| OMB APPROVAL |

OMB Number: 3235-0570 Expires: January 31, 2017 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-05685 | |

| Williamsburg Investment Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

W. Lee H. Dunham, Esq.

| Sullivan & Worcester LLP One Post Office Square Boston, Massachusetts 02109 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | March 31 | |

| | | |

| Date of reporting period: | March 31, 2016 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

ANNUAL REPORT March 31, 2016 |

THE DAVENPORT FUNDS

LETTER TO SHAREHOLDERS | May 25, 2016 |

Dear Shareholders,

What a ride. The first quarter of 2016 started off with the sharpest January sell-off since 2009, before sharply reversing course in mid-February to finish the quarter in positive territory. All told, the S&P 500 Index fell 11.44% before rallying 13.79% to finish the quarter with a modest 1.35% gain. Investors started the year full of pessimism, worrying over a potential recession, a tightening in domestic monetary policy, and continued weakness abroad. These fears created an oversold condition with many investors underinvested or caught short, which led to a buying panic in February, fueling the strongest intra-quarter recovery in the Dow (DIJA Index) since 1933.

As we highlighted last quarter, “growth” vs. “value” remained a key theme in the markets during Q1. We witnessed a strong reversal in the performance of the two styles with Value (+0.84%) performing much better than Growth (-4.24%). Last year’s high fliers (think FANG – Facebook, Amazon, Netflix & Google (now Alphabet)) sold off sharply and market leadership rotated to more defensive sectors: utilities, telecoms and consumer staples all performed well. Also of note, many industrials and commodity-related names reversed course and helped to lead the bounce higher in the second half of the quarter. The Davenport Funds have benefitted from both of these trends, as we have put money to work in downtrodden and oversold sectors, rather than try to chase the market’s latest darlings.

With many in the marketplace viewing the current economic recovery as fragile, the obsessive focus on monetary policy continues. Overseas counterparts enacted further easing measures during the quarter (e.g. the Bank of Japan experimenting with negative interest rates on new commercial banking deposits). More importantly for U.S. equity investors, the Federal Reserve continues to react in real-time to financial markets, and just a couple months after their initial 25bp rate hike, have returned to cooing dovishly. Thus far, the easy-money messaging appears to be working (once again) for stocks.

Earnings season is upon us, and Q1 earnings are forecasted to be down by 8.5%, significantly worse than the year-over-year declines we have witnessed for the past three quarters. These negative estimate revisions certainly played a role in the selloff, but encouragingly, stocks have been able to rally in the face of further cuts to numbers, indicating the market has adequately discounted Q1’s weakness and is looking toward improvement throughout the rest of the year. Importantly for earnings, oil has bounced sharply off its lows (benefitting the energy and materials sectors), and the U.S. Dollar has backed off its highs (aiding large multinational corporations).

We remain in a dynamic, uncertain macroeconomic landscape, and this year’s presidential election certainly isn’t reassuring nervous investors. While we continue to reiterate our view that we have entered a lower-return period for stocks after the uninterrupted gains of 2009-2014, the Davenport Funds’ portfolio holdings are performing well in today’s environment, and many are thriving. The violent selloff and subsequent rally in Q1 serve as a reminder for us not to cave into emotion when things look bleak and to continue our investment course, which has served us well over time.

Please read on for a discussion of Fund themes and ideas. We thank you for your trust and look forward to reporting back to you later in the year.

1

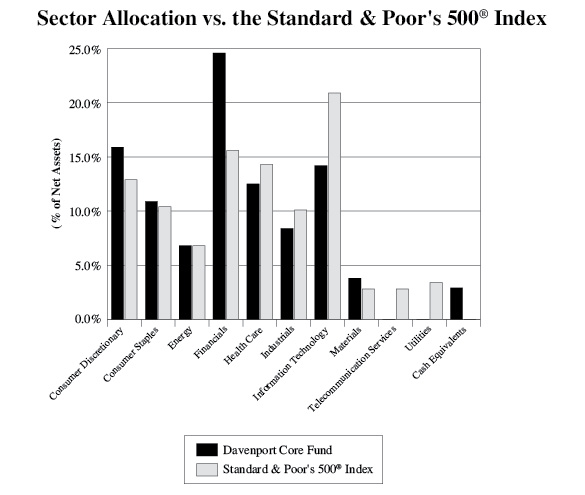

Davenport Core Fund

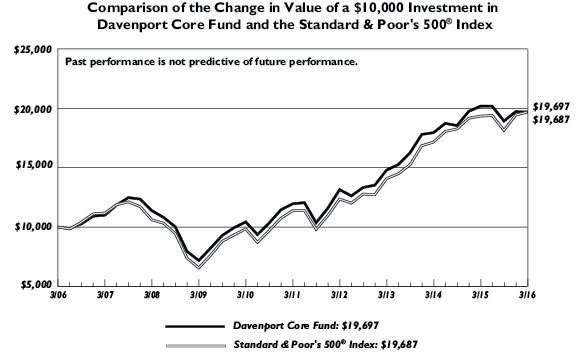

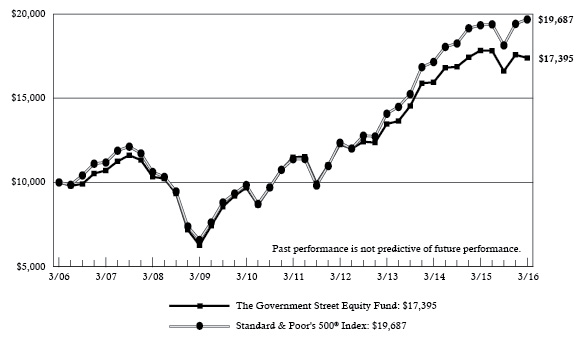

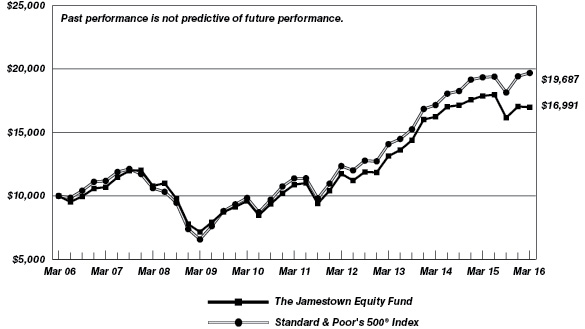

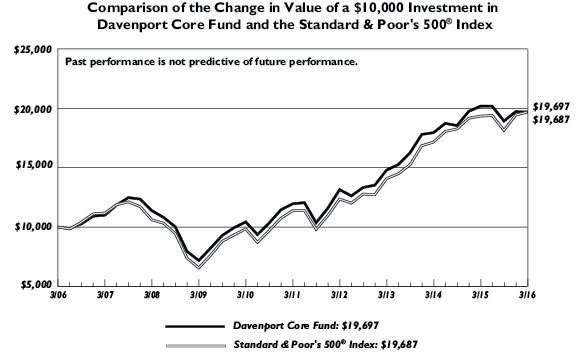

The following chart represents Davenport Core Fund (DAVPX) performance and the performance of the S&P 500 Index*, the Core Fund’s primary benchmark, for the periods ended March 31, 2016.

| Q1 2016 | 1 Year | 3 Years** | 5 Years** | 10 Years** | Since Inception** 1/15/98 | Fiscal Year 2016 Expense Ratio |

Core Fund | -0.08% | -2.39% | 10.01% | 10.49% | 7.01% | 6.05% | 0.92% |

S&P 500 Index* | 1.35% | 1.78% | 11.82% | 11.58% | 7.01% | 6.30% | — |

30-Day SEC Yield: 0.87%; Expense Ratio in current prospectus: 0.93%.

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

* | The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

After five years of strong returns for both the market and the Core Fund, returns took a breather in fiscal year 2016, with the Core Fund down 2.39% and the S&P 500 Index up 1.78%. As noted in last year’s letter, we had begun to implement slightly more contrarian moves in the portfolio, as the market’s “haves” (especially momentum-oriented companies with high growth) became increasingly popular. We chose to remain steadfast in our search for high quality businesses at reasonable valuations, and missed out on some of the impressive returns of the market’s high fliers, causing the portfolio to lag. Nevertheless, we remind investors of the usual consequences when the market gets overenthusiastic; already, some of the hot stocks of 2015 have started to crack. We remain confident that the portfolio’s positioning remains prudent.

On the plus side, our financial stocks performed much better than the index, and our underweight positioning in the energy sector paid off while oil prices cratered. Within financials, Brookfield Asset Management (BAM), American Tower (AMT), CME Group (CME) and Markel (MKL) all had strong years. Technology was another bright spot with Amazon (AMZN), Accenture (ACN) and Alphabet, the company formerly known as Google (GOOG), all having great years.

We spent the year with an underweight position in the energy sector, and we concentrated our holdings on market-leading companies with strong balance sheets, such as ExxonMobil (XOM), Chevron (CVX) and Schlumberger (SLB). This defensive positioning aided performance in what was a tough year for oil producers. Going forward, we are incrementally more positive on the direction for oil prices as the market rebalances, and in mid-March added Marathon Petroleum (MPC) to the portfolio (discussed briefly below), bringing us to an overweight stance in the sector for the first time in several years.

2

While we don’t fashion ourselves strictly as “value” investors, we are always looking to pay reasonable prices for our investments. Our additions to the portfolio in the most recent quarter are evidence of this valuation-centric lens. To wit, we added to out-of-favor names that had fallen to attractive valuation levels in the financial sector: Capital One Financial (COF) and Wells Fargo (WFC). We also added to industrial blue chip Praxair (PX) at an attractive price. Finally, we purchased domestic oil & gas transporter and refiner MPC after it fell nearly 50% in just three months, pressured by short term concerns. Although a crude measure of value, we note that on average these four stocks traded at a 12.5x price / 2016 earnings ratio at quarter-end, well below the S&P 500’s 17.1x.

In sum, it was a challenging fiscal year after several years of uninterrupted gains. Similar to our last update, we stayed true to our convictions and continued to focus on paying reasonable valuations for high quality businesses. Some of the trends that caused us to underperform in the prior year have started to reverse, with some of 2015’s favorites underperforming in 2016 and meaningful rallies in downtrodden sectors such as materials, industrials and energy. We like the portfolio’s positioning going into fiscal year 2017 and view the risk-reward of the portfolio as attractive.

The following are transactions performed in the Core Fund for the quarter ended March 31, 2016.

Recent Purchases

Adobe Systems Inc (ADBE) Due to a rapidly growing recurring cash flow stream, 20% top line growth rate and outstanding incremental margins, we initiated a position in this leading software provider.

Adobe Systems Inc (ADBE) Following a strong Q1 with impressive top line revenue growth, margin expansion and increased full year guidance, we chose to add to our position.

Capital One Financial Corp (COF) Concerns over recent increases in expense growth and provisioning rates weighed on the shares, allowing us to add to this name which we believe carries one of the more attractive risk/reward profiles within the financial sector.

Marathon Petroleum Corp. (MPC) With the stock down a third from its highs in early December 2015, we felt company specific concerns were adequately discounted into the shares of this high quality refiner (4th largest in the nation) and we therefore initiated a position.

Oracle Corp. (ORCL) We initiated a position in this leading integrated technology (hardware and software) provider, encouraged by its wide business moat and room for multiple expansion, given its recent shift from a license model to a revenue model.

