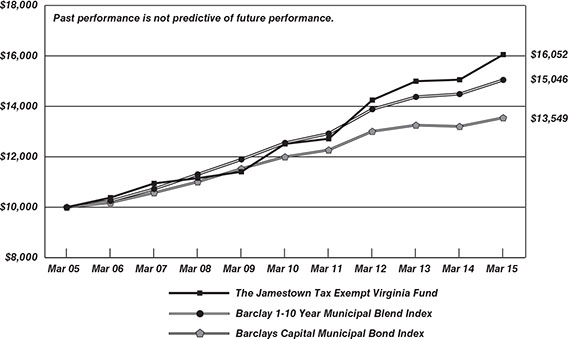

THE DAVENPORT FUNDS LETTER TO SHAREHOLDERS | May 11, 2015 |

Dear Shareholders,

Domestic equity markets behaved like a yo-yo in the quarter ended March 31, 2015. The S&P 500 Index (“S&P 500”) declined in January, bounced back sharply in February and declined once more in March. Ultimately, the S&P 500 finished the quarter up 0.95%. Smaller cap stocks acted better as evidenced by the Russell 2000 Index’s 4.32% gain for the quarter. This makes sense given that small-cap stocks underperformed in 2014 and are typically less exposed to the currency headwinds that have recently plagued many U.S. multinationals. We were pleased with the performance of The Davenport Funds, which generally fared better than their benchmarks.

Strength in the U.S. dollar has recently captured investor attention. The currency’s upward move has been both quick and violent. Indeed, the dollar has appreciated 23% versus a trade-weighted basket of currencies over the past 9 months.1 This phenomenon has been caused by an improving U.S. economy and resultant divergence of monetary policies with many other countries. In other words, the Federal Reserve now appears closer to raising interest rates, whereas other central banks are still trying to suppress interest rates in order to stimulate stagnating economies. The strong U.S. dollar has pressured the earnings of U.S. companies that do business all over the world as sales in foreign currencies are translated back into fewer dollars.

Dollar strength is understandable in the context of the current global economic environment and could persist. However, it may not continue at its recent pace and is starting to appear overdone. We certainly aren’t currency experts, but can recall just a few years ago when some investors were calling for the dollar’s collapse. In fact, a handful of celebrities publicly shunned the dollar and demanded payment in euros. Such fond memories should remind us not to get too caught up in prevailing headlines and trends. To that end, we think it’s an interesting time to invest in good companies with share prices that may be temporarily depressed by currency headwinds. As you will read in our portfolio discussions below, we’ve already begun to capitalize on a few of these opportunities.

The Federal Reserve remains in the spotlight. As our economy improves, investors continue to anticipate a departure from longstanding zero interest rate policy. With little evidence of any inflationary pressure and declines in many commodity prices (especially oil), we don’t think the Federal Reserve is in a rush to raise interest rates and will be very slow in doing so. We also note it may be harder for them to act with the backdrop of a strong dollar, which both dampens export growth and reduces inflationary pressures by allowing the U.S. to import goods more cheaply. Chairwoman Yellen’s recent comments certainly acknowledged these facts. Hence, even if we do see a slight rate hike, we don’t envision an end to generally “dovish” policy anytime soon.

Meanwhile, the picture continues to improve for domestic consumers. Job creation has trended upward and recent employment readings have been better than expected. In fact, the unemployment rate recently stood at 5.6%, a level that seemed unthinkable just a few years ago when we were dealing with a double-digit unemployment rate. Also, gasoline prices remain depressed alongside lower oil prices. Cheaper prices at the pump should provide a nice lift to discretionary spending. For these reasons, we remain bullish on the U.S. consumer and continue to overweight the consumer discretionary sector in the Funds’ portfolios.

All told, we think a combination of accommodative monetary policy and improving domestic trends provide a constructive backdrop for equity markets. While stocks are no longer “cheap” with the S&P 500 trading at 17.5x this year’s earnings estimate, they seem fair in the context of this backdrop. We reiterate our belief that returns should be okay going forward, but are unlikely to rival the past few years when declining interest rates and a wave of cheap money pushed valuations higher. As noted earlier, we also think that stocks with international exposure are beginning to look relatively attractive following a period of weak performance. Please read on for a discussion of Fund themes and ideas. We thank you for your trust and look forward to reporting back to you later in the year.

| 1 | Source: Federal Reserve, Bloomberg |

Davenport Core Fund

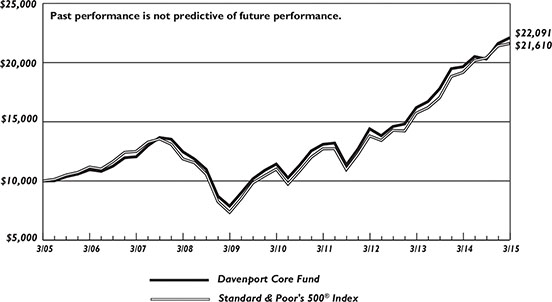

The following chart represents Davenport Core Fund (the “Core Fund”) performance and the performance of the S&P 500 Index*, the Core Fund’s primary benchmark, for the periods ended March 31, 2015.

| | Q1 2015 | 1 Year | 3 Years** | 5 Years** | 10 Years** | Since Inception** 1/15/98 | Fiscal Year 2015 Expense Ratio |

| Core Fund | 2.22% | 12.42% | 15.33% | 14.10% | 8.25% | 6.56% | 0.94% |

| S&P 500 Index* | 0.95% | 12.73% | 16.11% | 14.47% | 8.01% | 6.57% | — |

30-Day SEC Yield: 0.46%; Expense Ratio in current prospectus: 0.94%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

| * | The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

The Core Fund had a solid fiscal year, returning 12.42% for the year ended March 31, 2015, versus the 12.73% gain in the S&P 500.

The Core Fund’s holdings in the Health Care sector performed particularly well. Valeant Pharmaceuticals (VRX), AmerisourceBergen (ABC) and Anthem (ANTM) were top contributors. We elected to chip VRX and ABC as each stock reached new highs. Key detractors included many commodity-related names, which have been hurt by the strength in the U.S. dollar as well as the six month meltdown in oil prices. Examples include Range Resources (RRC), Chicago Bridge & Iron (CBI), Schlumberger (SLB), and Exxon Mobil (XOM). Fortunately, the Core Fund has been underweight the Energy sector for quite some time as we have been concerned about the growth in U.S. oil supplies, and this underweight position paid off for us in fiscal 2015.

Recent Fund transactions had a slightly contrarian feel. Two examples of new purchases, Mondelēz International (MDLZ) and The Priceline Group (PCLN), have been beaten up by near-term concerns about the impact of a stronger dollar on results. We think this has presented an attractive opportunity to purchase businesses with great cash flow generation and sustainable competitive moats that are well positioned for multiyear growth in earnings. MDLZ is the Kraft Foods international spinoff, selling food products in roughly 165 countries. In addition to currency headwinds, investors have been disappointed with margins that are well below industry averages. The company has an impressive slate of top tier food brands (such as Oreo, Cadbury and Trident), a stable business profile and an opportunity for “self help.” As management executes on a $3.5B restructuring program, we think the margin profile can increase from the low teens towards the targeted 15-16% range. Finally, we note the company is a rumored takeout candidate in a consolidating industry, which, alongside a meaningful stock buyback program, could provide downside support.

PCLN is an industry leading e-commerce company that provides access to online accommodation and travel reservation services through Priceline.com, Booking.com, KAYAK.com, rentalcars.com, and recently acquired OpenTable. The bulk of PCLN’s business is derived from international operations, primarily through Booking.com, as approximately 87% of gross bookings and approximately 94% of consolidated operating income was generated outside the U.S. during 2014. The stock has trailed the market for a year, despite executing well. As the key link between two fragmented end users (hotel operators and travelers), PCLN is able to achieve very impressive levels of profitability (gross margins were 90% of revenue in 2014) while maintaining share in a growing category.

We are pleased with the Core Fund’s performance in fiscal 2015. We constantly strive to reallocate funds towards situations we believe present the best risk/reward opportunity available, and we believe the actions discussed above are consistent with this approach. Going forward, we feel the Core Fund is well positioned given our focus on what we believe are high quality companies with defensible growth characteristics.

The following are transactions performed in the Core Fund for the quarter ended March 31, 2015 and we have provided our rationale for each transaction.

Recent Purchases

JPMorgan Chase & Company (JPM) We added to JPM after a flattening yield curve and a disappointing Q4 earnings release provided an attractive entry point.

Liberty Media Corporation (LMCK) LMCK recently spun off its cable assets, and the bulk of the value now comes from Sirius XM Radio, a highly cash generative business. We added to this position as we think the stock is trading at a discount to our sum of the parts valuation.

Mondelēz International, Inc. (MDLZ) We purchased a position in this Kraft Foods international spinoff given its stable business profile and prospects for margins to increase as management executes a restructuring program.

Priceline Group, Inc. (The) (PCLN) We purchased a position in PCLN due to robust cash generation and large international growth opportunity protected by sustainable barriers to entry.

Recent Sales

AmerisourceBergen Corporation (ABC) We chipped this position after numerous positive developments have transpired to move the stock significantly higher.

Automatic Data Processing, Inc. (ADP) We sold ADP after a long rally in the share price left the stock trading at a pricey ~30x earnings.

Celgene Corporation (CELG) We chipped CELG after an outsized rally provided an opportunity to reduce this position size slightly.

