| OMB APPROVAL |

OMB Number: 3235-0570 Expires: August 31, 2020 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-05685 | |

| Williamsburg Investment Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

John Chilton, Esq.

| Sullivan & Worcester LLP 1666 K Street, NW Washington, D.C. 20006 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | March 31 | |

| | | |

| Date of reporting period: | September 30, 2019 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

SEMI-ANNUAL REPORT

September 30, 2019

(Unaudited)

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting the Funds at 1-800-281-3217 or, if you own these shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by contacting the Funds at 1-800-281-3217. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held with the Fund complex or at your financial intermediary.

THE DAVENPORT FUNDS

LETTER TO SHAREHOLDERS | November 6, 2019 |

Dear Shareholders,

Equity investors experienced a wild ride in the third quarter. After a solid start in July, we witnessed a sharp swoon in August as trade tensions again took center stage. The S&P 500® Index posted declines of nearly 3% on August 5th and August 14th as volatility surged. Fortunately, the damage was mitigated by a late August rally followed by a decent September. In the end, the S&P 500 Index finished the quarter up 1.70% while the Russell 2000® Index was down 2.40%. Year-to-date, the S&P 500 Index and Russell 2000 Index finished the period up 20.55% and 14.18%, respectively.

All of our Funds outperformed their benchmarks during the quarter. While one month typically isn’t worth highlighting, we are also pleased to report our Funds again held up better than their benchmarks in August during market tumult (the same held true during periods of volatility in May). While we never enjoy pullbacks, we do strive to demonstrate less risk than the broader market. On a year-to-date basis, three of our strategies are nicely outperforming their benchmarks, while the other two are lagging.

Slowing economic growth, an intensifying trade war, a partially inverted yield curve and negative interest rates in many parts of the world seem to be suggesting deflationary pressures and/or rising chances of a recession. According to the Wall Street Journal, a recent survey of economists put the odds of a recession at 35%. True to form, the media has latched onto recent volatility to double down on calls for bad outcomes. It often seems the greatest risk is talking ourselves into a recession. For the moment, economic growth actually remains decent as evidenced by 2.0% GDP growth in Q2 and calls for 1.9% growth in Q3.

Economic worries and falling long-term interest rates have renewed pressure on the Federal Reserve (the “Fed”) to lower short-term rates. Indeed, the Fed lowered rates 0.25% at its September meeting and most economists expect one more rate reduction by year end. “Easy” policy could provide support to equities, although we note the Fed has less room than in prior easing cycles. The current fed funds rate is 2% as opposed to 5-6% at the beginning of the last two easing cycles. Put differently, the efficacy of monetary easing may be exhausted at some point.

Then there’s the “TINA” argument. In other words, “there is no alternative” to stocks and other risk assets if looking for decent returns in a world of ultra-low interest rates. Most would certainly rather borrow money than lend it in this cheap money environment. True, low rates should support equity valuations and the market’s current forward price-to-earnings ratio of 16.9x (or an earnings yield of 5.9%) actually looks reasonable in the context of 10-year Treasury rates at 1.7%. However, this argument breaks down if rates are low because they portend a recession.

Where do these contradictory signals leave us? We have no idea what the near term holds and expect trade talks and political chicanery may induce periodic volatility, but we are sticking by our case for more moderate returns in coming years. This seems to be in the early stages of coming to fruition. While markets are up nicely year-to-date, they are essentially flat over the past year.

This type of environment should play to our strengths. We think stock selection could become more critical. At this point in the cycle, being valuation sensitive and watching out for high risk situations may matter more than it has for much of this decade. We are seeing indications of this, as the red-hot initial public offering (IPO) market of Q2 cooled significantly in Q3.

1

Davenport Core Fund

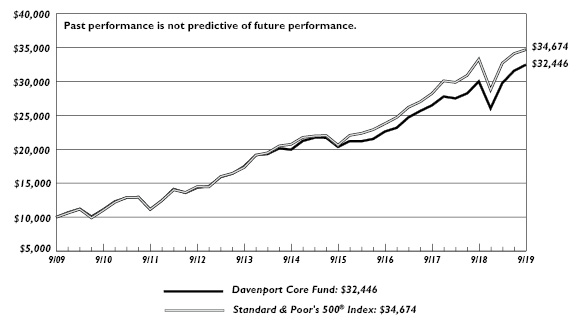

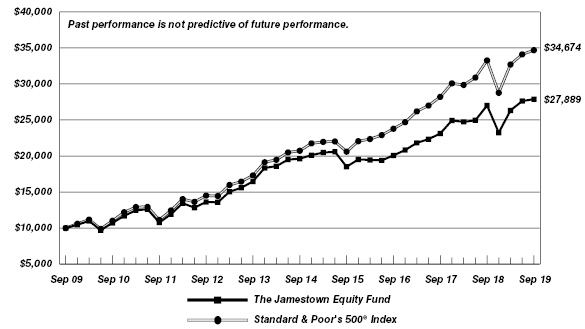

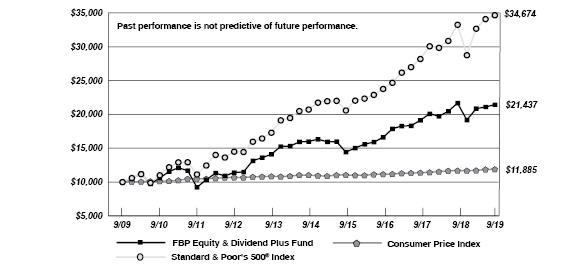

The following chart represents Davenport Core Fund’s (DAVPX) performance and the performance of the S&P 500 Index*, the Core Fund’s primary benchmark, for the periods ended September 30, 2019.

| Q3

2019 | 1 Year | 3 Years** | 5 Years** | 10 Years** | Since

Inception

1/15/98** | Fiscal

Year 2019

Expense

Ratio |

Core Fund | 2.80% | 8.17% | 12.78% | 10.22% | 12.49% | 7.13% | 0.89% |

S&P 500 Index* | 1.70% | 4.25% | 13.39% | 10.84% | 13.24% | 7.41% | |

30-Day SEC Yield: 0.32%; Expense Ratio in current prospectus: 0.89%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

* | The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. Standard & Poor’s Financial Services LLC, a division of S&P Global, is the source and owner of the registered trademarks related to the S&P 500 Index. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

** | Returns greater than one year are annualized. |

The Davenport Core Fund (DAVPX) posted another strong quarter in Q3, building on the first half of the year’s strength. The Core Fund returned 2.80%, ahead of the S&P 500® Index’s 1.70% advance. Year-to-date, DAVPX is up 24.63%, versus 20.55% for the S&P 500 Index.

Solid outperformance was driven by individual stock selection. Sherwin-Williams Co. (SHW), Martin Marietta Materials, Inc. (MLM), CVS Health Corp. (CVS), American Tower Corp. (AMT), Brookfield Asset Management, Inc. (BAM) and Markel Corp. (MKL) were all standout performers for us. It was also nice to see a name that we highlighted last quarter, Marathon Petroleum Corp. (MPC), catch a bid as a prominent investor called for a breakup to realize its sum-of-the-parts value. Our underweight stance in the Utilities sector was a drag as defensive stocks continue to perform well, amidst lower interest rates and signs of slowing global growth.

In the banking sector, we sold our position in Citigroup, Inc. (C) and added to our position in JPMorgan Chase & Co. (JPM), in an effort to increase the quality of the Fund. We also purchased two new positions: TJX Companies, Inc. (TJX) and Charles Schwab Corp. (SCHW).

TJX is a leading off-price retailer of clothing, accessories, and home fashions with 4,300 stores under the T.J. Maxx, Marshalls, and HomeGoods brands. We believe that the company will continue to be a winner in the changing retail landscape as customers love bargains and the “treasure hunt” experience at the company’s stores, driving market share gains. TJX leverages an extensive merchandising operation and proprietary inventory management system to maintain a rapidly changing product assortment at significant discounts across its banners. The company has posted positive same store sales growth for 23 consecutive years (only one down year in its 40+ year history) and has ample opportunity to continue to expand its store base. We also believe the stock is somewhat counter cyclical as consumers typically trade down to discount stores in

2

recessions. TJX trades at ~20x forward EPS, slightly above its 5-year average. While we don’t anticipate multiple expansion from here, we believe that the company will continue to compound earnings at a double-digit pace for the foreseeable future. The company has an A+-rated balance sheet and has grown its dividend at a 22% rate over the past five years to a current yield of 1.7%.

Schwab is a multifaceted financial services company in the U.S. with ~$3.5 trillion in total client assets. Lower short-term interest rates have weighed on the stock, and we think have presented an attractive buying opportunity. Organic growth remains strong (more than 100K new accounts have been opened for 28 consecutive months) and capital return is becoming a more important part of the story. The Board has recently taken actions on both the dividend (31% hike, current yield 1.8%) and buyback fronts ($4.0B authorization in January or 8% of current market cap). The current valuation of 14.5x forward EPS is at trough levels over the last two decades and is seven multiple points below its 5-year average of 22.0x. This valuation looks quite attractive considering SCHW’s A-rated balance sheet and 20% returns on equity. Recently, an announcement to eliminate commissions for U.S. ETFs and equities has pressured shares, highlighting the competitive nature of the industry. This should cause revenues to drop by 3-4%. Nevertheless, we view this business as a scale game, and with SCHW’s dominance, we suspect they will be able to regain some of this revenue over time through less visible fee streams and a growing asset base.

In sum, we remain pleased with the Fund’s performance year-to-date and over the past trailing twelve months (which encompasses the aggressive 4Q18 market selloff). We continue to hold a modestly elevated cash balance at 5% of the Fund. We believe the actions taken this quarter are consistent with our aim of continuously improving the Fund’s risk/reward profile. We look forward to reporting back at year end.

The following are transactions performed in the Core Fund for the quarter ended September 30, 2019.

Recent Purchases

Charles Schwab Corporation (SCHW) The prospects for lower short-term interest rates and the recent decline in long-term yields have weighed on the stock and we think have presented an attractive buying opportunity.

JPMorgan Chase & Co. (JPM)JPM offered one of the biggest positive surprises relative to consensus payout expectations. They are a stalwart in the banking industry, with leading investment bank, commercial bank, credit card, retail bank, and asset/wealth management franchises. Thus, we feel the risk/reward profile is favorable and see tremendous value in the company’s capital returns.

TJX Companies, Inc. (TJX)We expect the company to be a winner in the changing retail landscape. We believe the stock is somewhat counter cyclical as consumers typically trade down to discount stores in recessions, thus believing the company may compound earnings at a double-digit pace for the near future.

Recent Sales

Citigroup, Inc. (C) Citi has been a strong performer this year and continues to offer attractive capital returns following the recent Comprehensive Capital Analysis and Review (CCAR) results. Proceeds from the sale are being redeployed into two more growth-oriented issues.

3

Halliburton Company (HAL)We had forecasted that U.S. oil production would rebound from depressed levels last winter. Instead, oil prices have continued to languish and producers have continued to drop rigs, focusing on free cash flow. We find it difficult to see a path of sustained improvement for the oil services sector.

