| OMB APPROVAL |

OMB Number: 3235-0570 Expires: January 31, 2017 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05685

Williamsburg Investment Trust

(Exact name of registrant as specified in charter)

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

W. Lee H. Dunham, Esq.

Sullivan & Worcester LLP One Post Office Square Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: (513) 587-3400

Date of fiscal year end: March 31, 2015

Date of reporting period: September 30, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

SEMI-ANNUAL REPORT

September 30, 2014

(Unaudited) |

THE DAVENPORT FUNDS

LETTER TO SHAREHOLDERS | |

Dear Shareholders,

The third quarter brought a bumpier ride for equity investors. The S&P 500 Index eked out a modest gain of 1.13% for the quarter, but volatility increased and the Index closed the quarter with a 1.40% decline for September. Meanwhile, the small cap oriented Russell 2000 Index posted a 7.36% decline for the quarter and was down 6.05% in the month of September alone. Year-to-date, the S&P 500 was still up a very respectable 8.34% at September 30, while the Russell 2000 was down 4.41%.

The S&P 500's resilience seems to belie recent weakness elsewhere in the market. While the S&P 500 still resides near an all-time high, many areas of the market have experienced meaningful declines. This is evidenced in part by the wide performance spread between the S&P 500 and the Russell 2000. Indeed, we've seen many stocks pull back 20%+ from their recent highs. It seems the market's advance has become increasingly "narrow." In other words, it's been driven by a few pockets of strength that create a misleading façade.

As noted in prior writings, many continue to call for a market "correction." After all, the market (as measured by the S&P 500) hasn't experienced a 10%+ move to the downside in roughly 3 years. However, a "stealth" correction already seems to be underway. It seems to be happening sector by sector, with fewer and fewer areas being left unharmed. Thus far, the pain has been most acute in more cyclical areas such as energy and industrial stocks, which are most sensitive to slowing global growth, and small-cap stocks. By October 10th, the Russell 2000 had declined over 10% from its high, thereby officially qualifying as a "correction." Biotechnology is one of a few areas that have been bright spots, as the industry's growth prospects are more immune to economic conditions. Suffice it to say, the market's narrow advance has created a very challenging environment for "active" money managers. In fact, Morningstar recently pointed out the vast majority of mutual funds are underperforming their benchmarks this year.

While we are pleased to be enjoying another up year, we have been disappointed with our recent relative performance. The third quarter was particularly tough for The Davenport Funds when compared to their respective benchmarks. We provide more detail in each Fund's discussion below; however, it's safe to say we've been penalized both by what we own and what we don't own. Unfortunately, we have too little exposure to the aforementioned pockets of strength. We generally aren't inclined to chase today's popular stocks for fear they are becoming a little too popular. To the contrary, we're more likely to consider adding to laggards where our conviction levels remain high and valuations have become more attractive. It's challenging and sometimes frustrating to go against the grain, but it can often be rewarding.

In the near-term, we hope to play a little "catch up" as some of our holdings post better results. More importantly, we expect to continue delivering on our long-term promise of generating competitive returns while assuming below average risk. We may not always capture all the upside of up markets; however, we hope to avoid some of the downside in more turbulent times. This has been the case in the past as evidenced by our Funds' performance in tougher market environments. Tame expectations and still reasonable valuations lead us to remain constructive on stocks. But, given the market's run over the past few years, we think it makes sense to be increasingly attentive to risk, and we may take steps to further upgrade the quality of our holdings.

Davenport Core Fund

The following chart represents Davenport Core Fund (the "Core Fund") performance and the performance of the S&P 500 Index*, the Core Fund's primary benchmark, for the periods ended September 30, 2014.

| | Q3 2014 | 1 Year | 3 Years** | 5 Years** | 10 Years** | Since Inception** 1/15/1998 | Expense Ratio |

| Core Fund | -1.02% | 14.08% | 21.40% | 14.80% | 8.20% | 6.23% | 0.94% |

| S&P 500 Index* | 1.13% | 19.73% | 22.99% | 15.70% | 8.11% | 6.41% | — |

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

| * | The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

The Core Fund declined 1.02% during the third quarter, versus a 1.13% gain for the S&P 500 Index. Year-to-date, the Fund is up 4.17%, relative to the 8.34% gain for the S&P 500. Below, we provide a discussion of recent performance in addition to highlighting a few new ideas that we believe enhance the quality of the Core Fund.

Biotechnology stocks Amgen (AMGN) and Celgene (CELG) were top performers during the period alongside other Health Care names such as WellPoint (WLP) and AmerisourceBergen (ABC). Following what proved to be a timely add, CME Group (CME) was another top contributor as volumes on its exchanges spiked in tandem with increased volatility and expectations for higher interest rates. The Industrials, Information Technology and Energy sectors were the primary sources of weakness during the quarter. Significant declines in American Airlines (AAL) and Chicago Bridge & Iron (CBI) compounded general weakness across the Industrials sector during the quarter. We elected to sell the CBI position given a lack of clarity in the company's outlook in addition to waning confidence in management. In terms of technology, weakness in Activision Blizzard (ATVI) and QUALCOMM (QCOM), coupled with a lack of exposure to some of the industry's best performers weighed on results. Recently purchased Range Resources (RRC) was the key detractor in the Energy sector, as natural gas prices fell due to new supplies and an unseasonably mild summer.

We initiated positions in confectionary products giant Hershey (HSY), and leading oil service company Schlumberger (SLB), during the quarter. While in completely different industries, key similarities include trusted brands, leading market share, and well-respected management teams with strong track records of value creation. Furthermore, we note that each stock had pulled back at the time of purchase due to near-term factors that we feel do not impact the significant long-term earnings power of the franchise. Ultimately, we feel owning these quality businesses at reasonable prices upgrade the quality of the Core Fund while enabling outperformance throughout a complete market cycle.

Given the disappointing nature of recent relative results, we feel it is appropriate to provide some longer-term context with respect to our performance and investment philosophy. As we have communicated in the past, we strive to capture most of the market's upside while taking on less risk. Hence, we have cautioned that while we typically outperform in a down market, we may lag in

periods of extreme or prolonged market strength. The past five years have produced one of the more robust bull markets in recent history, and yet, over the five year period ended September 30, 2014, our strategy has managed to capture roughly 95% of the market's upside while taking modestly less risk (as measured by standard deviation).* Though we are never content to underperform in any environment, we remain confident in the Fund's positioning for the long term.

| * | Source: Zephyr StyleADVISOR. Risk is measured by standard deviation, which is the variability of returns around the average return. Core Funds standard deviation for the period: 12.88%; S&P 500 standard deviation for the period: 13.20%. |

New Positions

Citigroup, Incorporated (C) Despite being very well capitalized, C is the only large bank trading below its tangible book value. As management continues to improve operations, we expect the stock to rerate higher.

Dish Network Corporation – Class A (DISH) We purchased a position in this highly cash generative satellite TV company given its optionality associated with highly valuable spectrum assets and the founder and CEO's superior track record of value creation through savvy capital allocation.

Hershey Company (The) (HSY) We purchased this well-known chocolate maker as shares have sold off concerning short-term issues, presenting an attractive opportunity into this defensible franchise with 9%-11% annual earnings growth.

PVH Corporation (PVH) We purchased this position because we are impressed with management's track record of creating value through acquisition, and we think PVH is poised to grow earnings substantially as it folds in its recent acquisition of Calvin Klein jeanswear and underwear.

Schlumberger Limited (SLB) We purchased a position in this leading oil services company after a pullback in oil prices, as we believe the company's self-help initiatives will improve returns.

Increased Positions

Range Resources Corporation (RRC) We added to this best-in-class natural gas and liquids producer after a cool summer prompted a selloff in natural gas prices, creating an attractive entry point.

Decreased Positions

American Airlines Group, Incorporated (AAL) We chipped our position, electing to take some profits after a sharp move up. We continue to see additional upside surrounding the AMR/USAirways merger and believe our industry thesis is intact.

WellPoint, Incorporated (WLP) We chipped our position after a strong run, electing to take profits given continued uncertainty in the Health Care sector.

Wells Fargo & Company (WFC) We chipped our position after a period of outperformance, but continue to view WFC as the highest-quality U.S. bank.

Positions Sold

Chicago Bridge & Iron Company NV (CBI) We sold our position given challenges including a stretched balance sheet and tough industry that left us less confident they would be able to turn strong end-market tailwinds into shareholder value.

McDonald's Corporation (MCD) We sold our position as we feel persisting revenue headwinds may limit meaningful expansion in the stock's valuation.

National Oilwell Varco, Incorporated (NOV) We sold this oil and gas capital equipment maker in favor of a more attractive opportunity.

Valero Energy Corporation (VLO) We sold our position due to increased volatility surrounding concerns that the domestic ban on crude oil exports may be repealed.

Wal-Mart Stores, Incorporated (WMT) We sold our position as we think the company will continue to struggle in its attempt to grow same-store sales.