Valeant Pharmaceuticals International, Inc. (VRX) We chipped this position given recent strong performance as the stock has come back in favor with investors.**

Davenport Value & Income Fund

The following chart represents Davenport Value & Income Fund (the “Value & Income Fund”) performance and the performance of the S&P 500 Index, the Value & Income Fund’s primary benchmark, and the Lipper Equity Income Index for the periods ended March 31, 2015.

| | Q1 2015 | 1 Year | 3 Years** | Since Inception** 12/31/2010 | Fiscal Year 2015 Expense Ratio |

| Value & Income Fund | 1.76% | 11.92% | 16.24% | 15.69% | 0.92% |

| S&P 500 Index* | 0.95% | 12.73% | 16.11% | 14.84% | — |

| Lipper Equity Income Index* | -0.01% | 8.45% | 14.01% | 12.54% | — |

30-Day SEC Yield: 1.92%; Expense Ratio in current prospectus: 1.07%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

| * | The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. The Lipper Equity Income Index is an unmanaged index of the 30 largest funds in the Lipper Equity Income fund category. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

The Value & Income Fund returned 11.92% for the fiscal year ended March 31, 2015, nicely outpacing the Lipper Equity Income Index’s gain of 8.45% and just behind the S&P 500’s 12.73% gain for the period. Actively managed income funds lagged this year as the market began to price in an eventual hike in interest rates. We believe the Fund’s performance was driven largely by our focus on investing in what we consider to be high quality companies that can consistently grow their dividends at an above-average rate over time. Further differentiating our investment approach, we are willing to look in unconventional places in our search for value.

Speaking of unconventional places, the Value & Income Fund’s top performing stock for the year was the Deutsche X-trackers Harvest CSI 300 China A-Shares ETF (ASHR). Investor sentiment towards China had reached what we believed to be exceptionally bearish levels (just a few years after unbridled enthusiasm), and the domestic equity index was down 2/3rds from its high in 2007 at the time of our purchase. Trading under 10x forward earnings, the domestic Chinese market was, in our opinion, one of the cheapest in the world, despite having one of the fastest growing GDP rates. The Value & Income Fund was rewarded with a 90% gain during the year as the government has eased monetary policy and opened up markets for international investors.

Closer to home, leading HVAC distributor, Watsco (WSO), was a meaningful contributor for the year. Since we added to the position in October of 2014, the shares have produced gains north of 40%. WSO’s dividend has doubled since the end of 2013 (currently yields 2.2%), and we expect to see further increases alongside strong earnings growth. After struggling for much of the year, casino REIT Gaming and Leisure Properties (GLPI) has been another key contributor lately as the shares responded favorably to the announcement of the company’s hostile takeover bid for the real estate assets of Pinnacle Entertainment (PNK), a large regional gaming company. We added to the position during the quarter due to the company’s stable, above-average dividend (yielding 5.9%) and the belief that the aforementioned transaction should create significant value if consummated.

Commodity and material related stocks struggled during the year, as oil prices collapsed 50% due to oversupply from U.S. drilling and a lack of willingness from the Organization of the Petroleum Exporting Countries (OPEC) to cut production. Declining commodity prices and a strengthening U.S. dollar caused shares of Exxon Mobil (XOM), Eastman Chemical (EMN) and Potash (POT) to underperform. The strong dollar also impacted companies with significant international revenues, such as Johnson & Johnson (JNJ) and Phillip Morris International (PM). As described below, we elected to use this weakness as an opportunity to add to the Fund’s position in PM.

With virtually all of its revenue coming from outside the U.S., PM’s share price has struggled as currencies in its end market countries have fallen significantly versus the U.S. dollar. Despite these headwinds, the company continues to perform well at the operational level, with 2015 currency-neutral revenue growth expectations of 4-6% resulting in adjusted diluted Earnings Per Share (EPS) growth of 8-10%. Furthermore, we note the company pays a generous dividend that yields 5.3%, which should provide downside support. Dollar strength versus foreign currencies has tended to ebb and flow over time and, at some point, we think this headwind may again become a tailwind for PM. At a minimum, we feel stabilization in exchange rates should allow investors to focus more on the company’s strong brand portfolio, international growth runway and attractive dividend. Given these factors, we elected to use pronounced weakness to make the position more meaningful.

We initiated a position in global casino and resort developer Las Vegas Sands (LVS). Though it is better known to U.S. investors for properties in Las Vegas, NV, such as The Venetian and The Palazzo, the majority of the company’s earnings come from its four properties in Macau, China (60% of cash flow), in addition to a large property in Singapore (30% of cash flow). While the company’s domestic and Singapore operations have been performing well as of late, the Macau operations have been negatively impacted by Chinese anti-corruption regulation which, when combined with a recent smoking ban, has curbed visitation and gambling activity in the region. These developments have caused significant reductions to earnings estimates, resulting in a severe correction in the stock. Though the investment community lacks visibility into the near term outlook, we felt this was an attractive opportunity to gain access to a company with a top tier asset

portfolio, in a supply constrained market with clear long-term tailwinds such as China’s growing middle class. Furthermore, we note that management is committed to maximizing shareholders’ returns, as evidenced by recent announcements of a 30% dividend increase (yield of 4.7%) and a $2 billion stock repurchase program. With the stock down over 35% from recent highs, we felt the risk/reward was attractive.

We are pleased to have closed out the year on a strong note, especially in light of what was a difficult year for most “value” managers. Though we are likely to encounter volatility over the coming year, we feel our continued emphasis on strong franchises that can support and grow their dividends leaves us well positioned for the long term.

The following are transactions performed in the Value & Income Fund for the quarter ended March 31, 2015 and we have provided our rationale for each transaction.

Recent Purchases

Diageo plc - ADR (DEO) We added to this global spirits industry leader after the stock underperformed the last couple of years. Current yield: 3.0%

Gaming & Leisure Properties, Inc. (GLPI) We added to this position twice during the quarter as we still view the stock as a value situation and think that the potential Pinnacle deal could create a lot of value for shareholders. Current yield: 5.9%

iShares China Large-Cap ETF (FXI) We purchased a position in FXI as the H share market in Hong Kong now looks undervalued. Current yield: 2.4%

JPMorgan Chase & Company (JPM) We added to JPM after a flattening yield curve and a disappointing Q4 earnings release provided an attractive entry point. Current yield: 2.6%

Las Vegas Sands Corporation (LVS) We purchased a position after the stock was shellacked over the decline in the Macau gaming market. We think the stock is a good value here and don’t think gambling in China is dead. Current yield: 4.7%

McDonald’s Corporation (MCD) We added to this down and out stock as we remain attracted to the business model and the free cash flow it generates. Current yield: 3.5%

Merck & Company, Inc. (MRK) We added to this reasonably-priced pharmaceutical that appears to be well positioned to benefit from new drug launches. Current yield: 3.1%

Microsoft Corporation (MSFT) We purchased a position given weak recent performance as we are attracted to the company’s strong cash flow and economic moat. Current yield: 3.1%

Philip Morris International, Inc. (PM) We added to PM as currency headwinds have caused a selloff in the stock price. The 5.3% dividend yield should provide support for this high quality cash generator. Current yield: 5.3%

Sanofi-Aventis - ADR (SNY) We purchased this out of favor big pharmaceutical company, which gives us inexpensive ownership in highly profitable existing drugs and a promising pipeline. Current yield: 3.3%

Recent Sales

Automatic Data Processing, Inc. (ADP) We sold ADP after a sharp rally in the share price left the stock trading at a pricey ~30x earnings. Current yield: 2.2%

Aflac, Inc. (AFL) We sold AFL after the stock has struggled due to a weakening currency in their largest market (Japan) and extremely low interest rates that constrain profits. Current yield: 2.7%

Deutsche X-trackers Harvest CSI 300 China A-Share ETF (ASHR) We chipped ASHR as the A share market in China has generated significant profits in this holding. Current yield: 0.2%

Equity Lifestyle Properties, Inc. (ELS) We chipped this position after a strong rally brought share prices closer to intrinsic value. We also found it prudent to reduce the Fund’s REIT exposure in light of interest rate uncertainty. Current yield: 2.7%

Hartford Financial Services Group, Inc. (HIG) We chipped HIG after the stock moved much closer to its intrinsic value. Current yield: 1.7%

Kinder Morgan, Inc. (KMI) We chipped KMI given a fairly robust valuation, risks from the oil & gas environment, and share prices near highs. Current yield: 4.3%

Marathon Petroleum Corporation (MPC) We sold this position after a threefold increase as the risk/reward looks less attractive for this refiner. Current yield: 1.9%

Penn National Gaming, Inc. (PENN) We sold this small position and redeployed the proceeds into a higher yielding opportunity. Current yield: n/a

Sun Communities, Inc. (SUI) We chipped this position twice during the quarter after a strong rally brought share prices closer to intrinsic value. We also found it prudent to reduce the Fund’s REIT exposure in light of interest rate uncertainty. Current yield: 3.9%

Davenport Equity Opportunities Fund

The following chart represents Davenport Equity Opportunities Fund (the “Equity Opportunities Fund”) performance and the performance of the Russell Midcap Index, the Fund’s primary benchmark, and the S&P 500 Index for the periods ended March 31, 2015.

| | Q1 2015 | 1 Year | 3 Years** | Since Inception** 12/31/2010 | Fiscal Year 2015 Expense Ratio |

| Equity Opportunities Fund | 5.59% | 16.67% | 18.99% | 18.04% | 0.96% |

| Russell Midcap Index* | 3.95% | 13.68% | 18.10% | 15.31% | — |

| S&P 500 Index* | 0.95% | 12.73% | 16.11% | 14.84% | — |

30-Day SEC Yield: 0.25%; Expense Ratio in current prospectus: 0.98%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

| * | The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represent approximately 25% of the total market capitalization of the Russell 1000. The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

The Equity Opportunities Fund enjoyed a nice close to fiscal 2015. For the one year period ended March 31, 2015, the Fund advanced 16.67% as compared to gains of 13.68% and 12.73%, respectively, for the Russell Midcap and S&P 500 indices. We were pleased to see a handful of the Fund’s holdings perform admirably in what proved to be a choppy market environment at year end.

