UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number811-5823

DOMINI INVESTMENT TRUST

(Exact Name of Registrant as Specified in Charter)

180 Maiden Lane, Suite 1302, New York, New York 10038

(Address of Principal Executive Offices)

Amy Domini Thornton

Domini Impact Investments LLC

180 Maiden Lane, Suite 1302

New York, New York 10038

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code:212-217-1100

Date of Fiscal Year End: July 31

Date of Reporting Period: January 31, 2019

| Item 1. | Reports to Stockholders. |

A copy of the report transmitted to stockholders pursuant to Rule30e-1 under the Investment Company Act of 1940 follows.

SEMI-ANNUAL REPORT 2019 JANUARY 31, 2019 (UNAUDITED) DOMINI EQUITY FUNDSM DOMINI IMPACT EQUITY FUNDSM DOMINI IMPACT BOND FUNDSM

Beginning with the inception of our first mutual fund in 1991, we have made it apriority to focus on incorporating social and environmental standards intoour investment process seeking triple bottom-line results: positivefor people, planet, and profits. These standards guide our investmentsacross all our funds. Sharing them is justone way that Domini executes on our own transparency goals. Learn morebyvisiting domini.com/standards SIGN UP FORE-DELIVERY If you invest directly with Domini, you can avoid an annual fee of $15 by signing up for paperlessE-Delivery of your statements, reports and tax forms — just log into your account, go to “Account Options,” and select“E-Delivery Option.” If you invest through a financial advisor, brokerage firm, or employer-sponsored retirement plan, why not ask your advisor or plan sponsor how to receive your documents electronically? It can reduce your carbon footprint, save trees, and unclutter your life, all with just a few strokes of your keyboard!

TABLE OF CONTENTS

INVESTINGIN DIVERSITY

LETTER TO SHAREHOLDERS

Dear Fellow Shareholder,

The publication of our Semi-Annual Report gives us an opportunity to consider an issue of importance. In this report, we discuss some of the opportunities inherent in living and working in a world filled with human diversity, and some of the challenges that arise as we emerge from a more closed society.

Most Americans neither have the ability nor the desire to be a monoculture. We celebrate the foods, religions, exercise routines, fabrics, and cultures — for instance — of many peoples. And yet, in seemingly blind contradiction, we all too often make incorrect and even hurtful assumptions about the cultural sources of these pleasures. Social scientists insist that cultural bias is pervasive. As believers of scientific evidence, your fund managers recognize this fact and attempt to address it. Domini Impact Investments hold as twin goals universal human dignity and ecological sustainability. We cannot sit back and ignore inherent bias.

We have three basic tools at our disposal. First, we use standards to rank investments. These standards specifically address the ways that our investment might help, or harm, differing parties. Second, we engage with companies, through conversation, letter writing, and shareholder campaigns, to encourage behavior that will ameliorate the worst outcomes of specific business practices. Third, we invest directly into entities that, by virtue of their business practices, are a solution to issues of concern to us all. In regard to diversity, we use all three. The existence of a gender or racially diverse board is, in and of itself, indicative that the corporation in question is holding itself out as having moved beyond the norms of yesteryear. The pushing for great diversity by our letters, phone calls and other actions, leads to conversations that often result in such appointments. Some bonds we invest in provide loans to entities that strengthenat-risk communities that can help weaken, and hope to eventually stop, the cycle of poverty.

One of the more remarkable developments over the past two years has been the emergence of CEOs who speak out specifically on the issue. The pharmaceutical company, Merck, is run by CEO Kenneth C. Frazier, an African American who quit President Trump’s Advisory Council after hearing the President’s comments regarding the incident in Charlottesville last year. PayPal CEO Dan Schulman has recently been the subject of numerous spiteful articles as a result of stating, “Probably the most important value to us is diversity and inclusion” and speaking positively of the work done by Southern Poverty Law Center.

2

INVESTINGIN DIVERSITY

This is new. Companies’ leadership did not respond to public events historically. But important as this development is, it is not enough. True behavior change takes not only education but also, generally speaking, exposure. Robert Putnam’s breakthrough 1993 book,Making Democracy Work: Civic Traditions in Modern Italy led the reader through the core necessities to building trust and what he labeled ‘social capital.’ To unfairly summarize a complex subject, the research strongly suggests that meeting people for a common purpose, such as attending church or playing soccer, leads to higher employment, safer streets, and a more livable community.

In 2009 the United Nations published a principal ofnon-discrimination “to guarantee that human rights are exercised without discrimination of any kind based on race, color, sex, language, religion, political or other opinion, national or social origin, property, birth or other status such as disability, age, marital and family status, sexual orientation and gender identity, health status, place of residence, economic and social situation.” This is a tall order. It takes diligence to guarantee human rights.

Nonetheless the goal is present and the benefits are clear. Your fund management works to remove some of the most evident barriers. As with every challenge that we at Domini Impact Investments face, our first step toward solutions is to search for data. We believe that it takes facts to build knowledge and that with knowledge, effective action can be shaped. This is why we track the diversity statistics of management and boards at corporations. It is why we note with interest products or services provided to potentially disenfranchised populations. Collecting publicly available data is step one of achange-for-the-better agenda.

You will read on the following pages just how the three approaches presented in the third paragraph of this letter have made a difference. Our shareholders do, in fact, join the multitude of voices that strive to make a meaningful contribution to the future. We are proud to be of some assistance in the effort. After all, many voices build a wholesome dialog; prejudice should not be tolerated in the country called a melting pot.

We at Domini Impact Investments believe that the investor has a role to play in furthering the right to living with dignity. We have many initiatives in this work. Thank you for your investment and for the effect is has to help better the lives of others.

| | |

Carole Laible CEO | |

Amy Domini Founder and Chair |

3

INVESTINGIN DIVERSITY

Investing in Diversity

Diversity-related metrics are an integral part of the research process for Domini. We believe strong corporate diversity can mitigate risk to investors and an equitable workplace can enhance corporate performance. Companies with diverse management may be more likely to innovate thanks to a multiplicity of ideas and perspectives. Leadership with a range of backgrounds may be more likely to understand customer needs, anticipate societal trends and changes, and cultivate cooperation and connections within their workforce and communities. Having diverse leadership also helps deter discriminatory practices and foster a culture of tolerance and inclusiveness throughout an organization. Diverse organizations have been shown to have more positive workplace cultures and are thus better positioned to recruit and retain talent.

Around the world and across industries, we see signs of progress on corporate diversity. But women and minorities are still underrepresented on boards of directors and at all levels of management. Businesses are missing out on the benefits of diversity. Women also receive lower wages, leading to significant wealth gaps over the course of their careers. In the U.S., women in professional and management positions earn around $0.73 for every dollar a man makes. Women of color experience an even larger gap. Efforts to close these gaps have made only halting progress, both in the US and around the world. The impact of this lackluster improvement in workplace representation and equality has been stark in light of ongoing revelations about the scale andcover-ups of workplace sexual assault and harassment.

Higher levels of diversity could improve economic development and GDP growth around the world. Repeated research has confirmed that higher levels of diversity correlate with better long-term corporate performance. A company with low diversity may miss the most qualified candidates and have poor workplace culture. Lack of diversity can be a material risk for companies, particularly from litigation, as in recent high-profile cases of pay discrimination with large settlements and legal awards. Further, at the most basic level, support for diversity is in line with international human rights standards.

In 2018, we released our refreshed Impact Investment Standards, which serve as the backbone of our work. Our standards highlight the importance of companies’ consideration of diversity and what we look for, particularly as it applies to their employees, suppliers, and boards. Our standards for diversity in the workplace exemplify our approach for determining which companies we invest in:

Diversity in the workforce, whether related to gender, ethnicity or race, age, sexual orientation, disability, economic or class background,

4

INVESTINGIN DIVERSITY

religion, and political opinion, can be a hallmark of a well-managed corporation. A diverse workforce can help companies better understand the needs and desires of the full range of their current and prospective customers; anticipate new societal trends and emerging issues; foster understanding, mutual respect, and cooperation among their workforce; and improve a company’s ability to recruit from the widest possible pool of talent. Diversity, particularly among positions of authority, can indicate a corporate culture based on merit and open to new ideas and perspectives.

We look for companies that have substantial representation of women and minorities among management- level positions, particularly in senior line executives; companies that have created a notably open work environment for minority groups — for example, for LGBTQ+ employees; and companies with strong programs for training on sexual harassment and respect for diversity. Conversely, we view with concern companies that have a record of diversity-related controversies and regulatory sanctions, including those related to sexual harassment and discrimination.

(Domini Impact Investment Standards, January 2019,pp.34-35)

We look favorably on diversity across all industries as an indicator of company culture and commitment to a just and equitable workplace. Diversity among senior management, executive-level, and board-level employees has additional importance when it may directly impact services that a company provides and markets that it serves, for example in the financial and banking services industry and among advertising, media distribution & production companies. In these industries we consider diversity to be a Key Performance Indicator (KPI) that demonstrates quality of management. Beyond minority and female CEOs, management teams, and boards, we also look for initiatives to promote further improvement on diversity including strong disclosure practices and internal auditing to assess pay gaps.

While diverse leadership is not a guarantee of strong performance or a diverse workforce, Key Bank is a case where it has led to both. The firm has notably diverse leadership. Women and minorities account for 36% of Key Bank’s management team and 44% of its board. Key Bank’s CEO, Beth Mooney, is the first woman to head aTop-20 bank in the U.S., and under her tenure the company has rolled out a $16.5 billion community development investment plan, including funds for affordable housing, and increased products forlow-income and underserved consumers.

Accenture is another example of a company that through conscious planning has nurtured a diverse workforce in order to cultivate a progressive corporate culture. Already ranked number 1 on Thomson

5

INVESTINGIN DIVERSITY

Reuters Index of The World’s Most Diverse and Inclusive Companies, Accenture further seeks to increase diversity by pursuing the goal of having a50-50 female-male workforce by 2025. According to Ellyn Shook, Accenture’s chief leadership and human resources officer, “we believe that diversity is a source of innovation, creativity and competitive advantage and creates a workplace where everyone feels equally accepted with a real sense of belonging.” In addition to setting goals for gender equality, they also have programs dedicated to improving the workspace for people with disabilities in order to remove barriers of entry into the workforce, as well as programs to help promote a welcoming, safe community for LGBTQ+ employees. It is through this sort of sensible, dynamic governance that we believe will help build a more equal and innovative future.

