| Item 1. | Reports to Stockholders. |

| |

|

| |

| ANNUAL REPORT |

| |

| March 31, 2012 |

| |

THE DAVENPORT FUNDS LETTER TO SHAREHOLDERS | |

Dear Shareholders,

Equity markets enjoyed an unusually strong first quarter of 2012. The S&P 500 Index and Russell 2000 Index advanced 12.6% and 12.4%, respectively. Gains were consistent, as evidenced by positive results each month of the quarter. At the start of the quarter, we thought that markets could be poised to rally if elevated risk premiums began to subside. This thesis is proving correct thus far, with solid earnings reports, encouraging macroeconomic data, and accommodative monetary policy having fueled the fire. Each of our Funds performed well and finished the fiscal year ended March 31, 2012 on a strong note.

We benefitted from exposure to domestic recovery stories. Housing/real estate related plays performed particularly well. Given high affordability, low levels of inventory, and supportive policy, the housing market seems poised to turn. Credit Suisse First Boston (CSFB) recently noted that housing represents only 2.2% of GDP, but homes are roughly one third of household wealth. Hence, a recovery would have a positive wealth effect and support consumer spending. In fact, Ben Bernanke recently noted that every U.S. economic recovery since 1945 has been driven by housing. In addition to benefitting homebuilders, improvement would be a plus for many industries. Banking could be one of the biggest beneficiaries. Having struggled for years with credit losses, weak loan demand, capital constraints, and heightened regulation, domestic banks may be hitting an inflection point. Not only should loan demand improve, but most large financial institutions fared well in the most recent “stress test” and can now begin returning more capital to shareholders.

Many investors are skeptical of the market’s rally and are anticipating a correction in the near-term. This is logical when considering the market has rallied approximately 28% from the closing low this past October. Also, we’ve all been trained to expect a sell-off given the market’s tendency to vacillate wildly between “risk-on” and “risk-off” in recent years. We’ll be first to admit that it has become a little more difficult to find deals in the market; furthermore, it is highly unlikely that the pace of recent gains will be sustained. In fact, a setback is virtually guaranteed at some point and there are numerous potential catalysts for one (a new round of Eurozone concerns, higher gasoline prices, etc.). However, we still think that fiscal 2013 could be a good year for stocks; hence, it may not make much sense to try to time a bout of “risk-off.” Odds are, we’d probably be wrong, and the best thing to do is just accept a couple of bumps as we move forward.

Valuations still seem reasonable. When worrying about the market’s recent move or assessing the upside for some of our holdings, we remind ourselves that the S&P 500 Index is trading at a P/E multiple of 13.5x, well below the long-term average. Also, investors may be overlooking the fact that earnings expectations (the “E” part of the equation) could have upward mobility if we see ongoing improvement in employment, housing/real estate, bank lending, and corporate spending.

Could we be derailed by a shift in monetary policy? One day this will present a headwind, but it may be a ways off. The Federal Reserve recently stated it plans to keep rates “exceptionally low,” at least through 2014, and has repeatedly discussed the risk of removing accommodative policy too soon. Clearly, the Fed wants sustained evidence of economic improvement and is willing to tolerate the risk of inflation (a key risk for holders of long-dated bonds). Meanwhile, Europe

is implementing easier policy, and China may do the same if its economic growth slows. Such coordinated easing should put a tailwind behind stocks. The biggest risk may be the tighter fiscal policy that could happen alongside reflation efforts, but most policymakers seem to recognize that going too far with austerity measures could hurt economic conditions.

We also think investors may be under-allocated to stocks. We recently saw data suggesting that equities as a percent of fund assets were far below the average of the past 15 years. For the past few years, investors have been pouring money into bond funds while equity funds have seen significant withdrawals. Should an economic recovery take hold and/or investors get less complacent about inflation, this dynamic could reverse, which seems to be happening as we speak. Recall, the opposite was true during the tech bubble of the late 1990’s, when stocks witnessed significant inflows and bonds experienced outflows. However, over the following 10 years, bonds delivered solid returns while stocks were basically flat. If history is any guide, the decade to come may be much better for stock investors than bond investors.

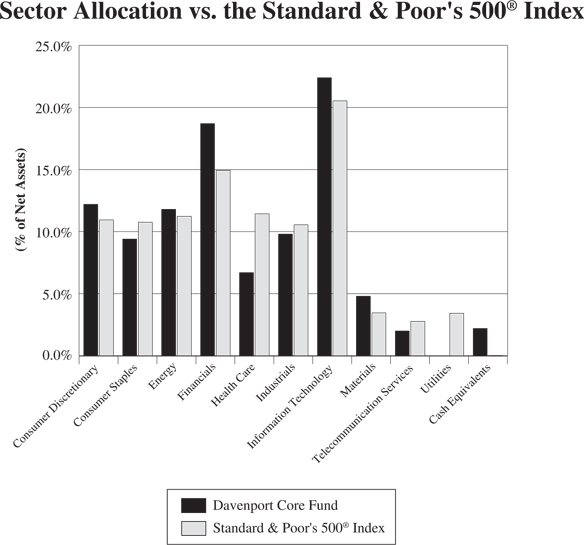

Davenport Core Fund

The following chart represents the Davenport Core Fund (the “Fund”) performance and the performance of the S&P 500 Index*, the Fund’s primary benchmark, for the periods ended March 31, 2012.

| | | | | | | Fiscal Year 2012 Expense Ratio |

| Core Fund | 13.42% | 9.99% | 22.32% | 3.64% | 5.03% | 4.80% | 0.96% |

| S&P 500 Index* | 12.59% | 8.54% | 23.42% | 2.01% | 4.12% | 4.66% | — |

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

| * | The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

The Core Fund had a solid year ended March 31, 2012, with its 9.99% total return nicely outpacing the 8.54% return for the S&P 500 Index. While the market seemed to be on a rollercoaster ride to nowhere through the first three quarters of the year, we kept our focus and were well positioned for a sharp advance during the fourth quarter. We are pleased to have captured our fair share of gains without dramatically altering the risk profile of the Fund. Furthermore, we continue to think a focus on quality domestic large cap stocks is prudent, and have benefitted recently from our exposure to the Financials and Consumer Discretionary sectors.

As the market rallied to close out the year, it was gratifying to see standout performances from names we recently emphasized, such as Charles Schwab (SCHW) and Lowe’s (LOW). Bank holdings such as Capital One (COF), JPMorgan Chase (JPM), and Wells Fargo (WFC) were

also particularly strong. Technology was a source of strength during the fourth quarter and the full year, as Apple (AAPL), QUALCOMM (QCOM), IBM (IBM), and Visa (V) hit fresh highs. The relentless run in the shares of AAPL has been truly remarkable. Though the company’s dominance may not last forever, we feel comfortable with the stock at current levels. In addition to its earnings momentum and cheap valuation, the company has an impressive balance sheet and generates a staggering amount of cash (AAPL’s recently announced annual dividend is larger than the market cap of approximately 40% of S&P 500 companies).

Despite making a charge at the end of the year, energy stocks were a source of weakness in fiscal 2012. Oil services names such as Transocean (RIG) and Schlumberger (SLB) were the weakest in the category, while exploration oriented issues such as Occidental Petroleum (OXY) and EOG Resources (EOG) also struggled. In the fourth quarter, we initiated a position in National-Oilwell Varco (NOV), and sold our position in RIG following a rally in the shares. Though not done in tandem, we believe the net result of these transactions high-grades our energy exposure. NOV sells equipment to over 90% of the world’s drilling rigs. In some segments, such as Rig Equipment, NOV has such strong market share that it has the nickname “No Other Vendor”. Despite a slight pullback in crude oil prices, integrated oil majors are growing capital expenditures significantly over the next few years (5%-15%). As such, we continue to believe NOV provides a great risk/reward opportunity in light of its dominant share, rock solid balance sheet (approximately $3 billion in net cash), and undemanding valuation. Despite the addition of NOV, we note we are slightly underweight in the Energy sector. Though we think it still makes sense to have high quality exposure to this category, we are comfortable with this weighting given prospects for softening oil prices in the face of meaningful domestic supply growth, waning infrastructure investment in China, and easing geopolitical tensions (i.e. Iran).

We initiated a position in e-commerce behemoth, Amazon.com (AMZN), near the end of the year. We have always been attracted to this company given its disruptive business model, large market opportunity, and virtually unrivaled returns on capital. As such, we took advantage of recent weakness in the stock to add a position. In many ways, AMZN is famous for its “lofty” P/E multiple; however, we believe this is misleading given the company’s free cash flow generation well in excess of earnings (and EBITDA in some cases). Though margins and earnings have disappointed as of late due to the company’s investments in distribution capacity, we think these investments should foster a continuation of the company’s impressive growth rate and lead to stronger margins down the road. Moreover, expansion into new product categories and further development of other business segments, such as the Kindle, Amazon Seller Services (third party), and Amazon Web Services (AWS), should lead to strong revenue growth for years to come.

In sum, we are pleased to have had such a strong close to a solid year. Though the fourth quarter’s return may have borrowed from future quarters, we still think large cap equities look attractive following decades of underperformance. Put simply, we sense this asset class is under-owned by many investors and has the potential to surprise to the upside. Should this occur, we feel our team is ready.

New Positions

Amazon.com, Inc. (AMZN) has evolved into one of the most trafficked Internet retail sites in the world, since opening for business as the “World’s Largest Bookstore” in 1995. Today the company directly sells, or acts as a platform for the sale of a wide range of products including books, music, videos, consumer electronics, clothing and household products. AMZN’s vast,

scalable retail platform allows it to offer the lowest prices around, add new features, and pump incremental sales through at very little cost.