Gaming & Leisure Properties (GLPI) emerged as the Fund’s top performing stock for the fourth quarter. We had been adding to shares of this casino REIT at what we considered to be depressed prices and were pleased to see it get some love from investors. We continue to think GLPI’s savvy management team can build value via acquisitions and note our patience is being rewarded with a 5.9% dividend yield. As we write this letter, we are hopeful that GLPI will come to an agreement to acquire the real estate of Pinnacle Entertainment (PNK), which is one of the largest regional casino operators. This deal would diversify the company’s tenant base, enhance its scale and potentially grow the dividend meaningfully. Colfax (CFX) and Discovery Communications (DISCK) were among the worst performers for the Fund. We’ve been adding to both positions as issues like currency headwinds have caused the stocks to decline sharply. Such headwinds are masking solid franchises run by exceptionally talented capital allocators, in our opinion. At current prices, we still feel both stocks have among the best risk/reward profiles in the Fund.

We reduced stakes in a few strong performers as we rotated capital to more depressed situations like DISCK and CFX. Penn National Gaming (PENN) and Sun Communities (SUI) serve as good examples. PENN has rallied roughly 40% over the last six months and has moved from being deeply out of favor to being a popular play on a regional gaming recovery. SUI, which operates manufactured housing communities, has steadily appreciated as the company consummated a large acquisition and the stock has hit the radars of income-thirsty investors. Both of these stocks should be okay long-term, but appear to offer more balanced risk/reward profiles and are unlikely to sustain the returns of recent quarters.

We’ve added a couple new positions to the Equity Opportunities Fund’s portfolio. The first is Live Nation (LYV), which is the world’s leading concert company. To put the company’s dominance into perspective, last year LYV controlled 22 of the top 25 global tours. There are four tailwinds to consider from a big picture perspective: 1) concert attendance is growing, 2) similar to live sporting events, the value of live concerts to advertisers is increasing as traditional media is being disrupted, 3) artists/musicians are more inclined to tour as traditional forms of promotion are impaired (e.g., radio), and 4) global popularity is adding a new international component to concerts/tours. The concerts themselves are low margin productions, but the company has built a machine where concerts feed other high margin businesses including venue management, artist management, advertising/sponsorship and Ticketmaster, which controls 60% of the ticketing market. The company is in the early stages of monetizing live content across these platforms and appears poised to drive meaningful free cash flow growth. We are also encouraged by the involvement of Liberty Media (LMCK), which is best known for Chairman John Malone’s long history of savvy deal-making and value creation. LMCK owns 27% of LYV and its CEO (and Malone protégé) Greg Maffei sits on the company’s Board. We think he will most certainly be a positive influence.

Continuing the LMCK/John Malone theme, another new investment is Liberty Broadband (LBRDK). This company was recently separated from LMCK and is comprised primarily of a 26% stake in cable company Charter Communications (CHTR). CHTR is a story of both operational improvement and growth by acquisition. CHTR CEO Tom Rutledge, a highly

regarded cable operator who joined in 2012, is improving system quality, customer service and customer penetration. On the acquisition front, CHTR has emerged as a likely acquirer of Time Warner Cable (TWC) after the mega-merger between TWC and Comcast (CMCSK) failed to clear regulatory hurdles. More recently, the company announced a deal to purchase Bright House, which is the country’s sixth biggest cable company with 2.5 million subscribers. All told, increasing scale will bring synergies (e.g., more negotiating clout with content providers) and allow Mr. Rutledge to work his operational magic across a bigger platform. We think LBRDK represents a unique way to play the CHTR growth story because it trades at a slight discount to the value of its investments and could have extra upside associated with Chairman John Malone’s deal making skills.

While we can’t guarantee markets won’t take a breather at some point soon, we do feel very good about the potential for new and existing holdings to create material value for investors in coming years. We like investing alongside talented value creators like Mr. Malone that have significant “skin in the game” and a history of exceptional results. Such leaders tend to have a penchant not only for compounding wealth, but also for managing risk through difficult economic and market cycles. Hopefully, we can do the same by aligning ourselves with them.

The following are transactions performed in the Equity Opportunities Fund for the quarter ended March 31, 2015 and we have provided our rationale for each transaction.

Recent Purchases

Capital One Financial Corporation (COF) We added to the Fund’s position in this high-quality credit card company with an inexpensive valuation.

Colfax Corporation (CFX) We added to this stock, well off its high due to weakness in oil & gas as well as European business, as we continue to like the long-term outlook.

Discovery Communications, Inc. (DISCK) We added to DISCK as we think concerns (euro weakness, recent subscriber trends) are overblown and upside is very meaningful.

Fairfax Financial Holdings Ltd. (FRFHF) We added to FRFHF as we continue to like the company’s defensive positioning and the stock has had a weak year to date.**

Gaming and Leisure Properties, Inc. (GLPI) We added to this position as the stock is still trading very cheaply and our confidence in management remains high.

Liberty Broadband Corporation (LBRDK) We purchased and subsequently added to this position as we find it an intriguing story of self help, growing scale and improving negotiating leverage with content providers, with M&A upside.

Live Nation Entertainment, Inc. (LYV) We purchased and subsequently added to this dominant concert promoter as we are attracted to the defensible long-term story of rising cash flows.

NRG Energy, Inc. (NRG) We added to NRG as lower natural gas has caused weakness in the share price that we believe is unjustified given numerous upside opportunities, including capacity payment reform and renewable power initiatives.

PRA Group, Inc. (PRAA) We added to PRAA on weakness related to an increased regulatory burden and limited credit supply. We view the company’s expansion into Europe favorably and think this management team will continue to create value for shareholders both here and abroad.

WABCO Holdings, Inc. (WBC) We added to WBC as currency (euro) concerns caused a pullback in this truck parts maker with a strong secular growth outlook.

Recent Sales

American Airlines Group, Inc. (AAL) We chipped this “high flying” airline stock, locking in some profits after a great year.

CarMax, Inc. (KMX) We chipped KMX after recent strength prompted us to reduce the position size.

Krispy Kreme Doughnuts, Inc. (KKD) We sold this doughnut maker as shares have moved higher and we found better opportunities elsewhere.

Morgan Stanley China A Share Fund, Inc. (CAF) We chipped this position after strong performance allowed us to lock in some profits.

Penn National Gaming, Inc. (PENN) We chipped this position three times during the quarter after a ~50% rally off the bottom six months ago, as the outlook for regional casinos has improved.

Sun Communities, Inc. (SUI) We chipped this position twice during the quarter after a strong rally has brought share prices closer to intrinsic value.

Davenport Small Cap Focus Fund

The following chart represents Davenport Small Cap Focus Fund (the “Small Cap Focus Fund”) performance and the performance of the Russell 2000 Index (the “Russell”), the Small Cap Focus Fund’s primary benchmark, for the periods ended March 31, 2015.

| | Q1 2015 | | Fiscal Year 2015 Gross Expense Ratio | Fiscal Year 2015 Net Expense Ratio |

| Small Cap Focus Fund | 4.10% | 4.10% | 1.42% | 1.25%1 |

| Russell 2000 Index* | 4.32% | 4.32% | — | — |

30-Day SEC Yield: -0.46%; Gross Expense Ratio in current prospectus: 2.15%; Net Expense Ratio in current prospectus: 1.26%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

| * | The Russell 2000 Index measures the performance of the 2000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

| 1 | Davenport & Company LLC has contractually agreed, until August 1, 2016, to reduce management fees and to reimburse other expenses to the extent necessary to limit total annual Fund operating expenses (excluding acquired fund fees and expenses) to an amount not exceeding 1.25% of the Fund’s average daily net assets. Total annual Fund operating expenses exclude brokerage costs, taxes, interest, costs to organize the Fund and extraordinary expenses. For additional details please request a prospectus. |

The Small Cap Focus Fund generated solid results during its inaugural quarter. Small cap equities, as measured by the Russell 2000, were up 4.32% for the quarter ending March 31, 2015, outperforming the large cap biased S&P 500’s 0.95% gain. This outperformance makes sense to us given the Russell 2000’s domestic bias and considering the fact that small caps underperformed in 2014; however, this environment made it challenging to keep up during the period. As such, we were pleased with the Small Cap Focus Fund’s 4.10% gain. As expected, the Small Cap Focus Fund’s cash position was a bit of a drag amid the market’s strong advances; however, we were pleased to see solid performance from individual names offset much of this impact while allowing us to deploy funds in a prudent manner. The Small Cap Focus Fund has a flexible approach in that it is not constrained by a particular investment style; however, we believe the Fund has a bit of a “value tilt” at the moment. Here again, we are glad to have kept pace given the outperformance of growth stocks during the period. Ultimately, we think a number of the Fund’s holdings look cheap and could be primed for future outperformance.

From a sector vantage point, the Small Cap Focus Fund is materially overweight Consumer Discretionary and Industrials stocks. Stocks in the consumer space have led the Fund’s performance as shares of retailers and regional casino companies such as Isle of Capri (ISLE), Monarch Casino & Resort (MCRI) and Penn National (PENN) have benefitted from cheaper gasoline prices and improving results. In terms of the regional casino stocks mentioned above, we have a long history with each company and felt it was an appropriate time to include them in the Small Cap Focus Fund. After struggling for much of 2014, each company finds itself in a “sweet spot” with improving same-store sales growth, cheaper gasoline prices and interesting development opportunities (not to mention no foreign currency exposure).

The Small Cap Focus Fund has been hurt somewhat by a few positions in the Energy and Materials spaces. We expect to typically be underweight in these sectors, but a few stocks that were already down sharply looked interesting as we started the year. While we have limited exposure to the energy industry and zero exposure to oil producers, the Fund does own what we consider to be a well run Canadian natural gas producer, Peyto Energy (PEYUF). The stock was sharply off its highs when purchased, but has remained weak. Even modest improvement in natural gas prices could help this depressed play with a long asset life and solid track record of value creation. The Small Cap Focus Fund also owns a meaningful position in industrial Colfax (CFX), which counts oil & gas as an important market and has also been impacted by currency headwinds. The stock was already down sharply when purchased, but has continued to drift lower and should be near a bottom in our opinion.