Strong Signals through Proxy Voting

Early this year Domini strengthened our proxy voting guidelines on diversity, now among the most rigorous in the industry. We felt this move was necessary to push more strongly towards our goal of a supportive, fair, and inclusive workplace. As of 2018, only 21.2% of board seats in the S&P 500 were filled by women. In a true meritocracy, a corporate board reflects the markets it serves. Companies have made some progress in representation of women in recent years, but more is needed, and proxy voting is a strong tool to communicate the demand for change.

Our policy has several layers of thresholds related to both racial, ethnic and gender diversity. We look for a minimum of 40% or three (whichever is greater) female board members. While racial and ethnic diversity are important globally, good data only exists in the United States, Australia, the United Kingdom, and Canada, so in these countries we look for at least 40% or three (whichever is greater)non-Caucasian board nominees. This figure is derived from research suggesting that this threshold is necessary to see significant benefits from resulting from diversity.

When board diversity is below the 40% threshold, we vote against members of the nominating committee, because they are the highest source of responsibility at the board level. When diversity is below a 30% threshold, we vote against the committee and all male nominees. If there are no women on the board, we vote against the entire board. In this case, we have sent letters to laggards, explaining our vote against them and the reasoning behind it.

Advocating for Diversity

Domini is awomen-led and founded firm, a rarity in the mutual fund world. Four out of five members of our executive team are women, including our chair, CEO, CFO, and General Counsel. This leadership is

6

INVESTINGIN DIVERSITY

reflected in the makeup of our firm, which is 54% women. Thanks to this strong performance on diversity, we have a solid platform from which to push other companies to improve.

We have a long history of engagement on diversity issues. Last year, Domini joined the Thirty Percent Coalition, an alliance of large asset owners, city and state treasurers and asset managers working to advance corporate board diversity. The name of the group refers to the minimum level of racial, ethnic, and gender diverse board members the group would like to see at public companies. The coalition advances this goal through letter writing campaigns and direct dialogue. These engagements are often multi-year, using shareholder resolutions as a tool of last resort. Much of the work has focused on laggards: companies with no or only one female board member. We have also focused engaging with all male boards, particularly in Japan. Progress is still limited, given Japan’s historically low levels of management diversity. The Japanese pension fund giant GPIF’s entrance into the Thirty Percent Coalition in 2016, followed by the selection of gender-focused index in 2018, sent ripples through the corporate and investment worlds.

While there remains a dire need for advancement on representation and fair pay, investors can play a substantial part in pushing the pace of change. There is a clear business case for the value of diversity to companies and their shareholders, but diversity may also make companies better neighbors and better able to serve diverse customers bases. Through setting standards related to diversity, having a strong proxy voting policy, and communicating our policies to companies and other investors, Domini is able to create lasting change and a better environment for our investments and our communities.

The holdings discussed above can be found in the Portfolio of Investments of the Domini Impact Equity Fund, included herein. The composition of the Domini Funds’ portfolios is subject to change.

An investment in the Domini Impact Equity Fund is not a bank deposit and is not insured. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost. You may lose money.

An investment in the Fund is subject to market, market sector, impact investing, and foreign investing risks. Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing security regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity.

This report is not authorized for distribution to prospective investors of the Domini Funds referenced herein unless preceded or accompanied by a current prospectus for the relevant Fund. Nothing contained herein is to be considered a recommendation concerning the merits of any noted company or security, or an offer of sale or a solicitation of an offer to buy shares of any Fund or issuer referenced in this report. Such offering is only made by prospectus, which includes details as to the offering price and other material information. Carefully consider the Funds’ investment objectives, risk factors and charges and expenses before investing. This and other information can be found in the Funds’ prospectus, which may be obtained by calling1-800-582-6757, or at www.domini.com. Please read the prospectus carefully before investing. The Domini Funds are distributed by DSIL Investment Services LLC (DSILD), member FINRA. Domini Impact Investments LLC is each Fund’s investment manager. The Funds are subadvised by unaffiliated entities. 3/19

7

DOMINI IMPACT INTERNATIONAL EQUITY FUND

Fund Performance and Holdings

The table and bar charts below provide information as of January 31, 2019, about the ten largest holdings of the Domini Impact International Equity Fund and its portfolio holdings by industry sector and country:

TEN LARGEST HOLDINGS (Unaudited)

| | | | | | | | | | |

| | | | |

| SECURITY DESCRIPTION | | % NET

ASSETS | | | SECURITY DESCRIPTION | | % NET

ASSETS | |

| | | | |

| Sanofi | | | 3.1% | | | Kering SA | | | 2.0% | |

| | | | |

| Novartis AG | | | 3.1% | | | Coca-Cola Euro Partners PLC | | | 1.8% | |

| | | | |

| Nissan Motor Co Ltd | | | 2.4% | | | AXA SA | | | 1.8% | |

| | | | |

| Allianz SE | | | 2.2% | | | Central Japan Railway Co | | | 1.7% | |

| | | | |

| Sandvik AB | | | 2.1% | | | Koninklijke Ahold Delhaize NV | | | 1.7% | |

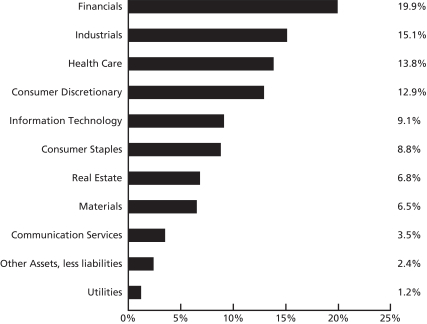

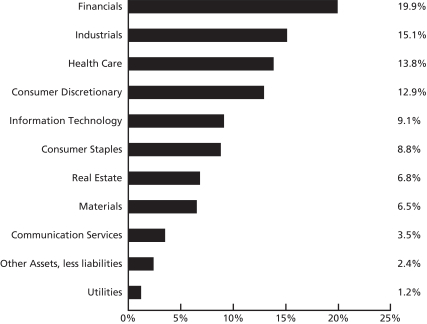

PORTFOLIO HOLDINGS BY INDUSTRY SECTOR (% OF NET ASSETS) (Unaudited)

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by Domini Impact Investments. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification nor shall any such party have any liability therefrom.

8

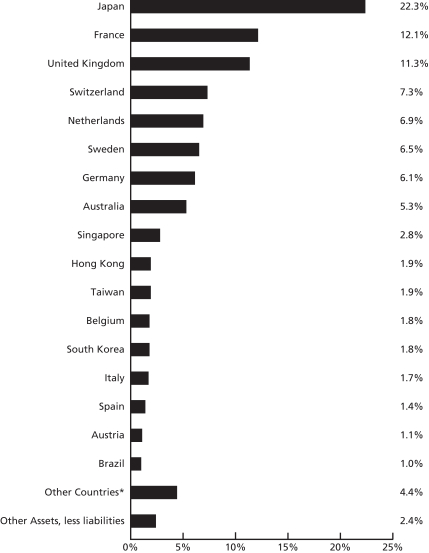

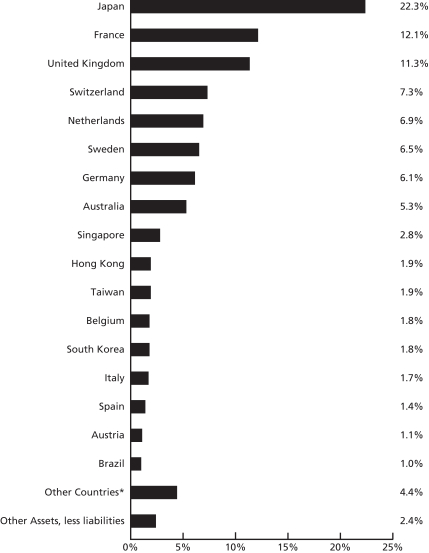

PORTFOLIO HOLDINGS BY COUNTRY (% OF NET ASSETS) (Unaudited)

The holdings mentioned above are described in the Domini Impact International Equity Fund’s Portfolio of Investments (as of 1/31/19), included herein. The composition of the Fund’s portfolio is subject to change.

*Other countries include Denmark (0.9%), Turkey (0.6%), Hungary (0.5%), India (0.4%), Israel (0.4%), Mexico (0.4%), South Africa (0.4%), China (0.3%), Finland (0.3%), Norway (0.2%), and Ireland (0.0%).

9

| | | | | | | | | | | | | | |

| |

DOMINI IMPACT INTERNATIONAL EQUITY FUND AVERAGE ANNUAL TOTAL RETURNS (Unaudited) |

| | | | | | |

| | | Investor

shares | | Class A shares

(with 4.75%

maximum

Sales Charge) | | Class A

shares (without

Sales

Charge) | | Institutional

shares1 | | Class Y

Shares2 | | MSCI EAFE

(net) |

| | | | | | | |

| As of 1/31/19 | | 1 Year | | -15.12% | | -19.27% | | -15.25% | | -14.89% | | -15.12% | | -12.51% |

| | | | | | | |

| | 5 Year | | 3.44% | | 2.39% | | 3.39% | | 3.82% | | 3.44% | | 2.66% |

| | | | | | | |

| | | 10 Year | | 9.50% | | 8.96% | | 9.50% | | 9.50% | | 9.50% | | 8.11% |

Past performance is no guarantee of future results.The Fund’s returns quoted above represent past performance after all expenses. The returns reflect any applicable expense waivers in effect during the periods shown. Without such waivers, Fund performance would be lower. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost.Call1-800-762-6814 or visit www.domini.com for performance information current to the most recentmonth-end, which may be lower or higher than the performance data quoted. A 2.00% redemption fee applies on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Quoted performance data does not reflect the deduction of this fee, which would reduce the performance quoted. See the prospectus for further information.

An investment in the Fund is not a bank deposit and is not insured. You may lose money. The Fund is subject to market, market segment, style and foreign investing risks. Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing security regulations and accounting standards limited public information possible changes in taxation, and periods of illiquidity.

Per the prospectus dated December 1, 2018, the Fund’s annual operating expenses totaled: 1.41% (Investor), 1.47%/1.43% (gross/net) (Class A), 1.02% (Institutional), 1.13% (gross/net) (Class Y). The Fund’s adviser has contractually agreed to waive certain fees and/or reimburse certain ordinary operating expenses in order to limit Class A and Class Y share expenses to 1.43% and 1.15%, respectively until November 30, 2019, absent an earlier modification approved by the Fund’s Board of Trustees.