Davenport Value & Income Fund

The following chart represents Davenport Value & Income Fund (the "Value & Income Fund") performance and the performance of the S&P 500 Index*, the Value & Income Fund's primary benchmark, and the Lipper Equity Income Index for the periods ended September 30, 2014.

| | Q3 2014 | 1 Year | 3 Year** | Since Inception**

12/31/2010 | Expense Ratio | 30 Day

SEC

Yield |

| Value & Income Fund | -0.54% | 15.16% | 21.65% | 15.45% | 1.07% | 1.92% |

| S&P 500 Index* | 1.13% | 19.73% | 22.99% | 15.19% | — | — |

| Lipper Equity Income Index* | -0.62% | 16.09% | 20.50% | 13.37% | — | — |

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

| * | The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. The Lipper Equity Income Fund Index is an unmanaged index of the 30 largest funds, based on total year-end net asset value, in the Lipper Equity Income Fund Index. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

The Value & Income Fund declined 0.54% during the third quarter, versus the 1.13% gain for the S&P 500 Index and the 0.62% decline for the Lipper Equity Income Index. Year-to-date as of September 30, the Value & Income Fund is up 5.15% relative to gains of 8.34% and 6.54%, respectively, for the S&P 500 and Lipper Equity Income Index. Despite a more hawkish tone from the Federal Reserve System (Fed) in its September meeting, stocks with above-average dividends tended to outperform the broader indices as their defensive qualities seemed to outweigh concerns over rising rates.

Archer Daniels Midland (ADM) was the Value & Income Fund's top performing stock during the quarter. Results have benefitted nicely from booming agricultural production, while new management's focus on cost improvements and returns on capital have helped the shares rerate higher. The Energy category has served as a drag on performance for much of the year given our more modest exposure to oil levered exploration and production companies amid rising oil prices. However, this trend reversed during the quarter as positions in Marathon Petroleum (MPC), Kinder Morgan (KMI) and Occidental Petroleum (OXY) proved to be more resilient as oil prices declined. The Consumer Discretionary and Industrials categories were the biggest drags

on performance during the quarter. Within Consumer Discretionary, Six Flags (SIX) gave back gains from the beginning of the year alongside concerns over soft visitation trends. Industrial names Eaton (ETN) and Watsco (WSO) were also meaningful detractors as disappointing results compounded increasingly bearish industry sentiment.

We initiated a position in Verizon (VZ) during the quarter. VZ is one of two major diversified telecommunications companies in the United States, serving over 100 million customers. Wireless accounts for two-thirds of revenue with wireline (including cable and internet service FiOS) accounting for the remainder. In late February, VZ bought back Vodafone's 45% ownership stake in VZ Wireless in a transaction valued at $130 billion. VZ now fully owns and controls the industry-leading wireless carrier in the U.S., which should benefit from growing mobility for years to come. Furthermore, we are attracted to the defensive earnings stream this vital service provides in more difficult economic times (it almost seems there are some consumers who would part with their homes before turning off their cell phones). These attributes should allow for returns on capital to continue rising over time. Finally, we note that VZ has a generous dividend that currently yields 4.4% and has room to go higher.

We also initiated a position in Lamar Advertising (LAMR). LAMR is the third largest outdoor advertising company in the U.S., focused primarily on small to mid-sized markets where larger competitors such as Clear Channel and CBS Outdoor do not operate. The company has a long-standing history in many of these markets, having pursued an aggressive acquisition strategy which has enabled it to gain huge market shares that run in the 80% plus range in many markets. We are attracted to the company's strong cash flows, enabled by low operating costs, minimal capital needs and useful lives of assets well in excess of depreciable lives. Earlier this year, the company received a Private Letter Ruling (PLR) from the IRS, enabling it to convert to a Real Estate Investment Trust (REIT). Initially, the company will pay a dividend of roughly $2.50 per share (6.7% yield), which we believe can grow at 10% per year alongside low single digit organic growth, cost reductions and increased cash flow contribution from the rollout of digital billboards. Finally, we note that the CEO Sean Reilly is a descendant of the founder and has served in various capacities at Lamar since 1978. The Reilly family has been a great steward of shareholder interests over time and currently owns 16% of the outstanding shares (controls approximately 65% of the voting power).

Given the low interest rate environment and uncharted course of the Fed, we have spent much time in prior communications discussing the Fund's ability to withstand rising interest rates and perform alongside an improving economy. Though we continue to position ourselves for these scenarios, we feel an often overlooked component of this strategy is its relative defensiveness in tougher times. Ultimately, we feel our focus on cash flow, quality of management, valuation and sustainable dividends creates a balanced approach that can not only keep up with the good times, but help preserve capital and income when markets turn down.

There is no guarantee that a company will continue to pay a dividend.

New Positions

Lamar Advertising Company (LAMR) We purchased a position in this billboard advertising company which recently converted to a REIT, pays a 6.7% yield that we expect can grow 10% per annum, and trades at an inexpensive valuation.

Verizon Communications, Incorporated (VZ) We purchased a position in this leading U.S. telecommunications provider for its defensible business, generous dividend yield and strong multiyear growth opportunity in wireless communications demand. Current yield: 4.4%

Waddell & Reed Financial, Incorporated (WDR) We purchased this high quality asset manager after fund manager departures prompted a selloff in the stock. Current yield: 2.6%

Increased Positions

Eastman Chemical Company (EMN) We added to EMN after shares sold off in response to an update in the company's earnings guidance, which we viewed as a buying opportunity. Current yield: 1.7%

Kinder Morgan, Incorporated (KMI) We added to the largest energy infrastructure company in North America after KMI announced plans to acquire its daughter Master Limited Partnerships (MLPs), lowering its overall cost of capital and increasing competitiveness. Current yield: 4.5%

Decreased Positions

Marathon Petroleum Corporation (MPC) We chipped this refiner amid fears of a repeal of the U.S. crude export ban. Current yield: 2.2%

WellPoint, Incorporated (WLP) WLP has been a great stock for us and we elected to chip the position given continued uncertainty in the Health Care sector. Current yield: 1.5%

Positions Sold

BP plc – ADR (BP) We sold BP given increased concerns around environmental liabilities and Russian exposure. Current yield: 4.8%

Fidelity National Financial Ventures (FNFV) We sold this small stub position that FNF created to track the value of its investments. We continue to hold our position in FNF. Current yield: n/a

GlaxoSmithKline plc – ADR (GSK) We sold our position, as GSK's growth in core drug franchises has slowed. As a result, we see increased risks to cash flow and the sustainability of the recently increased dividend. Current yield: 4.8%

Realty Income Corporation (O) O gave us strong performance in a short period of time, moving from a bargain to more fairly valued. We sold the stock to put the proceeds in a situation with further upside potential. Current yield: 4.8%

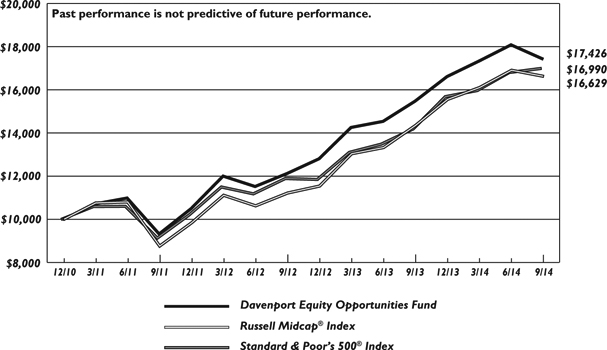

Davenport Equity Opportunities Fund

The following chart represents Davenport Equity Opportunities Fund (the "Equity Opportunities Fund") performance and the performance of the Russell Midcap Index*, the Equity Opportunity Fund's primary benchmark, and the S&P 500 Index for the periods ended September 30, 2014.

| | Q3 2014 | 1 Year | 3 Year** | Since Inception** 12/31/2010 | Expense Ratio |

| Equity Opportunities Fund | -3.66% | 12.59% | 23.17% | 15.97% | 0.98% |

| Russell Midcap Index* | -1.66% | 15.83% | 23.79% | 14.53% | — |

| S&P 500 Index* | 1.13% | 19.73% | 22.99% | 15.19% | — |

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

| * | The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000, which represent approximately 25% of the total market capitalization of the Russell 1000. The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

The Equity Opportunities Fund experienced a rough third quarter. The Fund declined 3.66% for the period as compared to a more modest 1.66% drop for the Russell Midcap Index and a 1.13% gain for the S&P 500 Index. As another point of reference, the Russell 2000 Index declined a more severe 7.36% for the quarter. Each of these benchmarks is a bit imperfect and we have a stated goal of outperforming each of them long term. Recently, the S&P 500 has been the most challenging comparison given its larger-cap bias and relative resilience, which has been supported by a narrowing group of market leaders. Year-to-date as of September 30, the Equity Opportunities Fund was up 4.87% versus gains of 6.87% and 8.34% for the Russell Midcap and S&P 500, respectively. The Russell 2000 ended the quarter down 4.41% year-to-date.