We added a couple new names that could be considered “deep value” situations – Stewart Information Services (STC) and FRP Holdings (FRPH). Stewart is a title insurance company with minimal analyst coverage. The company’s operating margins are far below industry standards and efforts to improve profitability could yield earnings power of $5.00+ per share (on a $40 stock). The increasing involvement of some activist shareholders seems to make this earnings target more likely. FRPH recently spun off a transportation business and is now comprised of two real estate businesses: mining royalties and property development. The mining business owns land with aggregate deposits and collects royalties under long-term mining agreements. The development business consists of both income generating real estate and undeveloped land including riverfront property in Washington D.C. We think the shares could trade into the mid-$40’s based on a conservative sum-of-the-parts analysis and would note this very small company gets virtually no Wall Street attention.

In our opinion, the most exciting aspect of small cap investing is the potential to find uncommon value in companies that are off the beaten path. We feel like we are currently finding such names and “stocking the pond” with companies that seem to have very good risk/reward profiles. You won’t hear about these companies at cocktail parties or on Fast Money, but they could deliver us solid returns over the next couple years.

We are pleased that The Davenport Funds are off to a good start thus far in 2015. We thank you for your trust and look forward to reporting back as we proceed through the year.

Sincerely,

John P. Ackerly, IV

President, The Davenport Funds

DAVENPORT CORE FUND

PERFORMANCE INFORMATION (Unaudited)

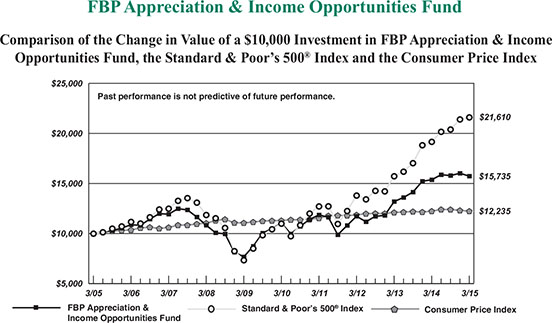

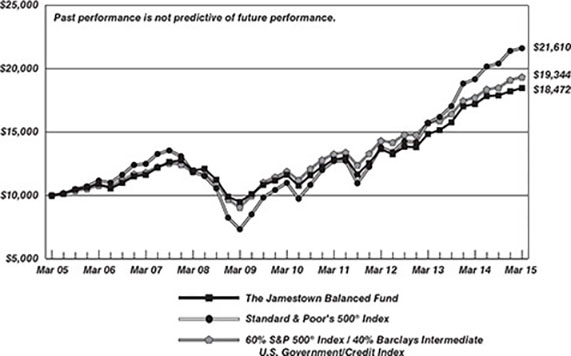

Comparison of the Change in Value of a $10,000 Investment in

Davenport Core Fund and the Standard & Poor's 500® Index

| | Average Annual Total Returns(a) (for years ended March 31, 2015) |

| | 1 Year | 5 Years | 10 Years |

| Davenport Core Fund | 12.42% | 14.10% | 8.25% |

Standard & Poor’s 500® Index | 12.73% | 14.47% | 8.01% |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

DAVENPORT VALUE & INCOME FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Davenport Value & Income Fund, the Standard & Poor's 500® Index

and the Lipper Equity Income Index

| | Average Annual Total Returns(a) (for periods ended March 31, 2015) |

| | 1 Year | Since Inception(b) |

| Davenport Value & Income Fund | 11.92% | 15.69% |

Standard & Poor’s 500® Index | 12.73% | 14.84% |

| Lipper Equity Income Index | 8.46% | 12.71% |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Commencement of operations was December 31, 2010. |

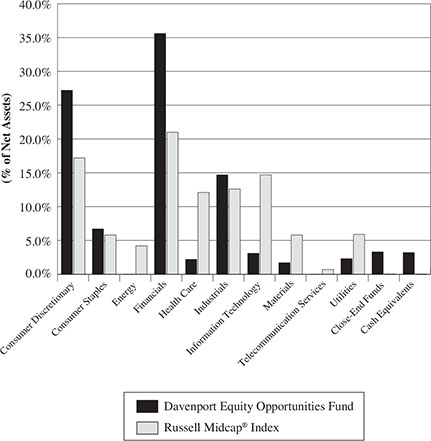

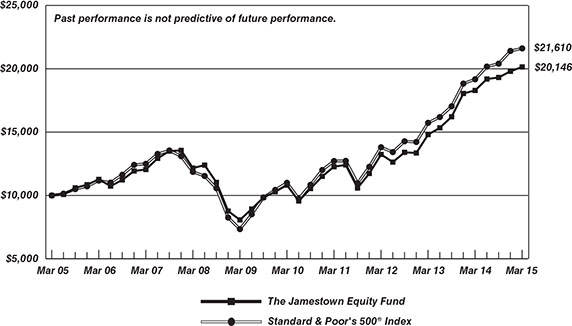

DAVENPORT EQUITY OPPORTUNITIES FUND

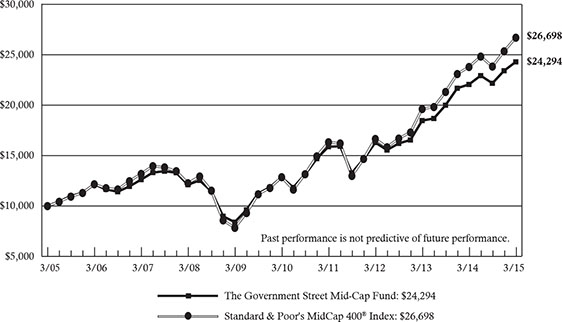

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Davenport Equity Opportunities Fund and the Russell Midcap® Index

| | Average Annual Total Returns(a) (for periods ended March 31, 2015) |

| | 1 Year | Since Inception(b) |

| Davenport Equity Opportunities Fund | 16.67% | 18.04% |

Russell Midcap® Index | 13.68% | 15.31% |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Commencement of operations was December 31, 2010. |

DAVENPORT SMALL CAP FOCUS FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Davenport Small Cap Focus Fund and the Russel 2000® Index

| | Total Returns(a) (for period ended March 31, 2015) |

| | Since Inception(b) |

| Davenport Small Cap Focus Fund | 4.10% |

Russell 2000® Index | 4.32% |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Commencement of operations was December 31, 2014. |

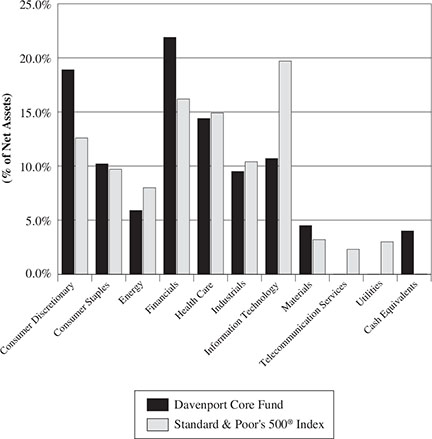

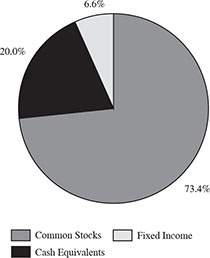

DAVENPORT CORE FUND

PORTFOLIO INFORMATION

March 31, 2015 (Unaudited)

Sector Allocation vs. the Standard & Poor's 500® Index

Top Ten Equity Holdings

| Security Description | % of Net Assets |

| CarMax, Inc. | 3.5% |

| Brookfield Asset Management, Inc. - Class A | 3.5% |

| Markel Corporation | 3.1% |

| Capital One Financial Corporation | 2.6% |

| Berkshire Hathaway, Inc. - Class B | 2.6% |

| American Tower Corporation - Class A | 2.6% |

| Danaher Corporation | 2.5% |

| Nestlé SA - ADR | 2.4% |

| Accenture plc - Class A | 2.3% |

| Celgene Corporation | 2.3% |

DAVENPORT VALUE & INCOME FUND

PORTFOLIO INFORMATION

March 31, 2015 (Unaudited)

Sector Allocation vs. the Standard & Poor's 500® Index

Top Ten Holdings

| Security Description | % of Net Assets |

| W.P. Carey, Inc. | 3.0% |

| Markel Corporation | 3.0% |

| SPDR EURO STOXX 50 ETF | 2.9% |

| Wells Fargo & Company | 2.7% |

| JPMorgan Chase & Company | 2.6% |

| Watsco, Inc. | 2.6% |

| Gaming and Leisure Properties, Inc. | 2.6% |

| Johnson & Johnson | 2.4% |

| Teva Pharmaceutical Industries Ltd. - ADR | 2.3% |

| Capital One Financial Corporation | 2.2% |

DAVENPORT EQUITY OPPORTUNITIES FUND

PORTFOLIO INFORMATION

March 31, 2015 (Unaudited)

Sector Allocation vs. the Russell Midcap® Index

Top Ten Holdings

| Security Description | % of Net Assets |

| Markel Corporation | 5.9% |

| Gaming and Leisure Properties, Inc. | 5.8% |

| Brookfield Asset Management, Inc. - Class A | 5.3% |

| CarMax, Inc. | 4.9% |

| Capital One Financial Corporation | 4.2% |

| American Tower Corporation - Class A | 4.1% |

| Colfax Corporation | 3.8% |

| Penn National Gaming, Inc. | 3.7% |

| WABCO Holdings, Inc. | 3.5% |

| J.M. Smucker Company (The) | 3.4% |

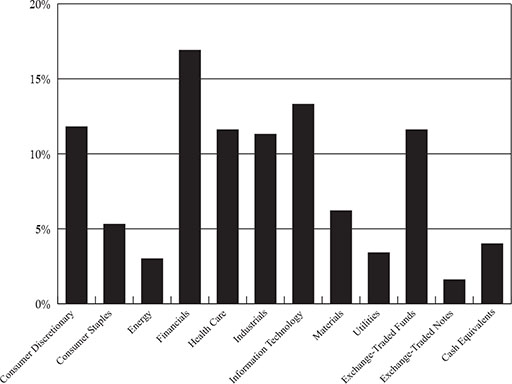

DAVENPORT SMALL CAP FOCUS FUND

PORTFOLIO INFORMATION

March 31, 2015 (Unaudited)

