| OMB APPROVAL |

OMB Number: 3235-0570 Expires: August 31, 2020 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-05685 | |

| Williamsburg Investment Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

John Chilton, Esq.

| Sullivan & Worcester LLP 1666 K Street, NW Washington, D.C. 20006 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | March 31 | |

| | | |

| Date of reporting period: | September 30, 2017 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

SEMI-ANNUAL REPORT September 30, 2017

(Unaudited) |

THE DAVENPORT FUNDS

LETTER TO SHAREHOLDERS | November 15, 2017 |

The market posted another quarter of solid gains in Q3, with the S&P 500 Index up 4.48% and the Russell 2000® Index advancing 5.67%. Year to date returns are an impressive 14.24% and 10.94%, respectively. The Dow Jones Industrial Average finished the quarter with eight consecutive quarters of gains, its longest positive streak in twenty years. The market continues to shrug off fears, which have recently included rising tensions with North Korea, two powerful hurricanes, and continued gridlock in Washington, DC.

The key driver behind the market’s advance has been impressive earnings growth, which has emerged from negative territory as recently as mid-2016 to around 10% year-over-year currently. Broadly, this is due to several factors, including modest top-line growth, efficiency gains on the expense side, and shareholder-friendly capital allocation in the form of stock buybacks. Adding to this backdrop is a weaker U.S. dollar, benefiting multi-nationals, and the energy and financials sectors coming off easy comparisons from a year ago.

The “goldilocks” environment—where economic expansion is neither too strong nor too weak—remains in place for equities. The economy continues to grow slowly, keeping inflation contained. Gross domestic product (GDP) is just strong enough to allow the Federal Reserve to tighten monetary policy in a measured way, without disrupting expectations of continued economic improvement. However, in recent months, we have seen the “reflation” trade re-emerge with improvement in economic data.

In a reflation scenario, economic growth heats up, stoking inflation and wage gains and disproportionately benefiting “old economy” sectors. While we are seeing the green shoots of reflation, it has yet to take hold more broadly. Building materials is an area that could benefit from this scenario, especially with the increase in renovations and housing formations that were delayed in the wake of the Great Recession. We have continued to invest in this industry.

Growth stocks have thrived under the current goldilocks environment, as investors have been willing to pay increasing premiums for the handful of companies that can post strong top-line growth in spite of the tepid broader economy. If reflation were to take hold, it would likely provide a shot in the arm to value stocks, which investors have shunned due to their uninspiring relative growth rates. While we have a balanced mix of growth and value across our funds, we remain quite valuation-sensitive and thus may stand to benefit from a reflation scenario.

The market is increasingly paying attention to the machinations in Washington regarding a tax package. The current administration’s efficacy has been weak, evidenced by the failure on healthcare reform, but the pressure to succeed has ratcheted up as we are now just a year out from mid-term elections. While stocks appear to have priced in a small amount of success on tax cuts towards the end of the quarter, Washington remains a wild card for the market.

Volatility remains extremely low. The market appears a bit complacent, and we do not want to be lulled into a false sense of security. While the market has posted strong returns so far this year, we remain cautiously optimistic going into year end, which is a historically favorable period for equity returns. While valuations remain slightly above their long-term averages, they do not strike us as unreasonable in the current low interest rate world.

1

Please see our fund letters for discussion of specific ideas and investment themes. Thank you for your trust.

Davenport Core Fund (DAVPX)

The Core Fund posted another strong gain this quarter, advancing 3.25%, versus the S&P 500 Index’s 4.48% advance. Year to date, the Core Fund is up 14.27%, in line with the S&P 500’s 14.24% gain. We remain pleased with the Fund’s ability to keep up with the broader index in such a strong market this year.

The bulk of our underperformance this quarter was due to declines in the shares of AmerisourceBergen (ABC) and Allergan (AGN) in Health Care, Southwest Airlines (LUV) in Industrials, and Martin Marietta (MLM) in Materials. Uncertainties around drug pricing and competition continue to weigh on Health Care names ABC and AGN. Southwest sold off fears of capacity creep, but profitability remains impressive. We added to our position in MLM, as shares had sold off due to weather, a seasonal lull in the business, and concerns around Washington’s ability to pass an infrastructure plan. We took the opportunity to increase the position as the underlying fundamentals of the construction industry remain positive and we continue to have confidence in the long-term opportunity for MLM to double its cash flow by 2020.

Continuing on a theme from last quarter’s sale of JM Smucker (SJM) in Consumer Staples, this quarter we sold Hormel (HRL). While we continue to have respect for the long-term track record of the company, management is having a tough time fixing the ailing turkey segment, and industry pressures appear to be intensifying. U.S. consumers are increasingly favoring fresher offerings such as those found around the edges of grocery stores, at the expense of packaged food companies like HRL whose products often sit in the middle aisles. This dynamic along with intense grocer competition is placing significant pricing pressure on branded package foods, who are discounting in an effort to maintain share. Ultimately, these trends are feeding down to slower profit growth, prompting us to search for a better opportunity elsewhere.

To that end, we purchased a new position in Sherwin Williams (SHW). Founded in 1866 and boasting an impressive track record, Sherwin is a vertically-integrated coatings company. Sherwin’s largest segment is also its most attractive: selling paint primarily to professional painting contractors, which have been taking share from “DIYers” for decades. Paint typically accounts for just 10% of a contractor’s operating costs, with the remainder devoted to labor. This cost imbalance incentivizes contractors to invest in high quality paint to cut down on labor (e.g. less coats applied, shorter curing times, etc.), and gives SHW tremendous pricing power with its dominant market share. Layering on the cost-cutting opportunities from the recent acquisition of Valspar, we believe we may see earnings power increases of up to $20 per share by the end of the decade. Since our purchase, SHW has updated its long-term financial targets at an analyst day, further bolstering our confidence in the name.

As mentioned above, we are pleased with the Fund’s ability to keep up in such a strong market, despite being significantly underweight in the hot Information Technology sector. Our actions in the quarter were designed to further improve the risk-reward of the Fund as we head into the final quarter of the year, and we remain excited about finding new investment opportunities such as SHW.

2

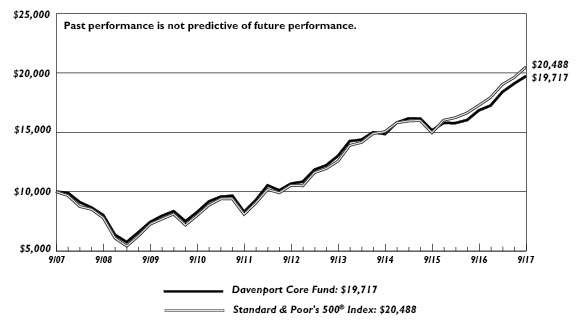

The following chart represents Davenport Core Fund (DAVPX) performance and the performance of the S&P 500 Index, the Core Fund’s primary benchmark, for the periods ended September 30, 2017.

| | Q3 2017 | YTD 2017 | 1 Year | 3 Years* | 5 Years* | 10 Years* | Since Inception* 1/15/98 |

| Core Fund (DAVPX) | 3.25% | 14.27% | 17.04% | 9.90% | 13.04% | 7.02% | 6.78% |

| S&P 500 Index** | 4.48% | 14.24% | 18.61% | 10.81% | 14.22% | 7.44% | 7.07% |

30-Day SEC Yield: 0.35%; Expense Ratio in current prospectus: 0.90%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

| * | Returns greater than one year are annualized. |

| ** | The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

Recent Purchases

Chevron Corporation (CVX)—Given the deterioration in investor sentiment, combined with a modestly improving fundamental outlook for oil, we felt that it was a decent time to add exposure to the Energy sector.

Martin Marietta Materials, Inc. (MLM)—We added to our position in MLM, as we think the underlying fundamentals of the construction industry remain positive and we continue to have confidence in the long-term opportunity for the company.

Sherwin-Williams Company (SHW)—We elected to initiate a position in SHW, the largest coatings company in the U.S. and one of the top three globally.

Recent Sales

Applied Materials, Inc. (AMAT)—While we continue to view AMAT as an enabler and beneficiary of a more connected world, we felt it prudent to take some profits while also dialing back our technology exposure after significant fund flow momentum.

Hormel Foods Corporation (HRL)—We remain concerned about shifting consumer preferences away from the “center aisle” as well as the likelihood that food deflation will creep its way up the supply chain. Additionally, we had a short-term loss in HRL, which should offset some gains taken earlier in the year.

Davenport Value & Income Fund (DVIPX)

The Value & Income Fund had a solid third quarter with a 4.28% gain, and is now up 10.92% year to date (YTD). This compares favorably to the Russell 1000® Value Index, which was up 3.12% in Q3 and 7.92% YTD, and the Lipper Equity Income Index, which was up 3.82% and 10.35% respectively. The S&P 500 Index was up 4.48% in Q3 and 14.24% YTD.

3

Boeing (BA) was our top-performing stock, increasing nearly 30% in the quarter. Investors have become believers in the cash flow generation story, near-term trends in the business have improved and estimates have moved higher. While we continue to like the outlook for Boeing, we thought it prudent to book some profits on the recent spike and chipped our position. Health Care was our biggest contributing sector, led by a strong move in Bristol-Myers Squibb (BMY). We also saw positive contributions from the Consumer Discretionary and Energy sectors.

The key detractor in the quarter was Altria (MO). Altria was hit by an announcement from the Federal Drug Administration, which is reviewing tobacco and nicotine regulations. The uncertainty caused by this announcement led the entire sector to sell off. Altria has been through this heightened scrutiny many times before, and note the company has been adept at navigating changes in the past. With a 4.2% dividend yield, we feel comfortable with our position in the name.

Our Real Estate Investment Trust (REIT) holdings were also a detractor in the quarter, including shares of Lamar Advertising (LAMR). We took advantage of the weakness to add to our position. Lamar is the leader in outdoor advertising (billboards), and we are attracted to the company’s earnings visibility, solid (and growing) dividend, and well-located assets. Additionally, we think the increasing digitalization of billboards will be a secular tailwind for LAMR. The stock currently yields 4.6% and trades at a discount to other REITs.

We initiated a new position in TE Connectivity (TEL), a global leader in the design and manufacturing of connector and sensor solutions serving a variety of end markets. With more than 500,000 SKUs, TE’s products are highly engineered and mission critical. Key end markets include automotive, industrial equipment, aerospace and defense, data, and devices. TE has undergone significant portfolio transformation over the past five years, focusing on products designed for “harsh environments” (extreme temperatures, pressures, etc.) which are more specialized and garner higher margins.