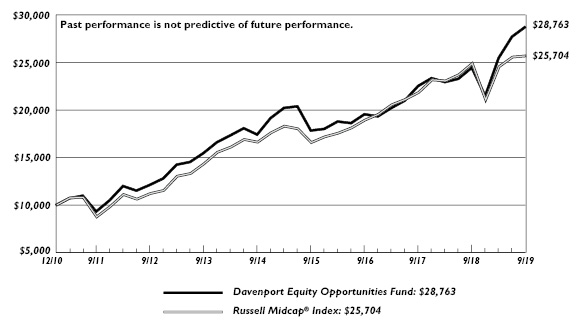

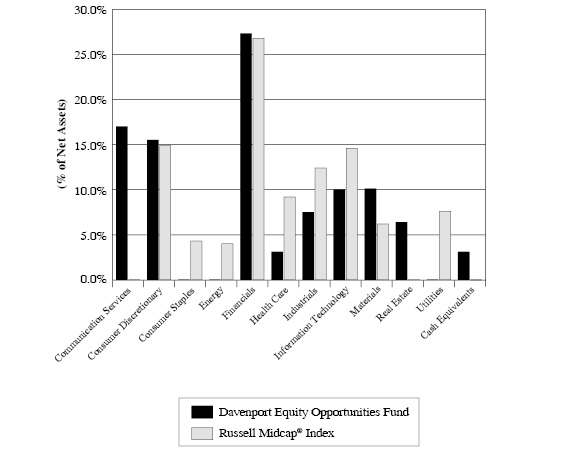

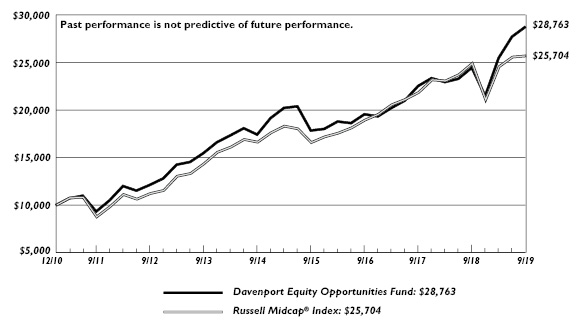

Davenport Equity Opportunities Fund

The following chart represents Davenport Equity Opportunities Fund (DEOPX) performance and the performance of the Russell Midcap® Index*, the Fund’s primary benchmark, and the S&P 500 Index* for the periods ended September 30, 2019.

| Q3

2019 | 1 Year | 3 Years** | 5 Years** | Since

Inception

12/31/10** | Fiscal

Year 2019

Expense

Ratio |

Equity Opportunities Fund | 3.75% | 17.60% | 13.72% | 10.54% | 12.84% | 0.91% |

Russell Midcap Index | 0.48% | 3.19% | 10.69% | 9.10% | 11.40% | |

S&P 500 Index* | 1.70% | 4.25% | 13.39% | 10.84% | 12.68% | |

30-Day SEC Yield: -0.19%; Expense Ratio in current prospectus: 0.91%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

* | The Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000, which represent approximately 25% of the total market capitalization of the Russell 1000®. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. Standard & Poor’s Financial Services LLC, a division of S&P Global, is the source and owner of the registered trademarks related to the S&P 500 Index. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

** | Returns greater than one year are annualized. |

The Davenport Equity Opportunities Fund (DEOPX) showed continued solid performance during the third quarter, advancing 3.75% versus the 0.48% for the Russell Mid Cap® Index. Year-to-date, the Fund is up 33.86%, nicely outpacing the Russell Midcap’s® 21.93% advance.

The Fund’s top contributor for the quarter was Sherwin-Williams Co. (SHW), which advanced roughly 20% on the heels of better-than-expected results, driven by an inflection in the margin profile of the business. We are encouraged to see the company’s pricing efforts finally catch up to volatile raw material costs and remain optimistic regarding the Valspar integration and renewed balance sheet flexibility. Brookfield Asset Management, Inc. (BAM), American Tower Corp. (AMT) and Martin Marietta Materials, Inc. (MLM) were also top contributors during the quarter. Following a strong response to quarterly results, we elected to chip our position in MLM. While we remain attracted to the company’s competitive moat, pricing power and visible demand profile, the position had become outsized relative to a more balanced risk/reward profile.

4

Key detractors during the period included a few top performers from the first half of the year. Autodesk, Inc. (ADSK), DISH Network Corp. (DISH) and MercadoLibre, Inc. (MELI) all took a “breather.” In the case of MELI, we were fortunate to reduce our position slightly with the stock near all-time highs, thus softening the blow of a late quarter drawdown. As was the case last quarter, Fairfax Financial Holdings Ltd. (FRFHF) continued to struggle during the period. While frustrated with the stock’s performance, we added to the position given the belief that a discount to book value is unwarranted for a company that is generating positive underwriting results, has conservative investment posturing and has recently instituted a meaningful share repurchase program.

We added to our position in water infrastructure company Xylem, Inc. (XYL), during the quarter. We liken XYL to a water ETF given the company’s exposure across many parts of the water cycle with products such as pumps, valves, treatment and testing equipment, controls and systems, and metering equipment. This business mix leaves Xylem well positioned to help tackle global issues such as water scarcity and infrastructure inefficiencies. Put simply, the company is bringing technology to a historically conservative and slow-to-adapt industry in need of a significant technological overhaul. We believe XYL will deliver on targets of 4-6% annual organic growth and 200-300 bps of margin expansion. With roughly $3.5 billion available for capital deployment into activities such as acquisitions and buybacks, we believe earnings can compound in the mid-teens for the foreseeable future. This algorithm could result in ~$5.00+ in EPS power in coming years, which we believe should drive the stock price meaningfully higher.

We also bought a position in Etsy, Inc. (ETSY), an online marketplace focused on handmade or vintage items and craft supplies. Founded in 2004, Etsy has built up a platform of 40 million active buyers and 2 million active sellers. Consumers desire the unique, authentic goods found on Etsy’s marketplace, and Etsy also benefits from the multi-decade shift to e-commerce. Etsy went public in 2015 and struggled in the public markets for its first two years, leading to a management transition. New management has been well received as they were able to expand margins and reaccelerate growth. However, the stock recently pulled back as management laid out long-term growth targets that underwhelmed expectations. We think this presented an attractive buying opportunity and consider management targets to be conservative as 1) they imply a significant deceleration in growth, 2) they do not incorporate further take rate expansion (peers are in the 10-15% take-rate range vs. ETSY at 5% -- take rate refers to the royalty rate that Etsy charges for goods sold on its marketplace), and 3) management’s target of 30%+ EBITDA margins are well below the high-30%s margins that have been achieved by peers such as eBay, Inc. (EBAY). Marketplace business models generate excellent free cash flow (in excess of net income) and Etsy has a modest net cash position on the balance sheet. Etsy is on the path to becoming a consistent high quality compounder, and we think free cash flow growth could approach 50% per annum over the next several years.

In closing, we are happy to report strong absolute and relative returns while continuing to emphasize quality and capital preservation. Though we hope the next three quarters resemble the prior three, we continue to position the Fund for a more moderate return environment.

5

The following are transactions performed in the Equity Opportunities Fund for the quarter ended September 30, 2019.

Recent Purchases

Etsy, Inc. (ETSY)ETSY went public in 2015 and struggled in the public markets for its first two years, leading to a management transition. With new management, expanded margins and reaccelerated growth, the stock had a massive run in the subsequent two years but has pulled back approximately 25% from its highs earlier this year. We believe this pullback was a buying opportunity that has the potential to generate consistent compounding growth going forward.

Fairfax Financial Holdings Ltd. (FRFHF) At current levels, FRFHF trades right on top of the FactSet consensus Q2 book value per share estimate of $463. We feel this may limit downside given the conservative nature of both the valuation of investments. We appreciate the defensiveness the stock should exhibit should market conditions deteriorate.

O’Reilly Automotive, Inc. (ORLY)The company appears poised to enter a period of easier sales comparisons, more favorable driving conditions (i.e. lower gas prices) and a more favorable age profile of the car park (6-10 year old vehicles set to make up a greater percentage of vehicles on the road).

Watsco, Inc. (WSO)While the stock has rallied from lows to start the year, shares have weakened recently in response to Q2 results. We believe recent management commentary and market development provide support for optimism. With the stock trading at the lower end of its historical valuation range, and considering the company’s rock solid balance sheet and attractive dividend, we felt the risk/reward looked attractive.

Xylem, Inc. (XYL)With multiple adds to XYL this quarter, our rationale is supported by the following: XYL has been a good performer since our initial purchase in May 2017. More recently, the stock has traded sideways as the company pushed out their 2020 operating margin targets. The explanation was having more investment opportunities to improve and grow the business than they originally expected. With a plethora of mergers and acquisitions roll up opportunities, a strong management team, and a solid balance sheet, we decided to bulk up our position in the stock.

Recent Sales

American Woodmark Corporation (AMWD)The stock is up 48% year to date and up 14% since the recent low a little over a week ago. Moreover, given the lower liquidity profile of the stock, we elected to sell the position on strength and redeploy the Fund into more favorable opportunities.

Martin Marietta Materials, Inc. (MLM)Shares of MLM are making new highs following a very solid 2Q report where the company beat Street expectations and raised guidance for FY2019. We remain very optimistic about the near- and long-term outlook for MLM as demand across the company’s footprint is accelerating. We decided to take some profits while maintaining MLM as a top-10 position in the portfolio (4.6% of the portfolio).

MercadoLibre, Inc. (MELI)While we remain attracted to the company’s attractive business model, massive growth opportunity and accelerating alternative business channels (i.e. payments), we feel the current valuation reflects a more balanced risk/reward profile.

6

Zoetis, Inc. (ZTS)The stock is up nearly 150% since our initial purchase, having tacked on an additional 34% since we last trimmed the position in November of 2018. While we remain excited about the growth backdrop for the industry and the company’s leadership position within it, we feel the valuation warrants taking some profits at this time.

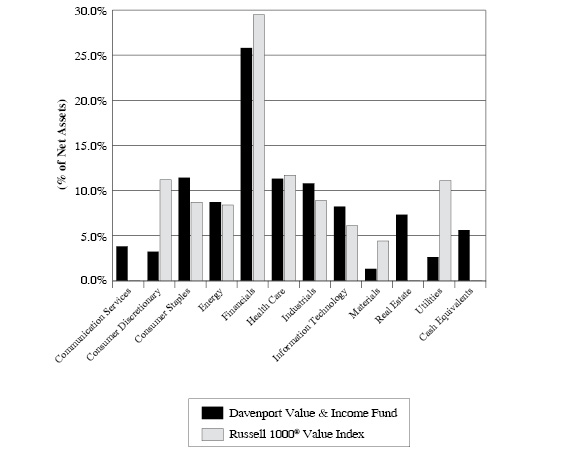

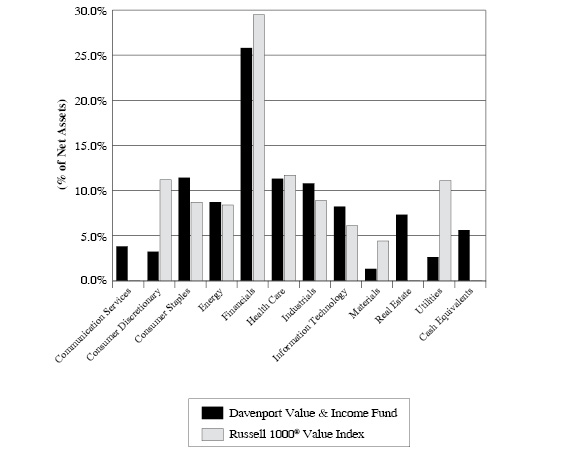

Davenport Value & Income Fund

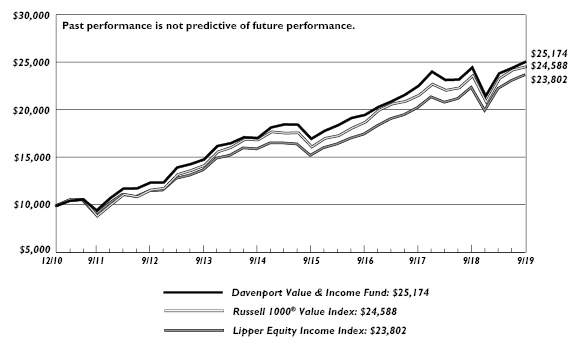

The following chart represents Davenport Value & Income Fund (DVIPX) performance and the performance of the Russell 1000 Value Index*, the Value & Income Fund’s primary benchmark, the S&P 500 Index and the Lipper Equity Income Index for the periods ended September 30, 2019.