The J.M. Smucker Company (SJM) has grown into a leading manufacturer and marketer of fruit spreads, peanut butter, dessert toppings and natural beverages such as coffee since its founding in 1897 as an apple butter company. Within these categories, the company’s brand portfolio boasts household names such as Jif, Folgers, Crisco, Pillsbury, and, of course, Smucker’s. In addition to strong brands and leading share, this company has a top quality management team, a solid balance sheet and generates strong cash flows. Furthermore, management is committed to returning cash to shareholders via dividends and share repurchases. The company’s growth to date has been impressive; however, we note that with a market cap of about $8.5 billion, SJM has a lot more room to grow organically and via acquisitions.

National-Oilwell Varco, Inc. (NOV) is an oilfield services company that designs, manufactures and sells systems, components and products used in oil and gas drilling and production. With the sustained elevated oil price, exploration and production companies and integrated majors are raising capital expenditures significantly (5-15%), and NOV is well-positioned to benefit from increased oil service equipment demand, and given its equipment is on 90% of the world’s rigs. We expect increased global oil production to provide significant earnings growth and margin expansion over the next few years. In addition to its attractive earnings profile, NOV has a strong balance sheet (approximately $3 billion in net cash) and a solid track record at executing.

News Corporation – Class A (NWSA) is a diversified global media company with operations in six industry segments: cable network programming, filmed entertainment, television, direct broadcast satellite television, publishing, and other. Flagship assets include the FOX Broadcast Network, 20th Century Fox, Fox News, FX, Fox Sports, and the Wall Street Journal. The company also owns numerous foreign assets such as Sky Italia and BSkyB.

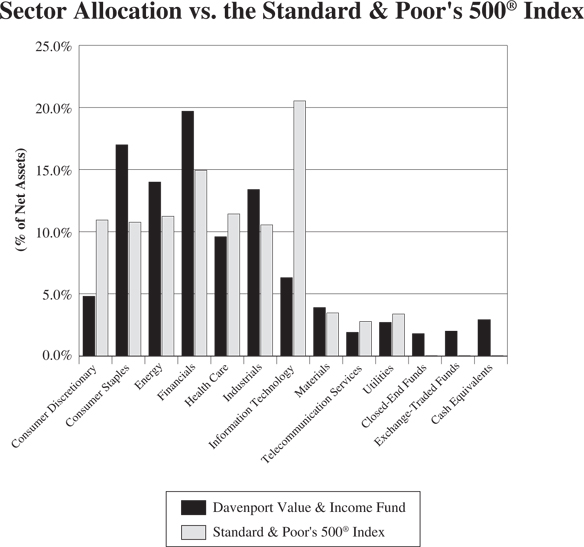

Davenport Value & Income Fund

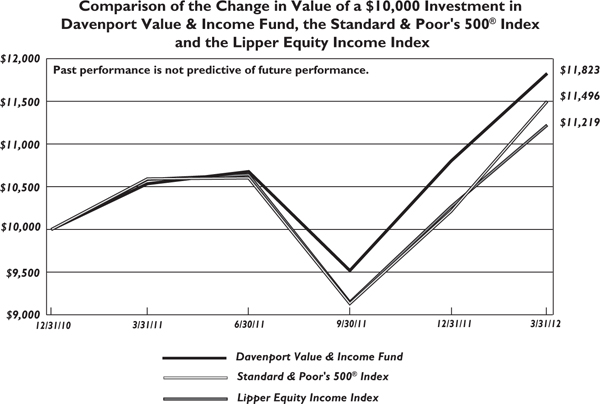

The following chart represents Davenport Value & Income Fund (the “Fund”) performance and the performance of the S&P 500 Index*, the Fund’s primary benchmark, and the Lipper Equity Income Index for the periods ended March 31, 2012.

| | | Since Inception** 12/31/2010 | Fiscal Year 2011 Expense Ratio |

| Value & Income Fund | 9.47% | 12.23% | 14.38% | 1.04% |

| Lipper Equity Income Index* | 9.28% | 5.99% | 9.67% | — |

| S&P 500 Index* | 12.59% | 8.54% | 11.84% | — |

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

| * | The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. The Lipper Equity Income Index is an unmanaged index of the 30 largest funds, based on total year-end net asset value, in the Lipper Equity Income Index. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

The Value & Income Fund performed well in fiscal year March 31, 2012, as its 12.23% total return significantly outperformed the 8.54% and 5.99% advances of the S&P 500 Index and the Lipper Equity Income Index, respectively. Expectations for a prolonged low interest rate environment have clearly made dividend paying stocks more attractive to investors; therefore, funds with a dividend focus have performed well. Though we realize our portfolio fits squarely into this so called “sweet spot,” we are pleased to have clearly outperformed our benchmark and comparable funds. We were especially pleased to see absolute performance keep up in the fourth quarter, as more conservative, yield oriented names lagged during a period in which investor risk appetites were rising. The Fund had a yield of 2.01% for the 30 days ended March 31, 2012.

Consumer Staples stocks lagged as the market rallied to close the year. We took this as an opportunity to add a position in PepsiCo (PEP), which has struggled amid commodity cost headwinds, a challenging consumer environment, and a need to reinvest in its business. Though we realize there are no quick fixes to any of these issues, we believe recent weakness has provided an attractive long term entry point into a situation with financial strength, powerful brands, and strong cash flow. On the other hand, financial stocks were strong in the back half of the fiscal year. Our bank holdings, including recently added SunTrust (STI), performed well as investor confidence in the company’s balance sheet and earnings power continued to strengthen. Non-bank financials, such as recently added Federated Investors (FII) and Fidelity National Financial (FNF), were top performers as well. In the case of FII, we were attracted to the stock’s cheap valuation and upside leverage in the event of rising interest rates. FNF is a dominant title insurance provider who we think should have a lot more upside, even amid a modest recovery in housing.

We purchased a position in leading manufactured housing developer, Sun Communities (SUI). SUI is a REIT with 159 manufactured housing and RV communities located in the Midwest and Southeastern U.S. Over the past several quarters, consumer demand has been quite strong, providing a nice tailwind to an industry that already has low capital needs and high barriers to entry. We believe SUI is one of the best managed companies in the space, and that cash flows stand to benefit from a variety of tailwinds, including improving occupancy, site growth, rent increases, and attractive acquisition opportunities. As these developments transpire, we believe both the dividend yield (5.8%) and the stock price have upside.

We believe recent volatility and media hysteria has yielded some interesting opportunities in quality companies that face obvious, but well discounted headwinds. In keeping with this theme, we elected to purchase a position in the SPDR EURO STOXX 50 ETF (FEZ). FEZ is an ETF designed to track the Euro Stoxx 50 Index, which includes 50 of the largest companies in the Eurozone. Though we are well aware of the economic and fiscal challenges facing the region, we believe the stock prices of Europe’s largest companies have gone a long way to reflect the risks. All of these companies are domiciled in troubled parts of the globe; however, the vast majority have well diversified income streams and strong balance sheets that should help them weather the storm at home. Given steep valuation discounts to other global indices, we think these stocks can rerate higher as the situation in Europe goes from “awful” to “less bad.” Furthermore, by using an ETF of the largest companies in the region, we believe we are diversifying away much of the company specific risk inherent in this strategy. Finally, FEZ offers a yield of 4.8%, which we feel is nice compensation while we wait for our thesis to play out.

In conclusion, we find high dividend yields attractive in this low rate environment, and note that dividends should continue to make up a significant proportion of total returns over time. We think it is important to focus on companies that not only pay above average dividends, but can

grow these distributions. While many companies have already responded to shareholder demand with dividend initiations or increases, we are encouraged that payout ratios remain below long term averages. As such, we think the stocks we own should have plenty of room to increase their dividends at a nice clip.

New Positions

Federated Investors, Inc. – Class B (FII) is one of the largest domestic managers of money market funds, with more than $270 billion in money market assets commanding nearly 10% share. Falling interest rates and increased regulatory uncertainty have depressed results and caused significant weakness in the shares over the last few years. Though both the regulatory and interest rate environment are difficult to predict, we believe fee waivers are approaching a trough and that regulatory challenges are manageable. The shares offer an attractive dividend that management is very committed to maintaining, and results have significant upside leverage to even a modest uptick in interest rates. Currently yields 4.3%.

PepsiCo, Inc. (PEP) is a global leader in the snack food and beverage industries, boasting brands such as Pepsi, Aquafina, Gatorade, Doritos, Frito Lay and Tropicana. Though the company is undergoing a transition period in which it must cut costs and invest in its brands, we are attracted to its financial strength, powerful brands and strong cash flow. PEP pays a $2.06 dividend, which we think can grow over time as earnings benefit from the aforementioned investment phase. Currently yields 3.1%.

SPDR EURO STOXX 50 ETF (FEZ) is an ETF designed to track the Euro Stoxx 50 Index, which includes 50 of the largest companies in the Eurozone. By using an ETF of the largest companies in the region, we believe we are diversifying away much of the company specific risk inherent in this strategy. Currently yields 4.8%.

Sun Communities, Inc. (SUI) is a REIT that owns, operates and develops manufactured housing communities. In addition to manufactured housing developments, the company also owns and operates Recreational Vehicle (RV) facilities. All told, the company’s portfolio consists of 159 communities (54,800 developed sites) located in the Midwest and Southeastern U.S. Currently yields 5.8%.

SunTrust Banks, Inc. (STI) is based in Atlanta, GA and is one of the nation’s largest commercial banking organizations; offering a full line of consumer and commercial banking solutions across the Southeast and Mid-Atlantic. Currently yields 0.8%.

Teekay Corporation (TK)** is a diversified midstream energy company with interests in offshore, liquid natural gas (LNG) and conventional tanker sectors. TK acts as a parent holding company, owning General Partner interests in two Master Limited Partnerships: Teekay LNG Partners (TGP) and Teekay Offshore Partners (TOO). In addition, TK has a third C-Corp subsidiary called Teekay Tankers (TNK). Currently yields 3.6%.