The table does not reflect the deduction of fees and taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return is based on the Fund’s net asset values and assumes all dividends and capital gains were reinvested.

The Morgan Stanley Capital International Europe Australasia Far East (MSCI EAFE) index (net) is an unmanaged index of common stocks. MSCI EAFE (net) includes the reinvestment of dividends net of withholding tax, but does not reflect other fees, expenses or taxes. It is not available for direct investment.

1Institutional shares were not offered prior to November 30, 2012. All performance information for time periods beginning prior to November 30, 2012, is the performance of the Investor shares. This performance has not been adjusted to reflect the lower expenses of the Institutional shares.

2Class Y shares did not commence operations until July 23, 2018. All performance information for time periods beginning prior to July 23, 2018 is the performance of the Investor Shares. This performance has not been adjusted to reflect the lower expenses of the Class Y shares.

10

DOMINI IMPACT INTERNATIONAL EQUITY FUND

PORTFOLIOOF INVESTMENTS

January 31, 2019 (Unaudited)

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

| Common Stock – 97.6% | |

Australia – 5.3% | |

BlueScope Steel Ltd | | Materials | | | 1,282,054 | | | $ | 11,749,573 | |

Dexus | | Real Estate | | | 1,304,145 | | | | 10,953,537 | |

Flight Centre Travel Group Ltd | | Consumer Services | | | 148,717 | | | | 4,681,129 | |

Fortescue Metals Group Ltd | | Materials | | | 3,317,746 | | | | 13,747,737 | |

Goodman Group | | Real Estate | | | 409,661 | | | | 3,497,381 | |

GPT Group/The | | Real Estate | | | 573,999 | | | | 2,434,572 | |

Harvey Norman Holdings Ltd | | Retailing | | | 689,641 | | | | 1,698,838 | |

Mirvac Group | | Real Estate | | | 7,518,213 | | | | 13,223,050 | |

Vicinity Centres | | Real Estate | | | 1,529,930 | | | | 2,921,801 | |

| | | | | | | | | | |

| | | | | | | | | 64,907,618 | |

| | | | | | | | | | |

| | | | | | | | | | |

Austria – 1.1% | |

Raiffeisen Bank International AG | | Banks | | | 262,333 | | | | 6,956,710 | |

Verbund AG | | Utilities | | | 134,688 | | | | 6,900,683 | |

| | | | | | | | | | |

| | | | | | | | | 13,857,393 | |

| | | | | | | | | | |

| | | | | | | | | | |

Belgium – 1.8% | |

Ageas | | Insurance | | | 186,584 | | | | 8,697,084 | |

Colruyt SA | | Food & Staples Retailing | | | 46,142 | | | | 3,322,004 | |

UCB SA | | Pharma, Biotech & Life Sciences | | | 117,327 | | | | 10,192,062 | |

| | | | | | | | | | |

| | | | | | | | | 22,211,150 | |

| | | | | | | | | | |

| | | | | | | | | | |

Brazil – 1.0% | |

Banco do Brasil SA | | Banks | | | 459,355 | | | | 6,544,486 | |

Itausa – Investimentos Itau SA | | Banks | | | 861,100 | | | | 3,193,397 | |

Porto Seguro SA | | Insurance | | | 147,537 | | | | 2,271,407 | |

| | | | | | | | | | |

| | | | | | | | | 12,009,290 | |

| | | | | | | | | | |

| | | | | | | | | | |

China – 0.3% | |

Future Land Development Holdings Ltd | | Real Estate | | | 1,646,367 | | | | 1,395,161 | |

Tingyi Cayman Islands Holding Corp | | Food & Beverage | | | 2,109,280 | | | | 2,937,656 | |

| | | | | | | | | | |

| | | | | | | | | 4,332,817 | |

| | | | | | | | | | |

| | | | | | | | | | |

Denmark – 0.9% | |

DSV A/S | | Transportation | | | 57,998 | | | | 4,639,748 | |

FLSmidth & Co A/S | | Capital Goods | | | 38,945 | | | | 1,829,717 | |

GN Store Nord A/S | | Health Care Equipment & Services | | | 58,691 | | | | 2,535,987 | |

Vestas Wind Systems A/S | | Capital Goods | | | 33,137 | | | | 2,745,736 | |

| | | | | | | | | | |

| | | | | | | | | 11,751,188 | |

| | | | | | | | | | |

| | | | | | | | | | |

11

DOMINI IMPACT INTERNATIONAL EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2019 (Unaudited)

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

Finland – 0.3% | |

Valmet OYJ | | Capital Goods | | | 194,086 | | | $ | 4,383,785 | |

| | | | | | | | | | |

| | | | | | | | | 4,383,785 | |

| | | | | | | | | | |

| | | | | | | | | | |

France – 12.1% | |

AXA SA | | Insurance | | | 946,869 | | | | 22,012,725 | |

Capgemini SE | | Software & Services | | | 107,081 | | | | 11,854,964 | |

Carrefour SA | | Food & Staples Retailing | | | 365 | | | | 7,236 | |

CNP Assurances | | Insurance | | | 202,651 | | | | 4,615,470 | |

Credit Agricole SA | | Banks | | | 231,361 | | | | 2,649,051 | |

Eiffage SA | | Capital Goods | | | 114,227 | | | | 10,728,137 | |

Eutelsat Communications SA | | Media & Entertainment | | | 58,235 | | | | 1,238,046 | |

Kering SA | | Consumer Durables & Apparel | | | 48,457 | | | | 24,362,786 | |

Peugeot SA | | Automobiles & Components | | | 734,906 | | | | 18,532,883 | |

Sanofi | | Pharma, Biotech & Life Sciences | | | 433,465 | | | | 37,769,670 | |

Schneider Electric SE | | Capital Goods | | | 74,160 | | | | 5,287,512 | |

Teleperformance | | Commercial & Professional Services | | | 59,217 | | | | 10,216,676 | |

| | | | | | | | | | |

| | | | | | | | | 149,275,156 | |

| | | | | | | | | | |

| | | | | | | | | | |

Germany – 6.1% | |

adidas AG | | Consumer Durables & Apparel | | | 64,261 | | | | 15,328,406 | |

Allianz SE | | Insurance | | | 129,804 | | | | 27,609,403 | |

CECONOMY AG | | Retailing | | | 497,200 | | | | 2,339,099 | |

HUGO BOSS AG | | Consumer Durables & Apparel | | | 41,445 | | | | 2,979,012 | |

Merck KGaA | | Pharma, Biotech & Life Sciences | | | 78,695 | | | | 8,283,475 | |

SAP SE | | Software & Services | | | 139,286 | | | | 14,438,755 | |

Wacker Chemie AG | | Materials | | | 45,610 | | | | 4,837,250 | |

| | | | | | | | | | |

| | | | | | | | | 75,815,400 | |

| | | | | | | | | | |

| | | | | | | | | | |

Hong Kong – 1.9% | |

AIA Group Ltd | | Insurance | | | 232,248 | | | | 2,097,205 | |

Hongkong Land Holdings Ltd | | Real Estate | | | 697,620 | | | | 5,018,606 | |

Kerry Properties Ltd | | Real Estate | | | 851,179 | | | | 3,535,592 | |

Swire Pacific Ltd Cl A | | Real Estate | | | 264,282 | | | | 3,130,127 | |

Swire Properties Ltd | | Real Estate | | | 905,378 | | | | 3,534,055 | |

Wharf Holdings Ltd/The | | Real Estate | | | 1,372,526 | | | | 4,148,699 | |

Wheelock & Co Ltd | | Real Estate | | | 297,708 | | | | 1,908,603 | |

| | | | | | | | | | |

| | | | | | | | | 23,372,887 | |

| | | | | | | | | | |

| | | | | | | | | | |

Hungary – 0.5% | |

OTP Bank Nyrt | | Banks | | | 136,789 | | | | 5,652,878 | |

| | | | | | | | | | |

| | | | | | | | | 5,652,878 | |

| | | | | | | | | | |

| | | | | | | | | | |

India – 0.4% | |

Dr Reddy’s Laboratories Ltd | | Pharma, Biotech & Life Sciences | | | 81,629 | | | | 3,121,799 | |

12

DOMINI IMPACT INTERNATIONAL EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2019 (Unaudited)

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

India(Continued) | |

Wipro Ltd | | Software & Services | | | 363,301 | | | $ | 1,883,822 | |

| | | | | | | | | | |

| | | | | | | | | 5,005,621 | |

| | | | | | | | | | |

| | | | | | | | | | |

Ireland- 0.0% | |

Irish Bank Resolution Corp Ltd/Old (a)(c) | | Banks | | | 138,674 | | | | 0 | |

| | | | | | | | | | |

| | | | | | | | | 0 | |

| | | | | | | | | | |

| | | | | | | | | | |

Israel – 0.4% | |

Check Point Software Technologies Ltd (a) | | Software & Services | | | 48,694 | | | | 5,449,832 | |

| | | | | | | | | | |

| | | | | | | | | 5,449,832 | |

| | | | | | | | | | |

| | | | | | | | | | |

Italy – 1.7% | |

A2A SpA | | Utilities | | | 4,253,966 | | | | 7,781,222 | |

CNH Industrial NV | | Capital Goods | | | 1,308,289 | | | | 12,890,835 | |

| | | | | | | | | | |

| | | | | | | | | 20,672,057 | |

| | | | | | | | | | |

| | | | | | | | | | |

Japan – 22.3% | |

Amada Holdings Co Ltd | | Capital Goods | | | 422,192 | | | | 4,253,015 | |

Brother Industries Ltd | | Technology Hardware & Equipment | | | 448,072 | | | | 7,568,247 | |

Central Japan Railway Co | | Transportation | | | 99,282 | | | | 21,475,778 | |

Dai Nippon Printing Co Ltd | | Commercial & Professional Services | | | 383,241 | | | | 8,877,858 | |

FUJIFILM Holdings Corp | | Technology Hardware & Equipment | | | 160,183 | | | | 6,888,453 | |

Hachijuni Bank Ltd/The | | Banks | | | 1,127,837 | | | | 4,998,363 | |

House Foods Group Inc | | Food & Beverage | | | 32,852 | | | | 1,144,738 | |

Ibiden Co Ltd | | Technology Hardware & Equipment | | | 113,786 | | | | 1,660,187 | |

K’s Holdings Corp | | Retailing | | | 765,107 | | | | 7,629,851 | |

Kose Corp | | Household & Personal Products | | | 81,543 | | | | 11,980,747 | |

KYORIN Holdings Inc | | Pharma, Biotech & Life Sciences | | | 104,344 | | | | 2,217,567 | |