| Q3

2019 | 1 Year | 3 Years** | 5 Years** | Since

Inception

12/31/10** | Fiscal

Year 2019

Expense

Ratio |

Value & Income Fund | 2.63% | 2.52% | 8.76% | 8.00% | 11.13% | 0.88% |

Russell 1000 Value Index | 1.36% | 4.00% | 9.43% | 7.79% | 10.83% | |

S&P 500 Index* | 1.70% | 4.25% | 13.39% | 10.84% | 12.68% | |

Lipper Equity Income Index* | 2.58% | 5.88% | 10.66% | 8.26% | 10.42% | |

30-Day SEC Yield: 1.67%; Expense Ratio in current prospectus: 0.89%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

* | The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. Standard & Poor’s Financial Services LLC, a division of S&P Global, is the source and owner of the registered trademarks related to the S&P 500 Index. The Lipper Equity Income Index is an unmanaged index of the 30 largest Funds in the Lipper Equity Income Fund category. The Russell 1000® Value Index measures the performance of the Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

** | Returns greater than one year are annualized. |

The Davenport Value & Income Fund (DVIPX) enjoyed a strong third quarter, increasing 2.63% and outperforming its primary benchmark, the Russell 1000® Value Index, which increased 1.36%. On a year-to-date basis, the Fund has increased 16.83% compared to the Russell 1000 Index, which has increased 17.81%. The S&P 500® Index increased 1.70% in the third quarter and is up 20.55% so far in 2019.

Health Care and Financial stocks were the key contributors to performance during the quarter. Our patience with Bristol-Myers Squibb Co. (BMY) and CVS Health Corp. (CVS) paid off as both stocks rallied nicely. BMY made progress towards closing its acquisition of Celgene Corp. (CELG) and CVS received welcome news from a federal judge that he would not block its acquisition of Aetna. Financials were led by stalwarts Brookfield Asset Management, Inc. (BAM) and Fidelity National Financial, Inc. (FNF), two of our larger positions. BAM continues to benefit from inflows into the alternative/real asset class and FNF was helped by lower mortgage rates, which stimulated refinancing and purchase demand.

7

Once again, our key detractors were an eclectic mix. Fairfax Financial Holdings Ltd. (FRFHF) continued to struggle but is trading at a discount to book value, which we think is too cheap given its solid insurance franchise and new share repurchase plan. Oil giant Royal Dutch Shell PLC (RDS.B) declined amid lower oil prices. Lastly, Johnson & Johnson (JNJ) declined as investor concerns over its potential liability in talc and opioid lawsuits increased. We think these risks are manageable for JNJ given its size and AAA-rated balance sheet.

In tandem with our expectation of more moderate returns going forward, our transactions were an effort to improve the defensive nature of the Fund and move capital from more growth-oriented situations to ideas where we saw long-term value opportunities at attractive prices. We chipped positions in Microsoft Corp. (MSFT) and Cisco Systems, Inc. (CSCO) and initiated a position in Wells Fargo & Co. (WFC). We also chipped Merck & Co., Inc. (MRK) and Citigroup, Inc. (C) and moved the proceeds into a new position in Berkshire Hathaway, Inc. (BRK.B).

Wells Fargo has been in the penalty box following various scandals that have led to multiple CEO departures. We felt the negative headlines were fully reflected in the stock price at less than 10x earnings and with a dividend yield close to 4.5%. We view WFC as an attractive long-term value situation based on the company’s strong balance sheet, impressive franchise, strong capital return and potential future profitability as it emerges from its current regulatory challenges. Subsequent to our purchase, WFC announced that it had hired Charlie Scharf as its new CEO. Mr. Scharf was a long-time veteran at JPMorgan Chase & Co. (JPM) and the stock reacted positively to the announcement given his past experience and general reputation within the industry.

Berkshire Hathaway has grown book value per share at a 9% compound annual growth rate (CAGR) over the past 20 years and this figure actually understates true economic returns, as it does not capture the growth in value of wholly-owned companies in Berkshire’s portfolio. Despite the solid returns, BRK.B’s price to book value has fallen to 1.25x, the low end of its multi-year range, which we believe could lead to an increase in share repurchases in the coming years. The company has an AA-rated balance sheet with $122 billion in cash. Given the balance sheet, excess free cash generation and track record of capital allocation in rougher economic times, we think BRK.B shares are likely to act defensively in a sustained market selloff. Ultimately, we see a lot of value in this diverse collection of businesses and don’t think the market is giving BRK.B enough credit from the optionality of all the excess cash sitting on the balance sheet and coming in the door.

In summary, we are pleased with the Fund’s performance during the third quarter, especially as it held up well during the dramatic market selloff in August. The Fund’s yield of 3.1% continues to provide attractive current income and we think recent transactions have improved the defensive characteristics of the Fund.

Recent Purchases

Berkshire Hathaway, Inc. (BRK.B) BRK.B does not pay a dividend. BRK’B has grown book value per share at a 9% compound annual growth rate over the past twenty years. We see a lot of value in this diverse collection of businesses and do not think the market is giving BRK.B enough credit for all the excess cash coming in the door.

Norfolk Southern Corporation (NSC)Norfolk Southern is one of a handful of Class I railroads in North America. The cost to move goods is substantially lower via rail than truck due to exponentially better efficiency. A strategy termed “Precision Railroading” by Hunter Harrison,

8

a deceased former railway executive, entails keeping the trains constantly moving and limiting time sitting in the yards, increasing efficiencies dramatically. This has resulted in a boost of profitability for the railroads who have adopted this strategy. Given the blueprint for this strategy has been laid out and executed multiple times at this point, and a similar asset base, we believe NSC will ultimately succeed in its shift to precision railroad.

Wells Fargo & Company (WFC) WFC has been in the penalty box following various scandals that have led to multiple CEO departures. We feel the negative headlines are fully reflected in the current stock price. Moreover, we believe the concern surrounding the potential for interest rate cuts factored into the current share price.

Recent Sales

Cisco Systems, Inc. (CSCO)CSCO has been a strong performer year-to-date, returning over 30%. With signs of tightening demand across the IT infrastructure universe and the name representing larger than typical portfolio weights, we elected to take some profits on the recent strength.

Citigroup, Inc. (C)Citigroup’s share price is flat over the past two years, as the lower interest rate environment weighs on profit potential, and economic challenges abroad have also posed an issue (roughly half of C’s revenues are outside North America).

Merck & Co, Inc. (MRK)MRK has been a standout performer for the portfolio over the past year and a half, as its immunoncology drug Keytruda has become a preferred method of treating lung cancer. In addition to rising sales, the price to earnings ratio has also expanded significantly.

Microsoft Corporation (MSFT)MSFT has been a strong performer year-to-date, returning over 35%. With signs of tightening demand across the IT infrastructure universe and the name representing larger than typical portfolio weights, we elected to take some profits on the recent strength.

PPG Industries, Inc (PPG)Absent an acceleration in global growth, we think upside from here would come from the company using its balance sheet by either committing to significant capital return, or pursuing large-scale mergers & acquisitions. We think this scenario could play out and ultimately elected to sell the position.

Davenport Small Cap Focus Fund

The following chart represents performance of the Davenport Small Cap Focus Fund (DSCPX) and the performance of the Fund’s primary benchmark, the Russell 2000 Index*, for the periods ended September 30, 2019.

| Q3

2019 | 1 Year | 3 Year | Since

Inception

12/31/14** | Fiscal

Year 2019

Expense

Ratio |

Small Cap Focus Fund | -0.21% | 5.01% | 11.77% | 8.74% | 0.97% |

Russell 2000 Index* | -2.40% | -8.89% | 8.23% | 6.54% | |

30-Day SEC Yield: 0.05%; Expense Ratio in current prospectus: 0.98%

9

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

* | The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® index, representing approximately 8% of the total market capitalization of the Russell 3000. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

** | Returns greater than one year are annualized. |

The Davenport Small Cap Focus Fund (DSCPX) proved relatively resilient during the third quarter. Though the Fund’s return was down slightly of 0.21% for the period, this outpaced the 2.40% decline for the Russell 2000® Index. Year to date, the strategy is up 26.23% versus 14.18% for the Russell 2000 Index.

While our Fund has outperformed, we point out that small-cap equities in general continue to underperform larger cap peers. In fact, the Russell 2000 Index has underperformed both the S&P 500® Index and the Russell Mid Cap® Index on a 1, 3, 5 and 10-year basis and the relative valuation gap between small and large cap indices is wider than long-term averages (suggesting small-caps are cheap). While attempting to time an inflection in this trend has not been fruitful as of late, we feel the asset class affords an element of timeliness and believe our strategy offers a high quality way to participate.

Water services provider Evoqua Water Technologies Corp. (AQUA) and building products distributor Builders FirstSource, Inc. (BLDR) were top performers during the quarter. We added to both of these names during periods of distress at the beginning of the year and have been pleased to see them recover nicely. We were also pleased to have early success with Switch, Inc. (SWCH) and Colfax Corp. (CFX), two names we highlighted in last quarter’s letter. Leading pet insurer, Trupanion, Inc. (TRUP) was the top detractor for the period, suffering a meaningful decline in response to an analyst downgrade. We are disappointed in the stock’s reaction; however, we maintain a high degree of conviction in the growth opportunity for pet insurance (~2% penetration in the U.S. versus 25% in the U.K.), value proposition that TRUP provides to its customers and the ultimate cash generation potential of this business. Furthermore, we believe the company has executed well and continue to support management’s decision to redeploy excess cash flow into new customer acquisitions given the attractive returns that result (30-40% IRRs on pet acquisition spend).

We added to Seaboard Corp. (SEB), a position we have held for some time but have yet to discuss in this medium. SEB is a holding company based in Merriam, Kansas with operations focused on global agribusiness, commodity trading and transportation. Though the company’s asset mix is diverse and far flung (SEB employs 25,000 worldwide across 45 nations), the key value drivers are its protein production assets. More specifically, SEB is one of the largest producers and processors of pork in the U.S., with additional exposure to turkey production via its partial ownership interest in Butterball LLC. While we have always been attracted to the company’s exposure to the global protein theme, recent developments in China and to ongoing company specific factors make the shares timely, in our opinion. China (with annual consumption of 122 billion pounds of pork) is dealing with a devastating outbreak of African Swine Fever, forcing

10

domestic producers to cull herds. According to the Wall Street Journal, China’s pork production could fall by as much as 35.7 billion pounds in 2019 – almost double the amount of pork traded globally in a year. This is already having a dramatic impact on local pricing, which should leak into U.S. markets as international capacity is used up. Interestingly, this is coming at a time when SEB is bringing on new capacity, thus increasing the company’s ability to deliver into a tight market. While earnings have been volatile and unpredictable on a short-term basis, the company’s history of long-term value creation is quite consistent. In light of the developments discussed above, we believe Seaboard could earn us a blue ribbon.

