenses | | | 9,673 | | | | 2,889 | | | | 328 | |

TOTAL EXPENSES | | | 1,341,060 | | | | 88,519 | | | | 66,958 | |

| | | | | | | | | | | | | |

NET INVESTMENT INCOME (LOSS) | | | 781,757 | | | | 140,872 | | | | (21,539 | ) |

| | | | | | | | | | | | | |

REALIZED AND UNREALIZED

GAINS ON INVESTMENTS | | | | | | | | | | | | |

Net realized gains from security transactions | | | 2,762,416 | | | | 71,734 | | | | 184,336 | |

Net change in unrealized appreciation/

depreciation on investments | | | 15,587,706 | | | | 1,229,440 | | | | 1,330,644 | |

| | | | | | | | | | | | | |

NET REALIZED AND UNREALIZED

GAINS ON INVESTMENTS | | | 18,350,122 | | | | 1,301,174 | | | | 1,514,980 | |

| | | | | | | | | | | | | |

NET INCREASE IN NET ASSETS

FROM OPERATIONS | | $ | 19,131,879 | | | $ | 1,442,046 | | | $ | 1,493,441 | |

| (a) | Except for Davenport Value & Income Fund and Davenport Equity Opportunities Fund, which represents the period from commencement of operations (December 31, 2010) through March 31, 2011. |

| | |

| See accompanying notes to financial statements. |

THE DAVENPORT FUNDS STATEMENTS OF CHANGES IN NET ASSETS |

| | | | |

| | | | | | |

| FROM OPERATIONS | | | | | | |

Net investment income | | $ | 781,757 | | | $ | 872,940 | |

Net realized gains (losses) from security transactions | | | 2,762,416 | | | | (1,188,524 | ) |

Net change in unrealized appreciation/

depreciation on investments | | | 15,587,706 | | | | 42,183,572 | |

Net increase in net assets from operations | | | 19,131,879 | | | | 41,867,988 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

From net investment income | | | (780,857 | ) | | | (865,302 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold | | | 27,476,146 | | | | 11,590,012 | |

Net asset value of shares issued in reinvestment

of distributions to shareholders | | | 741,331 | | | | 821,362 | |

Payments for shares redeemed | | | (19,335,638 | ) | | | (13,110,640 | ) |

Net increase (decrease) in net assets from

capital share transactions | | | 8,881,839 | | | | (699,266 | ) |

| | | | | | | | | |

TOTAL INCREASE IN NET ASSETS | | | 27,232,861 | | | | 40,303,420 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

Beginning of year | | | 132,661,587 | | | | 92,358,167 | |

End of year | | $ | 159,894,448 | | | $ | 132,661,587 | |

| | | | | | | | | |

UNDISTRIBUTED NET INVESTMENT INCOME | | $ | 21,810 | | | $ | 20,910 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

Shares sold | | | 2,149,143 | | | | 1,095,709 | |

Shares reinvested | | | 61,329 | | | | 76,595 | |

Shares redeemed | | | (1,570,298 | ) | | | (1,220,427 | ) |

Net increase (decrease) in shares outstanding | | | 640,174 | | | | (48,123 | ) |

Shares outstanding at beginning of year | | | 11,005,812 | | | | 11,053,935 | |

Shares outstanding at end of year | | | 11,645,986 | | | | 11,005,812 | |

| See accompanying notes to financial statements. |

DAVENPORT VALUE & INCOME FUND DAVENPORT EQUITY OPPORTUNITIES FUND STATEMENTS OF CHANGES IN NET ASSETS Period Ended March 31, 2011 (a) |

| | Davenport Value & Income Fund | | | Davenport Equity Opportunities Fund | |

| FROM OPERATIONS | | | | | | |

Net investment income (loss) | | $ | 140,872 | | | $ | (21,539 | ) |

Net realized gains from security transactions | | | 71,734 | | | | 184,336 | |

Net change in unrealized appreciation/

depreciation on investments | | | 1,229,440 | | | | 1,330,644 | |

Net increase in net assets from operations | | | 1,442,046 | | | | 1,493,441 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

From net investment income | | | (131,842 | ) | | | — | |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold | | | 47,565,809 | | | | 34,425,550 | |

Net asset value of shares issued in reinvestment

of distributions to shareholders | | | 110,894 | | | | — | |

Payments for shares redeemed | | | (156,377 | ) | | | (1,543,570 | ) |

Net increase in net assets from capital share transactions | | | 47,520,326 | | | | 32,881,980 | |

| | | | | | | | | |

TOTAL INCREASE IN NET ASSETS | | | 48,830,530 | | | | 34,375,421 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

