UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-5823

DOMINI INVESTMENT TRUST

(Exact Name of Registrant as Specified in Charter)

180 Maiden Lane, Suite 1302, New York, New York 10038

(Address of Principal Executive Offices)

Amy Domini Thornton

Domini Impact Investments LLC

180 Maiden Lane, Suite 1302

New York, New York 10038

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code: 212-217-1100

Date of Fiscal Year End: July 31

Date of Reporting Period: January 31, 2021

| Item 1. | Reports to Stockholders. |

| | (a) | A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 follows. |

TABLE OF CONTENTS

INVESTINGFOR GOOD®

LETTER TO SHAREHOLDERS

Dear Fellow Shareholder,

The six months ending January 31, 2021 were tumultuous ones for our personal and community lives while being as smooth as could be for investors. We were once again reminded that the stock market does not render an accounting of the health of the economy but of certain companies. The six month period ending January 31, 2021 saw the Standard & Poor’s 500 index rise by a stunning 14%. It also saw unemployment figures at levels not seen since the 1930s.

During this time, American citizens struggled with yet another reckoning over racial justice. Marches in our cities motivated many to finally look to government for positive social change. The events around the Presidential election were beyond anything most Americans could have imagined even a decade ago. COVID-19 continued to rip apart families, businesses, and our health care system. Then when a vaccine was made available, the federal government largely stepped aside, leaving the financially depleted and exhausted local governments and agencies to figure out the logistics of actually inoculating enough people to halt the virus before it mutates into something much worse.

Paradoxically, stocks and bonds rose. Stocks returned astonishing results. Of special interest to responsible investors was the dynamic improvement in the opinion of companies that offer solutions to hardships. The backdrop described above caused an urgent need for these solutions. Responsible investors had been intrigued by the concept of distance learning bringing courses from top universities to students in remote locations, but the pandemic made the product urgently needed. We had admired the capacity to offer a kinder, more family-friendly work environment with flexibility of location, but the immediate necessity to work from home caused those companies with such technology to flourish. We had long felt that much of health care could be done more efficiently for the consumer, but not until the pandemic did the market appreciate the need. In short, we witnessed a period during which responsible investors were rewarded for the foresight they had by applying the good-for-people-and-the-planet lens to stock selection.

Another trend we have seen accelerating is the creation, nurturing, and bringing to public markets of a number of companies which were explicitly created to do good. The new generation of entrepreneurs seeking solutions to global climate issues or to providing dignity to people has hit full stride. It is an exciting trend and one that could offer a real contribution to our shared desire for a pleasant future.

2

INVESTINGFOR GOOD®

It is never easy to look back over a six month period and in brief form, summarize the moment. The phrase, “at the crossroads,” comes to mind. The planet stood, perhaps still stands, at the crossroads of choosing democratic institutions for governance, of choosing to limit our lifestyles to save ourselves from climate disaster, to finalize — or not — the definition of humankind as encompassing all human beings, regardless of ethnicity or other potential differentiators. At Domini Impact Investments, we strive to give you, our investors, an opportunity to be part of the solution as we seek the universal human dignity and ecological sustainability necessary for the next seven generations.

Thank you for your continued support and interest in investing with impact.

| | |

Carole Laible CEO | |

Amy Domini Founder and Chair |

3

INVESTINGFOR GOOD®

STRENGTH IN NUMBERS

Sometimes, the path to impact investing starts small. With a cigarette, for example. As you bear the pain of a lost loved one, you wonder: is my money invested in tobacco companies?

The list may grow.

Weapons. Even if you never buy one personally, are your dollars helping to produce thousands?

Pesticides. Your lawn may not use them to grow, but does your money?

Gambling. You may only bet on a game once a year. But is your money feeding addictions that are causing high levels of debt among others?

The list goes on.

Fossil fuels.

Nuclear power.

For profit-prisons.

The issue becomes not our lack of dislikes — that list grows ever longer — but how we channel our dollars and our dislikes into things we do like; things we can feel good about.

Can you do good by buying stocks? Amy Domini’s answer is yes. In a piece that originally appeared in Kamp Solutions last summer, she calls financial asset management “a vast network of individuals, wired together, responsive immediately to new developments, continuously pricing in the risks and rewards implied by an action taken by a company.”

When used properly, she writes, a system that is ideal for delivering goods and services to people is also perfect for delivering wellbeing on a global scale. All that is needed is an investment adviser that cares, a set of standards that endures, an individual who believes, and a community that builds. Because if enough people come together with a care that’s mutual, the power of small becomes the greatness of all.

4

INVESTINGFOR GOOD®

Think of it as the “better effect.” When investors choose to invest only in companies that consider the environment and society, the definition of ‘better’ crystalizes. Securities markets of the world can begin to revalue the better-behaving companies, thereby delivering an incentive to corporate management for better behavior — and that kind of better is in all of our best interests.

This evolution of better has been part of Domini’s mission from the beginning. To achieve it, we start with standards; we always have. As a small, independent company, our standards loom large and our deep belief in universal human dignity and ecological sustainability, even larger. We seek investments that promote long-term environmental sustainability as well as universal values of fairness, equality, justice, and respect for human rights.

Our Impact Investment Standards

Universal human dignity and ecological sustainability are the goal.

Standards are the path we take to achieve it.

First, we evaluate companies to see if their core business model is aligned with our twin goals. Sometimes our assessment is straightforward because our exclusionary screens lead us to eliminate certain industries all together. Sorry, big tobacco. Hello, renewable energy. But usually, like the world, it’s complicated.

So next, we look at the company’s relations with its key stakeholders. This includes ecosystems; local, national, and global communities; customers; employees; suppliers; investors.

Our Impact Investment Standards focus on key themes that we believe best capture the strength of a corporation’s relations with each of these stakeholders.

Exclusionary Screens

Determining which lines of business are fundamentally misaligned with our goals of universal human dignity and ecological sustainability make some investment decisions easy. Divestment from these industries has allowed us to further debate of some of the most important and difficult issues of our time, such as climate change. The following exclusionary screens are applied consistently across all our Funds:

5

INVESTINGFOR GOOD®

Weapons & Firearms

| | We have a longstanding policy to avoid investment in manufacturers of weapons, including military weapons and civilian firearms, which can be used to cause incalculable harm. We believe it is irresponsible to combine weapons manufacturing with the pressure to maximize profits. |

Nuclear Power

| | We exclude companies involved in nuclear weapons production, as well as owners of nuclear power plants. We believe nuclear power technology presents significant risks to human health and safety, as well as the environment. We also have an exclusion on uranium mining. |

Fossil Fuels

| | We exclude companies in the energy sector involved in oil and natural gas exploration and production, coal mining, oil and gas storage, transportation, refining, marketing, and related services due to the urgent need to accelerate the low-carbon transition and address the environmental, social and financial risks of climate change. We also seek to avoid electric utilities with a majority of installed capacity from coal and exclude any utility that has announced or begun construction on new coal plants following the Paris Agreement. |

For Profit-Prisons

| | We exclude for-profit prisons and immigration detention centers due to the significant civil and human rights concerns that occur as a result of their business models, particularly for marginalized communities. The for-profit prison model incentivizes imprisoning the greatest number of people for the longest duration at the lowest cost to increase growth and profits. |

Tobacco, Alcohol & Gambling

| | We have never invested in companies that are significant manufacturers of tobacco products, alcoholic beverages, or significant providers of gambling goods and services. For these companies, effective marketing often means exploiting customers’ addictions to their products or lack of awareness of potential risks. |

| | In addition to these industry exclusions, we have generally avoided major producers of synthetic pesticides and agricultural chemicals due to environmental concerns related to this business. |

6

INVESTINGFOR GOOD®

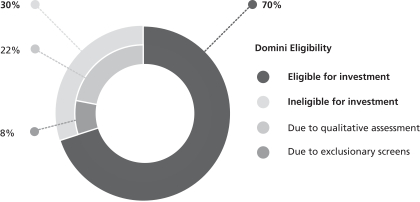

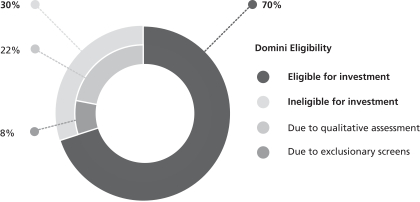

Our standards versus the S&P 500

The average investor may not know it, but the S&P 500 Index may include companies they don’t want to own, such as a weapons manufacturer. Here, we show what percentage of the S&P 500 we consider eligible for investment.

S&P 500 Index1

NOTE: The above information is as of December 31, 2020. Eligibility decisions are subject to change.

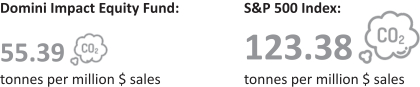

Small carbon footprint, big impact

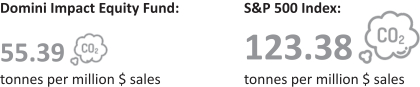

As supporters of a greener future, we’re proud to report that the Domini Impact Equity Fund’s portfolio as of December 31, 2020 was 55% less carbon intensive than its benchmark.

TCFD Carbon Intensity2

Our standards lead us to be underweight to more carbon-intensive sectors like Utilities and Energy. These numbers don’t happen by chance; we have developed proprietary key performance indicators (KPIs) to help guide our social and environmental research for all asset classes and sub-industries covered by our Funds. We revise these often to ensure we remain focused on the most relevant and meaningful information.

7

INVESTINGFOR GOOD®

For materials companies, for instance, we recently expanded our assessment of greenhouse gas emissions reduction targets to include time-bound transition plans, including reporting aligned with the recommendations of the Taskforce for Climate-related Financial Disclosures (TCFD).

When standards lead, inspiring outcomes follow

Perhaps the best way to understand our investment standards is to look at some of the companies we’re invested in and how these investments support our goals of universal human dignity and ecological sustainability. Here are some recent highlights and insights.

Domini Impact Equity Fund Investment Highlight: Sunrun

Sunrun is the leading residential solar installer in the U.S., with a demonstrated commitment to expanding access to affordable, clean energy. The company designs, installs, finances, insures, monitors and maintains rooftop solar systems, with little to no upfront cost to homeowners and predictable pricing for 20 years, often providing significant savings over the cost of traditional energy. Sunrun’s intelligent Brightbox battery storage solution helps customers maximize savings by optimizing generation and storage and reducing reliance on electric utilities during times of peak demand. As of 2019, Sunrun estimates that its solar systems have prevented 5.2 million metric tons of greenhouse gas emissions, produced over 7 billion kilowatt-hours of clean energy, and saved customers more than $300 million on electricity bills. Through a long-running partnership with GRID Alternatives, Sunrun has also helped provide access to solar power for thousands of low-income families in underserved communities across the country.

Domini Impact Equity Fund Investment Highlight: Salesforce.com

Salesforce.com Inc. engages in the design and development of cloud-based enterprise software for customer relationship management. The company’s internal diversity and inclusion programs are particularly strong, both in disclosure but also in action. The company discloses diversity data by gender, ethnicity, and by positions within the company (tech, non-tech, and leadership) and conducts equal pay audits annually to address unexplained difference in pay based on gender, race and ethnicity. In 2019, the company adjusted pay for 5% of employees globally to assure pay equity among its employees. The company also has strong gender and racial diversity in its executive team and board of directors, with over 30% representation on each.