WellPoint, Inc. (WP)** is one of the largest managed care companies in the U.S., operating the Blue Cross & Blue Shield plans in 14 states and covering roughly 34 million medical members in total. Currently yields 1.6%.

Davenport Equity Opportunities Fund

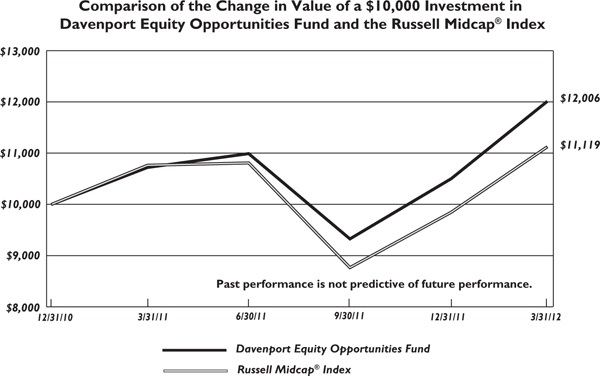

The following chart represents the Davenport Equity Opportunities Fund (the “Fund”) performance and the performance of the Russell Midcap Index*, the Fund’s primary benchmark, and the S&P 500 Index for the periods ended March 31, 2012.

| | | Since Inception** 12/31/2010 | Fiscal Year 2012 Expense Ratio |

| Equity Opportunities Fund | 14.34% | 12.00% | 15.80% | 1.10% |

| Russell Midcap Index* | 12.94% | 3.31% | 8.88% | — |

| S&P 500 Index* | 12.59% | 8.54% | 11.84% | — |

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

| * | The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000, which represent approximately 25% of the total market capitalization of the Russell 1000. The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

The Equity Opportunities Fund performed admirably in fiscal year ended March 31, 2012. For the year, the Fund advanced 12.00%, as compared to a 3.31% increase for the Russell Midcap Index, and an 8.54% gain for the S&P 500 Index. We were pleased to see the Fund outperform in both up and down markets, given the dramatic volatility we saw during the year. Like many managers, we had our fair share of mistakes along the way, but ultimately some of our top holdings allowed us to do better than both the broader market and our peer group.

Generally speaking, shares of companies that executed well were rewarded in fiscal 2012. O’Reilly Automotive (ORLY) is a good example. The company posted consistent growth, beat expectations, and used excess cash flow to aggressively repurchase its own stock. Fortunately, the company’s defensive business model and the ongoing integration of acquired stores provide visible growth that isn’t entirely dependent on a robust economic recovery. The stock was nicely rewarded with a near 60% gain on the year. Richmond, Virginia-based NewMarket (NEU) is another example. This company also consistently exceeded consensus expectations and reported impressive earnings growth for the year. Here again, return of capital to shareholders was an important theme, with the company repurchasing stock and dramatically increasing its dividend. In both of the aforementioned cases, stomach churning volatility tested investors’ sprits as we progressed through the year. We made such volatility an ally rather than an enemy by adding to each of these stocks at attractive prices.

We benefited from recent moves in the Financials sector later in the year. In the third quarter, we established positions in beaten-up names such as Capital One (COF) and SunTrust (STI). Both stocks appreciated more than 30% in the fourth quarter. Given moderating credit losses and the potential for improving loan growth, we continue to like these companies, and

added to our positions at attractive prices. We also got a lift from holdings in the Consumer Discretionary sector with names such as Hanesbrands (HBI), Penn National Gaming (PENN), Lamar Advertising (LAMR), and CarMax (KMX). While we chipped our position in LAMR early in the fourth quarter, all of these companies still seem to possess reasonable valuations when considering the potential for double digit EPS growth in coming years. One of our biggest detractors was Alpha Natural Resources (ANR), which struggled due to falling coal prices. While we emphasize individual companies first and foremost, it is worth noting we have little exposure to energy/commodities. If oil prices were to skyrocket alongside geopolitical conflict, we may lag the market since we are not only light in energy, but also overweight in consumer stocks, which could struggle.

We’ve also been discussing a desire to increase exposure to situations where we have high confidence levels. As such, we recently added to our stake in Markel (MKL), which is now our largest holding. We are officially beating a dead horse, but we really like the MKL story. Given the company’s underwriting acumen and demonstrated ability to invest insurance premiums at attractive rates of return, Markel has come to be known as a miniature Berkshire Hathaway. Low interest rates (i.e., depressed fixed income investment returns) and stiff competition for premium dollars present headwinds. Still, we think the company should be able to grow book value at a double-digit clip for years to come, and the stock seemed to carry below average risk when we added to the position. In fact, the shares were trading at a 15% premium to book value versus an average of 50% over the past 10 years. Also, we think Markel Ventures, which is buying privately held businesses, adds an exciting new growth angle to the story.

In sum, we are happy to have ended the fiscal year on such a strong note, and are excited about recent changes to the Fund. We are very confident in our current collection of businesses and, while the pace of recent gains seems unsustainable, we continue to feel the ingredients are in place for solid returns. Although most of our holdings are obviously more fully valued than a few months ago, they generally continue to have bright multi-year prospects. Therefore, we expect to remain close to fully invested, despite the potential for a market pullback.

New Positions

Alpha Natural Resources, Inc. (ANR) is one of the largest coal producers in the U.S. Its earnings are most levered to metallurgical coal production, which is tethered to global steel production (China is 45% of steel consumption). Subsequently, the Fund sold its position in ANR during the fourth quarter. While sentiment towards ANR is obviously depressed and may indeed be nearing a low point, fundamentals have become much worse since our purchase. We are concerned that the outlook for coal prices may not get better anytime soon, given a softer outlook for steel production and Chinese property/infrastructure growth. While we realize this was a short-lived hold, we thought it best to quickly cut our losses.

The J.M. Smucker Company (SJM) has grown into a leading manufacturer and marketer of fruit spreads, peanut butter, dessert toppings and natural beverages such as coffee since its founding in 1897 as an apple butter company. Within these categories, the company’s brand portfolio boasts household names such as Jif, Folgers, Crisco, Pillsbury, and, of course, Smucker’s. In addition to strong brands and leading share, this company has a top quality management team, a solid balance sheet and generates strong cash flows. Furthermore, management is committed to returning cash

to shareholders via dividends and share repurchases. The company’s growth to date has been impressive; however, we note that with a market cap of about $8.5 billion, SJM has a lot more room to grow organically and via acquisitions.

Sun Communities, Inc. (SUI) is a REIT that owns, operates and develops manufactured housing communities. In addition to manufactured housing developments, the company also owns and operates Recreational Vehicle (RV) facilities. All told, the company’s portfolio consists of 159 communities (54,800 developed sites) located in the Midwest and Southeastern U.S.

Increased Positions

Brookfield Asset Management, Inc. – Class A (BAM) is a specialty asset manager with a concentration in property, power and infrastructure assets. Within these categories the company has significant investments in commercial real estate, hydroelectric power and timber assets; all of which have high barriers to entry, long asset lives, and stable, predictable cash flows.

Capital One Financial Corporation (COF) is the 5th largest U.S. credit card provider, with operations in auto lending, consumer installment lending, small business lending and deposit taking activities.

Markel Corporation (MKL) is a diversified underwriter of specialty insurance products headquartered in Richmond, VA. In addition to underwriting a wide variety of specialty property and casualty business, the company invests in multiple non-regulated businesses through its Markel Ventures segment. This company has an impressive track record of underwriting success and shareholder value creation. We expect these trends to continue moving forward and find the shares to be attractive at current levels.

SunTrust Banks, Inc. (STI) is based in Atlanta, GA and is one of the nation’s largest commercial banking organizations; offering a full line of consumer and commercial banking solutions across the Southeast and Mid-Atlantic.

We are pleased that The Davenport Funds are off to a good start thus far in 2012. We thank you for your trust and look forward to reporting back as we proceed through the year.

Sincerely,

John P. Ackerly, IV

President, The Davenport Funds

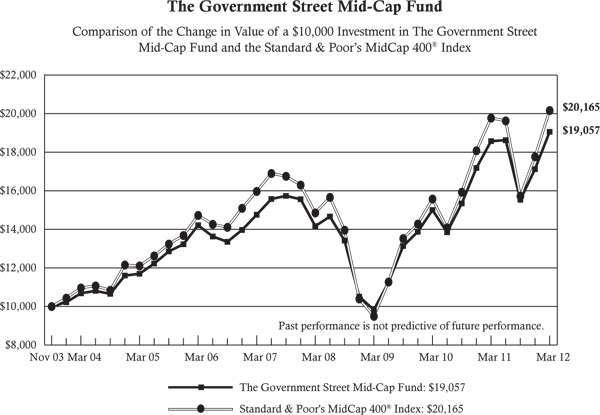

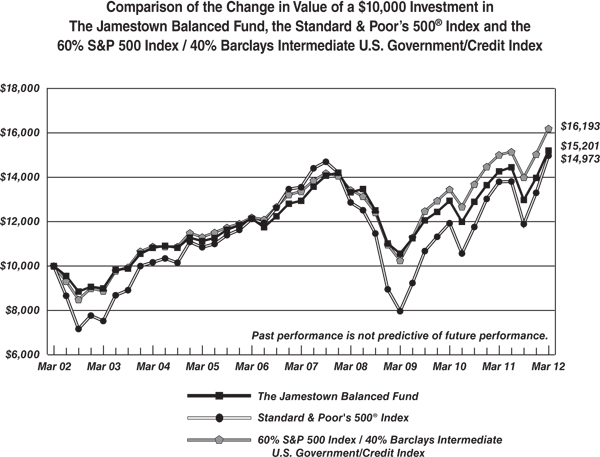

DAVENPORT CORE FUND PERFORMANCE INFORMATION (Unaudited) |

| | Average Annual Total Returns(a) (for periods ended March 31, 2012) | |

| | 1 Year | 5 Years | 10 Years | |

| Davenport Core Fund | 9.99% | 3.64% | 5.03% | |

Standard & Poor’s 500® Index | 8.54% | 2.01% | 4.12% | |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

