UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2006

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (NO FEE REQUIRED) |

For the transition period from to

Commission File Number 0-27558

CYTYC CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| DELAWARE | | 02-0407755 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

250 Campus Drive, Marlborough, MA 01752

(Address of principal executive offices, including Zip Code)

(508) 263-2900

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: The number of shares of the issuer’s Common Stock, $0.01 par value per share, outstanding as of October 26, 2006 was 112,630,139.

Total Number of Pages: 34

Exhibit index located on page 34

CYTYC CORPORATION

INDEX TO FORM 10-Q

2

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Cytyc Corporation

250 Campus Drive

Marlborough, Massachusetts

We have reviewed the accompanying condensed consolidated balance sheet of Cytyc Corporation and subsidiaries as of September 30, 2006, and the related condensed consolidated statements of income for the three-month and nine-month periods ended September 30, 2006 and 2005, and of cash flows for the nine-month periods ended September 30, 2006 and 2005. These interim financial statements are the responsibility of the Company’s management.

We conducted our reviews in accordance with standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with standards of the Public Company Accounting Oversight Board (United States), the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

Based on our reviews, we are not aware of any material modifications that should be made to such condensed consolidated interim financial statements for them to be in conformity with accounting principles generally accepted in the United States of America.

As discussed in Note 7 to the condensed consolidated interim financial statements, the Company changed its method of accounting for stock-based compensation on January 1, 2006, as required by Statement of Financial Accounting Standards No. 123R,Share-Based Payment.

We have previously audited, in accordance with standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of Cytyc Corporation and subsidiaries as of December 31, 2005, and the related consolidated statements of income, stockholders’ equity, and cash flows for the year then ended (not presented herein); and in our report dated February 16, 2006, we expressed an unqualified opinion on those consolidated financial statements. In our opinion, the information set forth in the accompanying condensed consolidated balance sheet as of December 31, 2005 is fairly stated, in all material respects, in relation to the consolidated balance sheet from which it has been derived.

/s/ Deloitte & Touche LLP

Boston, Massachusetts

November 3, 2006

3

Part I FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

CYTYC CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share amounts)

| | | | | | | | |

| | | September 30,

2006 | | | December 31,

2005 | |

| | (unaudited) | | | | |

| ASSETS | | | | | | | | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | $ | 174,637 | | | $ | 123,468 | |

Investment securities | | | 30,020 | | | | 97,151 | |

Accounts receivable, net of allowance of $1,753 and $1,592 at September 30, 2006 and December 31, 2005, respectively | | | 93,748 | | | | 82,833 | |

Inventories, net | | | 26,719 | | | | 24,033 | |

Deferred tax assets, net | | | 20,717 | | | | 4,266 | |

Prepaid expenses and other current assets | | | 6,591 | | | | 5,539 | |

| | | | | | | | |

Total current assets | | | 352,432 | | | | 337,290 | |

| | | | | | | | |

Property and equipment, net | | | 143,327 | | | | 113,610 | |

| | | | | | | | |

Intangible assets: | | | | | | | | |

Patents and developed technology, net of accumulated amortization of $20,672 and $13,018 at September 30, 2006 and December 31, 2005, respectively | | | 184,918 | | | | 192,572 | |

Goodwill | | | 384,991 | | | | 389,385 | |

| | | | | | | | |

Total intangible assets | | | 569,909 | | | | 581,957 | |

| | | | | | | | |

Other assets, net | | | 10,612 | | | | 7,022 | |

| | | | | | | | |

Total assets | | $ | 1,076,280 | | | $ | 1,039,879 | |

| | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

Current liabilities: | | | | | | | | |

Accounts payable | | $ | 12,039 | | | $ | 10,627 | |

Accrued expenses | | | 43,437 | | | | 74,291 | |

Deferred revenue | | | 6,627 | | | | 4,265 | |

| | | | | | | | |

Total current liabilities | | | 62,103 | | | | 89,183 | |

| | | | | | | | |

Deferred tax liabilities, net | | | 77,967 | | | | 70,101 | |

| | |

Long-term debt and other non-current liabilities | | | 267,342 | | | | 252,244 | |

| | |

Commitments and contingencies (Note 11) | | | | | | | | |

| | |

Stockholders’ equity: | | | | | | | | |

Preferred stock, $0.01 par value—Authorized—5,000,000 shares

No shares issued or outstanding | | | — | | | | — | |

Common stock, $0.01 par value—Authorized—400,000,000 shares

Issued— 133,952,437 and 132,743,281 shares in 2006 and 2005, respectively

Outstanding— 112,673,225 and 115,273,391 shares in 2006 and 2005, respectively | | | 1,340 | | | | 1,327 | |

Additional paid-in capital | | | 588,717 | | | | 545,761 | |

Treasury stock, at cost: 21,279,212 and 17,469,890 shares in 2006 and 2005, respectively | | | (307,586 | ) | | | (207,503 | ) |

Accumulated other comprehensive income | | | 2,555 | | | | 2,048 | |

Retained earnings | | | 383,842 | | | | 286,718 | |

| | | | | | | | |

Total stockholders’ equity | | | 668,868 | | | | 628,351 | |

| | | | | | | | |

Total liabilities and stockholders’ equity | | $ | 1,076,280 | | | $ | 1,039,879 | |

| | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

CYTYC CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | | 2006 | | | 2005 | | | 2006 | | | 2005 | |

Net sales | | $ | 154,256 | | | $ | 130,824 | | | $ | 445,193 | | | $ | 369,610 | |

Cost of sales (1) | | | 35,083 | | | | 27,923 | | | | 97,935 | | | | 77,956 | |

| | | | | | | | | | | | | | | | |

Gross profit | | | 119,173 | | | | 102,901 | | | | 347,258 | | | | 291,654 | |

| | | | | | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | | | | | |

Research and development (1) | | | 11,408 | | | | 8,245 | | | | 32,400 | | | | 23,002 | |

Sales and marketing (1) | | | 38,792 | | | | 32,761 | | | | 120,914 | | | | 96,152 | |

General and administrative (1) | | | 15,448 | | | | 11,453 | | | | 44,282 | | | | 33,650 | |

Arbitration decision | | | — | | | | — | | | | — | | | | 7,807 | |

| | | | | | | | | | | | | | | | |

Total operating expenses | | | 65,648 | | | | 52,459 | | | | 197,596 | | | | 160,611 | |

| | | | | | | | | | | | | | | | |

Income from operations | | | 53,525 | | | | 50,442 | | | | 149,662 | | | | 131,043 | |

Other expense, net: | | | | | | | | | | | | | | | | |

Interest income | | | 1,578 | | | | 596 | | | | 5,234 | | | | 2,014 | |

Interest expense | | | (1,925 | ) | | | (1,792 | ) | | | (5,509 | ) | | | (5,376 | ) |

Other | | | 165 | | | | (202 | ) | | | 88 | | | | (1,588 | ) |

| | | | | | | | | | | | | | | | |

Total other expense, net | | | (182 | ) | | | (1,398 | ) | | | (187 | ) | | | (4,950 | ) |

| | | | | | | | | | | | | | | | |

Income before provision for income taxes | | | 53,343 | | | | 49,044 | | | | 149,475 | | | | 126,093 | |

Provision for income taxes (1) | | | 17,263 | | | | 17,901 | | | | 52,351 | | | | 46,024 | |

| | | | | | | | | | | | | | | | |

Net income | | $ | 36,080 | | | $ | 31,143 | | | $ | 97,124 | | | $ | 80,069 | |

| | | | | | | | | | | | | | | | |

Net income per common share and potential common share: | | | | | | | | | | | | | | | | |

Basic | | $ | 0.32 | | | $ | 0.28 | | | $ | 0.85 | | | $ | 0.71 | |

| | | | | | | | | | | | | | | | |

Diluted | | $ | 0.31 | | | $ | 0.26 | | | $ | 0.81 | | | $ | 0.67 | |

| | | | | | | | | | | | | | | | |

Weighted average common and potential common shares outstanding: | | | | | | | | | | | | | | | | |