Matsumotokiyoshi Holdings Co Ltd | | Food & Staples Retailing | | | 106,781 | | | | 3,301,581 | |

Medipal Holdings Corp | | Health Care Equipment & Services | | | 254,296 | | | | 5,874,561 | |

MINEBEA MITSUMI Inc | | Capital Goods | | | 105,825 | | | | 1,742,241 | |

Mitsubishi Estate Co Ltd | | Real Estate | | | 90,054 | | | | 1,596,382 | |

Mitsubishi Gas Chemical Co Inc | | Materials | | | 687,998 | | | | 10,891,314 | |

Mitsui Fudosan Co Ltd | | Real Estate | | | 560,607 | | | | 13,631,752 | |

Mixi Inc | | Media & Entertainment | | | 216,700 | | | | 5,498,177 | |

MS&AD Insurance Group Holdings Inc | | Insurance | | | 267,005 | | | | 7,911,195 | |

Murata Manufacturing Co Ltd | | Technology Hardware & Equipment | | | 135,802 | | | | 20,417,411 | |

Nikon Corp | | Consumer Durables & Apparel | | | 712,571 | | | | 12,194,474 | |

13

DOMINI IMPACT INTERNATIONAL EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2019 (Unaudited)

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

Japan(Continued) | |

Nippon Electric Glass Co Ltd | | Technology Hardware & Equipment | | | 118,041 | | | $ | 3,290,149 | |

Nissan Motor Co Ltd | | Automobiles & Components | | | 3,410,866 | | | | 29,154,206 | |

Nitto Denko Corp | | Materials | | | 69,602 | | | | 3,940,490 | |

Nomura Real Estate Holdings Inc | | Real Estate | | | 63,243 | | | | 1,229,351 | |

NTN Corp | | Capital Goods | | | 5,300 | | | | 17,432 | |

ORIX Corp | | Diversified Financials | | | 1,222,812 | | | | 18,460,770 | |

Ricoh Co Ltd | | Technology Hardware & Equipment | | | 282,053 | | | | 3,007,299 | |

Seino Holdings Co Ltd | | Transportation | | | 416,167 | | | | 5,758,448 | |

Shionogi & Co Ltd | | Pharma, Biotech & Life Sciences | | | 283,657 | | | | 17,510,574 | |

Sony Corp | | Consumer Durables & Apparel | | | 68,006 | | | | 3,410,546 | |

Sumitomo Dainippon Pharma Co Ltd | | Pharma, Biotech & Life Sciences | | | 108,204 | | | | 2,549,773 | |

Suzuken Co Ltd/Aichi Japan | | Health Care Equipment & Services | | | 75,672 | | | | 3,976,670 | |

Taiyo Yuden Co Ltd | | Technology Hardware & Equipment | | | 75,389 | | | | 1,329,652 | |

Toppan Printing Co Ltd | | Commercial & Professional Services | | | 541,358 | | | | 8,880,066 | |

Toyo Seikan Group Holdings Ltd | | Materials | | | 348,727 | | | | 7,856,479 | |

Yamazaki Baking Co Ltd | | Food & Beverage | | | 118,527 | | | | 2,330,197 | |

| | | | | | | | | | |

| | | | | | | | | 274,455,994 | |

| | | | | | | | | | |

| | | | | | | | | | |

Mexico – 0.4% | |

Grupo Financiero Banorte SAB de CV | | Banks | | | 854,366 | | | | 4,775,101 | |

| | | | | | | | | | |

| | | | | | | | | 4,775,101 | |

| | | | | | | | | | |

| | | | | | | | | | |

Netherlands – 6.9% | |

ABN AMRO Group NV | | Banks | | | 430,557 | | | | 10,763,083 | |

Aegon NV | | Insurance | | | 1,091,680 | | | | 5,638,053 | |

ASR Nederland NV | | Insurance | | | 123,306 | | | | 5,213,766 | |

Coca-Cola European Partners PLC | | Food & Beverage | | | 477,226 | | | | 22,706,413 | |

Koninklijke Ahold Delhaize NV | | Food & Staples Retailing | | | 784,778 | | | | 20,727,321 | |

Koninklijke Philips NV | | Health Care Equipment & Services | | | 137,989 | | | | 5,453,772 | |

NN Group NV | | Insurance | | | 335,786 | | | | 14,214,657 | |

| | | | | | | | | | |

| | | | | | | | | 84,717,065 | |

| | | | | | | | | | |

| | | | | | | | | | |

Norway – 0.2% | |

Orkla ASA | | Food & Beverage | | | 249,439 | | | | 2,018,547 | |

| | | | | | | | | | |

| | | | | | | | | 2,018,547 | |

| | | | | | | | | | |

| | | | | | | | | | |

14

DOMINI IMPACT INTERNATIONAL EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2019 (Unaudited)

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

Singapore – 2.8% | |

CapitaLand Ltd | | Real Estate | | | 813,430 | | | $ | 2,018,994 | |

ComfortDelGro Corp Ltd | | Transportation | | | 4,300,966 | | | | 7,471,782 | |

United Overseas Bank Ltd | | Banks | | | 651,426 | | | | 12,222,575 | |

Yangzijiang Shipbuilding Holdings Ltd | | Capital Goods | | | 11,782,095 | | | | 12,328,278 | |

| | | | | | | | | | |

| | | | | | | | | 34,041,629 | |

| | | | | | | | | | |

| | | | | | | | | | |

South Africa – 0.4% | |

Mondi Ltd | | Materials | | | 187,077 | | | | 4,649,755 | |

| | | | | | | | | | |

| | | | | | | | | 4,649,755 | |

| | | | | | | | | | |

| | | | | | | | | | |

South Korea – 1.8% | |

BNK Financial Group Inc | | Banks | | | 445,386 | | | | 2,946,270 | |

Industrial Bank of Korea | | Banks | | | 495,138 | | | | 6,342,256 | |

LG Display Co Ltd | | Technology Hardware & Equipment | | | 143,172 | | | | 2,438,595 | |

LG Uplus Corp | | Telecommunication Services | | | 394,345 | | | | 5,359,967 | |

Woori Bank (a) (c) | | Banks | | | 412,218 | | | | 5,551,202 | |

| | | | | | | | | | |

| | | | | | | | | 22,638,290 | |

| | | | | | | | | | |

| | | | | | | | | | |

Spain – 1.4% | |

Banco Santander SA | | Banks | | | 2,078 | | | | 9,880 | |

Telefonica SA | | Telecommunication Services | | | 2,015,114 | | | | 17,376,314 | |

| | | | | | | | | | |

| | | | | | | | | 17,386,194 | |

| | | | | | | | | | |

| | | | | | | | | | |

Sweden – 6.5% | |

Alfa Laval AB | | Capital Goods | | | 487,767 | | | | 11,059,914 | |

Castellum AB | | Real Estate | | | 177,504 | | | | 3,365,538 | |

Fabege AB | | Real Estate | | | 236,445 | | | | 3,450,594 | |

Holmen AB Cl B | | Materials | | | 34,332 | | | | 735,834 | |

Industrivarden AB Cl C | | Diversified Financials | | | 361,096 | | | | 7,445,318 | |

Sandvik AB | | Capital Goods | | | 1,621,851 | | | | 25,920,073 | |

SSAB AB Cl A | | Materials | | | 419,784 | | | | 1,664,266 | |

Svenska Cellulosa AB SCA Cl B | | Materials | | | 1,692,088 | | | | 14,885,370 | |

Telefonaktiebolaget LM Ericsson | | Technology Hardware & Equipment | | | 1,247,462 | | | | 11,120,566 | |

| | | | | | | | | | |

| | | | | | | | | 79,647,473 | |

| | | | | | | | | | |

| | | | | | | | | | |

Switzerland – 7.3% | |

Chocoladefabriken Lindt & Spruengli AG | | Food & Beverage | | | 1,494 | | | | 9,522,091 | |

Novartis AG | | Pharma, Biotech & Life Sciences | | | 429,852 | | | | 37,615,297 | |

Swiss Life Holding AG | | Insurance | | | 36,048 | | | | 14,906,869 | |

Swiss Re AG | | Insurance | | | 53,200 | | | | 5,114,212 | |

Swisscom AG | | Telecommunication Services | | | 25,039 | | | | 12,029,677 | |

Vifor Pharma AG | | Pharma, Biotech & Life Sciences | | | 81,408 | | | | 10,385,675 | |

| | | | | | | | | | |

| | | | | | | | | 89,573,821 | |

| | | | | | | | | | |

| | | | | | | | | | |

15

DOMINI IMPACT INTERNATIONAL EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2019 (Unaudited)

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

Taiwan – 1.9% | |

Asia Cement Corp | | Materials | | | 4,604,127 | | | $ | 5,535,832 | |

AU Optronics Corp | | Technology Hardware & Equipment | | | 13,639,926 | | | | 5,346,833 | |

Lite-On Technology Corp | | Technology Hardware & Equipment | | | 1,977,512 | | | | 2,952,910 | |

Novatek Microelectronics Corp | | Semiconductors & Semiconductor Equipment | | | 858,761 | | | | 4,511,524 | |

United Microelectronics Corp | | Semiconductors & Semiconductor Equipment | | | 12,227,181 | | | | 4,669,777 | |

| | | | | | | | | | |

| | | | | | | | | 23,016,876 | |

| | | | | | | | | | |

| | | | | | | | | | |

Turkey – 0.6% | |

Turkiye Garanti Bankasi AS | | Banks | | | 2,424,803 | | | | 4,246,589 | |

Turkiye Is Bankasi AS | | Banks | | | 3,138,113 | | | | 3,447,447 | |

| | | | | | | | | | |

| | | | | | | | | 7,694,036 | |

| | | | | | | | | | |

| | | | | | | | | | |

United Kingdom – 11.3% | |

3i Group PLC | | Diversified Financials | | | 1,126,535 | | | | 12,609,868 | |

Auto Trader Group PLC | | Media & Entertainment | | | 283,147 | | | | 1,704,254 | |

Berkeley Group Holdings PLC | | Consumer Durables & Apparel | | | 281,099 | | | | 13,880,975 | |

Burberry Group PLC | | Consumer Durables & Apparel | | | 609,034 | | | | 14,439,195 | |

Ferguson PLC | | Capital Goods | | | 271,945 | | | | 18,263,755 | |

GlaxoSmithKline PLC | | Pharma, Biotech & Life Sciences | | | 943,153 | | | | 18,374,125 | |

Hikma Pharmaceuticals PLC | | Pharma, Biotech & Life Sciences | | | 191,068 | | | | 4,054,088 | |

J Sainsbury PLC | | Food & Staples Retailing | | | 4,244,620 | | | | 15,940,435 | |

Micro Focus International PLC | | Software & Services | | | 171,228 | | | | 3,274,061 | |

Next PLC | | Retailing | | | 127,895 | | | | 8,157,831 | |

Royal Mail PLC | | Transportation | | | 1,918,710 | | | | 6,780,268 | |

Segro PLC | | Real Estate | | | 338,394 | | | | 2,885,032 | |

Standard Chartered PLC | | Banks | | | 694,194 | | | | 5,615,191 | |

Unilever PLC | | Household & Personal Products | | | 237 | | | | 12,487 | |

Wm Morrison Supermarkets PLC | | Food & Staples Retailing | | | 4,129,193 | | | | 12,735,205 | |

| | | | | | | | | | |

| | | | | | | | | 138,726,770 | |

| | | | | | | | | | |

| | |

Total Investments – 97.6%(Cost $1,168,324,469) (b) | | | | | | | 1,202,038,623 | |

| | |

| Other Assets, less liabilities – 2.4% | | | | | 29,835,035 | |

| | | | | | | | | | |

| | | |

| Net Assets – 100.0% | | | | | | | $1,231,873,658 | |

| | | | | | | | | | |

(a)Non-income producing security.