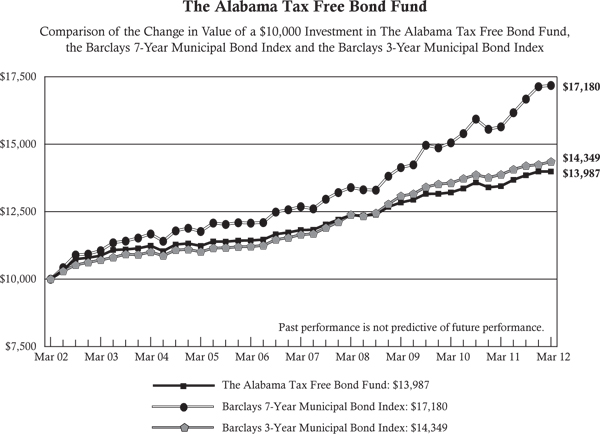

DAVENPORT VALUE & INCOME FUND PERFORMANCE INFORMATION (Unaudited) |

| | Average Annual Total Returns(a) (for periods ended March 31, 2012) | |

| | 1 Year | Since Inception(b) | |

| Davenport Value & Income Fund | 12.23% | 14.38% | |

Standard & Poor’s 500® Index | 8.54% | 11.84% | |

| Lipper Equity Income Index | 5.99% | 9.67% | |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Commencement of operations was December 31, 2010. |

DAVENPORT EQUITY OPPORTUNITIES FUND PERFORMANCE INFORMATION (Unaudited) |

| | Average Annual Total Returns(a) (for periods ended March 31, 2012) | |

| | 1 Year | Since Inception(b) | |

| Davenport Equity Opportunities Fund | 12.00% | 15.80% | |

Russell Midcap® Index | 3.31% | 8.88% | |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Commencement of operations was December 31, 2010. |

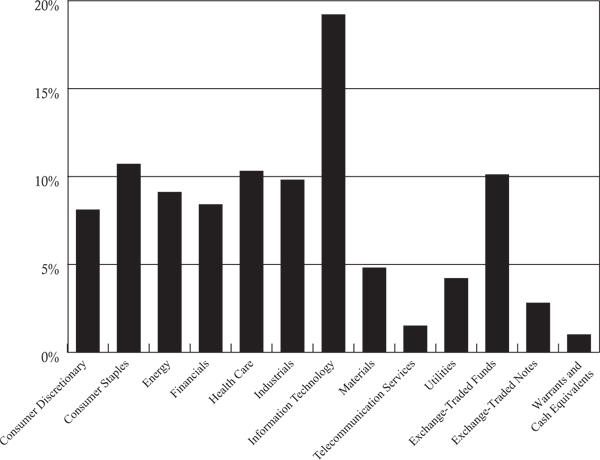

DAVENPORT CORE FUND PORTFOLIO INFORMATION March 31, 2012 (Unaudited) |

Top Ten Equity Holdings

| Security Description | % of Net Assets |

| Apple, Inc. | 3.2% |

| QUALCOMM, Inc. | 2.7% |

| Lowe's Companies, Inc. | 2.7% |

| Exxon Mobil Corporation | 2.6% |

| International Business Machines Corporation | 2.5% |

| Berkshire Hathaway, Inc. - Class B | 2.3% |

| Markel Corporation | 2.3% |

| CarMax, Inc. | 2.2% |

| American Tower Corporation | 2.2% |

| Brookfield Asset Management, Inc. - Class A | 2.1% |

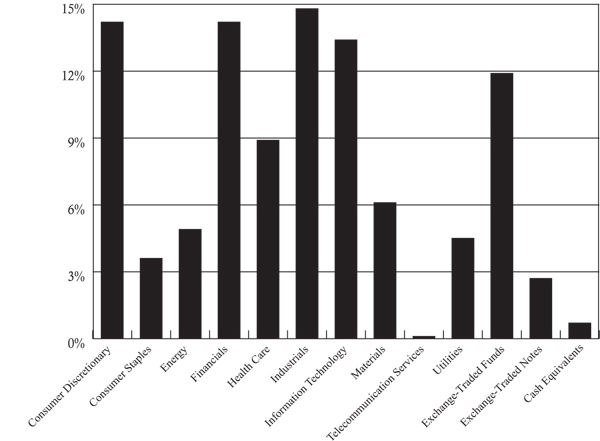

DAVENPORT VALUE & INCOME FUND PORTFOLIO INFORMATION March 31, 2012 (Unaudited) |

Top Ten Equity Holdings

| Security Description | % of Net Assets |

| Watsco, Inc. | 2.8% |

| Wells Fargo & Company | 2.7% |

| Royal Dutch Shell plc - Class B - ADR | 2.6% |

| Fidelity National Financial, Inc. - Class A | 2.5% |

| JPMorgan Chase & Company | 2.5% |

| GlaxoSmithKline plc - ADR | 2.3% |

| Weyerhaeuser Company | 2.3% |

| Chevron Corporation | 2.3% |

| Anheuser-Busch InBev SA/NV - ADR | 2.3% |

| Intel Corporation | 2.2% |

DAVENPORT EQUITY OPPORTUNITIES FUND PORTFOLIO INFORMATION March 31, 2012 (Unaudited) |

Top Ten Equity Holdings

| Security Description | % of Net Assets |

| Markel Corporation | 4.8% |

| CarMax, Inc. | 4.5% |

| Penn National Gaming, Inc. | 4.4% |

| Capital One Financial Corporation | 3.9% |

| SunTrust Banks, Inc. | 3.7% |

| Colfax Corporation | 3.7% |

| Millicom International Cellular S.A. | 3.5% |

| O'Reilly Automotive, Inc. | 3.4% |

| Hanesbrands, Inc. | 3.4% |

| Acacia Research Corporation | 3.3% |

DAVENPORT CORE FUND SCHEDULE OF INVESTMENTS March 31, 2012 |

| | | | | | |

| Consumer Discretionary — 12.2% | | | | | | |

Amazon.com, Inc. (a) | | | 9,073 | | | $ | 1,837,373 | |

CarMax, Inc. (a) | | | 113,481 | | | | 3,932,117 | |

| Lowe's Companies, Inc. | | | 149,812 | | | | 4,701,100 | |

| McDonald's Corporation | | | 27,659 | | | | 2,713,348 | |

| News Corporation - Class A | | | 122,880 | | | | 2,419,507 | |

| Starwood Hotels & Resorts Worldwide, Inc. | | | 50,910 | | | | 2,871,833 | |

| Walt Disney Company (The) | | | 67,815 | | | | 2,968,941 | |

| | | | | | | | 21,444,219 | |

| Consumer Staples — 9.4% | | | | | | | | |

| Anheuser-Busch InBev SA/NV - ADR | | | 34,245 | | | | 2,490,296 | |

| J.M. Smucker Company (The) | | | 33,180 | | | | 2,699,525 | |

| Nestle S.A. - ADR | | | 41,940 | | | | 2,642,220 | |

| PepsiCo, Inc. | | | 43,938 | | | | 2,915,286 | |

| Procter & Gamble Company (The) | | | 36,162 | | | | 2,430,448 | |

| Wal-Mart Stores, Inc. | | | 52,305 | | | | 3,201,066 | |

| | | | | | | | 16,378,841 | |

| Energy — 11.8% | | | | | | | | |

| Chevron Corporation | | | 34,782 | | | | 3,730,022 | |

| EOG Resources, Inc. | | | 23,128 | | | | 2,569,521 | |

| Exxon Mobil Corporation | | | 52,315 | | | | 4,537,280 | |

| National Oilwell Varco, Inc. | | | 31,395 | | | | 2,494,960 | |

| Occidental Petroleum Corporation | | | 27,648 | | | | 2,632,919 | |

| Schlumberger Ltd. | | | 42,358 | | | | 2,962,095 | |

| Transocean Ltd. | | | 30,894 | | | | 1,689,902 | |

| | | | | | | | 20,616,699 | |

| Financials — 18.7% | | | | | | | | |

| American Tower Corporation | | | 62,346 | | | | 3,929,045 | |

| Bank of America Corporation | | | 134,871 | | | | 1,290,716 | |

Berkshire Hathaway, Inc. - Class B (a) | | | 50,062 | | | | 4,062,531 | |

| Brookfield Asset Management, Inc. - Class A | | | 119,034 | | | | 3,757,903 | |

| Capital One Financial Corporation | | | 67,274 | | | | 3,749,853 | |

| Charles Schwab Corporation (The) | | | 180,015 | | | | 2,586,816 | |

| JPMorgan Chase & Company | | | 66,489 | | | | 3,057,164 | |

Markel Corporation (a) | | | 8,956 | | | | 4,020,707 | |

| T. Rowe Price Group, Inc. | | | 43,011 | | | | 2,808,618 | |

| Wells Fargo & Company | | | 99,046 | | | | 3,381,430 | |

| | | | | | | | 32,644,783 | |

| Health Care — 6.7% | | | | | | | | |

| Johnson & Johnson | | | 42,980 | | | | 2,834,961 | |

Laboratory Corporation of America Holdings (a) | | | 29,155 | | | | 2,668,848 | |

| Novo Nordisk A/S - ADR | | | 19,493 | | | | 2,703,874 | |

| WellPoint, Inc. | | | 48,981 | | | | 3,614,798 | |

| | | | | | | | 11,822,481 | |

DAVENPORT CORE FUND SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 97.8% (Continued) | | | | | | |