This was certainly one of the more difficult quarters we've seen in a while, both in an absolute sense and from a relative vantage point. However, we did have a few bright spots worth mentioning. Hanesbrands (HBI) continued its momentum from the prior quarter. Acquisition synergies, a heightened focus on premium/higher margin apparel and lower cotton costs have supported ongoing strength in the stock. Another core holding, American Tower (AMT), also remained strong alongside solid earnings momentum and enthusiasm surrounding their opportunity to exploit growing wireless demand in emerging markets. Lastly, recent purchase Alcoa (AA) was a standout due to both higher aluminum prices and support for the company's efforts to emphasize less commodity-sensitive businesses. We still like all of these companies and maintain meaningful holdings in them, but used recent strength as an opportunity to trim our positions under the assumption that more depressed situations may possess more upside.

A number of our holdings struggled in the third quarter. In many of these cases, recent declines would appear to present longer-term opportunity. Within the Industrials sector, both American Airlines (AAL) and Colfax (CFX) were particularly weak. AAL has been a great stock since our purchase, but "hot money" has fled the scene recently on fears of near-term earnings pressure. True, higher labor costs and rising competition in international routes may cool the company's momentum, but we still think merger synergies and structural change in the industry will result in meaningfully higher earnings power. We also note that declining jet fuel prices could provide a shot in the arm. Shares of CFX have been hurt as investors focus on the company's exposure to Europe (and a weaker Euro) and the Energy sector, a key end market that is contending with lower oil and gas prices. We acknowledge the macro backdrop doesn't favor the company right now, but management is comprised of exceptional capital allocators who are uniquely adept at making acquisitions. Hence, we have used price weakness to add to our position.

A few consumer stocks hurt us as well. Chief among these were CarMax (KMX) and Penn National Gaming (PENN). These are very different situations, with KMX being a long-term growth story and PENN more of a "deep value" situation, but they and our other domestic consumer holdings should benefit from lower gas prices, easing comparisons (last winter was tough on the sector),

and improving employment trends. While more of an international story, we've recently added to our holdings in the sector with the purchase of Discovery Communications (DISCA). DISCA is a global media company best known for channels such as Discovery, TLC and Animal Planet. The company has done a phenomenal job of building brands and viewership here in the U.S. and is now replicating that success abroad. In fact, DISCA has more channels in more countries than any media company. We think the company has a unique platform that should allow sustainable double-digit Earnings Per Share (EPS) growth as its increasing global scale begets higher advertising and distribution revenue. We are also intrigued by the company's capital allocation. Since 2010, it has aggressively repurchased stock, reducing the share count by 24%. More recently, DISCA has been acquiring European media assets, which appear attractively priced relative to U.S. assets and should allow the company to build distribution scale in those markets. On a final note, we also like the involvement of renowned investor Dr. John Malone, who has a 4% economic interest in DISCA and owns 22% of the voting stock.

Another stock we recently purchased is NRG Energy (NRG). Power prices have languished since the 2008 financial crisis as demand has weakened and natural gas prices are down significantly (power prices tend to move with natural gas, the marginal input). Low prices and a punitive regulatory regime have led to a very challenging operating environment for competitive power producers. However, NRG's forward-thinking management team has taken advantage of the down cycle to complete a number of large acquisitions at rock bottom prices, becoming the nation's largest competitive power generator. Trading at a 10%+ Free Cash Flow (FCF) yield, the stock offers compelling value today and provides significant optionality for a rebound in power prices. In the meantime, we think management will continue creating significant value for shareholders in related areas such as renewables, where NRG has grown to the nation's third largest renewable operator and has begun to monetize this stable, high-return income stream through the IPO of NRG Yield (NYLD).

As evidenced by our recent purchases, we remain laser focused on stories of talented managers that have the ability to reinvest capital at high rates of return. We continue to believe such stories of savvy capital allocation can yield years of compounding growth. While we haven't kept pace with the market in recent months, we are confident our collection of businesses can produce above-average returns over time. Furthermore, should markets decline, we think such businesses may possess less downside than the broader indices. As was the case in 2011, we hope the Equity Opportunities Fund will prove somewhat defensive in a more turbulent environment.

New Positions

Discovery Communications, Incorporated – Class A (DISCA) We purchased and subsequently added to this media company backed by John Malone, as we see a long growth runway and strong track record of value-creating capital allocation.

NRG Energy, Incorporated (NRG) We purchased a position in this integrated wholesale power generator given the company's strong cash generation, leverage to rising natural gas and power prices and management's strong track record.

Increased Positions

Capital One Financial Corporation (COF) We added to this inexpensive bank and credit card company as COF is posting results showing encouraging loan growth, reserve developments and returns on capital.

Colfax Corporation (CFX) We added to this industrial company that we believe to be one of the more compelling "value compounders" on our radar screen.

Pall Corporation (PLL) We added to this high quality industrial company after a sector-related selloff.

Penn National Gaming, Incorporated (PENN) We added to our position as we think the risk/reward looks even more favorable as results seem to be stabilizing and new projects should drive growth.

Decreased Positions

Alcoa, Incorporated (AA) We chipped our position following strong year-to-date performance as we are concerned aluminum prices may have gotten ahead of themselves ahead of an important London Metals Exchange court hearing.

American Tower Corporation (AMT) We chipped our position in this global wireless tower operator as the stock has become an outsized position following a period of strong performance.

Hanesbrands, Incorporated (HBI) We chipped our position after the stock's strong outperformance.

Positions Sold

Fastenal Company (FAST) We sold our position after underwhelming earnings leverage on sluggish sales growth dampened our enthusiasm.

Fidelity National Financial Ventures (FNFV) We sold this small stub position that FNF created to track the value of its investments. We continue to hold our position in FNF.

O'Reilly Automotive, Incorporated (ORLY) After increasing nearly sixfold since our purchase a few years ago, we sold our position in ORLY as we feel the stock now adequately reflects the strong prospects for the company.

Valero Energy Corporation (VLO) We sold our position due to increased volatility surrounding concerns that the domestic ban on crude oil exports may be repealed.

We thank you for your trust and look forward to reporting back to you in 2015.

Sincerely,

John P. Ackerly, IV

President, The Davenport Funds

DAVENPORT CORE FUND

PERFORMANCE INFORMATION (Unaudited)

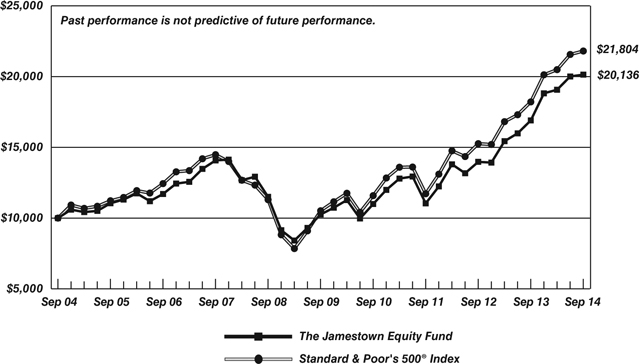

Comparison of the Change in Value of a $10,000 Investment in

Davenport Core Fund and the Standard & Poor's 500® Index

| | Average Annual Total Returns(a)

(for periods ended September 30, 2014) |

| | 1 Year | 5 Years | 10 Years |

| Davenport Core Fund | 14.08% | 14.80% | 8.20% |

Standard & Poor's 500® Index | 19.73% | 15.70% | 8.11% |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

DAVENPORT VALUE & INCOME FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Davenport Value & Income Fund, the Standard & Poor's 500® Index

and the Lipper Equity Income Index

| | Average Annual Total Returns(a)

(for periods ended September 30, 2014) |

| | 1 Year | Since Inception(b) |

| Davenport Value & Income Fund | 15.16% | 15.45% |

Standard & Poor's 500® Index | 19.73% | 15.19% |

| Lipper Equity Income Index | 16.09% | 13.37% |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Commencement of operations was December 31, 2010. |

DAVENPORT EQUITY OPPORTUNITIES FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Davenport Equity Opportunities Fund, the Russell Midcap® Index,

and the Standard & Poor's® 500 Index

| | Average Annual Total Returns(a)

(for periods ended September 30, 2014) |

| | 1 Year | Since Inception(b) |

| Davenport Equity Opportunities Fund | 12.59% | 15.97% |

Russell Midcap® Index | 15.83% | 14.53% |

Standard & Poor's 500® Index | 19.73% | 15.19% |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Commencement of operations was December 31, 2010. |