(b) The aggregate cost for federal income tax purposes is $1,176,698,530. The aggregate gross unrealized appreciation is $90,517,408 and the aggregate gross unrealized depreciation is $65,177,315, resulting in net unrealized appreciation of $25,340,093.

(c) Securities for which there are no such quotations or valuations are valued at fair value as determined in good faith by or at the direction of the Fund’s Board of Trustees.

As of the date of this report, certain foreign securities were fair valued by an independent pricing service under the direction of the Board of Trustees or its delegates in accordance with the Trust’s Valuation and Pricing Policies and Procedures.

SEE NOTES TO FINANCIAL STATEMENTS

16

DOMINI IMPACT EQUITY FUND

Fund Performance and Holdings

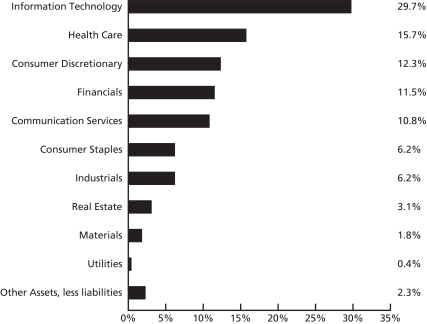

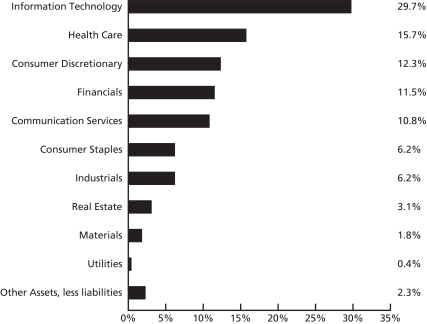

The table and bar charts below provide information as of January 31, 2019, about the ten largest holdings of the Domini Impact Equity Fund and its portfolio holdings by industry sector:

TEN LARGEST HOLDINGS (Unaudited)

| | | | | | | | | | |

| | | | |

| SECURITY DESCRIPTION | | % NET

ASSETS | | | SECURITY DESCRIPTION | | % NET

ASSETS | |

| | | | |

| Microsoft Corp | | | 4.9% | | | Pfizer Inc | | | 1.5% | |

| | | | |

| Amazon.com Inc | | | 4.3% | | | Procter & Gamble Co/The | | | 1.4% | |

| | | | |

| Apple Inc | | | 4.3% | | | Visa Inc Cl A | | | 1.4% | |

| | | | |

| Alphabet Inc Cl A | | | 4.1% | | | Verizon Communications Inc | | | 1.4% | |

| | | | |

| Bank of America Corp | | | 1.6% | | | Cisco Systems Inc | | | 1.3% | |

PORTFOLIO HOLDINGS BY INDUSTRY SECTOR (% OF NET ASSETS) (Unaudited)

The holdings mentioned above are described in the Domini Impact Equity Fund’s Portfolio of Investments (as of 1/31/19), included herein. The composition of the Fund’s portfolio is subject to change.

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by Domini Impact Investments. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification nor shall any such party have any liability therefrom.

17

| | | | | | | | | | | | | | |

| |

DOMINI IMPACT EQUITY FUND AVERAGE ANNUAL TOTAL RETURNS (Unaudited) |

| | | | | | |

| | | Investor

shares | | Class A shares

(with 4.75%

maximum

Sales Charge) | | Class A shares

(without Sales

Charge) | | Institutional

shares | | Class R

shares | | S&P 500 |

| | | | | | | |

| As of 1/31/19 | | 1 Year | | -7.10% | | -11.50% | | -7.09% | | -6.75% | | -6.85% | | -2.31% |

| | | | | | | |

| | 5 Year | | 6.50% | | 5.44% | | 6.47% | | 6.88% | | 6.81% | | 10.96% |

| | | | | | | |

| | | 10 Year | | 12.82% | | 12.30% | | 12.85% | | 13.28% | | 13.19% | | 15.00% |

NOTE: The Fund’s current investment strategy commenced on December 1, 2018 with SSGA Funds Management, Inc as its subadviser. Performance information for periods prior to December 1, 2018 reflects the investment strategies employed during those periods.

Past performance is no guarantee of future results.The Fund’s returns quoted above represent past performance after all expenses. The returns reflect any applicable expense waivers in effect during the periods shown. Without such waivers, Fund performance would be lower. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost. Call1-800-762-6814 or visit www.domini.com for performance information current to the most recentmonth-end, which may be lower or higher than the performance data quoted. A 2.00% redemption fee applies on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Quoted performance data does not reflect the deduction of this fee, which would reduce the performance quoted. See the prospectus for further information.

An investment in the Fund is not a bank deposit and is not insured. You may lose money. The Fund is subject to market, market segment, style and foreign investing risks. Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing security regulations and accounting standards limited public information possible changes in taxation, and periods of illiquidity.

Per the prospectus dated December 1, 2018, the Fund’s annual operating expenses totaled 1.06% (gross/net) (Investor), 1.34% (gross)/1.09% (net) (Class A), 0.72% (gross/net) (Institutional), 0.80% (gross/net) (Class R). The Fund’s adviser has contractually agreed to waive certain fees and/or reimburse certain ordinary operating expenses in order to limit Investor, Class A, Institutional and Class R share expenses to 1.09%, 1.09%, 0.74%, and 0.80% through November 30, 2019, absent an earlier modification approved by the Funds’ Board of Trustees.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Fund is based on the Fund’s net asset values and assumes all dividend and capital gains were reinvested.

The Standard & Poor’s 500 Index (S&P 500) is an unmanaged index of common stocks. Investors cannot invest directly in the S&P 500.

18

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS

January 31, 2019 (Unaudited)

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| Common Stocks – 97.7% | |

| Communication Services – 10.8% | |

AT&T Inc | | | 307,551 | | | $ | 9,244,983 | |

Alphabet Inc Cl A (a) | | | 26,262 | | | | 29,568,122 | |

CenturyLink Inc | | | 47,100 | | | | 721,572 | |

Charter Communications Inc Cl A (a) | | | 7,300 | | | | 2,416,665 | |

Comcast Corp Cl A | | | 201,300 | | | | 7,361,541 | |

Electronic Arts Inc (a) | | | 13,700 | | | | 1,263,688 | |

Interpublic Group of Cos Inc/The | | | 17,000 | | | | 386,750 | |

Netflix Inc (a) | | | 19,000 | | | | 6,450,500 | |

New York Times Co/The Cl A | | | 6,900 | | | | 177,399 | |

Omnicom Group Inc | | | 9,900 | | | | 771,012 | |

Sprint Corp (a) | | | 27,600 | | | | 172,224 | |

TELUS Corp | | | 26,500 | | | | 928,295 | |

Take-Two Interactive Software Inc (a) | | | 5,181 | | | | 546,855 | |

TripAdvisor Inc (a) | | | 4,700 | | | | 269,686 | |

Verizon Communications Inc | | | 180,063 | | | | 9,914,269 | |

Walt Disney Co/The | | | 63,342 | | | | 7,063,900 | |

| | | | | | | | |

| | | | | | | 77,257,461 | |

| | | | | | | | |

|

| Consumer Discretionary – 12.3% | |

Advance Auto Parts Inc | | | 2,957 | | | | 470,754 | |

Amazon.com Inc (a) | | | 18,039 | | | | 31,004,170 | |

Best Buy Co Inc | | | 10,103 | | | | 598,502 | |

Booking Holdings Inc (a) | | | 1,962 | | | | 3,595,973 | |

BorgWarner Inc | | | 8,800 | | | | 359,920 | |

Capri Holdings Ltd (a) | | | 6,635 | | | | 281,855 | |

CarMax Inc (a) | | | 7,700 | | | | 452,606 | |

Chipotle Mexican Grill Inc (a) | | | 1,188 | | | | 629,177 | |

Cie Generale des Etablissements Michelin SCA ADR | | | 39,700 | | | | 862,086 | |

eBay Inc (a) | | | 40,400 | | | | 1,359,460 | |

Expedia Group Inc | | | 5,200 | | | | 620,100 | |

Fast Retailing Co Ltd ADR | | | 24,000 | | | | 1,098,120 | |

Gap Inc/The | | | 12,345 | | | | 314,057 | |

Garmin Ltd | | | 5,800 | | | | 401,244 | |

Gentex Corp | | | 12,000 | | | | 254,160 | |

Genuine Parts Co | | | 6,200 | | | | 618,884 | |

Home Depot Inc/The | | | 48,618 | | | | 8,922,862 | |

Kohl’s Corp | | | 7,212 | | | | 495,392 | |

L Brands Inc | | | 10,719 | | | | 298,417 | |

LKQ Corp (a) | | | 12,600 | | | | 330,372 | |

Lennar Corp Cl A | | | 12,800 | | | | 606,976 | |

Lowe’s Cos Inc | | | 33,364 | | | | 3,208,282 | |

Marriott International Inc/MD Cl A | | | 12,209 | | | | 1,398,297 | |

Mohawk Industries Inc (a) | | | 2,800 | | | | 360,612 | |

NIKE Inc Cl B | | | 55,076 | | | | 4,509,623 | |

NVR Inc (a) | | | 150 | | | | 399,000 | |

Nordstrom Inc | | | 5,309 | | | | 246,391 | |

O’Reilly Automotive Inc (a) | | | 3,600 | | | | 1,240,776 | |

Ralph Lauren Corp | | | 2,439 | | | | 283,265 | |

19

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2019 (Unaudited)