8

INVESTINGFOR GOOD®

Domini Impact Bond Fund Investment Highlight: MacArthur Foundation

MacArthur Foundation is a not-for-profit organization headquartered in Chicago, Illinois that provides grants to address some of society’s most pressing challenges with the aim of building a more “just, verdant, and peaceful world.” Throughout its history, the Foundation has awarded more than $7.3 billion to nearly 10,000 organizations and individuals in 117 countries. The Domini Impact Bond Fund is invested in a social bond issued by the Foundation, which will be used to fund organizations and further initiatives that seek to address the economic and social challenges resulting from the COVID-19 pandemic, particularly among communities of color and the nonprofit sector more broadly, as well as to address the systemic issues exposed by the pandemic and the protests in response to police use of violence against persons of color, especially African Americans.

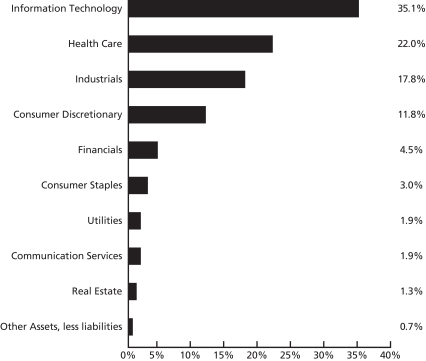

Domini Sustainable Solutions Fund

Our standards, applied to all our Funds, ensure we meet our goals of human dignity and environmental sustainability. On April 1, 2020 (yes, right in the middle of the pandemic), we introduced the Domini Sustainable Solutions Fund. This Fund offers high-conviction exposure to solution-oriented companies around the world helping to address the following sustainability themes:

We anticipated the need for a product that focuses solely on sustainability solutions. Think access to health care, access to food that’s clean and wholesome for the planet, and access to transportation that doesn’t rely on petroleum. For example, Tesla, which is our top portfolio holding in this Fund.

Top Ten Portfolio Holdings (%)3

| | | | | | | | | | |

| | | |

| Tesla Inc | | | 5.6 | | | Ameresco Inc Class A | | | 3.9 | |

| | | |

| Enphase Energy Inc | | | 5.5 | | | Atlassion Corp PLC | | | 3.9 | |

| | | |

| Square Inc (Class A) | | | 4.2 | | | First Solar Inc | | | 3.7 | |

| | | |

| Cree Inc | | | 4.1 | | | BlackLine Inc | | | 3.6 | |

| | | |

| Autodesk Inc | | | 4.1 | | | Vestas Wind Systems A/S | | | 3.6 | |

| | | |

| | | | | | Total | | | 42.3 | |

9

INVESTINGFOR GOOD®

Small. It’s the new big.

Our standards have allowed us to lead impact investing before impact investing led. When you uphold standards for over 25 years, impact investing becomes more than a trend; it becomes a tradition. One that knows that the secret to making an impact is small. It’s one individual, believing. It’s one community, sharing. It’s one organization, listening. It’s one founder, creating. It’s one Fund, caring. And it’s all of us, coming together with a care that’s mutual in Funds that are too, ready to tell the big financial world, welcome to Domini, where the power of small is the greatness of all.

Thank you for being an important part of our community.

| | | | |

| | Sign up for Domini news and impact updates at domini.com/subscribe | | |

1 S&P 500 Index weights. Numbers may not add up to totals due to rounding.

2 “TCFD carbon intensity calculations were made using Bloomberg’s Portfolio Carbon Footprint Tool. Carbon intensity is measured as tonnes of carbon dioxide equivalent emitted per USD millions in sales. The figures provided are the weighted averages of each company’s carbon intensity by its allocation in the portfolio or index. The carbon data used is Scope 1 and 2 (as available) for fiscal year 2019, the most recent year for which data was widely available. Where companies do not report Scope 1 and 2 emissions, they are estimated using the median of reported figures within the same industry group. For the calculations provided, such estimates were used for 35% of the Fund’s portfolio and 30% of the index.”

3 Fund Portfolio weights are as of December 31, 2020 and exclude cash and cash equivalents. Numbers may not add up to totals due to rounding.

The holdings discussed above can be found in the portfolio of the Domini Impact Equity Fund, Domini International Opportunities Fund, Domini Sustainable Solutions Fund, Domini Impact International Equity Fund and Domini Impact Bond Fund, included herein. The composition of each portfolio is subject to change.

An investment in the Domini Funds is not a bank deposit, not insured and is subject to certain risks including those described below. You may lose money. Investment return, principal value, and yield will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. See the prospectus for more information on risks.

The Domini Impact Equity Fund is subject to impact investing, portfolio management, information, market, recent events, and mid- to large-cap companies risks. The Domini International Opportunities Fund is subject to foreign investing, geographic focus, country, currency, impact investing and recent events risks. The Domini Sustainable Solutions Fund is subject to sustainable investing, portfolio management, information, market, recent events, and mid- to large-cap companies and small-cap companies risks. The Domini Impact International Equity Fund is subject to foreign investing and emerging markets, geographic focus, country, currency, impact investing and recent events risks. Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity. These risks may be heightened in connection with investments in emerging market countries. The Domini Impact Bond Fund is subject to impact investing, portfolio management, style risk, information, market, recent events, interest rate and credit risks.

This report is not authorized for distribution to prospective investors of the Domini Funds referenced herein unless preceded or accompanied by a current prospectus for the relevant Fund. Nothing herein is to be considered a recommendation concerning the merits of any noted company, or an offer of sale or solicitation of an offer to buy shares of any Fund or company referenced herein. Such offering is only made by prospectus, which includes details as to the offering price and other material information. Carefully consider

10

INVESTINGFOR GOOD®

the Funds’ investment objectives, risk factors and charges and expenses before investing. This and other information can be found in the Funds’ prospectus, which may be obtained by calling 1-800-582-6757 or at domini.com. Domini Impact Investments LLC is each Fund’s investment manager. The Funds are subadvised by unaffiliated entities. Shares of the Domini Funds are offered for sale only in the United States DSIL Investment Services LLC, Distributor, Member FINRA. 3/21

11

DOMINI IMPACT EQUITY FUND

Fund Performance and Holdings

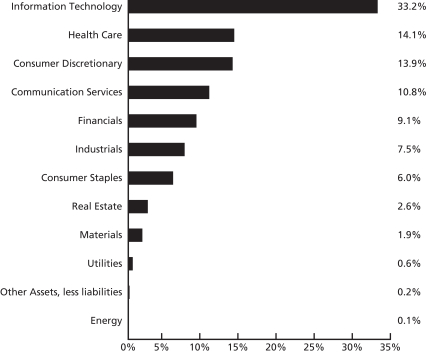

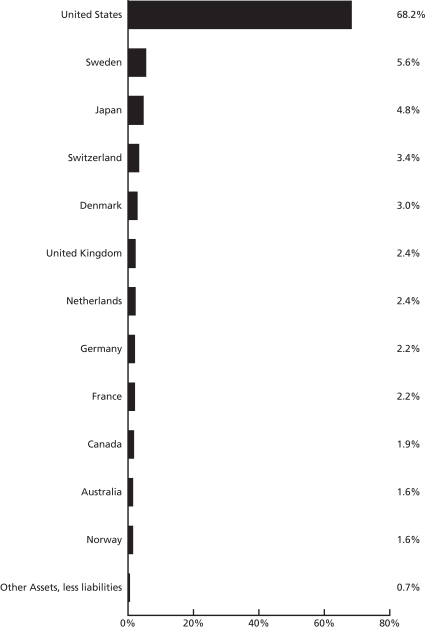

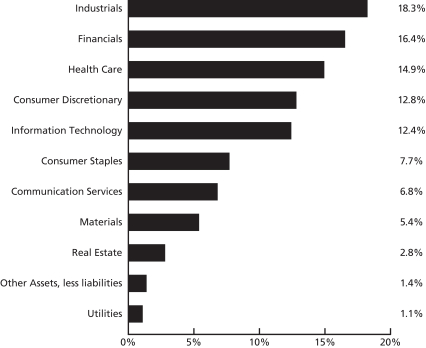

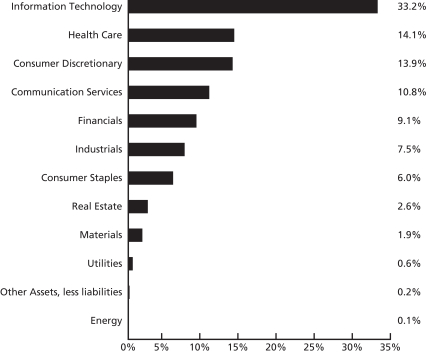

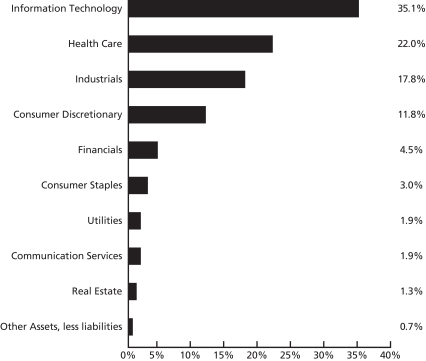

The table and bar charts below provide information as of January 31, 2021, about the ten largest holdings of the Domini Impact Equity Fund and its portfolio holdings by industry sector:

TEN LARGEST HOLDINGS (Unaudited)

| | | | | | | | | | |

| | | | |

| SECURITY DESCRIPTION | | % NET

ASSETS | | | SECURITY DESCRIPTION | | % NET

ASSETS | |

| | | | |

| Apple Inc | | | 8.3% | | | Procter + Gamble Co/The | | | 1.3% | |

| | | | |

| Microsoft Corp | | | 7.2% | | | NVIDIA Corp | | | 1.3% | |

| | | | |

| Amazon.com Inc | | | 5.7% | | | Walt Disney Co/The | | | 1.3% | |

| | | | |

| Alphabet Inc Class A | | | 4.6% | | | Home Depot Inc/The | | | 1.2% | |

| | | | |

| Tesla Inc | | | 2.5% | | | Mastercard Inc Class A | | | 1.2% | |

PORTFOLIO HOLDINGS BY INDUSTRY SECTOR (% OF NET ASSETS) (Unaudited)

The holdings mentioned above are described in the Domini Impact Equity Fund’s Portfolio of Investments (as of 1/31/21), included herein. The composition of the Fund’s portfolio is subject to change.

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by Domini Impact Investments. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification nor shall any such party have any liability therefrom.

12

| | | | | | | | | | | | | | |

| |

| AVERAGE ANNUAL TOTAL RETURNS (Unaudited) |

| | | | | | |

| | | Investor

shares | | Class A shares

(with 4.75%

maximum

Sales Charge) | | Class A

shares (without

Sales

Charge) | | Institutional

shares | | Class Y shares | | S&P 500 |

| | | | | | | |

| As of 1/31/21 | | 1 Year | | 29.00% | | 22.87% | | 28.99% | | 29.45% | | 29.34% | | 17.25% |

| | | | | | | |

| | 5 Year | | 16.55% | | 15.40% | | 16.53% | | 16.97% | | 16.90% | | 16.16% |

| | | | | | | |

| | | 10 Year | | 12.04% | | 11.50% | | 12.05% | | 12.46% | | 12.38% | | 13.50% |

NOTE: The Fund’s current investment strategy commenced on December 1, 2018 with SSGA Funds Management, Inc as its subadviser. Performance information for periods prior to December 1, 2018 reflects the investment strategies employed during those periods.

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. The returns reflect any applicable expense waivers in effect during the periods shown. Without such waivers, Fund performance would be lower. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost. Call 1-800-582-6757 or visit domini.com for performance information current to the most recent month-end, which may be lower or higher than the performance data quoted. A 2.00% redemption fee applies on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Quoted performance data does not reflect the deduction of this fee, which would reduce the performance quoted. See the prospectus for further information.