We see three primary long-term secular growth drivers for TE. The first is in autos where cars are becoming safer, greener, and more connected. Hybrid/electrical cars have more than 1.5x the connector content of a normal vehicle. In total, TE is growing its automotive content 4% - 6% per year. The second is factory automation, where smart factories are leading to ~3% content growth per year. Lastly is the increase in connected devices, whether cars, the “Internet of Things,” smart appliances, aircraft, etc. TE estimates that these devices will grow from 8 billion today to 20 billion in 2020. In total, we believe these factors may help TE grow its earnings and dividend on an annual basis. To fund the purchase of TE, we decided to sell our position in Time Warner (TWX), which is being acquired by AT&T (T).

We remain pleased with the Value & Income Fund’s results, especially in a year where, market-wide, growth stocks have dramatically outperformed value stocks. We continue to strive to find attractive ideas at reasonable prices with above-average dividend yields.

4

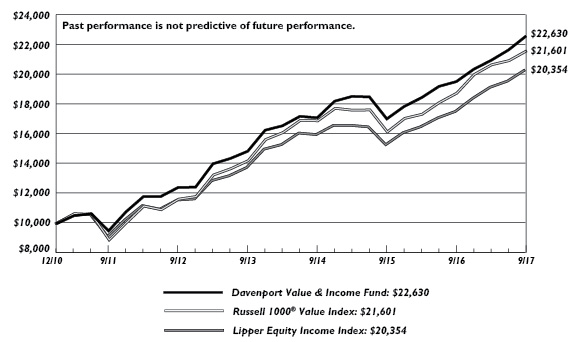

The following chart represents Davenport Value & Income Fund (DVIPX) performance and the performance of the Russell 1000® Value Index, the Fund’s primary benchmark, and the S&P 500 and Lipper Equity Income Indices for the periods ended September 30, 2017.

| | Q3 2017 | YTD 2017 | 1 Year | 3 Years* | 5 Years* | Since Inception* 12/31/10 |

| Value & Income Fund (DVIPX) | 4.28% | 10.92% | 15.64% | 9.72% | 12.71% | 12.87% |

Russell 1000® Value Index** | 3.12% | 7.92% | 15.12% | 8.53% | 13.20% | 12.09% |

| S&P 500 Index** | 4.48% | 14.24% | 18.61% | 10.81% | 14.22% | 13.22% |

| Lipper Equity Income Index** | 3.82% | 10.35% | 15.90% | 8.34% | 11.91% | 11.10% |

30-Day SEC Yield: 1.73%; Expense Ratio in current prospectus: 0.89%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

| * | Returns greater than one year are annualized. |

| ** | The Russell 1000® Value Index measures the performance of the Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. The Lipper Equity Income Index is an unmanaged index of the 30 largest funds in the Lipper Equity Income fund category. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

Recent Purchases

iShares MSCI Europe Financials ETF (EUFN)—European financial returns have been weak due to low (and negative) interest rates, a relatively weak economy, and onerous regulations; however, the European economy appears to be strengthening and yields are beginning to rise. As the European economy improves and rates rise, banks should be major beneficiaries.

Lamar Advertising Company (LAMR)—As shares of LAMR pulled back slightly since our chip in February, we decided to increase our position in this high-quality name. We are attracted to the company’s earnings visibility, solid (and growing) dividend, and well-located assets.

TE Connectivity Ltd. (TEL)—We initiated a position in this $28 billion global leader in the design and manufacturing of connector and sensor solutions. The company dates back 75 years and spun off from Tyco in 2007.

Recent Sales

Boeing Company (BA)—Management continues to expect gradual improvement in operating margins through the decade and backlog continues to grow (despite investor fears of a peaking cycle). We continue to like BA, but we thought it prudent to book some profits in light of the recent spike.

5

Time Warner, Inc. (TWX)—As a reminder, we sold AT&T (T) last October on news of the TWX acquisition, as we were skeptical of the strategic benefits. With the company looking more fully valued at this time and speculation the deal could be in jeopardy, we decided to move on and redeploy the proceeds into opportunities exhibiting a better risk reward profile.

Davenport Equity Opportunities Fund (DEOPX)

The Equity Opportunities Fund posted solid third quarter results. The Fund gained 7.33% as compared to a 3.47% gain for the Russell Midcap® Index. This brought our year to date gain to 16.51%, nicely ahead of the Russell Midcap at 11.74% as well as the S&P 500 Index at 14.24%. We started the year thinking a number of our holdings looked timely. It took some patience, but recent results indicate this was indeed the case.

Consumer stocks have been particularly friendly to us of late. During the quarter, Live Nation Entertainment (LYV), CarMax (KMX) and Dollar Tree (DLTR) were our top contributors. LYV has been a steady performer as concert attendance has reached new records and the company’s advertising and ticketing businesses have grown. KMX and DLTR, on the other hand, have faced a healthy dose of investor skepticism for much of the year. In both cases, it has paid to exercise patience. KMX doubters were fixated on deteriorating loan performance and new competition. The company’s recent strong results, which indicate healthy same-store sales growth and credit metrics, have disproved these fears. DLTR shares had been pressured by sluggish results at acquired Family Dollar stores and the heightened threat of Amazon (AMZN). More recently, flagship Dollar Tree locations have turned in better than expected results and Family Dollar is showing some signs of improvement. As far as Amazon goes, we recognize its impact on Main Street retail; however, we believe this threat has been vastly overstated.

This leads us to a new position: auto parts retailer O’Reilly Automotive (ORLY). We know this company well and have enjoyed past success with it, driven by robust same-store sales growth (a function of both market share gains and the rising age of cars on the road), significant profit margin expansion, and stock buy-backs. This year, the stock has pulled back sharply as the company lowered near-term growth expectations due to cyclical headwinds (mainly mild winter weather and more difficult comparisons) and investors fixated on the potential threat of Amazon aggressively entering auto parts retail. Even after recovering somewhat, the stock’s valuation stands at 16x next year’s earnings estimate versus 25x just 12 months ago. We think the shares adequately reflect prevailing risks and view this as an attractive price for a best-in-class operator. We look for growth to re-accelerate next year. There has been scant evidence of AMZN taking meaningful share from the incumbents and the top selling auto items on Amazon have very little overlap with ORLY. Furthermore, car parts require immediate availability and many parts require professional assistance. We suppose Amazon could buy its way into the industry with a splashy acquisition, but that’s a risk we’ll accept at ORLY’s current valuation.

Our worst performers for the quarter were Martin Marietta Materials (MLM) and DISH Network (DISH). Shares of construction aggregates producer MLM declined following weather-plagued Q2 results and less optimism surrounding Washington’s ability to pass infrastructure legislation. In our view, weather problems only defer shipments and the construction cycle remains in the early innings. We remain attracted to the aggregates industry given tremendous barriers to entry and consistent pricing power. Therefore, we have added to our position on recent weakness.

6

DISH has been a controversial story. We are still attracted to the company’s giant trove of wireless spectrum. Demand for finite spectrum continues to rise alongside increasing wireless data and video consumption. However, DISH’s plan for the spectrum remains unclear. This uncertainty has flummoxed investors and weighed on the stock. We believe the spectrum’s value will continue to rise (perhaps substantially) and trust the company will make the right decision to maximize shareholder returns. We recently added to our position on weakness.

All told, we are pleased with recent results, especially when considering our relatively light exposure to “hot” areas such as technology. While we’ve enjoyed strong performance this year, we continue to think many of our holdings are timely and may possess attractive upside. This is particularly true for the names above that we’ve added to recently. While they may face headwinds or uncertainty in the near-term, they are run by shrewd capital allocators who have compounded investor wealth at above-average rates for many years.

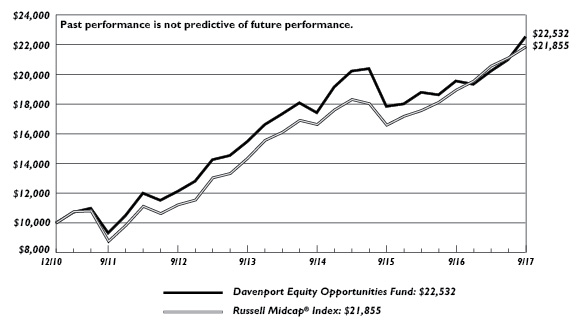

The following chart represents Davenport Equity Opportunities Fund (DEOPX) performance and the performance of the Russell Midcap® Index, the Fund’s primary benchmark, and the S&P 500 Index for the periods ended September 30, 2017.

| | Q3 2017 | YTD 2017 | 1 Year | 3 Years* | 5 Years* | Since Inception* 12/31/10 |

| Equity Opportunities Fund (DEOPX) | 7.33% | 16.51% | 15.20% | 8.94% | 13.19% | 12.79% |

Russell Midcap® Index** | 3.47% | 11.74% | 15.32% | 9.54% | 14.26% | 12.28% |

| S&P 500 Index** | 4.48% | 14.24% | 18.61% | 10.81% | 14.22% | 13.22% |

Expense Ratio in current prospectus: 0.92%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

| * | Returns greater than one year are annualized. |

| ** | The Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000, which represent approximately 25% of the total market capitalization of the Russell 1000®. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

Recent Purchases

DISH Network Corporation (DISH)—We continue to be focused on the value of the company’s vast spectrum of holdings. All indicators (rising wireless data usage, mobile video, Verizon (VZ) running short on spectrum in some markets, new iPhone features etc.) point to spectrum rising in value.

Martin Marietta Materials, Inc. (MLM)—While weather can have a near-term impact on quarterly results, we think the underlying fundamentals of the construction industry remain positive, and any movement on a federal infrastructure bill would be icing on the cake.

7

O’Reilly Automotive, Inc. (ORLY)—We believe the key issues behind the recent stock-price decline are company specific. Moreover, ORLY has already reported earnings for the same period and issued guidance contrary to what this report suggests.

TripAdvisor, Inc. (TRIP)—If the company shows progress on its goal of becoming the best one-stop shop to both research travel and book everything from hotels to attractions, the upside could be very meaningful.

Recent Sales

Church and Dwight Company, Inc. (CHD)—CHD has been a big stock over time and is one of the more innovative companies in the consumer products arena; however, we think we may see pricing pressure as competition intensifies and Wal-Mart, Amazon, etc. put pressure on packaged goods providers.

Live Nation Entertainment, Inc. (LYV)—Despite our confidence in the company’s long-term growth opportunity, barriers to entry and recent acceleration in revenue and profitability, we recently reduced the position to make room for a new idea.

Davenport Small Cap Focus Fund (DSCPX)

The Davenport Small Cap Focus Fund advanced 6.27% during the third quarter, outpacing the 5.67% return for the Russell 2000® Index. On a year to date basis, the Fund is up 13.32%, relative to the 10.94% gain for the Russell 2000 Index.