Praxair, Inc. (PX) Due to broad weakness across the industrial sector and emerging markets, PX shares fell to a four year low, prompting us to add to this high quality industrial with an ‘A’ rated balance sheet and 2.9% dividend yield.

PVH Corp. (PVH) We added to our holdings in this high quality operator as currency headwinds and weather disruptions weighed on the shares; both factors we view as short term in nature, masking a longer term growth story.

Wells Fargo & Co. (WFC) We took advantage of recent weakness and added to our position as fears around negative interest rates, economic growth expectations and exposure to the energy sector weighed on shares.

3

Recent Sales

Amazon.com, Inc. (AMZN) While we remain impressed by the company’s execution and widening business moat, we chose to take some profits and reduce our holding to a more normal weighting amid such universally positive sentiment (shares were up 117% in 2015).

Cisco Systems, Inc. (CSCO) While we remain attracted to the valuation and dividend yield (stock still owned by Davenport Value & Income Fund), we opted to sell the position amid lower expectations for enterprise I.T. spending and intensifying competitive threats to the core networking hardware business. We will look to direct proceeds toward names with a faster growth outlook.

Dish Network Corp. (DISH) As the timing and execution of spectrum monetization became less clear, we elected to sell our position and allocate proceeds into other names with more favorable risk/reward profiles.

Express Scripts Holding Co. (ESRX) While ESRX has been a solid performer since our initial purchase in 2013, we elected to sell the name and lock in gains due to concerns over generic drug price re-negotiations with their largest customer.

Parker Hannifin (PH) Given the stock’s rapid rally from lows experienced earlier in the year, we opted to sell this position as we have recently grown less confident in the company’s key end markets.

Starbucks Corp. (SBUX) While we remain impressed with the company’s execution, shares have performed well and experienced a sizable multiple rerating since our initial purchase and we therefore opted to reduce our position slightly.

Davenport Equity Opportunities Fund

The following chart represents Davenport Equity Opportunities Fund (DEOPX) performance and the performance of the Russell Midcap Index, the Fund’s primary benchmark, and the S&P 500 Index for the periods ended March 31, 2016.

| Q1 2016 | 1 Year | 3 Years** | 5 Years** | Since Inception** 12/31/2010 | Fiscal

Year 2016 Expense Ratio |

Equity Opportunities Fund | 4.32% | -7.07% | 9.64% | 11.89% | 12.78% | 0.93% |

Russell Midcap Index* | 2.24% | -4.04% | 10.45% | 10.30% | 11.34% | — |

S&P 500 Index* | 1.35% | 1.78% | 11.82% | 11.58% | 12.23% | — |

30-Day SEC Yield: 0.87%; Expense Ratio in current prospectus: 1.02%.

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

* | The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000, which represent approximately 25% of the total market capitalization of the Russell 1000. The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

4

Despite a solid close to the year, fiscal year 2016 was a challenging period for the Equity Opportunities Fund (DEOPX). For the full year, it returned -7.07% as compared to -4.04% and 1.78% for the Russell Midcap Index and S&P 500 Index, respectively. While the Fund fared well in the first and fourth quarters, it struggled during quarters two and three as a handful of key holdings posted meaningful declines and the broader market’s advance became confined to a shrinking handful of stocks.

We have recently witnessed a reversal of many 2015 trends. During the second half of calendar 2015, we struggled as investors became infatuated with a small subset of momentum-oriented growth stocks and shunned almost everything else. As such, it didn’t pay to zig when others were zagging as the gap between the markets haves and have-nots only widened. We suspected this trend would reverse course and are glad we stuck to our guns. During Q4, the performance of formerly “hot” stocks waned as investors finally gravitated to more depressed names.

Colfax (CFX) and Genesee & Wyoming (GWR) were among our biggest detractors for the full year; however, each reversed course as the year came to a close. We believe these well run companies were overly punished alongside the broad meltdown in commodity prices. While each has ties to commodities, they are well run businesses and their prices at year-end failed to reflect their long-term earnings power. Fortunately, the stocks recovered nicely in Q4 as investor sensed headwinds were more than adequately discounted. CFX was particularly strong with a 22% gain. We added to our position in this name in January and, while it has bounced sharply, we continue to think it’s reasonably valued.

Gaming & Leisure Properties (GLPI) also recovered impressively with a 14% gain in Q4. This casino REIT, which owns the land and buildings of casinos and charges rent to the operator, had been trading at a sharp discount to the broader REIT universe. Part of this discount may have also been associated with the company’s need to issue equity to fund its purchase of Pinnacle Entertainment’s (PNK) real estate. With this behind us, investors should focus on the merits of the deal including a more diversified tenant base, enhanced scale and a higher dividend. The stock continues to yield over 7% and has meaningful runway for growth via acquisitions. Furthermore, CEO Peter Carlino is a savvy value creator and very much an owner-operator (he and his family own nearly 10% of the company).

We increased a few positions recently. Among these were Fidelity National (FNF) and Live Nation (LYV). FNF, along with other title insurers, has struggled as slowing refinancing transactions and regulatory compliance costs have pressured near term results. We think this creates an attractive price to add to our position in the nation’s leading title insurer. After backing out FNF’s stake in the mortgage servicer Black Knight Financial Services (BKFS), FNF is trading at just less than 11x P/E multiple on its core title insurance business. We think this is too cheap for the highest margin title insurer, especially given the company’s solid dividend (2.6% yield), share buyback and considering the supportive housing market backdrop. In the case of LYV, the stock has languished despite solid results and prospects for ongoing double digit cash flow growth. Last year, we highlighted the company’s dominance in the concert business and ability to use such dominance to drive ticketing and advertising revenue. Since then, we have also grown incrementally excited about its ability to drive customer spending inside live events and view this as another source of upside. TripAdvisor (TRIP), which is a newer position, has been a laggard of late. The shares declined alongside fears that efforts to transition to more of a trip booking platform (i.e. more of a transaction than advertising model) would create short-term earnings disruption. While we recognize this risk, we underestimated the extent to which investors would

5

harp on it. We remain confident this transition will drive higher visitation to the site and solidify TRIP as a one-stop shop for both researching and booking travel. We also think the company has room for significant margin expansion as growth in marketing spend abates and new verticals (restaurants, attractions and vacation rentals) gain footing.

In sum, we were pleased to see some of the year’s weaker performers show much improved results in recent periods. Given our focus on opportunistic entry points and reasonable valuations, the current market environment favors us more than the “narrow”, momentum-fueled environment that characterized much of the year. While recent performance has improved, we continue to feel our Fund’s overall timeliness is very appealing given the attractive risk/reward profiles of our top holdings.

The following are transactions performed in the Equity Opportunities Fund for the quarter ended March 31, 2016.

Recent Purchases

Colfax Corp. (CFX) We added to our holdings as industrial sector and oil price weakness continued to pressure shares. While end-market headwinds remain, the margin profile of the business continues to improve, leaving the company well positioned for a rebound in global growth and increasingly attractive from a risk/reward standpoint.

Fidelity National Financial, Inc. (FNF) We elected to add to our position in this high-margin title insurer as shares softened alongside concerns over reduced activity in the refinance and commercial origination businesses.

Live Nation Entertainment, Inc. (LYV) With recent weakness in the broader equity markets weighing on shares (down ~35% from recent highs), we chose to add to this high quality operator, which possesses a variety of long term growth drivers, significant operating leverage and has shown savvy capital allocation practices over time. While continuing to believe LYV is in the early stages of a secular growth story, we chose to add again to this dominant concert operator during the month, following solid Q4 results and an incrementally positive outlook for 2016.

TripAdvisor, Inc. (TRIP) Impressed by company fundamentals, we chose to add to our holdings as broad market weakness led trading in the shares to levels not seen since the company’s announcement of its transformational deal with Priceline (PCLN).

WABCO Holdings, Inc. (WBC) Up modestly from our initial purchase, we chose to add to this industry leader on weakness given its solid growth outlook, strong balance sheet and commendable history of capital allocation over time.

Recent Sales

Amazon.com, Inc. (AMZN) While still attracted to the company’s strong competitive positioning and future growth prospects, we initially trimmed our position before selling the entire position given its significant appreciation over the past year. Proceeds were moved to high-conviction positions that we feel provide a more promising risk/reward perspective.

NRG Energy, Inc. (NRG) While still positive on many aspects of the business, we opted to use the recent bounce in share price to chip our holding and move proceeds into opportunities with a lower risk profile.

6

Penn National Gaming, Inc. (PENN) With the stock up over 30% from lows earlier in the year, we elected to chip the position, allocating proceeds toward more favorable risk-return opportunities.

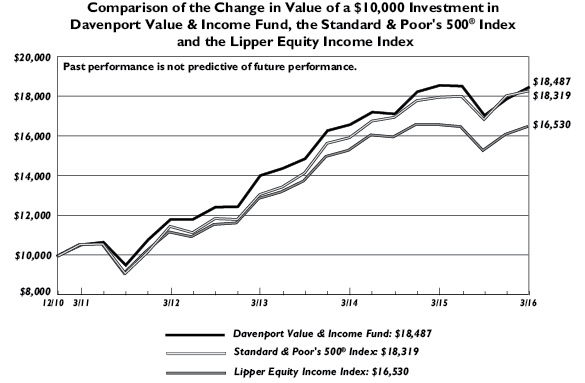

Davenport Value & Income Fund

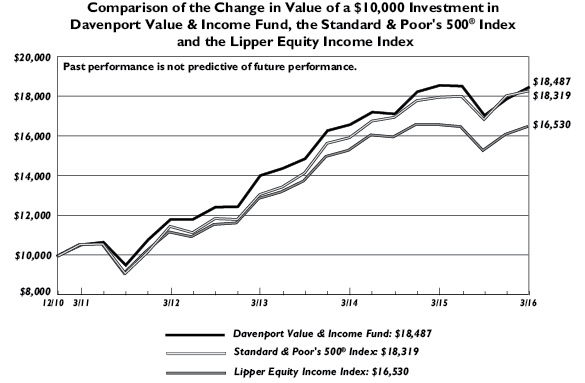

The following chart represents Davenport Value & Income Fund (DVIPX) performance and the performance of the S&P 500 Index, the Value & Income Fund’s primary benchmark, and the Lipper Equity Income Index for the periods ended March 31, 2016.

| Q1 2016 | 1 Year | 3 Years** | 5 Years** | Since Inception** 12/31/2010 | Fiscal

Year 2016

Expense Ratio |

Value & Income Fund | 3.29% | -0.46% | 9.62% | 11.90% | 12.42% | 0.91% |

S&P 500 Index* | 1.35% | 1.78% | 11.82% | 11.58% | 12.23% | — |

Lipper Equity Income Index* | 2.46% | -0.56% | 8.59% | 9.32% | 9.41% | — |

30-Day SEC Yield: 2.38%; Expense Ratio in current prospectus: 0.95%.

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

* | The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. The Lipper Equity Income Index is an unmanaged index of the 30 largest funds in the Lipper Equity Income fund category. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

After the strong performance of the last fiscal year, the Value & Income Fund returned -0.46%, trailing the S&P 500 Index but slightly outpacing the Lipper Equity Income’s 0.56% loss. Broadly, the year saw lackluster economic data and, at the margin, investors chose to hide in two opposite ends of the spectrum: highly defensive companies and high-growth darlings. Going forward, we feel the Fund is well positioned, as we have been emphasizing beaten-up, out of favor names that appear to offer superior risk/reward profiles.