Sector Allocation vs. the Russell 2000® Index

Top Ten Holdings

| Security Description | % of Net Assets |

| Liberty Broadband Corporation - Class C | 3.1% |

| Gaming and Leisure Properties, Inc. | 2.9% |

| Colfax Corporation | 2.8% |

| Monarch Casino & Resort, Inc. | 2.7% |

| Live Nation Entertainment, Inc. | 2.7% |

| Encore Capital Group, Inc. | 2.6% |

| Sunoco LP | 2.6% |

| Universal Corporation | 2.4% |

| Fortuna Silver Mines, Inc. | 2.4% |

| Marten Transport Ltd. | 2.3% |

DAVENPORT CORE FUND

SCHEDULE OF INVESTMENTS

March 31, 2015

| COMMON STOCKS — 96.0% | | Shares | | | Value | |

| Consumer Discretionary — 18.9% | | | | | | |

Amazon.com, Inc. (a) | | | 17,008 | | | $ | 6,328,677 | |

CarMax, Inc. (a) | | | 170,027 | | | | 11,733,563 | |

DIRECTV (a) | | | 62,925 | | | | 5,354,918 | |

Dish Network Corporation - Class A (a) | | | 67,210 | | | | 4,708,733 | |

| General Motors Company | | | 142,500 | | | | 5,343,750 | |

Liberty Broadband Corporation - Class A (a) | | | 10,584 | | | | 597,784 | |

Liberty Broadband Corporation - Class C (a) | | | 27,519 | | | | 1,557,575 | |

Liberty Media Corporation - Series A (a) | | | 42,337 | | | | 1,632,091 | |

Liberty Media Corporation - Series C (a) | | | 127,064 | | | | 4,853,845 | |

Priceline Group, Inc. (The) (a) | | | 3,938 | | | | 4,584,423 | |

| PVH Corporation | | | 51,272 | | | | 5,463,544 | |

| Starbucks Corporation | | | 53,035 | | | | 5,022,415 | |

| Walt Disney Company (The) | | | 50,256 | | | | 5,271,352 | |

| | | | | | | | 62,452,670 | |

| Consumer Staples — 10.2% | | | | | | | | |

| Anheuser-Busch InBev SA/NV - ADR | | | 38,960 | | | | 4,749,613 | |

| Hershey Company (The) | | | 48,065 | | | | 4,850,239 | |

| J.M. Smucker Company (The) | | | 55,612 | | | | 6,435,977 | |

Mondelēz International, Inc. - Class A | | | 131,520 | | | | 4,746,557 | |

| Nestlé SA - ADR | | | 106,802 | | | | 8,033,705 | |

| PepsiCo, Inc. | | | 53,461 | | | | 5,111,941 | |

| | | | | | | | 33,928,032 | |

| Energy — 5.9% | | | | | | | | |

| Chevron Corporation | | | 41,122 | | | | 4,316,987 | |

| Exxon Mobil Corporation | | | 62,127 | | | | 5,280,795 | |

| Range Resources Corporation | | | 94,117 | | | | 4,897,849 | |

| Schlumberger Ltd. | | | 60,245 | | | | 5,026,843 | |

| | | | | | | | 19,522,474 | |

| Financials — 21.9% | | | | | | | | |

| American Tower Corporation - Class A | | | 90,837 | | | | 8,552,304 | |

Berkshire Hathaway, Inc. - Class B (a) | | | 59,361 | | | | 8,566,979 | |

| Brookfield Asset Management, Inc. - Class A | | | 214,728 | | | | 11,511,568 | |

| Capital One Financial Corporation | | | 108,707 | | | | 8,568,286 | |

| Citigroup, Inc. | | | 89,812 | | | | 4,627,114 | |

| CME Group, Inc. | | | 79,336 | | | | 7,513,913 | |

| JPMorgan Chase & Company | | | 111,863 | | | | 6,776,660 | |

Markel Corporation (a) | | | 13,338 | | | | 10,256,388 | |

| Wells Fargo & Company | | | 109,149 | | | | 5,937,706 | |

| | | | | | | | 72,310,918 | |

| Health Care — 14.4% | | | | | | | | |

| AmerisourceBergen Corporation | | | 64,280 | | | | 7,306,707 | |

| Amgen, Inc. | | | 28,836 | | | | 4,609,435 | |

| Anthem, Inc. | | | 39,256 | | | | 6,061,519 | |

DAVENPORT CORE FUND

SCHEDULE OF INVESTMENTS (Continued)

| COMMON STOCKS — 96.0% (Continued) | | Shares | | | Value | |

| Health Care — 14.4% (Continued) | | | | | | |

| Baxter International, Inc. | | | 73,108 | | | $ | 5,007,898 | |

Celgene Corporation (a) | | | 65,393 | | | | 7,538,505 | |

Express Scripts Holding Company (a) | | | 81,126 | | | | 7,039,303 | |

| Johnson & Johnson | | | 54,138 | | | | 5,446,283 | |

Valeant Pharmaceuticals International, Inc. (a) | | | 22,837 | | | | 4,535,885 | |

| | | | | | | | 47,545,535 | |

| Industrials — 9.5% | | | | | | | | |

| American Airlines Group, Inc. | | | 100,470 | | | | 5,302,806 | |

| Cummins, Inc. | | | 28,709 | | | | 3,980,216 | |

| Danaher Corporation | | | 96,722 | | | | 8,211,698 | |

| General Electric Company | | | 152,520 | | | | 3,784,021 | |

| Parker Hannifin Corporation | | | 39,450 | | | | 4,685,871 | |

| United Technologies Corporation | | | 47,439 | | | | 5,559,851 | |

| | | | | | | | 31,524,463 | |

| Information Technology — 10.7% | | | | | | | | |

| Accenture plc - Class A | | | 80,761 | | | | 7,566,498 | |

| Apple, Inc. | | | 52,695 | | | | 6,556,839 | |

| Cisco Systems, Inc. | | | 173,988 | | | | 4,789,020 | |

Google, Inc. - Class A (a) | | | 6,820 | | | | 3,783,054 | |

Google, Inc. - Class C (a) | | | 6,370 | | | | 3,490,760 | |

| QUALCOMM, Inc. | | | 54,875 | | | | 3,805,032 | |

| Visa, Inc. - Class A | | | 82,536 | | | | 5,398,680 | |

| | | | | | | | 35,389,883 | |

| Materials — 4.5% | | | | | | | | |

| Alcoa, Inc. | | | 352,748 | | | | 4,557,504 | |

| Monsanto Company | | | 47,990 | | | | 5,400,795 | |

| Praxair, Inc. | | | 39,673 | | | | 4,790,118 | |

| | | | | | | | 14,748,417 | |

| | | | | | | | | |

Total Common Stocks (Cost $217,291,325) | | | | | | $ | 317,422,392 | |

DAVENPORT CORE FUND

SCHEDULE OF INVESTMENTS (Continued)

| MONEY MARKET FUNDS — 2.0% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 0.00% (b) (Cost $6,485,704) | | | 6,485,704 | | | $ | 6,485,704 | |

| | | | | | | | | |

Total Investments at Value — 98.0% (Cost $223,777,029) | | | | | | $ | 323,908,096 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 2.0% | | | | | | | 6,778,558 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 330,686,654 | |

ADR - American Depositary Receipt.

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of March 31, 2015. |

See accompanying notes to financial statements.

DAVENPORT VALUE & INCOME FUND

SCHEDULE OF INVESTMENTS

March 31, 2015

| COMMON STOCKS — 90.8% | | Shares | | | Value | |

| Consumer Discretionary — 7.2% | | | | | | |

| H&R Block, Inc. | | | 254,420 | | | $ | 8,159,250 | |

| Las Vegas Sands Corporation | | | 111,335 | | | | 6,127,878 | |

| McDonald's Corporation | | | 84,690 | | | | 8,252,194 | |

| Six Flags Entertainment Corporation | | | 139,825 | | | | 6,768,928 | |

| | | | | | | | 29,308,250 | |

| Consumer Staples — 13.4% | | | | | | | | |

| Altria Group, Inc. | | | 123,181 | | | | 6,161,514 | |

| Anheuser-Busch InBev SA/NV - ADR | | | 57,120 | | | | 6,963,499 | |

| Archer-Daniels-Midland Company | | | 144,555 | | | | 6,851,907 | |

| Coca-Cola Company (The) | | | 147,885 | | | | 5,996,737 | |

| Diageo plc - ADR | | | 67,720 | | | | 7,487,800 | |

| PepsiCo, Inc. | | | 77,795 | | | | 7,438,758 | |

| Philip Morris International, Inc. | | | 92,800 | | | | 6,990,624 | |

| Wal-Mart Stores, Inc. | | | 84,282 | | | | 6,932,194 | |

| | | | | | | | 54,823,033 | |

| Energy — 5.2% | | | | | | | | |

| Chevron Corporation | | | 55,106 | | | | 5,785,028 | |

| Exxon Mobil Corporation | | | 69,650 | | | | 5,920,250 | |

| Kinder Morgan, Inc. | | | 140,875 | | | | 5,925,202 | |

| Occidental Petroleum Corporation | | | 51,165 | | | | 3,735,045 | |

| | | | | | | | 21,365,525 | |

| Financials — 29.0% | | | | | | | | |

| Capital One Financial Corporation | | | 112,490 | | | | 8,866,462 | |

| Citigroup, Inc. | | | 152,265 | | | | 7,844,693 | |

| Equity Lifestyle Properties, Inc. | | | 150,295 | | | | 8,258,710 | |

| FNF Group | | | 227,785 | | | | 8,373,376 | |

| Gaming and Leisure Properties, Inc. | | | 284,939 | | | | 10,505,701 | |

| Hartford Financial Services Group, Inc. (The) | | | 143,505 | | | | 6,001,379 | |