Basic | | | 112,751 | | | | 112,889 | | | | 114,187 | | | | 113,243 | |

Diluted | | | 121,403 | | | | 124,750 | | | | 123,893 | | | | 125,101 | |

___________ (1) Balance includes stock-based compensation under SFAS 123R as follows (see

Note 7): | | | | | | | | | | | | | | | | |

Cost of sales | | $ | 319 | | | $ | — | | | $ | 1,024 | | | $ | — | |

Research and development | | | 744 | | | | — | | | | 2,391 | | | | — | |

Sales and marketing | | | 2,340 | | | | — | | | | 7,516 | | | | — | |

General and administrative | | | 1,914 | | | | — | | | | 6,149 | | | | — | |

| | | | | | | | | | | | | | | | |

Stock-based compensation expense, gross | | | 5,317 | | | | — | | | | 17,080 | | | | — | |

Effect on income taxes | | | (1,758 | ) | | | — | | | | (5,611 | ) | | | — | |

| | | | | | | | | | | | | | | | |

Total stock-based compensation expense, net | | $ | 3,559 | | | $ | — | | | $ | 11,469 | | | $ | — | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

CYTYC CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| | | | | | | | |

| | | Nine Months Ended

September 30, | |

| | | 2006 | | | 2005 | |

Cash flows from operating activities: | | | | | | | | |

Net income | | $ | 97,124 | | | $ | 80,069 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | |

Revenue relating to license issued in exchange for preferred stock | | | (1,933 | ) | | | — | |

Stock-based compensation expense pursuant to SFAS No. 123R | | | 17,080 | | | | — | |

Compensation expense related to issuance of stock to directors and executives | | | 395 | | | | 438 | |

Depreciation and amortization of property and equipment | | | 16,885 | | | | 12,435 | |

Amortization of intangible assets | | | 7,654 | | | | 4,447 | |

Amortization of deferred financing costs | | | 1,209 | | | | 1,157 | |

Provision for doubtful accounts | | | 219 | | | | 436 | |

Change in deferred income taxes | | | (8,168 | ) | | | 22,362 | |

Changes in assets and liabilities, excluding effects of acquisition: | | | | | | | | |

Accounts receivable | | | (10,347 | ) | | | (7,229 | ) |

Inventories | | | (2,525 | ) | | | (4,957 | ) |

Prepaid expenses and other current assets | | | (1,002 | ) | | | (2,044 | ) |

Accounts payable | | | 1,403 | | | | 1,460 | |

Accrued expenses | | | (4,348 | ) | | | 6,894 | |

Deferred revenue | | | 2,128 | | | | 1,513 | |

Tax benefit from exercise of stock options and employee stock purchase plan | | | 1,819 | | | | 9,100 | |

| | | | | | | | |

Net cash provided by operating activities | | | 117,593 | | | | 126,081 | |

| | | | | | | | |

Cash flows from investing activities: | | | | | | | | |

Acquisition of Proxima Therapeutics, Inc., net of cash acquired | | | (21,074 | ) | | | (161,825 | ) |

(Increase) decrease in other assets | | | (1,239 | ) | | | 133 | |

Increase in equipment under customer usage agreements | | | (18,733 | ) | | | (20,345 | ) |

Purchases of property and equipment, net | | | (14,222 | ) | | | (11,208 | ) |

Increase in patents and developed technology | | | (473 | ) | | | — | |

Purchases of investment securities | | | (112,617 | ) | | | (3,593 | ) |

Proceeds from sales and maturities of investment securities | | | 179,824 | | | | 111,710 | |

| | | | | | | | |

Net cash provided by (used in) investing activities | | | 11,466 | | | | (85,128 | ) |

| | | | | | | | |

Cash flows from financing activities: | | | | | | | | |

Purchase of treasury shares | | | (100,083 | ) | | | (50,055 | ) |

Proceeds from issuance of shares under employee stock purchase plan | | | 2,029 | | | | 1,443 | |

Proceeds from exercise of stock options | | | 20,049 | | | | 35,530 | |

Payments relating to securing line of credit facility | | | (1,576 | ) | | | — | |

Excess tax benefit from exercise of stock options and employee stock purchase plan | | | 1,595 | | | | — | |

| | | | | | | | |

Net cash used in financing activities | | | (77,986 | ) | | | (13,082 | ) |

| | | | | | | | |

Effect of exchange rate changes on cash | | | 96 | | | | (380 | ) |

| | | | | | | | |

Net increase in cash and cash equivalents | | | 51,169 | | | | 27,491 | |

Cash and cash equivalents, beginning of period | | | 123,468 | | | | 86,277 | |

| | | | | | | | |

Cash and cash equivalents, end of period | | $ | 174,637 | | | $ | 113,768 | |

| | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

(1) Basis of Presentation

The accompanying condensed consolidated financial statements of Cytyc Corporation and subsidiaries (the “Company” or “Cytyc”) have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) have been condensed or omitted pursuant to such rules and regulations. These financial statements should be read in conjunction with the financial statements and notes included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005.

The notes and accompanying condensed consolidated financial statements are unaudited. The information furnished reflects all adjustments, which, in the opinion of management, are necessary for a fair presentation of results for the interim periods. Such adjustments consisted only of normal recurring items. The interim periods are not necessarily indicative of the results expected for the full year or any future period.

The preparation of these condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of net sales and expenses during the reporting period. Actual results could differ from those estimates.

As described in Note 7, on January 1, 2006, the Company changed its method of accounting for stock-based compensation, as required by Statement of Financial Accounting Standards (“SFAS”) No. 123R,Share-Based Payment.

(2) Acquisition Activity

(a) Acquisition of Proxima Therapeutics, Inc.

On March 7, 2005, the Company acquired Proxima Therapeutics, Inc. (“Proxima”), a privately held company located in Alpharetta, Georgia, in a non-taxable transaction (the “Merger”). As a result of the Merger, all of Proxima’s fully-diluted equity immediately prior to the Merger was automatically converted into the right to receive an initial cash payment of approximately $160 million, plus contingent earn-out payments tied to future performance milestones. The contingent earn-out payments are based on incremental sales growth in the breast-related products during 2005 and 2006, are subject to an aggregate cap of $65 million and are recorded as additional goodwill when earned. In March 2006, the Company paid $21.1 million for the contingent earn-out payments relating to incremental sales growth in the breast-related products during 2005, of which $20.9 million was accrued at December 31, 2005. No amount was accrued as of September 30, 2006 for contingent earn-out payments relating to 2006 incremental sales growth as the minimum performance milestone had not yet been reached.

The initial purchase price payment was paid with Cytyc’s available cash. Pursuant to the agreement for the Merger, $15.8 million of the purchase price was placed in escrow to satisfy potential claims. During the three months ended March 31, 2006, the Company released the $15.8 million, plus interest, from escrow to the former Proxima shareholders.

The aggregate purchase price for Proxima, including the contingent earn-out payments relating to 2005 performance milestones, was $184.2 million, of which $181.1 million represented cash payable to Proxima shareholders and $3.1 million represented acquisition-related fees and expenses. The acquisition was accounted for as a purchase in accordance with SFAS No. 141,Business Combinations, and accordingly, the results of operations of Proxima were included in the consolidated statement of income from the date of the acquisition. The purchase price was supported by estimates of future sales and earnings of Proxima, as well as the value of sales force and other projected synergies.