| Industrials — 9.8% | | | | | | |

| Boeing Company (The) | | | 32,401 | | | $ | 2,409,662 | |

| Danaher Corporation | | | 66,329 | | | | 3,714,424 | |

| Illinois Tool Works, Inc. | | | 42,674 | | | | 2,437,539 | |

| Stanley Black & Decker, Inc. | | | 37,932 | | | | 2,919,247 | |

| Union Pacific Corporation | | | 21,405 | | | | 2,300,609 | |

| United Technologies Corporation | | | 40,040 | | | | 3,320,918 | |

| | | | | | | | 17,102,399 | |

| Information Technology — 22.4% | | | | | | | | |

| Accenture plc - Class A | | | 52,399 | | | | 3,379,735 | |

Apple, Inc. (a) | | | 9,336 | | | | 5,596,652 | |

| Automatic Data Processing, Inc. | | | 47,057 | | | | 2,597,076 | |

Check Point Software Technologies Ltd. (a) | | | 51,103 | | | | 3,262,416 | |

Fiserv, Inc. (a) | | | 50,998 | | | | 3,538,751 | |

Google, Inc. - Class A (a) | | | 4,004 | | | | 2,567,525 | |

| Intel Corporation | | | 104,588 | | | | 2,939,969 | |

| International Business Machines Corporation | | | 20,652 | | | | 4,309,040 | |

| Microsoft Corporation | | | 98,603 | | | | 3,179,947 | |

| QUALCOMM, Inc. | | | 70,070 | | | | 4,766,161 | |

| Visa, Inc. - Class A | | | 25,288 | | | | 2,983,984 | |

| | | | | | | | 39,121,256 | |

| Materials — 4.8% | | | | | | | | |

| Albemarle Corporation | | | 51,693 | | | | 3,304,217 | |

| International Flavors & Fragrances, Inc. | | | 40,040 | | | | 2,346,344 | |

| Praxair, Inc. | | | 24,719 | | | | 2,833,786 | |

| | | | | | | | 8,484,347 | |

| Telecommunication Services — 2.0% | | | | | | | | |

| Millicom International Cellular S.A. | | | 30,536 | | | | 3,450,568 | |

| | | | | | | | | |

Total Common Stocks (Cost $123,733,533) | | | | | | $ | 171,065,593 | |

| |

MONEY MARKET FUNDS — 2.1% | | | | | | |

First American Treasury Obligations Fund - Class Z, 0.00% (b) (Cost $3,641,028) | | | 3,641,028 | | | $ | 3,641,028 | |

| | | | | | | | | |

Total Investments at Value — 99.9% (Cost $127,374,561) | | | | | | $ | 174,706,621 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.1% | | | | | | | 191,085 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 174,897,706 | |

ADR - American Depositary Receipt.

| (a) | Non-income producing security. |

| (b) | Variable rate security. The rate shown is the 7-day effective yield as of March 31, 2012. |

See accompanying notes to financial statements.

DAVENPORT VALUE & INCOME FUND SCHEDULE OF INVESTMENTS March 31, 2012 |

| | | | | | |

| Consumer Discretionary — 4.8% | | | | | | |

| Home Depot, Inc. (The) | | | 36,475 | | | $ | 1,835,057 | |

| McDonald's Corporation | | | 16,105 | | | | 1,579,901 | |

| VF Corporation | | | 9,475 | | | | 1,383,160 | |

| | | | | | | | 4,798,118 | |

| Consumer Staples — 17.0% | | | | | | | | |

| Altria Group, Inc. | | | 47,186 | | | | 1,456,632 | |

| Anheuser-Busch InBev SA/NV - ADR | | | 30,820 | | | | 2,241,230 | |

| Coca-Cola Company (The) | | | 28,315 | | | | 2,095,593 | |

| Diageo plc - ADR | | | 21,685 | | | | 2,092,603 | |

| H.J. Heinz Company | | | 23,780 | | | | 1,273,419 | |

| PepsiCo, Inc. | | | 29,810 | | | | 1,977,894 | |

| Philip Morris International, Inc. | | | 23,480 | | | | 2,080,563 | |

| Procter & Gamble Company (The) | | | 23,370 | | | | 1,570,698 | |

| Wal-Mart Stores, Inc. | | | 32,317 | | | | 1,977,800 | |

| | | | | | | | 16,766,432 | |

| Energy — 14.0% | | | | | | | | |

| BP plc - ADR | | | 36,440 | | | | 1,639,800 | |

| Chevron Corporation | | | 21,086 | | | | 2,261,263 | |

| Exxon Mobil Corporation | | | 23,105 | | | | 2,003,897 | |

| Marathon Petroleum Corporation | | | 50,295 | | | | 2,180,791 | |

| Royal Dutch Shell plc - Class B - ADR | | | 35,915 | | | | 2,536,676 | |

| Spectra Energy Corporation | | | 64,525 | | | | 2,035,764 | |

| Teekay Corporation | | | 33,330 | | | | 1,158,217 | |

| | | | | | | | 13,816,408 | |

| Financials — 19.7% | | | | | | | | |

| Federated Investors, Inc. - Class B | | | 75,202 | | | | 1,685,277 | |

| Fidelity National Financial, Inc. - Class A | | | 137,670 | | | | 2,482,190 | |

| JPMorgan Chase & Company | | | 53,445 | | | | 2,457,401 | |

| Plum Creek Timber Company, Inc. | | | 47,970 | | | | 1,993,633 | |

| Sun Communities, Inc. | | | 45,088 | | | | 1,953,663 | |

| SunTrust Banks, Inc. | | | 72,690 | | | | 1,756,917 | |

| Travelers Companies, Inc. (The) | | | 36,740 | | | | 2,175,008 | |

| Wells Fargo & Company | | | 77,635 | | | | 2,650,459 | |

| Weyerhaeuser Company | | | 104,140 | | | | 2,282,749 | |

| | | | | | | | 19,437,297 | |

| Health Care — 9.6% | | | | | | | | |

| Abbott Laboratories | | | 25,095 | | | | 1,538,072 | |

| GlaxoSmithKline plc - ADR | | | 51,655 | | | | 2,319,826 | |

| Johnson & Johnson | | | 28,310 | | | | 1,867,328 | |

| Merck & Company, Inc. | | | 42,540 | | | | 1,633,536 | |

| WellPoint, Inc. | | | 28,950 | | | | 2,136,510 | |

| | | | | | | | 9,495,272 | |

DAVENPORT VALUE & INCOME FUND SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 93.3% (Continued) | | | | | | |

| Industrials — 13.4% | | | | | | |

| 3M Company | | | 18,760 | | | $ | 1,673,579 | |

| Eaton Corporation | | | 38,800 | | | | 1,933,404 | |

| General Electric Company | | | 93,025 | | | | 1,867,012 | |

| Illinois Tool Works, Inc. | | | 25,090 | | | | 1,433,141 | |

| Norfolk Southern Corporation | | | 27,000 | | | | 1,777,410 | |

| Raytheon Company | | | 34,605 | | | | 1,826,452 | |

| Watsco, Inc. | | | 37,225 | | | | 2,756,139 | |

| | | | | | | | 13,267,137 | |

| Information Technology — 6.3% | | | | | | | | |

| Automatic Data Processing, Inc. | | | 34,940 | | | | 1,928,339 | |

| Intel Corporation | | | 78,755 | | | | 2,213,803 | |

| Microsoft Corporation | | | 63,890 | | | | 2,060,452 | |

| | | | | | | | 6,202,594 | |

| Materials — 3.9% | | | | | | | | |

| Dow Chemical Company (The) | | | 58,940 | | | | 2,041,682 | |

| E.I. du Pont de Nemours and Company | | | 33,965 | | | | 1,796,748 | |

| | | | | | | | 3,838,430 | |

| Telecommunication Services — 1.9% | | | | | | | | |

| Vodafone Group plc - ADR | | | 69,165 | | | | 1,913,796 | |

| | | | | | | | | |

| Utilities — 2.7% | | | | | | | | |

| Dominion Resources, Inc. | | | 25,205 | | | | 1,290,748 | |

| Southern Company (The) | | | 30,070 | | | | 1,351,045 | |

| | | | | | | | 2,641,793 | |

| | | | | | | | | |

Total Common Stocks (Cost $81,664,291) | | | | | | $ | 92,177,277 | |

| |

| | | | | | |

| Tortoise Energy Infrastructure Corporation (Cost $1,680,947) | | | 42,730 | | | $ | 1,761,331 | |

| |

EXCHANGE-TRADED FUNDS — 2.0% | | | | | | |

SPDR® EURO STOXX 50® ETF (Cost $1,915,413) | | | 59,470 | | | $ | 1,930,396 | |

DAVENPORT VALUE & INCOME FUND SCHEDULE OF INVESTMENTS (Continued) |

MONEY MARKET FUNDS — 2.9% | | | | | | |

First American Treasury Obligations Fund - Class Z, 0.00% (a) (Cost $2,864,180) | | | 2,864,180 | | | $ | 2,864,180 | |

| | | | | | | | | |

Total Investments at Value — 100.0% (Cost $88,124,831) | | | | | | $ | 98,733,184 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.0% | | | | | | | 24,223 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 98,757,407 | |

ADR- American Depositary Receipt.

| (a) | Variable rate security. The rate shown is the 7-day effective yield as of March 31, 2012. |

See accompanying notes to financial statements.