Beginning of period | | | — | | | | — | |

End of period | | $ | 48,830,530 | | | $ | 34,375,421 | |

| | | | | | | | | |

UNDISTRIBUTED NET INVESTMENT INCOME | | $ | 9,030 | | | $ | — | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

Shares sold | | | 4,655,581 | | | | 3,357,207 | |

Shares reinvested | | | 10,830 | | | | — | |

Shares redeemed | | | (14,857 | ) | | | (149,512 | ) |

Net increase in shares outstanding | | | 4,651,554 | | | | 3,207,695 | |

Shares outstanding at beginning of period | | | — | | | | — | |

Shares outstanding at end of period | | | 4,651,554 | | | | 3,207,695 | |

| (a) | Represents the period from commencement of operations (December 31, 2010) through March 31, 2011. |

| | |

| See accompanying notes to financial statements. |

DAVENPORT CORE FUND FINANCIAL HIGHLIGHTS |

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Year | |

| | | | |

| | | | | | | | | | | | | | | |

| Net asset value at beginning of year | | $ | 12.05 | | | $ | 8.36 | | | $ | 13.82 | | | $ | 14.75 | | | $ | 13.99 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.07 | | | | 0.08 | | | | 0.11 | | | | 0.10 | | | | 0.10 | |

Net realized and unrealized gains

(losses) on investments | | | 1.68 | | | | 3.69 | | | | (5.17 | ) | | | 0.53 | | | | 1.28 | |

| Total from investment operations | | | 1.75 | | | | 3.77 | | | | (5.06 | ) | | | 0.63 | | | | 1.38 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.07 | ) | | | (0.08 | ) | | | (0.11 | ) | | | (0.10 | ) | | | (0.10 | ) |

| Distributions from net realized gains | | | — | | | | — | | | | (0.29 | ) | | | (1.46 | ) | | | (0.52 | ) |

Total distributions | | | (0.07 | ) | | | (0.08 | ) | | | (0.40 | ) | | | (1.56 | ) | | | (0.62 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of year | | $ | 13.73 | | | $ | 12.05 | | | $ | 8.36 | | | $ | 13.82 | | | $ | 14.75 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return (a) | | | 14.61% | | | | 45.20% | | | | (36.85% | ) | | | 3.44% | | | | 10.02% | |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of year (000’s) | | $ | 159,894 | | | $ | 132,662 | | | $ | 92,358 | | | $ | 155,799 | | | $ | 151,655 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 0.99% | | | | 1.00% | | | | 1.00% | | | | 0.96% | | | | 0.98% | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income

to average net assets | | | 0.58% | | | | 0.75% | | | | 0.98% | | | | 0.60% | | | | 0.67% | |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 34% | | | | 25% | | | | 39% | | | | 37% | | | | 26% | |

| (a) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| See accompanying notes to financial statements. |

DAVENPORT VALUE & INCOME FUND DAVENPORT EQUITY OPPORTUNITIES FUND FINANCIAL HIGHLIGHTS |

Selected Per Share Data and Ratios for a Share Outstanding Throughout the Period Ended March 31, 2011 (a) | |

| | Davenport Value & Income Fund | | | Davenport Equity Opportunities Fund | |

| Net asset value at beginning of period | | $ | 10.00 | | | $ | 10.00 | |

| | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | |

| Net investment income (loss) | | | 0.04 | | | | (0.01 | ) |

| Net realized and unrealized gains on investments | | | 0.49 | | | | 0.73 | |

| Total from investment operations | | | 0.53 | | | | 0.72 | |

| | | | | | | | | |

| Less distributions: | | | | | | | | |

| Dividends from net investment income | | | (0.03 | ) | | | — | |

| | | | | | | | | |

| Net asset value at end of period | | $ | 10.50 | | | $ | 10.72 | |

| | | | | | | | | |

Total return (b) (c) | | | 5.35% | | | | 7.20% | |

| | | | | | | | | |

| Net assets at end of period (000’s) | | $ | 48,831 | | | $ | 34,375 | |

| | | | | | | | | |

Ratio of total expenses to average net assets (d) | | | 1.25% | | | | 1.25% | |

| | | | | | | | | |

Ratio of net investment income (loss) to average net assets (d) | | | 1.99% | | | | (0.40% | ) |

| | | | | | | | | |

Portfolio turnover rate (c) | | | 10% | | | | 6% | |

| (a) | Represents the period from commencement of operations (December 31, 2010) through March 31, 2011. |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| See accompanying notes to financial statements. |

THE DAVENPORT FUNDS NOTES TO FINANCIAL STATEMENTS March 31, 2011 |

1. Organization and Significant Accounting Policies

Davenport Core Fund, Davenport Value & Income Fund and Davenport Equity Opportunities Fund (individually, a “Fund,” and, collectively, the “Funds”) are each a no-load, diversified series of the Williamsburg Investment Trust (the “Trust”), an open-end management investment company registered under the Investment Company Act of 1940. The Trust was organized as a Massachusetts business trust on July 18, 1988. Other series of the Trust are not incorporated in this report. Davenport Core Fund began operations on January 15, 1998. Davenport Value & Income Fund and Davenport Equity Opportunities Fund began operations on December 31, 2010.