Following two straight quarters of underperformance relative to large caps, small cap stocks outperformed in Q3 as the reflation trade garnered some momentum and optimism surrounding tax reform benefited the domestically oriented small cap indices. On a year to date basis, the technology sector (led by semiconductors) and health care sector (led by biotechnology) have comprised a meaningful share of market gains. While being underweight in these areas has served as a headwind to more relative performance, we are pleased with the Fund’s ability to outperform in these conditions.

Gaming stocks Monarch Casino (MCRI) and Eldorado Resorts (ERI) were key contributors for the quarter. Each is showing strong growth and exposure in some of the best markets in the country (Reno, NV and Black Hawk, Co). Despite logging gains of 53% and 57%, respectively on a year to date basis, we think there may be more upside for the stocks given improving results and rising takeout potential. Each company has very heavy inside ownership (fitting our owner-operator bias), so we can rest assured management has our best interests at heart. Speaking of owner-operators, leading pet insurance provider Trupanion (TRUP), which we highlighted last quarter, was a key contributor during the period. As a reminder, CEO Darryl Rawlings owns more than 10% of the shares outstanding and is focused on creating value on a per share basis. We remain confident that Trupanion’s unique approach to growth and underwriting may allow the company to garner more than its fair share of a rapidly growing and underpenetrated market.

The return of the aforementioned “reflation” trade gave a lift to building product and materials names such as American Woodmark Holdings (AMWD), Builders FirstSource (BLDR) and recently purchased Summit Materials (SUM). While the devastation caused by hurricanes Harvey and Irma will result in disruption to Q3 results, investors have looked past the near term

8

implications and are emphasizing the demand lift from the necessary rebuilding efforts. This phenomenon has also benefited the trucking sector where holdings in Marten Transport (MRTN) and Knight-Swift Transportation (KNX) have surged to new highs.

We have recently been adding to our position in KNX, as we believe both market dynamics and company specific factors may combine to elevate the earnings power of the franchise well beyond prior peak levels. From an industry perspective, the hurricane rebuilding efforts have added incremental demand to freight markets that were already showing signs of tightness heading into the all-important “peak” holiday season. Furthermore, we believe the electronic logging of driver hours at the beginning of 2018 will serve to tighten capacity further. On top of this, the company just closed on its merger with Swift Transportation (SWFT), which doubles the company’s size and gives Knight’s best in class management team an opportunity to leverage fixed costs on a much larger asset base while also improving legacy Swift’s below-average margin profile.

To close, we are encouraged by the Fund’s recent performance, and we remain committed to finding compelling ideas. Furthermore, we believe the asset class may continue to see momentum as “reflation” remains in vogue. While we are underweight some of the market’s “hottest” areas, we are encouraged by our relative results and remain focused on producing compelling risk-adjusted returns without chasing momentum.

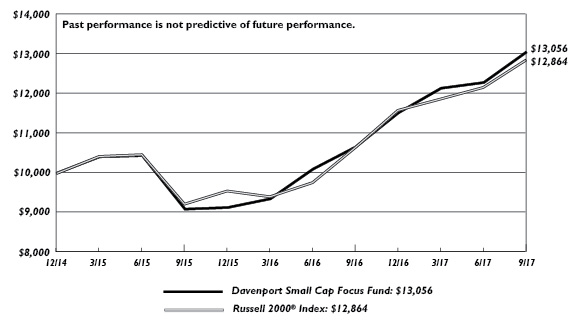

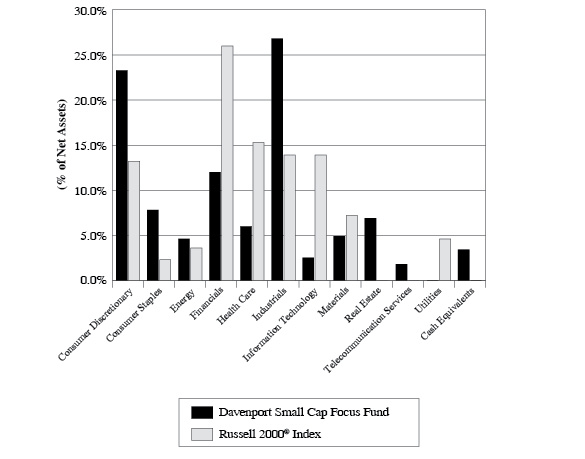

The following chart represents Davenport Small Cap Focus Fund (DSCPX) performance and the performance of the Russell 2000® Index, the Small Cap Focus Fund’s primary benchmark, for the periods ended September 30, 2017.

| | Q3 2017 | YTD 2017 | 1 Year | Since Inception* 12/31/14 |

| Small Cap Focus Fund (DSCPX) | 6.27% | 13.32% | 22.47% | 10.19% |

Russell 2000® Index** | 5.67% | 10.94% | 20.74% | 9.60% |

30-Day SEC Yield: 0.06%; Expense Ratio in current prospectus: 1.06%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

| * | Returns greater than one year are annualized. |

| ** | The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

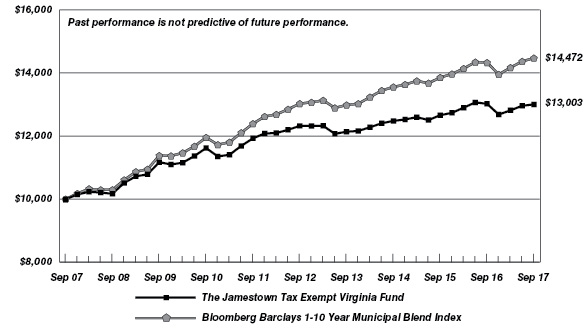

Davenport Balanced Income Fund (DBALX)

The Davenport Balanced Income Fund gained 2.81% in the quarter, versus a 3.12% increase for the Russell 1000® Value and 3.02% for the Morningstar US OE Allocation 50-70% Equity Index. Year to date, the fund was up 6.97%, compared to the Russell’s 7.92% and the Morningstar US

9

OE’s 9.51%%. The Fund performed well relative to the blended 60% Russell 1000 Value and 40% Bloomberg Barclays Intermediate Government/Credit Index returns of 2.12% and 5.69% for the quarter and year to date, respectively.

The equity portion of the Fund performed well during the quarter with Health Care leading the sector performance, driven by strong returns from Bristol-Myers Squibb (BMY) and Gilead (GILD). Additionally, our largest contribution came from Boeing (BA), which increased 30% during the quarter as near-term business trends have improved and earnings estimates have moved higher. Real estate was our weakest sector, with Lamar Advertising (LAMR) and Tanger Factory Outlet (SKT) the leading detractors. Despite the recent weakness we still favor the sector from a long-term perspective and chose to add to our position in Lamar.

During the quarter, we initiated a position in Blackstone Group (BX), the largest and most diversified of the alternative asset managers, focused in four segments: real estate, credit, private equity, and hedge funds. The company has been a fundraising machine, and recently has begun expanding into two additional segments: infrastructure and long-only Master Limited Partnerships (MLPs). Alternative investments have gained share versus traditional investments, and we believe Blackstone’s product innovation, fund-raising track record, and large global distribution could fuel faster growth in assets under management. The company pays a $2.29 dividend (about a 6.9% yield) based on trailing twelve-month distributions. Furthermore, the firm boasts a strong management team with a large vested interest, giving us additional confidence for the future of the stock. Given the favorable outlook and potential catalysts, we elected to initiate a position on the heels of a recent pullback.

The bond market treaded water during the recent quarter as investors looked for indications of what the next Federal Reserve move might be. Chair Janet Yellen said the Federal Reserve would start reducing their $4.5 trillion in assets in the fall, and anticipates raising rates at their December meeting. She considers the economy to be in good shape and expects the rate of inflation, which remains low, will gradually rise. Her view of a solid economy was reinforced with the last quarter GDP growth at 3.1%, and inflation remains around 1.5%.

Ten-year U.S. Treasury yields, the global benchmark, were unchanged for the quarter, closing at 2.33%. The 3-month Treasury bill yield was 1.1% vs. 1.0%, 2 Year notes were 1.5% vs 1.4%. Rates for the year tell a different story with short term Treasury rates up by 0.6%, 2 Years up 0.3%, and 1 Year lower by 0.1%.

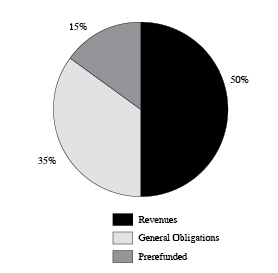

Our bond structure remains defensive, consistent with a conservative bias in what continues to be a low rate environment. The portfolio consists of 41 high quality corporate rate issues spread across 8 economic sectors with the top allocation of Financials at 30.4%, Consumer Staples at 19.4%, and 14.2% to Health Care. A new position in Capital One was initiated during the quarter. The bond portfolio is “A” rated, on average, has an average coupon of 3.2%, an effective maturity of 4.6 years, and a duration of 3.52 years.

We are pleased with our performance this quarter given the continued outperformance of growth strategies, and see value in a balanced approach as we continue through uncertain market conditions. Our allocation to more cyclical equities and defensive positioning in the bond portion of the portfolio may continue providing a volatility buffer in the near future, while focusing on current income and long-term capital appreciation.

10

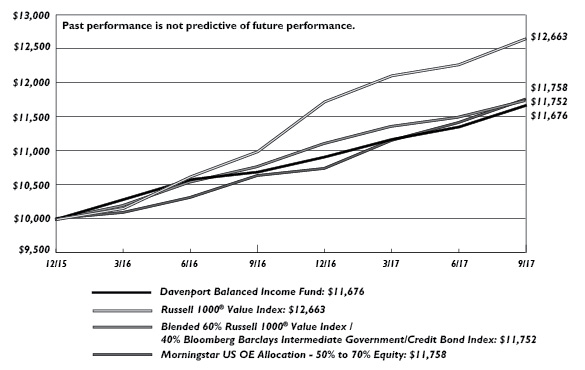

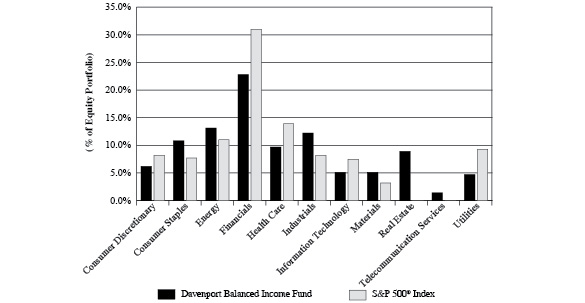

The following chart represents Davenport Balanced Income Fund (DBALX) performance and performance of the Fund’s primary benchmark, the Russell 1000® Value Index, along with the Morningstar US OE Allocation 50-70% Index and the blended 60% Russell 1000® Value Index / 40% Bloomberg Barclays Intermediate Government /Credit Bond Index for the period ended September 30, 2017.