DAVENPORT EQUITY OPPORTUNITIES FUND SCHEDULE OF INVESTMENTS March 31, 2012 | |

| | | | | | |

| Consumer Discretionary — 22.1% | | | | | | |

Brookfield Residential Properties, Inc. (a) | | | 78,460 | | | $ | 830,107 | |

CarMax, Inc. (a) | | | 77,330 | | | | 2,679,484 | |

Hanesbrands, Inc. (a) | | | 67,250 | | | | 1,986,565 | |

| International Game Technology | | | 68,530 | | | | 1,150,619 | |

Lamar Advertising Company - Class A (a) | | | 56,150 | | | | 1,819,821 | |

O'Reilly Automotive, Inc. (a) | | | 22,220 | | | | 2,029,797 | |

Penn National Gaming, Inc. (a) | | | 60,105 | | | | 2,583,313 | |

| | | | | | | | 13,079,706 | |

| Consumer Staples — 4.0% | | | | | | | | |

| Church & Dwight Company, Inc. | | | 22,655 | | | | 1,114,400 | |

| J.M. Smucker Company (The) | | | 14,945 | | | | 1,215,925 | |

| | | | | | | | 2,330,325 | |

| Energy — 3.7% | | | | | | | | |

CVR Energy, Inc. (a) | | | 29,150 | | | | 779,762 | |

Plains Exploration & Production Company (a) | | | 32,755 | | | | 1,397,001 | |

| | | | | | | | 2,176,763 | |

| Financials — 27.7% | | | | | | | | |

| American Tower Corporation | | | 27,630 | | | | 1,741,242 | |

| Brookfield Asset Management, Inc. - Class A | | | 59,950 | | | | 1,892,621 | |

| Capital One Financial Corporation | | | 41,316 | | | | 2,302,954 | |

| Fidelity National Financial, Inc. - Class A | | | 82,390 | | | | 1,485,492 | |

Markel Corporation (a) | | | 6,305 | | | | 2,830,567 | |

| Safety Insurance Group, Inc. | | | 34,300 | | | | 1,428,252 | |

| Sun Communities, Inc. | | | 26,325 | | | | 1,140,662 | |

| SunTrust Banks, Inc. | | | 89,970 | | | | 2,174,575 | |

| Walter Investment Management Corporation | | | 60,243 | | | | 1,358,480 | |

| | | | | | | | 16,354,845 | |

| Health Care — 3.5% | | | | | | | | |

Henry Schein, Inc. (a) | | | 15,465 | | | | 1,170,391 | |

Laboratory Corporation of America Holdings (a) | | | 10,035 | | | | 918,604 | |

| | | | | | | | 2,088,995 | |

| Industrials — 15.7% | | | | | | | | |

Acacia Research Corporation (a) | | | 46,070 | | | | 1,922,962 | |

Babcock & Wilcox Company (a) | | | 38,629 | | | | 994,697 | |

Colfax Corporation (a) | | | 61,495 | | | | 2,167,084 | |

| Cooper Industries plc - Class A | | | 19,095 | | | | 1,221,125 | |

| Rockwell Collins, Inc. | | | 21,090 | | | | 1,213,940 | |

| Watsco, Inc. | | | 23,655 | | | | 1,751,416 | |

| | | | | | | | 9,271,224 | |

| Information Technology — 10.5% | | | | | | | | |

Check Point Software Technologies Ltd. (a) | | | 21,720 | | | | 1,386,605 | |

Fiserv, Inc. (a) | | | 20,720 | | | | 1,437,761 | |

| Intuit, Inc. | | | 25,480 | | | | 1,532,112 | |

DAVENPORT EQUITY OPPORTUNITIES FUND SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 96.9% (Continued) | | | | | | |

| Information Technology — 10.5% (Continued) | | | | | | |

NCR Corporation (a) | | | 85,561 | | | $ | 1,857,529 | |

| | | | | | | | 6,214,007 | |

| Materials — 4.2% | | | | | | | | |

| Albemarle Corporation | | | 25,525 | | | | 1,631,558 | |

| NewMarket Corporation | | | 4,644 | | | | 870,286 | |

| | | | | | | | 2,501,844 | |

| Telecommunication Services — 3.5% | | | | | | | | |

| Millicom International Cellular S.A. | | | 18,400 | | | | 2,079,200 | |

| | | | | | | | | |

| Utilities — 2.0% | | | | | | | | |

| ITC Holdings Corporation | | | 15,555 | | | | 1,196,802 | |

| | | | | | | | | |

Total Common Stocks (Cost $49,284,726) | | | | | | $ | 57,293,711 | |

| |

MONEY MARKET FUNDS — 2.7% | | | | | | |

First American Treasury Obligations Fund - Class Z, 0.00% (b) (Cost $1,610,401) | | | 1,610,401 | | | $ | 1,610,401 | |

| | | | | | | | | |

Total Investments at Value — 99.6% (Cost $50,895,127) | | | | | | $ | 58,904,112 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.4% | | | | | | | 230,579 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 59,134,691 | |

| (a) | Non-income producing security. |

| (b) | Variable rate security. The rate shown is the 7-day effective yield as of March 31, 2012. |

See accompanying notes to financial statements.

THE DAVENPORT FUNDS STATEMENTS OF ASSETS AND LIABILITIES March 31, 2012 |

| | | | | Davenport Value & Income Fund | | | Davenport Equity Opportunities Fund | |

| ASSETS | | | | | | | | | |

| Investments in securities: | | | | | | | | | |

| At acquisition cost | | $ | 127,374,561 | | | $ | 88,124,831 | | | $ | 50,895,127 | |

| At market value (Note 2) | | $ | 174,706,621 | | | $ | 98,733,184 | | | $ | 58,904,112 | |

| Cash | | | — | | | | 414,686 | | | | — | |

| Dividends receivable | | | 164,549 | | | | 203,227 | | | | 18,032 | |

| Receivable for capital shares sold | | | 295,942 | | | | 870,406 | | | | 261,107 | |

| Other assets | | | 14,773 | | | | 10,358 | | | | 9,862 | |

| TOTAL ASSETS | | | 175,181,885 | | | | 100,231,861 | | | | 59,193,113 | |

| | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | |

| Payable for capital shares redeemed | | | 137,622 | | | | 31,642 | | | | 8,500 | |

| Payable for investment securities purchased | | | — | | | | 1,365,153 | | | | — | |

| Accrued investment advisory fees (Note 4) | | | 121,815 | | | | 60,479 | | | | 37,947 | |

| Payable to administrator (Note 4) | | | 20,900 | | | | 12,200 | | | | 8,900 | |

| Other accrued expenses | | | 3,842 | | | | 4,980 | | | | 3,075 | |

| TOTAL LIABILITIES | | | 284,179 | | | | 1,474,454 | | | | 58,422 | |

| | | | | | | | | | | | | |

| NET ASSETS | | $ | 174,897,706 | | | $ | 98,757,407 | | | $ | 59,134,691 | |

| | | | | | | | | | | | | |

| Net assets consist of: | | | | | | | | | | | | |

| Paid-in capital | | $ | 136,097,668 | | | $ | 89,117,517 | | | $ | 51,610,386 | |

| Undistributed net investment income | | | 20,397 | | | | 20,603 | | | | — | |

Accumulated net realized losses from security transactions | | | (8,552,419 | ) | | | (989,066 | ) | | | (484,680 | ) |

| Net unrealized appreciation on investments | | | 47,332,060 | | | | 10,608,353 | | | | 8,008,985 | |

| Net assets | | $ | 174,897,706 | | | $ | 98,757,407 | | | $ | 59,134,691 | |

| | | | | | | | | | | | | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.01 par value) | | | 11,656,032 | | | | 8,578,859 | | | | 4,945,056 | |

| | | | | | | | | | | | | |

Net asset value, offering price and redemption price per share (Note 2) | | $ | 15.00 | | | $ | 11.51 | | | $ | 11.96 | |

See accompanying notes to financial statements.

THE DAVENPORT FUNDS STATEMENTS OF OPERATIONS Year Ended March 31, 2012 |

| | | | | Davenport Value & Income Fund | | | Davenport Equity Opportunities Fund | |

| INVESTMENT INCOME | | | | | | | | | |

| Dividends | | $ | 2,587,919 | | | $ | 2,247,755 | | | $ | 399,860 | |

| Foreign withholding taxes on dividends | | | (44,483 | ) | | | (23,689 | ) | | | (13,794 | ) |

| Interest | | | 25 | | | | — | | | | — | |

| TOTAL INVESTMENT INCOME | | | 2,543,461 | | | | 2,224,066 | | | | 386,066 | |

| | | | | | | | | | | | | |

| EXPENSES | | | | | | | | | | | | |

| Investment advisory fees (Note 4) | | | 1,176,501 | | | | 499,145 | | | | 331,999 | |

| Administration fees (Note 4) | | | 215,129 | | | | 98,543 | | | | 70,911 | |

| Professional fees | | | 19,507 | | | | 16,877 | | | | 17,327 | |

| Custodian and bank service fees | | | 18,166 | | | | 20,591 | | | | 11,686 | |

| Compliance service fees (Note 4) | | | 16,171 | | | | 10,523 | | | | 9,125 | |

| Registration and filing fees | | | 16,264 | | | | 10,284 | | | | 9,908 | |

| Trustees’ fees and expenses | | | 10,876 | | | | 10,876 | | | | 10,876 | |

| Printing of shareholder reports | | | 14,079 | | | | 6,569 | | | | 5,644 | |

| Insurance expense | | | 11,672 | | | | 4,216 | | | | 3,174 | |

| Postage and supplies | | | 3,984 | | | | 3,578 | | | | 3,565 | |

| Other expenses | | | 6,523 | | | | 9,193 | | | | 11,274 | |

| TOTAL EXPENSES | | | 1,508,872 | | | | 690,395 | | | | 485,489 | |

| | | | | | | | | | | | | |

| NET INVESTMENT INCOME (LOSS) | | | 1,034,589 | | | | 1,533,671 | | | | (99,423 | ) |

| | | | | | | | | | | | | |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | | | | | | | | | |

Net realized gains (losses) from security transactions | | | 2,194,465 | | | | (989,066 | ) | | | (469,701 | ) |

Net change in unrealized appreciation/ depreciation on investments | | | 12,450,152 | | | | 9,378,913 | | | | 6,678,341 | |

| | | | | | | | | | | | | |

NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | 14,644,617 | | | | 8,389,847 | | | | 6,208,640 | |

| | | | | | | | | | | | | |

NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 15,679,206 | | | $ | 9,923,518 | | | $ | 6,109,217 | |

See accompanying notes to financial statements.