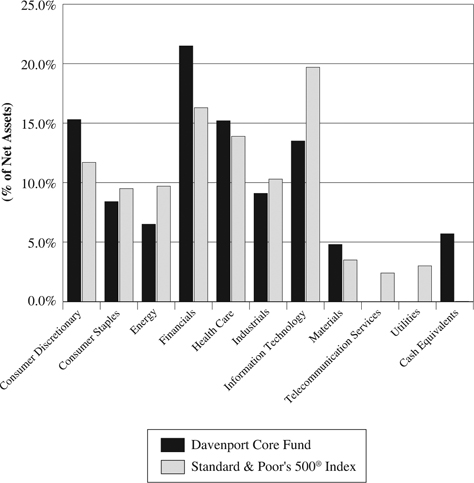

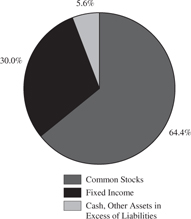

DAVENPORT CORE FUND

PORTFOLIO INFORMATION

September 30, 2014 (Unaudited)

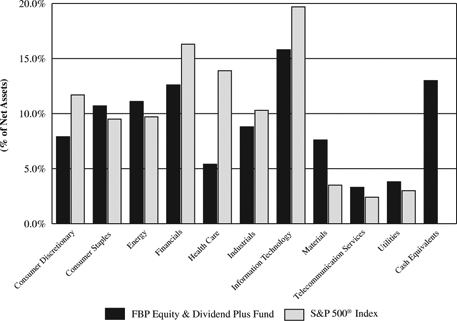

Sector Allocation vs. the Standard & Poor's 500® Index

Top Ten Equity Holdings

| Security Description | % of Net Assets |

| Brookfield Asset Management, Inc. - Class A | 3.2% |

| American Tower Corporation | 2.9% |

| Capital One Financial Corporation | 2.9% |

| Markel Corporation | 2.8% |

| Berkshire Hathaway, Inc. - Class B | 2.6% |

| Celgene Corporation | 2.5% |

| CarMax, Inc. | 2.5% |

| Danaher Corporation | 2.4% |

| AmerisourceBergen Corporation | 2.2% |

| Accenture plc - Class A | 2.2% |

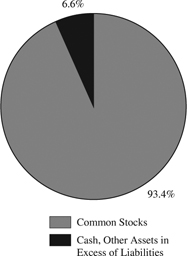

DAVENPORT VALUE & INCOME FUND

PORTFOLIO INFORMATION

September 30, 2014 (Unaudited)

Sector Allocation vs. the Standard & Poor's 500® Index

Top Ten Equity Holdings

| Security Description | % of Net Assets |

| W.P. Carey, Inc. | 3.1% |

| Archer-Daniels-Midland Company | 3.0% |

| Wells Fargo & Company | 2.8% |

| Johnson & Johnson | 2.8% |

| Markel Corporation | 2.7% |

| Sun Communities, Inc. | 2.5% |

| Capital One Financial Corporation | 2.5% |

| Hartford Financial Services Group, Inc. (The) | 2.4% |

| SPDR EURO STOXX 50 ETF | 2.4% |

| Kinder Morgan, Inc. | 2.4% |

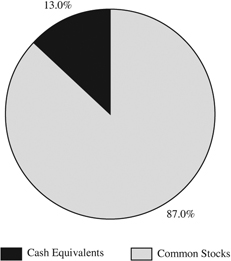

DAVENPORT EQUITY OPPORTUNITIES FUND

PORTFOLIO INFORMATION

September 30, 2014 (Unaudited)

Sector Allocation vs. the Russell Midcap® Index

Top Ten Equity Holdings

| Security Description | % of Net Assets |

| Penn National Gaming, Inc. | 5.8% |

| Markel Corporation | 5.6% |

| Brookfield Asset Management, Inc. - Class A | 5.2% |

| CarMax, Inc. | 4.9% |

| Gaming and Leisure Properties, Inc. | 4.8% |

| American Tower Corporation | 4.6% |

| Capital One Financial Corporation | 4.4% |

| Cabela's, Inc. | 3.8% |

| Colfax Corporation | 3.4% |

| J.M. Smucker Company (The) | 3.4% |

DAVENPORT CORE FUND

SCHEDULE OF INVESTMENTS

September 30, 2014 (Unaudited)

| COMMON STOCKS — 94.3% | | Shares | | | Value | |

| Consumer Discretionary — 15.3% | | | | | | |

Amazon.com, Inc. (a) | | | 16,363 | | | $ | 5,276,086 | |

CarMax, Inc. (a) | | | 162,807 | | | | 7,562,385 | |

DIRECTV (a) | | | 60,515 | | | | 5,235,758 | |

Dish Network Corporation - Class A (a) | | | 68,875 | | | | 4,447,947 | |

| General Motors Company | | | 136,775 | | | | 4,368,594 | |

Liberty Media Corporation - Series A (a) | | | 42,337 | | | | 1,997,460 | |

Liberty Media Corporation - Series C (a) | | | 84,674 | | | | 3,978,831 | |

| PVH Corporation | | | 37,972 | | | | 4,600,308 | |

| Starbucks Corporation | | | 49,290 | | | | 3,719,423 | |

| Walt Disney Company (The) | | | 50,256 | | | | 4,474,292 | |

| | | | | | | | 45,661,084 | |

| Consumer Staples — 8.4% | | | | | | | | |

| Anheuser-Busch InBev SA/NV - ADR | | | 37,495 | | | | 4,156,321 | |

| Flowers Foods, Inc. | | | 60,699 | | | | 1,114,433 | |

| Hershey Company (The) | | | 48,065 | | | | 4,586,843 | |

| J.M. Smucker Company (The) | | | 53,077 | | | | 5,254,092 | |

| Nestlé SA - ADR | | | 67,827 | | | | 4,994,102 | |

| PepsiCo, Inc. | | | 51,241 | | | | 4,770,025 | |

| | | | | | | | 24,875,816 | |

| Energy — 6.5% | | | | | | | | |

| Chevron Corporation | | | 39,402 | | | | 4,701,447 | |

| Exxon Mobil Corporation | | | 59,502 | | | | 5,596,163 | |

| Range Resources Corporation | | | 68,802 | | | | 4,665,463 | |

| Schlumberger Ltd. | | | 42,920 | | | | 4,364,535 | |

| | | | | | | | 19,327,608 | |

| Financials — 21.5% | | | | | | | | |

| American Tower Corporation | | | 90,837 | | | | 8,505,068 | |

Berkshire Hathaway, Inc. - Class B (a) | | | 56,886 | | | | 7,858,232 | |

| Brookfield Asset Management, Inc. - Class A | | | 210,488 | | | | 9,463,540 | |

| Capital One Financial Corporation | | | 104,087 | | | | 8,495,581 | |

| Citigroup, Inc. | | | 89,812 | | | | 4,654,058 | |

| CME Group, Inc. | | | 79,336 | | | | 6,343,310 | |

| JPMorgan Chase & Company | | | 75,323 | | | | 4,537,458 | |

Markel Corporation (a) | | | 13,013 | | | | 8,278,220 | |

| Wells Fargo & Company | | | 112,316 | | | | 5,825,831 | |

| | | | | | | | 63,961,298 | |

| Health Care — 15.2% | | | | | | | | |

| AmerisourceBergen Corporation | | | 85,985 | | | | 6,646,641 | |

| Amgen, Inc. | | | 35,975 | | | | 5,053,049 | |

| Baxter International, Inc. | | | 73,108 | | | | 5,246,961 | |

Celgene Corporation (a) | | | 80,000 | | | | 7,582,400 | |

Express Scripts Holding Company (a) | | | 81,126 | | | | 5,729,929 | |

| Johnson & Johnson | | | 54,138 | | | | 5,770,569 | |

DAVENPORT CORE FUND

SCHEDULE OF INVESTMENTS (Continued)

| COMMON STOCKS — 94.3% (Continued) | | Shares | | | Value | |

| Health Care — 15.2% (Continued) | | | | | | |

Valeant Pharmaceuticals International, Inc. (a) | | | 32,823 | | | $ | 4,306,378 | |

| WellPoint, Inc. | | | 40,341 | | | | 4,825,590 | |

| | | | | | | | 45,161,517 | |

| Industrials — 9.1% | | | | | | | | |

| American Airlines Group, Inc. | | | 103,060 | | | | 3,656,569 | |

| Cummins, Inc. | | | 26,524 | | | | 3,500,638 | |

| Danaher Corporation | | | 92,577 | | | | 7,034,000 | |

| General Electric Company | | | 144,275 | | | | 3,696,325 | |

| Parker Hannifin Corporation | | | 37,945 | | | | 4,331,422 | |

| United Technologies Corporation | | | 45,484 | | | | 4,803,110 | |

| | | | | | | | 27,022,064 | |

| Information Technology — 13.5% | | | | | | | | |

| Accenture plc - Class A | | | 80,761 | | | | 6,567,485 | |

| Activision Blizzard, Inc. | | | 203,288 | | | | 4,226,357 | |

| Apple, Inc. | | | 51,590 | | | | 5,197,692 | |

| Automatic Data Processing, Inc. | | | 53,420 | | | | 4,438,134 | |

| Cisco Systems, Inc. | | | 173,988 | | | | 4,379,278 | |

Google, Inc. - Class A (a) | | | 6,370 | | | | 3,748,172 | |

Google, Inc. - Class C (a) | | | 6,370 | | | | 3,677,783 | |

| QUALCOMM, Inc. | | | 52,860 | | | | 3,952,342 | |

| Visa, Inc. - Class A | | | 19,269 | | | | 4,111,427 | |

| | | | | | | | 40,298,670 | |

| Materials — 4.8% | | | | | | | | |

| Alcoa, Inc. | | | 344,698 | | | | 5,546,191 | |

| Monsanto Company | | | 34,491 | | | | 3,880,582 | |

| Praxair, Inc. | | | 38,078 | | | | 4,912,062 | |

| | | | | | | | 14,338,835 | |

| | | | | | | | | |

Total Common Stocks (Cost $199,867,149) | | | | | | $ | 280,646,892 | |

DAVENPORT CORE FUND

SCHEDULE OF INVESTMENTS (Continued)

| MONEY MARKET FUNDS — 1.9% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 0.00% (b) (Cost $5,771,006) | | | 5,771,006 | | | $ | 5,771,006 | |

| | | | | | | | | |

Total Investments at Value — 96.2% (Cost $205,638,155) | | | | | | $ | 286,417,898 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 3.8% | | | | | | | 11,220,535 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 297,638,433 | |