| | Q3 2017 | YTD 2017 | 1 Year | Since Inception* 12/31/15 |

| Balanced Income Fund (DBALX) | 2.81% | 6.97% | 9.20% | 9.26% |

Russell 1000® Value** | 3.12% | 7.92% | 15.12% | 14.44% |

| Morningstar US OE Allocation 50-70% Equity** | 3.02% | 9.51% | 10.59% | 9.71% |

60% Russell 1000® Value/40% BBIGC | 2.12% | 5.69% | 9.16% | 9.68% |

30-Day SEC Yield: 1.68% Expense Ratio in current prospectus: 1.13%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

| * | Returns greater than one year are annualized. |

| ** | The Russell 1000® Value Index measures the performance of the Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. The Morningstar US OE Allocation 50-70% Equity Index is composed of funds which seek to provide both income and capital appreciation by investing in multiple asset classes, including stocks, bonds, and cash. These portfolios are dominated by domestic holdings and have equity exposure between 50% and 70%. The blended 60% Russell 1000 Value/40% Bloomberg Barclay’s Intermediate Government/Credit (BBIGC) Index is included as an additional comparative index because it is representative of a balanced portfolio consisting of 60% equity and 40% fixed income securities. The BBIGC measures the non-securitized component of the U.S. Aggregate Index. It includes investment grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate rate securities. Intermediate maturity bonds include bonds with maturities of 1 to 9.999 years. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

11

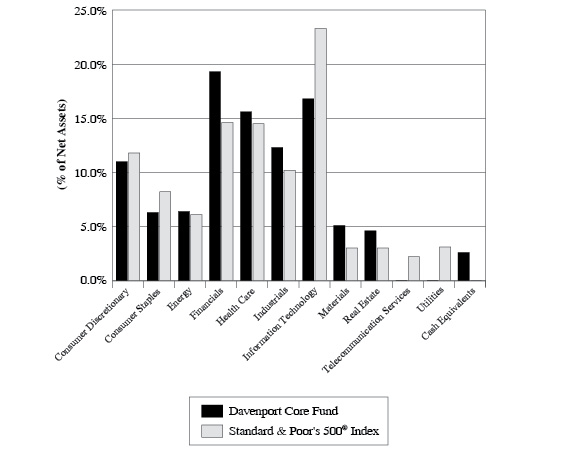

DAVENPORT CORE FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Davenport Core Fund and the Standard & Poor’s 500® Index

| | Average Annual Total Returns

(for periods ended September 30, 2017) |

| | 1 Year | 5 Years | 10 Years |

Davenport Core Fund(a) | 17.04% | 13.04% | 7.02% |

Standard & Poor’s 500® Index | 18.61% | 14.22% | 7.44% |

(a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

12

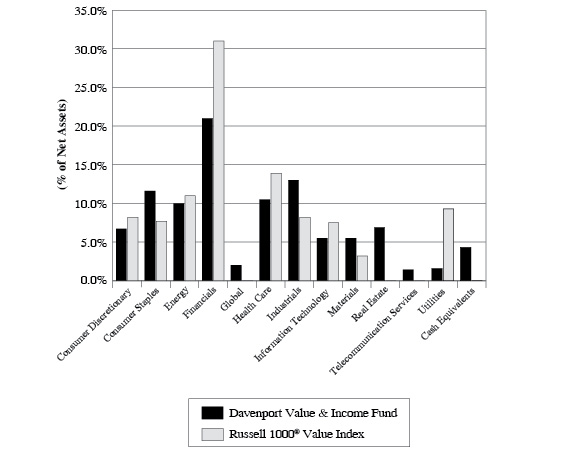

DAVENPORT VALUE & INCOME FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Davenport Value & Income Fund, the Russell 1000® Value Index

and the Lipper Equity Income Index

| | Average Annual Total Returns

(for periods ended September 30, 2017) |

| | 1 Year | 5 Years | Since

Inception(b) |

Davenport Value & Income Fund(a) | 15.64% | 12.71% | 12.87% |

Russell 1000® Value Index | 15.12% | 13.20% | 12.09% |

| Lipper Equity Income Index | 15.90% | 11.91% | 11.10% |

(a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | Commencement of operations was December 31, 2010. |

13

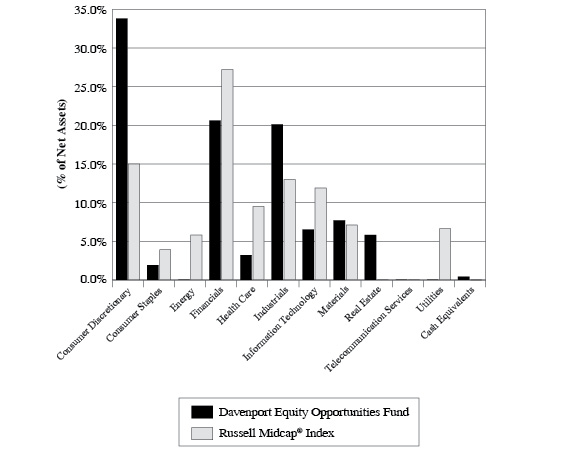

DAVENPORT EQUITY OPPORTUNITIES FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Davenport Equity Opportunities Fund and the Russell Midcap® Index

| | Average Annual Total Returns

(for periods ended September 30, 2017) |

| | 1 Year | 5 Years | Since

Inception(b) |

Davenport Equity Opportunities Fund(a) | 15.20% | 13.19% | 12.79% |

Russell Midcap® Index | 15.32% | 14.26% | 12.28% |

(a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | Commencement of operations was December 31, 2010. |

14

DAVENPORT SMALL CAP FOCUS FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Davenport Small Cap Focus Fund and the Russell 2000® Index

| | Average Annual Total Returns

(for periods ended September 30, 2017) |

| | 1 Year | Since Inception(b) |

Davenport Small Cap Focus Fund(a) | 22.47% | 10.19% |

Russell 2000® Index | 20.74% | 9.60% |

(a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | Commencement of operations was December 31, 2014. |

15

DAVENPORT BALANCED INCOME FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in Davenport Balanced

Income Fund, the Russell 1000® Value Index, a Blended 60% Russell 1000® Value

Index / 40% Bloomberg Barclays Intermediate Government/Credit Bond Index

and the Morningstar US OE Allocation - 50% to 70% Equity

| | Average Annual Total Returns

(for periods ended September 30, 2017) |

| | 1 Year | Since Inception(b) |

Davenport Balanced Income Fund(a) | 9.20% | 9.26% |

Russell 1000® Value Index | 15.12% | 14.44% |

Blended 60% Russell 1000® Value Index / 40% Bloomberg Barclays Intermediate Government/Credit Bond Index | 9.03% | 9.66% |

| Morningstar US OE Allocation - 50% to 70% Equity | 10.59% | 9.71% |

(a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | Commencement of operations was December 31, 2015. |

16

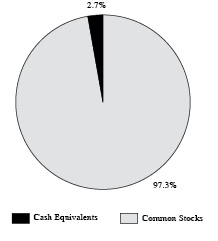

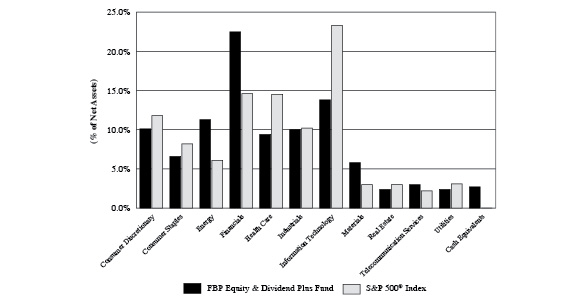

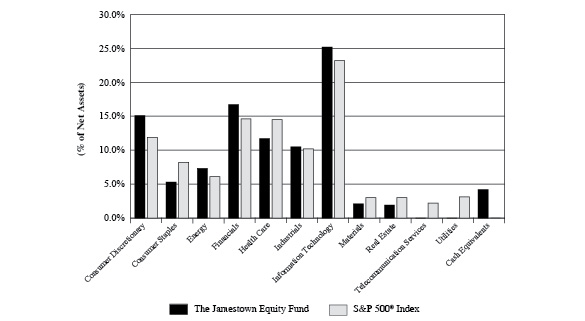

DAVENPORT CORE FUND

PORTFOLIO INFORMATION

September 30, 2017 (Unaudited)

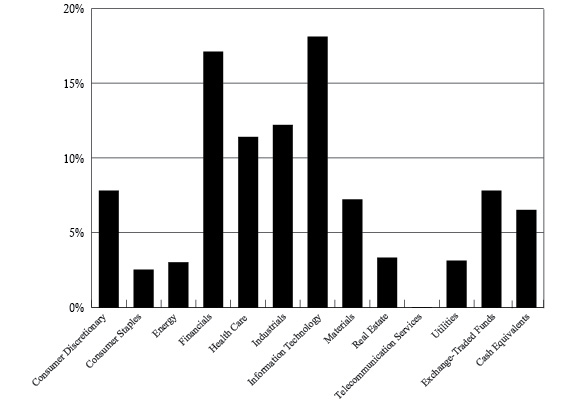

Sector Allocation vs. the Standard & Poor’s 500® Index

Top Ten Equity Holdings

| Security Description | % of Net Assets |

| Markel Corporation | 3.6% |

| Brookfield Asset Management, Inc. - Class A | 3.3% |

| Visa, Inc. - Class A | 3.3% |

| Capital One Financial Corporation | 3.2% |

| American Tower Corporation | 3.1% |

| Citigroup, Inc. | 3.0% |

| Johnson & Johnson | 2.8% |

| Berkshire Hathaway, Inc. - Class B | 2.7% |

| Accenture plc - Class A | 2.7% |

| CarMax, Inc. | 2.6% |

17

DAVENPORT VALUE & INCOME FUND

PORTFOLIO INFORMATION

September 30, 2017 (Unaudited)

Sector Allocation vs. the Russell 1000® Value Index

Top Ten Equity Holdings

| Security Description | % of Net Assets |

| FNF Group | 3.3% |

| Johnson & Johnson | 3.1% |

| Citigroup, Inc. | 2.9% |

| Capital One Financial Corporation | 2.9% |

| Markel Corporation | 2.9% |

| JPMorgan Chase & Company | 2.8% |

| Watsco, Inc. | 2.7% |

| Royal Dutch Shell plc - Class B - ADR | 2.6% |

| Diageo plc - ADR | 2.4% |

| Merck & Company, Inc. | 2.3% |

18

DAVENPORT EQUITY OPPORTUNITIES FUND

PORTFOLIO INFORMATION

September 30, 2017 (Unaudited)