DAVENPORT CORE FUND STATEMENTS OF CHANGES IN NET ASSETS |

| | | | | | |

| FROM OPERATIONS | | | | | | |

| Net investment income | | $ | 1,034,589 | | | $ | 781,757 | |

| Net realized gains from security transactions | | | 2,194,465 | | | | 2,762,416 | |

| Net change in unrealized appreciation/depreciation on investments | | | 12,450,152 | | | | 15,587,706 | |

| Net increase in net assets from operations | | | 15,679,206 | | | | 19,131,879 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (1,036,002 | ) | | | (780,857 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 17,735,914 | | | | 27,476,146 | |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | 972,757 | | | | 741,331 | |

| Payments for shares redeemed | | | (18,348,617 | ) | | | (19,335,638 | ) |

| Net increase in net assets from capital share transactions | | | 360,054 | | | | 8,881,839 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 15,003,258 | | | | 27,232,861 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 159,894,448 | | | | 132,661,587 | |

| End of year | | $ | 174,897,706 | | | $ | 159,894,448 | |

| | | | | | | | | |

| UNDISTRIBUTED NET INVESTMENT INCOME | | $ | 20,397 | | | $ | 21,810 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 1,299,210 | | | | 2,149,143 | |

| Shares reinvested | | | 73,427 | | | | 61,329 | |

| Shares redeemed | | | (1,362,591 | ) | | | (1,570,298 | ) |

| Net increase in shares outstanding | | | 10,046 | | | | 640,174 | |

| Shares outstanding at beginning of year | | | 11,645,986 | | | | 11,005,812 | |

| Shares outstanding at end of year | | | 11,656,032 | | | | 11,645,986 | |

See accompanying notes to financial statements.

DAVENPORT VALUE & INCOME FUND STATEMENTS OF CHANGES IN NET ASSETS |

| | | | | Period Ended March 31, 2011(a) | |

| FROM OPERATIONS | | | | | | |

| Net investment income | | $ | 1,533,671 | | | $ | 140,872 | |

| Net realized gains (losses) from security transactions | | | (989,066 | ) | | | 71,734 | |

Net change in unrealized appreciation/ depreciation on investments | | | 9,378,913 | | | | 1,229,440 | |

| Net increase in net assets from operations | | | 9,923,518 | | | | 1,442,046 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (1,522,098 | ) | | | (131,842 | ) |

| From net realized gains from security transactions | | | (71,734 | ) | | | — | |

| Decrease in net assets from distributions to shareholders | | | (1,593,832 | ) | | | (131,842 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 44,865,899 | | | | 47,565,809 | |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | 1,359,339 | | | | 110,894 | |

| Payments for shares redeemed | | | (4,628,047 | ) | | | (156,377 | ) |

| Net increase in net assets from capital share transactions | | | 41,597,191 | | | | 47,520,326 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 49,926,877 | | | | 48,830,530 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 48,830,530 | | | | — | |

| End of period | | $ | 98,757,407 | | | $ | 48,830,530 | |

| | | | | | | | | |

| UNDISTRIBUTED NET INVESTMENT INCOME | | $ | 20,603 | | | $ | 9,030 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 4,240,900 | | | | 4,655,581 | |

| Shares reinvested | | | 130,856 | | | | 10,830 | |

| Shares redeemed | | | (444,451 | ) | | | (14,857 | ) |

| Net increase in shares outstanding | | | 3,927,305 | | | | 4,651,554 | |

| Shares outstanding at beginning of period | | | 4,651,554 | | | | — | |

| Shares outstanding at end of period | | | 8,578,859 | | | | 4,651,554 | |

| (a) | Represents the period from commencement of operations (December 31, 2010) through March 31, 2011. |

See accompanying notes to financial statements.

DAVENPORT EQUITY OPPORTUNITIES FUND STATEMENTS OF CHANGES IN NET ASSETS |

| | | | | Period Ended March 31, 2011(a) | |

| FROM OPERATIONS | | | | | | |

| Net investment loss | | $ | (99,423 | ) | | $ | (21,539 | ) |

| Net realized gains (losses) from security transactions | | | (469,701 | ) | | | 184,336 | |

Net change in unrealized appreciation/ depreciation on investments | | | 6,678,341 | | | | 1,330,644 | |

| Net increase in net assets from operations | | | 6,109,217 | | | | 1,493,441 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net realized gains from security transactions | | | (163,030 | ) | | | — | |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 23,587,122 | | | | 34,425,550 | |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | 157,487 | | | | — | |

| Payments for shares redeemed | | | (4,931,526 | ) | | | (1,543,570 | ) |

| Net increase in net assets from capital share transactions | | | 18,813,083 | | | | 32,881,980 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 24,759,270 | | | | 34,375,421 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 34,375,421 | | | | — | |

| End of period | | $ | 59,134,691 | | | $ | 34,375,421 | |

| | | | | | | | | |

| UNDISTRIBUTED NET INVESTMENT INCOME | | $ | — | | | $ | — | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 2,186,580 | | | | 3,357,207 | |

| Shares reinvested | | | 15,593 | | | | — | |

| Shares redeemed | | | (464,812 | ) | | | (149,512 | ) |

| Net increase in shares outstanding | | | 1,737,361 | | | | 3,207,695 | |

| Shares outstanding at beginning of period | | | 3,207,695 | | | | — | |

| Shares outstanding at end of period | | | 4,945,056 | | | | 3,207,695 | |

| (a) | Represents the period from commencement of operations (December 31, 2010) through March 31, 2011. |

See accompanying notes to financial statements.

DAVENPORT CORE FUND FINANCIAL HIGHLIGHTS |

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Year |

| | | |

| | | | | | | | | | | | | | | |

| Net asset value at beginning of year | | $ | 13.73 | | | $ | 12.05 | | | $ | 8.36 | | | $ | 13.82 | | | $ | 14.75 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.09 | | | | 0.07 | | | | 0.08 | | | | 0.11 | | | | 0.10 | |

Net realized and unrealized gains (losses) on investments | | | 1.27 | | | | 1.68 | | | | 3.69 | | | | (5.17 | ) | | | 0.53 | |

| Total from investment operations | | | 1.36 | | | | 1.75 | | | | 3.77 | | | | (5.06 | ) | | | 0.63 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.09 | ) | | | (0.07 | ) | | | (0.08 | ) | | | (0.11 | ) | | | (0.10 | ) |

| Distributions from net realized gains | | | — | | | | — | | | | — | | | | (0.29 | ) | | | (1.46 | ) |

| Total distributions | | | (0.09 | ) | | | (0.07 | ) | | | (0.08 | ) | | | (0.40 | ) | | | (1.56 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of year | | $ | 15.00 | | | $ | 13.73 | | | $ | 12.05 | | | $ | 8.36 | | | $ | 13.82 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return (a) | | | 9.99% | | | | 14.61% | | | | 45.20% | | | | (36.85% | ) | | | 3.44% | |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of year (000’s) | | $ | 174,898 | | | $ | 159,894 | | | $ | 132,662 | | | $ | 92,358 | | | $ | 155,799 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of total expenses to average net assets | | | 0.96% | | | | 0.99% | | | | 1.00% | | | | 1.00% | | | | 0.96% | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income to average net assets | | | 0.66% | | | | 0.58% | | | | 0.75% | | | | 0.98% | | | | 0.60% | |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 19% | | | | 34% | | | | 25% | | | | 39% | | | | 37% | |

| (a) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

See accompanying notes to financial statements.

DAVENPORT VALUE & INCOME FUND FINANCIAL HIGHLIGHTS |

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period |

| | | | | Period Ended March 31, 2011 (a) | |

| Net asset value at beginning of period | | $ | 10.50 | | | $ | 10.00 | |

| | | | | | | | | |

| Income from investment operations: | | | | | | | | |

| Net investment income | | | 0.23 | | | | 0.04 | |

| Net realized and unrealized gains on investments | | | 1.02 | | | | 0.49 | |

| Total from investment operations | | | 1.25 | | | | 0.53 | |

| | | | | | | | | |

| Less distributions: | | | | | | | | |

| Dividends from net investment income | | | (0.23 | ) | | | (0.03 | ) |

| Distributions from net realized gains | | | (0.01 | ) | | | — | |

| Total distributions | | | (0.24 | ) | | | (0.03 | ) |

| | | | | | | | | |

| Net asset value at end of period | | $ | 11.51 | | | $ | 10.50 | |

| | | | | | | | | |

Total return (b) | | | 12.23% | | | | 5.35% | (c) |

| | | | | | | | | |

| Net assets at end of period (000’s) | | $ | 98,757 | | | $ | 48,831 | |

| | | | | | | | | |

| Ratio of total expenses to average net assets | | | 1.04% | | | | 1.25% | (d) |

| | | | | | | | | |

| Ratio of net investment income to average net assets | | | 2.30% | | | | 1.99% | (d) |

| | | | | | | | | |

| Portfolio turnover rate | | | 27% | | | | 10% | (c) |

| (a) | Represents the period from commencement of operations (December 31, 2010) through March 31, 2011. |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

See accompanying notes to financial statements.