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

|

| Consumer Discretionary(Continued) | |

Sony Corp ADR | | | 54,700 | | | $ | 2,741,564 | |

Starbucks Corp | | | 53,014 | | | | 3,612,374 | |

Tapestry Inc | | | 12,348 | | | | 477,991 | |

Target Corp | | | 22,933 | | | | 1,674,109 | |

Tenneco Inc Cl A | | | 2,298 | | | | 79,695 | |

Tesla Inc (a) | | | 11,166 | | | | 3,428,185 | |

Tiffany & Co | | | 5,100 | | | | 452,523 | |

Toyota Motor Corp ADR | | | 51,900 | | | | 6,392,523 | |

Ulta Beauty Inc (a) | | | 2,500 | | | | 729,800 | |

Under Armour Inc Cl A (a) | | | 15,100 | | | | 313,174 | |

Vail Resorts Inc | | | 1,800 | | | | 338,868 | |

Veoneer Inc (a) | | | 32,109 | | | | 957,169 | |

Wayfair Inc Cl A (a) | | | 2,700 | | | | 295,542 | |

Weight Watchers International Inc (a) | | | 36,512 | | | | 1,168,384 | |

Williams-Sonoma Inc | | | 3,600 | | | | 195,948 | |

| | | | | | | | |

| | | | | | | 88,079,182 | |

| | | | | | | | |

|

| Consumer Staples – 6.2% | |

Campbell Soup Co | | | 8,791 | | | | 311,465 | |

Church & Dwight Co Inc | | | 10,800 | | | | 697,788 | |

Clorox Co/The | | | 5,700 | | | | 845,766 | |

Colgate-Palmolive Co | | | 38,053 | | | | 2,461,268 | |

Costco Wholesale Corp | | | 18,920 | | | | 4,060,800 | |

Coty Inc Cl A | | | 20,700 | | | | 160,632 | |

Estee Lauder Cos Inc/The Cl A | | | 9,556 | | | | 1,303,630 | |

General Mills Inc | | | 26,375 | | | | 1,172,105 | |

JM Smucker Co/The | | | 4,746 | | | | 497,760 | |

Kimberly-Clark Corp | | | 15,141 | | | | 1,686,405 | |

Kraft Heinz Co/The | | | 27,823 | | | | 1,337,173 | |

Kroger Co/The | | | 36,101 | | | | 1,022,741 | |

Lamb Weston Holdings Inc | | | 6,400 | | | | 462,720 | |

Mondelez International Inc Cl A | | | 62,965 | | | | 2,912,761 | |

PepsiCo Inc | | | 60,561 | | | | 6,823,408 | |

Procter & Gamble Co/The | | | 106,255 | | | | 10,250,420 | |

Sprouts Farmers Market Inc (a) | | | 6,600 | | | | 158,268 | |

SunOpta Inc (a) | | | 356,643 | | | | 1,483,635 | |

Sysco Corp | | | 21,248 | | | | 1,356,685 | |

Unilever PLC ADR | | | 49,000 | | | | 2,577,400 | |

Walgreens Boots Alliance Inc | | | 35,648 | | | | 2,575,924 | |

| | | | | | | | |

| | | | | | | 44,158,754 | |

| | | | | | | | |

|

| Financials – 11.5% | |

Affiliated Managers Group Inc | | | 2,400 | | | | 251,880 | |

Aflac Inc | | | 32,852 | | | | 1,567,040 | |

Amalgamated Bank Cl A | | | 39,280 | | | | 704,683 | |

American Express Co | | | 30,591 | | | | 3,141,696 | |

Aon PLC | | | 10,500 | | | | 1,640,415 | |

Arthur J Gallagher & Co | | | 8,100 | | | | 605,151 | |

BB&T Corp | | | 33,300 | | | | 1,625,040 | |

20

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2019 (Unaudited)

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| | | | | | | | |

|

| Financials(Continued) | |

Bank of America Corp | | | 390,208 | | | $ | 11,109,222 | |

Bank of Montreal | | | 28,400 | | | | 2,078,596 | |

Bank of Nova Scotia/The | | | 54,339 | | | | 3,094,063 | |

BlackRock Inc | | | 4,900 | | | | 2,033,892 | |

CME Group Inc | | | 15,400 | | | | 2,807,112 | |

Capital One Financial Corp | | | 20,759 | | | | 1,672,968 | |

Chubb Ltd | | | 19,100 | | | | 2,541,255 | |

Cincinnati Financial Corp | | | 6,800 | | | | 551,616 | |

Citigroup Inc | | | 107,900 | | | | 6,955,234 | |

Comerica Inc | | | 7,054 | | | | 555,432 | |

Cullen/Frost Bankers Inc | | | 2,700 | | | | 262,656 | |

Discover Financial Services | | | 14,800 | | | | 998,852 | |

E*TRADE Financial Corp | | | 11,014 | | | | 513,913 | |

East West Bancorp Inc | | | 6,500 | | | | 327,080 | |

Everest Re Group Ltd | | | 1,800 | | | | 394,290 | |

Federal Agricultural Mortgage Corp Cl C | | | 15,532 | | | | 1,098,889 | |

Franklin Resources Inc | | | 12,700 | | | | 376,047 | |

Hartford Financial Services Group Inc/The | | | 15,900 | | | | 746,028 | |

Huntington Bancshares Inc/OH | | | 46,100 | | | | 610,364 | |

Intercontinental Exchange Inc | | | 24,595 | | | | 1,887,912 | |

Invesco Ltd | | | 18,500 | | | | 337,070 | |

KeyCorp | | | 45,300 | | | | 746,091 | |

MSCI Inc | | | 3,800 | | | | 647,026 | |

Marsh & McLennan Cos Inc | | | 21,900 | | | | 1,931,361 | |

Moody’s Corp | | | 7,300 | | | | 1,157,123 | |

Morgan Stanley | | | 57,792 | | | | 2,444,602 | |

Nasdaq Inc | | | 5,100 | | | | 449,004 | |

Northern Trust Corp | | | 9,200 | | | | 813,832 | |

PNC Financial Services Group Inc/The | | | 18,590 | | | | 2,280,435 | |

People’s United Financial Inc | | | 16,700 | | | | 273,546 | |

Principal Financial Group Inc | | | 12,600 | | | | 630,882 | |

Prudential Financial Inc | | | 17,987 | | | | 1,657,322 | |

Raymond James Financial Inc | | | 5,400 | | | | 434,700 | |

Regions Financial Corp | | | 43,728 | | | | 663,354 | |

Reinsurance Group of America Inc | | | 2,800 | | | | 404,460 | |

S&P Global Inc | | | 10,900 | | | | 2,088,985 | |

SEI Investments Co | | | 6,500 | | | | 309,010 | |

Starwood Property Trust Inc | | | 12,400 | | | | 273,792 | |

T Rowe Price Group Inc | | | 10,300 | | | | 962,638 | |

TD Ameritrade Holding Corp | | | 12,700 | | | | 710,565 | |

Toronto-Dominion Bank/The | | | 80,321 | | | | 4,522,876 | |

Travelers Cos Inc/The | | | 11,600 | | | | 1,456,264 | |

US Bancorp | | | 64,846 | | | | 3,317,521 | |

Unum Group | | | 9,400 | | | | 326,744 | |

Voya Financial Inc | | | 7,100 | | | | 329,653 | |

Westpac Banking Corp ADR | | | 151,700 | | | | 2,707,845 | |

Zions Bancorp NA | | | 8,200 | | | | 390,238 | |

| | | | | | | | |

| | | | | | | 82,418,265 | |

| | | | | | | | |

21

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2019 (Unaudited)