ADR - American Depositary Receipt.

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of September 30, 2014. |

See accompanying notes to financial statements.

DAVENPORT VALUE & INCOME FUND

SCHEDULE OF INVESTMENTS

September 30, 2014 (Unaudited)

| COMMON STOCKS — 90.8% | | Shares | | | Value | |

| Consumer Discretionary — 6.1% | | | | | | |

| H&R Block, Inc. | | | 162,955 | | | $ | 5,053,235 | |

| Lamar Advertising Company - Class A | | | 98,770 | | | | 4,864,422 | |

| McDonald's Corporation | | | 56,295 | | | | 5,337,329 | |

Penn National Gaming, Inc. (a) | | | 105,725 | | | | 1,185,177 | |

| Six Flags Entertainment Corporation | | | 127,450 | | | | 4,383,006 | |

| | | | | | | | 20,823,169 | |

| Consumer Staples — 14.1% | | | | | | | | |

| Altria Group, Inc. | | | 112,181 | | | | 5,153,595 | |

| Anheuser-Busch InBev SA/NV - ADR | | | 51,995 | | | | 5,763,646 | |

| Archer-Daniels-Midland Company | | | 202,055 | | | | 10,325,010 | |

| Coca-Cola Company (The) | | | 134,650 | | | | 5,744,169 | |

| Diageo plc - ADR | | | 33,035 | | | | 3,812,239 | |

| PepsiCo, Inc. | | | 70,810 | | | | 6,591,703 | |

| Philip Morris International, Inc. | | | 55,885 | | | | 4,660,809 | |

| Wal-Mart Stores, Inc. | | | 76,732 | | | | 5,867,696 | |

| | | | | | | | 47,918,867 | |

| Energy — 8.7% | | | | | | | | |

| Chevron Corporation | | | 50,211 | | | | 5,991,177 | |

| Exxon Mobil Corporation | | | 63,430 | | | | 5,965,591 | |

| Kinder Morgan, Inc. | | | 212,860 | | | | 8,161,052 | |

| Marathon Petroleum Corporation | | | 57,550 | | | | 4,872,759 | |

| Occidental Petroleum Corporation | | | 46,640 | | | | 4,484,436 | |

| | | | | | | | 29,475,015 | |

| Financials — 28.3% | | | | | | | | |

| Aflac, Inc. | | | 106,095 | | | | 6,180,034 | |

| Capital One Financial Corporation | | | 102,445 | | | | 8,361,561 | |

| Citigroup, Inc. | | | 138,705 | | | | 7,187,693 | |

| Equity Lifestyle Properties, Inc. | | | 171,555 | | | | 7,267,070 | |

| FNF Group | | | 207,405 | | | | 5,753,415 | |

| Gaming and Leisure Properties, Inc. | | | 141,119 | | | | 4,360,577 | |

| Hartford Financial Services Group, Inc. (The) | | | 223,875 | | | | 8,339,344 | |

| JPMorgan Chase & Company | | | 109,505 | | | | 6,596,581 | |

Markel Corporation (a) | | | 14,356 | | | | 9,132,569 | |

| Sun Communities, Inc. | | | 169,203 | | | | 8,544,751 | |

| W.P. Carey, Inc. | | | 163,279 | | | | 10,412,302 | |

| Waddell & Reed Financial, Inc. - Class A | | | 94,125 | | | | 4,865,321 | |

| Wells Fargo & Company | | | 184,450 | | | | 9,567,422 | |

| | | | | | | | 96,568,640 | |

| Health Care — 8.3% | | | | | | | | |

| Johnson & Johnson | | | 89,630 | | | | 9,553,662 | |

| Merck & Company, Inc. | | | 100,985 | | | | 5,986,391 | |

| Teva Pharmaceutical Industries Ltd. - ADR | | | 134,810 | | | | 7,246,037 | |

DAVENPORT VALUE & INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

| COMMON STOCKS — 90.8%(Continued) | | Shares | | | Value | |

| Health Care — 8.3% (Continued) | | | | | | |

| WellPoint, Inc. | | | 47,150 | | | $ | 5,640,083 | |

| | | | | | | | 28,426,173 | |

| Industrials — 10.4% | | | | | | | | |

| 3M Company | | | 44,610 | | | | 6,320,345 | |

| Eaton Corporation plc | | | 92,227 | | | | 5,844,425 | |

| General Electric Company | | | 315,695 | | | | 8,088,106 | |

| Illinois Tool Works, Inc. | | | 59,535 | | | | 5,025,944 | |

| Raytheon Company | | | 51,586 | | | | 5,242,169 | |

| Watsco, Inc. | | | 58,565 | | | | 5,047,132 | |

| | | | | | | | 35,568,121 | |

| Information Technology — 5.1% | | | | | | | | |

| Automatic Data Processing, Inc. | | | 82,980 | | | | 6,893,978 | |

| Cisco Systems, Inc. | | | 204,325 | | | | 5,142,860 | |

| Hewlett-Packard Company | | | 151,195 | | | | 5,362,887 | |

| | | | | | | | 17,399,725 | |

| Materials — 5.1% | | | | | | | | |

| E.I. du Pont de Nemours and Company | | | 80,790 | | | | 5,797,491 | |

| Eastman Chemical Company | | | 76,800 | | | | 6,212,352 | |

| Nucor Corporation | | | 98,230 | | | | 5,331,924 | |

| | | | | | | | 17,341,767 | |

| Telecommunication Services — 3.3% | | | | | | | | |

| TELUS Corporation | | | 131,970 | | | | 4,510,735 | |

| Verizon Communications, Inc. | | | 134,080 | | | | 6,702,659 | |

| | | | | | | | 11,213,394 | |

| Utilities — 1.4% | | | | | | | | |

| Dominion Resources, Inc. | | | 67,245 | | | | 4,645,957 | |

| | | | | | | | | |

Total Common Stocks (Cost $258,845,348) | | | | | | $ | 309,380,828 | |

| EXCHANGE-TRADED FUNDS — 4.5% | | Shares | | | Value | |

db X-trackers Harvest CSI 300 China A-Shares ETF (a) | | | 270,920 | | | $ | 6,981,609 | |

| SPDR EURO STOXX 50 ETF | | | 209,270 | | | | 8,308,019 | |

Total Exchange-Traded Funds (Cost $13,526,593) | | | | | | $ | 15,289,628 | |

DAVENPORT VALUE & INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

| MONEY MARKET FUNDS — 2.9% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 0.00% (b) (Cost $9,987,192) | | | 9,987,192 | | | $ | 9,987,192 | |

| | | | | | | | | |

Total Investments at Value — 98.2% (Cost $282,359,133) | | | | | | $ | 334,657,648 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 1.8% | | | | | | | 6,181,725 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 340,839,373 | |

ADR - American Depositary Receipt.

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of September 30, 2014. |

See accompanying notes to financial statements.