| JPMorgan Chase & Company | | | 175,670 | | | | 10,642,089 | |

| Lamar Advertising Company - Class A | | | 109,075 | | | | 6,464,875 | |

Markel Corporation (a) | | | 15,731 | | | | 12,096,510 | |

| Sun Communities, Inc. | | | 121,580 | | | | 8,111,818 | |

| W.P. Carey, Inc. | | | 178,974 | | | | 12,170,232 | |

| Waddell & Reed Financial, Inc. - Class A | | | 158,750 | | | | 7,864,475 | |

| Wells Fargo & Company | | | 202,090 | | | | 10,993,696 | |

| | | | | | | | 118,194,016 | |

| Health Care — 10.5% | | | | | | | | |

| Anthem, Inc. | | | 51,165 | | | | 7,900,388 | |

| Johnson & Johnson | | | 98,150 | | | | 9,873,890 | |

| Merck & Company, Inc. | | | 137,020 | | | | 7,875,910 | |

| Sanofi-Aventis - ADR | | | 160,060 | | | | 7,913,366 | |

| Teva Pharmaceutical Industries Ltd. - ADR | | | 148,060 | | | | 9,224,138 | |

| | | | | | | | 42,787,692 | |

DAVENPORT VALUE & INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

| COMMON STOCKS — 90.8%(Continued) | | Shares | | | Value | |

| Industrials — 11.5% | | | | | | |

| 3M Company | | | 48,975 | | | $ | 8,078,426 | |

| Eaton Corporation plc | | | 101,277 | | | | 6,880,759 | |

| General Electric Company | | | 346,760 | | | | 8,603,116 | |

| Illinois Tool Works, Inc. | | | 65,355 | | | | 6,348,585 | |

| Raytheon Company | | | 56,681 | | | | 6,192,399 | |

| Watsco, Inc. | | | 84,420 | | | | 10,611,594 | |

| | | | | | | | 46,714,879 | |

| Information Technology — 4.2% | | | | | | | | |

| Cisco Systems, Inc. | | | 224,370 | | | | 6,175,784 | |

| Hewlett-Packard Company | | | 166,105 | | | | 5,175,832 | |

| Microsoft Corporation | | | 139,458 | | | | 5,669,665 | |

| | | | | | | | 17,021,281 | |

| Materials — 5.6% | | | | | | | | |

| E.I. du Pont de Nemours and Company | | | 88,750 | | | | 6,342,962 | |

| Eastman Chemical Company | | | 84,195 | | | | 5,831,346 | |

| Nucor Corporation | | | 107,845 | | | | 5,125,873 | |

| Potash Corporation of Saskatchewan, Inc. | | | 168,560 | | | | 5,436,060 | |

| | | | | | | | 22,736,241 | |

| Telecommunication Services — 2.9% | | | | | | | | |

| TELUS Corporation | | | 144,905 | | | | 4,816,642 | |

| Verizon Communications, Inc. | | | 147,270 | | | | 7,161,740 | |

| | | | | | | | 11,978,382 | |

| Utilities — 1.3% | | | | | | | | |

| Dominion Resources, Inc. | | | 73,855 | | | | 5,234,104 | |

| | | | | | | | | |

Total Common Stocks (Cost $308,706,948) | | | | | | $ | 370,163,403 | |

| EXCHANGE-TRADED FUNDS — 6.2% | | Shares | | | Value | |

| Deutsche X-trackers Harvest CSI 300 China A-Shares ETF | | | 175,370 | | | $ | 7,302,407 | |

| iShares China Large-Cap ETF | | | 142,980 | | | | 6,355,461 | |

| SPDR EURO STOXX 50 ETF | | | 305,810 | | | | 11,871,544 | |

Total Exchange-Traded Funds (Cost $20,914,871) | | | | | | $ | 25,529,412 | |

DAVENPORT VALUE & INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

| MONEY MARKET FUNDS — 2.6% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 0.00% (b) (Cost $10,581,923) | | | 10,581,923 | | | $ | 10,581,923 | |

| | | | | | | | | |

Total Investments at Value — 99.6% (Cost $340,203,742) | | | | | | $ | 406,274,738 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.4% | | | | | | | 1,502,058 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 407,776,796 | |

ADR - American Depositary Receipt.

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of March 31, 2015. |

See accompanying notes to financial statements.

DAVENPORT EQUITY OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

March 31, 2015

COMMON STOCKS — 93.5% | | Shares | | | Value | |

| Consumer Discretionary — 27.2% | | | | | | |

Amazon.com, Inc. (a) | | | 21,640 | | | $ | 8,052,244 | |

Cabela's, Inc. (a) | | | 153,755 | | | | 8,607,205 | |

CarMax, Inc. (a) | | | 195,873 | | | | 13,517,196 | |

Discovery Communications, Inc. (a) | | | 316,970 | | | | 9,342,691 | |

Discovery Communications, Inc. - Class A (a) | | | 102,115 | | | | 3,141,057 | |

| Hanesbrands, Inc. | | | 250,390 | | | | 8,390,569 | |

Liberty Broadband Corporation - Class C (a) | | | 132,390 | | | | 7,493,274 | |

Live Nation Entertainment, Inc. (a) | | | 271,750 | | | | 6,856,252 | |

Penn National Gaming, Inc. (a) | | | 650,833 | | | | 10,192,045 | |

| | | | | | | | 75,592,533 | |

| Consumer Staples — 6.7% | | | | | | | | |

| Church & Dwight Company, Inc. | | | 106,820 | | | | 9,124,565 | |

| J.M. Smucker Company (The) | | | 81,580 | | | | 9,441,253 | |

| | | | | | | | 18,565,818 | |

| Financials — 35.6% | | | | | | | | |

| American Tower Corporation - Class A | | | 119,770 | | | | 11,276,346 | |

| Brookfield Asset Management, Inc. - Class A | | | 277,120 | | | | 14,856,403 | |

| Capital One Financial Corporation | | | 147,224 | | | | 11,604,196 | |

| Fairfax Financial Holdings Ltd. | | | 16,513 | | | | 9,224,327 | |

| FNF Group | | | 141,690 | | | | 5,208,524 | |

| Gaming and Leisure Properties, Inc. | | | 436,699 | | | | 16,101,092 | |

Markel Corporation (a) | | | 21,365 | | | | 16,428,830 | |

PRA Group, Inc. (a) | | | 136,540 | | | | 7,416,853 | |

| Sun Communities, Inc. | | | 102,115 | | | | 6,813,113 | |

| | | | | | | | 98,929,684 | |

| Health Care — 2.2% | | | | | | | | |

Henry Schein, Inc. (a) | | | 42,450 | | | | 5,926,869 | |

| | | | | | | | | |

| Industrials — 14.7% | | | | | | | | |

| American Airlines Group, Inc. | | | 145,895 | | | | 7,700,338 | |

Colfax Corporation (a) | | | 218,840 | | | | 10,445,233 | |

| Pall Corporation | | | 75,660 | | | | 7,595,507 | |

WABCO Holdings, Inc. (a) | | | 78,260 | | | | 9,616,589 | |

| Watsco, Inc. | | | 42,560 | | | | 5,349,792 | |

| | | | | | | | 40,707,459 | |

| Information Technology — 3.1% | | | | | | | | |

| Intuit, Inc. | | | 88,500 | | | | 8,580,960 | |

| | | | | | | | | |

| Materials — 1.7% | | | | | | | | |

| Alcoa, Inc. | | | 368,220 | | | | 4,757,402 | |

DAVENPORT EQUITY OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS (Continued)

| COMMON STOCKS — 93.5% (Continued) | | Shares | | | Value | |

| Utilities — 2.3% | | | | | | |

| NRG Energy, Inc. | | | 257,140 | | | $ | 6,477,357 | |

| | | | | | | | | |

Total Common Stocks (Cost $215,543,832) | | | | | | $ | 259,538,082 | |

| CLOSED-END FUNDS — 3.3% | | Shares | | | Value | |

| Morgan Stanley China A Share Fund, Inc. (Cost $6,756,651) | | | 280,665 | | | $ | 9,239,492 | |

| MONEY MARKET FUNDS — 2.8% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 0.00% (b) (Cost $7,731,436) | | | 7,731,436 | | | $ | 7,731,436 | |

| | | | | | | | | |

Total Investments at Value — 99.6% (Cost $230,031,919) | | | | | | $ | 276,509,010 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.4% | | | | | | | 1,194,472 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 277,703,482 | |

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of March 31, 2015. |

See accompanying notes to financial statements.