In sum, we are pleased with recent returns and the Fund’s resilience during market turmoil. In addition, we are excited about the relative value proposition of the asset class. We also note that the end of this year marks the 5th anniversary of the Fund. We are pleased with our returns since inception and look to build on this success over the next five years.

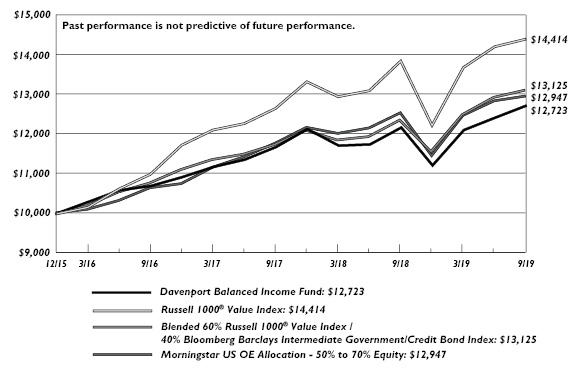

Davenport Balanced Income Fund

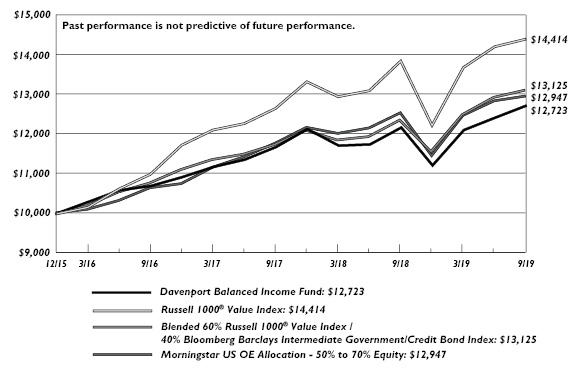

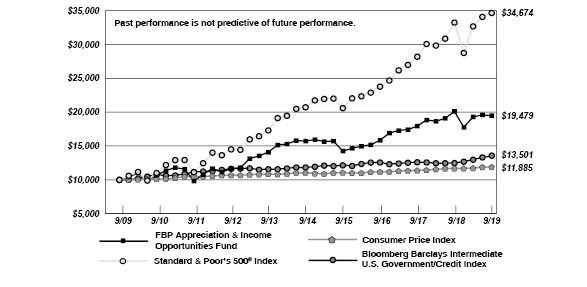

The following chart represents Davenport Balanced Income Fund (DBALX) performance, and performance of the Fund’s primary benchmark, the Russell 1000® Value Index, along with the Morningstar Allocation 50-70% Equity Index, and the blended 60% Russell 1000® Value Index / 40% Bloomberg Barclays Intermediate Government /Credit Bond Index for the period ended September 30, 2019.

| Q3

2018 | 1 Year | Since

Inception

12/31/15** | Fiscal

Year 2019

Expense

Ratio |

Balanced Income Fund | 2.46% | 4.56% | 6.63% | 0.96% |

Russell 1000® Value* | 1.36% | 4.00% | 10.24% | |

Morningstar Allocation 50-70% Equity* | 0.93% | 3.37% | 7.13% | |

60% Russell 1000® Value/40% BBIGC | 1.41% | 6.11% | 7.52% | |

30-Day SEC Yield: 1.69%; Expense Ratio in current prospectus: 0.96%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

* | The Russell 1000® Value Index measures the performance of the Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. The Morningstar US OE Allocation 50-70% Equity Index is composed of Funds which seek to provide both income and capital appreciation by investing in multiple asset classes, including stocks, bonds, and cash. These portfolios are dominated by domestic holdings and have equity exposure between 50% and 70%. The blended 60% Russell 1000 Value/40% Bloomberg Barclay’s Intermediate Government/Credit (BBIGC) Index is included as an additional comparative index because it is representative of a balanced portfolio consisting of 60% equity and 40% fixed income securities. The BBIGC measures the non-securitized component of the U.S. Aggregate Index. It includes investment grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate rate securities. Intermediate maturity bonds include bonds with maturities of 1 to 9.999 years. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

** | Returns greater than one year are annualized. |

11

The Davenport Balanced Income Fund (DBALX) increased 2.46% in the third quarter, outpacing the 1.36% increase for the Russell 1000® Value Index and the 1.70% increase for the S&P 500® Index. The blended index of 60% Russell 1000 Value Index/ 40% Bloomberg Barclays Intermediate Government Credit® Index was up 1.41% for the quarter. Year to date (YTD), DBALX has returned 13.48% compared to 17.81% for the Russell 1000® Value, 20.55% for the S&P 500 Index and 13.38% for the blended 60/40 index.

Financial stocks were again the top contributors to performance this quarter, with Blackstone Group, Inc. (BX), Brookfield Asset Management, Inc. (BAM), and Fidelity National Financial, Inc. (FNF) leading the pack. FNF benefited from lower mortgage rates, which helped spur refinancing and purchase demand, while BAM continues to see strong inflows into the alternative asset classes. Blackstone performed well following its July conversion to a C-Corp, and we used this strength to exit the position as we felt its valuation had become a bit stretched. Our biggest detractors to performance included Royal Dutch Shell PLC (RDS’B) and Fairfax Financial Holdings Ltd. (FRFHF). RDS’B fell victim to lower oil prices and FRFHF shares have struggled to recover following second quarter earnings. FRFHF shares are trading at discount to book value, which we believe is too cheap given the company’s solid insurance franchise and new share repurchase plan.

During the quarter, we elected to initiate a position in Nordstrom, Inc. (JWN), a leading fashion specialty retailer offering apparel, shoes, cosmetics and accessories for women, men, and children. At the time of our purchase, the shares were down over 55% from their twelve-month high primarily due to concerns surrounding the general retailing environment as well as weaker than expected earnings and guidance. We feel these concerns are overblown; moreover, JWN has a strong brand name and a well-earned reputation for quality and customer service. We felt the shares had been de-risked and offered an opportunity to purchase the stock at a compelling valuation and 5% dividend yield.

The bond market continued to chug along in the third quarter of 2019. Amid weaker than expected global economic data coupled with global central bank easing, safe haven assets continued to produce positive returns. While the Federal Reserve initiated its accommodative monetary policy stance with two rate cuts during Q3, yields around the globe continued to drop (prices rose). By August there were around $17 trillion sovereign bonds with negative yields. Investors continue to be attracted to the U.S. market, where one can attain positive yielding debt while providing a hedge to equity markets during bouts of volatility.

The 2-yr Treasury fell 13bps to 1.624%, while rates on the 10-yr and 30-yr Treasury dropped 34bps (1.67%) and 42bps (2.11%) respectively. The Bloomberg Barclays Intermediate Government/ Credit Index continued to perform well, adding 1.37% in Q3 taking its YTD return to 6.41%. The Bloomberg Barclays US FRN <5yr Index remained positive in Q3 up 0.78% bringing its YTD return to 3.21%.

The bond allocation of the Balanced Fund consists of 32 high-quality bonds across eight sectors with the top allocations to U.S. governments at 27.8%, Financials at 19.7%, and Energy at 16.0%. The fixed income portion of DBALX has an effective maturity of 4.2 years and a duration of 3.5 years. During the quarter, we continued to reduce our floating rate exposure by selling one of our Treasury floating rate notes and allowing a couple corporate floating rate notes (FRNs) to mature, bringing our exposure to 21.46% from 24.94% in Q2. FRNs still provide a good yield to duration ratio, but with the Fed cutting rates and future cuts being priced into the market, we

12

feel that 3-month LIBOR (London Inter-bank Offered Rate) has more risk to the downside. We also took advantage of the high activity in the corporate new issue market initiating positions in PayPal Holdings and Fiserv, while exiting our General Motors position. We continue to see value in Treasuries on pullbacks and our Treasury exposure remains around 27%.

The recent market volatility has been a good reminder of the value in a balanced approach. Value-based equity has been out of favor in recent years; however, we finally saw it return to glory in the last month of the quarter as political discord and trade negotiations led to increased market volatility. Given these uncertainties, we believe our allocation to value-based equities and defensive positioning in fixed income may provide a volatility buffer in the near future, while also providing income and potential for long-term capital appreciation.

Sincerely,

John P. Ackerly IV, CFA

President, The Davenport Funds

13

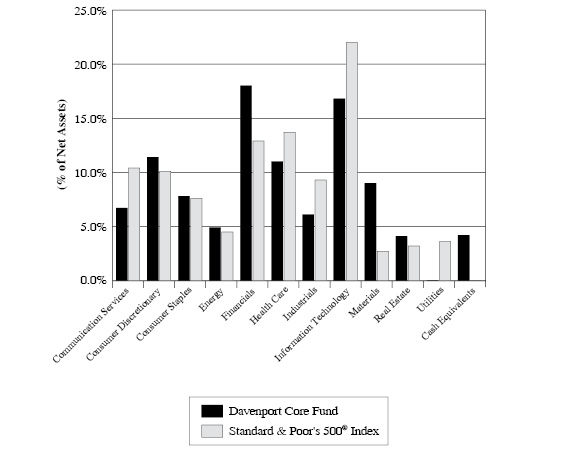

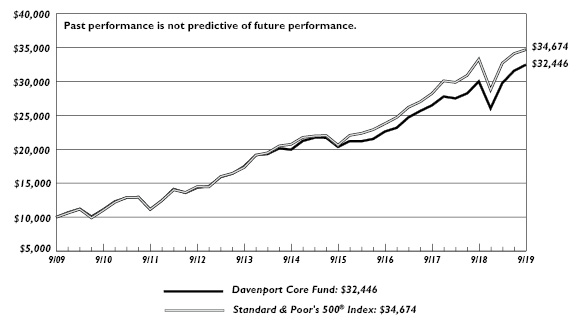

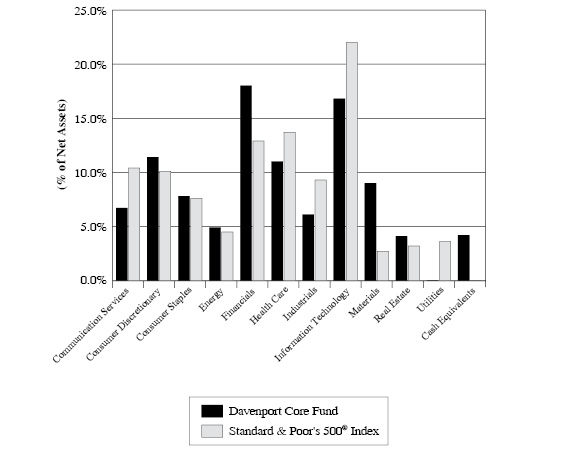

DAVENPORT CORE FUND

PERFORMANCE INFORMATION (Unaudited)