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| | | | | | | | |

| Health Care – 15.7% | |

ABIOMED Inc (a) | | | 1,900 | | | $ | 667,033 | |

AbbVie Inc | | | 62,611 | | | | 5,027,037 | |

Agilent Technologies Inc | | | 14,000 | | | | 1,064,700 | |

Alexion Pharmaceuticals Inc (a) | | | 9,500 | | | | 1,168,120 | |

Align Technology Inc (a) | | | 3,300 | | | | 821,535 | |

Amgen Inc | | | 27,353 | | | | 5,118,020 | |

Becton Dickinson and Co | | | 11,700 | | | | 2,918,682 | |

Bio-Rad Laboratories Inc Cl A (a) | | | 1,000 | | | | 249,870 | |

Bio-Techne Corp | | | 1,700 | | | | 296,582 | |

BioTelemetry Inc (a) | | | 30,329 | | | | 2,178,229 | |

Biogen Inc (a) | | | 8,739 | | | | 2,916,903 | |

Bristol-Myers Squibb Co | | | 69,787 | | | | 3,445,384 | |

Bruker Corp | | | 4,600 | | | | 161,276 | |

Celgene Corp (a) | | | 30,000 | | | | 2,653,800 | |

Cerner Corp (a) | | | 13,900 | | | | 763,249 | |

Cooper Cos Inc/The | | | 2,200 | | | | 613,272 | |

DENTSPLY SIRONA Inc | | | 9,500 | | | | 398,525 | |

Danaher Corp | | | 27,200 | | | | 3,017,024 | |

DexCom Inc (a) | | | 23,367 | | | | 3,295,448 | |

Edwards Lifesciences Corp (a) | | | 9,200 | | | | 1,567,864 | |

Gilead Sciences Inc | | | 55,365 | | | | 3,876,104 | |

GlaxoSmithKline PLC ADR | | | 108,000 | | | | 4,233,600 | |

Haemonetics Corp (a) | | | 2,351 | | | | 232,537 | |

Henry Schein Inc | | | 6,600 | | | | 512,820 | |

Hill-Rom Holdings Inc | | | 2,800 | | | | 280,056 | |

Hologic Inc (a) | | | 57,781 | | | | 2,565,476 | |

IDEXX Laboratories Inc (a) | | | 3,700 | | | | 787,286 | |

Illumina Inc (a) | | | 6,600 | | | | 1,846,614 | |

Incyte Corp (a) | | | 7,900 | | | | 636,661 | |

Ionis Pharmaceuticals Inc (a) | | | 5,700 | | | | 330,600 | |

Koninklijke Philips NV | | | 39,000 | | | | 1,537,770 | |

Merck & Co Inc | | | 112,901 | | | | 8,403,221 | |

Mettler-Toledo International Inc (a) | | | 1,100 | | | | 701,976 | |

Nektar Therapeutics (a) | | | 7,700 | | | | 326,018 | |

Novartis AG ADR | | | 104,800 | | | | 9,172,096 | |

Novo Nordisk A/S ADR | | | 73,800 | | | | 3,470,076 | |

OraSure Technologies Inc (a) | | | 136,050 | | | | 1,748,243 | |

PerkinElmer Inc | | | 4,800 | | | | 434,400 | |

Perrigo Co PLC | | | 5,900 | | | | 274,055 | |

Pfizer Inc | | | 251,900 | | | | 10,693,155 | |

Quest Diagnostics Inc | | | 5,900 | | | | 515,365 | |

Regeneron Pharmaceuticals Inc (a) | | | 3,500 | | | | 1,502,445 | |

ResMed Inc | | | 6,146 | | | | 584,915 | |

STERIS PLC | | | 3,800 | | | | 433,428 | |

Sanofi ADR | | | 98,500 | | | | 4,279,825 | |

Seattle Genetics Inc (a) | | | 23,942 | | | | 1,829,887 | |

Stryker Corp | | | 13,300 | | | | 2,361,681 | |

Teladoc Health Inc (a) | | | 34,635 | | | | 2,223,567 | |

Thermo Fisher Scientific Inc | | | 17,814 | | | | 4,376,365 | |

22

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2019 (Unaudited)

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| | | | | | | | |

| Health Care(Continued) | |

Varian Medical Systems Inc (a) | | | 3,900 | | | $ | 514,917 | |

Veeva Systems Inc Cl A (a) | | | 5,443 | | | | 593,614 | |

Vertex Pharmaceuticals Inc (a) | | | 11,300 | | | | 2,157,283 | |

Waters Corp (a) | | | 3,263 | | | | 754,471 | |

| | | | | | | | |

| | | | | | | 112,533,080 | |

| | | | | | | | |

|

| Industrials – 6.2% | |

3M Co | | | 25,215 | | | | 5,050,565 | |

AO Smith Corp | | | 6,500 | | | | 311,090 | |

Acuity Brands Inc | | | 11,467 | | | | 1,386,475 | |

Alaska Air Group Inc | | | 5,600 | | | | 358,120 | |

Allegion PLC | | | 4,200 | | | | 360,612 | |

Ameresco Inc Cl A (a) | | | 157,039 | | | | 2,344,592 | |

CH Robinson Worldwide Inc | | | 5,900 | | | | 511,943 | |

Canadian Pacific Railway Ltd | | | 6,300 | | | | 1,290,870 | |

Carlisle Cos Inc | | | 2,500 | | | | 269,325 | |

Copart Inc (a) | | | 9,200 | | | | 465,796 | |

Cummins Inc | | | 6,851 | | | | 1,007,851 | |

Deere & Co | | | 13,800 | | | | 2,263,200 | |

Donaldson Co Inc | | | 5,800 | | | | 274,224 | |

Emerson Electric Co | | | 27,400 | | | | 1,793,878 | |

Expeditors International of Washington Inc | | | 7,600 | | | | 526,680 | |

Fastenal Co | | | 12,700 | | | | 767,842 | |

Flowserve Corp | | | 5,900 | | | | 259,836 | |

Fortune Brands Home & Security Inc | | | 6,400 | | | | 289,920 | |

Graco Inc | | | 7,400 | | | | 320,642 | |

HD Supply Holdings Inc (a) | | | 7,500 | | | | 314,550 | |

Hubbell Inc | | | 2,400 | | | | 262,392 | |

IDEX Corp | | | 3,400 | | | | 468,724 | |

IHS Markit Ltd (a) | | | 15,400 | | | | 799,568 | |

Illinois Tool Works Inc | | | 12,700 | | | | 1,743,837 | |

Ingersoll-Rand PLC | | | 10,900 | | | | 1,090,436 | |

JB Hunt Transport Services Inc | | | 3,800 | | | | 406,752 | |

JetBlue Airways Corp (a) | | | 13,588 | | | | 244,448 | |

Johnson Controls International plc | | | 39,800 | | | | 1,344,046 | |

KAR Auction Services Inc | | | 6,100 | | | | 317,261 | |

Lennox International Inc | | | 1,700 | | | | 389,776 | |

Masco Corp | | | 13,100 | | | | 424,571 | |

Nielsen Holdings PLC | | | 15,500 | | | | 398,040 | |

Nordson Corp | | | 2,100 | | | | 272,244 | |

Owens Corning | | | 4,900 | | | | 256,711 | |

PACCAR Inc | | | 15,051 | | | | 986,142 | |

Pentair PLC | | | 7,300 | | | | 300,687 | |

Quanta Services Inc | | | 6,500 | | | | 229,710 | |

Robert Half International Inc | | | 5,451 | | | | 351,208 | |

Rockwell Automation Inc | | | 5,200 | | | | 881,504 | |

Roper Technologies Inc | | | 4,400 | | | | 1,246,344 | |

Sensata Technologies Holding PLC (a) | | | 7,100 | | | | 337,250 | |

Simpson Manufacturing Co Inc | | | 1,900 | | | | 116,622 | |

23

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2019 (Unaudited)

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| | | | | | | | |

|

| Industrials(Continued) | |

Snap-on Inc | | | 2,500 | | | $ | 414,975 | |

Sunrun Inc (a) | | | 107,468 | | | | 1,429,324 | |

TPI Composites Inc (a) | | | 42,090 | | | | 1,274,064 | |

Thomson Reuters Corp | | | 7,600 | | | | 397,784 | |

Trex Co Inc | | | 2,700 | | | | 188,352 | |

USG Corp | | | 3,900 | | | | 168,285 | |

United Parcel Service Inc Cl B | | | 30,131 | | | | 3,175,807 | |

United Rentals Inc (a) | | | 3,500 | | | | 438,410 | |

WW Grainger Inc | | | 2,070 | | | | 611,457 | |

Wabtec Corp | | | 3,900 | | | | 269,724 | |

Wolters Kluwer NV ADR | | | 44,617 | | | | 2,781,870 | |

Xylem Inc/NY | | | 7,700 | | | | 548,702 | |

| | | | | | | | |

| | | | | | | 44,735,038 | |

| | | | | | | | |

|

| Information Technology – 29.7% | |

2U Inc (a) | | | 41,082 | | | | 2,335,512 | |

ASML Holding NV | | | 18,200 | | | | 3,185,546 | |

Accenture PLC Cl A | | | 27,600 | | | | 4,237,980 | |

Adobe Inc (a) | | | 21,439 | | | | 5,313,013 | |

Advanced Micro Devices Inc (a) | | | 42,650 | | | | 1,041,087 | |

Akamai Technologies Inc (a) | | | 6,900 | | | | 449,190 | |

Analog Devices Inc | | | 15,800 | | | | 1,561,988 | |

Apple Inc | | | 186,108 | | | | 30,975,816 | |

Applied Materials Inc | | | 42,200 | | | | 1,649,176 | |

Arista Networks Inc (a) | | | 2,300 | | | | 493,994 | |

Atlassian Corp PLC Cl A (a) | | | 31,312 | | | | 3,081,101 | |

Autodesk Inc (a) | | | 28,272 | | | | 4,161,638 | |

Automatic Data Processing Inc | | | 17,900 | | | | 2,503,136 | |

Blackbaud Inc | | | 16,190 | | | | 1,159,204 | |

Blackline Inc (a) | | | 40,426 | | | | 1,923,469 | |

Broadcom Inc | | | 17,700 | | | | 4,748,025 | |

Cadence Design Systems Inc (a) | | | 12,100 | | | | 581,163 | |

Cisco Systems Inc | | | 196,718 | | | | 9,302,794 | |

Citrix Systems Inc | | | 5,685 | | | | 582,940 | |

Cognizant Technology Solutions Corp Cl A | | | 25,300 | | | | 1,762,904 | |

Corning Inc | | | 35,300 | | | | 1,174,078 | |

Cree Inc (a) | | | 69,937 | | | | 3,526,923 | |

DXC Technology Co | | | 12,247 | | | | 785,278 | |

F5 Networks Inc (a) | | | 2,600 | | | | 418,470 | |

Fidelity National Information Services Inc | | | 14,000 | | | | 1,463,420 | |

First Solar Inc (a) | | | 53,091 | | | | 2,685,874 | |

Fiserv Inc | | | 17,600 | | | | 1,459,568 | |

Fortinet Inc (a) | | | 6,400 | | | | 490,048 | |

Gartner Inc (a) | | | 3,900 | | | | 529,971 | |

HP Inc | | | 69,300 | | | | 1,526,679 | |

Hewlett Packard Enterprise Co | | | 66,400 | | | | 1,035,176 | |

IPG Photonics Corp (a) | | | 1,600 | | | | 212,800 | |

Integrated Device Technology Inc (a) | | | 5,800 | | | | 283,330 | |

Intel Corp | | | 195,446 | | | | 9,209,416 | |

24

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2019 (Unaudited)