Sector Allocation vs. the Russell Midcap® Index

Top Ten Equity Holdings

| Security Description | % of Net Assets |

| CarMax, Inc. | 6.1% |

| Colfax Corporation | 6.0% |

| WABCO Holdings, Inc. | 5.8% |

| American Tower Corporation | 5.8% |

| Brookfield Asset Management, Inc. - Class A | 5.5% |

| Dollar Tree, Inc. | 5.3% |

| Capital One Financial Corporation | 5.1% |

| DISH Network Corporation - Class A | 4.9% |

| Live Nation Entertainment, Inc. | 4.8% |

| Markel Corporation | 4.4% |

19

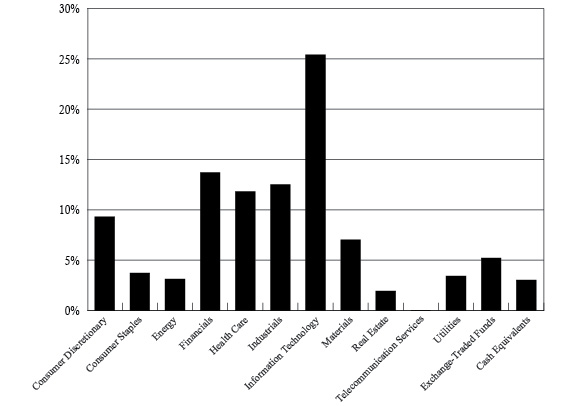

DAVENPORT SMALL CAP FOCUS FUND

PORTFOLIO INFORMATION

September 30, 2017 (Unaudited)

Sector Allocation vs. the Russell 2000® Index

Top Ten Equity Holdings

| Security Description | % of Net Assets |

| Monarch Casino & Resort, Inc. | 5.1% |

| American Woodmark Corporation | 3.3% |

| Genesee & Wyoming, Inc. - Class A | 3.1% |

| Liberty TripAdvisor Holdings, Inc. - Series A | 3.0% |

| Colfax Corporation | 3.0% |

| Live Nation Entertainment, Inc. | 3.0% |

| TowneBank | 3.0% |

| FRP Holdings, Inc. | 2.8% |

| Seaboard Corporation | 2.8% |

| Kinsale Capital Group, Inc. | 2.8% |

20

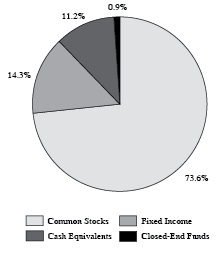

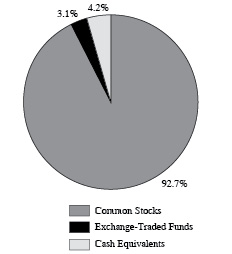

DAVENPORT BALANCED INCOME FUND

PORTFOLIO INFORMATION

September 30, 2017 (Unaudited)

| Asset Allocation (% of Net Assets) | | Ten Largest Equity Holdings | % of Net Assets |

| | FNF Group | 1.7% |

| Johnson & Johnson | 1.7% |

| Citigroup, Inc. | 1.6% |

| Capital One Financial Corporation | 1.5% |

| Markel Corporation | 1.5% |

| JPMorgan Chase & Company | 1.5% |

| Watsco, Inc. | 1.4% |

| Royal Dutch Shell plc - Class B - ADR | 1.4% |

| Diageo plc - ADR | 1.3% |

| Merck & Company, Inc. | 1.2% |

| Equity Sector Concentration vs. the Russell 1000 Value Index (57.2% of Net Assets) |

| Corporate Bond Portfolio (36.8% of Net Assets) | | Credit Quality | Composite Quality |

| Number of Fixed-Income Securities | 41 | | AAA | 0.0% |

| Average Quality | A | | AA | 17.8% |

| Effective Maturity | 4.6 yrs | | A | 60.6% |

| Average Effective Duration | 3.5 yrs | | BBB | 21.6% |

| Sector Breakdown | % of Corporate

Bond Portfolio |

| Consumer Discretionary | 8.6% |

| Consumer Staples | 19.4% |

| Energy | 6.5% |

| Financials | 30.4% |

| Health Care | 14.2% |

| Industrials | 7.3% |

| Information Technology | 7.6% |

| Telecommunication Services | 6.0% |

21

DAVENPORT CORE FUND

SCHEDULE OF INVESTMENTS

September 30, 2017 (Unaudited) |

| COMMON STOCKS — 94.1% | | Shares | | | Value | |

| Consumer Discretionary — 11.0% | | | | | | |

Amazon.com, Inc. (a) | | | 5,958 | | | $ | 5,727,723 | |

CarMax, Inc. (a) | | | 148,968 | | | | 11,293,264 | |

Liberty Broadband Corporation - Series C (a) | | | 54,649 | | | | 5,208,050 | |

Liberty SiriusXM - Series C (a) | | | 141,684 | | | | 5,932,309 | |

| NIKE, Inc. - Class B | | | 115,837 | | | | 6,006,149 | |

Priceline Group, Inc. (The) (a) | | | 4,726 | | | | 8,652,455 | |

| Walt Disney Company (The) | | | 55,331 | | | | 5,453,977 | |

| | | | | | | | 48,273,927 | |

| Consumer Staples — 6.3% | | | | | | | | |

| Anheuser-Busch InBev S.A./N.V. - ADR | | | 42,895 | | | | 5,117,373 | |

| Mondelēz International, Inc. - Class A | | | 146,710 | | | | 5,965,229 | |

| Nestlé S.A. - ADR | | | 117,457 | | | | 9,867,563 | |

| PepsiCo, Inc. | | | 58,966 | | | | 6,570,581 | |

| | | | | | | | 27,520,746 | |

| Energy — 6.4% | | | | | | | | |

| Chevron Corporation | | | 66,037 | | | | 7,759,347 | |

| Exxon Mobil Corporation | | | 75,578 | | | | 6,195,884 | |

| Marathon Petroleum Corporation | | | 139,408 | | | | 7,818,001 | |

| Schlumberger Ltd. | | | 90,110 | | | | 6,286,074 | |

| | | | | | | | 28,059,306 | |

| Financials — 19.3% | | | | | | | | |

Berkshire Hathaway, Inc. - Class B (a) | | | 65,366 | | | | 11,982,895 | |

| Brookfield Asset Management, Inc. - Class A | | | 354,654 | | | | 14,647,210 | |

| Capital One Financial Corporation | | | 164,589 | | | | 13,934,105 | |

| Citigroup, Inc. | | | 182,362 | | | | 13,265,012 | |

| CME Group, Inc. | | | 49,857 | | | | 6,764,598 | |

| JPMorgan Chase & Company | | | 88,652 | | | | 8,467,152 | |

Markel Corporation (a) | | | 14,638 | | | | 15,633,091 | |

| | | | | | | | 84,694,063 | |

| Health Care — 13.9% | | | | | | | | |

| Allergan plc | | | 27,057 | | | | 5,545,332 | |

AmerisourceBergen Corporation (a) | | | 92,875 | | | | 7,685,406 | |

| Amgen, Inc. | | | 31,781 | | | | 5,925,567 | |

Celgene Corporation (a) | | | 73,658 | | | | 10,740,810 | |

| Danaher Corporation | | | 128,757 | | | | 11,044,775 | |

| Johnson & Johnson | | | 94,987 | | | | 12,349,260 | |

| Merck & Company, Inc. | | | 123,720 | | | | 7,921,792 | |

| | | | | | | | 61,212,942 | |

| Industrials — 10.7% | | | | | | | | |

| FedEx Corporation | | | 43,851 | | | | 9,891,908 | |

| General Dynamics Corporation | | | 39,439 | | | | 8,107,870 | |

| General Electric Company | | | 235,961 | | | | 5,705,537 | |

| Johnson Controls International plc | | | 137,394 | | | | 5,535,604 | |

22

DAVENPORT CORE FUND

SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 94.1% (Continued) | | Shares | | | Value | |

| Industrials — 10.7% (Continued) | | | | | | |

| Southwest Airlines Company | | | 153,531 | | | $ | 8,594,665 | |

| Union Pacific Corporation | | | 79,079 | | | | 9,170,792 | |

| | | | | | | | 47,006,376 | |

| Information Technology — 16.8% | | | | | | | | |

| Accenture plc - Class A | | | 88,461 | | | | 11,948,427 | |

Adobe Systems, Inc. (a) | | | 74,614 | | | | 11,130,917 | |

Alphabet, Inc. - Class A (a) | | | 7,625 | | | | 7,424,615 | |

Alphabet, Inc. - Class C (a) | | | 6,677 | | | | 6,403,977 | |

| Apple, Inc. | | | 40,822 | | | | 6,291,487 | |

Facebook, Inc. - Class A (a) | | | 49,977 | | | | 8,539,570 | |

| MasterCard, Inc. - Class A | | | 55,275 | | | | 7,804,830 | |

| Visa, Inc. - Class A | | | 137,296 | | | | 14,449,031 | |

| | | | | | | | 73,992,854 | |

| Materials — 5.1% | | | | | | | | |

| Ecolab, Inc. | | | 62,069 | | | | 7,982,694 | |

| Martin Marietta Materials, Inc. | | | 38,301 | | | | 7,898,815 | |

| Sherwin-Williams Company (The) | | | 18,912 | | | | 6,771,253 | |

| | | | | | | | 22,652,762 | |

| Real Estate — 4.6% | | | | | | | | |

| American Tower Corporation | | | 100,937 | | | | 13,796,069 | |

| Weyerhaeuser Company | | | 188,445 | | | | 6,412,784 | |

| | | | | | | | 20,208,853 | |

| | | | | | | | | |

Total Common Stocks (Cost $270,704,253) | | | | | | $ | 413,621,829 | |

| EXCHANGE-TRADED FUNDS — 3.3% | | Shares | | | Value | |

| iShares Nasdaq Biotechnology ETF | | | 21,667 | | | $ | 7,227,895 | |

| iShares U.S. Home Construction ETF | | | 195,909 | | | | 7,158,515 | |

Total Exchange-Traded Funds (Cost $11,551,628) | | | | | | $ | 14,386,410 | |

23

DAVENPORT CORE FUND

SCHEDULE OF INVESTMENTS (Continued) |

| MONEY MARKET FUNDS — 1.4% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 0.89% (b) (Cost $6,359,738) | | | 6,359,738 | | | $ | 6,359,738 | |

| | | | | | | | | |

Total Investments at Value — 98.8% (Cost $288,615,619) | | | | | | $ | 434,367,977 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 1.2% | | | | | | | 5,204,456 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 439,572,433 | |

ADR - American Depositary Receipt.

(a) | Non-income producing security. |

(b) | The rate shown is the 7-day effective yield as of September 30, 2017. |

See accompanying notes to financial statements.