7

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

Purchase Price Allocation

The following table summarizes the fair values of the assets acquired and liabilities assumed at the date of acquisition (“Original Amount”) and includes the contingent earn-out payments relating to 2005 performance milestones and subsequent adjustments, for an aggregate purchase price of approximately $184.2 million, including acquisition costs:

| | | | | | | | | | | | | | | |

| | | Original

Amount | | | 2005

Contingent

Earn-out | | 2006

Adjustments | | | Amount as of

September 30,

2006 | |

| | | (in thousands) | |

Current assets | | $ | 6,622 | | | $ | — | | $ | — | | | $ | 6,622 | |

Property and equipment | | | 379 | | | | — | | | — | | | | 379 | |

Patents and developed technology | | | 101,900 | | | | — | | | — | | | | 101,900 | |

Goodwill | | | 76,279 | | | | 20,906 | | | (3,846 | ) | | | 93,339 | |

Other assets | | | 507 | | | | — | | | — | | | | 507 | |

Current liabilities | | | (4,143 | ) | | | — | | | 114 | | | | (4,029 | ) |

Long-term liabilities | | | (587 | ) | | | — | | | — | | | | (587 | ) |

Net deferred tax liability and valuation allowance—long-term | | | (17,827 | ) | | | — | | | 3,900 | | | | (13,927 | ) |

| | | | | | | | | | | | | | | |

| | $ | 163,130 | | | $ | 20,906 | | $ | 168 | | | $ | 184,204 | |

| | | | | | | | | | | | | | | |

As part of the purchase price allocation, all tangible and intangible assets and liabilities were identified and valued. Of the total purchase price, the Company allocated $2.9 million to acquired net tangible assets. The net deferred tax liability of $13.9 million is primarily comprised of $25.4 million of deferred tax assets, net of a $1.0 million valuation allowance, relating to acquired net operating losses and tax credits and deferred tax liabilities of $39.3 million relating to patents and developed technology. The Company determined the fair value of Proxima’s tangible assets and liabilities based on a review of Proxima’s historical and then current financial statements and an understanding of the ongoing nature of the assets and liabilities.

The Company also allocated $101.9 million to the acquired patents and developed technology, primarily associated with the MammoSite®Radiation Therapy System (“MammoSite”). The acquired patents expire at various dates through 2023. Based on the average life of the patent portfolio, the remaining economic life of the developed technology is expected to be approximately 15 years. The Company is amortizing the patents and developed technology over this period using the cash flow method, under which amortization is calculated and recognized based upon the Company’s estimated net cash flows over the life of the intangible asset, reflecting the pattern in which the economic benefits of the intangible asset are consumed in accordance with SFAS No. 142,Goodwill and Other Intangible Assets. The Company believes the patents provide sufficient coverage for differentiated products to sustain some competitive advantage in the marketplace over the average remaining life of the patents.

The Company valued the intangible assets acquired, including the portfolio of patents and technologies associated with MammoSite and the GliaSite® Radiation Therapy System, based on present value calculations of income using risk-adjusted cash flows for each product, an analysis of company accomplishments, an assessment of overall contributions, as well as project risks. The projections used in the valuation are based on estimates of relevant market sizes and growth factors, expected trends in technology, and the nature and expected timing of new product introductions by the Company and its competitors, as well as estimates of cost of sales, operating expenses, and income taxes resulting from the acquired products. In addition, the projections reflect the Company’s expectation that improvements to the current devices will continue to be made over the life cycle of the product lines. As a result, the completed technology that existed as of the acquisition date was assumed to represent a declining percentage of the devices’ technological composition over time.

The rate utilized to discount the net cash flows to their present value was based on estimated weighted-average cost of capital calculations. A discount rate of 25% was used to value the acquired intangible assets. This discount rate was higher than the Company’s weighted-average cost of capital due to the early-stage life cycle of the acquired products and related inherent uncertainties surrounding the successful commercialization and development of the acquired intangible assets, the useful life of such technology, the profitability levels of such technology, and the uncertainty of technological advances that were unknown at that time.

The projections used to value the tangible assets and liabilities, as well as identifiable intangible assets, reflected no material change in historical pricing, margins or expense levels specifically associated with these acquired net assets. There have been no variations from the Company’s underlying projections and assumptions as compared to actual operating results that would have had a material impact on the valuation.

8

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

Goodwill

The excess of the purchase price, including contingent earn-out payments relating to 2005 performance milestones, over the fair value of tangible and identifiable intangible net assets was allocated to goodwill, which is non-deductible for tax purposes and totaled $93.3 million. In accordance with SFAS No. 142, this goodwill will not be systematically amortized. Instead, the Company will perform an annual assessment for impairment by applying a fair-value-based test. As of December 31, 2005, the Company had recorded $97.2 million of goodwill relating to the Proxima acquisition. During 2006, adjustments to goodwill and deferred tax assets of $3.9 million were made primarily as a result of contingent earn-out payments relating to 2005 performance milestones and the finalization of net operating loss carryforwards.

(b) Pro Forma results

The following unaudited pro forma financial information for the three and nine months ended September 30, 2005 presents the combined results of operations of Cytyc and Proxima as if the acquisition had occurred as of January 1, 2005 and include $2.8 million of transaction fees and expenses incurred by Proxima, prior to the acquisition, related to the Merger. The pro forma adjustments are based upon available information and certain assumptions that management believes are reasonable. The unaudited pro forma financial information is not intended to represent or be indicative of the consolidated results of operations or financial condition of the Company that would have been reported had the acquisition been completed as of the January 1, 2005.

Pro forma results for the three and nine months ended September 30, 2005 were as follows:

| | | | | | |

| | | Three Months Ended

September 30, 2005 | | Nine Months Ended

September 30, 2005 |

| | | (in thousands, except per share amounts) |

Net sales | | $ | 130,824 | | $ | 373,805 |

Net income | | $ | 31,101 | | $ | 76,722 |

| | |

Net income per common share: | | | | | | |

Basic | | $ | 0.28 | | $ | 0.68 |

| | | | | | |

Diluted | | $ | 0.26 | | $ | 0.64 |

| | | | | | |

(3) Amortization of Intangible Assets

Amortization expense related to identifiable intangible assets that will continue to be amortized in the future, which consists of the Company’s acquired patents and developed technology, was approximately $2.7 million and $1.8 million for the three months ended September 30, 2006 and 2005, respectively, and approximately $7.6 million and $4.4 million for the nine months ended September 30, 2006 and 2005, respectively (see Note 10 for amortization expense by operating segment). Amortization expense related to identifiable intangible assets, which is an estimate for each future year and subject to change, is as follows:

| | | |

| | | Amount |

| | | (in thousands) |

Remaining three months ending December 31, 2006 | | $ | 3,242 |

Year ending December 31, 2007 | | | 14,539 |

Year ending December 31, 2008 | | | 17,326 |

Year ending December 31, 2009 | | | 19,607 |

Year ending December 31, 2010 | | | 19,194 |

Thereafter | | | 111,010 |

| | | |

Total | | $ | 184,918 |

| | | |

(4) Investment Securities

Investment securities at September 30, 2006 and December 31, 2005 consist of auction rate securities (“ARS”) and municipal bonds, all of which are classified as available-for-sale. The fair value of available-for-sale securities was determined based on quoted market prices at the reporting date for those securities. Available-for-sale securities are shown in the consolidated financial statements at fair market value. The Company would have the ability and intent to hold securities should fair value be less than cost.

At September 30, 2006, investment securities consisted entirely of $30.0 million of ARS and at December 31, 2005 included $65.1 million of ARS. Although the ARS generally have original maturities in excess of one year from date of purchase, the underlying interest rates on these securities typically reset within one month. Therefore, these ARS are priced and subsequently traded as investment securities because of remarketing and the interest rate reset feature.

9

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

At September 30, 2006 and December 31, 2005, the cost basis, aggregate fair value and gross unrealized holding gains and losses by major security type were as follows:

| | | | | | | | | | | | | |

| | | Amortized Cost | | Gross Unrealized Holding

Gains | | Gross Unrealized Holding Losses | | | Fair Value |

| | | (in thousands) |

September 30, 2006 | | | | | | | | | | | | | |

Auction rate securities (average interest rate reset of 0.3 months) | | $ | 30,020 | | $ | — | | $ | — | | | $ | 30,020 |

| | | | | | | | | | | | | |

December 31, 2005 | | | | | | | | | | | | | |

Auction rate securities (average interest rate reset of 0.6 months) | | $ | 65,075 | | $ | — | | $ | — | | | $ | 65,075 |

Municipal bonds (average maturity of 5.2 months) | | | 32,152 | | | — | | | (76 | ) | | | 32,076 |

| | | | | | | | | | | | | |

| | $ | 97,227 | | $ | — | | $ | (76 | ) | | $ | 97,151 |

| | | | | | | | | | | | | |

A significant portion of the Company’s investment portfolio was converted into cash and cash equivalents during the third quarter of 2006 in consideration of the Company’s tender offer for Vision Systems Limited (see Note 14 for discussion of this subsequent event).