In terms of performance, most of the Fund’s top performers were household blue chips such as General Electric (GE), McDonald’s (MCD), Philip Morris (PM), Altria (MO) and Microsoft (MSFT). Our top performer for the year was a lesser-known manufactured housing and recreational vehicle (RV) REIT Equity Lifestyle Properties (ELS), which continued to post strong growth in net operating income and raised its dividend by 13%. Rounding out the 30%+ return group was Spectra Energy (SE), a well-managed natural gas pipeline company.

On the other side of the ledger, our underweight positioning in utilities and telecommunication services hurt performance. At the start of the year, these sectors were already near the high end of their historical valuations, but investors bid them up even further in a flight to stability and perceived safety. Going forward, we believe the elevated valuations of these defensive companies leaves them more vulnerable to corrections than is normally the case. Additionally, we did not

7

escape the global economic slowdown unscathed, with competitive utility provider NRG Energy (NRG) and grain processor Archer Daniels Midland (ADM) examples of cyclical concerns that hurt performance.

Rather than chase the market’s latest favorites, we continued to search for income-producing securities trading for reasonable valuations in overlooked areas. In financials, we took advantage of weakness to add to title insurer Fidelity National (FNF) and megabank Citigroup (C). In the materials world we purchased paper and packaging company International Paper (IP) and have added to Potash Corp (POT), a low cost fertilizer provider with a solid balance sheet and sizeable dividend. Our defensive stance within the energy sector boosted performance for the year and we added to market leaders such as ExxonMobil (XOM) and Chevron (CVX) on weakness.

In conclusion, we are pleased with performance in light of the challenging macro environment over the preceding twelve months. Throughout the year, we have worked diligently to identify areas of market dislocations, and the elevated volatility has yielded above-average opportunities for us to harvest and redeploy funds. We think our actions have continued to sharpen the Fund’s risk/reward profile.

The following are transactions performed in the Value & Income Fund for the quarter ended March 31, 2016.

Recent Purchases

AT&T, Inc. (T) We initiated a position in T(2nd largest U.S. wireless carrier), believing recent M&A activity should allow the company to grow its earnings and cash flow at a higher than expected rate and lead to an increase to its annual dividend.

Boeing (BA) We initiated a position in the company, attracted to their dominant position within the commercial aerospace industry and ability to capitalize on a currently profitable airline industry generating funds to reinvest into newer, more efficient aircraft.

Capital One Financial Corp. (COF) Concerns over recent increases in expense growth and provisioning rates weighed on the shares, allowing us to add to this name which we believe carries one of the more attractive risk/reward profiles within the financial sector.

Citigroup, Inc. (C) We added to shares on weakness, as concerns over international markets and lowered expectations for further rate hikes outweighed the company’s well-capitalized balance sheet and shareholder-focused plan of future share buybacks and dividend increases.

Fidelity National Financial, Inc. (FNF) We elected to add to our position in this high-margin title insurer, as shares softened alongside concerns over reduced activity in the refinance and commercial origination businesses.

International Paper Co. (IP) A global leader in paper and packaging products, shares of IP have continued to decline (over 60% since early 2015) alongside currency headwinds, weakening containerboard prices, overcapacity and fears of slowing global growth. With current valuation giving little credit to this well managed, high margin, high barrier-to-entry business, we elected to initiate a position.

Procter & Gamble Co. (PG) Given the defensive nature of its business, positive signs on the turnaround front and a relatively attractive valuation, we increased our position, as PG still trades at a modest discount to its peer group.

8

Ralph Lauren Corp. (RL) Shares of RL weakened as currency fluctuations and weather disruptions weighed on the shares. While both are shorter-term headwinds in our view, we elected to add to our exposure in this iconic portfolio of brands.

Recent Sales

Equity Lifestyle Properties, Inc. (ELS) While we continue to view ELS as a best-in-class REIT with end market tailwinds, a proven management team, strong balance sheet and low payout ratio, we chose to chip the position and take profits with the stock hitting new highs and trading above its historical valuation.

NRG Energy, Inc. (NRG) While still attracted to many aspects of the business, we opted to use the recent bounce in share price to sell our holding and move proceeds into opportunities with a lower risk profile.

SPDR Euro Stoxx 50 ETF (FEZ) With the timeline on a European economic turnaround looking less clear, we elected to sell our position and move into closer-to-home opportunities with more dependable income streams.

Teva Pharmaceuticals Industry Ltd. (TEVA) A deep value situation when initially purchased, the company has since re-rated significantly alongside cost cutting initiatives and improved investor sentiment. Recent acquisition concerns and resulting debt have however increased the risk profile of the company and we therefore opted to move to the sidelines, selling the position.

Davenport Small Cap Focus Fund

The following chart represents Davenport Small Cap Focus Fund (DSCPX) performance and the performance of the Russell 2000 Index, the Small Cap Focus Fund’s primary benchmark, for the periods ended March 31, 2016.

| Q1 2016 | 1 Year | Since Inception** 12/31/2014 | Fiscal

Year 2016 Net Expense Ratio |

Small Cap Focus Fund | 2.41% | -10.19% | -5.26% | 1.15%1 |

Russell 2000 Index* | -1.52% | -9.76% | -4.73% | — |

30-Day SEC Yield: 0.36%; Gross Expense Ratio in current prospectus: 1.44%; Net Expense Ratio in current prospectus: 1.27%.

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

* | The Russell 2000 Index measures the performance of the 2000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

1 | Davenport & Company LLC (the “Adviser”) has contractually agreed, until August 31, 2016, to reduce Management Fees and to reimburse Other Expenses to the extent necessary to limit total annual ordinary operating expenses (excluding acquired fund fees and expenses) to an amount not exceeding 1.25% of the Fund’s average daily net assets. |

9

The Small Cap Focus Fund (DSCPX) finished the fiscal year down 10.19%, relative to the 9.76% decline for the Russell 2000 Index. Though this was a disappointing full year result, we were pleased to see results turn in the fiscal fourth quarter, as our strategy posted a 2.41% gain versus the 1.52% decline for the Russell 2000 Index.

Reflecting for a moment, it’s fair to say that very little went our way in 2015. Small caps generally struggled, value underperformed growth (we have a value bias) and a few opportunistic investments in commodity-related areas (where we expect to typically be underweight) hurt performance. In a way, we consider ourselves fortunate to now be only slightly lagging the Russell 2000 since inception given these challenges. We think our absolute and relative performance profiles could change for the better as recent investments begin to pay off.

At the risk of stating the obvious, we think a lot of pain has been discounted and that small caps as a whole have become more attractive. We are particularly excited about some of our largest holdings, which similar to the Russell 2000 have been under pressure (in some cases with very little in the way of fundamental reasons). As you know, we have a concentrated approach in the Fund, which stands out in a small cap world characterized by funds that oftentimes hold hundreds of stocks. We believe it is best to invest with conviction, even in small caps that can sometimes exhibit above-average volatility. This has yet to bear fruit and can cause large month-to-month performance swings, but hopefully will yield meaningful outperformance over time.

Thus far, we’ve been planting seeds that have only recently begun to germinate. Value-oriented investments, particularly in the under-followed small cap space, can take a long time to bear fruit, but when they do it can be especially gratifying. In looking at some of our key holdings, which we have built at favorable prices, we believe there could be significant pent-up energy. Take Monarch Casino (MCRI), Stewart Information Services (STC) and Outfront Media (OUT), for example. Each business possesses a solid fundamental outlook, generates prodigious free cash flow and possesses manageable (if not below-average) business risk. Yet, we believe each stock is very cheap and could re-rate much higher alongside steady results.

We also remind investors that merger & acquisition activity can sometimes be a nice fringe benefit of small-cap investing. Logically, small companies with solid market positions are often targeted by larger brethren pursuing new growth opportunities. We don’t invest in companies based on M&A activity, but it does sometimes represent a cherry on top of our thesis. Thus far in the Fund’s brief existence, we’ve benefitted very little from such activity. At some point this could change.

Recent Purchases:

FMC Corp (FMC) We are attracted to this specialty chemical company’s asset-light, decentralized manufacturing process and believe management’s focus on higher-value technology-based offerings can yield above-market growth over time.

Isle of Capri Casinos (ISLE) We have been encouraged by improvements in the regional casino operator’s balance sheet, margins and capital stewardship recently. With the stock trading close to half recent highs and sporting an attractive valuation, we found the risk/reward compelling.

Raymond James Financial (RJF) During a period of stress among interest rate sensitive financials, we saw an opportunity to gain exposure to a high quality financial services platform with a strong balance sheet, solid track record of returns and significant growth potential at an attractive valuation.

10

Recent Sales:

Echostar Corp (SATS) Given uneven results, risks associated with satellite launches and less confidence in the value of other businesses that comprised a sum of the parts valuation, we elected to exit the position.

Fidelity National Financial (FNFV) Following the monetization and separation of many of the company’s key assets, we became less enthusiastic with the remaining businesses and the strategy for future capital deployment and chose to sell the position.

Peyto Energy (PEYUF) The stock bounced sharply in the middle of the quarter alongside the rest of the energy complex. We used this strength to exit the position and add to higher conviction ideas.

Scripps Networks Interactive (SNI) Shares of SNI rallied after a prolonged period of weakness in media stocks. Though we remain attracted to the company’s content portfolio, we elected to use recent strength to sell and move proceeds to higher conviction ideas.

Sunoco LP (SUN) Following a strong rally in the MLP sector, we elected to use strength in the name to exit the position. Though we remain attracted to the quality of the company’s assets, concerns over the company’s aggressive pace of dividend increases eventually led to the decision to redeploy funds elsewhere.

Westmoreland Coal (WLB) We exited the position as the shares rallied alongside other coal related entities. Though we believe the company’s contracted volumes and close proximity to customers will result in more predictable cash flows relative to others in the industry, an inconsistent message from management in addition to high debt levels compelled us to use recent strength to exit the position.