DAVENPORT EQUITY OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

September 30, 2014 (Unaudited)

| COMMON STOCKS — 90.0% | | Shares | | | Value | |

| Consumer Discretionary — 26.1% | | | | | | |

Amazon.com, Inc. (a) | | | 17,825 | | | $ | 5,747,493 | |

Cabela's, Inc. (a) | | | 126,620 | | | | 7,457,918 | |

CarMax, Inc. (a) | | | 207,870 | | | | 9,655,561 | |

Discovery Communications, Inc. - Class A (a) | | | 84,070 | | | | 3,177,846 | |

Discovery Communications, Inc. - Class C (a) | | | 84,070 | | | | 3,134,130 | |

| Hanesbrands, Inc. | | | 52,270 | | | | 5,615,889 | |

Krispy Kreme Doughnuts, Inc. (a) | | | 319,475 | | | | 5,482,191 | |

Penn National Gaming, Inc. (a) | | | 1,031,809 | | | | 11,566,579 | |

| | | | | | | | 51,837,607 | |

| Consumer Staples — 6.5% | | | | | | | | |

| Church & Dwight Company, Inc. | | | 87,965 | | | | 6,171,624 | |

| J.M. Smucker Company (The) | | | 67,190 | | | | 6,651,138 | |

| | | | | | | | 12,822,762 | |

| Energy — 1.9% | | | | | | | | |

Ultra Petroleum Corporation (a) | | | 160,339 | | | | 3,729,485 | |

| | | | | | | | | |

| Financials — 34.0% | | | | | | | | |

| American Tower Corporation | | | 98,350 | | | | 9,208,510 | |

| Brookfield Asset Management, Inc. - Class A | | | 228,190 | | | | 10,259,422 | |

| Capital One Financial Corporation | | | 107,046 | | | | 8,737,095 | |

| Fairfax Financial Holdings Ltd. | | | 8,618 | | | | 3,845,429 | |

| FNF Group | | | 116,665 | | | | 3,236,287 | |

| Gaming and Leisure Properties, Inc. | | | 307,004 | | | | 9,486,424 | |

Markel Corporation (a) | | | 17,595 | | | | 11,193,059 | |

Portfolio Recovery Associates, Inc. (a) | | | 93,855 | | | | 4,902,047 | |

| Sun Communities, Inc. | | | 130,642 | | | | 6,597,421 | |

| | | | | | | | 67,465,694 | |

| Health Care — 2.0% | | | | | | | | |

Henry Schein, Inc. (a) | | | 34,965 | | | | 4,072,374 | |

| | | | | | | | | |

| Industrials — 10.5% | | | | | | | | |

| American Airlines Group, Inc. | | | 162,995 | | | | 5,783,063 | |

Colfax Corporation (a) | | | 119,195 | | | | 6,790,539 | |

| Pall Corporation | | | 62,295 | | | | 5,214,091 | |

| Watsco, Inc. | | | 35,045 | | | | 3,020,178 | |

| | | | | | | | 20,807,871 | |

| Information Technology — 3.2% | | | | | | | | |

| Intuit, Inc. | | | 72,870 | | | | 6,387,056 | |

| | | | | | | | | |

| Materials — 3.2% | | | | | | | | |

| Alcoa, Inc. | | | 396,080 | | | | 6,372,927 | |

DAVENPORT EQUITY OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS (Continued)

| COMMON STOCKS — 90.0% (Continued) | | Shares | | | Value | |

| Utilities — 2.6% | | | | | | |

| NRG Energy, Inc. | | | 169,825 | | | $ | 5,176,266 | |

| | | | | | | | | |

Total Common Stocks (Cost $159,296,809) | | | | | | $ | 178,672,042 | |

| CLOSED-END FUNDS — 3.2% | | Shares | | | Value | |

| Morgan Stanley China A Share Fund, Inc. (Cost $6,200,802) | | | 264,855 | | | $ | 6,435,976 | |

| MONEY MARKET FUNDS — 2.9% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 0.00% (b) (Cost $5,691,794) | | | 5,691,794 | | | $ | 5,691,794 | |

| | | | | | | | | |

Total Investments at Value — 96.1% (Cost $171,189,405) | | | | | | $ | 190,799,812 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 3.9% | | | | | | | 7,666,335 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 198,466,147 | |

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of September 30, 2014. |

See accompanying notes to financial statements.

THE DAVENPORT FUNDS

STATEMENTS OF ASSETS AND LIABILITIES

September 30, 2014 (Unaudited)

| | | Davenport

Core

Fund | | | Davenport Value & Income

Fund | | | Davenport Equity Opportunities Fund | |

| ASSETS | | | | | | | | | |

| Investments in securities: | | | | | | | | | |

| At acquisition cost | | $ | 205,638,155 | | | $ | 282,359,133 | | | $ | 171,189,405 | |

| At market value (Note 2) | | $ | 286,417,898 | | | $ | 334,657,648 | | | $ | 190,799,812 | |

| Cash | | | 7,999,487 | | | | 4,969,476 | | | | 6,964,398 | |

| Dividends receivable | | | 170,489 | | | | 1,044,405 | | | | 323,814 | |

| Receivable for securities sold | | | 3,274,931 | | | | — | | | | — | |

| Receivable for capital shares sold | | | 160,724 | | | | 660,152 | | | | 766,753 | |

| Other assets | | | 29,549 | | | | 31,110 | | | | 24,198 | |

| TOTAL ASSETS | | | 298,053,078 | | | | 341,362,791 | | | | 198,878,975 | |

| | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | |

| Payable for capital shares redeemed | | | 169,510 | | | | 258,887 | | | | 250,698 | |

| Accrued investment advisory fees (Note 4) | | | 208,457 | | | | 218,391 | | | | 135,658 | |

| Payable to administrator (Note 4) | | | 32,550 | | | | 35,950 | | | | 24,050 | |

| Other accrued expenses and liabilities | | | 4,128 | | | | 10,190 | | | | 2,422 | |

| TOTAL LIABILITIES | | | 414,645 | | | | 523,418 | | | | 412,828 | |

| | | | | | | | | | | | | |

| NET ASSETS | | $ | 297,638,433 | | | $ | 340,839,373 | | | $ | 198,466,147 | |

| | | | | | | | | | | | | |

| Net assets consist of: | | | | | | | | | | | | |

| Paid-in capital | | $ | 208,513,833 | | | $ | 282,302,656 | | | $ | 169,590,338 | |

| Accumulated net investment income | | | 31,709 | | | | 321,083 | | | | 405,018 | |

| Accumulated net realized gains from security transactions | | | 8,313,148 | | | | 5,917,119 | | | | 8,860,384 | |

| Net unrealized appreciation on investments | | | 80,779,743 | | | | 52,298,515 | | | | 19,610,407 | |

| Net assets | | $ | 297,638,433 | | | $ | 340,839,373 | | | $ | 198,466,147 | |

| | | | | | | | | | | | | |

Shares of beneficial interest outstanding

(unlimited number of shares authorized, $0.01 par value) | | | 15,714,744 | | | | 23,232,888 | | | | 13,210,603 | |

| | | | | | | | | | | | | |

| Net asset value, offering price and redemption price per share (Note 2) | | $ | 18.94 | | | $ | 14.67 | | | $ | 15.02 | |

See accompanying notes to financial statements.

THE DAVENPORT FUNDS

STATEMENTS OF OPERATIONS

Six Months Ended September 30, 2014 (Unaudited)

| | | Davenport

Core

Fund | | | Davenport Value & Income

Fund | | | Davenport Equity Opportunities Fund | |

| INVESTMENT INCOME | | | | | | | | | |

| Dividends | | $ | 2,233,917 | | | $ | 4,644,635 | | | $ | 1,340,264 | |

| Foreign withholding taxes on dividends | | | (76,985 | ) | | | (49,655 | ) | | | (10,656 | ) |

| TOTAL INVESTMENT INCOME | | | 2,156,932 | | | | 4,594,980 | | | | 1,329,608 | |

| | | | | | | | | | | | | |

| EXPENSES | | | | | | | | | | | | |

| Investment advisory fees (Note 4) | | | 1,107,239 | | | | 1,228,767 | | | | 713,820 | |

| Administration fees (Note 4) | | | 180,689 | | | | 197,112 | | | | 128,904 | |

| Registration and filing fees | | | 17,847 | | | | 23,286 | | | | 20,351 | |

| Postage and supplies | | | 15,276 | | | | 15,781 | | | | 17,151 | |

| Professional fees | | | 15,440 | | | | 15,682 | | | | 11,953 | |

| Compliance service fees (Note 4) | | | 14,190 | | | | 15,442 | | | | 10,292 | |

| Custodian and bank service fees | | | 11,452 | | | | 14,158 | | | | 8,338 | |

| Printing of shareholder reports | | | 6,078 | | | | 6,468 | | | | 5,428 | |

| Insurance expense | | | 5,701 | | | | 6,111 | | | | 3,664 | |

| Trustees' fees and expenses (Note 4) | | | 3,242 | | | | 3,242 | | | | 3,242 | |

| Other expenses | | | 1,211 | | | | 1,320 | | | | 1,079 | |

| TOTAL EXPENSES | | | 1,378,365 | | | | 1,527,369 | | | | 924,222 | |

| | | | | | | | | | | | | |

| NET INVESTMENT INCOME | | | 778,567 | | | | 3,067,611 | | | | 405,386 | |

| | | | | | | | | | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | | | | | | | | | |

| Net realized gains from security transactions | | | 8,334,164 | | | | 5,918,906 | | | | 8,860,961 | |

| Net change in unrealized appreciation/depreciation on investments | | | 365,693 | | | | 1,101,725 | | | | (8,610,428 | ) |

| | | | | | | | | | | | | |

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | 8,699,857 | | | | 7,020,631 | | | | 250,533 | |

| | | | | | | | | | | | | |

| NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 9,478,424 | | | $ | 10,088,242 | | | $ | 655,919 | |

See accompanying notes to financial statements.