(5) Other Balance Sheet Information

Components of selected captions in the condensed consolidated balance sheets at September 30, 2006 and December 31, 2005 consisted of:

| | | | | | |

| | | September 30,

2006 | | December 31,

2005 |

| | | (in thousands) |

Inventories, net | | | | | | |

Raw material | | $ | 9,391 | | $ | 9,000 |

Work-in-process | | | 2,910 | | | 3,436 |

Finished goods | | | 14,418 | | | 11,597 |

| | | | | | |

| | $ | 26,719 | | $ | 24,033 |

| | | | | | |

Property and Equipment | | | | | | |

Property and equipment | | $ | 128,899 | | $ | 101,604 |

Equipment under customer usage agreements | | | 86,075 | | | 66,832 |

| | | | | | |

| | | 214,974 | | | 168,436 |

Less—accumulated depreciation and amortization | | | 71,647 | | | 54,826 |

| | | | | | |

| | $ | 143,327 | | $ | 113,610 |

| | | | | | |

Accrued Expenses | | | | | | |

Accrued compensation | | $ | 19,649 | | $ | 20,999 |

Accrued acquisition (Proxima earn-out) | | | — | | | 20,906 |

Accrued taxes | | | 11,047 | | | 8,860 |

Other accruals | | | 12,741 | | | 23,526 |

| | | | | | |

| | $ | 43,437 | | $ | 74,291 |

| | | | | | |

10

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

The Company records a liability for product warranty obligations at the time of sale based upon historical warranty experience. The term of the warranty is generally twelve months. Product warranty obligations are included in accrued expenses. Changes in the product warranty obligations for the nine months ended September 30, 2006 and 2005 were as follows:

| | | | | | | | |

| | | Nine Months Ended | |

| | | September 30, | |

| | | 2006 | | | 2005 | |

| | | (in thousands) | |

Balance, beginning of year | | $ | 426 | | | $ | 397 | |

New warranties | | | 400 | | | | 204 | |

Payments | | | (281 | ) | | | (378 | ) |

Adjustments | | | (164 | ) | | | (27 | ) |

| | | | | | | | |

Balance, September 30 | | $ | 381 | | | $ | 196 | |

| | | | | | | | |

(6) Net Income Per Common Share

Basic net income per share is computed by dividing net income by the weighted average number of common shares outstanding. Diluted net income per share is computed by dividing net income by the weighted average number of common shares and potential common shares from outstanding stock options and convertible debt. Potential common shares for outstanding stock options are calculated using the treasury stock method and represent incremental shares issuable upon exercise of the Company’s outstanding stock options. The treasury stock method is affected by the amount of stock-based compensation attributable to future services and therefore not yet recognized. The Company’s adoption of SFAS No. 123R on January 1, 2006 resulted in an increase in unrecognized stock-based compensation expense relating to unvested employee stock awards, which reduced the dilutive effect of assumed exercises of stock options for the three and nine months ended September 30, 2006 by approximately 2.2 million and 1.8 million shares, respectively.

The following table provides a reconciliation of the net income and weighted average common shares used in calculating basic and diluted net income per share for the three and nine months ended September 30, 2006 and 2005:

| | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2006 | | 2005 | | 2006 | | 2005 |

| | | (in thousands, except per share data) |

Numerator: | | | | | | | | | | | | |

Net income, as reported, for basic earnings per share | | $ | 36,080 | | $ | 31,143 | | $ | 97,124 | | $ | 80,069 |

Interest expense on convertible debt, net of tax | | | 1,138 | | | 1,138 | | | 3,414 | | | 3,414 |

| | | | | | | | | | | | |

Net income, as adjusted, for diluted earnings per share | | $ | 37,218 | | $ | 32,281 | | $ | 100,538 | | $ | 83,483 |

| | | | | | | | | | | | |

Denominator: | | | | | | | | | | | | |

Basic weighted average common shares outstanding | | | 112,751 | | | 112,889 | | | 114,187 | | | 113,243 |

Dilutive effect of assumed exercise of stock options | | | 226 | | | 3,435 | | | 1,280 | | | 3,432 |

Dilutive effect of assumed conversion of convertible debt | | | 8,426 | | | 8,426 | | | 8,426 | | | 8,426 |

| | | | | | | | | | | | |

Weighted average common shares outstanding assuming dilution | | | 121,403 | | | 124,750 | | | 123,893 | | | 125,101 |

| | | | | | | | | | | | |

Basic net income per common share | | $ | 0.32 | | $ | 0.28 | | $ | 0.85 | | $ | 0.71 |

| | | | | | | | | | | | |

Diluted net income per common and potential common share | | $ | 0.31 | | $ | 0.26 | | $ | 0.81 | | $ | 0.67 |

| | | | | | | | | | | | |

Diluted weighted average common shares outstanding for the three months ended September 30, 2006 and 2005 excluded 7,455,131 and 2,462,729 potential common shares, respectively, from stock options outstanding and diluted weighted average common shares outstanding for the nine months ended September 30, 2006 and 2005 excluded 3,974,548 and 5,349,054 potential common shares respectively, from stock options outstanding, because the exercise prices of such stock options were higher than the average closing price of the Company’s common stock as quoted on The NASDAQ National Market during the periods mentioned and, accordingly, their effect would be anti-dilutive.

11

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

(7) Stock-Based Compensation and Stock Incentive Plans

(a) Stock-Based Compensation

In December 2004, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 123R, which requires all stock-based compensation to employees, including grants of employee stock options, to be recognized in the financial statements based on their fair values. The Company adopted SFAS No. 123R on January 1, 2006 using the modified prospective method and accordingly, prior period amounts have not been restated. In order to determine the fair value of stock options and employee stock purchase plan shares, the Company is using the Black-Scholes option pricing model and is applying the multiple-option valuation approach to the stock option valuation. The Company is recognizing stock-based compensation expense on a straight-line basis over the requisite service period of the awards for options granted following the adoption of SFAS No. 123R. For unvested stock options outstanding as of January 1, 2006, the Company will continue to recognize stock-based compensation expense using the accelerated amortization method prescribed in FASB Interpretation (“FIN”) No. 28,Accounting for Stock Appreciation Rights and Other Variable Stock Option or Award Plans.

Estimates of the fair value of equity awards will be affected by the future market price of the Company’s common stock, as well as the actual results of certain assumptions used to value the equity awards. These assumptions include, but are not limited to, the related income tax impact, the expected volatility of the common stock, the number of stock options to be forfeited and exercised by employees, and the expected term of options granted.

As noted above, the fair value of stock options and employee stock purchase plan shares is determined by using the Black-Scholes option pricing model and applying the multiple-option valuation approach to the stock option valuation. The options have graded-vesting on an annual basis over an average vesting period of four years. In applying the multiple-option approach, each option “tranche” is separately valued based upon when the tranche vests. The Company estimates the expected option term by calculating the average period of time before the employees exercise their options and adds this to the vesting period of each tranche. Historically, this period of time has averaged one year from the date the options vest. The expected term of employee stock purchase plan shares is the average of the remaining purchase periods under each offering period. For equity awards granted prior to the adoption of SFAS No. 123R, the volatility of the common stock was estimated using historical volatility. For equity awards granted since January 1, 2006, the volatility of the common stock is estimated using a combination of historical and implied volatility, as discussed in Staff Accounting Bulletin (“SAB”) No. 107. By using this combination, the Company is taking into consideration the historical realized volatility, as well as factoring in estimates of future volatility that the Company believes will differ from historical volatility as a result of the Company’s product diversification over the last two years, the market performance of the common stock, the volume of activity of the underlying shares, the availability of actively traded common stock options, and overall market conditions.