Per the prospectus dated November 30, 2020, the Fund’s annual operating expenses totaled 1.09% and 0.74% (gross and net) and 1.47%/1.09% and 0.94%/0.80% (gross/net) for Investor, Institutional, Class A, and Class Y shares, respectively. The Fund’s Adviser has contractually agreed to waive certain fees and/or reimburse certain ordinary operating expenses in order to limit Investor shares, Class A, Institutional, and Class Y share expenses to 1.09%, 1.09%, 0.74%, and 0.80%, respectively. These expense limitations are in effect through November 30, 2021. There can be no assurance that the Adviser will extend the expense limitations beyond such time. While in effect, the arrangement may be terminated for a class only by agreement of the Adviser and the Fund’s Board of Trustees.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Fund is based on the Fund’s net asset values and assumes all dividend and capital gains were reinvested.

An investment in the Domini Impact Equity Fund is not a bank deposit and is not insured. The Fund is subject to certain risks, including impact investing, portfolio management, information, market, recent events, and mid- to large-cap companies risks. You may lose money.

The Standard & Poor’s 500 Index (S&P 500) is an unmanaged index of common stocks. Investors cannot invest directly in the S&P 500.

13

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS

January 31, 2021 (Unaudited)

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| Common Stocks – 99.8% | |

| Communication Services – 10.8% | |

Alphabet, Inc., Class A (a) | | | 24,450 | | | $ | 44,678,952 | |

AT&T, Inc. | | | 303,685 | | | | 8,694,502 | |

Charter Communications, Inc., Class A (a) | | | 5,558 | | | | 3,376,819 | |

Comcast Corp., Class A | | | 188,221 | | | | 9,330,115 | |

Electronic Arts, Inc. | | | 12,018 | | | | 1,720,978 | |

Lumen Technologies, Inc. | | | 46,100 | | | | 570,718 | |

Netflix, Inc. (a) | | | 17,438 | | | | 9,283,817 | |

New York Times Co. (The), Class A | | | 49,199 | | | | 2,439,778 | |

Omnicom Group, Inc. | | | 8,700 | | | | 542,706 | |

Take-Two Interactive Software, Inc. (a) | | | 4,581 | | | | 918,261 | |

TELUS Corp. | | | 52,794 | | | | 1,089,140 | |

Verizon Communications, Inc. | | | 172,495 | | | | 9,444,101 | |

Walt Disney Co. (The) (a) | | | 74,993 | | | | 12,611,573 | |

| | | | | | | | |

| | | | | | | 104,701,460 | |

| | | | | | | | |

| | |

| Consumer Discretionary – 13.9% | | | | | | |

Advance Auto Parts, Inc. | | | 2,657 | | | | 396,265 | |

Amazon.com, Inc. (a) | | | 17,319 | | | | 55,528,178 | |

Aptiv PLC | | | 10,800 | | | | 1,442,880 | |

Best Buy Co., Inc. | | | 9,449 | | | | 1,028,240 | |

BorgWarner, Inc. | | | 9,900 | | | | 415,701 | |

Bright Horizons Family Solutions, Inc. (a) | | | 2,400 | | | | 364,728 | |

Chegg, Inc. (a) | | | 59,156 | | | | 5,635,201 | |

Chipotle Mexican Grill, Inc. (a) | | | 1,117 | | | | 1,653,160 | |

Cie Generale des Etablissements Michelin SCA ADR | | | 33,350 | | | | 919,459 | |

eBay, Inc. | | | 27,100 | | | | 1,531,421 | |

Fast Retailing Co., Ltd. ADR | | | 22,253 | | | | 1,924,217 | |

Gap, Inc. (The) (a) | | | 12,345 | | | | 249,986 | |

Garmin, Ltd. | | | 6,246 | | | | 717,416 | |

Home Depot, Inc. (The) | | | 43,451 | | | | 11,767,400 | |

Kohl’s Corp. | | | 6,912 | | | | 304,543 | |

Lowe’s Cos., Inc. | | | 30,141 | | | | 5,029,026 | |

NIKE, Inc., Class B | | | 50,749 | | | | 6,779,559 | |

NVR, Inc. (a) | | | 140 | | | | 622,507 | |

Sony Corp. ADR | | | 49,055 | | | | 4,695,054 | |

Starbucks Corp. | | | 48,967 | | | | 4,740,495 | |

Target Corp. | | | 20,651 | | | | 3,741,342 | |

Tesla, Inc. (a) | | | 31,185 | | | | 24,746,233 | |

Ulta Beauty, Inc. (a) | | | 2,198 | | | | 614,912 | |

Williams-Sonoma, Inc. | | | 3,200 | | | | 412,544 | |

| | | | | | | | |

| | | | | | | 135,260,467 | |

| | | | | | | | |

|

| Consumer Staples – 6.0% | |

Beyond Meat, Inc. (a) | | | 25,405 | | | | 4,524,122 | |

Campbell Soup Co. | | | 7,991 | | | | 384,447 | |

Church & Dwight Co., Inc. | | | 10,112 | | | | 853,756 | |

Clorox Co. (The) | | | 5,200 | | | | 1,089,192 | |

14

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2021 (Unaudited)

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

|

| Consumer Staples (Continued) | |

Colgate-Palmolive Co. | | | 35,225 | | | $ | 2,747,550 | |

Costco Wholesale Corp. | | | 18,303 | | | | 6,450,526 | |

Estee Lauder Cos., Inc. (The), Class A | | | 8,177 | | | | 1,935,087 | |

General Mills, Inc. | | | 25,199 | | | | 1,464,062 | |

JM Smucker Co. (The) | | | 4,446 | | | | 517,559 | |

Kimberly-Clark Corp. | | | 13,918 | | | | 1,838,568 | |

Kraft Heinz Co. (The) | | | 25,523 | | | | 855,276 | |

Kroger Co. (The) | | | 30,511 | | | | 1,052,629 | |

Lamb Weston Holdings, Inc. | | | 5,800 | | | | 433,260 | |

McCormick & Co., Inc. | | | 10,500 | | | | 940,170 | |

Mondelez International, Inc., Class A | | | 57,947 | | | | 3,212,582 | |

Orkla ASA ADR | | | 29,600 | | | | 288,304 | |

PepsiCo, Inc. | | | 56,631 | | | | 7,734,096 | |

Procter & Gamble Co. (The) | | | 100,925 | | | | 12,939,594 | |

Sysco Corp. | | | 20,003 | | | | 1,430,415 | |

Unilever PLC ADR | | | 103,585 | | | | 6,043,149 | |

Walgreens Boots Alliance, Inc. | | | 29,548 | | | | 1,484,787 | |

| | | | | | | | |

| | | | | | | 58,219,131 | |

| | | | | | | | |

| | |

| Energy – 0.1% | | | | | | |

Legrand SA ADR | | | 52,900 | | | | 973,889 | |

| | | | | | | | |

| | | | | | | 973,889 | |

| | | | | | | | |

| | |

| Financials – 9.1% | | | | | | |

Aflac, Inc. | | | 26,715 | | | | 1,206,984 | |

AGNC Investment Corp. | | | 22,200 | | | | 346,320 | |

American Express Co. | | | 24,848 | | | | 2,888,828 | |

Annaly Capital Management, Inc. | | | 57,600 | | | | 467,712 | |

Bank of America Corp. | | | 312,354 | | | | 9,261,296 | |

Bank of Montreal | | | 26,831 | | | | 1,993,812 | |

Bank of New York Mellon Corp. (The) | | | 33,200 | | | | 1,322,356 | |

Bank of Nova Scotia (The) | | | 49,966 | | | | 2,662,688 | |

BlackRock, Inc. | | | 5,734 | | | | 4,021,025 | |

Capital One Financial Corp. | | | 18,318 | | | | 1,909,835 | |

Cboe Global Markets, Inc. | | | 4,500 | | | | 412,785 | |

Charles Schwab Corp. (The) | | | 61,278 | | | | 3,158,268 | |

Chubb, Ltd. | | | 16,187 | | | | 2,357,960 | |

Cincinnati Financial Corp. | | | 6,311 | | | | 530,692 | |

Citigroup, Inc. | | | 85,308 | | | | 4,947,011 | |

CME Group, Inc. | | | 14,298 | | | | 2,598,519 | |

Comerica, Inc. | | | 5,954 | | | | 340,569 | |

Discover Financial Services | | | 12,200 | | | | 1,019,188 | |

DNB ASA ADR (a) | | | 35,948 | | | | 698,649 | |

East West Bancorp, Inc. | | | 6,000 | | | | 359,640 | |

Equitable Holdings, Inc. | | | 18,600 | | | | 460,908 | |

Everest Re Group, Ltd. | | | 1,700 | | | | 358,836 | |

FactSet Research Systems, Inc. | | | 1,500 | | | | 453,510 | |

Fifth Third Bancorp | | | 29,156 | | | | 843,483 | |

First Republic Bank | | | 7,000 | | | | 1,014,930 | |

15

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2021 (Unaudited)

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| | |

| Financials (Continued) | | | | | | |

Franklin Resources, Inc. | | | 11,200 | | | $ | 294,448 | |

Hartford Financial Services Group, Inc. (The) | | | 14,693 | | | | 705,558 | |

Huntington Bancshares, Inc. | | | 40,800 | | | | 539,580 | |

Intercontinental Exchange, Inc. | | | 22,695 | | | | 2,504,393 | |

Invesco, Ltd. | | | 16,303 | | | | 335,679 | |

KeyCorp | | | 39,200 | | | | 660,912 | |

London Stock Exchange Group PLC ADR | | | 56,400 | | | | 1,710,048 | |

MarketAxess Holdings, Inc. | | | 1,500 | | | | 811,140 | |

Marsh & McLennan Cos., Inc. | | | 20,530 | | | | 2,256,452 | |

Moody’s Corp. | | | 6,614 | | | | 1,761,044 | |

Morgan Stanley | | | 58,459 | | | | 3,919,676 | |

MSCI, Inc. | | | 3,205 | | | | 1,266,936 | |

Nasdaq, Inc. | | | 6,000 | | | | 811,620 | |

Northern Trust Corp. | | | 8,200 | | | | 731,358 | |

PNC Financial Services Group, Inc. (The) | | | 16,949 | | | | 2,432,520 | |

Principal Financial Group, Inc. | | | 11,100 | | | | 546,897 | |

Progressive Corp. (The) | | | 24,058 | | | | 2,097,617 | |

Prudential Financial, Inc. | | | 16,461 | | | | 1,288,567 | |

Raymond James Financial, Inc. | | | 5,000 | | | | 499,650 | |

Regions Financial Corp. | | | 38,628 | | | | 657,062 | |

Reinsurance Group of America, Inc. | | | 2,600 | | | | 273,130 | |

S&P Global, Inc. | | | 9,998 | | | | 3,169,366 | |

SEI Investments Co. | | | 5,200 | | | | 274,820 | |

Swiss Re AG ADR | | | 43,893 | | | | 974,864 | |

T Rowe Price Group, Inc. | | | 9,211 | | | | 1,441,337 | |

Toronto-Dominion Bank (The) | | | 74,617 | | | | 4,222,576 | |

Travelers Cos., Inc. (The) | | | 10,516 | | | | 1,433,331 | |

Truist Financial Corp. | | | 54,702 | | | | 2,624,602 | |

US Bancorp | | | 55,716 | | | | 2,387,431 | |

Voya Financial, Inc. | | | 5,000 | | | | 277,300 | |

Zions Bancorp NA | | | 7,099 | | | | 313,350 | |

| | | | | | | | |

| | | | | | | 88,859,068 | |

| | | | | | | | |

| | |

| Health Care – 14.1% | | | | | | |

AbbVie, Inc. | | | 70,352 | | | | 7,209,673 | |

ABIOMED, Inc. (a) | | | 1,800 | | | | 626,850 | |

Agilent Technologies, Inc. | | | 12,500 | | | | 1,502,125 | |

Alcon, Inc. (a) | | | 20,362 | | | | 1,460,159 | |

Alexion Pharmaceuticals, Inc. (a) | | | 8,781 | | | | 1,346,391 | |

Align Technology, Inc. (a) | | | 2,900 | | | | 1,523,602 | |

Alnylam Pharmaceuticals, Inc. (a) | | | 4,800 | | | | 722,304 | |

Amgen, Inc. | | | 23,819 | | | | 5,750,621 | |

Becton Dickinson and Co. | | | 11,751 | | | | 3,076,294 | |

Biogen, Inc. (a) | | | 6,267 | | | | 1,771,117 | |

BioMarin Pharmaceutical, Inc. (a) | | | 7,300 | | | | 604,294 | |

Bio-Rad Laboratories, Inc., Class A (a) | | | 900 | | | | 516,393 | |

Bio-Techne Corp. | | | 1,600 | | | | 519,856 | |

Bristol-Myers Squibb Co. | | | 91,801 | | | | 5,639,335 | |

Bruker Corp. | | | 4,600 | | | | 266,294 | |

16

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2021 (Unaudited)