DAVENPORT CORE FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended September 30,

2014 (Unaudited) | | | Year

Ended

March 31,

2014 | |

| FROM OPERATIONS | | | | | | |

| Net investment income | | $ | 778,567 | | | $ | 1,587,651 | |

| Net realized gains from security transactions | | | 8,334,164 | | | | 24,247,628 | |

| Net change in unrealized appreciation/depreciation on investments | | | 365,693 | | | | 21,071,593 | |

| Net increase in net assets from operations | | | 9,478,424 | | | | 46,906,872 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (773,860 | ) | | | (1,572,542 | ) |

| From net realized gains from security transactions | | | (14,094,415 | ) | | | (11,297,772 | ) |

| Decrease in net assets from distributions to shareholders | | | (14,868,275 | ) | | | (12,870,314 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 19,560,680 | | | | 44,315,591 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 14,382,586 | | | | 12,476,055 | |

| Payments for shares redeemed | | | (12,146,200 | ) | | | (20,495,991 | ) |

| Net increase in net assets from capital share transactions | | | 21,797,066 | | | | 36,295,655 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 16,407,215 | | | | 70,332,213 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 281,231,218 | | | | 210,899,005 | |

| End of period | | $ | 297,638,433 | | | $ | 281,231,218 | |

| | | | | | | | | |

| ACCUMULATED NET INVESTMENT INCOME | | $ | 31,709 | | | $ | 27,002 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 1,010,339 | | | | 2,414,969 | |

| Shares reinvested | | | 762,394 | | | | 681,244 | |

| Shares redeemed | | | (631,487 | ) | | | (1,117,243 | ) |

| Net increase in shares outstanding | | | 1,141,246 | | | | 1,978,970 | |

| Shares outstanding at beginning of period | | | 14,573,498 | | | | 12,594,528 | |

| Shares outstanding at end of period | | | 15,714,744 | | | | 14,573,498 | |

See accompanying notes to financial statements.

DAVENPORT VALUE & INCOME FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended September 30,

2014 (Unaudited) | | | Year

Ended

March 31,

2014 | |

| FROM OPERATIONS | | | | | | |

| Net investment income | | $ | 3,067,611 | | | $ | 5,531,182 | |

| Net realized gains from security transactions | | | 5,918,906 | | | | 14,211,440 | |

| Net change in unrealized appreciation/depreciation on investments | | | 1,101,725 | | | | 22,127,758 | |

| Net increase in net assets from operations | | | 10,088,242 | | | | 41,870,380 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (3,003,238 | ) | | | (5,277,593 | ) |

| From net realized gains from security transactions | | | (8,286,615 | ) | | | (9,157,892 | ) |

| Decrease in net assets from distributions to shareholders | | | (11,289,853 | ) | | | (14,435,485 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 39,437,719 | | | | 87,997,225 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 10,387,750 | | | | 13,263,859 | |

| Payments for shares redeemed | | | (12,072,093 | ) | | | (21,298,242 | ) |

| Net increase in net assets from capital share transactions | | | 37,753,376 | | | | 79,962,842 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 36,551,765 | | | | 107,397,737 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 304,287,608 | | | | 196,889,871 | |

| End of period | | $ | 340,839,373 | | | $ | 304,287,608 | |

| | | | | | | | | |

| ACCUMULATED NET INVESTMENT INCOME | | $ | 321,083 | | | $ | 256,710 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 2,654,970 | | | | 6,314,504 | |

| Shares reinvested | | | 703,022 | | | | 959,324 | |

| Shares redeemed | | | (813,284 | ) | | | (1,522,285 | ) |

| Net increase in shares outstanding | | | 2,544,708 | | | | 5,751,543 | |

| Shares outstanding at beginning of period | | | 20,688,180 | | | | 14,936,637 | |

| Shares outstanding at end of period | | | 23,232,888 | | | | 20,688,180 | |

See accompanying notes to financial statements.

DAVENPORT EQUITY OPPORTUNITIES FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended September 30,

2014 (Unaudited) | | | Year

Ended

March 31,

2014 | |

| FROM OPERATIONS | | | | | | |

| Net investment income | | $ | 405,386 | | | $ | 2,650,696 | |

| Net realized gains from security transactions | | | 8,860,961 | | | | 14,022,701 | |

| Net change in unrealized appreciation/depreciation on investments | | | (8,610,428 | ) | | | 10,046,548 | |

| Net increase in net assets from operations | | | 655,919 | | | | 26,719,945 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (2,452,135 | ) | | | (224,384 | ) |

| From net realized gains from security transactions | | | (8,921,254 | ) | | | (7,464,989 | ) |

| Decrease in net assets from distributions to shareholders | | | (11,373,389 | ) | | | (7,689,373 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 32,260,703 | | | | 54,980,702 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 10,969,996 | | | | 7,445,644 | |

| Payments for shares redeemed | | | (8,536,141 | ) | | | (9,646,854 | ) |

| Net increase in net assets from capital share transactions | | | 34,694,558 | | | | 52,779,492 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 23,977,088 | | | | 71,810,064 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 174,489,059 | | | | 102,678,995 | |

| End of period | | $ | 198,466,147 | | | $ | 174,489,059 | |

| | | | | | | | | |

| ACCUMULATED NET INVESTMENT INCOME | | $ | 405,018 | | | $ | 2,451,767 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 2,065,031 | | | | 3,699,725 | |

| Shares reinvested | | | 719,344 | | | | 510,464 | |

| Shares redeemed | | | (541,677 | ) | | | (651,385 | ) |

| Net increase in shares outstanding | | | 2,242,698 | | | | 3,558,804 | |

| Shares outstanding at beginning of period | | | 10,967,905 | | | | 7,409,101 | |

| Shares outstanding at end of period | | | 13,210,603 | | | | 10,967,905 | |

See accompanying notes to financial statements.

DAVENPORT CORE FUND

FINANCIAL HIGHLIGHTS

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period

| | | Six Months Ended

Sept. 30, 2014 | | | Years Ended March 31, | |

| | | (Unaudited) | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Net asset value at beginning of period | | $ | 19.30 | | | $ | 16.75 | | | $ | 15.00 | | | $ | 13.73 | | | $ | 12.05 | | | $ | 8.36 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.05 | | | | 0.12 | | | | 0.11 | | | | 0.09 | | | | 0.07 | | | | 0.08 | |

| Net realized and unrealized gains on investments | | | 0.58 | | | | 3.39 | | | | 1.75 | | | | 1.27 | | | | 1.68 | | | | 3.69 | |

| Total from investment operations | | | 0.63 | | | | 3.51 | | | | 1.86 | | | | 1.36 | | | | 1.75 | | | | 3.77 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.05 | ) | | | (0.12 | ) | | | (0.11 | ) | | | (0.09 | ) | | | (0.07 | ) | | | (0.08 | ) |

| Distributions from net realized gains | | | (0.94 | ) | | | (0.84 | ) | | | — | | | | — | | | | — | | | | — | |

| Total distributions | | | (0.99 | ) | | | (0.96 | ) | | | (0.11 | ) | | | (0.09 | ) | | | (0.07 | ) | | | (0.08 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of period | | $ | 18.94 | | | $ | 19.30 | | | $ | 16.75 | | | $ | 15.00 | | | $ | 13.73 | | | $ | 12.05 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total return (a) | | | 3.31 | %(b) | | | 21.32 | % | | | 12.47 | % | | | 9.99 | % | | | 14.61 | % | | | 45.20 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of period (000's) | | $ | 297,638 | | | $ | 281,231 | | | $ | 210,899 | | | $ | 174,898 | | | $ | 159,894 | | | $ | 132,662 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of total expenses to average net assets | | | 0.93 | %(c) | | | 0.94 | % | | | 0.95 | % | | | 0.96 | % | | | 0.99 | % | | | 1.00 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income to average net assets | | | 0.53 | %(c) | | | 0.64 | % | | | 0.71 | % | | | 0.66 | % | | | 0.58 | % | | | 0.75 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 16 | %(b) | | | 29 | % | | | 26 | % | | | 19 | % | | | 34 | % | | | 25 | % |

| (a) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

See accompanying notes to financial statements.