DAVENPORT EQUITY OPPORTUNITIES FUND FINANCIAL HIGHLIGHTS |

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period | |

| | | | | Period Ended March 31, 2011 (a) | |

| Net asset value at beginning of period | | $ | 10.72 | | | $ | 10.00 | |

| | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | |

| Net investment loss | | | (0.02 | ) | | | (0.01 | ) |

| Net realized and unrealized gains on investments | | | 1.30 | | | | 0.73 | |

| Total from investment operations | | | 1.28 | | | | 0.72 | |

| | | | | | | | | |

| Less distributions: | | | | | | | | |

| Distributions from net realized gains | | | (0.04 | ) | | | — | |

| | | | | | | | | |

| Net asset value at end of period | | $ | 11.96 | | | $ | 10.72 | |

| | | | | | | | | |

Total return (b) | | | 12.00% | | | | 7.20% | (c) |

| | | | | | | | | |

| Net assets at end of period (000’s) | | $ | 59,135 | | | $ | 34,375 | |

| | | | | | | | | |

| Ratio of total expenses to average net assets | | | 1.10% | | | | 1.25% | (d) |

| | | | | | | | | |

| Ratio of net investment loss to average net assets | | | (0.22% | ) | | | (0.40% | )(d) |

| | | | | | | | | |

| Portfolio turnover rate | | | 35% | | | | 6% | (c) |

| (a) | Represents the period from commencement of operations (December 31, 2010) through March 31, 2011. |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

See accompanying notes to financial statements.

THE DAVENPORT FUNDS NOTES TO FINANCIAL STATEMENTS March 31, 2012 |

1. Organization

Davenport Core Fund, Davenport Value & Income Fund and Davenport Equity Opportunities Fund (individually, a “Fund,” and, collectively, the “Funds”) are each a no-load, diversified series of the Williamsburg Investment Trust (the “Trust”), an open-end management investment company registered under the Investment Company Act of 1940. The Trust was organized as a Massachusetts business trust on July 18, 1988. Other series of the Trust are not incorporated in this report. Davenport Core Fund began operations on January 15, 1998. Davenport Value & Income Fund and Davenport Equity Opportunities Fund began operations on December 31, 2010.

Davenport Core Fund’s investment objective is long term growth of capital.

Davenport Value & Income Fund’s investment objective is to achieve long term growth while generating current income through dividend payments on portfolio securities.

Davenport Equity Opportunities Fund’s investment objective is long term capital appreciation.

2. Significant Accounting Policies

The following is a summary of the Funds’ significant accounting policies. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Securities valuation — The Funds’ portfolio securities are valued as of the close of business of the regular session of the New York Stock Exchange (normally 4:00 p.m., Eastern time). Securities traded on a national stock exchange are valued based upon the closing price on the principal exchange where the security is traded. Securities which are quoted by NASDAQ are valued at the NASDAQ Official Closing Price. Securities which are traded over-the-counter are valued at the last sales price, if available, otherwise, at the last quoted bid price. Fixed income securities will ordinarily be traded in the over-the-counter market and common stocks will ordinarily be traded on a national securities exchange, but may also be traded in the over-the-counter market.

When market quotations are not readily available, securities may be valued on the basis of prices provided by an independent pricing service. The prices provided by the pricing service are determined with consideration given to institutional bid and last sale prices and take into account securities prices, yields, maturities, call features, ratings, institutional trading in similar groups of securities and developments related to specific securities. If a pricing service cannot provide a valuation, securities will be valued in good faith at fair value using methods consistent with those determined by the Board of Trustees and will be classified as Level 2 or 3 (see below) within the fair value hierarchy, depending on the inputs used. Such methods of fair valuation may include, but are not limited to: multiple of earnings, multiple of book value, discount from market of a similar freely traded security, purchase price of the security, subsequent private transactions in the security or related securities, or a combination of these and other factors.

Short-term instruments (those with remaining maturities of 60 days or less) may be valued at amortized cost, which approximates market value. Money market funds have been determined to be represented at amortized cost which approximates fair value, absent unusual circumstances.

THE DAVENPORT FUNDS NOTES TO FINANCIAL STATEMENTS (Continued) |

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the Funds’ investments. These inputs are summarized in the three broad levels listed below:

• Level 1 – quoted prices in active markets for identical securities

• Level 2 – other significant observable inputs

• Level 3 – significant unobservable inputs

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Funds’ investments as of March 31, 2012 by security type:

| | | | | | | | | | | | |

| Common Stocks | | $ | 171,065,593 | | | $ | — | | | $ | — | | | $ | 171,065,593 | |

| Money Market Funds | | | 3,641,028 | | | | — | | | | — | | | | 3,641,028 | |

| Total | | $ | 174,706,621 | | | $ | — | | | $ | — | | | $ | 174,706,621 | |

Davenport Value & Income Fund | | | | | | | | | | | | |

| Common Stocks | | $ | 92,177,277 | | | $ | — | | | $ | — | | | $ | 92,177,277 | |

| Closed-End Funds | | | 1,761,331 | | | | — | | | | — | | | | 1,761,331 | |

| Exchange-Traded Funds | | | 1,930,396 | | | | — | | | | — | | | | 1,930,396 | |

| Money Market Funds | | | 2,864,180 | | | | — | | | | — | | | | 2,864,180 | |

| Total | | $ | 98,733,184 | | | $ | — | | | $ | — | | | $ | 98,733,184 | |

Davenport Equity Opportunities Fund | | | | | | | | | | | | |

| Common Stocks | | $ | 57,293,711 | | | $ | — | | | $ | — | | | $ | 57,293,711 | |

| Money Market Funds | | | 1,610,401 | | | | — | | | | — | | | | 1,610,401 | |

| Total | | $ | 58,904,112 | | | $ | — | | | $ | — | | | $ | 58,904,112 | |

Refer to each Fund’s Schedules of Investments for a listing of the securities valued using Level 1 inputs by sector type. During the year ended March 31, 2012, the Funds did not have any significant transfers in and out of any Level. There were no Level 2 or Level 3 securities or derivative instruments held by the Funds during the year ended or as of March 31, 2012. It is the Funds’ policy to recognize transfers into and out of any Level at the end of the reporting period.

THE DAVENPORT FUNDS NOTES TO FINANCIAL STATEMENTS (Continued) |

Repurchase agreements — The Funds may enter into repurchase agreements. The repurchase agreement, which is collateralized by U.S. Government obligations, is valued at cost which, together with accrued interest, approximates market. At the time a Fund enters into the repurchase agreement, the Fund takes possession of the underlying securities and the seller agrees that the value of the underlying securities, including accrued interest, will at all times be equal to or exceed the face amount of the repurchase agreement. In addition, the Funds actively monitor and seek additional collateral, as needed. If the seller defaults, the fair value of the collateral may decline and realization of the collateral by the Funds may be delayed or limited.

Share valuation — The net asset value per share of each Fund is calculated daily by dividing the total value of its assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of each Fund is equal to the net asset value per share.

Investment income — Interest income is accrued as earned. Dividend income is recorded on the ex-dividend date. Discounts and premiums on fixed-income securities purchased are amortized using the interest method.

Security transactions — Security transactions are accounted for on trade date for financial reporting purposes. Gains and losses on securities sold are determined on a specific identification basis.

Common expenses — Common expenses of the Trust are allocated among the funds within the Trust based on relative net assets of each fund or the nature of the services performed and the relative applicability to each fund.

Distributions to shareholders — Dividends arising from net investment income, if any, are declared and paid quarterly to shareholders of Davenport Core Fund and Davenport Value & Income Fund; and declared and paid annually to shareholders of Davenport Equity Opportunities Fund. Net realized short-term capital gains, if any, may be distributed throughout the year and net realized long-term capital gains, if any, are distributed at least once each year. The amount of distributions from net investment income and net realized gains are determined in accordance with federal income tax regulations which may differ from GAAP. Dividends and distributions are recorded on the ex-dividend date. The tax character of distributions paid during the periods ended March 31, 2012 and March 31, 2011 is as follows:

| | | | | | | |

| Davenport Core Fund | 3/31/12 | | $ | 1,036,002 | | | $ | 1,036,002 | |

| | 3/31/11 | | $ | 780,857 | | | $ | 780,857 | |

| Davenport Value & Income Fund | 3/31/12 | | $ | 1,593,832 | | | $ | 1,593,832 | |

| | 3/31/11 | | $ | 131,842 | | | $ | 131,842 | |

| Davenport Equity Opportunities Fund | 3/31/12 | | $ | 163,030 | | | $ | 163,030 | |

| | 3/31/11 | | $ | — | | | $ | — | |

THE DAVENPORT FUNDS NOTES TO FINANCIAL STATEMENTS (Continued) |

Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Federal income tax — It is each Fund’s policy to comply with the special provisions of Subchapter M of the Internal Revenue Code applicable to regulated investment companies. As provided therein, in any fiscal year in which a Fund so qualifies and distributes at least 90% of its taxable net income, the Fund (but not the shareholders) will be relieved of federal income tax on the income distributed. Accordingly, no provision for income taxes has been made.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also each Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of March 31, 2012:

| | | | | Davenport Value & Income Fund | | | Davenport Equity Opportunities Fund | |

| Cost of portfolio investments | | $ | 127,710,728 | | | $ | 88,124,831 | | | $ | 50,918,892 | |

| Gross unrealized appreciation | | $ | 48,704,705 | | | $ | 10,868,382 | | | $ | 8,486,355 | |

| Gross unrealized depreciation | | | (1,708,812 | ) | | | (260,029 | ) | | | (501,135 | ) |

| Net unrealized appreciation | | | 46,995,893 | | | | 10,608,353 | | | | 7,985,220 | |

| Undistributed ordinary income | | | 20,397 | | | | 20,603 | | | | — | |

| Capital loss carryforward | | | (8,216,252 | ) | | | (510,828 | ) | | | — | |

| Post-October losses | | | — | | | | (478,238 | ) | | | (460,915 | ) |

| Total distributable earnings | | $ | 38,800,038 | | | $ | 9,639,890 | | | $ | 7,524,305 | |