The risk-free interest rate used in the Black-Scholes option pricing model is determined by looking at historical U.S. Treasury zero-coupon bond issues with remaining terms equal to the expected terms of the equity awards. In addition, an expected dividend yield of zero is used in the option valuation model, because the Company does not expect to pay any cash dividends in the foreseeable future. Lastly, in accordance with SFAS No. 123R, the Company is required to estimate forfeitures at the time of grant and revise those estimates in subsequent periods if actual forfeitures differ from those estimates. In order to determine an estimated pre-vesting option forfeiture rate, the Company used historical forfeiture data. This estimated forfeiture rate has been applied to all unvested options outstanding as of January 1, 2006 and to all options granted since January 1, 2006. Therefore, stock-based compensation expense is recorded only for those options that are expected to vest.

The tax benefit related to the $5.3 million and $17.1 million of stock-based compensation expense recorded during the three and nine months ended September 30, 2006, respectively, was $1.7 million and $5.6 million, respectively.

Prior to January 1, 2006, the Company accounted for stock options using the intrinsic value method, pursuant to the provisions of Accounting Principles Board Opinion No. 25,Accounting for Stock Issued to Employees. Under this method, stock-based compensation expense was measured as the difference between the option’s exercise price and the market price of the Company’s common stock on the date of grant. Historically, under this method, the Company had no stock-based compensation from options granted to employees because stock options are granted at the market price of the common stock on the date of grant.

12

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

Had the Company accounted for stock awards pursuant to the provisions of SFAS No. 123,Accounting for Stock-Based Compensation, net income and net income per share would have been as follows for the three months and nine months ended September 30, 2005:

| | | | | | |

| | | Three Months Ended

September 30, 2005 | | Nine Months Ended

September 30, 2005 |

| | | (in thousands, except per share amounts) |

Net income as reported | | $ | 31,143 | | $ | 80,069 |

Assumed stock-based compensation cost, net of tax | | | 6,868 | | | 19,573 |

| | | | | | |

Pro forma net income | | $ | 24,275 | | $ | 60,496 |

| | | | | | |

Net income per common share: | | | | | | |

Basic — as reported | | $ | 0.28 | | $ | 0.71 |

| | | | | | |

Basic — pro forma | | $ | 0.22 | | $ | 0.53 |

| | | | | | |

Diluted — as reported | | $ | 0.26 | | $ | 0.67 |

| | | | | | |

Diluted — pro forma | | $ | 0.20 | | $ | 0.51 |

| | | | | | |

The underlying assumptions used in the Black-Scholes model were as follows for options granted during the three and nine months ended September 30, 2006 and 2005:

| | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | | 2006 | | | 2005 | | | 2006 | | | 2005 | |

Risk-free interest rate | | 4.9 | % | | 4.0 | % | | 4.7 | % | | 3.7 | % |

Expected dividend yield | | — | | | — | | | — | | | — | |

Expected lives (in years) | | 3.5 | | | 3.5 | | | 3.5 | | | 3.5 | |

Expected volatility | | 30 | % | | 51 | % | | 32 | % | | 57 | % |

Prior to the adoption of SFAS No. 123R, the Company presented all tax benefits for deductions resulting from the exercise of stock options and disqualifying dispositions as operating cash flows in the condensed consolidated statement of cash flows. SFAS No. 123R generally requires the benefits of tax deductions in excess of recognized compensation expense to be reported within cash flows from financing activities.

As of September 30, 2006, total unrecognized stock-based compensation expense relating to unvested employee stock awards, adjusted for estimated forfeitures, was $32.6 million. This amount is expected to be recognized over a weighted-average period of 3.2 years. If actual forfeitures differ from current estimates, total unrecognized stock-based compensation expense will be adjusted for future changes in estimated forfeitures.

(b) Stock Incentive Plans

The Cytyc Corporation 2004 Omnibus Stock Plan (the “2004 Omnibus Plan”), which is the Company’s primary plan for grants of equity, provides for the issuance of up to 12,250,000 shares of the Company’s common stock, no more than 8,200,000 of which shares may be issued as awards other than stock options or stock appreciation rights. The 2004 Omnibus Plan provides for grants of various incentives, including stock options and other stock-based awards. At September 30, 2006, 4,892,325 shares were available for future grant under the 2004 Omnibus Plan. Prior to the approval of the 2004 Omnibus Plan, the Company had various employee and director equity compensation plans, including the 1998 Stock Plan, the 1995 Stock Plan, the 1995 Non-Employee Director Stock Option Plan and the 2001 Non-Employee Director Stock Option Plan. These plans were terminated with the adoption of the 2004 Omnibus Plan and no further awards may be issued under these plans.

The following table summarizes options outstanding, by stock plan, as of September 30, 2006:

| | |

2004 Omnibus Plan | | 7,235,873 |

1995 Stock Plan | | 9,868,560 |

1998 Stock Plan | | 5,307 |

1995 Non-Employee Director Stock Option Plan | | 180,000 |

2001 Non-Employee Director Stock Option Plan | | 908,000 |

| | |

| | 18,197,740 |

| | |

13

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

The following schedule summarizes the activity under the Company’s stock plans during the nine months ended September 30, 2006:

| | | | | | | | |

| | | Number of Shares | | | Range of Exercise

Prices | | Weighted Average Exercise Price

per share |

Outstanding, December 31, 2005 | | 16,710,904 | | | $ 0.44 — $ 28.45 | | $ | 19.20 |

Granted | | 3,533,227 | | | 22.96 — 30.11 | | | 27.52 |

Exercised | | (1,111,102 | ) | | 2.69 — 28.45 | | | 17.46 |

Canceled | | (935,289 | ) | | 8.00 — 30.11 | | | 22.05 |

| | | | | | | | |

Outstanding, September 30, 2006 | | 18,197,740 | | | $ 0.44 — $ 30.11 | | $ | 20.78 |

| | | | | | | | |

Exercisable, September 30, 2006 | | 9,868,805 | | | $ 0.44 — $ 28.45 | | $ | 19.04 |

| | | | | | | | |

Exercisable, December 31, 2005 | | 9,206,763 | | | $ 0.44 — $ 28.45 | | $ | 18.70 |

| | | | | | | | |

The weighted average fair value per share of options granted during the three months ended September 30, 2006 and 2005 was $7.00 and $9.90, respectively, and for the nine months ended September 30, 2006 and 2005 was $8.18 and $10.50, respectively.

The total intrinsic value of options exercised during the three months ended September 30, 2006 and 2005 was $1.8 million and $15.4 million, respectively, and for the nine months ended September 30, 2006 and 2005 was $12.0 million and $25.9 million, respectively. The intrinsic value is calculated as the difference between the market value of the Company’s common stock on date of exercise and the exercise price per share.

The following table summarizes information about stock options outstanding at September 30, 2006:

| | | | | | | | | | | | |

| | | Options Outstanding | | Options Exercisable |

| Range of Exercise Prices | | Number of Shares | | Weighted Average Remaining

Contractual Life (in years) | | Weighted Average Exercise Price per Share | | Number of Shares | | Weighted Average Exercise Price per share |

| $0.44 – $11.29 | | 2,103,834 | | 3.00 | | $ | 9.17 | | 1,671,424 | | $ | 8.77 |

| 11.36 – 12.52 | | 182,950 | | 5.11 | | | 12.07 | | 147,463 | | | 12.09 |

| 12.60 – 12.65 | | 1,821,157 | | 3.14 | | | 12.65 | | 761,702 | | | 12.65 |

| 12.71 – 20.00 | | 1,965,321 | | 5.77 | | | 16.64 | | 1,437,545 | | | 16.41 |

| 20.02 – 21.90 | | 1,979,070 | | 5.06 | | | 21.13 | | 1,518,048 | | | 20.96 |

| 21.92 – 23.48 | | 1,847,327 | | 5.84 | | | 22.67 | | 1,060,848 | | | 22.32 |

| 23.51 – 24.31 | | 1,952,385 | | 6.10 | | | 24.13 | | 687,992 | | | 24.07 |

| 24.38 – 25.90 | | 1,958,097 | | 6.62 | | | 24.79 | | 1,359,096 | | | 24.64 |

| 25.92 – 28.00 | | 1,826,499 | | 4.21 | | | 26.69 | | 1,204,945 | | | 26.66 |

| 28.10 – 30.11 | | 2,561,100 | | 5.83 | | | 28.43 | | 19,742 | | | 28.34 |

| | | | | | | | | | | | | |

| $0.44 – $30.11 | | 18,197,740 | | 5.09 | | $ | 20.78 | | 9,868,805 | | $ | 19.04 |

| | | | | | | | | | | | | |

The aggregate intrinsic value of dilutive options outstanding and options exercisable as of September 30, 2006 was $82.1 million and $56.6 million, respectively. The intrinsic value is calculated as the difference between the market value of the Company’s common stock as of September 30, 2006 and the exercise price per share. The market value as of September 30, 2006 was $24.48 per share as quoted on The NASDAQ National Market.