DAVENPORT VALUE & INCOME FUND

FINANCIAL HIGHLIGHTS

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period

| | | Six Months Ended

Sept. 30, 2014 (Unaudited) | | | Year

Ended

March 31,

2014 | | | Year

Ended

March 31,

2013 | | | Year

Ended

March 31,

2012 | | | Period

Ended

March 31,

2011 (a) | |

| Net asset value at beginning of period | | $ | 14.71 | | | $ | 13.18 | | | $ | 11.51 | | | $ | 10.50 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.14 | | | | 0.30 | | | | 0.28 | | | | 0.23 | | | | 0.04 | |

| Net realized and unrealized gains on investments | | | 0.35 | | | | 2.04 | | | | 1.81 | | | | 1.02 | | | | 0.49 | |

| Total from investment operations | | | 0.49 | | | | 2.34 | | | | 2.09 | | | | 1.25 | | | | 0.53 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.14 | ) | | | (0.29 | ) | | | (0.27 | ) | | | (0.23 | ) | | | (0.03 | ) |

| Distributions from net realized gains | | | (0.39 | ) | | | (0.52 | ) | | | (0.15 | ) | | | (0.01 | ) | | | — | |

| Total distributions | | | (0.53 | ) | | | (0.81 | ) | | | (0.42 | ) | | | (0.24 | ) | | | (0.03 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of period | | $ | 14.67 | | | $ | 14.71 | | | $ | 13.18 | | | $ | 11.51 | | | $ | 10.50 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return (b) | | | 3.25 | %(c) | | | 18.25 | % | | | 18.69 | % | | | 12.23 | % | | | 5.35 | %(c) |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of period (000's) | | $ | 340,839 | | | $ | 304,288 | | | $ | 196,890 | | | $ | 98,757 | | | $ | 48,831 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of total expenses to average net assets | | | 0.93 | %(d) | | | 0.94 | % | | | 0.96 | % | | | 1.04 | % | | | 1.25 | %(d) |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income to average net assets | | | 1.85 | %(d) | | | 2.22 | % | | | 2.37 | % | | | 2.30 | % | | | 1.99 | %(d) |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 11 | %(c) | | | 32 | % | | | 29 | % | | | 27 | % | | | 10 | %(c) |

| (a) | Represents the period from commencement of operations (December 31, 2010) through March 31, 2011. |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

See accompanying notes to financial statements.

DAVENPORT EQUITY OPPORTUNITIES FUND

FINANCIAL HIGHLIGHTS

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period

| | | Six Months Ended

Sept. 30, 2014 (Unaudited) | | | Year

Ended

March 31,

2014 | | | Year

Ended

March 31,

2013 | | | Year

Ended

March 31,

2012 | | | Period

Ended

March 31,

2011 (a) | |

| Net asset value at beginning of period | | $ | 15.91 | | | $ | 13.86 | | | $ | 11.96 | | | $ | 10.72 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.02 | | | | 0.24 | | | | 0.03 | | | | (0.02 | ) | | | (0.01 | ) |

| Net realized and unrealized gains on investments | | | 0.07 | | | | 2.65 | | | | 2.17 | | | | 1.30 | | | | 0.73 | |

| Total from investment operations | | | 0.09 | | | | 2.89 | | | | 2.20 | | | | 1.28 | | | | 0.72 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.21 | ) | | | (0.02 | ) | | | (0.02 | ) | | | — | | | | — | |

| Distributions from net realized gains | | | (0.77 | ) | | | (0.82 | ) | | | (0.28 | ) | | | (0.04 | ) | | | — | |

| Total distributions | | | (0.98 | ) | | | (0.84 | ) | | | (0.30 | ) | | | (0.04 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of period | | $ | 15.02 | | | $ | 15.91 | | | $ | 13.86 | | | $ | 11.96 | | | $ | 10.72 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return (b) | | | 0.52 | %(c) | | | 21.57 | % | | | 18.77 | % | | | 12.00 | % | | | 7.20 | %(c) |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of period (000's) | | $ | 198,466 | | | $ | 174,489 | | | $ | 102,679 | | | $ | 59,135 | | | $ | 34,375 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of total expenses to average net assets | | | 0.97 | %(d) | | | 0.97 | % | | | 1.01 | % | | | 1.10 | % | | | 1.25 | %(d) |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss) to average net assets | | | 0.40 | %(d) | | | 1.96 | % | | | 0.23 | % | | | (0.22 | %) | | | (0.40% | )(d) |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 19 | %(c) | | | 49 | % | | | 41 | % | | | 35 | % | | | 6 | %(c) |

| (a) | Represents the period from commencement of operations (December 31, 2010) through March 31, 2011. |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

See accompanying notes to financial statements.

THE DAVENPORT FUNDS

NOTES TO FINANCIAL STATEMENTS

September 30, 2014 (Unaudited)

1. Organization

Davenport Core Fund, Davenport Value & Income Fund and Davenport Equity Opportunities Fund (individually, a "Fund," and, collectively, the "Funds") are each a no-load series of the Williamsburg Investment Trust (the "Trust"), an open-end management investment company registered under the Investment Company Act of 1940. The Trust was organized as a Massachusetts business trust on July 18, 1988. Other series of the Trust are not incorporated in this report. Davenport Core Fund began operations on January 15, 1998. Davenport Value & Income Fund and Davenport Equity Opportunities Fund each began operations on December 31, 2010.

Davenport Core Fund's investment objective is long term growth of capital.

Davenport Value & Income Fund's investment objective is to achieve long term growth while generating current income through dividend payments on portfolio securities.

Davenport Equity Opportunities Fund's investment objective is long term capital appreciation.

Davenport Core Fund and Davenport Value & Income Fund are each classified as a diversified fund. Davenport Equity Opportunities Fund is classified as a non-diversified fund.

2. Significant Accounting Policies

The following is a summary of the Funds' significant accounting policies. The policies are in conformity with accounting principles generally accepted in the United States of America ("GAAP").

Securities valuation — The Funds' portfolio securities are valued as of the close of business of the regular session of the New York Stock Exchange (normally 4:00 p.m., Eastern time). Securities traded on a national stock exchange are valued based upon the closing price on the principal exchange where the security is traded, if available, otherwise, at the last quoted bid price. Securities which are quoted by NASDAQ are valued at the NASDAQ Official Closing Price.

Fixed income securities are valued on the basis of prices provided by an independent pricing service. The prices provided by the pricing service are determined with consideration given to institutional bid and last sale prices and take into account securities prices, yields, maturities, call features, ratings, institutional trading in similar groups of securities and developments related to specific securities.

When market quotations are not readily available, if a pricing service cannot provide a price or the investment adviser believes the price received from the pricing service is not indicative of fair value, securities will be valued in good faith at fair value using methods consistent with those determined by the Board of Trustees and will be classified as Level 2 or 3 within the fair value hierarchy (see below), depending on the inputs used. Such methods of fair valuation may include,

THE DAVENPORT FUNDS

NOTES TO FINANCIAL STATEMENTS (Continued)

but are not limited to: multiple of earnings, multiple of book value, discount from market of a similar freely traded security, purchase price of the security, subsequent private transactions in the security or related securities, or a combination of these and other factors.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the Funds' investments. These inputs are summarized in the three broad levels listed below:

• Level 1 – quoted prices in active markets for identical securities

• Level 2 – other significant observable inputs

• Level 3 – significant unobservable inputs

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Funds' investments as of September 30, 2014 by security type:

| Davenport Core Fund | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 280,646,892 | | | $ | — | | | $ | — | | | $ | 280,646,892 | |

| Money Market Funds | | | 5,771,006 | | | | — | | | | — | | | | 5,771,006 | |

| Total | | $ | 286,417,898 | | | $ | — | | | $ | — | | | $ | 286,417,898 | |

| Davenport Value & Income Fund | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 309,380,828 | | | $ | — | | | $ | — | | | $ | 309,380,828 | |

| Exchange-Traded Funds | | | 15,289,628 | | | | — | | | | — | | | | 15,289,628 | |

| Money Market Funds | | | 9,987,192 | | | | — | | | | — | | | | 9,987,192 | |

| Total | | $ | 334,657,648 | | | $ | — | | | $ | — | | | $ | 334,657,648 | |

| Davenport Equity Opportunities Fund | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 178,672,042 | | | $ | — | | | $ | — | | | $ | 178,672,042 | |

| Closed-End Funds | | | 6,435,976 | | | | — | | | | — | | | | 6,435,976 | |

| Money Market Funds | | | 5,691,794 | | | | — | | | | — | | | | 5,691,794 | |

| Total | | $ | 190,799,812 | | | $ | — | | | $ | — | | | $ | 190,799,812 | |

THE DAVENPORT FUNDS

NOTES TO FINANCIAL STATEMENTS (Continued)

Refer to each Fund's Schedule of Investments for a listing of the securities by sector type. As of September 30, 2014, the Funds did not have any transfers in and out of any Level. There were no Level 2 or Level 3 securities or derivative instruments held by the Funds as of September 30, 2014. It is the Funds' policy to recognize transfers into and out of any Level at the end of the reporting period.

Share valuation — The net asset value per share of each Fund is calculated daily by dividing the total value of its assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of each Fund is equal to the net asset value per share.

Investment income — Interest income is accrued as earned. Dividend income is recorded on the ex-dividend date. Discounts and premiums on fixed-income securities purchased are amortized using the interest method.