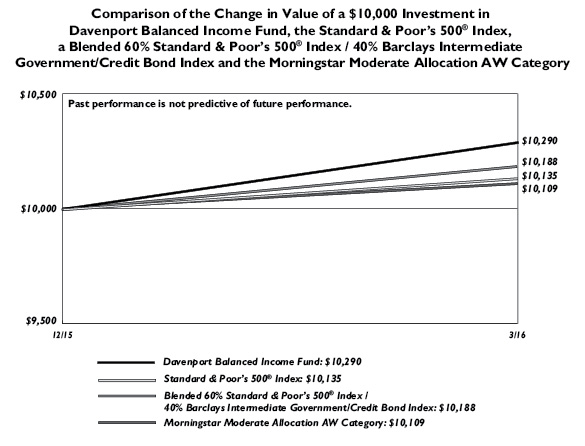

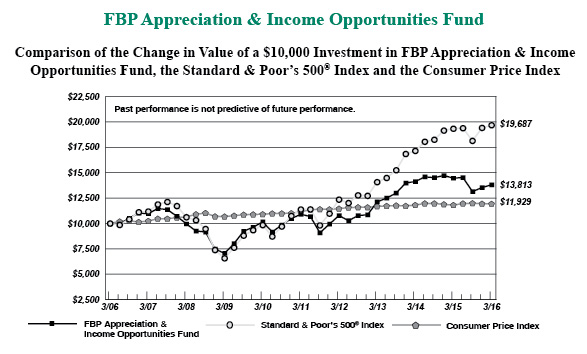

Davenport Balanced Income Fund

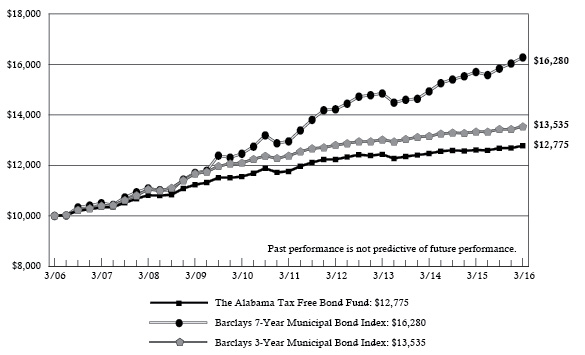

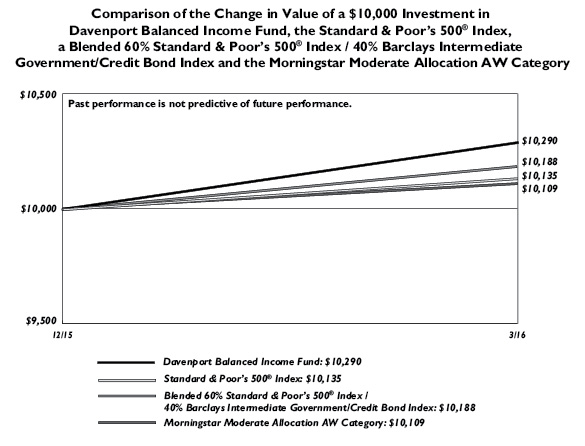

The following chart represents the performance of Davenport Balanced Income Fund (the “Balanced Fund”), Morningstar Moderate Allocation, S&P 500 Index, and Barclays Intermediate Government/Credit Index for the period ended March 31, 2016.

| Q1 2016 | Since Inception** 12/31/2015 | Fiscal

Year 2016 Net Expense Ratio |

Balanced Fund | 2.90% | 2.90% | 1.25%1 |

S&P 500 Index* | 1.35% | 1.35% | — |

Barclays Intermediate Gov/Credit Index | 2.45% | 2.45% | — |

Morningstar Moderate Allocation AW Category | 1.08% | 1.08% | — |

30-Day SEC Yield: 1.50%; Gross Expense Ratio in current prospectus: 1.82%; Net Expense Ratio in current prospectus: 1.25%.

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

* | The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

11

Barclays Capital Intermediate Government/Credit Index is an unmanaged index based on publicly issued intermediate government debt securities. The index has an average maturity of 4 years. This index represents asset types which are subject to risk, including loss of principal.

The Morningstar Moderate Allocation AW Category is comprised of portfolios seeking to provide both capital appreciation and income by investing in three major areas: stocks, bonds, and cash. These portfolios tend to hold larger positions in stocks than conservative-allocation portfolios. These portfolios typically have 50% to 70% of assets in equities and the remainder in fixed income and cash.

1 | Davenport & Company LLC has contractually agreed, until August 31, 2017, to reduce Management Fees and to reimburse Other Expenses to the extent necessary to limit total annual ordinary operating expenses (excluding acquired fund fees and expenses) to an amount not exceeding 1.25% of the Balanced Fund’s average daily net assets. |

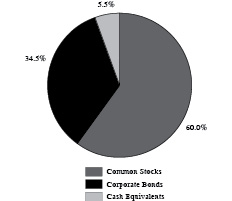

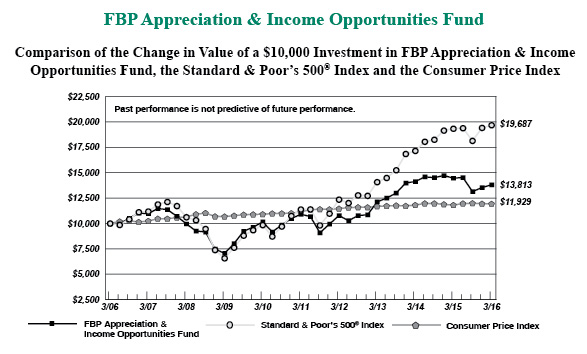

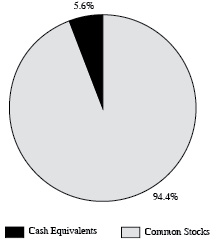

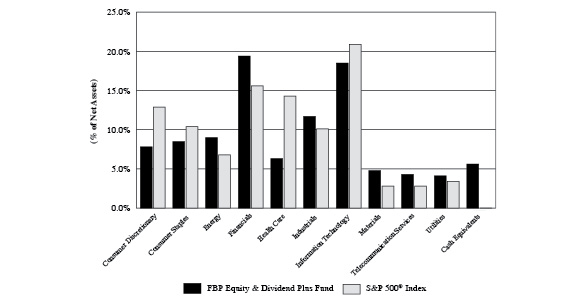

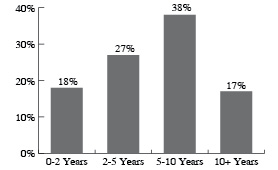

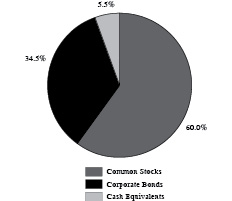

The Balanced Fund commenced operations 12/31/2015. The Fund compliments the other Davenport Funds by offering investors a lower volatility vehicle focused on current income and long term growth. The allocation range for stocks and bonds is 25-75% of Fund assets. The Fund’s allocation at the end of the quarter was 60.0% stocks, 34.5% bonds, and 5.5% cash.

The validity of the structure was demonstrated during the Fund’s first full quarter of operations as equity volatility increased while the bond allocation reduced the portfolio’s price sensitivity. Stocks suffered a decline during the first six weeks of 2016 while bonds rallied. Treasury yields fell during the first quarter of 2016 as the “risk off” trade dominated activity in the US bond market. Catalysts for the strong bid for U.S. Treasuries were: 1) a selloff in global equities, 2) fears of an accelerating global economic slowdown, and 3) continued low inflation. The fact that domestic equities sold off by 11.4% caused many investors to seek the safety of U.S. Treasury issues with the result of Treasury yields falling by 40 or more basis points for maturities of three years and longer.

The bond allocation of the Balanced Fund emphasized intermediate maturities with holdings invested across nine economic sectors. The effective maturity at the end of the quarter was 4.2 years with a duration of 3.8 years. The average credit rating was A2/A, a high quality profile.

The equity portion of the Balanced Fund advanced 3.29% during the Balanced Fund’s first quarter, versus the 2.5% gain for the Lipper Equity Income Index. Following a period of relative underperformance, we were pleased to see “value” stocks outperform “growth” stocks during the period. We also note that following a swoon to start the year in the wake of the Federal Reserve’s first interest rate hike, yield oriented investments rallied nicely alongside more dovish central bank posturing.

Spectra Energy (SE), was the portfolio’s top performer to start the year. The shares benefitted from a flight to quality within REITs and utilities, rewarding the company for its above average balance sheet strength and more stable client base. Johnson & Johnson (JNJ), was another beneficiary of a flight to quality within a challenged sector. Whereas above average dividend paying sectors such as REITS, Utilities and MLPs benefitted from the Federal Reserve’s more dovish tone, bank stocks (which benefit from higher rates) struggled. As such, Citigroup (C), Regions Financial (RF), JP Morgan (JPM) and Wells Fargo (WFC) were among our biggest detractors. Though the Balanced Fund is well represented in the group, we elected to add to the Fund’s position in Citigroup during the period, as the stock’s 30% discount to tangible book value seems excessive in light of the company’s improving capital position and potential for increased capital return in the future.

12

We believe the Balanced Fund demonstrated the strength of the concept of dampening market volatility for our shareholders. The strong stock performance, combined with positive bond returns, is an encouraging start to our entry into the balanced fund discipline. Accordingly, we see shareholders being the beneficiaries of this investment vehicle.

In conclusion, we are pleased that The Davenport Funds are off to a good start thus far in 2016. We thank you for your trust and look forward to reporting back as we proceed through the year.

Sincerely,

John P. Ackerly, IV

President, The Davenport Funds

13

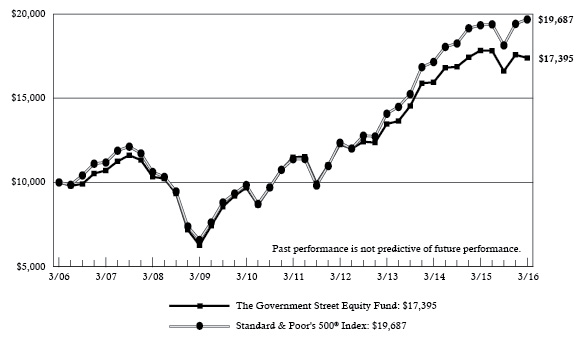

DAVENPORT CORE FUND

PERFORMANCE INFORMATION (Unaudited)

| | Average Annual Total Returns(a)

(for years ended March 31, 2016) |

| | 1 Year | 5 Years | 10 Years |

Davenport Core Fund | (2.39%) | 10.49% | 7.01% |

Standard & Poor’s 500® Index | 1.78% | 11.58% | 7.01% |

(a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

14

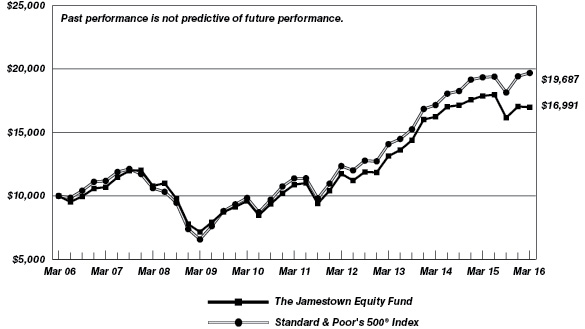

DAVENPORT VALUE & INCOME FUND

PERFORMANCE INFORMATION (Unaudited)

| | Average Annual Total Returns(a)

(for periods ended March 31, 2016) |

| | 1 Year | 5 Years | Since

Inception(b) |

Davenport Value & Income Fund | (0.46%) | 11.90% | 12.42% |

Standard & Poor’s 500® Index | 1.78% | 11.58% | 12.23% |

Lipper Equity Income Index | (0.56%) | 9.32% | 9.41% |

(a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | Commencement of operations was December 31, 2010. |

15

DAVENPORT EQUITY OPPORTUNITIES FUND

PERFORMANCE INFORMATION (Unaudited)

| | Average Annual Total Returns(a)

(for periods ended March 31, 2016) |

| | 1 Year | 5 Years | Since

Inception(b) |

Davenport Equity Opportunities Fund | (7.07%) | 11.89% | 12.78% |

Russell Midcap® Index | (4.04%) | 10.30% | 11.34% |

(a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | Commencement of operations was December 31, 2010. |