14

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

(8) Comprehensive Income

Comprehensive income for the three and nine months ended September 30, 2006 and 2005 was as follows:

| | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | | 2006 | | | 2005 | | | 2006 | | 2005 | |

| | | (in thousands) | |

Net income | | $ | 36,080 | | | $ | 31,143 | | | $ | 97,124 | | $ | 80,069 | |

Other comprehensive income, net of tax: | | | | | | | | | | | | | | | |

Unrealized gains on investment securities | | | 10 | | | | 29 | | | | 48 | | | 72 | |

Foreign currency translation adjustments | | | (137 | ) | | | (12 | ) | | | 459 | | | (923 | ) |

| | | | | | | | | | | | | | | |

Comprehensive income | | $ | 35,953 | | | $ | 31,160 | | | $ | 97,631 | | $ | 79,218 | |

| | | | | | | | | | | | | | | |

(9) Stock Repurchase Program

Under the current stock repurchase program, the Company is authorized to repurchase up to $200 million of its common stock through open market purchases or private transactions that will be made from time to time as market conditions allow. The stock repurchase program is expected to be in effect for a maximum of four years. Shares repurchased under this program will be held in the Company’s treasury. The stock repurchase program may be suspended or discontinued at any time without prior notice. During the three and nine months ended September 30, 2006, the Company repurchased 883,014 and 3,809,322 shares, respectively, with an aggregate cost of $21.5 million and $100.1 million (including $0.1 million in commissions), respectively. As of September 30, 2006, 21,279,212 shares with an aggregate cost of $307.6 million are held in treasury.

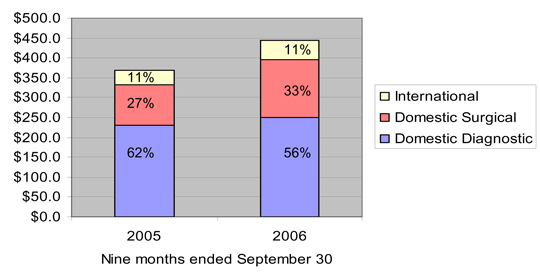

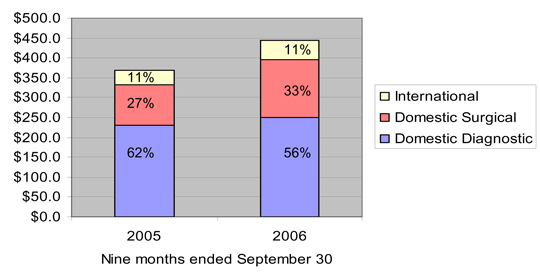

(10) Segment Information

SFAS No. 131,Disclosures About Segments of an Enterprise and Related Information, requires certain financial and supplementary information to be disclosed for each reportable operating segment of an enterprise, as defined. Prior to the fourth quarter of fiscal year 2005, the Company operated its business in two segments, worldwide diagnostic products and worldwide surgical products. In the fourth quarter of fiscal year 2005, the Company modified its management structure to establish an international division, managed by a divisional president, as a result of the growth in international operations and began to operate in three reportable segments: domestic diagnostic products, domestic surgical products and international. During the third quarter of 2006, the Company established the domestic diagnostic products and domestic surgical products divisions, each managed by a divisional president. Financial information for the three segments is included below for all periods presented and each segment is described as follows:

Domestic Diagnostic Products— This segment develops and markets the ThinPrep® System in the United States primarily for use in diagnostic cytology testing applications focused on women’s health. The ThinPrep System is widely used for cervical cancer screening and is the platform from which the Company launched its expansion into breast cancer risk assessment with the FirstCyte® Breast Test. The ThinPrep System consists of any one or more of the following: the ThinPrep 2000 Processor, ThinPrep 3000 Processor, ThinPrep Imaging System, and related reagents, filters, and other supplies, such as the ThinPrep Pap Test and the Company’s proprietary ThinPrep PreservCyt Solution.

Domestic Surgical Products— This segment manufactures the NovaSure® System, an innovative endometrial ablation device to treat menorrhagia, or excessive menstrual bleeding, the MammoSite Radiation Therapy System, a device for the treatment of early-stage breast cancer, and the GliaSite Radiation Therapy System for the treatment of malignant brain tumors, and markets these products in the Unites States.

International— This segment markets the Company’s diagnostic and surgical products outside of the United States through the Company’s subsidiaries, branch office and distributors. Products sold by the Company’s international segment are manufactured at domestic and international manufacturing locations.

The Company’s chief decision maker, who is the Chief Executive Officer, regularly evaluates the operating team of each segment on their ability to generate net sales and gross profit. Selling, general and administrative functions, as well as the treasury function, are administered on a global basis and therefore these expenses are recorded where disbursed. As such, the Company does not allocate these expenses across its three segments.

15

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

The Company’s operating results, by segment, are as follows:

| | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2006 | | 2005 | | 2006 | | 2005 |

| | | (in thousands) |

Net sales: | | | | | | | | | | | | |

Domestic diagnostic products | | $ | 84,038 | | $ | 78,546 | | $ | 248,821 | | $ | 230,555 |

Domestic surgical products | | | 52,956 | | | 39,890 | | | 147,684 | | | 100,850 |

International | | | 17,262 | | | 12,388 | | | 48,688 | | | 38,205 |

| | | | | | | | | | | | |

Total net sales | | $ | 154,256 | | $ | 130,824 | | $ | 445,193 | | $ | 369,610 |

| | | | | | | | | | | | |

Gross profit and net income: | | | | | | | | | | | | |

Domestic diagnostic products | | $ | 63,764 | | $ | 61,068 | | $ | 191,635 | | $ | 181,090 |

Domestic surgical products | | | 44,351 | | | 33,890 | | | 123,600 | | | 83,685 |

International | | | 11,058 | | | 7,943 | | | 32,023 | | | 26,879 |

| | | | | | | | | | | | |

Total gross profit | | | 119,173 | | | 102,901 | | | 347,258 | | | 291,654 |

Corporate expenses | | | 83,093 | | | 71,758 | | | 250,134 | | | 211,585 |

| | | | | | | | | | | | |

Net income | | $ | 36,080 | | $ | 31,143 | | $ | 97,124 | | $ | 80,069 |

| | | | | | | | | | | | |

SFAS No. 131 also requires that certain enterprise-wide disclosures be made related to products and services, geographic areas and significant customers. During the three and nine months ended September 30, 2006 and 2005, the Company derived its sales from the following geographies (as a percentage of net sales):

| | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2006 | | 2005 | | 2006 | | 2005 |

United States | | 89% | | 90% | | 89% | | 90% |

International | | 11% | | 10% | | 11% | | 10% |

| | | | | | | | |

| | 100% | | 100% | | 100% | | 100% |

| | | | | | | | |

During the three and nine months ended September 30, 2006 and the three months ended September 30, 2005, no customer represented 10% or more of consolidated net sales. During the nine months ended September 30, 2005, net sales to one customer within the Company’s domestic diagnostic products business represented 11% of consolidated net sales.

The Company operates manufacturing facilities in the United States and Costa Rica and has several offices, primarily for sales and distribution, throughout the world. Property and equipment is primarily located within the domestic diagnostic products segment in the United States.