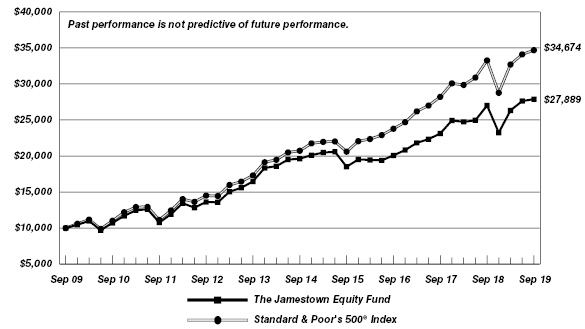

Comparison of the Change in Value of a $10,000 Investment in

Davenport Core Fund and the Standard & Poor’s 500® Index

| | Average Annual Total Returns

(for periods ended September 30, 2019) | |

| | 1 Year | 5 Years | 10 Years | |

Davenport Core Fund(a) | 8.17% | 10.22% | 12.49% | |

Standard & Poor’s 500® Index | 4.25% | 10.84% | 13.24% | |

(a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

14

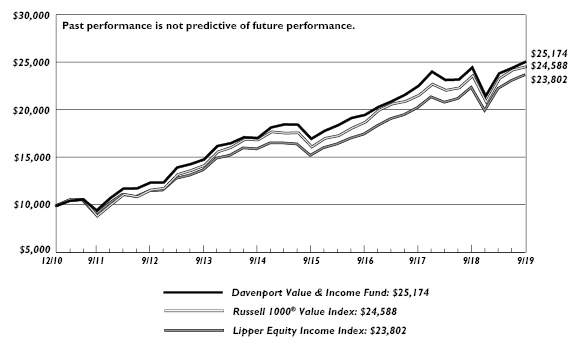

DAVENPORT VALUE & INCOME FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Davenport Value & Income Fund, the Russell 1000® Value Index

and the Lipper Equity Income Index

| | Average Annual Total Returns

(for periods ended September 30, 2019) | |

| | 1 Year | 5 Years | Since

Inception(b) | |

Davenport Value & Income Fund(a) | 2.52% | 8.00% | 11.13% | |

Russell 1000® Value Index | 4.00% | 7.79% | 10.83% | |

Lipper Equity Income Index | 5.88% | 8.26% | 10.42% | |

(a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | Commencement of operations was December 31, 2010. |

15

DAVENPORT EQUITY OPPORTUNITIES FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Davenport Equity Opportunities Fund and the Russell Midcap® Index

| | Average Annual Total Returns

(for periods ended September 30, 2019) | |

| | 1 Year | 5 Years | Since

Inception(b) | |

Davenport Equity Opportunities Fund(a) | 17.60% | 10.54% | 12.84% | |

Russell Midcap® Index | 3.19% | 9.10% | 11.40% | |

(a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | Commencement of operations was December 31, 2010. |

16

DAVENPORT SMALL CAP FOCUS FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Davenport Small Cap Focus Fund and the Russell 2000® Index

| | Average Annual Total Returns

(for periods ended September 30, 2019) | |

| | 1 Year | 3 Years | Since

Inception(b) | |

Davenport Small Cap Focus Fund(a) | 5.01% | 11.77% | 8.74% | |

Russell 2000® Index | (8.89%) | 8.23% | 6.54% | |

(a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | Commencement of operations was December 31, 2014. |

17

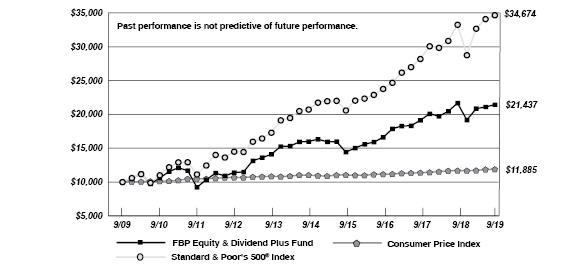

DAVENPORT BALANCED INCOME FUND

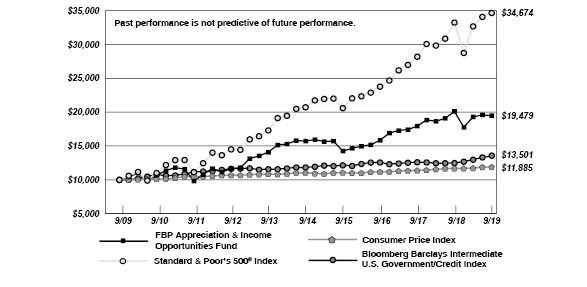

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in Davenport Balanced

Income Fund, the Russell 1000® Value Index, a Blended 60% Russell 1000® Value

Index / 40% Bloomberg Barclays Intermediate Government/Credit Bond Index

and the Morningstar US OE Allocation — 50% to 70% Equity

| | Average Annual Total Returns

(for periods ended September 30, 2019) | |

| | 1 Year | 3 Years | Since

Inception(b) | |

Davenport Balanced Income Fund(a) | 4.56% | 5.96% | 6.63% | |

Russell 1000® Value Index | 4.00% | 9.43% | 10.24% | |

Blended 60% Russell 1000® ValueIndex / 40% Bloomberg Barclays Intermediate Government/Credit Bond Index | 6.11% | 6.79% | 7.52% | |

Morningstar US OE Allocation - 50% to 70% Equity | 3.37% | 6.79% | 7.13% | |

(a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | Commencement of operations was December 31, 2015. |

18

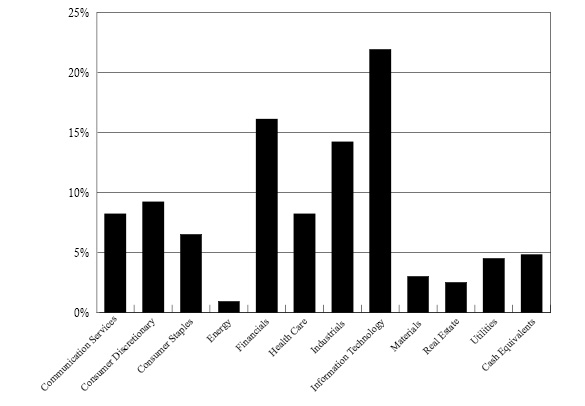

DAVENPORT CORE FUND

PORTFOLIO INFORMATION

September 30, 2019 (Unaudited)

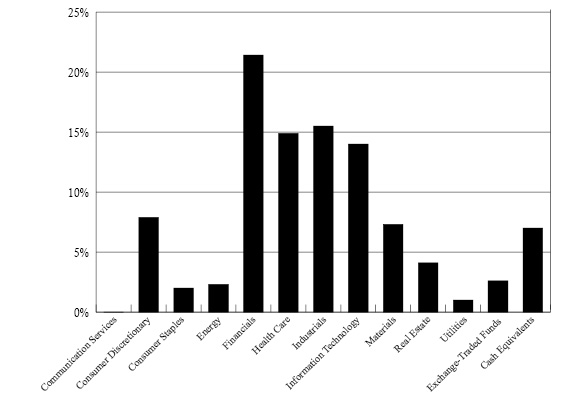

Sector Allocation vs. the Standard & Poor’s 500® Index

Top Ten Equity Holdings

Security Description | % of Net Assets |

American Tower Corporation | 4.1% |

Danaher Corporation | 3.5% |

Brookfield Asset Management, Inc. - Class A | 3.5% |

Markel Corporation | 3.2% |

Accenture plc - Class A | 3.2% |

Adobe, Inc. | 3.1% |

Berkshire Hathaway, Inc. - Class B | 3.0% |

CarMax, Inc. | 2.8% |

Visa, Inc. - Class A | 2.8% |

Mastercard, Inc. - Class A | 2.8% |

19

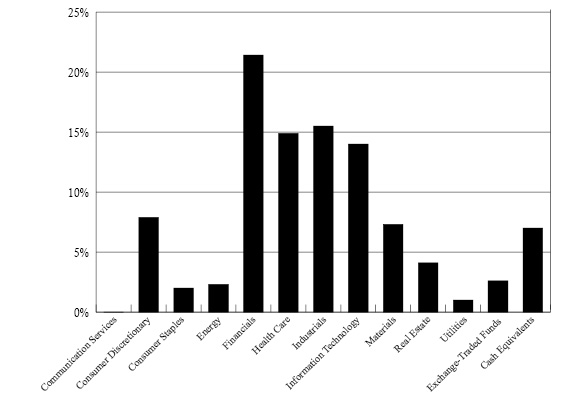

DAVENPORT VALUE & INCOME FUND

PORTFOLIO INFORMATION

September 30, 2019 (Unaudited)

Sector Allocation vs. the Russell 1000® Value Index

Top Ten Equity Holdings

Security Description | % of Net Assets |

Brookfield Asset Management, Inc. - Class A | 3.5% |

Fidelity National Financial, Inc. | 3.4% |

JPMorgan Chase & Company | 3.1% |

Markel Corporation | 2.9% |

Johnson & Johnson | 2.8% |

Anheuser-Busch InBev S.A./N.V. - ADR | 2.7% |

Royal Dutch Shell plc - Class B - ADR | 2.7% |

Bristol-Myers Squibb Company | 2.6% |

Watsco, Inc. | 2.6% |

Dominion Energy, Inc. | 2.6% |

20

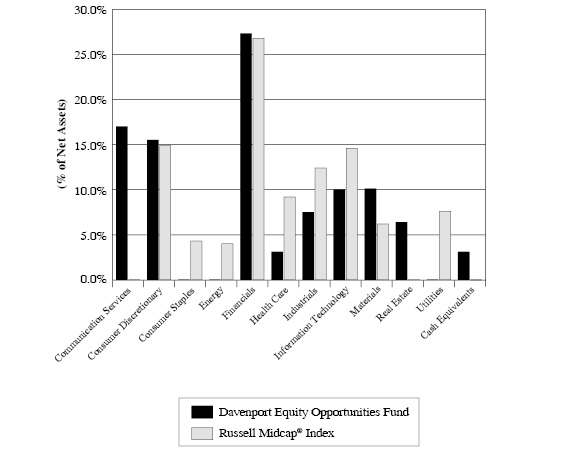

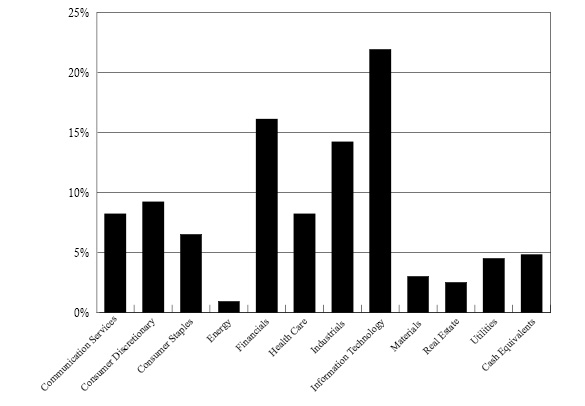

DAVENPORT EQUITY OPPORTUNITIES FUND

PORTFOLIO INFORMATION

September 30, 2019 (Unaudited)

Sector Allocation vs. the Russell Midcap® Index

Top Ten Equity Holdings

Security Description | % of Net Assets |

Brookfield Asset Management, Inc. - Class A | 6.4% |

American Tower Corporation | 6.4% |

Fairfax Financial Holdings Ltd. | 5.3% |

Markel Corporation | 5.3% |

Sherwin-Williams Company (The) | 5.1% |

CarMax, Inc. | 5.0% |

Martin Marietta Materials, Inc. | 5.0% |

Live Nation Entertainment, Inc. | 4.6% |

DISH Network Corporation - Class A | 4.5% |

Fidelity National Financial, Inc. | 4.1% |

21

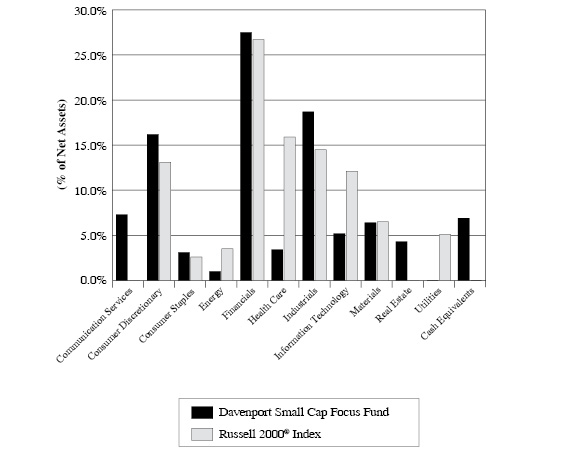

DAVENPORT SMALL CAP FOCUS FUND

PORTFOLIO INFORMATION

September 30, 2019 (Unaudited)