16

DAVENPORT SMALL CAP FOCUS FUND

PERFORMANCE INFORMATION (Unaudited)

| | Average Annual Total Returns(a)

(for periods ended March 31, 2016) |

| | 1 Year | Since Inception(b) |

Davenport Small Cap Focus Fund | (10.19%) | (5.26%) |

Russell 2000® Index | (9.76%) | (4.73%) |

(a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | Commencement of operations was December 31, 2014. |

17

DAVENPORT BALANCED INCOME FUND

PERFORMANCE INFORMATION (Unaudited)

| | Total Returns(a)

(for period ended March 31, 2016) Since Inception(b) |

| |

Davenport Balanced Income Fund | 2.90% |

Standard & Poor’s 500® Index | 1.35% |

Blended 60% Standard & Poor’s 500® Index / 40% Barclays Intermediate Government/Credit Bond Index | 1.88% |

Morningstar Moderate Allocation AW Category | 1.09% |

(a) | The total return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | Commencement of operations was December 31, 2015. |

18

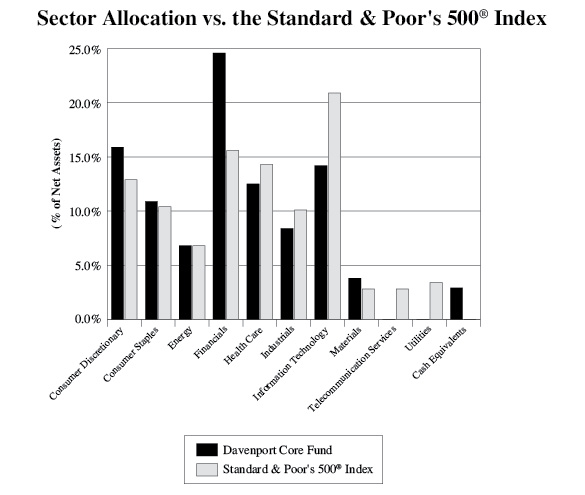

DAVENPORT CORE FUND

PORTFOLIO INFORMATION

March 31, 2016 (Unaudited)

Top Ten Equity Holdings

Security Description | % of Net Assets |

Markel Corporation | 3.7% |

Brookfield Asset Management, Inc. - Class A | 3.5% |

Danaher Corporation | 3.4% |

Capital One Financial Corporation | 3.2% |

Johnson & Johnson | 2.9% |

American Tower Corporation | 2.9% |

Accenture plc - Class A | 2.9% |

PVH Corporation | 2.6% |

Berkshire Hathaway, Inc. - Class B | 2.6% |

Nestlé S.A. - ADR | 2.5% |

19

DAVENPORT VALUE & INCOME FUND

PORTFOLIO INFORMATION

March 31, 2016 (Unaudited)

Top Ten Equity Holdings

Security Description | % of Net Assets |

Johnson & Johnson | 3.2% |

Markel Corporation | 3.0% |

Capital One Financial Corporation | 3.0% |

FNF Group | 2.9% |

Watsco, Inc. | 2.8% |

W.P. Carey, Inc. | 2.7% |

General Electric Company | 2.7% |

JPMorgan Chase & Company | 2.6% |

Wells Fargo & Company | 2.4% |

Coca-Cola Company (The) | 2.3% |

20

DAVENPORT EQUITY OPPORTUNITIES FUND

PORTFOLIO INFORMATION

March 31, 2016 (Unaudited)

Top Ten Equity Holdings

Security Description | % of Net Assets |

Discovery Communications, Inc. - Series C | 5.8% |

Brookfield Asset Management, Inc. - Class A | 5.5% |

American Tower Corporation | 5.1% |

Gaming and Leisure Properties, Inc. | 5.1% |

Dollar Tree, Inc. | 5.0% |

Colfax Corporation | 5.0% |

Capital One Financial Corporation | 4.8% |

Markel Corporation | 4.4% |

WABCO Holdings, Inc. | 4.0% |

CarMax, Inc. | 4.0% |

21

DAVENPORT SMALL CAP FOCUS FUND

PORTFOLIO INFORMATION

March 31, 2016 (Unaudited)

Top Ten Equity Holdings

Security Description | % of Net Assets |

Monarch Casino & Resort, Inc. | 4.1% |

Stewart Information Services Corporation | 4.1% |

Fortuna Silver Mines, Inc. | 4.0% |

VCA, Inc. | 3.6% |

Live Nation Entertainment, Inc. | 3.5% |

Colfax Corporation | 3.5% |

Genesee & Wyoming, Inc. - Class A | 3.5% |

Watsco, Inc. | 3.2% |

Liberty Broadband Corporation - Series C | 3.2% |

VWR Corporation | 3.2% |

22

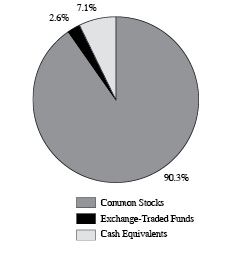

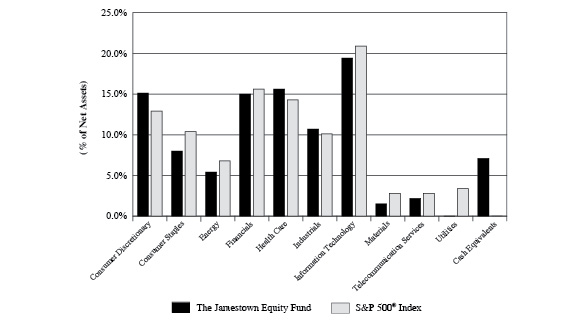

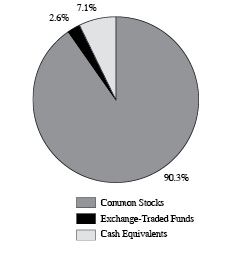

DAVENPORT BALANCED INCOME FUND

PORTFOLIO INFORMATION

March 31, 2016 (Unaudited)

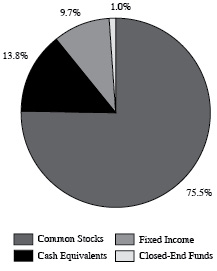

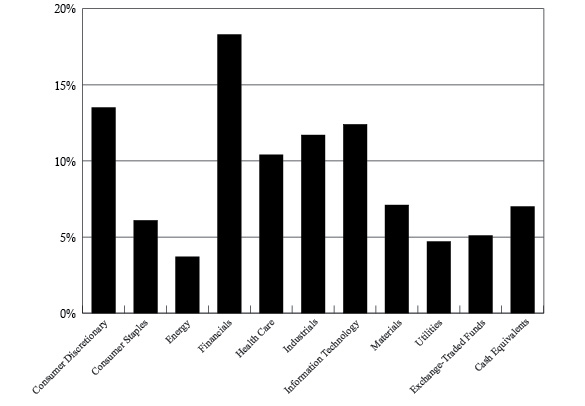

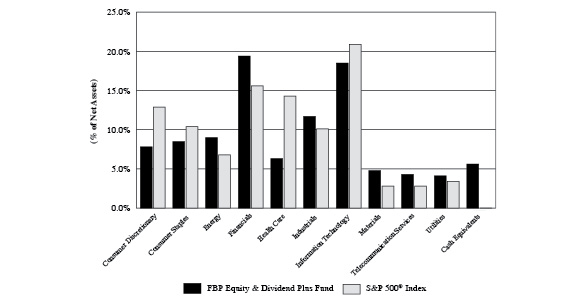

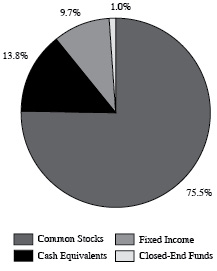

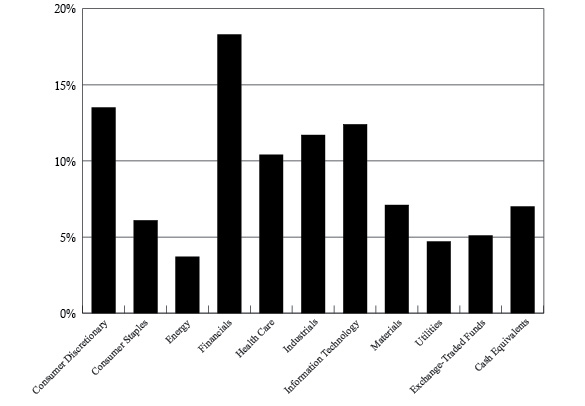

Asset Allocation (% of Net Assets) | | Ten Largest Equity Holdings | % of Net Assets |

| | Johnson & Johnson | 2.0% |

Markel Corporation | 1.8% |

Capital One Financial Corporation | 1.8% |

FNF Group | 1.8% |

Watsco, Inc. | 1.7% |

W.P. Carey, Inc. | 1.7% |

General Electric Company | 1.6% |

JPMorgan Chase & Company | 1.6% |

Wells Fargo & Company | 1.5% |

Coca-Cola Company (The) | 1.4% |

| |

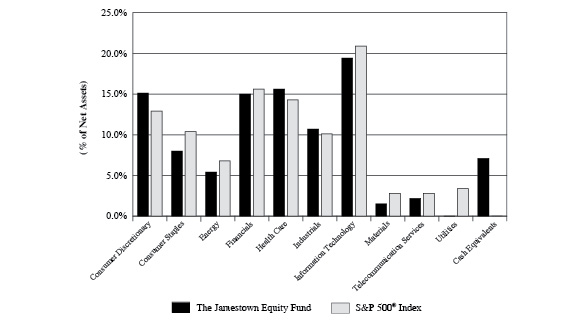

Equity Sector Concentration vs. the S&P 500® Index (60.0% of Net Assets) |

|

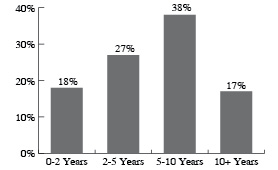

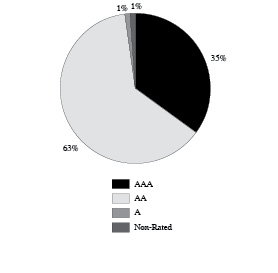

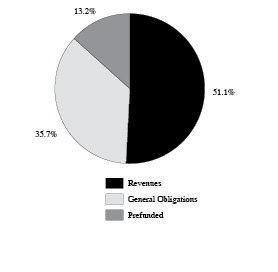

Corporate Bond Portfolio (34.5% of Net Assets) | | Credit Quality | Composite Quality |

Number of Fixed-Income Securities | 26 | | AA | 14% |

Average Quality | A | | A | 53% |

Effective Maturity | 4.2 yrs | | BBB | 33% |

Average Effective Duration | 3.8 yrs | | | |

Sector Breakdown | % of Corporate

Bond Portfolio |

Financials | 32.8% |

Consumer Staples | 20.9% |

Industrials | 17.0% |

Information Technology | 10.4% |

Consumer Discretionary | 8.9% |

Telecommunication Services | 6.6% |

Health Care | 3.4% |

23

DAVENPORT CORE FUND

SCHEDULE OF INVESTMENTS

March 31, 2016 |

COMMON STOCKS — 97.1% | | Shares | | | Value | |

Consumer Discretionary — 15.9% | | | | | | |

Amazon.com, Inc. (a) | | | 7,751 | | | $ | 4,601,304 | |

CarMax, Inc. (a) | | | 139,964 | | | | 7,152,160 | |

Discovery Communications, Inc. - Series C (a) | | | 185,986 | | | | 5,021,622 | |