The following table summarizes the Company’s intangible assets, by segment:

| | | | | | | | | |

| | | Patents and

Developed

Technology,

net | | Goodwill | | Total Intangible

Assets |

| | | (in thousands) |

September 30, 2006 | | | | | | | | | |

Domestic diagnostic products | | $ | 12,179 | | $ | 85,817 | | $ | 97,996 |

Domestic surgical products | | | 148,348 | | | 260,170 | | | 408,518 |

International | | | 24,391 | | | 39,004 | | | 63,395 |

| | | | | | | | | |

| | $ | 184,918 | | $ | 384,991 | | $ | 569,909 |

| | | | | | | | | |

December 31, 2005 | | | | | | | | | |

Domestic diagnostic products | | $ | 13,263 | | $ | 85,817 | | $ | 99,080 |

Domestic surgical products | | | 154,194 | | | 263,948 | | | 418,142 |

International | | | 25,115 | | | 39,620 | | | 64,735 |

| | | | | | | | | |

| | $ | 192,572 | | $ | 389,385 | | $ | 581,957 |

| | | | | | | | | |

16

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

Amortization expense related to identifiable intangible assets that will continue to be amortized during the three and nine months ended September 30, 2006 and 2005 was as follows:

| | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2006 | | 2005 | | 2006 | | 2005 |

Domestic diagnostic products | | $ | 361 | | $ | 368 | | $ | 1,084 | | | 1,103 |

Domestic surgical products | | | 2,109 | | | 1,465 | | | 5,846 | | | 3,344 |

International | | | 280 | | | — | | | 724 | | | — |

| | | | | | | | | | | | |

| | $ | 2,750 | | $ | 1,833 | | $ | 7,654 | | $ | 4,447 |

| | | | | | | | | | | | |

(11) Commitments and Contingencies

Commitments:

Earn-out Payments— Part of the purchase price for Proxima includes contingent earn-out payments tied to future performance milestones (see Note 2).

Credit Agreement— On June 30, 2006, the Company entered into a five-year Credit Agreement (the “Credit Agreement”) with JPMorgan Chase Bank, National Association, as Administrative Agent, Bank of America, N.A., as Syndication Agent and a syndicate of four other lenders. The Credit Agreement provided for a $150 million senior unsecured revolving credit facility. On October 6, 2006, the Company and its related lenders amended the Credit Agreement in order to, among other items, increase the committed amount of the revolving credit facility to $345 million, include one additional lender into the syndicate of lenders, and name SunTrust Bank as the new Administrative Agent. The Company may request an increase in available borrowings under the Credit Agreement by an additional amount of up to $155 million (for a maximum amount of $500 million) upon satisfaction of certain conditions. These increased borrowings may be provided either by one or more existing lenders, upon the Company obtaining the agreement of such lender(s) to increase commitments or by new lenders being added to the credit facility. The loan proceeds are available to be used by the Company and its subsidiaries to finance working capital needs and for general corporate purposes, including certain permitted business acquisitions. Four of the Company’s wholly-owned subsidiaries are guarantors under the Credit Agreement.

Amounts under the Credit Agreement may be borrowed, repaid and re-borrowed by the Company from time to time until the maturity of the Credit Agreement on June 30, 2011. Voluntary prepayments and commitment reductions requested by the Company under the Credit Agreement are permitted at any time without penalty (other than customary breakage costs relating to the prepayment of any drawn loans) upon proper notice and subject to a minimum dollar requirement. Borrowings under the Credit Agreement bear interest at a floating rate, which will be, at the Company’s option, either LIBOR plus an applicable margin (which is subject to adjustment based on financial ratios), or a base rate.

The Credit Agreement requires the Company to comply with maximum leverage and minimum fixed charge coverage ratios. The Credit Agreement contains affirmative and negative covenants, including limitations on additional debt, liens, certain investments, and acquisitions outside of the healthcare business. The Credit Agreement also includes events of default customary for facilities of this type. Upon the occurrence of an event of default, all outstanding loans may be accelerated and/or the lenders’ commitments terminated.

As of September 30, 2006, the Company had no balance outstanding under this Credit Agreement.

Bridge Loan Agreement— In addition to the Credit Agreement entered into on June 30, 2006, in September 2006 the Company entered into a bridge loan agreement with a financial institution for an amount of up to $150 million to be used solely for the acquisition of shares of Vision Systems Limited (see Note 14). No amounts have been borrowed under this arrangement.

Lease Commitment— On July 11, 2006, the Company signed a non-cancelable lease agreement for a building with approximately 146,000 square feet located in Marlborough, Massachusetts, to be principally used as an additional manufacturing facility. As part of the lease agreement, the lessor agreed to allow the Company to make significant renovations to the facility to prepare the facility for the Company’s manufacturing needs. The Company is responsible for a significant amount of the construction costs and therefore was deemed under GAAP to be the owner of the building during the construction period, in accordance with Emerging Issues Task Force (“EITF”) No. 97-10,The Effect of Lessee Involvement in Asset Construction.During the three months ended September 30, 2006, the Company recorded the fair market value of the facility of $13.2 million within property and equipment on its condensed consolidated balance sheet, with an offsetting increase to current and non-current liabilities. The Company plans to begin occupying the facility during the first quarter of 2007. As of September 30, 2006, significant construction had not yet occurred. During the construction period, the Company will capitalize the interest expense related to the lease obligation and amounts to be paid for construction will be recorded as construction in progress until construction is complete.

At the completion of the construction period, the Company will review the lease for potential sale-leaseback treatment in accordance with SFAS No. 98,Accounting for Leases: Sale-Leaseback Transactions Involving Real Estate, Sales-Type Leases of Real Estate, Definition of the Lease Term, and Initial Direct Costs of Direct Financing Leases—an amendment of FASB Statements No. 13,

17

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

66, and 91 and a rescission of FASB Statement No. 26 and Technical Bulletin No. 79-11. However, based on its preliminary analysis, the Company determined that the lease will not qualify for sale-leaseback treatment. Therefore, the building, improvements and associated liabilities will remain on the Company’s financial statements throughout the lease term. The building and tenant improvements will be depreciated on a straight line basis over their estimated useful lives.

The term of the lease is for a period of approximately 12 years commencing on October 1, 2006.

Future minimum lease payments under this lease are as follows:

| | | |

| | | Amount |

| | | (in thousands) |

Remaining three months ending December 31, 2006 | | $ | 32 |

Year ending December 31, 2007 | | | 588 |

Year ending December 31, 2008 | | | 924 |

Year ending December 31, 2009 | | | 939 |

Year ending December 31, 2010 | | | 982 |

Thereafter | | | 8,895 |

| | | |

| | $ | 12,360 |

| | | |

Contingencies— On November 17, 2003, DEKA Products Limited Partnership (“DEKA”) initiated arbitration proceedings against Cytyc alleging that Cytyc underpaid royalties due to DEKA pursuant to a cross-license agreement entered into in 1993 (the “1993 DEKA Agreement”). The dispute concerned the method of calculating royalties on the sale of the single use disposable ThinPrep Pap Test kit. In March 2005, the arbitration panel issued a partial final award in which it agreed with DEKA’s interpretation of the 1993 DEKA Agreement and on April 26, 2005, issued its final decision which Cytyc appealed. Cytyc recorded a pre-tax charge in the three months ended March 31, 2005 in the amount of $7.8 million, which was in addition to the $1.3 million previously recorded. Subsequently, each month, Cytyc recorded an accrual for the difference between the quarterly payments to DEKA and the amounts calculated pursuant to the arbitration panel decision. As a result of a final decision of the United States Court of Appeals for the First Circuit in February 2006, the Company paid DEKA $11.4 million. Prospectively, the Company will pay DEKA a one percent royalty on applicable net sales of ThinPrep Pap Test disposable components; however, this royalty is not expected to be material to the Company’s future operating results or financial position.

On June 16, 2003, Cytyc filed a suit for Declaratory Judgment in United States District Court for the District of Massachusetts asking the court to determine and declare that certain of TriPath Imaging, Inc.’s (“TriPath”) patents are invalid and not infringed by the Company’s ThinPrep Imaging System. On June 17, 2003, TriPath announced that it had filed a lawsuit against the Company in the United States District Court for the Middle District of North Carolina alleging patent infringement, false advertising, defamation, intentional interference, unfair competition, and unfair and deceptive trade practices. The non-patent claims have been dismissed and the patent cases have since been consolidated into a single action. A hearing occurred on August 2, 2006 in the United States District Court for the District of Massachusetts to hear oral arguments on summary judgment motions. The Company continues to believe that the claims against it are without merit and intends to vigorously defend this suit. Given the stage and current status of the litigation, the Company is unable to reasonably estimate the ultimate outcome of this case.

The Company is also involved in ordinary, routine litigation incidental to its business. Although the outcomes of these other lawsuits and claims are uncertain, management does not believe that, individually or in the aggregate, these other lawsuits and claims will have a material adverse effect on the Company’s business, financial condition, results of operations or liquidity.

(12) Income Taxes

During the three months ended September 30, 2006, the Company completed tax audits that resulted in the recognition of a tax benefit of approximately $2 million, which resulted in a decrease of the Company’s effective tax rate for the three and nine months ended September 30, 2006. The Company’s effective tax rate for the three and nine months ended September 30, 2006 was 32.4% and 35.0%, respectively, and for the three and nine months ended September 30, 2005 was 36.5%.

(13) Recent Accounting Pronouncements

In June 2006, the FASB issued FASB Interpretation No.48,Accounting for Uncertainty in Income Taxes - an interpretation of FASB Statement No. 109, which clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements in accordance with FASB Statement No. 109,Accounting for Income Taxes. FIN No. 48 prescribes a recognition threshold

18

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

and measurement criteria for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. FIN No. 48 also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure, and transition and defines the criteria that must be met for the benefits of a tax position to be recognized. The provisions of FIN No. 48 are effective on January 1, 2007, with the cumulative effect of the change in accounting principle recorded as an adjustment to opening retained earnings. The Company is evaluating the impact of adopting FIN No. 48 on its financial statements.

In September 2006, the FASB issued SFAS No. 157,Fair Value Measurements. Among other requirements, SFAS No. 157 defines fair value and establishes a framework for measuring fair value and also expands disclosure requirements regarding fair value measurements. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those years. The Company is evaluating the impact of adopting SFAS No. 157 on its financial statements.

In September 2006, the SEC issued SAB No. 108,Considering the Effects of Prior Year Misstatements When Quantifying Misstatements in Current Year Financial Statements, which provides interpretive guidance on how the effects of the carryover or reversal of prior year misstatements should be considered in quantifying a current year misstatement. SFAS No. 108 is effective for fiscal years ending after November 15, 2006. The Company does not believe SAB No. 108 will have any impact on its financial statements.

(14) Subsequent Events

In October 2006, the Company began acquiring shares of Vision Systems Limited (“Vision”), an Australia-based, worldwide developer and manufacturer of instruments and reagents for anatomical pathology, pursuant to a cash tender offer at a per share purchase price of 3.25 Australian dollars (approximately US$2.45). As of November 3, 2006, the Company had acquired approximately 25 million shares of Vision for a total cost of approximately US$61 million. Such investment represents ownership of approximately 12% of Vision’s fully diluted shares. In October 2006, another company announced its intent to offer Vision shareholders a price of 3.75 Australian dollars per share; however, Cytyc has announced its intent to maintain its offer price. Therefore, Cytyc’s current offer of 3.25 Australian dollars remains open for Vision shareholders to accept. The Company is considering its alternatives relating to this investment. Should the Company be successful in acquiring 100% of outstanding Vision shares, the total consideration would be approximately US$520 million.

On October 25, 2006, the Company acquired Helica Instruments Limited (“Helica”), net of certain assets. This acquisition included the Helica Thermal Coagulator (“HTC”) System, and all related intellectual property, developed and manufactured by Helica, a privately held company based in Edinburgh, Scotland. The HTC System is used by obstetricians and gynecologists for the treatment of endometriosis. The Company intends to develop a second-generation product for worldwide product launch estimated to occur in 2008. Under the terms of the agreement, the Company made an up-front cash payment of $1 million to Helica. Within two years or upon commercialization by the Company of the second-generation product, the Company will pay Helica an additional $2 million (“Commercialization Milestone Payment”). After making the Commercialization Milestone Payment, the Company will make contingent earn-out payments tied to future performance milestones. The contingent earn-out payments are based on sales of the second-generation product for the two year period following the Commercialization Milestone Payment. Total consideration under the agreement will not exceed $9 million.

19

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion should be read in conjunction with our consolidated financial statements and the related notes appearing in our annual report on Form 10-K for the year ended December 31, 2005. Our discussion contains forward-looking statements that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those referred to or set forth below under Part II. Item 1A. “Risk Factors”.

Overview

Cytyc Corporation is a diversified cancer and women’s health company that designs, develops, manufactures, and markets innovative and clinically effective products. Our products cover a range of cancer and women’s health applications, including cervical cancer screening, treatment of excessive menstrual bleeding, radiation treatment of early-stage breast cancer, breast cancer risk assessment and radiation treatment of patients with malignant brain tumors. We operate our business in three segments: domestic diagnostic products, domestic surgical products and international. Our domestic diagnostics products segment develops and markets the ThinPrep® System in the United States primarily for use in cytology testing applications focused on women’s health, such as cervical cancer screening. Our domestic surgical products segment manufactures the NovaSure® System, an innovative endometrial ablation device to treat menorrhagia, or excessive menstrual bleeding, the MammoSite® Radiation Therapy System, a device for the treatment of breast cancer that positions radiation sources directly into the post-lumpectomy site to optimize radiation treatment delivery while minimizing damage to healthy tissue, and the GliaSite® Radiation Therapy System for the treatment of malignant brain tumors. The domestic surgical products segment markets these products in the United States. Our international segment markets our diagnostic and surgical products outside of the United States.

Critical Accounting Estimates

Our discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, sales and expenses, and related disclosure of contingent assets and liabilities. A “critical accounting estimate” is one which is both important to the portrayal of our financial condition and results and requires management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain. We continuously evaluate our critical accounting estimates. We base our estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

Valuation of Long-Lived Assets, Intangibles and Goodwill. Tangible and intangible assets acquired in a business combination, including acquired in-process research and development, are recorded under the purchase method of accounting at their estimated fair values at the date of acquisition. The fair values of acquired assets are determined by management using relevant information and assumptions and assisted, in certain situations, by independent appraisers. Fair value of acquired intangible assets is generally calculated as the present value of estimated future cash flows using a risk-adjusted discount rate, which requires significant management judgment with respect to sales and expense growth rates, analyses of project accomplishments, assessment of overall contributions, project risks and the selection and use of an appropriate discount rate. Amortization of all our intangible assets with defined lives, including those acquired individually, is calculated either using the straight-line or cash flow method. The cash flow method requires management’s estimate of net cash flows over the life of the intangible asset, reflecting the pattern in which the economic benefits of the intangible asset are expected to be consumed, and is subject to change.

We assess the impairment of long-lived assets, identifiable intangible assets and goodwill whenever events or changes in circumstances indicate that the carrying value may not be recoverable and at least annually in the case of goodwill. If it is determined that the carrying value of long-lived assets, intangible assets or goodwill might not be recoverable based upon the existence of one or more indicators of impairment, we would measure any impairment based on a projected discounted cash flow method if the undiscounted cash flows did not exceed the carrying value of such assets. No such impairment charges have been recorded to date. We are required to perform an impairment review for goodwill on an annual basis, or earlier if indicators of potential impairment exist. Based on our impairment review during 2006, the carrying amount of goodwill did not exceed its fair value and, accordingly, no impairment was recorded. At September 30, 2006, we had $569.9 million of net intangible assets, of which $385.0 million represented goodwill. An impairment of our intangible assets could result in a material, non-cash expense in our consolidated statement of income.

Income Taxes and Deferred Taxes. We file income tax returns in eleven countries as well as many states and other localities. We must estimate our income tax expense after considering, among other factors, differing tax rates between jurisdictions, allocation factors, tax credits, non-deductible items and changes in enacted tax rates. Deferred taxes arise because of the different treatment

20