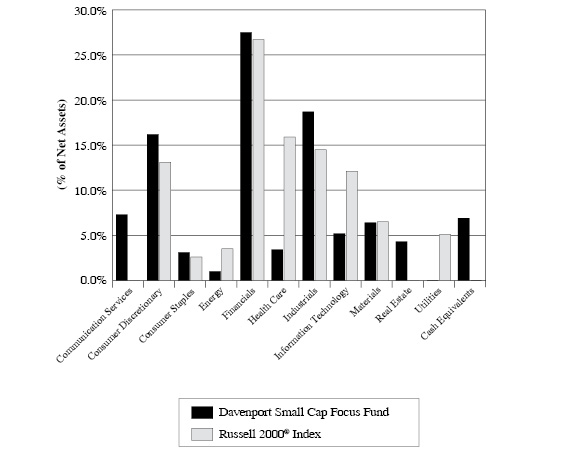

Sector Allocation vs. the Russell 2000® Index

Top Ten Equity Holdings

Security Description | % of Net Assets |

Colfax Corporation | 4.7% |

OneSpaWorld Holdings Ltd. | 4.5% |

Diamond Hill Investment Group, Inc. | 4.3% |

Cannae Holdings, Inc. | 4.3% |

Evoqua Water Technologies Corporation | 4.0% |

Monarch Casino & Resort, Inc. | 3.6% |

Kinsale Capital Group, Inc. | 3.4% |

Watsco, Inc. | 3.4% |

Black Knight, Inc. | 3.2% |

Seaboard Corporation | 3.1% |

22

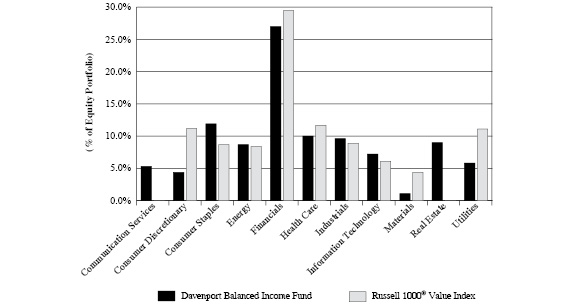

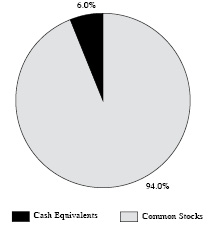

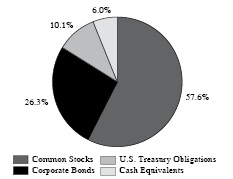

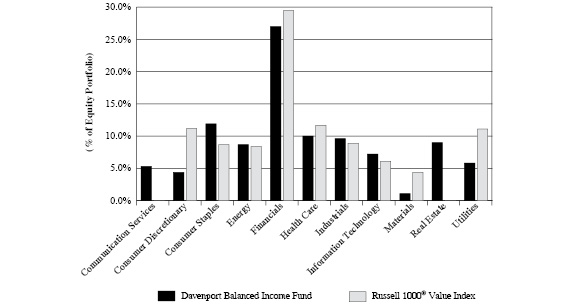

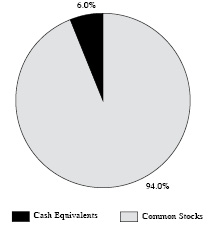

DAVENPORT BALANCED INCOME FUND

PORTFOLIO INFORMATION

September 30, 2019 (Unaudited)

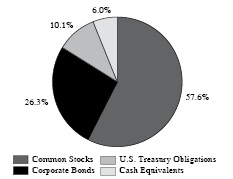

Asset Allocation (% of Net Assets) | | Ten Largest Equity Holdings | % of Net Assets |

| | Brookfield Asset Management, Inc. - Class A | 1.8% |

Fidelity National Financial, Inc. | 1.7% |

JPMorgan Chase & Company | 1.6% |

Markel Corporation | 1.5% |

Johnson & Johnson | 1.4% |

Dominion Energy, Inc. | 1.4% |

Royal Dutch Shell plc - Class B - ADR | 1.4% |

Watsco, Inc. | 1.4% |

Anheuser-Busch InBev S.A./N.V. - ADR | 1.4% |

Bristol-Myers Squibb Company | 1.3% |

| |

Equity Sector Concentration vs. the Russell 1000 Value Index (57.6% of Net Assets) |

Bond Portfolio (36.4% of Net Assets) | | Credit Quality | Composite Quality |

Number of Fixed-Income Securities | 32 | | AAA | 28.6% |

Average Quality | A+/A1 | | AA | 3.7% |

Effective Maturity | 4.2 yrs. | | A | 43.4% |

Average Effective Duration | 3.5 yrs. | | BBB | 24.3% |

| | | | Ba | 0.0% |

Sector Breakdown | % of Corporate

Bond Portfolio |

Communication Services | 1.7% |

Consumer Discretionary | —% |

Consumer Staples | 12.7% |

Energy | 16.0% |

Financials | 19.7% |

Health Care | 4.1% |

Industrials | 8.1% |

Information Technology | 5.4% |

Materials | 4.5% |

Utilities | —% |

U.S. Treasury | 27.8% |

23

DAVENPORT CORE FUND

SCHEDULE OF INVESTMENTS

September 30, 2019 (Unaudited) |

COMMON STOCKS — 95.8% | | Shares | | | Value | |

Communication Services — 6.7% | | | | | | | | |

Alphabet, Inc. - Class A(a) | | | 7,961 | | | $ | 9,721,496 | |

Alphabet, Inc. - Class C(a) | | | 6,941 | | | | 8,461,079 | |

Liberty Broadband Corporation - Series C(a) | | | 103,475 | | | | 10,830,728 | |

Walt Disney Company (The) | | | 69,634 | | | | 9,074,703 | |

| | | | | | | | 38,088,006 | |

Consumer Discretionary — 11.4% | | | | | | | | |

Alibaba Group Holding Ltd. - ADR(a) | | | 40,475 | | | | 6,768,634 | |

Amazon.com, Inc.(a) | | | 6,395 | | | | 11,101,145 | |

CarMax, Inc.(a) | | | 181,587 | | | | 15,979,656 | |

Home Depot, Inc. (The) | | | 56,232 | | | | 13,046,949 | |

NIKE, Inc. - Class B | | | 94,083 | | | | 8,836,275 | |

TJX Companies, Inc. (The) | | | 151,810 | | | | 8,461,889 | |

| | | | | | | | 64,194,548 | |

Consumer Staples — 7.8% | | | | | | | | |

Anheuser-Busch InBev S.A./N.V. - ADR | | | 144,921 | | | | 13,789,233 | |

Mondelēz International, Inc. - Class A | | | 154,758 | | | | 8,561,213 | |

Nestlé S.A. - ADR | | | 121,554 | | | | 13,176,454 | |

PepsiCo, Inc. | | | 62,225 | | | | 8,531,047 | |

| | | | | | | | 44,057,947 | |

Energy — 4.9% | | | | | | | | |

Chevron Corporation | | | 67,744 | | | | 8,034,438 | |

EOG Resources, Inc. | | | 95,470 | | | | 7,085,783 | |

Marathon Petroleum Corporation | | | 204,933 | | | | 12,449,680 | |

| | | | | | | | 27,569,901 | |

Financials — 18.0% | | | | | | | | |

Berkshire Hathaway, Inc. - Class B(a) | | | 82,053 | | | | 17,068,665 | |

Brookfield Asset Management, Inc. - Class A | | | 368,478 | | | | 19,562,497 | |

Capital One Financial Corporation | | | 150,286 | | | | 13,673,020 | |

Charles Schwab Corporation (The) | | | 207,471 | | | | 8,678,512 | |

CME Group, Inc. | | | 52,565 | | | | 11,109,087 | |

JPMorgan Chase & Company | | | 116,788 | | | | 13,744,780 | |

Markel Corporation(a) | | | 15,355 | | | | 18,148,075 | |

| | | | | | | | 101,984,636 | |

Health Care — 11.0% | | | | | | | | |

Becton, Dickinson and Company | | | 43,084 | | | | 10,898,529 | |

CVS Health Corporation | | | 130,146 | | | | 8,208,308 | |

Danaher Corporation | | | 135,736 | | | | 19,604,350 | |

Johnson & Johnson | | | 97,740 | | | | 12,645,601 | |

Merck & Company, Inc. | | | 130,354 | | | | 10,973,200 | |

| | | | | | | | 62,329,988 | |

24

DAVENPORT CORE FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.8% (Continued) | | Shares | | | Value | |

Industrials — 6.1% | | | | | | | | |

FedEx Corporation | | | 54,807 | | | $ | 7,978,255 | |

General Dynamics Corporation | | | 41,578 | | | | 7,597,548 | |

Honeywell International, Inc. | | | 49,524 | | | | 8,379,461 | |

Union Pacific Corporation | | | 65,235 | | | | 10,566,765 | |

| | | | | | | | 34,522,029 | |

Information Technology — 16.8% | | | | | | | | |

Accenture plc - Class A | | | 93,234 | | | | 17,933,560 | |

Adobe, Inc.(a) | | | 62,835 | | | | 17,358,169 | |

Apple, Inc. | | | 43,769 | | | | 9,802,943 | |

Broadcom, Inc. | | | 29,532 | | | | 8,152,899 | |

Mastercard, Inc. - Class A | | | 58,230 | | | | 15,813,521 | |

Microsoft Corporation | | | 73,568 | | | | 10,228,159 | |

Visa, Inc. - Class A | | | 92,686 | | | | 15,942,919 | |

| | | | | | | | 95,232,170 | |

Materials — 9.0% | | | | | | | | |

Air Products & Chemicals, Inc. | | | 37,095 | | | | 8,229,897 | |

Ecolab, Inc. | | | 42,886 | | | | 8,493,143 | |

Martin Marietta Materials, Inc. | | | 40,356 | | | | 11,061,580 | |

Sherwin-Williams Company (The) | | | 25,365 | | | | 13,947,452 | |

Vulcan Materials Company | | | 59,065 | | | | 8,932,991 | |

| | | | | | | | 50,665,063 | |

Real Estate — 4.1% | | | | | | | | |

American Tower Corporation | | | 105,272 | | | | 23,278,797 | |

| | | | | | | | | |

Total Common Stocks (Cost $326,822,066) | | | | | | $ | 541,923,085 | |

|

MONEY MARKET FUNDS — 1.4% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 1.85%(b) (Cost $8,160,239) | | | 8,160,239 | | | $ | 8,160,239 | |

| | | | | | | | | |

Total Investments at Value — 97.2% (Cost $334,982,305) | | | | | | $ | 550,083,324 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 2.8% | | | | | | | 15,780,806 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 565,864,130 | |

ADR - American Depositary Receipt.