24

DAVENPORT VALUE & INCOME FUND

SCHEDULE OF INVESTMENTS

September 30, 2017 (Unaudited) |

| COMMON STOCKS — 92.2% | | Shares | | | Value | |

| Consumer Discretionary — 6.7% | | | | | | |

| Carnival Corporation | | | 148,080 | | | $ | 9,561,526 | |

| General Motors Company | | | 228,245 | | | | 9,216,533 | |

| McDonald's Corporation | | | 57,545 | | | | 9,016,151 | |

| VF Corporation | | | 208,655 | | | | 13,264,198 | |

| | | | | | | | 41,058,408 | |

| Consumer Staples — 11.6% | | | | | | | | |

| Altria Group, Inc. | | | 117,356 | | | | 7,442,718 | |

| Anheuser-Busch InBev S.A./N.V. - ADR | | | 69,160 | | | | 8,250,788 | |

| Coca-Cola Company (The) | | | 244,370 | | | | 10,999,094 | |

| CVS Health Corporation | | | 127,010 | | | | 10,328,453 | |

| Diageo plc - ADR | | | 113,550 | | | | 15,003,361 | |

| PepsiCo, Inc. | | | 94,130 | | | | 10,488,906 | |

| Philip Morris International, Inc. | | | 77,790 | | | | 8,635,468 | |

| | | | | | | | 71,148,788 | |

| Energy — 10.0% | | | | | | | | |

| Chevron Corporation | | | 66,591 | | | | 7,824,443 | |

| Enbridge, Inc. | | | 204,967 | | | | 8,575,819 | |

| Exxon Mobil Corporation | | | 83,650 | | | | 6,857,627 | |

| Marathon Petroleum Corporation | | | 164,220 | | | | 9,209,458 | |

| Occidental Petroleum Corporation | | | 198,435 | | | | 12,741,511 | |

| Royal Dutch Shell plc - Class B - ADR | | | 257,370 | | | | 16,095,920 | |

| | | | | | | | 61,304,778 | |

| Financials — 19.5% | | | | | | | | |

| Capital One Financial Corporation | | | 210,865 | | | | 17,851,831 | |

| Citigroup, Inc. | | | 245,705 | | | | 17,872,582 | |

| Fairfax Financial Holdings Ltd. | | | 17,428 | | | | 9,045,132 | |

| FNF Group | | | 423,995 | | | | 20,122,803 | |

| JPMorgan Chase & Company | | | 180,760 | | | | 17,264,387 | |

Markel Corporation (a) | | | 16,460 | | | | 17,578,951 | |

| Synchrony Financial | | | 311,220 | | | | 9,663,381 | |

| Wells Fargo & Company | | | 194,575 | | | | 10,730,811 | |

| | | | | | | | 120,129,878 | |

| Health Care — 10.5% | | | | | | | | |

| AmerisourceBergen Corporation | | | 94,740 | | | | 7,839,735 | |

| Bristol-Myers Squibb Company | | | 220,115 | | | | 14,030,130 | |

| Gilead Sciences, Inc. | | | 112,490 | | | | 9,113,940 | |

| Johnson & Johnson | | | 146,950 | | | | 19,104,969 | |

| Merck & Company, Inc. | | | 221,450 | | | | 14,179,444 | |

| | | | | | | | 64,268,218 | |

| Industrials — 13.0% | | | | | | | | |

| 3M Company | | | 59,090 | | | | 12,402,991 | |

| Boeing Company (The) | | | 47,296 | | | | 12,023,116 | |

| Delta Air Lines, Inc. | | | 166,395 | | | | 8,023,567 | |

25

DAVENPORT VALUE & INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 92.2% (Continued) | | Shares | | | Value | |

| Industrials — 13.0% (Continued) | | | | | | |

| Eaton Corporation plc | | | 122,597 | | | $ | 9,414,224 | |

| General Electric Company | | | 419,370 | | | | 10,140,367 | |

| Illinois Tool Works, Inc. | | | 79,025 | | | | 11,692,539 | |

| Watsco, Inc. | | | 102,250 | | | | 16,469,407 | |

| | | | | | | | 80,166,211 | |

| Information Technology — 5.5% | | | | | | | | |

| Cisco Systems, Inc. | | | 364,930 | | | | 12,272,596 | |

| Microsoft Corporation | | | 167,708 | | | | 12,492,569 | |

| TE Connectivity Ltd. | | | 110,945 | | | | 9,215,091 | |

| | | | | | | | 33,980,256 | |

| Materials — 5.5% | | | | | | | | |

| International Paper Company | | | 193,705 | | | | 11,006,318 | |

| Potash Corporation of Saskatchewan, Inc. | | | 502,915 | | | | 9,676,085 | |

| PPG Industries, Inc. | | | 119,510 | | | | 12,985,956 | |

| | | | | | | | 33,668,359 | |

| Real Estate — 6.9% | | | | | | | | |

| Equity LifeStyle Properties, Inc. | | | 98,445 | | | | 8,375,700 | |

| Gaming and Leisure Properties, Inc. | | | 260,109 | | | | 9,595,421 | |

| Lamar Advertising Company - Class A | | | 187,120 | | | | 12,823,334 | |

| W.P. Carey, Inc. | | | 176,649 | | | | 11,904,376 | |

| | | | | | | | 42,698,831 | |

| Telecommunication Services — 1.4% | | | | | | | | |

| Verizon Communications, Inc. | | | 178,085 | | | | 8,813,427 | |

| | | | | | | | | |

| Utilities — 1.6% | | | | | | | | |

| Dominion Energy, Inc. | | | 125,780 | | | | 9,676,255 | |

| | | | | | | | | |

Total Common Stocks (Cost $444,065,035) | | | | | | $ | 566,913,409 | |

| EXCHANGE-TRADED FUNDS — 3.5% | | Shares | | | Value | |

| iShares MSCI Europe Financials ETF | | | 392,175 | | | $ | 9,208,269 | |

| Vanguard FTSE Emerging Markets ETF | | | 281,530 | | | | 12,266,262 | |

Total Exchange-Traded Funds (Cost $20,404,667) | | | | | | $ | 21,474,531 | |

26

DAVENPORT VALUE & INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

| MONEY MARKET FUNDS — 4.2% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 0.89% (b) (Cost $25,764,042) | | | 25,764,042 | | | $ | 25,764,042 | |

| | | | | | | | | |

Total Investments at Value — 99.9% (Cost $490,233,744) | | | | | | $ | 614,151,982 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.1% | | | | | | | 893,025 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 615,045,007 | |

ADR - American Depositary Receipt.

(a) | Non-income producing security. |

(b) | The rate shown is the 7-day effective yield as of September 30, 2017. |

See accompanying notes to financial statements.

27

DAVENPORT EQUITY OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

September 30, 2017 (Unaudited) |

| COMMON STOCKS — 99.6% | | Shares | | | Value | |

| Consumer Discretionary — 33.8% | | | | | | |

CarMax, Inc. (a) | | | 310,535 | | | $ | 23,541,659 | |

DISH Network Corporation - Class A (a) | | | 349,230 | | | | 18,938,743 | |

Dollar Tree, Inc. (a) | | | 238,271 | | | | 20,686,688 | |

Liberty Broadband Corporation - Series C (a) | | | 120,340 | | | | 11,468,402 | |

Live Nation Entertainment, Inc. (a) | | | 430,244 | | | | 18,737,126 | |

LKQ Corporation (a) | | | 346,986 | | | | 12,488,026 | |

O'Reilly Automotive, Inc. (a) | | | 48,175 | | | | 10,375,450 | |

TripAdvisor, Inc. (a) | | | 365,425 | | | | 14,810,675 | |

| | | | | | | | 131,046,769 | |

| Consumer Staples — 1.9% | | | | | | | | |

| Church & Dwight Company, Inc. | | | 152,715 | | | | 7,399,042 | |

| | | | | | | | | |

| Financials — 20.6% | | | | | | | | |

| Brookfield Asset Management, Inc. - Class A | | | 516,652 | | | | 21,337,728 | |

| Capital One Financial Corporation | | | 232,174 | | | | 19,655,851 | |

| Fairfax Financial Holdings Ltd. | | | 15,805 | | | | 8,202,795 | |

| FNF Group | | | 283,975 | | | | 13,477,453 | |

Markel Corporation (a) | | | 16,067 | | | | 17,159,235 | |

| | | | | | | | 79,833,062 | |

| Health Care — 3.2% | | | | | | | | |

| Zoetis, Inc. | | | 192,150 | | | | 12,251,484 | |

| | | | | | | | | |

| Industrials — 20.1% | | | | | | | | |

Colfax Corporation (a) | | | 563,071 | | | | 23,446,276 | |

Genesee & Wyoming, Inc. - Class A (a) | | | 200,395 | | | | 14,831,234 | |

WABCO Holdings, Inc. (a) | | | 151,975 | | | | 22,492,300 | |

| Watsco, Inc. | | | 50,820 | | | | 8,185,577 | |

| Xylem, Inc. | | | 141,385 | | | | 8,854,943 | |

| | | | | | | | 77,810,330 | |

| Information Technology — 6.5% | | | | | | | | |

Black Knight Financial Services, Inc. - Class A (a) | | | 93,425 | | | | 4,021,946 | |

| Intuit, Inc. | | | 114,694 | | | | 16,302,605 | |

| MercadoLibre, Inc. | | | 19,416 | | | | 5,027,385 | |

| | | | | | | | 25,351,936 | |

| Materials — 7.7% | | | | | | | | |

| Martin Marietta Materials, Inc. | | | 65,890 | | | | 13,588,494 | |

| Sherwin-Williams Company (The) | | | 45,620 | | | | 16,333,785 | |

| | | | | | | | 29,922,279 | |

| Real Estate — 5.8% | | | | | | | | |

| American Tower Corporation | | | 164,410 | | | | 22,471,559 | |

| | | | | | | | | |

Total Common Stocks (Cost $307,898,014) | | | | | | $ | 386,086,461 | |

28

DAVENPORT EQUITY OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS (Continued) |

| MONEY MARKET FUNDS — 0.5% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 0.89% (b) (Cost $1,894,056) | | | 1,894,056 | | | $ | 1,894,056 | |

| | | | | | | | | |

Total Investments at Value — 100.1% (Cost $309,792,070) | | | | | | $ | 387,980,517 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets — (0.1%) | | | | | | | (156,910 | ) |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 387,823,607 | |

(a) | Non-income producing security. |

(b) | The rate shown is the 7-day effective yield as of September 30, 2017. |

See accompanying notes to financial statements.