Davenport Core Fund’s investment objective is long term growth of capital.

Davenport Value & Income Fund’s investment objective is to achieve long term growth while generating current income through dividend payments on portfolio securities.

Davenport Equity Opportunities Fund’s investment objective is long term capital appreciation.

The following is a summary of the Funds’ significant accounting policies:

Securities valuation — The Funds’ portfolio securities are valued as of the close of business of the regular session of the New York Stock Exchange (normally 4:00 p.m., Eastern time). Securities traded on a national stock exchange are valued based upon the closing price on the principal exchange where the security is traded. Securities which are quoted by NASDAQ are valued at the NASDAQ Official Closing Price. Securities which are traded over-the-counter are valued at the last sales price, if available, otherwise, at the last quoted bid price. Fixed income securities will ordinarily be traded in the over-the-counter market and common stocks will ordinarily be traded on a national securities exchange, but may also be traded in the over-the-counter market. Short-term instruments (those with remaining maturities of 60 days or less) may be valued at amortized cost, which approximates market value.

When market quotations are not readily available, securities may be valued on the basis of prices provided by an independent pricing service. The prices provided by the pricing service are determined with consideration given to institutional bid and last sale prices and take into account securities prices, yields, maturities, call features, ratings, institutional trading in similar groups of securities and developments related to specific securities. If a pricing service cannot provide a valuation, securities will be valued in good faith at fair value using methods consistent with those determined by the Board of Trustees and will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used. Such methods of fair valuation may include, but are not limited to: multiple of earnings, multiple of book value, discount from market of a similar freely traded security, purchase price of the security, subsequent private transactions in the security or related securities, or a combination of these and other factors.

Accounting principles generally accepted in the United States (“GAAP”) establish a single authoritative definition of fair value, set out a framework for measuring fair value and require additional disclosures about fair value measurements.

THE DAVENPORT FUNDS NOTES TO FINANCIAL STATEMENTS (Continued) |

Various inputs are used in determining the value of the Funds’ investments. These inputs are summarized in the three broad levels listed below:

• Level 1 – quoted prices in active markets for identical securities

• Level 2 – other significant observable inputs

• Level 3 – significant unobservable inputs

For example, U.S. Government Agency Obligations held by the Funds are classified as Level 2 since values are based on prices provided by an independent pricing service that utilizes various “other significant observable inputs” including bid and ask quotations, prices of similar securities and interest rates, among other factors.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Funds’ investments as of March 31, 2011 by security type:

| | | | | | | | | | | | |

Common Stocks | | $ | 152,301,016 | | | $ | — | | | $ | — | | | $ | 152,301,016 | |

U.S. Government Agency Obligations | | | — | | | | 1,399,992 | | | | — | | | | 1,399,992 | |

Money Market Funds | | | 4,995,911 | | | | — | | | | — | | | | 4,995,911 | |

Total | | $ | 157,296,927 | | | $ | 1,399,992 | | | $ | — | | | $ | 158,696,919 | |

Davenport Value & Income Fund | | | | | | | | | | | | |

Common Stocks | | $ | 42,887,345 | | | $ | — | | | $ | — | | | $ | 42,887,345 | |

Closed-End Funds | | | 1,339,613 | | | | — | | | | — | | | | 1,339,613 | |

Money Market Funds | | | 1,089,726 | | | | — | | | | — | | | | 1,089,726 | |

Total | | $ | 45,316,684 | | | $ | — | | | $ | — | | | $ | 45,316,684 | |

Davenport Equity Opportunities Fund | | | | | | | | | | | | |

Common Stocks | | $ | 32,540,170 | | | $ | — | | | $ | — | | | $ | 32,540,170 | |

Money Market Funds | | | 866,058 | | | | — | | | | — | | | | 866,058 | |

Total | | $ | 33,406,228 | | | $ | — | | | $ | — | | | $ | 33,406,228 | |

Refer to each Fund’s Schedules of Investments for a listing of the securities valued using Level 1 inputs by sector type. During the year ended March 31, 2011, the Funds did not have any significant transfers in and out of Level 1 or Level 2. There were no Level 3 securities or derivative instruments held by the Funds during the year ended or as of March 31, 2011.

THE DAVENPORT FUNDS NOTES TO FINANCIAL STATEMENTS (Continued) |