(a) | Non-income producing security. |

(b) | The rate shown is the 7-day effective yield as of September 30, 2019. |

See accompanying notes to financial statements.

25

DAVENPORT VALUE & INCOME FUND

SCHEDULE OF INVESTMENTS

September 30, 2019 (Unaudited) |

COMMON STOCKS — 94.4% | | Shares | | | Value | |

Communication Services — 3.8% | | | | | | | | |

Comcast Corporation - Class A | | | 350,355 | | | $ | 15,794,003 | |

Verizon Communications, Inc. | | | 183,215 | | | | 11,058,858 | |

| | | | | | | | 26,852,861 | |

Consumer Discretionary — 3.2% | | | | | | | | |

Carnival Corporation | | | 272,801 | | | | 11,924,132 | |

Las Vegas Sands Corporation | | | 175,890 | | | | 10,159,406 | |

| | | | | | | | 22,083,538 | |

Consumer Staples — 11.4% | | | | | | | | |

Altria Group, Inc. | | | 178,636 | | | | 7,306,212 | |

Anheuser-Busch InBev S.A./N.V. - ADR | | | 198,915 | | | | 18,926,762 | |

Diageo plc - ADR | | | 90,780 | | | | 14,844,346 | |

Mondelēz International, Inc. - Class A | | | 246,890 | | | | 13,657,955 | |

PepsiCo, Inc. | | | 96,805 | | | | 13,271,965 | |

Philip Morris International, Inc. | | | 155,720 | | | | 11,823,820 | |

| | | | | | | | 79,831,060 | |

Energy — 8.7% | | | | | | | | |

Chevron Corporation | | | 68,366 | | | | 8,108,207 | |

Enbridge, Inc. | | | 301,622 | | | | 10,580,900 | |

Exxon Mobil Corporation | | | 85,975 | | | | 6,070,695 | |

Marathon Petroleum Corporation | | | 288,265 | | | | 17,512,099 | |

Royal Dutch Shell plc - Class B - ADR | | | 313,175 | | | | 18,759,182 | |

| | | | | | | | 61,031,083 | |

Financials — 25.8% | | | | | | | | |

Allstate Corporation (The) | | | 110,620 | | | | 12,022,181 | |

Bank of America Corporation | | | 355,000 | | | | 10,355,350 | |

Berkshire Hathaway, Inc. - Class B(a) | | | 68,234 | | | | 14,194,037 | |

Brookfield Asset Management, Inc. - Class A | | | 467,865 | | | | 24,838,953 | |

Capital One Financial Corporation | | | 180,355 | | | | 16,408,698 | |

Citigroup, Inc. | | | 157,450 | | | | 10,876,646 | |

Fairfax Financial Holdings Ltd. | | | 34,059 | | | | 15,019,338 | |

Fidelity National Financial, Inc. | | | 532,110 | | | | 23,631,005 | |

JPMorgan Chase & Company | | | 186,385 | | | | 21,935,651 | |

Markel Corporation(a) | | | 16,890 | | | | 19,962,291 | |

Wells Fargo & Company | | | 219,359 | | | | 11,064,468 | |

| | | | | | | | 180,308,618 | |

Health Care — 11.3% | | | | | | | | |

Bristol-Myers Squibb Company | | | 364,437 | | | | 18,480,600 | |

CVS Health Corporation | | | 232,380 | | | | 14,656,207 | |

Johnson & Johnson | | | 151,165 | | | | 19,557,728 | |

Medtronic plc | | | 122,070 | | | | 13,259,243 | |

Merck & Company, Inc. | | | 158,157 | | | | 13,313,656 | |

| | | | | | | | 79,267,434 | |

26

DAVENPORT VALUE & INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 94.4% (Continued) | | Shares | | | Value | |

Industrials — 10.8% | | | | | | | | |

3M Company | | | 43,445 | | | $ | 7,142,358 | |

Delta Air Lines, Inc. | | | 248,415 | | | | 14,308,704 | |

Eaton Corporation plc | | | 171,192 | | | | 14,234,615 | |

Norfolk Southern Corporation | | | 55,813 | | | | 10,027,364 | |

United Parcel Service, Inc. - Class B | | | 93,520 | | | | 11,205,566 | |

Watsco, Inc. | | | 109,050 | | | | 18,449,079 | |

| | | | | | | | 75,367,686 | |

Information Technology — 8.2% | | | | | | | | |

Cisco Systems, Inc. | | | 310,012 | | | | 15,317,693 | |

Intel Corporation | | | 230,160 | | | | 11,860,145 | |

Microsoft Corporation | | | 121,814 | | | | 16,935,800 | |

TE Connectivity Ltd. | | | 145,775 | | | | 13,583,315 | |

| | | | | | | | 57,696,953 | |

Materials — 1.3% | | | | | | | | |

Dow, Inc. | | | 183,351 | | | | 8,736,675 | |

| | | | | | | | | |

Real Estate — 7.3% | | | | | | | | |

Crown Castle International Corporation | | | 94,335 | | | | 13,113,508 | |

Gaming and Leisure Properties, Inc. | | | 269,164 | | | | 10,292,831 | |

Lamar Advertising Company - Class A | | | 189,120 | | | | 15,494,602 | |

W.P. Carey, Inc. | | | 139,374 | | | | 12,473,973 | |

| | | | | | | | 51,374,914 | |

Utilities — 2.6% | | | | | | | | |

Dominion Energy, Inc. | | | 225,465 | | | | 18,271,684 | |

| | | | | | | | | |

Total Common Stocks (Cost $534,547,981) | | | | | | $ | 660,822,506 | |

|

MONEY MARKET FUNDS — 5.5% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 1.85%(b) (Cost $38,407,418) | | | 38,407,418 | | | $ | 38,407,418 | |

| | | | | | | | | |

Total Investments at Value — 99.9%(Cost $572,955,399) | | | | | | $ | 699,229,924 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.1% | | | | | | | 830,082 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 700,060,006 | |

ADR - American Depositary Receipt.

(a) | Non-income producing security. |

(b) | The rate shown is the 7-day effective yield as of September 30, 2019. |

See accompanying notes to financial statements.

27

DAVENPORT EQUITY OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

September 30, 2019 (Unaudited) |

COMMON STOCKS — 96.9% | | Shares | | | Value | |

Communication Services — 17.0% | | | | | | | | |

DISH Network Corporation - Class A(a) | | | 637,889 | | | $ | 21,732,878 | |

Liberty Broadband Corporation - Series C(a) | | | 177,921 | | | | 18,622,991 | |

Live Nation Entertainment, Inc.(a) | | | 335,044 | | | | 22,226,819 | |

Take-Two Interactive Software, Inc.(a) | | | 153,871 | | | | 19,286,191 | |

| | | | | | | | 81,868,879 | |

Consumer Discretionary — 15.5% | | | | | | | | |

CarMax, Inc.(a) | | | 274,842 | | | | 24,186,096 | |

Dollar Tree, Inc.(a) | | | 123,435 | | | | 14,091,340 | |

Etsy, Inc.(a) | | | 193,757 | | | | 10,947,270 | |

MercadoLibre, Inc.(a) | | | 23,941 | | | | 13,196,997 | |

O’Reilly Automotive, Inc.(a) | | | 31,100 | | | | 12,393,661 | |

| | | | | | | | 74,815,364 | |

Financials — 27.3% | | | | | | | | |

Brookfield Asset Management, Inc. - Class A | | | 584,462 | | | | 31,029,087 | |

Capital One Financial Corporation | | | 185,970 | | | | 16,919,551 | |

Cboe Global Markets, Inc. | | | 110,758 | | | | 12,727,202 | |

Fairfax Financial Holdings Ltd. | | | 58,431 | | | | 25,766,902 | |

Fidelity National Financial, Inc. | | | 447,444 | | | | 19,870,988 | |

Markel Corporation(a) | | | 21,493 | | | | 25,402,577 | |

| | | | | | | | 131,716,307 | |

Health Care — 3.1% | | | | | | | | |

Zoetis, Inc. | | | 120,976 | | | | 15,072,400 | |

| | | | | | | | | |

Industrials — 7.5% | | | | | | | | |

Watsco, Inc. | | | 107,276 | | | | 18,148,954 | |

Xylem, Inc. | | | 224,492 | | | | 17,874,053 | |

| | | | | | | | 36,023,007 | |

Information Technology — 10.0% | | | | | | | | |

Autodesk, Inc.(a) | | | 107,467 | | | | 15,872,876 | |

Black Knight, Inc.(a) | | | 252,917 | | | | 15,443,112 | |

Intuit, Inc. | | | 64,192 | | | | 17,071,220 | |

| | | | | | | | 48,387,208 | |

Materials — 10.1% | | | | | | | | |

Martin Marietta Materials, Inc. | | | 87,873 | | | | 24,085,989 | |

Sherwin-Williams Company (The) | | | 44,220 | | | | 24,315,252 | |

| | | | | | | | 48,401,241 | |

Real Estate — 6.4% | | | | | | | | |

American Tower Corporation | | | 138,206 | | | | 30,561,493 | |

| | | | | | | | | |

Total Common Stocks (Cost $322,257,988) | | | | | | $ | 466,845,899 | |

28

DAVENPORT EQUITY OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS (Continued) |

MONEY MARKET FUNDS — 3.1% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 1.85%(b) (Cost $14,856,555) | | | 14,856,555 | | | $ | 14,856,555 | |

| | | | | | | | | |

Total Investments at Value — 100.0%(Cost $337,114,543) | | | | | | $ | 481,702,454 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.0%(c) | | | | | | | 91,269 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 481,793,723 | |

(a) | Non-income producing security. |

(b) | The rate shown is the 7-day effective yield as of September 30, 2019. |

(c) | Percentage rounds to less than 0.1%. |

See accompanying notes to financial statements.

29

DAVENPORT SMALL CAP FOCUS FUND

SCHEDULE OF INVESTMENTS

September 30, 2019 (Unaudited) |

COMMON STOCKS — 93.1% | | Shares | | | Value | |

Communication Services — 7.3% | | | | | | | | |

Cable One, Inc. | | | 3,538 | | | $ | 4,439,129 | |

Shenandoah Telecommunications Company | | | 169,855 | | | | 5,396,293 | |

Sinclair Broadcast Group, Inc. - Class A | | | 85,000 | | | | 3,632,900 | |

| | | | | | | | 13,468,322 | |

Consumer Discretionary — 16.2% | | | | | | | | |

Drive Shack, Inc.(a) | | | 706,490 | | | | 3,044,972 | |

Eldorado Resorts, Inc.(a) | | | 134,381 | | | | 5,357,770 | |

Etsy, Inc.(a) | | | 68,969 | | | | 3,896,749 | |

Monarch Casino & Resort, Inc.(a) | | | 161,068 | | | | 6,714,925 | |

Pool Corporation | | | 20,461 | | | | 4,126,984 | |

Red Rock Resorts, Inc. - Class A | | | 134,899 | | | | 2,739,124 | |

Six Flags Entertainment Corporation | | | 80,000 | | | | 4,063,200 | |

| | | | | | | | 29,943,724 | |

Consumer Staples — 3.1% | | | | | | | | |

Seaboard Corporation | | | 1,309 | | | | 5,726,875 | |

| | | | | | | | | |

Energy — 1.0% | | | | | | | | |

CONSOL Coal Resources, L.P. | | | 135,800 | | | | 1,833,300 | |

| | | | | | | | | |

Financials — 27.5% | | | | | | | | |

Cannae Holdings, Inc.(a) | | | 291,482 | | | | 8,007,011 | |

Cohen & Steers, Inc. | | | 80,350 | | | | 4,413,625 | |

Diamond Hill Investment Group, Inc. | | | 57,977 | | | | 8,008,363 | |

Kinsale Capital Group, Inc. | | | 60,151 | | | | 6,214,200 | |

OneSpaWorld Holdings Ltd.(a) | | | 531,932 | | | | 8,260,904 | |

Stewart Information Services Corporation | | | 140,000 | | | | 5,430,600 | |

TowneBank | | | 192,278 | | | | 5,346,290 | |

Trupanion, Inc.(a) | | | 198,813 | | | | 5,053,826 | |

| | | | | | | | 50,734,819 | |

Health Care — 3.4% | | | | | | | | |

Heska Corporation(a) | | | 42,666 | | | | 3,023,739 | |

Teladoc Health, Inc.(a) | | | 48,273 | | | | 3,269,048 | |

| | | | | | | | 6,292,787 | |

Industrials — 18.7% | | | | | | | | |

Builders FirstSource, Inc.(a) | | | 220,886 | | | | 4,544,729 | |

Casella Waste Systems, Inc. - Class A(a) | | | 109,921 | | | | 4,720,008 | |

Colfax Corporation(a) | | | 300,000 | | | | 8,718,000 | |

Evoqua Water Technologies Corporation(a) | | | 432,576 | | | | 7,362,443 | |

SiteOne Landscape Supply, Inc.(a) | | | 40,242 | | | | 2,978,713 | |

Watsco, Inc. | | | 36,593 | | | | 6,190,804 | |

| | | | | | | | 34,514,697 | |

30

DAVENPORT SMALL CAP FOCUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 93.1% (Continued) | | Shares | | | Value | |