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| | |

| Health Care (Continued) | | | | | | |

Cerner Corp. | | | 12,223 | | | $ | 979,185 | |

Cooper Cos., Inc. (The) | | | 1,900 | | | | 691,676 | |

Danaher Corp. | | | 25,915 | | | | 6,163,624 | |

DENTSPLY SIRONA, Inc. | | | 9,416 | | | | 503,662 | |

DexCom, Inc. (a) | | | 13,507 | | | | 5,063,099 | |

Edwards Lifesciences Corp. (a) | | | 25,072 | | | | 2,070,446 | |

Exact Sciences Corp. (a) | | | 6,200 | | | | 850,392 | |

Gilead Sciences, Inc. | | | 51,846 | | | | 3,401,098 | |

GlaxoSmithKline PLC ADR | | | 101,525 | | | | 3,781,806 | |

Guardant Health, Inc. (a) | | | 3,300 | | | | 513,150 | |

Haemonetics Corp. (a) | | | 2,051 | | | | 234,409 | |

Henry Schein, Inc. (a) | | | 5,700 | | | | 375,345 | |

Hill-Rom Holdings, Inc. | | | 2,800 | | | | 268,912 | |

Hologic, Inc. (a) | | | 67,015 | | | | 5,343,106 | |

IDEXX Laboratories, Inc. (a) | | | 3,419 | | | | 1,636,607 | |

Illumina, Inc. (a) | | | 5,849 | | | | 2,494,248 | |

Incyte Corp. (a) | | | 7,700 | | | | 691,075 | |

Insulet Corp. (a) | | | 2,700 | | | | 721,386 | |

Ionis Pharmaceuticals, Inc. (a) | | | 5,300 | | | | 318,371 | |

Koninklijke Philips NV (a) | | | 36,176 | | | | 1,963,995 | |

Masimo Corp. (a) | | | 2,100 | | | | 537,432 | |

Merck & Co., Inc. | | | 104,435 | | | | 8,048,805 | |

Mettler-Toledo International, Inc. (a) | | | 990 | | | | 1,156,419 | |

Moderna, Inc. (a) | | | 13,500 | | | | 2,337,660 | |

Novo Nordisk A/S ADR | | | 66,278 | | | | 4,612,949 | |

OraSure Technologies, Inc. (a) | | | 307,400 | | | | 4,681,702 | |

PerkinElmer, Inc. | | | 4,700 | | | | 691,229 | |

Pfizer, Inc. | | | 233,470 | | | | 8,381,573 | |

Quest Diagnostics, Inc. | | | 5,715 | | | | 738,092 | |

Regeneron Pharmaceuticals, Inc. (a) | | | 4,142 | | | | 2,086,905 | |

ResMed, Inc. | | | 5,846 | | | | 1,178,378 | |

Sanofi ADR | | | 87,816 | | | | 4,145,793 | |

Seagen, Inc. (a) | | | 30,645 | | | | 5,034,054 | |

STERIS PLC | | | 3,600 | | | | 673,596 | |

Stryker Corp. | | | 13,528 | | | | 2,989,823 | |

Teladoc Health, Inc. (a) | | | 18,598 | | | | 4,906,710 | |

Teleflex, Inc. | | | 1,900 | | | | 717,497 | |

Thermo Fisher Scientific, Inc. | | | 16,588 | | | | 8,454,904 | |

United Therapeutics Corp. (a) | | | 1,800 | | | | 294,876 | |

Varian Medical Systems, Inc. (a) | | | 3,900 | | | | 684,723 | |

Veeva Systems, Inc., Class A (a) | | | 5,406 | | | | 1,494,435 | |

Vertex Pharmaceuticals, Inc. (a) | | | 10,343 | | | | 2,369,374 | |

Waters Corp. (a) | | | 2,563 | | | | 678,349 | |

| | | | | | | | |

| | | | | | | 137,496,178 | |

| | | | | | | | |

| | |

| Industrials – 7.5% | | | | | | |

Alaska Air Group, Inc. | | | 5,100 | | | | 249,033 | |

Allegion PLC | | | 3,900 | | | | 417,339 | |

Ameresco, Inc., Class A (a) | | | 121,931 | | | | 6,839,110 | |

17

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2021 (Unaudited)

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| | |

| Industrials (Continued) | | | | | | |

AO Smith Corp. | | | 5,800 | | | $ | 314,940 | |

Assa Abloy AB ADR | | | 78,242 | | | | 965,506 | |

Brambles, Ltd. ADR | | | 30,300 | | | | 490,557 | |

Carlisle Cos., Inc. | | | 2,100 | | | | 304,353 | |

CH Robinson Worldwide, Inc. | | | 5,400 | | | | 462,024 | |

Cintas Corp. | | | 3,600 | | | | 1,145,232 | |

Copart, Inc. (a) | | | 8,800 | | | | 965,800 | |

CoStar Group, Inc. (a) | | | 1,571 | | | | 1,413,444 | |

Cummins, Inc. | | | 6,041 | | | | 1,416,131 | |

Dai Nippon Printing Co., Ltd. ADR | | | 18,200 | | | | 157,976 | |

Deere & Co. | | | 11,445 | | | | 3,305,316 | |

Deutsche Post AG ADR | | | 38,237 | | | | 1,893,114 | |

Donaldson Co., Inc. | | | 5,200 | | | | 309,088 | |

Emerson Electric Co. | | | 24,826 | | | | 1,969,943 | |

Expeditors International of Washington, Inc. | | | 6,600 | | | | 590,832 | |

Fastenal Co. | | | 23,358 | | | | 1,064,891 | |

Fortune Brands Home & Security, Inc. | | | 5,400 | | | | 465,750 | |

Graco, Inc. | | | 6,900 | | | | 475,686 | |

Hubbell, Inc. | | | 2,200 | | | | 342,320 | |

IAA, Inc. (a) | | | 5,500 | | | | 314,270 | |

IDEX Corp. | | | 3,200 | | | | 595,808 | |

IHS Markit, Ltd. | | | 14,994 | | | | 1,305,678 | |

Illinois Tool Works, Inc. | | | 11,752 | | | | 2,282,356 | |

Ingersoll Rand, Inc. (a) | | | 15,169 | | | | 634,671 | |

JB Hunt Transport Services, Inc. | | | 3,400 | | | | 457,844 | |

JetBlue Airways Corp. (a) | | | 13,988 | | | | 200,588 | |

Johnson Controls International PLC | | | 29,736 | | | | 1,481,448 | |

KAR Auction Services, Inc. | | | 5,500 | | | | 101,530 | |

Lennox International, Inc. | | | 1,400 | | | | 385,686 | |

Makita Corp. ADR | | | 9,800 | | | | 491,078 | |

Masco Corp. | | | 10,700 | | | | 581,117 | |

Middleby Corp. (The) (a) | | | 2,400 | | | | 325,728 | |

MSC Industrial Direct Co., Inc., Class A | | | 1,600 | | | | 124,112 | |

Nidec Corp. ADR | | | 81,156 | | | | 2,713,045 | |

Nielsen Holdings PLC | | | 15,500 | | | | 346,115 | |

Nordson Corp. | | | 2,100 | | | | 375,879 | |

Old Dominion Freight Line, Inc. | | | 4,400 | | | | 853,600 | |

Owens Corning | | | 4,533 | | | | 351,761 | |

PACCAR, Inc. | | | 14,200 | | | | 1,295,324 | |

Pentair PLC | | | 6,600 | | | | 359,436 | |

Robert Half International, Inc. | | | 4,751 | | | | 320,693 | |

Rockwell Automation, Inc. | | | 4,772 | | | | 1,185,985 | |

Roper Technologies, Inc. | | | 4,257 | | | | 1,672,618 | |

Schneider Electric SE ADR | | | 109,400 | | | | 3,215,266 | |

Sensata Technologies Holding PLC (a) | | | 6,100 | | | | 332,450 | |

Siemens AG ADR | | | 65,136 | | | | 5,038,270 | |

Simpson Manufacturing Co., Inc. | | | 1,600 | | | | 147,200 | |

SKF AB ADR | | | 18,000 | | | | 492,840 | |

Snap-on, Inc. | | | 2,300 | | | | 413,977 | |

18

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2021 (Unaudited)