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| | | | | | | | |

|

| Information Technology(Continued) | |

International Business Machines Corp | | | 39,439 | | | $ | 5,301,390 | |

Intuit Inc | | | 10,800 | | | | 2,330,856 | |

Itron Inc (a) | | | 35,908 | | | | 1,961,654 | |

Juniper Networks Inc | | | 14,800 | | | | 383,912 | |

KLA-Tencor Corp | | | 6,600 | | | | 703,362 | |

Lam Research Corp | | | 6,700 | | | | 1,136,186 | |

Mastercard Inc Cl A | | | 39,020 | | | | 8,238,293 | |

Micron Technology Inc (a) | | | 48,700 | | | | 1,861,314 | |

Microsoft Corp | | | 335,412 | | | | 35,027,075 | |

Mitek Systems Inc | | | 146,448 | | | | 1,615,321 | |

Motorola Solutions Inc | | | 7,301 | | | | 853,560 | |

NVIDIA Corp | | | 25,000 | | | | 3,593,750 | |

NetApp Inc | | | 11,208 | | | | 714,734 | |

Nordea Bank Abp ADR | | | 176,900 | | | | 1,623,058 | |

PayPal Holdings Inc (a) | | | 48,600 | | | | 4,313,736 | |

Paychex Inc | | | 14,100 | | | | 998,280 | |

Pluralsight Inc Cl A (a) | | | 58,537 | | | | 1,754,939 | |

Red Hat Inc (a) | | | 7,800 | | | | 1,387,152 | |

Salesforce.com Inc (a) | | | 31,700 | | | | 4,817,449 | |

Seagate Technology PLC | | | 11,100 | | | | 491,508 | |

Skyworks Solutions Inc | | | 7,700 | | | | 562,408 | |

Square Inc Cl A (a) | | | 61,166 | | | | 4,364,194 | |

STMicroelectronics NV | | | 112,147 | | | | 1,776,408 | |

SunPower Corp (a) | | | 148,484 | | | | 862,692 | |

Symantec Corp | | | 27,400 | | | | 575,948 | |

Synopsys Inc (a) | | | 6,300 | | | | 588,105 | |

Texas Instruments Inc | | | 41,400 | | | | 4,168,152 | |

Universal Display Corp | | | 23,649 | | | | 2,455,476 | |

VMware Inc Cl A | | | 3,230 | | | | 487,956 | |

VeriSign Inc (a) | | | 4,700 | | | | 795,569 | |

Visa Inc Cl A | | | 75,900 | | | | 10,247,259 | |

Western Digital Corp | | | 12,400 | | | | 557,876 | |

| | | | | | | | |

| | | | | | | 212,400,279 | |

| | | | | | | | |

|

| Materials – 1.8% | |

Air Products & Chemicals Inc | | | 9,600 | | | | 1,578,144 | |

AptarGroup Inc | | | 2,600 | | | | 257,712 | |

Avery Dennison Corp | | | 3,900 | | | | 407,355 | |

Axalta Coating Systems Ltd (a) | | | 9,700 | | | | 248,514 | |

Ecolab Inc | | | 11,200 | | | | 1,771,504 | |

International Paper Co | | | 17,800 | | | | 844,254 | |

Linde PLC | | | 24,300 | | | | 3,961,143 | |

Nucor Corp | | | 13,792 | | | | 844,622 | |

PPG Industries Inc | | | 10,600 | | | | 1,117,664 | |

Sealed Air Corp | | | 7,100 | | | | 280,450 | |

Steel Dynamics Inc | | | 10,036 | | | | 367,217 | |

Vulcan Materials Co | | | 5,900 | | | | 599,735 | |

Westrock Co | | | 10,985 | | | | 447,199 | |

| | | | | | | | |

| | | | | | | 12,725,513 | |

| | | | | | | | |

25

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2019 (Unaudited)

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| | | | | | | | |

| Real Estate – 3.1% | |

American Tower Corp | | | 19,200 | | | $ | 3,318,528 | |

Apartment Investment & Management Company Cl A | | | 6,900 | | | | 341,688 | |

Boston Properties Inc | | | 6,800 | | | | 896,716 | |

CBRE Group Inc Cl A (a) | | | 13,900 | | | | 635,925 | |

Crown Castle International Corp | | | 17,900 | | | | 2,095,374 | |

Digital Realty Trust Inc | | | 9,100 | | | | 985,894 | |

Duke Realty Corp | | | 15,500 | | | | 453,220 | |

Equinix Inc | | | 3,500 | | | | 1,379,000 | |

Essex Property Trust Inc | | | 2,800 | | | | 759,360 | |

Extra Space Storage Inc | | | 5,300 | | | | 522,633 | |

Federal Realty Investment Trust | | | 3,300 | | | | 437,481 | |

Host Hotels & Resorts Inc | | | 33,022 | | | | 596,377 | |

Iron Mountain Inc | | | 12,200 | | | | 453,840 | |

Liberty Property Trust | | | 6,600 | | | | 311,124 | |

Mid-America Apartment Communities Inc | | | 4,900 | | | | 496,272 | |

Prologis Inc | | | 27,500 | | | | 1,901,900 | |

Public Storage | | | 6,600 | | | | 1,402,632 | |

Realty Income Corp | | | 13,000 | | | | 892,970 | |

Regency Centers Corp | | | 6,900 | | | | 448,500 | |

SBA Communications Corp (a) | | | 4,900 | | | | 894,397 | |

UDR Inc | | | 11,400 | | | | 498,750 | |

Ventas Inc | | | 15,500 | | | | 999,595 | |

Welltower Inc | | | 16,500 | | | | 1,278,585 | |

| | | | | | | | |

| | | | | | | 22,000,761 | |

| | | | | | | | |

|

| Utilities – 0.4% | |

Alliant Energy Corp | | | 10,100 | | | | 449,147 | |

Avangrid Inc | | | 2,547 | | | | 127,019 | |

Consolidated Edison Inc | | | 14,227 | | | | 1,104,727 | |

Eversource Energy | | | 13,800 | | | | 957,858 | |

| | | | | | | | |

| | | | | | | 2,638,751 | |

| | | | | | | | |

| | |

| Total Investments – 97.7%(Cost $649,983,320) (b) | | | | | 698,947,084 | |

| | |

| Other Assets, less liabilities – 2.3% | | | | | 16,223,842 | |

| | | | | | | | |

| | |

| Net Assets – 100.0% | | | | | $715,170,926 | |

| | | | | | | | |

(a)Non-income producing security.

(b) The aggregate cost for federal income tax purposes is $652,227,885. The aggregate gross unrealized appreciation is $64,952,264 and the aggregate gross unrealized depreciation is $18,233,065, resulting in net unrealized appreciation of $46,719,199.

ADR — American Depository Receipt

SEE NOTES TO FINANCIAL STATEMENTS

26

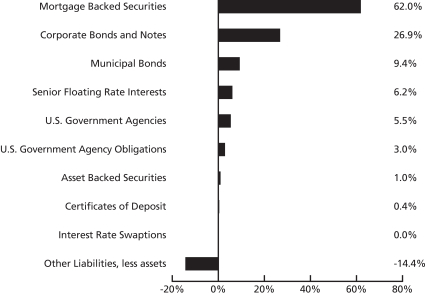

DOMINI IMPACT BOND FUND

Fund Performance and Holdings

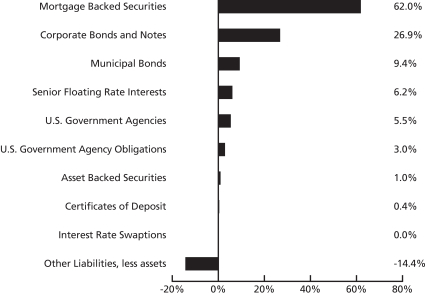

The bar chart below provides information as of January 31, 2019, about the percentage of the Domini Impact Bond Fund’s portfolio holdings invested in various types of debt obligations:

PORTFOLIO COMPOSITION (% OF NET ASSETS) (Unaudited)

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by Domini Impact Investments. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification nor shall any such party have any liability therefrom.

27

| | | | | | | | |

| |

DOMINI IMPACT BOND FUND AVERAGE ANNUAL TOTAL RETURNS (Unaudited) |

| | | |

| | | Investor

shares | | Institutional

shares1 | | Bloomberg Barclays U.S.

Aggregate Index |

| | | | |

| As of 1/31/19 | | 1 Year | | 1.55% | | 1.78% | | 2.25% |

| | | | |

| | 5 Year | | 1.92% | | 2.15% | | 2.44% |

| | | | |

| | | 10 Year | | 2.70% | | 2.70% | | 3.68% |

Past performance is no guarantee of future results.The Fund’s returns quoted above represent past performance after all expenses. The returns reflect any applicable expense waivers in effect during the periods shown. Without such waivers, Fund performance would be lower. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost. Call1-800-762-6814 or visit www.domini.com for performance information current to the most recentmonth-end, which may be lower or higher than the performance data quoted. A 2.00% redemption fee applies on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Quoted performance data does not reflect the deduction of this fee, which would reduce the performance quoted. See the prospectus for further information.

Per the prospectus dated December 1, 2018, the Fund’s annual operating expenses totaled: 1.14% (gross)/ 0.87% (net) (Investor), 1.03% (gross)/ 0.57% (net) (Institutional). Domini Impact Investments LLC has contractually agreed to waive certain fees and/or reimburse certain ordinary operating expenses in order to limit Investor and Institutional share expenses to 0.87% and 0.57%, respectively, absent an earlier modification by the Fund’s Board.

The table does not reflect the deduction of fees and taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return is based on the Fund’s net asset values and assumes all dividends and capital gains were reinvested.

An investment in the Domini Impact Bond Fund is not a bank deposit and is not insured. The Fund is subject to credit, interest rate, liquidity, impact investing and market risks. You may lose money.

During periods of rising interest rates, the Fund can lose value. Some of the Fund’s community development investments may be unrated and may carry greater credit risks than the Fund’s other holdings. The Fund currently holds a large percentage of its portfolio in mortgage-backed securities. During periods of falling interest rates, mortgage-backed securities may prepay the principal due, which may lower the Fund’s return by causing it to reinvest at lower interest rates.

Investments in derivatives can be volatile. Potential risks include currency risk, leverage risk (the risk that small market movements may result in large changes in the value of an investment), liquidity risk, index risk, pricing risk, and counterparty risk (the risk that the counterparty may be unwilling or unable to honor its obligations).

TBA (To Be Announced) securities involve the risk that the security the Fund buys will lose value prior to its delivery. There also is the risk that the security will not be issued or that the other party to the transaction will not meet its obligation, which can adversely affect the Fund’s returns.

The reduction or withdrawal of historical financial market support activities by the U.S. Government and Federal Reserve, or other governments/central banks could negatively impact financial markets generally, and increase market, liquidity and interest rate risks which could adversely affect the Fund’s returns.

The Bloomberg Barclays U.S. Aggregate Index is an index representing securities that are U.S. domestic, taxable, and dollar denominated and covering the U.S. investment grade fixed rate bond market, with index components for government and corporate securities and asset-backed securities. You cannot invest directly in an index.

1Institutional shares were not offered prior to November 30, 2011. All performance information for time periods beginning prior to November 30, 2011, is the performance of the Investor shares. This performance has not been adjusted to reflect the lower expenses of the Institutional shares.

28

DOMINI IMPACT BOND FUND

PORTFOLIOOF INVESTMENTS

January 31, 2019 (Unaudited)

| | | | | | | | |

| | | Principal

Amount* | | | Value | |