29

DAVENPORT SMALL CAP FOCUS FUND

SCHEDULE OF INVESTMENTS

September 30, 2017 (Unaudited) |

| COMMON STOCKS — 96.6% | | Shares | | | Value | |

| Consumer Discretionary — 23.3% | | | | | | |

| Cable One, Inc. | | | 2,914 | | | $ | 2,104,258 | |

| Core-Mark Holding Company, Inc. | | | 64,066 | | | | 2,059,081 | |

Eldorado Resorts, Inc. (a) | | | 66,454 | | | | 1,704,545 | |

Etsy, Inc. (a) | | | 40,000 | | | | 675,200 | |

Liberty TripAdvisor Holdings, Inc. - Series A (a) | | | 222,196 | | | | 2,744,121 | |

Live Nation Entertainment, Inc. (a) | | | 62,321 | | | | 2,714,079 | |

Monarch Casino & Resort, Inc. (a) | | | 118,330 | | | | 4,677,585 | |

| Pool Corporation | | | 15,900 | | | | 1,719,903 | |

| Red Rock Resorts, Inc. - Class A | | | 75,000 | | | | 1,737,000 | |

Unifi, Inc. (a) | | | 29,887 | | | | 1,064,874 | |

| | | | | | | | 21,200,646 | |

| Consumer Staples — 7.8% | | | | | | | | |

Boston Beer Company, Inc. (The) - Class A (a) | | | 13,871 | | | | 2,166,650 | |

| Seaboard Corporation | | | 557 | | | | 2,509,285 | |

| Snyder's-Lance, Inc. | | | 63,722 | | | | 2,430,357 | |

| | | | | | | | 7,106,292 | |

| Energy — 4.6% | | | | | | | | |

| Alliance Holdings GP, L.P. | | | 67,974 | | | | 1,890,357 | |

| CNX Coal Resources, L.P. | | | 18,415 | | | | 272,542 | |

| Dominion Midstream Partners, L.P. | | | 39,215 | | | | 1,254,880 | |

Navigator Holdings Ltd. (a) | | | 65,381 | | | | 725,729 | |

| | | | | | | | 4,143,508 | |

| Financials — 12.0% | | | | | | | | |

| Cohen & Steers, Inc. | | | 59,875 | | | | 2,364,464 | |

| Diamond Hill Investment Group, Inc. | | | 8,428 | | | | 1,789,686 | |

| Kinsale Capital Group, Inc. | | | 58,062 | | | | 2,506,536 | |

PRA Group, Inc. (a) | | | 55,000 | | | | 1,575,750 | |

| TowneBank | | | 81,001 | | | | 2,713,533 | |

| | | | | | | | 10,949,969 | |

| Health Care — 6.0% | | | | | | | | |

Aratana Therapeutics, Inc. (a) | | | 154,000 | | | | 944,020 | |

Heska Corporation (a) | | | 15,610 | | | | 1,375,085 | |

Trupanion, Inc. (a) | | | 86,000 | | | | 2,271,260 | |

VWR Corporation (a) | | | 24,764 | | | | 819,936 | |

| | | | | | | | 5,410,301 | |

| Industrials — 26.8% | | | | | | | | |

| AMERCO | | | 2,689 | | | | 1,008,106 | |

American Woodmark Corporation (a) | | | 31,384 | | | | 3,020,710 | |

Builders FirstSource, Inc. (a) | | | 121,118 | | | | 2,178,913 | |

Colfax Corporation (a) | | | 65,468 | | | | 2,726,088 | |

Genesee & Wyoming, Inc. - Class A (a) | | | 37,968 | | | | 2,810,012 | |

Knight-Swift Transportation Holdings, Inc. (a) | | | 55,508 | | | | 2,306,357 | |

| Marten Transport Ltd. | | | 90,551 | | | | 1,860,823 | |

30

DAVENPORT SMALL CAP FOCUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 96.6% (Continued) | | Shares | | | Value | |

| Industrials — 26.8% (Continued) | | | | | | |

Mistras Group, Inc. (a) | | | 86,419 | | | $ | 1,771,589 | |

NOW, Inc. (a) | | | 110,000 | | | | 1,519,100 | |

On Assignment, Inc. (a) | | | 23,987 | | | | 1,287,622 | |

WABCO Holdings, Inc. (a) | | | 14,019 | | | | 2,074,812 | |

| Watsco, Inc. | | | 11,340 | | | | 1,826,534 | |

| | | | | | | | 24,390,666 | |

| Information Technology — 2.5% | | | | | | | | |

Black Knight Financial Services, Inc. - Class A (a) | | | 51,652 | | | | 2,223,619 | |

| | | | | | | | | |

| Materials — 4.9% | | | | | | | | |

MAG Silver Corporation (a) | | | 157,005 | | | | 1,763,166 | |

| NewMarket Corporation | | | 2,637 | | | | 1,122,703 | |

Summit Materials, Inc. - Class A (a) | | | 50,100 | | | | 1,604,703 | |

| | | | | | | | 4,490,572 | |

| Real Estate — 6.9% | | | | | | | | |

FRP Holdings, Inc. (a) | | | 56,852 | | | | 2,572,553 | |

| Lamar Advertising Company - Class A | | | 36,278 | | | | 2,486,132 | |

| Outfront Media, Inc. | | | 48,774 | | | | 1,228,129 | |

| | | | | | | | 6,286,814 | |

| Telecommunication Services — 1.8% | | | | | | | | |

| Shenandoah Telecommunications Company | | | 42,760 | | | | 1,590,672 | |

| | | | | | | | | |

Total Common Stocks (Cost $72,691,080) | | | | | | $ | 87,793,059 | |

| MONEY MARKET FUNDS — 3.1% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 0.89% (b) (Cost $2,857,748) | | | 2,857,748 | | | $ | 2,857,748 | |

| | | | | | | | | |

Total Investments at Value — 99.7% (Cost $75,548,828) | | | | | | $ | 90,650,807 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.3% | | | | | | | 266,502 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 90,917,309 | |

(a) | Non-income producing security. |

(b) | The rate shown is the 7-day effective yield as of September 30, 2017. |

See accompanying notes to financial statements.

31

DAVENPORT BALANCED INCOME FUND

SCHEDULE OF INVESTMENTS

September 30, 2017 (Unaudited) |

| COMMON STOCKS — 57.2% | | Shares | | | Value | |

| Consumer Discretionary — 3.6% | | | | | | |

| Carnival Corporation | | | 13,790 | | | $ | 890,421 | |

| General Motors Company | | | 21,245 | | | | 857,873 | |

| McDonald's Corporation | | | 5,360 | | | | 839,805 | |

| VF Corporation | | | 19,390 | | | | 1,232,622 | |

| | | | | | | | 3,820,721 | |

| Consumer Staples — 6.2% | | | | | | | | |

| Altria Group, Inc. | | | 10,925 | | | | 692,864 | |

| Anheuser-Busch InBev S.A./N.V. - ADR | | | 6,430 | | | | 767,099 | |

| Coca-Cola Company (The) | | | 22,745 | | | | 1,023,752 | |

| CVS Health Corporation | | | 11,800 | | | | 959,576 | |

| Diageo plc - ADR | | | 10,570 | | | | 1,396,614 | |

| PepsiCo, Inc. | | | 8,755 | | | | 975,570 | |

| Philip Morris International, Inc. | | | 7,225 | | | | 802,047 | |

| | | | | | | | 6,617,522 | |

| Energy — 7.5% | | | | | | | | |

| Alliance Resource Partners, L.P. | | | 37,580 | | | | 727,173 | |

| Chevron Corporation | | | 6,180 | | | | 726,150 | |

| Dominion Energy Midstream Partners, L.P. | | | 26,290 | | | | 841,280 | |

| Enbridge, Inc. | | | 19,083 | | | | 798,433 | |

| Exxon Mobil Corporation | | | 7,785 | | | | 638,214 | |

| Marathon Petroleum Corporation | | | 15,345 | | | | 860,548 | |

| MPLX, L.P. | | | 22,750 | | | | 796,477 | |

| Occidental Petroleum Corporation | | | 18,475 | | | | 1,186,280 | |

| Royal Dutch Shell plc - Class B - ADR | | | 23,595 | | | | 1,475,631 | |

| | | | | | | | 8,050,186 | |

| Financials — 13.0% | | | | | | | | |

| Blackstone Group, L.P. (The) | | | 30,070 | | | | 1,003,436 | |

| Capital One Financial Corporation | | | 19,630 | | | | 1,661,876 | |

| Citigroup, Inc. | | | 22,875 | | | | 1,663,927 | |

| Cohen & Steers, Inc. | | | 22,045 | | | | 870,557 | |

| Fairfax Financial Holdings Ltd. | | | 1,635 | | | | 848,565 | |

| FNF Group | | | 39,470 | | | | 1,873,246 | |

| JPMorgan Chase & Company | | | 16,890 | | | | 1,613,164 | |

| Lazard Ltd. - Class A | | | 20,230 | | | | 914,801 | |

Markel Corporation (a) | | | 1,542 | | | | 1,646,825 | |

| Synchrony Financial | | | 28,535 | | | | 886,012 | |

| Wells Fargo & Company | | | 18,050 | | | | 995,457 | |

| | | | | | | | 13,977,866 | |

| Health Care — 5.6% | | | | | | | | |

| AmerisourceBergen Corporation | | | 8,685 | | | | 718,684 | |

| Bristol-Myers Squibb Company | | | 20,500 | | | | 1,306,670 | |

| Gilead Sciences, Inc. | | | 10,430 | | | | 845,038 | |

| Johnson & Johnson | | | 13,680 | | | | 1,778,537 | |

32

DAVENPORT BALANCED INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 57.2% (Continued) | | Shares | | | Value | |

| Health Care — 5.6% (Continued) | | | | | | |

| Merck & Company, Inc. | | | 20,620 | | | $ | 1,320,299 | |

| | | | | | | | 5,969,228 | |

| Industrials — 6.9% | | | | | | | | |

| 3M Company | | | 5,495 | | | | 1,153,400 | |

| Boeing Company (The) | | | 4,360 | | | | 1,108,356 | |

| Delta Air Lines, Inc. | | | 15,435 | | | | 744,276 | |

| Eaton Corporation plc | | | 11,420 | | | | 876,942 | |

| General Electric Company | | | 39,035 | | | | 943,866 | |

| Illinois Tool Works, Inc. | | | 7,350 | | | | 1,087,506 | |

| Watsco, Inc. | | | 9,520 | | | | 1,533,386 | |

| | | | | | | | 7,447,732 | |

| Information Technology — 2.9% | | | | | | | | |

| Cisco Systems, Inc. | | | 33,490 | | | | 1,126,269 | |

| Microsoft Corporation | | | 15,610 | | | | 1,162,789 | |

| TE Connectivity Ltd. | | | 10,305 | | | | 855,933 | |

| | | | | | | | 3,144,991 | |

| Materials — 2.9% | | | | | | | | |

| International Paper Company | | | 18,030 | | | | 1,024,465 | |

| Potash Corporation of Saskatchewan, Inc. | | | 46,810 | | | | 900,624 | |

| PPG Industries, Inc. | | | 11,130 | | | | 1,209,386 | |

| | | | | | | | 3,134,475 | |

| Real Estate — 5.1% | | | | | | | | |

| Equity LifeStyle Properties, Inc. | | | 9,165 | | | | 779,758 | |

| Gaming and Leisure Properties, Inc. | | | 24,365 | | | | 898,825 | |

| Lamar Advertising Company - Class A | | | 17,355 | | | | 1,189,338 | |

| Outfront Media, Inc. | | | 31,770 | | | | 799,969 | |

| Tanger Factory Outlet Centers, Inc. | | | 28,745 | | | | 701,953 | |

| W.P. Carey, Inc. | | | 16,450 | | | | 1,108,565 | |

| | | | | | | | 5,478,408 | |

| Telecommunication Services — 0.8% | | | | | | | | |

| Verizon Communications, Inc. | | | 16,580 | | | | 820,544 | |

| | | | | | | | | |

| Utilities — 2.7% | | | | | | | | |

| Brookfield Infrastructure Partners, L.P. | | | 23,275 | | | | 1,004,083 | |

| Brookfield Renewable Partners, L.P. | | | 28,660 | | | | 960,683 | |

| Dominion Energy, Inc. | | | 11,720 | | | | 901,620 | |

| | | | | | | | 2,866,386 | |

| | | | | | | | | |

Total Common Stocks (Cost $54,669,303) | | | | | | $ | 61,328,059 | |

33

DAVENPORT BALANCED INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

| FIXED RATE CORPORATE BONDS — 26.6% | | Par Value | | | Value | |

| Consumer Discretionary — 3.2% | | | | | | |

| Amazon.com, Inc., 3.30%, due 12/05/2021 | | $ | 1,500,000 | | | $ | 1,563,295 | |