Liberty Broadband Corporation - Series A (a) | | | 12,624 | | | | 734,212 | |

Liberty Broadband Corporation - Series C (a) | | | 51,714 | | | | 2,996,826 | |

Liberty Media Corporation - Series A (a) | | | 45,012 | | | | 1,738,813 | |

Liberty Media Corporation - Series C (a) | | | 133,979 | | | | 5,103,260 | |

Priceline Group, Inc. (The) (a) | | | 5,897 | | | | 7,600,997 | |

PVH Corporation | | | 89,081 | | | | 8,824,364 | |

Starbucks Corporation | | | 79,107 | | | | 4,722,688 | |

Walt Disney Company (The) | | | 52,531 | | | | 5,216,854 | |

| | | | | | | | 53,713,100 | |

Consumer Staples — 10.9% | | | | | | | | |

Anheuser-Busch InBev SA/NV - ADR | | | 40,875 | | | | 5,095,477 | |

Hershey Company (The) | | | 49,165 | | | | 4,527,605 | |

J.M. Smucker Company (The) | | | 57,907 | | | | 7,518,645 | |

Mondelēz International, Inc. - Class A | | | 138,640 | | | | 5,562,237 | |

Nestlé S.A. - ADR | | | 111,137 | | | | 8,291,932 | |

PepsiCo, Inc. | | | 55,701 | | | | 5,708,238 | |

| | | | | | | | 36,704,134 | |

Energy — 6.8% | | | | | | | | |

Chevron Corporation | | | 43,157 | | | | 4,117,178 | |

Exxon Mobil Corporation | | | 89,392 | | | | 7,472,277 | |

Marathon Petroleum Corporation | | | 134,208 | | | | 4,989,853 | |

Schlumberger Ltd. | | | 85,200 | | | | 6,283,500 | |

| | | | | | | | 22,862,808 | |

Financials — 24.6% | | | | | | | | |

American Tower Corporation | | | 95,322 | | | | 9,758,113 | |

Berkshire Hathaway, Inc. - Class B (a) | | | 61,801 | | | | 8,768,326 | |

Brookfield Asset Management, Inc. - Class A | | | 335,279 | | | | 11,664,356 | |

Capital One Financial Corporation | | | 157,324 | | | | 10,904,127 | |

Citigroup, Inc. | | | 172,367 | | | | 7,196,322 | |

CME Group, Inc. | | | 82,336 | | | | 7,908,373 | |

JPMorgan Chase & Company | | | 116,428 | | | | 6,894,866 | |

Markel Corporation (a) | | | 13,893 | | | | 12,386,582 | |

Wells Fargo & Company | | | 156,604 | | | | 7,573,370 | |

| | | | | | | | 83,054,435 | |

Health Care — 12.5% | | | | | | | | |

AmerisourceBergen Corporation | | | 67,785 | | | | 5,866,792 | |

Amgen, Inc. | | | 30,306 | | | | 4,543,779 | |

Anthem, Inc. | | | 30,048 | | | | 4,176,372 | |

Celgene Corporation (a) | | | 69,648 | | | | 6,971,068 | |

Johnson & Johnson | | | 91,542 | | | | 9,904,844 | |

24

DAVENPORT CORE FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 97.1% (Continued) | | Shares | | | Value | |

Health Care — 12.5% (Continued) | | | | | | |

Merck & Company, Inc. | | | 116,920 | | | $ | 6,186,237 | |

Perrigo Company plc | | | 34,744 | | | | 4,444,800 | |

| | | | | | | | 42,093,892 | |

Industrials — 8.4% | | | | | | | | |

American Airlines Group, Inc. | | | 141,130 | | | | 5,787,741 | |

Danaher Corporation | | | 121,722 | | | | 11,546,549 | |

General Electric Company | | | 159,750 | | | | 5,078,453 | |

Union Pacific Corporation | | | 74,744 | | | | 5,945,885 | |

| | | | | | | | 28,358,628 | |

Information Technology — 14.2% | | | | | | | | |

Accenture plc - Class A | | | 83,686 | | | | 9,657,364 | |

Adobe Systems, Inc. (a) | | | 54,468 | | | | 5,109,098 | |

Alphabet, Inc. - Class A (a) | | | 7,045 | | | | 5,374,631 | |

Alphabet, Inc. - Class C (a) | | | 6,387 | | | | 4,757,996 | |

Apple, Inc. | | | 39,672 | | | | 4,323,851 | |

Check Point Software Technologies Ltd. (a) | | | 62,562 | | | | 5,472,298 | |

Oracle Corporation | | | 121,082 | | | | 4,953,465 | |

Visa, Inc. - Class A | | | 106,801 | | | | 8,168,140 | |

| | | | | | | | 47,816,843 | |

Materials — 3.8% | | | | | | | | |

Monsanto Company | | | 70,788 | | | | 6,210,939 | |

Praxair, Inc. | | | 57,852 | | | | 6,621,162 | |

| | | | | | | | 12,832,101 | |

| | | | | | | | | |

Total Common Stocks (Cost $246,817,734) | | | | | | $ | 327,435,941 | |

MONEY MARKET FUNDS — 2.5% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 0.17% (b) (Cost $8,300,704) | | | 8,300,704 | | | $ | 8,300,704 | |

| | | | | | | | | |

Total Investments at Value — 99.6% (Cost $255,118,438) | | | | | | $ | 335,736,645 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.4% | | | | | | | 1,492,806 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 337,229,451 | |

ADR - American Depositary Receipt.

(a) | Non-income producing security. |

(b) | The rate shown is the 7-day effective yield as of March 31, 2016. |

See accompanying notes to financial statements.

25

DAVENPORT VALUE & INCOME FUND

SCHEDULE OF INVESTMENTS

March 31, 2016 | |

COMMON STOCKS — 95.7% | | Shares | | | Value | |

Consumer Discretionary — 9.2% | | | | | | |

Las Vegas Sands Corporation | | | 164,085 | | | $ | 8,479,913 | |

McDonald's Corporation | | | 72,800 | | | | 9,149,504 | |

Ralph Lauren Corporation | | | 68,784 | | | | 6,621,148 | |

Six Flags Entertainment Corporation | | | 154,510 | | | | 8,573,760 | |

Time Warner, Inc. | | | 118,585 | | | | 8,603,341 | |

| | | | | | | | 41,427,666 | |

Consumer Staples — 15.2% | | | | | | | | |

Altria Group, Inc. | | | 136,026 | | | | 8,523,389 | |

Anheuser-Busch InBev SA/NV - ADR | | | 63,130 | | | | 7,869,786 | |

Archer-Daniels-Midland Company | | | 159,630 | | | | 5,796,165 | |

Coca-Cola Company (The) | | | 223,235 | | | | 10,355,872 | |

Diageo plc - ADR | | | 74,885 | | | | 8,077,845 | |

PepsiCo, Inc. | | | 85,975 | | | | 8,810,718 | |

Philip Morris International, Inc. | | | 101,900 | | | | 9,997,409 | |

Procter & Gamble Company (The) | | | 112,615 | | | | 9,269,341 | |

| | | | | | | | 68,700,525 | |

Energy — 7.1% | | | | | | | | |

California Resources Corporation | | | 11,899 | | | | 12,256 | |

Chevron Corporation | | | 60,856 | | | | 5,805,663 | |

Exxon Mobil Corporation | | | 104,365 | | | | 8,723,870 | |

Occidental Petroleum Corporation | | | 129,960 | | | | 8,893,163 | |

Spectra Energy Corporation | | | 274,045 | | | | 8,385,777 | |

| | | | | | | | 31,820,729 | |

Financials — 28.8% | | | | | | | | |

Capital One Financial Corporation | | | 192,620 | | | | 13,350,492 | |

Citigroup, Inc. | | | 224,955 | | | | 9,391,871 | |

Equity LifeStyle Properties, Inc. | | | 132,270 | | | | 9,619,997 | |

FNF Group | | | 388,405 | | | | 13,166,929 | |

Gaming and Leisure Properties, Inc. | | | 315,734 | | | | 9,762,495 | |

JPMorgan Chase & Company | | | 194,705 | | | | 11,530,430 | |

Lamar Advertising Company - Class A | | | 162,190 | | | | 9,974,685 | |

Markel Corporation (a) | | | 15,054 | | | | 13,421,695 | |

Regions Financial Corporation | | | 871,335 | | | | 6,839,980 | |

Sun Communities, Inc. | | | 133,655 | | | | 9,571,035 | |

W.P. Carey, Inc. | | | 198,114 | | | | 12,330,615 | |

Wells Fargo & Company | | | 223,710 | | | | 10,818,616 | |

| | | | | | | | 129,778,840 | |

Health Care — 6.6% | | | | | | | | |

Johnson & Johnson | | | 134,320 | | | | 14,533,424 | |

Merck & Company, Inc. | | | 151,385 | | | | 8,009,780 | |

Sanofi - ADR | | | 176,785 | | | | 7,099,686 | |

| | | | | | | | 29,642,890 | |

26

DAVENPORT VALUE & INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.7% (Continued) | | Shares | | | Value | |

Industrials — 13.9% | | | | | | |

3M Company | | | 54,030 | | | $ | 9,003,019 | |

Boeing Company (The) | | | 52,895 | | | | 6,714,491 | |

Eaton Corporation plc | | | 111,857 | | | | 6,997,774 | |

General Electric Company | | | 383,055 | | | | 12,177,319 | |

Illinois Tool Works, Inc. | | | 72,135 | | | | 7,389,509 | |

Raytheon Company | | | 62,656 | | | | 7,683,505 | |

Watsco, Inc. | | | 93,465 | | | | 12,593,474 | |

| | | | | | | | 62,559,091 | |

Information Technology — 3.4% | | | | | | | | |

Cisco Systems, Inc. | | | 247,880 | | | | 7,057,144 | |

Microsoft Corporation | | | 153,183 | | | | 8,460,297 | |

| | | | | | | | 15,517,441 | |

Materials — 6.1% | | | | | | | | |

Eastman Chemical Company | | | 129,865 | | | | 9,380,149 | |

International Paper Company | | | 176,880 | | | | 7,259,155 | |

Nucor Corporation | | | 119,155 | | | | 5,636,032 | |

Potash Corporation of Saskatchewan, Inc. | | | 302,010 | | | | 5,140,210 | |

| | | | | | | | 27,415,546 | |

Telecommunication Services — 3.5% | | | | | | | | |

AT&T, Inc. | | | 172,520 | | | | 6,757,609 | |

Verizon Communications, Inc. | | | 162,665 | | | | 8,796,923 | |

| | | | | | | | 15,554,532 | |

Utilities — 1.9% | | | | | | | | |

Dominion Resources, Inc. | | | 114,890 | | | | 8,630,537 | |

| | | | | | | | | |

Total Common Stocks (Cost $377,333,236) | | | | | | $ | 431,047,797 | |

MONEY MARKET FUNDS — 3.6% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 0.17% (b) (Cost $16,339,652) | | | 16,339,652 | | | $ | 16,339,652 | |

| | | | | | | | | |

Total Investments at Value — 99.3% (Cost $393,672,888) | | | | | | $ | 447,387,449 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.7% | | | | | | | 3,059,492 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 450,446,941 | |

ADR - American Depositary Receipt.