DAVENPORT SMALL CAP FOCUS FUND

SCHEDULE OF INVESTMENTS

March 31, 2015

| COMMON STOCKS — 78.1% | | Shares | | | Value | |

| Consumer Discretionary — 23.1% | | | | | | |

Cabela's, Inc. (a) | | | 10,213 | | | $ | 571,724 | |

| Core-Mark Holding Company, Inc. | | | 10,918 | | | | 702,246 | |

Five Below, Inc. (a) | | | 15,064 | | | | 535,826 | |

Isle of Capri Casinos, Inc. (a) | | | 35,693 | | | | 501,487 | |

Liberty Broadband Corporation - Class C (a) | | | 16,889 | | | | 955,917 | |

Live Nation Entertainment, Inc. (a) | | | 33,405 | | | | 842,808 | |

Media General, Inc. (a) | | | 28,139 | | | | 464,012 | |

Monarch Casino & Resort, Inc. (a) | | | 44,405 | | | | 849,912 | |

Penn National Gaming, Inc. (a) | | | 22,256 | | | | 348,529 | |

Pinnacle Entertainment, Inc. (a) | | | 19,000 | | | | 685,710 | |

| Pool Corporation | | | 7,142 | | | | 498,226 | |

Unifi, Inc. (a) | | | 7,564 | | | | 272,985 | |

| | | | | | | | 7,229,382 | |

| Consumer Staples — 3.6% | | | | | | | | |

| Snyder's-Lance, Inc. | | | 11,221 | | | | 358,623 | |

| Universal Corporation | | | 16,197 | | | | 763,851 | |

| | | | | | | | 1,122,474 | |

| Energy — 5.4% | | | | | | | | |

Fission Uranium Corporation (a) | | | 320,000 | | | | 332,800 | |

Peyto Exploration & Development Corporation (a) | | | 20,334 | | | | 543,182 | |

Sunoco LP (a) | | | 15,778 | | | | 810,200 | |

| | | | | | | | 1,686,182 | |

| Financials — 15.7% | | | | | | | | |

| Diamond Hill Investment Group, Inc. | | | 3,366 | | | | 538,560 | |

Encore Capital Group, Inc. (a) | | | 19,492 | | | | 810,672 | |

FNFV Group (a) | | | 36,000 | | | | 507,600 | |

FRP Holdings, Inc. (a) | | | 11,129 | | | | 405,096 | |

| Gaming and Leisure Properties, Inc. | | | 24,750 | | | | 912,532 | |

| Outfront Media, Inc. | | | 18,617 | | | | 557,021 | |

PRA Group, Inc. (a) | | | 10,608 | | | | 576,226 | |

| Stewart Information Services Corporation | | | 10,400 | | | | 422,656 | |

| TowneBank | | | 12,000 | | | | 192,960 | |

| | | | | | | | 4,923,323 | |

| Health Care — 2.4% | | | | | | | | |

VCA, Inc. (a) | | | 6,744 | | | | 369,706 | |

VWR Corporation (a) | | | 15,000 | | | | 389,850 | |

| | | | | | | | 759,556 | |

| Industrials — 15.4% | | | | | | | | |

| Brink's Company (The) | | | 23,523 | | | | 649,940 | |

Colfax Corporation (a) | | | 18,338 | | | | 875,273 | |

Covenant Transportation Group, Inc. - Class A (a) | | | 10,000 | | | | 331,600 | |

Genesee & Wyoming, Inc. - Class A (a) | | | 6,700 | | | | 646,148 | |

| Marten Transport Ltd. | | | 31,637 | | | | 733,978 | |

DAVENPORT SMALL CAP FOCUS FUND

SCHEDULE OF INVESTMENTS (Continued)

| COMMON STOCKS — 78.1% (Continued) | | Shares | | | Value | |

| Industrials — 15.4% (Continued) | | | | | | |

Mistras Group, Inc. (a) | | | 37,362 | | | $ | 719,592 | |

MRC Global, Inc. (a) | | | 26,950 | | | | 319,358 | |

| Watsco, Inc. | | | 4,260 | | | | 535,482 | |

| | | | | | | | 4,811,371 | |

| Information Technology — 3.3% | | | | | | | | |

BlackBerry Ltd. (a) | | | 45,400 | | | | 405,422 | |

EchoStar Corporation - Class A (a) | | | 12,022 | | | | 621,778 | |

| | | | | | | | 1,027,200 | |

| Materials — 6.5% | | | | | | | | |

Fortuna Silver Mines, Inc. (a) | | | 194,016 | | | | 745,022 | |

Intrepid Potash, Inc. (a) | | | 25,311 | | | | 292,342 | |

| NewMarket Corporation | | | 738 | | | | 352,616 | |

| Tredegar Corporation | | | 32,482 | | | | 653,213 | |

| | | | | | | | 2,043,193 | |

| Telecommunication Services — 2.7% | | | | | | | | |

Iridium Communications, Inc. (a) | | | 50,000 | | | | 485,500 | |

United States Cellular Corporation (a) | | | 9,500 | | | | 339,340 | |

| | | | | | | | 824,840 | |

| | | | | | | | | |

Total Common Stocks (Cost $23,367,879) | | | | | | $ | 24,427,521 | |

| EXCHANGE-TRADED FUNDS — 6.1% | | Shares | | | Value | |

| iShares Core S&P Small-Cap ETF | | | 5,671 | | | $ | 669,348 | |

| iShares MSCI Emerging Markets Small-Cap ETF | | | 12,879 | | | | 608,790 | |

| iShares Russell 2000 Value ETF | | | 6,179 | | | | 637,735 | |

Total Exchange-Traded Funds (Cost $1,840,587) | | | | | | $ | 1,915,873 | |

| MONEY MARKET FUNDS — 17.8% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 0.00% (b) (Cost $5,586,579) | | | 5,586,579 | | | $ | 5,586,579 | |

| | | | | | | | | |

Total Investments at Value — 102.0% (Cost $30,795,045) | | | | | | $ | 31,929,973 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (2.0%) | | | | | | | (638,598 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 31,291,375 | |

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of March 31, 2015. |

See accompanying notes to financial statements.

THE DAVENPORT FUNDS

STATEMENTS OF ASSETS AND LIABILITIES

March 31, 2015

| | | | | | Davenport Value & Income Fund | |

| ASSETS | | | | | | |

| Investments in securities: | | | | | | |

| At acquisition cost | | $ | 223,777,029 | | | $ | 340,203,742 | |

| At market value (Note 2) | | $ | 323,908,096 | | | $ | 406,274,738 | |

| Cash | | | 6,360,686 | | | | — | |

| Dividends receivable | | | 196,056 | | | | 1,120,780 | |

| Receivable for capital shares sold | | | 652,849 | | | | 1,555,351 | |

| Other assets | | | 14,387 | | | | 14,643 | |

| TOTAL ASSETS | | | 331,132,074 | | | | 408,965,512 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Payable for capital shares redeemed | | | 191,477 | | | | 873,714 | |

| Accrued investment advisory fees (Note 4) | | | 210,400 | | | | 257,192 | |

| Payable to administrator (Note 4) | | | 35,400 | | | | 41,900 | |

| Other accrued expenses | | | 8,143 | | | | 15,910 | |

| TOTAL LIABILITIES | | | 445,420 | | | | 1,188,716 | |

| | | | | | | | | |

| NET ASSETS | | $ | 330,686,654 | | | $ | 407,776,796 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

| Paid-in capital | | $ | 224,334,867 | | | $ | 330,307,314 | |

| Undistributed net investment income | | | — | | | | 254,321 | |

| Undistributed net realized gains from security transactions | | | 6,220,720 | | | | 11,144,165 | |

| Net unrealized appreciation on investments | | | 100,131,067 | | | | 66,070,996 | |

| Net assets | | $ | 330,686,654 | | | $ | 407,776,796 | |

| | | | | | | | | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.01 par value) | | | 16,519,243 | | | | 26,382,501 | |

| | | | | | | | | |

| Net asset value, offering price and redemption price per share (Note 2) | | $ | 20.02 | | | $ | 15.46 | |

See accompanying notes to financial statements.

THE DAVENPORT FUNDS

STATEMENTS OF ASSETS AND LIABILITIES (Continued)

March 31, 2015

| | | Davenport Equity Opportunities Fund | | | Davenport Small Cap Focus Fund | |

| ASSETS | | | | | | |

| Investments in securities: | | | | | | |

| At acquisition cost | | $ | 230,031,919 | | | $ | 30,795,045 | |

| At market value (Note 2) | | $ | 276,509,010 | | | $ | 31,929,973 | |

| Cash | | | 15,352,862 | | | | — | |

| Dividends receivable | | | 65,159 | | | | 5,108 | |

| Receivable for capital shares sold | | | 889,534 | | | | 615,893 | |

| Other assets | | | 14,657 | | | | 10,974 | |

| TOTAL ASSETS | | | 292,831,222 | | | | 32,561,948 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Payable for investment securities purchased | | | 14,642,120 | | | | 1,247,766 | |

| Payable for capital shares redeemed | | | 269,081 | | | | 5,078 | |

| Accrued investment advisory fees (Note 4) | | | 172,378 | | | | 7,594 | |

| Payable to administrator (Note 4) | | | 31,100 | | | | 5,600 | |

| Other accrued expenses | | | 13,061 | | | | 4,535 | |

| TOTAL LIABILITIES | | | 15,127,740 | | | | 1,270,573 | |

| | | | | | | | | |

| NET ASSETS | | $ | 277,703,482 | | | $ | 31,291,375 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

| Paid-in capital | | $ | 225,517,552 | | | $ | 30,111,674 | |

| Accumulated net investment income | | | — | | | | 6,827 | |

| Undistributed net realized gains from security transactions | | | 5,708,839 | | | | 37,946 | |

| Net unrealized appreciation on investments | | | 46,477,091 | | | | 1,134,928 | |

| Net assets | | $ | 277,703,482 | | | $ | 31,291,375 | |

| | | | | | | | | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.01 par value) | | | 16,721,556 | | | | 3,006,132 | |

| | | | | | | | | |

| Net asset value, offering price and redemption price per share (Note 2) | | $ | 16.61 | | | $ | 10.41 | |

See accompanying notes to financial statements.