Information Technology — 5.2% | | | | | | | | |

Black Knight, Inc.(a) | | | 97,867 | | | $ | 5,975,759 | |

Switch, Inc. - Class A | | | 235,195 | | | | 3,673,746 | |

| | | | | | | | 9,649,505 | |

Materials — 6.4% | | | | | | | | |

Fortuna Silver Mines, Inc.(a) | | | 930,300 | | | | 2,874,627 | |

MAG Silver Corporation(a) | | | 438,831 | | | | 4,655,997 | |

NewMarket Corporation | | | 9,191 | | | | 4,338,979 | |

| | | | | | | | 11,869,603 | |

Real Estate — 4.3% | | | | | | | | |

FRP Holdings, Inc.(a) | | | 55,603 | | | | 2,670,056 | |

Lamar Advertising Company - Class A | | | 63,300 | | | | 5,186,169 | |

| | | | | | | | 7,856,225 | |

| | | | | | | | | |

Total Common Stocks (Cost $146,719,369) | | | | | | $ | 171,889,857 | |

|

MONEY MARKET FUNDS — 6.4% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 1.85%(b) (Cost $11,830,357) | | | 11,830,357 | | | $ | 11,830,357 | |

| | | | | | | | | |

Total Investments at Value — 99.5% (Cost $158,549,726) | | | | | | $ | 183,720,214 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.5% | | | | | | | 886,321 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 184,606,535 | |

(a) | Non-income producing security. |

(b) | The rate shown is the 7-day effective yield as of September 30, 2019. |

See accompanying notes to financial statements.

31

DAVENPORT BALANCED INCOME FUND

SCHEDULE OF INVESTMENTS

September 30, 2019 (Unaudited) |

COMMON STOCKS — 57.6% | | Shares | | | Value | |

Communication Services — 3.1% | | | | | | | | |

AT&T, Inc. | | | 42,400 | | | $ | 1,604,416 | |

Comcast Corporation - Class A | | | 41,880 | | | | 1,887,950 | |

Verizon Communications, Inc. | | | 21,190 | | | | 1,279,029 | |

| | | | | | | | 4,771,395 | |

Consumer Discretionary — 2.5% | | | | | | | | |

Carnival Corporation | | | 31,560 | | | | 1,379,488 | |

Las Vegas Sands Corporation | | | 20,380 | | | | 1,177,149 | |

Nordstrom, Inc. | | | 42,335 | | | | 1,425,419 | |

| | | | | | | | 3,982,056 | |

Consumer Staples — 6.9% | | | | | | | | |

Altria Group, Inc. | | | 20,565 | | | | 841,108 | |

Anheuser-Busch InBev S.A./N.V. - ADR | | | 22,325 | | | | 2,124,224 | |

Diageo plc - ADR | | | 10,400 | | | | 1,700,608 | |

Ingredion, Inc. | | | 10,231 | | | | 836,282 | |

Mondelēz International, Inc. - Class A | | | 28,255 | | | | 1,563,067 | |

PepsiCo, Inc. | | | 11,200 | | | | 1,535,520 | |

Philip Morris International, Inc. | | | 18,275 | | | | 1,387,621 | |

Universal Corporation | | | 14,230 | | | | 779,946 | |

| | | | | | | | 10,768,376 | |

Energy — 5.0% | | | | | | | | |

Chevron Corporation | | | 7,910 | | | | 938,126 | |

Enbridge, Inc. | | | 34,808 | | | | 1,221,065 | |

Exxon Mobil Corporation | | | 9,960 | | | | 703,276 | |

Marathon Petroleum Corporation | | | 32,998 | | | | 2,004,628 | |

MPLX, L.P. | | | 30,425 | | | | 852,204 | |

Royal Dutch Shell plc - Class B - ADR | | | 36,150 | | | | 2,165,385 | |

| | | | | | | | 7,884,684 | |

Financials — 15.6% | | | | | | | | |

Allstate Corporation (The) | | | 13,225 | | | | 1,437,293 | |

Bank of America Corporation | | | 41,400 | | | | 1,207,638 | |

Berkshire Hathaway, Inc. - Class B(a) | | | 7,680 | | | | 1,597,593 | |

Brookfield Asset Management, Inc. - Class A | | | 53,770 | | | | 2,854,649 | |

Capital One Financial Corporation | | | 20,810 | | | | 1,893,294 | |

Citigroup, Inc. | | | 17,708 | | | | 1,223,269 | |

Diamond Hill Investment Group, Inc. | | | 8,837 | | | | 1,220,655 | |

Fairfax Financial Holdings Ltd. | | | 3,740 | | | | 1,649,265 | |

Fidelity National Financial, Inc. | | | 61,060 | | | | 2,711,675 | |

JPMorgan Chase & Company | | | 21,565 | | | | 2,537,985 | |

Lazard Ltd. - Class A | | | 34,100 | | | | 1,193,500 | |

Markel Corporation(a) | | | 1,967 | | | | 2,324,797 | |

MetLife, Inc. | | | 27,870 | | | | 1,314,349 | |

Wells Fargo & Company | | | 25,191 | | | | 1,270,634 | |

| | | | | | | | 24,436,596 | |

32

DAVENPORT BALANCED INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 57.6% (Continued) | | Shares | | | Value | |

Health Care — 5.8% | | | | | | | | |

Bristol-Myers Squibb Company | | | 41,180 | | | $ | 2,088,238 | |

CVS Health Corporation | | | 26,585 | | | | 1,676,716 | |

Johnson & Johnson | | | 17,485 | | | | 2,262,209 | |

Medtronic plc | | | 14,125 | | | | 1,534,258 | |

Merck & Company, Inc. | | | 17,817 | | | | 1,499,835 | |

| | | | | | | | 9,061,256 | |

Industrials — 5.5% | | | | | | | | |

3M Company | | | 5,010 | | | | 823,644 | |

Delta Air Lines, Inc. | | | 28,700 | | | | 1,653,120 | |

Eaton Corporation plc | | | 19,760 | | | | 1,643,044 | |

Norfolk Southern Corporation | | | 6,325 | | | | 1,136,349 | |

United Parcel Service, Inc. - Class B | | | 10,795 | | | | 1,293,457 | |

Watsco, Inc. | | | 12,605 | | | | 2,132,514 | |

| | | | | | | | 8,682,128 | |

Information Technology — 4.1% | | | | | | | | |

Cisco Systems, Inc. | | | 34,541 | | | | 1,706,671 | |

Intel Corporation | | | 25,140 | | | | 1,295,464 | |

Microsoft Corporation | | | 13,778 | | | | 1,915,555 | |

TE Connectivity Ltd. | | | 16,710 | | | | 1,557,038 | |

| | | | | | | | 6,474,728 | |

Materials — 0.6% | | | | | | | | |

Dow, Inc. | | | 20,090 | | | | 957,289 | |

| | | | | | | | | |

Real Estate — 5.2% | | | | | | | | |

Brookfield Property Partners, L.P. | | | 62,920 | | | | 1,277,276 | |

Crown Castle International Corporation | | | 10,795 | | | | 1,500,613 | |

Gaming and Leisure Properties, Inc. | | | 31,155 | | | | 1,191,367 | |

Lamar Advertising Company - Class A | | | 21,880 | | | | 1,792,628 | |

Tanger Factory Outlet Centers, Inc. | | | 56,140 | | | | 869,047 | |

W.P. Carey, Inc. | | | 16,275 | | | | 1,456,613 | |

| | | | | | | | 8,087,544 | |

Utilities — 3.3% | | | | | | | | |

Brookfield Infrastructure Partners, L.P. | | | 30,685 | | | | 1,522,283 | |

Brookfield Renewable Partners, L.P. | | | 37,660 | | | | 1,529,749 | |

Dominion Energy, Inc. | | | 26,770 | | | | 2,169,441 | |

| | | | | | | | 5,221,473 | |

| | | | | | | | | |

Total Common Stocks (Cost $81,663,938) | | | | | | $ | 90,327,525 | |

33

DAVENPORT BALANCED INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

FIXED RATE CORPORATE BONDS — 18.3% | | Par Value | | | Value | |

Consumer Staples — 3.9% | | | | | | | | |

Altria Group, Inc., 4.75%, due 05/05/2021 | | $ | 1,500,000 | | | $ | 1,559,622 | |

J.M. Smucker Company (The), 3.50%, due 10/15/2021 | | | 1,500,000 | | | | 1,535,119 | |

PepsiCo, Inc., 2.75%, due 03/05/2022 | | | 1,200,000 | | | | 1,229,037 | |

Sysco Corporation, 2.60%, due 10/01/2020 | | | 1,700,000 | | | | 1,707,870 | |

| | | | | | | | 6,031,648 | |

Energy — 4.7% | | | | | | | | |

Boardwalk Pipelines, L.P., 4.45%, due 07/15/2027 | | | 1,250,000 | | | | 1,286,172 | |

Halliburton Company, 3.80%, due 11/15/2025 | | | 2,325,000 | | | | 2,462,694 | |

MPLX, L.P., 4.125%, due 03/01/2027 | | | 1,750,000 | | | | 1,845,513 | |

Occidental Petroleum Corporation, 3.50%, due 06/15/2025 | | | 1,750,000 | | | | 1,799,196 | |

| | | | | | | | 7,393,575 | |

Financials — 3.2% | | | | | | | | |

BlackRock, Inc., 3.50%, due 03/18/2024 | | | 1,150,000 | | | | 1,227,994 | |

Citigroup, Inc., 3.30%, due 04/27/2025 | | | 2,250,000 | | | | 2,353,194 | |

Fiserv, Inc., 3.20%, due 07/01/2026 | | | 1,400,000 | | | | 1,448,853 | |

| | | | | | | | 5,030,041 | |

Health Care — 0.8% | | | | | | | | |