(a) | Non-income producing security. |

(b) | The rate shown is the 7-day effective yield as of March 31, 2016. |

See accompanying notes to financial statements.

27

DAVENPORT EQUITY OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

March 31, 2016 |

COMMON STOCKS — 94.5% | | Shares | | | Value | |

Consumer Discretionary — 33.3% | | | | | | |

CarMax, Inc. (a) | | | 247,160 | | | $ | 12,629,876 | |

Discovery Communications, Inc. - Series A (a) | | | 116,935 | | | | 3,347,849 | |

Discovery Communications, Inc. - Series C (a) | | | 677,491 | | | | 18,292,257 | |

Dollar Tree, Inc. (a) | | | 190,991 | | | | 15,749,118 | |

Hanesbrands, Inc. | | | 363,380 | | | | 10,298,189 | |

Liberty Broadband Corporation - Series C (a) | | | 199,235 | | | | 11,545,668 | |

Live Nation Entertainment, Inc. (a) | | | 547,154 | | | | 12,207,006 | |

LKQ Corporation (a) | | | 333,316 | | | | 10,642,780 | |

Penn National Gaming, Inc. (a) | | | 252,337 | | | | 4,211,504 | |

TripAdvisor, Inc. (a) | | | 99,450 | | | | 6,613,425 | |

| | | | | | | | 105,537,672 | |

Consumer Staples — 3.7% | | | | | | | | |

Church & Dwight Company, Inc. | | | 127,540 | | | | 11,756,637 | |

| | | | | | | | | |

Financials — 32.7% | | | | | | | | |

American Tower Corporation | | | 158,970 | | | | 16,273,759 | |

Brookfield Asset Management, Inc. - Class A | | | 496,297 | | | | 17,266,173 | |

Capital One Financial Corporation | | | 220,579 | | | | 15,288,331 | |

Fairfax Financial Holdings Ltd. | | | 19,718 | | | | 11,042,080 | |

FNF Group | | | 215,950 | | | | 7,320,705 | |

Gaming and Leisure Properties, Inc. | | | 521,394 | | | | 16,121,502 | |

Markel Corporation (a) | | | 15,695 | | | | 13,993,191 | |

PRA Group, Inc. (a) | | | 212,308 | | | | 6,239,732 | |

| | | | | | | | 103,545,473 | |

Health Care — 2.8% | | | | | | | | |

Henry Schein, Inc. (a) | | | 50,685 | | | | 8,749,752 | |

| | | | | | | | | |

Industrials — 16.7% | | | | | | | | |

American Airlines Group, Inc. | | | 216,350 | | | | 8,872,513 | |

Colfax Corporation (a) | | | 549,221 | | | | 15,702,228 | |

Genesee & Wyoming, Inc. - Class A (a) | | | 139,035 | | | | 8,717,495 | |

WABCO Holdings, Inc. (a) | | | 119,135 | | | | 12,737,914 | |

Watsco, Inc. | | | 50,820 | | | | 6,847,487 | |

| | | | | | | | 52,877,637 | |

Information Technology — 3.5% | | | | | | | | |

Intuit, Inc. | | | 105,665 | | | | 10,990,217 | |

| | | | | | | | | |

Utilities — 1.8% | | | | | | | | |

NRG Energy, Inc. | | | 441,520 | | | | 5,744,175 | |

| | | | | | | | | |

Total Common Stocks (Cost $287,976,542) | | | | | | $ | 299,201,563 | |

28

DAVENPORT EQUITY OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS (Continued) |

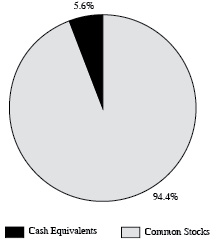

MONEY MARKET FUNDS — 5.6% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 0.17% (b) (Cost $17,824,702) | | | 17,824,702 | | | $ | 17,824,702 | |

| | | | | | | | | |

Total Investments at Value — 100.1% (Cost $305,801,244) | | | | | | $ | 317,026,265 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets — (0.1%) | | | | | | | (238,239 | ) |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 316,788,026 | |

(a) | Non-income producing security. |

(b) | The rate shown is the 7-day effective yield as of March 31, 2016. |

See accompanying notes to financial statements.

29

DAVENPORT SMALL CAP FOCUS FUND

SCHEDULE OF INVESTMENTS

March 31, 2016 |

COMMON STOCKS — 98.4% | | Shares | | | Value | |

Consumer Discretionary — 28.4% | | | | | | |

Cable One, Inc. | | | 1,500 | | | $ | 655,695 | |

Core-Mark Holding Company, Inc. | | | 13,571 | | | | 1,106,851 | |

Eldorado Resorts, Inc. (a) | | | 102,310 | | | | 1,170,426 | |

Isle of Capri Casinos, Inc. (a) | | | 50,000 | | | | 700,000 | |

Liberty Broadband Corporation - Series C (a) | | | 21,918 | | | | 1,270,148 | |

Liberty TripAdvisor Holdings, Inc. - Series A (a) | | | 36,000 | | | | 797,760 | |

Lions Gate Entertainment Corporation | | | 51,000 | | | | 1,114,350 | |

Live Nation Entertainment, Inc. (a) | | | 62,179 | | | | 1,387,214 | |

Monarch Casino & Resort, Inc. (a) | | | 83,925 | | | | 1,633,181 | |

Pool Corporation | | | 11,457 | | | | 1,005,237 | |

Unifi, Inc. (a) | | | 18,107 | | | | 414,831 | |

| | | | | | | | 11,255,693 | |

Consumer Staples — 7.4% | | | | | | | | |

Boston Beer Company, Inc. (The) - Class A (a) | | | 6,500 | | | | 1,202,955 | |

Seaboard Corporation (a) | | | 353 | | | | 1,060,063 | |

Snyder's-Lance, Inc. | | | 21,617 | | | | 680,503 | |

| | | | | | | | 2,943,521 | |

Energy — 0.9% | | | | | | | | |

CNX Coal Resources LP | | | 46,400 | | | | 333,152 | |

| | | | | | | | | |

Financials — 26.8% | | | | | | | | |

Cohen & Steers, Inc. | | | 20,500 | | | | 797,860 | |

Diamond Hill Investment Group, Inc. | | | 5,044 | | | | 894,604 | |

Encore Capital Group, Inc. (a) | | | 37,579 | | | | 967,283 | |

FRP Holdings, Inc. (a) | | | 21,893 | | | | 779,391 | |

Gaming and Leisure Properties, Inc. | | | 33,198 | | | | 1,026,482 | |

Lamar Advertising Company - Class A | | | 14,500 | | | | 891,750 | |

Outfront Media, Inc. | | | 54,289 | | | | 1,145,498 | |

PRA Group, Inc. (a) | | | 21,302 | | | | 626,066 | |

Raymond James Financial, Inc. | | | 14,000 | | | | 666,540 | |

Stewart Information Services Corporation | | | 44,529 | | | | 1,615,512 | |

TowneBank | | | 63,359 | | | | 1,215,859 | |

| | | | | | | | 10,626,845 | |

Health Care — 6.8% | | | | | | | | |

VCA, Inc. (a) | | | 25,155 | | | | 1,451,192 | |

VWR Corporation (a) | | | 46,361 | | | | 1,254,529 | |

| | | | | | | | 2,705,721 | |

Industrials — 18.3% | | | | | | | | |

Colfax Corporation (a) | | | 48,514 | | | | 1,387,015 | |

Covenant Transportation Group, Inc. - Class A (a) | | | 44,057 | | | | 1,065,739 | |

Genesee & Wyoming, Inc. - Class A (a) | | | 21,870 | | | | 1,371,249 | |

Marten Transport Ltd. | | | 60,178 | | | | 1,126,532 | |

30

DAVENPORT SMALL CAP FOCUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 98.4% (Continued) | | Shares | | | Value | |

Industrials — 18.3% (Continued) | | | | | | |

Mistras Group, Inc. (a) | | | 40,033 | | | $ | 991,618 | |

Watsco, Inc. | | | 9,558 | | | | 1,287,845 | |

| | | | | | | | 7,229,998 | |

Information Technology — 2.0% | | | | | | | | |

Black Knight Financial Services, Inc. - Class A (a) | | | 26,000 | | | | 806,780 | |

| | | | | | | | | |

Materials — 7.8% | | | | | | | | |

FMC Corporation | | | 21,000 | | | | 847,770 | |

Fortuna Silver Mines, Inc. (a) | | | 410,580 | | | | 1,601,262 | |

NewMarket Corporation | | | 1,636 | | | | 648,281 | |

| | | | | | | | 3,097,313 | |

| | | | | | | | | |

Total Common Stocks (Cost $39,932,464) | | | | | | $ | 38,999,023 | |

MONEY MARKET FUNDS — 1.5% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 0.17% (b) (Cost $604,635) | | | 604,635 | | | $ | 604,635 | |

| | | | | | | | | |

Total Investments at Value — 99.9% (Cost $40,537,099) | | | | | | $ | 39,603,658 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.1% | | | | | | | 32,404 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 39,636,062 | |

(a) | Non-income producing security. |

(b) | The rate shown is the 7-day effective yield as of March 31, 2016. |

See accompanying notes to financial statements.

31

DAVENPORT BALANCED INCOME FUND

SCHEDULE OF INVESTMENTS

March 31, 2016 |

COMMON STOCKS — 60.0% | | Shares | | | Value | |

Consumer Discretionary — 5.6% | | | | | | |

Las Vegas Sands Corporation | | | 3,960 | | | $ | 204,653 | |

McDonald's Corporation | | | 1,750 | | | | 219,940 | |

Ralph Lauren Corporation | | | 1,650 | | | | 158,829 | |

Six Flags Entertainment Corporation | | | 3,730 | | | | 206,977 | |

Time Warner, Inc. | | | 2,860 | | | | 207,493 | |

| | | | | | | | 997,892 | |

Consumer Staples — 9.3% | | | | | | | | |

Altria Group, Inc. | | | 3,285 | | | | 205,838 | |

Anheuser-Busch InBev SA/NV - ADR | | | 1,520 | | | | 189,483 | |

Archer-Daniels-Midland Company | | | 3,850 | | | | 139,793 | |

Coca-Cola Company (The) | | | 5,380 | | | | 249,578 | |

Diageo plc - ADR | | | 1,800 | | | | 194,166 | |

PepsiCo, Inc. | | | 2,070 | | | | 212,134 | |

Philip Morris International, Inc. | | | 2,460 | | | | 241,351 | |

Procter & Gamble Company (The) | | | 2,715 | | | | 223,472 | |

| | | | | | | | 1,655,815 | |

Energy — 4.3% | | | | | | | | |

California Resources Corporation | | | 198 | | | | 204 | |

Chevron Corporation | | | 1,470 | | | | 140,238 | |

Exxon Mobil Corporation | | | 2,515 | | | | 210,229 | |

Occidental Petroleum Corporation | | | 3,135 | | | | 214,528 | |

Spectra Energy Corporation | | | 6,610 | | | | 202,266 | |

| | | | | | | | 767,465 | |

Financials — 18.4% | | | | | | | | |

Capital One Financial Corporation | | | 4,640 | | | | 321,598 | |

Citigroup, Inc. | | | 5,410 | | | | 225,867 | |

Equity Lifestyle Properties, Inc. | | | 3,205 | | | | 233,100 | |

FNF Group | | | 9,340 | | | | 316,626 | |

Gaming and Leisure Properties, Inc. | | | 7,610 | | | | 235,301 | |

JPMorgan Chase & Company | | | 4,690 | | | | 277,742 | |

Lamar Advertising Company - Class A | | | 3,915 | | | | 240,773 | |

Markel Corporation (a) | | | 362 | | | | 322,748 | |

Outfront Media, Inc. | | | 7,905 | | | | 166,796 | |

Regions Financial Corporation | | | 21,475 | | | | 168,579 | |

Sun Communities, Inc. | | | 3,220 | | | | 230,584 | |

W.P. Carey, Inc. | | | 4,770 | | | | 296,885 | |

Wells Fargo & Company | | | 5,390 | | | | 260,660 | |

| | | | | | | | 3,297,259 | |

Health Care — 4.0% | | | | | | | | |

Johnson & Johnson | | | 3,245 | | | | 351,109 | |

Merck & Company, Inc. | | | 3,650 | | | | 193,122 | |

Sanofi - ADR | | | 4,270 | | | | 171,483 | |

| | | | | | | | 715,714 | |

32

DAVENPORT BALANCED INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 60.0% (Continued) | | Shares | | | Value | |