| Ford Motor Company, 4.346%, due 12/08/2026 | | | 1,250,000 | | | | 1,299,470 | |

| Home Depot, Inc. (The), 4.40%, due 04/01/2021 | | | 500,000 | | | | 536,718 | |

| | | | | | | | 3,399,483 | |

| Consumer Staples — 7.1% | | | | | | | | |

| Altria Group, Inc., 4.75%, due 05/05/2021 | | | 600,000 | | | | 650,320 | |

| Anheuser-Busch InBev S.A./N.V., 3.30%, due 02/01/2023 | | | 1,300,000 | | | | 1,347,807 | |

| CVS Health Corporation, 3.875%, due 07/20/2025 | | | 1,300,000 | | | | 1,355,916 | |

| J.M. Smucker Company (The), 3.50%, due 10/15/2021 | | | 1,500,000 | | | | 1,558,623 | |

| PepsiCo, Inc., 2.75%, due 03/05/2022 | | | 1,450,000 | | | | 1,486,711 | |

| Sysco Corporation, 2.60%, due 10/01/2020 | | | 1,250,000 | | | | 1,268,389 | |

| | | | | | | | 7,667,766 | |

| Energy — 2.4% | | | | | | | | |

| MPLX, L.P., 4.125%, due 03/01/2027 | | | 1,250,000 | | | | 1,272,722 | |

| Occidental Petroleum Corporation, 3.50%, due 06/15/2025 | | | 1,250,000 | | | | 1,279,317 | |

| | | | | | | | 2,552,039 | |

| Financials — 3.6% | | | | | | | | |

| Bank of America Corporation, 2.65%, due 04/01/2019 | | | 550,000 | | | | 554,950 | |

| BlackRock, Inc., 3.50%, due 03/18/2024 | | | 950,000 | | | | 993,520 | |

| Capital One Financial Corporation, 2.50%, due 05/12/2020 | | | 1,000,000 | | | | 1,004,656 | |

| General Motors Financial Company, 5.25%, due 03/01/2026 | | | 1,250,000 | | | | 1,356,945 | |

| | | | | | | | 3,910,071 | |

| Health Care — 3.8% | | | | | | | | |

| AbbVie, Inc., 2.50%, due 05/14/2020 | | | 1,300,000 | | | | 1,315,577 | |

| Becton Dickinson & Company, 3.25%, due 11/12/2020 | | | 1,250,000 | | | | 1,283,768 | |

| Express Scripts Holding Company, 3.00%, due 07/15/2023 | | | 1,500,000 | | | | 1,501,803 | |

| | | | | | | | 4,101,148 | |

| Industrials — 2.7% | | | | | | | | |

| Burlington Northern Santa Fe, LLC, 4.70%, due 10/01/2019 | | | 350,000 | | | | 369,640 | |

| Deere & Company, 4.375%, due 10/16/2019 | | | 500,000 | | | | 525,529 | |

| General Electric Capital Corporation, 4.65%, due 10/17/2021 | | | 1,000,000 | | | | 1,095,066 | |

| United Technologies Corporation, 4.50%, due 04/15/2020 | | | 850,000 | | | | 902,335 | |

| | | | | | | | 2,892,570 | |

| Information Technology — 2.2% | | | | | | | | |

| Apple, Inc., 3.20%, due 05/13/2025 | | | 1,000,000 | | | | 1,026,820 | |

| Applied Materials, Inc., 3.30%, due 04/01/2027 | | | 750,000 | | | | 763,891 | |

| Oracle Corporation, 3.625%, due 07/15/2023 | | | 500,000 | | | | 531,700 | |

| | | | | | | | 2,322,411 | |

34

DAVENPORT BALANCED INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

| FIXED RATE CORPORATE BONDS — 26.6% (Continued) | | Par Value | | | Value | |

| Telecommunication Services — 1.6% | | | | | | |

| AT&T, Inc., 3.40%, due 08/14/2024 | | $ | 1,000,000 | | | $ | 1,001,557 | |

| Verizon Communications, Inc., | | | | | | | | |

| 3.00%, due 11/1/2021 | | | 500,000 | | | | 510,261 | |

| 3.50%, due 11/1/2021 | | | 200,000 | | | | 207,971 | |

| | | | | | | | 1,719,789 | |

| | | | | | | | | |

Total Fixed Rate Corporate Bonds (Cost $28,533,366) | | | | | | $ | 28,565,277 | |

VARIABLE RATE CORPORATE BONDS (b) — 10.2% | | Par Value | | | Value | |

| Financials — 7.6% | | | | | | |

| American Express Credit Corporation, 2.092% (3MO LIBOR + 78), due 11/05/2018 | | $ | 1,250,000 | | | $ | 1,259,963 | |

| Bank of New York Mellon (The), 1.871% (3MO LIBOR + 56), due 08/01/2018 | | | 400,000 | | | | 401,819 | |

| BP Capital Markets plc, 1.974% (3MO LIBOR +65), due 09/19/2022 | | | 1,000,000 | | | | 1,005,533 | |

| Goldman Sachs Group, Inc., 2.485% (3MO LIBOR + 117), due 11/15/2021 | | | 945,000 | | | | 957,965 | |

| JPMorgan Chase & Company, 2.796% (3MO LIBOR + 148), due 03/01/2021 | | | 1,500,000 | | | | 1,548,000 | |

| Morgan Stanley, 2.109% (3MO LIBOR + 80), due 02/14/2020 | | | 1,250,000 | | | | 1,256,361 | |

| Royal Bank of Canada, 1.851% (3MO LIBOR + 54), due 07/30/2018 | | | 471,000 | | | | 472,671 | |

| Toronto-Dominion Bank (The), 2.153% (3MO LIBOR + 84), due 01/22/2019 | | | 500,000 | | | | 504,391 | |

| Wells Fargo & Company, 2.327% (3MO LIBOR + 101), due 12/07/2020 | | | 679,000 | | | | 691,778 | |

| | | | | | | | 8,098,481 | |

| Health Care — 1.4% | | | | | | | | |

| Amgen, Inc., 1.915% (3MO LIBOR + 60), due 05/22/2019 | | | 1,500,000 | | | | 1,510,548 | |

| | | | | | | | | |

| Information Technology — 0.6% | | | | | | | | |

| Cisco Systems, Inc., 1.665% (3MO LIBOR + 34), due 09/20/2019 | | | 670,000 | | | | 673,947 | |

35

DAVENPORT BALANCED INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

VARIABLE RATE CORPORATE BONDS (b) — 10.2% (Continued) | | Shares | | | Value | |

| Telecommunication Services — 0.6% | | | | | | |

| AT&T, Inc., 2.263% (3MO LIBOR + 93), due 06/30/2020 | | | 450,000 | | | $ | 456,093 | |

| Verizon Communications, Inc., 3.069% (3MO LIBOR + 175), due 09/14/2018 | | | 200,000 | | | | 203,136 | |

| | | | | | | | 659,229 | |

| | | | | | | | | |

Total Variable Rate Corporate Bonds (Cost $10,904,420) | | | | | | $ | 10,942,205 | |

| EXCHANGE-TRADED FUNDS — 1.8% | | Shares | | | Value | |

| iShares MSCI Europe Financials ETF | | | 36,020 | | | $ | 845,750 | |

| Vanguard FTSE Emerging Markets ETF | | | 25,985 | | | | 1,132,166 | |

Total Exchange-Traded Funds (Cost $1,879,541) | | | | | | $ | 1,977,916 | |

| MONEY MARKET FUNDS — 3.8% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 0.89% (c) (Cost $4,062,058) | | | 4,062,058 | | | $ | 4,062,058 | |

| | | | | | | | | |

Total Investments at Value — 99.6% (Cost $100,048,688) | | | | | | $ | 106,875,515 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.4% | | | | | | | 431,328 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 107,306,843 | |

ADR - American Depositary Receipt.

LIBOR - London Interbank Offered Rate.

(a) | Non-income producing security. |

(b) | Variable rate securities. The rates shown are the effective interest rates as of September 30, 2017. The benchmark on which the rate is calculated is shown parenthetically. |

(c) | The rate shown is the 7-day effective yield as of September 30, 2017. |

See accompanying notes to financial statements.

36

THE DAVENPORT FUNDS

STATEMENTS OF ASSETS AND LIABILITIES

September 30, 2017 (Unaudited) |

| | | Davenport Core

Fund | | | Davenport Value & Income

Fund | | | Davenport Equity Opportunities Fund | |

| ASSETS | | | | | | | | | |

| Investments in securities: | | | | | | | | | |

| At cost | | $ | 288,615,619 | | | $ | 490,233,744 | | | $ | 309,792,070 | |

| At value (Note 2) | | $ | 434,367,977 | | | $ | 614,151,982 | | | $ | 387,980,517 | |

| Cash | | | 4,967,311 | | | | — | | | | 61,482 | |

| Dividends receivable | | | 381,258 | | | | 1,185,046 | | | | 112,989 | |

| Receivable for capital shares sold | | | 255,575 | | | | 285,418 | | | | 264,454 | |

| Other assets | | | 43,252 | | | | 25,846 | | | | 23,513 | |

| TOTAL ASSETS | | | 440,015,373 | | | | 615,648,292 | | | | 388,442,955 | |

| | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | |