UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2007

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (NO FEE REQUIRED) |

For the transition period from to

Commission File Number 0-27558

CYTYC CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| DELAWARE | | 02-0407755 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

250 Campus Drive, Marlborough, MA 01752

(Address of principal executive offices, including Zip Code)

(508) 263-2900

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: The number of shares of the issuer’s Common Stock, $0.01 par value per share, outstanding as of May 16, 2007 was 115,229,382.

Total Number of Pages: 36

Exhibit index located on page 36

CYTYC CORPORATION

INDEX TO FORM 10-Q

2

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Cytyc Corporation

250 Campus Drive

Marlborough, Massachusetts

We have reviewed the accompanying condensed consolidated balance sheet of Cytyc Corporation and subsidiaries as of March 31, 2007, and the related condensed consolidated statements of (loss) income and cash flows for the three-month periods ended March 31, 2007 and 2006. These interim financial statements are the responsibility of the Company’s management.

We conducted our reviews in accordance with standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with standards of the Public Company Accounting Oversight Board (United States), the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

Based on our reviews, we are not aware of any material modifications that should be made to such condensed consolidated interim financial statements for them to be in conformity with accounting principles generally accepted in the United States of America.

As discussed in Note 12 to the condensed consolidated financial statements, the Company adopted FASB Interpretation No. 48,Accounting for Uncertainty in Income Taxes,on January 1, 2007.

We have previously audited, in accordance with standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of Cytyc Corporation and subsidiaries as of December 31, 2006, and the related consolidated statements of income, stockholders’ equity, and cash flows for the year then ended (not presented herein); and in our report dated March 1, 2007 (May 18, 2007 as to the effects of the restatement discussed in Note 15) we expressed an unqualified opinion and included explanatory paragraphs relating to the restatement of the Company’s consolidated financial statements and the adoption of Statement of Financial Standards No. 123(R),Share-Based Payment on January 1, 2006. In our opinion, the information set forth in the accompanying condensed consolidated balance sheet as of December 31, 2006 is fairly stated, in all material respects, in relation to the consolidated balance sheet from which it has been derived.

/s/ Deloitte & Touche LLP

Boston, Massachusetts

May 18, 2007

3

Part I FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

CYTYC CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share amounts)

(unaudited)

| | | | | | | | |

| | | March 31,

2007 | | | December 31,

2006 | |

| ASSETS | | | | | | | | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | $ | 132,781 | | | $ | 140,680 | |

Investment securities | | | 63,471 | | | | 157,030 | |

Accounts receivable, net of allowance of $2,050 and $1,951 at March 31, 2007 and December 31, 2006, respectively | | | 110,306 | | | | 94,943 | |

Inventories, net | | | 32,353 | | | | 29,503 | |

Deferred tax assets | | | 26,171 | | | | 9,065 | |

Prepaid expenses and other current assets | | | 6,419 | | | | 5,932 | |

| | | | | | | | |

Total current assets | | | 371,501 | | | | 437,153 | |

| | | | | | | | |

Property and equipment, net | | | 150,737 | | | | 149,007 | |

| | | | | | | | |

Intangible assets: | | | | | | | | |

Patents and developed technology, net of accumulated amortization of $27,490 and $23,914 at March 31, 2007 and December 31, 2006, respectively | | | 321,701 | | | | 182,477 | |

Goodwill | | | 595,011 | | | | 386,533 | |

| | | | | | | | |

Total intangible assets | | | 916,712 | | | | 569,010 | |

| | | | | | | | |

Other assets, net | | | 9,302 | | | | 9,544 | |

| | | | | | | | |

Total assets | | $ | 1,448,252 | | | $ | 1,164,714 | |

| | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

Current liabilities: | | | | | | | | |

Accounts payable | | $ | 17,703 | | | $ | 12,514 | |

Accrued expenses | | | 139,358 | | | | 56,688 | |

Deferred revenue | | | 5,195 | | | | 4,935 | |

Line-of-credit | | | 200,508 | | | | — | |

| | | | | | | | |

Total current liabilities | | | 362,764 | | | | 74,137 | |

| | | | | | | | |

Deferred tax liabilities, net | | | 91,707 | | | | 64,145 | |

| | |

Long-term debt | | | 250,000 | | | | 250,000 | |

| | |

Other non-current liabilities | | | 25,251 | | | | 17,459 | |

| | |

Commitments and contingencies (Note 11) | | | | | | | | |

| | |

Stockholders’ equity: | | | | | | | | |

Preferred stock, $0.01 par value—Authorized—5,000,000 shares No shares issued or outstanding | | | — | | | | — | |

Common stock, $0.01 par value—Authorized—400,000,000 shares Issued— 137,382,152 and 136,305,345 shares in 2007 and 2006, respectively Outstanding— 115,229,382 and 114,726,133 shares in 2007 and 2006, respectively | | | 1,374 | | | | 1,363 | |

Additional paid-in capital | | | 700,756 | | | | 673,168 | |

Treasury stock, at cost: 22,152,770 and 21,579,212 shares in 2007 and 2006, respectively | | | (332,607 | ) | | | (316,153 | ) |

Accumulated other comprehensive income | | | 3,070 | | | | 2,956 | |

Retained earnings | | | 345,937 | | | | 397,639 | |

| | | | | | | | |

Total stockholders’ equity | | | 718,530 | | | | 758,973 | |

| | | | | | | | |

Total liabilities and stockholders’ equity | | $ | 1,448,252 | | | $ | 1,164,714 | |

| | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

CYTYC CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF (LOSS) INCOME

(in thousands, except per share data)

(unaudited)

| | | | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2007 | | | 2006 | |

Net sales | | $ | 168,884 | | | $ | 140,540 | |

Cost of sales | | | 42,096 | | | | 29,789 | |

| | | | | | | | |

Gross profit | | | 126,788 | | | | 110,751 | |

| | | | | | | | |

Operating expenses: | | | | | | | | |

Research and development | | | 9,692 | | | | 10,311 | |

Sales and marketing | | | 41,169 | | | | 40,133 | |

General and administrative | | | 19,448 | | | | 14,025 | |

In-process research and development | | | 89,500 | | | | — | |

| | | | | | | | |

Total operating expenses | | | 159,809 | | | | 64,469 | |

| | | | | | | | |

(Loss) income from operations | | | (33,021 | ) | | | 46,282 | |

Other income (expense), net: | | | | | | | | |

Interest income | | | 2,629 | | | | 1,830 | |

Interest expense | | | (2,394 | ) | | | (1,792 | ) |

Other | | | 772 | | | | (77 | ) |

| | | | | | | | |

Total other income (expense), net | | | 1,007 | | | | (39 | ) |

| | | | | | | | |

(Loss) income before provision for income taxes | | | (32,014 | ) | | | 46,243 | |

Provision for income taxes | | | 19,195 | | | | 16,879 | |

| | | | | | | | |

Net (loss) income | | $ | (51,209 | ) | | $ | 29,364 | |

| | | | | | | | |

Net (loss) income per common share and potential common share: | | | | | | | | |

Basic | | $ | (0.45 | ) | | $ | 0.25 | |

| | | | | | | | |

Diluted | | $ | (0.45 | ) | | $ | 0.24 | |

| | | | | | | | |

Weighted average common and potential common shares outstanding: | | | | | | | | |

Basic | | | 114,725 | | | | 115,481 | |

Diluted | | | 114,725 | | | | 125,877 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

CYTYC CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| | | | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2007 | | | 2006 | |

Cash flows from operating activities: | | | | | | | | |

Net (loss) income | | $ | (51,209 | ) | | $ | 29,364 | |

| | |

Adjustments to reconcile net (loss) income to net cash provided by operating activities: | | | | | | | | |

| | |

Revenue relating to license issued in exchange for preferred stock | | | — | | | | (387 | ) |

Stock-based compensation expense | | | 4,352 | | | | 6,025 | |

Compensation expense related to issuance of stock to directors and executives | | | — | | | | 395 | |

Depreciation and amortization of property and equipment | | | 8,171 | | | | 5,246 | |

Amortization of intangible assets | | | 3,576 | | | | 2,397 | |

Amortization of deferred financing costs | | | 465 | | | | 386 | |

Acquired in-process research and development | | | 89,500 | | | | — | |

Gain on equity investments | | | (496 | ) | | | — | |

Loss on disposal of fixed assets | | | 267 | | | | — | |

Provision for doubtful accounts | | | 123 | | | | 73 | |

Tax benefit from exercise of stock options | | | 2,381 | | | | 1,507 | |

Deferred tax expense | | | 3,450 | | | | 5,200 | |

Changes in assets and liabilities, excluding effects of acquisitions: | | | | | | | | |

Accounts receivable | | | (6,656 | ) | | | 1,384 | |

Inventories | | | (1,925 | ) | | | (2,833 | ) |

Prepaid expenses and other current assets | | | (8 | ) | | | 1,076 | |

Accounts payable | | | 3,033 | | | | 2,682 | |

Accrued expenses | | | 1,400 | | | | (12,046 | ) |

Deferred revenue | | | 204 | | | | 698 | |

| | | | | | | | |

Net cash provided by operating activities | | | 56,628 | | | | 41,167 | |

| | | | | | | | |

Cash flows from investing activities: | | | | | | | | |

Acquisition of Adeza Biomedical Corporation, net of cash acquired | | | (365,017 | ) | | | — | |

Acquisition of Adiana, Inc., net of cash acquired | | | (58,096 | ) | | | — | |

Acquisition of Proxima Therapeutics, Inc. | | | (3,613 | ) | | | (21,074 | ) |

Increase (decrease) in other assets | | | 164 | | | | (463 | ) |

Increase in equipment under customer usage agreements | | | (5,199 | ) | | | (7,254 | ) |

Purchases of property and equipment | | | (3,549 | ) | | | (4,118 | ) |

Increase in patents and developed technology | | | — | | | | (473 | ) |

Purchases of investment securities | | | (128,640 | ) | | | (23,425 | ) |

Proceeds from sales and maturities of investment securities | | | 294,828 | | | | 20,097 | |

| | | | | | | | |

Net cash used in investing activities | | | (269,122 | ) | | | (36,710 | ) |

| | | | | | | | |

Cash flows from financing activities: | | | | | | | | |

Proceeds from line-of-credit | | | 200,508 | | | | — | |

Purchase of treasury shares | | | (16,454 | ) | | | (22,269 | ) |

Proceeds from exercise of stock options | | | 18,832 | | | | 15,292 | |

Excess tax benefit from exercise of stock options | | | 2,018 | | | | 1,354 | |

| | | | | | | | |

Net cash provided by (used in) financing activities | | | 204,904 | | | | (5,623 | ) |

| | | | | | | | |

Effect of exchange rate changes on cash | | | (309 | ) | | | (10 | ) |

| | | | | | | | |

Net decrease in cash and cash equivalents | | | (7,899 | ) | | | (1,176 | ) |

Cash and cash equivalents, beginning of period | | | 140,680 | | | | 123,468 | |

| | | | | | | | |

Cash and cash equivalents, end of period | | $ | 132,781 | | | $ | 122,292 | |

| | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

The accompanying condensed consolidated financial statements of Cytyc Corporation and subsidiaries (the “Company” or “Cytyc”) have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) have been condensed or omitted pursuant to such rules and regulations. These financial statements should be read in conjunction with the financial statements and notes included in Amendment No. 2 to the Company’s Annual Report on Form 10-K/A for the year ended December 31, 2006.

The notes and accompanying condensed consolidated financial statements are unaudited. The information furnished reflects all adjustments, which, in the opinion of management, are necessary for a fair presentation of results for the interim periods. Such adjustments consisted only of normal recurring items. The interim periods are not necessarily indicative of the results expected for the full year or any future period.

The preparation of these condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of net sales and expenses during the reporting period. Actual results could differ from those estimates.

| | (a) | Acquisition of Adeza Biomedical Corporation |

On February 11, 2007, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Augusta Medical Corporation, a Delaware corporation and a newly-formed wholly-owned subsidiary of Cytyc (the “Purchaser”), and Adeza Biomedical Corporation, a Delaware corporation (“Adeza”). Pursuant to the Merger Agreement, the Purchaser commenced a cash tender offer to purchase all outstanding shares of Adeza’s common stock (the “Shares”) in exchange for $24.00 per share in cash (the “Offer Price”). On March 19, 2007, Purchaser acquired a majority of Adeza’s outstanding Shares through the tender offer. On April 2, 2007, pursuant to the terms of the Merger Agreement, Cytyc acquired Adeza through the merger (the “Merger”) of Purchaser with and into Adeza. The Merger was consummated without a meeting of the stockholders of Adeza in accordance with the Delaware General Corporation Law. In connection with the Merger, Adeza’s name was changed from “Adeza Biomedical Corporation” to “Cytyc Prenatal Products Corp.” As a result of the Merger, all remaining outstanding Shares were converted into the right to receive $24.00 per share in cash, without interest, other than Shares held by Cytyc or any of its subsidiaries or Shares held by Adeza stockholders that perfect their rights to appraisal in accordance with the Delaware General Corporation Law. The purchase price was paid out of the Company’s existing cash and the Company’s existing credit facility.

The aggregate purchase price for Adeza was $456.7 million, of which $451.7 million represented cash payable to Adeza shareholders and $5.0 million represented acquisition-related fees and expenses. As of March 31, 2007, we paid $365.0 million of the purchase price (net of $26.3 million of cash acquired) and have $65.4 million accrued related to the Adeza acquisition, most of which was paid during April 2007. The acquisition was accounted for as a purchase in accordance with Statement of Financial Accounting Standards (“SFAS”) No. 141, Business Combinations, and accordingly, the results of operations of Adeza were included in the consolidated statement of loss from the date of acquisition of March 19, 2007. The purchase price was supported by estimates of future sales and earnings of Adeza, as well as the value of sales force and other projected synergies.

7

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

Purchase Price Allocation

The following table summarizes the preliminary fair values of the assets acquired and liabilities assumed at the date of acquisition, for an aggregate purchase price of $456.7 million, including acquisition costs:

| | | | |

| | | Amount

(in thousands) | |

Cash and cash equivalents | | $ | 26,346 | |

Investment securities | | | 72,019 | |

Other current assets | | | 10,865 | |

Property and equipment | | | 431 | |

Patents and developed technology | | | 142,800 | |

Goodwill | | | 208,451 | |

Other assets | | | 72 | |

Current liabilities | | | (19,676 | ) |

Long-term liabilities | | | (1,251 | ) |

Net deferred tax liability | | | (26,881 | ) |

In-process research and development | | | 43,500 | |

| | | | |

| | $ | 456,676 | |

| | | | |

As part of the purchase price allocation, all tangible and intangible assets and liabilities were identified and valued. Of the total purchase price, the Company allocated $61.9 million to acquired net tangible assets. The net deferred tax liability of $26.9 million is primarily comprised of $30.2 million of deferred tax assets relating to acquired net operating losses primarily related to net operating loss carry forwards and tax credits, offset by deferred tax liabilities of $57.1 million relating to patents and developed technology. The Company determined the fair value of Adeza’s tangible assets and liabilities based on a review of Adeza’s historical and then current financial statements and an understanding of the ongoing nature of the assets and liabilities.

The Company also allocated $142.8 million to the acquired patents and developed technology. The acquired patents expire at various dates through 2018. Based on the average life of the patent portfolio, the remaining economic life of the developed technology is expected to be approximately 12-15 years. The Company is amortizing the patents and developed technology over this period using the cash flow method, under which amortization is calculated and recognized based upon the Company’s estimated net cash flows over the life of the intangible asset, reflecting the pattern in which the economic benefits of the intangible asset are consumed in accordance with SFAS No. 142,Goodwill and Other Intangible Assets. The Company believes the patents provide sufficient coverage for differentiated products to sustain some competitive advantage in the marketplace over the average remaining life of the patents.

The Company also allocated $43.5 million of the purchase price to in-process research and development projects. This allocation represents the estimated fair value based on risk-adjusted cash flows related to the incomplete research and development activities. The incomplete research and development activities primarily were associated with Adeza’s development of Gestiva™, a therapeutic drug, which is currently pending final approval from the Food and Drug Administration (“FDA”), as well as an induction of labor diagnostic product.

The acquired in-process research and development was charged to expense as of the date of the acquisition and is included in the Company’s statement of loss for the three months ended March 31, 2007.

The Company valued the intangible assets acquired, including the portfolio of patents and technologies, and the in-process research and development projects, based on present value calculations of income using risk-adjusted cash flows for each product, an analysis of project accomplishments and remaining outstanding items, an assessment of overall contributions, as well as project risks. The value assigned to the in-process research and development projects was determined by estimating the costs to develop the acquired technology into commercially viable products, estimating the net cash flows resulting from the projects, and discounting the net cash flows to their present value. The Company expects to continue its efforts on the in-process research and development projects through the end of 2008.

The projections used to value the acquired intangible assets and the in-process research and development projects were based on estimates of relevant market sizes and growth factors, expected trends in technology, and the nature and expected timing of new

8

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

product introductions by the Company and its competitors, as well as estimates of cost of sales, operating expenses, and income taxes resulting from the acquired products and the in-process research and development projects. In addition, the projections reflect the Company’s expectation that improvements to the current products will continue to be made over the life cycle of the product lines. As a result, the completed technology that existed as of the acquisition date was assumed to represent a declining percentage of the products’ technological composition over time.

The rate utilized to discount the net cash flows to their present value was based on estimated weighted-average cost of capital calculations. A discount rate of 14% was used to value the acquired intangible assets and the in-process research and development projects. This discount rate was higher than the Company’s weighted-average cost of capital due to the earlier-stage life cycles of the acquired products, the inherent uncertainties surrounding the outcome of the projects and commercialization and development of the acquired intangible assets, the useful life of the acquired technology, the profitability levels of such technology, and the uncertainty of technological advances that were unknown at that time.

The allocation of the purchase price is substantially complete, with the remaining allocation to be completed primarily related to the resolution of tax matters.

Goodwill

The excess of the purchase price over the fair value of tangible and identifiable intangible net assets, as well as the in-process research and development projects, was allocated to goodwill, which is non-deductible for tax purposes and totaled $208.5 million. In accordance with SFAS No. 142, this goodwill will not be systematically amortized. Instead, the Company will perform an annual assessment for impairment by applying a fair-value-based test.

Pro Forma Results

The following unaudited pro forma financial information for the three months ended March 31, 2007 and 2006 presents the combined results of operations of Cytyc and Adeza as if the acquisition had occurred as of the beginning of each period presented.

Pro forma results for the three months ended March 31, 2007 and 2006 are as follows:

| | | | | | |

| | | Three Months Ended March 31, |

| | | 2007 | | 2006 |

| | | (in thousands, except per

share amounts) |

Net sales | | $ | 179,745 | | $ | 151,333 |

Net income | | $ | 32,117 | | $ | 27,250 |

| | |

Net income per common share: | | | | | | |

Basic | | $ | 0.28 | | $ | 0.24 |

| | | | | | |

Diluted | | $ | 0.27 | | $ | 0.23 |

| | | | | | |

Both periods include pro forma adjustments to reflect interest costs related to the borrowings on the line-of-credit facility (see Note 11). The pro forma results for the three months ended March 31, 2007 include $7.8 million of transaction fees and expenses incurred by Adeza prior to the acquisition related to the merger, but exclude $43.5 million of in-process research and development costs. The pro forma adjustments are based upon available information and certain assumptions that management believes are reasonable. The unaudited pro forma financial information is not intended to represent or be indicative of the consolidated results of operations or financial condition of the Company that would have been reported had the acquisition been completed as of the beginning of each period presented.

| | (b) | Acquisition of Adiana Inc. |

On March 16, 2007, the Company acquired Adiana, Inc. (“Adiana”), a privately-held company located in Redwood City, California, in a non taxable transaction. As a result of the acquisition of Adiana, all of its fully-diluted equity immediately prior to the acquisition was automatically converted into the right to receive an initial cash payment of $60 million, plus milestone payments. The milestone payments include (i) payment of up to $25 million tied to the timing of certain FDA milestone achievements of the Adiana permanent contraception product and (ii) potential contingent payments tied to future revenue performance milestones. The contingent payments are based on incremental sales growth of the Adiana permanent contraception product during the four-year period following FDA approval of this product and are subject to an aggregate cap of $130 million. No payments can be earned after December 31, 2012. According to the terms of the related merger agreement, total payments, including the initial cash payment, the potential FDA milestone payment and the four-year contingent payments, will not exceed $215 million.

9

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

The initial purchase price payment was paid out of the Company’s existing cash. Pursuant to the merger agreement, $3.0 million of the purchase price was placed in escrow to satisfy potential claims. The purchase price was supported by estimates of future sales and earnings of Adiana, as well as other projected synergies.

The aggregate purchase price for Adiana was $60.5 million, of which $59.4 million represented cash payable to Adiana shareholders and $1.1 million represented acquisition-related fees and expenses. As of March 31, 2007, we paid $58.1 million of the purchase price (net of $1.9 million of cash acquired) and have $0.5 million accrued related to the Adiana acquisition. The acquisition was accounted for as a purchase in accordance with SFAS No. 141, and accordingly, the results of operations of Adiana were included in the consolidated statement of loss from the date of acquisition.

Purchase Price Allocation

The following table summarizes the preliminary fair values of the assets acquired and liabilities assumed at the date of acquisition for an aggregate purchase price of $60.5 million, including acquisition costs:

| | | | |

| | | Amount

(in thousands) | |

Cash and cash equivalents | | $ | 1,931 | |

Other current assets | | | 210 | |

Property and equipment | | | 151 | |

Other assets | | | 18 | |

Net deferred tax asset | | | 19,973 | |

Current liabilities | | | (4,412 | ) |

Long-term liabilities | | | (3,401 | ) |

In-process research and development | | | 46,000 | |

| | | | |

| | $ | 60,470 | |

| | | | |

As part of the purchase price allocation, all tangible assets and liabilities were identified and valued. Of the total purchase price, the Company allocated $14.5 million to acquired net tangible assets. The net deferred tax asset of $20.0 million relates to acquired net operating losses and tax credits. The Company determined the fair value of Adiana’s tangible assets and liabilities based on a review of Adiana’s historical and then current financial statements and an understanding of the ongoing nature of the assets and liabilities.

The Company also allocated $46.0 million of the purchase price to an in-process research and development project. This allocation represents the estimated fair value based on risk-adjusted cash flows related to the incomplete research and development activities. The incomplete research and development activities are associated with the Adiana Complete Transcervical Sterilization System (“TCS”), a form of permanent female contraception intended as an alternative to tubal ligation, and primarily relate to activities to be performed in order to obtain FDA approval. The acquired in-process research and development was charged to expense as of the date of the acquisition and included in the Company’s statement of loss for the three months ended March 31, 2007.

The Company valued the in-process research and development project, based on present value calculations of income using risk-adjusted cash flows for, an analysis of project accomplishments and remaining outstanding items, an assessment of overall contributions, as well as project risks. The value assigned to the in-process research and development project was determined by estimating the costs to develop the acquired technology into a commercially viable product, estimating the net cash flows resulting from the project, and discounting the net cash flows to their present value. The Company expects to complete its efforts on the in-process research and development project in 2008.

The projections used to value the in-process research and development project were based on estimates of relevant market sizes and growth factors, expected trends in technology, and the nature and expected timing of new product introductions by the Company and its competitors, as well as estimates of cost of sales, operating expenses, and income taxes resulting from the in-process research and development project.

The rate utilized to discount the net cash flows to their present value was based on estimated weighted-average cost of capital calculations. A discount rate of 26% was used to value the in-process research and development project. The discount rate was higher

10

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

than the Company’s weighted-average cost of capital due to the early-stage life cycle of the in-process research and development project, the inherent uncertainties surrounding the commercialization and development of TCS, the useful life of the future product, the profitability levels of such technology, and the uncertainty of technological advances that were unknown at that time.

The excess of the fair value of tangible net assets over the purchase price of $3.2 million was allocated to expected contingent earn-out payments related to future milestones in accordance with SFAS No. 142 and recorded in long-term liabilities.

The initial allocation of the purchase price is substantially complete, with the remaining allocation to be completed primarily related to the resolution of tax matters.

The operating results of Adiana are not material to any periods presented and accordingly pro forma financial information is not presented.

| (3) | Amortization of Intangible Assets |

Amortization expense related to identifiable intangible assets, which consists of the Company’s acquired patents and developed technology, was approximately $3.6 million and $2.4 million for the three months ended March 31, 2007 and 2006, respectively (see Note 10 for amortization expense by operating segment). Prior to 2007, the Company allocated amortization of all of its intangible assets to research and development within its condensed consolidated statements of income as the developed technology has benefited multiple line items (i.e., cost of sales and research and development) and any allocation that would have been made to cost of sales was not deemed to be material. During 2007, the Company acquired a significant amount of developed technology ($142.8 million) as part of its acquisition of Adeza and is including the amortization of such developed technology within cost of sales based upon its intended use. For the amortization of its other developed technology, beginning in 2007, the Company is allocating the majority to cost of sales based upon its determination that such developed technology is primarily being used to generate sales of its products. A portion of the amortization expense also will be allocated to research and development based upon the Company’s determination that such developed technology is primarily being utilized to support the Company’s research and development efforts (e.g., FirstCyte Breast Test).

Amortization expense related to identifiable intangible assets, which is an estimate for each future year and subject to change, is as follows:

| | | |

| | | Amount |

| | | (in thousands) |

Remaining nine months ending December 31, 2007 | | $ | 16,691 |

Year ending December 31, 2008 | | | 25,975 |

Year ending December 31, 2009 | | | 29,435 |

Year ending December 31, 2010 | | | 29,259 |

Year ending December 31, 2011 | | | 28,003 |

Thereafter | | | 192,338 |

| | | |

Total | | $ | 321,701 |

| | | |

Investment securities at March 31, 2007 consist of commercial paper and municipal bonds as of and December 31, 2006 consist of only municipal bonds, all of which are classified as available-for-sale. The fair value of available-for-sale securities was determined based on quoted market prices at the reporting date for those securities. Available-for-sale securities are shown in the consolidated financial statements at fair market value with unrealized gains or losses recorded as a component of other comprehensive income.

11

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

At March 31, 2007 and December 31, 2006, the cost basis, aggregate fair value, and gross unrealized holding losses by major security type were as follows:

| | | | | | | | | | |

| | | Amortized Cost | | Gross Unrealized Holding Losses | | | Fair Value |

| | | (in thousands) |

March 31, 2007 | | | | | | | | | | |

Commercial paper (average maturity of 2.0 months) | | $ | 61,186 | | $ | (3 | ) | | $ | 61,183 |

Municipal bonds (average maturity of 0.6 months) | | | 2,288 | | | — | | | | 2,288 |

| | | | | | | | | | |

| | $ | 63,474 | | $ | (3 | ) | | $ | 63,471 |

| | | | | | | | | | |

December 31, 2006 | | | | | | | | | | |

Municipal bonds (average maturity of 0.7 months) | | $ | 157,030 | | $ | — | | | $ | 157,030 |

| | | | | | | | | | |

A significant portion of the Company’s investment portfolio was converted into cash and cash equivalents during the first quarter of 2007 to fund the Company’s acquisitions of Adeza and Adiana. The balance as of March 31, 2007 includes investment securities held by Adeza purchased as part of the acquisition.

| (5) | Other Balance Sheet Information |

Components of selected captions in the condensed consolidated balance sheets at March 31, 2007 and December 31, 2006 consisted of:

| | | | | | |

| | | March 31,

2007 | | December 31,

2006 |

| | | (in thousands) |

Inventories, net | | | | | | |

Raw material | | $ | 11,137 | | $ | 10,305 |

Work-in-process | | | 1,965 | | | 2,275 |

Finished goods | | | 19,251 | | | 16,923 |

| | | | | | |

| | $ | 32,353 | | $ | 29,503 |

| | | | | | |

Property and Equipment | | | | | | |

Property and equipment | | $ | 45,102 | | $ | 45,271 |

Equipment under customer usage agreements | | | 97,176 | | | 92,136 |

Computer equipment and software | | | 38,980 | | | 34,662 |

Furniture and fixtures | | | 5,558 | | | 5,186 |

Building | | | 20,736 | | | 20,401 |

Leasehold improvement | | | 14,452 | | | 14,350 |

Land | | | 3,224 | | | 3,224 |

Construction-in-process | | | 12,105 | | | 12,178 |

| | | | | | |

| | | 237,333 | | | 227,408 |

Less — accumulated depreciation and amortization | | | 86,596 | | | 78,401 |

| | | | | | |

| | $ | 150,737 | | $ | 149,007 |

| | | | | | |

Accrued Expenses | | | | | | |

Accrued compensation | | $ | 30,846 | | $ | 27,343 |

Accrued acquisitions (see Note 2) | | | 66,401 | | | 3,613 |

Accrued sales and marketing | | | 3,457 | | | 5,041 |

Accrued taxes | | | 15,987 | | | 9,174 |

Other accruals | | | 22,667 | | | 11,517 |

| | | | | | |

| | $ | 139,358 | | $ | 56,688 |

| | | | | | |

12

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

The Company records a liability for product warranty obligations at the time of sale based upon historical warranty experience. The term of the warranty is generally twelve months. Product warranty obligations are included in accrued expenses. Changes in the product warranty obligations for the three months ended March 31, 2007 and 2006 were as follows:

| | | | | | | | |

| | | Three Months Ended March 31, | |

| | | 2007 | | | 2006 | |

| | | (in thousands) | |

Balance, beginning of year | | $ | 381 | | | $ | 426 | |

New warranties | | | 269 | | | | 135 | |

Payments | | | (160 | ) | | | (83 | ) |

| | | | | | | | |

Balance, March 31 | | $ | 490 | | | $ | 478 | |

| | | | | | | | |

| (6) | Net (Loss) Income Per Common Share |

Basic net (loss) income per share is computed by dividing net (loss) income by the weighted average number of common shares outstanding. Diluted net income per share is computed by dividing net income by the weighted average number of common shares and potential common shares from outstanding stock options and convertible debt. As a result of the Company’s net loss during the three months ended March 31, 2007, all potential common shares from outstanding stock options and convertible debt, which totaled 10.3 million weighted average shares, were anti-dilutive and were excluded from the diluted net loss per share calculation. Potential common shares for outstanding stock options are calculated using the treasury stock method and represent incremental shares issuable upon exercise of the Company’s outstanding stock options. The treasury stock method is affected by the amount of stock-based compensation attributable to future services and therefore not yet recognized. The Company’s adoption of SFAS No. 123R,Share-Based Payment, on January 1, 2006, resulted in an increase in unrecognized stock-based compensation expense relating to unvested employee stock awards, which reduced the dilutive effect of assumed exercises of stock options for the three months ended March 31, 2006 by approximately two million shares. There was no such impact for the three months ended March 31, 2007, as the effect would have been anti-dilutive.

The following table provides a reconciliation of the net (loss) income and weighted average common shares used in calculating basic and diluted net (loss) income per share for the three months ended March 31, 2007 and 2006:

| | | | | | | |

| | | Three Months Ended March 31, |

| | | 2007 | | | 2006 |

| | | (in thousands, except per

share data) |

Numerator: | | | | | | | |

Net (loss) income, as reported, for basic earnings per share | | $ | (51,209 | ) | | $ | 29,364 |

Interest expense on convertible debt, net of tax | | | — | | | | 1,138 |

| | | | | | | |

Net (loss) income, as adjusted, for diluted earnings per share | | $ | (51,209 | ) | | $ | 30,502 |

| | | | | | | |

Denominator: | | | | | | | |

Basic weighted average common shares outstanding | | | 114,725 | | | | 115,481 |

Dilutive effect of assumed exercise of stock options | | | — | | | | 1,970 |

Dilutive effect of assumed conversion of convertible debt | | | — | | | | 8,426 |

| | | | | | | |

Weighted average common shares outstanding assuming dilution | | | 114,725 | | | | 125,877 |

| | | | | | | |

Basic net (loss) income per common share | | $ | (0.45 | ) | | $ | 0.25 |

| | | | | | | |

Diluted net (loss) income per common and potential common share | | $ | (0.45 | ) | | $ | 0.24 |

| | | | | | | |

For the three months ended March 31, 2007, diluted net loss per share excluded interest expense on convertible debt as well as the effect on weighted average diluted common shares outstanding of the assumed exercise of stock options and assumed conversion of convertible debt as such amounts would have been anti-dilutive. Diluted weighted average common shares outstanding for the three months ended March 31, 2006 excluded 50,875 potential common shares from stock options outstanding, because the exercise prices of such stock options were higher than the average closing price of the Company’s common stock as quoted on The NASDAQ Global Select Market during the period and, accordingly, their effect would be anti-dilutive.

13

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

| (7) | Stock-Based Compensation and Stock Incentive Plans |

| | (a) | Stock-Based Compensation |

In December 2004, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 123R, which requires all stock-based compensation to employees, including grants of employee stock options, to be recognized in the financial statements based on their fair values. The Company adopted SFAS No. 123R on January 1, 2006 using the modified prospective method and accordingly, prior period amounts have not been restated. In order to determine the fair value of stock options and employee stock purchase plan shares, the Company is using the Black-Scholes option pricing model and is applying the multiple-option valuation approach to the stock option valuation. The Company is recognizing stock-based compensation expense on a straight-line basis over the requisite service period of the awards for options granted following the adoption of SFAS No. 123R. For unvested stock options outstanding as of January 1, 2006, the Company will continue to recognize stock-based compensation expense using the accelerated amortization method prescribed in FASB Interpretation (“FIN”) No. 28,Accounting for Stock Appreciation Rights and Other Variable Stock Option or Award Plans.

Estimates of the fair value of equity awards will be affected by the future market price of the Company’s common stock, as well as the actual results of certain assumptions used to value the equity awards. These assumptions include, but are not limited to, the related income tax impact, the expected volatility of the common stock, the number of stock options to be forfeited and exercised by employees, and the expected term of options granted.

As noted above, the fair value of stock options and employee stock purchase plan shares is determined by using the Black-Scholes option pricing model and applying the multiple-option valuation approach to the stock option valuation. The options have graded-vesting on an annual basis over an average vesting period of four years. In applying the multiple-option approach, each option “tranche” is separately valued based upon when the tranche vests. The Company estimates the expected option term by calculating the average period of time before the employees exercise their options and adds this to the vesting period of each tranche. Historically, this period of time has averaged one year from the date the options vest. The expected term of employee stock purchase plan shares is the average of the remaining purchase periods under each offering period. For equity awards granted prior to the adoption of SFAS No. 123R, the volatility of the common stock was estimated using historical volatility. For equity awards granted since January 1, 2006, the volatility of the common stock is estimated using a combination of historical and implied volatility, as discussed in Staff Accounting Bulletin (“SAB”) No. 107,Considering the interaction between SFAS No. 123R and Certain Securities and ExchangeCommission Rules and Regulations. By using this combination, the Company is taking into consideration the historical realized volatility, as well as factoring in estimates of future volatility that the Company believes will differ from historical volatility as a result of the Company’s product diversification over the last two years, the market performance of the common stock, the volume of activity of the underlying shares, the availability of actively traded common stock options, and overall market conditions.

The risk-free interest rate used in the Black-Scholes option pricing model is determined by looking at historical U.S. Treasury zero-coupon bond issues with remaining terms equal to the expected terms of the equity awards. In addition, an expected dividend yield of zero is used in the option valuation model, because the Company does not expect to pay any cash dividends in the foreseeable future. Lastly, in accordance with SFAS No. 123R, the Company is required to estimate forfeitures at the time of grant and revise those estimates in subsequent periods if actual forfeitures differ from those estimates. In order to determine an estimated pre-vesting option forfeiture rate, the Company used historical forfeiture data. This estimated forfeiture rate has been applied to all unvested options outstanding as of January 1, 2006 and to all options granted since January 1, 2006. Therefore, stock-based compensation expense is recorded only for those options that are expected to vest.

In February 2007, the Company issued 160,700 performance-based stock units (“performance shares”) that vest over a three-year period based upon specific future performance milestones. A grantee may also earn, over the course of three years, a total number of shares ranging from 0% to 175% of the number of shares equal to his or her initial grant of performance shares, which range is based on the actual achievement of the performance milestones. The market price of the Company’s common stock on date of grant was $30.44. Each period the Company will assess its estimate of the probability that such performance milestones will be met and, if necessary, will adjust the related stock-based compensation expense. The Company is recording stock-based compensation expense for these equity awards over the three-year vesting period assuming all future performance milestones will be met.

14

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

Total stock-based compensation recognized in the Company’s condensed consolidated statements of (loss) income for the three months ended March 31, 2007 and 2006 is as follows:

| | | | | | |

| | | Three Months Ended March 31, |

| | | 2007 | | 2006 |

| | | (in thousands) |

Cost of sales | | $ | 261 | | $ | 361 |

Research and development | | | 609 | | | 844 |

Sales and marketing | | | 1,915 | | | 2,651 |

General and administrative | | | 1,567 | | | 2,169 |

| | | | | | |

Total stock-based compensation expense | | $ | 4,352 | | $ | 6,025 |

| | | | | | |

The underlying assumptions used in the Black-Scholes model were as follows for options granted during the three months ended March 31, 2007 and 2006:

Prior to January 1, 2006, the Company accounted for stock options using the intrinsic value method, pursuant to the provisions of Accounting Principles Board Opinion No. 25,Accounting for Stock Issued to Employees. Under this method, stock-based compensation expense was measured as the difference between the option’s exercise price and the market price of the Company’s common stock on the date of grant.

| | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2007 | | | 2006 | |

Risk-free interest rate | | 4.7 | % | | 4.6 | % |

Expected dividend yield | | — | | | — | |

Expected lives (in years) | | 3.5 | | | 3.5 | |

Expected volatility | | 28 | % | | 32 | % |

As of March 31, 2007, total unrecognized stock-based compensation expense relating to unvested employee stock awards, adjusted for estimated forfeitures, was $34.6 million. This amount is expected to be recognized over a weighted-average period of 2.6 years. If actual forfeitures differ from current estimates, total unrecognized stock-based compensation expense will be adjusted for future changes in estimated forfeitures.

| | (b) | Employee and Director Incentive Plans |

The Cytyc Corporation 2004 Omnibus Stock Plan (the “2004 Omnibus Plan”), which is the Company’s primary plan for grants of equity, provides for the issuance of up to 12,250,000 shares of the Company’s common stock, no more than 8,200,000 of which shares may be issued as awards other than stock options or stock appreciation rights. The 2004 Omnibus Plan provides for grants of various incentives, including stock options and other stock-based awards. At March 31, 2007, 3,974,527 shares were available for future grant under the 2004 Omnibus Plan.

The following table summarizes options outstanding, by stock plan, as of March 31, 2007:

| | |

2004 Omnibus Plan | | 7,522,489 |

1995 Stock Plan | | 6,660,890 |

1998 Stock Plan | | 5,307 |

1995 Non-Employee Director Stock Option Plan | | 180,000 |

2001 Non-Employee Director Stock Option Plan | | 898,000 |

| | |

| | 15,266,686 |

| | |

The following schedule summarizes the activity under the Company’s stock option plans during the three months ended March 31, 2007:

| | | | | | | | | | | | | | | |

| | | Number of Shares | | | Range of Exercise Prices | | | Weighted

Average

Exercise Price

per share |

Outstanding, December 31, 2006 | | 15,755,150 | | | $ | 0.44 | | — | | $ | 30.11 | | | $ | 20.82 |

Granted | | 912,700 | | | | 28.14 | | — | | | 33.87 | | | | 28.61 |

Exercised | | (1,076,807 | ) | | | 2.33 | | — | | | 28.97 | | | | 17.49 |

Canceled | | (324,357 | ) | | | 10.35 | | — | | | 28.97 | | | | 23.73 |

| | | | | | | | | | |

Outstanding, March 31, 2007 | | 15,266,686 | | | $ | 0.44 | | — | | $ | 33.87 | | | $ | 21.46 |

| | | | | | | | | | |

Exercisable, March 31, 2007 | | 8,582,862 | | | $ | 0.44 | | — | | $ | 28.81 | | | $ | 19.15 |

| | | | | | | | | | |

Exercisable, December 31, 2006 | | 8,482,964 | | | $ | 0.44 | | — | | $ | 28.45 | | | $ | 18.12 |

| | | | | | | | | | |

15

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

The weighted average fair value per share of options granted during the three months ended March 31, 2007 and 2006 was $7.91 and $8.45, respectively.

The total intrinsic value of options exercised during the three months ended March 31, 2007 and 2006 was $14.1 million and $9.1 million, respectively. The intrinsic value is calculated as the difference between the market value of the Company’s common stock on date of exercise and the exercise price per share.

The following table summarizes information about stock options outstanding at March 31, 2007:

| | | | | | | | | | | | |

| | | Options Outstanding | | Options Exercisable |

Range of Exercise Prices | | Number of Shares | | Weighted Average

Remaining

Contractual Life (in

years) | | Weighted Average

Exercise Price per

Share | | Number of Shares | | Weighted Average

Exercise Price per

share |

$0.44 – $12.46 | | 1,681,866 | | 2.87 | | $ | 9.48 | | 1,642,404 | | $ | 9.45 |

12.52 – 12.97 | | 1,642,738 | | 3.14 | | | 12.68 | | 949,870 | | | 12.70 |

12.98 – 20.75 | | 2,007,164 | | 4.57 | | | 18.51 | | 1,742,082 | | | 18.70 |

21.07 – 23.07 | | 1,575,860 | | 5.10 | | | 22.02 | | 1,030,725 | | | 21.96 |

23.19 – 24.31 | | 2,317,156 | | 5.62 | | | 23.95 | | 945,416 | | | 24.01 |

24.32 – 25.39 | | 1,580,014 | | 5.91 | | | 24.61 | | 1,219,023 | | | 24.53 |

25.40 – 28.17 | | 1,835,011 | | 7.22 | | | 27.04 | | 477,477 | | | 26.31 |

28.18 – 28.37 | | 162,800 | | 9.40 | | | 28.29 | | 17,359 | | | 28.27 |

28.39 – 28.39 | | 2,056,127 | | 4.82 | | | 28.39 | | 500,644 | | | 28.39 |

28.40 – 33.87 | | 407,950 | | 9.31 | | | 29.51 | | 57,862 | | | 28.81 |

| | | | | | | | | | | | | |

$0.44 – $33.87 | | 15,266,686 | | 5.11 | | $ | 21.46 | | 8,582,862 | | $ | 19.15 |

| | | | | | | | | | | | | |

The aggregate intrinsic value of dilutive options outstanding and options exercisable as of March 31, 2007 was $194.6 million and $129.3 million, respectively. The intrinsic value is calculated as the difference between the market value of the Company’s common stock as of March 31, 2007 and the exercise price per share. The market value as of March 31, 2007 was $34.21 per share as quoted on The NASDAQ Global Select Market.

| (8) | Comprehensive (Loss) Income |

Comprehensive (loss) income for the three months ended March 31, 2007 and 2006 was as follows:

| | | | | | | |

| | | Three Months Ended

March 31, |

| | | 2007 | | | 2006 |

| | | (in thousands) |

Net (loss) income | | $ | (51,209 | ) | | $ | 29,364 |

Other comprehensive (loss) income, net of tax: | | | | | | | |

Unrealized holding (losses) gains on investment securities | | | (2 | ) | | | 20 |

Foreign currency translation adjustments | | | 116 | | | | 107 |

| | | | | | | |

Comprehensive (loss) income | | $ | (51,095 | ) | | $ | 29,491 |

| | | | | | | |

| (9) | Stock Repurchase Program |

Under the current stock repurchase program, the Company is authorized to repurchase up to $200 million of its common stock through open market purchases or private transactions that will be made from time to time as market conditions allow. The stock repurchase program is expected to be in effect until November 15, 2009. Shares repurchased under this program will be held in the Company’s treasury. The stock repurchase program may be suspended or discontinued at any time without prior notice. During the three months ended March 31, 2007 and 2006, the Company repurchased 573,558 shares and 764,518 shares, respectively, with an aggregate cost of $16.5 million and $22.3 million, respectively.

16

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

SFAS No. 131,Disclosures About Segments of an Enterprise and Related Information, requires certain financial and supplementary information to be disclosed for each reportable operating segment of an enterprise, as defined. During the third quarter of 2006, the Company established the domestic diagnostic products and domestic surgical products divisions, each managed by a divisional president. Effective for the first quarter of 2007, as a result of the oversight of each segment by a divisional president, including review and ownership of discrete financial information, operating expenses are captured in the segment to which they relate, except for certain corporate expenses that benefit multiple operating segments and stock-based compensation expense (such expenses are included in “Corporate” below). Segment figures for 2006 have been restated to reflect the changes described above.

Financial information for the three segments is included below for all periods presented and each segment is described as follows:

Domestic Diagnostic Products— This segment develops and markets the ThinPrep® System in the United States primarily for use in diagnostic cytology testing applications focused on women’s health. The ThinPrep System is widely used for cervical cancer screening. The ThinPrep System consists of any one or more of the following: the ThinPrep 2000 Processor, ThinPrep 3000 Processor, ThinPrep Imaging System, and related reagents, filters, and other supplies, such as the ThinPrep Pap Test and the Company’s proprietary ThinPrep PreservCyt Solution. As a result of the Company’s acquisition of Adeza on March 19, 2007, this segment also develops and markets The FullTerm® Fetal Fibronectin Test, which offers clinical and cost benefits for the assessment of the risk of pre-term birth.

Domestic Surgical Products— This segment develops and markets the NovaSure® System, an innovative endometrial ablation device to treat menorrhagia, or excessive menstrual bleeding, the MammoSite® Radiation Therapy System, a device for the treatment of early-stage breast cancer, and the GliaSite® Radiation Therapy System for the treatment of malignant brain tumors, and markets these products in the Unites States. As a result of the Company’s acquisition of Adiana, this segment also develops the Adiana TCS System which is a form of permanent female contraception intended as an alternative to tubal ligation and for which the Company is in the process of seeking a pre-market approval (“PMA”) from the FDA.

International— This segment markets the Company’s diagnostic and surgical products outside of the United States through the Company’s subsidiaries, branch office and distributors. Products sold by the Company’s international segment are manufactured at domestic and international manufacturing locations.

The Company operates manufacturing facilities in the United States and Costa Rica and has several offices, primarily for sales and distribution, throughout the world. Property and equipment is primarily located within the domestic diagnostic products segment in the United States.

17

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

The Company’s operating results, amortization of intangible assets, and intangible assets by segment, are as follows:

| | | | | | | | | | | | | | | | | | |

Three Months Ended March 31, 2007 (in thousands) | | Domestic

Diagnostic

Products | | Domestic

Surgical

Products | | | International | | Corporate | | | Consolidated | |

Net sales | | $ | 89,176 | | $ | 59,264 | | | $ | 20,444 | | $ | — | | | $ | 168,884 | |

In-process research and development | | | 43,500 | | | 46,000 | | | | — | | | — | | | | 89,500 | |

Amortization of intangible assets | | | 361 | | | 2,846 | | | | 369 | | | — | | | | 3,576 | |

Income (loss) from operations | | | 4,351 | | | (21,910 | ) | | | 5,487 | | | (20,949 | ) | | | (33,021 | ) |

| | | | | |

As of March 31, 2007 | | | | | | | | | | | | | | | | | | |

Intangible assets, by segment: | | | | | | | | | | | | | | | | | | |

Patents and developed technology, net | | $ | 154,037 | | $ | 143,845 | | | $ | 23,819 | | $ | — | | | $ | 321,701 | |

Goodwill | | | 294,268 | | | 261,219 | | | | 39,524 | | | — | | | | 595,011 | |

| | | | | |

Three Months Ended March 31, 2006 (in thousands) | | | | | | | | | | | | | |

Net sales | | $ | 80,696 | | $ | 44,704 | | | $ | 15,140 | | $ | — | | | $ | 140,540 | |

Amortization of intangible assets | | | 361 | | | 1,826 | | | | 210 | | | — | | | | 2,397 | |

Income (loss) from operations | | | 46,651 | | | 14,894 | | | | 2,567 | | | (17,830 | ) | | | 46,282 | |

During the three months ended March 31, 2007, the Company acquired $142.8 million of patents and developed technology and $208.5 million of goodwill, as part of its acquisition of Adeza (see Note 2(a)), all of which are included in the domestic diagnostic products segment. There were no other material changes within the Company’s other operating segments during the three months ended March 31, 2007.

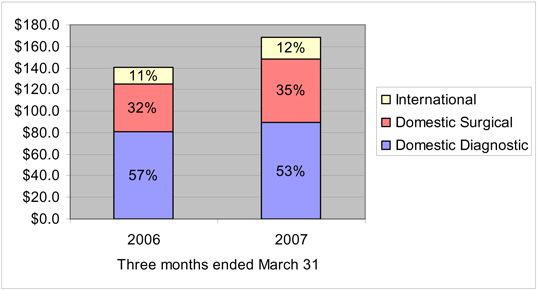

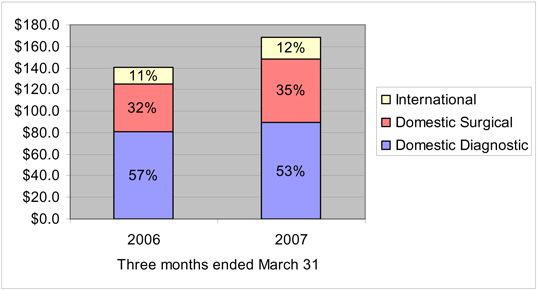

SFAS No. 131 also requires that certain enterprise-wide disclosures be made related to products and services, geographic areas and significant customers. During the three months ended March 31, 2007 and 2006, the Company derived its sales from the following geographies (as a percentage of net sales):

| | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2007 | | | 2006 | |

United States | | 88 | % | | 89 | % |

International | | 12 | % | | 11 | % |

| | | | | | |

| | 100 | % | | 100 | % |

| | | | | | |

During the three months ended March 31, 2007 and the three months ended March 31, 2006, no customer represented 10% or more of consolidated net sales.

| (11) | Long-Term Debt, Contractual Obligations, Commitments and Contingencies |

Long-Term Debt and Contractual Obligations:

Credit Agreement— On June 30, 2006, the Company entered into a five-year Credit Agreement (the “Credit Agreement”) with a syndicate of lenders. The Credit Agreement provided for a $150 million senior unsecured revolving credit facility. On October 6, 2006, the Company and its related lenders amended the Credit Agreement in order to, among other items, increase the committed amount of the revolving credit facility to $345 million and to include one additional lender into the syndicate of lenders. The Company may request an increase in available borrowings under the Credit Agreement by an additional amount of up to $155 million (for a maximum amount of $500 million) upon satisfaction of certain conditions. These increased borrowings may be provided either by one or more existing lenders upon the Company obtaining the agreement of such lender(s) to increase commitments or by

18

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

new lenders being added to the credit facility. The loan proceeds are available to be used by the Company and its subsidiaries to finance working capital needs and for general corporate purposes, including certain permitted business acquisitions. On May 14, 2007, the Company and its related lenders amended the Credit Agreement in order to: (1) extend to July 31, 2007 the delivery deadline for both the audited financial statements for the fiscal year ended December 31, 2006 and the unaudited financial statements for the fiscal quarter ended March 31, 2007 and (2) amend the negative covenant concerning Indebtedness (as such term is defined in the Credit Agreement) to increase the maximum size of the receivables financing facility permitted thereunder from $50 million to $100 million.

Amounts under the Credit Agreement may be borrowed, repaid and re-borrowed by the Company from time to time until the maturity of the Credit Agreement on June 30, 2011. Voluntary prepayments and commitment reductions requested by the Company under the Credit Agreement are permitted at any time without penalty (other than customary breakage costs relating to the prepayment of any drawn loans) upon proper notice and subject to a minimum dollar requirement. Borrowings under the Credit Agreement bear interest at a floating rate, which will be, at the Company’s option, either LIBOR plus an applicable margin (which is subject to adjustment based on financial ratios), or a base rate.

The Credit Agreement requires the Company to comply with maximum leverage and minimum fixed charge coverage ratios. The Credit Agreement contains affirmative and negative covenants, including limitations on additional debt, liens, certain investments, and acquisitions outside of the healthcare business. The Credit Agreement also includes events of default customary for facilities of this type. Upon the occurrence of an event of default, all outstanding loans may be accelerated and/or the lenders’ commitments terminated.

As of March 31, 2007, the Company had $200.5 million outstanding under this Credit Agreement at an interest rate of 5.32% (LIBOR) plus a margin of 0.475% providing a total interest rate of 5.795%.

Convertible Notes— On March 22, 2004, the Company completed the sale (the “Offering”) of $250 million aggregate principal amount of its 2.25% convertible notes due 2024. The convertible notes were sold to qualified institutional buyers pursuant to an exemption from the registration requirements of the Securities Act of 1933, as amended. The notes bear interest at a rate of 2.25% per year on the principal amount, payable semi-annually in arrears in cash on March 15 and September 15 of each year, beginning September 15, 2004. The holders of the notes may convert the notes into shares of the Company’s common stock at a conversion price of $29.67 per share, subject to adjustment, prior to the close of business on March 15, 2024, subject to prior redemption or repurchase of the notes, under any of the following circumstances: (1) during any calendar quarter commencing after June 30, 2004 if the closing sale price of the Company’s common stock exceeds 120% of the conversion price for at least 20 trading days in the 30 consecutive trading days ending on the last trading day of the preceding calendar quarter (if the specified threshold is met, the notes will thereafter be convertible at any time at the option of the holder prior to the close of business on March 15, 2024); (2) during the five business day period after any five consecutive trading day period in which the trading price per $1,000 principal amount of notes for each day of such period was less than 98% of the product of the closing sale price of the Company’s common stock and the number of shares issuable upon conversion of $1,000 principal amount of the notes; (3) if the notes have been called for redemption; or (4) upon the occurrence of specified corporate events.

Holders may require the Company to repurchase the notes on March 15 of 2009, 2014 and 2019 at a repurchase price equal to 100% of their principal amount, plus accrued and unpaid interest, including contingent interest and liquidated damages, if any, to, but excluding, the repurchase date. The Company may redeem any of the notes beginning March 20, 2009, by giving holders at least 30 days’ notice.

19

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

Commitments:

Earn-out Payments— Part of the purchase price for Adiana includes contingent earn-out payments tied to future performance milestones (see Note 2(b)).