Industrials — 8.4% | | | | | | |

3M Company | | | 1,305 | | | $ | 217,452 | |

Boeing Company (The) | | | 1,280 | | | | 162,483 | |

Eaton Corporation plc | | | 2,695 | | | | 168,599 | |

General Electric Company | | | 9,235 | | | | 293,581 | |

Illinois Tool Works, Inc. | | | 1,735 | | | | 177,733 | |

Raytheon Company | | | 1,515 | | | | 185,785 | |

Watsco, Inc. | | | 2,250 | | | | 303,165 | |

| | | | | | | | 1,508,798 | |

Information Technology — 2.1% | | | | | | | | |

Cisco Systems, Inc. | | | 5,980 | | | | 170,250 | |

Microsoft Corporation | | | 3,695 | | | | 204,075 | |

| | | | | | | | 374,325 | |

Materials — 3.7% | | | | | | | | |

Eastman Chemical Company | | | 3,135 | | | | 226,441 | |

International Paper Company | | | 4,270 | | | | 175,241 | |

Nucor Corporation | | | 2,870 | | | | 135,751 | |

Potash Corporation of Saskatchewan, Inc. | | | 7,285 | | | | 123,991 | |

| | | | | | | | 661,424 | |

Telecommunication Services — 2.1% | | | | | | | | |

AT&T, Inc. | | | 4,165 | | | | 163,143 | |

Verizon Communications, Inc. | | | 3,925 | | | | 212,264 | |

| | | | | | | | 375,407 | |

Utilities — 2.1% | | | | | | | | |

Brookfield Renewable Energy Partners LP | | | 5,590 | | | | 167,421 | |

Dominion Resources, Inc. | | | 2,770 | | | | 208,082 | |

| | | | | | | | 375,503 | |

| | | | | | | | | |

Total Common Stocks (Cost $10,156,558) | | | | | | $ | 10,729,602 | |

FIXED RATE CORPORATE BONDS — 28.2% | | Par Value | | | Value | |

Consumer Discretionary — 3.1% | | | | | | |

Amazon, Inc., 3.30%, due 12/05/2021 | | $ | 200,000 | | | $ | 213,704 | |

Home Depot, Inc., 4.40%, due 04/01/2021 | | | 300,000 | | | | 335,901 | |

| | | | | | | | 549,605 | |

Consumer Staples — 7.2% | | | | | | | | |

Altria Group, Inc., 4.75%, due 05/05/2021 | | | 350,000 | | | | 396,958 | |

CVS Health Corporation, 3.875%, due 07/20/2025 | | | 200,000 | | | | 215,825 | |

J.M. Smucker Company, 3.50%, due 10/15/2021 | | | 150,000 | | | | 158,857 | |

PepsiCo, Inc., 2.75%, due 03/05/2022 | | | 300,000 | | | | 314,818 | |

Sysco Corporation, 2.60%, due 10/01/2020 | | | 200,000 | | | | 203,903 | |

| | | | | | | | 1,290,361 | |

33

DAVENPORT BALANCED INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

FIXED RATE CORPORATE BONDS — 28.2% (Continued) | | Par Value | | | Value | |

Financials — 6.1% | | | | | | |

Bank of America Corporation, 2.65%, due 04/01/2019 | | | 50,000 | | | $ | 50,877 | |

BlackRock, Inc., 3.50%, due 03/18/2024 | | | 200,000 | | | | 211,993 | |

General Electric Capital Corporation, 4.65%, due 10/17/2021 | | | 200,000 | | | | 228,167 | |

Goldman Sachs Group, Inc., 2.90%, due 07/19/2018 | | | 300,000 | | | | 307,005 | |

Morgan Stanley, 2.125%, due 04/25/2018 | | | 200,000 | | | | 201,387 | |

SunTrust Banks, Inc., 3.50%, due 01/20/2017 | | | 100,000 | | | | 101,564 | |

| | | | | | | | 1,100,993 | |

Health Care — 1.2% | | | | | | | | |

Becton Dickinson & Company, 3.25%, due 11/12/2020 | | | 200,000 | | | | 208,735 | |

| | | | | | | | | |

Industrials — 5.9% | | | | | | | | |

Burlington Northern Santa Fe, LLC, 4.70%, due 10/01/2019 | | | 350,000 | | | | 386,778 | |

Deere & Company, 4.375%, due 10/16/2019 | | | 300,000 | | | | 330,467 | |

United Technologies Corporation, 4.50%, due 04/15/2020 | | | 300,000 | | | | 331,547 | |

| | | | | | | | 1,048,792 | |

Information Technology — 3.6% | | | | | | | | |

Apple, Inc., 3.20%, due 05/13/2025 | | | 200,000 | | | | 209,532 | |

Oracle Corporation, 3.625%, due 07/15/2023 | | | 400,000 | | | | 433,265 | |

| | | | | | | | 642,797 | |

Telecommunication Services — 1.1% | | | | | | | | |

AT&T, Inc., 2.30%, due 03/11/2019 | | | 200,000 | | | | 204,200 | |

| | | | | | | | | |

Total Fixed Rate Corporate Bonds (Cost $4,986,650) | | | | | | $ | 5,045,483 | |

VARIABLE RATE CORPORATE BONDS (b) — 6.3% | | Par Value | | | Value | |

Financials — 5.2% | | | | | | |

American Express Credit Corporation, 1.401%, due 11/05/2018 | | $ | 250,000 | | | $ | 248,602 | |

Bank of America Corporation, 1.239%, due 08/25/2017 | | | 150,000 | | | | 149,417 | |

Bank of New York Mellon, 1.176%, due 08/01/2018 | | | 200,000 | | | | 199,521 | |

Citigroup, Inc., 1.175%, due 03/10/2017 | | | 200,000 | | | | 199,744 | |

JPMorgan Chase & Company, 1.519%, due 01/25/2018 | | | 125,000 | | | | 125,387 | |

| | | | | | | | 922,671 | |

Telecommunication Services — 1.1% | | | | | | | | |

Verizon Communications, Inc., 2.382%, due 09/14/2018 | | | 200,000 | | | | 204,894 | |

| | | | | | | | | |

Total Variable Rate Corporate Bonds (Cost $1,126,905) | | | | | | $ | 1,127,565 | |

34

DAVENPORT BALANCED INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

MONEY MARKET FUNDS — 9.0% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 0.17% (c) (Cost $1,617,573) | | | 1,617,573 | | | $ | 1,617,573 | |

| | | | | | | | | |

Total Investments at Value — 103.5% (Cost $17,887,686) | | | | | | $ | 18,520,223 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets — (3.5%) | | | | | | | (634,747 | ) |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 17,885,476 | |

ADR - American Depositary Receipt.

(a) | Non-income producing security. |

(b) | The rates shown are the effective interest rates as of March 31, 2016. |

(c) | The rate shown is the 7-day effective yield as of March 31, 2016. |

See accompanying notes to financial statements.

35

THE DAVENPORT FUNDS

STATEMENTS OF ASSETS AND LIABILITIES

March 31, 2016 |

| | Davenport Core Fund | | | Davenport Value & Income

Fund | | | Davenport Equity Opportunities Fund | |

ASSETS | | | | | | | | | |

Investments in securities: | | | | | | | | | |

At acquisition cost | | $ | 255,118,438 | | | $ | 393,672,888 | | | $ | 305,801,244 | |

At value (Note 2) | | $ | 335,736,645 | | | $ | 447,387,449 | | | $ | 317,026,265 | |

Cash | | | 1,714,025 | | | | — | | | | 54,841 | |

Dividends receivable | | | 177,221 | | | | 1,175,712 | | | | 1,892 | |

Receivable for investment securities sold | | | — | | | | — | | | | 1,451,000 | |

Receivable for capital shares sold | | | 264,505 | | | | 2,480,101 | | | | 551,751 | |

Other assets | | | 14,410 | | | | 12,986 | | | | 13,412 | |

TOTAL ASSETS | | | 337,906,806 | | | | 451,056,248 | | | | 319,099,161 | |

| | | | | | | | | | | | | |

LIABILITIES | | | | | | | | | | | | |

Payable for investment securities purchased | | | — | | | | — | | | | 1,847,241 | |

Payable for capital shares redeemed | | | 423,780 | | | | 272,177 | | | | 221,740 | |

Accrued investment advisory fees (Note 4) | | | 210,629 | | | | 279,065 | | | | 195,549 | |

Payable to administrator (Note 4) | | | 36,100 | | | | 45,200 | | | | 35,100 | |

Other accrued expenses | | | 6,846 | | | | 12,865 | | | | 11,505 | |

TOTAL LIABILITIES | | | 677,355 | | | | 609,307 | | | | 2,311,135 | |

| | | | | | | | | | | | | |

NET ASSETS | | $ | 337,229,451 | | | $ | 450,446,941 | | | $ | 316,788,026 | |

| | | | | | | | | | | | | |

Net assets consist of: | | | | | | | | | | | | |

Paid-in capital | | $ | 252,261,963 | | | $ | 402,532,125 | | | $ | 302,305,575 | |

Undistributed (distributions in excess of) net investment income | | | 21,930 | | | | 452,698 | | | | (72,767 | ) |

Accumulated net realized gains (losses) from security transactions | | | 4,327,351 | | | | (6,252,443 | ) | | | 3,330,197 | |

Net unrealized appreciation on investments | | | 80,618,207 | | | | 53,714,561 | | | | 11,225,021 | |

Net assets | | $ | 337,229,451 | | | $ | 450,446,941 | | | $ | 316,788,026 | |

| | | | | | | | | | | | | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.01 par value) | | | 17,954,565 | | | | 31,284,911 | | | | 21,505,069 | |

| | | | | | | | | | | | | |

Net asset value, offering price and redemption price per share (Note 2) | | $ | 18.78 | | | $ | 14.40 | | | $ | 14.73 | |

See accompanying notes to financial statements.

36