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| | |

| Industrials (Continued) | | | | | | |

Stanley Black & Decker, Inc. | | | 6,354 | | | $ | 1,102,355 | |

Sunrun, Inc. (a) | | | 84,768 | | | | 5,871,879 | |

Thomson Reuters Corp. | | | 6,700 | | | | 546,385 | |

Toro Co. (The) | | | 4,500 | | | | 424,125 | |

Trane Technologies PLC | | | 9,707 | | | | 1,391,498 | |

Trex Co., Inc. (a) | | | 4,600 | | | | 422,142 | |

United Parcel Service, Inc., Class B | | | 28,393 | | | | 4,400,915 | |

United Rentals, Inc. (a) | | | 3,100 | | | | 753,331 | |

Vestas Wind Systems A/S ADR | | | 23,300 | | | | 1,675,270 | |

Watsco, Inc. | | | 1,300 | | | | 310,037 | |

Westinghouse Air Brake Technologies Corp. | | | 7,591 | | | | 563,328 | |

WW Grainger, Inc. | | | 1,870 | | | | 681,409 | |

Xylem, Inc. | | | 7,300 | | | | 705,107 | |

| | | | | | | | |

| | | | | | | 72,802,539 | |

| | | | | | | | |

| | |

| Information Technology – 33.2% | | | | | | |

Adobe, Inc. (a) | | | 19,261 | | | | 8,836,369 | |

Advanced Micro Devices, Inc. (a) | | | 49,550 | | | | 4,243,462 | |

Apple, Inc. | | | 615,196 | | | | 81,181,264 | |

Applied Materials, Inc. | | | 38,002 | | | | 3,674,033 | |

Atlassian Corp. PLC, Class A (a) | | | 21,852 | | | | 5,050,653 | |

Autodesk, Inc. (a) | | | 16,878 | | | | 4,682,464 | |

Automatic Data Processing, Inc. | | | 16,368 | | | | 2,702,684 | |

Blackline, Inc. (a) | | | 41,710 | | | | 5,406,450 | |

Broadcom, Inc. | | | 16,013 | | | | 7,213,856 | |

Cadence Design Systems, Inc. (a) | | | 10,884 | | | | 1,419,165 | |

Cisco Systems, Inc. | | | 160,991 | | | | 7,176,979 | |

Cree, Inc. (a) | | | 37,462 | | | | 3,786,659 | |

DocuSign, Inc. (a) | | | 7,000 | | | | 1,630,230 | |

Enphase Energy, Inc. (a) | | | 55,714 | | | | 10,159,448 | |

First Solar, Inc. (a) | | | 84,240 | | | | 8,352,396 | |

Intel Corp. | | | 169,579 | | | | 9,413,330 | |

International Business Machines Corp. | | | 36,866 | | | | 4,391,109 | |

Intuit, Inc. | | | 10,022 | | | | 3,620,247 | |

KLA Corp. | | | 6,410 | | | | 1,795,249 | |

Lam Research Corp. | | | 6,100 | | | | 2,952,095 | |

Mastercard, Inc., Class A | | | 35,652 | | | | 11,276,371 | |

Microsoft Corp. | | | 300,661 | | | | 69,741,326 | |

NetApp, Inc. | | | 9,008 | | | | 598,491 | |

NVIDIA Corp. | | | 24,577 | | | | 12,769,963 | |

Paychex, Inc. | | | 13,231 | | | | 1,155,331 | |

Paycom Software, Inc. (a) | | | 1,900 | | | | 721,506 | |

PayPal Holdings, Inc. (a) | | | 45,500 | | | | 10,661,105 | |

salesforce.com, Inc. (a) | | | 35,434 | | | | 7,992,493 | |

Square, Inc., Class A (a) | | | 35,836 | | | | 7,739,143 | |

STMicroelectronics NV, Class Y | | | 122,934 | | | | 4,911,213 | |

Synopsys, Inc. (a) | | | 6,043 | | | | 1,543,684 | |

Texas Instruments, Inc. | | | 37,652 | | | | 6,238,560 | |

Universal Display Corp. | | | 22,822 | | | | 5,267,774 | |

19

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2021 (Unaudited)

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| | |

| Information Technology (Continued) | | | | | | |

VMware, Inc., Class A (a) | | | 3,275 | | | $ | 451,459 | |

WEX, Inc. (a) | | | 1,916 | | | | 361,358 | |

Zoom Video Communications, Inc., Class A (a) | | | 9,129 | | | | 3,396,627 | |

| | | | | | | | |

| | | | | | | 322,514,546 | |

| | | | | | | | |

| | |

| Materials – 1.9% | | | | | | |

Air Products and Chemicals, Inc. | | | 9,159 | | | | 2,443,255 | |

AptarGroup, Inc. | | | 2,500 | | | | 332,425 | |

Avery Dennison Corp. | | | 3,500 | | | | 528,045 | |

Ecolab, Inc. | | | 10,548 | | | | 2,157,171 | |

International Paper Co. | | | 15,800 | | | | 794,898 | |

Linde PLC | | | 21,230 | | | | 5,209,842 | |

Novozymes A/S ADR | | | 8,100 | | | | 488,268 | |

Nucor Corp. | | | 12,092 | | | | 589,243 | |

PPG Industries, Inc. | | | 9,842 | | | | 1,325,816 | |

Sherwin-Williams Co. (The) | | | 3,364 | | | | 2,327,215 | |

Sonoco Products Co. | | | 3,900 | | | | 225,849 | |

Steel Dynamics, Inc. | | | 7,800 | | | | 267,306 | |

Vulcan Materials Co. | | | 5,444 | | | | 811,918 | |

Westrock Co. | | | 10,985 | | | | 455,109 | |

| | | | | | | | |

| | | | | | | 17,956,360 | |

| | | | | | | | |

| | |

| Real Estate – 2.6% | | | | | | |

Alexandria Real Estate Equities, Inc. | | | 5,486 | | | | 916,766 | |

American Tower Corp. | | | 17,909 | | | | 4,071,790 | |

Boston Properties, Inc. | | | 6,046 | | | | 551,818 | |

CBRE Group, Inc., Class A (a) | | | 13,822 | | | | 842,866 | |

Crown Castle International Corp. | | | 17,822 | | | | 2,838,332 | |

Digital Realty Trust, Inc. | | | 11,192 | | | | 1,611,088 | |

Duke Realty Corp. | | | 15,500 | | | | 613,180 | |

Equinix, Inc. | | | 3,631 | | | | 2,686,795 | |

Equity LifeStyle Properties, Inc. | | | 6,900 | | | | 419,796 | |

Essex Property Trust, Inc. | | | 2,700 | | | | 646,947 | |

Extra Space Storage, Inc. | | | 5,300 | | | | 603,087 | |

Federal Realty Investment Trust | | | 3,000 | | | | 262,680 | |

Host Hotels & Resorts, Inc. | | | 28,222 | | | | 382,408 | |

Kilroy Realty Corp. | | | 4,600 | | | | 260,498 | |

Mid-America Apartment Communities, Inc. | | | 4,600 | | | | 610,650 | |

Prologis, Inc. | | | 29,995 | | | | 3,095,484 | |

Public Storage | | | 5,977 | | | | 1,360,485 | |

Realty Income Corp. | | | 14,821 | | | | 875,328 | |

Regency Centers Corp. | | | 7,085 | | | | 334,270 | |

SBA Communications Corp. | | | 4,507 | | | | 1,210,896 | |

UDR, Inc. | | | 12,169 | | | | 467,898 | |

Ventas, Inc. | | | 15,263 | | | | 703,166 | |

| | | | | | | | |

| | | | | | | 25,366,228 | |

| | | | | | | | |

| Utilities – 0.6% | | | | | | |

Alliant Energy Corp. | | | 10,200 | | | | 496,230 | |

Avangrid, Inc. | | | 2,547 | | | | 117,850 | |

20

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2021 (Unaudited)

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| Utilities (Continued) | | | | | | |

Consolidated Edison, Inc. | | | 14,461 | | | $ | 1,023,550 | |

Eversource Energy | | | 14,158 | | | | 1,238,825 | |

National Grid PLC ADR | | | 28,619 | | | | 1,662,191 | |

Red Electrica Corp. SA ADR | | | 37,300 | | | | 353,604 | |

SSE PLC ADR | | | 42,500 | | | | 866,575 | |

Terna Rete Elettrica Nazionale SpA ADR | | | 18,600 | | | | 406,038 | |

| | | | | | | | |

| | | | | | | 6,164,863 | |

| | | | | | | | |

| |

| Total Investments – 99.8% (Cost $567,747,497) | | | 970,314,729 | |

| |

| Other Assets, less liabilities – 0.2% | | | 2,112,149 | |

| | | | | | | | |

| |

| Net Assets – 100.0% | | | $972,426,878 | |

| | | | | | | | |

(a) Non-income producing security.

Abbreviations

ADR — American Depositary Receipt

SEE NOTES TO FINANCIAL STATEMENTS

21

DOMINI INTERNATIONAL OPPORTUNITIES FUND

Fund Performance and Holdings

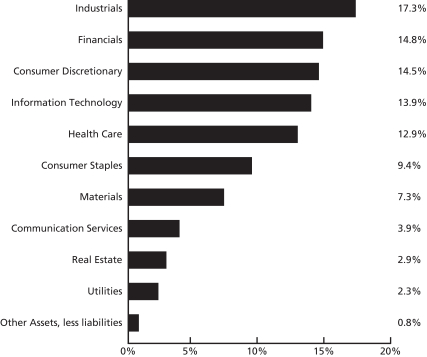

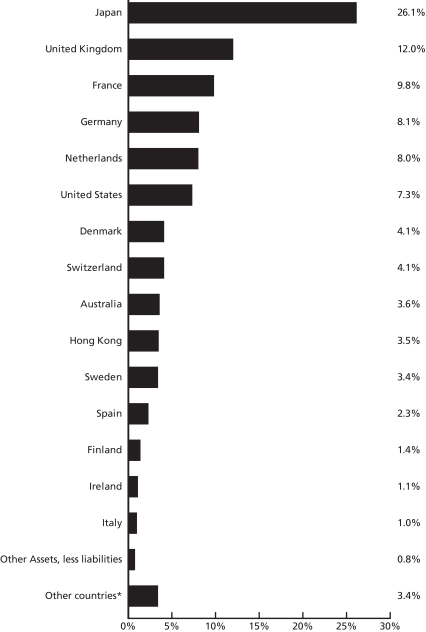

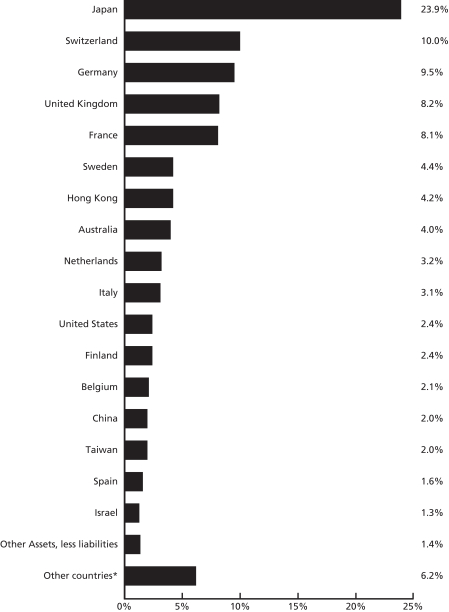

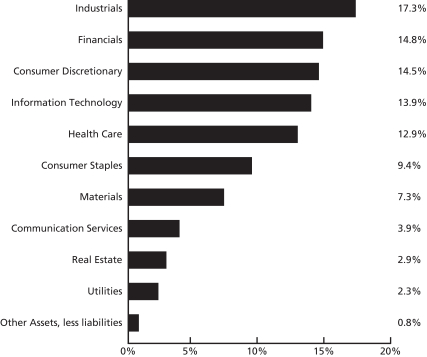

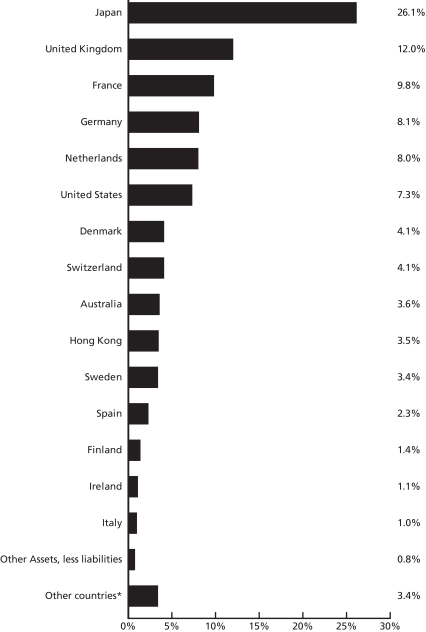

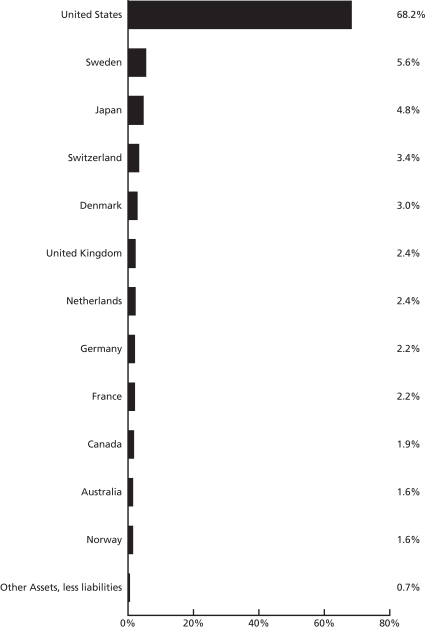

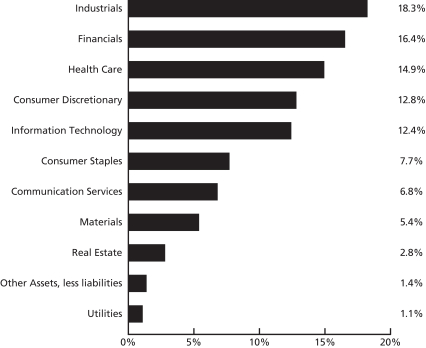

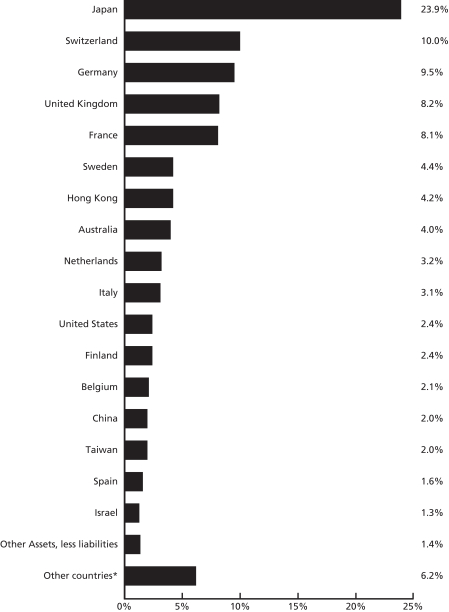

The table and bar charts below provide information as of January 31, 2021, about the ten largest holdings of the Domini International Opportunities Fund and its portfolio holdings by industry sector and country:

TEN LARGEST HOLDINGS (Unaudited)

| | | | | | | | | | |

| | | | |

| SECURITY DESCRIPTION | | % NET

ASSETS | | | SECURITY DESCRIPTION | | % NET

ASSETS | |

| | | | |

| ASML Holding NV | | | 3.2% | | | SiemensAG | | | 1.8% | |

| | | | |

| Toyota Motor Corp | | | 2.3% | | | Sony Corp | | | 1.7% | |

| | | | |

| Unilever PLC | | | 2.1% | | | Novo NordiskA/S Class B | | | 1.6% | |

| | | | |

| AIA Group Ltd | | | 2.1% | | | Softbank Group Corp | | | 1.5% | |

| | | | |

| Linde PLC | | | 1.8% | | | Sanofi | | | 1.4% | |

PORTFOLIO HOLDINGS BY INDUSTRY SECTOR (% OF NET ASSETS) (Unaudited)

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by Domini Impact Investments. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification nor shall any such party have any liability therefrom.

22

PORTFOLIO HOLDINGS BY COUNTRY (% OF NET ASSETS) (Unaudited)

The holdings mentioned above are described in the Fund’s Portfolio of Investments as of 01/31/2021 included herein. The composition of the Fund’s portfolio is subject to change.

* Other countries include Norway 0.7%, China 0.6%, Singapore 0.5%, Belgium 0.4%, Canada 0.4%, New Zealand 0.3%, South Africa 0.2%, Austria 0.1%, Hungary 0.1% and Poland 0.1%.

23

| | | | | | | | |

| |

| AVERAGE ANNUAL TOTAL RETURNS (Unaudited) |

| | | |

| | | Investor

shares | | Institutional

shares | | MSCI EAFE (net) |

| | | | |

| As of 1/31/21 | | 1 Year | | N/A | | N/A | | N/A |

| | | | |

| | 5 Year | | N/A | | N/A | | N/A |

| | | | |

| | 10 Year | | N/A | | N/A | | N/A |

| | | | |

| | | Since Inception1 | | 2.30% | | 2.30% | | 2.23% |

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. The returns reflect any applicable expense waivers in effect during the periods shown. Without such waivers, Fund performance would be lower. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost. Call 1-800-582-6757 or visit domini.com for performance information current to the most recent month-end, which may be lower or higher than the performance data quoted. A 2.00% redemption fee applies on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Quoted performance data does not reflect the deduction of this fee, which would reduce the performance quoted. See the prospectus for further information.

Per the prospectus date November 30, 2020, the Fund’s (gross/net) annual operating expenses totaled 1.78%/1.40% and 1.53%/1.15% for the Investor and Institutional Class shares, respectively. The Fund’s Adviser has contractually agreed to waive certain fees and/or reimburse certain ordinary operating expenses in order to limit Investor and Institutional share expenses to 1.40% and 1.15%, respectively. These expense limitations are in effect through November 30, 2021. There can be no assurance that the Adviser will extend the expense limitations beyond such time. While in effect, the arrangement may be terminated for a class only by agreement of the Adviser and the Fund’s Board of Trustees.

The table does not reflect the deduction of fees and taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return is based on the Fund’s net asset values and assumes all dividends and capital gains were reinvested.

An investment in the Domini International Opportunities Fund is not a bank deposit and is not insured. The Fund is subject to certain risks, including, foreign investing, geographic focus, country, currency, impact investing, recent events and market risks. Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity. You may lose money.

The Morgan Stanley Capital International Europe Australasia Far East (MSCI EAFE) index (net) is an unmanaged index of common stocks. MSCI EAFE (net) includes the reinvestment of dividends net of withholding tax, but does not reflect other fees, expenses or taxes. It is not available for direct investment.

1Inception Date 11/30/2020. “Since Inception” for the Morgan Stanley Capital International Europe Australasia Far East (MSCI EAFE) index (net) refers to performance since 11/30/2020.

24

DOMINI INTERNATIONAL OPPORTUNITIES FUND

PORTFOLIOOF INVESTMENTS

January 31, 2021 (Unaudited)

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

| Common Stocks – 99.2% | | | | | | | | |

Australia – 3.6% | | | | | | | | | | |

APA Group | | Utilities | | | 4,023 | | | $ | 30,030 | |

ASX, Ltd. | | Diversified Financials | | | 636 | | | | 34,889 | |

Brambles, Ltd. | | Commercial & Professional Services | | | 4,919 | | | | 39,734 | |

Cochlear, Ltd. | | Health Care Equipment & Services | | | 571 | | | | 86,192 | |

CSL, Ltd. | | Pharmaceuticals, Biotechnology & Life Sciences | | | 1,530 | | | | 318,447 | |

Dexus | | Real Estate | | | 3,614 | | | | 24,846 | |

Fortescue Metals Group, Ltd. | | Materials | | | 5,928 | | | | 98,028 | |

GPT Group (The) | | Real Estate | | | 6,336 | | | | 20,904 | |

Insurance Australia Group, Ltd. | | Insurance | | | 8,188 | | | | 30,300 | |

Magellan Financial Group, Ltd. | | Diversified Financials | | | 492 | | | | 17,946 | |

Mirvac Group | | Real Estate | | | 13,038 | | | | 23,620 | |

Stockland | | Real Estate | | | 7,961 | | | | 26,972 | |

Transurban Group | | Transportation | | | 9,205 | | | | 93,115 | |

| | | | | | | | | | |

| | | | | | | | | 845,023 | |

| | | | | | | | | | |

| | | | | | | | | | |

Austria – 0.1% | | | | | | | | | | |

Erste Group Bank AG (a) | | Banks | | | 1,150 | | | | 35,159 | |

| | | | | | | | | | |

| | | | | | | | | 35,159 | |

| | | | | | | | | | |

| | | | | | | | | | |

Belgium – 0.4% | | | | | | | | | | |

KBC Group NV (a) | | Banks | | | 961 | | | | 67,090 | |

Umicore SA | | Materials | | | 644 | | | | 36,516 | |

| | | | | | | | | | |

| | | | | | | | | 103,606 | |

| | | | | | | | | | |

| | | | | | | | | | |

Canada – 0.4% | | | | | | | | | | |

SunOpta, Inc. (a) | | Food, Beverage & Tobacco | | | 6,637 | | | | 94,113 | |

| | | | | | | | | | |

| | | | | | | | | 94,113 | |

| | | | | | | | | | |

| | | | | | | | | | |

China – 0.6% | | | | | | | | | | |

BYD Co., Ltd., Class H | | Automobiles & Components | | | 4,479 | | | | 135,271 | |

| | | | | | | | | | |

| | | | | | | | | 135,271 | |

| | | | | | | | | | |

| | | | | | | | | | |

Denmark – 4.1% | | | | | | | | | | |

Ambu A/S, Class B | | Health Care Equipment & Services | | | 737 | | | | 34,744 | |

Chr Hansen Holding A/S (a) | | Materials | | | 340 | | | | 30,793 | |

DSV A/S | | Transportation | | | 757 | | | | 118,239 | |

Genmab A/S (a) | | Pharmaceuticals, Biotechnology & Life Sciences | | | 220 | | | | 87,686 | |

GN Store Nord A/S | | Health Care Equipment & Services | | | 426 | | | | 32,489 | |

Novo Nordisk A/S, Class B | | Pharmaceuticals, Biotechnology & Life Sciences | | | 5,546 | | | | 386,796 | |

Novozymes A/S, Class B | | Materials | | | 665 | | | | 39,955 | |

Orsted A/S | | Utilities | | | 613 | | | | 116,551 | |

25

DOMINI INTERNATIONAL OPPORTUNITIES FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2021 (Unaudited)

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

Denmark (Continued) | | | | | | | | | | |

Vestas Wind Systems A/S | | Capital Goods | | | 605 | | | $ | 130,044 | |

| | | | | | | | | | |

| | | | | | | | | 977,297 | |

| | | | | | | | | | |

| | | | | | | | | | |

Finland – 1.4% | | | | | | | | | | |

Elisa Oyj | | Telecommunication Services | | | 484 | | | | 28,848 | |

Kesko OYJ, Class B | | Food & Staples Retailing | | | 1,275 | | | | 33,144 | |

Kone OYJ, Class B | | Capital Goods | | | 1,229 | | | | 96,763 | |

Nordea Bank Abp (a) | | Banks | | | 13,339 | | | | 108,443 | |

Sampo OYJ, Class A | | Insurance | | | 1,554 | | | | 65,405 | |

| | | | | | | | | | |

| | | | | | | | | 332,603 | |

| | | | | | | | | | |

| | | | | | | | | | |

France – 9.8% | | | | | | | | | | |

Air Liquide SA | | Materials | | | 1,592 | | | | 260,656 | |

BioMerieux | | Health Care Equipment & Services | | | 546 | | | | 84,497 | |

BNP Paribas SA (a) | | Banks | | | 3,767 | | | | 180,850 | |

Capgemini SE | | Software & Services | | | 530 | | | | 76,676 | |

Carrefour SA | | Food & Staples Retailing | | | 2,090 | | | | 35,480 | |

Cie Generale des Etablissements Michelin SCA | | Automobiles & Components | | | 539 | | | | 74,361 | |

Credit Agricole SA (a) | | Banks | | | 4,205 | | | | 47,646 | |

Edenred | | Software & Services | | | 817 | | | | 44,301 | |

Eiffage SA (a) | | Capital Goods | | | 261 | | | | 23,717 | |

Gecina SA | | Real Estate | | | 173 | | | | 24,606 | |

Hermes International | | Consumer Durables & Apparel | | | 113 | | | | 115,426 | |

Kering SA | | Consumer Durables & Apparel | | | 253 | | | | 166,237 | |

Legrand SA | | Capital Goods | | | 868 | | | | 79,847 | |

L’Oreal SA | | Household & Personal Products | | | 703 | | | | 247,591 | |

Orange SA | | Telecommunication Services | | | 6,670 | | | | 78,369 | |

Sanofi | | Pharmaceuticals, Biotechnology & Life Sciences | | | 3,631 | | | | 341,869 | |

Sartorius Stedim Biotech | | Pharmaceuticals, Biotechnology & Life Sciences | | | 81 | | | | 33,950 | |

Schneider Electric SE | | Capital Goods | | | 1,795 | | | | 263,010 | |

Unibail – Rodamco-Westfield | | Real Estate | | | 436 | | | | 36,857 | |

Valeo SA | | Automobiles & Components | | | 681 | | | | 25,380 | |

Worldline SA (a)(b) | | Software & Services | | | 773 | | | | 65,414 | |

| | | | | | | | | | |

| | | | | | | | | 2,306,740 | |

| | | | | | | | | | |

| | | | | | | | | | |

Germany – 8.1% | | | | | | | | | | |

adidas AG (a) | | Consumer Durables & Apparel | | | 585 | | | | 185,697 | |

Beiersdorf AG | | Household & Personal Products | | | 321 | | | | 35,078 | |

Continental AG | | Automobiles & Components | | | 354 | | | | 49,599 | |

Deutsche Boerse AG | | Diversified Financials | | | 621 | | | | 99,814 | |

Deutsche Post AG | | Transportation | | | 3,376 | | | | 166,943 | |

Encavis AG | | Utilities | | | 4,231 | | | | 115,293 | |

Henkel AG & Co. KGaA | | Household & Personal Products | | | 998 | | | | 93,422 | |

KION Group AG | | Capital Goods | | | 217 | | | | 18,757 | |

Knorr-Bremse AG | | Capital Goods | | | 220 | | | | 29,181 | |

LEG Immobilien AG | | Real Estate | | | 238 | | | | 34,156 | |

26

DOMINI INTERNATIONAL OPPORTUNITIES FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2021 (Unaudited)

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

Germany (Continued) | | | | | | | | | | |

Merck KGaA | | Pharmaceuticals, Biotechnology & Life Sciences | | | 437 | | | $ | 72,915 | |

Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen | | Insurance | | | 472 | | | | 125,294 | |

Nordex SE (a) | | Capital Goods | | | 3,364 | | | | 95,341 | |

Puma SE (a) | | Consumer Durables & Apparel | | | 302 | | | | 29,585 | |

Sartorius AG, Pfd Shs | | Health Care Equipment & Services | | | 121 | | | | 60,215 | |

Siemens AG | | Capital Goods | | | 2,683 | | | | 416,167 | |

Siemens Healthineers AG (b) | | Health Care Equipment & Services | | | 750 | | | | 42,108 | |

Symrise AG | | Materials | | | 410 | | | | 51,079 | |

Vonovia SE | | Real Estate | | | 1,909 | | | | 127,606 | |

Zalando SE (a)(b) | | Retailing | | | 563 | | | | 64,626 | |

| | | | | | | | | | |

| | | | | | | | | 1,912,876 | |

| | | | | | | | | | |

| | | | | | | | | | |

Hong Kong – 3.5% | | | | | | | | | | |

AIA Group, Ltd. | | Insurance | | | 40,648 | | | | 490,044 | |

Hong Kong Exchanges & Clearing, Ltd. | | Diversified Financials | | | 4,180 | | | | 267,216 | |

Techtronic Industries Co., Ltd. | | Capital Goods | | | 4,508 | | | | 67,337 | |

| | | | | | | | | | |

| | | | | | | | | 824,597 | |

| | | | | | | | | | |

| | | | | | | | | | |

Hungary – 0.1% | | | | | | | | | | |

OTP Bank Nyrt (a) | | Banks | | | 744 | | | | 33,972 | |

| | | | | | | | | | |

| | | | | | | | | 33,972 | |

| | | | | | | | | | |

| | | | | | | | | | |

Ireland – 1.1% | | | | | | | | | | |

CRH PLC | | Materials | | | 2,586 | | | | 106,970 | |

Kerry Group PLC, Class A | | Food, Beverage & Tobacco | | | 508 | | | | 69,016 | |

Kingspan Group plc (a) | | Capital Goods | | | 505 | | | | 34,357 | |

Smurfit Kappa Group PLC | | Materials | | | 847 | | | | 40,832 | |

| | | | | | | | | | |

| | | | | | | | | 251,175 | |

| | | | | | | | | | |

| | | | | | | | | | |

Italy – 1.0% | | | | | | | | | | |

Assicurazioni Generali SpA | | Insurance | | | 3,824 | | | | 65,336 | |

DiaSorin S.p.A. | | Health Care Equipment & Services | | | 104 | | | | 22,768 | |

Intesa Sanpaolo SpA (a) | | Banks | | | 57,655 | | | | 125,834 | |

Terna Rete Elettrica Nazionale SpA | | Utilities | | | 4,671 | | | | 33,913 | |

| | | | | | | | | | |

| | | | | | | | | 247,851 | |

| | | | | | | | | | |

| | | | | | | | | | |

Japan – 26.1% | | | | | | | | | | |

Aeon Co., Ltd. | | Food & Staples Retailing | | | 2,467 | | | | 77,325 | |

Asahi Intecc Co. Ltd. | | Health Care Equipment & Services | | | 738 | | | | 24,242 | |

Asahi Kasei Corp. | | Materials | | | 4,400 | | | | 48,951 | |

27

DOMINI INTERNATIONAL OPPORTUNITIES FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2021 (Unaudited)

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

Japan (Continued) | | | | | | | | | | |

Canon, Inc. | | Technology Hardware & Equipment | | | 3,370 | | | $ | 74,585 | |

Central Japan Railway Co. | | Transportation | | | 562 | | | | 80,512 | |

Daifuku Co., Ltd. | | Capital Goods | | | 372 | | | | 42,476 | |

Daiichi Sankyo Co., Ltd. | | Pharmaceuticals, Biotechnology & Life Sciences | | | 6,488 | | | | 208,955 | |

Daiwa House Industry Co., Ltd. | | Real Estate | | | 1,976 | | | | 56,048 | |

Denso Corp. | | Automobiles & Components | | | 1,454 | | | | 80,859 | |

Eisai Co., Ltd. | | Pharmaceuticals, Biotechnology & Life Sciences | | | 893 | | | | 65,205 | |

FANUC Corp. | | Capital Goods | | | 627 | | | | 163,769 | |

Fast Retailing Co., Ltd. | | Retailing | | | 179 | | | | 153,928 | |

FUJIFILM Holdings Corp. | | Technology Hardware & Equipment | | | 1,232 | | | | 70,605 | |

Hankyu Hanshin Holdings, Inc. | | Transportation | | | 765 | | | | 24,763 | |

Hoya Corp. | | Health Care Equipment & Services | | | 1,214 | | | | 155,410 | |

Japan Real Estate Investment Corp. | | Real Estate | | | 4 | | | | 24,387 | |

Kao Corp. | | Household & Personal Products | | | 1,551 | | | | 112,589 | |

Keio Corp. | | Transportation | | | 361 | | | | 26,432 | |

Keyence Corp. | | Technology Hardware & Equipment | | | 628 | | | | 337,322 | |

Koito Manufacturing Co., Ltd. | | Automobiles & Components | | | 392 | | | | 25,304 | |

Kurita Water Industries, Ltd. | | Capital Goods | | | 2,500 | | | | 101,524 | |

Kyocera Corp. | | Technology Hardware & Equipment | | | 1,077 | | | | 69,060 | |

Lasertec Corp. | | Semiconductors & Semiconductor Equipment | | | 254 | | | | 34,039 | |

LIXIL Corp. | | Capital Goods | | | 900 | | | | 20,998 | |

Makita Corp. | | Capital Goods | | | 800 | | | | 38,194 | |

Mitsubishi Estate Co., Ltd. | | Real Estate | | | 4,100 | | | | 64,893 | |

Mitsui Fudosan Co., Ltd. | | Real Estate | | | 3,100 | | | | 62,953 | |

MS&AD Insurance Group Holdings, Inc. | | Insurance | | | 1,560 | | | | 44,905 | |

Murata Manufacturing Co., Ltd. | | Technology Hardware & Equipment | | | 2,150 | | | | 206,602 | |

Nidec Corp. | | Capital Goods | | | 1,652 | | | | 219,950 | |

Nippon Paint Holdings Co., Ltd. | | Materials | | | 577 | | | | 51,911 | |

Nippon Prologis REIT, Inc. | | Real Estate | | | 7 | | | | 22,830 | |

Nippon Telegraph & Telephone Corp. | | Telecommunication Services | | | 7,900 | | | | 197,545 | |

Nissin Foods Holdings Co., Ltd. | | Food, Beverage & Tobacco | | | 229 | | | | 19,803 | |

Nitto Denko Corp. | | Materials | | | 482 | | | | 43,711 | |

Nomura Holdings, Inc. | | Diversified Financials | | | 10,100 | | | | 53,465 | |

NTT Data Corp. | | Software & Services | | | 2,081 | | | | 29,900 | |

Obic Co., Ltd. | | Software & Services | | | 210 | | | | 39,311 | |

Odakyu Electric Railway Co., Ltd. | | Transportation | | | 2,200 | | | | 63,979 | |

Oisix ra daichi, Inc. (a) | | Retailing | | | 2,500 | | | | 74,327 | |

28

DOMINI INTERNATIONAL OPPORTUNITIES FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2021 (Unaudited)

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

Japan (Continued) | | | | | | | | | | |

Omron Corp. | | Technology Hardware & Equipment | | | 629 | | | $ | 55,754 | |

Ono Pharmaceutical Co., Ltd. | | Pharmaceuticals, Biotechnology & Life Sciences | | | 1,314 | | | | 39,240 | |

Oriental Land Co., Ltd. | | Consumer Services | | | 646 | | | | 101,155 | |

ORIX Corp. | | Diversified Financials | | | 4,105 | | | | 65,900 | |

Panasonic Corp. | | Consumer Durables & Apparel | | | 7,176 | | | | 93,205 | |

Rakuten, Inc. (a) | | Retailing | | | 2,900 | | | | 28,557 | |

Recruit Holdings Co., Ltd. | | Commercial & Professional Services | | | 4,221 | | | | 183,690 | |

Rohm Co., Ltd. | | Semiconductors & Semiconductor Equipment | | | 281 | | | | 28,525 | |

Santen Pharmaceutical Co., Ltd. | | Pharmaceuticals, Biotechnology & Life Sciences | | | 1,243 | | | | 20,568 | |

Sekisui House, Ltd. | | Consumer Durables & Apparel | | | 1,960 | | | | 37,886 | |

Shimano, Inc. | | Consumer Durables & Apparel | | | 252 | | | | 59,115 | |

Shionogi & Co., Ltd. | | Pharmaceuticals, Biotechnology & Life Sciences | | | 1,006 | | | | 54,642 | |

Shiseido Co., Ltd. | | Household & Personal Products | | | 1,303 | | | | 84,631 | |

SMC Corp. | | Capital Goods | | | 206 | | | | 124,723 | |

SoftBank Group Corp. | | Telecommunication Services | | | 4,428 | | | | 343,214 | |

Sony Corp. | | Consumer Durables & Apparel | | | 4,154 | | | | 397,780 | |

Sumitomo Realty & Development Co., Ltd. | | Real Estate | | | 1,093 | | | | 33,009 | |

Sysmex Corp. | | Health Care Equipment & Services | | | 489 | | | | 57,075 | |

TDK Corp. | | Technology Hardware & Equipment | | | 415 | | | | 67,134 | |

Terumo Corp. | | Health Care Equipment & Services | | | 2,334 | | | | 90,756 | |

Tobu Railway Co. Ltd. | | Transportation | | | 646 | | | | 18,238 | |

Tokio Marine Holdings, Inc. | | Insurance | | | 2,100 | | | | 103,203 | |

Tokyu Corp. | | Transportation | | | 1,966 | | | | 23,128 | |

Toray Industries, Inc. | | Materials | | | 4,938 | | | | 32,234 | |

TOTO, Ltd. | | Capital Goods | | | 500 | | | | 27,706 | |

Toyota Motor Corp. | | Automobiles & Components | | | 7,613 | | | | 534,199 | |

Unicharm Corp. | | Household & Personal Products | | | 1,426 | | | | 63,986 | |

Yahoo Japan Corp. | | Media & Entertainment | | | 8,876 | | | | 55,167 | |

Yaskawa Electric Corp. | | Capital Goods | | | 823 | | | | 42,231 | |

| | | | | | | | | | |

| | | | | | | | | 6,180,218 | |

| | | | | | | | | | |

| | | | | | | | | | |

Netherlands – 8.0% | | | | | | | | | | |

ABN AMRO Group NV (a) | | Banks | | | 3,116 | | | | 32,580 | |

Adyen N.V. (a)(b) | | Software & Services | | | 86 | | | | 179,856 | |

Akzo Nobel NV | | Materials | | | 581 | | | | 59,211 | |

Arcadis N.V. (a) | | Capital Goods | | | 3,489 | | | | 122,462 | |

ASML Holding NV | | Semiconductors & Semiconductor Equipment | | | 1,394 | | | | 745,020 | |

Basic-Fit N.V. (a)(b) | | Consumer Services | | | 1,854 | | | | 63,631 | |

Euronext N.V. | | Diversified Financials | | | 202 | | | | 21,779 | |

ING Groep NV (a) | | Banks | | | 12,993 | | | | 115,654 | |

Koninklijke Ahold Delhaize NV | | Food & Staples Retailing | | | 3,672 | | | | 105,520 | |

29

DOMINI INTERNATIONAL OPPORTUNITIES FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2021 (Unaudited)

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

Netherlands (Continued) | | | | | | | | | | |

Koninklijke DSM NV | | Materials | | | 576 | | | $ | 100,805 | |

Koninklijke KPN NV | | Telecommunication Services | | | 11,323 | | | | 35,412 | |

Koninklijke Philips NV (a) | | Health Care Equipment & Services | | | 3,023 | | | | 164,965 | |

NXP Semiconductors NV | | Semiconductors & Semiconductor Equipment | | | 915 | | | | 146,830 | |

| | | | | | | | | | |

| | | | | | | | | 1,893,725 | |

| | | | | | | | | | |

| | | | | | | | | | |

New Zealand – 0.3% | | | | | | | | | | |

Spark New Zealand, Ltd. | | Telecommunication Services | | | 6,173 | | | | 21,256 | |

Xero (a) | | Software & Services | | | 406 | | | | 40,209 | |

| | | | | | | | | | |

| | | | | | | | | 61,465 | |

| | | | | | | | | | |

| | | | | | | | | | |

Norway – 0.7% | | | | | | | | | | |

DNB ASA (a) | | Banks | | | 2,983 | | | | 58,160 | |

NEL ASA (a) | | Capital Goods | | | 24,559 | | | | 86,868 | |

Orkla ASA | | Food, Beverage & Tobacco | | | 2,486 | | | | 24,201 | |

| | | | | | | | | | |

| | | | | | | | | 169,229 | |

| | | | | | | | | | |

| | | | | | | | | | |

Poland – 0.1% | | | | | | | | | | |

CD Projekt SA (a) | | Media & Entertainment | | | 209 | | | | 17,070 | |

| | | | | | | | | | |

| | | | | | | | | 17,070 | |

| | | | | | | | | | |

| | | | | | | | | | |

Singapore – 0.5% | | | | | | | | | | |

DBS Group Holdings, Ltd. | | Banks | | | 5,950 | | | | 112,310 | |

| | | | | | | | | | |

| | | | | | | | | 112,310 | |

| | | | | | | | | | |

| | | | | | | | | | |

South Africa – 0.2% | | | | | | | | | | |

FirstRand, Ltd. | | Diversified Financials | | | 12,369 | | | | 39,035 | |

| | | | | | | | | | |

| | | | | | | | | 39,035 | |

| | | | | | | | | | |

| | | | | | | | | | |

Spain – 2.3% | | | | | | | | | | |

Aena SME SA (a) | | Transportation | | | 223 | | | | 34,429 | |

Amadeus IT Group SA (a) | | Software & Services | | | 1,485 | | | | 94,913 | |

Banco Bilbao Vizcaya Argentaria SA | | Banks | | | 21,782 | | | | 99,496 | |

CaixaBank SA | | Banks | | | 11,510 | | | | 29,078 | |

Grifols SA | | Pharmaceuticals, Biotechnology & Life Sciences | | | 1,789 | | | | 52,722 | |

Industria de Diseno Textil SA | | Retailing | | | 3,723 | | | | 110,540 | |

Red Electrica Corp. SA | | Utilities | | | 1,382 | | | | 26,270 | |

Siemens Gamesa Renewable Energy SA | | Capital Goods | | | 739 | | | | 30,350 | |

Telefonica SA | | Telecommunication Services | | | 16,238 | | | | 70,143 | |

| | | | | | | | | | |

| | | | | | | | | 547,941 | |

| | | | | | | | | | |

| | | | | | | | | | |

Sweden – 3.4% | | | | | | | | | | |

Assa Abloy AB, Class B | | Capital Goods | | | 3,194 | | | | 79,238 | |

30

DOMINI INTERNATIONAL OPPORTUNITIES FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2021 (Unaudited)

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

Sweden (Continued) | | | | | | | | | | |

Autoliv, Inc. | | Automobiles & Components | | | 287 | | | $ | 25,460 | |

Essity AB, Class B | | Household & Personal Products | | | 2,176 | | | | 69,718 | |

Hennes & Mauritz AB, Class B (a) | | Retailing | | | 2,443 | | | | 52,391 | |

Kinnevik AB, Class B (a) | | Diversified Financials | | | 870 | | | | 42,814 | |

MIPS AB | | Consumer Durables & Apparel | | | 2,240 | | | | 132,869 | |

Nibe Industrier AB, Class B | | Capital Goods | | | 1,397 | | | | 46,775 | |

Samhallsbyggnadsbolaget i Norden AB | | Real Estate | | | 9,920 | | | | 32,588 | |

SKF AB, Class B | | Capital Goods | | | 1,437 | | | | 39,452 | |

Svenska Cellulosa AB SCA, Class B (a) | | Materials | | | 2,046 | | | | 36,151 | |

Svenska Handelsbanken AB, Class A (a) | | Banks | | | 5,048 | | | | 50,479 | |

Sweco AB, Class B | | Capital Goods | | | 5,168 | | | | 86,371 | |

Veoneer, Inc. (a) | | Automobiles & Components | | | 3,951 | | | | 103,872 | |

| | | | | | | | | | |

| | | | | | | | | 798,178 | |

| | | | | | | | | | |

| | | | | | | | | | |

Switzerland – 4.1% | | | | | | | | | | |

Chocoladefabriken Lindt & Spruengli AG | | Food, Beverage & Tobacco | | | 7 | | | | 60,727 | |

EMS-Chemie Holding AG | | Materials | | | 22 | | | | 20,777 | |

Geberit AG | | Capital Goods | | | 121 | | | | 74,156 | |

Kuehne + Nagel International AG | | Transportation | | | 188 | | | | 42,836 | |

Lonza Group AG (a) | | Pharmaceuticals, Biotechnology & Life Sciences | | | 248 | | | | 158,602 | |

Sika AG | | Materials | | | 452 | | | | 123,154 | |

STMicroelectronics NV | | Semiconductors & Semiconductor Equipment | | | 3,157 | | | | 126,700 | |

Swiss Re AG | | Insurance | | | 922 | | | | 81,390 | |

Swisscom AG | | Telecommunication Services | | | 86 | | | | 46,868 | |

Temenos AG | | Software & Services | | | 215 | | | | 27,184 | |

Zurich Insurance Group AG | | Insurance | | | 507 | | | | 202,984 | |

| | | | | | | | | | |

| | | | | | | | | 965,378 | |

| | | | | | | | | | |

| | | | | | | | | | |

United Kingdom – 12.0% | | | | | | | | | | |

3i Group PLC | | Diversified Financials | | | 3,235 | | | | 49,131 | |

Admiral Group PLC | | Insurance | | | 885 | | | | 34,956 | |

Barratt Developments PLC (a) | | Consumer Durables & Apparel | | | 3,369 | | | | 29,406 | |

Berkeley Group Holdings PLC | | Consumer Durables & Apparel | | | 411 | | | | 23,557 | |

Bunzl PLC | | Capital Goods | | | 1,111 | | | | 35,742 | |

Burberry Group PLC (a) | | Consumer Durables & Apparel | | | 1,368 | | | | 32,133 | |

Compass Group PLC (a) | | Consumer Services | | | 5,977 | | | | 107,003 | |

GlaxoSmithKline PLC | | Pharmaceuticals, Biotechnology & Life Sciences | | | 16,773 | | | | 312,190 | |

Halma PLC | | Technology Hardware & Equipment | | | 1,268 | | | | 42,835 | |

31

DOMINI INTERNATIONAL OPPORTUNITIES FUND

PORTFOLIOOF INVESTMENTS (continued)

January 31, 2021 (Unaudited)

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

United Kingdom (Continued) | | | | | |

Informa PLC (a) | | Media & Entertainment | | | 5,043 | | | $ | 34,391 | |

Intertek Group PLC | | Commercial & Professional Services | | | 535 | | | | 40,382 | |

J Sainsbury PLC | | Food & Staples Retailing | | | 7,673 | | | | 25,683 | |

Johnson Matthey PLC | | Materials | | | 643 | | | | 25,925 | |

Land Securities Group PLC | | Real Estate | | | 2,503 | | | | 21,004 | |

Legal & General Group PLC | | Insurance | | | 20,256 | | | | 67,519 | |

Linde PLC | | Materials | | | 1,724 | | | | 423,069 | |

London Stock Exchange Group PLC | | Diversified Financials | | | 1,189 | | | | 141,466 | |

Mondi PLC | | Materials | | | 1,613 | | | | 38,070 | |

National Grid PLC | | Utilities | | | 11,932 | | | | 138,907 | |

Next PLC (a) | | Retailing | | | 412 | | | | 43,593 | |

Ocado Group PLC (a) | | Retailing | | | 1,714 | | | | 65,210 | |

Pennon Group PLC | | Utilities | | | 1,413 | | | | 18,083 | |

Prudential PLC | | Insurance | | | 8,588 | | | | 137,709 | |

RELX PLC | | Commercial & Professional Services | | | 6,519 | | | | 161,760 | |

Schroders PLC | | Diversified Financials | | | 499 | | | | 23,322 | |

Segro PLC | | Real Estate | | | 4,028 | | | | 52,539 | |