THE DAVENPORT FUNDS

STATEMENTS OF OPERATIONS

Year Ended March 31, 2015

| | | | | | Davenport Value & Income Fund | |

| INVESTMENT INCOME | | | | | | |

| Dividends | | $ | 4,402,052 | | | $ | 9,216,273 | |

| Foreign withholding taxes on dividends | | | (87,512 | ) | | | (99,342 | ) |

| TOTAL INVESTMENT INCOME | | | 4,314,540 | | | | 9,116,931 | |

| | | | | | | | | |

| EXPENSES | | | | | | | | |

| Investment advisory fees (Note 4) | | | 2,283,706 | | | | 2,629,441 | |

| Administration fees (Note 4) | | | 369,866 | | | | 415,753 | |

| Registration and filing fees | | | 31,489 | | | | 40,310 | |

| Professional fees | | | 30,948 | | | | 31,448 | |

| Compliance service fees (Note 4) | | | 27,193 | | | | 30,438 | |

| Custodian and bank service fees | | | 23,767 | | | | 30,305 | |

| Postage and supplies | | | 18,294 | | | | 18,440 | |

| Insurance expense | | | 11,403 | | | | 12,222 | |

| Trustees’ fees and expenses (Note 4) | | | 11,804 | | | | 11,804 | |

| Printing of shareholder reports | | | 9,169 | | | | 9,950 | |

| Other expenses | | | 8,858 | | | | 9,417 | |

| TOTAL EXPENSES | | | 2,826,497 | | | | 3,239,528 | |

| | | | | | | | | |

| NET INVESTMENT INCOME | | | 1,488,043 | | | | 5,877,403 | |

| | | | | | | | | |

| REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | | | | | | |

| Net realized gains from security transactions | | | 14,551,320 | | | | 18,731,719 | |

| Net change in unrealized appreciation/depreciation on investments | | | 19,717,017 | | | | 14,874,206 | |

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | 34,268,337 | | | | 33,605,925 | |

| | | | | | | | | |

| NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 35,756,380 | | | $ | 39,483,328 | |

See accompanying notes to financial statements.

THE DAVENPORT FUNDS

STATEMENTS OF OPERATIONS (Continued)

Year Ended March 31, 2015(a)

| | | Davenport Equity Opportunities Fund | | | Davenport Small Cap Focus Fund | |

| INVESTMENT INCOME | | | | | | |

| Dividends | | $ | 2,807,597 | | | $ | 58,657 | |

| Foreign withholding taxes on dividends | | | (41,633 | ) | | | (1,152 | ) |

| TOTAL INVESTMENT INCOME | | | 2,765,964 | | | | 57,505 | |

| | | | | | | | | |

| EXPENSES | | | | | | | | |

| Investment advisory fees (Note 4) | | | 1,593,177 | | | | 45,624 | |

| Administration fees (Note 4) | | | 283,576 | | | | 15,000 | |

| Registration and filing fees | | | 38,485 | | | | 7,975 | |

| Professional fees | | | 23,748 | | | | 5,206 | |

| Compliance service fees (Note 4) | | | 20,644 | | | | 1,690 | |

| Custodian and bank service fees | | | 18,476 | | | | 3,453 | |

| Postage and supplies | | | 19,900 | | | | 1,849 | |

| Trustees’ fees and expenses (Note 4) | | | 11,804 | | | | 2,935 | |

| Printing of shareholder reports | | | 8,186 | | | | 2,305 | |

| Insurance expense | | | 7,328 | | | | — | |

| Other expenses | | | 9,752 | | | | 747 | |

| TOTAL EXPENSES | | | 2,035,076 | | | | 86,784 | |

| Fee reductions by the Adviser (Note 4) | | | — | | | | (10,744 | ) |

| NET EXPENSES | | | 2,035,076 | | | | 76,040 | |

| | | | | | | | | |

| NET INVESTMENT INCOME (LOSS) | | | 730,888 | | | | (18,535 | ) |

| | | | | | | | | |

| REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | | | | | | |

| Net realized gains from security transactions | | | 15,756,298 | | | | 63,308 | |

| Net change in unrealized appreciation/depreciation on investments | | | 18,256,256 | | | | 1,134,928 | |

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | 34,012,554 | | | | 1,198,236 | |

| | | | | | | | | |

| NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 34,743,442 | | | $ | 1,179,701 | |

| (a) | Except for Davenport Small Cap Focus Fund, which represents the period from the commencement of operations (December 31, 2014) through March 31, 2015. |

See accompanying notes to financial statements.

DAVENPORT CORE FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | |

| FROM OPERATIONS | | | | | | |

| Net investment income | | $ | 1,488,043 | | | $ | 1,587,651 | |

| Net realized gains from security transactions | | | 14,551,320 | | | | 24,247,628 | |

| Net change in unrealized appreciation/depreciation on investments | | | 19,717,017 | | | | 21,071,593 | |

| Net increase in net assets from operations | | | 35,756,380 | | | | 46,906,872 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (1,509,705 | ) | | | (1,572,542 | ) |

| From net realized gains from security transactions | | | (22,409,339 | ) | | | (11,297,772 | ) |

| Decrease in net assets from distributions to shareholders | | | (23,919,044 | ) | | | (12,870,314 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 43,532,772 | | | | 44,315,591 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 23,153,291 | | | | 12,476,055 | |

| Payments for shares redeemed | | | (29,067,963 | ) | | | (20,495,991 | ) |

| Net increase in net assets from capital share transactions | | | 37,618,100 | | | | 36,295,655 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 49,455,436 | | | | 70,332,213 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 281,231,218 | | | | 210,899,005 | |

| End of year | | $ | 330,686,654 | | | $ | 281,231,218 | |

| | | | | | | | | |

| UNDISTRIBUTED NET INVESTMENT INCOME | | $ | — | | | $ | 27,002 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 2,233,700 | | | | 2,414,969 | |

| Shares reinvested | | | 1,207,808 | | | | 681,244 | |

| Shares redeemed | | | (1,495,763 | ) | | | (1,117,243 | ) |

| Net increase in shares outstanding | | | 1,945,745 | | | | 1,978,970 | |

| Shares outstanding at beginning of year | | | 14,573,498 | | | | 12,594,528 | |

| Shares outstanding at end of year | | | 16,519,243 | | | | 14,573,498 | |

See accompanying notes to financial statements.

DAVENPORT VALUE & INCOME FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | |

| FROM OPERATIONS | | | | | | |

| Net investment income | | $ | 5,877,403 | | | $ | 5,531,182 | |

| Net realized gains from security transactions | | | 18,731,719 | | | | 14,211,440 | |

| Net change in unrealized appreciation/depreciation on investments | | | 14,874,206 | | | | 22,127,758 | |

| Net increase in net assets from operations | | | 39,483,328 | | | | 41,870,380 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (5,878,113 | ) | | | (5,277,593 | ) |

| From net realized gains from security transactions | | | (15,874,061 | ) | | | (9,157,892 | ) |

| Decrease in net assets from distributions to shareholders | | | (21,752,174 | ) | | | (14,435,485 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 93,258,289 | | | | 87,997,225 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 20,026,663 | | | | 13,263,859 | |

| Payments for shares redeemed | | | (27,526,918 | ) | | | (21,298,242 | ) |

| Net increase in net assets from capital share transactions | | | 85,758,034 | | | | 79,962,842 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 103,489,188 | | | | 107,397,737 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 304,287,608 | | | | 196,889,871 | |

| End of year | | $ | 407,776,796 | | | $ | 304,287,608 | |

| | | | | | | | | |

| UNDISTRIBUTED NET INVESTMENT INCOME | | $ | 254,321 | | | $ | 256,710 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 6,192,254 | | | | 6,314,504 | |

| Shares reinvested | | | 1,332,807 | | | | 959,324 | |

| Shares redeemed | | | (1,830,740 | ) | | | (1,522,285 | ) |

| Net increase in shares outstanding | | | 5,694,321 | | | | 5,751,543 | |

| Shares outstanding at beginning of year | | | 20,688,180 | | | | 14,936,637 | |

| Shares outstanding at end of year | | | 26,382,501 | | | | 20,688,180 | |

See accompanying notes to financial statements.

DAVENPORT EQUITY OPPORTUNITIES FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | |

| FROM OPERATIONS | | | | | | |

| Net investment income | | $ | 730,888 | | | $ | 2,650,696 | |

| Net realized gains from security transactions | | | 15,756,298 | | | | 14,022,701 | |

| Net change in unrealized appreciation/depreciation on investments | | | 18,256,256 | | | | 10,046,548 | |

| Net increase in net assets from operations | | | 34,743,442 | | | | 26,719,945 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (3,196,404 | ) | | | (224,384 | ) |

| From net realized gains from security transactions | | | (18,954,387 | ) | | | (7,464,989 | ) |

| Decrease in net assets from distributions to shareholders | | | (22,150,791 | ) | | | (7,689,373 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 86,334,585 | | | | 54,980,702 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 21,241,419 | | | | 7,445,644 | |

| Payments for shares redeemed | | | (16,954,232 | ) | | | (9,646,854 | ) |

| Net increase in net assets from capital share transactions | | | 90,621,772 | | | | 52,779,492 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 103,214,423 | | | | 71,810,064 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 174,489,059 | | | | 102,678,995 | |

| End of year | | $ | 277,703,482 | | | $ | 174,489,059 | |

| | | | | | | | | |

| UNDISTRIBUTED NET INVESTMENT INCOME | | $ | — | | | $ | 2,451,767 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 5,452,269 | | | | 3,699,725 | |

| Shares reinvested | | | 1,376,196 | | | | 510,464 | |

| Shares redeemed | | | (1,074,814 | ) | | | (651,385 | ) |

| Net increase in shares outstanding | | | 5,753,651 | | | | 3,558,804 | |

| Shares outstanding at beginning of year | | | 10,967,905 | | | | 7,409,101 | |

| Shares outstanding at end of year | | | 16,721,556 | | | | 10,967,905 | |

See accompanying notes to financial statements.

DAVENPORT SMALL CAP FOCUS FUND

STATEMENT OF CHANGES IN NET ASSETS

| | | Period Ended March 31, 2015 (a) | |

| FROM OPERATIONS | | | |

| Net investment loss | | $ | (18,535 | ) |

| Net realized gains from security transactions | | | 63,308 | |

| Net change in unrealized appreciation/depreciation on investments | | | 1,134,928 | |

| Net increase in net assets from operations | | | 1,179,701 | |

| | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | |

| Proceeds from shares sold | | | 30,137,020 | |

| Payments for shares redeemed | | | (25,346 | ) |