Lease Commitments:

On April 23, 2007, the Company signed a non-cancelable lease agreement for a building with approximately 164,354 square feet. This facility is located in Alajuela, Costa Rica, and will be used as an additional manufacturing facility and office building. The term of the lease is for a period of approximately ten years commencing on or around February 2008. The term of the lease may be extended for two consecutive five-year terms.

Future minimum lease payments under this lease are as follows at March 31, 2007:

| | | |

| | | Amount |

| | | (in thousands) |

Remaining nine months ending December 31, 2007 | | $ | — |

Year ending December 31, 2008 | | | 1,316 |

Year ending December 31, 2009 | | | 1,481 |

Year ending December 31, 2010 | | | 1,533 |

Year ending December 31, 2011 | | | 1,587 |

Thereafter | | | 10,921 |

| | | |

Total | | $ | 16,838 |

| | | |

As part of our acquisitions of Adeza and Adiana during the first quarter of 2007, we assumed non-cancelable leases for buildings located in California which have cash payments over the next two years totaling $0.3 million per year.

Finance Lease Obligation— On July 11, 2006, the Company signed a non-cancelable lease agreement for a building with approximately 146,000 square feet located in Marlborough, Massachusetts, to be principally used as an additional manufacturing facility. In 2011, the Company will have an option to lease an additional 30,000 square feet. As part of the lease agreement, the lessor agreed to allow the Company to make significant renovations to the facility to prepare the facility for the Company’s manufacturing needs. The Company is responsible for a significant amount of the construction costs and therefore was deemed under Generally Accepted Accounting Principles to be the owner of the building during the construction period, in accordance with Emerging Issues Task Force (“EITF”) No. 97-10,The Effect of Lessee Involvement in Asset Construction.During the year ended December 31, 2006, the Company recorded the fair market value of the facility of $13.2 million within property and equipment on its consolidated balance sheet, with an offsetting increase to current and non-current liabilities. The Company plans to begin occupying the facility during the second quarter of 2007. The term of the lease is for a period of approximately 12 years commencing on November 14, 2006.

Future minimum lease payments, including principal and interest, under this lease are as follows:

| | | |

| | | Amount |

| | | (in thousands) |

Remaining nine months ending December 31, 2007 | | $ | 556 |

Year ending December 31, 2008 | | | 924 |

Year ending December 31, 2009 | | | 939 |

Year ending December 31, 2010 | | | 982 |

Year ending December 31, 2011 | | | 982 |

Thereafter | | | 7,913 |

| | | |

Total minimum payments | | | 12,296 |

Less-amount representing interest | | | 5,773 |

| | | |

Total | | $ | 6,523 |

| | | |

Restructuring— During the fourth quarter of 2006, Company management approved a restructuring plan designed to reduce future operating expenses, by consolidating its Mountain View, California operations into its existing operations in Costa Rica and Massachusetts. In connection with this plan, the Company incurred $2.9 million of restructuring costs during the fourth quarter of 2006 related to severance expenses and accrued $0.3 million related to retention costs. The Company expects to incur and pay additional restructuring costs in 2007 of approximately $5 million to $6 million, primarily resulting from retention costs and incremental depreciation of leasehold improvements.

| | | | |

| | | Three Months Ended

March 31, 2007 | |

| | | (in thousands) | |

Balance, beginning of year | | $ | 3,227 | |

Adjustments | | | 1,165 | |

Payments | | | (558 | ) |

| | | | |

Balance, March 31 | | $ | 3,834 | |

| | | | |

20

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

During the three months ended March 31, 2007, we recognized restructuring expense of $1.2 million primarily related to retention costs for employees which are recognized in the Company’s statement of (loss) income on a straight-line basis over the employment period. During the first quarter of 2007, the Company made payments for severance and retention in the amount of $0.2 million and $0.4 million, respectively.

Contingencies— On June 16, 2003, Cytyc filed a suit for Declaratory Judgment in United States District Court for the District of Massachusetts asking the court to determine and declare that certain of TriPath Imaging, Inc.’s (“TriPath”) patents are invalid and not infringed by the Company’s ThinPrep Imaging System. On June 17, 2003, TriPath announced that it had filed a lawsuit against the Company in the United States District Court for the Middle District of North Carolina alleging patent infringement, false advertising, defamation, intentional interference, unfair competition, and unfair and deceptive trade practices. The non-patent claims have been dismissed and the patent cases have since been consolidated into a single action. A hearing occurred on August 2, 2006 in the United States District Court for the District of Massachusetts to hear oral arguments on summary judgment motions. The Court has scheduled a trial start date of October 29, 2007. The Company continues to believe that the claims against it are without merit and intends to vigorously defend this suit. Given the current status of the litigation, the Company is unable to reasonably estimate the ultimate outcome of this case.

The Company is also involved in ordinary, routine litigation incidental to its business. Although the outcomes of these other lawsuits and claims are uncertain, management does not believe that, individually or in the aggregate, these other lawsuits and claims will have a material adverse effect on the Company’s business, financial condition, results of operations or liquidity.

The Company’s effective tax rate for the three months ended March 31, 2007 was 60.0% as compared to 36.5% for the three months ended March 31, 2006. Exclusive of the effects of the non-deductible in-process research and development charges incurred in connection with our acquisitions of Adeza and Adiana in March 2007 the Company’s effective tax rate would have been 33.4% including the recognition of a tax benefit related to an examination closed during the period.

On January 1, 2007, the Company adopted FIN No. 48,Accounting for Uncertainty in Income Taxes—an interpretation of FASB Statement No. 109, which clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements in accordance with FASB Statement No. 109,Accounting for Income Taxes. FIN No. 48 prescribes a recognition threshold and measurement criteria for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. FIN No. 48 also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure, and transition and defines the criteria that must be met for the benefits of a tax position to be recognized. As a result of its adoption of FIN No. 48, the Company has recorded the cumulative effect of the change in accounting principle of $0.5 million as a decrease to opening retained earnings.

The Company had gross unrecognized tax benefits of approximately $12.8 million as of January 1, 2007. Of this amount, $6.8 million (net of federal benefit on state issues) represents the amount of unrecognized tax benefits as of January 1, 2007 that, if recognized, would result in a reduction of the Company’s effective tax rate. At March 31, 2007, the Company had $11.3 million of unrecognized tax benefits $5.3 million of which, if recognized, would result in the reduction of the Company’s effective tax rate. The decrease during the three month period ended March 31, 2007 in unrecognized tax benefits is primarily the result of the recognition of approximately $1.6 million of tax benefits related to an examination that closed during the period.

Consistent with its historical financial reporting, the Company has elected to classify interest expense related to income tax liabilities, when applicable, as part of income tax expense in its consolidated statement of (loss) income. As of January 1, 2007, accrued interest was approximately $0.9 million, net of federal benefit. As of January 1, 2007, no penalties have been accrued.

The Company and its subsidiaries are subject to United Sates federal income tax, as well as income tax of multiple state income and foreign jurisdictions. The last years examined by the Internal Revenue Service and the Massachusetts Department of Revenue were 2004 and 2003, respectively, and all years up through and including those years are closed by examination.

| (13) | Recent Accounting Pronouncements |

In September 2006, the FASB issued SFAS No. 157,Fair Value Measurements. Among other requirements, SFAS No. 157 defines fair value and establishes a framework for measuring fair value and also expands disclosure requirements regarding fair value measurements. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those years. We are evaluating the impact of adopting SFAS No. 157 on our financial statements.

21

CYTYC CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) — Continued

In February 2007, the FASB issued SFAS No. 159,The Fair Value Option for Financial Assets and Financial Liabilities—Including an amendment of FASB Statement No.115, which permits entities to measure various financial instruments and certain other items at fair value at specified election dates. The election must be made at initial recognition of the financial instrument, and any unrealized gains or losses must be reported at each reporting date. SFAS No. 159 is effective for financial statements issued for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. The Company is currently evaluating the potential impact that adopting SFAS No. 159 will have on its consolidated financial statements.

22

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations